WORKING IN WOOD PELLETS

FEATURES

12 INDUSTRY

Working in Wood Pellets

Results of an industry survey conducted by Pellet Mill Magazine indicate that overall job satisfaction is high in the wood pellet industry, the average career duration is long, and many facilities are seeing growth and new opportunities.

By Anna Simet16 PLANT SAFETY

Engineering a Safer Culture

Pellet Mill Magazine interviews process safety engineer Kayleigh Rayner Brown about her work with the Wood Pellet Association of Canada’s Safety Committee.

By Anna SimetCONTRIBUTIONS

22 FIRE & EXPLOSION PROTECTION

Modern Early Fire Detection in Biomass

The biomass market’s fire detection landscape has significantly advanced through technical innovation and a better understanding of fire safety needs.

By David C. Bursell24 OPERATIONS & MAINTENANCE

Bearing Failure at Pellet Plants: Top Causes

Bearings are a key replacement part in many pellet plant components, requiring proactive maintenance strategies and advanced technologies to minimize downtime and maximize operational efficiency.

By Holger Streetz Anna Simet EDITOR asimet@bbiinternational.com

Anna Simet EDITOR asimet@bbiinternational.com

And the Survey Says…

Pellet Mill Magazine recently conducted its first-ever workforce and salary survey. As for the results, there was a lot of data to digest. We realize there are some variables to consider while translating that information into digestible, meaningful statistics (and that there is room for improvement for the next survey), but we’re confident of the overall picture it paints of the industry— which is positive in many ways. It seems that overall, the wood pellet workforce is mostly satisfied with their jobs, benefits and overall experience at their plant or company. That said, the industry workforce is not without challenges—for one, it is clear that there is a need to focus on hiring and retaining young people. More than 44% of respondents indicated they were 55 or older, the majority of whom have worked in the industry for decades. Only 4% were younger than 35, and only 8% were female. This raises some questions, particularly how the industry can attract younger generations. Check out “Working in Wood Pellets” on page 12 for the survey results.

For our page-16 feature, “Engineering a Safer Culture,” I interviewed process safety engineer and hazard analysis expert Kayleigh Rayner Brown in a traditional-style Q&A. Rayner Brown has been working closely with the Wood Pellet Association of Canada’s Safety Committee for the past several years. During our discussion, she shed some light on safety culture and the measures to take to create a meaningful one, as well as common hazard trouble areas at pellet plants, the value of information sharing and more. In her responses, Rayner Brown emphasizes the impact every individual facility can have on the collective industry. “When there are loss-producing incidents, it affects the whole industry,” she says. “It impacts the access to affordable insurance, the ability to attract and retain the best talent, and the overall reputation.”

Considering that fire and explosion protection is the major theme of this issue of Pellet Mill Magazine, be sure to check out our podcast preview with Bob Petrochko of Dustcon Solutions, during which he discussed some real-world examples of trouble areas he’s observed while conducting dust hazard analyses at wood pellet plants. Petrochko’s insight really drives home Rayner Brown’s perspective on how critical and valuable it is to share information among producers in the industry, particularly when it comes to incident prevention.

By the time this issue hits desks, we’ll be roughly six weeks out from the Pellet Fuels Institute’s Annual Conference in Charleston, South Carolina. I’ll be making the trip—be sure to stop by our booth to say hello.

EDITORIAL EDITOR

Anna Simet | asimet@bbiinternational.com

ONLINE NEWS EDITOR

Erin Voegele | evoegele@bbiinternational.com

ASSOCIATE EDITOR

Katie Schroeder | katie.schroeder@bbiinternational.com

DESIGN

VICE PRESIDENT, PRODUCTION & DESIGN

Jaci Satterlund | jsatterlund@bbiinternational.com

GRAPHIC DESIGNER

Raquel Boushee | rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan | jbryan@bbiinternational.com

PRESIDENT

Tom Bryan | tbryan@bbiinternational.com

VICE PRESIDENT, OPERATIONS/MARKETING & SALES

John Nelson | jnelson@bbiinternational.com

SENIOR ACCOUNT MANAGER/BIOENERGY TEAM LEADER

Chip Shereck | cshereck@bbiinternational.com

ACCOUNT MANAGER

Bob Brown | bbrown@bbiinternational.com

CIRCULATION MANAGER

Jessica Tiller | jtiller@bbiinternational.com

MARKETING & ADVERTISING MANAGER

Marla DeFoe | mdefoe@bbiinternational.com

2024 International Fuel Ethanol Workshop & Expo

JUNE 10-12,

2024

MInneapolis, Minnesota

From its inception, the mission of this event has remained constant: The FEW delivers timely presentations with a strong focus on commercial-scale ethanol production—from quality control and yield maximization to regulatory compliance and fiscal management. The FEW is the ethanol industry’s premier forum for unveiling new technologies and research findings. The program is primarily focused on optimizing grain ethanol operations while also covering cellulosic and advanced ethanol technologies.

(866) 746-8385 | FuelEthanolWorkshop.com

2024 Biodiesel Summit: Sustainable Aviation Fuel & Renewable Diesel

JUNE 10-12, 2024

MInneapolis, Minnesota

The Biodiesel Summit: Sustainable Aviation Fuel & Renewable Diesel is a forum designed for biodiesel and renewable diesel producers to learn about cutting-edge process technologies, new techniques and equipment to optimize existing production, and efficiencies to save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers and producers to advance discussion and foster an environment of collaboration and networking through engaging presentations, fruitful discussion and compelling exhibitions with one purpose: to further the biomass-based diesel sector beyond its current limitations.

(866) 746-8385 | BiodieselSummit.com

2024 North American SAF Conference & Expo SEPTEMBER 11-13, 2024

Saint Paul RiverCentre, Saint Paul, Minnesota

The North American SAF Conference & Expo, produced by SAF Magazine in collaboration with the Commercial Aviation Alternative Fuels Initiative, will showcase the latest strategies for aviation fuel decarbonization and for key industry challenges and highlight the current opportunities for airlines, corporations and fuel producers. The North American SAF Conference & Expo is designed to promote the development and adoption of practical solutions to produce SAF and decarbonize the aviation sector. Exhibitors will connect with attendees and showcase the latest technologies and services currently offered within the industry. During two days of live sessions, attendees will learn from industry experts and gain knowledge to become better informed to guide business decisions as the SAF industry continues to expand.

(866) 746-8385 | www.safconference.com

2025 International Biomass Conference & Expo MARCH 18-20, 2025

Cobb Galleria | Atlanta, GA

Now in its 18th year, the International Biomass Conference & Expo is expected to bring together more than 900 attendees, 160 exhibitors and 65 speakers from more than 25 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming—powered by Biomass Magazine–that maintains a strong focus on commercial-scale biomass production, new technology, and nearterm research and development. Join us at the International Biomass Conference & Expo as we enter this new and exciting era in biomass energy.

(866)746-8385 | www.biomassconference.com

Timing is Everything

BY TIM PORTZLast October, the Pellet Fuels Institute gathered in Washington, D.C., to execute a federal policy fly-in. Three different groups of producer members met with nearly 30 members of Congress or their staff, discussing our industry and the contributions we make to rural economies and the forest products sector within our respective states and districts. Our fly-in team was well-prepared. At each meeting, we walked attendees through our full slate of federal policy priorities, from the expansion of the tax credit on qualifying wood pellet appliances to a lasting federal policy determination that forest-based energy is carbon neutral. Staffers and members alike nodded along in polite agreement, careful not to make specific promises one way or another. Some members demonstrated more familiarity, knowledge and support regarding wood pellet manufacturing than others, but there wasn’t a real sense of urgency in any of the meetings. When our team outlined the Farm Bill provisions that were important to and utilized within our sector, shoulders shrugged. No one felt optimistic that a Farm Bill would “get done” anytime soon. On several occasions, we heard a new Farm Bill might fall into 2025, after the 2024 election cycle. Within two weeks of our fly-in, a one-year extension of the existing Farm Bill was announced (to preserve vital agricultural producer payments) and forward progress on the bill was ground to a halt.

While the Pellet Fuels Institute considered its federal policy strategy for 2024, we were committed to once again executing an in-person fly-in to build upon the relationships that we’ve been working to establish, and to expand our reach by finding new superfans within the House and Senate. Our traditional fall fly-in isn’t feasible, however, being that it’s an election year that finds both chambers on recess for some campaigning back home. Summer also felt wrong, so we looked to the spring and decided that we would focus specifically on members in both chambers with appointments to their respective agriculture and forestry committees. Early in 2024, our legislative affairs committee decided that a trip with a sharp focus on the PFI’s Farm Bill priorities was our best bet, regardless of where Farm Bill negotiations were.

We selected May 1 somewhat arbitrarily and went to work securing our appointments and building out our day. As our advocacy group gathered for breakfast that morning, news was breaking that both a House and Senate version of the Farm Bill had been introduced. Unveiling the Senate’s version of the legislation fell to Chairwoman of the

Agriculture Committee Sen. Debbie Stabenow from Michigan. As it happened, our team was scheduled to sit down with committee staff that morning. Over eggs and bacon, we worked through the 94-page summary that outlined in broad strokes what was in the Senate’s version of the $1.5 trillion spending bill, looking specifically at the forestry and energy titles that contain the PFI’s small handful of Farm Bill priorities. A quick survey revealed that our priorities in the forestry title (Community Wood Grant and Wood Innovation Grant programs) were included, and in the case of the Community Wood Grant, doubled in size to $50 million. Within the energy title, the Advanced Biofuels Payment Program remained in place. While the bill’s funding was authorized as opposed to mandatory (meaning an appropriations step would be necessary each year), the news felt like a base hit—if not exactly a home run. Still, this was an introduced piece of legislation, a far cry from a bill likely to win passage through both chambers and signed into law.

Our meetings later that morning and in the afternoon stood in stark contrast our meetings last fall. The Farm Bill, and the two versions that had been introduced that day, were the talk of the town. Every staffer we met with was busying themselves with a thorough review of the summary documents and anticipating the debates and negotiations to come. Gone were the shoulder shrugs and resigned postures, and while no one was ready to say that a Farm Bill might get negotiated and signed into law before the election, everyone agreed the legislation was back on its feet and at least walking toward the finish line.

The PFI’s Farm Bill priorities, specifically the programs in the forestry and energy titles are tiny—miniscule even— in the context of a piece of legislation with over a trillion dollars in spending across its five-year life.

Generating attention for these remote corners of legislation isn’t easy, even with policymakers from states boasting significant pellet production. May 1 felt different. Our conversations felt urgent and tightly aligned with the news of the day. That alone felt like a win. The coming months will determine whether that day was the beginning of a resolution to a vital piece of federal policy, or if it was another false alarm. Either way, the PFI was there, and our timing could not have been better.

Author: Tim Portz Executive Director, Pellet Fuels Institute

Biomass Thermal Energy Council Rising

BY BILL BELLWhen the Biomass Thermal Energy Council was first organized in 2008-’09 with the help of a Washington, D.C., association management firm, wood heat was a rising star in the renewable energy universe. A November 2009 Capitol Hill briefing for congressional staff, organized by BTEC, the Pellet Fuels Institute and the Alliance for Green Heat, attracted a large audience. BTEC’s presentation pointed out that although transportation, electricity and heating each composed about one-third of the energy usage in the United States, heating had been getting only a sliver of public funding support. BTEC’s speaker also noted that, at the time, biomass energy was displacing 10 times more fossil fuel-generated energy than wind, solar and geothermal power combined.

Shortly thereafter, a storm cloud appeared on the horizon in the form of the 2010 Manomet Center’s Biomass Sustainability and Carbon Policy Study, which challenged the view of biomass as a carbon-neutral energy source. As they continue to do so today, media reports failed to note the Manomet Study’s distinction between biomass electricity and biomass heating.

Fast-forward a dozen years to 2022. BTEC, for a number of reasons, has lost its fastball. Our organization’s very capable executive, Joseph Seymour, supplied by its association management firm Technology Transition Corporation, has gone on to a different job. Several discussions about merging BTEC and PFI have failed of enactment. COVID-19 has curtailed BTEC’s formerly successful conferences and trade shows. The pellet industry’s Washington, D.C., legislative relations are being handled by the PFI and, interestingly, a coalition financially managed by the Maine Pellet Fuels Association.

By spring 2023, BTEC Board Chair Jeremy Mortl of Messersmith Manufacturing and Board Member Les Otten of Maine Energy Systems decided change was necessary. BTEC’s board met twice and concluded that a top priority must be major improvement in the federal tax incentives for modern wood heating in commercial buildings and residences. The board then transferred association responsibilities to a firm that was also managing the Maine Pellet Fuels Association.

Once all administrative transfers had been completed, BTEC’s directors met in early 2024, thanked Mortl for his interim leadership and elected new officers, asking John Ackerly of the Alliance for Green Heat to continue as secretary. Jon Parrott, who has a doctorate in forestry, was

elected board chair, with Frank Kvietok of Lignetics and Otten as vice chairs, and Tony Wood, a fifth-generation wood firm manager, as treasurer.

An important change was made in the February directors meeting: BTEC will henceforth be doing business as the BioThermal Energy Council. The change is designed to avoid the negative connotation that opponents of biomass-generated electricity have bestowed upon the word “biomass,” and also to promote collaborative working relationships with other renewable thermal energy groups, particularly thermal biogas.

So where is BTEC headed now? Importantly, to work collaboratively with the PFI toward shared goals. More broadly, to help realign the public dialogue back toward enthusiasm regarding modern wood heating. To quote BTEC Vice Chair Kvietok, “The current environment holds many opportunities for biomass-based energy, as well as threats. The reconstituted BTEC aims to take these challenges head-on through a combination of legislative advocacy and an education program built on a broad foundation of coalition building.”

Vice Chair Les Otten said, “The mission of BTEC is to educate policymakers and consumers who are concerned with the expansion of renewable energy to fight global warming.”

And BTEC Chairman Jon Parrott added, “Despite considerable tailwinds, the myopic goal of universal electrification will assuredly fall short of expectations. To meet greenhouse gas reduction benchmarks more effectively, society must use all decarbonization initiatives and embrace a mosaic of solutions.”

BTEC’s directors very recently approved the 2024 dues schedule, which is designed to attract new members and give recognition to “sustaining” members. The new BTEC website is about to go live, in sync with a membership invitational mailing. U.S. Sen. Angus King, I-Maine, is preparing legislation to improve and protect tax code incentives for modern wood heat installations.

BTEC is rising!

Author: Bill BellPellet News Roundup

Japan-based Renova Inc. announced that its 75-megawatt (MW) Ishinomaki Hibarino Biomass Power Plant, which is fueled by wood pellets and palm kernel shells, commenced operations in late March.

The power plant was originally scheduled to become operational in January, but Renova delayed startup of the facility until March. The company announced the delay in late January, citing the need for ad-

ditional time to make final adjustments to the boiler and turbine facilities to ensure long-term, stable operations. Renova is also working to bring its 75-MW Omaezakikou Biomass Power Plant online. Like the Ishinomaki plant, it was originally expected to begin operations in January, but startup was delayed until July. The plants are two of several biomass power projects being developed by Renova. In November 2023, the company announced that its 75-

MW Morinomiyako Biomass Power Plant had begun operations, and the following month, that its 74.8-MW Tokushima Tsuda Biomass Power Plant came online. Additional Renova biomass plants that are currently operational include the 20.5MW Akita Biomass facility and the 75MW Kanda Biomass plant. The 49.9-MW Karatsu Biomass facility is currently under construction.

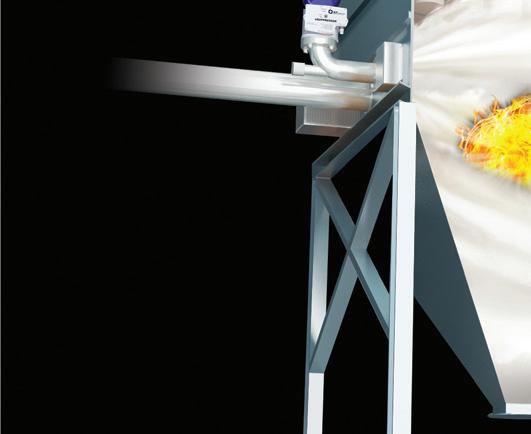

DON’T LET THIS HAPPEN TO YOUR FACILITY

Combustible dust can cause personnel injuries, equipment & plant damage. Spark & embers from dryers, hammer mills, pelletizers & coolers can cause cascading dust fires & explosions

GreCon Spark Detection & Extinguishing Systems

are a preventative measure against fire or dust explosions by detecting and extinguishing sparks & embers in processing and conveying equipment without production interruption.

The United States exported approximately 696,692 metric tons (mt) of wood pellets in February, down from 742,824 mt in January but up from 632,043 mt in February 2023, according to data released on April 4 by the USDA Foreign Agricultural Service. The U.S. exported wood pellets to approximately 18 countries in February. The United Kingdom was the top destination for U.S. wood pellet exports at 457,710 mt, followed by Denmark at 129,239 mt, France at 33,049 mt, the Netherlands at 31,475 mt and Japan at 29,967 mt.

U.S. wood pellet exports were valued at $135.66 million in February, down from $140.03 million the previous month but up from $117.99 million in February of last year.

Total U.S. wood pellet exports for the first two months of 2024 reached 1.44 million mt at a value of $275.69 million, compared to 1.27 million mt exported during the same period of last year at a value of $232.65 million.

Japan Petroleum Expansion Co. Ltd. (JAPEX) reported that an initial 25,000-metric-ton shipment of wood pellets that will be used to fuel the Ozu Biomass Power Plant arrived at the Nagahama Port on March 25.

JAPEX broke ground on the Ozu Biomass Power Plant in mid-2022. The 50-megawatt (MW) wood pellet-fueled facility is in Ozu City, Ehime Prefecture, Japan. At that time, JAPEX said it was working with Maeda Corp., Yonden Business Co. Inc. and Shinko Denso Co. to develop the project. Electricity produced at the facility will be sold to Shikoku Electric Power Transmission & Distribution Co. Inc. under the feed-in tariff system for renewable energy. In a March 29 announcement, JAPEX confirmed the Ozu Biomass Power Plant will begin commissioning in April, with commercial operations expected to begin this summer. According to JAPEX, it is responsible for the wood pellet supply

operations related to the bioenergy facility. The company noted that it also plans to begin supplying fuel to other biomass power plants.

The U.S. EIA has released the January 2024 edition of its Monthly Densified Biomass Fuel Report, which includes data collected from 76 operating wood pellet manufacturers. Total reported production capacity for these facilities in January was 13.17 million tons per year, with these facilities having a collective equivalent of 2,404 full-time employees. For the same month in 2023, the data collection included 79 operating manufacturers with a total production capacity of 13.05 million tons per year, and a collective equivalent of 2,544 full-time employees.

In January 2024, the monthly respondents purchased 1.55 million tons of raw biomass feedstock, produced 830,000 tons of densified biomass fuel and sold 650,000 tons. In comparison, in January 2023, respondents purchased 960,000 tons of raw biomass feedstock, produced 910,000 tons of densified biomass fuel and sold 650,000 tons.

Domestic sales of densified biomass fuel in January 2024 were 140,000 tons, averaging $226.72 per ton, down from 150,000 tons in January 2023 but up in price from $210.94 per ton. Exports in January 2024 were up in both volume and price compared to 2023 at 510,000 tons averaging $198.29 per ton, compared to 500,000 tons at $191.31 per ton in 2023.

PODCAST PREVIEW PLAY WITH BOB PETROCHKO, DUSTCON SOLUTIONS

Dustcon Solutions’ Bob Petrochko was the guest on Season 3, Episode 8, of the Biomass Magazine podcast. Petrochko, a senior process safety engineer, recently presented at the International Biomass Conference in Richmond, Virginia. During his discussion, Petrochko shared some findings that he compiled after visiting nearly a dozen wood pellet plants in 2023. Especially for those who missed the conference, Biomass Magazine invited him as a podcast guest to rehash some of that firsthand experience, which was focused on dust hazard analyses (DHAs), common problem areas and ways to mitigate safety hazards.

Tell us about Dustcon Solutions and

main goal is to provide clear and actional guidance that is easily understood and implemented. I’ve been with Dustcon for over four years as a senior consultant, and I’m focused primarily on DHAs and HACs, and I’m a member of the NFPA 61 Technical Committee. Before starting with Dustcon, I worked as a plant engineer on the receiving end of dust hazard analyses, so I can relate to our clients pretty well, I think.

Aligning with the theme of this issue of Pellet Mill Magazine, which is fire and explosion protection, let’s go back to the basics. Can you explain what a DHA is and what it serves to do?

[as well as] management system elements that are an integral part of preserving safety. The DHA document that we deliver should become an important reference for management of change reviews going forward.

You presented at the International Biomass Conference & Expo in March and shared a lot of information based on firsthand experience that you gathered from visits to 15 wood pellet plants in 2023, large and small, from northwestern Canada to the deep South U.S. You found some trouble areas—can you tell us about some of the most common and how they can be addressed?

Petrochko: I’ll preface my findings by noting that NFPA 664, the fire and explosion prevention standard for wood processing and woodworking facilities, does not provide all the direction that’s needed to

protect a drying system. I really try to understand a process as much as possible when I’m on-site and then afterward. I will also say that the Wood Pellet Association of Canada is an excellent online resource for safety reference. But starting with the front end of the process, rotary drum dryers are complicated. They can’t be directly explosion-protected because you can’t hang a device on a rotating drum, so the focus [is] predominantly on ignition prevention. So, you have spark detection extinguishment between the dryer and the inlet to the cyclone—that’s required and common; that’s what you see all the time—but what you don’t see all the time are the explosion venting needs on the cyclones, to prevent propagation of the dry fibers being blown back into the dryer. What’s even less common than that is explosion isolation on both ends of the cyclone. You need a whole package there to prevent propagation of an explosion back into the

dryer, since you can’t really protect the dryer itself, other than trying to close it off from the external ignition sources. In addition to combustible wood fiber, you also have a big risk from combustible gas, which is typically considered a syngas. Standard procedure is ensuring good furnace controls are in place and that they’re regularly tested, but you also must ensure that timely cleaning takes place to prevent buildup inside the dryer. Buildup inside the dryer and the ductwork itself downstream of the dryer can get to a point where the syngas is not purged effectively, and it could cause the problem we’re trying to prevent.

Listen to the rest of the podcast: www. biomassmagazine.com/pages/podcasts

WORKING IN WOOD PELLETS

Survey results indicate overall job satisfaction is high in the wood pellet industry, career duration is long and many facilities are seeing growth and new opportunities.

BY ANNA SIMETTo better understand and report on pellet plant personnel compensation and job satisfaction trends, Pellet Mill Magazine conducted an e-survey of U.S. pellet plant employees. Although a small amount of collected data was kept confidential to protect identities, much of it is shared in this story. Survey questions focused on topics including salary, benefits, hours, job retention and satisfaction, experience and education. Although this survey has variables to consider when interpreting the data, we believe it is a jumping-off point to help gauge where the industry stands in terms of competitiveness with related sectors, and may help highlight potential areas for improvement.

Plant Operations, Position, Experience

Respondents were asked about the average size of the plant/plants they work at, oversee or manage at their company. The range varied considerably, with a relatively even split across most categories with the exception of 250,000-500,000 tons, which only 3.2% of respondents selected.

To better understand the position facilities were in during the past 12 months, they

were asked the average capacity percent at which their plant/s operated. Just under 45% of respondents reported operating at 90-100% of capacity, with nearly 21% operating at 80-89% of capacity. Approximately 17% indicated they operated at an average between 70% and 79% of capacity over the past year, with about 7% of respondents between 50% and 69%. Just over 10% said they operated at less than 50% of capacity. See Figure 2 for tallied results.

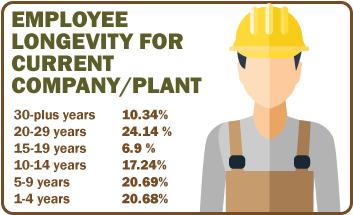

To gain knowledge of the longevity respondents have had in the industry, they

were asked how long they have been employed by their present facility or company, even if there was a break in employment. Per their responses, most have worked for their companies for at least 20 years, with 10 to 14 years being the second-most popular answer. Approximately 58.6% of respondents have worked at their respective companies for at least 10 years. Just over 10% have spent more than 30 years working for their plant or company. Responses are shown in Figure 3.

In a follow-up question that asked how many different plants or companies

the respondent had worked at during their careers, 10% said they had worked at or managed five or more companies or pellet plants. Nearly 70% had worked at the same one for the duration of their career, with approximately 14% having worked at two and the remaining 7% having worked at three.

As for the type of role respondents were in, nearly 36% were in positions including president, CEO, COO or other executive positions. Just over 14% were general managers, nearly 11% were plant managers, and approximately 7% were in fuel procurement, with the remaining respondents in other positions including maintenance, engineering and plant operations team member; lube technician; sales and distribution managers; safety and purchasing; and sales/business development.

As to the degree of decision-making influence respondents reported having at their facility for the selection of materials, supplies, services and new equipment, more than 81% of respondents indicated they authorize or approve selections and are part of the decision-making team at their operation.

The majority of companies/facilities reported that filling open positions a struggle some of the time. A quarter of respondents reported that most of the time it is difficult to find new employees, and just over 14% said positions are typically filled quickly and easily. Nearly 18% indicated that turnover is extremely low (see Figure 4).

As a follow-up question, respondents were asked which methods were used to fill open positions. Most indicated that word of mouth was the most effective method, with nearly 73% reporting it to be either very effective or sometimes effective. Recruiting from within was reported as next most effective, being either very or sometimes effective approximately 70% of the time, followed by recruiting from related industries. Approximately half of respondents reported having succession planning

Reported Wood Pellet Employer Benefits, to the Best of Respondents’ Knowledge

in place for management positions at their respective plants, and 40% said they had been contacted by a headhunter or recruiter within the past 12 months.

Just over half of respondents reported that COVID-19 is still having effects on their facility, whether operations or staffing, at least to some degree. Approximately 77% of respondents said that since the pandemic or within the past 24 months, they have taken on a broader role, more responsibilities or increased hours.

Schedule, Job Satisfaction & Compensation

When asked to characterize whether their plant was in a growth or transformation stage—i.e., expanding, taking on new projects or actively hiring—nearly half of respondents answered yes. An additional 32% said they were seeing growth at least to some degree, with the remaining 21% indicating that they were not currently seeing any kind of growth.

Of those who reported growth, 18% expected to hire six or more employees. Just over 11% said they will likely need five to six additional employees, and 37% expected to hire at least one to four more employees.

Respondents reported working long workweeks. The majority—27%—indicated 45 to 49 hours was typical, with 23% reporting 50- to 54-hour workweeks. Approximately 11% reported working from

55 to 59 hours; another 11% reported working 60 to 69 hours. About 22% of respondents said they typically work 44 hours or less.

Compensation aside, 92% of respondents reported being satisfied or very satisfied with their current position in the wood pellet industry, with less than 8% reporting being unsatisfied or very unsatisfied.

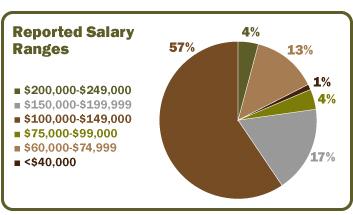

As for compensation, most respondents (56%) reported making between $100,000 and $149,000 per year. (See Figure 6 for additional salary data.) Most were not eligible for overtime compensation (68%), with 24% receiving time and a half and

8% taking paid time off in exchange for overtime hours. No respondents reported getting paid hourly. As for their opinions regarding their pay, just under half (48%) agreed they were compensated about right, with an equal percentage saying they were compensated too little, and 4% indicating they feel they are overcompensated.

Respondents were also asked about their overall benefits packages, and to answer yes or no to any benefit they knew was offered or included at their company, to the best of their knowledge. Results are indicated in Figure 5.

92% of respondents reported being satisfied or very satisfied with their current job in the wood pellet industry.

It is important to note that these salaries may take into account a range of positions, from plant managers to CEOs, and are an average of all survey respondents.

Most respondents said they generally receive annual performance reviews along with raises (68%). Whether irregular or modest, all respondents said they receive raises, but 24% indicated they do not undergo performance reviews. Additionally, 56% of respondents said they have received a raise within the past 12 months, with a 3% raise being the most common (37.5% of respondents), followed by less than a 3% raise (25% of respondents), a 5% raise (20.8% of respondents) and 1014% raise (8.3% of respondents).

As for bonuses, nearly 71% of respon dents reported receiving bonuses within the past year, with nearly 35% being paid between $1,000 and $5,000, and 17% re porting bonuses between $10,000 and $15,000. Approximately 26% said they did not receive any bonuses during the past 12 months.

Demographics and Education

Out of all survey takers, just 8% were female, and 36% were aged 60 years or older. Approximately 44% of respondents were 55 or older, 32% were between the ages of 45 and 54, and 20% were between the ages of 35 and 44. Just 4% were be tween the ages of 30 and 34, and no re spondents were under the age of 34.

Finally, respondents were asked about their education. The majority reported having post-graduate degrees (36%), with an additional 16% having college or university degrees, and 20% having at least some college or university experience. All respon-

dents had high school degrees or G.E.D.s, with 20% reporting that as their highest level of education.

Author:Anna Simet asimet@bbiinternational.com

ENGINEERING A SAFER CULTURE

Pellet Mill Magazine chats with process safety engineer Kayleigh Rayner Brown about her work with the Wood Pellet Association of Canada’s Safety Committee.

BY ANNA SIMET

You’re a process safety engineer by trade. Tell us about your background and what led you to that role.

KRB: I completed a degree in chemistry, followed by one in chemical engineering. Too often, we learn about catastrophic, loss-producing events that impact families, the environment and our communities. My role in process safety affords me the opportunity to help play a part in keeping safe the workers, assets and communities in which facilities operate. I completed my Master of Applied Science in process safety, focusing on hazard analysis and inherently safer design (reducing risk by designing out hazards rather than only relying on add-on equipment and procedures).

For the past several years, you have been working closely with the Wood Pellet Association of Canada. Can you give us an overview of what you have been doing with the organization and the ultimate goals?

KRB: The Canadian wood pellet industry is trying to continue improving the safety of the sector and their operations— they recognize that safety is good business. Safer facilities are more profitable and productive facilities. I’ve been working with WPAC and the Safety Committee since 2020 to help them in pursuit of improving the overall safety of the industry, primarily within process safety, which focuses mostly on preventing and mitigating hazards posed by combustible dust that is inherent to the wood pellet production process.

Can you offer more specific examples of initiatives at the plant level?

KRB: We began working together on hazard analysis of combustible dust in operations. This was through a research project funded by WorkSafeBC that aligned with a large initiative that was being undertaken to assess critical controls for dust hazards. I facilitated the bow-tie analysis workshops (a type of hazard analysis) for the plants in collaboration with the BC Forest Safety Council (the health and safety association for the pellet plants in BC). These workshops leveraged the expertise of plant production, operator and maintenance teams to evaluate hazards

We’ve also worked together on the launch of an operator training program, and studies on inherently safer design, combustible gas and deflagration isolation. I’ve supported numerous workshops, including full-day sessions focusing on process safety in Ottawa, Ontario, and Prince George, British Columbia. I also helped launch our Safety Hero program, where we recognize frontline personnel who are nominated for their outstanding efforts and contributions to safety.

We’re also focusing efforts on preventing incidents downstream during the handling and storage of pellets in biomass power plants. WPAC, in partnership with FutureMetrics, hosted an on-site workshop for plant personnel in Tokyo, Japan, in December 2023, and we’re hosting another one

The entire industry has been wonderful to work with, and it’s very gratifying work. It’s great to see how we’ve been able to reach people at the plant level and make a difference.

There seems to be varying viewpoints about incident occurrences at plants—those who tend to believe they’re inevitably going to happen and it's a matter of how to best prepare for or minimize them, and those who believe they are all preventable. What are your thoughts on this?

KRB: This is a great question. I believe safety culture is the key underlying concept here. Safety culture is consistently a topic of discussion amongst WPAC and the operations. We want to prevent complacency, and we want to maintain a sense of vulnerability. Having a sense of chronic unease that inci dents can happen helps identify any potential gaps in safety systems. Hazard identification and being aware of all the credible scenarios that could lead to incidents is fundamental to process safety. This includes not only ensur ing that the proper controls are in place to prevent or mitigate incidents, but also having measures in place to ensure that controls are effective and reliable.

And this is all central to a good safety culture. To help ensure that hazards are be ing effectively identified, we need to consider the following questions:

• Are workers at all levels involved with hazard assessments and incident investiga tions?

erations face. This includes fugitive combustible dust accumulations from leaking equipment or transfer points outside the process, as well as dust and material contained in the process as it moves through the production equipment.

Each area of a pellet plant has its own unique challenges. An area to pay attention to is the fiber yard. Self-heating is a risk when storing raw material. The material decomposes from microbial activity, which generates heat and gases, which can lead to smolders and fires. Additionally, the mobile equipment handling the material in the fiber yard is also a hazard to personnel—struck-by incidents are often fatal. We’re currently working on a research project (BC Forest Safety Council, Dalhousie University, WorkSafeBC) on mobile equipment risk reduction.

Dryers are another high-risk process on-site; combustible wood dust in dryers can

• Is there open and effective communi cation regarding process safety?

• Does the organization have initiatives to avoid complacency, such as routine safety meetings, sharing of safety bulletins, discus sion of safety incidents or near misses?

In terms of trouble areas or the most common components of pellet op erations that you most often see room for improvement—what are they?

KRB: Combustible wood dust is the biggest process safety hazard that pellet op-

lead to the generation of combustible gas, which can cause fires and explosions. WPAC undertook a belt dryer initiative in 2020-‘21, recently hosted a drum dryer symposium, and is forming a working group to continue working on overcoming challenges associated with drum dryers.

Let’s say a plant wants to ensure it is operating as safely as possible—from best practices in housekeeping, to operating and protecting assets, to protecting and educating its employees. Where do they begin?

KRB: The first place to begin is safety leadership and a visible and active commitment to safety from all levels of management. This will drive the development and maintenance of a strong safety culture. The programs, procedures and management systems will only work if safety is a core value,

• Hydraulic Truck Dumpers custom engineered for each application

• Live Bottom Hoppers including Backrakes for handling stringy bark

• Telescopic Cylinders specifically designed for use on a truck dumper

and if there is the collective belief in implementation and action.

The examples you highlighted above are important safety measures—operations can consider what they believe are their “critical controls” and focus on them, giving them high priority. For example, training on the shutdown procedures for drum dryers is very important; deviations from the procedure can lead to the combustible gas formation that I previously mentioned. It should be ensured that personnel are trained, routine observations are completed and the procedure is current. Also, it should be considered whether the process can actually be automated, which reduces the heavy reliance on operators. We use bow-tie analysis to evaluate critical controls, which is a powerful tool for this approach.

WPAC is in the early stages of implementing process safety management (PSM), which is a systematic framework for preventing and mitigating process safety-related inci-

dents. We completed a PSM research project to identify some high-priority elements that can help serve as a starting point, and they are as follows:

• Accountability: Formalize the role of senior management in establishing and achieving process safety goals.

• Process risk assessment and risk reduction: Take proactive steps to improve risk reduction and prevent incidents from occurring.

• Incident investigation: Learn from incidents to address gaps in risk reduction.

• Management of change: Address new risks presented by changes in the operations.

• Key performance indicators: Determine leading (e.g., near misses like bypassed safety systems) and lagging (e.g., fire) indicators to measure and trend for continuous improvement.

WPAC and its Safety Committee have a focus on information sharing. How can sharing information help improve the safety record of the industry?

KRB: When there are loss-producing incidents, it affects the whole industry. It impacts access to affordable insurance, the ability to attract and retain the best talent, and the overall reputation.

While each operation is unique in equipment and configuration, they are faced with similar challenges—combustible dust, mobile equipment and working at heights, to name a few. Information sharing helps improve the safety record of the industry by helping identify trending issues and focusing efforts to prevent recurring issues. In the monthly Safety Committee meetings, discussions and brainstorming often help identify solutions that may not have been developed working only in a silo, by bringing together different perspectives and experiences.

How critical is educating personnel on safety, and how can this effectively be done?

KRB: Everyone needs to understand the role they play in ensuring the safety of the operations. This is especially true when it comes to procedural safety measures that depend on personnel doing the right thing every time.

Approaches like toolbox talks, factsheets, in-person workshops, online learning programs, peer-to-peer learning opportunities, mentorship and job shadowing are a few ways to help facilitate safety. WPAC’s online operator training program is free and has modules on topics including upset conditions, combustible dust, plant operation and process safety management.

What are some of the major conclusions you have reached in working with WPAC and the Safety Committee over the past few years?

KRB: Reaching and involving key stakeholders, from the frontline to managers, is critical for raising awareness and sharing information to enhance safety.

A key shift in safety culture is needed to move from reactively responding to incidents to proactively implementing changes to prevent incidents.

We can benefit from reconsidering our approach to risk reduction and exploring ways to apply inherently safer design—can we redesign the work area or process to eliminate the hazard? Can we use a different process or equipment that minimizes the hazard? Can we simplify processes to reduce the likelihood of human error?

Safety is a journey and an evolution, and starting somewhere is better than not starting at all. Keep building on each safety initiative to gain momentum, make incremental changes, and in five years, you’ll look back to see how far you’ve come. You’ll be eager for everything you have planned for the next five.

Author: Anna Simet asimet@bbiinternational.com

Minimizing Pellets the TSG way!

Modern Early Fire Detection in Biomass

The biomass market’s fire detection landscape has significantly advanced.

The biomass industry is expanding rapidly, driven by growing interest in renewable energy and sustainable materials. This growth brings unique fire risks associated with the handling, processing and storing of biomass materials. Early fire detection systems stand at the forefront of mitigating these risks, offering unprecedented capabilities to detect and manage fire hazards before they escalate. The following article highlights modern fire detection systems’ core components and considerations, specifically for the biomass market, to enhance safety and protect valuable assets.

Fire Risks in the Biomass Market

Biomass materials, including wood chips, agricultural residues and other organic

BY DAVID BURSELLmatter, are highly combustible. The processing and storage of these materials create fine particles and dust that can accumulate and ignite spontaneously. Additionally, storing large volumes of biomass in confined spaces can lead to heat buildup and self-ignition, posing a significant fire risk. Early detection is crucial to preventing these incidents from escalating into catastrophic events.

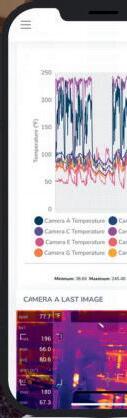

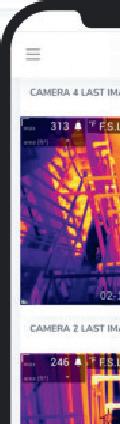

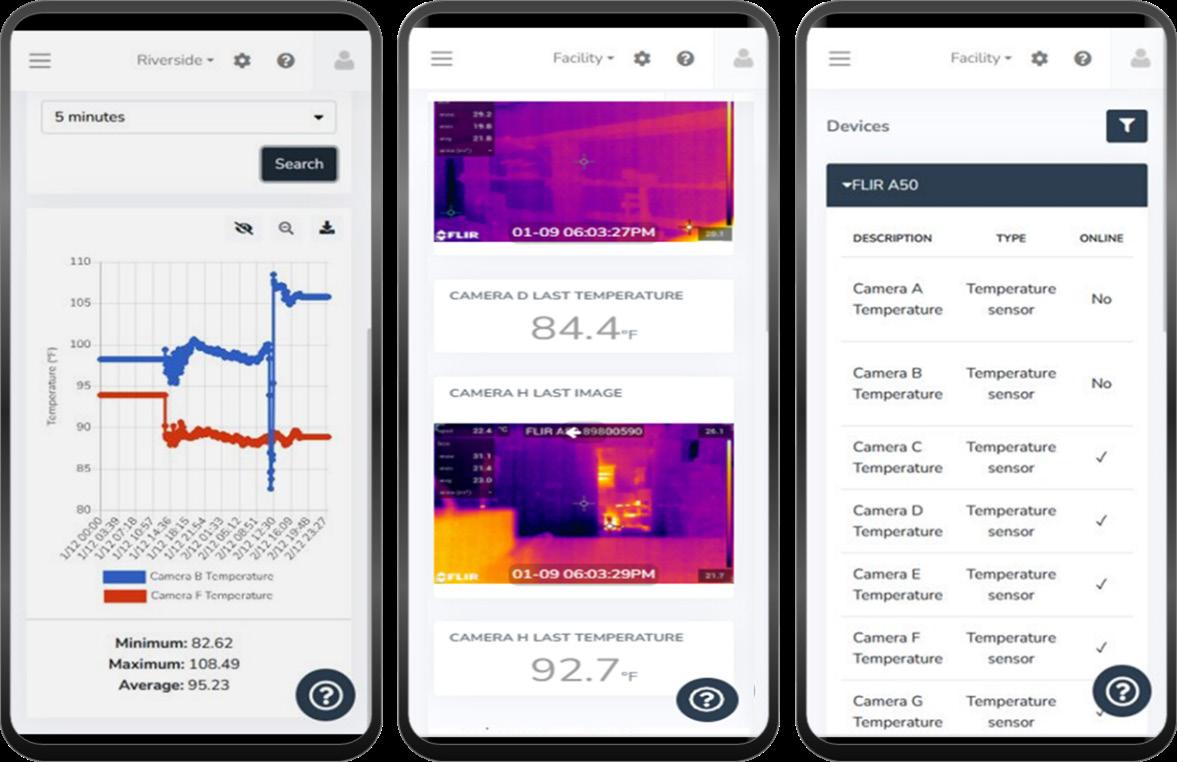

Advanced Sensor Technologies. At the heart of any effective fire detection system lies a network of sensors designed to identify fire hazards at their inception. Among these, infrared (IR) cameras are particularly noteworthy for their ability to detect temperature changes associated with the early stages of fire development. Unlike traditional smoke detectors, IR cameras can

identify hot spots through thermal imaging, allowing for a proactive response to potential fire threats. The precision of IR cameras in locating and monitoring these hot spots is unmatched, making them indispensable in modern fire detection systems. However, the diversity of fire detection sensors extends beyond IR cameras. Aspiration smoke detector (ASD) systems and photoelectric smoke detectors (PSD) cater to different aspects of fire detection, with ASDs offering enhanced sensitivity to smoke particles through air sampling and laser detection technologies. This sensitivity makes them ideal for environments where early smoke detection is crucial. On the other hand, PSDs excel in identifying larger smoke particles that are characteristic of smoldering fires, comple-

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Pellet Mill Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

menting the fast detection capabilities of IR cameras and ASDs.

Ensuring System Security. The digitization of fire detection systems introduces complexities related to cybersecurity. The decision between implementing an on-network system, which integrates with a company’s existing IT infrastructure, versus an off-network system, which operates independently, is pivotal. Off-network systems, particularly those utilizing cloud-based platforms or cellular connectivity, offer robust security measures, such as encryption and firewall protection, minimizing the risk of cyber threats while ensuring reliable fire detection capabilities.

Connectivity and Real-Time Alerts. Modern fire detection systems’ true potential is realized through their advanced connectivity features, which facilitate real-time alerts and notifications. With cloud-based platforms, organizations can implement flexible notification schedules that align with varying work shifts, ensuring that alerts are received by the appropriate personnel at the right time. This capability is critical in environments where staffing and operational hours may fluctuate. Furthermore, cloud platforms enable the configuration of tiered notifications based on the severity of detected alarms. For instance, a minor temperature increase might trigger a low-priority alert to local staff for investigation. At the same time, a more significant threat could escalate to high-priority notifications to emergency services and senior management. This tiered approach ensures a proportional response to potential hazards, optimizing resource allocation and response times.

The advanced dashboards and site views offered by these systems provide comprehensive oversight of fire detection alerts and sensor statuses. These dashboards can integrate alarm overlays on facility maps, which can be shared via SMS text messages, enhancing situational awareness for on-site personnel and remote stakeholders. The ability to share these insights internally and with external entities such as first responders and third-party monitoring services underscores

modern fire detection solutions’ versatility and collaborative potential.

Upgrades and Maintenance: Cloudbased Advantage. The dynamic nature of technology necessitates regular updates and maintenance to ensure fire detection systems remain effective and secure. Cloud-based solutions offer a significant advantage, enabling automatic software and firmware updates without manual intervention. This ease of maintenance ensures that systems benefit from the latest advancements and security measures, reducing downtime and enhancing overall system reliability.

Integration with Existing Infrastructure. Integrating fire detection systems into existing security monitoring infrastructures significantly elevates their performance and a facility’s overall security protocol. This process involves weaving the capabilities of fire detection components, like smart IR cameras and monitoring gateways, directly with the broader security apparatus already in place. Fire detection mechanisms are seamlessly integrated through the strategic use of protocols like Real-Time Streaming Protocol and Open Network Video Interface Forum, ensuring that all security system components communicate efficiently and effectively. The monitoring gateways are at the heart of this integrated approach, which acts as the nerve center for fire detection and security operations. These gateways facilitate the direct linkage of fire detection alerts to the security monitoring system, enabling immediate actions based on the nature of the detected threat. For instance, upon identifying a potential fire hazard, the system can automatically alert security personnel, activate sprinkler systems or initiate evacuation protocols, depending on the predefined response criteria.

The primary advantage of this tight integration is the creation of a unified security ecosystem that leverages the strengths of fire detection and traditional security monitoring systems. Firms can streamline their response strategies by ensuring that fire alarms and security alerts are managed through a single interface, reducing the time between detec-

tion and action. This unified approach not only simplifies operational demands, but also enhances the effectiveness of the facility's overall security measures. By integrating fire detection systems with existing security monitoring frameworks, facilities gain a comprehensive and cohesive defense mechanism against various threats. This synergy between fire detection and security monitoring systems underscores the importance of advanced technological protocols like RTSP and ONVIF in facilitating communication and interoperability among diverse security components, leading to a more secure, responsive and efficiently managed environment.

The

Role of Expert Integrators. The complexity of designing and implementing an effective fire detection system cannot be overstated. The selection of appropriate technologies, integration with existing systems, and ongoing maintenance require specialized knowledge and experience. Partnering with expert integrators, particularly those with a deep understanding of infrared technology and a proven track record in fire detection solutions, is critical. These professionals ensure the system’s optimal setup and provide invaluable support throughout its lifecycle, adapting it to evolving needs and technological advancements.

Conclusion

The fire detection landscape in the biomass market has significantly advanced, thanks to technological innovations and a better understanding of fire safety needs. Modern fire detection systems, with advanced sensors, strong cybersecurity measures and seamless integration with biomass plant operations, mark a substantial leap forward in protecting facilities, lives and properties. In this era of intelligent safety solutions, detecting and responding swiftly and effectively to biomass fire hazards is no longer a challenge—it’s a reality.

Author: David C. Bursell Vice President of Business Development, MoviTHERM www.movitherm.com

Bearing Failure at Pellet Plants: Top Causes

Bearings are a key replacement part in many pellet plant components.

BY HOLGER STREETZProduction rate and operating expenses (OPEX) highly depend on proper maintenance to ensure reliable operating equipment. At pellet plants, bearings are a key replacement part in chains, conveyors, moving floors, ventilators, hammer mills, pellet mills and many other devices. The following are some of the top reasons for bearing failure at pellet operations.

Lack of Lubrication and Contamination

When bearings spin under high loads with inadequate lubrication, they may experience metal-to-metal contact. This results in increased wear, overheating and potential

contamination of the lubricant. To prevent this, it is crucial to check that the right type and amount of lubricant is being used, and that it is being reapplied at the correct intervals. If contamination is detected, it is important to inspect the seals. In some cases, using a thicker lubricant may help, and in many cases, greases with solid particles are superior, as the particles act as an additional sealant. It is important to note that over-lubrication can also cause problems.

Electric Erosion

Electric erosion, which is caused by the electric current that passes through bearings, can lead to micropitting and failure. It is dif-

ficult to prevent electric discharges that damage the surface of bearings. Electric motors charge nearby bearings by emitting current. Most greases have a moderate to fair insulating character, but using high-insulation grease can help prevent electric discharge damage. However, the increased insulation can cause higher charges that discharge with much stronger force, causing more severe damage if the insulation is not sufficient. Other options include using insulated bearings and insulated couplings. Although these solutions are effective, they are also more expensive than shaft grounding.

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Pellet Mill Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

Vibration

Bearings can be damaged by vibration during transportation or during storage before installation. This can cause false brinelling, which appears as marks in the bearing races.

In pellet plants, this type of damage can happen when third parties refurbish rollers and other equipment outside of the facility. To prevent damage during transportation, it is important to secure the shaft axially and radially with a flat piece of steel and a strap, respectively. During storage, the shaft can be turned regularly to spread out any vibrational contact across the bearing surface. Pre-lubricating the bearings and additional no-load run-in procedures can also reduce possible damages from transport and storage.

Improper Installation and Setup

Improper installation and setup can cause various types of damage, such as true brinelling, misalignment, imbalance, excessive belt tension and mounting errors, leading to overloading. To avoid these issues, it is important to follow the recommended installation procedures and use quality instruments to check alignment, tension and other factors. Original equipment manufacturers and third parties offer staff training and share best practices.

Insufficient Loads and Overload

Bearings require a minimum load to function properly—an inadequate load can be just as damaging as excessive load. Damage from insufficient load appears as smearing on the rolling elements and races. This is especially important to keep in mind when using cylindrical roller bearings, which are designed for larger loads, and does not apply to preloaded bearings. Overload, on the other hand, results in deformations similar to shock loads or improper handling. Especially excessive, abrasive wear occurs with inadequate lubrication, wrong

volumes or insufficient quality. High-performance lubricants with a higher number of additives are able to cope with the demanding environments in a pellet plant and help improve the lifetime of bearings. When aiming for lower OPEX, a closer examination of the lubrication program is required.

Conclusion

In summary, addressing the underlying principles of bearing failure in pellet plants necessitates a multifaceted approach that encompasses lubrication management, elec-

trical protection, vibration mitigation, installation excellence and load optimization. By implementing proactive maintenance strategies informed by advanced technologies, as well as fostering a culture of continuous improvement, organizations can enhance equipment reliability, minimize downtime and maximize operational efficiency in pellet plant operations.

Author: Holger Streetz COO, Bathan AG h.streetz@bathan.ch

Protect Your Plant

The Int’l Biomass Conference & Expo is where future and existing producers of biobased power, fuels and thermal energy products go to network with waste generators and other industry suppliers and technology providers.

The Int’l Biomass Conference & Expo is the largest, fastest-growing event of its kind, the conference is expected to draw nearly 1,000 attendees in 2025. In 2024, the event drew 160 exhibitors and more than 900+ attendees, with 29% of attendees being producers. This growth is fueled by a world-class expo and an acclaimed program

Change Service Requested