Get to know Australia’s largest pub operator

Influencing through brand

PLUS discover our insights report on the latest trends and the Christmas that was

Welcome back to our latest instalment of Distilled - our first one for 2023. After a huge Christmas and New year’s trading season we certainly have a lot to reflect on and unpack.

This edition we take a look at our Hotels business - including their strategy and investment cycle; we hear from the team on the Personalisation Engine and the journey they have been on; as well a deep dive into some customer insights we’ve been seeing through our network.

This month, we of course held another Supplier Forum - it was fantastic to see so many of our partners getting involved and submitting questions!

Finally, nominations for our Supplier of the Year Awards have now closed and we are busy making our way through each of those. Thank you to all who made submissions - the judging process will be really tough this year given the volume of fantastic entries.

Formal invites for our Awards night will be sent in the coming weeks, and I can’t wait to catch up with everyone on what is going to be a fantastic night.

Bree Coleman General Manager Transformation, Range and Customer Value

Bree Coleman General Manager Transformation, Range and Customer Value

Tim reflects on the exciting opportunities within the Wine category and the ways we can engage with our Gen Z and Younger Millennial customers.

Our judges talk about what they are most looking forward to as they begin the shortlisting process.

Here, the team updates us on the progress of our Personalisation Engine and what we can expect to see this year.

Now, our customers can search for products as easily as snapping a pic.

We spoke to last year’s Best Brand Activation winner on the role social media played launching the crowd favourite, Better Beer.

28

design

Head of Format Operations for Dan Murphy’s describes the journey they have been on since the launch of Dan’s 2.0.

34 Supplier Spotlight: Diageo

Last year’s Digital Partner of the Year, Diageo, explains why digital is so important to their business strategy.

48

ALH Head of Format Operations, Shaun Dunleavy, outlines the on-premise investment program and what we can expect to see over the next 12 months.

How can you get the most out of the free Supplier Connect tools available to Endeavour Suppliers?

The latest insights designed to help keep you informed and across the biggest opportunities in our category.

Christmas Retrospective Population high-level trends

We get to know Australia’s largest pub operator and the purpose driving their strategy forward.

Q1: You speak a lot about the need to recruit Gen Z and Millennial customers into Wine. Can you talk to some of the initiatives and opportunities you’d like to see suppliers think about when it comes to actively engaging these customers?

A: Wine is one of the cornerstones of Endeavour Group, and as a producer in the industry, we share a mutual interest in seeing it flourish both here in Australia and internationally.

Over the last few years we have increased our focus on understanding what our customers want and continue to investigate what we can do to better meet their needs.

We are embracing these shifting customer demands, rethinking our approach to challenges, and we are starting to see the results with great innovation both in store now and in the pipeline.

These innovations appeal to our next generation of Wine drinkers, while also providing choice to those on moderation or wellness journeys, or those looking to make more informed purchase decisions.

The industry has never had a higher quality product, but the trick now is about investigating how we make it appealing to the Gen Z and Millennials.

Tim Carroll Director, Merchandise and BuyingWe are starting to gather a really clear picture of who this customer is, and how they shop:

• Moderation

They have the highest rate of intent to moderate.

• Technology

They have grown up with information at their fingertips. Therefore, you should be leveraging the suite of digital channels available to you to their fullest extent; including product information, rich content and data attributes.

These younger customers want products that fit into their lifestyle including brands that align with their beliefs and values i.e. sustainability.

During our Category Planning this year, we have pivoted to put occasions at the forefront; and never before have we seen the breadth of occasions within this customer demographic. They are playing across low, mid and high tempo occasions, on premise/ off premise and at home. We need to ensure that we are catering for all their needs across these occasions.

Easy drinking and refreshment is a key preference for this generation, hence the success of Seltzers. Within Wine we are seeing NPD have the largest penetration as they buy into the emerging varietals with styles of wine like Lo-Fi, Pet Nat and Piquette. They’re driving these trends and therefore driving the exciting change in Wine.

The types of packaging, whether it be bottle size, shape, or sustainability benefits, will assist with recruiting for more occasions.

Zero%* Alcohol will continue to grow within the Wine category and we will continue to work on developing a high quality diversified range in this space. However, we see the most opportunity to be within the <10% ABV segment which is three times larger than Zero%* Alcohol in sales, and is growing significantly faster.

Within Moderation, there are two areas we need to focus on to ensure we meet our customers’ needs: our younger customers, who are looking for a more approachable liquid; and our Core customers who want to

moderate with a range in standard bottles, and without the compromise of flavour that often goes with Zero%* Alcohol Wine. We think that there is a really important place for us to make sure whatever the proposition is for the customer that it plays back to the artisan nature of the category.

Core Customer: remind our customer how much they love Wine through discovery, experience and value.

Younger and Core Customers: we know they are looking to moderate so we will be looking to design, with our supplier partners, a range that will enable retention and recruitment.

Premium: although there will be a focus on value a lot in the year ahead, we will not forget our premium customers. We’ll continue to premiumise our range, look at store formats like Dan Murphy’s Cellar or Premium BWS, use the right marketing channels to inspire premium discovery and accelerate our events strategy to add the experiential element.

*contains no more than 0.5% ABV

We sat down to discuss what being a judge means to the panel, what inspires them by working with our suppliers, and lastly what style of drink they have been enjoying over the summer.

I was honoured to be a judge for Endeavour’s inaugural SOTYA, and I was incredibly impressed by the quality and diversity of the nominations. It was very exciting to see how engaged our supplier partners were with the Awards, and to learn how much innovation had been happening - even in the face of significant disruptions from the pandemic.

As this is our second year, I anticipate we’ll see a step up again in calibre as there were so many wonderful examples of innovation and collaboration. I’m both inspired and proud that we work in such a supportive ecosystem to deliver stories and products our customers love.

I can’t wait to see what our suppliers share with us about the awesome outcomes they have been achieving. During last year’s event, it was really wonderful to finally get the chance to celebrate the strength of Endeavour’s partnerships with our suppliers in person. We’re all in the business of promoting sociability, so I look forward to the June event and every opportunity we have to do what we do best, in person, together.

This summer, my number one ‘go to’ is always bubbles for any gathering with family and friends. But I have also been exploring the fast growing range of Zero%* Alcohol and I am loving it – so many options that don’t compromise on flavour.

I was blown away in our inaugural year by the sheer number of nominations in each category. As well as the time taken by our supplier partners to enter, along with such tough competition for each award. I am looking forward to seeing this same high standard from our suppliers amongst the nominees repeated this year.

I’m always excited to review the Product Innovation submissions, as new lines are the lifeline of our continued category growth, and it is amazing to see the sheer number of NPD right across the liquor industry.

Last year’s awards night in May was really the first major industry event since COVID, and it was great that Endeavour could lead the way and bring the industry back together after two very long years. To see so many familiar faces in the flesh was a true highlight, as was seeing our industry so strong and resilient despite the challenges all Australians faced.

Having been in the Liquor industry for over 30 years, I have built up many friendships, with many faces changing roles or companies over that time. But the friendships are still as strong as ever, and I am looking forward to catching up with old friends and making new ones at this year’s awards as we celebrate our respective achievements.

I am continuously inspired by the open communication we have with suppliers as we build strong relationships overtime, leading to partnerships that overcome obstacles and build ideas into success stories. This continues to drive my passion for the industry.

Having now been living on the Gold Coast for 12 months and enjoying the wonderful warm weather that QLD has to offer, I must say my love of Chardonnay has only continued to grow along with a refreshing Pale Ale.

Being the first year, I could not believe the amazing level of engagement from our suppliers and team alike. It was clear that there had been so many great products, activations and collaborations, and everyone wanted to recognise them.

However I definitely wasn’t surprised by the high calibre of these achievements, which provided us judges with an envious challenge of finding a winner amongst so many great finalists.

I am so excited to see this year’s nominations, and to read about the work that our suppliers are doing across so many areas such as sustainability, innovation, and how to attract

more customers through MixIn, digital channels and brand activations. I am also interested to see how many nominations bridge both on and off premise, now that we are able to include ALH beverage suppliers.

Like last year, I look forward to seeing many of our suppliers celebrated. It was really great to see us all come together in person and reflect on everything we have achieved together.

I enjoy trying new cocktails and experimenting with unusual or unlikely combinations to discover new tastes, but I’ll always enjoy a margarita.

“It was really great to see us all come together in person and reflect on everything we have achieved together.”Mario Volpe Managing Director, Hotels

I am so excited that we’re able to include ALH drinks suppliers into the awards this year, and with that, being able to be a judge. Last year I got so hear about the nominations and all the great work that was achieved and showcased through the finalists and winners and I am thrilled to be a part of the process.

This year is a great opportunity to highlight and bring to the forefront on-premise suppliers and all the great work that has been achieved together through nominations. I’m also excited to see any nominations that cover both on and off premise channels.

A highlight for me last year was being able to have an in person event and get to meet

many people in person, some for the first time and others for the first time in a couple of years. I am really looking forward to having our ALH drinks suppliers included in the night and build on last year’s event.

I continue to get a mass of energy from working with suppliers, due to the way our suppliers continue to find ways to innovate and their drive to work with us to constantly improve our customers’ experiences.

Hard to beat a cold crisp beer to enjoy on a hot summer evening.

This is my first year as a judge, so I’m really looking forward to being a part of the judging process. I know last year within the beer team, I loved reflecting on some of the achievements of our suppliers and the sheer number of incredible stories to be told.

With SOYTA recognising ALH suppliers this year, I am excited to see the on/off premise submissions and how the supplier community nominates across both channels. My highlight for last year’s Awards night was the atmosphere. Having everyone together, mingling and talking with a drink in hand and a smile on their face was an awesome buzz. After being apart for so long, it just felt like a cracking place to be.

These awards give an opportunity to take a moment to reflect and celebrate many areas that we work together with, but for me it’s the supplier’s stories of innovation and their willingness to partner that really inspires me.

I’m a beer man, but an ageing one, so I have been really loving easy drinking style craft beers that are super refreshing and maybe this is a callout to Melbourne summer this year but I found myself enjoying lighter style reds right the way through.

“I am excited to see the on/off premise submissions and how the supplier community nominates across both channels.”

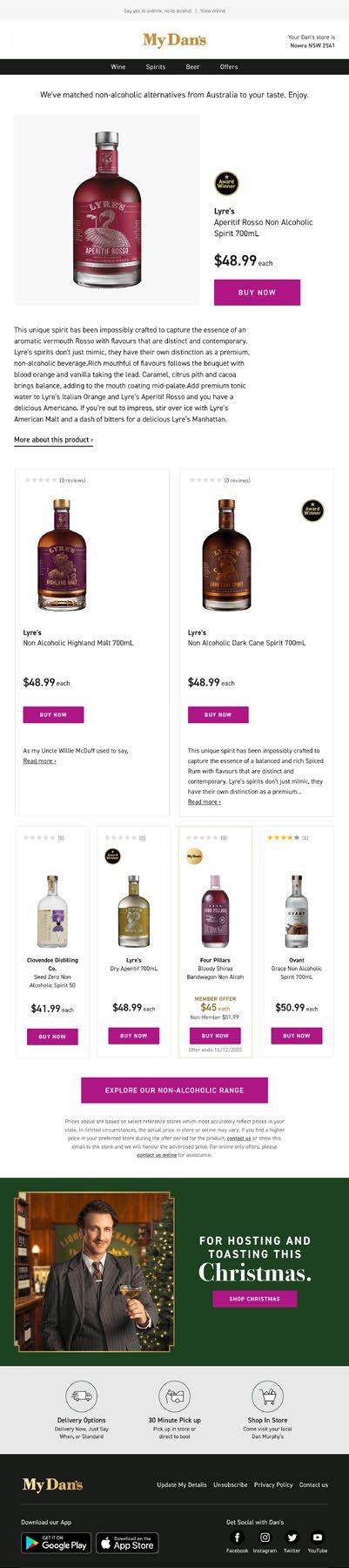

Personalisation, or “perso” as it has become affectionately known, launched in email to our My Dan’s loyalty members in early 2021. Here, Helen Birch - Group Product Manager, Personalisation - updates us on the progress and what suppliers can expect to see this year.

Since the launch of personalisation, our teams from endeavourX, Marketing and Merchandise have been focused on delivering the most relevant products and campaigns to our customers.

For over six million of our members, we have curated a list of more than 500 products, which are unique to each of those individuals. We use these to serve great recommendations and offers on drinks we know they will love.

Our personalisation engine harnesses the power of artificial intelligence and machine learning; utilising a combination of customer and product data to match each member with the most relevant products and marketing communications each week.

Each month we talk to over 3.2 million members through email, and are now expanding our reach through personalised recommendations on the Dan Murphy’s website and mobile app.

Our personalisation engine uses billions of data points such as a member’s purchase history, product category preferences, location e.g. favourite store; combined with rich product data to ensure we can predict the most relevant products for each member and connect the breadth of Dan Murphy’s range to our member base.

Since we launched ‘perso’ in the email channel, we have sent over 653 million personalised emails featuring over 15,000 products. In order for a product to be eligible to appear in email it must fulfil two key criteria; firstly the product must be live on the Dan Murphy’s website and secondly, the product must have stock available. The engine does the rest; matching the product using a relevance calculation to present to the customers who are most likely to engage and buy it. Sounds simple right? (Hint: it’s not!)

Already this year, we’ve had 53 million customer engagements (opens and clicks) with personalised recommendations from 194 million personalised impressions delivered across multiple channels.

Members who engage with our personalised communications spend on average 1.2 times more than non-members.

Personalisation helps Dan’s deliver on two important strategic focuses; Delivering drinks discovery and communicating value. We’ve found that discovery products (those a member hasn’t bought before) that are ‘on member offer’ perform strongly across generations, with higher click rates than other campaigns (in particular Gen X and Millennials are twice as likely to engage with these vs other emails).

We have sent over 653 million personalised emails featuring over 15,000 products.

Gen X and Millennials are twice as likely to engage with these vs other emails.

Members who engage with our personalised communications spend on average 1.2x times more than nonmembers.

Already this year, we’ve had 53 million customer engagements.

In FY23 we have focused on extending our personalisation capabilities to our digital channels, rolling out product recommendations across Dan Murphy’s website and app to allow us to talk to our members where they are most active. Email as a marketing channel continues to see overall engagement declining as the number of digital touchpoints increases.

Using the power of our engine we are able to provide relevant recommendations to be shown in key placements such as the homepage, personalise the sort order of products shown on pages such as category and catalogues, or curate the member offers displayed in the My Dan’s dashboard. We currently have 922 placements live across the site powered by perso, and like email, the engine selects the most relevant products for each member.

Another exciting feature has been recommending products that are new to Dan Murphy’s. As there was no sales data on a product when it lands in-store, our engine was not able to match it to a customer right away. Our new product-to-product model (P2P), has solved this customer problem. P2P uses data science and engineering models to compare a product to another product via the attributes that are stored in the system - the attributes that you, our suppliers, enter into digital enrichment platform - SKUvantage.”

In addition we’ve also been working with the ecommerce team to deliver the Under Wraps proposition to customers via the perso engine. This is a Dan’s Online Only campaign seeking to deliver renowned, high quality wines at amazing member-exclusive prices, direct to our Customer’s door.

These offers appeal to highly engaged customers who are wine enthusiasts and connoisseurs and delight in taking the plunge to “unwrap a mystery”. Since launching via email, we find that members are likely to buy multiple products in the same transaction and have a high basket order value. Already, we have seen personalisation driving an increase in member traffic to the Under Wraps landing page, an increase in overall order revenue and average order value.

The wines are handpicked by Dan’s expert tasting panel to represent value and quality - all wines are also supported by external Expert Reviews. Most importantly, they sell at a price that Dan’s Members cannot fail to be excited by. To get involved in Under Wraps, contact: stephen.marrs@edg.com.au

QAre your products eligible?

1. Are they live on the Dan Murphy’s website?

2. Is there stock available?

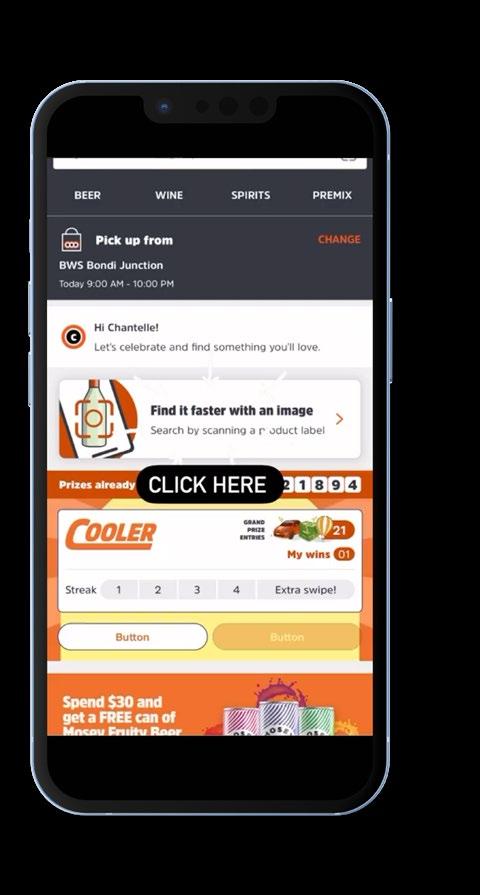

At Endeavour we are focused on improving the customer experience across our omni-channel journeys, and want to provide our customers with easier ways to shop. Now, our customers can search for products as easily as snapping a pic.

Recently, endeavourX has developed an image search feature allowing our customers to search with images rather than needing to remember a product name or spelling.

Customers can now simply take a photo of either a Beer, Wine or Spirit they’re enjoying at a restaurant or elsewhere and conveniently find out if it’s available at their local store. We’ll share all the details on what they’ve found, reviews, product details and it will even provide a smart recommendation for a similar drop if we don’t stock the exact match.

This feature uses machine learning to identify over 25,000 drinks labels and can be found in our Dan Murphy’s and BWS apps.

“We are looking for ways in which we can use technology and innovation to continue to enhance the customer experience in our physical stores,” Chief Information Officer Claire Smith said.

“The image search feature is a big step towards creating that seamless omnichannel discovery experience, helping customers browse and choose the right product while in store.”

The creation of the image search feature was driven by a need to exceed customer expectations and has been in development by endeavourX for roughly six months. A beta version was shared to Dan Murphy’s team members in August last year so the function could be tested and fine-tuned.

“We did extensive customer research instore earlier this year and one of the key findings was that customers are met with an abundance of options and decisions in-store, they find it difficult to discover, compare and choose what is best for them,” Smith said.

“The image search feature enables the customer to self-serve and access additional information and narrow down the options helping them make a selection.

“We are making significant investments in cutting-edge technology like machine learning, augmented reality and VR experiences, with a vision to enhance customers’ bricks and mortar experience with technology to create a harmonised, immersive omni-channel experience.”

With the backing of Mighty Craft, Better Beer is the brainchild of social media influencers Matt Ford and Jack Steele from The Inspired Unemployed, and founder of Torquay Beverage Company, Nick Cogger. We spoke to Mighty Craft’s Cam Buckland - Sales and Marketing Director - on the role social media played launching this crowd favourite.

Q Can you tell us about the activationthe channels, audience/s, assets etc.

The digital-first, social media-led approach of Better Beer’s launch made this brand ‘lagerthan-life’ in record time.

The Better Beer team and Mighty Craft, worked closely to create content for digital and social media platforms to launch the brand in November 2021.

Appealing to young Australians who want a carb and sugar free drink with their friends, and don’t take themselves too seriously, Better Beer activated an ‘always on’ social media campaign across Instagram and TikTok.

This was backed up by a strategic PR push to generate coverage across TV, radio, print, online and podcasts, which generated significant editorial, as well as in-store displays and visibility across the Endeavour network.

Q What were the insights behind this particular direction?

It was well understood that younger customers were becoming increasingly disengaged with the liquor category and one of our early goals was to build a brand that would re-engage these customers and get them excited about beer again.

With Matt and Jack’s extraordinary social media following and engagement, it was an obvious choice to put most of our efforts into creating unique content for their channels that would successfully resonate with the target audience and drive them into Dan Murphy’s and BWS stores.

The launch of Better Beer was an intense 12 months of planning and six months of close partnering with Endeavour.

Working hand in glove with Harriet and the team, we worked through every facet of the fully integrated launch plan. We wanted the Better Beer launch to be disruptive, engaging and most importantly a lot of fun.

The launch was a huge success, which subsequently created many further challenges after selling out of what we thought would be six weeks of stock, in the opening weekend!

“One of our early goals was to build a brand that would re-engage these customers and get them excited about beer again.”

“The launch of Better Beer was an intense 12 months of planning and six months of close partnering with Endeavour.”

Q Would you say the understanding that your audience connects digitally with brands more than ever before influenced this activation?

Absolutely. The Better Better launch demonstrates the power of digital marketing and the incredible reach of The Inspired Unemployed, especially with our target consumer.

Since its launch, Better Beer has amassed over 110,000 followers and its social channels have had over 20 million impressions and reached over 8 million people.

This level of reach has played a huge role in the success of Better Beer and continues to do so.

Q What have been some of the interactions with your audience during, and as a result of, this campaign?

Following the launch, Better Beer has gone on to stage successful campaigns including the Better Beer Drop Competition, Moan Challenge and our inaugural ‘Day for It Day’ launch, which was an incredibly successful campaign that welcomed the arrival of summer on the first Saturday of December.

in the opening weekend!”

Q What can we expect to see from the brand moving forward?

We’re thrilled that Better Beer has disrupted the beer category like nothing else we’ve seen in the past decade.

While Better Beer is eyeing a potential expansion overseas after robust sales in the New Zealand market, the focus is still on Australia and launching two new products in the first half of this year.

The brand is on course to exceed our year one expectations and we look forward to continuing to work alongside the Endeavour team to keep Better Beer top of mind and on everyone’s lips in the year to come.

“The launch was a huge success, which subsequently created many further challenges after selling out of what we thought would be six weeks of stock,Zero alcohol Better Beer

Dan Murphy’s launched their state of the art new format store in South Melbourne in March 2021. Here, we talk to Head of Format Operations, Tyson Holbery on the journey since then.

The launch of the Dan’s 2.0 format was a result of extensive collaboration across the Endeavour Group and was established to help bring the brand’s vision of Discovery to life.

With great collaboration across Format, Marketing, Merchandise, Operations, Finance and People and Culture, the format tested new ways to invite customers to discover new products and category experiences.

Big bets were placed in categories such as Craft Beer which saw the explosion of over 500 lines, a new Fine Wine department, a Cellar Release section to introduce customers to amazing back vintage wines, and a magic moment for customers to immerse themselves in new discoveries. Electronic shelf labels were also a game changer for team efficiency and allowed customers to search products via near field communication (NFC) with a simple tap of the phone.

With the successful launch of South Melbourne, another four 2.0 stores launched across the nation later in 2021. “This was the format’s first Christmas with the team and customers providing some great reflections to build upon,” Tyson said. “Differences were noted with the customer feedback and team experience in each of the stores which kicked off some great curiosity into what customers most liked about the 2.0 format, and how we could better deliver a great experience for our customers.”

A series of customer shop-alongs and store immersions were conducted, partnering with research agency Click Research. Customers were recruited across a variety of life stages and

affluence groups to understand if the 2.0 format was aligned to a specific demographic more than others.

“We had an initial hypothesis that younger customers loved the format but suspected that some of our more traditional customers were taking a little longer to adjust to the new format,” Tyson explained. “What we learnt has helped to shape the evolution of the format and refine the brand strategy and crystalise the purpose of each of our formats across Large, Neighbourhood and Cellar.”

“The format tested new ways to invite customers to discover new products and category experiences.”Lane Cove, NSW

• What customers told us was they loved the extended range of Craft Beer and Premix, but wanted to be able to continue to buy not only chilled, but also ambient beer across multiple pack sizes.

• Customers told us that they loved the ‘warehouse’ feeling in Dan Murphy’s and the ability to buy in bulk, and wanted us to merchandise our stores to help them buy in bulk and identify great value in our stores.

• Customers loved the improvements we made in Cellar Release and Fine Wine and

want to be able to readily buy a case of their favourite drop.

• One of the key learnings was that customers associate Dan’s with bulk buying and our focus on discovery had reduced the amount of stock weight in our stores, so this was addressed with our teams to strike the right balance between value and discovery.

• Ambient Beer and Premix was reviewed in the stores to increase its presence and better provide for the bulk buying occasions.

• Customers told us they loved the lower fixtures and navigation in our stores but

there were a couple of new fixtures that they didn’t understand. We took this feedback to further improve sightlines through the store and simplify the equipment we used which also allowed us to bulk up and amplify value perceptions across the store. Overall, the 2.0 format has been well received by customers and the research has helped us crystallise what matters to a customer at Dan’s, both across the fleet and in our new format stores. The newer 2.0 stores have further enhanced the customer experience and have the perfect balance between discovery and value for our customers.

"Customers loved the warehouse feeling in Dan Murphy's and the ability to buy in bulk."

Creating cut through with customers is critical to success today. We spoke to Diageo’s Emel Sullivan - Digital Commerce Lead - and Monkia HoltsbaumShopper Marketing Manager, on why Digital is their winning strategy.

Q Can you tell us what digital means to Diageo and why it is so important?

Digital is now the place of discovery, experimentation, recruitment and advocacy of our brands. It is powered by technology and data intelligence - driving us to be adaptable, agile and ultimately better connected to our customers.

Digital is no longer a channel to be considered in isolation, but as part of an overall business strategy.

“Digital is no longer a channel to be considered in isolation, but as part of an overall business strategy.”

Q Over the last few years, can you tell us what behavioural changes you have seen from customers in regards to digital engagement?

Today’s customers expect a seamless experience as they interact with retailers throughout their purchase journey.

We’re seeing the lines between online and offline blur even further as digital engagement enhances the in-store experience. Customers are more empowered than ever, using digital platforms not only to purchase online, but to also conduct research before buying in-store.

There has also been a continued trend towards luxury purchases taking place online, with the pandemic accelerating this shift.

It is therefore important that we partner closely with Endeavour to create tailored, personal and relevant experiences for customers.

“We’re seeing the lines between online and offline blur even further as digital engagement enhances the in-store experience.”

Q How have these insights informed Diageo’s digital strategy?

These insights all point towards a customercentric strategy. At the core of our strategy is understanding how customers interact online, and how we can better partner with retailers like Endeavour to enable that frictionless experience. Underpinning our digital strategy is brilliant execution on the digital shelf – capturing customers as they begin their purchase journey.

A key enabler of the strategy is data-driven decision making as well as the ability to lead with a test and learn mentality.

Q Product enrichment is the key to success on Endeavour’s digital platforms; how does Diageo ensure that product details are enhanced and maintained to give the customer a great experience?

To ensure that we are maximising the opportunity to engage customers and increase conversion, we closely monitor our digital shelf presence and provide Endeavour with high quality data (product attributes) and content (images, video) for our products.

We partner closely with SKUvantage and the Endeavour Product Data team to publish and regularly maintain this information.

One of the great benefits of the digital shelf is the ability to showcase brands in new and unique ways. We can help to create a great online experience for shoppers by partnering to provide the best quality content and data.

Q Taste the Top Shelf was just one example of Diageo and Endeavour’s digital partnership in action; can you tell us a bit about the activation and how you partnered with the Endeavour team during execution?

Taste the Top Shelf was developed in partnership with BWS as the destination for cocktail inspiration. The platform launched during the height of Covid when people had to stay home. We knew they were interested in cocktails, but we also knew the process could be overwhelming, and even intimidating.

In order to break this barrier, we not only provide simple cocktails, we partner with relevant Millz influencers to drive relevancy and vibrancy to the cocktail culture.

The collaboration with Endeavour has been seamless. The Taste the Top Shelf is an integrated platform that drives awareness and visibility with impactful free standing display units in BWS stores, all the way through to each of their digital channels from email, website and social.

Q What makes you most excited for the digital channel in the foreseeable future?

What makes the digital channel so exciting is that it is ever-changing; providing new opportunities to surprise and delight customers every day. A great example of this is the latest image search feature on the Dan Murphy’s & BWS app. We’re excited to see how AI and machine learning will enhance the customer experience by merging the online and offline worlds.

“One of the great benefits of the digital shelf is the ability to showcase brands in new and unique ways.”

As the on-premise arm of Endeavour Group, ALH operates over 350 licensed venues across Australia, with over 12,000 team members.

Epitomising the Endeavour purpose of sociability, our pubs play a significant role in many communities by offering a space for our regulars, irregulars, locals and team to connect. More than a place to eat and drink, our venues are often the cornerstone of those communities; a place for celebration, gathering, sports and culturethey are a part of the social fabric.

We take this role in the community very seriously and it is what’s behind our purpose of ‘Creating pub experiences locals love’.

With a rich, 50-year history, we’ve seen it all - from the 6 o’clock swill era, through the birth of Aussie rock and family dining, to the digitisation of hospitality.

Recently, we experienced the disruption of the global pandemic, and after a challenging period for our venues, teams and our customers, we believe the industry is moving into a period of relative stability. We’re extremely proud of the resilience of our team and the strength of our business to navigate these significant challenges and we are grounded in our strong foundations and opportunities to grow.

We now occupy leading positions in each of the markets we serve including Food, Bars, Gaming and Accommodation, and consider each of these to be equally important to our holistic view of each venue.

As Australia’s largest pub operator, ALH knows a thing or two about serving up a good time. Here, we look closely at the strategy behind their purpose of ‘Creating pub experiences locals love’.

Food plays an essential role in the Australian pub experience, and we’re proud of our diversified menus and the high-quality offer our customers can now enjoy.

Our food offering is tailored to each of our hotels and the communities they operate within, to celebrate ‘local’ and personalise our guests’ experiences.

“Underpinning all of our offerings is a strategy focussed heavily on our customers.”

Without compromising on our promise, the 2.5-3 star Nightcap Social ‘casualises’ life up a bit with communal spaces

2 Hotels

Pubs with accommodation offer a unique experience for customers, combining the comfort of a hotel with the social atmosphere of a pub. It provides customers with a place to socialise and relax while also having a comfortable place to stay. Our three accommodation offerings leverage a “good, better, best” model to bring tailored experiences to life for our hotels. Outside of this, we also have a number of unbranded accommodation sites that are currently in the process of being converted to our Nightcap brands.

Our bread and butter, Nightcap Hotels is the self appointed 3.5 star properties in our portfolio

68 Hotels

Everything you know and love about Nightcap... plus more. That’s what makes these pubs stand out with 4+ stars

5 Hotels

Underpinning all of our offerings is a strategy focussed heavily on our customers, our team and leveraging our vast and unique assets. We call this strategy the 5 Taps.

We believe that understanding what the pillars are within this strategy will help you as our suppliers to better grasp who we are, what we do, and why we do it.

As an empowered team, we create memorable moments for our guests. Our team is central to everything we do - the venue experience, the food, the look and feel of the venue - it touches every component. This strategic pillar focuses on giving our team a sense of purpose and helping them to know that they are making a difference, and that their work matters; they feel valued and heard. That’s why we are embracing our group purpose, to ‘Create a more sociable future together’, whilst also harnessing a warm hospitality ethos within the evolving ALH identity.

‘Moments that matter’ is all about attracting, retaining, developing the best team to deliver customers more than a transactional experience.

We lead in responsibility and are committed to sustainability.

We are deeply passionate about this and will continue to invest in these areas over the coming years. Making sure we are community-minded and help our patrons to enjoy our venues responsibly is only the beginning. Everything we do is underpinned by our Responsible Gaming Charter and we continue to take steps to adopt a leadership approach at our venues, with tangible examples such as:

• No complimentary alcohol served in gambling rooms nationally, even where permitted legally.

• Implementing advanced RSG training and substantial support services for our team - we are the only operator to provide advanced training for hotel managers and hosts.

• Monitoring of gambling behaviours by venue team members, including continuous playsupported by investments in technology.

• We are the only national operator across Australia to provide voluntary pre-commitment, enabled through our loyalty program.

We bring each pub’s story and potential to life to create rich and fulfilling experiences for our guests.

All of our pubs belong to their own unique community, and our customers love the fact that it is their local. Following Covid, we’ve found that our customers are more invested in their local community than ever before, and being authentic is something that we know drives really strong results when we get it right - as we’ve seen time and time again in retail.

How will we do this? It starts by tailoring our drivers. This means more local wines, more local beers, more local food, more local entertainment all wrapped up in the identity of the pub.

Next, we’ll look at our formats to engender a stronger local feel to inform how we renovate each pub as part of the redevelopment program.

And finally, it’s about ensuring that we grow our share of younger customers. We have an unparalleled understanding of our customers, and a huge opportunity to leverage this to ensure our offer is relevant to all current and potential future customers.

We enable personalised guest experiences supported by our digital and data capabilities

Easy, convenient, and digitally-led experiences are likely to be the next trends that shape our industry. We see this from the way our customers engage with our venues - at least half of all of our transactions start, or end, on our digital channels. This pillar is about bringing together the digital and physical in a simple way to deliver convenience as well as value.

This helps ensure that as we get to know our customers better, we can start to send them personalised and relevant offers to enhance their hospitality experience. We’ve seen the power of personalisation through retail and we have a great opportunity to leverage the Group’s capabilities here to improve the way we communicate with our customers.

We know that increasingly incorporating digital capabilities to unlock frictionless and convenient venue experiences is an opportunity to step change what we do in this space and lead the industry.

We innovate to grow and improve productivity in our hotels.

Crucially, to empower our teams to deliver on our strategic pillars, we must make it as simple as possible to focus on our customers and ensure we have enough time and attention to dedicate to improving and growing.

This is an area in which we have had resounding success in retail and we have unique capabilities to share best practices across our hospitality and retail businesses and harness our resources to improve performance.

As the digitalisation of hospitality becomes increasingly more important, and we make significant investment into the omni-channel experiences for our guests, the ALH team understands that our venues must match this market-leading offering.

“First class venues go hand in hand with our technological advancements,” Head of Format Operations, Shaun Dunleavy says.

“And the more we understand our customers, through the use of our digital channels, the more insight we have into the types of venues they expect from us.”

Portfolio management is an area of exciting opportunity for ALH and one they will be actively leaning into over the next one to three years.

“We have an extensive property portfolio and deploy a large amount of capital in this space every year. But, excitingly, there are a number of opportunities to optimise what we do and drive significant value for our guests in the process.”

Customers and communities are at the heart of every decision we make. Here, we talk to ALH Head of Format Operations, Shaun Deleavy about the on-premise investment program.

ALH’s approach to hotel investment can be categorised simply into seven areas of focus - two of which are unique to ALH. These can be broken down into two main categories - Sustaining and Growth.

“Sustaining covers a whole range of things from repairs to renovations, to updating and renewing gaming machines,” Shaun explains.

“When it comes to Growth, we’re looking at things such as hotel acquisition, large scale redevelopment of venues, property redevelopment rights through to investing in digital capabilities, loyalty programs and advanced analytics.”

“The spending on our network to date has led to a position where our hotels have an average ‘age since last investment’ in excess of eight years; catch up spend is required to reduce this.”

Over the next three years, Shaun explains that the renewal program will touch 20% of the fleet each year to enable investment of both high growth and sustaining ‘catch-up’ capital.

“This is a careful balance to maintain our great momentum, whilst transitioning to a customer-led model,” he says.

Over the last 12 months, over 50 renewals have been completed and you’ll see even more this year as the team places guests at the centre of format innovation and design.

“As we look to the future, our approach to renewals will increasingly leverage our Group capabilities with Endeavour-wide collaboration - this includes people, marketing, design, operations, finance and product,” Shaun says.

“As I’m sure you can imagine, this process is complex, so we break the investment cycle down into three stages.”

• Format development enabled by group-wide collaboration.

• Approach captures customer and team needs, business strategy and evolving global trends.

• Strategy is then defined and the ideation cycle begins (Innovate, refine, commercialise, iterate).

• Select sites based on criteria, including financial performance, and age of fleet.

• Site walks: Assess capital required, customer offering, and size of opportunities.

• Balanced program business case.

3. Execute renewals, monitor performance and leverage insights

• Go through the process of execution (Design, plan, build, land)

• Measure performance

• Leverage insights for future investments: What worked and where?

Underpinning the ALH investment program is a deep commitment to their customer as each project is purposely grounded in customer insights.

“Throughout the project, a lot of research goes into the local community to ensure we capture their needs, and understand their expectations for each of our venues,” Shaun explains.

“We perform demographic studies, study the competitive set, and analyse segmentation data,” he says. “And excitingly, as the technological and digital capabilities of ALH expand, so too will our insights into our unique ALH customers.”

With so many metrics and ways to measure performance, it’s important that our teams are on the same page when it comes to your products. As an Endeavour supplier, you may be eligible to access free tools through Supplier Connect that provide powerful insights and can better inform your conversations with our Category Managers.

Supplier Connect tools were designed to provide you and your contact at Endeavour with a joint, transparent, and consistent set of performance measures that are a balance of business and customer metrics.

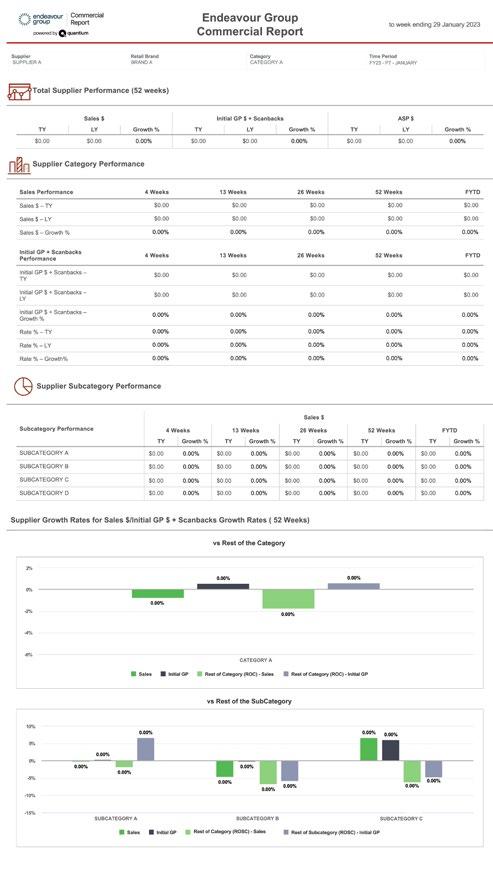

There are two main reports within Supplier Connect: the Supplier Scorecard and the Commercial Report. Each report is updated monthly, with several time frames, including 13, 26 and 52 weeks, as well as FYTD (July - June) - giving the ability to be able to compare, quickly identify changes, and view longer term trends.

Bree Coleman, General Manager, Merchandise Transformation, Range & Customer Value

Bree Coleman, General Manager, Merchandise Transformation, Range & Customer Value

The dynamic scoring system used in Scorecard enables you to see how your results compare to your peer set in each sub-category. You can easily toggle between your own results, and comparative or dynamic score for each metric, while trended reporting allows you to track your performance over time.

The Scorecard contains three reports:

1. An overview where you can see your latest results split by sub-category in one view.

2. A detailed view of each sub-category you have products in, with additional details of the metrics, your last three months’ results, and the current month’s dynamic score.

3. A trend report that you can toggle by sub-category between metric results or dynamic score for the last 12 months. Each report has the functionality to overlay a heat map. This provides an easy, visual and quick way to identify consistent performance or sudden changes.

There are 15 metrics measured in Scorecard which align to five key performance areas:

1. Customer impact

2. Growth and size

3. Competitiveness and profitability

4. Supply chain

5. Collaboration and capability

This report allows you to view customer, sales, and profit measures at the category and sub-category level.

With the Commercial Report, you have visibility of your sales growth within the category and sub-categories you have products in, as well as a clear view of the rest of the category and sub-category sales growth % at 13, 26 and 52 weeks. Allowing you to understand your performance compared to rest of category, providing insight into whether you are driving the overall category, gaining or losing share.

The Commercial Report also provides product-level performance data for your top and bottom products contributing to growth including sales, profit, average sell price, and growth over multiple time periods.

I encourage you to use these Supplier Connect tools to their fullest extent to identify areas for improvement and highlight your successes. The Supplier Connect tools were designed to remove ambiguity and form the foundation of every conversation you have with your Category Manager, to enable fact-based, data driven transparent conversations about performance.

Additionally, you can track your performance and shifts in metrics driven by large activations or changes. For example, you can use the net new customer metric to understand if a particular recruitment-based activity has increased the number of new customers you are bringing into a sub-category.

By using the Scorecard and Commercial Report together, we can identify strengths and opportunities, create a plan to leverage these strengths and implement actions against areas of opportunity.

The Supplier Connect tools are available for free via the Quantium platform to supplier partners who have products ranged in the BWS and Dan Murphy’s store networks.

James Marinelli, Head of Category Strategy and Insights

James Marinelli, Head of Category Strategy and Insights

As we mentioned in the last edition, each quarter we will be sharing some topical insights relevant to our customers, our categories and our industry. In this latest edition, we will be recapping what was a bumper Christmas and New Year’s selling season. We discuss the headwinds coming in but also reviewing some of the fantastic headlines and highlights that made Christmas ‘22 our biggest one yet.

We then reflect on the last fews years and discuss some of the macro environmental factors that have changed the shape of our customer’s behaviour and what impact this has had on performance.

Enjoy!

James

James

Another festive season has come and gone. James wraps up what was the largest Christmas week on record.

We have had pandemics, natural disasters, supply issues, and the most challenging economic conditions within recent times. So what dynamics have changed in the wake of all this?

Another festive season has come and gone. Here, James wraps up what was the largest Christmas week on record.

The lead-in to Christmas this year was not without its challenges. Customers were overwhelmed with messages of cost of living pressures, while at the same time Cyber Weekend posted the biggest result on record with experts predicting 25% of Christmas sales now happen during this week.

Cycling last year’s Omicron outbreak in December, customers could also now enjoy more occasions spread across both the on and off premise environments.

But the big news was the weather. The liquor category faced poor weather conditions with 33% higher rainfall across the nation and a cold front that resulted in average temperatures far cooler than the previous year. We even had snow in some alpine regions.

Despite these headwinds, we delivered record breaking weeks for Christmas and New year’s.

2%

2% growth in total customers during the weeks of Christmas and New year’s.

2 weeks

Over half of gifting purchases occurred in the two weeks leading up to Christmas.

Millennial and Gen Z customers share of sales were over-indexed versus full year.

18% $%

Gifting remains a key driver with 18% of Endeavour customers purchasing for gifting, an increase on the year prior.

Insights driven by Quantium

Price consciousness is top of mind with 1 in 4 customers seeking discount items or using discounted payment methods.

The flavour trend continues to drive growth across categories.

Premix delivered the bulk of total actual growth this Christmas driven primarily by premix vodka up +24% vs last year. While all generations grew, Gen X and Millennials drove the bulk of the growth.

Premix delivered the bulk of total actual growth this Christmas driven primarily by premix vodka up +24% vs last year. While all generations grew, Gen X and Millennials drove the bulk of the growth.

24%

Premix delivered the bulk of total actual growth this Christmas driven primarily by premix vodka up +24% vs last year. While all generations grew, Gen X and Millennials drove the bulk of the growth.

Agave, followed by North America Whisky and Liqueurs, drive

Agave, followed by North American Whisky and Liqueurs, drove growth within Spirits.

30%

Ginger beer was the fastest growing category, growing at over 30% and reaching a whopping 6% share of beer sales in QLD and WA. Fruity Beer almost contributed as much actual growth which is impressive especially considering time in market.

Almost a third of champagne sales happen in the month of December and this Christmas was no exception. Customers continue to celebrate with bubbles with Champagne and Sparkling delivering one third of total wine sales this Christmas.

Almost a third of champagne sales happen in the month of December and this Christmas was no exception. Customers continue to celebrate with bubbles with Champagne and Sparkling delivering one third of total wine sales this Christmas.

Almost a third of Champagne sales happen in the month of December and this Christmas was no exception. Customers continue to celebrate with bubbles with Champagne and Sparkling delivering one third of total wine sales this Christmas.

Great signs for Rose as the fastest growing wine subcategory during festive season and outpacing previous MAT performance.

growth within Spirits.

Over the past couple of years our category has faced pandemics, natural disasters, supply issues driven by war and unprecedented global supply constraints; and the most challenging economic conditions within recent times.

So how have these events changed the dynamics within the liquor category?

The pandemic presented an opportunity for many of our customers to reevaluate their lives and opt for a change of pace. We saw a migration from NSW and Victoria to QLD and WA, and we have seen a correlating shift in transactions.

In addition, we saw migration from Metro to Regional and once again transactions followed. In fact, this shift has caused an even more pronounced impact to transactions than crossborder migration.

Finally, we have seen a shift in sales from Attached and Metro to Standalone and Drivethrough formats, and unsurprisingly, states and regions that have a greater representation of these store types have been more resilient throughout this period.

On-premise's share of total liquor occasions was 15%. This has skyrocketed to 25% in 2022.

Throughout most of 2020 and 2021, lockdowns significantly impacted the on-premise channel with off-premise the benefactor.

In fact, on-premise’s share of total liquor occasions was 15% during that time. This has since skyrocketed to 25% in 2022 as we feel more comfortable to socialise and there is probably more headroom for growth.

Off-premise occasion decline has come from heartland in-home occasions as customers return to relaxed out-of-home consumption and on-premise. Given the inherent link between occasion and sub-category choice, sub-categories suitable to out-of-home group settings are benefiting as a result of this shift in behaviour.

Tourism was also significantly affected by Covid. I was surprised to learn through Tourism Research Australia that almost 60% of overnight stays in Australia are in Victoria and NSW - highlighting the reliance on interstate travel to these economies. Since 2019, these stays have declined in NSW and Victoria by -33% and -32% to June 2022 which would also be impacting our categories.

QLD tourism however was much more resilient through this period and liquor transactions also proved more resilient than other states. As interstate travel continues to pick up, we should expect to see dynamics shift again.

While we all hope that the level of disruption will be nowhere near as dramatic as the last two years, the pace of change continues to ramp up. It’s our job to reflect on the lessons learned during these unprecedented times and apply a more critical eye to the leading indicators at a macro level.

We need to take the learnings and adjust our ‘go to market’ strategy to match the current conditions, but we also need to anticipate the potential opportunities that the macroeconomic environment may present.

Let’s work together to ensure we have co-created plans in place for those opportunities.

BWS, Australia’s most convenient drinks retailer will be the official liquor retail partner of the AFL for the next two years. In 2023 and 2024, BWS will be there for all the moments that matter and provide all footy fans the best value to ensure everyone can celebrate all the best moments throughout the season. Through the BWS app and bws.com.au, they’ll be offering app exclusive offers and 30-minute pick up for orders placed through the BWS app.

BWS General Manager of Marketing, Josie Brown said: “BWS is excited to enter this partnership with the AFL and to better connect with footy fans watching the game at home.”

“We celebrate the great tradition of socialising while watching the footy, and importantly this partnership will enable us to showcase weekly offers to fans within AFL media channels and through the BWS app.”

BWS is a proud partner of DrinkWise, committed to shaping a healthier and safer drinking culture in Australia.

Our second Loud & Proud range has been launched with profits going to Pride Foundation Australia. Together, last year we raised over $350,000, supporting LGBTQIA+ and allied communities across Australia, enacting real and lasting change.

The Loud & Proud range includes Prosecco, Rose, Fruity Seltzer, Pale Ale and, for a first, a zesty Zero%* Alcohol Sauvignon Blanc.

This year’s label was created by artist Meg Minkley to capture the spirit of the initiative through each artwork.

“Not only is this a beautiful project supporting queer artists and the community, it’s an opportunity to allow the colours in my artwork to speak to the heart of everyone, every body, all shapes and stories. It’s not about a simple rainbow, it’s about the whole spectrum of colours,” Minkley said.

The Plan B campaign reminds drivers that if you’ve been drinking, you need a Plan B to get home safely. Here at Endeavour we have a responsibility to look out for our local communities so BWS and Dan Murphy’s are supporting this campaign in more than 50 stores. It’s focusing on areas with higher rates of drink driving.

With the help of our retail media business, MixIn, we reached over half a million customers over the weeks of Christmas and New year’s via our network of digital screens.

The Wine Industry Impact Awards aim to celebrate companies within the industry that are driving innovation and improving the industry as a whole. Vinpac and Orora

collaborated on a light weight Sparkling bottle and they have been awarded the winner in the 2022 Packaging and Design category.

In November last year Retail Drinks hosted its 2022 Retail Drinks Industry Awards and we are ecstatic to share that our team took home some of these awards:

• Liquor Store of the Year

BWS Windradyne Bathurst

• Liquor Store Manager of the Year

Shanais Marcus from Dan Murphy’s Tamworth

• Large Format Liquor Store of the Year

Dan Murphy’s West End Sunshine

The Retail Drinks Awards are the national awards for Australia’s retail liquor industry, celebrating the efforts made by people and companies in our industry to succeed in business, through either customer service, product knowledge and outstanding professionalism.

Congratulations to BWS Windradyne, Shanais and Dan Murphy’s West End Sunshine.

Ian “Guv” Sprawson and Susan Lewis, two of our Merchandise Assistants, work closely with suppliers everyday to navigate our systems and processes. With over 60+ years of merchandise experience, Guv and Susan have a wealth of knowledge to assist you in what training and support is available for you. Here, they share their top resources to make partnering with Endeavour as seamless as possible.

Learning videos at your pace – stop/start/ rewind whenever wherever you want:

Navigation basics

Submit new article

Manage Contacts and Super Users

Create and Manage List Views

Cost Changes

Pack Size change

GS1 reporting

Payments & Claims

Read

Support material to read through at your own pace:

Navigation basics

Submit new article

Manage Contacts and Super Users

Cost Changes

Packaging Details

Adding new pack details

Changing pack details

Adding an additional GTIN for existing pack

GS1 reporting

Payments & Claims

Facilitated training sessions run every six weeks.

Please book a spot here: Supplier Training Sessions

Technical Issues?

Email Partner Hub IT Support for any technical issues with the platform.

Error messages on cases?

Email the Partner Hub Team for assistance on cases that are showing error messages.

Phone 1800 100 012

Not an IT issue? Need an extra hand? Email our Merchandise Assistants with a brief description of what you need help with and one of the Team will come back to you.

Try the ‘need help’ button at the top right of your home page in the Partner Hub portal.

Need Help?

Engagement Windows are a time that our Category Managers have set aside to review product submissions. During the submission review, they will work with you on the correct in-store date based on product availability.

With our new agile review process, and to enable speed to market on the most exciting products, the in-store dates are not necessarily tied to the Engagement Window dates.

We also encourage you to continue to share any of your most exciting and innovative products with your Category Managers as they are developed, even if outside of a published Engagement Window.

Please note that Engagement Window timings may change based on alterations to our ranging plans.

April 2023

May 2023

June 2023

July 2023

We use Partner Hub to communicate Range Review Engagement Windows. You can now find these Windows within the ‘What’s New’ section from the home page of Partner Hub. Click here for a direct link to this page.

Leadership Team

Name Position

Tim Carroll Director - Merchandise & Buying tim.carroll@edg.com.au

Bree Coleman General Manager - Merchandise Transformation, Range & Customer Value bree.coleman@edg.com.au

Harriet Wischer Acting Head of Beer & Cider harriet.wischer@edg.com.au

Georgia Stott Category Manager, Trading - Beer & Cider (BWS) georgia.stott@bws.com.au

Darren McKenzie Category Manager, Trading - Beer & Cider (Dan Murphy’s) darren.mckenzie@edg.com.au

Beer & Cider

Billy Ryan Category Manager, Customer Discovery billy.ryan@edg.com.au

Jody Liddle Category Manager, Range - Commercial, Craft, Local & Cider jody.liddle@edg.com.au

Rylee Martin Category Manager, Pinnacle Range & Trade rylee.martin@edg.com.au

Sarah Hall Acting Head of Spirits, Premix & Complementary Categories sarah.hall3@edg.com.au

Michael Vagli Category Manager, Trading - Glass & Premix (Dan Murphy’s) michael.vagli@edg.com.au

Fahime Durbali Category Manager, Trading - Glass & Premix (BWS) fahime.durbali@edg.com.au

Spirits/ Complementary Categories

Hamish Fyfe Category Manager, Range - Premium Craft & Local Spirits (EG) hamish.fyfe@edg.com.au

James Duvnjak Category Manager, Range - Mainstream Glass (EG) james.duvnjak@edg.com.au

Stephanie Petracca Category Manager, Range - Premix (EG) stephanie.petracca@edg.com.au

Lance Friedman Category Manager, Complementary Categories (EG) lance.friedman@edg.com.au

Leigh Firkin Head of Commercial Wine leigh.firkin@edg.com.au

Mathew Young Category Manager, Trade - Wine (BWS) mathew.young@edg.com.au

Kristina Poljak Category Manager, Range - Wine (BWS) kristina.poljak@edg.com.au

Wine – Commercial

Ben Lafford Category Manager, Red Wine & Cellar (Dan Murphy’s) ben.lafford@edg.com.au

Darren Leivers Category Manager, White, Rose, Zero Alc & Cask (Dan Murphy’s) darren.leivers@edg.com.au

Tim Yu Category Manager, Champagne, Sparkling & Fortified Wine (Dan Murphy’s) tim.yu@edg.com.au

Wine – Fine Wine

Name Position Email

Andrew Shedden Head of Fine Wine andrew.shedden@edg.com.au

Ian Wolfe Category Manager (EG) - WA & SA ian.wolfe@edg.com.au

Tim Merrett Category Manager (EG)NSW, VIC, QLD & TAS tim.merrett@edg.com.au

Nicholas Rose Category Manager (EG) - Imported Wine nick.rose@edg.com.au

Ramon Gunasekara Category ManagerLangton’s Domestic Wine ramon.gunasekara@langtons.com.au

Jesper Kjaersgaard Category ManagerLangton’s Imported Wine jesper.kjaersgaard@langtons.com.au

Eleni Hatzigrigoriou Category Manager, eCommerce (DM’s) eleni.hatzigrigoriou@edg.com.au

eCommerce Team

Camille Singh Category Manager, eCommerce (BWS) camille.singh@edg.com.au

Sarah Linhart Category Manager, Subscriptions (EG) sarah.linhart@edg.com.au

Lachlan Brahe Head of Retail Media lachlan.brahe@edg.com.au

MixIn by Endeavour

Rhiannon Hart Production & Compliance Manager rhiannon.hart@danmurphys.com.au

Steve Jones Supplier Partnerships Manager steve.jones@edg.com.au

Jarrod Holt General Manager, Commercial jarrod.holt@edg.com.au

ALH Hotels

Andy Gupta National Merchandising Manager andy.gupta@alhgroup.com.au

ALH Merchandise Team merchandisingteam@alhgroup.com.au

Merchandise Assistants - Merchandise Assistants egmerchassist@edg.com.au

Marketplace - Marketplace Team partner@endeavourmarketplace.com.au

Product Data & Content - Product Data Team

product.data@edg.com.au

Edition 1

March 2021

Feature article:

It’s a generational thing

Click here to view.

Edition 2

July 2021

Feature articles: Get to know our premium customers

Low and no goes mainstream

Click here to view.

Edition 3

October 2021

Feature articles:

Peek into the future with leading trends

Interview with Claire Smith, Director endeavourX

Click here to view.

Distilled.

Edition

Edition 5

March 2022

Feature articles: A Christmas retrospective Innovation within industry

Click here to view.

Edition 6

June 2022

Feature articles: Supplier of the Year Award winners and finalists

Insights Report: Moderation

Click here to view.

Edition 7

September 2022

Feature articles:

MixIn: Our retail media business.

Christmas F22: Predictions

Click here to view.

Edition 4

December 2021

Feature articles: Making magic with Marketplace Building social brands

Click here to view.

Dates

Remember 2023

Edition 8

December 2022

Feature articles: Introducing Dan’s Daily Why sustainability matters more than ever

Click here to view.

Supplier of the Year awards