BIOMASSMAGAZINE.COM PLUS: Photo Review: Int’l Biomass Conference & Expo PAGE 14

Shutdowns: Piping and Duct Failures PAGE 20 Issue 2, 2023 BiomassMagazine.com

Airex Energy’s Path to Success PAGE 10

Avoiding

TORREFIED TRIUMPH

PEERLESS™ OG2 Red grease is exper tly for mulated to provide unmatched, extended equipment protection in all kinds of conditions —wet, dr y, hot, cold under force or extreme dust. Trust it to help you reduce maintenance costs and downtime while minimizing the need for frequent grease change-outs.

A leading manufacturer and global distributor of industrial wood pellets saw incredible success with PEERLESS™ OG2 Red:

78% decrease in pellet roll bearings

5,800 kg reduction in grease usage

$100,000+ saved annually

See for yourself how PEERLESS™ OG2 Red can impact your operation. Request a sample: lubricants.petro-canada.com/greases-guide

EXPERIENCE

THAT’S A CUT ABOVE THE

PROTECTION

REST

The

FEATURES

10 TORREFACTION

The Power of Technology and Timing

With its latest funding infusion of $38 million, Laval, Quebecbased Airex Energy is ready to expand biocoal, biochar and biocarbon production.

By Anna Simet

14 EVENT

All Options on the Table

The International Biomass Conference & Expo was held in Atlanta, Georgia, Feb. 28-March 2, and welcomed more than 900 attendees.

By Katie Schroeder

By Katie Schroeder

CONTRIBUTIONS

20 OPERATIONS & MAINTENANCE

Avoiding Unplanned Shutdowns Due to Piping and Duct Failures

Recognizing common piping and ducting system problems can prevent unexpected downtime and increase overall plant efficiency.

By CJ Horecky

By CJ Horecky

22 FIBER

Pulpwood Price Drivers and Mill Curtailments

Regional fiber price variations are as great as they have ever been, with record levels in the Northwest and West U.S.

By Brooks Mendell

24 OPERATIONS & MAINTENANCE

Commonly Overlooked Reasons for Anaerobic Digester Failures

Digester operators can help safeguard plant performance by improving awareness of the most common causes of failure.

By David Ellis, James Arambarri and Michael Nelson

28 BIOCHAR

Transforming Wildfire Fuel into Biocarbon

A demonstration project in Minnesota is producing biochar from Superior National Forest thinnings.

By June Breneman

30 PLANT EFFICIENCY

Optimizing Biogas Production Efficiency with Humidity Measurements

Understanding and controlling biogas humidity levels allows for optimized production and significant savings.

By Antti Heikkilä

BIOMASSMAGAZINE.COM 3 COLUMN 04 EDITOR’S NOTE A Common Theme By Anna Simet DEPARTMENTS 06 BIOMASS NEWS ROUNDUP 08 PODCAST PREVIEW

fast-growing renewable natural gas sector is the topic of discussion during Season 2, Episode 5, of the Biomass Magazine Podcast, featuring Viridis Energy’s Chet Benham.

ISSUE 2 | VOLUME 16 Biomass Magazine: (USPS No. 5336, ISSN 21690405) Copyright © 2023 by BBI International is published quarterly by BBI International, 308 Second Avenue North, Suite 304, Grand Forks, ND 58203. Four issues per year. Business and Editorial Offices: 308 Second Avenue North, Suite 304, Grand Forks, ND 58203. Accounting and Circulation Offices: BBI International 308 Second Avenue North, Suite 304, Grand Forks, ND 58203. Call (701) 746-8385 to subscribe. Periodicals postage paid at Grand Forks, ND and additional mailing offices. POSTMASTER: Send address changes to Biomass Magazine/Subscriptions, 308 Second Avenue North, Suite 304, Grand Forks, ND 58203. ¦ ADVERTISER INDEX 27 2024 Int’l Biomass Conference & Expo 34 Air Burners, Inc. 09 Detroit Stoker Company 12 EUBCE 2023 32 Hermann Sewerin GmbH 02 HF Sinclair 13 IHI Power Services Corp. 26 Jacobs Corporation 36 KEITH Manufacturing Company 33 KESCO, Inc. 23 Mid-South Engineering Company 07 MoistTech PAGE 10 PAGE 14

A Common Theme

At the recent International Biomass Conference & Expo in Atlanta, I once again had the opportunity to moderate the industry leader roundtable discussion. A question that I make a point to ask our panelists every year is: What is our message? Or in other words, what is our industry’s major selling point? Should we embrace one collective message, or is it best for each specific sector to home in on its particular strength? For the most part, all agreed that bioenergy’s decarbonization potential should be a major focus right now (the other major one was waste utilization), and many of the stories in this issue are reflective of that viewpoint. For a summary of the general session and a photo review, check out our page-14 feature, “All Options on the Table,” by staff writer Katie Schroeder.

On that note of decarbonization, our other feature, “The Power of Technology and Timing,” page 10, profiles Airex Energy, a Quebec-based company using a proprietary torrefaction technology to produce biocoal, biochar and biocarbon. Airex’s CEO Michel Gagnon chatted with me about the company’s history, technology and ongoing buildout, highlighting how the company’s progress has very conveniently aligned with the ramp up of global decarbonization policy and efforts. “The [torrefaction] industry itself has a lot of challenges, but there is a definitely a window [of opportunity] and we need to work hard to capture it,” he says. With a new funding round of $38 million, Airex is laser focused on expanding production in North America and Europe.

As for our quarterly theme of operations and maintenance, several contributions dive into troubleshooting, preventative and corrective maintenance, and plant optimization and efficiency, for biomass power plants, biorefineries and biogas facilities. Be sure to check out page-10 contribution, “Avoiding Unplanned Shutdowns Due to Piping and Duct Failures,” by Interep’s CJ Horecky, who presented at the biomass conference and boiled his presentation down for this story. Horecky is a boots-on-the-ground guy whose experience and knowledge translates perfectly into this contribution.

Finally, I would like to make anyone interested in the sustainable aviation fuel space aware of a new event that our new sister publication, SAF Magazine, has launched: The National SAF Conference & Expo, which will be held in Minneapolis, Minnesota, Aug. 29-30. Learn more at safmagazine.com under the events tab.

4 BIOMASS MAGAZINE | ISSUE 2, 2023

¦ EDITOR’S NOTE

ANNA SIMET EDITOR asimet@bbiinternational.com

EDITORIAL EDITOR

Anna Simet asimet@bbiinternational.com

ONLINE NEWS EDITOR

Erin Voegele evoegele@bbiinternational.com

STAFF WRITER

Katie Schroeder katie.schroeder@bbiinternational.com

ART

VICE PRESIDENT OF PRODUCTION & DESIGN

Jaci Satterlund jsatterlund@bbiinternational.com

GRAPHIC DESIGNER

Raquel Boushee rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan jbryan@bbiinternational.com

PRESIDENT

Tom Bryan tbryan@bbiinternational.com

VICE PRESIDENT OF OPERATIONS/MARKETING & SALES

John Nelson jnelson@bbiinternational.com

SENIOR ACCOUNT MANAGER/ BIOENERGY TEAM LEADER

Chip Shereck cshereck@bbiinternational.com

ACCOUNT MANAGER

Bob Brown bbrown@bbiinternational.com

CIRCULATION MANAGER

Jessica Tiller jtiller@bbiinternational.com

MARKETING & ADVERTISING MANAGER

Marla DeFoe mdefoe@bbiinternational.com

2023 Int’l Fuel Ethanol Workshop & Expo

JUNE 12-14, 2023

CHI Health Center, Omaha, NE

From its inception, the mission of this event has remained constant: The FEW delivers timely presentations with a strong focus on commercial-scale ethanol production—from quality control and yield maximization to regulatory compliance and fiscal management. The FEW is the ethanol industry’s premier forum for unveiling new technologies and research findings. The program is primarily focused on optimizing grain ethanol operations while also covering cellulosic and advanced ethanol technologies. (866) 746-8385 | FuelEthanolWorkshop.com

2023 National SAF Conference & Expo

AUGUST 29-30, 2023

Minneapolis Convention Center, Minneapolis, MN

The National SAF Conference & Expo is designed to promote the development and adoption of practical solutions to produce SAF and decarbonize the aviation sector. Exhibitors will connect with attendees and showcase the latest technologies and services currently offered within the industry. During two days of live sessions, attendees will learn from industry experts and gain knowledge to become better informed to guide business decisions as the SAF industry continues to expand.

(866) 746-8385 | www.nationalsafconference.com

2023 National Carbon Capture Conference & Expo

NOVEMBER 7-8, 2023

Iowa Events Center, Des Moines, IA

The National Carbon Capture Conference & Expo is a two-day event designed specifically for companies and organizations advancing technologies and policy that support the removal of carbon dioxide (CO2) from all sources, including fossil fuel-based power plants, ethanol production plants and industrial processes, as well as directly from the atmosphere. The program will focus on research, data, trends and information on all aspects of CCUS with the goal to help companies build knowledge, connect with others, and better understand the market and carbon utilization.

(866) 746-8385 | www.nationalcarboncaptureconference.com

2024 Int’l Biomass Conference & Expo

MARCH 4-6, 2024

Greater Richmond Convention Center, Richmond, VA

Now in its 17th year, the International Biomass Conference & Expo is expected to bring together more than 900 attendees, 150 exhibitors and 65 speakers from more than 21 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming—powered by Biomass Magazine—that maintains a strong focus on commercial-scale biomass production, new technology, and near-term research and development.

(866) 746-8385 | www.BiomassConference.com

www.biomassmagazine.com/pages/webinar

Subscriptions Biomass Magazine is free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.BiomassMagazine.com or you can send your mailing address and payment (checks made out to BBI International) to Biomass Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Back Issues & Reprints Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 701-746-8385 or service@ bbiinternational.com. Advertising Biomass Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Biomass Magazine advertising opportunities, please contact us at 701-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Biomass Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to asimet@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space.

BIOMASSMAGAZINE.COM 5

INDUSTRY EVENTS ¦

check our website for upcoming webinars

Please

TM Please recycle this magazine and remove inserts or samples before recycling COPYRIGHT © 2023 by BBI International

Biomass News Roundup

Marathon Petroleum Corp. announced the acquisition of a 49.9% interest in LF Bioenergy, an emerging U.S. producer of renewable natural gas (RNG), from Cresta Fund Management for $50 million. The agreement includes the potential for up to an additional $50 million based on the achievement of predetermined earn-out targets.

LF Bioenergy has been focused on developing and growing a portfolio of dairy farm-based, low-carbon-intensity RNG projects. Current projects are under various stages of development, with the first facility nearing completion and expected to be in service in the first half of 2023. As specific project milestones are achieved, MPC is expected to fund its share of capital expenditures, building out this portfolio to produce over 6,500 MMBtu per day by the end of 2026.

Enviva Inc. released fourth quarter financial results on March 1, reporting that the company delivered a record 1.5 million metric tons of wood pellets during the three-month period at higher-than-expected sale prices. Volumes delivered were up 35% when compared to the previous quarter and up 10% when compared to the fourth quarter of 2021. The company also announced three new industrial contracts, including a 10-year, take-or-pay off-take contract related to the production of biofuels, whereby Enviva’s wood pellets are expected to be refined into feedstock for the production of sustainable aviation fuel (SAF) and other renewable fuels. The contract is with an existing global customer, and is related to providing feedstock to a U.S.-based bioenergy facility, with deliveries of approximately 60,000 metric tons per year expected to begin in 2025. Within the past year and a half, Enviva said it has signed three SAF-related contracts that represent approximately 1.9 million metric tons per year of biomass supply at peak run rates. In addition, the company has completed test deliveries to two major oil companies in Europe that are constructing biorefineries and coprocessing biobased feedstock in existing refineries.

Drax Group plc released 2022 financial results on Feb. 23, reporting that the company produced 3.9 million metric tons of wood pellets at its North American facilities last year, up 27% when compared to the 3.1 million metric tons produced in 2021.

According to Drax, the increased wood pellet production reflects a full 12 months worth of production from Pinnacle’s plants following the April 2021 acquisition. It also reflects increased capacity at the company’s Morehouse and LaSalle facilities in Louisiana. In addition, Drax commissioned three new pellet plants last year, including the Demopolis plant in Alabama, and the Leola and Russellville facilities, both located in Arkansas. In September 2022, Drax also acquired a 90,000-metric-ton facility located in British Columbia from Princeton Standard Pellet Corp. Together, those four plants will add more than 500,000 metric tons of production capacity to Drax’s operations when at full capacity. Drax is also working to develop additional North American pellet capacity. In December, the company announced it has

made a final investment decision to develop two new pellet projects, including a 450,000-metric-ton-per-year facility at Longview in Washington state and a 130,000-metric-ton expansion of the company’s existing Aliceville plant in Alabama. Drax also plans to develop port infrastructure near the Longview plant.

The Washington State Senate on March 1 voted 46 to 2 in favor of a bill that aims to encourage the manufacture and purchase of sustainable aviation fuel (SAF) though tax incentives. The bill also directs Washington State University to convene a work group to further development of alternative jet fuels. The bill requires the Washington State Department of Ecology, the agency tasked with implementing the state’s Clean Fuels Standard, to allow one or more carbon intensity pathways for alternative jet fuel. A summary of the legislation indicates that the department would be directed to allow biomethane to be claimed as a feedstock for renewable diesel and alternative jet fuel consistent with that allowable for compressed natural gas, liquefied natural gas or hydrogen production. Among many other components, the bill would establish a business and operations (B&O) and public utilities tax credit for certain sales and purchases of alternative jet fuel. The amount of the credit would be $1 per gallon of alterative jet fuel that has at least 50% less carbon dioxide equivalent emissions than conventional jet fuel. The credit would increase by 2 cents for each additional 1% reduction beyond 50%, with a cap of $2 per gallon.

The U.S. EPA in March approved a fuel pathway filed by Martinez Renewables LLC that will allow the California-based biorefinery to generate D5 advanced biofuel renewable identification numbers (RINs) under the Renewable Fuel Standard for liquefied petroleum gas (LPG) made from biogenic waste fats, oils and greases (FOG) via a hydrotreating process.

Martinez Renewables is a 50/50 joint venture between Marathon Petroleum Corp. and Neste Corp. that has converted Marathon’s existing refinery in Martinez, California, to renewable diesel production. The pathway approval document published by the EPA indicates that the Martinez refinery produces LPG fuel from biogenic waste FOG using a process involving hydrotreating with grid electricity, natural gas and hydrogen produced from natural gas via steam methane reforming as energy sources. EPA’s analysis shows LPG produced at the Martinez refinery achieves a 78% greenhouse gas (GHG) reduction when compared to a 2005 diesel baseline. Biobased fuels must achieve a 50% GHG reduction to qualify for the generation of D5 RINs. According to information published by the EPA, the Martinez refinery is also able to generate D4 biomass-based diesel RINs for certain biobased fuels it produces, including renewable diesel.

Legislation currently pending in Minnesota aims to establish a clean transportation standard that would require the state’s transportation fuels to achieve 100% reduction in carbon intensity (CI) by 2050. The standard would phase in with a 25% CI reduction requirement by 2030, ramping up to a 75% reduction by 2040 and a 100% reduction

6 BIOMASS MAGAZINE | ISSUE 2, 2023

by 2050. A statement released by the Great Plains Institute indicates that, if signed into law, the bill will create the strongest statewide clean transportation standard in the U.S. It would also be the first such standard established in the Midwest

Natural Resources Canada on Feb. 28 announced a $35 million investment in Whitesand First Nation-owned Sagatay Co-Generation Limited Partnership to deploy a 6.5-MW, biomass-fired combined-heat-and-power (CHP) facility.

The plant will be fueled with locally sourced wood waste, reducing the use of diesel fuel for heat and electricity in Whitesand First Nation and the communities of Armstrong and Collins, Ontario.

Once operational, the CHP plant will connect to the local microgrid and provide power for the three communities. According to Natural Resources Canada, electricity generated by the facility will also provide heat and power to a new wood pellet plant and a fully electric wood merchandizing yard. The wood pellet plant has been proposed for longer than a decade and is known as Sagatay Wood Pellet LP The developers said it is expected to have a nameplate capacity of 90,000 metric tons per year.

Genesis Energy, a New Zealand-based electricity and natural gas retailer, on Feb. 21 announced the successful completion of a biomass

burn trial at its as part of its effort to find alternative options for the 953-MW coal-fired Huntly Power Station, New Zealand’s largest thermal power plant. The week-long trial used black torrefied biomass sourced from Canada. According to Genesis, the objective of the trial was to determine the technical viability of operating a Rankine unit solely on biomass. The trial was performed following significant research and work during the preceding year to identify the most suitable type of biomass to use, securing a supply of it from offshore, and understanding the adjustments needed to operate the Rankine.

Earlier in the month, Genesis announced it has signed a biomass agreement with Fonterra, a global dairy cooperative, to work together on exploring the viability of biomass as a substitute for coal. Currently, Genesis burns coal at its Huntly Power Station and Fonterra uses coal to generate heat for dairy processing. The agreement is for an initial period of two years and is designed to allow the companies to collaborate, share knowledge and foster innovation.

7 BIOMASS NEWS ROUNDUP ¦

PHOTO: GENSIS ENERGY

PODCAST PREVIEW PLAY WITH CHET BENHAM, VIRIDI ENERGY

Viridi Energy’s Chet Benham was the guest on Season 2, Episode 5, of the Biomass Magazine podcast. Benham has held leadership positions in the gas separation and biogas processing business for the past 15 years. Before Viridi, he spent more than 10 years working for Air Liquide, spearheading gas processing, biogas and midstream development projects. He also held the title of CEO of Air Liquide Advanced Technologies, U.S. During the podcast, Benham discussed keys to project success, the landscape of the RNG sector and how it has changed over the years.

BMM: Tell us about Viridis Energy and its origin, and what the company is all about.

Benham: It’s an interesting story—one of entrepreneurship, deep technical expertise and a world class balance sheet coming together at the beginning of the company’s evolution, rather than further along. Our equity sponsor, Warburg Pincus, really wanted find a way to get into the RNG space in a bit of a different way, but also rapidly. When we looked at the available opportunities, it was either acquisition, or try to stand up an RNG platform company—we chose the latter … Our thesis was, if we could recruit the best people from the industry and then, turn loose—in a structured way—with a $300 million equity commitment from Warburg, we could find and deliver

projects on a really accelerated timeline. By any measure, looking at it objectively, we’re off to a great start. We’ve got four active projects in construction across three different feedstocks, and we’ve got a pipeline of opportunities … we’re really happy with where we are, and we’re finding a lot of great reception in the industry. And of course, having the backing of a word class private equity firm like Warburg Pincus really lets us accelerate, and helps us attract the very best team in the industry.

BMM: There’s so much momentum in this space. How has Viridis seen the development landscape change in the past 12 to 18 months, and how do you play to those changes and looking ahead?

Benham: I have been in the RNG space a long time—I like to say before there was an ‘R’ in RNG, and I would say there are at least two things that any developer needs to have in terms of being successful today. The first is either scale, or the ability to develop to scale and operate successfully at scale. Clearly, some of the disrupted deals in the past have really changed the RNG industry, and what was big even two years ago isn’t really relevant today. In that landscape, you’ve really got to be able to get to scale and operate successfully at that scale, to be relevant. That’s one of the big changes. The other thing developers have to have to be a successful is an end-to-end approach across the entire RNG value chain. It starts with finding the right projects, as feedstocks are scarce—there is a pretty intense fight for feedstocks—and you need the ability to find, originate and develop projects, move them into operations and operate them success-

8 BIOMASS MAGAZINE | ISSUE 2, 2023

Y

Chet Benham

fully and safely with high plant availability, high levels of methane recovery, and you also need to have expertise in the gas market … which is one of the unique things about Viridis Energy.

Listen to the rest of the podcast: www.biomassmagazine.com/pages/podcasts

Don't Miss an Episode:

Biomass Magazine’s podcast series:

S2 E4 Experience Matters: Catching Up with KESCO

Featuring Jason Kessler, President and Owner, KESCO

S2 E6 Setting the Standard: Sustainability and Environmental Stewardship

Featuring Brandi Colander, Senior Vice President and Chief Sustainability Officer

UPCOMING

S2 E7 Will Charlton, president and founder, Digester Doc

Interested in being a guest?

Contact Danielle Piekarski at dpiekarski@bbiinternational.com

BIOMASSMAGAZINE.COM 9 PODCAST PREVIEW ¦

THE POWER OF TECHNOLOGY

AND TIMING

BY ANNA SIMET

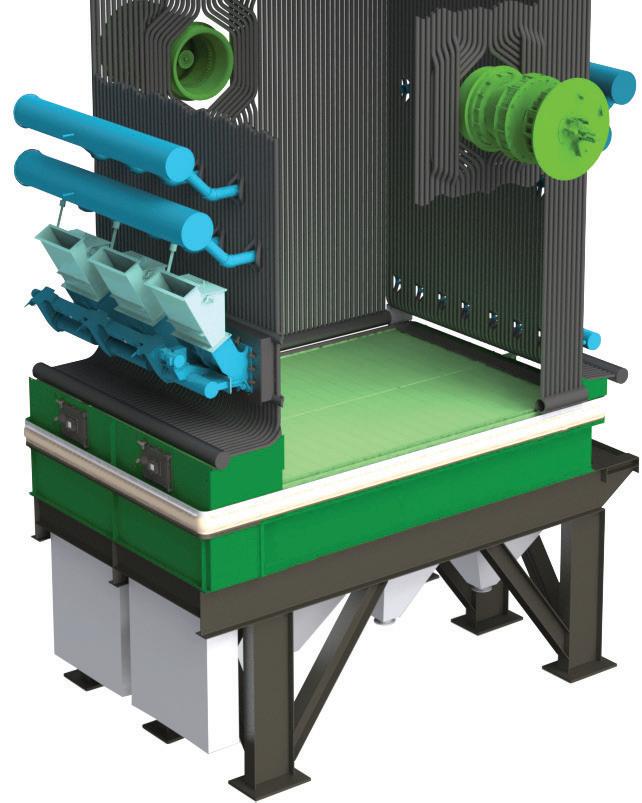

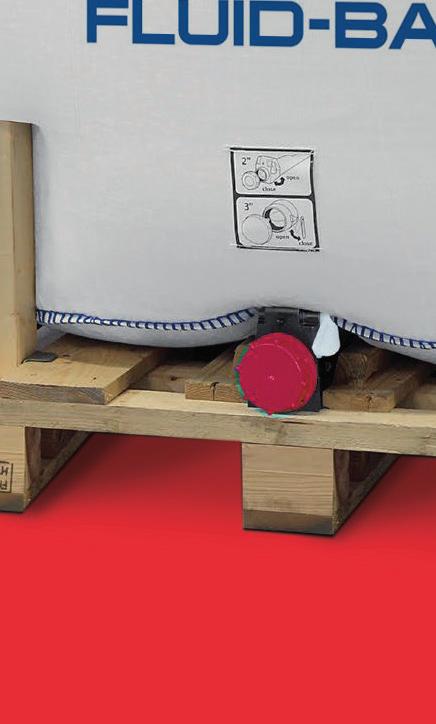

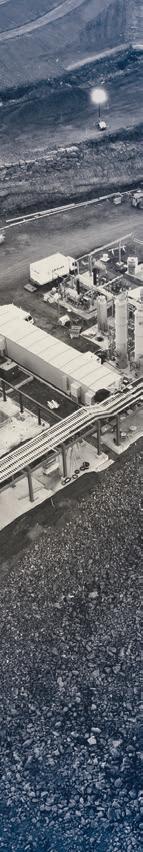

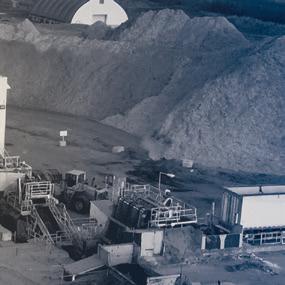

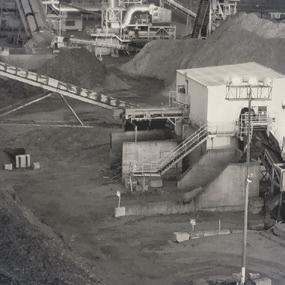

For the better part of the past decade, Airex Energy has been quietly achieving success in the southern Quebec town of Bécancour, roughly 120 miles north of the Vermont border. There, the company has been operating an industrial-scale biocoal plant on the south shore of the St. Lawrence River, deploying its proprietary CarbonFX technology. Fast-forward from the plant’s initial pilot-scale plant debut in Laval, Quebec, in 2011, to its demonstration-turned-commercial-scale plant startup in 2015 to today, and the company has exported its biochar, biocoal and biocarbon to customers around the world, recently raising $38 million in Series B funding that will be used to expand.

When asked what’s led AirEx Energy to success in torrefaction technology—an industry in which many have struggled— Michel Gagnon, CEO, says it has been a combination a technology and timing. And, perhaps, a whole lot of tenacity.

The Technology

As for the inception of Airex Energy, the company is a spinoff company from parent company Airex Industries, which was founded in 1975 and specializes in

dust collection and air filtration systems—a fitting origin. The company began research and development activities focused on torrefaction in 2010. “What’s interesting with our technology is that the inventor had been working in dust collection systems and air filtration, and he developed our process and technology, which captures nearly 100% of the dust,” he says. “As you can imagine, there is a lot of dust in the carbon environment— messy is normal—but if you visit our plant, you’ll see that it’s very clean.”

For Gagnon, that aspect of the technology was impactful enough to become a believer in Airex. He joined as CEO in May 2022. “For me, it was convincing enough to join the company,” he says. “The process is impressive. And when we get visitors interested in technology or the company, it’s always the same thing—how clean the technology is, and the quality of product.”

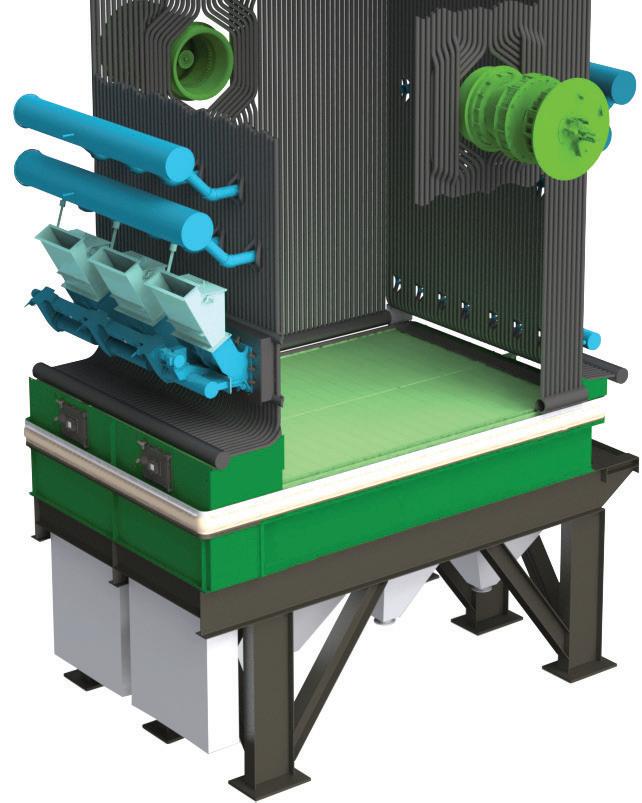

Gagnon says that besides cleanliness,

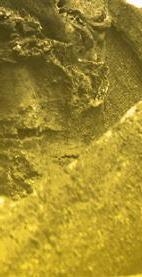

a main strength of the technology is its simplicity. As for how the process works, it consists of four main components—the predrying system, conditioning chamber, combustion chamber and cyclonic bed reactors. It begins with ground biomass— sawdust, in the case of the Bécancour plant—which is pneumatically conveyed into a silo with heat recovered from the torrefaction process. Moisture is reduced by roughly half, from 50% to 25%. From the silo, material goes into the double-wall conditioning chamber, where combustion gases circulate and heat the biomass, and moisture is further reduced to less than 5%.

Material is then conveyed into the cyclonic bed reactors, the final stage. Here, biomass is fed into the top of the reactors, spiraling

10 BIOMASS MAGAZINE | ISSUE 2, 2023 ¦ TORREFACTION

With its latest funding infusion of $38 million, Airex Energy is ready to expand.

Michel Gagnon, CEO Airex Energy

downward to land at the base, or sustentation ring. The sustentation ring allows the material to remain suspended through creation of a balance between the centrifugal force of the cyclonic effect, the gravitational force of the bulk material, and the pushing effect induced by the sustentation ring. Total residence time in the reactor is only a few seconds. At this point, biocoal exits through the bottom of the system via a screw conveyor and is cooled. Torrefaction gas is recovered and injected back into the combustion chamber. The process startup utilizes natural gas or propane and takes about an hour, but once the right temperature is achieved and the system is ready for biomass, no external fuel is needed, as torrefaction gas is used.

From Demo to Commercial

When the plant began operations in 2015, the intentions were to have it serve as a demonstration plant. “That was the original plan, but it has turned out to be a commercial plant,” Gagnon explains. “It reached capacity in 2016, and then some adjustments were made, of course, as it was a demo plant. Today, we’re able to produce on a continuous basis with very good results. The product has no dust, and the [biocoal] pellets themselves are quite durable—they don’t break easily. Now, now we’re shipping everywhere in the world, mainly to Asia and Europe.”

The Bécancour plant capacity was designed at two tons per hour, according to Gagnon. “So, we’re producing about 15,000

tons per year. That’s fairly small size, so the objective is to scale up. We have completed the engineering to do that and are finalizing a site to build a new capacity line, which will be five tons per hour with potential to increase to six or seven tons per hour; we think between 30,000 and 40,000 tons per year. We will build additional production lines and could easily ramp up a plant size close to 100,000 tons per year.”

The new funding round, led by Cycle Capital, will be used toward that initiative, Gagnon confirms, adding that the company is working on additional funding.

Airex’s buildout will consist of a combination of constructing and operating plants as well as licensing its technology to large-capacity operations to produce bio-

BIOMASSMAGAZINE.COM 11

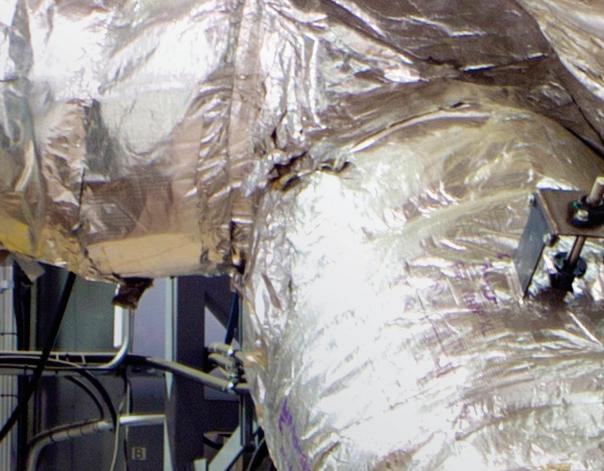

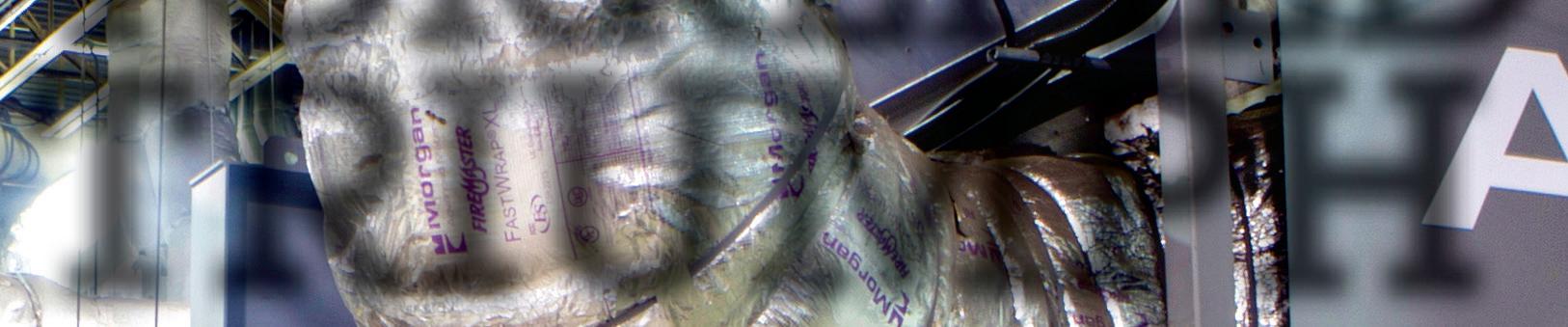

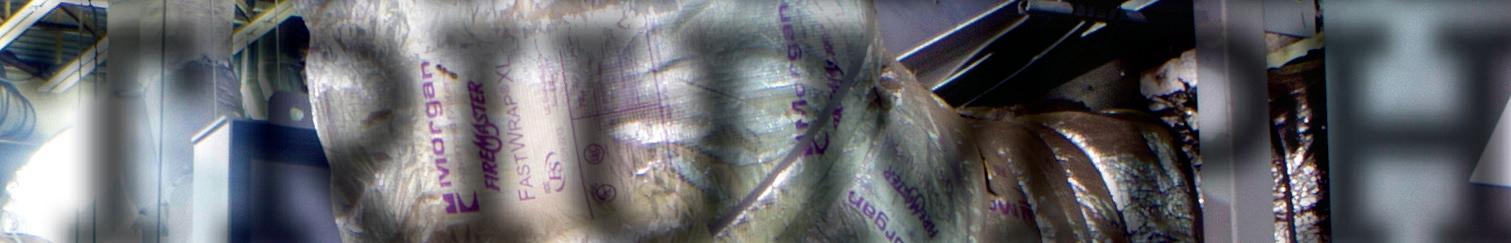

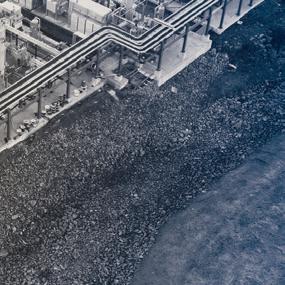

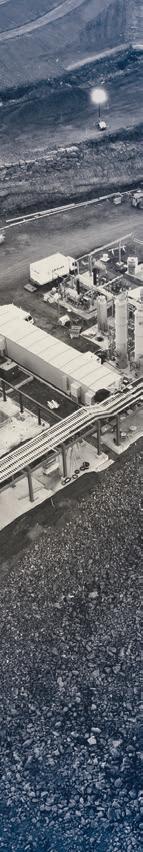

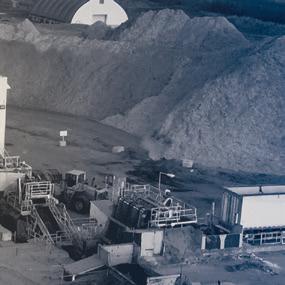

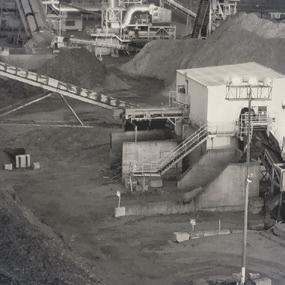

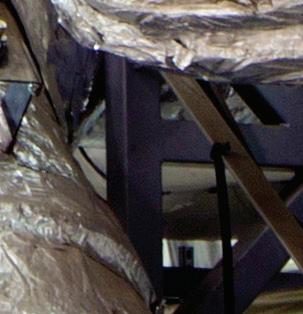

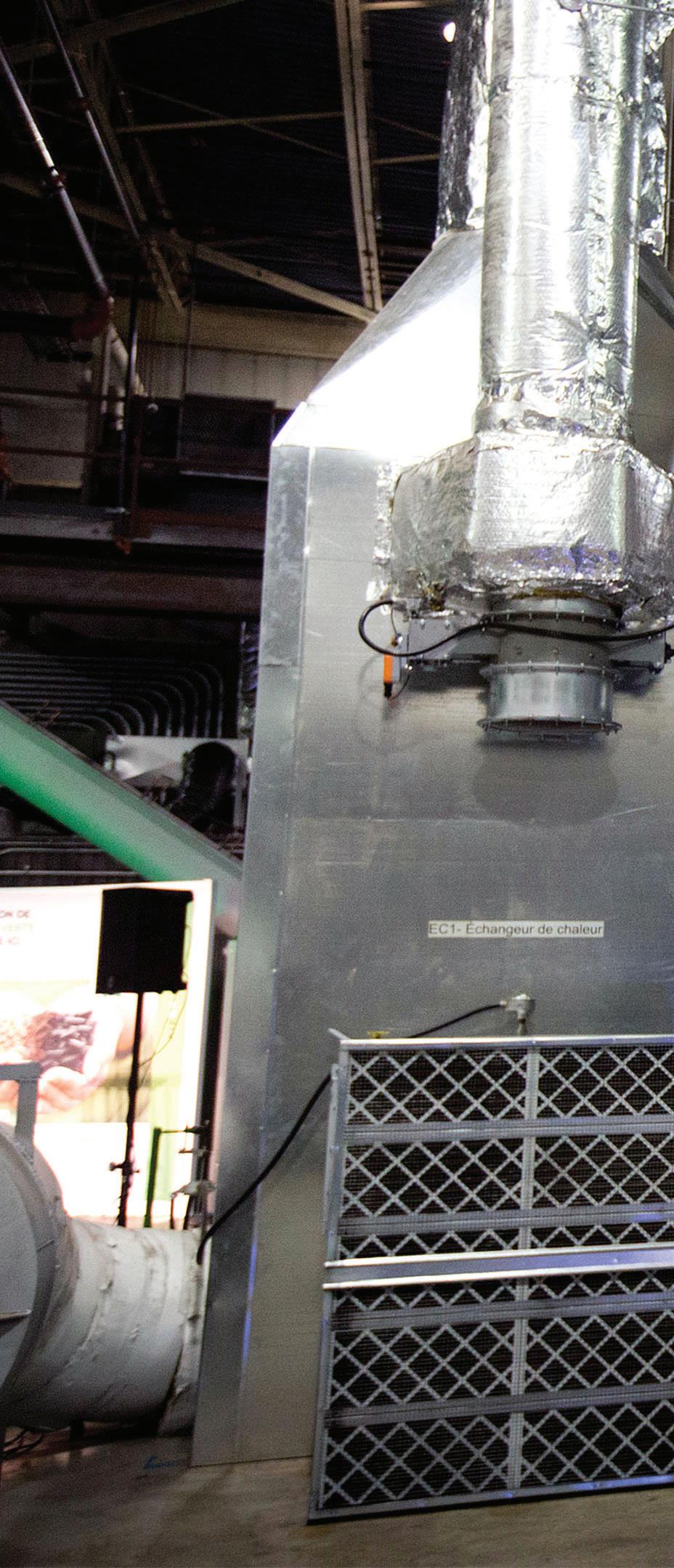

Airex Energy operates an industrial-scale biocoal plant in Bécancour, Quebec.

PHOTO: AIREX ENERGY

coal, biocarbon and biochar. Notably, the company has a partnership with SUEZ Group to ramp up biochar capacity in Europe and North America over the next decade-plus. “[Under the partnership] We will aim build 350,000 [metric] tons of biochar capacity by 2035, with first project in Quebec,” Gagnon says. “It will produce about 30,000 tons of capacity, and then we will move onto the second plant, which will most likely be in France.”

Gagnon says with a plant size of about

30,000 metric tons, it will require about one new plant every year to reach the partnership goal. “This is quite aggressive, but it’s something we want to do,” he says. “We would like to team up with local feedstock suppliers—this is very important.”

Current and projected biochar demand is a key driver in Airex’s plans, Gagnon notes. “We receive requests every week, from Europe and Asia. In Europe you have the energy crisis, but also lots of regulations and ambitions to exit coal. In Asia, there is

12 BIOMASS MAGAZINE | ISSUE 2, 2023

(All images) Of Airex’s team at its Bécancour plant, Gagnon says the company’s technical, repair and maintenance employees greatly contribute to the plant’s success.

5 - 8 June Conference & Exhibition 9 June Technical Tours Bologna Congress Centre INSTITUTIONAL SUPPORTERS Coordination of the Technical Programme European Commission - Joint Research Centre Support of the Industry Track CBE JU - Circular Bio-based Europe Joint Undertaking

PHOTOS: AIREX ENERGY

also a migration toward ending coal. If you use typical wood pellets, then you will need to do a lot of modifications to the plant and the energy content isn’t the same, so it does bring some challenges. If you use torrefied pellets, you can do cofiring or convert entirely without much modification, so that’s a big difference.”

As for the U.S., Gagnon says there currently is very little demand.

Moving Forward

Gagnon says Airex is still a modest size of around 30 or so employees, but is “in big expansion mode. We have a strong technical team, and very importantly, good repair and maintenance people for the plant—though it is quite amazing in terms of automation as well.”

Finally, Gagnon reiterates that Airex considers itself very fortunate to have had very good timing with its buildout. “The industry itself has a lot of challenges, but

there is a definitely a window [of opportunity] and we need to work hard to capture it,” he says. “With biochar, there is a movement—we’re all addressing a common goal and objective. There is strong demand; we need to collaborate and find ways together.

“Five years ago, everybody was starting to talk about decarbonization,” Gagnon adds. “Now, you need to do more than talk—you need to be active and work toward it.”

Author: Anna Simet asimet@bbiinternational.com

BIOMASSMAGAZINE.COM 13

TORREFACTION ¦

‘Five years ago, everybody was starting to talk about decarbonization. Now, you need to do more than talk—you need to be active and work toward it.’

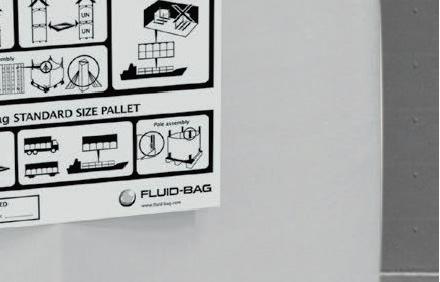

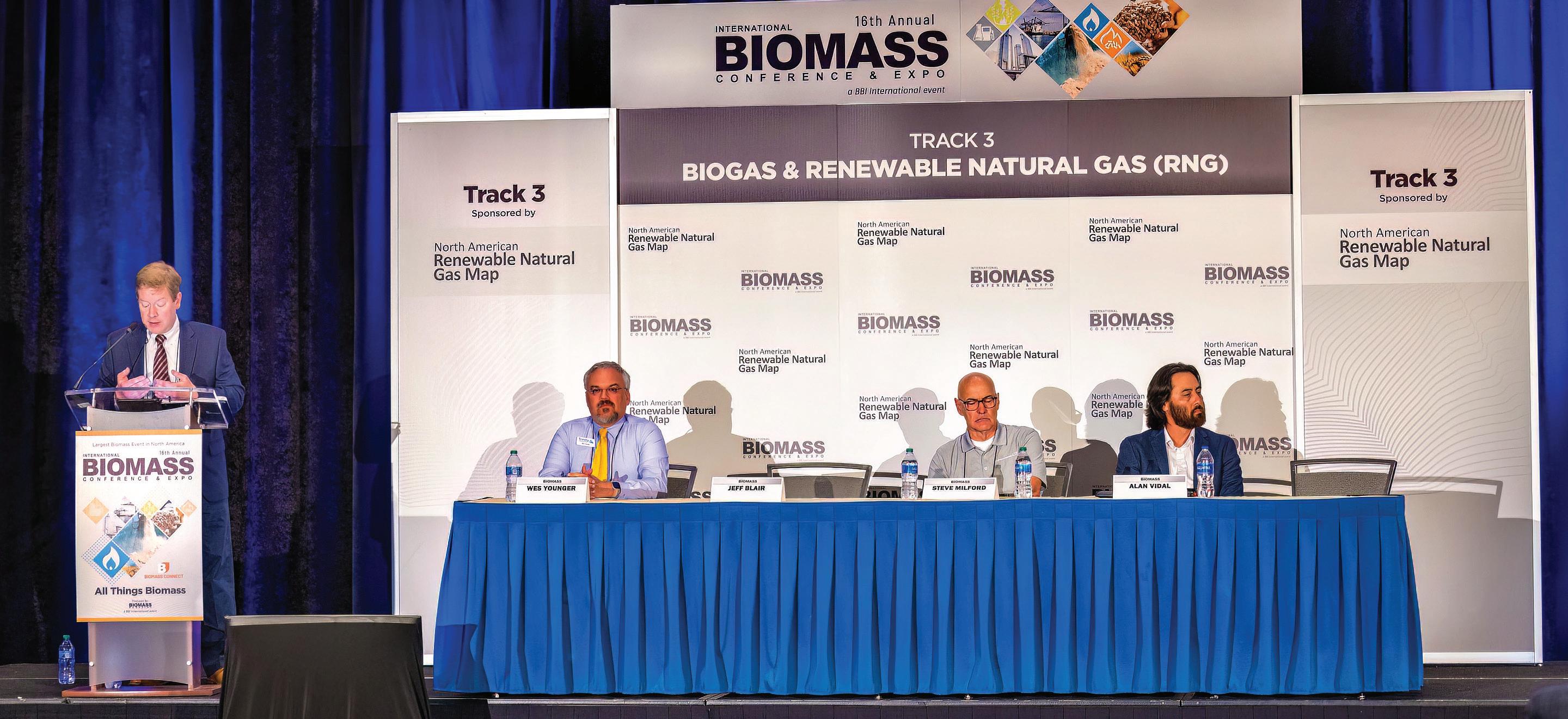

ALL OPTIONS ON THE TABLE

BY KATIE SCHROEDER PHOTOS BY: JM PHOTOGRAPHICS / BBI INTERNATIONAL

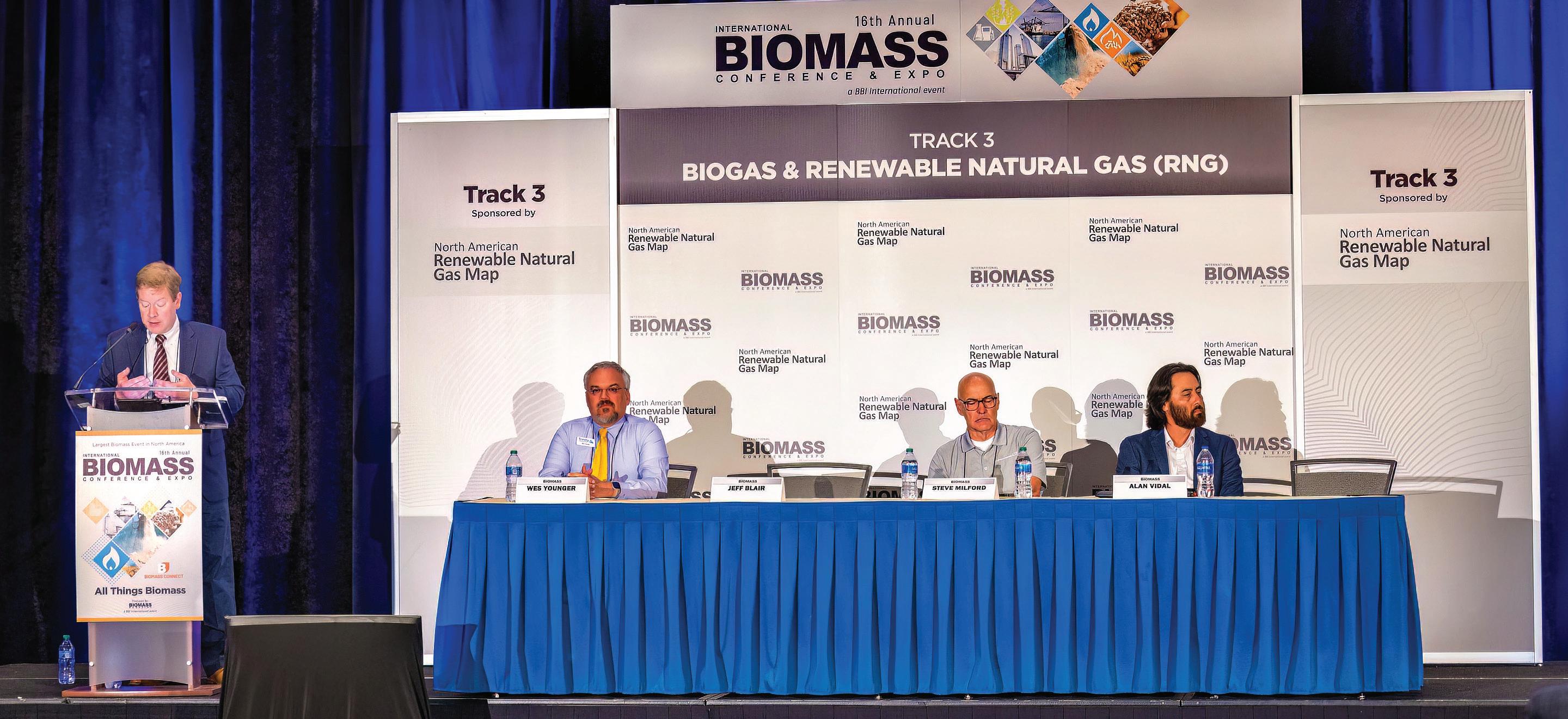

Attendance at the 2023 International Biomass Conference and Expo, held Feb. 28-March 2 in Atlanta, Georgia, was a solid indicator of just how critical the role of bioenergy is to the current push for global decarbonization. Ranking fifth in attendance in the conference’s 16-year history, the event drew industry constituents from 45 states, seven Canadian provinces and 25 countries.

Following a half-day of breakout panel sessions and the opening networking reception, the event’s general session began by bestowing annual industry awards. The Excellence in Bioenergy Award was given to Rob Davis, former owner of Forest Energy Corp. who dedicated the bulk of his career to forestry advocacy. The Groundbreaker of the Year Award went to Biomass One LP, a biomass power and biochar producer in White City, Oregon. Accepting the award on the company’s behalf was Karl Straub, chief operating officer.

Following the awards was the annual roundtable with association leadership, led by Anna Simet, editor of Biomass Magazine. Joining the panel were Carrie Annand, executive director of the Biomass Power Association; Tim Portz, executive director of the Pellet Fuels Institute; Patrick Serfass, executive director of the American Biogas Council; Amandine Muskus, executive director of the U.S. Industrial Pellet Association; and Paul Winters, director of public affairs and federal communications with Clean Fuels Alliance America.

When asked what facet of their industry sectors they see as the primary selling point for their industries and what should be of focus during conversations with policymakers and consumers,

IMAGE: BURGESS BIOPOWER

Portz said that he believes it would be waste utilization. “The reality is that cooking oil is still going to be produced, food is still going to expire, [we’re still] going to make square things out of round trees, and we do value-added things to those waste streams,” Portz said. “We have to help people understand that we’re not [deforesting] the American southeast to make industrial pellets. For instance, we’re not suddenly making more 2x4s so that our friends at Lignetics or Michigan Wood Fuels can make more wood pellets—that’s not how this works.”

Serfass explained that he thinks the key buzzword right now is “carbon” and explained that emphasizing how their industries can help reduce carbon is vital as carbon reduction policies become more prevalent. Annand said that she thinks adaptability is key to the biomass industry’s narrative by harnessing new technology while not forgetting the traditional benefits the industry provides. Muskus explained that “creativity” is her word for the pellet industry, as producers look for ways to use waste to make energy, and customers look for ways to decarbonize industries like aluminum and cement, which are difficult to decarbonize. Winters emphasized carbon as the key buzzword for his industry as well, as decarbonization has become a key issue that is getting attention form large corporations.

Winters explained that renewable diesel production in the United States has been growing rapidly, increasing by 500 million gallons in 2022. In light of this growth, there is a mismatch between U.S. EPA and what the industry is planning, which may limit investments, he explained. With the Inflation Reduction Act bringing a clean fuels credit determined by carbon lifecycle analysis, Winters explained

14 BIOMASS MAGAZINE | ISSUE 2, 2023

Burgess BioPower receives wood chips from more than 150 suppliers in the surrounding communities.

¦ EVENT

From biomass power to sustainable aviation fuel, decarbonization was a main theme at the 16th annual International Biomass Conference & Expo.

that the main issue the Clean Fuels Alliance is focused on ensuring that the U.S. Treasury “gets those rules right and allows equal access … to those tax credits.”

Though the year was average to below average from a sales and production standpoint due to a mild winter, policy was a different story for the domestic wood pellet industry, Portz said. For the home pellet heating industry, the Inflation Reduction Act provided an attractive 30% appliance tax credit for qualifying appliances. Although the IRA did not provide any incentives for heating systems for businesses, the 10-year timeframe of the tax incentives gives “a good, long runway” for homeowners to purchase stoves.

Serfass has seen significant growth in the renewable natural gas sector. “It’s a really good time to be in biogas,” he said. “In 2021, the number of operational projects turning biogas into RNG increased by 47%, and another 20 to 30% in 2022.”

The U.S. export sector for industrial wood pellets grew 20% percent year over year in 2022, the bulk of which are going to Europe and a growing market in Asia—specifically Japan, explained Muskus. She sees the industry as a good low carbon energy opportunity, offering a great option to continue a focus on decarbonization utilizing carbon capture and sequestration (CCS). Muskus is cautiously optimistic about the market opportunities in the EU after the Renewable Energy Directive. She discussed the potential impact of the IRA on bioenergy producers in the U.S. by increasing tax credits

for carbon capture and storage, making it possible for them to build this technology. “The other thing that I really think the IRA has recognized is the need for active forest management, and the multiple benefits that it provides,” Muskus said. “It’s no longer an option to leave forests on their own to face the many hazards of a changing climate. And part of what has come with this also is recognition by the U.S. government that we can utilize the fiber that is produced from sustainable forest management to displace fossil fuels and help the transition toward renewable energy.”

Annand discussed the impacts of the IRA on the biomass industry, including extended tax credits and the hike in 45Q tax credits, making it easier for bioenergy producers to implement carbon capture and storage systems. The IRA also gave $100 million to the Forest Service for distribution to the biomass industry to remove hazardous fuels that have built up in forests and increase the risk of wildfires. “We’re talking to the forest service every day about how to direct those dollars to the proper, effective use of the biomass [being cleared out] of the forest,” Annand said.

The 2024 International Biomass Conference & Expo will be held in Richmond, Virginia, March 4-6, 2024.

Author: Katie Schroeder Katie.schroeder@bbiinterantional.com

Author: Katie Schroeder Katie.schroeder@bbiinterantional.com

BIOMASSMAGAZINE.COM 15

The International Biomass Conference Expo general session industry roundtable discussion featured Anna Simet, editor at Biomass Magazine; Carrie Annand, executive director at the Biomass Power Association; Amandine Muskus, executive director of the U.S. Industrial Pellet Association; Patrick Serfass, executive director of the American Biogas Council; Tim Portz, executive director at the Pellet Fuels Institute; and Paul Winters, director of public affairs and federal communications for Clean Fuels Alliance America.

Portz and Winters shared the expected impact the Inflation Reduction Act will have on their respective industry sectors.

Biomass One, a biomass power and biochar producer in White City, Oregon, was awarded Groundbreaker of the Year. Accepting the award on behalf of the plant was Karl Straub, chief operating officer (right image). Rob Davis, unable to attend the event, was named winner of the Excellence in Bioenergy Award.

16 BIOMASS MAGAZINE | ISSUE 2, 2023 ¦ EVENT

Annand emphasized that biomass power plants must find ways to innovate and stay competitive.

BIOMASSMAGAZINE.COM 17 EVENT ¦

(Left) Bob Langstine, Zeeco Inc., presents “Practical Considerations for Aux Fuel Burners on Biomass Boilers” in the biomass power and thermal track.

(Above) Jason Kessler, KESCO Inc., (podium); Kyle Hoffman, CPM; Timo Mueller, SALMATEC GmbH; and Holger Streetz, Bathan AG, each contributed to panel, “An Overview of the Art of Making Wood Pellets.”

Jeff Blair, Eastern Controls (podium); Wes Younger, Trinity Consultants (moderator); Steve Milford, Endress & Hauser; and Alan Vidal, Ecotec., presented during panel, “Accurately Measuring Biogas Flow Rates and Removing Troublesome Components.”

18 BIOMASS MAGAZINE | ISSUE 2, 2023 ¦ EVENT

A full house for a track two panel that explored implications of the Inflation Reduction Act, as well as the Renewable Fuel Standard eRINs program. Speakers included Annand (podium); moderator Simet; William Strauss, FutureMetrics; and Lance Healy, FD Real Asset Advisors.

Brent Farley and Jeff Davis, Fike Corp., chat with a potential customer. Ed Verderose, Miura North America, and Shaunica Jayson represent the American Boiler Manufacturers Association.

BIOMASSMAGAZINE.COM 19 EVENT ¦

Pete Thomas and Gena Bergeron man the Samson Controls exhibit.

Tom Mazzella, Emisshield Inc., converses with booth visitors.

Bryon Otnes, Precision Machine & Manufacturing, greets booth traffic.

AVOIDING UNPLANNED SHUTDOWNS DUE TO PIPING AND DUCT FAILURES

Addressing common issues related to piping and ducting systems can prevent unplanned downtime and increase overall biomass plant efficiency.

BY CJ HORECKY

Keeping a biomass or biorefining plant operating efficiently is a delicate science. Nearly every piece of equipment in operation has the potential to bring the entire plant offline if it fails, and is usually complicated to understand in its own right—let alone understanding the intricacies of the way it interacts with the adjacent systems in the plant. Thankfully, piping and ducting systems are simple, straight forward, and don’t ever bring our plants offline—right?

Undergoing an unplanned shutdown because of a failure in your piping or ducting system is embarrassing. Sure, the ductwork,

like a network of veins and arteries, ties everything together, but it’s more of a peripheral feature. Ductwork is not the core equipment that the whole plant runs on—it’s just a system connector—so there is little grace for plant managers who experience a ductwork failure, and even less for maintenance managers who didn’t see it coming. King Solomon said, “There is nothing new under the sun,” and this applies to biomass plants as well. Technology has come a long way in the past 40 years, but our field experts have consistently found the same telltale signs of imminent piping and ducting failures. Watch for these, and you can avoid an unplanned shutdown.

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Biomass Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

20 BIOMASS MAGAZINE | ISSUE 2, 2023 ¦ OPERATIONS & MAINTENANCE

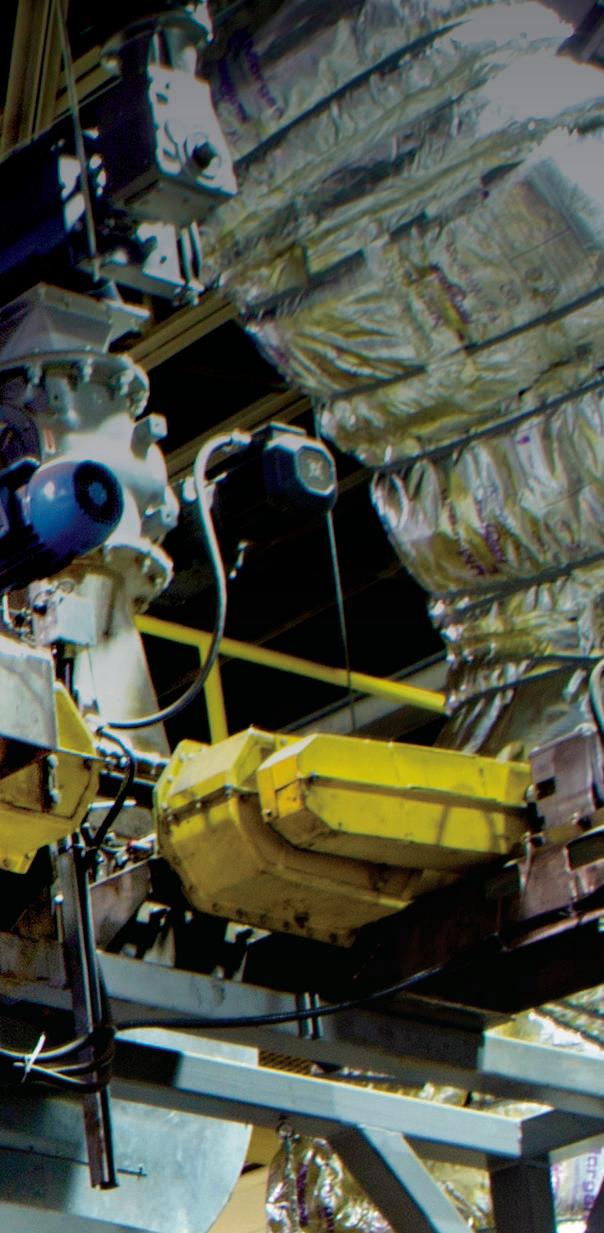

Galvanic metallurgical corrosion found by Interep during an inspection at a plant in Spain. / IMAGE: INTEREP INC.

Hidden Leaks

Water pooling on the ground, corroded structural steel, plumes in the air—we all know the signs of positive pressure leaks, and we know we have to fix them fast to avoid all kinds of damage, safety issues and environmental hazards. But what about negative pressure leaks? They’re just as detrimental in the long term, yet we tend to overlook them. Out of sight, out of mind, right? A negative pressure leak means ambient air is being sucked into the system; what’s doing the sucking? Your induced draft (ID) fan. If the ID fan is pulling in ambient air, it’s pulling in less process gas or using more electricity—both things plant operators hate. So, let’s talk about that ambient air: It’s wet. Even in dry environments, the average relative humidity is still significant, causing unseen leaks to bring moisture into the biomass gas stream, creating unintended issues in unexpected places. This will exhibit itself in the following symptoms.

• Slow drips or crystalline deposits running from beneath insulation or from gaskets and expansion joints.

• Loss of fan capacity (or becoming ID fan/blower limited in worst cases).

• Internal corrosion in vessels and equipment.

• Elevated oxygen process gas levels.

As for hidden leak points, the most common include the following.

• Fabric expansion joints that have outlived their useful life.

• Fabric expansion joints that have not been properly spliced.

• Holes in ductwork that are hidden beneath insulation.

• Loose flanges or equipment connections.

• Equipment doors/manways upstream (dry gas area).

• Expansion joints that have been insulated over but undocumented.

Low Points

We’ve discussed how the condensation and precipitation got into your ducting system, so now, how does it get out? Liquid seeks the lowest point in piping and ducting systems. This often occurs near elbows, in the bottoms of vessels, or in the convolutions of horizontal expansion joints. If you have a sagging area in ductwork or a low elbow or bend, you may need to install a drain to tap this excess moisture off into a sump until you can properly level the system at the next major shutdown. However, if it’s in a metal bellows expansion joint (common across large-diameter ductwork in biomass plants), you may need to find a solution for the pooling liquid. The following are possible solutions.

• Externally insulate the expansion joint (check to verify metallurgy and acceptable temperature first) to bring everything above dew point.

• Change the metallurgy to something that can handle the

excess moisture and continue to last between shutdowns.

• In certain circumstances, you may be able to add a drain to the bottom of a “heavy wall” single convolution expansion joint.

• Upgrade to two-ply designs with a monitoring system that will alert operations when the inner ply fails, so a routine maintenance system can be developed.

• Add either steam or electrical tracing to increase the bellows temperature above dew point.

Metallurgical Corrosion

Carbon steel, high-nickel alloy, fiber reinforced plastics, thermoplastics—you’ve seen it all, and you know what you like to use. You probably have a specification for the type of steel you want to see in your piping and ducting systems, and it’s probably followed fairly well. Here’s where things sneak up on you, though: your piping and ducting accessories. Does your pump vendor know that you want the flanges to be made of 316L to match the adjacent piping? Does your expansion joint vendor know that his T304 metal bellows are getting welded onto carbon steel? Does your damper manufacturer build his shaft packing glands to the same spec as your ductwork? You can end up with a slew of different pieces of equipment in your system, and it’s hard to vet them all first. Obviously, you would prefer to change any piece that has an incompatible metallurgy out for an upgraded one, but sometimes you can’t afford the downtime or upgrade cost. As for what to do if ductwork accessories are corroding and you can’t come offline:

• Determine if the part is acting as a heat sink and dropping the process gas within below dew point.

• Determine if the area upstream is airtight or if there are any major infiltration points contributing to the issue.

• Check metallurgical compatibility between accessory and adjacent ductwork.

• Take UT (ultrasonic testing) readings to determine corrosion rate and projected lifespan.

• Perform thermal scans to look for hot and cold spots or potential failure points.

By addressing these common issues related to piping and ducting systems, operators can avoid unplanned shutdowns and increase the overall efficiency of their biomass plant or biorefinery. Keep an eye on these warning signs and implement the necessary preventative measures to ensure smooth and continuous operation.

Author: CJ Horecky Executive Director, Interep Inc. www.interep.com cjh@interepinc.com

BIOMASSMAGAZINE.COM 21

PULPWOOD PRICE DRIVERS AND MILL CURTAILMENTS

Regional differences in fiber prices are as great as they have ever been.

BY BROOKS MENDELL

Fiber prices rose to record levels in the U.S. Northeast and West in Q4 2022. Labor availability factored into higher prices in both regions. A lack of logging capacity contributed to significant hardwood fiber scarcity in the Northeast, while a labor strike at Pacific Northwest Weyerhaeuser operations constrained softwood fiber availability there. The U.S. South remains a contrast as fiber prices largely fell. According to the Wood Fiber Review, regional differences in

fiber prices are as great as they have ever been, with prices for roundwood and chips varying by 100% or more on some products between the highest and lowest average cost across North American regions.

The variance across regions speaks to how the physical profiles of mill capacity to forest supplies differ significantly. Two good examples are the performance of pulpwood prices in the South and rapid changes in fiber markets in Western Canada.

Pulpwood Price Drivers in the US South

The relationship between demand and supply of roundwood pulpwood and pricing is more complicated than sawtimber due to the availability of residual sawmill chips as a roundwood substitute. The rapid increase in southern lumber production over the past decade increased residual chip production, buffering pulpwood roundwood prices. To better understand price behavior,

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Biomass Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

22 BIOMASS MAGAZINE | ISSUE 2, 2023 ¦ FIBER

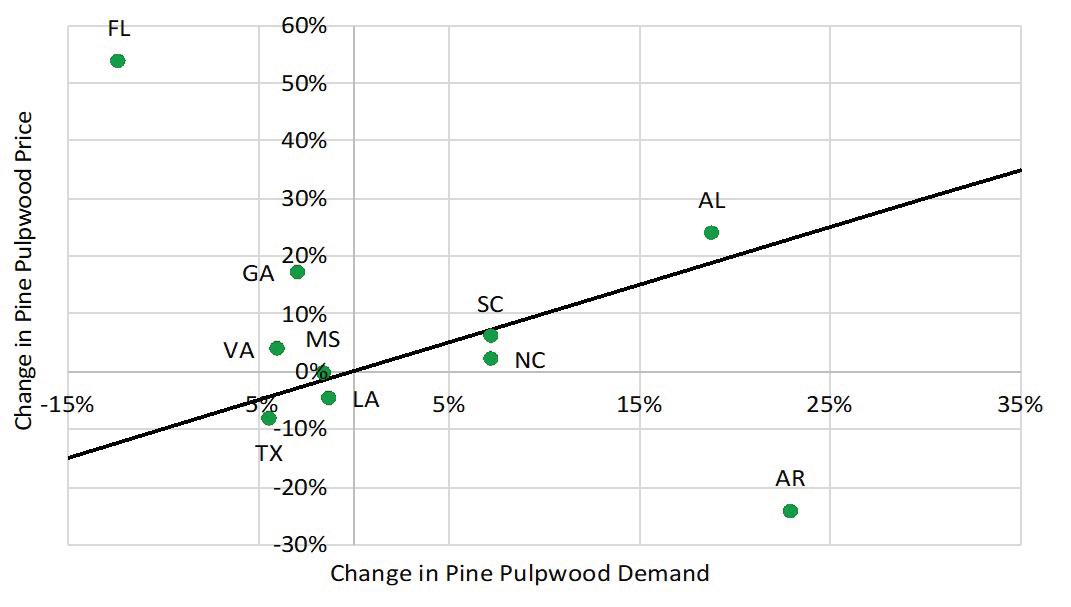

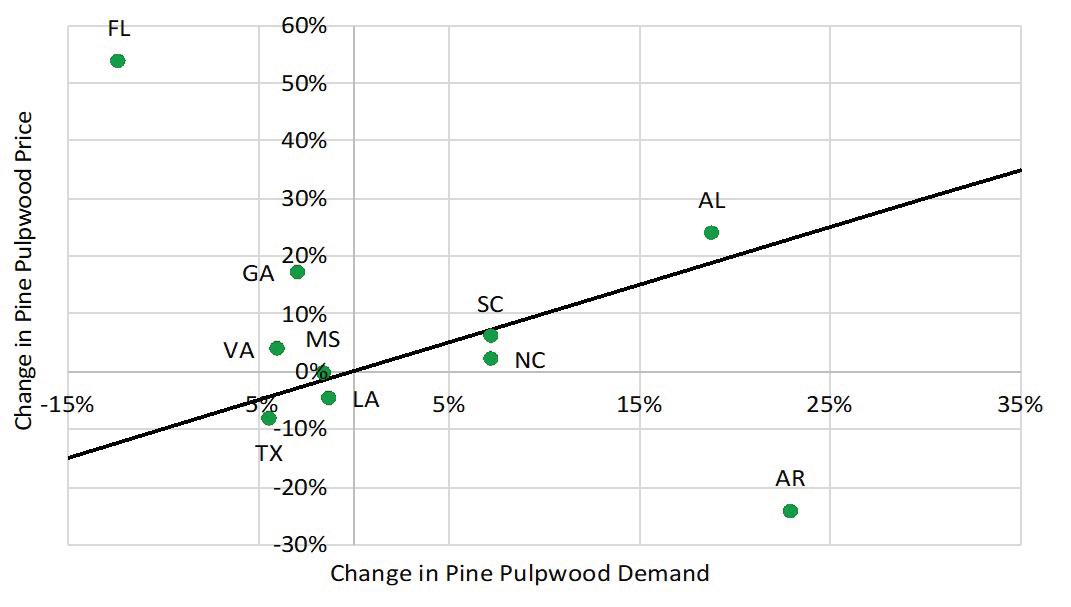

SOURCE: Q1 2023 FORISK RESEARCH QUARTERLY *LINE REPRESENTS ONE-TO-ONE RELATIONSHIP BETWEEN DEMAND

PRICE PERCENT.

Figure 1: Change in State-level Pulpwood Demand and Price, 2019-2022

AND

it is helpful to examine the dynamics of pulpwood pricing.

From 2015 through 2019, most southern states showed relatively small (less than 10%) changes in demand and price. Exceptions to this trend were Alabama, Arkansas, Mississippi and North Carolina. In these states, prices either fell despite minor drops in demand, or demand increased at a greater pace than prices. From 2019 through 2022, pulpwood prices increased 10% or more in three states, while demand increased a commensurate amount in only Alabama.

Comparing pulpwood price changes to demand changes from 2019 to 2022 reveals that fewer states appear to have a clear price response to demand changes (Figure 1). Instead, there are nearly as many states with negative relationships to demand as positive. Unlike the more straightforward relationship between demand and prices for sawlogs, pulpwood prices comprise a more complex web of relationships due to the roles of residual chips, oriented strand board demand and wood pellets, in addition to pulp markets and exports.

Curtailments: BC and Elsewhere

Since December 2022, announcements for sawmill curtailments and clos ings named over 20 mills in Western Can ada (Alberta and British Columbia) and removed over 1.2 billion board feet of capacity from the sawmill sector. Firms including Aspen Planers, Canfor, Conifex, Interfor, Sinclair, Skeena, Tolko, West Frase and Western Forest Products an nounced curtailments as of February 2023 for Western Canada alone.

The pulp and paper sector also an nounced meaningful downtime, primarily in Western Canada and the U.S. South. In addition to the announcements tracked by Forisk, many mills ran below capacity. Softening demand for finished goods and the downstream impacts on raw material supplies from fewer available manufactur ing residuals for pulp and paper mills are

already affecting firms, especially in Western Canada. In short, declining production at regional sawmills affect the feedstock reliability and viability of regional wood-using pulp mills.

For the Northwest, there is a potential upside. A heavy portion of the curtailment activity occurs in B.C., which could, in effect, boost the need for regional production in Oregon and Washington. It will be interesting to see what 2023 brings for log prices and production levels in the Pacific Northwest.

This article includes data from the Forisk Wood Fiber Review, a quarterly publication tracking North America’s major wood fiber markets, and the Forisk Research Quarterly, which includes forest industry forecasts and analysis by sector.

Author: Brooks Mendell Forisk Consulting LLC 770-725-8477 bmendell@forisk.com

BIOMASSMAGAZINE.COM 23

‘Since December 2022, announcements for sawmill curtailments and closings named over 20 mills in western Canada and removed over 1.2 billion board feet of capacity from the sawmill sector.’

IMAGE: AZURA

COMMONLY OVERLOOKED REASONS FOR ANAEROBIC DIGESTER FAILURES

Digester operators can help safeguard plant performance by improving awareness of the most overlooked causes of failure.

BY DAVID ELLIS, JAMES ARAMBARRI AND MICHAEL NELSON

Process upsets and failures of anaerobic digesters (AD) present significant headaches for owners and operators. Besides an immediate loss in biogas or renewable natural gas (RNG) production and revenue loss, upsets and failures can result in serious safety risks and generate offensive odors. In turn, these can cause community complaints and attract greater scrutiny from regulators.

Digester operators can help safeguard plant performance by improving awareness of the most overlooked causes of digester

failure. Based on more than 30 years experience with digester facilities, this article presents the top five commonly overlooked digester failure causes that operators can recognize to potentially avoid these pitfalls.

Recycle Streams

Recycle streams are probably the most overlooked aspect of AD processes. These relatively small flows can often carry a substantial quantity of interesting chemistry and biology that have

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Biomass Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

24 BIOMASS MAGAZINE | ISSUE 2, 2023 ¦ OPERATIONS & MAINTENANCE

caused costly upsets. Examples of recycle streams include the following.

• Digestate water from a solids press or filtration step being recycled to hydrate biomass solids, municipal sourceseparated organic (SSO) wastes, or other dry feedstocks.

• Treated effluent from a digestate wastewater treatment process being recycled to manage the solids content or moisture level in the digester.

• Undigested solids recycled back into an anaerobic digester for further biodegradation and biogas production.

Recycle streams can harm a digester by causing the accumulation of inhibitory or inert materials, such as the following.

Ammonia-nitrogen. When organic nitrogen in feedstocks is degraded, it is released into the water and measured as total ammonia-nitrogen (TAN), which measures both the ammonium (NH4+) and ammonia (NH3) forms. NH3 is highly inhibitory to digesters, with concentrations of 100 mg NH3-N per liter being significantly inhibitory to methane production. In most digesters that do not have recycle streams, the TAN concentration usually remains low enough that ammonia inhibition is not a concern. However, if nitrogen-rich liquid effluent is recycled to hydrate dry feedstocks, then there is a risk of ammonia building up, leading to an ammonia-driven upset and failure.

Salts. Salts such as potassium, sodium, and chloride play an important role in biology. Large amounts of salts, however, are inhibitory to some microbes, including those in anaerobic digesters. Since salts are not destroyed in the digester, liquid recycle streams will bring the salts right back into the digester, leading to a salt buildup, and ultimately, to biological upsets.

Inert colloidal solids. As organic material is broken down in the digester, some byproducts are very small, nonbiodegradable particles—inert colloids. These particles are difficult to remove without chemical treatment. Therefore, recycle streams can contain large amounts of colloids, which get recycled back to the digester. Large buildups of inert solids occupy reactor volume, reducing the digester’s treatment performance, and ultimately lead to a wide range of biological or mechanical upsets.

The easiest option may be to avoid having the recycle at all, if practical. Otherwise, be sure the facility process design considers the impact of recycle streams during the project development stages.

Nutrient Deficiencies

Poor nutrition is detrimental to the long-term health of anaerobic digesters. Fortunately, most digesters don’t have any nutritional deficiencies.

Digesters that take manure, biosolids (sewage sludge), or complex food waste feedstocks typically do not require any nutritional supplementation. Digesters that do require nutrient supplements are usually taking a small number of feedstocks such as high-fat wastes or agricultural residues that are lacking in nutritional value.

Many trace metals, such as cobalt, iron, nickel and molybdenum, play key roles in metabolic functions of the digester biology. These trace metals can come from either the digester feedstocks or from nutritional supplements. A deficiency of even one of these trace metals can significantly hamper biogas production and lead to further upsets.

Less extreme cases of nutrient deficiencies typically present simply as underperforming digesters. In these cases, you see feedstocks being only partially degraded in the digester, with low biogas output and an unusually odorous digestate. In more extreme cases, nutrient deficiencies can lead to high organic acid accumulation and subsequent upsets caused by acidification.

Just like a person’s diet, a digester needs a good mix of feedstocks providing the fuel value for the biogas and the nutrients that allow the biology to unlock that fuel value.

Over-acidification

Over-acidification is caused by a buildup of volatile fatty acids (VFAs). The buildup of VFAs is caused by the inability of the microbes that convert them into methane to keep up with how fast the hydrolyzing and fermenting microbes are producing VFAs. Buildup of VFAs and pH drop will hamper the methanogens further, worsening the problem. If the VFA accumulation is not halted, the digester will eventually be unrecoverable.

There are two main ways to avoid VFA accumulation, which are as follows.

Watch for digester overfeeding. When a digester is stable, the methanogens are in balance with the hydrolyzing and fermenting bacteria, and can convert the VFAs generated, keeping the VFA concentration stable. If the feeding rate is increased significantly, the hydrolyzing and fermenting bacteria will produce more VFAs than the methanogens can handle. As a result, the VFAs will build up in the digester. This again causes the pH to drop, which will further inhibit the methanogens, and the digester will become upset.

Inhibition of the Methanogens. Methanogens can be inhibited by any number of factors, including ammonia accumulation, heavy metal toxicity, and large temperature or pH shifts, to name a few. If any of these occur, the VFA-to-methane conversion rate will drop and VFAs will begin accumulating. If the inhibition is not reversed or the feeding rate is not reduced until the methane bacteria recover, the VFA buildup and pH drop will worsen, and the digester will become upset.

Fortunately, in most cases, VFA buildups are slow, so frequent and accurate measurements of VFA, alkalinity and pH can catch this problem before it becomes critical.

Seasonal Heating, Cooling Demands and Weather Challenges

Digesters operating in cold climate areas face challenges during the winter with sustained freezing temperatures. Similarly, in warm areas, digesters can become too warm during sustained hot weather.

BIOMASSMAGAZINE.COM 25

If the digesters are not properly designed, maintaining an optimal temperature of 95-100 degrees Fahrenheit (35-38 degrees Celsius) could prove difficult, which will hamper biogas production. Typically, any temperature shift beyond 2-3 F (1-2 C) per day will disrupt biogas production due to the sensitivity of methanogens.

Digester heating, including warming frozen feedstocks, needs to accommodate worst-case winter conditions. Similarly, cooling systems need to be able to operate during extreme summer hot periods.

Cold weather can also present mechanical challenges. Screw augers for solid feeders can become inoperably frozen, preventing further feeding until they are thawed out. Historically, this issue has been handled by flushing the screw auger systems with warm digestate to keep the material from freezing. Moisture in raw biogas pipelines can also become frozen at sensors and dead legs, causing cracks in biogas pipelines.

Conversely, hot weather can lead to digester overheating challenges. Hot weather can be more challenging to deal with than cold weather heat loss, as many digesters are not built with cooling systems. The biological heat generation from the biodegradation activity within the digester can be a significant heat contributor for consideration in the overall digester design work.

Under-appreciation of AD Parameter Variability

As a biological system, anaerobic digesters are dynamic and adaptable to change, but their adaptability depends on how fast the changes occur. When monitoring key parameters, understanding the difference between sensor or sample noise and significant changes of concern is necessary to understand when and how to respond.

Temperature, pH, VFA and alkalinity measurements will produce a significant amount of data noise, due in part to the high solids content of digestate and feedstocks. As a result, these parameters are rarely the same from day to day. When these fluctuations are small, within 10% of the long-term average, they can generally be considered stable. For example, an increase in VFAs from 2,000 milligrams per liter (mg/L) to 2,200 mg/L the next day is not of concern, as it may be measured at 2,000 mg/L the day after that. However, if overall increasing trend continues, reaching 3,000 to 4,000 mg/L, that’s an indication of a VFA buildup that warrants investigation.

Large changes in temperature and pH can lead to upsets as well, disrupting biogas production. If not corrected, these upsets may become unrecoverable. Significant pH shifts can also lead to upsets but are generally more an indicator of some other issue, such as an acid accumulation.

Conclusion

Understanding and avoiding upsets begins with getting a complete and accurate picture of the digester itself—what’s going in, what’s coming out, and what’s happening inside.

Author: David Ellis, Principal Engineer James Arambarri, Optimization Lead Michael Nelson, Process Analysis Lead Azura Associates Azuraassociates.com

¦ OPERATIONS & MAINTENANCE

Largest Biomass Event in North America

RICHMOND, VA

The Int’l Biomass Conference & Expo is where future and existing producers of biobased power, fuels and thermal energy products go to network with waste generators and other industr y suppliers and technology providers.

The Int’l Biomass Conference & Expo is the largest, fastest-growing event of its kind, the conference is expected to draw nearly 1,000 attendees in 2024. In 2023, the event drew 160 exhibitors and more than 900+ attendees, with 29% of attendees being producers. This growth is fueled by a world-class expo and an acclaimed program.

#IBCE24

twitter.com/biomassmagazine

866-746-8385

service@bbiinternational.com

SAVE THE DATE

TRANSFORMING WILDFIRE FUEL INTO BIOCARBON

BY JUNE BRENEMAN

BY JUNE BRENEMAN

The Superior National Forest in northern Minnesota has piles of biomass in need of disposal. To combat the threat of fast-spreading wildfires, the park service regularly hires crews to cut young, thin balsam fir from the forest. This is referred to as “ladder fuel” because it creates a dense understory that quickly moves a fire up to the tree canopy where it more easily spreads. Balsam fir was one of the major fuels that spread the Greenwood Fire in northern Minnesota in 2021—caused by a lightning strike, it burned 42 square miles.

“Fires have been on the landscape for tens of thousands of years,” explains Patrick Johnson, Superior National Forest fire management officer. “The fire itself isn’t bad, but when it runs into someone’s house, it becomes a problem.”

The only way to mitigate the balsam fir fire danger is to selectively remove that species. But with no markets for this soft wood resource, the piles are left to slowly decay or are burned. Both options release carbon dioxide into the atmosphere. Recently, a demonstration project at the University of Minnesota’s Natural Resources Research Institute in Duluth turned the balsam fir into engineered biocarbon, or biochar, and then applied it to a capped coal ash landfill. It’s long been known that biochar’s porosity makes it an excellent soil amendment, improving both microbial soil health and moisture retention.

“When I heard about the biochar possibility, I got really excited,” Johnson says. “We’re always looking for new ways to treat our balsam fir problem. There’s just so much of it across the landscape. If there was a market for it, that would be fantastic.”

Sequestering Solution

Carbon offset credits are generated when the downed fir is converted into biochars and that value can be reinvested to improve wildfire management. Carbon credits are generated from net-negative carbon projects and purchased by industries that cannot meet

28 BIOMASS MAGAZINE | ISSUE 2, 2023

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Biomass Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

A demonstration project in Minnesota is utilizing hazardous forestry material to produce biochar.

¦ BIOCHAR

(Top image) Brian Barry, NRRI chemist and project lead, and Alexy Kacharov, chemical engineer. (Bottom image) Balsam fir stands in the Superior National Forest PHOTOS: ALEXANDER MESSENGER

carbon emission goals. “This is an exciting moment for biochar in that there’s a lot of interest, with big industry backing carbon sequestration and the bioeconomy,” says Brian Barry, NRRI chemist and project lead. “This project will demonstrate how biochar can be deployed in hopes that we can help grow this industry.”

Biocarbon is charred biomass, basically like a charcoal. Once transformed, the carbon is locked in, and those carbon credits can be sold in an online marketplace. One cubic yard of biochar represents about 0.7 tons of CO2 equivalents, or 0.7 of a carbon offset credit. Market prices fluctuate with supply and demand, but carbon credits currently range between $40-$80 per metric ton, according to 8BillionTrees.com.

The charring process, in a zero- or low-oxygen kiln, produces highly porous granules that are excellent materials for various water treatment and soil amendment applications. “As a material, biochar has a lot of beneficial environmental qualities–from improving the microbial health of soils for more productive crops to removing contaminants from stormwater runoff,” Barry explains. “Minnesota is poised to be a biochar leader. We’re anticipating large-scale production facilities to be built in the next few years.”

Barry and his team are characterizing biochars made under varying conditions to impart specific properties for specific applications. The kiln temperature, time in the kiln, and biomass source all impact the biochar’s performance properties.

In Action

In partnership with energy provider Minnesota Power, NRRI is applying charred balsam fir to a capped coal ash landfill at the Boswell Energy Center in Cohassett, Minnesota. The goal is to improve the soil so that native grasses can revegetate this space for new uses. “Partic-

ularly for coal ash landfills, one of the challenges for revegetation is making sure the cover has decent water holding capacity,” Barry says. “And one of the key features of biochar is its porosity, allowing high water holding capacity.”

In late fall 2022, 12 super sacks of balsam fir biochar—about three tons—were applied to the ash landfill. This small-scale demonstration effort represents roughly eight carbon offset credits, and the removal of around 23 cords of wildfire fuel from the forest.

“If we had more financial resources, we would double or triple our capacity to remove balsam fir from the Superior National Forest,” Johnson says. “Biochar seems like a great solution where we can provide a product that’s worthwhile and find markets for it, that would be a great benefit to the public.”

A U.S. Forest Service Wood Innovation grant funded half of the $375,000 budget for this demonstration project, with the rest matched by Minnesota Power and NRRI.

Next Steps

While biochar has attracted quite a buzz, building market demand will require ongoing research to develop and demonstrate uses beyond agricultural applications. NRRI researchers will continue to seek partnerships with industry and government agencies to advance materials that lock away atmospheric carbon while offering enhanced performance and higher value.

Author: June Breneman Natural Resources Research Institute jbrenema@d.umn.edu

BIOMASSMAGAZINE.COM 29

‘When I heard about the biochar possibility, I got really excited. We’re always looking for new ways to treat our balsam fir problem. There’s just so much of it across the landscape. If there was a market for it, that would be fantastic.’

Patrick Johnson

Superior National Forest fire management officer

Optimizing Biogas Production Efficiency With Humidity Measurements

BY ANTTI HEIKKILÄ

BY ANTTI HEIKKILÄ

As the world transitions into a greener, cleaner and more sustainable place for future generations, biogas, or biomethane, is a key contributor to the sustainable energy industry. Produced from a variety of organic feedstocks, this renewable and reliable source of energy can reduce greenhouse gas emissions and dependence on fossil-based energy sources, but its production is subject to many variables—notably, the impact of humidity.

From methane volume calculations to the frequency at which carbon filters need to be changed, understanding the levels of humidity is crucial to ensure maximum efficiency and profitability at every stage of the biogas production process. Fortunately, advanced continuous in-line humidity measurement solutions offer producers the insight to optimize biogas production and profitability while helping build a more sustainable future.

Impacting the overall moisture con-

tent of the biogas production process, high humidity can affect biogas generation in several ways, including the equipment reliability, greater risk of water pass-through, accurate volume calculations and maintenance frequency. These factors combine to destabilize biogas production and lead to fluctuations that reduce overall biogas yield. Consequently, the gas must be treated before being utilized for electricity and renewable natural gas (RNG) production, whether removing moisture, hydrogen sulfide, silox-

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Biomass Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

30 BIOMASS MAGAZINE | ISSUE 2, 2023

anes and other volatile organic compounds. Most countries have strict regulations to ensure the quality of delivered RNG, in order to protect both infrastructure and the environment.

Humidity invariably impacts different aspects of biogas production, so monitoring and managing humidity levels is essential to optimize production efficiency.

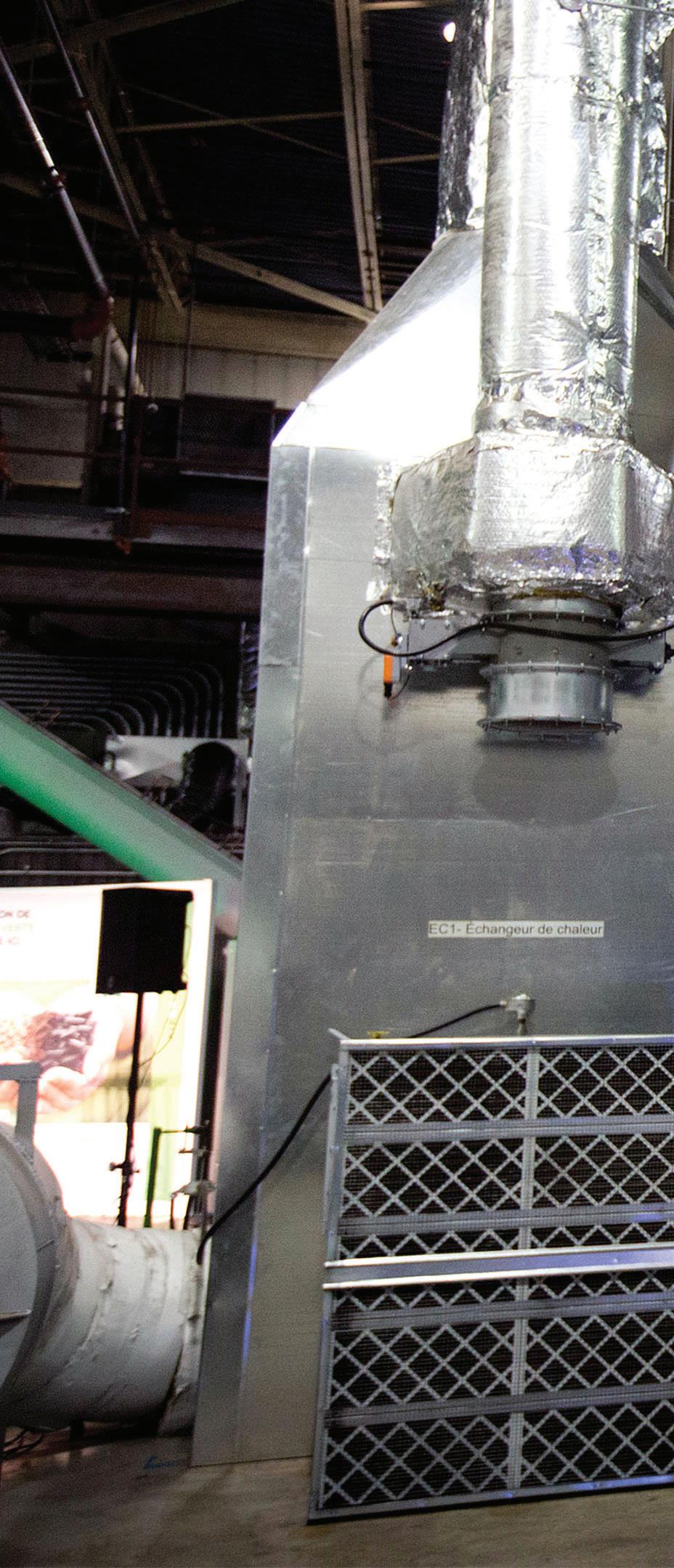

Heat Exchange Dryers and Humidity

The easiest way to remove excess humidity is to cool the gas to force condensation, followed by reheating the gas. When gases are removed from reactors, they naturally cool, but this level of cooling is not enough. To further remove humidity, plant operators use a heat exchanger to cool the gas down to the same temperature as in the coldest part of the heat exchanger, dropping the dew point to the same temperature.

In practice, the gas comes out fairly quickly, and the dew point is often higher than the cooler set point, as water vapor does not generally reach the set point uni-

formly and can be unstable. As a result, measuring the dew point after cooling is the only reliable way to know the true moisture content. Therefore, to optimize and ensure the performance of heat exchange dryers, it is important to monitor and control the humidity levels of the gas while in the process with sensors.

Active Carbon Filtration Efficiency and Humidity

Research shows a strong link between relative humidity of gas and filtration efficiency. High humidity can cause moisture to condense on the active carbon filter media and affect its absorption capacity, underscoring the vital need for drying. Too low humidity, on the other hand, significantly drops filtration efficiency, as carbon’s structure changes when too dry, especially in ambient temperatures. The best results appear in a range between 50% and 70% relative humidity.

When the cost of one activated carbon refill is typically in the $2,000 to $4,000-plus range, depending on filter type and size, improper humidity management can cut the lifetime of carbon filters in half. Worse yet, if humidity is not optimal and hydrogen sulfide and other impurities pass through, the cost of damage to biogas engines and biomethane upgrading units can be even more severe.

Humidity significantly impacts the efficiency of active carbon filtration, so monitoring and controlling humidity inside the process is crucial when implementing active carbon filtration techniques for gas purification.

CHP Engines and Humidity

Combined-heat-and-power (CHP) engines are sensitive to humidity. One important consideration is that dry gas contains more energy per volume than wet gas. As such, reducing humidity in a 1-MW CHP engine by one volume percent can increase the heat content of the gas by one percent.

High humidity levels not only cause moisture to condense in the engine’s air intake system, leading to a decrease in engine performance, but they can also increase the likelihood of corrosion and wear on the engine components. Condensate in fuel lines or the engine is also against most engine manufacturer specifications.

If water enters an engine, moisture can very quickly put the machine out of action—and when the loss of production for just a medium-sized engine costs roughly $5,000 per day, that result is untenable. Even if the engine doesn’t stall due to humidity, the noncondensing humidity levels still impact the engine’s lubrication, leading to increased maintenance needs.

From active carbon filtration to CHP engines, humidity monitoring costs significantly less than the combined costs of increased carbon filter replacement and oil exchange intervals, so including humidity measurement solutions in biogas plant instrumentation is best practice.

Biogas Upgrading Membranes and Humidity

Biogas presents a better value if it is upgraded to biomethane and sold as a replacement for fossil gas. The gas membranes often used to separate out the methane are operated at elevated pressures (above 10 bar), and gas is circulated in a cascade of upgrading membrane units.

As the pressure increases, so does the dew point, which can cause water vapor to condense on the surface of the membrane, decreasing production efficiency. If the dew point of raw biogas is too high before compression, condensation will occur after compression, even at high temperatures. Given that information, maintaining dew point at or below 0 degrees Celsius is important for the trouble-free operation of upgrading plants, and measuring this in-situ can provide valuable insight.

Biogas upgrading systems are more

BIOMASSMAGAZINE.COM 31

BIOGAS ¦

Antti Heikkilä, Vaisala

sensitive than CHP engines, and the value of the gas produced is higher than that of the electricity produced. Hence, the financial impact of lost production is even more significant.

To mitigate the impact of humidity on biogas upgrading membrane performance, maintaining and verifying appropriate humidity levels in the biogas stream is vital.

Leveraging Humidity Measurements

One effective solution to optimize biogas production and mitigate the impact of humidity is through in-situ, optical humidity measurements. As discussed, measuring humidity in the biogas production process has three main benefits.

First, reliable humidity data helps provide a comprehensive picture of biogas quality to calculate methane volume. Second, continuous in-line monitoring delivers accurate humidity readings directly from the gas line so that decision makers can adjust water removal accordingly, reducing CHP engine maintenance and downtime. Finally, humidity process control reduces how often to change the active carbon filters.