BANCO INDUSTRIAL GUATEMALA Digitization well beyond financial services

BIZAGI Enabling solutions for experts and beginners

ALSO: + NIU Solutions + FacePhi + Get LATAM/Tribal + Lenovo

Special Edition | Jan 2023 | www.thebostonbr.com

IS

and projects ahead of schedule Exclusive interview with: Bruna Bolorino, Vice-President and General Manager for Delphix in Latin America and the Caribbean Digital banking in a growing environment TECH & INNOVATION

ENSURING DATA

SAFE

www.power-street.com Follow us WITH POWERSTREET´S STRONG SOFTWARE I CAN SLEEP PEACEFULLY PowerStreet allows you to automate and expedite the comercial process of your company, accomplishing sales increase, and better understanding of the market behaviour. Omnichannel Supply Chain Software Click here to play Back office Commercial management Sales, Delivery Supervisor & Merchandisers Sales Contact Center Software E-ordering Dynamic Routing Business Intelligence

It’s great to be back in 2023 with a special edition which is also an acknowledgement about the efforts of companies in Latin America striving in tech development. Decades ago it was hard to think that this region could someday export anything IT related, even though there were individuals with capabilities; and nowadays different startups from Spanishspeaking countries are gathering clients and working for users well beyond their home country and even in Europe. This success has also made tech giants gravitate towards LATAM to set foot in this territory and take part of markets in development.

Delphix is one of such companies for which LATAM has become synonymous with growth, helping enterprises of different business sectors accelerate their processes set-up and launching. Delphix’s client Consubanco derived from a retail chain in Mexico who detected an opportunity by offering financing

and other services to segments of their market, and afterwards becoming essential to its customers’ lives.

Also well into the domains of Digital Transformation, Banco Industrial de Guatemala has stepped up for all of its different kinds of users by offering digital solutions to make life easier, even beyond financial services.

Bizagi, FacePhi and Tribal Worldwide have become enablers in specialized technology that have also become a very important part in the digitization of companies from different sectors, shining specially with their contributions to banking and finance.

NIU Solutions has grown from its home Guatemala at the pace it has expanded its services portfolio, becoming a complete solutions provider well beyond its borders. Have a happy 2023! Thanks for reading and sharing The Boston Business Review!

Mateo Rafael Tablado, Editor in Chief for The Baoston Business Review

Email: rafael.tablado@thebostonbr.com

www.thebostonbr.com 3

Jan. 2023

EDITOR’S LETTER

who we are

Managing Director

Jassen Pintado

Creative Director

Omar Rodríguez

Editor in Chief

Rafael Tablado

Editor for Brasil

Flavia Brancato

Translations

María Murgui

Finance Director

Christina Nichole

Social Media Director

Maria Elena Gastelum

Content Coordinator

Alicia Barrantes

Project Directors

Ana Macfarland

David Alarcon

Giuseppe Modenesi

Lucy Verde

Marcelo Modenesi

06.

34.

24.

Table of Contents 44. 60. 68. 78. 88. Solutions

Consubanco undergoes a digital transformation to offer customer-centered financial services as part of its competitive strategy

Consubanco becomes a financial environment growing its customer base and offering value through a better use of its tech resources and its strategic partners network displaying strength in the loan and credit segment. Through its digital transformation strategy, the bank seeks to maintain its leadership and conquer other segments

Produced by Jassen Pintado

Creative Direction Omar Rodríguez

Interviewees

Alfredo Flores, CEO for Grupo Consupago; Ing. Fidel Vargas Londoño, Associate Executive Director of Digital Transformation for Consubanco

PURCHASES AND TRANSACTIONS MADE EASY, TO THE BEAT OF THE 21ST CENTURY

Consubanco’s story is related to the Grupo Comercial Chedraui corporation -which also owns the Chedraui retail chain operating in Mexico-, dating back

with the Sherman Financial Group, the private equity global firm, whose affiliate companies enabled Consupago to operate in a large scale in the consumer financial industry, also creating Banco Fácil, which began operations in 2007, when Consupago was authorized to work as a Limited Purpose Financial Society (SOFOL, under Mexican regulations).

to 2001, when Sergio Chedraui created Consupago, with the purpose of being closer to customers, offering them retail financing, creating the “Paguitos” (small payments) credit system, and afterwards -thanks to his vision and understanding of the Mexican working class- he also began offering payrolldeductible loans with delegated collection, thus starting an industry that has contributed significantly to financial inclusion in Mexico.

In 2006, a partnership was struck

In 2012, Grupo Consupago (in charge of Consupago and Banco Fácil) acquired OPCIPRES (a SOFOM ENR, a Multiple Purpose Financial Society - Non-regulated Entity), an important player in the payroll loan business; and Banco Fácil became Consubanco, capitalizing Consupago’s assets, which consolidated and boosted both companies.

Consubanco became one of Mexico’s 500 most important companies in 2014, according to Expansión, an established Mexican business magazine and website. In

8 Consubanco January 2023

2017, Consubanco reached no. 13 among the “46 best banks”, from the Mundo Ejecutivo magazine. In 2019, the Bankaya platform was developed along with a group of successful entrepreneurs, aligned with the company’s efforts in digitization and growing its engagement products portfolio; and in 2020, Grupo Consupago started its inorganic

growth strategy by acquiring part of FAMSA bank’s liquidated portfolio, which was Financiera Independencia’s payroll loan operation as well as the beginning of apex financing to other qualified financial entities.

“The successful development of Grupo Consupago has been achieved as a result of a permanent surveillance of the market’s opportunities, driven to

www.thebostonbr.com 9

Finance, Loans and Credit

- Alfredo Flores, CEO for Grupo Consupago

- Alfredo Flores, CEO for Grupo Consupago

10 Consubanco January 2023

“What we have built during years -talent, processes, tech and business strategies-, has allowed us to keep being competitive”

develop a high-value bond for our customers,” commented Alfredo Flores Ibarrola, CEO for Grupo Consupago.

WIDE EXPERIENCE IN THE FINANCIAL AND CREDIT SERVICES INDUSTRY

Flores Ibarrola graduated as an Industrial and Systems Engineer from ITESM (Monterrey Institute of Technology and Higher Education, in Mexico), and afterwards he earned an MBA from IPADE (PanAmerican Institute for High Business Management, also in Mexico).

He has led Grupo Consupago for more than ten years and also takes part in the board of directors. He is in charge of a bank and three other financial institutions, all of them among the leaders in the payroll loan industry in Mexico.

Flores Ibarrola has been around for more than 25 years creating

enterprises and holding C-level positions in finance. In 2008 he created OPCIPRES, acquired by Grupo Consupago in 2012, and has since been in charge of the latter.

Flores Ibarrola is also a shareholder of other successful companies in the financial and insurance sector, as well as in the real estate business.

SIGNIFICANT ACHIEVEMENTS IN A SHORT TIME

In a short period of time, Consubanco has positioned itself as a solid, efficient entity towards its customership, after accomplishing synergies which have set a clear difference:

• Consubanco is the leading financial institution in the payroll loan business under the delegated collection scheme for retirees, pensioners and employees both in the public and private sectors, guaranteeing access and

www.thebostonbr.com 11 Finance, Loans and Credit

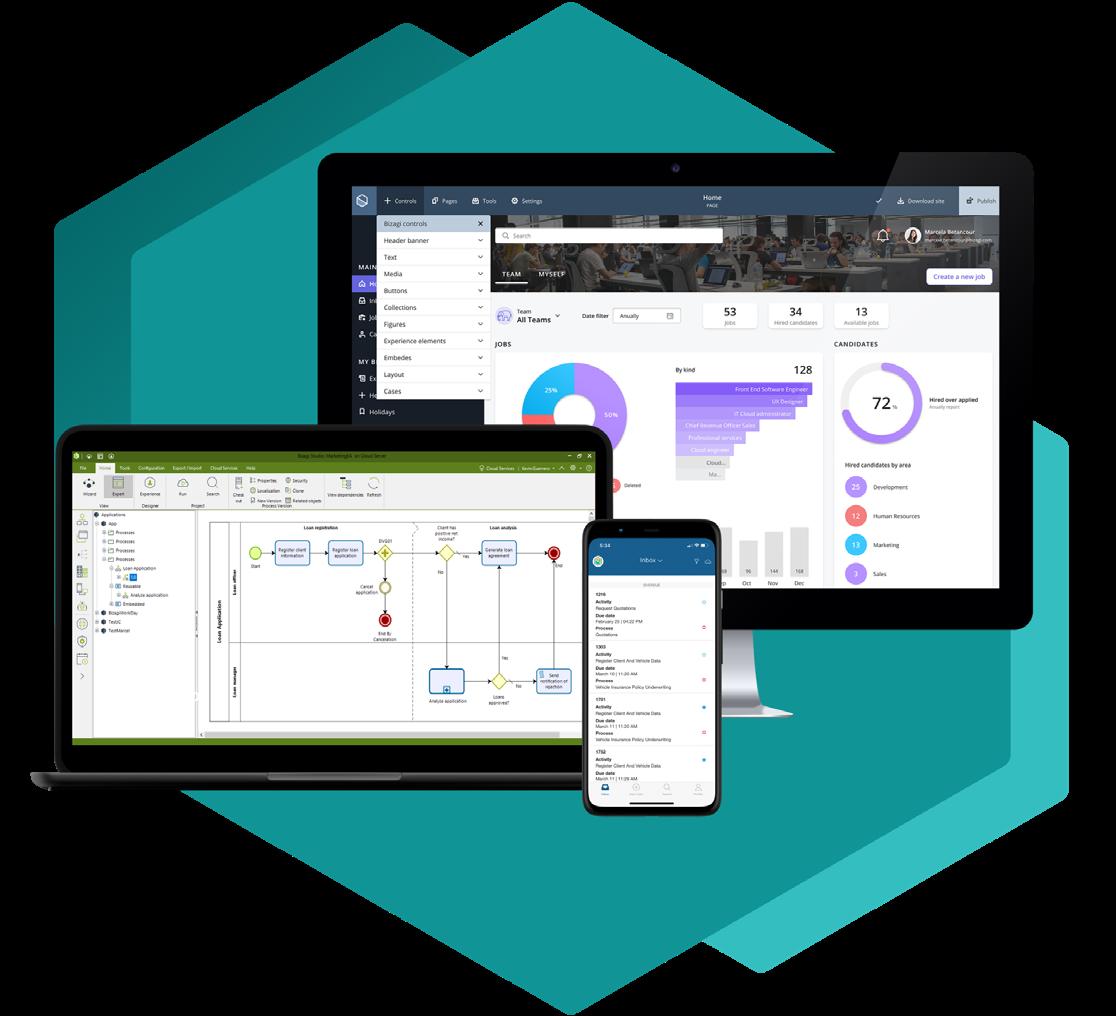

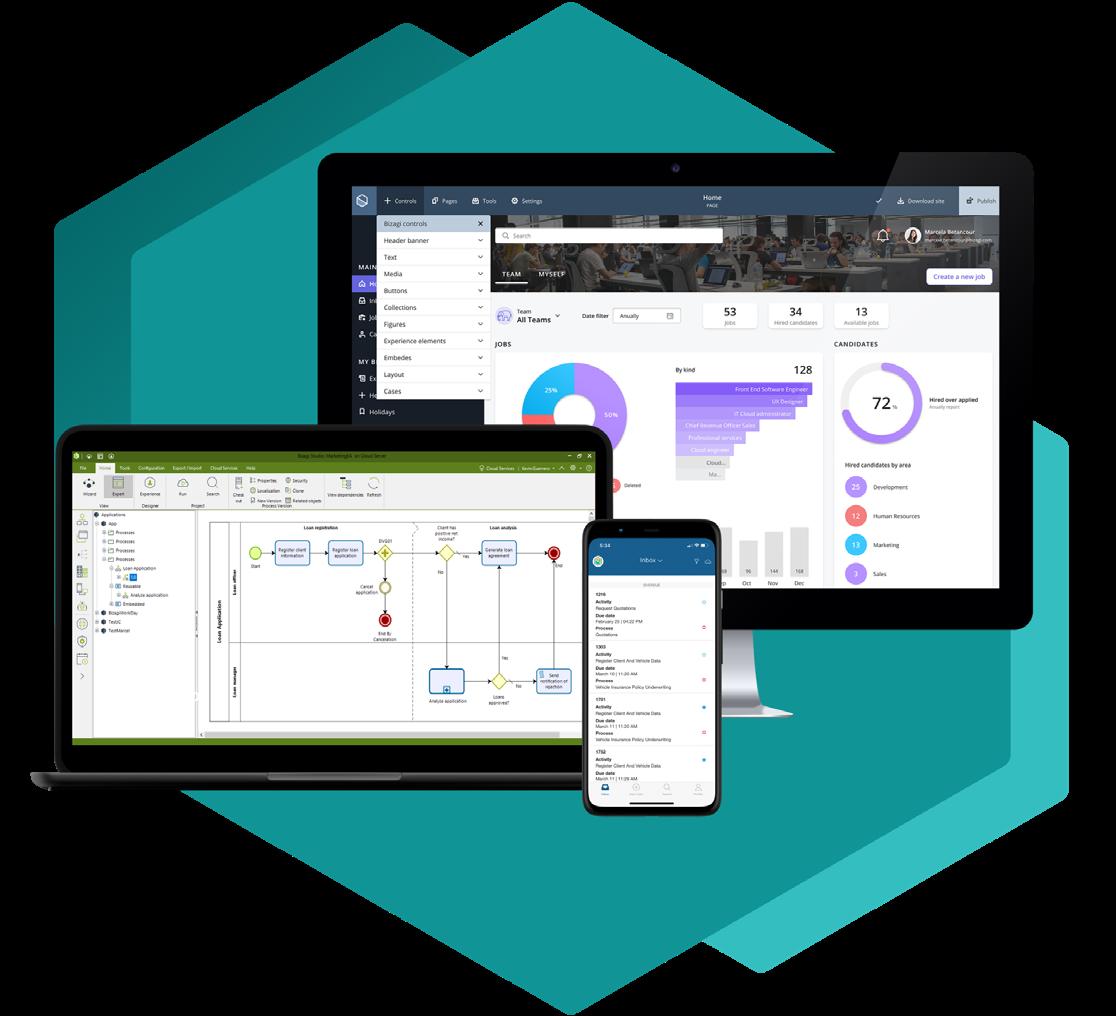

Modern Apps Powered by

Process

Rapidly build cloud apps with a low-code process automation platform

Bizagi’s industry-leading platform for low-code process automation connects people, applications, robots, and information. As the most business-friendly and flexible solution on the market, Bizagi’s cloud-native platform enables true collaboration between business and IT, delivering faster adoption and success.

Rapidly Create Modern Apps

Easy to use interface for every type of user regardless of technical knowledge.

Automate simple workflows through to end-to-end processes.

Key Areas of Expertise

Orchestrating Supply Chains

From procurement to vendor data, pricing, logistics and more, organizations use Bizagi to orchestrate processes to increase visibility, boost productivity and drive operational agility

Bring together business and IT in fusion teams to create apps for orchestration.

Modernizing Banking Operations Transforming the Public Sector

Banks use Bizagi to rapidly automate loans, credit, compliance and beyond, orchestrating operations to boost efficiency, manage risk and transform customer experiences

From acquisition management to onboarding and much more, agencies use Bizagi to deliver transformation that builds on existing assets - all in a FedRAMP approved cloud environment

Forrester study finds that Bizagi delivers 288% ROI

The Total Economic Impact™ Of Bizagi’s Low-Code Intelligent Process Automation Platform showcases an average of $33.3M in business benefits over three years.

Get in touch with Bizagi today to find out more.

Intuitive Powerful Unifying

continuation to financial services for a population segment with little access to credit. Up to date, Grupo Consupago has opened credit lines to a population segment with little access to credit.

• It has become one of the banks with the best fixed-term investment offers, bringing customers the opportunity to increase their wealth safely with high-yield.

• Along its history, the bank has positioned itself as a properly capitalized institution with highliquidity indexes that have allowed for solid, significant growth of its assets since its founding.

KEY FACTORS TO SUCCESS

Consubanco grows and evolves according to solid principles resulting in a financial stability, complying with customers, partners and authorities.

Consubanco’s vision combines business and product strategies which have become a competitive advantage.

Permanent surveillance in the macroeconomic environment enables the bank to take the best decisions upon an ever-changing environment. Its shareholders and external consultant’s wide experience has become crucial to the group’s successful development.

“The payroll loan industry is going through a deep transformation, the demise of important players should push the urgence of regulations within the industry into the financial authorities’ agenda. There are relevant challenges about the organizations that should take part in such credit operations, improve the legal certainty of participants, but especially to improve user experience in this financial service. We perceive great opportunities to provide a better

www.thebostonbr.com 15 Finance, Loans and Credit

“The main challenge for digital transformation isn’t technology, but rather creating empowerment and digital skills in individuals to solve business problems through technology”

- Fidel Vargas, Associate Executive Director of Digital Transformation for Consubanco

16 Consubanco January 2023

service to this market segment, and this is where our transformation strategy is set,” Flores Ibarrola pointed out.

DIGITAL TRANSFORMATION FOCUSED ON CUSTOMER SATISFACTION

Consubanco began its digital transformation journey looking forward to delivering customized offers to its customers, resulting in a high value engagement through a deep knowledge of their needs, customs and behavior. This brought the decision to invest in optimizing tech infrastructure, in process and operation reconfiguring through a continual improvement program known as “SOAR” (which in Spanish stands for simplifying, optimizing, automation and enabling profitability) and launching a new company culture allowing such deep changes within the organization. The evolution of the digital

transformation will allow to keep key differentiators to maintain a leadership in the loans segment in which the brand has built prestige, and also in the creation of a financial products and services environment in which customers are able to interact in a dynamic and friendly way, finding a wholesome offer according to their needs.

This transformation is designed from the relaunching of the company’s vision, mission and values, and comes along with the deployment of a new streamline work methodology, which allows a proper alignment in the execution of set goals.

“I would summarize the success we have accomplished in our capacity to foresee change and our rapid adaptation to it. Our personnel’s talent has been essential in this journey,” commented Fidel Vargas, Associate Executive Director of Digital Transformation for Consubanco.

www.thebostonbr.com 17 Finance, Loans and Credit

On the staff’s front, the transformation at Consubanco empowered employees, enabling them to develop up to their potential and placing them in the best position to successfully accomplish the tasks that result in the company reaching its goals.

The key aspects for Consubanco to work on, regarding recent technology are:

• Agility in processes

• Data analytics

• Journey to Cloud

• Tech evolution and modernization Vargas, originally from Colombia, arrived in Mexico to lead the bank’s digital transformation. The Bogotaborn computing and systems engineer is a specialist in software development and earned a master’s degree in IT architecture from Colombia’s University of The Andes. He’s widely experienced in digital transformation

and tech, having taken part in the transformation of important initiatives from the government in Colombia, as well as in companies such as Banco Falabella, Oracle and his recent experience in finance as Director of Strategy, Architecture and Tech Innovation in Grupo Bancolombia, Colombia’s largest financial group. Fidel Vargas arrived at Consubanco after his tenure in a startup with expertise on fidelity development systems to lead tech, analytic capabilities and bank operations.

THE VALUE OF ANALYTICS

Getting to know every customer becomes more valuable every day in every industry, and Consubanco is no exception.

In the company, decisions are taken based on data, which means analytics allows the creation and development of new relationship strategies with customers. Every

18 January 2023 Consubanco

“Our plans are centered in our capability to deliver a higher value to our customers not only from a financial perspective, but also within the transformation of their lifestyle and helping them day-in and day-out”

www.thebostonbr.com 19

- Alfredo Flores Ibarrola, CEO for Grupo Consupago

Finance, Loans and Credit

interaction is taken as an opportunity for the bank to get to know more about a customer, in a way that the bank can foresee their needs.

Some time ago the Datahub was deployed, and it became an essential resource for Consubanco. Datahub analyzes behaviors and validates value hypotheses in different fronts, such as experience and knowledge about a customer, operational

excellence, finance, cybersecurity and fraud, and compliance.

Even when these cover different aspects, they share data and models that offer larger support in decisionmaking,” Vargas added.

CONTRIBUTING PARTNERS

The structures enabling Consubanco to offer excellent financial services and products as it grows a customer

20 January 2023 info@karalundi.com.mx +52 (55) 4744-1510 karalundi.com.mx

Mexican company founded in 2006 with the vision of improving the customer experience, preventing fraud and reducing operating costs, through the integration of innovative technologies

KOALA VSP PLATFORM

• Facial, fingerprint and voice biometrics

• Liveness check

• Digital signature and digital stamp (NOM-151) with legal validity

• Implementation on-premises, or in the cloud

• Mobile applications and BPO

“I

- Fidel Vargas, Associate Executive Director of Digital Transformation for Consubanco

- Fidel Vargas, Associate Executive Director of Digital Transformation for Consubanco

Finance, Loans and Credit www.thebostonbr.com 21

would summarize the success we have accomplished in our capacity to foresee change and our rapid adaptation to it. Our personnel’s talent has been essential in this journey”

portfolio are a result, in a large scale, of the work of different strategic partners that provide different resources to develop solutions.

As a solid organization, Consubanco maintains the same high reputation with partners and purveyors as it does with customers, through clear and transparent agreements.

“Every area in the bank is concerned about our efficiency, competitiveness, being solid and maintaining a good

relationship with partners and purveyors,” Flores Ibarrola remarked.

ALIGNED TO PROVIDE A BETTER USER EXPERIENCE

After exponential growth during 2020 and 2021, Consubanco aims to boost its environment through the synergies created mainly with the Chedraui retail chain and the Bankaya app, as with other business lines and companies.

Consubanco’s focus remains in

22 Consubanco January 2023

placing the customer at the center of operations to sustain its growth, retention and profitability.

“Our plans are centered in our capability to deliver a higher value to our customers not only from a financial perspective, but also within the transformation of their lifestyle and helping them day-in and day-out”, finalized Alfredo Flores Ibarrola, CEO for Grupo Consupago.

FOUNDED: 2007 as Banco Fácil

INDUSTRY: Finance, loans and credit

CONTACT:

www.consubanco.com

afloresi@consubanco.com

fvargas@consubanco.com

www.thebostonbr.com 23

Finance,

and Credit

Loans

ENABLING PROCESSES IN NO TIME!

Bizagi is a leading platform for processes automation and for the creation of low code applications to be used by different sectors. It offers easy-to-use automation tools, both for developers and for users in all business areas… All of it hosted in the cloud!

Produced by Jassen Pintado

Creative Direction

Omar Rodríguez

Translation by María Murgui

Bizagi contributes to the Digital Transformations of different organizations from different sectors through its processes automation platform, able to integrate Artificial Intelligence (AI) and robotics to optimize different processes, enabling launch in a short time as it orchestrates the client’s different working areas, delivering fully satisfying results for the end user. Besides its presence in Latin America,

Bizagi has brought its business to Germany, Singapore, the UK and the USA, to name a few countries, servicing entities from the banking and financial, insurance, public, manufacturing, retail, shipping and logistics, health, hotel, and tourism industries, among others.

WIDE FUNCTIONALITY

Bizagi is a leading company in the automation and management of

Technology/Innovation

www.thebostonbr.com 25

different business technologies and solutions such as legacy systems, RPA systems and AI, web services, existing databases, CRM, ERP, files management and storage systems, among others, acting as an orchestrator within the entity, thus organizing these systems simply and efficiently.

Its low-code solution for app development is intuitive, and it also offers an assistant to create applications in seven steps, which accelerates the app’s launch as well. This modality provides greater visibility and control over the resources, costs, and terms associated with the business processes, besides allowing the organization’s users as well as the IT department to collaborate in the processes’ standardization and improvement.

Being a low-code platform, it solves problems more quickly not

only for all the company’s users but also for developers.

Advanced users can choose among the assistant, expert, and experienced displays, relying on the whole development capability the platform offers, with the possibility of quickly covering core and strategic processes.

OPTIMIZING USER’S EXPERIENCE

Bizagi offers a module completely devoted to creating unique, modern, and customized experiences for different users.

This option allows the identification of the different people working within the applications, thus enabling the creation of totally customized and contextualized pages, menus, reports, lists, and other elements for each individual.

Bizagi understands the importance of making every user feel unique, and, for that reason, it offers different options to achieve it.

26 Bizagi January 2023

BIZAGI UNDERSTANDS THE IMPORTANCE OF MAKING EVERY USER FEEL UNIQUE, AND, FOR THAT REASON, IT OFFERS DIFFERENT OPTIONS TO ACHIEVE IT

Technology/Innovation

www.thebostonbr.com 27

MULTIPLE PRODUCTS WITHIN THE SAME PLATFORM

• Bizagi Modeler: Offers clients the chance of modeling, documenting, and simulating business processes by making use of BPMN 2.0 notation. It also allows the creation of value diagrams, the use of mining processes technology, and the

publication of the processes used for all the organization’s collaborators via a processes’ library.

• Bizagi Studio: it eases process automation and development. It can be adapted to the user’s needs, thus offering no-code and low-code automation tools even for expert

28

January 2023

Bizagi

developers. Users can rely on an assistant to create modern and capable applications by only following seven simple steps.

• Bizagi Automation: This is where the applications developed with Bizagi Studio are displayed. Bizagi Automation is 100% hosted in the

Cloud, it is scalable and flexible, and it allows the creation of unique and modern experiences for several kinds of users.

KEY FEATURES

Bizagi’s features are provided by a mixture of easiness of use and the

Technology/Innovation www.thebostonbr.com 29

BIZAGI IS A LEADING COMPANY IN THE AUTOMATION AND MANAGEMENT OF DIFFERENT BUSINESS

TECHNOLOGIESAND SOLUTIONS

30

January 2023

Bizagi

capability to achieve the desired processes able to generate results in a short time.

• It is intuitive. Easy to use for any user without the need of owning specialized technical knowledge.

• Powerful. Bizagi can cope with automation from beginning to end, from simple working flow to complex processes.

• Unifying. Its ease of use not only does contribute to the promotion of the Citizen Developer initiative but also contributes to promoting fusion teams seeking specialized business users who work hand in hand with IT teams to achieve the expected results regarding functioning and user experience.

Bizagi also offers 130 process accelerators available, which include cross-business processes for different industries and markets, completely automized and ready to use. Besides,

it also has connectors that allow for the easy integration of several external tools, as well as widgets that can be used to customize the final user’s interfaces.

Being a 100% Cloud-native platform allows each development to grow according to its requirements without having problems with bandwidth use during peak traffic, thus decreasing the allocation of resources to maintenance and monitoring of hosting infrastructure and use.

PROVEN TRACK RECORD BEYOND BOUNDARIES AND CONTINENTS

Bizagi was started over 30 years ago to develop a project for the former Banco Cafetero, in Colombia, thus transforming processes to accelerate them. This meant an opportunity to develop tools that didn’t exist in the market, creating a platform able to automate the company’s processes that could be easily and quickly implemented.

Technology/Innovation www.thebostonbr.com 31

BIZAGI HAS BEEN RECOGNIZED AS THE GLOBAL LEADING COMPANY IN PROCESS AUTOMATION

After this first step, Bizagi was brought to the European market, where it earned clients such as Adidas in a short time, among other feats which proved how important it was to rely on the solutions created by Bizagi. Later, it developed a Scala ERP system for Apple, and it also became one of the first Microsoft partners in Colombia, as well as a partner of the German company Novodata.

The company’s growth has earned it international recognition, thus competing in the global market for highly important projects.

Bizagi has been recognized as the

global leading company in process automation by Gartner and Forester.

A VISION WITH CLEAR STRATEGIES

Bizagi’s developments for 2023 and onward years rely on four strategic pillars:

• Modern apps. Building of modern apps powered by processes, thus considering processes as the axis of the application, so it can result in unique and customized experiences for each user.

• Orchestration at a company level. Creation of new options

32 Bizagi January 2023

that allow the integration of other interfaces, applications, and services within the Bizagi platform, thus offering high-quality services.

• Citizen Developers. Facing a lack of specialized personnel, Bizagi relies on the creation of environments and providing tools so those who don’t have web development knowledge become enabled to generate and optimize processes as fast as possible.

• Fast Value Delivery. The inclusion of functionalities with a value management console offers the possibility of visualizing the different processes a company may have and the stage of each of them (definition, development, delivery). This comes as a response to the need of offering the future of process optimization where using AI makes it possible to make automatic predictions and allocation of smart resources.

We invite you to download our eBook: The essential guide to modernizing banking operations

https://go.bizagi.com/Bizagi-Banking-Ebook.html

www.bizagi.com/en

Technology/Innovation www.thebostonbr.com 33

Important data in the best hands

An innovative approach to data protection during the development, test management and interactions in multiple clouds processes also provides speed and value, which become a significant difference

Companies from different sectors that handle large amounts of data digitally are at a risk during the process, besides being obliged to adhere to strict regulations regarding possible access to this information, guaranteeing that third parties don’t have any access to users’ and customers’ data, avoiding misuse. Delphix has provided companies with support and has become the global leader in the data industry for processes such as DevOps, Test Data Management (TDM), and Data Masking, automating complex data operations which comply with privacy regulations.

Producido por Jassen Pintado

Written by Mateo Rafael Tablado

Translation by María Murgui

Creative Direction Omar

Rodríguez

Interviewee:

Bruna Bolorino, Vice-President and General Manager for Delphix in Latin America and the Caribbean

Bruna Bolorino, Vice-President and General Manager for Delphix in Latin America and the Caribbean

The company was set up in 2008 in Menlo Park, California, and currently has a global presence, spreading throughout Latin America and Europe. It is operated by more than 700 direct employees, besides third parties from other companies. Delphix’s roster of clients include 30% of the companies on the Fortune 100 list.

Delphix’s presence in Latin America dates to 2013, when the first step was taken with the opening of the Sao Paulo (Brazil) office. The company is currently present in Argentina and Mexico, where it started operating in 2018.

The operations in Latin America mean 12% of Delphix’s endeavors worldwide. The company also relies on the work of 23 partners in the region. In Argentina, Brazil, Colombia, Chile, Jamaica, and Mexico, Delphix has presently more than 60 active clients in the region, among which companies like Consubanco, Invercap, Natura, and Office Depot are included.

Delphix facilitates the availability of

data able to comply with protection regulations during the development process, thus decreasing idle time for developers, contributing to creating more productive environments, decreasing the wait for launch or release, and improving code quality, thus reducing costs and environmental impact.

“Delphix can be applied in every industry that handles large amounts of data, be it to accelerate their projects or to protect their environments, from data leaks to ransomware attacks,” added Bruna Bolorino, Vice-President and General Manager for Delphix in Latin America and the Caribbean.

LEADERSHIP IN CHARGE OF BUSINESS GROWTH

Bruna Bolorino graduated in Business Administration at ESPM (Higher School of Advertising and Marketing, in Sao Paulo, Brazil). Her 17-year experience in IT has taken Bolorino to companies such as Oracle, SAP, Dell EMC, and IBM, among others, holding leadership roles.

36 Delphix January 2023

The results she has achieved for Delphix in Brazil and Latin America have been recognized by the company at a global level, having received awards every year since she joined Delphix. Besides, not only did she bring new business and sales, but also created operations from zero in different countries in Latin America and the Caribbean.

USEFUL SOLUTIONS FOR DIFFERENT ENVIRONMENTS

The solutions Delphix offers can be applied to all industries, mainly supporting financial sectors such as banking and insurance, the retail sector, and the education sector, among others.

The three main pillars on which Delphix solutions stand out are -undoubtedly- DevOps, Zero Trust

Technology / Innovation www.thebostonbr.com 37

environments, and Multi-Cloud structures:

• DevOps. Delphix optimizes the data delivery to testing environments, preparing brief data environments, and managing timing reduction for projects launch. The series of tools the company has allows the automation of different IT aspects and offers code management, infrastructure, implementation, and other processes.

• Zero Trust. Delphix provides protection to testing environments through the identification and elimination of all confidential data. This

allows for solving compliance and security problems.

• Multi-Cloud. Delphix collaborates with moving large amounts of data from complex environments to the cloud, thus increasing the project’s viability and reducing costs with agility and security.

“Besides automation and drastically reducing the data handling time, we offer protection before delivery, which means we can find confidential data automatically and mask them in

38 Delphix January 2023

- Bruna Bolorino, Vice-President and General Manager for Delphix in Latin America and the Caribbean

“Delphix can be applied to all the industries that handle large amounts of data, be it to accelerate their projects or to protect their environments”

accordance with security regulations,” the executive commented.

THE ADVANTAGES OFFERED BY THE MOST COMPLETE PLATFORM

Delphix offers extremely valuable advantages for companies, considering it can take hours, days, and even weeks to prepare the appropriate environment for a new project, thus devoting more time to data handling.

Delphix replies to key questions regarding the value companies can obtain when innovating with them, as well as the moment in which this innovation will mature to provide said value, considering that the capacity to access data rapidly usually implies delays in the applications development value chain. Delphix has got the capacity of adopting functionalities for Continuous Data (protecting continuous data flux) and Continuous Compliance. The first modality delivers data for internal use, as with TDM processes, recovery after disasters

and integration with monitoring applications; whereas Continuous Compliance secures the protection of data delivered for different internal use.

• It admits multiple data sources, from mainframe to modern databases, from installations to cloud, SaaS, PaaS, backup tools and cloning.

• It is a complete platform to handle data and can also be used for TDM, fast recovery, creation of training environments and sandbox, identification of confidential data, data masking, migration, or data synchronization between multiple data centers (or clouds), protection against ransomware and other uses.

“There is no other competitor at the platform level offering all the benefits with the same license. We count on a team devoted to supporting our clients to obtain the maximum value from their investment in our platform,” Bolorino pointed out.

Technology / Innovation www.thebostonbr.com 39

CONSUBANCO: STAGES TO TAKE STEPS TOWARDS INTEGRAL SOLUTIONS

The first challenge Delphix faced when it started providing solutions to Consubanco was related to compliance with data security regulations from the low environments (also considered “non-productive”, as development areas, testing, staff training, backups with access to third parties, among others), as

the data handled by the institution were perfectly well protected in the productive environments, but not in the low ones, thus being at great risk.

The first step was to find the sensitive data to identify confidential data, especially in SAP environments, which intentionally don’t include many descriptions in the database metadata. However, the profiles generator can map confidential data beyond metadata and uses the data

40 Delphix January 2023

formats, meaning that confidential data is always mapped.

Following the confirmation of the development and security teams, Delphix gets involved with the inventory to carry out data masking, which takes some hours when first executed, depending on the volume of the data set. This process is important regarding compliance with the commitment to the client’s data protection, established by the National

Banking and Stock Commission, an autonomous entity within the Mexican government in charge of financial institutions.

After establishing the conditions that will secure compliance with data protection, the next challenge was data speed and quality in these low environments. Delphix investigated, along with the Consubanco team, what the necessary automation was to provide all the environments that

Technology / Innovation www.thebostonbr.com 41

needed it with such implementations, reaching a point in which the different solutions are being tested, in order for Consubanco to benefit from everything Delphix offers regarding data handling and protection.

SPREADING THROUGHOUT THE REGION VIA PARTNERSHIPS

Delphix’s development in Latin America grows at giant steps, and, at the end of 2022, the company registered a growth of 37% in new clients in the region. Only during the last quarter of 2022 did the company

experience a 300% growth with respect to the same period of the previous year.

An important factor for the Delphix spread and growth all throughout Latin America is relying on proper partners, whose work has provided more than 90% of results for the company in the region. Currently, the team’s growth is getting close to 55% a year.

Besides having important clients in Brazil, Mexico, Argentina, Chile, and Colombia, Delphix is spreading its operations to more countries in South America, Central America, and the

42 Delphix January 2023

- Bruna Bolorino, Vice-President and General Manager for Delphix in Latin America and the Caribbean

“Besides automation and drastically reducing the data handling time, we offer protection before delivery, which means we can find confidential data automatically and mask them in accordance with security regulations”

Caribbean: Ecuador, Caiman Islands, Jamaica, Panama, Paraguay, Peru, Puerto Rico and Uruguay.

FAVORABLE EXPECTATIONS

There are precise purposes to fulfill in 2023 and beyond, as a strong standpoint in certain countries, the spreading of Delphix and its products, and more results derived from its important partnerships with analysts such as Gartner and IDC are expected.

“We are investing not only spreading the word about Delphix, but also in building local teams with Delphix direct employees, and not just operating through partners. From this year on we will have a local team inr Mexico. In 2023, the growth in Mexico will be greater than the growth in Latin America, regarding investment,” added Bruna Bolorino, Vice-President and General Manager at Delphix for Latin America and the Caribbean.

FOUNDED: 2008

INDUSTRY: Technology / Innovation

CONTACT: www.delphix.com

Technology / Innovation www.thebostonbr.com 43

Beyond DIGITAL BANKING

Banco Insdustrial’s complete diagram of digital solutions, which go beyond digital banking, allow the access to services and products while contributing to the clients’ development all throughout the region

Prouced by

Jassen Pintado

Creative Direction

Omar Rodríguez

Interviewee

Javier Ramírez Penagos, Head of Digital Transformation at Banco Industrial

For more than 50 years Banco Industrial has helped to support, drive and promote Central America’s economical development. This banking institution was conceived in 1968 within the Guatemalan Chamber of Industry, offering universal banking services to business and corporate sectors, MSMEs and individuals since then.

Banco Industrial belongs to the BI Capital Corporation holding, which contributes to the region’s growth by being present in Honduras with

Banco del País and Seguros del País (insurance company), in El Salvador with Banco Industrial, and in Panama with BI Bank.

In Guatemala, banco Industrial has been named “Best Bank in Guatemala” for more than ten consecutive years

by the most internationally prestigious financial magazines, recognizing its strength, leadership, positive impact on the region, innovative culture and its outstanding service.

“Our financial services are complemented with integrated

46 Banco Industrial January 2023

ecosystems which allow the generation of solutions to drive the growth and development of customers as well as of the communities where the brand offers its services”, commented

Javier Ramírez Penagos, Head of Digital Transformation at Banco Industrial.

EXPERIENCE TO LEAD THE EVOLUTION

Ramírez Penagos earned a bachelor’s

degree in Systems Engineering from the Universidad Rafael Landívar and an MBA from INCAE (Central American Business Administration Institute), besides other certificates.

His career at Corporación BI started 12 years ago, during which he has performed at different positions in different areas. During his tenure, he has overseen the corporation’s strategy of transformation and digitalization since 2017. While

- JJavier Ramírez

Head of Digital Transformation at Banco Industrial

Penagos,

Banking and Financial Services / Innovation www.thebostonbr.com 47

Our financial services are complemented with integrated ecosystems which allow the generation of solutions to drive the growth and development of customers as well as of the communities

leading the implementation of digital strategies, Ramírez Penagos and his team have obtained different accolades thanks to the functionalities that have led Banco Industrial’s electronic banking.

“I lead the Open Banking and Innovation strategy, forming new partnerships as well as discovering and deploying disruptive technologies adapted to the banking industry”, the executive added.

ENTIRE CAPACITY AND EFFECT OF A GLOBAL BANKING INSTITUTION

Banco Industrial’s reach provides its customers with first level and world class attention through three main divisions:

• Strong, integral and international Corporate Banking.

• Business Banking, with the capacity of driving and contributing to the development of the country’s economy for companies at different stages of their evolution.

• Individual Banking, providing services to a wide customers and users portfolio with financial and tech solutions, and which has been recognized due to its customer service’s high standards.

Banco Industrial offers financial products and services through a network with more than 3,180 locations throughout Guatemala, and access to the most complete electronic banking both via the bank’s website and mobile devices from all over the world. From these, customers can make payments to more than 2,400 service providers, bank transfers to their own accounts or accounts from other banks, as well as international transfers and a regional connection.

DIGITAL STRATEGY AND THE PLANS TO DEPLOY IT

The goal of Banco Industrial’s Digital Transformation division is to make

www.thebostonbr.com 49

Banking and Financial Services / Innovation

Electronic Banking available to all its customers -individual business and corporative banking clientsboth through its website as well as via its app, so they can make all the money transactions and other bank movements without attending the bank’s locations.

Banco Industrial offers totally digital products (for savings and monetary accounts) to all its customers, and with these digital products it simplifies the acquisition of a new product or service, thus allowing its clientele to carry out these transactions when and where it’s more convenient for them.

“We want to become that hub where our app is the most used in the country, by providing our clients with value-added services and giving them the possibility of managing issues beyond financial services online through BI en Línea”, pointed out Carlos Vides, Modern Banking

Assistant Manager at Banco Industrial.

The institution considers Digital Transformation as a continuous and permanent process, whose achievements are constantly measured and goals evaluated after factors such as the growing number of users, functionalities and other parameters that ease the decision-making process at which efforts can be aimed.

For that reason, new technologies and functions able to generate value and optimize the user’s experience are constantly introduced to digital banking.

On the other hand, Innovation teams have been created, finding themselves steps ahead regarding new technologies and trends in the banking and financial sectors.

“We are working on updating our current resources, but always looking ahead. This allows us not only to update our infrastructure, but also

50 Banco Industrial January 2023

www.the bos tonbr.co m 51

- JJavier Ramírez Penagos, Head of Digital Transformation at Banco Industrial

We believe in solutions built from diversity and union, so we go ‘Together, always forward’

DIGITAL TRANSFORMATION TO TAKE YOUR BUSINESS TO THE NEXT LEVEL

As your strategic ally, we accelerate your digital transformation process. Our focus lies on improving the customer experience with technological solutions in Marketing, Sales, Customer Service and IT.

niu.solutions

info@niu.solutions

Follow us

CLICK TO PLAY

to be up to date with our clients’ needs and demands”, Ramírez Penagos explained.

If the bank’s Digital Transformation process is understood as a continuous process, this area is subject to investments on technology and innovation to support Digital Banking, which allows the bank to continue offering services focused on fulfilling its clients’ needs and expectations.

As part of its strategy, the bank is considering these products and services to go beyond the bank’s digital channels to be used by third parties such as fintechs and entrepreneurs, among others, so BI’s services would be offered through different platforms, and the same experience offered to new customers.

STRATEGIC PARTNERS CONTRIBUTING TO EVERY IMPROVEMENT

To successfully develop its Digital Strategy and offer customers a wide array of products and services,

Banco Industrial has its key partners’ support regarding technologies and other areas.

The institution holds a productive relationship with GBM to support almost all the digital strategy stages: from Infrastructure and User’s Experience to new technologies and multiple innovations, thus achieving the implementation of strategical projects such as an Artificial Intelligence chatbot know as ABI, an Open Banking strategy and the implementation of resources on the cloud, among others, besides offering consultancy services on strategical matters.

NIU Solutions, on its behalf, enabled Banco Industrial to be pioneers in inbound marketing, by using tools such as HubSpot, besides contributing to take part in digital sales and implementing new portals to manage products digitally, such as CrediAuto, CrediMoto,

www.thebostonbr.com 53

Banking and Financial Services / Innovation

CrediVivienda, among others.

Facephi, a company focused on face biometrics -and other servicesis also one of the institution’s most important allies, with contributions to the improvement of the user’s experience on the BI en Línea app, and also with its security by

integrating its technology with GBM’s, thus making Banco Industrial to become, in 2016, the fourth bank in Latin America and the first one in the region to own this technology.

There is also a more than ten-year productive relationship with Tribal WW regarding consultancy and

54 Banco Industrial January 2023

strategy matters, development and innovation in digital channels from their creation to the marketing stage of this services.

“The work of many people from both Banco Industrial and its suppliers has helped us achieve this great improvement”, Ramírez

Penagos commented.

EFFORTS AIMING AT CUSTOMER SATISFACTION

Banco Industrial has more than 15,000 collaborators who are key when dealing with the constant efforts made to satisfy customers and users

www.thebostonbr.com 55 Banking and Financial Services / Innovation

Growth Oriented Design

Technology has changed the way in which users relate to brands: from more punctual and occasional moments of relationship, we have moved on to intense, personalized and more participatory contacts.

www.tribalworldwide.gt/en

with efficiency and trustworthiness.

The institution’s personnel is bound to constant learning to increase and update their talent and skills, so they can innovate in every aspect.

“We believe in solutions built from diversity and union, so we go ‘Together, always forward’, as a brand’s promise”, the executive added.

DRIVING DEVELOPMENT IN EVERY FRONT

The boost BI provides to all of its customers is the same that leads the institution to drive the development of the community it serves with excellency.

“Guatemala presents multiple challenges and needs, so Banco Industrial invests, in an active and participative way, in initiatives oriented to generate integral and sustainable welfare in our society”, commented María José Paiz, from the Institutional Relationships Department at the Corporation.

The following are included

among the programs in which the bank is involved:

• Education as a driving force for progress. BI constantly invests in educational programs and platforms for children, younglings, and women. Additionally, it has designed a specific financial welfare Platform, which, through different formats, provides individuals and MSMEs with knowledge and training resources. The Platform was created with the goal of enabling the financial inclusion of people who make decisions after being informed of its benefits.

• Education and sports. Support to different literacy programs, academical, technical, and university scholarships and the implementation of computing and technical labs. It includes daily sports practice for 1,550 children and youngsters as a measure for preventing violence and crime.

• Innovation, entrepreneurship, acceleration and escalation for MSMEs. The bank provides resources at no cost for financial

www.thebostonbr.com 57

Banking and Financial Services / Innovation

58 January 2023

Guatemala presents multiple challenges and needs, so Banco Industrial invests in initiatives which are oriented to generate integral and sustainable welfare

- María José Paiz, from the Institutional Relationships department at the Corporation

welfare, acceleration and escalating programs, partnerships with academic institutions for business strengthening, development of skills for the exportation of products and services, seed capital and grants for companies led by women, among others.

Additionally, the bank contributes with health and communal development programs which boost the community’s welfare.

FOUNDED: 1968

INDUSTRY: Banking and Financial services / Innovation

CONTACT:

www.corporacionbi.com

jaramirez@bi.com.gt

www.thebostonbr.com 59

YOUR BIOMETRIC DATA IS THE KEY

Produced by Jassen Pintado

Creative Direction Omar Rodríguez

Produced by Jassen Pintado

Creative Direction Omar Rodríguez

And digital identity verification leads the revolution

Today’s user demands brands to offer personalized attention, flexibility and commitment. The business relationship was forced to change, and with it, so have changed the services we offer. Digitalization, the result of years in which the search for new processes has become a must, is now pushing us to standardize new tools. Biometrics, a technology that makes digital verification possible, is now the key to standardizing and simplifying many of the procedures that until now required a great deal of effort, both for the company or institution and for the user. Time, money and other resources can be used more efficiently

www.thebostonbr.com Tecnology/Innovation

by adopting a technology that, already well established in the banking sector, is making its way into events, leisure, transport, retail, mobility, etc. But where does its versatility come from?

Asking for a loan, gaining access to a venue, checking exam grades, boarding a plane or requesting a medical appointment can all be done quickly and securely thanks to biometrics. The options offered by the use of biometric data are infinite and radically different, thus being imperative that the level of security we apply to this information is both sensitive and appropriate. This is the only way to make digital identity verification an answer to fraud and identity theft.

The value of biometric data lies in its uniqueness and resistance against fraud. This information, which results from the encryption of our facial

features and takes place during the onboarding process, must be treated as part of the user’s identity. It is valuable information and we must be extremely meticulous when dealing with it. Fraud is increasing daily and the user of the digital environment needs protection and privacy. This is what we guarantee at FacePhi thanks to using the best remote identity verification systems.

Legislation can’t keep up with technological progress, and, for this reason, as a company, we accept an additional responsibility: to develop a respectful and representative algorithm. For this to happen, we work on solutions that keep the user at the centre of the whole process, i.e., we strive for ethical biometrics. This means that the algorithm is trained with representative and constantly updated databases in order to minimise the risk of a biased result.

62 FacePhi January 2023

Tecnology/Innovation www.thebostonbr.com 63

THE OPTIONS OFFERED BY THE USE OF BIOMETRIC DATA ARE INFINITE AND RADICALLY DIFFERENT

64 FacePhi January 2023

Also, to guarantee privacy, we encrypt the information extracted from the user’s photo (during onboarding or authentication) making it impossible to reconstruct the original image and use it for fraudulent purposes. But in addition to looking after the user, we also look after our clients, regardless of the sector, so they are

enabled to work with a solution that fits their different needs. FacePhi Identity Platform is multi-biometric, allowing clients to design any digital onboarding and authentication process with full control and with the capability to adjust it as desired. This tool also stores and provides the client all recorded data of the different processes carried out by the user.

www.thebostonbr.com 65

Tecnology/Innovation

This platform provides both the client and the user with the most secure verification processes, as the use of FacePhi biometrics guarantees compliance with the main standards that regulate the sector. Passwords or awkward questions are no longer necessary or secure, we

have something much better now, our digital identity: unique, private and non-transferable. And thanks to it, we can now satisfy new needs, or provide answers to old problems, in a faster, cheaper and, above all, more convenient way. Digital identity verification is a future we can enjoy today.

66 FacePhi January 2023

FACEPHI IDENTITY PLATFORM

IS MULTI-BIOMETRIC, ALLOWING CLIENTS TO DESIGN ANY DIGITAL ONBOARDING AND AUTHENTICATION PROCESS WITH FULL CONTROL AND WITH THE CAPABILITY TO ADJUST IT AS DESIRED

www.thebostonbr.com 67 Tecnology/Innovation en.facephi.com

Transformation, Customer Experience and Digital Business Innovation

• A transformation that allows achieving business objectives

• The union of experiences: customer and business

• Closeness to people: Multichannel, Centralization, and Technology

Produced by Jassen Pintado

Written by Juan Carlos Ruiz

Creative Direction Omar Rodríguez

Tribal Worldwide is part of the world renowned Omnicom Group and offers consulting services in the digital transformation, business acceleration, and client experience industries. In Guatemala, the company is represented by GET Latam.

The digital business strategy agency has expanded its services as a consultant for the strategic design of business solutions, with a continuous presence in more than 16 countries around the world. It offers agility, flexibility, and support throughout the entire process of end-to-end projects with closeness and open integration with other partners as a competitive advantage. Its goal is to create awareness about the existing need for universal digitization in companies, promoting their digital transformation processes and delivering results through tangible solutions.

Its solutions cover the key phases for the following digitization of models: discovery, creation or acceleration, and business scalability. From the audit and consultative phase, to the ideation and launch of products, services, and the “go to market” strategy.

Tribal WW Centro adds value to specific needs in current times of uncertainty caused by constant digital evolution. For this reason, they have launched different initiatives, where leaders of Transformation, Experience, Digital Business, and Innovation eliminate barriers, solve challenges and discover new opportunities. It connects the best professionals from different countries, who stand out in their respective sectors and apparently have nothing in common, but once together and collaborating, make wonderful things happen so that we can all learn.

Tecnology/Innovation www.thebostonbr.com 69

A TRANSFORMATION THAT ALLOWS ACHIEVING BUSINESS OBJECTIVES

The Central American market is focusing on creating the best customer experience based on other successful models and anticipating the demands of current and future users, ensuring leadership in a new stage where there will be a generational change and a new demand for services.

The first step for a successful transformation is to understand what is happening in the environment and in organizations, this allows us to trace a path that leads to achieving the companies’ vision. It involves processes and methodologies to understand the current relationship with customers, with the distribution network, and with products and services as a basis for building futures, based on the current digital maturity of companies.

Within the current context, the correct use of technology and

knowledge of the changing needs of customers is clearly postulated as an essential competitive advantage in order to meet the challenges of the coming years. In this sense, companies are increasingly betting on a transformation of their model, prioritizing the use of technological capabilities in order to optimize marketing processes and customer experience. Such change will become unforgiving to those who do not adapt to this revolution, nor will there be time to react for those who have a late start.

Tribal WW Centro positions the user as the center of all its solutions, prioritizing user behavior with technology acting as an enabler for the day to day relationship, always taking into account that technology has changed the way in which users relate to brands: from more punctual and occasional moments of relationship we have moved on

70 Tribal January 2023

Tribal WW Centro positions the user as the center of its solutions Tecnology/Innovation www.thebostonbr.com 71

to intense, personalized, and much more participatory contacts. This has exponentially multiplied the companies’ value when building their products, making it difficult to standardize relationships.

THE UNION OF EXPERIENCES: CUSTOMER AND BUSINESS

The use of data is a very important opportunity to increase companies’ business and the legislation that such opportunities represent. But, on the other hand, users are more aware, demanding and vindictive with the counterpart of the use of such data. What do you get in return? Each point of contact must be relevant and useful for the user.

This requires companies to be accompanied by a strategic partner who, due to their experience, has worked on different projects related to the design of relationship models that are based on those lessons that will eliminate uncertainty and generate

value from the first moment of a project. In this context, Tribal WW Center makes multidisciplinary teams available to its partners to co-create, develop, and implement the most effective solutions for the company. We are talking about the union of experiences: customer and business. The design of new strategies and the implementation of objectives focused on the satisfaction of these two experiences helps to successfully achieve such goals.

CLOSENESS TO PEOPLE: MULTICHANNEL, CENTRALIZATION, TECHNOLOGY

People-centered methodologies ensure being close to the customer. The fact that a B2B client is a company does not imply it’s not human, quite the opposite, whoever manages the process will be a person or a team of employees who need an understandable and close language. This allows us to discover great

72 Tribal January 2023

challenges such as the creation of multi-channel and omni-channel strategies, so that the people who will use these services and solutions carry out their query and purchase journey from anywhere, in the order they prefer, with the ease of creating a bond with companies.

One of the most common problems in B2B companies is that many departments keep using an overly

complex work scheme. The solution is to simplify, and to achieve this, companies must rely on a technology capable of centralizing all the key processes in a single place, being enabled to manage: product, databases, resources and people involved in a clearer and more affordable process.

The B2B buyer is tired of listening; he wants to see, try and experience

www.thebostonbr.com 73

Tecnology/Innovation

74 Tribal January 2023

for himself in public channels (website or marketplaces) as well as in presentations. Demos are a vital part of the B2B sales process and cuttingedge technology is increasingly being demanded by customers: chatbots, augmented reality, and virtual reality are some examples.

Business objectives to be set must be digital, but also omnichannel, since the sales processes are hybrid. In addition, these objectives must reflect across the related business

units and possess a progressive yearon-year scalability. The developed Digital Roadmap must be an integrator with the current company projects, involving the main stakeholders. The process of creating a Digital Business Unit must be incremental.

Tribal WW Center is a company focused on the growth of its clients, creating products to meet indicators and co-creating products with their partners contributing to make their business grow, helping users perceive

www.thebostonbr.com 75 Tecnology/Innovation

Business objectives to be set must be digital, but also omnichannel, since the sales processes are hybrid

From consulting and strategy

Tribal WW Centro contributes to the evolution of Banco Industrial’s internal products

more value, thus creating a better relationship among all parties involved.

TRIBAL WW + BANCO INDUSTRIAL

For more than 10 years, Tribal has developed a close relationship with Banco Industrial, helping to solve different kinds of problems. From consulting and strategy, Tribal WW Centro contributes to the evolution of Banco Industrial’s internal products. In mobile transfers, Tribal helped to understand how the product could reach more people, and through mass use increase the number of transactions, users and exceed the

proposed goals. Based on such goals, they jointly created a strategy to identify how the product should grow in terms of design, processes and user experience.

From the software development service, Tribal helped Banco Industrial solve integration problems with other purveyors, with different types of services, implement a different and innovative type of mobile development, -due to the new and complex server driven development-, this allows the server to tell the application which layout to display, depending on certain user-defined

76 Tribal January 2023

flows, conditions, or constraints.

Another contribution was the creation of a fully dynamic module in which, depending on the user, the flow created in the application or in selected options, different types of design are displayed in the application, improving user experience. It also provides support on security issues with an encryption between application and server, where the security level is very high.

Together, they have solved issues derived from usability, performance, analytics, and data generation for demographics. This teamwork improved internal processes resulting in the optimization of delivery times,

not only from Tribal WW Center but also within the organization, reducing a project’s timeline to completion. Previously, the average time was eight to ten months, and our optimizations brought this down to two months.

The Modern Banking unit has earned internal recognition for improvements in productivity, efficiency, and goal achievement.

Tribal WW Centro is the strategic partner with which Banco Industrial has managed to integrate test automation tools, contributing to the development of automation for code testing, unit testing and code security reviews.

www.tribalworldwide.gt/en

www.thebostonbr.com 77

Tecnology/Innovation

NIU SOLUTIONS:

A Model in Digital Transformation

Produced by Jassen Pintado

Creative Direction

Omar Rodríguez

Produced by Jassen Pintado

Creative Direction

Omar Rodríguez

A complete services portfolio for the development, deployment and operation of digital products and solutions allows NIU Solutions to enable important companies for the digital world in Guatemala and other countries in the region

NIUSolutions offer services in the Marketing, Sales, Customer Service and Information Technology areas to companies from different business sectors experiencing Digital Transformation processes. The knowledge NIU Solutions has acquired from its experience in this field enables the company to develop and integrate the technological solutions that best suit each of its clients’ needs.

“Knowledge and experience are key factors for succeeding. Unlike traditional digital marketing agencies or tech development companies, we integrate deployment and align

execution with each client’s business goal”, commented Rubén Ríos, NIU Solutions co-founder.

CUSTOMIZED SOLUTIONS FOR EACH KIND OF BUSINESS

There are three kinds of services offered by NIU Solutions:

• Strategic solutions, involving aspects such as search engine optimization (SEO), content and sales strategy, user experience, inbound marketing, and content creation, among others.

• Tech solutions: web development, cross-platform

Technology/Innovation www.thebostonbr.com 79

integration, CRM, omnichannel and mobile apps development.

• Data solutions: Analytics, business intelligence, big data, AI and machine learning are some of the resources which will ease the decision-making process in different industries.

Currently, NIU Solutions is focused on helping companies in the banking and insurance business, the automotive industry, e-commerce, and real estate. Projects can be engaged in different modalities: The Audit and Digital Strategy level consist of consultative services that take one or two months;

implementation, divided into projects that take between two or three months, depending on their nature; and Optimization through a 12-month operations contract.

SUCCESSFUL STRATEGIC PARTNERSHIPS

To offer the best solutions and deploy digital strategies that generate the best results, NIU Solutions partners with worldwide prestigious companies which provide different sets of tools to ease the digital implementations’ performance according to each of the projects.

80 Niu Solutions January 2023

We integrate deployment and align execution with each client’s business goal

- Rubén Ríos, NIU Solutions Co-founder

Technology/Innovation www.thebostonbr.com 81

These applications have provided improvements to the client’s experience, besides extending NIU’s products and services portfolio, thus fulfilling their value promise, taking part in the different commercial aspects from marketing to e-commerce.

NIU Solutions has been consolidated as an important partner in the region for HubSpot (at a Platinum level) and as a partner for Credolab,

MessageBird, Google, Jumio and Microsoft.

“The ‘know-how’ we are acquiring is based on certifications with our partners”, Ríos pointed out.

EXPERIENCED LEADERSHIP

Rubén Ríos’ career before founding NIU Solutions is as extensive as it is important. During his 20 years’ experience in the corporate world,

82 Niu Solutions January 2023

he worked at the IT field at companies such as GBM, sole IBM distributors in Central America and some Caribbean countries, where he acted as general manager for eight years. Later, he joined Microsoft in Guatemala, also as a general manager, a tenure from which his learning on interesting aspects about the company’s internationalization and global view can be highlighted.

EVOLUTION TOWARDS AN INTEGRAL SERVICES OFFER

In mid-2015, Ríos decided to create a company where he could successfully apply all the knowledge he obtained during his previous positions. For that reason, he partnered with Niky Arroyave, who already had some experience in the digital field, to create NIU, starting as a marketing company which could provide support to

Technology/Innovation www.thebostonbr.com 83

84 Niu Solutions January 2023

The ‘know-how’ we are acquiring is based on certifications with our partners

- Rubén Ríos, NIU Solutions Co-founder

companies in the creation of digital channels, something new at the time.

To go beyond branding, the market’s most common offer, NIU became a HubSpot distributor, thus deploying the inbound marketing methodology, which caught the attention of companies they had already established a commercial relationship with.

During the first couple of years, the new company entered the market successfully, providing inbound marketing strategies, besides gaining experience in sectors such as finance and insurance. In 2017, Niky left the company; NIU’s achievements up to that date could not have been possible without her valuable partnership.

BI AND INTERNATIONALIZATION

NIU started its commercial relationship with BI and Seguros El Roble -both being part of Corporación BI-. Among

the projects developed with BI companies, in 2019 they transformed the execution of the digital strategy when developing the Crediauto en Línea marketplace, followed by other projects, which earned NIU an innovation award in 2020.

After these successful implementations, NIU contributed to the deployment of the BP Automotriz en Línea automobile marketplace and BP Vivienda en Línea for Banpaís, both in Honduras, as well as an e-commerce project in El Salvador.

BEYOND CENTRAL AMERICA

After gaining proven experience with large and important companies in Guatemala, NIU has shown its professionalism and dedication, leading to partnerships with North American and Mexican companies, contributing to the implementation of a marketplace for housing loans in the latter, with the company with the

Technology/Innovation www.thebostonbr.com 85

highest marketshare in this type of financing in the real estate market in Mexico.

THE HUMAN FACTOR

NIU Solutions’ personnel is made up by a multidisciplinary team which enables the company to provide value to its clients.

Among the values the company shares with its collaborators, going further and walking the extra mile regarding the services the clients receive and their experience within the company undoubtedly stand out.

These are values that have earned them new clients outside Guatemala, besides nurturing its excellent relationship with clients with the most seniority.

Factors such as each of the collaborators’ human quality and professionalism, as well as teamwork with clients, are highly

considered for recruitments.

“We hire the best talent we can find; we seek its development and a culture in which each person knows what to do”, Ríos explained.

FOLLOWING THE STEPS TO BECOME A LEADER

To increase and maintain their prestige by offering integral digital solutions for companies, NIU Solutions is steps ahead by knowing the trends which may be implemented in the different sectors it attends, which has favored the detection of new opportunities.

The market has undergone a transformation regarding the habits of a more and more demanding consumers who wishes to find all the information related to its products online, a flexible method to shop and learn about the most convenient options. All these factors were accelerated by the pandemic, meaning a challenge for companies, becoming

86 Niu Solutions January 2023

in an alignment of businesses from different sectors to keep their position in the market.

NIU Solutions believes that more opportunities will arise from MSMEs in Central America, depending on each country’s infrastructure and digital maturity, and it is already figuring out opportunities by offering solutions to

the Colombian banking industry to keep on growing.

NIU Solutions has become a referent with its qualities and personnel support, as well as with strategical partnerships which can be established in the region and beyond.

niu.solutions info@niu.solutions

Technology/Innovation www.thebostonbr.com 87

We hire the best talent we can find; we seek its development and a culture in which each person knows what to do

- Rubén Ríos, NIU Solutions Co-founder

THINKPAD Z SERIES

by Lenovo

by Lenovo

88 January 2023

ThinkPad Z Series, the new family of laptops

The changes experienced by society in recent years have shown that it’s everyone’s responsibility -including organizationsto make various efforts to contribute to the well-being of society and the environment. Currently, one of the main concerns is the search for

sustainability in an environment that is increasingly affected by climate change, environmental pollution and the different actions from mankind harming the ecosystem.

In this sense, organizations can also take part in this problem and contribute with diverse actions to

Produced by Jassen Pintado

www.thebostonbr.com 89

Creative Direction Omar Rodríguez

offering greater productivity, elegance and care for the environment

find a solution that favors everyone. According to PwC, “18% of CEOs in Peru consider that climate change will lead to new products and services”, and this is a reality that is already being experienced, since new products and services are emerging in technology seeking to contribute to the sustainability of society.

Lenovo, on its behalf, has just announced the new ThinkPad Z Series, made up of two modern laptops: the ThinkPad Z13 and the ThinkPad Z16. These devices are focused on providing productivity and efficiency, but also on caring for the environment since both are designed with eco-friendly materials. This launch is one of the many efforts that the tech multinational has been making in order to contribute to the well-being of the environment through products and services.

One of the ThinkPad Z13 and ThinkPad Z16’s main features is that both have been designed with recycled aluminum, vegan leather and various eco-friendly supplies. Also, the packaging is made from 100% recyclable and compostable bamboo and sugarcane, and the AC adapter uses 90% post-consumer content (PCC). Therefore, both devices contribute to sustainability and the protection of the ecosystem.

“We are totally proud of our new ThinkPad Z Series, this new series will offer productivity, efficiency, elegance and, above all, it will contribute to the environment. Innovation is in our DNA, from design and development to engineering and supply chain. We will continue to push boundaries, make changes, and work with close partners like AMD and Microsoft to deliver innovative, more secure products like the ThinkPad Z13 and Z16, designed

90 Lenovo January 2023

- Jerry Paradise, Vicepresident of Global Commercial Product Portfolio, Lenovo PC and Smart Devices

Tech & Innovation www.thebostonbr.com 91

“We are proud of our new ThinkPad Z Series, this new series will offer productivity, efficiency, elegance and, above all, it will contribute to the environment”

to exceed customer needs today and in the future,” said Jerry Paradise, Vice President of Global Commercial Product Portfolio, Lenovo PC and Smart Devices.

THE EXCEPTIONAL DESIGN OF THE THINKPAD Z13 AND Z16

The new ThinkPad laptop series features stunning, disrupting designs, introducing new colors and materials to its range of premium business laptops. Its minimalist design provides a sophisticated and coveted look. Also, the displays are optimized with ultra-narrow bezels and productive 16:10 aspect ratios. On the other

hand, a larger 120mm crystalmade haptic ForcePad has been introduced, which flows seamlessly with a crystal touchpad for quick and easy input. Also, for those familiar with the red TrackPoint, you will witness new functionality: doubletap the TrackPoint to launch the Communication QuickMenu for quick access to common camera and microphone settings.

The goal of the new ThinkPad

Z Series is to delight users with a distinctive look using recycled materials, deliver on the brand promise of an exceptional experience, and ensure great business-class

92 Lenovo January 2023

performance, security, reliability, and manageability.

EXCLUSIVE COLLABORATION BETWEEN LENOVO AND AMD

For this new series, Lenovo and AMD have teamed up to deliver cuttingedge platform design, optimizing every aspect of the system from silicon to hardware to software.

The ThinkPad Z13, coupled with the exclusive AMD Ryzen™ 7 PRO 6860Z processor, offers an extraordinary collaboration experience. The processor is optimized to deliver transparent audio and video performance, maximize responsiveness, and deliver incredible battery life in apps like Teams and Zoom.

Tech & Innovation www.thebostonbr.com 93

Lenovo

Who Are The Data-Centered?

94 Lenovo January 2023

The ThinkPad Z16 can also be configured along the new AMD Radeon™ RX 6500M discrete graphics with AMD Smart Technologies, increasing productivity, enabling advanced content creation and casual gaming. When paired with Ryzen processors, AMD Smart Shift Max delivers an instant boost in power to both the CPU and GPU, and Smart Shift Eco is designed to maximize battery efficiency.

THE BEST OF TECHNOLOGY WITHIN YOUR REACH

The ThinkPad Z13 and Z16 have several features that make them the ideal choice for heavy workflows. Additionally, they are well suited to organizations with a growing staff who, as consumers, may not be very familiar with Windows-based devices.

In order to provide a complete and satisfying audiovisual experience, both devices feature vivid display options, including 2.8K touch OLED on the Z13

www.thebostonbr.com 95

-

Jerry

Paradise, Vicepresident of Global Commercial Product Portfolio, Lenovo PC and Smart Devices

Tech & Innovation

“We will continue to push boundaries, make changes, and work with close partners to deliver innovative, more secure products, designed to exceed customer needs today and in the future”