EQUIPPED FOR A CLEANER FUTURE

PLUS: The Growth Potential of Energy Crops

PAGE 16

Measuring Up: The Carbon Intensity of Ethanol-to-Jet

PAGE 32

www.safmagazine.com

in the

to

20

Honeywell

Transition

SAF PAGE

Issue 1, 2024

04 EDITOR'S NOTE

All Eyes on GREET

By Anna Simet

05 EVENTS

06 NEWS ROUNDUP

08 US Businesses Need Certainty to Meet SAF Goals

By Paul Winters

09 SPOTLIGHT: Clariant Corporation

Unlocking Feedstock Potential with Highly Efficient Adsorbents

11 SPOTLIGHT: BDI-BioEnergy International GmbH Vast Experience in Waste Oils

12 SPOTLIGHT: GREATER MSP

Taking Flight: Minnesota's SAF Hub

14 What's All This Noise About 100% SAF?

By Steve Csonka

FEATURES

16 CARBON

Ethanol-to-Jet: Capacity and Carbon Calculations

Corn supplies are expected to rise as corn ethanol carbon intensity declines, but what the new version of GREET means for ethanol-to-jet is to be determined. By

Susanne Retka Schill

20 TECHNOLOGY

Refining a Cleaner Future

SAF Magazine chats with Honeywell about its novel Ecofining technology and the company’s role in the future of clean aviation fuels.

By Katie Schroeder

24 EVENT

Connected Energy

CONTRIBUTIONS

28 POLICY SAF: Ready to Soar

The sustainable aviation fuel market is poised for takeoff, but overnight growth may be difficult without policy support that renewable diesel enjoyed in its early years.

By Jordan Godwin

30 INDUSTRY

Overcoming the Challenges of SAF Adoption

Even with positive momentum, achieving future SAF production targets will be a challenge.

By Carrie Song

32 FEEDSTOCK

The Growth Potential of Energy Crops

Clean Fuels Alliance America’s annual conference was held in Fort Worth, Texas, in early February.

By Anna Simet

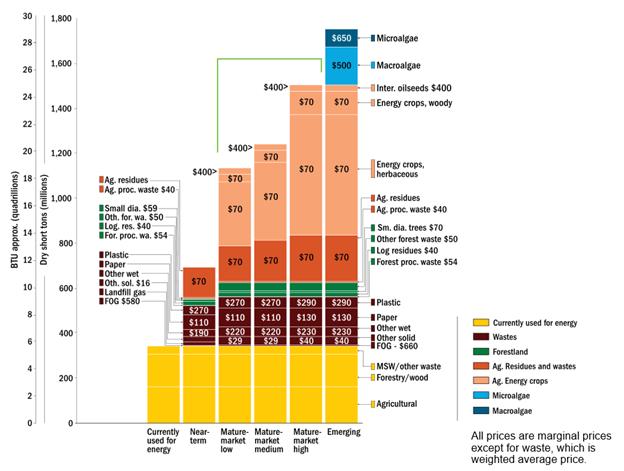

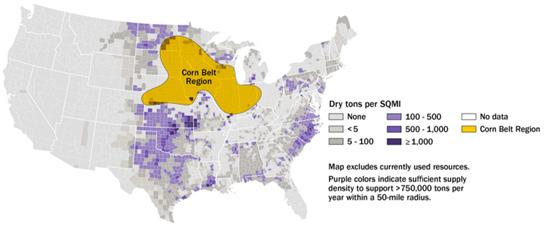

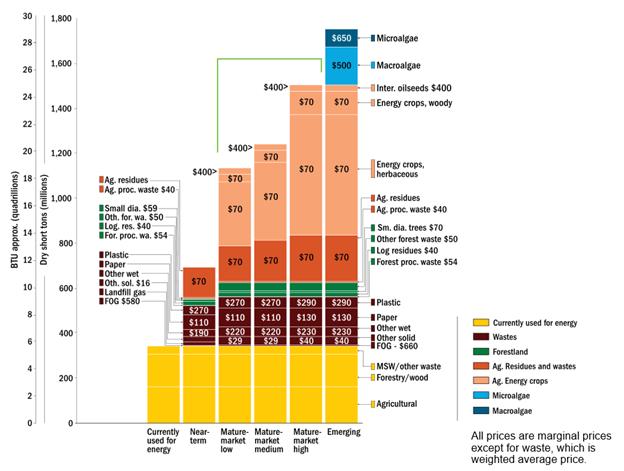

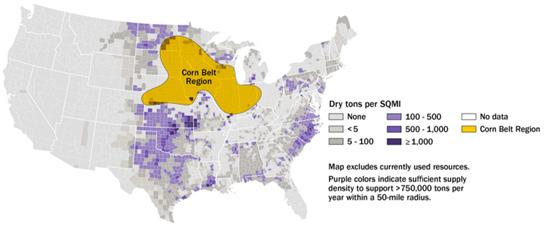

Energy crops represent a key part of the nation’s biomass production portfolio.

By Matthew Langholtz

SAFMAGAZINE.COM 3 2024 | VOLUME 2 | ISSUE 1

DEPARTMENTS

COLUMNS &

Anna Simet EDITOR asimet@bbiinternational.com

Anna Simet EDITOR asimet@bbiinternational.com

All Eyes on GREET

This issue didn't necessarily have a theme when we began putting it together, but the final product speaks otherwise. Alcohol-to-jet, GREET and the current uncertainty around ethanol-based SAF’s carbon intensity score is the buzz of the SAF space right now (well, one of them), and a common thread throughout many of these pages. As I write this on February 29, the Treasury Department has yet to release the modified version of the GREET model that, in December, it indicated would be released by March 1. By the time you read this, the updated version could be out (could, but we know how these things go, and history often repeats itself). For some good insight and to learn more about what’s on the line, be sure to check out our page-18 feature, “Ethanol-to-Jet: Capacity and Carbon Calculation,” by Contributing Writer Susanne Retka Schill. And, you’ll find a great recap of what’s happened to date regarding the uncertainty of new tax policy and its impact on SAF investments already in the op-ed by Clean Fuels Alliance America’s Paul Winters on page 6.

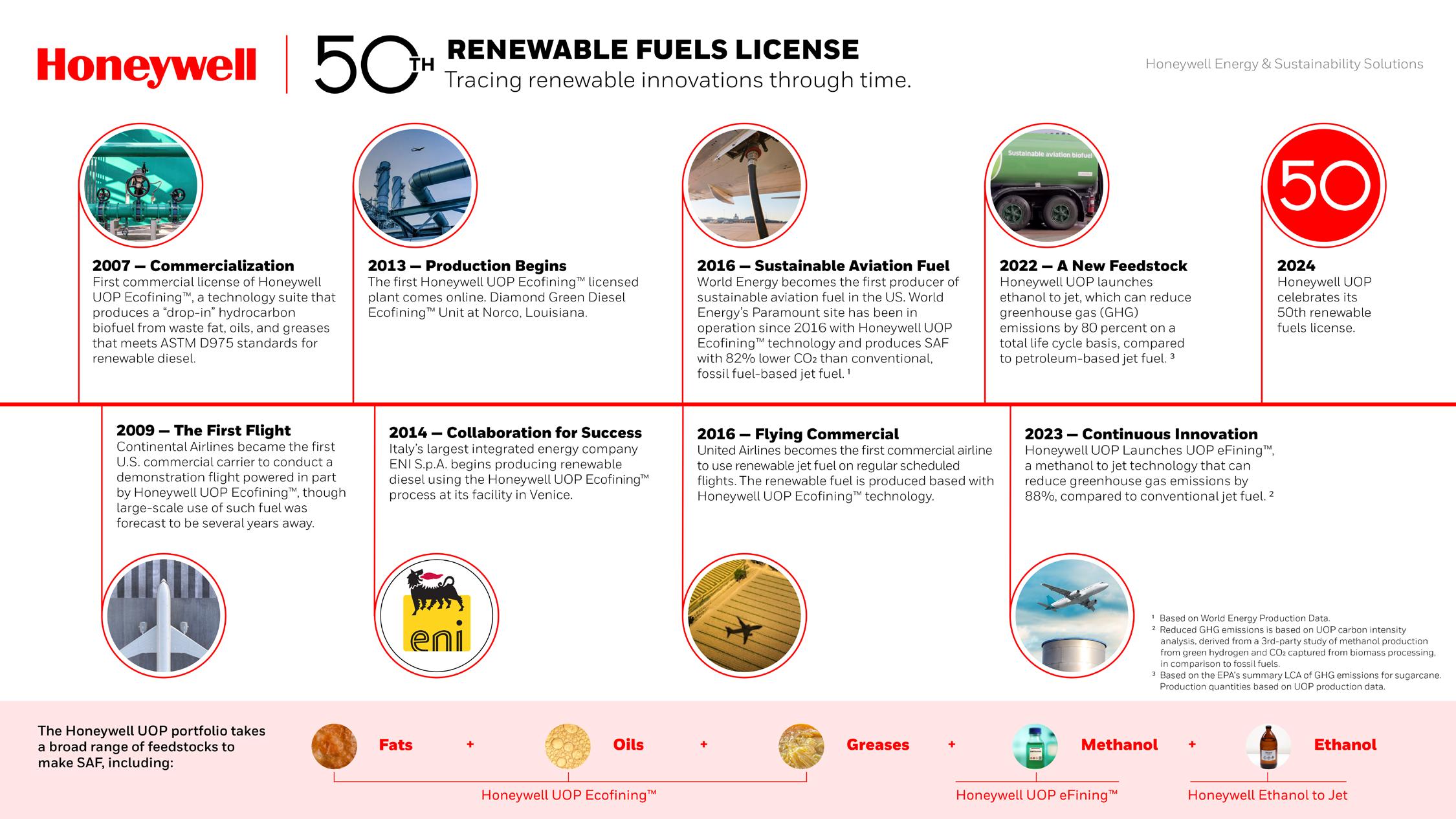

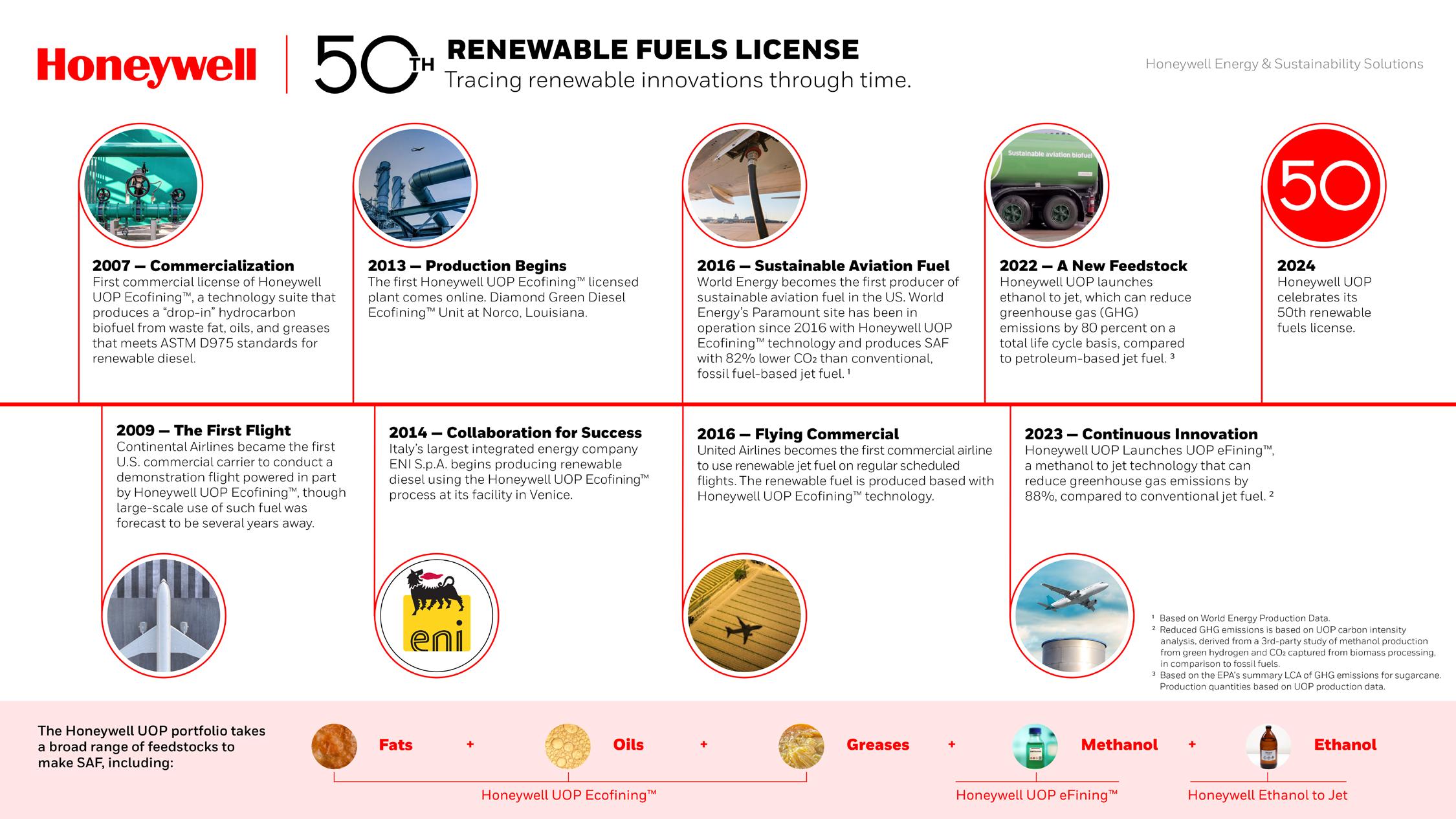

Moving on, our page-22 feature and cover story, “Refining a Cleaner Future,” highlights Honeywell’s SAF technologies, which includes its novel and well-known HEFA Ecofining process, an ethanol-to-jet and a CO2-to-SAF process, as well as another in development that will convert biomass into syncrude and ultimately SAF, according to Barry Glickman, vice president and general manager for Honeywell’s Sustainable Technology Solutions. During an interview with associate editor Katie Schroeder, Glickman also discusses the companies “asks” from the government and the unique and challenging roles technology providers face in the global energy transition. Said Glickman, “Technology providers are essential, or we’re not going to get there. And I say that not just because I’m a technology provider, but as a consumer of various products. We as consumers generally are not interested in or willing to make dramatic changes in our behavior.”

We’re also thrilled to include bylines from Oakridge National Laboratory, Neste, OPIS and the Commercial Aviation Alternative Fuels Initiative (CAAFI), our partner for the North America Sustainable Aviation Fuel Conference & Expo. I think this variety of writers and topics speaks volumes to the depth of this fascinating industry, and really, we’re just scratching the surface.

Editor,

4 SAF MAGAZINE ISSUE 1 2024

Subscriptions to SAF Magazine are free of charge distributed twice/year. To subscribe, visit www.SAFMagazine.com or you can send your mailing address to SAF Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Back Issues & Reprints Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or service@bbiinternational.com. Advertising SAF Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about SAF Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to SAF Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to asimet@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space.

SIMET

ANNA

SAF Magazine Editor's Note

EDITORIAL EDITOR

Anna Simet | asimet@bbiinternational.com

ONLINE NEWS EDITOR

Erin Voegele | evoegele@bbiinternational.com

ASSOCIATE EDITOR

Katie Schroeder | katie.schroeder@bbiinternational.com

DESIGN

VICE PRESIDENT, PRODUCTION & DESIGN

Jaci Satterlund | jsatterlund@bbiinternational.com

GRAPHIC DESIGNER

Raquel Boushee | rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan | jbryan@bbiinternational.com

PRESIDENT

Tom Bryan | tbryan@bbiinternational.com

VICE PRESIDENT, OPERATIONS/MARKETING & SALES

John Nelson | jnelson@bbiinternational.com

SENIOR ACCOUNT MANAGER/BIOENERGY TEAM LEADER

Chip Shereck | cshereck@bbiinternational.com

ACCOUNT MANAGER

Bob Brown | bbrown@bbiinternational.com

CIRCULATION MANAGER

Jessica Tiller | jtiller@bbiinternational.com

MARKETING & ADVERTISING MANAGER

Marla DeFoe | mdefoe@bbiinternational.com

Industry Events »

2024 International Fuel Ethanol Workshop & Expo

June 10-12, 2024

Minneapolis Convention Center | Minneapolis, MN

Celebrating its 40th year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longestrunning ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine—that maintains a strong focus on commercial-scale ethanol production, new technology, and near-term research and development. The event draws more than 2,000 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

(866) 746-8385 | www.fuelethanolworkshop.com

2024 Biodiesel Summit: Sustainable Aviation Fuel & Renewable Diesel

June 10-12, 2024

Minneapolis Convention Center | Minneapolis, MN

The Biodiesel Summit: Sustainable Aviation Fuel & Renewable Diesel is a forum designed for biodiesel and renewable diesel producers to learn about cutting-edge process technologies, new techniques and equipment to optimize existing production, and efficiencies to save money while increasing throughput and fuel quality.

(866) 746-8385 | www.fuelethanolworkshop.com

2024 Carbon Capture & Storage Summit

June 10-12, 2024

Minneapolis Convention Center | Minneapolis, MN

Capturing and storing carbon dioxide in underground wells has the potential to become the most consequential technological deployment in the history of the broader biofuels industry. Deploying effective carbon capture and storage at biofuels plants will cement ethanol and biodiesel as the lowest carbon liquid fuels commercially available in the marketplace. The Carbon Capture & Storage Summit will offer attendees a comprehensive look at the economics of carbon capture and storage, the infrastructure required to make it possible, and the financial and marketplace impacts to participating producers.

(866) 746-8385 | www.fuelethanolworkshop.com

2024 North American SAF Conference & Expo

September 11-13, 2024

Saint Paul RiverCentre | Saint Paul, MN

The North American SAF Conference & Expo, produced by SAF Magazine in collaboration with the Commercial Aviation Alternative Fuels Initiative (CAAFI), will showcase the latest strategies for aviation fuel decarbonization, solutions for key industry challenges, and the current opportunities for airlines, corporations and fuel producers. The North American SAF Conference & Expo is designed to promote the development and adoption of practical solutions to produce SAF and decarbonize the aviation sector.

(866) 746-8385 | www.safconference.com

SAFMAGAZINE.COM 5

Please recycle this magazine and remove inserts or samples before recycling COPYRIGHT © 2024 by BBI International

LanzaJet Inc. has announced a $30 million investment by Southwest Airlines Co. As part of the agreement, the companies intend to work toward the development of a SAF production facility and collaborate to advance the operations of SAFFiRE Renewables LLC, a corn stover-to-ethanol technology company in which Southwest is invested. LanzaJet plans to undertake project development efforts for the SAF production facility in the United States, with Southwest as the anchor SAF offtaker. Southwest's investment comes on the heels of the opening of LanzaJet Freedom Pines Fuels in Soperton, Georgia, which the company said is the world's first commercial-scale ethanol-to-SAF plant.

Neste Corp. released 2023 financial results on Feb. 8, reporting that renewable diesel production was up more than 15% when compared to 2022, with SAF production up nearly 59%. According to Neste’s fourth quarter report, the company produced nearly 3.27 million metric tons of renewable diesel last year, up from 2.83 million metric tons the previous year. SAF production reached 251,000 metric tons, up from 158,000 metric tons in 2022. Neste President and CEO Matti Lehmus said the renewables product segment was able to increase its comparable sales margin to $863 per ton, up from $779 per ton last year. “This was enabled by successful global optimization across feedstocks, markets and products,” he said. According to Lehmus, sales volumes for renewable diesel and SAF were 3.3 million metric tons, up from 3 million metric tons in 2022.

In late January, Phillps 66 confirmed that the renewables conversion of its Rodeo, California, refinery is nearing completion. The facility shut down crude oil operations in February and was expected to begin producing renewable fuels during the first quarter of the year. Company officials discussed the project during a fourth quarter earnings call held Jan. 31.

Phillips 66 made a final investment decision to move forward with the conversion project in May 2022. At that time, Phillips 66 explained that the scope of the project includes the construction of pretreatment units and the repurposing of existing hydrocracking units to enable production of renewable fuels. Once fully operational, the facility is expected to have the capacity to produce more than 50,000 barrels per day (800 MMgy) of

renewable fuels, including renewable diesel, renewable gasoline and SAF.

During the earnings call, Rich Harbison, executive vice president of refining at Phillipps 66, explained that the company planned to shut down the facility in February. The shutdown would allow the company to tie in the common utilities for one of the hydrocrackers that is currently in the conversion process, he said. The hydrocracker was expected to begin operations in March and quickly ramp up to approximately 50% of the conversion project’s expected capacity. In April, the company will finish work on the feedstock pretreatment unit and continue the conversion of the second hydrocracker system, Harbison said. That work will be completed the following month, with commissioning expected to continue into May. Optimization work will continue, and the facility is expected to be operating at full run rates by the end of the second quarter, he added.

Strategic Biofuels and Sumitomo Corporation of Americas have entered into a joint development agreement for Strategic Biofuels’ previously announced Louisiana Green Fuels project at the Port of Columbia in Caldwell Parish, Louisiana.

Per the agreement, SCOA will take an anchor position and lead the formation of a Japanese-based investment consortium aimed at funding the majority of development capital needed to carry the project to financial investment decision (FID) and commencement of construction in early 2025. In a decisive strategic shift related to the investment, Strategic Biofuels also unveiled plans to change its primary renewable fuel product from

6 SAF MAGAZINE ISSUE 1 2024 SAF Magazine News

LanzaJet held the grand opening of its 10 MMgy ethanol-to-jet fuel plant in Soperton, Georgia, in January.

IMAGE: LANZAJET

renewable diesel to SAF. SCOA intends to provide a 20-year offtake for the approximately 640 million gallons of renewable fuels produced as well as all state and federal renewable fuel credits.

CVR Energy Inc. released fourth quarter financial results on Feb. 20, reporting that the feedstock pretreatment unit at its Wynnewood biorefinery in Oklahoma is mechanically complete. The company is also continuing to evaluate projects to add SAF capacity at two of its refineries.

David Lamp, CEO of CVR Energy, discussed both the existing Wynnewood renewable diesel project and the company’s plans to expand to SAF production during a fourth quarter earnings call held Feb. 21. For the full year 2023, the Wynnewood facility processed approximately 82.5 million gallons of vegetable oil feedstock. Lamp said the new feedstock pretreatment unit at the Wynnewood facility was mechanically complete at the end of the first quarter and was expected to begin processing feedstock within days of the call. He also indicated that the com-

Cepsa and Bio-Oils, a subsidiary of Apical, have reported beginning construction of the largest secondgeneration biofuels plant in southern Europe. The plant will flexibly produce 500,000 tons of SAF and renewable diesel annually, allowing the joint venture to double its current production capacity. The new 2G biofuel plant, along with the existing facilities operated by Cepsa and Bio-Oils in Huelva, Spain, will form the second-largest renewable fuel complex in Europe, with a total production capacity of 1 million tons per annum.

Start-up of the new facility, which will be built in Palos de la Frontera, is planned for 2026. It will require a 1.2-billion euro ($1.29 billion) investment and generate 2,000 direct and indirect jobs during the construction and operation phases, according to the companies.

The plant will consume hydrogen and use 100% renewable electricity, emitting 75% less CO2 than a traditional biofuel plant, the companies said, and is designed to achieve net-zero emissions in the medium-term. In addition to renewable diesel and SAF, the plant will also produce biogas.

pany is continuing to evaluate opportunities for renewables expansions, particularly the addition of SAF capacity at the Wynnewood facility and CVR Energy’s Coffeyville refinery in Kansas.

For the potential Wynnewood expansion, Lamp said the company plans to begin soliciting bids over the next few months for offtake agreements that would support the conversion of the existing renewable diesel unit to 100% SAF. CVR Energy is also considering a larger project at the Coffeyville facility. Lamp said the company currently expects to have preliminary engineering and cost-estimating work complete for that potential project by the end of the first quarter. CVR Energy currently plans to approach the market in the second half of 2024 to solicit bids for partners to invest in the construction of a renewable diesel and SAF facility near Coffeyville with a capacity of up to 500 MMgy, he said. Board approval of the project will depend on the company’s ability to find partners willing to fund the cost of construction, Lamp said.

The initial work for the development of these facilities will focus on earthmoving and land improvements, urbanization, and infrastructure foundation as well as the start of marine construction at the southern pier of the Port of Huelva, given that the project also encompasses the development of auxiliary facilities in

the port necessary for its operation, according to a press release issued by the companies.

SAFMAGAZINE.COM 7

Cepsa and Bio-Oils, a subsidiary of Apical, are beginning construction of the largest second-generation biofuel plant in southern Europe. The facility will have the capability to flexibly produce 500,000 tons of SAF and renewable diesel.

IMAGE: CEPSA

US Businesses Need Certainty to Meet SAF Goals

For the foreseeable future, sustainable aviation fuel (SAF) is the best available option for decarbonizing air transportation. Accordingly, the United States has joined the global effort and set aggressive goals for producing SAF for domestic markets.

In 2023, the U.S. used 24.5 million gallons of renewable jet fuel. Reaching the nation’s goal of producing 3 billion gallons of SAF by 2030 will require doubling that amount every single year. Meeting the future goals will depend on building new supply chains with new feedstock sources, production facilities and technologies.

Unfortunately, uncertainty in new tax policies is already delaying the necessary investments. In August 2022, Congress adopted a new Section 40B Sustainable Aviation Fuel excise tax credit as part of the Inflation Reduction Act. This revised credit is only available to taxpayers for 2023 and 2024, since it is scheduled to be replaced by the new Section 45Z Clean Fuel Production Credit in 2025. The law designates the International Civil Aviation Organization’s Carbon Offsetting and Reduction Scheme for International Aviation model to demonstrate the required emissions reduction and calculate both the 40B and 45Z tax credit values for SAF.

Potential SAF producers waited all 2023 for guidance from the U.S. Treasury and Internal Revenue Service. One question was whether they would be allowed to use the Argonne National Laboratory’s Greenhouse Gases, Regulated Emissions and Energy Use in Technologies model as a similar methodology. The GREET model is familiar to the industry because it is incorporated in California’s Low Carbon Fuel Standard.

Unfortunately, the IRS’s December 2023 guidance indicated that the existing GREET model was not sufficiently comparable to CORSIA. The only existing model that Treasury determined to be similar to CORSIA is the EPA’s Renewable Fuel Standard lifecycle modeling. EPA has not updated its RFS modeling since 2010. The CORSIA model incorporates the GREET model; however, it does not utilize the most up-to-date data from GREET; some of the values used in CORSIA are from 2013.

Lifecycle greenhouse gas emissions (GHG) analysis has evolved considerably in the last decade. The GREET model is updated every year to incorporate real-world data.

The IRS guidance further promised that an interagency working group composed of EPA, USDA, and the Departments of Energy and Transportation would develop a modified “40B SAF GREET” model by March 1 that would be sufficiently similar to the CORSIA model for use in the tax credit.

Environmental groups went on record to insist that the outdated indirect land use change estimates from CORSIA or EPA’s 2010 model be used in this new modified GREET model. The groups disparage the Argonne model as “industry friendly” because it utilizes recent data reflecting advances in biofuel and crop production.

The problem with waiting until March 1 to answer these questions is that biofuel producers are already negotiating and setting feedstock contracts for 2025. Those contracts will determine whether they expand production or not. It’s too late for the 40B tax credit to incentivize additional production for 2024.

Producers are looking for the new modified GREET model as a signal of what to expect in 2025 and beyond with the new 45Z credit. The Treasury is expected to start a rulemaking process for that credit later this year.

In July 2023, President Biden predicted that over “the next 20 years, farmers are going to be providing 95% of all the sustainable airline fuel.” The roadmap for the SAF Grand Challenge makes very clear that reaching the 3-billion-gallon goal this decade will unquestionably require U.S. grown crops as a major feedstock.

The real question is whether U.S. businesses can rely on the tax credit as an incentive for long-term investments necessary to meet the Grand Challenge. Those investments will only make sense if there is potential to incorporate new low-carbon technologies and agricultural practices over time. There should be no room in the modified GREET model for outdated data.

8 SAF MAGAZINE ISSUE 1 2024

Paul Winters

Column

Clean Fuels Alliance America

Unlocking Feedstock Potential with Highly Efficient Adsorbents

In 2022, the International Energy Agency posed a critical question: Is the biofuel industry approaching a feedstock crunch? Sustainable aviation fuel is crucial to tackling climate change and is primarily produced by processing used cooking oil and other sustainable feedstocks. This offers game-changing decarbonization potential for transportation. However, producers must contend with diverse contaminants that drastically reduce production efficiency.

The worldwide production of biofuels has increased roughly tenfold since 2000, to about 175 billion liters per year, replacing more fossil fuels in transportation. And the ramp-up continues: According to IEA estimates, total annual biofuel demand will increase by about 35 billion liters between 2020 and 2027, and SAF demand is estimated to increase eightfold. In the United States alone, as of January 2023, biofuels production capacity reached 87 billion liters annually, reflecting a 6% increase from January

2022. Moreover, U.S. production capacity of renewable fuels has already surpassed biodiesel. This rapid expansion is projected to more than double current renewable diesel capacity by 2025.

To meet the market’s rising appetite, a more sustainable path unfolds in utilizing waste and residue oils and fats. These alternatives contribute to sustainability by utilizing waste, reducing greenhouse gas emissions and aligning with incentivized practices, without imposing additional strain on resources. Consequently, regulatory and market incentives drive a transition to second-generation and advanced feedstocks, comprising of used cooking oil, waste animal fat and distillers corn oil.

As demand grows for sustainable feedstocks from waste oils and fats, improved purification methods become essential. These feedstocks contain higher contaminant levels, including metals and soaps, which can disrupt production. Risks like cat-

alyst poisoning pose significant challenges.

Clariant addresses this through its TONSILTM series—highly efficient adsorbents and refining aids with expansive, active surfaces that remove a wide array of contaminants. This flexibility is crucial for utilizing a broader range of sustainable feedstocks. TONSIL enhances pretreatment effectiveness, eliminating contaminants reliably, whether used as feedstock pretreatment in biofuels production, or posttreatment polishing to meet specifications.

By enabling access to an ever-wider range of sustainable feedstocks, advanced purification technology minimizes the risk of a potential feedstock crunch, while the world watches with anticipation as industries and policymakers navigate the economics and innovation in the promising and evolving landscape of biofuels.

IMAGE: SAFRAN HELICOPTER ENGINES

IMAGE: SAFRAN HELICOPTER ENGINES

Spotlight | Clariant Adsorbents Americas

Vast Experience in Waste Oils

BDI-BioEnergy International began engineering waste oil-processing biodiesel plants in the mid-1990s. Since then, the company has gained a wide range of experience in the specialization of the handling of waste oils and their unique properties, leading to numerous process and design adaptions.

Biologic crude oils and fats contaminant variation is much higher compared to fossil crude oil. Due to degradation processes, this variation is even higher for waste oils with biological origin. Furthermore, sticky and gluey properties of waste oils increase with progressing degradation. This goes along with fouling and deposits within the pipes and the equipment. Special design for equipment (e.g., heat exchangers) not only mitigates fouling and enables easy cleaning, but also ensures a stable process with a certain tolerance to fouling. Subsequently, this design optimization decreases downtime and increases availability of the overall plant.

Modular Concept, High Yield

The modular approach of BDI PreTreatment allows adaptation to customers’ re-

quirements in view of feedstock and product properties. BDI is committed to finding the best solution for each individual request.

The core technology of the BDI PrePurification unit—the first processing stage—is based on a special type of centrifuge, a technology that was introduced 1998, the result of collaboration between BDI and the centrifuge supplier. The companies working in tandem resulted in various improvements of the machine.

As for how it works, the centrifuge enables a solids release with a very low oil content. The solids are dried before being discharged, and therefore, the oil can be reduced to a maximum of 60% of the solids content within this process step. This results in a higher yield of about 0.5 to 1% compared to other technologies.

Using a robust horizontal centrifuge in the first process step addresses the difficult properties of waste oils. While sticky and gluey substances combined with solids tend to plug the very small gaps in disc stack centrifuges, they can be handled and discharged

quite well in the horizontal centrifuge. This directly impacts downtime and availability of the plant.

Due to the centrifuge's special design for waste oils drawn from BDI's many years in waste oil processing, as well as the implemented robust technology, excessive downtime for cleaning procedures can be avoided and the availability of the plant can be kept on a high level.

Flexible Plant Operation, Analytical Management

Changes in the future regarding feedstock properties and composition may require adjustments to the operation mode. With BDI Advanced PreTreatment, operation modes can be adapted, and parameters adjusted easily without the requirement of programmers or experts.

BDI will train the concept of adjusting certain operating parameters based on analytical results of feedstock, intermediate and product samples. This method is the key skill to keep a high product quality despite changing feedstock parameters.

Spotlight | BDI-BioEnergy International

GmbH

www.bdi-bioenergy.com for highest yield customized perfection +2 5 years of experience in pretreatment of waste oils and fats lowest impurities measurable solutions for ADVANCED PRETREATMENT PROCESS FOR WORST FEEDSTOCK QUALITIES

Taking Flight: Minnesota’s SAF Hub

In August 2023, the Greater MSP Partnership and a handful of anchor collaborators including Delta Airlines, Ecolab, Xcel Energy and Bank of Amerca unveiled an unprecedented initiative to launch the first largescale sustainable aviation fuel hub in the country. While Minnesota is home to leading universities, institutions and other collaborators who are all on board to accelerate SAF delivery to Minneapolis-Saint Paul International Airport, the ambition of this group is so big that they are welcoming stakeholders from across the country to join the mission, which is well underway.

Making a Market

As for why, exactly, Minnesota is an ideal location for a SAF hub, the short answer is that producing sustainable aviation fuel is a puzzle that requires many different pieces that the state just so happens to have, says Peter Frosch, CEO of the GREATER MSP Partnership. “First and very importantly, it has a large-scale concentration of demand—the Minneapolis-Saint Paul International Airport,” he says. “Second, we have research capabilities at the University of Minnesota that are aligned with many of the technical areas in SAF where problem solving is required. Third, we have clean power—Xcel Energy has a 100% renewable mandate by 2040 and is on track to be 85%-plus clean power by the end of this decade. That's a big advantage, and is absolutely necessary in order to meet carbon reduction goals. Fourth, we have a major agricultural economy that produces multiple large-volume commodities with the entire integrated value chain including transportation, and related to that, we have an existing large-scale biofuels industry. So, we have technical knowhow for doing work in this industry, and a group of leaders and institutions in Minnesota capable of tackling the SAF challenge. We have this hub not just because Minnesota makes sense as a place to go for a SAF economy, because the will exists among key leaders and institutions to do that.”

When the partners began engaging in efforts 18 months ago, Frosch says, it quickly became clear that many entities want to participate in the SAF market. However, reality was that only about 20 million gallons of SAF was available in the U.S. last year. “So really, the market does not exist at scale,” he says. “We're focused on a strategic effort to build an industrial-scale value chain to produce the product at scale. There are some players trying to participate in a market that doesn't yet exist, and many fewer who are willing to step forward, roll up their sleeves and help build that market. We welcome conversations with any interested party who would like to play a role in problem-solving in Minnesota. We have worked to create different avenues of engagement that require varying levels of commitment and visibility. We welcome any and all interest.”

Pathways, Policy and Possibilities

With many different technologies available, it isn’t a matter of preference, according to Frosch. “The Minnesota SAF hub is anchored on an ambition to build an industrial-scale value chain for SAF that delivers a large volume of low-carbon, affordable SAF to the airport in incremental milestones,” he says. “This strategy requires multiple technology paths, given the volumes that we're seeking, acknowledging the many uncertainties that exist, and considering the technology economics of today. All partners of the hub agree that there are multiple ways to make SAF, and ultimately, we're going to have to engage multiple different technology pathways whether its HEFA, ATJ, power to liquid or something else.”

As for challenges or barriers, Frosch says that, one of them is uncertainty. “What we're doing is new, so we need to prioritize and solve problems in a sequential and disciplined way, but one example of a challenge right now is regulatory uncertainty— the Treasury Department hasn’t released its updated version of the GREET model used to calculate lifecycle greenhouse gas reductions for the purposes of the Section 40B SAF tax credit, so that’s an unknown.”

Along with challenges comes learning,

and that's constantly happening, Frosch says. “That’s the big idea here. We must bring an innovation mindset to the overall effort. Every day, every week, blocking and tackling—it’s necessary to make this work. So little is built, so we have to see ourselves as innovators. A lot of this work is very exciting. We've learned many things about technology and what's possible—what might be possible sooner than we imagined if certain conditions came into play. And on the technology side, faster solutions, more economical, greater carbon-intensity-reduction potential than we imagined just six or eight months ago. The real challenges are more about the economics, and less about the technology.”

Cost, Carbon & Climate

The cost of SAF compared to conventional jet fuel is an often-discussed topic— Frosch says that the partnership has a plan to initiate the market by covering the initial premium of SAF. “The new Minnesota state incentives for SAF, which were signed into law in August, can be layered with federal SAF incentives, and we have a demand consortium of private sector companies that we are working with in order to order to completely close that initial gap of the cost of SAF and Jet A.”

Ultimately, the motivation of Delta Airlines and all the other key partners in this effort is to decarbonize air travel and do it in a way that is sensitive to all other environmental factors, Frosch says. “The strategy of the Minnesota SAF hub has aggressive and innovative aims around not only initiating a SAF market, but scaling volume and reducing the life cycle carbon intensity of SAF as quickly as possible,” he adds. “This is where a focus on regenerative agriculture is so important—what we're striving to do is achieve both carbon and climate mitigation targets with biodiversity and land use priorities. We want to work with environmental organizations, locally and nationally, to cocreate a high-integrity, Minnesota-based SAF economy that could become a model for how this can be done throughout the country and the world.”

12 SAF MAGAZINE ISSUE 1 2024

Spotlight | GREATER MSP

What’s All This Noise About 100% SAF?

BY STEVE CSONKA

Readers have likely seen or heard a lot of things recently about the aviation industry pursuing 100% sustainable aviation fuel (SAF) as part of its decarbonization commitments. There have been multiple news stories about research activities and flight demonstrations that have used 100% synthetically derived SAF. Some of these may even have generated some angst for readers, especially those associated with airport fuel handling, who wonder if they are going to have to deal with fuel segregation requirements going forward. Understanding synthetic jet fuel activity requires some nuance and understanding of detail, and therefore the headlines coming from the industry have been viewed by some as confusing or inconsistent with expectations regarding the focus on drop-in fuels that can be used in existing infrastructure and aircraft. So it should be no surprise that many have reached out to Commercial Aviation Alternative Fuels Initiative asking, “What are these efforts, what do they mean? Are these still drop-in fuels, and is the industry changing strategies?”

The short answer to the last question is, no, the aviation industry is not changing strategies. These activities simply provide a glimpse into the depths of the strategy the aviation industry has been pursuing since before the aviation sector’s first Industry Commitment to Action on Climate Change in 2008. The entire industry continues to pursue SAF, drop-in synthetic fuels that can deliver significant lifecycle greenhouse gas (GHG) emissions reductions (and other environmental and social benefits) at reasonable costs. This strategy includes moving beyond the blending requirements found in the current SAF specifications and addressing the opportunity for up to 100% synthetic jet fuels produced from an ever-broadening range of SAF production pathways (i.e., new hydrocarbon feedstock sources and conversion technologies).

The industry has been using SAF continuously since its initial introduction in 2016 at Los Angeles International Airport. That first million gallons of SAF was produced via the hydroprocessed esters and fatty acids (HEFA) pathway, defined in ASTM Specification D7566 Annex A2. The SAF was delivered at blend levels between 30% and up to 50% with petroleum-based jet fuel and delivered 60% to 80% reductions in net GHG emissions per gallon consumed. Fastforward to 2023, when the International Air Transport Association reported an estimated 158 million gallons of neat SAF production worldwide. In the U.S., EPA highlights the usage of 26.3 million gallons of RFS-compliant neat SAF blending component in the U.S. in 2023 and 9.6 million gallons in January 2024 alone! This is evidence of the industry entering a growth trajectory that's anticipated to deliver on various SAF commitments and policy, goals and mandates being created worldwide (e.g., the 3 billion gallon per year U.S. production goal of the SAF Grand Challenge by 2030).

ASTM specifications currently require SAF to be blended with petroleum-based jet fuel at levels up to 50%. We recognize that removing blending restraints on current SAF production concepts is one of the ways to accelerate decarbonization for the sector while also potentially reducing costs and net lifecycle carbon. However, such an approach can only be done within the bounds of a fuel that meets the specifications needed to maintain the type certificate of existing aircraft—i.e., a drop-in fuel.

How and when can the aviation industry use 100% synthetic aviation turbine fuel that also delivers the sustainability society expects from the sector?

Aviation manufacturers will continue to ensure that their aircraft (legacy, in-production, pending and future concepts) are able to operate on all drop-in fuels. This is the

essence of the industry’s fuel qualification approach outlined in the requirements of the ASTM D4054 specification. It is worth noting that the current fuel specification allows a great deal of flexibility in the composition of jet fuel. Each jet fuel refiner (petroleum-based or otherwise) around the world produces fuel that is molecularly distinct, predicated on the type of crude they use and the processes in the refinery. But they all produce a fuel that falls into the range of physical and fit-for-use properties defined and bounded by the jet fuel specification (ASTM D1655).

While we support ongoing efforts to qualify SAF that is fully compatible with today’s fleet of aircraft, manufacturers are also working to ensure that new aircraft produced after 2030 will be able to use as wide a range of drop-in SAF types as possible, including up to 100%. The 100% SAF demonstration flights in recent months by United Airlines, Emirates, Gulfstream and others relied on obtaining aromatics that were produced from biomass. However, the current requirement that we have aromatic content in such SAF blends makes it more costly to produce and distribute SAF. This is due to an additional blending step that is often required to introduce these compounds into the fuel.

In terms of expanding potential dropin SAF compositions, one example is the consideration of jet fuel formulations with varying aromatic type and content. Aromatics are important components in today’s petroleum-based jet fuel, delivering physical and fit-for-purpose attributes for the aircraft. Unfortunately, certain aromatic compounds such as polycyclic naphthalenes can generate particulate matter during combustion. Research also indicates that their removal from jet fuel may help mitigate the formation of persistent contrails that represent a nonCO2 climate impact of aviation. Removing these specific aromatics, naphthalenes, from the fuel will likely reduce the negative impacts of aviation on air quality and radiative

14 SAF MAGAZINE ISSUE 1 2024 CAAFI

forcing. However, the removal of all aromatics will likely have negative impacts on operability and efficiency. Nevertheless, there may be ways to tailor certain 100% synthetic definitions, such that we get advantaged fuel formulations without naphthalenes. For example, testing has shown that certain cycloparaffins and non-naphthalenic aromatics can replace less desirable aromatics while still delivering a drop-in SAF. The aviation enterprise is collaborating with the research community and fuel producers on utilizing the full range of the fuel specification, comprised of various types and quantities of synthetic components that still result in a dropin SAF, and getting such fuels qualified for use by 2030.

What signs of progress should we expect to see next?

An industry task force has been convened under subcommittee ASTM D02.J0 to facilitate the evaluation and approvals needed for 100% drop-in SAF. There are several potential ways to achieve the qualification of higher SAF blending component, or even 100% SAF, that center around the idea of producing a set of molecules that fully match the overall characteristics of jet fuels refined from petroleum. These concepts include:

• Current approach: The current approach requires synthetic blendstocks to be blended with petroleum-based jet fuel. This is the approach we have been using since the start of our SAF journey and is reflected in the qualified pathways found in the Annexes of ASTM D7566 (eight at present and increasing) as well as the coprocessing pathways found in Annex A1 of D1655 (three at present and increasing). In some cases, we may be able to increase the maximum level of allowable blending.

• Near-term advancements: These advancements allow specific pathways that produce fully formulated SAF (with all the required molecular components necessary for performance and safety), mimicking petroleum-based jet, to be qualified under the ASTM D7566 (e.g., potentially three of the existing pathways that include certain C7-C17 range iso-, normal-, and cyclo-paraffins and

aromatics as well as other approaches going forward).

• Closely following the near term: These advancements allow individual blending components of already qualified pathways to be blended to get to 100% drop-in SAF. This solution may not help as much with cost, except in some unique circumstances, but will help with maximizing net carbon reductions out of any gallon of SAF used.

So, progress on these concepts will not be widely discussed in public, but will be worked toward behind the scenes within the fuel specification subcommittees (several hundred aviation fuel specialists from across the industry and around the world) and unveiled as changes to D7566, likely within the next 18 months.

What else is being worked on?

Some aircraft may also be able to operate on nondrop-in fuels, today or tomorrow, to achieve various operational efficiencies (for example, utilizing fuels with higher-energy-per-unit mass, higher-energy-per-unit volume, or having greater heat capacity). However, the aviation industry recognizes there are many nonaircraft issues to address before these concepts can advance to commercialization, if ever. The industry will continue to explore such in the background (e.g., through the collaboration of the International Aerospace Environmental Group) to see if these issues can be addressed in meaningful ways (e.g., through aircraft modifications) where the benefits clearly outweigh the risks and costs for all jet fuel consumers. One of the outcomes of this evaluation is the potential creation of a nondrop-in jet fuel specification being referred to by various names (e.g., Jet-X, 100% HEFA), primarily for use by the manufacturers in evaluating future designs under a common understanding of any potential new fuel definition. The use of hydrogen as a gas turbine fuel falls into this category of future evaluation efforts. So, when you hear about such concepts, do not confuse them with the mainstream activity around which the entire aviation enterprise is aligned—moving to affordable, sustainable, 100% drop-in SAF.

Steve Csonka

Executive Director, Commercial Aviation Alternative Fuels Initiative

Steve Csonka

Executive Director, Commercial Aviation Alternative Fuels Initiative

Takeaway

In conclusion, yes—there has been a great deal of interest in the aviation sector to accommodate 100% SAF to maximize GHG emissions reductions without negatively impacting aviation’s ability to deliver on its value proposition of safe, high-speed movement of people and freight.

Aircraft and gas turbine jet engines are robust in their designs and operability, which contribute to aviation’s safety. Nondrop-in fuels can likely provide fundamental power production in an engine, but they are not considered viable in the near term, as they will require changes to delivery and storage infrastructure, engines, aircraft, etc., at greater-than-practical societal cost. While such concepts are still being researched (e.g., to prepare the industry to fend off uniformed policy pursuits), they are unlikely to reach commercial viability in the foreseeable future.

Aviation advocates should join us in welcoming 100% SAF concepts in the near term and expect to hear more as such efforts continue. Rest assured that such adoption doesn’t need to cause apprehension. The systems are in place to ensure that 100% SAF can be produced and used safely as drop-in fuels with existing systems and airport infrastructure, and such an approach helps accelerate the industry toward achieving its commitments.

Author: Steve Csonka Executive Director, Commercial Aviation Alternative Fuels Initiative www.caafi.org

SAFMAGAZINE.COM 15

ETHANOL-TO-JET: CAPACITY AND CARBON CALCULATIONS

Ethanol-to-jet (ETJ) is projected to soon catch up to hydroprocessed esters and fatty acids (HEFA) in supplying growing demand for sustainable aviation fuel (SAF). But questions have quickly arisen: How much ethanol is available near- and longterm? And what’s the likelihood that corn ethanol will be able to reduce its carbon intensity enough to qualify as a SAF feedstock?

The revised Greenhouse Gases, Regulated Emissions and Energy Use in Transportation (GREET) model will address how corn ethanol’s carbon intensity (CI) is to be

measured, although it had not yet been released at press time in mid-March. The revised model will be used to evaluate greenhouse gas (GHG) reductions to qualify for Inflation Reduction Act incentives. Another big unknown is how the regulatory process will play out for proposed pipelines to transfer ethanol CO2 to suitable sequestration sites—the quickest and most costeffective means to slash ethanol’s GHG footprint. The outcome on both fronts will either accelerate or slow ETJ’s prospects, but ethanol industry spokesmen express confidence that ethanol’s SAF potential will be realized regardless.

Net-Zero Ethanol Goal

Initially responding to California’s Low Carbon Fuel Standard, the ethanol industry has embraced CI reduction. The spreading adoption of low carbon fuel standards, plus the buzz surrounding corporate netzero pledges, prompted ethanol producers to up the ante. In 2021, ethanol producer members of the Renewable Fuels Association adopted a goal of 70% GHG reduction relative to gasoline by 2030 and net zero by 2050. Other industry groups soon announced their own pledges.

The net-zero goal was enthusiastically embraced by RFA members, says Geoff Cooper, CEO of the Washington-

16 SAF MAGAZINE ISSUE 1 2024

based ethanol association. In 2022, RFA released a study, “Pathways to Net-Zero Ethanol,” which was commissioned to support the decarbonization effort. The study evaluated more than two dozen potential GHG reduction actions, prioritizing them by technical feasibility, scale of reduction and cost. Conducted by Informed Sustainability Consulting, the study found that an ethanol producer who optimizes multiple plant efficiencies and is located in a region with high adoption rates of climate-smart farming practices could meet RFA’s 2030 target of 70% GHG reduction without carbon capture and sequestration (CCS). In addition to modeling the impact of wide-

spread adoption of plant efficiency improvements already implemented by industry leaders, the study looked at wider adoption of advanced fermentation technologies, increased renewable electricity and biomethane, among other technologies.

The RFA followed that study with a survey last year. “Nearly eight out of 10 member facilities are on track to achieve net zero by 2050 or sooner,” Cooper says. All producer members have adopted at least one, and most more than one, of the carbon-reduction technologies identified in the pathways paper, reporting a 12% reduction in average CI since 2016. Over a third already capture biogenic CO2 and more than three-quarters intend to adopt sequestration technologies.”

Cooper points out that with an industry capacity of 18 billion gallons, “the ethanol and feedstock assets are already in place to support to the first billion gallons of ethanol-to-jet fuel.”

Not only is ethanol capacity greater than current utilization, but it’s also greater than projected demand from existing markets. The USDA Economic Research Service projects that 2021’s domestic ethanol use of 13.9 billion gallons will grow to just 14.7 billion gallons by 2030. Current exports of around 1.4 billion gallons annually are projected to grow to 2.1 billion gallons by 2030.

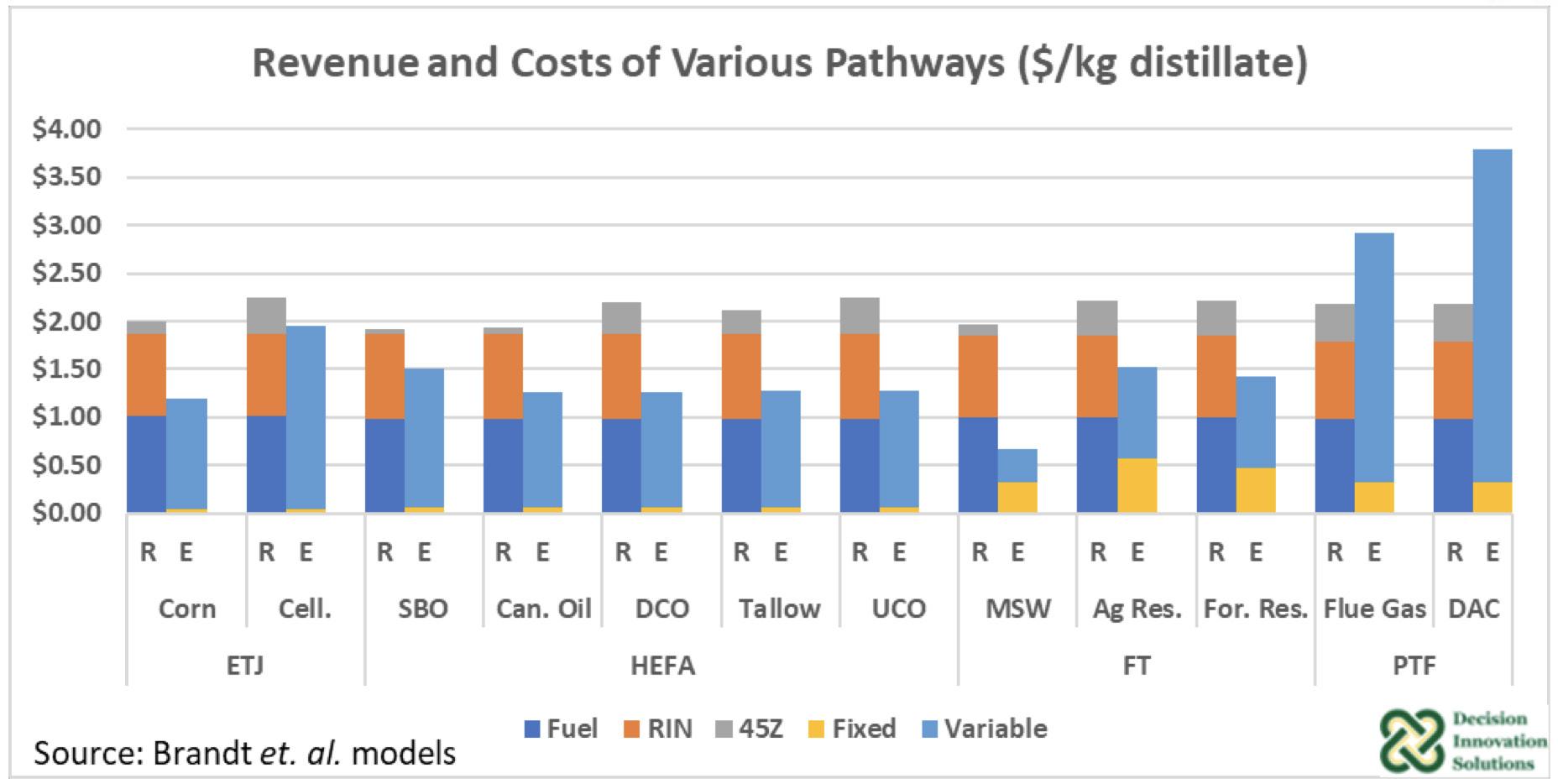

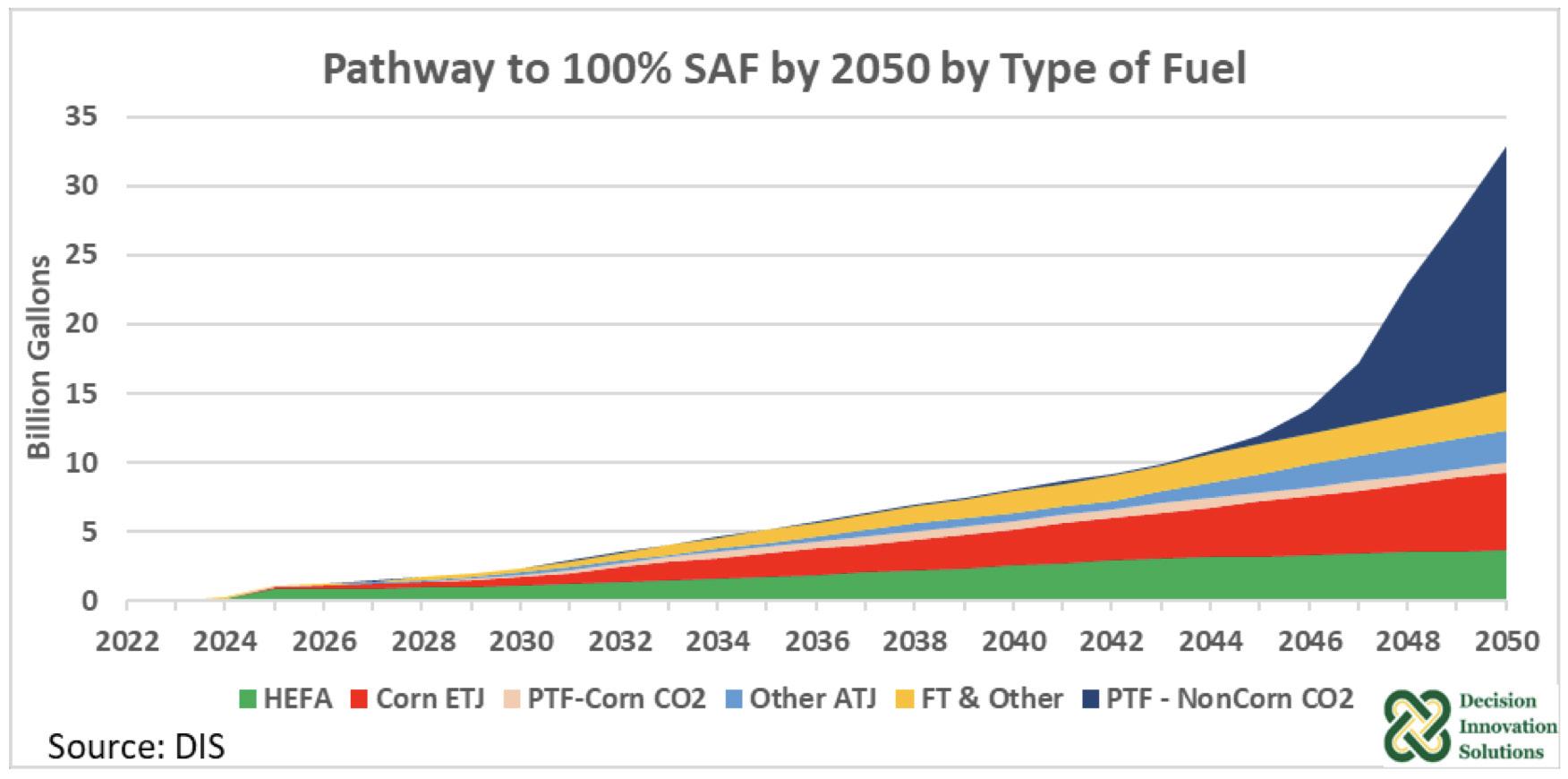

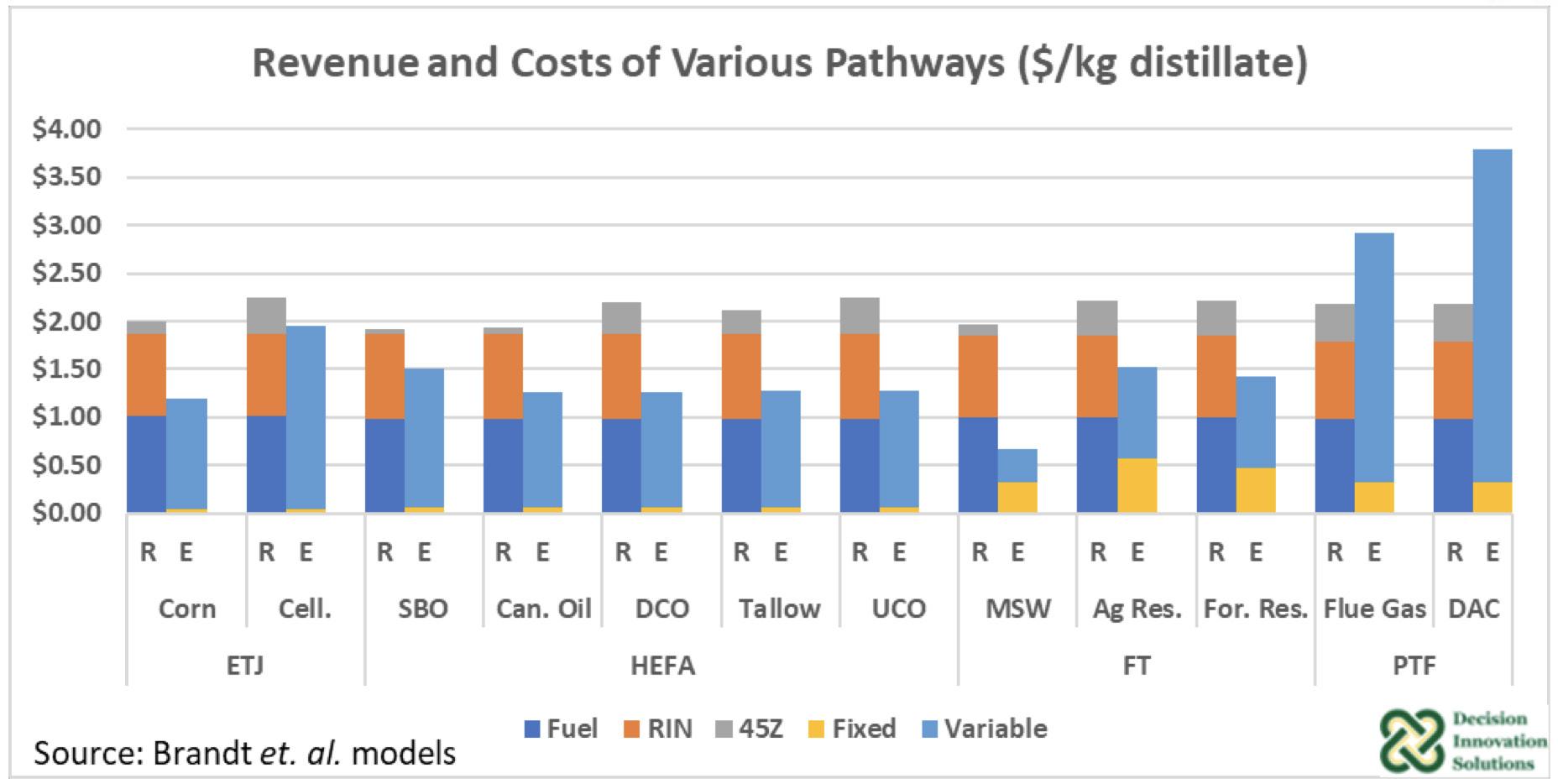

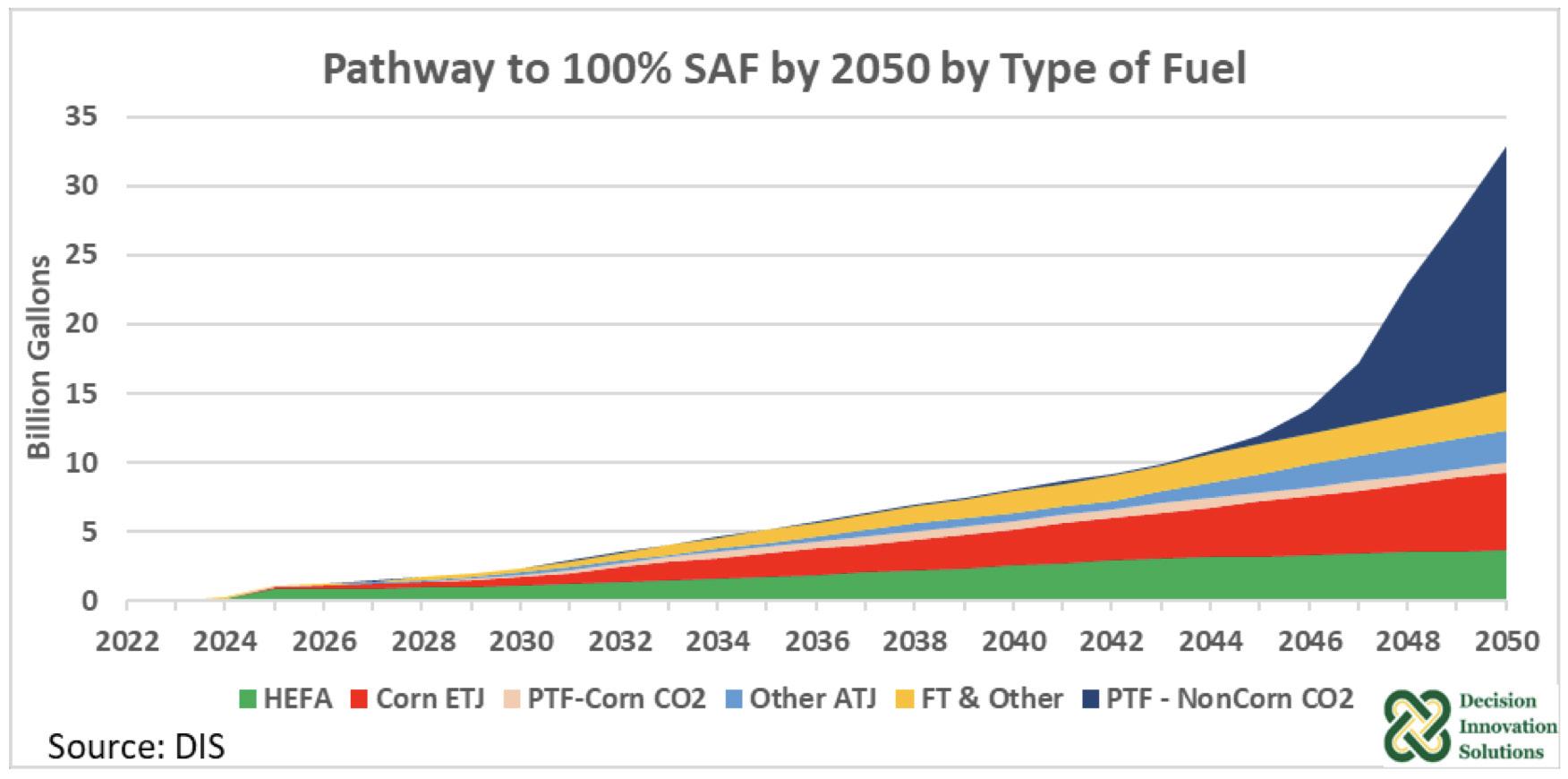

A billion gallons of ETJ will bring the nation one-third of the way to the Biden administration’s goal of 3 billion gallons of SAF from all sources by 2030. The 2050 goal of 35 billion gallons is a bigger challenge. For the country to achieve 100% SAF by 2050, all feedstock pathways will be needed—ethanol, HEFA, municipal solid waste and wood chips—says David Miller, analyst with Decision Innovation Solutions. “We need it all.”

In January, the Iowa Renewable Fuels Association released Miller’s analysis, “Sustainable Aviation Fuel for the Future: What Does the Midwest Have to Gain?”

Miller projects that HEFA-based SAF and ethanol-to-jet will be the two most

prominent, cost-effective pathways for SAF production for the next 20 years. In his analysis, the ETJ pathway begins with 21 million gallons coming online in the near term, ramping up to 623 million gallons in 2030, and rising through the remaining period to 5.59 billion gallons of ETJ-SAF by 2050.

LanzaJet lays claim to bringing the first ethanol-to-SAF plant online in January at Soperton, Georgia. Its Freedom Pines Fuels plant will produce 9 MMgy SAF and 1 MMgy renewable diesel—the first commercial-scale unit of the technology it plans to quickly scale, expecting to reach 1 billion gallons of global capacity by 2030. One project announced in 2022 proposes a 120 MMgy SAF facility in Hennepin, Illinois, where Marquis Energy operates a 350 MMgy corn ethanol plant. The news release announcing the memorandum of understanding says the plant will employ on-site CCS and renewable energy to produce SAF with a lifecycle GHG reduction of more than 70% compared to conventional jet fuel.

Corn Availability

Long-term projections for the corn ethanol supply are based on the expected size of the corn crop. Miller uses the 40year trend line for corn production and subtracts the 10-year trend line volume of nonethanol use (exports, feed and food use for starch and high-fructose corn syrup) to project that by 2050, an extra 5 billion bushels of corn will be available for ethanol production—nearly double the roughly 5.4 billion bushels used today. In Miller’s modeling, corn production will increase, on average, 210 million bushels a year, while nonethanol demand increases 55 million bushels a year for feed and food use.

Midwest farmers need SAF demand for ethanol to maintain the ag economy, Miller says. “We’re back into a period where we’re going to grow ending corn stocks without new demand.” In past cycles when supply outpaced demand for corn, farm prices declined, he says, which suggested

SAFMAGAZINE.COM 17

Carbon

Carbon

that the downward cycle had begun again. “In the past 18 months, we’ve gone from $6 to $4 corn, and ending stocks have gone from 1 billion to 2 billion bushels.”

The only thing helping further price decline, he says, is weather problems in Argentina and elsewhere in the global market.

With no evidence of corn yields declining or even leveling off, Miller says, new SAF demand is not only critical to maintain Midwest agriculture, but it could spark impressive economic impacts. As corn production increases, one to two ethanol plants could be built each year for 20 years, he says. “Our numbers said we need 68 new plants by 2050. So we will have a construction effect for a long time. We modeled that, in 2050 with 68 new plants operating, it’s $79 billion a year of output on the ethanol side.”

Adding the impact of SAF plants and HEFA, he says, “SAF becomes a $100 billion industry that is ag-driven. That’s huge. That rivals the kind of economics we’re getting from the whole livestock industry.”

Reducing Corn’s CI

Although the volume of corn necessary to support a doubling of production will be available, ethanol’s carbon intensity must be drastically cut to qualify for the new incentives under the Inflation Reduction Act. SAF needs a CI under 45, Miller points out, and with SAF conversion adding about 12 points, the ethanol feedstock has to have a CI score of 32 or less. Currently, Miller says, Midwestern dry mill ethanol plant scores range between 52 and 58 CI points, depending on the plant and electrical mix. The average is 55.

Plants could cut 20 points by converting to all renewables for electricity and thermal energy, combined with farm-level CI reductions through climate-smart farm-

ing practices and green ammoniabased nitrogen fertilizers, he says. “You have to do all [of that] to get 20 points off, but they’re all way more expensive than getting 30 points off with carbon sequestration.”

The lengthy and contentious CO2 pipeline permitting process introduces uncertainty regarding how quickly and widely CCS will be deployed in the ethanol industry. Most plants aren’t located on geologic formations suitable for on-site sequestration and will require access to a pipeline. However, Miller estimates that if all current ethanol plants with the potential to do on-site sequestration build out CCS, it would account for 42% of the ethanol needed for SAF by 2050.

Brian Jennings, CEO of the American Coalition for Ethanol, agrees with Miller on the advantage of CCS. “Without question, carbon capture and sequestration is the single most important step that could be taken to reduce the carbon intensity of corn ethanol.”

ACE, however, is focusing on a different component of corn ethanol’s CI— the corn feedstock itself. Corn production at 27 CI points accounts for roughly half of ethanol’s CI score, Jennings says. The 2023

GREET updates, released in December, lower corn's CI from 29 points, he points out, plus assign a value for two climatesmart farming practices. “The GREET model suggests that the implementation of continuous no-till corn could shave 10 points off corn’s CI,” Jennings says. “Another three points could be subtracted if farmers adopt 4R nitrogen management—right time, right place, right form, right rate. You can get down to 14-CI-point corn.”

When asked about the pending announcement of the GREET revisions to be used for determining eligibility for the SAF incentives in the Inflation Reduction Act, Jennings reports mixed feelings. “When looking at the 2023 GREET, it does make one very optimistic that GREET is accounting for modern day farming practices,” Jennings says. If included, it would

18 SAF MAGAZINE ISSUE 1 2024

David Miller

Geoff Cooper

Brian Jennings

FIGURE 1: Corn ETJ is modeled as one of the most cost-effective pathways to SAF in an analysis by David Miller, Decision Innovation Solutions. The chart shows revenue (R) and expense (E) for various feedstocks under ethanol-to-jet (ETJ), hydroprocessed esters and fatty acids (HEFA), Fischer Tropsch (FT) and power-to-fuel (PTF).

SOURCE: DECISION INNOVATION SOLUTIONS, IOWA RENEWABLE FUELS ASSOCIATION

SOURCE: DIS, IOWA RENEWABLE FUELS ASSOCIATION

SOURCE: DIS, IOWA RENEWABLE FUELS ASSOCIATION

be the first program to accept farm-level CI reductions in carbon scores. “I do feel optimistic, but there are a lot of forces trying to box corn ethanol out of being able to qualify as a feedstock for SAF.”

A major point of contention surrounds land use. “Direct land use change is easier to measure and determine,” Jennings says, “but international indirect land use has always been more abstract. EPA still claims a 29-CI-point penalty for corn ethanol when it comes to indirect land use change.

The GREET model says it’s in the seven or eight gram neighborhood.”

How that 20-point difference settles out in the Department of the Treasury guidance, developed by an interagency task force involving treasury, DOE, EPA and USDA, will play a big role in how difficult it will be for ethanol to meet CI reduction requirements.

Another issue surrounds the challenge of measuring and verifying on-farm practices to satisfy regulators, policymak-

ers and environmentalists that the claimed GHG reductions are accurate and auditable. Since verification and auditing could potentially be cumbersome and expensive for facilities buying corn from hundreds of farmers, there are several groups working with farmers and ethanol producers on automated systems tapping into technologies such as block-chain, satellite imagery and farm implement GPS data.

ACE is leading an effort to demonstrate a different approach to use existing ag models that quantify carbon and GHG emissions based on precipitation, temperature, climate, soil type and specific farming practices. A cover crop in Missouri, for example, would earn more credits for sequestering carbon than a cover crop in Minnesota where the growing season is shorter, Jennings says. The concept would facilitate replacing the national averages currently used to determine corn’s CI with region or county average CI scores.

The research collaboration to demonstrate and validate the concept is funded with a USDA grant. South Dakota State University is conducting research on 15,000 acres in the seven counties surrounding ethanol producer Dakota Ethanol at Wentworth, South Dakota. The five-year program pays farmers to introduce no-till cover crops or 4R nutrient management and allow SDSU researchers to closely monitor and measure the resulting GHG benefits. In turn, that data will be used to pressure-test the models used to determine corn’s GHG emissions. Funding to expand the project to include farmers surrounding 13 ethanol plants in 10 states was announced in late February.

“The long-term goal is to empower farmers and ethanol producers to increase the value of their corn and corn ethanol, whether selling to an SAF producer, getting a greater tax credit or marketing fuel in low-carbon fuel markets,” Jennings adds.

Author: Susanne Retka Schill Contributing Writer, SAF Magazine

SAFMAGAZINE.COM 19

FIGURE 2: HEFA and corn ETJ will be the primary pathways to SAF near term, as they are mature technologies with sufficient feedstocks. All pathways and feedstocks will be needed to meet 2050 goals, according to Miller’s analysis.

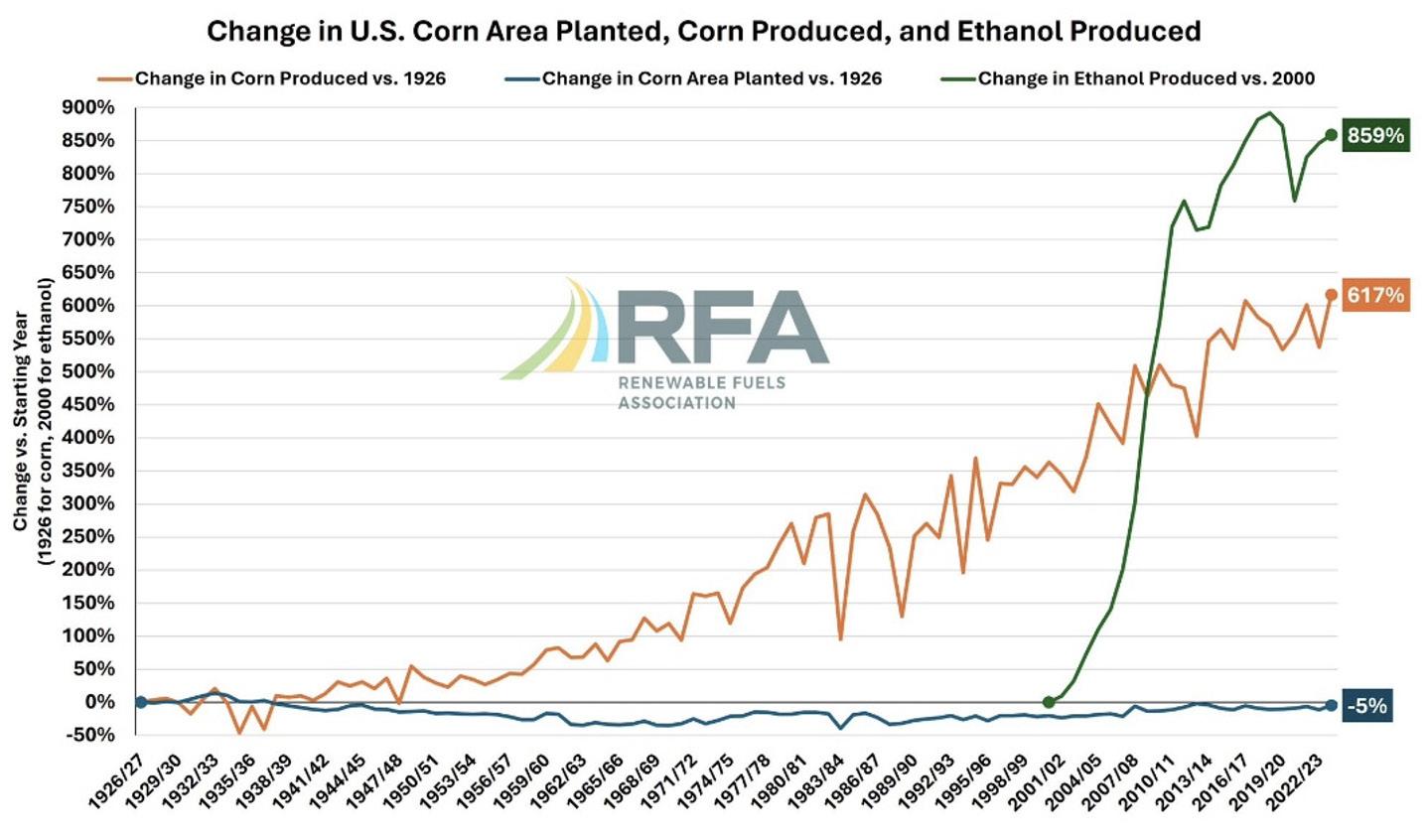

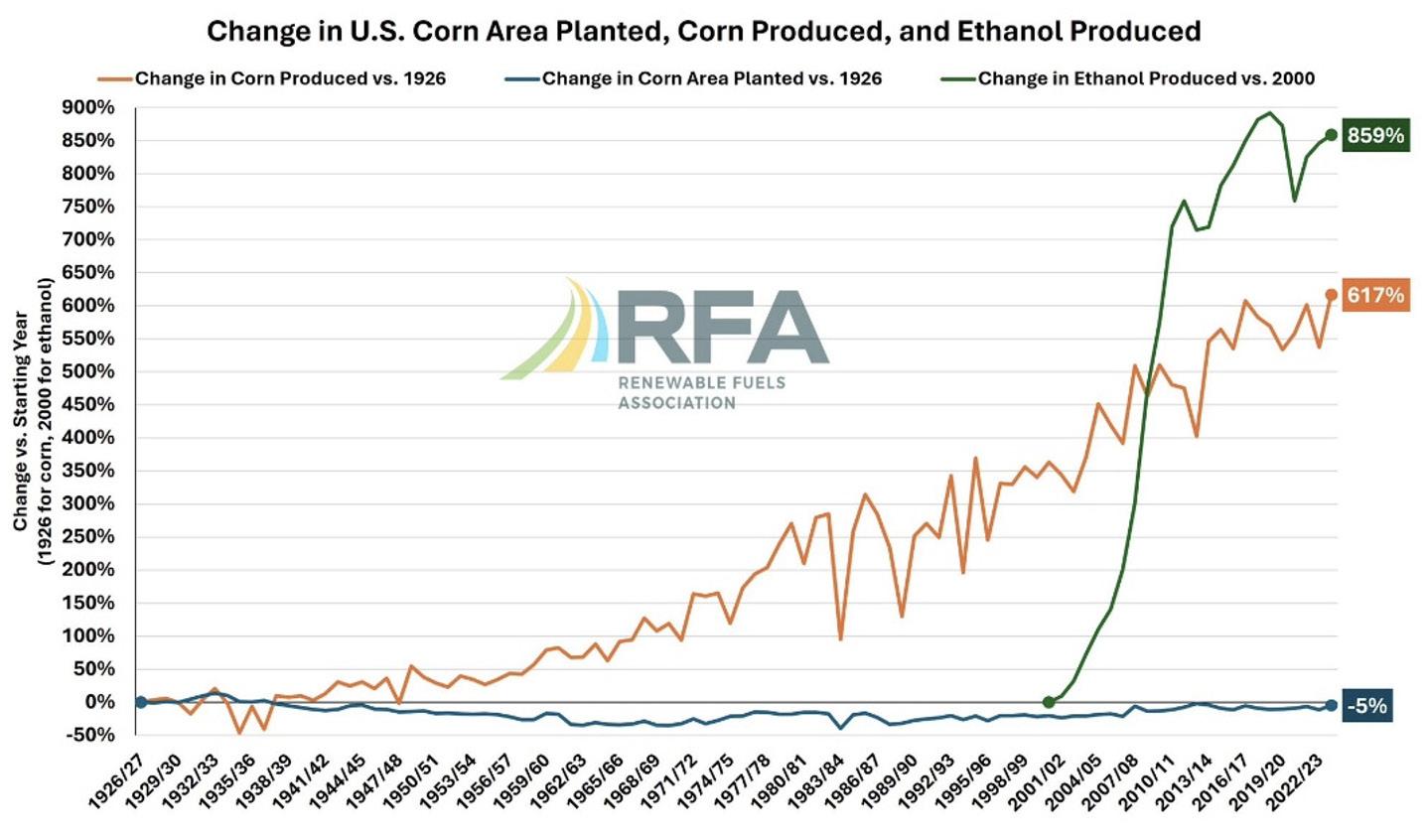

FIGURE 3: RFA CEO Geoff Cooper refers to this chart to respond to concerns about using cropland for ethanol production. Land used for corn production has actually declined by 5% in the past century while corn production grew more than 600%.

SOURCE: DECISION INNOVATION SOLUTIONS, IOWA RENEWABLE FUELS ASSOCIATION

REFINING A CLEANER FUTURE

Honeywell discusses its novel Ecofining technology and the company’s role in the future of clean aviation fuels.

BY KATIE SCHROEDER

Global SAF production doubled in 2023, reaching over 600 million liters (approx. 158.5 million gallons), according to the International Air Transport Association. Remarkably, production is expected to triple in 2024, reaching 1.875 billion liters. With an all-hands-on-deck approach needed in this massive effort to decarbonize the global aviation sector, technology developers like Honeywell are key in driving this surge in production forward. Recently, SAF Magazine spoke with major player Honeywell's Barry Glickman, vice president and general manager of sustainable technology solutions, about the company’s technology and efforts in the industry.

In January 2024, Honeywell reorganized its businesses into different branches themed around automation, the future of aviation and energy transition. These four businesses are Aerospace Technologies, Industrial Automation, Building Automation and Energy and Sustainability Solutions. Glickman begins by discussing Honeywell’s Ecofining technology and the importance of technology providers in finding sustainable solutions. Honeywell’s

Ecofining technology turns nonhydrocarbon fats, oils and greases into biodiesel or sustainable aviation fuel. The process takes the feedstock through a pretreatment phase, a hydroprocessing phase, and a fractionation phase. Ecofining uses the hydroprocessed esters and fatty acids (HEFA) process, which is widely recognized by the industry as a “capacity constrained” solution to decarbonizing aviation and other industries due to the disparity between feedstock availability and the volume of SAF and renewable diesel needed worldwide.

Recognizing this issue, Honeywell developed a program to enable the use of additional feedstocks. Two such technologies are Honeywell’s ethanol-to-jet fuel technology, known as ethanol-to-jet (ETJ), as well as a CO2-to-SAF process, entitled eFining. Glickman explains that Honeywell finds that one technology is missing, namely a process that turns biomass into syncrude, and then turns that syncrude into SAF. This technology is “actively developing” at Honeywell, says Glickman.

Enabling the Energy Transition

As nations and corporations worldwide announce net-zero emissions goals,

technology providers have a unique and challenging role to play in making those goals a reality. “Technology providers are essential, or we’re not going to get there,” Glickman says. “And I say that not just because I’m a technology provider, but as a consumer of various products. We as consumers generally are not interested in or willing to make dramatic changes in our behavior.”

It is critical that countries’ electrical grids are reliable and that transportation’s

20 SAF MAGAZINE ISSUE 1 2024

Technology

safety and reliability is not sacrificed for the sake of the energy transition, Glickman explains. “There’s a possibility we will displace very short haul with some other form of transportation or with some other form of fuel,” he says. “But for longhaul aviation, the demand is going to increase—we’re not willing to change; therefore, we need technology companies to provide solutions that we need and governments to provide the market frameworks to enable the solutions.”

The world’s population is growing, and along with it, air travel is likely to grow. To develop the technologies needed to move the SAF industry forward, innovators need regulation clarity from governments. Glickman divulges Honeywell’s two “asks” for regulators around the world when having conversations about the energy transition. “The first is, there must be an explicit price of carbon,” he says. “Honeywell is generally indifferent on the market mechanism, but there has

to be a way to notify the marketplace that CO2 has a cost. If you don’t do that, then it’s very difficult to drive energy transition. But the second feature that we ask [for] when we meet with regulators is that there [be] a way to provide the fiscal infrastructure for things like CO2 transportation and sequestration, the movement of hydrogen, and the movement of SAF within existing fiscal infrastructures.”

There are different approaches across the world to addressing technolo -

SAFMAGAZINE.COM 21

gy developers' needs, Glickman explains. For example, the United States uses a benefits structure to encourage CO2 reduction, whereas EU member states use a combination of requirements for the total volume of renewable fuels used along with an explicit tax on CO2 emissions. "Many countries fit into one of these two groups; however, the third group of countries are those that have some form of a renewable fuel goal in place without any mandate, subsidy or tax structure to support it," he says. "If you map all the countries of the world, generally [each country] will fit into one of those three categories,” he says. “The third category is the hardest to get traction with.”

Process Specifics

SAF has the advantage of being a drop-in fuel when blended with 50% Jet A, meaning that both fuels are chemically identical to their fossil fuel counterparts. “Airlines are getting a mix of SAF and Jet A that doesn’t require them to change anything in their infrastructure,” Glickman says. “That’s the beauty of our products.”

The second advantage is that the refining technology and infrastructure for

the finished products already exists. The challenges for renewable diesel and SAF made with Ecofining technology are rooted in regulations and feedstock supply rather than the production process.

Ecofining begins with a waste or renewable feedstock such as used cooking oil (UCO), which fits into the fats, oils and greases category of feedstocks. There are two different types of Ecofining processes, a single-stage process for renewable diesel and a two-stage process for making SAF. In both processes, the UCO is sent through a pretreatment process to remove contaminants that would foul up the downstream process. “Step one is [the result of] an industry out there that is collecting and aggregating the feedstocks. The operators contract with the feedstock suppliers, the feedstock generally arrives at the site and then goes through an onsite pretreatment process to be part of the Ecofining process,” Glickman explains.

The UCO then goes through a deoxygenation and isomerization process that removes oxygen and adds hydrogen to the feedstock. The single-stage process does both deoxygenation and isomerization in the same reactor, while

the two-stage process does deoxygenation in one step, then hydrocracking and isomerization. Following these steps, the feedstock is ready to be distilled or fractionated into components such as SAF, renewable diesel, naphtha or renewable gasoline. “The novel piece is really the feedstock they’re using, the pretreatment and the hydrotreating or hydroprocessing stage of the process that Honeywell UOP has been doing a long time and has the process experience and the feedstock specific catalysts, which enable the first stages of the refining process for these novel feedstocks in a way that minimizes the capital costs—the operating costs of the conversion,” he says. The process is compatible with both greenfield projects and oil refinery retrofits.

Currently, Honeywell has more than 50 licensees for their renewable fuels technologies, which include Ecofining, ETJ, and UOP eFining. In these relationships, Honeywell provides a range of technology, including license and engineering, catalysts, digital services and equipment. Glickman explains that the process is often incorporated into an existing refining footprint. Honeywell also

22 SAF MAGAZINE ISSUE 1 2024

IMAGE: HONEYWELL

works closely with the operators when they purchase the engineering. “There are numerous plants that are already producing renewable diesel and SAF, there are eight plants in operation at commercial scale, and there are dozens more in the process of coming online,” he says.

Hydrogen Production

The hydrogen used in the Ecofining process will be one of three “colors”: gray, blue or green, which indicate the process by which it was made. Traditionally, refiners made gray hydrogen by changing natural gas into syngas using a steam methane reformer or an auto thermal reformer. The hydrogen is then pulled out of the syngas. Blue hydrogen uses the same process as gray hydrogen but captures the carbon dioxide and sequesters it. Honeywell makes the carbon capture technology needed to turn gray hydrogen into blue hydrogen, integrates it into the refinery, and provides the equipment, system and services. The carbon capture and storage (CCS) system enables the

operator to capture the CO2 out of the hydrogen or syngas process so that it can be transported or sequestered. CCS significantly decarbonizes the Ecofining process and the final product. “From a global decarbonization standpoint, capturing CO2 from the production of hydrogen may be one of the most impactful near-term activities the world can do to decarbonize,” Glickman says. “We have a project with Exxon Mobil at its Baytown refinery that will enable Exxon to capture over seven million tons of CO2 per year.”

The process of making green hydrogen is entirely different from gray and blue hydrogen. “If you want to do green hydrogen, you’re not dealing with [autothermal reforming] or [steam methane reforming]. If you are making green hydrogen, you are dealing with an electrolyzer, which is the device that takes renewable power and uses it simply to crack water, Glickman says. "What you get is water and electrical currents intaking oxygen and [putting] hydrogen out. Honeywell doesn’t provide electrolyzers; we provide

the intel inside portion of the electrolyzer, which is the catalyst-coated membrane.”

Found inside the stack of the electrolyzer, the CCM Honeywell manufactures reduces the cost of the green hydrogen produced and leverages the company’s expertise in membranes and catalysis, Glickman explains.

As demand for renewable diesel, SAF and related fuels and chemicals soars, Ecofining and the supporting technologies of CCS and hydrogen provide fuel producers with options to accelerate decarbonization with fully commercialized technology. “Honeywell renewable fuels are not R&D—these are commercially available, commercial-scale technologies in places with multiple operators around the world,” Glickman adds. "They're very well-demonstrated and proven technologies."

Author: Katie Schroeder Staff Writer, SAF Magazine katie.schroeder@bbiinternational.com

SAFMAGAZINE.COM 23

Technology

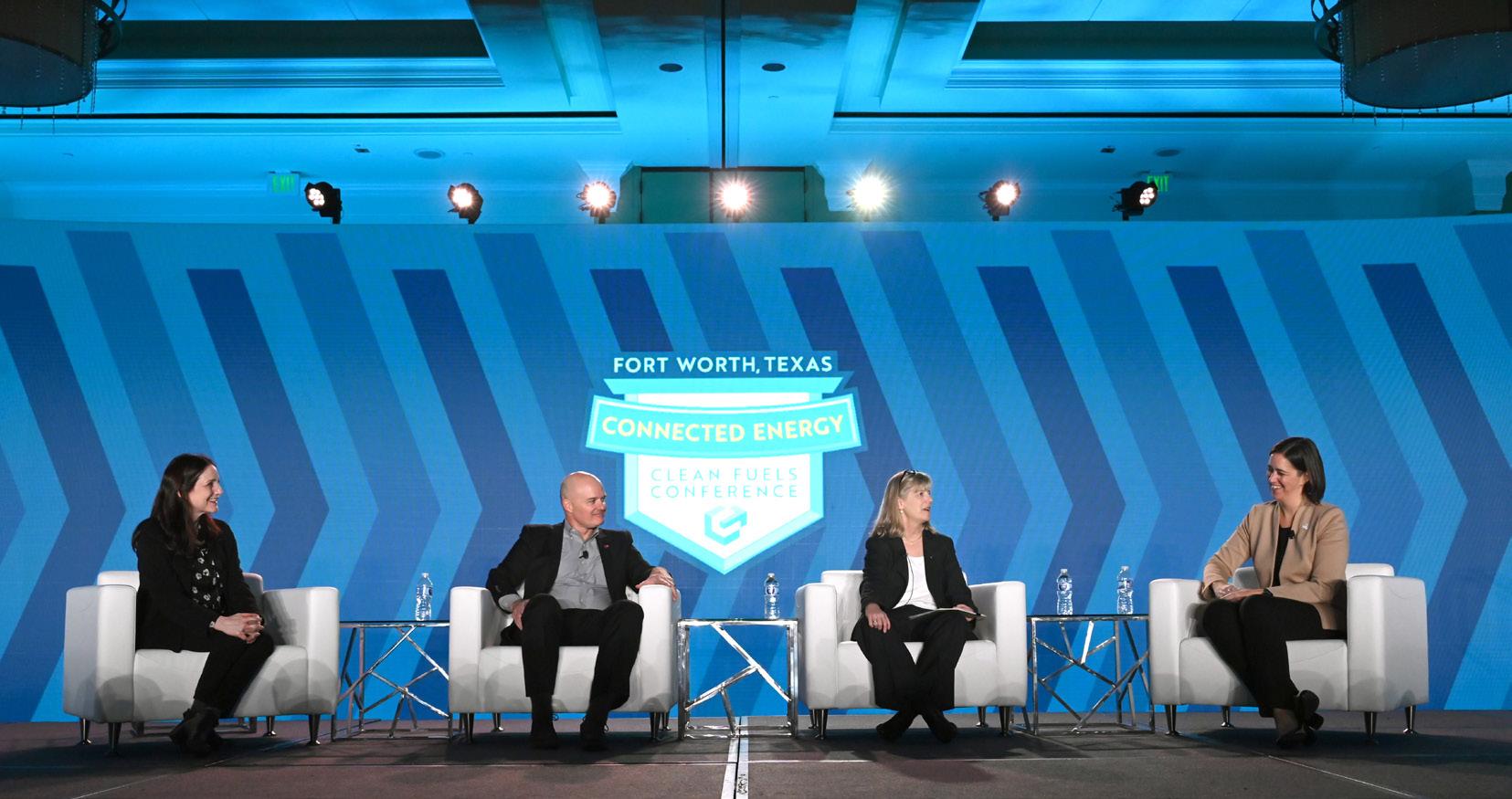

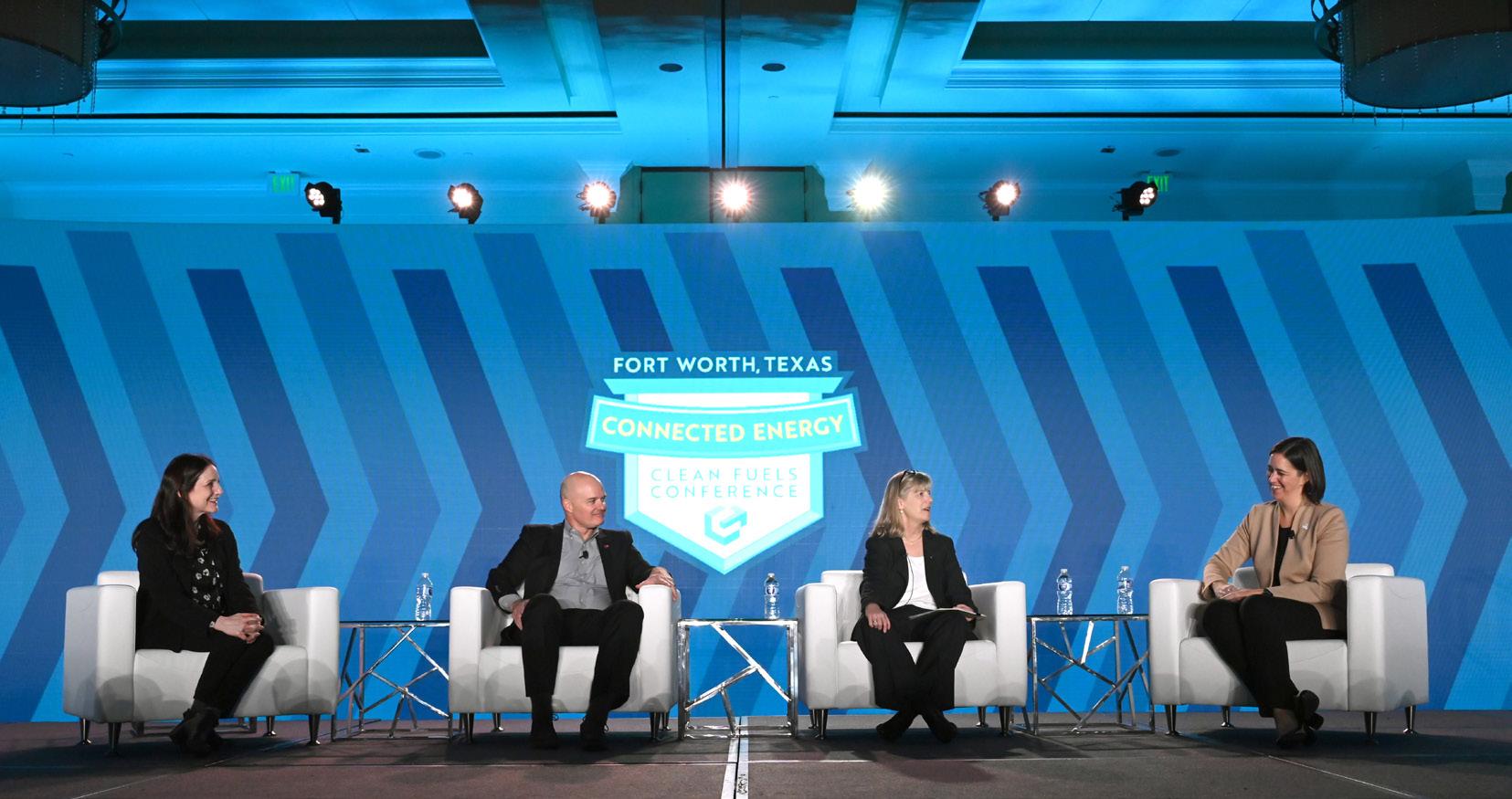

With a theme of Connected Energy, the 20th Clean Fuels Conference was held in Fort Worth, Texas, in early February. Hosted by Clean Fuels Alliance America (formerly known as the National Biodiesel Board), the event has expanded in recent years to include renewable diesel and SAF—and has also attracted some prominent companies including BSNF Railways, PepsiCo and American Airlines. However, the addition of the re-

newable diesel and SAF markets wasn’t necessarily what drove these companies to attend, said Donnell Rehagen, CEO of CFAA during his keynote address. “These companies are committed to decarbonization like never before, and they can’t wait for nascent or future technologies to come along if they’re going to meet their own aggressive decarbonization targets. They are looking for solutions now, especially in heavy duty applications, and here we are ... ready to assist them in their journey.”

Rehagen discussed the conference in years past and the strides technology and

fuels have made parallel to each other over the decades. “Today, our industry’s vision is that the use of our fuels will exceed 6 billion gallons by 2030 and, with advancements in feedstocks, that we will reach 15 billion gallons by 2050,” Rehagen said. “Now, for the first time, it feels like the world is ready to meet us in that vision, because companies have realized they have to adapt and evolve, too. And, that they have a critical role in leading others to sustainable practices in support of our planet. Our paths have finally crossed in a way that we always hoped that they would; corporate de-

24 SAF MAGAZINE ISSUE 1 2024

Donnell Rehagen, CEO of Clean Fuels Alliance America, delivers the keynote address at the 20th anniversary of the organization’s annual event.

IMAGE: CLEAN FUELS ALLIANCE AMERICA

Connected Energy

SAF Magazine attended Clean Fuels Alliance America’s annual conference in Fort Worth, Texas, in early February.

BY ANNA SIMET

carbonization goals are ruling the day and driving demand. The government and major Fortune 500 companies have looked at us and really see us for what we are: an immediate low-carbon solution that works with the existing infrastructure.”

As for emerging and potential markets, the marine market alone could mean another 7 billion gallons of demand of bio-based diesel fuel in the U.S. alone, Rehagen said, highlighting a recently introduced bill, The Renewable Fuel for OceanGoing Vessels Act, which would allow companies to earn RIN credits under the

Renewable Fuel Standard for ocean-going vessels.

Rehagen also discussed challenges regarding low RFS renewable volume obligation numbers set by the U.S. EPA and the impacts it has had on producers but expressed confidence the market would right itself. “I’m a strong believer in the marketplace. I always believe we’ll adjust and settle,” he said. “We’ve seen an increase of renewable diesel over the past several months as the market response to lower RVOs, and if that continues, it should provide us with some relief with RIN val-

ues. The market almost always tends to right itself, and in our case, the market has to right itself, because the demand for our low-carbon fuels is so high. Markets tend to pay the most attention when there is growing demand and growing supply. Why is that? Because opportunity exists in the marketplace under those conditions. As an industry, we should take a position of confidence and optimism. We should focus on the opportunities, some of which might be extremely hard to see at this moment. Our challenge is always to see the changing market dynamics and to

SAFMAGAZINE.COM 25

Event

respond with the appropriate adjustments to our businesses.”

Now is not the time to hunker down and wish for the good old days, Rehagan said. "These can be the good new days. There is a bounty of market opportunities due to these unprecedented carbon reduction goals, and we as an industry must lean into those.”

Soaring with SAF

A panel focused on SAF explored topics including airline decarbonization commitments, government support and policy, SAF production and infrastructure challenges and more.

Moderated by CFAA director of environmental science Veronica Bradley, participants included Jill Blickstein, vice president of sustainability at American Airlines; John Briere, director of fuel supply and trading at Southwest Airlines; and Nancy Young, chief sustainability officer at Gevo.

American Airlines has a goal to reach net-zero emissions by 2050, and “SAF is a huge part of that,” Blickstein said, adding that it’s unlikely AA will be able to reduce all those emissions within the business, and therefore will probably buy carbon offsets. “But what we’re really trying to focus on is our strategy [regarding] what we can do to reduce the impact of the jet fuel that we burn, and jet fuel is about 99% of our total carbon footprint. We’ve got to focus on jet fuel. We have a goal of 10% SAF by 2030.”

Blickstein discussed the SAF Grand Challenge, segueing into the offtake agreements the airline has made to date, describing it all as “exciting, but also incredibly daunting. It’s really just the beginning of what will one day be a very big market,” she said. “Nobody knows how long it will take, but it’s a big challenge, and I feel like every day we trip over what we call transition issues. It’ll be one thing to actually have the SAF, and even if we do have it, then there are questions like, how will we get it to the airports? How will we get it into the planes? These are the kinds of issues that come with it.”

Briere discussed Southwest Airlines’ sustainability goals, initially branded as “Nonstop to Net Zero,” but recently amended to “Net Zero by 2050.” That includes some nearer-term goals of 10% SAF by 2030, with carbon emission-intensity reductions of 25% by 2030 and 50% by 2035.

“And of course, SAF is our North Star and ultimately how we’re going to decarbonize,” he said.

Young said Gevo’s big goal is to deliver its alcohol-to-jet Net-Zero 1 Project in Lake Preston, South Dakota, which the company

says will have an eventual SAF production capacity of 65 MMgy. “We’re true believers in ethanol-to-jet, and we’ve done a lot in terms of developing that opportunity,” she said. “We’re very dedicated in supporting our farmers and helping with climatesmart agriculture to realize additional values in the supply chain. We’re also focused on every element of decarbonization in our supply chain.”

Panelists all agreed on how critical government support and policy will be in reaching SAF production goals. “There are

26 SAF MAGAZINE ISSUE 1 2024

(From left) Jill Blickstein, vice president of sustainability at American Airlines; John Briere, director of fuel supply and trading at Southwest Airlines; Nancy Young, chief sustainability officer at Gevo; and Veronica Bradley, Clean Fuels Alliance America director of environmental science

IMAGE: CLEAN FUELS ALLIANCE AMERICA

Event

Hundreds of professionals in the biobased diesel industry attended content sessions at the Clean Fuels Conference in Fort Worth, Texas.

IMAGE: CLEAN FUELS ALLIANCE AMERICA

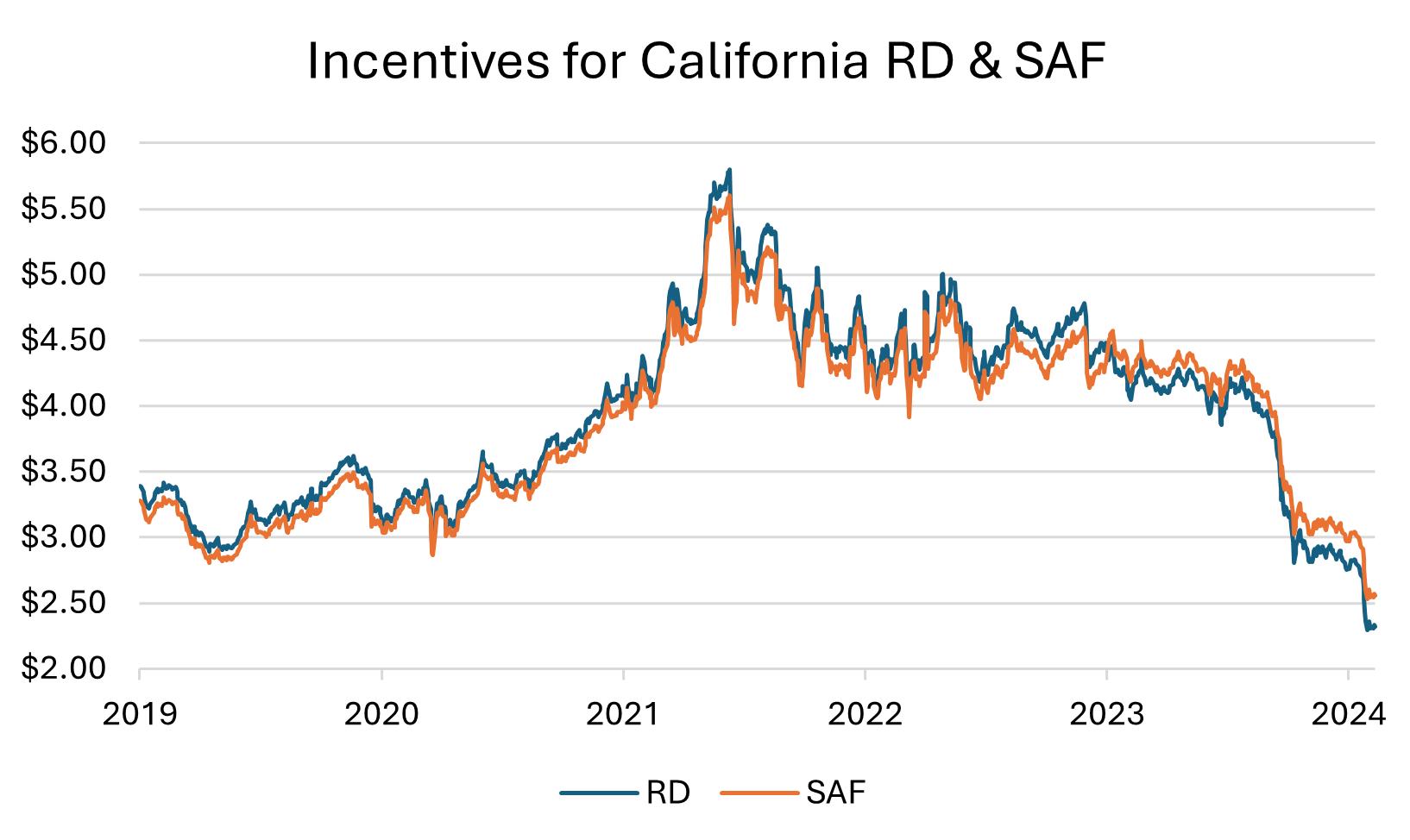

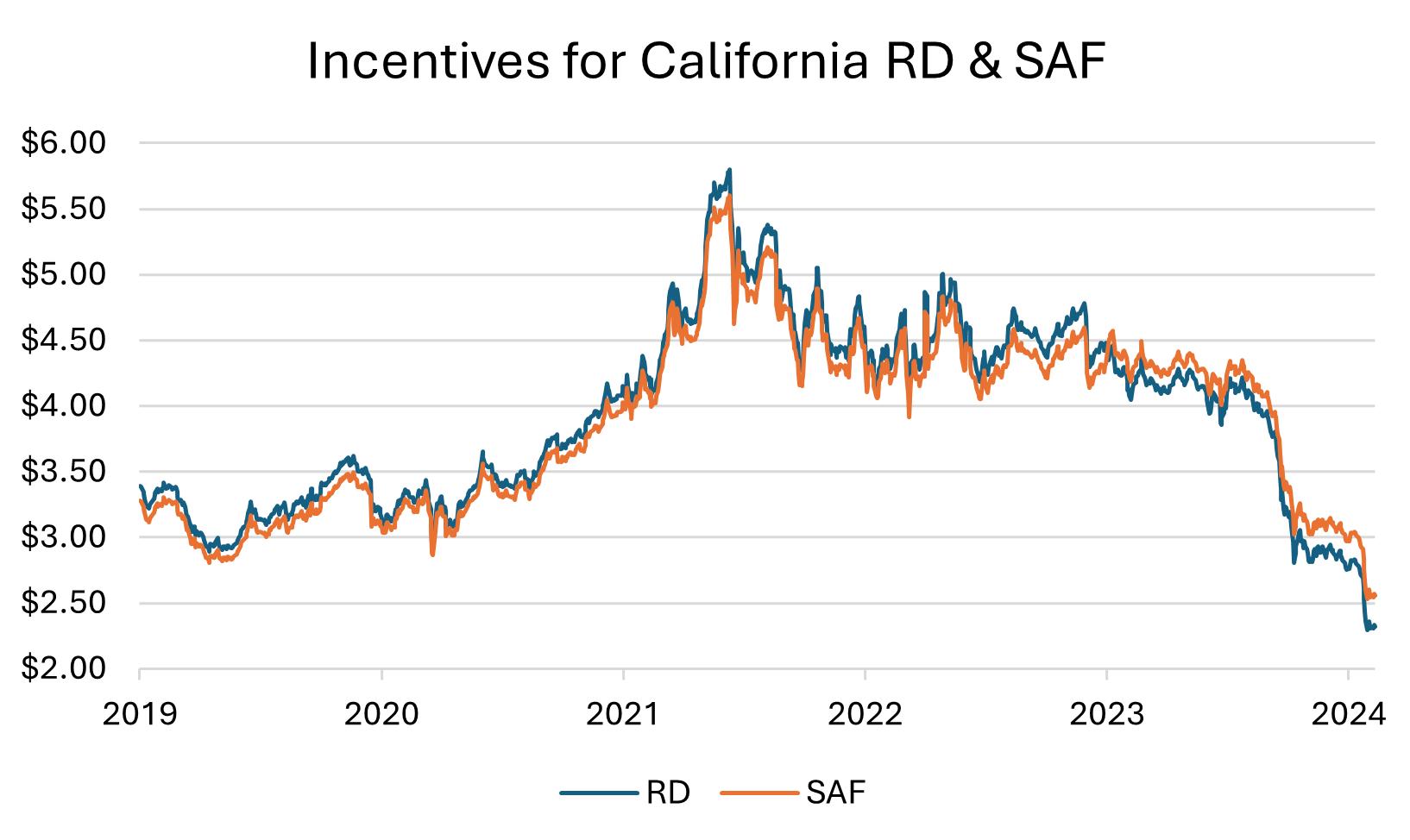

a lot of people who want to make SAF and a lot of ways to make it ... but those efforts will be really slow to develop if we don’t have the right federal and state policy in place,” Blickstein said. “It’s amazing that Congress passed a SAF blenders tax credit, and it does show that there is the will to create this, but there are a lot of problems.”