Are

our next Copywriter?

Are you our next Bookkeeper?

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

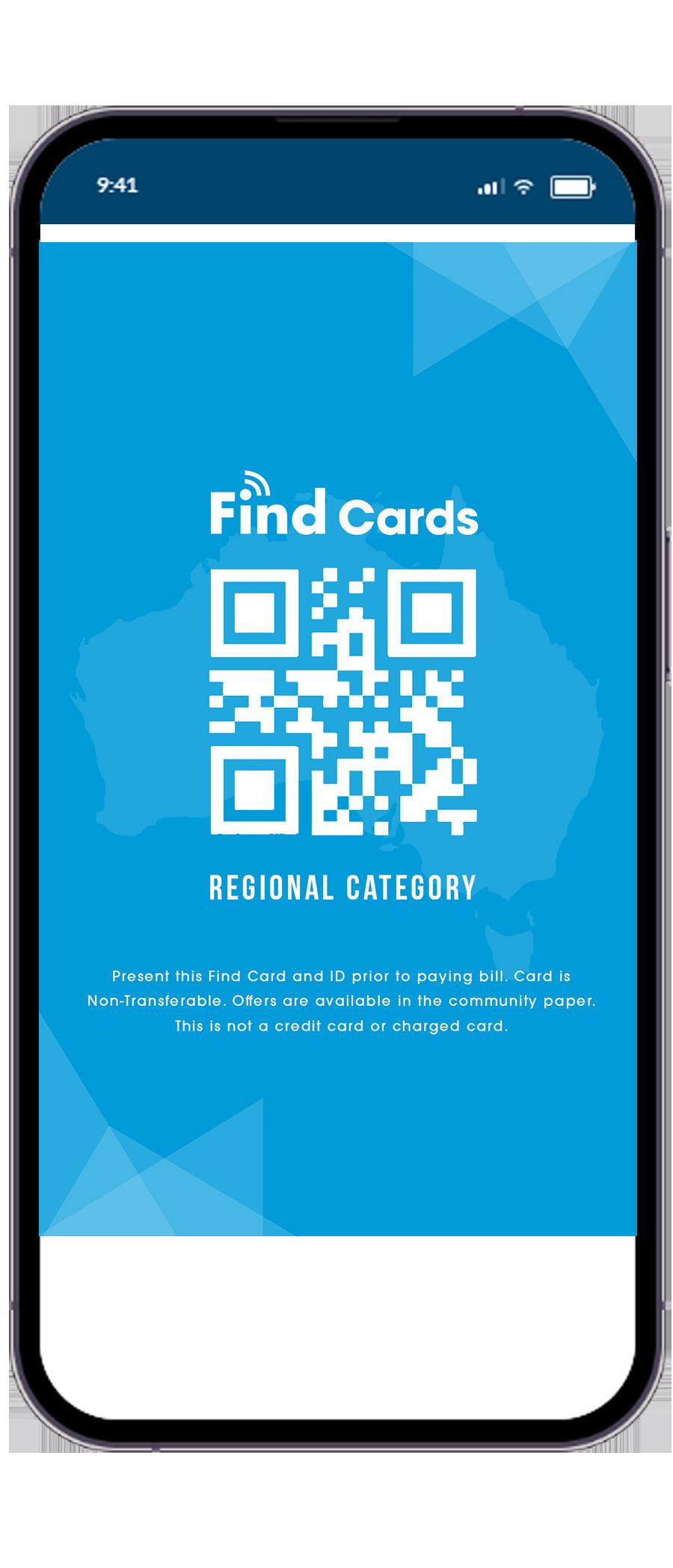

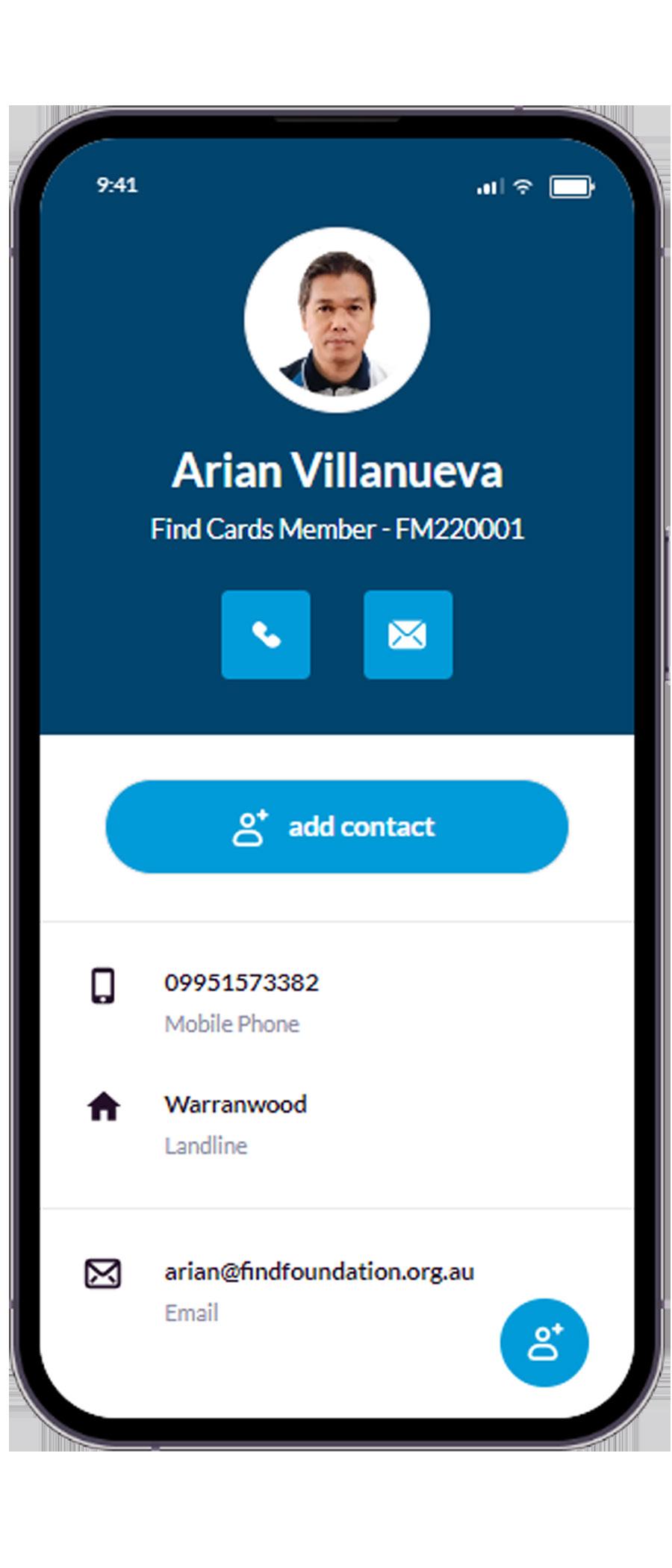

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

As the calendar flips towards the end of the year, a familiar chill settles over the business world. Deadlines loom, budgets tighten, and a sense of urgency hangs thick in the air. This period, known as the fiscal year-end, can feel remarkably similar to the arrival of winter. While seemingly disparate, these two seemingly unrelated phenomena share surprising parallels that reveal a hidden rhythm within our economic cycles.

Just as animals in nature enter a state of hibernation to conserve energy during the harsh winter months, businesses at the fiscal year-end engage in a similar form of strategic "hibernation." Resources are meticulously assessed, non-essential projects are shelved, and budgets are scrutinised to ensure smooth operation through a potentially slower period. Inventory becomes a focus, much like squirrels gathering nuts in preparation for winter. Companies take stock, evaluating performance and analysing successes and failures – a vital self-reflection akin to the introspection that often accompanies the quietude of winter.

However, the fiscal year-end isn't simply a time for hunkering down. Similar to the flurry of activity seen in winter holidays and gift-giving, the closing months can be a period of intense activity. Companies launch sales blitzes to clear inventory and meet quotas, mirroring the last-minute shopping sprees that mark the holiday season. It's a "fiscal flurry" fueled by a desire to wrap up loose ends

and maximise results before the new year dawns. Just as winter often ushers in resolutions for self-improvement, the fiscal year-end becomes a time for goal setting and strategic planning for the upcoming year. Both become opportunities to chart a course for a fresh start, leaving behind the baggage of the past year.

The fiscal freeze isn't without its challenges. Just as winter can bring feelings of isolation and cabin fever, the pressure and deadlines associated with the year-end can create stress for employees. However, this analogy offers valuable insights for navigating this period. Companies can learn

from nature's resilience – leveraging technology for optimised workflows, fostering open communication to create a supportive environment, and celebrating achievements just as sunlight breaks through winter clouds.

Ultimately, the fiscal year-end isn't just a point of closure, but a season of reflection and renewal. By embracing the "fiscal freeze" as a time for strategic planning and resource optimisation, companies can emerge stronger and more prepared for the growth opportunities that lie ahead, just like flowers pushing through the winter snow, ready to bloom in the new year.

Last month we discussed GST and when to register your business for GST. Now that you are registered there are a few things you need to do.

1. Start adding GST to all your invoices. You will need to determine which items on your invoice are required to have GST added and which ones are not. Most goods and services should have GST added however there are several things that may be GST free. These include most basic food (generally unprocessed foods), some medical services and products, some childcare services, water supply, some education courses, and precious metals to name just a few. See the ATO website for a comprehensive list. There are also some items that are input-taxed such as bank fees and residential rent (see note at the end of the article).

If you are registered for GST but don’t add GST to your invoices for your clients to pay, you will be required to pay it anyway. This means it is coming out of your profit.

2. You must provide a tax invoice for anything above $75+GST ($82.50 inc GST) within 28 days if requested by a customer.

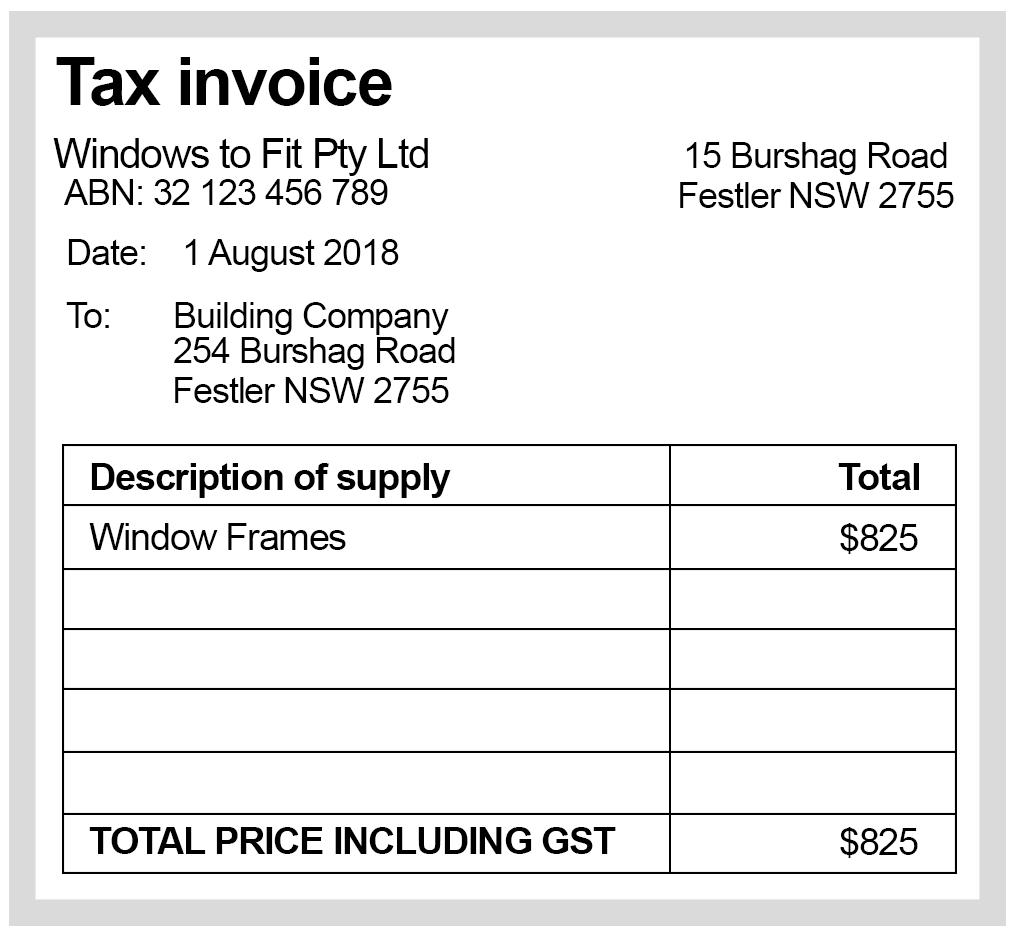

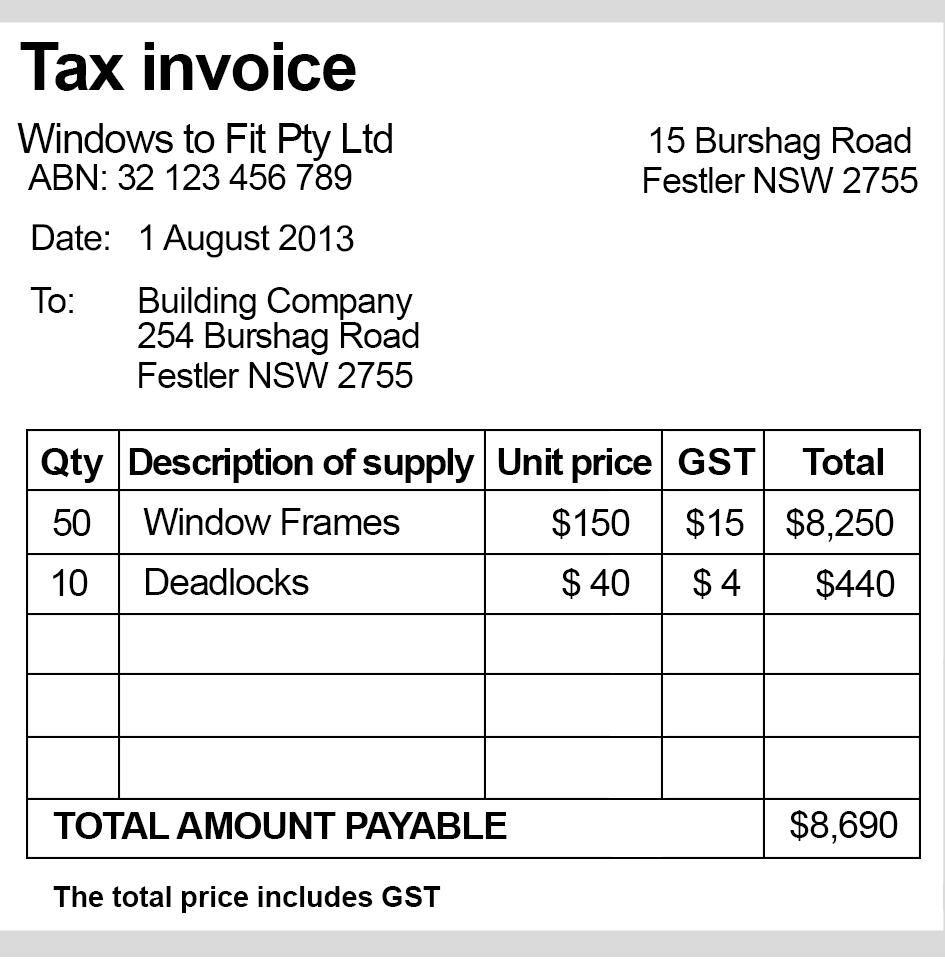

3. Update your invoice so they are legal. There are certain requirements that must be met for a GST invoice. These

depend on the sale amount, the type of sale (taxable items or non-taxable items), and who issued the invoice.

For sales under $1,000

a. Show that the document is a tax invoice

b. Seller’s identity

c. Seller’s Australian Business Number (ABN)

d. Date the invoice was issued

e. Brief description of the items sold, including quantity if applicable and the price

f. GST amount (if any) payable – this can be shown separately or, if the GST is exactly one-eleventh of the total price, as a statement which says ‘Total price includes GST’

g. Extent to which each sale on the invoice is a taxable sale (clearly show which items have GST and which items exclude GST.

Credit ATO website

For sales of $1,000 or more

Same as for invoices under $1,000 PLUS

h. the buyers identity or ABN.

Difference between GST-free and Inputtaxed

GST-free - If you are registered for GST and sell or provide GST-free products and services, you can still claim the GST on your expenses related to those products or services.

Input-taxed – If you are registered for GST and sell or provide Input-taxed products or services, you cannot claim the GST on expenses related to those products or services.

It’s June, the tax year is coming to an end, and once July starts it’s also the time to get those receipts and documents ready for your 2024 tax returns.

Speaking of documents and receipts, we just received news from the Australian Taxation Office (ATO) that it will be taking a close look at 3 common errors being made by taxpayers. These are:

• Incorrectly claiming work - related expenses

• Inflating claim for rental properties

• Failing to include all income when lodging

As the ATO Assistant Commissioner Rob Thomson said: “ These are the areas people are most likely to get wrong and while these mistakes are often genuine, sometimes they are deliberate. Take the time to get your return right.”

In 2023 the ATO had more than 8 million people claim a work-related deduction, and around half of those claimed a deduction related to working from home.

On June 1st, 2023 the ATO revised the fixed rate method of calculating work from home deductions. They increased the rate to 67 cents per hour, expanded the inclusions and adjusted the records a taxpayer has to keep.

This year the changes are in full swing. With that in mind it is best to keep comprehensive records to substantiate claims, just as you would for any deduction.

As a tax agent we strongly encourage our clients to keep and send us their records, logbooks and any documentation to substantiate their claim, especially for the 2024 FY. The ATO has identified a massive

78% adjustment rate in work claims for tax agent lodged returns! As a result, the ATO is getting stern for the 2024 tax year and has announced an audit crackdown on work related claims, surprise!.

It isn’t exactly a surprise as the ATO’s announcements stipulate that it will generally keep an eye on working from home deductions. These include:

1. Deductions for home running costs when you work from home.

There are 2 methods you can choose from for calculating work from home expenses. These are the Revised Fixed Rate Method or the Actual Cost method.

• Revised fixed rate method - This method allows you to use a fixed rate of 67 cents per hour for every hour you work from home in a financial year. This rate includes expenses such as mobile phone and internet costs, stationery and computer consumables, and electricity and gas for power, heating and cooling. To claim using this method, you are required to keep a log book of the number of hours you work each and every day for the financial year.

• Actual Cost Method - As the name of the method states, we use this to claim the actual cost of working from home expenses. This method is more involved and requires you to keep every receipt and invoice that you wish to claim as well as a logbook of the number of hours worked. Some of your expenses will also need to be apportioned for business vs personal use so it is generally a more complex method than the fixed rate method but usually has a higher value in deductibles.

In deciding the method you would like to use, there is one factor that they both need and that’s substantiation. We strongly recommend that each of our clients provide receipts, logbooks and any other documentation to

support their claims and to give grounds for why your expense is a tax deduction. Comprehensive recording. and documentation mean flexibility. We can calculate both methods and choose the best result for your return

2. Deductions for occupancy expenses related to a taxpayer’s home which are eligible to claim when your employer requires you to work from home and can’t provide you with a different place to work from, or you have an area in your home that you are only using for work purposes and is not capable of being used for any other purpose. For this deduction, we will often require a floor plan of your home to work out the floor area of where you work.

Occupancy expenses include:

-Mortgage Interest

-Rent

-Council and Water rates

-Land Taxes

-House Insurance premiums.

As an employee working from home, generally:

-You can’t claim occupancy expenses

-There are no CGT implications for your home

3. For depreciation claims related to office furniture and equipment, office furniture or equipment over $300 needs to be depreciated. If it's less than $300, you can just write off the cost as an expense.

As we identify the areas that the ATO will be targeting it's also good to know the Expenses that we cannot claim a deduction for related to working from home.

• You can’t claim other general household items like coffee, tea, milk or other beverages even if your employer may provide these at work.

• You can’t claim costs related to your children’s education, such as equipment you buy e.g. iPads, Desk and subscriptions for Online learning.

• Items your employer provides e.g. a laptop or mobile phone

• Expenses where your employer reimburses you for the cost.

Rental properties have remained in the sights of the ATO for a couple of

years now. The ATO have noted that 9 out of 19 rental property owners are getting their income tax return wrong. According to Mr Thomson: “‘We often see landlords making mistakes when it comes to repairs and maintenance deductions on rental properties, so we’re keeping a close eye on this.’

‘This year, we’re particularly focused on claims that may have been inflated to offset increases in rental income to get a greater tax benefit,’

The most common error in rental properties reporting is the capital works deduction. The easiest explanation for this is when you have a damaged item in your property e.g. doors, windows, lights, carpets, that would be considered an immediate deduction for repairs and maintenance.

On the other hand, capital works deductions would be a property improvement during the time you hold the property. An example of this would be if you have an old bathroom and would like to take it out and put in a new one - this instance is considered a capital improvement rather than a repair for the property and is only deductible over time as a capital works deduction.

The easiest way to get the capital works deductions right would be to get a depreciation schedule for your property done by a Quantity Surveyor. Your tax agent would be able to recommend a Quantity Surveyor. We recommend this to our clients as this is the 2nd largest amount to claim for your rental property right next to interest. This can take a couple of months to get though so you will need to factor that in when your a looking to get your tax returns completed.

We can’t stress enough the importance of keeping comprehensive records and documents, and this is especially important when it comes to your investment property which can be quite complex.

We all want to get our tax returns sorted as early as possible to get it off our list of obligations and responsibilities for the year, especially if we think we’re getting a refund. However we recommend clients to hold off on lodging until their payment summaries are finalised. This can be early July, but is usually mid to late July.

We can manually fill these in using bank statements and a hard copy of your payment summary but this takes time which you will end up paying for. We want to get our clients tax returns as accurate as possible which is why we wait until payment summaries are completed and information from other sources such as banks and private health insurers flow through to the ATO. We are then able to cross check everything and compare the amounts to the documentations the client has provided.

Mr Thomson says: “We see lots of mistakes in July where people have forgotten to include interest from banks, dividend income,payments from other government agencies and private health insurers,’

Before finalising a client’s tax return, we prefer to wait for three things – the ATO Prefilling Report, the finalised payment summary, and the client’s comprehensive records. Doing so allows us to get their tax return as accurate as possible as one small error can cost a client great inconvenience by triggering an ATO amendment or an ATO initiated Audit.

There are different methods for claiming depreciation deductions for cars. However, if you deduct car expenses using the cents per kilometre basis, you can't also claim a deduction for the car under the simplified depreciation rules (as this method already allows for depreciation).

If you use the cents per kilometre method, you allocate the car to the small business pool with a business use percentage of 0%, resulting in a zero deduction for depreciation.

If you change from the cents per kilometre to the logbook method, you'll need to estimate a business use percentage. If the estimated business use is more than 10%, you must use the adjustment formula to adjust the opening pool balance.

If the car is owned or leased by a company or trust that qualifies for and has chosen to use the simplified deduction rules, its full cost will generally be depreciated under the simplified depreciation rules. In this case, any private use by you or other employees or associates will be subject to fringe benefits tax.

In the case the ATO has deemed your deductions incorrect, they would initiate an ATO amendment which in our experience can take quite a while to finish

The easiest way to avoid this is to delay completing your tax return until at least late July and providing your tax agent with comprehensive records.

At Find Accountant Pty Ltd we would like to give our clients a smooth and streamlined process and the best way to achieve that is through comprehensive record keeping. Our clients have the option of sending us their documents throughout the year or uploading them to their secure portal when they are ready to complete their tax return. By working together we hope to achieve the best result for our clients.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

This information is of a general nature only. It does not take into account your particular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies,graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations. Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document. This information contained does not constitute legal or tax advice.

Raoul begins business in September 2016 and chooses to use the simplified depreciation rules for the 2016–17 income year. In this first year, Raoul claims his car expenses on a cents per kilometre basis.

Given that he has chosen to use the simplified depreciation rules, the car is allocated to the small business pool with a business use percentage of 0% –so, he can't deduct depreciation for the car in that year.

In 2017–18, Raoul decides to claim his car expenses using the logbook method, which entitles him to claim depreciation for the car.

Raoul works out from his logbook that he uses the car 60% of the time for his business in 2017–18. The adjustable value of the car at the time he allocated it to the pool in 2016–17 was $22,000. Because there has been an increase of more than 10% in how much he uses his car in his business, Raoul must adjust the opening pool balance for 2017–18 using the adjustment formula.

Raoul increases the opening pool balance by:

0.85 × $22,000 × (60% − 0%) = $11,220.

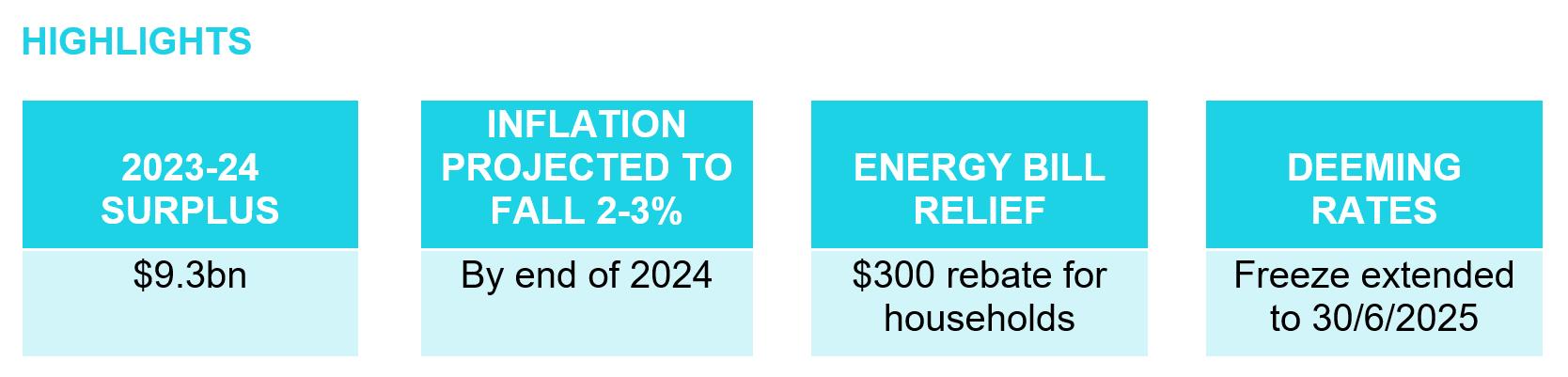

On the evening of 14 May 2024, the Government delivered what is possibly its last Budget in the current parliamentary term. The next election is expected to be held either late this year or early in 2025. Inflation, cost of living pressures, and housing all continue to dominate the fiscal landscape, impacting the lives of Australians.

The key challenges addressed in this year’s Budget include:

• Easing cost of living and inflationary pressures,

• Building more houses,

• Strengthening Medicare and the care economy.

Importantly, the measures announced in the Budget are not a fait accompli. They will be subject to the successful passage of relevant legislation.

The Treasurer announced a pleasing $9.3bn surplus for the 2023-24 financial year. This is the second consecutive surplus however deficits have been forecast for the next three financial years as the government embarks on what it describes as “unavoidable spending.”

Real GDP growth is expected to continue to improve from 1¾% in 2023-24 to 2¾% by 2027-28

The unemployment rate in recent years has placed Australia in an enviable

position. The current historically low unemployment rate is expected to increase marginally in 2024-25 to 4½%.

As announced previously, the Government predicts the inflation rate will continue to fall, returning to the Reserve Bank of Australia’s target range of 2 – 3% by the end of 2024.

Now for a more detailed look at some of the key announcements impacting you from a financial planning perspective.

The Budget was remarkably silent of superannuation changes with two exceptions:

From 1 July 2025, superannuation guarantee contributions of 12% will be paid on all Commonwealth funded paid parental leave payments.

Enforcement activity and unpaid super

The Government will provide additional funds from 1 July 2024 to strengthen the ATOs ability to detect, prevent and mitigate fraud against the tax and superannuation systems.

The Fair Entitlements Guarantee Recovery Program will be recalibrated to pursue unpaid superannuation entitlements owed by employers in liquidation or bankruptcy from 1 July 2024.

The previous government had proposed introducing an amnesty that would allow members of superannuation funds that were locked into old style legacy pension products to exit those products without incurring adverse tax or social security consequences. While we understand the current government is favourably disposed towards this, the Budget was silent on this initiative.

In addition to the amnesty for legacy pensions, simplification to the way selfmanaged super funds are managed when members moved overseas had previously been proposed. Sadly, this Budget has not advanced those proposals.

The Budget reconfirms that 13.6 million Australian taxpayers will receive tax cuts from 1 July 2024. These changes have previously been legislated in the form of the amended Stage 3 tax cuts.

Instant asset write off

Small businesses with an annual turnover of less than $10 million will have the current instant write-off of assets extended for another year to 30 June 2025. This will apply to assets costing less than $20,000 that are first used or installed ready for use by 30 June 2025. The asset threshold applies per asset so small businesses could instantly write off multiple assets.

The Government continues to focus on increased wages for aged care workers, funding to help improve the quality of care for both home care recipients and those in residential care facilities, and additional funding to implement recommendations identified in the Royal Commission into Aged Care.

On 3 April 2024, the Government announced that the commencement of a new Aged Care Act will be deferred. Originally the new Act was to commence on 1 July 2024. It will now commence from 1 July 2025.

This is in response to recommendations made in the Final Report of the Aged Care Task Force which was released in March 2024. This report proposed several key changes, including the:

• calculation of home care and residential care co-contributions

• phase out of lump sum accommodation payments, and

• reintroduction of a retention amount.

The Government will provide $2.2 billion over five years from 2023–24 to deliver key aged care reforms and to continue to implement recommendations from the Royal Commission into Aged Care Quality and Safety.

Most Australians want to be able to age in place and remain in their homes as long as they are able. To support older Australians, the Government is investing $531.4 million to release an additional 24,100 Home Care Packages in 2024–25 to reduce average wait times and to support people to age at home if that is their preference.

Supporting Australians with cost-of-living relief at the same time as implementing measures to place downward pressure on inflation was once again a key focus for the Government in relation to welfare announcements. Energy cost relief for all Australian households, further increases to Rent Assistance, significant spending on social housing and reducing the impact of indexation on student loans are a feature.

The Government will provide $3.5 billion over the next three years to extend and expand the Energy Bill Relief Fund to provide a $300 rebate to all Australian households and a $325 rebate to eligible small businesses on 2024–25 bills.

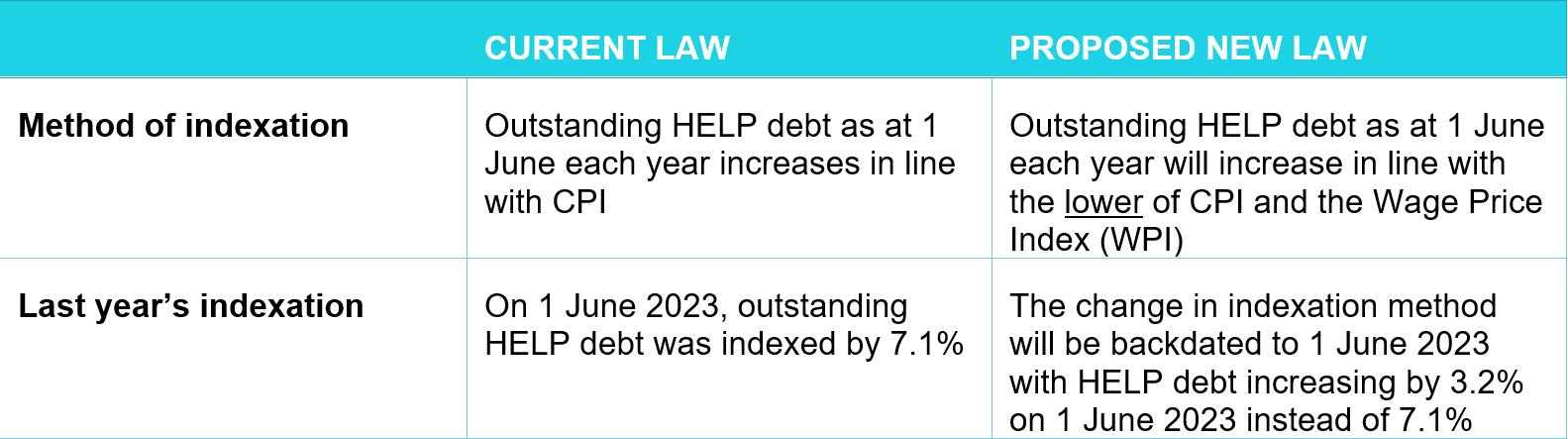

Tonight, the Government confirmed a previously announced measure to change the way Higher Education Loan Program (HELP) debt is indexed. As a result, $3 billion in student debt will be cut.

Two measures have been proposed as follows:

Students who had their loans indexed on 1 June 2023 and will be subject to indexation on 1 June 2024, will receive an indexation credit. The indexation credit can be estimated using the Government’s HELP Indexation Credit Estimator.

This year’s budget provides good news for pensioners concerned about predicted increases in the deeming rates, waiting times when corresponding with Centrelink staff as well as those needing additional support with rising rental prices.

The Government will freeze social security deeming rates at their current levels for a further 12 months until 30 June 2025, to

From 20 March 2025, Carer Payment recipients will have increased flexibility to undertake work, study, and volunteering activities whereby recipient’s participation limit will be amended to 100 hours over four weeks and will only apply to employment.

Additionally, if the participation limit is exceeded, payments will be suspended for up to six months, rather than being cancelled.

Support to help combat rental affordability

With rental prices in most Australian locations increasing rapidly over the past decade, rental affordability for many, including those on Government income support and family benefits, is a major concern.

After an increase in Rent Assistance in last year’s budget of 15%, the Government is providing a further $1.9 billion over five years to increase maximum rates of Rent Assistance by a further 10%.

Increase in JobSeeker rate for those with partial capacity to work

The higher rate of JobSeeker Payment, a boost of at least $54.90 per fortnight, will be extended to single recipients with a partial capacity to work of zero to 14 hours per week from 20 September 2024.

support Age Pensioners and other income support recipients who rely on income from deemed financial investments, as well as their pension payments, to manage cost of living pressures.

It was anticipated that the current low deeming rates of 0.25% and 2.25% would increase from 1 July 2024 after a twoyear freeze, impacting many pensioners. Fortunately, pensioners will now have comfort knowing that these low rates will be retained for at least another year.

Currently, to be eligible for a Carer Payment, a carer has a participation limit of 25 hours per week which includes employment, study, volunteering activities and travel time to and from work.

to

The Government will set aside $2.8 billion over the next five years in an attempt to improve the way Services Australia (Centrelink) delivers services to the Australian community.

The funding is earmarked to assist with:

• additional frontline staff to help with claims and services

• sustaining the myGov platform and ensuring continued development of its capability

• enhance safety and security at Services Australia centres including an increased security presence and enhancements to service centre design.

As a business owner and employer, it is your responsibility to ensure the health and safety of your employees within your workplace. This includes providing your team with a safe work environment and protection from hazards. You can achieve this by understanding your obligations under the Occupational Health and Safety (OHS) laws and by complying with them.

Victoria's construction industry is being urged to check fall prevention measures after a worker died and several others were injured in a recent spate of serious incidents.

WorkSafe is investigating the death of a 56-year-old worker after an incident at a residential construction site in Doncaster East on Tuesday 26th March. It is understood the worker was pouring concrete when he fell more than two metres and sustained lifethreatening head injuries about 4:30pm. The man died in hospital on Thursday.

The death is the 11th confirmed workplace fatality for 2024. There were 18 workrelated deaths at the same time last year.

WorkSafe responded to a serious fall on a building site in each of the first three days of last week – making it four such incidents in nine days, and six in the previous three weeks.

• A 28-year-old worker suffered serious spinal and head injuries on 7 March, after falling 3.7 metres from a ladder at a construction site in Carrum Downs.

• A day later, a 32-year-old working from first storey floor joists fell approximately three metres onto a concrete slab in Glen Waverley, sustaining head and shoulder injuries.

• A 31-year-old worker was seriously injured after a three metre fall while working from roof trusses at a building site in Brunswick East on 18 March.

• On 25 March, a 27-year-old carpenter was taken to hospital after falling 3.1 metres when a ladder slid out from under him at a construction site in Dromana.

• A 53-year-old worker suffered back and pelvic injuries after falling from the second storey of a house under construction in Portarlington on 27 March.

WorkSafe Executive Director Health and Safety Narelle Beer said it was frustrating because falls from height were preventable, yet remained a top cause of workplace harm. "A fall can happen in just seconds but the consequences can last a lifetime, including devastating injuries and loss of life," Dr Beer said. "It might be easy to think that a tragic incident will never happen on your site, but if safety is not the top priority every day then the chances are high that it will."

Tragically, nine workers died in Victoria last year as a result of a fall from height, including four in the construction industry. More than 400 claims were also accepted from construction workers injured in a fall from height in 2023. Of those injured, 160 fell from ladders, 46 from steps and stairways, 31 from buildings or structures, 27 from scaffolding, and 13 from openings in floors, walls or ceilings.

Dr Beer said WorkSafe inspectors had conducted more than 3,700 visits to construction sites so far this year, issuing more than 1,100 notices. "We have a dedicated team of inspectors visiting sites across the state and there is zero tolerance for employers who fail to take the well-known risks of falls seriously," she said.

WorkSafe completed 39 successful prosecutions relating to the risk of a fall from height in 2023, with the courts imposing fines totalling more than $1.9 million.

To prevent falls from height WorkSafe Victoria indicated employers should implement the highest possible measures from the five levels in the hierarchy of controls:

• Level 1 Eliminate the risk by, where practicable, doing all or some of the work on the ground or from a solid construction.

• Level 2 Use a passive fall prevention device such as scaffolds, perimeter screens, guardrails, safety mesh or elevating work platforms.

• Level 3 Use a positioning system, such as a travel-restraint system, to ensure employees work within a safe area.

• Level 4 Use a fall arrest system, such as a harness, catch platform or safety nets, to limit the risk of injuries in the event of a fall

• Level 5 Use a fixed or portable ladder, or implement administrative controls.

As a business owner, are you confident that you do not have shortfalls in your

efforts to keep your workers healthy and safe? Do you have an understanding of your responsibility to ensure the safety of your employees? Are you confident that you can provide a safe work environment and comply with OHS laws? Do you believe that you are effective in carrying out risk assessments, employee consultation and providing training? Do you regularly review these measures to ensure that they remain fit for purpose and keep you and your employees healthy and safe? Why not make a New Year’s resolution to get your house in order?

At Beaumont Advisory we assist business owners clarify what they currently have in place, as well as where there are shortfalls. We then assist in developing effective systems and documentation, working with businesses to ensure effective implementation. Checks are put in place to monitor ongoing effectiveness, to ensure that going forward, they are sound and comply with the Act, and most importantly keep you and your employees informed, and healthy and safe. Please feel free to contact me, Mark Felton, at Beaumont Advisory on 0411 951 372 or mfelton@ beaumontlawyers.com.au for an obligation and cost-free initial discussion. Mark Felton

Occupational Health & Safety www.thebeaumontgroup.com.au

What is the creature living in my ceiling cavity or wall cavity? With winter approaching the creatures we have not seen for a while, begin to look for shelter. First the noise maker needs proper identification, is it mice, rats, possums or protected native Antichinus?

Here are some pics to help

Mice will nest and breed quickly if not dealt with

will these get into your roof. They exit these garden nests at night to eat rose petals, fruit and new green shoots. They are picked off the powerlines by stealthy Owls. They use the high wires to stay off the ground where cats and dogs are. This is nature work, balancing species.

Rats, also will breed and will make a scampering sound that cats and some dogs will be alert to and will stare at the wall, where they can be heard.

Antichinus, with rounded ears and a very pointy snout, are Australian animals and are protected. Like all the others they will die if poisoned. This is actually illegal given their native status. Generally, they are garden dwellers and are unlikely to invade your house.

https://www.environment.sa.gov.au/ goodliving/posts/2020/07/nativeantechinus

This is of a very common “football” of dry twigs and chewed off branches made by the Ringtailed Possum, rarely

Big Bushy tailed possums are generally the roof inhabitants due mainly to lack of nesting hollows in trees that have shed a branch previously and over time a hollow forms, inside the tree. Many people will have the tree removed as it might be perceived as dangerous just because a limb has dropped. This is not necessarily the case, and the possums are left homeless.

Loose roof tiles, crumbling pointing, pipes exiting the roof without small gauge wire under the vent cap, will all be possible points of entry. The best way to remove them is wait until it has landed on the roof and scampered off to forage, then carefully, in the dark get to the entry point and seal it up well enough that it cannot re- enter in the early hours of the next morning before sunrise.

This nest has also been discovered by bees, who have begun attaching wax curtains from the roof of the space. Bees often like enclosed spaces too and if they can invade your wall, they can do the same.

If you want to relocate a bushytailed possum, you need to provide a home in your own garden. If you try to trap one and relocate it, another will find the space and move in. You also run the risk of creating possum overload in a native reserve, which might kill trees through overgrazing, or there might be a fight to death between the resident and the new neighbour, either way it is a bad idea.

Here are some great ways to use old timber if you can get access to it, but the hole needs to be much larger for the bigger animal.

Whatever your inhabitant, be kind, do not hurt the animal, and understand that we have moved into their habitat really, and we need to co-exist.

Otherwise try an easy option of two hanging baskets. Called possum drey, there are youtube videos to show how.

Depending on the size of your possum you can adapt the entry size.

By Erryn Langley

By Erryn Langley

Superannuation can be used to start an account-based pension once a person retires (or meets another condition of release).

This allows income to be received as a series of regular payments (usually monthly, quarterly, half yearly, or yearly).

A minimum amount of income needs to be paid each year and additional lump sum withdrawals can generally be made at any time. The pension can also be stopped (fully commuted) and be rolled back to the accumulation phase of superannuation, or rolled over to start another income stream, or be taken as a lump sum. Restrictions apply to taking lump sum withdrawals where the pension is being paid under transition to retirement rules.

Account based pensions stop once the account balance is exhausted, the pension is commuted, or upon the death of the person unless there is an automatic continuation of the pension to a nominated reversionary beneficiary.

The maximum amount that may be used to commence a ‘retirement phase pensions’ is limited to an individual’s transfer balance cap. The general transfer balance cap is currently $1.9m however where a person commenced a retirement income stream prior to1 July 2023, their personal transfer balance cap may be less than $1.9m. Pensions paid under transition to retirement rules are not a retirement phase pension and are therefore not affected by the transfer balance cap.

The person can select how much income to receive each financial year. This allows flexibility to meet individual needs. The only rules for how much pension must be taken are:

• An income payment must be made at least once each financial year.

• A minimum level of income must be paid each year based on a percentage of the account balance at commencement of the account-based pension and again at the start of each financial year. If the income stream commences part-way through a financial year, or is commuted before the end of a financial year, the minimum payment is pro-rated for that year.

When a superannuation death benefit is paid as a death benefit income stream, how is the minimum pension calculation performed?

As we know, there are minimum pension standards that apply to retirement income streams such as account-based pensions. These minimum payments are based on the age of the client and the account balance at 1 July each year or at the commencement of the pension.

However, when a death benefit account-based pension commences, the minimum pension payments that must be received by the beneficiary (usually the surviving spouse) will depend on whether the account-based pension automatically reverted to the beneficiary or not.

The following table provides a comparison of the minimum payment requirements in the financial year the death benefit pension started based on whether the pension automatically reverted to the beneficiary or not.

Pensions being paid under transition to retirement rules are subject to a maximum income limit of 10% of the account balance.

Every withdrawal (income or lump sum or death benefit) from a pension is split into taxable and tax-free components in the same ratio that applied when the pension commenced. The tax on each component depends on the person’s age as shown in the table below:

Every withdrawal (income or lump sum or death benefit) from a pension is split into taxable and tax-free components in the same ratio that applied when the pension commenced. The tax on each component depends on the person’s age as shown in the table below:

Taxation of Lump Sums - Over age 60

If you are age 60 or over the tax on lump sum withdrawals is shown in the table below for the 2023-24 financial year.

Taxation of Lump Sums - Preservation age but under age 60

If you have reached your preservation age but are under age 60, the tax on lump sum withdrawals is shown in the table below for the 2023-24 financial year.

Taxable (element taxed)

Taxation of Lump Sums - Under your preservation age If you are under your preservation age, the tax on lump sum withdrawals is shown in the table below for the 2023-24 financial year.

Earnings added to a retirement phase pension account (excluding transition to retirement pensions) are tax-free. No tax is payable within the superannuation fund, and this can help to boost the effective earnings rate. * Plus,Medicare Levy

* Plus,Medicare Levy “The

(element

If you withdraw a taxable component and tax is paid on this amount, it is added to your assessable income and may impact your entitlement to other tax offsets or benefits. This may mean you pay more tax than you expect on other income in that year.

is a Corporate

Representative (No

of AllianceWealth Pty LtdABN 93 161 647 007 (AFSL No.449221).Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/

Erryn Langley is Authorised representative (No.1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

Over the last few years we have seen all of the major Banks remove themselves from lending to Self-Managed Super Funds. This was solely due to the limited recourse nature of this type of lending, meaning that if a SMSF was to default on their loan, the only recourse the Bank had to recoup the debt was through the asset purchased with the SMSF Loan. The Bank could not access any of the other assets in the SMSF to help repay the debt, which provided the SMSF members with additional protection of their other assets, but represented a greater risk to the lender which they offset by charging higher rates.

At present most SMSF loans with these Banks are being charged around 10%, and they are not prepared to review these rates at all. The Banks would seemingly prefer that these loans are refinanced and off their books, so they

are not offering any discounts on these products to retain this business. If your SMSF has a loan with a lender who has exited this market, now is the perfect time to review your loan and obtain a much better outcome for your SMSF.

There are a number of Lenders who still offer property loans to a SMSF. The rates on offer to refinance could be over 3% better than your current lender is charging, which would represent a significant improvement in the cashflow for the SMSF, allowing you to invest in other areas or pay off the property loan quicker. Some lenders will also offer to reduce establishment fees for loans that are refinanced.

It is important to note that while refinancing an SMSF loan is allowed, according to the Superannuation Industry (Supervision) Act 1993 (SIS Act), you are restricted from releasing equity in the property to complete any renovations to the investment property unless those funds are necessary for upkeep to

maintain the property at the market rent standard. You also cannot access equity to buy another property with the SMSF, or use the funds to invest in other markets such as shares or manage funds.

At SHL Finance, we are experts in SMSF lending and have helped many clients, with SMSF loans at very high rates, refinance into a much better financial position and making the process as painless as possible. Please call Reece Droscher on 0478 021 757 to find out more about improving your SMSF financial position can lead to a better outcome at retirement.

Please call Reece Droscher on 0478 021 757 to book in a review and discuss your options.

reece@shlfinance.com.au www.shlfinance.com.au

Whilst anxiety is part of life, and in some cases it’s even helpful (like when you know your 2-year-old could run onto the road at any moment!). There are many times it can stop you in your tracks and prevent you from normal functioning.

Anxiety disorders form the most common mental health disorders in Australia, effecting 14% of us each year, and 25% of us at some stage of life. These disorders range from generalised anxiety which is an everyday uncontrollable worry, to social anxiety, panic disorders, phobias, obsessive compulsive disorder (OCD), and post-traumatic stress disorder (PTSD).

For some people their anxiety is obvious: they may feel fear, panic, or dread, whilst others sometimes notice digestive symptoms, dizziness, shortness of breath, or trouble concentrating, with less obvious mental symptoms.

The problem with anxiety treatment is that it is often with drugs that have unwanted side effects. Whist they can be helpful for some people, for others the risk outweighs the benefits.

Nervous system tonics

Herbal medicines are very effective in treating anxiety, both when you notice it mentally, but also when you only have physical symptoms. What I love about treating with natural products like herbs is that they actually help to heal your body rather than just masking the symptoms which is often the case with pharmaceutical medications.

The first group of herbs for treating anxiety are nervous system tonics. These herbs improve the tone and function of the nervous system. Some herbs in this class energise the nervous system which is more helpful in depression, and others that relax the nervous system, which is what is often used in anxiety disorders.

The next class of herbal medicines that are helpful in anxiety are adaptogens. These herbs increase the body’s resistance to physical, environmental, or emotional stress, they help you to adapt afterwards. These are really useful when anxiety began after a time of trauma,

stress, or even sickness to return the body back to normal functioning. They are like the ‘energiser bunny’ of herbs, they can help you to keep going at times when the ‘battery’ would have already run out.

If your sleep has been affected, then sedative herbs can be really helpful. These are very different to sedative medications in that they will calm and relax the mind to help with sleep without the side effects of sedative medication such as morning drowsiness. Usually, these herbs are just taken before bed, so that your mind and body can relax into sleep.

There are other herbs that can be used if digestion or concentration is affected, or if anger is a prominent emotion. As a naturopath I will prescribe differently for each person, depending on what the best herbs for them are.

Another modality that is really useful in anxiety is homeopathy. Homeopathy can be really effective either alongside herbal medicines or on its own. Homeopathics are prescribed on an individual, depending on their symptoms. The type of anxiety is more important here, as the prescription will be different for anticipatory anxiety (worried about an event or public performance), restless anxiety, anxiety bought on by grief, feeling constantly ‘wired’, or specific phobias.

Nutrition also plays a really important role in mental health. Glucose spikes can have a big impact on mood causing both highs and lows, and a lack of nutrients can leave you craving the foods that you know you shouldn’t be eating. In terms of supplements, magnesium is calming to the nervous system and a great starting point for natural anxiety treatment. Choose a magnesium citrate or magnesium glycinate for the best effects.

The B group of vitamins can be helpful for a low mood or lack of energy, and are great to take in the morning if your energy is low. Ideally choose a high quality multi – B vitamin, but be sure you’re not talking other vitamins that also contain B vitamins, as it can be easy to overdose if you are getting them from more than one source.

Breathing exercises can be an amazing tool to bring your body from the ‘fight or flight’ mode back into ‘rest and digest’ mode. There are so many available but for best results, choose an exercise where the time taken to exhale is longer than the time to inhale as this is what makes the biggest difference. Sometimes breath holds can also be helpful, but you want one that feels comfortable and calming to you.

If you’re looking for individualised anxiety treatment, a naturopathic appointment can make sure you are getting the best products for your unique symptoms.

Kathryn Messenger

BHSc (Naturopathy)

kathryn@wholenaturopathy.com.au Suite 1 53/1880 Ferntree Gully Rd Mountain Gate Shopping Centre Ferntree Gully, Victoria

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

Pensioners and those on Veterans' entitlements will be enticed back into the workforce with an increase to their work bonus concession balance. This measure is being supplemented with an increase to the time limit for the suspension of pension entitlement from 12 weeks to 2 years. This means if a pensioner earns too much income over a period of time, their pension will be suspended instead of cancelled.

Effective from 1 January 2024, all pensioners over pension age and eligible Veterans now have a maximum work bonus balance limit of $11,800 up from $7,800 and all new age pension recipients have a maximum work bonus income balance of $4,000 (previously nil). Also effective from 1 July 2024, employment income nil rate will be doubled to 24 weeks (previously 12 weeks) for income support recipients.

The ATO has finalised guidance on whether an asset that is made up of a number of components (a composite item) is itself a depreciating asset, or whether one or more of its components are separate depreciating assets.

The Taxation Ruling TR 2024/1 provides the Commissioner’s view on identifying the relevant depreciating asset and hence its effective life and depreciation rate for the purposes of Div 40 of ITAA 1997.

Guiding principles have also been provided to help ascertain the level of “interest in the underlying asset” and apply the decline in value provisions for the purposes of s 40-35.

This Ruling does not address Div 43, which provides deductions for certain capital works expenditure.

The Labor government announced changes to personal tax rates that will provide a tax cut for every Australian taxpayer commencing from 1 July 2024.

Changing the original course of action, as announced by the previous Coalition government, the new tax changes aim to focus on the low and middle income earners and provide cost-of-living relief.

The Medicare levy low-income thresholds for 2023-24 have also been increased, reducing or eliminating the amount of Medicare levy paid by Australians on lower incomes.

The bills amending income tax rate thresholds, tax rates for individuals and Medicare levy low-income thresholds, have now received Parliamentary approval to become law.

Announced: 25-Oct-2022 Updated: 6-Feb-2024

Announcement(3-Oct-2023) Consultation period Released(31-Jan-2024)

Announcement(25-Jan-2024) Consultation(6-Feb-2024) Introduced(6-Feb-2024) Passed(27-Feb-2024)

Royal Assent(5-Mar-2024) Date of effect(1-Jul-2024)

In an initiative to promote women’s economic equality, the Labor government has announced plans to pay superannuation on paid parental leave (PPL) for government-funded payments from 1 July 2025.

If enacted, this measure will provide parents who access the PPL government scheme with super contributions paid into their nominated super account equivalent to 12% of their leave pay.

An expansion to Australia’s PPL is also currently before the Senate, which will give families an additional 6 weeks of PPL, increasing to 22 weeks from July 2024, 24 weeks from July 2025, and 26 weeks from July 2026.

This measure is currently in the announcement stage and requires parliamentary approval to become law.

Announced: 7-Mar-2024 Updated: 14-Mar-2024

The Commissioner of Taxation now has the power to allow companies to reduce their FBT compliance costs by utilising other corporate tax records.

This measure reduces the complexity of FBT compliance obligations as employers can rely on other substantiation documents to finalise FBT returns.

Employers may still choose to use approved forms such as employee declarations and the prescribed forms detailing the fringe benefits provided to employees and associates if they wish. In some instances, it may benefit an employer to continue using standard FBT measures.

The effective start date for the change will be 1 April 2024 (commencement date of the 2025 FBT year).

Announcement(9-Sep-2022)

Consultation(9-Sep-2022)

Introduced(23-Nov-2022) Passed(21-Jun-2023)

Royal Assent(23-Jun-2023) Date of effect(1-Apr-2024)

Announced as part of the 2021-22 Federal budget, were the reforms to the reporting requirements for not-forprofit (NFP) oraganisations that would self-assess as income tax exempt.

From 2023-24 income year onwards, if an NFP has an active ABN number, it is required to lodge a NFP selfreview returm to access the income tax exemption.

The NFP self-review return may be lodged anytime between 1 July and 31 October 2024.

Charities registered with the ACNC are exempt from these new reporting requirements.

Announced: 12-Nov-2023

Updated: 8-Apr-2024

Individuals who receive an eligible lump sum payment in arrears after 1 July 2024 will not have to pay Medicare levy on that amount.

These payments are usually made to an individual for reasons such as compensation for previously underpaid wages.

If your client would be eligible for other offsets or rebates relating to arrears payments, and they otherwise would have a reduced Medicare levy, this exemption will be available for them.

The Treasury has released exposure draft legislation proposing amendments to the Medicare Levy Act 1986, which will commence in the quarter following the date the bill receives royal assent.

Announcement(9-May-2023)

Consultation(5-Apr-2024)

Introduced

Passed

Royal Assent Date of effect

The Bill proposing to increase the instant asset write off threshold in Div 328 of ITAA 1997 has been passed by the Senate with amendments raising the threshold to $30,000 from the previously proposed $20,000.

Originally announced in the 2023 Federal Budget, the increased threshold applies from 1 July 2023, amendments made by the Senate also propose to increase the aggregated annual turnover eligibility from $10 million to $50 million, therefore also including medium sized businesses.

This proposed measure applies to the cost of eligible depreciating assets, second element costs and general small business pools.

Eligible assets must be first used or installed ready for use between 1 July 2023 and 30 June 2024, and the write-off applies on a per asset basis.

Announcement(9-May-2023)

Consultation(13-Sep-2023)

Introduced(13-Sep-2023)

Passed

Royal Assent Date of effect

Join Kirsty Bishop-Fox of Sustainability Pathways in this workshop where you'll discover practical strategies to make the most of the food you already have, effectively reducing waste and stretching your budget.

Learn how to transform leftovers and scraps into delicious meals, and explore the possibilities of regrowing vegetables from kitchen scraps. Additionally, we'll demonstrate how to cultivate quick and nutritious sprouts and bean

shoots right on your kitchen bench.

Key Topics Covered:

• Maximising your budget by minimising food waste

• Effective meal planning to reduce waste

• Creative ways to use commonly leftover ingredients

• Understanding food expiration dates and when they can be disregarded

• Innovative tips and recipe ideas for repurposing scraps into meals and more

Participants will have the opportunity to set up their own sprouting jar during the workshop, allowing them to continue growing sprouts or bean shoots at home. Please bring along a good sized jar at least 500 mL –about the size of a pasta sauce jar.

Walking Netball is a health and well being program catering to all fitness levels. The program brings together a variety of low-intensity cardio, strength, flexibility and balance in one fun game.

Everyone is welcome to enjoy Walking Netball regardless of physical fitness, age or previous netball experience. We want you to stay active by enjoying a game of netball and having a laugh with friends.

Wear something comfortable, your runners & bring a bottle of water and have fun!

• When: Weekly sessions will run each Monday 12noon to 1pm during the School Term

• Where: Maroondah Nets, HE Parker, 154 Heathmont Rd, Heathmont

• Cost: $5 per session. Payment by cash before you take the court.

• Age: This session is for anyone over 65s so bring your friends along to have some fun and a laugh whilst staying active.

Find out more on the Melbourne East Netball Association website.

Learn a new skill from scratch or put your skills to the test as we craft unique and fun decorations. No supplies or experience needed, available to all skill levels.

Class details

• Date: Monday afternoons

• Time: 1pm to 3pm

• Venue: Maroondah Nets, 154 Heathmont Road, Heathmont 3135

• Cost: $5.50 per session. Cost is dependent on individuals funding circumstances.

Social inclusion and Wellbeing program

This class is part of Maroondah's Social Inclusion and Wellbeing program,

which ensures that residents who are frail/aged, have a disability, or are socially isolated receive support to remain independent and continue to participate in the community.

These programs are aimed to help you to stay active, healthy and connected to others in the community.

You’re invited to a special Men’s Health Week online event with clinical psychologist, researcher and leading men’s mental health expert Dr Zac Seidler.

Dr Seidler is the Director of Mental Health Training at Movember and a 2022-2026 National Health and Medical Research Council (NHMRC) Emerging Leader Fellow. Zac has devoted several years to the goal of reducing the male suicide rate, treating and researching men’s mental health with over 50 peer-reviewed articles published.

This one-hour webinar and Q&A will help to open the conversation around masculinity and raise awareness of men’s mental health challenges.

Our petition asks for the right to apply for a Department of Veteran Affairs Gold Health Card. This card would cover our medical and dental care in our old age. We believe it would be fair reparation for two years of our youth, taken from us, under threat of imprisonment, by our forced military service.

Nasho Fair Go is an association formed in February 2022. Its charter is to try and obtain reparation for National Servicemen who served between 1965 and 1972 but did not serve in Vietnam. There were 48,200 of us. Actuarial sources estimate there should be 30,000 of us who are still alive. The oldest of us is now 78 and the youngest, 72. Obviously, we are a rapidly diminishing cohort.

Our claim is based on the gross unfairness of the balloted conscription that existed between 1965 and 1972, and the two years of full-time military service it demanded. This was the only occasion in Australian history that such a national service scheme has been used.

A mere 63,375 men were forced to leave their homes, families, sweethearts, and careers, while over 800,000 men their age got to live their lives unhindered. Only one twenty-year-old in 14 was finally forced into service. For many of us our lives would be changed for ever.

15,100 of our comrades would serve in Vietnam, of whom 210 would die and over 1,000 would be seriously injured. A very large number of the survivors, like all veterans of war, would suffer from ongoing mental and physical problems because of this futile war. On return to civilian life many were reviled which only added to their anguish.

Since 2020, all Vietnam Veterans, national servicemen or regular soldiers, qualify for a DVA Gold Card. This will pay all medical and dental expenses for the rest of their lives. This was long overdue and the very least our government should do.

So, what of the rest of us? We 30,000 old men who did not serve in Vietnam? Did we blissfully serve our two years and then happily slip back into civilian life, picking up where we left off, and live happily ever after? Some did, but unfortunately, most didn’t.

Many of our members suffered such great upheaval in their lives because of their service – broken romances, ruined careers, loss of friendship groups, inability to fit back into civilian life, shame at having not gone to Vietnam, and survivor guilt when close mates, who did go, were killed – that they have never fully gotten over it. Many of our members still have unresolved physical and mental problems relating to their service. Many abuse alcohol and prescription and illicit drugs. Depression is widespread.

What are two years of a young man’s life worth? Who can say? Our unashamed goal is to obtain DVA Gold Cards for our members. This would give them some peace of mind as they enter old age.

If you are a 1965-72 Nasho, who did not serve in Vietnam, or, if you know one, we would love to have you contact us. Please go to our website www.nashofairgo.com.au or contact us at hello@nashofairgo.com.au or phone on 0418 392 748.

Our nursery was started 30 years ago by a group of interested volunteers. The aim was to conserve local native plants, encourage revegetation to provide habitat for local wildlife and enhance biodiversity.

Within 5 years the nursery had won local and national awards for our contribution to the local environment and community and had become financially viable. In the past 30 years, we have educated and inspired many thousands of people across three council areas to get involved in protecting and enhancing the biodiversity of our precious local environment. New developments continue to encroach on and impact what is left of our natural environment. Now more than ever, the nursery is a crucial link in the chain of environmental organisations that support a healthy and thriving environment for our families and provide essential habitat for our local wildlife.

Covid-19 and the lockdowns hit us hard. With no volunteers allowed on site, we struggled to grow and care for our native plant stock, maintenance of the nursery’s infrastructure was reduced to the absolute minimum, and retail sales were halted. In January 2024, it seemed as though the nursery would have to shut down.

Fortunately, in February, one of the nursery’s founding members rejoined the Committee of Management, new members and volunteers were recruited and the fight to save our beloved organisation began. We started a GoFundMe fundraising campaign to publicise the immediate financial needs of our community business and renewed the connections we had built up over the past decades. In just two and a half months, we have made great progress towards our goal of saving Candlebark for the community and the environment.

We are rapidly returning to being the vibrant community organisation we were before Covid. The nursery provides a space for friendship, sharing, skills acquisition and environmental education. Volunteers are the heart of our organisation and come from diverse backgrounds and experiences. Our volunteers work in many different areas, including collecting, sorting and cataloguing seed, propagating plants from seed and cuttings, preparing stock for sale, selling our plants in the retail area, keeping our site safe by maintaining the facilities, and using their IT skills to up-date our website. With more volunteers, we can grow more plants, maintain the nursery, and have more people to call on when we attend local markets and community events selling plants and spreading the word about the great work we do for people and the environment. Our retail area is open to the public on Wednesday, Thursday, Friday, and Sunday from 10.00 am to 2.00 pm. Volunteers are on- site for full or half-days from 9.00 am - 3.00 pm Tuesday to Friday, and 10.00 am - 2.00 pm on Sunday. If you would like to join us, we would love to hear from you!

We have achieved a great deal in just three months under the direction of the new Committee of Management. A recent visit from Jane Edmanson, horticulturalist and presenter on Gardening Australia, was also a great boost to our spirits. In other good news, our membership has more than doubled since the start of the year. We encourage those of you who support our aims and objectives to help us rebuild our organisation by spreading the word about our fundraiser with friends and colleagues. Please check out the details here: https://gofund.me/ea0beea7 All donations, small or large, are gratefully received! The future is looking bright for Candlebark. We hope you will visit Candlebark Community Nursery when you next need native plants to fill a small gap or a large paddock, if you are looking for advice on native gardens, or if you’d like to join our friendly community of volunteers.

Candlebark Community Nursery Incorporated

308 Hull Road, Mooroolbark 3138

Email: info@candlebark.org.au

Phone: (03) 9727 0594

The U3A in Ringwood is part of the larger U3A movement which focuses on providing educational, recreational and social activities for older adults. U3A Ringwood offers a range of courses tailored to the interests and needs of its members. These courses might include things like art classes, discussion groups, fitness activities and outings to local attractions.

Membership fees for U3A Ringwood are typically kept low to make participation accessible to as many people as possible.The fees cover administrative costs,venue rentals and other expenses associated with running the organisation. Additionally, U3A groups rely on volunteers to organise and lead activities, helping to keep costs down.

Participating in U3A Ringwood can provide not only opportunities for learning and personal growth, but also a chance to connect with others in a friendly, relaxed and social environment. Many members find that participating in U3A activities helps them to stay active, engaged and connected with their local community as they age.

Our current Committee was re-elected unopposed - reinforcing the members confidence in their Committee to administer and successfully run U3A Ringwood. We hosted a sausage sizzle at Ringwood Bunnings in April this year. It was a great way to engage with the local community, spread information about U3A and raise some money to help cover some of our administrative costs.

If you are interested in joining U3A Ringwood, please check out our website u3aringwood.org.au or email info@u3aringwood.org.au or ring 0481 221 576.

FAMILY EVENT: 2-4PM SUNDAY 4 AUGUST $10 PER FAMILY

Purchase tickets via QR or events humanitix com/mtl-boardgame-events/tickets

ADULT EVENT: 7-9PM WEDNESDAY 3 JULY $10 PER PERSON

www.findmaroondah.com.au/nfp-free-advertising or

Let our May Collection take you there.

Rain, tail or shine. Whatever your style, whatever the weather, let our May Collection take you there. Dazzle in the drizzle with the hottest new raincoats and umbrellas, dress you and your pet in your kikki.K best, and accessorise with all-new silk-cotton scarves. Navigate new terrain with prints inspired by nature and splashes of colour unique to kikki.K. Shop in-store or online today.

Celebrating the innovation of Australia’s First Nations people in fashion and textiles. Launched in 2020, the national Indigenous Fashion Awards (NIFA), provide a vibrant and exciting platform to celebrate the innovation, diversity and ethical practices of Aboriginal and Torres Strait Islander artists and fashion designers.

This showcase celebrates and brings national exposure to our winners and all of the amazing talent and work being done in First Nations Fashion and Textile Design.

Visit

Australia’s #1 destination for trend-setting girls. We are Sportsgirl, and we’re glad you’re here! Discover up-tothe-minute global trends, designed with that unique Australian-girl edge.

Trailblazers of the high street, the Sportsgirl story began in 1948 in Melbourne, and has since expanded to over 120 stores nationwide (and online!).

At Sportsgirl you’ll find up-to-the-minute fashion, exclusive designer collaborations and an ever-evolving range of the latest beauty and accessory trends.

We are committed to discovering and supporting new talent, promoting positive body image through our partnership with the Butterfly Foundation, and bringing the best and brightest fashion news and talent direct to you in store and online.

Add a pop of unexpected this Autumn by integrating unexpected twists into your style. Cast aside typical seasonal hues and introduce buttery yellow, a bright summer shade, into the Autumn mix. It's a refreshing choice that stands out against the season's earthy tones.

Revamp classic silhouettes with new textures; think denim trenches adding an edge to outerwear. Refresh mature styles with youthful vibes by incorporating preppy jumpers, marrying nostalgia with sophistication.

This season is not just about variety—it's about redefining fashion norms. Bring 'special occasion' items into daily wear by mixing laid-back and luxe elements, like sweatpants paired with heels, or sneakers with elegant slip dresses. Elevate basics with unexpected accessories for a subtle yet impactful transformation.

Your Autumn wardrobe is a canvas for creativity and contrast, where small surprises make big statements. Find that pop of unexpected at Eastland this season and turn the ordinary into the extraordinary with just the right twist.

For most people when they retire, they will have only one form of income to help cover their future lifestyle expenses. This income is usually in the form of an account-based pension. They will likely have enough assets that restrict them from obtaining the age pension.

An account-based pension is created from superannuation monies. The money is then invested in assets; be it defensive assets like cash and fixed interest, and growth assets like property, Australian equites, and international equities.

For these clients, it is important to consider placing some money in growth assets so as to avoid the effects of inflation risk, but this comes at a cost of volatility risk which may lead to short-term capital losses.

At the same time, they will require a steady income and will be required to withdraw regular income from their pension accounts. Ideally, trying to avoid drawing down capital when the market has fallen as this will force the sell down investments, including growth assets, at a time when those investments might not be lower than one would otherwise hope.

Managing the competing requirement to draw down income but not reduce the capital balance of the assets supporting the pension is a challenge for retirees, especially when facing a bear market. One solution is a bucket strategy.

Not all financial planners use a bucket strategy for their clients, but it has some merit especially when the advisor is not actively managing the underlying assets of the clients portfolio but wants to reduce some of the risk associated with a falling market.

A bucket strategy is so called because it establishes the use of different pools of savings or ‘buckets’ to address various needs with the aim that there will be enough the buckets to provide for future pension drawdowns.

What is a bucket strategy?

A bucket strategy aims to help balance the need for ongoing income and capital growth throughout retirement by establishing and maintaining different pools of savings, each with their own purpose. The aim is to generate good capital growth while reducing the risk of having to sell investments when the market is down. There are many variations, but a typical option is to create three buckets.

How does the strategy work?

The bucket approach splits your retirement into phases, and appropriate investments must be selected to finance each phase. These varying investments are all held within a single account-based pension.

In our three-bucket example, your retirement savings would be divided into:

1. The short-term bucket

This is the liquid component of your retirement savings, from which all pension payments are drawn. It is invested in stable assets such as cash that can be accessed immediately or at short notice. This portion is not designed to grow, but rather to give you peace of mind that the next few years’ income is available and not subject to market fluctuations.

2. The medium-term bucket

The second bucket is intended to balance the need for stability with the potential for some capital growth in the medium term. Positive investment returns from this bucket are used to top up the short-term bucket. Typically 30–50% of this bucket would be invested in growth assets such as shares and property, with the remainder in more stable income-producing assets such as bonds and cash. The appropriate allocation depends on your attitude to investment risk and your goals and may fall outside the usual range.

3. The long-term bucket

The third bucket is for long-term capital growth, reducing the risk your retirement savings will run out. It is invested mainly in growth assets and will fluctuate more in the short term but should generate higher returns than the other buckets in the long run.

Positive returns from this bucket can be used to top up the short-term bucket. If the market declines, assets from this bucket are ideally not sold, but are held for the longer-term to ride out market volatility.

Bucket maintenance and repair

Once the strategy has been established, it must be maintained. Some super funds offer a bucket strategy investment option that will do this maintenance for you based on preestablished rules.

Maintenance involves adjusting the buckets periodically, usually annually or every six months, with the cash bucket being topped up from returns generated in the other buckets. This is sometimes called ‘rebalancing’.

When market declines cause a fall in value in one or both growth buckets, the rebalancing process may be postponed

entirely or restricted to moving assets only from a bucket that has experienced growth into the short-term bucket, leaving any assets that have declined in value untouched. Income can continue to be withdrawn from the remaining cash, with complete rebalancing postponed until the value of the other buckets recovers from the market decline.

Keep in mind that in the case of a serious downturn there may not be time for the medium- and long-term buckets to fully recover before the balance of the short-term bucket runs out. The bucket strategy reduces the chance you will need to sell assets that have declined in value but cannot eliminate it completely.

Sita retired at 65 and started an accountbased pension on 1 July 2018 with a balance of $620,000. She decided to withdraw income of $37,000 per year to combine with her husband’s retirement income.

Sita invested her account balance as follows:

(60% defensive assets, 40% growth assets - her fund’s conservative option)

term bucket $255,000 (7% defensive assets, 93% growth assets - her fund’s high-growth option)

Total balance $620,000

After one year, Sita checked the balance in her investment options and rebalanced her buckets. Her target was to top up her shortterm bucket for three years’ income and to split the remaining balance equally across her other two buckets as shown below: