DISCOVER THE UK’S NO.1 NICOTINE POUCH*

AVAILABLE AT VAPERMARKET.CO.UK

Speak with your local BAT Representative

This product contains nicotine and is addictive. For adult nicotine consumers only.

*Based on NielsenIQ RMS data for the Nicotine Pouches category for the 12-month period ending 04/02/2023 for the UK total retail market (Copyright © 2023, Nielsen Consumer LLC)

The UK’s leading symbol group reaches 500-store milestone in Scotland.

Glass out as troubled scheme gets the nod

Cash in on warm weather

NEWS

06 In-Store Services PayPoint and NFRN team up to offer a Christmas savings club.

07 Deposit Return Scheme A UK Government decision means Scotland’s DRS can go ahead – but without glass.

08 National Lottery Sales for the last financial year are the Lottery’s second-highest ever.

10 Tech CJ Lang enhances its SalesTrack software, which gives retailers key insights into how products are performing.

12 News Extra Cost Of Living Scottish government removes income thresholds from its Best Start Foods benefit.

22 Product News Lucozade and Xbox team up, while Monster brings back its retailer support scheme.

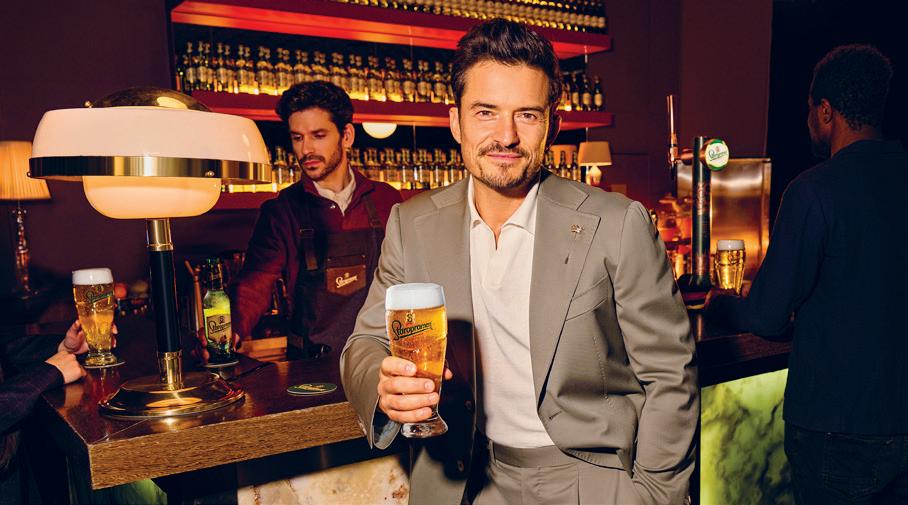

26 Off-Trade News Havana Club celebrates the Cuban mindset and a film star is the new face of Staropramen.

28 GroceryAid Jim Harper explains why One O One is so passionate about supporting the industry charity.

31 Checkout Scotland GroceryAid Scotland’s flagship event unveils its 2023 headlining acts.

32 Store Profile Nisa Yokermill Road Arbaaz Hayat and his family have helped revitalise a community by re-opening a store that had lain empty for nine months.

34 Hotlines The latest new products and media campaigns.

42 Competition You could win £50-worth of BrewDog Lost Lager in our easy-to-enter competition.

54 Under The Counter The Auld Boy is less than delighted when the World Avocado Organisation reaches out to him.

36 Summer Drinks The fine-weather season is upon us and with it the opportunity to drive summer drinks sales.

46 Summer Festivals Festival season is back in full swing, and brands are gearing up for another period of boosted sales – meaning good news for retailers.

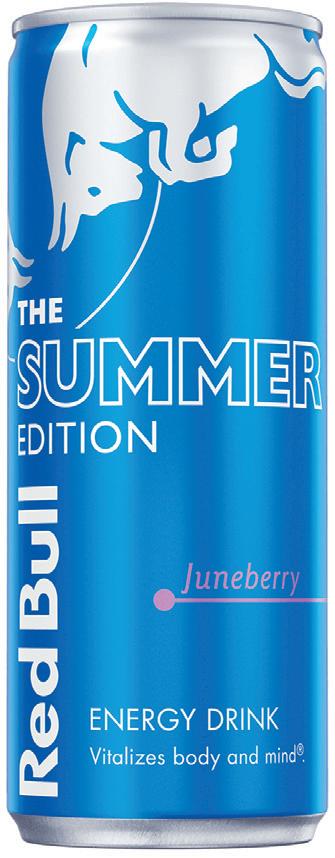

48 Nicotine Alternative nicotine solutions are offering adult smokers increasingly powerful ways to secure their hits.

52 Food-To-Go Shoppers are still looking for on-the-go treats that won’t break the bank.

The Snappy Group has appointed Brad Jones as Head of Marketing. His role will focus on boosting local businesses and their communities by growing brand awareness of the Snappy Group, through the promotion of Snappy Shopper, Hungrrr, and digital high street propositions. He will prioritise in growing Snappy Shopper’s presence in new and existing areas in the UK and globally.

Spar Scotland’s second annual awards will again be presented at the symbol group’s annual tradeshow on 28 September. The categories are: Independent community retailer of the Year, Company-owned community store of the Year, Independent Retailer of the Year, Companyowned Store of the Year, and Supplier of the Year. A shortlist of stores will be drawn up judges and sponsors to visit.

The Scottish Borders Licensing Board has granted MFG a premises licence to sell alcohol from the yet-to-be-built Tweedbank Service Station, at Tweedbank Industrial Estate. Members agreed to the application on the grounds that 10% of the shop space was devoted to alcohol sales – not the 14% applied for. The site is expected to open around the first week of August this year.

A Newtongrange shopkeeper and his employer have been issued fixed penalty notices for selling a nicotine-based vape product to a person under 18. Acting on a tip-off, Midlothian Council’s trading standards team carried out test surveillance that confirmed the sales. Councillor Stuart McKenzie said: “Quite frankly anyone caught doing this and fined up to £200 in the first instance is getting off lightly.”

deal of PayPoint One, Park Savings, and parcels.

e new scheme will be rolling out in the summer ahead of the start of the Christmas 2024 season. NFRN members that are interested can visit paypoint.com/parksavings or email parksavings@paypoint. com to register their interest.

PayPoint and the NFRN have formed a new partnership that will see the organisations work together to create a network of more than 1,500 Park Christmas Savings Super Agents over the next few months.

Park Christmas Savings, now part of the PayPoint Group, is the UK’s biggest Christmas savings club, helping more than 350,000 families manage the cost of Christmas, by o ering a range of gi cards and vouchers from some of the biggest high street names.

e new partnership will see participating NFRN members access an earning opportunity of over £1,000 per annum, recruiting savers in their local area. Each store will get access to an extensive support package, including training roadshows, digital and in-store POS, personalised saver communications and a national £2.5m advertising campaign driving awareness of the scheme.

Nick Wiles, Chief Executive of PayPoint, said: “ is forms part of our longstanding commitment to add extra value and revenue into the pockets of all PayPoint retailer partners. We’re looking forward to working closely with the Fed to roll this out over the coming months.”

Jason Birks, National President of the NFRN, added: “ is exclusive partnership creates a great opportunity for members to make more money from PayPoint in their store whilst o ering a vital service to customers in their community. I would encourage all members to get involved.” ILLICT TRADE

Fed members who are not currently PayPoint retailers can also take advantage of an exclusive bundle

ACS has responded to an HM Revenue and Customs consultation on tougher sanctions to tackle illicit tobacco, welcoming measures that could reduce the impact of the illicit trade on retailers and consumers.

HMRC is considering the introduction of fines for up to £10,000 for persistent offenders selling large quantities of illicit tobacco and the six-month removal of track and trace for severe cases of noncompliance.

In the submission, ACS highlights the lack of previous meaningful enforcement action when it comes to dealing with businesses that were found to be selling illicit tobacco, with almost half of businesses in 2019 (48%) receiving a verbal warning.

Edinburgh and East Lothian convenience store chain Margiotta is set to open a new store in the capital a er securing £725,000 in funding from HSBC UK.

e new 2,000sq store will be located in Harrison Gardens, at a site that was previously owned by an architecture rm.

e store, the second in the Shandon area of Edinburgh for the family-run business, will be used to host food and drink from local

suppliers – such as Fortitude Co ee and Heather Hills Honey – as well as a range of homeware products.

e existing Shandon store will remain a newsagent, with the addition of homemade gelato, paninis, and co ee.

Founder and Managing Director Franco Margiotta said: “Both we and our customers value local produce from quality suppliers, so we’re looking forward to being able to expand our product range with our increased footprint.

“HSBC UK’s support has helped us to grasp the opportunity to buy this new space and explore a new venture as we bring to life our rst café-style venture at our older store.”

e UK government has granted Scotland a temporary exemption from the Internal Market Act to enable the Deposit Return Scheme (DRS) to go ahead, but it only covers PET plastic, aluminium, and steel.

Glass bottles were a key part of Scottish government proposals for DRS, which are due to go start in March 2024, but UK ministers excluded glass from English and Northern Irish schemes shortly before granting Scotland’s exemption to internal market rules.

In a letter to the First Minister, the UK government said including glass “would have created a potentially permanent divergence from the schemes planned for England and Northern Ireland”.

Hamza Yousaf has accused the UK government of trying to

“sabotage” the DRS in Scotland, as businesses had already signed up to and spent money on a scheme including glass.

He said he would have to hold urgent talks with businesses and examine the viability of the Scottish scheme.

ACS Chief Executive James Lowman said: “ e announcement of the exclusion of glass from DRS in Scotland is welcome news for many local shops that were concerned about asking their store colleagues to handle and store glass that could be broken or soiled.”

Tomra, a supplier of reverse vending machines (RVMs), has appointed a new Scotland-based Managing Director for the UK and Ireland.

Ryan Buzzell takes up his post at an important juncture for the business as it makes a multi-million-pound investment in new sta and resources ahead of the introduction of Scotland’s Deposit Return Scheme in March 2024.

Buzzell, who will be based at the rm’s current Scottish operations hub in Livingston, will aim to double Tomra’s current Scottish workforce to 60 by the end of 2023 as it works to install and maintain RVMs, including contracts with major supermarket chains and smaller shop operators.

He has experience internationally in the implementation of deposit return schemes, most recently as President and Chief Executive of Tomra Collection Australia.

Buzzell has held a series of senior roles with Tomra during his 18 years with the rm, rstly in New York and then Sydney, where he was based for more than ve years, and also had responsibility for expanding the company’s interests across the Paci c region.

e Scottish Wholesale Association added: “While the UK Government’s late timing of this announcement is disrespectful to all the businesses which have been waiting for this con rmation, it’s now critical that the Scottish and UK governments work together, and with those a ected businesses, at pace to ensure that the Scottish scheme can go live smoothly next spring and the UK-wide schemes can work as seamlessly as possible in future.

“We know there has been considerable e ort and investment put into plans for glass to be included. It cannot be beyond the wit of both governments to nd ways in which that infrastructure and investment might be channelled to assist glass recovery outwith the DRS.”

Glasgow City Council has almost 900 illegal vapes from an unnamed East End store after its trading standards team received a consumer complaint. The council tweeted: “Tests will be carried out on the vapes – many of which had tanks exceeding the legal limit.” In March, the council backed the call for a ban on the sale of single-use vapes amid growing health and environmental concerns.

Dunfermline RVM planned Co-op has applied for planning permission for a reverse vending machine outside its store at Shamrock Street, Dunfermline. The move is in preparation for the deposit return scheme, which has been delayed until May 2024. If approved, the machine – which would be just under 2.5 metres in height and 1.4m wide – would be installed to the left of the store entrance. The store offers bakery, National Lottery, PayPoint, and parcel services.

Deliveroo delivers the news

Plans for two new Co-op stores in Sandwick and Scalloway, Shetland, have been scrapped.

Property developer Seamount had hoped the stores would open by early 2023, but a 50% increase in building costs and contractor availability meant it was “unable to proceed”.

The property developer said it would be happy to revisit the proposals if the situation changed.

Speaking to The National, the Co-op said it is committed to serving Shetland and shares the developer’s disappointment that works are unable to progress.

Deliveroo trialled the sale of weekend newspapers through Deliveroo HOP, its rapid grocery delivery service, over the coronation weekend. These included The Telegraph, The Guardian, Daily Mirror, Daily Mail, and Daily Express. The company said it newspaper delivery could become a regular feature on the Deliveroo app if the five-city trial proved to be a success.

A Keystore-branded convenience store in Alexandria, West Dunbartonshire, has been put on the market. The store, located at 156 Main Street, achieves weekly sales of around £14,500. The business, which is being marketed by Christie & Co, occupies one of the ground floor units in a two-storey building with parking at the rear of the store. It is available on a leasehold basis, with an asking price of £100,000, and annual rent of £12,800.

A store in Saltcoats has had a number of illegal tobacco products seized. Ayrshire police said that 64 packs of counterfeit cigarettes and six pouches of illicit tobacco were taken from the store. North Ayrshire Trading Standards and Police Scotland are continuing checks in the area after 18 pouches of illicit tobacco, 59 packets of counterfeit cigarettes, and 302 illegal vape products were seized from one Irvine store last week.

One in 10 younger adults has admitted stealing items at supermarket self-checkouts over the past year as food prices soared, according to a poll for money-saving app ZipZero. The survey found one in 25 adults said they have intentionally skipped or incorrectly scanned items at the checkout. In addition, 6% cent have borrowed money to handle rising grocery costs and 5% have started using food banks.

A Londis located near Glasgow Central Station is seeking to install an ATM on its shopfront. Londis Union Street, which is located at 60 Union Street, is hoping to install an ATM of “standard design” on the righthand side of the main entrance. The planning document says there is no CCTV, but the ATM would be installed in a well-lit open area, and the store plans to be open 24 hours a day.

Unitas has launched its first Plan for Profit Guide of 2023.

The Impulse Guide features advice and highlights must-stock products across confectionery, sweet snacking, crisps and soft drinks to help retailers maximise sales and profits. It has been developed in collaboration with suppliers and member category experts using data and insight from its network of wholesalers and industry sources.

National Lottery sales increased by £99.6m to £8.19bn in the year ended 31 March – the second-highest annual sales total since the Lottery’s launch.

Camelot said a strong performance from EuroMillions over the period helped propel drawbased games sales to £4.7bn – up £91.9m. In addition, Lotto continued to perform steadily despite seeing fewer sales-driving ‘Must Be Won’ draws over the period.

A series of huge EuroMillions rollover draws also helped to grow sales across the Instants category, which rose by £7.7m to £3.45bn – with players buying Instant Win Games as spontaneous add-on products to go with their EuroMillions tickets. Elsewhere within the category, Scratchcard sales dipped in a re ection of people’s changing shopping habits and the ongoing challenging retail environment.

Despite tough trading conditions, in-store sales recovered slightly over the past six months to reach £4.49bn for the full year, as people visited stores more frequently in search of best value.

As a result of this strong performance, returns to good causes from ticket sales alone hit an all-time high of £1.8bn in 2022/23, £6.2m higher than in the previous year.

Camelot Co-Chief Executives, Clare Swindell and Neil Brocklehurst, said: “It’s clear that e National Lottery is delivering for players and society in what are very challenging times.

“We have more exciting plans lined up for the year ahead to ensure that e National Lottery remains front of mind and brings people together at key national moments.” HOME

Snappy Shopper has teamed up with EPoS supplier, ShopMate, to integrate its system with Snappy Shopper retailers.

The company says the introduction of ShopMate – which is powered by Retail Data Partnership – will reduce time spent on administrative tasks, as purchases are directly updated to systems at the point of purchase, which will free up hours to deliver a better customer experience to drive repeat orders and store loyalty.

Forecourt operator Ascona has been granted permission to increase the size of the alcohol display area at its newly refurbished Re nery Service Station, in Grangemouth.

Ascona took over the site on Bo’ness Road in August and Falkirk Council’s licensing board transferred the licence from the previous owners, but changes have been made that required a non-minor variation.

One of the additions to the licence was including a hot and cold food takeaway – now a Greggs – and the biggest change was increasing the alcohol display area because of changes to the layout.

ere were no objections to any of the changes and they were granted as applied for.

ShopMate’s automated price, product and promotional data updates – which are sent both daily and at key period changes directly to Snappy Shopper retailers – will help them to best understand, operate and synchronise their in-store and online menus.

After a successful testing phase, the nationwide rollout of the partnership will begin in May 2023.

There has been an increase in experimental vaping among 11–17-year-olds, from 7.7% last year to 11.6% this year, according to a survey for Action on Smoking and Health. The data shows disposable vapes are the e-cig of choice for youngsters; last year 52% of respondents said they mostly used disposable vapes, and this has grown to 69% in 2023. Of young people who currently vape, 72% usually buy vapes themselves.

The asking price for a c-store in Muirkirk, East Ayrshire, has been dropped. The store, on Pagan’s Walk, was originally advertised for sale in March with a guide price of £30,000. This has now been reduced to £25,000. Being marketed by Prime Property Auctions (Scotland), Glasgow, the shop extends to approximately 750sq ft. It has a kitted-out storeroom downstairs and a fully plumbed sink and a toilet to the rear.

Food Standards Scotland has launched a new free online allergen training tool to support food businesses and give their staff a better understanding of food hypersensitivities. The tool is made up of five video sections: food allergies explained;, rules and regulations; providing allergen information; allergen management; and your responsibility as a food business.

Around 50,000 illegal cigarettes were found during raids at shops across Glasgow. A tobacco detection dog was used during searches at four businesses in Govanhill, visited as part of Operation CeCe Scotland, a joint initiative between Scottish Trading Standards Services and HMRC. Glasgow City Council said: “Boo is trained to sniff out tobacco that’s been purposefully hidden in locations which would not have been apparent during a routine inspection.”

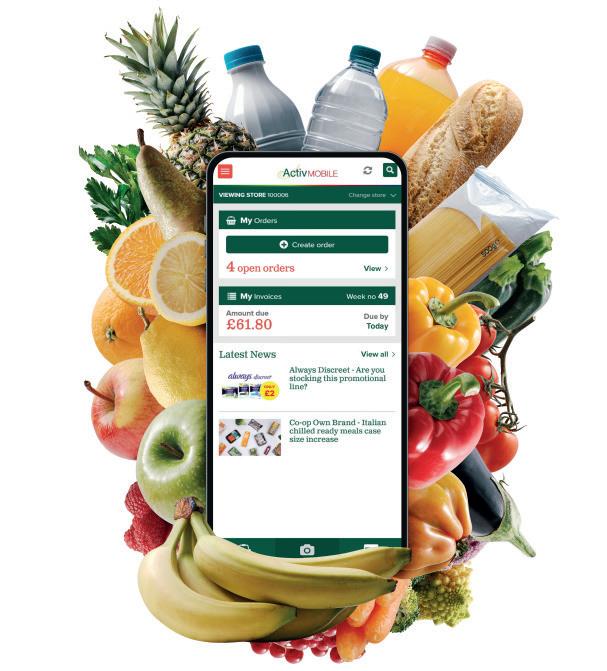

CJ Lang & Son is to customise its Spar Scotland SalesTrack platform, a tool that allows the business to report both its wholesale shipments and EPoS sales data in one platform, a er seeing traction with its suppliers and retailers.

By toggling between wholesale and retail metrics, suppliers can seamlessly track product performance through depots, into retail and out to the consumer. e data can be used to educate retailers on what is driving performance in their own stores.

e Spar Scotland SalesTrack platform has just undergone an upgrade, designed in close collaboration with the CJ Lang trading team, which has unlocked a series of new features to take performance and reporting to the next level by adding customised

functionality that is unique to Spar Scotland SalesTrack. is includes customised segmentations for their customers; time reporting for CJ Lang’s nancial year; and internal reports to monitor pro tability and drive category development. is is in addition to TWC planned upgrades, which includes new charting options for space and ranging analysis, a pivot function for large data extracts, and new reports in retail and wholesale.

Richard Collins, Trading Director at CJ Lang & Son, said: “We are delighted with the new features on Spar Scotland SalesTrack from TWC. It gives our suppliers and retailers more ways to accurately understand what’s working and what isn’t in our stores.

“We demonstrated the developments to over 300 suppliers at our recent Supplier Brie ng sessions a couple of weeks ago and the feedback was extremely positive.”

Tanya Pepin, Managing Director at TWC, added: “As a business we are committed to a development roadmap for our technology to ensure that it continues to evolve with our clients’ requirements.”

SYMBOL GROUPS Nisa has already recruited 130 stores this year to date

GroceryAid has launched a new awareness campaign to highlight the range of services that it has available to colleagues who may be in need of support.

The new ‘Always Open’ campaign aims to remind retailers and workers that GroceryAid is always open, providing free and confidential emotional, practical and financial support.

GroceryAid has developed a range of printed materials, including posters, leaflets, stickers and wallet cards that employers can order and distribute internally.

The charity has also created a set of digital materials, including social media assets and digital banners, that can be downloaded directly from its website.

Nisa is aiming to open a further 400 stores this year as part of an ambitious recruitment drive.

e symbol group opened 473 new stores last year and says it has seen a strong start to 2023, with 130 stores having been recruited year to date. Over the past two years, Nisa has recruited almost 900 stores. Recruitment of wholesale partners, including Greens Retail and MPK, has almost doubled in the same period year-on-year.

e recruitment drive is being supported by investments in price and a simpli ed version of Nisa’s Fresh Rewards rebate scheme.

Peter Batt, Managing Director at Nisa, said: “ e sustained

growth in recruitment is not only down to the brilliant team at Nisa, who have gone from strength to strength, but also to the strength of Nisa’s proposition for independent retailers.

“At Nisa we’re committed in ensuring our retailers are at the heart of the decisions we make,

and we’ll continue to invest in our o er.”

Victoria Lockie, Head of Retail at Nisa, added: “We strive to be the best we can be for all our partners and we look forward to welcoming everyone joining the Nisa family.”

e symbol group currently supplies 2,480 stores.

Spice and herb sales are booming in the UK, but what does that have to do with convenience retail you may ask?

The answer is one that could be crucial for our sector. The steep rise in food prices, especially for core staple items, and the ongoing costof-living crisis mean that more people than ever are keeping a tight grip on shopping budgets. The boom in spice and herbs sales is a sign that many more people are looking for adventurous, cost-effective recipes that they can try at home.

This is a great opportunity for retailers to promote Scotland’s world-class local produce and to help customers looking for a healthier at-home option. Supporting local economies, our wonderful local producers and struggling households.

SGF is proud to work with the Scottish Government to deliver both our Healthy Living Programme and our Go Local Programme.

The Healthy Living Programme works closely with retailers to promote healthier options throughout the store and increase the range, availability, quality and affordability of fresh produce and healthier products. This works in tandem with our ‘Go Local’ grant fund, which is open now, promoting the very best of Scottish produce across convenience stores, in communities all over the country.

The way people shop and the products on the shelf are always changing. Convenience stores are at the very heart of their communities and best placed to meet the changing needs of their customers.

The removal of thresholds will increase eligibility for Best Start Foods to around an additional 20,000 people from February 2024.

e Scottish government has revealed that income thresholds are to be removed from its Best Start Foods bene t, which provides help to pregnant women and families with children aged up to three years old, so they can buy healthy food, milk or baby formula.

e bene t is currently paid to people who receive qualifying bene ts, so long as their incomes are not above set thresholds. e Scottish government will introduce regulations that remove those thresholds increasing eligibility for Best Start Foods to around an additional 20,000 people from February 2024.

Social Justice Secretary Shirley-Anne Somerville said: “Rising food prices disproportionately hurt those on the lowest incomes, so removing the threshold for qualifying bene ts means around 20,000 people will now get vital help to buy healthy foods.

“Best Start Foods is one of our ve family payments, including the Scottish Child Payment, which together could be worth more than £10,000 by the time a rst child turns six and more than £20,000 by the time an eligible child is 16.”

Best Start Foods is delivered via a prepaid card and provides £19.80 every four weeks throughout pregnancy, £39.60 every four weeks from birth until a child turns one, then £19.80 every four weeks until a child turns three.

e bene t is to be promoted at more than 2,200 local convenience stores under a new partnership with the Scottish Grocers Federation Healthy Living Programme. e initiative will raise awareness of the payment and encourage the 40,000 holders of the prepaid card to use it at their local shop.

Retailers will display information around their store to let customers know they accept the prepaid card as a method of payment. e Scottish Grocers Federation’s Healthy Living Programme will also train

and encourage sta in shops to get their customers used to paying with Best Start Foods cards.

Among the chains involved in the new scheme are Spar, Keystore, Nisa, and Premier. e network of small shops promoting Best Start Foods spans the whole of Scotland, from the Shetland Isles in the north to the Scottish Borders in the south and from Harris, Stornoway in the west to Peterhead in the east.

Social Security Scotland Chief Executive David Wallace, who launched the scheme, commented: “Local convenience shops can sometimes be the lifeblood of their communities. is initiative means owners and sta can o er support to their customers, ensuring they use all of the nancial support available to them.

“I would encourage anyone who has a Best Start Foods card to check their balance and to make sure they are using it regularly.

“As well as the smaller local stores the card can be used in most big supermarkets and online.”

Kathryn Neil, Programme Director of the Scottish Grocers’ Federation’s Healthy Living Programme, added: “ is positive partnership presents the opportunity for Healthy Living Partnership to join up with other Scottish Government policies.

“Healthy Living Partnership’s relationships with the convenience and wholesale sector allows us to deliver the information to consumers in the most deprived areas of Scotland and reaching those who are eligible.”

Chris Watson, owner of Keystore in Ness Avenue, Johnstone, said: “I’ve been in convenience retail for over 30 years and times are really hard for my customers.

“If I can highlight the Best Start scheme and customers can bene t from it, it can only be a good thing.”

So, it looks like the Scottish retailing community will finally get what it was hoping for all along: a DRS that’s aligned with the UK and doesn’t include glass. As always with DRS, however, it’s not quite that simple and we’re certainly not out of the woods yet.

The tale of DRS has had more twists and turns than the recent Monaco Grand Prix and there will undoubtedly be a few more before we finally reach the chequered flag. But the UK Government’s confirmation that it would grant a “temporary and limited” exemption from the Internal Market Act means we may be edging towards some sort of clarity, arguably for the first time since we first learned what the letters ‘D-R-S’ stood for all those years ago.

The exemption is “temporary” because it only extends from the launch in Scotland in March 2024 (if it goes ahead) until other planned schemes are in place in the rest of the UK, and it’s “limited” because it doesn’t allow for the inclusion of glass.

For all the vacillations and proclamations and remonstrations and aggravations of Lorna Slater and Co over the last few years, all it took was one brief Saturday morning in Westminster to bring things to a head and what looks like the bones of a conclusion.

First Minister Humza Yousaf quickly took the opportunity to denounce the UK Government’s glass decision as a “democratic outrage” – all perceived interference from London being automatically considered a democratic outrage by the SNP – but I wouldn’t be surprised if he was secretly pleased at the removal of glass. It squares neatly with his business-friendly approach – and there were lots of businesses who wanted glass out – while simultaneously allowing him to howl at the injustice of Westminster “trying to undermine devolution”. A win-win for him, if you like.

Meanwhile Lorna Slater said she would have to look very seriously at the viability of a Scottish DRS without glass and Yousaf has said he doesn’t want to proceed with a glassless scheme after millions were spent on preparing it… but he will look at his options.

As my grandfather used to tell me as a boy: there’s a hard way and an easy way to do everything. It looks to me very much like the Scottish Government has chosen the very, very hard way to find itself back where it was always likely to end up: a UK-aligned scheme without glass.

EDITORIAL

Publishing Director & Editor Antony Begley abegley@55north.com

Deputy Editor Liz Wells lwells@55north.com

Features Editor Gaelle Walker gwalker@55north.com

Features Writer Elena Dimama edimama@55north.com

Web Editor Findlay Stein fstein@55north.com

ADVERTISING

Sales & Marketing Director Helen Lyons 07575 959 915 | hlyons@55north.com

Advertising Manager Garry Cole 07846 872 738 | gcole@55north.com

DESIGN

Design & Digital Manager Richard Chaudhry rchaudhry@55north.com

EVENTS & OPERATIONS

Events & Circulation Manager Cara Begley cbegley@55north.com

Scottish Local Retailer is distributed free to qualifying readers. For a registration card, call 0141 222 5381. Other readers can obtain copies by annual subscription at £50 (UK), £62 (Europe airmail), £99 (Worldwide airmail).

55 North Ltd, Waterloo Chambers, 19 Waterloo Street, Glasgow, G2 6AY Tel: 0141 22 22 100 Fax: 0141 22 22 177 Website: www.55north.com Twitter: www.twitter.com/slrmag

DISCLAIMER

The publisher cannot accept responsibility for any unsolicited material lost or damaged in the post. All text and layout is the copyright of 55 North Ltd.

Nothing in this magazine may be reproduced in whole or part without the written permission of the publisher.

All copyrights are recognised and used specifically for the purpose of criticism and review. Although the magazine has endevoured to ensure all information is correct at time of print, prices and availability may change.

ANTONY BEGLEY, PUBLISHING DIRECTOR

This magazine is fully independent and not affiliated in any way with the companies mentioned herein.

Scottish Local Retailer is produced monthly by 55 North Ltd.

The UK’s leading symbol group and SLR’s reigning Symbol Group of the Year recently opened its 500th store in Scotland after a period of rapid growth.

BY ANTONY BEGLEYPremier, the biggest symbol group in the UK with over 4,000 stores, has recently celebrated another milestone achievement by opening its 500th store in Scotland.

e achievement follows a period of remarkable growth for the Booker-owned group which has seen Premier add around 150 stores in the last two-and-a-half years, cementing its position in Scotland.

e last few years have been marked by extreme ux in the symbol group arena in Scotland but SLR’s reigning Symbol Group of the Year has used that time wisely, attracting a huge in ux of independent retailers tempted by the relatively simple, no-nonsense manner of Premier and its enduringly successful modular approach to helping retailers build busy, pro table stores.

e 500th store is Ali’s Convenience Store in Tranent on the outskirts of Edinburgh, a store with all the hallmarks of Premier’s tried-andtested modular approach that allows retailers to pick and choose from a range of solutions that focus on high margin, high volume, minimum intervention products and services.

Run by husband-and-wife team Zul qar and Anila Ali, the 1,400sq store took many learnings from agship Premier stores down south like Mandeep Singh’s Premier store in She eld and, more recently, Premier Talbot Village in Bournemouth.

In essence, Premier o ers a bank of proven solutions to retailers who can then pick and choose according to the needs of their own customer base, tting as many high margin, high volume solutions into their stores as possible –although Premier does encourage to retailers to retain a spacious, approachable layout, something that is very much in evidence in the Tranent store a er a £210,000 re t.

Among the ‘modules’ to be found in Ali’s is

the must-have Refresh@Premier Bar featuring Tango Ice Blast and Coca-Cola Frozen slush machines as well as a two-station milkshake unit and a Costa Co ee machine.

Premier’s Refresh Bar is a feature of most re ts in Premier stores these days and it’s not di cult to see why. In Ali’s the Zone is already taking £3,500 a week only 10 weeks or so a er reopening and margins are typically around 65%.

Equally importantly, as Booker Sales Director for Retail Martyn Parkinson pointed out during the visit: “ e Refresh Bar requires no input from sta , which helps keep costs down. e machines cost only around £10 a day to run and customers serve themselves, which is a feature of many of the solutions we o er to our Premier retailers.”

Similarly, the Tranent store features a showstopping 400sq beer cave that was added during the re t by repurposing part of an old storeroom. e cave o ers a real point of di erence over local competitors as well as over supermarkets.

As well as having a vast array of chilled beers, wines, ciders and RTDs – over 50 new lines were added – the cave o ers a vast selection of multipacks, something the major multiples can’t do, which goes a long way to making the store a true destination store in the local area, particularly around major sporting events and when the sun comes out.

O ering a point of di erence isn’t the only bene t of a beer cave though. “We haven’t got enough data on this particular store yet,” says Parkinson, “but typically we expect to see an electricity cost saving of around 50% when compared with traditional chillers. We do know, however, that the total energy bill for the store has fallen by £100 in the rst month, so that’s a great indication.

“Additionally, part of the point of the beer cave is to minimise what’s stocked in in the

backshop and get it all out front. Touching stock is expensive, as we all know, so every time we reduce the amount of times it needs to be moved by sta we reduce cost for the business.”

In a similar vein, the store features 500 digital shelf edge labels which greatly reduces the time required to manually switch labels around, particularly during promotional period changes. “Even with 500 labels, we reckon that the store is saving about seven and a half hours of sta time a week,” comments Parkinson.

On the tech front, the store has also abandoned printed promotional lea ets in favour of scannable QR codes that customers can use to access deals.

Another key focus in the modern Premier blueprint is fresh and chilled, and the Tranent store toes this line too. e chilled section was expanded from two meters to seven and the range was increased from around 70 lines to more than 320.

“Fresh and chilled is critical these days but we are very aware of retailers’ concerns around waste, so we’ve worked very hard to massively increase the number of longer-life fresh and

chilled products we are able to o er our retailers,” says Parkinson. “Over 80% of the lines in our fresh and chilled range now have at least 20 days’ life.”

Anila Ali doesn’t mind admitting that the huge expansion of the fresh and chilled section was her biggest concern during the re t: “Before the re t we didn’t do much and we were not known for it, so I was a little nervous at how big the section became but when I see it now, it just makes me so happy and proud! We’re not quite there yet on it as we still have some work to do to make sure all our customers know it’s here now but Premier made it clear that it would be the section that would take the longest to really ourish – but I’m positive we’ll get there, and it totally transforms the look and feel of the shop.”

Also added during the re t was a new foodto-go cabinet which features a range of pastries, cakes and treats. As none of the food is prepared in the store, the so-called ‘Natasha’s Law’ does not apply, minimising e ort and labour costs. “ e food-to-go unit requires no extra sta ,” explains Parkinson. “Anyone behind the till can just stick on a pair of blue gloves and serve the customer in seconds.”

With value as critical as ever, the store stocks an extensive range of Jack’s and Euro Shopper ownlabel lines as well as Premier’s well-known ‘Mega Deals’ that help drive sales and communicate value.

On top of all of that, the store has stepped up its home delivery game post-re t, growing by about 30% already, and now turns over in excess of £6,000 a week using Snappy Shopper.

Anila and Zul qar have had the store for over

17 years, 16 of those with Premier, but Anila says the re t has been the most transformative development for the business that they’ve ever undertook.

“We had to close the store for about four weeks for the re t,” says Anila, “but we couldn’t leave the local community without a shop, so we continued to trade from a shipping container out the front!

“It wasn’t ideal, and I certainly wouldn’t want to do it again, but it kept our customers served and it helped maintain loyalty, as well as keeping some money coming in. We actually retained about 75% of our business, which we were very happy with.”

When it came to the re t, Anila says she and her husband pretty much gave Premier a free hand: “We had some ideas but we trust Premier and they know what they’re doing so we just went with almost everything they suggested. In just 10 weeks sales are up 50% so it looks like everything they suggested is working, so we’re absolutely over the moon. e store is unrecognisable and it’s just what our fantastic customers deserve!”

To coincide with the reopening, the store took advantage of Premier’s new social media support service. is does all the heavy li ing to make it quick and pain free for retailers to ensure that all key promotions are posted onto Facebook, which is still the key social media platform for Premier customers, according to Parkinson. e support service helped the store quickly grow its following from 200 to over 1,200 in just a matter of weeks which directly helped grow footfall, sales and pro ts.

“We’re seeing around 1,000 more customers coming to the store every week now,” says Anila.

As for Premier itself, Parkinson is delighted that so many retailers are willing to invest in their stores.

“ e really encouraging thing for us is that retailers are seeing what we are doing with the

Premier model, they’re seeing other Premier stores reap the bene ts and they’re willing to invest in refurbishing their own stores to a very high standard,” he says. “ e Tranent store saw £210,000 invested and none of that was on building work – that was all re t and that’s a considerable investment.

“We know how tough it is out there at the moment and that’s why we’re working so hard to get our Premier retailers’ margins up to 30%. Stores that follow the blueprint typically see margins increase by 6% or 7%. It’s all about creating a great in-store environment and working smart in key categories, keeping cost down and maximising PORs.

We believe that if you follow our blueprint, you will get margins to 30% and you can expect full payback on your investment within 12 months.”

To mark the 500th Scottish store milestone, Premier will plant500 trees in Scotland as part of its ongoing sustainability plan and will also be o ering the chance to win £10,000 towards a new Refresh@ Premier Bar to retailers who join Premier in the next six months.

“It’s an exciting time in Scotland for Premier,” concludes Parkinson. “We have a long and very successful history in Scotland and I’m looking forward to welcoming more Scottish stores to Premier in the future.

Premier Foods has launched an on-pack promotion with Cadbury Cakes to give shoppers in the UK and Ireland the chance to win instant cash. Running until 25 August, ‘Find the Golden Token, Win Cash’ features across Cadbury Mini Rolls and Cake Bars. Over 1,000 golden tokens have been placed inside promotional packs and lucky shoppers who find one can go online to claim a cash prize of either £1,000, £100 or £10.

KP Snacks has launched a new on-pack promotion to fund new community cricket pitches as part of its partnership with The Hundred tournament. The promotion is part of KP Snacks’ initiative to give back to local communities and get people active. Each pack purchased will help fund 35 permanent community cricket pitches. In addition, the promo gives shoppers the chance to win one of over one hundred £100 cash prizes from now until November, by entering a prize draw.

Frubes has launched its biggestever marketing campaign, encouraging consumers to try freezing the children’s yogurt. The six-figure campaign includes media, summer sampling, influencer and social media activities. Three Frubes limitededition Try Me Frozen packs have also been launched to clearly communicate the freezing opportunity.

Unilever’s deodorant brand Sure has launched its 72hr Nonstop Protection technology into Roll

On formats and has added two new scents to its existing female and male 72hr aerosol range –Sure Nonstop Freesia & Waterlily and Sure Men Nonstop Sensitive.

A £5m marketing campaign supports the launches, with a marketing campaign running from May to September across both male and female portfolios.

Lucozade Energy has teamed-up with Bethesda So works and Xbox to give shoppers the chance to win Xbox prizes every day.

Ahead of the launch of Bethesda’s much anticipated Star eld video game, the promotion lets consumers enter an extended reality experience where they can discover Star eld in-game content and take part in challenges to win additional exclusive Xbox prizes.

Shoppers just need to scan special edition packs to ‘Unlock Your Universe’.

e partnership runs across Lucozade Energy Orange, Lucozade Energy Original, and Lucozade Zero Pink Lemonade avours. It is supported by in-store point of sale material, and outof-home and paid social advertising.

supported by in-store point of sale material, and out-

Robinsons ready to drink is once again giving consumers the chance to win a pair of tickets to The Hundred cricket competition via a QR code on-pack, as well as a £20 voucher to spend on food and drink on the day.

A total of 112 pairs of tickets are up for grabs over the duration of the tournament, which runs from 1 to 27 August.

This is the second year of a three-year deal as the brand’s official soft drinks partner for The Hundred. It will support the partnership through POS, digital and in-store activations, as well as in-ground advertising during the tournament.

The Robinsons ready to drink range is available in Blackberry & Blueberry, Raspberry & Apple, and Peach & Mango flavours in 500ml packs price-marked at £1.09.

Prizes include a one-month an

Prizes include a one-month Xbox Game Pass Ultimate subscription, and an Xbox Series S can be won every day. Additionally, participants will be entered into a draw to win prizes including Star eld merchandise bundles.

e promotion follows last year’s successful partnership between Lucozade Energy, Xbox and Halo In nite.

CCEP’s Capri-Sun brand is once again partnering with Merlin Entertainments for an on-pack promotion – this time, for the World of Jumanji at Chessington World of Adventures Resort.

e promotion gives a free adult or child entry to Chessington World of Adventures Resort with a full ‘On e Day’-priced adult ticket. e resort is home to a theme park, zoo, aquarium and more – and the world’s rst World of Jumanji, which is new for 2023.

Running until the end of this June, QR codes on ve million promotional packs of Capri-Sun can be used to secure a voucher for buy-one-getone-free entry, valid until 30 June 2024.

e promotion is designed to reward young families with a fun day out this summer, while boosting sales of the £60m kids’ juice drinks brand.

It is supported by out-of-home, social media and in-store activities.

Promotional packs include 4x200ml multipacks of Capri-Sun Orange, No Added Sugar Orange, and No Added Sugar Apple & Blackcurrant, and 8x200ml multipacks of CapriSun Orange, Tropical, Blackcurrant, Jungle, No Added Sugar

Orange and No

Added Sugar Apple & Blackcurrant.

Mondelez has again joined forces with Merlin Entertainments for the return of its familyfavourite summer promotion. Running across a variety of Cadbury products, this year’s onpack promotion offers up to 50% off ticket prices to a variety of Merlin attractions. The promotion runs until September and is bolstered by digital, radio and social media activities, as well as in-store support and point of sale materials.

Comfort has reformulated its Concentrated Fabric Conditioner Core and Creations ranges, promising shoppers 100 days of freshness and fragrance, and unveiled a redesigned bottle that offers greater standout and has a new optimised shape so more units can be stocked on-shelf. The relaunch is supported by a £12m campaign that puts an increased focus on inclusivity, with audio descriptions featuring in TV adverts.

Müller has unveiled ‘Make Pots of Profit,’ a new category initiative created specifically for convenience stores to offer help and advice to improve the effectiveness of their Chilled Yogurts and Potted Desserts category. The guidance includes a selection of planograms for retailers to use according to their store size. These are available from the makepotsofprofit.co.uk dedicated microsite.

Frozen potato manufacturer

McCain Foods has partnered with Community Shop to open a new social supermarket store in Eastfield, North Yorkshire – the home of McCain GB since 1969. The store sells surplus products that are perfectly good to eat or use and have been donated by major retailers, brands and manufacturers. The surplus products may have otherwise gone to waste.

Natalie Lightfoot of Londis Solo in Baillieston stars in the campaign, alongside English retailers Amrit Singh and Jack Matthews.

e trio have also been sharing their advice on how to get the most out of the energy drinks through a Q&A hosted on the SalesSupercharged.co.uk platform, which can be viewed at vimeo. com/822067505.

Monster Energy has brought back its SalesSupercharged.co.uk convenience retailer support initiative for a third year, in a bid to help retailers make the most of the energy drinks sales opportunity – and also provide chances to win some prizes.

e online platform and trade communications campaign will continue to provide the low-down

on the latest trends and details on key segments within energy drinks, alongside tips and advice around ranging and execution in-store.

e 2023 SalesSupercharged. co.uk campaign features three successful convenience retailers, all of whom have taken advantage of the resources on the platform and recognise the sales opportunity energy drinks present.

Imperial has added four new flavours to its range of blu bar disposable vapes.

With Blueberry now the top-selling disposable vape flavour and Berry growing rapidly by 60% month-onmonth, Imperial has responded to this consumer demand by launching Blueberry Ice, Blueberry Sour Razz, Berry Mix and Grape Ice flavours.

They join existing blu bar variants – Kiwi Passionfruit, Mango Ice, Banana Ice, Peach Ice, Watermelon Ice and Strawberry Ice – to bring the total range up to 10 flavours.

All are available at an RSP of £5.99 per device. Each blu bar contains 20mg/ml of nicotine in 2ml of e-liquid providing up to 600 puffs and features an LED indicator that lights up when in use, along with a compact pocket design.

Tom Gully, Imperial Tobacco’s Head of Consumer Marketing UK&I said: “We’d recommend that retailers stock up on these new tasty additions now to tap into the seasonal sales on offer this summer.”

Natalie commented: “Monster has always been such an important brand for our business, so to have the opportunity to show and educate other retailers on the importance of a well-maintained energy category was a no-brainer.”

e campaign also gives retailers the chance to win two Grandstand tickets to the 2023 MotoGP British Grand Prix at Silverstone on 6 August with £500 towards travel, accommodation and food & drink costs for the day. Retailers should enter the free prize draw before it closes on 30 June. Winners will be noti ed by 6 July.

Soft drinks brand Rio has added a new 1.5-ltr pack of its Tropical Fruit flavour to its range, as demand grows for take-home formats.

According to new research, 40% of fruit carbonated shoppers buy a 1.5-ltr or 2-ltr drink once a week or more, showing that consumers are opting for drinks in formats that can easily be shared among family and friends.

Portobello-based sour beer producer Vault City Brewing has launched an imperial stout based on the deep-fried Mars Bar. DDF M*RS BAR (Double Deep Fried M*rs Bar) is is “packed to the brim” with chocolate malt and cacao nibs. Real battered Mars Bars were apparently also used during the production process to guarantee an authentic deepfried flavour for the 15.5% ABV brew. Contact sales@vaultcity. co.uk for stock enquiries.

Socially responsible beer brand

Brewgooder has collaborated with Brooklyn Brewery to create the UK’s first beer made using West African ‘super-grain’ fonio. Fonio has strong sustainability credentials due to its drought resistance and ability to grow in nutrient-poor soil. Fonio Session

IPA is at 4.3% ABV with a light finish and is available exclusively for purchase as a 4-pack from Co-op stores for £6.

Absolut has launched two new cocktails in cans, Espresso Martini and Strawberry Spritz. They join the brand’s existing Passionfruit Martini RTD to create a three-strong range of ‘Absolut Cocktails’. All are ABV 5% and come in 250ml cans (Espresso Martini 200ml) with a £2.50 RSP. They are available from wholesalers including Bestway. The launch will be supported by sampling activity.

The Scotch Whisky Association has launched a new campaign to tackle harmful drinking.

‘Made to be Measured’ aims to raise awareness of the alcohol content of drinks in units and the recommended weekly guidelines. The campaign runs across digital and consumer platforms and helps convey and clarify the units within Scotch and other alcoholic drinks.

Pernod Ricard’s rum brand Havana Club is back with a campaign called ‘Cuban Mode’.

e new multi-million-pound campaign celebrates the Cuban mindset and Cuba’s vibrant collective energy – described as La Cubanía. It includes digital, social and online video media, and outof-home marketing in grocery and impulse, as well as pubs and bars. A range of POS materials is also available.

Centred around the brand’s rum portfolio, Cuban Mode seeks to capture the very essence of Cuba by combining iconic landmarks with vibrant party scenes.

Josh McCarthy, Brand Director at Pernod Ricard UK, commented: “Havana Club is THE iconic Cuban

LIQUEURS

rum and Cuban Mode is here to reveal La Cubanía to the world and spread its energy with and through our community. La Cubanía is the essence and lifestyle born in the streets of Havana, but it is meant to be felt by everyone everywhere.

“Over the last few years, we’ve built a solid position as a street culture icon amongst Generation Z, and we’re con dent this campaign will further accelerate brand growth and welcome new audiences to the brand.”

Malibu has added Strawberry flavour to its core range, which launches alongside a new Strawberry Daiquiri ready-to-drink (RTD) can.

Made with white rum and bursting with strawberry flavour, new Malibu Strawberry offers a refreshing taste and is a sweet switch from the brand’s signature coconut taste. It comes in a 70cl bottle (ABV 21%) and has an RSP of £17.19.

Erdinger Alkoholfrei has launched an off-trade promotion to support its ‘Your Ritual After Sport’ campaign.

Promotional neck collars give consumers the chance to win a selection of sporting equipment including Ribble Gravel bikes, Garmin watches and sport sunglasses.

It

The new sparkling Malibu Strawberry Daiquiri sees white rum mixed with strawberry and lime for a convenient on-the-go serve. It is available in 250ml cans (ABV 5%) with a £2.40 RSP. Both are available now from Booker.

Liam Murphy, Brand Director at Pernod Ricard UK, commented: “Strawberry spirit variants overindex with young adult shoppers and remains in high demand in the on-trade, and the launch of Malibu Strawberry will allow us to continue the flavour momentum.”

Rolling out at the end of June, the neck collars feature on 500ml bottles of Erdinger Alkoholfrei and have a QR code that shoppers can scan to see if they’ve bagged a prize.

Peter Gowans, Erdinger UK Country Manager, commented: “Erdinger Alkoholfrei’s isotonic properties help to replace lost fluids quickly and it also contains valuable nutrients including the essential vitamins B9 and B12, which help reduce tiredness and contribute to the normal function of the immune system.”

Retailers should visit carlsbergmarstons. co.uk for stock enquiries.

Treasury Wine Estate’s (TWE) premium wine brand, Wolf Blass has launched a range of no-alcohol wines – Wolf Blass Zero.

The range consists of Shiraz, Sauvignon Blanc, Sparkling and Rosé. All three are ABV 0.5% and RSP at £5.50.

The launch is supported with an integrated marketing campaign that includes trade press, social media and instore activities.

Pirates

e TV spot, along with supporting marketing activities, will focus on the 150-year history of the Prague beer, marking the next phase of Staropramen’s award-winning ‘Brewed by Experts, for Experts’ campaign.

e new ad is set in Prague and features Bloom explaining his links to the city, having lived and worked there for a number of years, and how its beer culture emerged.

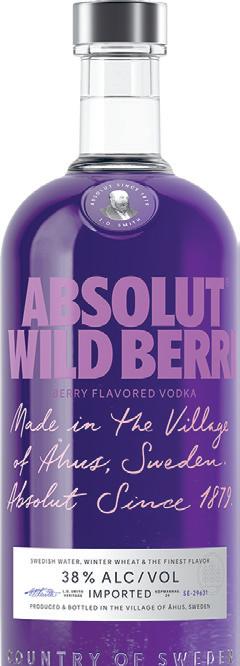

VODKA Launch forms part of the brand’s Born To Mix campaign

Premium vodka brand Absolut has added to its avour portfolio with the launch of Absolut Wild Berri. Available now from Booker with an RSP of £21, the 38% ABV vodka is made using only natural avours and no added sugar. It o ers a natural taste of freshly picked blueberries, blackberries and wild strawberries combined with hints of spice.

e launch is supported by paid social and in uencer activity, and forms part of the brand’s Born To Mix avours and cocktails media campaign that is running throughout May and June.

Liam Murphy, Brand Director at Pernod Ricard UK, commented: “Absolut Wild Berri is an exciting new example of how the brand continues to embody and drive forward its values of being Born To Mix and o ering consumers exceptional cocktails.

“ e launch brings with it new ways and occasions to enjoy the iconic avour of Absolut, whether that’s with a wide range of mixers or in a cocktail, and we’ve used our expertise and passion to create a premium vodka that allows its natural berry avours to shine through.”

Ben Blake, Head of Marketing EMEA at TWE, said: “We recognise there is sizeable and growing demand for no and low products in the UK, and consumers are leaning towards big brands within this space for reassurance on taste. With the launch of the exceptional Wolf Blass Zero range into the UK, we aim to use the quality credentials of our award-winning wines to recruit more consumers into the category.”

Global Brands, owner of the Hooch and VK brands, has announced record trading for its financial year ending 30 September 2022. The company reported a 26.6% growth in turnover, rising to £84.4m, versus sales of £66.6m the year before. An operating profit of £6.9m was up from £6.1m in 2020/21. The Derbyshire-based business is now the biggest supplier of branded canned cocktails to the UK off-trade.

Greene King, brewer of Old Speckled Hen and the Belhaven range of beers, has raised £1m for Macmillan Cancer Support’s Emergency Grants Appeal, fulfilling a pledge it made at the start of 2023. The funds raised could help almost 3,000 families with a financial grant. The money will help people living with cancer manage unexpected or additional costs related to their diagnosis during the cost-ofliving crisis.

Guinness brand owner Diageo has opened a Guinness time capsule sealed in 1953 to mark the Coronation of Queen Elizabeth II. Diageo GB boss Nuno Teles had the honour of opening the capsule. It contained a half-pint bottle of Coronation Commemorative Guinness Foreign Extra Stout and a selection of Sovereign coins, as well as a copy of The Daily Express from 3 June 1953.

Brooklyn Brewery has launched new festival-friendly 440ml cans of Brooklyn Pilsner to the off-trade, to coincide with the beer’s naming as Official Beer of Glastonbury Festival. The tie-in sits alongside a multimillion-pound national marketing campaign that includes on- and off-trade POS; video on demand; partnerships; out-of-home and digital advertising; and social, PR and experiential activities.

One O One Convenience Stores has been a generous and enthusiastic supporter of GroceryAid Scotland for many years. We catch up with Head of Operations Jim Harper to find out why the business is so passionate about helping industry colleagues.

One O One Convenience Stores has been a supporter of GroceryAid for four years, building up a partnership with the industry charity during that time through fundraising, engagement, sponsorship, and direct annual contributions.

At the outset, many of our colleagues and indeed wider business had little awareness of GroceryAid and it took time to communicate the range of services that were on o er.

Once our colleagues gained improved understanding of the charity, they realised they could access nancial grants, emotional support, practical advice and many other services, accessing this through the free and con dential helpline or GroceryAid website.

Our teams found the support invaluable during these past few years we have all experienced.

Paul Stirling, Group Retail Director of One O One, is an avid supporter of the charity and passionate about raising awareness of the services available to all our teams throughout the company. He said: “ e services o ered from the charity have real bene t to our employees. As the world recovers from the pandemic, and our teams and wider public deal with the current cost-of-living crisis, there is no better support than GroceryAid to help all in the retail industry.”

Paul encourages all our support teams to always carry information about GroceryAid’s welfare services with them to allow our teams to get immediate support when it is needed. Lyndsey, our HR Manager, sends newsletters out every month, containing information about

the charity’s services, and stores have printed materials in sta areas so employees can learn what GroceryAid does and get easy access to contact details. At One O One we are proud to be a Gold Partner with GroceryAid and we would encourage all retailers, wholesalers, producers and service providers to the retail food industry to join us and support their teams.

When Checkout Scotland came around last year, sponsorship was a win-win. At One O One, we wanted to support GroceryAid with its rst event as a thank you for the support they have given to our teams. Also, sponsorship helps develop industry awareness of our brand and we were proud to sit alongside the major multinational companies that also sponsored the event.

For me, it was amazing to network with so many colleagues from the di erent parts of the industry. e event was something special that people, once they had been the rst time, would think “we need to bring our colleagues along to this next year”. e event is the only one of its kind within the grocery industry, which has made it quite unique.

ere were many fabulous DJs playing on the day and we were very lucky that the weather was great.

We also brought along many of our central and store teams, as the sponsorship package

contained tickets too. at was a great way to reward and recognise individuals.

Simply put: to raise awareness of the charity whilst attending the biggest Scottish industry music event on the Scottish retail calendar. One

O One hopes to be part of the event for many years to come.

Firstly, I think bringing more colleagues along!

We had about 30 colleagues there last year and I’m looking forward to seeing the faces of those that might be surprised about how good an event it is. I am also really looking forward to seeing this year’s new outside activation area.

e venue itself is special, so seeing over 1,000 colleagues at the event, enjoying amazing, entertainment, DJs, acts and new sponsored activation will be great. I am so looking forward to it all!

e Scottish convenience and grocery marketplace is made up of so many businesses and Checkout Scotland is for everyone in the industry, small or large. We’ve talked a lot about awareness for the One O One brand, but it’s also about raising awareness of Grocery Aid’s services too and fundraising for the charity at the same time. Many of those businesses’ employees could bene t from GroceryAid’s free emotional, practical, and nancial support.

Sponsors will also get the chance to speak to everyone within the industry on the day in a relaxed environment, which is a unique opportunity.

Lastly, I think it’s really important to get across how it’s helped our business. One O One is a big supporter of GroceryAid and we stand very proudly on the Gold Award winners list amongst some of the biggest FMCG players in the UK. Even if a business buys a few tickets for the event, it’s worthwhile to come along and gain an understanding of what the charity is and what it can do for you. Send a couple of your colleagues along and let them come back and tell you how amazing the charity is.

If you’re not involved, you’ve got to ask yourself the question ‘why not?’

I can’t wait for Checkout 2 on 31 August 2023.

Henderson Technology realises that retail is a rapidly changing business and recognises the impact of innovative technology. The company provides forward-thinking solutions for convenience stores and forecourt retailers, enabling their businesses to maintain their competitive edge and ultimately boost profitability.

EDGEPoS covers the three main areas of running a retail business –operational efficiency, security and business development.

With continuous development and innovative integrations and partnerships, EDGEPoS is now one of the most powerful and featurerich systems in the UK.

There are a number of different products available. From Retail, Head Office, Self-Checkouts to ESELs, EDGEPoS has everything a forward-thinking business needs.

One retailer who has installed the EDGEPoS system onsite is Manpreet Bawa from Burnpark Service Station in Kilmarnock Manpreet, who fronts Bawa Group, has a wealth of experience in using EPOS systems and made the decision to install EDGEPoS into his Gulf and Premier branded store, with the EDGEPoS Go Live, in May last year.

He said: “We are delighted with the functionality of EDGEPoS. It allows us to be able to refund a fuel transaction instantly right back onto the existing pump it came from. A simple refund function and it appears back on the till.

“Over the years we found it really hard to find a system which can easily do our wetstock management, instead of having to pay an outside company to do it. Henderson Technology has reduced the

cost when it comes to wet stock management. We used to have to do it every day. Now we do it once or twice a week and the fuel stock is always perfect to within a litre.”

Darren Moir, Store Manager at Westhill Service Station in Aberdeen, has worked for the family run store for over 30 years

He said: “We chose EDGEPoS over other systems because of the ease of use. That, alongside the ability to install the system within our timeline; and the competitive pricing model secured the partnership between Westhill Service Station and Henderson Technology.”

Westhill Service Station has also implemented the fully integrated Appetite! Home Delivery and Click n Collect App instore.

EDGEPoS is the future of retail technology and with its innovative and cost-effective self-checkout solution for retailers, alongside the award-winning Gander, Appetite and Ubamarket app integrations.

Henderson Technology works with all its customers to ensure that the award-winning EPOS solution brings added functionality and integrations into the fuel forecourt and convenience sectors.

The Scottish committee of GroceryAid has recently unveiled the headline acts for this year’s Checkout Scotland event which takes place at Barras Art & Design in Glasgow on 31 August.

e acts feature something for everyone with crossover dance music star Example headlining the event. He will be joined by popular Irish girl group B*Wtiched and legendary Scottish songsters e Supernaturals.

e event is set to build on the phenomenal success of last year’s launch event and more than 1,000 industry colleagues are expected to attend the musical extravaganza.

Checkout Scotland will once again help raise awareness of the free and con dential support that GroceryAid o ers to all industry colleagues in need of a little help. at support ranges from nancial and emotional to practical and is available 24 hours a day, seven days a week. GroceryAid Scottish Committee Co-Chairman Peter Steel said: “It is unbelievably important that everyone who works in the convenience retailing industry in Scotland is aware of the help that GroceryAid can o er them if they need and want it. We never know what’s round the corner but knowing that there’s help available can be a real bene t.

“ at’s why Checkout Scotland is such an important event. It’s a great chance to have a fantastic day out with industry friends and colleagues but it’s also an important tool to help us raise funds and awareness. Whether you would like to reward your team for their hard work, showcase your brand and product or simply support the charity that supports the Scottish grocery industry, we would love to see you there.

“ e sponsorship options are perfect for archetypal Scottish brands and suppliers who want to engage with the Scottish trade.”

Contact peter.steel@groceryaid.org.uk to nd out more about sponsorship opportunities and visit groceryaid.org.uk/event-bookings/CS2023 to purchase tickets for the event, which cost £75 + VAT. See you down the front!

By Antony Begley

By Antony Begley

Anewly-re tted Nisa Local store on Yokermill Road in Glasgow is helping revitalise its community and o er a hub for the local area a er having lain empty for nine months.

e store was o cially opened at the end of April by Carol Monaghan, MP for Glasgow North-West and o ers a strong range of products and services including fresh and frozen, groceries, a Post O ce, a dessert parlour, a Costa Co ee machine and a hot food counter.

Arbaaz Hayat, one of the owners of the family-run business, said he and his family had a very speci c vision for this particular store and added the family has plans to expand its portfolio of stores in the future should the right opportunities arise.

“ e vision with this wasn’t just to open a shop or just to be a convenience store,” said Arbaaz. “ e vision was to be a one-stop point for the community and to provide something exciting. We wanted to give the community options that aren’t on o er elsewhere and make it a bit of an attraction. I think it’s important

to have somewhere that, even if you come in feeling not so great, you can leave feeling bright and vibrant.”

Arbaaz said a lot of work went into the design, layout, and lighting of the shop to make sure it created the right kind of atmosphere. Since opening, Arbaaz said he had made a point of carefully listening to customer feedback and has used it to help continually shape the store’s o er to make sure it perfectly meets the needs of the local customer base.

“Customers have come to us with requests, so we try our best to ful l them,” said Arbaaz.

Unsurprisingly, the reaction from the local community has been phenomenal: “ e response has been absolutely incredible, even better than we expected,” he said. “I think –because of the way the shop was previously and the improvements that we have made – people really appreciate it.

“It’s about people being able to get everything they need in one place. It’s important to give

people somewhere local to get everything they need and to minimise the trips further out.”

One of the biggest upgrades to the Yokermill Road site is the addition of a new hot food counter which o ers a wide range of options including sandwiches, burgers, freshly made samosas – handmade every day – and chips.

Matthew Howie, Retail Development Manager at Nisa, added: “ e main di erence that this store brings to the community is a huge range in comparison to what was here before, as well as good value. is store is all about community and I’m looking forward to seeing the di erence the store can make in the community using Nisa’s Making a Di erence Locally charity.

“I’ve been coming here about three times a week for the last six months so it’s great to see the store get to this point.

“ ere have been some hurdles, but we’ve got there which is the main thing. I’m also looking forward to developing more stores with the guys, because they do have plans to do that.”

“The vision wasn’t just to open a shop, it was to be a one-stop point for the community and to provide something exciting.”

ARBAAZ HAYAT

Available in Original Raspberry and Sour Cherry & Apple flavours, the pouches are made with real fruit juice, and contain no added sugar. They are available with a £1.39 RSP in single-flavour shelf-ready cases of 12.The range is exclusively sold and distributed by Rose Marketing (rosemarketinguk.com).

F’real’s new limited-edition Mint Choc Chip flavour, which is made with delicately minted, dairy ice cream and chocolate chips. The launch is supported with digital POS and social media assets, as well as brand-new packaging and fresh blender artwork. It is available through all f’real’s distributors, including Booker and Eden Farm, with an RSP of £3 to £4, dependent on retailer discretion.

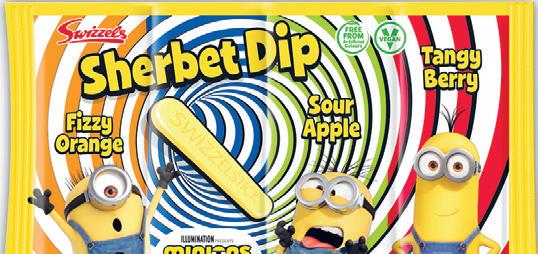

Minions Sherbet Dip comes in three flavours – Fizzy Orange, Sour Apple and Tangy Berry – all with a classic Swizzelstick for dipping. It is available now in shelf-ready cases of 36 x 23g sachets that have a 50p RSP. The launch will be supported by a targeted social media campaign in the summer. The new vegan-friendly product joins a range that already includes Minions Chew Bags and Minions Chew Bars.

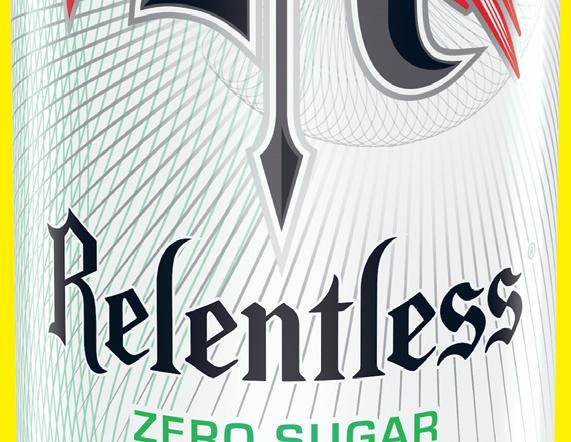

Coca-Cola Europacific Partners has extended its Relentless Zero Sugar range with a new Watermelon flavour.

Rolling out now, Relentless Zero Sugar Watermelon comes in an eye-catching white, black, pink and vibrant green can design with the recognisable Relentless ‘R’ motif in the centre. It is available in both plain and price-marked 500ml cans.

To support the launch in-store, POS materials and digital downloads are available to retailers from My.CCEP.com.

The new flavour builds on the successful launch of the Relentless Zero Sugar Raspberry and Peach flavours last summer, which have already added more than £5.3m to the energy drinks category in less than a year.

Pippa Collins, Associate Director of Commercial Development at CCEP GB, said: “The energy drinks segment has established itself as one of the key value and volume growth drivers within soft drinks, adding more than £205m to the category over the last year.

“This is largely due to the segment becoming more mainstream over the last decade, appealing to more consumers on more occasions and this is thanks to the arrival of new flavours, functionality and zero sugar options like the Relentless Zero Sugar range.

“Innovation continues to be incredibly important to the segment, delivering almost a quarter of energy drinks growth and we’re confident that this new Relentless Zero Sugar Watermelon variant will contribute to this moving forward so would recommend that retailers get stocked up.”

This new range of hand-crafted jams, chutneys, pickles and more is exclusively available to the convenience channel. Products come in double-facing shelf-ready cases of six, that highlight the brand’s Great Taste Awardwinning status. POS and merchandising materials are available on request. To stock, retailers can contact info@cottagedelight. co.uk, call 01538 382020 or visit cottagedelight.co.uk.

The new beverage is a zingy fusion of lemon and lime, giving a point of difference against current single-flavour SKUs in the category.

It is available in 250ml cans, pricemarked at 75p. Citrus-flavoured beverages continue to grow by 16% in the market, with lime flavours in eye-popping 900% growth and lemon up by 60%.

Premium milk drink Chocomel has launched a new £1.69 price-marked pack for its 250ml cans. The launch coincides with Chocomel’s latest £10m TV campaign, under the banner ‘Sharing Not Required’, that is expected to reach 80% of UK adults eight times. Within retail, the launch is supported by van sales to drive distribution, in-depot takeovers, and quick commerce support.

Drinks

Manchester Drinks has added a new Iron Brew flavour to its range of Slush Puppie Frozen Pouches. The new variant is exclusive to Scotland and launches alongside a Mango flavour. Both are available now in 250ml resealable pouches and join existing flavours Blue Raspberry, Strawberry and Sour Cherry. For more information email info@ manchesterdrinks. com or call 0161 763 0033.

Oetker Group

This new flavour puts a vegan spin on Dr. Oetker’s classic Italian-style pizza, combining a thin and crispy Ristorante crust with passata, dairy-free mozzarella and vegan pepperoni-salame. It follows the 2021 launch of the Ristorante Vegan Margherita Pomodori, which was the brand’s first vegan pizza and has become the most valuable vegan frozen pizza in the category, worth over £2m as of February 2023.

Weetabix

Weetabix has added a new Chocolatey Hazelnut variant to its Melts range. The new soft-centred crunchy hazelnut bites are HFSScompliant and comes in 360g packs with a £2 RSP. Asda will be the first retailer to stock Chocolatey Hazelnut Melts in early May, with a wider roll out over the summer months. Existing Chocolate Melts variants outperformed the chocolate pillow leader in taste tests.

Available now, Oasis Zero Exotic Fruits is a blend of mango and passion fruit flavours with no calories and no sugar. It is HFSS compliant and comes in 500ml recycled and recyclable plastic bottles. The launch is supported by social media, out of home advertising, and experiential activity focusing on young urban adults seeking lunchtime refreshment on the go.

Perfetti Van Melle

Chupa Chups has added a new Green Apple flavour to its Big Babol bubblegum range. Soft and chewy in texture, Big Babol Green Apple is available in packs of six individually wrapped extra-large pieces per pack. Packs have a 55p RSP and come in display-ready cases of 20. The launch is supported by a multiplatform social media campaign that seeks to drive awareness amongst the brand’s key teen shopper audience.

Soreen’s new vegan friendly and HFSS-compliant soft bakes launch in Blueberry, Raspberry & Vanilla, and Chocolate Orange flavours. The bars offer fewer than 140 calories, B vitamins, malt, fibre, potassium, folate. Multipacks of four (RSP £2.25) are available in Morrisons and Asda, with a wider roll out throughout the summer.

A new £13m campaign from Lynx trumpets its Lynx Africa variant as the GOAT (Greatest Of All Time) when it comes to male fragrances. A new ad – streaming across TV, VOD, cinema, YouTube, Twitch and Spotify – features an animated goat holding a Lynx Africa Body Spray. The campaign also includes digital outof-home and social media activities.

‘Better with Pepsi Max’ seeks to promote the drink’s ability to enhance the taste of food and includes partnerships with KFC, celebrity chef Big Zuu, Amazon Ads and food media brand Twisted, coupled with out-of-home, digital and radio advertising. Social media content from Twisted and Big Zuu features 15-minute recipes that pair well with Pepsi Max.

Dr. Oetker is back on TV with ‘Share a Little Joy,’ a new campaign celebrates how little gestures of kindness can make a big difference in creating happy memories. Running on TV, video on demand, social and digital, a new ad shows how one homebaked gesture of kindness can create a chain reaction of good deeds with feelgood results.

KP Snacks has unveiled a new £250,000 radio campaign for Pom-Bear, with adverts and competitions designed to drive awareness of the family snacking brand. The campaign runs until September in partnership with Magic Radio and features Pom-Bear’s core range of Original, Cheese & Onion, and Salt & Vinegar flavours.

deck