APRIL 2023 www.ethanolproducer.com PLUS Ethanol M&A Deals Prioritize Asset Synergies PAGE 20 Near-Site CCS Specialist Locks In On Ethanol PAGE 28 PAGE 12 Alcohol-to-Jet Partnerships, Tech Roundup Into-Wing

MISSION

cte-global.com

by a team of industry experts with a continuous eye on future trends and market developments, our Technology Center will help your plant processes to improve e ciency, increase yields, reduce costs, lower CI scores, and unlock new revenue streams.

Powered

7.5 billion gallons per year of SAF by 2040

The

Edge

SAFFiRE

• Ultralow CI Score • Additional Revenue Source • Reduce Operating Costs • Produce High-Demand Aviation Fuel

Luke Geiver

ON THE

The U.S. Department of Energy's SAF Grand Challenge calls for 3 billion gallons of sustainable aviation fuel by 2030 and 35 billion gallons (total replacement of fossil-based jet fuel) by 2050. Worldwide, the demand is expected to rise to 100 billion gallons. The aviation industry will unquestionably need alcohol-based SAF to achieve those goals.

PHOTO: STOCK

4 | ETHANOL PRODUCER MAGAZINE | APRIL 2023 DEPARTMENTS 4 AD INDEX/EVENTS CALENDAR 6 EDITOR'S NOTE Alcohol-to-Jet Could Become Predominate SAF Platform By Tom Bryan 7 VIEW FROM THE HILL It’s a Fact: Consumers Support Ethanol By Geoff Cooper 8 BUSINESS BRIEFS 34 MARKETPLACE Ethanol Producer Magazine: (USPS No. 023-974) April 2023, Vol. 29, Issue 4. Ethanol Producer Magazine is published monthly by BBI International. Principal Office: 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Periodicals Postage Paid at Grand Forks, North Dakota and additional mailing offices. POSTMASTER: Send address changes to Ethanol Producer Magazine/Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, North Dakota 58203. FEATURES 12 SAF Off the Ground Ethanol-based SAF projects, tech roundup By Katie Schroeder 20 M&A Similarity Sells Acquisitions, JVs reflect attraction to sameness By Luke Geiver 28 CCS Locked In On Near-Site CCS Sequestering CO2 close to the plant By

Contents

COVER

APRIL 2023 VOLUME 29 ISSUE 4 12 20 28

EDITORIAL

President & Editor

Tom Bryan tbryan@bbiinternational.com

Online News Editor

Erin Voegele evoegele@bbiinternational.com

Staff Writer

Katie Schroeder katie.schroeder@bbiinternational.com

DESIGN

Vice President of Production & Design

Jaci Satterlund jsatterlund@bbiinternational.com

Graphic Designer

Raquel Boushee rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan jbryan@bbiinternational.com

Vice President of Operations/Marketing & Sales

John Nelson jnelson@bbiinternational.com

Senior Account Manager/Bioenergy Team Leader

Chip Shereck cshereck@bbiinternational.com

Account Manager

Bob Brown bbrown@bbiinternational.com

Circulation Manager

Jessica Tiller jtiller@bbiinternational.com

Marketing & Advertising Manager

Marla DeFoe mdefoe@bbiinternational.com

EDITORIAL BOARD

Ringneck Energy Walter Wendland

Little Sioux Corn Processors Steve Roe

Commonwealth Agri-Energy Mick Henderson

Aemetis Advanced Fuels Eric McAfee

Western Plains Energy Derek Peine

Front Range Energy Dan Sanders Jr.

Advertiser Index

Upcoming Events

2023 Int'l Fuel Ethanol Workshop & Expo June 12-14, 2023

CHI Health Center, Omaha, NE (866) 746-8385 | FuelEthanolWorkshop.com

From its inception, the mission of this event has remained constant: The FEW delivers timely presentations with a strong focus on commercial-scale ethanol production—from quality control and yield maximization to regulatory compliance and fiscal management. The FEW is the ethanol industry’s premier forum for unveiling new technologies and research findings. The program is primarily focused on optimizing grain ethanol operations while also covering cellulosic and advanced ethanol technologies.

2023 Biodiesel Summit: Sustainable Aviation Fuel & Renewable Diesel

June 12-14, 2023

CHI Health Center, Omaha, NE (866) 746-8385 | BiodieselSummit.com

The Biodiesel Summit: Sustainable Aviation Fuel & Renewable Diesel is a forum designed for biodiesel and renewable diesel producers to learn about cutting-edge process technologies, new techniques and equipment to optimize existing production, and efficiencies to save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers and producers to advance discussion and foster an environment of collaboration and networking through engaging presentations, fruitful discussion and compelling exhibitions with one purpose, to further the biomass-based diesel sector beyond its current limitations.

2023 National SAF Conference & Expo

August 29-30, 2023

Minneapolis Convention Center, Minneapolis, MN (866) 746-8385 | www.nationalsafconference.com

The National SAF Conference & Expo is designed to promote the development and adoption of practical solutions to produce SAF and decarbonize the aviation sector. Exhibitors will connect with attendees and showcase the latest technologies and services currently offered within the industry. During two days of live sessions, attendees will learn from industry experts and gain knowledge to become better informed to guide business decisions as the SAF industry continues to expand.

2023 National Carbon Capture Conference & Expo

November 7-8, 2023

Iowa Events Center | Des Moines, IA

(866) 746-8385 | www.nationalcarboncaptureconference.com

Please recycle this magazine and remove inserts or samples before recycling

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer.com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to editor@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space. TM

COPYRIGHT © 2023 by BBI International

The National Carbon Capture Conference & Expo is a two-day event designed specifically for companies and organizations advancing technologies and policy that support the removal of carbon dioxide (CO2) from all sources, including fossil fuel-based power plants, ethanol production plants and industrial processes, as well as directly from the atmosphere. The program will focus on research, data, trends and information on all aspects of CCUS with the goal to help companies build knowledge, connect with others, and better understand the market and carbon utilization.

ETHANOLPRODUCER.COM | 5 2023 Int'l Fuel Ethanol Workshop & Expo 10-11 CPM 19 CTE Global, Inc. 2 D3MAX LLC 26-27 Fagen, Inc. 14 Fluid Quip Mechanical 15 Fluid Quip Technologies, LLC 30 Growth Energy 24 ICM, Inc. 36 Lallemand Biofuels & Distilled Spirits 32 Phibro Ethanol 34 POET LLC 33 SAFFiRE Renewables 3 WINBCO 31

Alcohol-to-Jet Could Become Predominate SAF Platform

It’s a fact that the projected global demand for sustainable aviation fuel can only be met by using both lipids and alcohol-based feedstocks. The SAF currently being made from plant oils, restaurant grease and animal processing waste—an already over-pressured category of feedstock—can only take SAF so far. The biojet fuel race has hardly begun, and every available drop of used cooking oil seems to be claimed before it’s left the kitchen. Corn oil is in ultra-high demand, too, largely because of renewable diesel, and massive soybean crushing plants are being built (one in North Dakota with a reported $400 million price tag) to keep pace with what’s coming. Yes, the rise of renewable diesel and SAF from hydrotreated esters and fatty acids has been awesome to watch, but it can only deliver a few billion gallons of SAF to the world, at most. That’s a lot, but according to the U.S. Department of Energy, 100 billion gallons of SAF will be needed globally by 2050. And the only way to get remotely close to that number, other than something like CO2-to-syngas, is by using ethanol—and, yeah, corn ethanol.

As we report in our page-12 cover story on SAF projects and technologies, “Off the Ground,” SAF production, in general, remains nascent, and alcohol-to-jet hasn’t really begun—not at commercial scale. But, as the story explains, the world’s major airlines are keen to use ethanol because it is ubiquitous, clean, understood and transformation ready. Some carriers would prefer to use non-grain ethanol to attain the lowest carbon-intensity fuel possible. SAFFiRE Renewables, a partnership between Southwest Airlines and D3MAX, is pursuing SAF from corn stover-based ethanol, for example, and LanzaJet, at the landmark plant it’s building in Georgia, plans to use sugar cane ethanol, first, and second-generation ethanol later. But chasing cellulosic isn’t for everyone. At least a few airlines appear to believe U.S. ethanol producers can take corn ethanol to a low enough CI for SAF. Blue Blade Energy, a partnership between Green Plains, Tallgrass Energy and Untied Airlines, is pursuing SAF from low-CI corn ethanol, as is Gevo, which has offtake agreements with several airlines. While neither is producing corn alcohol-to-jet at the moment, the industry’s massive scale—volume, infrastructure and reliability—could make it the largest SAF feedstock virtually overnight, should prevailing winds blow that way.

Next, in “Similarity Sells,” on page 20, we take a look at recent ethanol plant acquisitions that, if nothing else, remind us that producers, when investing in other plants, tend to look for assets that resemble, complement or compound what they already have: familiar tech, matching equipment, shared customers and suppliers, parallel products and the like. You’ll see what we mean when you read the story: buyers clearly appreciate assets that resemble what they already own.

The quest to make corn ethanol worthy of being an SAF feedstock is in no small part related to the potential of carbon capture and sequestration. In “A Team Built for Near-Site CCS,” on page 28, we introduce a rising CCS developer focused on working with ethanol producers that are uniquely positioned to sequester CO2 near their plant. As we have reported before, stand-alone sequestration, for those able to do it, is a good opportunity to get into CCS now, while the big aggregation projects get to the finish line.

6 | ETHANOL PRODUCER MAGAZINE | APRIL 2023 FOR INDUSTRY NEWS: WWW.ETHANOLPRODUCER.COM OR FOLLOW US: TWITTER.COM/ETHANOLMAGAZINE Editor's Note

It’s a Fact: Consumers Support Ethanol

For more than a decade, the Renewable Fuels Association has worked with national polling groups to regularly survey American voters about their attitudes toward ethanol, the Renewable Fuel Standard, and other marketplace and policy issues important to our industry. Our most recent round of polling, in which Morning Consult surveyed 1,999 registered voters, showed that support for low-cost, low-carbon renewable fuels like ethanol continues to grow.

According to the survey, nearly 65 percent of the voters support the Renewable Fuel Standard, while only 15 percent expressed some level of opposition to the program. Meanwhile, 64 percent of respondents have a favorable opinion of ethanol, compared to just 18 percent unfavorable. When it comes to higher blends of ethanol, 68 percent support increasing the availability of E15 to help lower fuel prices and bolster energy independence, and 66 percent said it is important for the federal government to promote the production and sale of flex-fuel vehicles in the United States.

This round of polling also looked at some of the current policy debates and questions facing the industry, and the results are not surprising. The survey showed 60 percent of respondents support the Next Generation Fuels Act, which would drive the use of more efficient, lower-carbon liquid fuels like E25 or E30, compared to just 18 percent who oppose such legislation. And when it comes to electric vehicles, 77 percent of voters say it is important for automakers to disclose (to potential buyers) the emissions impacts of the electricity used to power electric vehicles, and 66 percent oppose policies that would ban the sale of new cars with traditional liquid-fueled engines.

RFA also conducted a round of focus groups in late January, held virtually with consumers in Ohio, Florida and California. These sessions provided a more qualitative assessment and a deeper look into how some people view these matters. While there was some ambivalence or misunderstanding about ethanol at first, a short discussion of ethanol’s benefits quickly led to more support; and we learned, again, that consumers are on our side. Over and over in both the Morning Consult polling and our focus groups, consumers say they want fuel options that are lower in cost, American-made, and better for air quality and carbon emissions. And there is still a lot of concern—even among voters in California—about moving too rapidly toward an all-EV future.

When you’re in the trenches fighting for ethanol every day, it’s easy to get distracted by the negative attacks and myths that continue to be hurled at our industry. But the conclusions we can draw from this public opinion work are clear. Americans strongly support expanded use of lower-cost, lower-carbon renewable fuels like ethanol, want greater access to higher ethanol blends, and strongly oppose policies that remove options at the gas pump or the auto dealership. It’s evident that voters understand and support the environmental advantages, energy security benefits, and affordability that renewable fuels like ethanol offer.

ETHANOLPRODUCER.COM | 7 Geoff Cooper President and CEO Renewable Fuels Association 202-289-3835

gcooper@ethanolrfa.org

View from the Hill

BUSINESS BRIEFS

Cooper testifies at national CFP committee hearing

Renewable Fuels Association President and CEO Geoff Cooper testified at a hearing of the U.S. Senate Committee on Environment and Public Works in late February, telling lawmakers that a national Clean Fuel Program that incorporates a market-based, technology-neutral approach could be critical to decarbonizing the U.S. transportation sector.

“While policies such as the Renewable Fuel Standard, the Inflation Reduction Act, and light-du-

ty vehicle fuel economy and tailpipe standards will play a vital role in reducing greenhouse gas emissions from transportation, other complementary solutions will also be required to truly decarbonize the sector by mid-century,” Cooper said. “If properly structured, a national Clean Fuel Program (sometimes called a Low Carbon Fuel Standard or Clean Fuel Standard) offers the best potential to rapidly accelerate the decarbonization of the transportation sector.”

Minnesota E15 sales volume hit record in 2022

Sales of E15 hit a record 171 million gallons in Minnesota in 2022, according to a recent Renewable Fuels Association analysis of data from the Minnesota Department of Commerce. This represented a 31 percent increase over the prior year due to a combination of more stations offering E15, ethanol’s cost-competitiveness, and steps taken by the Biden administration to avoid obsolete restrictions on summertime E15 sales nationally.

RFA has estimated that American consumers saved $57 million in 2022 due to U.S. Environmental Protection Agency waivers allowing E15 to be sold between June 1 and September 15 in conventional gasoline areas, at a time when retail gasoline prices hit a record high. The trade group warned, however, that E15 sales will be severely limited this coming summer unless the EPA takes action soon to allow year-round availability.

Gevo adds future SAF plant to Summit Carbon Solutions pipeline

An alcohol-to-jet fuel plant under construction near Lake Preston, South Dakota, has signed on to join the proposed Summit Carbon Solutions pipeline. Colorado-based Gevo broke ground on its $800 million Net-Zero 1 plant last year, beginning dirt work while finalizing project finance. When built, the plant will produce 55 MMgy of ethanol-based SAF, possibly starting in 2025. A wind-energy project is being developed to supply carbon-

neutral electricity to the plant, which may also be used to produce green hydrogen from water and renewable natural gas.

Summit reached a major project milestone in February, achieving landowner agreements for more than 60 percent of the proposed pipeline route across five states—Iowa, Minnesota, Nebraska, South Dakota and North Dakota—a total of 4,000 total landowner agreements.

8 | ETHANOL PRODUCER MAGAZINE | APRIL 2023

PEOPLE, PARTNERSHIPS & PROJECTS

Ethanol, DDGS achieve record export values in 2022

The Renewable Fuels Association reported in February that the value of the U.S. ethanol industry’s exports soared to a record level of $7.2 billion in 2022. Ethanol exports strengthened to 1.35 billion gallons, the fourth-highest level on record, and distillers grains registered at 11.0 million metric tons, down slightly from 2021. While volumes shipped were not unprecedented, the cumulative sales values of both products were all-time highs.

Ethanol exports increased 9 percent over 2021—the highest volume since 2019—and the value of U.S. ethanol exports surged to $3.77 billion, a record high and an increase of $1 billion over 2021. Distillers grains exports in 2022 represented nearly a third of total domestic production. While export volumes were down slightly year-over-year, the product’s value surged to a record $3.4 billion.

Illinois governor signs bill establishing SAF tax credit

Illinois Gov. JB Pritzker on Feb. 3 signed the Invest in Illinois Act. The legislative package, in part, creates a $1.50 per gallon sustainable aviation fuel (SAF) purchase tax credit to support the supply and use of SAF within the state.

The SAF tax credit will become effective June 1, 2023, and remains in place through Jan. 1, 2033. The credit applies to SAF sold to or

used by an air carrier. To be eligible for the credit, SAF must achieve a 50 percent lifecycle greenhouse gas reduction when compared to petroleum-based jet fuel using either the lifecycle methodology for SAF developed by the International Civil Aviation Organization or the most recent version of Argonne National Laboratory’s GREET model.

USDA-ERS predicts increased ethanol demand through 2030

USDA Economic Research Service analysts, using EIA data, recently predicted that by 2030, international (non-U.S.) ethanol use, under "historical" blend rates, will increase by just 7.4 percent. However, under “targeted” blend rates, international ethanol consumption could increase by 173 percent by 2030, due mostly to demand growth in Canada, Brazil and China.

U.S. gasoline consumption could either decrease by as much as 3.3 percent or increase by

as much as 5.3 percent, causing domestic ethanol consumption to grow between 1.4 percent and 10.4 percent by 2030.

“The projected increase in ethanol consumption across all scenarios—despite falling gasoline consumption in some scenarios—is due in part to EIA’s assumption that the Renewable Fuel Standard will increase total U.S. consumption of renewable fuels,” said the ERS researchers in the report.

ETHANOLPRODUCER.COM | 9

JUNE 12-14, 202

Omaha, Nebrask

F uelEthanolWorkshop

THE ENERGY INDUSTRY IS ABOUT TO CHANGE

Register by May 3rd Save $200 on Full Registration

All Events For One Registration Price Production Facilities Receive Complimentar y Passes

Last Year Nearly 2,200 attendees & 550 Biofuels Producers Attended Last Year Attendees Said… Made Valuable Contacts

98% Want to Return

93%

94% Rated a Positive ROI

For ethanol producers and associated industry suppliers, the FEW is the single most relevant, important event to attend. It’s feet on the ground, where decision makers and innovators can come together for mutual bene t. Bob Miller, BetaTec Hop Products, Inc

The FEW is the conference for the ethanol industry. The combination of speaker topics and exhibitors is exceptional.

- Doug Rivers, Lee Enterprises Consulting

A great opportunity to meet so many in a single location!

- Trevor Morgan, Bridgeport Ethanol

C o-locatied Ev ent Preconf erence Ev ents

866-746-8385 | service@bbiinternational.com | #FEW23 @ethanolmagazine Produced By

the

for the

industry.

Biofuels

Consider FEW

standard

biofuels

– Chris Veit, Lallemand

& Distilled Spirits

Sustainable aviation fuel production remains nascent, but it is already clear that the feedstocks predominantly being used to make SAF today will not satisfy total future demand. Billions of gallons of SAF are needed, but only so much used cooking oil, waste fat, corn oil and soybean oil is available and unclaimed. A host of other feedstocks are plausible, but hard to convert, hard to find or hard to defend. These marketplace realities are drawing the SAF industry to an input that is ubiquitous, clean, understood and transformation ready: low-carbon ethanol.

Multiple airlines forged ethanol connections—some inking formal commitments—last year as interest in feedstocks and technologies of all types hit a near fever pitch and alcohol-to-jet was widely deemed both necessary and inevitable. In August, Congress passed the Inflation Reduction Act, which created an attractive federal tax credit for qualifying SAF, sparking intense questions about how, if at all, low-carbon corn ethanol might qualify. Almost all analyses of the legislation suggest corn ethanol is substantially hampered by the bill’s carbon math, but that hasn’t quelled ethanol producer enthusiasm for SAF, nor carbon reduction investments related to it. Corn etha-

nol producers are engaging in the play not as a result of SAF’s first big federal incentive, but almost despite being virtually excluded from it.

The federal SAF credit starts at $1.25 per gallon for qualifying biobased jet fuel that reduces carbon emissions by 50 percent, with one cent added for each additional percentage point of reduction, capping out at $1.75. SAF made from corn ethanol, experts say, has a difficult-to-impossible time qualifying since the law measures GHG reduction using the International Civil Aviation Organization’s CORSIA methodology rather than the Department of Energy-Argonne National Laboratory’s GREET model,

12 | ETHANOL PRODUCER MAGAZINE | APRIL 2023

ON TRACK: LanzaJet is making great progress on its 10 MMgy SAF and renewable diesel plant in Soperton, Georgia, dubbed Freedom Pines Fuels. The facility will be the first large-scale alcohol-to-jet SAF plant in the nation.

PHOTO: LANZAJET

which is more friendly to corn ethanol and believed by many experts to be the most appropriate lifecycle analysis methodology for the determination of SAF emissions.

In December, when the IRS issued guidance on the federal SAF tax credit—just a month after the DOE unveiled a roadmap for its SAF Grand Challenge—corn ethanol remained effectively sidelined as a result of the credit’s GHG methodology, despite the ethanol industry’s pleas for the adoption of GREET. In February, legislation signed into law in Illinois established a $1.50 per gallon tax credit for SAF. Unlike the IRA, the state legislation allows SAF producers to qualify using either CORSIA or GREET,

OFF THE GROUND

Several alcohol-to-jet projects, partnerships and technologies have been announced in the past 18 months. Ethanol Producer Magazine checks in on each, looking at where they stand and what they might ultimately achieve.

By Katie Schroeder

By Katie Schroeder

presumably putting low-carbon grain ethanol in the action. The bill was signed into law by Illinois Gov. J.B. Pritzker on Feb. 3 and becomes effective June 1. Not only has the Illinois SAF credit sparked excitement among conventional ethanol producers, but put more weight behind ongoing appeals to somehow work GREET into the IRA.

With or without the IRA credit, the ethanol industry is all over SAF, and the United States’ potential to be a major global producer of biobased jet fuel is undeniably tied to its massive ethanol production and delivery infrastructure. The International Energy Agency has, in fact, identified the U.S. as the country with the most “signifi-

cant growth potential for SAF,” likely due to its existing biofuels production capability, the passage of the IRA and the DOE’s Grand Challenge, which calls for 3 billion gallons of SAF production and use by 2030, and completely replacing domestic jet fuel for aviation by 2050.

Marykate O’Brien, chief sustainability officer with Southwest Airlines, explains the demand for SAF, the feedstocks available and the technologies being deployed. “I think it’s a really great time for the SAF industry when you have the major players, the major off-takers saying they want to replace 10 percent of their fuel by 2030 and a hundred percent by 2050,” she says.

ETHANOLPRODUCER.COM | 13

SAF

COMING TOGETHER: In December, LanzaJet completed most of the structural work on Freedom Pines Fuels and commenced with technology installation. The alcohol-to-jet fuel plant is expected to be completed and commissioned later this year.

14 | ETHANOL PRODUCER MAGAZINE | APRIL 2023

PHOTO: LANZAJET

To replace all of the aviation fuel in the U.S. with a biobased counterpart, roughly 35 billion gallons of SAF will be needed. Worldwide, the demand is around 100 billion gallons. Southwest wants a tenth of its jet fuel to be SAF by 2030 and all of it by 2050. As of now, Southwest Airlines has offset around 0.05% of its overall jet fuel use, O’Brien explains. The company’s four pillars used to meet these goals: reduce, offset, replace and partner. “Reducing” involves implementing improved technologies that allow for more efficient use of fuel; “offsetting,” is about Southwest eventually scaling back and redirecting those efforts into replacing and partnering; “replacing” involves offtake agreements to substitute fossil fuels with SAF; and “partnering” is the R&D piece, involving some SAF offtakes and investment opportunities.

The last pillar, partnering, is the element behind Southwest’s investment in SAFFiRE Renewables (see page 16), O’Brien explains. “That’s where we think the opportunity is strong enough that we want to put some money down on the table to help advance that technology,” she says. “One big thing about our investment in SAFFiRE is that it is Southwest Airlines’ first investment in anything [outside of] an airline acquisition in our entire history as a company. So, that illustrates how important it is to us and how much potential we think this technology has to make a dent in the overall need for SAF.”

O’Brien sees ethanol as one of the feedstocks with high potential to yield the gallons needed to produce SAF, while also having some of the most advanced technology for conversion. “I think we have some really promising near-term pathways, and ... ethanol is certainly one of those, I think there are very few potential pathways that can claim the same maturity that ethanol has,” O’Brien says. “The infrastructure is there, the know-how is there, we still need some of the (alcohol-to-jet) buildout, but it’s proven technology at this point. I think,

near-term, the ethanol industry has a huge opportunity to impact those initial gallons that we’re going to need.”

Freedom Pines Fuels

SAF company LanzaJet, has a 10 MMgy SAF and renewable diesel plant under construction in Soperton, Georgia. LanzaJet’s Freedom Pines Fuels will be the nation’s first alcohol-to-jet SAF production facility. The plant will use undenatured ethanol from a variety of feedstocks, including waste-based sources, to make 9 MMgy of SAF and 1 MMgy of renewable diesel. In January, the EPA approved LanzaJet to generate D4 RINs using sugarcane-based ethanol for its renewable diesel and SAF. This was a key milestone in the company’s EPA approval process, and the first approval of ethanol as a feedstock for SAF. LanzaJet is pursuing approval for ethanol made from other feedstocks as well, including novel and waste-based sources.

In December, LanzaJet hit another major project milestone with the completion of construction and fabrication, and the start of installation for its trademarked alcohol-to-jet technology. The plant is on track to be completed and begin startup later this year. “We’re most looking forward to seeing our sustainable aviation fuel from LanzaJet Freedom Pines Fuels serve as a compatible, drop-in replacement fuel for existing aircraft currently in use around the world that can significantly reduce aviation lifecycle emissions today,” Meg Whitty, vice president, corporate relations and marketing with LanzaJet, tells Ethanol Producer Magazine. “The facility is planning to fully transition to second-generation ethanol in the coming years as production develops and supply chains mature, establishing a new market for scalable ethanol from wastebased sources.”

Whitty explains that LanzaJet is simultaneously working on developing additional projects around the world. “We’re excited to play a significant part in building and scaling

PLANT UPTIME IS IMPORTANT TO EVERYONE

Our full service team of experts have 20 years of ethanol plant maintenance reliability and uptime history 24/7 support and ready access to a full inventory and all Fluid Quip equipment parts, ensures that you maintain your plant’s uptime status.

PARTS

• OEM Parts Warehouse

• $1 million+ on-hand inventory

• Fully stocked trucks

• Overnight/hot shot shipping

EQUIPMENT SERVICE

• Factory Trained & Certified

• MSC™ Systems

• SGT™ Grind Systems

• FBP™ Fiber By-Pass Systems

• MZSA™ Screens

• Paddle Screens

• Grind Mills

• Centrifuges

SAF

a new industry while enjoying the privilege of partnership with incredible public and private sector leaders that have supported the work on this journey,” she states.

LanzaJet signed a memorandum of understanding in 2022 with Marquis Sustainable Aviation Fuel to build an SAF plant in Illinois, while also receiving government grant funding in the U.K. to support the deployment of its technology there. In early 2023, the company announced a memorandum of understanding with Indian Oil Corporation to pursue a joint venture to produce SAF in India.

Blue Blade Energy

Green Plains, Tallgrass Energy and United Airlines announced a joint venture in January to pursue the commercial production of SAF by developing a novel technolo-

gy that uses ethanol as its feedstock. Should the technology succeed, they plan to start construction on a pilot facility in 2024, followed by a commercial facility in 2028. The offtake agreement could provide enough SAF to supply 50,000 flights between United’s hub airports in Denver and Chicago.

“Our transformation to a true decarbonized biorefinery model has positioned Green Plains to help our customers and partners reduce the carbon intensity of their products by producing low-carbon proteins, oils, sugars and, now, decarbonized ethanol to be used in SAF,” said Todd Becker, president and CEO of Green Plains in a January press release announcing Blue Blade. “This partnership with world-class organizations like United Airlines and Tallgrass, shows the value creation that is possible with our lowcarbon platform. The potential impact of

this project is a gamechanger for U.S. agriculture, aligning a strong farm economy and a robust aviation transport industry focused on decarbonizing our skies.”

The technology Blue Blade plans to use was initially developed by Pacific Northwest National Laboratory. Tallgrass will manage the research and development of the technology, including development of the pilot plant, as well as managing construction of the production facility. Green Plains will supply low-carbon ethanol to the SAF plant and manage its operation. United will assist with SAF development, fuel certification and “into-wing” logistics. The airline company has agreed to buy up to 2.7 billion gallons of SAF produced from the joint venture (over 20 years), according to the press release.

“The production and use of SAF is the most effective and scalable tool the airline industry has to reduce carbon emissions and United continues to lead the way,” said United Airlines Ventures President Michael Leskinen. “This new joint venture includes two expert collaborators that have the experience to construct and operate large-scale infrastructure, as well as the feedstock supply necessary for success. Once operational, Blue Blade Energy has the potential to create United’s largest source of SAF, providing up to 135 million gallons of fuel annually.”

SAFFiRE Renewables

SAFFiRE Renewables is partnered with Southwest to make cellulosic SAF with an ultra-low CI score, using corn stover as a feedstock. Mark Yancey, chief technology officer with D3MAX and SAFFiRE (an acronym for Sustainable Aviation Fuel from Renewable Ethanol) explains the potential of corn stover and other agricultural residues as feedstock. “Since corn is the biggest

16 | ETHANOL PRODUCER MAGAZINE | APRIL 2023

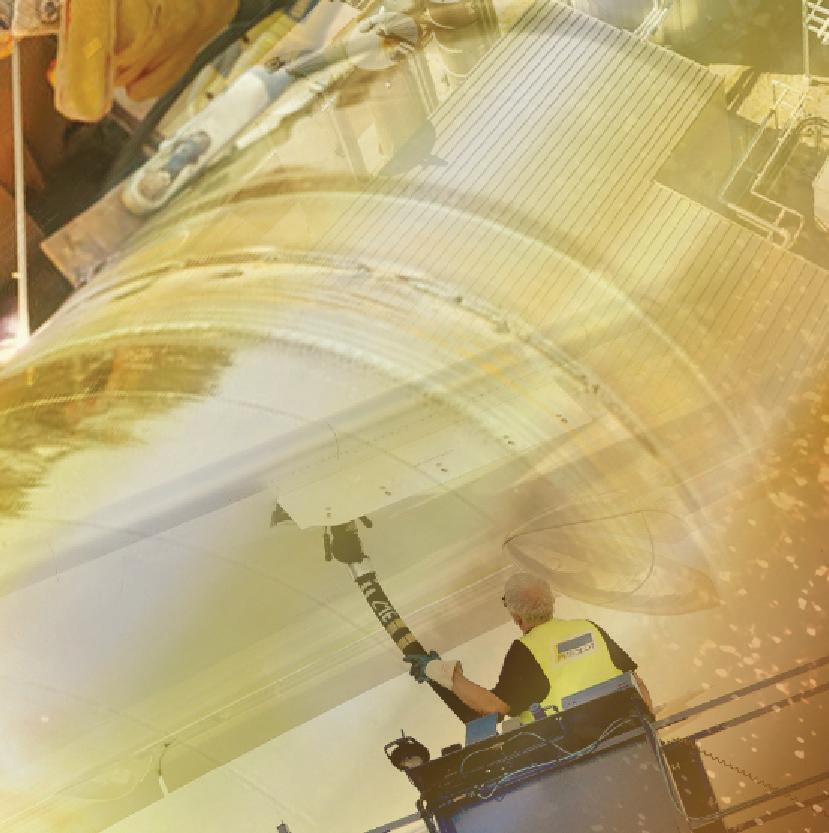

'INTO-WING' PARNTER: As an engaged off-take participant in the Blue Blade Energy project, United Airlines will assist with SAF development, fuel certification and "into-wing" logistics. The airline has agreed to purchase up to 2.7 billion gallons of SAF from the joint venture over time.

PHOTO: STOCK

SOURCE OF SUPPLY: Each facility in Green Plains' fleet of U.S. biorefineries, potentiality including the one pictured here in Shenandoah, Iowa, could help supply as much as 135 million gallons of low-carbon ethanol per year for conversion to SAF.

PHOTO: GREEN PLAINS

SAF

crop in the U.S., it is the biggest agricultural residue available by far, bigger than anything else,” he says. “It just makes sense for SAFFiRE to start with corn stover, but I see us moving to wheat straw, energy crops, switchgrass and other fast-growing crops down the road. But with corn stover alone, I think we could conceivably produce seven-and-a-half billion gallons of SAF with SAFFiRE technology. Theoretically, it could approach 10 billion gallons based on how much stover is out there.”

SAFFiRE’s cellulosic SAF will have an estimated CI score of 15, without the addition of renewable energy and carbon capture and sequestration technology, which would lower the CI score further.

With matching funding from the DOE’s SAF Grand Challenge, SAFFiRE aims to commercialize a low-temperature deacetylation and mechanical refining pretreatment process first created and tested at the National Renewable Energy Laboratory

in Colorado. The process combines enzymatic hydrolysis and C5/C6 sugar fermentation to make cellulosic ethanol. DOE selected SAFFiRE to prove its technology at pilot scale before ramping it up to produce commercial volumes of ethanol as a biointermediate feedstock for SAF.

The company is in the mid-to-late stages of what it calls Phase One, which involves completing the plant design, permitting, updating lifecycle analysis, working on the

business plan, updating the financial analysis and more, Yancey explains. With the project’s first phase scheduled for completion by the end of August, pending DOE reviews, SAFFiRE will move into Phase Two.

“Once the design package is completed, there will be another validation step with the DOE and the third-party engineering company,” O’Brien explains. If they look at the package and think everything looks

ETHANOLPRODUCER.COM | 17

CONVEYOR OF CHANGE: Southwest plans to replace 10 percent of its jet fuel use with SAF by 2030, and 100 percent by 2050.

PHOTO: STOCK

ALIGNED INVESTMENT: Southwest's backing of SAFFiRE Renewables is the corporation's first major investment outside of an airline acquisition. Company officials say the unprecedented nature of the deal illustrates how important SAF is to its future.

PHOTO: STOCK

promising and reasonable—the technology is there, the due diligence is there—then we will move on to further finalizing design, construction and operation. So that will be the exciting piece, when we get into Phase Two of this, which would be completing construction and operating the pilot plant for a year.”

Multiple key partners have been contracted to make the plant a reality, including engineering firm Advance Bio (to design the plant); Equinox (to handle feedstock procurement); Novozymes (to provide enzymes to the pilot plant) and Lallemand (to provide yeast).

The pilot plant, when built, will produce roughly 800 gallons of cellulosic ethanol per day, or the capacity to produce and ship 8,000 gallons of SAF every 10 days. The construction of commercial-scale SAF biorefineries would eventually follow.

Gevo: Net-Zero 1

Technology company Gevo has its Net-Zero 1 project underway in Lake Preston, South Dakota. The project will utilize ethanol made from low-carbon corn as the feedstock for SAF, oxygenated blendstocks for gasoline and renewable premium gasoline. Gevo broke ground in September at its 240-acre location in Lake Preston. According to a January update from the company, the facility is projected to produce 65 MMgy

of renewable liquid hydrocarbons, including 55 MMgy of SAF. This volume is part of the roughly 375 million gallons of SAF Gevo is contracted to provide to the airlines it has signed agreements with, including Virgin Atlantic, Iberia Airlines, Qatar Airlines, Delta, Japan Airlines and others.

The Net-Zero 1 plant will utilize regenerative agriculture, carbon capture and sequestration, biogas, green hydrogen and renewable energy to reach net-zero carbon emissions as calculated with the GREET model.

In January, Ethanol Producer Magazine reported that Net-Zero 1 is on track to startup in 2025. At the time, Gevo had nearly completed front-end engineering design work and selected an engineering, procurement and construction contractor for the project. Gevo plans to develop other facilities for the production of SAF and has signed letters of intent with existing ethanol plants that are good candidates to develop alcohol-to-jet technologies, while other projects would be greenfield facilities. “We remain on track with our projects and I am very optimistic about the future of Gevo’s 1-billion-gallons-per-year goal of Net-Zero fuels,” Patrick Gruber, CEO of Gevo, stated in a January project update. “We have multiple attractive sites that we are considering for Net-Zero 2 and beyond. Our process to raise project financing is underway

and going well. I believe that momentum is going our way.”

Gruber went on to point out the significance of the federal SAF tax credit and the new Illinois SAF credit. “This bill allows for the use of Argonne GREET, inclusive of agricultural practices and CCS, to measure carbon intensity score,” he said, suggesting that Gevo's low-carbon corn ethanol SAF could qualify for the state incentive.

Honeywell: Ethanol to SAF Technology

Technology development company Honeywell has developed an alcohol-to-jet technology that produces SAF with an 80 percent carbon reduction over fossil-based jet fuel, according to the comapny. “The new technology that we’re launching right now ... takes ethanol, processes it and converts it into aviation fuel” says Kevin O’Neil with Honeywell UOP.

O’Neil explains that the company sees the market for this technology coming from several places including existing ethanol plants, oil refiners and project developers. According to O’Neil, Honeywell has the capability to modularize its plants, building the pieces off-site and then delivering SAF plants to ethanol producers for on-site installation. “The [process] can be very simple and very quick, and you can save a lot of time that way, you can also save a lot of cost, you don’t need large pools of labor out in the middle of rural areas to construct a plant, you can do it in a shop where that labor already exists,” O’Neil says.

Honeywell’s process starts with dehydrating the ethanol to make ethylene, which is then run through oligomerization, and finishes with hydrogenation to saturate the olefin molecules in hydrogen. The SAF is essentially finished after this step, but it is run through a final refining step to ensure it meets ASTM standards.

“We’ve been talking to a lot of producers who are looking for alternate uses for their ethanol, and asking, 'What can I do if

18 | ETHANOL PRODUCER MAGAZINE | APRIL 2023

MOVING DIRT: Gevo's Net-Zero 1 biorefinery is in the early stages of development but could reportedly start up within two years. The company intends to develop multiple SAF facilities and has signed letters of intent with existing ethanol plants for possible future alcohol-to-jet locations.

PHOTO: GEVO

the gasoline market starts to slow down or starts to get less profitable.' And ... adding a little bit of processing to convert their ethanol to SAF is a very attractive option to basically every ethanol producer we’ve talked to,” O’Neil says.

In a world where around seven million barrels of aviation fuel are used each day across the planet, O’Neil believes that the progress being made with SAF is going to make a big impact. “We’ve developed something that we think is robust and ultimately will serve the market with the lowest possible cost,” he says.

BASF: Catalyst for Bio-Ethylene from Ethanol

BASF has brought its CircleStar dehydration catalyst to the market, which assists in dehydrating ethanol for conversion into ethylene. Kerstin Hoffman, global communications officer with BASF, explains that CircleStar enables lower temperature operation of the E2E process and helps further decrease the footprint of bio-ethylene by 10 percent while maintaining the same performance. The development of this product is part of BASF’s role as a “key enabler” in attaining a net-zero transformation.

“We understand the challenges of the traditional E2E catalyst, [for example] high pressure drop in the reactor, byproduct formation and coking due to mass transfer limitation,” Hoffman explains. “Therefore, we developed CircleStar to solve those challenges and to support the commercialization of bio-ethylene with lower PCF.”

Bio-ethylene is a crucial component of many chemical processes, including the production of SAF. This catalyst provides producers with a variety of different benefits, including reduction in energy costs for the dehydration process, less mechanical wear out and more.

A September press release explains that the catalyst’s performance is due to its novel star shape “that maximizes the active geometrical surface area for the reaction.”

With a growing demand for SAF, both Gen 1 and Gen 2 ethanol producers have an opportunity to put their product into a new market in line with the mission they've shared for decades: reducing carbon emissions.

SAF producers and developers agree that ethanol is a key feedstock that will help advance the SAF industry and meet the de-

carbonization goals set in both the private and public sector.

Author: Katie Schroeder Contact: katie.schroeder@bbiinternational.com

Author: Katie Schroeder Contact: katie.schroeder@bbiinternational.com

ETHANOLPRODUCER.COM | 19

SAF

SIMILARITY

Three recent plant acquisitions and a pertinent joint venture reveal how ethanol producers, when investing, often seek facilities that resemble, or bring balance to, their existing assets.

By Luke Geiver

By Luke Geiver

20 | ETHANOL PRODUCER MAGAZINE | APRIL 2023

M&A

COUPLING CAPABILITIES: Through partnership, Aurora Cooperative and KAAPA Ethanol plan to update a facility in Aurora, Nebraska, enhancing its benefit to local farmers and making both operations stronger.

PHOTO: KAAPA ETHANOL

SELLS

ETHANOLPRODUCER.COM | 21

It’s true in ethanol plant M&A that a good deal isn’t enough. Price is important, yes, but acquisitions, like joint ventures, have to fit logistically, strategically and, quite often, geographically. Buyers are also attracted to assets that are similar to their own: analogous tech, matching equipment, shared customers and suppliers, parallel product lines and infrastructure that syncs.

This checklist of M&A traits is illustrated in three recent ethanol plant acquisitions, plus a joint venture with similar qualities, pulled straight from the pages of Ethanol Producer Magazine’s plant data notebook. Each deal has unique dynamics and drivers, but all serve as reminders that, even in an increasingly diversified industry, producers are drawn to investments that resemble, complement or compound what they already have.

Positioned for Biorefining

A 110 MMgy ethanol plant in Jefferson, Wisconsin, idle since the height of the pandemic, has changed hands. About 18 months ago, Valero sent a letter to local leaders explaining its decision for an indefinite workforce reduction at the facility, which Valero had acquired eleven years earlier for $72 million in bankruptcy court.

Prior to operating as Valero RenewablesJefferson, the plant was Renew Energy and, before that, Ladish Malt. The letter was the proverbial writing on the wall that the plant was possibly ready for new ownership, and a fourth name.

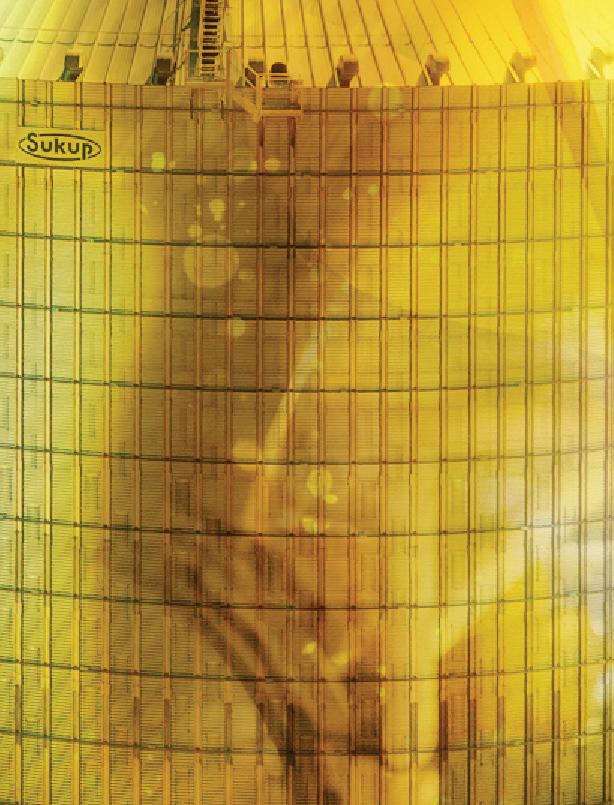

Today, the ethanol plant is doing business as Aztalan Bio LLC, a company owned by ClonBio Group Ltd., which owns Europe’s largest ethanol plant, Pannonia Bio. Eric Sievers, director of investments for ClonBio, tells Ethanol Producer Magazine the newly acquired plant remains idle but has impressive capabilities that could potentially match its operation in Europe.

“Pannonia Bio is the only other 100-plus-million-gallon plant that has an upfront dry fractionation system,” Sievers says. It has, among other things, upfront fractionation, a full mechanical vapor recovery system (the first of its kind worldwide), a large renewable natural gas plant running on corn fiber, dry organic fertilizer production, extra-neutral alcohol capabilities, a 50 percent-plus corn protein concentrate, a 60 percent-plus barley protein concentrate, several grades of corn oil, single-cell protein production capabilities and a number of novel food and feed ingredients in the pipeline.

Pete Moss, president of Cereal Process Technologies LLC, explains that frac-

tionation technology is primarily what makes both ClonBio plants unique. Moss is pleased that CPT’s dry corn fractionation tech will be utilized as intended to diversify ethanol production and open up a wide array of new and more valuable products in Wisconsin. “When combined with CHP,” Moss says, “fractionation will enable the facility to become an advanced ethanol plant per EPA regulations. Another benefit is that 100 percent of the DDG will be high protein because the fiber and germ streams are removed on the front-end.”

When the plant was purchased by Valero, the company touted its capability to become a true biorefinery because of the CPT technology. Like a growing number of U.S. ethanol producers, ClonBio refers to its European ethanol plant as a biorefinery. At the site near Budapest, Hungary, ClonBio purchases 1.1 million tons of feed corn annually from local farmers. The facility produces 500 million liters (roughly 132 MMgy) of ethanol along with 350,000 tons of high-protein animal feed and 15,000 tons of corn oil. Built on the west bank of the Danube River, the complex sits on roughly 90 acres (40 hectares), runs 24/7 and exports to more than 27 countries throughout Europe and further. The biorefinery has loading bays for barge, rail and over-theroad transport of product.

22 | ETHANOL PRODUCER MAGAZINE | APRIL 2023

M&A

PILES OF POSSIBILITY: ClonBio has run an advanced biorefinery in Hungary for years. Planning to mirror its success with ethanol production in Europe, ClonBio has acquired a facility in Wisconsin that has similar technology to what it uses abroad.

PHOTO: CLONBIO

While Sievers didn’t disclose whether the Jefferson, Wisconsin, facility will ultimately adopt all of the operational practices of ClonBio’s European plant, the company is clearly focused on a diversified business model that embraces the fullest value of corn—not just fuel, but feed, food and more.

Coupling Operations in Nebraska

KAAPA Ethanol Holdings LLC and Aurora Cooperative Elevator Co. recently closed on a new joint venture involving Aurora Cooperative’s ethanol and grain facilities near Aurora, Nebraska. Chuck Woodside, KAAPA Ethanol CEO, spoke to Ethanol Producer Magazine just before the deal was finalized, saying both entities are optimistic about what it accomplishes.

Aurora Cooperative will utilize the expertise and investment from KAAPA to upgrade production, reconfirming its commitment to the region and enhanceing the overall operation in Aurora. Through the joint venture agreement, significant investments will be made, both parties confirm.

“We are looking forward to partnership with KAAPA Ethanol at our ethanol and grain facilities. KAAPA has a track record of operational expertise and strong financial performance,” said Bill Schuster, board chair at the cooperative. “We believe this partnership will strengthen the future of the ethanol plant for our farmer-owners.”

KAAPA got its start in 2001 as KAAPA Ethanol Commodities, formed by local farmers. Since then, the company has built an ethanol plant in Minden, Nebraska (and followed the purchase with a plant expansion); invested in an ethanol facility in Janesville, Minnesota; purchased a controlling interest in an ethanol facility in Lima, Ohio; purchased a position of an ethanol plant in Hankinson, North Dakota and purchased, expanded and then debottlenecked the Ravenna Ethanol plant in Nebraska, which was formerly owned by Abengoa.

Chris Decker, CEO of Aurora, says he is excited to partner with KAAPA, reinforcing the idea that the move will be good for local farmers. “Like Aurora Cooperative, KAAPA is owned by farmers. Aurora Cooperative and KAAPA share similar values and exist for the sole purpose of serving our farmer-owners,” he says, adding that the partnership will bring needed investments for the facility to remain a value-added destination market for area corn growers.

Going for Higher Alcohols

A Louis Dreyfus ethanol plant near Norfolk, Nebraska, has been sold for what appears to be a high-end alcohol reorientation. Earlier this year, Indiana-based CIE

met with city officials to explain why the company was interested in acquiring the facility. CIE’s rationale for making the purchase, in part, was that the plant was similar to one they already own. According to Brett Carey, director of business development for CIE, the company currently operates a relateively comparable plant in Indiana, which was designed by ICM Inc. to produce fuel ethanol but, over the past decade, has been transformed to produce high-end alcohols for a variety of commercial and beverage market applications.

In January, CIE officially acquired the Louis Dreyfus facility. The purchase, according to the new owner, “is key to CIE’s ability to continue to serve its growing customer

ETHANOLPRODUCER.COM | 23

LEVERAGING EXPERIENCE: KAAPA Ethanol has a long history of investing in growth and retrofitting and running ethanol plants. At its Raveena plant (pictured on page 22), it has already performed multiple expansions. The company intends to upgrade the Aurora complex soon. The two ethanol plants pictured here, Aurora West, above, and Aurora East, below, had a combined production capacity of about 155 MMgy. Aurora East, the smaller of the two plants, was idled by its previous owner in 2019.

PHOTO: KAAPA ETHANOL

CLEANER ROAD TR IPS AWAIT

base by increasing capacity and expanding CIE’s strategic footprint within the United States.”

CIE is calling the Nebraska plant basically a sister facility to its Indiana operation. The Norfolk-based plant, however, provides a strategic location and logistical advantage. The current plan is to add the Elkhorn Valley employees to the CIE family and invest further in the business.

CIE started two decades ago and has grown into a globally recognized distiller of a variety of alcohols. The company believes it is redefining the concept of alcohol craftsmanship at commercial scale.

Joining an Industrial Renaissance

It’s possible—but not yet official— that a long beleaguered ethanol plant (formerly Sunoco) at the site of a former Miller Brewing Co. site in Fulton, New York, could be headed back to production. After shuttering prior to 2019, a Georgia-based company called Attis Biofuels acquired the plant. Successful operations never came for Attis. In 2021, a silo fire was left in a state of controlled smolder at the site, causing an understandable ruckus with nearby residents. Attis had reportedly exhausted its

APRIL 2023

Join the East Family on a Green American Road Trip

more at

Learn

M&A

A FEW LEVELS UP: CIE refines its alcohols by utilizing a set of nine distillation columns configured in proprietary ways that allow for the targeted removal of unwanted impurities and odors. The result is world-class alcohol.

PHOTO: CIE

SIGN OF GROWTH: Building on its success with high-end alcohol production in Marion, Indiana, CIE has acquired an ethanol plant in Norfolk, Nebraska, with the intention of elevating its capabilities to the same end.

PHOTO: CIE

ability to correct that and other problems at the plant. From the city council to county officials to Sen. Charles Schumer, D-New York, regional leaders worked to find a way to stop the slow burn in the silo and, with it, the unpleasant smell of smoldering grain.

As of late 2022, the grain smolder is extinguished and the regional chamber of commerce in Oswego County is hoping that a new plan and offer to buy the site will restore production. Through county legislation, a series of resolutions has passed that will put the site into the hands of Fortune 500 company Global Partners. For roughly $13 million, GP has proposed to purchase the site and restore ethanol production.

The county had to take possession of the tax delinquent parcels and work with Attis’s creditors to complete the sale to GP, which isn’t the only big investor looking to revamp different parts of the sprawling campus where the former Sunoco plant resides. Next door, TDJ Properties has purchased a 67-acre property for $5.5 million. TDJ is a large supplier of screening and crushing equipment in the Northeast and has purchased the area next to the ethanol plant for a totally different purpose: microchips.

Further down the road from the ethanol and TDJ sites, Micron has plans to spend $100 billion on a massive semiconductor facility to also produce microchips. Oswego County has since experienced a land rush to house applicable businesses, according to the chamber.

Global Partners has not yet released any public information on its purchase of the ethanol plant, other than its stated intent to restart, submitted to the Oswego County legislators. The company does own and operate a major terminal in Albany, New York, that is able to supply ethanol to customers throughout the East Coast. On the opposite side of the country, in Oregon, Global Partners handles multiple grades of ethanol, which allows the company to engage in export markets.

“The advantageous location of our terminals, coupled with our expertise in moving product by rail, barge and truck, makes [GP] a leading supplier of ethanol on the East Coast and a participant in the West Coast export market,” the company says.

Author: Luke Geiver Contact: editor@bbiinternational.com

Author: Luke Geiver Contact: editor@bbiinternational.com

ETHANOLPRODUCER.COM | 25

A VERTICAL PLAY: Global Partners owns and operates multiple fuel terminals that supply petroleum products and biofuels, including this one (above) in Albany, New York, that supplies ethanol to customers throughout the East Coast. Below, a group tours the beleaguered ethanol plant site GP is working to acquire and refurbish on the campus of a former brewery.

PHOTOS: GP/STOCK

A TEAM BUILT For Near-Site CCS

With carbon capture and sequestration taking ethanol towards net-zero, one rising CCS developer is focused on working with producers that are uniquely positioned to sequester near their plant.

By Luke Geiver

Vault 44.01 is a company named for the industry it serves—more specifically, the greenhouse gas molecule it seeks to capture and lock away. 44.01 represents the molecular mass of carbon dioxide, and it may soon be a number, or at least a name, that’s well known across all carbon-emitting industries. Vault may not be unique in its mission to capture and sequester industrial carbon, but the lane it has chosen is. The company isn’t focused on pipelines or multi-plant CO2 aggregation, but near-site CCS. The ethanol sector is currently its top focus, and after only two years in business, Vault’s unique rise, early backing from by major investors and ability to find enthusiastic partners in ethanol production reveals much about its drive and trajectory. Scott Rennie, co-founder, president and CEO of Vault 44.01, offers valuable perspective on the ongoing connection between ethanol and carbon, the

role ethanol producers might play in laying a blueprint for the broader CCS movement and the commitments required to make it all happen.

Building Broad Expertise In-House

Rennie has experience with companies that have helped pioneer large-scale CCS. Prior to forming Vault, he spent time developing major CCS projects in North America with Schlumberger and ConocoPhillips, the former having completed more than 60 CCS projects globally and the latter having captured some 120 million metric tons of C02

To build Vault, Rennie wanted to combine his CCS experience with a broad team of geoscientists, subsurface reservoir experts, finance specialists, project developers and others. The roster assembled is nothing short of A-list talent, he believes, and the credentials of Vault’s team members

prove him right. The company has, in aggregate, over 60 years of direct experience with CCS, including Class VI permitting expertise (Class VI permits are required by the U.S. Environmental Protection Agency to ensure safe storage of captured CO2 in a secure geological formation). The team has been rounded out with professionals experienced in land acquisition, investment evaluation, capital formation and, importantly, project implementation.

Scott Rennie Vault 44.01 President & CEO

“I wanted a strong core with real-world CCS project experience,” Rennie says. “CCS is an emerging industry, and it presents a lot of really interesting challenges, most of which our team has encountered in prior ventures including CCS projects dating back to 2005. We’re proud of the team

28 | ETHANOL PRODUCER MAGAZINE | APRIL 2023

CCS

we’ve built, growing from eight founding members in 2021 to 35 today, and continuing to grow to meet the needs of our expanding set of projects.”

A handful of large ethanol production companies may be capable of handling CCS project development in-house—from the installation of gas compression and dehydration equipment to permanent CO2 sequestration in deep reservoirs—but the vast majority don’t. That’s one reason Rennie and his team have made the ethanol industry a top focus. Ethanol plants typically don’t employ the types of professionals needed to make a CCS project come together, like geophysicists, reservoir engineers, experienced subsurface developers.

“Broadly, the geological characterization, the permitting process, the drilling of wells, shooting seismic, planning for long-term monitoring and site care—all the things that are important to building the sequestration site—most folks need that help,” Rennie says. “Sometimes the need

moves upstream into the compression and tax credit monetization aspects of the project, and we have the capability to take on those scope elements as well.”

JVs and Other Options

Rennie and his team are currently working on several projects with multiple ethanol facilities in areas that are well suited for on- or near-site sequestration, which he says can significantly improve project economics. A recently announced project in Indiana illustrates Vault’s flexible role in developing ethanol plant CCS.

In January, Vault and Cardinal Ethanol LLC announced a joint venture to design, implement and operate a CCS project at Cardinal’s facility near Union City, Indiana. The project aligns the goals of both Cardinal and Vault (to focus on near-site sequestration using its extensive industry know-how and financial backing). Cardinal and Vault’s partnership will be able to take advantage of the 45Q tax credit, which is

currently valued at $85 per ton of carbon captured and permanently sequestered. In addition to 45Q, Cardinal and Vault retain an option to further benefit from programs such as 45Z tax credits, low-carbon fuel credits and voluntary carbon market credits.

Producing roughly 135 MMgy, Cardinal generates nearly 400,000 metric tons of CO2 per year from its corn fermentation process. Through the joint venture, One Carbon Partnership, Vault will help design, plan and construct the capture and injection infrastructure. The necessary Class VI permit has been submitted to the EPA.

Jeff Painter, CEO of Cardinal, says the partnership enhances shareholder value by bringing in the latest technology. It also helps the company “on its path to zero emission liquid fuels,” he says.

Rennie and his team worked with Cardinal for more than a year to develop the project to its current stage, and also to build trust with Cardinal and local stakeholders. Establishing trust is an important part of

ETHANOLPRODUCER.COM | 29

COMBINED KNOW-HOW: With broad expertise in CCS project implementation, Vault 44.01 has assembled a team of professionals that have, in aggregate, over 60 years of direct experience with CCS, including subsurface analyses, Class VI permitting expertise, capital formation, land acquisition and more. The team is currently working on projects with multiple ethanol facilities in areas that are well suited for on- or near-site sequestration.

PHOTO: VAULT 44.01

MORE COULD YOU ASK FOR?

the process, he says, as ethanol producers and landowners, with limited background on how the process works, will ultimately have to trust Vault to execute on the ideas it presents. “We’re involved end-to-end with Cardinal—from the fermenters to the reservoir,” Rennie says. “With CCS, you need to get six to 10 aspects right. You have to get the geology right. You have to understand the permitting process. You have to get the real property rights, both surface and subsurface. You have to execute by well drilling and doing seismic. And you have to make sure that the finance and economics of the project are set up to provide a good return for both Vault and our ethanol partners.”

The Cardinal project represents only one of a few different ways Vault intends to work with ethanol clients, or those from other industries. Rennie and his team are open to a variety of commercial arrangements. With Cardinal, a joint venture was set up, and both parties hold a 50 percent stake in the project. Area leaders in Randolph County, where the ethanol plant is located, are happy with the development.

At a commission meeting in December, county commissioners commented on the project, saying it was an exciting opportunity. In addition to building permits and other zoning requirements, the county commissioners commented that road-use agreements from wind and solar projects in the area could also apply to the ethanol CCS plan, with the roads being returned to good shape, if not better, post construction.

Another option for entities looking to work with Vault puts the host facility in charge of choosing, installing and running the compression and dehydration process. In that case, the ethanol plant would be responsible for capturing the carbon and preparing it for sequestration. “In that structure, we will pick up the CO2 at the plant gate and build the sequestration site and put it underground,” Rennie says.

Rennie and his team are proud to be serving the ethanol industry. “The ethanol industry sits at the vanguard of the CCS industry,” he says. “What happens with ethanol will create knowledge, infrastructure and practices that will extend into many

©2023 All rights reserved Fluid Quip Technologies, LLC. All trademarks are properties of their respective companies. Scan the code to unlock more oil today! MORE OIL, MORE REVENUE, PROVEN TECHNOLOGY. WHAT

SITE VISIT: Standing together outside a Midwest ethanol plant, Jennifer O’Keefe, land and stakeholder engagement manager, left, and Kat Perkins, senior landman, are among Vault 44.01’s nearly 40-person team, which includes geologists, engineers, land specialists, permitting analysts, and project finance experts.

PHOTO: VAULT 44.01

other industries as the CCS industry matures.”

Not just any team of CCS experts can find success serving the ethanol industry, or others like power, forestry or cement production (all areas Vault is looking to or already involved with). In 2022, a private equity firm, Grey Rock Investment Partners, committed a capital round of up to $300 million into Vault. Understanding why the investment fund is backing Vault helps explain how important, and how big, CCS could become because of ethanol.

Capital Partnership

From day one of building their business model, the Vault team knew they needed access to capital. “We knew we weren’t going to go into CCS projects as consultants, but rather as equity participants, alongside our partners. We were going to invest in assets and take on certain elements of project risk that make sense for Vault so that our partners don’t have to,” Rennie says, “The need for capital was always there.”

In 2021 the team went to the capital market, including Grey Rock Investment Partners, a private equity firm that has invested over $1.3 billion in energy projects. The firm invests in the energy value chain, including but not limited to carbon capture, industrial electrification, power optimization, methane abatement, and natural resources. What Vault found across the private equity sector was a large group of firms that wanted to invest in the energy transition, but fewer that had a clear strategy around investing in CCS.

According to Rennie, the Grey Rock team had met with several other companies proposing big things in the CCS space. “I think what got them comfortable with Vault was the experience we had on the team and the way we were focusing on actionable projects,” he says. “We had put an early focus on ethanol.” In turn, Rennie says, Grey Rock intended to put a substantial proportion of capital

toward CCS investments, a strategy that was attractive to the Vault team.

From a business execution angle, the philosophical approach applied by Vault’s team resonated with Grey Rock. Instead of getting a project and then outsourcing the technical work, Vault has always thought it would do the work better in-house with talent already on the team. “If somebody is on our team full time, they are going to work

to fix the next problem or advance the business in any way they can,” he says. “We have an amazingly committed team and we work to get better every day. We are grateful for the faith that our ethanol partners have put in us, and we truly enjoy working with them toward delivering great projects.”

Author: Luke Geiver Contact: editor@bbiinternational.com

ETHANOLPRODUCER.COM | 31 CCS

MEET TODAY’S GOALS. ANSWER TOMORROW’S QUESTIONS.

SOLUTIONS, DESIGNED BY LBDS.

We put Fermentation First™. You get yeast, yeast nutrition, enzymes and antimicrobial products, alongside the industry leading expertise of our Technical Service Team and education resources. Find the right solution for your ethanol business at LBDS.com.

© 2023 Lallemand

& Distilled Spirits

Biofuels

in rh ythm with natur e fueling

our future

A N T I B I O T I C S | Y E A S T | CLE ANING | E N Z Y M E S © ©2023 Phibro Animal Health h th Corporpporatation, Phibro Eth Et anonol, l Total l C Cle Cl aning ng Pro P graam, m and nd P Phibrbro logo go desig s n are trarademark r s owned by o y r l rlice c cense ns d to P Phhib hi ro o Ani A imal ma m He H alt t a h Corp rppora raatio ioon o no n r i its t Contact your Phibro representative today for more inf ormation. phibroethanol.com

ETHANOLPRODUCER.COM | 35 GAIN MAXIMUM EXPOSURE & CONTACT INFO Live + OnDemand www.EthanolProducer.com/pages/webinar Website All emails Advertisements Sponsor Featured On: Contact us today for more information service@bbiinternational.com or 866-746-8385. WEBINAR SERIES Webinar page on EthanolProducer.com OnDemand material Attendee Information 800-279-4757 | 701-793-2360 Over50YearsofExperience Callusforafree,no-obligation consultationtoday. www.natwickappraisal.com natwick@integra.net The Specialist in Biofuels Plant Appraisals • Valuation for nancing • Establishing an asking price • Partial interest valuation EPM Marketplace

308 2nd Ave. N., Suite 304

Forks, ND 58203

Grand

By Katie Schroeder

By Katie Schroeder

Author: Katie Schroeder Contact: katie.schroeder@bbiinternational.com

Author: Katie Schroeder Contact: katie.schroeder@bbiinternational.com

By Luke Geiver

By Luke Geiver

Author: Luke Geiver Contact: editor@bbiinternational.com

Author: Luke Geiver Contact: editor@bbiinternational.com