For now, the money rolls in... Friday, April 29, 2022

The projection above from the Legislative Analyst's Office (LAO) suggests - as we pretty much already know - that state revenues will likely run ahead of the governor's projections back in January.* We also know that the same LAO is warning that in the future - but not quite yet - the combination of the Gann Limit and other constitutional provisions will cause budgetary problems as more revenue will create a need to spend beyond the added revenue.** But that's tomorrow. Politico is summarizing legislative objectives:***

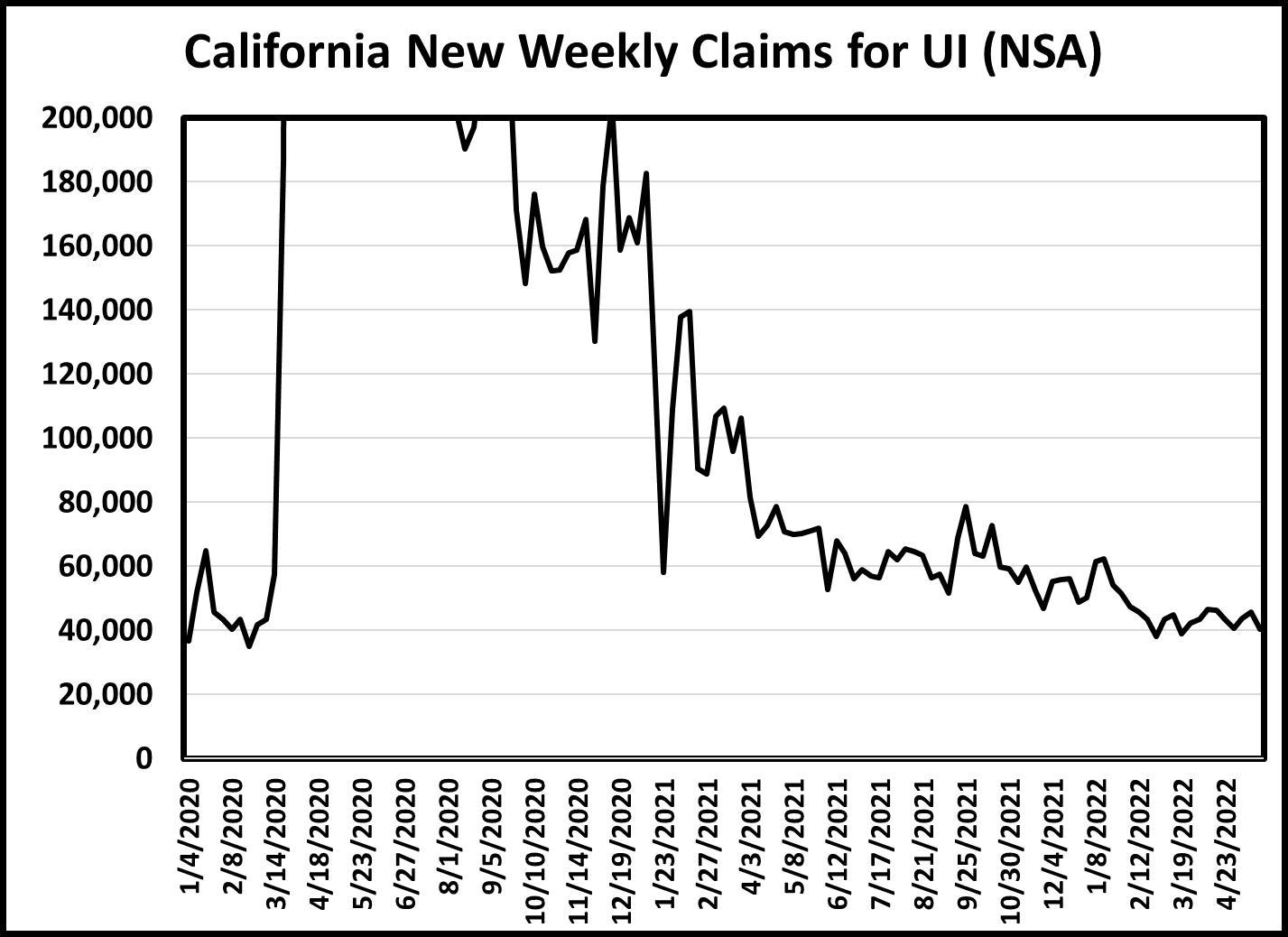

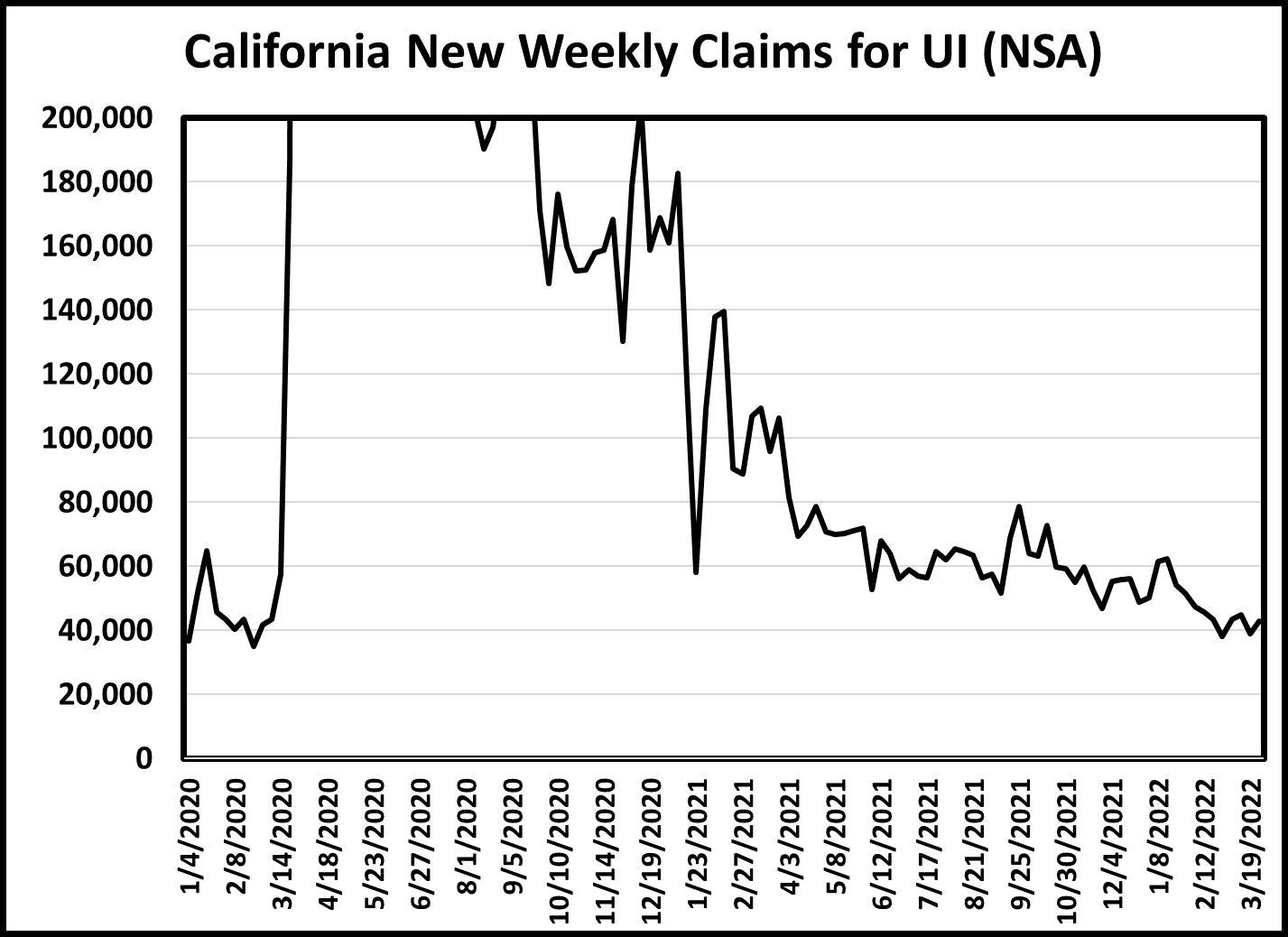

California’s swelling coffers mark a sharp reversal from early in the pandemic, when unemployment spiked and officials braced for steep budget cuts. Instead, a booming stock market and tech sector have brought in record revenues, even as Californians with lower incomes contended with job losses and sky-high housing costs. Other states are also awash in cash . Atop the spending list is a proposal to send $8 billion in payments to taxpayers, a move that Senate President Pro Tem Toni Atkins (D-San Diego) and Senate Budget Chair Nancy Skinner (D-Berkeley) pitched as a way to combat rising costs of energy and consumer goods. The plan would also include rebates to small businesses and nonprofits to help repay federal unemployment debt, along with grants that could be used to offset new costs from the state’s supplemental Covid-19 sick leave program. The rebate proposal is reminiscent of the Golden State Stimulus checks the state mailed out last year. Meanwhile Gov. Gavin Newsom has proposed an $11 billion relief package to offset rising gas prices. The governor is expected to reveal an updated state spending plan next month. ...Around $43 billion — would go to bolster the state’s budget reserves under the Senate proposal, which the LAO in November estimated to be north of $21 billion for the 2022-23 fiscal year.

UCLA Faculty Association Blog: 2nd Quarter 2022

83