SLR Products of the Year 2022 winners unveiled! p24 FEBRUARY 2023 | ISSUE 238 WWW.SLRMAG.CO.UK

FEBRUARY 2023 | ISSUE 238 WWW.SLRMAG.CO.UK SLR Products of the Year 2022 winners unveiled! – p24 +

PRIME TIME

Farm

1,000 bottles in just

an hour

DRS UPDATE Legal challenge green light, handling fee increased

Pinkie

sells

half

BLURRED LINES Bestway blurs grocery/convenience divide with £200m stake in Sainsbury’s.

NEWS

06 Store Sales Buyers continue to outstrip the number of stores available, says a new Christie & Co report.

07 Vaping Environmental concerns prompt the Scottish Government to consider banning single-use vapes.

08 Access To Cash New data shows that there are still over five million people reliant on cash machines in the UK.

10 Rural Shops ACS urges MPs to recognise the crucial role that rural shops play in their constituencies

12 News Extra Energy The new energy scheme for businesses draws flak from trade associations.

18 Product News Ferrero expands its Easter range and Oreo unveils a new Xbox promotion.

20 Off-Trade News WKD announces a Love Island double date while Brewdog backs a mental health campaign.

INSIDE BUSINESS

22 Research Digest Cost-conscious consumers present an opportunity for retailers, according to new Barclaycard data

24 Product of the Year Awards The votes have been counted and it’s time to reveal the hottest NPD of 2022.

26 Deposit Return Scheme Handling Fees increase slightly as Abdul Majid’s legal challenge goes ahead.

28 GroceryAid Scotland The industry charity’s popular Checkout music festival will return in August.

30 Hotlines The latest new products and media campaigns.

46 Under The Counter The Auld Boy discovers he has something in common with the humble Rich Tea biscuit.

FEATURES

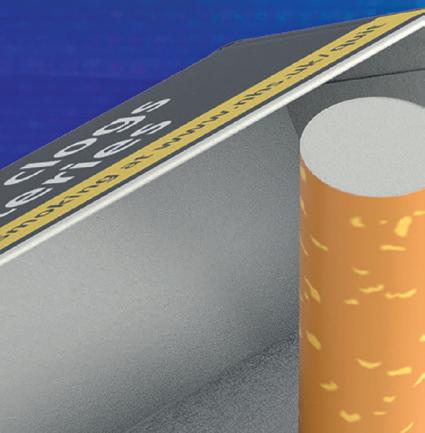

32 Tobacco As cost pressures increase, smokers are seeking further value for money in the tobacco category.

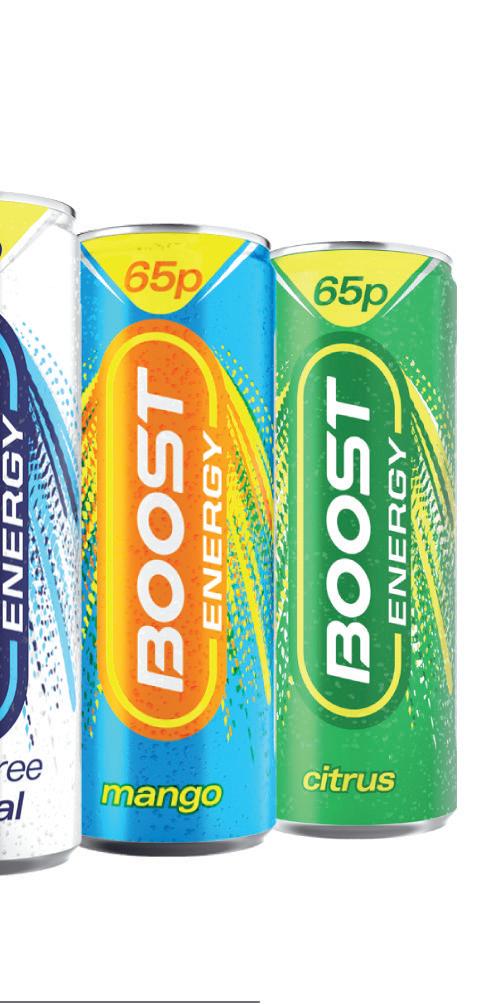

34 Soft Drinks The soft drink category continues to provide growth for retailers.

40 Price-marked Packs PMPs could be a key growth driver this year as inflation bites and consumer spending stalls.

44 Beer & Cider Beer and cider continue to act as a cornerstone for the convenience market.

www.slrmag.co.uk FEBRUARY2023| SLR 5 Contents February 2023

ISSUE 238

Contents

ON THE COVER 16

6 21 26 28 31 38

Industry

Consolidation The once clean line between the grocery and convenience is blurred further as Bestway takes a £200m share of Sainsbury’s.

New Year financial hangover for consumers

Consumer confidence fell by three points in January to -45, according to data from market research firm GfK. The company’s Consumer Confidence Index reveals four measures of confidence were down in January, while one measure was up, compared to the previous announcement. Joe Staton, Client Strategy Director at GfK, said: “The forecast for consumer confidence this year is not looking good.”

Aldi to strengthen Scottish presence with £35m spend

Aldi is set to invest £35m in Scotland in 2023, including £10m to open new stores in Cumbernauld and Coatbridge. The supermarket has also committed an additional £5m to upgrade its existing stores under its ‘Project Fresh’ initiative and will invest £20m to prepare for the roll-out of the Deposit Return Scheme, which will launch in August 2023.

55 North receives GroceryAid Gold Award

SLR Publisher 55 North has been presented with a GroceryAid Gold Award in recognition of its support and fundraising efforts for the industry charity throughout 2022. 55 North joins the ranks of companies who gave the charity the highest levels of support over 2022, participating in eight activities across all three of its ‘critical pillars’ including awareness, fundraising, and volunteering.

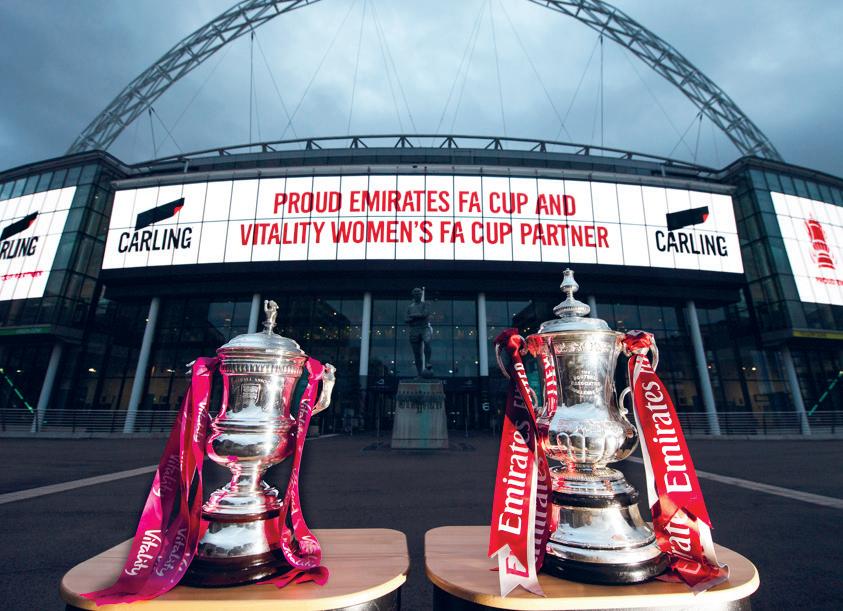

TWC launches convenience market report

Data and digital consultancy

TWC Group is launching a convenience market report covering independent retail and wholesaler-supplied symbol stores. The ‘SmartView Convenience’ report comprises around 6,500 stores, with a combined turnover of £5.6bn. The service will let retailers better understand sector and category performance and trends.

Convenience retail ‘best placed’ to weather headwinds in 2023

Convenience store buyers did not appear to be deterred by any shortterm decline in consumer spending and demand for stores remained strong throughout 2022, a new report from Christie & Co reveals.

e ‘Business Outlook 2023

Finding Clarity’ report reveals Christie & Co’s retail team sold 41% more convenience stores than it did pre-Covid and subsequently recorded a 1.5% rise in its retail price index for 2022.

Key market insights included in the report reveal buyers continued to outstrip the number of stores available, which o en resulted in competitive bidding and an average of 7.5 o ers for each business. is gure has been steadily increasing over the past few years.

e report also notes that while some of the larger corporates have

scaled back their new development plans, they continue to churn their portfolios which provides a fantastic opportunity to the wide pool of independent buyers seeking sites, with pro tability and growth potential becoming key considerations in light of increasing operational costs.

e report also outlines Christie & Co’s market predictions which are:

Q e threshold for a viable corporate business has increased again, leading to more and better-quality corporate

TRENDS

Scottish Government urged to match UK business rates support

divestments. is presents an acquisition opportunity for independents.

Q All sellers will need to be realistic about pricing, to re ect the performance of their business and a new cost base.

Q Price expectations will be a key focus for 2023.

Steve Rodell, Managing Director of Retail at Christie & Co, said: “2022 turned out to be a very busy year for our team, with activity levels surpassing modest expectations which were set during the Covid years.

“We are very encouraged by the healthy number of deals we are taking into this year and feel con dent that the sector will remain resilient despite the challenging economic climate.”

Pinkie Farm sells almost 1,000 bottles of Prime in half an hour

Pinkie Farm, in Musselburgh, sold almost 1,000 bottles of the popular energy drink Prime in about 35 minutes. The drink, which was created by YouTubers Logan Paul and KSI, comes in five flavours. It has been selling out quickly in supermarkets across the UK and demand remains high.

The retailer restricted purchases to one bottle of each flavour per customer and stock was positioned behind the tills.

Industry bodies across the retail sector in Scotland have written to Deputy First Minister John Swinney, urging the Scottish Government to match the Chancellor’s commitment of 75% rates relief for retail businesses in 2023/24.

Representatives of the Scottish Grocers’ Federation (SGF), the Scottish Retail Consortium, the British Independent Retailers Association, and the Booksellers Association signed the joint letter, highlighting the signi cant challenges facing the sector.

SGF Chief Executive Pete Cheema said: “Many retailers are facing an extremely challenging trading environment, and some are struggling to keep the lights on. So there’s no time to lose, the Scottish Government needs to act now.”

Dan Brown, Managing Director of Pinkie Farm, said: “It was crazy. We had 80 crates of 12 drinks sell out in about 35 minutes, there was a queue right down the street for it.”

The store has kept back some bottles so it can run an online competition.

News

KEEP UP WITH THE LATEST NEWS AS IT HAPPENS – FOLLOW US ON TWITTER @SLRMAG SLR |FEBRUARY2023 www.slrmag.co.uk 6

BUSINESS RATES Industry representatives highlight the challenges facing the sector

STORE SALES Buyers continue to outstrip the number of stores available

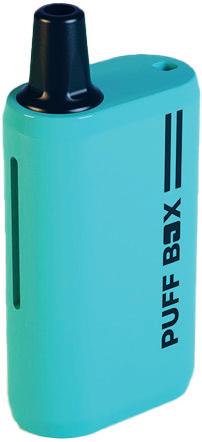

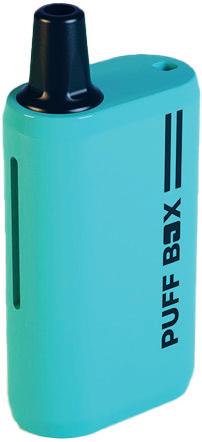

Disposable vapes face ban in Scotland

Single-use disposable vapes could be banned in Scotland as part of new plans to tackle waste and other hazards associated with the devices, which are now used by more than 15% of vapers.

Zero Waste Scotland is to lead an urgent Evidence Review of the environmental impacts and management of single-use vapes following “emerging concerns around the negative consequences of the disposable devices”.

e review, which will consider international experience and action, will inform potential policy responses, which could include a ban of the products, a government minister said.

Disposable smoking devices have been linked to issues including litter, plastic waste and re risk.

Other approaches could include increasing access to responsible disposal options, improved product design or public communications campaigns.

Circular Economy Minister Lorna Slater said: “Not only are single-use vapes bad for public health, they are also bad for the environment. From litter on our streets, to the risk of res in waste facilities, there are issues which need to be addressed urgently.

“We will consider the evidence and expert advice and come forward with policy options, which could include a potential ban on single-use vapes.

“In the meantime, we would urge everyone who uses these products to make sure they are disposed of properly.”

DEPOSIT RETURN SCHEME

Judicial review proceedings against Circularity Scotland to proceed

The judicial review petition raised by convenience retailer Abdul Majid against Circularity Scotland Limited (CSL), which was appointed by the Scottish Government in 2021 to administer Scotland’s Deposit Return Scheme (DRS), will now proceed in the Court of Session.

Abdul is challenging the legality of the retailer handling fees which CSL seeks to impose on retailers. He is concerned that the retailer handling fee levels will not cover his costs following the introduction of the DRS and will be detrimental to his business both in the short and long term thereby threatening the viability of his store, which provides key services and groceries to his local community.

The action has been welcomed by SGF, which has also been trying to get Circularity Scotland to review the Retailer Handling Fee.

SGF boss Pete Cheema, said: “The Court has granted permission for the judicial review petition brought by Abdul Majid & Son Limited to proceed following a Court hearing on 15 December 2022.

“SGF has been and remains fully committed to a fit-for-purpose deposit return scheme but for that to happen recognition must be given and action taken to address the concerns around retailer handling fee levels which has been raised in Mr Majid’s petition.”

PREVENTING UNDERAGE SALES

Make sure all staff members are fully trained. Follow these top tips:

TAKE YOUR TIME

Distractions can prevent proper checks from taking place

MAKE EYE CONTACT with customers to assess their age

CHECK

IF IN DOUBT, ASK FOR ID and check that it’s an acceptable form of identification

REMEMBER: Mystery shopper visits are carried out in support of preventing underage sales. If your store doesn’t correctly ask for ID on 3 separate occasions, you could lose your terminal.

Rules & Procedures apply. Players must be 18+.

News www.slrmag.co.uk FEBRUARY2023| SLR 7

DISPOSABLE VAPES Review will examine the environmental impacts and management of singleuse vapes

LOOK STOP

538621 TNL Responsible Retailing SLR Advert 265x93mm AW1.indd 1 07/09/2022 14:42

Issa brothers mull Asda and EG Group merger

The Issa brothers are reportedly considering merging Asda and EG Group in a deal that would create a retail giant worth more than £10bn. The combination would create a group with 581 supermarkets, 700 petrol forecourts, and more than 100 c-stores in a bid to refinance current debt. The news has prompted fresh calls from GMB to expand the Competition and Markets Authority’s powers.

Food sales soar in Scotland

Scottish food sales increased by 11.5% year-on-year in December, according to the latest SRCKPMG Scottish Retail Sales Monitor. The data shows that December’s performance was below the three-month average growth of 11.6% and above the 12-month average growth of 5.2%. In addition, the threemonth average was above the UK level of 7.9%. Total sales in Scotland increased by 11.3% year-on-year in December.

Waitrose to bin all disposable vapes

Waitrose has announced a “complete withdrawal” from the disposable vapes market. The retailer, which currently operates seven stores in and around Glasgow and Edinburgh, had already decided not to stock a number of disposable vaping products, but has now opted to de-list all single-use vapes. The move, Waitrose said, came amid “growing environmental concerns”.

SWA Achievers Awards set to be biggest

The Scottish Wholesale Association is advising those yet to book their place at the SWA Achievers Awards to do so without delay as this year’s event is attracting a recording number of bookings. This year’s event will be held at Edinburgh’s O2 Academy on 23 February. Places can be booked via the SWA website or via awards@ scottishwholesale.co.uk.

Consumers withdrawing more cash from ATMs

UK customers withdrew £83bn from cash machines compared to £79bn in 2021, according to new data from the UK’s cash access and ATM network Link.

e data shows there was also a 5% increase in the total number of ATM transactions last year, rising from just over 1 billion to 1.024 billion.

is means the average withdrawal per person over 16 in the UK was £1,564 last year, compared to £1,462 in 2021.

However, ATM use is still considerably down and unlikely to return to pre-pandemic levels. In 2019, £115bn was withdrawn from cash machines.

Northern Ireland remains the most cash-heavy of the nations with Northern Irish banking customers withdrawing an average £2,266 in 2022 compared to the South-West, where the average customer withdrew £1,069.

ATM withdrawals represent 90% of all cash withdrawals in the UK ahead of counter transactions at bank branches and post o ces.

e number of ATMs decreased from 52,547 to 51,253. ere was a fall in the number of charging ATMs, whereas the number of freeto-use machines increased slightly.

Graham Mott, Director of Strategy at Link, said: “ ese numbers aren’t surprising. It’s easy to forget that there was quite a signi cant lockdown at the beginning of 2021 and therefore 2022 was the rst year we’ve had since 2019 where there were no interruptions. What we know is that our relationship with cash

Appetite for forecourts remains despite EV deadline

e looming ‘Road to Zero’ and 2030 deadline is having little e ect on buyer appetite for petrol stations, according to business property adviser Christie & Co.

e company’s ‘Business Outlook 2023 Finding Clarity’ report reveals it received an average of ve o ers per transaction, re ecting the strong ongoing demand, causing a 1.5% increase in Christie & Co’s retail price index for 2022.

e growth of other income streams such as ‘fast-moving convenience goods’ was also identi ed in the report as a key trend shaping the market, with 88% of the UK’s lling stations now featuring a retail o ering, 31% of which are a full convenience store.

e report also outlines Christie’s predictions, for 2023:

Q e threshold for a viable corporate business has increased again, leading to more and better-quality corporate divestments, which presents an acquisition opportunity for independents.

Q All sellers will need to be realistic about pricing, to re ect the performance of their business and a new cost base.

Q Price expectations will be a key focus for 2023.

and ATMs has changed. While many people are now happy to use contactless or digital payments, our research shows there are very few people that are completely cashless. We also know that people are visiting cash machines less o en, but on average take out more cash.

“It’s extremely good news that the government is introducing legislation to help protect free access to cash. ere are still over ve million people who rely on access to cash and face-to-face banking services.”

FUNDING PayPoint extends Funding Circle partnership

PayPoint has extended its partnership with Funding Circle which provides its network of 28,000 UK retailer partners access to funding.

The extension of the partnership will allow retailers on its loyalty scheme to apply for a Funding Circle loan.

The companies claim applications take no longer than 10 minutes to complete, with no more than a 24-hour wait for a decision to be made.

Mark Latham, Banking Services Director at PayPoint, said: “When businesses want to invest in adapting to market conditions, they should be able to do so swiftly and with confidence. This was the key reason for expanding PayPoint Group’s partnership with Funding Circle.”

News

KEEP UP WITH THE LATEST NEWS AS IT HAPPENS – FOLLOW US ON TWITTER @SLRMAG SLR |FEBRUARY2023 www.slrmag.co.uk 8

FORECOURTS Fast-moving convenience goods is a key trend shaping the market.

ACCESS TO CASH New Link data shows there are still

five

on cash machines

over

million people reliant

YE’LL BE BACK FUR MORE! Delicious toasted! Hovis Farmhouse Cheddar Muffins ® Soft White 800g More great products from Hovis Hovis Farmhouse Hovis Tasty Wholemeal Medium 800g Hovis Seed Sensations Seven Seeds 800g Hovis Tasty Wholemeal Thick 800g Hovis Granary Thick 800g ® ® ® ® Hovis Soft White Medium 800g Hovis Best of Both Medium 750g Hovis Soft White Thick 800g Hovis Best of Both Thick 750g ® ® ® ® ® ® ® ® Mothers Pride - Lovingly made by Hovis for you

One Stop doubles home delivery range

One Stop is doubling its home delivery range with more than 2,500 products now available online. The increased range will initially be rolled out to 600 company-owned stores that offer home delivery. One Stop has also recently installed self-service checkouts in 58 of its company-owned stores, with another 80 shops planned for early 2023, including some franchise stores.

Shut that door

The Campaign to Stop High Street Heat Loss has launched a new petition that urges the government to pass legislation that insists on shop front doors being kept shut, to prevent further environmental impact. Research from Cambridge University revealed that retailers that kept their doors open consumed twice as much electricity as those that did not.

Sainsbury’s and Just Eat partner up

Sainsbury’s has launched a new partnership with food delivery app Just Eat. The partnership will widen the range of products available, starting with more than 3,000 items ready for consumers to buy online. The partnership will launch with more than 175 stores by the end of February in locations including Edinburgh, with plans to roll out to many more cities across 2023. Just Eat also has partnerships with brands such as Getir, Asda, Booker, Spar, and Shell.

Out-of-home eating occasions fall

The number of out-of-home eating occasions fell by 5% yearon-year in the 12 weeks ending 26 December 2022, according to TWC/MealTrak. The data shows food-to-go value sales declined by -2% on a 12-week ending basis versus 2021. Multiples (+18%) and discounters (+19%), remain “the clear winners,” although convenience stores are in decline (-16%).

ACS urges MPs to support rural shops

ACS is encouraging MPs to support its Rural Shops Pledge by recognising the crucial role that rural shops play in their constituencies.

e trade body is calling for more support for rural areas as part of the government’s ongoing levelling-up agenda, supporting investment in digital infrastructure to provide rural shops with reliable broadband and mobile coverage, and enabling rural shops to maintain a viable network of free-to-use cash machines.

e call came as the ACS launched the 2023 Rural Shop Report, which highlights the crucial contribution that the UK’s 17,720 rural shops make to their communities, this year it reveals:

Q Rural shops provide local, exible and secure jobs to 142,000 people, with more than half of rural colleagues walking to work.

Q More than one in four rural shops provide a local grocery delivery service to customers.

Q More than three in four rural shops (77%) have engaged in some form of community activity over the last year.

Q In the past year, rural shops have made investments worth over £214m to secure the future of their businesses.

CJ Lang selects RELEX to automate and optimise supply chain

CJ Lang & Son has chosen RELEX, a provider of uni ed supply chain and retail planning solutions, to automate and optimise its supply chain processes.

RELEX will deliver integrated store and distribution centre forecasting and replenishment, as well as improved allocations and promotional forecasting for CJ Lang’s company-owned stores and distribution centre. RELEX will also drive improved order accuracy, sharing of forecasts to suppliers, and fresh assortment optimisation.

CJ Lang sought a solution that could signi cantly improve the management and automation of its ordering processes so it could focus on more value-adding tasks.

e company looked to RELEX for its market reputation in convenience forecasting and replenishment, as well as to deliver improvements to promotions and product lifecycle management and save sta time to focus on customer experience.

ACS Chief Executive James Lowman said: “We’re calling on all MPs in rural areas to support their local shops at this incredibly challenging time for the whole rural convenience sector, as the loss of any rural shop would have a huge impact on the community that it serves.”

Lowman added: “ e government has failed in its attempt to come up with a solution to help rural businesses that need urgent support on energy costs, instead opting for a scattergun approach that won’t make a dent in the bills of thousands of shops facing huge hikes in the energy bills this year. Without urgent intervention to allow businesses to renegotiate fairer contracts, local shops will be forced to close their doors in numbers.”

Illegal tobacco factory raided in West Lothian

One of Scotland’s biggest illegal tobacco factories has been dismantled a er a raid in West Lothian.

e state-of-the-art factory, which included expensive machinery and insulation to hide noise and smells, was uncovered in an operation by HMRC and Police Scotland.

Four tonnes of tobacco were recovered, worth an estimated £1m in unpaid duty, and suspected counterfeit tobacco pouches were also found.

Joe Hendry, Assistant Director, Fraud Investigation Service, HMRC, said: “We will continue to work with our law enforcement partners to target anyone we suspect as being involved in the illicit tobacco trade.”

Five people have been arrested and charged. Investigations are ongoing.

News

KEEP UP WITH THE LATEST NEWS AS IT HAPPENS – FOLLOW US ON TWITTER @SLRMAG SLR |FEBRUARY2023 www.slrmag.co.uk 10 ILLICIT TOBACCO HMRC bust uncovers four tonnes of tobacco

LOGISTICS The system will deliver integrated store and distribution centre forecasting and replenishment

RURAL

2023 Rural

Report

SHOPS The ACS’

Shop

highlights the crucial contribution that the UK’s 17,720 rural shops make to their communities

EXPLORE A WORLD OF FOR EXISTING ADULT SMOKERS & VAPERS ONLY. This product contains nicotine. 18+ only. Not a smoking cessation product. Fontem 2022. OVER 18 ONLY STOCK UP NOW THAT’S UNLIT For more information visit our blu bar Knowledge Hub. www.blubarhub.co.uk

Scottish Grocers’ Federation

Convenience Matters with the SGF

Scotland’s Food & Drink sector is globally recognised for exceptional produce and the Alcohol sector alone accounts for approximately 3.3% of GDP.

Retailers, wholesalers and farmers are vital for the wider supply chain and have hugely contributed to the economic success of the Drinks industry. Many rural communities depend on it to promote tourism and create employment.

SGF promotes responsible retailing, our members are at the very heart of their communities. Alcohol products are part of providing a ‘full basket’ for customers, with 18.1% of overall turnover attributable to alcoholrelated sales. Nevertheless, convenience stores are facing an incredibly challenging trading environment.

For the Scottish Government to choose this moment to introduce a consultation proposing a complete prohibition on alcohol advertising, banning alcohol branding, and removing alcohol products from public view is – to say the least –surprising. These restrictions could have a significant impact on our sector and thousands of businesses.

SGF encourages all its members to respond to the consultation, closing 9 March. We have been building evidence to support our retailers and producers, and have written to MSPs and ministers to highlight the damaging impact the proposals could have.

Businesses desperately need a period of stability and support from our governments. Come and have your say at the next Cross Party Group meeting in the Scottish Parliament on 28 February. Please contact jamiem@ sgfscot.co.uk for details.

ENERGY The government’s new energy support measures come into force on 1 April

Scaled-back energy support measures for businesses unveiled

The new energy scheme for businesses has attracted criticism from trade associations who fear that shops will go out of business as a result.

BY LIZ WELLS

A new energy scheme for businesses has been con rmed by the government ahead of the current scheme ending in March.

e government is currently reducing business energy bills by e ectively controlling wholesale energy prices. It will move away from this model on 1 April and instead provide a subsidy to electricity bills of 1.96p per kilowatt hour for all business customers paying over a minimum rate.

Chancellor Jeremy Hunt said: “My top priority is tackling the rising cost of living – something that both families and businesses are struggling with. at means taking di cult decisions to bring down in ation while giving as much support to families and business as we are able.

“Wholesale energy prices are falling and have now gone back to levels just before Putin’s invasion of Ukraine. But to provide reassurance against the risk of prices rising again we are launching the new Energy Bills Discount Scheme, giving businesses the certainty they need to plan ahead.”

ACS Chief Executive James Lowman, called the new package “woefully inadequate”.

He said: “By moving to a subsidy on energy bills and failing to target speci c sectors or those worst a ected, the government has spread £5.5bn support over every type of business, the result being a level of subsidy that is ultimately pointless.

“Local shops will go out of business if the government does not rethink its approach before April. Retailers who struck contracts at

the peak of the wholesale energy price will still see their bills quadruple even with this meagre support, blowing their commercial model out of the water. Our sector is resilient, plays a vital role in communities, and in fact o ers energy bill payment facilities for millions of customers including the most vulnerable. is policy will have very serious consequences for our members and the customers and communities they serve.”

e NFRN’s National President Jason Birks was equally dismissive: “ is is hugely disappointing for many independent retailers who are struggling to survive. With rising energy bills, falling margins, and rising payroll costs, small businesses will continue to struggle or, indeed, cease to exist unless additional nancial support is available.”

Gordon Balmer, Executive Director of the Petrol Retailers Association, said: “Our members have worked hard to keep their communities fuelled and fed during unprecedented times. e government’s failure to provide targeted help to sectors most in need will threaten fuel resilience in the UK.

“We urge the Chancellor to reconsider his decision and o er

support to business who might struggle to survive a er this cut.”

e Federation of Small Businesses in Scotland also voiced concerns over the “dramatic” scaling back of energy bill support for small businesses. Andrew McRae, FSB Scotland Policy Chair, said: “ is is a signi cant reduction in support – and it will have realworld impacts.

“Energy costs are still the singlebiggest challenge for many of our members, with six in 10 reporting utilities as the main driver of cost increases. By switching the support from a cap to a discount on wholesale costs, businesses are once again at the mercy of the global events that drive those prices.”

e Chancellor has also written to OFGEM, asking for an update in time for the Budget on the progress of its review into the nondomestic market. He has asked for the regulator’s assessment of whether further action is needed to secure a well-functioning market for non-domestic customers following reports of challenges certain customers are facing, including in relation to the pricing and availability of tari s, standing charges and renewal terms, and the ability of certain sectors to secure contracts.

News Extra Energy support scheme NewsExtra

SLR |FEBRUARY2023 www.slrmag.co.uk 12 LEVERAGE THE VALUE-FOR-MONEY TOBACCO SEGMENT – P32

Crime & Wellbeing Seminar APR 19 MAY 18 Mini Summit OCT 12-13 For more information, scan the QR code or visit www.sgfscot.co.uk/networking-events Golf Tournament MAR 7 Annual Conference SGF 2023 Events Announced! Hampden Park, Glasgow Crowne Plaza, Glasgow Breakouts Exhibition Networking HFSS DRS Alcohol Display & MUP Vaping Macdonald Inchyra, Falkirk Gleneagles Golf Networking Competitions Advice Lived-experience Solutions All events free to attend for independent retailers

SO MANY QUESTIONS... SO LITTLE TIME

I’ve said it before: the most saddening thing about the DRS debacle is the size of the missed opportunity. If it had been well planned and executed, the entire nation –retailers, producers, wholesalers and consumers – could have been looking forward together to 16 August with pride and excitement.

Instead, with only about seven months until the go-live date, the scheme remains mired in confusion, controversy and confoundment.

Experience and common sense tell you a project as complex as DRS takes years of careful consultation, planning, research and commitment from a lot of people. And, to be fair, the Scottish Government has had a lot of years. Nicola Sturgeon first unveiled her plans for a scheme way back in September 2017. Yes, Covid threw an almighty spanner in the works but anyone close to DRS over the last four or five years will tell you that the scheme was never going to be match fit for August 2023, Covid or no Covid. There were just too many mountains that required moving and not enough time to move them.

The most curious aspect of this whole debacle is the Scottish Government’s apparent lack of appetite to actually help get those mountains moved. They only appointed the Scheme Administrator last March with not much more than a year to go until they were supposed to deliver a working DRS. Circularity Scotland have become the whipping boys, but they were handed a poisoned chalice remit: deliver the undeliverable.

So here we are with seven months left and with many of the really important questions still unanswered. And there’s been more flip-flopping than on a beach in Lanzarote in July. We’ve seen U-turns and shifts on everything from exemptions and return point numbers to producer fees and handling fees.

Call me cynical but it looks like the government long since realised it couldn’t deliver the original scheme on time, the one that was promised and set in law, so they decided to knock off a few corners to try to create something – anything – that would let DRS go live in August. Are we heading for DRS-lite?

And as if all the in-built, systemic weaknesses with the plans weren’t enough, there have been plenty of unforeseen external challenges to further test the resolve of the government. The handling fee issue is subject to a legal challenge, the collection schedule is still a long way off and a plethora of other very serious problems still beset the scheme.

The biggest issue here, to return to my original point, is that this could all have been so different. If the Scottish Government had engaged – genuinely engaged – with industry, it could have ploughed its way through all the many legitimate challenges that launching a DRS en tails, one bite at a time. It wouldn’t have been easy and it wouldn’t have been pretty in parts, but it would have been the grown-up way to swallow that elephant.

ANTONY BEGLEY, PUBLISHING DIRECTOR

EDITORIAL

Publishing Director & Editor Antony Begley abegley@55north.com

Deputy Editor Liz Wells lwells@55north.com

Features Editor Gaelle Walker gwalker@55north.com

Features Writer Elena Dimama edimama@55north.com

Web Editor Findlay Stein fstein@55north.com

ADVERTISING

Sales & Marketing Director Helen Lyons 07575 959 915 | hlyons@55north.com

Advertising Manager Garry Cole 07846 872 738 | gcole@55north.com

DESIGN

Design & Digital Manager Richard Chaudhry rchaudhry@55north.com

EVENTS & OPERATIONS

Events & Circulation Manager Cara Begley cbegley@55north.com

Scottish Local Retailer is distributed free to qualifying readers. For a registration card, call 0141 222 5381. Other readers can obtain copies by annual subscription at £50 (UK), £62 (Europe airmail), £99 (Worldwide airmail).

55 North Ltd, Waterloo Chambers, 19 Waterloo Street, Glasgow, G2 6AY Tel: 0141 22 22 100 Fax: 0141 22 22 177

Website: www.55north.com

Twitter: www.twitter.com/slrmag

DISCLAIMER

The publisher cannot accept responsibility for any unsolicited material lost or damaged in the post. All text and layout is the copyright of 55 North Ltd.

Nothing in this magazine may be reproduced in whole or part without the written permission of the publisher.

All copyrights are recognised and used specifically for the purpose of criticism and review. Although the magazine has endevoured to ensure all information is correct at time of print, prices and availability may change.

This magazine is fully independent and not affiliated in any way with the companies mentioned herein.

Scottish Local Retailer is produced monthly by 55 North Ltd.

Comment

SLR |FEBRUARY2023 www.slrmag.co.uk 14 ©55NorthLtd.2023 ISSN1740-2409.

LOWERED PRICES QUALITY AS STANDARD LOW RRP FOR YOU AND YOUR CUSTOMERS NEW PRICE *RRP correct as of 9th January 2023. You remain free at all times to price as you choose.

BESTWAY BLURS BOUNDARY EVEN FURTHER

The once clean line between the grocery and convenience channels is being blurred further with Bestway taking a £200m share of Sainsbury’s while Asda plans a mega-merger of its supermarket and forecourt businesses.

BY ANTONY BEGLEY

It wasn’t that long ago that the grocery and convenience channels were considered as entirely separate entities, if not downright sworn enemies. Back in the day the word ‘mult’ was invariably used by a local retailer as a pejorative term, a form of insult aimed at the big, bad supermarket chains with their massive budgets and their equally massive ambitions.

at once clear demarcation line between grocery and convenience, however, has become ever-blurrier over the years. Last month Bestway did their bit to accelerate the trend by taking a substantial stake in Sainsbury’s. So, where and how will it end?

e attraction of the convenience channel to big players is not new of course. Many of the major supermarkets have had a go at the channel, in one way or another – with varying degrees of success. Tesco Express and Sainsbury’s Local are only a couple of examples of the big boys’ attempts to gain a proper footing in smaller format retailing. But everybody from Amazon to B&Q have had a crack at the channel, again with varying degrees of success.

e blurring, however, moved up a gear in 2017 with Tesco’s £3.7bn acquisition of Booker. at move caused consternation in board rooms across the UK as competitors scrambled to work out how they could compete with a merger of the UK’s biggest supermarket chain with the UK’s biggest wholesaling business.

en Asda was sold by Walmart to the Issa brothers in 2020 and private equity rm bought Morrisons a year later.

Since then we’ve seen a continuing wave of deals, partnerships, tie-ups and agreements as the market wrestles with the new groceryconvenience world order, the latest of which is Bestway’s near £200m investment in Sainsbury’s, with the potential for the wholesaler to take an even bigger position in the future.

For its £200m, Bestway got a 3.45% stake in the UK’s second-biggest supermarket, making it Sainsbury’s sixth-biggest shareholder. Exactly why Bestway made the punt is up for debate. Ostensibly, the company said the stake was purely “for investment purposes” but I doubt there are many people buying that argument. It won’t surprise anyone down the line if another reason for the investment emerges. A trading collaboration of some sort, for instance.

Interestingly, Bestway categorically stated that it was not considering a takeover bid –something the £4.5bn-turnover company could probably just about do if it really fancied. Under nancial rules, however, the fact that it clearly stated it was not planning a takeover bid means it now can’t do so for at least six months – unless a rival bidder appears out of the undergrowth.

Meanwhile, Asda appears to be doing its best to blur the lines between grocery and convenience with a proposed mega merger of its supermarket and forecourt businesses that would create a retail giant worth more than £10bn with 581 supermarkets, 700 forecourts and over 100 convenience stores.

Cover Story Industry Consolidation

SLR |FEBRUARY2023 www.slrmag.co.uk 16

According to the GMB trade union, the latest attempt at the merger “isn’t in the interests of the 200,000 impacted workers, or the UK economy, or even consumers” but is, it says, being driven forward because it “suits the debt re nancing arrangements of a private equity rm and their business partners”.

Nadine Houghton, GMB National O cer, said: “ is proposed merger raises the spectre of a private equity black hole on the UK high street. More and more of our essential household goods – from food to fuel – are controlled by unaccountable private equity backers.

“GMB stands on the side of hard-working families in calling for the role of the CMA to be expanded – giving greater regulatory oversight in relation to private equity buyouts and ensuring greater protection of both consumers and workers.”

So where does that leave independent local retailers? Convenience is hot and everybody wants a piece of the action, including global private equity rms with their infamously short attention spans and fast buck proclivities. We’ve already seen a supermarket buy a wholesaler

and it probably wouldn’t surprise anyone to see a wholesaler buy a supermarket at some point in the future. Will grocery and convenience ultimately coagulate into one amorphous mass, the lot of it owned by three or four groups? It has happened before in other sectors. e vast majority of the global beer and spirits industries are owned by just a handful of players, for instance.

It’s a possibility, of course, but Scotland is, as ever, insulated to a certain extent because of the simple nature of the geography. is is God’s country, as we like to say. And he clearly made it on one of his more expansive days. Outwith the major cities, Scotland is particularly hard to service – which is why so few businesses try to do it properly.

ere will be more consolidation in the future. Of that there is no doubt. But even the bottomless reserves of private equity and the equally bottomless ambitions of the supermarkets cannot overcome the simple fact that Scotland is big, not very populous and very, very spread out.

Maybe God’s not da a er all.

Cover Story Industry Consolidation www.slrmag.co.uk FEBRUARY2023| SLR 17

Eggs-cellent news

Chocolate lovers of a certain age will be delighted to learn that Mondelez has decided to put the sweets that accompany its Cadbury Easter eggs back where they belong: inside the chocolate shell. The dramatic move is part of a relaunch and repositioning that sees the full range divided into clear, distinctive and easyto-shop categories. These are ‘Surprise & Delight’, ‘Traditional Gift’ and ‘Special Gesture’.

Vitalite is shining bright

Saputo Dairy UK’s dairy free spread brand, Vitalite, has launched new brand positioning and a new website. ‘Shine Bright’ is a call-to-action for consumers to focus on all-round health and wellbeing, and recognises the links between physical and mental health and how eating well is an important part of this. The brand, which marks 20 years of being dairy free in 2023, has also unveiled new product packaging and a new website.

KP unveils Mini Chips price-marked packs

KP Snacks has expanded its price-marked pack range with the launch of KP Mini Chips Salt & Vinegar £1.25 PMP (60g) and KP Mini Chips Beef £1.25 PMP (60g). Both roll out into stores from mid-February. Their launch coincides with a fresh new look for the Mini Chips range. The savoury snacking giant has also given its PMP portfolio of 45 SKUs a range and pricing restructure.

PayPoint adds Google Play and life:style vouchers

PayPoint has extended its digital voucher range with the addition of Google Play and life:style. PayPoint retailer partners can now sell ‘pin on receipt’ vouchers for Google Play worth anything between £1 and £200. Life:style vouchers can be preloaded with any amount between £20 and £100 and are intended to be given as a physical card to the customer to take away to present as a gift.

Ferrero expands Easter range

Ferrero UK has expanded and refreshed its Easter range for 2023.

orntons has expanded its range of moulded gures with the launch of a white chocolate bunny in a 90g format to cater for gi ing occasions. orntons’ existing 170g Bunny is already the third-bestselling branded SKU in value sales within novelties, worth £1.48m, according to Nielsen.

Meanwhile, a full pack re-design is set to roll out across orntons’ kids eggs, with animations and colourful backgrounds aiming to drive standout on shelf for parents.

What’s more, Ferrero Rocher has revealed two boxed egg packs for Easter 2023, a Ferrero Rocher

CONFECTIONERY

Egg and a Ferrero Collection (Milk) Egg, which both include a large 175g egg and six Ferrero Rocher. On top of this, Ferrero is introducing a new 100g Bunny for Easter.

In addition, Kinder Seasonal is returning for Easter 2023 with

familiar favourites such as Kinder Joy, Kinder Egg Hunt and Kinder Figures.

e Kinder 75g Bunny is now worth £1.1m, bene tting from additional distribution in 2022 across grocery and convenience throughout the Easter sales period.

World of Sweets teams up with chocolate liqueur brand

World of Sweets has expanded its partner brands portfolio by adding liqueur-filled chocolate maker Anthon Berg to its range.

A new distribution deal brings the Danish brand to a whole new market, vastly expanding its UK customer base and positioning it as an all-year-round gifting option for retailers, as well as focusing efforts around popular events like Valentine’s Day, Mother’s Day, Father’s Day and Christmas.

The brand is best known for its bottle-shaped chocolates, Its current includes Premium Chocolate Liqueurs, Chocolate Cocktail Liqueurs, Chocolate Coffee Liqueurs, Single Malt Scotch Collection, Chocolate Liqueur Tablets, Chocolate Pralines, Fruits in Marzipan, Marzipan Bars and an Advent Calendar. Anthon Berg is said to have the best selection of globally recognised spirits brands in the chocolate category, and World of Sweets plans to make the most of all product formats in its portfolio, including gift boxes, sharing pouches, tablets and bars.

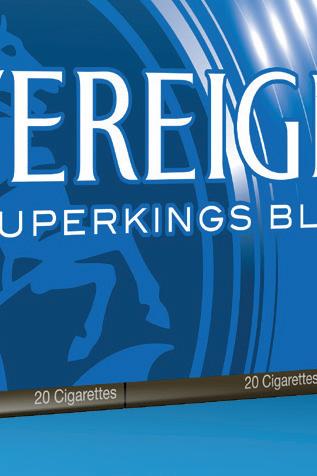

Sovereign Blue joins JTI’s ultra-value range

JTI has repositioned Sovereign Blue’s RSPs including KS, SK and Sky Blue KS to align with its ultra-value o erings as part of a pricing restructure across the tobacco manufacturer’s portfolio of Conventional Tobacco Products.

Sovereign Blue’s RSP (20-pack) will change to £10.65, joining Mayfair Silver and Kensitas Club as part of JTI’s ultra-value range.

Mark McGuinness, Marketing Director at JTI UK, commented:

“Price is an important purchasing factor for existing adult smokers and 80.5% of all sales volumes are currently in the value or ultra-value RMC and RYO sector.

“We’ve brought Sovereign Blue in line with our other ultra-value options to provide more choice of well-known brands to consumers at this end of the market.

“Shoppers will still receive the same high-quality Sovereign Blue product, whilst retailers can maximise the sales opportunity by o ering this heritage brand at a new value RRP.”

News SLR |FEBRUARY2023 www.slrmag.co.uk 18 Products Product News CONFECTIONERY

New seasonal products for Thorntons and Ferrero Rocher

TOBACCO JTI restructures its tobacco portfolio

KEEP UP WITH THE LATEST NEWS AS IT HAPPENS – FOLLOW US ON TWITTER @SLRMAG

SENSATIONAL SOFT DRINKS SALES – P34

Oreo launches new Xbox promo

Cookie brand Oreo has teamed up with gaming giant Xbox for a new promotion that seeks to “bring shoppers together through playful experiences”.

To celebrate the partnership, the Oreo cookie has been transformed to pay homage to the Xbox controller – with six embossed Oreo Xbox Special Edition cookies available to order now.

By scanning the cookies or entering the bar code from any participating pack, shoppers can unlock exclusive Oreo-themed in-game content across three of Xbox’s top-played games, including an Oreo ‘Parade Ground’ Armour Coating in Halo In nite, an Oreo

CONFECTIONERY Big Night In competition returns Retailers

‘Valiant Corsair’ Sail Set in Sea of ieves and an Oreo Edition ‘2009 Pagani Zonda Cinque Roadster’ in Forza Horizon 5.

In addition, thousands of prizes will be available over the promotional period, such as Xbox Series S consoles, Xbox Stereo Headsets and Xbox Game Pass Ultimate subscriptions. All entries will go into a grand prize draw for the chance to win a family holiday to California.

can win a grand with Swizzels

Swizzels has launched its Big Night In campaign for a fourth year, giving retailers the chance to win a cash prize of £1,000 when they buy any three cases from the sweet maker’s hanging bag range.

e range includes Curious Chews, Minions Tropical Chew Bars, Drumstick Choos, Refreshers Choos, Luscious Lollies and Scrumptious Sweets.

e campaign will be supported by POS for cash & carrys, wholesalers and retailers, as well as marketing support across customers’ own trade channels.

To enter, retailers need to upload their invoice or receipt via the QR code on POS or at swizzels. com/tradecomp. e competition runs from 1 February until 30 April.

Mark Walker, Sales Director at Swizzels, said: “ e Big Night In is now a rmly established trend that shows no signs of slowing down. We anticipate that more people will choose to socialise at home at the beginning of 2023 due to rising costs.

“Our hanging bags contain a selection of well-loved sweets with something for everyone, making them the ideal product to share on a Big Night In.”

“At Oreo, we love to surprise our consumers with new, fun activations that get them excited,” said Rafael Espesani, Senior Brand Manager for Oreo. “ is partnership is set to bring people together as they unlock playfulness with friends and family.”

Oreo’s brand owner Mondelez International advised retailers to stock up now on the limitededition cookies to make the most of the partnership.

New taste for Dr Pepper Zero

Coca-Cola Europacific Partners (CCEP) has unveiled a new and improved taste for Dr Pepper Zero. The relaunch is supported by a targeted out-of-home and social media advertising campaign that targets young adult shoppers.

Consumers will also be able to sample Dr Pepper Zero’s new and improved taste at universities and through food delivery services.

Martin Attock, Vice President of Commercial Development at CCEP, commented: “We know that taste is the number one consumption driver for Dr Pepper fans, and we’ve identified an exciting opportunity to make our Zero variant taste even better, with no significant taste difference between the regular variant.

“We’re starting the year as we mean to go on with Dr Pepper, and have big plans to keep investing in the brand after it became the no.2 flavoured carbonate brand in 2022.”

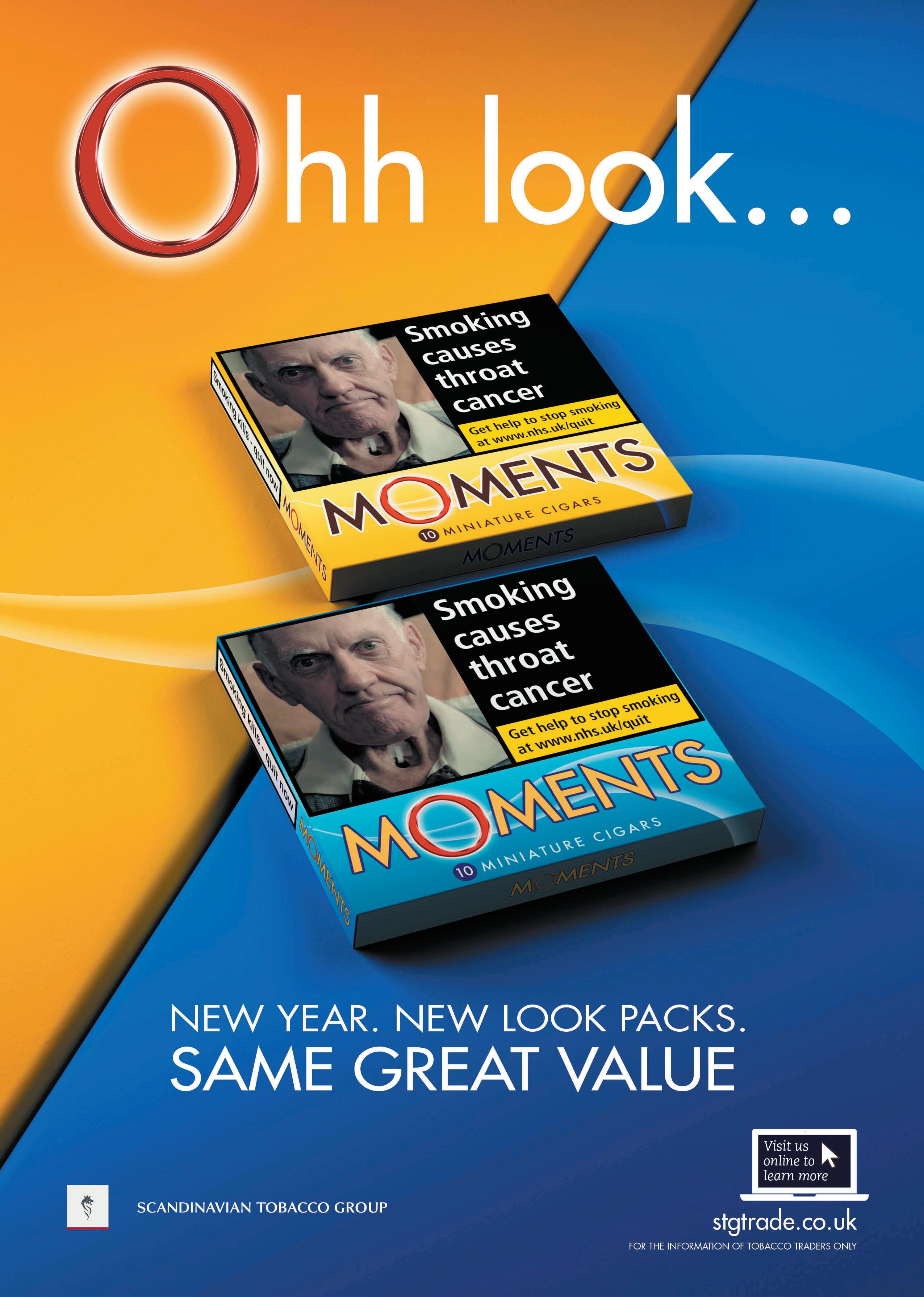

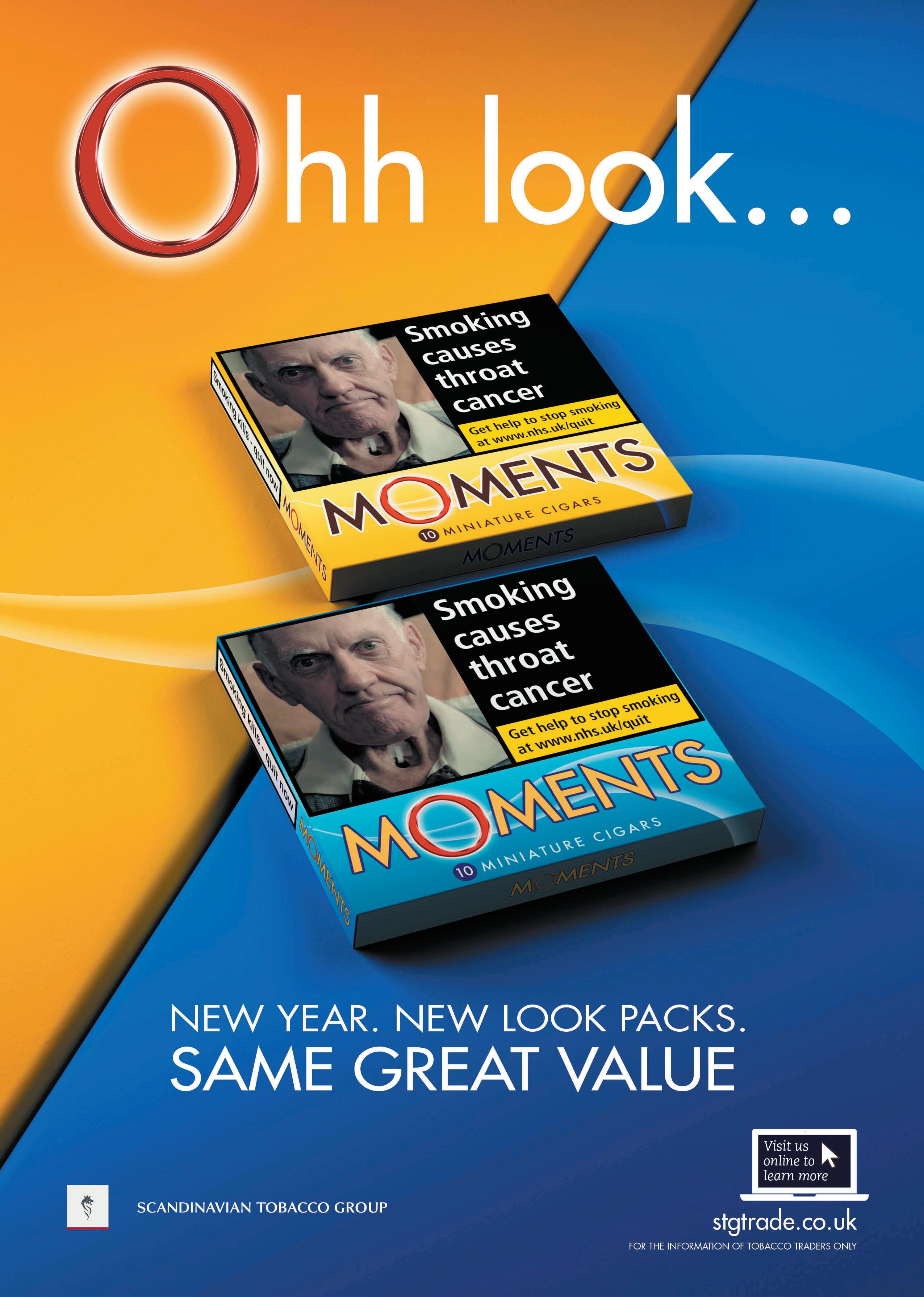

STG rebrands Moments

Scandinavian Tobacco Group has redesigned its value-formoney Moments brand with a new modern and eye-catching look that intends to start a shift from a ‘value, yet quality’ to a ‘value and quality’ message. The updated design features now on Moments Blue and Moments Original, with Moments Panatella following in May. New packs feature a bigger, more simplified logo and fresher colour scheme.

Nice prizes

Cadbury has launched ‘Spectacularly Nice,’ a new promotion across its hot chocolate range that gives shoppers the chance to win a raft of prizes. London West End theatre evenings and overnight trips to Paris are up for grabs, along with hundreds of Cadbury Hot Chocolate hampers that include takeaway vouchers. The promotion is bolstered with extensive out-of-home and instore support.

Hancocks launches

Ultimate Pick and Mix offer Confectionery wholesaler

Hancocks has unveiled its Ultimate Multibuy Pick and Mix to offer its customers choice from big name brands and value for money. The deal applies to bulk bags of pick and mix of 1.5kg and over. Customers who buy 20 or more bags will get a discount of 20p per bag. For customers buying 40 or more bags, the discount will be 50p per bag.

Brownie blues

Snack bar brand Fibre One 90 Calorie is out to banish the blues with a new on-pack promotion across its brownie range. Running until 20 February, the brand is offering the chance to win the ‘ultimate craveable experience’. A whopping 600 luxury prizes, including spa days, are up for grabs. To enter, shoppers must purchase their favourite brownie flavour and go online to see if they’ve won. The promotion is supported by shopper marketing activity.

News Products www.slrmag.co.uk FEBRUARY2023| SLR 19 BISCUITS

Partnership sees roll-out of limited edition cookies

SOFT DRINKS

Devilish ad campaign

Chilean wine brand Casillero del Diablo is back on TV with a rerun of its 2021 ad campaign, The World’s Greatest Thief, starring Chilean-American actor Pedro Pascal. The ad will be shown during episodes of The Last of Us on Sky Atlantic. The new drama series, which features Narcos and Game of Thrones star Pascal, is on air until 21 March. The brand is hoping for 90,000 adult ABC1 impressions over the ad’s 10-week run.

Mardi Gras makeover

Whiskey liqueur Southern Comfort has launched its third limited-edition bottle to celebrate Mardi Gras (21 February). This year, the bottle has been designed by Liverpudlian street artist John Culshaw, who took inspiration from the sights, sounds and tastes of New Orleans. Shoppers can scan an on-pack QR code to have a chance of winning a trip to New Orleans for Mardi Gras 2024.

Thatchers rolls out 2023 Community Orchard Project

Thatchers Cider has launched its Community Orchard Project for the third consecutive year. The Somerset cider maker is looking to give away 500 apple trees to community groups up and down the country, encouraging planting in both urban and rural communities. In 2022, Thatchers gave away 350 apple trees to over 50 organisations, doubling the number it was able to support in the project’s first year.

Government urged to promote low/no drinks

The Portman Group has called on the UK government to do more to encourage uptake of low- and no-alcohol drinks and finally launch its consultation on low-alcohol descriptors. Delayed now for almost two years, the consultation would seek views on standardising the terminology around the various ways in which products below 1.2% ABV are marketed – a major source of confusion for UK consumers.

WKD kicks-off Love Island double date

A er a two-year association as the O cial Alcohol Partner of Love Island, ready-to-drink brand WKD has expanded the collaboration for a further two series in 2023.

For the rst time ever, the ITV2 reality show is broadcasting two separate series in the same year, and WKD is O cial Alcohol Partner for both Series 9 (on air now) and Series 10 (summer).

e 2023 partnership provides WKD with extensive co-branded opportunities and to be the focal point of the brand’s marketing

LOW AND NO

support. Plans to leverage WKD’s exclusive O cial Alcohol Partner status and maximise the tie-in have already started and these include social, digital and in uencer activities.

Alison Gray, Head of Brand for WKD at SHS Drinks, commented: “We believe there’s no better match for WKD than Love Island! e success of the partnership is a key reason behind WKD’s impressive recent performance.

“Consumers and stockists can look forward to another year of

Broadland Drinks adds alcohol-free trio to Three Mills range

Broadland Drinks has added three nonalcoholic SKUs to Three Mills wine range.

Initially launching with a Fruity & Zesty White, a Light & Fruity Rosé, and a Juicy & Smooth Red, the new SKUs are available from this month.

Blended with 100% natural botanical flavours, Three Mills 0% is vegan, glutenfree and less than 40 calories per serving.

“Whilst it is younger consumers who are most likely to not drink alcohol, almost 40% of regular wine drinkers are actively moderating their consumption and seeking a great-tasting alternative,” said Nicola Cannon, Senior Brand Manager at Broadland Drinks.

“Caffeine and other soft drinks are not designed to target the same need state as alcohol; there’s very little choice for consumers looking for a great-tasting wine alternative.”

fun, innovative Love Island-related activity from WKD and, with two Love Island series in a year for the rst time ever, we’re doubly happy and doubly con dent that this really is a win: win, win: win scenario.”

CIDER Westons spends £2m on sustainability

Westons Cider has announced details of a £2m investment to enhance its fruit pressing capacity, while using the latest technology to reduce overall energy consumption, as part of the producer’s mission to reduce its carbon footprint.

The investment will see two state-of-the-art cider presses installed at its Herefordshire mill. Running entirely off renewable energy sources, and 20% more efficient than the current on-site presses, the new technology represents a significant step towards the company’s target of reducing its carbon emissions by 46% by 2030.

The installation of the new presses, set to begin in May, will enable Westons to press around 30% more fruit in the coming harvest when compared to the 2022 season.

The project is the latest measure introduced by Westons to reduce its carbon output. Last year, the company invested in a £3m canning line to improve its recyclable packaging capabilities and reduce the need to transport cider elsewhere.

News SLR |FEBRUARY2023 www.slrmag.co.uk 20 Off-Trade O -TradeNews RTDs WKD expands collaboration with ITV2’s popular reality show

KEEP UP WITH THE LATEST NEWS AS IT HAPPENS – FOLLOW US ON TWITTER @SLRMAG PACK A PUNCH WITH PMPs – P40

BrewDog backs mental health campaign

BrewDog is promoting positive mental health through a tie-up with #IAMWHOLE, an award-winning mental health campaign aimed at young people, encouraging them to speak out and seek help and support.

A donation from the sales of limited-edition four-packs of BrewDog’s Punk IPA Alcohol-Free 330ml will go towards supporting #IAMWHOLE.

e campaign is supported with a guerrilla-style out-of-home and digital awareness campaign, encouraging people to think about

why mental health openness is still such a taboo for men, and to get them talking.

Alex Dullard, Brewdog’s Head of Customer Marketing, said that the start of a new year can be di cult for many and a time when we

Zealand Wine rebrands

Trade association New Zealand Winegrowers has unveiled a new global brand platform, ‘New Zealand Wine, Altogether Unique,’ to highlight the very best of the country’s wine industry.

A short storytelling video has been created as part of the rebranding that aims to create an emotional connection to New Zealand wine. is features Kiwi actor and winemaker Sam Neill of Jurassic Park and e Piano fame, who has been a part of the New Zealand wine story for over 25 years. Neill is the proprietor of Two Paddocks, a family vineyard based in Central Otago, New Zealand.

“ is storytelling asset will tell the foundational story of New Zealand wine through the lens of the key pillars of purity, innovation, and care – aspects that make New Zealand wine and the New Zealand wine industry, so unique and special,” said Charlotte Read, General Manager Marketing, New Zealand Winegrowers.

“With global activity returning to ‘normal’, it’s more competitive than ever to have voice of the New Zealand Wine brand heard, and a clear premium brand message is essential. Creating a compelling brand positioning for New Zealand Wine is important as we seek to engage and motivate evolving wine drinking audiences.”

need to look a er our mental and physical health.

He added: “ at’s why we are teaming up with #IAMWHOLE for the second year and this time we are promoting it on-pack.

“ e campaign does great work at breaking down the taboos around mental health and we’re really thrilled to be able to help spread the word.”

To nd out more about Brewdog’s support of #IAMWHOLE, or if you feel the need to talk to someone about your own mental wellbeing, please visit whole.org.uk/giveaf.

Nikka releases two new single malts

Japanese whisky brand Nikka is releasing two new expressions in the UK, exclusively distributed by Speciality Brands, as part of its Discovery Series. The new limited editions aim to highlight the brand’s whisky-making expertise whilst overturning preconceptions about single malts. Both Yoichi Single Malt Discovery Aromatic Yeast (70 cl – 48% ABV) and Miyagikyo Single Malt Discovery Aromatic Yeast (70 cl – 47% ABV) will be available from this month with an RSP of £245.

Top tequila

RTDs

Global buys Hooch, Hooper’s and Reef trademarks

Global Brands has announced its purchase of the Hooch, Hooper’s, and Reef trademarks from Molson Coors.

The brands have been produced and distributed by Global since 2012.

Steve Perez (pictured), Chairman and Founder of Global Brands said the move gave the company the opportunity to invest further into the brands with the added security of owning the equity.

He added: “Hooch is a staple of the RTD category sold by major retailers. This deal will reinforce Global Brands’ position as the leading independent producer of RTD brands in the UK.

“We have lots of ideas for innovation and look forward to sharing these with the trade and consumers shortly.”

The latest CGA data has found that independently owned Cazcabel is the UK’s bestselling 100% agave tequila. As well as leading the way in both volume and value sales, Cazcabel is also the fastest-growing premium tequila in the market, enjoying 857% growth over the last three years. Cazcabel Blanco Tequila (ABV 38%) has an RSP of £25.99 for a 70cl bottle.

Seventh heaven

Ehrmanns Wines has unveiled a new Sauvignon Blanc from the Marlborough region of New Zealand. Crisp, zesty and refreshing, Seven Degrees (ABV 12.5%) has an RSP of £12 and offers notes of citrus fruit, lime, lemongrass and passionfruit. Apparently, 7°C is the best serving temperature for Sauvignon Blanc, hence the name.

Amber Beverage names

new COO Spirits producer Amber Beverage Group (ABG) has appointed Ewan MacLean as its Global Chief Operations Officer. He becomes a member of ABG’s Executive Committee Team and will oversee and organise all ABG production and supply chain processes reporting to the Group’s CEO, Jekaterina Stuge. MacLean joins ABG from Stock Spirits where he was Group Operations Director.

News Off-Trade

CRAFT BEER A donation from sales will bolster award-winning #IAMWHOLE

WINE Jurassic Park star spearheads marketing push New

www.slrmag.co.uk FEBRUARY2023| SLR 21

FOOD DELIVERY DRIVER PAY

‘FALLS 13%’

Food delivery driver pay fell up to 6% in 2022 compared to 2021 – with real-terms earnings plunging up to 13% when inflation is taken into account, according to data from gig worker app Rodeo.

Driver pay fell 6% in 2022 at Just Eat, 2.4% at white label delivery subcontractor Stuart, 1.3% at Uber Eats and 0.3% at Deliveroo respectively, according to the insight.

When taking average 2022 inflation of 8.9% into account, all four platforms saw realterms pay fall dramatically. Just Eat pay dropped almost 14%, while Deliveroo, Uber Eats and Stuart all saw driver earnings per order down about 10%.

COST-SAVING BEHAVIOURS PRESENT OPPORTUNITIES FOR RETAILERS

New data from Barclays has highlighted some key shopper cost-saving trends, offering opportunities for retailers.

From batch-cooking healthier meals at the weekends to buying more own brand products, new data from Barclays has revealed how consumers have adopted a more cost-conscious approach to New Year’s resolutions in 2023.

Insights from Barclays’ monthly Consumer Spending Index, which combines hundreds of millions of customer transactions with consumer con dence data, highlight some of the key trends and ag up opportunities for retailers.

e cost-of-living squeeze has apparently dampened appetite for New Year’s resolutions with 11% saying they have not made any resolutions at all due to rising costs, and an additional 10% feeling that resolutions are “less important this year” for the same reason.

A key trend identi ed is a sharp increase in people looking to get more value from the shopping spend

each week. Some two-thirds (65%) are actively looking for ways to get more value from their spending with almost half (49%) saying they are shi ing to ownbrand or budget goods over branded goods.

Meanwhile, over one-third (34%) of those who are aiming to make their resolutions more cost-e ective this year are planning to get a head start by preparing healthier or cheaper meals by batch cooking at the weekends, creating opportunities for retailers able to meet demand for ingredients.

A signi cant 63% of shoppers plan to reduce how o en they eat out at restaurants, presenting more opportunities for retailers.

Commenting on the ndings, Esme Harwood, Director at Barclays, said: “When purse strings tighten, the categories which tend to perform well include takeaways as a substitute for meals out, and staycations instead of holidays abroad.”

RETAIL ENJOYS BEST MONTH ‘FOR 20 YEARS’

Total retail food sales in Scotland increased by 11.5% compared with December 2021, according to the SRCKPMG Scottish Retail Sales Monitor for December 2022, representing “the best monthly performance in 20 years”. is gure was marginally ahead of the total retail sales growth gure of 11.3%. Adjusted for in ation, the year-on-year change was 3.9%.

On a like-for-like basis, total Scottish sales increased by 4.6% year-on-year.

David Lonsdale, Director, Scottish Retail Consortium, said: “A er two miserable years Scotland’s retailers were nally able to toast sparkling Christmas sales as 2022 nished with a ourish. December’s retail sales shone compared to

recent months and the comparable month the year before as shoppers returned to spending and took advantage of the rst Christmas in three years without pandemic-era curbs or instructions to shun socialising. Retail sales grew by almost 4% in real terms, the highest in three years, and at a much faster rate than during the second half of 2022. In gross terms, taking into account in ation and excluding Covid-era distortions, this was the best monthly performance in 20 years.

“Retail is far from being out of the woods yet. It’s an industry in transition with retailers navigating their own costs crunch, cash-conscious consumers, and the twin challenges of the economic legacy of Covid and in ationary pressures.”

SLR |FEBRUARY2023 www.slrmag.co.uk 22 Inside Business Market Research

deseed and chop the pepper. Heat the oil in a large saucepan and fry the chicken for 5 minutes until browned. Add the onion and pepper and fry Stir in the rice and curry powder and fry for another 2 minutes. Add the water and raisins. Bring to the boil and simmer for 20-25 minutes until the rice is cooked, stirring occasionally. Add more water if necessary. Add the peas 5 minutes before Once the rice is cooked, use a slotted spoon to dish up and enjoy hot. You can use white or brown rice or even a mix of the two

Ingredients• 1 Tablespoon (10g) Vegetable Oil Always check the label of each ingredient for • 400g Diced Chicken Breast Or Read the fu recipe on reverse > Energy 401 kcals 1701 kj Carbohydrate 62.8g Fat 4.8g Sugar 18.8g Saturates 0.7g Salt 0.2g Protein 30.4g Sodium 86mg NSP Fibre 4.7g Nutritional Information Per 356g serving Preparation: 5 mins Cooking: 40 mins Serves: 4 Cost: Under £5.00 i en Biryani Scan the QR code to view the recipe online! NEW POS AVAILABLE NOW! NEW step by step videos available to use in store and on social media to encourage consumers to cook at home. All filmed by Scotland’s National Chef –Gary MacLean. Call now to find out more. 0131 343 7602

Recipesup

RETAILERS’ FAVOURITE NEW PRODUCTS OF 2022 REVEALED!

The votes have been counted, so read on to see the winners of SLR’s Product of the Year Awards 2022...

BY GAELLE WALKER

BY GAELLE WALKER

As experienced retailers know by now, the survival, success and growth of the local retailing industry depends on all elements of the supply chain working in harmony. If retailers themselves are the heart and soul of the sector, then new products must surely be the lifeblood. Innovative new launches deliver a steady stream of chances to grow footfall, sales and pro ts.

SLR’s Products of the Year awards 2022 celebrate the very best of these game-changing new products – the bright sparks that have

helped to ignite growth in what was another challenging but successful year.

Crucially, the winners have been crowned by those who matter the most, local retailers themselves, with store owners’ thoughts, opinions and accounts having helped to shape every stage of the judging process.

So sit back, relax and bask in the glow of 2022’s most-prized new products, the tipples, treats and sweets that provided a welcome shot in the industry’s arm, setting it up for a healthier start to the year ahead.

HOW WERE THE WINNERS CROWNED?

The winners were decided exclusively by retailer vote.

All products that were launched in the 2022 calendar year and were available in the Scottish local retailing channel were eligible for entry.

The shortlist was curated from a list of every product that was carried in the print and digital versions of SLR and scored against a range of key engagement criteria including digital views, reads and clicks and offline retailer feedback.

All winners are entitled to showcase the special Winners logo on pack and in their marketing materials while all shortlisted entrants can display the special Shortlisted logo.

SLR |FEBRUARY2023 www.slrmag.co.uk 24 Inside Business SLR Products of the Year 2022

SLR PRODUCT YEAR 2022 OF THE

MEET THE WINNERS

BEER, CIDER AND LOW/NO ALCOHOL BEER

THATCHERS BLOOD ORANGE

BISCUITS AND CAKES

OREO TWISTS

BREAD AND HOME BAKING

WARBURTONS MAKE IT GRAIN

CANDY

SQUISHY CLOUDZ CHOCOLATE CONFECTIONERY

CADBURY TWIRL CARAMEL

CRISPS AND SNACKS

HEALTHY SNACKS/BREAKFAST BARS

NATURE VALLEY FRUIT & NUT

RTDS

DEAD MAN’S FINGERS: SPICED RUM & COLA SOFT DRINKS

RELENTLESS ZERO SUGAR

SPIRITS AND NO- OR LOW-ALCOHOL SPIRITS

SMIRNOFF BERRY BURST

SPORTS & ENERGY

LUCOZADE ALERT ORIGINAL

SQUASH

WOTSITS

CRUNCHY DRINKS TO GO

COCA-COLA EUROPACIFIC PARTNERS AND COSTA COFFEE DRINK FRAPPÉ RANGE

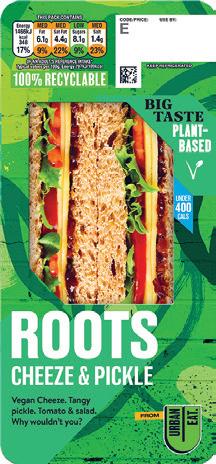

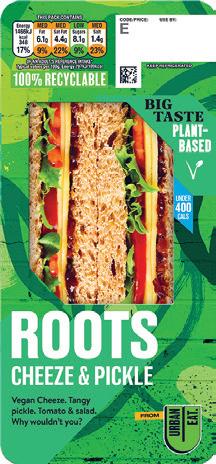

FOOD TO GO

RUSTLERS PERI PERI CHICKEN TENDERS BURGER

FREE FROM

CATHEDRAL CITY PLANT-BASED GUM

MARS WRIGLEY EXTRA, APPLE AND BLUEBERRY

HARD SELTZERS

AB INBEV CORONA TROPICAL ICE CREAM

BEN & JERRY’S SALTED CARAMEL BROWNIE PEACE POP

PROTEIN

BRANSTON BEANS

ROBINSONS ‘READY TO DRINK’ BLACKBERRY & BLUEBERRY

TOBACCO

NORDIC SPIRIT BERGAMOT WILDBERRY EXTRA STRONG VAPING

GEEK BAR E600 WINE

JAM SHED CHILEAN MERLOT CHILLED

KEFIR DRINKS

FROZEN

DR. OETKER RISTORANTE PRICE-MARKED PACK (PMP)

GROCERY

QUAKER’S FLAVOURED PORRIDGE RANGE

Inside Business SLR Products of the Year 2022 www.slrmag.co.uk FEBRUARY2023| SLR 25

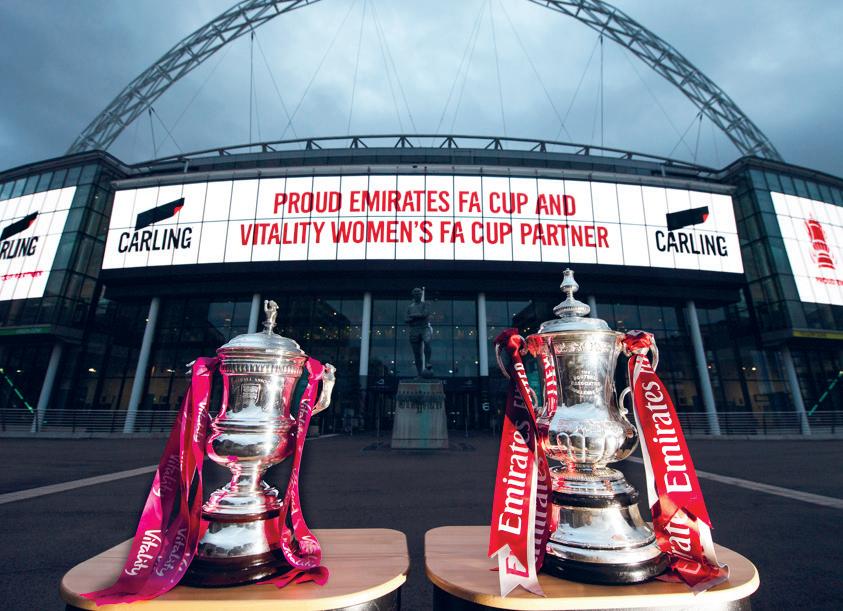

DRS HANDLING FEE UPPED AS LEGAL BATTLE PROCEEDS

DRS administrator Circularity Scotland has announced a slight increase in Handling Fees as Lanarkshire retailer Abdul Majid’s legal challenge is given the green light to proceed.

Inside Business DRS Update

HANDLING FEE RECALCULATIONS

DRS ROADSHOW

To help retailers prepare for DRS, CSL is running a series of registration workshops this month at venues across Scotland, as well as online.

With Return Point Operator Registration opening in March, the CSL workshops are open to all local retailers. They will last just over three hours and will cover:

*Return Point Operators will receive the Automatic Level 1 fee for the first 8,000 qualifying containers processed each week and the Automatic Level 2 fee for every container above the 8,000 threshold.

With retailers seeking more clarity and transparency on Scotland’s ground-breaking Deposit Return Scheme, these qualities seem in very short supply as the scheme draws ever closer to its go-live date on 16 August this year. e latest major hand grenade in proceedings is the prospect of a legal challenge to the Handling Fees retailers will receive for being part of the scheme. Bellshill retailer Abdul Majid’s quiet con dence that a legal challenge he is mounting would be allowed to proceed appears to have been well founded: the Court of Session has formally granted permission for his Judicial Review petition to proceed.

HANDLING ERROR

As previously reported in SLR, Abdul is challenging “the legality of the retailer Handling Fees which DRS administrator Circularity Scotland (CSL) is seeking to impose on retailers”.

Unsurprisingly, the Scottish Grocers’ Federation (SGF), which is backing Abdul’s challenge, has welcomed the news that the challenge will now proceed.

SGF CEO Pete Cheema said: “Scottish Grocers’ Federation has been and remains fully committed to a t for purpose Deposit Return Scheme but for that to happen recognition must be given and action taken to address the concerns around retailer handling fee levels which has been raised in Mr Majid’s petition.”

Abdul’s concern is that, a er extensive analysis, he feels that the Handling Fee levels

will not cover his costs and “will be detrimental to his business both in the short and long term thereby threatening the viability of his store which provides key services and groceries to his local community in Bellshill”.

FEE RECALCULATION

In the wake of this news, CSL then unexpectedly revealed an increase in the return Handling Fees. Increases of up to 19% were announced a er the fees had been “recalculated following feedback from industry and an independent assessment from PwC, which considered the impact of in ation and changes to the guidance around exemptions for return points announced by the Scottish Government last year”.

e recalculation sees the manual Handling Fee remain at 2.69p per container while the fee for those using automated Reverse Vending Machines (RVMs) rises from 3.55p to 3.70p per container for the rst 8,000 containers each week and from 1.35p to 1.60p for every container above the 8,000 threshold each week.

CSL said the revisions will not increase the total anticipated cost of the scheme and follow the December announcement of a reduced producer fee, which was slashed by 40%.

David Harris, Chief Executive of CSL, said: “We’re focused on delivering a Deposit Return Scheme that works for businesses of all sizes and delivers for Scotland. We will continue to work closely with industry, helping them to prepare for the scheme and ensuring that the scheme runs as e ciently and at as low cost as possible from August 2023.”

Q Producer Registration process

Q Return Point Operator Registration process

Q Operations overview: how the scheme works

Q Exemptions: eligibility criteria

Q Q&A session

There are two seminars at each location at 9am and 2pm each day. The seminars take place on:

Q Tuesday 7 February at Macdonald Drumossie Hotel, Old Perth Road, Inverness IV2 5BE

Q Wednesday 8 February at The Ben Nevis Hotel & Leisure Club, North Road, Fort William PH33 6TG

Q Thursday 9 February at Malmaison Dundee Hotel, 44 Whitehall Crescent, Dundee, Angus DD1 4AY (Please note: There is no parking available at the Malmaison Dundee Hotel but it is a short walk from several public car parks)

Q Monday 13 February – DoubleTree by Hilton Edinburgh Airport, 100 Eastfield Road, Edinburgh, EH28 8LL

Q Tuesday 14 February - Philipburn Hotel, Linglie Road, Selkirk TD7 5LS

Q Wednesday 15 February – DoubleTree by Hilton Glasgow Central, 36 Cambridge Street, Glasgow G2 3NH

Q Thursday 16 February – Cairndale Hotel, English Street, Dumfries, DG1 2DF

Q Friday 17 February – Webinar, 11am (a recording will be available after the event)

To register for the events or for further information, please visit www.circularityscotland.com

Inside Business DRS Update www.slrmag.co.uk FEBRUARY2023| SLR 27

Original Fee Revised Fee Manual 2.69p 2.69p Automatic Level 1* 3.55p 3.70p Automatic Level 2 1.35p 1.60p

CHECKOUT SCOTLAND: GET INVOLVED!

GroceryAid Scotland’s hugely popular Checkout music festival is back later this year and Scotland’s local retailers are being invited to get involved.

Scotland’s local retailing community is being urged to get involved in Checkout Scotland, the outstanding charity music festival organised by the Scottish Committee of industry charity GroceryAid. Following a hugely successful launch last year, the event will return in August with plans to ensure that the event is even bigger and even better.

e event returns on 31 August 2023 and will provide the perfect opportunity for the sector to gather, enjoying a fantastic day out and support the many industry colleagues who have fallen on hard times or face di cult challenges. e e ects of Covid have made the free, con dential support services that GroceryAid provides

more vital than ever. Unfortunately, demand for practical, nancial and emotional support has never been higher in the charity’s 166-year history.

In the last year alone GroceryAid has given out £434,000 in grants in Scotland.

GET INVOLVED

Jim Harper, Joint Chairman of the GroceryAid Scotland Committee, told SLR: “ e free, con dential support that GroceryAid provides is invaluable and, sadly, that support is more important than ever.

“Checkout Scotland is the perfect opportunity for local retailers in Scotland to play their part in supporting our industry colleagues who need a

little help, while also enjoying a great day out.

“We would encourage everyone to get involved by buying tickets, coming along and showing their support. A high-pro le event like Checkout Scotland really helps us raise awareness of GroceryAid and the many vital services it can o er to industry colleagues who may need emotional, practical or nancial help. e more colleagues that know that GroceryAid is there to help the better.”

Tickets cost £75 and are available now. ere are also a number of sponsorship packages available. All funds raised from the event will go towards helping colleagues in need with emotional, practical and nancial support from GroceryAid.

SLR PUBLISHER HITS GOLD

SLR publisher 55 North has once again received a coveted Gold Award from GroceryAid. Gold Award winners are companies that have participated in eight activities across all three of the charity’s critical pillars: Awareness, Fundraising and Volunteering. Other Gold winners include Asda, Booker, Budweiser, CCEP, Diageo, Heineken and Moet Hennessy.

SLR |FEBRUARY2023 www.slrmag.co.uk 28 Inside Business Checkout Scotland 2023

SAVE THE DATE! 31 AUG 2023 GLASGOW

FOR ALL EVENT INFORMATION AND SPONSORSHIP OPPORTUNITIES VISIT GROCERYAID.ORG.UK/EVENTS/CHECKOUT-SCOTLAND OR CONTACT PETER.STEEL@GROCERYAID.ORG.UK

THE SCOTTISH BUYING GROUP FOR INDEPENDENT RETAILERS SINCE 1976

Scotland’s best kept retail secret, working with independent retailers for over 40 years providing access to one of the leading convenience retail groups while allowing you to run your store, your way with great ranges and great support delivered direct to your store.

Delivered direct to store, with manageable order quantities.

14,000 SKU count across all categories including Food to Go

Access to the excellent and extensive Co-op Own Label Ranges

Three weekly promotion cycle available

Year round seasonal sales opportunities

Fascia and branding opportunities through the well established brand

Rebate scheme for qualifying members, spend level applies

Extensive supplementary direct to store ranges and services

Simple Invoicing*, one consolidated weekly statement and one direct debit

*Small weekly Admin Fee applies