We are looking for business owners who like to join the

• Accounting Services

• Acupuncture

• Architect

• Architectural Interior Design

• Attorney- Family

• Auctions- Real Estate

• Bookkeeper

• Bowen Therapy

• Builder- Commercial

• Business Coach

• Business Equipment Financing

• Business Insurance

• Cabinets

• Caterer

• Graphic Designer

• Plasterer

• Chinese Medicine

• Chiropractor

• Creative Director

• Commercial Mortgage

• Computer Repair

• Computer Web Design

• Concrete

• Copywriting/Copy Editing

• Counselor/ Psychotherapist

• Dentist

• Digital Media

• Electrical Operations

• Electrician

• Finance Bookeeper

• Financial Planner

• Fitness Trainer

• Flooring

• Pilates

• Garage Doors

• General Insurance

• Health & Wellness Coach

• Homeopathy

• Lactation Consultant

• Lawn Care

• Lawyer

• Life Coach

• Loans

• Marketing

• Massage Therapist

• Meditation/Yoga

• Mortgage Broker

• Naturopathic Medicine

• Nutrition

• Osteopathy

• Painter

• Personal Trainer

• Photographer

• Plumber

• Podiatrist

• Printer

• Project Management

• Psychologist

• Real Estate Rentals

• Real Estate Sales

• Reiki

• Residential Cleaning

• Residential Mortgage

• Security

• Signs

• Solar

• Solicitor

• Travel Agent

• Website Developer

• Wedding Planner

The Find Manningham is a community paper that aims to support all things Manningham. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Manningham for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 warren@findnetwork.com.au

PUBLISHER: Issuu Pty Ltd

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmanningham) so you keep up to date with what we are doing.

We value your support,

The Find Manningham Team.

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmanningham.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: sport@manningham.com.au

WEBSITE: www.findmanningham.com.au

The Find Manningham was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-ForProfits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Manningham has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Manningham is a local government area in Victoria, Australia in the north-eastern suburbs of Melbourne. Manningham had a population of approximately 125,508 as at the 2018 Report which includes 27,500 business and close to 45,355 households. The Doncaster and Templestowe Council administered the area until December 15, 1994.

The Find Manningham acknowledge the Traditional Owners of the lands where Manningham now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Manningham accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

As the calendar flips towards the end of the year, a familiar chill settles over the business world. Deadlines loom, budgets tighten, and a sense of urgency hangs thick in the air. This period, known as the fiscal year-end, can feel remarkably similar to the arrival of winter. While seemingly disparate, these two seemingly unrelated phenomena share surprising parallels that reveal a hidden rhythm within our economic cycles.

Just as animals in nature enter a state of hibernation to conserve energy during the harsh winter months, businesses at the fiscal year-end engage in a similar form of strategic “hibernation.” Resources are meticulously assessed, non-essential projects are shelved, and budgets are scrutinised to ensure smooth operation through a potentially slower period. Inventory becomes a focus, much like squirrels gathering nuts in preparation for winter. Companies take stock, evaluating performance and analysing successes and failures – a vital self-reflection akin to the introspection that often accompanies the quietude of winter.

However, the fiscal year-end isn’t simply a time for hunkering down. Similar to the flurry of activity seen in winter holidays and gift-giving, the closing months can be a period of intense activity. Companies launch sales blitzes to clear inventory and meet quotas, mirroring the last-minute shopping sprees that mark the holiday season. It’s a “fiscal flurry” fueled by a desire to wrap up loose ends

and maximise results before the new year dawns. Just as winter often ushers in resolutions for self-improvement, the fiscal year-end becomes a time for goal setting and strategic planning for the upcoming year. Both become opportunities to chart a course for a fresh start, leaving behind the baggage of the past year.

The fiscal freeze isn’t without its challenges. Just as winter can bring feelings of isolation and cabin fever, the pressure and deadlines associated with the year-end can create stress for employees. However, this analogy offers valuable insights for navigating this period. Companies can learn

from nature's resilience – leveraging technology for optimized workflows, fostering open communication to create a supportive environment, and celebrating achievements just as sunlight breaks through winter clouds.

Ultimately, the fiscal year-end isn't just a point of closure, but a season of reflection and renewal. By embracing the "fiscal freeze" as a time for strategic planning and resource optimisation, companies can emerge stronger and more prepared for the growth opportunities that lie ahead, just like flowers pushing through the winter snow, ready to bloom in the new year.

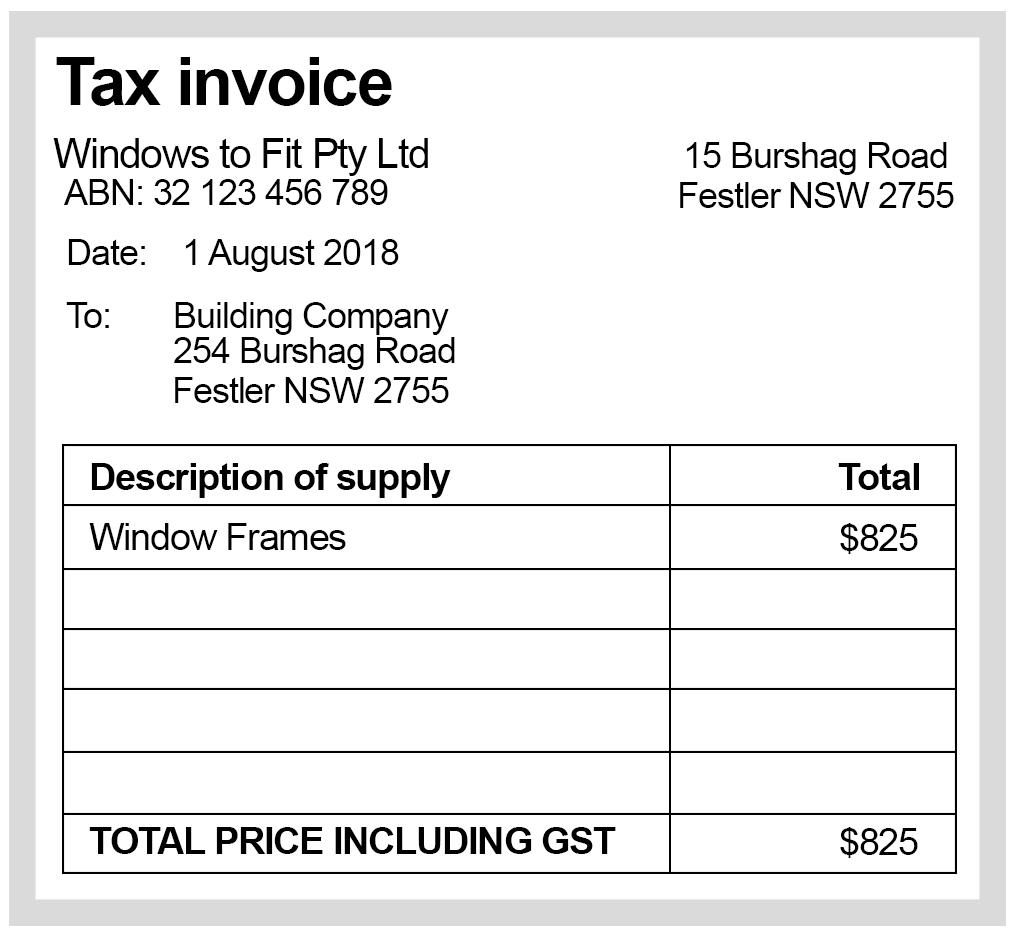

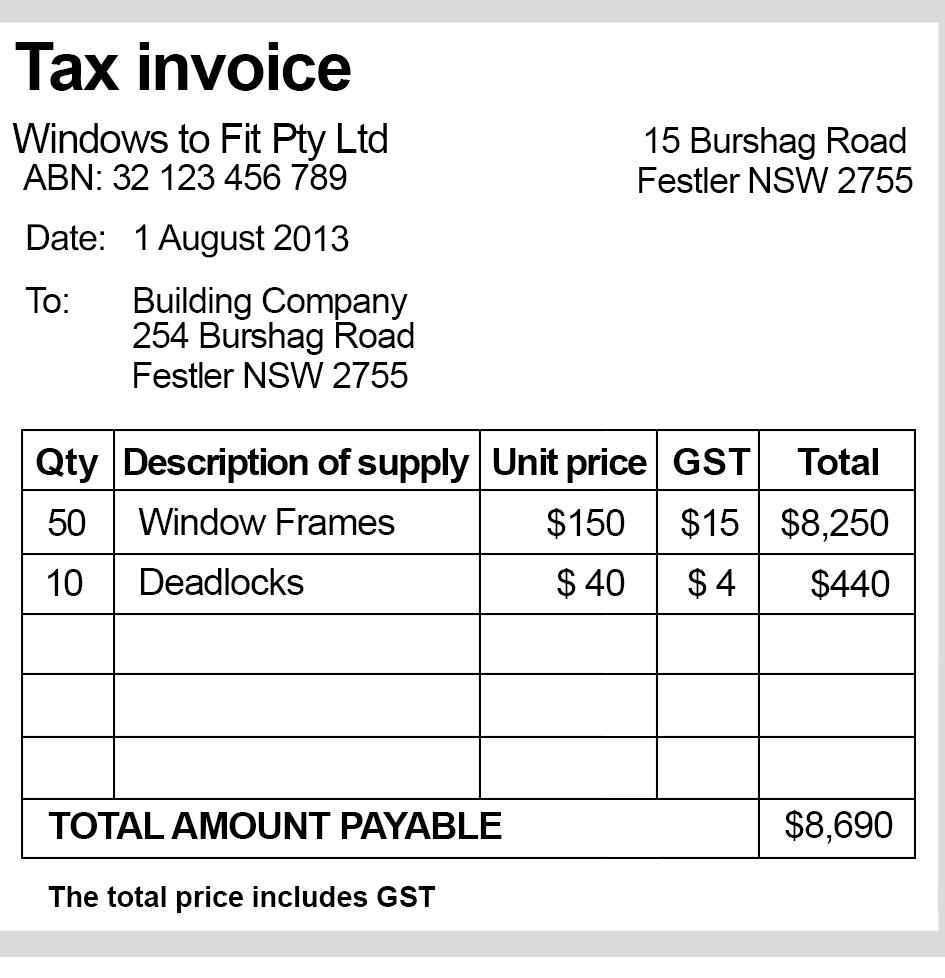

Last month we discussed GST and when to register your business for GST. Now that you are registered there are a few things you need to do.

1. Start adding GST to all your invoices. You will need to determine which items on your invoice are required to have GST added and which ones are not. Most goods and services should have GST added however there are several things that may be GST free. These include most basic food (generally unprocessed foods), some medical services and products, some childcare services, water supply, some education courses, and precious metals to name just a few. See the ATO website for a comprehensive list. There are also some items that are input-taxed such as bank fees and residential rent (see note at the end of the article).

If you are registered for GST but don’t add GST to your invoices for your clients to pay, you will be required to pay it anyway. This means it is coming out of your profit.

2. You must provide a tax invoice for anything above $75+GST ($82.50 inc GST) within 28 days if requested by a customer.

3. Update your invoice so they are legal. There are certain requirements that must be met for a GST invoice. These

depend on the sale amount, the type of sale (taxable items or non-taxable items), and who issued the invoice.

For sales under $1,000

a. Show that the document is a tax invoice

b. Seller’s identity

c. Seller’s Australian Business Number (ABN)

d. Date the invoice was issued

e. Brief description of the items sold, including quantity if applicable and the price

f. GST amount (if any) payable – this can be shown separately or, if the GST is exactly one-eleventh of the total price, as a statement which says ‘Total price includes GST’

g. Extent to which each sale on the invoice is a taxable sale (clearly show which items have GST and which items exclude GST.

Credit ATO website

For sales of $1,000 or more

Same as for invoices under $1,000 PLUS

h. the buyers identity or ABN.

Difference between GST-free and Inputtaxed

GST-free - If you are registered for GST and sell or provide GST-free products and services, you can still claim the GST on your expenses related to those products or services.

Input-taxed – If you are registered for GST and sell or provide Input-taxed products or services, you cannot claim the GST on expenses related to those products or services.

Whilst anxiety is part of life, and in some cases it’s even helpful (like when you know your 2-year-old could run onto the road at any moment!). There are many times it can stop you in your tracks and prevent you from normal functioning.

Anxiety disorders form the most common mental health disorders in Australia, effecting 14% of us each year, and 25% of us at some stage of life. These disorders range from generalised anxiety which is an everyday uncontrollable worry, to social anxiety, panic disorders, phobias, obsessive compulsive disorder (OCD), and post-traumatic stress disorder (PTSD).

Symptoms

For some people their anxiety is obvious: they may feel fear, panic, or dread, whilst others sometimes notice digestive symptoms, dizziness, shortness of breath, or trouble concentrating, with less obvious mental symptoms.

The problem with anxiety treatment is that it is often with drugs that have unwanted side effects. Whist they can be helpful for some people, for others the risk outweighs the benefits.

Nervous system tonics

Herbal medicines are very effective in treating anxiety, both when you notice it mentally, but also when you only have physical symptoms. What I love about treating with natural products like herbs is that they actually help to heal your body rather than just masking the symptoms which is often the case with pharmaceutical medications.

The first group of herbs for treating anxiety are nervous system tonics. These herbs improve the tone and function of the nervous system. Some herbs in this class energise the nervous system which is more helpful in depression, and others that relax the nervous system, which is what is often used in anxiety disorders.

Adaptogens

The next class of herbal medicines that are helpful in anxiety are adaptogens. These herbs increase the body’s resistance to physical, environmental, or emotional stress, they help you to adapt afterwards. These are really useful when anxiety began after a time of trauma,

stress, or even sickness to return the body back to normal functioning. They are like the ‘energiser bunny’ of herbs, they can help you to keep going at times when the ‘battery’ would have already run out.

If your sleep has been affected, then sedative herbs can be really helpful. These are very different to sedative medications in that they will calm and relax the mind to help with sleep without the side effects of sedative medication such as morning drowsiness. Usually, these herbs are just taken before bed, so that your mind an body can relax into sleep.

There are other herbs that can be used if digestion or concentration is affected, or if anger is a prominent emotion. As a naturopath I will prescribe differently for each person, depending on what the best herbs for them are.

Another modality that is really useful in anxiety is homeopathy. Homeopathy can be really effective either alongside herbal medicines or on its own. Homeopathics are prescribed on an individual, depending on their symptoms. The type of anxiety is more important here, as the prescription will be different for anticipatory anxiety (worried about an event or public performance), restless anxiety, anxiety bought on by grief, feeling constantly ‘wired’, or specific phobias.

Nutrition also plays a really important role in mental health. Glucose spikes can have a big impact on mood causing both highs and lows, and a lack of nutrients can leave you craving the foods that you know you shouldn’t be eating. In terms of supplements, magnesium is calming to the nervous system and a great starting point for natural anxiety treatment. Choose a magnesium citrate or magnesium glycinate for the best effects.

The B group of vitamins can be helpful for a low mood or lack of energy, and are great to take in the morning if your energy is low. Ideally choose a high quality multi – B vitamin, but be sure you’re not talking other vitamins that also contain B vitamins, as it can be easy to overdose if you are getting them from more than one source.

Breathing exercises can be an amazing tool to bring your body from the ‘fight or flight’ mode back into ‘rest and digest’ mode. There are so many available but for best results, choose an exercise where the time taken to exhale is longer than the time to inhale as this is what makes the biggest difference. Sometimes breath holds can also be helpful, but you want one that feels comfortable and calming to you.

If you’re looking for individualised anxiety treatment, a naturopathic appointment can make sure you are getting the best products for your unique symptoms.

Kathryn Messenger

BHSc (Naturopathy)

kathryn@wholenaturopathy.com.au Suite 1 53/1880 Ferntree Gully Rd Mountain Gate Shopping Centre Ferntree Gully, Victoria

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

It’s June, the tax year is coming to an end, and once July starts it’s also the time to get those receipts and documents ready for your 2024 tax returns.

Speaking of documents and receipts, we just received news from the Australian Taxation Office (ATO) that it will be taking a close look at 3 common errors being made by taxpayers. These are:

• Incorrectly claiming work - related expenses

• Inflating claim for rental properties

• Failing to include all income when lodging

As the ATO Assistant Commissioner Rob Thomson said: “ These are the areas people are most likely to get wrong and while these mistakes are often genuine, sometimes they are deliberate. Take the time to get your return right.”

In 2023 the ATO had more than 8 million people claim a work-related deduction, and around half of those claimed a deduction related to working from home.

On June 1st, 2023 the ATO revised the fixed rate method of calculating work from home deductions. They increased the rate to 67 cents per hour, expanded the inclusions and adjusted the records a taxpayer has to keep.

This year the changes are in full swing. With that in mind it is best to keep comprehensive records to substantiate claims,just as you would for any deduction.

As a tax agent we strongly encourage our clients to keep and send us their records, logbooks and any documentation to substantiate their claim, especially for the 2024 FY. The ATO has identified a massive

78% adjustment rate in work claims for tax agent lodged returns! As a result, the ATO is getting stern for the 2024 tax year and has announced an audit crackdown on work related claims, surprise!.

It isn’t exactly a surprise as the ATO’s announcements stipulate that it will generally keep an eye on working from home deductions. These include:

1. Deductions for home running costs when you work from home.

There are 2 methods you can choose from for calculating work from home expenses. These are the Revised Fixed Rate Method or the Actual Cost method.

• Revised fixed rate method - This method allows you to use a fixed rate of 67 cents per hour for every hour you work from home in a financial year. This rate includes expenses such as mobile phone and internet costs, stationery and computer consumables, and electricity and gas for power, heating and cooling. To claim using this method, you are required to keep a log book of the number of hours you work each and every day for the financial year.

• Actual Cost Method - As the name of the method states, we use this to claim the actual cost of working from home expenses. This method is more involved and requires you to keep every receipt and invoice that you wish to claim as well as a logbook of the number of hours worked. Some of your expenses will also need to be apportioned for business vs personal use so it is generally a more complex method than the fixed rate method but usually has a higher value in deductibles.

In deciding the method you would like to use, there is one factor that they both need and that’s substantiation. We strongly recommend that each of our clients provide receipts, logbooks and any other documentation to

support their claims and to give grounds for why your expense is a tax deduction. Comprehensive recording. and documentation mean flexibility. We can calculate both methods and choose the best result for your return

2. Deductions for occupancy expenses related to a taxpayer’s home which are eligible to claim when your employer requires you to work from home and can’t provide you with a different place to work from, or you have an area in your home that you are only using for work purposes and is not capable of being used for any other purpose. For this deduction, we will often require a floor plan of your home to work out the floor area of where you work.

Occupancy expenses include:

-Mortgage Interest

-Rent

-Council and Water rates

-Land Taxes

-House Insurance premiums.

As an employee working from home, generally:

-You can’t claim occupancy expenses

-There are no CGT implications for your home

3. For depreciation claims related to office furniture and equipment, office furniture or equipment over $300 needs to be depreciated. If it's less than $300, you can just write off the cost as an expense.

As we identify the areas that the ATO will be targeting it's also good to know the Expenses that we cannot claim a deduction for related to working from home.

• You can’t claim other general household items like coffee, tea, milk or other beverages even if your employer may provide these at work.

• You can’t claim costs related to your children’s education, such as equipment you buy e.g. iPads, Desk and subscriptions for Online learning.

• Items your employer provides e.g. a laptop or mobile phone

• Expenses where your employer reimburses you for the cost.

Rental properties have remained in the sights of the ATO for a couple of

years now. The ATO have noted that 9 out of 19 rental property owners are getting their income tax return wrong. According to Mr Thomson: “‘We often see landlords making mistakes when it comes to repairs and maintenance deductions on rental properties, so we’re keeping a close eye on this.’

‘This year, we’re particularly focused on claims that may have been inflated to offset increases in rental income to get a greater tax benefit,’

The most common error in rental properties reporting is the capital works deduction.

The easiest explanation for this is when you have a damaged item in your property e.g. doors, windows, lights, carpets, that would be considered an immediate deduction for repairs and maintenance.

On the other hand, capital works deductions would be a property improvement during the time you hold the property. An example of this would be if you have an old bathroom and would like to take it out and put in a new one - this instance is considered a capital improvement rather than a repair for the property and is only deductible over time as a capital works deduction.

The easiest way to get the capital works deductions right would be to get a depreciation schedule for your property done by a Quantity Surveyor. Your tax agent would be able to recommend a Quantity Surveyor. We recommend this to our clients as this is the 2nd largest amount to claim for your rental property right next to interest. This can take a couple of months to get though so you will need to factor that in when your a looking to get your tax returns completed.

We can’t stress enough the importance of keeping comprehensive records and documents, and this is especially important when it comes to your investment property which can be quite complex.

We all want to get our tax returns sorted as early as possible to get it off our list of obligations and responsibilities for the year, especially if we think we’re getting a refund. However we recommend clients to hold off on lodging until their payment summaries are finalised. This can be early July, but is usually mid to late July.

We can manually fill these in using bank statements and a hard copy of your payment summary but this takes time which you will end up paying for. We want to get our clients tax returns as accurate as possible which is why we wait until payment summaries are completed and information from other sources such as banks and private health insurers flow through to the ATO. We are then able to cross check everything and compare the amounts to the documentations the client has provided.

Mr Thomson says: “We see lots of mistakes in July where people have forgotten to include interest from banks, dividend income,payments from other government agencies and private health insurers,’

Before finalising a client’s tax return, we prefer to wait for three things – the ATO Prefilling Report, the finalised payment summary, and the client’s comprehensive records. Doing so allows us to get their tax return as accurate as possible as one small error can cost a client great inconvenience by triggering an ATO amendment or an ATO initiated Audit.

There are different methods for claiming depreciation deductions for cars. However, if you deduct car expenses using the cents per kilometre basis, you can't also claim a deduction for the car under the simplified depreciation rules (as this method already allows for depreciation).

If you use the cents per kilometre method, you allocate the car to the small business pool with a business use percentage of 0%, resulting in a zero deduction for depreciation.

If you change from the cents per kilometre to the logbook method, you'll need to estimate a business use percentage. If the estimated business use is more than 10%, you must use the adjustment formula to adjust the opening pool balance.

If the car is owned or leased by a company or trust that qualifies for and has chosen to use the simplified deduction rules, its full cost will generally be depreciated under the simplified depreciation rules. In this case, any private use by you or other employees or associates will be subject to fringe benefits tax.

In the case the ATO has deemed your deductions incorrect, they would initiate an ATO amendment which in our experience can take quite a while to finish

The easiest way to avoid this is to delay completing your tax return until at least late July and providing your tax agent with comprehensive records.

At Find Accountant Pty Ltd we would like to give our clients a smooth and streamlined process and the best way to achieve that is through comprehensive record keeping. Our clients have the option of sending us their documents throughout the year or uploading them to their secure portal when they are ready to complete their tax return. By working together we hope to achieve the best result for our clients.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

This information is of a general nature only. It does not take into account your particular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies,graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations. Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document. This information contained does not constitute legal or tax advice.

Raoul begins business in September 2016 and chooses to use the simplified depreciation rules for the 2016–17 income year. In this first year, Raoul claims his car expenses on a cents per kilometre basis.

Given that he has chosen to use the simplified depreciation rules, the car is allocated to the small business pool with a business use percentage of 0% –so, he can't deduct depreciation for the car in that year.

In 2017–18, Raoul decides to claim his car expenses using the logbook method, which entitles him to claim depreciation for the car.

Raoul works out from his logbook that he uses the car 60% of the time for his business in 2017–18. The adjustable value of the car at the time he allocated it to the pool in 2016–17 was $22,000. Because there has been an increase of more than 10% in how much he uses his car in his business, Raoul must adjust the opening pool balance for 2017–18 using the adjustment formula.

Raoul increases the opening pool balance by:

0.85 × $22,000 × (60% − 0%) = $11,220.

By Liz Sanzaro

By Liz Sanzaro

What is the creature living in my ceiling cavity or wall cavity? With winter approaching the creatures we have not seen for a while, begin to look for shelter. First the noise maker needs proper identification, is it mice, rats, possums or protected native Antichinus?

Here are some pics to help

Mice will nest and breed quickly if not dealt with

will these get into your roof. They exit these garden nests at night to eat rose petals, fruit and new green shoots. They are picked off the powerlines by stealthy Owls. They use the high wires to stay off the ground where cats and dogs are. This is nature work, balancing species.

Rats, also will breed and will make a scampering sound that cats and some dogs will be alert to and will stare at the wall, where they can be heard.

Antichinus, with rounded ears and a very pointy snout, are Australian animals and are protected. Like all the others they will die if poisoned. This is actually illegal given their native status. Generally, they are garden dwellers and are unlikely to invade your house.

https://www.environment. sa.gov.au/goodliving/ posts/2020/07/native-antechinus

This is of a very common “football” of dry twigs and chewed off branches made by the Ringtailed Possum, rarely

Big Bushy tailed possums are generally the roof inhabitants due mainly to lack of nesting hollows in trees that have shed a branch previously and over time a hollow forms, inside the tree. Many people will have the tree removed as it might be perceived as dangerous just because a limb has dropped. This is not necessarily the case, and the possums are left homeless.

Loose roof tiles, crumbling pointing, pipes exiting the roof without small gauge wire under the vent cap, will all be possible points of entry. The best way to remove them is wait until it has landed on the roof and scampered off to forage, then carefully, in the dark get to the entry point and seal it up well enough that it cannot re- enter in the early hours of the next morning before sunrise.

This nest has also been discovered by bees, who have begun attaching wax curtains from the roof of the space. Bees often like enclosed spaces too and if they can invade your wall, they can do the same.

If you want to relocate a bushytailed possum, you need to provide a home in your own garden. If you try to trap one and relocate it, another will find the space and move in. You also run the risk of creating possum overload in a native reserve, which might kill trees through overgrazing, or there might be a fight to death between the resident and the new neighbour, either way it is a bad idea.

Here are some great ways to use old timber if you can get access to it, but the hole needs to be much larger for the bigger animal.

Whatever your inhabitant, be kind, do not hurt the animal, and understand that we have moved into their habitat really, and we need to co-exist.

Otherwise try an easy option of two hanging baskets. Called possumm drey, there are youtube videos to show how.

Depending on the size of your possum you can adapt the entry size.

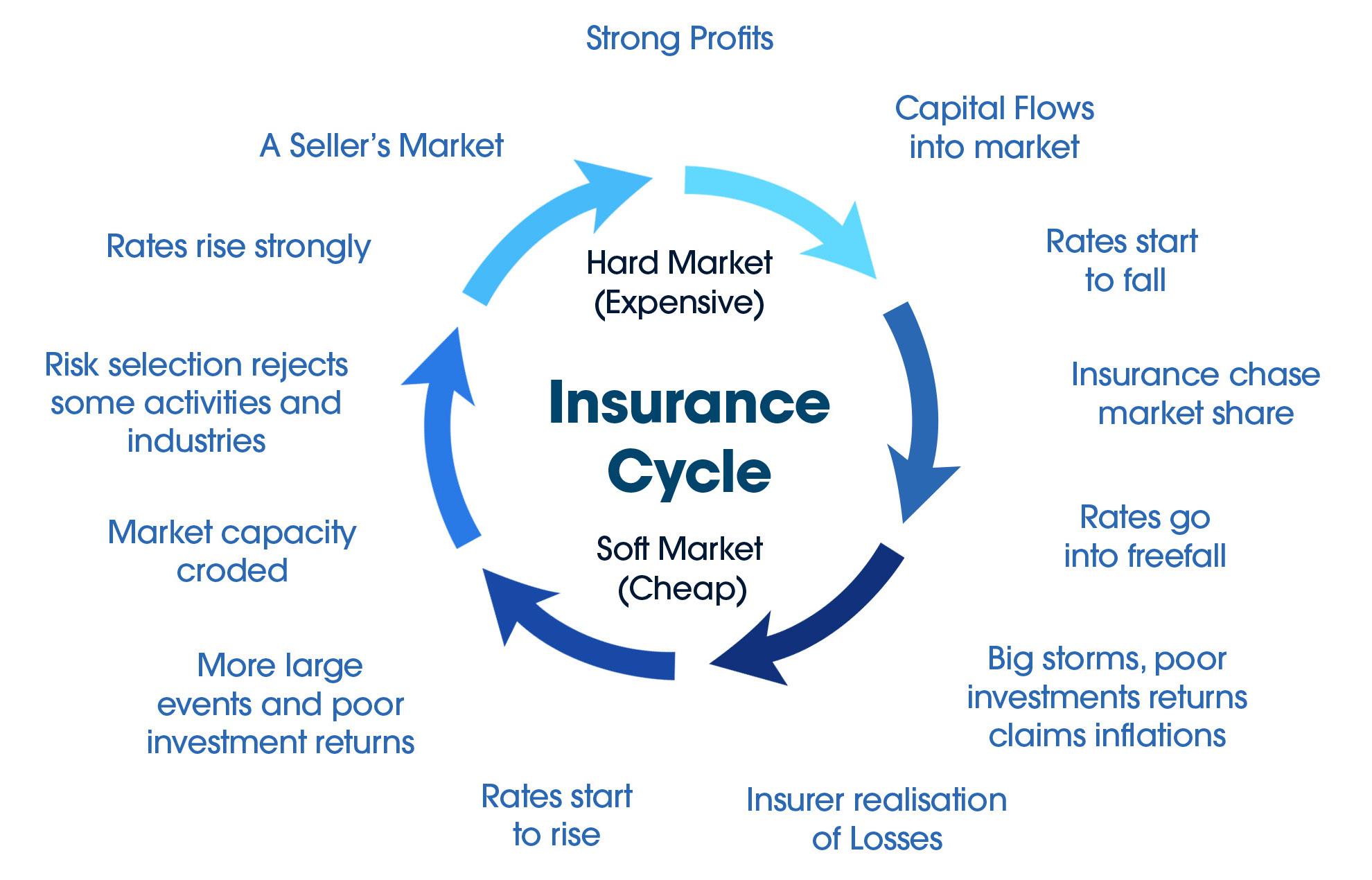

By Craig Anderson GENERAL INSURANCE

By Craig Anderson GENERAL INSURANCE

The insurance market is historically cyclical, moving through both hard and soft markets. A soft market is generally characterised by lower premiums, high limits and readily available cover. In a hard market, insurance premiums increase and insurer capacity will generally decrease. This can be caused by a number of factors:

• falling investment returns / low interest rates

• increases in frequency or severity of losses

• reduced capacity

• cost of reinsurance

• regulatory intervention

In recent years while interest rates were low, it meant that insurers could no longer rely on their investment returns to bolster unprofitable results. Insurers focussed on underwriting profitability, which meant raising premiums, tightening underwriting guidelines and being more selective about risk they were prepared to insure.

Rising interest returns for insurers and their investors, and falling loss frequency alone have not been enough to soften the market though as we have seen recently. The rapid inflationary pressure applied to claims costs has outstripped the savings created, and this has led to further increases. For example in regard to property damage losses, interest rates have now increased since 2020 by more than 3.5%, however the cost of materials like corrugated roof sheeting, plasterboard and plywood bracing have all increased in excess of 30% which is putting upward pressure on claims costs, and in turn insurance premiums.

Adding to this is the cost of the wellintentioned compliance regime implemented in the wake of the Wood Royal Commission. Insurers and Underwriting Agencies are spending more time, and more money on meeting recently imposer regulatory changes, and this has added to the staff costs which ultimately get passed on to the consumer.

A shortage of qualified applicants in the insurance industry has led to claims bottlenecks and this is adding costs due to the delays. In an effort to

shorten waiting times and to circumvent trade shortages there has been a shift towards cash settlements. Whereas the insurer may in the past have engaged the trades and supervised the works it's now harder to action, so the easier but more expensive option of cash settlements is taken. Big data has also had an impact Big data has also had an impact, as insurers can utilise more accurate flood mapping, and increase premium in a targeted way. This often means large jumps in specific areas, as opposed to a cost spreading approach. Reinsurance cost is now calculated using better long-term catastrophe models, so this additional future cost is factored in earlier. Rate adjustments are largely being driven by reinsurance markets, who are the insurers who provide the underlying capacity insurers need in order to provide their offerings to the public and businesses alike.

In relation to financial lines like Professional Indemnity, insurance claims are increasing because of social inflation, which is the societal trend towards increased litigation, broader contract terms, plaintiff-friendly legal decisions and larger jury awards (Insurance Journal, 4 December 2019). An example of this is the increased number of Securities Class Actions (think

Centro Group, Commonwealth Bank, Takata airbags) seen over recent years.

In fact in the 12 months to 31 March 2020 underwriting profitability decreased by almost 50% for most major classes of insurance, and that was before the impact of COVID-19 emerged over the following 12 months (KPMG General Insurance Insights, May 2020).

So where is the good news? The cycle always returns to a soft market eventually, and there is no reason to think that when inflation is under control, and financial conditions improve, that we will not see a return to the buyersmarket within the next few years.

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives,needs and financial situation).

Craig Anderson

Brokers www. heightsafetyinsurancebrokers.com.au 0418 300 096

For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives, needs and financial situation).

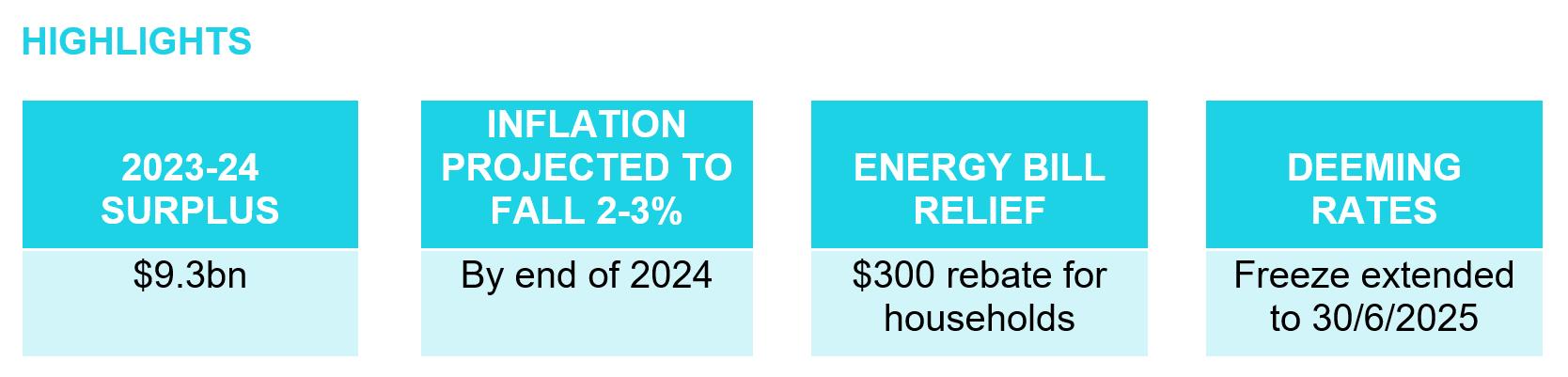

On the evening of 14 May 2024, the Government delivered what is possibly its last Budget in the current parliamentary term. The next election is expected to be held either late this year or early in 2025. Inflation, cost of living pressures, and housing all continue to dominate the fiscal landscape, impacting the lives of Australians.

The key challenges addressed in this year’s Budget include:

• Easing cost of living and inflationary pressures,

• Building more houses,

• Strengthening Medicare and the care economy.

Importantly, the measures announced in the Budget are not a fait accompli. They will be subject to the successful passage of relevant legislation.

The Treasurer announced a pleasing $9.3bn surplus for the 2023-24 financial year. This is the second consecutive surplus however deficits have been forecast for the next three financial years as the government embarks on what it describes as “unavoidable spending.”

Real GDP growth is expected to continue to improve from 1¾% in 2023-24 to 2¾% by 2027-28

The unemployment rate in recent years has placed Australia in an enviable

position. The current historically low unemployment rate is expected to increase marginally in 2024-25 to 4½%.

As announced previously, the Government predicts the inflation rate will continue to fall, returning to the Reserve Bank of Australia’s target range of 2 – 3% by the end of 2024.

Now for a more detailed look at some of the key announcements impacting you from a financial planning perspective.

The Budget was remarkably silent of superannuation changes with two exceptions:

From 1 July 2025, superannuation guarantee contributions of 12% will be paid on all Commonwealth funded paid parental leave payments.

The Government will provide additional funds from 1 July 2024 to strengthen the ATOs ability to detect, prevent and mitigate fraud against the tax and superannuation systems.

The Fair Entitlements Guarantee Recovery Program will be recalibrated to pursue unpaid superannuation entitlements owed by employers in liquidation or bankruptcy from 1 July 2024.

The previous government had proposed introducing an amnesty that would allow members of superannuation funds that were locked into old style legacy pension products to exit those products without incurring adverse tax or social security consequences. While we understand the current government is favourably disposed towards this, the Budget was silent on this initiative.

In addition to the amnesty for legacy pensions, simplification to the way selfmanaged super funds are managed when members moved overseas had previously been proposed. Sadly, this Budget has not advanced those proposals.

The Budget reconfirms that 13.6 million Australian taxpayers will receive tax cuts from 1 July 2024. These changes have previously been legislated in the form of the amended Stage 3 tax cuts.

Instant asset write off

Small businesses with an annual turnover of less than $10 million will have the current instant write-off of assets extended for another year to 30 June 2025. This will apply to assets costing less than $20,000 that are first used or installed ready for use by 30 June 2025. The asset threshold applies per asset so small businesses could instantly write off multiple assets.

The Government continues to focus on increased wages for aged care workers, funding to help improve the quality of care for both home care recipients and those in residential care facilities, and additional funding to implement recommendations identified in the Royal Commission into Aged Care.

On 3 April 2024, the Government announced that the commencement of a new Aged Care Act will be deferred. Originally the new Act was to commence on 1 July 2024. It will now commence from 1 July 2025.

This is in response to recommendations made in the Final Report of the Aged Care Task Force which was released in March 2024. This report proposed several key changes, including the:

• calculation of home care and residential care co-contributions

• phase out of lump sum accommodation payments, and

• reintroduction of a retention amount.

The Government will provide $2.2 billion over five years from 2023–24 to deliver key aged care reforms and to continue to implement recommendations from the Royal Commission into Aged Care Quality and Safety.

Most Australians want to be able to age in place and remain in their homes as long as they are able. To support older Australians, the Government is investing $531.4 million to release an additional 24,100 Home Care Packages in 2024–25 to reduce average wait times and to support people to age at home if that is their preference.

Supporting Australians with cost-of-living relief at the same time as implementing measures to place downward pressure on inflation was once again a key focus for the Government in relation to welfare announcements. Energy cost relief for all Australian households, further increases to Rent Assistance, significant spending on social housing and reducing the impact of indexation on student loans are a feature.

The Government will provide $3.5 billion over the next three years to extend and expand the Energy Bill Relief Fund to provide a $300 rebate to all Australian households and a $325 rebate to eligible small businesses on 2024–25 bills.

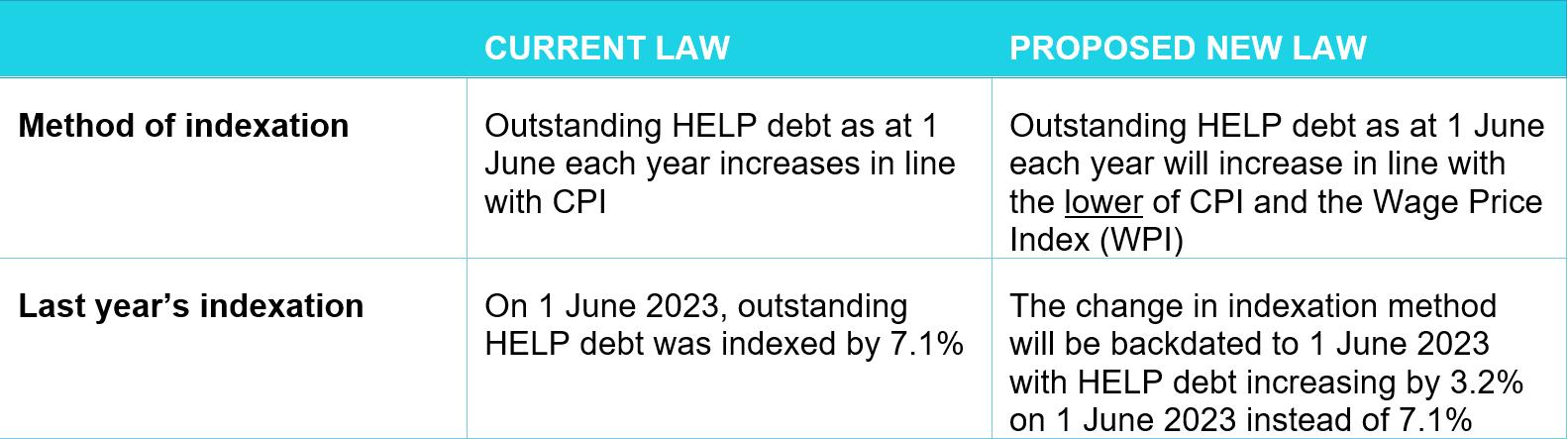

Tonight, the Government confirmed a previously announced measure to change the way Higher Education Loan Program (HELP) debt is indexed. As a result, $3 billion in student debt will be cut.

Two measures have been proposed as follows:

Students who had their loans indexed on 1 June 2023 and will be subject to indexation on 1 June 2024, will receive an indexation credit. The indexation credit can be estimated using the Government’s HELP Indexation Credit Estimator.

This year’s budget provides good news for pensioners concerned about predicted increases in the deeming rates, waiting times when corresponding with Centrelink staff as well as those needing additional support with rising rental prices.

The Government will freeze social security deeming rates at their current levels for a further 12 months until 30 June 2025, to

From 20 March 2025, Carer Payment recipients will have increased flexibility to undertake work, study, and volunteering activities whereby recipient’s participation limit will be amended to 100 hours over four weeks and will only apply to employment.

Additionally, if the participation limit is exceeded, payments will be suspended for up to six months, rather than being cancelled.

Support to help combat rental affordability

With rental prices in most Australian locations increasing rapidly over the past decade, rental affordability for many, including those on Government income support and family benefits, is a major concern.

After an increase in Rent Assistance in last year’s budget of 15%, the Government is providing a further $1.9 billion over five years to increase maximum rates of Rent Assistance by a further 10%.

Increase in JobSeeker rate for those with partial capacity to work

The higher rate of JobSeeker Payment, a boost of at least $54.90 per fortnight, will be extended to single recipients with a partial capacity to work of zero to 14 hours per week from 20 September 2024.

support Age Pensioners and other income support recipients who rely on income from deemed financial investments, as well as their pension payments, to manage cost of living pressures.

It was anticipated that the current low deeming rates of 0.25% and 2.25% would increase from 1 July 2024 after a twoyear freeze, impacting many pensioners. Fortunately, pensioners will now have comfort knowing that these low rates will be retained for at least another year.

Increased flexibility for those on Carer Payment

Currently, to be eligible for a Carer Payment, a carer has a participation limit of 25 hours per week which includes employment, study, volunteering activities and travel time to and from work.

to Centrelink resources

The Government will set aside $2.8 billion over the next five years in an attempt to improve the way Services Australia (Centrelink) delivers services to the Australian community.

The funding is earmarked to assist with:

• additional frontline staff to help with claims and services

• sustaining the myGov platform and ensuring continued development of its capability

• enhance safety and security at Services Australia centres including an increased security presence and enhancements to service centre design.

Superannuation can be used to start an account-based pension once a person retires (or meets another condition of release).

This allows income to be received as a series of regular payments (usually monthly, quarterly, half yearly, or yearly).

A minimum amount of income needs to be paid each year and additional lump sum withdrawals can generally be made at any time. The pension can also be stopped (fully commuted) and be rolled back to the accumulation phase of superannuation, or rolled over to start another income stream, or be taken as a lump sum. Restrictions apply to taking lump sum withdrawals where the pension is being paid under transition to retirement rules.

Account based pensions stop once the account balance is exhausted, the pension is commuted, or upon the death of the person unless there is an automatic continuation of the pension to a nominated reversionary beneficiary.

The maximum amount that may be used to commence a ‘retirement phase pensions’ is limited to an individual’s transfer balance cap. The general transfer balance cap is currently $1.9m however where a person commenced a retirement income stream prior to1 July 2023, their personal transfer balance cap may be less than $1.9m. Pensions paid under transition to retirement rules are not a retirement phase pension and are therefore not affected by the transfer balance cap.

The person can select how much income to receive each financial year. This allows flexibility to meet individual needs. The only rules for how much pension must be taken are:

• An income payment must be made at least once each financial year.

• A minimum level of income must be paid each year based on a percentage of the account balance at commencement of the account-based pension and again at the start of each financial year. If the income stream commences part-way through a financial year, or is commuted before the end of a financial year, the minimum payment is pro-rated for that year.

When a superannuation death benefit is paid as a death benefit income stream, how is the minimum pension calculation performed?

As we know, there are minimum pension standards that apply to retirement income streams such as account-based pensions. These minimum payments are based on the age of the client and the account balance at 1 July each year or at the commencement of the pension.

However, when a death benefit account-based pension commences, the minimum pension payments that must be received by the beneficiary (usually the surviving spouse) will depend on whether the account-based pension automatically reverted to the beneficiary or not.

The following table provides a comparison of the minimum payment requirements in the financial year the death benefit pension started based on whether the pension automatically reverted to the beneficiary or not.

Pensions being paid under transition to retirement rules are subject to a maximum income limit of 10% of the account balance.

Every withdrawal (income or lump sum or death benefit) from a pension is split into taxable and tax-free components in the same ratio that applied when the pension commenced. The tax on each component depends on the person’s age as shown in the table below:

Every withdrawal (income or lump sum or death benefit) from a pension is split into taxable and tax-free components in the same ratio that applied when the pension commenced. The tax on each component depends on the person’s age as shown in the table below:

Taxation of Lump Sums - Over age 60

If you are age 60 or over the tax on lump sum withdrawals is shown in the table below for the 2023-24 financial year.

* Plus,Medicare Levy

Taxation of Lump Sums - Preservation age but under age 60

If you have reached your preservation age but are under age 60, the tax on lump sum withdrawals is shown in the table below for the 2023-24 financial year.

Taxable (element taxed)

Taxation of Lump Sums - Under your preservation age If you are under your preservation age, the tax on lump sum withdrawals is shown in the table below for the 2023-24 financial year.

(element taxed)

(element taxed)

Earnings added to a retirement phase pension account (excluding transition to retirement pensions) are tax-free. No tax is payable within the superannuation fund, and this can help to boost the effective earnings rate. * Plus,Medicare Levy

If you withdraw a taxable component and tax is paid on this amount, it is added to your assessable income and may impact your entitlement to other tax offsets or benefits. This may mean you pay more tax than you expect on other income in that year.

AllianceWealthPtyLtdABN93161647007(AFSLNo.449221).PartoftheCentrepoint Alliance group https://www.centrepointalliance.com.au/

Erryn Langley is Authorised representative (No.1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

Over the last few years we have seen all of the major Banks remove themselves from lending to Self-Managed Super Funds. This was solely due to the limited recourse nature of this type of lending, meaning that if a SMSF was to default on their loan, the only recourse the Bank had to recoup the debt was through the asset purchased with the SMSF Loan. The Bank could not access any of the other assets in the SMSF to help repay the debt, which provided the SMSF members with additional protection of their other assets, but represented a greater risk to the lender which they offset by charging higher rates.

At present most SMSF loans with these Banks are being charged around 10%, and they are not prepared to review these rates at all. The Banks would seemingly prefer that these loans are refinanced and off their books, so they

are not offering any discounts on these products to retain this business. If your SMSF has a loan with a lender who has exited this market, now is the perfect time to review your loan and obtain a much better outcome for your SMSF.

There are a number of Lenders who still offer property loans to a SMSF. The rates on offer to refinance could be over 3% better than your current lender is charging, which would represent a significant improvement in the cashflow for the SMSF, allowing you to invest in other areas or pay off the property loan quicker. Some lenders will also offer to reduce establishment fees for loans that are refinanced.

It is important to note that while refinancing an SMSF loan is allowed, according to the Superannuation Industry (Supervision) Act 1993 (SIS Act), you are restricted from releasing equity in the property to complete any renovations to the investment property unless those funds are necessary for upkeep to

maintain the property at the market rent standard. You also cannot access equity to buy another property with the SMSF, or use the funds to invest in other markets such as shares or manage funds.

At SHL Finance, we are experts in SMSF lending and have helped many clients, with SMSF loans at very high rates, refinance into a much better financial position and making the process as painless as possible. Please call Reece Droscher on 0478 021 757 to find out more about improving your SMSF financial position can lead to a better outcome at retirement.

Please call Reece Droscher on 0478 021 757 to book in a review and discuss your options. reece@shlfinance.com.au www.shlfinance.com.au

By Liz Sanzaro

By Liz Sanzaro

What is the creature living in my ceiling cavity or wall cavity? With winter approaching the creatures we have not seen for a while, begin to look for shelter. First the noise maker needs proper identification, is it mice, rats, possums or protected native Antichinus?

Here are some pics to help

Mice will nest and breed quickly if not dealt with

will these get into your roof. They exit these garden nests at night to eat rose petals, fruit and new green shoots. They are picked off the powerlines by stealthy Owls. They use the high wires to stay off the ground where cats and dogs are. This is nature work, balancing species.

Rats, also will breed and will make a scampering sound that cats and some dogs will be alert to and will stare at the wall, where they can be heard.

Antichinus, with rounded ears and a very pointy snout, are Australian animals and are protected. Like all the others they will die if poisoned. This is actually illegal given their native status. Generally, they are garden dwellers and are unlikely to invade your house.

https://www.environment. sa.gov.au/goodliving/ posts/2020/07/native-antechinus

This is of a very common “football” of dry twigs and chewed off branches made by the Ringtailed Possum, rarely

Bushy tailed possums are generally the roof inhabitants due mainly to lack of nesting hollows in trees that have shed a branch previously and over time a hollow forms, inside the tree. Many people will have the tree removed as it might be perceived as dangerous just because a limb has dropped. This is not necessarily the case, and the possums are left homeless.

Loose roof tiles, crumbling pointing, pipes exiting the roof without small gauge wire under the vent cap, will all be possible points of entry. The best way to remove them is wait until it has landed on the roof and scampered off to forage, then carefully, in the dark get to the entry point and seal it up well enough that it cannot re- enter in the early hours of the next morning before sunrise.

This nest has also been discovered by bees, who have begun attaching wax curtains from the roof of the space. Bees often like enclosed spaces too and if they can invade your wall, they can do the same.

If you want to relocate a bushytailed possum, you need to provide a home in your own garden. If you try to trap one and relocate it, another will find the space and move in. You also run the risk of creating possum overload in a native reserve, which might kill trees through overgrazing, or there might be a fight to death between the resident and the new neighbour, either way it is a bad idea.

Here are some great ways to use old timber if you can get access to it, but the hole needs to be much larger for the bigger animal.

Whatever your inhabitant, be kind, do not hurt the animal, and understand that we have moved into their habitat really, and we need to co-exist.

Otherwise try an easy option of two hanging baskets. Called possum drey, there are youtube videos to show how.

Depending on the size of your possum you can adapt the entry size.

For most people when they retire, they will have only one form of income to help cover their future lifestyle expenses. This income is usually in the form of an account-based pension. They will likely have enough assets that restrict them from obtaining the age pension.

An account-based pension is created from superannuation monies. The money is then invested in assets; be it defensive assets like cash and fixed interest, and growth assets like property, Australian equites, and international equities.

For these clients, it is important to consider placing some money in growth assets so as to avoid the effects of inflation risk, but this comes at a cost of volatility risk which may lead to short-term capital losses.

At the same time, they will require a steady income and will be required to withdraw regular income from their pension accounts. Ideally, trying to avoid drawing down capital when the market has fallen as this will force the sell down investments, including growth assets, at a time when those investments might not be lower than one would otherwise hope.

Managing the competing requirement to draw down income but not reduce the capital balance of the assets supporting the pension is a challenge for retirees, especially when facing a bear market. One solution is a bucket strategy.

Not all financial planners use a bucket strategy for their clients, but it has some merit especially when the advisor is not actively managing the underlying assets of the clients portfolio but wants to reduce some of the risk associated with a falling market.

A bucket strategy is so called because it establishes the use of different pools of savings or ‘buckets’ to address various needs with the aim that there will be enough the buckets to provide for future pension drawdowns.

What is a bucket strategy?

A bucket strategy aims to help balance the need for ongoing income and capital growth throughout retirement by establishing and maintaining different pools of savings, each with their own purpose. The aim is to generate good capital growth while reducing the risk of having to sell investments when the market is down. There are many variations, but a typical option is to create three buckets.

How does the strategy work?

The bucket approach splits your retirement into phases, and appropriate investments must be selected to finance each phase. These varying investments are all held within a single account-based pension.

In our three-bucket example, your retirement savings would be divided into:

1. The short-term bucket

This is the liquid component of your retirement savings, from which all pension payments are drawn. It is invested in stable assets such as cash that can be accessed immediately or at short notice. This portion is not designed to grow, but rather to give you peace of mind that the next few years’ income is available and not subject to market fluctuations.

2. The medium-term bucket

The second bucket is intended to balance the need for stability with the potential for some capital growth in the medium term. Positive investment returns from this bucket are used to top up the short-term bucket. Typically 30–50% of this bucket would be invested in growth assets such as shares and property, with the remainder in more stable income-producing assets such as bonds and cash. The appropriate allocation depends on your attitude to investment risk and your goals and may fall outside the usual range.

3. The long-term bucket

The third bucket is for long-term capital growth, reducing the risk your retirement savings will run out. It is invested mainly in growth assets and will fluctuate more in the short term but should generate higher returns than the other buckets in the long run.

Positive returns from this bucket can be used to top up the short-term bucket. If the market declines, assets from this bucket are ideally not sold, but are held for the longer-term to ride out market volatility.

Bucket maintenance and repair

Once the strategy has been established, it must be maintained. Some super funds offer a bucket strategy investment option that will do this maintenance for you based on preestablished rules.

Maintenance involves adjusting the buckets periodically, usually annually or every six months, with the cash bucket being topped up from returns generated in the other buckets. This is sometimes called ‘rebalancing’.

When market declines cause a fall in value in one or both growth buckets, the rebalancing process may be postponed

entirely or restricted to moving assets only from a bucket that has experienced growth into the short-term bucket, leaving any assets that have declined in value untouched. Income can continue to be withdrawn from the remaining cash, with complete rebalancing postponed until the value of the other buckets recovers from the market decline.

Keep in mind that in the case of a serious downturn there may not be time for the medium- and long-term buckets to fully recover before the balance of the short-term bucket runs out. The bucket strategy reduces the chance you will need to sell assets that have declined in value but cannot eliminate it completely.

Sita retired at 65 and started an accountbased pension on 1 July 2018 with a balance of $620,000. She decided to withdraw income of $37,000 per year to combine with her husband’s retirement income.

Sita invested her account balance as follows:

After one year, Sita checked the balance in her investment options and rebalanced her buckets. Her target was to top up her shortterm bucket for three years’ income and to split the remaining balance equally across her other two buckets as shown below:

Note: Actual returns from AustralianSuper’s pension product have been used to provide a real-life example. For the shortterm bucket we used the cash option, the medium-term bucket reflects the stable option, and for the long-term bucket we chose high growth. Past returns are no guarantee of future returns.

Note that Sita’s total balance after one year is higher than her starting balance, despite her $37,000 of income withdrawals. In this example, Sita experienced strong investment returns during 2019.

After rebalancing she has moved some earnings from both her medium-term and long-term buckets into her short-term bucket.

The table below shows Sita’s situation after the second year. The balances of her mediumterm and long-term buckets have not grown very much because of the market crash that occurred during the COVID pandemic. Sita decides not to do any rebalancing this year because she feels secure in having at least another two years of income ready in her short-term bucket and hopes her other buckets will perform better next year.

After a further year, returns have recovered strongly, and Sita decides to rebalance her account using the same rules as year one – returning her short-term bucket to three years of income and splitting her remaining balance evenly in the other buckets.

After

In the fourth year, returns in the mediumand long-term buckets have been negative. Sita again decides to hold off rebalancing her buckets to avoid selling assets after a loss. Her situation is shown below.

In the fifth year, Sita’s returns in the medium and long-term buckets have been good and the balance in both is higher than in June 2021 when she last rebalanced. She decides to again place three years of income in the short-term bucket.

held. The knowledge that you have a cash reserve and a strategy to cope with market fluctuations will give you increased confidence and help you avoid the trap of locking in your losses.

It will also benefit those retirees who simply do not want to have all their money placed into only one model portfolio (sometimes called a pre-mixed model portfolio e.g., stable option) or managed investment scheme (MIS) where the rule of the MIS is to sell down across all investments when providing for an income stream. Ideally, retirees should not have their funds placed in just one type of ‘option’ otherwise they may experience a greater loss in the asset base supporting their pension payments when the markets fall. Unfortunately, there are many retirees taking this approach and even some financial planners recommend this strategy because it is the easier approach when setting up a pension.

Despite its attractions, a bucket strategy may not suit everyone. Some issues to keep in mind are:

1. Complexity – Setting up and maintaining the strategy can be difficult. Decisions must be made about how many buckets to maintain, how much to invest in each, and the asset allocation (investment choice) that should apply to each bucket. Rules for maintenance need to be chosen and followed regularly. Personalised financial advice could help.

2. Potentially unsuitable for conservative investors – Returns from the short-term (cash) bucket will be low. For the strategy to be effective, the longer-term buckets must contain significant exposure to riskier growth assets. For conservative investors, this may be uncomfortable. More financial education or advice from a trusted professional could help overcome this, as the cash reserve in the short-term bucket does provide a buffer from negative returns.

If you’re unsure whether a bucket strategy is for you, there are alternatives to managing the risk in your retirement portfolio. You might consider a lifetime pension or annuity for part of your savings – we call this layering of income.

It is important for retirees to consider the underlying investments when setting up their retirement income streams. We do not encourage the transfer of monies from super to pension and simply placing all those funds into one investment ‘option’.

We strongly recommend you seek financial planning advice before you retire so that you can explore if layering of income is right for you and to discuss how the financial planner will invest your money.

At Find Retirement, whilst we don’t take a bucket strategy approach, we actively manage our clients’ investments and review them regularly. For instance, when Australian shares have jumped up significantly in price, we will consider selling the shares to realise the gain and with the proceeds either purchase lower value shares or place the funds into the cash account. With each decision we make the client receives our recommendations prior to implementation so that they are kept well informed of our investment decisions.

Combine our active management with that of low fees we believe our retirement offering is something all pre-retirees and retirees should consider. Feel free to give us a call to discuss your retirement needs.

Who could benefit from a bucket strategy?

The bucket strategy is most suitable for people who fear a downturn in the market and want to take a more conservative approach to managing their investments. It enables a certain level of cash to be

3. It allows for complacency to set in – Once you have set up the strategy you might feel as though the underlying investments within each bucket do not need to be reviewed or monitored frequently. This can be a trap especially for those assets sitting in the non-cash buckets. To truly benefit from this strategy, one needs to actively manage the investments otherwise when the market has fallen and is low for an extended period, there may not be the opportunity to top up the cash bucket from the other buckets due to falling prices. Seeking a financial advisor that actively managers your investments is ideal even if you do not wish to implement a bucket strategy.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-todate information.No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities,employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information. Financial Planning, SMSF, Super, Insurance, PreRetirement & Retirement Planning (Financial Planning) are offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth, Find Insurance and Find Retirement. Find Wealth Pty Ltd is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221).Part of the Centrepoint Alliance group(www.centrepointalliance.com.au/fsg/aw)

Warren Strybosch is Authorised representative (No. 468091) of Alliance Wealth Pty Ltd.

Credit to: Councillor Carli Lange

We are looking forward to consulting our community following Friday’s announcement by Victorian Minister for Environment, Steve Dimopoulos, that we will receive grants to upgrade two dog off-lead areas locally.

The grants, totalling $700,000, will see amenities for dog owners improved at Warrandyte Reserve (northern oval) and Burgundy Reserve, Doncaster.

Dog parks are an important feature in Manningham’s Public Open Space. Council will consider further upgrades

of other facilities when funding becomes available in the second round of the State Government’s New and Upgraded Dog Parks Program.

We will consult the community prior to delivering final designs for Warrandyte Reserve and Burgundy Reserve early in 2025.

We expect the projects to be delivered in mid-2026 and thank the State Government for their contribution to improvements for our community.

Are you covered for emergencies at home?

We are holding a home insurance workshop with Eastern Community Legal Centre (ECLC), a multidisciplinary legal service that works to prevent problems and support community resilience.

The session will cover important topics including:

• having an up-to-date insurance policy

• the right insurance amount for your home and contents

• what to look out for in your existing insurance policy.

Participants are encouraged to bring insurance policy documents for personal reference during the session.

It’s free to register but bookings are essential.

Understanding the lived experiences of local residents will be a crucial step to improving road safety in Manningham. Manningham Council is seeking community input on road safety issues to inform the development of its new 10-year Road Safety Strategy.

Council will use this feedback, along with the latest crash and incident data, and feedback from Victoria Police and other road safety partners to develop the strategy.

Since implementing the previous Road Safety Strategy in 2010, Manningham has seen a downward trend in crash incidents. However, between 2017 and 2023, there were still 409 serious injuries and 11 fatalities on Manningham roads. “We’re striving for vision zero in Manningham, which means nobody is seriously injured or killed

on our roads. Because one is one too many,” said Manningham Mayor, Councillor Carli Lange.

“We’re taking a data-driven approach to road safety. Hearing from our community about their lived experiences is critical to ensure we can draw a bigger picture and help people feel safe on our roads.”

Manningham’s previous Road Safety Strategy delivered improvements to infrastructure through the Manningham Bicycle Strategy and roads program.It also supported the ongoing implementation of awareness and behavioural programs such as the Manningham-Whitehorse L2P program and Wise Driver program.

The new strategy will provide a framework and action plan that aligns with the Victorian and National Road Safety Strategies 2021-2030 and adopt

Safe System principles to reduce crashes, particularly those involving pedestrians and cyclists. It will consider infrastructure maintenance and improvements, advocacy to state and federal governments, and road safety education and outreach programs.

The Transport Accident Commission is funding the strategy renewal under its Local Government Grant Program.

The community survey will be open until 5.00pm on Monday 17 June.

Council will present the draft strategy for consultation via public exhibition later this year.

For further information, go to yoursay. manningham.vic.gov.au/manninghamroad-safety-strategy-2025-2034.

It’s not too late to join the 730 people who shared their feedback and contributed to Manningham Council’s proposed 2024/25 Budget and proposed 10 Year Financial Plan.

The draft documents were endorsed by Councillors at their meeting on Tuesday night (28 May 2024).

Now, community members can have a sneak peek and tell Council what they think before the Draft Budget and 10 Year Financial Plan are finalised in late June.

Manningham Mayor, Councillor Carli Lange said, “For this year’s engagement on the Budget and 10 Year Financial Plan, we did things a little differently! “After hearing from community members about their priorities for Council spending, we invited them along to pitch their ideas for inclusion in the proposed 2024/25 Budget and 10 Year Financial Plan.

“As a result, the draft documents align with our community’s priorities and will see us deliver an operating budget of $155 million to deliver more than 100 valuable services for our residents, businesses and visitors.”

This includes a $54 million capital works program to maintain and enhance community assets, like:

• $12 million for roads and bridges

• $6 million for footpaths and cycleways

• $4 million for drainage

• $3.1 million for the Schramm’s Cottage Museum Complex Visitor Centre

• $1.6 million for playspace renewals

• $1.2 million for Ruffey Lake Park Masterplan implementation

• $1.1 million for Rieschiecks Reserve Management Plan

• $1.0 million to commence works on a co-working hub

• $1.0 million for a battery for Mullum Mullum stadium

• $0.3 million for a youth hub

“We will also continue to deliver on our Climate Emergency Action Plan to reduce the impacts of climate change. We have allocated $11 million in our capital works program over the next ten years for Circular Economy, sustainability initiatives,” Cr Lange said.

The Mayor added, “With inflation continuing to be higher than average, we are conscious of costof-living pressures in our community.”

Council will continue to support rate payers through:

• Financial hardship provisions including rates rebates for Low Income (LI) Health Care Card holders.

• $2.25 million for community grants and contributions programs.

• Continued financial support to agencies that provide emergency relief to those in need in the community.

• Funding for the provision of food relief for those in need in the community.

• Subsidies for school holiday programs.

• An average general rate increase in line with the State Government’s rate cap of 2.75 per cent.

“Conscious of cost of living pressures we have also proposed to freeze the waste service charge well below the 4.80 per cent increase in the cost of waste services to Council.”

Cr Lange said increasing prices for delivering Council services, particularly around materials, labour and State Government cost shifting had created a challenging economic environment.

“Despite this, we have continued to focus on ongoing financial sustainability

through innovation, efficiencies and responsible spending. We are also seeking alternative sources of income to reduce the dependence on rate income.”

We’re delivering on our Council Plan, including:

• $21 million for a healthy community

• $40 million for liveable places and spaces

• $19 million for a resilient environment

• $6 million for a vibrant prosperous economy

• $33 million for a well governed Council

Visit Your Say Manningham to view the proposed 2024/25 Budget and proposed 10 Year Financial Plan and complete a short survey to provide your feedback.

The survey closes at 5pm Monday 10 June 2024.

Hard copies of the proposed documents and survey are available at the Manningham Civic Centre customer service desk and Manningham libraries. The final 2024/25 Budget and 10 Year Financial Plan will be considered for endorsement by Council at its meeting on 25 June 2024.

A café work experience program for local people with disabilities has delivered so much more than great coffees.

Since December, Manningham Council Depot staff have been treated to warm drinks lovingly prepared by Onemda’s Embrace Café.

On Wednesday (29 May), the Embrace Café crew poured their last coffee for Manningham Mayor, Councillor Carli Lange before wrapping up for winter.

“We’re grateful for not just for the coffees and treats but also for the welcoming smiles and how lovely and kind you have been to everyone. Our staff have really enjoyed getting to know you since December,” Cr Lange said.

“I’m sure you’ve all learned some very important skills over the last six months and I can’t wait to hear how they help you thrive in the future.”

Cr Lange joined Onemda CEO, Simon Lewis, to present certificates of appreciation to each participant and thanked them for their hard work and fantastic customer service.

Cr Lange said Council was proud to support the Pathway to Employment program and see it growing into a strong, sustainable initiative which made a difference to everyone involved.

“Firstly, through our Community Partnership Grant, which provides funding to support the in-house training component at Onemda, and secondly, through the wonderful café, here at the Depot.

“This has been a meaningful opportunity to gain valuable employment experience and skills in customer service, food preparation, money handling and running a business.

“We look forward to deepening our links with Onemda so that participants can keep putting their great skills to work!”

At the event, Councillors joined Council

and Onemda staff to celebrate the 16 participants, their families and carers. The crowd heard from Patrick, who spent Mondays serving coffee and Wednesdays baking delicious, salted caramel cookies, chocolate fudge slices and banana bread for the café.

Patrick said he had learned to greet customers in a polite, happy way.

“It is very important because people don’t want to buy coffee from grumpy people!

“I like work; it makes me happy because I like helping people. My experience at the café was really good because it is helping me to get a job.”