PLUS MATERIAL HANDLING IS THE SECTOR ON THE COME UP?

CONEXPO SPECIAL SPECIAL LOOK AT THE POST-COVID EVENT

TURKEY EARTHQUAKE

PLUS MATERIAL HANDLING IS THE SECTOR ON THE COME UP?

CONEXPO SPECIAL SPECIAL LOOK AT THE POST-COVID EVENT

TURKEY EARTHQUAKE

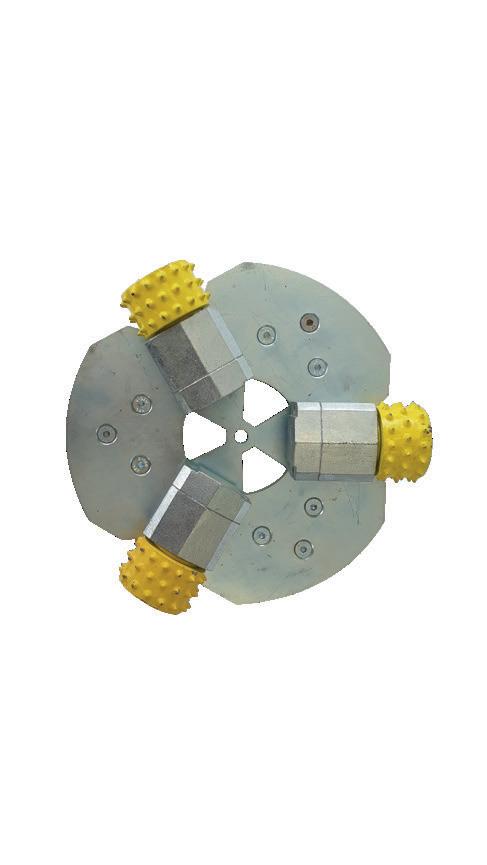

WE HAVE NOW LAUNCHED PROFESSIONAL GRINDING AND MILLING MACHINES

SUITABLE TOOLS

- Diamond grinding segments

- Grinding segments PKD

- Cup grinders

- Polishing pads

6_NEWS

The latest news from across the region and further afield.

12_CUTTING

Diamond tools deliver versatility that other tools cannot match, argues Jeff Bennett, General Manager at Husqvarna Construction.

CMME talks to Invest Northern Ireland about bringing the country’s expertise to a booming Saudi mining market.

16_RUSHING

CMME looks at how the international equipment sector has reacted to the Turkey-Syria Earthquake. 20_STANDING

Global events such as the Ukraine conflict and supply chain disruptions expected to have a continuing impact on the global forklift market.

10 SPOTTED RESPONDERS

ATLAS equipment steps into the front line with first responders in Germany.

I’ve never been a believer in the saying that you should never go back, and so when the opportunity came to return to Construction Machinery Middle East halfway through January – I naturally jumped at the chance.

For those who started reading the magazine in the last few years, that line may make absolutely no sense at all. For the unitiated, my time with Construction Machinery Middle East dates all the way back to the start of the magazine which was, unbelievably, over a decade ago after I made the jump from another well-known title in the equipment world.

From the off, I adored working with the team at CPI and even more with the many people that I met in the industry. I was at last year’s Construction Machinery Awards at the Radisson Red, and it was a real pleasure to catch-up with friends from the sector that I hadn’t seen for half-a-decade. We all may have had a little more grey hair but what struck me was how much this sector still means to us all.

So when Mark Dowdall announced that he was to take on an exciting new challenge, I was hoping that it could lead to at least some time to help out the team – and then was honoured when I was approached to take on the role as head of the magazine again. After all, some of my favourite moments in my writing career came from working on this magazine that is in your hands or on your screen as you read this.

There were the early forays into Saudi Arabia, the missed flights because interviews went off into improbable but exciting tangents, the coffees which would mix industry gossip and advice to me as a young father, the trips to the top of tower cranes over cities that were only just being built. The industry was a very different place in those early years. The boom and bust of

the late-naughties left many wondering whether we many companies could survive into the next decade. The traditional trading of equipment was also stalling with unsused equipment bought for projects that would never be built was sitting idle in yards with even auction houses wondering whether they could shift it in a reserved sale. The prices tumbled, inventories became liabilities and capex funding dried-up.

Everything was big, not much was compact. I remember when we started covering mini-excavators and loaders, the discussion was whether the market would ever ‘get’ them. As ever, we always remained determined to cover anything that was interesting, anything that could fit into a contractor’s fleet – even if they didn’t yet appreciate it. Thankfully the market stabilised, Saudi Arabia started to re-emerge and Dubai won the Expo – and the sector began to recover.

Coming back to it after all these years, I am very pleased that sense of community is still there – you only have to look at the reaction to the Turkey-Syria earthquake. It is also in a much more advanced state, rental companies perform as safety valves, digital technology is opening up new ways to construct and operate, safety is much more important – and the magazine is now also a website and a series of events. It’s exciting to be back – and I can’t wait to catch up with you all in the months ahead.

GROUP MANAGING DIRECTOR

RAZ ISLAM raz.islam@cpitrademedia.com

+971 4 375 5471

MANAGING PARTNER

VIJAYA CHERIAN vijaya.cherian@cpitrademedia.com

+971 4 375 5713

DIRECTOR OF FINANCE & BUSINESS OPERATIONS

SHIYAS KAREEM shiyas.kareem@cpitrademedia.com

+971 4 375 5474

PUBLISHING DIRECTOR ANDY PITOIS andy.pitois@cpitrademedia.com

+971 4 375 5473

EDITORIAL EDITOR

STEPHEN WHITE stephen.white@cpitrademedia.com

+44 7541 244 377

ADVERTISING

SALES MANAGER BRIAN FERNANDES brian.fernandes@cpitrademedia.com

+971 4 375 5479

DESIGN

ART DIRECTOR SIMON COBON simon.cobon@cpitrademedia.com

DESIGNER PERCIVAL MANALAYSAY percival.manalaysay@cpitrademedia.com

MARKETING

EVENTS EXECUTIVE MINARA SALAKHI minara.s@cpitrademedia.com

+971 4 433 2856

SOCIAL MEDIA EXECUTIVE DARA RASHWAN dara.rashwan@cpitrademedia.com

CIRCULATION & PRODUCTION

DATA & PRODUCTION MANAGER

PHINSON MATHEW GEORGE phinson.george@cpitrademedia.com

+971 4 375 5476

WEB DEVELOPMENT

ABDUL BAEIS UMAIR KHAN

FOUNDER

DOMINIC DE SOUSA (1959-2015)

PUBLISHED BY The

Stephen White Editor, CMMEKanoo Cranes offers engineered solutions for any lifting requirements with knowledgeable experts engaged in the field of lifting with Mobile cranes,Crawler cranes, Tower cranes and passenger hoists with a combined experience of more than 50 years and we continue to retain an excellent reputation alliance agreements with:

• JASO

• SMIE-Anti collision

• MEADA

• SPIERINGS

• ALBA

Our Focus is to provide engineered crane solutions to the Construction, Oil and Gas and Industrial markets.

KANOO CRANES L.L.C

P.O.Box: 290, Dubai, United Arab Emirates

info@kanoocranes.com www.kanoocranes.com

T: +971 4 446 5532 F: +971 4 446 5538

JASO

ALBA

MEADA

SMIE

JASO

ALBA

MEADA

SMIE

CONSTRUCTION

Eshraq announces successful land transaction with Danube

ANALYSIS: Is Oman’s construction industry waking up?

PROPERTY

Modon Properties opens new fish market in Abu Dhabi’s Mina Zayed district

CONSTRUCTION

RSG awards $266mn contract to AL-AYUNI for first phase of development at Amaala

INTERVIEW: Omnix and IMSCAD ink deal to bring VDI environments to AEC firms

INFRASTRUCTURE

RTA opens Sheikh Zayed bin Hamdan Al Nahyan street improvement project

CONSTRUCTION

Deyaar completes Mesk and Noor districts

INTERVIEW: “COP28 has the potential to have a significant impact”

Expert intel on Access & Handling, boosting output, functionality and workplace best practice

CONSTRUCTION

Saudi’s PIF and Samsung C&T partner to develop construction tech and modular housing

As part of the deal, Samsung C&T Corp will build modular homes in the Kingdom in a joint investment with PIF

PROPERTY

Espace Real Estate expands with two new Dubai offices

The brokerage said it plans to expand progressively into the off-plan and new projects sectors

INDUSTRY

Extreme weather is driving investments into climate risk digital solutions says Verdantix McKinsey, Conning, BlackRock, Moody’s and S&P Global and others have acquired or launched climate resilience solutions in the past two years

INDUSTRY

2023 could be tough for cement producers says World Cement Association Director Market pressures could gradually push cement producers to establish higher cement prices

PROPERTY

219 ultra-prime homes sold in Dubai in 2022 says Knight Frank

The record-breaking year has the highest $10mn+ villa sales ever recorded

SUSTAINABILITY

Sheikh Mohamed bin Zayed Al Nahyan announces 2023 as the ‘Year of Sustainability’

PROPERTY

Knight Frank report shows Grade A warehouse lease rates continue to escalate

CONSTRUCTION

Tasjeel and SAM launch first site offering testing services for vehicles in Sharjah

INDUSTRY

Alstom certified as ‘Top Employer’ in three Middle East markets

CONSTRUCTION

World’s first 3D-printed mosque to be developed in Dubai

Doosan Bobcat has provided equipment worth around $1 million for relief and recovery activities in the earthquakestricken areas of Turkiye. Construction equipment will be promptly delivered through Doosan Bobcat’s dealer network to be of practical help in lifesaving activities in affected areas and to help restore critical infrastructure such as collapsed buildings and roads. The equipment being supplied includes skid-steer loaders and excavators to remove and clean debris, and portable generators and lighting towers to be used at sites with power supply issues. By providing equipment that can be used immediately for relief and recovery efforts, Doosan Bobcat hopes to help residents of the affected areas in Turkiye to begin to recover their daily lives as soon as possible.

The donation will be financed in cooperation with Doosan Bobcat’s mother company, Doosan Group, which has supported previous major disasters with equipment and donations, such as hurricanes and earthquakes in the U.S., China, Haiti, Japan and Nepal over the past 20-plus years.

Joining Bobcat Doosan in the race to save lives included the local office of leading Chinese construction machinery producer Xuzhou Construction Machinery Group Co (XCMG), after the firm immediately “initiated an emergency mechanism”, coordinating the movement of three excavators to the quake-hit Turkish city of Gaziantep, the Global Times reported. The company was also reaching out to its local dealers to bring more excavators to the region, XCMG, as CMME went to press.

In a bid to support and boost the growth of the construction sector in the emirate, the Dubai Chamber of Commerce has announced the launch of four business groups: building materials; cement and readymix; ceramics and paint coating, and gypsum. According to Dubai Chamber of Commerce’s President Mohammad Ali Rashed Lootah, the groups will encourage transparent communication among members, and drive the growth of the construction sector in Dubai, which had a market size valued at $81bn in 2021, with a projected annual growth rate of more than 3% from 2023 to 2026.

Auger Torque has announced a special product showcase event taking place in partnership with Galadari Equipment later this month. All construction and industrial professionals in the GCC region are invited to attend the event which is focused on demonstrating how the use of cutting-edge hydraulic attachments can deliver “ground-breaking performance to projects in the Middle East”.

Taking place on February 22nd and 23rd at Galadari Equipment in Dubai, Auger Torque will showcase their hydraulic attachment range to the GCC market. Attendees will be able to see a wide range of attachments on JCB machinery including; excavators, skid steers, and backhoes. Attachments will include: drilling solutions, dewatering augers, trenchers, drum cutters, hydraulic breakers and sweeper brooms.

The attachments are suitable for a wide range of applications: from demolition and excavation to material handling and recycling.

The Kinshofer Group-owned company added that it aims to show how its hydraulic attachments enhance efficiency, productivity, and safety on job sites, and are built to the highest standards using the latest technology. While seeing the attachments, construction professionals at the event will have the opportunity to speak with experts about how they can improve their operations.

JCB’s partner in the UAE, Galadari Equipment is the distributor of the Auger Torque range of products, with their knowledge of the market and the industry, and with a stock holding of product, they are wellplaced to bring these solutions to the GCC, added Auger Torque.

JCB have used their experience in designing tough, hardworking equipment to ensure their electric scissors range are also built to higher standards. With high quality paint finish and many unique features, the machines have higher levels of safety, ease of use, reliability and serviceability. Industry standard components across the range allow seamless integration into existing rental fleets. JCB also offer higher levels of support through an unrivalled dealer network with quick start guides, good parts availability, finance and technical advice.

For more information, please contact your local dealer.

www.jcb.com/access-platforms

from expanded service, support, and training. Under the new entity, Kito Crosby team members will be participants in the employee ownership programme.

The Crosby Group, a leading provider of lifting and rigging solutions, and KITO CORPORATION, a leading manufacturer of material handling equipment with 90 years of experience in the development and production of hoists and cranes, have completed their merger. The announcement follows the settlement of The Crosby Group’s cash tender offer for all outstanding shares of KITO CORPORATION for JPY 2,725 per share and the completion of the

related squeeze-out process and de-listing of KITO CORPORATION from the Tokyo Stock Exchange. This combination, under the name Kito Crosby, brings together two industry-leading companies with complementary geographic footprints and product portfolios to better serve customers, team members, and their global communities. The combined company will invest in its people, products, and facilities to advance innovative solutions for customers, who will benefit

Robert Desel, CEO of Kito Crosby, said: “I am thrilled to announce we have completed the business combination of The Crosby Group and KITO CORPORATION to form Kito Crosby, a global provider of comprehensive lifting solutions. Together, our highly complementary product portfolios and mutual commitments to safety, reliability, and innovation will create exceptional value for our customers and other stakeholders. I am honored to be leading this organisation and its 4,000 team members around the world to bring together two amazing businesses with rich traditions and histories. I am very excited to announce that under the combined company we will be extending our expanded employee ownership program to Kito Crosby team members.”

ENOC’s Tasjeel in collaboration with Sharjah Asset Management has broken ground on its first site offering testing services for both light and heavy vehicles.

Located in the Al Sajaa area of Sharjah, the new site brings the total number of testing centres in the emirate to 13, a statement said.

Spanning a total area of 32,777sqm, the new Tasjeel site will have five testing lanes for light vehicles, and five testing lanes for heavy vehicles. It will also contain a workshop, as well as a food court, including a drive-thru restaurant.

In addition to offering seamless testing and registration processes for both categories of vehicles, the site will offer a range of automotive facilities, including vehicle and driver licensing services, the statement continued.

Tasjeel owns and operates 30 sites – all of which use stateof-the-art equipment – as well as three mobile units.

CSCEC TO TAKE

OVER FROM NPC AT CAVALLI TOWER

Developer DAMAC Properties has awarded China State Construction Engineering Co. the main works construction contract for its 71-storey Cavalli Tower, following the completion of piling and excavation works by NPC.

2023 could be a challenging year for the cement industry according to World Cement Association (WCA) Director, Emir Adiguzel. He made the comments as part of his Outlook for 2023 presentation.

Reflecting on the past two years of high demand post pandemic, Adiguzel said that several issues including tighter monetary policies, increased sea freight rates, and high fluctuations in the cost of energy may gradually exert pressure on cement producers to establish higher cement prices. In addition, Adiguzel stated that major multinational cement companies will continue to divest cement assets in emerging markets, creating a unique opportunity for players in such markets, including China, to enlarge their portfolios in positive growth markets by acquiring the cheapest European cement assets.

Liebherr is set to sell used machines, attachments and spare parts to customers via an all-new digital marketplace. The global trading platform is being developed in partnership with softwareas-a-service provider Krank.

Krank is a software-as-a-service (SaaS) platform that provides a new way to remarket used equipment. Subscriber-branded (Liebherr in this case), it helps customers sell faster and improve revenues. The UK headquartered firm enables customers to manage the sale process and keep direct control of their business network and data.

Replacing an existing digital marketplace, the new solution will centralise the sale of Liebherr used mining, construction and material handling technology worldwide. Due to launch during the first quarter of 2023, the platform underlying the marketplace is being

developed in close collaboration with the UK SaaS experts.

The new marketplace will be a Krank-developed platform that allows Liebherr sales partners worldwide to quickly and conveniently manage their used equipment sales processes – and market them online. It will cover the sale of used mining, earthmoving

and material handling machines, mobile and crawler cranes, tower cranes, maritime cranes, concrete technology and corresponding used attachments and spare parts.

Commenting on the choice of Krank as its development partner, Daniel Hecker, Business Development Sales at LiebherrEMtec GmbH said: “We were

looking for an expert in creating marketplaces for used construction equipment – and Krank is the stand-out partner. With the relaunch of the marketplace, we will have a central platform for our global used equipment business. Customers will be able to independently search our virtual marketplace for the used equipment they need, while our sales partners will register and manage their used equipment via the platform and its associated apps.”

“The marketplace will bring together on a single platform the entire supply and demand sides of our used equipment business,” Hecker continues. “It will have the ability to combine Liebherr’s strengths of personal advice and customer relationships with the much greater visibility a global digital marketplace offers.”

uick support in emergencies – flexible and extremely agile ATLAS 140W blue mobile excavator – 15t power and effectiveness in operation – excellent performance in challenging assignments like fires, danger of collapse and securing of a crime scene. The members and experts of the Technisches Hilfswerk (THW) provide professional help in numerous situations of threat, such as fires, buildings in danger of collapsing, crime scene evidence securing and many more. They offer experience, dedication and modern equipment. The ATLAS mobile excavator and its potential are regularly put to use. Two years ago, the THW integrated 30 ATLAS 140W blue mobile excavator with 15t operating weigh into its fleet. Many of which have proven themselves in THW deployments.

Around 650 firefighters were in action to extinguish a massive fire at a recycling plant in Diez, near Limburg. Several hundred members of the THW from eight local sections and THW experts of the specialist

unit “clearing” supported them. To be able to control the flames, machineries used for clearing pulled the burning material apart.The 15t ATLAS 140W blue mobile excavator was in action here with sufficient power to pull apart heavy bales of paper, parts of the hall etc.

In Börtlingen, near Göppingen the THW was called to assist the police in enabling the securing of evidence in a specialised building business. THW’s building expert advisor assessed the situation in the hall, which was close to collapse. The roof had to be dismantled bit by bit and the ATLAS 140W blue was deployed for this task. The THW ATLAS mobile excavators are equipped with an adjustable boom. The ATLAS excavator showed, that delicate work, such as with the demolition grabber, is more than just a duty, but a pleasure. The extremely sensible and independent navigation of the accessory equipment and the boom make this possible. The delightful raw material hops becomes dangerous, once it is being turned into a fire instead of beer.

“The delightful raw material hops becomes dangerous, once it is being turned into a fire instead of beer”

Everyone knows the lyrics to the hit song ‘diamonds are a girl’s best friend, but few outside the construction business are aware of the crucial function diamonds play in the industry, where diamond tools must perform to extremely high standards.

Rock, concrete, steel and brick are some of the most challenging materials known to man, and cutting through them with immense precision requires something even harder – a diamond tool. Construction sites are fitted out with equipment designed to use optimized diamond tools to treat construction material quickly and exactly. Worldwide demand for diamond tools is projected to increase owing to spur in investments in the construction sector as well as the growing adoption of Industry 4.0. According to Persistence Market Research, the global diamond tools market totaled

$12.31 billion in 2021, and sales of diamond tools are expected to reach $26.78 billion by 2032, increasing at a CAGR of 7.4% over the next 10 years.

Strong spur in regional demand

Closer to home, the demand for diamond tools, particularly in the UAE, Saudi Arabia and the wider Gulf region will only increase, as project activity accelerates with significant spending in the construction sector on the back of still-high oil and gas revenues.

Last month, Saudi Arabia was described as the biggest construction site the world has ever known as projects valued at over $1.1 trillion are underway in the Kingdom according to real estate consultancy Knight Frank. The UAE currently has more than $650 billion of projects planned or underway, making it the second largest projects market in the region after Saudi Arabia. The UAE has also launched Operation 300 billion, a national program to develop the country’s industrial sector and enhance its role in stimulating the national economy. Operation 300 billion aims to raise the

Investment in Abu Dhabi’s industrial sector has tripled over the past year with the total value of factories that switched to the in-production stage rising to Dh3.1 billion during the first six months of 2022 compared to Dh1.03 billion in the same period last year. As commodity prices remain considerably higher and crude producers continue to accrue an oil windfall, we anticipate massive rise in construction activity and new government developments that support future economic growth in the region, which in turn will boost demand for diamond tools.

Diamond tools have been growing in popularity due to the need for high cutting speed, high precision, premium performance, high wear resistance and durable tools in all applications across many industries including construction, mining, engineering, and stone processing. And the construction industry is no

UAE industrial sector’s contribution to the GDP from Dh133 billion to Dh300 billion by 2031.exception, where diamond tools can also be used to finish and smooth out surfaces like walls, floors, and other objects, which is expected to increase demand for such tools. As new materials and sophisticated designs continue to emerge, contractors expect a superior and seamless experience from equipment used, which ultimately comes down to a feeling of confidence, control and safety when conducting their tasks in often challenging and sometimes dangerous working conditions.

The quality of the diamonds including grit size, their concentration in the segments, and the machine’s and diamond tools’ optimal performance all affect how well the equipment performs. Contrary to the popular cliche, a diamond does not last forever. The diamonds in the surface of the segments wear down eventually. At the same time as the bond is worn away to expose new diamonds, making it important that the hardness of the bond is suitable for the material to be cut. This makes designing the perfect diamond tool is an art in itself. The design of high-performance diamond tools requires extensive knowledge of diamonds, metal powders, production technologies and machines, along with deep knowledge and understanding of the way that diamond tools are used and work in practice. This is why building truly effective tools can only be achieved through close collaboration with users on site.

Husqvarna Construction is committed to a collaborative approach, providing more than nine million diamond tools every year, including saw blades, drill bits, wires, and grinding tools, to professional contractors, artisans, and machinery hire companies all over the world. Husqvarna Construction is one of the world’s top producers of diamond tools and the

only company integrating all these fields of expertise. Because adapting a diamond tool to the machine’s power, the application or type of job, and the materials that it needs to cut, is critical.

For example, users can either opt for a universal tool that works well on several different materials or an optimised tool designed for cutting a specific material. They can also pick based on which of the tool’s properties is most important to their project – cutting speed or wear resistance. High cutting speed helps get the job done quickly, with less effort. High wear resistance means longer service life in more extensive jobs. And for both high cutting speed and high wear resistance, there are premium performance tools. Husqvarna Construction’s highest-

performing diamond tools are developed especially for professional users who require maximum cutting speed and service life in all applications.

Meanwhile, Husqvarna’s heavy demolition unit has the highest knowledge in the development of custom-built diamond tools and machines for very special applications such as its very powerful Cobra® wire tool. Husqvarna is able to accommodate both small and large applications, as well as in-demand ones like cutting substantial steel structures in offshore and nuclear applications. A preferred diamond wire in the heavy demolition industry, the Husqvarna’s Vacuum Brazed wire has been developed especially for demanding applications such as cutting large steel structures in off-shore and nuclear applications (both wet and dry), giving customers peace of mind.

Ultimately, diamond tools deliver versatility that other tools cannot match. As global experts, with a continuous presence in the nuclear, offshore, chemical and construction industries, Husqvarna Construction offers innovative solutions to make even the most complex and challenging project a success. With diamond tools currently accounting for 15% to 20% share of the global tools market and anticipated to expand 2X between 2022 and 2032, according to Persistence Market Research, we foresee significant growth in demand for new cutting-edge diamond tools in the Gulf and wider Middle East region. For professional contractors in the construction business, using cutting-edge technology and choosing the suitable optimised diamond tools will be vital to higher productivity and efficiency, making diamonds their ongoing genuine companion.

“Diamond tools have been growing in popularity due to the need for high cutting speed, high precision, premium performance”

The Kingdom of Saudi Arabia sits at the heart of minerals crossroad called the Arabian-Nubian Shield; this continent-crossing seam is estimated to contain $1.3 trillion worth of potential minerals across numerous commodities, including copper, phosphate, gold, iron ore and rare earth minerals.

The sixth largest phosphate producer in the world and the largest gold producer in the Middle East, with 20 million ounces of gold reserves below ground, the Kingdom of Saudi Arabia has invested billions into the sector as part of its plans to reduce its economic reliance on the oil and gas industry. To achieve its ambitious Saudi Vision 2030 plan, it has recognised that it still needs to be partnering with mining experts from across the globe if it is to expand and develop the $17 billion sector.

Last month’s Future Minerals Forum was an opportunity for KSA to update the mining community on its progress and invite many of the world’s leading experts and exponents of cutting-edge technology. As such, it was a valuable opportunity for Invest Northern Ireland to showcase the country’s worldclass innovations in Mining, Quarrying, and Bulk Materials Handling Machinery.

“Investment in mining forms part of the country’s Vision 2030, which aims to make the sector the third pillar of the national industry in compliance with the objectives of the National Industrial Development and Logistics Programme,” explains Amit Jain, Sector Lead – Engineering, Middle East and India at Invest Northern Ireland, following his return from the organisation’s participation at Future Minerals Forum in Riyadh, Saudi Arabia.

Jain tells CMME that the week proved useful in connecting Northern Irish companies with regional stakeholders.

“Invest Northern Ireland is the regional economic development agency for Northern Ireland and is committed to working collaboratively with key partners in the Materials Handling and Mining industry to help companies from Northern Ireland trade more effectively in the region. With our office presence in Jeddah, we support businesses from Northern Ireland explore relevant opportunities and partners in Saudi Arabia,” comments Jain.

He adds that the Northern Ireland industry has specific areas of expertise that are needed for the Saudi Vision 2030 programme, such as mobile crushers and screeners, bulk materials handling systems, stockpilers, remote monitoring sensors for vibrating m/cs, conveyor belts, ultra-fine recovery plants, tailings management, sand and aggregate washing machinery, jaw crusher un-blockers, spare parts, and more.

“Northern Ireland has a lot to offer the mining sector in Saudi Arabia,” adds Jain. “It is a recognised

“In Northern Ireland, you will find engineering and manufacturing excellence supported by a comprehensive supply chain and fused with a close collaboration with government and academia. Solutions are reliable and high performing always deliver economic and environmental benefits. The unique cluster of solution providers excel at engineering, innovation and are truly global. Northern Ireland’s unique cluster

leader in the design and manufacturing of mining and quarrying machinery, particularly in the tracked mobile crushing and screening equipment segment, which accounts for 40% of the total global market. Furthermore, companies like CDE Group, Powerscreen, and Sensoteq – all present during the event,are already well-regarded in their respective fields and ably supported by one of the world’s most successful clusters of over 100 engineering companies, developing state-of-the-art equipment and machinery for exports globally.

“Northern Ireland also has an innovative cluster of companies developing and delivering solutions for the global mining Industry. These successful companies are well-supported by a comprehensive and competitive supply chain. Invest Northern Ireland is assisting them in developing business opportunities in emerging markets and expanding into various regions, including India, the Middle East and Africa.”

Powerscreen, for instance, has supplied Mobile Crushing and Screening machines for Limestone and Gypsum Mining in Oman. Powerscreen’s Regional Sales Manager (ME&EA) Imran Kazi describes the firm’s attendance at the event as presenting opportunities ‘beyond the horizon’ in the Saudi market.

“It was an eye-opener for many and will surely act as a change agent when it comes to perspective on Saudi Arabia’s construction and mining industry; we wouldn’t be surprised to see the event turning into the leading construction and mining industry show of the region in the next couple of years and look forward to attending and participating in the upcoming events. It was a great opportunity and a must-visit show for professionals from all construction and mining industry segments.” comments Kazi.

Fellow Northern Ireland firm CDE Group successfully delivered Silica Sand washing plants to Muadinoon Mining Company in 2021; the Regional Manager for MEA Ruchin Garg stated on their participation: “It was an interesting event showcasing Saudi’s potential in the mining/mineral sector. We truly believe in Saudi

excels at engineering and innovative global world-class products which have applications across different sectors including construction, mining, quarrying, demolition, ports, agriculture, airports and recycling. We take pride in continually adapting and investing in R&D to meet the needs of global customers. As every material, geography, climate and site presents different challenges, we do not just sell machines, we provide solutions in collaboration with customers.”

Arabia’s potential for our business in the region and will be keen to engage at different levels.”

Speaking of the event, Idir Boudaoud, CEO of Sensoteq, commented: “I had the pleasure of attending the Future Minerals Forum in Riyadh, which showcased the pace and scale of the region as it embarks on an ambitious mineral growth strategy. The potential for the Kingdom to establish itself as an international mining leader is strengthened by the sovereign wealth (PIF) joint venture with Ma’aden, which will directly invest up to US$3B in international iron ore, copper, nickel, and lithium projects.”

“Sensoteq first entered the Saudi Arabia market in 2022, providing condition monitoring technologies for the Oil and Gas industry. As the Kingdom embarks on strategic growth within the minerals space, we look forward to supporting the digitalisation of new and existing mining operations to facilitate maximum mine machine productivity,” Boudaoud adds.

• Manufactures over 40% of the world’s tracked mobile crushing and screening equipment.

• More than 8,000 people in over 100 companies in sector.

• 60 years of global leadership in Mobile Bulk Materials Processing equipment.

• Products operate 24/7 in the most demanding markets and harshest environments – from -40 to 50° C.

The January showcase ably demonstrated what Northern Ireland has to offer as a vibrant and highly sophisticated advanced manufacturing and engineering sector to the region.

“Northern Ireland machinery manufacturers can help Saudi mining companies optimise their materials handling operations,” enthuses Jain. “As well as providing a great platform, the event also helped our in-market staff expand their knowledge of the sector and meet potential end-users and equipment distributors in the mining sector.”

We will see greater collaboration between Northern Ireland firms and Saudi stakeholders in the near future,” states Jain. “The preferred route to market is through local Saudi distributors who can offer 24x7 aftermarket support. Invest Northern Ireland will work closely with in-market heavy machinery distributors and Northern Irish manufacturers and help facilitate their introductions for long-term associations.”

On 6 February, two massive earthquakes registering 7.8 and 7.5 on the Richter scale hit Diyarbakir, Turkey leaving more than 40,000 people dead and widespread devastation across the country and neighbour Syria. As after tremors continued to cause destruction, the equipment industry moved at a rapid pace to step in and help find survivors in the rubble.

The first call for help came from the Turkish Contractors Association (TMB) asking its members to mobilise their construction equipment and aid the rescue mission.

“It is important to reach the citizens under the rubble within 48 hours,” urged the TMB as the recovery of victims was made even more difficult with snow and heavy rain stalling rescue missions surrounding the hardest hit regions in Turkey and northern Syria.

“We offer our condolences to the relatives of those who lost their lives in the earthquake and a speedy recovery to the injured. We convey our best wishes to all of Turkey,” added the TMB in its statement to the media. It became quickly apparent that this was a disaster not seen for several generations in the area and soon rescue teams and individual nations including France, Germany, the US and the UK were offering their assistance. Reports initially estimated

casualties in the region of 5,000 people but it was soon clear that thousands more were in trouble and likely killed during the devastating event.

“We always see the same thing with earthquakes, unfortunately, which is that the initial reports of the numbers of people who have died or who have been injured will increase quite significantly in the week that follows.”

Fortunately, the international machinery community was also soon stepping up to rush equipment to the hardest hit areas.

Within hours Doosan Bobcat said it would provide construction equipment for relief and recovery activities in the earthquakestricken areas of Turkey.

In a statement, the company said that US $1mn worth of equipment would be promptly delivered through its dealer network, so as to be of practical help in lifesaving activities in affected areas, and to help restore critical infrastructure such as collapsed buildings and roads.

Doosan Group promised that the corporation would send around 1.25 billion won ($1 million) worth of Doosan Bobcat’s construction equipment for disaster relief in Turkey.

Doosan planned to promptly deliver the equipment, with the support of a local contractor, to be used for rescuing people and restoring basic infrastructure such as roads and buildings. The equipment would be delivered includes skid loaders and excavators to remove debris and portable power generators and lighting equipment

It became quickly apparent that this was a disaster not seen for several generations in the area and rescue teams needed to be spread across a vast area.

“It became quickly apparent that this was a disaster not seen for several generations”

to be used at sites with no electricity.

Doosan Group has provided its equipment and donations to disaster relief sites in the past, including for Hurricane Katrina in 2005, earthquakes in China in 2008, in Haiti in 2010 and in Japan in 2011, a typhoon in the Philippines in 2013 and another earthquake in Indonesia in 2018.

“We hope these can provide practical help in disaster relief and damage repair,” a spokesperson for Doosan said.

HD Hyundai was also soon responding to the disaster pledging to provide ten mid-size excavators through its local dealer to the regions hit by the earthquake.

“We hope the aid can provide some help for a quick recovery,” an HD Hyundai spokesperson said in a press release on Wednesday. “We hope that local residents will be able to return to their peaceful, daily lives as soon as possible.”

Hyundai Motor’s Turkish subsidiary, which runs its own manufacturing operation in Turkey also said it will send $500,000 in relief aid to the earthquake-ridden region. The corporation also rushed in $50,000 worth of equipment for rescue operations and use the other $450,000 for the purchase of rescue equipment and relief supplies for victims in consultation and through Turkey Disaster and Management Authority (AFAD).

Japan’s Bridgestone expressed “its deepest sympathy to all the people affected by the earthquake” and wished for a speedy and full recovery for the people and communities. It also said it would donate one million dollars through the Red Cross

The TMB said that the first 48 hours were critical in the search for survivors. Fortunately, they were soon getting aid from the machinery community.

and a local foundation to support relief and rebuilding efforts for the people and areas affected by the earthquake. Brisa, a joint venture of Bridgestone Corporation and Sabanci Holdings and Turkey’s tyre industry leader, also rapidly provided needed supplies to the affected areas.

Chinese manufacturer XCMG’s own Turkey subsidiary, which is stationed in Ankara, the capital of the country and 700km from the epicentre set up an emergency rescue group immediately following the earthquake

led by Liu Jiansen, VP of XCMG Machinery and general Mmnager of XCMG Import & Export Co., Ltd. The group said it had been keeping in close touch with the frontline and dispatched rescue teams around the clock.

XCMG has approximately 600 units of excavators in Turkey, and XCMG Turkey activated their emergency response protocol immediately and reported the local situation to XCMG headquarters, while coordinating three XCMG excavators that were deployed near Gaziantep to deliver aid in the disaster area.

XCMG Turkey said it reached out to multiple parties and arranged 12 units of excavators and loaders of different tonnage from close proximity to stand by, while actively answering to the call of the Chinese embassy in Turkey and General Chamber of Commerce of Chinese Enterprises in Turkey (the “Chamber”) to coordinate resources and provide assistance.

During the day following the initial earthquakes, a family of three were located and trapped in a collapsed three-story building in Iskenderun, Hatay Province. XCMG sent out an excavator immediately for the rescue mission.

Working for eight hours non-stop, operator Kerim Cesur cautiously removed the collapsed floor, bricks and rebars and successfully saved the family.

The following day an XCMG rescue team traveled 20 hours to Kırıkhan, Hatay, one of the most remote regions where the roads were seriously damaged by the earthquake, with freezing rain in low temperature.

“It is important to reach the citizens under the rubble within 48 hours”

Operator Nevrez Ünsal saved two residents trapped from two collapsed buildings and fellow XCMG operators – and father and son – Talip Öztürk and Emre Öztürk, arrived in Gölbaşı, Adiyaman as first responders and worked over 10 hours to save a child from the ruins.

Over 100 XCMG staff and dealers were mobilised to help with the earthquake rescue. And as a member of the Chamber, XCMG Turkey also arranged flights, accommodations and supplies for rescue teams departing from China to aid the earthquake relief operation.

In the five hours after the first earthquake, XCMG purchased the first batch of recuse supplies, including blankets, baby products, hygiene products and more that total over 50,000 Turkish lira and delivered them to the hard-hit area at once, while working with local clients and dealers to deploy excavators, cranes and loaders and arrange operators to provide assistance.

“We also joined the TMB and signed up with the local authorities, prepared to respond to emergency rescue at any time,” said Liting Jin, country manager of XCMG Turkey. “The Turkish government has requisitioned all handcarts and transportation vehicles, the XCMG equipment has arrived in disaster areas to aid rescues, and we are also coordinating with our clients in Turkey to bring more assistance.”

As the rescue turned to questions about why homes and infrastructure in a vulnerable area were unable to withstand the quake, the TMB announced 100 people had been

arrested in allegations related to building standards. It added that the industry would donate 1% of the cost of the public rebuilding efforts in 2023, amounting to $0.25 billion.

“As the Turkish Contractors Association family – the contracting companies that have completed the most important projects in our country – we have decided to contribute to the reconstruction effort, in order to meet the housing needs of our more than one million citizens who have become homeless, as soon as possible.

Rescue teams worked through the night to clear rubble in the hope of finding survivors in the stricken areas. It was soon clear that fatalities were far higher than first thought.

“Public contractors, who are not members of our Association, with whom we had the opportunity to share our decision, also stated that they agree with our proposal.”

“Our companies have also opened construction site facilities in the region to meet the shelter and food needs of our citizens in the disaster, and they have started to work on the establishment of container and tent cities and have sought to supply a large number of food and necessities.”

“We hope these can provide practical help in disaster relief and damage repair”

The impact of COVID-19 continues to affect shipments of forklifts as economic turbulence and government policies to tackle spending and inflation.

“By 2029 global shipments of forklifts are predicted to exceed 3 million a year, with APAC expected to account for 52% of the total”

The global forklift market is expected to experience consistent growth of 4%-5% over the 10 years out to 2032. But new research shows that worldwide economic turbulence and inflation continued to curtail growth in 2022. According to Interact Analysis’ Global Forklift Market – Dec 2022 report, although growth was lower in 2022 than previously forecast (4% versus 8% in the previous edition), the overall forecast remains robust and consistent over the ten-year period. Growth in forklift shipments plateaued in 2019, having been at a low level for several years. The Covid-19 pandemic,

supply chain constraints and delays in project completion caused a widening gap between order intake and shipments. Shipment growth is set to continue in 2022 and 2023, as most suppliers are still processing 2021 orders. However, there is a 10% decline in orders forecast for 2022. In addition, prices are being driven up by rising materials, energy and logistics costs, as well as by the war in Ukraine and Covid lockdowns in Asian countries.

The impact of COVID-19 continues to affect shipments of forklifts – not only economic turbulence and government policies to tackle spending and inflation – but also, the control measures in APAC have led to a low production rate which in turn worsens delivery efficiency. The ongoing war in Ukraine is also negatively affecting sales globally, particularly

within the European region. All these factors have weakened investment in large-scale factory and warehouse automation projects and made investors more cautious. This cautiousness continues among both manufacturing and warehousing automation customers throughout 2022 and is expected to carry into 2023.

However, the core driver for forklift market growth has not changed: the continuing rise in labor costs is placing pressure on companies to push ahead with their automation plans and reduce demand on manual labour. As a result, demand for automation equipment is set to continue rising steadily over the long term. Electrification will continue to be a key trend in the global forklift industry.

Within the EMEA region, automation investment in Eastern Europe has increased sharply in recent years, but the war in Ukraine is expected to constrain growth in the short to mid-term (2022 and 2023). Within the Americas, rising inflation and interest rates have led to caution among investors when it comes to large-scale automation projects. And in the APAC region, repeated Covid-19 waves and lockdowns in Asian countries, have caused a sharp decline in forklift shipments following two years of growth. This decline is expected to continue into the first half of 2023. From 2023, shipments in APAC will grow with a CAGR of 5.3% to 2027. Investment in all regions is expected to resume as inflation eases and global

The material handling market overall is expected to show strong growth out to 2026. Shipments of forklifts with traditional engines will decline over the decade.

uncertainty subsides.

Maya Xiao, Senior Analyst at Interact Analysis, comments, “After 2021’s sharp recovery, 2022 was a ‘cold’ year for the global forklift market, with problems in all regions. APAC registered the lowest growth accounting for 50.4% of total shipments.

By 2029 global shipments of forklifts are predicted to exceed 3 million a year, with APAC expected to account for 52% of the total.”

“Electrification, particularly Li-ion

battery technology, is a growing trend that is showing no signs of slowing down as markets for new energy vehicles continue to boom. This is expected to continue within the global forklift industry, as shipments of forklifts with traditional engines decline over the next 10 years and electrified vehicles take their place.”

` In 2020, the sector accounted for 25% of the market, this will increase to 28.8% by the end of the forecast period. At a CAGR of 8%, material handling will outpace growth of the overall market which will show a CAGR of 5.3%. Ongoing supply chain issues caused knock-on effects for mobile hydraulics last year.

For example, the average selling price of hydraulics increased between 2020 and 2022 after a period of erosion. This is due to volatility in material prices, such as aluminum, which is now forcing the average selling price of hydraulic components up, which out to 2026 will increase between 1.6% and 2.1% annually.

Brianna Jackson, Research Analyst at Interact Analysis comments, “One thing that came as a surprise when conducting this research was that vehicle electrification is not driving the increased demand for hydraulic substitutes at the rate we expected. Many OEMs are still prioritizing cost over efficiency. Even in applications where replacing hydraulics with an electro-mechanical counterpart seems most feasible, uptake has been slow as vehicle OEMs are reluctant to make changes to vehicle architectures.

“Although the hydrogen vehicle market is very much in its infancy some significant developments are being made”

Improvements to hydraulic architecture are being overlooked by vehicle OEMs, yet, without these improvements, full electrification for off-highway vehicles will be virtually impossible. Despite this, by the end of the forecast period we expect that the average selling price of hydraulic components will increase slightly as a result of an increase in demand, when OEMs finally begin to attach more importance to efficiency.”

The COVID-19 pandemic shook the mobile hydraulics market in EMEA and the Americas. In 2020, these regional markets contracted by -9.7% and -3.2% respectively. EMEA’s share in the agricultural machinery production market (a dominant user of hydraulic equipment) has since eroded. However, a boom in the material handling sector in the region will boost the hydraulics market significantly. Both EMEA and the Americas rebounded in 2021, and this is expected to continue into 2022 as order backlogs are met.

APAC showed impressive growth throughout the past two decades and accounted for 50% of the market in 2020. Despite this, growth in Asia will stabilise as the regional market matures.

Whilst 2022 was positive for the APAC regions, growth is likely to decelerate as a result of a slowdown in the construction sector. Towards the end of the forecast period, the research shows that growth in the Americas will pick up exponentially because of the major infrastructure overhaul scheduled for 2026.

While the electrification of the materials handling market has been a phenomena decades in the making, hydrogen is also being seen as a viable alternative.

In fact the off-highway market is currently led by forklifts, but Interact Analysis is beginning to see some traction from larger vehicles, including haul and dump trucks, and excavators.

North America is the largest market for hydrogen forklifts, with retail companies such as Walmart and Amazon the main

As the world emerges from the aftermath of the COVID-19 pandemic, updated research by Interact Analysis reveals that the off-highway vehicle market has experienced strong growth. In part, this has been driven by a pandemic ‘bounce-back’.

However, a huge uptake in electrified forklifts and material handling equipment, and a strong construction industry are also fueling growth. Despite this, global events such as the Ukraine-Russia conflict and ongoing supply chain disruptions are expected to have a continuing impact on the off-highway vehicle market.

In particular, the Chinese offhighway machinery market

suffered a difficult year in 2022.

In the long term, market growth for the off-highway vehicle sector looks set to remain positive due to strong investment in warehousing solutions, India’s pledge to mechanize agriculture and the US’s investment in infrastructure.

In the short term, the extended lockdown period in China has had an unprecedented downward impact on market growth within the APAC region, while ongoing freight delays and component shortages have impacted the ability of manufacturers to meet demand.

In 2022, OEMs experienced very strong order intakes, but due to supply chain disruption were unable to fully meet market

customers. Europe, Japan and China are also developing demonstration projects for hydrogen forklifts but on a much smaller scale compared with North America. Government policies in China will increase China’s share in this market over the coming years.

By 2030, over 20,000 hydrogen forklifts are forecast to be shipped in China, double the figure for the US. Early developments are also being made in the hydrogen rail, maritime and aerospace markets but developments will be limited this side of 2030.

Marco Wang, Research Analyst at Interact Analysis says, “Although the hydrogen vehicle market is very much in its infancy some significant developments are being made. By 2030 the global market will look very different and much more consolidated.

“The TCO of hydrogen vehicles currently makes them unfavorable compared with traditional diesel alternatives,” adds Wang. “But the cost competitiveness of fuel cell powertrains will improve substantially when the demand scales up. Hydrogen availability is also an issue. But the commitment and ongoing actions of government authorities dedicated to hydrogen infrastructure provides a positive look on the future. More importantly, we really need to decarbonize vehicles where a full battery has proven unfeasible and fuel cell technology is the exclusive zero emission solution for them.”

demand, restricting growth.

The Chinese market performed worse than Interact Analysis forecast back in 2021 due to the country’s strict covid policies. Nevertheless, as the country represents the largest market for off-highway machinery it is expected to bounce back well in the coming years. This has led Interact Analysis to be more bullish with their forecasts for global electrification.

Electrification – and other alternative fuels - within the off-highway market is now well established. Almost all machine manufacturers have at least one - often several - battery electric or hydrogen models available

to purchase or in the pipeline. Although hydrogen powertrains are becoming established in some material handling applications and in larger equipment, it is battery electric powertrains that are forecast to dominate in the long term when it comes to alternative powertrains.

Alastair Hayfield, Senior Research Director at Interact Analysis, comments, “It’s promising to see that even some of the larger machinery types such as excavators and haul trucks are being electrified. Smaller machinery electrification has paved the way for this, enabling OEMs to experiment before moving on to larger, more complex machinery.

07 March 2023

About the

Wave upon wave on new generation machinery is constantly changing even the most basic aspects of access and handling. But do you know the working practices this equipment requires and how to reap maximum return from this strongly mechanised culture?

The Access & Handling Summit assesses the impact of increasingly ‘smart’ machines, bound together by the Internet of Things, and presents detailed accounts of safe, efficient working – always focusing on real-world applications and the routes to best practice.

There is also a unique showcase of the latest equipment and inaction demonstrations of features and capabilities.

The event presents you with an opportunity to interact with regional industry decision makers and influencers. There are several innovative ways to sponsor, from interactive live polls to session background branding, and from lead generation campaigns to presentations. Contact us now for detailed information.

The one-day conference will feature high quality dialogue and provocative discussions; we will be hosting leading names from across the region, providing a terrific opportunity to see how the realities behind the major debates are progressing.

The latest releases from the world of construction machinery.

How has the US market evolved since the last CONEXPO event in Las Vegas?

The brand formally known as Terex Trucks showcases its range at CONEXPO for the first time as Rokbak.

TOP

Ten basic steps to carry loads without causing a hazard.

The history of the brothers who pioneered compact loading equipment.

NEW IMPROVED ROBUSTNESS AND THE FUEL EFFICIEN T D24 STAGE V ENGINE COMMON IN ALL NEW DOOSAN MINI EXCAVATORS.

Doosan has launched the new DX85R-7 8 tonne mini-excavator, the latest addition to the company’s next generation range of Stage V mini-excavators. The DX85R-7 reduced tail swing (RTS) excavator is designed to offer maximum performance, optimum stability, increased versatility, enhanced operator comfort, controllability, durability, ease of maintenance and serviceability.

The DX85R-7 utilises a newly improved upper structure platform offering increased durability and robustness and a different boom swing cylinder layout resulting in an increased boom swing angle of 60o. Together the RTS design and boom swing angle make

the DX85R-7 ideal for work in confined spaces on projects in construction, landscaping, utilities, rental, agriculture, recycling, waste and many other areas.

The bucket digging force of the DX85R-7 is 6.7 tonne and this is combined with a traction force of 6.6 tonne, whilst travel speeds are a mobile 2.9 km/h in the low range and 4.8 km/h in the high range.

Sharing the new global styling common to new Doosan mini-excavators from 2-10T, the DX85R-7 is powered by the Doosan D24 Stage V compliant diesel engine providing 65 HP of power at 2100 RPM. As a result, it offers fuel efficiency, among the best in its class. It also combines exceptional power output and high torque at low RPM, more than 9% more than the previous DX85R-3 model. A combination of Diesel Oxidation Catalyst and Diesel Particulate Filter aftertreatment methods ensure compliance with Stage V regulations. The DPF offers a 25% increased ash cleaning period of 5000 hours compared to the DX85R-3. With a height to the top of the cab of over 2.6 m and a width of 2.25 m, the new cab on the DX85R-7 is especially roomy and comfortable, providing excellent operator comfort and controllability. The cab has a full glass entry door to maximise operator visibility on this side of the machine from inside the cab. The four standard high luminance LED work lamps on the cab further enhance visibility.

THE INTEGRATION OF LATEST AFTERTREATMENT SYSTEMS

FEATURES THE SINGLE MODULE AND SWITCHBACK, WITH COMBUSTION AND AIR HANDLING TECH.

Cummins has unveiled a new generation of clean off-road engines that meet China National Stage IV emissions (CS IV) which started in December. The upgraded engines, with displacements from 2.8 to 15-liters, range from 48-674 hp (36-503 kW). They achieve higher power output and torque than their predecessors, and continue to bring proven, premium performance ideally suited for the toughest duty cycles.

The integration of latest aftertreatment systems, the single module and switchback, with leading combustion and air handling technology allows the B6.7, L9, X12 and M15 CS IV engines to be EGR free, offering benefits of improved NOx conversion efficiency and better fuel economy. Multiple configurations fit diversified off-road applications with easier installation into equipment, service and maintenance.

“Cummins provides a broad and diverse product portfolio in off-road market to ensure we are compliant in all applications and geographic markets,” said Jason WANG, Cummins VP of Engine Business Unit of China. “We are uniquely positioned to be the right value partner for OEM customers as they seek dependable and all-around solution to meet both stringent emissions standards and tough requirements on economy and performance.”

“Cummins has invested in China for almost half a century,” said SU Zimeng, chairman of China Construction Machinery Association (CCMA).

60o improvement in new 8t mini excavator over the previous models

BETTER OPERATOR EXPERIENCE WITH A LARGER ENTRANCE, AND MORE CABIN AND FOOT SPACE THAN THE EARLIER KX71-3S.

Kubota Tractor Corporation is expected to start selling its newest robust compact excavator, the KX030-4, in the US next month. The new KX030-4 replaces the KX71-3S in the 2-3t segment and is reportedly designed with landscape and construction operators in mind, the new KX030-4 will be available at authorized Kubota dealers beginning in March 2023.

“The new KX030-4 delivers increased breakout and lifting force while decreasing the overall weight of the machine, making for easier trailering and transport between jobsites,” said Bill Holton, Kubota product manager, construction equipment told the media in the US. “With more than 500 pounds (0.25t) of additional bucket breakout force than the KX71-3S and nearly 300 pounds (0.15t) more lifting

force, the KX030-4 will be a great asset to the rental, landscape, and general construction and utility markets.”

The excavator is powered by Kubota’s direct-injection diesel engine engineered to “maximise digging and lifting performance while minimizing noise, vibration and fuel consumption.”

Available in both canopy and cab models, the new KX030-4 provides 24.7 horsepower, a working range that includes a digging depth of 9 ft., 7 in., and a bucket breakout force of just over 3t. The KX030-4 auto-downshift feature allows the operator to travel in second speed and make turns without having to manually downshift, all while traversing a jobsite for better travel and increased productivity. A hydraulic diverter valve is located on the dipper arm and comes standard on the KX030-4, allowing operators to easily switch between

attachments with the turn of a wrench. The standard third-line hydraulic return system allows oil to return directly back to the tank without flowing through the control valves resulting in less back-pressure, less heat and greater efficiency. The work light is positioned under the boom for better protection and increased visibility.

0.25t

A spacious interior is designed to create a better operator experience with a larger entrance, and more cabin and foot space than the KX71-3S. A large, easyto-read digital operator instrument panel is conveniently positioned in the lower right corner of the operator’s line of sight to seamlessly monitor current working conditions, engine RPM, temperature and oil levels. The front glass window of the KX030-4 opens “with ease by flipping the latch and sliding up, while the deluxe suspension seat and cup holder optimise operator comfort.”

New compact excavator is capable of an extra 0.25t of bucket breakout force compared to the KX71-3S

THE MCT 1005 M50 ALLOWS FOR THE HANDLING OF AN IMPRESSIVE 8T AT THE END OF ITS MAXIMUM 80M JIB.

Manitowoc has debuted the Potain MCT 1005 M50, the largest topless tower crane to be manufactured at its Zhangjiagang facility in China. Designed for use in emerging markets and Southeast Asia, and boasting a huge 50t capacity, the crane is available with a choice of three counterjib options that will further enhance its seamless integration into confined jobsites. The MCT 1005 M50 allows for the handling of an impressive 8t at the end of its maximum 80m jib, which is configured from 11 sections of either 5m or 10m in length. Only three sections are required to deliver its shortest configuration of 20m, at which distance it can lift its full 50t. The same maximum capacity is also available between 3.5-16.8m when the jib is built to 80 m, or from 3.5 - 25.2m when the jib is 30m in length. Many customers will also appreciate the option of configuring the crane with the 45 m jib, which delivers a hefty 24.8 t maximum capacity at the jib end.

These heavy payloads are supported with counterjib options of 15m for jib configurations of up to 45m; 17.5m for jib configurations of up to 55m; and 20m when working with jibs from 60 to 80m. This aids the crane’s ability to work in proximity to other cranes or nearby structures.

THE BULLDOG, WHICH IS 10.9M LONG, IS DESIGNED TO WORK IN CONFINED AREAS, AND ITS FORWARD DISCHARGE CONVEYOR SYSTEM RETRACTS TO GIVE AN 2.5M WIDTH MAKING IT IS EASY TO TRANSPORT.

Mastenbroek will unveil its first-ever utility trencher designed specifically for North America at CONEXPO-CON/ AGG 2023 next month.le. The leading designer and manufacturer of selfpropelled trenchers and crawler trucks will use North America’s largest construction trade show to unveil the Bulldog, a small footprint, compact yet incredibly powerful trencher designed to meet the need of utility cable and pipeline layers. The Bulldog, which is 10.9m long, is designed to work in confined areas, and its forward discharge conveyor system retracts to give an 2.5m

width making it is easy to transport.

Borrowing much of Mastenbroek’s engineering prowess from the existing 17/17 trencher, the new Bulldog features a new engine and enhanced digging mechanism.

The new US-specific trencher features a US EPA Tier 4 final compliant Volvo 8-litre engine offering the ideal combination of power, efficiency and emissions

Complementing the Volvo engine is a new diesel hydrostatic drive system developed by Mastenbroek to power the new heavier digging mechanism, which can achieve the six-foot trench depth required by US cable layers.

T-4

The new US-specific trencher features a US EPA Tier 4 final compliant Volvo 8-litre engine

The Bulldog also features an offset cutting head and forward swing conveyor making it ideal for operating in cities and on highways where access is restricted and excavated material needs to be loaded onto trucks for removal offsite. A steerable undercarriage enables curved trench lines, and the track lift allows the machine to straddle raised pedestrian walkways. Mastenbroek’s commercial director, Christopher Pett said:

“The Bulldog has been designed with the needs of companies laying underground power cables along the west coast of America firmly in mind.”

Give your fleet the benefit of sustainability with innovative engine oil for heavy-duty diesel vehicles with 200+ approvals

Always check ground conditions before any lift operation is started. A crane is as good as the ground it is stood on – weather, such as ice or rain can change ground conditions quite quickly, making jobs inefficient or dangerous.

Mobile cranes are expensive pieces of machinery – it takes skill and care to operate a crane correctly. But safety can also play a vital role in operating a mobile crane; in the wrong hands, a mobile crane can be dangerous, says Atilda Crane Hire.

MOBILE CRANES CAN BE A HAZARD IN THE WRONG HANDS. A MISTAKE COULD NOT ONLY BE COSTLY BUT DANGEROUS

DON’T SKIP INSPECTIONS, THEY ARE ESSENTIAL TO SAFETY

You should also do a full inspection of the crane before each use – checking for any mechanical, electrical, structural or hydraulic issues.

MAKE SURE YOU ARE USING THE RIGHT OUTRIGGER SET-UP

Ensure that the correct pads and cribbing are used for the lift operation to avoid outrigger fail or a sink.

STOP

If something doesn’t feel right during a lift; stop and reassess the situation, is there a safer way to do the task?

09

LISTEN TO THE SAFETY WARNINGS… Few operators ever sit in the cab without having to hear an alarm go off. Frustrating while it can be, never ignore it and never override the computer in a mobile crane.

DO NOT IGNORE THE FUEL GAUGE Before starting the crane, double check fuel and other fluids that may need to be replenished.

...BUT DO IGNORE THE PHONE PINGS

Never use a mobile phone whilst operating a mobile crane. You wouldn’t use a phone whilst driving on a car – it’s the same thing.

VOLVO SAYS ITS PRIMED TO ITS DEMONSTRATE ROAD TO NET-ZERO IN LAS VEGAS AS IT LOOKS TO THE FUTURE

The first post-COVID, CONEXPO is looking like a big deal for some Volvo Group brands. This is exemplified by the two strands to engine-maker Volvo Penta’s presence at the US’ big machinery show. As you would expect, the company will be majoring in its electric progress, but there is also a message to the industry that it must collaborate if it is to developed at pace in the years ahead.

Visitors at the Volvo Penta showcase will see its technologies and service offerings in Las Vegas. It is a range that has evolved with helping to support both the current demands to reduce emissions and the future business needs of construction and mining customers, as well as those operating in a range of other industrial applications.

As part of the Volvo Booth, F8926 in the Festival Grounds, Volvo Penta will demonstrate its electric driveline alongside its current portfolio of ultra-efficient Stage V and Tier 4 Final combustion engines –the D5, D8, D13 and D16.

In addition to leveraging an array of proven technologies from across the Volvo Group, the innovative electric driveline solution would not have been possible without the firm foundation provided by Volvo Penta’s more mature power solutions and the expertise of the company’s engineers. Volvo Penta will also highlight how it’s delivering in its service offering, focusing on creating value with customers through connected solutions.

On top of all this, Volvo Penta will unveil the expansion of a collaborative partnership with one of its customers. The North American OEM will showcase a new concept machine powered by Volvo Penta. No further details are being announced at this stage, but it’s an exciting new concept not to be missed promises the company’s top team.

“We are looking forward to unveiling the expansion of our collaborative partnership with one of our OEM customers at CONEXPO,” says Fredrik Högberg, President of Volvo Penta North America.

“In order to succeed on our transformation journey into new, sustainable technologies to meet the industry’s net-zero ambitions, as well as achieve the Science Based Targets initiative (SBTi) for net-zero value chain emissions by 2040, we believe that strong

collaboration with customers and partners is crucial.

“We cannot deliver the changes that need to happen alone – that’s why we are working closely with our customers, supply chain partners, governments, societies and other stakeholders.”

A popular choice in a wide range of machinery from excavators and underground mining trucks to crushers and screeners, Volvo Penta’s industrial combustion engines have been proven and optimized to meet customer needs in terms of productivity, uptime and total cost of ownership (TCO). Passive regeneration of the aftertreatment system eliminates unplanned stops during operation, while fuel consumption has been reduced by up to 5% over the previous models.

Since 2016, Volvo Penta’s industrial engines can run on renewable diesel (HVO), enabling a more sustainable choice. Further supporting customers who are looking to transition to lowcarbon solutions, is Volvo Penta’s dual-fuel hydrogen engine – an evolution of the company’s proven D8 model. The engine mainly uses hydrogen as a renewable fuel source and reduces CO 2 emissions by up to 80%, without impacting power or performance. Volvo Penta will continue to evolve its engine range to run on compatible alternative fuels, enabling the transition towards lower-emissions in those markets that cannot yet support fully electric solutions.

Another aspect of Volvo Penta’s transformation journey is its growing foothold in electromobility as a system supplier. Volvo Penta’s electric power solutions are backed by connectivity to help customers actively monitor the health of their drivelines in a predictive way throughout their lifespan.

“No matter where customers are on their transformation journey, Volvo Penta can offer solutions to meet their machine, application and business needs,” concludes Fredrik. “We work closely with our customers and form long-term partnerships to create purpose-built power solutions based on their requirements.

“As part of the Volvo Group, we leverage proven technology, investments and competence from Volvo Trucks, Volvo Buses and Volvo Construction Equipment. We combine this with our customer, market and application knowledge, allowing us to optimise designs and technology for specific machines and

applications, considering the duty cycles, climate and environment in which they will operate.”

It has been almost a decade, nine years, since Terex Trucks was scooped up by Volvo but only two since the heavy hauler family was formally renamed Rokbak.

While the brand has been at Bauma since then, next month marks the first time that Rokbak will bring a pair of its massive trucks

and a strong team to CONEXPO in Las Vegas. Those familiar with the history of the brand will know that despite its non-descript global name, its reputation is founded on its steel and girder Scottish heritage. This, however, will be an opportunity to show exactly how the brand has become a major mover in both in the US and global market.

The Scottish articulated hauler manufacturer is bringing both its RA30 and RA40 models to the largest construction show in North America, providing attendees

with the chance to get up close and personal with the earth-moving machines and demonstrate exactly how they can offer grounded ‘Rok-solid’ performance Stateside.

“We cannot wait to get back to CONEXPO and give the RA30 and RA40 pride of place on our stand,” says Paul Douglas, managing director, Rokbak.

“We’re looking forward to getting as many attendees interacting with what we’ve got lined up as possible, as well as introducing people to our knowledgeable team who are keen to show off our robust and hardworking haulers. Rokbak will be there to show customers first-hand the quality our machines and why we’ve become known as one of the most reliable and trusted articulated hauler manufacturers in the market.”

Rokbak, which was previously known as Terex Trucks, will be located at Booth F8926 in the Festival Grounds, together with fellow Volvo Group companies Volvo Construction Equipment and Volvo Penta.

The company says, CONEXPO will be the perfect opportunity to highlight the machines’ abilities to benefit construction projects, talk to customers about how the haulers deliver new benchmarks in both performance and total cost of ownership, and reinforce the company’s commitment to sustainability and journey to net-zero as part of the Volvo Group.

With sustainability in mind, the Rokbak event booth uses materials that are recycled or reusable. Two 40ft customised shipping containers, adorned in the recognisable

“We cannot wait to get back to CONEXPO and give the RA30 and RA40 pride of place”

Rokbak aesthetic, will be used for meeting rooms and product information displays. Following the event, these will be shipped back to Motherwell for reuse at future events.

Product experts will be ready and waiting to discuss the technical capabilities and key aspects of the haulers, welcoming everyone to the booth where there will be merchandise giveaways and competition prizes up for grabs throughout the event –as well as plenty of refreshments.

“Rokbak is seeing huge demand for its RA30 and RA40 articulated haulers in the US,” says Robert Franklin, Rokbak’s director of Sales – Americas. “The US is leading articulated hauler demand globally with huge infrastructure spend. There is a lot of construction activity at the moment around house and road building, so we are keen to meet with customers and potential customers at CONEXPO and discuss how the RA30 and RA40 can help with these projects.”

It was to the USA that Motherwell-based Rokbak’s first sand-coloured machines were delivered following the rebrand in September 2021, with a pair of RA30s sold to earthmoving, utility and clearing company Linco Construction of Houston, Texas, via Easton Sales and Rentals, to assist with earthworks, underground utility and clearing work. Most US dealers went on to confirm orders within the first few months – and there could/should be more ahead come March.

“No matter where customers are on their transformation journey, Volvo Penta can offer solutions to meet their machine, application and business needs”

Like other markets, the US has not been immune to the after-effects of the COVID pandemic. Next month’s CONEXPO 2023 event has taken on extra meaning as a bellweather for the huge machinery market’s recovery as well as the US economy in general.

Inflation continued to rear its ugly head in 2022, challenging contractor profitability and threatening pending projects from moving forward. The Association of General Contractors (AGC) reported in early December that overall costs for construction are “still rising at painfully high rates.” Products used in highway and heavy construction experienced double-digit price increases from November 2021 to last month. The index for liquid asphalt, used in paving projects, jumped 19.8%, while the index for concrete products climbed 14.3%. The producer price index for diesel fuel leaped by 59.6% despite a one-month decline of 3.4% in November. Through December 9, the producer price index for construction machinery has risen 10%, on top of an 8% increase in 2021.