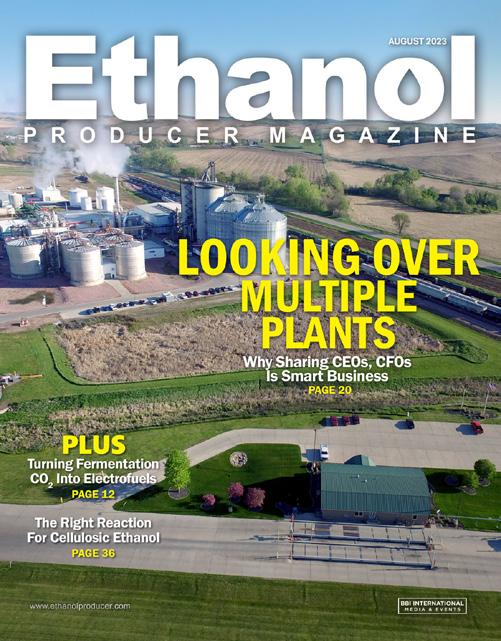

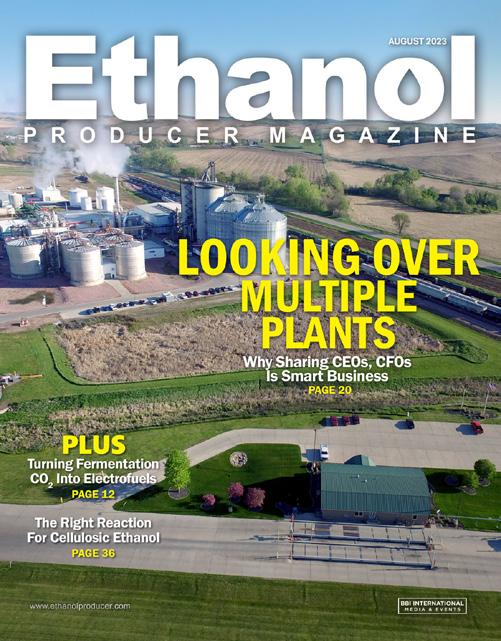

AUGUST 2023 www.ethanolproducer.com PAGE 20 Why Sharing CEOs, CFOs Is Smart Business LOOKING OVER MULTIPLE PLANTS PLUS Turning Fermentation CO2 Into Electrofuels PAGE 12 The Right Reaction For Cellulosic Ethanol PAGE 36

INNO VA TION is more than products Contact a representative today. cte-global.com Introducing CTE Global Educational Programs CTE Global leads innovation from the ground up. Led by our team of industry experts, we guide you through hands-on training and plant-specific statistical analysis, then o er insights and best practices to improve your workforce at every turn.

35 Billion Gallons of Low Carbon SAF Required within the U.S. by 2050

• Ultralow CI Score

• Additional Revenue Source

• Reduce Operating Costs

• Produce High-Demand Aviation Fuel

The SAFFiRE Edge

Siouxland Ethanol LLC, a 90 MMgy corn ethanol plant in Jackson, Nebraska, is one of three facilities managed by CEO Nick Bowdish, owner of N Bowdish Company. Bowdish also manages Elite Octane in Atlantic, Iowa, and Little Sioux Corn Processors, in Marcus, Iowa. PHOTO: SIOUXLAND ETHANOL

Geiver

Geiver

Pursuing ethanol from tall-growing grass in Florida

Geiver

Geiver

4 | ETHANOL PRODUCER MAGAZINE | AUGUST 2023 DEPARTMENTS 5 AD INDEX/EVENTS CALENDAR 6 EDITOR'S NOTE So Much More to Learn By Tom

8 VIEW FROM THE HILL Plugging in an FFV? The Best of Both Worlds By Geoff Cooper 10 BUSINESS BRIEFS 43 MARKETPLACE Ethanol Producer Magazine: (USPS No. 023-974) August 2023, Vol. 29, Issue 8. Ethanol Producer Magazine is published monthly by BBI International. Principal Office: 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Periodicals Postage Paid at Grand Forks, North Dakota and additional mailing offices. POSTMASTER: Send address changes to Ethanol Producer Magazine/Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, North Dakota 58203. FEATURES 12 COPRODUCT CO2 Utilization: Biofuel From the Stack U.S. labs explore drop-in electrofuels By

MANAGEMENT

A Knowledge Tree

executive, financial leadership

PROFILE

INNOVATION

Bryan

Katie Schroeder 20

Growing

Multi-plant

By Katie Schroeder 28

NCERC’s 20 Years of Impact R&D facility's reach, legacy continue to grow By Luke

36

Taking A New Crack at the Cellulosic Code

Contents

COVER

By Luke

ON THE

AUGUST 2023 VOLUME 29 ISSUE 8 12 20 28 36

EDITORIAL

President & Editor

Tom Bryan tbryan@bbiinternational.com

Online News Editor

Erin Voegele evoegele@bbiinternational.com

Staff Writer

Katie Schroeder katie.schroeder@bbiinternational.com

DESIGN

Vice President of Production & Design

Jaci Satterlund jsatterlund@bbiinternational.com

Graphic Designer

Raquel Boushee rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan jbryan@bbiinternational.com

Vice President of Operations/Marketing & Sales

John Nelson jnelson@bbiinternational.com

Senior Account Manager/Bioenergy Team Leader

Chip Shereck cshereck@bbiinternational.com

Account Manager

Bob Brown bbrown@bbiinternational.com

Circulation Manager

Jessica Tiller jtiller@bbiinternational.com

Marketing & Advertising Manager

Marla DeFoe mdefoe@bbiinternational.com

EDITORIAL BOARD

Ringneck Energy Walter Wendland

Little Sioux Corn Processors Steve Roe

Commonwealth Agri-Energy Mick Henderson

Aemetis Advanced Fuels Eric McAfee

Western Plains Energy Derek Peine

Front Range Energy Dan Sanders Jr.

Advertiser Index

Upcoming Events

2023 North American SAF Conference & Expo

August 29-30, 2023

Minneapolis Convention Center, Minneapolis, MN (866) 746-8385 | www.safconference.com

The National SAF Conference & Expo is designed to promote the development and adoption of practical solutions to produce SAF and decarbonize the aviation sector. Exhibitors will connect with attendees and showcase the latest technologies and services currently offered within the industry. During two days of live sessions, attendees will learn from industry experts and gain knowledge to become better informed to guide business decisions as the SAF industry continues to expand.

2023 National Carbon Capture Conference & Expo

November 7-8, 2023

Iowa Events Center | Des Moines, IA (866) 746-8385 | www.nationalcarboncaptureconference.com

The National Carbon Capture Conference & Expo is a two-day event designed specifically for companies and organizations advancing technologies and policy that support the removal of carbon dioxide (CO2) from all sources, including fossil fuel-based power plants, ethanol production plants and industrial processes, as well as directly from the atmosphere. The program will focus on research, data, trends and information on all aspects of CCUS with the goal to help companies build knowledge, connect with others, and better understand the market and carbon utilization.

2024 International Biomass Conference & Expo

March 4-6, 2024

Greater Richmond Convention Center | Richmond, VA (866) 746-8385 | www.biomassconference.com

Organized by BBI International and produced by Biomass Magazine, this event brings current and future producers of bioenergy and biobased products together with waste generators, energy crop growers, municipal leaders, utility executives, technology providers, equipment manufacturers, project developers, investors and policy makers. It’s a true one-stop shop – the world’s premier educational and networking junction for all biomass industries.

2024 International Fuel Ethanol Workshop & Expo

June

10-12, 2024

Minneapolis Convention Center | Minneapolis, MN (866) 746-8385 | www.fuelethanolworkshop.com

Please recycle this magazine and remove inserts or samples before recycling

COPYRIGHT © 2023 by BBI International

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer.com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to editor@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space. TM

Celebrating its 40th year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine —that maintains a strong focus on commercial-scale ethanol production, new technology, and near-term research and development. The event draws more than 2,000 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

ETHANOLPRODUCER.COM | 5 AgCountry Farm Credit Services 11 ArrowUp 34 Aztalan Bio 17 Beyond ( a Christian Company) 22 Check-All Valve Mfg. Co. 15 Cone Drive Operatons, Inc. 26-27 CTE Global, Inc. 2 D3MAX LLC 18-19 Fagen, Inc. 44 Fluid Quip Mechanical 23 Fluid Quip Technologies, LLC 30 Growth Energy 31 ICM, Inc. 16 IFF, Inc. 9 Keit Industrial Analytics 32 Lallemand Biofuels & Distilled Spirits 7 Phibro Ethanol 35 PLAAS, Inc. 39 POET LLC 42 Premium Plant Services, Inc. 40 RPMG, Inc. 33 SAFFiRE Renewables 3 Sicgil Industrial Gases Limited 14 United Plant Services 25 WINBCO 41

So Much More to Learn

It’s well known that ethanol plants are a great source of 99% pure, biogenic CO2. And not only is it ideal for sequestration, but for transforming into myriad biobased fuels and chemicals. A white-hot new segment of CO2 utilization is the pursuit of electrofuels, or e-fuels, and it’s showing up in our headlines often. Earlier this summer, for example, e-fuels developer Infinium and Navigator CO2, a carbon dioxide aggregator, announced a partnership to deliver 600,000 tons of CO2 per year from the latter company’s proposed pipeline system to a future Infinium biorefinery. When that news broke, we were already working on another story about e-fuels, albeit from the angle of public sector research.

In “CO2 Utilization: Biofuel from the Stack,” on page 12, we look at R&D aimed at commercializing e-fuels from ethanol plant fermentation CO2, ideally paired with renewable energy like wind power. We explain how the U.S. Department of Energy is working with labs across the country (NREL, Berkeley, Argonne, Lawrence Livermore and Oak Ridge) to elevate e-fuel pathways from the lab to commercial scale. The idea is that, through one of several possible conversion routes, an ethanol plant’s CO2 can be converted into ethanol or another intermediate, then upgraded to a drop-in fuel like SAF. It will be interesting to see if and how e-fuels reach commercialization at the intersection of public research and private sector investment.

Next, in “Growing A Knowledge Tree,” on page 20, we look at how multi-plant executive management can enhance opportunities for information and resource sharing between facilities. As the story explains, multi-plant executive management allows for production synergies, mistake avoidance, solutions sharing and the exchange of advice on any number of issues a facility might experience. The executives we talked to had like-minded beliefs—and similar hands-on approaches—geared toward fostering plant cultures that value communication, or as one CEO put it, a “learner mindset” to build trust between personnel working together at the same location or hundreds of miles apart.

Speaking of fostering a learner mindset, this year marks the 20th anniversary of a corn ethanol R&D hub that’s helped train hundreds of industry professionals while advancing innumerable production technologies—The National Corn-to-Ethanol Research Center at Southern Illinois University-Edwardsville. As we report in “NCERC’s 20 Years of Impact,” on page 28, the facility, under the leadership of John Caupert for the past 17 years, has been a dependable outlet for entities ranging from multinational corporations to small startups looking to test, validate or improve a component of the ethanol production process. Almost every ethanol plant in the U.S. is using at least one technology or product that has some connection to NCERC. But for all that Caupert and his team have previously accomplished, this milestone seems to be more about NCERC’s future than its past.

Finally, be sure to read “Taking A New Crack at the Cellulosic Code,” on page 36, which chronicles the vision of a Florida company chasing what others have struggled to accomplish at scale—the production of ethanol from cellulosic biomass. We explain how Blue Biofuels intends to convert 15-foot-tall king grass—managing the feedstock itself—into low-carbon biofuel. Making commercial quantities of ethanol (and lignin) from purpose-grown biomass has proven troublesome for other companies in the past, but true visionaries are rarely deterred by what others have failed to achieve.

6 | ETHANOL PRODUCER MAGAZINE | AUGUST 2023 FOR INDUSTRY NEWS: WWW.ETHANOLPRODUCER.COM OR FOLLOW US: TWITTER.COM/ETHANOLMAGAZINE Editor's Note

MEET TODAY’S GOALS. ANSWER TOMORROW’S QUESTIONS.

SOLUTIONS, DESIGNED BY LBDS.

We put Fermentation First™. You get yeast, yeast nutrition, enzymes and antimicrobial products, alongside the industry leading expertise of our Technical Service Team and education resources. Find the right solution for your ethanol business at LBDS.com.

© 2023 Lallemand Biofuels & Distilled Spirits

gcooper@ethanolrfa.org

Plugging in an FFV? The Best of Both Worlds

Earlier this year, the Renewable Fuels Association unveiled our 2022 Ford Escape plug-in hybrid electric flex-fuel vehicle—the first of its kind anywhere in the world. While automakers have previously combined “mild hybrid” technology with flex-fuel capability (Ford manufactured a small number of hybrid FFV Escape demonstration vehicles in 2007 and Toyota offers hybrid FFVs in Brazil and India), our 2022 Escape is the first in the world to combine external plug-in charging and an independent battery-powered motor with a flex-fuel internal combustion engine.

Why are we doing this? The answer is simple. We want to prove to policymakers, auto manufacturers, and (most importantly) American drivers that low-carbon renewable liquid fuels in combination with plug-in hybrid technology can deliver excellent environmental performance at a lower cost than a full battery electric vehicle. We want to show that consumers don’t need to sacrifice optionality, convenience, or affordability for superior environmental benefits. And we want to show that ethanol and electricity can be complementary decarbonization solutions.

In recent surveys, both current owners and potential buyers of battery electric vehicles have expressed several concerns and challenges that have caused them to think twice about their next vehicle purchase. Range anxiety, long recharging times, lack of public charging locations, higher vehicle purchase price, lack of flexibility, the cost of installing home charging capacity, and other obstacles were commonly cited.

Most—if not all—of these concerns can be overcome with a plug-in hybrid electric FFV like our new Escape.

With a full tank of E85 and a full charge of the battery, it can travel about 430 miles, with most of that coming from the E85. That’s about double the mileage range of a comparable battery electric vehicle. And, depending on the carbon intensity of the ethanol used in the E85, this vehicle can reduce emissions by about 80 percent today compared to a Ford Escape running on gasoline. One day soon this could be the first real Zero Emissions Vehicle to run on 100 percent renewable liquid fuels!

In addition, recent testing of the RFA Escape conducted by the University of California, Riverside (UCR) showed major benefits in reducing emissions of other harmful pollutants. When operating on E85, the vehicle showed a 48-79% reduction (compared to E10) in emissions of nitrogen oxides (NOx), which causes smog and is a contributor to respiratory illnesses and heart disease. Emissions of particulate matter— which contributes to poor air quality and human health concerns—fell 70-76% when operating on E85.

Meanwhile, the Escape has not seen the “mileage penalty” that critics typically associate with E85’s lower energy density. During the UCR testing, the vehicle’s onboard computer showed just a 3-4% loss in miles-per-gallon on E85, and nearly 15,000 miles of real-world driving have generated similar fuel economy results. It is likely that the Escape’s 2.5-liter Atkinson cycle 4-cylinder engine, which has an impressive 13:1 compression ratio, can take advantage of E85’s higher octane rating to overcome the fuel’s lower energy density.

Next up: the University of Illinois in Chicago and Life Cycle Associates are conducting a detailed lifecycle greenhouse gas emissions analysis on the Escape using several different liquid fuel and electricity sources. We expect the study to show that a plug-in hybrid electric FFV running on cleaner, greener E85 can offer comparable—or better—carbon performance than many battery electric vehicles.

Unfortunately, you can’t go to your local dealership and buy a plug-in electric FFV today. Our Escape is a concept vehicle. But we hope to change that by continuing to push for policies that take a more reasonable and rational approach to the future of our fuel and vehicle options. It is our hope that one day soon, after proving the benefits of this technology, consumers will be able to choose a true zero-emissions vehicle that meets their everyday needs and doesn’t break the bank.

8 | ETHANOL PRODUCER MAGAZINE | AUGUST 2023

Geoff Cooper President and CEO Renewable Fuels Association 202-289-3835

View from the Hill

S YNERXIA ® GEMS T ONE C OLLE CTION

UNL O CK Y OUR PL ANT’ S PO TENTIAL

Yeast blends are often greater than the sum of their parts. Achieve the perfect synergy of fermentation yield, speed and robustness with the SYNERXIA® Gemstone Collection.

Our broad portfolio of yeasts and yeast blends offers greater flexibility to tailor solutions based on shifting process requirements or market conditions.

Powered by XCELIS® AI, our proprietary data analytics and predictive modelling tool, the SYNERXIA® Gemstone Collection helps de-risk decision making with custom yeast blends that take your ethanol production process to the next level.

Find the right yeast or yeast blend to meet your plant performance goals.

Learn more at bioscience.iff.com/synerxia-gemstone

©2023 International Flavors & Fragrances Inc. (IFF). IFF, the IFF Logo, and all trademarks denoted with ™, or ® are owned by IFF or its affiliates unless otherwise noted

X CELIS® Yeasts

BUSINESS BRIEFS

FQT starts up low-energy, high-quality alcohol systems at Three Rivers Energy

Fluid Quip Technologies has announced the successful startup of its cutting-edge LED (Low Energy Distillation) and GNS (Grain Neutral Spirits) technologies at the Three Rivers Energy ethanol plant in Coshocton, Ohio.

LED’s process balances the amount of energy used and reclaimed within the alcohol production process, for a total energy savings of up to 40 percent. The technology can be integrated into

Novozymes unveils newest advanced dry yeast

Novozymes has launched a new yeast called Innova Apex ADY, which is designed to allow ethanol producers that prefer dry yeast to break fermentation bottlenecks while creating plant efficiencies. Innova Apex ADY is the tenth advanced yeast solution to join the company’s Innova yeast platform, which is aimed at helping producers hit their yield and reliability targets. Apex ADY also reduces urea additions without sacrificing robustness to common production stressors, such as high temperature and organic acids;

POET donates nearly $150,000 through Community Impact Grant Program

POET, the world’s largest biofuel producer, has donated nearly $150,000 through its 2023 POET Community Impact Grant Program. All of POET’s 33 bioprocessing facilities across eight Midwest states and POET Terminal-Savannah, Georgia, participated in this year’s grant program. POET Community Impact Grants are one-time grants of up to $4,000 for local non-profits, schools, churches, Earth-friendly groups, and individuals who are leading initiatives to improve their local communities.

Whitefox membrane installed at The Andersons Denison plant

The Andersons Inc. has successfully installed the Whitefox ICE membrane dehydration system at its ethanol plant in Denison, Iowa. It is Whitefox’s 11th installation in the U.S. The ICE system treats existing recycling streams to both free up and debottleneck distillation-dehydration capacity, allowing producers to lower natu-

current alcohol systems to achieve a more sustainable production model, a lower carbon footprint and enhanced profitability. Complementing the LED system, FQT’s GNS technology provides a unique approach to optimizing high-purity, beverage-grade alcohol production. The system is designed to achieve ultra-pure alcohol specifications within the first 24 hours of start-up.

and it provides ethanol plants with the choice of a dry yeast format after the successful launch of Innova Apex cream yeast last year. The new product delivers up to 2% more ethanol than leading advanced dry yeasts in the market, lowers demand for urea by up to 90% and can eliminate the need for other fermentation aids like nutritional supplements.

“For over 35 years, POET has worked to change the world,” said Alyssa Broin Christensen, POET vice president of Team & Community Impact. “We believe that making a positive, lasting impact starts in the communities we call home, with our friends, families and neighbors. The Community Impact Grant Program was created to support the organizations and individuals who share our never-satisfied mentality to leave the world better than we found it.”

ral gas usage, cut carbon emissions, improve plant cooling and potentially increase production capacity.

“We have been evaluating Whitefox technology for some time, and saw that the system aligned with our goals for upgrading the Denison plant, which include lower steam use and energy cost

10 | ETHANOL PRODUCER MAGAZINE | AUGUST 2023

PEOPLE, PARTNERSHIPS & PROJECTS

per gallon,” said Bill Krueger, COO and president of The Andersons Trade and Processing. “It also helps to drive our objective of reducing carbon intensity across our production facilities. I am excited that this project is now completed as it addresses several of our strategic priorities.”

Alfa Laval introduces new double-seat valves

Alfa Laval has unveiled two new hygienic valves, the Alfa Laval Unique Mixproof CIP valve and the Unique Mixproof Process valve, extending its hygienic double-seat valve range to meet market demands. With the introduction of these new products, the company says producers concerned about product integrity now have a cost-effective way to enhance product safety while boosting process efficiency.

These new valves are built on proven performance, yet refined for purpose. The Unique Mixproof CIP valve is a doubleseat product that safely and efficiently manages the flow of cleaning media during clean-in-place. The Unique Mixproof Process valve, a compact product, is configurable and available in various sizes to meet manufacturers’ fundamental hygienic processing requirements. Both are capable of simultaneously routing two different fluids without the risk of cross-contamination, contributing to more uptime and reduced total cost of ownership.

ETHANOLPRODUCER.COM | 11 CUSTOMIZED SERVICE Relationships matter in agriculture. Work with a lender who values you and understands your business. Our Agribusiness and Capital Markets team will customize a plan to fıt your needs. Contact Jess Bernstien and Nicole Hatlen today to get started. 877-811-4073 AgCountry.com F OCUSED ON A G. FOCUSED ON YO U.

CO2 UTILIZATION: BIOFUEL FROM THE STACK

The potential demand for ethanol plant CO2 is growing, and a DOE research consortium exploring e-fuels could broaden an already promising spectrum of transformation prospects.

By Katie Schroeder

Utilization technologies are stimulating interest in ethanol producers’ constant coproduct, carbon dioxide. An initiative from the U.S. Department of Energy has formed the CO2 Reduction and Upgrading for Efuels Consortium—or CO2RUe—made up of labs across the country working on developing technologies to upgrade CO2 into valuable drop-in electrofuels, also known as “e-fuels.” Ethanol plants are the best source of 99 percent pure, biogenic CO2, and are made a more attractive target for utilization technologies because of how many of them are in close proximity to renewable energy such as wind power.

Valerie Reed, director of the DOE’s Bioenergy Technologies Office, or BETO, explains that the consortium will research what’s required to make CO2 derived fuels a reality through applied R&D, with the goal of overcoming technical barriers as well as researching the economic side of deploying these fuels nationwide. “Those things are all incorporate[ed] into the thinking of the consortia, and its ultimate vision is to give

us e-fuels as another tool in our toolbox to reduce CO2 emissions, particularly from the hard-to-decarbonize sectors like sustainable aviation fuel,” Reed says.

Laboratories involved in the consortium include NREL, Berkeley, Argonne, Lawrence Livermore and Oak Ridge. There are also several partners and representatives from various industries involved in the research.

Electrofuel production requires electricity and CO2, as well as hydrogen, depending on which process is used, Reed explains. If the CO2 is first changed into an intermediate like carbon monoxide, ethanol or methanol, and upgraded to a drop-in fuel, then hydrogen is not necessary. Because CO2 is an oxidized molecule without energy left to expend, large amounts of electricity are needed to upgrade the molecule. It is vital that the electricity used comes from renewable sources in order to achieve the necessary carbon reduction

Currently, slightly over 20 percent of the nation’s total energy supply comes from renewable sources, according to data from the U.S. Energy Information Administra-

12 | ETHANOL PRODUCER MAGAZINE | AUGUST 2023

Coproduct

TEAMWORK: Researchers from NREL, shown here, are among those involved in the CO2RUe consortium, along with many others from Berkeley, Argonne, Lawrence Livermore and Oak Ridge. The consortium has three working groups researching different aspects of electrofuels, electrolysis, electrochemistry and biological upgrading.

PHOTO: NREL

ETHANOLPRODUCER.COM | 13

tion. The availability of renewable electricity is one of the primary limiting factors to the growth of electrofuels. “In order for us to reduce the CI score and go as low as possible, we absolutely need … renewable electricity,” Reed says. “Right now, the sheer magnitude, or need for many uses, really [requires] opportunities to be based on location, so if you have a dedicated supply of renewable electricity near your self-supply of CO2, it’s going to be a logical business case to pursue that.”

Scope of Research

Michael Resch, director of CO2RUe, explains that the consortium has three working groups researching different aspects of electrofuels production and analysis, including electrolysis and electrochemistry, as well as biological upgrading. The goal of the consortium is to pursue applied research, examining what it takes to bring methods that work in the lab up to commercial scale. “[That is] where the national labs fit in, to take on these high-risk, highreward projects and test them out,” Resch says.

Gary Grim, staff scientist with NREL, explains that his role with the consortium is to develop techno-economic and lifecycle

assessments for CO2 conversion processes. The research will be used to determine which technologies require more research to become competitive in the market and attain a low carbon intensity score.

The consortium is studying at least five or six CO2 conversion technologies, according to Grim. The various technologies include electrolysis, biochemistry, conventional thermochemistry—which utilizes high temperatures and pressure with a catalyst to transform the CO2—and plasma technology. Grim explains that converted CO2 can be used to create a variety of unique products and chemicals.

“It means for people like me who are doing lifecycle and economic analyses there’s a lot of different pathways to explore, there’s a lot of opportunity out there in terms of what we can make, how we can make it and how it impacts downstream utilization cases,” he says.

Electrolysis is one of the conversion techniques with the lowest technology readiness level (TRL), Resch explains. NREL is currently setting up a pilot facility to study scaling electrolyzers. “We are currently setting that up in NREL’s pilot demonstration unit,” Resch says. “So, 1,000-liter fermentation is … a small pilot, but it will produce

around 20 liters, up to 50 liters a minute of CO2. We’re having two stacks of 1,000-centimeter squared electrolyzers that can use up to 50 liters a minute of CO2 and convert that into the intermediate of syngas.”

Electrofuels and Ethanol

Grim outlines why the purity of CO2 generated at ethanol plants makes it a great feedstock option. “It’s very helpful on our side because it cuts down on purification costs and potential issues of ‘poisoning’ downstream with various catalysts and other processes. So, that’s [principally] why we like bioethanol CO2,” he says.

Implementing conversion technology, an ethanol plant’s CO2 would be converted into ethanol or another intermediate, then upgraded to a drop-in fuel, such as SAF or renewable gasoline. CO2RUe’s research is primarily focused on the first step of turning CO2 into a molecule with a higher carbon number, because most of the processes that turn intermediates into the final product are more mature, Grim explains. Because CO2 is a fully oxidized molecule with no energy, a lot of electricity is needed to convert the C1 molecule into a molecule with a higher carbon number, such as benzene. “It’s really difficult to make a fuel-

14 | ETHANOL PRODUCER MAGAZINE | AUGUST 2023

Coproduct

range hydrocarbon from CO2 in a single step,” he says. “You’re unlikely to get from a C1—carbon dioxide—to … octane or a dodecane in a single step.”

The intermediate used will depend greatly on the final product you are trying to make, Grim explains. For example, ethylene is a good intermediate for upgrading to jet fuel and use within the plastic industry. Carbon monoxide can be combined with hy-

drogen to make syngas. Methanol, ethanol and methane are also “intermediates of interest” with a variety of uses. Intermediates produced using biological methods include acetic acid, which can be used for vinegar, formic acid and fatty acids.

“If we want to use our existing infrastructure and our existing vehicles, we need a drop-in replacement fuel that’s green, and so taking it on to the next level, which is

all the way up through that carbon chain, and introducing a substitute for jet fuel that looks just like jet fuel is really the definition of e-fuels for us,” Reed says.

CO2RUe did a case study of what implementation of these technologies could look like at a 40 MMgy ethanol biorefinery. A first-generation ethanol plant that size would produce around 14 tons of CO2 per hour, Resch explains. With the introduction

Mo re than a Check v alv e

ETHANOLPRODUCER.COM | 15

GREEN BEGETS GREEN: Because CO2 is a fully oxidized molecule without energy, large amounts of electricity are needed to upgrade the molecule. It is vital that the electricity used comes from renewable sources like wind or solar in order to achieve the carbon reductions researchers envision.

PHOTO: STOCK

Order at: ww.check all.com Call us at 515-224-2301 or email us at sales@checkall.com

of CO2 conversion technology, the carbon dioxide could be converted to ethanol using electrochemistry and gas fermentation, and the plant’s output would increase 30 percent—up to 58 MMgy of ethanol. However, this increase in output would come with an added 47 megawatts of power needed for the conversion process, which would need to come from renewable sources. To produce that much renewable energy, a total of 94-100 wind turbines would be needed.

If an ethanol producer is interested in integrating electrofuels technology into their plant, Grim recommends pursuing opportunities for systems integration, to identify the synergies of combining an ethanol biorefinery and a CO2 conversion process.

“With every year that passes, there’s likely going to be higher and higher demand for the carbon dioxide that’s coming out of the fermenter, because it’s just—ask any-

body you have a discussion with—it’s an ideal feedstock for these e-fuel processes,” Grim says. “There’s going to be a lot of demand for it … in the future.”

Limitations and Challenges

One of the primary limiting factors to the development of electrofuels is the amount of cheap renewable electricity available on the market. Resch believes that more access to renewable energy will be needed before e-fuels can become widespread.

Although the Inflation Reduction Act and the SAF Grand Challenge have both been a driving force for advanced biofuel innovation in recent years, Resch sees electrofuels as a long-term goal regardless of the administration. “We try to take kind of a nonpartisan view of this and that it’s, in general, good for the country, good for this administration or the next administra-

I beg your carbon...

Coproduct Diverse feed opportunities CI reduction opportunity Operational benefits Investment flexibility Diversification without compromising your carbon intensity score? You heard right. Discover more at icminc.com/APP.

| 87 7. 45 6. 8588

tion, because this is not a short-term goal,” Resch says. “This is a path toward decarbonization, no matter the political lens.”

The advancement of technology that can convert ethanol into other fuels could be beneficial as EVs may begin to reduce the size of the liquid fuel market. Although e-fuels are farther down the road, Reed sees near-term ethanol markets in the SAF industry. “Ethanol is and always has been an incredibly important molecule to our nation’s economy; as we see electric vehicles come into the market and reduce potential ethanol market share, first of all that will be slow,” Reed says. “That’s going to happen over time and ethanol will remain an impor-

SELECT SOURCE: Fermentation CO2 generated at ethanol plants is an ideal e-fuels feedstock option due to its purity. “It’s very helpful on our side because it cuts down on purification costs and potential issues of ‘poisoning’ downstream with various catalysts and other processes. So, that’s [principally] why we like bioethanol CO2,” says Gary Grim, staff scientist with NREL.

tant fuel, certainly as an oxygenate for the existing gasoline we’ll need to provide for those legacy vehicles. There are near-term options to convert ethanol through an alcohol-to-jet process that can produce sustainable aviation fuel today, and we see this with companies like LanzaJet and Gevo, which are both moving in that direction, so there are ways to get to aviation fuel, utilizing ethanol as an intermediate and [achieving] reductions [of] 70 to 80 percent greenhouse gas.”

Electrofuels may be another way for ethanol producers to use their CO2 coproduct to continue to create valuable fuels that lower greenhouse gas emissions. Although e-fuels are still being researched, they could give producers an inventive way to increase their output.

Author: Katie Schroeder

Author: Katie Schroeder

Contact: katie.schroeder@bbiinternational.com

PHOTO: STOCK

PHOTO: STOCK

A Knowledge Growing

Tree

By Katie Schroeder

In recent years, multi-plant executive management has been on the rise. The boards of some ethanol plants are consolidating their resources by sharing a CEO between multiple plants— even those not owned by the same company—or hiring a CFO on a temporary basis. Ethanol Producer Magazine recently spoke with industry executives who manage two or more plants to shed light on why multiplant executive management happens, as well as the benefits and challenges of this strategy.

Experience and Qualifications

In order to be a CEO or CFO of an ethanol plant you need to have experi-

ence and knowledge that qualifies you for the job, even more so if you are managing multiple facilities. Seth Harder, general manager and CEO of Husker Ag LLC and Lincolnway Energy LLC, says his experience comes from over 20 years of work in the ethanol industry, a journey that began post-college in 2001. He started out working on building a small ethanol plant in Stanton, Nebraska, then joined Husker Ag in 2002, working as production manager when the plant started up in 2003. After a short stint with ICM in 2004, being involved in around seven startups and plant retrofits, Harder returned to

Husker Ag at the end of 2004 as the plant manager and general manager shortly after, eventually taking on the title of CEO. He worked to build a second Husker Ag plant in Plainview, Nebraska, which he currently manages along with the original Husker Ag facility and Lincolnway Energy in Nevada, Iowa.

Nick Bowdish also got his start in the ethanol industry straight out of college in 2007 with an ag business degree. He worked with Fagen Inc.—as he explains, the construction company that built half the etha-

20 | ETHANOL PRODUCER MAGAZINE | AUGUST 2023

Management

Throughout the ethanol industry, multi-plant executive management is an approach that leads to unique opportunities for networking and growth for the plants involved.

Seth Harder General Manager, CEO Husker Ag LLC

LOOKING OVER THE BUSINESS: Siouxland Ethanol LLC, shown here, is a 90 MMgy corn ethanol plant in Jackson, Nebraska, managed by CEO Nick Bowdish.

PHOTO: SIOUXLAND ETHANOL LLC

nol industry—and led Platinum Ethanol in Arthur, Iowa, from 2008 to 2013. After the plant was sold in 2013, Bowdish decided to pursue his dream of working for himself and created N Bowdish Company, which runs and manages ethanol plants at the executive level. Over the past eight years, Bowdish has been CEO of both

Siouxland Ethanol in Jackson, Nebraska, and, for the past five years, Elite Octane in Atlantic, Iowa. Elite Octane was a newly constructed plant that Bowdish and some partners planned, developed and built, and it has been running since mid-2018. More recently, Bowdish also became CEO of Little Sioux Corn Processors in Marcus, Iowa, following the retirement of LSCP’s longtime CEO, Steve Roe, in July.

The role of CEO is not the only executive management position that may be handled by one person for multiple plants.

Jeff Kistner, owner of Flagleaf Financial Management, works as a CFO-for-hire, helping ethanol producers assess and manage risk as well as set strategic vision, typically working with a producer for two to seven years. Currently, he works primarily with Harder and his team at Husker Ag and Lincolnway Energy. His

ETHANOLPRODUCER.COM | 21

Nick Bowdish President & CEO N Bowdish Company

Jeff Kistner CFO Flagleaf Financial Management

goal is to ultimately “work himself out of a job” with the producer that hires him, he says, by helping them reach their goals and making an exit.

Synergy and Collective Knowledge

Harder says CEOs in his position have a unique opportunity to grow a “knowledge tree” by connecting with employees and sharing information. It takes a “boots on the ground” approach, he says, when coming into a new plant, finding people who are staying engaged and excited about trying a new approach.

This type of information sharing is key to a plant’s success, according to Bowdish. He explains that multi-plant executive management allows for operational synergies, mistake avoidance through experience and solutions sharing, and the exchange of advice on issues they are experiencing. “One of the common characteristics of the group of plants in our industry that financially struggle, is that many of them, I perceive … go to extremes to keep everything under wraps and in a cocoon; [it’s a] guise of believing that they have so many things they do [that are] especially unique,” Bowdish says. “Quite the contrary, what I see in many of the best financially performing plants are those that are led by people who network the best—and multi-plant executive management is networking.”

A learner mindset and sharing openly are key to developing a trusting relationship with other producers to learn from each other’s struggles and successes. “The plants I’m privileged to lead definitely make each other better,” Bowdish says. “We too are also learning from others in the industry; we’ve grown a mutual trust and benefit from that … [and it] isn’t a one-way street. We openly share our challenges and things that work and don’t work, and we make each other better.”

Harder also discusses the ways that ethanol plants under the same executive management can benefit from sharing R&D, taking turns testing out new technologies and learning from each other’s findings. “We’ll do one thing at one plant that benefits the other plants that we’re in,” he says. “We kind of share the R&D across the platforms, so that one place isn’t always the guinea pig.”

The ‘Why?’ of Multi-Plant Executive Management

“The main ‘why’ [of multi-plant management] is that investors want to maximize their financial return, so they seek out professionals with the experience and track record to achieve their financial goals,” Bowdish says. Ethanol producers all operate in the same volatile market, with similar

Management

input costs from natural gas, corn prices and coproduct prices. However, Bowdish explains that the variability of profit from plant to plant at times exceeds 30 percent. “Typically, a portion of that variability, or delta, stems from regional supply and demand; for instance, with the crop year we’re in this year, corn is plentiful in the east and scarce in the west, [and that can cause] some of the difference,” he says. “But also, I would say a good portion of the delta exists purely based on management decisions made.” In today’s complex market, investors seek out someone who they see has “delivered good results” in the past to help manage the company through a transition.

There are also cost benefits that come with hiring a temporary CFO, because it is generally cheaper than hiring another full-

PLANT UPTIME IS IMPORTANT TO EVERYONE

Our full service team of experts have 20 years of ethanol plant maintenance reliability and uptime history 24/7 support and ready access to a full inventory and all Fluid Quip equipment parts, ensures that you maintain your plant’s uptime status.

PARTS

• OEM Parts Warehouse

• $1 million+ on-hand inventory

• Fully stocked trucks

time employee, Kistner explains. As someone who works for multiple plants, Kistner is also able to bring a good knowledge base from his experiences. “I’m not a full-time person. I’m shared amongst several locations, [so I may frequently] have some experience or knowledge that another plant’s already completed this, or this one hasn’t yet, and I can bring that,” he says.

Approaching a New Environment

When Harder comes to a new plant, he observes the way the plant is run, talks with operators and hears what problems they encounter with the process. Building trust is a key first step in developing these relationships, he explains, and the best way to accomplish that is by working alongside operators and demonstrating a

• Overnight/hot shot shipping

EQUIPMENT SERVICE

• Factory Trained & Certified

• MSC™ Systems

• SGT™ Grind Systems

• FBP™ Fiber By-Pass Systems

• MZSA™ Screens

• Paddle Screens

• Grind Mills

• Centrifuges

BRANCHING OUT: In addition to managing Siouxland Ethanol and Elite Octane, Nick Bowdish recently became CEO of Little Sioux Corn Processors LLC, a 165 MMgy corn ethanol plant in Marcus, Iowa.

PHOTO: LSCP

desire for their success and growth. Harder sees sharing knowledge about the ethanol plant’s process as vital to helping increase process efficiency. After building relationships, Harder shows them some of the basic physics of an ethanol facility, stimulating growth of that “knowledge tree.”

This strategy of trust, communication and education helped bring Lincolnway Energy out of the 40s or 50s in benchmark metrics up to the top 10 or 15 percent in net income. Harder credits the shift to the improvement in energy management and amount of electricity that was being used, increasing yields and reducing maintenance costs. These process adjustments mean a lot to the ethanol plants productivity and can mean dollars and cents in a world with tax credits for carbon reduction, he explains. “When I look at the industry average and what we see coming for carbon and lowering our carbon scores and knowing what we’ve been able to achieve [at] … these

three facilities, and seeing what the industry averages are and the benchmarks, we know there’s an improvement that’s available out there,” Harder says. “And we know that a chunk of that can come from operators being taught what a British thermal unit is, and how to save Btus, and how to save kilowatts, and tuning valves, and not putting too much water in the process … showing people what saving water on their scrubber or testing [does] if they run a clean plant.”

Bowdish explains that he tries to avoid conference calls and power points and instead takes a team-oriented, hands-on approach. “That type of leadership out in the field that no matter what our title or organizational position is, we’re all in this together to deliver top-end financial results for our shareholders, while doing it in a way that we all take pride in the facility, how it looks and what we’re doing,” Bowdish says.

“That’s what’s worked for me in the past, and I think that has truly become one of

the challenges that rises to the top of my mind … just continuing to embrace and lead that type of culture.”

Assessing Investments

Executive management often is a part of making decisions on what technologies or improvements need to be added to an ethanol plant. With so many technologies to consider, Harder explains that networking is vital to learning about a new technology, and conferences provide a great opportunity to hear about other producers’ experiences. “We’re busy as plant management, so we don’t have time to talk to our buddies every single day in the industry, when we get to these conferences that’s where a lot of this knowledge transfers,” he says. Doing the math, understanding the technology, knowing the local markets and what the plant is capable of are tactics that help management make good investments.

24 | ETHANOL PRODUCER MAGAZINE | AUGUST 2023

UNDER THE SAME CANOPY: Elite Octane LLC, a 150 MMgy corn ethanol plant in Atlantic, Iowa, is under the management of N Bowdish Company, along with two other Midwest biorefineries.

PHOTO: ELITE OCTACTE

Making good capital allocation decisions has become “more of an art than a science” at the executive management level, according to Bowdish, due to the constant innovations and improvements across the ethanol industry.

For Kistner, determining good investments is similar to doing a feasibility study; examining potential payback time on investment, cost and return, amount of capital needed, as well as assessing the markets. “Does it make sense for us to do it? And I use this a lot of times, just because we think it doesn’t mean we need to do it,” Kistner says. “And that’s where companies fail, if they don’t have a strong balance sheet … [or] if they missed some of the risks associated with these projects.”

Challenges of Multi-Plant Management

Bowdish and Harder both agree that there are challenges that come with man-

aging multiple biorefineries. For Bowdish, one of the challenges is making sure he remembers the name of every single operator, maintenance technician and staff member at each location. “At the end of the day, people want to work for people who care, and a huge part of our past success was the learned culture of doing more than just grabbing samples or wiring up a motor,” Bowdish says. “For me, as a challenge, I think as the organizations grow that I’ve got the opportunity and privilege to lead, I have to find new ways to stay connected with the people that are day in and day out, delivering all the action items that snowball into the organization’s success.”

The biggest challenge for Harder is time; managing plants that are located a four-hour drive apart can be difficult, even with a small airplane to make travel a bit faster. Harder explains that he prioritizes visiting Lincolnway at least two days a week to make sure that he is present as much as

possible. “I feel like if you’re not doing that, are you doing everybody a service then at that point?” Harder says.

Multi-plant executive management provides more opportunities for teamwork and information sharing between plants, two factors that are vital to growth and problem solving.

“It truly is building a great team, watching them grow around you. We all only get so much time on this planet,” Harder says. “It’s really a strong belief of mine that there’s some really great people out there or there’s greatness in everybody, it’s just helping them to realize it.”

Author: Katie Schroeder

Contact: katie.schroeder@bbiinternational.com

ETHANOLPRODUCER.COM | 25 Management

NCERC’s 20 YEARS of Impact

Two decades after opening—helping the ethanol industry advance as it experienced 12-fold growth—the Southern Illinois research facility is not only proving why it's worth celebrating, but how it can impact the future of biorefining.

By Luke Geiver

The National Corn-to-Ethanol Research Center at Southern Illinois University-Edwardsville turns 20 this year. For two decades, NCERC has been a dependable outlet for entities ranging from multinational corporations to small startups looking to test, validate or improve a component of the ethanol production process. There are several milestone moments that have occurred since NCERC's inception. Hundreds of ex-

perts, researchers, tech developers, managers and other personnel across the ethanol industry are have ties to the center. And although NCERC has achieved a status within the industry that warrants a tribute that looks back at what it’s done, this moment doesn’t seem to be only about celebrating the past. As our conversation with John Caupert, executive director of NCERC for all but three years of its existence, shows, the facility’s 20-year anniversary is perhaps more about what NCERC is doing now,

and how it can impact ethanol production and corn utilization in the future.

Part of Ethanol’s History and Future

NCERC is roughly 30 minutes from St. Louis. When the International Fuel Ethanol Workshop & Expo (the world’s largest gathering of ethanol producers) would take place in St. Louis, NCERC was almost always a featured stop on the event’s facility

28 | ETHANOL PRODUCER MAGAZINE | AUGUST 2023

Profile

NCERC'S TOUCH ON TECH: Almost every U.S. ethanol plant (200-plus) is using at least one product or technology that, at some point, passed through the doors of NCERC. Shown here, NCERC team members are busy working in the fermentation suite (top) and lab (lower). The tanks pictured are part of "fermentation alley" at the facility.

PHOTO: NCERC

ETHANOLPRODUCER.COM | 29

tours. Even today, industry professionals not only want to see the latest work being done there, but industry sponsors—companies that support NCERC—enjoy being onsite. At one time, the building may have been considered on-trend. Today, it serves its purpose. The link between industry sponsors/partners and the facility has always been healthy. NCERC receives a mix of state funding, federal dollars and payment from industry partners that use the resources offered in Edwardsville in exchange for a fee. Siemens and Shimadzu Corp., for example, are two major sponsors associated with NCERC and its continual quest to improve fermentation and research.

The facility employs roughly 30 to 40 full-time team members, with interns, guest researchers and others contributing at any given time. The fully-integrated facility has multiple bioreactors and can provide engineering design, method development, process control and automation, doing so with client confidentiality, intellectual property protection and commercialization services. For that, the team at NCERC provides project design, proof of concept, third-party validation and scaleup insight.

Through its fermentation lab, the team can evaluate potential fermentation products at 250mL and 5L. At its fermentation suite, pilot-scale bioreactors at 30, 150 and 1,500 liters are ready. A pilot plant includes four 22,000L anaerobic bioreactors. And, in the analytical lab, high quality data is collected and secured.

When talking with Caupert about what the center can do for the industry, and perhaps specifically fermentation, he says it should be more a question of what the center can’t do.

According to Caupert, in the early days the center did a tremendous amount of collaborative work with the USDA. They were looking at the possible yield of ethanol per bushel of corn. “We wanted to know how many gallons we could get, and we were primarily looking at the conversion of the endosperm or the starch portion of the kernel,” he says.

After that, came a focus on de-oiling of the kernel. They also used to talk a lot about the biorefinery concept. “Today we have a biorefining reality,” Caupert says.

Dry grind ethanol plants are now taking a kernel of corn and producing multiple value streams. That reality has altered some of the work done at the center.

WE

SOLUTIONS. Engineering excellence to help you succeed. ©2023. All rights reserved Fluid Quip Technologies LLC. All trademarks are properties of their respective companies. Scan here to schedule a meeting today! FQT

CI.

BRING

brings sound OPEX and energy reduction strategies to increase profits and lower

TWO DECADES OF DEVELOPMENT: The National Corn-to-Ethanol Research center opened its doors to the industry in late 2003, quickly building a reputation as a highly effective R&D facility for validating and accelerating ethanol production technology.

PHOTO: NCERC

STEPPING UP TO SCALE: NCERC's approach to ethanol research pivots on scale up. Here, an NCERC team member works in the facility's fermentation suite. Projects at NCERC typically begin with bench-scale work and bench-scale validation before advancing to pilot-scale/intermediate, fermentation and, eventually, 22,000-liter fermentations prior to commercialization efforts.

NCERC isn’t just about what its name implies. They do a lot more, from work on biorenewable polymers to municipal solid waste to ethanol processes.

The corn ethanol industry was 1.3 billion gallons when NCERC opened its doors. Today the industry is closer to 16 billion gallons. “We are still very true to our mission, which is to facilitate commercialization that can be used in the fuel ethanol space.”

Ethanol Research at Scale

There are many aspects of the center and its approach to ethanol research that are unique, but what stands out the most is its focus on scalability. According to Caupert, scalability is a driving force for his team of researchers and experts. The industry needs to operate at scale. There

has to be a pathway or possibility of that, he says. “We take a deliberate approach to scale,” Caupert says.

When they start a project, they begin with bench-scale work and bench-scale fermentors. After they are satisfied with that step, they will move to piloting or intermediate fermentation that is 30L up to 1,500L.

“We spend a significant amount of time at intermediate-scale fermentation. Then, from there it's into the 22,000L bioreactors,” Caupert says.

At NCERC, when your project makes it to the 22k bioreactors, you are only a step away from the commercialization pathway. In some cases, NCERC has clients that come in with data already generated at their own facilities. They think they will be ready for the 22k bioreactors, Caupert explains. The team encourages them to relook at the early data. NCERC will, and often does. “If we can replicate what they have done, it is good to go.”

Most of the time, the work to validate the early data is actually credited back to the client, Caupert says. “We always find something in that early data.”

Roughly 90-percent of the time, the NCERC team discovers findings that are in favor of the client’s projects, usually associated with efficiency gains.

Reach Beyond R&D

You will be hard pressed to find a more passionate or well-spoken ethanol advocate than Caupert. He’s used that trait to help the center play a role in the ethanol industry’s place in the world of energy and politics.

“What I’ve learned in my time as executive director here is that we must as an industry continue to work—and work on the broadening and evolution of our base of friends and supporters,” he says.

NCERC is in a great place to educate others because of its prominence across the ethanol sector. Its depth of knowledge and

SUMMER WAS MADE FOR ROAD TR IPS

We’ve put together some eco-friendly, perfect-for-summer itineraries with Get Biofuel stops and mustsee sights built in. Browse the itineraries & learn more at

Profile

PHOTO: NCERC

Meet the Executive Director

John Caupert

Background: Agriculture economics and policy, and former farm kid from southern Illinois

Career In Ag: 34 years

Previous Work: Corporate contractor with Anheuser Busch; National Corn Growers Association.

NCERC Start Date: October 2006

You wouldn’t look at the road only once every 8 hrs...

...so why do you do that with your fermentation?

Real time, continuous, on-line measurement of liquefaction, fermentation and distillation.

acids, alcohols, FAN & PAN, and fusels all in real time Visit www.keit.co.uk for more information.

Sugars,

history lend credibility to what the NCERC team says. Policymakers are looking for that. For example, the U.S. EPA frequently draws upon expertise from NCERC on the issue of corn kernel fiber to cellulosic ethanol.

Caupert points to Congress, for example, as another area where it could play a lobbying role. “Every election cycle there are fewer people from rural America who get elected. We have to constantly work to build and expand our base of support. I think you look no further than the U.S. Congress. We have to educate, motivate and inform those policy makers.”

It’s safe to say Caupert and crew are doing their part. Every year they meet with or host prominent farm groups, members of Congress or other interested parties that have well-known (or sometimes less known) positions on ethanol in the U.S. A recent rundown of meetings shows just how many people of varying backgrounds come into contact with the man with all that ethanol passion. They recently talked with Farm Credit of Illinois, SIUE staff senate, the St. Louis Agribusiness Club, delegates of the Midwest Biomanufacturing Summit, and a host of others.

Impact On Production

NCERC is not a national lab or affiliated with a federal agency. The tech that has come through the center runs the gamut, from A to Z, according to Caupert. Roughly 80 percent of the work done there is through client contracts.

“We might get two guys from San Diego working out of their garage,” he says. “And on the other end of the spectrum, we’ll work with multinational companies and big names in the fuel ethanol industry.”

The center never takes a position on any kind of product or technology. They don’t endorse either. “There is no perceived bias by anyone on a project or technology,” he says. “We will not compromise the scientific integrity of anything.”

Another thing NCERC doesn’t have to worry about is its reach into the ethanol industry. In 2015, Caupert commissioned a study to see what NCERC’s scope and impact in the industry truly was. The study (which Caupert plans to update soon) showed that of the 209 ethanol plants operating at the time, every plant was using at least one product or technology that had

passed through the doors of the Southern Illinois center.

The reach of the center and its greatest impact is also about more than tech. It’s the people. Today there are more than 400 industry professionals that have received some form of hands-on, applied training from NCERC.

ETHANOLPRODUCER.COM | 33

Profile

“Every single one of those 400 people is employed in the fuel ethanol industry,” Caupert says.

Some are in quality control. Some are sales managers. There is a big variety. For Caupert, it means he has a sales and recruiting team of 400-strong.

What Caupert envisions being most worth celebrating when his tenure at NCERC is over, he says, is the people.

“If I were to put together an alumni catalog it would be extensive,” he says. At times, that can be an issue. He is used to losing coworkers to outside ethanol companies. Everyone wants people from NCERC.

All those people, including Caupert, will continue to play a major role in the ethanol industry. They’ve had a great 20-years, but Caupert believes the success of NCERC is just getting started.

“When it comes to a low carbon future, I truly believe that ethanol and ethanol from corn is not only part of that solution,” he says, “I feel it is the solution.”

He believes NCERC and the greater industry has just scratched the surface and its capabilities.

“We don’t know the next innovation that is going to come about,” he says, “but it

will come.” And based on its first 20 years, chances are NCERC will play a role in not just the next one or two industry breakthroughs, but countless innovations on the way.

Author: Luke Geiver Contact: editor@bbiinternational.com

Revolutionizing yeast fermentation in the ethanol industry

Stinger One offers environmentally friendly chlorine dioxide technology propelling ethanol production towards unmatched efficiency. Combined with the new Stinger Safety System with its patent-pending S3 Technology, you’ll experience unprecedented safety and performance.

• Superior performance over antibiotics.

• Faster fermentation rate (improved counts and budding).

• Lower CI score.

ST. LOUIS, MO • 302.593.9568 ARROWUPGLOBAL.COM

SCAN FOR INFORMATION ON HOW YOU CAN BENEFIT WITH STINGER ONE Profile

'There is no perceived bias by anyone on a project or technology. We will not compromise the scientific integrity of anything.'

- John Caupert, Executive Director, NCERC

Taking A New Crack at the CELLULOSIC CODE

By Luke Geiver

Blue Biofuels is trying to grow in multiple areas. From its home state of Florida, the aspirant advanced biofuel production company is trying to expand its knowhow and commercial readiness with a novel mechano-chemical cellulosic ethanol process. The Florida team is also working to streamline a feedstock growing and harvest operation that will allow for the use of king grass as its main source of cellulosic material. Outside of the Sunshine State, the Blue Biofuels leadership group is trying to gain the support of additional investors, all while working to crack the code to true, cost-effective commercial-scale cellulosic ethanol production. We checked in with two company executives to see where the company is at on its cellulosic journey and how much of that historically-tough cellulosic code they’ve figured out.

Blue Biofuels Production Approach

Using any biomass ranging from grass to agricultural waste, the process starts by shredding the feedstock down to size. A recyclable catalyst is added to the shredded biomass, fed into a new CTS Reactor, broken down into soluble sugars that are then fermented into ethanol. The byproduct is a high-purity lignin. As history in the cellulosic ethanol production space has proven, this concept or previous versions of it are easier said than done.

Both Ben Slager, the new CEO with a history in tech and chemicals and the commercial build-out of such related entities, and Anthony Santelli, the CFO with a background in managing companies and working in venture capital, know that cellulosic ethanol isn’t easy.

“In the past a lot of other companies have tried to create cellulosic biofuels, and

36 | ETHANOL PRODUCER MAGAZINE | AUGUST 2023

After revamping its process and management team, Blue Biofuels believes it is primed for big cellulosic ethanol achievements at commercial scale.

Innovation

THE RIGHT REACTION: With technology and equipment partners, Blue Biofuels has created a roller system that presses shredded biomass into a reactor with a catalyst mix, creating molecular contact between the catalysts and cellulosic material, breaking up the feedstock into soluble sugars.

PHOTO: BLUE BIOFUELS

ETHANOLPRODUCER.COM | 37

those processes used were not economical,” Santelli says. “But we have finally been able to crack the code. It is a new process we’re using that hasn’t been tried before.”

The new process is a combination of mechanical and chemical. On the mechanical side, Slager and team created a roller system that presses the shredded feedstock into the reactor with the catalyst mix.

“What we have done is to create molecular contact between the catalysts and cellulosic material,” Slager explains. “Under the right conditions, the cellulose breaks up into soluble sugars.”

According to Slager, the process creates “a very intimate contact with the catalysts,” and it goes very quickly. Reaction time hap-

pens in under a minute, a vastly different time than the hours or days seen in other systems, he says.

Slager basically invented the new system— with a bit of help—when he took over as CEO, and the results have propelled Blue Biofuels to its current state of development. The new reactor was developed with strategic partner K.R. Komarek, a global industry leader in briquetting, compaction, and granulation equipment. According to Blue Biofuels, K.R. Komarek has extensive experience and knowledge on equipment design and production of machines at commercially relevant throughput of up to 50 tons/hr.

When Slager announced in August 2022 the results of pilot scale CTS reactor testing using the compaction and roller elements designed in part by K.R. Komarek, he said the

new design features were scalable and should have the same success at commercial scale.

On the SAF side, Blue Biofuels has turned to a licensing option with Vertimass LLC, a California-based company that obtained a license for its catalyst from Oak Ridge National Laboratory. The catalyst used has been proven to convert ethanol into a hydrocarbon blendstock for use in transportation fuels, including sustainable aviation fuel.

Vertimass obtained worldwide exclusive rights from ORNL in 2014. They call it the Consolidated Alcohol Deoxygenation and Oligomerization (CADO) tech. CADO is simple, Vertimass says, and requires a single reaction system that results in low capital and operating costs.

At the heart of CADO is an inexpensive catalyst known as a zeolite. The zeolite catalyst directly produces longer hydrocarbon chains from the original alcohol, including ethanol, and replaces a multi-step process with one that is more energy efficient.

38 | ETHANOL PRODUCER MAGAZINE | AUGUST 2023

GROWING MORE GALLONS: King grass and other tall-growing varieties of reed grass like the crop shown here can typically be harvested twice per year, providing the feedstock for up to 3,500 gallons of fuel per acre annually.

PHOTO: STOCK

Ben Slager CEO

Anthony Santelli CFO

In recent years, zeolite catalysts have been in the research spotlight by chemical engineers and chemists in the petrochemical space. As an alternative to fluid catalytic cracking of crude oil, petrochemical engineers have been studying the synthesis process known as methanol-to-hydrocarbon reaction, a process that can convert many biomass sources into methanol. The catalyst used for that process: zeolites.

The catalysts themselves are crystalline microporous structures that have regular pore size and are friendly to industrial processes.

Through the work of Vertimass, Blue Biofuels has found an option that works for its SAF from cellulosic ethanol production ambitions. Slager and Santelli believe it gives them the lowest cost option to turn alcohol into jet fuel. Vertimass' version produces chemical building blocks BTEX (benzene, toluene, ethylbenzene and xylenes). Slager and team believe the advantages of the Vertimass option are many. It allows for a single step in production that can either be built from the ground up or bolted on to an existing process. There is no need for hydrogen.

FEEDSTOCK: Blue Biofuels is handling its feedstock management mostly in-house. The company is currently working with growers to develop enough king grass in Florida to feed its future operation, a proposed 500,000 gallon per year biorefinery.

The entire process produces high liquid product yields with complete ethanol use. Reaction times can take place at atmospheric pressure and 275 to 350 degrees Celsius. The catalyst itself is very robust. There is a possibility of replacing molecular sieves and potentially rectification through the ability to use 5 to 100 percent ethanol concentrations. Overall, the process uses less production energy across the plant and less water.

“We are working to industrialize it and manufacture larger volumes of the feedstock,” Slager says.

ETHANOLPRODUCER.COM | 39

Innovation

FLORIDA

PHOTO: STOCK

Growing Cellulosic Feedstock In Florida

To bring its cellulosic vision into fruition, Blue Biofuels is taking its feedstock in-house. The company is currently working with king grass, a 15-foot tall grass that grows well in Florida’s climate. The grass can be harvested twice per year and offers a significant carbon reduction compared to most other feedstocks. While corn provides the feedstock to produce roughly 500 gallons per acre, Slager

says, the king grass option can provide up to 3,500 gallons an acre per year.

To ensure it has access to the feedstock, Blue Biofuels has leased a total of 182 acres in southwest Florida to grow, harvest and transport from the king grass it needs. According to the company, the land should provide sufficient feedstock to create around 500,000 gallons of ethanol per year. In addition, it will be optimized for planting, growing and harvesting at large volumes.

PRODUCTION PLANNING: To ensure it has access to enough feedstock, Blue Biofuels has leased 182 acres of land in southwest Florida to grow, harvest and transport the king grass it needs. The company intends to lease additional land to allow for continuous cycles of king grass planting and harvesting, similar to what's shown here.

The growing team will stagger when the grass is planted. The amount of material that needs to be harvested at any given time will put the transport needs in the spotlight every two weeks or so, Slager says.

“We expect to sow this additional land in a manner to allow for continuous cycles of planting and harvesting to yield a regular, uninterrupted supply of ready-to-process king grass,” Slager says.

Someday, the company may look at other feedstock possibilities, but for now it is king grass in Florida. The goal is to use it at a 500,000 gallon/year demonstration plant in Florida using the mechano-chemical process already proven at pilot scale.

Blue Biofuels Continues Growing

Blue Biofuels is actually the second iteration of the company. Until mid-2021, it operated under the name Alliance Bioenergy Plus. But even before the name change, Slager and Santelli were actively turning things around and resetting the company’s path to the trajectory they feel it is on today.

40 | ETHANOL PRODUCER MAGAZINE | AUGUST 2023

Innovation

With ch oice s fr om spon geblas ting , hyd ro bl as ting , indus tr ia l vacu uming and mor e , P re mium Plan t S er vi ces has t h e r ig h t mix o f maint enance options for your f ac ilit y. • Conf ined space rescue • Dr y ice blasting • Hydroblasting • Hydro reclamation • Indus trial vacuuming • Restoration • Sandblas ting • Slurr y blasting • Spongeblasting • Surface chemical cleaning • Tube bundle and heat exchan ger cleaning . Hibbing M N • D ubuque , I A • Tra cy M N St even s P oint , W I ( 888 ) 54 9- 18 69 WE ’V E GO T YOU COV ERED.

PHOTO: STOCK

Slager, an investor with a unique background in tech, chemicals and helping companies go commercial, joined the company in 2016. Since then, he and Santelli have turned the company around. The redesign of the bioreactor system, along with the Vertimass agreement and overall vision of feedstock usage has changed the trajectory. Despite Blue Biofuel's past challenges, Slager and Santelli both say the company's preservation of existing investors, and the addition of new ones, after its realignment offer validation of its potential.

“The unique selling point is that we produce a fuel with 80-percent carbon reduction,” Santelli says. “That is the main driver. That we make real clean biofuel.”

Slager says this is not the first time he or others on his team have done a job like this one. You know those little chips on your debit card? Slager was involved with designing and bringing that to market.

The current effort is different than all the rest, however. The market is bigger. Slager knows that. Ask him about the electric vehicle sector, European biofuel needs or any other big concept topic that will impact generations to come and he can wax poetic with facts and philosophies gleaned from his broad entrepreneurial experience. Santelli connects the current version of the company to investors, both new and old. For the past few years they’ve been receiving several patents, adding team members from engineering and biopolymer sectors, leasing

land and taking the expected steps of a confident, growing company.

They believe they have cracked the code like those before them weren’t able to. What happens in southwest Florida on 182 acres in combination with another site created to put that mechano-chemical process to the test will tell how much cellulosic code breaking they have truly done. The work and the effort it will require is something Santelli agrees with Slager on.

“The scale and potential of this project,” Slager says, “will be the biggest of all my previous ones.”

Author: Luke Geiver Contact: editor@bbiinternational.com

Author: Luke Geiver Contact: editor@bbiinternational.com

ETHANOLPRODUCER.COM | 41

in rh ythm with natur e

ETHANOLPRODUCER.COM | 43 Post unlimited 30-day online listings for 1 year jobs.ethanolproducer.com POST UNLIMITED JOBS Get Your Message Out Now Quickly Reach 40,000+ Industry Contacts Easily Track Your Performance Digital Press Package By Ethanol Producer Magazine Interested? Contact us at 866-746-8385 FUEL ETHANOL EPM Marketplace 800-279-4757 | 701-793-2360 Over50YearsofExperience Callusforafree,no-obligation consultationtoday. www.natwickappraisal.com natwick@integra.net The Specialist in Biofuels Plant Appraisals • Valuation for nancing • Establishing an asking price • Partial interest valuation

International

2nd Ave. N., Suite 304

58203

BBI

308

Grand Forks, ND

Geiver

Geiver

Geiver

Geiver

Author: Katie Schroeder

Author: Katie Schroeder

PHOTO: STOCK

PHOTO: STOCK

Author: Luke Geiver Contact: editor@bbiinternational.com

Author: Luke Geiver Contact: editor@bbiinternational.com