The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local businesses owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

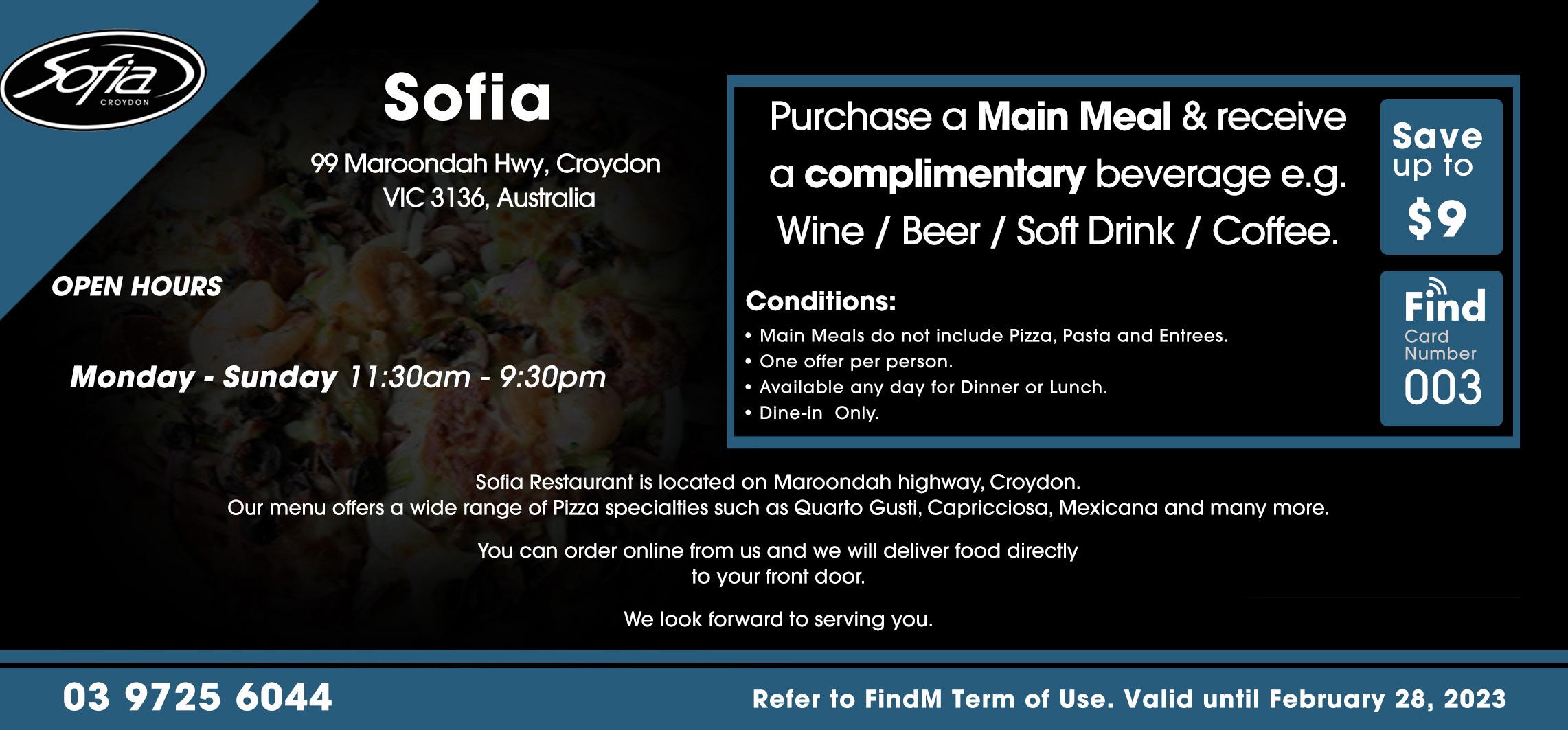

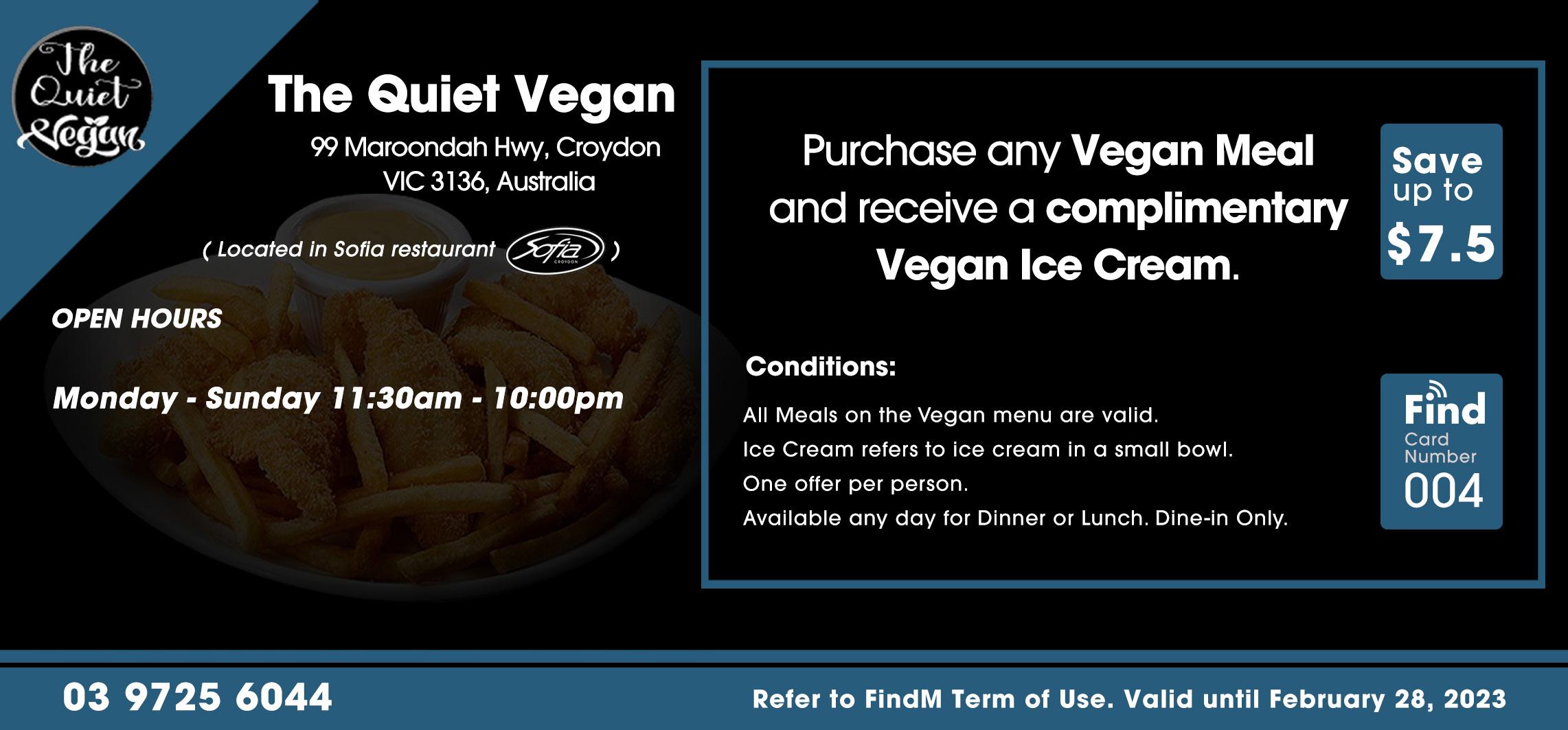

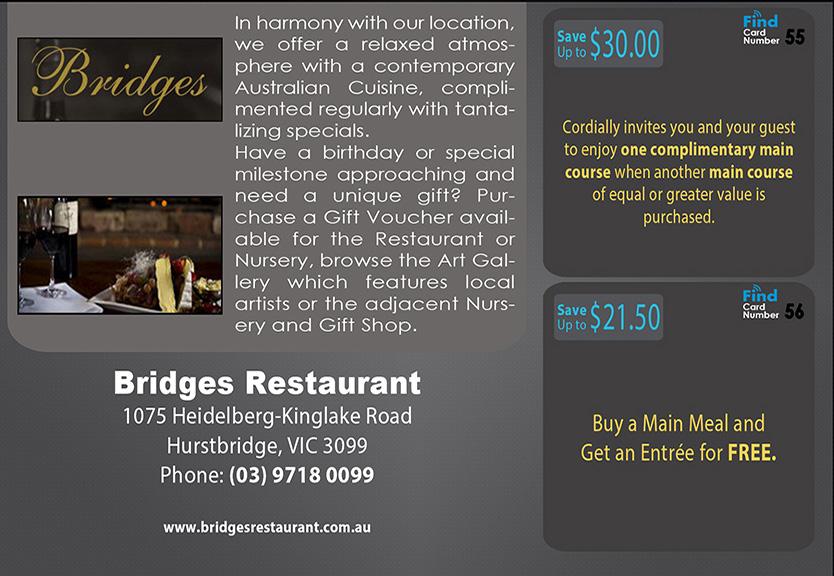

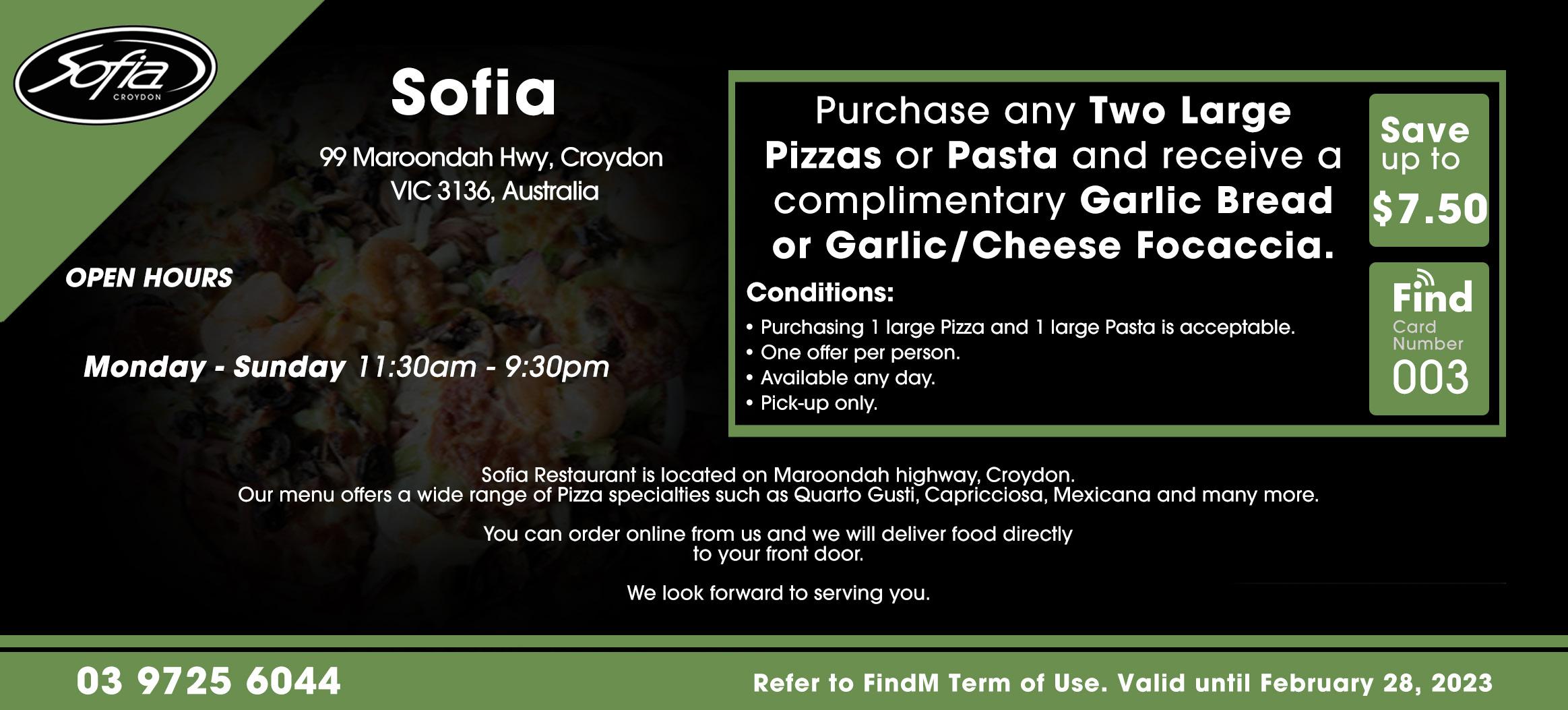

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with is core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

Military service at Monterey base in Albert Park during World War II was top secret. Now at 96 years old, veteran Jocelyn Kelso is ready to tell her story of service.

During her first days at Monterey, newly enlisted Women’s Royal Australian Navy Service (WRAN) recruit Jocelyn Smith was shown a secret cabinet where her American superiors kept a pistol and was given strict instructions about how the weapon was to be used if the Japanese invaded Melbourne. Death by her own hand would be more merciful than torture, her commanders explained. It was a brutal baptism of war for the 19-year-old secretary from Geelong who boarded a train “with butterflies in her stomach” to join the war effort to “do her bit”, and unwittingly became a spy. During World War II, Jocelyn Smith (now Jocelyn Kelso) was one of 80 young women handpicked to work at the topsecret Monterey base in Albert Park after they enlisted with the Navy. Monterey was a joint operation between American, British and Australian Naval Forces — Australia’s version of Bletchley Park — and the WRANS worked around the clock intercepting and decoding messages sent between Japanese forces. The women vowed to never tell a soul about their highly classified work and although the Leading Writer was discharged from official duty in July 1946, Jocelyn kept that promise for almost eight decades.

Now 96, Jocelyn is sharing her story and thanks to her good friend and legatee, John Graham, she is finally being recognised for her service with a special medal from the UK Government and Bletchley Park.

"I don’t know that I ever really sat my family down and told them what I did. No one really spoke about the war, we all just got on with our lives. I told my grandson first because he was very interested in history and he said to me, ‘Nan you were a spy!’." JOCELYN KELSO.

“I think we achieved a lot in hindsight, but I never thought of myself as a hero — we just did what anyone would do under the circumstances. What I did was nothing compared to a lot of others,” she said humbly. The Monterey unit operated in Albert Park between 1942 and October 1944. The codebreakers are credited for playing a significant role in the allied victories in the Pacific, including the destruction of a Japanese convoy of more than 5000 army reinforcements and the death of Japanese Admiral Yamamoto, which proved a devastating blow to Japanese morale. The women were threatened with prison if they told a single soul about their work and most dutifully took their secrets to the grave. Consequently, few were ever acknowledged for the incredible role they played in our war effort. In 2010, UK Prime Minister David Cameron struck a medal to recognise all those who served with Bletchley Park, an honour extended to their Australian comrades, including those who worked at the Monterey unit. When former research scientist John Graham retired, he joined Hamilton & District Legacy to give back to the generation he describes as “selfless, stoic and heroic”, and became Jocelyn’s legatee. Jocelyn’s husband, Keith Kelso, served in the Air Force but Keith passed away more than 30 years ago. John’s help and support was welcomed by the fiercely independent widow.

“The first day I turned up, I noticed there was a broken picture frame by the door. I said to her, ‘I can fix that’. She was thrilled to get the job done and it broke the ice. We started chatting and after a while she said to me, ‘You know I served as well. I’m a widow but I served in the war too.’ And I hadn’t known that. That’s when she started to tell me her story,” John said. “It didn’t take much for me to realise this lady was well worthy of recognition.” John contacted Bletchley Park in England. Within a few months the medal was on its way to Hamilton in Western Victoria, where Jocelyn lives.

"I don’t think what I did was anything noble and I didn’t really want any fuss about it, but it’s lovely to receive the medal.

When I signed up, I was just happy to be sent wherever I was needed."

JOCELYN KELSOJohn Graham is thrilled that Bletchley Park acted so quickly on his request for Jocelyn to be recognised and he is organising a special presentation with the Hamilton RSL Sub-Branch for her to be formally honoured. He has now been Jocelyn’s legatee for more than a year; a relationship he treasures.

Elynne KiftSecretary of Heatherdale Community Action Group Inc. hcag@iinet.net.au www.hcag.online

As a business owner, I want to once again stress that it is your responsibility to ensure the safety of your employees. One major responsibility here is the effective management of hazardous substances in the workplace. By understanding the risks associated with hazardous substances, as well as taking steps to mitigate those risks, you can create a safe working environment for your employees.

Hazardous substances are any materials that have the potential to cause harm to people, property, or the environment. Some examples of hazardous substances include chemicals, compressed gases, and asbestos. It is important to note here that when they are used improperly or in an unsafe manner, even non-hazardous substances can become hazardous.

The risks associated with hazardous substances are numerous, including fires and explosions, skin and eye irritation, as well as respiratory problems, and in severe cases, exposure can lead to death. Hence the importance of taking steps to manage these risks in the workplace.

There are a number of steps you can take to manage the risks associated with hazardous substances in your workplace, including:

• Identify all of the hazardous substances present in your workplace, including chemicals and non-chemicals (e.g. compressed gases).

• Evaluate the risks associated with each substance, considering the worst-case scenario. Put steps in place to prevent it from happening, e.g. where there is a risk of exposure, ensure that all employees are properly trained in handling the substance, and provide them with easy access to proper personal protective equipment (e.g. gloves and respirators).

• Prepare a written plan outlining the management of each substance, and review this plan regularly and update as necessary.

• Use the hierarchy of controls and implement measures to mitigate the risks associated with each substance. These measures could include the substitution of a less hazardous substance or using engineering controls (such as ventilation) to limit exposure.

• Provide training to all employees on the proper procedures for the handling of each substance. Ensure that safety information is readily available to employees, and that they know who to contact if they have any questions or concerns.

• Monitor employee exposure to each substance regularly. This

could involve air monitoring or biomonitoring (such as blood tests).

Does your business have adequate measures in place to properly manage hazardous substances? Do you regularly review these measures to ensure that they remain fit for purpose and keep you and your employees healthy and safe? Are you doing what you need to create a safe workplace for your employees? We assist business owners clarify what they currently have in place, as well as where there are shortfalls. We then assist in developing effective systems and documentation, working with businesses to ensure effective implementation.

Checks are put in place to monitor ongoing effectiveness, to ensure that going forward they are sound and comply with the Act, and most importantly keep them and their employees informed, healthy and safe.

Please feel free to contact me, Mark Felton, at Beaumont Advisory on 0411 951 372 or mfelton@beaumontlawyers. com.au for an obligation and cost-free initial discussion.

Occupational Health & Safety www.thebeaumontgroup.com.au

By Liz Sanzaro

By Liz Sanzaro

Along Wicklow Avenue in Croydon, you will see ribbons tied to many of the trees and bushes.

These are part of the whole linear planting that the level crossing authority LXRP, has told us needs to be removed when the work is started for the rail uplift. Due to one single rail-line being kept operational during the re- build, until very near the end, the whole project will be much wider, as it is in Mooroolbark. On top of that they tell us they need a huge trench for their services in the ground, we have not been advised as to the width.

We don’t know if the rail side of Gallipoli parade on the opposite side from Wicklow will also be completely denuded, as well. It seems very likely, since their access is paramount, according to them, while the job is underway. We think spaces could be cut between, where access is required.

The LXRP have authority over every other body, Council were completely unaware of this vegetation removal. Vic roads were unaware of the possession of their strip of land (on which most of our planting was done). We asked if Vic roads, had given permission, they knew nothing about the silent acquisition.

We have written an open letter to Jacinta Allen the Minister for the rail project, but have had no reply, at all.

Everywhere we turn, there is silence. But Croydon Conservation Society’s facebook page has been burning hot with comments from residents who are very concerned at the concrete-isation of Wicklow avenue.

Reservoir Station, as the Croydon one may look, right up to the curb and channel of the road we are told. Instead of the Memorial wall of native greenery planted about 40 years ago by CCS members.

No more pleasant view for the residents, no more sound deadening, that the trees have provided, no more habitat for birds and other creatures that call that strip home. No more cooling in hot weather, in fact the extra concrete will absorb enormous heat and radiate it back at night, when it should be cool. This is known as the heat island effect, which contributes to cities getting hotter each year. Not exactly in line with taking Climate change seriously.

Once the garage was stuffed from top to bottom and side to side, they would request a truck from the Australian Paper Mill plant in Fairfield. All the men would gather to stack the truck, lunch was supplied by Florence Crane, who also has a memorial to her work in the sundial at Croydon Library, which you walk past on the entry path.

To as insult to injury, this linear planting is a memorial one to one of the founders of the original Croydon Tree Preservation Society, now CCS. Athol Crane and a few other members of Croydon Community who wanted to protect the vegetation and biodiversity of the area, formed our group.

To assist with finances for their conservation plantings, they collected newspapers from local residents, tied into bundles, the men would regularly collect these bundles and store them at Athol’s property in his garage in Braemar St off Dorset Rd.

Money raised from the paper sale has been wisely and carefully used by CCS for some of our planting, such as adding to the Significant Roadside vegetation in Mt Dandenong Rd near Beaufort rd. Those same funds are what keep us operational, supported by some annual donations from paid up members, at $10 per year.

To make the Station precinct worse, LXRP believe they must adhere to no net loss of car-parkinng space, so instead of making the under the station area, some place to enjoy they intend to fill it completely with carparking. Certainly, there needs to be space for disability members of our community, but we have a “white elephant multi storey car park” that Council was given funds for from the previous Federal election, as a vote winner. It is very underutilised and makes up for any loss from the Wicklow avenue side.

If you care about Croydon, and the permanent loss of 2.3 kilometres of planting, can you talk to friends, try to discuss it on talk back radio, or if you have contacts, initiate a TV story regarding how our rail hub will destroy a significant location in our “ Green Leafy Suburb”.

Because we have this.

ByJennifer Dudley-NicholsonAustralian holiday-makers can expect to see more electric and hybrid vehicles on the roads this festive season as rental firms expand their fleets to include ecofriendly options.

And the companies say greener vehicles are in high demand, both from curious motorists keen to take test drives and bargain-hunters trying to avoid rising petrol costs this Christmas.

It’s a challenge being tackled by some of the country’s biggest car hire outfits, including Hertz, Europcar and Thrifty, as well as smaller operations and car-share services such as Turo, Evee and Uber Carshare.

Hertz Asia Pacific vice-president Eoin MacNeill said a survey of more than 1000 Australian motorists showed two in three wanted to rent electric vehicles, and many would use the holiday season to to do so.

“There’s curiosity about trying one of these cars,” he said.

“There’s a particular curiosity from travellers and if you’re not doing a massive road trip across Australia these are perfect for driving around Noosa and having a nice holiday.”

Mr MacNeill said the car rental firm, which added Tesla and Polestar vehicles to its fleet in 2022, was also seeing interest in electric cars from savvy shoppers cutting costs.

“There are cost savings to hiring an EV, particularly if there are petrol price spikes at Christmas, which there are normally,” he said.

Powering an electric vehicle costs about a third the price of fuel.

“There’s also an added benefit in that normally our customers have to refill our vehicles with fuel before they return them

We need something like this.

whereas they don’t have to do that with these vehicles. We can charge them,” Mr MacNeill said.

While electric vehicles made up just 3.39 per cent of new vehicles sold in the year to September, the technology was increasingly being offered for hire.

NRMA launched a fleet of MG and Tesla electric vehicles under the SIXT brand, and services including Evee, Uber Carshare and Turo rent a range of battery-powered cars, including models from Hyundai, Mini and BYD.

Some firms were also offering hybrid vehicles for rent in Australia, including Thrifty and Kinto.

Kinto marketing head Vesna Benns said the Toyota-owned company offered

vans and four-wheel drives for rent but almost all its smaller vehicles were hybrid models.

“We’re moving towards a full hybrid fleet,” she said.

“We’re sitting about 97 per hybrid for our passenger cars so it means people can experience what that’s like if they haven’t done that before and people can rent a car with the knowledge they’re doing something a bit greener and using less petrol.”

Ms Benns said customer feedback had been positive but some first-time users phoned to complain they could not hear the engine.

“It’s been fun talking people through that and helping them experience a hybrid vehicle for the first time,” she said.

By Kathryn Messenger

By Kathryn Messenger

In the hot weather our fluid requirements increase and whilst just plain water is usually all that’s required, here are some healthy options to replace soft drinks, bubble teas, and smoothies which often contain mostly sugars.

If you don’t like it plain, experiment with adding 1 or more of the following to give it a bit of flavour: lemon or lime juice, cucumber, berries, ginger (place fresh slice or powdered in a little boiling water and allow to steep, then add cold water and ice). Berries can be added to ice blocks before freezing, then placed in drinks.

Matcha is green tea powder and whilst it can give you a caffeine hit, it is also high in antioxidants and studies show many health benefits. Be sure to buy unsweetened matcha, then add ¼ tsp

to a little boiling water, whisk, fill glass with cold water and ice. Drink it as it is or add fresh lemon juice or mint leaves to flavour.

This smoothie is actually a meal as it contains protein and fats as well as fruit and makes a great summer breakfast. If you’re short of time in the morning, you can make it the night before and store it in the fridge.

• 1 piece (or 1 cup) fruit such as banana, apple or berries

• ½ cup nuts and seeds, or ¼ cup natural protein powder

• 1 tab coconut oil, macadamia oil, or ½ avocado

• ½ cup leafy green vegetables such as kale, silverbeet, spinach or celery

• ½ cup other vegetables such as carrot or cucumber

• Spices for flavour, ginger, cinnamon, vanilla, cacao or lemon juice

• Top with milk, plant milk or water and blend.

To change it up, try making a smoothie bowl, by placing your smoothie in a bowl and topping with fresh fruit nuts and seeds.

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

kathryn@wholenaturopathy.com.au

Suite 1, 24/1880 Ferntree Gully Rd

Mountain Gate Shopping Centre

Ferntree Gully, Victoria

This is the fourth of five publications where we are running a series of sensory experiences in nature.

Each experience will take about 10 mins and you are encouraged to read through the instructions before you commence your time in nature to maximise your experience.

Find a spot outside where you can sit or lie down comfortably. This could be in your backyard, your local reserve or in a national park. You may like the familiarity of the same place you have practised before or you may like to try somewhere new.

Take a few moments to regulate your breathing and settle into your position.

We are going to practise ‘belly’ breathing in this exercise.

Put one hand on your belly.

Breathe in through your nose and feel the air moving through your nostrils and expanding your stomach, feeling your hand moving.

Breathe out and feel your stomach gently contracting to push the air out and your hand return to its original position.

If helpful, put your other hand on your chest to ensure that it isn’t moving.

Do this for a couple of minutes.

Relax your hands and allow your breath to continue naturally.

If you are comfortable, shut your eyes. If not, focus on a spot down in front of you. For the next 5 mins, tune in to what you can observe with your sense of smell.

Take some breaths and notice what you can smell?

Is there moisture in the air that you can smell? Pollen?

Can you smell the scent of flowers, leaves etc?

Pause for a moment and allow your sense of smell to take all of your attention. If you wish, touch some leaves, the earth, flowers and enjoy each individual smell for several moments. Do this from where you are positioned or move very slowly to a place where you can experience different smells.

Ensure that you pause for a minute or so with each smell.

Allow your sense of smell to become larger.

If your mind gets distracted, just draw your thoughts and attention back to what you are smelling.

Try to stay focused and enjoy the experience of tuning into your sense of smell.

When you choose to complete your experience, you may wish to take a moment of gratitude for nature and for the experience you have just had.

When you choose to complete your experience, you may wish to take a moment of gratitude for nature and for the experience you have just had.

is the founder of Admirari Nature Therapy who provide nature experiences for schools, business and individuals. For more information visit admirari.com.au

our

is an important way to disconnect from the fast pace of modern life.

If you have terms and conditions properly in place, every step of what we do should be for fees that are recoverable from your clients and debtors.

Primarily, the best way to ensure you get paid is to have strict credit protocols in place, so that your clients understand that if your invoices or accounts are not paid within the time frames you allow, there will be a follow up. It doesn’t have to be rude or aggressive, in fact the follow up can be a tool to show your clients that you actually care about them.

Here is what we suggest is the best protocol for ensuring you get paid when you want to be paid.

1. After carrying out the work or rendering an invoice that is not immediately payable (and then paid), ensure that the invoice has a date for payment, clearly stated.

2. Immediately after the date for payment has passed, some action must be taken. We suggest a generic email from your accounting package eg Xero or MYOB to the effect that the payment has not been received, and could they contact you if payment is not going to be made in the next three days (or whatever time frame works for you). If you don’t have an accounting package, then it is a good idea to set up an email address for accounts eg. accounts@yourdomain.com. au from which you can send this generic email yourself eg We have not received your payment in the amount of $[insert amount], which was due on [insert date]. If you have made payment, please ignore this email.

3. At the end of that second time period, someone must call or attempt to call the client or debtor. Ideally it will be a bookkeeper or someone other than

the owner, and that communication should essentially be “Hi, I am from the accounts section for [Your business name] and I have a reminder from our system that your payment, which was due on [insert date], has not been received. Is there a problem with payment? Was there something wrong with our service/product?”Usually, the debtor will say something like they are sorry and they’ll get to payment at some vague time in the future eg “I’ll pay it next week.” It is very important that whomever is speaking to them pins down an actual date, by saying “So that means you will make payment by [insert date]?”. The client or debtor will realise at this point that if he confirms a date, and the payment is not made by that date, he or she will be contacted after the next date again for payment. This is often all that is needed, and payment will be made.

4. If payment is not made by the next date, that is the time that the owner or manager should call the debtor personally. That call should not be a demand for payment, but rather an enquiry as to whether something is wrong!! The point of the call becomes “I just wanted to check that everything is OK with your business? You haven’t made payment, even though our accounts people contacted you, so I thought maybe there was a problem that I could help with?The fact that you are making the call personally, and enquiring about their business rather than demanding money, will often predispose the client or debtor to make payment. It’s also an easy way to leave a message, assuming the debtor does not answer the phone. The message should say something like “Hi [client or debtor name], it’s [your name], from [your business name], I was just calling to check that everything is OK. I haven’t heard from you and payment hasn’t been made so I am concerned there might be some problem. Can you

let me know if everything is OK?”. Of course, put it in your own words to make it more genuine.

5. If that still elicits no response, then it may be time to take the next step. The next step is an email in which you warn that legal proceedings may follow, and that the matter may be potentially referred to your solicitor. An example email is as follows:Mr/ Ms [Insert client surname]We have issued you with invoices for payment of [the products]/[the services] we have provided. We have not received payment of the amounts due under the invoices, and despite numerous attempts at contacting you to find out why, there has been no reasonable response.If you do not make payment within seven days, we will have no choice but to refer the matter to our solicitor, Mr Dean Bosman, for the commencement of legal proceedings. Please note that Mr Bosman has been cc’d to this email.

Please also note that the commencement of Court proceedings will incur and may make you liable for costs in certain circumstances, those costs include the scale legal costs of the statement of claim, together with interest pursuant to Section 100(7) of the Magistrates Court Act 1989 (VIC) (as amended) and the rate is that is fixed by the Penalty Interest Rates Act 1983 (as amended).

Please also note that the commencement of Court proceedings will incur and may make you liable for costs in certain circumstances, those costs include the scale legal costs of the statement of claim, together with interest pursuant to Section 100 of the Civil Procedure Act 2005 (NSW).

Please also note that the commencement of Court proceedings will incur and may make you liable for costs in certain circumstances, together with relevant interest.

No further warning or notice will be given.

End the email with your signature.

Use the yellow highlighted section for Victoria, the green highlighted section for NSW, and the blue for anywhere else.

Debt recovery is a necessary part of running a business, however it shouldn’t be a part of the business that costs you money.

6. The above email is all that is required to warn your client or debtor that legal proceedings may follow. If you issue this demand, we can go straight to legal proceedings without the cost of a demand. The costs for issuing legal proceedings are covered by scale fees, which means that the fee we charge is fully recoverable from your client or debtor.

7. If you want to use my email address, please send a request through our contact page – we can’t put the email address here because it then attracts spam and phishing emails from bots the crawl the web. There is no fee for using this template.

Something you should note is that the older a debt is, the more difficult it is to recover, so you should have a set process in place, and follow it. The above should help you to recover debt without offending your clients. There is a six year statute of limitations which means that if your debt is older than six years, you can’t recover it, but you can for anything under six years.

If you have any questions about the above, or any questions about the legal process, please feel free to call us, there is no charge for the call. For issuing legal proceedings we charge set scale fees that are recoverable from the debtor, and we set out those fees before we commence so that you know how much it will cost, and what will happen.

creditor. The demands shall notify the debtor about the debt that is due and payable. The terms for settling the debt must also be clearly outlined.

Our lawyers will carefully explain every step of the debt recovery litigation process, from the preparation stage to court proceedings and what comes after, in order to secure your financial future.

After successful court proceedings, the court will issue a decree so that an enforcement action can be taken in order to recover the debt. Our team will be happy to assist you in enforcing the decree and getting the due payment.

Insolvency proceedings commence when the debtor has not made their payments after 21 days. Our solicitors will help you navigate this process and aid you in issuing petitions at the Court.

A statutory demand is served to the debtor when the debt is not disputed. This is a written demand for the payment of the debt.

Provided that the court proceedings are successful, the court will then issue a decree that allows an enforcement

action to be taken in order to get the due payment and recover the debt.

For large claims, it is highly recommended that an experienced solicitor advices you. Here at Mercantile Legal, we provide honest legal advice before, during, and after the proceedings since the trial can be a long, tedious, and expensive process.

Proper securities will be put in place to in order to allow the payment dispute to be decided. We will help you prepare your claim, making sure that your documents and evidence are well-presented.

The Security of Payment Act is a statebased legislation that helps streamline a court judgment specifically for the building and construction industry.

A client may apply for cost assessment in which any and all information shall be clearly and succinctly set out.

03 9098 8750

www.mercantilelegal.com.au

The founder of the Find Group of companies draws on his diverse background, which ranges from teaching, to serving in the army, to taxation and accounting, to coach and help clients live their best financial lives. A multi-award winner, Warrens’s innovative approach in business means he was a champion of virtual financial advise long before the pandemic. Warren established the Find Foundation, which owns and operates accros Victoria.

The financial advisers featured in this guide are a diverse group: some specialise in responsible investment advice, some provide financial advise to specific professions, and some focus on addressing market gaps, mwith several finding themselves on the list for the very first time. But they all have one thing in common: they all wield influence that can create the blueprint for the future of financial advice in Australia. Not all of them are faniliar names but just because they are not making a lot of noise doesn’t mean they are not making waves. Meet our Power 50.

By Dr. Joanna Strybosch

By Dr. Joanna Strybosch

In my private osteopathic and lactation consulting practice I see quite a number of babies who have a persistent head tilt or turn. This condition is called torticollis (latin for “twisted neck”) and most of these cases are what we call congenital muscular torticollis. This means the baby was born with it and its origin is muscular.

When the sternocleidomastoid (SCM) muscle in the side of the neck is shortened, contracted or tight, it produces a characteristic tilt of the head to the affected side as well as a turn away from that side. In some babies, the head tilt component is more noticeable and in others it is the turn. The condition makes it difficult and uncomfortable for the baby to hold their head straight or to turn it the other way.

The cause of congenital muscular torticollis is usually due to the way the baby was positioned in utero. When a developing foetus grows in a restricted position within the confines of the uterus, their head can be abnormally tilted to one side. This persistent position impacts the way the SCM muscle grows and

develops and then after birth the altered tone of the muscle affects its function and we see the characteristic postural changes.

Sometimes a baby’s head tilt is not very noticeable at birth, and it is not until the baby reaches a few weeks or even months of age that a caregiver may begin to notice it. However, it can be a missed cause for early breastfeeding difficulties.

In order to latch correctly, a baby must be able to position at the breast comfortably. If a baby has restricted movement in their neck from torticollis, there will usually be challenges for baby to turn into the breast on one side and this will manifest as difficulty latching and/or sustaining a latch. Baby may have difficulty latching onto the breast altogether, they may slip on and off repeatedly, they may come off early and cry, or they may tire quickly and stop before they have had a full feed. Baby often has extra difficulty regulating their state, quickly becoming unsettled and overwhelmed at the breast, and unable to relax enough to feed well.

This is one reason I always assess a baby’s neck during a lactation consultation, and especially if mum describes a

history of difficulty with latching. It is also why I often want to observe and assess a breastfeed when mum reports a head tilt or preferential turn.

As both an Advanced Pediatric Osteopath and an International Board Certified Lactation Consultant (IBCLC), I find combining these two skill sets invaluable in the assessment and management of congenital muscular torticollis and to provide good clinical outcomes.

As an osteopath, I usually provide gentle hands-on treatment to massage and relax the tight SCM muscle. I also advise parents on different home-based strategies, such as the best positions to hold baby in while breastfeeding, ways to gently and safely stretch the affected side of the neck and how to use tummy time to effectively assist in the management of this condition. Most babies go on to recover and to breastfeed well.

Osteopath B.App.Sc(Clin.Sc)/B.Osteo.Sc/Grad Dip Paeds

LACTATION CONSULTANT www.childrensosteopathiccentre.com

By Warren Strybosch

By Warren Strybosch

One of the biggest tax topics for 2022 relates to trust distributions. In the past, clients who owned a discretion trust or family trust, could distribute income to another company, trust, or adult children without attracting any attention from the ATO. However, the ATO, has cracked down on who can receive distributions and it does not bode for many trustees. Trustees will need to understand the ATO’s position on trust distributions, more specifically, 100A of the Income Tax Assessment Act 1936 (ITAA 1936) and Taxation Ruling TR 2022/4 and the Practical Compliance Guidance PCG 2022/2 (Section 100A reimbursement agreements – ATO compliance approach) which the ATO clarified and confirmed its position on the 8th of December 2022.

The guidance issued by the ATO under TR 2022/4 and PCG 2022/2 is comprehensive and details several commonly encountered situations with trust arrangements. The key message is that the ATO’s core compliance approach to s100A will depend on where on a trust arrangement sits on the ATO’s three-coloured risk framework. Each zone in this risk framework represents a risk rating and denotes the level of ATO engagement that can be expected by trustees for their trust arrangement. Whilst the ATO’s approach is a softer one compared to their draft rulings released in February 2022, the manner in which income distributed to a corporate or adult beneficiary based on these new frameworks may still potentially attract ATO scrutiny regarding current and previously set up trust arrangements.

Whilst the TR 2022/4 focuses on the 4 basic requirements of s100A, the accompanying PCG 2022/2 outlines the ATO’s confirmed guidance on how it will assess trust arrangements for the potential application of s100A.

The ATO will be differentiating and managing risk for a range of trust arrangements based on which of the 3 zones a trust arrangement falls in:

1. White (low risk)– applied to pre-1 July 2004 arrangements.

2. Green (low risk) – covers several common familial scenarios including receipt of the entitlement within 2 years and the trustee's retention of funds and ordinary dealings.

3. Red – these are high-risk trust arrangements that include but are not limited to the circular flow of funds between a corporate beneficiary and trust which is a shareholder, as well as arrangements where entitlement to income has been ‘gifted’ back to the trustee (or a parent) or otherwise forgiven.

At this stage it is important to note two important differences between the previously drafted PCG 2022/D1 and the newly issued PCG 2022/2:

The number of zones in the risk framework has been reduced from 4 to 3 with the blue zone now removed.

The green zone has been expanded and is still considered to be low risk.

It is important that trustees try to understand where their trust arrangements sit in these zones. As such, the ATO has provided more practical examples to assist trustees to understand if they fall within one of the zones that might attract the ATO’s attention e.g., green or red zones. There are several examples set out in PCG 2022/2, however, the ATO’s consensus is that it will not dedicate compliance resources to white-zoned arrangements.

Green zone arrangements will not attract ATO scrutiny in terms of considering the applicability of s100A,

rather resources will be deployed to confirm that the trust arrangement meets the green zone features.

Being high-risk, red zone arrangements will be the focus of the ATO’s scrutiny with a strong level of engagement and deployment of resources expected.

PCG 2022/2 will have application both before and after its date of issue, however, for entitlements arising before 1 July 2022 the Commissioner will uphold his position in Trust Taxation – reimbursement agreement, issued in July 2014, to the extent that it is more favourable to the taxpayers circumstances than PCG 2022/2

For those trustees with complex trust structure set ups it is advisable to seek advice from an accountant or lawyer that specialises in this area.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au www.findaccountant.com.au

Businesses have so far proved resilient to turbulent economic conditions domestically and overseas but next year is not looking so rosy.

In the final chapters of 2022, the 300 basis point lift in the cash rate from record lows is just starting to show up in weaker business confidence and easing conditions.

NAB’s business survey revealed the first negative confidence reading in November despite another robust but weakening result on conditions, suggesting rising interest rates and the slowing global economy are starting to worry business owners.

As well as weighing on consumer spending and demand for goods and services, sustained rate rises are directly hitting businesses by making it harder for them to borrow or refinance.

University of Sydney finance lecturer Alessio Galluzzi said small and mediumsized businesses were particularly vulnerable to swings in the business cycle.

“The overall uncertainty about future prospects is weighing down investors’ expectations and willingness to invest,” he said.

Dr Galluzzi said there were reasons to be optimistic about the period ahead as falling energy commodity prices provided some breathing room.

“Cost inflation is also coming down thanks to the normalisation of the supply chain after two years of disarray – as much as question marks remain due to the recent changes to zeroCOVID policies in China,” he said.

Australian Chamber of Commerce and Industry boss Andrew McKellar said worsening economic conditions were starting to bite and the chamber’s gauge of industrial business conditions dropped sharply into negative territory over the December quarter.

Mr McKellar said the final quarter results came as a surprise as they showed the slowdown in industrial business activity happening much quicker than expected.

While recognising the downward pressures on key inflationary drivers

such as energy, he said a worst-case, stagflation-type scenario was still possible. “We don’t want to have a situation where we’re continuing to struggle with high input costs, declining profitability, but at the same time, you know, seeing that demand and output are pulling back,” he said.

Government policy will also help shape the fortunes of Australian businesses in the new year.

Additional industrial relations changes still in the pipeline, such as reforms to casual and labour hire employment, could pose challenges for businesses in 2023 if the government took the wrong direction, Mr McKellar said.

Council of Small Business Organisations chair Matthew Addison said 2022 had been tough on the mental wellbeing of business owners and employees, and he was worried about the year ahead.

He said labour shortages – exemplified by an unemployment rate stuck near 50-year lows – were weighing heavily on small businesses.

Mr Addison welcomed the federal government’s efforts to overhaul training and the migration system to help plug workforce gaps.

“Australia needs to become an attractive place to migrate to with a clear road to permanent Australian residency,” he said.

Employment Hero chief executive officer Ben Thompson said small and medium-sized businesses were likely to struggle to maintain headcount as interest rates rose and wages lifted.

“Cashflow is often the biggest hurdle for small and medium-sized businesses, especially in times of crisis – increased wages will be too demanding for most next year,” the HR platform company boss said.

But despite the gloomy outlook, Australia is in a better position than most nations to ride out economic headwinds and dodge a recession.

CreditorWatch chief economist Anneke Thompson said strong employment would serve as an important safety net for Australians and ensure most borrowers could make their repayments.

“Businesses may also start seeing some increased ‘slack’ in the labour force, helping them run their operations more efficiently and with less disruption,” she said.

An Australian made solar-powered race car has narrowly set a provisional Guinness World Record in a 1000 kilometre race, overcoming challenges to claim the title with just six minutes to spare.

The Sunswift 7 vehicle, created by a team of UNSW engineering students, is now on track to hold the record for the fastest electric car to travel more than 1000 kilometres on a single charge.

But the low-profile vehicle almost missed the finish line, with a battery management issue causing a 14-minute pit stop that almost cancelled the record attempt.

The Sunswift 7 vehicle, powered by a battery and solar panels on its roof and bonnet, completed 240 laps of Victoria’s Australian Automotive Research Centre to complete the challenge, or the equivalent of driving further than Sydney to Melbourne.

Sunswift team manager Andrea Holden said the win had been “validation of all the effort everyone in the team” had put in after originally creating the vehicle for the biennial Bridgestone World Solar Challenge that was cancelled due to the COVID-19 pandemic in 2021.

“It feels very weird to think that we’ve helped to make something that’s the best in the entire world,” Ms Holden said. “Two years ago, when we started to build this car, everything was going

By Marion Rae (Australian Associated Press)Australia will develop robotics and automation across the economy by combining research and manufacturing skills under a new strategy.

Minister for Industry and Science Ed Husic has appointed an advisory committee to develop a national robotics strategy that will meet for the first time on Tuesday and be chaired by Australia’s chief scientist Professor Bronwyn Fox.

“We also want to ensure that we develop our robotic strength alongside human skills, delivering secure well-paid jobs,” Mr Husic said. Robotics companies are estimated to be worth $18 billion in annual revenue to the economy,

into lockdown and there were a lot of difficult moments.”

But the engineering students, led by former Red Bull Racing operations head UNSW professor Richard Hopkins, faced significant challenges on race day, with one tyre puncture and a battery issue that forced a mid-track repair.

The fix took 14 minutes and 52 seconds out of 15 minutes allowed. Prof Hopkins, who helped lead the Red Bull team to four World Championships, said the achievement was even more “incredible” in light of the obstacles the team had to overcome. “Let’s remember these are not the bestpaid professional car makers in

up from $12 billion in 2018, serving sectors ranging from mining to agriculture as well as advanced manufacturing. “Australian made and maintained robotics and automation systems have the potential to boost local manufacturing, open up export opportunities and create safer and more productive work environments,” Mr Husic said. “And while we’re recognised as possessing strength in

Stuttgart working for Mercedes,” he said.

“This is a bunch of very smart amateurs who have taken all the ingredients and put it together in a brilliant way.”

The Sunswift 7 race car weighs about a quarter as much as a standard electric vehicle at 500kg and boasts a lowprofile body with a drag coefficient of just .095.

Prof Hopkins said the vehicle would not be “a production car of the future” due to cost and other practicalities but said its design could provide valuable lessons to the design of future fuelefficient vehicles.

field robotics, we can do better, across a wider range of activities.” Upgrading industrial capability is one of the federal government’s priorities under a $15 billion national reconstruction fund, which has allocated up to $1 billion to quantum, robotics and artificial intelligence technologies.

Read more

By Erryn Langley

By Erryn Langley

Poverty is not just a financial measure –it can also affect health. But life insurance can help manage the risks.

More than 40% of Australians report such low levels of physical and mental wellbeing that they are defined as living in ‘health poverty’, according to new research.

It suggests many Australians are unaware of the risks they face given life and disability insurance levels continue to decline.

The comprehensive analysis by the ARC Centre of Excellence in Population Ageing Research (CEPAR) assessed more than 30,000 Australians’ views of their health across physical function, role function, social function, pain, mental health, and vitality.

“Our investigations of what aspects of health were contributing to health poverty suggests lack of role functioning and vitality were the most important elements,” the report found.

“They account for much of the change over time, the differences between groups, and the differences in trends between groups.”

While there are measures of poverty across several aspects of life, there is no established measure of health poverty, according to the report.

According to the CEPAR measure, the rate of health poverty fell between 2001

and 2009, but then quickly climbed again, in line with rising diabetes and drug-induced deaths.

The research found specific groups, including women and Indigenous Australians, were more at risk of health poverty.

Around 44% of women suffered from health poverty in 2001 compared to 40% of men. The gap grew larger (33% for men and 40% for women) by 2010, with women’s health poverty continuing to get worse, reaching a record high of 46% in 2018.

Indigenous Australians were also at risk, suffering extreme rates of health poverty of more than 60% by 2018.

While older Australians tend to have more health problems, the health poverty gap between older and younger people narrowed over the last two decades.

The report shows many Australians are at risk of health poverty, yet actuarial firm Rice Warner (recently merged with PwC) estimated Australians were underinsured by $1.8 trillion in 2017.

And the gap has widened. Rice Warner’s 2020 analysis revealed that the total sum insured has decreased by 17% and 19% for death and TPD cover respectively over the previous two years.

The table below estimates the actual average level of death and TPD insurance that 30 and 50-year-old parents need.

(The amount is lower for older parents as they have less time until retirement, lower expected debt, higher super savings, and spend less time looking after children.)

Table: Average insurance need per parent

Age of parents

30 $561,000 $874,000

50 $207,000 $499,000

If you would like to review your current life insurance cover, contact your adviser.

A1 Trends in Health Poverty in Australia, 2001-2018 | CEPAR. (2021, July 30). Retrieved from https://cepar.edu.au/ publications/ working-papers/ trends-health-poverty australia-2001-2018 Rice Warner (2020, November 19) https://www.ricewarner. com/new-research-shows-a-larger-underinsurance-gap/

This

been provided as general advice. We have not considered your

circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

Starting from 1 July 2023, operators of sharing economy platforms will be required to report transactional information to the ATO. The Taxable Payments Reporting System already applies to some businesses in industries where non-compliance is deemed to be high risk. By adding operators of sharing economy platforms to the regime, taxpayers who hold or use assets for short-term lease or contract work will have their information collected.

The identification of users of sharing economy platforms means that, as an adviser, you should be informing taxpayers who earn income off these platforms of their tax obligations. This includes short-term accommodation, ride-sharing transport and food delivery platforms. Also, other task or time-based service platforms will be required to report for income years beginning on 1 July 2024. The start date of the proposed changes have been delayed after the former Bill was prorogued at the last federal election.

First announced in May 2021, the digital games tax offset (DGTO) has received the green light from the Labor government to be implemented as legislation in the coming months. The DGTO is aimed at giving a boost to the digital economy as well as the digital gaming industry in Australia. This offset will allow eligible businesses to claim a refundable tax offset of up to 30% on qualifying Australian gaming development expenditure. The offset (currently draft legislation) will be implemented through amendments to the Income Tax Assessment Act 1997 through the creation of a new Div 378.

Age pensioners and income recipients are set to benefit from a change in rules to the eligibility tests in relation to their principal home. Changes to the assets test and income test will provide greater flexibility for homeowners to downsize or more into a property that better suits their needs. The intention of the changes is so pensioners and income recipients have more time to decide their next course of action when it comes to housing without any penalty to their support payments and entitlements.

The Commissioner of Taxation will be given new powers to direct a taxpayer to undertake a record-keeping education course in lieu of an administrative penalty. The new directive will be initially limited to small business owners in order to assist them in keeping up to date with tax obligations. The individual must then provide the Commissioner with evidence of completion of the course in order to avoid financial penalty. The new directive will be available after the Bill receives Royal Assent.

A business with an aggregated turnover of less than $50 million will be entitled to a 20% bonus deduction for expenditure relating to a digital business adoption.

The bonus deduction will be available for expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (2022 Federal Budget night) until 30 June 2023.

Eligible deductions are limited to an annual cap of $100,000, which can be claimed by a business on both business expenses and depreciating assets simultaneously.

An employer who provides an employee with an electric vehicle will not be liable for fringe benefits tax on the employee’s private use. The new legislation comes into effect for electric vehicle first held by employers on or after 1 July 2022.

To be eligible for the exemption, the electric vehicle must be below the luxury car limit, which is currently sitting at $84,916.

The exemption provides a viable option for employees to reduce their tax bill by salary packaging.

Small businesses will get a bonus tax deduction on top of the allowable deduction for training their employees.

Businesses with an aggregated turnover of less than $50 million will be entitled to claim a 120% deduction for eligible expenditure. Eligible expenditure refers to external training courses delivered to a business’s employees by a registered training organisation in Australia.

The skills and training boost is available from 7:30pm (AEDT) on 29 March 2022 until 30 June 2024.

Downsizer contributions have been available to members of complying superannuation funds since 1 July 2018. From that date, a person aged 65 years or older has been able to make a contribution up to $300,000 from the proceeds of selling their main residence. A legislative amendment originally from the 2021 Federal Budget reduced the age limit from 65 to 60 from 1 July 2022.

Further, another legislative amendment by the federal government from August 2022 has reduced the age limit again from 60 to 55. The change will come into effect on the day the Bill receives royal assent. To be eligible to make a downsizer contribution, an individual must have owned their main residence for at least 10 years. It is available to both members of a couple for the same home, even if only one is on the title deed.

Downsizer contributions are in addition to existing rules and caps and are exempt from the:

age test, and $1.7 million total superannuation balance test for making non-concessional contributions.

Individuals will now have the ability to claim a higher deduction for self-education expenses. From the 2022–23 income year, legislation that limited the self-education deduction to costs above $250 each income year has been repealed.

In order to claim a self-education deduction, an individual must demonstrate a necessary connection of the expense with their assessable income.

The announcement originally came from the 2021 Federal Budget and is somewhat related to a Treasury discussion paper released in December 2020. However, other matters addressed in the paper, such as deductions for expenses unrelated to current employment, have not been taken further at this stage.

Announcement(27-Jul-2022)

Consultation

Introduced(27-Aug-2022) Passed(28-Nov-2022)

Royal Assent(12-Dec-2022) Date of effect(1-Jul-2022)

Announcement(29-Mar-2022) Consultation(29-Aug-2022) Introduced(1-Dec-2022) Passed Royal Assent Date of effect

Announcement(10-May-2017) Consultation Introduced(3-Aug-2022) Passed(28-Nov-2022)

Royal Assent Date of effect(1-Jul-2018)

Announcement(11-May-2021)

Consultation

Introduced(3-Aug-2022) Passed(28-Nov-2022)

Royal Assent Date of effect(1-Jul-2022)

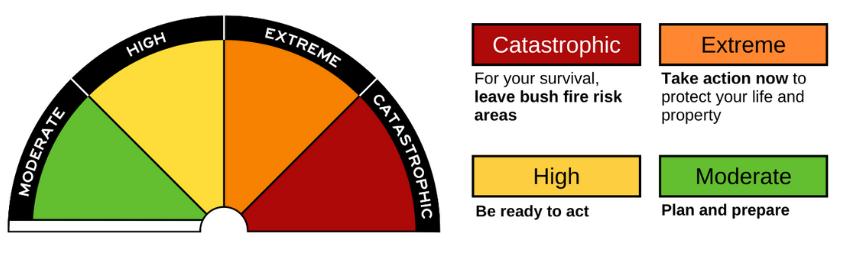

Look out for the new Australian Fire Danger Rating System (AFDRS), which was introduced on 1 September 2022.

The new Fire Danger Rating System will be nationally consistent and uses the latest technology and research, greatly improving the ability to accurately predict fire behaviour and the potential threat. This will help emergency services be better prepared, make improved decisions, and provide better advice to the community.

The four new AFDRS levels and messages are:

• Moderate: plan and prepare

• High: prepare to act

• Extreme: take action now to protect your life and property

• Catastrophic: for your survival, leave bush fire risk areas

Importantly, the highest level is now ‘catastrophic’, replacing ‘code red’ in Victoria, so all fire danger rating signs in Victoria are being replaced.

Fire danger ratings describe the potential level of danger if a bushfire starts, rather than the chance of a

fire occurring. The higher the fire danger rating, the more dangerous the conditions are and the greater the impact will be if a fire starts.

It’s important to understand the new

ratings and know what your fire risk is. Council encourages everyone to use the VicEmergency website or app to monitor conditions, especially before travelling, or use the CFA website for daily fire danger ratings.

Maroondah City Council is among six eastern metropolitan councils to share $180,000 in Victorian Government funding for a project to prevent homelessness in women over 55 years of age.

Mayor of Maroondah, Councillor Rob Steane, said the project aims to prevent homelessness in those who are most at risk in the community.

“Single women over 55 are the fastest growing group of people experiencing homelessness in the Eastern Metropolitan Region.

“This project will explore the lived experiences of women over 55 and identify service gaps in the region. This will help find critical points where intervention could help keep older women safe from homelessness,” Cr Steane said.

“The findings will be used to inform all levels of government about preventive approaches and alternative housing models for women over 55 that could be delivered locally and across the eastern region.” The Preventing Homelessness in Older Women Project commenced in October and is being undertaken by the Eastern Affordable Housing Alliance (EAHA), with sponsorship from Knox City Council. The project is also being supported by fellow EAHA members Maroondah, Manningham, Monash,

Whitehorse and Yarra Ranges councils. Since 2009, the EAHA has worked towards addressing the lack of social and affordable housing across the Eastern Metropolitan Region.

Data compiled by the EAHA found there is currently a shortfall of 9,400 dwellings in the region, which could increase to 11,800 by 2032 without initiatives like this project.

Rising rents in the private rental market, living alone, working part-time, having little savings, and being from a nonEnglish speaking country or Indigenous are among complex factors that can place older women at greater risk of homelessness.

The $180,000 was provided to the Eastern Metropolitan Partnership under the Victorian Government’s Metropolitan Partnerships Development Fund.

Join us for Australia Day celebrations at Ringwood Lake Park on Thursday 26 January.

You're invited to join us on Thursday 26 January at our Australia Day celebrations at Ringwood Lake Park! Australia Day is a great day to come together and celebrate our great nation and the Maroondah community. The event will include an Australia Day Awards and Citizenship Ceremony, a BBQ and free sausage sizzle, live music and free children's activities and entertainment.

Learn about cloth nappies. Join this session for a comprehensive introduction to cloth nappies, suitable for both expectant parents and those who already have children in nappies. The presentation will cover: the benefits of cloth nappies (environmental, economical, etc.) the different styles (fitted, pockets, AI2s, prefolds etc.) how to wash and care for cloth nappies hacks to make cloth super easy. With over 60 nappies and accessories, participants can not only ask questions and be shown a wide variety of cloth nappies, but also other reusables such as ‘pull ups’, swim nappies and cloth wipes.

Learn more about the new FOGO service coming in May 2023. From May 2023, Maroondah residents will be able to put their food waste to good use, with a food and garden organics (FOGO) waste collection service. To help residents collect food waste in their kitchen, each household with a residential waste collection service is eligible to receive a free FOGO kit. Each FOGO kit contains a kitchen caddy, compostable liners and an information pack.

Dog owners are being encouraged to pick up after their pets and ensure that any dog poo is collected and placed in a bin, following an increase in dog poo being left in Council reserves and open spaces.

Dog owners are reminded to carry an appropriate bag or pooper-scooper to remove or dispose of dog waste in a bin, when out walking or in the community.

You may have seen our new video on social media, which depicts how not picking up after your dog can have unpleasant impacts on those around you, and new signage and footpath decals in Council parks, reserves and open spaces. There are also bin stickers on the bins at our two dog parks that include QR codes that will allow residents to report when the bins are full. Mayor of Maroondah, Councillor Rob Steane, encourages residents to do the right thing.

“Maroondah is a wonderful place to live, work and play, but we all have a responsibility to help keep it that way.

“Pet owners can play their part in this by ensuring they pick up after their dog, which can help make a big difference for all who enjoy using Council reserves, parks and open spaces,” Cr Steane

Wednesday, 15 March 2023

10:00am to 11:30am

Learn how to reduce food waste at home with some simple recipe ideas.

Whether you’re overstocked with food right now, or if your cupboard is running bare, with some know-how and a little planning there are simple ways you can manage your kitchen. Make the most of your leftovers and food scraps with a little creativity to turn them into meals or more.

The workshop will cover:

• ideas for using random leftovers so nothing in your fridge goes to waste

• tips for waste free packed lunches

• how to get your portions right to avoid waste

• we’ll demonstrate how to make a quick and easy zero waste meal out of leftovers

said. “Maroondah is a wonderful place to live, work and play, but we all have a responsibility to help keep it that way.

“Pet owners can play their part in this by ensuring they pick up after their dog, which can help make a big difference for all who enjoy using Council reserves, parks and open spaces,” Cr Steane said.

“It’s every dog owner’s responsibility to ensure Maroondah is dog poo free.”

Here’s how picking up after your dog helps our community:

• Helps ensure our children can play in our reserves safely, as well as

people using our sporting grounds for sport and recreation.

• Lowers the risk of other dogs or people getting sick, as some dogs can carry worms and diseases.

• Ensures our Parks and Bushland team can maintain our parks and reserves safely, without coming into contact with dog poo.

• Helps reduce pollution in our waterways.

A reminder that dogs must be kept on a lead at all times when in a public place, except in areas that are marked ‘off-leash’.

Learn more about responsible pet ownership.

Event details

• Date: Wednesday 15 March 2023

• Time: 10am to 11.30am

• Location: Maroondah Federation Estate - Federation Room Register online

Council hosts a range of community waste and recycling webinars within the municipality each year. Sign up to our waste event newsletter to find out about free upcoming seminars, workshops, competitions and events as well as information on educational presentations for schools and community groups.

Come along and learn about Floral Friday in the Torres Strait Islands. Join Cecelia Wright (See Kee) and Jackie Bennett from Connecting the Dots through Culture to learn about Floral Friday and how you can embed Torres Strait Island perspectives into your practice in an authentic and fun way.

The session will include practical elements and many examples of how you can embrace Torres Strait Islander activities and culture.

Find out more

Learn how to ditch the clingwrap by creating a beeswax wrap! Beeswax wraps are a great alternative to cling wrap or foil, as they can be reused over and over again! Register your place in this informative workshop which will be presented by Ben's Bees. You'll learn how to make your own beeswax wrap and have a large beeswax wrap to take home. All attendees will also receive a small block of beeswax to take home and make their own wraps.

Come and learn the art of lino cutting.

In this full day relief printmaking workshop, you will learn the art of creating your own hand-carved lino print.

Participants will hand carve their own bird design in the lino surface and work towards printing their own small edition on paper.

Find out More

To acknowledge the increased stress on our emergency services this summer , @grilldburgers have pledged to donate $78,500 to three leading emergency support services through their Local Matters Program in January. For the month, all restaurants will showcase St John Ambulance, state based Fire Brigades and Emergency Services and Surf Life Saving Australia, visit your local to pop a token in one of their jars. Find out more grilld.com.au/local-matters.

The beautiful world of Pandora awaits at Zing Pop Culture with their Zing Exclusive Avatar: The Way of Water range.

The bell has rung, school is out and we know you're sick of hearing 'are we there yet?'. It's definitely time to reward your family with some much-needed time away.

Summer Cocktails! Sunny days are here again and our Summer Cocktails are perfect for enjoying the warmer weather.

One of the most important steps in planning to save for your retirement is figuring how much you will need to spend each year to live a comfortable lifestyle. However, many people struggle when it comes to developing a budget for their future needs, particularly when their retirement is many years away.

The Association of Superannuation Funds of Australia (ASFA), have produced data to help pre-retirees understand how much they might need before they retire and what their likely budget might be if they wish to live a

comfortable or modest retirement. For those who are about to retire and have reached the age of 65, it is estimated you will need about $545,000 as single person and $640,000 if you are a couple.

goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment, and domestic and occasionally international holiday travel.

The lump sum estimates take into account the receipt of the Age Pension both immediately and into the future and assumes the retirees own their own home outright and are relatively healthy. The Age Pension is adjusted regularly by either the increase in the CPI or by a measure of wages growth, whichever is higher.

We have included below the ASFA’s detailed budget for those aged 65-84. It is a good guide as to too how much you will likely spend in retirement.

So close, yet so far away! Although it wasn’t to be this time, the Eastfield U18 T20 team had a great tournament winning 3 out of 4 games. Pipped at the post in the end by their two close competitors drawing in the last round, the boys narrowly missed out on finals.

Thank you to everyone at Eastfield for supporting the boys and the club for hosting so generously. Paul Taylor Matthew Barnard Cam Rodg Bruce Ross.

And most of all thank you to the following boys and their respective clubs for allowing them to play.

Liam Walker, Josh Holmes, Ben Taylor, Tige Ridley, Sascha Kelly, Kyan Brasher, Jesse Llewellyn, Reagan Wilkins, Nick Sheridan, Arnav Chobisa, Ayush Pindoria, Matt & Ryan Smit, Lachlan Francis, Will Boote & Ben Speith.

As for our Eastfield OG’s Liam, Josh & Ben…..they’ve worked so hard to get the band back together (with a few ring ins). Good mates, good times and lots of fun Eastfield the home of cricket!

A very very special thank you to Stewart and Bel Walker for all their work in pulling the team together and doing everything to make it possible each week. Including washing the smelly shirts after every game!

Past players and officials day will be round 4 vs Park Orchards on the 6th of May. It's sure to be a huge day with the 2003 premiership team celebrating their 20th anniversary. More details such as costs and times will be circulated in the new year.

Thank you to everyone who came down and enjoyed the

Cricket Club Christmas party! A great night had by all with a special visit to end the night. Thank you also to all the volunteers who made it happen and make the club run.

Any changes or updates to these 'Terms of Use' of the Find Cards and/or Find Coupons can be found here.

The barter trade, sale, purchase, or transfer of the Find Coupons &/or Find Cards, by any person or entity, including but not limited to business placing offers in the Find Paper, printers, publishers, and distributors of the Find Coupons /Find Card, is strictly prohibited, unless expressly authorized by Find Pty. Ltd. Find reserves the right to make changes to the participants and their offers at its sole discretion. Members will be notified of these changes via email or via the Site.

The Find Coupons and its Offers are intended for the non-profits and other participating organiations use of the individual purchaser of the Find Cards &/or Find Coupons. Additionally, the use of the Find Coupons &/or Find Cards or any of the Offers placed in our Find Paper, for advertising purpose, in any form of fashion, is strictly prohibited. Any use of a Offers in violation of these Rules will render the Offer VOID, and violators will be prosecuted. Offers may not be reproduced and are void where prohibited, taxed, or restricted by law. Find, will not be responsible if any establishment breaches its contract of refuses to accept the Find Cards / Offers with in the Find Paper: we will however, use our best efforts to secure compliance, Find, will not be responsible in the events beyond its control. © 2022 Find.

Find Restaurant, Find Cafe & Find Brekky, Brunch and Lunch offers can be used at participating businesses any time except the following days: *Christmas Eve *Christmas Day *Boxing Day * New Year’s Eve *New Year’s Day * Valentine’s Day *Good Friday *Easter Sunday *Mother’s Day. Some restaurant/Cafe/ Coffee establishments will have additional terms and conditions on the page where the business is advertising their offer).

All cards will have a ‘Valid End’ date and cannot be used beyond this date. For instance, if the Valid End: 03/24, then the Find Card is NOT VALID from April 2024 onwards.

You are required to present your Find Card at any participating businesses if you wish to secure the discount or goods/service being offered.

All Find Cards must display your name and/or signature and be within the ‘Valid End’ date to be deemed VALID. If your Find Cards does not display your signature and the correct ‘Valid End’ date, the business can refuse to provide the discount offer advertised. The business has the right to ask you to provide other Proof of Identity e.g., Drivers Licence, to match up your name/signature on your Find Card. If they do not match, then the business has the right to refuse the discount offer.

All Find Cards will have individual credit card numbers. All Find Card participants must provide their Name, Email Address and Post Code prior to using the Find Card. Registering your Find Card will enable the Find Team to email you offers directly. Some offers will only be available for one day so it is important to provide your details so you can be informed of these offers and not miss out.

Fashion is the armor to survive the reality of everyday life.

Make a coupon offer and benefit from the Find Cards in order to increase exposure and traffic to your business. We are working to bring in revenue for Not-For-Profits through our Local Coupons.