SayGay!

LGBTQ+ ENTREPRENEURS LIKE ANDRES MUNAR FIND SUCCESS IN A TOUGH SPACE

MARKETING TO THE LGBTQ+ COMMUNITY DISCRIMINATION IS STILL PREVALENT IN HOMEBUYING JOURNEY

DEALING WITH DIFFICULT PEOPLE

HOW TO WIN WITH CASH BUYERS

THERE’S MONEY TO BE MADE DOWN THE ROAD

SPECIAL SECTION

PRISM AWARDS

2023

> PAGE 56

A PUBLICATION OF AMERICAN BUSINESS MEDIA

Leverages in High Places Leverages in High Places And a Process as Smooth as Tennessee Whiskey And a Process as Smooth as Tennessee Whiskey Rates that Won’t Achy Break Your Heart (or Wallet) Rates that Won’t Achy Break Your Heart (or Wallet) INFO@RCNCAPITAL.COM RCNCAPITAL.COM 860.432.5858 ©RCN Capital, LLC. 2023 All Rights Reserved. NMLS #1045656. RCN Capital, LLC is licensed in AZ (License #: 0932325), CA (Loans made or arranged by RCN Capital, LLC pursuant to a California Finance Lenders Law license # 60DBO-46258), MN (MN-MO-1045656), and OR (ML-5571). This is not an offer to lend. All offers of credit are subject to due diligence, underwriting and approval. Not all borrowers will qualify and not all borrowers that qualify will receive the lowest rate or best terms. Actual rates and terms depend on a variety of factors and are subject to change without notice. MOSEY ON DOWN WITH YOUR DEAL, NOW LENDING NATIONWIDE! MOSEY ON DOWN WITH YOUR DEAL, NOW LENDING NATIONWIDE!

SayGay!

LGBTQ+ ENTREPRENEURS LIKE ANDRES MUNAR FIND SUCCESS IN A TOUGH SPACE

MARKETING TO THE LGBTQ+ COMMUNITY DISCRIMINATION IS STILL PREVALENT IN HOMEBUYING JOURNEY

DEALING WITH DIFFICULT PEOPLE

HOW TO WIN WITH CASH BUYERS

THERE’S MONEY TO BE MADE DOWN THE ROAD

SPECIAL SECTION

PRISM AWARDS

2023

> PAGE 56

A PUBLICATION OF AMERICAN BUSINESS MEDIA

4 Embracing Everyone Why NMP is spotlighting the tribulations of being an LGBTQ+ mortgage originator. 6 People Who Annoy You Sometimes they need help with communication. 8 Decoding Complex Media Learn your way around diverse social media. 12 Junk Those Fees Uncle Sam is battling against budget-busting fees. 15 AMC Resource Guide Wholesale Lender Resource Guide Private Lender Resource Guide 17 People on the Move See who the movers and shakers are in the mortgage industry. 18 Build-A-Broker: Build A Bankruptcy Book Learn how to benefit from others’ bankruptcies. 24 Your First Million Dollars: Important Life Lessons You need to be better at life to be better at work. 26 Benchmarks & Best Practices: A Rule Of Firsts Some first-time home buyers have been there before. 28 Non-QM Lender Resource Guide 30 My Best Deal From Kennels To A Home Helping man’s best friend and their owner shelter. 32 Data Bank 34 Make Cash Buyers Customers Look at the longterm benefits of these competitors. 38 LBGTQ+ Buyers Need Advocates See how this diverse population needs originators willing to work with them. 64 Non-QM Lender Directory 65 Wholesale Lender Directory Originator Tech Directory Private Lender Directory AMC Directory 66 Facebook Thoughts: Break (fast) Dancing nationalmortgageprofessional.com JUNE 2023 Volume 15 Issue 6 CONTENTS nationalmortgageprofessional.com COVER STORY PAGE 46 Busting Down Doors Andres Munar’s journey as a gay entrepreneur. SPECIAL AWARDS SECTION PAGE 56 National Mortgage Professional magazine honors mortgage lenders for their commitment to diversity and inclusion. 2023 PRISM AWARDS NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 | 3

Accepting All, In Faith And Finance

I’m expecting to get a lot of hate mail. Across this nation, we’re witnessing an abhorrent rush to eradicate, or at the very least marginalize, anyone and anything that doesn’t comport with what some conservative zealots believe.

If you’re a woman, your health choices are no longer your own — even in states bragging that they are making it easier for people to have bodily autonomy regardless of how many other people suffer. Mobs who profess to cherish freedom of speech want to stop the free speech of drag queens.

If you’re transgender, all the science and advice of trained medical professionals isn’t stopping cruel and sadistic politicians from using bad law to try to eradicate you. And if you’re LGBTQ+, discrimination is being reinvigorated and reimagined in new laws that give folks wide latitude to refuse service or goods based on their religious beliefs, be they strongly held or simply convenient excuses.

From an extended period in which we, as a nation, embraced the idea that each of us should be free to live our life in love and community, we are rapidly descending into a new era of condescension, bigotry, and stupidity. We want to curtail freedom, impose arbitrary and capricious morals on others, and put a boot heel on the necks of any who disagree. If people are allowed to deny service to a gay couple because of a moral objection, it will not be long before we are back to the dark ages of refusing housing or financing because of someone’s “difference.”

At NMP, we’re glad to spotlight the diversity inherent in our nation, whether that be because of race, wealth, or gender. The world is big enough for everyone. But it’s hard for non-white, non-male, non-conservative mortgage pros to grow and find support and harmony in other colleagues in the industry. How can we be sure? Because when we simply sent out an email asking for companies who support these initiatives to identify themselves, we were bombarded with vicious, vile, and vindictive responses. Clearly, there are many in the mortgage ecosystem who want gay participants to get out or shut up and sit down. (We see the same whenever we look for achieving women.)

Read through this issue, and you’ll find a number of amazing and talented mortgage pros who happen to be LGBTQ+. If we, as an origination community, are to be a source for home loans, we each need to be that source for everyone — not just those who look and think like the originator. We need the widest possible pool of potential borrowers. It’s the only way out of this mortgage recession we’re in. Let’s accept everyone for who they are, and celebrate not just folks who are top producers, but those who are still overcoming roadblock after roadblock. It seems to me that’s the wisest — and most human — course to take.

I’m expecting to get a lot of hate mail.

VINCENT M. VALVO Publisher, Editor-in-Chief

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR

David Krechevsky

EDITOR

Keith Griffin

SENIOR EDITOR

Gary Rogo

SPECIAL SECTIONS EDITOR

Mary Quinn

MULTIMEDIA PRODUCER

Erica Drzewiecki, Katie Jensen, Ryan Kingsley, Sarah Wolak

STAFF WRITERS

Rob Chrisman, Dave Hershman, Erica LaCentra, Harvey Mackay, Lew Sichelman, Mary Kay Scully

CONTRIBUTING WRITERS

Nicole Coughlin, Nichole Cakirca

ADVERTISING ASSOCIATES

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Steven Winokur

CHIEF MARKETING OFFICER

Julie Carmichael

PROJECT MANAGER

Meghan Hogan

DESIGN MANAGER

Stacy Murray, Christopher Wallace

GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins

MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Joel Berman

FOUNDING PUBLISHER

Submit your news to editors@ambizmedia.com

If you would like additional copies of National Mortgage Professional Call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. National Mortgage Professional magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991 info@ambizmedia.com

JUNE 2023

Volume 15, Issue 6

LETTER FROM THE PUBLISHER

4 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023

Acra Lending is a registered dba name of Citadel Servicing Corporation, 3 Ada Parkway, Ste 200A, Irvine, CA 92618; (888)-800-7661 (“CSC”) NMLS ID# 144549, Licensed under Arizona Mortgage Bankers License # 1034431, California Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act license # 41DBO-74196, Finance Lenders License # 60DB0-94450, CA-DRE #01799059, Florida Mortgage Lender Servicer License # MLD523, Georgia Mortgage Lender License/Registration # 23462, Minnesota Residential Mortgage Originator License Other Trade Name #1 MN-MO-144549.1, Nevada Mortgage Company License # 4449, North Carolina Mortgage Lender License # L-160722, Oregon Mortgage Lending License # ML-5599, Tennessee Mortgage License # 125315, Utah-DRE Mortgage Entity License - Other Trade Name #1 12074249, Virginia Lender License # MC-5845. For mortgage professionals only. This is for informational purposes only. For legal and professional advice on applicable state and local licensing requirements that apply to you, please contact an attorney. Acra Lending is an equal opportunity lender. Rates, terms, and programs subject to change without notice. O er of credit subject to credit approval per applicable underwriting and program guidelines, applicant eligibility, and market conditions. Not all applicants may qualify. Not valid in the following states: AK, ND, and SD.

over 50 years of experience as originators and C-Suite Executives, our team understands the challenges of the loan process. We strive to deliver programs and a platform by originators for originators PREMIER BUSINESS PURPOSE LOANS FOR REAL ESTATE INVESTORS INVESTOR LOANS CONTACT US TODAY! (888) 800-7661 THE INDUSTRY’S LEADING PRIVATE MORTGAGE LENDER SALES@ACRALENDING.COM | WWW.ACRALENDING.COM WWW.ACRAINVESTORLOANS.COM VISIT OUR WEBSITE FOR SIMPLE FIX & FLIP SOLUTIONS SIMPLE. EFFICIENT. TRANSPARENT.

Our Acra Lending team has firsthand knowledge of what it means to be a borrower and broker. With our experience as originators and entrepreneurs, we have traversed and overcome the unique obstacles of the investor lending world REFINANCE Rate & Term, Rehab, and Cash-Out PURCHASE WITH REHAB 100% Rehab Financing Available PURCHASE 12-Month Interest Only With No Prepayment Penalty

With

WHY WORK WITH US?

Dealing With Today’s More Difficult People

Help them isolate the issues through good communication

BY DAVE HERSHMAN, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

You just need to look at the news lately to realize that there are more difficult people out there. People are getting arrested for being unruly on airlines it seems almost every day. The number of incidents continues to climb incessantly. As a manager, today you are more likely to have to deal with difficult employees, plus you are more likely to have to counsel your employees who are dealing with difficult customers. It is just a sad,

but true sign of the times.

Within my mortgage management books and seminars, I have often spoken of this important rule … Fire the Wrong People

A simple rule stated even more simply: If you hire the wrong people and keep them, you will never, never, never be a good manager. It is impossible to manage well with the wrong people.

When you get in the position of analyzing who is “right” and who is “not right” for your office, you will be in effect more likely to be dealing with

DAVE HERSHMAN 6 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 RECRUITING, TRAINING, AND MENTORING CORNER

a difficult person. That does not mean that all people who are not succeeding are difficult. But even if someone is the nicest person in the world, if you have to correct their actions or take more serious disciplinary measures, it is at best a difficult situation. Sometimes it is easier to fire someone who is difficult as opposed to someone who is nice. So, someone is difficult. How do you deal with them?

• First find the source of difficulty. If they are complaining all the time about poor processing, is it poor processing or are they unhappy with something else? They may be unhappy with themselves and their performance. Or they may be causing inefficient processing because of the quality of their originations. But they are not going to be wandering around complaining about themselves. They are going to complain about processing.

• Second, help them isolate the issues through good two-way communication. Start with general, open-ended questions that get them

talking. For example — you have mentioned several times that you are unhappy with ________. What has caused you to become unhappy and if this situation were corrected do you feel that you could perform up to your potential? Just the fact that they have been heard may take away some of the stress associated with the situation.

• After the issue is isolated, take steps to deal with the problem. They may be handling the complaint in the wrong way, but it does not mean that there is not a problem that needs to be solved. Solving it helps you in two ways. First, it makes your office/company better. Second, it removes their barrier to better performance, whether the barrier was real or not.

you will have a harder time dealing with difficult people and difficult situations. When rates rise and refinances dwindle, you will have more difficult personnel choices to implement. When production is flowing, personnel flaws may not stick out as much because everyone is so busy. When people have more time on their hands, it is easier to spot issues that need to be corrected. On the other side of the coin, if a loan officer is difficult but a good producer, it is tougher to cut the cord as production wanes. Therefore, it becomes more imperative for you to “address” the situation rather than just cut the cord.

Most important of all, if you are harboring difficult people and not addressing the situation, you may be preventing great people from coming to your company. Many times I have

• Follow-up. After the barrier has been removed, do not let the person off the hook by letting them wander off. Let them know that you are expecting reciprocity. If they don’t see you making them accountable, then there is no reason for them to change their behavior. Do not get the idea that difficult people are just those who complain. There are many other types of difficult people. For example, those who do not listen and those who explode or overreact every time something goes wrong. Each situation entails a different process to resolve the issue. The ability to adapt to different situations is a management trait that is very important.

It is also important to note that the hiring process and development of a company culture is all-important in preventing these situations before you get to the confrontational and/or firing stages. Are outbursts by others tolerated because they may be seen as more valuable players? Even more important, are you the best example in this regard? If you can’t be the best example, then

heard this in the industry: I would not work at that company because I know ______ is there.

Ask yourself this question: is your present staff hampering your recruiting efforts?

Again, most of this advice applies to your customers who are being difficult. Our loan officers need to handle their grievances much in the same way. The fact that production is lower feeds an environment that we are either originating loans with more difficult situations and/or tolerating abuse of employees by customers because we “need the business.” Lower production environments should give us more time to deal with difficult situations, but in reality they can give us more situations to deal with. n

Dave Hershman is a top author in this industry with seven books published as well as the founder of the OriginationPro Marketing System and the OriginationPro Mortgage School. He can be reached at dave@hershmangroup.com.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 | 7

If you hire the wrong people and keep them, you will never, never, never be a good manager.

Making Algorithms Work For You

How social media content performance varies across platforms

ocial media continues to be a powerful marketing tool for companies in the mortgage industry. Whether you are large or small, it’s incredibly important to have an established presence across all social media platforms. However, one of the biggest challenges that marketers deal with when planning their social media strategy is figuring out how they can gain the greatest visibility.

While developing great content is important when it comes to getting more views, marketers should keep social media algorithms in mind as they develop their strategy.

Each social media platform operates based on its own algorithm, which essentially determines what content is most relevant to certain users and why one piece of content is displayed over another. So, if social media algorithms are such an essential factor in determining if your content strategy will be successful, what can marketers do not only to understand each social media platform’s algorithm, but also use them to their advantage?

ERICA LACENTRA, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 THE XX

ERICA LACENTRA

FACTOR

ALGORITHMS EXPLAINED

At the most basic level, algorithms are a set of rules that automatically rank content on a social media platform. These rules are often based on a user’s demographic, their likes, other accounts they currently follow or engage with, and how likely they are to watch or interact with a piece of content. Social media algorithms are why each user’s feed across any platform will be unique even if users are following the same accounts or have similar interests.

Each social media platform uses a different algorithm, so this is where it can get tricky for marketers. What works on one platform might not work as well on another. However, since each social media platform algorithm is based on machine learning, it all comes down to understanding what the ranking signals or rules are on each platform. This will allow you to be strategic in your postings and ultimately rank higher on each platform. So, let’s talk about what the specific ranking signals are for each platform.

LINKEDIN

LinkedIn continues to be a great resource in the professional world and an excellent means of reaching your clients on a platform where they expect more business-focused content. At the core of LinkedIn’s algorithm is the level at which users are connected to other users. For example, you may have noticed that you have your first connections, those you have directly added to your network; your second connections, those connected to someone in your network but not to you directly; and your third connections, essentially the LinkedIn version of a friend of a friend.

LinkedIn will always prioritize content from your closest connections first, and then topic priority is usually determined by the types of groups, companies, or pages you follow.

From there, LinkedIn looks for what it deems to be high-quality content: think video, links, your insights, or anything that it thinks will appeal to your connections. Finally, it’s all about engagement, especially early engagement. If your first connections are engaging with your content off the bat, LinkedIn ranks this higher, and there will be a greater likelihood of your content being shown to second and third connections. By the same token, if you are posting frequently without engagement from your connections, you are going to have a harder time getting your content to show within your first connections, let alone get content pushed out further.

FACEBOOK

Facebook and its groups continue to be a great resource for mortgage industry professionals. Much like LinkedIn’s algorithm, one of the primary drivers of what content shows up on your feed is who you are connected with. Whether it be people or pages, what and who you follow and interact with will be displayed first.

However, Facebook’s algorithm relies heavily on looking at the type of content you interact with to determine what you are seeing. If you typically watch a lot of video content

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 | 9

on Facebook, more video content will appear on your feed. If you engage with text posts, you’ll see more text posts. Finally, Facebook looks at engagement. Much like LinkedIn, Facebook prioritizes popular posts that have significant initial engagement, especially if they are also receiving engagement from people you are connected with. These are highly likely to be boosted by the algorithm and appear on your feed.

INSTAGRAM

Instagram is a great tool for marketers to increase and reinforce brand awareness with its potential client base. Much like the previous two platforms, Instagram also prioritizes the content of the people you follow and engage with. So, for companies using Instagram, it is critical to encourage engagement from your followers and respond to that engagement. Instagram also gauges your interests based on engagement and the content you look at already, suggesting similar content. Finally, unlike LinkedIn and Facebook, Instagram places a heavy emphasis on the popularity of content and how it fits in with current social media trends.

However, Instagram is known for having frequent changes to its algorithm. For this platform, you will

likely have to pivot and adjust your strategy regularly. For instance, about six months ago, Instagram pushed to prioritize video content. If you posted reels and video, you likely have seen greater engagement than if you were posting a photo or carousel of photos. But due to user feedback and complaints about Instagram becoming too similar to TikTok, Instagram is once again shifting to prioritize photos. This is one social media platform that you’ll need to stay on your toes to keep up with for the greatest success.

MAKE THE ALGORITHMS WORK FOR YOU

With all of this information about what social media algorithms prioritize, where are some of the common threads and how do you use them to your advantage? First and foremost, it’s imperative that you focus on creating relevant, quality content that essentially matches what the social media platform and the users of the platform expect. This means that what you create for LinkedIn won’t work on Instagram as is. Gain an understanding of the formats and content types that do the best on each platform and formulate your social strategy accordingly. Also, make sure the content you are creating appeals specifically to your target

audience on each platform.

From there, clear engagement and connecting with your audience are key. Encourage engagement, follows, shares, and likes, and respond back to that engagement. That will ultimately get your content in front of more users. You can often accomplish this by running contests, asking questions, starting a conversation with a post, or posting content that naturally encourages engagement such as a new bit of insight or something on trend.

Finally, while it’s important to stay on top of trends so your content is relevant, it will come down to a lot of trial and error and experimenting with the posts. There is no magic formula to beating the algorithm; you will likely have to try and try again to achieve success. Keep track of what is working and what isn’t. See what your top-performing content is on each platform and build off that.

Once you figure out what works, you can be more consistent with what you are posting because you know that is what your audience wants. Social media algorithms aren’t an exact science, but if you stay informed, and keep up with trends, you ultimately can use each platform’s algorithm in your favor. n

THE XX FACTOR

Erica LaCentra is chief marketing officer for RCN Capital.

10 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023

Clear engagement and connecting with your audience are key.

Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. www.carolinasconnectmortgage.com Produced By ORIGINATORCONNECTNETWORK.COM JUN 13 2023 The Carolinas’ top gathering for mortgage pros. Join your community of mortgage professionals at the Carolinas’ largest event for mortgage originators, The Carolinas Connect Mortgage Expo. Don’t miss out on our lineup of engaging events centered around networking, skill-building, and having a great time with your peers at our early year edition in Charlotte. CHARLOTTE Attend for free by using the code NMPFREE.

Uncle Sam Trashes GARBAGE FEES

A mind-boggling array of deceptive fees punishing homeowners

BY LEW SICHELMAN, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Uncle Sam is going hard after what it deems to be unconscionable, if not illegal, junk fees, particularly in the servicing and rental sectors.

Most recently, U.S. Housing and Urban Development Secretary Marcia Fudge called out property managers and apartment owners for nailing their tenants with such suspect charges as move-in fees and convenience fees. But before her, Rohit Chopra, head of the Consumer Finance Protection Bureau, chastised servicers

for charging excessive late fees and fake mortgage insurance premiums, among other fishy tariffs.

It appears as if one federal agency is trying to outdo the other, except they’re not. Rather, it’s all part of a concerted effort by the Biden Administration to rid the real estate sector, among others, of excessive and often unwarranted charges. Fees, said Fudge, should reflect “the actual and legitimate costs to housing providers.”

CORRODING FINANCES

In a special edition of its supervisory highlights, the CFPB

12 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 THE MORTGAGE SCENE LEW SICHELMAN

reported finding “old and new ways that mortgage servicers attempt to run up unlawful fees that are charged to homeowners.” The consumer watchdog agency said such charges corrode family finances, drive up families’ banking and borrowing costs, and are not easily avoided, even by financially savvy consumers.

I mentioned these charges last month, but they are so onerous they deserve repeating:

• Charging the maximum late fee allowed by state law, even though the borrower’s mortgage contract capped the charges below the state limits.

• Sending inspectors to addresses

known to be incorrect and charging consumers for each visit.

• Including monthly private mortgage insurance premiums that borrowers did not owe.

• Failing to waive fees that were forbidden by law for borrowers entering some loss mitigation were nailing

The bureau addressed improper fees in its previous supervisory highlights, noting that some servicers hammered consumers with late fees and other “default-related” charges while they were in forbearance. And it raked several unnamed mortgage companies for violating the Equal Credit Opportunity Act by discriminating against African Americans and women — but not Hispanics.

Nasty stuff, for sure. No wonder the CFPB received some 29,000 mortgage complaints last year. In 95% of these gripes, moreover, consumers reported they attempted to resolve their issues before resorting to seeking help from the government. That, alone, is very telling.

But when it comes to junk fees, mortgage servicers don’t hold a candle to landlords. A recent report from the National Consumer Law Center (NCLC) lists 16 “gotcha” charges renters face when they try to find and keep apartments.

Some of the 16 are not trash, at least in my mind. For example, nearly all property managers charge application fees, which they use to pay for credit reports and criminal background checks. But the charges slide into garbage territory when they are nonrefundable and are completely over the line when the reports can’t be used to apply at other properties.

MIND-BOGGLING FEES

The NCLC also found some add-ons that boggle the mind, including convenience fees, roommate fees and processing fees. In one instance, landlords charged a “January” fee for no other apparent reason than it was the first month of the new year.

It’s all about finding ways to monetize whatever landlords can get away with. For instance, one Tampa firm sends invoices for sub-metered water and sewer service. Nothing underhanded there. Most places charge for utilities. But it also charged a billing fee and a meter reading fee.

Tenants were dunned electronically, not with a more expensive snail-mail process. So, landlords can’t gripe about the extra cost of paper and postage. But no matter how the invoice was delivered, why should anyone have to pay to be billed? How can you pay without a bill?

The extra charges amounted to only a few bucks. But multiply that by each tenant annually, and you end up with a nice little profit center. But pure and simple, these are costs of doing business that should be borne by the property owner, not his tenants.

Speaking of utilities, one major landlord came under fire last month for

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 | 13

In one instance, landlords charged a “January” fee for no other apparent reason than it was the first month of the new year.

stripping utilities out of its rental rates and charging by occupancy rather than usage. Under that system, why should tenants care about saving energy?

Elsewhere, a Kansas City property demands a $200 one-time fee for pets — plus $15 a month. Nothing unusual there; most places charge for cats and dogs. But this place also charges for fish. Not only that, but it also lists them as “aggressive” breeds. Even goldfish!

I am informed that the real worry isn’t the fish but water damage from the tank, so maybe the fee isn’t all that outlandish. But other owners are looking to save money by operating their properties without any on-site personnel. No resident manager, no maintenance people, no security staffers. One outfit reportedly already operates unstaffed properties and plans to push that number to 35-40 by year’s end.

UNNECESSARY FEES

The Law Center report comes in the wake of an “open letter” from HUD Secretary Fudge, who called on the housing industry to address such fees, charges she said raise costs and hit vulnerable people the hardest.

“Many renters today face fees that are hidden, duplicative and unnecessary,” Fudge wrote. “These fees limit options for renters and strain household budgets, particularly for renters with low and moderate incomes who already face high rental cost burdens.”

In particular, the HUD secretary cited non-refundable application fees, which she said can run into hundreds or even thousands of dollars for tenants applying to multiple places. She also noted that the credit reports for which applicants pay often have inaccurate information and are of questionable validity in predicting renter behavior.

Fudge also mentioned such “hidden fees” as move-in charges, late charges, high-risk fees, security bonds and convenience fees for tenants who pay their rent online. But the Law Center went further, noting that the vast majority of landlords impose excessive late fees, and more than half charge other bogus fees.

To compile its list, the Washington, D.C.-based nonprofit surveyed legal services and non-profit attorneys

about the types of fees they have seen. The survey period was in November and December last year.

Of the 95 responses from 26 states and the District, nearly nine out of 10 said landlords collect application fees. And almost three out of four said they had seen utility-related charges.

So far, not totally dubious. But 87% said landlords also impose excessive late charges. Moreover, 68% have seen processing or administrative fees, 60% noticed convenience fees, 59% reported seeing insurance fees, and 56% saw notice fees.

Seven percent reported seeing fees to report on-time rent payments to credit bureaus. And the aforementioned January fee was reported by two Minnesota advocates, “seemingly for no reason,” the survey said.

PREVENTING DECEPTIVE PRACTICES

Noting that nearly half of all renters — some 19 million households — spend more than a third of their incomes on housing, April Kuehnhoff, a senior attorney at the law center and a co-author of the report, said: “There simply isn’t room in their budgets for junk fees.”

The report calls on the Federal Trade Commission and state legislatures to investigate landlords who impose against the burdensome fees, calling

them “unavoidable and exploitive.” The FTC should develop guidance to prevent “this potentially deceptive practice,” it said, and states must limit or ban fees that exceed landlords’ costs.

HUD’s Fudge had essentially the same message in her open letter, urging all housing providers and state and local governments to “take action to limit and better disclose fees charged to renters in advance of and during tenancy.” Fees, she said, should reflect “the actual and legitimate costs to housing providers.”

The secretary’s message amplifies the Biden Administration’s “Blueprint for a Renter Bill of Rights,” which challenges stakeholders to commit to clear and fair leases without hidden or illegal fees. Since the White House launched the challenge, Fudge wrote, “many” state and local governments and housing providers, as well as several rental platforms and small property owners, have announced policies aligned with the program. Among other things, they have agreed to limit application fees and allow applicants to reuse their applications multiple times at no extra cost. n

Lew Sichelman is a contributing writer to National Mortgage Professional magazine. He has been covering the housing and mortgage sectors for 52 years. His syndicated column appears in major newspapers throughout the country.

THE MORTGAGE SCENE

14 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023

AMC RESOURCE GUIDE

Home Base Appraisal Management

Sandy, Utah

HomeBaseAMC.net

Michael@homebaseamc.net

(801) 449-9200

AREA OF FOCUS: Apprasial Management Company — We Care — INC 5000 Fastest Growing 5X

DESCRIPTION OF PRODUCTS OR SERVICES: From a Regional powerhouse to a national INC 5000 fastest growing company five years running. Home Base Appraisal Management has put their stamp on the Apprasial industry and brought service levels to all new heights. All of this without a marketing team!? This company truly breaks the mold with their different approach to the industry of real estate appraising.

WHOLESALE LENDER RESOURCE GUIDE

PRIVATE LENDER RESOURCE GUIDE

ACC Mortgage Rockville, MD

ACC Mortgage is the oldest NonQM lender that has never stopped lending in 22 years. We specialize in Bank Statement, ITIN, P&L, Foreign National and DSCR lending. Price, Product and Process are what make for Non-QM success.

ACCMortgage.com

LICENSED IN: AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA

Stratton Equities

Pine Brook, NJ

Stratton Equities is the leading Nationwide Direct Hard Money & NON-QM Lender that specializes in fast and flexible lending processes. Our Hard Money and Direct Private Money loan programs support the following investment projects:

• Fix and Flip

• Soft Money Loans

• Cash Out — Refinance

• Fixed Commercial Loans

• Commercial Bridge Loans

• Bridge Loans

• Stated Income/No-Income Verification Loans

• Rental Loans

• Foreclosure Bailout Loan

• NO-DOC

• Blanket Loans

PCV Murcor Pomona, CA

pcvmurcor.com

sales@pcvmurcor.com

(855) 819-2828

AREA OF FOCUS: Nationwide Real Estate Valuations Management — Appraisal Management Company

DESCRIPTION OF PRODUCTS OR SERVICES: Licensed in all 50 states, plus D.C., PCV Murcor provides nationwide appraisal management and valuation advisory for residential and commercial real estate. An industry leader with over 40 years of experience managing valuation needs for mortgage lending, financial institutions, estate and litigation, real estate investors, and mortgage servicers.

Change Wholesale Irvine CA

Change Wholesale gives mortgage brokers an unfair advantage to close more loans, faster. Our CDFI certification from the U.S. Department of the Treasury allows us to offer proprietary programs that are tailored to meet the needs of commonly overlooked prime borrowers. Our flagship Community Mortgage requires no income, employment, or DTI documentation. Prime borrowers looking for their dream home or vacation getaway can get approved with just the first page of the bank statement.

ChangeWholesale.com (949) 255-6085 info@changewholesale.com

LICENSED IN:, AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

• Fixed Rental Programs

• Multi-Family Loan

No Upfront fees! No Junk Fees! No Tax Returns!

strattonequities.com

(800) 962-6613

info@strattonequities.com

LICENSED IN: All States except for: AK, ND, NV, SD, UT

Find the full list of Wholesale Lenders on page 65 Find the full list of Private Lenders on page 65 Find the full AMC list on page 65

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 | 15

Tear the paper ceiling that is keeping you from discovering over 70 million STARs: workers Skilled Through Alternative Routes that are being held back by degree screens, stereotypes and more. Find out how STARs can meet your talent needs.

#HireSTARs

Keith, Data Analyst, Google Career Certificate Graduate, STAR

Keith, Data Analyst, Google Career Certificate Graduate, STAR

TEAR THE PAPER CEILING.ORG

It’s time for “qualified” to mean qualities, not just a bachelor’s degree.

HOW

BUILD A BROKER Making Money Off Bankruptcy

YOUR FIRST MILLION DOLLARS Better Life Means Better Business

BENCHMARKS & BEST PRACTICES

Your First May Be Your Second Or Third

MY BEST DEAL

Helping Fido Find Shelter

CAREER TICKER

People On The Move

> Cenlar FSB, a mortgage loan subservicer, announced that Brad Cargile has been appointed Vice President of IT Infrastructure.

> Lance Miller, president of Momentum Loans, announced the appointment of Rob Allphin as executive vice president. He has over three decades experience in the mortgage business.

> Birchwood Credit Services has appointed Sam Markwood as chief operating officer.

> Mortgage Cadence, a subsidiary of Accenture, has announced George Morales has joined the company as its new reverse mortgage product manager.

PEOPLE ON THE MOVE //

NMP’S MONTHLY SECTION OF HANDS-ON PRACTICAL ADVICE

SPONSORED BY NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 | 17

Make Bank Off Bankruptcies

BY KATIE JENSEN, WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

The powerful rush of refinances and conventional purchases has been reduced to a trickle, and loan officers across the country are running out of options. Typically, lenders and brokers expand their product offerings to capture as many buyers as possible. That’s a smart move, but not as clever as expanding the pool of potential borrowers. In order to do that, experts say venture where most loan officers don’t care to go — bankruptcy court.

The word bankruptcy might set off a red flag. There’s a perception that these people are unreliable and untrustworthy, or just lazy and don’t know how to manage their finances. But hard times fall on everyone and just one unfortunate event — falling seriously ill, suffering a work accident, or having to take care of a family member — can leave a person financially destitute.

Brian Sacks, branch manager and national mortgage expert at Homebridge Financial Services, sees their potential.

“I view these as what we lend on are

accidents waiting to happen,” Sacks said. “It’s far better to deal with someone whose accident has already happened because they can’t file bankruptcy again for another seven years.”

FHA REFINANCES

David Luna isn’t just a charismatic NMLS instructor; he’s also a veteran of the mortgage industry and knows how hard it can be in a down market. Back when he was a loan officer and business was slow, Luna said he would

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

> BSI Financial Services, an Irving, Texas-based mortgage operating platform, has named Harold Lewis as its president and chief operating officer.

> Jake Fehling, Movement Mortgage’s vice president of marketing, has been promoted to the company’s first-ever chief marketing officer.

> Polly, a provider of mortgage capital markets technology, announced that Parvesh Sahi has joined the company as chief revenue officer.

> CBC Mortgage Agency has hired seasoned servicing executive Alicia Wood for the newly created director of servicing and asset management position.

PEOPLE ON THE MOVE

//

BUILD-A-BROKER 18 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023

Loans can be a bit more complicated, but they add more loans to the pipeline

This list (which is public information) would include all state residents who have filed bankruptcy. Specifically, he would look for debtors who:

1. Are homeowners

2. Have been in their home for at least five years

3. Have equity in their homes

4. Have been in Chapter 13 bankruptcy for at least two years

5. Have been current on payments for the last 12 months

After finding these borrowers on PACER or by going to the bankruptcy court for a list, Luna would write a letter to the bankruptcy attorney and trustee of the court that is essentially a sales pitch. He would explain that he was a certified mortgage loan originator, state how many years he has worked in the industry, and how he would like to help their clients. It is necessary to get the trustee’s and sometimes the attorney’s permission before working with the client.

After receiving this letter, the trustee of the court and attorney may want to set up a meeting with the inquiring loan officer. But Luna assures that this will only happen once or twice before they begin to automatically approve the letters. Once the trustee of the court gives the loan officer permission to pursue the client, the loan officer is set to proceed.

Now, let’s look at why Luna has these five qualification rules previously mentioned. First, finding a homeowner takes care of the inventory problem. They don’t have to go house hunting for an affordable property in a highly

competitive market.

Why should someone be in their home for at least five years? Because today’s interest rate — that newer homebuyers complain is too high — is the same level interest rate homeowners were paying five years ago. Just make sure the income they’re making is comparable as well.

Why should someone be in Chapter 13 bankruptcy for at least two years? Luna said, “If they’ve been in Chapter 13 for at least two years, I know I can go backwards and possibly find 12 months of fulfilled payments.”

Of course, loan officers can also consider contacting people who have only eight months of good payments.They can give them a call and say “Let me know when you make that 12th payment to the court and we can get you set up for a refinance,” so the borrower and LO can prepare in advance.

Why does the debtor need to have equity in their home? To help pay off their debt.

“I think we can all agree that over the last few years, appreciation has really risen and now they have equity,” Luna said. “So we just pay off the bankruptcy court, which gets another file off of that trustee’s desk. And trustees are really happy about doing that.”

Matthew Zimmelman, NYC principal law attorney and licensed real estate broker, said he has seen this work for a number of his clients. Zimmelman has helped thousands by way of bankruptcy filings or developing strategies and careful planning to help

others avoid bankruptcy. Recently, one of his clients was able to exit bankruptcy with a cash-out refinance after only two and a half years.

“Refinances

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 | 19

> Farmers National Bank expanded its mortgage lending team with the recent hire of Karen Jindra as mortgage sales manager out of Fairlawn, Ohio.

> Fort Wayne, Ind.-based residential mortgage lender Ruoff Mortgage named Blake Music as its new president.

> Farmers National Bank expanded its mortgage lending team with the recent hire of Karen Jindra as mortgage sales manager out of Fairlawn, Ohio.

> Fort Wayne, Ind.-based residential mortgage lender Ruoff Mortgage named Blake Music as its new president.

> Cenlar FSB, a national mortgage loan subservicer, hired Theodore “Ted” Mugnier as its director of information security. SPONSORED BY

> CBC Mortgage Agency, a nationally chartered housing finance agency based in Cedar City, Utah, has hired Mark Leslie as director of capital markets.

go down to the bankruptcy court and ask the clerks for a list. Nowadays, you can find this list online at PACER.

David Luna, president, Mortgage Educators and Compliance

remainder of the other debt within the bankruptcy. So now they’ve exited bankruptcy early and they’re essentially debt free, with the exception of just this new mortgage.”

Using this

potentially close an extra five, 10, 20 loans per month.

FHA PURCHASES

One of Sacks’s most memorable clients was a female NICU nurse who went through bankruptcy and foreclosure. She had been working in the NICU for 30-plus years, and her husband was “a piece of work,” Sacks said. He became physically and verbally abusive, and a drug addict. With very little money, the woman fled from her husband with her daughters and her daughters’ kids.

“I said to her, ‘But you’re a NICU nurse. You’ve been a NICU nurse at University of Maryland for 35 years. I’m sure you have some sort of retirement account, right?’ She said, ‘Yes.’ Well, we used some of her retirement funds to get her into a home very shortly after the bankruptcy. It was a high rate, to be fair. But a year later we refinanced her and her payment was significantly lower than it would’ve been had she rented,” Sacks said.

Many folks in bankruptcy don’t think they’re eligible for a home purchase until after seven to 10 years, but this woman Sacks helped only one year after being discharged from Chapter 13 bankruptcy. But in many circumstances, even for purchases, debtors don’t have to be discharged to get an FHA loan.

“You have to be paying for one year and get the approval of the court from the trustee

so that it won’t interfere with your bankruptcy plan,” Sacks said.

Doing purchase loans for folks in bankruptcy can be a bit more complicated, but it’s absolutely worth adding more loans to the pipeline and the joy of helping those going through hard times. That being said, there are some additional criteria Sacks recommends for those wanting to do purchase loans for Chapter 13 bankruptcies.

He typically looks for Chapter 13 bankruptcy folks making at least $75,000 a year in income, are currently renting, and have filed bankruptcy more than one year ago or as far back as five years ago. These borrowers are also expected to have poor credit, which is why FHA with a 580 FICO score qualification is recommended.

Sacks has also taken on clients with a 500 FICO score. In these cases it is necessary for the loan officer to inquire why the credit is so low, and determine whether this client should attempt to repair it by using a credit card.

“When you have folks who’ve had a bankruptcy, it could be due to errors in their report,” Sacks said. “So sometimes it’s simple. You can fix the credit report just by sending it back and having it reported accurately.”

Sacks also suggests advising the client to take out a few credit cards. It’s okay if it’s a secured one where the consumer pays a cash deposit upfront to guarantee their credit line.

“Buy gas for 50 bucks, pay it off; buy groceries for 50 bucks, pay it off. And then, I might follow up with them

CONTINUED ON NEXT PAGE

HAVE A NEW HIRE OR PROMOTION TO SHARE? Submit the information to Keith Griffin at kgriffin@ ambizmedia.com for possible publication. Announcements should include a headshot.

BUILD-A-BROKER

> Ewing, N.J.-based Cenlar FSB, a national mortgage loan subservicer, announced Marlon Groen has joined as chief compliance officer and Jennifer Rowen was named senior vice president, core operations.

> Keeping Current Matters, a Richmond, Va.-based market insight education and content provider for the real estate industry, has named George

Ratiu its chief economist.

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

PEOPLE ON THE MOVE //

Brian Sacks, branch manager and national mortgage expert, Homebridge Financial Services

20 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023

Veterans, when you’re struggling, soon becomes later becomes someday becomes ...when?

Don’t wait. Reach out .

Whatever you’re going through, you don’t have to do it alone. Find resources at VA.GOV / REACH

BUILD-A-BROKER

again in six months. See how they’re doing, see if they’re ready,” Sacks said.

Sacks was recently able to close a deal with a client that took three and a half years to improve his credit.

“He couldn’t get out of his own way,” Sacks said. “He was a single dad with three little boys. But you know, he sat at the settlement table and cried. He said no one else would’ve taken the time. But, what time is a three-minute phone call? How are you doing? How are you doing with what we talked about? Not good. Okay. We’ll call you again.”

REFERRAL SOURCES

Consider this opening: Hi, I’m Katie Jensen. I’m a mortgage loan officer who offers great rates. I have excellent service, and offer a great product mix. I’d love to be able to meet your agents.

That pitch is not likely to go anywhere. Plenty of realtor offices have their own in-house loan officer who can handle a variety of products. Instead, look at Sacks’s pitch:

“Hey, I know that you have your own in-house loan officer, and I know they do a tremendous job, and I know your agents have great relationships with other loan officers as well. But I’m able to help you and fill in a crack that your loan officers may not be able to handle. I’m able to work with some of the buyers you’re turning away.

Maybe because they had a bankruptcy, maybe because they have a credit challenge. Would your agents be interested in discussing this further?”

Realtors will be much more receptive to a pitch like that, because Sacks is offering a unique service — not many loan officers willingly and purposefully seek out folks in bankruptcy.

Teaching classes about this to realtors is also another way to build referral sources. Teach them how people in bankruptcy can get a mortgage before they’re discharged, and what qualifications are expected. That is an efficient way to gain referrals because then the loan officers come across as experts and they’re speaking to 10 or 20 realtors at once.

It’s also important to develop a partner relationship with one or a few bankruptcy attorneys. Zimmelman has a few tips and warnings for loan officers who are attempting to build a relationship with a bankruptcy attorney.

He advises that a loan officer knows what the process is like and not come off too eager to get the loan closed quickly.

“It’s rare that I can rush and get an approval for a loan if you tell me, ‘Hey, we need to close in three days,’” Zimmelman said. “I need the terms and I need the time. You must have that understanding and not just act like the stereotypical, aggressive mortgage broker or mortgage lender who just wants to plow through 17 deals, like let’s make all this happen immediately. It just doesn’t work that way.”

Zimmelman usually tells his clients it’ll take one to two months to get the approval of the court. An application can’t be filed without the terms of the loan being approved by the trustee of the court and a judge. It can take weeks or months before a judge even sees it. The attorney must appear before the judge for the motion to be granted and signed. Many delays can hold up this process, but only after its completed can

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

“You’re seeing the economy become much more challenging and difficult, and that’s when bankruptcies spike.”

22 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023

> Brian Sacks, branch manager and national mortgage expert, Homebridge Financial Services

the client proceed with the loan.

Coming off too ambitious can leave a bad taste in some people’s mouths. It comes off as scam-like or greedy when a loan officer is acting too aggressively. For example, Zimmelman says he doesn’t like it when loan officers pull a list of all his bankruptcy filings and active cases, then show up at his office saying they can help x, y, and z clients get a mortgage.

“I look at it as almost stalker-like,” Zimmelman said. “If it’s someone I haven’t met yet or we just scheduled their first meeting, and now you’ve come to me saying, ‘Hey, I know you filed cases for … ’ and just run through a whole slew of names. Yes, it’s all

Borrowers don’t need Chapter 13 discharge

According to HUD guidelines on FHA loans mandated by HUD 4000.1 FHA handbook, borrowers can qualify for an FHA 203(b) loan in Chapter 13 bankruptcy during the repayment plan and do not need to wait until they’re discharged — as long as the borrowers have made their payments for at least 12 months.

“A lot of people believe that borrowers have to be discharged from a bankruptcy, which is not true,” David Luna said. “Borrowers can take out a loan while they are currently in a Chapter 13 bankruptcy. This does not work for Chapter 7 or Chapter 11, just Chapter 13.”

Please note that some states like Texas have Homestead Laws, preventing banks from seizing property, so this strategy might not apply to every state but it will apply to most. Luna suggests loan officers speak with their local account executive to see if they can get Chapter 13 debtors to apply for FHA.

public records, but slow down.”

In that first meeting, loan officers should focus on demonstrating their understanding of the bankruptcy process, then explain what they’re capable of doing to help the attorney’s clients. This will help establish trust. From there, the attorney will decide if this loan officer is useful or not. If they are, the attorney will follow up and say, “I think you can assist. Let me go back through my clients, see what I can find, and then we’ll have a follow up meeting.”

Zimmelman also doesn’t like it when loan officers go straight to his clients, telling them they can absolutely qualify for a mortgage. Oftentimes, his clients call him saying they’ve spoken to a loan officer who can get them a mortgage or a refinance. He said this leads the client to have unrealistic expectations based on the conversation they had with this loan officer, and that may not fall in line with the way things actually work. He would rather partner with a few loan officers that understand the process.

“Rather than approach the client, get them all excited, and now they think that we can just make this happen quickly. I could build that partnership with a professional or a handful of professionals, and potentially reach out to my clients and say, ‘This might be an option. Would you be interested in speaking to somebody?’ And if they’re interested,

then I could pass along a couple of phone numbers and everyone knows how this process works, and now we’re all working together rather than someone being sold an idea,” Zimmelman said.

THE WAVE IS COMING

Experts like Sacks and Zimmelman foresee a spike in bankruptcies later in the year as pandemic aid comes to an end and poor economic conditions — caused by rising interest rates and high inflation — putting more stress on household budgets.

“You’re seeing the economy become much more challenging and difficult, and that’s when bankruptcies spike,” Sacks said.

Bankruptcy filings spiked in January 2023, up 19% from the previous year, according to data from legal research firm Epiq. The number of people who filed bankruptcy across Chapter 7, 11, and 13 shot up 20% in January from last year.

As the year goes on it seems the bankruptcy filings are piling on. In March, total filings were 33% higher than in February. Individual chapter 13 filings during the first quarter 2023 were 42,364, a 28% increase over the same period last year.

“My goodness,” Luna said. “Having a solution for these people is really going to change many families and individuals’ lives.” n

SPONSORED BY

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 | 23

Matthew Zimmelman, NYC principal law attorney and licensed real estate broker

Good, Better, Best. Never Let It Rest.

The keys to better business are also the keys to a better life

BY HARVEY MACKAY, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

he truly great athletes often focus on an area where they can improve and work on it to get better in the off-season. But there is no off-season in business, so any time is a good time to examine how we can improve in our professional lives. These are some of the areas I

Get better organized. I am a habitual packrat. My filing system is piles … one pile for each project. And that’s a lot of piles. I like to joke that I never lose anything; I just misplace things. But I am vowing to do better. And if I can do it, anyone can do it. Eliminate or reduce

distractions. Productivity’s number one enemy is interruptions. Set aside a period of time each day — even if it’s only 10 minutes — when you are unavailable for anything less than a four-alarm fire. That goes for office visitors, telephone calls, emails, and carrier pigeons. There is also the option of coming to work early or staying late.

Read more and embrace learning. People’s lives change in two ways — the books they read and the people they meet, according to Charles “Tremendous” Jones, a fellow member of the National Speakers Association. I’ve always said that libraries are an untapped gold mine. Your computer, tablet, or phone offer unlimited reading options. Knowledge is power.

Build deeper relationships. You can take all my money! You can take all my factories! You can take all my land! But leave me my network

HARVEY MACKAY BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

YOUR FIRST MILLION DOLLARS

24 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023

of relationships, and I’ll be back to where I was today in three to five short years. I’ve worked constantly to build relationships. It has served me every day of my life in ways I could never have imagined.

Volunteer. When you volunteer, you always get back more than you give. Volunteering has made my life so much better, and I suspect that anyone who has become passionate about a cause will tell you the same thing. People who do volunteer work are inclined to be go-getters and consistently report being happier and more contented.

It doesn’t matter whether you are young or old, student or professional, working your way up or at the top of your game. Needs abound wherever you are. Don’t just make a living, make a life worth living.

Practice humility. As American humorist Will Rogers used to say, get someone else to blow your horn and the sound will carry twice as far. Humility is not difficult to practice. It doesn’t involve downplaying your achievements. It doesn’t mean that

you won’t be recognized for your contributions. It does mean that you realize that others have been involved in your success, and you are prepared to be involved in theirs. You start by giving credit where it is due. The co-workers who participated in the early stages of a project surely deserve some recognition, and the folks who mopped the floors and kept the lights on so you could work late are team players too.

Find role models or teachers you can learn from. Mentoring can change your life — and theirs. Mentoring means helping less experienced people observe, experiment and evaluate different ways of doing work to find out which strategies work best. And the benefits are not limited to young people. People of all ages can gain from the guidance of a more experienced person, even someone younger than you. A mentor can help even experienced managers boost their job performance and advance their careers. And remember, mentors change over a lifetime. Set a goal and work toward it. Ask any successful CEO, superstar athlete, or winning person what their keys to success are, and you will hear four consistent messages: vision, determination, persistence, and setting goals. Set your goals for the year, for the decade, or for the rest of your life. After all, if you don’t set goals to determine where you’re going, how will you know when you get there?

Follow your passion. Passion is at the top of the list of the skills you need to excel at whether you’re in sports, sales, or any other occupation. When you have passion, you speak with conviction, act with authority, and present with zeal. If you don’t have a deep-down, intense, burning desire for what you are doing, there’s no way you’ll be able to work the long, hard hours it takes to become successful.

Mackay’s Moral: Even the best work hard to get better. n

Harvey Mackay is a seven-time New York Times best-selling author with 15 books.

SPONSORED BY NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 | 25

Don’t just make a living, make a life worth living.

What Makes a First-Time Homebuyer?

BY MARY KAY SCULLY, COLUMNIST, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Can someone who has owned a home before be considered a first-time homebuyer again? The answer is yes. If this surprises you, it’s time for a refresher.

It’s National Homeownership Month, which makes it a great time to brush up

who they are not, and how to help them on their journey to homeownership.

WHO THEY ARE

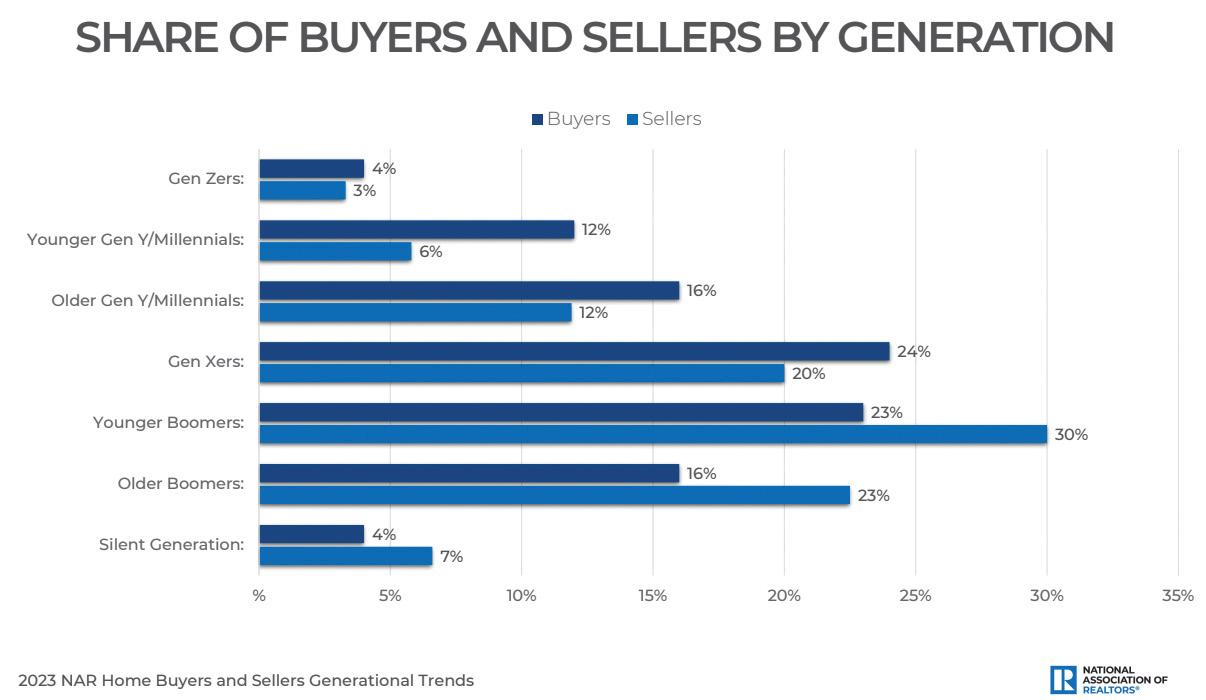

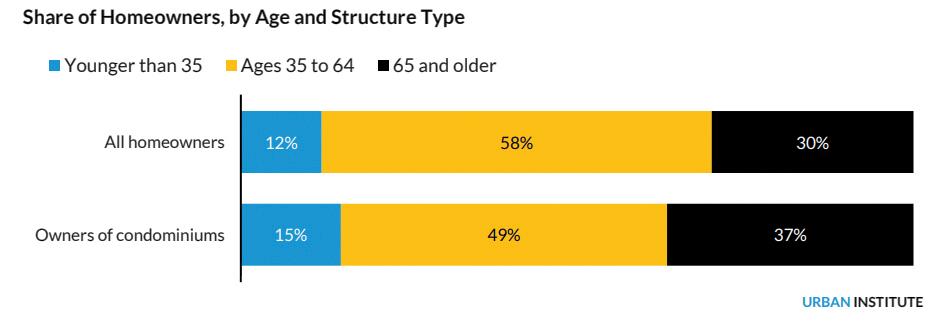

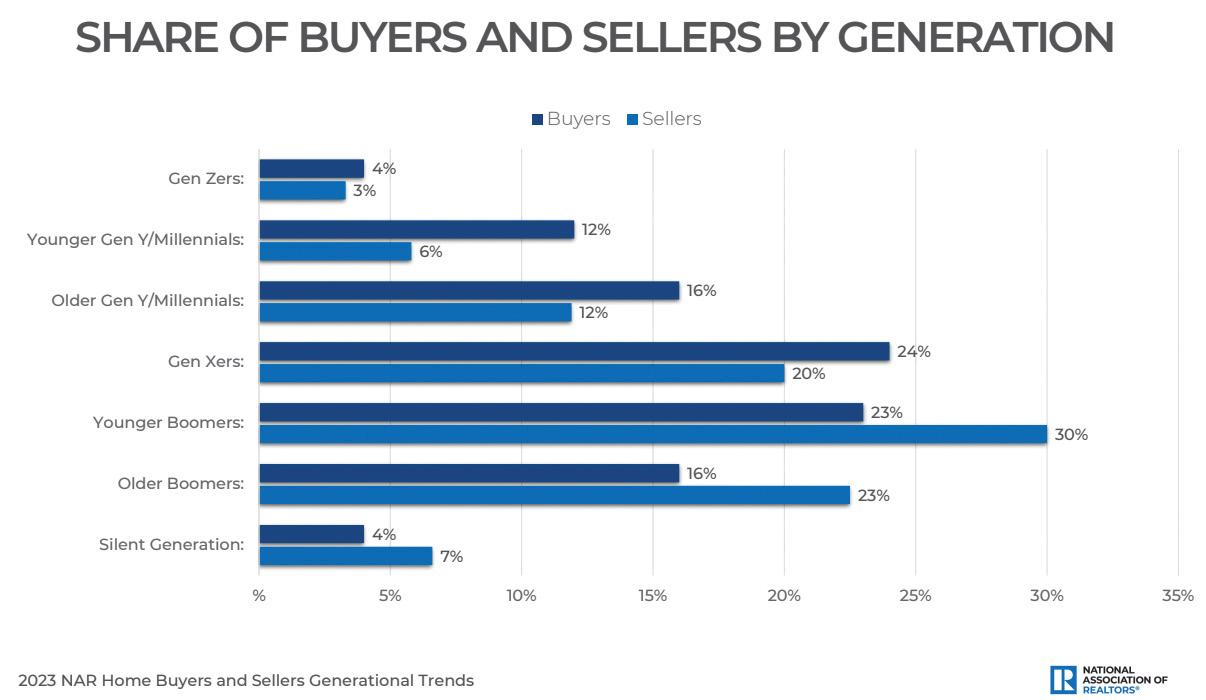

Buyer demographics are changing. The stereotypical 20-something, newlymarried couple is not always going to be your first-time homebuyer. According to the National Association of Realtors (NAR), in 2022 the average age of the first-time homebuyer was 36. Also in 2022, first-time buyers made up 26% of the market. Additionally, NAR reported that 29% of these buyers cited saving for a down payment as the hardest part of buying a home, and 28% used a gift from family or friends to help make it happen.

So, do you really know who your first-time buyers are? Fannie and Freddie say anyone who hasn’t owned in the last three years is considered a firsttime homebuyer. Your “first-time” buyer could be someone who has previously owned a home but moved around often for work, recently had a divorce, or has been living with a family member as a caregiver.

Many circumstances could make someone who has owned a home before revert to first-time homebuyer status. How does this definition change the way you work with them? There are a plethora of programs in place to help first-time homebuyers. It is your job as the loan officer (LO) to connect them with the right resources and make sure they are set up for success. You can only do this when you are tuned in to who your first-time homebuyers actually are.

HOW TO HELP

Let’s talk about those resources. There is a lot of material out there to help educate first-time homebuyers — be sure you are sharing it with them. The Consumer Financial Protection Bureau (CFPB) has great resources available to help first-time buyers prepare themselves for this huge financial commitment. Even if your buyer has previously owned a home, it is likely that the market, regulations, and technology have changed enough to where the process may feel very different for them

BENCHMARKS & BEST PRACTICES MARY KAY

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

SCULLY

26 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023

People who have owned homes previously might qualify

this time than it did when they last purchased a home. Education remains important regardless of experience.

There also are programs in place to help first-time buyers with costs. For example, the agencies offer lower loan-level pricing adjustments (LLPAs) on certain program types and for borrowers at/or within area median income limits. Additionally, local housing finance agencies (HFAs) and nonprofits may have a first-time homebuyer program to help with down payments.

It’s important for you, the LO, to know what is available to certain types of buyers so that you are able to connect them with the right resources early on.

WHO THEY AREN’T

Knowing who your first-time

homebuyers are not is just as important as knowing who they are. When working with first-time prospective buyers, you may notice that some just are not ready to buy yet — and that’s OK. Don’t write them off right away. Remember that a conversation may be deemed an application for some disclosure purposes, so stay vigilant in compliance efforts.

These buyers are still an opportunity. You can and should take the initiative to help them become ready to buy. First-time homebuyer resources can help them learn how to budget, build credit, and do whatever else is needed to get in a secure financial position to buy a home. Not every buyer will know where to start, but you can help them figure it out. They will remember how

you took the time to help them and more than likely come back to you once they are ready to buy.

These buyers who are not yet ready also could be long-term referrals. Just because they cannot buy right now does not mean they don’t have friends or family that they can send your way. Especially if you are taking the time to work with them and prepare them for homeownership, this can build loyalty that ends in referrals for your business.

This National Homeownership Month — and every month — keep up with how your buyers are changing. Know who can be considered a good first-time buyer and who cannot. Knowing the type of buyer you’re working with ultimately helps you know exactly what resources they need and creates a better experience for everyone. n

SPONSORED BY

Mary Kay Scully is the Director of Customer Education at Enact, leading the development of the company’s customer education curriculum.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 | 27

It is your job as the loan officer to connect them with the right resources.

Acra Lending

Lake Forest, CA

Acra Lending is the leader in NonQM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience.

acralending.com

(888) 800-7661

sales@acralending.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

Champions Funding

Gilbert, AZ

Mission Driven Non-QM + CDFI

Wholesale Lender

At Champions Funding, we Non-QM all day, every day! It’s our core business, and we live to serve underserved borrowers through our valued broker partners. We put diversity and inclusion into mortgage lending by empowering the mortgage broker community to provide solutions for non-traditional credit profiles and those who cannot get approved with standard financing. Through our highly coveted CDFI certification backed by the U.S. Department of the Treasury, we can offer our flagship neighborhood products and tap into a $1 Trillion market of historically underserved communities in the country.

Focused on speed to closing (in days, not weeks), smooth processes, and userfriendly access to our underwriting and support teams, we offer modern, flexible, and responsible non-traditional lending solutions.

champstpo.com

(949) 763-9494

Wholesale@ChampsTPO.com

LICENSED IN: AZ, CA, CO, CT, DC, FL, GA, HI, IL, IA, MD, MI, NJ, NC, OR, PA, SC, TN, TX, UT, VA, WA

FIND IT.

Civic Financial Services

Redondo Beach, CA

CIVIC delivers fast, honest, simple lending for real estate investors. Description of your products or services.

CIVIC Financial Services is a private money lender, specializing in the financing of non-owner occupied residential investment properties.

CIVIC provides Mortgage Brokers and Real Estate Investors with a fast and cost effective funding source for their real estate investment needs. civicfs.com

(877) 472-4842

info@civicfs.com

LICENSED IN: AZ, CA, CO, FL, GA, HI, ID, IL, IN, LA, MD, MA, MI, MN, NV, NJ, NC, OH, OK, OR, PA, SC, TN, TX, UT, VA, WA, WI

THE COMPANIES AND TOOLS YOU NEED

When searching for products or services to help your business, browse through our Resource Guides, or find a specific provider through one of our Directories.

Originator Tech, Non-QM, Wholesale, AMC. These listings provide quick, easy access to the resources you need, all in one convenient location.

Find

NON-QM LENDER RESOURCE

GUIDE

the company and tools you need. Browse through our directories.

Find

what you’re looking for. Visit nationalmortgageprofessional.com/ directories

Global Integrity Finance LLC McKinney, Texas

DSCR Rental NO DOC Loans

As a direct, private lender, Global Integrity Finance takes a commonsense approach to underwriting, with all approvals made in-house. We are dedicated to providing quick responses to time-sensitive loans, often times with the ability to close in as few as 3 business days. At Global Integrity Finance, we value referrals and our brokers are protected. We are committed to the highest level of customer service, because our success thrives in building relationships.

globalintegrityfinance.com

(214) 548-5190

toby@globalintegrityfinance.com

LICENSED IN: AL, AR, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NH, NJ, NM, NY, NC, OH, OK, OR, PA, RI, SC, TN, TX, UT, VT, VA, WA, WV, WI

Luxury Mortgage Corp. Stamford, CT

Non-QM, Wholesale, Delegated Correspondent, Non Delegated Correspondent

The Simple Access® Non-QM suite of products was built around the idea that it doesn’t have to be complicated to finance a home. We have created a diverse selection of borrower friendly programs that are simple, innovative, and flexible. For more information on our Correspondent division, visit www. luxurymortgagecorrespondent.com

luxurymortgagewholesale.com (949) 516-9710

tpomarketing@luxurymortgage.com

LICENSED IN: AL, AK, CA, CO, CT, DC, DE, FL, GA, IL, LA, ME, MD, MA, MI, MN, NV, NH, NJ, NM, NY, NC, OH, OR, PA, RI, SC, TN, TX, UT, VA, WA, WI, WY

Hands-On Advice

Industry

NON-QM LENDER RESOURCE GUIDE

Find the full list of Non-QM Lenders on page 64 TOP OF MIND RECOGNITION Be where they are when they’re looking for you. Take out your Directory Listing in NMP Magazine™ today to be listed among the companies making their services available to our readers. Visit nationalmortgageprofessional.com/purchase-alisting today to get started reaching your audience. through our company database, or find a specific provider through one of BE SEEN.SHORT-TERM VACATION RENTAL FINANCING RATESLIKENOTHING ELSE UNDERTHESUN The Leverage essto Flourish SPECIAL ADVERTISING SECTION: ORIGINATOR TECH DIRECTORY COMPANY AREA OF FOCUS WEBSITE Calyx Loan Origination Software Solutions calyxsoftware.com Capacity AI-powered mortgage support automation platform that connects your entire tech-stack. capacity.com FileInvite: Document Collection on Autopilot Automated document collection and client portal for workflow productivity.fileinvite.com Lender Price Most Advanced Mortgage Pricing & Underwriting Engine On The Market Company lenderprice.com MonitorBase Customer Intelligence monitorbase.com COMPANY SPECIALTY/NICHE STATES LICENSCED WEBSITE ACC Mortgage Non-QM AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA ACCMortgage.com Acra Lending Non-QM / Jumbo AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY acralending.com Angel Oak Mortgage Solutions Non-QM, Non-Agency AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, WA, WV, WI, WY, DC angeloakms.com Change Wholesale Helping mortgage brokers close more loans, faster. AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY ChangeWholesale.com First National Bank of America Non- QM All 50 U.S. States fnba.com/mortgage-brokers SPECIAL ADVERTISING SECTION: WHOLESALE LENDER DIRECTORY SPECIAL ADVERTISING SECTION: WHOLESALE LENDER DIRECTORY nmplink.com/subscribe KNOW IT ALL. Way more than a magazine.

Stories We discuss the issues in the industry others may be too wary to touch, and we never let advertise relationships affect our stories.

Stronger

Find actionable advice from professionals across the industry with tips to further your career, grow your business, and more.

just read the news — understand it. Find insightful articles from leading industry voices to help digest all the changes in the industry.

Insights Don’t

HELPING A FRIEND (& Dogs) Find A Home

elsewhere, and she was paying for them to be in a kennel. The fact that I was able to help her and advocate for her along the way made it the best deal. My friend and her dogs are well and loving their home.

How much was your best deal for?

It was for $620,000. God gave me the ability to complete a very difficult transaction and it was my first.

What made it your best deal? This transaction was last year July. I was able to assist my friend who needed a home in a time crunch. She was living in a storage facility basically and at a family member’s home. Her dogs were living

I had a horrible experience with a Realtor who was not willing to work for the client. We had many hiccups and change of circumstances that were definitely a main difficulty when we were first qualifying the borrowers for the home. This shaped my career by educating more clients so that they are fully engaged in the process. I also became a Realtor in addition afterwards to never repeat that homebuying experience from that which we all had to deal with from that former Realtor.

I recently did one for a single mom and that was such a rewarding experience. She is the first homeowner in her family and her three-year-old daughter was able to experience the joy of knowing that was her home.

What else was interesting about the deal?

What was interesting about the deal was this was the first deal I ever closed. n

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE WANTS TO FEATURE YOU! Submit your story using the link, and your deal could be featured in a future My Best Deal column! nmplink.com/bestdeal

SONLIFE HOME MORTGAGE LLC

813-841-0771 SOCIAL MEDIA HANDLES instagram.com/yvie.homes

yvonne.cano@sonlifehm.com

30 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023

NO add-ons to pricing based on property type, credit score, LTV or transaction type.

PRICING. EXPERT SUPPORT. Wholesale Loan Features: Up to 90% CLTV for loans up to $3.5 million Fixed-rate loans, ARMs and HELOCs available No seasoning period or limits for cash-outs2 Available to LLCs and Revocable Trusts FICO ® sco re only required for PM I loans Only one apprai sa l report regardless of loan size (718) 240-4780 jnoviello@ridg ewoodbank.com NMLS ID# 625762 (917) 731-4870 bfaras sat@ridgewoodbank.com NMLS ID# 646654 1 Contact Our Experienced Wholesale Lenders Today: Joseph Noviello Bijan Farassat 1. 1–2 family and condo purchases and rate and term refinances – primary residences. | 2. On primary residences. (LTVs apply). Terms and conditions subject to change without notice. Loans subject to credit approval. | © 2023 Ridgewood Savings Bank. All rights reserved. Learn more at ridgewoodbank.com NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 | 31

TRANSPARENT

32 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023

DATABANK NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | JUNE 2023 | 33

CASH Doesn’t Have To Be KING

Cash buyers may swoop in with big bucks, but opportunities abound

BY SARAH WOLAK, STAFF WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

34 | NATIONAL

MAGAZINE | JUNE 2023

MORTGAGE PROFESSIONAL

Originators are tired. They’re being hit in all directions with roadblocks: rising mortgage rates and home prices. Especially frustrating? Buyers who have enough cash outright to buy a home are steadily claiming nearly a third of the purchases.

According to ATTOM, all-cash home buying increased from 22.7% of all sales in 2020 to 34.4% in 2021 and finally to 36.1% in 2022.

“The number of single-family houses and condos flipped shot up 64% from the first three quarters of 2020 to the first three quarters of 2022. About twothirds of those homes were purchased by investors with cash last year, with that figure remaining larger than in 2020,” ATTOM CEO Rob Barber said. “The result was that all-cash purchases by home flippers went up from about 117,000 in the first three months of 2020 to 208,000 during the same period last year.”