The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

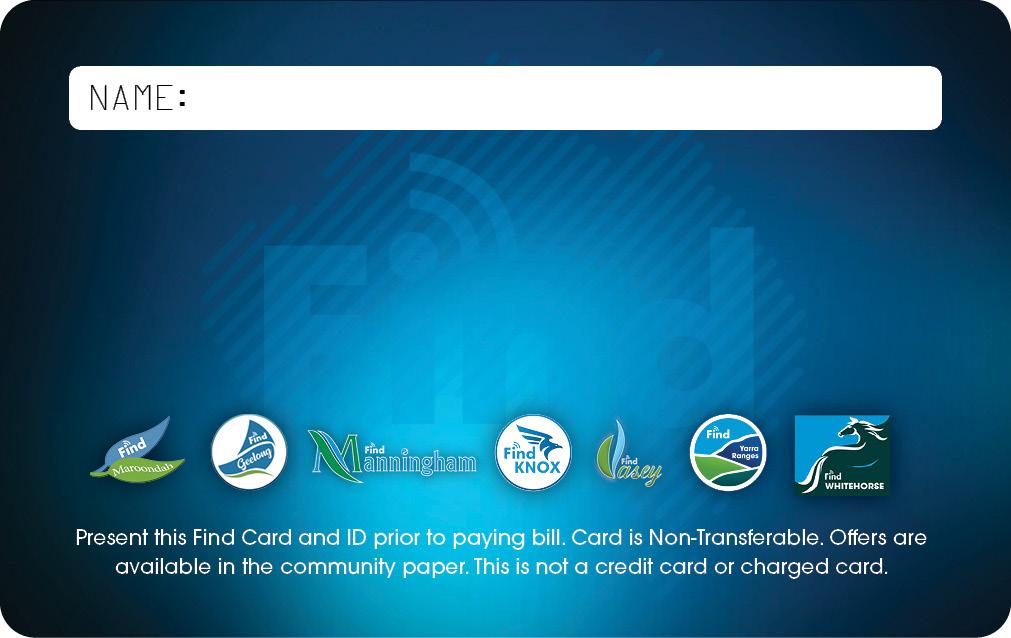

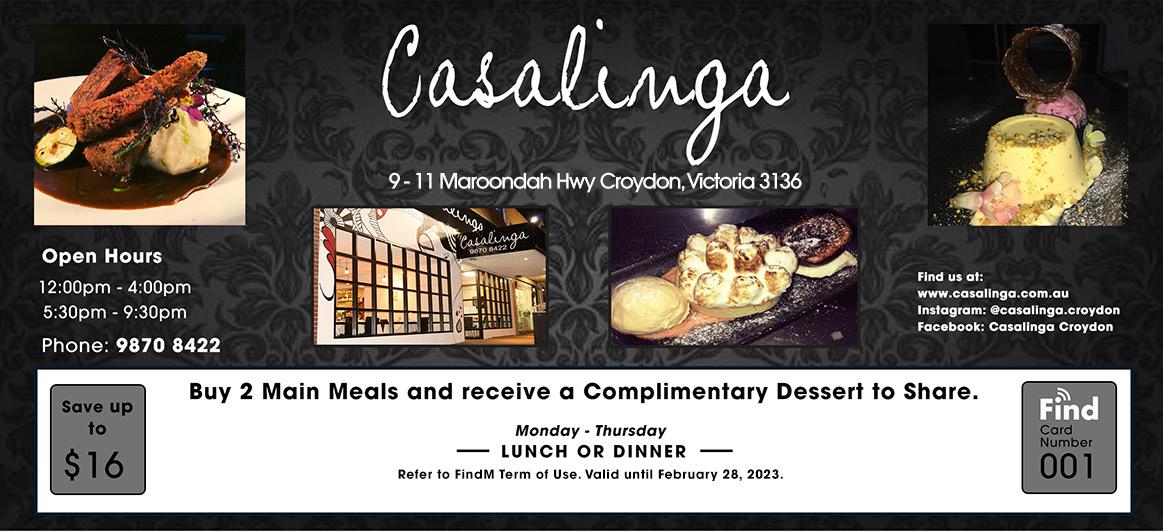

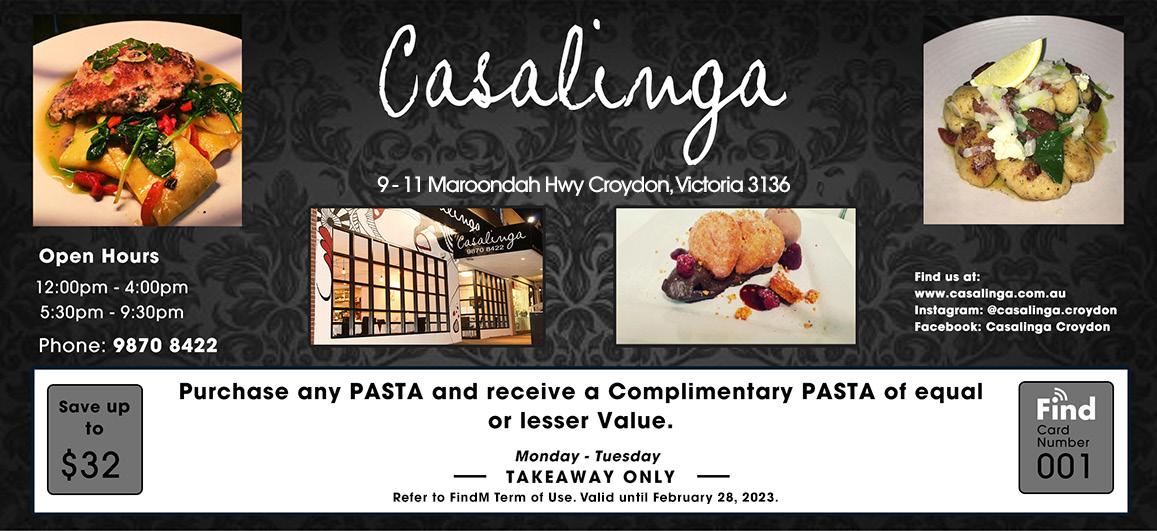

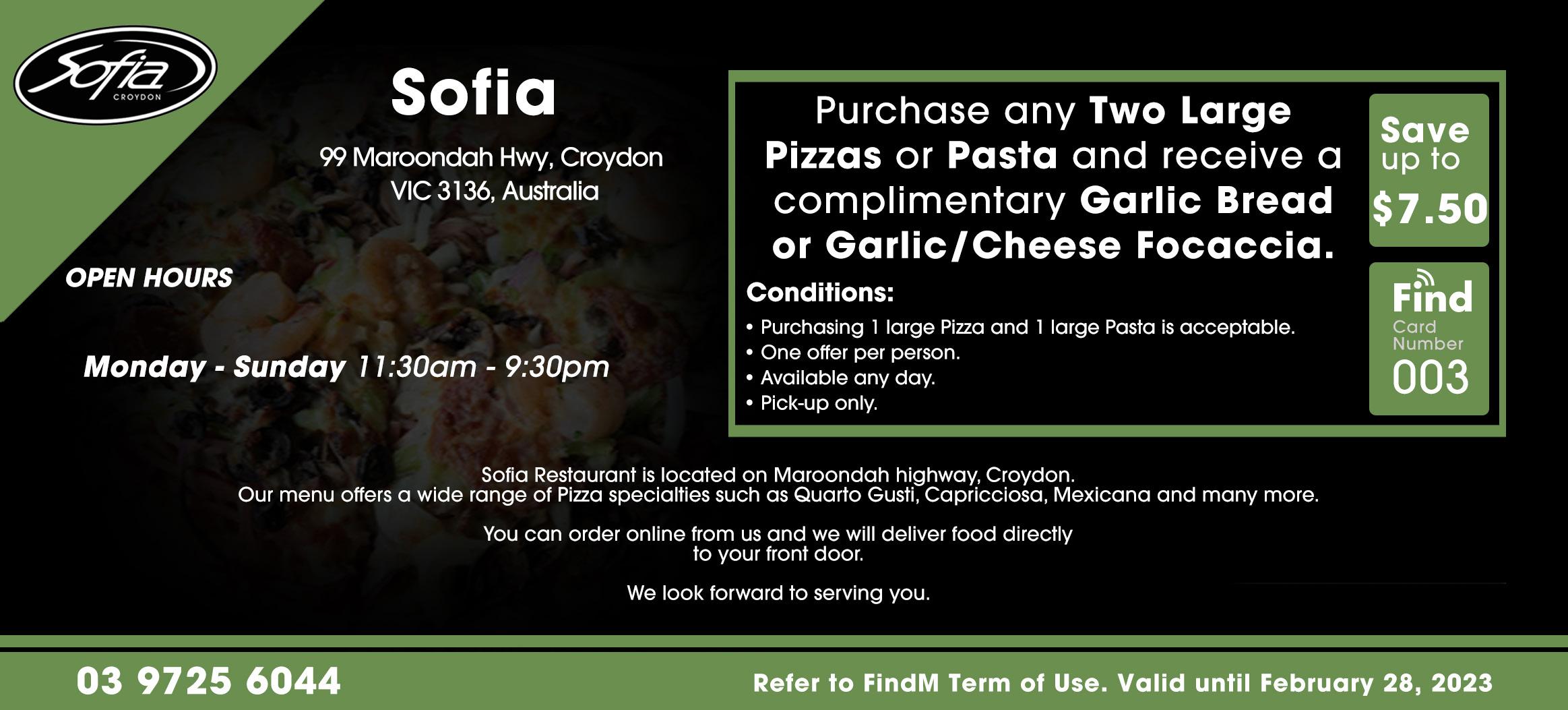

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support, The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

Available Sizes:

Rates:

• Double Page Spread (408 x 276mm) $1650 Full Page (198 x 276mm) $1100

• Half Page Landscape (198 x 138mm) $715

• Half Page Portrait (95 x 276mm) $715

• Third Page (189 x 90mm) $550

• Quarter Page (97 x 137mm) $440

• Business Card Size (93 x 65mm) $275

• Ads Smaller than (85 x 55mm) and Below $121

• Design Services

We can create your ad for you. Prices start at $77 for the very first hour and $22 for each hour thereafter.

Next Issue of the Find Maroondah will be published on Wednesday May 8, 2023. Advertising and Editorial copy closes Monday May 1, 2023.

The Advisor Innovation Summit is back in 2023 with a focus on how advisers can adapt to transform and thrive in the future.

As the advice industry copes with economic uncertainty and generational shifts in wealth management, the highlyanticipated Adviser Innovation Summit is returning this year to arm advisers with the strategies they need to flourish in an ever-changing landscape.

Taking place over two days — 8 and 15 June 2023 — the summit will unpack how advice practices could revamp their business models to succeed even when the market is volatile and deliver cost-effective advice, boost efficiencies, and meet compliance requirements. The IPA conference, also over two days, will provide delegates with key information to enhance their technical knowledge, understand emerging

I am excited to announce that I’ll be speaking at the Cape Schanck Hybrid Conference and 2023 Advisor Innovation Summit at The Great HallUniversity of Technology Sydney.

management and professional skills and discuss thought-provoking insights on professional and ethical standards.

The summit is aimed at financial advisers, fintech consultants, executives, IT and compliance managers, practice managers, product managers, and decision makers. The IPA conference is aimed at accountants or accounting technicians.

One of the industry leaders, Warren Strybosch, will be one of the speakers at this year's summit. He will be joined by other industry leaders to discuss the latest data and strategies that could help other advisors transform their practice into an accessible, compliant, well-oiled machine, and look at the opportunities and threats unique to the financial planning industry. Warren will also be speaking at the Institute of Public Accountant

(IPA) Conference this April. He will be joined by other thought leaders in the accounting profession to discuss ethical standards in the accounting profession.

The Advisor Innovation Summit and IPA Conference will push advisers and accountants to reimagine their operational structures and find new practice efficiencies to provide quality advice.

You can read the full article about the summit here: https://www.ifa.com.au/ news/32536-adviser-innovation-summit2023-to-future-proof-advice

If your an IPA member and would like to attend the IPA Conference, you can read more here: https://www. publicaccountants.org.au/events/ conferences/2023-cape-schanckhybrid-conference

Thursday 20

Friday 21 April 2023

By Ethan Strybosch

By Ethan Strybosch

In today’s digital age, having a strong online presence is essential for any business looking to succeed. One of the best ways to increase your visibility and reach potential customers is through advertising on Google. With over 5 billion searches conducted on Google every day, it’s a platform that no business owner can afford to ignore.

In this month’s article, we'll explore some of the key reasons why businesses should advertise on Google.

Firstly, Google Ads allows you to target your ideal audience with precision. By selecting specific keywords, locations and demographics, you can ensure that your ads are shown only to the people who are most likely to be interested in your products or service. This level of targeting ensures that your advertising budget is being used effectively, as you are reaching the people who are most likely to convert into paying customers.

In addition to precise targeting, Google

Ads also allows you to track your results in real-time. This means that you can see exactly how many people have clicked on your ads, how much each click is costing you, and how many conversions you are getting from those clicks. Armed with this data you can quickly and easily adjust your campaigns to improve your return on investment.

Another benefit of advertising on Google is that it’s incredibly scalable. You can start with a small budget and increase it. Over time as you see positive results. This allows you to test different strategies and find what works best for your business without committing to a large investment upfront.

Google Ads also provides a range of ad formats, including text ads, image ads, and video ads. This means that you can choose the format that works best for your business and target audience. For example, if you have a visually appealing product, you might want to use image ads to showcase it to potential customers.

Finally, advertising on Google is a great way to stay ahead of the competition. If your competitors are advertising on

Google and you’re not, they may be capturing potential customers that could have been yours. By advertising on Google, you can ensure that your business is visible to anyone searching for keywords related to your industry, giving you a competitive edge.

In conclusion, advertising on Google is a smart investment for any business owner looking to increase their online visibility and attract new customers. With precise targeting, real-time tracking, scalability, a range of ad formats, and the ability to stay ahead of the competition, Google Ads is a platform that should not be overlooked. If you’re not already advertising on Google, now is the time to start.

If you have any more questions, please reach out to:

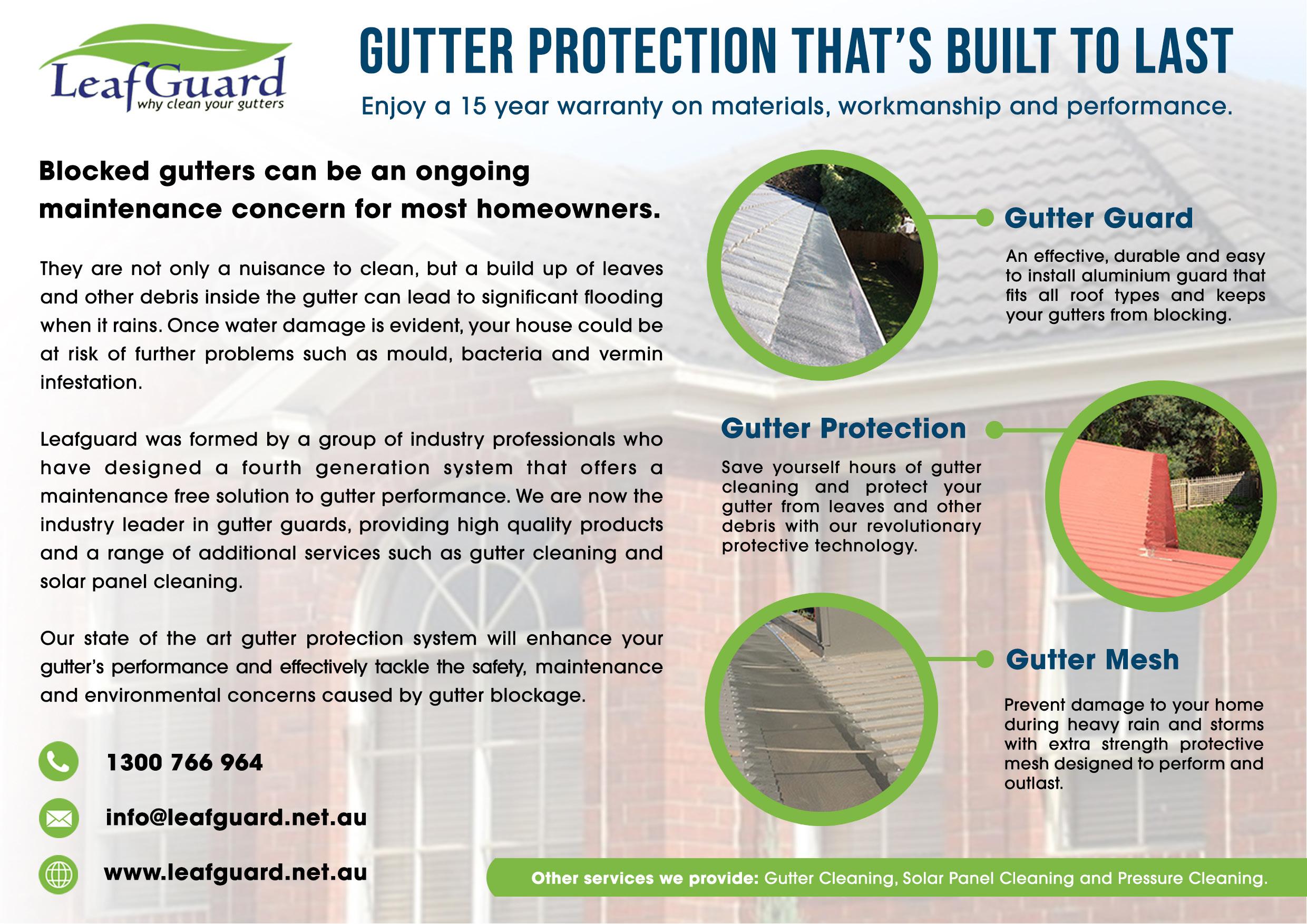

As we head into the cooler months, and the leaves start to pile up in your gutters at work as well as at home, I’m here to remind you about preventative maintenance. Your insurer has a fair and reasonable expectation that your building will be maintained in a serviceable condition; and under certain circumstances, they can deny a claim if they feel the building has been damaged as the result of negligence. Blocked gutters and downpipes are increasingly the cause of unnecessary water ingress claims due to poor maintenance. However, this is only part of the story. Stormwater pits and pipes also need maintenance and as a result of being out of sight, are overlooked frequently. When they back up due to a blockage, huge volumes of water can

enter your building with catastrophic results, when gutters and downpipes can’t discharge the rainwater fast enough, or perhaps not at all.

Often the cost to maintain stormwater systems is cheaper than paying the policy excess and having your home or business damaged, not to mention the stress a water ingress event adds to your life. It’s certainly cheaper than paying the resultant damage yourself if a claim is rejected. Insurance renewal premiums can be impacted, resulting in ongoing increased costs to you, and deteriorating claims history does not make you attractive to a new insurer either.

I am seeing insurers become more focused on these types of claims due to the massive jump in storm related claims, and I can say from recent experience they will dig in their heels if they believe neglect is involved, or if they believe a

system is inadequate. Hopefully this little reminder might save you a painful claim.

For a “health check” of your business insurance, contact Small Business Insurance Brokers via email: sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives,needs and financial situation).

GENERAL INSURANCE

Small Business Insurance Brokers

0418 300 096

As a business owner and employer, it is your responsibility to ensure the health safety of your employees within your workplace. This includes providing your team with a safe work environment and protection from hazards. You can achieve this by understanding your obligations under the Occupational Health and Safety (OHS) laws and by complying with them. WorkCover Victoria will investigate instances where an employer is not meeting their obligations, and will prosecute and fine that employer, regardless of whether or not an injury has occurred.

WorkCover Victoria reported that a food manufacturer in Bairnsdale was convicted and fined $32,500 in March after workers' lives were endangered working from height without fall protection.

Vegco Pty Ltd was sentenced in the Bairnsdale Magistrates' Court after earlier pleading guilty to one charge of failing to provide safe systems of work, and another charge of failing to provide information, instruction and training to employees to perform their work safely. The company was also ordered to pay costs of $2,467.

The Court heard that in October 2020, two workers were investigating a chemical smell coming from a sloping roof at the factory. The pair used a scissor lift to access the roof, which was about 6-8 metres high and wet from overnight rain.

During this process, a WorkSafe inspector visited the site as part of a routine inspection and observed the men working without harnesses or other fall protection in place. The inspector also found that although the scissor lift was operating in a shared zone with pedestrians, vehicles and other mobile plant, it had no impact protection, and the two workers were not trained, instructed or aware of the company’s traffic management plan for mobile plant.

The Court heard that it was reasonably practicable for Vegco to have provided and maintained safe systems of work both for working at heights and the use of mobile plant at the workplace. It was established that the company should also have provided information, instruction and training to workers in relation to the traffic management plan, working at heights and the use of elevated work platforms.

WorkSafe Executive Director of Health and Safety Narelle Beer said although no one was harmed in this instance, the company's offending was still serious, with falls from height and incidents involving mobile plant among the leading causes of workplace deaths and injuries. "Since 2018, 39 workers have fallen to their deaths. Each could have been prevented if safety measures, such as a passive fall prevention device, were in place," Dr Beer said. "It's a reminder to all employers that WorkSafe won't hesitate to prosecute if they fail to do everything they can to eliminate or reduce risks to health and safety."

As a business owner, do you have an understanding of your responsibility to ensure the safety of your employees? Are you confident that you can provide a safe work environment and comply with OHS laws? Do you believe that you are effective in carrying out risk assessment, employee consultation and providing training? Do you regularly review these measures to ensure that they remain fit for purpose and keep you and your employees healthy and safe? We assist business owners clarify what they currently have in place, as well as where there are shortfalls. We then assist in developing effective systems and documentation, working with businesses to ensure effective implementation. Checks are put in place to monitor ongoing effectiveness, to ensure that going forward, they are sound and comply with the Act, and most importantly keep you and your employees informed, and healthy and safe. Please feel free to contact me, Mark Felton, at Beaumont Advisory on 0411 951 372 or mfelton@beaumontlawyers. com.au for an obligation and cost-free initial discussion.

Mark Felton

Mark Felton

As a mortgage broker one of the most common questions I receive from clients is whether they should fix the interest rate on their Home Loan. With the Reserve Bank pausing rate increases, at least for this month, some economists are now suggesting the cash rate may actually fall later in the year depending on inflation results. In the current climate the timing and length of time to fix a rate could save you, or cost you, thousands of dollars.

Given the current interest rate climate is now the best time to fix the rate on your Home Loan? There are advantages and disadvantages to locking in your interest rate which would determine if fixing your rate is the best option for you.

1. Security

When you fix a rate on your Home Loan you are guaranteed that the rate will not change for the period you have fixed for. This means your repayments will also remain unchanged which is helpful for household budgets.

2. Potential Money Saver

If you are able to fix your rate at the right time you could save money on interest, potentially thousands of dollars.

3. Some Flexibility

Most lenders will allow borrowers to make additional repayments when they have a fixed rate loan without incurring a penalty. It is most common for any extra repayments to be capped at a maximum $10,000 per year. Some lenders also offer the ability to have an offset account linked to the fixed rate loan to help reduce interest costs further,

although these are generally only partial offsets usually 40%. For example if you had a $1,000 balance in an offset account only $400 of that balance would be offsetting your loan.

1. Penalties may be payable for early repayment

If you become dissatisfied with your lender, decide to sell your home or you simply want to take advantage of better deals elsewhere, when you are locked in to a fixed rate you could be charged a substantial interest penalty to break the contract. A complex formula is used to determine what the loss to the lender would be if the fixed rate contract is broken which is outlined in any Home Loan Contract. This penalty could offset any benefit you received by locking in originally.

2. Most flexible features are unavailable

Flexible features that are standard on most variable rate loans are either not available or offered with reduced benefits on a fixed rate loan. Offset is typically not available, or only offered as partial offset which reduces the effect it has on interest saving, and redraw is also not available on fixed rate loans.

3. Potential to lose on the interest rate bet

Fixing a rate is effectively betting that the fixed rate will be lower than the variable rate for the time you choose to lock in for. In a volatile interest rate environment, where variable interest rates are dropping, if you have a fixed loan your rate will not reduce. The inflexibility of the fixed rate which is great in stable environments can be a curse at other times.

4. Potential for higher repayments once the fixed rate expires

A large number of borrowers have fixed their rates at historically low rates for the next few years. Once these rates expire the new interest rate will have increased significantly during this period, so their loan repayments will be much higher than what they have been used to paying.

If you can’t decide which option is the best one for you it is possible to hedge your bets. Lenders also offer a split loan option which means you can have a portion of your loan at a fixed rate and the balance on a variable rate.

By splitting your loan you retain the flexible repayment features of a variable rate loan, as well as having some of your loan locked away securely on a fixed rate for a few years.

It is always a great idea to speak with a mortgage broker who can guide you through the process, advise you on which loan structure would suit your needs best and recommend the most suitable lender to meet your requirements.

At SHL Finance we are available to speak with you at any time. We are already proactively helping our clients negotiate a better rate with their current lender, reviewing their existing loans and discussing ways to potentially save clients thousands of dollars. We would love the opportunity to help you too.

Please call Reece Droscher on 0478 021 757 to discuss your options.

The perception has been for a long time that lawn bowls is a sport for ‘older’ people.

Let’s blow that perception sky high. It is a sport for people of ALL ages – young, old, male, female – no matter what age category you fit into lawn bowls is a sport that has its doors open for you to walk through.

Lawn Bowls is a sport that takes you outdoors 52 weeks of the year and it also provides great exercise with plenty of walking on offer. It’s the perfect combination – playing outdoors in the fresh air and plenty of exercise.

And there is another important ingredient to playing lawn bowls – you get to mix with other people. Make new friends whilst enjoying a game of bowls. That is on offer to people of all ages – why sit at home on your own when you can be meeting new people and developing new friendships.

Call into your nearest Bowls Club and find out how you can become a member. Most people start out as social members and then progress via coaching to playing lawn bowls at a higher level.

During summer many bowls clubs run ‘barefoot bowls’ – this is potentially another starting point to your lawn bowls career. And it’s another way for people of all ages to ‘have a go’.

Why not get a group together, call your local bowls club, find out when you can play and book in.

Many people think it’s just a case of rolling the bowl from one end of the green to the other.

It’s a lot more complex than that. There is a high level of skill associated with lawn bowls and with the support of an authorised coach you will soon find out what is required to elevate you from playing social bowls to playing pennant bowls or competing in tournaments held at bowls clubs around Australia.

It doesn’t matter how old you are once you get started you will want to get better and better at it and test out your bowling expertise against other bowlers.

The decision to take up lawn bowls rests with you. Don’t just think about it –do something about it.

No matter what Bowls Club you contact you will be welcomed and provided with every opportunity for lawn bowls to become your number one active sport – NO MATTER YOUR AGE.

Fri 28 April, 9:00am - 5:00pm | Lilydale Library

Come and try your hand (and feet) at some heritage games! Many have been lost to time, others are old favourites. Bring some friends for a fun-filled adventure back through history. Games will be available all day for you to try (FREE). Bookings not required.

Robotic companion animals: a new addition to our Dementia Care Collection!

Fri 28 April, 10:00 - 11:00am Realm Library

Just like any other cat or dog, these furry robotic equivalents offer those with dementia comfort, companionship, and joy as they purr, meow, wag their tails, and much, much more. Come and watch library staff demonstrate this special, new addition to our Dementia Care Collection (FREE).

Wed 26 April, 2:00 - 3:30pm Ferntree Gully

Meet Barbara McCarthy, local author of Just a Hint of Autumn and My windows, my views...my life and travels. Barbara will speak about her books and experience of publishing at a mature age (FREE).

By Liz Sanzaro

By Liz Sanzaro

Some might say, very little, but what they may not realise is that entire ecosystems depend on our original native vegetation. Others understand the importance and are embracing native vegetation in many ways. An interesting example is the native warrigul greens, which is a leafy green plant that is a replacement for spinach, and is now so popular it can be found in the plant section at Bunnings. Recipes for how to prepare it abound on the internet, where chefs of celebrity status have provided their own spin on the recipe. Macadamia nuts are also a fully Australian food, just better known generally for a longer time.

In terms of what we have left of the original native vegetation, that supports our indigenous wildlife, we might only have a strip of land beside a road. In Croydon along Mt Dandenong Rd, there is a special section between Carcoola Rd and Murray Rd. A sign on the land declares it to be State Significant Roadside vegetation right in Maroondah, something to be very keen to protect.

However in Drouin, land that had been grazing land is now being offered to developers under a new State Government initiative called a Special Precinct Plan or SPP. This SPP over-rides the local environmental strategy of Council of Baw Baw, and the consequences are a disaster for all of us collectively.

Croydon Conservation Society stands with Drouin’s trees group, in condemning this wholesale destruction of what actually belongs to us, through our State Government, roadside vegetation land. Some Councils have developed their own roadside management protection plans, to ensure there is no loss of these precious strips of significant roadside vegetation, which provides habitat, biodiversity, shade on the road, important in extreme hot weather, slowing of wind, carbon sequestration, and not forgetting the health benefits of the view and clean air to everyone.

We need to appreciate what we have left in terms of original vegetation, and protect as much as possible. Often road sides provide the best examples of our native cultural heritage in terms of the original growth of plants in that specific region. Clearly the road making itself will have removed a linear strip, and if the surrounding land is owned by locals, the other side of the road reserve will often be farming land, like dairy, sheep, crops, like canola, barley or market garden crops, sometimes there may be no native vegetation left at all.

Because the developer, is allowed to maximise the investment, they are allowed to use the land right up to the boundary. Clearly this land is in the shadow of the roadside trees, and once the land is cleared, these external roadside trees, if retained may suffer from windshear, causing them to blow over in ever increasing wind speeds, across the now barren land so the roadside vegetation is perceived as a threat and then removed to ensure safety in the dwellings. Here is the result.

Along with wholesale vegetation removal at some of the level crossing removal projects, we are losing the habitat, biodiversity and benefits of trees, right at a time where we are looking at ways to prevent further human destruction of our natural heritage. Croydon Conservation Society has a very interesting website, explaining many things relating to conservation, from the value of a single tree (not monetary) to explaining fracking, to acidified oceans and everything else of local interest. If this interests you, you might like to support us by becoming a member, through the contact us tag.

Sanzaro

Whilst most people will experience reflux with extreme fullness occasionally, often with overeating (think Christmas day!), for some people this is a daily occurrence.

In healthy digestion, food enters the stomach via the oesophagus through a valve called the lower oesophageal sphincter, which opens only to let food in, then it closes again. Reflux is when this sphincter opens at other times and lets food or stomach acid through, often causing a burning pain in the oesophagus or an acid taste in the mouth.

The acid in your stomach plays a very important role in breaking up foods, killing bacteria (along with other foreign substances like bugs). The stomach is an amazing organ in that the acid can destroy human cells and will burn anywhere else in the body, but the lining of the stomach prevents it from destroying the stomach itself.

What most people do when they have reflux, is to take an antacid. This makes sense, of course, since at first glance, the problem is too much acid in the oesophagus. What can happen here though, is that further problems develop because they haven’t treated the cause. The acid is really important in breaking up foods and low stomach acid can lead to reduced digestion. This means that the food sits in the stomach for longer, placing increased pressure on the sphincter, which in turn can lead to increased reflux.

What you actually want to do, is be sure that your stomach has enough acid, strengthen the sphincter, and heal the oesophagus if it has been damaged by the acid. Another important point is that your body produces less acid as you age, so extra care is required as time goes by.

Stomach acid is produced when your nervous system is in ‘rest and digest’ mode as opposed to ‘fight or flight’ mode, which I have talked about previously.

So eating in a calm environment when you’re not in a hurry is a great starting point. Your body will also produce more acid when you think about food or smell food.

This happens when you walk past a restaurant, smell the food and your stomach starts gurgling – it’s increasing the stomach acid ready for digestion. Another way you can do this by stopping work or other distractions 15 minutes or so before eating and think about and smell the food you are about to eat.

Sometimes it can be helpful to add acid by drinking lemon juice or apple cider vinegar in a little water just before you eat. Be careful not to drink too much water with meals though, as this can dilute the acid in your stomach and make digestion harder, you’re best to drink water away from food by 1 hour. Bitter herbs can stimulate your body to produce more stomach acid and are best taken 15-20 minutes before eating. If you get really stuck, or are already taking medications to reduce your stomach acid, it can be helpful to take digestive enzymes with food so that your body has lots of acid with meals to digest them, then low acid in between. This can also help with other digestive issues such as fullness or pain. There are also some great herbs to heal the lining of the oesophagus if it has been damaged by the acid.

If you can follow your way to the cause of your health issues, you can go much further with your treatment.

Whole Naturopathy can help provide you with natural products such a bitter herbs and digestive enzymes, along with dietary advice for reflux and fullness.

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

Kathryn MessengerBHSc (Naturopathy)

kathryn@wholenaturopathy.com.au

Suite 1, 24/1880 Ferntree Gully Rd

Mountain Gate Shopping Centre

Ferntree Gully, Victoria

Transfer Balance Cap (TBC) were introduced in July 2017 and set in place a limit on how much an individual could transfer from their accumulated superannuation account into their retirement pension account.

The first general transfer balance cap (GTBC) limit was set at $1.6 million and then this increased by $100,000 on 1st July 2021. The mechanism for the increase is covered in the income tax assessment act 1997 (ITAA) with inflation being the key factor as to when and how much it will increase each financial year. Based on recent inflation levels it is expected the increase on the 1st of July 2023 will be $200,000 and take the GTBC to $1.9 million.

For those who are yet to set up a pension and are likely to have assets in super exceeding $1.7 million at 1st July 2023, would want to consider setting up their pension after the 1st of July, 2023 to take advantage of the increase in the GTBC. Remember, if you exceed the GTBC, you are liable to pay tax on the excess transfer balance earnings (excess transfer balance tax). You also need to transfer any excess to a super accumulation account or withdraw it as a lump sum.

For most Australian’s they will not exceed their personal transfer balance cap (PTBC) of $1.9 million. If they are close to exceeding their PTBC, there are strategies that can be put in place to reduce an individual’s funds in their accumulation account and so avoid going over their PTBC. It is important for individuals who believe they might exceed their PTBC to seek financial planning advice ahead of time and not leave it until they are just about to retire.

For those who are already in pension phase, their PTBC could be anywhere from $1.6 million to $1.9 million depending on when they set up their pensions and how much they had in their accumulation account at the time. Everyone will be different and it is not a matter of simply adding $200,000 to your existing PTBC.

For those who are already in the retirement phase of their lives, a Transfer Balance Account (TBC) is required to track an individual's use of their PTBC.

Transactions are recorded based on the reporting of various events (refer below table). The most common being the commencement of retirement phase pensions and commutations from those pensions.

Debits (deacrease in a account balance)

Commutation of capital value of the pension (inpcludes partial lump sum payments)

Structured settlement value

Family Law payment splits

Losses due to fraud or bankcruptcy

Reduction in defined pensions due to a change in circumstances

Currently, you could report either annually or quarterly with many reporting annually. For SMSF’s it would either be:

• Quarterly reporters – reporting of events required to be lodged within 28 days after the end of the quarter in which it occurs.

• Annual reporters – events to be reported no later than the lodgement of the SMSF’s Annual Return for the year in which the event occurs.

From 1 July 2023 the reporting laws will change and everyone, including SMSFs, will be required to report on a quarterly basis.

This will also capture all reportable events that may have occurred in the 2022/23 financial year. In effect, all reportable events that occur from 1 July 2022 – 30 September 2023 will have a reporting date of 28 October 2023.

There will be no grandfathering of the

Credits (deacrease in a account balance)

Value of all retirement phase pension accounts as at 30 June 2017

Commencement value of new retirement phase pension

Commencement of death benefit pensions

National earnings that accrue on excess balance

Repayments of LRBAs commenced from 1 July 2017 where there is value shifting between accumulation and pension phase

old rules either. Funds that were previously identified as annual reporters will be quarterly reporters from 1 July 2023 and will need to consider the above-mentioned reporting date for events that have, or will occur, this financial year.

Existing quarterly reporters do not receive an extension to lodge and will still need to report events from the 2022/23 financial year on a quarterly basis.

Going forward, reporting dates will be:

Quarter Reporting Date

1 July - 30 September 28 October

1 October - 31 December 28 January

1 January - 31 March 28 April

1 April - 30 June 28 July

There will continue to be some instances where reporting must occur earlier:

• Commutations resulting from a member voluntarily responding to an excess determination are to be reported within 10 business days

after the end of the month in which the event occurs.

• Commutations required due to the receipt of a commutation authority from the ATO must be reporting within 60 days of the authority being issued.

Many trustees and their advisors would be reporting on an annual basis, especially those who are processing their financial accounts annually. For those trustees of SMSF, who current report annually, will need to put in place processes to remind them to report quarterly should an event occur that would impact their TBA.

Often it is the SMSF accountant or administrator who is lodging the Transfer Balance Account Reports (TBAR), and they also will need to be aware of these new reporting rules and keep an eye out for any events that might require the lodgement of a TBAR.

Thankfully, estimated values of the event can be lodged, with more accurate information reported via an amendment at a later date. However, this does create inefficiencies as the reporting mechanism is often linked to the software the transactions are processed in. Having to create ‘dummy

entries’ in order to lodge a TBAR will result in double handling and increase the chances of errors occurring. We would not encourage this process as this might lead to the further scrutiny by the ATO regarding the specific event being reported.

Transfer balance account reporting is akin to the requirement to lodge tax returns and activity statements in that, late lodgement may lead to penalties for failure to lodge on time. A penalty unit, currently $275, can apply for each 28 days (or part thereof) that a report is lodged late. Up to a maximum of 5 penalty units.

While the ATO have chosen not to apply penalties for late lodgement to date, it cannot be expected that this will continue. With the streamlining of reporting and having all SMSFs on the same reporting regime, it will be easier for the ATO to start imposing penalties. It is important to note that there is only a requirement to lodge if there are events that need to be reported. Unlike an activity statement, for example, where you may still be required to lodge a nil statement when there is nothing to report, transfer balance account reporting is driven by an actual reportable event.

Given the pending increase in the general transfer balance cap from 1 July 2023 and the implications for personal transfer balance caps, the sooner events are reported, the sooner these values can be correctly determined.

These new requirements are likely to place additional pressures on accountants and administrators of SMSF. It is important for accountants and administrators of SMSF to review their reporting practices to try and avoid late lodgements of TBARs. This is especially important for those clients that have previously been able to lodge their TBARs at the same time as lodging their SMSF Annual Return.

By Erryn Langley

By Erryn Langley

Jane (not her real name) rang me up last week. Jane was a member of one of the network groups I attended and I had not seen her around for quite a few months. This was not unusual for Jane as she would often be away on holidays. Jane and her husband love to ski and they would take every opportunity to travel and ski when and where they could whilst doing their work around their skiing trips.

We talked for a while and then Jane wanted to share with me some news… her husband has lymphoma. Her husband had gotten really sick recently whilst they were overseas on one of their ski holidays. Initially, they thought he had a bad cold or the flu but he could not seem to get over it and he started getting worse. They decided to go to the local hospital near the ski fields but received no conclusive answer so they decided to cut short their trip and return to Australia. After seeing their local doctor, they were provided the bad news a week later. Jane, being the fighter she is, told me that it was one of the more aggressive types of lymphoma, which apparently was good news, as it is one of the rarer types that is easier to combat, and has a higher chance of recovery.

I was saddened by the news and when it was appropriate to do so, I asked her a question that no one had yet asked her. I asked her if she knew what personal insurances her husband had in place. Jane had already shared with me during our conversation that their circumstances had changed and she was reviewing all her financial options now that she was looking after her husband. Initially, she did not understand what I meant and I explained that he might have personal insurance cover in super or a policy outside of super and that one of these policies e.g., Income Protection, could help cover some of their medical expenses and/or loss of earnings if a claim was put in. Jane had not even considered this and admitted to me that she had no idea what her husband had in the way of personal insurances. She said she would look into it after she spoke

with me. Jane suggested I should write about this and so here we are.

Personal insurances, such as life insurance, disability insurance, and critical illness insurance, can provide financial security for both you and your partner in the event of an unforeseen circumstance. For example, if your partner were to become seriously ill or pass away, having appropriate insurance coverage could help alleviate the financial burden and ensure that you and your family are taken care of.

Additionally, personal insurances can be particularly important if your partner is the primary breadwinner in your household. Without adequate insurance coverage, the loss of their income could be devastating for your family. However, if they have appropriate insurance coverage, it can provide a safety net and ensure that you and your family are financially secure, even if your spouse/ partner is unable to work.

Furthermore, personal insurances can also provide peace of mind. Knowing that your partner has appropriate insurance coverage can alleviate some of the stress and anxiety that can come with unexpected events. It can help you feel more prepared and in control, knowing that you have a plan in place to handle any potential challenges that may arise.

So, with all these potential benefits in mind, it may be worth knowing whether or not your partner has personal insurances. However, it's important to approach this topic delicately and respectfully. Some people may feel uncomfortable discussing their finances, or may not want to disclose personal information about their insurance coverage even to their partner. It's important to respect your partner's wishes and boundaries when it comes to discussing these topics.

If you do decide to broach the topic of personal insurances with your partner, it may be helpful to start the conversation by expressing your own concerns and priorities. For example, you could explain that you want to ensure that your family

is financially secure in the event of an unforeseen circumstance, and that you're curious about whether or not your partner has appropriate insurance coverage to help achieve that goal.

It may also be helpful to approach the conversation as a team effort. Rather than trying to dictate what your partner should do, work together to explore your options and come up with a plan that works for both of you. This can help ensure that both you and your partner feel heard and respected, and can help you reach a mutually beneficial decision. In conclusion, knowing whether or not your partner has personal insurances can be important for your financial security and peace of mind. However, it's important to approach this topic delicately and respectfully, and to work together as a team to come up with a plan that works for both of you.

If you or your partner require a review of your personal insurances, or would like to know how much cover you ideally should have in place, then consider having a discussion with your local financial planner. If you do not have a local financial planner than reach out to Erryn or Warren from Find Wealth or call Find Insurance on 1300 88 38 30 and they will organise a time for you to speak to an advisor and help you find the right cover in place for you or your family.

Erryn Langley1300 557 144 | erryn@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth. Find Wealth is a Corporate Authorised Representative (No 468091) of AllianceWealthPtyLtdABN93161647007(AFSLNo.449221).PartoftheCentrepoint Alliance group https://www.centrepointalliance.com.au/

Erryn Langley is Authorised representative (No.1269525) of Alliance Wealth Pty Ltd. This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

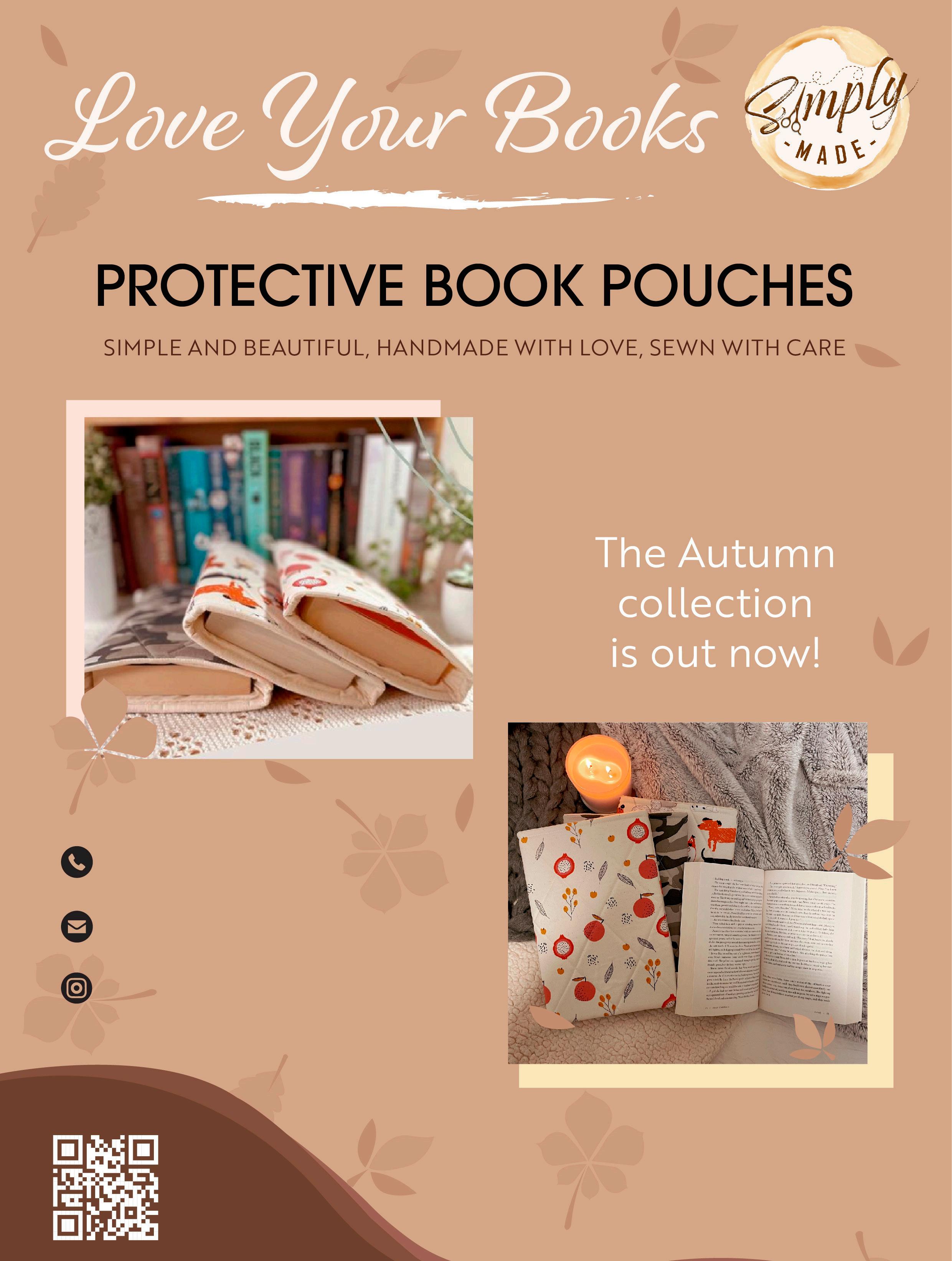

Silverettes are small, reusable, and ecofriendly nursing pads made from pure 925 silver. They are designed to be worn inside a mother’s bra to promote soothing and healing of sore nipples during breastfeeding. They are made in a small cone shape, to allow a comfortable fit over the nipple without compressing it. When applied correctly, with a drop of breastmilk inside, they will gently suction onto the breast over the areola area and remain in place inside the bra. No additional nipple creams or lotions are required when using silverettes.

Some mothers prefer silverettes to disposable nursing pads because they

are washable, and can be reused for an extended period of time. This makes silverettes an environmentally friendly option to disposable breast pads. They are easily cleaned by rinsing under warm water.

Silver has been used for centuries for its antimicrobial properties. It is believed that the silver ions that occur naturally in 925 silver have antimicrobial, anti-bacterial and anti-fungal benefits. Some studies have suggested that silver may have anti-inflammatory and wound-healing properties, which could make silverettes beneficial for sore and cracked nipples. Silverettes have the added advantage of providing a protective barrier between the nipple and clothing, reducing friction or irritation.

Many mother’s report that silverettes are

effective at healing their sore nipples quickly. It is important to note that research on the effectiveness of silverettes for nursing mothers is limited, and more studies are needed.

In general, if you are considering using silverettes for breastfeeding, discuss this with your healthcare provider or a lactation consultant to ensure that they are safe and appropriate for your individual needs.

Osteopath B.App.Sc(Clin.Sc)/B.Osteo.Sc/Grad Dip Paeds LACTATION CONSULTANT www.childrensosteopathiccentre.com

We’re highlighting the story of Leading Senior Constable Lisa Atkinson – a woman whose journey to working in the Ballistics Unit was anything but straightforward.

From a qualified beauty therapist to a mechanic apprenticeship and a track rider between, Lisa had no shortage of careers before deciding to step into policing.

While in the role of stay-at-home mum with two daughters, she saw a police recruitment ad and thought to herselfthis gig looks good, I reckon I could do that.

Taking on a 31-week training structure at the Academy while juggling a busy household wasn’t easy, but the support of her squad members made the journey one she reflects positively to this day.

While carrying out the all-rounder responsibilities of a general duties officer Lisa seized opportunities offered to her, completing several secondments to specialist units.

After 12 years in a general duties role and once again feeling the itch for change, Lisa decided to investigate where her career could take her next. This led her to the Ballistics Unit within the Forensic Services Department.

Here, Lisa found her happy place, with the flexibility to be around for her three daughters and study for her Advanced Diploma of Forensic Investigation.

Her advice for anyone contemplating a career in policing? To make the most of the opportunities presented to you, just like she had.

"There's just so much you can do at Victoria Police, so much you haven't even thought about," she said.

"I never thought I would work in ballistics - I never thought I was smart enough - but here I am today."

If, like Lisa, you’re feeling the itch to make a change, Victoria Police could provide the change of direction you're looking for. We’re recruiting now. Learn about the possibilities at Victoria Police https:// policecareers.info/3mh0OEu

Learn more about how Lisa took aim at a new career by looking at the newest edition of the Police Life MagazineView More

2002 Completes Holistic Beauty Therapy and finds work at spa near Nelson, her hometown.

2003 Moves to Christchurch and starts working as a track rider at a racecourse.

2004 Moves to Melbourne, starting a mechanic apprenticeship.

2006 First daughter is born.

2008 Welcomes second daughter.

2009 While juggling two young children at home, Lisa begins training at the Victoria Police Academy.

2010 Graduates from the Academy and is deplyode to Dandenong, later transferring to Cranbourne, where she takes advantage of secondments to specialist units.

2015 Third daughter is born.

2021 Joins the Ballistics Unit at Forensic Services Department.

This is the fifth of five publications where we have been running a series of sensory experiences in nature.

Each experience will take about 10 mins and you are encouraged to read through the instructions before you commence your time in nature to maximise your experience.

Find a spot outside where you can sit or lie down comfortably. This could be in your backyard, your local reserve or in a national park. You may like the familiarity of the same place you have practised before or you may like to try somewhere new.

Take a few moments to regulate your breathing and settle into your position. For this breathing exercise, we will follow a pattern of 4 counts in, holding for 7 and then exhaling for 8.

Follow this pattern, allow it to take all of your focus and to help you unwind. Repeat for a few minutes.

Allow your breathing to find its natural rhythm once more.

For the next 5 mins we are going to practise tuning into all of our senses while we do a slow walk. You may only move a few metres within the 5 mins, the point of the exercise being to tune in to your senses of sight, smell, hearing and feeling as you go. Draw your attention to the details, get in close to nature, take time to experience the full experience of each moment.

You are trying to slow down your senses, slow down your experience. Try not to allow distractions to come into your mind, be fully present to the experience. If you do get distracted, don’t stop, just

tune back in and continue.

When you choose to complete your experience, you may wish to take a moment of gratitude for

and for the experience you have just had.

Turning into our senses is an important way to disconnect from the fast pace of modern life.

nature

Individuals will now have the ability to claim a higher deduction for self-education expenses. From the 2022–23 income year, legislation that limited the self-education deduction to costs above $250 each income year has been repealed. In order to claim a self-education deduction, an individual must demonstrate a necessary connection of the expense with their assessable income.

The announcement, which recently became law after receiving royal assent, originally came from the 2021 Federal Budget and is somewhat related to a Treasury discussion paper released in December 2020. However, other matters addressed in the paper, such as deductions for expenses unrelated to current employment, have not been taken further at this stage.

Announcement(11-May-2021)

Consultation

Introduced(3-Aug-2022)

Passed(28-Nov-2022)

Royal Assent(12-Dec-2022)

Date of effect(1-Jul-2022)

Starting from 1 July 2023, operators of sharing economy platforms will be required to report transactional information to the ATO. The Taxable Payments Reporting System already applies to some businesses in industries where non-compliance is deemed to be high risk. By adding operators of sharing economy platforms to the regime, taxpayers who hold or use assets for short-term lease or contract work will also have their information collected.

The identification of users of sharing economy platforms means that, as an adviser, you should be informing taxpayers who earn income off these platforms about their tax obligations. This includes operators of shortterm accommodation, ride-sharing transport and food delivery platforms. Also, other task or time-based service platforms will be required to report for income years beginning on 1 July 2024.

Announcement(25-Aug-2021)

Consultation

Introduced(3-Aug-2022)

Passed(28-Nov-2022)

Royal Assent(12-Dec-2022)

Date of effect(1-Jul-2023)

Australian Business Number (ABN) holders will now be required to be

accountable and comply with annual income tax lodgment obligations.

First announced in the 2018–19 Federal Budget as an integrity measure, this exposure draft legislation seeks to strengthen disruptions to black economy and tax avoidance behaviour.

Currently, ABN holders are able to retain their ABNs regardless of whether or not they meet income tax obligations. This measure will provide more accountability on enterprises by giving the regulator the ability to cancel ABNs. This means advisers need to ensure clients keep their lodgments up to date, or at least keep a clear line of communication with the ATO.

The ATO has finalised TR 2022/4 and PCG 2022/2 in relation to distributions made by trustees of discretionary trusts. This was complemented by TA 2022/1, which discusses parents benefitting from the trust entitlements of the adult children. All 3 documents focus on schemes where income is diverted from an intended beneficiary in order to reduce tax liabilities.

The rulings discuss these at detail and include significant attention to an important carve out for dealings that are “ordinary family or commercial dealings”. These dealings are excluded from the anti-avoidance provisions. Along with these regulatory resources, the ATO has reiterated its stance in many areas relating to s 100A. In particular, where situations would generally come under an ordinary family or commercial dealing. Trustees need to make sure that their distributions are in accordance with the expectations of the ATO, otherwise they may be subject to an audit. Helping them understand their obligations is paramount coming up to the end of the current income year.

Announcement(12-Apr-2019)

Consultation(29-Nov-2022)

Introduced

Passed

Royal Assent

Date of effect

Announcement(23-Feb-2022)

Consultation period(29-Apr-2022)

Released(8-Dec-2022)

Crypto assets are to be specifically excluded as a foreign currency within income tax and GST legislation.

The legislation maintains the current tax treatment of crypto assets such as Bitcoin and removes uncertainty following the decision of the Government of El Salvador to adopt Bitcoin as a legal tender.

When the legislation receives royal assent, the new laws will be in effect from income years that include 1 July 2021.

The individual tax residency rules will be replaced by a new framework with a primary physical presence test.

Under the new primary test, a person who is physically present in Australia for 183 days or more in any income year will be an Australian resident for tax purposes. Individuals who do not meet the primary test will be subject to secondary tests that consider a combination of physical presence and other measurable criteria.

These new rules contrast with the current rules which look at the ordinarily resides test as the primary indicator to reviewing Australian residency.

Changes to the individual tax residency rules will be required to go through the legislative process and will commence after royal assent has been given.

Announcement(6-Sep-2022)

Consultation(6-Sep-2022)

Introduced(23-Nov-2022)

Passed

Royal Assent

Date of effect(1-Jul-2021)

Announcement(11-May-2021)

Consultation

Introduced Passed Royal Assent

Date of effect

In 2019 the Australian tax residency of an individual was ruled incorrect by the Full Federal Court on appeal, reversing an earlier determination by the Commissioner of Taxation. A subsequent appeal to the High Court of Australia by the Commissioner was also dismissed.

This was a major case for expatriates living abroad, as the individual in question had been living in “temporary” serviced apartments in the Middle East. During the time in question, the taxpayer’s family had been living in Australia in a property jointly owned by the individual.

The case was overturned on account of the term “permanent place of abode” which is part of the Australian tax residency question. The ATO has recently provided further guidance with TR 2022/D2 for expatriates wishing to remain a non-resident of Australia for tax purposes when working overseas.

Announced: 27-Feb-2019

Updated: 20-Jan-2023

The Commissioner of Taxation now has new powers to direct a small business taxpayer to undertake a record-keeping education course in lieu of an administrative penalty.

The new directive will be initially limited to small business owners in order to assist them in keeping up to date with tax obligations.

The individual must then provide the Commissioner with evidence of completion of the course in order to avoid financial penalty. The Commissioner will be able to issue a tax-records education direction to an entity from 12 March 2023.

Announcement(3-Aug-2022)

Consultation

Introduced(3-Aug-2022)

Passed(28-Nov-2022)

Royal Assent(12-Dec-2022)

Date of effect(12-Mar-2023)

Council is calling on residents to share their thoughts in the Australian Liveability Census - the largest social research project in Australia!

The census invites residents in communities across the nation to take part in a short survey and share their thoughts on the things they value, need and experience within their local neighbourhoods.

Whether it's more shops, parking, access to green spaces, or improving public safety, your voice will help guide decision making and contribute to national research regarding liveability.

Mayor of Maroondah, Councillor Rob Steane, said the survey is a great opportunity for residents to help shape Maroondah’s future.

“By taking part in the Australian Liveability Census, which takes less than 15 minutes to complete, Maroondah residents can provide a wealth of knowledge about what matters most to them in our local community,” Cr Steane said.

“This will help ensure Council can consider the needs, values and goals of our residents when planning future programs, initiatives, facilities and more. I encourage everyone to complete the survey and share their feedback.”

The 2023 Australian Liveability Census

Council formally adopted the Maroondah Tennis Strategy at the Council meeting on 20 March 2023.

The strategy highlights key considerations that may influence tennis participation in Maroondah and may impact Maroondah tennis clubs, while acknowledging that other actions and projects may be identified to support changing community needs over time.

Deputy Mayor of Maroondah, Councillor Tasa Damante, said the strategy will help increase participation in tennis and support local tennis clubs.

“The Maroondah Tennis Strategy will provide a framework for supporting tennis clubs, which have long played a valuable role in sport and recreation options for the Maroondah community,” Cr Damante said.

survey is now open. All participants who complete the survey by Wednesday 30 June 2023 will have the chance to win one of 50 x $100 vouchers! Visit Council’s Your Say Maroondah website to share your thoughts or to learn more.

“The strategy will also help improve accessibility to tennis in Maroondah and increase participation in the sport, which can be enjoyed by people of all genders and generations.”

The strategy builds on Council’s work in the tennis space, which saw Council receive the Supporting Tennis - Local Government Award at the 2022 Victorian Tennis Awards.

This work includes leading a regional tennis governance review and undertaking a facility infrastructure audit, as well as taking part in Tennis Victoria’s Thriving Tennis Communities Project as a pilot Council - a project that saw local tennis clubs review participation in the sport, along with reviewing their practices and procedures.

Council also collaborated with Tennis Victoria to engage with local tennis clubs to develop the draft Maroondah Tennis Strategy, which was then presented for feedback via Council’s Your Say Maroondah website in December 2022 and January 2023.

The Maroondah Tennis Strategy is available to read on Council’s website.

Come see what’s happening at the Bedford Park Community Garden & Sustainability Hub based at Central Ringwood Community Centre. Room 10 (Around the back of the building) Offerings each month will vary a little but regularly include:

• Knife/scissor sharpening

• Clothes swap/share (You can still participate if you don't have clothes to give)

• Food swap/share (you can still participate if you don't have garden produce to share)

• Bike care & repair tutorial. Bring your bike or come and watch and learn without one, all welcome

• and on some occasions food waste education from the amazing Maroondah City Council Waste education team. Come along and learn about composting and the new FOGO system

Date and Time

• Sunday, 16 April 2023 - 10.00am to 12.00pm

• Sunday, 21 May 2023 - 10.00am to 12.00pm

• Sunday, 18 June 2023 - 10.00am to 12.00pm

• Sunday, 16 July 2023 - 10.00am to 12.00pm

• Sunday, 20 August 2023 - 10.00am to 12.00pm

Nature Play Week is a national initiative that encourages younger generations to explore their natural surrounds and enjoy the many untapped benefits of spending time in nature and connecting to the outdoors.

We provide support to all communities in prevention-led activities and, in doing so, aim to build stronger networks and trust within our community,” Michelle said.

“By raising awareness about genderbased violence in our community, we can move towards change. Events are run each year, and anyone can be involved.”

Have you seen the mosaic installations at the Croydon and Ringwood police stations?

The mosaics were created as part of the 16 Steps to Respect Project, a partnership between Council, Mullum Mullum Indigenous Gathering Place, Boorndawan Willam Aboriginal Healing Service, Victoria Police and Eastern Community Legal Centre. The project was funded by Safe and Equal, the peak body for specialist family violence services in Victoria.

The collaborative project brought men, women, elders and young people together to talk about what respect looks like, as part of the 16 Days of Activism against Gender-Based Violence campaign in late 2022.

The tiles were gifted to Victoria Police and installed in Croydon and Ringwood police stations earlier this year.

Mayor of Maroondah, Councillor Rob Steane, said the partnership is an important part of ensuring a safe, culturally inclusive and welcoming community.

“Council is proud to have partnered in this collaborative project with Mullum Mullum Indigenous Gathering Place, Boorndawan Willam Aboriginal Healing Service, Victoria Police and Eastern Community Legal Centre, as part of our support for the 16 Days of Activism campaign,” Cr Steane said.

“Projects that bring our community together, like this project did, are so important for ensuring all members of our community feel safe and respected.”

Elke Smirl, Chief Executive Officer, and Merilyn Duff, Health Coordinator/ Ochre Program Team Leader, both of Mullum Mullum Indigenous Gathering Place, said the project was “deeply meaningful” in helping to “break down barriers” by “sharing stories and being vulnerable”.

“Shared experiences and stories increase our sense of courage and strength to step forward and to break cycles of violence and disempowerment,” they said.

“It is important to bring everyone together. This brings shared understanding, strengthens relationships and educates everyone. Most importantly, we better understand each other’s stories and experiences.”

Elke and Merilyn said the project also aimed to create a “greater sense of cultural safety for community members accessing police stations”.

“We want our Aboriginal community to know that there are safe places and safe people to speak to. By having our artwork and stories on the walls [in local police stations], we hope this will help.”

Michelle Maslen, Acting Inspector, Local Area Commander for Maroondah Police Service Area, hopes the project will help members of the community feel comfortable with reporting violence or abuse or calling out disrespectful behaviour.

“It is important that conversations are generated around the prevention and elimination of gender-based violence.

Along with this partnership, Council supported the 16 Days of Activism campaign by displaying billboards around Maroondah, expressing messages of safety, non-violence, respect and gender equality. The messages were developed with local partner organisations and members of our Indigenous community, two Burmese communities and women with disabilities.

Council also shared social media posts in support of Women’s Health East’s Together for Equality and Respect (TFER) regional campaign, and supported Respect Victoria’s Respect Women: Call it Out (Respect Is) social media campaign.

If you or someone you know is impacted by gender-based violence, partner violence, elder abuse or sexual assault, contact:

• 1800 RESPECT or 1800 737 732 for 24/7 confidential counselling, support and safety planning by trained counsellors

• 1800 015 188 Safe Steps - Victoria’s 24/7 family violence support service

• 1800 542 847 WithRespect - a specialist LGBTIQ+ family violence service

• 13YARN / 13 92 76 - a national crisis support line for mob, with Lifelinetrained Aboriginal and Torres Strait Islander Crisis Supporters available 24/7

• InTouch Multicultural Centre Against Family Violence - call the Telephone Interpreter Service (TIS) on 131 450 and ask them to call 1800 RESPECT or 1800 737 732

In an emergency, you should always call 000.

For more information, visit the Safe and Equal website and the Respect Victoria website.

Inspired by multiple fantasy stories, this is a holiday program not to be missed! No day will be the same when your professors take you on a wild journey into the magical world of Wizardry.

Our school holiday program consists of changing rooms and characters to produce a fully immersive magic school experience. No day will be the same when your professors take you on a wild journey into the magical world of Witchcraft and Wizardry.

Artists, arts and cultural groups and organisations are invited to apply for a share in funding to support their projects through Council’s Arts and Cultural Grants funding program for 2023/24.

The grants provide support for projects at any stage of the creative process and reflect the rich diversity of the Maroondah community. Grant applications open on Tuesday 14 March and close at 4pm on Friday 28 April 2023

Mayor of Maroondah, Councillor Rob Steane, said the funding can be used for a variety of projects.

Read More

Council was recently named a Mental Health First Aid (MHFA) Champion Community by Mental Health First Aid Australia.

Through the program, Council has connected and worked with like-minded groups to empower community members to be mentally healthy while supporting the mental health of others. This has helped reduce stigma around mental health through honest and meaningful conversations on mental health concerns.

In December 2021, Council consulted with the community and key stakeholders on how they use the existing Woodland Park in Croydon South and what they would like to see in the southern part of the Councilowned section of the former Croydon South Primary School land.

From the feedback provided, a draft enhancement plan has been developed and includes:

• enhancement and preservation of the environmental values

• improved connections for walkers

• enhanced play and gathering spaces.

Mayor of Maroondah, Councillor Rob Steane, encouraged residents to view the draft enhancement plan and invited them to share their feedback.

“The draft enhancement plan aims to ensure Woodland Park continues to

Volunteers in Maroondah are invited to take part in our two-day Mental Health First-Aid training.

Across two days, Wednesday 22 March and Wednesday 29 March, Council is offering free Mental Health First Aid training to Maroondah volunteers 18 years and older who are interested in gaining their Mental Health First Aid accreditation.

The aim of the training is to build up a participant’s knowledge of mental health first aid to help them identify mental illness and further support the people they care for in their service.

The two-day workshop will provide participants with:

• skills in how to recognise the signs and symptoms of mental health conditions and possible causes or risk factors

meet the needs of the community, so we are calling on those who use the Council-owned space to share their thoughts and help shape its future,” Cr

• how to give appropriate initial help and support to someone experiencing a mental health condition.

Anyone can learn Mental Health First Aid regardless of prior experience or training. Mental health first aid is the help provided to a person who is developing a mental illness, or in a mental health-related crisis, until appropriate professional treatment is received or the crisis resolves.

This event has sold out however please click on the link below to join our wait list.

Book online

Participants who complete the training will receive a 3-year Mental Health First Aid certificate from MHFA Australia.

Council is proud to be recognised as a Mental Health First Aid Champion Community with Mental health First Aid Australia.

For further information on the training, please contact Fiona Burridge, Be Kind Facilitator at bekind@maroondah.vic. gov.au or phone 1300 88 22 33.

• Wednesday, 22 March 2023 - 9.30am to 4.00pm

• Wednesday, 29 March 2023 - 9.30am to 4.00pm

Monday 17 April to Sunday 23 April | Aquahub, Croydon

Head into Aquahub and try out a cycle class! Cycle classes are open to all fitness levels, giving you the freedom to work out according to your own ability. This is a great opportunity to try out a cycle class and bring a friend with you - all for free! Check out our timetable, and book into a session that suits you. Bookings open 48 hours prior to the class start time.

Find out more

Tuesday 18 April, Saturday 29 April, Wednesday 3 May | Online and in-person

From 1 May, Maroondah residents will be able to put their food waste into their garden organics bin. FOGO kits including a caddy and roll of compostable liners are being delivered to Maroondah households to help them collect food waste in their kitchen. These sessions will provide more information about what the caddies and liners are and how they can be used. Visit Council's website for details and to find a session that suits you.

Find out more

Friday 21 April | 11am to 2pm | Barngeong Reserve, Croydon

Join us for a Nature Play Week event that will inspire your little nature adventurers to care for our local nature and have lots of fun outside too! The day will include activities suitable for children aged 2 to 8 years. Families with younger children, older children and all abilities are welcome. Children can use their Nature Ninja skills in the interactive and creative activities including a nature hunt, story book trail, cubby building and more. Registrations are essential - register via Council's website.

Read More

We do have an interesting story about our logo, one we would like to share. In 2012 a letter was written to Kilsyth Council in Scotland asking for their permission to use their Coat of Arms, this was refused. An article appeared in the local Kilsyth Chronicle Scotland about this dance Group in Melbourne Australia and it was read by a Mr William Chalmers. He contacted the Melbourne RSCDS Branch and the Secretary passed on his details to us.

William designed our logo which incorporates the old Coat of Arms of Kilsyth, Scotland and he followed up with a description of what it entailed:

• Top right hand side - Crossed Swords: reminds us of the Battle of Kilsyth, August 1645

• Top left hand side - the open Bible: explains many of the historical events in Scotland’s history

• Bottom left hand side - symbolises the weaving in the town and hardships of the men and women

• Bottom right hand side - Glenny lamp, depicts the coal mining industry

• The design of the logo is embedded within the Kilsyth Tartan. Centre top we have the Australian flag and centre bottom, the Lion Rampant.

We are a non-profit Group and our aim is to teach Scottish Country Dancing (SCD) within the community. It is the social form of dancing in Scotland and it is danced the world over. Reels, Jigs and Strathspey’s are the three tempo’s used for Scottish Country Dancing. SCD is usually danced with 6 or 8 dancers, who form into sets (this is not solo dancing). Five basic steps are used to form a variety of formations that go into making the dance.

Classes are held: Venue:

Monday evenings commencing 6th March, 8pm-10pm.

Croydon Senior Citizens Club, Unit 1, 7 Civic Square, Croydon.

Contact:

Eleanor Email: eallan@bigpond.net.au

SCD can Boost your Social Life, Great Fun Exercises both Mind and Body.

No special clothes just soft shoes Low-cost Entertainment No Partner Necessary

This is a General class, Beginner’s are made welcome. If you like the Scottish music and your feet tap along to it why not come, join in the fun and give Scottish Country Dancing a go - all would be welcome.

Upcoming Event: Family Fun afternoon Ceilidh Dance

Date: Sunday 30th April. 2023 Time: 2.00pm Venue: Croydon Senior Citizens Club, Unit 1, 7 Civic Square, Croydon.

Bookings essential for catering purposes

Contact: Eleanor email: eallan@bigpond.net.au

After class we have a lovely cup of tea/coffee and a chat before heading home and at the Ceilidh the Group provide a lovely afternoon tea.

You don’t have to be Scottish to come along to either the Ceilidh or the General Class.

Follow us:

11 May 9:30AM $45

Paint your pot plant your cactus and take it home

Bookings via QR code or by phoning 9720 0877

Bayswater North

Ringwood U3A is looking for volunteer tutors and/or class leaders for their 2023 courses.

If you have a skill, interest or hobby which you are willing to share with others, Ringwood U3A offers a friendly and relaxed environment where you can make new friends and share your interests with the other U3A members.

Ringwood is a small and friendly group which operates out of 2 convenient and comfort locations in Ringwood which are well equipped to host classes.

Alternatively if you are looking to join our U3A we offer varied courses which cover exercise, craft, discussion groups, wine tasting/education, games, languages and more.

To learn more, look at our website u3aringwood.org.au, email info@u3aringwood.org.au or ring 0481 591 224.

Photography

Learn to take better pictures

Mondays 7:00 - 8:30PM 1 May - 5 June $75

Kilsyth Scottish Country Dance Group Inc

“Are having a Ceilidh”

Sunday 30th April 2023

Venue

Croydon Senior Citizens Club Unit 1, 7 Civic Square, Croydon.

2 pm - 4 pm

Lively Scottish Music, fun dances, Casual clothes - soft shoes No partner necessary Prizes to be won And You don’t have to be Scottish

Afternoon Tea provided

Donation: Adults $10.00 School Age children free

Bookings required for catering purposes

Contact Eleanor: 0409 967 701 Or email: eallan@bigpond.net.au

Boronia View Club will be meeting on Friday 21 April at Eastwood Golf Club, Liverpool Rd., Kilsyth with a 2-course lunch costing $27 followed by Christine Ingram speaking on "Rugs, and all things knitting". There will be the usual book stall, trading table and raffle with all monies raised going to The Smith Family Learning for Life program helping needy Australian children with their educational requirements. Ladies of all ages and backgrounds will be warmly welcomed.

Looking for some magical fun these school holidays? Let us entertain you! From ice-cream cookie decorating, pizza and burger making to glittering slime and cloudy dream jars, these school holidays are what dreams are really made of!

Discover the full program here or visit each magical event below to book your little one’s in today.

In this hands-on masterclass, kids see all the secrets to the famous Grill'd burgers, learn nutrition only dreams are made of and build a perfect burger from the bun up!

The Ultimate Best Time Ever! Pick your favourite colours, glitters and charms add-ons to make your favourite DREAM slime with Slimelab!

Kids will enjoy learning the fundamentals of sushi making with our experienced sushi chefs. Kids will create their own rolls using the tools and fresh yummy ingredients!

By Warren Strybosch

By Warren Strybosch

With higher interest rates in Australia, it may be a good idea for people who are about to retire to consider paying off their mortgage. Higher interest rates can increase the cost of borrowing, making it more expensive to carry debt, including a mortgage.