DeRisk your projects. A start up project has lots of components from financing, locating equipment and contractors, and managing the day to day operations.

BE&E o ers complete construction management ser vices to take the risk out of this process. We have prequalified vendors and two decades of experience in the biomass bulk handling sector. Keep your project on track with a supplier that will take you from planning to startup.

Manufacturers of the VIBRAPRO™ line of vibrator y conveyors. Works in conjunction with the SMART™ system. Designed to sort, seperate and move bulky materials from receiving stage to distribution.

• Construction of facility operations building

• Base rock and concrete machinery foundations

• Finished access roads and work area access pads

• Supply of all electrical components, controls and machinery

• Electrical connections from transformer

• Installation and startup

•Training on all supplied machinery

• CMMS maintenance program

•Technical support

Lisa Gibson

New and unique feedstocks abound for the

industry, with each potential option offering significant carbon reduction potential.

Katie Schroeder

SAF Production Set to Grow Amid Renewable Diesel Switching

Sustainable aviation fuel markets have been slow to produce substantial volumes, but renewable diesel producers facing depressed margins may soon make the switch.

By Jordan Godwin

28 INDUSTRY

Growing SAF Production and Accessibility to Help Cut Aviation Emissions

The key to increasing SAF production is investing in renewable products production capacity, but it also requires vision and commitment.

By Alexander Kueper

30 TECHNOLOGY

From Municipal Solid Waste to Airmiles: A Pragmatic Approach to Producing SAF

A proprietary gasification process can address the challenges of producing sustainable aviation fuel at a scale.

By Andy Cornell

32 PRETREATMENT

The Contaminant Challenge: Boosting Efficiency and Flexibility with Pretreatment

The choice of pretreatment technology is a critical decision given the impact on downstream processing and overall final product quality.

By Matthew Clingerman

34 INDUSTRY

Trends, Pathways and Feedstocks

Topsoe's Production Line Director Milica Folic shares perspective on the current state-of-play in the SAF market, and what the future may hold in terms of technology and production pathways.

By Topsoe

It’s a pivotal year for the nation’s energy economy, with what’s tracking to be a very close election just a couple of months away. While there are varying views of what might ensue under a Trump Administration, some of opinions I’ve read and listened to believe sustainable aviation fuel will fare just fine. This is partly given Trump’s previous track record of support for farmers and agriculture, but mainly that the most SAF-relevant parts of the Biden administration's landmark Inflation Reduction Act (tax credits) are likely to be safe from dismantling, particularly because many Republican-led districts are benefitting from the IRA. In fact, according to a new report by E2, more than 60% of all IRAfueled projects over the past two years are in Republican districts (North Carolina's 9th district leads for clean energy investments with nearly $9.9 billion, followed by Georgia's 11th congressional district at $6.6 billion). On top of that, some predictions suggest that a Trump victory may even result in more relaxed standards/regulations, which could potentially accelerate ethanol projects’ qualification for 45Z credits. Despite all the speculation, we still have about three months to go until Election Day, and we’ll be ready to cover it as it all unfolds.

As for stories in these pages, our first feature, “Carbon Rebrand” on page 14, takes a look at California-based Twelve’s technology that uses CO2 electrolysis for the production of chemicals, materials and e-fuels like SAF. There are many different applications for the technology, says its founders Ashwin Jadhav and Nicholas Flanders, but Twelve chose to focus on SAF first because of its “demand and impact.” The company’s first commercial-scale facility is under construction in Moses Lake, Washington, and is expected to begin delivering fuel in mid-2025.

The second feature and our cover story, “Expanding the Feedstock Arsenal” on page 20, details some unconventional feedstocks as SAF contenders, from cassava to milk permeate to hybrid hemp. As feedstock competition intensifies, developers will need to look outside their traditional inputs, and maybe one of the options featured in this story will appeal to them.

Finally, we’ve included five industry contributions on a range of different topics, including one from OPIS’s Jordan Godwin on current renewable diesel margins, and the allure and process of switching to SAF. I’m amazed at the continual interest in contributing to SAF Magazine, and if you'd like to but haven’t yet reached out, please do so. Send me a note at asimet@bbiinternational.com.

ANNA SIMET Editor, SAF Magazine

EDITORIAL

EDITOR

Anna Simet | asimet@bbiinternational.com

ONLINE NEWS EDITOR

Erin Voegele | evoegele@bbiinternational.com

STAFF WRITER

Katie Schroeder | katie.schroeder@bbiinternational.com

DESIGN

VICE PRESIDENT, PRODUCTION & DESIGN

Jaci Satterlund | jsatterlund@bbiinternational.com

GRAPHIC DESIGNER

Raquel Boushee | rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan | jbryan@bbiinternational.com

PRESIDENT

Tom Bryan | tbryan@bbiinternational.com

VICE PRESIDENT, OPERATIONS/MARKETING & SALES

John Nelson | jnelson@bbiinternational.com

SENIOR ACCOUNT MANAGER/BIOENERGY TEAM LEADER

Chip Shereck | cshereck@bbiinternational.com

ACCOUNT MANAGER

Bob Brown | bbrown@bbiinternational.com

CIRCULATION MANAGER

Jessica Tiller | jtiller@bbiinternational.com

MARKETING & ADVERTISING MANAGER

Marla DeFoe | mdefoe@bbiinternational.com

September 11 - September 13, 2024

Saint Paul RiverCentre | Saint Paul, Minnesota

Taking place September 11-13, 2024 in Saint Paul, Minnesota, the North American SAF Conference & Expo, produced by SAF Magazine, in collaboration with the Commercial Aviation Alternative Fuels Initiative (CAAFI) will showcase the latest strategies for aviation fuel decarbonization, solutions for key industry challenges, and highlight the current opportunities for airlines, corporations and fuel producers.

(866)746-8385 | NationalSAFConference.com

March 18 - March 20, 2025

Cobb Galleria Centre | Atlanta, Georgia

Now in its 18th year, the International Biomass Conference & Expo is expected to bring together more than 900 attendees, 160 exhibitors and 65 speakers from more than 25 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming—powered by Biomass Magazine–that maintains a strong focus on commercial-scale biomass production, new technology, and near-term research and development. Join us at the International Biomass Conference & Expo as we enter this new and exciting era in biomass energy.

(866) 746-8385 | BiomassConference.com

CHI Health Center | Omaha, Nebraska

The Sustainable Fuels Summit: SAF, Renewable Diesel, Biodiesel is a premier forum designed for producers of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to learn about cutting-edge process technologies, innovative techniques, and equipment to optimize existing production. Attendees will discover efficiencies that save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine and SAF Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers and producers to advance discussions and foster an environment of collaboration and networking. Through engaging presentations, fruitful discussions and compelling exhibitions, the summit aims to push the biomass-based diesel sector beyond its current limitations.

Co-located with the International Fuel Ethanol Workshop & Expo, the Sustainable Fuels Summit conveniently harnesses the full potential of the integrated biofuels industries while providing a laser-like focus on processing methods that deliver tangible advantages to producers. Registration is free of charge for all employees of current biodiesel, renewable diesel, and SAF production facilities, from operators and maintenance personnel to board members and executives.

(866) 746-8385 | SustainableFuelsSummit.com

June 9 - June 11, 2025

CHI Health Center | Omaha, Nebraska

Now in its 41st year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine—that maintains a strong focus on commercial-scale ethanol production, new technology, and near-term research and development. The event draws more than 2,300 people from over 31 countries and from nearly every ethanol plant in the United States and Canada. (866) 746-8385 | FuelEthanolWorkshop.com

The aviation industry stands at the cusp of a monumental shift as it grapples with its significant carbon footprint. Sustainable aviation fuel (SAF) is poised to revolutionize air travel, but widespread adoption hinges on overcoming several critical challenges. The industry is on the verge of this transformation, yet achieving it requires advancements in technology, scaling up production and understanding the role of policy.

SAF, a cleaner and more sustainable alternative to conventional jet fuel, has generated robust demand from the outset. Airlines are urgently seeking to reduce greenhouse gas emissions, driven by both environmental responsibility and external pressures such as the flight-shaming movement popularized by Greta Thunberg. In a recent episode of Clean Fuels Alliance America’s “Better. Cleaner. Now!” podcast, Veronica Bradley, Clean Fuels director of environmental science, emphasized that this proactive stance by the airline industry marks a significant shift from fossil fuels to renewable sources, a necessary step toward reducing the aviation sector's carbon footprint. "The airlines are committed to decarbonizing and see liquid renewable fuels as the only viable mechanism for achieving this in the near term," Bradley said.

However, the scale of the challenge is daunting. In 2022, the U.S. consumed approximately 24 billion gallons of jet fuel, while global consumption was around 99 billion gallons. Bradley highlighted that current SAF production is still in the millions of gallons, orders of magnitude away from meeting this demand. Even so, the industry is optimistic about ramping up production. "There are numerous projects projected to come online between now and 2027," said Jonathan Martin, Clean Fuels director of economics and market analytics.

New production projects span various technologies, including alcohol-to-jet and hydroprocessed esters and fatty acids (HEFA), the latter being similar to processes used for renewable diesel. Martin elaborated on the technical differences between conventional jet fuel and SAF. Drawing on his background in chemical engineering, he explained that SAF is more paraffinic, consisting of long, straightchain molecules, whereas conventional jet fuel includes a mix of these molecules and aromatic compounds, which are crucial for certain engine functions. "One of the main differences is that aromatic compounds are needed for the O-rings and other components inside the plane to function properly," Martin said.

Currently, SAF must be blended with conventional jet fuel, with blending limits ranging from 5% to 50% to meet ASTM standards.

The United States and European Union are at the forefront of SAF production. Companies like Diamond Green Diesel are converting existing facilities to SAF production in response to high demand. Bradley pointed out that historically, only a few companies produced SAF at commercial volumes, but this is rapidly changing. "We will see a much more diverse portfolio of SAF producers in the near term," she said.

Looking ahead, the industry faces both challenges and opportunities. While the immediate focus is on scaling up SAF production, understanding the role of supportive policies and incentives is also crucial. Bradley highlighted how policy can influence both production and adoption of SAF. "Airlines are looking for opportunities to partner with agencies and governments that support decarbonization," she said.

At the federal and state levels, there are already significant efforts to incentivize SAF use, which may facilitate its broader adoption. While SAF is still in its early stages, it holds tremendous promise for the aviation industry. With strong demand from airlines, ongoing technological advancements and the role of supportive policies, SAF could play a pivotal role in reducing the carbon footprint of air travel. As Martin succinctly put it, "The outlook is very positive; the advantage SAF producers have is a willing customer base."

The future of aviation is not just about flying higher or faster, but about flying cleaner—and that future is being shaped now.

Clean Fuels Alliance America www.cleanfuels.org info@cleanfuels.org

The National Renewable Energy Laboratory, in partnership with the U.S. Department of Energy Bioenergy Technologies Office, released the first two parts of the Sustainable Aviation Fuel (SAF) State-of-Industry Report. The report focuses on how to achieve the near-term fuel production goals set forth in the SAF Grand Challenge, a joint effort between DOE, USDA, Transportation Department and other federal government agencies.

Part 1 examines the overall state of the SAF production process and covers challenges and gaps in meeting near-term targets associated with the SAF Grand Challenge. This segment of the report is designed to address broad challenges facing the bioenergy industry when producing SAF, and is not specific to any single feedstock or production pathway.

Part 2 specifically focuses on evaluating the current supply chain for the hydroprocessed esters and fatty acids (HEFA) pathway. Facilities using this pathway are already producing volumes of liquid fuel today, and they are expected to play a major role in meeting the 2030 production target from the SAF Grand Challenge. This segment of the report looks at potential obstacles that could hinder the commercial production and use of SAF from these facilities.

As part of developing this report, NREL conducted extensive discussions, consultations and collaborative sessions with stakeholders in the SAF supply chain.

DG Fuels, a U.S.-owned sustainable aviation fuel (SAF) company, in cooperation with the Nebraska bioeconomy, has selected Phelps County, Nebraska, for its first Midwest production facility. The plant will produce 193 million gallons of SAF per year and meet ASTM fuel standards. Production is expected to begin in 2030.

On July 17, Clean Fuels Alliance America delivered a formal notice of intent to sue the U.S. Environmental Protection Agency for its failure to issue timely 2026 Renewable

Fuel Standards. By statute, EPA is required to finalize volumes 14 months before the start of the compliance year; for 2026, that deadline would come at the end of October this year. On June 28, the White House Office of Management and Budget released the Spring 2024 Unified Agenda of Regulatory and Deregulatory Actions, setting out a timeline for EPA to propose the 2026 RFS volumes by March 2025 and finalize the rule by December 2025. “EPA’s failure to timely issue the 2026 RFS volumes compounds another issue: EPA set the volumes for 2023 through 2025 too low,” Clean Fuels states in the letter.

Sens. Sherrod Brown, D-Ohio, and Roger Marshall, RKansas, and 13 colleagues on July 30 sent a letter to U.S. Treasury Secretary Janet Yellen urging the administration to restrict the 45Z Clean Fuel Production Credit to fuels made from domestic feedstocks. “45Z is intended to stimulate the development of a domestic, low-carbon fuel supply chain and to increase American competitiveness in the renewable and traditional energy markets,” the senators wrote. “If drafted and implemented correctly, the credit will help to support robust American energy independence—incentivizing the production of biofuels made with domestically produced feedstocks. In order to ensure this objective, it is essential that the 45Z rule articulate clear, workable pathways for domestically produced renewable fuels derived from domestically produced feedstocks, to lead the way in lowering the carbon intensity of American transportation fuels.”

“While the use of foreign feedstocks can play an important role in producing domestically manufactured ethanol and biodiesel, the rule must make it clear that the tax credit may only apply to biofuels produced from domestic feedstocks,” the senators continued. “This would be keeping with the two-fold intent of Congress in creating 45Z: 1) support domestic biofuels manufacturing, and 2) utilize domestic feedstocks to lead the way in lowering the carbon intensity of American transportation fuels. This approach marks a deliberate change from the previous Blenders Tax Credit, and it is important that Treasury’s guidance capture this nuance and accurately reflect Congressional intent.”

According to the senators, if Treasury fails to ensure only renewable fuels made from domestically produced feedstocks qualify for the credit, renewable fuel producers will take the path of least resistance and import foreign feedstocks, such as used cooking oil (UCO) from China to produce renewable diesel or Brazilian ethanol as a feedstock for sustainable aviation fuel (SAF). “This would reduce the utility of the credit to a manufacturing credit, rather than a credit that supports both manufacturing and feedstock production,” the senators wrote. This was not the intent of Congress.

“One need look no further than the dramatic increase in imports of Chinese UCO and Brazilian tallow, and the current use of Brazilian ethanol in producing SAF to understand the conse-

quences of a failure to properly craft the 45Z tax credit in a manner that supports American feedstocks,” they stated. “This has occurred, in part, because under the current guidance for the 40B tax credit for sustainable aviation fuel, no domestically produced ethanol is able to achieve the criteria set forth by the Treasury Department. This has unintended and counterproductive consequences.”

Phillips 66 on July 30 confirmed its Rodeo Renewable Energy Complex in California will begin producing sustainable aviation fuel (SAF) during the third quarter. The company also expects renewable diesel margins to improve later this year.

The biorefinery project has been under development since mid-2022 and reached full processing rates of approximately 50,000 barrels per day during the second quarter of 2024. During a second quarter earnings call, Phillips 66 Chairman and CEO Mark Lashier explained that the facility’s two hydrocrackers and both pretreatment units are now fully operational. The facility is currently transitioning to lower-carbon-intensity (CI) feedstocks as the company optimizes the economic performance of the facility, he added.

Rich Harbison, executive vice president of refining at Phillips 66, said the Rodeo facility has been running approximately 50% to 55% soybean oil, but plans to increase the share of lower-CI feedstocks throughout the third and fourth quarters. According to Harbison, SAF production will begin during the third quarter, with SAF sales beginning in the fourth quarter. The Rodeo facility will be able to blend up to 20,000 barrels per day of SAF, he added.

Brian Mandell, executive vice president of marketing and commercial at Phillips 66, said that biofuel margins were low but positive during the second quarter, despite a 10% increase in renewable diesel consumption when compared to the first quarter of the year. Looking into the future, Mandell said the company currently expects renewable diesel margins to begin to improve. He cited several factors the company expects to contribute to im-

proved margins, including the conversion of some current renewable diesel capacity to SAF, the shutdown of additional marginal biodiesel producers, declining feedstock prices as new crush facilities open in the United States and Canada, and changing tax credit structures.

Neste has commissioned terminal capacity at ONEOK’s terminal in Houston, Texas for blending and storing Neste MY Sustainable Aviation Fuel, expanding the availability of Neste’s SAF to airlines also operating from airports east of the Rocky Mountains all the way to the East Coast.

The new capacity at ONEOK’s terminal in Houston provides Neste with storage capacity of up to approximately 33.5 million gallons and is directly connected to the energy pipeline infrastructure in the eastern part of the U.S. Already in 2021, Neste demonstrated its ability to supply SAF to New York’s LaGuardia Airport using existing fuel distribution infrastructure. In September 2023, Neste also expanded its capability to supply renewable fuels to customers on the West Coast, commissioning terminal capacity in Los Angeles, California.

American Airlines consumed 2.7 million gallons of sustainable aviation fuel (SAF) in 2023, according to its 2023 Sustainability Report, released in July. While the airline's consumption of SAF was up 4% when compared to 2022, it accounted for less than 1% of total fuel use during the year.

According to the report, American Airlines is actively working to increase the volume of SAF it procures. “We’ve signed commitments with multiple SAF producers, at a premium, to try to secure supply and, in the case of Infinium, to help attract capital to bring a new, lower-carbon SAF technology to market sooner,” stated the report. “But the volume of SAF available today and likely to be ready over the next several years is a tiny fraction of what’s needed.”

American Airlines has set a goal to achieve 10% SAF usage by 2030.

As the global mission to decarbonize the aviation industry moves forward, waste feedstock utilization will be a core component of many successful renewable diesel and sustainable aviation fuel (SAF) fuel producers’ feedstock strategies. Competition for higherquality, traditional feedstocks has already intensified, bringing the need for feedstock pretreatment to the fore.

Pretreatment capabilities have become critical to the economic, efficient and reliable operation of a biofuel plant. As compared to higher-quality feedstocks that have historically been used in the biofuel industry—such as soybean or canola oil—the impurities of waste feedstocks require more complex pretreatment processes to meet quality requirements. Flexible pretreatment process configurations, a specialty of Austria-based BDI-BioEnergy International, are essential to address waste feedstock impurities, particularly when different feedstock types are processed in the same production line.

The BDI Advanced PreTreatment process is modular, allowing for adaptation to raw material requirements based on the core modules of prepurification, drying and adsorption. The process also includes additional modules such as polyethylene reduction with a special process patented by BDI, as well as the separation or conversion of free fatty acids from raw material. The modular concept allows operators to easily make adjustments to operation modes and parameters without the need for specialized expertise.

The core technology of the BDI PrePurification unit, the initial processing step, is based on a special centrifuge technology that tackles the challenges linked to the nature of waste oils and fats, especially as the sticky properties of lower-quality feedstocks increase with progressing degradation. The robust equipment design prevents fouling, simplifies cleaning and ensures a stable process. The centrifuge maximizes yields within the process step and

minimizes downtime in cleaning processes, ensuring high plant availability.

Armed with three decades of experience in managing diverse oils and fats, BDI provides comprehensive support throughout the entire project, from initial raw material analyses to operational support. This includes training operators to adjust parameters based on analytical results.

Built for flexibility, BDI’s plants are suited to meet challenges down the road, with critical factors already addressed in each tailor-made solution.

While high-quality feedstocks are the most ideal for processing, demand-driven price increases and scarcity will likely force some producers to consider lower-quality feedstocks. BDI’s Advanced PreTreatment system provides operators with the ability to adapt to utilize these raw materials now and in the future, which will be a key advantage to many facilities.

measurable solutions for

highest yield customized perfection for

+2 7

years of experience in pretreatment of waste oils and fats

As the renewable fuel industry positions itself for growth, refiners are adapting to complex feedstocks and mounting environmental regulations. Central to this transformation is the pretreatment stage, which plays a crucial role in renewable diesel and sustainable aviation fuel (SAF) production. Given these developments, refiners should focus on optimizing the total cost of ownership (TCO)—a comprehensive measure encompassing all costs associated with the operation, maintenance and lifecycle of pretreatment units.

In renewable fuel processing, pretreatment is crucial for safeguarding the downstream process. Emerging technologies offer new perspectives in feedstock processing, particularly in the degumming stage followed by crucial adsorbent treatment. Novel approaches, like microfluidic array reactor concepts, are making headway and can improve the TCO for refiners and their pretreatment units.

Process intensification technologies can achieve improved degumming results. For

example, a microfluidic array reactor concept that operates in laminar flow conditions improves mass transfer between feedstocks and water to remove impurities, with additional acid or enzyme to the process. This method is effective for feedstocks free of solids, with low to moderate impurities, and a low tendency for fouling. Another approach involves increasing flow rates to create turbulence, or solely increasing pressure and temperature. Hydrothermal processes have long been used for fat splitting, but can cause issues if certain criteria are not met. Higher fouling tendencies at elevated impurity levels can lead to unexpected downtime and high wastewater production.

To evaluate the reliability and efficiency of the process for refiners or pretreatment units, assessing both short- and long-term benefits, including TCO, is crucial. Key factors in this calculation include manpower, product loss, waste disposal, utilities and downtime. Effective waste disposal strategies are essential for minimizing environmental impact and

complying with regulations while managing costs. Optimizing utility usage and minimizing downtime through robust process design ensures continuous production and avoids costly disruptions.

The established degumming process with TONSILTM adsorbents has shown exceptional performance in removing impurities like metals and phosphorus from various feedstocks. Designed for versatility, TONSILTM adapts to changes in feedstock composition, ensuring consistent purification outcomes. This adaptability enhances both the efficiency and reliability of pretreatment, making TONSILTM an excellent choice for modern renewable fuel production.

Building on its success in traditional pretreatment, TONSILTM can also be integrated as an advanced polishing material within new degumming processes. This integration further refines feedstock purification, empowering refiners to achieve a more favorable TCO and improved renewable fuel production outcomes.

Feedstocks cultivated in the heartland are meeting the demand for clean fuels and connecting our nation to cleaner energy. Now.

California-based Twelve is making SAF with carbon dioxide from industrial processes like ethanol production. Once established, the versatile technology will branch out into other fuels, chemicals and materials, all from CO2.

BY LISA GIBSON

The Carbon Transformation Technology developed by California-based Twelve splits apart carbon dioxide (CO2) at low temperatures using electrochemistry, creating foundational elements for fuels, chemicals and plastics.

Twelve, founded in 2016, has partnered for demonstration projects to produce the world’s first laundry detergent ingredients from CO2 with Procter & Gamble, the world’s first car parts from CO2 with Mercedes Benz and, most recently, the world’s first e-jet fuel from CO2 with the United States Air Force. “As we’ve embarked on this journey, not only have we invented our technology, but we’ve also seen the right

amount of investment and support from the right partners and customers,” says Ashwin Jadhav, vice president of business development at Twelve. “We’ve seen and participated in many sectors growing.”

With so many potential applications, Twelve chose to focus first on sustainable aviation fuel (SAF) because of its demand and impact, according to Jadhav and Nicholas Flanders, Twelve cofounder and CEO. SAF provides a ready market and customers with a strong drive to decarbonize, as well as incentives through state programs and the Inflation Reduction Act. But fundamentally, the technology is ideally suited for e-fuels, with its low-temperature process and ability to integrate with a variety of electricity sources, including (and preferably) renewables, Flanders says.

Jadhav also emphasizes the immediate need to reduce reliance on fossil fuels and to remove CO2 from the atmosphere. Aviation, he cites, accounts for 3% of global carbon emissions—1 billion tons of CO2 per year. Twelve’s e-jet SAF, made with CO2, water and renewable electricity, has up to 90% lower emissions than conventional jet fuel. “Pretty quickly after the Air Force demonstration announcement, we started to attract commercial airline customers,” Flanders says. Alaska Airlines is the first commercial airline partner and, along with Microsoft, already has off-take agreements in place for the e-jet fuel produced at Twelve’s first commercialscale production plant, currently under construction in Moses Lake, Washington. “We’ve really anchored on SAF as a core product,” Flanders says.

Though carbon capture has become a key piece of the solution to reducing emissions, Jadhav envisions a more circular, useful application. “At Twelve, we believe in taking that carbon and transforming it. That captured carbon goes back into the operational loop. So, we’re creating a cyclical carbon economy ... it thereby eliminates the reliance on fossil fuels, because you’re using the carbon dioxide as a feedstock.”

Carbon Transformation Technology is a CO2 electrolyzer that uses renewable electricity, CO2 and water to produce carbon monoxide. That outputted carbon monoxide is added to hydrogen (also produced by Twelve through water electrolysis) to make syngas, what Jadhav calls a “foundational element.” To produce

the e-jet fuel, that syngas is run through a Fischer-Tropsch reactor. The result is an ASTM-certified, drop-in fuel that will not need recertification.

The Federal Aviation Administration currently caps SAF blending at 50%, but Jadhav expects that figure to increase as more testing proves SAF to be a reliable fuel. “As we test at higher blend ratios, we should be able to use it at higher ratios in the future,” he says, adding that successful tests are being conducted already with SAF at 100%. “So, it’s just a matter of getting the hours into those engine cycles and making sure that there’s no degradation of engine parts or long-term degradation in general. And as that happens more and more, regulatory authorities will get the confidence to start increasing the blend levels.”

Jadhav says potential customers regularly ask if the technology is real, and are amazed when they see it in person in Alameda, California. “It is real, and we are progressing—the dream that Nicholas, Etosha and Kendra had back in 2016 is starting to become a reality.”

Twelve cofounders Flanders, Chief Science Officer Etosha Cave, and Chief Technology Officer Kendra Kuhl started the company based on the Phd research of Cave and Kuhl at Stanford Business School. The two were both focusing on electrocatalysis for CO2 conversion, while Flanders was working on his joint engineering and business administration masters' degrees. “It certainly struck a chord for me because it was a way of adding value to captured CO2 as opposed to just taking CO2 and pouring it in the ground,”

Flanders says. The team needed to take these scientific principles and turn them into an industrially efficient and scalable device that could be used at a significant enough scale to have a real impact on the climate.

The technology was incubated at Stanford’s Lawrence Berkeley National Laboratory through a fellowship program now called Activate. All of the funding was government-derived to start, Flanders says, from the Energy Department, NASA and the National Science Foundation. “With some traction and proof of concept demonstration and interest from customers, we were able to attract venture capital.”

Then, in 2021, the Air Force expressed interest, not only for sustainability and flexibility, but also as a means to save lives, as fuel transports are often targeted, Flanders says. Twelve started to look toward commercialization and further scale-up, eventually growing to 270 employees. The company is well funded, Jadhav says, and raised over $250 mil-

lion in the past few years. “The amount of confidence and support we’ve seen from investors and partners has been tremendous. We’ve attracted some of the biggest investors,” he says, citing Microsoft, Capricorn Investment Group, DCVC and Microsoft Climate Investment Fund. Twelve also has a 14-year, multimilliongallon deal with International Airlines Group, as well as an agreement with the Sustainable Aviation Buyers Alliance, a group of corporate customers interested in purchasing SAF credits. “The last few years of commercialization have been tremendous because we wouldn’t have imagined corporate customers pooling together to buy large amounts of SAF credits, for example,” Jadhav says. “Just being part of that process has been tremendous.”

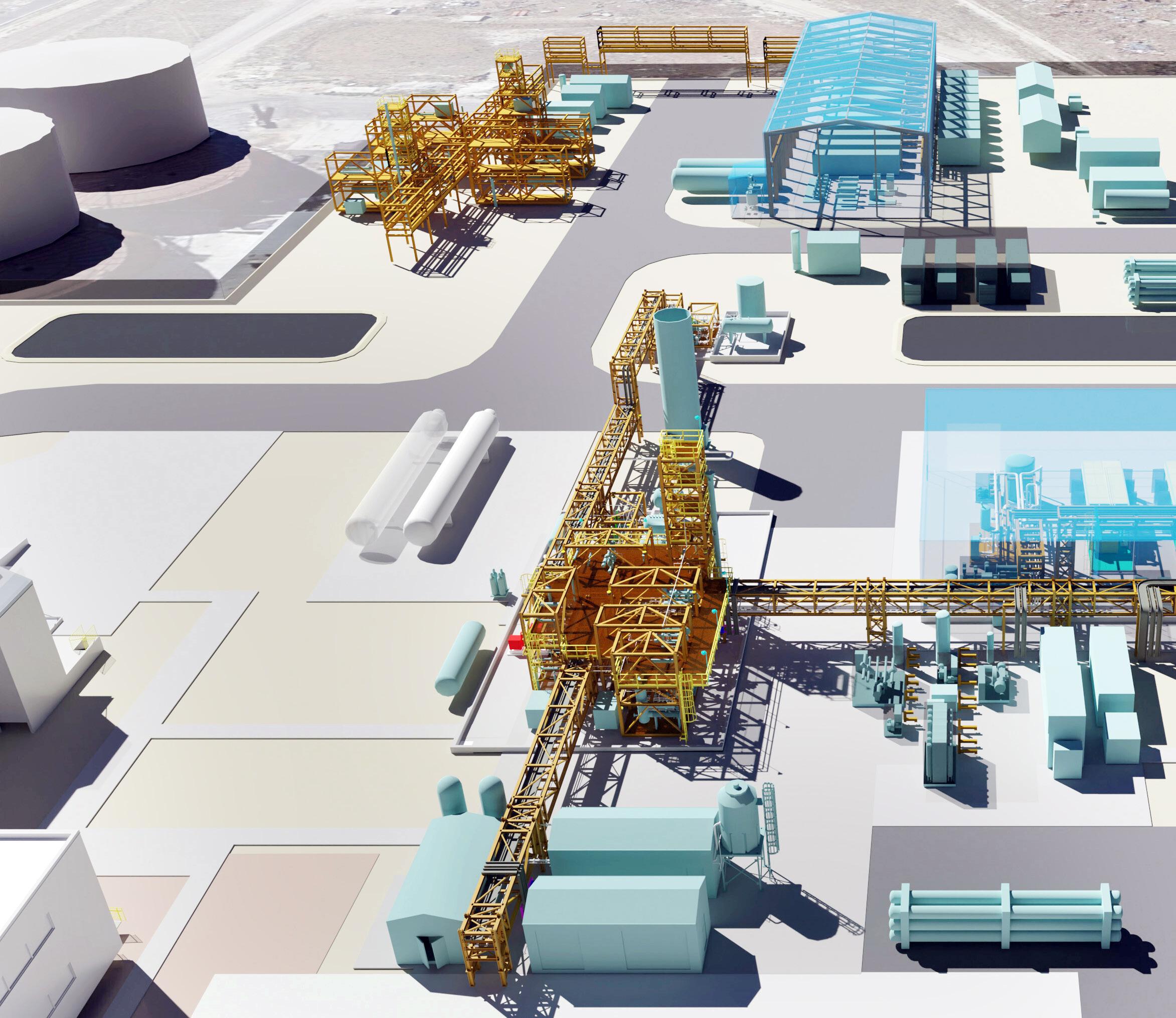

About 50% complete, Twelve's commercial plant in Moses Lake is expected to begin delivering fuel in mid-2025, Jadhav says. Much of the electrolysis equipment

is in place and significant milestones on the hydrogen process are expected in the next few months. “It’s progressing as we hoped and we’re lucky to have partners like Alaska Airlines that also are looking forward to the fuel starting next year,” he says.

The CO2 supply for the plant will come from undisclosed ethanol producers. “It’s fairly concentrated CO2, it’s fairly clean, which means it’s relatively easy and cheap to capture and process,” Flanders says. “We’re quite compatible with this existing industry that’s making biogenic CO2 emissions, and we can now put them to use and turn them into clean fuel.” Estimating CO2 emissions of about 40 million tons across the U.S. ethanol industry annually, Flanders says, “There’s a huge amount of CO2 that’s just being thrown away every day. We can turn that CO2 into e-jet fuel.”

The goal for scale-up is to colocate near ethanol plants for Twelve’s dozen or so future U.S. facilities, Flanders says, before branching out internationally. Siting

‘Our future vision here is that one day, CO2 will improve its brand image—going from a pollutant to a feedstock that is essential to create not just fuel, but other materials and chemicals.’

- Ashwin Jadhav, vice president of business development, Twelve

Twelve uses carbon electrolysis, carbon dioxide and water to produce sustainable aviation fuel with 90% lower emissions than conventional fuel.

IMAGE: TWELVE

Technology

what Twelve calls AirPlants—producing e-jet fuel and e-naphtha—relies heavily upon demand, electricity costs and policy environments.

Washington has demand for SAF, on account of its significant air traffic, Boeing facilities and other industries, Jadhav says. It also has favorable costs for land, CO2 and clean electricity. Twelve is looking to solar, wind and hydro power, with as little fossil content as possible. “Washington has a lot of hydropower and at reasonable cost,” Jadhav says. “That was one of the key, key elements right there because our process uses such a large amount of electricity, and that electricity cost is one of our key drivers to where we locate.”

But likely the most important factor in choosing Washington for the first air plant is its policy environment. “Washington has a very visionary perspective on sustainable fuels and renewable diesel and anything climate-oriented, and they’re

putting together the right policies,” Jadhav says. “And we ended up signing an agreement with Alaska Airlines and Microsoft, so with the delivery of the fuel going to Seattle, everything became just very cohesive and aligned.”

Successful scale-up for the SAF industry will require discipline, Jadhav says. “For the industry to really meet the objectives we’ve set out for 2050, there has to be disciplined growth, from a value-driven perspective, simply because the cost has to be looked at very closely because the product itself—fuel and SAF in general— cannot cost the same in 2050 as it does right now. It’s our responsibility to embark on that cost curve. We could hypothetically build multiple plants at the same time, but that won’t give us the cost synergies that we want. In a very disciplined way, we are focused on building our first commercial plant, learning from that and then building the next one around 2028.” The readily available feedstock and mod-

ular design also are favorable for Carbon Transformation Technology to successfully scale.

After SAF scale-up, Twelve will continue to explore other options for its technology. “The applicability is quite diverse, but we’ve chosen to be very disciplined and choose one product, prove out the technology and grow the business using that product, and diversify in the future when it makes sense from a business perspective and an industry perspective,” adds Jadhav, who lists sunglass lenses, laundry detergent, plastics for chairs and picture frames among the possibilities. “We want to succeed, and our future vision here is that one day, CO2 will improve its brand image—going from a pollutant to a feedstock that is essential to create not just fuel, but other materials and chemicals.”

Author: Lisa Gibson

Contributing Writer, SAF Magazine

New and unique feedstocks abound for the SAF industry, offering significant carbon reduction potential for the aviation industry.

BY KATIE SCHROEDER

As momentum behind the sustainable aviation fuel (SAF) industry has grown, so has the need for nontraditional feedstocks. According to U.S. DOE’s 2023 Billion-Ton Report, there is up to 1.5 billion tons of biomass available on a sustainable basis in the U.S. each year, from waste to forest residuals to ag waste. Currently available but unused biomass resources can add around 350 million tons of additional biomass per year above current uses, according to the report, which indicates that 1 billion tons of biomass can produce about 60 billion gallons of biofuel, or 1.7 times the amount of sustainable energy needed to achieve the Sustainable Aviation Fuel Grand Challenge.

With feedstock competition heating up, many are looking at new and unconven-

tional feedstocks. SAF Magazine discussed some promising options with experts who will be making their cases at the upcoming SAF Conference & Expo in St. Paul, Minnesota, Sept. 11-13.

The feedstock of choice for Omid McDonald, founder of Dairy Distillery, is a byproduct of the dairy production process called permeate. McDonald explains that there are two different types of permeate: whey and milk. Whey permeate is left over after the proteins are filtered out of the whey following cheesemaking. Similarly, the filtration process of skim milk to concentrate the proteins found therein leaves behind milk permeate, which is made up of lactose, water and some remaining minerals.

Milk permeate is a waste product, meaning that it is not something any dairy producer makes intentionally. “No one milks cows or processes cheese to make permeate, and any value that dairy processors get from permeate is trivial, so from a carbon

accounting point of view you could call it a waste,” McDonald says. This status means that none of the upstream carbon emission accounting needs to be done, giving ethanol made from milk permeate a low carbon intensity score of 15 grams CO2 per megajoule. When adding the generally used score of 15 grams CO2 per megajoule attributed to upgrading ethanol to jet fuel, this gives milk permeate-based SAF a score of 30 grams CO2 per megajoule, well below the threshold of 44.

Although there is not enough milk permeate to meet all SAF demand, there is enough to make a difference. “American cows produce a lot of milk, and 4% of that milk by weight is lactose, which is the sugar in the permeate that we ferment,” McDonald says. “It’s going to be impossible to use every drop of lactose to make sustainable aviation fuel, but if you were [able to], just to give you an idea of scope, you’re talking about 370 million gallons of SAF.”

Making 370 million gallons using milk permeate is the “theoretical maximum” he

explains, however, it is plausible to reach 10% to 15% of that. Also, as demand for liquid dairy products fluid milk decreases and demand for dairy products (cheese, proteins) without lactose increases, the amount of permeate available will only increase.

The other challenge of using milk permeate as a SAF feedstock is how spread out dairy processing plants farm locations are. “There isn’t a single dairy plant that could produce enough ethanol to be turned into SAF, and you need to get to a certain scale size for a SAF plant,” McDonald says. “We have to aggregate ethanol from a couple dairies, which is not a huge problem, but it is different than if you’re attaching a SAF plant to a giant corn ethanol plant.”

One of the benefits of the cassava plant is its potential to be utilized as a feedstock under two different SAF processing methods, explains Jerome Friler, CEO of Satarem America. Cassava root holds a lot of starch, making it a great feedstock for ethanol pro-

duction, which can then be upgraded to SAF using the alcohol-to-jet process. The stem of the cassava plant is essentially woody biomass, which can be gasified and turned into a syngas, which can be changed into SAF via the Fischer-Tropsch method.

There are several key benefits of utilizing cassava as a feedstock, Friler explains. “First, it’s very easy to grow, and in Africa, they’ve been growing it for hundreds of years, so it grows well and [has] a good yield,” he says. “This is actually the best plant or the best seed to [make] alcohol. And then the alcohol-to-jet the process basically is the same, whether you make the alcohol from corn or from sugarcane or from cassava.”

The stems of the plant are plentiful and underutilized, making them an ideal waste feedstock. Cassava roots are also being used to make bioethanol in Brazil and Thailand.

Satarem is interested in pursuing both methods of production to both maximize market opportunities worldwide and the volume of SAF they are able to produce. “The

ethanol part is already developed, but we are working full steam on the SAF part, alcohol-to-jet and [cassava] residue-to-SAF,” Friler says. The company is developing a SAF plant in the Tiebissou area of the Belier region of Ivory Coast.

Cassava offers a great opportunity for project developers in parts of the African continent. All countries signed a mandate in November 2023 at an International Air Transport Association conference that states every airport on the continent must have a minimum of 5% SAF by 2030. “For Ivory Coast, we will need to produce approximately 50,000 [metric] tons per year of SAF for Abidjan [International] Airport, and we are planning on producing 100,000 altogether, so 50,000 for the local market and another 50,000 for export,” he says. Even 100,000 tons of SAF would only meet 20% of the Addis Ababa airport fuel needs.

One of the benefits of developing this project in Ivory Coast is the availability of local manpower to harvest the cassava, explains Friler. However, building a plant in the country is challenging because of

the complex land rights. “It’s a mixture of legal issues plus local issues and so on, so it takes quite some time to get the land,” he says. “Then you have to bring the fertilizers and the irrigation [because that equipment is not] over there. Apart from that—especially in Ivory Coast where we work—it rains a lot, and when it doesn’t rain you have a lot of sunshine, so things grow very, very fast, and that’s a good advantage.”

Although hemp was outlawed in the U.S. for several decades, a new hybrid strain of this oilseed offers U.S. farmers and SAF producers a unique opportunity to maximize SAF feedstock availability. John McKay, chief scientist at New West Genetics, explains that NWG hybrid hemp possesses more oil content than soybeans. Since hemp was made legal in 2014, New West Genetics has worked on developing a hybrid industrial hemp plant—titled Amplify—that yields double a standard plant’s yield. This makes it a great fit for project developers producing SAF through

the hydroprocessed esters and fatty acids (HEFA) production process due to the increased yield and sustainability of the crop compared to standard hemp and other energy crops.

According to the GREET Feedstock Carbon Intensity Calculator, NWG Amplify has a much more favorable CI score than other oilseeds serving fuel. Hemp’s profile in general yields more oil than soybeans, with 30% of the seed being made of oil compared to 20% for soybeans. “[Basically,] we made a competitor to soy in terms of yield of oil per acre,” says Wendy Mosher, CEO of New West Genetics. "The sustainability and water needs are lower, drought and frost tolerance are better, as well as the carbon sequestration potential—it is much greater than most annual crops.”

This hybrid hemp is an attractive option for farmers desiring to grow two crops in the same field each growing season. New West Genetics’ scientists have also worked to improve the cold hardiness of the plant, allowing it to be planted earlier so that winter wheat or another crop could

be planted after the hemp is harvested.

AMPLIFY’s higher yield is also an advantage over some other low-CI crops frequently discussed in the SAF space. “[Higher yields] make it an attractive crop for this supply chain,” McKay says. “Obviously, lower-yielding crops are not in favor with farmers; the processors don’t like them because you’re only getting 500 to a thousand pounds of the oilseed per acre. The farmer can’t possibly make that much money.”

Mosher explains that hemp faces the same challenges as any new crop in the current day agriculture supply chain: scaling up. New crops are not favored under

the crop insurance programs benefitting farmers in the U.S., and this makes planting a new crop inherently risky for farmers— even crops with clear economic potential.

Hemp stalks also provide farmers with an additional revenue stream through utilization in making products like textiles, building materials and insulation.

“I think people are very excited about hemp,” Mosher says. “We’ve seen largerscale adoption of hemp than these other crops over the past 10 years. Farmers like the rotation; there’s benefits to it. I’m really excited about the AMPLIFY hybrids, and ... [if] we can add soil sequestration and soil carbon credits—there are some private

markets popping up for that—I see a lot of potential.”

Novel biogenic feedstocks such as municipal solid waste (MSW), corn stover and wood residuals often come with unique feedstock supply chain and processing challenges. Idaho National Laboratory is dedicated to understanding problems and identifying solutions to help producers mitigate the risk involved in using these feedstocks. Luke Williams, senior research engineer with INL, explains that preprocessing and supply chain considerations are often overlooked when consid-

ering a potential feedstock. “People often assume that the [currently] available, industrial size-reduction equipment will produce a viable feedstock that will feed and handle well,” he says. “What gets missed is how much wear they’re going to have on their equipment and how often their hoppers, feed systems and screens will break or plug as the moisture content on their corn stover changes with harvest conditions or biologically degrades. There are a lot of logistical challenges around solids handling that I think are underappreciated broadly in the biomass industry, and that is what we are trying to help solve.”

INL’s team thoroughly examines feedstock characteristics, runs technoeconomic analyses and lifecycle assessments to help fuel producers understand the feedstock’s logistics and processing needs to make a conversion-ready feedstock. His team has assessed feedstock supply, logistics and preprocessing for everything from corn stover, loblolly pine residues, ocean plastics, cover crops and more. “At our processing facility, we take power consump-

tion measurements, processing throughputs, failure modes, initial and final particle sizes, as well as chemical and mechanical analysis so you know how much it takes to transform a raw waste into something that is useful that we can then tie to lifecycle assessments,” Williams says.

INL does not study feedstock conversion past gram-scale screening experiments, and instead partners with the National Renewable Energy Laboratory and other conversion facilities to understand how feedstocks convert into fuels and chemicals. INL does perform contract research for companies, because the lab does not compete with industry, so the researchers there do not perform services like sample testing alone.

Raw biomass is an attractive feedstock for SAF producers, but in some cases, only 30% of raw biomass gathered fits into a biorefinery’s specifications and it needs to be engineered into a much narrower specification, Williams explains. Adhering to these narrow specifications is vital, because producers must be able to efficiently

convert their feedstock and ultimately keep their CI scores low by avoiding process upsets and increasing operational reliability. INL performs the breadth of research needed to understand the challenges associated with turning a waste stream into well-characterized, conversion-ready feedstocks.

Although it is almost certain that no individual biogenic feedstock is available at the scale needed to supply the entire global aviation industry, as McDonald says, every little bit counts. Whether that feedstock is available in millions or billions of tons, there could be a place for each one within the SAF industry. Economics, supply chain logistics and processing technology will determine which feedstocks will gain the most momentum in the market.

Author: Katie Schroeder Associate Editor, SAF Magazine Katie.schroeder@bbiinternational.com

Power ed by 4AIR, the Assur e SAF Registry is a private blockchain-based web platfor m to track certified fuels thr ough the physical supply chain and enable virtual transfers thr ough book and claim. Additional benefits include:

•Automated Product Transfer Document (PTD) Generation

•Track Fuel Regulatory Program Eligibility

• Secure Document Sharing with Customers

• Streamlined Renewable Fuels Inventory Accounting

• Integrated Chain of Custody Tracking for Mass Balance and Book and Claim Transfers

• Ensured Accurate Downstream Accounting & Customer Reduction Claims

• Simplify Customer Reporting for Emission Reduction Claims

Sustainable aviation fuel markets have been slow to produce substantial volumes, but renewable diesel producers facing depressed margins are ready to flip the switch. - Jordan Godwin

The U.S. sustainable aviation fuel (SAF) industry has been stuck on the runway in recent years as investment, construction and production capacity have struggled to keep up with lofty promises and goals, but help is on the way from an unlikely source: renewable diesel.

As renewable diesel producers in a suddenly crowded space trudge through lackluster margin conditions in 2024, they’re increasingly eyeing the possibility of switching to SAF. Considering the current size of the SAF market, taking

on new volumes from renewable diesel could provide meaningful growth.

In 2023, renewable diesel volumes used to generate renewable identification number (RIN) credits under the Renewable Fuel Standard topped 2.9 billion gallons, a 52% jump from 1.9 billion gallons in 2022, according to data from the U.S. Environmental Protection Agency. Through the first half of 2024, volumes totaled 1.6 billion gallons, well on pace to top 2023’s record. However, margins that regularly topped $2 per gallon in those

early years of growth have dwindled to well below $1 per gallon for much of 2024.

In contrast, SAF volumes totaled a little more than 26 million gallons in 2023, a small increase from less than 16 million gallons in 2022, EPA data shows. At the 2024 midpoint, SAF volumes topped 51 million gallons, already nearly doubling 2023’s total volume, but we’re still a far cry from the expectations set forth in recent years.

At least 43 airlines have committed to use about 4.3 billion gallons of SAF in

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of SAF Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

2030, according to the International Air Transport Association. The Biden Administration in its 2021 SAF Grand Challenge set a goal of boosting domestic SAF production to 3 billion gallons per year by 2030. In July, the U.S. Energy Information Administration increased its forecast for SAF production to reach 51,000 barrels per day (b/d), or 460 million gallons, in 2025, up from 19,000 b/d (30.6 million gallons) in 2023.

So, where’s this anticipated growth coming from? Largely, from existing renewable diesel producers switching to SAF. Phillips 66 said in June that its Rodeo facility in California had reached its target of 50,000 barrels per day of renewable fuel, of which 10,000 barrels per day are SAF. That ratio of renewable diesel to SAF production has to date been the optimal formulation for renewable diesel producers, according to refinery consultant Andy Lipow, president of Lipow Oil Associates.

Lipow said the lightest part of renewable diesel in the production process can be distilled off to make SAF at the expense of renewable diesel, but extra equipment is required. He said refineries have several important factors to consider when weighing whether to produce more renewable diesel or more SAF. “When you think about SAF versus renewable diesel, you always go back to the traditional refinery model where you’re looking for the best possible margin,” Lipow said. “Just like when refiners are making decisions around what kind of crude to process and products you want to make, you have to produce the fuels that make the most sense.”

When refineries produce more SAF, Liplow said, they also make more renewable naphtha and renewable liquefied petroleum gas, which is “worth way less” than renewable diesel. Lipow also pointed out that SAF generates only 1.6 RIN credits per gallon, while renewable

diesel typically generates 1.7 RIN credits per gallon. When OPIS assessed D4 biomass-based diesel RINs at an average price of $1.66 per RIN in 2022 and $1.35 per RIN in 2023, that extra tenth of a RIN added 17 cents and 14 cents, respectively, to the renewable diesel price premium over SAF. Compare that to the first half of 2024, when we assessed D4 RINs at an average of 54 cents per RIN, and it puts renewable diesel’s premium to SAF at only 5 cents.

The majority of renewable diesel and SAF volumes have gone to California to take advantage of the state’s Low Carbon Fuel Standard incentives. The 1.97 billion gallons of renewable diesel consumed in the state in 2023 carried an average carbon intensity (CI) score of around 42.5, while SAF’s 23 million gallons had an average score of 45.2. The lower the CI score, the more LCFS credits a renewable fuels producer can generate, but similar to the currently downtrodden RINs incentive, an LCFS credit averaging $58 per credit through the first half of 2024 hardly moves the needle compared to $98 per credit seen in 2022 and $73 per credit in 2023.

Various tax incentives also account for slices of the margin pie. The Inflation Reduction Act of 2022 created a two-year, $1.25-per-gallon credit for SAF blends that reduce carbon emissions by at least 50% compared to conventional jet fuel. For every additional percentage point in reduced emissions, the credit increases by 1 cent, up to a cap of $1.75 per gallon. Beginning in 2025, that tax credit will be replaced by the Clean Fuel Production credit, which will be offered to transportation fuels with a CI score of no more than 50. Credits will be rewarded at rates of 35 cents per gallon to $1.75 per gallon for SAF. That credit will be in effect through 2026.

An existing $1-per-gallon biomassbased diesel blenders tax credit is slated to expire at the end of this year, but a group of lawmakers in July introduced a

House bill proposing to extend it for another year, so it’s not necessarily dead yet. How the tax credit situation plays out for the rest of 2024 could greatly impact the choice between renewable diesel and SAF in 2025.

Either way, the Diamond Green Diesel joint venture between Valero and Darling will be full-steam ahead with its $315 million project to upgrade approximately 50% of its current 470 MMgy production capacity at its Port Arthur, Texas, facility to SAF. “There is a premium for SAF over RD,” said Eric Honeyman, Valero’s vice president of renewables operations and low-carbon fuels, during a recent earnings call. “It's going to give us a margin that will be stronger than renewable diesel, and our outlook is that it will meet the economics of our project.”

DGD, which uses low-carbon-intensive feedstocks like used cooking oil and waste fats, will also enjoy a competitive advantage over SAF producers using crop-based feedstocks. The European Union will require a 2% SAF blend beginning next year, which would equate to nearly 750 million gallons, based on the EU’s 2023 consumption of jet fuel. Since SAF made from crop-based biofuels cannot be used toward the mandate, DGD will likely see strong European demand for the roughly 235 million gallons of SAF it plans to produce next year in Port Arthur.

Lipow added that SAF producers would be wise to target states that offer SAF incentives, such as Illinois, Washington, Minnesota and Nebraska.

Regardless of which incentives and economic factors ultimately tip the scales, it’s evident that SAF’s future is getting brighter as renewable diesel producers make the switch for stronger margins.

Author: Jordan Godwin Director of Biofuels Markets, OPIS jgodwin@opisnet.com

The key to increasing SAF production is investing in renewable products production capacity, but it also requires vision and commitment.

- Alexander Kueper

For the aviation industry, sustainable aviation fuel (SAF) is one of the major levers to reduce greenhouse gas (GHG) emissions from flying. According to a report from the International Air Transport Association, SAF’s growth trajectory will continue in 2024 with an expected production of 1.5 million metric tons (495 million gallons). Though this is already tripling the SAF production of 2023, it will still only account for 0.53% of aviation’s

total global fuel consumption. It is clear there is no time to wait in the fight against climate change, so what are the ways to increase SAF production and accessibility from a producer’s perspective?

The key to increasing SAF production is investing in renewable products production capacity, but with a market

in its early stages of development, it also requires vision and commitment to make the necessary investments. In the early 2000s, Neste made the decision to invest in solutions to combat climate change, focusing on renewable fuels. This led to the first renewables-only refineries in Singapore and the Netherlands that produced mainly renewable diesel, as part of the company’s transformation journey.

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of SAF Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

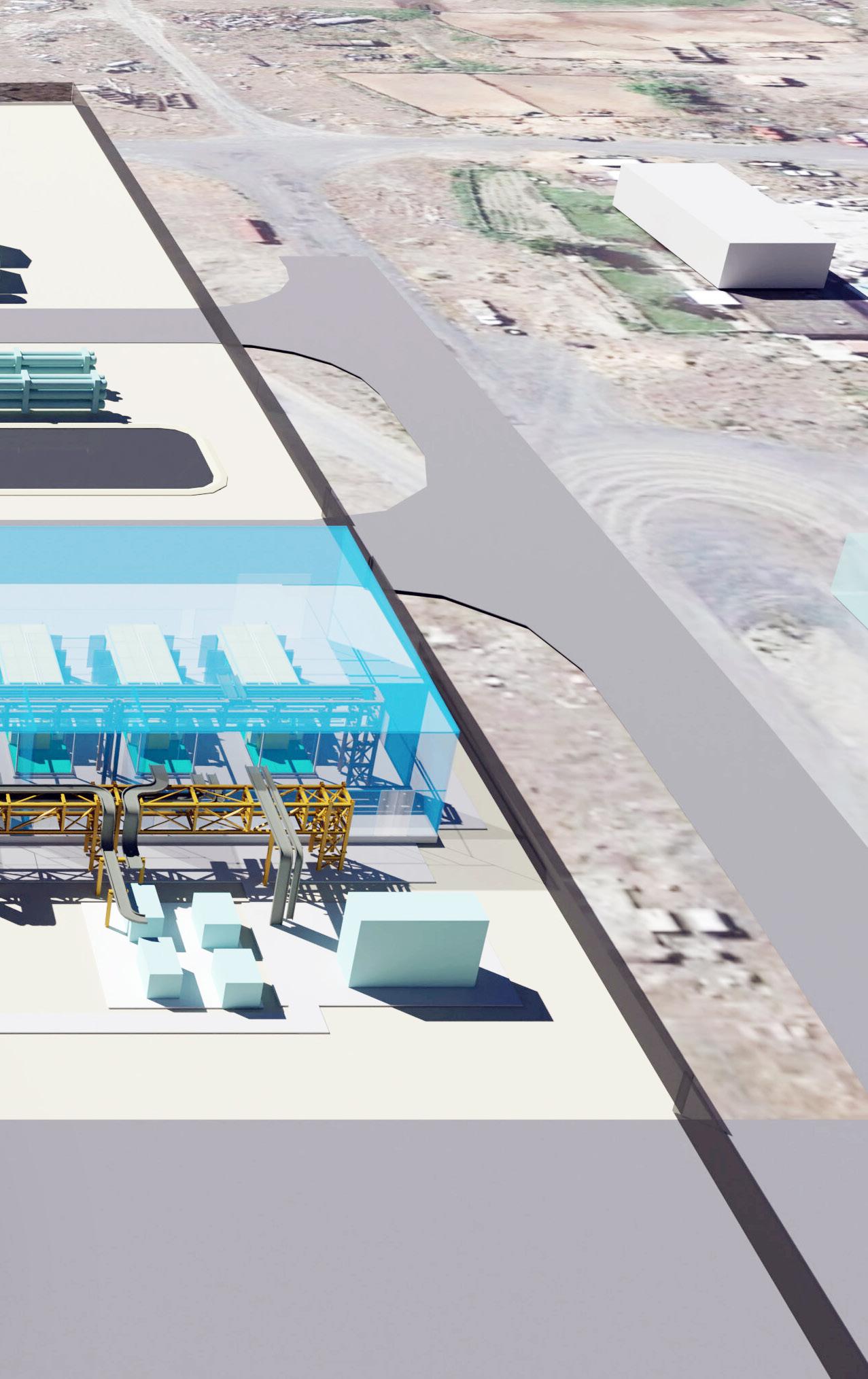

Fast forward to 2018, after observing the success achieved by renewable diesel in decarbonizing road transportation and recognizing the need for more renewable fuels to reduce emissions from other heavy-duty sectors like aviation, Neste made the decision to expand production capacity at the Singapore refinery. Completed in 2023, the expansion doubled the refinery's total production capacity and included the capability to produce up to 1 million tons of SAF per year.

Following the Singapore investment decision, Neste also decided to modify its existing renewables refinery in Rotterdam, the Netherlands, to enable up to 500,000 tons of SAF production. This modification is nearing completion and will increase Neste’s total global SAF production capability to 1.5 million tons per annum in 2024.

Regulatory support and investor interest are crucial for encouraging the development of new renewable fuels production and we see encouraging developments. What will also help ramp up production is converting conventional refineries to renewable fuels production. Not only can refineries produce loweremission fuel to combat climate change, they also can leverage subsidies and tax breaks to do so. Even better, processing renewable raw materials can help refiners achieve their environmental goals.

Neste uses sustainably sourced, 100% renewable waste and residue raw materials, such as used cooking oil and animal fat waste to produce SAF. These raw materials are sourced globally from over 60 countries. In the United States alone, acquisitions of companies that are

specialized in used cooking oil (UCO) collection give Neste the access to UCO from over 85,000 locations, which include restaurants, theaters, sports venues, airports and more.

Industry reports estimate the global availability of waste and residue oils and fats, which can be used to produce renewable fuels such as SAF, could exceed 40 million tons per year by 2030. What we are doing is leveraging these immediately available resources to produce drop-in solutions that can help to mitigate the effects of climate change.

In addition to efficiently collecting waste and residue materials, constantly exploring the possibility of using new generations of raw materials for renewable fuels production is important, too. In the future, SAF may be produced from other renewable resources such as algae, forestry waste, or even via power-to-X.

The research and development of power-to-X technologies is one of Neste’s key focus areas of innovation. Renewable hydrogen produced by green electricity and carbon capture and utilization play an important role in combating climate change. Low-emission e-fuels produced using these technologies are particularly suitable for segments that are difficult to electrify, such as aviation and marine. Efuels offer a way to expand the carbonneutral transport fuel pool beyond biomass-based renewable fuels to replace fossil fuels. In the aviation sector specifically, where the constraints of weight pose challenges, the development of liquid e-fuels suitable for current aircraft and distribution infrastructure must play an important role in reducing the use of fossil fuels.

One of SAF’s greatest advantages is that it’s a drop-in solution, meaning that it can be used in existing engines and fuel infrastructure, opening up the world’s vast existing energy infrastructure. This includes pipelines, storage tanks or termi-

nals that carry fossil products to be easily used for SAF, giving airlines or business aviation companies easier access to this lower-carbon fuel. This is what Neste has been doing.

In 2022, Neste’s SAF was delivered to New York’s LaGuardia Airport through the Colonial and Buckeye pipeline systems—two essential pieces of American energy infrastructure. In 2023, Neste commissioned capacity at Vopak’s Los Angeles terminal in California for storing SAF. This partnership further expanded the availability of Neste’s renewable fuels in the Southern California region.

It is also key to gain access to airport fuel infrastructure to be able to service airlines that want to use SAF across their operations. It’s not always easy, but examples show that it works: Using the new integrated supply chain into Singapore Changi Airport, Neste delivered its first locally produced SAF to Singapore Airlines, quickly followed by a similar delivery at the airport to Emirates. Collaboration with energy industry partners is an essential part of making SAF more widely available.

All of us in the industry—fuel producers, airlines, business aviation companies, corporate and even individual travelers— have the responsibility to reduce aviation emissions. SAF provides a today solution, but we need to work together across the entire value chain to ramp up SAF production and increase accessibility to ensure a more sustainable future for aviation.

Author: Alexander Kueper Neste Renewable Aviation Business Vice President

A proprietary gasification process can address the challenges of producing sustainable aviation fuel at a scale.

- Andy Cornell

There is a perfect storm forming over the aviation industry. The imperative to decarbonize is being hit by limited availability of feedstocks, and the near desperation to produce sustainable aviation fuel (SAF) in sufficient quantities in an ambitious timeframe is seeing companies invest billions in unproven technology and processes. Often, with disastrous effect.

There is another way—one that is proven, pragmatic and uses technology from established partners that helps mitigate risk to both investment and reputation.

At present, most SAF is being derived either from food and wood crops or from hydroprocessed esters and fatty acids (HEFA); essentially used cooking oil and fats. Last year, 150 million gallons

(570 million liters) of SAF was produced. To put that in context, the U.S. alone consumed around 23 billion gallons of jet fuel. There is a limited availability of HEFA and there will be competition with other offtakers, including marine and road transport, and industrial heat. So, meeting global SAF mandates by 2030— whether 10% in the United Kingdon or 3

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of SAF Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

billion gallons in the United States—is going to require alternative feedstocks—and at some scale. This is a view widely held across the aviation industry. In an interview with the Financial Times, Lauren Riley, chief sustainability officer for United Airlines, expressed confidence that new technologies would enable SAF production from a wider range of sources, including municipal solid waste.

At its facility in Swindon, U.K., ABSL is using proprietary technology to create clean, tar-free syngas from a mixed waste stream that can easily be converted into liquid fuels, including SAF, in a scalable process. Eighty miles west of London, it is the only plant in the world working in a continuous commercial setting to convert a broad range of solid feedstocks into syngas. ABSL has engaged with world-class engineering partners, including industry specialist Hatch, to produce a clean syngas that can be integrated into standard process trains for SAF, biomethane, biomethanol and biohydrogen production.

ABSL’s proprietary RadGas technology converts wastes and biomass into a high-quality syngas that can be used to produce biofuels and capture biogenic carbon dioxide in an efficient, reliable process. The specialized technology integrates four process steps based on mature technologies and is a key enabler in biohydrogen, biomethanol and SAF production while simultaneously releasing negative emissions credits that help airlines fund and meet their net zero obligations.

The RadGas process first converts waste and biomass materials into raw gas via a circulating fluidized bed gasifier using oxygen and steam. Then, a direct current electric plasma arc furnace reforms tars, and ash is captured. Next, a heat exchanger that cools the syngas also raises steam that is used in the gasifier at the start of the process. Finally, dry and wet gas scrubbing removes fine ash, acid and alkali contaminants, resulting in a clean syngas free from tar and particulates. Plasma is widely accepted as being highly effective at reforming tars,

and because operating temperatures are lower than other approaches, process efficiency is high.

RadGas technology provides higher levels of reliability than other processes by using already proven technologies with established operating and maintenance procedures. This reduces technical risk, which is further mitigated by ABSL’s commercial demonstration plant that presently converts 1 metric ton (mt) of waste an hour, removing 10,000 mt of waste away from landfills and converting it into 27 gigawatt-hours of gas per year.

Running all four RadGas process steps in this environment has provided a huge amount of operational and technical learning, based on over 10 years of experience of waste and biomass gasification— a track record that few alternative syngas producers can match. This contrasts with many businesses in the same sector that have tried but failed to produce at industrial scale without fully proving their approach in a pilot or demonstration plant. In particular, the high-profile collapse of Fulcrum BioEnergy’s Nevada waste-tofuel plant in June 2024 has not only cost public and private investors over $1 billion, but it also leaves multiple project developers in the U.S. and U.K. without

the model on which they were banking to meet new and challenging SAF mandates.

As businesses and investors strive for ways to solve the challenges of difficult-to-abate industries like aviation, at the scale required and within a highly ambitious timeframe, there must be innovation and experimentation. However, such initiatives must be tempered with pragmatism and experience. By taking an incremental approach that has been built on a long history using established technologies in its demonstration plant, ABSL provides investors and partners with greater confidence that these SAF challenges and targets can be conquered. This will help pave the way not only for sustainable aviation, but also for wider clean energy applications such as heavy transport, industrial heat and manufacturing feedstocks.

Author: Andy

Cornell

CEO,

ABSL Ltd. info@absl.tech +44 01793 832 860

The choice of pretreatment technology is a critical decision given the impact on downstream processing and final product quality.

- Matthew Clingerman

The hydroprocessed esters and fatty acids (HEFA)-based route to sustainable aviation fuel (SAF) is at the forefront of the transition from traditional fossil fuels to those made from renewable sources. Hydrotreated vegetable oil (HVO), also referred to as renewable diesel, has also become a leading biomass-based fuel. The processes used to convert fats, oils and greases (FOG) into finished fuels are

CONTRIBUTION:

well established. However, opportunities exist to improve upon the process used to pretreat the incoming raw materials. The feedstocks from which fatty acid-based SAF is produced contain numerous impurities that can negatively impact the conversion process. Contaminants such as chlorides, phosphorus and metals contribute to premature catalyst deactivation, mechanical corrosion and

potential process instability. Waste oils and lower-quality feedstocks are gaining popularity, but impurity levels are much higher, which further increases process complexity and the risk of complications. Therefore, the pretreatment unit is a critical step in the conversion process.

Physical refining has been the technology of choice. Originally developed for the edible oils and oleochemical markets,

the process consists of water or acid degumming, mechanical separation using centrifuges, and dry pretreatment with bleaching earth. Additional steps and multiple units may be required as contaminant levels increase. Although capable of removing impurities, more severe treatment to reach ultra-low levels of key contaminants is only possible with significant additional investment.

Sulzer’s technology for pretreatment uses thermal cracking to treat feedstocks prior to hydrotreating. In a process analogous to refinery visbreaking, the fats and oils are converted using heat to break the chemical bond and reduce the molecular weight. The typical targets of FOG pretreatment—metals, phosphorus and chlorides—are reduced to levels below which the hydrotreater unit's performance will not be impacted. The triglyceride and fatty acid molecules are cracked into distillate-range hydrocarbons that are a mixture of paraffins, olefins and aromatics, along with some unconverted oils. The process does not require mechanical separation, nor does it use catalyst or chemicals. Product properties and yield profile are determined by operating severity and internal recycle rate.

In addition to breaking down the fats and oil into shorter-chain hydrocarbons, the process generates a light ends stream, which is comprised of light gases from C1 to C4. Because hydrogen is not added to the unit, oxygen is removed via decarboxylation. Approximately half of the oxygen present in the raw feed will be taken out with the offgas. The remainder will be removed by hydroprocessing in the downstream unit. Some aqueous waste is also generated in small quantities that can be recycled or treated.

Using the pretreat unit to achieve partial conversion of the feedstock introduces several optimizations that are not possible with physical refining. By implementing a more severe form of pretreatment, the range of feedstocks that can be used is widened, including those of lower quality. A variety of feeds have been studied, including distillers corn oil,

soybean oil, used cooking oil and waste chicken fats. Results showed phosphorus and chlorides less than 1 weight parts per million (wppm) each, and metals are less than 10 wppm. The process performance indicated here was achieved in a commercial plant that began operation in 2023. The ultralow impurity levels reached in the commercial plant confirm the results obtained earlier in pilot plant studies.

Additionally, hydrogen requirements are reduced. Typical grassroots HVO and HEFA units consist of two stages: deoxygenation followed by isomerization. Conventional processes typically require hydrogen consumption greater than 2,500 standard cubic feet per barrel (scf/bbl) or 410 normal cubic meter/cubic meters, (Nm3/m3). However, the partially converted product obtained by thermal cracking the feedstock will require less hydrogen downstream. This is because a portion of the oxygen has already been removed, and the molecules have cracked to distillate-range hydrocarbons. Because of this, the hydrotreater will be smaller, and hydrogen consumption reduced by up to 60%.

With such a significant reduction in hydrogen consumption, further economic efficiencies can be gained by operators focused on production of HVO. As outlined above, triglycerides that have been thermally cracked become a mixture of distillate-range hydrocarbons and a portion of unconverted or underconverted feedstock. These distillate hydrocarbons and partially converted triglycerides need only minimal treatment to remove the remaining oxygen and tune the material to meet the necessary HVO specifications. Furthermore, deoxygenation and isomerization, which typically requires two stages, can now be accomplished in a single reactor. In this scenario, the CAPEX savings can be as much as 50%. Base metal catalyst may also be used for isomerization, which reduces cost as well.

Adjusting the operating conditions of the pretreatment unit, namely the amount of internal recycling, will also have an in-

fluence on the final product from the hydrotreater. With a once-through design, the thermal cracking followed by hydrotreating can produce a diesel product with 28 degrees Fahrenheit (-2 degrees Celsius) cloud point with approximately 1,230 scf/bbl (200 Nm3/m3) hydrogen consumption. By recycling the unconverted oils from the cracking reactor, the cloud point and hydrogen consumption are reduced to 2 F and 960 scf/bbl (159 Nm3/m3), respectively.