PLUS SAMOTER 2023

BREAKING A SIX-YEAR HIATUS MACHINES AND TOOLS LISSMAC IS A CUT ABOVE AND BELOW

PLUS SAMOTER 2023

BREAKING A SIX-YEAR HIATUS MACHINES AND TOOLS LISSMAC IS A CUT ABOVE AND BELOW

JCB INTERVIEW

CMME TALKS TO JCB ABOUT BRINGING COMPLETE SOLUTIONS TO THE MARKET

6_NEWS

The latest news from across the region and further afield.

12_WHERE WE ARE GOING FROM HERE

JCB’s Svetlana Petrova on how the British brand is positioning itself on the cutting edge of the equipment sector.

16_SAMOTER: BACK FROM A BREAK

CMME looks at the Italian show’s much anticipated return after six years of disruption in the industry.

20_CREATING A BUZZ

CMME talks to Lissmac’s Johnson Pereira on the company’s diverse range – and surprising – applications.

10 SPOTTED LR11000

Liebherr’s 1,000t machine goes high and heavy to lift a wind farm.

26_NEW RELEASES

The latest releases from the world of construction machinery.

28_TOP TEN TIPS: CRANE POWER

How to power your crane fleet safely on site.

30_COMPACTS KEEP GROWING

CMME looks at the on-going growth in popularity of compact equipment in fleets.

I met Joe Keller, the son of Louis Keller, on the sidelines of Bobcat’s Demo Days last month. And what a pleasure and privilege that was.

For the uninitiated, Louis Keller and his brother Cyril invented the first skid steer loader back in 1950s and Joe has devoted the latter years of his life to preserving their legacy.

Born the same year as that first machine, Joe has never known a world without Bobcat – or Melroe, the original company that stumped up the case for the brothers to produce machines in larger quantities.

While he was too young to remember the formative years, being from a machinery family company meant that talk of new modifications or new farms that had bought a new machine was always a big part of the dinner table chat. Small wonder that when Joe beat out his own career he ended up with his patents bearing his own name.

Having retired, Joe has steadily been researching the early years of Bobcat, finding machines and stories where he can find them, mostly around the Minnesota and Dakota heartlands where the Keller’s founded their company.

Back then most of their customers were farmers with Cyril heading out on the road with a skid steer hooked up on a trailer at the back. He invariably only headed back when he managed to sell it.

For the brothers, perseverance and hard work were the order of the day.

The name Bobcat only exists today because they worked long hours to keep the machine development going. But then

they were also helping people who also had to graft.

The first machines were three wheelers with a caster at the back and were ideal for Turkey farm barns that had hard floors.

Putting the skid steers in the barns mechanised the slog of clearing waste, unsurprisingly making the machines popular with the farm hands that worked in them.

However, when the turkey market fell through the floor, so to speak, the brothers had to find other ways to be useful to farms.

In the end they, threw away the caster wheel and added a second axle, and the first true skid steer loader was born.

What struck when talking to Joe Keller, was how much of his life has been shaped by being part of an entrepreneurial family with machinery in their blood.

And what also struck me was the similarities between that upbringing and many of the family-owned companies here.

Joe Keller may have been born thousands of miles away and in a different era, but I suspect Joe Keller would have a heck of a lot in common with the machinery and equipment industry here.

GROUP

MANAGING DIRECTOR

RAZ ISLAM raz.islam@cpitrademedia.com

+971 4 375 5471

MANAGING PARTNER

VIJAYA CHERIAN vijaya.cherian@cpitrademedia.com

+971 4 375 5713

DIRECTOR OF FINANCE & BUSINESS OPERATIONS

SHIYAS KAREEM shiyas.kareem@cpitrademedia.com

+971 4 375 5474

PUBLISHING DIRECTOR ANDY PITOIS andy.pitois@cpitrademedia.com

+971 4 375 5473

EDITORIAL EDITOR

STEPHEN WHITE stephen.white@cpitrademedia.com

+44 7541 244 377

ADVERTISING

SALES MANAGER

BRIAN FERNANDES brian.fernandes@cpitrademedia.com

+971 4 375 5479

DESIGN

ART DIRECTOR SIMON COBON simon.cobon@cpitrademedia.com

DESIGNER PERCIVAL MANALAYSAY percival.manalaysay@cpitrademedia.com

MARKETING

EVENTS EXECUTIVE MINARA SALAKHI minara.s@cpitrademedia.com

+971 4 433 2856

SOCIAL MEDIA EXECUTIVE DARA RASHWAN dara.rashwan@cpitrademedia.com

CIRCULATION & PRODUCTION

DATA & PRODUCTION MANAGER

PHINSON MATHEW GEORGE phinson.george@cpitrademedia.com

+971 4 375 5476

WEB DEVELOPMENT

ABDUL BAEIS UMAIR KHAN

FOUNDER DOMINIC DE SOUSA (1959-2015)

PUBLISHED BY

Stephen White Editor, CMMEJCB have used their experience in designing tough, hardworking equipment to ensure their electric scissors range are also built to higher standards. With high quality paint finish and many unique features, the machines have higher levels of safety, ease of use, reliability and serviceability. Industry standard components across the range allow seamless integration into existing rental fleets. JCB also offer higher levels of support through an unrivalled dealer network with quick start guides, good parts availability, finance and technical advice.

For more information, please contact your local dealer.

www.jcb.com/access-platforms

CONSTRUCTION

Global construction machinery to achieve CAGR of 9% in 2023

ANALYSIS: Saudi real estate is experiencing a dynamic expansion

CONSTRUCTION

CSCEC rated as world’s ‘most valuable’ construction brand

PROPERTY

Prestige One Developments launches new projects

INTERVIEW: Broadening business horizons

CONSTRUCTION

Hyatt signs MoU for KSA beach and mountain resorts

EXPERTS: Green hydrogen – Six core considerations to keep your project on track

INFRASTRUCTURE

Kuwait’s MEWRE awards

Mitsubishi Power optimisation contract for key facility

ENERGY

Hatta hydroelectric plant 70% complete says DSCE

The facility valued at US $387m is said to be on track for completion in Q4 2024

CONSTRUCTION

Development of $523mn third phase of Al Falah housing project commences

The Al Falah project was first launched in 2012 and has already provided citizens with 4,857 homes

PROPERTY

Azizi appoints Peri for its Beachfront 1 project

Beachfront 1 comprises three 14-storey developments totalling 439-units

INFRASTRUCTURE

Our port is now open for business, says NEOM

FINANCE

Dubai retains number one position for attracting FDI

INFRASTRUCTURE

KEZAD Group and SWS to develop pilot polished water plant project

CONSTRUCTION

GCC Construction industry has highest level of confidence in EMEA

‘How We Build Now’ benchmark report by construction management software provider Procore Technologies, Inc.

ENERGY

Dubai biogas-to-energy project now completed High-tech new initiative at Warsan can generate 44,250 MWh of electricity per year

CONSTRUCTION

Restoration of Deira Clocktower roundabout has begun

FINANCE RAK Properties Q1 revenue grows by 141%

RECRUITS JLG

EMEA’S ENRICO

MARIGHELLA

Platform Basket has appointed a former sales lead of JLG’s EMEA operation as it looks to expand and develop its export operation.

Enrico

Euro Auctions Group’s first sale at its new, permanent site in Abu Dhabi has raised almost $4 million as bidders turned out in their droves to the live auction.

Euro Auctions is Europe’s largest auction house and oversees sales for industrial plant, construction equipment and agricultural machinery in the Middle East, UK, Germany, Spain, Australia and the USA. On the 4th May, the auctioneers held their first live and online, unreserved sale at the new site in KEZAD, Abu Dhabi. With a sale inventory of 518 lots, from 35 vendors, from five countries including, UAE, GB, USA, Seychelles and Sri Lanka, the hammer total was $3.66 million, with a total from floor bidders being $2.33 million and $1.33 million transacted online, reported the firm in a statement.

“There was much interest on the day, with 365 registered bidders participating, of which 102 of those bidders were bidding for the first time. The sale attracted interest from a global audience

with the top buying countries being: UAE, Iraq, India, UK, Armenia, Saudi Arabia and Bolivia,” said Euro Auctions.

Euro Auctions’ general manager for the UAE, Richard Sweatt, added: “On sale day we saw plenty of familiar faces and our loyal clients commented that they were glad we are back! We had a good inventory of stock, with many late plate, low hours machines, for this first sale and we attracted new consignors and new bidders.

“The prices achieved at this sale pleased both consignors and buyers. Getting that balance right is the essence of a good sale. The crowds were impressed with the new facility.”

“With large development projects in the region, in the UAE, and KSA, including oil & gas, rail, hospitality and domestic housing, new or late, low hours excavators of all sizes were in great demand, as were telehandlers, skidsteers, commercial vehicles and 4x4s.”

Marighella joins the Italian spider lift and boom lift maker as Export Area Manager and according to numerous reports will report to managing and sales director Carlo Alberto Molesini. He will be responsible for covering territories with existing partners and managing further expansion and development of the export network.

He served in a range of sales roles at JLG in the EMEA region for over two decades. He previously worked in the rotating equipment sector.

Sankyu Saudi Arabia Co. has taken delivery of its first mobile cranes from the market leader. The specialist in plant construction, operational support and logistics services will mainly use the LTM 1050-3.1 and LTM 1160-5.2 for maintenance work in refineries and other industries.

The high safety standards of the Liebherr cranes and the reliable service were important purchasing criteria for Sankyu. Liebherr says it will provide this highly qualified service through Saudi Liebherr Company.

“To grow our business in Saudi Arabia and live up to our vision and mission of being number one in mechanical industry maintenance, we need to rely on strong customer service and products with a high level of safety,” said Mahdi Al Salem, deputy Branch Manager, Sankyu Saudi Arabia.

“The new cranes from Liebherr are a perfect fit for our support team. With Liebherr, we can rely on competent and fast service should the cranes ever break down. Crane operations in refineries and other sensitive industries are very challenging.”

Sankyu also cited the priceperformance ratio and reliability as key factors in its decision to use Liebherr cranes. The 50-tonne LTM 1050-3.1 mobile crane and the LTM 1160-5.2 with a maximum lifting capacity of 180 tonnes, combined with special equipment for working in different industries, precisely meet the requirements of major Saudi clients such as the oil production company Saudi Aramco.

With their long telescopic booms and high lifting capacities in their respective crane classes, the Liebherr mobile cranes are the perfect choice for the jobs planned by Sankyu, said the German manufacturer.

When it’s hard. When it’s painful. When it’s loud. TADANO Rough-terrain crane GR series has it covered. Demonstrating impressive robustness and high performance, our line-up from 30t to 145t rough-terrain cranes feature state-of-the-art technology to handle even the most demanding requirements. With efficient motors, the longest boom in its class (GR-1000EX-4), compact design and smart assistant systems, everything is on board for maximum success. The GR series: maximum flexibility for your success.

to grow to $6.4 billion in 2028 from its current volume, which is $4.26 billion.

HD Hyundai Infracore says it is targeting the Middle East and Africa (MEA) market with its new brand, DEVELON, formerly known as Doosan Construction Equipment.

The company recorded revenue of $330 million last year in the MEA region, which is a sharp increase of 116% compared to $150 million in 2020.

The number of machines sold has also exceeded 2,400 units, marking a 60% increase over that in 2020, mainly due to the company’s focus on

securing large scale customers with new advanced technology equipped machine launches and customized services.

The construction equipment market volume in MEA increased from 16,720 units in 2020 to 32,786 units in 2022, which shows that the market is experiencing a steep growth with a 96% increase over the past three years.

According to a global market research agency, Research and Markets, the MEA construction equipment market is growing annually by 4% and is expected

Developer Azizi Developments has partnered with Peri, the German manufacturer and supplier of formwork and scaffolding systems, for its Beachfront 1 project, which is said to be key.

HD Hyundai Infracore say it has been paying great attention to strengthening its presence in the Middle East through its office in Dubai and is contesting for first place in Saudi Arabia, whilst pulling ahead of other global competitors after winning business on large scale construction projects in UAE. This year, it aims to sell 1200 units in UAE, which is an increase from 1,000 units sold last year. With Saudi Arabia planning the world’s largest project, Neom City, which is expected to exceed $500 billion in volume, HD Hyundai Infracore anticipates that this will result in more construction equipment demand in the near future.

HD Hyundai Infracore has also recently established a new African office in Accra, Ghana to expand its network and secure more customers in Western and Central Africa.

Emirates Global Aluminium (EGA) says that its CelestiAL solar aluminium will be “blasted into space” through a partnership with Gulf Extrusions and the Mohammed Bin Rashid Space Centre (MBRSC). EGA’s metal has been formed in Jebel Ali into parts for MBRSC’s MBZ-SAT, the region’s most advanced commercial satellite in the field of high-resolution satellite imagery, which is due to be launched in 2024. The partnership is a space sector milestone for Make it in the Emirates, supporting the UAE’s Operation 300bn ambition to more than double the size of the industrial sector by 2031, and for the UAE’s goal of being a leader in space exploration. The first fully UAE-made parts have already been delivered to the Mohammed Bin Rashid Space Centre at Al Khawaneej in Dubai.

Aramco and the Public Investment Fund (PIF) have joined forces with Baosteel, the world’s largest steel conglomerate, to establish an integrated steel plate manufacturing complex in the Kingdom. It is set to provide a production capacity of up to 1.5m tonnes per year.

Subject to customary regulatory approvals and closing conditions, the joint venture (JV) complex will be built in Ras Al-Khair Industrial City, one of the four new special economic zones recently announced by His Royal Highness Prince Mohammed bin Salman bin Abdulaziz Al Saud, Crown Prince, Prime Minister and Chairman of the Council of Economic and Development Affairs.

It will be the first facility of its kind in the Kingdom (as well as in the GCC region), and is expected to strongly advance the regional steel industry ecosystem. The project aims to enhance the domestic manufacturing sector.

The global construction equipment rental market is forecast to be worth US $225bn annually by 2032, with a projected CAGR of 4% for the period 2023-2032, according to a report by Global Market Insights.

The market growth is mainly driven by the rising demand for tech innovations in construction equipment, implementing the latest smart technologies such as the Internet of Things (IoT) compatibility, artificial intelligence and machine learning, and the growth of telematics and remote operating.

Typically, rental specialists in this industry lease out or rent construction equipment such as cranes, scaffolding, crane lorries, MEWPs, graders, bulldozers and excavators to carry out a host of

four LTM 1500-8.1s with a lifting capacity of 500 tonnes.

building activities. Moreover, the market’s key providers are more frequently engaging in strategic initiatives such as partnerships, mergers and acquisitions, R&D investments, and new product launches to gain a competitive edge in the industry.

For instance, in January 2023, Al Faris Group recently extended its portfolio with addition of 24 Liebherr heavy-duty mobile cranes to its fleet, said the report. The delivery includes a range of models with lifting capacities from 110 to 700 tonnes, including +

Overall, the construction equipment rental market is very much segmented in terms of product and region. Based on product, the concrete equipment segment, for example, is expected to achieve over 5% CAGR between 2023-2032. This growth is being driven by changing production requirements in the sector: modern concrete producers are using cutting-edge technologies to eliminate raw material waste and reduce the need for costly storage space.

Moreover, a rising preference for high-capacity, innovative batching plants – taking advantage of incremental scale – will also drive demand, the report outlined.

When German heavy lift and crane outfit MAXIKraft took delivery of its newest Liebherr LR 11000, it knew that it had a very special and high task for the crawler crane. The first deployment of the brand new LR 11000 took the 1,000t machine to Dünfus wind farm, a few kilometres north of Cochem, where MAXIKraft had been commissioned to assemble a Vestas 5.6MW wind turbine. The V150-5.6MW has a rotor diameter of 150m, a hub height of 169m, and a total height of 244m. This makes it one of the most powerful turbines in Germany. The heaviest part is the gondola, which weighs around 100t and had to be lifted to a height of 170m. On 19 April, crane driver Marco G. was able to lift the gondola onto the tower with a special yoke after it had been approved by the site manager. It was estimated to take around two hours. Important argument for the deployment of crawler cranes: After picking up the gondola, the crane had to travel about 20m on excavator mats to reach the assembly position. For the Dünfus deployment, MAXIKraft configured the LR 11000, powered by a Liebherr 8-cylinder 500 kW engine, in the

SL10DF2BV set-up version with a 162m main boom, 21m lattice type fixed jib and 42m derrick boom. The crane is equipped with six winches as standard. These move two hook blocks, the luffing gear for the main boom and luffing jib as well as the V-frame for ballast positioning.

Immediately after assembly of the last rotor blade, the 1,000t machine was dismantled and will travel with more than 50 trucks to the next site. The compact dimensions of the components are particularly advantageous here. These have a maximum width of 3.5m and a height of 3.2m. The massive expansion of wind power will “gift” the large blue/silver MAXIKraft crawler cranes many more spectacular deployments.

The LR 11000 is now the third of this type to join the group of companies’ crane fleet. MAXIKraft says it appreciates the highly flexible nature of the 1,000-tonne machine from the Liebherr factory in Ehingen.

“With its special configurations, the LR 11000 offers enormous lifting capacities for wind power assemblies. But it also offers flexible deployment options for other applications,” says company owner Maik Kanitzky, justifying the investment in what is now the third Liebherr 1,000t machine.

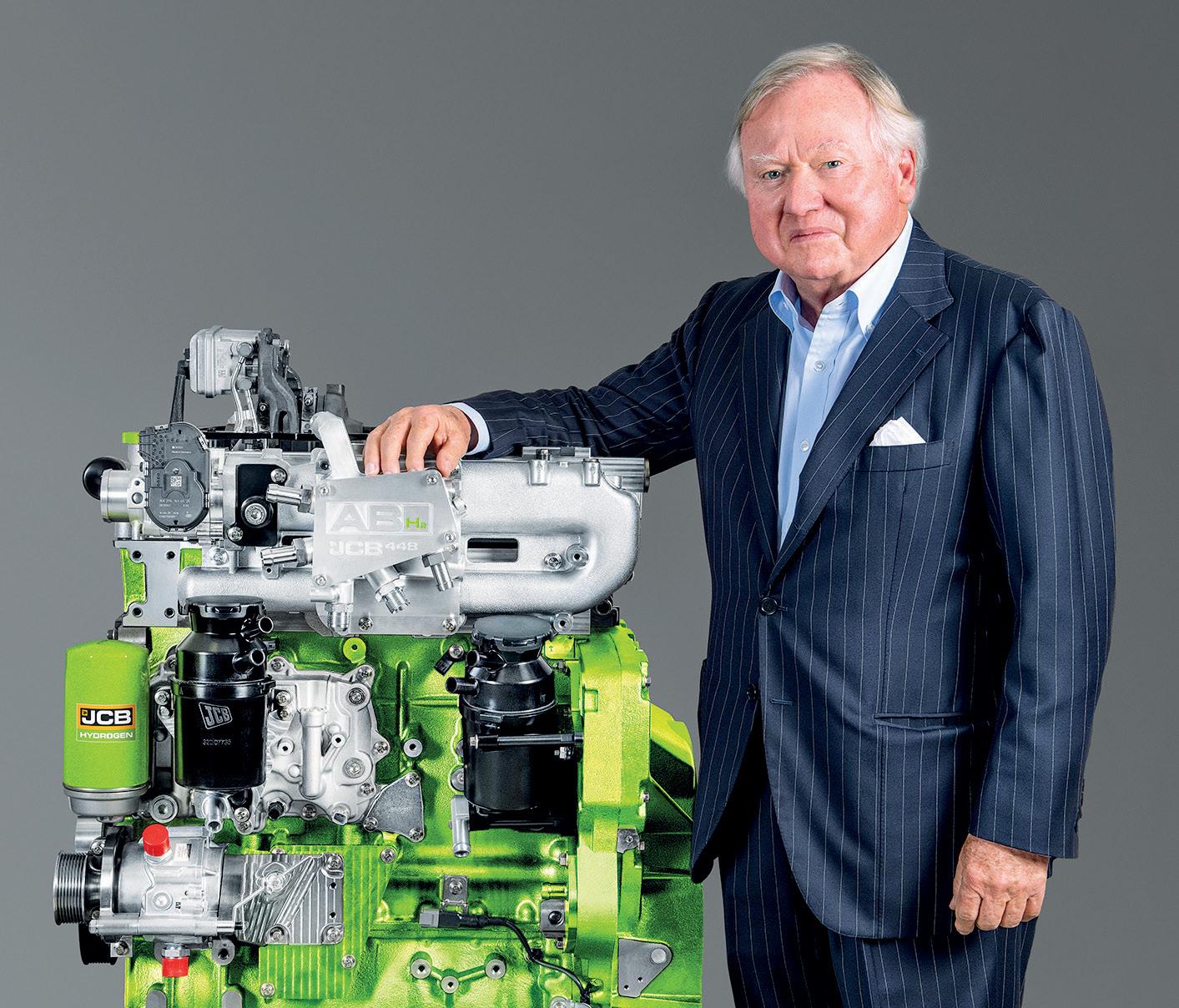

here many companies struggled during the COVID crisis, JCB wisely chose to use the time to its advantage. Where other operations ground to a halt, the British brand instead accelerated its development plans, switching through the gears of its product line-ups and even found time to emerge with the world’s first hydrogen combustion engine for construction applications.

Of course, product development and new technology from the cutting edge might excite the media, but rarely does it guarantee that it will find a market. But then, JCB has been out in the field tackling entrenched machinery habits head on for several decades; taking time on site to win people over with its versatile range of machines, including its legendary JCB Backhoe.

Typifying this approach, Svetlana Petrova, regional director, International Sales – CIS, Turkey, Middle East, Africa S&E, AsiaPacific tells CMME, she established herself at JCB by cultivating its reputation in the still emerging CIS market.

“My journey with JCB started 16 years ago when I joined the company in South Russia. It was an agricultural multi-franchise dealership, which had just started selling JCB

Wproducts... Nobody knew what a telescopic handler could do, especially in agriculture,” she begins. “It was quite the adventure… going into the market to sell a product that was sometimes twice or more times more expensive than the conventional machines they used for the same application.”

A move across to the manufacturing side followed five years later when she was recruited into JCB’s Moscow office as business manager for its agricultural machines across the sprawling country, and, subsequently, the entire CIS region. For the remainder of the decade she worked tirelessly to educate the farming industry on how JCB could modernise its approach.

“It went from a zero to a 1,000 telescopic handler sales,” she notes.

Unsurprisingly, her work did not go unnoticed; leading to an opportunity to take her knowhow to JCB headquarters in the UK. There she could join the venerable British brand’s on-going strategy to demonstrate how machines like its telescopic handlers can be an asset in territories that need flexible and durable kit backed-up with solid support.

“It was a very interesting role; helping develop the product and being a link between the market and the products,” she adds.

“European markets are well-developed in terms of the telescopic handler, but in markets like India or Brazil, for example, nobody knew what to do with them. I think my experience helped to support those people on the ground.

“In most places where we were coming with a telescopic handler we were helping to replace manual labour. The work is cheap, very basic and takes a lot of time to do and a lot of effort. And there is no safety at all. So, when you bring a telescopic handler, they see you can do the same job much quicker, much safer, and more efficiently of course.”

With the shadow of COVID now seemingly lifting on the world stage, JCB has proven to be a rare British manufacturing success in an era where many brands have struggled to impose themselves against global opposition.

Unlike many of its counterparts, it has embraced the potential of moving production into localised markets and is prepared to think and act globally.

Petrova moved to its expanded office in Dubai early this year to work alongside the teams dedicated to JCB’s strongest areas of expertise such as material handling, earthmoving and agriculture. She tells CMME, this is part of an on-going process to make the company even more agile and quick to respond to market needs.

“This is about being close to the market, improving our knowledge of what customers want, and working closely with our dealers. We are now fast to go, fast to meet and fast to set-up”.

It is fair to say that the JCB machine is churning through some impressive numbers across the huge territory (including Africa, the Middle East, CIS, and much of the Asia Pacific) now managed from Dubai. Petrova tells CMME within the construction and rental sectors its two main machines, the backhoe loader and the telescopic handler are particularly strong sellers.

“We are doing really well in the 80,000unit backhoe loader market and 70,000-unit telescopic handler market” she says adding that there remains a lot of potential for its other lines, such as mini and large tracked and wheeled excavators, skid-steers, rollers, power products and lifting equipment. “Together with our dealers we are pursuing a strategy of diversification of our offering to our customers”.

It can be argued that JCB has one of the most compelling line-ups of machines including the heavy segment.

“You have traditional construction machinery markets like the mini excavator market which is 300,000 to 350,000 units per year. The next volume market is the large tracked excavator market which is 250,000 to 300,000 units a year globally.

“These are the markets where we have a way to go, but we have the products now, and are getting closer to the customer. We

“The main thing is keeping the customer at the centre of your attention and thinking about what they need from a machine”

want to say, okay, we are doing very well with backhoe loaders and telehandlers, but we know we can do much better in other products as well. And this is where we put all our engineering efforts now and our sales efforts; to develop products and ensure they are suitable for different markets.”

Digging into the detail of this strategy, CMME asks how Petrova compares the need to market across the globe versus what she learned from the early part of her career.

“Well, the main thing is keeping the customer at the centre of your attention and thinking about what the customer needs from a machine. This is how our backhoe loader appeared, this is how our telehandler appeared and this is how we are now developing the machines where traditionally we’ve not been the founders of the concepts.”

She says that JCB is prepared to innovate in these newer segments to offer choice to the market and develop its own take on machine designs.

In the case of the HYDRADIG wheeled excavator, for example, you can see shared strands of DNA with the 2in1 backhoe and the side-engine telehandler. Uniquely, it allows the operator the ability to see all four wheels from the driving position, lowers the centre of gravity for more stability, and reduces the counterweight and tailswing for increased obstacle avoidance.

Its 109hp twin-articulation-boom machine can tow 3.5 t at a maximum of about 40 km/hr, giving it the ability to trailer attachments and other jobsite tools.

With the engine and double skinned tanks mounted on the all-steel chassis, the weight is evenly distributed between axles to reduce nod and pitch while driving.

“It is very different to the traditional wheeled excavator,” she explains. “You’ve got your engine and your hydraulic system on the side of the machine rather than at the back as it is traditionally done. It can rotate its upper structure within the dimensions of the machine. It’s very manoeuvrable. It’s very fast.”

Another machine which has garnered a lot of attention has been the award-winning JCB Pothole Pro.

The unique 3in1 machine is based on the HYDRADIG platform but is specifically designed to sort out any pothole repair or large reinstatement operations, efficiently, economically and permanently. The machine itself comes with three dedicated attachments to cut, crop and clean. With no need for additional specialist equipment or extra manpower, the Pothole Pro is proving to be an attractive option for municipalities or road contractors looking to save time and money.

“With this machine you can manage to repair one pothole in eight minutes,” she tells CMME. “In one day you can repair 250sqm, and you reduce your cost from 75 dollars per square metre to 33 dollars per square metre. It’s gaining popularity in the market just like many, many years ago in 1953 we developed the backhoe and in 1977 the Loadall.

“These were machines that were absolutely different from anything else in the market. They are very much loved now and this is what we try and do with our new machines as well.”

Quite naturally, the conversation turns to JCB’s work in the decarbonisation of construction. Petrova is soon presenting an illustration of JCB’s line-up of greener machines, including its E-Tech compact line-up of electrified machines, such as its mini-excavator (the award-winning 19C-1E E-TECH mini excavator was its first e-machine in 2019), access platforms, powerpacks, its dumper, and the flagship of the range, its

“It is very different to the traditional wheeled excavator ... It’s very manoeuvrable. It’s very fast”

all-new 525-60E compact telehandler.

“All of these are powered by lithium-ion batteries. It’s very advanced technology compared to the traditional lead-acid batteries. All of these products are already on the market and being used,” she explains.

“The 520-60E telehandler is very popular and very much loved by rental companies in Europe because, it’s very quiet, can do the same job as a diesel machine, but you can extend your work hours because it produces no noise, no emissions. You can work with this machine in a hospital, in a city centre, at a school, in a museum. Whatever you need to do without emissions and noise, there goes your JCB.”

While the E-Tech range has been wellreceived in the market and is selling well across the world, it has its limitations, especially in applications where you need more power and have limited or no access to an electrical power source. For those roles, JCB is exploring another technology: hydrogen power.

“We started thinking about what else JCB can offer to the market? And how do we do our net zero job?” Petrova says, adding that JCB chairman Lord Anthony Bamford was personally very determined that the company pursued hydrogen as viable alternative way to power its machines.

“It was his idea. A couple of years ago, he said, okay, so what’s our next net zero solution for the future? I want it to be hydrogen, please.”

With hydrogen fuel cells proving to be too complex, too costly and not robust enough for the construction sector, the R&D team set about creating an Internal Combustion Engine (ICE) that could be powered by hydrogen gas.

“As of today, we are running a backhoe loader and a telescopic handler powered

by hydrogen internal combustion engines,” Petrova states proudly. “This is new technology but it has already proven itself.”

Once the development of infrastructure to supply hydrogen at scale catches up, Petrova believes that JCB, as it has done repeatedly in the past, will be able to offer a game-changing technology to the market. It is even working on solutions to provide mobile hydrogen tanks to fuel machines in the field and on site.

“We’re testing both machines and they’re

up and running well on real job sites; proving themselves to be suitable for that job. It’s just the fuel which is different, the rest of the machine is exactly the same in terms of power and performance, apart from the fact that hydrogen gas cylinders have replaced the diesel tank.” And as Svetlana Petrova has seen throughout her career, earning customer trust and proving investing new technology can pay off are the most powerful selling tools you can have.

“We started thinking about what else JCB can offer to the market? And how do we do our net zero job?”

“We are running a backhoe loader and a telescopic handler powered by hydrogen internal combustion engines”

After a series of postponements and delays, the 31st Samoter construction machinery exhibition finallly closed on 7th May at Veronafiere after attracting more than 40,000 specialist visitors over the five days of the event from 91 countries, with Germany, Spain and France in the first three places in terms of number of arrivals. There was also good attendance from Asia, Africa, North and South America, demonstrating the show’s enduring international appeal.

It may have been six years since the last event, but it was a welcome return for a machinery show which plays a central role in Italy’s industrial site and construction machinery and equipment value chain. Demonstrating that importance was the attendance of the Minister of Foreign Affairs and International Cooperation, Antonio Tajani, who highlighted how Samoter is a full part of the integrated promotion strategies abroad for Italian companies during the week. Federico Bricolo, president of organisers and hosts Veronafiere, said

that the event had successfully justified its return as demonstrated by the excellent attendance and satisfaction from those exhibiting on the show floor.

“Returning successfully to the field after 6 years of absence because of the pandemic was not so obvious for a triennial event,” said Bricolo. “Nonetheless, Samoter 2023 achieved its goal with an edition that proved to be a full-scale tool for doing business, opening up new markets and getting to know the latest news for companies and many operators arriving from abroad. It means that we worked well as organisers, as a team with institutions, the local area, the ICE-Trade Agency, all the most important associations in the sectors covered by the show and our exhibitors who understood the value of being part of the Samoter community.”

“The very positive results posted by the 31st Samoter are proof that exhibitors and buyers have understood and appreciated the new format of the event,” added Maurizio Danese, managing director of Veronafiere. “Innovation was the central theme of this edition, which also welcomed the début of two new areas dedicated to the technological revolution that represents the future of construction machinery.

“High attendance and local attention was proof that exhibitors and buyers understood and appreciated the new format of the event”

“We wanted to put the exponents of this sector and their needs even closer to the heart of the event by designing Samoter to ensure it was worth every euro and minute invested by exhibitors and visitors. We are already working with Unacea on the next edition which will certainly build on this experience, especially as regards the digital construction site and the world of sustainability.”

The digitisation of the construction sector has continued apace since the last time the show open its doors to the industry and was the buzzword during the event’s array of conferences and workshops.

Digitisation is making its way into construction sector in its own right and does so by providing technologies applicable not only for medium-large construction sites but even smaller work areas.

The road-building sector in one which has already clearly understood the importance of digitisation and its application to every kind of construction site.

We have developed technologies that can be used even in very small construction sites,” explained Luca Iozzi of Leica Geosystems during the “Digitalisation and road construction sites – operating solutions” conference organised by e-construction, Vado e Torno. “A single software package now makes it possible

Five points for inclusion in the agenda at Samoter were intended to form a ‘Marshall plan’ for the Italian building industry.

“The construction industry is a supply chain that makes an important contributes to the growth of the country. Nevertheless, it has experienced tough times since 2008,” said Senator Stefano Patuanelli, member of the Senate Budget Commission. “However, it is not enough simply to allocate resources to boost the sector. We must speed up

completion times for work projects and also encourage training and innovation. The 110% superbonus is a virtuous measure which, by its very nature, had to have a fixed term. What is required is to structure a system of measures to favour planning and programming: entrepreneurs need certainties.”

“The sector has gone through serious recessions but has always found the strength to get going again,” said Ettore Rosato, Foreign Affairs Commission. “The shortage of labour is

to coordinate all the machines at work, from excavation to paving through to completion of the project.”

“Digitisation responds to the challenge of increasing productivity in the sector,” said Cristiano Volz of Topcon. “From surveying to milling, by way of resurfacing asphalt, we have created an efficient process that adapts to all contexts.”

In turn, Corrado Bocci of Pavi outlined the advantages of the digital road building site: “The site is constantly connected

another critical issue, but innovative equipment requiring specific skills ensures qualified employment. I am in favour of bonuses but to avoid ‘doping’ the market, bonuses must envisage a participation fee paid by companies that implement them. We need to dose contributions and ensure they are stable.”

“The professional world supports incentives,” argued Pier Paolo Giovannini, National Council of Surveyors. “But a structured, longterm project is vital.”

with the technical office and this helps reduce on-site assistance costs. All the more, waste materials are reduced and paving quality is improved. Yet, above all, complaints from clients are prevented, since everyone knows about the project from the early stages.”

“Digitalisation is an opportunity to improve the construction world and all companies, from the smallest to the largest, can adopt it today,” said Alessandro Chiodin of Spektra. “We start off with a digitalisation plan and define the objectives, which include environmental and economic sustainability.”

“Until recently, we invested in technology to increase precision,” concluded Julius Bacchus of Ecovie. “Today, given the shrinking margins of building sites, digitalisation introduces criteria such as efficiency and transparency.”

The merits of digitisation were also discusses by Andrea Bresciani, Marketing Manager with CGT who - during the “Digital platforms for remote monitoring of efficiency” workshop explained: “Technologies on-board machinery, in particular telemetry and remote services, have launched a new period of evolution in the construction sector, because they make using machines safer, easier and quicker.

“In addition, these systems provide data about productivity, use, costs and maintenance status, thereby allowing remote control of individual machines, the entire fleet or even the entire construction site.

“Thanks to digitisation,” he added, “the operator and the entrepreneur can forget about machine management, because the control tower, i.e. a team of technicians

“Samoter 2023 achieved its goal to be a full-scale tool for doing business and opening up new markets”

based in our offices, handles this issue remotely.”

Digitisation was also discussed by Valentina Neri, Sales Manager at Kiwitron, during the “Reducing on-site accidents: the best technological solutions for promoting safety” event. This meeting summed up non-selective radars, pedestrian tags to be worn in man-machine interaction areas, anti-collision devices and zoning systems using antennas to intervene on machinery and slow them down if necessary. “A single cloud set-up means we can manage different machines by different brands,” he said. “Our technologies can be installed on all vehicles by any manufacturer to make machines smart and improve the good work of operators without interfering with their decision-making skills.”

Road building has clearly been identified as a key a feature for Veronafiere to expand upon anhd took centre stage in the Samoter LAB demo area. As in previous editions, Samoter was held alongside Asphaltica, the exhibition for road paving, safety and road infrastructure technologies and solutions.

Across the week there was a strong focus on the implementation of new technologies in the construction world to help it become increasingly competitive and sustainable. Visitors therefore had the chance see the machinery of the future at work in the new dynamic exhibition area that made its début this year.

This year’s event also boasted a new high-tech area: Cantiere Digitale - The Digital Construction Site, a fullscale automated construction site set up in the Samoter LAB demo area in collaboration with Quelli del Movimento Terra. Machinery and technologies were at work from CGT Caterpillar, Develon, Dynapac-Fayat Group, Incofin, Komatsu, Leica Geosystems, Spring Machine Control, Topcon Positioning, SITECH-Spektra A Trimble Company and Way.

“Samoter Lab,” said Raul Barbieri, sales director at organising company Veronafiere, “came about thanks to constant and continuous debate with the sector, which expressed the need for a venue specifically for technological displays, combined with updating, discussion and training opportunities. Samoter LAB consequently focuses on technological innovation, digitalisation, de-carbonisation, safety and training. Cantiere Digitale - The Digital Construction Site is the natural outcome of all this, as a full-scale work place for cutting-edge machinery and technologies.”

Companies taking part in the SaMoTer LAB project because they believe in the

value of this initiative were: CGT Caterpillar, Cenati, Hitachi Construction Machinery, Kiwitron, Komatsu, Leica Geosystems, Ma-Estro, Moba, S.C.S. Survey Cad System, SITECH-Spektra A Trimble Company, Spring Machine Control and Way.

The Digital Construction Site hosted typical construction site processes several times a day to highlight advantages in terms of productivity, quality and safety thanks to the use of these technologies. Visitors attending the show also had

It has been over a decade since the last Samoter event and there was more chatter about the effect of digitisation in the worksite this time around.

Without data control, construction sector companies cannot accurately assess and improve their performance and this makes growth more complicated. Today, however, constant and continuous performance monitoring is possible thanks to technology, although it must be fully understood before being implemented. This topic was discussed at Samoter during the “Management control and data flow - The importance of digital technology” conference organized in collaboration with the online news portal E-construction.

“We have always measured average production costs on a monthly basis,” said Giorgio Manara, owner of Maestro, “but

the chance to watch 4.0 machinery and digital control technologies at work in the construction of road infrastructure across three strategic stages.

These included: surveying with drones, GPS, scanners, mobile mapping and robotics; design, with the creation of a 3D project to ensure a flat and regular new road surface and start renovation work; machine-to-machine interaction, which is the stage when the project is uploaded to the processing machinery used.

“While the construction machinery sector is currently coping with rapid technological evolution,” added Tubi. “Samoter is back on the scene! Samoter LAB and the Digital Construction Site are a major response valorising the extent of these necessary changes.”

Business, innovation, internationalisation and training were all key topics at Samoter this year. The event brought together 536 exhibiting companies at the Verona Exhibition Centre, 115 international from 23 countries, with the return of major players in the sector such as CGT Caterpillar and Hitachi.

In addition to business that included more than 500 B2B meetings set up by companies with more over 106 foreign top buyers from 36 countries selected by Veronafiere and ICE-Trade Agency, Samoter confirmed its status as a trade fair with great content, thanks to more than 80 training initiatives and educational activities organised with high-profile technical-scientific partners.

it was difficult to identify peaks and then implement corrective action. Having overcome our initial hesitation as regards technology – and thanks to a simple, customised and intuitive data dashboard – we have undertaken continuous monitoring of production cost trends and this has revealed hidden costs. In a short time, we improved our performance by 30%: we realised that knowing means optimising. And optimising,” Manara continued, “does not necessarily mean producing more but also reducing production times, which in turn helps reduce overheads.

“Just think of energy costs and the reduced environmental

impact of work activities.”

“Remote solutions can be used to monitor individual machines, fleets or the entire construction site,” pointed out Gianluca Calì of CGT.

“On-board technology and connectivity enable data collection for the position of the machines, consumption, work hours and emissions, which effective benefits: you may discover unnecessary fuel consumption or that some machines need maintenance. Monitoring and controlling data ultimately means being able to implement corrective action. Briefly,” Cali summed up, “digital technology helps improve efficiency.”

It’s a blistering day in Dubai’s industrial district Al Quoz as we stand as a group looking down at our feet on a typically dusty warehouse floor. To say this feels like a million miles away from the glitz and glamour many people associate with the city, would be an understatement. However, while we are surrounded by hardbaked concrete, the patch of 2mx2m square beneath is a perfectly smooth surface of polished flooring. The sort that wouldn’t look out of place if you were wheeling your favourite Gucci suitcase to a 5* star resort or airport business lounge.

CMME is soon sitting with Johnson Pereira, a veteran of the local market, who has now made the jump to Europe to help spread the word about

how Lissmac’s powerful range can do the dirty work when you need to grind, polish and saw your way to a smooth finish or a touch of luxury.

“I like doing these events,” he grins.

Lissmac is a global machinery of Floor Saw Machines, Masonary Saws, Concrete Floor Grinding Machines and its Floor Scarifier Machine. When CMME last spoke with Pereira he was on his way to The Big-5 Saudi event.

The Germany-headquartered company which also operates in France, the USA and the UAE used the show, like the Al-Quoz event, to demonstrate how it can help a range of sectors.

Lissmac, for instance, is the largest manufacturer for floor saws specialising in machines for deep cutting in airports and grooving and grinding of runways. Able to cut through time and costs it

produces the specialist equipment that can help countries or organisations that need want to work quickly but demand a quality finish.

According to Pereira, who has personally been involved in the construction of high profile projects such as Dubai Park and Resort, Lissmac believes its machines “need to be used on all airport and infrastructure development in Saudi. The construction industry in Saudi is massive but needs a lot of education to adopt the new construction technology, there by using faster, economical and safer methods of construction.”

He once again grins: “Saudi is exciting. Although there is a lot of chaos, they are trying to race and catch up with what Dubai took to 15 to 20 years to achieve. They want to do it all in five years, so there is a lot of education needed in the market.”

While the Big-5 Saudi presented an opportunity to meet potential customers, as well as source a potential dealer for its floor grinding and scarifying machines in the Saudi market, the day in Al-Quoz was an opportunity to highlight its professional construction machinery to a Dubai audience. With a range that stretches from high-precision diamond saws to cutting technology for civil engineering, its floor saws, core drilling machines, working platforms and machinery seem ideal for a maturing market that is becoming more concerned with renovation.

“I would recommend any factory or storage facility to go with this floor,” says Pereira. “It’s durable: we all know that concrete is the strongest material for flooring the market. You also don’t have to put any epoxy coating or anything on top. Plus, you get a really flat floor as a finish.”

It could also be perfect for sites in the hospitality sector that are looking for a clean, but industrial, finish to their coffee shops, retail units or hotels.

Tom and Serg breakfast joint a few blocks away.

“That floor we have just made, is the same finish without the grains exposed. With this machine you can polish the floor in two ways. You can get the grains in the concrete exposed, or some customers prefer them not to be. If a customer says, I don’t like that glossy finish, I want a little bit matte, you can also change the type of sealer on the top surface.”

Being able to apply sealer while creating the smooth surface is crucial, he adds.

“Concrete is porous by nature…,” he pauses, takes a look at the coffee the CMME are team sipping on: “If you drop your coffee or tea, it will go into the concrete if you don’t seal your concrete properly…”

“Industrial flooring is a fashion,” he says, adding that Lissmac’s provided the polish to the fashionable

Fortunately, he says the Dubai market is well-served by companies that understand the importance of delivering a high quality finish for their customers.

“We have a lot of high quality applicators in the market who understand about industrial flooring. We know most of them already and talk to them frequently.”

Pereira describes Lissmac as the Mercedes-Benz

of its niche part of the construction machinery market.

“We are the industrial Mercedes-Benz. Why do I say that?” He asks. “When you look at the power of our machines. Today we have seen a 650 grinder. All of our competitors’ 650 grinders have 7.5kW in motor, but we have an 11kW motor. When you have that much power, you have two advantages straight away. We can add more weight (we have an extra 50kg) onto the machine which can be used to create more force when grinding. We can also make the body heavier.”

He points to front base of the machine: “We have all of the weight there.”

CMME is surprised that whole machine weighs 435kg and requires one standing operator, even with the rig using two wheels at the back and a third optional wheel strapped to the top of the machine if required.

“You can’t move the machine when it’s not working,” explains Pereira. “It’s designed to move when the motor is turned on. The weight, the power, all helps the machine. It gives you inertia and allows the operator to push.”

Be it for a fashionable café or vast warehouse, you get the sense that Lissmac and its machines will be pushing for a long time in the region.

Chinese construction giant China State Construction Engineering Corporation (CSCEC) brand value was up by 16% to USD31.9 billion in 2022 retains its position as the most valuable brand in the global Engineering & Construction sector, according to a new analysis by the world’s leading brand valuation consultancy, Brand Finance.

As one of the largest construction companies in the world by revenue, the China State Construction Engineering Corporation saw another year of brand value growth post-pandemic.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 50 most valuable and strongest Engineering & Construction brands are included in the annual Brand Finance Engineering & Construction 50 2023 ranking. CSCEC’s brand value increase is a direct result of improved business performance, as well as an improved Brand Strength Index (BSI) score of 76.4 out of 100 and corresponding AA+ rating. Annual

performance indicators saw significant year-on-year growth, including revenue and new construction contracts. In 2022, CSCEC delivered 28 venues and auxiliary projects for the Beijing Winter Olympics. The brand’s ability to deliver high quality projects, and operation and maintenance plans, has positively contributed to CSCEC’s brand recognition.

“Generally, Chinese Engineering & Construction brands continue to grow. These brands, however, are now faced with new expectations of sustainability,” said Richard Haigh, managing director, Brand Finance. “Now that the Chinese government has announced its 5-year plan for the Engineering & Construction industry, these brands will need to adapt and integrate sustainability into their core strategies to maintain brand value and strength.”

On the ESG front, the Chinese government announced a five-year plan for a smarter, greener, and safer Engineering & Construction sector in a bid to reducing carbon emissions, adopting digital technologies and improving the safety and quality of buildings. In response, Engineering & Construction brands have adopted various measures in line with an increasing focus on sustainability. CNBM (brand value up 7% to USD8.9 billion), the largest cement and concrete brand in China, implemented its Dual Carbon Goals aimed at advancing green development

and low-carbon technology, as well as leading green and intelligent transformation of the cement industry.

US-based Ferguson (brand value up 38% to USD5.3 billion) was the fastest-growing brand of the 2023 ranking. A key driver of Ferguson’s five rank hike to 26th is the acquisition of HVAC distributor, Airefco. The acquisition has accelerated the brand’s geographic expansion and a larger multi-brand footprint, improving Ferguson’s brand recognition. Ferguson has also benefited from investments made into 17 acquisitions across the 2021-2022 period, generating additional revenues of approximately USD750 million.

In terms of ESG-related initiatives, in 2022 Ferguson launched its national partnership with Rebuilding Together, an organisation centred around repairing the homes of people in need.

The partnership saw Ferguson strengthen its relationships with external communities and stakeholders. Of this year’s four fastest-growing brands, three of them are American. Caterpillar (brand value USD11.2 billion) increased 36.4%, with John Deere (brand value USD10.8 billion) up 33.1%.

Six new entrants joined the Brand Finance Engineering & Construction 50 ranking this year. China Energy Engineering Corporation (CEEC) is the most valuable newcomer, entering the ranking with a brand value of USD9.1 billion.

CEEC’s impressive inaugural brand value is a consequence of its late 2021 merger with Chinese Gezhouba Group Corporation (CGGC). The merger saw CEEC, a Hong Kong listed company, absorb CGGC, a mainland China listed company. This merger is the first of its kind, as well as the largest seen in recent years in terms of value. As the surviving company, CEEC has gained all assets and contracts and combined brand value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in 38 countries and across 31 sectors.

John Deere, meanwhile has secured its title of world’s strongest Engineering & Construction brand for another year, maintaining AAA rating.

John Deere (brand value USD10.8 billion) holds its position as global Engineering & Construction’s strongest brand, with a Brand Strength Index (BSI) score of 86 out of 100, which corresponds to a AAA rating. Brand Finance’s ranking also saw John Deere improve three ranks following a 33% increase in brand value (previously USD8.1 billion), entering the top 10 of the world’s most valuable Engineering & Construction brands.

Worldwide net sales and revenues increased by

19% as demand for farm and construction equipment remains strong. John Deere also benefits from its continued innovation, announcing in 2022 a fully autonomous tractor. Ready to be produced on a large scale, the brand’s development of its automated features has further solidified brand recognition, as well as its strategy for smart industrials.

As part of its analysis, Brand Finance assesses the role that specific brand attributes play in driving overall brand value. One such attribute, growing rapidly in its significance, is sustainability. Brand Finance assesses how sustainable specific brands are perceived to be, represented by a ‘Sustainability

Perceptions Score’. The value that is linked to sustainability perceptions, the ‘Sustainability Perceptions Value’, is then calculated for each brand. CREC (brand value USD19.8 billion) is keenly aware of the importance of protecting the natural environment. With a Sustainability Perceptions Score of 5.77 out of 10, CREC is perceived by consumers as the most sustainable Engineering & Construction brand. Having implemented an ESG management system since 2008, CREC is thought to be continuously considering the environment. Each of CREC’s projects undergo detailed assessments for potential environmental impacts, producing detailed programs for environmental protection. This includes the brand’s cautious handling of waste, minimising air and water pollution, and protecting biodiversity. As the ranking’s third most valuable brand, CREC is also ranked second in terms of Sustainability Perceptions Value at USD723 million. CSCEC, Engineering & Construction’s most valuable brand at USD31.9 billion, also has the highest Sustainability Perceptions Score of USD948 million. In line with the Chinese government’s new standards towards a sustainable Engineering & Construction industry, CSCEC has actively participated in environmental and ecological restoration projects, as well as contributing towards cleaner energy and low-carbon office practices.

The brand’s perceived support of the government-proposed initiative will positively contribute to the CSCEC’s overall value, as the brand benefits from its alignment with China’s political leadership. The brand’s position at the top of the SPV table is not an assessment of its overall sustainability performance, but rather indicates how much brand value it has tied up in sustainability perceptions. The brand’s Sustainability Perception Score was also 4.69 out of 10.

With its compact design and light weight the applicators reach challenging project sites with ease. The improved LWSE hi-frequency motor and the compact control unit are also suitable for expanding to wire sawing and core drilling units, handing out a wide range of applications to construction sites.

Excellent weight-to-performance ratio.

Lightest saw head for depths up to 705mm. Remote controlled operations for maximum safety.

Suitable to use 1600mm diameter blade guard. Special cooling bypass system for wet and dry cutting applications.

The latest releases from the world of construction machinery.

YOU NEED TO KNOW

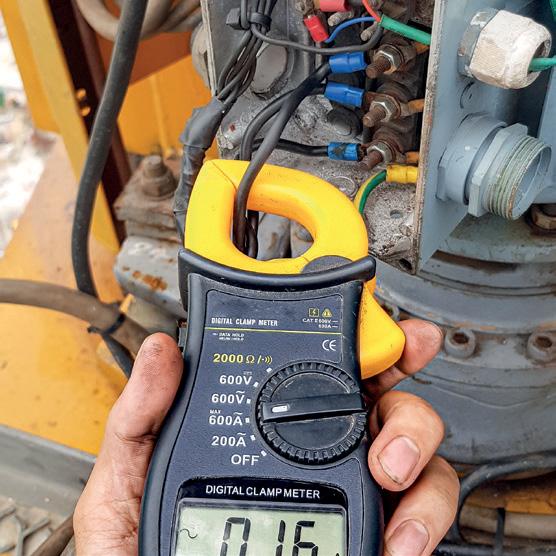

28 TOP 10: WAYS TO POWER YOUR CRANE SAFELY

Ten tips to protect your team on the jobsite.

GROWING

The compact machinery market hasn’t yet reached its full potential.

32_KONECRANES AND LTC READY FOR LIFT-OFF IN DUBAI

Jibs and overheads top partnership in the UAE.

AS INDIA’S FIRST ELECTRIC CRANE, THE 4X4 MOBILE CRANE WILL BE VIEWED AS TEST-CASE FOR THE COUNTRY’S ABILITY TO KEEP PACE WITH THE GLOBAL INDUSTRY.

Indian construction equipment manufacturer ACE recently announced the launch of its electric crane with lifting capacity of 180 tonnes. The introduction of electric vehicles (EVs) in the construction equipment will be the first step in contributing towards reducing the carbon footprints.

The ACE F150-ev 4X4 is a zero-emission machine with a lifting capacity of 15 tons, and the crane delivers the best possible combination of green credentials, customer benefits, and efficiency.

The crane has been specifically designed to suit both road travel and pick-n-carry use. As part of the initiative to introduce sustainable technologies, the electric crane has been specially designed to deliver optimum power and productivity while maintaining the versatility of the equipment for Indian conditions. With 4-wheel drive and required traction, this Electric Crane is suitable for rough terrain operations and is equipped with unparalleled safety features with best-in- class durability and stability

As per ACE Group, with 4-wheel drive and required traction, this electric crane is suitable for rough terrain operations and is equipped with safety features. As part of the initiative to introduce sustainable technologies, the electric crane has been specially designed to deliver optimum power and productivity while maintaining the versatility of the equipment for Indian conditions.

SWITCHING TO AN ELECTRIC WHEEL LOADER MEANS A HUGE REDUCTION IN MOVING PARTS AND LOWER TOTAL COST OF OWNERSHIP.

The GEL line of electric wheel loaders now includes the GEL-5000, HEVI’s newest loader design. Although engineered from the ground up with sustainability in mind, the GEL-5000 can still achieve a 5 ton lifting capacity. With its expanded battery capacity, the GEL-5000 provides 8 hours of operation with as little as 3 hours of charging time. As a result, you can expect to see the GEL-5000 become a staple on the job sites of the future. Inside the GEL-5000’s air-conditioned cab operators will be comfortable even on the hottest July afternoon. Additionally, all vital metrics are easily accessible from the monitor. As a result, operators will be aware of everything from the battery’s charge to motor temperature,

increasing safety of operation. You can also keep tabs on the outside of your vehicle with the dash-mounted backup camera, providing a wide range of vision to allow operators to safely avoid collisions with objects or people on your site.

As with all of HEVI’s equipment, the GEL5000 is all-electric. As a result, the GEL5000 isn’t just an industrial workhorse: it also provides several sustainability benefits. Naturally, with zero operating emissions, the GEL-5000 is suitable for businesses working to meet the latest government regulations. Exhaust isn’t the only thing that HEVI is clearing from the air, however.

As an added benefit, the lack of an internal combustion engine (ICE) eliminates much of the noise found at typical work sites.

A true “silent benefit,” this will protect operators from hazardous on-site noise levels. Believe it or not, workplace noise has resulted in 14% of construction employees suffering hearing loss. With an ICE, diesel equipment requires a lot of maintenance. Alternatively, switching to an electric wheel loader means a huge reduction in moving parts. In turn, you can expect reduced maintenance, resulting in lower total cost of ownership over the lifetime of the equipment.

With its expanded battery capacity, the GEL-5000 provides eight hours of operation with as little as three hours of charging time

THE 744 P-TIER AND 824 P-TIER MODELS ARE THE FIRST PERFORMANCE TIERED LOADERS AVAILABLE IN SELECT EUROPEAN COUNTRIES.

After making their debut in the United States in September of 2022, the 744 P-tier and 824 P-tier models are the first performance tiered loaders available in select European countries. As part of the Deere & Company family of brands, the Wirtgen Group will manage distribution of the P-Tier line-up through their European dealer network.

The 744 P-tier and 824 P-tier loaders offer exceptional results at high levels with reliable components such as extradurable axles and enhanced transmission capabilities. The extra-durable axles boast larger capacity front axle input bearings, axle shaft diameter and bearing size increases, and pressure lubed front input bearings designed to help reduce heat, increase component life,

and boost overall machine reliability.

The P-tier transmission includes a standard lockup torque converter, which adds additional torque during operation and improves fuel economy while transporting materials. The improved lockup logic increases performance and shift quality, while the updated speed sensors improve low torque shifting and downshift, improving performance when going into piles. Both loaders come equipped with the John Deere 9.0-liter engine that increases horsepower while minimising fuel consumption for a robust performance overall.

back on the job sooner. The optional auto lube system ensures automatic greasing takes place while the machine is operating for more effective grease distribution.

9.0L

Loaders come equipped with the John Deere 9.0-litre engine which increases horsepower while minimising fuel consumption

Aimed to simplify serviceability, the 744 P-tier and 824 P-tier loaders feature ground level servicing, including a remote engine oil dip stick, and improved electrical and hydraulic routing, getting your machine

The redesigned interior cab gives the operator more space, extra storage and enhanced visibility supporting the overall machine and operator safety on the job. Optional features that improve operator comfort and experience include heated and ventilated seats with increased adjustment capabilities, an upgraded HVAC system, and additional power ports and aux mounting capabilities inside the cab. The P-tier machines were also designed with productivity enhancing features such as and EH controls with multifunction programmable buttons to offer optimal performance on the job.

The tower crane must be grounded to prevent electrical shock. All electrical equipment must be properly grounded to the earth to ensure electrical current does not build up on the equipment.

The operator and anyone working on or around the tower crane must be aware of overhead power lines. If a crane comes in contact with a power line, the electrical current can flow through the crane and harm anyone in the vicinity.

Tower crane operators should follow safe operating procedures at all times. This includes proper rigging and signaling, maintaining a safe distance from power lines, avoiding overloading, and maintaining proper communication with other workers on the job site. Operators should also be aware of weather conditions and take appropriate precautions when operating a crane in high winds or rain.

Tower crane safety is essential to prevent accidents and injuries in the construction industry. Operators should be properly trained and certified, and cranes should undergo regular inspection and maintenance.

Always turn off the power when the tower crane is not in use. This can prevent accidental activation of the crane and reduce the risk of electrical hazards.

Only trained and authorised personnel should operate and work on tower cranes. Proper training can help ensure that everyone knows how to work safely around electrical equipment.

Each crane has a specific load capacity limit that must be strictly adhered to. Operators should never exceed this limit, as it can lead to crane failure, collapse, or tip-over. Proper rigging is essential to ensure that the load is stable and secure. This includes selecting the right type of rigging equipment, inspecting it for defects, and attaching it to the load correctly.

Recent years have seen a transformation in the electrified construction vehicle sector, with every major manufacturer now looking at electric solutions for some of their products. However, it is early days and electric machinery still comprises less than 1% of all construction equipment sold.

Interact Analysis forecasts that the Europe, Middle East and Africa (EMEA) region will have a penetration rate of battery-electric excavators that is double that of North America in 2030—12% compared to 6%. Looking only at Western and Northern Europe, that figure could be three or four times that of North America.

A major challenge is infrastructure. How do we get power into construction sites to recharge machines?

Big power supply cables, even transformers, may be needed, or mobile high-power charging systems. This may be difficult when one of the biggest problems at construction sites is lack of space. Or

is it realistic for machines to be charged off-site?

For smaller machines, battery-swapping may be a short-term solution, but on-site charging will still most likely be needed in the longer run. For the largest machines with very intensive duty cycles, the technology simply isn’t there for a battery-electric solution. This is where hydrogen comes in.

Total Cost of Ownership (TCO) could be a major driver in the electrified heavy machinery market. In 2019, an in-depth study by McKinsey predicted that by 2023, the TCO of heavy electrified machinery could be up to 21% lower than that of similar ICE equipment. Key factors here were the 40 to 60% reduction in operational outgoings – lower fuel costs and a more efficient drive-train bringing lower maintenance costs owing to the machinery having fewer moving parts. These reductions would offset the higher up-front costs, including that of the battery and charging infrastructure.

There is also a factor that lies central to the operation of construction machinery – the machine operators themselves – the people in the cabs. Within living memory, health, safety, and comfort

issues used to be a low priority in the construction industry. Not so today, for, as we all know, safety takes centre stage in the working environment. A key characteristic of the battery electric vehicle is its smooth interface with the person at the controls. It’s easy to operate, clean, quiet, and comfortable.

There is little jolting or vibration. Electric construction vehicles are also more versatile. They can operate in enclosed environments where ventilation is an issue. And they can be used in close proximity to people, in city centres, for example, without creating unacceptable noise or pollution. This is a major advantage, living, as we do, in a time when there is considerable intensification of building and infrastructure projects in our cities.

Compact construction equipment is leading the charge toward electrification in the off-highway market around the globe. The market for battery electric compact construction equipment will be nearly 100 times bigger in 2030 than it is now.

What is driving this? First, these are the ‘easiest’ machines to electrify. The relatively low power requirements make engineering electric versions

easier (and cheaper) than their larger siblings. Second, because of their size, these types of machines can be used indoors – in basements or demolition work – so making them emission free is a health benefit. Third, the lower noise level from electric machines versus diesel machines makes them a much better fit for work in urban areas – particularly residential areas – where they can operate for extended hours causing less nuisance for residents.

Although the global penetration of battery electric compact equipment is forecast to be only 10% by 2030, there is quite a lot of variation by country and machine type. In Western and Northern Europe, penetration will be closer to 20%, while in China it will be 15%. The penetration rate for mini-excavators will be 13% in 2030, compared with

only 6% for compact track loaders and skid steers. Although the leading countries for market adoption of battery electric vehicles are in Western and Northern Europe, market volumes are going to be greatest in those countries with the largest overall markets for construction equipment. That means that largest markets for battery electric compact equipment in 2025 will be China, the USA, Germany, the UK and the Netherlands. If the USA can accelerate its policy landscape and provide more incentives, it could even overtake China by the end of the decade.

We’re often asked: what could make the market speed up adoption of battery electric machinery?

Well, the answer is relatively simple – better incentives and clearer government policy. There is still a gap in total cost of ownership (TCO) between a battery electric excavator and its diesel equivalent. Although the gap is narrowing and will become positive in the mid-term, incentives that help offset the higher cost of battery electric machinery will speed up adoption. Furthermore, there is very little clear government policy related to battery electric construction machinery. If more countries and cities announced plans to phase out diesel machinery it would allow fleets to invest in the new technology, giving manufacturers and suppliers the confidence of greater volumes, helping them to reduce prices.

“If more countries and cities announced plans to phase out diesel machinery it would allow fleets to invest in the new technology”

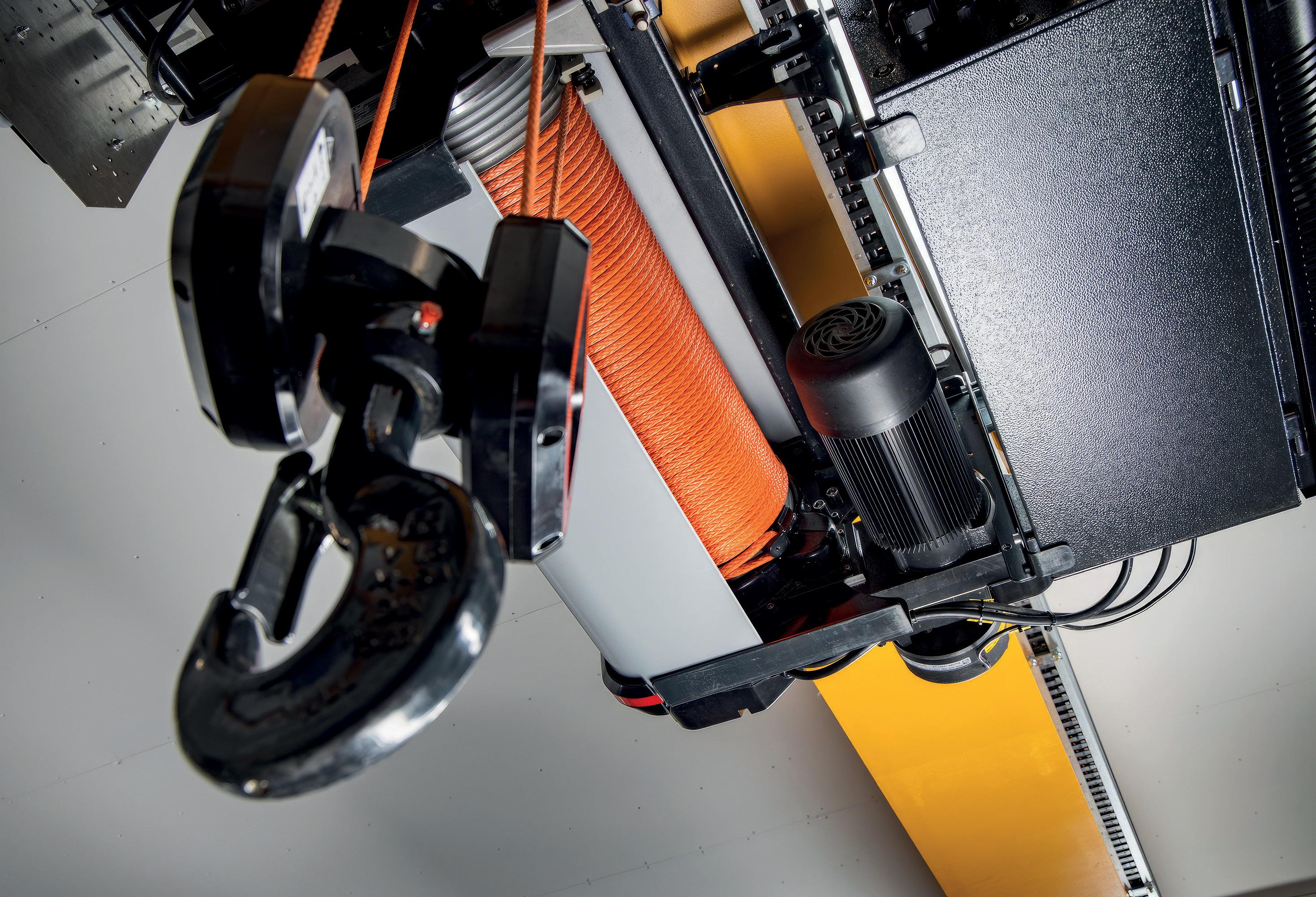

Konecranes’ equipment and services will play a critical role at the heart of Legnano Teknoelectric Company (LTC) Group’s new 30,000 m2 manufacturing plant in Dubai, UAE, supporting the entire material flow from incoming raw materials to finished products including transformers.

The 21-crane and service contract was booked in Q1 2023, with deliveries expected to take place CMME went to press.

Konecranes is supplying 12 S-series and CXT electric overhead cranes and 9 jib cranes. It will also modernize an existing crane at the site to enhance functionality.

In addition, Konecranes will be responsible for the safe and optimised running of the cranes under a 3-year annual maintenance contract, extending a business relationship with LTC Group that first started in 2011.

and the manufacturing process needs both reliable and cutting-edge equipment. Konecranes’ products and services meet those needs, which made it natural to choose them for this project,” says Mauro Mereghetti, managing director LTC Middle East FZCo.

“Customers like LTC Group are increasingly asking for equipment and services that reliably and safely support their material flow, and with reduced carbon emissions. Our cranes do just that, delivering precise lifting while significantly cutting down on wear and tear,” added Ajit Kumar, director, Industrial Cranes, UAE.

Konecranes is supplying 12 S-series and CXT electric overhead cranes and 9 jib cranes

LTC Group is the world leader in magnetic cores and laminations for a wide range of transformers and reactors. As it continues to grow its renewable energy sector business, its new facility in Dubai –which will double its production capacity in the region – will play a prominent role in supplying transformers for wind power, photovoltaic, hydroelectric, cogeneration and biomass facilities.

“Our production line uses high quality materials

Konecranes is a worldleading group of Lifting Businesses, serving a broad range of customers, including manufacturing and process industries, shipyards, ports and terminals. Konecranes provides productivity enhancing lifting solutions as well as services for lifting equipment of all makes. In 2022, Group sales totaled EUR 3.4 billion. The company believes its strong focus on customers and commitment to business growth and continuous improvement make it a lifting industry leader: “This is underpinned by investments in digitalization and technology, plus our work to make material flows more efficient with solutions that decarbonise the economy and advance circularity and safety.”

The efficient, hardworking and hard-wearing machine is packed with technology found on its 100t counterpart which has been proven on jobsites throughout the world. From the outstanding body and drivetrain engineering through to ancillary equipment and complementary services, this is a machine designed to get the absolute most out of every working day. With operator productivity a focus comfort and safety form core elements of the R60 design.

Find more informations: