BIM Management

Project Collaboration

Contract Management

Asset Management

Field Management

BIM Management

Project Collaboration

Contract Management

Asset Management

Field Management

KEO and Johnson Controls ink deal to deliver turnkey decarbonisation services in the region

A wrap-up of the biggest international construction news stories for the month

Despite challenges such as inflation, elevated interest rates, geopolitical tensions and unprecedented weather conditions in Q1 2024, JLL remains positive about the UAE’s construction market

Somendra Khosla , Chairman of SOHO Development talks to Big Project Middle East about how the developer stands out in the market, the future of the UAE real estate market, and the firm’s plans for the future

The

David Clifton , Regional Director at AtkinsRéalis reveals insights into the UAE’s economic diversification, construction’s contribution to GDP, FDI growth, and what’s on the horizon

The 2024 Critical Infrastructure Summit featured 20 speakers spread across three panel discussions and two presentations, and explored a variety of topics connected with regional infrastructure

Decarbonising the maritime shipping industry is a complex challenge, requiring concerted efforts by key industry actors says Buro Happold’s Fabien Jean Pierre Loy

40

Merex Investment’s J1 Beach on track for September opening

Welcome to a new edition of Big Project Middle East (BPME), dear readers! With the ME

Digital Construction Awards (ME DC Awards) gala dinner scheduled to take place on 26 June, the BPME editorial team is working hard on all of the event’s various moving parts.

Nominations for the awards closed in early May and I’m pleased to report that the event recorded nearly 100 submissions across its 15 categories (covering individuals, companies and projects). The first round of eliminations, which is carried out by the editorial team, took roughly a week, following which the event’s panel of judges were given access to the remaining nominations. By the time you read this note, the in-person meeting for the judges will have taken place, leaving the editorial team to tally up everyone’s votes and produce the shortlist. Congratulations in advance to everyone that makes the shortlist!

The shortlist will be revealed on Middle East Construction News (MECN), while the BPME commercial team will simultaneously be contacting individuals and

companies who have been shortlisted with regards to attendance to the gala dinner.

Once the second edition of the ME DC Awards enters the history books, the BPME editorial team will then have the opportunity to focus on the events planned for H2 of this year. I’m pleased to announce that we have a couple of new events in Saudi Arabia, the first of which will kick off BPME’s H2 event calendar in early September. While it’s too early to reveal the name and dates of those new events, I can confirm they will take place in Riyadh.

Following the first event in Saudi Arabia, BPME will be returning to Dubai for its flagship summit – the Digital Construction Summit (formerly the ME BIM Summit). This event will take place on 25 September, and will have a significant focus on leveraging technology and new innovations to improve the build quality and resilience of assets (covering structures primarily).

There’s more to come in terms of BPME events in October (we’re back in Saudi Arabia), November and December of course, but I’ll reveal details about those events in the fullness of time. Until them, I look forward to catching up with you at the ME Digital Construction Awards. See you then!

Jason Saundalkar HEAD OF CONTENT

Jason Saundalkar HEAD OF CONTENT

jason.s@cpitrademedia.com MEConstructionNews me-construction-news

SOMENDRA KHOSLA TALKS TO BPME ABOUT STANDING OUT IN A COMPETITIVE MARKET, EVOLVING CLIENT REQUIREMENTS AND HIS FIRM'S PLANS FOR THE FUTURE

ON THE COVER

Somendra Khosla, Chairman of SOHO Development on his firm’s laser focus on crafting quality living experiences for their clients

MEConstructionNews.com

@meconstructionn

MEConstructionNews me-construction-news

The publisher of this magazine has made every effort to ensure the content is accurate on the date of publication. The opinions and views expressed in the articles do not necessarily reflect the publisher and editor. The published material, adverts, editorials and all other content are published in good faith. No part of this publication or any part of the contents thereof may be reproduced, stored or transmitted in any form without the permission of the publisher in writing. Publication licensed by Dubai Development Authority to CPI Trade Publishing FZ LLC. Printed by Al Salam Printing Press LLC.

CPI Trade Media. PO Box 13700, Dubai, UAE. +971 4 375 5470 cpitrademedia.com

© Copyright 2024. All rights reserved.

Group

MANAGING DIRECTOR Raz Islam raz.islam@cpitrademedia.com

DIRECTOR OF FINANCE & BUSINESS OPERATIONS Shiyas Kareem shiyas.kareem@cpitrademedia.com

PUBLISHING DIRECTOR Andy Pitois andy.pitois@cpitrademedia.com

Editorial

HEAD OF CONTENT Jason Saundalkar jason.s@cpitrademedia.com

+971 4 375 5475

Advertising

SALES DIRECTOR Arif Bari arif.bari@cpitrademedia.com

+971 4 375 5478

Design

ART DIRECTOR Simon Cobon simon.cobon@cpitrademedia.com

DESIGNER Percival Manalaysay percival.manalaysay@cpitrademedia.com

Photography

PHOTOGRAPHER Maksym Poriechkin maksym.poriechkin@cpitrademedia.com

Marketing & Events

EVENTS EXECUTIVE Minara Salakhi minara.s@cpitrademedia.com

+971 4 433 2856

Circulation & Production

DATA & PRODUCTION MANAGER Phinson Mathew George phinson.george@cpitrademedia.com

+971 4 375 5476

Web Development

WEB DEVELOPER Abdul Baeis abdul.baeis@cpitrademedia.com

WEB DEVELOPER Umair Khan umair.khan@cpitrademedia.com

FOUNDER Dominic De Sousa (1959-2015)

CONSTRUCTION

Züblin leverages 3D printing to deliver load-bearing concrete walls

PROPERTY

DMCC and Signature

Developers launch new luxury tower in JLT

CONSTRUCTION

Six firms in the running for Oman mixed-use project

INFRASTRUCTURE

Development of US $250mn logistics park commences in Jeddah Port

CONSTRUCTION

Creating beach sand for Kuwait’s Sabah Al Ahmed Sea City

FINANCE

Emaar’s Q1 revenue reaches US $1.8bn

Extremely strong start for 2024 includes 16% growth on profitability year-on-year

ENERGY

Japan’s Marubeni appointed for KSA wind projects

SUSTAINABILITY

Abu Dhabi invests in material recovery facility

Tadweer Group closes bidding for reprocessing plant set to play a crucial role in diverting emirate’s waste from landfill

PROPERTY

Symbolic announces residential project in Al Furjan

Sky Garden residences will feature ‘greened’ balconies, smart home management and generously-sized apartments

OPERATIONS

Saudi Red Sea Authority issues marina licences

The boating facilities have achieved certification for technical procedures, quality of service, and sustainability

CONSTRUCTION

Construction of Tesla Megapack battery begins in Shanghai

PROPERTY

INFRASTRUCTURE

CONSTRUCTION

Shapoorji Pallonji wins Roshn residential contract

The firm will develop 429 units in the Riyadh community with an emphasis on sustainability and reduced utility costs

Abu Dhabi DMT launches ‘Plan Capital Survey’

INDUSTRY Azizi appoints Arup for spatial planning of

40% of global carbon emissions come from buildings according to the World Green Building Council

KEO and Johnson Controls have entered into a strategic collaboration, which aims to deliver turnkey decarbonisation services in the region. As per the terms of the deal, the two companies will offer an end-to-end decarbonisation action plan, and a suite of engineered solutions to drive cost

and carbon reductions. This will enable organisations to achieve their Net Zero goals, including comprehensive target setting, providing a roadmap, to produce tangible outcomes.

Founded on a shared vision and complementary expertise, this unique collaboration draws on KEO’s 60 years of expertise in engineering, consultation, and advisory services,

and Johnson Controls 140 years transforming the built environment to reduce energy consumption and emissions, improve building efficiency, increase productivity and wellbeing, and ultimately contribute to a greener and more sustainable future, said KEO in a statement.

"This collaboration represents a significant step forward in our mission to empower organisations to achieve their sustainability goals. By combining KEO’s sustainability and engineering excellence with Johnson Controls cutting-edge technologies, we are uniquely positioned to deliver impactful solutions that drive real environmental change,” said Greg Karpinski, COO at KEO.

The World Green Building Council has gone on record noting that buildings are responsible for nearly 40% of global carbon emissions and represent one of the fastest - if not the fastest - paths to meeting global climate targets. With the UAE and Saudi Arabia spearheading (one of) the world’s most ambitious decarbonisation programs, organisations in the region will benefit from such collaborations to more quickly and effectively meet the region’s goals, the statement noted.

Karpinski added, “We understand that managing the bidding for a complex scope decarbonisation project can be a challenging task for

The World Green Building Council has gone on record noting that buildings are responsible for nearly 40% of global carbon emissions.

Sharing expertise KEO and Johnson Controls aim to empower businesses with the tools and expertise needed to drive sustainability leadership in the region and elsewhere.

organisations, involving significant costs and efforts. Through our collaboration with Johnson Controls, we aim to alleviate these challenges, offering clients a hassle-free experience from start to finish.”

Devrim Tekeli, General Manager for Service GCC at Johnson Controls remarked, “We are delighted to initiate this collaboration with KEO, which will empower our mutual customers to achieve their Net Zero commitments. Our comprehensive capabilities across technology manufacturing, HVAC, fire, security,

controls, and connectivity via our OpenBlue digital platform are setting a benchmark in the region. These capabilities are already demonstrating tangible environmental and financial benefits. Together with KEO, we aim to empower businesses with the tools and expertise needed to drive sustainability leadership in this region and beyond.”

The collaboration between KEO and Johnson Controls marks a significant milestone in the pursuit of sustainability, ushering in a new era of innovation and collaboration in the fight against climate change, said KEO.

By combining KEO’s sustainability and engineering excellence with Johnson Controls cutting-edge technologies, we are uniquely positioned to deliver impactful solutions that drive real environmental change ”

The partnership between the two firms aims to deliver comprehensive smart city initiatives that encompass IoT, data analytics, cloud computing, and more

An agreement has been signed by Moro Hub and Oman’s cybersecurity services provider, National Security Services Group (NSSG), with the goal of introducing innovative Smart City and IoT solutions across Oman. The collaboration is said to mark a significant milestone in both companies' efforts to revolutionise urban living and drive digital transformation in the region.

The agreement was signed by Arif Almalik, Chief Digital Products Officer of Moro Hub and Hamza Al Jaafari, Chief Technology Officer of NSSG.

The partnership aims to explore cutting-edge solutions tailored to

enhance the infrastructure and efficiency of cities in Oman. In addition, the engagement underscores the client's keen interest in leveraging Moro Hub's state-of-the-art technologies to address their evolving needs and aspirations, said a statement from Moro Hub, which is a subsidiary of Dubai-based Digital DEWA.

"We are pleased to associate with NSSG advancing Oman's digital landscape. Our collaboration represents more than just a partnership; it's a commitment to empowering communities, revolutionising infrastructure, and fostering sustainable growth. Together, we stand at the forefront of innovation, harnessing the power of Smart Cities to redefine urban living and elevate the quality of life for citizens across Oman,” stated Eng. Mohammed Bin Sulaiman, CEO of Moro Hub. Sulaiman continued, “With our combined expertise and unwavering dedication, we are set to unveil limitless possibilities, driving progress and prosperity for generations to come. This initiative exemplifies Moro Hub's core values of innovation, collaboration, and excellence, as we continue to push the boundaries of what's possible in the digital age.”

With the rapid pace of urbanisation and the growing demand for advanced technological solutions, the alliance between Moro Hub and NSSG aims to deliver comprehensive smart city initiatives that encompass IoT, data

analytics, cloud computing, and more, the statement explained.

By combining Moro Hub's digital innovation expertise with NSSG's insights and network, the partnership will empower cities across Oman with scalable, sustainable, and interconnected solutions.

Sulaiman noted, "We're thrilled to join forces with NSSG to bring our Smart City and IoT solutions to Oman. This collaboration exemplifies our commitment to driving progress and innovation, as we work to create smarter, more resilient cities that cater to the needs of citizens and businesses."

and interconnected solutions.

Milestone

The deal is said to be a milestone in both companies' efforts to revolutionise urban living and drive digital transformation.

"Our collaboration with Moro Hub opens up new avenues for technological advancement and economic growth in Oman. By harnessing the power of digital innovation, we aim to foster sustainable development and enhance the quality of life for communities across the Sultanate,” added Hamza Al Jaafari, Chief Technology Officer of NSSG. Moro Hub said that the collaboration with NSSG highlights its commitment to driving progress and innovation in the region, as it works to create smarter, more resilient cities that cater to the needs of citizens and businesses alike.

Wylfa in Anglesey, North Wales has been selected by the UK government as the location for its third largescale nuclear power station. The proposed facility is expected to be able to generate enough energy to power six million homes for 60 years.

The decision is said to have come after the government acquired the site from Hitachi for US $202mn in early 2024.

Wylfa’s location is considered ideal due to its access to cooling water and a history of nuclear activity.

Imdaad-Misr has entered into a new service agreement with Egypt-based developer Gates Developments.

As per the terms of the deal, ImdaadMisr will provide integrated FM services to Gates Developments’ three projects in the Administrative Capital, five projects in West Cairo, and the new Lyv project in Ras El Hikma on the North Coast.

The deal also aims at reducing the long-term operating costs of buildings by maintaining and enhancing assets, with a focus on creating added value and driving high-quality standards.

Germany-based Züblin has said that it has constructed a building from a single 3D-print with load-bearing concrete walls. The achievement is a ‘world first’ according to the company, which is a subsidiary of Putzmeister and Strabag.

According to a report, the structure is Strabag Baumaschinentechnik International’s newest warehouse in Stuttgart, Germany, and its construction will not only create a new facility for Strabag but also serve as a bench test for Züblin’s 3D printing capabilities and processes.

Ground has been broken on a new logistics park which will come up on a 415,000sqm area in Jeddah Port. The project is being jointly developed by DP World and the Saudi Ports Authority (Mawani).

According to DP World, the new facility will provide modern storage and distribution facilities, as well as help boost trade in the Kingdom of Saudi Arabia and the wider region. Established in 2022 as part of a 30-year concession, Jeddah Logistics Park will be developed in two phases with a planned opening in Q2 next year.

A US $255mn loan has been approved by the European Bank for Reconstruction and Development (EBRD) for the construction of the southern section of Armenia’s Sisian-Kajaran road.

The funding will enable the Government of Armenia to construct 24km of a new southern road section between Sisian and Kajaran, forming part of the North-South Road Corridor.

The project is said to be the largest road infrastructure project ever financed by the EBRD in Armenia.

A tender has been floated for the construction of a new seawater reverse osmosis (SWRO) desalination plant by Bahrain’s Electricity and Water Authority (EWA). The plant is due to take shape on Hawar Island off the southeastern coast of the Kingdom. The deadline for sending the tenders has been set at 23 June.

According to a report, the New Hawar SWRO desalination plant will comprise a desalination facility with a net water capacity of one to two MIGD of potable water, as well as two ground storage tanks (GSTs) of one MIG capacity each, along with the associated forwarding pumps.

Larsen & Toubro has won the contract to construct a 605-bedroom hospital and medical college in Rajarhat, Kolkata, India. The facility will be built across an area of 1.2m sqft.

In addition to the college, which will have an annual intake capacity of 150 students, the firm will also build a hostel for students, interns, nurses and residents, the company confirmed.

The contractor’s health business unit is said to have secured the deal from the Institute of Neurosciences Kolkata, on a design and build basis.

Construction has begun on a factory that will be able to produce 10,000 Tesla Megapack battery storage units a year. The new plant is set to start production in early 2025.

The Lin-gang Group is said to be overseeing construction of the factory, which is taking shape close to Tesla’s Shanghai Gigafactory, which produces Tesla cars. The gigafactory is the firm’s largest plant outside of the US.

The new factory will cost approximately US $203.9mn and will span an area of 200,000sqm.

Construction works on what is said to be China’s longest single-bore, double-track railway tunnel is complete according to China Railway No.2 Group.

The firm notes that the 23km-long Desheng tunnel took some 10-years to build and sits at 3,000m above sea level.

The tunnel is part of the ChengduHuangshengguan section of the SichuanQinghai Railway.

Passenger trains on the section are expected to travel at speeds of up to 200km/h and freight trains at up to 120km/h.

UNITED ARAB EMIRATES

Despite challenges such as inflation, elevated interest rates, geopolitical tensions, and unprecedented weather conditions in Q1 2024, JLL remains positive about the UAE’s construction market

Over the past four years, the Gulf Cooperation Council (GCC) and wider Middle East and North Africa (MENA) region have demonstrated remarkable resilience amidst the pandemic, and have steadfastly pursued economic diversification. As a result, the projects market in the region has thrived with a high-value pipeline, especially in the UAE, which is actively working towards its economic diversification goals.

Despite facing challenges such as persistent inflation, elevated interest rates, geopolitical tensions, unprecedented weather conditions in Q1 2024, and the potential impact of the US presidential election in Q2, JLL maintains a positive outlook about the UAE. The

country’s GDP grew by 3% in 2023, with further projections of 3.8% growth in 2024 and 3.9% in 2025, according to Oxford Economics.

Although the S&P Global purchasing managers index (PMI) for the non-oil private sector experienced a slight decline in March 2024, recording at 56.9 compared to February’s index of 57.1, the result is still considered robust by Emirates NBD Research. With a PMI above the 50.0 mark, the non-oil private sector remains in growth territory.

In 2023, consumer inflation in the UAE remained below the global average, standing at 1.6%, as reported by the Federal Competitiveness and Statistics Centre. The tourism sector displayed strong performance indicators, with a significant 15% growth in hotel revenues in 2023 compared to the

11,000 13,500

Structural Steel (AED/t) 400 500

same period in 2022, contributing to a total revenue of US $11.8bn. Furthermore, the number of passengers arriving at Dubai International Airport soared to unprecedented heights, surpassing both pre- and postpandemic statistics. In 2023, the airport recorded a remarkable record of 86.9 million passengers, exceeding the figures of 86.3 million in 2019 and 66 million in 2022.

According to JLL Research, Dubai is expected to witness the delivery of approximately 25,000 residential units in the remaining nine months of 2024, with around 10,000 units delivered in the first quarter alone. These projections align with a noteworthy 21% year-on-year surge in sales and rental prices as of March 2024. As a result, the total residential stock in Dubai is anticipated to reach approximately 754,000 units.

In Abu Dhabi, around 1,600 units were delivered during Q1 2024, with an additional

3,500 3,000 2,500 2,000 1,500

Concrete (AED/m3) 4,100 4,700

Rebar (AED/t) 40 55

Excavation & Disposal (AED/m3) -

6,000 units in the pipeline for the remainder of 2024. This is expected to result in a total stock of 294,000 units. Additionally, the capital recorded more moderate annual increases of 5% in sales prices and 2% in rental rates, respectively. Developers in Dubai may encounter challenges due to the rising land and construction costs. To address these challenges, they may explore the possibility of developing smaller-sized units and projects in secondary areas.

In the hospitality sector, Dubai witnessed the addition of 2,000 hotel rooms to its existing stock in Q1 2024, primarily focusing on the 5-star category. Looking ahead, another 5,000 keys are expected to be added in 2024, resulting in a total of 160,000 hotel rooms in Dubai.

In Abu Dhabi, there are plans to add approximately 500 keys in 2024, resulting in a total of 34,000 hotel rooms.

JLL’s forecast indicated that the UAE is expected to observe a tender price inflation (TPI) of 3% in 2024. However, in other key markets, such as Saudi Arabia, the TPI is expected to exceed this figure due to the rapid expansion of the projects market and the escalation of construction costs. JLL’s estimation considers historical construction price trends, prevailing market conditions, the value of the project pipeline, and external factors that may impact construction prices.

According to the RICS construction monitor, the UAE construction market exhibits resilience and promising growth prospects across all sectors despite ongoing economic challenges. The Construction Activity Index (CAI) has demonstrated a consistent upward trend, as observed in Q4 2023. However, feedback from the local industry highlights financial constraints arising from increasing material costs, and in

certain instances, shortages in materials have impacted construction activity. The RICS report identifies several factors influencing the current UAE construction market, including market competition, demand dynamics, delays related to material, project financing, and the adoption of digital construction processes.

Amid the thriving UAE construction sector, reports indicated a record-high number of awarded projects in 2023, valued at $87bn. This figure demonstrates the UAE’s commendable progress in economic diversification and investment, aligning with the country’s goals. However, it is crucial to acknowledge the persisting challenges within the industry.

As market dynamics constantly evolve, JLL diligently monitors market updates and

their impact on construction costs. Recently, we have observed volatile construction costs caused by various factors, such as global economic headwinds, capacity constraints in the local market, rising shipping costs, and the escalation of interest rates.

According to the latest data from the World Bank, commodity prices experienced a 5% increase in Q3 2023, primarily driven by rising oil prices and the conflict in the Middle East. However, despite this uptick, prices were still 29% lower than their peak in June 2022. The rise in oil prices was a result of production cuts implemented by the OPEC+ group, resulting in an increase from $72 per

barrel to $90 per barrel by the end of Q3 2023. The World Bank predicts that oil prices will average $81 per barrel in both 2024 and 2025.

Conversely, the World Bank expects base metal prices to decline by 5% in 2024. However, Emirates NBD Research and Bloomberg forecasts suggest a subsequent increase in 2025. JLL has observed a historical correlation between iron ore and rebar prices, noting that as of Q1 2023, the rebar supply price remained stable despite a rise in the price of iron ore.

JLL closely monitors construction rates in the UAE to stay abreast of the ongoing price fluctuations. These fluctuations stem from local market demand dynamics and external factors, including rising input costs. Notably, JLL acknowledges the

significant impact of market shocks related to shipping and transportation, which heavily influence local construction rates due to the reliance on imported materials.

In 2024, disruptions resulted in a notable increase in freight shipping prices, with the Drewry Index rising from $1,800 per 40-foot container in March 2023 to over $3,000 in March 2024. Although still below the peak price index observed in Q1

2022, conflicts and disruptions continue to pose potential risks for freight prices.

Amid the recent disruptions and supply challenges, JLL’s analysis indicates that material availability is currently stable. While a significant reliance on imported materials like glazing, facade systems, and timber persists in the local and regional markets, the mediumto long-term outlook foresees improvements in local manufacturing capabilities. These

improvements are driven by the demand generated by major projects in Saudi Arabia.

According to the World Steel Association (WSA), global steel production experienced a 1.6% decline from January 2023 to January 2024. However, steel demand is anticipated to grow by 1.9% in 2024. Additionally, in the MENA region, steel demand is projected to rebound in 2024, fuelled by mega projects and the residential sector.

Soho Development

SOMENDRA KHOSLA, CHAIRMAN OF SOHO DEVELOPMENT TALKS TO BIG PROJECT MIDDLE EAST ABOUT HOW THE DEVELOPER STANDS OUT IN THE MARKET, THE FUTURE OF THE UAE REAL ESTATE MARKET, AND THE FIRM’S PLANS FOR THE FUTURE

he real estate market in the UAE, and Dubai - in particular - has been enjoying an upward trend post pandemic, and has attracted investors as well as new developers, the latter of which have added, and continue to add, new properties to Dubai’s residential property segment.

Property portal Bayut’s recent Q1 2024 report on Dubai’s property marketed stated that the previous upward trend in property prices across the emirate has “stabilised considerably with certain areas even reporting declines in average prices.”

Its report revealed that “there has been a modest increase in sales prices for apartments and villas in prominent

neighbourhoods of Dubai, with the highest surges reaching up to 7% during the first quarter of 2024. As per Bayut’s report which leverages Dubai Land Department information, the emirate saw a cumulative total of 36,946 property sale transactions in Q1 2024. The transactions encompassed both residential and commercial acquisitions and had a monetary value of US $29.8bn.

The statement from the firm said, “While the market has continued to enjoy sustained interest from investors and end-users, there is also a healthy influx of new properties, ensuring adequate supply to meet the demand for housing within the emirate.”

The reported continued, “In the affordable segment, transactional sales prices for apartments in highly searched areas have decreased from 1% to 16%, with the exception of Dubai South, which registered a moderate increase of 4.48%.” It added, “The average transaction prices for affordable villas have predominantly seen upticks ranging from 7% to 62%, with

2008

The developer was founded in 2008 by fatherson duo Somendra and Sahil Khosla

Dubailand reporting the most significant increase in transactional price.” It also revealed, “When it comes to mid-tier properties, there has been a significant rise in the average sales transaction prices for apartments, ranging from 6% to 42%, with the most noticeable uptick recorded in Jumeirah Lake Towers. Similarly, sought-after areas featuring mid-tier villas have observed increases in average transaction sales prices ranging from 5% to 14%. Notably, Al Furjan stands out as an exception, experiencing a slight decrease of 0.37% in its transactional sale price.”

Bayut’s report also added there is a resurgence in the demand for family villas. “The market has witnessed a heightened interest in larger familyoriented residences, particularly within luxury and mid-tier communities, indicating a shift towards more spacious properties and a preference for family-friendly living environments,” said Bayut in its statement.

While the appetite for quality living experiences is seeing a resurgence,

it’s something luxury residential developer SOHO Development has been focused on for over a decade. The developer says it is committed to creating non-branded residences that offer luxury amenities in a bid to create hotel-inspired living spaces.

Founded in 2008 by father-son duo Somendra and Sahil Khosla, the firm says it seamlessly blended architectural innovation with interior elegance, starting with its project on Dubai’s Sheikh Zayed Road, and continuing on with nine villas on Palm Jumeirah’s G and I fronds, as well as its SOHO Palm Jumeirah project on Palm West Beach.

Here, Big Project Middle East speaks to Somendra Khosla, Chairman of SOHO Development about the firm’s approach to residential real estate, the market in the UAE and Dubai, and the firm’s plans for the future.

What is SOHO Development’s inspiration and vision with regards to residential real estate?

Our luxury homes and premium apartments are locally inspired by renowned hospitality brands such as Four Seasons Hotels & Resorts, The Ritz Carlton, One & Only Resorts, as well as home-grown brands like Address Hotels and Vida Hotels and Resorts etc, ensuring excellence in quality and service delivery.

We offer a unique proposition in the Dubai real estate market, providing highquality, fully furnished living without the premium price tag associated with

branded properties. This makes them an attractive choice for buyers seeking luxury without overspending. For investors, the pricing not only enhances the resale potential of these properties but also widens the potential buyer pool.

Share insights on the nonbranded luxury residential/ serviced home market in the UAE. How do you see this market developing in the next two years?

In the United Arab Emirates, the nonbranded luxury housing industry is booming, especially in Dubai, where the affordable market segment is growing.

Appetite Investors are in the market for homes that are of high-quality and are affordable. This trend has fuelled demand for non-branded luxury residences says Khosla.

Non-branded residences typically have lower service charges, making them an attractive option for investors looking to maximise rental yields. Their lower entry price makes them more accessible to a broader range of investors and leads to faster resales.

Average professionals/investors now seek high-quality, affordable luxury homes, fuelling demand for unique, non-branded luxury residences. Over the next two years, we expect this market to continue its robust growth, driven by a maturing real estate sector and evolving buyer preferences for individuality and affordability.

What impact will the growing appetite for branded residences have on non-branded luxury residential offerings in the UAE?

Attention to detail Khosla states that a meticulous attention to detail and the selection of materials and finishes are what sets a luxury residential project apart from a more standard residential offering.

The growing appetite for branded residences in the UAE complements rather than overshadows non-branded luxury residential offerings, as both segments cater to distinct consumer preferences. The maturing market and increasing consumer appetite for unique, bespoke options ensure that non-branded residences remain highly attractive to buyers seeking individuality and bespoke spaces. This growth in both segments enriches the luxury real estate sector, offering diverse

investment opportunities and fostering a sophisticated, dynamic market.

The last big shift in customer appetites for residential real estate was triggered by the pandemic. Have appetites changed since then, or are they much the same? What do your buyers value/prioritise?

Since the pandemic, customer appetites for residential real estate have evolved significantly. Young professionals and investors are increasingly drawn to Dubai for its safety, opportunities, and lifestyle, often extending their stays indefinitely. Today’s buyers and investors prioritise non-branded residences that are high in quality and sustainable and promise long-term yields. They value attention to detail, quality of life, and prime locations, reflecting a shift towards more thoughtful, futureoriented investment strategies. This trend underscores a growing emphasis on sustainability and long-term value in the residential real estate market.

The UAE has multiple luxury residential offerings on the market; in your experience where do developers struggle to deliver on their promise of luxury living and a luxury lifestyle? How can this be avoided?

In their pursuit of quick construction and cost reduction, some developers occasionally overlook critical aspects such as finishes, size, layout, and material selection. These shortcuts can result in subpar quality, cramped living spaces, and a lack of premium feel. Developers should instead prioritise maximising space while still maintaining high-quality finishes, thoughtful and spacious layouts, and the use of premium materials. This ensures that luxury residential offerings meet buyer expectations, uphold the market reputation, and foster customer loyalty, not only retaining existing buyers and attracting new ones but also enhancing the brand image. This positive perception reinforces the brand’s position in the market, and facilitates long-term growth and expansion.

At SOHO Development, we stand out by offering more than just villas

SOHO Palm consists of 62 luxury furnished apartments

and apartments. With years of industry experience and a focus on excellence, we provide high-quality products that exceed market expectations and set new benchmarks in luxury living.

Collaborating with the industry’s best to ensure every aspect of our buildings and villas meets the highest quality standards, we provide a hotel-inspired lifestyle in Dubai’s prime locations, such as beachfront or parkfront areas. Our residences are designed by leading architects, constructed by quality contractors, and fully furnished with impeccable aesthetics.

What is SOHO Development’s

overarching vision in terms of its projects in the UAE? What differentiates your projects from other contenders in the market?

Our vision at SOHO Development is to provide a hotel-inspired lifestyle with quality, amenities and designled aesthetics. What sets us apart from others in the market is our commitment to exceeding expectations. We collaborate with industry leaders to set new benchmarks in luxury living, offering fully furnished flats designed by leading architects.

Our projects are strategically located in prime areas like beachfront or parkfront locations, and we anticipate

and provide amenities beyond the traditional, such as co-working spaces and zen studios for wellness activities. We aim to understand and accommodate the diverse lifestyles and preferences of today’s buyers. Our goal is not only to meet but exceed the expectations of our residents, fostering a sense of belonging and fulfilment in their living spaces.

What are some of your key projects in the UAE? What is their USP compared to other contenders in the market? We launched our very first flagship development on Sheikh Zayed Road,

hosting the global luxury brand Ethan Allen, and quickly expanded our portfolio to develop nine luxury villas on Palm Jumeirah. These lavish beachfront villas on I, N and G fronds are designed as custom-built retreats on exclusive beachfront, offering ultradiscrete living. Fully furnished, these villas provide curated experiences that cater to the luxury lifestyle. This success further fuelled the development of ‘SOHO Palm’, a landmark build-to-rent residential building project that embodies our commitment to high-quality luxury living. Each fully furnished apartment features ultra-modern aesthetics and

uninterrupted beach views, enhancing the allure of trendy community living. Unique to this project, residents enjoy private beach access—a rarity among residential buildings in West Palm Beach.

We are now spearheading the development of two new residential buildings in Dubai Hills, set in a tranquil parkfront location with elevated amenities. Additionally, we are expanding our project offerings to develop two bespoke luxury villas on Jumeirah Bay Island.

Compared to other contenders in the UAE market, our USP lies in our commitment to delivering fully furnished, curated experiences that blend luxury, exclusivity, and convenience. Our projects are designed to exceed market expectations and offer residents unparalleled living experiences.

What differentiates a regular residential project from a luxury residential project? How do you guarantee a luxury living experience for buyers? What sets apart a luxury residential project is the meticulous attention to detail and the selection of materials and finishes. In our luxury developments, every aspect, from the kitchen to the wardrobe, from sanitary ware to appliances, is inspired by hospitality standards. We prioritise using premium materials and highend finishes to elevate the living experience to a luxurious level.

Upholding these high standards throughout every stage of development, we guarantee a luxury living experience for our buyers and tenants. Our commitment to excellence ensures that each home is crafted with precision and care, delivering exceptional build quality and craftsmanship that rivals even branded residences.

Moreover, our fully furnished residences offer a hotel-inspired lifestyle, complete with amenities that cater to every aspect of modern living. From well-maintained gyms to expansive swimming pools, children’s play areas, and beautifully landscaped gardens, we provide a comprehensive living experience that consistently surpasses the expectations of our residents.

What are some of the key challenges SOHO Development has faced in terms of planning and delivering luxury residential offerings in the UAE? How did you tackle these challenges?

As developers, one of our primary challenges is staying attuned to the evolving needs of our buyers. With demands shifting constantly, our ability to adapt becomes crucial in meeting and exceeding expectations.

When we successfully identify the buyer’s needs, the next important step would be strategic timeline planning, which becomes essential to delivering quality residences. Unforeseen challenges when finalising designs or materials, are inevitable in these projects, emphasising the importance of proactive planning and allowing adequate time for these tasks.

Moreover, identifying the right partners and engaging them from the project’s start is essential for effective timeline management. Early involvement allows us to plan for contingencies, incorporate feedback, and ensure smoother project progression, while maintaining our high standards.

What is the inspiration behind the architecture and interior design/fit-out of your projects?

At SOHO Development, we draw inspiration from the hospitality sector to craft luxurious living experiences that seamlessly blend with residential comfort. This approach appeals to discerning individuals seeking privacy, comfort, and exceptional value without compromising quality.

When it comes to design, we collaborate closely with a select group of preferred designers who share our vision and values. These designers, including renowned LW Design, XBD Collective,

For its inspiration, Khosla says the developer took inspiration from hospitality brands including the Four Seasons Hotels & Resorts, The Ritz Carlton and others.

SOHO Development says it is focused on ensuring that sustainability benefits the planet, as well as its residents, investors and other stakeholders.

Saota, and Naga to name a few, bring a wealth of expertise and creativity to our projects. Their innovative approach to architecture and interior design helps us create spaces that not only meet but exceed the expectations of our clients. By working with these preferred designers, we can ensure that each project reflects our commitment to delivering the highest standards of luxury living.

How does SOHO Development approach sustainable development?

Do you strive for performancebased certifications or criteriabased certifications?

As a developer, our approach to sustainable development revolves around continuous improvement and delivering better products. We understand that embracing sustainability not only benefits the planet but also adds value for residents, investors, and stakeholders. Our commitment to sustainability involves developing buildings that comply with industry standards, leading to reduced operational costs. By designing properties that efficiently consume resources like water, heating, and electricity, we contribute to environmental conservation while enhancing the long-term viability of our projects. Furthermore, we prioritise urban landscaping to create green barriers that help reduce overall temperatures within our properties, promoting a healthier and more comfortable living environment.

David Clifton, Regional Director at AtkinsRéalis reveals insights into the UAE’s economic diversification, construction’s contribution to GDP, FDI

The United Arab Emirates’ (UAE) continuous economic growth has been primarily driven by diversification. The government’s strategy in this area has accelerated the transition to non-oil sectors, including tourism, finance, real estate, and technology.

With the UAE GDP growing by 3.7% in 2023 after a robust and strong recovery in 2021 and further significant growth in 2022, the UAE is on target to become a two trillion AED economy by 2027, ahead of the initial goal of 2030. This is largely driven by strong non-oil GDP growth of 9.1% and 9.2% in 2022 and 2023 respectively.

With oil now representing c.30% of GDP, the economic diversification of the economy is progressing at pace, with services now representing c.35% of GDP (of which tourism is 9% of GDP) and industry / other sectors contributes c.35%.

The UAE GDP is expected to grow by 3.9% in 2023, driven largely by nonoil GDP, but also by The Abu Dhabi National Oil Company’s (ADNOC) five-year investment plan to increase oil production from 3.2m barrels

per day (bpd) to 5m bpd, but with a strategy to remove 0.2m bpd (plus the extra 1.8m) from the global market and open petrochemical plants.

The plan noting that peak oil is expected between 2050-2100 (depending on estimates), but that peak petrochemical (feedstocks etc.) will not reach peak demand due to population growth globally until at least 2150.

With debt to GDP 29.1% and its vast Sovereign Wealth Funds (SWFs) will mean that even with an expected global slowing of growth, the country has the fiscal means to keep investing in its local diversification.

When looking at the real estate sector, it represented 14.4% of Dubai’s GDP in H2 2023.

With the population of the UAE now just over 10m, the GDP per capita is expected to be $52,520 in 2024, which places the country as the 7th richest country in the world by this metric.

The GDP per capita we forecast to grow by CAGR of 4% per annum in 2025/6 as the country looks to attract higher paid, service and manufacturing staff to achieve its Visions (2030, 2040 and 2050).

With 2023 being a record year for construction award in the UAE – largely driven by two key sectors, ADNOC’s investment program and real estate

(mostly town houses and apartments), and the continued status of the UAE as a ‘flight to safety’ for capital from areas of conflict or unsettled political situations. The net contribution to GDP has jumped from 6.4% to 7.07% in spite of a further significant jump in countrywide nominal GDP.

In 2021, the UAE set a target to deliver $150bn USD of FDI in the 10 years to 2030 – an average of $15bn per annum. Having historically averaged c.$10bn per annum, the effective

target was to raise FDI consistently by 50% for 10 years. In the first three years of working to this target, this target has been easily surpassed.

In 2023, the UAE, having risen up the global FDI rankings since 2019, reached 16th worldwide, as well as Dubai placing first globally for greenfield projects, with 511 schemes, this represents 6.8% of all projects across countries measured. Initial forecasts suggest that the country will achieve its $15bn target in 2024, with an estimated sales in real estate being a significant contribution to GDP and FDI, of which an estimated

150bn

In 2021 the UAE set a target to deliver $150bn of FDI by 2030

70% ($10.5bn) of investment is from external to the country.

We have factored the industry contribution to assume a 30% award of pipeline for 2024/5, as this has been the mean trend since the mid-2000s. Should construction contract awards outstrip the mean, the upper range should be considered likely. Likewise, should the contract awards undershoot the 30% factor, as they did in 2019 and 2020, the lower range of the sensitivity analysis will be most likely.

When schemes move from precontract to post contracts in the UAE in the second-half of 2024, we should see circa $25bn USD worth of awards from the main client real estate developer organisations. We forecast that for 2024 and 2025 $83bn will be awarded.

We expect in the real estate industry for the four major entities that now exist due to major recent mergers to have the potential to create their own microcosm of mini-inflation bubbles due to the scale and type of works that are being delivered, in many respects replicating some of the challenges that have been seen by perception and realisation of work awards in Saudi Arabia.

With the shoring up approach from a federal and Abu Dhabi level government initiative, we expect certain schemes to start moving with a view to ensuring attraction and maintenance of population within the UAE.

The surprise area of recent growth being Dubai and Abu Dhabi real estate and the likelihood that over the coming 12 months we will start to see real estate demand peak and start to dip to price points being more accessible and driving up rental demand as yields maintain and price points drop.

This has been causing challenging cost of living issues for those that have moved into the market with families where historically may not have been considered a place where families stay for long periods

of time. That mixture actually starts playing to the supported demand curves and make it more affordable to consider a longer-term relationship with the country. Looking at the whole market works already in construction or in precontract or early-stage planning, the total for the UAE is c.$797bn USD.

We would expect an aggregated compound annual growth rate (CAGR) of circa 5.5% per annum given current forecast awards based on planned works but also extrapolating

sales revenue announcements across major developers and using a multiplier to reach expected values.

With that being the case, we would also expect the percentage of GDP contribution to continue moving further upwards towards potentially the 8% to 8.5% market dependant on national GDP as well as an acceleration of GDP due to economic diversification.

With that we would also be looking to witness an increasing in staffing of c.3 to 4% as a minimum based on supply chain risk appetite and ability to secure working capital, as some of the complex scheme requires the reintroduction of capability not just capacity.

The move towards technology for delivery, whilst an area of great interest will continue to be a process of evolution, not revolution, requiring manpower to still be mobilised, although at a slower rate than the CAGR due to the introduction of more dynamic systems and modern methods of construction.

The UAE construction and development market remains robust and largely attractive to investors and suppliers alike. Capability and capacity being the key challenges as project types and scales fluctuate. With over $2tn USD in sovereign wealth fund (SWF) assets under management (AuM), the country has significant resources to maintain and grow both the economy and the industry over the short to mid-term.

The event featured 20 speakers spread across three panel discussions and two presentations, and explored a variety of topics connected with regional infrastructure

The inaugural Critical Infrastructure Summit took place on 8 May at the Two Seasons Hotel in Dubai, and recorded over 120 professionals in attendance, the Big Project Middle East (BPME) team confirmed. The event was officially endorsed by The Chartered Institute of Building (CIOB) and Royal Institution of Chartered Surveyors (RICS).

The event focused on a variety of topics relating to regional airports, advanced aerial mobility (AAM), data centres, seaports, and urban mobility, and explored

how cities and infrastructure can become more resilient to extreme weather events.

Delegates and speakers included industry bodies, developers & operators, construction and engineering stakeholders, the editorial team said.

The event was opened by Jason Saundalkar, Head of Content at Big Project Middle East, following which the first session of the day took place. The ‘Data Centres – The Backbone of a Digital World’ panel discussion was moderated by Engi Jaber, CEO/ Managing Director at Climatize, while panelists included Hassan

Younes, Co – CEO & Founder, grfn, Lewis Wright, Project Director, PMKConsult, Qusay Abu-Abed, Regional Sales Manager, MENA & Data Center in-Charge at Danfoss Turkey Middle East and Africa, Suhail Arfath, CEO, Hloov and Tinboat Arslanouk, Senior Director Partner Strategy and Growth, Khazna Data Centers.

The first presentation of the day saw Chandra Dake, Group CEO at Dake Group Limited give a presentation on harnessing the principles of sponge cities, to create urban landscapes that not only withstand new climate realities but also thrive within it.

The second panel discussion ‘Resilient connections: Airports & Seaports in Focus’ was moderated by Katarina Uherova Hasbani, Partner and Global Director of Strategy and Advisory at AESG. Her panelists included: Dr. Rana El-Dabaa, Assistant Professor of Architecture, Heriot-Watt University Dubai, Dr. Talia Sherrard, Regional Director Strategic Sales & Marketing, MEI, Fugro, Fabien Jean Pierre Loy, Associate Engineer, Buro Happold, Laith Haboubi, Vice President – Middle East Region, Vector Corrosion Middle East Services and Rhona Hunter,

Managing Director, Hunter Horizon Consulting.

That session was followed by the second presentation on the development of Dubai’s commercial AAM network.

Daniel O’Neill, Regional Manager – Middle East at Skyports Infrastructure took delegates through milestones that have been achieved from an operational, regulatory and development perspective, and outlined what the next 18 months of effort would entail ahead of the network’s 2026 launch goal.

The Third panel discussion, ‘Developing state of the art urban mobility in the GCC’ was moderated by Samya Ghosh, Practice Director, Strategic

Following months of planning for the Critical Infrastructure Summit, it was immensely satisfying to be on the ground, and hear the brilliant insights shared by our speakers”

Planning & Advisory, AECOM. His panelists included: Mohammad Shamlouli, Geographic Information Systems Manager, Insite, Nadeem Shakir, Regional Director – Transport & Mobility Planning, Zutari Engineering International PTY Limited –Dubai Branch, Shane Mitchell, Director, Advisory EMEA, Parsons, Steven Velegrinis, Design Director and Regional Head of Cities Practice, Gensler and Stuart Watts, Senior Transportation Engineer, KEO International Consultants.

“Following months of planning for the Critical Infrastructure Summit, it was immensely satisfying to be on the ground, and hear the brilliant insights

shared by our speakers. I couldn’t be happier with the discussions and presentations that took place through the day, and it was great to see that we retained the majority of our audience right through to the end of the day. Infrastructure is a hugely important topic, and I look forward to covering works done on existing and new projects in the coming months,” said Saundalkar.

The event was supported by: Gold Sponsor: KEO International Consultants; Strategic Content Partner: ALEC, and Silver Sponsor: AECOM. The summit will return for its second showing in 2025, the BPME team concluded.

Decarbonising the maritime shipping industry is a complex challenge, requiring concerted efforts by key industry actors

Ports are essential assets facilitating the movement of commodities through the supply chain. Maritime transport has been shaping modern global economy, and recent events across the globe often remind us how reliant we are on ports and global trade routes.

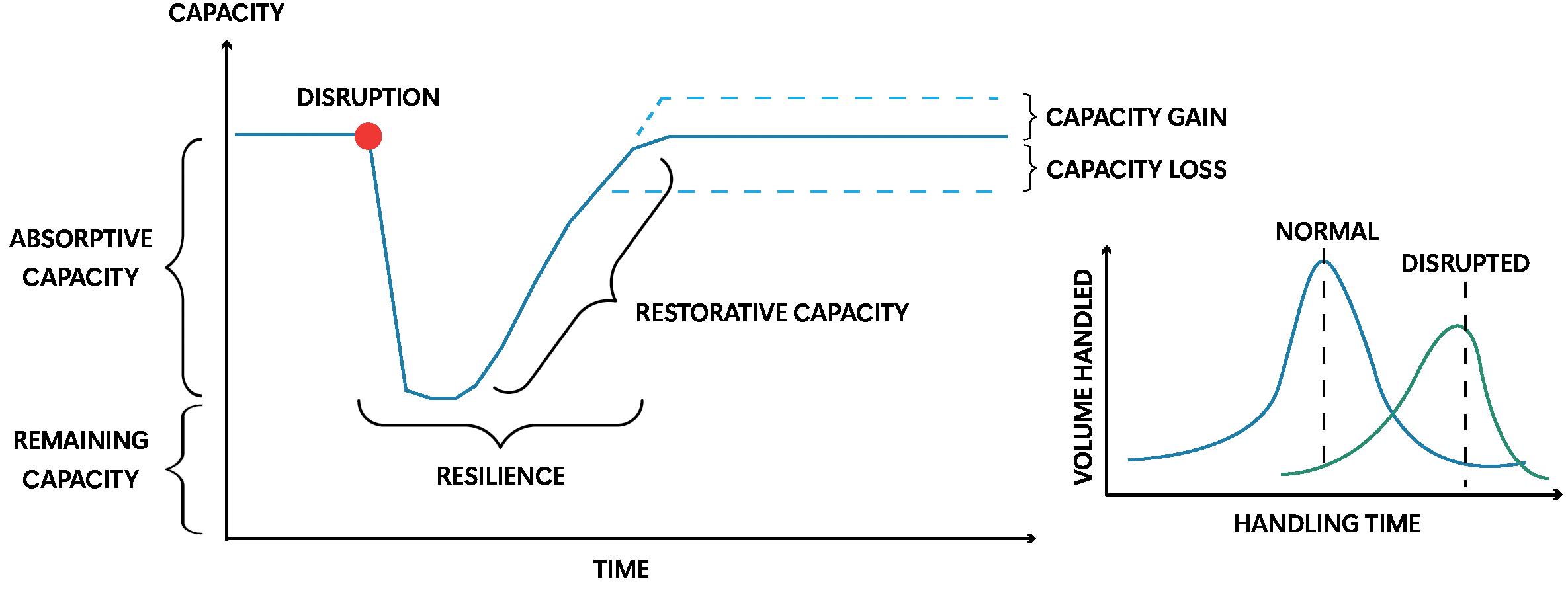

Big Project ME’s Critical Infrastructure Summit was a fantastic opportunity to engage on the topic of resilient ports and cities in the Middle East. By definition, port resilience is the ability to maintain an acceptable level of service in the face of disruptions (e.g. pandemics, natural disasters and cyber or terrorist attacks).

This concept is illustrated in the figure and can be estimated by considering the time to recovery (TTR). For people affected by recent flooding events, TTR corresponds to the time a certain

road or a metro station took to reopen for instance. As authorities respond as quickly as possible, their capacity is linked with parameters such as planning, agility, communication, etc. A port’s focus is to be able to handle an average traffic level and to maintain the associated revenue level.

As engineers our duty is to help derisk projects and operations for our clients. One of the key strengths of Buro Happold (BH) design teams is to capture the site conditions in detail, highlight risks and opportunities, and improve project performance by eliminating those potential future delays. Extreme weather events due to climate change are likely to become more frequent and more intense with a risk to damage port infrastructure. In our marine

projects, I work with our sustainability and infrastructure experts to factor in climate change and sea level rise in the design process. On strategies and largescale masterplans, I get involved with our transport and strategic planning teams to assess how ports and infrastructure networks perform at present day and in future by modelling various throughputs, populations, disruption events, to demonstrate that back-ups are in place with multiple sources of supply and alternative modes of transport available.

To increase efficiency, Middle East ports look to embrace digitalisation for applications such as security, utilities metering, logistics, emissions tracking, etc. Port operations and asset management have benefited from the development of accurate 3D BIM models over the last decade, and more recently of the emergence of digital twins, which facilitate monitoring activities and the integration of smart systems.

In recent years, I have helped authorities and developers integrate requirements for nature-based solutions, regenerative design and lifecycle assessment in their ambitious new directives. The objective is to guide and incentivise designers, developers, and operators to follow best practice on sustainable design and environmental planning.

BH’s advisory team helps policymakers and investors develop tailored solutions to match national and regional objectives on topics such as renewable energy, sustainable infrastructure, biodiversity conservation and emission reductions. This work can be linked with the emerging trend of ‘Green Ports’ which represents ports’ efforts to become

Resilience

Port resilience is the ability to maintain an acceptable level of service in the face of disruptions (e.g. pandemics, natural disasters and cyber or terrorist attacks) says Loy.

environmentally aware in their operations with eco-friendly practices in mind. Speaking to other panellists, we agreed that stakeholder engagement is paramount for the success of sustainability initiatives and large-scale infrastructure projects. Actors forming part of the port resilience ecosystem can be split across three categories: port level (authority, operators), carrier’s level (shipping lines, rail, trucks), and other stakeholders.

More than 3% of global GHG emissions caused by human activities are attributed to the shipping sector. With the world’s trade demand increasing, those emissions are also likely to keep growing if no further measures are taken. The International Maritime Organisation

(IMO) coordinates all stakeholders’ efforts towards GHG emissions reductions targets: at least 20% by 2030 and Net Zero emissions around 2050.

At a regional scale, Middle East port operators align with the national targets, as well as the UN’s Sustainable Development Goals. For example, on the expansion of Khalifa Port, Abu Dhabi Ports Group identified key opportunities such as the installation of solar panels, replacement of cement with GGBS and shore to ship power.

BH energy team are presently working with the Port of Aberdeen (UK) in a Demonstrator Project to cut 80% of vessel emissions at berth. Key focus is on shore power solutions and green energy generation on site to significantly reduce gas emissions and enhance air quality.

To fully decarbonise their fleets, shipowners need to rethink fuel choices. A range of technologies exist to meet IMO ambitions, those future marine fuels include LNG, LPG, Methanol, Biofuels, SNG, Hydrogen, Ammonia. Shipping firms such as Maersk have been advocating for a stronger regulatory framework. The Ane Maersk, large container ship which recently visited Jebel Ali Port can sail up to 23,000 nautical miles thanks to its dual fuel type engine.

The OECD forecasts a tripling of global freight demand by 2050, with maritime trade potentially exceeding 120,000 billion tonne-miles. The overall shipping demand is not expected to slow down, which makes today’s challenges more pressing. Changes to the supply chain could be considered to reduce volume of import trade in the region. Local production would add more resilience to ME countries and generate more profit to the local economy.

Decarbonising the maritime shipping industry is a complex challenge, requiring concerted efforts by key actors. National and international authorities are making progress towards a more sustainable future, driven by a combination of regulatory pressure, market forces, and environmental awareness. Consultants have a key role to play in advising clients, developing practical solutions and de-risking projects.

Bringing people, tools and processes together in the construction industry will lead to numerous benefits writes WalkThru Contracting’s Bachar Gebran

Simply put, collaboration is all about working well together. And as Henry Ford said, “If everyone is moving forward together, then success takes care of itself”. While this might seem obvious as an idea, some industries, particularly construction, have always struggled to put it into action. Despite being among the top 20 fastest growing industries in the world, it ranks amongst the lowest in terms of efficiency rates. This can be

directly linked to the many challenges in the way that construction teams communicate and collaborate currently. True collaboration in the industry is unusual because we continue to stick on to the ‘old and familiar ways of working’. The client hires the designer, the designer hires the contractor and the contractor hires the supplier. There is a power hierarchy and a linear flow of information. The teams often work in silos and there is a top-down approach to the way we conduct business.

Another challenge faced by the industry is the lack of trust. Many clients fear that collaboration between designers and contractors could imply that they are in cahoots and deals are happening under the table even if that is necessarily not the case.

Having said that, there are many entities in the country - within the oil & gas industry as an example -that successfully employ a collaborative model for their design and build projects. In more mature construction markets, collaboration has proven its benefits beyond doubt. These include sticking to timelines, avoiding duplication, rework and waste, better quality standards, improved safety, increased productivity and keeping projects within budget.

Given these desirable benefits, does it not make sense to create a sea change in the way we operate as an industry? This will mean bringing people, tools and processes together to create a system that will work seamlessly. In my opinion, here are four essential guidelines that will enable this shift to a more collaborative culture:

Construction is one of the least digitised sectors globally. Despite the size and growth potential of the market, IT spend is appallingly low. The reasons for that are many. First off, builders are neither flexible nor tech savvy. They are happy working with more traditional methods such as Excel spreadsheets, email and WhatsApp. Unfortunately, these tools don’t offer project status visibility in real time. There is also a resistance to change and an unfounded fear of job security. Under these circumstances, leaders of construction firms have to step up, change the work culture through employee buy-in and move towards adopting cloud-based construction software that ideally operate under a single and unified platform. This will ensure that teams have

access to comprehensive, inclusive real-time data – the crucial element that will make or break a project.

Miscommunication is the number one cause of all project errors and failures. Setting up proper communication channels will mean setting the ground rules, the systems and making time for structured and regular communication. It may seem like a no-brainer to talk about clear, frequent and recorded communications but harder to implement unless all teams work towards the same vision. This is why, it is also equally important to engage all the key players early on in the project and set up a system that enables collaboration from the get go. Effective communication is also a two-way street. There is an attitude in the construction industry that communication is about following instructions from C-level professionals, when in fact there is no hierarchy when it comes to solving challenges on site as hands-on experience holds value in itself. Collaboration means respect, clarity and fostering both top-down and bottom-up communications.

There is an old Arab proverb that says, “Give your bread dough to the baker even if he eats half of it”. While this suggests the importance of working with experts, in a cost sensitive market such as ours, it is often overlooked leading to disastrous outcomes. This practice of skimping costs will have to change if we are to achieve excellence in this industry. It is always better to partner with specialists because in the long run the investment will pay off with proper solutions, minimised errors, faster delivery and better quality. In order to do this, it is important for construction companies to filter their partners right from engineers to suppliers, geotechnical experts and now with the region facing the brunt of climate crisis, waterproofing experts too!

If you cannot trust a contractor, don’t go into contract with them. A contract is a partnership based on trust and not a document that outlines how you are going to solve issues when you go to court.

Trust can only be built over time through track record, maintaining transparency with clients, valuing relationships and not being solely economically driven. The end result has to matter equally if not more than monetary gains.

The project is said to exemplify Merex Investment’s commitment to sustainability and innovation

Merex Investments has achieved a significant milestone on its flagship beachfront project in Jumeirah. The firm notes that J1 Beach is nearing 94% complete and is on track for opening in September 2024. J1 Beach is poised to redefine the

Dubai beachfront experience with its innovative design, luxury dining and world class amenities, the firm said.

The firm noted that the architectural and engineering aspects are being managed by SSH International Engineering, the main consultant, who are leveraging global expertise to push the boundaries of design and innovation. Construction works are being led by ARCO Turnkey Solutions, whose precision, and excellence are instrumental in realising the vision for this iconic destination, the firm noted.

“We are pleased to announce that J1 Beach is nearing completion, and we’re on track to unveil a beachfront like no other in Dubai this September. J1 Beach embodies our dedication to creating innovative and industryleading destinations that cater to the

Merex notes that J1 Beach is nearing 94% complete

sophisticated clientele of Dubai. Our flagship project is poised to become a leading destination, attracting discerning residents and visitors alike. This project reinforces Dubai’s position as a global leader in hospitality and tourism,” explained Shahram Shamsaee, CEO of Merex Investment.

J1 Beach is designed to be Dubai’s next ‘must-visit’ destination, featuring an urban riviera that brings the world’s best to Dubai’s shores. With 13 high-end dining venues, including globally acclaimed establishments and original concepts, J1 Beach is poised to become a pinnacle of gastronomic excellence. Visitors will enjoy direct beach access and exceptional services such as dedicated valet parking, enhancing the seamless luxury experience, the firm stated.