•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

The Find Manningham is a community paper that aims to support all things Manningham. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Manningham for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

EDITORIAL ENQUIRES:

Warren Strybosch | 1300 88 38 30 warren@findnetwork.com.au

PUBLISHER: Issuu Pty Ltd

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmanningham) so you keep up to date with what we are doing.

We value your support,

The Find Manningham Team.

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmanningham.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: sport@manningham.com.au

WEBSITE: www.findmanningham.com.au

The Find Manningham was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-ForProfits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Manningham has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Manningham is a local government area in Victoria, Australia in the north-eastern suburbs of Melbourne. Manningham had a population of approximately 125,508 as at the 2018 Report which includes 27,500 business and close to 45,355 households. The Doncaster and Templestowe Council administered the area until December 15, 1994.

The Find Manningham acknowledge the Traditional Owners of the lands where Manningham now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Manningham accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

Australian Rules Football (AFL), usually referred to as either Aussie Rules or simply "Footy", stands as a cornerstone of Australian sporting culture. Since its inception in the late 19th century, the AFL has evolved into a dynamic and highly competitive league, captivating the hearts of millions across the continent. This article delves into the rich history, unique aspects, and the current landscape of the AFL, providing a comprehensive overview of the sport that has become a national obsession.

The roots of Australian Rules Football can be traced back to the mid-1800s, with various forms of football gaining popularity in different parts of the country. However, it was in Melbourne in 1858 that the first set of rules resembling modern-day AFL was established, laying the foundation for the sport we know today. Over the decades, the game has undergone significant changes, adapting to the demands of players, fans, and the ever-shifting sporting landscape.

One of the distinctive features of Australian Rules Football is its combination of elements from various sports. The game incorporates aspects of soccer, rugby, and Gaelic football, creating a fastpaced and physically demanding spectacle. Played on a circular field with an oval-shaped ball, the AFL boasts a unique set of rules that sets it apart from other football codes globally.

The AFL consists of 18 teams, each vying for the ultimate prize—the Premiership Cup. From the perennial powerhouses like the Essendon Bombers and Collingwood Magpies to the newer entries like the Gold Coast Suns and Greater Western

Sydney Giants, the league showcases a diverse array of teams representing different cities and regions. The competition is fierce, with clubs battling it out over a grueling 23-round regular season to secure a coveted spot in the finals series.

The AFL Finals Series is the culmination of the season, where the top eight teams compete in a knockout format to determine the champion. The atmosphere during these games is electric, as fans pack into stadiums across the country to witness the drama unfold. From nail-biting finishes to memorable upsets, the finals series is a testament to the unpredictable nature of the sport.

The AFL boasts a roster of exceptional athletes who showcase skill, agility, and

endurance. From legendary figures like Gary Ablett Sr. and Leigh Matthews to contemporary stars such as Patrick Dangerfield and Dustin Martin, these players contribute to the league's rich tapestry, leaving an indelible mark on the history of Australian football.

Australian Rules Football transcends the boundaries of sport, uniting communities and fostering a sense of identity across the nation.

As the AFL continues to evolve, embracing new challenges and opportunities, its place in the Australian cultural landscape remains firmly entrenched. This article serves as a glimpse into the heart and soul of the AFL, celebrating its past, present, and undoubtedly, its future.

In 2023, the cashback craze was on steroids. Lenders vying for refinancing business were offering sweeteners of $5,000 or more to borrowers who switched over their home loans.

In 2024 the landscape is vastly different. Fewer and fewer lenders are offering cashbacks, and those who have reduced the amount they’re willing to hand over. The average cashback is now around $2,000.

So, has the refinance boom finished? Let’s take a look.

What happened in 2023?

Last year, we saw homeowners refinancing their home loans in record numbers. As interest rates soared, more and more borrowers decided to shop around in order to find a more competitive home loan.

The surge in refinances was no doubt driven by the amount of borrowers rolling off low fixed rate mortgages on to higher variable interest rates. Reserve Bank of Australia (RBA) data shows 880,000 borrowers came off fixed rates in 2023. Their repayments jumped significantly when this happened.

According to Australian Bureau of Statistics figures, monthly mortgage refinances peaked at $21.5 billion in July

2023. That was 21.8% higher compared to the year prior. However, as the year progressed, refinancing started to slow down. By December 2023, the value of refinances had dropped to $17.1 billion.

What’s the outlook in 2024?

The number of fixed rate mortgages expiring is lower in 2024 compared to last year, which means the number of people refinancing may also slow down. Having said that, there are still 450,000 fixed rate home loans set to expire in 2024, according to the RBA. If you fall into this category, it’s important to review your home loan early and ensure it still meets your needs

What happens if your fixed rate expires?

Usually, your home loan will revert to your bank’s standard variable rate once your fixed term is up. If that rate is higher than your fixed term rate, you may see your repayments jump significantly.

Why it pays to consider refinancing

Refinancing can help you achieve all sorts of goals, including:

• Finding a more competitive home loan

• Accessing interest-saving features like offset accounts and redraw facilities

• Using your equity to buy another property, renovate, or make another big-ticket purchase

• Consolidating your debt so that

you can budget and manage your repayments more effectively.

Like to explore your options?

If you’re approaching the fixed-rate cliff, get in touch sooner rather than later to explore your options.

As your mortgage and finance broker, we can help you work out what your repayments would look like when you roll off your fixed rate on to a variable rate. We may be able to suggest other ways to prepare, like making extra repayments now as a buffer for when your fixed term ends.

In some instances, we may be able to negotiate a better rate with your current lender or suggest another bank with a more competitive home loan that better suits your needs.

We’re here to help, so get in touch. Call me on 0478021757 to discuss your options.

Please call

Reece Droscher on 0478 021 757 to book in a review and discuss your options. reece@shlfinance.com.au www.shlfinance.com.au

Financial Reports

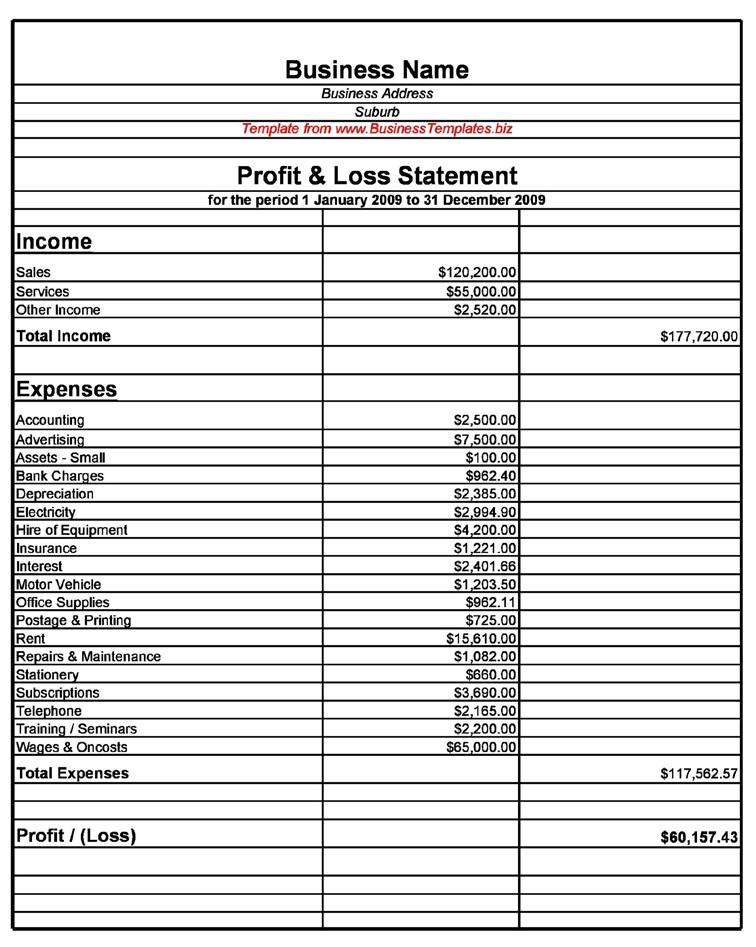

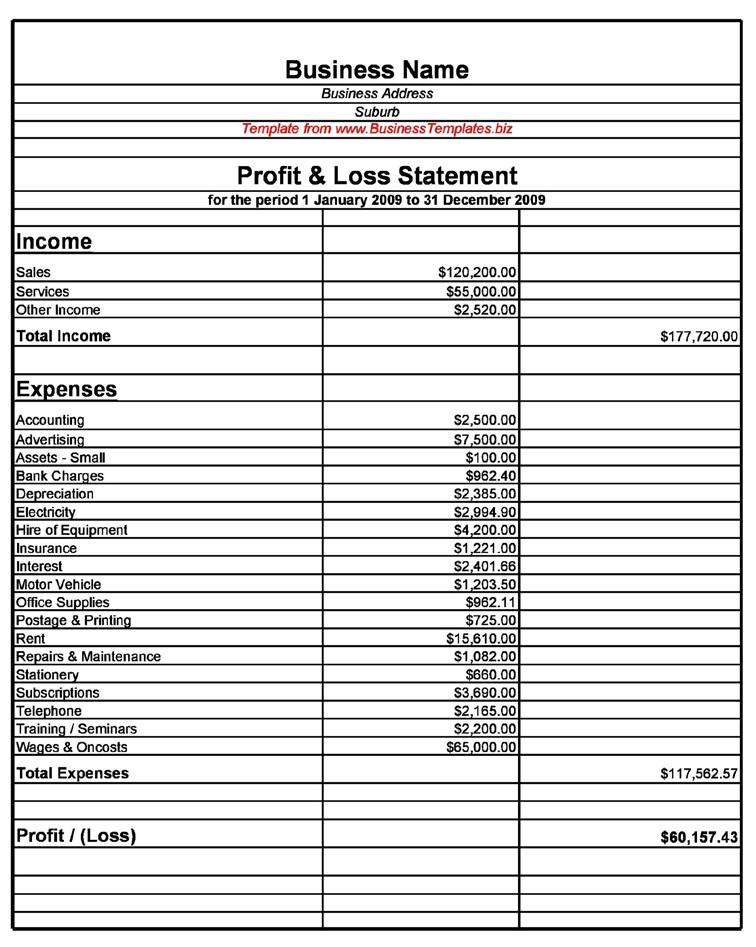

There are many reports that are useful in running your business. They can be used at tax time to complete your tax return, to keep track of how well your business is doing, and to apply for a loan, to name just a few uses. Your financial report can also be used by different people such as Creditors, the ATO, your accountant, investors, and management. It is important that the reports are accurate and there are several guidelines that must be followed when producing them so that they can be easily read by any of the users.

Over the past few editions, we have been working through the bookkeeping process from creating your Chart of Accounts to recording your transactions to now, creating your financial statements.

Trial Balance

A Trial Balance is produced to check that all your ledger accounts balance. It lists the total balances of every general ledger account at a specific point in time. The accounts are listed down the left of the report and the amounts are in two columns on the right. The Debit Accounts (Assets and Expenses) have their totals in the left column, and the Credit Accounts (Liabilities, Revenue, Equity) are on the right. Both columns are then added up, and if your books are all balanced you will find both columns equal each other. Please note however, just because your columns balance, doesn’t mean your trial balance is accurate so it is important to double check your work. A trial balance is used to create the next two reports, so it is important to take your time on this to get it right.

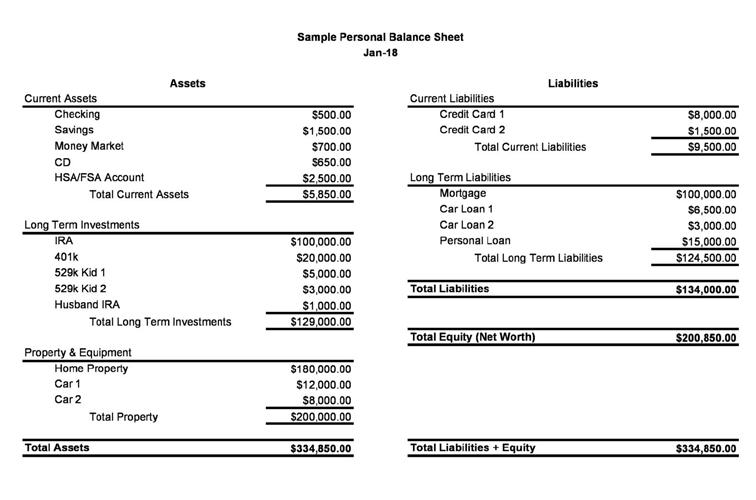

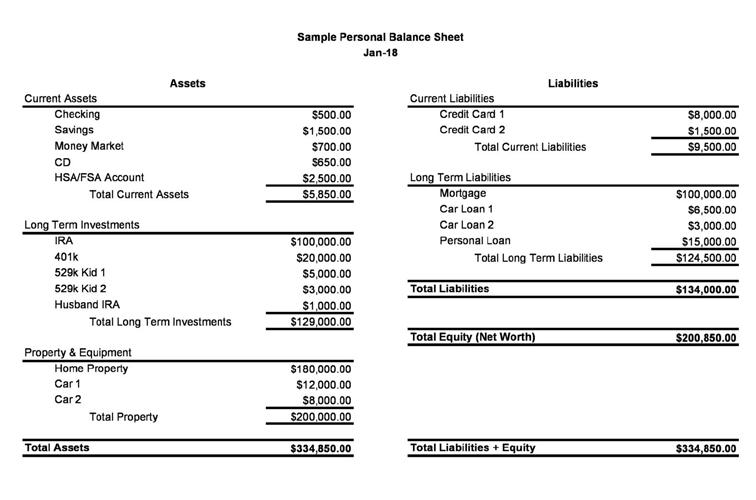

Where the Trial Balance includes Asset accounts, Expense accounts, Liability accounts, Revenue accounts and Owners Equity accounts, the Profit and Loss Statement shows the Revenue and Expense accounts, and the Balance Sheet shows the Assets, Liabilities and Owners Equity Accounts.

Profit and Loss Statement

Also known as an Income Statement, the Profit and Loss Statement shows whether your business is making a profit over a certain period. Usually this will be over the last 12 months but could be over a week, month or even years. Once you list out your revenue earned over that period and your expenses over the same period, the difference will tell you if you have made a profit of loss for that period. This profit or loss amount is then transferred to the Balance Sheet under the Owners Equity category.

From the Trial Balance we now transfer the Assets, Liabilities and Owners Equity (including the Profit or Loss that you determined in the P&L Statement) to the Balance Sheet. The Balance Sheet shows you how your business is doing when it comes to your company’s overall wellbeing. If your liabilities are greater than your assets for example, then you aren’t going to have anything in your owners equity which is a huge problem when it comes to the survival of your business.

These three reports really do give you the best idea of how well your business is doing. The Trial Balance allows you to check that the general ledger accounts balance, the profit and loss statement whether you are gaining profit or losing money, and the balance sheet can give an idea on the longevity of your business.

There is one more report that can be helpful in understanding your business, the Cash Flow Statement. I’ll cover this next month.

By Liz Sanzaro

By Liz Sanzaro

When plastic sandals were rubbing blisters on feet, children of the 1960's will remember taking these shoes off to get relief only to find that the Asphalt footpath was scorching upwards of 70 degrees celsius, hot enough to cook an egg.

Now that climate change is really impacting us all in ways we never thought of, the clever minds and the creative people among us are starting to think about possible solutions.

What is a COOL ROAD? For starters, the darker the colour the more heat

is absorbed. A cool road is one that has had an extra layer coating it in a lighter colour sealant to help prevent melting of the bitumen as well as reflect sunlight. The United States have already begun this process, with some small reduction in the surface heat temperature of the newly coated roads, a mammoth task for countries like ours where the road network is extensive. Expensive too!

For us to have a good quality of life, we need our living environment to have at least 30% tree cover. Maroondah has been lucky with many trees planted years ago by residents. With slogans like "don't ringbark Ringwood", and Arbor days when the Croydon Conservation Society and local schools obtained tube stock and planted for the future, it looked like Maroondah would be safe.

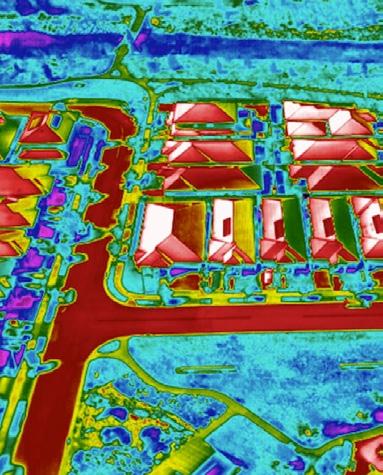

Sadly, things have changed and people seem to be more focused on finances, housing affordability, and justifiably, finding a spot to build a home for the family. The next image says it all really. It shows how built form and paving become a heat sink, holding the heat and radiating. You really need to spot the patches of pinky purple, which is where shade is.

That future is here now, but instead of treasuring our mature trees some developers see them as obstacles to be removed and will wear the cost of fines. Here in lies the problem.

Collectively many Councils under the group called MAV, the municipal association of Victoria have written to the Minister for the environment and the Premier asking for the State fine for illegal tree removal to be re- visited.

CCS has also been lobbying the same two ministers to discuss a better method of deterrent for anyone who unlawfully

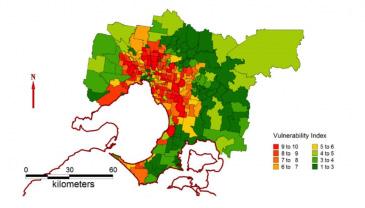

removes a tree, which in the broad view of life on Earth should be of benefit to us all. Monash University has mapped the vulnerability of areas of Melbourne by postcode. Make no Mistake; extreme heat is a serious health issue for people who are young, old, sick, have no access to air-conditioning or just forget to keep hydrated, or in the shade. We cannot afford for our municipality to lose any more of our heritage tall shady trees.

So how best to get the State Government to revisit the State Environment law to look at a revision to improving the deterrent, so that trees are not just removed because they are in the way.

CCS has already written to both the Premier Jacinta Allan and the Environment Minister, Steve Dimopolous, who is the minister for everything. Member for Oakleigh. Minister for Tourism, Sport, Major Events, Environment & Outdoor Recreation. Frustratingly we have not heard back from either as yet.

We hope to keep up the pressure to the Government, and hope people begin to understand and help protect the mature trees we live amongst. If you hear chain saws at the weekend and you are concerned Maroondah Council has 24/7 ranger bylaw officer, you can contact on 1300 88 22 33, and someone will attend to ensure it is legal, or needs to be stopped.

For more information on Cool Roads, visit the ABC Science website and search 'Cool Roads'.

President of Croydon Conservation Society liz@sanzaro.com

www.croydonconservation.org.au

The Federal Government has confirmed that there will be an increase in the non-concessional and concessional contribution caps.

Currently, you could place up to $27,500 per year into super as a concessional contribution. Concessional contributions included your Superannuation Guarantee Contributions (SGC), Salary Sacrifice of super, additional employer contributions and personal contributions for which you wish to claim a tax deduction and where an Intent to Claim form had to be filled out. From 1st July 2024, the concessional cap will increase to $30,000 per year.

For non-concessional contributions, the current cap was $110,000 per year and this will now increase to $120,000. This is good news for those who are getting closer to retirement and wish to place more funds into super as the

bring forward provisions, will allow nonconcessional contributions to increase from $330,000 to $360,000.

Additionally, from 1 July 2024, the Total Superannuation Balance (TSB) thresholds used to determine the maximum amount of bring-forward non-concessional contributions available to an individual will also be adjusted.

The TSB is a fairly easy concept to understand. It's usually the total amount of money you have in your super at any one time. The ATO measures your TSB each 30 June to determine which super measures you are eligible to use in the following financial year as follows:

• carry-forward concessional contributions

• non-concessional contributions cap and the bring-forward of your non-concessional contributions cap

• work test exemption

• government co-contribution

• spouse tax offset

• segregated asset method for calculating exempt current pension income.

You can view your TSB by using ATO online services . Select Super then Information then Total superannuation balance .

You can call them on 1300 88 38 30 or email info@findaccountant.com.au www.findaccountant.com.au

There are many reports that are useful in running your business. They can be used at tax time to complete your tax return, to keep track of how well your business is doing, and to apply for a loan, to name just a few uses. Your financial report can also be used by different people such as Creditors, the ATO, your accountant, investors, and management. It is important that the reports are accurate and there are several guidelines that must be followed when producing them so that they can be easily read by any of the users.

Over the past few editions, we have been working through the bookkeeping process from creating your Chart of Accounts to recording your transactions to now, creating your financial statements.

A Trial Balance is produced to check that all your ledger accounts balance. It lists the total balances of every general ledger account at a specific point in time. The accounts are listed down the left of the report and the amounts are in two columns on the right. The Debit Accounts (Assets and Expenses) have their totals in the left column, and the Credit Accounts (Liabilities, Revenue, Equity) are on the right. Both columns are then added up, and if your books are all balanced you will find both columns equal each other. Please note however, just because your columns balance, doesn’t mean your trial balance is accurate so it is important to double check your work. A trial balance is used to create the next two reports, so it is important to take your time on this to get it right.

Where the Trial Balance includes Asset accounts, Expense accounts, Liability accounts, Revenue accounts and Owners Equity accounts, the Profit and Loss Statement shows the Revenue and Expense accounts, and the Balance Sheet shows the Assets, Liabilities and Owners Equity Accounts.

Also known as an Income Statement, the Profit and Loss Statement shows whether your business is making a profit over a certain period. Usually this will be over the last 12 months but could be over a week, month or even years. Once you list out your revenue earned over that period and your expenses over the same period, the difference will tell you if you have made a profit of loss for that period. This profit or loss amount is then transferred to the Balance Sheet under the Owners Equity category.

From the Trial Balance we now transfer the Assets, Liabilities and Owners Equity (including the Profit or Loss that you determined in the P&L Statement) to the Balance Sheet. The Balance Sheet shows you how your business is doing when it comes to your company’s overall wellbeing. If your liabilities are greater than your assets for example, then you aren’t going to have anything in your owners equity which is a huge problem when it comes to the survival of your business.

These three reports really do give you the best idea of how well your business is doing. The Trial Balance allows you to check that the general ledger accounts balance, the profit and loss statement whether you are gaining profit or losing money, and the balance sheet can give an idea on the longevity of your business.

There is one more report that can be helpful in understanding your business, the Cash Flow Statement. I’ll cover this next month.

Enhancing Online Reputation and Driving Growth in the Digital Age

In today's digital age, online reviews wield unparalleled influence over businesses. Among the plethora of review platforms, Google Reviews stand out as a critical factor in shaping a company's online reputation. Positive Google Reviews not only enhance visibility but also build trust among potential customers.

Importance of Positive Google Reviews:

1. Visibility and Credibility:

Positive reviews on Google enhance a business's visibility in search results. Google's algorithm prioritizes businesses with higher ratings, making them more likely to appear in local search queries. Furthermore, positive reviews contribute to a company's credibility, fostering trust among prospective customers.

2. Consumer Decision-Making:

Modern consumers heavily rely on online reviews to inform their purchasing decisions. According to recent statistics, 93% of consumers rely on Google Reviews to determine the quality of a

business, and 72% won't act until they've read reviews. Positive Google Reviews serve as social proof, reassuring potential customers that they are making a sound choice by choosing your product or service.

3. Competitive Edge:

In a crowded marketplace, positive Google Reviews set your business apart from competitors. A higher star rating and positive testimonials can be the differentiating factor that influences a customer to choose your business over others.

Strategies to Generate Positive Google Reviews:

1. Automated Review Requests:

Implementing automated systems to request reviews can streamline the process. After a customer completes a purchase or service, an automated email or text message can be sent, politely requesting feedback. This ensures that satisfied customers are prompted to leave a review without significant effort on their part.

2. Incentivizing Positive Reviews:

While it's important to remain ethical and compliant with review platform policies, offering small incentives can motivate customers to share their positive

experiences. Consider discounts, loyalty points, or exclusive access to promotions as tokens of appreciation for leaving a positive review.

3. Timing and Personalization: Timing is crucial when requesting reviews. Send requests when the positive experience is fresh in the customer's mind. Personalize the request by addressing the customer by name and referencing specific details of their interaction with your business, demonstrating that their feedback is valued. This can all be automated in our El.ite marketing software.

4. Engage with Existing Reviews: Actively engage with existing reviews, both positive and negative. Responding to reviews, expressing gratitude for positive feedback, and addressing concerns in a constructive manner not only demonstrate excellent customer service but also encourage others to leave reviews.

Ethan Strybosch Co-Founder www.elmedia.com.au

Ethan Strybosch Co-Founder www.elmedia.com.au

Australians aged 55 and over who sell their home are able to make a contribution of up to $300,000 into superannuation from the sale proceeds. Both members of a couple can take advantage of this rule for the same home, resulting in a total possible contribution of $600,000 per couple.

Contributions made under this legislation will not count towards other superannuation caps. Additionally, no work test or age restrictions apply, but you must have owned your home for at least 10 years, and it must have been your principal residence at some stage.

To be eligible to make a downsizer contribution, each of the following conditions must be met:

• You must be aged 55 or older at the time you make the downsizer contribution.

• The contract for the sale of the property was entered into after 30 June 2018.

• The home was owned by you and/ or your spouse for at least 10 years.

• The home is in Australia and is not a caravan, houseboat, or mobile home.

• The proceeds from the sale of the home qualify for a full or partial main residence exemption from capital gains tax.

• You provide your superannuation fund with a “Downsizer contribution into super” form no later than when the contribution was made.

• You make the contribution within 90 days of the sale proceeds being received.

• You have not made a downsizer contribution from the sale of another property in the past.

Important note:

If you are a member of a couple, however, you own 100% of the home being sold, your spouse can still make a downsizer contribution as long as you both meet the eligibility criteria.

To make a downsizer contribution, it is not necessary to purchase a new home. For example, a downsizer contribution may be made following the sale of an eligible home even if you are moving in with family, into a retirement village, residential aged care facility, or into another property you own.

Case Study:

Geoff (70) and Janine (64) have recently sold their family home for $900,000 after living there for 20 years.

Geoff was the sole owner of the home at the time of sale.

They now plan to move to the coast, where they own a holiday home.

Both Geoff and Janine are eligible to make a $300,000 downsizer contribution to super ($600,000 in total). That’s an additional $600,000 to generate tax-free pension payments to supplement their retirement income.

Although Janine did not own the home, she can make a downsizer contribution as Geoff’s spouse. Additionally, there is no requirement to purchase a new property to benefit from a downsizer contribution and boost retirement savings.

Remember, the downsizer contribution must be made within 90 days of selling the property (generally settlement date).

Age Pension entitlements: You may risk losing some or all of your Age Pension if you sell your home and make a downsizer contribution. While the family

home is exempt from the Asset Test, the $300,000 you contribute to super as a result of downsizing will be an assessable asset if you have reached pension age. This may impact your pension entitlements.

ATO assess eligibility: The Australian Taxation Office (ATO) determines if you are eligible to make a downsizer contribution. If you make the contribution and the ATO subsequently determines that you were ineligible, they will notify you and your super fund to assess what options are available. There is a risk that an ineligible contribution could count towards your non-concessional contribution cap.

1300 557

Erryn Langley

144 | erryn@findwealth.com.au

www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a

Find Wealth. Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the Centrepoint Alliance group https://www.centrepointalliance.

Whilst

Historically, Fatty Liver Disease (FLD) was associated with excessive alcohol consumption, but now has evolved into two distinct categories: Alcoholic Fatty Liver Disease (AFLD) and NonAlcoholic Fatty Liver Disease (NAFLD). Next month, I’ll delve into NAFLD, but for now, here’s the breakdown of ALFD.

AFLD was first seen in prolonged alcohol abuse, where the liver struggles to metabolise the excessive intake of alcohol. This led to the accumulation of fat, impairing liver function and paving the way for inflammation. This is diagnosed with a blood test, but usually if you have FLD, you will find that you don’t metabolise alcohol well and will take a longer time to recover after drinking than your friends, or than you used to. You may also have other problems such as worse sleep after drinking.

Alcohol, intriguingly, shares a metabolic pathway with sugar in our bodies. When we consume alcohol, it undergoes a process in the liver akin to the metabolism of sugars by liver enzymes. similarity helps explain why excessive alcohol consumption can contribute to the accumulation of fat in the liver. In both cases,

whether from alcohol or sugar, the liver faces an influx of substances that can overwhelm its processing capacity, leading to fat storage and eventually conditions like AFLD.

But regardless of the state of your liver, there are dietary and lifestyle changes that can turn your liver around.

It’s likely that stress, anxiety or depression have led to the high intake of alcohol. But rather than just using will power to move through this (as it’s doomed to fail once again), identify your stressors and find one or two that you can remove from your life. Find other ways to reduce your stress so that alcohol is not your only way to relax.

Now that you have reduced your stressors, start to reduce your alcohol consumption. Find something to do such as a new hobby with others to replace the time that you used to spend drinking.

No dietary issue is in isolation, and it is highly likely that diet, along with alcohol has contributed to this disease. Below are some suggestions to get started, but we’ll dive into that in more detail next month.

- Prioritise Whole Foods: integrate an array of nutrient-rich fruits and vegetables into your diet, providing essential vitamins and antioxidants. These elements reduce inflammation and aid in liver repair.

- Proteins for Repair: include protein

- sources such as beef, lamb, kangaroo, poultry, fish, tofu, and legumes. These proteins play a crucial role in liver cell repair, bolstering its structural integrity.

- Mindful Fat Consumption: Opt for healthy fats like those found in avocados, nuts, and olive oil, steering clear of trans fats and deep fried foods. This ensures a balanced lipid profile, preventing the accumulation of unhealthy fats within the liver.

Whilst food is a powerful medicine, sometimes we need a bit more than that to help us along. Whether it’s dietary advice or natural medicines you need, Whole Naturopathy is here to help. Natural medicines, particularly herbs, have an amazing effect on your liver as well as on your mental health, which may be what got you into trouble in the first place. I would love to help your journey to optimal health, and help you live a long life with the health and energy to do well.

BHSc (Naturopathy)

kathryn@wholenaturopathy.com.au

Suite 1 53/1880

Ferntree Gully Rd

Mountain Gate Shopping Centre

Ferntree Gully, Victoria

Often it can feel like the mountain of debt for the business is inescapable, and it burns through your mind day in and day out, trying to get on top of the debt, whilst still needing suppliers to give you material for your business. Often it can be one or two major clients having gone into liquidation that leaves you overextended and unable to make ends meet.

There are a lot of issues to consider of course, and there are no simple answers, however there are some options that can take the pressure off, and in some cases remove it altogether. The simplest and most effective options are Small Business Re-Structuring, Safe Harbour Protections, and Liquidation, sale and purchase through a new entity. These are great options, but with a number of caveats.

For smaller enterprises, the Small Business Restructuring (SBR) process provides an alternative to traditional insolvency procedures. The SBR process aims to streamline the restructuring of small businesses, making it more cost-effective and less time-consuming. Under this scheme, eligible small businesses can develop and propose a restructuring plan to creditors, allowing them to continue trading while addressing their financial challenges. The director stays in control, and the forensic accountant (a registered liquidator) provides suggestions and advice about how to manage the debt, how to streamline the business, for example outsourcing things that can be done faster and better by specialists, but mainly dealing with your creditors and making a deal with them. Many creditors will take a lesser amount on the basis that there will be ongoing trade for them.

In order to qualify for SBR, you need to have a maximum of $1M in debt, your tax returns and BAS’s up to date, and employee entitlements (read Superannuation) up to date. You will need to engage a registered liquidator.

Recognizing the challenges faced by directors in distressed companies, the

government has introduced safe harbour provisions. These provisions provide directors with a degree of protection from personal liability for insolvent trading if they take prompt and reasonable steps to develop a course of action that is likely to lead to a better outcome for the company and its creditors.

To avail yourself of safe harbour protections, directors must be able to demonstrate that they have acted in good faith and with due diligence to prevent the company from trading while insolvent. This may involve seeking professional advice, developing a restructuring plan, or taking other measures to improve the company's financial position. By doing so, directors can shield themselves from personal liability and contribute to the preservation of the company's value. Again, you will need a registered liquidator to assist.

Creation of New Corporation, Sale of Business to the new Corporation, then Liquidation of the old, indebted Corporation

First of all, this is not a Phoenix Operation. A Phoenix Operation is where the old corporation transfers its assets, accounts, funds, stock in trade etc to a new entity, and then carries on trading, avoiding the old company’s debts. It will often involve de-registering the old corporation. This is unlawful, and quite simply a foolish way to try and resolve things.

There are two ways you can go about this:

1. Engage a registered business valuer to provide a formal valuation on the business, and then purchase the business from the old corporation with a new corporation. Do not use funds from the old corporation for

the purpose, or the new corporation will be owned by the old one. The transaction must be an ‘arms length’ transaction, which means the funds must come from elsewhere – it can be a loan to the new entity, you may have savings that have accrued from drawing your salary from the old corporation, as long as you have paid PAYG tax, you can pay yourself with franked dividends (ask me about this if you’re unsure, as it’s an entire article on its own). As long as the source of the funds does not come back to the old corporation.

You will need to have a formal business sale contract to ensure everything is done legitimately, and the contract will list all the assets, stock etc that are being transferred, so there is a clear path in which the assets are transferred as part of the transaction.

You can then appoint a liquidator to the company, though the funds for the purchase must stay with the old entity. Those funds can be used to pay the liquidators fees, and any balance will be spread among the creditors of the old corporation (usually for a small percentage of the debts owed). The liquidator will review the transaction to make sure it is not an ‘uncommercial transaction’ – for instance if the valuer says the business is worth $50,000, but you only pay $30,000, the liquidator will come after the new entity for the $20,000 difference. Also be aware

that if you have given personal guarantees for debts, this process will not avoid the guarantees, and the creditors with guarantees will still come after you personally.

2. Engage a liquidator for the old entity, then create a new entity and have the liquidator provide a valuation on the business of the old entity from a registered valuer, and as above, the new entity buys the business from the liquidator. As long as the transaction is an “arms length” transaction, then the transition to the new entity is genuine and without issues. Again, the liquidator uses the funds from the sale of the old business to pay out the creditors, and the old corporation is de-registered.

The good thing about this process, whichever you use, is that the former owner of the business is best placed to pay the highest value – someone who does not know the business would be taking a risk, and therefore will not pay as much for the old business.

Now the caveats.

If the director has carried on a long time with the debts, incurring new liabilities with no chance of paying them, he or she may be trading whilst insolvent, and may have exposed themselves to personal liability for the debts of the company. Accordingly, the

hosted by Ben Nash @findfoundation/videos

sooner the better to take action before any chance of insolvent trading looms.

Navigating insolvency does require an understanding of the legal options available to businesses in distress. Liquidation and business sale, conducted through ‘arm's length’ transactions, can provide an avenue for companies to shed the burden of old debts and continue operations under a new corporation. Additionally, the implementation of safe harbour provisions and Small Business Restructuring, offers directors protection from personal liability, encouraging them to take the necessary steps to revive the company's financial health.

It is crucial to seek advice before taking steps, so feel free to call me to discuss. There is no fee for an initial discussion, which can include talking with an insolvency practitioner to ensure compliance with the relevant laws and regulations. We have a number of liquidators we use, and they are very good at navigating the issues with you.

www.mercantilelegal.com.au

dean.bosman@mercantilelegal.com.au

0422 114 300

Join tennis champion and Australian Open broadcaster, Jelena Dokic as the keynote speaker at Doncare’s International Women’s Day charity luncheon.

Enjoy sparkling and canapes on arrival plus a two-course meal and wine at the stunning Bramleigh Estate.

All funds raised support Doncare Community Services. Doncare has been serving the Manningham community since 1969. By attending this event, you will be supporting woman and children recovering from family violence, and helping families to access financial and material aid and counselling services in Manningham.

The event is proudly supported by our sponsors - Bramleigh Estate, Bendigo Banks, Doncaster East and Templestowe Village Community Bank Branches, CoreDNA, LogIn Systems, Luxury Escapes and the Australian Wine Tour Company.

Nani Puspasari is a Chinese-Indonesian visual artist based in Naarm (Melbourne). Her latest exhibition Childhood Cheeks, Grown-Up Madness is an emotive exploration that beckons viewers into the subtle interplay between innocence and experience.

The canvas unfolds as a vibrant narrative, with expressive paint strokes sharing tales

of enthusiasm and introspection, while whimsical clay forms add a tangible layer to the storytelling. This artistic journey transcends mere observation, offering a profound reflection on the paradoxical nature of the path to adulthood.

The installation stands as an emotional proof to the delightful chaos inherent in the shift from carefree childhood to the

intricate realities of grown-up life. It urges individuals to embrace the enduring beauty found in the inherent madness of growth and self-discovery, even within the complexities of life, creating a space for a heartfelt exploration of the multifaceted layers of personal evolution.

Image courtesy of the Artist

Deborah White is a Melbournebased artist who works across performance-based photography, video and mixed-media installations.

Everlasting Happiness entertains the utopian idea of love as a political concept. The underlying philosophy of this aspiration is to love the most distant.

This is not a sentimental notion of love. It is a robust kind of love with a revolutionary power. Viewing the actions of love as a deployment of force, this work intertwines supernatural wonder with the spectacle of war

The playful and vibrant performancebased video depicts an anarcho-mystic quest battling against the pathology of the post-truth world. Featuring fictitious characters that defy the rational world, the video is infused with flower power, music and animal warriors that open the heart to hope and joy. All the characters are performed by the artist—serving as a self-reflection on the internal struggle to love unconditionally. This work strives for the idealistic desire of a utopian non-place of the imagination. (Sound design is by Jamie Coghill.)

Video still from Everlasting Happiness (2023).

HD digital video, 11:15 mins, 1 or 3 channel, looped, variable dimensions.

Image courtesy of the Artist.

As part of the Inspired Living Series, Sarah Wilson will present This One Wild and Precious Life at the Manningham Function Centre.

Sarah is a multi-New York Times and Amazon best-selling author, podcaster, international keynote speaker, philanthropist and climate change advisor. Her most recent title, This One Wild and Precious Life, won the 2021 US Gold Nautilus Award.

Sarah is an expert at creating a sense of hope and inspiring communities to thrive, united through connection - recognising that deep down, many of us are feeling that same itch for a new way of living.

This powerful presentation will challenge you to reclaim your wild, precious life and offer a radically hopeful path forward.

Inspired Living Series - keynote speaker events

The Inspired Living Series - keynote speaker events showcases five insightful, not-to-be-missed evenings at the iconic Manningham Function Centre.

The series will introduce you to a diverse line-up of local and international keynote speakers offering unique insights on how we can all shift to a greener future. Topics range from permaculture to

sustainable fashion. Each speaker will inspire and motivate simple, positive lifestyle choices, connection to nature and growing a thriving community in the midst dynamic change.

Presented by the Astronomical Society of Victoria (ASV) and Manningham Council,

Join the ASV with a stargazing evening at Westerfolds Park, Templestowe. ASV astronomers will be on hand with telescopes and demonstrators.

Bring a torch covered with red cellophane (to keep your night vision), mosquito repellent and warm clothes. Telescopes will be set up on the grassy field near the Parks Victoria Office. Expect evening dew and a cold evening. Children will especially appreciate warm footwear and snacks!

Please reverse your car into the parking space to reduce headlight shine on exit.

This event may be cancelled due to cloud cover (more than 25 percent cover) or in the event of a total fire ban or bad weather. Please provide a relevant contact mobile phone number or email for an automated update on any event changes.

• Children must be supervised by a parent or guardian at all times.Please arrive 10 minutes prior to start time.

• Come prepared and dress for the weather on the day. Please wear closed-toed footwear.

• Don’t forget to bring a snack and water bottle for morning tea.

• In the event of extreme weather, this event will be cancelled.

• Currawong Bush Park is protected habitat, dogs are not permitted in the park at any time.

Celebrating its 50th year, the Manningham Concert Band will hold their Autumn Favourites - a mix of classic, contemporary and movie themes along with two unique soloists.

Featuring Sibelius’ Finlandia, one of the true wonders of the musical world, music from Willy Wonka and the Chocolate Factory (the beloved.

original) and our Timpani. Plus, a guest soloist taking us on a smooth journey with a surprise wind instrument that fits a concert band very well There will be a fun interactive competition during the concert with prizes to be won.

Bookings open from Sunday 11 February, or tickets at the door.

Keep social, fit and happy!

Join the Seniors Happy Life Club Inc for a fun afternoon of line dancing and board games every Monday at the Heimat Centre from 12.45 to 2.45pm.

Free entry for members. Membership fee is $30 per year.

March is now the perfect time to declutter our homes and clean up our parks with our Waste Drop Off Day and National Clean Up Australia Day events being held on the first weekend in March.

Manningham Mayor, Councillor Carli Lange is looking forward to participating and help keep Manningham clean and tidy.

“Its great to have these events available. The Waste Drop Off Day on Saturday 2 March is an opportunity to dispose of a range of materials that cannot be placed into household bins (bookings essential).

“National Clean Up Australia Day on Sunday 3 March is a chance for all of us to make a difference to the health of our outdoor spaces. This year’s event will be held on the banks of the Yarra River in Warrandyte. Come along, join in and enjoy a free barbeque lunch afterwards.

“We also have a third event, Detox Your Home on Saturday 16 March where toxic household chemicals such as cleaning products, pool

chemicals and pesticides can be safely disposed of (bookings essential).

“By taking part in these events, we are helping to keep our home environment and precious green spaces safe and healthy now and into the future,” Cr Lange said. These events support community efforts towards achieving net zero community

emissions by 2035 as stated in Council’s Climate Emergency Response Plan.

Register for Saturday 2 March, Waste Drop Off Day

Register for Sunday 3 March, Clean Up Australia Day

Register for Saturday 16 March, Detox Your Home

Inspired Living Series keynote speaker line-up

Date

Thursday 14 March

Thursday 23 May

Thursday 25 July

Thursday 12 September

Thursday 14 November

Topic

Keynote speakersv

This One Wild and Precious Life Sarah Wilson

Manningham’s Weather and Changing Climate

Nate Byrne, Professor David Karoly and Greg Moore

Sustainable Building Design and Tiny Homes Jesse Glascott and Elle Paton

Permaculture and Waterwise Gardens Hannah Maloney

National Recycling Week: Sustainable Fashion in a Circular Economy

Visit Inspired Living Series for more information.

The Inspired Living Series kicks off in March with something for everyone across a diverse range of activities and events focusing on sustainable living.

Manningham Mayor, Councillor Carli Lange is excited about the range of activities and events offered throughout the year.

“From toy and clothing swaps, webinars on solar and batteries, growing vegetables and much more,

I encourage everyone to register and get involved. These activities and events are for free (registration is essential).

It’s a great opportunity to discover new ways to help our local environment and make positive lifestyle choices.

“The keynote speaker events are a highlight of the Series. We have a fantastic line up of five local and international speakers sharing their

Nina Gbor and the panel

knowledge and stories on sustainability.

“It will be fantastic to hear about their personal sustainability journeys and practical tips to help make a difference at home and in our community,” Cr Lange said.

The Inspired Living Series supports community efforts towards achieving net zero community emissions by 2035 as stated in Council’s Climate Emergency Response Plan.

Arts and culture fans are in for a treat with the launch of Manningham Art Gallery’s 2024 Exhibition Program.

Manningham Mayor, Councillor Carli Lange, said this year’s program will explore themes of culture, connection to place and community.

“This is an exciting chance to explore lived experience and healing through the lens of these artists, on themes that seem in this current time as relevant as ever.

“We strive to support both emerging and established contemporary artists, by providing a space to feature exhibitions that highlight innovative and unique takes on different themes through various art forms.

“I am excited for the community to experience this year’s exhibitions and would encourage all artists to put their work forward for future exhibitions,” Cr Lange said.

The seven exhibitions feature both Melbourne-based artists as well as artists from Manningham’s diverse community.

Wednesday 21 February to Saturday 6 April 2024 Deborah White presents Everlasting Happiness, a performancebased video which entertains the

utopian idea of love as a political concept. The underlying philosophy of this aspiration is to love the most distant.

The playful and vibrant video depicts an anarcho-mystic quest battling against the pathology of the posttruth world and features fictitious characters that defy the rational world.

Viewing the actions of love as a deployment of force, this work intertwines supernatural wonder with the spectacle of war. The characters are performed by the artist, serving as a self-reflection on the internal struggle to love unconditionally. Sound design is by Jamie Coghill.

Wednesday 21 February to Saturday 6 April 2024

Nani Puspasari is a Chinese-Indonesian visual artist based in Naarm (Melbourne). Her exhibition Childhood Cheeks, GrownUp Madness is an emotive exploration that beckons viewers into the subtle interplay between innocence and experience.

The canvas unfolds as a vibrant narrative, with expressive paint strokes sharing tales of enthusiasm and introspection, while whimsical clay forms add a tangible layer to the storytelling.

The installation stands as an emotional proof to the delightful chaos inherent

in the shift from carefree childhood to the intricate realities of grown-up life.

This artistic journey transcends mere observation, offering a profound reflection on the paradoxical nature of the path to adulthood.

Wednesday 24 April to Saturday 8 June 2024

Matthew Harris, of mixed European and Koorie descent, debases dominant hierarchies through socially critical painting and sculpture.

Nicholas Currie is an emerging artist, curator, and descendant of the Mununjali clan of Yugambeh people of Brisbane and Beaudesert.

I Fall to Pieces brings together artworks by Naarm-based artists Matthew Harris and Nicholas Currie that traverse topics of mental health and healing. Rich and differing First Nations materials and processes are deployed along with key tenants of Western Abstraction, offering conceptual and immediate encounters with paint and form.

Wednesday 26 June to Saturday 10 August 2024

karu kin is a special project led by Manningham resident, Grace Dlabik.

karu kin is a special project led by Manningham resident, Grace Dlabik. Connecting Indigenous women and non-binary folk through clay making using memory, embodiment, nurture, nourishment, and connection. karu kin invites you to view the cyclical nature of the materials used in this project, from raw clay, and traditional practices, to shared experiences within community.

Moustachioed Women and Rhinoplastic Girls

Wednesday 28 August to Saturday 12 October 2024

Iranian-Australian artist Ramak Bamzar seeks to enter a deeper understanding of the culture and behaviour of women in the Middle East and uses social media as a source to inspire the creation of staged portraits of contemporary Iranian women.

Guided by Antoin Sevruguin’s historical photographs, she recreates images of Iranian women from the 19th Century to confront the ideals of beauty as fleeting and fickle and reveal the impact of the male gaze on the face and female identity in the Middle East.

Emphasising the distinction between modern expectations and ancient traditions, she portrays women’s choice of fashion, appearance, and beauty to represent how the limitations and pressures of the male-oriented culture can affect women’s perception, self-esteem, self-image, and individual identity.

Wednesday 2 October to Saturday 16 November

Lara Chamas is a first-generation

Australian-Lebanese artist. Through, storytelling, trans generational trauma and memory and tacit knowledge; a set of hand made and cast objects explores links and meeting points between narrative theory, cultural practice, current political and societal tensions, and the body as a political vessel.

Sequence Unseen: New Acquisitions

Wednesday 23 October to Saturday 14 December 2024

A curated series of recent acquisitions to the Manningham Art Collection, exploring unseen stories and perspectives through contemporary artistic practices.

Artists include Atong Atem, Richard Young, Jade Plitz, Rhys Cousins, Grace Dlabik amongst others.

To find out what’s on at the Manningham Art Gallery visit, manningham.vic.gov.au/gallery

Manningham Art Gallery is accepting expressions of interest to be part of gallery’s 2025 exhibition program.

The gallery space is well-suited to ambitious solo presentations and artists from around Victoria are encouraged to apply, manningham.vic.gov.au/gallery-eoi

By Rob “Stormy” Fairweather

By Rob “Stormy” Fairweather

Donvale Bowls Club is indeed indebted and beholden to many of our beloved characters which define and distinguish it.

One such character at Donvale is Richard Davis. A brief insight into Richard’s working life, his eventual involvement at Donvale Bowls Club, and the experiences it has provided.

Richard was born in 1946 in Coburg, attending the Coburg Primary and High Schools.

He went on to Melbourne University and graduated with a BA and became a secondary teacher. In those days a huge shortage of teachers existed, the government provided Secondary Studentships which paid their fees and a living allowance, without that he couldn’t have attended university.

The agreement meant you would teach in any school in Victoria for three years. His first assignment, Wodonga Tech. In 1975 he met Margaret, she was teaching at Lalor Primary, they married in 1969.

Next school was Preston East Tech which had the reputation of being the roughest school in Melbourne, despite its negative reputation,

it was well run, serving the community well. From there he taught at Coburg Tech for 2 years, Doncaster High for 4 years, and Hadfield High for 3 years.

He also attended Richmond Secondary and Doncaster Secondary (for a second time) spending 11 years at each of those schools.

After VCE was introduced in 1987, he began marking VCE examination papers which he continued to do for the next 25 years, in addition tutoring students outside school hours for many years.

Richard loved sport and was always involved in coaching. Coached athletic teams at most of the schools at which he taught, distance and cross-country running being his forte.

For three years he was Assistant Manager and then Manager of the Victorian Secondary Schools Athletics team, competing against other states.

In 1993 he transferred to Doncaster and was asked to be swimming coach; he was bemused because he had no background other than the swimming feats of his children who attended the school. It continued, lasting the next 7 years.

In his own personal sporting life, he

played football, athletics, became a runner, a goal umpire in the Diamond Valley Football League where he umpired with Ray Halliday on occasions.

Unfortunately, at 25 years of age due to a back injury he needed to retire, but not before playing in a premiership team with Kiewa- Sandy Creek in the Tallangatta Football League. The club hadn’t won a premiership for 27 years, have since won 13 flags.

He retired from teaching in 2004, joined the U3a run by Barry and Julie Wilkins deciding to try a new sport, lawn bowls, in the class were Rob & Cheryl McAnally, Bob Grosvenor and Colin Davis.

He asked Barry where he should play, Greythorn or Templestowe, both clubs nearest to him. His response “No way you’re playing at Donvale.

17 years later I’m still here, Margaret joining a year later, playing in two Metropolitan Finals.

Richard loves the club, it’s friendly and inclusive nature, strong administration, and the wide network of friends they have made, he’s looking forward to many more enjoyable years at Donvale…. Well done, Richard, a life well lived!