There’s a maxim in all the romance self-help books: Before you can love others, you have to love yourself.

That’s also true of anyone who’s trying to find their place in the business world. Whether the market is flush or foul, only belief in your own abilities and work ethic will pay off in the long run. When all is going well, reap everything possible and save for the bad times. And when the bad times press down, use your strength (and your savings) to power through to the next cycle of success.

That kind of action only comes from inner strength, from a core belief that you will persevere regardless of the obstacles. Your plan might include a momentary retreat or re-grouping. Or it might be a bold strategic bet on a new approach. Neither will work if you don’t have a bedrock, unshakeable belief that you can do whatever you set your will to.

In other words, you have to love yourself.

That’s what this issue is all about. Top originator? Why shouldn’t that be you? Is there something stopping you, something in your way? Get clever, get working, get beyond it. Every breakthrough in history came after someone decided that something couldn’t be done — and then someone went and did that impossible thing. You don’t need to shoot for top LO in the nation: How about top LO in your neighborhood? Once you’ve achieved that, go for top LO in your town, then your region, your county, your state. It can be done, and in this issue, we write the stories of success of multiple originators who’ve done just that. Every one of them has a simple technique that can be replicated; do so, and next year we’ll again be writing about LOs who’ve conquered the market, but this time it will be the story of your success.

We bet you’d love that.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR

David Krechevsky

EDITOR

Keith Griffin

SENIOR EDITOR

Gary Rogo

SPECIAL SECTIONS EDITOR

Mary Quinn

MULTIMEDIA PRODUCER

Erica Drzewiecki, Katie Jensen, Ryan Kingsley, Sarah Wolak

STAFF WRITERS

Rob Chrisman, Dave Hershman, Erica LaCentra, Harvey Mackay, Lew Sichelman, Mary Kay Scully

CONTRIBUTING WRITERS

Nicole Coughlin, Nichole Cakirca

ADVERTISING ASSOCIATES

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Steven Winokur

CHIEF MARKETING OFFICER

Julie Carmichael

PROJECT MANAGER

Meghan Hogan

DESIGN MANAGER

Stacy Murray, Christopher Wallace

GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins

MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Joel Berman

FOUNDING PUBLISHER

Submit your news to editors@ambizmedia.com

If you would like additional copies of National Mortgage Professional Call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. National Mortgage Professional magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991 info@ambizmedia.com

In my last column, we discussed the importance of leveraging your sphere within the recruiting process. Networking is the process by which we work our sphere while recruiting. Some may have forgotten, but when social media was first introduced to the world, the terms social media and social networking were interchangeable. Social networking is not utilized as much anymore as a term, but the fact is, networking through social media is exactly what we need to be doing to support our recruiting efforts.

I have found that LinkedIn is the most important site for recruiters who are networking. LinkedIn is a site for business contacts, as opposed to a site such as Facebook, which is focused on personal information. There are Facebook business pages, but the purpose of these pages is typically to attract consumers. On LinkedIn, the users are more focused upon business-to-business connections and

even the company pages on LinkedIn are more likely to focus upon the delivery of business-to-business value.

How can social media be used to facilitate the recruitment process?

1. Accomplish research on candidates or potential candidates. Before you meet with a candidate, or even to help you decide whether you would want to meet with someone, visit his or her LinkedIn profile. What are you looking for?

• Certainly, their work history is significant. If they have worked at five companies for the past five years, this is not evidence of a stable work history. Stability, experience length, and production focus can all be extrapolated from a robust LinkedIn profile.

• Even the types of companies they have worked for can be very important information. What is the reputation of these companies? Do they have a similar business model to your company? For example, if

you represent a large bank with a strict structure in place and their work history is with small entities in which the loan officers are fiercely independent, this might not be a match.

• Even the professionalism of their profile is important. It can tell you whether they are serious about using social media and also may be a reflection of how they approach other aspects of their business. Would their present profile even pass compliance tests within your company?

• The testimonials posted on their site would also supply you with

went to the same school, came from the same hometown, or worked at the same company as a potential candidate. Your request for a connection should cite that commonality with statements such as — I see we both went to the University of ABC — do you remember _______________? These commonalities can also give you more to discuss when meeting candidates. Remember, recruiting is about developing relationships and trust.

The key to successful use of social media is to deliver value to your connections and potential connections. That means posting statements such as “come work here” is ineffective compared to posting valuable articles that will help your connections do more business.

pertinent information. What their customers and referral sources say will speak volumes about the way they go about their business. If they have no testimonials published, this raises questions. Are they not using this tool the way it should be used, or are they not providing great customer service?

2. A look at their work background and connections can also give rise to potential references. Perhaps you know one of their connections well. These references might be checked after interviews or before a potential interview to determine whether you should meet with this candidate. In this regard, a call to a connection may prevent you from wasting your time.

3. The search feature on LinkedIn can also give you information about those with whom you might have experiences or backgrounds in common. These commonalities facilitate connections with potential candidates. Perhaps you

Going back to our initial premise regarding networking providing the best basis for recruiting — we will acknowledge that recruiters often use LinkedIn to facilitate cold calling. I have gotten calls from recruiters who quite obviously did not read my profile carefully. This is a scatter-gun approach and is not likely to be effective. Good quality producers don’t have time to take a cold call, and if they do, they are not going to be swayed by a cold call. Therefore, those you would attract would trigger a process of adverse selection by attracting lower-quality candidates who are not likely to stick at your company as well.

The same concept applies to advertising for candidates on LinkedIn. What good loan officer is going to respond to an advertisement? Great loan officers have plenty of choices without searching. Again, your best vehicle for finding quality candidates is through the networking process, and social media provides a great tool for social networking — if you go about it in the right way. n

Dave Hershman is the top author in this industry with seven books published as well as the founder of the OriginationPro Marketing System and the OriginationPro’s on-line comprehensive mortgage school. Dave is also Director of Branch Support for McLean Mortgage. His site is www. OriginationPro.com and he can be reached at dave@hershmangroup.com

Social media provides a great tool for social networking — if you go about it in the right way.

t can happen to anyone at any time. You may feel unmotivated, despondent, or just generally dissatisfied with how your career is going. While it’s normal to experience ups and downs in your career, a growing feeling of dread about your job usually indicates greater issues. When you start feeling as if your day has become repetitive and tedious, and you’re generally stuck, you have likely fallen into a career rut. Now before you panic and think you must make a huge change, it’s important to know that it’s completely normal to get into a professional rut. According to a survey conducted by Oracle, “more than 75% of surveyed employees feel stuck, both personally and professionally.” However, to ultimately pull yourself out of this rut and move your career forward, you need to first identify why you are feeling stuck. So, what exactly causes someone to get into a professional rut and how can you fix it?

While it may be hard to pinpoint why you’re feeling this way, there are numerous reasons why you may feel stuck in your career. One of the most common reasons is because people no longer feel challenged. This could be because you are no longer

, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

able to reach new professional milestones, your current role has no room for growth, or you simply aren’t learning new skills. Whatever the case may be, not having a driving force which makes you want to do more is typically what creates that stagnant feeling.

It can be very challenging to want to continue a career where nothing changes, and you feel you have lost the purpose behind your work. There needs to be an obstacle to overcome, meaning to why you do what you do, or that next goal to propel you forward. Without challenges and purpose in your job, you will likely be wondering what’s the point.

Thankfully, once you have identified why you feel stuck, you can take the appropriate steps to move forward and identify what that plan looks like.

Now that you’ve figured out why you’re in a professional rut, it’s time to determine what is keeping you there and ultimately what steps you need to take to get out of it. This also can mean you may

be scary to leave the comfort of a job you know to pursue something new, if you likely can’t get out of your professional rut without a change, it’s time to approach the situation logically and use decision-making framework to determine if a new job should be in your future.

Ask yourself the following: Do I need a new purpose for my career? Am I no longer excited by how I spend my time or the problems I am solving within my job? Would my experience be better suited

have to take a long hard look at your job if the obstacles you have determined can’t really be fixed in your current career.

However, before you immediately decide to quit your job, list what you feel are obstacles making you feel stuck. For example, if you no longer feel challenged, what is preventing you from taking on new projects that would reinvigorate you?

If you feel as if you aren’t growing, can you invest in yourself or work with others in your organization to learn new skills? If you feel your career isn’t progressing, can you speak with your manager about opportunities for growth within the organization? There are usually actionable and often immediate steps you can identify to get back on track and start moving in the right direction again.

If you are able to outline ways to get out of your rut within your organization, it’s important to connect with the people within your company who can help make those plans a reality and commit yourself to keeping on track. Focusing on that bigger picture and having support as you start working your way out of your rut can help you get to that next level.

So, what happens if you have identified obstacles preventing you from moving forward and they aren’t anything that can be fixed while in your current job? It could be time to weigh the pros and cons of your situation and try a new opportunity to get unstuck. While it can

to a different role, and could I make a greater impact somewhere else? Does my organization allow me to grow and do the people I work with make me better?

Chances are asking yourself these tough questions will give you the answers you need to know if you want to take steps outside of your current organization. If that is the case, lay out what your next steps are to find new opportunities that better align with what you are now looking for. It may be challenging in the short term, but it will be infinitely more rewarding long term.

Whether your professional journey to get out of a rut in your career requires you to look inward or outward for the next steps, it’s important that whatever you do, you need to be determining a path forward and sticking to it. Yes, career ruts are normal, but they don’t have to be something you just live with. Develop your plan of action, have a clear vision to get what you want, and pursue it. The only way to get out of a professional rut is your own action and momentum, so take the time to focus on your own progress and move forward. n

Erica LaCentra is chief marketing officer for RCN Capital.The only way to get out of a professional rut is your own action and momentum.

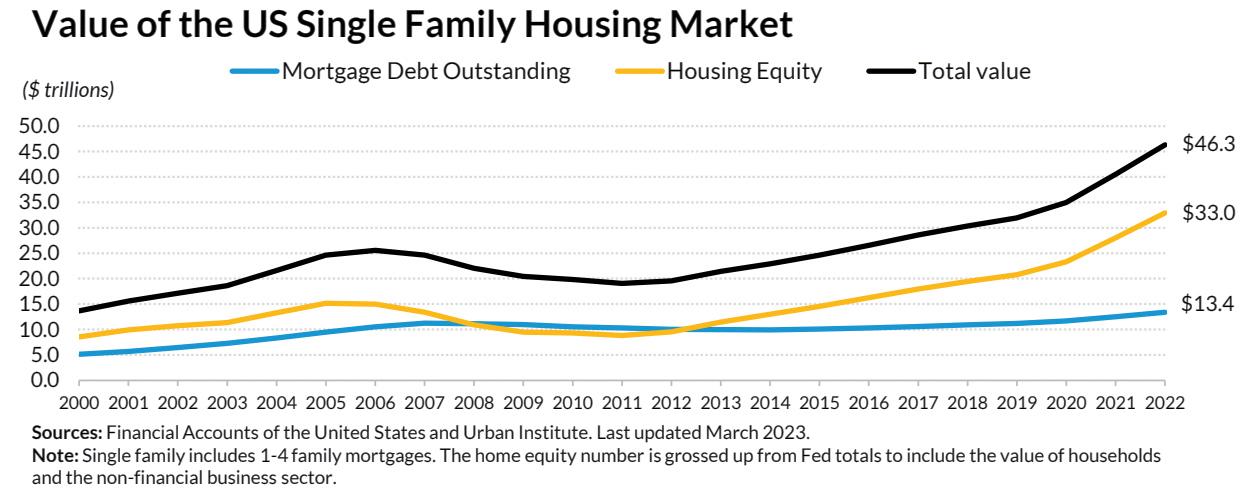

Like the old grey mare, the mortgage business ain’t what she used to be. High interest rates — above 7% at this writing — and ever rising housing prices — a median of $396,000 in May — have seen to that. Both have forced would-be sellers as well as wanna-be buyers to the sidelines: sellers because they balk at paying a higher rate then they have now and even if they were willing, there isn’t much to buy. According to Redfin, fewer houses were for sale in May then at any other time since 2012.

The impact has been severe. Numerous lenders have shut down, sold out or cut their workforces to the bone. According to the latest Bureau of Labor Statistics report, the bloodbath that followed resulted, at last count, in some 50,000 poor souls who have lost their jobs in just the last 12 months.

At the same time, property data provider ATTOM reports that lending in the first quarter was down 70% from the same period two years earlier. Lending was at its lowest point in Q1 since late 2000, and it was down, although not evenly, in every facet, from purchase money mortgages to refinancings.

But there’s another factor besides high rates, high prices and low inventories at play here: cash buyers.

Of course, everyone is a cash buyer at closing, whether they have financing or not. But true cash buyers, those who don’t need a mortgage, now account for roughly a third of all transactions. And when you don’t need a loan, you don’t need title insurance, mortgage insurance and possibly not even an appraiser.

According to the Census Bureau, 11% of all new home sales were for cash in last year’s fourth quarter. That’s the highest share since 1990 — 32 years! And according to the latest from the National Association of Realtors, 78% of 2022’s existing home buyers financed their deals, down from 87% the previous year. That leaves 22% who went commando.

“I talk to agents (from all over the country) every single day,” says Denise Lones, a sales trainer based in

Bellingham, Wash., “and they all are saying the same thing: ‘There’s an awful lot of cash these days.’”

There’s good reason to pay cash. Because there are no lenders involved, it puts you at the head of the line, as in cash buyers are gold. But at the same time, it might not be such a smart idea to put everything you’ve got into a illiquid asset that cannot be traded like stocks and bonds. And as long as the financed buyer does his homework, like obtaining a preapproval and passing on a laundry list of contingencies, he should be just as solid.

This isn’t to debate the pros and cons of buying with cash, though. Rather, it is to take a deeper dive into the impact cash sales have had on companies and people all along the mortgage food chain.

First, however, there seems to be some disagreement on the impact of cash deals on overall lending. While some — like Lones — say it has been severe, others

saying the same. “The data from the Realtors Confidence Index is directly from a member survey,” says Jessica Lautz, second in charge of NAR’s economics department. “They are reporting higher shares” of cash sales.

Pushing aside this ongoing debate, let’s look at the impact all-cash deals have had on the mortgage food chain:

Mortgages — If the above figures from ATTOM don’t resonate, here’s this from the Mortgage Bankers Association’s first quarter performance report, courtesy of analyst/advisor Joe Garrett: The loss per loan was 67 basis points. That’s down from a 99-tick loss in last year’s fourth quarter. But lenders are still losing money when they write a mortgage.

Refinancing is all but gone! Not as many people are buying houses! And a third of those who do buy pay with cash! “It’s a triple whammy,” says Michael Isaacs, CEO of Columbus, Ohio-based

discount the affect. “Nothing major in the overall scheme of things,” says ATTOM CEO Rob Barber.

While cash deals have doubled, they’re only responsible for about 20% of all transactions, which have declined substantially, Barber believes. In hard numbers, he believes the actual quarterly number of cash sales has declined by half, from 500,000 to 250,000. So, while cash money is “helping somewhat” to drive down lending, he says, “it doesn’t look like a major factor.”

Redfin’s latest figures seem to confirm that. While cash deals were down 35% year-over-year in April, overall sales were off 41%. But a a third of the places that did sell went for cash, the highest share in nine years. And NAR’s members are

GO Mortgage, which has actually grown its business by adding loan officers picked up from other companies. “That’s just one more customer we don’t have.”

Meanwhile, a small survey by payroll data company Everee of just 314 commission-based industry professionals — managers, loan officers, processors and underwriters, half of whom had been in the business for more than five years — found that 60% are living from paycheck to paycheck. Moreover, a third of them plan to exit the field in the next 12 months while 15% more haven’t made up their minds.

Mortgage Insurance — The type of home buyer who needs private mortgage insurance is not typically the type who pays with greenbacks. First-timers who have trouble scraping a few nickels together for a downpayment need mortgage insurance, while move-up

While cash deals have doubled, they’re only responsible for about 20% of all transactions, which have declined substantially, Barber believes.

buyers taking a passel of equity with them from the sale of their former residence are the most likely to pay cash.

Of all the loans purchased using private MI last year, 62% supported first-time buyers, reports Brian Berry, a spokesman for the US Mortgage Insurers trade group. Consequently, the MI business doesn’t slump much when cash buyers proliferate. And that’s why the MI business enjoyed its third best year ever in terms of colume in 2022.

At the same time, though, a surprising 6% of all first-timers paid cash in 2021, NAR reported in May of that year. And it’s likely a similar number are currently paying cash, if not more. So the business has been impacted, if only minimally.

Title Insurance — It’s hard to get a handle on title insurers. The American Land Title Association has no economist on staff, so the group does not produce much in the way of statistics. But spokesman Jeremy Yohe told me he doesn’t think all-cash sales have had much of an impact. “I don’t think it is any greater than during the run-up to the Great Recession,” he said. “Nominal.”

Because title practices vary from state to state, cash deals have had little to no affect in places like Texas where sellers have traditionally paid for the buyer’s

coverage. But in markets where buyers pay, title companies usually get two shots at the brass ring — once for the lender’s policy and once for the buyer’s. And when someone pays cash in those places, insurers lose at least the lender-policy share.

Chrissy Ziccardi of SingleSource Property Solutions, the Pittsburgh-based settlement firm, says her company has seen an increase in business recently, largely because it can close deals far more quickly — 16–20 days vs. 30–45 days when

While it’s admirable that some buyers have enough money — cash, savings and/or investments — that they don’t have to worry about the cost of borrowing, do all-cash buyers really want to tie that much to a single asset, one that doesn’t always rise in value over time?

Sure the stock market hasn’t performed that well, mostly because the Federal Reserve Board has driven up interest rates to control inflation. And yes, earnings on savings accounts or even CDs aren’t what they used to be.

But eventually, inflation will be tamed and the stock market should take off on the back of an otherwise strong economy. Banks may never pay as much as they once did. But it’s

important to have some cash set aside — some financial experts suggest six months’ worth of your total monthly expenses — in case of an emergency.

It’s a conundrum, all right. But there is a way for buyers to pay cash and then finance their purchases later. The little known technique is called a “delayed finance exception” that is offered through both Fannie Mae and Freddie Mac. For the exception to work, though, the cash sale must adhere to the GSE’s rules.

Under Fannie’s guidelines, for example, the sale has to be an arm’s length transaction. Then, the borrower must meet all of the GSE’s borrower eligibility requirements, including a good credit score, a manageable debtto-income ratio and an acceptable

a lender’s involved. ‘We can get ‘em in and out the door much quicker,” she told me. But because there are fewer lenderinvolved loans, revenue is down 20–25%. The second ring? When buyers understand the benefits of title insurance, they generally buy coverage, says Washington, D.C., settlement attorney Harvey Jacobs. “They usually listen to reason,” he said. “People who don’t (buy coverage) tend to be flippers” who study the market and know their costs.

appraisal. And after that, borrowers have to move fairly quickly. They have only six months from the day they closed on the property to the day they close on the financing. After those 180 days, the opportunity is off the table.

The loan amount cannot exceed what you paid for the house as documented by the settlement statement plus closing costs, prepaid fees and points on the loan. But there are limits: Loan amounts cannot exceed $762,200 in most places but go as high as $1,089,300 in high-cost markets.

There can be no existing liens, either. If there are, they must be paid off either before closing on the loan or with funds from the new mortgage.

> LEW SICHELMANPerhaps to press the issue, two title companies owned by a major MidAtlantic real estate firm reportedly are refusing to settle transactions in which the buyer turns down buyer’s coverage. Repeated attempts for comment from the agency or its in-house title outfits have gone unanswered, so I have been unable to verify this report.

Appraisers — “All of us who focus on the residential market are feeling the slowdown to some extent,” says Appraisal Institute President Craig Steinley of Steinley Real Estate Appraisals in Rapid City, S.D. “This is the third cycle I’ve seen where volume is down; it’s all part of being in the mortgage lending business.”

Steinley can’t point to any specific numbers but he says most cash buyers eventually obtain an appraisal — investors when they put places back on the market after they fix them up or equity-rich move-up buyers when they refinance at a later date to take cash back out of their purchases.

Of course, it doesn’t help the appraisal business that a fair number of appraisal waivers are being obtained on FannieFreddie loans. According to Ed Pinto at the American Enterprise Institute’s Housing Center, appraisals were waived on 13 percent of all loans purchased by the GSEs in April. That’s fewer than in previous months, largely, says Pinto, because of “the shift away from refis.”

But cash deals also mean fewer deals for valuators. “Cash buyers almost never get an appraisal,” realty agent Robert Goldman of Michael Saunders & Co. in Venice, Fla., told me. And in his suburban Washington, D.C., market, Joe Shaver of RE/MAX in Olney, Md., says 75% of all cash buyers pass on an appraisal. “Rarely,” adds broker Rob Jensen, who works Las Vegas’ high-end, guard-gated communities, where a whopping 57% of the sales in May

were cash on the barrel head.

Goldman, a former attorney, estimates that cash sales in his Sarasota region account for more than 50% of all sales — and two-thirds of his transactions. Down the road in Naples, Matthew Klinowski of Downing Frye Realty reports that 67% of all deals in his market in April were for cash.

Most buyers shun a valuation because it’s not required when no lender is involved. But, Goldman warns that buying sans appraisal is “not a good practice.” After all, cash buyers have 100% exposure when they pay above market value. Appraisers are “not always the be-all, end-all final arbitrator of fair market value,” he told me. Nevertheless, they perform an important function.

Because cash buyers may order property condition reports and other products, Steve Kahane of Greater Houston Property Appraisals says “it’s hard to say” exactly how much cash deals alone have impacted his business. But overall, he reports, his purchase mortgage appraisals are down 33–40% from an otherwise “normal” year.

“You can’t know what you don’t get,” agrees Mark Hammack of Appraisals of South Florida. “There have always been cash deals, so its not really measurable.

It’s been nearly a decade since the share of buyers purchasing a house without a mortgage has been as high as it is now. Certainly, interest rates bouncing around 7% at this writing are a major factor, but they do no tell the entire story.

One reason is the proliferation of multiple-bid situations in which more than two would-be buyers go head-to-head for the same house. While multiple-bidding is not nearly as widespread as it was during the height of the pandemic, the typical seller still receives 2.7 offers, according to data from the National Association of Realtors.

Another is the movement of people who sell their houses in highcost markets and use the proceeds to buy a place in less expensive markets. The typical buyer who had owned his previous house for a decade had more than $200,000 to play with last year, NAR reports.

Baby Boomers make up the largest share of cash buyers. More than half of all buyers age 68 and over paid cash in 2022, while 53 percent of the Silent Generation did the same. Historically, the percentages of Boomers paying cash is about 33 percent. But the number of all-cash purchases “has jumped” for all generations, says Jessica Lautz, NAR’s deputy chief economist.

Add cash transaction to the mix of high interest rates and fewer refis and the impact is profound. “My business is down 65% year-over-year,” Hammack told me. “It’s definitely slow.” n

Lew Sichelman is a contributing writer to National Mortgage Professional magazine. He has been covering the housing and mortgage sectors for 52 years. His syndicated column appears in major newspapers throughout the country.

Surprisingly — or not — single women are the most likely cash buyers at 28%. Married couples account for 27%. Women cash buyers often are widowed or divorced and have housing equity to burn.

White buyers are more likely to pay cash than Blacks, but not by all that much — 23% vs. 15%. But then, about half of Blacks were first-time buyers last year. Only 8% of both Hispanics and Asian/ Pacific Islanders used cash.

> LEW SICHELMAN“I don’t think [cash sales are] any greater than during the run-up to the Great Recession.”

> Jeremy Yohe, American Land Title Association

Rockville, MD

ACCMortgage.com

DESCRIPTION OF

PRODUCTS OR SERVICES: ACC Mortgage is the oldest Non-QM lender that has never stopped lending in 22 years. We specialize in Bank Statement, ITIN, P&L, Foreign National and DSCR lending. Price, Product and Process are what make for Non-QM success.

LICENSED IN: AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA

Change Wholesale

Irvine CA

ChangeWholesale.com (949) 255-6085 info@changewholesale.com

AREA OF FOCUS: Helping mortgage brokers close more loans, faster.

DESCRIPTION OF PRODUCTS OR SERVICES: Change Wholesale gives mortgage brokers an unfair advantage to close more loans, faster. Our CDFI certification from the U.S. Department of the Treasury allows us to offer proprietary programs that are tailored to meet the needs of commonly overlooked prime borrowers. Our flagship Community Mortgage requires no income, employment, or DTI documentation. Prime borrowers looking for their dream home or vacation getaway can get approved with just the first page of the bank statement.

LICENSED IN:, AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

First National Bank of America

East Lansing, MI fnba.com/wholesale/ requests@fnba.com (800) 400-5451

AREA OF FOCUS: Non-QM

DESCRIPTION OF PRODUCTS OR SERVICES: FNBA is a portfolio lender with over 65 years of experience. We offer Non-QM mortgage solutions nationwide, helping borrowers who don’t fit traditional guidelines. We understand that in the NonQM business, service makes all the difference. That’s why our team is committed to providing you with the fastest turn times, exceptional service and loan programs that make growing your business easy!

LICENSED IN: All 50 States

Newfi Wholesale Emeryville TX

newfiwholesale.com (888) 415-1620

support@newfi.com

AREA OF FOCUS: DSCR, Bank Statement, 1099, Asset Depletion, Buydowns, Full Doc Non-QM

DESCRIPTION OF PRODUCTS OR SERVICES: No one knows Non-QM like us. Newfi Wholesale is an exception-based Non-QM lender dedicated to helping brokers find success. We offer a full Non-QM product suite including: Full-Doc, Bank Statement, 1099, Asset Depletion, Interest Only, NonQM ITIN, Non-QM Buydown, DSCR 1-4 & 5-8 Units, DSCR Condotels, Graduated Payment Mortgages, and more. At Newfi about 1/3 of our funded deals have exceptions that we make in-house!

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, WA, WV, WI, WY

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Visit www.thewarrengroup.com to learn more today!

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

Inquire about our NMLS Data Licensing and LO Contact Database options.

NMP’S MONTHLY SECTION OF HANDS-ON PRACTICAL ADVICE

BUILD A BROKER

Fannie Mae’s Appraisal Shift YOUR FIRST MILLION DOLLARS

Don’t Embrace The Monkey Culture

BENCHMARKS & BEST PRACTICES

Build Your Book With Renovations

CAREER TICKER

People On The Move

> Zillow Group Inc. said that Jeremy Hofmann has been promoted to chief financial officer, succeeding Allen Parker. > Radian Group Inc. said that Sumita Pandit has been named senior executive vice president and chief financial officer. > Union Home Mortgage, an independent mortgage banking company based in Ohio, promoted Matt Roberts to regional manager focusing on sales growth across much of the Western U.S. > Trustar Mortgage LLC, a subsidiary of Trustar Bank, has hired Chip Beveridge as executive vice president of mortgage production. PEOPLE ON THE MOVE //BUILD-A-BROKER

Kim Nichols

Kim Nichols

The agencies’ efforts to “modernize” appraisal options and provide borrowers with more alternatives to full appraisals create yet another opportunity for mortgage brokers to deliver an exceptional customer experience to homebuyers. Fannie Mae was the latest to announce changes to property valuations, which expanded their range of options for establishing a property’s market value. Their focus is to reduce turn times related to

PEOPLE ON THE MOVE //

> Cenlar FSB, a national mortgage loan subservicer, announced the promotion of Tristan Watson as the new director of subservicing pricing.

> Union Home Mortgage, an independent mortgage banking company based in Ohio, recently appointed Linda Thomas as regional manager for the company’s Florida operations.

> Fannie Mae announced Chetlur S. Ragavan has been appointed to its board of directors and will serve on the risk policy and capital committee and nominating and corporate governance committee.

VALUE ACCEPTANCE + PDC

Key points:

• Available on purchase and refinance transactions for one-unit properties, including condos, that meet loan eligibility requirements

• PDCs are not appraisals: they are an alternative to full appraisals

• Requires full exterior and interior on-site inspections

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | AUGUST 2023 | 19

> First Home Mortgage Corporation welcomed the return of Jeff Modeski to a new role as branch manager of the company’s Columbia, Md., office.

> The Oakleaf Group, a provider of advisory services and solutions for the mortgage and financial services industries, appointed Steinunn Seay as the new managing director of relationship development.

> First Home Mortgage Corporation welcomed the return of Jeff Modeski to a new role as branch manager of the company’s Columbia, Md., office.

> The Oakleaf Group, a provider of advisory services and solutions for the mortgage and financial services industries, appointed Steinunn Seay as the new managing director of relationship development.

condition of the property

• It is possible to lose value acceptance on DU if loan terms change during the loan process

PDCs require on-site inspections, where an inspector goes to the property to collect data and photos. They inspect the exterior and interior, but unlike an appraisal, they do not collect property market data, nor do they provide a value estimate.

DU has already accepted the value, and the inspector reports on the property’s condition and will determine if repairs are needed. That is the only job of the inspector. They are not there to render an opinion of value. The only purpose of the PDC is to collect data and provide information about the condition of the property.

Meeting appraisal contingencies can be quicker with these appraisal alternatives, which can be useful for originators to have in their tool kits as they compete for business in a purchase-driven market. It can also help strengthen their referral network. For borrowers, the cost savings of PDCs could be up to hundreds of dollars when compared to the cost of an appraisal. In competitive situations where appraisal contingencies need to be waived, Value Acceptance + PDC can also provide early assurance for homebuyers.

Fannie Mae only has a handful of Appraisal Management Companies,

or AMCs, certified to deliver PDCs. Wholesale lenders who have aligned with Fannie Mae’s updates are working with certified AMC partners to take these orders for their mortgage brokers. Overall, it is exciting to see the industry pushing to create a more streamlined mortgage process. While we have much more to do, let’s continue to move the needle and innovate toward greater accuracy, increased speed in loan decisioning and reduced costs for consumers. n

Kim Nichols is senior managing director, Pennymac TPO, and spearheads production and long-term strategy for the Pennymac TPO Channel (broker and non-delegated correspondent segments).

The only purpose of the PDC is to collect data and provide information about the condition of the property.

EXCLUSIVELY ON

PRODUCED BY NMP FOR THE INTEREST

FEATURING BILL BODNAR, CRO OF TABRASA

TUNE IN EVERY MONDAY FOR YOUR MARKET UPDATE.

HARVEY MACKAY, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Twenty monkeys wearing shock collars were placed in a room. In the middle of the room was a pole with bananas on top. Every time a monkey climbed up the pole to grab a banana, it received an electric shock. Soon the monkeys stopped climbing the pole. Then a new monkey without a shock collar was introduced to the cage, and one of the original monkeys was removed. The new monkey immediately climbed up the pole to grab a banana, but the other 19 monkeys pulled

CONTINUED ON PAGE 24 >

EXCLUSIVELY ON

PRODUCED BY NMP FOR THE INTEREST

FEATURING SHANE KIDWELL, COACH WITH NEXT LEVEL LO s TUNE IN EVERY TUESDAY FOR YOUR TECH ROUNDUP.

it down numerous times until it got the message that the bananas were off-limits.

This experiment continued until all 20 monkeys were swapped out from the original ones. They all collectively knew the bananas were forbidden, although none were shocked. They had created a culture of fear.

One of the hottest words for leaders today is culture. Culture affects perception. It influences behavior, and it shapes our personalities. Creating culture is a concentrated, conscious choice.

Tony Hsieh, CEO of Zappos, said, “If you get the culture right, most of the other stuff will just take care of itself.”

He makes it sound so easy.

Creating a positive, high-performing, people-focused, result-oriented environment does not just happen. It takes a tremendous amount of work and soul-searching and cannot happen without both. It is what separates the highest-performing organizations.

Every company has a culture, whether it is intentional or unintentional, desirable or undesirable. Managers and leaders influence culture by the attention they give it. Those who focus

on culture tend to create a vibrant environment while those who ignore culture end up with a struggling and confused workplace.

Hence, leaders must make creating a positive culture a priority. Employees recognize the difference between workplaces where they want to come to work, feel valued, and know what the company stands for. Customers notice as well.

Leadership author Glenn Van Ekeren observes: “Culture is movable, fluctuating, shifting. It requires continual attention, nurturing, direction and adjustments. Culture doesn’t function well on automatic pilot. It flourishes when leadership is continually passionate about infusing culture with their influence.”

Van Ekeren said you must be there for people and demonstrate that you have their backs and best interests at heart.

He mentioned the conversation between Winnie the Pooh and his dear friend Piglet. Piglet crept up to Pooh from behind and said, “Pooh?”

“Yes, Piglet?”

“Nothing,” said Piglet. “I just wanted to be sure of you.”

In an organization with a healthy culture, employees should never have to ask to be sure. You cannot build a culture if you are disconnected from your people. Culture at a company is everyone’s responsibility, but leadership is heavily responsible for its development. Employees and middle managers

will learn what their bosses permit and reward and will enforce it on each other. And if management fails at any point, it requires immediate proactive effort to mitigate the damage.

So how does an organization develop a desirable culture? I can tell you what I did when I started my company and we continue to do six decades later.

Know why you are in business. What is your purpose? Set goals and make them known throughout the company so your employees understand what’s important to your business.

Hire thoughtfully and carefully. Ask questions during interviews and make your position regarding expectations crystal clear. I believe in being completely upfront about what we need because I don’t want to waste my time or theirs training someone who isn’t a team player. And I don’t hesitate to fire an employee who won’t comply.

Lead by example. Staff should look forward to coming to work and doing a stellar job. Recognize and reward people for their efforts. Give credit where it is due. And absolutely be the first to admit when you’ve messed up. Then let folks know how you are going to fix it.

Love what you do. I know I may sound like a broken record, but if you don’t love what you do, you will have a hard time doing it well. Your attitude will show whether you are just in it for the money, or if you really want to make a difference.

Back to the monkeys. Why have a bunch of bananas if no one can ever have one? Your corporate culture will only thrive if the rewards are not only visible but attainable.

Mackay’s Moral: A team culture is a living organism. Feed it and watch it grow. n

You cannot build a culture if you are disconnected from your people.

EXCLUSIVELY ON

PRODUCED BY NMP FOR THE INTEREST

FEATURING DAVID LUNA, PRESIDENT OF MORTGAGE EDUCATORS & COMPLIANCE TUNE IN EVERY WEDNESDAY FOR YOUR REGULATORY UPDATE.

Ilove watching HGTV. My favorite shows are all about taking old houses and bringing them back to life or making ugly homes attractive. This got me thinking about how much our industry needs to embrace

Everyone’s concerned about low inventory, but there’s still hope out there. Renovations solve the problem for both homeowners and lenders. Homeowners may not have incentive to move, but they can renovate, and this gives lenders new loans to keep business moving. Let’s talk about renovations and how they’re an important solution in the current market.

First, we need to take a look at the current inventory of homes, for sale and otherwise. According to data from the St. Louis Fed, there are only about 500,000 homes for sale in the U.S. right now. The National Association of Home Builders (NAHB) also has recently reported that the median age of owneroccupied homes was 40. And, to add to all of this, the Census Bureau reported that new housing starts are down from where they were just a year ago. These conditions alone can

make the house hunt tricky for many prospective buyers. There are not many homes to choose from, not many new builds to replenish the lack of inventory, and the houses that are out there are only getting older. While this may sound like a recipe for disaster, it actually highlights an opportunity of which lenders should be taking advantage.

Buying new is not a very viable option right now, but renovating can help owners fall in love with their homes again. If they need more space, they can build an addition or close in an existing space like a garage. If the borrower is aging, they can complete updates to help make the house more accessible. Or maybe the house is simply dated, and they just want to make updates that make it feel fresh and new again. There is a wide range of possibilities for updates homeowners can complete to make sure

their house works for their needs.

One of the HGTV shows I liked is called “Bang for Your Buck,” where viewers got to see two different renovations with the same budget and see which one had the most impact. When borrowers consider renovations, they will likely have questions about what will give them the most return on their investment, just like the show.

According to a 2022 study by Houzz, a company that offers software for, among other things, architecture and interior design, the median national spend on home renovation projects in 2021 was $18,000, and higher budget projects at the top 10% of spend rang in at $100,000. With these price tags, homeowners want

to spend these big investments wisely. In these scenarios, make sure homeowners are weighing preference vs. resale value. Of course, they want to make a good return on their investment, but they also need to pick what they will like and what will work best for their specific needs. It’s their home, not just an investment.

Research from the National Association of Realtors (NAR) found that refinishing hardwood floors, installing new wood floors, insulation upgrades, basement conversions, and closet renovations had some of the best return on investment. Weigh that against the fact that NAR also found that different projects like painting the interior of the home, or adding an office brought homeowners the most joy.

Ultimately, those looking to renovate need to decide what’s most important to them.

Frank Lloyd Wright, the American architect, designer, writer, and educator, stated this perfectly, “If you invest wisely in beauty, it will remain with you all the days of your life.”

Fannie, Freddie, and the FHA all have products for renovations, but these programs are sometimes forgotten about. It’s important that loan officers know the details so they can help borrowers looking to renovate. These products can help cover:

• Labor and materials

• Soft costs (architect fees, permits, licenses)

• Required contingency reserve funds (which may come from the mortgage proceeds or directly from the borrower)

• An amount up to, but no more than, six monthly payments of principal, interest, taxes and insurance (PITI)

• 50% of the cost of materials, which may be advanced to the contractor at closing

To qualify for these products, the project doesn’t have to be a full teardown. The word renovation, to many people, sounds like it must be a huge overhaul, but these projects also can be updates or enhancements like installing energy efficient heating and cooling systems, improvements to kitchens and bathrooms or even additions.

If you can’t buy the house you love, love the house you’re with. There are plenty of products out there that help homeowners do just that. Being educated about the options can help lenders keep business moving along, even without inventory. n

Mary Kay Scully is the Director of Customer Education at Enact, leading the development of the company’s customer education curriculum. The statements in this article are solely the opinions of Mary Kay Scully and do not necessarily reflect the views of Enact or its management or the opinions and beliefs of HGTV or the productions mentioned.

Buying new is not a very viable option right now, but renovating can help owners fall in love with their home again.

Acra Lending is the leader in NonQM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience.

acralending.com

(888) 800-7661

sales@acralending.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

Gilbert, AZ

Mission Driven Non-QM + CDFI Wholesale Lender

At Champions Funding, we Non-QM all day, every day! It’s our core business, and we live to serve underserved borrowers through our valued broker partners. We put diversity and inclusion into mortgage lending by empowering the mortgage broker community to provide solutions for non-traditional credit profiles and those who cannot get approved with standard financing. Through our highly coveted CDFI certification backed by the U.S. Department of the Treasury, we can offer our flagship neighborhood products and tap into a $1 Trillion market of historically underserved communities in the country.

Focused on speed to closing (in days, not weeks), smooth processes, and user-friendly access to our underwriting and support teams, we offer modern, flexible, and responsible non-traditional lending solutions.

champstpo.com

(949) 763-9494

Wholesale@ChampsTPO.com

LICENSED IN: AZ, CA, CO, CT, DC, FL, GA, HI, IL, IA, MD, MI, NJ, NC, OR, PA, SC, TN, TX, UT, VA, WA

Emeryville TX

DSCR, Bank Statement, 1099, Asset Depletion, Buydowns, Full Doc Non-QM

No one knows Non-QM like us. Newfi Wholesale is an exception-based Non-QM lender dedicated to helping brokers find success. We offer a full Non-QM product suite including: Full-Doc, Bank Statement, 1099, Asset Depletion, Interest Only, Non-QM ITIN, Non-QM Buydown, DSCR 1-4 & 5-8 Units, DSCR Condotels, Graduated Payment Mortgages, and more. At Newfi about 1/3 of our funded deals have exceptions that we make in-house!

newfiwholesale.com

(888) 415-1620

support@newfi.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, WA, WV, WI, WY

PCV Murcor Pomona, CA

pcvmurcor.com

sales@pcvmurcor.com

(855) 819-2828

AREA OF FOCUS: Nationwide Real Estate Valuations Management — Appraisal Management Company

DESCRIPTION OF PRODUCTS OR SERVICES: Licensed in all 50 states, plus D.C., PCV Murcor provides nationwide appraisal management and valuation advisory for residential and commercial

real estate. An industry leader with over 40 years of experience managing valuation needs for mortgage lending, financial institutions, estate and litigation, real estate investors, and mortgage servicers.

EXCLUSIVELY ON

PRODUCED BY NMP FOR THE INTEREST

FEATURING VINCENT VALVO

TUNE IN EVERY FRIDAY FOR YOUR POETIC MOMENT.

hen Jordan Bernbaum answers the Zoom call, his appearance reflects a typical work-from-home setting with a tidy desk, a plain background, and a casual blue T-shirt. The faint background street noise adds to the ambiance. It seems like any one of the thousands of online meetings happening at any given moment across the U.S.

But Bernbaum’s not in an apartment in his native Arizona. He’s calling from Istanbul, Turkey, where the 10 a.m. call stateside happens as the Turkish workday winds down.

Bernbaum’s wife, Hadeer, shuffles around in the background of the video call. The couple married in early March after meeting in Turkey. But their marriage wouldn’t have been possible if Bernbaum hadn’t taken his work overseas.

Bernbaum works as a senior loan officer for NEXA Mortgage. He’s been in the mortgage industry since December 2014 and with NEXA since 2018. Up until two years ago, he worked remotely from his apartment — about 30 miles from NEXA’s Chandler, Ariz., headquarters. Now, that’s not the case. “I always took a big trip annually in the fall and would visit a few countries, and I realized that I kept focusing on when the next trip would be,” he said. “While I was in Thailand, I met a group of freelancers who told me they traveled for months at a time and still worked, and that

Winspired me to ask my boss about [my] being able to keep doing loans and travel.”

After comparing his cost of living to would-be travel expenses, Bernbaum found that it was cheaper to live in other countries, including the costs of airfare. He approached his boss, NEXA CEO Mike Kortas, about exploring the option to work beyond Arizona’s borders. “I prepped for an hour-long presentation, and I was given the go-ahead in the first minute,” Bernbaum said.

Kortas was “beyond supportive” of Bernbaum’s decision. “NEXA Mortgage makes life abroad possible because of our massive support platform,” Kortas said. “From corporate support, lenders, and even to vendors used by mortgage professionals alike, everyone is online all the time to support LOs from any location around the globe. Living abroad? No problem. Traveling abroad on vacation? No problem.”

Bernbaum knows that he could have pursued other freelance gigs while living abroad, but he stuck with what he knew. “I don’t have a background in graphic design or

teaching yoga or any of the typical freelance work that I was seeing out there,” he explained. “I wanted to make my job at NEXA work, even though I work weird hours to be congruent with U.S. time.”

Those weird hours to which Bernbaum referred are between 7 p.m. and 4 a.m. Turkey time, which Bernbaum doesn’t mind. (When it’s 7 p.m. in Istanbul, it’s 9 a.m. in Arizona.)

“After my work day, I get to wake

Jordan Bernbaum takes in the pyramids at Teotihuacan, Mexico.

Jordan Bernbaum takes in the pyramids at Teotihuacan, Mexico.

“After my work day, I get to wake up after resting and am able to go out and explore whatever country I’m in. The schedule works and it offers a lot of flexibility.”

>Jordan Bernbaum, senior loan officer for NEXA Mortgage

explore whatever country I’m in. The schedule works, and it offers a lot of flexibility,” he said. “And, my wife also has a remote job based on the same hours, so we get to spend our entire days exploring together. It’s not hard to have a work-life balance.”

Bernbaum initially thought his biggest issue would be communicating effectively with clients in different time zones, especially without being able to meet them for coffee or at open houses. “I miss that aspect of being in the states, but, thankfully, my customers have been responsive and engaging over the phone just as much,” he said.

In hindsight, Bernbaum’s biggest challenge has been keeping track of market downshifts while not physically in the states. “I struggled at the tail end of 2022 when the [market] shift negatively started affecting referral leads and my work,” he said. “I took the last half of the year to make videos for social media, attract leads, and build up my knowledge.

As of right now, I’m picking up business

again. I’m part of [NEXA’s] business development team, and I’m able to take in national leads. And referrals have picked up again.”

In the downturn, Bernbaum says he’s been able to find a niche in the market: “golden visa” refinances. “The premise is that borrowers can sell their refinances in order to get their golden visas, which essentially means that [they] can shortcut their way into a second citizenship of a country if they invest a certain dollar amount into a property,” he explained. “For example, if you invest $500,000 cash — or equity — into a property in Spain, you fast-track Spanish citizenship regardless of whether you occupy that property or not.”

Of course, there are rules Bernbaum has to follow according to where he can practice as an LO. Bernbaum’s NMLS number is Arizona based and his LinkedIn profile advertises that he’s in the Greater Phoenix area, but as Bernbaum puts it, “It’s hard to write that I’m pretty much based everywhere.” Because of distance regulations and lack of a permanent address, Bernbaum had to drop state licenses in Washington and Oregon.

“Luckily, I do most of my business in Arizona and Colorado where it doesn’t matter my physical distance from where my customers live,” he explained. “But I wouldn’t be able to do loans in states with a distance requirement. I’m lucky that I was able to contact both Arizona and Colorado state regulators and get the go-ahead.”

EnjoyingadayoutonİstiklalStreet(averyfamous walking street) in the Taksim area of Istanbul. Lots of

shopping and food all around. Behind us is a famous

street car that goes up and down the whole area.

Now that Bernbaum is on the road with his new wife and his business to boot, he’s become selective about where he moves. “Obviously, internet and privacy are super important for me to work, so if we stay in hostels it’s for a very short period of time,” he said. “Otherwise, we prefer Airbnbs with good internet, a kitchen, laundry, and ideally, a dedicated workspace.” As Bernbaum puts it, being abroad affects every aspect of his life and impacts which services he uses. “I use Dialpad and have a local Arizona phone number. I have a U.S-based VPN that I take with me and multiple sim cards to ensure that I’m always reachable,” he explained. n

AtanelephantsanctuaryinPhuket,Thailand.Oneof theseelephantsisblindandtheotheralwaysstaysby theirside,protectingthem.Itwasareallycoolspotwhere youarenotallowedtotouchthem,butyoucanwalk withthemandtheyteachyouallabouttheirhistory.

At Disneyland Paris for Hadeer’s birthday. It was her first time to ever go to Disneyland, as it’s not very accessible from the Middle East.

EXCLUSIVELY ON PRODUCED BY NMP FOR THE INTEREST

FEATURING STEVE RICHMAN

TUNE IN EVERY FRIDAY FOR YOUR MONEY-MAKING TIPS.

Standing out is tough to do in a serious, suit-clad industry. But some industry professionals have figured out a way to incorporate a schtick into their self-branding — whether it’s a motto or a style of dress.

Dalila Ramos is an industry veteran who learned how to make her career more her style. She started in the industry in 2001 and has worked in several roles since: originator, account executive, recruiting, and title work. And as she pursued each of these roles at various companies, Ramos picked up a hefty following and professional network, and she wanted to use that to her advantage. In 2019, she was inspired by a colleague, Sean Cochran, to use her following as a way to enforce her brand and, in turn, boost her business. “Sean’s a Realtor who calls himself the cowboy of real estate, and he told me if I wanted to brand myself better, then I should combine something that I love with mortgages,” Ramos said. “After I thought about it some more, I figured why not incorporate tacos into my brand.”

Just one week later, Ramos hosted her first Taco Tuesday with Dalila video, which she uploaded to LinkedIn. That was at the tail end of 2019 and, due to the onset of the pandemic, Ramos pursued these videos on her own.

“I feel so blessed to have started the videos right before the pandemic because it became my outlet,” she said. “It allowed me to add value to my career and helped me educate and form relationships. It really helped me blossom.”

As pandemic guidelines became more lax, Ramos started incorporating guests into the videos, which helped them continue to gain popularity. She was even approached by people in the industry who offered to pay her to appear on a Taco Tuesday episode.

Back when Ramos curated her Taco Tuesday brand in 2019, she worked for Planet Home Lending. “They really let me take off and run with my own personal brand,” Ramos said. “They knew that it was positive branding and videos that were driving business.” But, as Ramos

Curating a brand is one thing, but making yourself memorable is how to reach a niche audience

EXCLUSIVELY ON

PRODUCED BY NMP FOR THE INTEREST

FEATURING SARAH WOLAK, STAFF WRITER FOR NMP TUNE IN EVERY FRIDAY FOR YOUR WEEKLY FORECAST.

moved forward working at other financial services companies, she found that she was being asked to choose between her personal and company branding.

“As you get older and make [the mortgage industry] a career, it’s vital to understand the power of presence,” she said. “I’m one of the only women in the industry who check a lot of boxes. I’m a mixed-race woman, a single mom, and bilingual. So I wanted to embrace what made me stick out rather than be pale, male, and stale.”

From there, Ramos started her own company, Love and Tacos Media. The Orlando-based company is what Ramos describes as half media and half content creation. “It’s mainly me and my media partner, Michael Hammond,” she explained. “We essentially do ghost marketing for other companies in the mortgage industry. We do press releases, email campaigns, video creation, and even cross-promote with Taco Tuesday.”

Today, Ramos has monetized her schtick — and not just for herself. “Way back when I was offered by a guest to pay me to have them on my show, I decided to put a package together to offer that to others,” she explained. “Now as part of my media company, people can collab by being on Taco Tuesday. They can pay for one or a few episodes, keep and chop the video

CEO of Dwell Mortgage, started his self-branding well before his career as a mortgage originator took off. The topproducing CEO is known for wearing his baseball cap backwards, casual appearance, and for always having a cup of coffee in hand.

As a former Seattle firefighter, Kidwell was used to a physically taxing blue-collar environment. “After every shift, I would make it a point to stop at a new coffee shop,” he said. “It became a part of my identity as a fireman that I decided to carry with me into my career in the mortgage industry.”

But when Kidwell took a job at a mortgage company following early retirement from the Seattle Fire Department, he found that it felt inauthentic to be clad in a suit and tie and sitting behind a desk. “It didn’t feel like me, and what I realized was people cared less about how I looked and they cared more about what I knew and how I treated them,” Kidwell said. “But I knew that if I were to dress however I wanted to look and feel, then I have to be really good at what I’m saying and be good at my brand.”

Kidwell says he started wearing hoodies and backward baseball caps, and customers began to realize that they could relax and let their guard down around him.

“I didn’t want people to feel formal

were three reasons why it made sense [to brand myself this way.] One, it was how I felt most comfortable. Two, it made others feel comfortable. Three, it made me more memorable.”

Kidwell said that although his schtick was a conscious decision, it wasn’t hard to “curate” his brand. “Your brand is who you are. When you’re being authentic and you have a good sense of self, it’s not hard to brand,” he said. “It’s only hard to brand when people try to do things outside of who they are.”

Kidwell knows that he doesn’t come across as a serious mortgage guy, but that doesn’t deter potential customers. “Your audience is looking you up before they ever come in contact with you, so people already know what I’m about,” he

> Shane Kidwell, CEO, Dwell Mortgage

EXCLUSIVELY ON

PRODUCED BY NMP FOR THE INTEREST

FEATURING VINCENT VALVO & ANDREW BERMAN

TUNE IN EVERY FRIDAY FOR A NEW ROUND.

Sometimes the ancient wrench that Granddad passed down — the one buried at the bottom of the Craftsman Tool Box — proves to be the best tool for a hard job.

In an industry flooded by new technology, amidst a challenging market for borrowers, loan originators and Realtors, the beginner’s course that’s been around almost as long as homebuying is more valuable than ever.

A gathering at the local banquet hall, online or in a hybrid format that caters to both types of attendees, First-Time Home Buying (FTHB) seminars are still a great way to educate — and score — new clients.

“If you don’t have any clients right now, I would be taking an all-of-the-above

approach,” says Bill Mervin of the Bill Mervin Mortgage Team at NJ Lenders Corp. “All of your time needs to be spent talking to people who need to borrow money or people who talk to people who need to borrow money. That should be your sole focus right now in this business.”

Based in Greater Philadelphia, his firm hosts a FTHB event at least quarterly and usually sees up to half of attendees book one-on-one loan consultations afterwards. Their last event was in June.

“Almost exclusively these folks came in without real estate agents, so we got to refer them to our partners, which is ideal for us,” Mervin says. “We more than covered our event costs with the loans we closed.”

CONTINUED ON PAGE 42 >

“I like to link arms rather than have outstretched hands with my Realtor partners.”

> Bill Mervin of the Bill Mervin Mortgage Team at NJ Lenders Corp.

Do you have what it takes to be the best?

The mortgage industry is going through a significant change. For mortgage origination professionals, it’s a struggle to keep on top of all the changes, and to keep your sales strategies and marketing initiatives at their peak. You need to keep your pipeline filled, and you need the tools and directions to st ay profitable, efficient, and effective. We’ve brought together the best in the business to create a top tier event specifically designed for mortgage origination pros.

California Broker Magazine readers like you can attend for free by using the code NMPFREE.

SEPT 12

OAKLAND, CA Hilton Oakland Airport

www.camortgageexpo.com Produced By

> CONTINUED FROM PAGE 40

Eric Morgenson, director at large for the California Association of Mortgage Professionals, Orange County, says that in a challenging market, LOs need to look for any way possible to stay above water.

“We’re in this big holding pattern, so how are you going to make any money?” Morgensen points out. “All loan officers work on commission only — this is our quandary.”

For Mervin, the solution is continuing to provide that personal touch, the same kind that is fostered at FTHB events.

“I think the real battle for the heart and soul of our industry moving forward is educators, mortgage professionals, and advisors vs. the folks who want to uberize our business,” he says. “If we’re going to win that battle — and I think it’s important because consumers need that advice, guidance and expertise — then we need to frame and position ourselves that way.”

Not only is a FTHB seminar a place to meet potential borrowers, it’s also an opportunity for an LOs to help their real estate

“We do it as a way to add value to them without just coming to them with our hands out,” Mervin explains.

“I like to link arms rather than have outstretched hands with my Realtor partners.

“When I can have a part in helping them plan and execute and have a

successful first-time buyer, I think it makes me indispensable versus the people who might also be good at doing loans but kind of sit there with a oneway expectation.”

Last year the Mervin team promoted its FTHB events on social media and used an outside vendor, sending notifications to those registered ahead of time. The theme was “six firsttime homebuyer mistakes you don’t want to make,” and the content was updated each time to reflect market changes.

“We were getting anywhere between 25 and 45 people registered, and half to two-thirds would pull through,” Mervin says.

The intent is to have enough content that attendees don’t feel as if it’s all a promotion for the team, while still featuring booking information prominently throughout the presentation.

“Such a large portion of our job today is the psychology and dispelling the myths of what’s going on in the marketplace,” Mervin says. “Misinformation creates a lot of fear and uncertainty for our clientele and partners as well. We present a backdrop to create some confidence and dispel the fear and anxiety homebuyers have.”

The team reviews market data, loan programs, pre-approval vs. pre-qualification and other pertinent information with attendees.

“Those things are evergreen items that really stand the test of time,” Mervin says. “Those are the types of things I think add the most value and take you outside of the normal ‘let me tell you how great I am and how quick I can close your loan.’ That’s really providing the type of insight and guidance clients need and real mortgage professionals should be delivering.”

Concepcion Guerrero with Mortgage Guaranty Insurance Corp. (MGIC) says her company offers seminar “kits” that package everything LOs and their team need to host a FTHB event.

“From the flyers to promote the event to the presentation they can use to host the seminar,” Guerrero says. “We have additional collateral as well that touches on various topics originators can use to hand out during the seminar to further educate potential homebuyers.”

MGIC’s products are available in both English and Spanish, she adds. n

“Such a large portion of our job today is the psychology and dispelling the myths of what’s going on in the marketplace.”

> Bill Mervin

The mortgage industry, which is cooler than expected, is forcing loan officers to go back to the basics and figure out creative ways to stir up business.

Brian Atallian, a mortgage consultant for Delaware-based Pike Creek Mortgage, says that the market’s current state is concerning. Traditionally, Atallian says that inventory and market activity pick up with the onset of the spring season. This year, not so much.

“Obviously things are slower, for the short term it’s

getting worse as inventory remains low,” he said. “People don’t want to move and lose their lowinterest rates, they’d rather put their money into home renovations rather than sell.”

Atallian has been in the mortgage business for just over 20 years, so he’s experienced the ebbs and flows. “My business has always been referral based. It’s still hard to use my approach pre-pandemic, which was sitting down in person with my clients, realtors, and potential borrowers,” he said. “It goes a long way when you’re able to engage with someone face-to-face and explain the benefits of

homeownership to them, and almost act as their financial advisor. It solidifies the

However, Atallian says that the challenges have only forced him and his team to find other methods of engagement. The team uses the app Cardtapp — a digital business card platform — to engage with borrowers and Realtors. “The app has a mortgage calculator and rates on it. When borrowers and Realtors use the app, my team gets updates about their activity and we’re able to help them or reach out about what they might need through the app,” Atallian explained. “The app also ties in the whole mortgage process for everyone, not just the borrower.”

Because Atallian’s business is heavily influenced by referrals, he says he doesn’t do much marketing outside of email blasts to his clients. He says he prefers a personal touch when approaching customers, especially at a time when LOs have to compete for a small pool of buyers. “When I get down about the market, I go through my books and call up old contacts to check in and see if I can be of assistance,” he said. “I try to do follow-ups with customers on their loan anniversaries and tell them I’m available if they want to refinance or change mortgage insurance. The biggest roadblock that I face right now is struggling to develop trust between customers and my team since we’re approaching them by email or text. A call is more personal.”

While a cooling market may promulgate uneasiness, some LOs aren’t letting the housing blues affect their approach. “The great thing about the business is that you can create whatever business you want and focus on different audiences. There are so many new ways of information and you can get creative with it,” Atallian said. “[In times like these], you get excited over small accomplishments.”

For Jason Schneider, who is a sales manager at Movement Mortgage, a lukewarm environment means working harder to re-establish relationships — especially with referral partners. “Obviously, we’ve seen [fewer] buyers and sellers in the market

which means no income,” Schneider said. “But it reminds me to double back and check up on those relationships, especially since some of my referral partners have become friends of mine. Right now, I’m trying to reach around 20 people per day that I haven’t connected with in a while.”

It makes sense that Schneider is taking time to put in more hours during his week dedicated to relationships. Simply grabbing coffee with referral partners has saved him. And better yet, he’s been able to reciprocate. “If I have a great relationship with someone whether they’re in the industry or not, my natural progression is to refer them to someone who I like that can help them,” he explained. “I don’t believe in cold calling. I’d rather just ask my trusted friends and partners if they have any clients who would be open to having a conversation with me.”

Brian Mitchell started at Integrity Home Mortgage Corporation in November 2022 as a senior vice president and regional sales manager, just when the market started to shift again. “It’s hard not to be discouraged. Like most independent mortgage bankers, we’re not making money,” he said with a chuckle. “But the company is still optimistic about being able to pull through. It’s a cyclical market, and the only guarantee is that at some point, it will be strong again.”

Like Atallian and Schneider, Mitchell has been honing in on the basics, especially forming strong relationships. “Right now, it’s a game of survival,” Mitchell said. “We can’t change the rates. But what I

“When I get down about the market, I go through my books and call up old contacts to check in and see if I can be of assistance.”

> Brian Atallian, mortgage consultant for Delawarebased Pike Creek Mortgage

can do is get in front of as many people as I can, create conversations, create relationships, and recognize that there are plenty of people who are still buying houses — we just need to be top of the line for referral partners.”

So how is Mitchell doing that? He explained that he and his sales team are using old-fashioned communication — phone calls — to touch base with referral partners and try to market to niche markets such as NonQM. Mitchell also added that as painful as the market is right now — especially with many LOs stepping back from renewing their licenses — the market “needs attrition” for it to cycle through.

Mitchell says that putting the market into perspective has helped him to remain focused on trying to find the light at the end of the tunnel. “A lot of people are obsessed with looking at interest rates day-to-day and focus on the doom and gloom. It’s easy to spiral downward into negative attitudes. You need to realize you can only control what you can control,” he said. “For me, this is the worst market I’ve seen in 21 years, and we need to be patient.”

Shane Kidwell, CEO of Washington-based Dwell Mortgage and a founder and coach at Next Level

Loan Officers, isn’t discouraged about the market. If anything, Kidwell says that this is a good time for him to focus on building up his personal brand and his relationships with not just customers, but business clients, too. He says that the first conversations with a colleague or client are crucial for business. “I saw a poll from Gallup Analytics that every conversation that you have with a business colleague is an instant $200,” he said. “That stuck with me. And if you talk to every person in the room you’re bound to get business whether you introduce me to someone, I set you up with a coaching class, I refer business to you, etc.”

What keeps Kidwell going in a down market is dedicating extra time to his agents. “I challenge everyone to do what I do and send a Friday market report to their agents,” he said. “It’s a great way to check up on them while providing a service.”

Kidwell says that he does these reports in a video format — and for a good reason. He says that customers and clients want easy access to your social presence to know whether to trust you or do business with you. “Everything is digital now, when you want something the first thing you do is go online or watch a video that explains what you can do,” he explained. “If you’re not leveraging tools like video — which your customers need and look for — then you have nothing.” n

“If you’re not leveraging tools like video — which your customers need and look for — then you have nothing.”

> Shane Kidwell, CEO of Dwell Mortgage and a founder and coach at Next Level Loan OfficersBrian Mitchell, senior vice president and regional sales manager, Integrity Home Mortgage Corporation

Picture your dream home. Now look down. There’s a bright red line keeping you out. Join host Katie Jensen as we dive into redlining and the legacy of discrimination. You’ll hear first-hand accounts from those who’ve had to fight back to achieve their dreams. And we’ll challenge industry leaders on how to rewrite this legacy.