British Plastics and Rubber

EAST MEETS WEST IN BOLE-PROPLAS SUCCESS STORY

BP&R TALKS TO HARDEEP

KHERA - SEE PAGE 10

RESIN PRICES

The end of turbulent times?

GREENER & CLEANER Microban on protecting plastics

ROBOTS & RESHORING Automation for the nation?

INTERPLAS AT 75: PlastikCity returns, and Wittmann goes big

INTERPLAS AT 75: PlastikCity returns, and Wittmann goes big

issue 01/23 Jan/Feb

bp&r

How much energy could you save with a Yizumi A5-EU machine? What other efficiencies could you get? Call our engineers today for a chat on 01933 27 27 47 or visit us at: www.stvmachinery.co.uk/yizumi A5-EU series (the one with the really wide tie bar spacing). The smart, green, energy-saving machine. MUCH MORE THAN JUST A MACHINE DISTRIBUTOR Comprehensive three year guarantee. Machines in stock here in the UK. Seeing is believing! Visit our working showroom and meet our engineers.

British Plastics and Rubber

www.interplasinsights.com

Head of content: Dave Gray

T: +44 (0) 1244 680 222

E: david.gray@rapidnews.com

Junior editorial content producer: Daniel Ball

T: +44 (0)1244 680 222

E: daniel.ball@rapidnews.com

Head of sales: Mandy O’Brien

T: +44 (0) 01244 952 519

E: mandy.obrien@rapidnews.com

Portfolio sales manager: Gareth Jones

T: +44 (0) 1244 952 370

E: gareth.jones@rapidnews.com

Portfolio sales manager: Kelley Jo Gwatkin

T: +44 (0) 1244 952 375

E: kelleyjo.gwatkin@rapidnews.com

Portfolio sales manager: Debra Brown

T: +44 (0) 1244 952 385

E: debra.brown@rapidnews.com

Head of studio: Sam Hamlyn

T: +44 (0) 1244 680 222

E: sam.hamlyn@rapidnews.com

Subscriptions:

T: +44 (0) 1244 680 222

E: subscriptions@rapidnews.com

Publisher: Duncan Wood

T: +44 (0) 1244 680 222

E: duncan.wood@rapidnews.com

Print subscription

Qualifying Criteria

UK – Free Europe – £249 ROW – £249 FREE digital issues available to view and download online

British Plastics & Rubber is published monthly (8 times/year)

by Rapid Plastics Media Ltd, Carlton House, Sandpiper Way, Chester Business Park, CH4 9QE

T: +44 (0) 1244 680222

F: +44 (0) 1244 671074

© 2023 Rapid Plastics Media Ltd

While every attempt has been made to ensure that the information contained within this publication is accurate the publisher accepts no liability for information published in error, or for views expressed. All rights for British Plastics & Rubber are reserved. Reproduction in whole or in part without prior written permission from the publisher is strictly prohibited.

ISSN 0307-6164

Incorporating Polymer Age and Rubber and Plastics Age.

COMMENT

New year, new look

Welcome to 2023 (admittedly the year will be well under way by the time this editorial hits desks), and welcome to your new-look British Plastics & Rubber magazine. Regular readers will notice a vastly different style, not least in the front cover design. Going forward, each edition will focus on an interview with a leading light in the plastics industry.

We’re kicking this off with my interview with Hardeep Khera, general manager at Bole UK. A relative newcomer to the UK IMM supplier network, Bole have certainly shaken things up. Made in China, these machines have proven to be an attractive option for moulders and manufacturers, both for commodity and more technical work. Long-standing European suppliers seem to be moving towards offering the ‘no frills’ standard machine options that were historically offered to the Asian markets. With some brand owners reshoring their output in recent years, it makes sense that the machines bestsuited to the job would come to the West as well.

Also new is our ‘Meet the Moulder’ feature, which this issue focuses on WSM Plastics. I caught up with Neil Paice at WSM to learn more about the challenges facing the firm – and indeed many moulders – in the current climate. Not surprisingly, one of the critical pain points is the continual onslaught of rising overheads, from energy costs to resin price hikes. While both factors are showing signs of a shift to a *slightly* more palatable scenario at the start of the year, conditions remain far from ideal for healthy profit margins. That said, WSM remain optimistic, and have taken some sustainable learnings from the challenges of recent years. Turn to page 16 to find out more.

On the subject of sustainability and energy, I just finished recording the latest episode of the Interplas Insights podcast, which was a special focus on sustainable plastics processing in the face of high energy costs. I was joined by Jo Davis, managing director at Broanmain Plastics, Robin Kent, managing director at Tangram Technologies, and probably

Now recruiting: Editorial Advisory Board

British Plastics & Rubber is compiling an Editorial Advisory Board comprised of independent industry experts. If you or someone you know would like to assist in the planning of features, regular columns and contributions, as well as providing critical reviews of technical articles, please email

david.gray@rapidnews.com. Nominated individuals must not be employed by suppliers of equipment or materials to the plastics industry. Ideally, candidates will have a background in either: technical consultancy, academia and research, or policy and regulation, but other fields will be considered.

the world’s leading voice on this topic, and finally Carl Reeve, managing director at Premier Moulding Machinery/Haitian. It was a wide-ranging discussion, which explored the priorities for moulders’ capex, as well as smaller, less costly changes that can make a big difference. Jo herself has been on one of Robin’s courses, and through the changes they’ve made at Broanmain, the company has even been able to afford staff an early finish on a Friday, so significant were the savings.

More important than financial investment though is an investment in culture change. Most of us are at work more than we’re at home. At home, we’ve learned to be recyclers, we’ve learned to turn off the lights when we’re not using them. So why don’t we do that at work? Because it’s not our money? To leave the planet in a sustainable state for the next generation, we need to be thinking differently at work. Find out more in the next episode of the podcast, search Spotify, Apple Podcasts or Google Podcasts (or whichever provider you use) for ‘Interplas Insights’, and subscribe to make sure you don’t miss an episode.

Head of Content

DAVE GRAY

PEFC/16-33-254 PEFC Certified pro from sustainably managed forests and controlled sources fc.org

“At home, we've learned to be recyclers, we've learned to turn the lights off when we're not using them. Why don't we do that when we're at work? Because it's not our money?”

33 PRSE Europe’s plastics recycling conference returns with political input

16

MEET THE MOULDER

Dave Gray speaks with Neil Paice, WSM Plastics

18

ANTIMICROBIAL AND SUSTAINABLE Kimberley Cherrington at Microban explains how antimicrobials

30

CASE STUDY: BLOWN FILM FOR RECYCLABILITY

How one firm’s new blown film line makes for sustainable packaging

32

CUTTING THE COST OF USING RECYCLATE

Why your blending setup could make a material difference

23 POLYMERMAN

Mike Boswell looks back on a turbulent year, and forecasts for 2023

39 COLUMN David Raine, PMMDA

42 COLUMN Phillip Law, BPF

4 www.interplasinsights.com 6 INTERPLAS IS BACK PlastikCity returns to the show, plus Wittmann’s optimism 10 COVER STORY Hardeep Khera at Bole on breaking into the UK market 12 ROBOTS FOR RESHORING Nigel Smith at TM Robotics on robots for reshoring 14 A UK TOOLMAKING FIRST

Moulds invests for high cavity tooling 3 COMMENT

year CONTENTS

Faulkner

Dave Gray on a new look for a new

REGULARS

12 10

34 Industry news 18

INTERPLAS

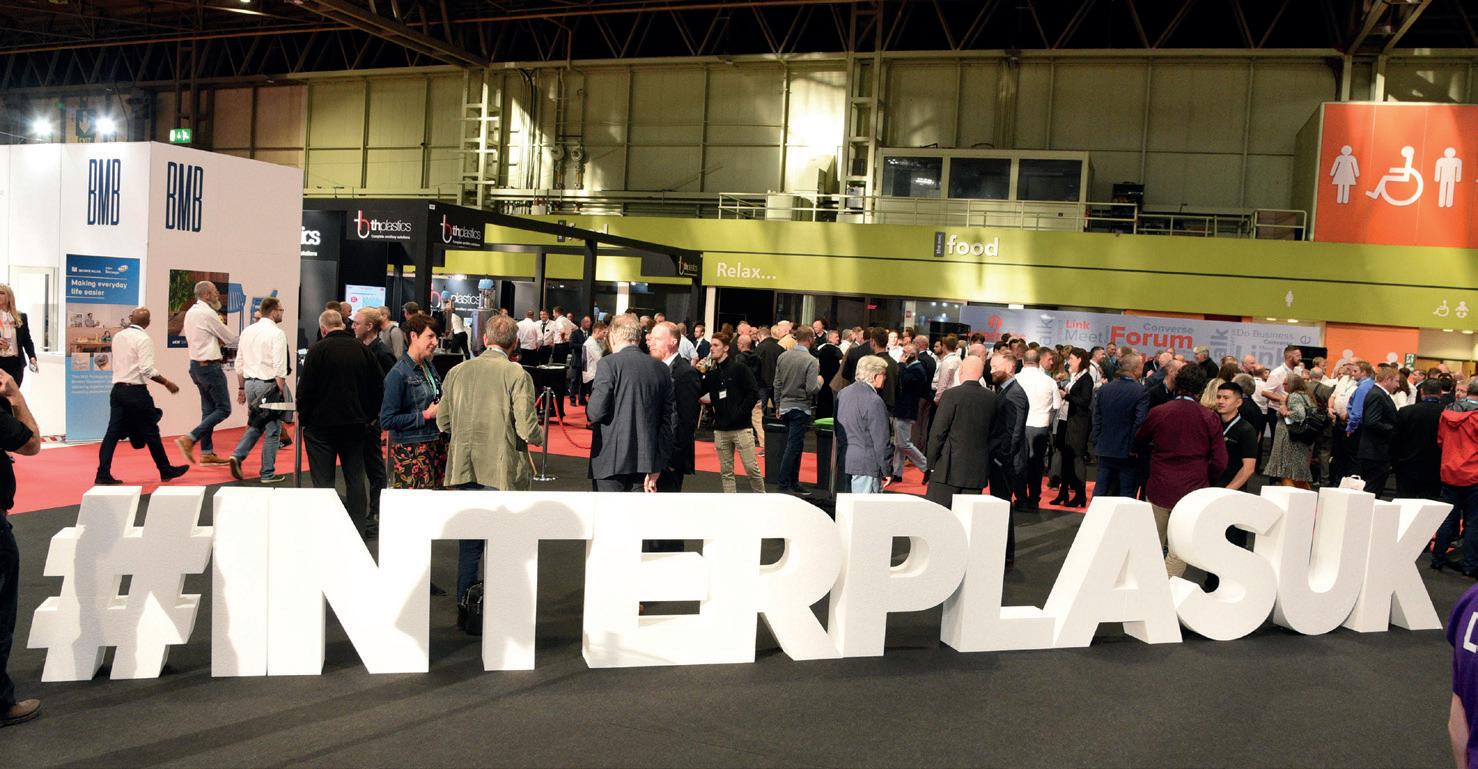

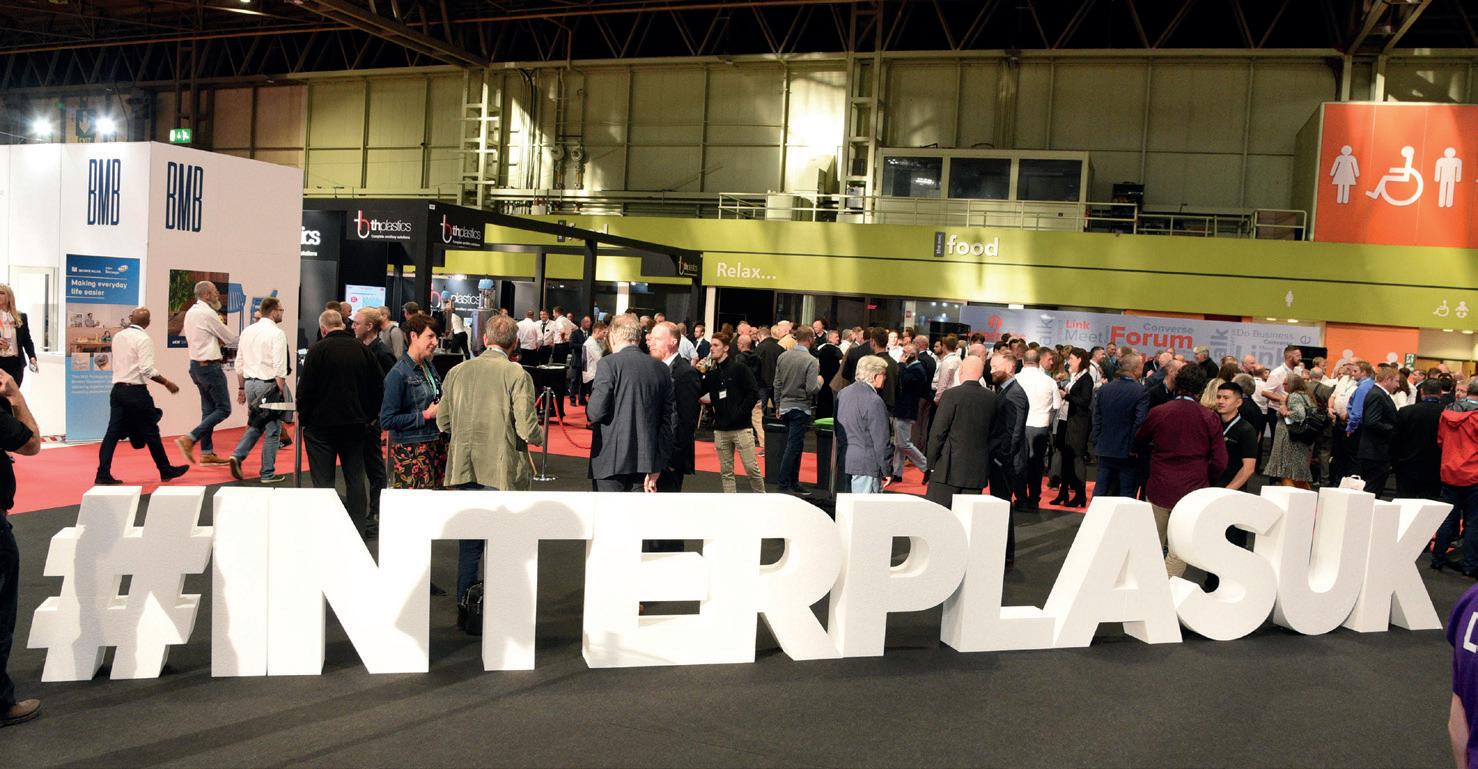

In 2023, Interplas, the definitive and longest running UK plastics exhibition will be celebrating its 75th anniversary. Amidst a host of exciting features and new developments is the return of the PlastikCity pavilion for the third edition since its debut in 2017.

returns to Interplas for 2023

The PlastikCity Pavilion was first introduced at Interplas in 2017 and following a successful second outing in 2021 the show organisers, Interplas Events Ltd, part of the Rapid News Group and PlastikCity are delighted to announce it is back for Interplas 2023, from 26 – 28 September at the NEC Birmingham.

The pavilion is designed to provide opportunities for high-quality UK & Irish suppliers that may not normally exhibit at

the show, for example, suppliers who may not have the resources to occupy a large individual stand, or who wish to dip their toe in the water for the first time to assess the benefits.

As a result of exhibiting in 2017 and 2021 several PlastikCity members have gone on to take a larger place on the show floor with the experience that their time on the PlastikCity Pavilion has given them confidence they can achieve return on investment.

Duncan Wood, CEO, Interplas stated, “We are delighted that Carl, Jess and the PlastikCity Pavilion are back for 2023. It is a big year for Interplas with our 75th birthday celebrations and this pavilion presents a great opportunity for smaller companies to join the party. The PlastikCity Pavilion is a firm fixture on the show floor at Interplas and we look forward to seeing the breadth of suppliers on there that our visitors will be able to connect with.”

Carl Futcher, Managing Director at PlastikCity added, “We’re thrilled to once again bring the PlastikCity Pavilion to Interplas, especially for this special commemorative edition of the show. With over 100 of our partner companies exhibiting, and 20 more SMEs attending alongside us on the pavilion, the show is set to be a highlight of 2023 for the UK plastics industry.

6 www.interplasinsights.com

>

PLASTIKCITY PAVILION

“Teh show is set to be a highlight of '23 for the UK plastics industry”

- Carl Futcher

Wittmann Battenfeld UK shares optimism ahead of INTERPLAS 2023

Wittmann Battenfeld UK has said it has high hopes for a strong performance in 2023, despite the turmoil throughout the globe and in business and supply chains generally. The optimism is reflected the group’s stand booking at Interplas, its largest exhibition space in recent times.

Joint managing director Tracy Cadman said: “The price-performance features of our class-leading and energy saving machines have helped us to retain customer loyalty, and have also attracted significant new business to us. Despite the economy’s common afflictions – extended supply chains and general inflation to name but two – we remain energised at WIBA UK for 2023.”

Interplas 2023, which takes place at the NEC, Birmingham, September 26-28, 2023, is celebrating its 75th anniversary this year. “As the industry well knows, Wittmann is a key innovator – all across the board,” said Dan Williams, WIBA UK Joint MD. “We wanted the extra room at Interplas 2023 to demonstrate the latest innovations on offer, including our one-stop-shop.”

Interplas 2023 will host Wittmann injection moulding machine production cells with proprietary materials handling, automation and recycling hardware and software, as well as Wittmann 4.0 production, allied with the latest TEMI+ software.

“A Wittmann-based production cell is more than the sum of its parts,” said Williams. “Our equipment is designed to produce added synergies when all are seamlessly linked together - reducing customers’ valuable

ABOVE: A positive K Show confirmed the group’s confidence in the return of trade shows post-pandemic.

time, energy and manufacturing costs.”

Wittmann said the decision to book such a major stand at Interplas 2023 comes after Wittmann’s experiences at last year’s K exhibition confirmed the perception that the gap in the calendar created by the pandemic has accelerated a global desire for the latest technologies and production solutions.

“Events and exhibitions are key to this link, for both customers and potential customers” said Williams. “We look forward to welcoming everyone onto our Interplas booth this September at the NEC.”

Williams added: “Day-to-day, Wittmann continues to innovate and provide the market with the best energy saving solutions that moulders can buy. We know that UK government energy help for industry is assured until the end of March 2023 and we trust that that assistance will be ongoing. However - and for added peace of mind - most moulders are now investing in energy proofing their future manufacturing business.”

7 www.interplasinsights.com INTERPLAS

“We wanted the extra room at Interplas 2023 to demonstrate the latest innovations on offer, including our one-stopshop.”

Exhibi t w it h u s

Interplas is back in 2023, bringing with it the opportunity for you to experience the UK’s largest plastics industry exhibition showcasing the full spectrum of plastics processing machinery, materials, software, services and ancillaries in one place.

It’s also the only plastics event in the UK where visitors can see working machinery LIVE on the show floor and where they’ll come to compare, contrast and buy.

With an expected 12,000+ attendees across the three-day event, as well as new features and an expanded floorplan, now is the time to position yourself as a company that can offer solutions, showcase innovation and offer expertise to an audience known for its quality and purchasing power.

26-28 SEPTEMBER 2023

@InterplasUK #InterplasUK www.interplasuk.com +44 (0) 1244 952 519

“The PlastikCity Pavilion is a great way for companies who aren’t regular exhibitors to test the waters and attend the show in a low-stress and affordable manner. You still receive all the benefits of a full exhibitor, and the Pavilion always generates a buzz on the show floor.

“We’ve had strong interest in our 20 available pavilion pods already, so if you’d like any more information regarding the package and benefits of attending Interplas, please get in touch with our team without delay!”

Interplas and PlastikCity are currently taking bookings for 2023 and encourage companies to get in touch quickly to reserve and book their slot as booths on the pavilion are predicted to fill up quickly.

Last year PlastikCity reached the milestone of a decade in business. Starting out with a handful of partners and only five site categories, the PlastikCity platform has grown to include over 260 partners and 400+ categories of equipment and services required in the plastics industry.

PlastikCity was founded by Carl Futcher on 26 October 2012, with the official website launch in May 2013. The idea came about back in 2011, when the plastics industry was facing difficult times; it was evident that managers had less time to meet with prospective suppliers, yet still wanted to ensure they were being offered the latest technology and competitive prices. As the industry started to get busier, time pressures worsened, as companies tried to keep headcount low. Alongside this, it was also clear that everyone, regardless of age, was using the internet to conduct market research, find suppliers, and compare products. Carl decided to start a business and platform that would address these issues, which led to the formation of PlastikCity.

PlastikCity is designed to modernise the way the plastics industry operates, bringing more efficiency to manufacturers in the UK and Ireland by providing a choice of leading suppliers and comparative quotes, all in one step. The company has stuck with its initial principle of only promoting established

UK & Ireland based businesses – known as PlastikCity Partners – with high-quality equipment and services. All PlastikCity Partners are vetted and must meet certain criteria before they’re able to join the site, ensuring users can buy with confidence.

As well as helping plastics processors to source equipment and services to keep their mould shop running, PlastikCity also assists all sorts of companies in finding suitable manufacturers for moulding projects in the UK. This has involved helping to reshore many moulding projects and bring more manufacturing back from the Far East to the UK, of which PlastikCity and its teams are huge supporters.

Please contact Will Clarke at will@ plastikcity.co.uk for more information and to reserve your spot on the pavilion for September 2023. This opportunity is available to current PlastikCity Partners only.

For all other Interplas booking enquiries contact mandy.obrien@rapidnews.com.

9 www.interplasinsights.com INTERPLAS

“It is a big year for Interplas with our 75th birthday celebrations, and this pavilion presents a great opportunity for smaller companies to join the party.”

ON

THE COVER

EAST MEETS WEST IN BOLEPROPLAS SUCCESS STORY

Bole, a supplier of IMMs from China, has made significant inroads into the UK market since entering the fray a few years ago. Dave Gray caught up with Hardeep Khera, general manager, Bole UK, to find out about his work with injection moulder Proplas 2008, and how the relationship set the benchmark for Bole’s UK presence.

IMAGES: Khera said the Bole machines supplied in the UK tend to be of a higher spec than those sold domestically.

10 Q&A

DG: So Hardeep, the partnership with Proplas 2008 started with the firm taking a trip to Chinaplas in 2016 right? What were they looking for on that trip, and what did they find?

HK: That’s right, they went to Chinaplas, not with the intention of looking for machinery, but just looking for toolmakers and moulds more than anything. But they’ve got a really good friend out there who introduced them to Bole. As a result of a bad experience in the UK that they had with an OEM, they also wanted to look to at Chinese brands, and have a look at the technology that they were bringing. So they kind of stumbled across Bole. They had a look at the machine, they didn’t have any intention of buying the machine, but they had a look at it, and they noticed the quality. And I think they saw the

They’ve invested $25 million dollars in a short period of time.

DG: And so going back to Proplas 2008, you put together a machine replacement program, is that right? What did that involve, in their case?

HK: Well, as I said, the first machine that was purchased was the 520, which was really a trial and error machine, they wanted to see what it was capable of. And by the way, that first machine is still running really well today. So after that, they started purchasing more machines, but at the same time, we started to increase the specification on those machines for them. They don’t have to be just standard, no-frills machines. We can increase the spec to run more faster cycling jobs, or more technical jobs for example. So

of both worlds. You know, I always say to people that Chinese machines are like jigsaw puzzles, you can pretty much just add on whatever you want and keep changing it to whatever you need it to be. The addons are pretty much endless. Due to cost, the options that people might want on European machines aren’t always feasible. That cost tends to be a lot lower on Chinese machines, giving people the chance to try those add-ons.

DG: Do you find that a lot of the sales that you’ve seen in the last couple of years are for commodity applications? Or are your machines being used for a mix of commodity and highly technical work?

HK: I always say to people, there is always a cheaper machine out there, just as there’s

direction the company was going in. So that really encouraged them to make the first investment in a 520 tonne machine. And then from there it just snowballed. They realised that Bole were challenging the stereotypes of Chinese machines, and that the quality is there, and is progressing in the right direction.

DG: So are those stereotypes a problem for you? How do you challenge them?

HK: It’s similar to when Italian machinery first came into the market. Obviously, the German brands dominated the market, and when Italian brands entered the fray, there was some skepticism there, which is no longer there today, because the quality has been proven. And of course, China as a country is so quick to progress. They want to compete, so they’ll bring in the best engineers, they’ll bring in the best designers, and just give them the creative freedom to build the machine that’s going to compete.

DG: And are Bole still investing in R&D?

HK: By the end of this year, they’ll have a second plant up and running, which is going to be three times the size of the current plant. And it’s going to triple the current output, from 6000 to around about 18,000 machines worldwide. And they’re also looking to bring some suppliers in-house, building factories for their other equipment. That gives them more control over lead times and production for things like screws and barrels, servo motors, as well as testing.

the later machines that they purchased were quite high spec in order to allow them to run far more difficult jobs. For example, one of the machines is a 550 tonne machine, with a separate robot, and it’s running the cycle time around 13 seconds, which is quick for a large machine - that rivals some of the European brands out there. But it was definitely a learning curve for both of us.

DG: So how does that work? Do you feed the requests back to China and then they make the modifications? Or is it stuff that you can do at your end?

HK: A lot of it comes from China. So our machines in the UK, they’re a higher spec compared to some of the Bole machines in other countries. And that’s that’s reflective of what we found in the UK. We listened to what customers wanted on the machines, we listened to what customers might have needed on the machines. It’s great to represent a company that takes ideas from its international teams and puts those changes into effect.

DG: And what do you think about some of the machines larger European brands are launching? In recent times, a couple of major European brands have brought machines originally targetted at the Asian market into the UK and Europe, for those customers who just need a quality, ‘no frills’ machine.

HK: Probably the best way to say it is that with Bole, we think we can offer the best

always going to be a more expensive machine. It’s about finding the right machine with the right service. As I said, the machines we sell are capable of being adapted to a range of complex and technical jobs.

DG: And as for the reshoring that we’ve seen in recent years, is it just a moment that’s going to come and pass? Or is it a long term trend?

HK: It’s a difficult one, I think. At the end of the day, everyone needs to look at the prices they’re offering to their consumers. If there is a country that does it cheaper, people tend to go that way. Because obviously, it’s difficult right now, you know, a lot of companies aren’t making profit, a lot of companies aren’t breaking even. So wherever they can save a few pennies on a project, you know, they will look at it. One of the major factors that influenced reshoring was container prices increasing massively during the pandemic, it went from $2,000 to $20,000. But if you have a look at it now, container prices are actually back around $2,200 compared to what they were during COVID. Hopefully a lot of the trade moulders have built relationships with UK customers where price isn’t the only important factor; reliability and quality are major benefits.

DG: And part of the ambition for Proplas 2008 was to upgrade some really old machines and start getting some energy savings. So how has that turned out for them? >

11 www.interplasinsights.com

“You know, I always say to people that Chinese machines are like jigsaw puzzles, you can pretty much just add on whatever you want and keep changing it to whatever you need it to be.”

HK: They’ll have a few more machines up for replacement this year, which will continue to help them bring their energy usage down. It’s a case of saving where we can, even the small differences: not just machinery, but lightings and fixtures, you know, it all makes a difference at the end of the day.

DG: And when it comes to upgrading machinery, it’s no small undertaking no matter what brand you buy from. What support is there for moulders?

HK: We’re quite fortunate to work with finance brokers in the UK, so we can offer really competitive finance deals. We also work quite closely with a Birminghambased grant application company, who are able to find suitable grants in order to help UK moulders just to recoup a little bit of their money as well.

DG: So for Proplas, how have the Bole investments helped with their long-term strategy?

HK: Since COVID, turnover has been increasing. So they’re clearly doing something right on that side. But their focus right now isn’t so much on sales, it’s on finding the savings. And I think that’s where they really benefit from their investments.

DG: And did the machines help them to get a foothold into any new markets?

HK: Well, by bringing in more energy efficient machines and more reliable machines, they’ve been able to win big UK and potential European contracts. They’ve actually grown their sales revenues massively over the last few years. The larger capacity does allow them to go on the hunt for larger contracts and new business. It’s really good news for UK manufacturing.

DG: So finally, what’s the next step in Bole’s journey?

HK: Expansion and investment. We’re still a relatively young company, but over the last few years we’ve managed to get a foot in the door in the UK market. So we’ll be looking to build upon that. And obviously Interplas is coming up this year. Our first Interplas really helped put us on the map. So we’ll be looking to build on the success of that show. And finally, we want to keep challenging the stereotypes around Chinese machines, and we’ll continue to do that by demonstrating the quality and longevity of the Bole brand.

RESHORING WITH ROBOTS

Manufacturers hope that, by reshoring, they can bring supply closer to demand in order to achieve shorter lead times and better service against the current global supply chain issues and increasing import costs. Here, Nigel Smith, CEO of industrial robot specialist TM Robotics, the official distributor of Shibaura Machine, explains the vital role of advanced robotics in these trends.

“Mama, I’m coming home,” Ozzy Osbourne once sang, “here I come, but I ain’t the same.” This could apply to manufacturers that are trying to quickly reshore production back to their own countries, under slogans such as “buy British” in the UK. In doing so, companies hope to mitigate supply chain issues caused by the after-effects of the COVID-19 pandemic, Brexit, the Ukraine conflict and material shortages.

But, to paraphrase Ozzy, manufacturing is no longer the same. Gone are the preCovid days when managers and suppliers could take supply chains for granted, and manufacturing was outsourced to countries like China at a significant profit. Instead, businesses are under pressure to reshore their production while keeping it economically viable, reducing lead times and improving quality of service, despite the supply chain disruptions.

However, according to the London School of Economics, robotisation might

www.interplasinsights.com ON THE COVER

12

Q&A

LEFT: Nigel Smith, CEO, TM Robotics

play a vital role in helping manufacturers bring their operations back home to the UK.

High production

Take injection moulding for instance, a manufacturing process that Digital Journal predicts will see booming growth between 2023 and 2030. Injection moulding is used to manufacture a huge variety of plastic parts — everything from medical devices to takeaway food containers — with good repeatability, consistently high production with low waste, and a low-cost-per-part. However, the injection moulding process can be expensive, overall. Estimates range from £3,000 to £100,000, relative to the size of the product, the volume of manufacture and the speed of production.

How can automation and robotics lower these costs? First, let’s consider that 90 per cent of the costs of injection moulding are attributable to the electricity used

to power the injection moulding machine itself. Machines powered by a hydraulic motor are often favoured because they produce higher energy levels and higher injection pressures, and the initial cost of the machine is lower.

But, there are disadvantages. The machine’s hydraulic power is connected to an electric power unit, so works at maximum capacity during the entire moulding process and even consumes energy when idle. These factors significantly impede the energy efficiency, and are why manufacturers should instead consider all-electric machines.

AUTOMATION & ROBOTICS

ABOVE: Injection moulding, used to manufacture plastic products for a range of sectors, is expected to see significant growth over the coming decade.

Energy efficiency savings

Let’s examine the case of one TM Robotics customer, a large UK manufacturer of plastic containers. The company relies on Shibaura Machine’s all-electric injection moulding machines (IMM) supplied by TM Robotics. Performance benefits of the IMM include a range of clamping force from 50 to 2,500 tons, which can be calibrated by a digital direct screw transfer (DST) control for added production flexibility. While all-electric machines are initially more expensive with lower injection pressures, they greatly outperform hydraulic versions in a variety of other ways.

Advantages of all-electric IMMS include higher rates and speeds of injection, because they rely on toggle clamping rather than direct pressure clamping, which is better for high-speed injection moulding. Other benefits are improved dry cycle times and the overall stability of the mould itself.

But what about the energy savings?

Performance tests by Shibaura Machine measured its EC650SX-61B IMM, with a clamping force of 650 tons, against a hydraulic servo machine.

It delivered a 51 per cent energy reduction. Another EC-SX model, the 1,800 ton

13

“According to the London School of Economics, robotisation might play a vital role in helping manufacturers bring their operations back home to the UK”

www.interplasinsights.com

RIGHT: The TVL700 6-axis robot >

AUTOMATION & ROBOTICS

ABOVE: The SXIII can integrate with robots like the TVL700

BELOW: Shibaura Machine’s SXIII injection moulding machine

EC1800SX-155B, was tested against a competing all-electric IMM. Although both machines had the same energy consumption, the Shibaura Machine IMM delivered a faster cycle time, for overall energy efficiency savings of 30 per cent.

Bringing it all back home

Meanwhile, the TM Robotics’ customer has experienced 20 to 40 per cent lower running costs and 35 per cent faster cycle times with the all-electric IMMs, plus a lower cost-per-mould.

Thanks to these benefits, the manufacturer of plastic containers has ordered several more Shibaura Machine IMMs from TM Robotics, specifically its newest SXIII range of injection moulding machines. An additional benefit is that the SXIII can be easily integrated with Shibaura Machine robots like the TVL industrial robot range that are compact, lightweight and space saving. Each robot has varying reach and payload specifications, and a longer arm length compared with previous robot ranges.

The advantages of all-electric injection moulding machines, like the EC-SX and SXIII, demonstrate how automation and robots can help manufacturers bring their operations back home to the UK. Reshoring can be achieved with cost- and energy-efficiency as well as productivity benefits — even if, as Ozzy sang, things “ain’t the same.”

A ‘UK-first’ for multi-cavity high production toolmaking

In fact, the group believes the cell is “very likely a world-first”, which it hopes will enhance the quality and efficiency of its mould tool manufacturing. The production cell particularly supports multicavity, high-production tooling.

The manufacturing cell will feed both the 5-Axis and spark erosion machines, enabling automated changes of electrodes and of workpieces, further increasing capacity for high cavity tooling.

For example, the tool pictured has 16 impressions, and is guaranteed for a million shots and moulds at a seven second cycle time. Faulkner Moulds recently reduced the cycle time on a new 12 impression packaging tool for a household name, from a target of 8.5 seconds to just 6.98 seconds.

www.interplasinsights.com

BRITISH TOOLMAKER FAULKNER MOULDS HAS INSTALLED WHAT IT CLAIMS IS A UK-FIRST ROBOTIC PRODUCTION CELL AT ITS YORKSHIRE-BASED TOOLROOM.

ABOVE: The new cell further increases capacity for high cavity tooling

RIGHT: Skills and training are core to the operation at Faulkner Moulds

14

Faulkner Moulds’ managing director Duncan Faulkner said: “Our success lies in focusing on three things –customer service, skills and training, and technology. We never stay still – we are constantly innovating and finding ways to move forward for our customers”.

In 2022, the three-times UK ‘Toolmaker of the Year’ winner also took delivery of a new Hurco TM8i 2 axis CNC turning centre (lathe) and Mitutoyo Crysta-Apex S CNC Co-ordinate Measuring machine. The CMM machine responds to increased demand for ever tighter tolerances in toolmaking, allowing highly accurate 3D measurements at high speed. Dedicated software algorithms eliminate even miniscule geometrical imperfections in the guideways.

The turning centre has in-built features to ease programming, enhance machine speed and ensure outstanding accuracy and surface finish. Faulkner Moulds’ recent experience in high precision

INJECTION MOULDING

turning includes projects for the medical, packaging and industrial sectors.

Other recent investments include a new wire erosion machine and a new CNC sparker that runs to three microns accuracy all day.

The three newest machines are already in daily use, helping Faulkner Moulds respond to increased demand for high precision multi-cavity toolmaking and extreme measurement accuracy.

Last year the firm won the Business for Calderdale ‘Manufacturer of the Year’ Award. The awards celebrate local business achievements, shining a spotlight on businesses that have “gone above and beyond”.

Faulkner Moulds moved into the Calderdale area in 2012 and, after implementing a Business Plan focussing on technology and skills, the business has flourished.

Duncan Faulkner, Managing Director, said: “I am so proud of our team and all we have achieved together. We have embraced ‘world firsts’ in terms of technology and have pioneered new skill sets. We’re absolutely delighted to have won this award and are proud to be part of a thriving local economy with many varied industries and manufacturers in this area. Our goal is to be known as the UK’s number one choice, especially for multicavity and complex tooling”.

Caroline Faulkner, Director, added: “The team truly deserve this recognition as they have been with us every step of the way, from our roots as a one-man band, through to national recognition as 3-times UK ‘Toolmaker of the Year’ and establishing ourselves as a pioneer in UK toolmaking technology and techniques”.

Celebrating the contribution of manufacturers to the Calderdale economy, the award recognises SMEs that have delivered consistent growth and demonstrate innovative products and processes, outstanding initiative, and efficiency.

15 www.interplasinsights.com

“One tool has 16 impressions, and is guaranteed for a million shots and moulds at a seven second cycle time”

INJECTION MOULDING

MEET THE MOULDER: WSM PLASTICS

WSM PLASTICS IS ONE OF THE UK’S MANY MOULDERS AT THE FRONT LINE OF THE PUSH TO KEEP THE COUNTRY’S MANUFACTURING SECTOR COMPETITIVE. DAVE GRAY CAUGHT UP WITH NEIL PAICE, SALES MANAGER AT WSM, TO DISCUSS THE LATEST TRENDS AND CHALLENGES FACING THE LANCING-BASED FIRM.

16 www.interplasinsights.com

MAIN IMAGE: WSM Plastics is based in Lancing

TOP RIGHT: The firm offers a well-equipped moulding operation RIGHT: WSM also has toolmaking facilities in the UK and overseas

DG: What are some of the customer trends that you’re seeing in moulding enquiries at the moment?

NP: At WSM, we specialise in high-end materials and applications with more requirements than a straightforward plastic moulding. So for example, our customers might need some additional additives for strength, particular colours, something a bit more complex. As a result of our capabilities in that area, we do quite a bit of work in the aerospace industry on things like seating and you know, and the peripherals around the aircraft: things like USBs, monitor surrounds, etcetera. Naturally the aerospace market is

INJECTION MOULDING

there have been some real headaches there.

DG: It sounds challenging, but you’ve weathered that particular storm, which is great. You have a toolroom too right? Tell me what you’re seeing coming through the doors there?

NP: Well we have a facility in China that makes tools and as you say, we have a UK facility that makes a lot of tooling. During the pandemic of course we saw more people trying to source British-made tools. So that was good news for us, because it meant our tool room was busy. As we’re coming out of the pandemic, more people are saying they want a hybrid approach. So they would like tools made in China, but production in the UK – and the maintenance of those tools dealt with here. So there is some drift, but we’re also retaining some of that business here in the UK. And at WSM, we are lucky that we have some extremely talented toolmakers, some of the best in the country, and they can make some really quite exquisite tooling. Which is great, because we like the more specialist plastic mouldings where a complicated tool is required. So while we’re seeing a trend again towards part-sourcing the tool from China, we’re also seeing more interest in using British engineering to solve problems and improve quality.

starting to pick back up again after COVID. During the pandemic, as you can imagine, the aerospace market was very downtrodden, and limited for us. Last year, it started to show signs of coming back, and this year it’s starting to increase quite considerably. So demand for aerospace materials and applications is growing right now. That said, it’s been hard work, keeping up with material price increases, and trying to

manage the customer through the impact of that. In recent months that does look to be stabilising a little bit, but we went through a period last year where we were getting price increases from suppliers every two weeks. And quite often they were sending materials in under order and those prices had gone up compared to the day we’d placed the order. So they'd refuse to deliver unless we paid the additional price. So

DG: Let’s talk about Interplas now. What are you hoping to talk to customers about during the three days in Birmingham, and why is it important for UK moulders to exhibit?

NP: It’s a platform for all the plastic manufacturers, so you get to see what the competition is up to, and understand what trends they’re seeing. The primary thing, however, is an exercise in sourcing new business. We >

17 www.interplasinsights.com

“We are lucky that we have some extremely talented toolmakers, some of the best in the country, and they can make some really quite exquisite tooling.

”

INJECTION MOULDING

do want to become a more global company, which would give us a competitive edge in the UK, so we want to meet other global businesses. And we also want to meet aspiring startups who have secured funding for new products. We’re very keen to be there at the beginning of their journey, and lend our support and technical knowledge in both plastics and toolings.

DG: We’ve talked about supply chain challenges. Now we’re facing a new obstacle, with energy prices being what they are. Has it given you an opportunity to look at your processes in house? A lot moulders are making changes, whether that be through capital investment, or through process changes, or even behavior changes in-house. Have you been able to do anything like that?

NP: Absolutely, we’re continually looking at how we make things and how we can make them more cost-effective for our customers. And internally, we have a team that are almost entirely focused on that, to try and see how we can improve. So for those increased costs, we can offset some of those by being better at what we do. Part of that process involves us reviewing what we’re doing. We’re looking at all sorts of things like recycling our waste, but more than that, we’re exploring options to offer our customers return services, for instance. That’s all a work in progress at the moment, but they’re all opportunities that we’re looking at in a way that does justice to the cause, and makes a positive impact.

DG: Finally, what about incorporating recycled materials? Is that something that you’re seeing more demand for? And is it something that you can cater to?

NP: That’s a good question. A lot of what we do, because the applications use more complex materials, they can sometimes be less recyclable than perhaps off-the-shelf, standard materials. But at the same time, those components don’t tend to be the things that end up in landfills and waste streams. They’re specialist plastics with an extremely long lifespan, destined to be used over many years.

I have to say, in the most part, the majority of plastic is now recyclable. And for me, it feels like it’s an education thing as much as anything else. Let’s stop talking about how bad plastics are for the environment, because in actual fact, most plastics are highly recyclable and highly productive in the functions they’re used for. So let’s educate people not to just chuck these things into landfill, let’s make it clear that these products can be recycled, and they can be reused and upcycled as well.

And perhaps, this focus on plastics being terrible is more down to our need to just throw something away rather than think about what we can do with it afterwards. We’re very conscious as a business that we recommend recycled and recyclable materials wherever we can. We find that new startup businesses are very keen on incorporating those things. Top of their list is always “let’s use recycled and recyclable materials in the products we're proposing to make in order to safeguard future generations”. We’re on board with that fully. And we’re very, very keen to recommend those things wherever we can and work with businesses to try and help reduce those carbon footprints.

Antimicrobial

solutions FOR MORE SUSTAINABLE PLASTICS

Kimberley Cherrington, International Marketing Manager, Microban International

Kimberley Cherrington, International Marketing Manager, Microban International

Plastic is one of the most versatile materials on earth, being used in a huge array of different products and industries. Its revolutionary discovery has led to the development of diverse, flexible and costeffective materials that have made previously unattainable products available and affordable to people all around the world. The demand for plastic is continuing to

skyrocket, but in recent years its reputation as a wonder material has been tarnished by its potential environmental repercussions.

Getting to the source of the problem

The issue lies in the fact that plastic items are typically short-lived and easily disposed of, so as soon as they appear less than perfect, they are quickly replaced. One of

18 www.interplasinsights.com

MASTERBATCH & ADDITIVES

susceptible to contamination. Additionally, items subject to warm and moist conditions with a plentiful energy source, such as chopping boards, food storage containers, refillable shampoo bottles and even home appliances, provide the ideal environment for bacteria and mould to flourish. These microbes not only affect the overall aesthetics of the product, but they can even lead to diminished performance, leading to premature disposal and replacement.

On top of this, some plastics contain high levels of plasticisers that act as a carbon-rich food source for bacteria and fungi, and others have a molecular structure that makes them particularly susceptible to the penetration and accumulation of bacteria, mould and mildew. Altogether, these factors make it very difficult to prevent stains, odours and degradation on plastic goods, which in turn contributes to our throwaway culture and adds to the volume of plastic waste that ends up in landfill.

the main culprits here is a build-up of microbes on the product’s surface, which leads to premature degradation and unpleasant odours and stains. Some plastic items are more prone to microbial growth than others, because of their usage, environment, and lack of accessibility for cleaning. For example, hightouch products and surfaces – like soap dispensers, medical carts and even airport security trays – are constantly exposed to large numbers of people around the clock, making them particularly

One way to address these issues is to thoroughly clean surfaces with disinfectants on a routine basis. However, many plastic components are hard to clean frequently because they are out of reach or particularly fragile, such as the brittle grout in showers, which cannot withstand constant scrubbing or corrosive detergents. Added to this, common disinfectants only offer limited residual activity once sprayed onto a surface so, as soon as a product is used again, it becomes re-contaminated with microorganisms. For shared products, contamination events will be very frequent, and regular cleaning practices are simply not adequate – or realistic – for keeping microbial numbers below the recommended threshold. >

19 www.interplasinsights.com WWW.PLASTRIBUTION.CO.UK | EXPERTS IN THERMOPLASTICS

MASTERBATCH & ADDITIVES

A comprehensive approach to product protection

Minimising or even preventing microbial contamination is a remarkably effective alternative that, in conjunction with regular surface cleaning regimes, can help to overcome these challenges and extend product longevity. Antimicrobial additives are increasingly being adopted by a whole host of industries, and can be seamlessly incorporated into a wide range of polymers at the point of manufacture without affecting the product’s aesthetics or performance. They therefore become an intrinsic part of the plastic that will not wash off, wear away or succumb to rigorous cleaning, working 24/7 to limit the growth of odour- and stain-causing microbes for the entire lifetime of the product.

One of these innovative solutions is LapisShield by Microban, from Microban International, the global leader in built-in antimicrobial product protection. LapisShield has been specifically developed for water-based coatings that are applied to polymer products, and is proven to inhibit bacterial growth by up to 99.99%, as well as limiting the growth of mould and mildew. It achieves this through disrupting cells’ internal enzymes, blocking metabolic pathways, and creating an inhospitable environment where these microbes cannot proliferate.

Ascera is another next generation antimicrobial offering from Microban, and is designed for use in olefinic polymer masterbatches and solvent-based coatings. This additive has antibacterial efficacy and works by interfering with the absorption and conversion of nutrients to inhibit bacterial cell

growth and survival. Ascera represents the company’s commitment to developing a new class of sustainable chemistries, as it is based on an active ingredient inspired by nature.

Adding to this impressive list of advantages, both LapisShield and Ascera are completely free from heavy metals, further alleviating environmental concerns and giving added peace of mind to both manufacturers and customers.

Antimicrobial additives: adding up to a sustainable future Consumers are increasingly expecting higher quality, longer-lasting goods, as well as becoming more aware of the ecological issues surrounding plastics in general. Coupled with

this, governing authorities are formulating ever-stricter laws aimed at protecting the environment and preventing pollution. This puts pressure on manufacturers to find ways of making their plastic products more environmentally friendly, including extending their lifespan and durability. Built-in antimicrobial technologies such as those produced by Microban have great potential for sustainable product development, and could ultimately go a long way towards reducing the volume of plastic waste entering the environment, helping to shape a greener planet.

20 www.interplasinsights.com WWW.PLASTRIBUTION.CO.UK | EXPERTS IN THERMOPLASTICS

Kimberley Cherrington, International Marketing Manager, Microban International

30 years specialising in complex tooling solutions

Design for Manufacture principles

Continual investment in latest skills and technologies

Product design consultation service

ISO9001: 2015 certification

5-Axis Mikron high-speed graphite and hard metal machining centre

Mitutoyo CMM

Sodick spark erosion

Fanuc wire erosion

Current SolidWorks/SolidCAM 01422 371072 info@faulknermoulds.net faulknermoulds.net

Times

Toolmaker of the Year

»

»

»

»

»

»

»

»

»

»

Three

UK

quality, on time,

time,

professional

and

in

Specialists

“ Faulkner Moulds are a rare breed in this field. Excellent

every

no exceptions. I have nothing but praise for this

toolmaker.” Sales

Marketing Director, manufacturer

leisure and automotive industry

in multi-cavity high production tooling with fast cycle times.

Award-winning oral medical device twin-shot tool.

To enter the draw to win the half-price discount, email us at sales@jenco.co.uk, to tell us how you would use this product if you won!

With our specially designed loss-in-weight control function, the ColorSave 1000U-3 Doser gives complete precision and control, as well operational ease and zero set-up time. This new, innovative design minimizes the risk of under or overdosing materials.

The UKs leading designer, manufacturer and refurbisher of screws and barrels for the plastics and rubber industry

Screws:

• Single, parallel and conical twin. Multi start & mixing.

• Specialist abrasion & corrosion resistant screw coatings.

• Designs and specifications to suit your specific processing and production requirements.

Barrels:

Bimetallic, through-hardened and nitride specifications. Air, water and oil cooled, adaptors, flanges and breaker plates.

Feed sections and liners:

• Smooth and grooved bores, nitride and bimetallic specifications.

Refurbishment: Screw flight rebuild and barrel bore honing. Fast track repair service.

Certification:

• ISO 9001: 2015

On site Services and technical support: Wear check surveys, measure and record for manufacture, installation and allignment.

www.magog.co.uk

To discover more about our products and services, contact Magog: +44(0)1920 465201 | enquiries@magog.co.uk

Process Experience | Manufacturing Expertise | Engineering Excellence

to the risk of material overdosing in injection moulding

ColorSave 1000U-3 Doser HALFWINPRICE DISCOUNT

By emailing us your answer you are entering the competition and agreeing to our terms & conditions which can be seen at

www.jenco.co.uk Say goodbye

with the

01933 235910 | www.jenco.co.uk

POLYMERMAN

How2022affectedmaterialsprices... and what's in store for 2023

In his first report of the year, Mike Boswell, managing director, Plastribution, takes a deep dive into the influences on resin prices last year, and looks ahead to 2023.

The market in 2022 was dominated by the Russian invasion of Ukraine, which was an event that came as a complete surprise to the whole world in February. What for Russia, was expected to be a short conflict has subsequently become a long battle in which the support for Ukraine from the West has resulted in retaliation from the Russians in the form of energy sanctions. Whether inflation was already becoming an issue in developed economies or not, the spiralling energy costs resulting from the Russian energy supply restrictions caused significant inflation with rates typically in and around 10%. Central banks in the US, Europe and the UK then applied significant hikes in base interest rates in an attempt to curb inflation. Here in the UK the Bank of England rate has already jumped up 3.4%, with more likely to come, albeit the impact of these changes on a generation of consumers who have never experienced more normal borrowing rates is unproven.

In the crude oil and petrochemicals sector the risk of global recession far outweighed any initial concerns about scarcity of oil and gas supply from Russia and prices fell dramatically from the record highs recorded just before the middle of the year, with the ‘polyolefins basket’ price falling some 25% by the end of December.

Energy costs became a key topic both for polymer producers and polymer converters with each sector defined as energy intensive. For polymer converters in the UK, it was commonplace to hear of electricity price increases of up to 400% whenever fixed price deals were up for renewal, however some of this extreme cost inflation has been offset by falling raw material costs and the possibility of some temporary government support. Polymer producers made some valiant efforts to pass through their energy cost increases, often in the form of surcharges, but these became unhinged by the challenging market dynamics.

Whilst the burgeoning supply of PP and PE from Russia was quickly aborted following the Russian invasion of Ukraine, the combination of diminished demand and revived PE supply from the USA, following constrained supply from that region in 2021, ensured that supply was plentiful. Furthermore, falling East-West shipping costs in H2 enabled the normal movement of plastics to resume on the basis that it is once again economically viable.

Despite the challenges of 2022, the UK plastics sector has once again demonstrated resilience in the face of significant challenges.

UK Economy & Brexit

Subject to confirmation from HM treasury it is likely that the UK economy will have moved into recession, by recording at least two consecutive quarters of negative GDP growth. Many economists predict a short and shallow recession lasting between 12 and 24 months and likely to see annual GDP growth dip into the -1.5% to -2.0% range. The impact on the industrial sector may be less severe, as other sectors such as retail and hospitality bear the brunt of a fall in consumer spending.

One element that is difficult to isolate is the move from ‘just in time’ to ‘just in case’ and back to ‘just in time’. The move to ‘just in case’ resulted in part from Brexit and then was continued as a result of supply chain disruption and abnormal demand during the Covid-19 pandemic. The return to ‘just in time’ is driven by a combination of falling prices and recession; as prices fall there is no financial incentive to keep inventory and companies trend towards cash rather than inventory in times of economic uncertainty. This situation may go some way to explain the very pessimistic outlook being recorded in the UK Manufacturing Purchasing Managers’ Index (PMI).

The S&P Global/CIPS UK manufacturing PMI published on 3.1.23 included the following commentary: “The seasonally adjusted S&P Global/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) fell to a 31-month low of 45.3 in December, down from 46.5 in November but above the earlier flash estimate of 44.7. The PMI has remained below the neutral 50.0 mark for five successive months (fig. 1). Excluding the series lows registered during the first pandemic lockdown, the current PMI reading is one of the weakest since mid-2009. The seasonally adjusted S&P Global/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) fell to a 31-month low of 45.3 in December, down from 46.5 in November but above the earlier flash estimate of 44.7. The PMI has remained below

Who is ‘Polymerman’?

Mike Boswell is Managing Director of UK materials distributor, Plastribution, as well as the Chairman of the British Plastic Federation’s Polymer Compounders and Distributors Group and its ‘BREXIT Committee’. ‘Polymerman’ is the title used for announcements made via his Twitter account. This column is compiled using data from PIE (Plastics Information Europe) www.plastribution.co.uk | www.pieweb.com

23 www.interplasinsights.com

FIG 1 >

the neutral 50.0 mark for five successive months. Excluding the series lows registered during the first pandemic lockdown, the current PMI reading is one of the weakest since mid-2009.”

Already two years have passed since the UK finally left the EU, and much of the fallout became inextricably combined with the broader impact of the Covid-19 pandemic on the UK and global economy. The trade agreement made on 31.12.20 removed the imposition of duties of goods manufactured in the EU27 and UK passing from one to the other. However, administration has become burdensome as import and export regulations have been more strictly imposed, and the Northern Ireland situation continues to generate controversy.

Political events in the UK caused economic turmoil and in particular the short stint of service by Liz Truss as Prime Minister and Kwasi Kwarteng as Chancellor of the Exchequer caused untold grief as their ‘mini budget’ was announced. The ensuing reaction from the financial markets enabled a rapid correction and much confidence has now been restored through the appointment of Rishi Sunak.

Nonetheless, international markets remain concerned about the future prospects for the UK economy, and hence the continued pressure that is being placed upon the value of the GBP against other leading currencies.

Logistics

As illustrated in figure 2, the extreme inflation in East-West container shipping rates peaked in mid-2022, since which time prices have fallen back to near normal levels. And as illustrated in the table below, high shipping costs in the context of typical polymer prices became prohibitive and effectively isolated Europe from the perspective of importing more competitively priced polymer, where exporters did not have the protection of shipping rates that were contracted. It should be noted that shipping rates within Europe have declined less, and this is having an impact on trade within the continent. Finally, it is possible that a similar East-West shipping crisis could recur, as China relaxes its Covid-19 restrictions with the risk that much of the Chinese manufacturing sector is shuttered in an attempt to control the spread of the virus.

Within the UK, the shortage of HGV drivers appears to be less acute, with a combination of more drivers and the economic slowdown both contributing to more availability of resources.

Exchange Rates

Following the invasion of Ukraine by Russia, the USD gained strength as there was a market move to what is perceived to be a safe currency (see figure 3). The negative impact of the UK ‘mini budget’ is clearly evidenced in the September performance, with intra-month GBP:Euro falling well below 1.10, although the predictions of sub-parity against the Euro and USD were never realised. Most recently the USD has weakened as concerns grow about a slowdown in the US economy.

(Source Bank of England https://www. bankofengland.co.uk/monetary-policy/the-

interest-rate-bank-rate)

After almost 14 years, interest rates in the UK have increased significantly, as the Bank of England takes action to reduce inflation from the current rates of 10% to the target level which is below 2%. Whilst the objective is to reduce consumer spending, businesses who raise working capital through borrowing are also facing significant increases in the cost of financing.

Crude Oil

Crude Oil prices are often regarded as a proxy for the global economic outlook and following a long-term recovery from the

24 www.interplasinsights.com

ABOVE: FIG 2

FIG 4

FIG 3

low point that ensued from the Covid-19 pandemic hitting the Western World in April 2020, prices have been falling since mid2022 as concerns about global economic growth continue to mount.

Feedstock

The volatility of aromatic feedstock continued in 2022, with both Benzene and Styrene monomer recording large swings, which were almost entirely independent of Brent Crude and Naphtha.

In terms of olefins and to some extent Naphtha, the market situation was quite unusual, in that a strong recovery in demand for transport fuels coupled with supply restrictions of refined products from Russia resulted in refineries operating at exceptionally high rates. Furthermore, the high demand for refined fuels from Europe resulted in exceptionally high refinery margins, which could easily be observed through the persistently high

retail prices for petrol and diesel at a time when crude oil prices were moderating. Since petrochemical feedstocks are typically a by-product of crude oil refining, supply significantly exceeded demand and hence prices fell. This phenomenon was especially apparent in the case of the C3 (Propylene) spot price because the FCC (Fluidised Catalytic Cracker) used in the petrol refining process results in significant C3 and hence the C3 spot price falling below the crude oil price in September as C3 molecules desperately sought buyers, so that the refineries could continue to operate and cash in on the high margins for fuels. Towards the end of 2022 the retail price of petrol and diesel started to fall, suggesting that supply and demand are starting to become more balanced. Figure 7 below demonstrates that all monomers were discounted in 2022, and the relative reduction in C3 compared to C2 is further evidence of the excess supply outlined

above. None-the-less all monomers have recorded a significant net gain over the two-year period and the economics of monomer production remain attractive.

The passing through of monomer price adjustments to polymer prices remained a matter of serious contention between buyers and sellers. In attempts to recover increased energy costs polymer producers sought to discount reductions but to pass any increases on in full and in some cases applied energy surcharges. Ultimately, the level of reductions was a reflection of the market with plastic processors typically enjoying the full reductions as producers continued to chase volumes, even in spite of their best efforts to balance the market through reduced operating rates.

The graph clearly confirms through spot pricing the over-supply of C2 and C3, which were effectively cross subsidised by the high margins resulting from refining transport fuels.

25 www.interplasinsights.com

FIG 5

FIG 7

FIG 6

FIG 8

>

Figure 8 clearly illustrates the volatility of aromatic feedstocks, with periods of discount and significant premium.

Polyolefins

2022 was really a tale of two halves, with already high prices, escalating to record highs in September, before prices rapidly fell away. The negative market sentiment was driven by oversupply to a market where demand fell significantly, and even despite the efforts of polymer producers to curb output rates prices continued to drop on the back of oversupply.

Polypropylene has traded at a discount to polyethylene throughout 2022, and is a combination of factors including:

1. A relative reduction in the C3 price compared to the C2 price

2. PP producers taking advantage of the low C3 spot pricing

3. Lower production and/or demand for consumer durables such as cars and white goods for which PP is a much more significant component than PE

In the course of 2022 the supply of PE from the USA resumed, following a period of restricted supply in 2021, and towards the end of the year significant volumes of C4 and C6 LLDPE for film applications and HDPE for blow moulding were physically present in the UK market, and as mentioned above these materials have substituted the volumes from Russia that have now disappeared from the market.

Styrenics

As in the prior year, the volatility of aromatic feedstock costs was a key factor in the economics of the production of styrenebased polymers. In addition, volumes from Asia were constrained for much of the year as a result of the high shipping costs. The softening of prices after the summer is a reflection of demand in Asia, the reduction in shipping costs and some dramatic falls in feedstock costs.

The year ended with the shocking announcement that Trinseo would discontinue styrene production at its Böhlen site in Saxony, Germany due to poor economics and a failure to find a buyer for the business. The closure will remove 300k tonnes of European capacity and will have a significant impact on the supply demand balance.

Engineering Polymers

The engineering polymers market very much reflected the broader economic situation; up until about the mid-year point supply for most grades was limited and demand from most sectors, apart from automotive, quite robust. However, the realities of a global economic slowdown coupled with falling East-West shipping

26 www.interplasinsights.com

FIG 9

FIG 10

FIG 13

FIG 11

FIG 12

>

Serving the same customers for decades, the Rosti UK site offers high precision plastic injection moulding. Having recently completed our capacity expansion plan, we are now available to take on more strategic customers Rosti UK, Bridge Works, Stamford Bridge, York YO41 1AL From concept to reality UK | China | Germany | Malaysia | Poland | Romania | Sweden | Turkey | USA Get in touch: www.rosti.com sales@rosti.com Rosti Group C M Y CM MY CY CMY K STANFORD_BRIDGE_print_2.pdf 1 08/02/2023 11:13 The HASCO USA cooling system with its comprehensive range of variant combination options guarantees future-oriented solutions for all challenges in cooling technology. Cooling Range USA System • One hand operation • Reliable radial sealing Easy - Online - Ordering www.hasco.com Anz_USA_System_190x124_EN.indd 1 08.02.2023 11:59:06

rates started to put prices under pressure from September onwards. The nonintegrated nature of engineering polymer production enabled producers to recover margins after a dip in the summer months that was related to the volatility of aromatic feedstocks, however energy input costs will also be a matter of concern with the relocation of some base resin production for PBT compounds being relocated to Asia on economic grounds.

Trinseo announced that in addition to closing SM (styrene monomer) capacity, that it would also shutter one of its two production lines for polycarbonate in Stade, Germany, citing overcapacity and poor economics as the rationale for this decision.

28 www.interplasinsights.com

FIG 14

FIG 15

FIG 18

FIG 16

FIG 17

2023 OUTLOOK

UK Economic Outlook

Even before any mention of recession, most economists were already predicting that the UK would have the lowest rate of growth in the G7 due to the negative impacts of Brexit on trade. A global economic slowdown and rampant inflation will put further pressure on the UK economy, and higher interest rates will have a significant impact on the housing sector in which transaction volumes are expected to fall, but the prospect of falling average house prices will also significantly dent consumer confidence.

Whilst a UK economic slowdown may be more likely to affect services including leisure and entertainment, businesses will face significant cost pressures from factors including fixed and variable cost inflation, higher finance costs and an increase in the rate of corporation tax from 19% to 25%.

The UK Government continues to review the UK REACh legislation and has extended the deadlines for the full registration and announced that it will enter into discussion with regards to the need to closely follow EU REACh, or to take a different approach.

Global Geopolitical Issues

A rapid resolution of the Russian intention to invade Ukraine looks to be highly unlikely, and with this comes the prospect of increased tensions between East and West, although China appears to be resisting calls from President Putin to become more involved in the conflict. The protracted withdrawal Russian origin crude oil, natural gas, refined products and petrochemical derivatives has resulted in a jump in prices for many these essential commodities, and substitution with products from alternative origins will continue to require significant investment in infrastructure and resources, which in turn will have longterm consequences for price levels which are now likely to remain elevated into the longterm.

Logistics

The extreme spike in international shipping cost in 2022 is unlikely to recur in the foreseeable future, and as such the movement of polymers around the globe will not be subject to any prohibitive premiums. There remains the possibility that container shortages could recur if Covid-19 results in significant issues for the Chinese economy, or if the economic slowdown in the West results in slower turnarounds of shipping containers. Since the crisis last year, more shipping capacity is now on-stream and additional containers introduced.

On the domestic front the issue with a shortage of HGV drivers appears to have eased, and even in the final quarter of 2022 when seasonal demand is high, there were no significant issues.

Further logistics cost inflation will take place in 2023, as providers look to recover cost increases and improve profitability. Inevitably these costs will be passed through the entire supply chain, and in part are an important factor in retail inflation.

Exchange Rates

Relative prospects for the UK economy are likely to dominate exchange rates throughout 2023. Whilst USD:GBP exchange rates are a typical reference, the perceived weaking of the US economy means that referencing against more stable currencies such as the Euro and JPY is likely to give a more accurate reflection of the views of the international markets on the value of the GBP.

With more stable domestic politics, there should be less volatility with exchange rates and it is expected that the GBP:Euro will continue to trade a similar levels throughout 2023.

Crude Oil

The likely scenario is that Brent Crude will continue to trade in the 70 – 90 USD per barrel range, with energy companies trying hard to manage supply in an economic environment that will tend towards falling prices, in an effort to stabilise the slowdown that is taking place. It is notable that many traditional energy companies that have been heavily reliant on Crude Oil sales, have increasingly diversified their sources of revenue, with many now turning more to renewables for sustainability both of the planet and for their business models.

Feedstock C2 (Ethylene)

Ethylene pricing is likely to be heavily influenced by the level of PE imports from the USA, which started to resume in 2022. With the expectation that US imports will further increase, as new capacities come on stream, it is likely that local demand for C2 within Europe will be suppressed. If this proves to be the case then the likelihood is that ethylene prices will decline, which along with competitively priced PE US imports will tend to cap European PE prices at similar levels to the end of 2022.

C3 (Propylene)

C3 has a double reliance on crude oil refining in which C3 is a significant cooutput of Naphtha cracking for ethylene and also a biproduct of the FCC (Fluidised Catalytic Cracking) process used to upgrade the petroleum fraction of crude oil distillate to the required environmental standards. Whilst the ratio of C2 to C3 in the Naphtha cracking process can be adjusted, this is within a relatively narrow window and therefore low C2 demand along with refinery output rates will impact C3 availability.

Benzene

This is an important aromatic hydrocarbon compound which is the basis for the following intermediates including:

Ethylbenzene

Cumene | Cyclohexane | Nitrobenzene | Linear Alkylbenzene | Maleic Anhydride | Others

Price volatility is expected to continue, particularly as petrochemical producers seek to improve the economics of this important aromatic petrochemical compound.

Styrene

Monomer (SM)

The fortunes of SM are closely related to Ethylbenzene and in turn Benzene. An important characteristic of SM and the Benzene family is the relative ease with which these products can be shipped around the world in tanker vessels, and this tends to increase volatility as material is either distressed in the case of surplus and exported or imported in the case of shortage.

Polyolefins

2023 will continue to be challenging for Polyolefins as new capacity for all grades comes on stream and demand is not expected to match it. Highly commoditised grades such as high melt PPHP, HDPE for blow moulding and LLDPE C4/C6 for film applications will be under the most pressure. Oversupply in these sectors will push producers to increase output of more specialised grades which will bring downward price pressure in these more premium products

Styrenics

The situation for 2023 starts with a similar level of uncertainty surrounding the impact of higher energy, and raw material costs and this is likely to be most focused around the more volatile materials such as PS. That said, for most of the styrenic polymers it is unclear what will happen during this year, with the most likely scenario is that prices will remain low and material plentiful throughout the year.

29 www.interplasinsights.com

CASE STUDY:

Sustainable plastic packaging with

ManuliTech, based in Cambiago near Milan, produces multilayer blown films for customers primarily in the food and pharmaceutical industries. The company has undergone a rapid rise to success; in 2018, production capacity was around 12,000 tonnes, and in 2019, it was increased to 15,000 tonnes.

“ManuliTech has achieved a very high level of quality within a very short time,” said Nicola Pirani, Alpine’s representative in Italy.

The first Alpine line was installed at the site in northern Italy in 2020. The quality of the film produced from that line has been a key part of the firm’s rapid group, according to Alpine.

This was followed last year by the construction and configuration of the new, flexible 7-layer highperformance line with inline MDO to meet the emerging demand for full-PE films in Italy.

“The market for full-PE barrier films is growing in Italy, but it is still difficult for endcustomers to get these films in consistently good quality and sufficient quantity,” Pirani said. ManuliTech targeted this gap in the market with its capital investment.

In many cases, in order to achieve the desired product properties in these applications, composites have needed to be produced from different materials that cannot be fully recycled. Full PE packaging with films made from pure polyethylene composites, however, can be fully recycled after their original use and reused without material loss for

Italian packaging manufacturer ManuliTech has invested in a 7-layer blown film line with inline machine-direction orientation (MDO) from Hosokawa Alpine, to produce laminating and laminate films with an oxygen barrier in full PE. It’s the company’s attempt to corner the market for plastic packaging with recyclability credentials.

end products, making for a more sustainable product, and resource efficiency. “We support this circular economy approach and offer our customers suitable solutions for it,” said Alessandro Manuli, managing director at ManuliTech. “This is a longneeded development for the sustainability principle and a promising growth market for us,” he added.

“More than 100 MDOs made by us are in operation worldwide,” said Stefan Sager, operations director in the film extrusion division

30 www.interplasinsights.com Find sustainable solutions from Ultrapolymer

The new 7-layer blown film line with inline MDO from Hosokawa Alpine installed at ManuliTech near Milan.

MDO technology

at Hosokawa Alpine. The technology was first introduced 25 years ago. Working with its customers, Hosokawa Alpine designs each MDO blown film line to fit the desired film production, tailored to the customer’s needs. “That’s one secret to our success, the other is the quality of MDO film,” said Sager. Alpine claims that film produced on its equipment is characterised by excellent processability, optimised flatness and no hanging edges. To achieve this, the MDOs are equipped with three features:

TRIO technology (Trim Reduction for Inline Orientation) for best flatness and roll cylindricity, flexible stretch gap adjustment to reduce neck-in, and unique vacuum technology for best flatness and excellent process stability.

Hosokawa Alpine MDO technology is based on monoaxial stretching of blown film. In this process, the film is drawn between two rolls which rotate at different speeds. Depending on the application, the film runs over eight to twelve rolls, two of which are stretching rolls. After heating to the optimum temperature, the film is brought to the desired ratio in the stretching phase. The stretching process reduces the film thickness while improving its optical and mechanical properties. These include, for example, barrier properties, transparency or processability. “This technology reduces the need for raw materials in a resource-saving way, while also increasing efficiency,” said Sager. The stress created during stretching is reduced

in the subsequent annealing phase. Finally, the film cools down and compensates for the thermal shrinkage.

TRIO increases

finishing

quality