service – have you got the right mix?

In this edition:

l eInvoicing: helping with fast, efficient and secured payments.

l 5 ways AR automation will help your team.

l A special Tribute to Eric Milne, LICM CCE

l Distance Education – now is the perfect time to take charge of your learning.

The Publication for Credit and Financial Professionals IN AUSTRALIA Volume 30, No 2 April 2023

Automation and customer

Our 2023 supporters

National partners

Divisional partners

Divisional supporting sponsors

2 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

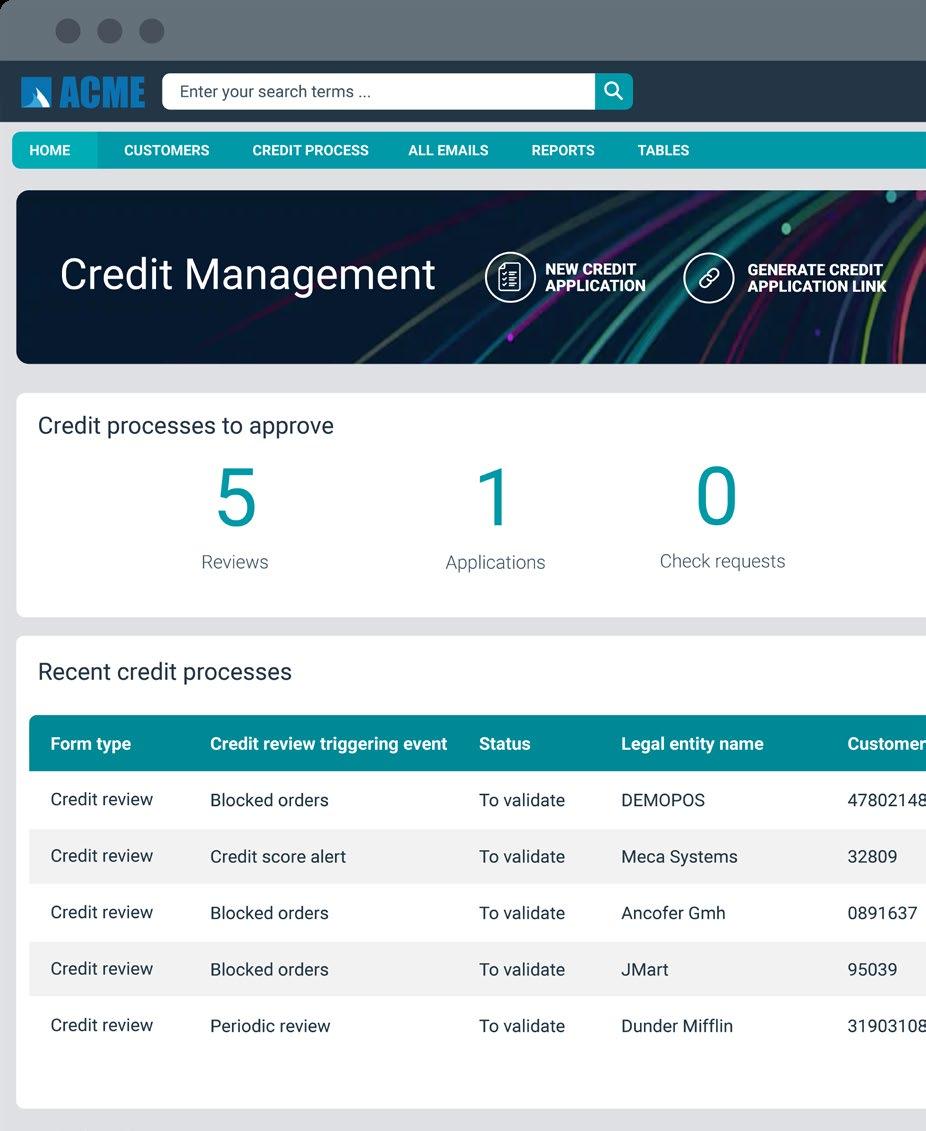

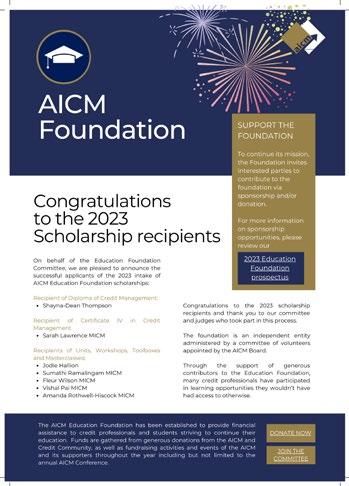

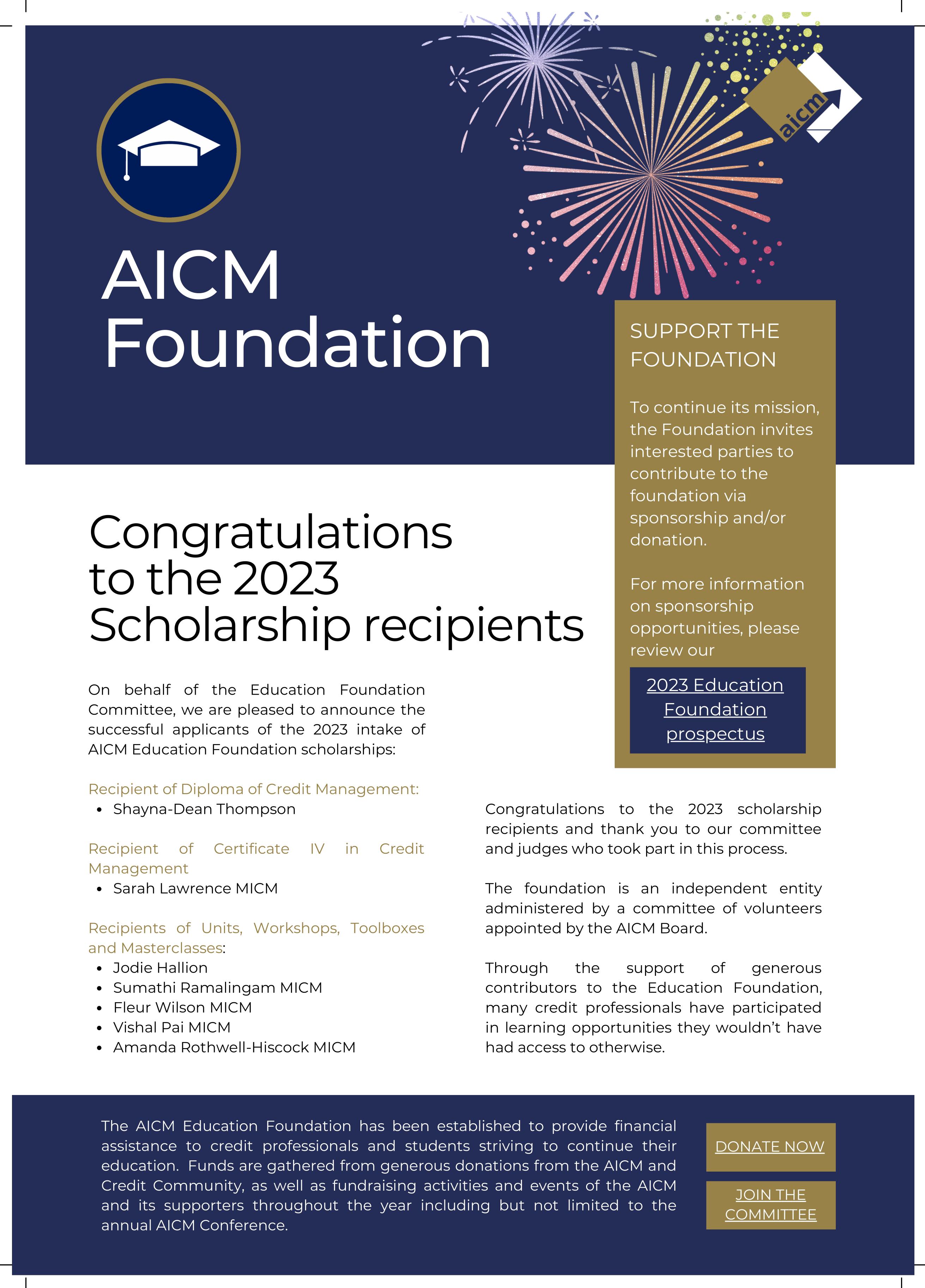

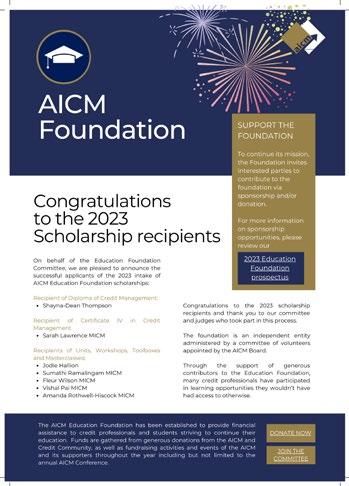

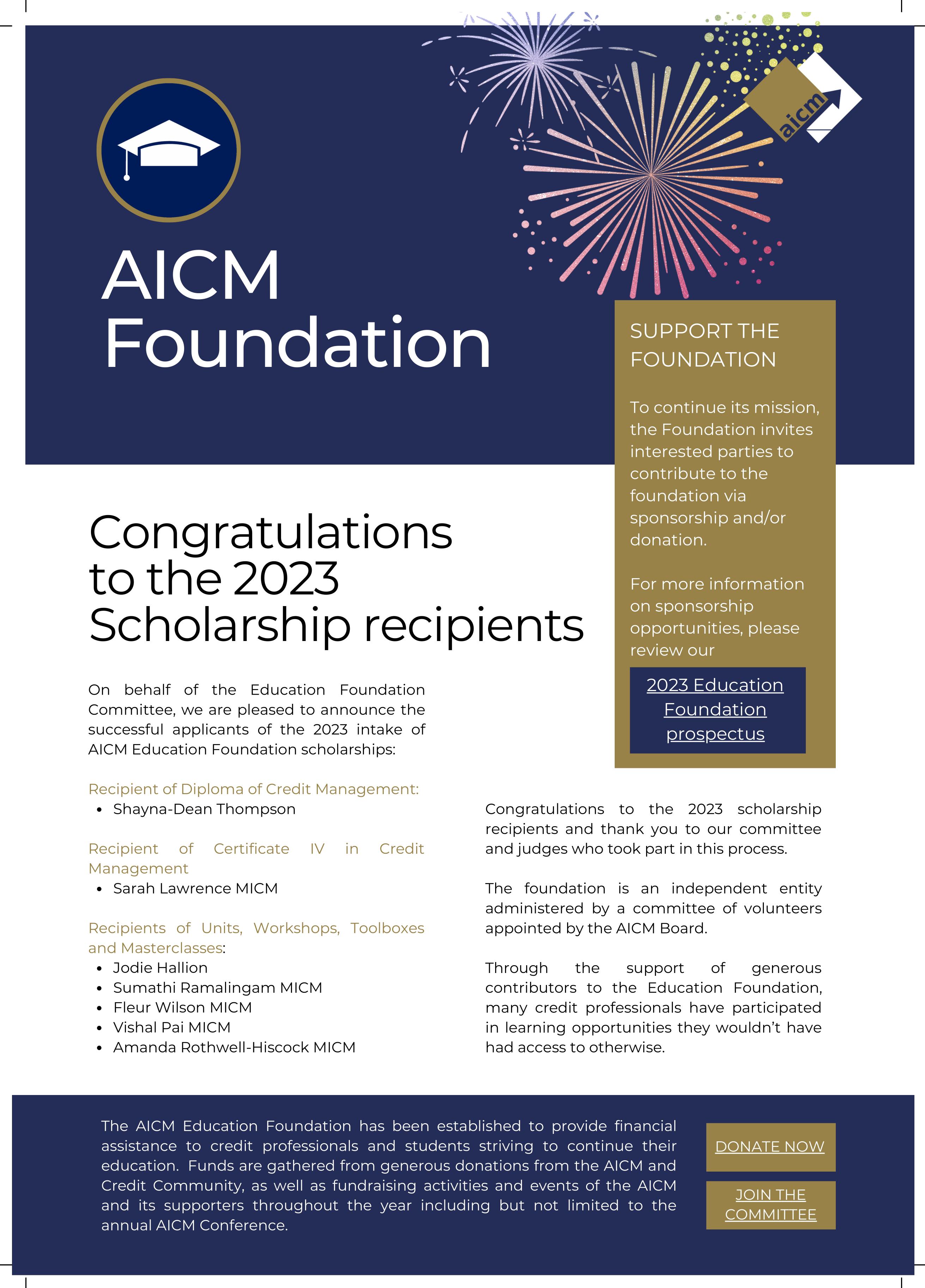

CREDIT MANAGEMENT SOFTWARE

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 3 Contents Volume 30, Number 2 – April 2023 Eric Milne Tribute 8 Message from the President 6 Special Tribute A tribute to Eric Milne 8 AICM Foundation 13 Pathways Distance education in the credit sector 14 AICM recent graduates 16 Classroom training calendar 16 Masterclass 17 Credit Management Effective Credit Management – Part 2 18 Terms and Conditions of Trade Mark Logue MICM CCE 2023 National Conference 21 Economic Outlook Credit rating downgraded for 33% of construction 22 companies Brad Walters MICM Update from across the ditch: 26 Cost of living impacting Kiwi households Monika Lacey MICM Customer Service & Technology Why automated collections are better than 32 spreadsheets Matt McFedries Monika Lacey Matt McFedries 26 32 Mark Logue 18 AICM Foundation 13 National Conference Brad Walters 21 22

Contents

ISSN 2207-6549

DIRECTORS

Julie McNamara MICM CCE – Australian President

Lou Caldararo LICM CCE – Victoria/Tasmania & Australian VP

Rowan McClarty MICM CCE – Western Australia/ Northern Territory

Gail Crowder MICM – South Australia

Peter Morgan MICM CCE – New South Wales

Debbie Leo MICM – Consumer

Steven Staatz MICM CCE – Queensland

CHIEF EXECUTIVE OFFICER

Nick Pilavidis FICM CCE

Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065

PO Box 64, St Leonards NSW 1590

Tel: (02) 8317 5085, Fax: (02) 9906 5686

Email: nick@aicm.com.au

PUBLISHER

Nick Pilavidis FICM CCE | Email: nick@aicm.com.au

CONTRIBUTING EDITORS

NSW – Gary Poslinsky MICM

Qld – Emma Purcival MICM CCE

SA – Clare Venema MICM CCE

WA/NT – Jeremy Coote MICM CCE

Vic/Tas – Alex Hawtin

EDITOR/ADVERTISING

Claire Kasses, General Manager

Tel Direct: 02 9174 5727 or Mob: 0499 975 303

Email: claire@aicm.com.au

EDITING and PRODUCTION

Anthea Vandertouw | Ferncliff Productions

Tel: 0408 290 440 | Email: ferncliff1@bigpond.com

THE EDITOR reserves the right to alter or omit any article or advertisement submitted and requires idemnity from the advertisers and contributors against damages or liabilities that may arise from material published. CREDIT MANAGEMENT IN AUSTRALIA is published by the Australian Institute of Credit Management, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065. The views expressed in CREDIT MANAGEMENT IN AUSTRALIA are not necessarily those of Australian Institute of Credit Management, which does not expect or invite any person to act or rely on any statement, opinion or advice contained herein (whether in the form of an advertisement or editorial) and neither the Institute or any of its employees, agents or contributors shall be liable for any opinion contained herein. © The Australian Institute of Credit Management, 2023.

JOIN US ON LINKEDIN

Click Here

EDITORIAL CONTRIBUTIONS SHOULD BE SENT TO:

The Editor, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065 or email: aicm@aicm.com.au

eInvoicing: Helping credit professionals with fast, 35 efficient and secured payments

The human side of AR: 5 Ways AR automation 38 helps your team. Feel better, work smarter and stay longer

Eric Maisonhaute MICM How

make cash flow your tool for success

4 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

44

Adrian Floate

35

38

Mark Stockwell

Eric Maisonhaute

Mark Stockwell

44 Adrian Floate MICM Member anniversaries 48 Division Reports South Australia 50 Queensland 54 Victoria/Tasmania 60 SA: The Beerenberg Family Farm 50

to

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 5 Contents Volume 30, Number 2 – April 2023 For advertising opportunities in Credit Management In Australia Contact: Claire Kasses, General Manager Ph: 1300 560 996 E: claire@aicm.com.au Vic/Tas: Mary Petreski MICM CCE, Brody Viney Senior Economist at NAB and Michelle Carruthers MICM. WA/NT: Economic Breakfast Presenter Aiden Depiazzi from Deloitte Access Economics. 60 66 NSW: NSW Council dinner. 69 81 Qld: Economic Breakfast: Full Room at Darling & Co. 54 Western Australia/Northern Territory 66 New South Wales 69 New members 78 Marketplace 81

from the president

Welcome to the second edition of the AICM’s Credit Management Magazine for 2023.

It is shaping up to be a fantastic year of events within the AICM with both learning opportunities and social events.

Planning is well underway for an even bigger and better Young Credit Professional Award to be presented at this year’s National Conference in Adelaide together with a great line up of speakers and sessions currently being built. I look forward to yet another amazing conference and catching up with you all in October. We thank ARMA, a Credit Clear Company and CreditorWatch for their continued support of this award now in its 26th year.

I am excited to announce that we are launching the Credit Professional of the Year award that will recognise professionals who lead a team of 2 or more direct reports or work as a credit specialist at a senior/strategic level within a credit provider. Applications for the division awards will open shortly with the national award presented at the National Conference. We thank illion for sponsoring this award and making it possible for us to recognise the achievements of our high achieving credit professionals.

Our 2023 Women in Credit, WINC theme is “A Catalyst for change” and celebrates AICM’s actions toward a gender equal future. We have already had a great start of the WINC program with the first webinar, “4 Questions to move from Stuck to Significance” recently being held on International Women’s Day, 8th March. We had a record of 247 registrations and we are

Julie McNamara MICM CCE National President

already in the planning for the next webinar in July. I do hope you all took something away from the webinar as did I.

Almost all face-to-face WINC events are now open for registrations. The first WINC luncheon is kicks off in Sydney on the 5th of May! We are likely to sell out in most locations so check out the calendar in your state and hurry if you don’t want to miss out.

We look forward to supporting our chosen charity for 2023, The Women’s Resilience Centre.

We have published two reports since the last edition of the magazine with the Overdue Credit Index Report and Risk Reports being circulated, both of which are available on our website.

The Risk Report was published on the 22nd of March to inform the profession as a whole. The report draws on a survey of AICM members and Certified Credit Executives to provide insight on how recent and future economic conditions are impacting their ability to manage risk and ensure their businesses are paid promptly.

Our National Roadshow is currently taking place with the Risk Seminars and Economic Breakfasts.

We have been organising the Risk Seminar series for six consecutive years now; this seminar has been developed by a national committee of credit, legal and insolvency professionals in collaboration with the Australian Restructuring Insolvency and Turnaround Association, ARITA with a purpose to:

l Identify where credit and insolvency risk may arise

l Manage and forecast to include risk

6 CREDIT MANAGEMENT IN AUSTRALIA | April 2023 aicm

l Adapt to new reforms and the ever changing landscape

l Understand emerging trends

AICM’s annual Economic Breakfasts are designed to give members a holistic view of economic conditions relevant to how they manage credit risk and cash flow for their business. Not to mention a lovely opportunity to network with old and new friends.

With the recent failures of significant building companies leaving so many families with unfinished homes, it is becoming more and more obvious that 2023 will be a time to be diligent and proceed with caution when we are making our day to day credit decisions making it even more prevalent to be attending AICM’s events provided for our benefit and to keep us all informed.

Don’t miss your opportunity to register and attend these great events including our new courses outlined on the AICM websiteAICM provides a range of qualifications and short courses for beginners who are keen to advance in their careers, right through to more senior position holders wishing to refresh their knowledge, or test their skill with the coveted CCE, Certified Credit Executive status.

The new AICM member portal makes it very easy to check your points and start planning how you can achieve 100 points to qualify to sit the assessment and achieve your Certified Credit Executive status.

There are many ways to earn your points whilst at the same time keeping up to date with changes in legislation, from the many seminars, workshops, certifications such as Cert IV and Diploma in Credit Management

through to the free webinars which are frequently and readily available.

We are on track with our membership target with great results to date, we are striving to reach 3,000 members by the end of June thanks to our hard working and passionate council members.

Once again, on behalf of our distinguished board of directors, I would like to thank all our members, colleagues, sponsors, partners and our AICM office for their continued support.

The AICM board, National office and Division Councils strive to continually provide more opportunities for you to succeed in your role and career. This work is highly reliant on a small but passionate group of credit professionals who volunteer on the board and division councils. Like all credit professionals these volunteers have very busy lives and workloads so on behalf of all members I thank them all for their contributions. You can see who your council representatives are here.

To continue growing the AICM we need more passionate credit professionals to step forward and contribute to their profession. If you feel you have the experience and passion to enable you to help in any way and you feel you could support your council or board, I encourage you all to do so. It is the most rewarding and satisfying experience knowing you can make a difference. We are currently looking to grow in most areas, particularly South Australia and Perth, so please email aicm@aicm.com.au and we will put you in touch with your local division council.

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 7 aicm from

president

the

Julie McNamara MICM CCE National President

“AICM provides a range of qualifications and short courses for beginners who are keen to advance in their careers, right through to more senior position holders wishing to refresh their knowledge, or test their skill with the coveted CCE, Certified Credit Executive status.”

A tribute to Eric Milne

Eric joined the AICM in January 1981 at that time working for the Bank of NSW (now Westpac) in their Bankcard department, established in 1972 as Australia’s first universal credit card scheme.

He was recruited as one of several specialist consumer credit manager/controllers to set up and run this new department. He worked closely with long standing and very conservative senior bank managers to review and adjust conservative lending and collection policies to suit this new product. A key step to this was advocating for the bank to sign up with Credit Reference Australia (now Equifax), now fundamental to credit management but a significant step at the time.

Eric served 10 years on the NSW Divisional Council which he reflected on as a very rewarding experience where he witnessed the progression of the AICM from State/Divisional based organisation to a more unified and truly national body.

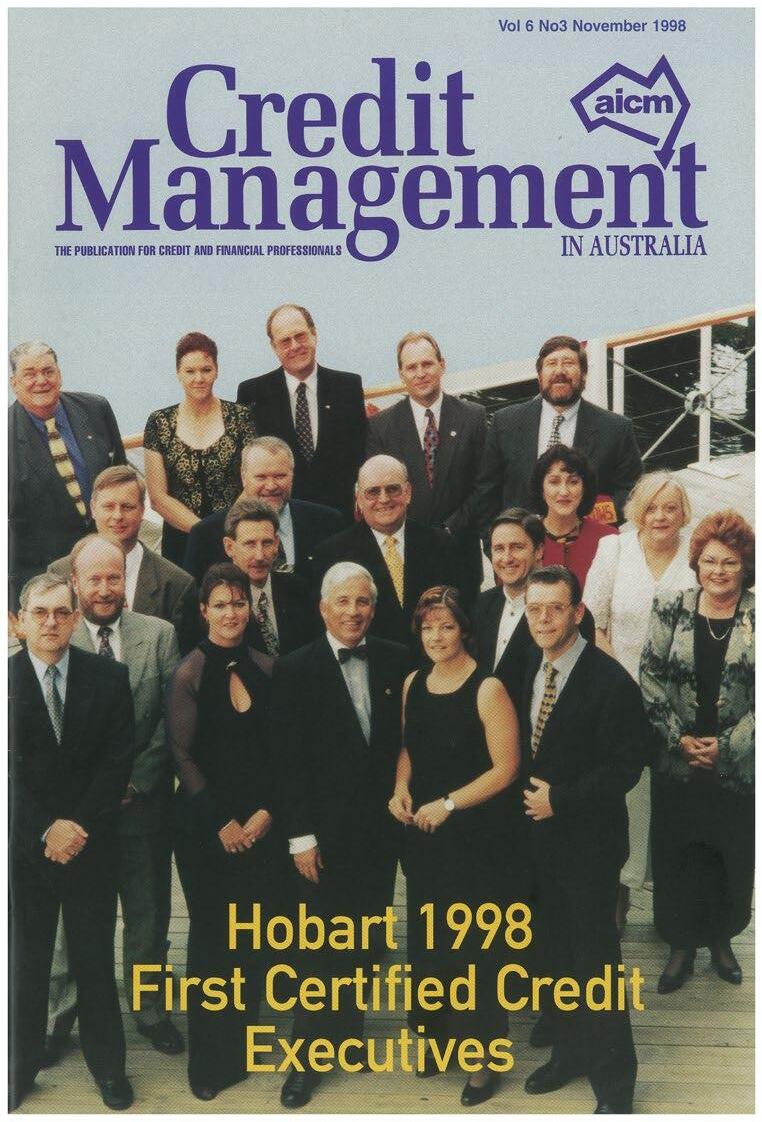

In 1998 Eric sat and passed the inaugural Certified Credit Executive exam in Hobart in 1998 maintained this certification ever since, including in recent years volunteering to review and update the classroom exam.

Eric is remembered by members from around Australia for his friendship and willingness to share and debate all aspects of credit management. He shared his knowledge generously through numerous forums including as a lecturer in Advanced Credit Theory and Practice at the NSW TAFE course, AICM conferences, authoring numerous articles and was invited to chair and present at several international credit management conferences including Kuala Lumpur, Mumbai and Hong Kong.

His experience spanned a number of industries, and he found a niche in the consumer electronic industry having worked for over 20 years for such global companies as Casio, Aiwa, Toshiba, Panasonic and Fujitsu General. At the 2022 National Conference Eric was sharing his most recent experiences and contributions in his role with Master Builders (NSW) where he had significantly increased cash collections and maintained member engagement.

In 2009 Erics contributions to the AICM and credit profession were recognised with Life Membership but this didn’t signal the culmination of his contributions as he continued to contribute to the AICM and his vast network of peers and close friends in all aspects of the credit industry.

Eric is missed by many but his experiences, knowledge, passion for credit management and zest for life lives on in all that had the pleasure of spending time with him as is seen from the testimony of his peers that follow.

We invite members to contribute their tributes and view other on the AICM Credit Network here

8 CREDIT MANAGEMENT IN AUSTRALIA | April 2023 aicm special tribute

July 2013: Eric Milne presents A Credit Management Hypothetical in Adelaide.

From David Hunt MICM CCE President – Australian Credit Forum and National Credit Manager FUJIFILM Australia

Eric was a great man and a huge contributor to the credit industry.

In addition to his extensive contributions to the AICM, Eric was a very long-standing Member of the Australian Credit Forum (ACF) a closed group of senior credit professionals who meet regularly to exchange experiences and strengthen their own credit standards and knowledge.

Eric served on the ACF Executive Committee for many years President before handing over the reigns to me in 2017 It always amazed me the time and energy he put to the ACF knowing he put equal passion into his professional career, credit bureaus the AICM and of course his personal life. But that is what made Eric such a great credit professional and person to know, he understood that leveraging a strong

network of peers professionally and personally is what empowers a credit professional to achieve outstanding results.

On a personal note, after moving to Sydney 15 years ago he was the first person to take me under their wing when I first started attending credit industry events. Singling me out wanting to get to know me and introducing me to others.

We went on to have many adventures, one that stands out is after I acquired another Harley, the two of us set off from Sydney to the Gold Coast for the 2014 AICM National Conference. It’s a long ride so he had booked a night’s accommodation at a resort in his beloved Port Macquarie. Our stay included ample time at the bar, enjoying steak and a bottle of red and watching the All Blacks beat the Wallabies yet again in a Bledisloe Cup match, complete with Eric’s version of the Haka!

My mentor, my friend will be greatly missed by me and many others in particular his wife Sharon.

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 9 aicm special tribute

July 2010: Life members Eric Milne and David Francis receiving their newly designed life membership pins from Nick Pilavidis.

December 2010: MS Bike Ride

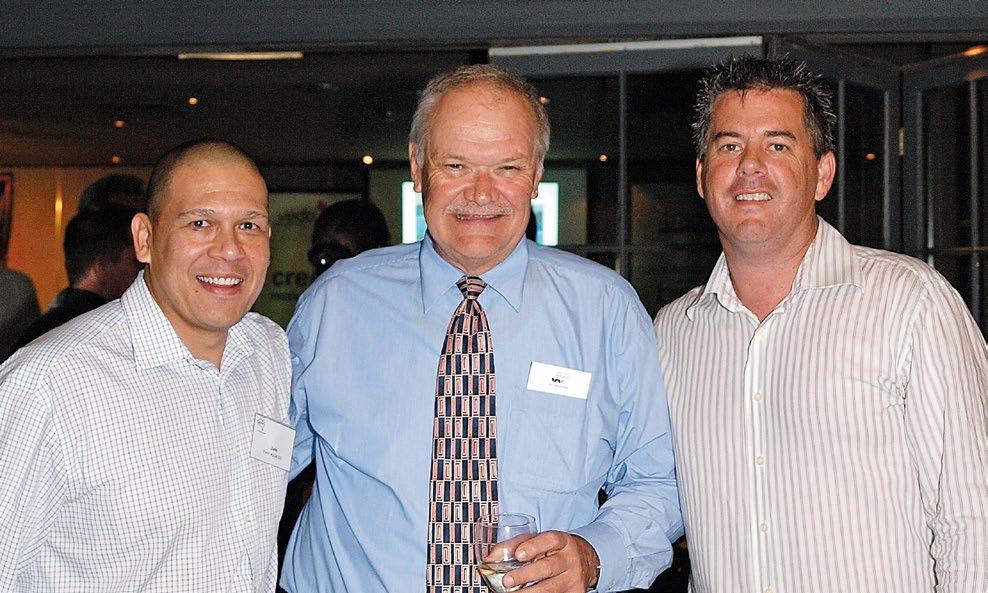

March 2010: John Field – Commercial Credit Services Pty Ltd, Eric Milne – Fujitsu General, James Van Poppel –Commercial Credit Services Pty Ltd.

October 2007: Four members of the AICM NSW Division who attended and spoke at an International Credit Conference in Malaysia in July 2007. L-R: Eric Milne FICM CCE, (Santhirasegaran, Past President, Association of Credit Management Malaysia), Dinah Gould MICM, Geoff McDonald MICM, Joe Laban, MICM CCE, (Amu Pillay, Conference organizer).

A tribute to Eric Milne

Tribute from Jeff Hurst LICM CCE FIML Director Trade Bureaux Australia

We all meet people during our journey that leave an impression both good & sometime sadly bad. Eric Milne was one that has left great impressions!

I was lucky enough to have met Eric far too many years ago to mention. His passion for this Industry was way beyond what you may say was normal.

The many papers he presented were always topical/ easy to understand and so helpful not only to those new to this industry but for those of us who have been involved for many years. So, for that I say “Eric, thanks heaps mate.” Your assistance over the years was truly appreciated.

Each conference I have looked forward to sitting down over a single malt or meeting up for dinner on some of my trips to Sydney and discussing not only Credit related issues but topics that we both had opinions on. To say the AICM Conference will no long be the same without seeing you there is an understatement.

To think that the Oct 2022 conference was the last time is hard to accept but that’s life.

So, will raise a Single Malt in your name Eric –and simply say thanks mate.

From John Field FICM CCE CEO & Founder Reworq Consulting

I am truly saddened by the loss of my good friend and my mentor of over 25 years, Eric Milne. My immediate thoughts are of his wife, Sharon, and their respective families.

Eric was a proud and passionate supporter of the credit industry and in particular, our young credit professionals as they navigated their careers towards a senior credit role. He was only too happy to impart his vast knowledge of credit but especially with understanding your customers business (and situation) over numerous industry sectors.

I was privileged and honoured to be mentored by Eric. I also shared the stage presenting various topics at AICM Networking Meetings, Professional Development Workshops, and National Conferences over many years. He very much enjoyed presenting to an audience, the many hours researching material and the delivery engagement.

Eric provided a significant contribution to the Certified Credit Executive (CCE) program by not only preparing each year’s national exam questions but also undertook many coaching sessions with our Members, via the CCE Trial Exam journey by aspiring Members to sit (and pass) the exam. He always enjoyed researching new questions and topics over many years…I know because he would continually call me to bounce off so many of his ideas or direction!

When I joined Philips Electronics Australia in 2002 as National Credit Manager, Eric was the Chairman of the Consumer Electronics Credit Bureau (CECA) at the time. He welcomed me to the group but advised that I needed to take on another role! What role? Well, I eventually became the Chairman of CECA and Eric took on the new role of Social Secretary…he was so good at his research!

Until the day when we meet again Eric, I look forward to seeing your big smile, hearing your loud jovial laugh, sharing a great meal (with a few wines) and reminiscing on your thoughts for the next CCE Exam paper.

10 CREDIT MANAGEMENT IN AUSTRALIA | April 2023 aicm special tribute

July 2014: Credit Network Night speaker Eric Milne with Amy Webster (left) and Lisa Clements (right) following presentation to Qld Members.

Tribute from Roger Bates

National Credit Manager for 47 years (retired)

AICM Member (45 years)

Ex Chairman and Life Member ACF

My friend Eric Milne left us far too early.

After almost 50 years of friendship; of sharing professional and personal insights, I had developed a sincere appreciation for Eric’s unapologetic authenticity. I recognised a man with an absolute passion for his chosen profession and I respected that his contributions were met with real appreciation from his peers.

There is no doubt that my friend’s passing is a loss to the credit industry but his legacy should not go unnoticed, in his inimitable fashion he established an enviable work ethic which set new benchmarks in professional involvement; an inspiration to those who follow, possibly even raising perception of the industry itself.

Following my retirement to Port Macquarie Eric became a frequent visitor, initially dressed

in full leathers, rumbling up my driveway on his “weekend” Harley Davison but later as a well-groomed and fashionable man-abouttown; an evolution brought about by the one person who will suffer his loss more than any other.

When Sharon entered Eric’s world, the changes were significant and entirely positive. Noticeably, his life took on new meaning, he embraced a whole new present and began to chart an exciting future. As a couple, they relocated from Sydney to Port Macquarie and the sun began to shine.

The cruelty of early passing is hard on friends and extended family but devastating for those closest, whose hearts and souls are entwined with a loved one lost. Eric and Sharon shared a relatively short time together but held plans for a lifetime.

I will remember Eric Milne for his passion and friendship and I sincerely hope that Sharon will be able to take solace in the knowledge that she brought so much joy to his final years. RIP my friend.

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 11 aicm special tribute

November 1998

Eric and his wife Sharon

A tribute to Eric Milne

Tribute

from

James Van Poppel MICM CCE Managing Director Commercial Credit Services

We lost not only a great man, but also someone who was very passionate about what it was to being a credit manager and a key contributor to the credit industry.

I was privileged to have met Eric in the very early days of my entry to the world of credit and collections and was introduced to him by Ian Coates. Eric saw I was new to the industry and he took me under his wing and we developed a master and apprentice kind of relationship over the initial period.

I was blessed to have a business and personal relationship that has spanned 20 years. Over that journey we have worked together and we have also been part of different professional bodies. Eric was someone that loved life and he was able to combine his knowledge and experience with a genuine zest for the networking side of the profession. He did not see one more important than the other, but each was equally important in the quest to be a credit manager. He taught me a lot over the years and I know a lot of people who crossed paths with him testify to the same thing.

We miss you Eric and thank you for the man you were. I know as many people would agree, you were a great teacher, fountain of knowledge and friend.

Tribute from Andrew Le Marchant LICM CCE

My overriding memory of Eric will be how much of a people person he was. He spent his life thinking of others and derived such joy from planning the next event and who would attend. His generosity was legendary.

He had a huge heart and made time for others in both his personal and professional capacity and this is seen through the comments made here by his peers in the credit profession.

I met Eric through my involvement in a bureau in the 1990’s and would interact with him and seek out his senior credit management experience whenever I was fortunate enough to attend one of his insightful presentations whether they be on a serious credit risk topic or his involvement in the NSW division’s end of year debates.

Later my partner Tyson and I were privileged to be invited to social events and our friendship deepened and we were present at the first social outing where Sharon was given a baptism of fire into a group of credit professionals. We will miss our times together.

I am deeply saddened that my friend’s time was cut short as he certainly lived to the full and I know his children Brigham and Ashley will miss his involvement with his beloved grandchildren.

12 CREDIT MANAGEMENT IN AUSTRALIA | April 2023 aicm special tribute

Article from 1997

Distance education in the credit sector

Distance education offers a great opportunity for learners to experience a collaborative learning environment. Collaborative learning is an important way to help learners gain experience in interaction and develop important skills in critical thinking, selfreflection, and construction of knowledge which helps busy credit professionals.

In a collaborative learning environment, knowledge and understanding of the subject are shared and transmitted among leaners as they work toward common learning goals or a solution to a problem. Learners gain interactive experiences as they participate in discussions, search for information, and exchange opinions.

A high-quality collaborative learning environment provides learners with opportunities to engage in interactive and collaborative activities and to get better learning outcomes including the development of critical thinking skills.

This is the perfect time to take charge of your learning with these simple steps.

Ideas for fostering motivation and engagement to achieve that education goal in an distance education learning environment

One step at a time

Feeling overwhelmed at work is a common sentiment among AICMs existing students that can cause them to lose motivation, no matter how passionate they are about a credit

topic. Keeping focused on one subject at a time is very important. It’s also a good way to motivate students to focus on one thing at a time, so they don’t feel overwhelmed.

Review progress and set realistic goals

Defining learning milestones based on what an individual has already achieved sets them up for success and helps to ensure motivation to learn remains strong. It can also make a huge difference in attitude and expectations for individuals when looking to complete a qualification. This helps them chart their progress and set goals for the future.

Self-directed learning and motivation

In an online learning environment students take an active vs. passive role in managing their time and assessing their own progress. This encourages intrinsic motivation, as there is no outside pressure to perform or meet deadlines. Students set the pace and decide how much material to cover in each section of the course. A self-directed approach set within the general guidelines of an online course can be extremely motivating, particularly for students who like to complete a set of assessments each week to maintain progress.

How much should I study?

This is a question which every student asks at some point in their studies. You must remember that it’s not the amount of time spent studying, but rather the quality of the

pathways 14 CREDIT MANAGEMENT IN AUSTRALIA | April 2023 aicm

“

In a collaborative learning environment, knowledge and understanding of the subject are shared and transmitted among leaners as they work toward common learning goals or a solution to a problem.”

study that counts. It’s also important to note that there is no single answer. Some students study more effectively than others and will not need to spend as long studying a particular subject. Each student will find some subjects more difficult than others and have to spend more time studying a particular subject. It is always best to focus on your own needs and abilities, rather than others in the group. Your goal should be to improve your study methods so that you maximise the results.

Before looking at the amount of time you need to spend studying, remember the following points:

l Some subjects consume more of your time than others. This is natural and it will depend on how much work you need to do in each one.

l It’s easy to focus on the subjects we are familiar with, so be careful not to neglect other subjects.

l It can be difficult to keep on top of everything during the week, so the weekend can be a good time to catch up in some areas.

The decision is now up to you

The good news is that deciding to invest in your career/future is never a bad decision. If you are ready to study with AICM and obtain a nationally recognised qualification in 2023, contact us today for further information aicm@aicm.com.au we are here to help.

Once you develop a passion for learning, you will never stop growing!

AICM offers training courses which change according to the needs of the credit industry and with its high level of flexibility enables it to provide practical programs that will provide you with valuable knowledge and skills no matter at what stage you are with your career.

pathways April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 15 aicm

“

Some students study more effectively than others and will not need to spend as long studying a particular subject.”

AICM recent graduates

AICM would like to congratulate its recent graduates:

FNS30420 – Certificate III in Mercantile Agents

Monica Aboudha New South Wales Probe Group

Hayley Sheen New South Wales CCSG

FNS40120 – Certificate IV in Credit Management

Raymond Kaaya Queensland TFH Hire Services

Tracy Johnson Victoria Recoveries Corp

FNS51520 – Diploma of Credit Management

Brody Cowling New South Wales BCU

Joshua Cundasamy New South Wales Waco Kwikform Group

Statement of Attainments

Stacy Ridge NSW FNSCUS402 – Resolve disputes SMEG Australia

Stacy Ridge NSW FNSCRD405 – Manage overdue customer accounts SMEG Australia

Classroom training calendar

Tuesday 2nd May Masterclass Understanding the fundamentals of consumer lending

Wednesday 3 May Thursday 4 May Elective unit Diploma BSBCNV614 – Apply principles of trust accounting

Tuesday 9 May Toolbox Understanding credit risk

Wednesday 10 May

Thursday 11 May Core unit of Certificate IV FNSCRD401 – Assess credit applications

Tuesday 16 May Toolbox Fundamentals of Credit

Thursday, 18 May Toolbox Collect with confidence

Tuesday 24 March

Wednesday 25 March Elective Unit Diploma BSBMGT502 Manage people performance

Tuesday, 6 June Elective unit of Cert III FNSFLT213 – Develop knowledge of debt and consumer credit

Wednesday 7 June Masterclass How to trade with trusts

Thursday, 8 June Workshop Understanding Financial Hardship

Tuesday, 13 June

Wednesday, 14 June Elective unit Cert IV BSBOPS404 – Implement customer service strategies

Thursday, 15 June Toolbox Understanding Credit Risk

Tuesday, 20 June

Wednesday, 21 June Core unit of the Diploma BSBOPS504 – Manage business risk

Thursday, 22 June Workshop Personal Property Securities

pathways 16 CREDIT MANAGEMENT IN AUSTRALIA | April 2023 aicm Date Type Topic/event name

Effective credit management - Part 2 Terms and Conditions of Trade

By Mark Logue MICM CCE*

This is the second article of the series discussing the importance of credit risk management to all businesses that provide credit. In Part 1, published in October 2022, we discussed the cost of bad debts, the correct approach to opening a new account and the role of a collection agency in recovering overdue debts. In part 2 we discuss terms and conditions of Trade.

A credit application and terms of trade form the basis of your relationship with customers. They establish the rules of the game and if a problem occurs with the relationship, you want to rely on these documents to resolve the issue.

Just like a prenuptial agreement, when the relationship is travelling smoothly, you don’t give it a second thought, but if things go awry, it is the document you reach for to check your options.

A well drafted credit application and terms of trade will pay big dividends over many years by removing any uncertainty about what was agreed between you and your customer. AMPAC regularly relies on these documents when chasing overdue debts and sometimes we find they are lacking in protection for the creditor.

Below are a few clauses which can help you recover overdue accounts and reduce the associated costs.

Compare the clauses listed below against your current credit documents to identify where you could benefit from a small investment which will pay you back many times over.

Cost Recovery Clause

l A cost recovery clause allows you to recover most of your collection costs (including collection agency commission), thereby reducing the overall cost of recovering your debt. In most cases your collection agency will be able to automatically add all recovery costs to a debt and often you will recover not only the amount owing, but also most of your recovery costs.

Do your terms contain a Cost Recovery Clause? YES NO

Credit Management 18 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

Mark Logue MICM CCE

Interest Clause

l This allows the charging of an agreed amount of interest from the date the debt was due for payment. This is a real incentive for a customer to pay. It also provides a powerful negotiating tool to bring about a settlement.

Do your terms contain an Interest Clause?

Jurisdiction and Governing Law

YES NO

l Where organisations trade nationally, their terms and conditions should specify the state and the law to be used to determine a dispute. For example, if you are located in NSW, then the matter is heard in NSW, using NSW law. Predetermining where a matter will be heard and which law will be applied can save a lot of time and inconvenience.

Do your terms establish jurisdiction and Governing Law?

YES NO

Registration of Security Interest

l If you supply goods, and want to retain ownership until paid, then this applies to you. The Personal Property Securities Act 2009 (PPSA) was introduced in 2012 and allows a supplier of goods (not services) to register their Security Interest in the property, goods or equipment. Businesses need to consider

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 19

“A well drafted credit application and terms of trade will pay big dividends over many years by removing any uncertainty about what was agreed between you and your customer.”

whether registration of a security interest is appropriate in their circumstances, and if so, update their documentation to secure ownership.

Have you considered PPSA in relation to your business? YES NO

Guarantee and Indemnity (with a Charging Clause)

l Successful litigation is of little use if the debtor has no assets. If the debtor is a company, often assets will be secured by a financier, so wherever possible it is important to have the company directors guarantee payment of your debt. A good Guarantee will also contain a charging clause which allows you to lodge a caveat over property owned by the guarantor.

Do your terms contain a Personal Guarantee? YES NO

Variation Clause

l Over time, you may need to vary certain terms in your agreement. This could result from a change in legislation a new product or market opportunity, or perhaps an acquisition of, or the sale of a part of your business. Does your documentation allow you to vary the way you do business and your terms of business? YES NO

Warranting Information Accuracy

l When granting credit, it is important to have confidence that the information provided is correct. If later, the information is found to be inaccurate, you may gain a tactical advantage in any subsequent legal proceeding. Do you require your customer to warrant their information? YES NO

Dealing with Trusts

l Where the customer is a trustee of a trust, it is likely that it has no assets, and all the assets are held in the trust. It is therefore important to bind the debtor in its capacity as trustee of a trust. Is your position secure when dealing with trusts? YES NO

Limiting Liability

You can’t contract out of warranties implied by the various Trade Practices Acts however, you can limit liability in the event that you breach the terms of your supply contract. For example, in the case of faulty goods, suppliers often limit their liability to either the repair or replacement of the goods or services.

Do your terms limit your liability?

Privacy Statement and Policy

YES NO

l The Privacy Act covers organisations with an annual turnover more than $3 million which means the Australian Privacy Principles (APPs) apply. These organisations must have a privacy policy in place. It is also a requirement that organisations meeting this criteria post a Privacy statement if they collect any customer or website visitor information, including email and physical addresses.

Are your privacy obligations up to date?

YES NO

These are just a few things to consider, and should be part of your ongoing credit risk management which costs little, but returns lots.

*Mark Logue MICM CCE AMPAC Debt Recovery

E:

m.logue@4ampac.com.au

T: 0409 749 709

www.4ampac.com.au

Credit Management 20 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

Mark Logue is a debt collection specialist and the joint managing director of AMPAC Debt Recovery. He has more than 30 years’ experience in the debt recovery and credit reporting sector, covering all segments of industry and commerce throughout Australia and overseas.

“

A credit application and terms of trade form the basis of your relationship with customers. They establish the rules of the game ... ”

Credit rating downgraded for 33% of construction companies

By Brad Walters MICM*

Around this time last year, we wrote an article in this magazine warning of the difficulties ahead for Australia’s construction industry. Our data showed that construction industry insolvencies would be on the rise and that small construction business operators were dipping into their personal finances to keep their operations afloat.

A year goes by A year later, and the future is no brighter for this embattled sector.

In January 2023, 33% of the construction entities Equifax assessed had their credit rating downgraded. Considering the credit rating of many entities in this sector is in the Highly Speculative ‘B’ range, many businesses were already in a position where they were vulnerable to adverse business, financial and economic conditions. When faced with adverse conditions over a protracted period, the headroom

is often insufficient to weather the storm.

Should this trend of credit downgrades continue, we expect more construction entities over 2023 to be rated in the ‘CCC’ / High-Risk Credit Watch category. CCC-rated businesses exhibit significantly higher risk attributes, and the market typically avoids engaging with them. Where no viable alternative exists, principals and partners typically limit their exposure to these contracting entities by requiring third-party guarantees and strict contract terms.

With construction failures on the rise, financiers, insurers and other stakeholders are becoming more cautious. Equifax insolvency data for the financial year-to-date reveals construction insolvencies are up 89%. Construction insolvencies increased by 50% in the second half of 2022 compared to the first half. The construction industry has become one of the top five late-payers, and

Economic Outlook 22 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

Brad Walters MICM

we’ve observed a higher proportion of construction businesses experiencing cash flow difficulties with many reporting net cash outflow.

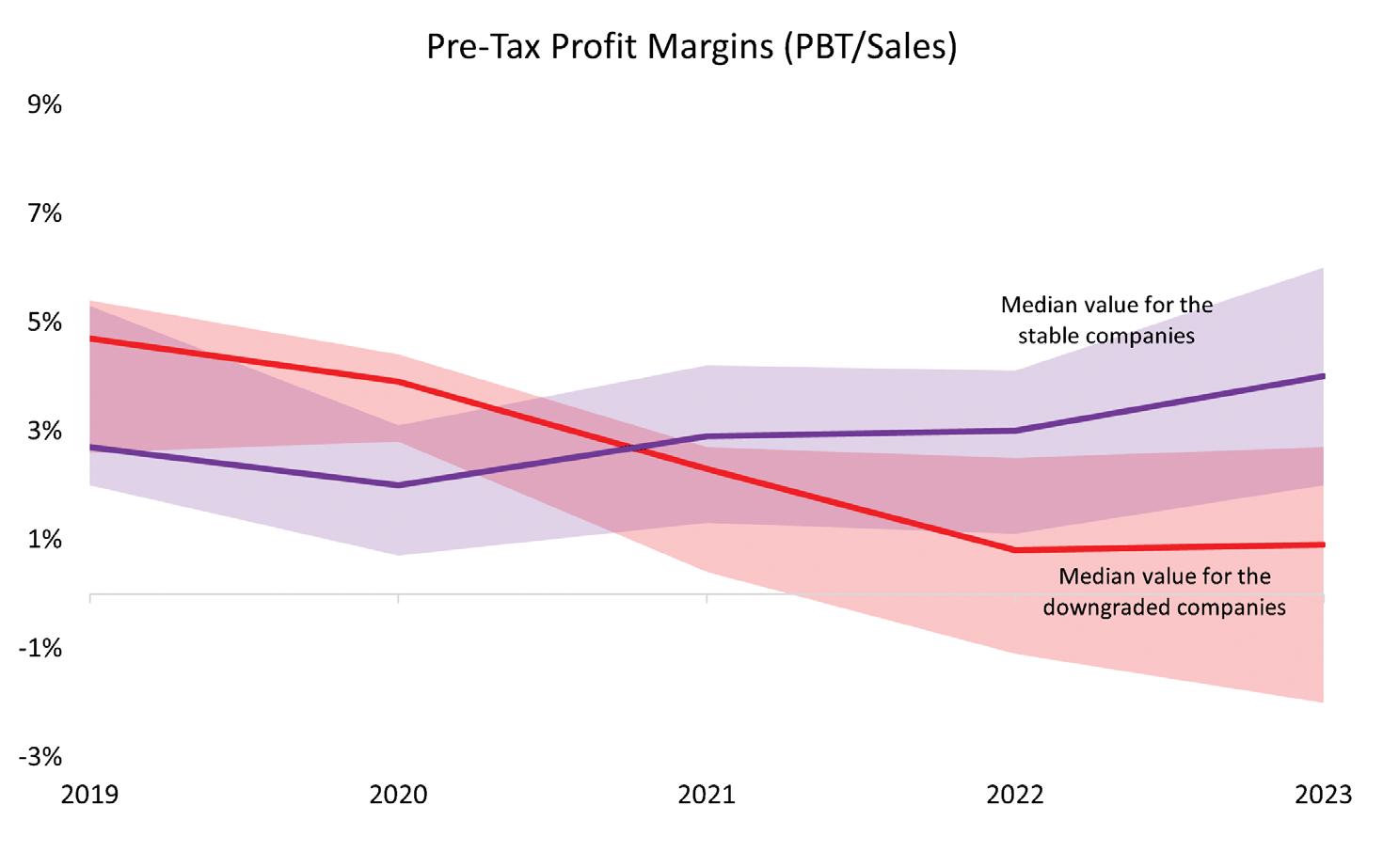

Erosion of margins

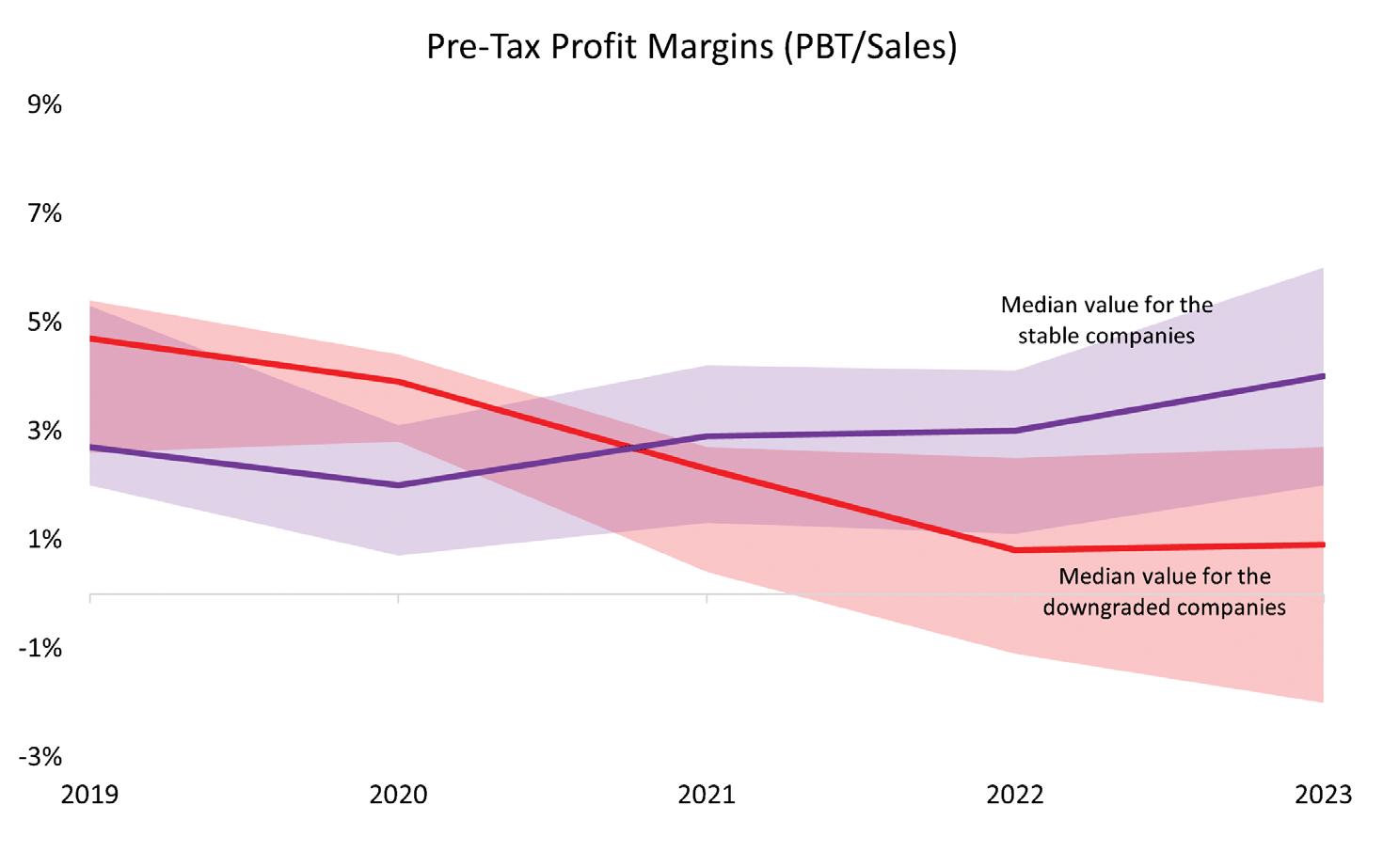

As shown in Exhibit 1, eroded profit margins are a characteristic associated with entities that have had their credit rating downgraded.

For too long, construction businesses have had to cope with supply chain issues, labour shortages and adverse weather events,

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 23

“

In January 2023, 33% of the construction entities Equifax assessed had their credit rating downgraded.

”

Exhibit 1: Pre-Tax Profit Margins (PBT/Sales)

contributing to higher project costs and delay blowouts. This pressure can be too hard to bear in an environment where construction companies without the protections of rise and fall clauses may be unable to pass on increased costs under fixed price contracts.

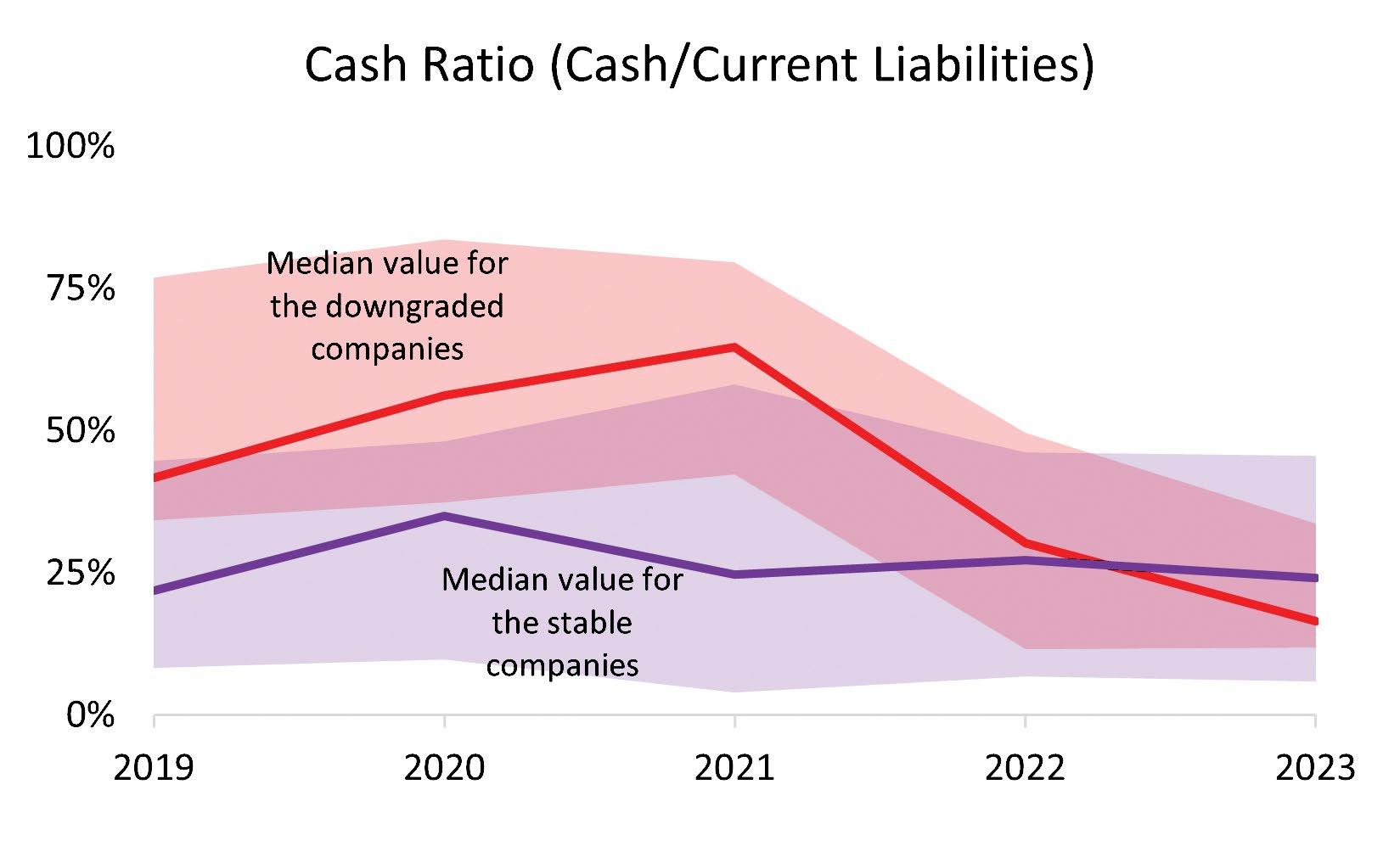

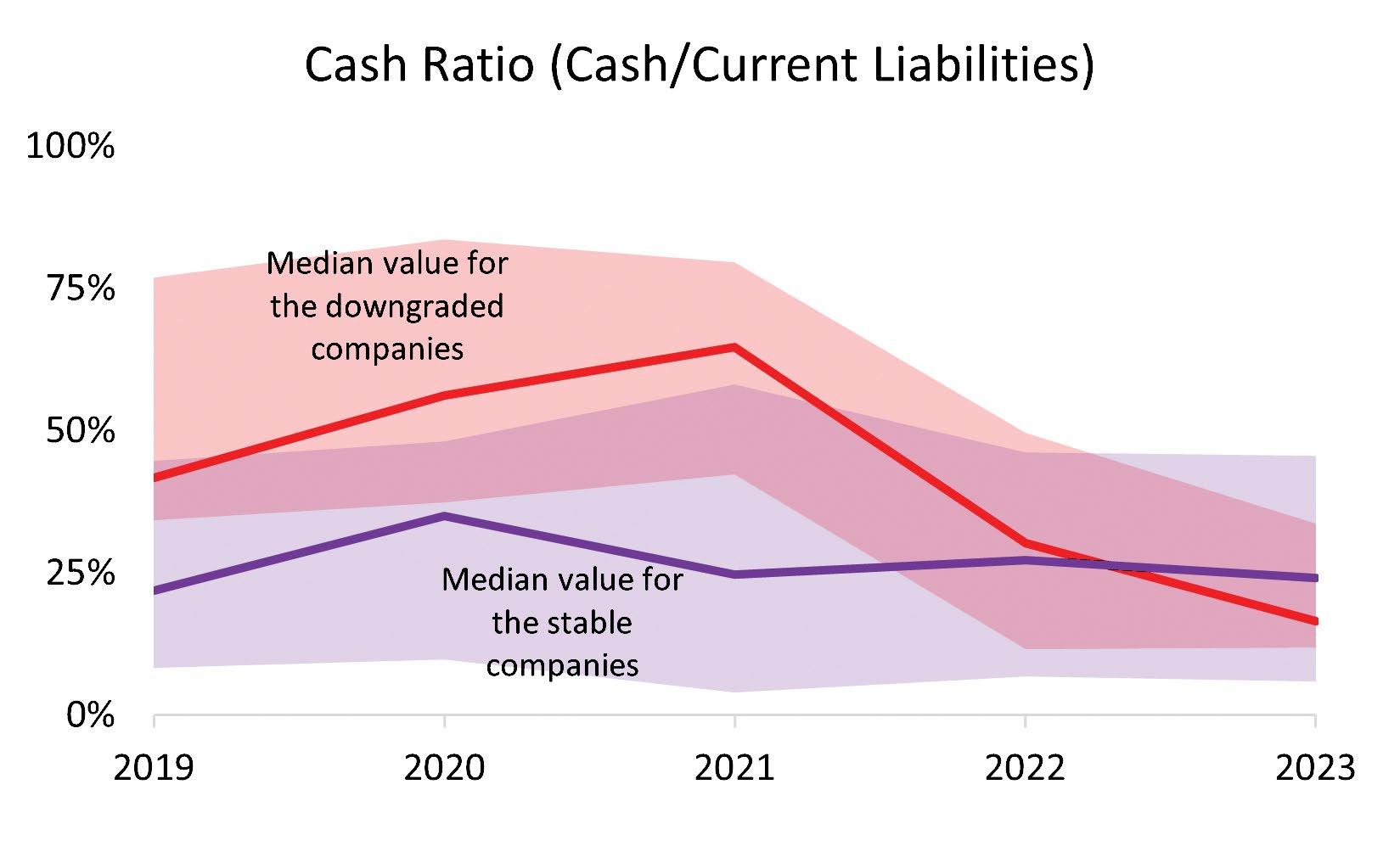

Reduced cash balances

Exhibit 2 shows that weaker margins have seen companies eat into their cash balances over the last 12 months. The decrease has been swift for more vulnerable entities who relied on temporary relief mechanisms and supportive policies through Covid to improve their cash levels. This rapid downturn points to further issues on the immediate horizon.

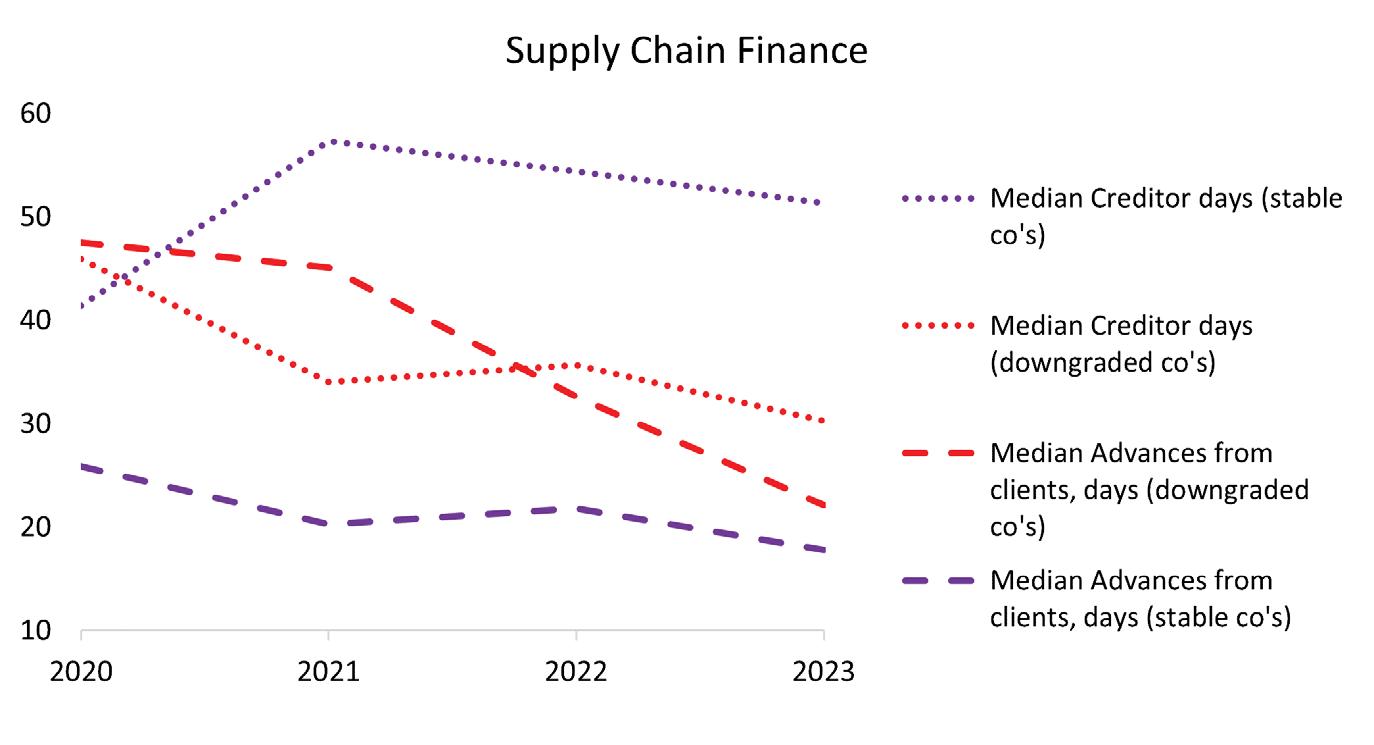

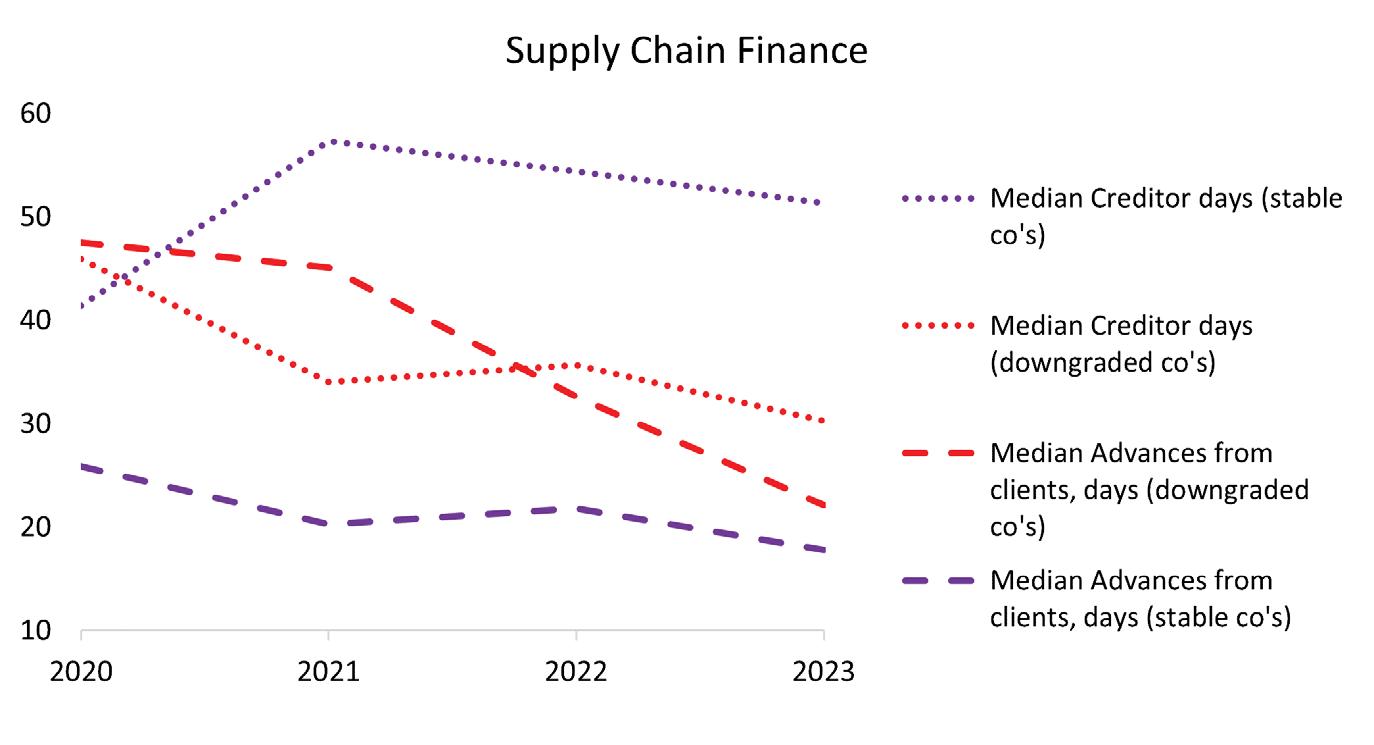

Supply chain finance impacted

As shown in exhibit 3, entities with downgraded credit ratings have lower creditor days outstanding, which could reflect their reduced bargaining power with creditors. The slowing economy has made it harder for these businesses to continue to rely on supply chain finance from trade credit and early customer deposits, which have often been used to fund their operations.

Fewer new construction projects and reduced cash reserves have made it increasingly difficult for struggling businesses to have the resilience to weather further shocks to their cash flows. With increased interest

rates and a more cautious lending environment, the question remains how these businesses with relatively small balance sheets and diminished cash reserves will fund themselves for the remainder of 2023.

Economic Outlook 24 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

“With construction failures on the rise, financiers, insurers and other stakeholders are becoming more cautious. ... data for the financial year-to-date reveals construction insolvencies are up 89%. Construction insolvencies increased by 50% in the second half of 2022 compared to the first half.”

Exhibit 3: Supply Chain Finance

Exhibit 2: Cash Ratio (Cash/Current Liabilities)

Introducing a transparent & auditable risk assessment process

Despite the challenges facing the construction sector, there are still operators exhibiting sufficient financial capacity, capital, capability and resilience to weather the storm. To recognise and reward these trustworthy players, a public and private sector working group has collaborated around a new star-rating regime, which enables construction businesses to go through an independent and rigorous review process to obtain a star-rating outcome that substantiates and verifies their resilience.

The new Independent Construction Industry Rating Tool, iCIRT from Equifax provides an opportunity for more reliable players to differentiate themselves in the market and be accountable for the quality of the built assets they deliver. Higher standards drive improved public trust and market confidence, vital ingredients for an industry’s long-term viability and profitability.

More than 200 construction businesses are working through the assessment to receive a rating of between one and five stars. By expanding the line of sight and providing early visibility into who are the reputable players, dealing with trustworthy

constructors is now a choice people can make. Confidence is already returning to the industry with the recent introduction of latent defects insurance, giving rated developers a way to offer 10-year protection to residential apartment buyers.

Real estate agents, financiers, insurers and industry partners are also beginning to seek out credentialed, star-rated builders and developers in a trend that may yet counterbalance some of the construction industry’s headwinds.

*Brad Walters MICM Head of Product & Rating Services Equifax www.equifax.com.au

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 25

“Despite the challenges facing the construction sector, there are still operators exhibiting sufficient financial capacity, capital, capability and resilience to weather the storm.”

Update from across the ditch: Cost of living impacting Kiwi households

By Monika Lacey MICM*

The beginning of 2023 has been challenging for many households in New Zealand as the increased cost of living continues to squeeze wallets nationwide.

In February, the Reserve Bank made the tenth consecutive increase to the Official Cash Rate – up an additional 50 basis points to 4.75%.

Furthermore, New Zealand’s GDP fell 0.6% in the last three months of 2022. Despite coming off several quarters of consistent upward growth, this fall fuels ongoing concern the country is heading towards an engineered recession this year.

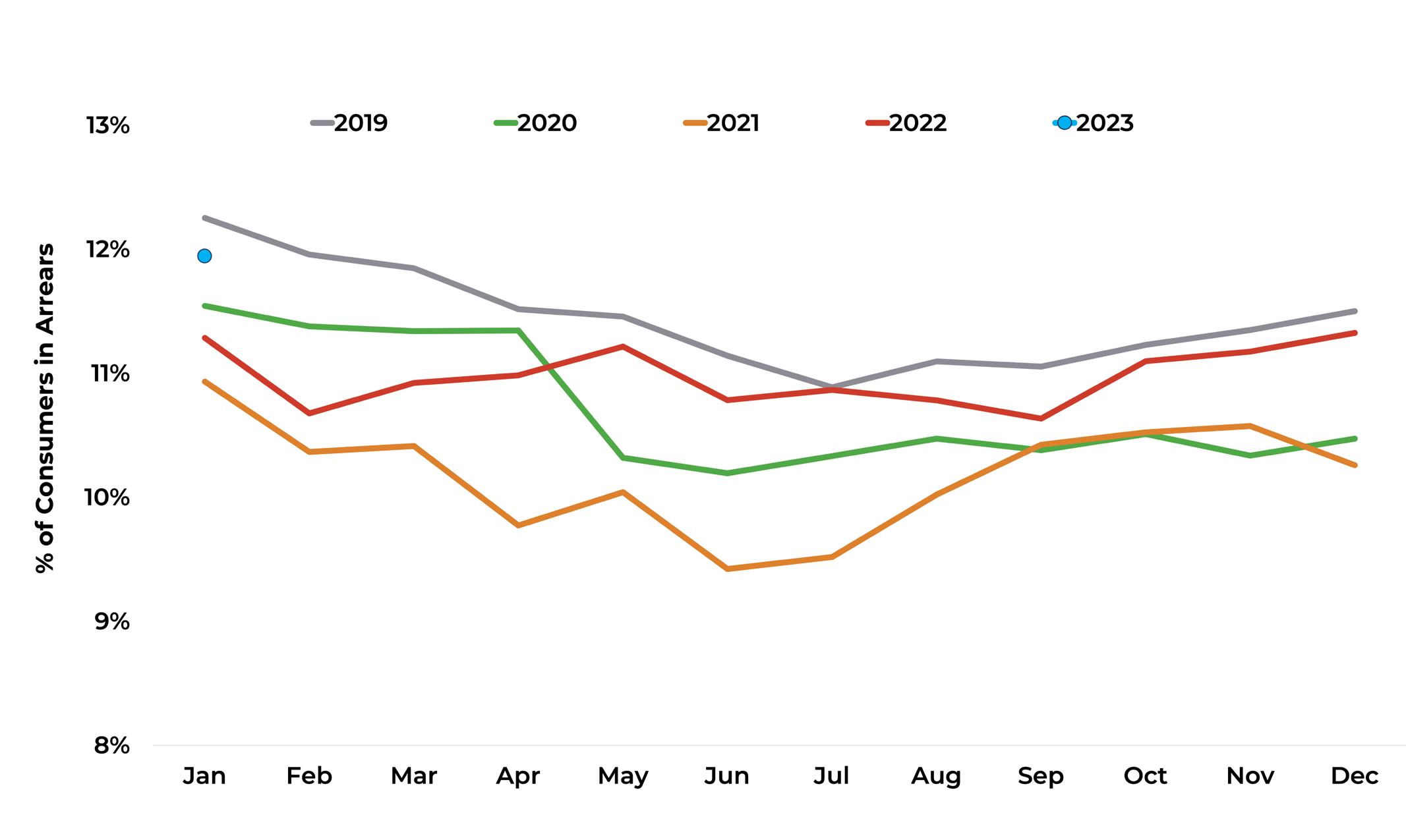

Climbing arrears highlight financial squeeze

Movements in credit behaviour are a good reflection of consumer confidence. For

example, the current arrears trends in NZ point towards a rising difficulty for households to meet their credit repayment commitments.

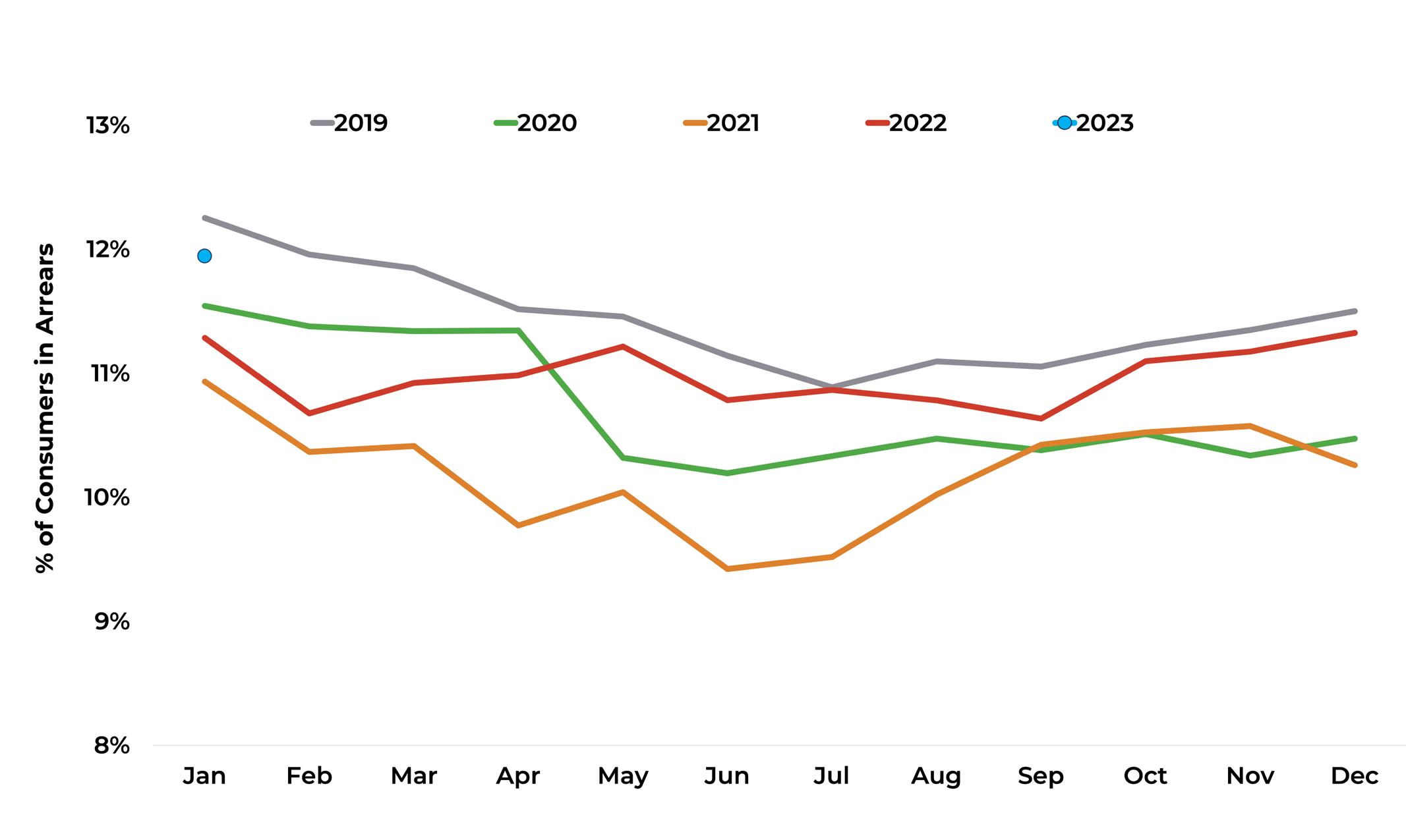

In January 2023, consumer arrears rose to 11.9% of the active credit population, with approximately 430,000 Kiwis behind on their repayments. This was a 20,000 increase from December 2022, with 4.8% of credit active consumers currently 30+ days past due (up from 4.4% in January 2022).

While the arrears cycle tends to peak post-Christmas, the current arrears level is 6% higher compared to the same time last year, as economic conditions continue to deteriorate.

Although the increasing arrears rates are concerning and something to keep a close eye on, it is important to point

Economic Outlook 26 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

Monika Lacey MICM

“

... the current arrears trends in NZ point towards a rising difficulty for households to meet their credit repayment commitments.”

out that we are still below prepandemic levels.

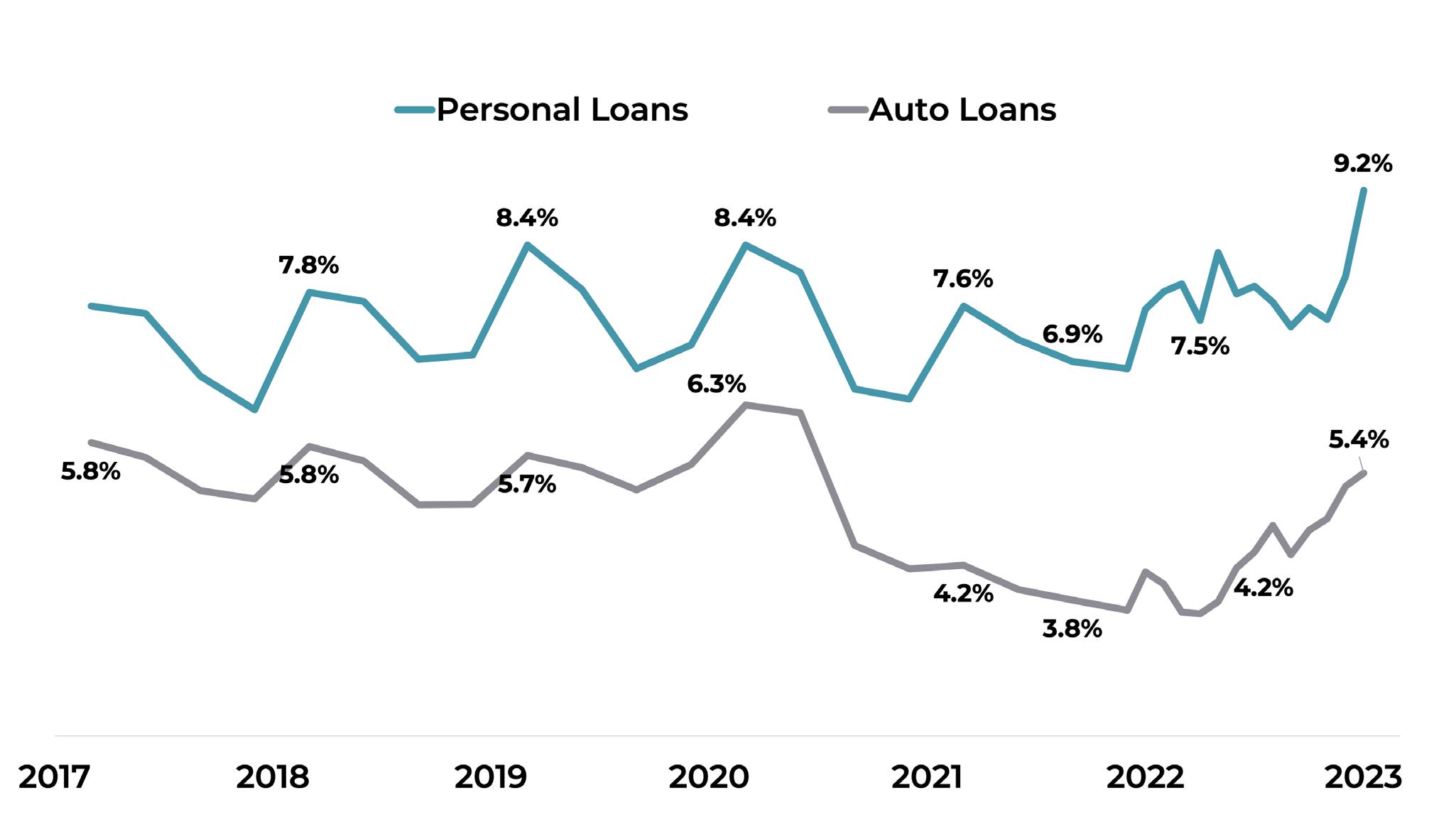

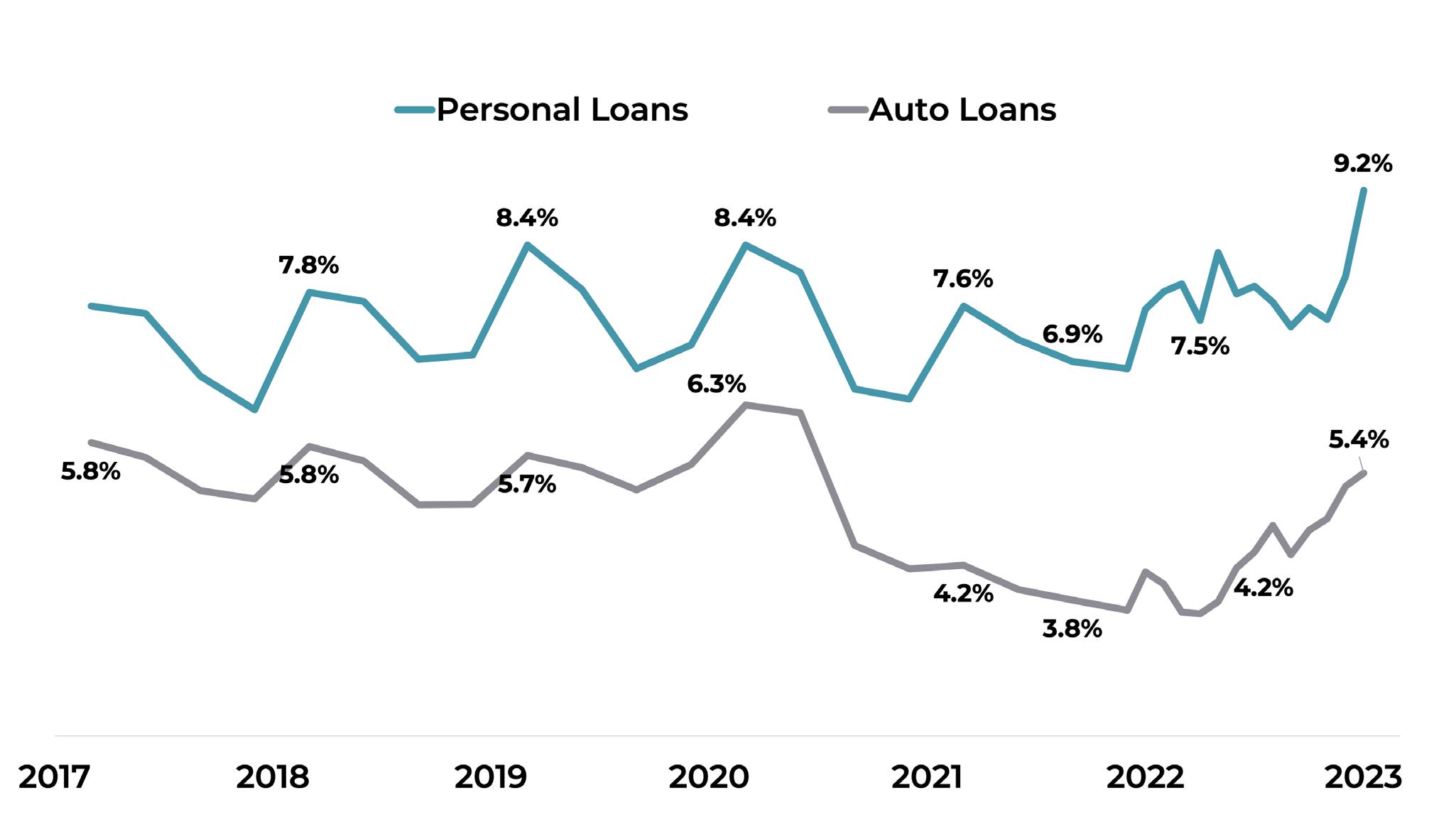

Unsecured personal loan

Consumer Arrears Trend

Consumer Loan Arrears

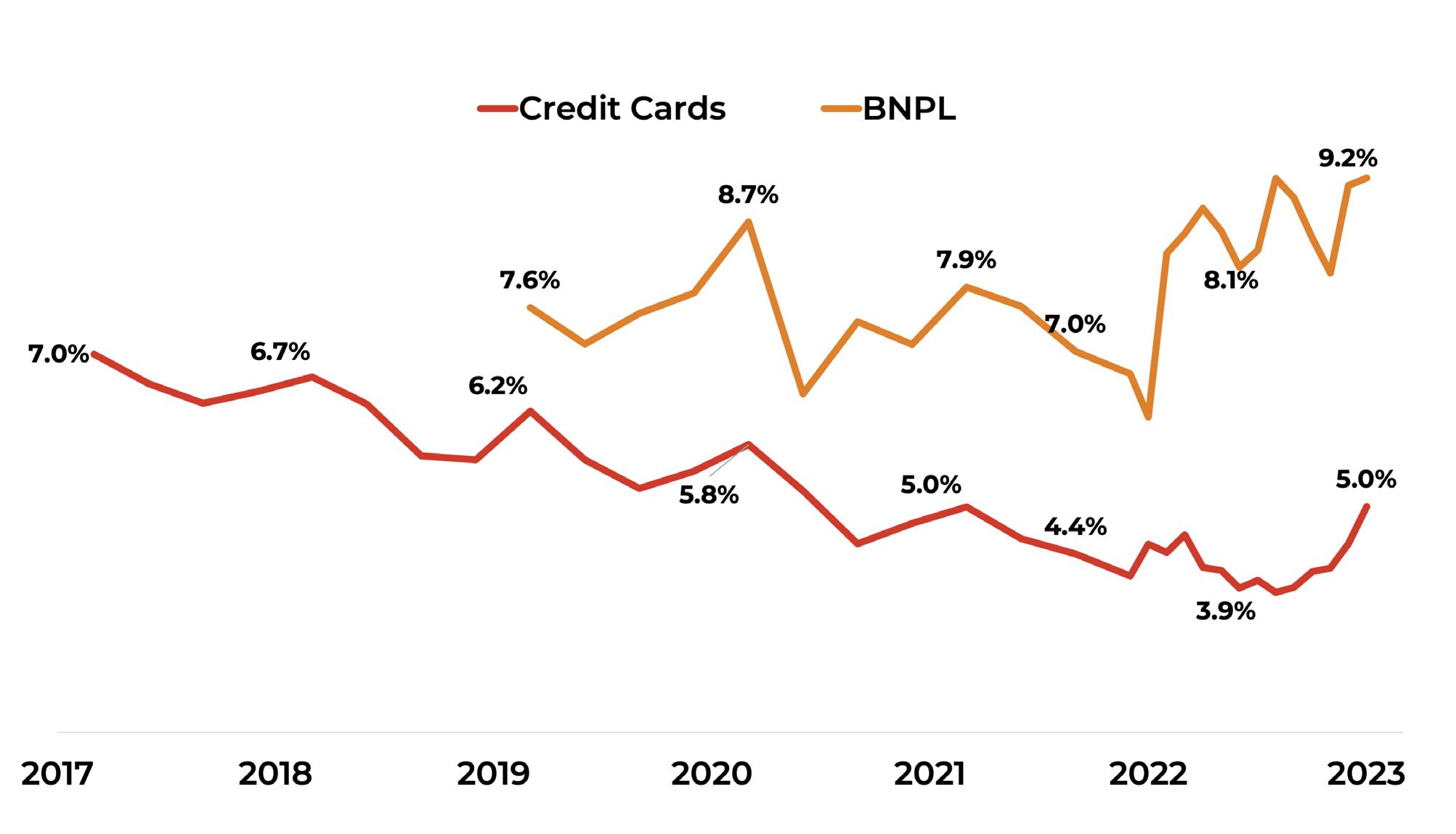

arrears jumped to 9.2% in January 2023 – the highest percentage on record since 2017.

Vehicle arrears continued to climb to 5.5% in January 2023 (up from 4.9% year-on-year).

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 27

Alongside consumer arrears, the number of Kiwis falling behind on their mortgage repayments is also beginning to climb back up from record lows

recorded at the end of 2022.

The number of households behind on mortgage repayments in January 2023 has risen to the largest number since April

Home Loan Arrears

2020, with approximately 18,400 mortgage accounts past due – or 1.26% of all mortgages.

This is a 22% year-onyear increase, which could be

Credit Card & BNPL Arrears

Economic Outlook 28 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

attributed to Kiwi households rolling off fixed home loans and onto higher interest rates as the Official Cash Rate continues to climb.

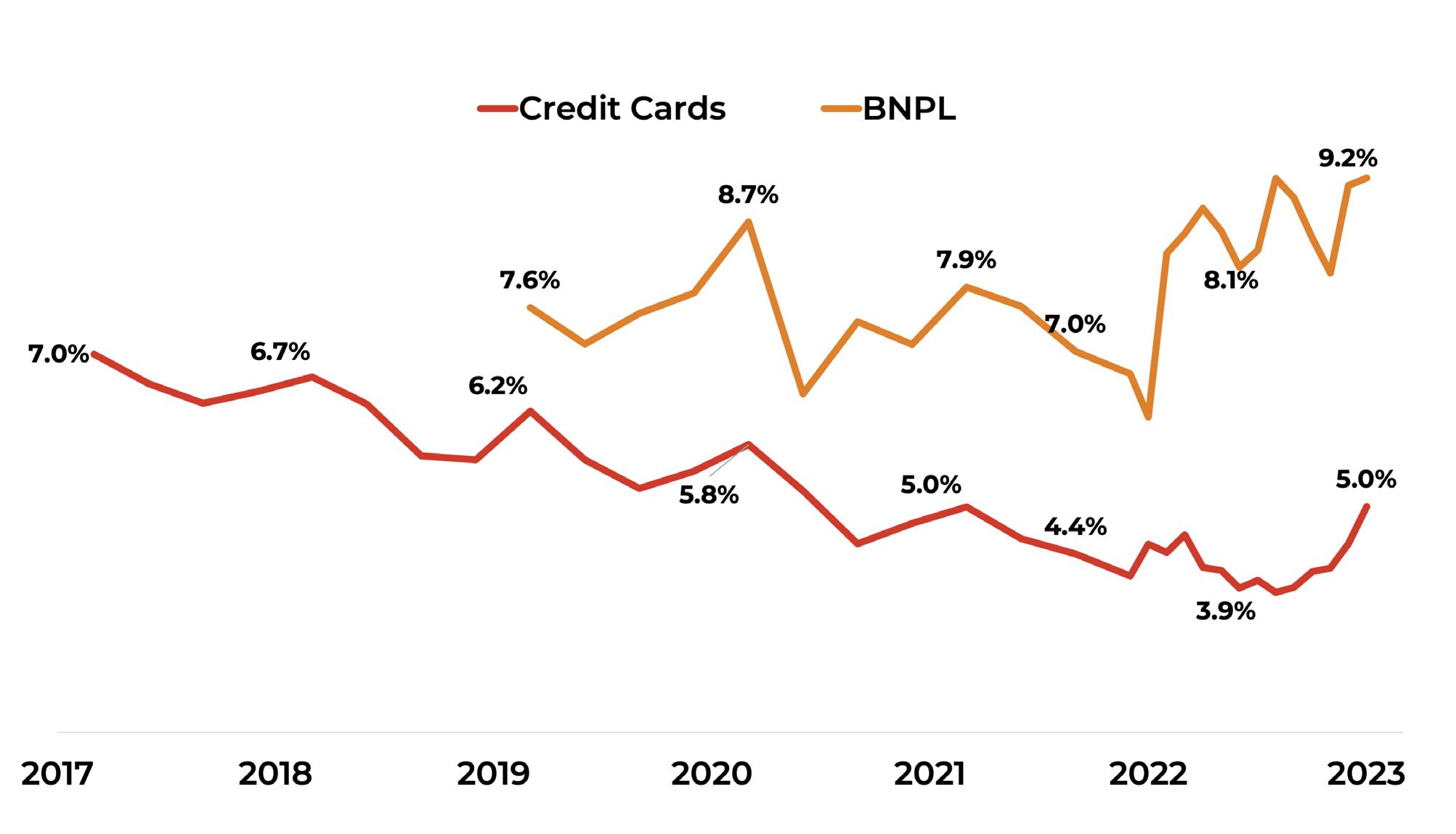

Arrears on discretionary spending have also risen, with both credit card and Buy Now Pay Later repayments slipping in early 2023.

Credit card arrears have climbed to 5% of active accounts in January 2023, the highest level recorded since January 2021.

Buy Now Pay Later arrears have also climbed to the highest level recorded (9.3%), which is similar to arrears rates seen in unsecured personal loans.

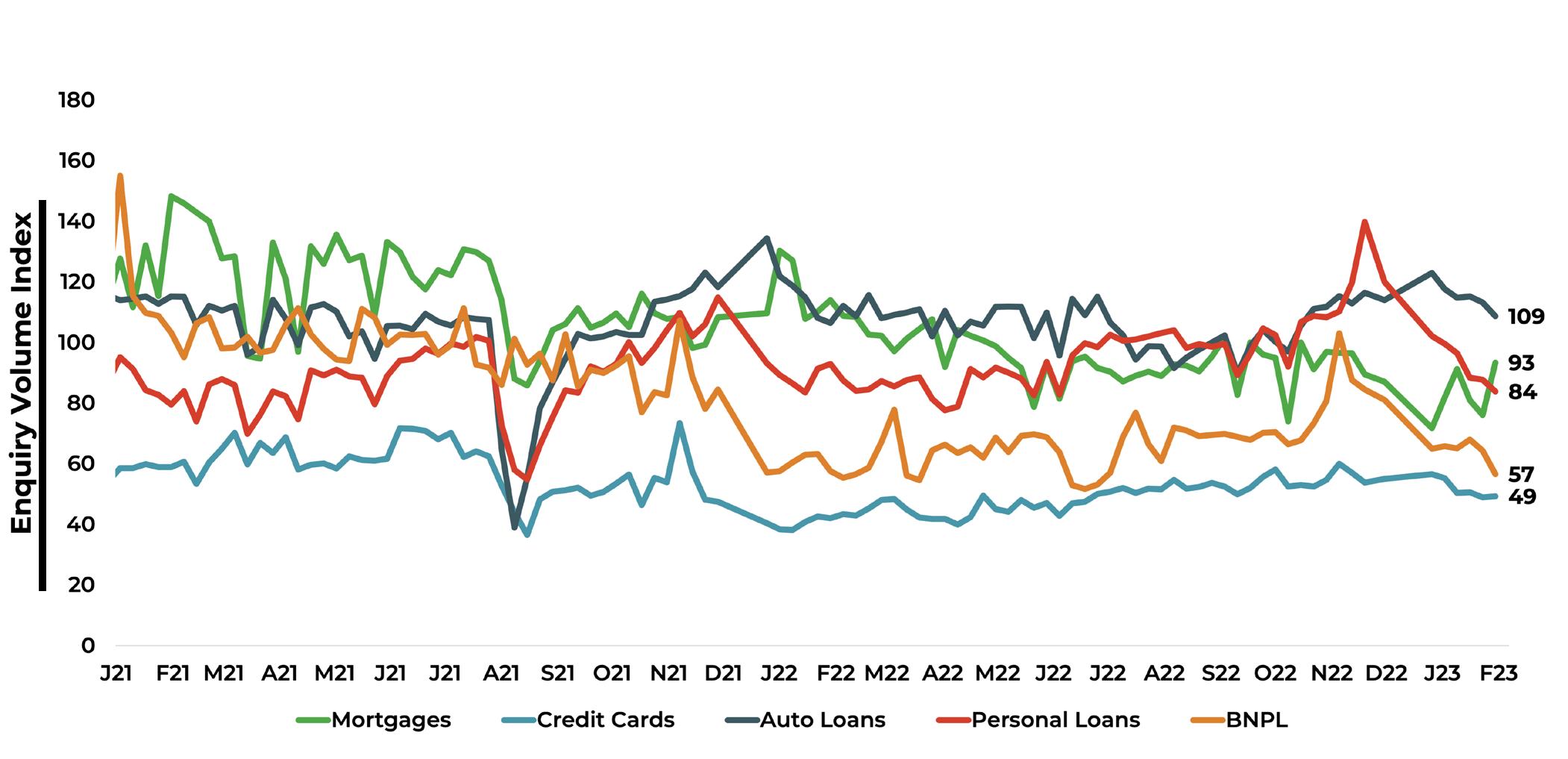

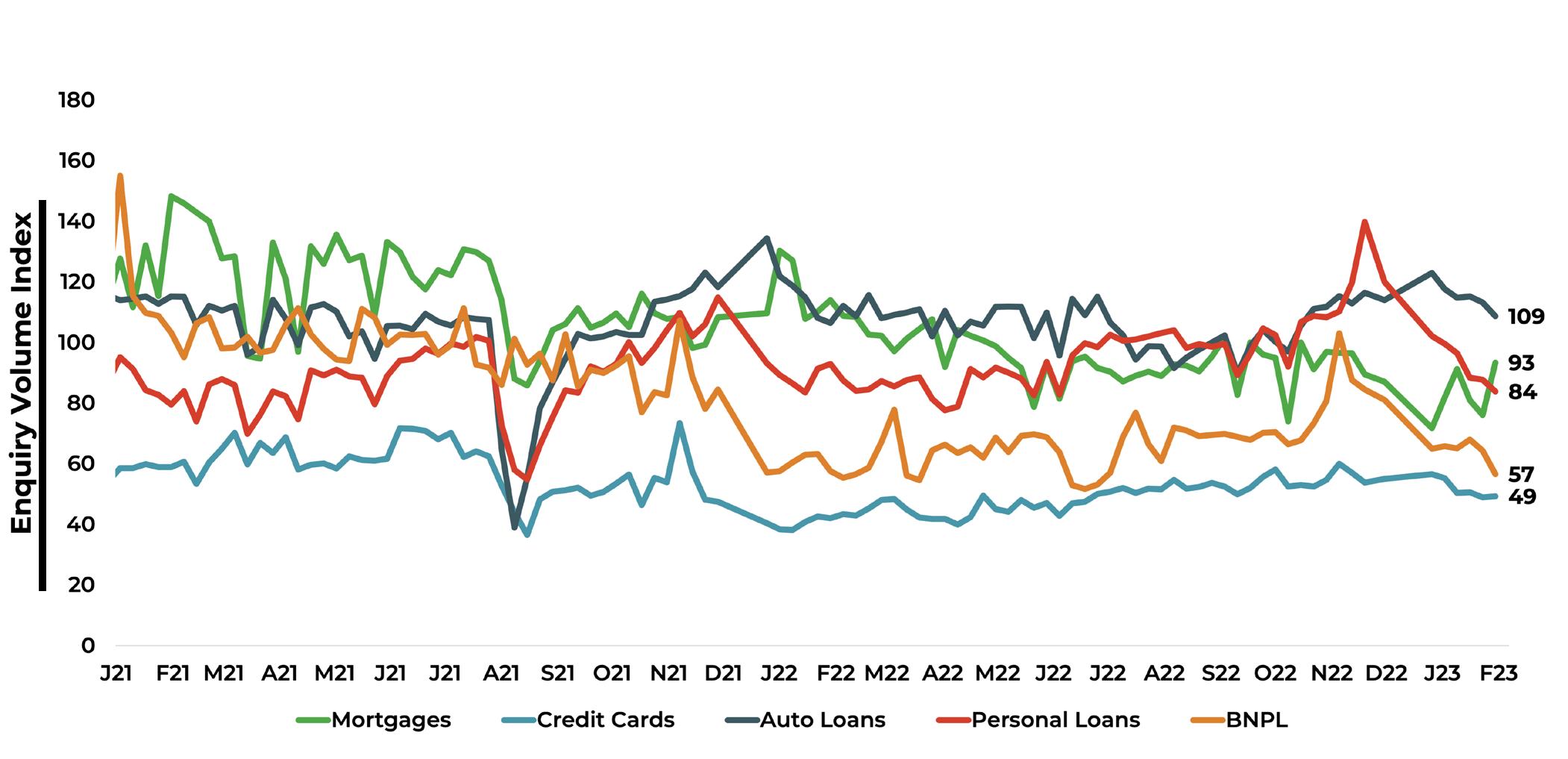

Fluctuating credit demand recorded

Alongside arrears, the demand for new credit is also a good measure of how consumers are feeling financially.

In February 2023, the demand for credit cards has climbed 21.7% year-on-year, while new mortgage applications are down 25.6% year-on-year in February 2023.

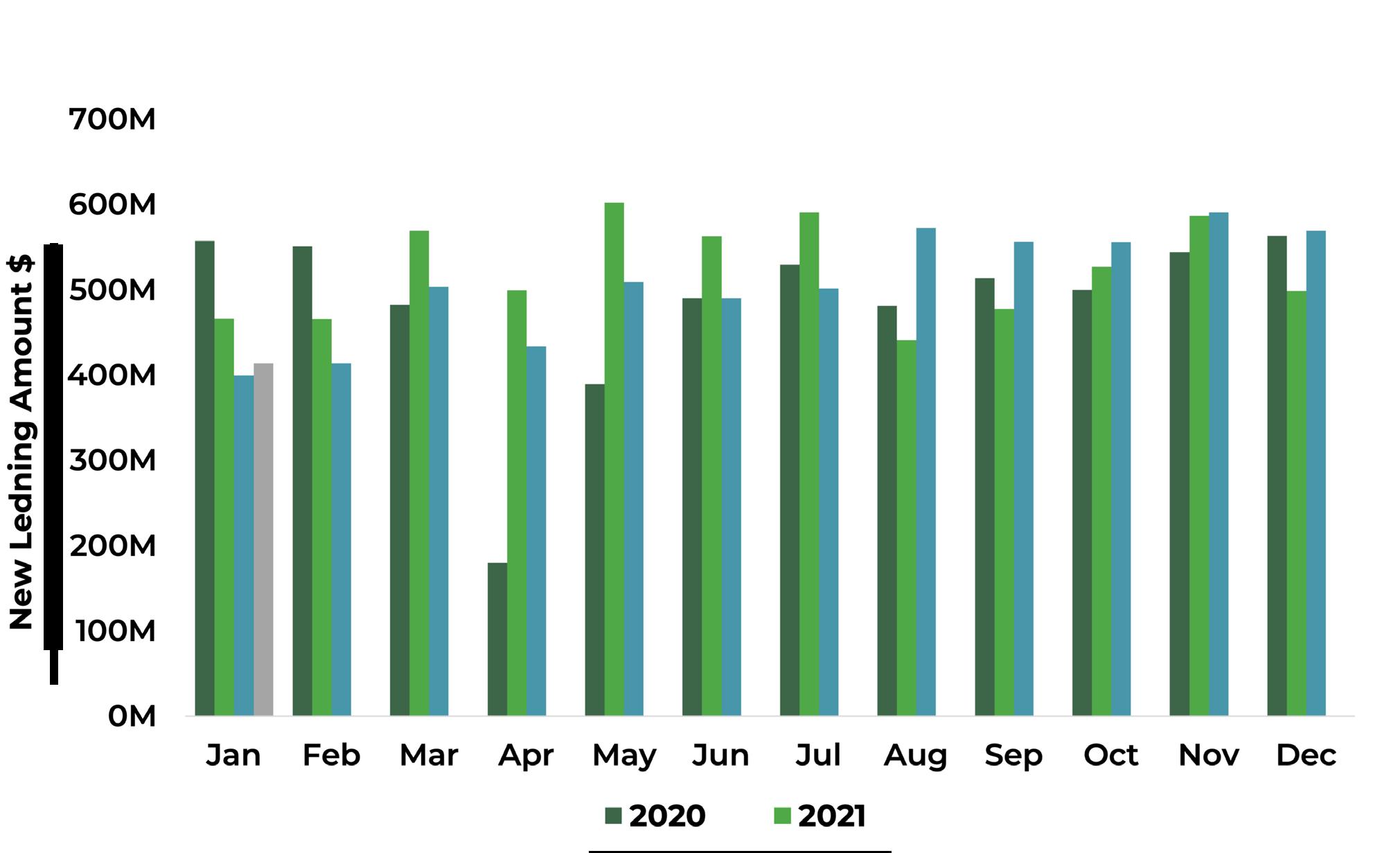

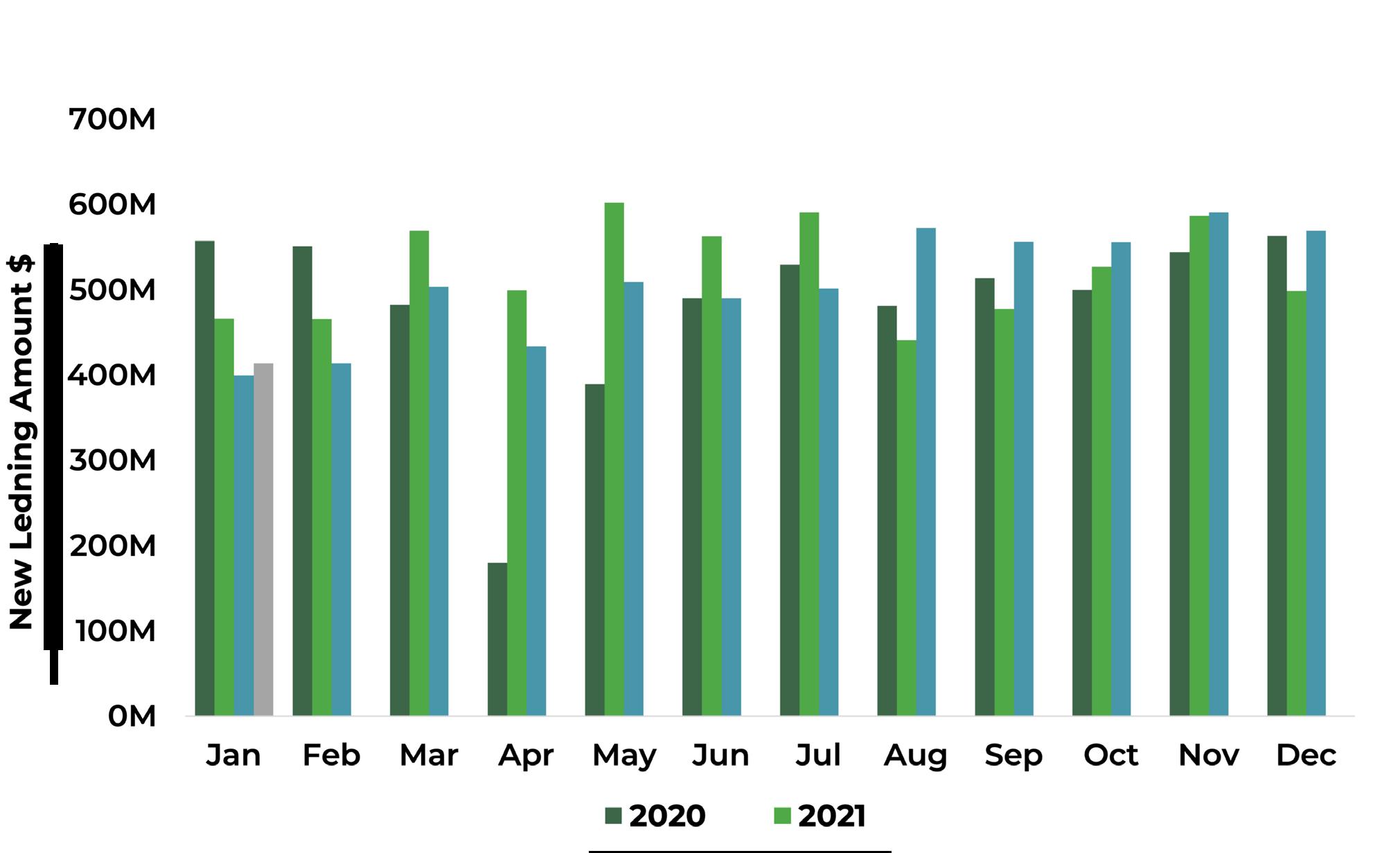

In terms of new lending, new mortgage borrowing was 24% down year-on-year as the NZ housing market downturn persists.

However, new lending for consumer loans –while down from December 2022 – was up 3% year-on-year in January 2023. This could be due to households taking on more credit to get through the holiday season or maintain lifestyles.

Credit Demand by Product Type

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 29

“Although the increasing arrears rates are concerning and something to keep a close eye on, it is important to point out that we are still below pre-pandemic levels.”

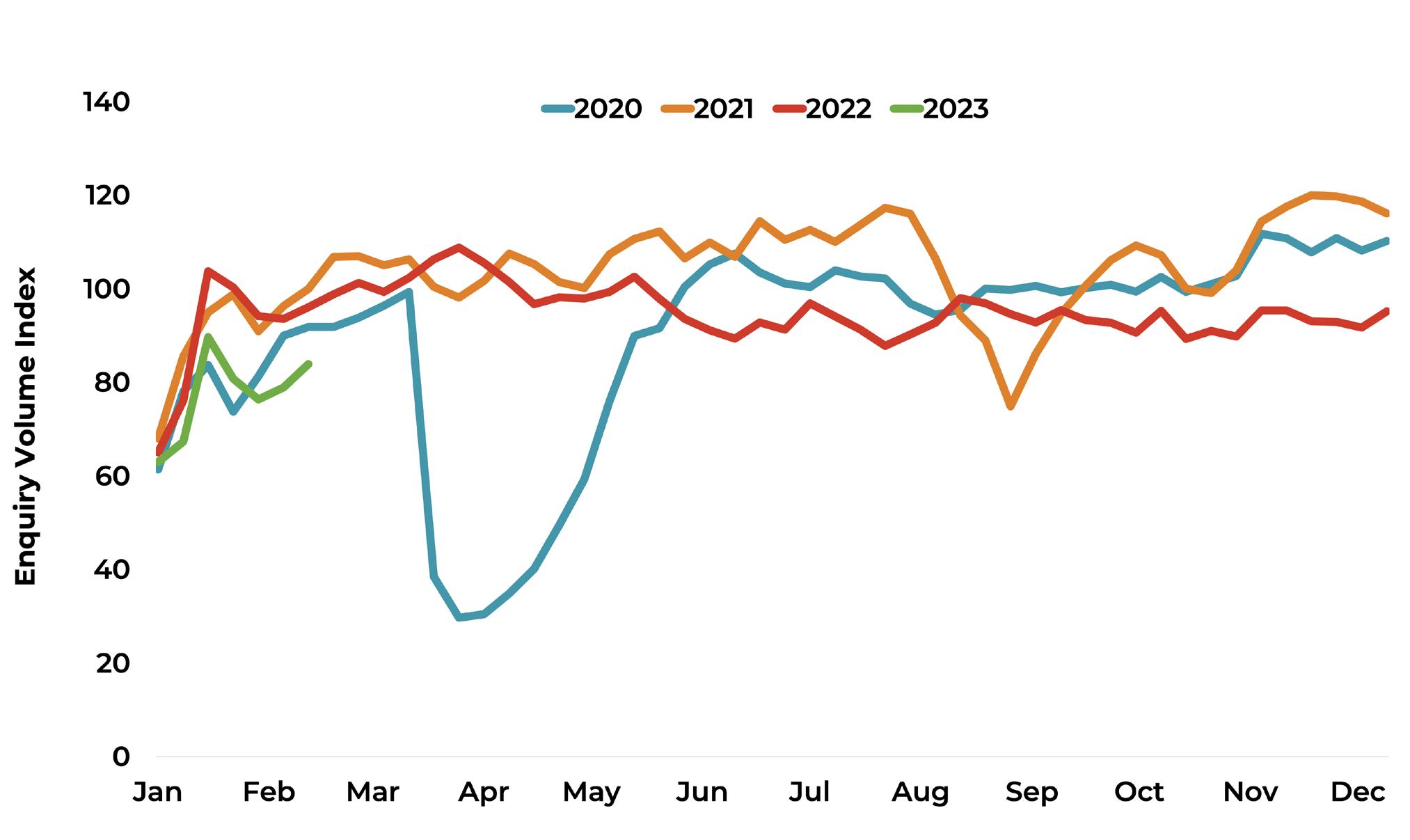

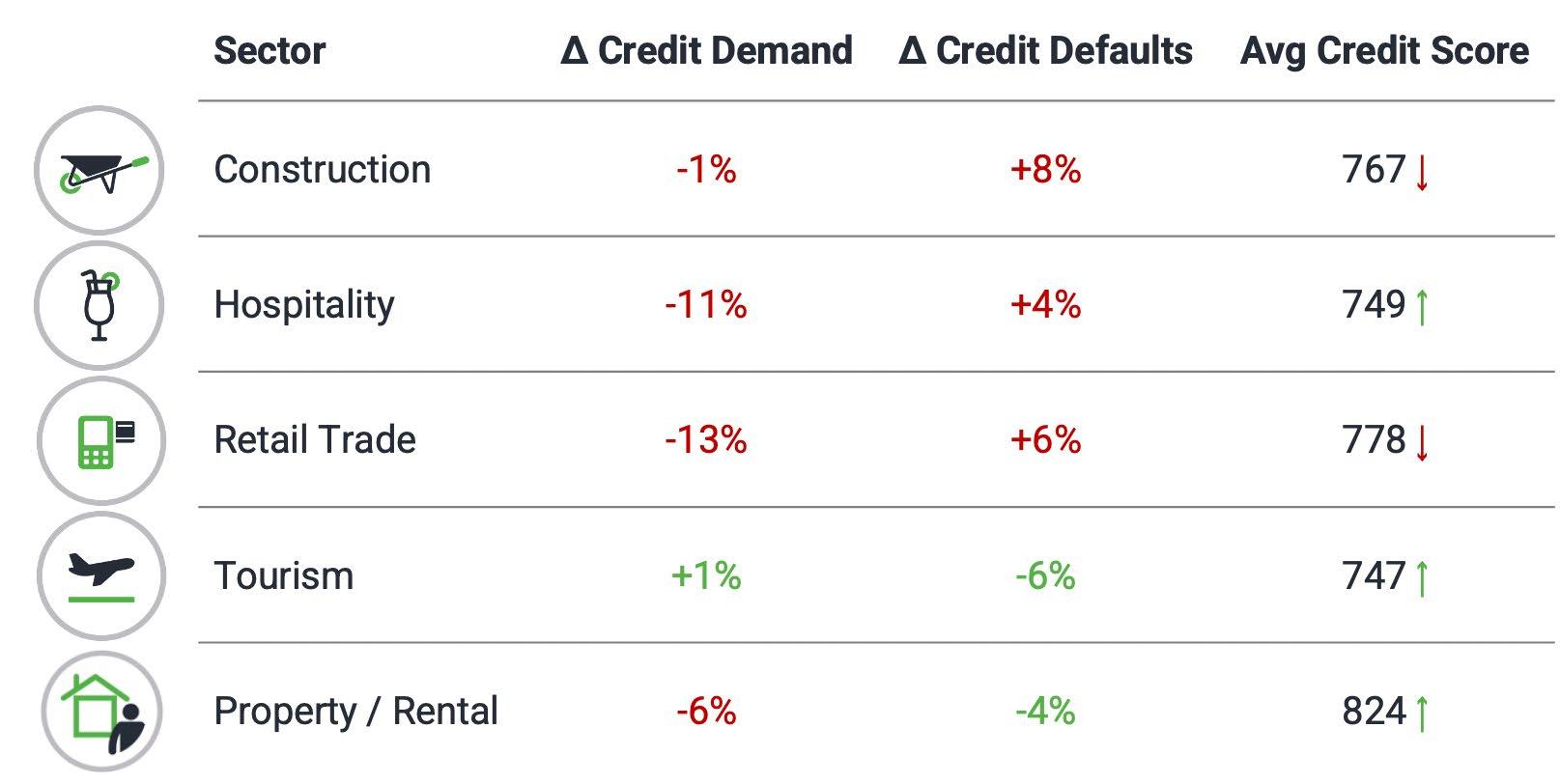

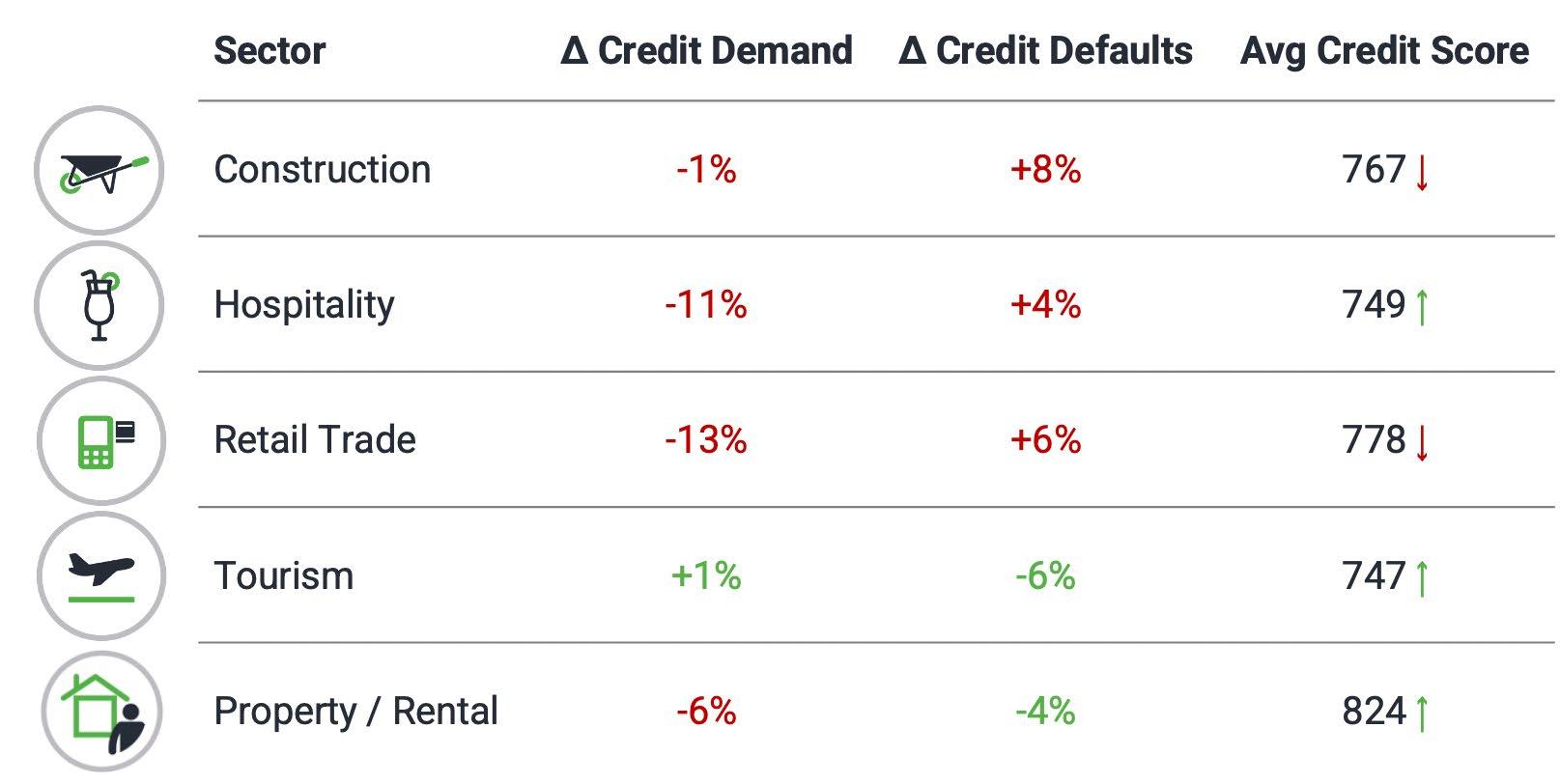

Ongoing pain for business sectors

Overall business credit demand is down 13% year-on-year in February 2023, impacted largely

by the retail trade and hospitality sectors, as discretionary spending slows and consumer confidence falls.

Additionally, credit defaults in

the construction sector climbed 8% in February.

However, tourism continues to improve compared to 2022 as the impact of open borders and

New Lending Amount: Mortgages

New Lending Amount: Consumer Loans

Economic Outlook 30 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

renewed foreign tourists helps to reignite the sector.

With further changes to the Official Cash Rate expected to try to rein in inflation, the challenging economic landscape is well and truly impacting Kiwi households.

Only time will tell if the next

quarter brings another fall in GDP and the beginning of recessionary times, which is likely to be front and centre as campaigning begins ahead of the election in October 2023.

For those who are struggling with meeting their repayments, now’s the time to get in touch

with creditors. It’s better to come to a repayment agreement than to slip into arrears and further financial strife.

*Monika Lacey MICM Chief Operating Officer Centrix Credit Bureau of New Zealand www.centrix.co.nz

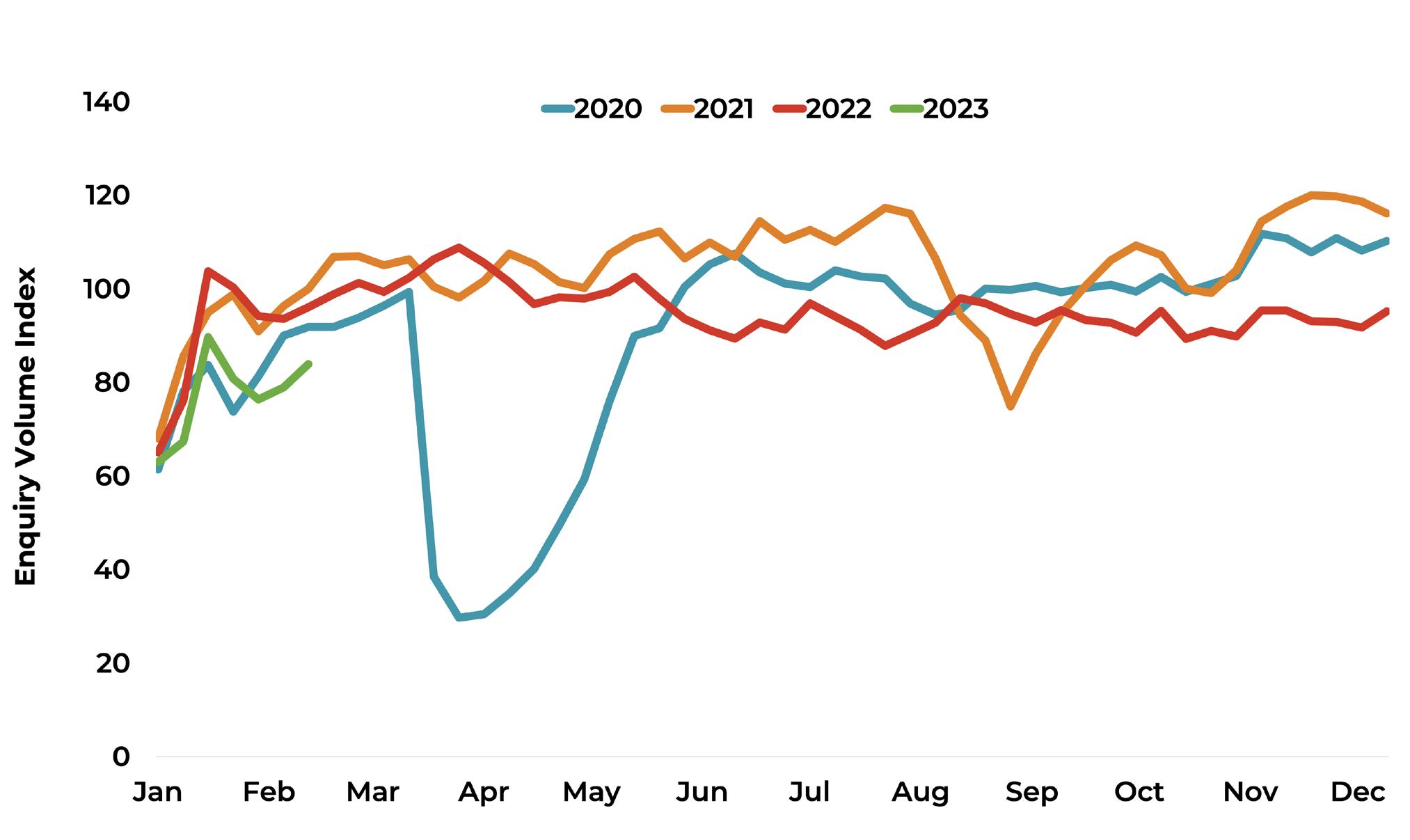

Business Credit Demand: 2020 to 2023

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 31

Why automated collections are better than spreadsheets

By Matt McFedries*

Almost 90% of CFOs say that a lack of automation is one of the main roadblocks to an efficient financial close process. Yet most businesses continue to rely on spreadsheets and only the most basic level of automation when it comes to their accounts receivable.

The spreadsheet status quo

We’ve heard the story before. Things are running fine. You’ve got that one team member who runs your credit control like a robot. They have lists and spreadsheets, reminder emails are automated via your accounting system. All the individual customer knowledge is stored in their head. They know the best time to phone business

A is 11am on a Monday morning. Like clockwork, they remind

business B of their invoice to pay every Thursday by email. And they know that business C will eventually pay their monthly bill, it’s just always eight days late. They are your accounts receivable superstar.

Shifting to automated accounts receivable

While the status quo might keep things ticking over, it’s not necessarily the best solution. If you want to be competitive, then automating your accounts receivable process, properly, is a simple but effective way to get the upper hand.

Automating accounts receivables tasks benefit businesses and teams in so many ways. In particular, automation increases productivity and protects cash flow.

Customer Service & Technology 32 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

Matt McFedries

“If you want to be competitive, then automating your accounts receivable process, properly, is a simple but effective way to get the upper hand.”

Key benefits of automating accounts receivable

How can swapping out spreadsheets for automation deliver such significant results?

It’s about enablement. A finance team who isn’t bogged down with mundane, manual tasks is enabled to be more productive. They in turn will be enabling the business to grow through:

l A reduction in human error

l A decrease in risk due to reliance on one key person

l An increase in strategic thinking time

l Adding value with better debtor insights and reporting

l Decreasing the cost of AR

l Protecting cash flow through chasing all overdues, not just the large invoices.

Reduction in human error

We’re human. We make mistakes. Even with spreadsheets, automated formulas and a dedicated superstar whose memory is a vault of customer finance gold. Implementing simple, easy to use AR automation removes the risk of simple human error – think copying the wrong

email address into a reminder email. Small mistakes here can have larger consequences down the track, both in terms of customer experience and cash flow.

Decrease in knowledge risk

Automation also eliminates risks associated with a key person being your business’

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 33

“

Having one key staff member as the brains and knowledge vault for all things accounts receivable is quite common but is high risk. Most businesses in this situation don’t have a plan for if that person gets seriously ill or leaves quickly and unexpectedly.

”

knowledge base for all things credit control. Having one key staff member as the brains and knowledge vault for all things accounts receivable is quite common but is high risk. Most businesses in this situation don’t have a plan for if that person gets seriously ill or leaves quickly and unexpectedly. There might be some ‘handover notes’ floating around, but these often lack detail and can take time to digest. If either of these scenarios occur, cash flow can be impacted significantly with accounts receivables tasks slowed down even further and limited credit control happening.

More time for strategy

Strategic thinking. Something most of us want to do more of, but often struggle to find the time. Automated accounts receivable is one of the quickest and most effective ways to enable yourself and your team to have more strategic thinking time. And importantly, not to the detriment of your accounts receivables. With spreadsheets made a thing of the past, and your automated workflows humming, there’ll be more time

for strategy and better overall cash flow results.

Adding value with knowledge

Ever had someone ask you a question which you know you can answer, except there’s a ‘but’. Is the question so valuable to answer that it’s worth all the time required to trawl through spreadsheets, run figures and then write up the report? With automated accounts receivables, you’ll have a clear accounts receivable process in place which will help uncover better insights. You’ll also have instantly accessible dashboards. So, when that important debtor question arises or the leadership team asks for a report on debtor days, you’ll have the details within a matter of minutes. It won’t just save time; it’ll look a whole lot slicker as well.

Protecting cash flow

With a manual process managing your accounts receivable it can be difficult to stay on top of all overdue invoices. What usually happens is that the highest value ones are prioritised and chased with smaller invoices left to gather

dust. Automated accounts receivable software solves this problem. All overdue invoices, no matter how large or small, are chased on a regular and welltimed basis via the automated reminder workflows. Time is then freed up so that your team can focus on any added efforts required to collect cash from the highest value invoices or the longest outstanding.

Decreasing the cost of AR

Yes, if you automate your AR chances are you’ll be paying a subscription fee to a platform which delivers the tool. However, most solutions out there aren’t that pricey, and they’re certainly a lot cheaper than a full-time human being. Most customers we talk to find automating their AR results in maintaining of their dedicated AR resource, despite growth. Plus, with an automated accounts receivable process in place, your cash flow will be a lot healthier decreasing costs associated with chasing and collecting bad debt.

Matt McFedries Head of CreditorWatch Collect

Customer Service & Technology 34 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

*

“Automated accounts receivable is one of the quickest and most effective ways to enable yourself and your team to have more strategic thinking time.”

“With automated accounts receivables, you’ll have a clear accounts receivable process in place which will help uncover better insights.”

eInvoicing: Helping credit professionals with fast, efficient and secured payments

By Mark Stockwell*

By Mark Stockwell*

eInvoicing is different from the traditional methods such as paper, PDF and email and therein lies its power. eInvoicing is the exchange of standardised and structured invoice data between buyers’ and suppliers’ software via a secure network. It doesn’t matter what eInvoicing software you are using, any business set up to send or receive eInvoices can exchange eInvoices with any other eInvoicing enabled business. The Australian Government has been working to promote eInvoicing as a more efficient and secure way for SMEs to manage their invoices.

One of the key benefits of eInvoicing comes through increased productivity and

reduced admin costs. With eInvoicing, businesses sending eInvoices will benefit from timely and accurate delivery of their invoices, save time spent on chasing late invoices, can enjoy faster payments and better management of receivables. Businesses receiving invoices will save time and money currently spent on scanning, data entry, following up missing information and fixing errors when processing invoices. Better quality data will help businesses to further streamline their accounts payable processes, improve accuracy and reduce errors. It can also deliver other potential benefits, including better supplier relationships and decision making supported through data analytics, and help reporting obligations, such as Payment Times Reporting.

In addition to the productivity benefits, eInvoicing can also

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 35

In today’s fast-paced and increasingly digital world, eInvoicing has become a popular and efficient method for automating invoicing processes.

Mark Stockwell

“Better quality data will help businesses to further streamline their accounts payable processes, improve accuracy and reduce errors.”

help to improve the security of business transactions. As cyber threats continue to increase against businesses it is more important than ever to make sure your business is as safe and secure as possible. eInvoicing can help keep do just this. eInvoicing provides increased security for businesses since invoices are sent and received via a secure network of accredited service providers, bypassing the need to use email, helping to eliminate emails and PDFs as possible attack vectors. This can help mitigate the risk of your businesses becoming the victim of a false billing or payment redirection scam and reduces the number of opportunities for attackers to send viruses disguised as PDF invoices. All of

this can help reduce the risk of theft and loss of money, data, or sensitive information, keeping you, your trading partners, and the community safe.

eInvoicing can also help businesses meet their ESG targets by reducing the environmental impact of their invoicing processes through reduced paper usage, minimized energy consumption for mailing and processing invoices, and decreased greenhouse gas emissions, and demonstrating good governance through the

enhanced accuracy and security eInvoicing provides.

The Australian Government has adopted the Peppol framework as the standard for eInvoicing. Peppol is a set of procurement standards, legal agreements and an eInvoicing delivery network that is used by more than 40 nations worldwide, including New Zealand, Singapore, and Japan in our region, to facilitate the exchange of eInvoices and other procurement documents.

In Australia, eInvoicing is not

Customer Service & Technology 36 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

“

As cyber threats continue to increase against businesses it is more important than ever to make sure your business is as safe and secure as possible.”

used for tax compliance. While the ATO is appointed as the Australian Peppol Authority, its role is to govern the framework. The ATO manages the changes to specifications, accredits service providers and works with many stakeholders across the economy to drive adoption. The ATO can’t see eInvoices transmitted through the network and does not collect any invoice data.

The ATO has worked closely with many large companies, including Bunnings and Woolworths, to determine the value of Peppol for digitally mature businesses and implementation impacts for their customers and suppliers. These companies are now eInvoicing champions, supporting their

trading partners’ transition to this new invoicing channel and reaping mutual benefits.

The ATO are also working closely with eInvoicing solution providers to ensure that their products are eInvoicing ready, including a range of free and low-cost solutions for small businesses with simple invoicing needs. Many small businesses are already enabled via their existing software, making your supply chain more efficient and secure. The more of your trading partners that get eInvoicing enabled the greater the benefits that will be seen by everyone as the network of businesses using eInvoicing grows.

Getting started with eInvoicing has never been easier, with more and more

eInvoicing ready products available on the market. The ATO website provides valuable information on eInvoicing and offers resources for businesses to explore their options and get started with eInvoicing. By embracing eInvoicing, businesses can improve productivity, reduce administrative costs, enhance security, and support their ESG targets while also contributing to a more sustainable future.

To find out more about eInvoicing, and to start your exploring your options, visit ATO.gov.au/eInvoicing

*Mark Stockwell Director eInvoicing Australian Taxation Office E: einvoicing@ato.gov.au

*Mark Stockwell Director eInvoicing Australian Taxation Office E: einvoicing@ato.gov.au

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 37

The human side of AR: 5 Ways AR automation helps your team Feel better, work smarter and stay longer

By Eric Maisonhaute MICM*

ABOUT THIS ARTICLE

What does it mean to be a human-centric organisation? Free snacks? Ping pong tables? A flexible schedule with unlimited PTO? While perks are appealing, there are far deeper factors driving the engagement, loyalty and happiness of today’s employees – particularly those in accounts receivable (AR).

This article explores the psyche of modern AR professionals, how prioritising their humanity brings about broader company success, and why AI-driven automation is an ideal solution for nurturing such personal and professional fulfillment within your team.

Introduction The human story

Before we get into the weeds of invoices, payments and allthings AR, it’s worth asking ourselves as humans: How did we get here? Time for a quick 4.5-billion-year recap: See figure 1.

Working 9 to 5

What do people want in an AR career?

A huge part of the modern human experience involves what many consider an inescapable inconvenience – going to work. But despite its compulsory nature, most people still care a great deal about what they do and how they do it.

For example, AR folks generally excel at math, research and record-keeping but doesn’t mean they expect to work a boring, one-dimensional job. Yes, a generous salary and benefits go a long way, but there’s much more fuelling their fulfillment (see Table 1).

Anatomy of an unhappy AR employee

Think members of your AR team might be part of the 40% of the unhappy workers1 looking for new opportunities? Typically, the signs and symptoms of a disgruntled AR employee are present long before they come

Customer Service & Technology 38 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

Eric Maisonhaute MICM

The human story

Before we get into the weeds of invoices, payments and all-things AR, it’s wor th asking ourselves as humans: How did we get here? Time for a quick 4.5-billion-year recap:

The Big Bang

The hot, dense, cosmic explosion that theoretically star ted it all … guess you just kinda had to be there.

Humans appear

Homo sapiens stumble out of the menagerie, eventually inhabiting every corner of ear th. Yay for us?

You are here

Life emerges

Our planet cools whilst

insects all enter the chat.

Modern day

The age of airplanes, air conditioning and accounts receivable. What a time to be alive, indeed.

Professional growth

Of the people who quit their jobs from April 2021 to April 2022, 41% did so due to lack of career development and advancement opportunities.1

Meaningful work

Does poring over sticky notes and spreadsheets sound rewarding? AR folks don’t think so, which is why they value work that’s meaningful vs. mundane.

to the boss quoting Johnny Paycheck lyrics. Here’s what to look for:

According to survey results by Gartner:

Personal well-being

Whether it’s flex schedules or recognition of good work, attractive companies are those that prioritise people’s professional and psychological needs.

People over process Understanding AI’s

potential

After years of continuous change, adapting a more human-centric AR approach is now a prerequisite for keeping a business competitive. Yet it goes far beyond a revamped mission statement or meagre salary bump.

3.2x

Employees who operate in human-centric work models –where they are seen as people, not just resources – are 3.2 times more likely to enjoy their jobs with a high intent to stay.2

To truly put people over process, AR departments need the help of modern technology that’s capable of transforming the ability of AR employees to perform daily tasks, serve customers and fulfill their own professional aspirations.

For many Finance teams, that technology is AI-powered automation – a solution arguably best defined by what it doesn’t do vs. what

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 39

Introduction

Figure 1

Table 1

it does. For example, in an AR environment, automation:

Doesn’t replace humans or eliminate nuance. Functioning more like a highly specialised team member, AI-driven automation does the mundane “heavy lifting” so your team is free to perform more strategic tasks.

Doesn’t supplant existing tech stacks. Automated AR solutions maximise the value of whatever systems are in place by working alongside them and augmenting areas they may fall short in (i.e., manual gaps).

Doesn’t mean you’ll solve every issue. Even with AI assisting, your AR process won’t be running on autopilot.

Sustained success will require a proactive strategy and dedication to continuous process improvement.

5 ways AR automation helps your team feel better, work smarter & stay longer

According to Gallup research, only 32% of U.S. employees were actively engaged in their jobs in 2022 – down from 36% engagement as recently as 2020.3 Not great news for AR, which is one of the largest assets on the balance sheet and a department that deals directly with customers. In the following pages, you’ll learn about AR automation’s role in combating this disturbing trend – detailing the five major ways it dramatically improves the output and outlook of the average AR employee.

1. Makes onboarding & training crazy-simple

You know what today’s workers hate? Obstacles. That’s why AR employees – particularly those who fall in the category of Millennial or Gen Z – gravitate toward companies that allow them to hit the ground running from day one.

Automated solutions are a great way to bypass drawn-out onboarding processes or painful training sessions thanks to their ability to remove any unnecessary delays, disruptions or duress for your newest team members.

A single interface with custom KPIs

Not only are AR automation solutions backed by a cloud infrastructure for 24/7 availability, all the information your team needs – from invoices, contracts and credit apps to credit risk data and customer details – flows directly through a single, easy-to-use interface.

No mastery of tribal knowledge necessary!

2. Replaces the mundane with meaning

It’s no secret that traditional AR operations can be a hotbed for all sorts of menial and downright mindnumbing work. This isn’t just destructive to your team’s well-being, it’s also antithetical to the kind of strategic value-driving that’s now expected out of modern AR departments.

Thankfully, AR automation solutions have powerful technologies working behind the scenes that absolve employees of these time-consuming tasks. What’s more, the “free time” they’re now afforded can be directed toward work that is more meaningful and valuable – both to the individual and the enterprise.

Customer Service & Technology 40 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

Digital credit approval

Automating credit applications and approval workflow takes a lot of pressure off your AR staff, making customer onboarding a walk in the park.

Real-life receivables Meet

Andrea

Automated invoice delivery

Instead of folding, stuffing and stamping paper invoices, AR staff can mail them directly from your ERP for worldwide postal delivery in < 24 hours.

AI-driven cash application

Free up your team for higher value tasks by automating the manually intensive process of matching payments received from incoming payment information sources.

Strategic collections

Priority call suggestions. Customised to-do lists. Personalised bulk messages and templates. Automated solutions have no shortage of AI tools to help your team optimise its collections strategy.

For Credit Manager Andrea Linke, “busy work” was often the rule rather than the exception for her team at Kuriyama of America, Inc. That is, until they decided to explore digital solutions for centralising their collections process and delivering new levels of speed, efficiency and visibility to the team.

3. Nurtures an environment of mutual trust & respect

Much like being a good server at a restaurant with atrocious food, it’s hard being an exceptional AR employee at an organisation with second-rate CX strategies. From when a collection call was made, to how a claim was managed, to what payment options were offered – every point of customer contact within AR ultimately reflects on your team, for better or worse. A consistently bad CX sows the seeds for consistently unhappy employees. Thankfully, customer–employee tension is cut down dramatically when AR automation is employed. Payment allocation is immediate and accurate, dispute resolution is quick and painless, and essential data is just a click away for all parties.

Online payment options

Most automated solutions offer a convenient online portal where your customers can choose their preferred payment option (card or direct debit) and process their payments on a selfserve basis. The result is happier customers and an AR team with more time to spend on collections and other dopamine-producing activities.

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 41

“

The call prioritisation feature is a favourite within the team.

Every morning it generates what calls need to be done which makes it incredibly easy to plan their day.”

– Andrea Linke, Credit Manager, Kuriyama of America, Inc.

4. Opens the door for growth opportunities galore

Currently, only 1 in 3 workers feel as though they receive ongoing recognition for their work.4 Not only is this statistic more than a little depressing, it’s also straight up bad for business. Consistent praise is shown to increase employee’s sense of belonging, their work performance, and their willingness to stay at their current job.

Naturally, with praise comes opportunity.

Automated AR solutions enable both by not only helping managers use KPIs to better identify top-performing AR employees, but also creating new career-pathing opportunities by necessarily redefining some positions.

Performance monitoring KPIs

Good work never goes unnoticed in an automated environment!

From response time to follow-up calls, customisable dashboards allow AR managers to track metrics tied to individual team members – ensuring high achievers are consistently recognised and rewarded (and never blamed for a laggard’s poor performance).

Real-life receivables Meet Pamela

Receiving up to 700 payments a day, the Banking team at Laminex had heavy manual workloads – particularly at month-end when payment allocation was priority No. 1. What was Operational Team Leader Pamela Rochester’s solution for improving her team’s workload and well-being? Automating daily remittance advice processing.

5. Relieves insecurities about their job & future

While the concept of “worker insecurity” is seemingly baked into our economic model, more and more companies are finding out just how harmful it can be to their employees and bottom line. In addition to its effects on people’s mental well-being and physical health, recent research found that engagement decreased by 37% among workers with fears of job stability.5

Automated AR solutions play an important role in quelling many of these fears. Not only do they help AR employees create more value for their team (thus becoming less expendable), they provide the company itself with a strong, modern digital foundation that makes it much easier to stay competitive and resilient should more COVIDesque disruptions be in our future.

Customer Service & Technology 42 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

“

The Banking team is under much less pressure to complete payment allocations each day. They have more time to focus on other duties and learn new tasks.”

– Pamela Rochester, Operational Team Leader, Laminex

Positive-sum growth

One of AR automation’s uniquely non-tangible features is its ability to benefit every stakeholder without ever achieving that success at the expense of another party.

For employees, this concept of “positive-sum growth” means that everyone in their orbit is ensured a better experience – teammates, managers, customers, even the business itself. And when everyone wins, well, everyone wins.

Conclusion

It’s time to awaken the humanity in your AR team Accounts receivable is no longer some back-office afterthought. In a time of significant change and challenge, companies are looking to their AR departments to secure revenue and fortify critical customer relationships.

The ones tasked with carrying out these imperatives are not robots or commodities. They are living, breathing human beings with physical,

emotional and intellectual needs that require fulfilling. Automated solutions do all the above, helping AR employees make more of an impact, with fewer obstacles, and with a greater sense of dignity and value.

Humans have come a long way in a just couple hundred thousand years – a testament to the power of humanity. By putting people at the centre of your AR function, you can awaken this power for the betterment and longevity of all.

*Eric Maisonhaute MICM Director – Accounts Receivable Solutions Esker Australia Pty Ltd

T: +61 479 089 668

esker.com.au

SOURCES:

1. The Great Attrition is making hiring harder. Are you searching the right talent pools? July 13, 2022. McKinsey Quarterly.

2. Gartner Research Shows Human-Centric Work Models Boosts Employee Performance and Other Key Talent Outcomes, Press Release, December 7, 2022. Gartner, Inc.

3. Harter, Jim. U.S. Employee Engagement Needs a Rebound in 2023 January 25, 2023. Gallup.

4. Nink, Marco, Robison, Jennifer. Add Team Praise to Your Employee Recognition Toolkit. February 9, 2021. Gallup.

5. Nelson, Bailey. Supportive Managers Relieve Job Insecurity, Boost Engagement. August 27, 2019. Gallup.

April 2023 | CREDIT MANAGEMENT IN AUSTRALIA 43

How to make cash flow your tool for success

By Adrian Floate MICM*

Inflation, rising interest rates and geopolitical uncertainty remain key threats to businesses as recent global events, such as the collapse of Silicon Valley Bank and the emergency buyout of Credit Suisse by UBS, indicate that decades of relaxed monetary policy and poor risk management have left some companies over-exposed and over-leveraged.

These recent events are a signal for company executives, finance teams and credit managers to make strong cash flow a priority. And while managing a company’s financial risk and boosting cash flow in an unstable global economy can feel like an insurmountable task, it also serves an important lesson. Take steps now to improve the systems and processes that can boost cash flow across

your business and you’ll have a competitive edge in a particularly challenging market.

Start with accounts receivable

Accounts receivable is the lifeblood of a business’s cash flow. While revenue may be growing, and there’s a strong sales pipeline, these factors don’t matter if customers aren’t paying their invoices on time. In Australia, for example, 30-day payment terms are standard across many industries. But when an invoice is paid late, companies often wait 50 to 55 days to get paid, resulting in a slow credit-to-cash conversion cycle. To speed up this cycle, businesses should start by identifying and addressing weaknesses in their accounts receivable management process.

Customer Service & Technology 44 CREDIT MANAGEMENT IN AUSTRALIA | April 2023

Adrian Floate MICM

“Take steps now to improve the systems and processes that can boost cash flow across your business and you’ll have a competitive edge in a particularly challenging market.”

Typical weaknesses in legacy accounts receivable management systems and processes include:

l Data entry errors

l Disjointed manual systems

l Slow or no follow-up of overdue invoices