www.biomassmagazine.com/pellet Producer Certifications on the Rise Page 16 HOT DEMAND Issue 1, 2023 PLUS: Plant Equipment Considerations

24 Assessing the Russian Wood Pellet Sector

12

Page

Page

DEPARTMENTS

FEATURES

12 MARKETS

Ripple Effects

Sanctions have sent Russia's once-thriving biomass industry into a decline.

By Eugene Gerden

By Eugene Gerden

16 STANDARDS Quality Matters

Chris Wiberg of Biomass Energy Lab discusses the crafting of wood pellet quality standards and the current surge of interest in certifications.

By Anna Simet

By Anna Simet

CONTRIBUTIONS

22 OPERATIONS

Hammer Mill Maintenance: Keys to Performance

Size reduction and homogenization are critical to a pellet mill’s steady, high output.

By Holger Streetz

24 EQUIPMENT

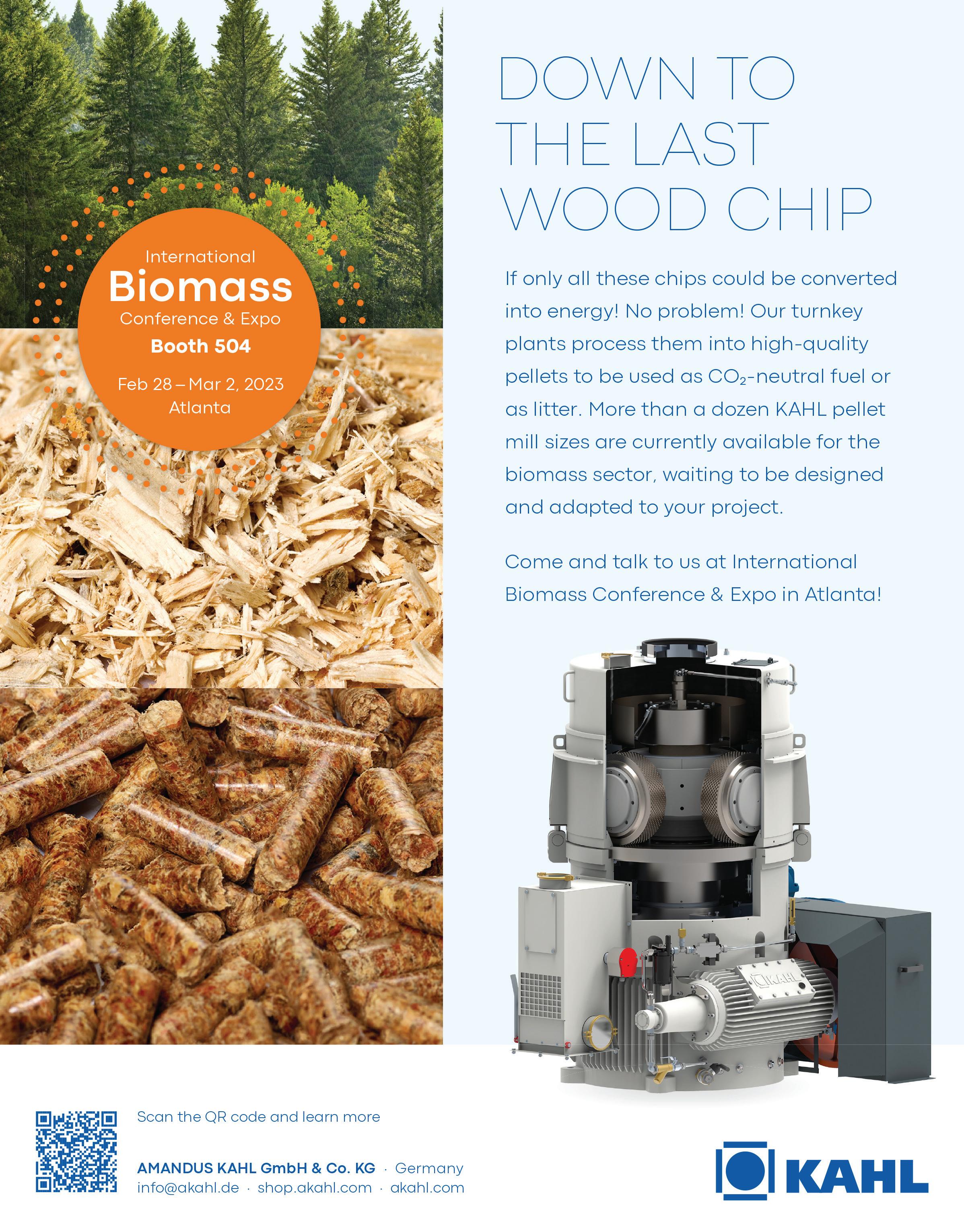

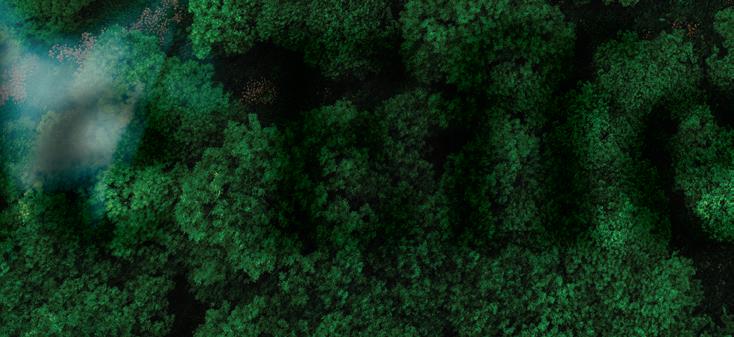

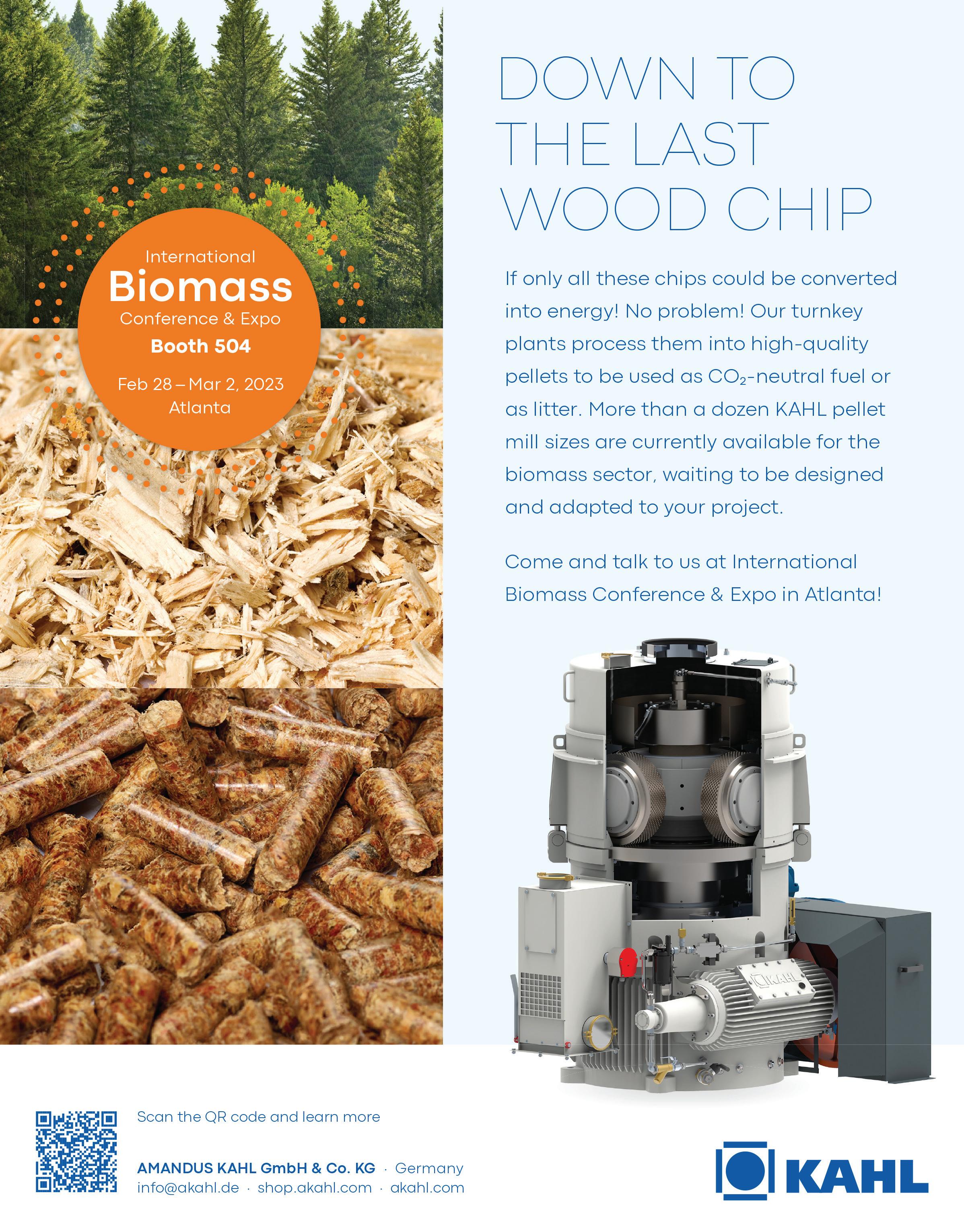

When Life Hands You Green Chips, Make Pellets

Tackling a new pellet mill of any size is a massive undertaking with many unique details for consideration.

By Aaron Edewards

BIOMASSMAGAZINE.COM/PELLET 3 Pellet Mill Magazine Advertiser Index 27 2023 International Biomass Conference & Expo 2 AMANDUS KAHL GmbH & Co. KG 19 Andritz Feed & Biofuel 9 Columbia Industries, LLC 21 CPM 23 Jacobs Corporation 15 KEITH Manufacturing Company 7 KESCO, Inc. 20 Mid-South Engineering Company 10 MoistTech 28 North American Lubricants 14 Phelps Industries 26 Player Design 25 SGS Canada Inc. 11 Uzelac Industries C ontents » 2023 | VOLUME 13 | ISSUE 1

04 EDITOR'S NOTE Building Out Smart By Anna Simet 05 EVENTS 06 Electrification Nation By Tim Portz 08 NEWS ROUNDUP

12 16

Building Out Smart

The North American wood pellet industry has gone through several phases in the 15 years I have been writing about it. I recall an interview I had in 2009, with the owner of a plant in Oregon that no longer exists, and he told me, “It [the wood pellet industry] goes through [development] cycles and has not experienced very steady growth over the past 20-plus years.” He lamented what he essentially described as a gold rush—too many plants were built in a short time in response to a perceived shortage and soaring demand—and the result was excessive capacity, he said. Well, a decade and many lessons learned later, things have changed to a degree. While capacity growth doesn’t come close to that of some industries in the bioenergy space—such as renewable natural gas, for example—it has been moderate, cautious growth. The U.S. heating pellet sector is particularly mindful of market saturation (or oversaturation), and seasoned producers only invest in new hardware when they are confident they can move the additional tonnage. Their relationship with buyers is very different than those of industrial producers that have long-term contracts with overseas clients.

Lately, there has been an uptick in announced capacity expansion and new plant plans. As for what’s on our radar, Grand River Pellets Ltd. in St. Leonard, New Brunswick, is doubling its capacity to 220,000 metric tons; Drax is expanding its Aliceville, Alabama, plant from 250,000 to 380,00 tons; and California-based Golden State Natural Resources announced initial development of two plants in California, in Tuolumne and Lassen counties, at 300,000 and 700,000 tons, respectively. Requests for interviews with GSNR went unanswered, but they have released a fair amount of information. The last project I’ll mention is a plant proposed in Vermont—30,000-ton-per-year PK Wood Pellet LLC, which was awarded $450,000 via the USDA’s Rural Energy for America Program. While this isn’t an exhaustive roundup, all of these announcements were made within just a couple of months.

As global demand for pellet increases, so does the demand for certifications, particularly ENplus. For this issue, I had a lengthy discussion about standards with Chris Wiberg, vice president of Biomass Energy Lab, from their initial development to potential areas for improvement, to a surge in ENplus certifications. Wiberg is the go-to guy when it comes to meeting specs, and he had a lot of interesting things to share in our page-16 feature, Quality Matters.

Our second feature, written by international freelancer Eugene Gerden, provides an overview of the Russian biomass sector. We’ve covered the impact of the banishment of the country’s participation in the global wood pellet market on other countries, but this piece pivots to the implications on this market itself (though perhaps the situation isn’t quite as dire as it should be, as there is growing suspicion Russian pellets are still illegally entering the market).

Finally, my usual plug for the International Biomass Conference: If you’re reading this, you might be there. We’ll have wood pellet trade organization leaders Tim Portz, Pellet Fuels Institute, and Amandine Muskus, U.S. Industrial Pellet Association, joining me on stage for our annual association round table. Be sure to bring your questions—hope to see you there.

You can also fax a subscription form to 701-746-5367. Back Issues & Reprints Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or service@bbiinternational.com. Advertising Pellet Mill Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Pellet Mill Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Pellet Mill Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to asimet@ bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space.

4 PELLET MILL MAGAZINE ISSUE 1 2023

Subscriptions to Pellet Mill Magazine are free of charge distributed 4 times/year to Biomass Magazine subscribers.To subscribe, visit www.BiomassMagazine.com or you can send your mailing address to Pellet Mill Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203.

« Editor's Note

EDITORIAL EDITOR

Anna Simet | asimet@bbiinternational.com

ONLINE NEWS EDITOR

Erin Voegele | evoegele@bbiinternational.com

STAFF WRITER

Katie Schroeder | katie.schroeder@bbiinternational.com

DESIGN

VICE PRESIDENT, PRODUCTION & DESIGN

Jaci Satterlund | jsatterlund@bbiinternational.com

GRAPHIC DESIGNER

Raquel Boushee | rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan | jbryan@bbiinternational.com

PRESIDENT

Tom Bryan | tbryan@bbiinternational.com

VICE PRESIDENT, OPERATIONS/MARKETING & SALES

John Nelson | jnelson@bbiinternational.com

SENIOR ACCOUNT MANAGER/BIOENERGY TEAM LEADER

Chip Shereck | cshereck@bbiinternational.com

ACCOUNT MANAGER

Bob Brown | bbrown@bbiinternational.com

CIRCULATION MANAGER

Jessica Tiller | jtiller@bbiinternational.com

MARKETING & ADVERTISING MANAGER

Marla DeFoe | mdefoe@bbiinternational.com

2023 Int’l Biomass Conference & Expo

FEBRUARY 28

- MARCH 2, 2023

Cobb Galleria Centre, Atlanta, GA

Now in its 16th year, the International Biomass Conference & Expo is expected to bring together more than 800 attendees, 140 exhibitors and 65 speakers from more than 21 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming—powered by Biomass Magazine—that maintains a strong focus on commercial-scale biomass production, new technology, and near-term research and development.

(866) 746-8385 | BiomassConference.com

2023 Int’l Fuel Ethanol Workshop & Expo

JUNE 12-14, 2023

CHI Health Center, Omaha, Nebraska

From its inception, the mission of this event has remained constant: The FEW delivers timely presentations with a strong focus on commercial-scale ethanol production—from quality control and yield maximization to regulatory compliance and fiscal management.

The FEW is the ethanol industry’s premier forum for unveiling new technologies and research findings. The program is primarily focused on optimizing grain ethanol operations while also covering cellulosic and advanced ethanol technologies.

(866) 746-8385 | FuelEthanolWorkshop.com

2023 Biodiesel Summit: Sustainable Aviation Fuel & Renewable Diesel

June 12-14, 2023

CHI Health Center, Omaha, Nebraska

The Biodiesel Summit: Sustainable Aviation Fuel & Renewable Diesel is a forum designed for biodiesel and renewable diesel producers to learn about cutting-edge process technologies, new techniques and equipment to optimize existing production, and efficiencies to save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers and producers to advance discussion and foster an environment of collaboration and networking through engaging presentations, fruitful discussion and compelling exhibitions with one purpose, to further the biomass-based diesel sector beyond its current limitations.

(866) 746-8385 | BiodieselSummit.com

2023 Carbon Capture & Storage Summit

June 12, 2023

CHI Health Center, Omaha, Nebraska

Capturing and storing carbon dioxide in underground resivoirs has the potential to become the most consequential technological deployment in the history of the broader biofuels industry. Deploying effective carbon capture and storage at biofuels plants will cement ethanol and biodiesel as the lowest carbon liquid fuels commercially available in the marketplace. The Carbon Capture & Storage Summit will offer attendees a comprehensive look at the economics of carbon capture and storage, the infrastructure required to make it possible and the financial and marketplace impacts to participating producers.

(866) 746-8385 | FuelEthanolWorkshop.com

BIOMASSMAGAZINE.COM/PELLET 5

Industry Events »

Please check our website for upcoming webinars www.biomassmagazine.com/pages/webinar TM Please recycle this magazine and remove inserts or samples before recycling COPYRIGHT © 2023 by BBI International

Electrification Nation

BY TIM PORTZ

The inclusion of a 30% tax credit for qualifying residential pellet appliances in the sweeping Inflation Reduction Act of 2022 has rightly been called the single largest policy victory for the wood pellet industry to date. Certainly, there were some disappointing caveats. The tax credit doesn’t extend to commercial installations, and a $2,000 cap on the credit was introduced, significantly blunting the impact of the tax credit on larger, more expensive whole home pellet boiler systems. Still, producers and the Pellet Fuels Institute cheered the tax credit and its 10-year runway. With a trend toward warmer and shorter heating seasons, it is imperative that more pellet-burning units be installed if wood pellet demand is expected to remain stable, to say nothing of experiencing even modest growth.

With nearly $370 billion of the legislation’s $433 billion in total spending earmarked for energy security and climate change, it is crystal clear that the Biden administration has ambitions for the rapid acceleration of clean energy to be its enduring legacy. Considering the disappointment many in the broader clean energy sector felt when the Obama administration chose instead to feature health care reform as its legacy platform, the Inflation Reduction Act’s sharp focus on clean energy may initially feel like a policy dream come true, not only for wood pellet producers, but also for the broader biomass sector. Still, a close read and analysis of the Inflation Reduction Act suggests that the clean energy future that this piece of federal policy imagines and is aiming for is shifting toward an energy system less concerned with “renewable resources” and is instead tightly focused on net zero carbon.

The pivot is understandable, as climate scientists stress that to slow the pace of climate change, carbon is all that matters, along with technologies that have no carbon consequence but deliver energy for our cars, trucks, homes, businesses, airplanes and data centers. The easy targets, of course, are the carbon-dense fossil fuel energy sources the global economy has relied upon since the earliest days of the Industrial Revolution. While opinions may vary about how likely human beings are to actually divorce themselves from the use of fossil fuel, what is not up for debate is that policymakers around the world, heading the pleadings of climate scientists, intend to do exactly that.

A close read of the Inflation Reduction Act reveals that electrification will be incentivized to unseat fossil fuels from its incumbent position wherever practicable. Elec-

tric vehicles are the most widely reported on and visible manifestation of this aim, but work is being done to electrify almost every other place humans need energy, including space heating. Heat pumps are a mature technology, incentivized by the Inflation Reduction Act to the same degree as qualifying wood heat appliances, and are increasingly being tabbed as the swiftest way to the decarbonization of our space heating load. Many states are aligned in this thinking. The report, “Building Electrification: Programs and Best Practices,” authored in February 2022 by the American Council for an Energy Efficient Economy, found 42 state or local program incentivizing a transition to electrified space and/or water heating via heat pumps, up from 22 in 2020. Of these programs, 13 can be found in the heart of traditional wood pellet markets, the U.S. Northeast.

The drive for decarbonization need not be regarded as a death knell for the biomass nor pellet sector. Each corner of the biomass industry points regularly to carbon benefits, and in many instances have earned policy victories and market growth as a result of successfully connecting biomass use to delivered carbon benefit. Consider the subsidies and feed-in tariffs that gave rise to the industrial wood pellet market. That example, however, can be viewed as a cautionary tale, as well as the continued support of power production using biomass fuel, which continues to draw scrutiny and legions of detractors who call for the end of continued subsidization.

The domestic wood pellet market for home heating operates in a wholly different marketplace than global power markets. Take away the one piece of policy support the industry currently enjoys, the tax credit for qualifying stoves, and market and industry would continue to march forward. Growing its reach would be a steeper hill to climb, but the industry would remain in place. That said, it is becoming increasingly clear that the long-term prospects for this sector and its continued support from policymakers and regulators alike will hinge on its ability establish and defend its place as a clean, carbon-beneficial solution for space heating.

Author: Tim Portz Executive Director, Pellet Fuels Institute tim@pelletheat.org www.pelletheat.org

6 PELLET MILL MAGAZINE ISSUE 1 2023

Pellet News Roundup

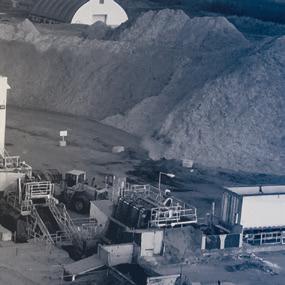

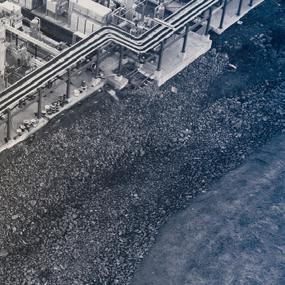

Two North American industrial wood pellet manufacturers have recently announced capacity expansions. J.D. Irving Ltd.’s Grand River Pellets, located in northern New Brunswick, reported it has undertaken a $30 million project to more than double its capacity, from 140,000 to 220,000 metric tons per year, once commissioned in May. The plant uses sawdust and bark from sawmills owned by J.D. Irving, as well as independent suppliers, to manufacture wood pellets for export markets.

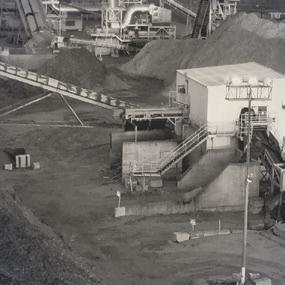

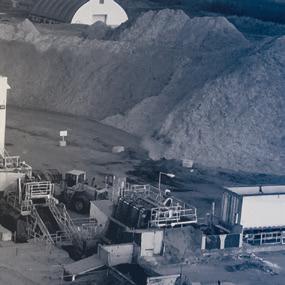

Drax also announced plans to expand its Aliceville, Alabama, facility. The $50 million dollar investment will increase production capacity by nearly 50%, from 250,000 tons to 380,000 tons, according to Drax. The company said the expansion includes upgrades to existing systems, as well as new truck dumps and pelletizer units. The additional capacity is expected to begin commissioning in 2024.

8

MILL MAGAZINE ISSUE 1 2023

PELLET

PHOTO: GRAND RIVER PELLETS

PHOTO: DRAX

In late January, Canadian forest products company Canfor Corp. announced it will permanently close its pellet plant in Chetwynd, British Columbia, as part of a restructuring of its operations within the province. Canfor celebrated the grand opening of the Chetwynd pellet plant in August 2016. The facility has the capacity to produce 100,000 metric tons of industrial-grade wood pellets annually. The company said its British Columbia restructuring plan aims to better align manufacturing capacity with the available longterm fiber supply. Canfor’s Chetwynd sawmill will also permanently close as part of the restructuring.

Canadian wood pellet production for 2022 remained consistent with the previous year, according to a report filed with the USDA Foreign Agricultural Service Global Agricultural Information Network. Exports were up an estimated 5% due to increased demand from Europe and Asia.

Canada produced an estimated 3.5 million metric tons (MT) of wood pellets last year, flat with 2021, but up from 3.3 million MT in 2020. The country has 47 pellet production facilities, unchanged from 2021 but up from 46 in 2020. Total nameplate production capacity was at 4.79 million MT in 2022, down from 5.054 million MT in 2021. Approximately 45% of Canadian pellet mill production capacity is in British Columbia, with 21% in Quebec, 17% in Alberta, 8% in New Brunswick, 7% in Ontario, and 4% located in the rest of Canada.

Canada primarily produces wood pellets for export markets. Domestic consumption was at 530,000 MT last year, up from 500,000 MT in 2021 and 430,000 MT in 2020. Producers exported 3.3 million MT of wood pellets in 2022, up from 3.153 million MT in 2021.

The U.S. Energy Information Administration recently released data showing U.S. manufacturers produced approximately 950,000 tons of densified biomass fuel in September, with sales reaching 1.11 million tons. The report was released as part of the December edition of EIA’s Monthly Densified Biomass Fuels Report, which contains data for September.

The 80 manufacturers surveyed for September had a total combined production capacity of 13.28 million tons per year and collectively had the equivalent of 2,467 full-time employees. Respondents purchased 2.39 million tons of raw biomass feedstock in September, produced 950,000 tons of densified biomass fuel and sold 1.11 million tons of densified biomass fuel. Production included 157,917 tons of heating pellets and 729,921 tons of utility pellets.

Domestic sales of densified biomass fuel in September reached 212,710 tons at an average price of $208.31 per ton. Exports in September reached 904,9003 tons at an average price of $244.19 per ton. Inventories of premium/standard pellets fell to 185,500 tons in September, down from 256,337 tons in August. Inventories of utility pellets fell to 383,321 tons in September, down from 473,038 tons in August.

Data gathered by the EIA shows that total U.S. densified biomass fuel capacity reached 13.37 million tons in September, with all of that capacity listed as currently operating or temporarily not in operation.

BIOMASSMAGAZINE.COM/PELLET 9 PELLET NEWS ROUNDUP »

NORDEN recently announced a successful customized solution to assist a customer in shipping wood pellets from the U.S. to a small port outside of Copenhagen, Denmark. The operation involved a transhipment of approximately 50,000 metric tons of wood pellets onboard a Supramax vessel to the port of Aarhus, Denmark. Port restrictions prevented Supramax vessels from entering the port, so following the transhipment to Aarhus, eight smaller vessels were used to perform a ship-to-ship operation, discharging the wood pellets directly from the large vessel onto the smaller vessels. These vessels then transported the cargo to its final destination outside of Copenhagen. With this solution, according to NORDEN, the customer only needed to conduct one voyage from the U.S. to Denmark using one Supramax vessel, rather than having to conduct eight voyages with smaller vessels.

Enviva Inc. on Dec. 21 announced the signing of a 10-year take-or-pay off-take fuel supply contract with an existing European customer, extendable for up to five years. Enviva expects to supply 800,000 metric tons of industrial-grade wood pellets per year, with deliveries expected to commence during 2027, subject to certain conditions precedent. Enviva’s total weighted-average remaining term of take-or-pay off-take contracts is approximately 14 years, according to the company, with a total contracted revenue backlog of over $23 billion. This contracted revenue backlog is complemented by a customer sales pipeline exceeding $50 billion, which includes contracts in various stages of negotiation.

To recognize and show gratitude toward heroes in communities across the country, Harman and Lignetics Group teamed up for the ninth time to supply a Harman Hero recipient with a Harman Accentra52i-TC pellet insert, 1 ton of CleanFire Superior heating pellets and 1 ton of large animal bedding. This year’s Harman Hero recipient was social worker and therapist Rachel Novak of Hanson, Massachusetts. The pellet insert was by The Chimney Chaps, and the heating pellets were delivered by WoodPellets.com, a company under the Lignetics Group, which also donated the animal bedding. Venting was donated by Duravent.

10 PELLET MILL MAGAZINE ISSUE 1 2023

» PELLET NEWS ROUNDUP

PHOTO: NORDEN

Graanul Invest Woodville Pellets LLC celebrated an important milestone in logistics efficiency, the company announced in mid-January. In December, Graanul began loading MS Nemea with 50,042 tons of wood pellets at its logistics hub in Port Arthur, Texas, for shipment across the Atlantic to the U.K. Jason Ansley, Graanul vice president of U.S. operations, thanked partner Drax

for being flexible, “as the shift from handysize vessels to supra size required some preparations and was not without its challenges.”

Graanul operates 12 wood pellet plants in the Baltics and the U.S., and six renewable combined-heat-and-power plants in Estonia and Latvia.

BIOMASSMAGAZINE.COM/PELLET 11 PELLET NEWS ROUNDUP » MA IN OFFICE Greendale, WI 414.529.0240

PHOTO: GRAANUL INVEST

Ripple Effects

Russia has the world’s largest reserves of natural biomass with about 25% of the world’s timber resources and about 45% of the world's peat reserves. The annual amount of organic waste from the agro-industrial complex is about 700 million tons, with a total gross energy content of about 90 million tons of fuel.

BY EUGENE GERDEN

BY EUGENE GERDEN

At the same time, the biomass sector is one of the youngest branches of the Russian timber complex, the actual development of which began a little over a decade ago. In 2013, the first federal program for the development of the domestic biofuel market was adopted—the "Action Plan for creating favorable conditions for the use of renewable wood sources for the production of heat and electricity." As part of this plan, production and use of biofuels in the country were to significantly increase, but Russia’s attack on Ukraine and sanctions pressure from the West has put an end for implementation of these plans—at least in the foreseeable future—and has also significantly impact export markets, with subsequent ripple effects.

12 PELLET MILL MAGAZINE ISSUE 1 2023

Once a rising powerhouse in the industry, the Russian biomass sector is on the downslide.

Densified Biomass Production

According to industry trade data, traditionally, 95% of wood pellets and about 60% of briquettes produced in Russia were exported to foreign markets, with more than 80% of its exports being sent into the EU market. The imposition of the fifth package of sanctions by the EU led to the suspension of such supplies, and revocation of Russian exporters' ENPlus certifications.

Prior to late February of last year, the annual volume of pellet production in Russia varied in the range of 2.6 million to 2.8 million metric tons (MT), according to Rosleskhoz, the Russian Federal Agency for Forestry. Of these, 2.4 million tons worth €504 million ($611 million) were sent for exports. In 2021, Russia ranked fifth in the world in terms of annual pellet production. While the official results for 2022 have not yet been announced, most analysts expect Russia will lose its status as one of

the world’s largest pellet and biofuel exporters, and some have predicted that the overall sales for Russian pellet producers in the domestic and foreign markets will have declined by 80% in 2022 compared to 2021, with sales ranging from 30,000 to 40,000 metric tons per month.

During the recent Russian International Forestry Forum— one of Russia’s most important annual events in the field of forestry and biomass—Yuri Vorobyov, deputy chairman of the Russian Federation Council, said Russian timber companies have been forced to significantly reduce output due to sanctions, with the biggest decline being observed in the case of wood pellets.

The domestic market has also seen decreases in demand. In general, according to Vorobyov, logging volumes in Russia have declined by more than 13% across the country as a whole, and by 30% in some densely forested cities of the country. So far, the industry has faced massive shutdowns of enterprises, while some companies are cutting staff or transferring them to part-time. Among the largest producers of wood pellets in Russia in 2021 were Segezha Group (part of AFK Sistema) at 360,000 annual metric tons (MT), Sawmill 25 (part of the group of companies Titanium) at 160,000 MT, and Ustyansky timber processing plant (ULK Group) at 300,000 MT.

While the companies were not available for comment, local analysts expect that most of them will revise 2023 production plans. In late December, Lesprom reported that ULK Group, the largest sawmiller in the northwest Russia, announced it would cease all wood pellet production due to lack of sales, and lay off 1,500 workers.

According to Rosleskhoz, before sanctions were imposed, Russia’s share of total wood pellets imported into the EU was an estimated 10%. The largest consumers were Denmark (958,000 MT) and Belgium (381,000 MT). Most of that volume was purchased by large energy companies including German RWE and Uniper, the British Drax, the French Engie and the Danish Orsted. A significant portion was also sent to Baltic countries, Scandinavia and South Korea.

A Mounting Problem

Ekaterina Mikhailova, executive director of the Russian Pellet Union, says the annual volume of sawdust, which is accumulating in Russia and used in the production of wood pellets, is estimated at 12 to 15 million cubic meters. As production has been cut, it is unclear how these volumes of sawdust will be utilized. “If the production of pellets and biofuels stops, then there will be a mountain of sawdust three meters high in our forests, lying on an area of 2,000 hectares,” she says. In this case, according to Mikhailova, the risk of forest fires will significantly increase. In addition, sawmills are left with disposal problems and must seek alternative ways to use the material.

BIOMASSMAGAZINE.COM/PELLET 13

Markets »

Amidst the reduction in exports, prices for pellets in the domestic market are also declining, creating more problems for producers. According to experts of the Russian Ministry of Agriculture, demand for wood pellets in Russia is varied, in the range of 200,000 to 600,000 tons per year, or about 23% of domestic production. Due to inability of exports, producers and the government plan to take measures to switch a significant part of exported pellets to the domestic market. As part of these plans, the government is evaluating the possibility of converting approximately 30% of domestic boilers from coal and fuel oil to pellets, as well as the use of up to 5% of fuel pellets for combustion in coal-fired thermal power plants.

Despite the potentially positive implications, actual implementation of these plans may be quite difficult due to high costs. As experts of the Russian Ministry of Construction have recently warned, the costs of converting a coal-fired boiler to wood biofuel are comparable to those of building a new boiler. But the department believes that such projects can be important to replace outdated, smallcapacity coal-fired boilers in remote areas of the country. In addition,

biofuels can be used as additives in waste incinerators, and as the main fuel for new boiler houses in difficult-to-reach areas where it is impossible to provide gas, coal, fuel oil and diesel fuel at affordable prices.

Plans of more active use of biofuels in energy complexes have been recently announced by the heads of some regions of Russia. For example, authorities of the Krasnoyarsk Territory, Russia’s largest region in Siberia, are considering the sale of fuel pellets at a discount to municipal boiler houses, while officials of the Russian Arkhangelsk region have the same plans. However, according to experts of the Russian Pellets Union, switching boilers from coal to pellets could take months, while the receipt of all the necessary approvals could take years. In addition, a public campaign is needed to promote the use of pellets for heating private houses in Russia, which, to date, has been uncommon for the country.

A significant increase in the consumption of pellets and other biomass in Russia is nearly impossible due to the low popularity of the concept of “green economy” in Russia, and its cheap hydrocar-

14 PELLET MILL MAGAZINE ISSUE 1 2023 « Markets

‘If the production of pellets and biofuels stops, then there will be a mountain of sawdust three meters high in our forest, lying on an area of 2,000 hectares.’

• Hydraulic Truck Dumpers custom engineered for each application • Live Bottom Hoppers including Backrakes for handling stringy bark • Telescopic Cylinders specifically designed for use on a truck dumper P.O. Box 1093 • Little Rock, Arkansas 72203 • (501) 375-1141 • Fax (501) 375-6565 www.phelpsindustries.com sales@phelpsindustries.com Specializing in hydraulic truck dumpers since 1970 Visit us at Booth #830

— Ekaterina Mikhailova, Russian Pellet Union

bon reserves. According to data of the Russian Ministry of Agriculture, Russia annually consumes only 150,000 to 300,000 tons of pellets, or approximately 5% to 8% of the country’s total production volume, with small households being the major consumers. There were some plans to begin supplying wood pellets and other biofuels to some Russian cement and steel plants, but so far, the initiative has not been implemented.

Moving Markets

In order to compensate for losses associated with the exit from the EU market, leading Russian wood pellet and biofuel producers are considering increasing supplies to Asian markets. Currently, Asian markets remain available for Russian pellet and biofuel producers, although their consumption is significantly lower than the EU. While South Korea has made significant purchases of Russia’s biofuels, Japan has only explored such a possibility.

In case of South Korea, from January to November 2022, Russian companies managed to redirect about 20% of their wood pellets exports from the EU to the South Korean market, despite very high transport and logistics costs. While the government has promised to provide subsidies to cover at least part of these costs, most producers and analysts believe they will be insufficient to ensure profitability.

In the case of China, there is a currently a ban on the import of biofuels from other countries, with an exception of some border

areas of the country. As Olga Rakitova, head of IAA INFOBIO, tells the Russian Lesnoy Region forestry paper, China produces about 8 million tons of pellets per year, almost 100% of which is consumed in the country. Therefore, the need to import foreign supplies is minimal.

In 2011, the Russian Vyborg Cellulose Company launched the world's largest wood pellet plant in Russia. The volume of its production is 1 million tons per year. Prior to the war, the company had the potential to meet about 30% of all European demand. Due to the current situation in Russia and its ever growing isolation, the company will have to find alternative sale markets for its products.

The situation is also complicated by the lack of equipment and machinery in the industry. Prior to sanctions, most equipment was supplied to Russia from abroad, particularly from EU states.

While the exodus of Russian pellets from the EU market provides an opportunity for foreign rivals to fill the vacant niche, at the same time, there are growing concerns of Russian pellets being recertified, repacked and illegally exported through other countries.

Author: Eugene Gerden International Freelance Writer

Author: Eugene Gerden International Freelance Writer

BIOMASSMAGAZINE.COM/PELLET 15

16 PELLET MILL MAGAZINE ISSUE 1 2023

Chris Wiberg is vice president of Biomass Energy Lab, which serves customer needs ranging from routine quality control tests to certification of an export shipment of wood pellets.

PHOTO: BEL

Quality Matters

BY ANNA SIMET

BY ANNA SIMET

Those with roots in the North American wood pellet industry may be familiar with the story of the first transatlantic shipload of wood pellets setting sail from North America to Europe, which was done under the direction of industry pioneer John Swaan just over 25 years ago. Few were likely in the business at the time, as it was very small and in its infancy—but Chris Wiberg was. “I started in wood pellets in 1998, that same year,” says Wiberg, who is vice president at the Conyers, Georgiabased Biomass Energy Lab. Wiberg joined BEL and Timber Products Inspection in 2011, to assist in building out the lab’s biomass-based services.

BEL is a joint venture between Timber Products Inspection and Control Union USA, a global supply chain auditing firm, Wiberg explains. While

the company operates as BEL for international services, its domestic title is known as Timber Products Inspection. “TP is essentially an auditing agency and lab system for wood products—lumber, treated lumber, trusses, wood packaging materials, log homes, plywood, and wood pellets … anything made out of wood that has some kind of a grade behind it. Our services include performing thirdparty verification at the production site to confirm that the plant is doing what it needs to, as well as for the end product quality—typically, the lab receives samples and runs tests to verify the quality of any one of those various products.” TP is a certification and inspection body, and testing laboratory for the PFI Standards Program.

As for Control Union, if a ship is readying to load cargo, the company

BIOMASSMAGAZINE.COM/PELLET 17

Biomass Energy Lab’s Chris Wiberg discusses the inception and evolution of wood pellet quality standards, plant certification and industry trends.

Standards »

ensures it is clean and ready to accept it, and oversees its loading. “During the loading, they’ll collect the samples,” Wiberg explains. “If it’s a wood pellet shipment, then those samples come to our laboratory for testing of the contracted criteria.”

When the lab was built, it was done so with new equipment aligning with the international pellet standards that were under development, according to Wiberg. “The standards were just coming to fruition during that timeframe, and we were really the only lab performing to that international standard, operating out of the U.S.,” Wiberg says. “That’s about when I started to understand that wood pellets were something different—something special.”

Crafting Standards

In 2005, Wiberg became involved with the Pellet Fuels Institute and realized the lack of standards were causing some industry struggles. “I attended a PFI conference and it was clear that standards were needed,” he says. “I became a member of the PFI standards committee, and we began writing the first version back in that timeframe—2006, 2007. It took a lot of years for it to come together. It wasn’t until about 2010 that the first version came out, and a couple more years until the current program became real. I was chairman of the standards committee and a primary author of a large extent of it, though lots of people worked on the project.”

Soon, Wiberg became the go-to guy for producers wanting to get involved in the standards program. “One by one, I started working with them to get their quality systems set up and their on-site labs built. To this day, I have assisted in launching quality management programs in the neighborhood of 100 plants in the U.S., Canada and overseas. So, you can imagine the time onsite, visiting all of these places.”

While the PFI Standards were being written, Europe had a similar initiative underway, which ultimately turned out to be the ENplus standards. “They were trying

to do the same thing at the same time, so we had a lot of back and forth conversations, swapped some language and versions of our standards,” Wiberg says. “We worked together to try to align them, but over time, ENplus changed direction to become broader and more encompassing—like covering the complete supply chain, traders, etcetera—but PFI was written mainly for U.S. producers so that they could comply with the U.S. EPA's New Source Performance Standards for Residential Wood Heaters. So, they deviated over time.”

Wiberg emphasizes the complicated nature of developing standards and all of the individual testing methods such as ash

or moisture. “In the early days, we used all ASTM procedures, but they were incomplete for biomass. Coal had a complete set of standards including sampling, sample prep, all test methods and so on. But biomass methods didn't really align. Different methods were picked and matched, like from the RFD [refused-derived fuel] industry and then some coal standards.”

Wiberg notes that when Europe initiated the development of solid solid biofuel standards, it was done through the EU’s Central European Committee for Normalization Technical Committee 335. “They wrote the first version of the current solid biofuel standards and various test parame-

18 PELLET MILL MAGAZINE ISSUE 1 2023

David Robles is lab manager at Biomass Energy Lab.

PHOTO: BEL

ters that are used today, but Canada and the U.S. didn’t have a seat at the table. Global standards should have everyone participate, so the EU forwarded its work product to the ISO, which is the format that allows all participating countries to have input and a vote.”

The technical advisory group that oversees the U.S. position on this matter is the American Society of Agricultural and Biological Engineers working group ES238, which Wiberg has served as the chairman of since 2013. “Annually, some other U.S. delegates and I have traveled internationally to wrangle with other countries over how to write these standards. It was difficult at first, as there are many European countries that get one vote each, but the U.S. and Canada each only get one vote, so we were always outvoted. One way to have more influence was to become involved as a project leader, which is what I

did. I took on a suite of projects for moisture, volatiles, ash and some other things, and became very involved in the standards writing.

Today, Wiberg is on the advisory committee for ENplus and is one of only a few ENplus auditors in North America, overseeing all ENplus certifications in the U.S.

Making the Grade

Regarding offtake export agreements and producers seeking to determine how the different test methods, standards and contract terms apply to their product and whether it can make the grade, Wiberg can assist. “People call me for interpretations or with their conceptual projects, and through some testing, we can tell them if they’ll be potentially poised for the ENplus market, the PFI market or the international power markets, helping identify where they can go with their materials.”

Technical aspects of the job aside, Wiberg says there is never a dull moment. “It’s really multifaced—we get a lot of calls from people trying everything under the sun, trying to use every possible form of biomass … pits and seeds of all kinds of fruits, coconut shell husks, oat straw, wheat straw, switch grass, bagasse and some things that we try to steer clear of. Some things you’ll recognize, and endless things you haven’t heard of. Ask us, and the answer will likely be ‘Yeah, we’ve tried that, too. ’”

Those struggling with product quality can also benefit from engaging TP/BEL to assist. “For example, if a plant is having a hard time keeping [pellet] durability in spec, they might think it’s a compression issue—it’s not durable enough, so they think they need to pack it tighter. However, that’s not necessarily true. It could be a moisture problem, a length issue or any number of things. When you look at the data, it will

BIOMASSMAGAZINE.COM/PELLET 19 Standards »

tell you more than you would think. It’s not about looking at any one parameter, but about the entire sheet of parameters, and how they link together. We help people understand their data, we use the testing to help solve problems.”

Looking Ahead

As for what’s keeping TP/BEL busy, Wiberg says the normal throughput runs at a feverish pace, but even more so as of late. “The ships keep ramping up, the number that are going to various customers overseas—typically to Europe—and every one of them loaded needs a full analysis. That alone keeps us very busy, but one of the things that has blown the roof off the norm is the absence of Russian volume on the market—wood pellet buyers are looking all around the globe for any available wood pellet production that could be diverted to Europe.”

As a result, Wiberg says, there is a huge boom in the number of clients looking to get ENplus certified, including some smaller producers, and though ENPlus certification requirements for Europe were waived for one year, he believes it’s likely to return when that time period ends. “My phone is ringing off the hook. It is a lot of work to get a plant set up initially, much more so than maintaining the standard once they have achieved it—and everyone is trying to achieve it now.”

Wiberg acknowledges that though ENplus is a very sound, comprehensive program designed to check all the boxes, it isn’t perfect. “A problem is that it’s written in such a fashion to capture how people do pellets all over the world, but more so from a European perspective,” he says.

“So one of the challenges with ENplus is that a lot of the requirements are based on the model of how pellets are used in Germany and Austria, and of course all over Europe. There’s the pneumatic truck and conveyance equipment that sends three tons of pellets into somebody’s basement hopper, and then they move to the next

20 PELLET MILL MAGAZINE ISSUE 1 2023

(From left to right) Biomass Energy Lab staff: Drake Townsend, Ruben Robles, David Robles, Chris Larson, Walter De Guire and Binh Chau.

PHOTO: BEL

house. But this isn’t how a 500,000-ton plant works—these producers fill ships.”

The current model does have some disconnect in terms of rules that don’t necessarily apply around the globe, and are more written to reflect the European need, from Wiberg’s perspective. “For example, there is a temperature requirement—pellets cannot be distributed to an end user unless they are less than 40 degrees Celsius. But in the U.S. South, ambient air temperatures are sometimes above that. So how can the temperature of the product be lower than the ambient air on certain days of the year?”

Wiberg reiterates that writing the standards perfectly would be nearly impossible. “There are always opportunities for improvement,” he says. “It’s very tough to have one scheme that accomplishes the needs of the entire world.”

As for within the U.S., there is presently no demand for ENplus production, as PFI is considered the golden standard for U.S. product.

When asked about the growing barbeque pellet market and whether industry standards should be developed—an idea that some industry stakeholders have debated for many years—Wiberg did not hesitate to answer. “Absolutely,” he says. “Even for the simplest idea of preventing chemically treated materials from being used in BBQ,” he says. “There are potentially contaminated materials out there, or chemically treated, and there really isn’t anything that prevents them from going into the BBQ pellet market. At minimum, there could be some standards for fiber

sourcing to ensure the materials being used are clean.

Wiberg adds that some standards could enhance the BBQ pellet market, such as a required percentage of wood species used in product to be able to label them as such. “This would help with issues like, what does a pellet’s composition have be to in order to be labeled as a mesquite pellet—10%, or

100% mesquite?,” he says. “There are those topics of argument, but I’m less concerned about things like that. At a minimum, I think the industry would be up to ensuring that corrosive materials are not damaging stoves, and to assure the health and safety of the general public by ensuring the fiber is clean. They can wrangle over what they would like to include, but I think those would be beneficial.”

Author: Anna Simet Editor, Pellet Mill Magazine asimet@bbiinternational.com

BIOMASSMAGAZINE.COM/PELLET 21

‘To this day, I have assisted in launching quality management programs in the neighborhood of 100 plants in the U.S., Canada and overseas.’

Standards »

— Chris Wiberg, vice president, Biomass Energy Laboratory

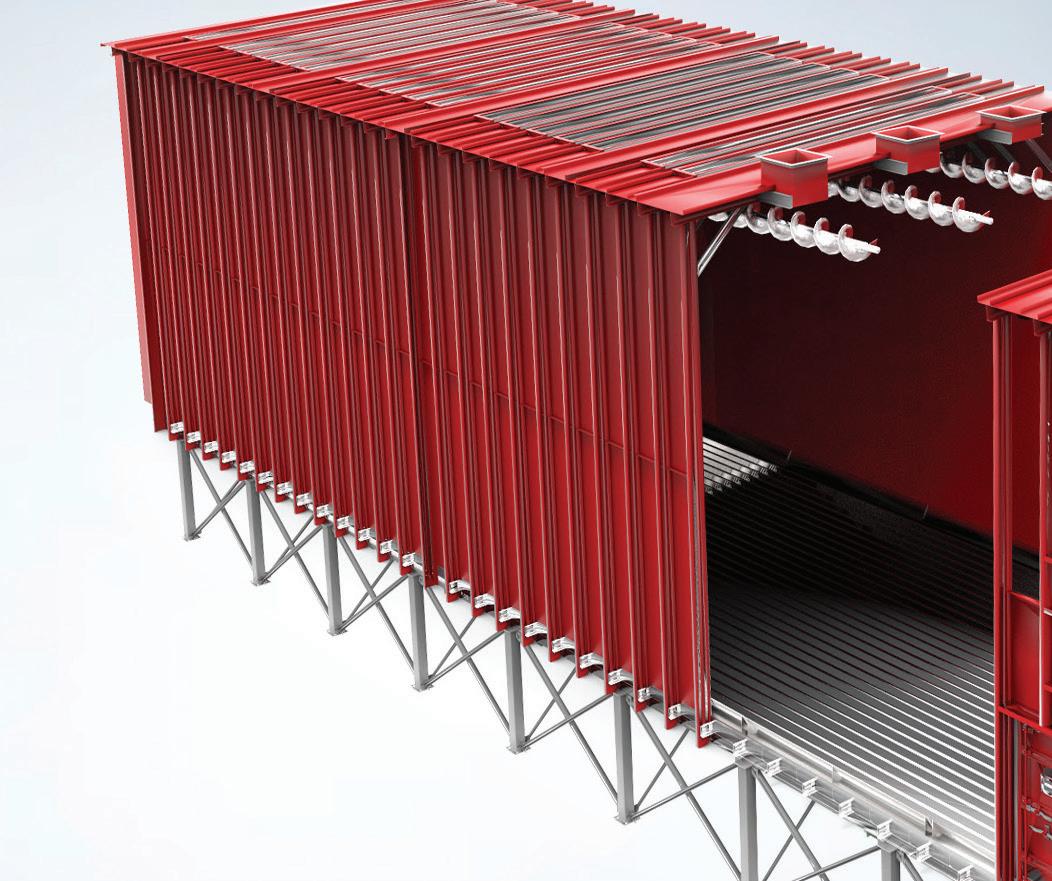

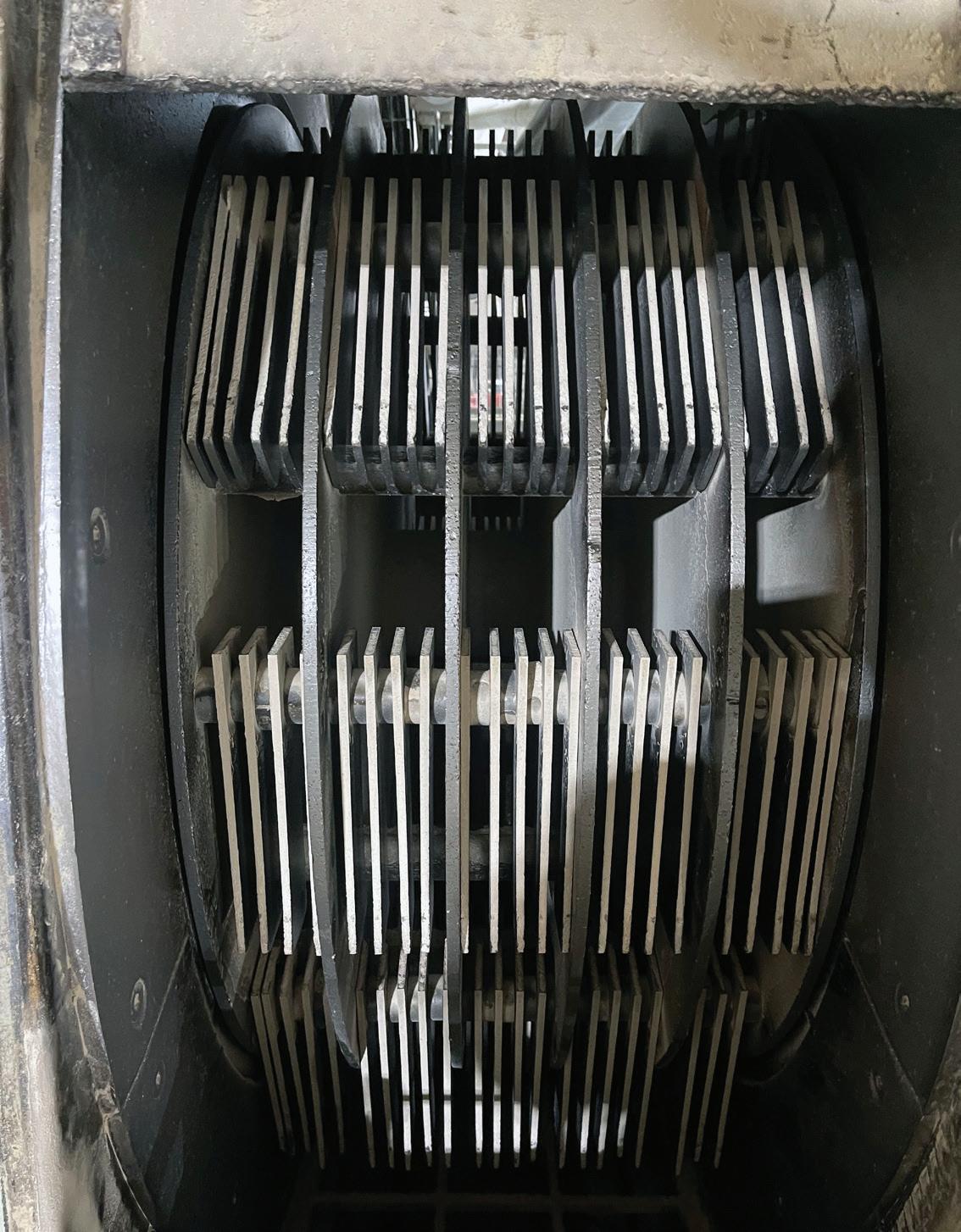

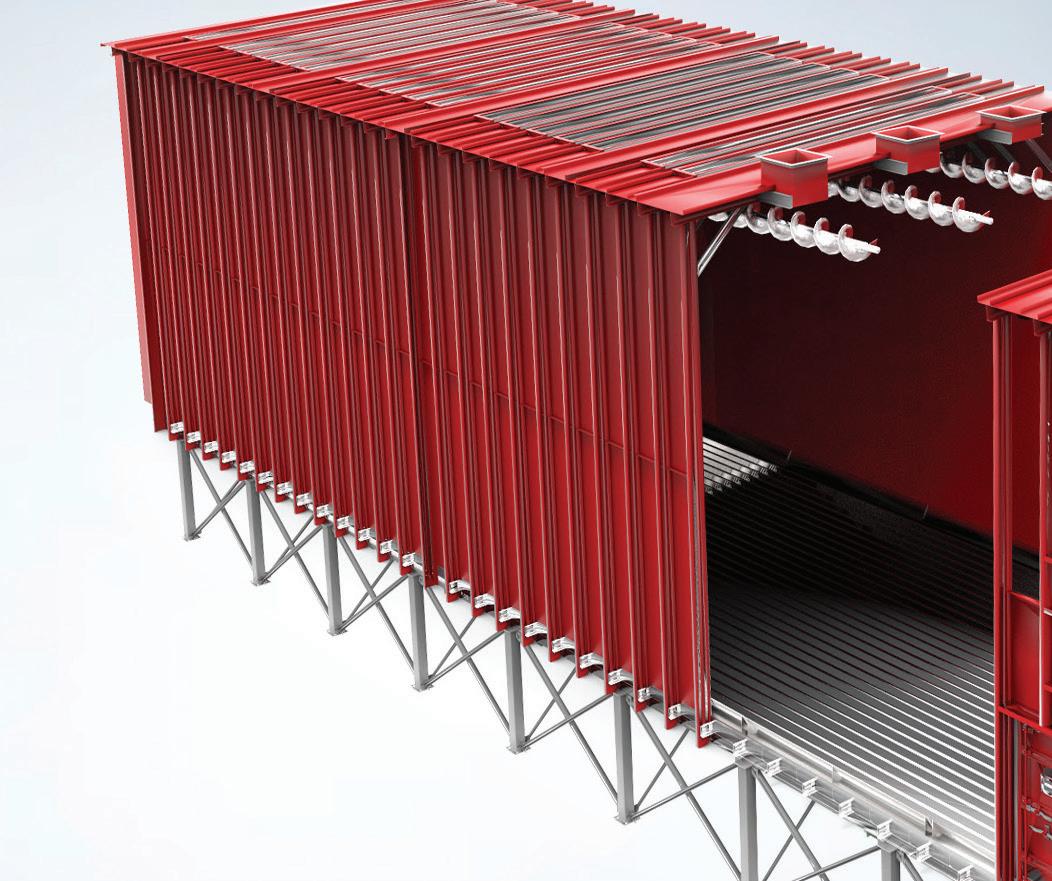

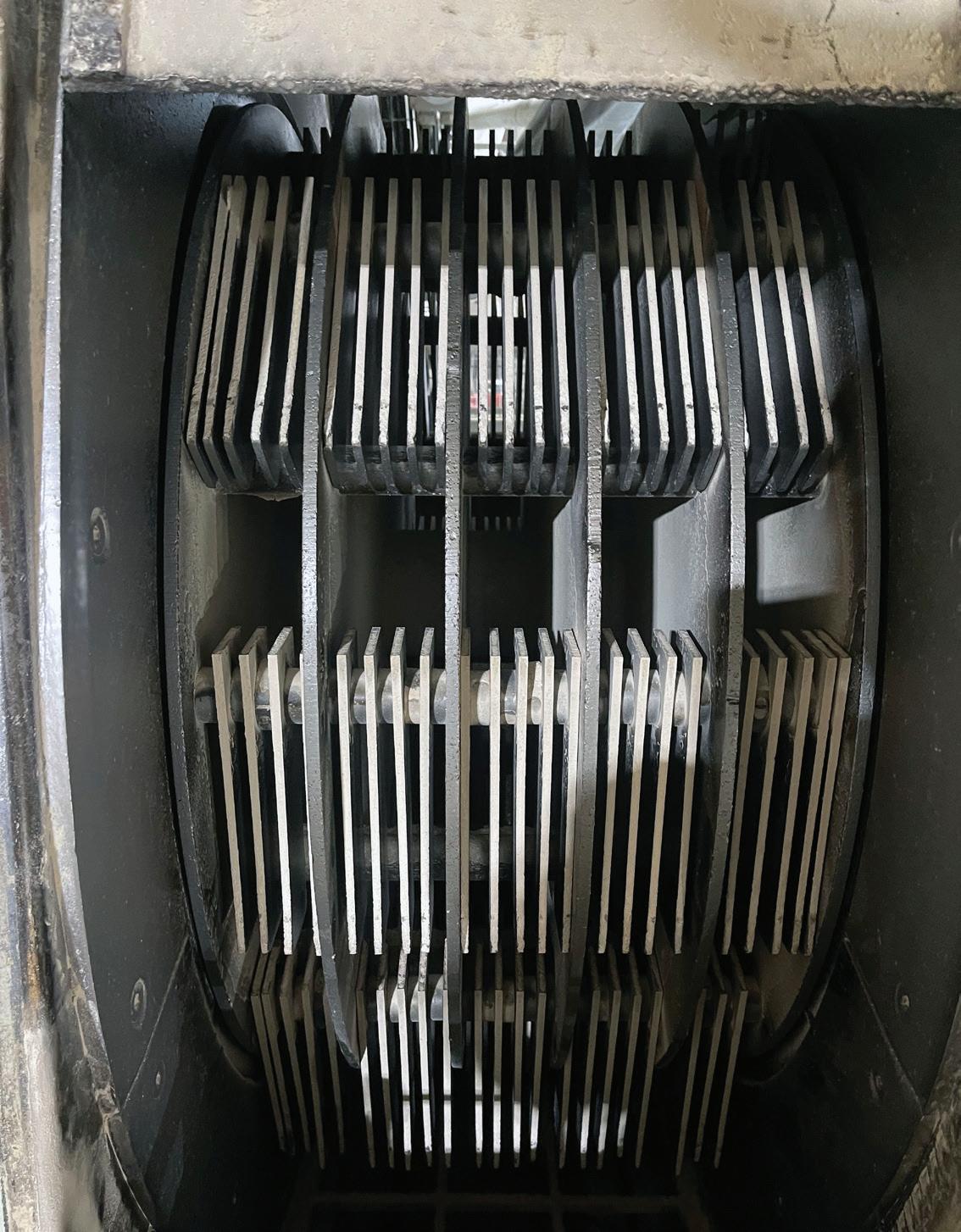

Hammer Mill Maintenance: Keys to Performance

Size reduction and homogenization is a key parameter to a pellet mill’s steady, high output.

BY HOLGER STREETZ

BY HOLGER STREETZ

Hammer mills prepare woody biomass for the pelleting process. It is vital to pay close attention to the hammer, as it has an important influence on performance. Hammer mills turn heterogeneous material into homogeneous material. Grinding with hammer mills is done in feed mills, food processing, plastic waste and biomass operations. There are many applications for ground woody biomass, such as insulation

material, animal bedding, packaging accessories and filling agents.

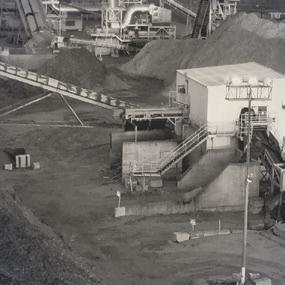

A typical pellet plant has a two-stage size reduction. Wet or green wood hammer mills are designed for wet grinding of shavings and chips in preparation for the drying process. These hammer mills can have a throughput of up to 60 tons per hour. Dry hammer mills further reduce the size of pre-dried woody particles for pelleting.

Typical dry hammer mills in wood pellet preparation have a throughput of 9 to 11 tons per hour using a 600 horsepower motor, but performance characteristics depend on the raw material quality.

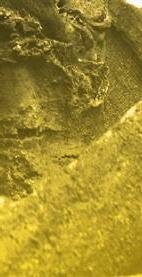

High-quality raw material, such as clean sawdust from a manufacturer’s own sawmill, is so clean that hammers will virtually last forever. Pictures from a German wood pellet supplier with its own sawmill shows very

22 PELLET MILL MAGAZINE ISSUE 1 2023

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Pellet Mill Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s). « Operations

IMAGE 1 IMAGE 2

PHOTO: BATHAN AG

well as nails and screws in German industrial wood. With very sandy soil, sand can be deposited into the wood. Even with highquality raw material, the resin content has a significant effect on performance.

The performance of a hammer mill is mainly determined by the sieve perforation size and the number of hammers. The more hammers and the wider the holes, the higher the output. Additionally, the distance between hammers and sieves has an influence. With rough grinding, the distance between hammers and sieves is relatively larger than with fine grinding. With a wider distance, the fiber is longer and larger. This is not ideal for wood pelleting, as too many large particles lead to overrunning rollers and clogging of the die (Image 2). Thus, the focus of the maintenance plan should be on material quality and the wear of hammers. In general, the hammers should be changed when the plating is worn off. Reality, however, is sometimes a lot different. With low attention to the hammer mill, completely worn hammers can occur (Image 3), resulting in particles that are too large, and subsequently having a negative effect on pellet mill performance.

low wear (Image 1), whereas lower-quality raw material, including bark, decreases hammer mill lifetime dramatically. It is obvious that softwood is less aggressive on ham-

mers than hardwood. Other quality factors are metals and dirt in the woody biomass. We have encountered large bicycle parts in eastern European raw material batches, as

3

Author: Holger Streetz COO, Bathan AG h.streetz@bathan.ch

IMAGE

When Life Hands You Green Chips, Make Pellets

BY AARON EDEWARDS

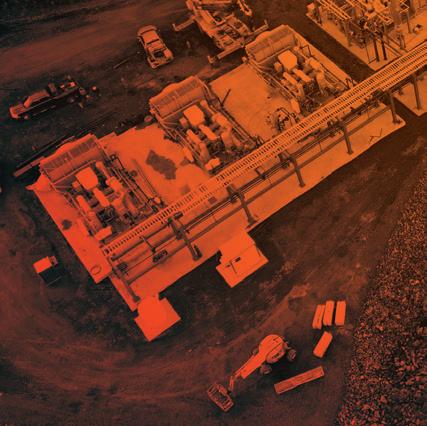

Tackling a new pellet mill of any size is a massive undertaking, and the devil is in the details. Even if this isn’t your first rodeo, the considerations are daunting, to say the least. Each improvement over your last build is considered and weighed against cost and timing. It has to produce, but it has to be profitable. It has to fit in the space you procured, and it has to be up and running by third quarter. Steel is up, but your favorite vendors are at least six months out. Thee traffic study is done—you have how many trucks per day? And what about the wood yard?

When the phone isn’t ringing off the hook, you’re making calls and setting up meetings. You turn to the usual suspects and begin to prepare to take quotes on truck dumps, hoppers, drag chains, belt conveyors, stacker reclaimers, silos, green hammer mills, dry hammer mills, dryers, cyclones, surge bins, and of course, the pellet mills themselves. The thought lingers in the back of your mind, “Has anything changed in the past few years?”

“This kind of research can be fruitful,” says Chris Duffy, sales manager at Bruks

Siwertell. Acknowledged as a leader in bulk handling, Duffy points out that in certain applications, air-cushion conveying and enclosed conveyors are a functional shift for the better. He also points to their Tubulator, a fully enclosed system eliminating the environmental impact of fugitive dust. Many clients turn to engineering solutions to remediate fugitive dust on older systems. From truck dumps to conveyors to the various systems in the mill, this is a constant battle.

Bob Decker, Advanced Conveyor Technologies, says another emphasis is to avoid drag conveyors in favor of belt conveyors to

24 PELLET MILL MAGAZINE ISSUE 1 2023

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Pellet Mill Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

Bruks Siwertell markets its Tubulator to operators looking for high-capacity, lighter-density dry bulk material conveying.

PHOTO: BRUKS SIWERTELL

move the final product. One advantage, he points out, is the ability to forgo dust explosion vents that would be necessary with drag chains. Drag chains are entirely appropriate with the delivered chips, but the industry has moved away from them for pellets. Additionally, with belt conveyors, operators can avoid the pellet degradation issues inherent to drag chains moving finished product. “Ideally, after the cooler, you would use only belt conveyors,” Decker says.

Once operators are confidently moving material toward and through their processes, they should shift gears and focus on sizing, screening and drying. Andy Turner, BM&M Screening Solutions, describes the virtues of a gyratory screen offering full contact for greater efficiency and proper sizing. When sizing the machine, he likes to stay twice as long as wide with the screen. Fines are a significant consideration, meaning the higher fines content of the feedstock, the greater the need for more square footage of screen area, so this must be carefully considered by the project owner and their consultants. “Higher capacity is the hallmark of the gyratory screen,” Turner says. “The gyratory screen’s full contact configuration allows you to make use of the whole screen.”

The chips may be right where they’re wanted, but they’re still the size they were

when they came in—and that’s not going to work. Enter Mark Lyman. Lyman is president of West Salem Machinery, and an all-around sizing expert. The company’s Super Shredder was developed to handle high volumes of green wood fiber from diverse biomass feedstocks. Lyman says the company has come up with a unique concept for high-volume green milling. “Our machine has stood out because it handles high volumes and diverse feedstocks,” he says. “When you’re trying to feed a plant with a million tons of fiber, it increases the ability to handle sustainable biomass materials, including forestry and sawmill residuals, and properly prepares the furnish so downstream equipment can operate to its highest level of performance. It can be a huge advantage, allowing the project owner to go after lower-priced feedstocks. As the industry moves toward those sustainable inputs, it’s important for the machinery to adapt to the broader range of feedstocks.”

Raise your hand if you hate damp chips. I see you there, and so does your pelletizer, so let’s tackle the daunting task of drying those out. “So many considerations go into selecting a dryer, from heating technology to passes to material classification,” says Trevor Frazier of TSI Inc. Frazier’s high-level pass at explaining their offering included a few bits of advice project owners can take

to heart. TSI’s dryers feature bolt-together setup so they can be deployed quickly. Additionally, the dryer is single pass. The goal of a single-pass dryer is to create a “blizzard” effect inside the drum with a homogenous shower of chips, across the full width and along the full length of the drum. The gas velocity inside the drum is one-third that of an equivalent triple pass. The chips are nudged forward by the hot gas as they shower, and there is a “classification” effect, with small chips traveling faster than larger or wetter chips. This enables the drum to dry everything to the same end moisture content. Typical moisture tolerance is less than +/- 1% (compared to +/- 3% to 5% in a triple pass)—certainly something to consider when making a choice.

Naturally, every individual mill has a number of unique factors to weigh, so no solution is one-size-fits-all—and there is innovation in space. A good place to start when determining how to outfit your pellet mill is by choosing a good engineering partner—that is a relationship sure to bear fruit.

Author: Aaron Edewards Business Development Director Evergreen Engineering Inc.

Author: Aaron Edewards Business Development Director Evergreen Engineering Inc.

If you would like more information please feel free to contact us at Ca.Agri.Biomass@sgs.com or at 604-629-1890

BIOMASSMAGAZINE.COM/PELLET 25 Equipment »

SGS and Biomass; not only for

Inspec tion and Analytical ser vices

also for all

related certi cation programs

Sustainable Carbon Cer ti cation)

ENplus

WHEN YOU NEED TO BE SURE

your

but

your

like ISCC (International

and

Largest Biomass Event in North America

SAVE THE DATE

RICHMOND, VA

The Int’l Biomass Conference & Expo is where future and existing producers of biobased power, fuels and thermal energy products go to network with waste generators and other industr y suppliers and technology providers.

The Int’l Biomass Conference & Expo is the largest, fastest-growing event of its kind, the Int’l Biomass Conference & Expo is expected to draw nearly 800 attendees in 2024. In 2022, the event drew more than 700+ attendees, double the attendance of the inaugural show. This growth is fueled by a world-class expo and an acclaimed program.

#IBCE24

twitter.com/biomassmagazine

866-746-8385

service@bbiinternational.com

PR EMIU M PRODUCTS , NOT PR EMIU M PR IC ES BBI International 308 2nd Ave. N., Suite 304 Grand Forks, ND 58203

Change Service Requested

By Eugene Gerden

By Eugene Gerden

By Anna Simet

By Anna Simet

BY EUGENE GERDEN

BY EUGENE GERDEN

Author: Eugene Gerden International Freelance Writer

Author: Eugene Gerden International Freelance Writer

BY ANNA SIMET

BY ANNA SIMET

BY HOLGER STREETZ

BY HOLGER STREETZ

Author: Aaron Edewards Business Development Director Evergreen Engineering Inc.

Author: Aaron Edewards Business Development Director Evergreen Engineering Inc.