THEBUSINESSMAGAZINEFORCASH&CARRY/DELIVEREDWHOLESALERSFEBRUARY2023 SPOTLIGHT:CRAIGSTEVENSONOFBRAEHEADFOODS BIDCORPMAKES STRATEGICMOVE Independentfoodservice wholesalersacquiredfor CaterfoodBuyingGroup ApplebyWestward investsover£10m CATEGORY MANAGEMENT Yourultimate38-pageguide STOCK THE NEW TASTE SENSATIONS VUSE GO FLAVOURS IN RECHARGEABLE ePOD UP TO 1900 PUFFS PER PACK* Dispose of responsibly. 18+ only. This product contains nicotine and is addictive. For adult nicotine consumers only. For trade use only. *Based on laboratory testing (including recharging) of VUSE ePod 2 device and may vary depending on individuals usage behaviour.

Contents February2023 Thismonthdon’tmiss... CraigStevensonofBraeheadFoodsgottoknowhisemployeesalot betterduringthepandemicandsawthattheyare‘superstars’. 07 BestwayinvestsinSainsbury’s andseesan11%riseinturnover. 09 AfirewalkbyCJLangcolleagues raisesover£4,000forcharity. 08 ScottishWholesaleAssociation joinscallforDRSgraceperiod. ESSENTIALS FEATURES 05 06 Editor’sComment IndustryNews InFocus BidcorpUKisstrengtheningits Bidfooddepotnetworkandalso acquiringindependentfoodservice wholesalerstogiveitsCaterfood BuyingGroupnationalcoverage. Spotlight CraigStevenson,managingdirectorofBraeheadFoods. 12 18 www.cashandcarrymanagement.co.uk February2023 03 SPARcontinuessponsorshipof LancashireSchoolGames. 18 14 19 Vaping&NGPs Therapiddevelopmentofthe vapingandnext-generationproductcategoriesprovidesanopportunityforadditionalsalesandprofitsforwholesalersandtheirretail customers. CategoryManagement Adefinitiveguidetoenhancingthe customerexperience,withadvice fromkeysuppliersonmaximising opportunitiesinspecificproduct categories,plusanoverviewofthe supportthatwholesalersandbuyinggroupsaregivingtoretailers. CATEGORYINSIGHT 08 22 Wholesalersandbuyinggroups talkaboutcategorymanagement.

Professionally formulated cleaning products with trusted brands

YOUR GUIDE TO POWERFUL CLEANING

Unilever and Diversey come together to give you Pro Formula, a complete range of ready to use professional cleaning products, paired with trusted Unilever brands.

The range is specifically developed for your professional cleaning needs, and comes with free online cleaning & HACCP guides, helping you meet hygiene standards.

Domestos Professional Disinfectant Toilet Cleaner

Domestos Pro Formula Disinfectant Toilet Cleaner kills germs, protects your business, and leaves your toilet clean and limescalefree with a fresh lime scent.

This conveniently-sized 750ml bottle will help kill germs and get rid of limescale whenever you need it to. Add this descaler to your supply of washroom cleaners for longer-lasting results, as this toilet gel grips for longer below the waterline to remove all limescale and kill the germs that live within it.

Domestos Pro Formula Disinfectant Toilet Cleaner is also 3 times thicker than other toilet limescale removers – so, germs need to watch out!

• Kills 99,9% of bacteria and viruses

• Up to 3x thicker, long-lasting formula*

• Leaves behind a fresh lime scent

• Effective limescale remover

101105754 Domestos Pro Formula Disinfectant Toilet Cleaner

E N14476 EN1276 H.A.C .C.P

Bigbusiness intentions

Twoitemsofnewsinthepast coupleofweekshaveparticularlycaughtmyattention: Bestway’sstakebuildingin Sainsbury’s(page7)andBidcorp’s acquisitionoftwoindependentwholesalerstostrengthenitsCaterfood BuyingGroup(pages12-13).

Bestway’sinitialpurchaseofa3.45% stakeinSainsbury’s,followedbyan increaseto4.47%,hasfuelledspeculationthatthewholesalerisplanningto takeoverthesupermarketgiant.This speculationhasbeenheightenedbya reportin TheTelegraph thatCostcutter’s founderColinGraveshadadvised Bestway’smanagingdirectorDawood Pervez“totakeSainsbury’sprivateand combinethetwogroups”.

AlthoughBestwaytooktheunusual stepoftellinginstitutionalshareholders tocontactaspecificbrokeriftheywish toselltheirsharesinthesupermarket group,itdeniedithadanyplansto makeanofferforSainsbury’s.

Industrycommentatorsbelievethat amoreimminentdevelopmentwould beBestway’sWellPharmacybusiness replacingSainsbury’scurrentpartner LloydsPharmacy,whichrecently announcedplanstocloseallofitsconcessionsinSainsbury’sstores.

InaturallyapproachedBestwayto findoutmore,butPervezdeclinedto commentfurther–eitheronBestway’s intentionsforSainsbury’soronits recentresults(page7).

MoreforthcomingabouthisbusinessintentionsisAndrewSelley,CEO ofBidcorpUK,whichrecentlyacquired ThomasRidleyFoodserviceandHarvest FineFoodsfortheCaterfoodBuying Group.

Hetold Cash&CarryManagement thatheislookingforadditionalwholesalerstoaddtothegroupinorderto providecompletecoverageinGB.

Eachofthebusinesseswithin CaterfoodBuyingGroupoperates autonomously,supportedbyBidcorp’s strategicandfinancialstrength,includingitssubstantialbuyingpower.

Selleyexplainedthat,withBidfood providinganationalserviceand Caterfoodmembersofferingamore localproposition,Bidcorp“canmeetthe needsofeverycustomer”.

Bidcorp’sstrategytodevelopthe CaterfoodBuyingGrouphasrepercussionsforthetraditionalbuyinggroups thatpreviouslybenefitedfromthe wholesalers’membership:inthecase ofHarvestFineFoodsandThomas Ridley,CountryRangeGroupisnow twomembersdown.

Alotofpeopleinthewholesale industrywillbewaitingwithbated breathtoseewhichindependentoperatorwillbesnappedupnext.Isuspectit won’tbelonguntilwefindout.

KirstiSharratt ManagingEditor

KirstiSharratt ManagingEditor

NEVERMISSANISSUE...

Cash&CarryManagementisfreetocash&carryand deliveredwholesaledirectors,buyersandmanagers. Themagazineisavailabletoothersubscribersforjust £74ayearor£7percopy.Overseasyearly subscriptionsarepricedat£95.Backissuesdating backto2011areavailableonline.

Emailmail.winlove@btconnect.comorcall(01342) 712100formoreinformation.

Address WinlovePublicationsLtd

POBox366

EastGrinstead

RH194ZE

Tel (01342)712100

Email mail.winlove@btconnect.com

Publisher WinlovePublicationsLtd

EDITORIAL ManagingEditor KirstiSharratt Contributor SiobhanKielty

ADVERTISINGANDMARKETING PublishingDirector MartinLovell MediaSalesManager ClarePhillips

4,448 July2018–June2019 AuditBureauofCirculations

PrintedbyBishopsPrinters ISSN1352-254X

Allmediarates,featurelistsand deadlinescanbeaccessedonlineby visiting: cashandcarrymanagement.co.uk

THE BUSINESS MAGAZINE FOR CASH & CARRY/DELIVERED WHOLESALERS FEBRUARY 2023 SPOTLIGHT: CRAIG STEVENSON OF BRAEHEAD FOODS STOCK THE NEW TASTE SENSATIONS ST TAST E N HT TOC SENSA TE ATIONS BIDCORP MAKES STRATEGIC MOVE Independent foodservice wholesalers acquired for Caterfood Buying Group Appleby Westward invests over £10m CATEGORY MANAGEMENT Your ultimate 38-page guide

THREEWAYSTOGET INVOLVEDTHISMONTH

ONLINE

LINKEDIN

1.

Catchuponallthelatestnewsvia ourwebsite,includingdevelopments fromwholesalersandsuppliers,and viewourcurrentonlinemagazine edition,aswellasbackissues. cashandcarrymanagement.co.uk 2

Joinourofficialpageforlatest events,announcementsandforum discussions.

TWITTER

3.

Followustoreceivebreakingnews, plusliveupdatesfromindustry conferences. @CandCManagement

[ EDITOR’SCOMMENT ] www.cashandcarrymanagement.co.uk February2023 05

Marwoodsuccessor

Bigger Kitchen Candyfor children

WorldofSweets has launchedanewchildren’s confectionerybrand.

CandyRealmshasbeen createdtoincorporatea rangeofpopularconfectioneryproductsincluding candycupsandsharebags.

Theaffordableselection istargetedatayoungeraudienceofsweetloverswith adventurousimaginations. Thecharacters–Realm Rulers,TheLLamacorn,Pearl &TheMermaids,Captain S.PaceandChompasaur–thatfeatureonthepackaging aredesignedtohelpthe productsstandoutinstore.

Solesupply agreement

QCatering hassecureda solesupplyagreementwith IndependentCateringManagement(ICM),after15 yearsofsharingthebusiness withBrakes.

ICMisoneoftheleading schoolmealprovidersinthe SouthEastofEngland.

Foundedin1996,ICMtoday caterstoover90schoolsin Kent,SurreyandSussex, cookingtensofthousandsof mealsaday.

Inothernews,QCatering haslaunchedanewdedicatedtelesalesservice, allowingcustomerstoplace anorderupto10pmfor next-daydelivery.

AFBlakemore&Son has appointedCarolWelchas chiefexecutive.

Shewilljointhebusiness inApril,succeedingJerry Marwoodwhoisleavingto focusmoretimeonhisnonexecutivedirectorshipsand consultancyroles.

Welch(right)iscurrently managingdirectorUK& IrelandandcommercialofficerEuropeatOdeon CinemasGroup.Shehas alsoheldpositionsatCosta Coffee,AssociatedBritish Foods,Cadbury-Schweppes, andPepsiCo.

Welchcommented:“AF Blakemoreisafantasticbusinesswithadeepunderstandingofretail,wholesale andfoodserviceandan enviablevalues-ledculture, fuelledbymorethan7,000 colleaguesandpartnerswho arepassionateaboutdeliveringgreatfoodanddrink solutions.”

ChairmanPeterBlakemoresaid:“Caroljoining

seestheculminationofour CEOsuccessionplanfollowingJerry’sdecisiontoleave thebusinessattheendof thisfinancialyear.Jerryhas doneanoutstandingjob overthelast11years.”

Marwoodadded:“I’ve hadafabuloustimeatAFB andhadtheprivilegeof workingwithanoutstanding groupofpeople.Together wehaveproventhataprivately-ownedfamilybusinesscansucceedinoneof themostcompetitivemarketsintheUKandstill upholdcorevaluesthat makeusallproudtobepart oftheteam.”

FreshDirect –partofSysco SpecialityGroup–has invested£2millionatits BicestersitetoscaleupproductionforitsFreshKitchen brand.

FreshKitchenproducesa comprehensiverangeof sauces,pickles,slaws,marinades,relishesanddesserts forthefoodserviceindustry andhasreportedafourfold riseinproductionoverthe pastthreeyears.

Asaresult,ithasincreased thesizeofitsmanufacturing facilityby20%toallowfor extraovens,blastchillersand otherequipment.Ithasalso recruitedtwomoredevelopmentschefsandaproduct developmentexecutive.

NominationsinvitedbyFWD

The FWD haslauncheda newsetofawardsforpeople whoaredevelopingtheir skillsthroughapprenticeships,trainingoracademic studywiththesupportof theiremployer.

TheWholesaleStars (Skills,TrainingandApprenticeship)AwardswillbepresentedattheHouseof Commonson18April(35pm)andallFWDmembers areinvitedtoattend.

FWDmembersare encouragedtoselectupto fivemembersoftheirteam whohavetakenontraining andcareerdevelopment coursesinthepasttwo years.Theseawardsarenot

competitiveandentriesare notjudged–allthenomineeswillbeinvitedtothe HouseofCommonsto receivetheirawardsandto meetministersandMPs.

Oneoftheaimsoftheinitiativeistodemonstratethat wholesalersarevitalemployersandarecommittedto upskillingtheworkforce.

EnlistingthehelpofMPsto

ensurethattheGovernment recognisesandsupportsthis effortandinvestmentisa vitalpartoftheFWD’s engagementstrategy.

FWDdirectorofcommunicationsDavidVisicksaid: “Wehaveanenormousnumberofpeopleinallkindsof roleswithinwholesalewho arebuildingtheirskills throughexternalandinternal traininganddevelopment.

“Theiremployersback theminthisbecauseweall needthoseskillsinoursector.Boththeindividualsand thecompaniesdeserve recognition,andthat’swhat theWholesaleStarsisall about.”

[ INDUSTRYNEWS ] 06 February2023 www.cashandcarrymanagement.co.uk

PositiveresultsandSainsburystake

BestwayWholesale sawan 11%riseinturnoverto£2.94 billionintheyearended30 June2022,whileprofit beforetaxincreasedby90% to£70.8million.

“Theincreaseinrevenue wasdrivenbythefull-year impactoftheacquisitionof Costcutter,aswellasunderlyinglike-for-likesales growthdrivenbyinflation alongsideincreaseddemand inindependentconvenience retail,duetocustomers choosingtoshopmore local,”saidgroupchiefexecutiveZameerChoudrey.

“Theincreaseinprofitabilityhasbeendrivenby thefull-yearimpactofthe acquisitionofCostcutterand thedeliveryofassociated scalebenefits.Theincrease inprofithasalsobeendriven byimprovedmarginrates

duetocontinuousreviewof thebusiness’spricingand promotionalstrategy.

“Thebusinesshasalso benefitedfromoperational efficienciesthroughreorganisingdeliveryprocessesand restructuringback-office operations.”

Choudreycontinued: “Themarketconditionsin thewholesalesectorremain challenging,withsupply

chainandstaffavailability issuespersistingandwith theUKmarketenteringintoa highinflationenvironment.

“Despitethesechallenges,BestwayWholesale hasremainedcommittedto itsstrategicplanofoffering improvedserviceandconveniencetocustomers.”

Lookingahead,Choudrey added:“Thewholesalebusinesswillcontinuetofocus ongrowingshareinacompetitivemarketbyleveraging itsscaleinfrastructure.The businesswillalsobefocused ondeliveringoperationalefficienciesandonproviding customerswiththebestprice andavailabilitytosupport end-customers,giventhe increaseinthecostofliving.”

Theresultswerepublishedasnewsbrokeof BestwayGrouppurchasinga

3.45%stakein Sainsbury’s. Afewdayslater,Bestway increaseditsstaketo4.47%.

AlthoughBestwaysaid thatitisnotconsideringan offerforSainsbury’s,ittook theunusualstepoftelling institutionalshareholdersin Sainsbury’swhoareinterestedinsellingtheirshares tocontactthebroker Redburn.

Thereisspeculationthat Bestwaymaybelookingfor its WellPharmacy business toreplaceSainsbury’scurrentpartnerLloydsPharmacy.Thelatterhasrecently announcedplanstocloseall 237ofitsconcessionsin Sainsbury’ssupermarkets.

Investmentincapitalandseniormanagement

ApplebyWestward, the SPARretailerandwholesaler intheSouthWest,has announceda£10millionpluscapitalinvestmentprogramme.

Scheduledtogetunderwaythisyearisan£8.5millionprojectatthecompany’s HQinSaltash,Cornwall.

“Awarehouseextension willbebuiltonthelandwe ownadjacenttoourcurrent warehousebuildings,”said managingdirectorMike Boardman.“Inaddition,we willbeimprovingon-sitecar parking,redesigningand refittingtheofficefacilities andmodernisingtheexisting warehousebuildings.”

Amongnewwarehousing facilitieswillbeachilled crossdeck,enablingthe companytoprovidemultitemperaturedeliveriesfrom

itsSaltashsiteandthe GregoryDistributionfacility atCullompton.

Inaddition,a£1.6million programmetoinvestinthe developmentofthe140strongcompany-owned storesestatewillrun throughouttheyear.Theaim istoimprovethefabricof storesforbothcustomers andstorestaff,ensuring back-of-housefacilitiesare upgradedandredecorated.

ApplebyWestwardhas alsosetaside£500,000for co-investmentstoredevelopmentprogrammesforits independentSPARretailers andistargetingtherecruitmentof35storesthisyear.

“Theseprojectsdemonstrateourcontinuedsuccess andintentiontogrowthe businessoverthecoming years,”saidBoardman.

ApplebyWestwardhas alsocreatedanewdivisional

board.KelvinBeardsleyhas beenappointedoperations director,LucieColemanjoins asretaildirector,andDuncan Jelfsisthenewcommercial director.Existinggroup financedirectorJoeKeohane alsojoinsthenewboard.

Beardsleyhasseveral years’experiencedirecting operationsinthelogistics industry;Colemanwasformerlyretaildirectorat Jollyes–ThePetPeople, whichhas80stores;and Jelfswaspreviouslyheadof BargainBoozeandCo-op franchiseatBestway.

Boardmansaid:“This moveisdesignedto strengthentheseniormanagementstructuretoreflect boththerapidsalesgrowth withintheorganisationand theincreasingcomplexityof ouroperations.”

[ INDUSTRYNEWS ] www.cashandcarrymanagement.co.uk February2023 07

ZameerChoudrey:‘The marketremainschallenging.’

TheSaltashsitewillbenefitfroman£8.5milliondevelopment.

Partnership extended

Syscocompanies Fresh Direct and WildHarvest havejoined Brakes’ London depotinforminganewpartnershipwithemergency foodcharityCityHarvestto providesurplusfoodtovulnerablegroups.

Thepartnershipwillsee CityHarvestcollectfrom FreshDirectandWild Harvest’sDagenhamdepot twiceaweek,inadditionto weeklycollectionsfrom Brakes’siteinParkRoyal. FooddonatedbySyscoGB isexpectedtoprovideabout 200,000mealseveryyear.

Driverchallenge

Grantsfor goodcauses

Followingthesuccessofits £100,000CommunityCashbackSchemelastyear, SPAR isrepeatingtheprogramme thisyear,givinggrantsto localorganisationsand charities.

Alorrydriverwith James Hall&Co issettochallenge himselfagainstpeersfrom aroundtheworld.

SteveMetcalf(pictured) willtraveltoSwedenin Marchtoparticipateinthe firsteverSPARInternational DriveroftheYearcontest.

Metcalfgainedthefirstof hisHGVlicencesafterleavinghismanagerialposition inthecorporateworlda decadeago.Hehasbeen drivingHGVsfor10yearsfor JamesHall&Co,andhe

visitsYorkshire,Cumbria,the NorthMidlands,andstores aroundLancashireinatypicalworkingweek.

Metcalfsaid:“WhenIleft mydeskjob,Ineverthought thejourneywouldtakemeto whereIamtoday.Ihaveno regrets;Ihavelovedevery minuteofit.”

Inothernews,itisconfirmedthattheLancashire SchoolGameswillbesponsoredbySPARforthe17th yearrunningthroughitsassociationwithJamesHall&Co.

Shoppersfromallover theUKcanapplyforagrant foranorganisationorcharity theyfeeldeservesfunding. Applicationswillbeopen until15March2023.

Amountsupto£10,000 areavailable,andsuccessful applicantswillbevisitedand awardedtheirgrantbytheir localSPARrepresentative.

Thetop100shortlisted charitieswillthenhavethe chancetobeshowcased acrossSPARsocialchannels andwebsiteforamonth, givingthecharitiesvaluable exposureandamplifyingthe SPARCommunityCashback campaign.

SWAjoinscallforDRSgraceperiod

The ScottishWholesale Association(SWA) isoneof severaltradebodiescalling foran18-monthlegalgrace periodandtheoptiontoopt intotheDepositReturn Scheme(DRS)forthethousandsofsmallproducersin Scotland.

TheSWA,alongwiththe SocietyofIndependent Brewers,theWineandSpirit TradeAssociation,the ScotchWhiskyAssociation andScotlandFood&Drink, warnsthatwithouturgent changesbytheScottish Governmenttothescheme, manyproductswillnolonger beavailableinScotlandfrom 16Augustandpriceswill substantiallyincrease.

InanopenlettertoLorna

Slater,MinisterforGreen Skills,CircularEconomyand Biodiversity,thetrade groupshighlightthecontinuedlackofclarityonhowthe schemewillworkandthe actionthatsmallproducers needtotaketoprepare.They

alsocallforSlatertoamend therulesforonlinetakeback.

TheSWAhasalsobeen collaboratingwithother tradebodiestoexploreways toprotectwholesalersthat areimportersand/orproducersviaagraceperiod.SWA

chiefexecutiveColinSmith said:“Agraceperiodwill allowthemtoovercomethe significantchallengesthey stillfaceintryingtoget readytogolivewithDRS becausethereremainfundamentalunansweredquestionsonkeyissuessuchas VAT,price-markedpacks,IT systemrequirements,and whathappenstostockin bondedwarehouses.

“Inaddition,ourrequest forade-minimisonSKUs belowa50,000unitper annumthresholdwouldprotecttheavailabilityand choiceofawiderangeof uniqueorlimitedlow-volumeSKUsthatmanywholesalersandtheircustomers stock.”

[ INDUSTRYNEWS ]

08 February2023 www.cashandcarrymanagement.co.uk

ColinSmithdiscussesDRSwithFirstMinisterNicolaSturgeon.

Divisionaldirector

KitwaveGroup hasrecruited LucieMilburn(below)asthe newdivisionaloperations directorofitsfrozen&chilled division.

Newfleetdesigns

mostrecentlysupplyfinance director.

Kitwave’schiefoperating officerBenMaxtedcommented:“Lucie’sextensive experiencewilladdconsiderablevaluetothefrozen& chilleddivisionaswecontinuetodriveorganicgrowth.

“Asthegrouppursues furtheracquisitions,Lucie’s rolewillalsobepivotalinthe successfulintegrationofnew businessesandthedelivery ofoperationalefficiencies.”

Kitwave’sfrozen&chilled divisioncomprisestwobusinesses:EdenFarmand CentralSupplies.Together theycovernineUKdepot locations.

Milburnhasmorethan17 yearsofexperiencewithin supplychainoperationsand financeatDiageo,andwas

Reduced charges

SugroUK isofferingits wholesalemembersthe chancetoreducecostlycard transactionchargeswitha newopenbankingservice.

Thebuyinggrouphas agreedadealwithb2b.store torolloutB2BOpenBanking.

B2BOpenBankingallows wholesalerstoacceptpaymentbybanktransfer–a secure,fastandconvenient methodthatcostslessthan credit/debitcardtransactions.

Thereisalsoacashflow benefit:moneyispaidintoa bankaccountalmostimmediatelycomparedtothetwo orthreedaysforcardpaymentstoclear.

“Openbankingtechnologyhasthepotentialtobea gamechanger,”saidSugro’s headofcommercial&marketingYuliaPetitt.

Inaddition,Kitwavehas appointedTeresaOctavioas non-executivedirector.

Octaviohasheldanumberofexecutiverolesat globalbusinesses,including KantarConsulting,Diageo andProcter&Gamble.She hasalsobeenanindependentadvisorforseveralboard andexecutive-levelmanagers.

Bidfood hasaddedfournew designsoflandscapestoits fleettocelebrateovera decadesincetheoriginal designsfirsthittheroads.

Acompetitionwas launchedamongemployees andtherewerenearly100 entries.

Thefourdesigns–an underwater-scape,tropical paradise,sunriseoverafarm andwintercastlescene–weresenttoprofessional

Firewalkfundraiser

Morethan40colleagues from CJLang&Son have takenpartinafirewalkatthe company’sDundeedepotto raisefundsforSPAR’snational charitypartnerMarieCurie.

The40peoplefromall areasofCJLang’sbusiness–distribution,logistics,warehouse,headofficeandSPAR

Scotlandstores–havesofar raised£4,000inonlineand offlinedonationsbywalking

acrossthehotembers.

PaulaMiddleton,marketingmanagerofCJLang, said:“Thefirewalkwasan excitingopportunitytonot onlychallengeourselves personallyandtickitoffour bucketlists,buttoraise fundsforMarieCurie.”

Inothernews,CJLang hasselectedRELEXtoautomateandoptimiseitssupply chainprocessesacrossits retailandwholesalebusiness.

RELEXwilldeliverintegratedstoreandDCforecastingandreplenishment, aswellasimprovedallocationsandpromotionalforecastingforCJLang’scompany-ownedstoresanddistributioncentre.RELEXis alsotaskedwithdrivingbetterorderaccuracy,sharingof forecaststosuppliers,and freshassortmentoptimisation.

foodartists,whophysically builtthedesignsusingproductsandingredientsordered viaBidfoodDirect.

Thewinnerswere:businessmanagerAlanGaunt andhiswifeJane;MaggiemayBull,aged8,daughterof telesales&customerservicesmanagerAshleyBull; telesalesexecutiveDenise Cavey;andemployee& engagementmanagerBen FisherandhiswifeLiz.

Suitable forvegans

CountryRangeGroup has revampedtherecipeforits DeepDishBramleyApplePie sothatitisnowsuitablefor vegans.

MadeusingIrishBramley applesandveganpastryproducedfromorganicflour milledintheCotswolds,the dessertispre-portionedinto 14slicesandcomesinboxes oftwo.

[ INDUSTRYNEWS ]

www.cashandcarrymanagement.co.uk February2023 09

Returnto SugroUK

ShrutiSenapatihasrejoined SugroUK asabusiness developmentmanager.

Senapati(below)returns totheorganisationfrom MullerPropertyGroup, whereshe spent17 monthsas marketing manager. Beforethat shelooked afterthe marketing forSugro fornearlythreeyears.

SugroUK’sheadofcommercial&marketingYulia Petittsaid:“Itisfantasticto haveShrutibackintheteam. Shrutihasanextensive knowledgeofthewholesale industryandisverypassionateaboutthegroupandits members’success.Iamconfidentthatshewillbeagreat assetforthebusiness.”

SuchaSingh

SuchaSingh,formerowner of ThamesCash&Carry and afoundingmemberofthe Today’sGroup,hasdied.

Singh,71,passedaway suddenlyon1February.

Hehadretiredfromthe wholesaleindustryfour yearsagotospendtimeon hisotherbusinessinterests andtobewithhisfamily.

“Suchawillberememberedasasoftlyspoken, truegentlemanwhowillbe sadlymissedbythemany thatknewhiminthewholesaletrade,”saidaUnitas spokesperson.

“Thethoughtsofthe Unitasteamandourwholesalemembershiparewith Sucha’sfamilyandfriends.”

Tributescameinfrom acrosstheindustry.Jason Stocker,wholesale&conveniencecontrolleratNestlé, said:“Verysadnews.Had somegoodtimeswithSucha intheoldToday’sGroup days,andwasoneofthefirst

buyinggroupmembersI wenttoinmyearlycareer.”

MohanKhurana,general manageratSunMark, added:“Suchsadnews,He wasawonderfulpersonand agoodfriend.RIP.”

SimonHannah,CEOof JWFilshill,said:“Suchawas awonderfulpersonbothpersonallyandprofessionally.A manoffewwordsbutwhen hespoke,peoplelistened.”

SimonGray,CEOof BoostDrinks,added:“Sucha taughtmanyofussomuch, andhiswholesalewisdom willstandthetestoftime.”

Inrecognitionofthecontributionthatsuppliershave madeoverthepastyear workinginpartnershipwith Bestway’s tradingteams, thecompanyrecentlyhelda ‘ThankYouLunch’atitsHQ.

Theeventincludedthe wholesaler’sinaugural‘Thank YouSupplierAwards’to recognisethebesttalentand risingstarsinthetrade.

Thewinnerswere:

a KeyAccountManager: StuartGriggs,Coca-Cola EuropacificPartners

a SpecialAchieversAward: CrispinNewborough,KP Snacks

a MarketingProfessional: AmyHallandKateFrenzel, bothDiageo

a NewcomeroftheYear:Joe Liquorish,NestléGrocery

a Data&InsightStar:Keir O’Sullivan,Heineken

a DigitalInnovator:Kevin Rhodes,PepsiCo.

Doncasterdepot NewConfexmember

Confex hasanewmember: AdamsFoodserviceTrading.

TheBradford-basedfamilyownedwholesalerhasa turnoverofmorethan£80 milliontoaddtotheConfex’s £3billioncombinedmember turnover.

LWCDrinks hasopeneda newpurpose-builtdistributiondepotinDoncaster,creating50jobs.

The£7millionprojecthas beencompletedona58,000 sqftsite.Fromthere,LWC willservecustomersin SouthandEastYorkshire, Lincolnshire,NottinghamshireandDerbyshire.

Thenewfacilityhousesa

warehousemanagement systemwithimprovedinventorymanagementandforecastingaccuracy,plusvoice recognitiontechnology.

Thefamily-owneddrinks wholesalerhasembarkedon expansionplans,withthe acquisitionofthreenew depots,includingDoncaster, andtherecruitmentof300 newemployeesinpastyear.

Establishedin1985, AdamsFoodservicehas grownfrombeingalocal grocerystoretooperating specialistfoodservicecash &carriesinBradford, Birmingham,Hull,Leeds, Liverpool,Nottingham, PrestonandSheffield.

Thebusinesshasitsown logisticsdivision,focusing ongivingacompletefoodservicelogisticssolution, makingitconvenientto

partnerwithAdams,accordingtoConfex.

OwnerSajadHussain said:“AdamsFoodserviceis acompanythatpridesitself onbuildinglong-lastingrelationshipswithourcustomersandsuppliers,and givingbacktotheregionsit operatesfrom.”

AdamsFoodserviceprovides“alltheessentialsthat afoodoutletorindependent wholesalermayrequire”. Itsrangeincludesfrozen, chilled,freshandambient food,aswellaspackaging andcleaningproducts.

[ INDUSTRYNEWS ] 10 February2023 www.cashandcarrymanagement.co.uk

Suppliers recognised

Ontheacquisitiontrail

BidcorpisnotonlystrengtheningitsBidfooddepotnetwork,itisalsobuyingindependent foodservicewholesalersinordertogiveitsCaterfoodBuyingGroupnationalcoverage.

TheacquisitionsofThomas RidleyFoodserviceand HarvestFineFoodsalreadythis yearillustratethedeterminationofCaterfoodBuyingGroup–partof BidcorpUK–toofferanationalservice.

“Wearecurrentlyinastateofexpansionandaresearchingoutadditional businessestoaddtothegroupinthe NorthofEnglandandScotlandfor completecoverageinGreatBritain,” declaresthecompany’swebsite.

Atpresent,almosteverypartof EnglandandWalescanbeservicedbya CaterfoodBuyingGroupbusiness.

“AswedeveloptheCaterfoodfamily, wearefocusingongrowthinareas wherewehavetheopportunitytobuild onourexistingpresenceandreach, minimisingcompetitionandoverlap withinthegroupasfaraspossible,”said AndrewSelley,CEOofBidcorpUK.

“TheCaterfoodBuyingGroupis whollyfocusedonbuildingafamilyof successfulfoodservicewholesalebusinessesacrosstheUKthatoperate autonomously,inlinewithourdecentralisedbusinessmodel.Thesethriving, independentbusinesseshavetheirown

identityandoffers,butareunitedby theirpassionandcommitmenttodeliveringexcellentservicetotheircustomers,”saidSelley.

Thelatestacquisitionsmake Caterfood“oneofthemainbuying groupsservingthefoodservicewholesalesector,”heclaimed.

“Thisisalreadyshapinguptobean incrediblyexcitingyearforusasabusiness,”hecommented.“Afterbeing delightedtowelcomeHarvestFine FoodsintotheBidcorpfamily,itgives megreatpleasuretoextendthatsame warmwelcometotheteamatThomas RidleyFoodservice.

“ThomasRidleyisahighlyexperiencedandaccomplishedfoodservice supplier,andwillperfectlycomplement theCaterfoodBuyingGroup.Aswith theacquisitionoftheotherindependent businesseswithinthegroup,Thomas Ridleywillcontinueoperatingasan autonomousandindependentbusiness.

Country R ange Group loses two members

Bidcorp’sacquisitionsofHarvestFine FoodsandThomasRidleyFoodservice meanthatCountryRangeGrouphas losttwomembers.

asacomplimentthatpeopleare takingnoteofourmembers’values, businessesandsuccess.Itmeans we’redoingsomethingright.

WithitsheadofficeinBoston,Lincs, whereSouthLincsFoodserviceis based,theorganisationalsoincludes Caterfood(Paignton),Cimandis Foodservice(theChannelIslands),Elite FineFoods(Newhaven),HarvestFine Foods(Totton),NicolHughes Foodservice(Chester),andThomas RidleyFoodservice(BuryStEdmunds).

Eachofthecompanieswithinthe CaterfoodBuyingGroupoperatesasan autonomous,independentandstandalonebusiness,withitsownfullyoperationalsalesandcommercialinfrastructureandteams,businessplansand strategies.Bidcorpprovidestrategic, marketingandinsightssupportwhere appropriate,aswellasleveragingits scaletoenhancethewholesalers’buyingcapabilities.

CRGchiefexecutiveMartinWard commented:“We’vethoroughly enjoyedworkingwiththeteamat Harvestthispastsixyears.Wehave achievedsomefantasticsuccesses togetherandmadesomemagical memoriesalongtheway,evenduring someincrediblychallengingeconomictimes.WewishRichard Strongman,histeamandthebusiness allthebestinthefuture.”

OnthelossofThomasRidley Foodservice,headded:“Ourgroupis extremelycloseandit’salwaysa shamewhenweloseamember,especiallyoneaslongstandingasThomas

Ridley.WewishJustinandthewider ThomasRidleyteambestwishesfor thefuture.

“Acquisitionsarepartofbusiness and,althoughit’snotideal,wetakeit

“Thefactthatourmembers becomeattractivepropositionstothe takeovermerchantscomeswiththe territory.Ourjobistocontinueto supportandgrowtruefamily-owned, independentbusinesses.”

[ INFOCUS ]

12 February2023 www.cashandcarrymanagement.co.uk

AndrewSelley:‘Thisisalreadyshaping uptobeanincrediblyexcitingyearfor usasabusiness.’

MartinWard:‘Ourmembersbecome attractivepropositions.’

Bidfoodistoopentwonewdepotsin 2023–andanotherin2024–aspartof awiderplantostrengthenitsexisting 24-strongdepotnetworkandoffer customersatrulylocalservice.

Thefirstofthenewsiteswillbein Glasgow.The90,000sqftsitewill covertheWestofScotlandandisset toopeninearlyspring.

ThesecondsiteisinBedfordshire andaimstocommencetradinginthe autumn.At160,000sqft,itwillbeone ofthecompany’slargestsitestodate anditwillenablethewholesalerto strengthenitsserviceacrosstheSouth EastofEngland.

Bothnewdepotshavebeendesigned withstate-of-the-artsystems,technology

andfittingstosupportBidfoodin reducingitscarbonfootprintandcontinuingtoworktowardsitstargetof greenerdepots.

MarkWood,chiefoperatingofficer atBidfood,said:“Thisisareallyexcitingtimeforthebusiness,aswecontinuetogrowourinfrastructureto strengthenoursupportforcustomers.

“Bothsiteswillenableustooperatefromahighqualityandmodern facilitywhichwillalleviatepressureon existingdepotsinScotlandandthe SouthEast,aswellasservethecommunitiesinwhichtheyoperateby providingjobstolocalpeople.”

Athirdadditionaldepot–inthe Midlands–hasalsobeencommissioned;however,thiswillnotbe activeuntil2024.

Bidfood’snetworkofdepotsacross theUKmeansthatthemajorityofits depotteamsarenomorethan80 milesawayfromtheircustomers.

“Welookforwardtoworkingalongsidethemtolearnfromtheirexpert teams,aswellassupportingthemfrom afinancialandstrategicperspective.”

Foundedin1808,ThomasRidley Foodservicedeliverstoover2,000customersacrossavarietyofsectors includinghealthcare,education,hospitality,hotels,restaurantsandretail.

Commentingonthedecisiontosell up,JustinGodfrey,managingdirector ofThomasRidley,said:“Thebusiness hasbeenrunbymyfamilyforover200 yearssoitwasimportantthatwejoined acompanythatsharesthesamecustomer-focusedDNA,makingfooddeliveryonelessthingtoworryabout.

“BidcorpUK’sCaterfoodBuying Grouphastheresourcetosupport ThomasRidleyFoodserviceinfurther improvinganddevelopingourofferand serviceleveltoourcustomerswhilst keepingthosefamilyvalues.

“TheGodfreyfamilygenuinelyfeel thattheCaterfoodBuyingGroupstrategyofallowingThomasRidleytooperateasanautonomousbusiness,whilst supportedbythepowerandscaleof Caterfood,isthebestoptionforall stakeholders.”

HarvestFineFoods’managingdirector

RichardStrongmanwassimilarlypositiveaboutsellingtoCaterfood:“Weare lookingforwardtobecomingpartofthe Bidcorpfamily,whichsharesourpassionforqualityproducts,competitive pricesandunrivalledservice,”hesaid.

sourced,fantasticlocalproduce,aswell asgreatservicetotheircustomers.We lookforwardtosupportingtheteam withourfinancialandstrategicstrength alongsidetheirlocalexpertiseand range.”

WiththeCaterfoodBuyingGroup andBidfood,Selleyisaimingtooffera propositionthatfulfilstherequirements ofeveryfoodserviceoperator.

“Theteamwillcontinuetofocuson thedevelopmentandgrowthofoursuccessful,service-ledbusiness,underthe sameidentityandculture.”

HarvestFineFoods,whichwas establishedin1988,offersarangeof 4,500productstomorethan1,000 cateringestablishments.

Selleyremarked:“HarvestFine Foodsisalreadyathrivingfoodservice supplier,achievingacompoundgrowth of20%overthelast12years.

“Wehavebeenreallyimpressedby theirpassion,theirethicalethosand theirreputationforprovidingethically-

Heexplained:“Thebusinessesthat makeuptheCaterfoodBuyingGroup retaintheirownidentityandofferoutstandinganddiversechoicesofquality andlocalproducts,tightranges,aswell asaflexibleserviceoffer,usingsmaller deliveryvehiclesabletomakefrequent deliveries,withallofthistailoredtothe needsofthecustomerstheyservein theirrespectiveregions.

“Bidfoodisanationalwholesaler, sharingthesamecommitmenttoserviceexcellence.Itsgrowingnetworkof depotsacrosstheUK,thebreadthand depthofitsrange,andunrivalledadded valueallowBidfoodtoremaincloseto itscustomers,servingbothindependent andmorecomplexnationalcustomers.”

Heconcluded:“Betweenthetwo businesseswecanmeettheneedsof everycustomer.”

CCM

INFOCUS ] www.cashandcarrymanagement.co.uk February2023 13

‘Betweenthetwo businesseswecan meettheneedsof everycustomer’ AndrewSelley,CEO, BidcorpUK

Bidfoodtoopenthreemoredepotswithintwoyears [

Makingtherightchoices

Vapingisanincreasinglyvaluablecategory,aswellasarapidlydevelopingone.Butare wholesalersabletoguidetheircustomersthroughthisflourishingsalesopportunity?

Thevapingmarketiscontinuingtogrow,withthe conveniencechannelbenefitingfrom35%ofsales. Withsignificantfurthervalueforecast–thecategory isexpectedtogrowfromthecurrent£1.2billionto £1.47billioninthenextthreeyears–it’svitalthatwholesalersandtheirconvenienceretailcustomersstayabreastof consumertrendsandsupplierdevelopments.

continueddemandfromconsumersforvapingproducts.To tapintothisrisingtrend,wholesalersneedtoensuretheyare dedicatingsufficientspaceforvapingproductsandstocking therightrangefortheircustomerbase.”

Theblubarrangefeaturessixvariants:KiwiPassionfruit, MangoIce,BananaIce,PeachIce,WatermelonIceand StrawberryIce.Eachdevicecontains20mgofnicotinein2ml ofliquid,andfeaturesanLEDindicatorthatlightsupwhen thevapeisinuse.Thevibrantpackagingisdesignedtomaximiseon-shelfappealandthedeviceshaveanrspof£5.99.

Supportingthelaunchisadedicatedtrademicrositeto assistandeducatewholesalersandretailersabouttherange. “Thereisahugevarietyofdifferentproductsavailable

ImperialTobacco hasidentifiedaflourishingsubsectorin disposables,whichhasseen5%growthinmarketshare since2021.“Tocaterforthisgrowingdemand,weare excitedtoannounceourentranceintotheexpandingdisposablesmarketwithournewblubarvaperange,”saysTom Gully,headofconsumermarketingUK&Ireland.

“ThenumberofvapersintheUKhasgrownby3%over thepastyear(ECigIntelligence),soit’sclearthattherewillbe

14 February2023 www.cashandcarrymanagement.co.uk

‘Wholesalersneedtoensurethey arededicatingsufficientspacefor vapingproductsandstockingthe rightrangefortheircustomerbase’

[ VAPING&NGPS ]

TomGully,headofconsumermarketing, ImperialTobacco

EXPLORE A WORLD OF FOR EXISTING ADULT SMOKERS & VAPERS ONLY. This product contains nicotine. 18+ only. Not a smoking cessation product. Fontem 2022. OVER 18 ONLY STOCK UP NOW THAT’S UNLIT For more information visit our blu bar Knowledge Hub. www.blubarhub.co.uk

onthemarkettoday,sodecidingwhattostockcanbea dauntingtask,”saysGully.“Wholesalersarethereforeinan excellentpositiontoprovideadvicetoretailersonwhat productstheyshouldbestocking,aswellasinsightsintothe latesttrendsshapingthecategory,suchastherisingdemand forvalue.

“Bybeinginformedaboutthemarketandfamiliarising themselvesandtheirstaffwiththedifferentproducts,terminologiesandmarkettrends,wholesalerscanprovideguidancetoretailersaboutwhatconsumersarebuying.”

PhilipMorrisLtd haslaunchedtheIQOSOriginalsDuo,a revampedupdatetotheIQOS3Duo.Thenewversionhas beguntoreplacetheIQOS3Duonaturally,withnobuy-back orproductswappingnecessary,andisalsoavailabletoorder throughthePMLDigitalTrade EngagementPlatform.Each kitcontainsthetwo-piece devicealongwithtwopacks ofHEETS,andhasanrspof £39.

“45%ofadultex-smokers abandonedpreviousattempts atswitchingtoalternatives duetotheproductnotbeing rightforthem,”saysaPML spokesperson.

“Whileretailerscancommunicatethebenefitsofalternativesatthepointofsale,it’stheresponsibilityofmanufacturerstomeetcustomerdemandsandpreferencesthrough productinnovation.Thisisperhapswhy62%ofretailers believethatmanufacturersshouldfocusonimprovingthe acceptabilityofsmoke-freeproductsamongadultsmokers.”

JuulLabs hasechoedthiscommitmenttoproductinnovationinresponsetoitsawardofProductoftheYear2023in theVaping&HeatedTobaccoProductscategory.“Weare extremelyproudthatourcommitmenttoproductqualityand innovationhasbeenrecognisedbythevoterswhoawarded JUUL2thisaccolade,”saysEfeAbebe-Heywood,senior directorofcommunications&brand.

“OurnewJUUL2systemhasmarkedastepchangein vapourtechnology,providingadultsmokerswithaproduct thatmorecloselyresemblestheconsistencyandexperience ofcombustiblecigarettestosupportthemontheirswitching journey.

“Weremaincommittedtoourmissiontotransitioneven moreadultsmokersfromcigarettes, whilecombatingunderageuse.”

Themanufacturer’slatestadditiontoitsportfolioistheJUUL2 BlackcurrantTobaccovariant,aclassictobaccoflavourwithblackcurrantnotes.

“Wehavebeenencouragedby thenumberofadultsmokersand vapouruserswhohavetransitioned tothenewJUUL2systemsince launchlastyearandweareconfidentthattheintroductionofour newBlackcurrantTobaccopodswill

provideevenmoreadultsmokerswithgreaterchoicetohelp themmoveawayfromcombustiblecigarettes,”statesJohn Patterson,countryleadofJuulLabsUK.“Itistestamentto ourcontinuedfocusontechnologicalinnovation,adultfocusedportfoliorangeandresponsiblemarketstewardship thatwe’vebeenawardedrecognitionasProductoftheYear.”

JuulLabsiscurrentlytriallingatake-backandrecycling programmeforusedpodsanddevices,andthisshouldbe introducedtothewidermarketlaterintheyear.“Aspartof ourgoaltoeliminatecombustiblecigarettes,wewillcontinue workingcollaborativelywithretailersandkeystakeholdersto ensureamoreresponsibleandenvironmentallysustainable marketplaceasthesectorevolves,”saysPatterson.

Vapebrand Geekbar isinvestinginahighlevelofsmart technologyinordertoincreaseefficiencyandcombatcounterfeiting.Themanufacturerestimatesthatthefuturisticproductionfacilitywillbereadyintwoyearsandwillresultina 90%automatedassembly.Thetechnologywillenabletrackingfromfactorytocustomeraswellasprovidinganalmost fault-freeproductionprocess.

“Digitisationandsmartmanufacturingwilloffergreatbenefits,notjustinproductionvolumeandefficiencies,butalso inassuringretailersandconsumersintheUKandaroundthe worldthatourproductsaremadetoconsistentlyhighqualitystandardsandcanbeenjoyedsafely,”saysAllenYang, chiefexecutiveofficer.“Theintegratedpackagingtechnology andthree-levelQRcodingintroducesahigherleveloftraceabilitytodefeatcounterfeitandillicitsales.”

TheannouncementcomesastheOfficeforNational StatisticssaysthatvapinghasplayedamajorroleinUK smokingratesdroppingtoanall-timelowof13.3%,while thenumberofvapersisatanall-timehigh.Therearenow6.6 millionsmokersandfourmillionvapersintheUK. CCM

16 February2023 www.cashandcarrymanagement.co.uk

[ VAPING&NGPS ]

JohnPatterson,countrylead,JuulLabsUK

‘Wewillcontinueworking collaborativelywithretailersand keystakeholderstoensureamore responsibleandenvironmentally sustainablemarketplace’

TechinvestmentssuchasGeekbar’sintelligentproductionis resultinginmoreefficient,accountablemanufacturing.

Viriginia Tobacco Autumn Tobacco Ruby Menthol Summer Menthol Polar Menthol Crisp Menthol n o a o ol r ol ol ol New JUUL2 Blackcurrant Tobacco Expand your product range. WARN ING: This product contains nicotine WARNING: This product contains nicotine which is a highly addictive substance. which is a addictive substance. Winner Vaping & Heated Tobacco Category. Survey of 8,000 by Kantar.

‘Adifferentoutlook’

Whathavebeenyourbiggestachievementsinworkandoutsidework?

Outsidework,raisingafamilywithmy wife.Wehavetwodaughters,fivegrandkids,andtwofantasticsons-in-law.In work,stillbeinginbusinessafter25years!

MyyoungestdaughterAileenhas workedinthebusinessallherworking life–she’sbeenineverydepartment andisnowoperationsdirector.My olderdaughterGilliandidherownthing infinancethencameintothebusiness atthebeginningofCovid[asbusiness improvementmanager]andhasstayed.

AslongasI’mbreathing,Iwillremain inthebusiness,butiftheywanttotake itoninthefuture,it’sthereforthem.I haveseensomanybusinessesgetting forceduponchildren,soit’suptothem!

Whohasbeenthebiggestinspiration toyou?

Mymotherandfather.Theywerehardworkingpeople,andtheirdetermination wasinspirational.Mymotherwasa hairdresserandmyfatherwasafarmer untilhecontractedpolioandlostthe useofhislegs.MydaddiedwhenIwas 18–hehadaheartattack–anditmade megrowupveryquickly.

Whatwereyourambitionswhenyou weregrowingup?

Iwantedtobeadiesel/lorrymechanic.It wasthetimeoftheYTS[theyouthtrainingschemeforschoolleavers]andifI hadjoinedthatasadieselmechanicI wouldhavegot£45aweekbutIended upgoingintoanabattoir,whereIearned £150aweek,soitwasnocontest.

Whatareyourinterestsoutsidework andhowdoyoumaintainawork-life balance?

Myfamily.Twoofmygrandkidslive withGillianinDubai,andtheotherthree livelessthanhalfamileawayfromme. Workdoesn’tfeellikework:forme,the cliche‘findajobyouloveandyouwill neverhavetoworkadayinyourlife’is

true.Iwork,eat,sleep,work.EvenasI gotosleepatnight,I’mfiguringout howtoimproveaprocessatwork!

Whatapproachdoyoutakeinbusiness (andinlife)?

PreCovidIwantedtotakeoverthe worldandIhadlotsofcompetitors; nowIdon’thavecompetitors,Ihave peoplewhoareinthesameindustryas me.Ihaveadifferentoutlookonlife:it’s

aboutdoingtherightthingnow.My teamisnotaworkforceanymore,it’sa familyoffamiliesthatIneedtosupport. Iwouldgivesomeonetheshirtoffmy back–Iwouldalwayshelpsomeoneas longastheydon’ttellmelies!

DuringCovid,wehadquitealotof employeeswholivedalone.Ihave COPDsoIranthebusinessfromthe kitchentable.OneofthethingsIcame upwithwastohaveaZoomcallwith everymemberofstaff,morningand afternoon.Throughthosecalls,Igotto knowmyemployeesalotbetterand sawthattheyaresuperstars.

Whatisyourfavouritefilmand song/pieceofmusic?

Film: SummerHoliday withCliff Richard.Music:everythingfromclassicaltorock&roll.IfI’mflyingbackfrom Dubai,Icanbelisteningtohitsfromthe ’60srightuptothepresentday.

Whatwouldpeoplebesurprisedto knowaboutyou?

Ican’tcook!AlotofpeoplethinkI’ma chefbutI’mnot.Mycookingabilityis perhapsafouroutof10.

CCM

18yearsinvansales

Onleavingschool,CraigStevenson workedinanabattoirforsevenyears. Theseasonalityoftheworkprompted himtomoveintovansaleswherehe couldearnadecentwageallyear round.HeworkedforRiverside BakeriesandUnitedCentralBakeries foratotalof18years,andthenin 1998,afterbeingmaderedundant, heboughtintoKilmarnock-based BraeheadFoods.Itprocessedgame andhadawholesaleoperation,and Stevensongrewthewholesaleelement,doublingturnoverinthefirst yearto£1million.HeaddedThe CookSchoolScotlandin2009asa trainingfacilityandaProduction Kitchenin2010tocreatebespoke productsforchefs.Today,Braehead Foodshasaturnoverof£17million.

[ SPOTLIGHT ]

CraigStevenson,managingdirector,BraeheadFoods

18 February2023 www.cashandcarrymanagement.co.uk

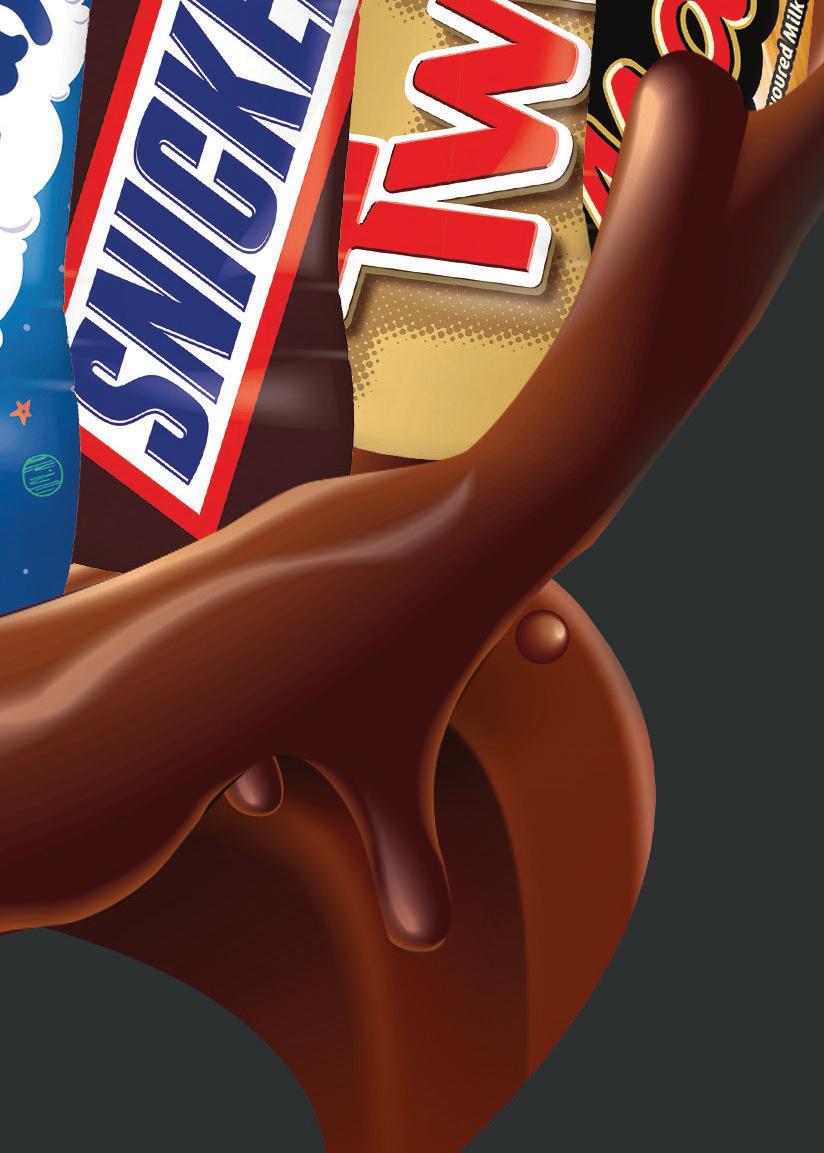

CATEGORYMANAGEMENTGUIDE

FEBRUARY2023

GETTHE BASICS RIGHT!

YOURDEFINITIVEGUIDE TOCATEGORYMANAGEMENT

CategoryManagement–thewholesaleperspective

BagSnacks,sponsoredbyKPSnacks

Biscuits,sponsoredbyMondelezInternational

Cereal,sponsoredbyKelloggCompany

ChewingGum,sponsoredbyMarsWrigley

Cigars,sponsoredbyScandinavianTobaccoGroup

Coffee,sponsoredbyNestléGrocery

Confectionery,sponsoredbyMondelezInternational

Dairy,sponsoredbyKerrymaid

EnergyDrinks,sponsoredbyBoostDrinks

FlavouredMilk,sponsoredbyMarsChocolateDrinksandTreats

MeatSnacking,sponsoredbyJackLink’s

Tea,sponsoredbyYorkshireTea

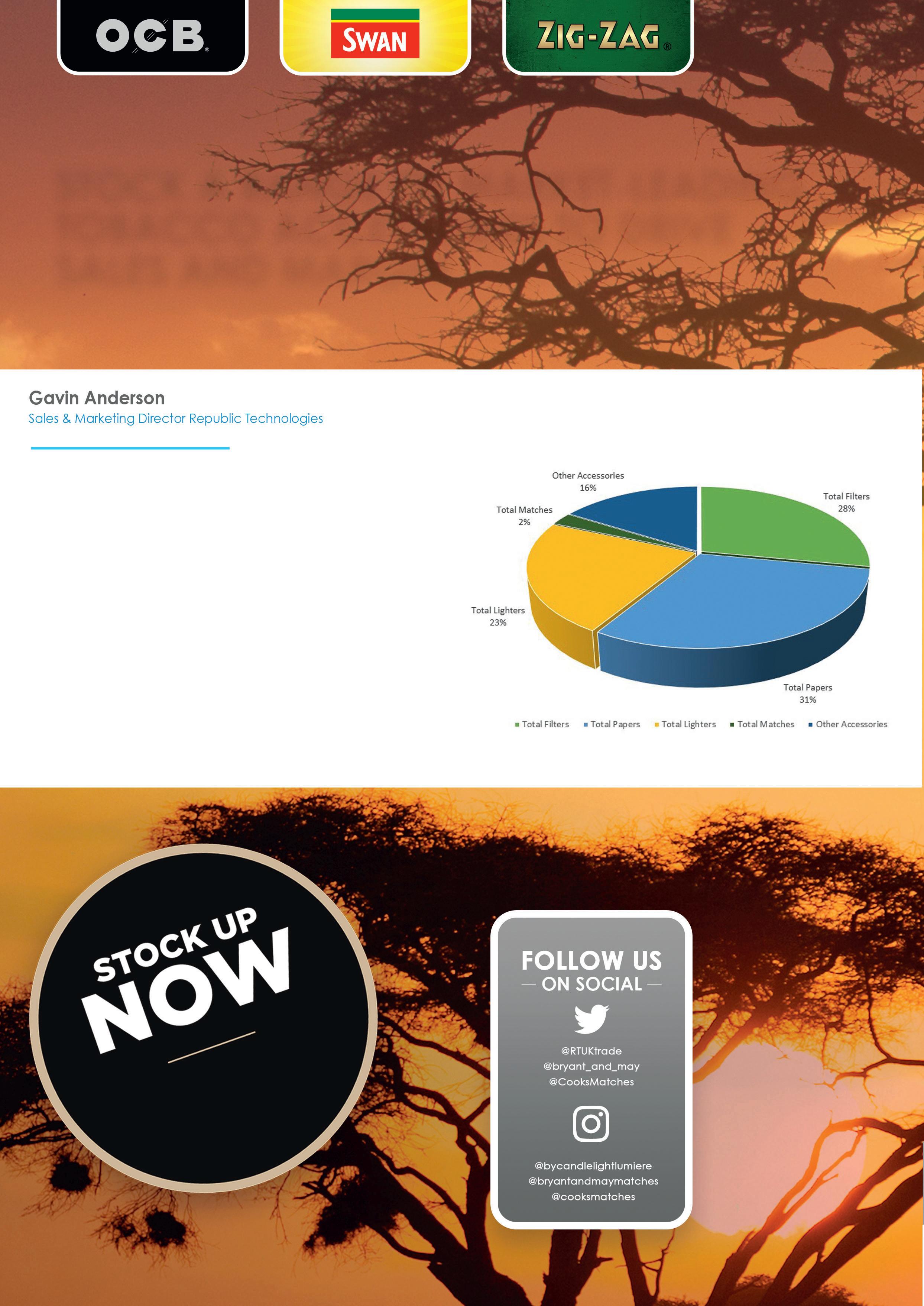

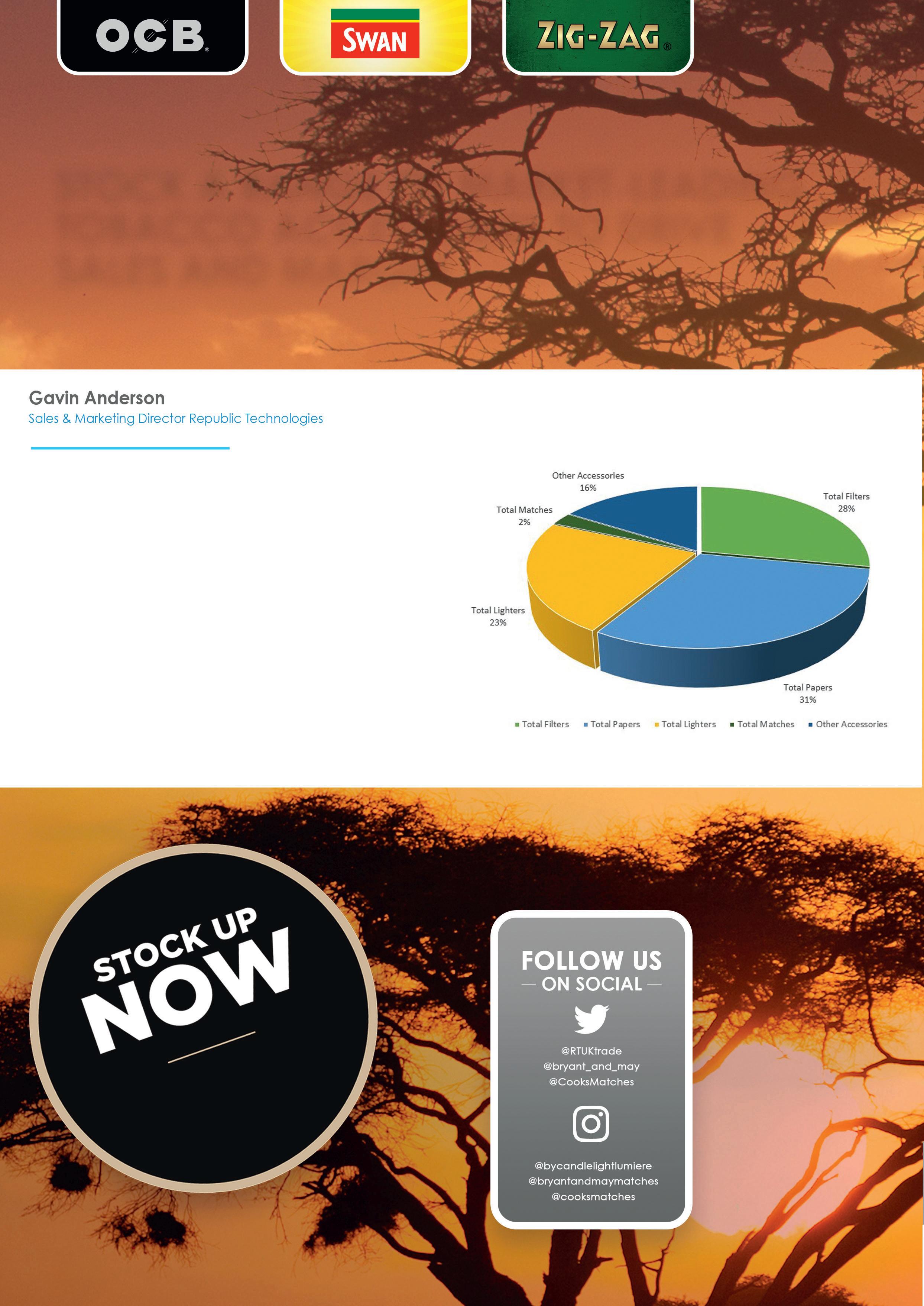

TobaccoAccessories,sponsoredbyRepublicTechnologies

Vaping,sponsoredbyBAT

WorldFoods,sponsoredbyWanisInternationalFoods

22 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54

Thebenefitsofsoundadvice

Knowledgeispowerwhenitcomestocategorymanagement,andwholesalersareusing salesdataandsupplierinsightstoensurethattheguidancetheygivetoretailersisrobust.

Wholesalersandbuying groupsareworkingwith keysuppliersandusing up-to-datesalesdatato provideeffectivecategorymanagement guidancethatcanhelptheircustomers maximisesalesandprofitsinstore.

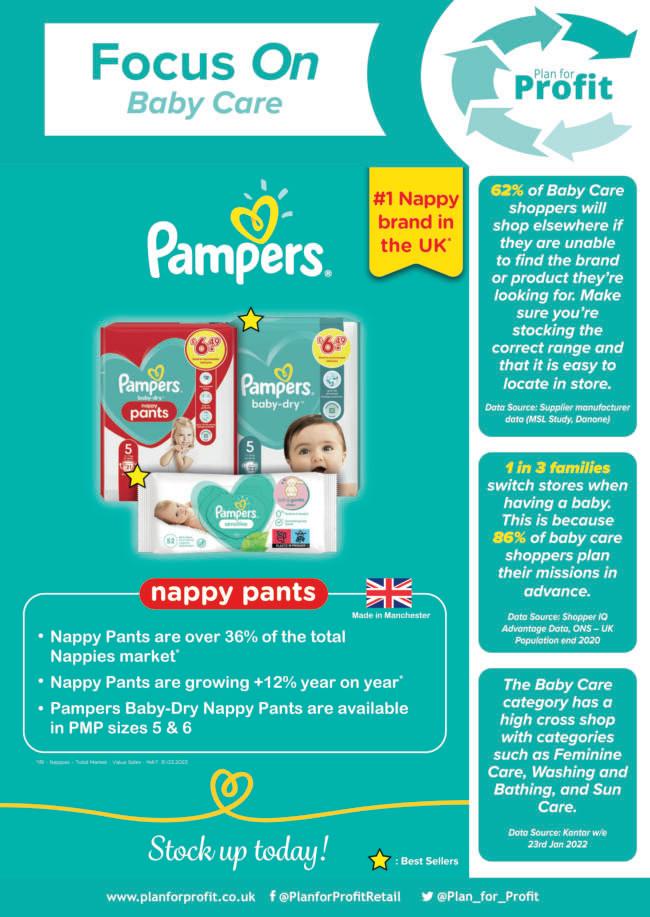

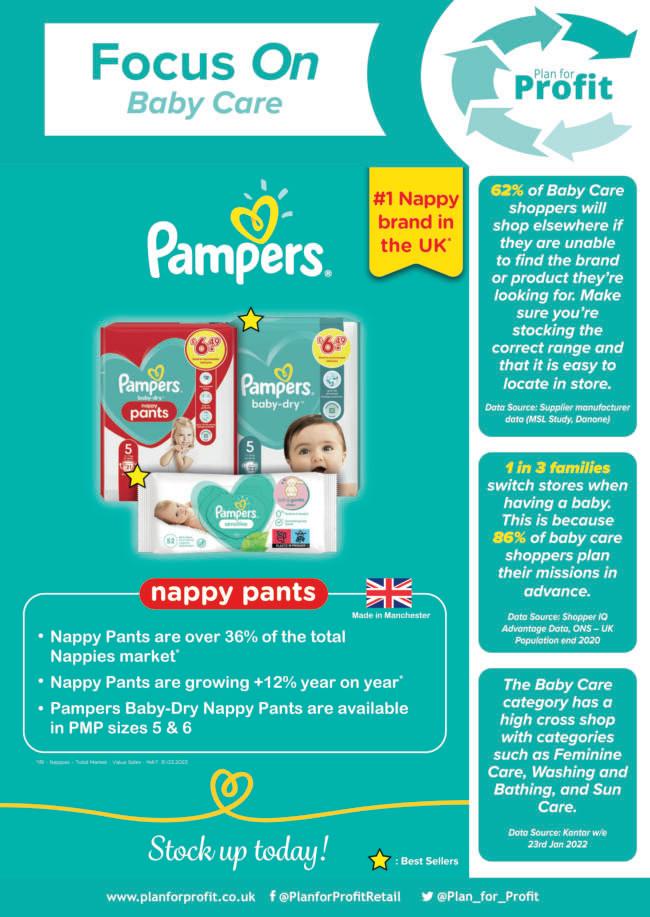

UnitasWholesale’s PlanforProfit (PfP)corerangerecommendationsand planogramsareupdatedyearly,and 20,000guidesaredistributedtothe group’swholesalermembersandretailers.Allguidescanbeviewedand downloadedviathePfPwebsiteandPfP app,andthewebsiteisopentoallretailers,increasingthereachandinfluence ofthePfPprogramme.

InadditiontotheyearlyPfPcore rangeguides,UnitasproducesPfP ‘FocusOn’minicategoryguides,which aimtoeducateretailersonhowtoget themostoutofsupplierbrandsand meettheneedsoftheircustomers.

Intotal,80wholesalerdepotssupportthePfPscheme.AllthePfPproductsarehighlightedinthedepotsand onsomeofthe wholesalers’ websites,with somehaving directlinksto thePfPwebsite tohelpsupport theirretailcustomerswith corerange,categoryinsights andplanogram advice.

“ThroughPfPcorerangeauditswe canmonitorouryear-on-yearperformanceimprovement,andwemonitor stockinglevelsofourPfPcoreranges onacyclicalbasisthroughInspire[field marketingagency],”explainsPlanfor ProfitcategorycontrollerTracey Redfearn.“Theirreportshelpustoidentifydistributiongaps,andtherefore indicativesalespotential,acrossour memberdepotsandtheirretailestate.”

Shecontinues:“Corerangedepot monthlyauditshavedemonstrated improvedyear-on-yearperformances,

movingourMATaveragecloseto96%! Despitethecontinuingchallenges acrossthesupplychain,ourwholesale membersareholdingfasttotheirPfP coreprinciples,withInspireField Marketinghelpingtomaintaindepot standardsthroughthesitingofcore rangePoSin-depotoneveryvisit.”

Shiftinranges

Sheadds:“Supplychainissueshave affectedanumberofproductranges andhaveresultedinashiftinranges,so wesupportedourmembersthrough ourmonthlycorerangeauditwhich wouldidentifythegapstoensurethey arestillstockingtherightrange.

“Forretailerswehavefoundan increaseinstorerefreshes,where remerchandisinghelpswiththeircurrentfixturesandtoensurethatbestsellersineachcategoryareavailable.We appreciatethatduringthistime,where stockavailabilitywasparamountin store,theirfocuswasmoreabouthavingstocktoselltocustomers.”

Unitas’scorerangeplanogramsare builtinpartnershipwithsupplierswho providechannel-specificIRIorNielsen dataforsymbolandindependents,and

thisassistsUnitastoutilisethemost currentdatareflectingcurrenttrends. “Ourreviewsarealsosupportedwith salesandcompliancedatafromour members,andthedatafromourdata partner,”Redfearnadds.

Relevantchanneldata-drivencategorysplits,shopperneedstates,and theutilisationof‘good,better,best’ merchandisingprinciplessupport Unitasinproducingitsregionallybased planograms.

Therearesomeproductcategories thatcouldstillbenefitfromincreased focusbytheretailer,shesays.“Baby careshouldbethemostsimplefixture instoretogetright;however,itcan oftenstillbeacategoryforwhichthe retailerneedsadvice,especiallygiven thatthiscategoryisrecognisedtohave avitalroleindrawingin‘destination’ shoppers.

“Weappreciatethatsomeretailers needsupportingettingthefundamentalsrightintheirstoressoweprovided a‘FocusOnBabyCare’(copycanbe foundonthePfPwebsite)attheendof lastyear,andweareexploringthe opportunityofsettingupanumberof storetrialsduringthisyear.”

UnitasproducedaBabyCareguide,in recognitionthatretailersneededadvice.

Itisimportantthatthefood-to-go sectionismanagedcorrectly.

UnitasproducedaBabyCareguide,in recognitionthatretailersneededadvice.

Itisimportantthatthefood-to-go sectionismanagedcorrectly.

[ CATEGORYMANAGEMENT ] 22 February2023 www.cashandcarrymanagement.co.uk

TraceyRedfearn: ‘Wemonitor stockinglevels.’

SteveMoore,headofretailat Parfetts, believesthatallcategories deservefocus.

“Successfulconvenienceretailingis thesumofallparts,”heinsists.“You couldsaythatyoushouldfocusonyour strengths,suchasalcohol,butthenby takingabroaderviewofthestore,there couldbemissedopportunitiesthat needtobeunearthed–forexample, whereastoreislocatedinamoretransientareaandimpulseneedsasharper focus.”

ParfettsusesUnitas’sPlanforProfit programmeandworkscloselywithits team.“Byprovidingpreandpostsales data,wecaneffectivelymeasureand thensharewiththeretailerstheimpact categorymanagementcanhaveon theirsalesandmargin,”saysMoore.

“Wealsoactivelyencourageour retailerstoparticipateinsupplierincentives,suchastheHeinekenstarretailer scheme,astheyalsoprovidefieldsales teamstoworkwithretailersdirectly.”

Parfettsholdsregularmeetingswith keysupplierstodiscussrange,NPDand ahostofotherfactors.“Wefindthat mostsupplierswillstatetheytakea wholecategoryapproach.Wealsowork closelywithdataspecialistsonanongoingbasistoensureweareuptospeed onNPDandwiderconsumerinsights,” hestates.

Achangeinconsumerhabitsthat Parfettshasnoticedisconsumers switchingtoownbrandandseeking brandedpromotionsasthecost-of-

livingcrisisbites.“Asabusiness,we provideawiderangeofown-brand productsthatdelivergreatretailermarginswhilstalsogivinggreatconsumer value.Impulseisstillabigdriverinconvenienceretail,andweensurethisis reflectedwithinourrangingadvice alongsidefoodtogo,”Mooreadds.

Nisa hasalsoseenaswitchfrom brandedtoown-labellines.SpaceplanningmanagerRossWrightcomments: “Demandforvaluehasneverbeen higherandconsumersarecomparing pricesattheshelfanddiningoutless, andbrandloyaltyisindecline.Weperformedareviewofourplanogramsand rangingtoensureNisaretailersusethe strengthoftheCo-opownbrandalong withCo-opHonestValuelineswhere appropriate.”

‘Significantimpact’

TheintroductionoftheHFSSguidelines in2022hasalsohadasignificantimpact ontheadviceNisaprovides,anditsupporteditsretailerstoensuretheirstores andrangesarecompliant.

NisacreatesandupdatesplanogramsinlinewithCo-op’srangereview activity.Additionally,itundertakesactivitywithitscategorysupplypartners–forexample,lastyearitworkedwith pladistoreviewthebiscuitrange.A newlayoutwastrialledinNisastores, resultinginastrongsalesgrowthduring theactivity,Wrightreports.

Allrangereviewactivityischecked againstNisa’sinternalsalesdatato ensurethattherecommendationsare rightforNisacustomers,headds.

Nisahasateamofmicro-spaceplannersthatprovidecategoryrangingand productplacementadvice.Theywork closelywiththestoredevelopment teamwhocreatethestorelayoutsin linewiththeconceptlayouts,ensuring thatNisaretailersreceivethecorrect commodityspacerecommendationfor theirstoresizeandlocation.

Planogramsareloadedontoa retailer’sMyPlanssystemandcanbe viewed/downloadedasrequired.

Whilerecognisingthatallcategories benefitfrom categorymanagement,Nisa recommends that,inthefirst instance,its retailersfocus onimpulse categoriesthat delivermostof theirsales–like softdrinks, beers,wines& spirits,confectioneryandcrisps& snacks.

“Focusshouldalsobegiventochill categorieswhereweseesignificant opportunitiesforourretailerstogrow salesandmeettheexpectationsoftheir consumers,”saysWright.“Thespace planningteamhereatNisahavecreated chillplanogramsfromthreebaysupto 30bayssothereshouldbesomething foreveryone.”

ThespaceplanningteamatNisa managesupplychainissuesona weeklybasis,usingtheinformationprovidedbythetradingteamwhere

Nisarecommendsthatitsretailersfocusonimpulsecategoriesinthefirstinstance.

SteveMoore:‘Weworkcloselywith dataspecialists.’

[ CATEGORYMANAGEMENT ] www.cashandcarrymanagement.co.uk February2023 23

RossWright:‘We performedareview ofourplanograms.’

analternativetoanout-of-stockis available.“Planogramsareupdated accordinglysothatNisacustomerscan downloadtheupdatedplanogramor usetheweeklysubsanddelistinformationprovided,”Wrightexplains.

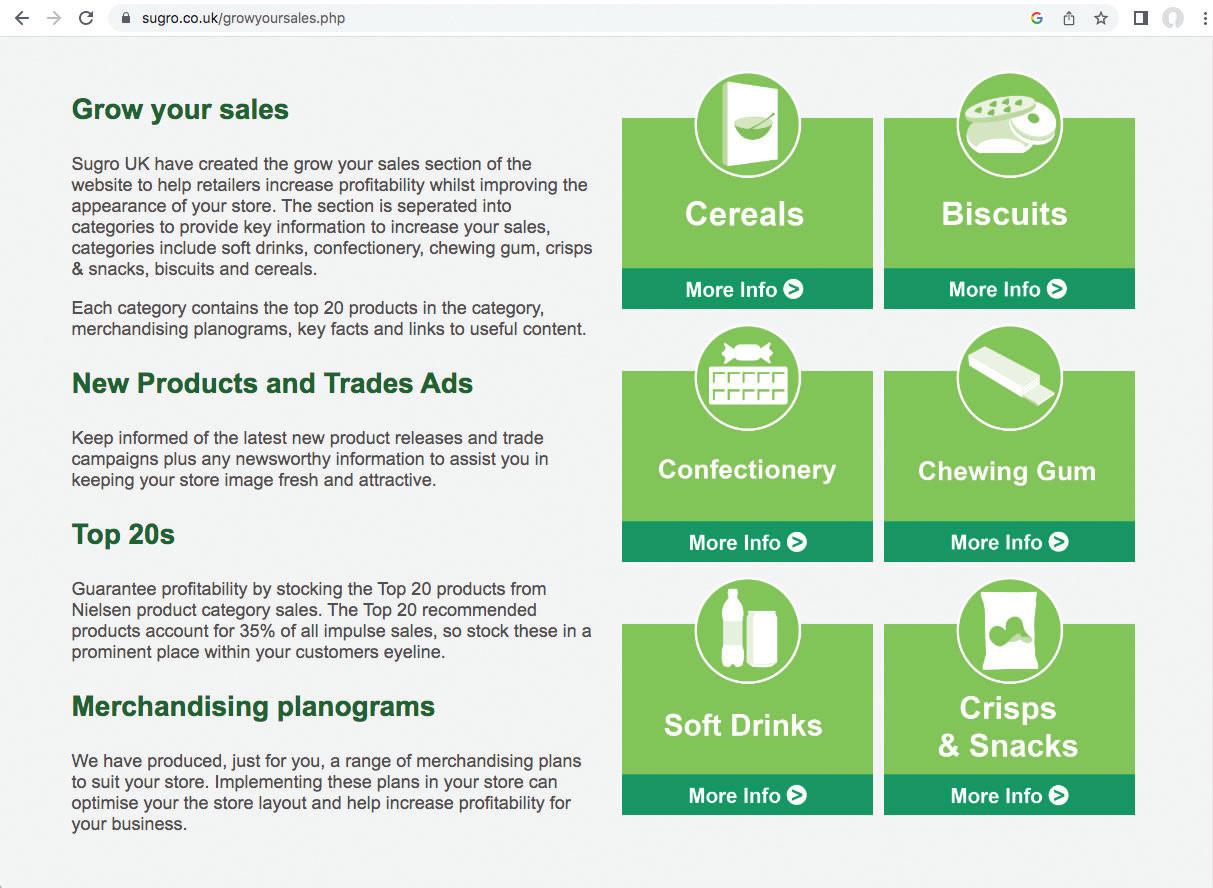

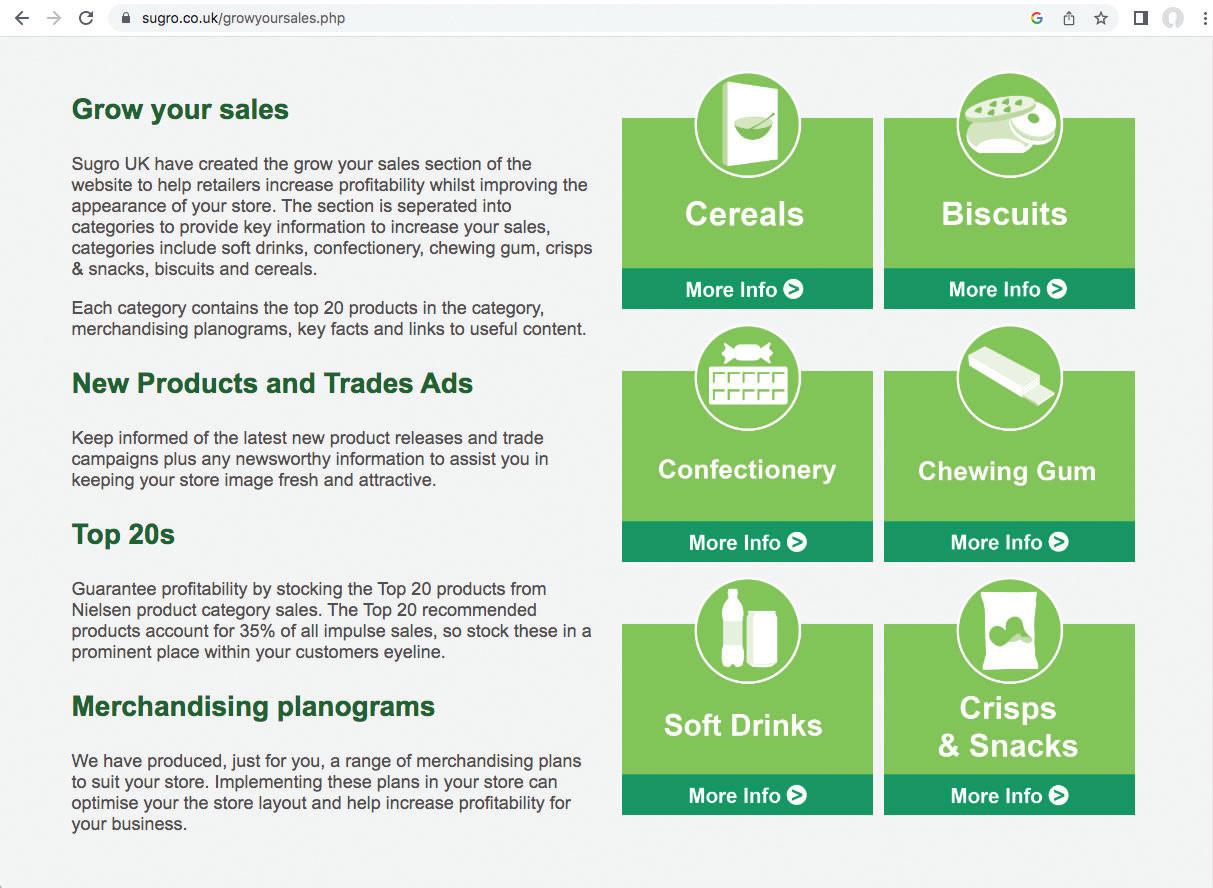

AccordingtoImranAmbalia,trading &marketingcontrollerat Sugro, the confectionery andsoftdrinks categoriesbenefitfromcategorymanagementthemost duetothenumberofproducts thatareavailableinthese twocategories.

“It’simportant thatretailersare awareofwhichlinestheyshouldbe stockingthatdrivethehighestrateof sale,”hesays.“Weproduceplanogramsforallthecategoriesthatwe tradeinbutgroceryisakeyfocusarea forSugro.”

SugrousesIRIorNielsendataand workscloselywithanumberofsupplier partnerstoensurethatitsplanograms areunbiasedbutmoreimportantlydata led.“Thisensuresthattheretailcustomershavetherightinformationon whichSKUstheyshouldbestockingto maximisetherateofsale,”Ambalia explains.Thegroupproducesits planogramsonanannualbasisbased onthe52-weekdataread.

“Weproduceplanograms,adviceon top20bestsellersbycategoryand bespokecategoryleafletscontaining categoryinformationaroundbutnot limitedtoChristmas,Easterandmini seasons.Weoffercategoryadvicedigitallyandthroughprintedmarketing,” Ambaliapointsout.

Assessmentofneeds

IainMain,whojoined JWFilshill last yearasthewholesaler’sfirst-everdedicatedcategoryrangeplanner,visits KeyStoreretailerstoassesstheirneeds.

“Igointothestore,spendtimewith theretailerandgettoknowthem,then recommendthespaceandrangethat shouldbeallocated,”heexplains.“It canbequiteslowprogressbutwecan supplyefficientplanogramsacrossall categories–foreverysizeofstore,takingintoconsiderationthespaceavailable.

“Asweallknow,someretailersare moreproactivethanothersandare reallykeentoletususeourexperience toworkoutwhat’sbestforthem.It’s importanttotakeintoconsiderationthe retailer’sviewstoo,though,andweave inproductsthatweknowsellwellin theirareaandthatcustomerswant,particularlythosefromlocalproducers.

“However,ultimately,ifacategoryis notlocatedintherightareaofthestore andisnoteasytoshop,andit’snot easytoaccess,thentheretailer’scustomerswon’tbuyfromit.”

Filshillhas“excellentdata”through itsEPoSsystem,andusingdatafromits suppliers,itisabletoidentifywhich productsshouldbestocked.“Ourbuyersworkcloselywithsupplierswhocan giveusvaluablecategoryinsightand helpidentifyfuturetrends–it’simportanttobeaheadofthegame,”saysMain.

“There’salsoanunderstandingthat thereisno‘onesizefitsall’whenit comestocategorymanagementbutit reallyhelpswhenaretailerusesour EPoSsystem,andwehavejustover100 storesusingitnow.Thisenablesusto alsoanalysesalesofwhatastoreissellingfromothersources.”

Mainbelievesthatthefast-moving categoriesalwaysbenefitfromstrict categorymanagement–crispsand snacks,impulsesoftdrinksandconfectioneryareprimeexamples.“Seasonal categoriesalsoneedtobemanaged carefullyandefficientlyforthebest resultsfortheretailer,”headds.

“Ifyouconsiderthat20%ofthe overallrangewillaccountfor80%of sales,that’salwaysagoodstarting point.Itcanbedifficultmakingsome retailersunderstandthat‘lessismore’ andagoodexampleisarecentthreemonthtrialwedidwithWalkers.

ImranAmbalia: ‘Groceryisakey focusareaforSugro.’

Sugroofferscategoryadvicedigitallyandthroughprintedmarketing.

[ CATEGORYMANAGEMENT ] 24 February2023 www.cashandcarrymanagement.co.uk

Filshillsuppliesefficientplanogramsacrossallcategoriesforeverysizeofstore.

“Weidentifiedaclusterofstores usingourEPoSsystemandcreateda planogramtoslimdowntherangeand stopreplications.Wegavetheretailers acashincentivetoparticipateandgave themscopetoincludeacoupleoflines oftheirownchoice.Acrossthe90 storestherewasa20%increasein sales.”

Mainsays thatitisalso importantto stocknewproductsacrossthe boardbecause astore’scustomersexpect toseetheproductsintheir localc-store.

Intermsof growingcategories,hepointstovaping. “Itishugejustnow,”hesays.“The tobaccocategoryisdyingandvapingis growingatitsexpense,withmany retailersnowsellingcigarettesfroma drawerunderthecountertofreeup spaceinthekiosk.It’sacategorythat’s

changingandevolvingallthetimewith brandsandflavourscomingonstream. Thechallengeiscreatingsufficient spaceinthekiosktoaccommodate this.”

Filshillisalsoworkingwithretailers totakeadvantageof,forexample,£1 bagsofcrispswhichaccountfor50%of thecategorynow.Thesebiggerpacks alsoofferbettermargins,Mainpoints out.

Importanceofeducation

“Energydrinksisanothercategorythat someretailersarefullyexploiting,with RedBullthenumberonebrand.It’s abouteducatingretailerstoensure thereisenoughproductinthechillerso theyarestockedalldayandstaffdon’t havetokeeprestocking.

“Withbothenergydrinksandsoft drinks,itcansometimesbechallenging persuadingretailersthattheydon’t needtostockeverysinglebrand–concentrateonthebest-sellinglines.”

Filshilladaptsitsadvicetotakeinto accountproductshortages.“There’sno

Parfetts hasexpandeditsteamto supportretailers.

Threenewregionalmanagershave beenappointedtoleadanetworkof 25regionaldevelopmentadvisorsand fourstoredevelopmentmanagers.

Thewholesalerisexpandingwitha newdepotopeninginBirminghamin thespring.Itwillalsoappointanadditionalthreeregionaldevelopment advisorsacrossthenetwork.

ChristineReastjoinsParfettsto managetheEastregion.ShepreviouslyworkedforBestwayRetail, wheresheheldtheroleofregional controllerforthepast14years.

IntheWestMidlands,Richard Huxleybecomesregionalmanagerfor theMidlands.Hewillfocusonsupportingthenewdepotandexpanding thesymbolgroupintheregion. HuxleyhasbeenwithParfettsforthe lastsixyears,mostrecentlyaslead retaildevelopmentadvisor.

SteveMillerwillmanagetheNorth Westregionandmovestotherole fromaseriesofseniorpositions

acrossParfetts,includinggeneralmanageratAintree.

Commentingonthedevelopment, headofretailSteveMooresaid:“Aswe grow,it’svitalthatwehavethebest peopleinplacetosupportourretailers andprovidegreatservice.”

Additionally,JohnO’Neillmovesinto thenewlycreatedroleofretailsales controller.Hewillsupporttheretail teamandworkonkeyprojects,suchas

doubtthatsupplychainissuesaffect categorymanagementandwe’ve noticedthatparticularlywiththehealth andbeautycategory,”Mainreports.

“Supplyhasbeenquiteerraticbut wearesourcingwhatwecantoensure ourcustomershavesomethingtooffer shopperswhopopinbecausethey’ve runoutofsomething.Itmightnotbe theirpreferredbrandbutmostshopperswillpickupanotherbrandorown label.” CCM

categorymanagement,storedevelopment,andmarketing.Hewillalso headupthedevelopmentofThe Local,Parfettslicensedfasciaoffer. O’NeillhasbeenatParfettsfor17 yearsandmostrecentlyheldtherole ofcustomerdevelopmentmanager.

Meanwhile,ChrisMoorehasbeen appointedasstoredevelopmentmanager.HepreviouslyworkedatThe JordonGroupasaprojectmanager.

IainMain:‘It’s importanttobe aheadofthegame.’

[ CATEGORYMANAGEMENT ] www.cashandcarrymanagement.co.uk February2023 25

Parfetts expands team to support retailers as symbol store estate grows

Filshillworkswithretailerstotake accountofchangingshopperhabits.

Great Value from our most loved brands! *NielsenIQ, Value Sales, Total Coverage, MAT, w/e 23.05.22, **NielsenIQ MAT, Singles and Sharing combined in Total Coverage 23.05.2022, †NielsenIQ, Total Impulse, Latest 12 wks to 03.12.2022 STO C K STOCK THE KP PMP RANGE GROWING AT † KP SNACKS BBQ Beef Big HoopsThe UK’s Sharing PMP* NEW PMPS

PMPS still offering your consumers great CHOICE & VALUE!

SHARING PMP RANGE

VAT FREE

VAT FREE

The UK’s Ridge Cut Crisp*

The UK’s Nut Brand*

The UK’s ‘better for you’ Brand**

The UK’s Popcorn Brand*

The UK’s Ridge Cut Crisp*

The UK’s Nut Brand*

The UK’s ‘better for you’ Brand**

The UK’s Popcorn Brand*

The biscuit category is in growth - now worth £3.3bn1 – and biscuits were purchased by nearly 28 million households in the UK in 20222 . The category can be broadly split into 3 segments: Healthier*, Savoury and Sweet, which are all in growth3 , and there are two consumption occasions: In-home and ‘on-the-go’. Healthier, special treat and savoury biscuits are key value drivers, while sweet everyday treats are a key volume driver.

BISCUITS TOP TIPS

Have a display of both take-home and on-the-go biscuits (we recommend 80% of space is take-home)

Group products clearly into sweet, savoury and healthier biscuits lock by brands to help retailers nd what they are looking for Allocate the space according to sales potential, giving more space to bestsellers. Do ensure growing sectors that drive value are represented, however, including Healthier, Savoury and Special Treats (see table)

Highlight bestselling lines

Display clear pricing, showing cash margins er both and non- lines

Encourage retailers to make the most of the seasonal opportunity by creating impactful displays to catch their attention when making purchase decisions in depot Select brands that are aligned to consumer trends like wellbeing, sustainability, value and occasions

Ensure D and promotional products are stocked in advance of consumer media and work with suppliers who are supporting launches

RECOMMENDED MUST-STOCK BiSCUiTS – TAKE-HOME**

1.Oreo Original

2.Cadbury Dairy Milk Chocolate Fingers

3.Time Out Wafer Bar

4.Oreo Double Creme

5.belVita Honey and Nut

6.Ritz Original Crackers

RECOMMENDED MUST-STOCK BiSCUiTS – ON-THE-GO

1.belVita Soft Bakes Choc Chip

2.Mikado

3.Cadbury Nuttier

4.Grenade Salted Caramel

5.Grenade Cookie Dough

6.Grenade Oreo

or the full ondele nternational core range recommended list go to www.snackdisplay.co.uk

Digital marketing guidance for wholesalers4

Retailers’ use of digital channels has increased so a focus on retaining these customers is key:

• ook at your data, and use a ‘test and learn’ approach

•Have fast-working pages and consider having lists, past orders and favourites

•Understand top search terms

• roduct images are key 6 – reach out to suppliers for these

•Have facilities to lter pages by brand

•Don’t forget telephone sales as these tend to peak at busy times so are still important

For market best-sellers, product information, latest trends, category information and retail display advice, visit www.snackdisplay.co.uk Bringing snack sales to life in independent retail: Confectionery • Biscuits and Snack Bars • Hot Beverages • Cheese

ielsen , Total market incl. Discounters, wks w e 0 .11. antar , Total arket, w e 0.10. ielsen , Total market incl. Discounters, wks w e 0 .11. 4 umina holesale nline eport 0 1 GD holesale nline est ractice 0 1 6 GD holesale nline est ractice 0 1 As de ned by ielsen. rice marked packs available. etailers are free to set their own prices.

gers CategoryValue(in£)SalesVolume (in1000KG) Value/Tonnes TotalBiscuits£2,642,861,174433888 EverydayTreats500,031,137972835.1 EverydayBiscuits£313,663,6251089692.9 ChocolateBiscuitBars£303,371,353449426.8 SpecialTreats£201,293,211212659.5 HealthierBiscuits£582,015,714607989.6 SavouryBiscuits£290,225,035339708.5 Children'sBiscuits£122,824,421176746.9 Crackers&Crispbreads£173,802,151281416.2 SeasonalBiscuits£153,775,170207507.4 Source: ielsen, Total arket, AT, .1.

ARE YOU GROWiNG THE VALUE FROM YOUR BiSCUiTRANGE?

* Non Price marked packs available. Retailers free to set their own prices ** Nielsen, total coverage exc discounters, value sales, w.e. 17.12.22 *** Nielsen, total independents & symbols, value sales, w.e. 17.12.22 POSITIVE ENERGY STARTS HERE BEST- SELLING BELVITA BREAKFAST FLAVOUR IN THE CONVENIENCE CHANNEL*** STOCK UP NOW 46755 NEW

Strong Availability and Great Visibility Grows Profits!

Availability and visibility are key for successful gum sales. More than half of all gum purchases are unplanned, with 65% of gum purchases being made on impulse1. This means it has never been more important for retailers to improve gum availability and visibility to every shopper, every trip.

By considering key occasions to upsell gum, retailers can further drive impulse sales as recent years have seen an evolution of traditional ‘on the go’ shopper missions.

CHEWPEOPLEGUM2 1IN 3

As consumer habits develop and change, on-the-go consumption continues to remain a crucial part of the category. The leading reason why consumers chew gum is to freshen their breath, and with levels of movement increasing, this is creating more on-the-go purchases to fulfil this need.

More than 40% of consumers chew gum because they enjoy it2 . This occasion is driving sales of fruity flavours like EXTRA Refreshers.

EFFECTIVE MERCHANDISING

46% of gum shoppers will just not buy gum if the product they want is not available3, so ensuring retailers stock the correct range at all times is crucial.

POINT OF SALE can increase awareness of new campaigns or products, intriguing and engaging consumers.

TIPS: IMPROVE VISIBILITY by placing popular SKUs just below eye level, at ‘buy level’ to take advantage of incremental sales. Moving gum from below to above the counter is proven to drive a 20% increase in sales4.

EFFECTIVE SECONDARY SITINGS can boost impulse sales, with more than half of gum purchases being unplanned.

INCREASE BASKET SPEND by offering cross-category promotions with gum and consumers’ morning routines, such as coffee or snacks.

For more information visit www.mars.co.uk and www.availabilityintoaction.co.uk

Source: 1. IPSOS MORI Shopper Survey 2019, Convenience Stores 2. Wrigley internal data 3. Snacking & treating usage study, Kantar 2017 4. Mars Wrigley internal case study 5. Kantar June 2019

r

rove

TOP 5 Products

Gum Singles:

1. Extra Peppermint Pellets

2. Extra Spearmint Pellets

3. Extra White Bubblemint Pellets

4. Airwaves Menthol & Eucalyptus Pellets

5. Extra Cool Breeze Pellets

TOP 5 Products

Gum Bottles:

1. Extra Peppermint Pellets

2. Extra Spearmint Pellets

3. Extra White Bubblemint Pellets

4. Airwaves Menthol & Eucalyptus Pellets

5. Extra Refreshers

RECOMMENDED GUM RANGE:

45% of Airwaves shoppers only buy Airwaves

AIRWAVES

Airwaves Menthol and Eucalyptus remains an important sales driver for retailers. This brand has a loyal consumer following who seek out intense mint flavour when purchasing gum. As 90% of gum is consumed during the week, Airwaves can help consumers refresh more than just their mouths2. Work and study are two key occasions when consumers choose Airwaves. Airwaves is a must stock and ensuring it’s visible in store can drive gum sales.

Availability into Action is Mars Wrigley’s NEW retailer website. Visit www.availabilityintoaction.co.uk for merchandising information and sales advice to drive gum sales.

5 y

PLANNING FOR PROFIT

Maximising returns from the cigar category in 2023

THE CIGAR CATEGORY

“The retail sales value of the cigar category has remained stable over the last year, now standing at just under £285m. This performance is largely driven by the cigarillo segment, which barely existed three years ago but now accounts for 46.7% of all cigars sold in volume terms and is worth £98.1m in annual sales. Miniatures remain the largest segment within cigars, currently worth £98.9m in annual sales and led by our Signature Blue brand, and ably supported by our Moments Blue brand, which is especially relevant right now as a good quality, value cigar.”

THE CATEGORY IS WORTH JUST UNDER £285M IN RETAIL SALES

Moments has a new eye-catching design

VALUE BRANDS ARE KEY!

“There’s no doubting the importance of value as a consumer trend at the moment. Many consumers are becoming increasingly price conscious as the cost-of-living crisis continues to bite, and this will affect cigars and the wider tobacco category purchases just as much as any other category in-store, so retailers should ensure they are highlighting their value brands to customers to help them save money and cash and carries should do the same in depot. With that in mind we’ve recently announced a modern and eye-catching re-design for our Moments brand. The new pack design can be seen now on packs of Moments Blue and Moments Original, with packs of Moments Panatella following closely behind in May. Moments Blue has been the fastest growing VFM cigar in the UK and is well-known amongst tobacco-selling retailers as a popular choice amongst those customers who are looking to save money.”

Quotes and expert commentary from Nataly Scarpetta, Marketing Manager at Scandinavian Tobacco Group

Quotes and expert commentary from Nataly Scarpetta, Marketing Manager at Scandinavian Tobacco Group

Cash and carries would be wise to always have brands like our Henri Wintermans

Half Corona in stock as it is the UK’s best-selling medium / large cigar

GETTING THE RANGE RIGHT

“It’s worth noting that the top ten cigar brands account for over 90% of total sales, so don’t tie up your cashflow with slow moving brands. Cigarillos are the growing segment in cigars at the moment, so I’d encourage cash and carries to consider stocking our Signature Action brand if you don’t already do so. It may not be the best-selling cigarillo on the market, but it’s growing steadily in popularity and a good option for adult smokers who enjoy the peppermint flavour. Finally, irrespective of the time of year, I think it’s always important for cash and carries to offer retailers a range of cigars with different price points to meet the different needs of their customers.”

KEY OCCASIONS FOR THE CIGAR CATEGORY

“It’s also worth considering that there are key times of the year when cigar sales are on the rise. Typically, as Spring approaches, bringing with it more outdoor smoking opportunities, some adult smokers will treat themselves and ‘trade up’ to a larger format option, but of course this doesn’t mean that retailers need to start stocking larger more expensive handmade cigars! It may be as simple as a Miniature cigar smoker opting to jump to a Panatella for example. In general, I think cash and carries would be wise to always have brands like our Henri Wintermans Half Corona in stock as it is the UK’s best-selling medium / large cigar and a popular choice throughout the year.”

HOW CAN CASH & CARRIES MAXIMISE SALES?

“I believe it is very important to ensure our products are merchandised in a way that it makes it easier for the retailers to navigate, find them and purchase them. Of course, consistent availability and competitive cost prices are essential, but keeping the range in sight for the retailer to buy, will ensure we have our products at the ‘risk of sale’ within their outlets. Brand blocking is an effective tool to merchandising, along with a clear category versus market trend approach to stocking products.”

10 PACK L O OW W O U T T O F P O C K E ET T P R ICCE P E P P E R M MI N T C L I C K F ILLTTER R All figures sourced from IRI MarketPlace, Value and Volume sales, Time Period: w/e 25-12-2022, unless otherwise stated.

Consumers are becoming increasingly price conscious - value brands are key

Winning in Convenience with

Hot Beverages remains a prominent category within grocery, with 96.5% of UK households purchasing a Hot Beverages proposition in 20221 Having such a high reach has meant that over 60 billion Hot Beverage cups were consumed in the last year1. In 2022 we have experienced an increase in out of home consumption as consumption levels return to normal in a post covid environment. This has meant that in home consumption, especially on segments such as Coffee Pods has marginally reduced, back down to pre covid levels. However, despite in home consumption dropping, the category is ahead of where it was pre covid in terms of value and buyers, as more shoppers converted into Coffee during lockdown.

But why is coffee an important segment for retailers? Coffee is the 12th most valuable category and 9th highest penetration in the Total Market1. In addition, it is expected in the next three years to overtake Tea to become the most consumed Hot Beverage in the UK. The Coffee category is worth £1.6bn in the UK and has grown 1.4% versus 20212. If retailers want to win in Hot

Segment Share of Market

Beverages, then it is vital that they are winning in coffee, given that coffee accounts for 63.7% of all Hot Bev value, being approximately 2.5 times bigger than the next biggest segment Tea2.

Coffee in the Wholesale and Convenience (W+C) Channel

Convenience coffee (exc. Major mults) is worth £82.9M, growing 2.8% over the last quarter3 Convenience experienced significant declines as a result of covid and we are now seeing a return to normal shopping behaviours. Needs for today still remains the number one shopper mission for the convenience shopper, so ensuring the right pack offerings and propositions are available will enable retailers to win in the channel. Symbols & independent retailers are worth £62.3M in coffee and grew value 3.3% in the last quarter of 2022 showing strong signs of recovery.3 Across W+C, there is a strong over index on Core Instant propositions and this is the most important segment to W+C coffee, with Core Instant worth 67.6% of total W+C coffee.4

1 Source Kantar Worldpanel | Hot Bevs | W/E 25.12.22 2 Source IRI | IRI All Outlets & KWP Discounters | 52W | Value | W/E 31.12.22 3 Source IRI | Convenience (Exc. Mults) | 52 &12 W | Value | W/E 31.12.22 4 Source IRI | Convenience (Exc. Mults) | 52W | Value | W/E 31.12.22 3.3% 11.5% 17.5% 67.6% 2.7% 12.5% 18.3% 66.5% 4.5% 10.6% 11.9% 73.1% ConvenienceSymbols & IndiesForecourts & Travel

(%) Core Instant Instant Mixes R&G Pods

Which products are crucial to list?

Which core segments are more valuable in Wholesale and Convenience?

Core Instant is broken into 5 subsegments: Regular, Premium, Decaf, Super Premium and Origins & Organic. In W+C, a substantial amount of value in Core Instant is driven by Premium and Regular subsegments. For retailers, having a strong presence on shelf in these segments should enable them to drive a lot of value into their coffee category.

Which products should retailers be listing?

The following products are the key products for convenience retailers to list as part of their range to really maximise their value.

What to do with a limited space

Ranging and merchandising is essential for any retailer, no matter the size of their coffee fixture. Around two thirds of the fixture should be dedicated to Core Instant propositions so that they are on a fair space to sales. Then a representation of Mixes and R&G to cover need states and ensure that the Needs for Today shopper mission is met. On bigger fixtures there is then scope to add Pods into the range to further the range.

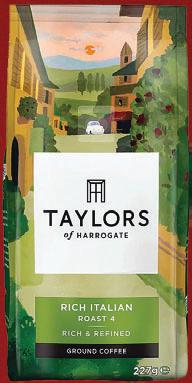

1 Nescafe Original PMP 95G (Regular) 2 Nescafe Original 3in1 6s (Mixes) 3 Nescafe Gold Blend 200G (Premium) 4 Nescafe Original 200G (Regular) 5 Kenco Smooth Instant PMP 100G (Premium) 6 Taylors of Harrogate Rich Italian Ground 227G (Ground) 7 Nescafe Gold Blend PMP 95G (Premium) 8 Kenco Rich Instant PMP (Premium) 9 Nescafe Azera Americano PMP 90G (Super Premium) 10 Nescafe Gold Blend Cappuccino PMP Sachets (Mixes) Regular Origins & Organic Decaf Premium Super Premium Core Instant Decaf MixesR&G RegularPremium Super Premium

STEPSTOSWEET SUCCESS

The confectionery market saw growth in 2022, with consumers returning to on-the-go consumption, renewing the importance of singles and duos formats. Research shows when it comes to purchasing confectionery website and depot purchases are the most popular for retailers, with 89% of retailers purchasing from depot, so it’s important to have a strong aisle display to help increase sales1.

CONFECTIONERY IN DEPOT: TOP TIPS

Display a core range covering singles, duos, blocks, bags and gifting Allocate the space according to sales potential, allocating more space to best sellers

Highlight best selling lines

Have clear pricing, showing clear cash margins er both and non lines

Encourage retailers to make the most of the seasonal opportunity, for example by displaying on rack ends at appropriate times

RECOMMENDED MUST-STOCK LiSTS*

CHOCOLATE SiNGLES

1Cadbury Twirl

2Cadbury Wispa

3Cadbury Starbar

4Cadbury Crunchie

5Cadbury Twirl Orange

DUOS

1Cadbury Wispa Duo

2Cadbury Boost Duo

6Cadbury Wispa Gold

7Cadbury Boost

Ensure D and promotional products are stocked in advance of consumer media and work with suppliers who are supporting launches and creating consumer awareness

32%2 of retailers purchase confectionery from the main aisle so create impactful displays to catch the eyes of retailers when they are making purchase decisions in depot. Displaying products by the till point is one of the most e ective placements

Use the category knowledge of suppliers who help to promote best practice to retailers, including sharing planograms

Advise retailers about spending strategy – some retailers go for best margin, that’s not always the best approach– a great margin on a product that doesn’t sell isn’t helpful

8Cadbury Dairy Milk Original

9Cadbury Dairy Milk Caramel

10Cadbury Picnic

Dai Dairy Milk y Picnic

3Cadbury Double Decker Duo

4Cadbury Wispa Gold Duo

5Cadbury Dairy Milk Duo

6Cadbury Twirl Xtra

MINTS

1Trebor Extra Strong Peppermint

permint

rmin

2Trebor Softmints Peppermint

3Trebor Softmints Spearmint

4Trebor Softfruits

5Trebor Extra Strong Spearmint

mint t

or the full ondele nternational core range recommended list go to www.snackdisplay.co.uk

Digital marketing guidance for wholesalers**

Retailers’ use of digital channels has increased so a focus on retaining these customers is key:

Look at your data, and use a ‘test and learn’ approach

Have fast-working pages and consider having lists, past orders and favourites

Understand top search terms

roduct images are key - reach out to suppliers for these Have facilities to lter pages by brand

Don’t forget telephone sales as these tend to peak at busy times so are still important