Returning results with MixIn

PLUS Hear from ALH on summer drinking

Cool Room is heating up brands

Returning results with MixIn

PLUS Hear from ALH on summer drinking

Cool Room is heating up brands

Our guiding principles:

• We're transparent

• We keep things simple

• We work together as genuine partners

Ourpurpose,'Creatingamoresociablefuture,together'inspiresustokeeppeopleattheheart ofeverythingwedo.Webelievethatourabilitytogrowreliesonstrongrelationships.Wevalue oursuppliersasstrategicpartners;integraltoourabilitytodeliveronrange,qualityandvalue forourcustomers.

View the Trade Supplier Charter document here

Weʼre committed to showing the way we do business. Guided principlesof transparency,genuinecollaboration, this Charter sets out our ways our trade supply partners. Throughthese principles, build lastingrelationshipsmutual,sustainable and seek to promote ethical conduct. Scope

Thischarterappliestoallsuppliersofmerchandise(orothergoods-for-retail)whohave,orareindiscussionswith ustohave,adirectcontractualrelationshipwithEndeavouroranyofitsbrands.

Weʼretransparent Weopenlyshareourgoalsandexpectationswithoursuppliers,andprovidetimely,qualitydatatohelpthemmake informedbusinessdecisions:

● Weshareandinvolveoursuppliersinforecastingsothattheyhavethenecessaryinformationtoprepare effectively.

● Weprovidecleartimelinesandcriteriaaspartofourrangereviews,ensuringthatsupplierscanbewellprepared andawareoftheevaluationprocess.

● Wecommittorespondingtosupplierquerieswithin24hours,MondaytoFriday.Evenifwedon answersrightaway,weletoursuppliersknowwe

● Wearealwaysopentofeedbackonourpartnershipsandcommitments,whichhelpsustoaddressanyissues

Ourpurpose,'Creatingamoresociablefuture,together'inspiresustokeeppeopleattheheart ofeverythingwedo.Webelievethatourabilitytogrowreliesonstrongrelationships.Wevalue oursuppliersasstrategicpartners;integraltoourabilitytodeliveronrange,qualityandvalue showing respectthrough Guided bythe transparency,simplicityand this Trade Supplier waysof workingwith partners. principles, we endeavour to relationshipsthat promote sustainable growth,drive innovation, promotehighstandards of

We keep things simple

Weʼre committed to simplifying our systems and processes for our partners so that they can c what they do best - making great products our customers love:

● We continuously focus on reducing complexities for our suppliers, including through regular reviews of our onboarding process New suppliers have access to a dedicated team to support them every step of the way

● We keep things easy for our small supply partners with faster payment terms to support cash flow, assisting them to continue to grow with us

● Our end-to-end merchandising workflow solution, the Endeavour Partner Portal, offers a streamlined process for our current suppliers to submit products for review

● We keep things as simple as we can but we never compromise on quality or sourcing integrity Where relevant, we will work with suppliers to ensure that products are manufactured in line with our standards, including our Responsible Sourcing Policy

We work together as genuine partners

Together, we strive to align product innovation to meet consumer demand, respond quickly to challenges, and capitalise on opportunities:

● We share insights (including relevant consumer data) through our quarterly publication for suppliers, Distilled, as well as through supplier forums, our Supplier Connect tool, and regular category deep dives This helps keep our suppliers well informed about market trends, customer behaviour and other factors influencing our industry.

Thischarterappliestoallsuppliersofmerchandise(orothergoods-for-retail)whohave,orareindiscussionswith ustohave,adirectcontractualrelationshipwithEndeavouroranyofitsbrands. retransparent

● We give our supply partners access to their Distribution Centre and network inventory levels through relevant reports, allowing them to manage their inventory more effectively and respond quickly to changes in demand

● We understand the importance of local success for our smaller suppliers Thatʼs why we have specialised resources dedicated to seeking out local market opportunities This approach helps smaller suppliers grow their presence in their own communities with access to valuable, localised market insights.

Weopenlyshareourgoalsandexpectationswithoursuppliers,andprovidetimely,qualitydatatohelpthemmake informedbusinessdecisions:Weshareandinvolveoursuppliersinforecastingsothattheyhavethenecessaryinformationtoprepare effectively.

● We always negotiate in good faith Our goal is to reach mutually beneficial agreements that support our suppliers, our customers, and our business

Weprovidecleartimelinesandcriteriaaspartofourrangereviews,ensuringthatsupplierscanbewellprepared andawareoftheevaluationprocess.

● We celebrate our supply partnersʼ success, coming together to celebrate their achievements through our annual Supplier of the Year Awards

Wecommittorespondingtosupplierquerieswithin24hours,MondaytoFriday.Evenifwedon ʼthaveallthe answersrightaway,weletoursuppliersknowwe ʼreworkingonfindingtheinformationtheyneed.

Wearealwaysopentofeedbackonourpartnershipsandcommitments,whichhelpsustoaddressanyissues andcontinuouslyimprove.OursuppliersareencouragedtoprovidefeedbackatanytimetotheirEndeavour categoryteam.Inaddition,supplierscanprovidefeedbackthroughourVoiceofSupplier

For any issues they donʼt feel comfortable raising with their category team, we encourage our suppliers to use our Whistleblowing service to raise complaints related to an actual or potential breach of this charter or any of our Endeavour policies

VOS surveys,which areanonymousandvoluntary.

● Small Supplier Policy

● Supplier Trading Terms

● Responsible Sourcing Policy

● Whistleblowing Policy

Welcome to our December edition of Distilled. As 2024 comes to a close, we eagerly count down the days to Christmas, New Year, and the summer holidays. Together, we work harder than ever in the lead up to ensure our customers have the products they desire to create memorable festive occasions.

There's no denying that many of our customers are doing it tough this holiday season. As we navigate this current wave together, we're doing everything we can as an industry to ensure our customers experience value. In a challenging economic climate, gaining perspective can be beneficial, and examining past trends can be informative. Our Insights Report delves into liquor trends over the past decade,

demonstrating how our industry pivots to meet our customers' needs, regardless of economic uncertainty. By reflecting on Category trends, we can be guided by patterns that may inform future directions. Our Category Insights Team has worked hard to deliver this valuable report to you and it makes for highly recommended reading.

For me, this edition is particularly bittersweet, as it marks the last time you'll see me on these pages. The new year brings new adventures as I bid farewell to the Endeavour Merchandise family to embrace my next challenge. I am thrilled to introduce Nikki Bull to you all who will

be taking over from me. Nikki joins the Merchandise Team from her position as General Manager – Accelerators & Incubators and brings with her a wealth of retail experience from M&S in the UK, Coles and five years at Endeavour. As I pass the baton, I have no doubt that Nikki will bring a fresh and exciting energy to our team, and I look forward to following her progress.

Enjoy this packed edition of Distilled and take a welldeserved break with friends, family, and your favourite festive drink; after all, that's what this time of year is all about - being social together.

Cheers, Karly Georgiou General Manager Merchandise Operations & Transformation

and Project Specialists explain how you can make the most of our supplier training programmes.

After winning the Account Team of the Year at the Supplier of the Year Awards, we sat down with Mick McKeown to learn what makes an award-winning team.

We speak to Brown-Forman’s Mariano Favia about what made their latest Jack Daniel’s campaign clickbait for customers.

Ever wondered how you can get your brand in front of

Z? BWS Cool Room is waiting to help you elevate your brand with our

reveals what he believes

with our

Q How has innovation and new product development (NPD) impacted sales this past year for Endeavour?

Innovation and new product development (NPD) have absolutely played a critical role in our success in F24. We achieved a record $400 million in sales from products that did not exist just a year ago and introduced 1,596 new product lines - with over two-thirds of those coming from our small suppliers.

Staying customer-focused is at the heart of what we do, and it’s helped us stay ahead in what is a very competitive market right now. Partnering with all of you to bring our customers exciting new products that meet their changing needs, is what we are all about.

The record-breaking results in F24 just goes to show that without these innovative efforts sales growth would likely stagnate.

Tim Carroll Director, Merchandise and Buying

It’s clear that NPD isn’t just a nice to haveit’s essential for thriving in today’s fast-paced retail environment.

Q The global wine industry is concerned that younger generations are not ageing into wine in the same way older generations did. What can we do to help engage those customers?

It is a big issue we need to address. In the next couple of years the majority of Australian liquor consumers will be MilZ so, as a category, Wine needs to think about how to speak to them.

There are many dynamics at play here, including the cost of living pressures on our younger generations, mindful consumption, a commitment to sustainability, and the sophisticated and exciting offerings from the Spirits and Premix categories.

Compared to Spirits and Premix, Wine has been a bit slow off the mark when it comes to addressing the needs and occasion requirements of the twentysomething consumer. The competition for their engagement has never been tougher. One of the factors that stops these customers from moving over to Wineas they have historically done - is this increase of Spirits and Premix offerings.

Engaging Generation Z and Younger Millennials with Wine requires a focus on education, experience, and occasion, while making Wine more approachable. Sustainable and environmentally friendly practices also resonate with the values of our younger consumers, so being mindful of winemaking practices, packaging choices and highlighting sustainable attributes on labels are all worth considering.

Authenticity plays an important role for these younger demographics too. They have strong radars for insincerity so sharing genuine brand stories about the heritage and passion behind your Wines creates emotional connections that resonate with this audience. They also have a low boredom threshold and their world moves fast so product innovations and new offerings that can cater to individual tastes are also important. We delve into this challenge in this edition’s Insights section, where we look at generational behaviour and liquor trends over the decades.

Understanding where we have come from and analysing past patterns is important in shaping how we meet our future consumer needs.

Q Retail Media is now two years old. Can you explain how suppliers benefit from engaging in MixIn campaigns, and are the benefits measurable?

The MixIn arm of our business, launched in August 2022, is a great tool for suppliers to engage with our customers. Through MixIn we reach 80% of Australia’s drinking population, and we work hard to ensure your campaigns are perfectly timed and targeted to deliver the right message to the right customers.

Our team collaborates closely with the Merchandise team, aligning with category strategies and objectives to enhance effectiveness. We also deliver closed-loop campaign reporting, enabling precise measurement and optimisation. Over time, our post-campaign reporting has evolved to provide deeper insights into performance, enhancing our strategic approach for future

campaigns. In this edition we report on the results from a successful MixIn collaboration with Brown-Forman.

Q How important is the Advantage Group Mirror Survey and Voice of Supplier to how we do business with you?

It is essential. We get feedback from you on how we are doing; what we are doing well but, more importantly, what we could do better. Voice of Supplier (VOS) is our communication channel for honest and open dialogue with you. Through the Advantage Group Survey, we ask you questions that allow you to tell it like it is. And it has proved a vital tool in improving our business. It has led to shifts and upgrades in the way we work with our suppliers and initiated transformations in our business. We encourage all our suppliers, big or small, to have your say. Whatever we can do to improve our ways of working with you is a win-win. Take a deeper look into the process later in this edition.

Q What are your thoughts on Endeavour welcoming a new CEO in 2025?

In September, we announced our CEO, Steve Donohue, will step down from his role as Chief Executive Officer and Managing Director.

After six years in the role and 30 years in the business, the Board and Steve decided it was the right time to pass the baton to a new leader to deliver the next phase of the company’s growth.

With your support and since our demerger from Woolworths in 2021, we have achieved strong results by focusing on our customers and guests through providing value and great products, and Steve could not be more grateful to you all - some of whom he has known for a good number of those 30 years.

You will still see Steve around for a while yet, as he remains in the role while the search for his replacement is underway.

In the meantime, we are committed to maintaining our strong partnership with you and ensuring continuity during this period. Thank you for your ongoing support and collaboration. If you have any questions, please reach out to the team.

We spoke to the Head of Sales and Marketing at Good Drinks, Mick McKeown, about investing in the right people, building passionate teams and what makes successful partnerships.

Q Why do you think you received SOTYA’s Account Team of the Year award?

Our business has really evolved, and I think this award highlights that growth. We’ve shown we can take on big, mature brands that have stagnated and bring them back to life. With this, we’ve scaled up our teams - our account team, our field sales team, and marketing. Everyone's working together to create demand for our products. Our team focus has been on creating strong relationships and maintaining trust, both internally and externally. In the end, I believe this award recognises our commitment to growth, our people-focused culture, and the way we’ve aligned our efforts to achieve these results. It’s a reflection of our whole team’s hard work and dedication.

Q What are the key elements that make Good Drinks’ account team award-winning?

At Good Drinks, we have a strong culture. Our MD’s mantra - "don’t die wondering" - really shapes the way we work. We encourage taking risks and learning from failure, and that mindset has allowed us to grow and adapt. Trust and transparency are huge for us. We’ve built a solid relationship with Endeavour Group because we’re upfront, data-driven,

Good Drinks, was the proud recipient of the coveted Account Team of the Year at this year’s Endeavour Group Supplier of the Year Awards (SOTYA).

and always open to feedback, whether it’s good or bad. We don’t take a onesize-fits-all approach. Instead, we test, learn, and improve, making sure data and insight back our decisions. Being a smaller operation, we can pivot quickly and personalise our strategies, and that’s been a big advantage. This award is a testament to the trust we’ve built, the results we’ve delivered, and the strong willingness from both sides to succeed.

Q How did your team stand out to the judging committee?

I think what set us apart was our ability to simplify complex situations. We took a fresh approach by understanding where we wanted to go, recognising our strengths, and clearly communicating that vision. We also made sure we had fun along the way! Feedback has been a huge part of our journey - it’s helped shape how we operate without losing our core DNA. We recently participated in the Advantage Survey for the first time, and the feedback we received allowed us to refine our processes

Feedback from the SOTYA Judging Committee was Good Drinks ‘made significant efforts to align with our (Endeavour's) strategic strategic goals and partner to achieve them’.

SUPPLIEROF Account Team of the Year

even further. Our approach is all about alignment - making sure there’s energy and alignment between us and Endeavour Group in terms of values and goals. We’ve also embraced an entrepreneurial spirit, always thinking outside the box and taking calculated risks. This combination of innovation, simplicity, and feedbackdriven improvement really helped us grab the attention of the committee.

Q Can you highlight the members of your award winning team and their contributions?

Our team is made up of some incredibly talented people. Paul Rathborne, our Head of National Chains, brings a wealth of experience in category and sales. He’s pragmatic and always encourages the team to think ahead and build deeper relationships. Torrey Young, our National Business Manager, has strong data analytics and commercial finance skills. He has created better tools for insights and approaches everything with an objective, fact-based mindset.

“This award is a testament to the trust we’ve built, the results we’ve delivered, and the strong willingness from both sides to succeed.”

Hugh Thompson, our National Account Executive, has experience with premium spirits and understands consumer behaviour inside and out. His operational knowledge helps us maximise consumer engagement at the point of purchase. What ties them all together are their strong personal skills and their drive to go the extra mile. They’ve made a dynamic, high-performing team that’s truly earned this recognition.

Q What does a successful partnership with Endeavour Group look like for your team?

A successful partnership is all about being easy to work with. We focus on breaking down barriers and maintaining open communication. The phrase “don’t die wondering” is key for us - we take risks and stay aligned with Endeavour Group on mutual values. It’s not just about transactions but about building strong relationships at all levels, from the trading team to the operations side. Innovation and transparency play a big role, too.

We try to keep things simple on the back end but bring creative solutions when challenges arise. We’ve taken the Endeavour Group team through our 18-month innovation horizon, and instead of presenting a long list of ideas, we’ve focused on what we do best. It’s about aligning on goals, executing together, and staying adaptable when things pop up. This approach has helped drive real growth and mutual success.

Brown-Forman’s Ecommerce Manager, Mariano Favia tells us why he chose to invest in MixIn for Jack Daniel’s Father’s Day gifting occasion and why he believes Retail Media is the new frontier.

Q How did the collaboration with MixIn enhance the visibility of the Jack Daniel's brand for Father’s Day gifting sales opportunities?

MixIn's sponsored products, on-site displays, and Meta ads - now partnered with Zitcha, have significantly boosted our brand's visibility within Dan Murphy's and BWS. This collaboration has been fantastic as it allows us to utilise these three distinct channels per brand, enabling us to focus on the most suitable product for each banner.

Mariano Favia

For BWS, we concentrate on convenience products, while for Dan Murphy's, we emphasise gifting or premium products. MixIn offers flexibility and supports our community ownership, aligning with our brand strategy. We have noticed improved engagement and online sales directly resulting from the campaign.

Q How does this collaboration align with Jack Daniel's marketing goals?

Anything that boosts our visibility to shoppers is beneficial, and that's precisely what we achieve with MixIn. We aim to collaborate on promoting products to new customers, existing customers, and competitors, tailoring different messages effectively.

Q How do you see digital Retail Media disrupting the advertising landscape?

There's a lot of buzz. Brands can access a more qualified audience, and the landscape is shifting. This is just the beginning, with ample room for collaboration. Currently, brands are testing, experimenting, and measuring. I anticipate a consolidation of strategies with Retail Media over the next two years. The channel is set to evolve, with personalisation being the next big step. We might both see the same ad, but it will be tailored to our personal tastes. There's no limit; we're just at the start. I believe Endeavour Group is leading the narrative at this point.

Q Based on your experience, what would be your advice to other brand managers considering MixIn in their media mix?

As part of a marketing strategy, it not only enhances brand awareness but also boosts sales. With Retail Media, brand managers can achieve both brand awareness and conversions. For us, it performs well due to the quality of data, and direct shopper access correlates with improved performance.

It’s new to everyone but it’s great to be in the front seat to see what happens next. The MixIn team at Endeavour are great to work with. They know what they are doing, and we trust the placements will work for us.

Q Can you talk to the sales results you have seen as a direct result of this campaign.

Our partnership with MixIn allows BrownForman to come up with marketing and sales initiatives that can influence the entire consumer journey from awareness to conversion. Sponsored Products have been great and allow us to us to attribute our marketing spend to sales in a very simple manner. Equally, we are happy to be one of the first suppliers to test Meta Managed Partner ads in partnership with MixIn and its relationship with Zitcha. This activity influences the mid funnel and allows our flagship brand - Jack Daniel's - to reach qualified shoppers resulting in uplift on online sales.

The collaboration between MixIn and Brown-Forman's Jack Daniel's brand demonstrates the effectiveness of integrating Meta's Dynamic Product Ads into a comprehensive retail media strategy.

We want all our valued suppliers to understand the value of Retail Media in their marketing mix. And for all our smaller suppliers out there, you don’t need a big brand to give MixIn a go. All brands can reap the benefits for brand awareness and sales. Contact Martyn Raab or Hayley Robinson here. They will be more than happy to help you amplify your brand awareness and sales with our customers.

BWS Cool Room is not just about music - it’s about creating a unique, unboring experience that’s driving cultural relevance while accelerating awareness and sales for our suppliers with Gen Z and Young Millennials.

At BWS, we’ve spent the past year taking our iconic Cool Room experience to new heights, and the results speak for themselves. Whether it’s bringing chart-topping artists like G Flip and The Jungle Giants to centre stage or launching exciting new products like BOX Alcoholic Juice and Largo, the Cool Room has become a powerful platform for engaging Gen Z and Younger Millennials. These gigs aren’t just concertsthey’re intimate, exclusive performances inside inflatable BWS Cool Rooms, creating unforgettable moments for superfans.

Last year in Melbourne, we expanded the Cool Room beyond store walls, kicking off with G Flip’s Cool Room performance and debuting G Flip’s new product, BOX

Alcoholic Juice. In Sydney, we turned up the volume with The Jungle Giants’ performance at SXSW, featuring popular beer brand, Largo for a second year.

The Cool Room resonates with Gen Z and Younger Millennials by tapping into their music passions and connecting with them through meaningful experience. This activation has reinforced BWS as a relevant, modern, stylish, and youthful brand while also providing a one-of-a-kind experience our audience loves.

Our Cool Room has delivered significant exposure for our suppliers, and the numbers show just how relevant the platform is:

G Flip Cool Room Campaign:

• Paid reach: 10.2 million in August

• Organic reach: 3.8 million in August

• Press coverage: Featured in top publications including Herald Sun, Rolling Stone, KIIS FM, and Smallzy’s Surgery on Nova

• Social media engagement:

- 91.43% increase compared to benchmark

- 3 million organic impressions

- Over 4.5K likes, 200+ comments, and 350 shares

The Jungle Giants Cool Room Campaign:

• Customer resonance: Strong connection with audience, building equity in the Cool Room concept

• Positive sentiment: 52% (vs. 47% benchmark)

• Cut-through: 64% (vs. 56% benchmark)

• Sales impact: Notable performance in key markets like QLD, NSW, VIC

• More information to come: We’re excited to share even more details and results from this campaign soon.

These impressive results demonstrate the strong connection between the Cool Room and our core demographics - Gen Z and Younger Millennials. With significant social media engagement and over 70% of competition entries coming from this audience, the Cool Room continues to resonate and drive cultural relevance.

Cool Room doesn’t just build buzz - it drives sales. The recent launch of BOX Alcoholic Juice alongside G Flip is a key example of just how powerful the platform can be. Following the event, BOX returned an impressive 49% sales increase compared to the baseline period, clearly demonstrating the influence of pairing music experiences with product launches. Likewise, Largo, championed at The Jungle Giants’ Cool Room performance at SXSW, has maintained performance during the event period across key regions, especially in QLD, NSW, and VIC.

The partnership with this ARIA awardwinning Australian band helped boost brand awareness and credibility, reinforcing the natural connection between music and drinks. By aligning with the Cool Room, Largo continues to be part of an innovative platform that resonates with the next generation of customers. Why get involved?

The Cool Room is more than just a concert -it’s an immersive platform for suppliers to authentically connect with customers through music culture. Whether launching a new product or strengthening your brand’s presence, the Cool Room

offers distinct ways to partner with BWS. You can choose a national product launch tied to a well-known artist for maximum exposure and reach, or take a more targeted approach by focusing on regional markets to boost brand awareness.

The last regional Cool Room we staged was last year in Newcastle and was a huge success locally.

If your brand is connected with an artist, we’d love to explore partnership opportunities and amplify your message, but it’s not a requirement so even if you are not affiliated and you are interested, reach out anyway.

The Cool Room continues gaining momentum, becoming a key driver of growth and brand love for BWS and our suppliers. Don’t miss out on this exciting opportunity to connect with your audience through the power of music.

Get in contact with your Category Manager or Assistant Category Manager today and prioritise your brand in the minds of MilZ with the BWS Cool Room.

Michael McPherson, our ALH Hotels beverage mastermind and gun Head of Beverages delivers his predictions on what we might expect to see guests drinking over summer in the on-premise. Think flavour evolutions of the perennially popular Margarita, more Spritz and one rogue prediction that will have you intrigued.

Q What do you expect to see on-premise as the trending cocktail for summer?

We expect to see another summer of Spritz, with guests seeing the value and convenience in these ready-toserve drinks. Margaritas continue to perform and we can expect to continue to see creative variations on the classic such as Coconut proving to be a goto favourite at the bar. And while Spicy Margaritas have been around for a while we expect them to really hit their stride in our pubs this summer having evolved out of high-end cocktail bars.

Q Will we see the Limoncello craze make its presence known on-premise?

Anything Lemon is a big hit at the moment. It will certainly be one of the flavours of summer. As offpremise trends take time to arrive in the on-premise, we predict after a winter of drinking Limoncello Spritz at home or on Northern Hemisphere summer holidays they’ll be looking for it over what is hopefully a long hot summer at the pub.

Q Do you expect to see growth in the Premix category over summer?

Premix has been a very interesting category for us to watch and we are seeing a shift to Premix in venues with our guests enjoying the consistency and quality of product and the familiarity - they know exactly what they are getting for their money.

Q What other on-premise drinks trends do you expect to emerge as temperatures warm up?

We’re still seeing growth in “non-Beer” with guests now starting to look for their favourite Ginger Beer or Hard Lemon. And my rogue prediction for the Beer of summer will be Guinness as an easy drinking dark beer.

Q At what rate are guests calling out their favourite Spirits brands at the bar?

There’s a definite growth in guests looking for brands they are familiar with and we’ve settled into a bit more of a happy medium - people aren’t looking for the cheapest but they’re not necessarily reaching for the top shelf either. Given the current economic climate, they still want to drink the brands they know and love while being cost-conscious.

Q How important is consumer-toconsumer influence in drinks choices in the on-premise?

There is always an element of “I’ll have what they’re having” when you see visually appealing drinks such as the classic Instagrammable Spritz or pink drinks leave the bar, but with “occasion” being a key driver, guests usually arrive knowing what they want to drink. Is it a Beer day or is it a Rose day?

Q How can suppliers best assist venue managers with the guest experience this summer?

Understand that for our venue managers December is the busiest and the best time to work in hospitality so our venue teams will be 100% focused on delivering the best guest experience possible.

I suggest checking in with them as soon as possible and let them work their magic through December and the summer months. And as always, ensure supply challenges are communicated as early as possible to your Category team representative.

Q And finally, what will be your drink of choice this summer?

A cold beer in a beer garden is pretty tough to beat - an easy drinking Pale Ale is usually my go-to. If I’m at a picnic or a BBQ though, a couple of rosés go down nicely on a hot day!

We are working hard to improve the Fulfilled by Endeavour (fbe) process to expand our reach to more regions across Australia so our suppliers can get more product into stores and into the hands of our customers.

Do you have a med-low velocity or localised product and you are looking to route your products into our stores? fbe ticks the box for many of our small to medium suppliers so we are rolling it out to more of Australia and constantly working on improving our processes. Supporting of creating a more sociable future together, fbe provides an efficient and reliable network that enables superior customer and supplier experiences. It is an alternative end to end transportation and distribution channel to Direct to Store Delivery (DSD) via DELIVERY by Endeavour.

DELIVERY by Endeavour will collect your order from your preferred pick up location and deliver it to our stores. At the point of collection, we take responsibility of your stock, ensuring a stress-free delivery. If your goods are lost or broken during the transport journey, we incur the cost, and you still get paid. It’s a win win.

One of the great benefits of fbe is there is no minimum order quantity. DELIVERY by Endeavour organises collection and delivery of your product and you can track your deliveries on the Endeavour Marketplace portal. Payments are easier to administer too, as we deduct the fees off remittance, so you don’t have to pay individual invoices like with DSD. With fbe you are also less likely to submit a claim for payment due to the store receipt process.

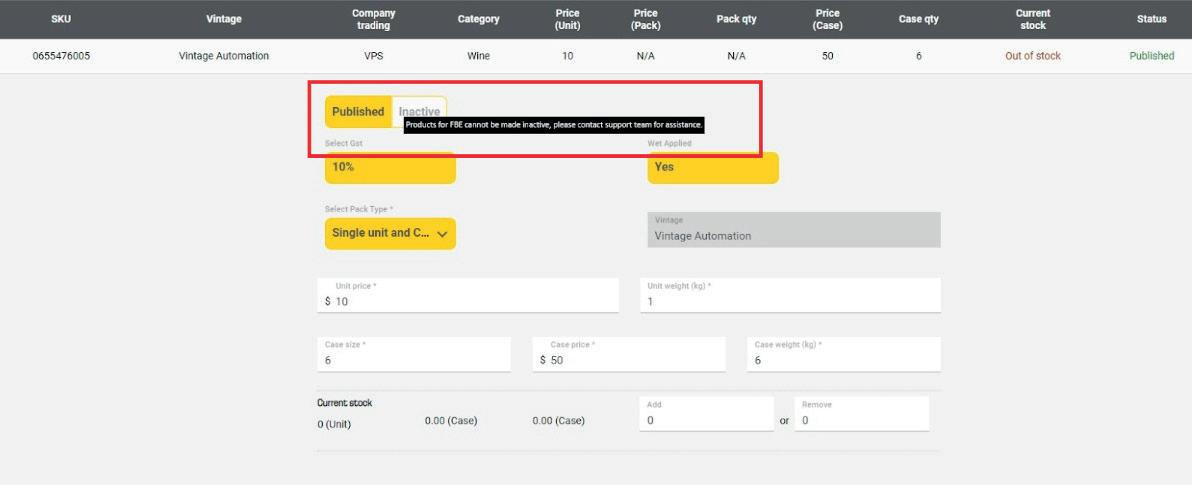

To make things simpler for fbe suppliers, particularly our small suppliers benefiting from using our Marketplace portal, we have enhanced the process by disabling the ‘Inactive’ button for fbe products and added a hover message with instructions to contact the fbe support team for assistance. This enhancement prevents suppliers from accidentally deactivating fbe products, which can lead to high order cancellations. Another way we are working to make the process smoother is by removing the ‘Display of Payment Status’ for fbe orders, to minimise confusion by eliminating incorrect payment status updates and enhancing accuracy for financial and order processing. In addition, paper invoices and delivery dockets are a thing of the past. Everything we need is on the carton label, generated in the Endeavour Marketplace portal. We also have a dedicated fbe team on call 1800 773 503 to support you technically and operationally with a full onboarding service to get you up and running fast.

There are now analytics reports available for fbe suppliers that show planned orders and provide more information around store stock on hand, as well as a refreshed KPI replenishment report. These allow greater visibility over what is coming down the line to help make resourcing and inventory decisions.

Have a 3PL or looking to onboard one?

Our 3PL integration solution will soon allow for seamless data exchange and communication between our system and your 3PL, enabling more efficient management of logistics and supply chain operations. The goal is to automate workflows, reduce manual errors, and improve the overall efficiency of the fbe process.

We are working on how we can expand our collection and delivery reach for fbe. Critical to this is making sure we have the right visibility for suppliers and our stores, ensuring orders are collected and delivered at the right times, with any issues followed up and resolved as quickly as possible.

In the new year, to enable better order visibility, our first trial in integrating our scanning and systems will begin in Western Australia with 3rd party carrier, Aramex.

OPERATIONAL:

- A more aggressive stock build approach to lead up to peak to support stores, our ED network and vendors.

- Expect to see larger order volumes earlier than previous years, before they taper off approaching December.

New analytics reports available on Partner Hub to help plan stock volumes and resourcing throughout the year

OPERATIONAL:

Rosters resume from the 6th Jan

GROWTH MILESTONE: 3PL intergration- increasing our reach and ability to service nationally through fbe - fbe expansion of serviced areas, enabling greater choice for new and existing vendors

- fbe roster skipped 23/12 and 30/12

- Expect smaller or no order volumes from 9th Dec

Improvements to Marketplace portal to remove confusion for fbe vendors:

- Disabling inactive button

- Disabling create shipping label option

- Removal of payment status

• Expanded collection and delivery reach using integrated partnership with 3rd party carriers, without compromising order visibility for suppliers or store experience.

• More targeted and relevant communications for fbe suppliers about their fbe orders, instead of getting generic Endeavour Marketplace communications.

• fbe brand presence on Marketplace website and Endeavour Marketplace portal to support and enable self service for current fbe suppliers and educate and inform potential suppliers on fbe.

• Automatically populate fbe products with weight and carton size information.

- Create a dedicated fbe support page

- More relevant and targeted email communications

We currently support all metro suppliers for the following locations:

• NSW to all other states

• VIC to all other states

• SA to all other states

• QLD to all other states

• WA to WA only

If you are interested in becoming an fbe supplier for your current or future store ranging, or would like to find out more, get in touch by emailing us at support@endeavourmarketplace.com.au.

You're the voice

And we want to hear it! Our quarterly Voice of Supplier or VOS feedback initiative and the annual Advantage Group Mirror Survey exist to cultivate communication and foster our relations with you, our suppliers.

Every quarter you can have your voice heard. Both our Voice of Supplier and the Advantage Group Mirror Survey serve as a platform for our suppliers to provide anonymous feedback on their experiences and interactions with our business. This feedback helps us understand supplier needs, identify areas for improvement, and enhance overall collaboration. It is your line of communication and our way of delivering the values outlined in our Trade Supplier Charter of transparency, simplicity of working and genuine partnership.

Here’s how VOS works:

• Feedback Collection: Suppliers can anonymously share their experiences and opinions through our Voice of Supplier survey.

• Analysis: The feedback is analysed to identify common themes, challenges, and opportunities for improvement.

• Action Plans: Based on the insights gained, we develop and implement strategies to address concerns and enhance supplier relationships. You spoke and we listened

Successful initiatives we have launched following feedback from you are our Category Deep Dives and our Supplier Summit. You said you wanted more information on the Wine, Beer and Premix and Spirits categories so we rallied the Category teams to deliver a virtual comprehensive and timely analysis of our strategy at Category level and how this informs ranging decisions. It was received with such enthusiasm from you that our Category Deep Dives will return in 2025.

Likewise, our Networking Event at this year’s Supplier Summit addressed feedback from our smaller and medium suppliers calling for more opportunities to get in front of our Category teams. We hosted over 400 small and medium suppliers who took the opportunity to meet our teams in person fostering stronger relationships for future collaboration.

Other issues you have raised through VOS feedback have led to our enhancement of supplier arrangements including our 14-day payment terms (originally a short term measure) now available for eligible smaller suppliers on an ongoing basis plus an improved onboarding process to get new products on our shelves more quickly. Other supplier feedback called for more assistance with our systems so we created our Merchandise Support Training programme to streamline your experience working with us, making it as easy as possible for you.

While VOS and the Advantage Group Mirror Survey are both effective ways of delivering your feedback to us, please don't dismiss the power of email. You can reach us anytime via the Supplier Communication email and if you would like to be included in the next Voice of Supplier survey let us know by emailing supplier.communication@edg.com.au.

While we make every effort to address all your valuable feedback, we acknowledge there is always more we can do and more ways for us to improve. We are all ears when it comes to working more effectively together for the mutual benefit of all business. Let’s make sure we make the most of our open communication channels for best practice.

In September, we were excited to deliver our new in-house supplier training resource. We moved away from the grocery-led Woolworths model to offer our supplier partners liquor-specific support. Working back in our wheelhouse has been a real game-changer. Now, a few months in, we talk to our Merchandise Coaches and Project Specialists, Ian ‘Guv’ Sprawson and Susan Lewis, about how we’re tracking since launch, how our suppliers can make the most of our new fit-forpurpose training opportunity, and how it facilitates better ways of working together.

Q How are our Endeavour training sessions going so far?

We are thrilled to report we have had many of our suppliers attend our curated sessions as well as our “Further Support” casual drop in sessions.

It's been a pleasure connecting with many of our suppliers and helping them on their learning journey.

Q What has been the supplier response to our new liquor-specific focus?

Our suppliers appreciate and are excited that they have dedicated resources to assist them in doing business with us.

Below are some verbatim from our attendees:

“Very helpful in step x step procedure and explaining descriptions of terms used on the sheets. I have a better understanding of how the system works.”

“Really good training, engaging, information that was shared was relevant and useful. 10/10”

“I had a new starter who I booked into these sessions, so valuable!”

Q Explain how our new liquorspecific training platform facilitates better ways of working

Our aim is to simplify the ways of working with us whilst navigating our sometimes complex systems. Our intent is that our supplier partners have a seamless and positive, ‘right first time’ experience when dealing with us.

Remember, our team is here for you. Whether that is face-to-face or online, we are on hand to help.

Let us help you reset in January with some basic Partner Hub and Smartsheet training so that you can launch into our systems confidently in the New year.

In case you need a quick recap here’s how to book a session with us.

It’s easy to book

You can access the Supplier Training Dashboard here through your profile on Partner Hub. Then it’s as simple as clicking ‘Book a Session’ and choosing your training option from the dropdown menu.

At the Supplier Summit, Complete Liquor was introduced as a groundbreaking data tool being developed by Circana to become your go-to source for all things data and insights in the retail liquor market.

What makes Complete Liquor so special? Well, it will bring together unmatched measurement capabilities and deep industry know-how, collaborating with major retailers across the liquor sector to deliver a master source of data in relation to off-premise liquor retail sales.

This means you'll have the power to innovate faster, track your performance against the market, and gain visibility of the total size of key liquor categories.

For the first time, the industry will receive a free quarterly report offering a toplevel overview of the retail sales value and volume for Beer, Wine, Spirits, and Premix categories. It will provide a market perspective and help to encourage customer-focused thinking. In addition to the free industry report, a subscriptionbased solution will be available, providing greater granularity, more frequently.

While the intent was to deliver Complete Liquor to you in November, setting up this game-changing initiative has proved quite the journey, involving many complex steps. All stakeholders involved have been

crunching the numbers to get everything ready for a launch in the new year. So, gear up for the invaluable data and insights coming your way!

As a teaser for what we hope is to come here is a snapshot of the Category and SubCategory information that should be available.

TOTAL LIQUOR

BEER - TOTAL

Beer - Sub Categories/Segments*

CIDER - TOTAL

Cider - Sub Categories/Segments*

SPIRITS TOTAL

Spirits - Sub Categories/Segments*

SPIRITS PRE-MIX - TOTAL

Spirits Premix - Sub Categories/Segments*

WINE - TOTAL

Wine - Sub Categories/Segments*

Available Not

If you haven't registered for updates yet, please don't hesitate to do so via Circana here. We're here to support you every step of the way.

*Sub Categories/Segments across contributors are being aligned once finalised details will be shared.

Then and now:

Unpacking Liquor trends

MilZ – Our core customer of the future: Now is the time to prepare

Unpacking category shifts: Customer preferences shaping Category

Insights powered by Quantium

James Marinelli, Head of Category Strategy and Insights

Wherewere you in 2014, and what were you drinking? Your choice would have been influenced by your age, gender, stage of life, lifestyle and the societal macro trends of the time. For me, that would have been a Little Creatures Pale Ale and maybe a Chivas and Coke.

Between 2014 and today, Liquor trends have experienced leaps of change, with the impact of the COVID-19 pandemic having had an unprecedented influence. This edition of Distilled examines the cultural, generational, and economic factors that inform customer and category shifts. We address how our customers have approached value over the years and how we deliver value in challenging times—particularly for today’s customers.

We unpack innovation over the decade, mindful consumption, changes in occasions and demographics, and the impact of flavour trends and styles on consumption.

It is hard to comprehend that Millennials, Gen Z, and Gen Alpha will amount to just under 50% of the Australian adult population in just two years. While keeping our focus on our core Gen X and Baby Boomer customers, engaging with the emerging MilZ cohort is essential for our industry's future development and growth. We analyse MilZ insights, purchasing behaviours, and Category choices and ask how we can grow and evolve with MilZ to align with their lifestyles and values to meet their future needs.

Speaking of Categories, we look at recent shifts in Wine, Beer, Spirits, and Premix, including sub-categories trending up and slowing down. What is clear is that our customers are championing refreshing drinks on the lighter side across all Categories; think Ginger Beer, Vodka Premix, and Sparkling Wine Spritzes.

This Insights Report is one of the most comprehensive examinations into past liquor trends and how they inform our future our Category Insights team has created. We are confident you will find the information on these pages extremely valuable.

In challenging times, we should remind ourselves that we are in the business of creating social occasions that foster connections and bring people together, particularly at the most sociable time of the year.

Until 2025, Happy Holidays!

- James

MilZ – Our core customer of the future This cohort will mean business and now is the time to prepare

Unpacking category shifts

Category is shaped by changing customer preferences

Then and now

Understanding historical Liquor trends provides crucial insights into the future. By accurately identifying and delivering emerging trends to our customers, we can drive growth in our industry. These insights help us tailor offerings to align with evolving customer preferences, so we can enhance the products the products and experiences we deliver.

Liquor consumption trends have long been shaped by social and cultural factors, a pattern that continues today.

Over the past decade in Australia, we have seen our customers’ purchasing behaviour influenced by macro factors such as technological advancements, environmental sustainability initiatives, demographic shifts, the COVID-19 pandemic, and an increased focus on mindful consumption.

Recognising these influences is key to understanding the evolving needs of tomorrow's customer. For our industry to continue thriving, it’s vital to expand our customer base, boost basket size, and increase customer spending per visit. But how do we do that in a meaningful and sustainable way?

First, we must gain a deep understanding of our customers' thoughts, feelings, actions, and motivations.

Technological advancements and digital connectivity have reshaped customer behaviour and expectations, profoundly impacting how Australians perceive value across all generations.

In the 1980s and 1990s, value was primarily about price. Customers, often with time on their hands, would scour catalogues, travel distances, and visit multiple stores to secure the best deals.

This era was defined by a customer focus on getting the most for their money, with little regard for the time invested.

Moving into the 2010s, the concept of value began to shift. Time became a significant factor alongside price. Customers started weighing the tradeoff between the cost savings and the time spent to achieve them. The convenience of finding good deals without excessive travel became increasingly important.

As convenience and experience are prioritised, opportunities exist right now to innovate in

product offerings and marketing strategies.

Today, the 2020s social media generation has introduced a new dimension to value: experience. While price and time remain crucial, there's a growing emphasis on how purchases reflect on social media and in social settings. We see that our younger generations are not only valueconscious but also willing to pay more for ultra-convenience offered by services like DoorDash, Uber, Menulog and MilkRun.

It is important to understand this evolution of our customers’ perceptions of value. As convenience and experience are prioritised, opportunities exist right now to innovate in product offerings and marketing strategies.

Over the past decade, Australia has experienced a variety of economic conditions that have influenced spending behaviours. From a period of economic growth and low inflation pre2020, to the challenges posed by the COVID-19 pandemic, including increased unemployment and cost-of-living pressures, these shifts have shaped how our customers manage their wallet.

So right now, more than ever, we are committed to delivering value to our customers. Understanding that value

is more than price and that it means different things to different people, we aim to provide a range of options that cater to diverse needs and preferences.

For some customers, value is found in larger pack formats, offering cost-effective solutions without compromising their choice. During F24 we saw an increasing popularity in value packs offering customers cost-per-litre savings. In Beer, we saw value share gain from 24 packs into 30 packs (+0.9%). In Premix the shift was from 6 to 10 packs (+5.6%). And in Spirits customers shifted from 700ml to 1L formats (+1.5%).

As mentioned above, others seek value through convenience and choice, often opting for online shopping and delivery services that save time and offer competitive pricing.

Our teams are continually exploring innovative ways to enhance the shopping experience, ensuring that customers can find the right products that fit both their budgets and lifestyles.

By understanding and responding to the varied perceptions of value, we can continue to meet customer expectations and maintain strong engagement through challenging economic times.

Innovation in the Liquor industry has evolved dramatically from its traditional roots.

Over the last decade, we have experienced an unprecedented era of innovation in our stores, driven by the creative ingenuity of suppliers and their deepening understanding of evolving customer preferences. Together, we’ve delivered an explosion of new lines, redefined category norms and now offer customers an abundance of choice.

In the past year alone, new product development (NPD) has achieved remarkable success, with record sales of $400 million from products that did not exist a year ago. This achievement highlights the industry's capacity to rapidly adapt and respond to customer demands with fresh, exciting offerings.

Suppliers have embraced the challenge of delivering products that resonate with contemporary consumers, particularly those seeking experiences that align with their lifestyles and values - such as the proliferation of Lighter in Alc**, Low and Zero%* products. Technological advancements have undoubtedly facilitated the speed at which these innovations reach the market. However, it is the willingness of our suppliers to be agile and responsive that truly drives this

innovation. By continuously tapping into insights and by remaining flexible, suppliers have been able to deliver products that captivate our customers. And of course, innovation is more than liquid. Packaging solutions like the Bagnum and single-serve offerings, cater to modern demands for sustainability and convenience, while interactive product labels are really engaging our younger consumers and playing into their demand for personalised and digital experiences.

As the industry continues to evolve, the combination of creative thinking, technological prowess, and an agile mindset will be crucial in maintaining momentum. By leveraging these strengths together, we can continue to capture the interest of our customers, ensuring the industry, as well as our instore and online experiences remain vibrant and forward-thinking.

In recent years, customers have enjoyed exploring a wider variety of beverage options that align with their individual lifestyles and values. This trend towards mindful consumption highlights a growing interest in diverse choices within the beverage market.

The increasing range of lighter styles, as well as lower in alcohol and Low Carb products, provides customers with a broad range of options for their social occasions.

It also presents exciting opportunities to innovate and explore the concept of mindfulness. Transparency and authenticity continue to be important to customers, with many showing interest in the stories behind their product of choice. Suppliers can leverage this interest by leaning into storytelling and emphasising the people behind the product, sustainability credentials, or unique production methods.

Creating these moments of connection with customers will be a critical part of success with our younger generations where brand loyalty is hard-earned.

We all know now that the nature of social occasions have evolved, reflecting broader changes in lifestyle, technology, and societal norms. The COVID-19 pandemic, in particular, accelerated the shift

towards digital and virtual interactions, significantly influencing how our customers connect and celebrate.

As a result, there has been a rise in more casual and home-based gatherings, with technology enabling people to connect virtually and share experiences from afar. This shift has led to an increased demand for products that suit smaller, more

intimate settings, as well as those that are convenient and easy to enjoy at home.

However, the trend towards outdoor and experiential social activities is also influencing customer preferences. Products that are portable and versatile, such as canned cocktails and bagnums, have gained popularity as they cater to these dynamic social settings.

By understanding and responding to these changes in social occasions, particularly the digital and virtual trends accelerated by COVID-19, we can continue to connect with our customers and their occasions in a way that is relevant in a fast-changing world.

As our population becomes more diverse, with shifts in age, cultural backgrounds, and lifestyle preferences, naturally the more diverse our range needs to become. As we’ve already touched on, younger generations, such as Millennials and Gen Z, are bringing fresh perspectives and preferences to the table. They tend to value experiences, authenticity, and brands that align with their values. At the same time, Australia's multicultural

landscape continues to evolve, leading to a growing demand for products that reflect a variety of cultural tastes and traditions such as Korean Soju, Japanese Shochu, Chinese Baijiu and Asian Beer. Soju, for example, has experienced unprecedented growth (10x) since 2019.

Similarly, our calendar of key selling events has also expanded to include celebrations for Chinese New Year and Lunar New Year, for example, and we see great success and engagement from our customers. Nearly 1 in 3 people in Australia were born overseas

Source: ABS https://www.cia.gov/the-world-factbook/field/alcoholconsumption-per-capita/country-comparison/

Nostalgia has a powerful influence on customer behaviour, as people often seek comfort in familiar tastes and experiences. We have seen this play out with the resurgence of classic beverages and traditional flavours.

Customers are continuing to be drawn to products that evoke memories, leading to a revival of interest in vintage cocktails, retro branding, and time-honoured recipes. This renewed appreciation for the classics is an opportunity to reintroduce beloved favourites, or develop a contemporary twist.

For example, we’ve seen success from vintage-inspired products offering a modern spin, appealing to both nostalgic consumers and new generations seeking unique experiences.

Lighter styles: Refreshing our tastes

Customers preferencing lighter-tasting and more refreshing styles is a growth trend reflected across all categories over the past decade. Lighter refreshing styles are outpacing category performance

In Wine, lighter styles are increasing in share with shifts into varietals with refreshing palate profiles. We have seen an increase in spend on segments such as Pinot Gris, Rosé, Prosecco, Champagne and more recently Spritz. This trend is evident within Red Wine too, with growth in Pinot Noir.

Share of Light Premix has more than doubled over the past decade, with flavour a key driver as customers prioritise flavour and familiarity over the base alcohol. This is reflected in the rise of the neutral-spirit sub-categories like Premix Vodka and Vodka Spirit that allow flavour to take prominence. Lower IBU (International Bitterness Unit) Beer has also grown over the last decade and over-indexes with younger generations who typically prefer more sessionable styles. We see Millennials choose Craft Beer more often when looking for a complex flavour profile within a lighter style, such as Pale Ale. Lemon takes centre stage

We’ve said it in a few editions of Distilled now; Lemon is having a moment in the sun. Springboarding off the trend for flavour-forward products, the refreshing nature of Lemon makes it an exciting choice for NPD across all categories.

In the cocktail scene, Lemon has always been a staple ingredient in classics like Tom Collins and Whisky Sours. However, now, Lemon is making waves in the world of Craft Beer, Premix and even Wine with the dominance of Limoncello Spritz over the last 12 months.

Premix is a prime example of a category experiencing a nostalgic resurgence in Lemon-flavoured products. Stoli Lemon Ruski, a revolutionary product from the 1990s, introduced the Vodka brand to a new generation. Recently, there's been a renewed Lemonthemed focus in the Category with NPD like Suntory’s -196 Double Lemon and CUB’s Hard Rated leading the

- Last 2 Years

Source: Quantium Last 104 Weeks

charge, with many suppliers following suit with their own citrus offerings.

The popularity of Lemon has also been bolstered by the latest trends in Spritzes. This renewed awareness of the familiar flavour has intersected with the trend for Prosecco-based Spritzes, made even more refreshing with a splash of Limoncello. Last Christmas, we saw 26% of all aperitif baskets at Dan Murphy’s include Sparkling Wine, highlighting the cross-category benefits of the Limoncello trend. As customers increasingly look to mix their own Spritz Cocktails at home, the love for Lemon continues to grow.

The big impact Lemon has had on growth of Category begs the question, what is the next big flavour in drinks?

By 2034, Millennials, Gen Z, and Gen Alpha will account for 60% of the Australian adult population, which will likely impact the future category mix.

By 2026, MilZ will surpass Baby Boomers as the largest customer cohort, making up 47% of the market. And during the 14-year span from 2020 to 2034, Gen Z is projected to nearly triple its share of liquor customers.

Why is this important?

While it’s critical that we don’t alienate our current core customers, Gen X and Baby Boomers, it's crucial to connect with the emerging MilZ cohort now, to understand their needs and engage with them in meaningful ways.

Lower shopping frequency among younger generations currently hinders their generational share, so one key focus for the next decade is to discover innovative strategies to increase shopping value within this group.

Right now, we know that Premix products are particularly popular among MilZ consumers, driven by NPD and the introduction of innovative flavours that keep them engaged. If current trends persist, Premix has a significant tailwind to remain relevant to Gen Z and Millennials as they age.

Unlike previous generations, Gen Z and Millennials are not transitioning to Wine at the same rate. This presents an opportunity for Wine to drive interest through education, engagement, and new product development to gain relevance among these future core customers.

The tendency that we see for MilZ to remain engaged with the Premix Category as they age poses challenges for both Beer and Wine, with forecasts suggesting a potential decline in value share. All categories should consider adopting elements that resonate with this cohort, such as innovative flavours, fizz, unique formats and packaging, as well as lower-carb options and brands that resonate with their values.

For Gen Z and Younger Millennials, the top sub-categories include Premix Vodka, Premix Bourbon and Full Strength Beer, followed by Vodka Spirits

The presence of Low and Mid-Strength Beer in the top ten sub-categories highlights the mindful consumption trend among our younger cohorts who are looking for lighter choices. Additionally, we are seeing premiumisation emerge with interest in Red Wine, Whisky, and Craft and International Premium Beer

Sub-category trends show generation shifts benefit Premix

Gen Z & Gen Alpha will be 60% of +18 population

While younger demographics continue to favour Premix, their engagement with Wine is also worth noting. Gen Z, in addition to their love of Red Wine, in particular Shiraz, show a preference for refreshing styles like Sauvignon Blanc, Sparkling Wines such as Prosecco, and sweeter profiles like Moscato. Millennials maintain a preference for Sauvignon Blanc, with Pinot Noir becoming a popular choice for its lighter profile.

For Older Millennials, while Premix remains in the top five, Red Wine, Whisky, and Full Strength Beer take the top spots, with Wine becoming more prevalent.

PREMIX DRINKS - VODKA

PREMIX DRINKS - BOURBON

STRENGTH BEER

LOW CARB BEER

WINE MID STRENGTH BEER

NORTH AMERICAN WHISKY

PREMIUM BEER INTERNATIONAL

Source: Quantium Last 52 Weeks

White Wine makes its first appearance among Older Millennials, with Red Wine ranking number one. Among generations older than and including Gen X, Wine consistently ranks in the top two, with White Wine leading for Traditionalists, followed by Red Wine. Interestingly, Premix Bourbon maintains a top ten position for these older generations, suggesting they are sustaining the demand for Dark Premix.

PREMIX DRINKS - VODKA

PREMIX DRINKS - BOURBON

STRENGTH BEER

WINE

LOW CARB BEER

MID STRENGTH BEER

PREMIUM BEER INTERNATIONAL CRAFT BEER AUSTRALIAN NORTH AMERICAN WHISKY

STRENGTH BEER

PREMIX DRINKS - BOURBON

PREMIX DRINKS - VODKA MID STRENGTH BEER WHITE WINE

CRAFT BEER AUSTRALIAN

PREMIUM BEER INTERNATIONAL

LOW CARB BEER

Here we dive into how customer preferences have transformed over the past decade, reshaping our categories. From the rise of sessionable Beers to new Premix flavours, we explore the trends driving these shifts and where the opportunities lie moving forward.

Over the past decade, the way customers engage with the Beer Category has evolved.

Beer

Emphasis on lower IBU, sessionable, refreshing profiles with lower alcohol and carb attributes.

We have seen a shift as customers gravitate towards more sessionable Beers with lower International Bitterness Units (IBUs), reflecting a preference for smoother, less bitter flavours. Ginger Beer, for instance, has gained popularity and grown ten-fold over the decade, aligning with the trend for refreshing, sessionable drinks.

The concept of "Premium" has also shifted. Over the last decade, there has been a long-term move away from Premium International Beers towards Craft Beers, which saw a peak during the COVID years.

Ten-year Craft Beer trends show a growing customer preference for lighter and more refreshing profiles, with a shift towards lower IBU variants. Since 2014, styles like Golden, Dark, Sour, Amber, and

Red Ale have declined, making way for the rise of Pale Ales Variants such as Hazy, India, Extra, and Pacific Pale Ales are experiencing growth, driven by brands that meet demand for fresh, sessionable styles.

We’ve also seen growth in Mid-Strength, Non-Alcoholic, and Low-Carb Beers. These sub-categories have experienced double-digit share growth with gains across all generations.

Additionally, the Japanese Beer sub-category is gaining traction, driven by its crisp, refreshing taste profile that resonates with current preferences and Australia's shifting demographics. Japanese and Japanese style Beer has also grown ten-fold over the last decade.

From 2019 to 2021, Spirits gained market share accelerated by COVID lockdowns and the subsequent cocktail popularity surge.

Spirits Drive penetration with new signature serves and emerging tastes.

Sub-category shifts in Spirits

In Glass Spirits, there's been a noticeable shift towards Light Spirits, which are outpacing Dark Spirits. Gin's popularity increased over the past decade, peaking during the pandemic and slightly declining post-pandemic. Importantly, Gin's share gains did not detract from other Light Spirits, as Tequila Blanco continues to rise. Gains in Soju, Aperitivos, and Limoncello also reflect this trend.

Despite the impressive growth of Agavebased spirits, there is still headroom for Tequila as penetration remains lower than Gin and Vodka, highlighting an opportunity to develop a simple Agave serve to further engage consumers.

Dark Spirits, however, have not enjoyed the same share gains, with American Whiskey, Whisky, and Rum losing share over the

decade. Green shoots are appearing in Scotch Single Malt, Irish, Japanese, and Australian Whisky, all showing growth. Our younger generations could present an opportunity for Dark Spirits as Whisky and American Whiskey fall into the top ten sub-categories for MilZ, while Vodka ranks at number three for Gen Z only dropping out of the top ten for Younger Millennials as Whisky gains favour.

To build relevance with younger consumers, Dark Spirits need to evolve, offering flavour-forward options and relevant brands. While Bourbon is still critical, encouraging exploration with Dark Spirits such as Rum and Whisky - can broaden appeal.

Premix has gone from strength to strength, gaining share right through to 2024 and growing four share points over the last decade.

Light Premix

Potential to lean into familiar, nostalgic flavour profiles.

Dark Premix

Flavour-forward liquids and brands that resonate with younger customers.

While Premix Bourbon is the leading sub-category, and Bourbon’s loyal customers will remain a priority, its share has declined by about one-third over the past decade due to the success of Light Premix mainly through innovation

Similarly, Premix Rum and Whisky have seen reductions, albeit from smaller bases.

Dark Premix faces the challenge of retaining market share by aligning with younger generations' preference for refreshing styles. Recent product launches suggest brands are heeding these calls, aiming to develop Dark Premix options that address emerging needs, flavour and relevance. That said, this sub-category is critical and will remain a priority for years to come.

Conversely, Light Premix has experienced exponential growth with Vodka, which has doubled its share since 2014, leading the charge and almost reaching parity with Dark Premix.

Vodka Premix has doubled its share since 2014.

The rapid rise and fall of sub-categories like Gin and Seltzer illustrate the fastpaced nature of Premix brand lifecycles.

Breakthrough NPD like Hard Rated and -196 Double Lemon have driven growth in the Light Premix space, thanks to popular flavour profiles and approachable branding. The focus for us all is on identifying the next big flavour profile to maintain Premix's appeal.

While Wine preferences are changing, these shifts are less dramatic and have occurred over a longer term.

Wine Lighter and refreshing varietals

preferences have evolved, as seen in the transition from the oak-forward buttery style of Chardonnay in the 1980s to the fresher, fruit-forward versions in the commercial wine space to the premium steely and austere styles that align with modern palates.

Now, we have reached a point of maturity with Australian Chardonnay. Today, customers can choose their own adventure from the kaleidoscope of options that is modern Chardonnay. The job to be done is helping our customers find their style.

The recent resurgence in the buttery style for example is winning over Baby Boomers and Gen X who fell in love with the style back when it was popular in the 1980s. In recent years, lighter varietals and styles have emerged as growth leaders, although Shiraz and Sauvignon Blanc remain our dominant sales varietals representing over 25% of all wine sales. Rosé was in growth leading into the pandemic and has established its position since. Rosé has enjoyed the

highest percentage growth in Wine over the past five years and shows no sign of slowing. Pinot Gris/Grigio, Pinot Noir and Grenache continue to gain popularity, particularly with younger consumers. It is also worth noting the growth of styles and varietals such as Sangiovese and Sangiovese blends and Non-Alc* gaining favour with customers. Although off small bases now, it will be interesting to watch how these sub-categories develop. Since COVID, Sparkling Wine has gained market share within Wine,

*C ont ains not more than 0.05% ALC/ VOL

2014-2024

driven by the Prosecco and the Spritz trend. The introduction of Zoncello's ready-to-pour Limoncello Spritz has spurred innovation in the segment, leading to a boost in the run of growth in subcategories like Prosecco, Sparkling Rosé and Sparkling Spritz. Emerging format trends we expect to accelerate over the coming years include Piccolos, appealing to Traditionalists, Baby Boomers and Gen X and 1.5L Bagnum, appealing to Gen X and Older Millennials with their convenient and sustainable packaging.

Esteemed winemakers were celebrated across the country at the Langtons

Classification of Australian Wine tasting event.

Last held in 2018, the event marks a special moment in Australian wine history, bringing together some of the country’s most iconic wines and their talented producers. The 8th edition of the Langtons Classification showcases the passion, dedication, and craftsmanship of some of Australia’s most sought-after wines today.

19 new wines joined the ranks, including The Relic Shiraz Viognier and The Schubert Theorem Shiraz (The Standish Wine Company), Hoffmann Dallwitz and Little Wine Shiraz (Sami-Odi), Tolpuddle Vineyard Chardonnay and Pinot Noir (Tolpuddle Vineyard), and Quartz Chardonnay (Bindi Wines) underlining a clear new direction to more elegant styles of Shiraz and southeast regions featuring Pinot Noir and Chardonnay.

We were proud to support the winemakers whose work has shaped the industry and continues to set new standards for excellence.

Here’s to the remarkable winemakers behind every bottle – and to the future of Australian fine wine.

Our teams have been hitting the books for our customers.

Our Dan Murphy’s teams have just reached the one million lessons mark on Small Batch Learning, and the entire Endeavour Group, including our teams at BWS and ALH Hotels, have collectively completed a whopping two million lessons.

With thousands of team members registered, we’re raising the bar on customer experience. From in-store activations to mastering the nuances of Wines, Beers, Spirits and Premix, our teams are committed to delivering the best.

We're thrilled to welcome The Cavenagh, affectionately known by locals as The Cav, to our Endeavour Group family.

Serving the people of Darwin, The Cav has been a mainstay of the community since opening its doors in the 1930's. We're sure if walls could talk, we'd hear a story or two.

It’s an honour for us to become the custodians of such an iconic venue, and we’re dedicated to preserving what makes The Cav great while also looking for ways to enhance and protect it for the future.

Whether you're popping in for a meal and a drink at the bistro, enjoying a staycation, or lounging by the pool, The Cav promises an unforgettable experience.

Join us in giving a warm welcome to The Cavenagh Hotel and make sure to visit soon.

ALH Hotels continues to actively promote safer gambling practices, and its latest focus is the recently launched Well Played.

The new guest-facing initiative ensures gaming remains a safe form of entertainment and provides strategies to empower players and reduce gambling harm.

At Endeavour Group, we recognise the importance of fostering safe and enjoyable environments for everyone. Nadine Ewing,

Head of Responsible Gaming and Andrew Lancaster, Head of Gaming Operations are building awareness around how Well Played works across ALH, Endeavour Group and in our pubs, including how it connects back to the internal safer gambling strategy, Player Protect.

The Well Played initiative highlights ALH’s commitment to responsible gaming and guest welfare. It aims to educate venue teams and guests on responsible gaming practices while positioning Well Played as a trusted brand developed to reduce the risk of gambling harm.

Engagement Windows are a time that our Category Managers have set aside to review product submissions. During the submission review, they will work with you on the correct instore date based on product availability. You can review Engagement Window timings at any time within the Supplier Dashboard.

We also encourage you to continue to share any of your most exciting and innovative

products with your Category Managers as they are developed, even if outside of a published Engagement Window. To submit these products please complete the New Product Submission form.

Please note that Engagement Window timings may change based on alterations to our ranging plans.

When are the Engagement Windows for my Category?

Find out when to submit your products by viewing the Engagement Windows on our Supplier Dashboard

How do I submit products outside of these Windows?

To submit a product outside of our Engagement Windows please fill out our New Product Submission form

Name

Leadership Team

Beer & Cider

Position

Tim Carroll Director - Merchandise & Buying

Nikki Bull

General Manager - Merchandise Operations & Transformation

Gill Webb Head of Beer & Cider

Georgia Stott

Jody Liddle

Fernando Fernandes

Hugh Smith

Nerissa Budynek

Category Manager, Trading - Beer & Cider (BWS)

tim.carroll@edg.com.au

nikki.bull@edg.com.au

gill.webb@edg.com.au

georgia.stott@bws.com.au

Category Manager, Trading - Beer & Cider (Dan Murphy’s) jody.liddle@edg.com.au

Category Manager, Range - Commercial, Craft, Local & Cider

fernando.fernandes@edg.com.au

Assistant Category Manager, Range - Local Craft Beer & Cider (EG) hugh.smith@edg.com.au

Category Manager, Strategy and Innovation - Beer & Cider

nerissa.budynek@edg.com.au

Spirits & Premix

Name

Position

Sarah Hall Head of Spirits & Premix sarah.hall3@edg.com.au

Michael Vagli

Calum Susko

Hamish Fyfe

Finlay Gustus

Stephanie Petracca

Edward Cass

Complementary Categories

Wine Commercial

Lance Friedman

Category Manager, Trading - Glass & Premix (Dan Murphy’s) michael.vagli@edg.com.au

Category Manager, Trading - Glass & Premix (BWS) calum.susko@edg.com.au

Category Manager, Range - Dark Spirits (EG) hamish.fyfe@edg.com.au

Category Manager, Range - Light Spirits (EG) finlay.gustus@edg.com.au

Category Manager, Range - Premix (EG) stephanie.petracca@edg.com.au

Assistant Category Manager, RangeLocal Spirits & Premix (EG) edward.cass@edg.com.au

Category Manager, Complementary Categories (EG) lance.friedman@edg.com.au

Leigh Firkin Head of Commercial Wine leigh.firkin@edg.com.au

Mathew Young

Joe Armstrong

Ben Lafford

Darren Leivers

Tim Yu

Andrew Shedden

Ian Wolfe

Wine Fine Wine

Rob Aitken

Nick Rose

Ramon Gunasekara

Category Manager - White, Rose, Zero Alc, Cask & Bagnums (BWS) mathew.young@edg.com.au

Category Manager - Red, Fortified, Champagne & Sparkling (BWS) joe.armstrong@edg.com.au

Category Manager, Red Wine & Cellar (Dan Murphy’s) ben.lafford@edg.com.au

Category Manager - White, Rose, Zero Alc, Cask & Bagnums (Dan Murphy's) darren.leivers@edg.com.au

Category Manager, Champagne, Sparkling & Fortified Wine (Dan Murphy’s) tim.yu@edg.com.au

General Manager - Premium for Endeavour andrew.shedden@edg.com.au

Category Manager (EG) - WA & SA ian.wolfe@edg.com.au

Category Manager (EG)NSW, VIC, QLD & TAS

rob.aitken@edg.com.au