THE ADVANTAGE OF ABUNDANCE

EDITORIAL

President & Editor Tom Bryan tbryan@bbiinternational.com

Online News Editor Erin Voegele evoegele@bbiinternational.com

Associate Editor Katie Schroeder katie.schroeder@bbiinternational.com

DESIGN

Vice President of Production & Design Jaci Satterlund jsatterlund@bbiinternational.com

Graphic Designer Raquel Boushee rboushee@bbiinternational.com

PUBLISHING & SALES

CEO Joe Bryan jbryan@bbiinternational.com

Vice President of Operations/Marketing & Sales John Nelson jnelson@bbiinternational.com

Senior Account Manager/Bioenergy Team Leader Chip Shereck cshereck@bbiinternational.com

Account Manager Bob Brown bbrown@bbiinternational.com

Circulation Manager Jessica Tiller jtiller@bbiinternational.com

Marketing & Advertising Manager Marla DeFoe mdefoe@bbiinternational.com

EDITORIAL BOARD

Ringneck Energy Walter Wendland Little Sioux Corn Processors Steve Roe Commonwealth Agri-Energy Mick Henderson

Aemetis Advanced Fuels Eric McAfee Western Plains Energy Derek Peine Front Range Energy Dan Sanders Jr.

Advertiser Index

Upcoming Events

2025 International Biomass Conference & Expo March 18-20, 2025

COBB GALLERIA CENTRE | ATLANTA, GEORGIA

Now in its 18th year, the International Biomass Conference & Expo is expected to bring together more than 900 attendees, 160 exhibitors and 65 speakers from more than 25 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic businessto-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming—powered by Biomass Magazine–that maintains a strong focus on commercial-scale biomass production, new technology, and near-term research and development. Join us at the International Biomass Conference & Expo as we enter this new and exciting era in biomass energy.

2025 International Fuel Ethanol Workshop & Expo

June 9-11, 2025

CHI HEALTH CENTER | OMAHA, NEBRASKA

Now in its 41st year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine —that maintains a strong focus on commercial-scale ethanol production, new technology, and nearterm research and development. The event draws more than 2,300 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

Carbon Capture & Storage Summit

June 9-11, 2025

CHI HEALTH CENTER | OMAHA, NEBRASKA

Please recycle this magazine and remove inserts or samples before recycling

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer.com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-7468385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to editor@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space. TM

Capturing and storing carbon dioxide in underground wells has the potential to become the most consequential technological deployment in the history of the broader biofuels industry. Deploying effective carbon capture and storage at biofuels plants will cement ethanol and biodiesel as the lowest carbon liquid fuels commercially available in the marketplace. The Carbon Capture & Storage Summit will offer attendees a comprehensive look at the economics of carbon capture and storage, the infrastructure required to make it possible and the financial and marketplace impacts to participating producers.

COPYRIGHT © 2024 by BBI International

Ethanol’s Next Big Thing Isn’t Just Growth, but Change

It would be easy to assume that America’s ethanol industry grew slowly and steadily over time from a cottage industry of farm-based stills to its current 17.7-billion-gallon size, but it didn’t happen that way. The industry leaped forward in bursts of expansion when policy and marketplace opportunities aligned. The Clean Air Act amendments of 1990 launched the “oxygenated fuels” era in earnest. The nationwide replacement of MTBE in the early 2000s made E10 ubiquitous. And half a decade later, the creation of the Renewable Fuel Standard ushered in a multi-year period of plant construction that may never be equaled. Each seminal moment created a pronounced growth spike followed by a plateau, or levelling-off period, defined by efficiency gains, plant expansions and process improvements. And that’s basically where we are now, level and on the precipice of something big, not just straight line growth this time but real transformation.

The age of sustainable aviation fuel is here, and all signs point to the fact that low-carbon ethanol—perhaps by sheer volume alone—will eventually become the world’s top SAF feedstock. Amid the rise of electric vehicles, predictions about the impending death of gasoline-powered vehicles have fallen woefully short. It’s not happening at the pace many envisioned. Nonetheless, ethanol industry leaders know there’s some truth, however distant, to an EV future. And they know SAF production can absorb any gallons lost to EVs over time. The idea is that as one market contracts, another will grow. The SAF industry will, in fact, need billions of gallons of feedstock. It takes about two gallons of ethanol to make one gallon of SAF, and the U.S. government has set a goal of replacing 100% of its fossilbased jet fuel—35 billion gallons—by 2050, starting with 3 billion gallons by the end of this decade. It’s possible that even the early target will not be achieved with lipid feedstocks alone, much less the ultimate goal. A lot of ethanol will be needed.

This issue explores the role ethanol will have in America’s moonshot effort to build out its SAF industry. We start with “Giving Lift to 45Z,” on page 14, a look at how the essentially interim 40BSAF-GREET model is giving industry leaders a chance to recommend changes to the next iteration of the tax credit, 45Z, which will largely define the near-term viability of ethanol-based SAF. Then, in “Availability Advantage,” on page 22, our sources explain why ethanol is in a much stronger position than lipid feedstocks to bring SAF production up to a multi-billion-gallon scale. And already, ethanol-based SAF projects are popping up, like the proposed Illinois plant featured in our page-30 story, “Ethanol-to-Jet Aspirations.”

Grain ethanol will be used for SAF production, no doubt, but cellulosic SAF is the ultimate prize. And production challenges aside, there should be more than enough of it. In “SAF’s Billion-Ton Question,” on page 30, we report on the U.S. DOE’s updated Billion-Ton Report, which concludes that there isn’t just 1 billion tons of non-grain biomass available in the U.S. for advanced biofuels production, but possibly 1.5 billion tons.

Finally, be sure to check out “Milestone Meeting,” on page 44, a photo-heavy review of the 40th annual International Fuel Ethanol Workshop & Expo. With 2,400 registered attendees, this year’s show was one of the largest, most vibrant industry gatherings of the last decade. Thanks for being there!

Profit-Driven Passion: Loving Ethanol for the Money

Although ethanol’s ability to provide immediate and significant greenhouse gas reductions continues to be maddeningly ignored in U.S. vehicle emission reduction policies, there are many positive signs pointing to increased ethanol use—in other nations, as they consider higher blends to meet their carbon reduction goals, and in uses beyond the boundaries of ethanol as a traditional vehicle fuel, from serving as a feedstock for bioplastics to use as a cooking fuel to powering air travel as sustainable aviation fuel.

Yet, even with all of those exciting and sophisticated new possibilities on the horizon, the upcoming end of the latest and largest of the U.S. Department of Agriculture’s (USDA) Higher Blends Infrastructure Incentive Program (HBIIP) offerings seems to provide a good opportunity for us to step back, appreciate the successes the program is providing, and remind ourselves not to forget that long-term success in developing new ethanol markets doesn’t come from innovation or infrastructure as much as it comes from showing prospective ethanol retailers how to “do the math.”

If we take a break from congratulating ourselves on getting well over a billion dollars’ worth of public and private money deployed to install new higher ethanol blend infrastructure, I wonder how many of us would say we thought that spending would result in E15 and/or E85 being sold in about 5,000 of the nation’s 120,000 retail fuel stations? That’s not to say HBIIP hasn’t done what it’s supposed to do, but where retailers have added E15 with the help of HBIIP, their competitors have not responded by also offering E15.

There are multiple reasons retailers haven’t jumped on the E15 bandwagon, not the least of which is the lack of a law making year-round E15 legal, permanently. There’s also the market reality that single store and small chain retailers don’t respond to larger competitors adding new products the way larger chains respond when small competitors offer new products that threaten the big guys’ market share. Small operators are used to not having everything their more well-heeled competitors have, and often assume the big chains have those products because only companies with a lot of money can afford to add them.

The most successful E15 and flex fuel retailers are the marketers who “do the math” and understand the retail market advantage and profit potential of higher ethanol blends. They know they might not need to buy any new equipment to sell E15, and they know what we know—ethanol costs less than gasoline (especially when the RIN value is included), competitors who only sell E10 can’t match E15, and even when E15 is offered as the lowest-priced “fighting-grade” fuel at the pump, the retailer can often make better margins on higher ethanol blends than their other fuels. State incentives rewarding retailers that sell higher blends help the math and drive new volume, too.

E10 went nationwide in a few years’ time when we taught retailers ethanol math, including the fuel tax credit they got for adding ethanol to gasoline. Assuming we can get its year-round policy problem corrected, E15 could grow just as quickly. While we’d all like retailers and consumers to love ethanol because it helps pay for new equipment, benefits the environment and rural economic development, or any of the other reasons we all love ethanol, we need to be OK with being loved for our money—or, more accurately, the money we can make or save those station owners and customers when higher ethanol blends are sold. In the fuel world, that’s the only kind of love that lasts.

Ron Lamberty Chief Marketing Officer

American Coalition for Ethanol

Mackenzie Boubin Director of Global Ethanol Export Development

Grains Council

U.S. Grains Council Advances Ethanol Exports to Southeast Asia

Emerging opportunities in Southeast Asia for the U.S. Grains Council’s ethanol programs are beginning to show significant merit and engagement. After years of market development efforts in the top tier markets in the region, namely the Philippines, Vietnam and Indonesia, these markets are showing immense promise and potential within the near- and long-term.

In June, the Philippines Department of Energy officially submitted notice that fuel retailers in the country can increase ethanol blending to E20 on a voluntary basis, representing 86 million gallons of potential increase in ethanol demand.

Currently, the Philippines consumes 1.8 billion gallons of gasoline annually and was one of the earliest adopters of ethanol blending programs globally. Ethanol production and demand has increased since its E10 mandate began in 2013, delivering significant economic benefits to rural communities, alleviating pump prices for consumers and reducing greenhouse gas emissions from the transportation sector.

This success story is further enhanced through the mutual trade partnership that the Philippines and the U.S. enjoy. In 2023, the country imported 55 million gallons of ethanol from the U.S., accounting for 85% of all ethanol imports and 40% of the Philippines’ total ethanol demand.

Alternatively, Vietnam is considering a potential migration of its current E5 RON92 mandate to all grades of gasoline as an immediate goal, with a longer-term aim of implementing E10 blending. A nationwide E5 mandate would increase ethanol consumption by an estimated 400%, creating opportunity for the U.S. ethanol industry to support Vietnam’s clean energy transition with supplemental supply.

The Council is working through a multistakeholder program to educate the public, governments and fuel supply chain on the benefits poised by E5 and E10 blends, which includes partnering with the local automobile and motorcycle industries. The Council has organized trade missions of Vietnamese industry leaders to visit the U.S. and witness firsthand ethanol’s seamless integration into our fuel supply.

Finally, Indonesia continues to be of the fastest growing fuel markets in the world; ideal for integrating ethanol blending. In marketing year 2023/24, Indonesia has increased its ethanol imports from the U.S. by over 500% and is a top 10 market destination for U.S. ethanol with over 26 million gallons sold so far. Much of this product is being preblended as an E3 to overcome the current 30% import tariff on U.S. ethanol into the country.

Pertamina, Indonesia’s state-run oil refinery, continues to expand its E5 pilot program in the country, targeting nearly 60 retail locations carrying E5 RON95 by the end of 2024, and the new government is committing under their draft National Energy Policy to implement E40 by 2060. In addition, Pertamina also has vocally announced plans to launch an E7 called Pertamax Green 92, although no timeline has been given.

Given the significant movement within the region for these three markets, the Council’s Southeast Asia ethanol team is focused on internal consultations and engaging national strategy to align with global decarbonization efforts. This combination of the Philippines, Vietnam and Indonesia represents an immense opportunity for U.S. ethanol producers and creates a regional success story for other ASEAN members to follow.

U.S.

THE FUTURE OF FERMENTATION IS HERE

Enter a new era of ethanol production with FermaCore™ Propel, the LATEST INNOVATION IN LIQUID YEAST OFFERINGS. Featuring extreme robustness and the fastest fermentation kinetics we’ve ever o ered, FermaCore™ Propel is a true breakthrough designed to MAXIMIZE ETHANOL YIELDS AND INCREASE ENZYME REPLACEMENT — leading to LOWER CARBON INTENSITY. Whatever form you need it to take, you can expect more from FermaCore™ Propel. Because at LBDS, fermentation is at our core.

START SHAPING THE FUTURE OF ETHANOL PRODUCTION

BUSINESS BRIEFS

PEOPLE, PARTNERSHIPS & PROJECTS

ICM and Western New York Energy enter agreement to implement FOT Oil Recovery system

ICM Inc. announced strategic collaboration with Western New York Energy, LLC, to implement ICM’s cutting-edge FOT Oil Recovery system.

Under the terms of the agreement, ICM will be responsible for engineering, equipment procurement, and installation of its proprietary FOT Oil Recovery system at WNYE’s advanced facility in Medina, New York. This agreement marks the sixth commercial installation of ICM’s proprietary oil recovery technology.

FOT Oil Recovery, a two-step separation system integrated after the distillation process, significantly increases downstream oil recovery by optimizing solids-liquid separation in the whole stillage. This system also dewaters the whole stillage cake as it goes to the dyer, reducing a plant’s natural gas load.

The on-site installation of FOT Oil Recovery is slated to commence this fall, with a system startup in the spring of 2025.

Raízen selects ION's TriplePoint for its strategic digital evolution applications

ION Commodities, a global leader in energy and commodity management solutions, announced that Raízen Energia, the world’s largest sugar exporter and cellulosic ethanol producer, has selected ION’s TriplePoint solution to manage its extensive commodities portfolios of sugar, biofuels, fossil fuels and renewable certificates.

Raízen plays a significant role in the global bioenergy market, serving over 50 million end consumers annually with 35

billion liters of fuel sold, 11.3 million tons of sugar sold, and 3 billion liters of cane ethanol produced.

Raízen opted for TriplePoint, ION’s Commodity Trading and Risk Management solution, due to its comprehensive, out-of-the-box, end-to-end capabilities and sophisticated risk engine. TriplePoint supports agricultural trading, biofuels, fossil fuels and renewable credits—all within a single system.

Blue Biofuels receives Canadian patent on CTS process

Blue Biofuels Inc. is pleased to announce that it has received a Notice of Allowance in Canada for the primary patent on its CTS process, #3,121,695 “System to Convert Cellulosic Materials into Sugar and Method of Using the Same.” The company previously received the primary patent in the United States, Japan and El Salvador, and anticipates receiving it in the EU and the rest of the world soon.

As reported in the 8-K that the company filed on May 17, Blue Biofuels was required to change auditors as the prior auditor was suspended from practicing before the SEC. Blue Biofuels engaged Assure CPA, LLC as its new independent PCAOB-certified audit firm.

Verbio starts expansion to build second biorefinery in North America

In May, Verbio started construction to convert its South Bend, Indiana ethanol plant into the second integrated biorefinery plant in North America. The facility will incorporate both the production of renewable natural gas (RNG) and bioethanol using an innovative production approach. The company, a subsidiary of Europe`s leading biofuels and bioenergy producer Verbio SE, had received approval for its expansion proposal from the City of South Bend in

April. Following the application of the Verbio technology and commissioning, Verbio targets a production capacity of at least 85 million gallons of corn ethanol and 2.8 billion cubic feet of RNG annually.

The RNG produced at Verbio South Bend will be fed to the regional natural gas grid and support the needs of industrial and commercial uses.

GIVING LIFT TO 45Z

Analyzing the pros and cons of the 40BSAF-GREET model, industry leaders suggest what its replacement tax credit structure, 45Z, should preserve, change and eliminate to fairly and effectively accelerate alcohol-to-jet SAF production.

By Katie Schroeder

Since the passage of the Inflation Reduction Act, which came with the allure of new tax credit opportunities for biofuel producers, the ethanol industry has been waiting for details. What would ethanol’s participation in the sustainable aviation fuels (SAF) industry look like under the IRA? The industry waited for not months, but years to get an answer to that question, finally receiving direction in the 40BSAF-GREET 2024 model, released at the end of April.

In an exclusive podcast interview with Ethanol Producer Magazine, Geoff Cooper, CEO of the Renewable Fuels Association, explained that the process of bringing the new model forward was a steep challenge punctuated by the fact that it is widely considered to be a starting point. Cooper and others say the 2024 version of GREET— used in calculating greenhouse gas (GHG) emissions for both hydroprocessed esters and fatty acids (HEFA) and alcohol-to-jet (ATJ) SAF pathways—is the first step in

working out how to translate greenhouse gas reduction into the language of the tax code. The modified GREET will only apply to the existing 40B SAF blending credit, which expires at the end of 2024. It will be replaced with 45Z, also known as the Clean Fuels Production tax credit, in 2025, and ethanol’s top voices are working diligently to shape it into a useful mechanism for ATJ production growth.

The History of 40BSAF-GREET

As Ethanol Producer Magazine previously reported, the 40B tax credit is a biofuel production incentive created by the IRA, signed into law in August 2022. The 40B tax credit offers SAF producers $1.25 per gallon of fuel that has a 50% greenhouse gas (GHG) reduction compared to petroleum-based jet fuel. For SAF with a GHG reduction greater than 50%, the incentive increases— one cent for each percentage point—up to $1.75 per gallon. In the legislation, the International Civil Aviation Organization’s most current CORSIA (Carbon Offsetting

and Reduction Scheme for International Aviation) model “or similar methodology” were identified as acceptable ways to calculate the GHG of the SAF seeking to qualify for the program.

Early on, the ethanol industry championed the use of the Department of Energy-Argonne National Laboratory’s GREET (Greenhouse Gases, Regulated Emissions and Energy Use in Transportation) model, arguing that it should qualify as a “similar methodology.” They argued, effectively, that GREET offers a more accurate calculation of U.S. farming practices than CORSIA, which is governed by international consensus. “We and others pushed the administration, and specifically Treasury, to recognize the GREET model as that ‘other methodology,’” says Brian Jennings, CEO of the American Coalition for Ethanol. In mid-December, the Treasury department and the IRS released SAF tax credit guidance, stating that taxpayers would be able to use an updated iteration of the GREET model, made specifically for the 40B tax credit. Chris Bliley, senior vice president

of regulatory affairs with Growth Energy, explains that the organization views “Argonne GREET”—the preceding version of the model—as the “gold standard” when it comes to GHG emissions analysis.

The new model and guidance were released on April 30, nearly two months after the self-imposed deadline of March 1. Industry representatives have applauded the inclusion of a variety of GHG reduction strategies including regenerative farming practices, renewable energy usage and carbon capture and sequestration. However, there are several GHG emissions reduction strategies not included in the model and others that are undervalued, explains Bliley.

Pros and Cons

Industry representatives point to encouraging elements included in 40BSAFGREET, as well as some of the ways the model is lacking.

A lower induced land-use change number for ATJ SAF compared to the CORSIA

ACCESSING ALTITUDE: The timing of 40BSAF-GREET has left ethanol and SAF producers with little time to take advantage of tax credits; however, the industry is looking ahead to 45Z, which includes credits for on-road fuel as well as SAF.

PHOTO: STOCK

NEW OPPORTUNITY: Signed into law on August 16, 2022, the IRA was heralded as a door to new opportunities for ethanol, but pursuant guidance has been slow, leaving producers with questions about their ability to access tax credits.

PHOTO: STOCK

model is one of the positive elements present in the model. 40BSAF-GREET assigns a nine-point induced land-use change penalty to SAF produced using corn ethanol, which is better than what ACE was expecting. “There’s not zero land-use change, but EPA and others have suggested that landuse change should be 20 or 30 points, so a nine-point induced land-use change penalty is reasonable and something we can certainly live with,” Jennings says. There was some worry that the indirect land-use change (ILUC) number would be unreasonably inflated out of concerns that farmers might start growing SAF feedstocks more aggressively with new market incentives in place.

The ILUC number for corn ethanolbased SAF dropped from 14 grams per megajoule under 2023 Argonne GREET, an encouraging development, but not low enough, Cooper says. “Yes, that’s a step in the right direction, but we believe that the data—the evidence from the real world— [justifies] zero penalty or a very low number, low enough to be negligible,” he says.

The GHG benefit of carbon capture and sequestration (CCS) is defined within the new GREET model, too, giving ethanol producers the option to reduce emissions by 33 points by integrating it into

their process. Many ethanol producers have been considering CCS as a strategy to meet the low GHG threshold, either as part of a CO2 pipeline project or onsite sequestration, Jenning explains. This 33-point valuation is what’s needed for many ethanol producers to reduce their emissions enough to reach the SAF market.

One of the most important breakthroughs within 40BSAF-GREET is the inclusion of climate-smart agriculture practices. “It opened the door for the very first time [to formally recognizing that] agriculture practices indeed have a meaningful impact on the carbon intensity of biofuels, so we were pleased with that,” Jennings says. ACE is helping lead the U.S. Department of Agriculture’s Regional Conservation Partnership Program, or RCPP, partnering with corn farmers and ethanol producers to demonstrate the impact that these farming practices can have.

“We don’t have any objections to the GREET model per se, we’ve always believed the GREET model is by far the superior method or approach to calculate lifecycle greenhouse gas emissions,” Jennings says. “The concerns we have with 40BSAFGREET are not the GREET model itself, [but rather the] limitations or conditions

[that have been] attached to [it] that have more to do with, frankly, politics than science.”

The carbon reduction impact assigned to climate smart agriculture practices within 40BSAF-GREET is one of the elements that Jennings believes must be decided by science alone. Although the model acknowledges that there is a carbon reduction benefit associated with these practices, it requires corn production to include a combination of enhanced efficiency fertilizer application, cover crops and no-till farming to attain a 10-point CI reduction. This value is significantly out of step with the benefits that the Argonne GREET model assigns to these practices, and an all-in-one approach “just isn’t practical,” Jennings explains. “If you really required those three practices on corn bushels, the greenhouse gas credit should be 20 to 25 points, not nine to 10,” he says.

Cooper also emphasizes that it is a mistake for Treasury to take a “one-size-fits-all” strategy when calculating the benefits of climate-smart farming. He explains that the requirement to use the three different practices together also simply does not work in the northern regions of the Corn Belt, and the model should account for the unique

climate conditions and geography found in different parts of the country. “There needs to be more flexibility for farmers to really choose the carbon reduction practices that work best for them and their operations,” Cooper says. “And that’s going to be a big focus for us as we look at, again, getting 45Z right, and kind of avoiding some of the mistakes or flaws with 40B.”

There are also several key GHG reduction strategies that are not included in 40BSAF-GREET, including combinedheat-and-power technology, energy sources such as hydroelectric power and biomass-

to-power, sorghum as a feedstock for ethanol, as well as ethanol wet mills, explains Bliley. “It’s not so much what’s there that’s the issue, other than the bundling [of climatesmart agriculture practices],” he says. “The issue is [what’s not] included.” And as 40B draws to an end, it is vital that proven CI-reducing innovations are credited under 45Z.

Because the 40BSAF-GREET model came out roughly seven months before the credit expires, there is little practical opportunity for producers interested in supplying the SAF market with low-carbon ethanol to take advantage of 40B tax credits. It is

unlikely that new investment dollars will flow into ATJ projects as a direct result of the credit, Cooper explains. However, he believes it sets the stage for 45Z moving forward.

Looking Ahead

In April, EPM reported that agencies will do further work on modeling, data, assumptions and verification to credit climate-smart ag practices for 45Z; it’s also been stated that a new 45Z-GREET model will be developed for use with the 45Z tax credit.

SUSTAINABLE STRATEGIES: 40BSAF-GREET is the first time that climate-smart agriculture practices, such as the no-till planting pictured here, have been recognized in the law as having GHG reduction benefits.

PHOTO: STOCK

PHOTO: STOCK

In talks with Treasury, ACE has emphasized the importance of a timely completion of the proposal and comment period process before 45Z goes into effect on January 1, 2025. Delays with 40B and a lack of guidance from the Treasury on 45Z have led to an atmosphere of “anxiousness” from producers looking forward to 45Z, Jennings explains. The producers in Jennings’ organization are eager to receive the details and rules that could determine whether the investments they have made, or plan to make, in efficiencyimproving technologies will pay off in the context of access to 45Z tax credits. “They’ll be in the money for 45Z, based on what we know, but what we don’t know is what concerns folks, like any other stipulations or conditions that may be placed on the carbon intensity reductions,” he says. “So, it’s just an overall anxiousness about getting the rules, understanding the rules and ... getting the tax credit on time.”

ACE has been in communication with Treasury about the problems within 40B, making a case for certain aspects of the model to be eliminated or changed in the forthcoming credit structure. Some of those problematic components were communicated in an

MISSING ENERGY: Wind energy was one of the renewable energy sources recognized by 40BSAF-GREET, but there are others that the industry would like to see recognized, including biomass-to-power.

ACE presentation, outlining the importance of allowing for individual climatesmart ag practices, as well as stacking of those practices, rather than limiting GHG credits based on an all-or-none approach.

“Our goal going into this was we want to end up in a better place than [where] we started six months ago with 40B,” Cooper says. “Really, at that time, there was no way; there was no pathway for corn ethanol to qualify as a tax-credit-generating feedstock for sustainable aviation fuel, so ... we negotiated that hurdle. It isn’t perfect, but there are pathways—there are ways, using this new model, that corn ethanol can absolutely qualify as a feedstock under 40B for SAF.”

Ending on a good note with 40B sets up the ethanol industry to pursue further refinements and improvements as the 45Z process begins, explains Cooper. Although 45Z offers a plethora of opportunities for the ethanol industry, SAF industry and their agriculture partners, it is vital that model-

ing and implementation are correct. One of RFA’s priorities moving forward is making sure the auditing and verification process are implemented in a way that does not discourage investment, and instead ensures that the process is extensive enough to provide the “assurance” needed by the IRS and Treasury department, he explains.

45Z tax credits are currently slated to run from the beginning of 2025 to the end of 2027, these three years are a small window for qualifying GHG reduction technologies to be financed and rolled out, Bliley explains. He wants to see 45Z be “less prescriptive and more expansive,” embracing the GHG reduction technologies producers are utilizing. Timely guidance is also vital, as it grants producers more certainty as they choose what investments to make and seek financing. “Ultimately, we would want a rulemaking finalized before the end of the year, that would be the important thing, that these rules get done and finalized before the

tax incentive takes place,” Bliley says. I think it’s important to see these signals, because, again, these are pretty significant investments and ... people are looking at financing these projects; it’s really important that they understand how that’s going to work.”

Although the journey with the 40B model is complete, the quest to make 45ZGREET even better is underway. 40BSAFGREET is by no means a perfect model; however, some important progress has been made, and ethanol trade organizations plan to use it as a steppingstone to a more accurate representation of their industry’s innovations.

Author: Katie Schroeder

Contact: katie.schroeder@bbiinternational.com

S YNERXIA ® GEMS T ONE C OLLE CTION

THE RIGHT YEAS T S, A T THE RIGHT TIME, F OR THE RIGHT PURPOSE

Yeast blends are often greater than the sum of their parts. Achieve the perfect synergy of fermentation yield, speed and robustness with the SYNERXIA® Gemstone Collection.

Our broad portfolio of yeasts and yeast blends offers greater flexibility to tailor solutions based on shifting process requirements or market conditions.

Powered by XCELIS® AI, our proprietary data analytics and predictive modelling tool, the SYNERXIA® Gemstone Collection helps de-risk decision making with custom yeast blends that take your ethanol production process to the next level.

Learn more at bioscience.iff.com/synerxia-gemstone

AVAILABILITY ADVANTAGE

Ethanol holds promise as an SAF feedstock, due in no small part to its availability of supply relative to lipid feedstocks, which are feeling global pressure.

By Lisa Gibson

As the sustainable aviation fuel industry in the U.S. takes shape, it’s becoming clear that an all-of-the-above approach to feedstock and technology will present the best chances of meeting aggressive domestic production goals. But existing supply constraints in lipid markets are raising concerns that ramping up the SAF industry will cannibalize feedstocks for other renewable fuels.

Ethanol’s current 17.7-billion-gallon industry has an enormous opportunity to occupy a share of the SAF feedstock pie and potentially help relieve pressure on global oilseed markets. Through the Inflation Reduction Act’s 40B and forthcoming 45Z structures, pathways that result in a 50% greenhouse gas (GHG) reduction over conventional jet fuel receive a $1.25 per gallon tax credit, with higher GHG cuts reaping as much as $1.75 per gallon. The U.S.’s SAF Grand Challenge outlines incremental goals, starting with 3 billion gallons in 2030 and increasing to 35 billion by 2050.

“The issue is that we’ve set these really lofty goals,” says Susan Stroud, analyst at No Bull Ag. “It’s not just the U.S.—it’s all of these increasing targets around the world. We’re ramping up and we’re going green in a big way, and that puts more pressure on all feedstocks.”

Renewable diesel, in particular, is experiencing dramatic growth, which is expected to continue through 2030.

“As we’ve seen production ramp up in an unprecedented way for RD, one of the big results is, as we see demand for those fat, lipid feedstocks grow, soybean oil wins as default because it [has been] the most widely available and the most relatively inexpensive,” Stroud says. “But the abundance of soybean oil that we’ve had is the

reason we saw it take the largest piece of the pie for so long.”

She adds, “That’s going to be squeezed out eventually when SAF comes online.”

Total soybean crush capacity in the U.S. is expected to grow 23% in the next three years. But U.S. soybean oil demand is expected to grow from an estimated 27.45 billion pounds in the 2023/24 marketing year to a projected record of 28.8 billion pounds in 2024/25, Stroud says. One bushel of soybeans yields just 11 pounds of oil.

“Yes, I think you’ll see some of that renewable diesel capacity pivot to SAF,” says Jimmy Samartzis, chief executive officer and board director of LanzaJet, which operates an alcohol-to-jet fuel production facility in Georgia. “It will be a shift from one product to another product ... For ethanol, it’s a phenomenal opportunity to provide support for the aviation sector through technologies like ours.”

“The target of opportunity (for ethanol) absolutely is significant, not just from corn starch, but also corn stover and lignocellulosics,” says Steve Csonka, executive director of the Commercial Aviation Alternative Fuels Initiative.

“We have always been working an all-of-the-above approach, with respect to multiple feedstocks, multiple conversion approaches for those feedstocks, even competing conversion processes for the same type of feedstock, etc.,” Csonka adds. “Feedstocks are not ubiquitous around the world, and we definitely have a worldwide transportation system [with] needs we’re trying to satisfy.”

Imports and Acreage

The increased pressure on feedstock supply from ramped-up renewable fuels means larger imports to sustain production, Stroud says. “One of the biggest things we've seen as this evolves is record amounts of imports.”

SHOW US YOUR SAVI NGS

Take a photo at the pump showing cost savings with UNL88 and we’ll put it on the fuel finder map.

The U.S. imported a record 742 million pounds of canola oil in March, and 672 million pounds in April. Soybean oil, too, recently hit a billion-pound month for imports, and tallow—preferred for renewable diesel for its status as a waste—has more than doubled its percentage share of all feedstocks from 2022 to March 2024 (8% to 20%).

“We’ve always imported a huge amount of canola for food and feed, and now that that oil is approved as a feedstock—we’ve seen a tremendous uptick in canola imports going into biofuel applications,” Stroud says. “We’re using record amounts in biomass-based diesel.”

If the U.S. puts restrictions on used cooking oil from China as analysts have speculated, Stroud says, that particular renewable diesel feedstock would be even more constrained, and it is no small volume.

“Chinese used cooking oil imports have absolutely exploded,” she says. “We imported essentially nothing from China in 2022 and then in 2023, 51% of our (used cooking oil) imports, out of a total of 3.1 billion pounds, came from China.”

In the first four months of 2024 alone, the U.S. imported 1.55 billion pounds of used cooking oil globally, compared with 717 million in the same period of 2023. “We’ve more than doubled,” Stroud emphasizes.

“At the end of the day, that total pool of available molecules is going to be limited because of the amount of fats, oils and greases that are available, especially on the waste side, because it’s inelastic with respect to demand,” Csonka says, adding that prices of fats, oils and greases also will likely rise as a result of the increased interest.

Stroud and Csonka agree that policies guide which markets the feedstocks will supply. Research shows, for instance, larger incentives for SAF would redirect soybean oil there from renewable diesel production, Stroud says.

But Csonka also points to supply constraint relief likely coming through efforts to expand acreage of oilseed crops such as camelina, pennycress and carinata, many on the verge of commercialization. “There is the opportunity to bring several billion gallons of purpose-grown oilseed crops into the picture,” he says.

FLIGHT PLAN: The U.S.’s SAF Grand Challenge outlines incremental goals for biobased jet fuel production and use, starting with 3 billion gallons in 2030 and increasing to 35 billion by 2050.

PHOTO: STOCK

Ethanol’s Exceptions

Even with expanded production, limitations exist on hydrotreated esters and fatty acids (HEFA) technologies, Samartzis says, citing Illinois and the UK. In addition, the U.S. has the existing capacity to produce roughly 17.7 billion gallons of ethanol, plus the chance for more to come

Outlook

online as a result of SAF demand and lower carbon intensities.

According to research by Worley Consulting, ethanol could add 6.6 billion gallons of SAF to the supply by 2050, if 85% of a very conservatively estimated 15 billion-gallon-per-year capacity was diverted from gasoline to SAF. As a result of supply constraints and lower yield per acre, among other factors, that’s 2.6 times more than the potential contribution of soybean oil in that timeframe, according to the analysis.

But ethanol’s opportunity in SAF is not limited to the U.S., Samartzis says. “The opportunity is a global one for U.S. ethanol. (Ethanol can) support SAF through ATJ (alcohol-to-jet fuel) in other countries as well.” Particularly, he adds, countries that don’t have the 50% threshold for emissions reduction.

Carbon Intensity Requirements

In fact, the 50% threshold is a hindrance to ethanol’s immediate promise as an SAF fuel, Csonka says.

“To see the ethanol-to-jet fuel space moving forward, we really have to be talk-

Our team of experts have over 20 years of ethanol plant maintenance expertise. We o er full service and parts for all Fluid Quip equipment to ensure peak performance.

• OEM Parts Warehouse

•$2 million+ inventory on-hand

•Factory Trained & Certified Techs

•MZSA™ Screens

•Paddle Screens

•Grind Mills

•Centrifuges

•Gap Adjusters

ing about getting corn ethanol down to the 20-units-of-carbon level, and that’s going to require some significant effort,” Csonka says. “My organization is going to be looking at how we can foster the thinking around producing low carbon-intensity (CI) ethanol in order to help facilitate our own journey.”

Measures to reduce ethanol’s CI include conversion to renewable heat and

power, carbon capture and sequestration, and regenerative ag practices such as reduced tillage, cover crops and green fertilizers. Carbon capture and sequestration (CCS) alone can have a large impact on an ethanol plant’s CI score, to the tune of a 40% reduction, according to an analysis by Worley Consulting.

Stroud, Samartzis and many others are optimistic that the ethanol industry

will meet the challenge, especially if CCS pipelines under development come online. Csonka says he is encouraged by the work Marquis is doing for CCS onsite in Illinois, as well as the well-publicized Summit Carbon Solutions pipeline with plans for CCS from 57 plants throughout Iowa, Minnesota, North Dakota, South Dakota and Nebraska. In addition, Tallgrass Energy has approval from the Federal Energy

FIELD TO SKY: Industry analysts expect soybean oil prices, along with other fats, oils and greases, to rise as SAF production takes off. PHOTO: STOCK

Regulatory Commission to convert an existing natural gas pipeline to instead transport carbon dioxide.

Samartzis also points to a LanzaTech technology under development that can convert the pure carbon dioxide from fer-

mentation at ethanol plants into more ethanol. “So instead of sequestering it or shipping it out, you can actually make a really low carbon-intensity ethanol reusing that CO2 that gets created through the ethanol production process.”

With CI reduction, Stroud, Csonka and Samartzis all agree that ethanol can play a key role in SAF markets. Plenty of research even suggests the SAF Grand Challenge cannot be met without the help of ethanol. But demand will be crucial, too, and some states with airline hubs are setting up SAF incentives to encourage development and the economic benefit it would bring.

For now, the only commercial alcoholto-jet facility in the U.S. is LanzaJet’s. With a technology that can use several different kinds of ethanol (cellulosic, sugar cane, corn, etc.), the company is poised to take advantage of any feedstock availability benefits ATJ offers in the future.

“I think there’s a significant opportunity for ethanol production to find a new market and be incrementally additive to what ethanol producers do today,” Samartzis says.

Author: Lisa Gibson, Freelance Journalist Contact: writer@bbiinternational.com

SOURCE: SUSAN STROUD, NO BULL AG

in rh ythm with natur e

Ethanol-to-Jet ASPIRATIONS

Advised by several former CEOs from big-name companies, Avina Clean Hydrogen is on an ambitious lateral pursuit in Illinois: sustainable aviation fuel production via ETJ.

By Luke Geiver

Until recently, Avina Clean Hydrogen’s name was spot on. The company is on a mission to build at least eight large-scale renewable hydrogen, ammonia or methanol production facilities within three to five years—and it’s determined to become a global green hydrogen player. So, having Hydrogen in its name was perfectly apropos. Now, however, with its decision to enter the ethanol-to-jet (ETJ) fuel production space, the company may want to consider a moniker as broad as its envisioned portfolio.

As Vishal Shah, CEO and founder of Avina, says, ethanol—ETJ in particular— presents a unique opportunity for the company, which aspires to serve a worldwide customer base across virtually every major sector of energy.

Big Names, Big Ideas

The Avina team—including an advisory board that reads like a veritable who’s-who of major industry—boasts an impressive grouping of strategic thinkers that gives weight to the company’s directional decision-making. On its corporate staff, Avina has an investment banker from Barclay’s with experience in cleantech. It has a global hydrogen sales expert with ties to companies like Air Liquide and Chart Industries. Shah himself has worked in private equity and was named a top clean-tech equity analyst by Institutional Investor from 2009 to 2017. He founded the company in 2021, and through a series-A investment, raised an initial $10 million. But what’s more

impressive is the clout linked to the company’s advisory board. Avina receives guidance from the former CEOs of Cummins, BP Americas, Rolls Royce, U.S. Steel, JetBlue and more.

“The board is extremely important,” Shah says. “We have a lot of CEOs that are, and have been, involved in these [types of] projects—and they all play an important role.”

Shah adds that Avina’s team-building efforts are far from complete; the team in place now was there prior to the company’s decision to pursue ETJ, so it is expected that executives from the biofuels space could join the board. “We are certainly building a great team,” he says.

While jumping into sustainable aviation fuel (SAF) was no small decision, it didn’t require an especially long meeting of Avina’s advisory board to gain consensus to do it, says Shreya Jetty, product manager for the company’s ethanol venture.

Jetty is heading up Avina’s effort to build an SAF production plant in Illinois by 2027. Announced in April, the proposed facility would be engineered to make 120 million gallons of SAF annually. To do that, Avina will source low-carbon-intensity (CI) ethanol from Illinois plants equipped with carbon capture and sequestration (CCS) technology, which should lower the CI of corn ethanol enough to qualify as credit-generating SAF feedstock.

Currently, the only plant in Illinois that produces CCS-linked ethanol is the ADMDecatur facility, which has a sequestration component to its production capabilities.

So far, Jetty and her team have completed the preliminary front-end engineering design (pre-FEED) for the project, and she says FEED should kick off this summer. Funding for what’s referred to as the FID (final investment decision) has been secured. The FID, the company says, is crucial as it largely settles the “go/no-go” project finance question.

According to Avina management, the project has a good chance of getting the ultimate go-ahead to proceed. The team is already engaged in “advanced discussions” with strategic and financial investors to fund the Illinois ETJ project. And Jetty expects an announcement this summer about a licensing agreement for a technology that, in her opinion, will give the entire project a competitive advantage.

Technology licensing, partnership formation and strategic project development decision-making are the core capabilities of Avina’s management team and board. On other projects in the green hydrogen space, the company has already announced major partnerships with world-renowned technology providers, formed strategic collaborations with suppliers or end-users, and accomplished the challenging connective work of large-scale biofuels project development.

In its push to supply renewable fuel sources to ground transportation, maritime and aviation end-users, Jetty says ethanol is an excellent near-term, financially viable solution that complements its green hydrogen and ammonia pursuits. Plus, she says, etha-

BIG VISION: Avina believes Illinois is the right place to locate its first SAF plant due to the customer base at Chicago O’Hare and the state’s biofuel workforce and production support.

PHOTO: O’HARE INTERNATIONAL AIRPORT

nol as a feedstock for SAF makes sense in the context of forecasted changes in the gasoline market. “With more penetration of EVs, ethanol will need to find a new home in other markets,” she says.

If constructed, the Avina Illinois SAF plant would need about twice as much ethanol coming into the facility as SAF going out. In other words, making 120 MMgy of SAF will require roughly 240 MMgy of ethanol each year. Jetty and her team have already begun talking with multiple ethanol suppliers.

The goal of the project is to ultimately produce SAF that can be railed or trucked into Chicago O’Hare and other airports in the state.

“The U.S. airline industry is experiencing notable demand for SAF in response to commitments to utilize 3 billion gallons of SAF by 2030,” says Shah. “Avina is proactively collaborating with airline customers and other stakeholders to play a key role in meeting this target.” He adds, “The strategic

location, scale and cost-effectiveness [of the ETJ project in Illinois] offers a significant advantage.”

Ethanol-to-Jet has Its Challenges

The excitement that Avina’s management team is exuding about ETJ is accompanied by pragmatic caution. Karen White, the company’s director of regulatory and

business development, says there are several challenges that lie ahead apart from securing the necessary funding for the multi-billiondollar plant.

Right now, she says, the markets are very clear on the outlook and market value of ethanol as an input for SAF. “What we don’t know is what the price will be for ethanol with a premium CI score,” she says. “That price is going to evolve.”

READY FOR TAKEOFF: If Avina’s vision for ethanol-to-jet production happens, roughly 240 million gallons of ethanol will be needed annually for just one facility.

The cost of inflation will also be an issue going forward. White says it is still hard to gauge the cost of products needed to build the proposed plant. There will also be challenges with site infrastructure.

And then there is the issue of policy. White and Jetty both want to see more clarity, especially in the context of establishing greater certainty.

The Inflation Reduction Act and other government-led initiatives have created some favorable policies for the project, but there remains uncertainty as to how long any of it will last.

At the state level, Illinois has taken steps to be a leader in SAF. Last July, Illinois instated a SAF Purchase Credit that creates a $1.50-per-gallon tax incentive for air carriers. For an SAF product to be

eligible for the credit, the fuel must show a 50% lifecycle greenhouse gas emissions reduction compared to petroleum-based jet fuel. Airlines for America, an advocate for the aviation industry, has estimated that the average flight from Chicago O’Hare to Miami requires 2,500 gallons of fuel to fly south and 3,500 gallons to return north. Just to fly south, the $1.50 tax credit could provide significant savings for the airline.

Templink Multi-Sensor Temperature Monitoring

Cloud-based

wireless monitoring and notification system

Perfect solution for monitoring bearing temperatures, heat trace activity, VFDs, MCC rooms and ser ver rooms, process flows, cooling tower activity and more

GET NOTIFIED WHEN TEMPERATURES GET TOO HIGH OR TOO LOW

INCENTIVIZING SAF: In 2023, Illinois passed a tax incentive for SAF that provides $1.50 per gallon for air carriers.

PHOTO: INTERSECT ILLINOIS

SAF DEMAND IS GLOBAL: From Rolls Royce in the U.K. to major airlines in the U.S., the demand for SAF is large and growing.

PHOTO: ROLLS ROYCE

As of June, the cost of Jet-A/A-1, the standard jet fuel used in the U.S., was $2.35 per gallon.

Illinois passed the tax credit in part because of the large customer base in the state that could utilize the credit. With nine international airports—and two of the top15 cargo airports in the world—there is a lot of aviation fuel used in Illinois. Plus, the state boasts a big biofuels workforce along with ample feedstock supply (No. 2 U.S. corn producer) and ethanol produced (No. 3 U.S. ethanol producer). Illinois also has several organizations committed to growing the in-state SAF industry, including the Illinois Corn Growers Association and other groups.

“Sustainable aviation fuel could grow into the largest new market for U.S. [ethanol], and Illinois manufacturers have the opportunity to be at the forefront, creating jobs and taking the lead in efforts to reduce global carbon emissions,” said Mark Denzler, president and CEO of the Illinois Manufacturers’ Association, when the state’s tax incentive was first announced.

White hopes the state of Illinois stays committed to SAF. She says a lot of legwork needs to be done to develop and prepare the state’s workforce to be able to scale-up and support SAF and other next-generation, low-carbon fuels.

The future of SAF made from ethanol is poised for dramatic growth for one simple

reason, according to Jetty: demand—the airlines desperately want the product. “There is so much demand for [SAF],” she says. “We don’t have to find an off-taker or find someone to take the product.”

In spite of uncertainty with federal incentives for SAF, “we do see a lot of overall incentives to pursue this work,” she adds. The demand and incentives for SAF were part of the reason Avina’s management team, along with its advisors, expanded its vision from green hydrogen into the ETJ arena, Jetty says.

“As a clean fuels developer, it [made sense to bring it] into our portfolio,” she explains.

White believes projects like the proposed Avina ETJ facility could be replicated in other places. And midstream companies are expressing interest in working with Avina, which Jetty views as a healthy signal across the supply chain—that all conceivable parties with potential involvement want the young industry to expand.

“In terms of the story on this project,” White says, “the most important thing our team could say is that it is clearer than ever that this can be implemented effectively, now, with several partners across the space.”

Author: Luke Geiver, Freelance Journalist Contact: writer@bbiinternational.com

FROM PLANTING TO PLANES: A farmer plants corn over a cover crop. Among U.S. states, Illinois is No. 2 in corn production and No. 3 in ethanol production.

The Rail Transloading Experts

Embrace the benefits of both truck and rail transportation with TRANSFLO – the Eastern U.S. leader in bulk-commodity transloading. Our team of logistics experts are standing by, ready to grow your business with innovative transportation solutions and best-in-class environmental stewardship.

Commodities We Move: • Chemicals • Plastics • Energy

Food Grade Products • Dry Bulk

• Waste Materials transflo.net

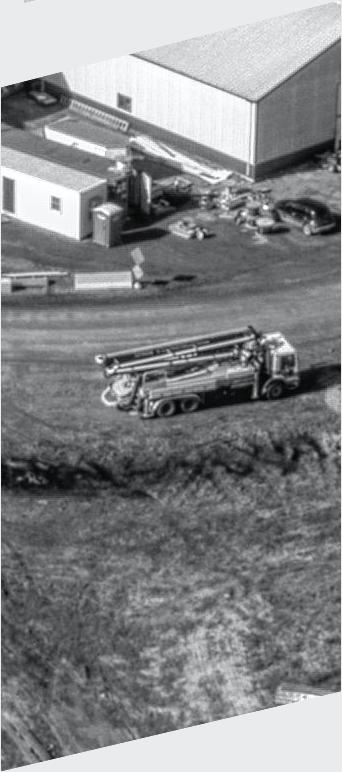

SAF’S BILLION-TON QUESTION

A new U.S. DOE report helps answer a basic—but big—question about the future of the U.S. SAF industry: Is there enough biomass feedstock to meet the nation’s goals?

By Luke Geiver

This spring, the U.S. Department of Energy air-dropped a report that should give the nascent sustainable aviation fuel (SAF) industry a massive crate of confidence. With the release of the 4th installment of a decades-old study designed to highlight the available volume of biomass in the U.S. suitable for bioenergy and bioproduct production, the DOE answered a big question about the future of SAF: Is there enough biomass to produce it commercially, long-term, at scale?

“We did not set out to find a billion tons of biomass,” said Mark Elless, technology manager for the Bioenergy Technologies Office of Renewable Carbon Resources at DOE, when asked about the objective of the latest 2023 Billion-Ton Report released in early 2024. In fact, the large team that worked on the Biomass Resource Availability Study actually found that the U.S. has closer to 1.5 billion tons of biomass

available for use as feedstock for a wide range of applications.

“The BT23 report can be used to inform policy and resource assessments for bioenergy applications,” Elless said, “such as meeting the volumetric goals of the Sustainable Aviation Fuel Grand Challenge.”

Valerie Sarisky-Reed, director of the Bioenergy Technologies Office (BETO), talked directly about the implications of the report in relation to that SAF Grand Challenge.

“The goal of meeting 100% of U.S. aviation fuel needs has been set for 2050, and that's projected to be approximately 35 billion gallons,” Sarisky-Reed said. “The Billion-Ton Report shows that this resource can indeed be met sustainably.”

Apparent SAF Focus

The BT23 is designed to be policy and end-use agnostic, according to Elless. But during the report-release webinar outlining the main takeaways, three of the four present-

ers spoke to what the report means for SAF production in their opening statements. The only speaker not to address SAF spoke instead about the tools and data accessibility options available to navigate and utilize the report.

The BT23 was built upon the biomass report’s last version, released in 2018, and represents an advancement in the understanding of biomass resources including quantity, spatial distribution and economic accessibility, Elless explained. “Each report adds additional feedstock analysis, better modeling and the latest available input data,” he said.

The robust report was co-authored by 54 individual contributors from six federal agencies, five national labs, five universities and 14 industry stakeholders, according to BETO.

Both Sarisky-Reed and Matt Langholtz, a natural resource economist from Oak Ridge National Laboratory, emphasized that the analysis is conservative.

“This resource assessment could really be considered to be conservative,” Sarisky-Reed

MORE THAN ENOUGH: According to the U.S. DOE, the amount of biomass currently available in the U.S. from food waste, municipal solid waste, agricultural and forest wastes, animal wastes and energy crops is between 1.1 to 1.5 billion tons.

said. “In other words, there is more biomass resource potentially available in the U.S. than we’re accounting for because of the overlying sustainability constraints.”

Langholtz explained that the assessment was intended to be a survey of primarily existing biomass-producing industries. “This report doesn’t say how much biomass should go to SAF,” he said. “It explores an end-use agnostic, overall production capacity. But certainly, production demands for SAF and other decarbonization goals could be realized with the capacity we have here.”

By the numbers, the amount of biomass available in the U.S. right now is between 1.1 to 1.5 billion tons from the following sources: food waste, municipal solid waste, agricultural and forest wastes, animal wastes and energy crops. If every ton of available biomass was utilized, 15% of future U.S. energy needs could be met. Certain factors, like sustainability, economic viability in the context of near-term conditions, along with other variables, helped SOURCE: DOE

PHOTO: STOCK

determine if a biomass resource should be included in the available tonnage amount.

The report team did note multiple examples of uncertainty in their assessment, including: product-specific market demands (which might incentivize a mix of energy crops different from those included in the report); the adoption of premiums, which could cause prices to vary over time and by region; shortstature corn, which could present unknown impacts to residue availability; progress in

waste reduction; and changes in future energy profiles.

The numbers also show a clear fact about biomass and SAF. According to the report, 1 billion tons per year of biomass is roughly enough biomass to produce approximately 60 billion gallons of fuel, or 1.7 times the volume needed to achieve the SAF Grand Challenge, a call by the U.S. to achieve 100% replacement of its overall aviation fuel use with SAF by 2050, starting with the near-term objective of

CLIMATE-SMART PRACTICES: To receive the SAF tax incentive, ethanol producers must produce with feedstock grown with all three prescribed climatesmart practices no till, cover crops and efficient fertilizer usage.

3 billion gallons of SAF by 2030. In a maturemarket scenario, 1.5 billion tons of biomass per year “is more than enough to meet the goals,” the report states.

Feasible Near-Term Feedstock for SAF

Although the BT23 doesn’t address the main feedstocks most suitable for the nearterm production of SAF, a different BETO RFI (request for information) summary released last September does add color to the question.

BETO called for input regarding SAF supply chains from industry, academia, national labs, government agencies and other stakeholders. The RFI was open to the public for two months. Two themes were observed throughout the RFI responses, BETO said. First, a clear need exists for long-term, stable policy to serve as an indicator of regulatory certainty for the industry. Second, stakeholder coalitions can and should provide a functional platform for collaboration and engagement among a diverse set of supply chain participants.

In total, 86 responses were recorded and created more than 600 pages of material. Feedstock suppliers, SAF producers and SAF endusers all commented.

Some want an SAF registry to enable the sharing of key fuel documentation and attributes. “This type of tool could not only alleviate barriers in the carbon tracing and accounting process due to hesitations from shareholders to share data, but could also help capture global SAF usage data,” one partici-

pant in the RFI said. Such info could be used to optimize the supply chain.

The creation of a tool to identify resources and availability of SAF would also be beneficial for the overall supply chain buildout. Such tools could identify feedstock suppliers, SAF producers, fuel blenders, quality control options and delivery/logistics routes all with the ability to visualize or simulate different scenarios. “Understanding demand and ideal SAF distribution to major airports would also help participants strategically select future facility locations,” another RFI participant said.

A list of constraints or barriers to the advancement of SAF and its supply chain were long. There are issues with short-term policy timelines, including many incentives that sunset before some SAF facilities can even be built. There is competition between state incentives. There are also inconsistent definitions of renewable biomass within legislation, commenters said.

“For example,” one RFI participant stated, “differences between the RFS program’s definition of renewable biomass and the U.S. Forest Service’s wildfire crisis 10-year strategy means a difference of tens of millions of tons of biomass per year available for SAF production.”

Carbon-intensity (CI) scoring presents an issue for new feedstocks not used in large volumes before. Technology compatibility will take time for new or novel pieces to be tested. And some of the newest technology products—like electrolyzers used in hydrogen production—require long wait times of 18 to 24 months.

With ch oice s fr om spon geblas ting , hyd ro bl as ting , indus tr

vacu uming and mor e , P re mium Plan t S er

o f maint enance options for your f ac ilit y.

• Conf ined space rescue

• Dr y ice blasting

• Hydroblasting

• Hydro reclamation

• Indus trial vacuuming

• Restoration

• Sandblas ting

• Slurr y blasting

• Spongeblasting

• Surface chemical cleaning

• Tube bundle and heat exchan ger cleaning

GROWING SAF CROPS: Researchers are looking at drought-tolerant energy crops to diversify the country’s supply of sustainable aviation feedstock by type and location.

PHOTO: OAK RIDGE NATIONAL LABORATORY

Feedstock

RA ISIN G TH E BAR IN GR AIN SILO CLEA NOUT

Experience

More than 35 years of tackling the most dif cult silo cleanout projects in 30+ countries worldwide.

Safety

Professional service technicians are MSHA and OSHA-certi ed and adhere to a rigorous continuing education program.

Capability

We conquer the most dif cult cleanout projects in the world with our proprietary silo cleaning technology.

Another issue called out in the RFI work by BETO was related to pre-commercial demonstration requirements. Many new technologies using novel catalysts, reactors and process configurations need to go through a demonstration phase. “Not only is the demonstration of these complex integrated processes an extremely challenging undertaking, but these must also be carried out in different geographic locations to validate opportunities from diversified feedstock sources,” which the commenter noted, “introduces entirely new challenges.”

So which feedstocks are most viable in the near-term for SAF production? That answer may have already been provided by the BETO team. Jim Spaeth, program manager, systems development and optimization of sustainable aviation and international engagement for BETO, has previously explained that the technology needed for SAF production already exists: ethanol-to-jet (ETJ) conversion. Speath wrote about ETJ in 2021. “The technology needed for SAF production already exists,” he said when the SAF Grand Challenge initiative came out in 2021. Those technologies include ETJ conversions, he said.

Other feedstocks and the novel processes, technologies and supply chains needed to make them viable might be a longer-term scenario, as concerns voiced in the RFI summary for SAF show.

No matter what the feedstock of choice ends up being, BETO believes 1 billion tons of biomass will be needed to produce 60 billion gallons of SAF annually (which, as BETO noted, is 1.7 times more than would be required to meet the SAF Grand Challenge). Currently, the U.S. uses 340 million tons of biomass per year for fuel and power, with 145 million tons of that biomass in the form of corn. Waste and byproducts can provide an additional 180 to 220 million tons to the total available biomass volume. Timberland resources can provide another 32 to 64 million tons. Agricultural resources, depending on the scenario, can provide 150 to 890 million tons of biomass. Each biomass source could conceivably be used as a feedstock to produce SAF or other bioproducts.

The new 40B GREET model may help ethanol take the lead as a top feedstock for SAF production. Earlier this year, the model was updated to provide a tax incentive for ethanol produced with climatesmart agricultural practices, including all of the following for qualification: no till, cover crops and enhanced efficiency fertilizers. With the next iteration of the tax credit—45Z—replacing 45B in 2025, work is underway by trade associations and ethanol stakeholders to clear the pathway even further for ethanol as a feedstock for SAF production.

For now, the SAF industry has checked off another box—the feedstock availability question—on its way to truly taking off. The BT23 study provides a solid answer to a major question about largescale U.S. SAF production: Is there even enough biomass to produce SAF at a transformational scale? According to the report—reviewed by government and private experts and stakeholders in multiple fields, agencies and organizations—yes.

Author: Luke Geiver, Freelance Writer Contact: writer@bbiinternational.com

June 10-12, 2024 MINNEAPOLIS

MILESTONE MEETING

In June, the industry gathered in Minnesota for the largest, longest-running ethanol conference in the world. After four decades, the FEW remains a can’t-miss early summer event for ethanol plant personnel and the companies that support them.

By EPM Staff

Photos: BBI/Sarah Morreim

Together at the 40th annual International Fuel Ethanol Workshop & Expo in Minneapolis, Minnesota, top industry voices conveyed to a packed room of over 2,000 attendees that the state of ethanol is strong and on a trajectory of growth. Trade association executives representing the nation’s big three groups—the Renewable Fuels Association, Growth Energy and the America Coalition for Ethanol—headlined the 2024 FEW general session June 11 at the Minneapolis Convention Center. Kicking off the show, BBI International CEO Joe Bryan

thanked FEW participants for supporting the event over four decades. “It’s because of you—our speakers, our exhibitors and our sponsors—that all of this has been possible,” he said.

Keynote speaker Chris Bliley, Growth Energy’s senior vice president of regulatory affairs, delivered the keynote address, emphasizing the importance of ethanol’s role in the bioeconomy and meeting carbon reduction goals. “We are made for this moment,” he said.

Bliley addressed how this year’s upcoming elections may impact the ethanol industry. “Our greatest strength is our bipartisan ap-

peal,” he said. “We’re American-made and lowcarbon. We support job security for American workers and energy security for American consumers. ... We are positioned for success.”

Following Bliley’s keynote speech, the FEW’s general session policy panel, hosted by BBI International Program Developer Tim Portz, discussed the industry’s top policy, regulatory and market development priorities in the context of today’s low-carbon landscape, the rise of sustainable aviation fuel and the upcoming presidential election. Panelists included Brian Jennings, CEO of the American Coalition for Ethanol; John Fuher, vice presi-

dent of government affairs at Growth Energy; and Troy Bredenkamp, senior vice president, government and public affairs at the Renewable Fuels Association.

The three-day event, held June 10-12, attracted over 2,400 biofuel industry professionals with myriad areas of biofuels expertise— production, service, sales, research, academia and more—from 47 U.S. states and 30 countries. Living up to its status as the largest ethanol conference in the world, this year’s FEW included plant personnel representing 85% of total installed U.S. capacity, or 15 billion gallons of domestic ethanol production.

AND THE WINNERS ARE: The FEW's annual presentation of awards, a perennial highlight of the event's general session, included the presentation of four accolades this year. Jeanne McCaherty (top left), CEO of Guardian Energy Management LLC, was recognized as the winner of the Women in Ethanol Award; David Zimmerman, CEO of Big River Resources LLC received the High Octane Award, which was accepted by Big River Resources COO Deb Green (top right); Mark Yancey (lower left), chief technology officer of D3MAX and SAFFiRE Renewables LLC, won the Award of Excellence; and the founder and retired CEO of BBI International, Mike Bryan (lower right, flanked by his sons, Joe and Tom Bryan), received the FEW's Distinguished Service Award.

DELIVERING SUBSTANCE: While the FEW is perhaps best known for its sprawling trade show, its carefully planned breakout sessions are what give its time-honored "workshop" name merit. This year's event, including co-located events and Innovation Stage programming, featured roughly 50 panels and 200 speakers. After 40 years, the conference is still earning its reputation as a premier educational opportunity for producers and industry professionals of all backgrounds and experience levels.

FAMILIAR FACES: The FEW has become a renowned annual gathering place for producers and the hundreds of companies that serve and support them. This year, the event boasted more than 2,400 registered attendees from all over the world, In addition to more than 500 plant personnel from over 180 biorefineries, the event's Expo included hundreds of companies that provide ethanol plants with services, support, equipment and technologies. In fact, more than 1,200 participants at this year's show were affiliated with an exhibiting company.

Say goodbye to expensive and hazardous eight hour waits between samplings, and take back control of your process - with the revolutionary IRmadillo™ from KEIT

This highly robust, ‘fit and forget’ process monitor, installs directly into your line and vessels to give you unprecedented 24/7 instant analysis at multiple stages of your process.

Using ground-breaking static-optics FTIR technology, IRmadillo™ allows you to make adjustments based on up-to-the-minute data to stop burning your profits, improve liquefaction and fermentation, reduce energy wastage in distillation, and completely remove the potentially catastrophic hazards of excess ethanol in your waste stream.

Already successfully operating in over 20 plants, the IRmadillo™ is boosting bottom lines across the US. Email enquiries@keit.co.uk today for details of your local agent - because if you’re not in control of your process - you’re not in control of your profits.