Are

our next Copywriter?

Are you our next Bookkeeper?

By Warren Strybosch

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

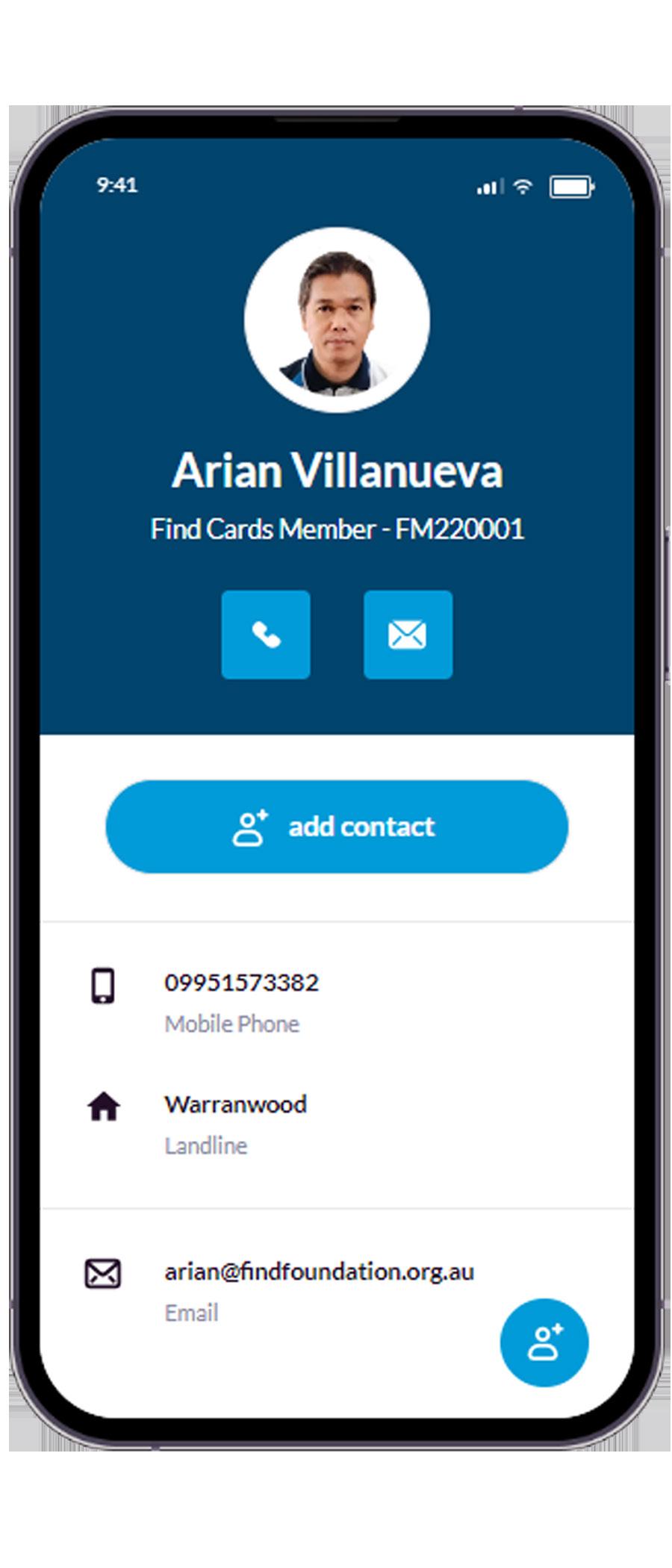

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

By Mary Barnes

The phrase "Buy Local, Support Local" has become more than just a slogan; it's a powerful movement that fosters economic growth, community cohesion, and environmental sustainability. When you choose to spend your money within your community, you're injecting lifeblood into the economy.

These purchases create a ripple effect, supporting jobs, local businesses, and ultimately, the overall well-being of your neighbourhood.

Beyond the economic benefits, buying local contributes to the unique character of your community. Local businesses often reflect the area's culture and values, creating a sense of place. Additionally, supporting local businesses often means supporting sustainable practices, as shorter transportation distances reduce carbon emissions.

Moreover, building relationships with local business owners strengthens community bonds, Engaging with those who live and work in your area fosters a sense of belonging and shared purpose. When you know the people behind the

businesses, you're more invested in their success and the community's overall prosperity.

Choosing to buy local is a powerful way to make a positive impact on your community. By supporting local

businesses, you're not just making a purchase; you're investing in a brighter future for everyone. Let's come together and embrace the "Buy Local, Support Local" movement, creating thriving communities where people and businesses flourish.

Budgets. A task no one likes doing but without which you could easily find your business floundering.

By Jodie Moore

Regardless of the size of your business a budget is a really important tool to assist you in achieving your future goals. Most businesses know what their goals are. If not then that is the first priority. Once you have determined your goals, you need to work out how you are going to achieve them, and that is where a budget comes in.

A budget allows you to decide where money and resources are best used or spent, and this is determined by your

goals. Generally, you will be setting goals for a new financial year. Perhaps you have spent the past year getting set up, training staff, and devising systems and processes. Now you are ready to ramp up and grow your business by getting more customers. What is your budget going to look like?

To get more customers you will generally spend more money on marketing. If you spend more on marketing though, you will likely have to spend less somewhere else so you will need to have a look at your expenses and decide what is not relevant anymore, perhaps training.

A budget should not be a set and forget though, never to look at again. You can refer to it over the course of the year, perhaps make a few tweaks along the way.

At the end of the time period, you can then look back on your budget to see whether you were on track or if therewere any variances, both good and bad. If there were variances, it is helpful to determine what caused the variance.

If the variance was good, what happened. Was it something you did or just something that happened in the local economy that you were able to benefit from? Can you repeat it?

If the variance had a negative impact on your business, what could you change next time?

As tedious as doing a budget may seem, a little planning can go a long way. Spending enough time on working on your budget can save countless hours, money and heartache and should not be ignored.

By Liz Sanzaro

For those of us the other side of 50 who chose to live inconveniently (to the city) in the outer east, to enjoy space, backyards, birds a plenty and frogs, yabbies, and so much more, we are now faced with a world we never could have imagined with Melbourne now expected to accommodate more than 6 million people anytime soon and 8 million by 2050.

These new residents will have to live everywhere, including the outer east, so building is running overtime to try to catch up with demand. We all know this, as this is what is driving up house costs and rent. The State Government is now pushing ahead with Plan Melbourne.

Quote“Plan Melbourne is a metropolitan planning strategy that defines the future shape of the city and state over the next 35 years. Integrating long-term land use, infrastructure and transport planning, Plan Melbourne sets out the strategy for supporting jobs and growth, while building on Melbourne's legacy of distinctiveness, liveability and sustainability.”

Part of this is the big build, to allow for easier transport options to ease congestion on the roads. Another part is that some planning applications will be fast tracked and one of these is early childhood care facilities. It makes sense that to increase productivity and to enable mothers to return to work (to afford the mortgage) early child care is essential.

There are a plethora of investors wanting to back these enterprises, as soon as they are built, so we were told by the developer. Recently in Maroondah a company that applies for the planning permit as a first step, found a spot in Waters Grove Heathmont. This backs onto Dandenong creek and the old house which has been there for over 50 years is no longer interesting to anyone but a developer. Sold for $3million in 2023, it is now before Maroondah Council with a view to it becoming a child care centre.

The concept of childcare in any community, is that it needs to be spread across areas so as to be easily available to parents. Nearby in Maroondah there are 8 other child care centres.

• Chocklits at 319 Canterbury Rd

• Cuddly bear at 74 Canterbury rd

• Heathmont Erly learning at 13 Armstrong Rd

• Grow Early Learning Heathmont at 203 Canterbury Rd

• Community kids Haethmont at 40 Marlborough rd

• Little angels Family day care at 1 Heathmont Rd

• Kids quarter Family Day care

• Montessori facility at 39 Vivianni Crescent

It seems there is an oversupply of child care centres close by. A meeting of objectors at Council had over 30 people in the room, some very emotionally distressed at the proposed removal of 40% of the trees, with one objector saying they had counted trees adjacent to the site so it seems a lower percentage.

Quote from Parliament of Australia “The early childhood education and care (ECEC) sector is critically short of appropriately qualified staff. United Voice, the union which represents ECEC workers, claims that about 180 educators leave the sector each week because of low wages and poor conditions.” News from around the State budget, a while ago, is that building new facilities should be put on hold, as there is currently thousands of people staff shortage in this area.

It was evident that most people who reside in the vicinity enjoy the ambience of the creek-line and all the wildlife that the reserve supports, and these birds mostly visit their properties as well bringing enjoyment to the residents. Council has declined this application as it must abide by its own planning scheme that has a SLO 3 over this area, meaning it is viewed as significant landscape including the vegetation.

Now the developer is taking MCC to VCAT at great expense for Council. The Hearing set for September, but with a compulsory conference held on July

17th. We should be grateful that our Council will take a firm stand over their ability to defend their own Planning Scheme.

The developer was quite unfamiliar with the area, as it was said that staff could ride share and or walk from public transport, if this were to be a train, it is a long walk from Heathmont station. It was sloppy work on their part too, as it was pointed out that the document available had it as the Shire of Macedon, not Maroondah that the application was for. They admitted they had another application in Gisborne and said the public was not anti that one, so why is it different in Maroondah?

Croydon Conservation Society was an objector to this development, on environmental grounds.

At this time Council is looking at engaging with the people of Maroondah to see how they can communicate better. This is a great opportunity for people to tell Council why they do not seem to participate in responding to strategies, or future planning and how can Council do a better job of getting messages out to the community.

www.youtube.com/watch?v=1G8VwBemtA will take you to Councils you tube video explaining why their communication strategy is important

https://yoursay.maroondah.vic.gov.au/ communications-and-customer-service/ surveys/have-your-say will take you to a short survey.

People often bag out Council for small inconvenient issues, like missed rubbish collection, or dead street trees that have been newly planted. If you have a new tree out the front, take some ownership for your community and don’t let it die for lack of water. Maroondah Council has some really great programs for us all, and it is worth signing up for what interests you for example their Nature Havens program, which provides assistance to make your garden wildlife friendly.

By Warren Strybosch

Social security measures become law

Social Services and Other Legislation Amendment (More Support in the Safety Net) Bill 2024 has now passed both houses of Parliament and will become law.

This Bill implements three measures announced in the 2024 Federal Budget.

From 20 September 2024, the maximum rate of Rent Assistance will increase by 10%. Regular indexation will also be applied in September on top of the 10% increase.

Currently, to be eligible for a Carer Payment, a carer has a participation limit of 25 hours per week which includes employment, study, volunteering activities and travel time to and from work.

From 20 March 2025, Carer Payment recipients will have increased flexibility to undertake work, study, and volunteering activities whereby recipient’s participation limit will be amended to 100 hours over four weeks and will only apply to employment.

Additionally, if the participation limit is exceeded, payments will be suspended for up to six months, rather than being cancelled.

JobSeeker rate increase for some

From 20 September 2024, the higher rate of JobSeeker Payment will be extended to single clients who have a partial capacity to work up to 14 hours per week.

This measure will provide an additional $54.90 per fortnight income support to these recipients on top of the standard indexation.

Warren Strybosch

1300 88 38 30 | warren@findwealth.com.au www.findwealth.com.au

Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty LtdABN 93 161 647 007 (AFSL No.449221).Part of the CentrepointAlliancegroup https://www.centrepointalliance.com.au/

Warren Strybosch is Authorised representative (No. 468091) of Alliance Wealth Pty Ltd. Services offered are superannuation, retirement planning and aged care advice.

This information has been provided as general advice.We have not considered your financial circumstances, needs or objectives.You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date.As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

By Craig Anderson

Most Public Liability policies will have a similar insuring clause, which rather vaguely tells you they will insure your described activities and pay amounts for which you become liable in the course of doing business. The following 50 plus pages then sets about defining what is and is not considered covered by defining the meaning of all the important words and excluding the events they wish not to cover.

Then there are the policy exclusion clauses which tell you what won’t be covered, unless another requirement is first met. These are quite often confusing to the insured and if read without first reading the definitions and preceding sections, and policy schedule, the wrong conclusion will be drawn. They can sound like “double negative” statements, and often operate that way.

There may also be endorsements added by the underwriters to the policy schedule which can cause an important

clause to be deleted and replaced, modified, or sub-limited. These must be read in conjunction with the policy, so as to correctly understand the extent of cover.

An example of this would be a recent Public Liability quote received for a service company working on plant and equipment repairs and refits to multi storey buildings. The insuring clause looked good, the definitions and exclusions were acceptable, but when it came to the endorsements imposed on the quote schedule, the proposed cover became unacceptable. The underwriter had imposed a crane load condition, whereby the client would not have been covered if crane lifting plant and equipment if a boom larger than 20m was used, and a claim occurred. As using 20m plus crane booms was a regular occurrence, the quote was deemed unacceptable, so another insurer with appropriate policy wording and schedule was selected and cover bound.

If the policy wording alone had been examined, and the endorsements on the schedule had been ignored, this could have led to a massive uninsured loss.

Hopefully, this example helps to illustrate that policies may look similar or even the same at a glance, but can be entirely changed by the addition of a few words on the schedule which follows the quote.

An insurance broker will take the guesswork out of the insurance process, and give you the certainty you need to effectively, and confidently, do business. There’s no time like the present to check if your policy is right for you.

For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives,needs and financial situation).

By Erryn Langley

Most investments (assets) generally provide you with income on a regular basis. But some investments, like shares and property, can also increase in value. This increase is called growth or capital gain.

If you sell your investment for more than you paid for it then you realise a capital gain and you may have to pay tax on this gain. Capital Gains Tax (CGT) is payable on the taxable portion of a capital gain if you acquired the investment

If you bought or acquired an asset before 20 September 1985, the CGT rules do not apply. Any capital gain can be received by you tax-free.

You are deemed to acquire an asset if you:

• Buy it

• Inherit it

• Build it, or

• Receive it as a gift

• You are deemed to dispose of an asset if you:

• Sell it

• Give it away, or

• It is lost or destroyed

• If the transaction is done at a price lower than the asset’s market value, the market value will be deemed to be the acquisition or disposal price, even though this is not the amount of cash you received.

Horace purchased a parcel of shares for $10,000 in May 2004. The shares increased in value and were worth $24,000 in November 2009 when he decided to gift the shares to his son.

Horace did not receive any payment for the shares, but for CGT purposes the shares are deemed to have been sold for $24,000. This means he has realised a capital gain of $14,000 and needs to calculate how much tax is payable on this gain.

Gains on the following assets acquired on or after 20 September 1985 are likely to be subject to CGT:

• Shares

• Managed funds

• Property investments

Not all assets which increase in value will be subject to CGT. Two main assets that are exempt from CGT are:

• Your principal home, and

• Assets purchased before 20 September 1985 (pre-CGT assets)

Your home can continue to be exempt from CGT for up to six years after you move out, provided you do not buy another home that you elect to claim the exemption on.

The taxation of a capital gain depends on how long you have owned the asset.

If you have held the asset for less than 12 months the full amount of the gain less any capital losses (from current year or carried forward from previous years) is added to your assessable income in your tax return. This amount is taxed at your marginal tax rate.

you have held the asset for 12 months or more, capital losses (from current year or carried forward from previous years) are deducted from the capital gain, then only 50% of the net gain is added to your assessable income and taxed at your marginal tax rate.

Note: if your asset was purchased before 21 September 1999 you could choose to calculate the taxable portion of the gain using an indexation method, but tax advice should be sought.

Example

Horace (in example above) had held the shares for more than 12 months. So his taxable capital gain is reduced by 50% to $7,000. This amount is added to his other assessable income and is taxed at his marginal tax rate.

If Horace had only owned the shares for less than 12 months, tax would be payable on the full $14,000.

If the asset is owned in the name of a company, the 50% exemption does not apply. Further tax concessions may apply if it is a business asset.

If you sell an asset for less than you paid for it, you may realise a capital loss. A capital loss can reduce your taxable capital gains on other assets (as explained above) but cannot be used to reduce tax on other income sources. The reduction is done before you claim the 50% exemption.

Example

Last year Horace sold an asset which realised a capital loss of $2,000. This can be used to reduce his taxable capital gain as follows:

Taxable capital gain = ($14,000 - $2,000) x 50% = $6,000

Horace will only add $6,000 to his assessable income and pay tax at his marginal tax rate on this amount.

If you cannot use the loss in the year that it is realised, the loss can be carried forward to reduce taxable capital gains in future years. However, it is better to use losses as quickly as possible because the value of the loss diminishes over time with inflation.

Erryn Langley

1300 557 144 | erryn@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth. Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221).Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorisedadviserforthemostup-to-dateinformation.Nowarrantyisgivenin respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

advice and solutions

I commenced my

and became an authorised

on 13 December 2021.

By Mark Felton

As a business owner and employer, it is your responsibility to ensure the health and safety of your employees within your workplace. This includes providing your team with a safe work environment and protection from hazards. You can achieve this by understanding your obligations under the Occupational Health and Safety (OHS) laws and by complying with them.

WorkSafe Victoria recently reported that a steel fabrication and installation company has been convicted and fined $40,000 after continuing to put workers at risk on a Geelong construction site, even after a worker was seriously injured.

NJ Steel Fabrications Pty Ltd was sentenced in the Geelong Magistrates' Court on Thursday 27 June 2024, after pleading guilty to three charges of failing to provide and maintain a safe workplace and one charge of failing to provide information, instruction or training.The company was also ordered to pay $8,375 in costs.

The court heard NJ Steel Fabrications had been engaged to provide structural steel works for an alfresco dining area at a retail premises in Geelong, including the installation of steel and plastic roof sheeting.

In January 2022, two workers were on top of the steel structure installing roof sheets when one of them fell through a gap approximately 3.85 metres to the ground below. He sustained serious injuries including bleeding on the brain, a fractured pelvis, several fractured ribs, lacerations to his liver and kidney and bleeding associated with his adrenal gland.

WorkSafe inspectors attended and found there was no safe work method statement (SWMS) on site and one that had been prepared for the installation was not reviewed and revised to address the high risk construction work being performed. There were also no fall prevention measures being used and none of the workers on site were experienced or trained in working at heights.

It was reasonably practicable for NJ Steel Fabrications to install passive fall prevention devices such as guard railing and safety mesh, and to have provided training to workers on the hazards and risks of working at heights, the need for passive fall prevention devices and their implementation.

In February 2022, inspectors returned to the site and found the company's director and another worker on the roof without internal fall prevention measures in place. Within an hour of WorkSafe leaving the site, the director was again observed working on the roof without adequate fall protection.

The court found NJ Steel Fabrication had failed to control the risk of a fall from height by affixing safety mesh to the entire roof area of the steel structure.

WorkSafe Executive Director Health and Safety Sam Jenkin said the company's blatant disregard for the safety of workers was inexcusable. "It is no secret that there is simply no safe way to work from heights without the appropriate training and fall prevention measures in place," Mr Jenkin said. Mr Jenkin went on to say "It beggars belief that this company still failed to install adequate controls to ensure the site was safe even after the risk had eventuated and a worker had suffered serious injuries."

To prevent falls from height employers should implement the highest possible measures from the five levels in the hierarchy of controls: measures from the five levels in the hierarchy of controls:

• Level 1 - Eliminate the risk by, where practicable, doing all or some of the work on the ground or from a solid construction.

• Level 2 - Use a passive fall prevention device such as scaffolds, perimeter screens, guardrails, safety mesh or elevating work platforms.

• Level 3 - Use a positioning system, such as a travel-restraint system, to ensure employees work within a safe area.

• Level 4 - Use a fall arrest system, such as a harness, catch platform or safety nets, to limit the risk of injuries in the event of a fall.

• Level 5 - Use a fixed or portable ladder, or implement administrative controls.

When undertaking High Risk Construction Work (HRCW), duty holders must:

• Ensure HRCW is not performed unless a Safe Work Method Statement (SWMS) is prepared.

• Ensure that once a SWMS has been developed, all HRCW work is undertaken in accordance with that SWMS.

• Stop work immediately, or as soon as it is safe to do so, once they become aware a SWMS is not being followed.

• Review the SWMS whenever there is a change in the work being undertaken or if there is an indication that control measures are not adequate.

As a business owner, are you confident that you do not have gaps in your efforts to keep your workers healthy and safe? Do you have an understanding of your responsibility to ensure the safety of your employees? Are you confident that you can provide a safe work environment and comply with OHS laws? Do you believe that you are effective in carrying out risk assessments, employee consultation and providing training? Do you regularly review these measures to ensure that they remain fit for purpose and keep you and your employees healthy and safe? Why not make a New Year’s resolution to get your house in order?

At Beaumont Advisory we assist business owners clarify what they currently have in place, as well as where there are shortfalls. We then assist in developing effective systems and documentation, working with businesses to ensure effective implementation. Checks are put in place to monitor ongoing effectiveness, to ensure that going forward, they are sound and comply with the Act, and most importantly keep you and your employees informed, and healthy and safe. Please feel free to contact me for an obligation and cost-free initial discussion.

Mark Felton

Occupational Health & Safety 0411 951 372

www.thebeaumontgroup.com.au mfelton@beaumontlawyers.com.au

New Zealand was once home to giant flightless birds called moa. They had grown accustomed to life without predators. So the arrival of humans in the mid-13th century presented a massive – and ultimately insurmountable –challenge to their existence.

Moa were unable to cope with even low levels of hunting by people. All nine species of moa were driven to extinction soon after first contact with humans. These moa populations collapsed and disappeared so swiftly it seemed impossible to trace their declines, until now.

In our new research, we reconstructed patterns of population decline, range contraction and extinction for six moa species. We simulated interactions of moa with humans and their surroundings using hundreds of thousands of scenarios. Then we validated these simulations against information from fossils.

We found all six species collapsed and converged on the cold, isolated mountains of New Zealand’s North and South Islands. These happen to be the same sites where the last of New Zealand’s flightless birds can be found today.

The Polynesian colonisation of New Zealand

Oceanic islands tend to be hotspots of biodiversity, harbouring some of the most bizarre evolutionary marvels on Earth. They include daisies the size of trees, elephants the size of great Danes, and countless species of flightless birds.

Authors

Unfortunately, islands are also hotspots of extinction. This is particularly true for oceanic islands in the Pacific, which were among the last areas on the planet to have been settled and transformed by humanity.

Human expansion across the Pacific began some 4,000 years ago, when people set out on extraordinary sea voyages from Taiwan. They first headed south into the Philippines, and then onto some of the most isolated islands on the planet.

These daring journeys required impressive seafaring vessels and navigational skills to cross thousands of kilometres of open waters.

Migration into central and east Polynesia was the final phase of these ancient voyages. It culminated in the colonisation of the New Zealand Archipelago in the mid-13th century by Polynesians, the ancestors of Māori.

People started fires, hunted animals and introduced invasive species – including Pacific rats. Accordingly, New Zealand’s unique biodiversity was decimated

in one of the largest and most rapid collapses of native wildlife in the Pacific.

Range collapses and extinctions of moa Moa disappeared within three centuries of human arrival.But they didn’t all go at once.

Our research suggests Mantell’s moa went first, within just 100 years. Almost another 100 years would pass before the extinction of any other moa species.

Mantell’s moa was especially vulnerable to extinction because of its slow population growth rate. Unfortunately, even low but sustained harvesting well exceeded the bird’s capacity to reproduce and compensate for these losses.

Other species were slightly more resilient. They benefited from attributes such as higher growth rates, larger ranges, bigger populations or better abilities to live at higher altitudes (far from people).

The stout-legged moa lasted the longest. It finally disappeared some three centuries after human arrival.

Our research suggests all moa disappeared from high-quality lowland habitats first. These were places favoured by people.

The rate of population decline then decreased as you go higher into the mountains and further away from the coastline.

It was previously thought the ranges of species under pressure would contract to their optimal or preferred habitats, where they were most abundant, rather than as far away from people as they could get.

By Warren Strybosch

You may recall that a self-contained area of your home is assessed under both the income and assets tests if a near relative lived there for Centrelink purposes.

In summary, where a self-contained area of the home is vacant or let to a near relative (a parent, child or sibling), then the area is considered part of the principal residence and is not an assessable asset.

Where the area is let to someone other than a near relative, the area is not a part of the principal residence and is an assessable asset.

From an income test perspective, rent received from a near relative is not assessable under the income test.

In this month’s edition of TechniView, we wish to expand on this concept and address two frequently asked questions, namely:

1. If I rent out a room/s in my home to a third party to generate additional income, how will this impact my Age Pension?

2. If I plan to travel for an extended period of time and wish to rent out my home while travelling, how will my home be assessed?

Renting out room/s - boarders and lodgers

Income generated from your principal home where a room, multiple rooms or even a self-contained area is rented out to someone that is not a near relative

(definition above) is assessable under the Income Test.

How much is assessed depends on whether the person pays rent solely for accommodation or if meals are included as follows:

Note: If more than 5 rooms are let, Centrelink will treat the operation as a commercial venture and the actual netprofit from the operation is assessable for social security purposes.

A client can request a reassessment of income for a lower amount than the percentages indicated in the table below If they can provide evidence of actual expenses associated with boarders and lodgers being more than allowed for.

Extended periods of travel – temporarily vacating the home

Whether clients are gradually making their way around Australia in a van or travelling to overseas destinations, with the current cost of living pressures, we are fielding an increasing number of questions relating to renting out the principal home while away.

From a social security perspective, does renting impact the asset test treatment of the home?

If a client intends to vacate their home permanently, the home value is an assessable asset immediately and the non-homeowner asset test thresholds apply.

If the client intends to return to the home at some stage in the future, this will result in Centrelink treating the absence as temporary.

Under these circumstances, the home will retain its principal residence status (asset

test exempt) and the client continues to be defined as a homeowner, for up to 12 months.

This 12 month exemption applies even when the client plans to be away for more than 12 months, provided there is the intention to return home at some stage.

If the absence extends beyond 12 months, the home is no longer the client’s principal residence and the market value of the property is assessable.

Under special circumstances, the 12 month period may be extended. For example, if a client is unable to return from an overseas holiday due to circumstances beyond their control.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

This information is of a general nature only. It does not take into account your particular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies,graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations.Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document. This information contained does not constitute legal or tax advice.

By Kathryn Messenger

Did you know that some foods can be keeping your blood sugars in the diabetic range, and contributing to the disease, whilst there are others that can help to balance your blood sugar?

Here is an explanation of what each of the foods are and why they make a difference to your diabetes. The principles here are aimed at type 2 diabetes, but should also be helpful in type 1, and gestational diabetes.

Before I get into the details, make sure that your diabetes is being monitored by a doctor and if you do make changes to your diet, be sure to monitor your glucose levels, so that your blood sugars stay within the safe range.

Firstly, we need to start with an understanding of diabetes. Food from carbohydrates is broken down into glucose, meanwhile, your pancreas secretes the hormone insulin, which is required for the cells of your body to use the glucose for energy. Diabetes is generally understood to be a lack of insulin which means that your blood is left with too much glucose as it can’t move into your cells.

But what if the problem is not a lack of insulin, but too much glucose?

I am fully aware that there are genetic components to diabetes, and that some people are more susceptible to it, but

what if it was your diet contributing to the disease, or at worst has caused the disease?

3 foods to avoid for diabetes

Sugar

Sugar is often seen as a normal part of a balanced diet, but since it has had the vitamins, minerals and fibre stripped from it, it lacks any goodness that the original sugar cane has. Sugar is converted to glucose very quickly and requires a large amount of insulin to metabolise it. Look for all of the places where you might consume sugar, from lollies and hot drinks, to biscuits, cakes and pastries.

But be aware of chemical sweeteners as a sugar replacement as they are sometimes worse for you than the sugar. So if you crave something sweet, eat a piece of fruit or use a little honey instead.

White flour products

In a very similar way to sugar, white flour products are quickly converted to glucose, and once again are not in their natural form having had the wheatgerm and fibre removed. White flour is not only in bread and baked goods, but also foods like pasta and couscous. Swap to a wholemeal option where you can.

Fruit juice

Being a liquid, this is absorbed quickly and can also cause a sudden high amount of glucose in the blood stream. If you eat the whole fruit with the fibre, this slows down the uptake of the glucose.

Foods that will improve diabetes

To some extent, the foods to include are the opposite of those to avoid, for example: wholegrains instead of white

refined grains, and a piece of fruit, rather than just the juice. But there are a couple of others that are helpful in their own right.

Bitter green leafy vegetables are particularly helpful, they not only regulate insulin, but can help to change your palate to desire less sweet foods. These include roquette, kale, cabbage, and broccoli. Aim to eat some of these each day.

Healthy fats will keep you full and help prevent the sugar cravings, so be sure to add some to every meal.

If you would like further support with diabetes, either with a new diagnosis, or alongside medications, there are many additional herbal and nutritional products that can help support your body back to health. Please let me know if you would like to work with me to improve your insulin resistance or diabetes.

Amendments to tax legislation have been announced in the 2024 Federal Budget that will give the Commissioner of Taxation a discretion to not use a taxpayer's refund to offset old tax debts.

As per s 8AAZL of the Tax Administration Act 1953, the Commissioner is required to apply refunds in the running balance account (RBA) to offset current or anticipated RBA and non-RBA tax debts.

This discretion will apply to individuals, small businesses and not-for-profits, and will maintain the Commissioner's current administrative approach.

This announcement applies to old tax debts put on hold by the Commissioner prior to 1 July 2017. After the enactment of legislation, we expect the Commissioner to release regulatory resources in relation to the practical application of this announcement.

As part of the 2024 Federal Budget, an announcement may make more carers eligible for government financial assistance and support.

The eligibility requirements will change from 20 March 2025, where the existing 25 hour per week participation limit to receive Carer Payment will be amended to 100 hours over 4 weeks.

Also, currently the participation limit applies to employment, volunteering and study. From 20 March 2025, only employment will count against the participation limit.

Further adjustments will be made, meaning that if an individual goes over these limits, the ramifications relating to future support will not be as severe.

A 2024 Federal Budget announcement will provide additional support for businesses who participate in the Australian Apprenticeships Incentive System.

The last adjustment to this scheme was announced in the March 2022 budget, where the Phase Two incentive system payments would begin reducing from 1 July 2024.

The new announcement states that the reduction in incentive payments will not reduce for apprentices, trainees and their employers in priority occupations.

As a result, the expected Phase Two incentive system payments for apprentices in a priority occupation will increase from $3,000 to $5,000 if it was due to received after 1 July 2024. Also, if an apprentice in a priority occupation is hired after 1 July 2024, there will not be a reduction in that incentive payment either.

Announced as part of the 2023 Federal Budget, was a proposed expansion of the general anti-avoidance provisions for income tax.

This announcement intended to allow schemes that achieve an Australian income tax benefit to come into the scope of Part IVA, even if the dominant purpose was to reduce foreign income tax.

This announcement was set to apply from 1 July 2024, however, as per the 2024 Federal budget this has been pushed to income years commencing after amended legislation receives royal assent, regardless of whether the scheme was entered into before that date.

Announcement(13-May-2024) Consultation Introduced Passed Royal Assent Date of effect

Announcement(13-May-2024) Consultation Introduced Passed Royal Assent Date of effect

Announced: 13-May-2024 Updated: 27-May-2024

Announcement(9-May-2023) Consultation Introduced Passed Royal Assent Date of effect

In an initiative to promote women’s economic equality, the Labor government has announced plans to pay superannuation on paid parental leave (PPL) for government-funded payments from 1 July 2025.

If enacted, this measure will provide parents who access the PPL government scheme with super contributions paid into their nominated super account equivalent to 12% of their leave pay.

An expansion to Australia’s PPL is also currently before the Senate, which will give families an additional 6 weeks of PPL, increasing to 22 weeks from July 2024, 24 weeks from July 2025, and 26 weeks from July 2026.

This measure is currently in the announcement stage and requires parliamentary approval to become law.

Announced: 7-Mar-2024

Updated: 13-Jun-2024

Please note: In the 2024 Federal Budget, the government has announced the discontinuation of this proposed measure, as these integrity issues are being addressed through other administrative processes implemented by the ATO.

Australian Business Number (ABN) holders will now be required to be more accountable and comply with annual income tax lodgment obligations.

First announced in the 2018–19 Federal Budget as an integrity measure, this exposure draft legislation seeks to strengthen disruptions to black economy and tax avoidance behaviour.

Currently, ABN holders are able to retain their ABNs regardless of whether or not they meet income tax obligations. This measure will provide more accountability on enterprises by giving the regulator the ability to cancel ABNs. This means advisers need to ensure clients keep their lodgments up to date, or at least keep a clear line of communication with the ATO.

Announced in the 2024 Federal Budget, the ATO will have additional time to review suspected fraudulent business activity statements (BAS) refunds prior to their release.

The current required notification period of 14 days as set out in s 8AAZLGA(3)(a) of the Tax Administration Act 1953 will be extended to 30 days to align with time limits for non-BAS refunds.

The taxpayer will receive a notification from the ATO when a BAS refund is retained for further investigation.

This measure will take effect from the start of the first financial year after assent of the enabling legislation.

The Bill proposing to increase the instant asset write off threshold in Div 328 of ITAA 1997 has received Parliamentary approval to become law and is now available to use for the 2023–24 income year.

Originally announced in the 2023 Federal Budget, the increased threshold applies from 1 July 2023, for small businesses with an aggregated annual turnover of less than $10 million.

The write-off applies to the cost of eligible depreciating assets, second element costs and general small business pools.

Eligible assets must be first used or installed ready for use between 1 July 2023 and 30 June 2024, and the write-off applies on a per asset basis.

Assent Date of effect

Announced: 13-May-2024 Updated: 24-Jun-2024 Announcement(12-Apr-2019) Consultation(29-Nov-2022)

approach would apply to general fund expenses incurred after 1 July 2023.

Royal Assent(28-Jun-2024) Date of effect(1-Jul-2023)

Assent(28-Jun-2024) Date of effect(1-Jul-2023) Announcement(9-May-2023)

Announced: 14-May-2024 Updated: 22-Jul-2024 Announcement(24-Jan-2023)

Some of the 2024/25 Arts and Cultural Grants recipients at a celebration event in July.

A range of creative arts projects will be rolled out in Maroondah over the next 12 months, with support through Council’s Arts and Cultural Grants Program for 2024/25.

The program supports a diverse and culturally rich Maroondah by supporting community driven projects, initiatives and events that increase participation in the arts while raising the profile of arts in Maroondah. Seven recipients will share in $26,000 of funding under the 2024/25 program.

Mayor of Maroondah, Councillor Kylie Spears, said the Arts and Cultural Grants provide support for projects at any stage of the creative process, and which reflect the rich diversity of the Maroondah community.

“The Arts and Cultural Grants Program is a fantastic opportunity to obtain Council support for a range of projects, including creative development and presentation, arts and cultural programs, and the activation of new arts and cultural spaces,” Cr Spears said. “Council continues to receive welldeveloped and diverse applications for projects which will continue to strengthen the important arts and cultural fabric of our city.

“We look forward to seeing the impact that this will have across Maroondah and wish all of the recipients the very best with their upcoming projects.”

Among this year’s recipients is local organisation Just Sing Something, who received a grant to support The Singing Sandwich Project - a six-week program of lunchtime singing sessions for people working in central Ringwood, working from home, commuting, shopping or looking for a mood boost. The sessions, to be held at Realm in Ringwood, will welcome people of all singing abilities.

Lucy Graham, Founder and Creative Director of Just Sing Something, said the project will help address loneliness experienced by people in the community, such as those who work from home, live alone or who do not have time for many hobbies, by providing “easily accessible opportunities to connect with others during the day”.

“Group-singing is powerful! But unless you're in a choir, or go to church, you have few chances to get the positive benefits,” Lucy said.

"Scientific studies have found groupsinging is beneficial to mental health, cognition, language development, social connection, physiological health, respiration, heart rate, pain relief, memory, mood, immunity, efficiency, community, and wellbeing.

“The Singing Sandwich Project will embrace what we already know about the power of group-singing, offer a timeefficient opportunity during the workday, create a welcoming, encouraging and safe space, and improve capacity for social connection.”

Another recipient is Ringwood and District Historical Society. The Society received a grant to support the production of Artists of Ringwood District and their Art - a colour booklet that accumulates research on local artists and samples of their work.

“The book will…have a strong historical content that shows that the artists were involved in [the] local community, went to school or grew up in the area. Some artists have been very successful in the art world, some have derived considerable pleasure from art and the social bonds with like-minded artists,” Russ said.

Russ said the Society also hopes the project will encourage current and aspiring artists to “continue their work and share it via Maroondah’s art galleries or other community displays,” or with friends and acquaintances.

On Friday 12 July, Council celebrated the School Crossing Supervisor of the Year awards with School Crossings Victoria.

Fourteen Maroondah City Council School Crossing Supervisors were nominated by the local community. The award categories were split into multiple regions across the state. Region 3 included Maroondah, Bayside, Glen Eira, Monash, Nillumbik, Port Phillip, Stonnington and Whitehorse Councils. Local Maroondah School Crossing Supervisor Mario Coppolino won for our region and was awarded a trophy for his achievements.

Mayor of Maroondah, Councillor Kylie Spears, said the achievement is welldeserved.

“Congratulations to Mario on this wonderful achievement. To be recognised across multiple Councils is a testament to the vital role that Mario

also pays tribute to the impact that his work has across our community,” Cr Spears said.

“I also extend my congratulations to

municipality. Their care and commitment to safety helps keep hundreds of Maroondah families safe each year. The number of nominations this year highlights the very important place they hold in each school community and the wider Maroondah community.” Council thanks Mario for his meaningful contribution to the community and for keeping the Warranwood Primary School community safe around roads and traffic.

Mario has been a school crossing supervisor at Warranwood Primary School for four years. He has enjoyed his time as a School Crossing Supervisor and says watching the kids smile in the morning gives him the incentive to get up every day.

“I’ve been working with kids for a long time now, before this job I was a bus driver for children with a disability,” Mario said.

all of our nominees and thank our 106 wonderful school crossing supervisors for their dedication. Rain, hail or shine,

“I was supposed to retire but I took this job. The biggest benefit is that going to the school each day gives me a reason to get up every morning and be there for the kids. It’s nice to be able to help kids and other people cross safely on a busy road, it’s a good feeling,” Mario

Mario was overwhelmed o learn he had won, particularly with so many School Crossing Supervisors being nominated this year. “To be awarded the winner was a great feeling, it has been a whirlwind. All the kids and parents at Warranwood Primary School are excited for me...it’s

Want to become a school crossing supervisor? Find out more at School Crossing Safety.

The 2024 Local Government Community Satisfaction Survey results have been released, with excellent results for Maroondah.

The survey, conducted by an independent market research firm on behalf of the Victorian Government, indicates that Maroondah City Council continues to excel in seven key performance areas compared to the average ratings of Councils state-wide. These areas include:

• Overall performance

• Value for money

• Community consultation

• Advocacy

• Customer service

• Overall Council direction

• Making decisions in the interest of the community

Survey respondents were asked to provide feedback on Council’s performance over the past 12 months, with the survey conducted quarterly from June 2023 to March 2024.

Council’s overall performance consistently scored well above the average ratings for Councils in metropolitan Melbourne. The ‘overall performance’ rating for Council (66) was 12 points higher than the state average (54). Maroondah also rated 11 points higher (59) in ‘value for money’, when compared with the state-wide average (48).

Other highlights for Council include that Council’s rating for ‘informing the community’ (67) was 11 points higher than the state-wide average (56) and the rating for ‘making decisions in the interest of the community’ (60) was 10 points higher than the state-wide average (50).

Council’s performance also rated higher when measured against other Melbourne metropolitan Councils as well as the state-wide average for a range of other indicators, including recreational facilities, arts centres and libraries, environmental sustainability, general town planning policy, community consultation/engagement, and more.

Mayor of Maroondah, Councillor Kylie Spears, said Council was pleased with this year’s results.

“Thank you to those members of the community who gave their time to participate in the 2024 Local Government Community Satisfaction Survey. Your input is highly valued, as this survey is among a range of tools that we use to ensure our activities are relevant to our community’s needs,” Cr Spears said.

“We are proud to see that our 2024 results have been positive overall, as this demonstrates that Council’s service delivery and initiatives continue to be valued by our community.

“Twenty-one of our services were rated as significantly higher than the statewide average and 12 were

rated as significantly higher than the metropolitan Melbourne average.

“These results indicate that the Maroondah community generally feels positive about Council’s overall performance and direction, customer service, our advocacy efforts and consultation and engagement with our community, as well as other key focus areas,” Cr Spears said.

“The results are also a testament to our employees, who aim to provide excellent services, programs and initiatives to our community. We will continue to strive towards improving these services for the community to achieve even better results.”

The Local Government Community Satisfaction Survey is one of many engagement methods used by Council to monitor its performance annually. It complements other methods of gathering community feedback about service delivery, initiative development and implementation, programs and more.

Council’s 2024 results were measured against other participating Melbourne metropolitan Councils including Banyule, Boroondara, Glen Eira, Greater Dandenong, Hobsons Bay, Kingston, Manningham, Melbourne, Moonee Valley, Port Phillip, Stonnington and Whitehorse.

Council will use the survey results to inform future strategic planning and implementation.

affected by family violence and a local charity providing food relief to those in need are among 90 community groups to share in $200,630 as part of Council’s latest round of community grants.

Each year, Council offers eligible notfor-profit groups, with limited access to financial resources, the opportunity to share in funding made available through its Community Grants Program, Arts and Cultural Grants Program, and Capital Funding for Community Groups Scheme.

In congratulating this year’s grant recipients, Mayor of Maroondah, Councillor Kylie Spears, said the funding will support valuable community projects and initiatives, while also helping to improve services.

“In March, we invited community groups and organisations to submit funding applications demonstrating how their project, initiative or service would positively contribute to the Maroondah community,” Cr Spears said.

“Once again, we saw a diverse range of funding applications that included community projects, disability, arts and culture, health, emergency relief, recreation and sport.

“Council is pleased to be able to assist these groups to develop and deliver programs, projects and events, which might otherwise have taken years of fundraising efforts to achieve.”

vice president Nicholas Lee said the grant was “critical” to FOFA continuing its vital work.

“With more people in the community financially strained by the rising cost of living, demand for food has skyrocketed, and it’s getting harder for us to meet the demand,” Nicholas said.

Nicholas said the Emergency Relief Grant would enable the organisation to distribute approximately 2,000 meals to those in need, while also supporting other local food relief agencies.

“For families struggling to put a meal on the table each night, FOFA meals provide parents peace of mind that their children are having at least one healthy, vitamin-packed meal that day,” he added.

A podcast series and online resources celebrating Chin culture will also be made possible with the help of a community grant to local organisation Psylaw Incorporated.

Psylaw founder Raviana Salio said the project funding would make a significant impact, with the potential to extend beyond Maroondah.

The project aims to preserve and share Chin cultural identity with young people through ancestral stories and ways of life, building a sense of belonging to their culture.

FVREE, an organisation dedicated to supporting those affected by family violence, was awarded a Community Development Grant. The funding will help launch a pilot project providing family violence education and volunteer assistance to volunteers at Maroondah Toy Library. The collaboration will also enable children to gain access to toys, offering them much-needed comfort and support during times of upheaval.

Janene Evans, General Manager Services and Impact at FVREE, said the project aims to “improve the wellbeing of families experiencing family violence” while temporarily living in emergency accommodation.

“This grant will enable us to provide opportunities for children, young people and their families who have had to flee their homes due to family violence, to play and connect with one another despite this trauma. We hope to bring some fun and normality to the lives of these families in what is a very stressful and trying time,” Janene said.

Other projects to be funded in 2024/25 include programs to promote active participation in community sport for people with a disability, community learning opportunities to support positive ageing, and programs helping settlement of newly arrived migrants.

https://www.handsacrossthewater.org.au/fundraisers/andrewtonkin/red23-ride-to-provide-2024

Hands Across the Water riders began at Beung Khan and finished at Yasothon some 525 kms later. The forty riders, a record number in one ride so far, have raised a record amount of $260,000 for disadvantaged and orphaned children in Thailand. Each day was a massive challenge of personal endurance and weather extremes.

It was such a relief to see the final resting place each day after starting at 7:00am and finishing the day’s journey at about 4:00pm. The first two and a half days were in humid but wet conditions and the latter two and a half days were in humid and hot conditions.

Fortunately, there was an excellent support crew who supplied energy drinks, snacks and fruit every 22 kms and had our bikes cleaned and ready each day for action. We followed the Mekong River through picturesque farm land and villages on mainly sealed roads. There were rice fields, rubber tree plantations, chilli plants, corn, sugar cane, bananas, fishing boats and oyster beds.

The final day was a highlight with police blocking traffic for the Hands group to ride into the town of Yasothon. A band was playing on the back of a truck and dancers filled the street. Then to enter the orphanage to dancing, drumming and singing and meet the children was a great thrill for everyone. After freshening ourselves up we enjoyed a welcoming ceremony, stage performances and dinner together.

This year commemorates twenty years since the tsunami in 2004 and Peter Baines, founder of Hands Across the Water and awarded an Order of Australia for his work, is intending to run 1400 kms in December and raise $1m to further the work to provide a life of choice for some 350 young orphans.

An exciting new activity for parents, carers and their preschoolaged children has begun in Ringwood and Croydon. Burmese Storytime and Play are bilingual sessions in English as well as Falam-chin and Hakha-Chin, with a dynamic translator present.

Early childhood professionals facilitate the fun play, stories, activities and craft which allow parents and carers to socialise with each other as children learn, develop and interact. The two sessions are available and free to attend thanks to a grant from the Victorian Government Health Department.

The weekly sessions also provide opportunities for education on support programs and health and wellbeing information in accessible ways to migrant families. This partnership between Ringwood Church of Christ and Maroondah City Council is a unique way to provide caring and professional assistance to diverse communities within the local area.

Providing support through play and fun connections improves the wellbeing of children and their parents and caregivers. Serving migrant families by providing information in their own dialect removes barriers that can exist due to language. Maroondah is a cultural mesh and creating opportunities to mix in familiar and entertaining ways breaks down blocks that may prevent access to what is more widely known to those who speak English as a first language.

Burmese Storytime and Play is open to all families regardless of ethnicity. Wednesday’s group is run out of the facilities at Ringwood Church of Christ with a Falam-Chin focus. The Thursday session is held at Maroondah Maternal and Child Health in Croydon with a Hakha-Chin dialect focus. Both sessions run from 10-11:30am weekly, except for public holidays. Please see the flyer in this newsletter or contact Zing Tha Thluai at Maroondah City Council (caldoutreach@ maroondah.vic.gov.au) for more information.

THE HEATHERDALE COMMUNITY ACTION GROUP INC. WOULD LIKE TO INVITE MEMBERS OF THE COMMUNITY TO THEIR ANNUAL GENERAL MEETING ON Wednesday 11th September,2024. where we will have BRENDAN NOTTLE OF

THE SALVATION ARMY speaking on Family and domestic violence, youth crime, homelessness, and financial stress causing need WITHIN FAMILIES… Brendan tells me that it is not only the city which is affected but the eastern suburbs as well.

Anyone is welcome to attend. We’d love to pack the hall! Enquiries and bookings to: heatherdalecag@gmail.com

For every $50 spent at our dining retailers, receive a $10 gift card*

Enjoy More When You Dine at Eastland!

Support your local sports clubs and their rising stars by voting for their chance to win a share of over $7,000 in prizes!

We've partnered with the Australian Sports Commission and the Australian Institute of Sport to support the next generation of Australian sporting champions.

Discover how you can get involved in local sport.

The Australian Sports Commission has partnered with national sporting organisations and national sporting organisations for people with disabilities to help more Australians connect with sport

By Warren Strybosch

The time you’ll spend in retirement and the lifestyle you’re planning both make a difference to the savings and income you’ll need. Being realistic and getting clear about plans for your future can help you figure out the cost of your ideal retirement.

“I’ve always lived on a budget and live comfortably... I still believe in budgeting, wise spending, but I don’t feel restricted. People who are retired re-evaluate priorities and where you are willing to spend the money”. Donna, aged 66, retired for two years.

Start with a ballpark estimate

Retirement Standard figures from The Association of Super Funds of Australia (ASFA) make a good starting point for estimating the income you might want or need. By comparing these calculations with your own spending plans, you’ll get a rough idea of how your overall spending in retirement could add up.

The Retirement Standard estimates the total annual budget for either a comfortable or modest lifestyle for retired singles and couples. Figures are updated each quarter in line with the changing costs of living in retirement and include detailed budget breakdowns for all sorts of living costs. What they don’t include is rent or home loan payments. Each estimate assumes an individual or couple live in their own home, mortgage free.

How much will you need in

The retirement you’ll be planning for will be as unique as you are. Maybe dining out isn’t your thing but you couldn’t bear to give up overseas travel. The things you need to make life more comfortable could be quite different from assumptions made for these estimates.

Online retirement spending planners such as Challenger’s for singles and couples can help you figure out how much you may ‘need’ in retirement (essential spending) and how much you ‘want’ (discretionary spending).

How much can you safely spend?

Figuring out how much you’ll need to spend in retirement is a good start for your retirement planning. Knowing what you can afford to spend based on the savings you have will also help you by identifying any gaps between your expectations and reality.

Retirement income model

Challenger have a comprehensive retirement income model that they use in their research, tools and calculators.

This model calculates safe spending rates, taking into account the means tested Age Pension, as well as the three major risks to your retirement income (inflation, market and longevity).

By testing 2,000 simulations, they can calculate the degree of confidence that your savings balance could support a specific level of spending.

The tables on the next page show the ‘safety’ of different spending rates for couples and singles of different levels of wealth, retiring at age 67 today.

A spending level is considered to be ‘safe’ if the household has a high degree of confidence that they can continue spending their desired amount for at least as long as both spouses are expected to live (their life expectancy). You may have a different idea of the amount you can safely spend and still have confidence that your savings will last.

$1,000,000

Retirement.FindWealth Pty Ltd is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221).Part of the Warren Strybosch is Authorised representative (No. 468091)

Here are the steps involved:

1. Email to info@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address

2. A Tax engagement letter will be emailed to you for signing via your mobile (no printing or scanning required).

3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes.

4. We will then require you to upload your documents to our secure portal.

5. Once we have received all your documentation, we will complete the return.

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf.

If you wish us to create your ad, we will do this for a minimal cost. Go to www.findmaroondah.com.au/graphic-design to upload your details and we will create this for you.

At

• Lactation Consultant ----------- 39

• Swen Pouches ---------------------- 40

• Hair Dresser --------------------------- 00

• Chiropractor ------------------------- 00

• Beauty Therapy -------------------- 00

• Gym --------------------------------------- 00

• Massage Therapy ---------------- 00

Osteopathy in Australia is a government registered, allied health profession. Osteopaths focus on improving the function of the neuro-musculoskeletal system (bones, muscles, nerves and connective tissues) to optimise health and well-being.

Joanna is highly qualified and experienced in the osteopathic assessment and treatment of babies and infants.

She can assist with the following assessments:

• Gross motor development (milestones)

• Primitive reflexes

• Tongue function and it’s relation to sucking skills

• Biomechanics of the jaw and mouth

IBCLC lactation consultants are recognised around the world as the experts in lactation care. They provide evidencebased knowledge to assist mothers to establish and maintain breastfeeding. As professionals, they are charged with promoting, protecting and supporting breastfeeding.

Joanna can help with a broad range of lactation consulting services, including:

• Teaching a new mum how to hold and position her baby to breastfeed

• Assess the suck, swallow and breathing of an infant

• Assess for tongue function and determine any evidence of restriction (tongue tie)

• Pre and post-frenectomy breastfeeding support

• Help increase or decrease milk supply

In a big week in international sport, Norwood past player Kim Keedle was centre stage with Melbourne's Oscar Piastri winning the Hungarian F1.

Kim who played 88 junior games and 42 senior games played alongside brothers Lincoln and Mitch at Norwood.

If you watch F1 Kim is often seen beside Oscar on race day, he is the High Performance Coach at McLaren and personal physio / dietician to Oscar, on Tik Tok clips he also doubles as Oscar's driver! Prior to coming to Mclaren, Kim held the same position with F1 Team Hass & Driver Romain Grosjean.

Congratulations Kim and good luck on your journey with Mclaren and Oscar

The Week 2 winner is Kirsty Boote!

Congratulations on winning and thanks for your support.

Stay tuned for more updates building into the season and next Wednesday for the next winner.

Training kicks off tonight at 7pm!

Great night to get down and start to get ready for the season ahead.

Get along, drag your mates out even bring some new friends along. See you at 7!

Not wanting to play cricket but still want to support the club?

A social membership is perfect for you.

Including a hat or beanie and a stubby holder, as well as discounts at the bar and canteen and invitation to a social day the membership represents great value for those supporting on the sidelines.

Get in contact with Paul Taylor or Matt Barnard for more details and to get your membership today.

Big welcome to two new bowlers to Ringwood Bowls Club Inc. Tomislav Ristic and Gillian Baxter.

Both amazing people and very handy bowlers, they will be great to have around the club to continue our push for success in 24/25 season.

Well it was the last session for our Taylor new and emerging bowlers academy before we have a month off and regroup for the start of the new season.

Thanks to all our coaches who helped out Barrie, Ash and Tony as well as others who have since left the club.

Thanks to all our participants over the last three months or so it has been going and we all hope you have all learnt some new things that make your bowls more enjoyable and your knowledge has improved over the time spent with the coaches.

Also a special shoutout to some of our sponsors who have helped kit out our participants and coaches as well as donated challenge prizes each week.

Taylor Bowls Australia Manhattan Hotel The Dorset Hotel As well as Rhys at West Coast bowls who has discounted some new jackets for the coaches just recently due to rain and arctic conditions.

Simply upload your ad at www.findmaroondah.com.au/nfp-free-advertising or you can email the ad to the editor@findmaroondah.com.au and we will do the rest for you.

Senior

Karen

NextGen

Worship

Transform

Community

Children's