08

At its annual congress, EmiratesGBC highlighted the role of the built environment in building a zero-emissions future

12 The Big Picture

A wrap-up of the biggest international construction news stories for the month

14 Market Report

CBRE’s Taimur Khan says that activity in Saudi Arabia’s real estate sector has showcased a fragmented performance in the first quarter

18

Jason Saundalkar speaks to Estilo Architects’ Ezaht Al Doory about the growing ultra-luxury segment in Dubai, property development, UHNWI client requirements and sustainability

24

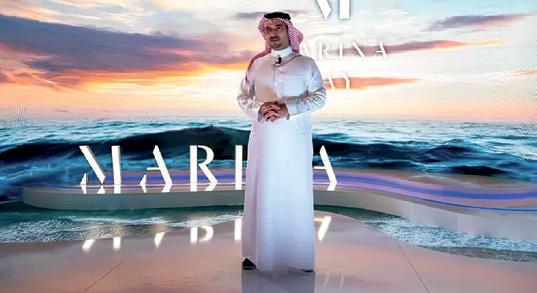

Mar Casa

Big Project ME speaks to Deyaar CEO Saeed Mohammed Al Qatami about the developer’s smart and sustainable approach, and how its newest coastal development adds to its already impressive project pipeline

36 Comment

Heriot-Watt University Dubai’s Mohamed Al-Musleh shares his insights on the measures required to accelerate transportation sustainability

38 Comment

Mixed-use development paves the way for an urban renaissance writes Ravi Menon , Co-Chairman of Sobha Realty

Seven new footbridges spanning 888m-long across Dubai roads have been completed according to Dubai’s Roads and Transport Authority (RTA)

Welcome to another edition of Big Project ME (BPME)! Time is certainly flying, and the team and I are now hard at work prepping for what will be an incredible second half of the year.

We kick things off with the inaugural Future of Water Summit on 6 September. While I’m sure you’ve already seen our emailers and social media posts highlighting this event, I can reconfirm that it will discuss the crucial topic of water, and will cover aspects including: COP28 and its focus on water security and water sustainability; demand side management; water usage in the built environment (during construction and in the operation of structures), regional water challenges and solutions, desalination technology, greywater recycling and wastewater facilities, the use of technology to boost the efficiency of water distribution networks, and more. If you’d like to learn more about this event or wish to register, please visit: https://2023.fowsummit.com/.

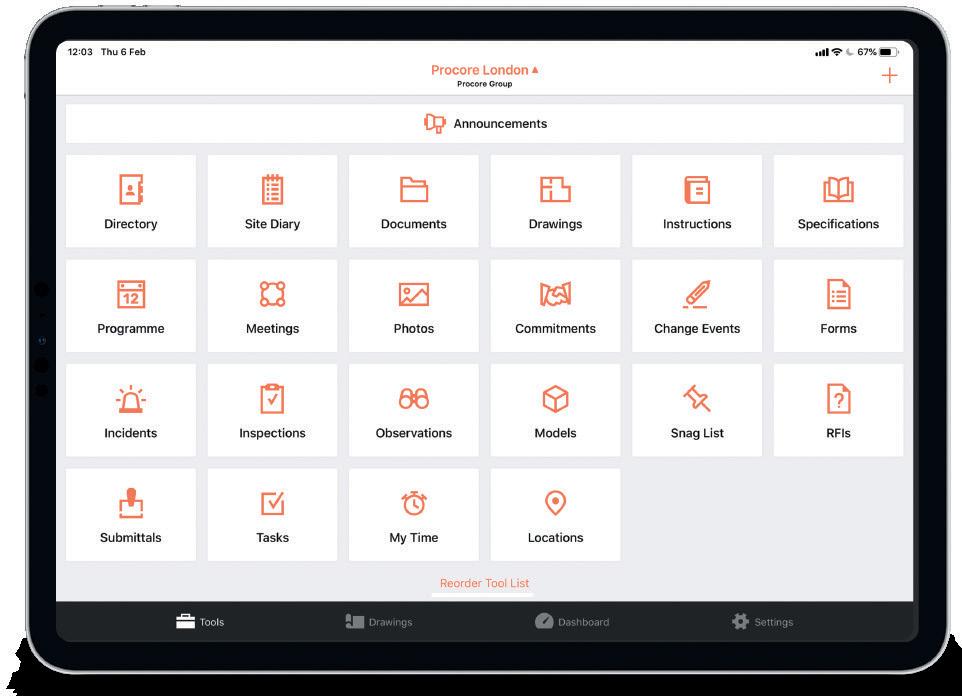

Soon after, BPME will shine a light on digital construction and technology, with

the next edition of its Digital Construction Summit. Scheduled to take place on 26 September, this year’s event will be based on several themes including: Construction 4.0; data and digital collaboration tools that facilitate the efficient delivery and operation of megaprojects; modern construction methodologies, technologies, and materials; integrating robotics and AI into the delivery and operations of projects; securing the digital elements of projects and assets, and striving for greater safety in the built environment. You can read more about this event and/ or register via its dedicated website here: https://2023.digitalconstructionsummit.com/. Both events will bring together well respected speakers from across the region to shine a spotlight on poignant topics in the built environment, and shouldn’t be missed. If these topics are your bread and butter and you’re passionate and keen to share your knowledge, do get in touch with me via my email address (listed below) to discuss the possibility of speaking at the events. The aforementioned events are just two of the four planned summits for the second half of 2023 but, rest assured, once things are a little more concrete, I’ll share more information with you right here. Until then, stay safe.

Jason Saundalkar HEAD OF CONTENT

jason.s@cpitrademedia.com

MEConstructionNews me-construction-news

MEConstructionNews me-construction-news

Group

MANAGING DIRECTOR Raz Islam raz.islam@cpitrademedia.com

MANAGING PARTNER Vijaya Cherian vijaya.cherian@cpitrademedia.com

DIRECTOR OF FINANCE & BUSINESS OPERATIONS Shiyas Kareem shiyas.kareem@cpitrademedia.com

PUBLISHING DIRECTOR Andy Pitois andy.pitois@cpitrademedia.com

Editorial

HEAD OF CONTENT Jason Saundalkar jason.s@cpitrademedia.com

+971 4 375 5475

Advertising

SALES DIRECTOR Raed Kaedbey raed.kaedbey@cpitrademedia.com

+971 4 375 5715

SALES EXECUTIVE Madeleine Martin madeleine.martin@cpitrademedia.com

+971 4 375 5714

Design

ART DIRECTOR Simon Cobon simon.cobon@cpitrademedia.com

DESIGNER Percival Manalaysay percival.manalaysay@cpitrademedia.com

Photography

PHOTOGRAPHER Maksym Poriechkin maksym.poriechkin@cpitrademedia.com

Marketing & Events

EVENTS EXECUTIVE Minara Salakhi minara.s@cpitrademedia.com

+971 4 433 2856

SOCIAL MEDIA EXECUTIVE Dara Rashwan dara.rashwan@cpitrademedia.com

Circulation & Production

DATA & PRODUCTION MANAGER Phinson Mathew George phinson.george@cpitrademedia.com

+971 4 375 5476

Web Development

WEB DEVELOPER Abdul Baeis abdul.baeis@cpitrademedia.com

WEB DEVELOPER Umair Khan umair.khan@cpitrademedia.com

FOUNDER Dominic De Sousa (1959-2015)

ENERGY

Major Saudi-Chinese credit deal signed as ACWA secures portfolio funding

ANALYSIS: Indians invested US $4.32bn in property in Dubai in 2022

CONSTRUCTION

Adnoc Gas Processing awards $700mn EPC contract to Petrofac

CONSTRUCTION

South Bay development further up-scales

INTERVIEW: Advocating for Nature-Based Solutions to Address Water Security

SUSTAINABIITY

Engie and Posco led consortium to develop green ammonia project in Oman

EXPERTS: Leading the charge on food waste solutions

PROPERTY

Dar Global partners with Automobili Lamborghini for $308mn luxury development

PROPERTY

New Palm Jebel Ali masterplan approved by Sheikh Mohammed

Occupying an area twice the size of Palm Jumeirah, the Palm Jebel Ali will feature extensive green spaces and unique waterfront experiences

CONSTRUCTION

Al Maktoum Solar Park fifth phase launched When complete, the plant is expected to reduce 6.5 million tonnes of carbon emissions annually

ENERGY

Saipem secures $550mn drilling contracts

PROPERTY

DAMAC announces Cavalli-curated towers

INFRASTRUCTURE

RTA completes upgrade project and deploys 14,000 LED lights LED lights consume 60% less energy than traditional lights and offer increased lifespans by up to 177%

CONSTRUCTION

Al Habtoor Tower will “redefine the concepts of luxury and comfort” says Mohammed Al Habtoor The 82-storey development features 18 high-speed elevators and is set to attract key investors

ENERGY

Posco-led consortium wins $6.7bn deal to build green hydrogen plant in Oman Consortium partners include Samsung Engineering, Engie and PTTEP and others

PROPERTY

$200mn Marina Bay project set for Bahrain

CONSTRUCTION

Dubai Municipality sets up hiking tracks at Mushrif National Park

FINANCE

Chinese corporates commit to $266mn investment in Modon

goals, in a bid to highlight the role of the built environment as a critical solutions provider for a resilient and zero-emissions future.

Under the theme ‘Pathway to COP28: The Role of Sustainable Built Environment in Accelerating Climate Action’ and organised ahead of the 28th Conference of the Parties (COP28), the annual congress called for greater collaboration to sharpen accountability and accelerate the transformation of the built environment.

General of Denmark, delivered the keynote address. The Congress organised panel discussions under thematic sessions including: COP28: Prospects and Aspirations, Transition to Net Zero, Green Finance for the Built Environment, and Innovation, Technology, Resilience and LEED.

At its 12th Annual Congress, the Emirates Green Building Council (EmiratesGBC) brought together academia, industry leaders, policymakers and regulators around shared climate

EmiratesGBC said it hosted prominent regional and international experts at the Grand Plaza Mövenpick Media City in Dubai, enabling them to debate the challenges and opportunities in driving the sector’s green transition.

Dr. Ali Al Jassim, Chair of EmiratesGBC, welcomed guests and Ambassador Lars Steen, Consul

Highlighting the power of collaboration in supporting decarbonisation pathways, Dr. Ali Al Jassim urged industry stakeholders to accelerate action across the value chain for the sustainable transition of the built environment. He stated, “We are united by a common purpose - to build a sustainable tomorrow.

EmiratesGBC’s 12th Annual Congress serves as a platform for us to learn from one another, share best practices, and explore innovative solutions that will drive the transformation of our built environment. Together, we

At its 12th Annual Congress, EmiratesGBC highlighted the critical role of the built environment to building a zeroemissions future

37% The construction sector accounts for 37% of energy emissions and over 34% of energy demand globally

stand at the forefront of change, ready to make a significant impact on our journey toward a greener future.”

Stating that COP28 would be witness to the UAE's unwavering dedication to the preservation and safeguarding of the planet, he called on all stakeholders to take collective responsibility in shaping a more sustainable world. Celebrating 2023 as the Year of Sustainability is an affirmation of the UAE’s steadfast commitment to placing sustainability at the forefront of its agenda, Dr. Ali Al Jassim added.

As part of her opening remarks, Eng Naseibah Almarzooqi, Director of Studies, Research and Development Department at the Ministry of Energy and Infrastructure, highlighted the strong commitments made by the UAE to embedding sustainability across all aspects of the construction sector, which accounts for 37% of energy emissions and over 34% of energy demand globally.

The UAE has demonstrated its capabilities in improving the resilience of the building sector in the country by laying down guidelines to cut emissions across the full lifecycle of buildings, starting from planning, designing and execution to operation and maintenance. In addition, Eng Almarzooqi highlighted the UAE’s leading role in developing a decarbonisation roadmap for 22 countries in the region to support Net Zero goals in the construction sector by 2050.

As a member of the Global Alliance for Buildings and Construction (GlobalABC), the UAE has also been spearheading efforts globally and prioritising action to ensure that the buildings and construction sector are on track and aligned with the Paris Agreement goals, she added.

Calling for inclusive action amongst all stakeholders, Eng Almarzooqi, further pointed out that at the upcoming COP28, the UAE would draw global attention to the importance of developing low carbon building materials to help decarbonise the construction sector and contribute to achieving the UN Sustainable Development Goals (SDGs).

Collaboration

Recognising the key role of the private sector in driving sustainability, the congress highlighted the importance of private sector engagement in COP28.

Leading the way

As a member of the GlobalABC, the UAE has been spearheading efforts to ensure the built environment aligns with the Paris Agreement goals.

The congress is said to have gone beyond the realm of sustainable building practices, offering insights into lessons learned from COP27 and expectations from COP28. Recognising the pivotal role of the private sector in driving sustainability, the Congress highlighted the importance of private sector engagement in COP28. From effective building policies to the integration of sustainable design processes, valuable insights for driving decarbonisation, sustainability,

and Net Zero were also discussed during the event. Additionally, participants emphasised the role of green finance in supporting sustainable development and explored the latest advancements in glass decarbonisation and heating systems.

“The challenges that lie before us are significant, but they are not impossible. By harnessing our collective knowledge, expertise, and passion, we can chart a path toward a more sustainable future,” Dr. Ali Al Jassim concluded.

SAUDI ARABIA Landing) aircraft has received special flight authorisation and performed test flights in the Kingdom of Saudi Arabia.

NEOM and Volocopter have announced the successful completion of a series of air taxi test flights in the Kingdom

NEOM and urban air mobility (UAM) pioneer, Volocopter, have successfully completed a series of air taxi test flights. The occasion stands as the first time an eVTOL (electric Vertical Take-Off and

The flight test campaign is said to have lasted over a week and follows on from 18 months of collaboration between NEOM, the General Authority of Civil Aviation (GACA), and Volocopter, with the aim of implementing and scaling an electric UAM ecosystem and testbed in the smart and sustainability focused NEOM development. The parties worked closely to ensure full regulatory compliance and safety ahead of the test campaign, it was announced.

According to a statement, the Volocopter eVTOLs will be key to NEOM’s smart and sustainable multimodal mobility system, which will be powered by 100% renewable energy, generated by solar and wind energy sources. They will be used in a variety of roles including as air taxis

and emergency response vehicles, and are quieter, more easily adaptable, and cheaper to operate than the helicopters often employed today.

They have smaller on-ground infrastructure footprint, fewer operating restrictions, and employ smart and autonomous capabilities that ensure both safety and sustained relevance in future contexts, the statement pointed out.

“The successful test flight of a Volocopter eVTOL is not just another milestone towards the creation of NEOM’s innovative, sustainable, multimodal transportation system – it is a tangible example of NEOM as a global accelerator and incubator of solutions to the world’s most pressing challenges. Driving the development of smart, sustainable, and safe mobility systems will improve liveability and connectivity in cities around the

18

The flight test process was carried out over the span of a week, and follows 18 months of groundwork

world and reduce carbon emissions, creating a cleaner future for all,” said Nadhmi Al-Nasr, CEO of NEOM.

His Excellency, Abdulaziz A. Al-Duailej, President of the General Authority of Civil Aviation (GACA) of the Kingdom of Saudi Arabia added, “This safe and successful test flight represents an important milestone of the Saudi aviation sector and another steady step towards achieving the aviation sector’s strategy, through innovation and employing emerging technologies to create new industries that contribute to the output GDP and create more jobs.”

He added, “It also confirms the GACA’s commitment to enabling the safe integration of innovative air transport patterns that improve the mobility experience of individuals in urban areas and the quality of life in the Kingdom of Saudi Arabia.”

NEOM and Volocopter share a joint vision of creating a better future through innovative, clean technology. As part of a multimodal transport system, electric

air mobility reflects NEOM’s ambition to revolutionise mobility and transform people’s lives. In 2021, NEOM and Volocopter founded a joint venture (JV) company to scale advanced air mobility and position NEOM as a collaborative, global living lab for the future of transportation, the statement explained.

Christian Bauer, Chief Commercial Officer of Volocopter stated, “It is beyond exciting to see our work from

the past 18 months come to fruition. As the first eVTOL aircraft to ever test in Saudi Arabia, we are proud to have lain the groundworks for our future collaboration here in NEOM.”

The test campaign focused on the flight performance of the Volocopter aircraft in local climate and environmental conditions, as well as testing its integration into the local unmanned aircraft system traffic management (UTM) system.

The test flight announcement builds on NEOM’s $192mn investment and JV with Volocopter, and positions NEOM as a leader in future mobility solutions. Volocopter expects to obtain type certification of its VoloCity air taxi in 2024, enabling future commercial operations.

Volocopter also recently announced the commencement of VoloCity serial production at its facilities in Bruchsal, Germany, with a capacity to deliver more than 50 aircraft a year under one shift conditions.

Sweco has been appointed to carry out a feasibility study and preliminary research into a proposed network of hydrogen and CO2 pipelines in Ghent and Antwerp by energy infrastructure firm Fluxys Belgium.

The feasibility study assignment covers about 70km of pipeline. Sweco’s contract is also said to includes design, environment impact assessment and safety coordination.

According to a report, as the demand for hydrogen as a low-carbon fuel increases, the ports of Ghent and Antwerp have been earmarked as important hubs for hydrogen distribution across Europe.

A memorandum of understanding (MoU) between Hefei-based Gotion High-Tech and Moroccan officials has been inked. The MoU allows the Chinese group to invest US $6.4bn into the development of a battery manufacturing complex in the country.

Gotion High-Tech specialises in energy storage products and has operations in China, Singapore, Germany, and California. It last year achieved 122% revenue growth to reach $3.2bn and said it intends to enter Africa with a gigafactory in Rabat, with an annual production capacity of 100GWh, creating around 25,000 jobs.

02 FRANCE

The contract for the expansion of The Chemours Company’s green hydrogen production facility in the Villers-Saint Paul region of France has been awarded to AECOM. The project will allow Chemours to increase capacity and advance its Nafion Ion Exchange materials platform, which is said to be a key component for electrolysers to produce green hydrogen.

As per AECOM, the project will enable Chemours to support the growing demand for clean hydrogen generation, while supporting its broader global decarbonisation efforts.

The Global Cement & Concrete Association (GCCA) has announced that the United Nations (UN) has backed its plan to achieve Net Zero carbon emissions by 2050. UN Secretary General António Guterres addressed around 200 industry leaders in Zurich via video call, and said he wanted to see “concrete pledges from the concrete industry”.

Guterres’ comments followed a rallying call from GCCA Chief Executive Thomas Guillot for the industry to redouble its efforts and work in partnership with governments to achieve Net Zero.

Maintenance work including two major overhauls on two gas turbines at the Khor Al Zubair power plant in Iraq have been completed according to GE Gas Power. The project is said to support the Iraqi Ministry of Electricity (MoE) in boosting power generation ahead of peak summer demand, in addition to improving the units’ efficiency and performance.

The two gas turbines have a capacity of 200MW. The firm said it also completed the servicing of a 100MW gas turbine unit at the Shatt Al Basra power plant, following a thorough inspection and replacement of major gas turbine components.

A US $6.7bn deal to build the world’s largest green hydrogen plant in Duqm, Oman has been awarded to a consortium led by South Korean steelmaker Posco Group.

The consortium partners on the project include Samsung Engineering and two other Korean state-run power companies, as well as French energy major Engie and Thai national petroleum company PTTEP.

According to a report published by The Korea Economic Daily, Omani authorities will be signing the deal on 21 June with the Posco consortium, in the presence of its energy and minerals minister.

A 3.4km road tunnel under the Karnaphuli river in the port city of Chittagong in Bangladesh is nearing completion, following four years of construction works. The project was officially launched by Bangladeshi Prime Minister Sheikh Hasina and Chinese President Xi Jinping in October 2016, with work on the tunnel beginning in March 2019.

The Bangabandhu Sheikh Mujibur Rahman Tunnel is being built by China Communications. Its US $930mn cost is being financed by a concessional $540mn loan from the Export–Import Bank of China.

A 50:50 joint venture (JV) between Balfour Beatty and Gammon Construction has been appointed to build a 10-storey building at Hong Kong’s Cyberport business park. The contract is said to be worth US $473mn. According to a report, the structure will contain office space, a data services platform, multi-functional hall, ancillary facilities and waterfront enhancements. Main construction works are scheduled to begin on the project in 2025. At the height of building work, over 1,000 staff will be employed at the development.

Construction of a new train line that will connect Tokyo Station and Haneda International Airport has begun, and was marked with a special ceremony, a report by Kyodo has outlined. The project, valued at US $2bn, is expected to begin service before March 2032, which is said to be two years later than originally planned. According to the report, the new airport line will be operated by East Japan Railway Co, and will allow passengers to travel the approximately 14km journey in 18 minutes, compared to the current 30-minute journey on existing lines.

According to Oxford Economics, Saudi Arabia’s GDP is expected to grow by 1.6% in 2023, down from 8.7% a year earlier.

This slower rate of growth is amidst a more challenging global economic backdrop, due to which CBRE is expecting

lower levels of oil production and prices for the year, which in turn has led to forecast for oil sector GDP falling by 1.9% in 2023. The non-oil sector, on the other hand, is expected to grow by 4.6% over the same period.

Despite a slight softening month-onmonth, Saudi Arabia’s Purchasing Managers’ Index (PMI) continue to expand at a strong rate in March 2023 with a reading of 58.7. The headline figure receded slightly due to softer, although once again very strong, readings in the new orders and output subindices during the month. The index’s employment sub-index also registered strong readings as firms in Saudi Arabia’s non-oil private sector continue to increase staffing levels.

“Activity in Saudi Arabia’s real estate sector has showcased fragmented performance in Q1 2023, much of which can be underpinned by a shortage of suitable stock. Despite heightened levels of demand from occupiers, which continues to be centred towards

Riyadh, there is a considerable lack of Grade A stock available for immediate occupation. This is driving strong performance in this segment of the market across the Kingdom.

In the residential market, due to higher costs of financing and lack of suitably affordable options, we have seen a marked decrease in transaction activity and fragmented price performance, with Riyadh being the only location to continue to see price growth in both the apartment and villa segments of the market.”

In Q1 2023, the total number of mortgage contracts issued by banks continued to trend down. The total for the first quarter registered at 30,213, which equates to a total value of $6.07bn. In comparison to the same period in 2022, the total number of contracts issued shows a decline of 35.8%. Furthermore, the total value of these contracts has fallen by

37.1% when compared to the corresponding period in 2022. In terms of new loans issued by property type over the first quarter, houses retained the majority share with 68.8%, apartments accounted for 25.8% and land represented the remaining 5.4%. In terms of residential price performance, average villa prices across major cities in Saudi Arabia saw mostly positive performances in the year through to Q1 2023. Over this period, average villa prices have improved in Dammam, Jeddah and Riyadh by 28.1%, 10.2% and 6.0% to reach $958, $1,503 and $1,477 per sqm

respectively. Khobar’s villa market was the only one to record a fall in prices, which saw average prices falling to $937 per sqm, a decline of 6.1% in the year to Q1 2023. In the Kingdom’s apartment market segment, Riyadh was the only city where average apartment prices increased on an annual basis, with average prices increasing by 17.3% to reach $1,214 per sqm. In Jeddah, apartment prices declined by 0.7% to reach $1,065 per sqm. In Dammam, prices fell by 2.5% settling at $743 per sqm, while Khobar’s average apartment price dropped by 1.6% to $901 per sqm.

During Q1 2023, Riyadh remained the focal point for occupier activity in the Kingdom, with demand in the likes of Jeddah and the Damam Metropolitan Area (DMA) remaining relatively limited over the period. Demand from both existing and new occupiers has continued to grow. This is despite the fact there is extremely limited levels of occupiable stock available across the market. In terms of occupiers, demand continues to stem from mainly government, semi-government and global institutional occupiers, with the former two sectors

accounting for the highest proportion of required space within the market.

Throughout Q1 2023, the office sector in Riyadh exhibited strong performance in both the Grade A and Grade B sectors of the market. In the Grade A segment, the average rental rate saw an annual rise of 9.3%, with rents reaching $471 per sqm in Q1 2023. In the Grade B segment of the market, rents rose by 14.0% to $386. in terms of occupancy rates, both Grade A and Grade B offices saw average occupancy rates increase with Grade A segment reaching 99.8%, representing a 1.8 percentage point annual increase, and Grade B segment reaching 99.0%, indicating an improvement of 2.1 percentage point year-on-year.

In the Eastern Province, we have seen a uniform increase in average rental rates across all markets. In Dammam, average rents for Grade A offices reached $251 per sqm in the year to March 2023, marking a 9.7% growth rate, and average rents for Grade B offices increased to $142 per sqm, reflecting an annual rise of 1.6%. In Khobar’s Grade A market, average rents rose to $288 per sqm, an increase of 8.0% in the year to Q1 2023. In the year to March 2023, average

occupancy rates in Dammam and Khobar’s Grade A market increased by 6.7 percentage points and 6.0 percentage points to reach 82.2% and 81.0%respectively. Over the same period, Grade B occupancy stood at 67.6%, increasing marginally by 1.2 percentage points.

In Jeddah, average rents for Grade A offices have risen by 13.8% in the year to Q1 2023, reaching $330 per sqm. Moreover, Grade B offices’ average rental rate averaged $188 per sqm, reflecting an annual growth of 1.0%. Average occupancy rates for Grade A and Grade B segments sat at 91.8% and 79.3% respectively, up 4.3 and 4.7 percentage points.

Whereas in 2022, only two out of the four major tourism markets exceeded their pre-pandemic levels, all key performance indicators in all major markets sit above their pre-COVID baseline, in the year to date to March 2023 compared to the same period in 2019. Over this period, the average occupancy and ADR now sit 8.9 percentage points and 46.3% above their 2019 levels, which in turn has led to RevPAR increasing by 67.7%.

On a country level, year-on-year in the year to date to March 2023, Saudi Arabia

has seen relatively strong performance levels, with its average occupancy increasing by 11.5 percentage points and its ADR increasing by 32.3%. Over this period, its RevPAR increased by 58.6%.

On a city level, year-on-year in the year to date to March 2023, with the removal of visitation restrictions and the start of the month of Ramadan, the holy cities of Makkah and Madinah saw a sharp increase in occupancy levels and ADRs of 21.2 and 18.5 percentage points and 91.5% and 62.0%, which underpinned RevPARs increasing by 166.2% and 108.9% respectively.

In Jeddah, over the same period, the average occupancy rate and ADR rose by 7.9 percentage points and 4.8%, which led to a 21.5% increase in its RevPAR. Shifting focus towards Riyadh, despite a marginal decline in occupancy of 0.4 percentage points, a 12.0% increase in ADR has meant that the capital’s RevPAR increased by 11.3%.

Finally, the Eastern Province’s hospitality market largely recorded lackluster performance year-on-year in the year to date to March 2023, with RevPARs in Al Khobar increasing by only 1.6% and falling by 8.0% in Dammam.

We have seen a marked decrease in transaction activity and fragmented price performance, with Riyadh being the only location to continue to see price growth in both the apartment and villa segments of the market”

JASON SAUNDALKAR SPEAKS TO ESTILO ARCHITECTS ’ EZAHT AL DOORY

ABOUT THE GROWING ULTRA-LUXURY SEGMENT IN DUBAI, PROPERTY DEVELOPMENT, UHNWI CLIENT REQUIREMENTS AND SUSTAINABILITY

ost pandemic, the luxury and ultra-luxury residential segments in the UAE’s key real estate market of Dubai has been on an upward trajectory. According to data from the Dubai Land Department, which has been analysed by LUXHABITAT Sotheby’s International Realty, Dubai’s prime residential market witnessed transactions of approximately US $4bn in Q1 2023 alone, with the top transaction in the quarter - for the Jumeira Bay Island Bulgari Lighthouse - coming in at $112mn.

The appetite for ultra-luxury homes in markets such as Dubai looks set to continue in the future, as the number of global ultra-high-net-worth individuals is forecasted to grow. As per Knight Frank’s 2023 Global Branded Residences Report, “Positive long-term trends mean that the population of UHNWIs is projected to rise by 28.5% between 2022 and 2027”. The report also noted, “The US and China will contribute significantly to wealth creation, but countries such as Canada, Australia, India, Germany, and the UK will also see substantial growth in the number of UHNWIs. At a regional level, growth will be led by Australasia, Asia, and the Middle East.”

The report also said, “The pandemic boosted residential property demand from UHNWIs, with around 17% purchasing homes in 2022. Despite higher interest rates, there remains healthy underlying demand with 15% of UHNWIs considering a purchase in 2023. Global sales of prime and superprime properties have rebounded, and key hub markets such as the US, UK, Australia, Spain, and France are favoured destinations for second home purchases.”

Thanks to the apparent mid- to longterm health of the ultra-luxury residential segment, local and international entities are focusing on designing and developing opulent homes. Estilo Architects has, over the last decade, developed a luxury home and residential portfolio within

the region and across Europe. The firm is said to specialise in the full end-to-end design and build home approach, and positions itself as an expert in architecture, interior design, and construction. The firm is also developing property, with properties and land plots owned on the Palm Jumeirah and Dubai Hills to date.

Speaking to Ezaht Al Doory, Founder & CEO, Estilo Architects (EA) about his thoughts on Dubai’s ultra-luxury residential segment and key areas in the city, he says, “From a developer’s perspective, Dubai’s residential real estate segments offer varying potential for business and growth over the next 12 to 24 months. Palm Jumeirah continues to be the leading contender, attracting a high number of clients and transactions. In the past year, it has witnessed an average of 20% year-on-year growth in transaction volume, making it the busiest residential real estate hub in Dubai.”

“Another promising segment is Jumeirah Bay, despite its higher price range. Although it offers limited land availability, Jumeirah Bay has witnessed notable construction activities and significant transactions. In the last six months alone, Jumeirah Bay experienced a 35% increase in high-value transactions, indicating its growing prominence in the market. Moving from ultra-luxury to the high-end segment, Dubai Hills

has been experiencing remarkable growth. With a larger community and a favorable price point compared to ultra-luxury areas, Dubai Hills has become a booming hotspot. It has experienced an impressive 25% year-onyear growth in transaction volume.”

Shedding light on his firm’s plans for the future, he states, “In light of these market dynamics, EA has strategic plans to capitalise on the opportunities presented by these residential real estate segments. These plans include a focus on Palm Jumeirah and Jumeirah Bay in the short and medium terms. Additionally, EA recognises the potential of Dubai Hills and Emirates Hills as viable options for development and will closely monitor their market performance.”

Due to the robustness of Dubai’s ultraluxury segment, the number of entities operating in the space has increased significantly in last couple of years. As a result, standing out in the ultra-luxury development space can be challenging.

Asked about how his firm approaches this issue, Al Doory responds, “Unlike many other developers who struggle to complete their projects or compromise on quality due to their limited market experience, EA has been successfully designing, building, and selling properties for over four years. We are proud to be one of the few developers who have both initiated and completed projects in this highly demanding market.”

“One key differentiator is that we have an integrated approach. While most developers outsource construction to contractors, we have our own in-house team of expert builders. This enables us to maintain strict control over quality, sales, and timelines. With Estilo as our architect, PPK as the project management company and Tri-lines as our construction arm, we have a cohesive entity that handles the entire process seamlessly. By managing all aspects internally, we ensure our ultra-luxury projects meet and exceed expectations.”

Highlighting the firm’s success and commitment to excellence, Al Doory points to the company’s extensive portfolio of projects. “On the iconic Palm Jumeirah alone, we have more than 35 live

4 Estilo has been successfully designing, building, and selling properties in the region for over four years

projects in progress, and an impressive track record of completing 10 projects to date - our projects can be found on most fronds of the Palm. Our portfolio includes a mix of our own developments, architecture and interiors, as well as turnkey projects. In fact, with a remarkable 55 projects to our name, we proudly hold the title of the largest portfolio on the Palm.”

“Estilo has been fortunate to achieve these milestones thanks to our unwavering dedication and unmatched expertise. When it comes to ultra-luxury projects, our comprehensive approach, in-house construction capabilities, and extensive portfolio make us the leading choice for those wanting nothing but the epitome of opulence on Palm Jumeirah,” he emphasises.

Taking into account the significant sums of money that ultra-luxury residences command, the UHNWIs who invest in these opulent properties have high expectations. Here, Al Doory notes that these properties have to offer several elements to justify their significant price tags.

“When it comes to ultra-luxury properties on The Palm, achieving a price point of $40.8mn requires meeting criteria including: a minimum of six bedrooms, offices within the property, ample car parks, basements, sub basements, ‘man caves’, and even indoor-outdoor pools on the roof. All of these elements need to be present to justify the price tag of such prestigious property,” explains Al Doory.

“One very obvious difference in a high-end buyer versus an ultra-luxury one is the preference for using the best-ofthe-best materials, rather than relying on local resources. Ultra-luxury clients have a discerning eye and demand topnotch quality both inside and outside the property. Budget constraints are simply not a concern for developers targeting this segment. To command prices in the range of $55mn to $82mn, a significant investment in the interior is necessary. Every aspect of the property, from light fixtures to kitchen appliances and furniture, needs to be branded. Buyers in this segment have sophisticated tastes and extensive experience in building and owning properties globally. They know precisely what they want, and

only the finest materials and brands will meet their expectations.”

Sharing his thoughts on current design preferences, Al Doory points out that while modern architecture was previously prominent, clients are now looking for something more unique and distinctive.

“A modern design is no longer sufficient. For example, if we take an architecture, interior and construction client of ours, we’re not doing a ‘modern house’ for him. He wants something modern, but different. Hence, we’re introducing curves, varying heights, and different materials to add that extra oomph and to differentiate their properties. Each property becomes an opportunity to deliver something fresh and remarkable, while still adhering to the overall design brief.”

Asked to elaborate on key asks from clients for their ultra-luxury homes in recent times, Al Doory states that the desires and demands of clients have evolved. “We have closely observed these shifting trends and catered to the unique requirements of our clientele. Over the past 12 to 24 months, we have witnessed a surge in requests

Post pandemic trend Health and wellness remains a crucial consideration in the ultra-luxury space since the outbreak of the pandemic in 2020.

55 Estilo currently holds the title of the largest portfolio on Palm Jumeirah, with a total of 55 projects

for extraordinary features that truly redefine opulence,” he outlines.

Highlighting an emerging trend, he shares, “One prominent trend is the integration of nightclubs within residential properties. Clients now seek the ultimate entertainment experience within the confines of their own homes. Consequently, we have designed and constructed houses with fully functional nightclubs, offering stateof-the-art sound systems, immersive lighting setups, and luxury VIP areas.”

“Another noteworthy demand from our clients revolves around the concept of security and personal safety. With an increasing focus on safeguarding their well-being, clients are requesting panic rooms and safe rooms as essential components of their luxury homes. These fortified spaces provide a sense of security and peace of mind, equipped with features such as mechanical hatches, bulletproof glass, advanced access control systems, and even fingerprint or key card authentication.”

He elaborates, “In response to these requirements, we have incorporated panic rooms with mechanical hatches in one of our current projects. On Frond J, we have constructed a safe room that resembles a walk-in wardrobe but boasts bulletproof glass, a safety keeper, and sophisticated access control measures.”

The integration of cutting-edge technology has become a prominent aspect of luxury home construction. Motion sensors, advanced surveillance systems, and bulletproof glass have gained

Key requirements

To achieve a price point of $40.8mn requires meeting criteria including: a minimum of six bedrooms, offices within the property, car parks, basements, sub basements, ‘man caves’, and indoor-outdoor pools on the roof.

popularity, as clients strive to create secure and technologically advanced environments that elevates the overall ultra-luxury experience, he adds.

Al Doory also says that the health and wellness trend has maintained its momentum since the outbreak of the pandemic. “Health and wellness remains a crucial consideration; statistics indicate the demand for dedicated wellness facilities within homes has soared. Approximately 90% of our luxury homes now feature state-of-the-art

gyms, spas, saunas, and cold or plunge pools as standard prerequisites. These wellness amenities have become essential components of the modern luxury home, offering residents the convenience and privacy of accessing these facilities within their own living spaces.”

Sustainability has emerged as a key topic in the built environment over the last several years, particularly in the UAE. With the country stepping up its focus on

One key differentiator is that we have an integrated approach.

While most developers outsource construction to contractors, we have our own inhouse team of expert builders”

sustainability by declaring 2023 the ‘Year of Sustainability’ and with Dubai set to host COP28 later in the year, the emphasis on sustainable development will only grow.

Asked for his thoughts on sustainability and the integration of sustainable elements in EA’s ultra-luxury developments, Al Doory says his firm incorporates both active and passive elements.

“Energy efficiency takes precedence as a focus in client briefs. To ensure optimal energy performance, we utilise insulation systems that effectively protect the house and contribute to maintaining a cooler indoor environment. By minimising heat transfer, these insulation systems reduce the need for excessive cooling and thus lower electrical consumption rates.”

“Estilo also selects high-end air conditioning units that are designed to operate with reduced energy consumption. We also implement sustainable practices for swimming pools; we opt for more efficient chillers that are specifically chosen to minimise the electrical load associated with pool heating and cooling. By carefully considering and optimising the energy usage in these areas, we ensure that the overall electrical load in the house remains within sustainable limits.”

Al Doory says his firm is also committed to securing relevant sustainable certifications for its developments. “Certifications serve as

a testament to the firm’s commitment to sustainability and environmental responsibility. While specific certifications may vary depending on the project, Estilo actively seeks to attain well-recognised sustainability certifications in the industry including LEED and Estidama. In doing so, EA demonstrates its dedication to creating sustainable, eco-friendly, and high-performance ultra-luxury properties.”

Highlighting savings achieved through the firm’s deployment of sustainable measures, Al Doory notes the firm has: seen average cooling requirements reduced by up to 25% through effective insulation systems; air conditioning units with 15-20% lower energy consumption compared to standard units; achieved average 30% reduction in electrical load associated with pool heating and cooling systems.

He adds, “Estilo integrates sustainability into its design philosophy and by pursuing sustainable certifications, we set a benchmark for excellence in sustainable luxury construction, contributing to the UAE’s broader agenda of promoting sustainability and environmental stewardship.”

Sharing his closing thoughts, Al Doory notes that in terms of design trends, modern aesthetics have been a prevailing force in home design, however other demands are causing a shift in preferences.

“The demand for uniqueness and distinction has spurred a shift in preferences. Clients are looking for a modern design that goes beyond the ordinary; they want elements that break away from traditional norms, such as incorporating curves, varying heights, and utilising different materials. Simply put, a standard modern design no longer suffices; it requires an added touch of extraordinary flair to stand out.”

He continues, “Ultra-luxury buyers are making purchases at the pinnacle of the market - our properties are being sold for prices ranging from $27mn to $41mn. Currently, we are in negotiations for a property valued at $30mn; if finalised this sale will mark our most significant transaction to date. The deal includes an option to rent the property for one year, priced at $2.72mn, setting a new record for the highest rental on the Palm. Last year, we achieved the highest rental record at $2.18mn.”

He concludes, “At Estilo, we take pride in our ability to remain attuned to our clients’ desires and anticipate their evolving needs. By incorporating extraordinary features into our ultraluxury homes, we continue to push boundaries, redefine opulence, and provide our clients with residences that epitomise extravagance, security, and technological advancement.”

90% of Estilo’s luxury homes feature state-ofthe-art gyms, spas, saunas, and cold or plunge pools as standard

DEYAAR’S CEO, SAEED MOHAMMED AL QATAMI, TALKS TO BIG PROJECT ME ABOUT THE FIRM’S SMART AND SUSTAINABLE APPROACH TO CONTRIBUTING TO THE UAE’S REAL-ESTATE GROWTH, AND HOW ITS NEWEST COASTAL DEVELOPMENT, MAR CASA , IS A STANDOUT ADDITION TO ITS ALREADY IMPRESSIVE PROJECT PIPELINE

he Dubai skyline is undoubtedly one of the most recognisable in the world, and the city’s impressive urban landscape has echoed the emirate’s growth story as an international destination. This is an unfolding narrative that Deyaar has played an active role in for over twenty years.

“Since its establishment in 2002, the company has become one of the largest developers in the region,” says Saeed Mohammed Al Qatami, Chief Executive Officer of Deyaar Development. “Using the breadth of our expertise and the strength of financial intelligence to create a positive and lasting impact on Dubai’s built environment, we aim to unlock potential, maximise opportunity, and create enduring and recognisable value for our investors and customers.”

In its bid to expand following its IPO in May 2007, Deyaar was committed to diversifying its service offerings and divided the organisation into six business units: Property Development, Property Management, Facilities Management, Community Management, Hospitality, and

Asset Management. Al Qatami says these divisions provide multipurpose property services, accentuating Deyaar’s appeal and stature within the real estate industry.

“The Deyaar vision traverses boundaries. With international developments to our credit, we have firmly established ourselves as a global property developer. We constantly seek opportunities to enhance our international footprint within the revered cities of the world,” comments Al Qatami.

To date, Deyaar has been focusing on commercial towers, residential buildings and hotels that combine comfort, luxury and modern lifestyle with projects spread over prominent areas in Dubai, such as Business Bay and high-end residential areas, such as Dubai Marina, Al Barsha, Dubai International Financial Center (DIFC), Jumeirah Lakes Towers, Dubai Silicon Oasis, Dubai Production City, Dubai Science Park and Dubai Maritime City. In addition, Deyaar also has projects in Sharjah and Ajman and is also expanding to other emirates including Abu Dhabi.

Deyaar’s ambitious and resilient strategy was developed in full alignment with the ever-evolving real estate sector in the GCC region. Al Qatami notes, “In the UAE, we have been witnessing an upward trend thanks to the positive environment here, attracting more and more investors and homebuyers from different countries,

thus leading to increased demand for both commercial and residential properties.”

Citing recent reports underlining the positive upturn within the industry, Al Qatami points to the CBRE 2023 Market Outlook, which shows that the total value of real estate projects planned or underway in the GCC currently stands at US $1.36tn, with the UAE having $293bn worth of projects that account for 21.6% of the total.

Deyaar’s strong performance has mimicked the country’s positive growth. Citing impressive numbers from their Q1 2023 report, Al Qatami says Deyaar has recorded profits of $15.34mn in the first quarter, achieving a remarkable 125% increase from the same period in 2022, where profit stood at $6.80mn.

“In addition, Q1 2023 profits enjoyed a 37% over Q4 2022’s reported profits of $11.16mn. The remarkable profit follows a successful financial year. It includes achieving unprecedented success in selling Deyaar’s recent project launches, such as Regalia at Business Bay, Tria in Dubai Silicon Oasis, and Mar Casa at Dubai Maritime City,” he points out.

Al Qatami further says that Deyaar has always been part of the growth story of Dubai, and to meet future demand, the company has significantly increased the frequency of its project launches. “A number of new areas are currently being developed for luxury, upper-mid segment, and hospitality projects,” he states.

Diverse portfolio Deyaar’s focus has been on commercial towers, residential buildings and hotels that combine comfort, luxury and modern lifestyle.

580

The Mar Casa project will have a total of 580 apartments, which include one-, twoand threebedroom units

Among the projects in the pipeline, Mar Casa is said to have been drawing significant interest. Located in Dubai Maritime City, Mar Casa aims to seamlessly blends the beauty of the sea with the cutting-edge design of a modern metropolis inspired by the fluidity of the waves and the serenity of nature, creating a harmonious connection between land and sea.

“Mar Casa redefines the region’s urban life and reinvents the boundaries of conventional luxury; it is a residential destination at Dubai Maritime City where heritage meets modernity. It’s not just a residence but a landmark that stands as a testament to the emotional luxury of living in the birthplace of Dubai,” notes Al Qatami.

Set to be completed by October 2026, the 52-floor residence will have

580 apartments, which include one-, two- and three-bedroom units. In total, the project is valued at $299.4mn. The intention, explains Al Qatami, is to ensure the luxurious units at Mar Casa offer prospective buyers a wide range of options, with one-bedroom units ranging from 740-1,265sqft and starting at $348,000. Two-bedroom apartments and duplexes range between 1,100-3,285sqft, while three-bedroom apartments and duplexes are available from 1,850-4,170sqft. The ultra-luxury Executive and Royal duplex penthouses meanwhile are said to offer between 2,780-5,830sqft of built-up area.

Elaborating further, Al Qatami highlights that each unit will enhance the panoramic ocean views and offer airy, well-balanced living spaces that delight the senses.

“Mar Casa is aligned with our mission to create an urban environment that meets

development will have a total of

With international developments to our credit, we have firmly established ourselves as a global property developer. We constantly seek opportunities to enhance our international footprint within the revered cities of the world”

the high standards set by the nation’s leaders, with a diverse portfolio of quality real estate developments and differentiated services, a return on investment for stakeholders and value for customers, whilst providing the tools to our employees to realise their potential,” he elaborates.

For Al Qatami, the core concept for Mar Casa is “passion for living life to the fullest”. This is reflected in the social spaces that promote wellness, active recreation, and healthy habits suitable for all ages. “From beautiful leisure spaces to the invigorating workout facilities, Mar Casa will offer plenty of opportunities. The experiences are designed to encourage interaction, making it easy to connect and make lasting memories,” he says.

With this objective standing as a critical driver of design, Al Qatami notes that residents of Mar Casa can indulge

Maximising natural light Mar Casa’s residences are designed to maximise natural daylight. It also features energy efficient fixtures to further reduce energy consumption.

2026 Mar Casa is set to be completed by October 2026

in luxury surrounded by breath-taking natural scenery and enjoy meticulously selected indoor and outdoor amenities that cater to the demands of all seasons.

The residential project’s facilities will include a sand infinity pool with cabanas that offers a beach-like experience with unforgettable views of the Arabian Gulf, a roof-top infinity pool for adults with spectacular views that provides the ideal venue for recreation, a kids’ play area and a kids club for children of all ages. Its location will also mean it is connected to other parts of the city, including the financial centre of Dubai, as well as the Jumeirah area, with Downtown Dubai and its landmarks including Dubai Mall and Burj Khalifa only a short drive away.

A smart and sustainable lifestyle is also at the heart of Mar Casa, remarks Al Qatami, who shares that every living space has been designed to

Mar Casa redefines the region’s urban life and reinvents the boundaries of conventional luxury... It’s not just a residence but a landmark that stands as a testament to the emotional luxury of living in the birthplace of Dubai”

maximise natural daylight, reducing the need for artificial lighting.

He points out, “Energy-efficient light fixtures and daylight sensors in public areas will further reduce energy consumption. Kitchens and bathrooms will be fitted with efficient fixtures to minimise water demand, and an energyefficient MEP system is being installed to reduce overall energy demand and carbon footprint. The development will also be equipped with home automation and smart building management systems that enables residents to manage energy usage and reduce environmental impact. Non-toxic construction materials were carefully selected to ensure better indoor air quality, and a reduced environmental footprint. EV charging facilities will be provided to encourage the use of electric vehicles and further reduce our carbon footprint.”

“Every apartment and penthouse at Mar Casa will be a smart homes featuring advanced IP intercoms, keyless entry, smart access control system and smart lighting control. The larger units will be thoughtfully equipped with a range of smart appliances, elevating modern convenience,” he continues.

Sustainability and smart living are critical pillars driving much of Deyaar’s project vision throughout all of its endeavors of late. Al Qatami shares, “We have committed to achieving the maximum degree of sustainability that can be attained when developing any real estate project by designing and implementing integrated and sustainable projects that are environmentally friendly, adding great value to local communities and creating spaces that harmonise seamlessly with neighbouring areas. This includes integrating an innovative approach to reducing carbon footprints by using a wide range of technologies that help reduce energy and water usage in all projects.”

Such an investment has paid off in spades, with Deyaar achieving qualitative leaps in energy consumption efficiency in the field of complex management. To date Al Qatami says that Deyaar has achieved savings of more than $1.9mn

in 2022 according to the consumption fees charged by Empower (the cooling provider for the company’s projects).

“With our efficient water, energy, and waste management practices, we were able to achieve electricity savings of 2.7m kWh and 0.5m IG of water savings. We are also working to reduce the usage of paper, and have been therefore going for digital transformation in our services and businesses through several projects. This includes automating the daily sanitation reports, promoting online payments, using online three-dimensional (3D) technology that allows customers to view the project and explore it from the inside before the construction work is completed, and switching to electronic signing (eSignature), which is 2022 helped to save 124,595 pages being used.”

Deyaar has also launched services such as an e-portal for tenants, which enables them to submit renewal, cancellation, or maintenance requests through an intuitive website. “After the platform’s launch, online lease renewals witnessed an increase to reach more than 50% of renewed

contracts,” Al Qatami states. “As we continue to grow, sustainability will always be part of our projects and operations.”

In 2023 and beyond, Al Qatami points out Deyaar intends to continue to launch quality projects, while strengthening its income-generating portfolio to improve profits and shareholders’ equity.

Such an approach is evident with its busy project pipeline. In addition to Mar Casa, Deyaar has also recently launched the Tria Project in Dubai Silicon Oasis. The company also announced investments of $81.7mn in Al Furjan through three projects, the first of which is Amalia Residences. Additionally, the construction of the third and fourth phases in Midtown are at an advanced stage.

“We also handed over the Mesk and Noor projects at Midtown recently, which feature over 900 residential units. And keeping up with Deyaar’s track record and commitment, the projects were delivered two months ahead of schedule,” he says.

Work is also underway on the luxury Regalia project in Business Bay, which Al Qatami says has successfully sold out in record time with total sales of $272mn. “We have also just launched Talia Residences, an exquisitely designed hotel apartments offering operated by Millennium Hotels & Resorts,” he adds.

Situated in Al Furjan, Talia Residences aims to set a new standard of living and is Deyaar’s second project in Al Furjan out of a portfolio of $81.6mn. In addition, the final phase of the Midtown project, the Jannat district, which launches in June this year, features two interconnected towers spanning a plot area of 96,400sqft.

In terms of further expansion, Al Qatami notes Deyaar will focus on monetising and developing new projects on its remaining plots, assessing potential joint ventures and replenishing its land bank with new diversified land.

“We will have a phased development strategy focused on availability, profitability, and diversification,” he comments. With a healthy land bank, an impressive array of projects, and a future-proof vision, Al Qatami confirms Deyaar is well on its way towards reaching new heights.

125% Deyaar has recorded profits of $15.34mn in the first quarter of 2023, a 125% increase from the same period last year

JASON SAUNDALKAR SPEAKS

TO PROPERTY FINDER PRESIDENT ARI KESISOGLU ABOUT THE BOOMING RESIDENTIAL REAL ESTATE MARKET IN DUBAI

ith its origins dating back to 2005, Property Finder has had an interesting journey that has seen it constantly evolve in a bid to keep pace with the region’s dynamic demands. Originally a bi-weekly property print magazine known as Al Bab World, Property Finder is now a fully digital enterprise with over 300 staff and ambitions to become a regional unicorn.

Ari Kesisoglu joined the firm as its President in early 2020 and is tasked with driving the leadership team to create a technology company that will have a lasting impact on the entire tech ecosystem in the region. Kesisoglu is a veteran of the technology sector, having held several senior roles at global technology firms including Facebook and Google. Prior to this, Kesisoglu began his career by launching his own start-up.

Following Property Finder’s recent PF Connect event, which was held in late May 2023 in Dubai, Big Project Middle East (BPME) caught up with Kesisoglu to discuss Dubai’s booming property market, its drivers, challenges and what might be in store next.

Share a snapshot of some of the key real estate trends that Property Finder has tracked in the Dubai market over the last 12 months. We have seen an upward trend in ownership, evolving consumer preferences and a growing appetite for significant returns over investments. Consumer buying behaviours have recently shown an incline towards longerterm investments, with tenants opting for ownership over rental, driven by a surge in average market value by 25%.

Simultaneously, we have also noticed newer preferences emerge in the market including a need for diverse amenities,

larger spaces, multiple bedrooms, attractive outdoor spaces, waterfront living and ultra-luxury surroundings. Earlier unexplored areas such as Dubai Hills Estate, Palm Jumeirah, Arabian Ranches, DAMAC Hills and Mohamed Bin Rashed City in Dubai are now making it to the most searched lists.

There has been a consistent rise in returns over investments across both owned and rental properties for apartments and villas. A massive boost in sales, high-value transactions and greater foreign investments continue to bolster a brighter future for the Dubai market in the coming years.

What is driving the real estate boom in Dubai? What are the key drivers and how long does Property Finder anticipate these drivers will sustain the real estate market in the city? Driven by widespread economic diversification, increased foreign investments, new residence and visa policies, the UAE as a nation now offers a range of diverse opportunities for people from around the world. This remarkable evolution, especially since the pandemic has fuelled the growth of real estate, igniting the scope for greater innovation and seamless customer experiences.

The current real estate boom in Dubai is matched by a great deal of opportunities that help support the growing number of developments across the city. We have also seen interest from buyers looking for ultra-luxury waterfront living.

All these opportunities are driven by the ability to access properties from anywhere in the world, an enhanced consumer experience and a reduced agent-buyer gap within the market. As home search enablers, we look forward to supporting the current growth in Dubai’s fast evolving realestate sector by providing homeseekers with the latest in PropTech to get people living the life they deserve.

Based on our latest data, the mortgage market also exceeded expectations and maintained its growth in Q1 2023, with a remarkable 19% increase compared to the same period in 2022. This is inspite of a significant hike in both interest rates and property prices.

Amid this bustling landscape, it is now more important than ever to focus on digital transformation and AI integration. Through digital transformation, we are driving a more friendly customer experience for home seekers that helps provide for the growth in interest from searchers - be it locally or globally. Nowadays, people increasingly rely on their digital devices for a wide range of house-hunting activities – from searching for pricing information to comparing and viewing their potential future homes. This is a trend that will continue to shape the future.

Additionally, through our expertise in AI integration, we look forward to welcoming this new wave of living experiences through our trusted listings and dedicated SuperAgents that can help customers get quicker and trusted access to all the information they need for a transparent decisionmaking process, enabling them to begin living the life they deserve.

In recent years, residential buyers/ renters have increasingly begun seeking out developments that are built and run sustainably or offer wellness focused features. Comment on this trend and whether real estate with these focuses are still attracting growing interest? It’s an interesting trend that’s just begun surfacing within search trends. We are seeing a growing interest in more conscious choices among home searchers. Our recent Market Watch data and monthly reports indicate a growing emphasis on environmentally friendly properties.

Homebuyers are increasingly interested in eco-friendly features such as energy-efficient appliances, solar panels, and sustainable building materials. Masdar City is emerging as one of the most searched areas in Abu Dhabi, which clearly indicates that having a quality lifestyle rooted in sustainability will be more and more popular in the future.

In terms of residential real estate is there enough stock still in the market or due to come online to sustain the growth in this segment? Yes, absolutely for home seekers especially, it’s a great time to invest,

with a wide range of options to choose from. This is particularly the case with off-plan properties that are slowly garnering more sales. In Q1 2023 itself, we have seen a record of 15,948 transactions compared to 8,467 in Q1 2022, accounting for 51.5% percent of the total transactions. Buyers are able to see greater return on investments on these properties, hence revealing the scope for a future that is surely driven by stability and diversity.

In relation to the previous question, what challenges or issues could cool the residential property market in the coming months? We see the industry occupying a bigger share of the GDP and contributing much more to Dubai’s wider economy. Although, this growth needs to be matched by more trusted benchmarks for regulating quality listings. To make the real estate industry better one listing at a time, we recently launched the AAA Manifesto that aims to encourage more transparent dealings by ensuring all our listings remain ‘Authorised, Accessible and Available’.

Homebuyers are increasingly interested in eco-friendly features such as energy-efficient appliances, solar panels, and sustainable building materials.

Guided by the AAA manifesto, we aim to deliver upon a better vision for the industry, giving our partners and customers access to a trusted and transparent marketplace that has everything they need to navigate the current and future property landscape.

As a buyer wishing to purchase residential property in Dubai today, is there still an opportunity to realise fair ROI, given that residential real estate prices have risen significantly in the last 12 months? For those looking to own a property, this seems to be a good time to invest. Our observations from recent data have shown a consistent rise in return on investments across both - owned and rental interests, for different kinds of apartments and villas. We are seeing an interesting market scenario today with unique trends opening up a range of possibilities. As property search enablers, we remain positive about seeing a fair share of growth backed by sustained return on investments in an industry that is now more multifaceted and active as ever.

19%

The mortgage market has maintained its growth in Q1 2023, with a 19% increase compared to Q1 2022

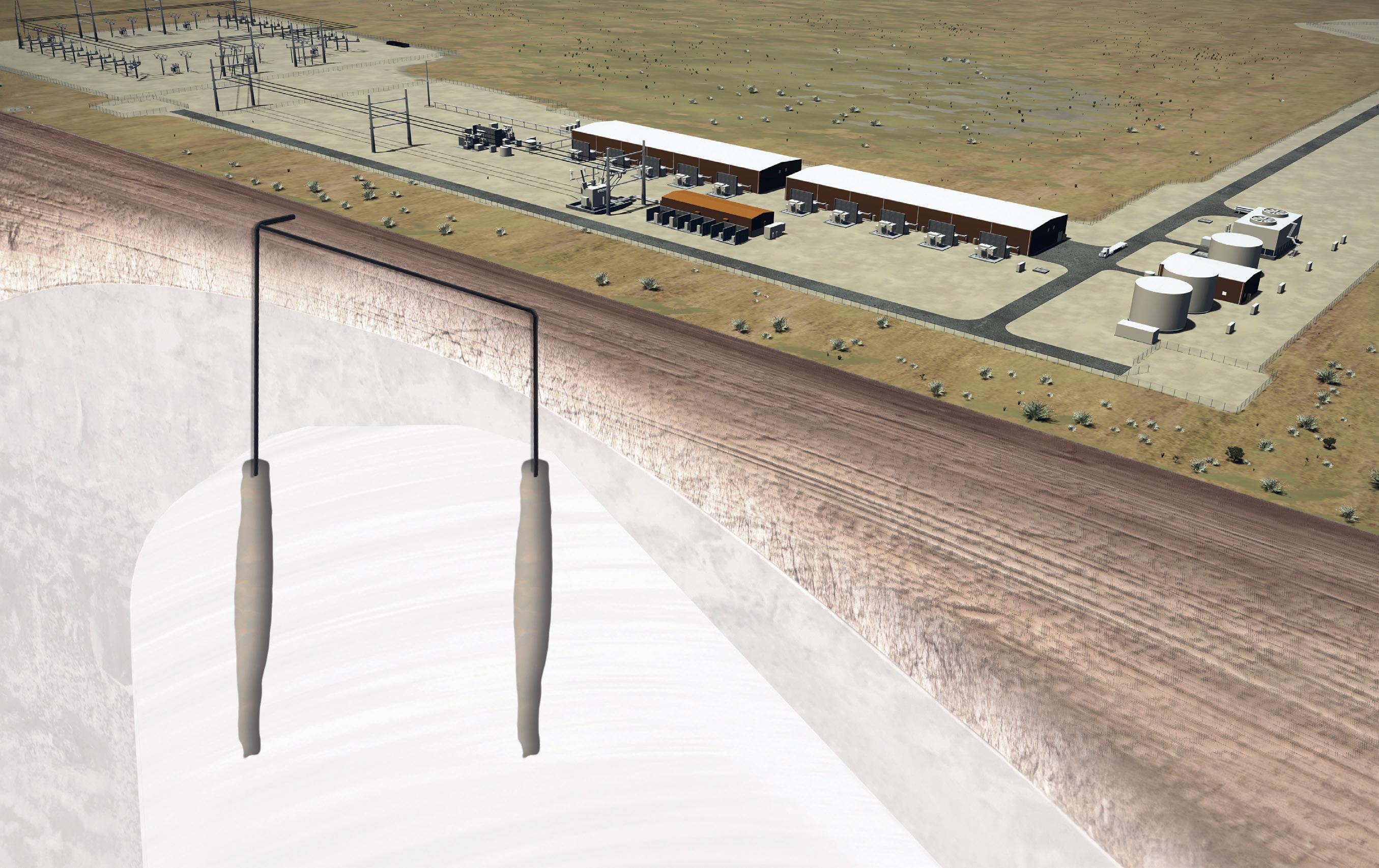

Green hydrogen can be used as zero-carbon fuel, feedstock and energy carrier, and as a method of longterm energy storage. As a result, green hydrogen is key to decarbonisation strategies the world over, leading to an expected ten-fold growth in demand for the element and its derivatives by 2050. In the Middle East green hydrogen is expected to have a major role not just in decarbonisation, but also the region’s continued prosperity. Very favourable irradiation resources coupled with strong wind resources allow the region to generate cost effectively the renewable energy upon which green hydrogen production relies, resulting in the potential to produce the element at a competitive price. The ability to act as both revenue stream and decarbonisation cornerstone

is driving ambitious green hydrogen goals across the region. Oman is aiming for annual green hydrogen production of between one-and-1.25-million tonnes by 2030, with Abu Dhabi’s Masdar targeting up to one million tonnes of production by the same date. When complete in 2026, Saudi Arabia’s NEOM facility is on track to be among the world’s largest green hydrogen plants; while Egypt’s new National Hydrogen Strategy envisages green hydrogen contributing between US $10-$18bn to the country’s GDP by 2025. While ambitions are big, most of the Middle East’s green hydrogen projects are currently small and nascent, often comprising memoranda of understanding, feasibility studies and pilot-scale proof-of-concept facilities.

While the technologies utilised for green hydrogen production and

Youssef Merjaneh, Managing Director of Black & Veatch in EMEA, looks at the value of an EPC wrap in ensuring green hydrogen projects are bankable

storage - electrolysis, water treatment, AC to DC power conversion - are not new, the design and construction of projects currently being developed is unprecedented. Traditionally, hydrogen has been produced for heavy industry by industrial gas suppliers; with supplier and user often in close proximity. Green hydrogen allows for more distributed production in more diverse locations, serving a broadening client base.

This has heralded an abundance of new projects - many first-of-a-kind in terms of location, scale, configuration and technology - and new entrants into the hydrogen market. This combination has the potential to increase the risk profile for green hydrogen projects, making bankability more challenging.

Our experience, however, suggests an engineer, procure, construct (EPC) wrap offers an effective way, but not the only way, to mitigate some of these risks. For some client types it may be that open book or EpCM contracting forms offer a suitable alternative to balancing risk. Regardless of contract type, the contractor should be engaged at the outset of project design, in order to undertake the pre-feed or FEL 1 studies necessary to identify, and therefore mitigate, risk as the project is structured.

Black & Veatch is currently the EPC contractor on two commercialscale green hydrogen projects, among them the world’s largest green hydrogen production and storage hub with a production capacity of 100 tonnes per day. Both projects are well advanced with production scheduled to commence in 2025.

Green hydrogen is created by using renewable energy to power electrolysis – the decomposition of water into its elemental constituents. Current electrolyser production capacity cannot match the demand envisaged to meet the needs of the burgeoning hydrogen economy. This, and the potential rewards, means a lot of new electrolyser suppliers are entering the market. Because the electrolyser is mission critical to a green hydrogen production project, using electrolyser suppliers new to the market can pose technical and financial risk for a project, affecting bankability. Technical uncertainty lies in whether an unproven system will deliver asforecast or as-specified performance; how much performance will degrade

over the lifetime of the project and the extent to which reliability will affect availability. There is also a degree of programme uncertainty around a new supplier’s ability to deliver equipment to schedule and, when it arrives on site, the buildability of new systems.

Financially, even if the technology is good, a new electrolyser supplier may not have a strong enough balance sheet to provide the necessary investor confidence; or be able to satisfy investors and insurers of their longer-term viability.

A proven EPC partner – with a high degree of technical expertise – can undertake the technical and financial due diligence necessary to minimise their own exposure to risk when selecting the most appropriate technology supplier, thus reducing the overall risk for investors and enhancing bankability.

Successfully navigating the supply/ demand pressures that will affect the electrolyser supplier market for the short to medium term requires a technology agnostic EPC provider able to flex between proven and new electrolyser suppliers, and identify the insurances and performance guarantees best suited to the project’s specific needs.

Technical risk extends beyond the ability to select the most suitable electrolyser supplier. Because a green hydrogen plant requires the coexistence of electrons and molecules within the project - bankability requires an EPC partner expert in the technologies and disciplines that define green hydrogen projects, and are able to successfully manage the complex interfaces between them.

Finally, there is the financial strength of the EPC provider itself. Because the EPC provider acts as the single entity responsible for mitigating risk and ensuring technical and commercial viability, investors need confidence not just in the EPC’s ability to select bankable technology suppliers and manage programme risk, but also in the bankability of the organisation providing the EPC wrap. A robust, proven EPC entity with a sufficiently strong balance sheet will, of itself, enhance the bankability of the overall project.

MIDDLE EAST

Heriot-Watt University

Dubai’s Mohamed AlMusleh shares his insights on the measures required to accelerate transportation sustainability

There is an urgent need to adopt alternative modes of transport to reduce emissions and accelerate the path to Net Zero. According to the U.S. Department of Energy, highway vehicles release about 1.7bn tons (1.5bn metric tons) of greenhouse gases (GHGs) into the atmosphere each year. In response to reports such as this and others, Gulf Cooperation Council (GCC) countries are integrating sustainability objectives

into their national development plans, with a particular focus on transportation and mobility.

This sector plays a pivotal role in achieving their goals, as the region heavily relies on road infrastructure and privately owned vehicles, leading to significant carbon dioxide emissions, traffic congestion, and subsequent economic burdens.

To address this challenge, several GCC cities are making substantial investments in the enhancement

and establishment of modern public transportation systems. This includes the development of new metro lines, trams, and bus networks. Some cities have even set ambitious targets to adopt cutting-edge smart mobility technologies within the next decade.

However, to meet Net Zero goals by 2050, a holistic framework that restructures the transportation paradigm by reducing the emphasis on private car ownership and expanding public transportation options is required.

Additionally, promoting electric and hybrid vehicles, implementing vehicle sharing programs, and integrating micromobility solutions such as bicycles and scooters are essential components of this comprehensive approach.

The World Economic Forum reported a global surge of over 60% in electric vehicle (EV) sales in 2022. This growth can be attributed to a wider selection of models, improved battery range, government subsidies, and high oil prices. Despite this impressive progress, EVs still make up only around 14% of new car sales, indicating that it will take many years to fully embrace electric vehicles. Addressing the challenges associated with traditional EV charging is crucial to boost EV adoption. Firstly, traditional charging methods, even with fast-charging stations, can be time-consuming, which ultimately poses difficulties for drivers who rely on frequent vehicle usage. Moreover, while the cost of EVs is decreasing, the expense of installing and maintaining charging stations remains high, discouraging some individuals and businesses from investing in EVs. Lastly, limited availability or malfunctions of public charging stations in certain areas can cause inconvenience for EV drivers. In summary, achieving widespread EV adoption necessitates substantial investments in charging infrastructure, including the establishment of new charging stations and upgrades to the electrical grid.

Dubai and other major cities in the GCC have been investing heavily in improving their public transportation systems. This includes the expansion of metro networks, the introduction of trams and buses, and the implementation of integrated smart transportation solutions to enhance connectivity and accessibility.

Last year, authorities in Dubai approved a roadmap to make public transport emission-free by 2050. Additionally, Etihad Rail, the UAE’s national railway network, will be the GCC’s first railway line that will join

EV challenges

Achieving broad EV adoption necessitates substantial investments in charging infrastructure, including the establishment of new charging stations and upgrades to the electrical grid.

the UAE, Oman and Saudi Arabia over a 1,200km network. By 2030, the railway service is projected to transport over 36m passengers annually.

2050

The development of sustainable transportation infrastructure is a key focus in the GCC’s transportation plans. This involves constructing efficient road networks, promoting pedestrianfriendly urban designs, and incorporating dedicated cycling lanes to encourage alternative modes of transportation.

Although the GCC is located in an arid and hot region, it is possible to use alternative methods to move around the city such as walking, riding scooters, and cycling at specific times of the day throughout the year. Abu Dhabi is a great example of this as the city has a Surface Transport Master Plan (STMP), which aims to deliver a sustainable transport system that supports the capital’s economic, social and cultural, and environmental goals. Sustainable transportation is not just an environmental goal but a societal one as well. By embracing sustainable transportation practices, cities in the GCC can enhance the quality of life for their residents, improve public health, and foster economic growth. With concerted efforts and collective determination, the GCC region can pave the way for a sustainable transportation future that benefits generations to come.

Last year, authorities in Dubai approved plans to make public transport emissionfree by 2050

MIDDLE EAST

As cities become denser and lifestyles get more integrated, urban planning places a greater emphasis on incorporating mixed-use development projects. This approach prioritises placemaking and sustainability, reflecting an increasing desire for diversification in order to future-proof property assets in a dynamic market. By seamlessly integrating various functions within a single area, such as residential, commercial, cultural, and leisure facilities, these projects can offer holistic living experiences that enrich the community and harmonise with the surrounding environment.

The idea of sustainable development has emerged as the most iconic, enigmatic, contentious and subversive concept in the last ten years of the twentieth century. In constant co-evolution and between quantity and quality of development, it promotes integration and balance between the economic, social, and environmental policy objectives (OECD 1999). Cities are thrust into the global stage of the future, thanks to the concept of urban sustainability, which can be exceptionally driven by the emerging trend of mixed-use developments.

In recent years, numerous developers are turning to mixed-use projects as the appeal of walkable urban surroundings grows. These projects combine office