MOULIN ROUGE HOTEL AND CASINO

Neighborhood Multi-Site

Revitalization

EXECUTIVE SUMMARY

1.0

Executive Summary

A. Project Concept

The Las Vegas Moulin Rouge LLC (LVMR LLV) is proposing to re-develop, finance and build Phase I, II & III of the Moulin Rouge Hotel & Casino in the City of Las Vegas. On April 2, 2008, the City of Las Vegas approved a re-zoning of 15.44 contiguous acres located in “Uptown” Las Vegas. The historic re-zoning allows for the rebirth of one of Las Vegas’ oldest chartered hotel and casinos, and now allows for an unparralled investment opportunity in an emerging market in the Las Vegas Market.

This proposed project is in a unique position to capitalize not only on the propoerty’s Historic Significance but on the continued revitalization of “Downtown Las Vegas” as it is already home to the Smith Center, the Lou Rouvo Brain Institute, the Clevland Clinic and the World Market Center (currently planning an expansion starting in 2018). Las Vegas as whole is experiencing a renaisance of new and existing project expansions that only add to the opportunity which included the promise of a mono-rail stop along the eastern edge of the project.

Phase One Costs of the New Moulin Rouge Hotel & Casino are projected to be approximately $400 million, Phase Two is estimated be an additional $400 million with $ 800 million required for Phase Three including all additional property aquisitions.

Executive Summary

Moulin Rouge Hotel & Casino: Transforming the Westside into “Uptown” Las Vegas

The hotel and casino will be built in two primary phases. At full build-out, the Moulin Rouge Hotel & Casino will be the centerpiece for a comprehensive master plan development of the west side of Las Vegas encompassing a Performing Arts Center, World Entertainment Center (WEC) complex, mixed-use residential/commercial and retail components, and high-rise condominium apartment projects transforming the area into “Uptown” Las Vegas. With over $400 million of “minority” money being spent in Las Vegas each year, MRDC is poised to capture a large portion of this revenue through a two-phase build-out. Phase I is anticipated to be a locals and destination hotel and casino, while the second phase will be geared toward attracting small to large conventions that continue to be a large revenue generator to the world’s most popular city.

Phase I - The first phase of the Moulin Rouge Hotel & Casino maximizes the unrestricted gaming license with an over 36,000 SF gaming floor, 200 new hotel rooms with “Venetian Style” suites in one hi-rise tower, Three restaurants, 30,000 SF of convention and meeting rooms, as well as a poolside night club. Included is a 2,000-seat show room, lounges, a “Vegas” style pool with a pool-side sports book, along with supporting retail and spa facilities. The pool areas will emphasize live performances. The new hotel

will also incorporate the current historic “Moulin Rouge” neon sign as well as portions of the original casino façade. A 7,500 SF historical museum is also included in the initial phase of the project.

Phase One will create thousands of direct and indirect jobs to the west side of Las Vegas and will include major public subsidy for roadway and pedestrian improvements. At its completion, the hi-rise hotel tower will be a visible historic landmark that will become a beacon for the newly-created “Uptown” Las Vegas.

Phase II - is currently in the conceptual design phase, which will include additional gaming floor, retail spaces, entertainment, and restaurant venues as well as an additional hotel tower containing 1,000 new hotel rooms along with 50,000 SF of new convention space and associated structured parking facilities. The conceptual design of Phase II is completed with full design and construction drawings commencing as market demand dictates the need for additional hotel keys.

Master Plan: LVMR continues to acquire adjacent properties that surround the Moulin Rouge Hotel & Casino. This includes land to the east where the new alignment of Freeway Interstate 15 will see a new off ramp directly onto West Bonanza Road, land to the north that is owned and controlled by the Housing and Urban Development Department, and properties across West Bonanza Road (south) in order to accomodate Phase Three of the planned development.

History of moulin rouge

1.1

History of f moulin rouge

•The Moulin Rouge opened on May 24, 1955, built at a cost of $3.5 million. It was the first integrated hotel casino in the United States. Until that time almost all of the casinos on the Strip were totally segregated—off limits to blacks unless they were the entertainment or labor force.

•A veritable "A" list of performers regularly showed to party until dawn. Great black singers and musicians such as Lena Horne, Sammy Davis Jr., Louis Armstrong, Sarah Vaughan, Nat King Cole, Duke Ellington, Dorothy Dandridge, Harry Belafonte, Pearl Bailey, and Count Basie would perform often. These artists were banned from gambling or staying at the hotels on the Strip. In November 1955 the Moulin Rouge closed its doors, and by December 1955, the casino had declared bankruptcy.

•In 1992 the building was listed on the National Register of Historic Places and became a symbol of the expanding of black civil rights, and a monument of Las Vegas’s racist past.

•The Moulin Rouge is the only entertainment site recognized on the U.S. National Register of Historic Places for its significance to the civil rights movement.

current state of affairs

1.2

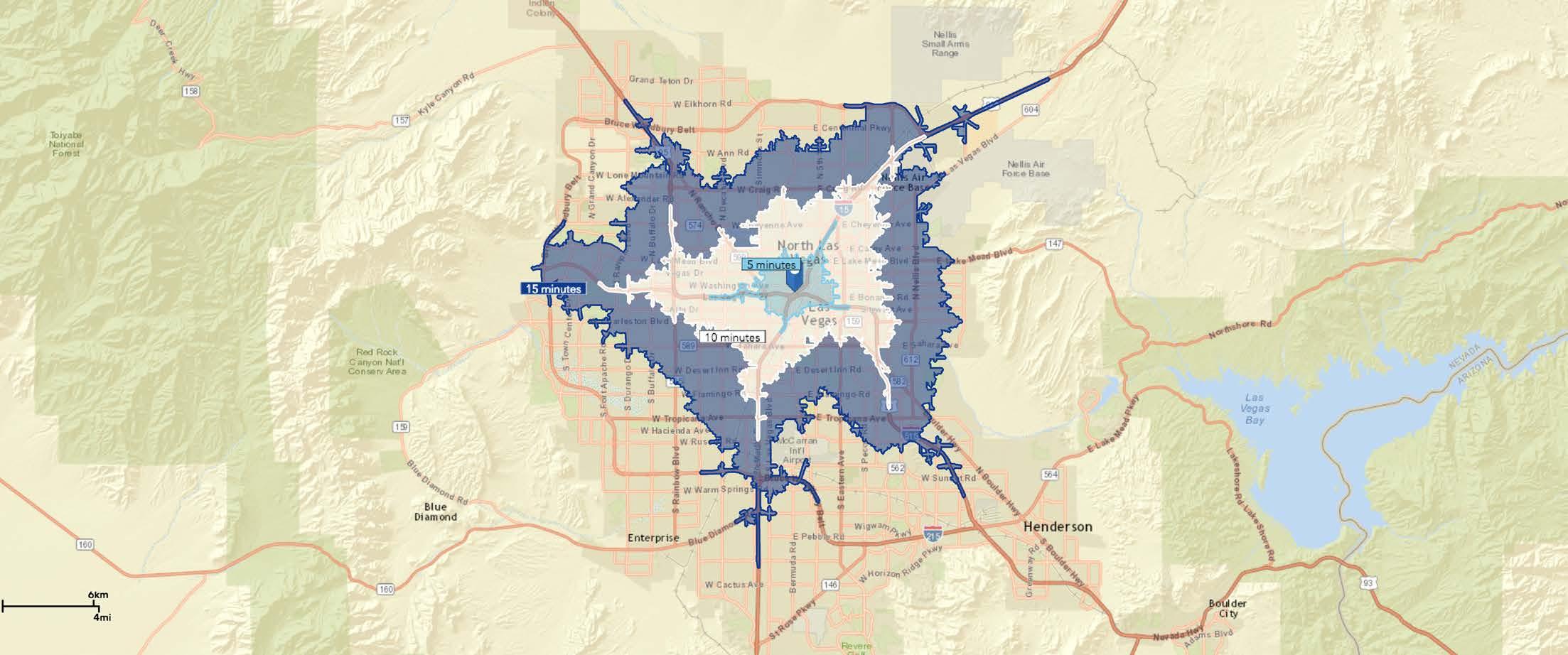

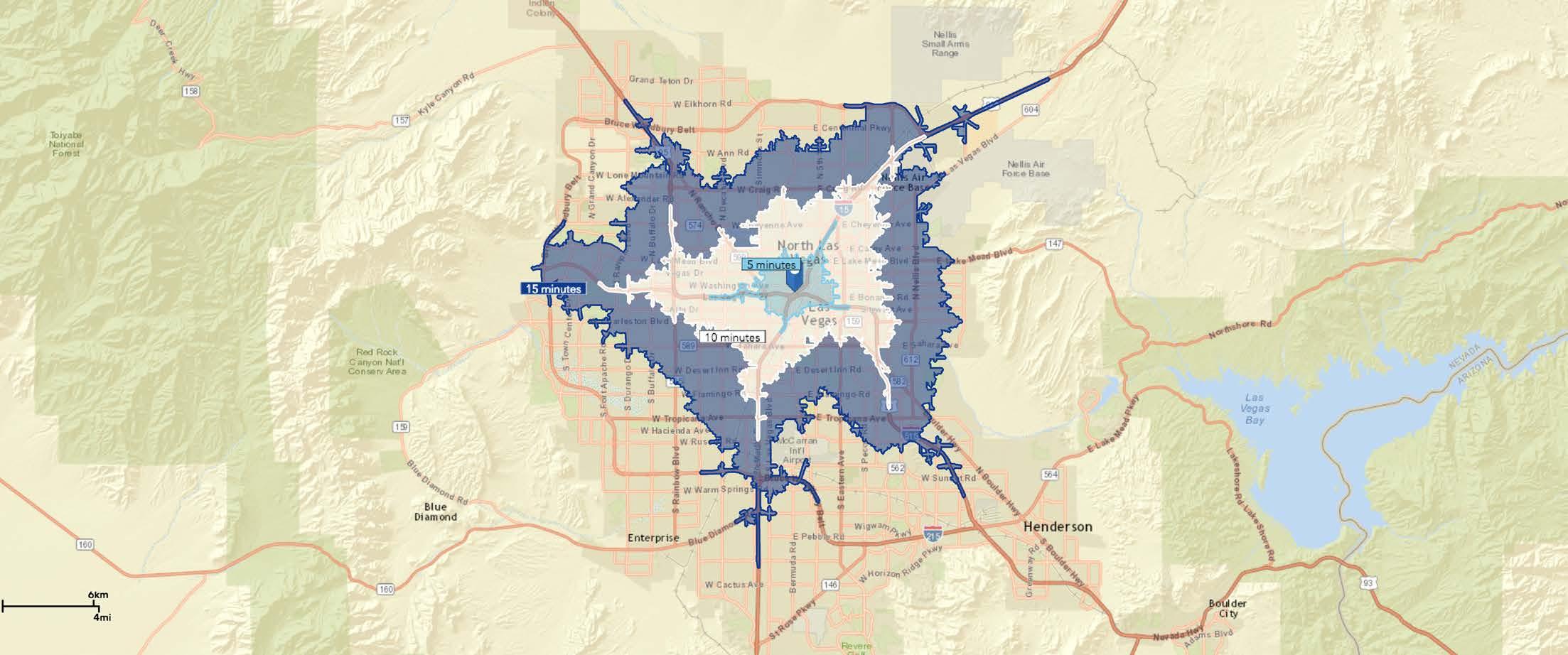

Moulin Rouge project is a 15.44 acre site located 15 minutes from McCarran International Airport and less than 1 mile from Downtown Las Vegas.

Historic gaming area 5.44 acres of project has a grandfathered non-restricted gaming license and an unlimited liquor license. Gaming license is renewed every two years.

Property is in foreclosure and controlled by Resource Transition Group of Seattle Washington. Las Vegas Moulin Rouge LLC has lease contract and purchase agreement.

Site has been abandoned for a number of years. Estimated $3.5M required to raze existing structures. Property is zoned for intended use.

Gaming licensse

1.3

Moulin rouge gaming license

In November 1955 the Moulin 1955, the casino had declared Nevertheless, to maintain its closed properties) operates minimum of eight hours every

The Moulin Rouge Non-restricted

While numerous types of licenses non-restricted gaming license, ü a property having 16 or ü a property having any number device, race book or sports

license status

Moulin Rouge closed its doors, and by December declared bankruptcy. its gaming license, the Moulin Rouge (like many operates on a temporary basis for a state-mandated every two years.

Non-restricted Gaming License is Active and Intact licenses and approvals can be granted by the commission. The license, is granted for the operation of: or more slot machines; number of slot machines together with any other game, gaming sports pool at a single location.

Location by Google earth

Planned use

1.5

strateegy

Moulin Rouge will be three (3)phases of development. When fully built out, the Moulin Rouge Hotel and Casino will be the center piece of a comprehensive master planned development which will include a performing arts center, world-class entertainment center complex, and a mixed-use residential /commercial project.

Phase1 Hotel and Casino, Bars, Meeting Rooms, Restaurants, Buffet, Showroom, Historical Museum

Phase2 Additional Rooms and Gaming + Entertainment, retail and restaurant venues

Phase3 Mixed Use residential space with street level retail, office, parking and a 12,000 seat arena.

Based on an appraisal done in 2008 by Cushman Wakefield

74M

Land on Las Vegas Blvd with per acre. Off the Strip it is 1.6

We take a conservative approach to the valuation and estimate

20M+

Current Appraisals will be ordered during the due diliigence period ??M

with gaming license is valued between $16M -$33M is valued between $2M – $4M per acre.

COMPETITIVE ANALYSIS

2.0

Las vegas stats and facts

How many visitors Las Vegas per year? 42,312,216 Q1

What is Las Vegas revenue? (Strip & $6.842 Billion Q2

What is the average gambling budget per $579 Q3 2.1

*The data based on LVCVA Research Center

How downtown performed in the past six months

Downtown Las Vegas is up for the period (+2.10%), with a growing slot win(+ 2.65%) helped slightly by a growing game win (0.33%).

T Total win +2.10% S Slot win +2.65%

G Game win 0.33%

2.2

$60,000,000

$50,000,000

$40,000,000

$30,000,000

$20,000,000

$10,000,000

Slot Win

Game Win

Total

How downtown performed by top table games

Craps $29,346,000 34 Units 3-Card Porker $10,005,000 17 Units

2.3

Roulette

$14,034,000

32 Units

Other Games $9,450,000 29 Units

Twenty-one $47,601,000

216 Units

Pai Gow $4,162,000 15 Units

MOULIN ROUGE

PROPERTY OVERVIEW

The subject property consists of 4 separate parcels totaling 15.18 acres which was formerly the historical Moulin Rouge Hotel & Casino site and the adjacent parcels that have been previously improved with a 109-unit motel in 1955, a 56-unit apartment facility in 1964 and a 59-unit condominium complex in 1964. The structures were typically constructed of wood frame and stucco on concrete slabs which have all been boarded up, vacant and, based on information provided as well as an exterior inspection, are in a poor, uninhabitable condition. As such, the existing improvements no longer contribute to the value to the subject and the valuation of the parcels will be based on land value minus costs to demolish existing improvements.

The subject is located in the City of Las Vegas’ redevelopment area which is planned for revitalization. It is our understanding that the 5.44 acre parcel has been grand fathered with a non-restricted gaming license and that the remaining parcels benefit from their immediate proximity to the site.

Michele W Shafe - Assessor

VICINITY MAP

W. Bonanza

Martin L. King Blvd.

W. McWilliams

LAS VEGAS REVIEW JOURNAL

BOYS & GIRLS CLUB OF AMERICA

MANUFACTURING

TERRIBLES HERBST CAR WASH / CHEVRON PENSKE TRUCK

TENAYA CREEK BREWERY

KEENAN SUPPLY

BUISNESS INCENTIVES

BUISNESS INCENTIVES

Moulin Rouge | 15.18 Acres •

LAS VEGAS STRIP

W. Bonanza Rd.

W. Bonanza Rd. W.BonanzaRd.

PROJECT NEON

2.9

LAND INVESTMENT OPPORTUNITY | MOULIN ROUGE

Project NEON will “Spaghetti Bowl”

Moulin Rouge | 15.18 Acres • Project Neon

will widen 3.7 miles of Interstate 15 between Sahara Avenue and the interchange in downtown Las Vegas.

2.9

CURRENT PROJECTS

NFL STADIUM

Excerpt from nfl.com

By Gregg Rosenthal | March 2017

The Raiders are leaving Oakland again, this time for the neon lights of Las Vegas.

In a decision that would have been hard to fathom not so long ago, NFL owners voted 31-1 on Monday at the Annual League Meeting to approve the Raiders’ proposal to relocate to Las Vegas.

The decision comes after years of fruitless efforts by Raiders owner Mark Davis to build a viable stadium in Oakland. The failure to do so, which goes back to Davis’ late father Al Davis’ stewardship of the team, led to exploring stadium options in Los Angeles and eventually Las Vegas, where Nevada lawmakers approved $750 million in public funding for a new stadium. The Autumn Wind will no longer blow through Raiders games as the team is expected to move into a planned $1.7 billion domed stadium in Las Vegas.

In what is sure to be an awkward process, the Raiders won’t be moving immediately. The new stadium in Las Vegas is not expected to be ready until 2020. The Raiders plan to play at the Oakland Coliseum in 2017 and 2018, Davis said in a statement. Davis also expressed openness to staying in Oakland in 2019, although NFL Commissioner Roger Goodell said the league would look into potential venues for 2019. In the meantime, the Raiders will remain the Oakland Raiders.

“My father always said, ‘the greatness of the Raiders is in its future,’ and the opportunity to build a world-class stadium in the entertainment capital of the world is a significant step toward achieving that greatness,” Davis said.

This is a surreal moment involving one of the NFL’s most iconic franchises, although NFL teams changing cities is sadly becoming routine. The news caps a frenetic 14-month stretch during which three teams announced plans for relocation. The Rams moved from St. Louis back to Los Angeles last year and the Chargers announced their decision to move from San Diego to L.A. in January. Goodell said last week on MMQB Peter King’s podcast that leaving Oakland would be “painful.” ...”

LAND INVESTMENT OPPORTUNITY | MOULIN ROUGE

Moulin

UNLV SCHOOL OF MEDICINE

from espn.com

By Arash Markazi | March 2017

The Vegas Golden Knights officially joined the NHL as the league’s 31st team and were formally cleared to make trades and roster transactions before the league’s trade deadline.

While the team finished the day without making its first transaction, Foley and general manager George McPhee are beginning to get a good sense of the team they will be able to put together following June’s expansion draft and entry draft.

“We’ve been downstairs the last 2½ days doing mock drafts with all of the pro scouts and going through every team, and George is getting calls periodically from various teams on potential ideas for things that could happen,” Foley said. “We’ve done nothing yet. There are lots of different discussions, but we’re just not in a position to make commitments. We just don’t want to do something that would hamper us in the expansion draft.

“That’s what we’re all preparing for now: The focus on various players is becoming more clear and more pronounced. We’re picking the same players assuming they’re going to be available.”

Foley was initially scheduled to make his final payment on April 5 to make the team an active member of the NHL, but he moved up that date up so the team could field calls during the trade deadline, and McPhee could participate in the general managers meetings in Boca Raton, Florida, next week, and Foley could prepare for the board of governors meetings next month.

“The whole notion of moving it up to March 1 from April 1 came up casually several months ago,” McPhee said, “but I said, ‘Gee, it would be kind of nice to do it on March 1 so we can be involved in the trading deadline and I can go to the GM meetings and we can start competing for young free agents out there.’ Bill said, ‘Well, if we need it, I’m going to do it.’ That’s a big help for all of us...”

Excerpt from knpr.org

By Joe Schoenmann | February

2017

Nevada lawmakers provided $27 million two years ago to get the school up and running. Governor Brian Sandoval wants to add another $53 million to that total. The request is in his current budget.

Most of that money has been used to hire faculty, Atkinson said.

The first 60 students in the school will pay no tuition. That means the total of their more than $100,000 in debt will be covered by a fundraising effort Atkinson spearheaded.

With big help from the Engelstad Family Foundation -- which is paying tuition for 26 students for each of the next four years -- she raised $13.5 million in just 60 days in 2015.

Meanwhile, the city of Las Vegas is expecting a big redevelopment spurt in the city’s urban core from the medical school. Betsy Fretwell, city manager, said by 2020--just three years from now -- the school will have a $600 million impact on the economy; will result in more than 4,000 new jobs; and bring in an addition $30 million in tax revenue.

In 13 years, those numbers are projected to quadruple.

Excerpt

Excerpt from knpr.org

By Joe Schoenmann | February 2017

CONVENTION CENTER

CURRENT PROJECTS

Excerpt from reviewjournal.com

By Richard N. Velotta

| December 2016

The $1.4 billion Las Vegas Convention Center expansion and improvement project authorized in a special session of the Nevada Legislature in October took a big step forward Tuesday.

The Las Vegas Convention and Visitors Authority board of directors approved the second phase of the project by unanimously authorizing an eight-month $1.28 million contract extension with its builder representative, Cordell Corp., to begin the process of designing a 600,000-square-foot exhibit hall.

The first phase involved demolition of the Riviera.

Between the middle of February and the end of March, Cordell officials will meet with convention authority staff, its contracted partners and customers that conduct conventions and trade shows in Las Vegas to solicit ideas for needs in the construction program. Those ideas will be reviewed by the authority board and a seven-member oversight panel appointed by Gov. Brian Sandoval to develop the building design.

Cordell principal Terry Miller said he hopes to bid the design and engineering of the project by August and have a construction process in place by the end of the year, with the groundbreaking of the new hall by early 2018.

Terry Jicinsky, senior vice president of operations, said Cordell would conduct focus groups and interviews and present industry trends and best practices to develop a quality facility.

“We’re not looking at using Italian marble and building a 300,000-square-foot ballroom, but we won’t be using residential carpet either,” Jicinsky said of the quality the authority will work to provide...”

Moulin Rouge | 15.18 Acres

HAINAN AIRLINES INTERSTATE-11

Excerpt from lasvegassun.com

By Mick Akers | March 2017

Construction of the first 15 miles of Interstate 11, which will link Las Vegas to Phoenix and could eventually stretch from Mexico to Canada, is making progress.

The Nevada Department of Transportation is in charge of the 2.5-mile phase one, while the Regional Transportation Commission is heading the 12.5-mile phase two. Both phases have been under construction since 2015 and are expected to be completed by 2018.

The first phase of the $318 million Interstate 11 project is about 60 percent complete, according to the Nevada Department of Transportation.

NDOT’s phase is projected to make up $83 million of the project’s total cost. “We opted to use concrete pavement due to its longevity, which, federally funded studies show, costs 13 to 28 percent less in the long run than asphalt

” NDOT spokesman Tony Illia said. “It also reduces rutting and potholes, thereby cutting maintenance expenses by up to 75 percent.”

The stretch will allow motorists to bypass the main street through Boulder City, alleviating frequent bottlenecks and quickening the drive between Las Vegas and Phoenix.

Excerpt from prnewswire.com Provided by Hainan Airlines Co | December 2016

The maiden voyage of Hainan Airlines’ new non-stop service took off from Beijing and landed at McCarran International Airport in Las Vegas at 11:00 am on December 2, 2016, following a 12-hour journey. The flight, serviced by a Boeing 787 with a Kung Fu Panda motif adorning the plane’s cabins, served as the announcement of Hainan Airlines’ formal launch of non-stop service between Beijing and Las Vegas. The new service further complements the airline’s intercontinental network. Hainan Airlines is the sole Chinese airline providing non-stop service between the two cities.

A brief yet grand welcoming ceremony for the maiden voyage was held by the Las Vegas Convention and Visitors Authority at the arrivals hall in McCarran International Airport, after the plane landed at the airport.

Data from the US government shows that close to 7.3 million Chinese tourists are projected to travel to the US between now and 2021. Since the launch of the BeijingSeattle service in 2008, Hainan Airlines has continued to expand its flight services to the US. Hainan Airlines’ non-stop flight to Las Vegas adds an additional transportation choice for business travelers, international students and tourists traveling between China and the US.

CURRENT PROJECTS

PARADISE PARK

By Todd Prince | January 2017

Wynn Resorts Ltd. hopes to start construction of its Paradise Park before the end of 2017, Chief Executive Office Steve Wynn said Thursday.

”I think we have nailed it down,” Wynn told investors and analysts on a call to discuss the company’s fourth-quarter results.

“I hope to take the business plan to our board of directors in the second quarter and be in a position to begin work in the fourth quarter,” Wynn said of the the proposed 38acre lagoon surrounded by a convention center and hotel on the Strip.

Wynn Resorts’ future lies in nongaming attractions, Wynn said. It is those attractions that in turn bring people to the gaming tables.

“We want to take our noncasino revenue to enormously high levels,” he said while explaining the project’s concept.

Wynn commented after his company reported fourth-quarter net revenue rose 37.3 percent, beating analysts’ estimates. Shares surged despite adjusted profits missing estimates as Wynn said business was off to a strong start in China.

Wynn Resort’s revenue increased $353.5 million to $1.3 billion for the last three months of 2016, the company said in a statement. Wall street analysts expected the company to post revenue of $1.25 billion, based on Zacks Investment Research data....”

RESORTS WORLD

HYPERLOOP

Excerpt from vegasinc.com

By Jeff Gillan | May 2016

Resorts World Las Vegas will begin full-scale construction sometime in the last three months of this year, an executive affiliated with the $4 billion project told Nevada gaming regulators today.

Appearing before the Nevada Gaming Control Board almost exactly a year after the project held its ceremonial groundbreaking, Resorts World General Counsel Gerald Gardner said construction would get underway in earnest in the fourth quarter, with site activity starting to ramp up this summer.

Gardner said construction of the Chinese-themed resort should be finished in early 2019. Project officials had previously said it would open in 2018.

Genting Chairman K.T. Lim told board members his company’s goal for Resorts World was to complement the Strip’s existing resorts while creating a “new and unique” destination. He said he remained “very excited and engaged” with the plans moving forward.

Once building activity is in full swing, Resorts World is expected to create about 5,000 direct construction jobs, Gardner said.

The resort will have about 2,500 full-time employees at opening and aims to attract both Asian and domestic tourists, Gardner said.

Plans for the debut of Resorts World include a hotel tower with more than 3,000 rooms, a 150,000-square-foot casino and other amenities that Gardner said would be the “latest, greatest thing on the Strip...”

Excerpt from vegasinc.com

By Daniel Rothberg | March 2016

If Hyperloop Technologies Inc. has its way, North Las Vegas could become one of the few locations for testing the futuristic transportation platform that propels pods down pneumatic tubes.

With city and state officials working to make that happen, the company is expected to receive tax incentives today worth an estimated $9.2 million for a full-scale track. The company’s new commitment expands upon its initial goal to create a smaller open-air test track at the largely vacant Apex Industrial Park.

The full-scale 2-mile track, to be operational at Apex by the end of 2016, is expected to bring the company’s workforce here to more than 100 jobs and give it a permanent presence in Nevada.

Officials see it as a big economic development win. Hyperloop Tech estimates that it will invest more than $121 million, yet the technology remains untested, and experts are unsure about any company’s ability to bring Hyperloop to the market soon.

The Hyperloop idea came from a design floated by Tesla CEO Elon Musk, who has described the levitating pods as a mix between a Concorde supersonic passenger jet, a rail gun and an air hockey table. Los Angeles-based Hyperloop Tech is one of several teams vying to build a working model of the frictionless high-speed pods that can transport people and goods in enclosed tubes.

Hyperloop Tech declined to comment for this story, but in its tax incentive application, an executive wrote that “if selected, Nevada would be poised to compete for future expansions.”

“I think it helps solidify Nevada’s brand as a place where really innovative technology is taking place and where the future of transportation is happening,” said Steve Hill...”

PROPOSED DEVELOPMENT

3.0

MASTER PLAN

PHS 1 PHS 2 PHS 3a PHS 3b PHS 3c

FLOOR PLANS

3.2

FLOOR PLANS

3.2

FLOOR PLANS

3.2

FLOOR PLANS

3.2

PHASE TWO - LEVEL

FLOOR PLANS

3.2

PHASE TWO - LEVEL

TECHNICAL PLAN

3.2

PHASE ONE & TWO

Dark grey area indicates the original 5.5 acres of the Moulin Rouge. All gaming positions must fall within this area.

SITE PLANS

3.2

SITE PLANS

3.2

PROJECT IMAGES

3.3 PHASE ONE - LOOKING

LOOKING

SOUTH WEST

PROJECT IMAGES

3.3 PHASE TWO - LOOKING

LOOKING NORTH EAST

PROJECT IMAGES

PHASE THREE - CONVENTION

CONVENTION CENTER & HOTEL -LOOKING NORTH EAST

PROJECT IMAGES

3.3 PHASE THREE - OFFICE

PROJECT IMAGES

3.3 PHASE THREE - MIXED

MIXED USE DEVELOPMENT - LOOKING EAST

MASTER

PLAN IMAGE - LOOKING SOUTHEAST

SOUTHEAST

PROJECT TEAM

Scott Johnson Principal | LVMR LLC

CAREER SUMMARY

Scott Johnson has been an active community member of Las Vegas since 1991. Scott graduated from the University of Arkansas, Fayettville with a B.S., in Construction Management, and was the recipient of Transition, Retention, Minority Engineering Scholarship.

Through this he has become more than proficient at the use of all construction management software, Excel, Peachtree and the like. Having had his contractor’s license in the state of Nevada for over 24 years now, has allowed Scott the opportunity to work on a broad scope of both private and public construction and infrastructure projects including 24 years as the project manager and superintendent for the Richardson Construction Company.

Scott’s current position of President of Las Vegas Moulin Rouge LLC., has allowed him the honoured position of voluntary community spokesperson and activist for the Las Vegas community. Scott has utilized this opportunity to continue to fight for the heritage and community prosperity of Las Vegas through his persistency in pursuit of the iconic Moulin Rouge Hotel and Casino, granting a huge employment influx and expansion of the socio-economic status of the community as a whole.

Gene Collins

Principal | LVMR LLC

CAREER SUMMARY

Eugene (Gene) Collins is a community activist and leader who served as the NAACP President of Las Vegas Chapter from 1999-2003. He was the National Action Network President of the Las Vegas Chapter from 2001- 2012.

Gene sought public office in 1982-86 and became State Assemblyman of Nevada 6th District. He was instrumental in introducing the Martin Luther King Jr. Day, holiday bill during his term.

Mr. Collins was involved in establishing the first business incubator in “Historical West Las Vegas.” During this period, he was actively involved in passing the City of Las Vegas redevelopment plan, first black president of the Sara Allen Credit Union and advocated on the committee for the construction of West Las Vegas Library. Through his activism he fought against one of Nevada gaming giants the MGM Resorts International. He held MGM Resorts accountable for not extending service contracts to minority own businesses. Because of this, in 2009, MGM Resorts was the only company based in Nevada to be named the Diversity Inc., Top 50 Companies for Diversity. In 2005, Terri Lanni, former chairman and chief executive officer of MGM, personally acknowledged Mr. Collins for his efforts.

Richard Stern

Principal | Bravo West Investments

CAREER SUMMARY

Richard Stern, is the Managing Member/ President of Bravo West Investments, LLC. Mr. Stern will oversee the development of the Moulin Rouge Hotel/Casino and Entertainment MixedUse Project.

Mr. Stern has a B.A. from UCLA, and an MBA from the University of Southern California. He also presently maintains an active California Real Estate Broker’s license. Mr. Stern’s banking background began at Union Bank National Division, and then he transitioned to the Controller of an eight branch Savings and Loan.

Within the Real Estate industry, Mr. Stern was President of Professional Mortgage Corporation focusing on residential and multi-family lending. Later, as President of Wheatley Investments Inc., he successfully orchestrated the purchase, finished construction, and resale of nine condominium projects.

In the entertainment field, Mr. Stern directed the profitable renovation, operation, and ultimate sale of a 2500 seat concert venue in Southern California.

PROJECT TEAM

Rick Richards General Manager | LVMR LLC

CAREER SUMMARY

A third-generation gaming executive Mr. Richards began his career with Boyd Gaming as a dealer. During the next 10 years he realized his dream of following in his father’s footsteps as a top casino professional. From 1991 thru 1995, he honed his craft at Caesars Palace on the Las Vegas strip where he oversaw the pit operations. Working his way up in the fast growing gaming world, Mr. Richards was highly sought after for his even temperament and sharp approach to business. He held top positions such as the National Branch Marketing Manager for Hilton Corporation in Houston, TX.

Returning to Las Vegas he took over as the VP of Operations for Bally’s Casino. He next held the position of VP and Assistant General Manager at Players Island in Lake Charles, LA. Mr. Richards later began a multi-position relationship with Hard Rock Casino Hotel from pre-opening, beginning as Casino Shift Manager and later as the VP of Casino Operations.

Finally Mr. Richards shepherded the Hard Rock Casino through the most profi table 6 quarters in the resorts history as the General Manager of this quality based trendy casino. In mid 2002, Mr. Richards took his vast experience to San Diego to the San Pasqual tribes Valley View Casino.

Greg Yochum

CFO | LVMR LLC

CAREER SUMMARY

A second second-generation finance professional, Mr. Yochum graduated from Canisius College in 1988 with a Business Administration degree with a focus in Accounting. Later he became a Certified Public Accountant in New York State.

Mr. Yochum first entered the gaming business as Senior Auditor with BDO Seidman. Later assuming the Controller/Director of Finance duties at Lady Luck Casino in Las Vegas Mr. Yochum was responsible for the modernization of the accounting procedures in a very traditional environment.During the next 7 years Mr. Yochum facilitated a $47 MM refinancing package for Lady Luck which allowed access to $7 MM in additional capital. In 2000 Mr. Yochum was named Assistant General Manager and soon after VP and General Manager of Lady Luck. At the helm of this venerable property he was responsible for all aspects of the operation.

Mr. Yochum assumed the Director of Finance position at Sunset Station Hotel Casino in Las Vegas during which this time he implemented value/cost relationships in departmental budgets focused on service and guest relations. This property is widely considered the premier “locals” casino in Las Vegas and has enjoyed incredible success during Mr. Yochum’s tenure. Most recently Mr. Yochum has been the VP and Chief Financial Officer of the Valley View Casino in San Diego California.

Edward

Vance,

Architect | LVMR LLC

FAIA

CAREER SUMMARY

Edward A. Vance, FAIA, is the founder and design principal of EV&A Architects, a specialized design firm serving the hospitality, commercial, and healthcare industries. With a career spanning more than four decades, Mr. Vance has made a profound impact on his clients, community, and the architectural profession. Known for his unwavering commitment to design excellence, his body of work has garnered numerous accolades and led to a series of significant commissions that define his distinguished career.

He founded EV&A Architects in 2006 to provide a more personalized approach to serving clients and advancing the profession. Based in Las Vegas, Nevada, his firm now employs 18 talented professionals uniquely qualified to deliver innovative solutions in the healthcare, hospitality, and commercial sectors. Mr. Vance’s legacy in Las Vegas is marked by over three decades of outstanding service, earning him numerous prestigious honors, including the AIA Nevada Young Architect Citation, the AIA Nevada Service Award, and the AIA Nevada Silver Medal, the highest architectural accolade in the state. His national contributions include serving on the AIA National Board of Directors, where he earned the Richard Upjohn Fellowship in 2012. In 2014, Mr. Vance was elevated to the AIA College of Fellows and received the AIA Regional Silver Medal. As the 57th Chancellor of the AIA College of Fellows in 2019, he further cemented his reputation as a visionary leader in the architectural profession.

PROJECT TEAM

4.2

Sam Nicholson Founder | Grand Canyon Dev.

CAREER SUMMARY

Nicholson is the Founder of Grand Canyon Development Partners. With more than 40 years of civil and building construction experience ranging from manufacturing ready-mix concrete and asphalt paving, to the construction of water and amusement parks, hotel casinos, sports facilities, sports arenas, retail and entertainment venues.

Some of the notable projects he and his team have been associated with include the Cosmopolitan of Las Vegas, Grand Bazaar Shops of Las Vegas, Paris Hotel & Casino, Luxor Hotel, Caesars Coliseum, Trump International Hotel, Green Valley Ranch, Marriott Renaissance, Hyatt Regency, Phoenix Coyotes Hockey Arena, Arizona Diamondbacks Baseball Stadium, and the Phoenix Suns Basketball Arena.

Grand Canyon has performed pro-bono work for St. Jude’s Ranch for Children, Southern Nevada Children First, Noah’s Animal House, and many other organizations in Nevada, assisting in the development and construction of new projects, or the repair and remodel of current facilities.

Project Organizational Chart

Structure/Finance Bravo West

Public Relations

R&R

Program Manager Grand Canyon

General Contractor

TBD

CIVIL Engineer

TBD

Geo-Tech Engineer McGettigan Consulting

Sr. Project Manager

Matthew K. Burns, AIA EVP | COO

Project Manager

Kurt P. Walden, CDT Vice President

Project Design

Kim Galbe, AIA

Lead Designer

Principal-in-Charge

Edward A. Vance, FAIA, NCARB President | CEO

Design Director

Erik B. Swendseid, AIA Vice President

Interior Design Principal

Kellie Wanbaugh, NCIDQ, RID Sr. Vice President

Structural Engineer

Brent Wright, SE Principal | Wright Engineers

Fire Life Safety | Code | ADA | FH

Michael Gentille, CBO President | PCNA

Security | Telcom | AC | PC | AV

Kent Bell, PE Principal | HCE

Specification Consultant

Walter R. Scarhrantz President | Hall AEC

MP&E+FP+Low Voltage Engineers

Kent Bell, PE Principal | HCE

Landscape Architect

Stanton Southwick, ASLA Principal | SLA

Auditorium Designer Sceno Plus

Lighting Designer

Ken Reynar, MIES Principal | Light Solutions

PROJECT FINANCIALS

Rouge

200 Rooms 1,200 Games

LVMR Program & OPC

Project Timeline - LVMR

2026

2027

2028

SUPPLEMENTAL

Promotion Video links

Projec

https://www.dropbox.com/sh/kjjtcj68o8sddao/AAA-18IEJGAb-TD95APHVoHLa?

oref=e&n=268035549&preview=Flyover+of+Masterplan+02-14-2008.wmv

Moulin

https://www.dropbox.com/sh/kjjtcj68o8sddao/AAA-18IEJGAb-TD95APHVoHLa?

oref=e&n=268035549&preview=Promo+Video+by+Shelter.avi

Projec

https://www.youtube.com/watch?v=Y8JYmPj-orw

https://www.dropbox.com/sh/kjjtcj68o8sddao/AAA-18IEJGAb-TD95APHVoHLa?

oref=e&n=268035549&preview=Flyover+of+Masterplan+02-14-2008.wmv

n Rouge Promotion

https://www.dropbox.com/sh/kjjtcj68o8sddao/AAA-18IEJGAb-TD95APHVoHLa?

oref=e&n=268035549&preview=Promo+Video+by+Shelter.avi

https://www.youtube.com/watch?v=Y8JYmPj-orw

Non disclosure privacy agreement

• By accepting this following:

• PROTECTION OF CONFIDENTIAL acknowledges that the Confidential the investment of significant valuable, special and unique competitive advantage, and receipt by the Recipient of the

ü No Disclosure. The Recipient disclose the Confidential Information Owner. No Copying/Modifying. without the prior written consent

ü Unauthorized Use. The aware of any possible unauthorized ü Application to Employees. any employees of the Recipient, Information in order to perform Agreement. Each permitted non disclosure agreement substantially

document the recipient agrees to the

CONFIDENTIAL INFORMATION.

The Recipient understands and Confidential Information has been developed or obtained by the Owner by significant time, effort and expense, and that the Confidential Information is a unique asset of the Owner which provides the Owner with a significant and needs to be protected from improper disclosure. In consideration for the the Confidential Information, the Recipient agrees as follows: Recipient will hold the Confidential Information in confidence and will not Information to any person or entity without the prior written consent of the Copying/Modifying. The Recipient will not copy or modify any Confidential Information consent of the Owner.

The Recipient shall promptly advise the Owner if the Recipient becomes unauthorized disclosure or use of the Confidential Information.

Employees. The Recipient shall not disclose any Confidential Information to Recipient, except those employees who are required to have the Confidential perform their job duties in connection with the limited purposes of this permitted employee to whom Confidential Information is disclosed shall sign a substantially the same as this Agreement at the request of the Owner.

Neighborhood Multi-Site

Revitalization