President & Editor

Tom Bryan tbryan@bbiinternational.com

Online News Editor

Erin Voegele evoegele@bbiinternational.com

Staff Writer

Katie Schroeder katie.schroeder@bbiinternational.com

DESIGN

Vice President of Production & Design

Jaci Satterlund jsatterlund@bbiinternational.com

Graphic Designer

Raquel Boushee rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan jbryan@bbiinternational.com

Vice President of Operations/Marketing & Sales

John Nelson jnelson@bbiinternational.com

Senior Account Manager/Bioenergy Team Leader

Chip Shereck cshereck@bbiinternational.com

Account Manager

Bob Brown bbrown@bbiinternational.com

Circulation Manager

Jessica Tiller jtiller@bbiinternational.com

Marketing & Advertising Manager

Marla DeFoe mdefoe@bbiinternational.com

Ringneck Energy Walter Wendland

Little Sioux Corn Processors Steve Roe

Commonwealth Agri-Energy Mick Henderson

Aemetis Advanced Fuels Eric McAfee

Western Plains Energy Derek Peine

Front Range Energy Dan Sanders Jr.

August 29-30, 2023

Minneapolis Convention Center, Minneapolis, MN (866) 746-8385 | www.safconference.com

The National SAF Conference & Expo is designed to promote the development and adoption of practical solutions to produce SAF and decarbonize the aviation sector. Exhibitors will connect with attendees and showcase the latest technologies and services currently offered within the industry. During two days of live sessions, attendees will learn from industry experts and gain knowledge to become better informed to guide business decisions as the SAF industry continues to expand.

November 7-8, 2023

Iowa Events Center | Des Moines, IA (866) 746-8385 | www.nationalcarboncaptureconference.com

The National Carbon Capture Conference & Expo is a two-day event designed specifically for companies and organizations advancing technologies and policy that support the removal of carbon dioxide (CO2) from all sources, including fossil fuel-based power plants, ethanol production plants and industrial processes, as well as directly from the atmosphere. The program will focus on research, data, trends and information on all aspects of CCUS with the goal to help companies build knowledge, connect with others, and better understand the market and carbon utilization.

March

Greater Richmond Convention Center | Richmond, VA (866) 746-8385 | www.biomassconference.com

Organized by BBI International and produced by Biomass Magazine, this event brings current and future producers of bioenergy and biobased products together with waste generators, energy crop growers, municipal leaders, utility executives, technology providers, equipment manufacturers, project developers, investors and policy makers. It’s a true one-stop shop – the world’s premier educational and networking junction for all biomass industries.

June 10-12, 2024

Minneapolis Convention Center | Minneapolis, MN (866) 746-8385 | www.fuelethanolworkshop.com

Please recycle this magazine and remove inserts or samples before recycling

COPYRIGHT © 2023 by BBI International

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer.com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to editor@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space. TM

Celebrating its 40th year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine —that maintains a strong focus on commercial-scale ethanol production, new technology, and near-term research and development. The event draws more than 2,000 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

Acknowledging the energy transition that’s occurring right now is a good way to ensure that we’re a big part of it. That is, talking about what’s happening is a smart strategy for the ethanol industry, but also a tricky one. Not everyone wants to openly discuss what’s coming—decarbonization, yes—but this whole thing is really about electrification, the rise of EVs. And frankly, our industry’s true concern should be ethanol’s role in the predicted EV world.

Fortunately, it looks like we have a plan. The posture we’ve taken as an industry is, first, that higher blends of ethanol can accomplish things EVs can’t—right now. Second, low-carbon liquid fuels will be needed for decades to come as electrification faces obstacles. And third, ethanol can be paired with electric (flex-fuel/EV hybrids) to achieve what neither can alone. So, we’re challenging assumptions about electrification while advocating for technology-neutral policy and sharing a vision of how ethanol and EVs might work together. This and other bright concepts about our industry’s future were discussed in detail during the general session of the 39th annual International Fuel Ethanol Workshop & Expo in June, which is recapped in “Front and Center at the FEW,” on page 18.

The tone of this year’s FEW, held in Omaha, Nebraska, was set by keynote speaker Geoff Cooper, president and CEO of the Renewable Fuels Association. Cooper engaged conference attendees on ethanol’s role in the energy transition and the hazards of ill-conceived policy moves toward universal electrification. He pointed out the true carbon intensity of EVs (and no, they are not net-zero) and called for a market-based approach to decarbonization instead of tipping the scales toward electric.

“Rather than trying to force prescriptive technologies onto a market that may not be ready for them, energy transition policy should adopt a technology-neutral approach that embraces the diverse portfolio of low-carbon transportation options,” Cooper told FEW attendees. “Let the marketplace do what the marketplace does. Let the market go to work, let the market solve its problem.”

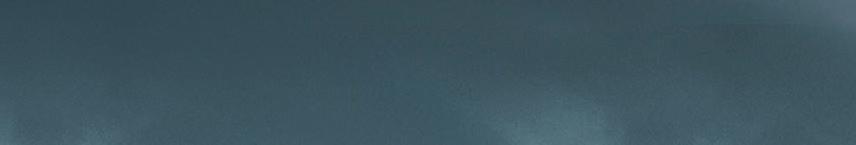

While we keep challenging assumptions about the carbon intensity of EVs, U.S. ethanol producers continue to inch closer to their own net-zero future. And what’s cool about this is that a lot of innovation is happening at older, legacy plants. In our cover story, “Staying Power,” on page 34, we profile Adkins Energy LLC, which celebrated its 20th anniversary last year but is doing anything but slowing down. Since 2002, the facility has continually gained new efficiencies and production volume, expanding from a nameplate of 33 MMgy to 60 MMgy today. Adkins has always been a trailblazer. The plant was built with the ability to generate its own electricity with CHP, and it made the bold move to integrate biodiesel production in 2014. Now, its management team is evaluating another daring venture—CO2to-methanol production. It could be an interesting new chapter for Adkins, and potentially other producers. As Bill Howell, the plant’s general manager, tells us, “There are a lot of people hoping that we are successful.”

Finally, be sure to check out “Squaring Up Cybersecurity,” on page 28, which delivers a stark reminder that it’s not just your business systems that are at risk of cyber crime, but your actual plant operations. If you haven’t already done so, it’s time to shore up your cyber defenses.

Yeast blends are often greater than the sum of their parts. Achieve the perfect synergy of fermentation yield, speed and robustness with the SYNERXIA® Gemstone Collection.

Our broad portfolio of yeasts and yeast blends offers greater flexibility to tailor solutions based on shifting process requirements or market conditions.

Powered by XCELIS® AI, our proprietary data analytics and predictive modelling tool, the SYNERXIA® Gemstone Collection helps de-risk decision making with custom yeast blends that take your ethanol production process to the next level.

Find the right yeast or yeast blend to meet your plant performance goals.

Learn more at bioscience.iff.com/synerxia-gemstone

I recently discovered one of the country’s leading “one weird trick” internet marketing companies is Barton Publishing, headquartered a few miles away from me here in South Dakota. And having just completed year two of a three-year program proving there’s an inexpensive and simple way to reduce carbon pollution and improve public health quickly—using a common product grown by farmers—it struck me that this assertion sounds a lot like one of the “they hate us” and “one weird trick” promos, and maybe that’s a way to get more eyeballs on “HEFF,” ACE’s Hybrid Electric Flex Fuel vehicle. But making the long-winded video linked to those ads (so I'm told—I would never fall for that stuff) isn’t in my skill set, and more importantly, our weird trick actually works, which might confuse regular clickers. So, I’ll just provide an update on our results, but as a homage to my newly discovered “one weird trick" neighbors, you’ll have to read a bunch of my blather before I cough up numbers.

To recap, almost three years ago, when California’s governor announced a zero-emissions vehicle (ZEV) requirement for the state, most media (and probably the governor) understood that to mean electric vehicles (EVs) only. However, if the state is truly interested in zero emissions vehicles, we theorized a standard hybrid with an internal combustion engine (ICE) powered by E85, could be a ZEV, and when total lifecycle greenhouse gas (GHG) emissions are tallied (not just tailpipe, where CA EVs stop), will have similar or lower CI than plugin EVs. Further, when carbon intensity (CI) scoring correctly reflects CI reductions possible and already being achieved by farmers and ethanol producers, a standard hybrid FFV can be a ZEV long before any EV.

We’re testing our theory using a standard-sized hybrid vehicle, so results won’t be dismissed as coming from a specialty vehicle or tiny clown car. We bought a 2019 Ford Fusion Hybrid in July 2021 for about $50k less than the most popular new EVs, filled it with E10 and drove 3,688 miles to establish a real-world fuel use baseline, rather than competing with fictional best-case showroom sticker mileage and EPA emissions estimates saying our car should get 42 mpg on E10, with lifecycle CO2 of 255 grams per mile. That’s much better than the 25 mpg and 430 g/m of the non-hybrid Fusion, but pre-transition E10 HEFF’s results were just under 35 mpg and 310 g/m CO2. We’ve also periodically run tanks of E10 to recalibrate for winter temps, age, and battery capacity changes. All results are used to estimate gas consumption and cost with each fill; our goal is to demonstrate low CI and durability, but critics always ask about mileage and cost.

By comparison, depending on where you plug in, EPA estimates 2019 Tesla 3 Long Range emits 110 to 180 grams/mile CO2 based on 310 miles per charge. Unscientific Uber driver estimates say they get 225 to 240 miles, and Car and Driver’s scientific 40,000-mile test agreed, getting 80 miles below 310 per charge, making Tesla’s real CO2 number 150-245 grams/mile.

Our baseline trip ended in San Diego, where Pearson Fuels arranged to transform the Fusion to HEFF with an eFlexFuel Plus conversion kit. Recording price, miles, and ethanol content of every fuel purchase, and calculating E10 use and cost, so far, the one weird trick of running our hybrid 24,867 miles on flex fuel produced average lifecycle GHGs of 202 g/m CO2—comparable to real Tesla numbers. Regular gas in the vehicle would’ve emitted 375 g/m CO2. And HEFF chugged 958 gallons of E71 vs. a calculated 770 gallons regular, but the E71 cost $2,500, compared to $2,719 for gas. More details to come!

We put Fermentation First™. You get yeast, yeast nutrition, enzymes and antimicrobial products, alongside the industry leading expertise of our Technical Service Team and education resources. Find the right solution for your ethanol business at LBDS.com.

Launched in 2021, the Biden administration’s Sustainable Aviation Fuel Grand Challenge aims to produce enough low-carbon jet fuel to slash aviation emissions in half by 2050. Thanks to new incentives created by the Inflation Reduction Act (IRA), that goal appears much more attainable than it did two years ago, but getting there will require the Internal Revenue Service (IRS) to take a page from the U.S. Department of Energy when it comes to following the best available science on climate modeling.

Currently, farm-based feedstocks—including bioethanol and corn oil, among others—are the only viable sources of clean, renewable energy available in large enough volumes to meet projected demand for sustainable aviation fuel (SAF). In fact, the U.S. ethanol industry accounts for over 80 percent of biofuel production capacity in the U.S. at 17.4 billion gallons per year.

Unfortunately, a handful of interest groups have been encouraging the U.S. Treasury to decide who can earn credit for making SAF based on an emissions model used in Europe. Not only does that outdated model ignore years of data about U.S. agriculture and biofuel production—it also effectively blocks American farmers from participating in a major new market for green energy. This means that this effort to decarbonize aviation would be hugely dependent on foreign feedstocks. One of the best things about biofuels is that they increase America’s energy independence and reduce our reliance on foreign resources. Choosing this European model would effectively do the opposite.

There is a better way. The DOE and Argonne National Laboratory have invested decades into building the world’s best lifecycle analysis (LCA) model for transportation emissions. It’s called the Greenhouse Gases, Regulated Emissions, and Energy Use in Technologies (GREET) model.

GREET was created by researchers with real-world expertise examining both the domestic agricultural supply chain and the latest hard data from the U.S. Department of Agriculture and the Environmental Protection Agency. The gold standard for lifecycle modeling, it harnesses the latest data on everything, including yield, fertilizer and agriculture inputs.

In fact, several provisions of the IRA specifically require the use of GREET to calculate the benefits of other transportation fuels, such as hydrogen and non-aviation low carbon fuels. Unfortunately, the legislation didn’t offer the same clear guidance on SAF—an omission that could keep U.S. SAF production grounded for good.

Leaders at the U.S. Treasury could easily avoid that outcome by relying on the GREET model, which would incentivize further emissions reductions and advance the IRA’s climate goals.

As Growth Energy noted in our letter to the IRS this July, “When implementing the Section 40B and 45Z SAF tax credits, IRS must ensure LCA methodologies used for calculation of credits reflect the best available science so as to incentivize increased production of low carbon-intensity SAF in order to further Congress’ core objective of accelerating the reduction of GHG emissions from the U.S transportation system. Implementing the statute in this matter is critical to the decarbonization and continued economic competitiveness of the U.S. aviation sector."

In short, it would be climate malpractice to anchor our SAF ambitions to outdated, foreign models that disregard U.S. innovations in biofuel production and climate-smart agriculture and tie U.S.-based carbon incentives to inaccurate foreign carbon models. The biofuels industry is already lowering carbon emissions, reducing our reliance on foreign oil, saving drivers money at the pump, and creating new American jobs. And by following the best available science, bioethanol can clear the way for America’s bioeconomy to deliver even greater progress toward low carbon aviation.

The role of sustainable biofuels in the transition from a fossil-based economy to carbon neutrality has been the subject of intense and often misinformed debate over the last few years. Lately, however, there has been cause for optimism that Europe could move to a more constructive discussion. Consider a couple of recent signs that European policymakers are waking up to what their counterparts around the world already know: that renewable ethanol offers strategic advantages for energy independence, food security, and the fight against climate change.

One such development is a declaration by the G7 group of leading economic nations—a statement co-signed by EU leaders—asserting that sustainable biofuels have a vital role to play in transport decarbonization. This was a welcome turnaround from recent efforts to downplay the proven ability of biofuels to reduce GHG emissions in transport.

Another positive signal was a European Court of Auditors report calling into question the current EU strategy of betting everything on electric vehicles as the way to decarbonize road transport—and phasing out all other options. The EU’s main auditing institution found that Europe’s ambitions to rely on electric vehicles for road transport leave it vulnerable to long-term dependency on China and the U.S. for battery technology, and threaten its ability to meet goals for reducing CO2 emissions from cars. In other words, the consequences of banning new sales of internal combustion engine cars after 2035, without making allowances for cars that could run on carbon-neutral liquid fuels, are potentially serious.

To be sure, there are still problems with the EU’s political approach to biofuels. Some EU countries, most recently Sweden, have decided to curtail biofuels blending obligations in a misguided effort to reduce fuel prices and, thus, risk missing their climate targets. More generally troubling is the EU’s inconsistent approach to biofuels among various pieces of climate change legislation: the so-called Fit for 55 package. While the Renewable Energy Directive revision confirms that sustainable crop-based biofuels have a role to play, other legislation on energy taxation, aviation and maritime actively discourage their use.

The solution for the EU, of course, is to be more inclusive and technology-open on all of these fronts. This is especially true considering the strategic importance of EU renewable ethanol production, for producing more than just fuel. Ethanol biorefineries across the EU contribute to several European strategic objectives, including:

• Climate change mitigation: Biofuels continue to be the main renewable energy in transport and a proven solution for reducing emissions from cars. According to the latest data, renewable ethanol produced by ePURE members reduced GHG emissions by more than 78% compared to fossil fuel—and is getting closer to carbon-neutrality every year.

• Energy independence: Domestic production of renewable ethanol helps reduce the EU’s dependence on imported fossil fuel. EU policies that unfairly hamper the use of sustainable biofuels such as ethanol are, by definition, opening the door to more fossil oil.

• Food security: The “food vs. fuel” argument reared its head again in 2022, but once again has been shown to be a complete myth. In fact, EU biorefineries produced more food and animal feed than fuel in 2022, helping reduce the EU’s need to import protein.

• Strategic autonomy: Domestic ethanol production also creates other beneficial products, including biogenic CO2 that is essential to ensure supply.

It’s clear Europe still needs more than one solution to achieve meaningful transport de-fossilization. Sticking to a one-size-fits-all EV strategy is destined to disappoint. Let’s hope European policymakers recognize this reality and take a more inclusive approach.

Elevating Sustainable Fuel for a Better Tomorrow. Tomorrow.

Ultralow Carbon SAF

35 Billion Gallons of Low Carbon SAF Required within the U.S. by 2050

• Ultralow CI Score

• Additional Revenue Source

• Reduce Operating Costs

• Produce High-Demand Aviation Fuel

A power generator genset capable of running on ethanol, relying on novel engine technologies patented by ClearFlame Engine Technologies, has successfully progressed through phase-one trials. The trial was conducted by Electric Power Research Institute (EPRI) in partnership with ClearFlame and Duke Energy. In addition to a series of other tests, the genset completed a successful 24-hour continuous power test.

“The pilot demo marked the first ever genset demonstration for our company,” said Robert Schanz, ClearFlame vice president, research and development, adding that the trials were performed at the Battery Innovation Center in Newberry, Indiana. “We're pleased to report that the feedback was very positive overall. All eyes now focus on the second pilot, where our engine will power a real customer with a renewable lowcarbon fuel.”

Phase two testing in conjunction with ComEd, an Exelon company in Illinois, will be the next step in the product development process.

“There’s a clear need in the power generation market for reliable clean power to supplement and complement EV grids, whether during episodic black-outs, daily peak power periods or when a rapid recharge is required,” said Kevin Cellucci, ClearFlame’s director of strategy. “ClearFlame’s engine allows the genset unit to run on clean, widely available ethanol, reducing carbon, cutting costs and offering a sustainable mobile power source that we are developing to work in nearly all weather and terrain conditions. It’s exciting to see this new product continue to prove its value and efficacy.”

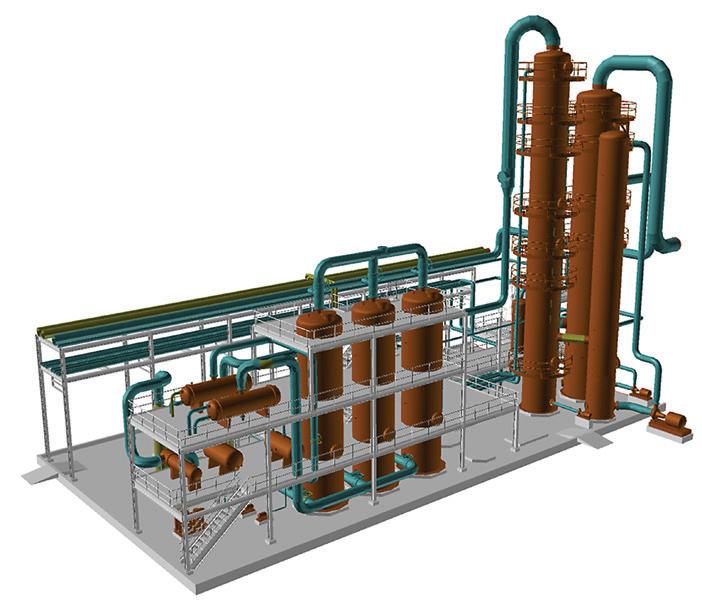

Gevo Inc. has entered into a master services agreement (MSA) with a subsidiary of McDermott International Ltd. to provide front-end engineering and early planning services for Gevo’s development of multiple sustainable aviation fuel (SAF) facilities in North America. The first facility, Net-Zero 1, is expected to be located near Lake Preston, South Dakota. The Net-Zero 1 plant is expected to produce up to 65 million gallons of SAF, diesel and renewable gasoline that, when consumed, is designed to have a lifecycle net-zero greenhouse gas footprint.

Under the scope of the MSA, McDermott will provide engineering, execution planning and pricing for the engineering, procurement and construction (EPC) phase of Gevo’s Net-Zero 1 project. The MSA is expected to lead to a final EPC agreement with Gevo for its Net-Zero 1 project to be finalized in coordination with the timing of Gevo’s financing activities for the project.

Florida-based Blue Biofuels Inc. has received a U.S. Department of Energy Small Business Innovation Research (SBIR) Phase 1 grant. The grant, valued at $206,500, will further propel Blue Biofuels' mission to create sustainable transportation and aviation fuel.

The DOE grant will enable Blue Biofuels to advance its efforts to scale and optimize its patented cellulose-to-sugar (CTS) process. The funding will support the company’s team of scientists and engineers as they complete Phase 1 scaling objectives and continue to refine cutting-edge fuel technology aimed at reducing carbon emissions and mitigating climate change.

"We are honored to be awarded the DOE SBIR grant, which recognizes our com mitment to developing clean and sustainable fuels,” said CEO Benjamin Slager. “This grant not only validates our ongoing efforts but also provides us with the resources needed to accelerate our research and move closer to commercialization."

The United Airlines Ventures Sustainable Flight Fund—a way for companies and consumers to come together and increase the supply of sustainable aviation fuel (SAF) through the support of start-ups—has increased its investment power to nearly $200 million and added eight new corporate partners, five months after its initial launch.

American Express Global Business Travel, Aramco Ventures, Aviation Capital Group, Bank of America, Boston Consulting Group, Groupe ADP, Hawaiian Airlines, and JetBlue Ventures, will join inaugural fund partners Air Canada, Boeing, GE Aerospace, JPMorgan Chase, and Honeywell.

United customers also have the option to contribute to supplement the airline's investment in the Sustainable Flight Fund when they book flights. Since the fund launched, more than 60,000 United customers have contributed a total of more than $200,000.

To date, United has invested in the future production of over 5 billion gallons of SAF—the most of any airline in the world.

For more than 14 years, the Growth Energy Biofuels Summit has served as the biofuel sector’s premier opportunity to build and strengthen our relationships with industry allies and champions on Capitol Hill. Follow along

Our team of experts have over 20 years of ethanol plant maintenance expertise. We o er full service and parts for all Fluid Quip equipment to ensure peak performance.

Green Plains Inc. has entered into a technology collaboration with Equilon Enterprises LLC, a subsidiary of Shell. This collaboration allows for Green Plains Inc., via Fluid Quip Technologies’ precision separation and processing technology (MSC), to be used with Shell Fiber Conversion Technology (SFCT). The two technologies will combine fermentation, mechanical separation and processing, and fiber conversion into one platform. Their joint objective is to create a new process to liberate all available distillers corn oil currently bound in the fiber fraction of the corn kernel, generate cellulosic sugars for production of low-carbon ethanol, and enhance and expand available high protein.

• OEM Parts Warehouse

•$1 million+ inventory on-hand

Green Plains’ biorefinery in York, Nebraska, is the location for both the MSC pilot plant and the SFCT demonstration facility, which will demonstrate the scalability of this technology. Commissioning is expected in 2024.

•Factory Trained & Certified Techs

•MZSA™ Screens

•Paddle Screens

•Grind Mills

•Centrifuges

•Gap Adjusters

The newly formed American Carbon Alliance announced it has added the nation’s three most preeminent ethanol organizations to its ever-growing coalition. The American Coalition for Ethanol, Growth Energy, and the Renewable Fuels Association have recently joined the ACA to bring attention to the benefits that carbon capture technology will have on rural communities, the nation’s economy, and the ethanol industry.

“These three powerhouse organizations are a force when it comes to leading the charge for America’s farmers, producers, corn growers, and ethanol plants,” said Tom Buis, CEO of the American Carbon Alliance. “We’re thrilled to add them to our coalition and look forward to working with them to bring about a new energy future in America.”

“There’s no doubt that carbon capture and sequestration puts ethanol on a unique trajectory to reach both net-zero and net-negative emissions,” said Brian Jennings, CEO of the American Coalition for Ethanol.

HYCO1 Inc. has entered into a 20-year carbon dioxide supply agreement with Kansas Ethanol, located in Lyons, Kansas, for the planned construction of the world's largest biogenic carbon dioxide utilization facility, Green Carbon Synthetics Kansas LLC.

HYCO1 is a Houston, Texas-based technology company that has created a disruptive CO2 conversion catalyst and related low-cost CO2 process technology. HYCO1 CUBE Technology (carbon utilization, best efficiency) cost-effectively utilizes carbon dioxide and various methane source feedstocks to create low-cost, low-carbon, chemical-grade syngas in a single pass. The syngas produced is used to produce low carbon intensity downstream products at a competitive cost to fossil-based feedstocks.

The new HYCO1 project will be co-located with Kansas Ethanol, utilizing all of the plant’s 800 tons per day of CO2 to produce approximately 60 million gallons per year of low-carbon and zero-carbon products.

Allotrope Partners LLC, Axens North America, and Sumitomo Corporation of Americas have announced the signing of an agreement to develop a joint study for a commercial plant producing cellulosic ethanol utilizing the Axens Futurol process. The biofuel will be produced from woody biomass through Allotrope Cellulosic Development Co. LLC, a project development company based in California.

The project will use feedstock based on local Californian forest thinning materials and agricultural residues. These feedstocks, in part, come from the waste generated in large forest fire prevention activities to reduce risk of wildfires that have become a critical challenge in California in recent years. This project will produce a commercial-grade ethanol, while at the same time contributing to the reduction of carbon released into the atmosphere from the massive wildfires that have severely impacted the environment and residents in California.

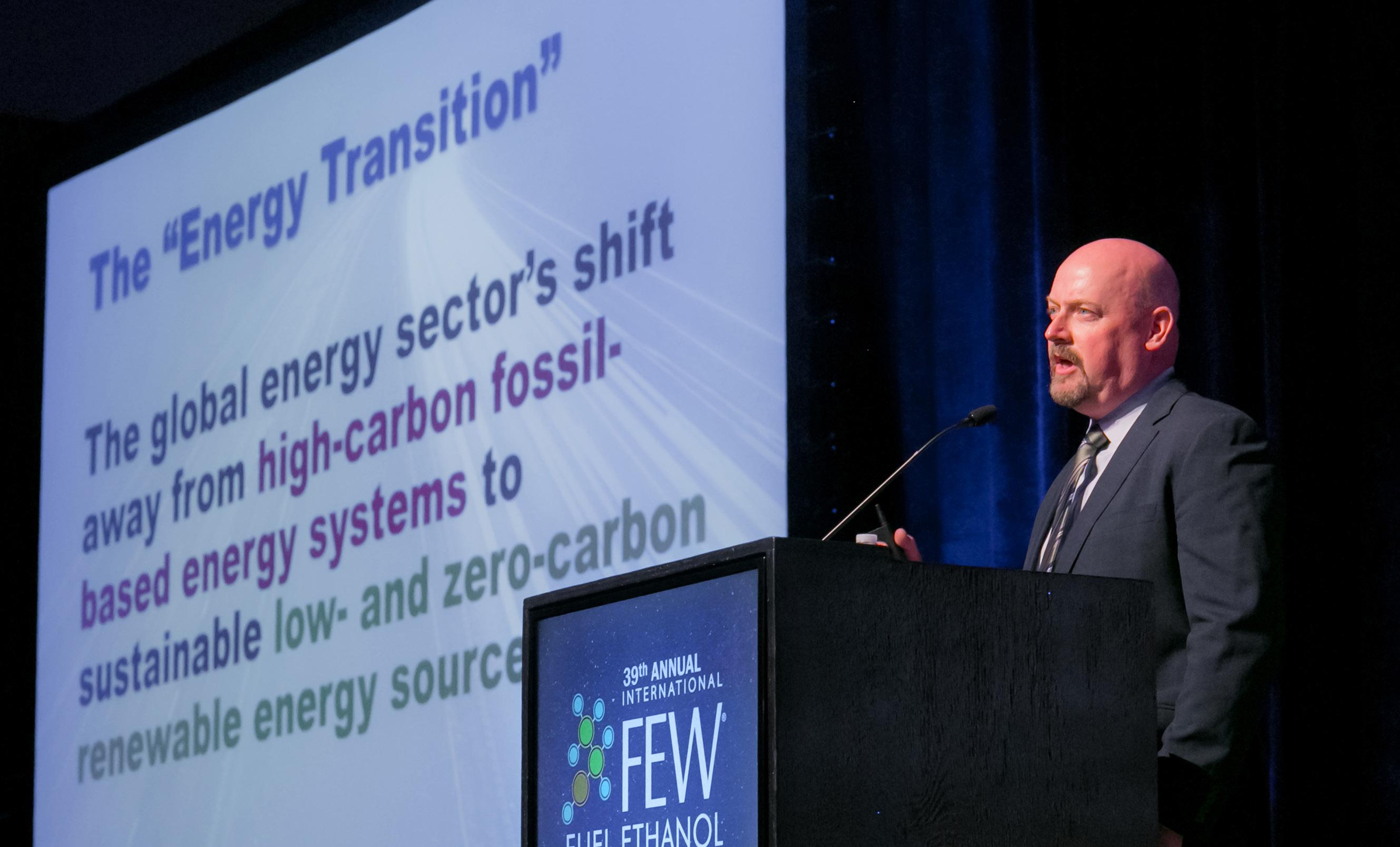

The keynote speaker and general session panelists at the world’s largest ethanol conference discussed the industry’s role in decarbonizing the transportation sector, recent policy developments and the importance of CI modeling to ethanol’s future.

By Katie SchroederThe plenary session of the 39th annual International Fuel Ethanol Workshop & Expo, held in Omaha, Nebraska, in mid-June, was anchored by a keynote and general session panel focused on policy, market growth and ethanol’s role in a global energy transition. BBI International CEO Joe Bryan welcomed conference participants to Omaha, highlighting the industry’s commitment to community and thanking attendees for sustaining the FEW during the pandemic. “Through the pandemic, that sense of community was what allowed this conference and this industry to move forward,” Bryan said, noting that attendance at the 2023 FEW, the largest, longest-running ethanol conference in the world, reached 2,400—a fourth of which were renewable fuel producers— from 26 countries, 48 U.S. states and seven Canadian provinces.

Prior to the keynote address, awardees and scholarship recipients were announced. The recipients of the FEW Kathy Bryan Memorial Scholarship, a $2,000 scholarship awarded to high school graduates or college students with family members employed

at ethanol plants, were announced by John Nelson, BBI International vice president. He also presented the 2023 FEW Award of Excellence and High Octane Award, two of the most prestigious accolades in the industry. The High Octane Award, which recognizes someone who has helped the industry progress throughout the years, was given to Mick Henderson, general manager of Commonwealth Agri-Energy in Hopkinsville, Kentucky. Henderson has worked in the industry for 42 years, improving plant systems, overseeing expansions and taking on new ventures, such as pursuing high-purity alcohol. “[Corn ethanol producers] have achieved greatness, this industry is really, really an industry to be proud of,” Henderson said. “Every one of us should be thankful for our jobs.”

The Award of Excellence, which recognizes those who have made significant contributions on a technical, research or policy front, was presented to Kelly Davis, vice president of New Energy Blue. Davis, the longtime technical director for the Renewable Fuels Association, helped many of her colleagues with her willingness to answer technical questions and solve problems over the years. Working for the industry’s best interests as a long-time appointee to the U.S. Grains Council, a member of the

ASTM Committee for Petroleum Products and more, she was ready to assist members of the industry, Nelson explained. “It’s a new beginning for all the ethanol industry, and an exciting opportunity for me to be [standing] here today,” Davis said. “I can’t promise you what the future will bring, but I intend to be part of it, and I hope you will too.”

The 2023 FEW featured the first Women in Ethanol award ceremony, presented to Emily Skor, CEO of Growth Energy. Skor emphasized the importance of new perspectives and experiences being present in the ethanol industry, encouraging her fellow women in the industry to strive to be more than the “best woman” in their respective jobs, but to be the best.

The general session was kicked off with a keynote address from Geoff Cooper, president and CEO of the Renewable Fuels Association. Cooper engaged conference attendees on ethanol’s role in the “energy transition,” future market opportunities and the hazards of bad energy policy. The “energy transition,” he explained, is a term used to describe the global energy shift away from fossil-based hydrocarbons to low- and zero-carbon renewable energy sources. “When you hear ‘energy transition,’ it’s all about reducing greenhouse gas

emissions and doing so as quickly as possible and in a sustainable way,” he said.

The Biden administration has announced the goal of reaching net-zero emissions by 2050, eliminating 1.8 billion tons of GHG emissions from transportation. However, Cooper explained that this transition has been accompanied by ill-conceived policy moves toward universal electrification, eliminating liquid fuels for light-duty vehicles almost entirely. This would require a mass market transition, which is a risky idea given that a transition on this scale would take a long time and be expensive. California has taken this approach by banning the sale of new internal combustion engines throughout the state by 2035, Cooper explained that this is an example of “bad policy” that arbitrarily picks technology winners and losers.

“Big transitions like the energy transition are hard, they’re really hard, they’re messy, they’re complex, they’re unpredictable, and that’s where government policy can play a role,” Cooper said. “Good policy can help bring down marketplace barriers, foster innovation, speed up technology adoption, reduce consumer costs and help mitigate those unforeseen [outcomes].”

In order to achieve a successful energy transition, Cooper said he believes it is necessary to provide an improvement to the consumer’s quality of life and livelihood. He explained that electric vehicles (EVs) currently receive zero in emissions calculations. Cooper explained that calling EVs “zero emission vehicles” is ridiculous, since it doesn’t take into account the rare minerals used in the batteries and the emissions used in electricity production. A shift to 100 per-

cent EVs would require a 40 to 50 percent increase in electricity production and two to three thousand more power plants or largescale clean energy generation hubs.

Proponents of an across-the-board move to electrification point out the transition from horse and buggy to motorcar as an example of how massive transitions can happen quickly. However, cars were a similar price to a horse and buggy, while also improving quality of life and solving the manure problem that many cities were facing. Cooper explained that this comparison is inaccurate because it does not take into account the fact that EVs may not improve the quality of life for every consumer the same way early motorcars did. EVs tend to be expensive vehicles that cost more to repair and insure, and they also decrease in value faster than internal combustion-powered vehicles.

The market may not be ready for the scale of a complete transition to EVs; only 1.2 percent of the current fleet is currently made up of battery or plug-in hybrid vehicles, he explained. Banning the internal combustion engine is the wrong way to jumpstart an energy transition, Cooper said. It is important that the transition is market based instead of mandate based.

“Rather than trying to force prescriptive technologies onto a market that may not be ready for them, energy transition policy should adopt a technology neutral approach that embraces the diverse portfolio of low-carbon transportation options,” he said. “Policy makers should set stable, predictable, long-term carbon reduction targets, create a level playing field by removing barriers that prevent competition, then let the marketplace do what the marketplace does. Let the market go to work, let the market solve its problem.”

Pursuing a technology neutral approach would encourage technology innovation while empowering consumers to find the best fit for their needs. As a low-cost, low carbon solution, ethanol would thrive in a truly technology-neutral environment and help “kickstart the energy transition.”

Cooper covered the positive policy advancements for the ethanol industry, including progress on the E15 front, the re-

introduction of the Next Generation Fuels Act, constructive dialogue with the federal government on implementing the Inflation Reduction Act, and the continuation of the RFS program under the EPA. Bills legalizing E15 year-round have received bipartisan support, as well as the support of some large oil companies due to negotiations between RFA and the American Petroleum Institute. RFA and other allies are also advocating to make sure that the IRA is implemented in the way Congress intended, he explained. The act offers a clean fuel production credit of up to $1 per gallon, an SAF credit of $1.25 to $1.75 per gallon, an expanded CCUS credit of $60 per metric ton for CCU and $85 per metric ton of sequestered CO2. It also grants $500 million for higher biofuel blend infrastructure and $20 billion in ag conservation and carbon programs. “In my view, this policy marks the most significant federal amendment to low-carbon biofuels since the RFS was expanded in 2007,” Cooper said. “And one of the most exciting provisions in the Inflation Reduction Act for ethanol producers is the clean fuel production credit.”

The ethanol industry’s pursuit of net zero by 2050 is already yielding significant carbon reduction benefits. Currently, ethanol offers a 44 to 52 percent reduction compared to gasoline, between 2025 and 2030,

this reduction is expected to average 70 percent, Cooper said. Today, an FFV running on E15 provides comparable carbon reduction to an electric vehicle. In the future, the carbon reduction benefits could be even better. RFA demonstrated carbon reductions that are possible through its hybrid FFV designed to run on E85 and electricity that comes with a 430-mile range. Cooper explained that this vehicle demonstrates a potential opportunity for consumers to buy a zero-emissions vehicle that doesn’t break the bank.

The industry association panel, including Chris Bliley, senior vice president of regulatory affairs with Growth Energy; Brian Jennings, CEO of the American Coalition for Ethanol; Troy Bredenkamp, senior vice president of regulatory affairs with the Renewable Fuels Association; and moderated by Tim Portz, BBI International program developer, discussed a variety of topics including the importance of modeling that accurately reflects the carbon intensity of ethanol, promising policies and increased blend rates.

The panel discussed the Next Generation Fuels Act, which Jennings called “a more intelligent way to tackle the energy transition.” The act would implement a higher octane rating requirement for vehicles, starting at 95 RON in 2028, increasing up to 98 RON by 2032, with a requirement that the octane enhancing agent must provide a 40 percent reduction in GHG emissions compared to gasoline. Bredenkamp explained that the act’s high octane requirements would cause OEM’s to harden new vehicle engines up to the point that they can handle E85. At the moment, the associations are doing the “shoe leather” work

to lay the groundwork needed to move the bill forward.

“It’s a really good policy, [and] we do need to build more support for it,” Jennings said. “We need more co-sponsors in Congress, so that’s something that you can do at your facilities when [you're planning to] talk to your members of Congress.”

Bredenkamp said he believes the bill has an opportunity given the amount of discussion around an energy transition. “I think there is a necessity that’s coming sooner than we know, where a Next Generation Fuels Act might be coupled with a clean fuels standard concept, that type of major legislation will have opportunity, and I think it may come sooner than we think,” he said.

A major topic for the panel was the importance of accurate modeling and how it

impacts the markets available to the ethanol industry. “We all feel very confident about the future of corn-based ethanol, where it’s headed, we think it’s headed to zero, we think it could be a carbon negative [option], whether that’s in a gas tank or as a feedstock or some other use,” Bredenkamp said. “None of that happens if we don’t get this modeling right. We absolutely have to stand on a hill and make sure that the modeling is correct, because without it we don’t really have the opportunity to participate in any of the burgeoning markets like SAF, like biorefining.”

Jennings explained that modeling is key to determining the impact the Inflation Reduction Act has on ethanol’s potential as a feedstock for SAF within the alcohol-tojet production process. While most of the tax credits within the IRA use GREET as the model for determining the carbon intensity of the renewable fuel, the SAF portion of the act uses a model developed by the International Civil Aviation Organization (ICAO). Right now, ICAO’s model lists corn-based ethanol with a carbon intensity number of 91, which is an obstacle to accessing the real potential of the tax credit, Bredenkamp said. The panelists said it is vital that the GREET model is adopted as the Treasury Department determines the implementation of the Inflation Reduction Act. Jennings called it the “gold standard” for modeling because of how frequently it is updated, and Bliley agreed, saying it is “a true, accurate measuring stick for our industry.”

The IRA does provide a good foundation for utilization of ethanol within the SAF industry. However, taking advantage of 45Z credits may require getting tax extenders in the near future since the window for these credits opens in 2024 and ends in 2027, there is not much time for producers to implement new technologies or products needed to take advantage of these credits associated with carbon capture technologies. “We’re going to be up against some expiration dates, [so] we will all be working on a tax extender to make that program really

work,” Bredenkamp said. “But I think the nuts and bolts are there to at least get this jumpstarted pretty well.”

However, GREET still has room for improvement. Jennings explained that ACE is trying to bring down the amount of carbon intensity assigned to land use impact to better reflect modern farming practices, reducing it from the current penalty of eight grams of carbon. Updating GREET prior to 2025 might allow some producers to access 45Z, Jennings explained. Argonne has been receptive to conversations about adjustments, he said, as long as peer-reviewed science can back up the industry’s assertion. “I think they’re open to arguments, which, you’ve got to have the science behind you, and as my colleagues have appropriately said, that modeling is really the foundation upon which these future policies are going to be constructed … and with the increased demand for low-carbon fuels, it’s necessary to get it done.”

Reducing CO2 is vital as the ethanol industry seeks to reach net zero emissions by 2050, with the two most vital strategies being carbon capture and sequestration followed by regenerative agriculture, Jennings explained. “Climate-smart agriculture,” as the EPA terms it, includes utilizing strategies such as 4R nutrient management, lowor no-till planting, and cover crops. “In many cases, these are practices [that] a lot of you, if you’re a farmer, have been doing for a long time,” he said. “We just need to make sure that we can validate the benefits of those from a greenhouse gas standpoint, get the modelers to accept it, sounds easy right, get the regulators to accept it and then get you to the point where you can monetize those opportunities in the marketplace.”

Farmers are often willing to implement technologies and practices that make economic sense, Bredenkamp said. If regulators incentivized growers for low-carbon farming practices, they would likely seize the opportunity. However, that is unlikely to happen unless policymakers are willing to incentivize these practices. Bliley explained that it is important for modelers and regula-

tors to align in recognizing carbon reductions at the farm level.

“The modeling has to be right, that’s why we all work very closely together to make sure that the treasury, which isn’t as familiar with our product as other agencies, knows the ability and benefits of cornbased ethanol,” Bredenkamp said.

Bliley also emphasized the importance of providing guidance to ethanol producers on 45Z to give them a better understanding of which investments will allow them to access the tax credits. “It’s getting the modeling right, making sure it captures everything that we’re doing—and it’s making sure the guidance matches up with the modeling so people can plan and invest accordingly,” he said.

Another talking point was the Brazilian tariff on U.S. ethanol and, comparatively, how Brazilian ethanol is favorably treated

in the U.S. market. The panelists explained that Brazilian sugarcane ethanol is able to access advanced RINs as well as the LCFS market in California while U.S. ethanol is not able to qualify in Brazil’s RenovaBio program. In February, Brazil implemented a 16 percent tariff on U.S. ethanol imports that will increase up to 18 percent next year. “We can’t have programs here in the U.S. that give Brazilian ethanol a [shake] here when they have a tariff and a low carbon market that doesn’t let U.S. ethanol in,” Bliley said. “We just know we’re among the most competitive in the world, and we just want an opportunity to compete in those key markets.”

Export markets were strong in 2022, Jennings said, with 1 billion gallons of ethanol exported around the world. He emphasized the importance of increasing the capacity of the domestic market but said exports provide a good outlet for extra ethanol supply. Bredenkamp agreed, saying, “They certainly are able to soak up a lot of excess supply. We have capacity of around 13.9 [billion] or so in the [domestic] system,

and so we need more, and if exports help soak up some of that, it certainly helps.” Several countries such as Canada and Japan are utilizing ethanol as part of their solution for GHG reduction.

While some export markets can be fickle, they are an “important part of the puzzle,” Jennings explained. A shift in the political climate of a country with an established market can undo years of work developing trade relationships, making export a challenge.

The panelists discussed how states have taken the widespread use of E15 into their own hands. E15 is a high priority for all of the association members because, as Jennings explained, it is an important steppingstone to higher blends.

States across the Midwest are in the process of opting out of the RVP requirements, making E15 available year-round. Some states, such as Iowa and Nebraska, have taken pro-E15 efforts to the next level, passing legislation to encourage the use of

ON GOOD POLICY: During his keynote, Cooper said, “Big transitions like the energy transition are hard, they’re really hard, they’re messy, they’re complex, they’re unpredictable, and that’s where government policy can play a role. Good policy can help bring down marketplace barriers, foster innovation, speed up technology adoption, reduce consumer costs and help mitigate those unforeseen [outcomes].”

higher blends. Iowa passed an E15 mandate, requiring all qualifying retailers to sell and advertise E15, which comes into effect in 2026. In June, Nebraska Gov. Jim Pillen signed the Adopt E15 Access Standard legislation, which gives fuel retailers tax credits for selling higher ethanol blends. “Essentially, it provides access to higher blends, to consumers, and forces the retailers to provide access to these higher blends,” Bliley said. States are providing “critical leadership” on the E15 issue in the absence of action from Congress or the EPA.

“We shared in our appreciation of what these things are doing on a state-by-state basis, they’re taking their future into their own hands, they’re saying Washington’s not getting it done for us, we’re going to do it for ourselves, they’re allowed to do that to a degree within the Clean Air Act, so we’re very supportive and appreciate the work done in Nebraska this year, Iowa last year,” Bredenkamp said. “The eight state opt out, opted out of the RVP program that was the only reason why we started to have conversations with API.”

In order to fully tap the potential of E15, an RVP waiver needs to be implemented nationally, Bliley explained. If E15 were available year-round, it could increase market capacity by five to seven billion gallons of capacity. It is vital that consumers have the opportunity to purchase E15/Unleaded 88, not only year-round, but also at every gas pump or gas station island throughout the nation. “It’s really about access,” Bliley said. “It’s about giving the consumer the same kind of [refueling capability] they have with any other fuel, frankly. This is what you’re fueling up your car with; they see the price difference; they see the octane difference in how it’s sold, and it’s about giving them the opportunity to choose it.”

Jennings added that it is key to make E15 attractive to retailers, because consumers are interested in using cheaper fuel and saving money. “Consumers will tell you they care about the environment, and they care about energy independence, consumers re-

ally care about saving money when it comes to buying gas,” Jennings said. “And what we’ve got going for us with E15 is it’s the lowest cost product on the pump that virtually every car can use, and so that’s why tax incentives are important, we’re already cost competitive.”

The panel discussed the importance of the RFS being administered as intended. However, the program has been mismanaged under each president, Jennings explained. “The blend wall waiver under Obama, small refinery exemptions under Trump, right now, so far, we’re looking pretty good as far as how the Biden administration has implemented the RFS, the EV situation is a totally different ballgame, but the RFS, so far so good,” he said.

EPA’s decision to release blending requirements for multiple years is important because it provides needed certainty for the years ahead. However, Jennings advised vigilance in the years ahead to make sure

that the EPA does not go in an unwanted direction in the future, and ensure that oil refiners are not able to find an angle to exploit. “It’s really incumbent upon us [to stay engaged with the agency on current and future RVOs] now that EPA has even more power with which to set these volumes beyond 2025,” Jennings said.

Bredenkamp agreed with Jennings’ assessment that vigilance is needed, and reiterated the importance of the RFS, not only to the ethanol industry, but as a vital and effective tool in reducing GHG emissions. The RFS was not over in 2022, and in spite of the number of headlines that the IRA has been making, the RFS remains a vital policy for the ethanol industry.

Although the U.S. ethanol industry is facing the challenge of policy pushing for widespread electrification and inaccurate modeling, good policies such as the IRA are reinforcing the importance of low carbon liquid fuels. As the industry continues

to pursue reducing ethanol’s carbon inten sity through CCS and climate smart farming practices, ethanol’s environmental benefit continues to grow.

“We’re certainly excited about IRA in centives, excited about E15, but a lot of this is foundational to the things people have done around the RFS, the pathways that we have filed, how they have generated RINs, that type of thing,” Bliley said. “I think that is really important, and it’s also really impor tant to show that there was no cliff in 2022, we are building on the success that we’ve had for the last decade and moving ahead for the next three years.”

Author: Katie Schroeder

Contact: katie.schroeder@bbiinternational.com

Author: Katie Schroeder

Contact: katie.schroeder@bbiinternational.com

Ramsdell’s got you covered. Our secondary containment systems have been protecting valuable tank contents—and the environment—since 1988. From storage tanks to railcars, when what’s inside gets out, you have one chance to capture it.

Across nearly every major industrial sector—from healthcare to education to energy— news reports, whitepapers and entire business symposiums are echoing the same warning about cyberattacks: “It's not a matter of if but when.” And, unfortunately, it’s a very real threat that applies directly to every modern, connected ethanol plant. Knowing what a cyberattack looks like, how they usually occur, where they can do the most damage, and who to work with to manage all things cyber is critical to preventing and mitigating potential attacks.

Spencer Banister is the operational technology group manager at Novaspect Inc., an Emerson Impact Partner company that provides engineering and service of industrial process controls. For Banister, cybersecurity work in the ethanol space is very active right now. After working on program control systems and server installations, Banister began focusing on cyber security in 2019. Since then, he and his team have become go-to experts in the industry.

“Within the ethanol space right now, I would say cybersecurity is a buzz word, Banister says. “What we find, though, with a lot of ethanol customers is that they don’t know where to start.”

It’s not just the abundance of warnings coming out about the rise of cyberattacks

that have ethanol plant IT teams on high alert. The new and increasingly sophisticated ways attacks are happening are also alarming. Phishing, malware and spoofing are now well-known entry points for cyber criminals. But now, more intricate—and potentially harmful—forms of attack are happening, like denial-of-service, code injection and (hopefully not) ransomware.

As Banister explains, insurance providers have been helping to inform businesses about the full spectrum of cybercrime, and how to deal with it all. Insurance companies want to know what a plant’s cyber security management plan includes. According to Banister, they want to know what a plant will do to get back on track after an attack, if the plant has the right procedures or policies, and how the facility will keep

By Luke Geiver

By Luke Geiver

its employees safe. Often, those responsibilities can fall on a small team or even one in-house IT professional working for the producer.

“If they come in and you don’t have that plan of action and ability to implement it, your insurance premium will go pretty high, and your risk to personnel will be pretty high,” he says.

Ethanol plants need to consider the impact of cyber on both their IT and OT operations. IT commonly refers to the internal informational data and storage capabilities at a plant, while the OT refers to the process and operations controls used to run production.

As Banister points out, if a bad actor gains access to a control system, like the distillation process, things can break, pro-

cesses could go seriously wrong and even cause injuries. Novaspect specializes in the OT part.

“That is what foreign actors want to do,” he says, talking about the physical disruption that could occur at a plant following a cyberattack.

In addition to insurance concerns and the fallout from foreign actors, Banister says most ethanol plants need to consider their staff. Most plants have staff rotation. There are always people coming in or out. General maintenance and policies around cyber need to start with that in mind.

Trent Vanderheiden, a network administrator for South Dakota-based IT Outlet, shares a similar sentiment to Banister. Vanderheiden and his team have established their firm as a go-to provider of IT services

and supplies by creating custom solutions for a range of clients from school systems, healthcare, energy, and even ESPN.

For Vanderheiden, staff security or education about cyber attacks is an often overlooked component of cybersecurity. He says that, depending on the report, 91 to 93 percent of all Ransomware attacks (the kind that demand a ransom in return for releasing a system back to the original operator) are delivered via email. These attacks are crippling not only financially, but encryption algorithms now know industrial machinery and can completely destroy things. Vanderheiden makes a simple statement about it all, saying, “If you look at your environment and it has a blinky light on it, it’s at risk.”

IT/OT professionals can help safeguard biorefineries from cyberattack by understanding criminal tactics, backing up data and being ready to act when bad things happen.

Banister now has a team of 15 that focuses on control system upgrades, virtualization and reliability. Every member of his team participates in cyber security installations. The focus of their work centers around a set of requirements becoming popular across industries: they follow the guidelines and direction of IEC 62443. The number refers to a set of standard requirements created by the International Society of Automation for implementing and maintaining electronically secure industrial automation and control systems (the things with those blinky red lights). According to the ISA, “the standards set best practices for security and provide a way to assess the level of security performance. Their approach to the cybersecurity challenge is a holistic one, bridging the gap between operations and information technology, as well as between process safety and cybersecurity.”

The IEC 62443 standard has been a big change across the industry for industrial manufacturers, Banister says. In the next five years, everyone will be familiar with it. Some customers have already adopted the basics from the standards and Novaspect is even certifying its engineers in the process. In summary, the standards create a multistakeholder approach to creating, manufacturing, applying and maintaining industrial components organized and installed in a zone-based scheme that enable the best chance of mitigating the most risk from a cyberattack.

Cybersecurity solutions in the ethanol plant have to deal with what Banister calls a flat-network. Everything across a plant is typically on the same network. Everything can talk to everything.

“We have to create a good separation of network traffic,” he says. Novapsect does that by creating a proper way to pass data from the business systems to the process systems.

Vanderheiden puts it another way. “At the end of the day, you’re an IP address to a threat actor,” he says.

And, although most industries think they are unicorns not exposed to cyber threats, Vanderheiden explains that the ethanol space is no different than a school or mom and pop coffee shop. Every entity needs to start somewhere with cyber.

Banister’s team starts with cyber threat assessments. They go in with a toolkit, scan the entire system and determine where a plant is at with risk to cyber. Then they go hit the “easy things” first including OT systems hardening, blocking USBs from being used on computers, making sure people can’t remotely access in to machines they shouldn’t have access too, making sure everyone at the plant doesn’t have access to operate machines or make control changes and more. In addition, the team will provide a user permission workshop to provide clarity and confidence to the staff.

BEYOND CLOUD BACKUP: These days, ethanol producers are being advised to protect their critical data in multiple ways and not let that data stay in one location. Without good backups, reprograming a system to its previous version prior to an attack that ruined or corrupted essential data could cost tens of thousands of dollars.

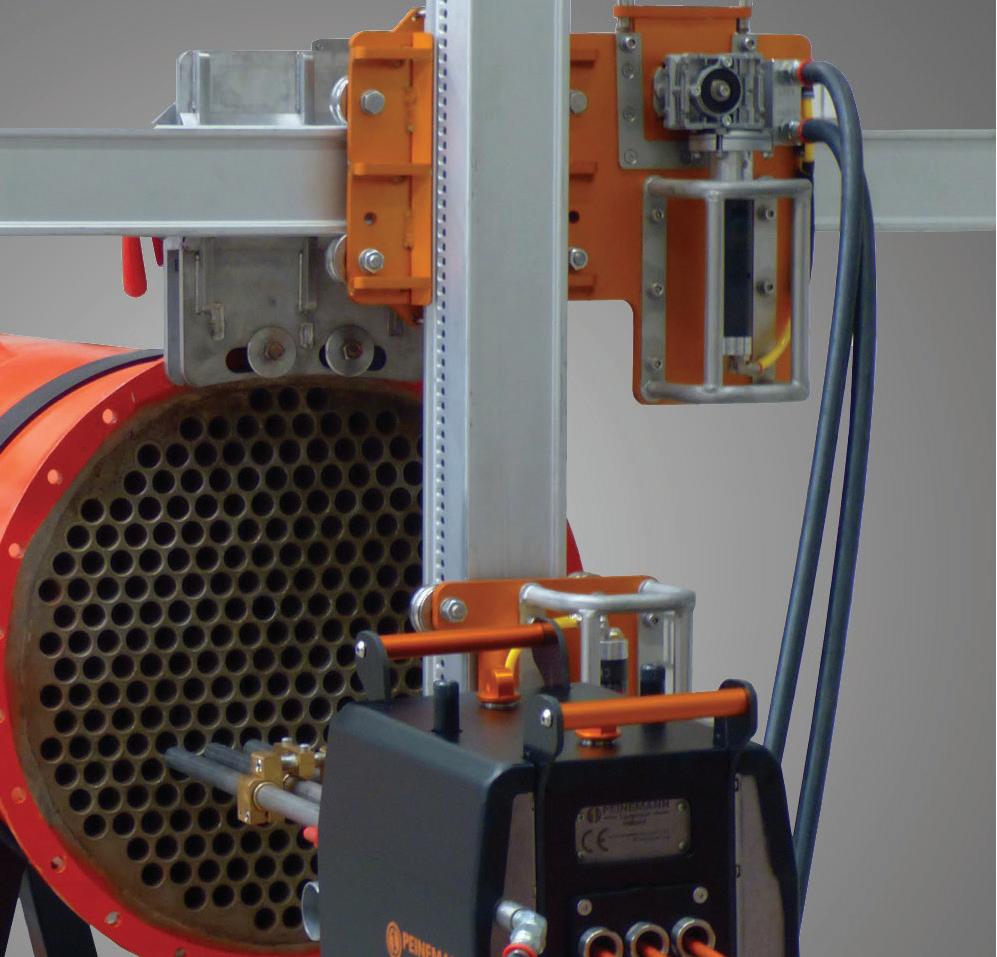

There ’s no more ve rsatile solution for tough clea ning jobs than a Peineman n TL X flex lance feeder with an ultra- reli able NLB pump

Only the TLX can be easily converted for 1, 2 or 3 lances (even 4 or 5) with optional kits, to clean evaporators, heat exchangers and more. Lightweight carbon fiber construction and gear driven speed control provide dependability and versatility, while remote operation enhances safety.

The TL X is available in North America from NLB, th e leade r in high -p ressure water jet solution s.

PHOTO: STOCK

PHOTO: STOCK

FQT’s patented Low Energy Distillation (LED) technology significantly reduces energy usage and downtime.

• Reduce steam usage by up to 40%

• Eliminate downtime to CIP

• Integrates with pressure and vacuum distillation

• Increase capacity

The U.S. Department of Energy’s Bioenergy Technologies Office (BETO) will host a Bioenergy Cybersecurity Workshop on September 11. The virtual event, organized by Sandia National Laboratories, will identify cybersecurity risks in biofuel and bioproduct manufacturing, and develop approaches to addressing these risks.

The workshop will focus on the importance of cybersecurity in biomanufacturing safety, operational continuity and competitiveness. The event will include panel presentations by bioprocessing and cybersecurity experts, along with participant discussions. Participants will discuss the state of biofuel and bioproduct cybersecurity practices and the security of biobased processes to help identify and define cybersecurity technologies and research needed for cybersecure bioenergy production.

Visit www.energy.gov/eere/bioenergy/articles/bioenergy-cybersecurity-workshop-announced to register for the event.

After that, the team looks at hardening the system more with backup recovery and essentials. “If you get ransomware, backup recovery is your best friend,” Banister says.

Vanderheiden and his IT Director Dusty Sperlich have become well versed in backup recovery and creating a reliable, efficient system. Sperlich has helped create intricate and effective systems for major healthcare providers, small schools and even the territory of Guam. One of the interesting topics he is currently looking at is a spin on what most non-IT people might think about data storage.

“Now the trend is that you have to back up your cloud data,” Sperlich says. “It is almost ironic that we moved from backing up stuff to the cloud to having complete cloud infrastructures to backing up that cloud environment back locally or to another cloud.” The thing to remember, Sperlich says, regardless of all that data backup work, is that you have to protect your critical data in multiple ways, and you can’t let that data stay in one location.

Without good backups, Banister says, reprograming a system to its previous version prior to an attack that ruined or corrupted operating essential data could cost tens of thousands of dollars.

The last thing is patch management, which is related to applying the latest hotfixes. “Process disruptions at an ethanol facility can be thousands of dollars per minute,” Banister says. “We understand all of the pieces and parts from the switches to the servers.”

Generally, hardware is recommended to be swapped out every five to seven years. Servers from 2022 are the current generation, and should last until 2027 to 2029 before becoming outdated.

For control systems to have the latest and greatest features, Banister says the newest options are always the best because that is what all the newest connected tech is built off of.

Recently the Novaspect team has been highly focused on developing network threat detection solutions. It is based off

a software that allows Novaspect to mirror the network traffic and identify irregularities. When put in an online mode, it will start to identify things that are not normal.

For instance, when you watch a control system, most changes occur between the hours of 8 a.m. and 5 p.m. If someone is downloading info at 1 a.m., it generally means something is happening that shouldn’t be, Banister says. For cybersecurity, both Banister and Vanderheiden believe knowing what is happening is important.

“The sooner you can get a notification, the sooner you can take action,” Banister says.

Author: Luke Geiver Contact: writer@bbiinternational.comBenefitting from the experience of its many longtime personnel, Adkins Energy has transformed itself over the past 20 years into a one-of-a-kind biorefinery worth celebrating.

By Luke GeiverAdkins Energy was formed in 2002 to provide value to local corn producers. Although its origin may not sound unique to the ethanol industry, the plant’s 20-plus year run proves otherwise. Ethanol Producer Magazine caught up with the team in late July to talk about about the evolution of Adkins and how the plant has transformed in size, scope and direction. Much has changed at the Lena, Illinois, biorefinery, but as you’ll hear from one of the company’s original employees, its ability to thrive over two decades is not only about what has changed, but what hasn’t.

Jason Townsend was an original employee of Adkins. He started as a floating operator right out of college before moving into a lab manager role. After that, he became a production supervisor and then plant manager. As of last year, Townsend’s title has been assistant general manager. He didn’t plan to work at the plant for decades or build a dedicated career in ethanol, but the opportunity to get in on the ground floor—and then advance—was always too great to pass up, he says. Along with nine others, he’s been there from the start. Today, the plant employs roughly 47 to 50 people. Townsend could give you names

and titles of everyone if you ask. For the small Illinois town closest to the plant, the ethanol facility offers a great employment opportunity, he says.

The plant runs four teams with three operators and a shift supervisor. There are two floating positions. Approximately 23 team members work on the production side with the remaining staff focused on lab operations, management, administrative and sales.

The workforce breakdown is important because it relates, in no small part, to the Ad-

kins story, according to Townsend. The success of their operation has always been about the people that work there. And for the crew from Lena, it has meant keeping employees for as long as possible. Despite all the changes at the plant over the years, the Adkins team has remained largely in tact. The culture of innovation, efficiency and safety has stayed constant, too. That, along with consistent operations, is a direct result of low turnover. Townsend is proud of that, pointing out multiple times during his interview with EPM that employee longevity is a big part of the Adkins success story. “We’ve always had a great team, and everyone seems to want to stay around,” he says.

Check out the socials for Adkins and it's clear there is an established culture. Work there and your birthday is celebrated. Have a student eligible for a scholarship? Don’t forget what Adkins offers. They’ve given out scholarships for several years based on the ability of applicants to explain the benefits of ethanol. Looking for an organization for community involvement? Adkins is probably already involved in some way. The plant specifically lists multiple regional organizations that it participates in on its website. There is proof everywhere that Townsend’s talking point about the plant’s people is a real thing.

There is a lot to manage at the facility. What started as an ICM-engineered plant— designed nearly identical to the original ICM

Kansas plant—has morphed. Today, the Adkins has expanded ethanol production to 60 MMgy, along with more than 100,000 annual tons of DDGS and another 100,000 tons of wet distillers grains. In 2014, the plant added a biodiesel production operation that pumps out more than 2.5 MMgy. The biodiesel is made from distillers corn oil, roughly 1.5 million gallons.

Adkins has become a modern biorefinery in many ways, Townsend believes, and it's just getting started. Getting to this point took a lot of work, however. Expansions or additions to the plant have included adding two additional fermenters, performing pump upgrades, expanding the cooling tower, adding a steam turbine to capture some of the wasted

energy and more. A ring dryer was added to help with drying and to expand the options for future coproducts. The plant has always been able to generate all of its electricity. The original design included a built-in CHP system.

The plant’s current enhancements include work on an ICM Selective Milling Technology upgrade to improve corn oil and ethanol yield. They are also replacing the plant’s 20-year-old centrifuges to gain more flexibility and reduce maintenance expenses.

“We’ve always tried to stay as consistent as possible operationally while also staying focused on minimizing our expenses,” Townsend says. “We try to operate as efficiently as possible.”

Bill Howell, the current GM of the plant, has been with Adkins for the past eight months. Howell returned to the biofuels industry after previously working with Shell, BASF, and POET (he was also a jet pilot). Howell says what stood out about the Adkins facility was the fine shape it was in relative to its age.

“What impressed me from the beginning about Adkins was how clean it was,” he says. “They have spent the money to keep the plant up.”

Although they might work smart at Adkins, that doesn’t mean they don’t work hard. On most days, Townsend starts reviewing

important information before he ever makes it to the office. He checks the previous day's production level, the volume of bushels ground, ethanol produced and energy consumed via emailed reports. “Then, I’m here for a shift change to review the operations teams and make a plan for what is [happening] during the day or the week,” he says.

After that he checks in with the office and maintenance teams to make sure there is clear communication between all parties. Additional meetings fill in his time when he’s not walking the plant. “I like to get to all parts of the plant during the day,” he says.

Adkins energy is unique to the ethanol industry for many reasons. The plant is one of the few owned by a local co-op. Pearl City Elevator, a local agricultural cooperative, helped form Adkins Energy LLC in 2002 and today has a majority interest in the plant.

Adkins Energy LLC is owned by approximately 275 general members of the former Adkins Energy Cooperative and PCE. Adkins Energy shares are available to the public, and

any area producer can sell grain to Adkins Energy through PCE.

The ethanol plant is co-located with a biodiesel production facility. The plant distills its own corn oil into a pure, colorless product that can be used in any weather. The majority of the biodiesel is purchased and sold by local ag retailers. WB Services of Kansas helped bring the 8,500 square foot plant into production.

In 2020 during the pandemic, Adkins partnered with Lena Brewing Company to produce ethanol-based FDA-approved hand sanitizer. The product was used to supply the greater Chicago area.

Recently, Adkins has been exploring the option of carbon capture for the production of methanol. While many ethanol producers are aligning with carbon pipeline systems or exploring onsite sequestration efforts, Adkins is looking at a different alternative. Working with CapCO2 and the New York firm's tech-

nology, the group is determining if a CO2 capture system that ultimately creates green methanol could be viable in Lena.

Real Carbon Tech, the technology developer that CapCO2 is basing its system on, has created a single-phase process that takes readily available flue gas capture technology and uses it in a methanol conversion process the company says is different than those used at fossil fuel-based operations that rely on the production of syngas. In some cases, the system can be mobile and housed in a standard shipping container. The product is popular with several major maritime shipping operations because of its properties. Green methanol is liquid at room temperature, making it less costly to store and transport than gaseous fuels. It also has the lowest carbon footprint of all liquid fuels.

Currently, Adkins is performing a feasibility study and running the financials on the CO2 project. Howell is hopeful of the results and knows that others from industry are watching and waiting. Adkins is one of only a few ethanol plants evaluating a CO2 to methanol project. If an underground injection option was available or a pipeline in the near-term, Howell says the plant might have explored those options in addition, but those weren’t even an option.

The CO2 tech will collect flue gas from the fermenters and redirect it. The resulting single-phase process creates hydrogen, oxygen and methanol. The hydrogen is reused to create the methanol, and the oxygen can also be sold as a byproduct.

“There are a lot of people hoping that we are successful,” he says.

Like its operational strategies, Adkins is consistent in how it approaches new technology. Townsend says it starts with the operations team. Because the team is so good, there is time to explore or consider new technology. The board is supportive of upgrades and to date, Adkins has found success by adding or altering technology at the plant.

“We always try to stay informed on new technologies and do our research,” he says.

With yeasts or enzymes, they don’t like to be the first plant to run it commercially. And,

they want to be confident in the lab data. “We take it fairly slow on that process,” he adds.

With new process equipment, they really work to understand how something can be integrated into the current infrastructure. The team will travel to other plants to look at systems in action and if it is a brand new technology, the Adkins team is willing to let vendors set up or run trials onsite at the plant.

“We are always looking at new technology,” Townsend says. “Always.”

Running a profitable biorefinery in Lena hasn’t always been easy, Townsend admits. “We have seen our fair share of tough ethanol margins over the years,” he says. One year, they had to slow down production to wait for corn to come in for the next year. Covid was a unique challenge. “It seems like the ethanol industry always finds a way to correct itself though,” Townsend says.

Part of the industry’s ability to adapt comes from the new products and strategies hitting the market. “I’ve been surprised at how fast things change,” he says.

Like most ethanol producers in 2023, Townsend and team are following the opportunities that are linked to sustainable aviation fuel. That opportunity, they believe, is huge. But part of that opportunity comes from a plant's ability to lower its carbon intensity (CI) score. Adkins is highly focused on its CI score so it can participate in the low carbon market. The team is also looking at efficiency improvements and potentially even more ethanol production increases.

“I still think that diversification will be important to the longer-term play,” Townsend says.

Through years of change and myriad projects and upgrades at the plant, the team believes in keeping everyone informed and up to speed. There shouldn’t be surprises, Townsend says. Change is going to happen, he adds. And, for a plant that just celebrated its billionth gallon of ethanol produced this May, it’s clear that things certainly have changed at the northern Illinois plant. As the success of Adkins shows, change can be a good thing, Howell adds.

“Coming back into the biofuels space,” he says, “it’s as if we have stepped into the rebirth of biofuels. It’s very exciting.”

Author: Luke Geiver Contact: writer@bbiinternational.com

Author: Luke Geiver Contact: writer@bbiinternational.com

Mole-Master Services Corporation helps ethanol producers avoid stress when it comes to cleaning and removing blockages in bulk dry storage vessels during shutdown.

“Time is money,” says Dan Bruenderman, project manager with Mole-Master. “And what our tooling, our technique and our experience allows is that we can get in, get out and get the job done quicker, more efficiently, and get the plants back up in operation again.”

Producers may be able to do some of this cleaning with technology they can deploy themselves, however, finding people to operate that equipment can be a challenge, Bruenderman explains. Mole-Master’s proprietary highpressure air tooling and equipment allows the experienced service provider to accomplish difficult jobs with ease.

The Mole-Master team operates in groups of six to eight, running around the clock, typically starting on Monday and finishing on Wednesday or Thursday, depending on the

size of the job. Three to four men working the day shift, and three to four working during the night. Bruenderman explains that the team will set up on the surge bins that feed the grinding mills, lowering their equipment in from the top of the corn stack and breaking loose any hardened material, which then feeds out of the bottom.

“Gravity is our friend, so [the material basically comes out of the vessel through] the normal discharge,” Bruenderman says. “But in the case of some plants that haven’t cleaned on a routine basis, where they’ve had an extensive amount of buildup—large chunks of material—we’ll actually just empty that stuff out right to the floor and use a vacuum truck to suck it up.”