But will the government’s ban prove to be the disaster for convenience retailing that many predict?

06 Taxes Trade bodies voice alarm at a proposed business rate surtax on larger retailers.

07 Junk Food Regulations The Scottish Government launches a consultation on proposals to restrict the promotion of food and drink high in fat, sugar and salt.

08 Sustainability A new collaboration aims to tackle litter and improve recycling in Forth Valley.

09 Wholesale The Scottish Wholesale Association holds its annual Achievers Awards.

10 Pricing The CMA investigates potential milking of the baby formula market by manufacturers.

11 National Lottery The National Lottery operator changes for first time in the draw’s 30-year history.

12 News Extra Minimum Unit Pricing The Scottish Government increases MUP to 65p, “to counteract the effects of inflation”.

20 Product News Cadbury gives retailers the chance to win £5,000 and Lucozade turns blue.

22 Off-Trade News SBF GB&I launches a new RTD and Diageo shakes up the canned cocktail market.

24 Above & Beyond Awards The unsung heroes of local retailing will be celebrated at a ceremony later this month.

26 GroceryAid Day Our industry charity’s annual awareness day takes place on Thursday 9 May.

28 SLR Awards It’s time for our judging panel to decide which stores will be shortlisted.

30 Competition Your chance to win six cases of Irn-Bru Xtra’s new limited-edition flavours.

31 Business Costs With high energy prices hurting businesses, we asked Douglas Harding from Business Energy Scotland to share his top energy-saving tips.

34 Hotlines The latest new products and media campaigns.

54 Under The Counter The Auld Boy is shocked to discover ageing rocker Rod Stewart shops in Tesco.

36 Nicotine Unwavering shopper demand for quality products and value means retailers should pay particular attention to the tobacco category.

42 Confectionery Brimming with innovation and a wealth of well-trusted and sought-after brands, confectionery is still a category retailers can count on.

44 Sports & Energy An ever-growing demand for new flavours and stimulants has seen the category boom – especially in convenience.

50 EPoS SLR speaks to Faisal Sattar of MHouse Solutions to get the lowdown on how a capable EPoS system sits at the heart of an efficient business

52 Impulse Must-Stocks Snacking and an increasing demand for value products are driving sales in the impulse category more than ever before.

16 Disposable Vape Ban The ban on single-use vapes is seemingly a dark cloud looming over the convenience sector, but is it going to be as bad as you think?

SGF survey looks at impact of wage rises

SGF has launched a survey to assess the impact of the increase of the National Living Wage and National Minimum Wage on its members. The findings will help inform SGF’s annual ‘Real Cost of Employment 2024’ report and will feed into its response to the Low Pay Commission consultation this summer. Visit bit.ly/48rIElW to take part in the survey.

MFG and Morrisons form strategic partnership

Motor Fuel Group is to acquire 337 Morrisons forecourts –including fuel, convenience retail kiosk and ancillary services –and more than 400 associated sites across the UK for UltraRapid EV charging development. The proposed £2.5bn deal forms a new strategic partnership between the two companies.

As part of the deal, Morrisons will take a minority stake of approximately 20% in MFG, and enter into commercial and supply agreements with it.

Illegal cigarettes and vapes found in Maryhill

More than 38,000 illegal cigarettes, 600 vapes, and 2.5kg of tobacco have been seized in Maryhill, Glasgow, after officers raided four shops. The operation was carried out by Police Scotland’s Greater Glasgow division, Glasgow City’s Council Trading Standards team, and HMRC. The city’s only tobacco detection dog lent a nose in uncovering the contraband.

Best Start Foods changes extend eligibility for help

Changes to the Scottish government’s Best Start Foods benefit will see an estimated 20,000 people able to access money to help with the cost of food shopping for the first time. Best Start Foods, which was paid to more than 46,000 people in 2022/23, is money every four weeks to help pay for healthy food from pregnancy until a child turns three.

A group of trade associations have jointly written to Deputy First Minister and Finance Secretary, Shona Robison, to voice alarm at the government’s consideration of a new business rate surtax on larger retailers and what it means for wider tax policy towards commerce.

e 16 organisations that signed the letter include the Scottish Retail Consortium, Scottish Chambers of Commerce, National Association of Shop tters, Scotch Whisky Association, IoD Scotland, and the Scottish Wholesale Association.

e collective call came ahead of the Stage 1 debate and vote on the Scottish Budget at Holyrood.

e letter said: “It is profoundly

concerning that new taxes on business are being countenanced in such an arbitrary way and with apparently little regard to trading or economic conditions. We understand it is being considered to plug a gap in government nances.

“ e way the announcement was made falls well short of the thrust of the New Deal for Business, which talks of no surprises and involving business at the very inception of policy development. It contradicts New Deal commitments on a more competitive and less complex business rates system. It also reinforces the perception that Ministers view rates more as a revenue generator and less as a means to stimulate much needed

commercial investment and growth.”

e letter added: “A more ad hoc and less predictable approach to business taxes in Scotland sends out a poor message. We fear this move opens the door to other sectors being similarly targeted, particularly if the projected scal gap widens.

“We therefore urge you to reject introducing fresh complexity, cost, and unpredictability into the rates system with a new surtax, or with similar taxes aimed at other sectors in the future. We want Scotland to be a great place to do business and a clear signal from you that economic growth is the priority would be a positive step.”

Glasgow-based ethical grocery business Locavore has fallen into administration after its expansion into new stores and a larger warehouse incurred significant set-up costs and after being adversely impacted by rising costs.

Blair Nimmo and Geoff Jacobs from Interpath Advisory have been appointed joint administrators to Locavore Community Interest Company, which operated four zero-waste organic supermarkets in Govanhill, Partick, Kirkintilloch, and Edinburgh.

Prior to their appointment, a transaction took place which saw The Chard Holding Group CIC acquire the stores in Govanhill and Partick, the vegetable box business, and the Locavore brand.

It is understood 77 members of staff transferred to The Chard Holding Group CIC as part of that transaction. The Edinburgh store closed earlier

in January 2024, the administrators closed the remaining store in Kirkintilloch, which resulted in five redundancies, with one other employee also made redundant.

Jacobs said: “It is disappointing that, despite the investment made, this not-for-profit enterprise has not been able to make its expansion plans come to fruition.”

Spar Garthamlock held a party to mark the launch of festivities for the 2024 World Athletics Indoor Championships in Glasgow.

e party saw one of Scotland’s most accomplished international athletes, Eilidh Doyle, join in the activities on the day.

Also attending was Scottee the o cial mascot for the 2024 World Athletics Indoor Championships in Glasgow.

Hundreds of residents attended and children from two local primary schools, Avenue End Primary and Sunnyside Primary, also visited. e schools were each were presented with a £250 cheque donation.

In addition, SGF’s Healthy Living Programme was set up in the store.

e Scottish government has launched a consultation on proposals to restrict the promotion of food and drink high in fat, sugar and salt.

e consultation, which will run for 12 weeks, will outline the details of proposed regulations aimed at creating a food environment that better supports healthier choices.

Proposals include restricting multi-buys, unlimited re lls or selling at locations such as at checkouts and front of store.

Feedback on the proposals will help to inform regulations to be laid before the Scottish Parliament, subject to the outcome of the consultation.

Public Health Minister Jenni Minto said: “We want to ensure Scotland is a place where we eat well and have a healthy weight. e Scottish government is committed to restricting promotions of foods high in fat, sugar or salt at the point of purchase as research shows this is when people make decisions about what and how much to buy, for themselves and their families.”

SGF has welcomed the exemptions for retailers with fewer than 50 sta and location exemptions for stores smaller than 2,000sq , but warned that those hit by the regulations could be put at a signi cant disadvantage.

For example, the SGF has called for the government to make it clear that independent stores that trade under a common fascia but are otherwise independent are not targeted by these restrictions.

Chief Executive, Pete Cheema, said: “Many of our members are facing a range of higher costs, including increased energy prices and in ation, alongside a rising tide of new regulation.

“Placing an additional burden on struggling stores at this time will mean that customers inevitably must pay more for their shopping, and businesses are less viable overall. For that reason, we strongly believe that the exemption for location restrictions should be increased to 3,000sq .”

e consultation will close on 21 May 2024.

ere are an average of nearly 60 physical attacks on shop and emergency workers every single day in Scotland, new research reveals.

Analysis by 1919 Magazine, the monthly justice and social a airs publication, has uncovered the scale of the crisis, with an average of 58.2 attacks recorded every day where data is available.

Figures released by the Scottish government reveal there have already been more than 500 convictions under the Protection of Workers Act, which came into force in 2021.

In the 11 months to November 2023 there were 2,233 assaults recorded – the equivalent of around seven per day.

Scottish Grocers’ Federation Chief Executive Pete Cheema said: “ is information comes to light amidst a torrent of widespread shop the , some of which involves organised crime groups, reports of sta resigning because they fear for their safety, and suspected losses worth millions of pounds to local businesses.

“Crime against retailers is a clear and present threat and current economic conditions, alongside budgetary strains on the police, have caused the situation to worsen further.”

Scottish Labour MSP Daniel Johnson, who introduced the Protection of Workers Bill to Holyrood, added: “ ese shocking gures show how many shopworkers face violence and harassment at work.

“Retail crime in Scotland is reaching crisis point and retail sta are bearing the brunt.”

The number of incidents of violence and abuse against retail workers soared to 1,300 per day in 2022/23, from almost 870 per day a year earlier, according to the British Retail Consortium’s latest crime survey.

The survey shows retailers spent £1.2bn on security measures and the cost of theft to retailers went up to £1.8bn from £953m the previous year, meaning the total cost of crime to retailers stood at £3.3bn –double the previous year.

Jisp’s strong start to 2024

Jisp has reported that retail sales through its Scan & Save mobile app solution were up 65% year-on-year in January. The app’s performance figures also showed a marked improvement in scan, tap and redemption totals – up 68%, 77% and 80%, respectively. The uplift in taps and redemptions points to a higher level of conversion to sale following a scanning action in store, which has contributed to the higher retail sales value.

Booker redistributes over six million meals

Booker redistributed the equivalent of six million meals in 2023 through partnerships with food waste charities FareShare and Olio. It supported more than 730 FareShare charities and community groups and fed more than 14,000 families via Olio’s Food Waste Heroes. Booker currently redistributes food via distribution depots and 196 of its branches across the UK.

Henderson Technology hits ESEL milestone

Henderson Technology has hit the one million Electronic Shelf Edge Label (ESEL) milestone. The company installed its first ESEL into Smyth’s Eurospar in Ballymoney in 2019 and five years later the EPoS company has now grown this to one million labels in more than 220 convenience and forecourt stores, the latest being Filco Supermarkets in South Wales.

Spar offers school sports day grants

Spar UK is offering another £50,000 to support schools in its local communities across the UK through its Spar School Sports Day Grants campaign. The campaign will give Spar shoppers in England, Scotland and Wales the chance to apply for a £200 grant for their local primary or secondary school to enable them to buy muchneeded sports equipment.

Food waste app Gander has appointed Damien Corcoran as its new Chief Operating Officer. Corcoran joins Gander with a wealth of retail and hospitality knowledge from C-suite roles at Whole Foods Market, Sainsbury’s, and Aldi. He also spent six years as a Commissioned Officer with the Royal Corps of Signals, leading and managing global communication programmes.

Confex buying group has formed a partnership with Jisp to launch a wholesale loyalty and rewards platform for its members and their retailers. The ‘Confex Savings Club powered by Jisp’ provides wholesalers with the opportunity to reward their retailers for buying through them with exclusive product promotions and loyalty rewards at no added cost to the wholesaler.

Mohammad Zahid of Eyemouth General Store, in Berwickshire, has won £1,000 in The National Lottery’s Site, Stock, Sell quarterly prize draw. Allwyn’s Director of Channel Operations, Alex Green, said: “Keeping high in-store standards not only helps increase [retailers’] own shop’s sales but also contributes to the more than £4m raised every day by players and retailers alike.”

Scotmid has launched a competition for under-18s to design the front cover of a magazine for its charity partner, RNLI. The competition comes ahead of RNLI’s 200th anniversary and budding artists are invited to submit a design that highlights the spirit of its work over the years within its communities, emphasising elements of inspiration, courage, and community spirit.

Single-use packaging generated from on-the-go food and drink is being tackled through a collaboration between environmental charity Keep Scotland Beautiful, Forth Valley College, local authorities in Stirling, Clackmannanshire and Falkirk, and Coca-Cola Europaci c Partners (CCEP).

Students and employees from Forth Valley College, which has its main campuses in Alloa, Falkirk and Stirling, have been asked to consider how they can help reduce on-the-go food and drink litter, which accounts for 63% of all litter counted across the three sites.

To reduce litter and improve recycling, street bins near the three campuses have been wrapped with messaging, a billboard and targeted digital online advertising will be

deployed, and increased recycling provision will be introduced on campus during a seven-week campaign targeting Forth Valley College students and sta and the wider community until the end of March.

Students and sta were asked for their views earlier this year and 78% con rmed they enjoy at least one item of on-the-go food or drink each week. However, 75% indicated the damage that on-thego food and drink litter could do to the environment and nature was of concern to them.

Lidl has rolled out its own bottle return scheme trial in Glasgow. Shoppers in the city can get unlimited cash rewards in return for empty PET plastic and aluminium drinks containers via in-store reverse vending machines.

e machines will accept single-use drinks packaging made from either polyethylene terephthalate (or PET plastic) or aluminium, are between 100ml and three litres in size, and have a readable barcode to scan at the point of donation. Dairy items, such as HDPE plastic milk or yoghurt drinks, Tetra-pack, paper-based cartons, glass or pouches are not eligible for return.

Launching across all 21 of its Glasgow stores, with potential to roll out further, shoppers will receive a 5p reward for each eligible item that they return. is can either be redeemed against their shopping or donated to Lidl’s long-standing charity partner, the STV Children’s appeal, which it has been supporting since 2011.

ere is no cap on the number of items that can be returned, and the discounter will accept qualifying bottles and cans purchased from any retailer, as long as they are clean and uncrushed.

Unlike DRS, the discounter’s bottle return scheme does not place a deposit on the retail price of the original product.

Keep Scotland Beautiful CEO Barry Fisher said: “It is vital that we encourage everyone to consider what they do with their packaging. Only by working in collaboration with national and local government, businesses and communities will we be able to test campaign messages and evaluate their success.”

Jo Padwick, Senior Sustainability Manager at CCEP GB, added: “Collaborating with businesses and government organisations is one important way we can continue to drive our sustainability goals forward and look to create a more circular economy.”

e campaign is delivered by Keep Scotland Beautiful as part of the National Litter and Flytipping Strategy and Action Plan, and is part funded by CCEP.

Snappy Shopper has partnered with EPoS supplier MSP Systems and IPOSG, an EPoS applications provider for retail and hospitality sectors.

The integrations are part of Snappy Shopper’s ongoing commitment to evolve the retailer experience, allowing them to streamline processes and focus on scaling their business.

Mike Callachan, Co-Founder and Chief Executive of the Snappy Group, said: “IPOSG’s cutting-edge technology will provide the convenience to accelerate the growth of online food and grocery sales even further in 2024.”

e Scottish Wholesale Association has rewarded the most forwardthinking, resilient and innovative wholesalers at its annual Achievers Awards.

Around 520 guests attended the Achievers gala dinner and awards presentation, hosted by TV sports presenter Amy Irons, at the O2 Academy Edinburgh, on 22 February.

Multiple winners on the night included CJ Lang & Son, picking up Best Delivered Operation – Retail, Best Symbol Group, and Community Service Award, while Faílte Foods claimed Best Delivered Operation –Foodservice and Employee of the Year for Paul Ellwood, Senior Buyer.

United Wholesale (Scotland) won Best Cash & Carry for its depot in Queenslie, Glasgow and Best Licensed Wholesaler.

Two categories were claimed by Brakes Scotland with Kelsey Brannan, Area Sales Manager, a popular winner of Rising Star of Wholesale, while the wholesaler also picked up Best Marketing Initiative for its enhanced loyalty scheme, My Brakes Rewards.

Bidfood, meanwhile, won the Best Innovation category for its new portal where chefs can create menus, calculate margin, provide full allergen traceability and order products.

For Booker, it was the wholesaler’s commitment to best practice across the three pillars of sustainability – environmental, social and economic –that saw it clinch Sustainable Wholesaler of the Year.

e Local Supplier of the Year award went to Perthshire-based Clootie McToot. e winner scored maximum points not only for those aspects, but also for its understanding of the Scottish wholesale channel, its local roots, and marketing and ecommerce activities.

Meanwhile, AG Barr won Project Scotland for the launch of its Pwr-Bru big can energy range – ful lling its aim to drive incremental sales and pro ts by o ering retailer incentives, driving excellent execution in depot, and investing in wide-ranging consumer activity.

In the Best Foodservice Supplier category, judged on the same principles, the award went to Mrs Tilly’s.

SWA Chief Executive Colin Smith said: “I’ve spoken before about how resilient wholesale is and you don’t need me to remind you of the challenges we have faced in recent years – and more recent issues that certainly don’t make running a wholesale business any easier.

“So, it’s only right that we celebrate our industry – whether it’s retail, hospitality, tourism, sustainability, economic transformation, or health and wellbeing – with the SWA’s wholesale and supplier members but also our colleagues and partners from across industry, and from within the Scottish government.”

Royal Mail and PayPoint are partnering to offer limited Royal Mail services at selected Collect+ locations. Initially the services will be for click-anddrop acceptance items and home shopping returns only. The services are expected to start rolling out this month and Royal Mail expects to be live in around 5,000 Collect+ sites by the summer.

UK shoppers are set to spend £1.7bn on Mother’s Day this year, a 1.1% increase on 2023, according to a report from data and analytics company GlobalData. The report shows more than half of consumers intend to purchase an item to celebrate the occasion, though price remains a main concern. The data reveals that 41% of consumers who intend to, or have already purchased, an item for Mother’s Day have or will spend under £20 on gifts.

The Spar store in Kincorth, Aberdeen, welcomed the Scottish Gas Women’s Scottish Cup last month. Access to the cup was possible from the extension of Spar Scotland’s sponsorship with the SFA. SGF’s Healthy Living Programme was also in attendance, along with children from local school Abbotswell Primary, who had their photos taken with the cup.

City of Edinburgh Council has become the first in Scotland to crackdown on pavement parking. The council is using new powers designed to protect pedestrians which came into effect earlier this year – especially people in wheelchairs and with buggies. Motorists now face a £100 fine for parking on pavements, at dropped kerbs, and for double parking. There is an exemption for delivery drivers.

e Competition and Markets Authority (CMA) has launched a market study into the supply of baby formula in the UK.

e move follows the CMA’s Autumn 2023 report into price in ation and competition in the groceries sector, which found that the average price of infant formula had risen by 25% over the previous two years and that families could make signi cant savings of more than £500 over the rst year of a baby’s life, through buying cheaper infant formula options.

e CMA will now be able to use its compulsory information gathering powers, rather than rely on rms providing information voluntarily. Any recommendations to government resulting from the work will now also have a formal status.

e CMA intends to conduct the market study with the intent of publishing a nal report in September 2024. e study will gather additional evidence on: Q consumer behaviour, the drivers of choice, and the

Bestway Wholesale is to expand its retail range across its depot network, adding hundreds of new and bestselling products.

The wholesaler has added more than 1,500 additional listings across depots and enhanced its online service to ensure all delivered retailers have access to the full range available from their local depot.

Bestway Wholesale’s Managing Director, Dawood Pervez, said: “By increasing our range, we aim to be a one-stop shopping destination for our retail customers offering them a wide variety of products across different categories.

information and advice available to consumers to support their decisions.

Q the role of the regulatory framework and its enforcement in in uencing market outcomes.

Q the supply-side features of the market (such as barriers to entry and expansion).

e CMA will then consider whether there are problems in the market and, if so, what actions could or should be taken to address these. is could include making recommendations to government – for example, on the regulations governing how baby formula is marketed, or on the information provided to parents to help them choose a baby formula brand.

Sarah Cardell, Chief Executive of the CMA, commented: “We’re concerned that parents don’t always have the right information to make informed choices and that suppliers may not have strong incentives to o er infant formula at competitive prices.”

“We have also been reviewing our awardwinning Best-one own-label range which is widely respected for its quality and the gap it fills in the marketplace, and will be making announcements soon in this respect.”

In addition, Bestway Wholesale has also improved its support for retailers on these new ranges with a new planogram service.

ACS has highlighted the crucial role that the UK’s 17,986 rural shops play across the UK.

As part of the launch of the 2024 Rural Shop Report, ACS engaged with MPs on the actions that government can take to support rural shops.

ACS Chief Executive James Lowman said: “We are calling on MPs to help rural retailers in the battle against shop the and abuse, to enable stores to continue providing access to cash for customers, and to level up the digital infrastructure that connects rural shops so that they can invest in modernising their businesses.”

e full 2024 Rural Shop Report is available at bit.ly/4bh20Ni.

e Fourth National Lottery Licence has started, marking the rst time that responsibility for operating e National Lottery has changed hands in its 30-year history.

New licence operator Allwyn says its marketing investment over the coming months will showcase how the games di er from each other.

In addition, Allwyn’s games strategy over the course of the licence aims to create even more new millionaires and prize winners.

Allwyn says the high street will continue to play an important role over the coming decade and it has plans to grow the retail presence further, with stores standing

to bene t from greater sales support, more investment in marketing, new points of sale and, over time, signi cant upgrades to its technology infrastructure underpinned by Vodafone’s mobile connectivity.

Allwyn is also investing in a “broader” technology transformation programme to support the modernisation of e National Lottery, including the move to a new technology platform with Scienti c Games. is will enable a richer and more relevant experience for individual players, while also using data to support healthy play.

In addition, Allwyn has started on a journey to create a net zero National Lottery and will invest a ring-fenced £1m every year from its own pro ts into social value initiatives to help deliver a positive legacy.

Andria Vidler, Chief Executive of Allwyn UK, added: “It will be a journey that will take time – but one that has many incredible milestones along the way, o ering us more opportunities to re ect on all the good that comes from it.

“ is year is particularly signi cant, with the Olympic and Paralympic Games and e National Lottery’s 30th birthday. We want the birthday year, and the decade that follows, to be full of more unmissable and unforgettable moments for more people in more ways.”

Allwyn has revealed that a h of post o ces in the UK are to stop selling lottery tickets and scratchcards.

It comes a er Post O ce decided last year to end its group contract with the National Lottery at the request of postmasters who wanted to receive full commission from sales. Previously Post O ce took around 1% from each transaction.

e new lottery operator told the PA news agency that 900 of the 5,800 branches that had previously stocked National Lottery products have not signed up to continue.

Allwyn says more than 600 had chosen not to due to reasons ranging from religious beliefs to low sales, while up to 200 were unable to because of county court judgements.

Calum Greenhow, who runs a post o ce in West Linton in the Scottish Borders with his wife and is Chief Executive of the National Federation of SubPostmasters, told the BBC: “We would still be selling [lottery tickets] if it wasn’t for the scratchcards.

“Under the previous group contract, the Post O ce would cover the cost of the cards, but now each individual branch must pay for them themselves.”

In addition, Allwyn said that 98.5% of its 23,000 independent retailers overall had signed up to sell lottery products under the fourth licence.

Menzies Distribution is to increase its carriage charges by an average of 3%.

The rise takes effect from 6 April, just days after the mandatory national living wage for employers aged 21 and over increases by nearly 10%, and without any consultation with Menzies’ retail partners.

The increase will be capped at £4.99 per week for customers in the highest bands in Menzies’ carriage charge template.

NFRN’s National President Muntazir Dipoti commented: “Continual increases to carriage charges year in and year out are not sustainable for independent news retailers.”

Nisa charity reaches over 180,000 people in UK

Nisa’s Making a Difference

Locally charity reached more than 180,000 people in the UK throughout 2023, with 2,000 donations. Over £935,000 was donated through MADL to worthy community causes and charities across the UK. This includes more than £310,000 donated to shelter and security causes, and £175,000 donated to food poverty initiatives.

Asda opens six c-stores in Scotland in February

Asda opened six convenience stores in Scotland in February, as part of its goal to reach 1,000 stores across the UK. The chain is converting Co-op and EG Group convenience sites to Asda Express stores as part of a multi-million-pound investment. The stores are in Glasgow (two), Aberfeldy, Dundee, Glenrothes, and on the Isle of Skye. The retailer said they will cater to various customer needs.

Hancocks flash deals

Hancocks is offering weekly in-store exclusive deals on big brands across its 14 depots, including the one in Glasgow. The deals – on offer every Thursday – have previously included special prices on top-selling lines like Cadbury Creme Eggs. Branch managers are curating their own deals and special offers, which are tailored for each region based on what local customers are buying.

ACS welcomes proposals to improve access to cash

ACS has welcomed the Financial Conduct Authority’s proposals to ensure that banks and building societies consider reasonable cash access services, and has repeated its calls for a review of interchange fees to ensure that enough retailers can continue to provide access to cash. ACS boss James Lowman said provision is becoming “too scarce, too fast”.

What does an increase to Minimum Unit Price mean for our sector?

Last autumn, SGF surveyed its members to inform its consultation response. You may think that data gathered directly from retailers would be incredibly useful and informative for Ministers tasked with making these decisions. Did they listen? No.

Instead, the Scottish Government ploughed ahead with an increase from 50p to 65p. Which was their intention from the get-go. Despite covid lockdowns and changing consumer habits making it impossible to measure any correlation between MUP and drinking behaviour.

Nevertheless, we were thankfully successful at convincing the government that a 1 May changeover would be undeliverable. Officials listened to industry concerns and rightly moved the go live date back to 30 September – a silver lining at least!

SGF worked closely with Ministers to implement MUP in 2018 and launch our Retailer’s Guide and an online calculator, which will be updated this year. Likewise, MUP ensures that local stores stay on a level playing field with supermarkets, many of whom cut alcohol prices to the bone to drive footfall prior to 2018.

However, increasing MUP at this difficult time is incredibly short sighted. Households are struggling with a cost-of-living crisis, and wages have not increased with the rampant inflation of the past 18 months.

Small businesses and local shops are vital for their communities and economic growth. On top of a host of unwelcome product regulations and more costs coming down the road, raising prices adds unnecessary pressure on the pockets of both retailers and customers.

The government says the decision to increase the minimum unit price of alcohol, which comes after a consultation, has been taken to counteract the effects of inflation.

e Scottish government has announced that the minimum price per unit of alcohol will increase from 50 pence to 65 pence from 30 September 2024.

Last September, the Scottish government launched a consultation on increasing the minimum unit price of alcohol a er campaigners called for a change.

e government says a price increase is required to counteract the e ects of in ation. No future date has been set for the price to be reviewed again in the coming years.

Deputy First Minister Shona Robison said: “We believe the proposals, which are supported by Scotland’s Chief Medical O cer, strike a reasonable balance between public health bene ts and any e ects on the alcoholic drinks market and impact on consumers. Evidence suggests there has not been a signi cant impact on business and industry as a whole.

“Alongside MUP, we will continue to invest in treatment and a wide range of other measures, including funding for Alcohol and Drug Partnerships.”

As a result of the increase, the minimum cost of a standard bottle of whisky in Scotland will be pushed from £14 to £18.20, vodka to £16.90, and a four-pack of basic lager to £4.58.

In response, the SGF has warned that the increase could deepen the cost-of-living crisis, impacting local businesses and hitting struggling households the hardest.

SGF welcomed the nine-month lead time before prices change, despite calling for a 12-month implementation period, and stated that it will continue to engage with the Scottish government over the coming months.

e trade body worked with the Scottish government to publish a guide for retailers on MUP and hosted an easy-to-access online MUP calculator for retailers to use in 2018. In the coming months, SGF hopes to repeat this process for the new price of 65p.

SGF Chief Executive Pete Cheema said: “Many convenience retailers are working at out just to keep the lights on, and doors open. It is o en the case that convenience stores are at the very heart of their communities. Providing essential services such as post o ces, bill payment services and access to cash.

“Continuing to provide a ‘full basket’ for customers means that if one product category has limited value, then income needs to come from other items. Restrictions and higher prices inevitably come at a greater cost to doing business, putting more pressure on budgets and struggling household incomes.

“Ministers didn’t listen to us on DRS, they didn’t listen to us on NDR, and now they are not listening to us on MUP.”

e Scottish Licensed Trade Association (SLTA), a long-time supporter of minimum unit

pricing for alcohol, welcomed the announcement.

SLTA boss Colin Wilkinson said: “Scotland has long had a challenging relationship with alcohol and the link between low prices and increased consumption is clear. e sale of cheap alcohol has been a major factor in many people developing alcohol-related problems so a proportionate increase in MUP make absolute sense.”

He added: “ e 50p level was approved in the Scottish Parliament nearly 12 years ago so we believe that with rises in in ation since then, it was time to increase MUP from 30 September.”

In addition, the NFRN says raising the minimum price for alcohol sold in Scottish shops will not stop problem drinking but could put retailers at further risk from retail crime.

NFRN National Vice-President Mo Razzaq said: “ e government is not spending enough to get people addicted to alcohol with the help they need. ere also needs to be highly e ective campaigning to help change Scotland’s attitude towards drink. As usual, it is passing the buck to businesses.”

We’ve known it’s been coming for a long time now, but it looks very much like the days of the disposable vape are numbered. April 2025 seems all set to be the deadline for removing them from the market and it’s critical that we use the time that remains to get our vaping ducks lined up so that they don’t all swim off a cliff, taking thousands of pounds of weekly sales and huge margins with them.

The argument for banning them is, frankly, difficult to counter. Once touted primarily as smoking cessation tools – and very effective tools at that – the stellar rise of disposable vapes took the once floundering category off in an entirely new direction. But the environmental impact they have and the wellchronicled rise in youth consumption, mostly people who had never smoked a cigarette in their lives, was only ever going to end one way.

The scale of the challenge the sector faces is monumental. For many stores, vaping has been the category that drove the profits and for some stores, the chances are that vaping is the only reason they’re still in business today.

The big question, however, is what will happen next April? There are several possible scenarios. We could see vapers shift seamlessly onto rechargeable devices. We could see some people quit vaping. It’s not out of the question that we see some people shift back onto cigarettes. The question is, what’s most likely?

My own personal feeling is that the migration from disposable to rechargeable won’t be quite as pain free as we might hope. From listening to the retailers who contributed to our cover story this month though, it seems that most are quietly optimistic that the mass migration will occur with a minimum of fuss. That would be nice.

Regardless of what happens, it will impact on retailers’ profits. The commercials around rechargeable vapes will be different, for a start. Plus, there’s the latest threat of a special tax being imposed on vapes, very much along the tobacco model. It’s still early days on that discussion but this seems like one of those ‘no smoke without fire’ subjects. It will surprise no-one if the cash-strapped government views a vaping levy as another of those morally justifiable supertaxes on products deemed to be unhealthy.

If that comes to pass, what does the category look like then? It will have lost a lot of its value to retailers, and it will undoubtedly have a negative impact on their end of year profits. And that’s before we even start talking about the likely impact on the illicit trade and the further damage it will do to legitimate retailers.

It’s a complex challenge and I would urge all retailers to start getting some plans together now for how they plan to navigate the April deadline and mitigate the impacts as much as they possibly can.

ANTONY BEGLEY, PUBLISHING DIRECTOR

Web Editor

Findlay Stein fstein@55north.com

ADVERTISING

Sales & Marketing Director

Helen Lyons 07575 959 915 | hlyons@55north.com

Advertising Manager Garry Cole 07846 872 738 | gcole@55north.com

DESIGN

Design & Digital Manager

Richard Chaudhry rchaudhry@55north.com

EVENTS & OPERATIONS

Events & Circulation Manager

Cara Begley

cbegley@55north.com

Scottish Local Retailer is distributed free to qualifying readers. For a registration card, call 0141 22 22 100. Other readers can obtain copies by annual subscription at £50 (UK), £62 (Europe airmail), £99 (Worldwide airmail).

55 North Ltd, Waterloo Chambers, 19 Waterloo Street, Glasgow, G2 6AY Tel: 0141 22 22 100

Fax: 0141 22 22 177

Website: www.55north.com

Twitter: www.twitter.com/slrmag

DISCLAIMER

The publisher cannot accept responsibility for any unsolicited material lost or damaged in the post. All text and layout is the copyright of 55 North Ltd.

Nothing in this magazine may be reproduced in whole or part without the written permission of the publisher.

All copyrights are recognised and used specifically for the purpose of criticism and review. Although the magazine has endevoured to ensure all information is correct at time of print, prices and availability may change.

This magazine is fully independent and not affiliated in any way with the companies mentioned herein.

Scottish Local Retailer is produced monthly by 55 North Ltd.

Make sure all staff members are fully trained. Follow these top tips:

STOP

Take your time Distractions can prevent proper checks from taking place

LOOK

Make eye contact with customers to assess their age

CHECK

If in doubt, ask for ID and check that it’s an acceptable form of identification

Remember: Mystery shopper visits are carried out in support of preventing underage sales.

If your store doesn’t correctly ask for ID on 3 separate occasions, you could lose your terminal.

The ban on single-use vapes is a dark cloud looming over the sector with many retailers relying heavily on them for sales and profits every week, but is it going to be as bad as you think?BY LIZ WELLS

Disposable vapes are the most widely used tobacco harm reduction alternative in the UK with more than half of adult vapers preferring these devices owing to their convenience and a ordability. erefore, it’s not unreasonable to think that the upcoming ban on disposable vapes will have a dramatic – and negativeimpact on retailers, but is that really the case?

e ban on the sale and supply of single-use vapes in Scotland is due to come into e ect on 1 April 2025, under proposed legislation published at the end of February. From that date, it will be an o ence for a person or business, to supply, o er to supply, or have in their possession for supply, single-use vapes. ose found in breach will be subject to a summary conviction of up to two years and/or a ne.

e move takes forward the recommendation to ban single-use vapes from a consultation on ‘Creating a Smokefree Generation and Tackling Youth Vaping,’ which ran across Scotland, England, Wales and Northern Ireland last year.

Circular Economy Minister Lorna Slater said: “ e public consultation demonstrated

that there is strong support for tougher action on vaping. From causing res in waste facilities to more than 26 million disposable vapes being consumed and thrown away in Scotland in the past year, single-use vapes are a threat to our environment as well as to our public health.”

Despite the ban helping to tackle littering, other environmental issues and underage sales, many fear that it will put stores under even more pressure at a time when the sector is already beset with challenges.

SGF Chief Executive Pete Cheema told SLR: “ e convenience retail sector is under a huge amount of pressure. Not least from the cost of energy, higher in ation and interest rates and the conveyor belt of regulation government is piling onto small businesses. From restrictions to promotion of alcohol and of foods high in fat, salt and sugar, and Minimum Unit Pricing, to reduced business rates relief and the generational ban.”

He believes many retailers are already struggling to make ends meet, as are their customers, and that the ban on single-use vapes will add to the challenging economic circumstances retailers nd themselves in.

“ ere is simply no room for the sector to absorb these additional costs and unfortunately that means they will most likely be passed onto customers. Exasperating both in ation and the cost-of-living crisis,” Cheema added.

Retailers will be under more pressure if their customers fail to readily migrate from disposable to rechargeable vapes. However, Naeem Khaliq, Head of Symbol at United Wholesale (Scotland), is con dent that vapers will make the switch, so much so that he’s already purchased lots of stock.

“It doesn’t need much upselling, so not much impact on retailers,” he said.

Saleem Sadiq, owner of Spar Renfrew, agreed: “I’m fairly con dent vapers will migrate, especially with tobacco prices on the up.”

Meanwhile, Pete Cheema thinks its “not clear” how customer habits will change a er the ban, but predicts there will be “some panic buying” beforehand and “a surge in illicit trade” a er.

He said: “Undoubtedly some people will automatically switch to re llables or other

alternatives, and retailers will continue to o er that service.”

East Lothian retailer Ferhan Ashiq warns that if customers do not migrate in substantial numbers, then retailers will be forced to raise prices “substantially” to pay for all the costs, which will have “a large in ationary impact”.

Ferhan added: “We should note, though, that there is only so many price rises that a consumer will be prepared to take and thus some store owners will be in a position where they cannot pay their basic bills and will have to close.”

It’s widely believed that customers unwilling to migrate from disposables to rechargeable vapes will turn to the illicit market for their x.

Saleem Sadiq believes there will “de nitely” be an increase in illegal vapers. He said illicit is “already huge” because there are not enough police or trading standards. He added: “I think we need more help from the government, almost every hairdresser, kebab shop, laundry shop, night clubs are selling vapes, mostly to under ages, and most local shops are being unfairly targeted.

“Trading standards together with the police and HMRC need to enforce the Tobacco Register and close down any shop caught selling illegally; a slap on the wrist and or a small ne will never deter these rogue traders.”

e SGF believes it is just as likely that some people will seek out illicit goods, which will be unregulated and may be harmful. It that case, it won’t only be retailers that are impacted, it will drive crime within communities and across the economy.

Pete Cheema explained: “SGF wants to see tighter regulation of these products. Particularly on packaging and naming conventions. ey should not be targeted at younger people and should only be sold by legitimate traders who take their responsibilities seriously. ose found in breach of the rules should feel the full force of the law. However, if the current regulation had been enforced properly, many of these problems could have been avoided.”

SGF is pledging to continue to work with both the industry and the Scottish and Westminster governments to get the “best solution” for retailers, and part of that will be ensuring that “enforcement is fully resourced”.

WHAT WOULD EXISTING UK DISPOSABLE VAPERS DO AFTER A BAN IS INTRODUCED?

Q SWITCH TO TOBACCO: 8%

Q STOP VAPING: 20%

Q KEEP USING DISPOSABLE VAPES: 24%

Q SWITCH TO RECHARGEABLE VAPES: 44%

Q SWITCH TO ALTERNATIVE TOBACCO PRODUCTS: 4%

is view is supported by the UK Vaping Industry Association. Its Director General John Dunne said: “Local authorities desperately need more money to fund trading standards, and with predictions that the black market will ourish when disposables are banned, the UKVIA believes that a focus on enforcement is now more important than ever.”

Online vape retailer Vape Club, in consultation with the vaping sector, including the UKVIA, wider retail industry and trading standards, has developed a comprehensive framework for the UK’s rst vape retailer and distributor licensing scheme, which was unveiled at a Parliamentary reception on 21 February.

“ is scheme, which goes much further than the Scottish Register of Tobacco and Vape

Retailers, could generate more than £50m per year, allowing trading standards to fund a national programme of enforcement – including bi-annual test purchasing and stock checks,” Dunne added.

ACS Chief Executive James Lowman believes the main impact that a ban on disposable vapes will have on rogue sellers will be to “drive more people to seek out their products when they can’t get them from legitimate retailers”.

“We need a clear plan to tackle the illicit market and proper consultation with the retail sector about the impact of the proposed ban,” Lowman commented.

It’s almost universally agreed that the ban will hit retailers’ sales gures in some way, but for how long is more up in the air.

Anand Cheema, owner of Costcutter – Fresh in Falkirk, said: “ e ban will cause a downturn in sales initially but when knowledge about rechargeable vapes increases I think they will switch over, but it won’t have the same appeal.”

He says he will ll the void le by disposable vapes by looking at other areas that are doing well and increase those, but he’s expecting it to be “di cult”, but retailers “will have to nd a way”.

Anand said that “everything is up in the air in vaping” with other regulations being considered on taxing, avours, and packaging.

“It’s di cult for manufacturers, but they are trying their best,” he added.

Meanwhile, Ferhan Ashiq expects the leaders in the disposable category to introduce new products and systems and hopes that his customers will migrate to them.

e SGF says that once the legislation is passed, there will be at least six months before any new laws come into e ect, but the industry is already preparing for the transition.

“Several suppliers are bringing out new re llable vapes to encourage consumers to switch from disposables,” Pete Cheema said.

Indeed, Eco Vape and Aspire have partnered to meet the demands of the customer by listing the UK’s rst Hybrid product – the ‘BEAR + Aspire R1 Hybrid Device’ – capable of more than 3,500 pu s. e system couples a nicotine

“It’s not clear how customer habits will change after the ban, but there will certainly be some panic buying beforehand and a surge in illicit trade afterward.”

PETE CHEEMA OBE, CHIEF EXECUTIVE, SGF

salt range of e-liquids with the “best device (and coil) in the business”.

e BEAR + Aspire R1 provides the customer with over 24 avours from the Eco Vape BEAR Flavours range, with a rechargeable device, the Aspire R1.

e manufacturers explain: “No longer is the vaper limited to ‘600 pu s’ or driven to purchase illegal and untested 3,500 pu devices. Now, they can vape tested and proven avours on a device that brings out the avour notes of each e-liquid, providing an unrivalled vaping experience so that they will never need to return to a substandard single-use disposable vape again.”

e number of vapers who ultimately switch will be in uenced by factors including how e ectively the message that re llable vapes are a viable alternative to disposables is communicated to them, according to UKVIA.

“I’m fairly confident vapers will migrate from single-use to rechargeable vapes, especially with tobacco prices on the up.”

SALEEM SADIQ, SPAR RENFREW

Dunne explained: “Retailers are ideally placed to educate vapers about alternatives to disposables and now is the time to start doing this, rather than wait until a ban comes into e ect.”

In April, UKVIA will launch its annual VApril vaping awareness month and this year it will also include information to help vapers switch from disposables to re llable vapes. UKVIA is encouraging retailers to visit vapril.org to take part in the campaign.

“Taking part in VApril 2024 is an obvious way that retailers can help educate their customers in making the switch,” Dunne added.

As is pointing out how much money consumers could save over a year from switching from disposables to reusables and highlighting that they have much less of an impact on the environment.

Pete Cheema says many retailers will already be considering what products they will stock to replace disposables and there is evidence that more reusables are already nding their way onto retailers’ shelves.

Meanwhile, Ferhan Ashiq says retailers need manufacturers to put in processes to take back excess stock from retailers near the time of the ban being implemented.

“ is will give retailers the con dence to keep investing with the manufacturer, giving the retailer security,” he added.

So, it seems there’s plenty for retailers, trade associations, and ministers to be getting on with in the run up to 1 April 2025.

We’ll be visiting stores to see how we can help you reach the support level - who will be the first?

Monster multipack PMPs

Coca-Cola Europacific Partners has unveiled price-marked four-packs of Monster Juiced Mango Loco (£5.49 PMP) and Monster Zero Sugar Lewis Hamilton (£4.99 PMP), exclusive to convenience stores. Monster multipacks have added over £16.3m in value over the last year. In fact, they are growing faster than multipacks from any other major brand in the energy category (20.7%).

Walkers is launching larger cases across its Walkers and Doritos price-marked packs. The move, which Walkers said will help retailers make the most of PMPs, sees outers grow from 15 to 18 packs. As well as helping retailers manage stock, it will also help Walkers meet its broader sustainability goals, with the bigger case sizes set to reduce greenhouse gas emissions by 4%.

Rockstar Energy has been given a makeover, which sees simplified branding and enhanced graphics on 500ml cans. The new look is supported by a marketing campaign that includes social media, digital advertising, out-of-home media, influencer partnerships and sampling events. On-pack QR codes give consumers the chance to win free tickets to O2 Academy venues.

Former Marketing Director Adrian Hipkiss has taken on the newly created role of Commercial Director at Boost Drinks. Hipkiss joined the sports & energy brand in 2019 and has led the overall brand strategy, accelerated insight-led advertising and NPD, restructured the marketing team, overseen a sales and distribution agreement with Rio and championed the closer alignment of sales, marketing and category teams within the business.

As part of its year-long 200th anniversary celebrations, Cadbury has launched a new competition that gives retailers the chance to win £5,000 in cash.

e Great Retail Ideas Exchange invites retailers to share their ideas around retail success – big or small – with other store owners. To enter,

retailers need to share an idea via the SnackDisplay.co.uk tradefocused advice and information site.

e ideas will be judged by a panel of industry experts and chaired by an independent judge, who together will select the winners.

e total prize fund is £25,000.

e best idea put forward will win the top prize of £5,000, while the 10 next best ideas will win £1,000 each. All other ideas will be entered into a nal random prize draw, which will see 20 further prizes of £500 awarded.

To kick o the campaign, and to provide other retailers with inspiration, some leading retailers have already shared their thoughts:

Q Avtar Sidhu: “Strategically merchandise your store to spread the hotspots around

– milk, bread, our COOK concession, alcohol. People dwell at these places, so spread them out and get shoppers to walk the store, make the journey work. Understand that journey and how you can maximise that.”

Q Nishi Patel: “Delist products a lot. Every two to three months, do a review of certain areas to make the space you have work better. If something doesn’t sell, get rid and put something that will sell in its place.”

Q Suki Athwal: “Make sure you’re posting something on social media every day. You might not have time to do it every day, or they forget. We’re busy. When you do get ve minutes, get it all scheduled for the week. It means your stu is going out even when you’re not doing it at that moment.”

of plastic packaging used for six-

KP Snacks is cutting the amount of plastic packaging used for sixpacks of Discos, Roysters and Frisps by 35%.

is follows a further investment

is follows a further investment in ow wrap equipment by the snacking giant and will see 100 tonnes of packaging saved every year.

e move also translates to 620 fewer lorry journeys annually, reducing greenhouse gas emissions.

As well as ticking a number of sustainability boxes, the new owwrapped packs will also create more space on shelves, enabling retailers to display extra stock.

e new ow-wrapped packs include Frisps Variety 6-pack, Roysters T-Bone Steak six-pack and Discos Variety 6 six-pack, which all have an RSP of £1.50.

Launching in a six-pack format for the rst time, Discos Salt & Vinegar will also be ow-wrapped to deliver additional packaging savings.

John Leslie, Packaging Technology Manager, KP Snacks, commented: “Protecting the environment is one of the core pillars of our People and Planet programme, and we are committed to taking a responsible and proactive approach to safeguarding nature. We remain focused on reducing both our plastic packaging and carbon emissions in any way that we can.”

Spray oil brand Frylight has announced a new partnership with the author and creator of the food platform Bored of Lunch, Nathan Anthony.

Antony will develop a series of air fryer recipes for the brand, showcasing the versatility of the Frylight range.

The focus of the recipes will be to raise awareness of how a few sprays of Frylight can elevate air fryer cooking, providing consumers with a lighter, tastier and more convenient cooking experience.

Lucozade has rolled out three new blue-coloured drinks: Lucozade Sport Blue Force, Lucozade Energy Blue Burst and Lucozade Alert Blue Rush.

Marking a huge change in Lucozade’s marketing strategy, the launch of Blucozade is the rst time all three Lucozade sub-brands have appeared side by side in a single launch, with new drinks across function, avour and format.

e new products are supported by in-store POS, as well as a shopper-facing campaign that runs through to April.

e three variants all have a di erent avour, which their names do little to reveal, leaving it

up to shoppers to gure out what they’re drinking.

Brand owner Suntory Beverage & Food GB&I suggested that retailers brand block Blucozade, strategically showcasing the NPD to create “an unmissable eyecatching display” for shoppers.

know Blucozade will appeal to di erent shoppers and have a big contribution to the continued success of the Lucozade brand.”

Blucozade is available in the following formats:

Premier Foods has launched a new on-pack Easter Adventure competition across its Mr Kipling and Cadbury Cakes ranges. Shoppers can win a dream family holiday for four people, days out and more than 100 other prizes. The campaign runs until 16 May across a number of Easter SKUs, including Mr Kipling Lemon & Raspberry Mini Batts and Mr Kipling Deliciously Good Hot Cross Pies.

“Uniting our Sport, Energy

Elise Seibold, Marketing Director at Suntory Beverage & Food GB&I, commented: “Uniting our Sport, Energy and Alert brands together for the rst time ever is a huge step change in the way we market Lucozade, with even more to come this year.

“With its three di erent avour pro les, we

Nescafé has relaunched with a refreshed new look aimed at modernising the 85-year-old brand.

Updated packs are rolling out across the Nescafé Original, Nescafé Gold Blend, Nescafé Azera and Nescafé Frothy Co ee ranges.

e new design emphasises the accent above the second letter ‘e’ in Nescafé, includes images of co ee beans, and draws attention to the brand’s sustainability credentials with a “100% responsibly sourced co ee” message.

e rebrand will be supported by extensive marketing campaigns across multiple channels, including TV, digital and social media.

Sophie Demoulin, Nescafé Marketing Director at Nestlé UK and Ireland, said: “ is relaunch represents a signi cant milestone for our brand as we continue to evolve and stay ahead in the ever-changing co ee industry.

“We know that co ee enthusiasts have emotional connection with the brand, and we are con dent that our refreshed new look will resonate with them.”

Q Lucozade Alert Blue Rush: both standard 500ml and £1 PMP 500ml cans;

Q Lucozade Energy Blue Burst: both 500ml and 900ml bottles, in plain packs and PMPs;

Q Lucozade Sport Blue Force: 500ml bottles, in price-marked and plain packs, as well as in fourbottle plain multipacks.

Imperial Tobacco has added a resealable foil to packs of its Regal Signature cigarettes range.

The foil seals in moisture, ensuring that the last cigarette removed from each pack is as fresh as the first.

Regal Signature cigarettes feature high-quality paper, a firm filter and a round-cornered box for a more contemporary and premium feel.

The range, now featuring the new Fresh Protect pack protection, including Kingsize and Superkingsize formats, is available now in packs of 20 with an RSP of £12.75.

Nestlé is to cease production of its Breakaway bar this month due to a drop in sales of the chocolate biscuit, which first hit shelves in 1970. The Yorkie Biscuit bar (not the Yorkie chocolate bar) is also getting the chop. The move will allow the food and drink giant to invest in NPD, with a number of new products apparently in the pipeline for 2024.

PepsiCo has launched a new on-pack promotion across Walkers Max and Doritos, giving shoppers the chance to win tickets to the UEFA Champions League 2024 final alongside instant cash prizes. Walkers Max is supporting the promotion, which runs until 31 March, with a digital and influencer campaign to drive awareness of the prize. The promotion is the first in a number of football-focused campaigns PepsiCo has planned for 2024.

Happy free-from Easter

Free-from chocolate brand

Moo Free’s Easter collection includes two new products, the re-formatting of a bestseller in a new sharing pack, and the return of five popular SKUs. The latest additions to its Easter offering are the Strawberry Sundae Egg and the Rocky Road Easter Egg (both 85g, RSP £4.50). Moo Free has also re-packaged its Caramel Mini Eggs in a sharing pouches format (88g, RSP £3.50).

Revamped Diageo One platform rolls out Diageo has overhauled its ‘Diageo One’ online support platform – previously only available to the on-trade – to include advice, insight and tools to help independent retailers grow their businesses. Free to use, the platform now offers direct Diageo support, free marketing tools, exclusive training materials, and the latest category trends. Retailers should visit diageo-one.com to sign up.

Booker-only Fruit Fusion

Echo Falls, the UK’s number one flavoured wine brand, is launching a fresh fruity flavour –Watermelon & Kiwi Fruit Fusion – that will be exclusively available to Booker customers from March to May, with an RSP of £5.50. With a 9% ABV, the new launch targets a young consumer demographic as it bids to lure RTD and sweet cider drinkers towards fruit wines.

Absolut has released the latest instalment of its Born To Mix campaign, collaborating once again with Eurovision contestant Olly Alexander. The brand’s latest campaign celebrates the power of community and strength of people coming together to drive change. It sees Alexander champion three UK changemakers: Lady Phyll, founder of UK Black Pride; Trina Nicole, founder of Curve Catwalk; and ShayShay, cofounder of The Bitten Peach.

Spirits distributor Speciality Brands has taken over all UK commercial and marketing activities for Takamaka rum. The Seychelles-based brand offers two award-winning ranges, one of easy-drinking and approachable rums, and a second aimed at seasoned rum drinkers. Email sales@ specialitybrands.com to find out more and for any trade queries.

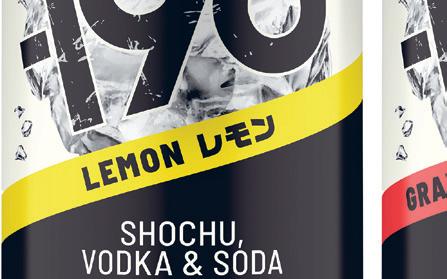

Lucozade and Ribena producer, Suntory Beverage & Food Great Britain and Ireland (SBF GB&I), has entered the RTD market with the GB launch of Japanese brand -196 (minus one-nine-six).

Available from April in 330ml cans, -196 rolls out in two avours, Lemon and Grapefruit. Both are 6% ABV. Since its launch by Suntory Holdings in Japan in 2005, -196 has been a well-established RTD brand in the country and continues to grow in popularity. A er launches in Australia (2021) and China (2023), this year sees the brand expand into Great Britain, Germany, the US and Southeast Asia.

e -196 name refers to the process used to create the drink. is involves freezing the fruit used to create the avour down to -196°C with liquid nitrogen, crushing it into powder and then mixing it with vodka.

Carol Robert, Chief Operating O cer at SBF GB&I, commented: “ is launch marks a signi cant move for us into the ready-to-drink alcohol market and is part of a much bigger strategy for portfolio growth. We’re very proud of our Japanese heritage and honoured to be launching one of Suntory’s iconic brands in our business for the rst time.”

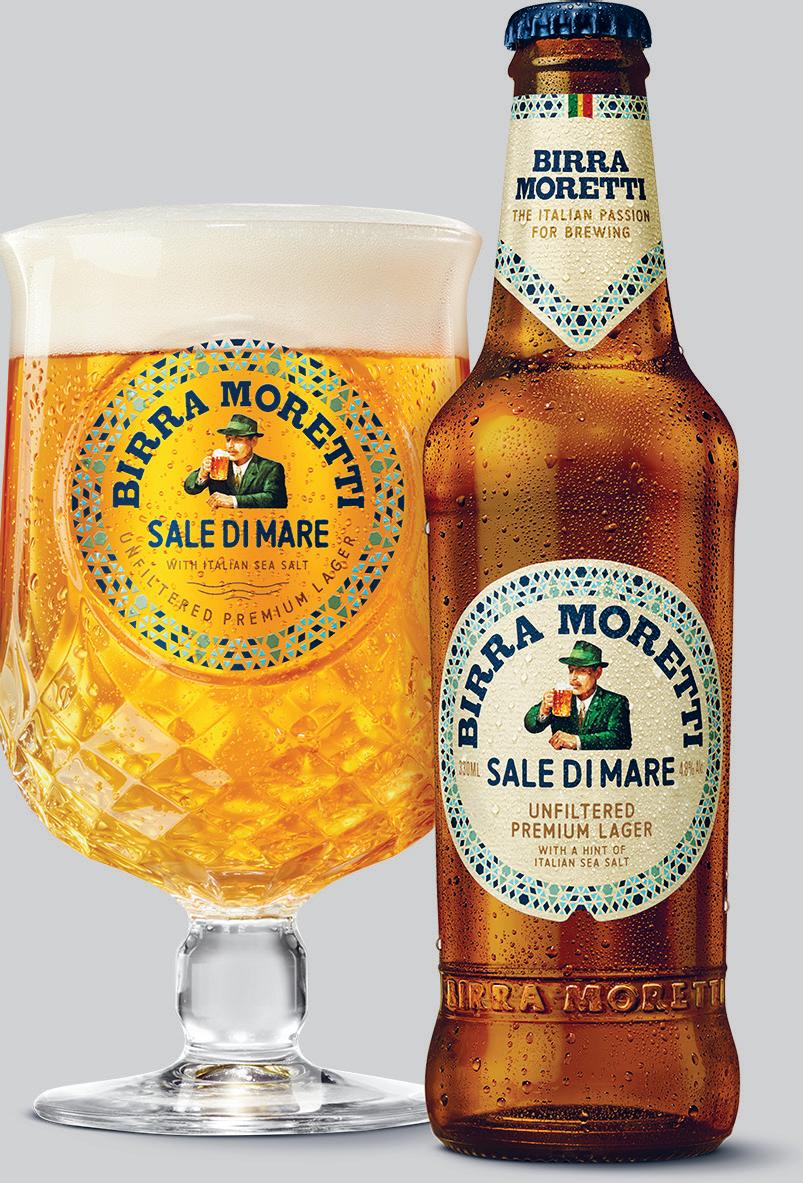

Heineken has launched new Birra Moretti Sale di Mare (4.8% ABV), available now in multipacks of 4 x 330ml and single 660ml bottles.

Sale di Mare (salt of the sea) offers an unfiltered, medium-bodied premium lager made with a hint of sea salt harvested from Sicily.

The launch will be supported by a multi-million-pound nationwide marketing campaign, which starts on TV in April, as well as a glassware gift with purchase for the multipack format. Packaging also includes a game accessible via QR code that gives consumers the chance to win prizes and access food and beer pairing inspiration.

Richard Barnes, Birra Moretti Marketing Manager, commented: “We know that Birra Moretti is a well-loved brand synonymous with quality, and we are excited to encourage more beer discovery with the launch of Sale di Mare.”

Cobra Beer has unveiled chefs Jeremy Pang and Marni Xuto as its new brand ambassadors.

Jeremy Pang, who has featured on TV shows including Sunday Brunch and Jeremy Pang’s Asian Kitchen, will work with Cobra throughout the year to develop a host of bespoke Asian-inspired dishes that pair well with Cobra and Cobra Zero. Cobra has also become the o cial beer at Jeremy Pang’s Covent Garden restaurant, School of Wok.

Recipe developer, author and creator of the ‘ ai Food Made Easy’ blog, Marni Xuto, will also work with Cobra to create exclusive recipe content that highlights the versatility of Cobra as a food pairing, and host cooking demonstrations in partnership with Cobra throughout the year.

Diageo has unveiled e Cocktail Collection, a trio of premium ready-to-drink cocktails based on three of its leading brands.

e new RTDs are available now in 500ml bottles, with a 100ml can format rolling out in April.

e range includes Johnnie Walker Old Fashioned (20.5% ABV), Tanqueray Negroni (17.5% ABV), and Cîroc Cosmopolitan (17.5% ABV). Each bottle contains ve serves, and been speci cally created for sharing and social occasions, or as gi s for special occasions.

e launch taps into the ‘drinking less but better’ trend, capitalising

on the interest in premium spirits and consumer demand to make cocktails at home.

e RTD category is the fastest growing within the total alcohol category in the o -trade and cocktails have been the fastestgrowing category in the last two years, with premium cocktails accelerating the growth by 82%.

Heineken hopes to tap into a growing nostalgia trend and an increase in consumers looking to cut back their drinking with the launch of Foster’s Proper Shandy (ABV 3%).

e new 3% ABV brew is available now in 440ml packs of four and 10, with RSPs of £3.75 and £9.25 respectively.

e launch targets the two- hs (40%) of adults who say they want to moderate their drinking and comes at a time when shandy and lager top account for 4.5% of all serves in the on-trade.

Foster’s Proper Shandy will be supported by a marketing campaign that includes TV, digital and out-of-home advertising.

Richard Barnes, Marketing Manager – Foster’s at Heineken, commented: “We are thrilled to be launching Foster’s Proper Shandy to the o -trade, delivering something brand new into classic lager and reigniting interest in the category – not only for existing drinkers, but also to help recruit new ones.

“Foster’s is such a well-known, trusted brand and there was a clear gap in the market for a quality shandy in a convenient format and at an a ordable price. Coupled with the growth of moderation, as well as the growing nostalgia trend, Foster’s Proper Shandy taps perfectly into these moments too. We look forward to seeing how the innovation performs.”

Nin Taank, Marketing Manager RTDs for Diageo GB, said: “ e range is set to revolutionise the way people enjoy drinks at home by providing accessible, premium options – the expertly cra ed cocktails mean consumers can pour the perfect serve every time with ease.

“ e bottles are perfectly suited for sharing whilst the cans lend themselves to on-the-go occasions. We are really excited about the launch of e Cocktail Collection as it delivers on avour and versatility and enables people to enjoy popular, bartender quality drinks at home.”

Coca-Cola Europacific Partners (CCEP)

GB has updated the packaging design for Jack Daniel’s and Coca-Cola Zero Sugar, to clearly set it apart from the Jack Daniel’s and Coca-Cola Original Taste variant and help retailers tap into the opportunity for zero sugar options.

New cans feature a bright red collar to improve standout on shelf. This is replicated on the shelf-ready packaging trays with a bolder red stripe and ‘Zero Sugar’ callout. Displayed next to the Jack Daniel’s and Coca-Cola Original Taste variant, which is unchanged in primarily black packaging, it’s now far easier for shoppers to tell them apart.

The news follows the announcement that Absolut Vodka & Sprite has joined CCEP’s premixed portfolio. See Hotlines (p35).

Love Drinks launches

Japanese white rum

Love Drinks has added Kiyomi Rum (40% ABV, 70cl, RSP £54.29) to its portfolio. It is produced by the Helios Distillery on the island of Okinawa, Japan’s most southerly region. An extended fermentation yields a rum that offers notes of truffle, banana flambé and other tropical fruits. For more information call Love Drinks on 0207 501 9630, email info@lovedrinks.co.uk or visit lovedrinks.com.

Peroni pairs up with Ferrari

Peroni Nastro Azzurro 0.0% has announced a new global multi-year tie-in with Ferrari. Throughout the partnership, Peroni branding will be visible on Ferrari racing cars and driver uniforms. Joint bespoke social media content will also be produced. A short film has also been released to mark the deal. ‘The Brake In’ sees Ferrari drivers Charles Leclerc and Carlos Sainz sneak into Peroni’s brewery for some high jinks.

Margarita time

Pernod Ricard’s Altos Tequila brand has launched a new, ready-to-serve margarita. Made with Altos Plata Tequila, triple sec, natural lime flavour and agave syrup, Altos Classic Lime Margarita is available now in a 750ml glass bottle (RSP £15, ABV 14.9%) at Amazon, Tesco, Asda and Go Puff, ahead of a wider spring roll out. Pernod Ricard said the product “makes it so simple for people to create the perfect margarita at home”.

Brothers Cider has relaunched its flagship cider brand after conducting extensive consumer research into today’s flavoured cider drinkers. The relaunch takes in new liquids, new packaging and new flavours, coupled with a new creative identity and is supported by a major marketing campaign that will start in May and run throughout the summer.

SLR’s first-ever Above and Beyond Awards take place later this month, celebrating local retailing’s unsung heroes.

Anticipation is building ahead of SLR’s inaugural Above and Beyond Awards that are due to be presented at a celebratory lunch in Glasgow’s swanky Corinthian Club on 13 March.

e awards were launched to shine a light on the outstanding e orts and achievements of team members in stores across Scotland. We asked you nominate your store’s unsung heroes and were, quite frankly, amazed at the number, strength and diversity of the entries received.

e passion, drive and innovative spirit displayed by our shortlist is quite simply astounding – some entries literally brought the judging panel to tears.

From life-saving sales assistants to business-boosting supervisors, motivating managers and caring community champions, 2024’s sparkling crop of nalists are all true heroes – routinely going above and beyond the call of duty and making an invaluable di erence to the stores in which they work, to their colleagues, to their customers and to the communities that they serve.

Each and every one deserves to win. We wish them the very best of luck!

Cadbury is celebrating its 200th year, and throughout 2024 we’re engaging in a huge range of exciting activities, promotions, and celebrations to mark this landmark anniversary.

To show thanks to the retailers who have helped support the brand throughout its long history, Cadbury is continuing the gift of giving and the spirit of generosity by getting store owners to share their Great Retail Ideas with their peers and entering those ideas via a competition to win huge cash prizes.

The Great Retail Ideas Exchange invites retailers to share their ideas around retail success – however big or small they may be! – with other store owners. Any retailer who shares an idea via a specially-created form on SnackDisplay. co.uk, MondelĐz International’s trade-focused advice and information site, willbe entered into a competition to win a cash prize of up to £5,000*.

The ideas will be judged by a panel of industry experts and chaired by an independent judge, who together will select the winners. The total prize fund is £25,000*, with the best idea put forward set to win the top prize of £5,000, while the 10nextbestideaswillwin£1,000each.Allotherideaswill be entered into a final random prize draw, which will see 20 further prizes of £500 given to 20 additional winners who have put forward ideas.

To enter the prize draw and submit their ideas to the Cadbury Great Retail Ideas Exchange, retailers simply need to go to the specially created form on Cadbury’s retail trade website, Snack Display. The page to enter ideas is: https://www.snackdisplay.co.uk/competitions/ cadbury200retailideas Goodluck!

Susan Nash, Trade Communications Manager at Mondeléz International

Susan Nash, Trade Communications Manager at Mondeléz International

GroceryAid Day takes place on Thursday 9 May and is the annual awareness day of our industry charity GroceryAid and it’s the ideal opportunity to let your colleagues know about the free, confidential support that is available.

Thursday 9 May will see this year’s annual GroceryAid Day help elevate the awareness of our industry charity in stores and businesses across the UK – and GroceryAid wants your business to be one of them.

e special day o ers you the chance to join hundreds of organisations in letting your colleagues know about the charity’s free and con dential nancial, emotional and practical services available to them 24/7, 365 days a year.

Colleagues can access GroceryAid’s services and support from the rst day of their employment. A er just six months of continuous employment, if colleagues have experienced a drop in income, they may be eligible for a non-repayable nancial grant.

If they need immediate emotional support, then can call GroceryAid’s FREE and con dential Helpline, which is available 24 hours a day, 365 days a year on 08088 021122. eir call will be answered by a trained counsellor who can either give them immediate

support or signpost them to another GroceryAid service that may help. More than 200 languages are also supported through the Helpline, on request.

Support and further advice are also available through the website, groceryaid.org.uk/get-help. e website has an accessibility toolbar which translates the content into over 100 di erent languages, as well as text to speech in 60 languages.

For regular updates about the support available and updates on nancial grants such as School Essentials Grant, follow the charity on Facebook @groceryaid or Instagram @groceryaid_uk.

All of GroceryAid’s services are completely free and con dential and its service providers do not disclose any details back to the charity. Emotional and practical support is also available to spouses, partners and dependants.

GroceryAid Day is a great way to help you ensure that your colleagues can reach out to GroceryAid for support.

From posters and leaflets to wallet cards and stickers, there’s everything you need to make all of your colleagues aware of the free and confidential financial, practical and emotional support that is available to them, should they need it.

With entries to the SLR Awards now closed, it’s time for our judging panel to decide which stores will be shortlisted.

By the time you’re reading this –unless your postie has unlocked the secrets of time travel – it will in all likelihood be too late to enter this year’s SLR Awards.

Which means only one thing: it’s time for our judges to roll up their sleeves and start poring over all the entry forms.

And it’s quite a pile they have to work through; despite an earlier deadline due to the Awards returning to their traditional summer slot, we have received the proverbial barrowload of entries.

Our panel of expert, experienced and independent judges from across the UK will now assess every single one. Scores will be allocated to each entry and this scoring system will be used to draw up the shortlist in each category.

Shortlisted stores will be announced online later this month and published in the April edition of SLR.

A er that, our unique judging model will see SLR Publisher Antony Begley visit every single shortlisted store in an epic road trip that will take him the length and breadth of

the country – from Southerness to Shetland if needs be. He will deliver a level of judging consistency that means all stores are judged fairly and transparently.

Awards judging visits will be unannounced to ensure your stores are seen exactly the way your customers do.