PLUS: Evaluating SAF Feedstocks PAGE 18 Addressing Hydrogen Sulfide Risks at RNG Plants PAGE 26 Issue 4, 2023 BiomassMagazine.com EVERY SCRAP OF VALUE Bioenergy Devco’s First US Food Waste Biogas Plant PAGE 12

Consulting Electrical Chemicals & Additives Enzymes GET LISTED Get Your Free Print + Online Listing BIOMASS INDUSTRY DIRECTORY Deadline:November 29TH Listings Not Automatically Renewed Please Create a New Listing GO T O: BiomassMagazin e. co m ONLINE | PRINT | DIGITAL | WEBINARS | EVENTS | MAPS | DIRECTORY | PODCASTS Interested in Advertising? Contact us at 866-746-8385 or ser vice@bbiinternational.com BIOMASS INDUSTRY DIRECTORY BiomassMagazine.com Ch En g cals mes emi nzym MillsHammer Cleaning Information Technology Services Sign Up Today! Separators

By Anna Simet

FEATURES

12 RNG

All the Right Foods

Bioenergy Devco has brought online its first U.S.-based digester, which takes in food waste from dozens of nearby processors, distributors and waste haulers.

By Anna Simet

By Anna Simet

18 SAF

Exploring SAF Feedstock Markets

Feedstock availability, strategy and challenges were discussed at the North American SAF Conference & Expo.

By Katie Schroeder

CONTRIBUTIONS

22 PELLETS

Utilizing Bagasse to Battle Deforestation

A pellet plant built in rural Malawi aims to reduce deforestation while utilizing sugar manufacturing waste.

By Cornelius van Tonder

26 RNG

Unexpected Risks of Hydrogen

Sulfide at RNG Plants

Understanding the risks of digester hydrogen sulfide accumulation can improve safety and efficiency at renewable natural gas facilities.

By Peter Quosai and Dave Ellis

28 BIOCOAL

A Collaborative Approach to Handling, Storing Biocoal

Combining technologies can address high chemical oxygen demand levels in leachate and potential for self-heating in biocoal.

INDEX

By Thomas P. Causer and Hiroshi Morihara

ON THE COVER

BIOMASSMAGAZINE.COM 3 COLUMN 04 EDITOR’S NOTE Data Collection Season

DEPARTMENTS 06 SPOTLIGHT: HEYL PATTERSON THERMAL PROCESSING Custom Calciners for Biochar 08 BIOMASS NEWS ROUNDUP 10 PODCAST PREVIEW 11 REPORT North American Wood Fiber Pricing and Demand

By Brooks Mendell and Stephen Wright

ISSUE 4 | VOLUME 16 Biomass Magazine: (USPS No. 5336, ISSN 21690405) Copyright © 2023 by BBI International is published quarterly by BBI International, 308 Second Avenue North, Suite 304, Grand Forks, ND 58203. Four issues per year. Business and Editorial Offices: 308 Second Avenue North, Suite 304, Grand Forks, ND 58203. Accounting and Circulation Offices: BBI International 308 Second Avenue North, Suite 304, Grand Forks, ND 58203. Call (701) 746-8385 to subscribe. Periodicals postage paid at Grand Forks, ND and additional mailing offices. POSTMASTER: Send address changes to Biomass Magazine/Subscriptions, 308 Second Avenue North, Suite 304, Grand Forks, ND 58203. ¦ ADVERTISER

21 2023 National Carbon Capture Conference & Expo 02 2024 Biomass Industry Directory 30 2024 Int’l Biomass Conference & Expo 24 2024 Renewable Natural Gas Map 07 Air Burners, Inc. 06 Carrier Process Equipment Group, Inc. 14 Evergreen Engineering 09 Hermann Sewerin GmbH 32 KEITH Manufacturing Company 25 KESCO, Inc. 17 Mid-South Engineering Company 15 MoistTech 16 Uzelac Industries PAGE 12

Bioenergy Devco’s food waste-based RNG plant in Jessup, Maryland, has an annual capacity of 110,000 tons of organic material.

Bioenergy Devco

IMAGE:

ANNA SIMET EDITOR asimet@bbiinternational.com

The Season of Data Collection

As we work to update our U.S. and Canada fuel pellet map, we have come across some interesting updates. Right off the bat, I will say this round will see the most changes we have made to the map in many years. For the U.S. alone, I expect total capacity—operating, under construction and proposed—to exceed last year’s numbers by at least three million tons. We’ve added several plants that were quietly built and we just recently became aware of, some restarts and a few new, interesting projects such as Delta Biofuel’s bagasse pellet project in Louisiana, MaineFlame’s steam-exploded pellet facility in Ashland, and Prairie Clean Energy’s flax straw pellet facility in Saskatchewan. Some producers have made or are in the process of modest to fairly significant capacity expansions, and in one case, raw material shortages prevented the plant from producing any pellets at all in 2023.

Lately, we have received some feedstock regarding the addition of BBQ pellet production facilities to the map, based on the idea that these plants can easily produce fuel pellets if the market dynamics make sense (i.e., the BBQ pellet market is saturated, or there is a surge or increased demand for fuel pellets). This is something we’re strongly considering for next year, so if you’re reading this and own one of those facilities, I invite you to reach out.

On a final note regarding the map, we’re in the midst of overhauling our online plant list, so when a plant undergoes a change in capacity, status, etc., we can change that in real time. I look forward to sharing the data when it’s complete. You can also expect our annual U.S. Biomass Power and Waste-to-Energy Map data to be available soon. While we didn’t see so many changes with this dataset, it is exciting to see some of the small-scale biomass power plants—2 to 3 MW with biochar-producing capabilities—enter construction. I think we’ll see even more of this next year, as these facilities are really being viewed as a way to manage high-hazard forest material in the West—with multiple other benefits.

As for content in this feedstock-focused issue, we’ve included stories on a food waste-toRNG project in Maryland, development of a Malawi bagasse-to-pellet plant, as well as SAF feedstock potential and challenges, content that was derived from the North American SAF Conference & Expo held in Minneapolis at the end of August. It was an exciting, well-attended event that kicked off with a big announcement by Greater MSP, Delta Air Lines, Ecolab, Bank of America and Excel Energy (check out our news section on page 8 for a little more on that). While we expect to continue covering the SAF space in Biomass Magazine, if that industry is of high interest, I encourage you to check out SAF Magazine, one of our newest publications.

Finally, the printing of this issue takes us to the end of our 2023 volume (you can find every past issue online in our archives). Thanks for sticking with us—we look forward to our 17th year of bringing you the latest biomass industry news.

4 BIOMASS MAGAZINE | ISSUE 4, 2023

¦ EDITOR’S NOTE

EDITORIAL EDITOR

Anna Simet asimet@bbiinternational.com

ONLINE NEWS EDITOR

Erin Voegele evoegele@bbiinternational.com

STAFF WRITER

Katie Schroeder katie.schroeder@bbiinternational.com

ART

VICE PRESIDENT OF PRODUCTION & DESIGN

Jaci Satterlund jsatterlund@bbiinternational.com

GRAPHIC DESIGNER

Raquel Boushee rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan jbryan@bbiinternational.com

PRESIDENT

Tom Bryan tbryan@bbiinternational.com

VICE PRESIDENT OF OPERATIONS/MARKETING & SALES

John Nelson jnelson@bbiinternational.com

SENIOR ACCOUNT MANAGER/ BIOENERGY TEAM LEADER

Chip Shereck cshereck@bbiinternational.com

ACCOUNT MANAGER

Bob Brown bbrown@bbiinternational.com

CIRCULATION MANAGER

Jessica Tiller jtiller@bbiinternational.com

MARKETING & ADVERTISING MANAGER

Marla DeFoe mdefoe@bbiinternational.com

2023 National Carbon Capture Conference & Expo

NOVEMBER 7-8, 2023

Iowa Events Center, Des

Moines, IA

The National Carbon Capture Conference & Expo is a two-day event designed specifically for companies and organizations advancing technologies and policy that support the removal of carbon dioxide (CO2) from all sources, including fossil fuel-based power plants, ethanol production plants and industrial processes, as well as directly from the atmosphere. The program will focus on research, data, trends and information on all aspects of CCUS with the goal to help companies build knowledge, connect with others, and better understand the market and carbon utilization.

(866) 746-8385 | www.nationalcarboncaptureconference.com

2024 Int’l Biomass Conference & Expo

MARCH 4-6, 2024

Greater Richmond Convention Center, Richmond, VA

Now in its 17th year, the International Biomass Conference & Expo is expected to bring together more than 900 attendees, 150 exhibitors and 65 speakers from more than 21 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming—powered by Biomass Magazine—that maintains a strong focus on commercial-scale biomass production, new technology, and near-term research and development.

(866) 746-8385 | www.BiomassConference.com

2024 Fuel Ethanol Workshop & Expo

JUNE 10-12, 2024

Minneapolis Convention Center, Minneapolis, Minnesota

Now in its 40th year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine —that maintains a strong focus on commercial-scale ethanol production, new technology, and near-term research and development. The event draws more than 2,000 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

(866) 746-8385 | www.FuelEthanolWorkshop.com

www.biomassmagazine.com/pages/webinar

Subscriptions Biomass Magazine is free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.BiomassMagazine.com or you can send your mailing address and payment (checks made out to BBI International) to Biomass Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Back Issues & Reprints Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 701-746-8385 or service@ bbiinternational.com. Advertising Biomass Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Biomass Magazine advertising opportunities, please contact us at 701-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Biomass Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to asimet@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space.

BIOMASSMAGAZINE.COM 5

INDUSTRY EVENTS ¦ Please check our website for upcoming webinars

TM Please recycle this magazine and remove inserts or samples before recycling COPYRIGHT © 2023 by BBI International

Custom Calciners for Biochar

If utilizing waste biomass to produce valuable biochar and potentially generate carbon credits is of interest, Heyl Patterson Thermal Processing has the experience and capabilities to transform a customer’s project concept to reality.

The company, a Carrier Process Equipment Group subsidiary that was founded in 1874, has been delivering these solutions— custom-made calciners—to clients for over a half century. Heyl Patterson’s Jeffrey Morris notes that though the terms are often used interchangeably, calciners are different than kilns. Most notably, calciners are typically indirectly heated, whereas kilns are direct-fired. “Both are very high-temperature processes and many people call calciners kilns, but they’re different,” he says.

As for how a calciner functions, biomass is typically dried down to approximately 10% moisture prior to the calcining or pyrolysis process, which converts the material into biochar. By heating the material in an oxy-

gen-free environment, volatiles are driven off as a synthesis gas (syngas), which is commonly captured and used for another purpose. “It’s a heat source, so we don’t waste that,” Morris says. “It’s combustible, so many times it’s used as a heat source for the dryer or even the calciner, as there is plenty to do both.” Morris notes that in some cases, customers may qualify for carbon credits when using the syngas as a heat source, opposed to fossil fuels.

Heyl Patterson can build units ranging from six inches to more than 10 feet in diameter, with capacities from a few hundred pounds to 10 tons of biochar per hour. Typically, the carbon content of the raw biomass dictates the biochar yield, Morris explains. “Usually, there’s about 20 to 25% fixed carbon in the raw biomass,” he says.

The company has several operating systems in North America, some of which have been producing biochar for as long as nine years.

Morris highlights the company’s test facility in Louisville, Kentucky, which includes all of its thermal processing equipment offerings, from dryers to calciners. “We have run hundreds of tests on different biomass types, from wood chips to grain, rice and oat hulls, corn stover, sugarcane bagasse and various weeds, as well as waste construction and demolition materials, railroad ties and telephone poles. Just about any kind of biomass, we’ve tested it.”

There has been a surge of interest in the company’s calciners and biochar production as of late, from around the world, Morris says. “We’ve been doing this since the 1960s, and we’ve built the largest in the world,” he adds. “We have the test facilities to demonstrate our capabilities and we provide performance guarantees on all of our equipment, which is custom made to suit each application.”

¦ SPOTLIGHT Heyl Patterson Thermal Processing

Biomass Processing Rotar y Calciners Rotar y Dr yers Mul tiDisc™ Thermal Processors Heyl Patterson Thermal Processing Equipment is customizable, dependable and versatile. For more information visit us online. hpprocess.com

POWERED BY NATURE Eliminate Wood Waste. Generate Power. Charge Electric Vehicles. O -Grid. 772.220.7303 Sales@AirBurners.com AirBurners.com Scan the QR code to learn more about our machines No Grinding Required Clean, Fast Burns Job Done O -Grid Produces Electric & Thermal Energy EV Battery Charging Station The BioCharger® gives you the power to fight climate change by closing the energy loop so you can work o -grid to charge your vehicles, equipment, and power tools. Here’s how: The BioCharger eliminates and converts wood waste into electricity and transfers it to the Battery Storage Module (BSM), so you can recharge your battery-powered machines. The BioCharger developed through a successful, strategic partnership with Volvo Construction Equipment and Rolls Royce, is an eco-friendly, cost-e ective, renewable energy solution for today—and tomorrow Contact us for a quote today.

Biomass News Roundup

The U.S. exported 651,698 metric tons (MT) of wood pellets in July, down from 865,995 MT the previous month, but up slightly when compared to the 651,104 metric tons exported in July 2022, according to data released by the USDA Foreign Agricultural Service on Sept. 6. The U.S. exported wood pellets to approximately 18 countries in July. The U.K. was the top destination for U.S. pellet exports at 252,242 MT, followed by Japan at 151,637 MT and the Netherlands at 124,750.9 MT. Total wood pellet exports for the first seven months of 2023 reached 5.24 million metric tons at a value of $968.66 million, compared to just over 5 million metric tons exported during the same period of last year at a value of $857.86 million.

Through the Greater MSP Partnership, anchor member companies Bank of America, Delta Air Lines, Ecolab and Xcel Energy have established the Minnesota SAF Hub—the first large-scale SAF hub in the U.S. These companies and other leading institutions, including the state of Minnesota, have teamed to implement an ambitious shared strategy for aggressively decarbonizing the airline industry. After eight months of behind-the-scenes collaboration, the coalition shared its ambitious objectives at the North American SAF Conference and Expo, held in Minneapolis on in late August. Progress to date includes establishing a shared, multiphase strategy; securing nation-leading financial incentives from the state of Minnesota; and building a growing coalition of Minnesota-based organizations including the anchor companies. As early as 2025, the coalition aims to bring commercial-scale volumes of SAF to the Minneapolis-Saint Paul International Airport from out of state.

In January 2023, U.S. production capacity of renewable diesel and other biofuels reached 3 billion gallons per year, surpassing U.S. biodiesel production capacity for the first time, according to recent reports published by the U.S. EIA. Since 2021, renewable diesel and other biofuel production capacity has more than tripled in the U.S. Nationwide, overall biofuel production capacity—which includes renewable diesel, biodiesel, ethanol, and other biofuels— reached 23 billion gallons per year in January 2023, a 6% increase in total production capacity from January 2022. Fuel ethanol accounted for 78% of U.S. biofuel production capacity, renewable diesel and other biofuels accounted for 13% and biodiesel accounted for 9%.

Japan has been dramatically increasing wood pellet imports under its feed-in-tariff (FIT) program, with wood pellet imports expected to reach an estimated 4.25 million bone dry tons (BDT) this year, according to a report filed with the USDA Foreign Agricultural Service Global Agricultural Information Network in August. Wood pellets used under the FIT scheme are subject to sustainability requirements. Beginning earlier this year, the Ministry of Economy, Trade and Industry has also required biomass power generators to calculate lifecycle greenhouse gas (GHG) emissions and has published default GHG emissions values associated with biomass feedstock eligible for the FIT programs for power generation. METI has indicated it plans to require power plants to provide information to verify their GHG emissions calculations.

Wood pellet imports reached an estimated 3.74 million BDT last year, up from 2.64 million BDT in 2021 and 1.72 million BDT in 2020. Wood pellet imports are currently expected to reach 4.25 million BDT this year. Approximately 54% of 2022 wood pellet imports came from Vietnam, with 31% from Canada and 7% from the U.S.

In addition to imported wood pellets and domestic sources of biomass, palm kernel shells (PKS) are also used to fuel biomass power facilities. Starting in April 2024, METI plans to introduce mandatory sustainability requirements for PKS for use in the FIT program. The report predicts that these new sustainability requirements could slow imports of PKS in the future.

Aemetis Inc. announced the sale of 88,883 D3 renewable identification number credits (RINs), the company’s first commercial D3 RIN transaction under the federal Renewable Fuel Standard generated by the Aemetis Biogas Central Dairy Digester Project in California. The D3 RINs were generated by the sale of dairy renewable natural gas (RNG) to customers in June 2023 and begins ongoing monthly revenues from the sale of D3 RINs. To date, Aemetis has signed 37 diaries to supply biogas digesters with animal waste for the project; has built and is operating seven

8 BIOMASS MAGAZINE | ISSUE 4, 2023

(From left) Chris Tindal, CAAFI; Peter Frosch, Greater MSP; Peter Carter, Delta Air Lines; Brett Carter, Xcel Energy; Sam Hsu, Ecolab IMAGE: BBI INTERNATIONAL

dairy digesters; has installed over 33 miles of biogas pipeline that is planned to be utilized for the next 30 digesters; built and is op-

erating a centralized biogas-to-RNG production facility and has interconnected it to the PG&E gas utility pipeline.

Brightmark RNG Holdings LLC, a joint venture partnership between Chevron U.S.A. Inc. and Brightmark Fund Holdings LLC, announced the delivery of the RNG from its Larson Project in Okeechobee County, Florida. The Larson Project is comprised of four lagoon anaerobic digesters located at Larson Family Farms. Its completion marks the joint venture’s inaugural RNG project in the state and builds on its extensive network of projects across the U.S.

South Jersey Industries, an energy infrastructure holding company, and OPAL Fuels Inc., a producer and distributor of RNG and renewable energy, announced a 50/50 joint venture to develop, construct, own and operate RNG facilities. The first facility will be at the Atlantic County Utilities Authority solid waste landfill in Egg Harbor Township, New Jersey. It is anticipated to have a nameplate capacity of 2,500 standard cubic feet per minute of landfill gas and is expected to produce more than 603,000 MMBtu, or nearly 4.8 million gasoline gallon equivalent per year of RNG. The facility will replace a previously decommissioned power plant, and the RNG will be injected into the South Jersey Gas network.

BIOMASSMAGAZINE.COM 9

BIOMASS NEWS ROUNDUP ¦

Brightmark RNG Holdings LLC’s Larson RNG project in Okeechobee County, Florida.

IMAGE: BRIGHTMARK RNG HOLDINGS LLC

PODCAST PREVIEW

WITH BRANDY JOHNSON, BABCOCK & WILCOX

For Season 2, Episode 13, of the Biomass Magazine podcast, we chatted with Brandy Johnson, chief strategy and technology officer at Babcock & Wilcox. Johnson is responsible for B&W’s strategy development and execution across the company, including leading the development of B&W’s ClimateBright suite of decarbonization and hydrogen production technologies, as well as the deployment, scale-up and commercialization activities of its BrightLoop novel hydrogen generation technology.

BMM: Recently, Babcock & Wilcox released big news— an agreement for General Hydrogen to purchase and transport green hydrogen from biomass, from a production facility that B&W is developing in Louisiana. Can you tell us more about this agreement, what it means for your company, and a little more about B&W’s role as a clean energy technology company?

Johnson: B&W is a 155-year-old company, and we have constantly tried to stay at the leading edge of energy technology for our customers, whether it was the design of the first safe watertube boiler that started our company, to the supply of some of the largest boilers in the world, to our groundbreaking environmental and cooling equipment and our state-of-the art boiler cleaning and ash handling equipment. We’ve constantly worked to have that next technology ready for when our customers needed it. Today is no different—we’re working diligently to expand our portfolio of technologies for the energy transition as our customers work to decarbonize their energy needs. This is a great opportunity for us. With General Hydrogen, we’re pleased to have reached this agreement with them. This project in Louisiana will feature our novel BrightLoop technology that will provide carbon-negative hydrogen—from biomass, and we’ll sequester the CO2—to help our customer decarbonize, and General Hydrogen will help us distribute that hydrogen. They have been selling hydrogen and other gasses

for decades so it’s not something new for them, but it’s an opportunity for them to be able to expand their network further west. It’s a win-win for both of us.

BMM: What’s the timeline to develop this new facility and when do you expect it to come online?

Johnson: We’re going through the project development the design phase right now ... We expect to be making hydrogen in this unit by 2026. It doesn’t seem like too long from now, and we’ve got a lot of work to do to make that happen.

BMM: What is Brightloop? How do you use it to make hydrogen from biomass? And what about carbon capture?

Listen to Johnson’s response by tuning into the podcast at www.biomassmagazine.com/pages/podcasts

Don't Miss an Episode:

Biomass Magazine’s podcast series:

S3 E14 Adding Value to Biomass Energy Operations

Featuring Bruce Bruso, CBA Environmental Solutions

S2 E12 Current Global Wood Pellet Market Dynamics

Featuring William Strauss, FutureMetrics

S2 E11 Remote Monitoring for Assets in the Biomass Industry

Featuring Scott Affelt, Expert Microsystems Inc.

Interested in being a guest?

Contact Danielle Piekarski at dpiekarski@bbiinternational.com

10 BIOMASS MAGAZINE | ISSUE 4, 2023

PLAY

Brandy Johnson

North American Wood Fiber Pricing and Demand

BY BROOKS MENDELL AND STEPHEN WRIGHT

Wood fiber markets are largely retreating across North America as firms shutter less competitive operations. In the Pacific Northwest, WestRock’s closure of its Tacoma, Washington, pulp mill adds to Packaging Corp. of America’s Wallula, Washington, curtailment and the continued shuttering of Cosmopolis. In Eastern Canada, Domtar is closing its Espanola, Ontario, pulp mill. Western Canada continues to struggle with fiber availability, and Paper Excellence extending the curtailment at their Crofton, British Columbia, mill adds to the list of regional closures and curtailments. The South is losing WestRock’s pulp mill in Charleston, South Carolina, Evergreen Packaging’s Canton, North Carolina, pulpmill, and a Roseburg particleboard mill in Taylorsville, Mississippi.

Capital is still flowing into the forest industry. Two new oriented strand board mills are being built in the South, in addition to several new and expanding pellet mills. Longview, Washington, is also gaining a new pellet mill, being built by Drax. In addition, the recently announced merger of WestRock and SmurfitKappa creates the largest paper manufacturer in the world.

Despite these investments, mill events impacted markets. One forestry executive in the South observed, “Pulp mill closures, like those in Charleston and Panama City, have a ripple effect” on regional pulpwood and fiber markets. On the same theme, a regional manager for a wood products manufacturer with operations in the Lake States and south central U.S., said, “Pulpwood is in the trash in my areas right now. Some guys are leaving it in the woods.”

With respect to fiber prices, the Northeast stands out as an exception, as prices increased in all four fiber categories (Figure 1). Hardwood residual chip prices increased the most with an 18% rise. Hardwood roundwood prices jumped 11% while softwood roundwood prices increased 14%. Despite weak finished product markets, these increases are likely due to difficult logging conditions brought on by the wettest summer on record for the region.

In the West, softwood fiber prices fell 13% for chips and pulp logs. The reset from high prices last year and continued contraction in mill demand resulted in lower prices year-over-year for chips and pulplogs. U.S. South fiber prices remained less volatile than other

North American regions. Southeast softwood chips fell 3% quarter-over-quarter. All southern fiber prices are 4-7% lower year-overyear. Weak paper markets over the past year continue to erode fiber demand and contribute to the price reductions.

In western Canada, British Columbia softwood chip prices fell 17% and softwood pulplog prices dipped 4%. Despite fiber shortages, prices fell recently, though both chips and roundwood are slightly higher on a year-over-year basis. In eastern Canada, softwood chip prices fell 6% in Ontario and Quebec. Maritime roundwood prices rose for both softwood and hardwood, the only North American region with prices up across all products.

This article includes data from the Forisk Wood Fiber Review and the Forisk Research Quarterly.

Authors: Brooks Mendell and Stephen Wright Forisk Consulting LLC 770-725-8477 bmendell@forisk.com

BIOMASSMAGAZINE.COM 11

REPORT ¦

SOURCE: FORISK WOOD FIBER REVIEW

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Biomass Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

BY ANNA SIMET

12 BIOMASS MAGAZINE | ISSUE 4, 2023

¦ RNG Armed with 25 years of experience and a robust portfolio, Bioenergy Devco recently fired up its first U.S. digester.

All the Right FOODS

BIOMASSMAGAZINE.COM 13

The Maryland Bioenergy Center’s digestion tanks can recycle 110,000 tons of organic food waste each year.

IMAGE: BIOENERGY DEVCO

About 15 miles southwest of Baltimore, the town of Jessup is right in the heart of the Maryland Food Center Authority. Stretching across nearly 400 acres, the center includes the Maryland Wholesale Produce Market and the Maryland Wholesale Seafood Market, with a self-proclaimed mission of providing quality food products efficiently and inexpensively.

But inevitably, where there is perishable food, there is waste. And to Bioenergy Devco, the site was the ideal candidate for a food waste-based anaerobic digestion (AD) project. To date, the company has constructed over 250 AD projects in seven countries. “We have the largest market share in Italy and France for AD plants and biological operations,” says Shawn Kreloff, CEO. “A few years ago, we decided to bring the business to the U.S., which led us to our first plant in Jessup, and many others are under development.”

When evaluating sites for the company’s first U.S. plant, officials of Howard County, Maryland, were receptive of and enthusiastic about the concept, Kreloff says. “Once they understood what we were doing, they got really excited about it. We received a lot

of support locally and we were able to get land from the state of Maryland. The plant is right in the middle of the Maryland Food Center Authority, which is state property, and there are about 20 to 25 different food processors and distributors within a 10-mile radius. So, it ended up being a great location. You have to have support, you have to have your feedstock, and you need the right place to put your gas.”

The plant took roughly 16 months to construct, with a slight slowdown due to COVID-19. Having a capacity of about 110,000 tons of waste organics, it can produce approximately 312,000 MMBtu of renewable natural gas (RNG) per year, and around 16,000 tons of digestate.

The Process

As for how organic material gets to the facility, Kreloff says it varies. “We’re flexible—sometimes, they bring it to us, and other times we work with third-party waste haulers looking for a place for their organic waste. We also work directly with food processors and distributors.

When trucks arrive at the Jessup facility, they drive over a scale while en route to the receiving building (they will drive over

another scale when leaving, to calculate the weight of what was left behind). There, the door closes and negative air pressure assures the air is filtered prior to leaving the building. “We have quick-opening and -closing doors,” Kreloff explains. “As trucks come in the doors open, but there is a massive amount of air moving around the building, which keeps the air pressure inside—if there is any odor, and really there isn’t that much—it doesn’t leave the building.”

If the delivery is liquid waste, the truck’s contents are pumped directly into a pre-tank. If it is solid—i.e., fruits or veg-

14 BIOMASS MAGAZINE | ISSUE 4, 2023

‘You have to have support, you have to have your feedstock, and you need the right place to put your gas.’

¦ RNG

—Shawn Kreloff, CEO, Bioenergy Devco

etables—it’s dumped on the tipping floor and visually inspected. “We pride ourselves on the fact that once the material is tipped on the floor, it doesn’t stay there for long,” Kreloff says. “It goes right into the feed hoppers. If it spends an hour outside the tank, I would be surprised.”

As for the importance of the visual inspection, you never know what’s in the back of a waste-hauling truck, he says. “We want to ensure what’s going into the tanks is what we expect, so we’re looking for anomalies—sometimes, there is metal or wood in there, and we want to remove that. We also have our own lab on-site where we do testing if the material is from someone we really don’t know.”

Inspected feedstock is lifted by front loaders and tipped into the hopper where augers move the material to the next stage. If it arrives in packaging, there’s a solution for that, too. “We have our own depackaging equipment,” Kreloff explains. “It does several things—simultaneously depackages paper and plastic, and then slurries the organic material, creating kind of a liquid smoothie thickness.”

Food packaging is disposed of into a container and eventually hauled away. “We

always try to make sure that it’s recycled,” Kreloff says.

From the initial pre-tanks, the slurry is custom-blended and sent into large digester tanks, where it is continuously mixed and kept at a steady temperature to optimize microbe performance. As biogas is generated, the double membrane at the top of the tank rises. Biogas is pumped out of tank and sent to a gas filtration skid to be filtered and cleaned for pipeline injection, and can also be sent into the facility’s combined-heat-

and-power unit (CHP). “The unit makes all the energy for our plant, around 1 MW, and we use the waste heat for our tanks,” Kreloff says. “We can even use our own biogas to make power and be to be completely off the grid if we choose, or supply backup power in case of an emergency. We’re working with some utilities to do that. In areas like where we are—industrial with a lot of refrigeration—it’s good to have backup power.”

15

The Maryland Bioenergy Center has a combined-heat-and-power unit that can generate up to 1 MW of power to be used on-site or as a backup power source for neighboring businesses in the case of an emergency. IMAGE:MARYLAND ENERGY ADMINISTRATION

Legislation to Combat Food Waste

According to the Maryland Department of the Environment, in 2020, approximately 774,400 tons of food waste was disposed of in Maryland in landfills and incinerators. Only 167,200 tons were recycled at organic recycling facilities such as composters and anaerobic digesters. However, new legislation has been passed to reduce the amount of landfilled organics. House Bill 264/Senate Bill 483 establishes certain regulatory conditions for persons required to divert food residuals from final disposal in a refuse disposal system. The law went into effect beginning Jan. 1, 2023, for persons, businesses or cafeterias generating two or more tons a week of food residuals, and will go into effect on Jan. 1 of next year for those generating 1 ton per week. There are exceptions, however, including one for entities that are located more than 30 miles away from a recycling facility that can accept the entirety of their organic waste. Several other states—including California, Connecticut, Massachusetts and Vermont—have passed laws to ban, divert or reduce the amount of landfilled food waste.

16 BIOMASS MAGAZINE | ISSUE 4, 2023 MA IN OFFICE Greendale, WI 414.529.0240

IMAGE:MARYLAND

The Maryland Department of Energy maintains an interactive map that illustrates known organics recycling facilities in and around Maryland, as well as each facility’s 30-mile buffer.

DEPARTMENT OF ENERGY

To help with the cost of the CHP unit, the Maryland Energy Administration provided Bioenergy Devco with $467,500 from its CHP Grant Program, funded by the Maryland Strategic Energy Investment Fund.

Finally, the solids left behind after the digestion process are pumped out of the bottom of the tank, dewatered and turned into digestate, and any remaining water is either recycled back into the process or filtered through the plant’s on-site wastewater treatment system.

While the amount of food waste generated in the U.S. is quite astounding— nearly 60 million tons each year, or 30 to 40% of the food supply, according to USDA—it is vastly underutilized.

Food Waste Potential, Challenges

The statistics speak for themselves: According to the American Biogas Council, the U.S. has more than 2,400 sites producing biogas in all 50 states. That includes 473 anaerobic digesters on farms, 1,269 at water resource recovery facilities, 566 landfill gas projects, but only approximately 102 stand-alone systems that digest food waste. The ABC believes there is potential for about 2,000 of them. Kreloff says their lack of deployment is likely because of the difficult-to-digest nature of food waste.

“It’s exponentially more difficult than an imal manure-based systems because the biology is a lot more complicated,” he says.

“When we first commission our tanks, we actually seed our tanks with cow manure— the microbes that are in the cow manure are what we need.”

When using 100% food waste, the microbes require extra care, which Kre loff believes is one of the main reasons that manure-based plants are much more common around the U.S. and the world.

“You’re replacing the microbes with the feedstock every time it goes in, but with food waste, you really have to take care of them,” he says. “Digesters can easily

become upset—things like acid can build up and become antimicrobial. But while it’s a lot more difficult to do, we’re food waste experts. We have 18 patents and have done a lot of invention and creation.”

Kreloff highlights Bioenergy Devco’s lab in Italy, which he says is the largest lab in the world dedicated to AD, with over 100,000 tests performed a year. The company also has a small testing lab at the Jessup facility.

As far as future plans go, Kreloff could divulge details of a couple of new projects—one with a poultry partner on the Delmarva Peninsula on the eastern shore of the Chesapeake Bay, and another in Middlesex County, New Jersey, to build a digester next to a landfill in order to repurpose the organic material destined for the landfill.

Both projects will produce RNG. Kreloff says the incentives to make RNG right now are far better than those to make electricity, but if the U.S. EPA ever implements eRINs through the Renewable Fuel Standard, that could change things.

Kreloff adds that hydrogen from methane is also a possibility for the company.

“Most of the hydrogen we have in the country right now is made from methane that has been steam reformed. Mixing steam with methane under the right pressure changes the methane into hydrogen, and we’re definitely interested in that. We’re in the R&D process right now to make it happen.”

Author: Anna Simet asimet@bbiinternational.com

BIOMASSMAGAZINE.COM 17

RNG ¦

EXPLORING SAF FEEDSTOCK MARKETS

At the inaugural North American SAF Conference & Expo, panelists discussed opportunities, risks and challenges regarding feedstock for the momentous SAF industry.

BY KATIE SCHROEDER

BY KATIE SCHROEDER

As the SAF industry is attempting to rise to the Grand Challenge set forth by the government to reach three billion gallons of SAF by 2030, one of the major obstacles in is the need for a large feedstock volume. Multiple panels at the first annual North American Sustainable Aviation Fuel Conference held in Minneapolis, Minnesota, in late August explored the biomass feedstock landscape.

Trip Jobe, vice president of sales with ResourceWise’s Forest Value Chain, explained the importance of doing a feedstock availability assessment to better understand the market dynamics around feedstocks SAF producers may be interested in utilizing. The company’s resource studies evaluate risk by examining a feedstock’s availability, market dynamics, government regulations and incentives, and sustainability impacts. Jobe discussed risk dynamics within SAF projects and explained how feedstock resource assessments help mitigate risk for both investors and developers, contributing to the site’s longterm success.

According to ResourceWise, an estimated 1 billion dry tons of biomass can be collected sustainably each year in the U.S., enough to produce 50 to 60 billion gallons of low-carbon biofuels. These resources include corn grain, oil seeds, algae and other fats, oils and greases, ag and forestry residues, wood mill waste, municipal solid waste streams, wet wastes like manure and wastewater treatment sludge, and dedicated energy crops. The largest, Jobe said, is forestry

resources, as there are approximately 1.4 trillion live trees on more than 635 million acres of forestland in the continental U.S.

Feedstock availability is an important consideration for developers who are exploring a SAF project. No singular feedstock is going to be able to supply the entire volume of SAF needed, Jobe emphasized. Understanding the location, trade flows and market for that particular feedstock are all part of the assessment. One factor that can limit availability is the presence of other entities that utilize the same feedstock and could compete for usage. “If you’re using woody forest residues, what are other markets out there? How is that going

18 BIOMASS MAGAZINE | ISSUE 4, 2023

Tim Portz, program director at BBI International, delivers the welcome remarks at the North American SAF Conference & Expo.

IMAGE: JOE SZURSZEWSKI

¦ SAF

to impact your potential either from a consumption perspective or a pricing perspective as other biomass markets or other feedstocks … come into your area or location,” Jobe said.

Looking for disruptions or additions to the market and at how those elements could impact the future of the project is key to the long-term viability of these projects, according to Jobe. “It’s really incredibly important if we think about these developments that take two to three years from shovel in the ground to operating,” he says. “How are we looking at the markets today, and how are we looking at them in three years when you’re starting to operate, and 10 years

into the future? What would be the implications for those markets?”

Regulations around various feedstocks also need to be considered, Jobe explained. He referenced the EU’s restrictions on food crops as feedstocks for SAF, and discussed how that type of regulation will make the use of these feedstocks a battle in some parts of the world.

Sustainability is the another element of feedstock risk Jobe discussed. Many companies are pursuing decarbonization but have started to move away from using carbon credits and offsets to meet their net zero goals, and are instead developing their own projects.

BIOMASSMAGAZINE.COM 19

“Will carbon credits go away? Absolutely not,” he says. “We know that there are still going to be markets for them, there are still going to be companies that are out there, but what’s the value of it? Jobe explained that though carbon markets may be a potential value stream for some SAF projects, it is important to consider that these markets may not be an attractive revenue source due to market uncertainty.

Biomass Case Study

Jobe shared a case study of USA BioEnergy in Bon Weir, Texas, in which Forest2Market assessed the availability and sustainability of feedstock supply both currently and in the future. The $1.7 billion biorefinery is planned to convert 1 million green tons of biomass into 34 million gallons of renewable fuel per year including SAF, renewable naphtha and renewable diesel. The study examined market supply and demand, considering local landowners and suppliers, timberland characteristics, forest supply characteristics and pine pulpwood consumers. “We have to make sure we meet RFS2 standards, but what’s the livelihood of the land owners, is it state-owned, is it plantation, is it private-owned, corporately owned?” Jobe said. “All of those factor into the supply and demand, the pricing, and the ability to set up long-term contracts for this type of development.”

Other aspects considered include feedstock availability, price forecast and related projections. Studying inventory in light of harvest timing, which would take place every 15 years for soft pine feedstock, is an important part of understanding the ongoing sustainability of these markets, Jobe explained. Potential competition is also important to consider—knowing the likelihood of a mill starting up nearby helps developers become aware of potential future reductions in woody residues when making long-term investments. “Ultimately, develop a forecast— what does that forecast look like for 20 years? How does that, in the normal case, in the best case, and potentially the worst case, with the impacts across all these different categories, [impact] the project market?” Jobe said.

Feedstock supply studies are a good tool for reducing the risk of these expensive development projects, he added. With so many feedstock options—an estimated one billion dry tons of biomass total—a lot of innovation is occurring, and a new market brings risk. “The potential reward of producing 50 to 60 billion gallons of low-carbon biofuel has a lot of people interested.”

Lipids Markets

Lipids of a variety of types are currently being used for SAF production. Ryan Standard, managing editor of Americas with

Fastmarkets, provided a snapshot of current lipids markets in the U.S. and outlined the limitations of various lipids as feedstocks for SAF. The feedstocks discussed included tallow, used cooking oil (UCO), yellow grease, distillers corn oil (DCO) and soybean oil.

The total lipid feedstock capacity is not capable of meeting SAF production goals on its own. One factor is competition with the renewable diesel and biodiesel industries, which both need a significant volume of these feedstocks and are growing rapidly. According to Standard, the renewable diesel industry alone needs 28 billion pounds (14 million tons) of feedstock each year, while biodiesel industry needs around 16.3 billion pounds of feedstock. Total U.S. production of low-carbon lipid feedstocks grew 3.4% in 2023, reaching 18.1 billion pounds. There are 28 billion pounds of soybean oil on the market as well; however, the two combined are not able to meet the 43.5 billion-pound capacity demand found in the biodiesel, renewable diesel and early-stage SAF industries. “If you take every single pound of rendered fat, used cooking oil and distillers corn oil, it’s not even close enough to fuel the current capacity in the market,” Standard said.

Domestic supply is unable to satisfy market demand for low-carbon feedstocks, so producers have begun looking abroad, importing the needed capacity from around the

20 BIOMASS MAGAZINE | ISSUE 4, 2023

IMAGE: ANNA SIMET

An engaged audience asks panelists questions following presentations at the North American SAF Conference & Expo.

‘The potential reward of producing 50 to 60 billion gallons of low-carbon biofuel has a lot of people interested.’

—Trip Jobe, ResourceWise

world. Standard explained the trade balance has shifted in the U.S. for feedstocks such as tallow and UCO, to the point that the U.S. is importing more than it exports. “We’ve seen a lot of imports start to come into the U.S.— tallow, used cooking oil, all of the products that have been covered for the past several years—historically, they were not imported, they were exported; there [was] more material in the U.S. than the U.S. market could use,” he said.

Shifting Trade Balance

Seven or eight years ago, producers of UCO and tallow were excited to export volume to new markets such as China, prior to the renewable diesel and biodiesel markets’ significant growth. Now, producers are importing the equivalent of seven million heads of cattle worth of tallow, primarily from Australia and New Zealand, along with volume from Canada, Brazil, Uruguay and Sweden. The U.S. is also importing large volumes of UCO from China, Australia, New Zealand, South America and Canada. Most

of that imported volume, around 500,000 metric tons of it, is coming from China, Standard explained. Part of the import market growth is due to arbitrage opportunities, where renewable fuel producers are able to buy feedstock from other countries at a cheaper rate than U.S. feedstock.

Low-carbon lipids such as tallow and UCO are waste products; therefore, the supply of them is unable to drastically increase. “Because they are considered waste-based, no meat packer is going to start slaughtering cattle for tallow—it’s steaks, it’s hamburgers, it’s meat,” Standard explained. “It’s the same thing with pork, it’s the same thing with poultry, and that may seem obvious to some of you, but I’ve been asked that question many, many, many times over the years, ‘Why don’t these guys just kill more cattle and pump their tallow out?’ Well, you look at the price of a T-bone and you look at the price of a pound of tallow, and the answer’s pretty obvious.”

Soybean oil prices increased this year due to drought throughout parts of the Mid-

west, according to Standard. He said that higher RBD (refined, bleached and deodorized) soybean oil prices could possibly lead to lower UCO availability, as restaurants may slow down turnover on their fryers to save money. However, UCO volumes have gone up in recent years due to the post-COVID-19 rebound in the restaurant business. Higher DCO volumes also contributed to the 2023 increase in low-carbon lipids volume in the U.S., he said. Increased ethanol production and improved oil extraction technology have contributed to the increase in volume. “That’s not enough to fuel the growth, and I think things are just going to continue to get more competitive in these markets, as the carbon credits are there, the tax credits are there, and the RIN values should be there,” he said. Alternative feedstocks such as corn stover and camelina, alongside ethanol, are the path forward for expanding the industry, Standard said.

Author: Katie Schroeder Katie.schroeder@bbiinternational.com

BIOMASSMAGAZINE.COM 21

SAF ¦

UTILIZING BAGASSE WASTE TO BATTLE DEFORESTATION

BY CORNELIUS VAN TONDER

BY CORNELIUS VAN TONDER

Like large parts of the developing world, Malawi is a country that faces severe deforestation with a heavy reliance on rudimentary energy sources. To understand the energy landscape within Africa, one must know that at the root of every home cooked meal is charred wood as the main energy source. Locals will buy this charred wood at their nearest market and carry it over underdeveloped terrains on bicycles, most of the time over long distances. The charred wood is then used in

a drum-type grill setup in the open air. Within this cooking setup, the locals are not equipped with fire lighters, which necessitates the use of waste plastic and some kindle from a nearby bush to set the char ablaze. The fire would then be required to sustain heat for approximately two hours, in which typically Chambo and Nsima would be cooked (freshwater fish from nearby lake Malawi and an unsalted maize porridge).

22 BIOMASS MAGAZINE | ISSUE 4, 2023

BARA Industrial Plant Consultants recently designed and built a pellet plant in rural Malawi, aiming to utilize sugar manufacturing waste and reduce deforestation.

IMAGE: BARA INDUSTRIAL PLANT CONSULTANTS CONTRIBUTION:

The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Biomass Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

According to the Global Forest Watch, a decline of 224,000 hectares (approx. 553,500 acres) of tree cover has been reported in Malawi since 2001. The loss in tree cover equates to 94 metric tons CO2e emissions. This is especially prevalent in areas surrounding northern and central Malawi, with Nkhota Bay and Mzimba being responsible for 52% of the total tree cover loss in the country. On a global scale, this equates to below 0.1% of total deforestation, but this is quite significant, considering that Malawi has a population of less than 20 million people. While deforestation is so prevalent in these areas, the far north of Malawi is partially protected due to the conservation reserve located on the northwestern border with Zambia. However, a marked decline in tree cover within these areas can still be noted, regardless of the conservation status.

Considering the statistics and the energy landscape within Malawi, a solution is required to produce an affordable fuel alternative—something that will change the energy landscape and empower the locals to better living conditions. This is true for most of the developing world, but the boundaries of such a solution are tightly defined. Being that it must be cost effective, as most of Malawi is far below the global average poverty line, the solution must outperform in the market with the charred wood product. It has to be durable and easy to combust within the current cooking setup without doing any modifications. The last point is extremely relevant when taking a new product to market within an underdeveloped world: The product will not sell if it cannot be used on what is at home. This would mean that an energy-dense product with a high calorific value and a low burnout time would be required. Furthermore, this energy source must measure up or even outperform any durability test and standards, as the product will face harsh handling conditions.

Considering all these requirements, one of Malawi’s sugar producers approached BARA Industrial Plant Consultants (a multi-disciplinary consulting firm with a footprint in both the U.S. and Southern Africa) to design, manufacture and implement a solution that would utilize bagasse waste from the sugar mill while addressing the energy landscape and deforestation need, as well as the sugar mill’s problem of waste handling. In addition, a solution that could potentially change the energy landscape in Malawi and create a previously nonexistent revenue stream—the perfect solution for the sugar mill and the local communities.

During the initial feasibility studies, direct feedstock briquetting was ruled out as a solution due to the lack of durability thereof, thus making it unfeasible for the rough terrain the product needs to travel. Direct feedstock briquetting also showed that it would not be able to sustain the heating requirements, and that the preconditioning requirements would render the process as unviable from an economic standpoint. That is considering that the moisture content in the raw bagasse is quite high and variable, depending on the time of milling season. Alternatively, biofuel technology like

pyrolysis and torrefaction of the bagasse were considered, but the liquid market and upfront investment were found to be outside the scope of the current project. However, this was placed as a future consideration, as it does show promising return on investment. The biggest hesitation in this case was market maturity of pyrolysis products for the Malawian landscape.

A solution was developed to use the bagasse as-is in a densification process, for pellets 12 millimeter (mm) by 15 mm, and then secondary projects would include further biomass beneficiation via thermochemical processing techniques. The project kicked off with much excitement, but it was soon realized that to get things done in central Africa does not come without its headaches. From power installations to availability of resources like quality steel for fabrication, or even concrete for flooring, were all extremely challenging. However, after a 12-week manufacturing and installation period, commissioning started.

As the plant was made live and the equipment started, Junior Fakane, a Malawian plant operator, excitedly exclaimed, “Today, I will cook Nsima with the product from my plant!” But much to his dismay—within the first hour—the plant grinded to a halt. It was soon learned by the whole team that pelleting of bagasse is not as easy as one would think, considering that bagasse is exposed to various elements, forms of degradations and upstream variability in the sugar extraction process. All these factors contribute to the large-scale variability in feedstock, posing a significant question: How can such large-scale variability be overcome while still maintaining pellet integrity and keeping the process design within the limits of the equipment?

The answer did not come easy, as this led to a time of rigorous testing, first principal compression model development, investigating and optimizing every single process variable within the pelleting process, from feedstock moisture to compression ratio. The solution was found within the compression rate. Bagasse is a notoriously difficult material to handle, as it has a high enough sugar content to block any chute, choke any auger and compact any mill, a low enough density to make throughput quite challenging, and a variability in incoming fiber length that adds another layer of complexity. All these challenges are being overcome, with rigorous testing and optimization. The pellets produced are being market tested, and the feedback has been remarkable.

In conclusion, pellets from waste sources are a viable source of energy in the developing world that may not even have access to fossil fuels.

Author: Cornelius Van Tonder Director, BARA Industrial Plant Consultants cornelius@baraconsultants.com www.baraconsultants.com

BIOMASSMAGAZINE.COM 23

BAGASSE ¦

REACH 7,000 PROFESSIONALS All Biomass Magazine subscribers All RNG Coalition Members Mailed to Renewable Natural Gas Production Facilities in North America International Biomass Conference & Expo (in attendee bags) RNG Summit RNG Works PURCHASE A SPOT ON THE RENEWABLE NATURAL GAS MAP Receive 12 Months FREE Online Advertising! Advertise now on the Renewable Natural Gas Map. It is the easiest and most cost-effective way to get your name, product and/or service in front of renewable natural gas professionals for 12 months at a time. Book Your Ad AD SPOTS LIMITED Ad Deadline: Nov. 1, 2023 Mailed with the Quarter 1 issue of Need more info on advertising opportunities? service@bbiinternational.com - 866-746-8385 - BiomassMagazine.com 2024

REACH YOUR TARGET AUDIENCE

UNEXPECTED RISKS OF HYDROGEN SULFIDE AT RNG PLANTS

Understanding the risks of anaerobic digester hydrogen sulfide accumulation can improve safety and efficiency at renewable natural gas facilities.

BY PETER QUOSAI AND DAVE ELLIS

Renewable natural gas (RNG) plants play a vital role in converting food and other organic wastes into clean energy through anaerobic digestion. While plant operators are familiar with the dangers of poorly ventilated spaces and hydrogen sulfide (H2S) accumulation, this article sheds light on three common scenarios where H2S can pose a threat in well-ventilated spaces and at well-maintained digester sites. Understanding these risks can improve the safety and efficiency of RNG plants. The following information will explore the risks

and possible remedies to prevent a potential disaster.

Rapid release of dissolved H2S gas: Under normal circumstances, feedstocks being received at an anaerobic digester may contain H2S dissolved in alkaline or neutral pH feedstocks. When these H2Srich feedstocks are mixed with a low pH counterpart, the H2S becomes less soluble and is quickly converted to a gas. For example, mixing acidified industrial fats, oils and grease (FOG) waste and H2S-rich alkaline manure or brewery waste could release a surge of H2S bubbles from the feedstock

storage tank. Such instances can endanger plant workers by exposing them to a cloud of poisonous gas.

Sulfuric acid formation and corrosion: In some digesters, air injection is used to lower the H2S concentration present in the biogas. While this method economically mitigates H2S in the biogas, it introduces a new concern. Sulfur-oxidizing bacteria use the oxygen in the air to convert part of the H2S gas to sulfuric acid. This sulfuric acid can then corrode concrete digester walls, roof structures, or other unprotected materials in the digester’s headspace. If left

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Biomass Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

26 BIOMASS MAGAZINE | ISSUE 4, 2023

50cfm Biogas 50,000cfm Biogas 50ppm H2S 50,000ppm H2S In-Situ Treatment (Iron or Ox ygen) Adsorption (Iron or Carbon) Bio -Scrubber Scrubber with Caustic Recovery Condensation

Figure 1: This diagram shows a selection of technologies for hydrogen sulfide removal from biogas, and the guidelines for which hydrogen sulfide concentrations and biogas flows may be cost effective.

SOURCE: AZURA ASSOCIATES

unchecked, corrosion can cause significant damage to plant infrastructure, leading to costly repairs and potentially hazardous conditions for workers if structural digester elements collapse.

H2S accumulation in anaerobic sediments: Digestate storage lagoons, common to many RNG plants, usually accumulate anaerobic sediments over time. These sediments can serve as reservoirs where biogas containing H2S can build up unnoticed. Disturbing the sediments before field application or during routine mixing can cause the rapid release of trapped H2S gas, posing a risk of poisoning plant personnel.

Preventive Measures

To mitigate these unexpected risks, plant operators should be vigilant and take appropriate preventive measures. The following are practical solutions.

Feedstock Management: Characterizing feedstocks to identify the potential for hydrogen sulfide generation and release can help operators proactively identify potentially dangerous situations. Once operators know the risks, they can follow simple rules to manage feedstock mixing to avoid a sudden release of H2S. Maintaining separate storage and mixing facilities for feedstocks with significantly different pH levels or sulfur concentrations can prevent dangerous interactions while giving greater control to optimize digester performance.

Sulfide Treatment Systems: Sulfide treatment systems can be economical and effective when designed to meet the needs of the plant. Factors that should be considered include feedstock sulfur concentration, digester biology’s sensitivity to sulfide toxicity, and offtake or engine requirements.

For large-scale systems where biogas is being converted to RNG, large-capital, low-consumable treatment technologies are often considered during the initial process design stage. For smaller systems and existing digesters, in-situ iron addition can

achieve H2S reduction targets. It is important to be aware that the chemical availability of iron additives can vary substantially between additive type and manufacturers.

Air injection for in-situ biological sulfide removal has very low costs per pound of sulfide removed. If a digester has been designed with a high-surface-area headspace and has regular dome maintenance, air-injection may be a promising avenue for sulfide removal. If the digester has not been designed to accommodate sulfur-oxidizing bacteria, other options may need to be explored. Adding iron supplements to a digester can quickly reduce hydrogen sulfide concentrations in biogas and improve digester health. If lower H2S concentrations in biogas or RNG are required, adsorbent media beds and scrubbers should be considered. Figure 1 illustrates some available options and general guidelines for when the different technologies might be selected. While the figure is a useful guide, it is important to consider the specific needs of your project to minimize the overall risk and cost.

Digestate Management: Digestate storage and disposal or land application can be managed to minimize odor, tank cleanout costs, and avoid dangerous H2S release. Owners and operators can benefit from understanding the solids and sulfur loadings in their digestate to manage the risks with minimal cost. For example, high solids digestate storage tanks and lagoons should be mixed to prevent the accumulation of large H2S bubbles in the sediment, as well as reducing the frequency of lagoon clean outs. In-situ treatment systems, including iron-based additives and oxygen injection, can reduce the load of sulfur in the digestate that can be converted to H2S gas. Reducing sulfide concentrations in digestate reduces odorous emissions and risk to operators.

Monitoring and Safety Protocols: Online monitoring of H2S in biogas and in enclosed spaces is standard practice for

RNG plants. However, the safety protocols and gas treatment systems to respond to high H2S concentrations are not standard and should be considered to protect workers and equipment, and to maintain the gas quality requirements for offtake. If an increase in H2S concentration is detected, iron-based additives can be added to the digester to remove H2S from solution. Additionally, regular inspection and maintenance of the flare and biogas handling system can identify corrosion early.

Conclusion

Hydrogen sulfide is a well-known risk to human health, equipment and profitability. While the acute risks of working in confined spaces and corrosion in engines are often discussed, the risks associated with mixing feedstocks, corrosion of digester structures, and lagoon sediments are often overlooked. Understanding these risks not only helps to avoid injuries, but also provides insight into the many biochemical processes at work in an anaerobic digester. By considering each stage in the plant from receiving to gas production to digestate storage, as well as developing safety protocols accordingly, a robust risk management strategy can be devised. Developing a strategy that considers the many biochemical processes present in an anaerobic digester can improve both plant performance and safety. By embracing preventive strategies and scientific insights, we can safeguard personnel, protect property and ensure the continued success of RNG projects, leading the industry toward a cleaner and safer energy landscape.

Authors: David Ellis, Principal Engineer Peter Quosai, Bioprocess Analyst Azura Associates Azuraassociates.com

BIOMASSMAGAZINE.COM 27 BIOGAS ¦

A COLLABORATIVE APPROACH TO HANDLING, STORING BIOCOAL

Advanced Torrefaction Systems and HM3 Energy combine technologies to address high chemical oxygen demand levels in leachate and potential for self-heating in biocoal.

BY THOMAS P. CAUSER AND HIROSHI MORIHARA

Under pressure to decarbonize, many coal plant operators have begun testing biocoal or black pellets produced from torrefied biomass as a renewable, carbon-neutral replacement for coal. The energy content and grindability of biocoal makes it a promising candidate. And, like coal, properly manufactured biocoal is hydrophobic, so it can be stored outdoors, providing capital cost savings for end users. Although the benefits of biocoal are excellent, some practical issues remain to be addressed.

Biocoal Leachate, Self-heating Issues

Some testing of bulk deliveries of sample biocoal by end users has indicated two issues of concern. First, high chemical oxygen demand (COD) levels in leachate can occur when biocoal is stored outdoors in the elements without cover, exposed to rain and snow. As a result, runoff can create environmental challenges. Secondly, there have been instances where biocoal, when stockpiled, has self-heated and ignited.

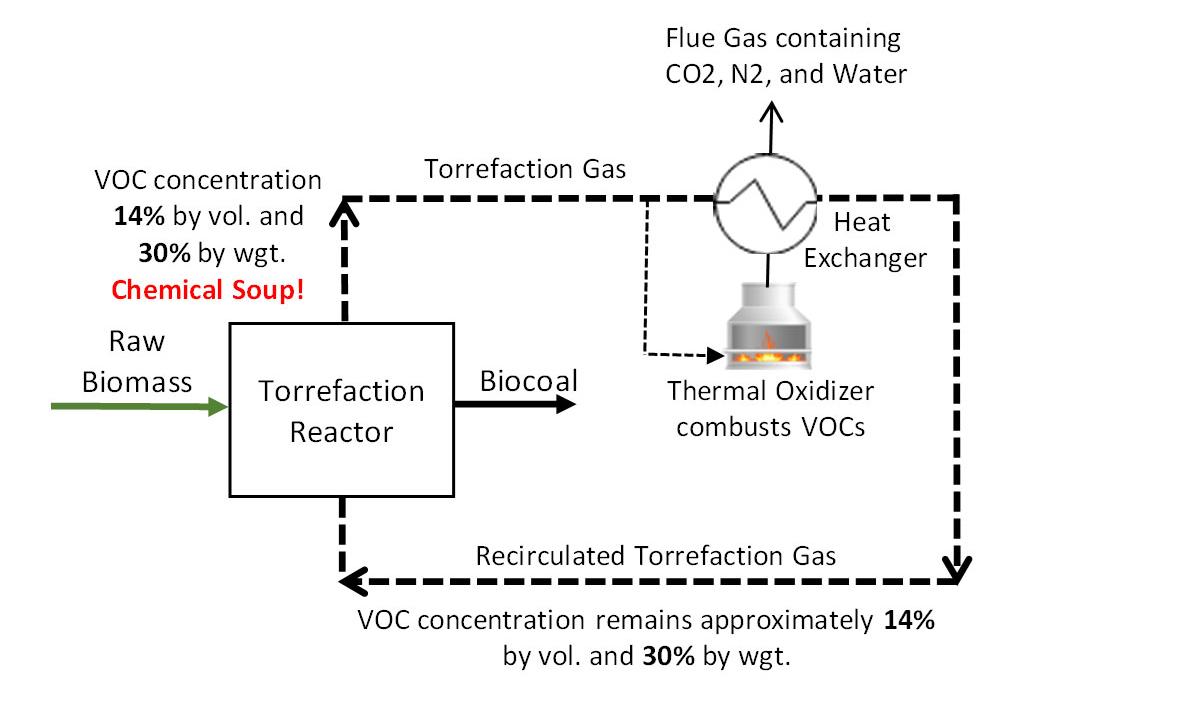

Raw biomass undergoing torrefaction produces volatile organic compounds (VOCs). VOCs can condense and cause serious prob-

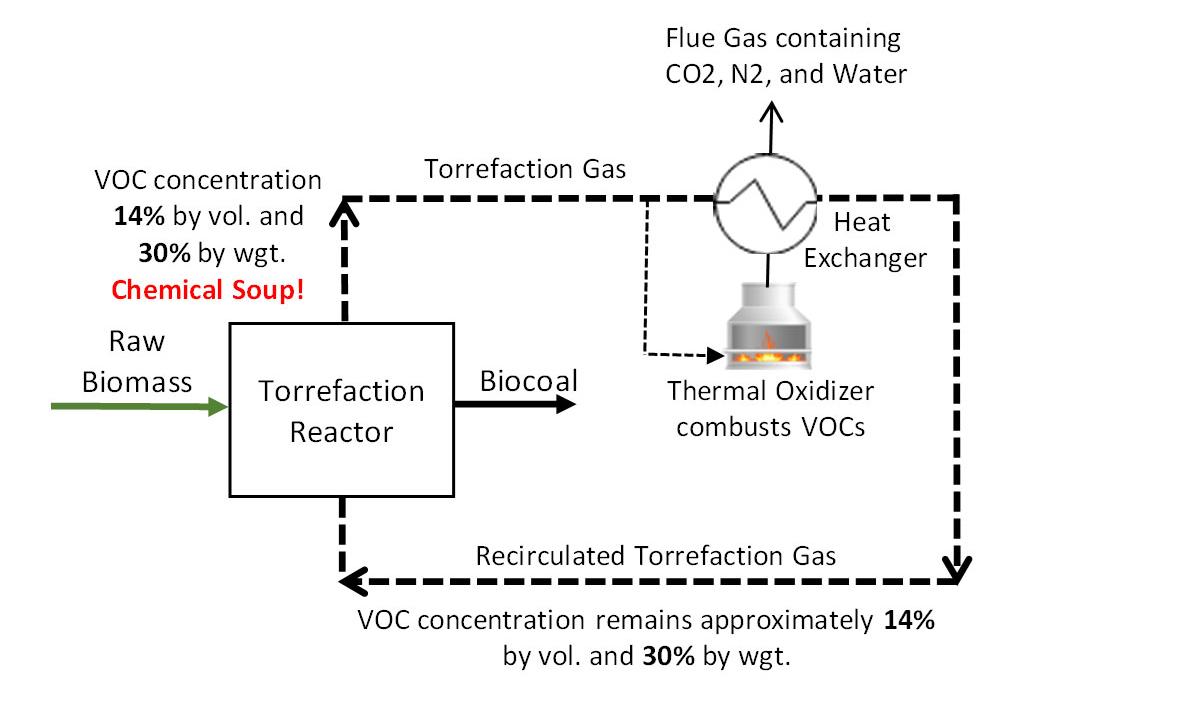

lems both in the process and in the final product. Conventional torrefaction technologies employ recirculation of a major portion of the torrefaction gases, with a small portion of the gas stream extracted and combusted in order to provide adequate temperature control of the larger portion that is then recirculated back to the reactor to provide the necessary process heat. The problem with this method is that the gas recirculated to the reactor is laden with VOCs, and when when used in the reactor, results in a very high concentration of VOCs in the overall torrefaction system—approximately 30% by weight (14% by volume), as shown in Figure 1. As a result, VOCs readily condense and adhere to the surface of the torrefied biomass as it exits the reactor, remaining in the final biocoal product after densification.

Reducing VOCs to Acceptable Levels

Based on extensive experience in torrefaction, HM3 Energy Inc. and Advanced Torrefaction Systems LLC have concluded that the presence of excessive VOCs in the biocoal is the cause of high COD levels in the leachate, self-heating and auto-ignition. To resolve this

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Biomass Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

28 BIOMASS MAGAZINE | ISSUE 4, 2023 ¦ BIOCOAL

SOURCE: ADVANCED TORREFACTION SYSTEMS, HM3 ENERGY

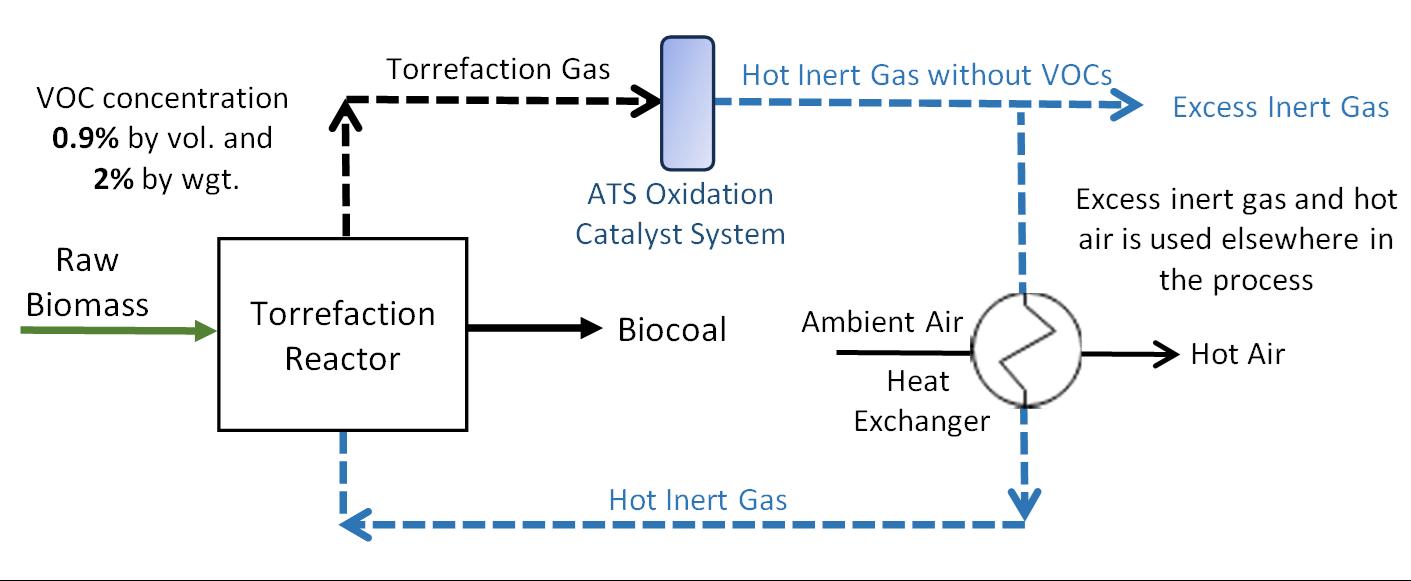

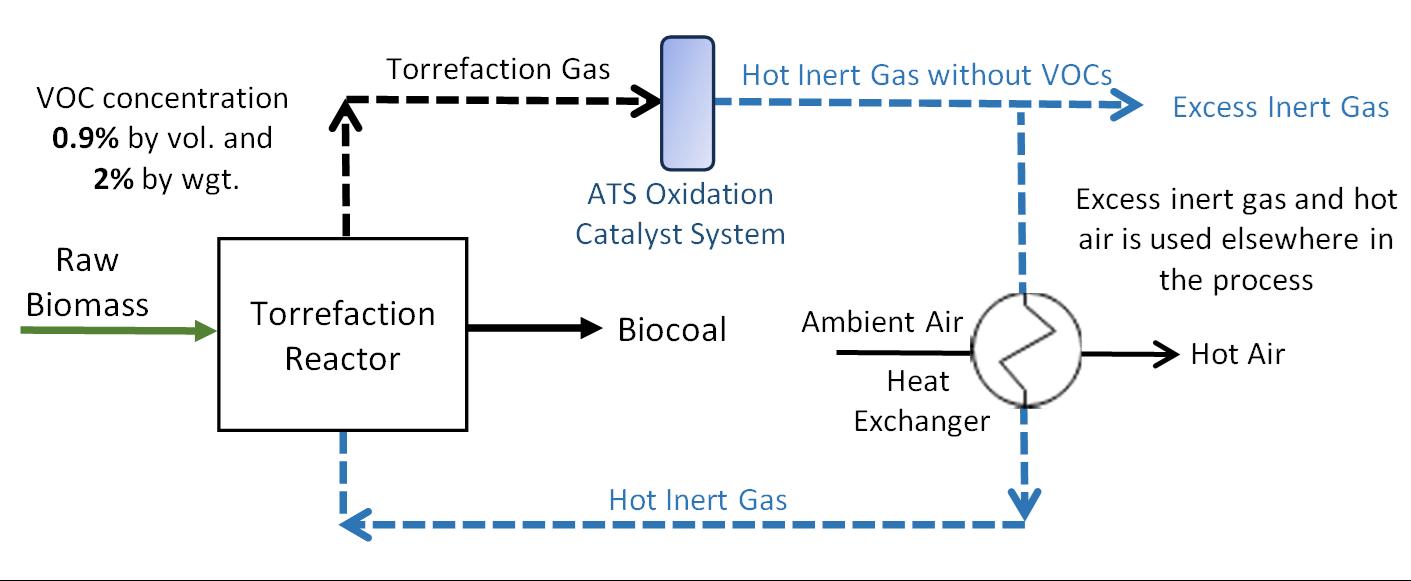

problem, two steps are required. First, the VOCs must not be recirculated to the torrefaction reactor. Secondly, inert gas must be used as a purge gas to strip away any evolving VOCs from the torrefied biomass as it exits the reactor. The combined technologies of HM3 and ATS accomplish these steps.

ATS has designed and patented an oxidation catalyst system that drastically reduces the concentration of VOCs in the overall torrefaction system (Figure 2). The system creates an essentially inert catalyst flue gas that provides the necessary heat to the reactor (without adding VOCs as with conventional torrefaction technologies) and a purge gas that strips VOCs from the biocoal.

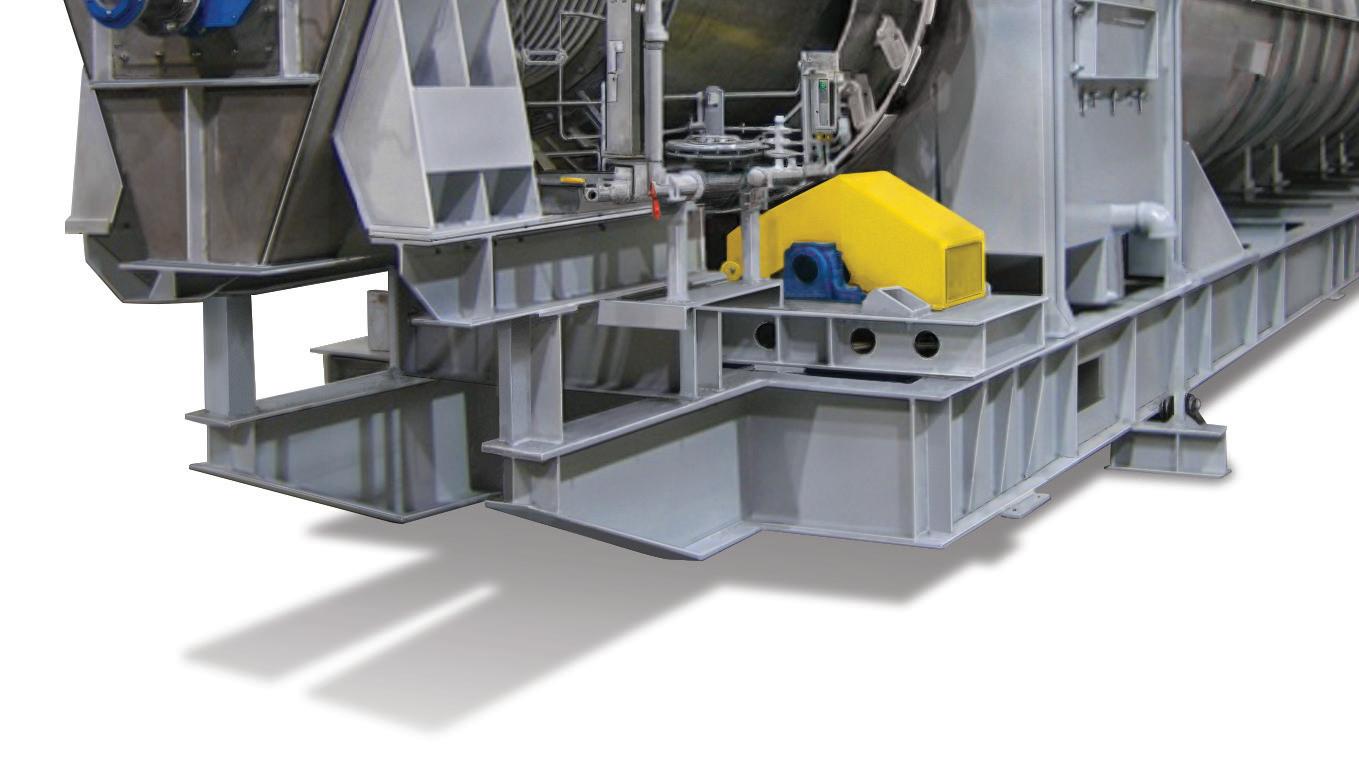

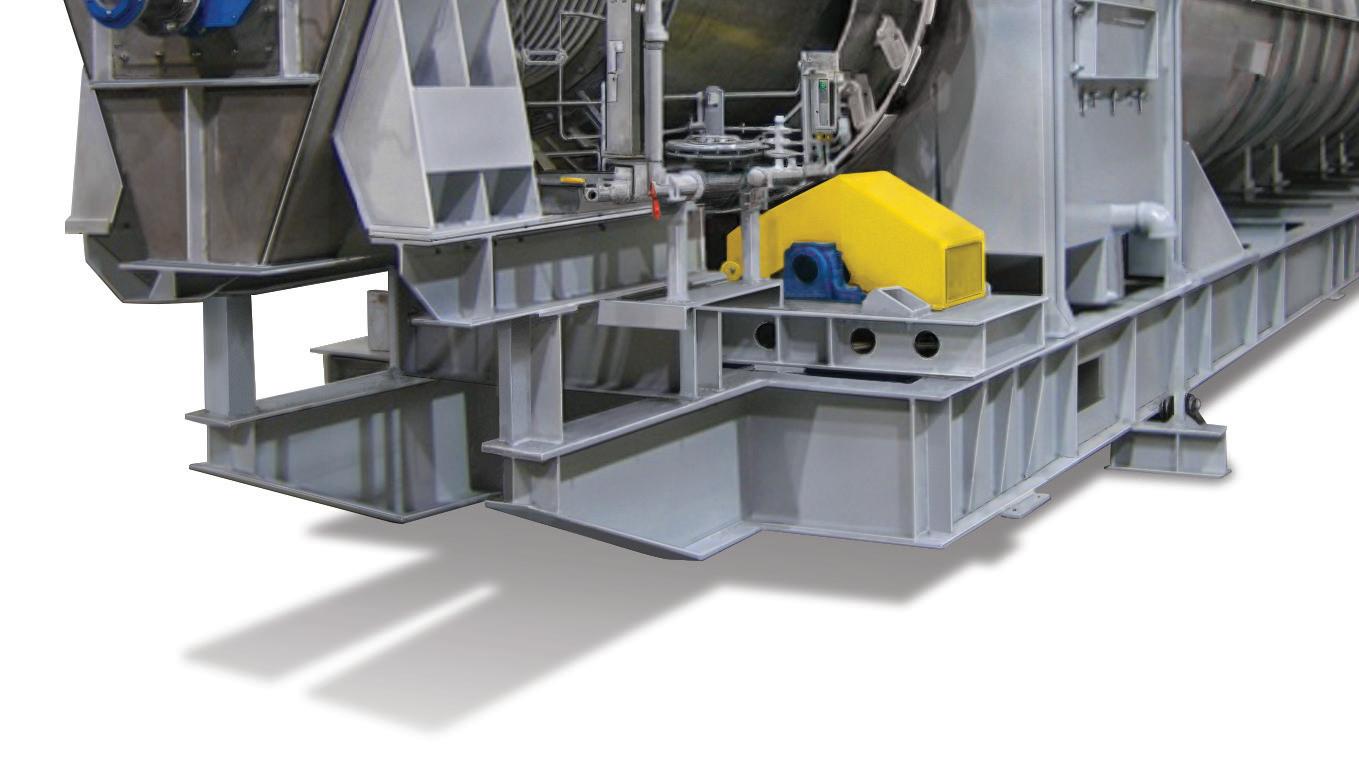

HM3 has designed and patented a three-section, vertical mass flow torrefaction reactor capable of torrefying a broad range of biomass feedstocks. The top section or head space area allows proper disengagement of the countercurrent flow gas stream from the biomass. The middle section dries the biomass, heating the material to torrefaction temperature. Once the biomass is torrefied, it is cooled in the lower section of the reactor, terminating the torrefaction reaction and providing a final purge of any remaining VOCs from the torrefied biomass.

HM3’s torrefaction system provides three core functions: uniform torrefaction with excellent temperature control in the torre-

faction section (no hot spots), controlled termination of the torrefaction reaction in the cooling section, and production of torrefied biomass that has been scrubbed of any remaining VOCs. This reactor design has a high thermal efficiency, is relatively inexpensive and has few moving parts. A simplified block diagram of HM3’s reactor using ATS’s catalytic oxidation system is shown in Figure 3.

In conclusion, the combined HM3 and ATS approach results in a drastic reduction in the concentration of VOCs in the system and a final biocoal product that has been purged of VOCs from its surface. ATS and HM3 believe this reduction of VOCs in conjunction with HM3’s densification into sturdy hydrophobic briquettes will dramatically reduce COD levels in leachate to an acceptable level, and reduce or eliminate the occurrence of self-heating and auto-ignition in storage.

Authors: Thomas P. Causer Advanced Torrefaction Systems LLC www.atscat.com

Hiroshi Morihara HM3 Energy Inc. www.hm3e.com

BIOMASSMAGAZINE.COM 29

SOURCE: ADVANCED TORREFACTION SYSTEMS, HM3 ENERGY

SOURCE: ADVANCED TORREFACTION SYSTEMS, HM3 ENERGY

BIOMASSMAGAZINE.COM 31 Biomass Magazine Marketplace

Since 1972 Xchanger is a leading manufacturer of custom heat exchangers and blower aftercoolers, with over 25,000 units installed worldwide. We can optimize any of our 10 standard product models to control temperature and humidity in almost any application. By making simple changes to our standard models, our Mechanical Engineers are able to provide custom designs at a fraction of the cost. Xchanger 952-933-2559 xchanger.com