The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support, The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

Available Sizes:

Rates:

• Double Page Spread (408 x 276mm) $1650 Full Page (198 x 276mm) $1100

• Half Page Landscape (198 x 138mm) $715

• Half Page Portrait (95 x 276mm) $715

• Third Page (189 x 90mm) $550

• Quarter Page (97 x 137mm) $440

• Business Card Size (93 x 65mm) $275

• Ads Smaller than (85 x 55mm) and Below $121

• Design Services

We can create your ad for you. Prices start at $77 for the very first hour and $22 for each hour thereafter.

Next Issue of the Find Maroondah will be published on Monday April 11, 2023. Advertising and Editorial copy closes Friday March 31, 2023.

Inspiring women. Empowering girls.

International Women’s Day is a chance to celebrate strong, female role models and to raise the voice of girls and young women across the community. As one of Victoria’s leading organisations for female empowerment, Girl Guides Victoria aims to create the space and opportunities for girls and women to find and share their voices each and every day.

Guides are given the chance to explore new possibilities and take on new challenges designed just for them – all with the support of girls and women who cheer them on every step of the way. From camping to rock climbing, sailing to STEM activities, theatre to hiking, Guides offers a diverse range of activities that allow girls to explore and grow. Through its programs and activities, Girl Guiding encourages girls and young women to challenge stereotypes, develop critical thinking skills, and become agents of change in their communities.

We know that Guiding makes a real and impactful difference in the lives of our members. A recent survey of Guiding

in Australia found that involvement with the Girl Guides program has a lasting and positive impact on Guides, leading to increased confidence, resilience and coping skills, wellbeing, and a greater sense of connection.

Girl Guide Units meet weekly in towns and cities right across Victoria through the school term. Throughout the year, Guides have access to a variety of exciting and fun local activities and adventures, as well as the opportunity to join in on district and regional activities and camps. Guides also have the chance to take part in larger events like state and national camps and sleepouts, creating incredible

experiences and memories and friendships that will last a lifetime.

While our weekly Guiding program is for girls aged 5-17, Girl Guides offers opportunities for women of all ages. Our programs are brought to life by passionate and dedicated volunteers from all walks of life. Volunteering offers the opportunity for women to develop important leadership and volunteer skills, and foster community connections and friendships. We also have a dedicated program for young women aged 18-30, and a connected community of Trefoil Guild members who remain connected and active at all ages.

When girls and volunteers join Girl Guides they become part of like-minded and supportive local communities. They also become part of something much bigger. Through Girl Guides Australia, which is a member of the World Association of Girl Guides and Girl Scouts, Girl Guides Victoria is part of a thriving global community of over 10 million members in 150 countries.

This IWD, the global conversation is around cracking the code and innovating for a gender-equal future. Promoting technology and the role it can have in creating an equal future for women is an ongoing focus for Girl Guides Victoria – from a recent field trip for Guides to gain first-hand insight into

manufacturing technology and inspire thinking about STEM careers, to weekly STEM activities and robotic technology, and our ongoing state-wide drone program to give Guides and volunteers hands-on access to drone technology.

Girl Guides Victoria has activities and groups right across Victoria. Learn more, find your Local Unit and start your Guiding journey today at www.guidesvic.org.au

guides@guidesvic.org.au

(03) 8606 3500

Suite 812, 401 Docklands Drive, Docklands VIC 3008

In the last few days, you may have become aware that Optus has disclosed that a cyber-attack against them has resulted in a hacker accessing the personal details of many of their customers. Details accessed may include name, date of birth, email, phone number, address, and ID numbers such as drivers license or passport numbers. If this can happen to a multi-million dollar global communications giant with a full time IT department, then it can happen to you.

This news should send a shiver down the spine of all small and medium enterprises as well, because similar data breaches experienced by small businesses put up to half of them out of business within 12 months. Reputational damage and associated lack of trust is certainly a revenue killer, even if the horrendous cost of rectifying a breach isn’t enough to bankrupt the business first. Fines and penalties will sometimes be a problem too, and there are potential EU General Data Protection Regulation fines, which may apply within Australia if the affected

party is from an EU country.

So what might a Cyber Policy typically cover?

a. Business interruption financial loss due to a network security failure or attack, human errors, or programming errors

b. Cost of data loss and restoration including decontamination and recovery of files and hardware

c. Emergency incident response and investigation costs, supported by an insurer appointed contractor

d. Delay, disruption, and acceleration costs from business interruption event that stems from a cyber-related issue

e. Crisis communications with clients and reputational damage mitigation expenses

f. Civil Liability costs arising from failure to maintain confidentiality of data

g. Civil Liability arising from unauthorised use of your network

h. Computer/data network, or data extortion / blackmail (where insurable. Paying this may be illegal under certain circumstances)

i. Online media civil liability

j. Regulatory investigations expenses

As diligent as you may be at managing your clients’ data, system intrusions can still happen. Given that cyber-crime profits have eclipsed the global drug trade in turnover, I would say it’s a pretty fair assumption that the SME sector will take a beating sooner rather than later. Talk to your broker about Cyber Insurance today, and protect yourself and your clients against extensive losses. For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives,needs and financial situation).

Craig AndersonGENERAL INSURANCE

Small Business Insurance Brokers

0418 300 096

As a business owner and employer, it is your responsibility to ensure the health safety of your employees within your workplace. This includes providing your team with a safe work environment and protection from hazards. You can achieve this by understanding your obligations under the Occupational Health and Safety (OHS) laws and by complying with them.

Amongst the many OHS legal requirements that business owners must comply with, there are three leading requirements you should have a clear awareness of. Namely:

Business owners are required to assess the risks present in their workplace and put control measures in place to eliminate or minimise those risks. By conducting risk assessments, the hazards present can be identified, as well as the likelihood of someone being harmed and how seriously they could be harmed.

Business owners are required to provide and maintain a safe work environment for their employees. This also includes contractors and visitors. This obligation on business owners includes providing adequate lighting, ventilation, flooring, signage, emergency plans, as well as ensuring that plant and equipment is suitable for use and properly maintained.

As a business owner, it is imperative that you consult with your employees about health and safety matters in the workplace. You must also provide them with adequate training on how to perform their duties safely. Consultation with employees can be achieved in a number of varied ways, including regular toolbox talks, safety meetings and inductions.

As a business owner, do you have an understanding of your responsibility to ensure the safety of your employees? Are you confident that you can provide a safe work environment and comply with OHS laws? Do you believe that you are effective in carrying out risk assessment, employee consultation and providing training? Do you regularly review these measures to ensure that they remain fit

for purpose and keep you and your employees healthy and safe? We assist business owners clarify what they currently have in place, as well as where there are shortfalls. We then assist in developing effective systems and documentation, working with businesses to ensure effective implementation.

Checks are put in place to monitor ongoing effectiveness, to ensure that going forward, they are sound and comply with the Act, and most importantly keep business owners and their employees informed, and healthy and safe. Please feel free to contact me, Mark Felton, at Beaumont Advisory on 0411 951 372 or mfelton@beaumontlawyers. com.au for an obligation and cost-free initial discussion.

Mark Felton

Health

Safety

Mark Felton

Health

Safety

In the current interest rate and inflationary climate Mortgage Brokers are spending a lot of time engaged with their existing clients, discussing what will happen when the current fixed rate on their Home Loan expires. When rates were at their lowest a lot of borrowers, quite smartly, took advantage of this and locked in their rate for anywhere between 1 and 5 years. Most took a fixed rate of 2-3 years at rates as low as 1.79%. As all good things must come to an end, these rates will be coming up to their expiry dates over the next few months, and some borrowers could see their mortgage rates increase by almost 5% when their fixed rate expires.

If you are in this situation there is one important thing you should do to plan for this eventuality and to try and mitigate, as much as possible, the inevitable impact on your cashflow that you will be about to experience.

It is vitally important to get a real understanding of your options, and

discussing your situation with a mortgage broker will be the best course of action to ensuring you get the best deal and minimise the financial impact of a significant increase in your interest rate. We can talk to your current lender to see what they can offer as an incentive to remain with them or see what else is available in the market that may be a better option.

There are a number of lenders offering cash-back incentives to attract new business, some up to $4,000 depending on the loan amount and other factors. They may also be negotiable on the interest rate to ensure they win your business. Your mortgage broker is in the perfect position to help with these negotiations by presenting a case to the lenders, then seeing who is offering the most suitable deal.

Mortgage Brokers can also negotiate with your current lender if you provide them permission to do so. I have personally re-negotiated rates for new clients who were placed on the standard variable rate once their fixed rate expired, and their existing Bank discounted their rate by almost 1.5% to ensure they retained the business. It costs Banks more money to attract a new client than to keep their existing customers, so they are being a lot more aggressive using their business

retention teams to offer existing clients better deals.

It is also important to note that a mortgage broker is required to act in the best interest of their client, which is not a requirement of the Banks or other lenders. When you engage a broker to review your loan we are required to provide our clients with the most suitable option to meet their needs, even if the best option is for the client to remain with their current lender and the broker receives no remuneration by recommending this option. This ensures that you are receiving the best advice available at the time of the review.

Every client’s requirements are different, and dealing with a Mortgage Broker will provide you with a much wider range of options than just dealing with your current lender. At SHL Finance we are helping our clients save thousands by reviewing their loans and ensuring they are getting the best deal to meet their needs.

Please call Reece Droscher on 0478 021 757 to arrange a review. www.shlfinance.com.au

Ever wondered how many sporting clubs there are in the City of Maroondah.

Football, Cricket, Basketball, Tennis, Netball, Lawn Bowls – the list goes on and on.

And guess what – all clubs are seeking to increase their membership, increase the number of participating players, increase their revenue streams through sponsorship, social activities, membership fees – just to name a few.

Just picture it – dozens of sporting club representatives trying to attract new sponsors, retain existing sponsors and creating benefits to showcase the reasons why companies should become a sponsor.

Maybe it’s time to consider working together – time for non-competing sporting clubs to consider how they can develop alliances that will assist in attracting new members, encourage sponsors to promote their products and services to more than one club and to give people the opportunity to take up a sport that may be more suitable to their skills.

Like many clubs some people decide that after giving it a try a particular sport may not be to their liking and they drop out. Where do they turn to? What other sport can they consider?

With sporting clubs working together it may open up new sporting challenges and provide opportunities for people to seek another club and take up a different sporting code.

Just think about the benefits that a potential sponsor could receive if their business was promoted by more than one sporting club.

Attractive sponsorship rates, a wider variety of sponsorship benefits, a larger target market and the potential for greater participation with club members.

Working together the non-competing clubs would be in a position to hold combined membership drives,

conduct open days and undertake joint promotional activities.

Think it has merit – think your club could be interested? The Ringwood Bowls Club is ready to look at working together with other sporting clubs and is keen to get the ball rolling.

All it takes is a phone call and an initial meeting to discuss what needs to be done and how to go about it.

Why not get a representative from your club to give the Ringwood Bowls Club a call – pick up the phone and call Peter Horton on 0412 606 486 – what have you got to lose.

Neurodiversity Celebration Week is a worldwide initiative that challenges stereotypes and misconceptions about neurological differences. Together, let’s change the narrative to understand, accept, and celebrate neurodiversity!

We're excited to present a week of great events at Croydon & Realm Libraries during Neurodiversity Celebration Week. Events include:

• Social morning for adults with Different Journeys (Croydon)

• Growing in to Autism with author Prof Sandra Thom-Jones (Croydon)

• Different Journeys information session (Croydon)

• Gently Gently Storytimes (Croydon & Realm)

• Games afternoon for children & teens with Different Journeys (Realm)

New ATO rules you need to understand if you wish to claim a tax deduction at the end of this financial year.

Even before COVID hit, many people were working from home, and it was costing the ATO a lot of money. During COVID the amount of work from home (WFH) deductions that were claimed, increased dramatically.

During COVID, the ATO was generous enough to offer a shortcut method to calculate the WFH deductions. You simply added up all of your hours working from home and multiplied it by 80 cents per hour.

Unfortunately, a lot of individuals who submitted their own tax returns got it wrong or over claimed the amount they were entitled too.

The shortcut method was supposed to include your phone and internet use and the depreciation of items purchased for your home office. However, it seems some people claimed the hours as well as claiming phone, internet and office equipment. Even some tax agents and accountants were getting it wrong.

As such, the ATO has tightened up on WFH claims for 2023 and made it an arduous process for those wishing to claim the WFH expenses from 1st March 2023.

The first thing the ATO did was get rid of the COVID shortcut method and will only allow two methods to calculate WFH: the fixed rate method or the actual costs method.

In the past, most people would simply opt for the fixed rate method because it was less onerous to keep records but that is all about to change. The ATO is now applying a rigorous approach to record keeping where WFH expenses are involved including under the fixed rate method.

The fixed rate deduction will be 67 cents per hour but those who now work from home must keep a diary of all the hours they work from home. The ATO will not allow an estimate based over several weeks. No, the ATO wants you to record every single hour you work from home under the fixed rate method.

The ATO stated that taxpayers should

keep records “as they occur” as “timesheets, rosters, logs of time spent accessing employer or business systems, or a diary for the full year”.

Not only will taxpayers need to keep a detailed record throughout the whole financial year of the hours they have worked from home, but they must also keep a copy of their utility bills, phone, internet, stationary and computer consumables e.g. paper and ink for the printer.

It is believed that if a taxpayer is audited in the future, they will have to justify that their working from home costs were incurred. The ATO wants to see an increase in costs to justify the claim being made.

The fixed rate method will still allow a separate claim to be made for depreciation of computers and office furniture, which was not allowed under the fixed rate method during COVID. Other items like repairs, cleaning and maintenance can also be claimed separately.

Those claiming 67c an hour will also need to keep bills for costs included in the fixed rate, which covers electricity, gas, phone, the internet, stationery and computer consumables. The threshold cost for depreciation of an asset remains at $300.

What has changed is that those working from home do not now need to have a dedicated home office to claim WFH expenses, which was a requirement in past years. The ATO believes this will be a boon for taxpayers.

However, Assistant Commissioner Tim

Loh warned that taxpayers “carrying out minimal tasks, such as occasionally checking emails or taking calls” were ineligible to claim because “you must be working from home to fulfil your employment duties”. So, if you are doing work from home but it was not a requirement by your employer to do so or there was no arrangement in place to carry out those work duties from home, then you will be ineligible to claim future WFH expenses.

Mr Loh said the ATO would accept a representative record of hours worked from home for the period 1 July 2022 to 28 February 2023, but after that “taxpayers will need to record the total number of hours they work from home”. “And remember, you can’t claim for things like coffee, tea, milk and other general household items, even if your employer may provide these kinds of things for you at work.”

What does this mean for tax agents and accountants who prepare tax returns? It is likely the tax agent or accountant will be asking the client to verify their WFH expenses. This will initially cause friction between the taxpayer and their accountant/tax agent, but as the saying goes, ‘don’t shoot the messenger’. We encourage everyone to work with their accountants/tax agents where further information has been requested of the taxpayer to substantiate their WFH claims.

Warren StryboschYou can call them on 1300 88 38 30 or email info@findaccountant.com.au

It had to happen. With record spending under Labor, and Australia’s debt continuing to skyrocket, Labor has been under pressure to find ways to either curb spending or find new ways to increase revenue. Given Labor is not known for having a good fiscal policy and would rather give away money to the masses, they have sought to raise revenue instead.

They did not have to look too far. With total superannuation assets worth $3.3 trillion at the end of the September 2022 quarter (https://www.superannuation. asn.au/), there is a massive amount of money at the governments fingertips ready for the taking. Obviously, they cannot simply take the funds, but they can sure as heck can tax it. This is exactly what they have decided to do.

The Prime Minister, on the 27th of July, announced that from 1st July 2025, anyone with superannuation balances over $3 million, will be taxed at 30 cents

in the dollar. That is a whopping 100% increase in taxes for those with large super balances.

The change will take place after the next federal election. Labor is hoping that by taxing the rich it will be resonant with the less fortunate. After all, who really cares about the big end of town? Ironically, more and more people in the future are going to find themselves with likely super balances above 3 million dollars. In the next 10 to 15 years, we are going to see the largest movement in intergenerational wealth that the world has ever seen and a lot of that transfer of wealth will be likely placed into superannuation…well, it was going to be.

For those who have worked hard and made their fortunes, they will be forking the bill for those who have not once again. Again, who cares, right?

Mr Albanese said the reform would “strengthen the system by making it more sustainable”.

“The savings that are made from this tax breaks will contribute $900 million to the bottom line of the forward estimates and some $2 billion when it is operating over the full year period,” he said.

We are not sure how these changes will ‘strengthen the system by making it more sustainable’?

Isn’t the amount of superannuation assets growing year by year? I think he means that this will make it more sustainable for them to keep spending money like it grows on trees by taking it from others.

Will this win votes with the average Aussie punter? Likely it will as we are known for our tall poppy syndrome in Australia. We are all on about given the battler a go but don’t get too high or we will try and pull you down.

In short, super is getting taxed again and this is likely to lead to more scepticism about using super in the future.

Traditionally in many cultures menopause was celebrated as freedom from childbearing and a sign of wisdom. Sadly in our culture many women struggle with the loss of youth, it can be good to be reminded to enjoy this stage of life and look for some positives.

The average age for menopause is 51, and by definition is 12 months with no period. Perimenopause is the transition stage and usually occurs from age 45 to 55. Changes occur due to changes to main female hormones: oestrogen and progesterone. Oestrogen is the ‘strong’ hormone, it has a role in strengthening bones with calcium, and during perimenopause the levels fluctuate. Progesterone is the ‘calming’ hormone, it relaxes the nervous system, and in perimenopause the levels drop. During the reproductive years, these hormones generally create balance and after menopause, even though much less of each of these hormones are produced, they are also in balance. It’s unbalanced ratio in perimenopause that causes the symptoms of increased anxiety, unstable mood, changes to the menstrual cycle, and hot flushes.

Premenstrual syndrome (PMS) is often due to a drop in oestrogen and often women who had PMS previously can find symptoms to be worse or last longer in perimenopause. But there’s something easy that can make a big difference: phytoestrogens. This is a group of foods that are chemically similar to the hormone oestrogen and when consumed help to modulate oestrogen levels. Phytoestrogens are found in soy products, linseed, as well as other seeds and legumes, eating these foods can help to offset the fluctuating oestrogen levels.

Often the first sign of perimenopause is higher stress levels due to the loss of progesterone. Rather than try to fight the hormonal changes, find activities that you can do each week that you find relaxing or fun. Magnesium is a great nutrient for calming the nervous system: magnesium citrate or magnesium glycinate are the best forms.

The early stages of perimenopause can

also be characterised with a shorter menstrual cycle and very heavy periods, be sure to have your iron levels checked if this is the case, as low iron can lead to exhaustion. There are herbal medicines that do well at regulating the cycle, and a naturopath or herbalist can help with this.

Hot flushes occur due to the fluctuating oestrogen levels and can be somewhat regulated with phytoestrogens. Sage is a great herb for hot flushes with excessive sweating, and whilst it can be consumed as a tea (chilled), capsules may be more convenient. Homeopathic Amyl nit can be taken with each hot flush to reduce the severity, especially in severe cases such as waking to saturated sheets from sweat, or being unable to regulated body temperature afterwards.

After menopause, due to the reduced oestrogen levels, women are at higher risk of osteoporosis. Adequate consumption of calcium in foods such as dairy, soy, tinned fish with bones, nuts and seeds are important in the diet. Vitamin D is required to move the calcium into bones, so time should be spent outside each week as this vitamin is made by your skin, but not long enough for sunburn. Weightbearing exercise increases bone density and 30 minutes of exercise a day is recommended.

There is so much that can be done naturally to support the transition to menopause.

Whole Naturopathy can help provide you with natural products to help ease the transition into menopause.

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

Kathryn MessengerBHSc (Naturopathy)

kathryn@wholenaturopathy.com.au

Suite 1, 24/1880

Ferntree Gully Rd

Mountain Gate Shopping Centre

Ferntree Gully, Victoria

Insurance is designed to protect clients in those specific instances in which an event occurs.

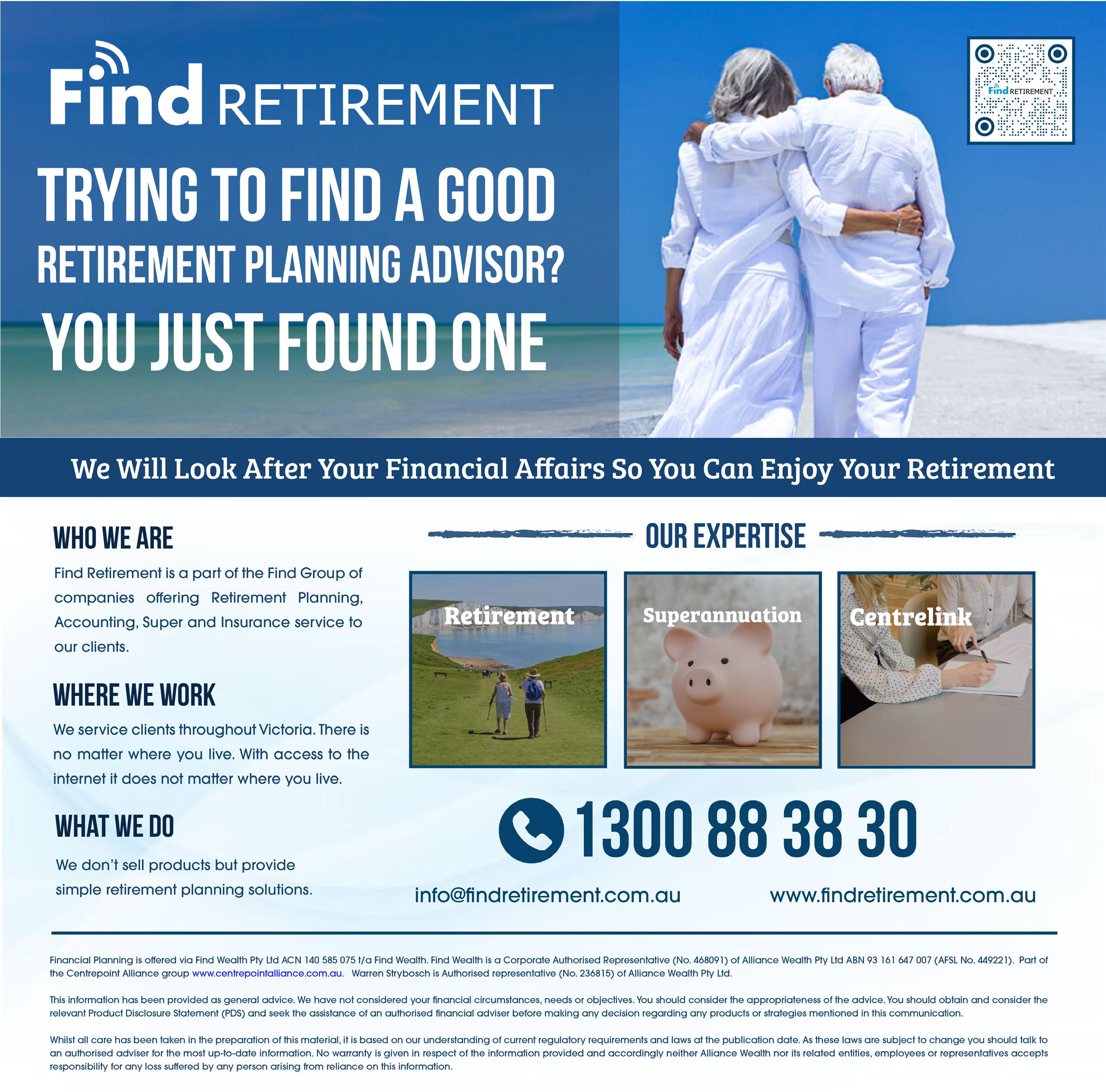

There are various types of insurances (summarised in Figure 1) available and it is fundamental for you to understand the key differences between each. A good advisor will help guide you through the process of choosing the right type and amount of cover that you need.

The discussion will usually include:

• Understanding the client’s current situation and why they may require personal insurance;

• Work out what the client’s needs are by asking a series of questions;

• Identifying any issues that may arise and steps that need to be taken e.g., pre-existing medical conditions;

• The costs associated with having insurances in place. It is not always about how much more it will cost but sometimes finding ways to save on premiums;

• Provide quotes and agreeing on what to take up/hold and/or what to scope out; and

• Implementing the insurances which includes underwriting and disclosures.

Note: Various insurance product providers may have different names for their products, for example, trauma cover may also be known as crisis recovery or critical illness insurance.

As of 1 October 2021, the Australian Prudential Regulation Authority (APRA) mandated the change in income protection (IP) products for “life companies to better manage riskier product features by:

• ensuring DII [disability income insurance] benefits do not exceed the policyholder’s income at the time of claim, and ceasing the sale of Agreed Value policies;

• avoiding offering DII policies with fixed terms and conditions of more than five years; and

• ensuring effective controls are in place to manage the risks associated with longer benefit periods. (APRA 2019).”

Note: The terms disability income insurance (DII) and individual disability income insurance (IDII) have the same meaning. Both terms will be referred to as IP going forward.

It is important to understand the key differences that now apply to income protection and more importantly, if you decide to cancel and replace your current IP policy, what benefits you might lose.

In the past you could choose between agreed and indemnity. Now you can only be provided with an indemnity style policy. Most Agreed policies would ask you to prove your earnings at time of application whereas an indemnity policy would ask you to proof your earnings at time of claim. The big difference was that if you had an agreed policy, it would likely pay you the agreed amount regardless of what you were earning at the time of claim. This meant, you could have been earning less for several years prior to the claim being submitted and still be entitled to the amount you insured yourself for. Whereas, with indemnity, you get paid based on what you earned up to 12 months prior to the claim was submitted. Obviously, an agreed policy is more beneficial to have and keep compared to an indemnity type policy. APHRA decided to remove the ability for insurers to offer an agreed policy because it was costing the insurance industry way too much money in claims.

For those who have older IP policies, you would likely be entitled to receive 75% of your income at claim time. However, new policies only allow you to insure up to 70% of your income. If you have a new policy that has a benefit period longer than 5 years, then the income may reduce down to 60% after the first 2 years. Some insurers will allow you to maintain the 70% but other terms and conditions will apply. Anyone wanting to take out a policy with a benefit period greater than 5 years must make sure they understand these changes that occur after the 2 year period when on claim.

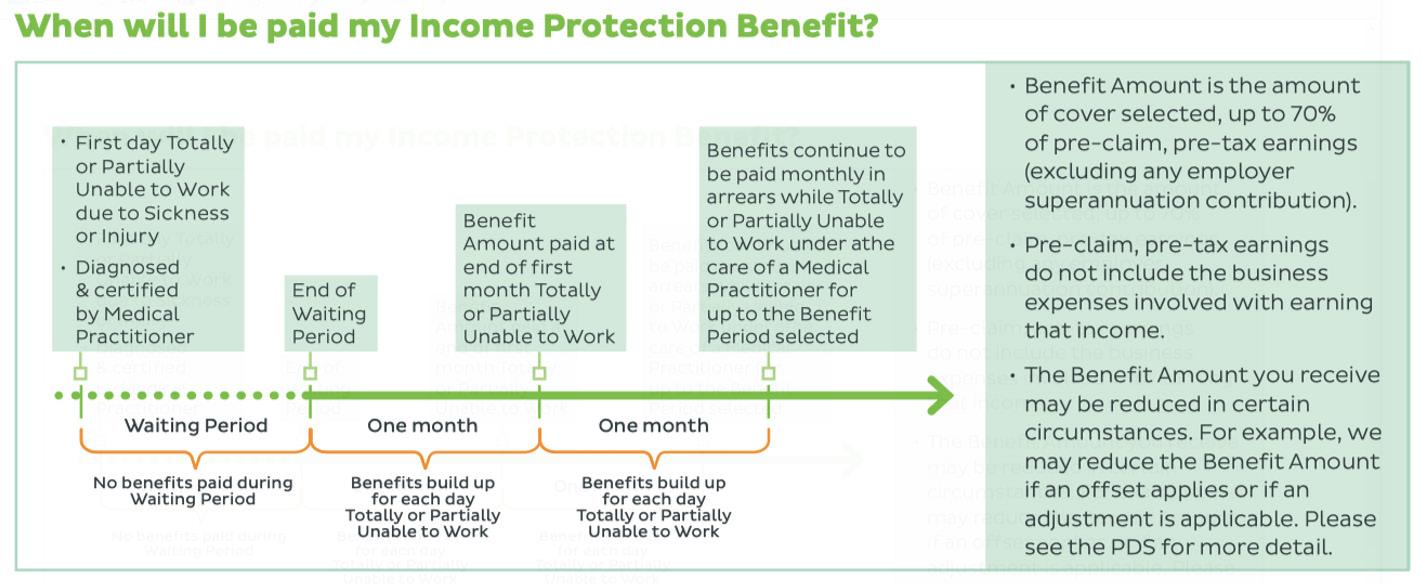

Source: TAL 2022

What are the key benefits that might be lost if you replace your IP policy?

Before I can mention benefit periods, I need to explain the difference between an ‘Any’ occupation and ‘Own’ occupation definition. For the most part, you would want to have an ‘Own’ occupation IP policy. This meant that if you could not do your ‘own’ job because of injury and/or illness, you would be paid at claim time, subject to waiting periods. However, APHRA have decided that an ‘Own’ occupation definition is too generous and have now restricted the use of an ‘Own’ occupation definition to a maximum of 5-year benefit period. Going forward, if a young person wants a benefit period greater than 5 years e.g., up to age 65 or 70, they will only be allowed an ‘Own’ occupation for the first 2 years and then the policy reverts to an ‘Any’ occupation definition. As a financial planner, this new change

in definition for those wanting a benefit period longer than 5 years is disconcerting. It means that the insurer could potentially force you to return to work after the 2 years or you lose your payments. This new change in definitions has not been tested yet and we await the outcome when the first client has no choice but to return to work.

Note: For those who choose benefit periods of 5 years or less will continue to have an ’own’ occupation definition.

During the waiting period

Disabled means solely because of sickness or injury:

• you are unable to perform the material and substantial duties of your regular occupation at full capacity for the duration of the waiting period; and

• you are not working in any capacity for 14 days out of the first 19 consecutive days of the waiting period.

For the first 30 months following the date of disability.

Disabled means solely because of sickness or injury:

• you are unable to perform the material and substantial duties of your regular occupation at full capacity; and

• your monthly earnings are less than 80% of your pre-disability earnings; and

within your regular occupation you are unable to work the lesser of:

• 38 hours or more per week

• the number of hours you regularly worked prior to disability.

(Source: www.clearview.com.au)

After 30 months from the date of disability

Disabled means solely because of sickness or injury:

• you are unable to perform the material and substantial duties of any suited occupation at full capacity; and

• you monthly earnings are less than 80% of your pre-disability earnings; and

within any suited occupation you are unable to work the lesser of:

• 38 hours or more per week

• the number of hours you regularly worked prior to disability.

One of the most difficult changes to understand is the new benefit periods that have come into effect. For those who choose a 2 year or 5-year benefit period, not a lot has changed. For those who wish to have a benefit period longer than 5 years, each insurer has a different way of assessing the amount you will receive after the 2- or 2.5-year mark when on claim as well as the change in definitions (already discussed above). Most insurers will not continue to pay up to 70% of the benefit amount after the 2-year claim benefit period has been reached. Often it will drop down to 60% of the insured amount. APHRA believes this will encourage more people to try and return to work faster than if they were to continue to be paid the 75% amount offered on old IP policies.

Most insurers have reduced the number of waiting periods on offer with many only going up to 13 weeks, with the most common waiting period being 8 weeks or 3 months. Before you can receive any benefits once a claim has been submitted, you must have completed your waiting period.

For instance, if you are a director of a company that produces a profit, your profit may be offset against your IP benefit amount whilst on claim.

Income protection insurance is a must have for all those who are currently working and especially if they do not have enough assets or other sources of income to supplement their current earnings should an event occur which results in them not being able to work.

It is surprising how many people have no income protection in place or have simply accepted the default insurances provided by their superannuation funds. Having some insurance is ‘good’ but we want to make sure you have moved to ‘better’ or ‘best’ cover.

Personal insurance is a necessary evil in that it costs money to hold on to it and you hope you never have to use it, but when you do need to use it, you are very thankful you have it in place.

We encourage everyone to speak to a financial planner about personal insurances. If you don’t have a financial planner then reach out to Find Insurance (www.findinsurance.com.au) and book a meeting with them or call 1300 88 38 30

1300 557 144 | erryn@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth.Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No.449221).Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

(Source: tal.com.au)

Most insurers will apply ‘offsets’ to benefits. Some will include sick leave and annual leave as an offset, but some do not. Others will offset ‘other payments’ and ‘earnings.’

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

It is said that preparation is the key to success but how do you best prepare for breastfeeding? For something you have never experienced before? For learning a new skill that you cannot practice ahead of time? And how do set yourself up for success when there are so many potential roadblocks and variables, which you cannot predict?

Breastfeeding is a learned skill, that improves with practice and is empowered by knowledge. Many of today’s new mums do not have the benefit of having observed other women work through the learning process of early breastfeeding and seen how common issues can be resolved. In our society today, most women who give birth will have never held a newborn baby before, never changed a nappy or burped a baby. Never bathed or dressed a baby, settled a baby to sleep or seen a baby breastfeed up close and personal.

What we know from the data is that many women run into difficulties with breastfeeding in the early weeks. In Australia most women want to try breastfeeding. Approximately 92% of mothers start out breastfeeding after birth, however by 6 months of age, the number of women exclusively breastfeeding has reduced to just 14%. Many mums report that early breastfeeding is much harder than they had expected. What are the factors that seperate those that go on to long term breastfeeding success and those that don’t?

Breastfeeding takes both practice and perseverance. Research clearly tells us that women who report higher rates of self-efficacy have better breastfeeding outcomes, both in terms of initiation and duration. In other words, women who feel confident about their ability to face challenges with determination and who have a wider plan to overcome obstacles, are more likely to breastfeed and to stick at it for longer. They are prepared to work hard and are open to testing different ideas and suggestions as needed. And if things don’t work out, they are more likely to blame external circumstances rather than blame themselves.

Learning a new skill is not always easy, but approaching the task with positive

expectation, rather than fear and selfdoubt, is really important. So, in preparing to breastfeed, mums will benefit firstly by having a realistic and positive attitude towards it and a mindset to trust their body and to work at it, even if things don’t turn out as easy as she expected. In order to feel positive and empowered, women need to be informed and they need appropriate support from those around them.

Mothers want to be informed about what to expect. Attending breastfeeding education classes through the Australian Breastfeeding Association (available online) is an excellent way to gain information and knowledge. Classes both educate and empower mothers. They teach her important skills such as how to identify her baby’s feeding cues, how to latch and position her baby at the breast and how to know if her baby is getting enough milk. Learning as much as she can before the arrival of her baby will help her confidence.

Getting in touch with an International Board Certified Lactation Consultant (IBCLC) is another great way to get informed. Even before the birth of her baby, it’s a good idea to make contact with her local lactation consultant so that she can build a connection and know exactly where to turn once her baby arrives. After her baby is born, she will benefit from having the sort of personalised, one-on-one, hands-on help that a lactation consultant can provide.

Mothers also need appropriate support, and lots of it. This can come from many sources; her health care professionals, her partner, her own mother and friends as well as her wider family, co-workers and society at large. Reading, discussing and asking questions will allow the expectant mother time to think about what it might be like, how she may respond to the challenges of breastfeeding and what sort of emotional and practical support she would prefer. She needs to be able to ask questions and to receive reassurance. In particular, mothers want their health care professionals to have good breastfeeding knowledge, to have an “authentic presence”, to listen well, to give positive reflection to their emotions and to provide practical suggestions and advice.

Being informed, supported and connected with a skilled lactation consultant can be invaluable in getting mum and baby off to the best possible start and avoiding many of the pitfalls that are common in the early months and set them up for long term breastfeeding success.

Dr. Joanna Strybosch

Dr. Joanna Strybosch

Osteopath B.App.Sc(Clin.Sc)/B.Osteo.Sc/Grad

This is the fifth of five publications where we have been running a series of sensory experiences in nature.

Each experience will take about 10 mins and you are encouraged to read through the instructions before you commence your time in nature to maximise your experience.

Find a spot outside where you can sit or lie down comfortably. This could be in your backyard, your local reserve or in a national park. You may like the familiarity of the same place you have practised before or you may like to try somewhere new.

Take a few moments to regulate your breathing and settle into your position. For this breathing exercise, we will follow a pattern of 4 counts in, holding for 7 and then exhaling for 8.

Follow this pattern, allow it to take all of your focus and to help you unwind. Repeat for a few minutes.

Allow your breathing to find its natural rhythm once more.

For the next 5 mins we are going to practise tuning into all of our senses while we do a slow walk. You may only move a few metres within the 5 mins, the point of the exercise being to tune in to your senses of sight, smell, hearing and feeling as you go. Draw your attention to the details, get in close to nature, take time to experience the full experience of each moment.

You are trying to slow down your senses, slow down your experience. Try not to allow distractions to come into your mind, be fully present to the experience. If you do get distracted, don’t stop, just

tune back in and continue.

When you choose to complete your experience,

you have just had.

Turning into our senses is an important way to disconnect from the fast pace of modern life.

you may wish to take a moment of gratitude for nature and for the experience

While smart home technology has been around since the 1990s, people are just beginning to appreciate having it.

The devices in a smart home are interconnected and accessible from a single hub, such as a smartphone, tablet, laptop or gaming console. A smart home automation system allows the user to operate devices and appliances remotely, including lights, door locks, televisions and multimedia sets, thermostats, home monitors, cameras and refrigerators.

With a smart home, you can enjoy the following advantages:

Since having a smart home allows you total control over your appliances, including your lighting, heating and cooling systems, you know exactly when they’ll power up. You won’t need to worry about forgetting to turn off the lights before leaving home. You can also set your thermostat to an optimum temperature. You can even program your refrigerator to remind you when it’s time to go shopping and so on.

Automating your home means not having to lift a finger to turn certain devices and appliances on and off.

You also don’t need to peep outside to see who’s ringing your doorbell, as you’ll be using a video intercom. Best of all, since you can operate your smart home remotely, you can manage your household even from afar.

3.

With your CCTV system being accessible even while you’re away, you’re assured of your household’s safety and security against home invaders. You’ll also be alerted if there’s a fire accident in your home, so even first responders can help. Also, you can have smart locks installed, so you won’t need to take any keys with you ever again.

The quickest albeit expensive way to have a smart home is to buy one. However, there are also things you can do to turn your regular home into a smart one.

• Choose a hub. Examples of this include Samsung Bixby, Amazon Alexa and Google Nest.

• Set a budget. Know how much you’re willing to spend and for what in turning your place into a smart home.

• Create a priority list. There are lots of devices and appliances you

can use to automate tasks in your household. However, purchasing and installing them all at the same time can be expensive and timeconsuming. If you can afford only a few things to start, prioritise your lighting system first.

• Know the steps needed to program your devices. If you’re unsure, you can always research or get professional home automation help.

• Get everything set up and installed. Again, you can DIY this process or get the help of smart home experts.

Perfecting your smart home system can take weeks of practice.

Once you’ve mastered the steps, you’re sure to enjoy living in your smart home even more.

If this article has inspired you to think about your own unique situation and, more importantly, what you and your family are going through right now, please contact your advice professional.

This information does not take into account the objectives, financial situation or needs of any person. Before making a decision, you should consider whether it is appropriate in light of your particular objectives, financial situation or needs.

From 1 January 2023 the former Department known as DELWP, which stood for Department of Environment, Land, water & Planning has now become the Department of Energy, Environment, and Climate Action. So where has Planning gone and why has it been separated from the Environment?

The portfolio of Planning has been given to another minister Sonia Kilkenny working closely with Jacinta Allen, who also just happens to also head up the LXRP. The LXRP, have ultimate power, over land use in Council jurisdictions and including Vic Roads Land which can be acquired if and when needed.

Can anyone else see a problem here?

Every new station will be promoted to us voters, as an excuse to allow much higher development towers in close proximity to every station, to house the anticipated 20 million Victorians by 2040. Has no one realised that in much of Europe this does not happen, buildings are kept to max 4 stories which allows retention of human scale, and people seem to find places to live without subscribing to towers of concrete and glass.

Developers must be rubbing their hands in glee, at the thought of all this opportunity to create mini cities, at all new Stations, hopefully not copies of Box Hill. We cannot sit by idly in the face of such obvious catastrophic weather events and pave more of our treed paradise, to build more monstrosities in overshadowing tall satellite cities.

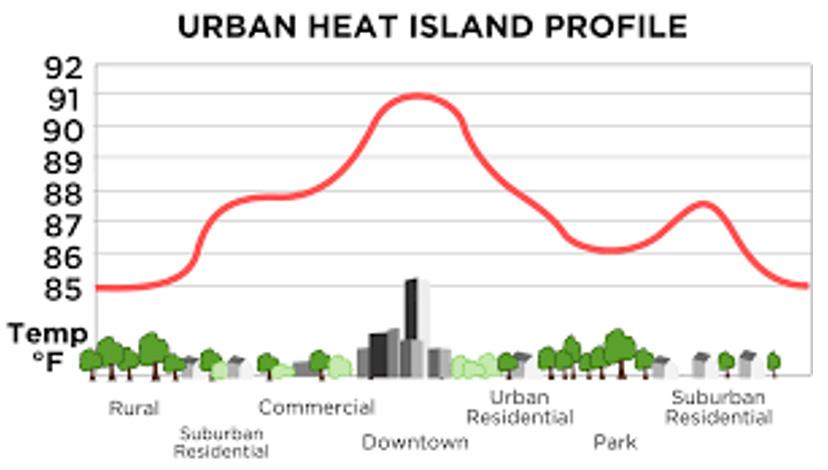

This urban renewal in the form of highrise housing to home our expected 20 million Melbournians flies in the face of the United Nations IPP 2022 Impacts, Adaption and Vulnerability. They made a statement regarding climate change, that “every person should have the right to live in a healthy environment”. Instead, these new hubs are destined to become huge heat sinks, made of hard materials that absorb heat, and keep it hot all night. The antithesis of the direction we need to be taking. Will the newly formed Department of Energy, Environment, and Climate Action have to negotiate with Planning and Transport ministries? Who will win?

The story by Mark Santomartino of Channel 9, highlighted the lack of easy dialogue between all stakeholders, with the LXRP. The incident could have been perceived as bullying as it was suggested quite forcefully that the shop owner should take down the sign. The story went to air on 9 news TV on Thursday 16th February. When asked, David Southwick from the opposition said the individual from LXRP should be stood down pending an investigation.

The traders in Surrey Hills and Mont Albert, who used to rely on passing foot traffic by commuters, to get their daily needs provided, will lose much of passing trade which could mean the end for them in business local shopping strips that are at the heart of a community. If you want to support them you can do so by scanning the QR code on the notice below, or visit Eastsider news.

We need to be actively noisy, if we want our voices to mean anything, otherwise we may lose our right to a meaningful democracy.

Buildings radiate out their stored heat overnight, preventing cooling, that happens here where there is vegetation. Excessive power is required to run air conditioning for residents in these towers, again this is not the direction required to reduce our dependence on power.

There is an element of usurped authority displayed by these Big Build Projects, that is displayed by some of the staff. Just recently an LXRP communications manager took issue with a shopkeeper who displayed a sign in their window in Union Rd Surrey Hills, saying that the Residents and Retailers Association is not happy with the LXRP. The communications manager suggested the sign be removed and that it would lose them business. He went on to basically say that 200 workers on the line, would not “feel comfortable” buying fish and chips from this store, he remained in the store for quite a while hoping to see the sign removed.

Will our right to free speech and input to where and how we live be usurped? It requires dialogue for a Democracy to fulfill its obligations to voters.

President of Croydon Conservation Society

President of Croydon Conservation Society

On a very hot Wednesday in February 1983, 19-year-old Don Garlick had finished work for the day in Heatherdale, and as he was getting into his car he glanced up at the hills and saw a billow of smoke.

As a volunteer with Lilydale Fire Brigade, Don knew he needed to make his way to the station to find out what was going on. After collecting his gear, Don recalled he was assigned to a tanker (with fellow Lilydale fireys Rick Hauck and Ross Blair) that had recently arrived from Glenburn Fire Brigade.

“We were dispatched to a fire which had broken out in the Warburton area. When we mustered at Millgrove, we were tasked with scouting the fire and checking its path,” Don said.

“Dusk was falling as we arrived in Powelltown, making the fire clearly visible from afar. As we moved closer, it became increasingly obvious there was trouble ahead.

“When we attempted to radio back to Millgrove crews, there was no response as we were out of radio range.”

The crew turned around to travel back within range, stopping on the way to put out spot fires.

“I remember being on the back of the truck operating the pump, while Rick and Scott were on the ground with hoses in their hands.”

Don’s recollection of what happened next will never leave him.

“It suddenly became eerily quiet, as a windstorm ripped down from the hills. Before we really knew what was happening, we found ourselves in the middle of a firestorm with balls of fire raining down like huge hailstones.

“Ross and Rick ran to the truck and as we took off, they were pulling the hoses back in after them.”

The crew drove ahead of the fire back into Powelltown, where they started evacuating houses on the outskirts of town.

“At one of the houses, we bundled an old lady into a car with her pets. I remember the phone ringing as I was walking through the house.

“It was the woman’s daughter. I told her we were getting her out because of the fire.”

Not long after the homes were evacuated, the fast-moving fire caught up to the Glenburn tanker, leaving the crew only a few moments to make it to the open ground of the nearby Forests Commission office, where they took cover.

“We had a small patch of lawn on the same side the fire was coming from, and bushland surrounded the rest of the area.”

Don and the crew had just enough time to climb under the tanker with a couple of hoses for protection.

“We just used the hoses to keep the worst of the fire off us, as the fire jumped over the top and moved around us. Today, this is what is called a burnover.

“We fared all right because of the clearing, being able to keep ourselves prone on the gravel and, of course, having the hoses.

“The tanker was small, made almost entirely of steel and didn’t have much to burn. I don’t recall the tanker sustaining any damage.”

When the fire had passed and the crew miraculously found themselves unharmed, they continued towards the township to help local residents.

“We found most of the townspeople huddled in the centre of the footy oval, dazed and scared.

“I remember being asked how much had been destroyed by the fire and not being able to tell them, because we simply didn’t yet know the level of destruction.” It was later determined that 44,500 hectares were impacted and 30 houses in the Warburton area were destroyed by fire.

“We spent the rest of the night putting out small spot fires, mainly in public buildings like the school and sawmill.

“Eventually we caught a couple of hours sleep in the footy club change rooms. We were woken by the sound of naval recruits being taught how to make a fire break.”

The crew of Glenburn tanker were relieved around lunchtime the next day and had to figure out how to get back home.

“We didn’t see anyone from Lilydale brigade, so we started walking and hitched a ride on an army truck.

“When we finally got back to the Lilydale station, we received a warm welcome as we had originally been thought lost.”

As a CFA volunteer since 1978 (not including a 10-year hiatus), and current Captain of Wendouree Fire Brigade, Ash

Wednesday was the first major incident Don attended, but it certainly wasn’t the last.

This Thursday, 16 February 2023 will mark the 40-year anniversary of Ash Wednesday.

You can watch the Ash Wednesday 40th Anniversary Commemorative Event on CFA's YouTube channel.

Anniversaries of significant events such as the Ash Wednesday fires can bring up difficult memories and feelings including sadness, fear and grief.

In the weeks leading up to Ash Wednesday, and in the days after, if

you find yourself experiencing strong emotions, we recommend that you contact Lifeline on 131114 or Beyond Blue on 1300 224 636 which offer support services nationwide.

CFA members and their families can contact the CFA Wellbeing Support Line on 1300 795 711 for free,confidential 24/7 access to psychologists, counsellors, peers and chaplains.

Elwynne KiftIndividuals will now have the ability to claim a higher deduction for self-education expenses. From the 2022–23 income year, legislation that limited the self-education deduction to costs above $250 each income year has been repealed. In order to claim a self-education deduction, an individual must demonstrate a necessary connection of the expense with their assessable income.

The announcement, which recently became law after receiving royal assent, originally came from the 2021 Federal Budget and is somewhat related to a Treasury discussion paper released in December 2020. However, other matters addressed in the paper, such as deductions for expenses unrelated to current employment, have not been taken further at this stage.

Announcement(11-May-2021)

Consultation

Introduced(3-Aug-2022)

Passed(28-Nov-2022)

Royal Assent(12-Dec-2022)

Date of effect(1-Jul-2022)

Starting from 1 July 2023, operators of sharing economy platforms will be required to report transactional information to the ATO. The Taxable Payments Reporting System already applies to some businesses in industries where non-compliance is deemed to be high risk. By adding operators of sharing economy platforms to the regime, taxpayers who hold or use assets for short-term lease or contract work will also have their information collected.

The identification of users of sharing economy platforms means that, as an adviser, you should be informing taxpayers who earn income off these platforms about their tax obligations. This includes operators of shortterm accommodation, ride-sharing transport and food delivery platforms. Also, other task or time-based service platforms will be required to report for income years beginning on 1 July 2024.

Announcement(25-Aug-2021)

Consultation

Introduced(3-Aug-2022)

Passed(28-Nov-2022)

Royal Assent(12-Dec-2022)

Date of effect(1-Jul-2023)

Australian Business Number (ABN) holders will now be required to be

accountable and comply with annual income tax lodgment obligations.

First announced in the 2018–19 Federal Budget as an integrity measure, this exposure draft legislation seeks to strengthen disruptions to black economy and tax avoidance behaviour.

Currently, ABN holders are able to retain their ABNs regardless of whether or not they meet income tax obligations. This measure will provide more accountability on enterprises by giving the regulator the ability to cancel ABNs. This means advisers need to ensure clients keep their lodgments up to date, or at least keep a clear line of communication with the ATO.

The ATO has finalised TR 2022/4 and PCG 2022/2 in relation to distributions made by trustees of discretionary trusts. This was complemented by TA 2022/1, which discusses parents benefitting from the trust entitlements of the adult children. All 3 documents focus on schemes where income is diverted from an intended beneficiary in order to reduce tax liabilities.

The rulings discuss these at detail and include significant attention to an important carve out for dealings that are “ordinary family or commercial dealings”. These dealings are excluded from the anti-avoidance provisions. Along with these regulatory resources, the ATO has reiterated its stance in many areas relating to s 100A. In particular, where situations would generally come under an ordinary family or commercial dealing. Trustees need to make sure that their distributions are in accordance with the expectations of the ATO, otherwise they may be subject to an audit. Helping them understand their obligations is paramount coming up to the end of the current income year.

Announcement(12-Apr-2019)

Consultation(29-Nov-2022)

Introduced

Passed

Royal Assent

Date of effect

Announcement(23-Feb-2022)

Consultation period(29-Apr-2022)

Released(8-Dec-2022)

Crypto assets are to be specifically excluded as a foreign currency within income tax and GST legislation.

The legislation maintains the current tax treatment of crypto assets such as Bitcoin and removes uncertainty following the decision of the Government of El Salvador to adopt Bitcoin as a legal tender.

When the legislation receives royal assent, the new laws will be in effect from income years that include 1 July 2021.

The individual tax residency rules will be replaced by a new framework with a primary physical presence test.

Under the new primary test, a person who is physically present in Australia for 183 days or more in any income year will be an Australian resident for tax purposes. Individuals who do not meet the primary test will be subject to secondary tests that consider a combination of physical presence and other measurable criteria.

These new rules contrast with the current rules which look at the ordinarily resides test as the primary indicator to reviewing Australian residency.

Changes to the individual tax residency rules will be required to go through the legislative process and will commence after royal assent has been given.

Announcement(6-Sep-2022)

Consultation(6-Sep-2022)

Introduced(23-Nov-2022)

Passed

Royal Assent

Date of effect(1-Jul-2021)

Announcement(11-May-2021)

Consultation

Introduced Passed Royal Assent

Date of effect

In 2019 the Australian tax residency of an individual was ruled incorrect by the Full Federal Court on appeal, reversing an earlier determination by the Commissioner of Taxation. A subsequent appeal to the High Court of Australia by the Commissioner was also dismissed.

This was a major case for expatriates living abroad, as the individual in question had been living in “temporary” serviced apartments in the Middle East. During the time in question, the taxpayer’s family had been living in Australia in a property jointly owned by the individual.

The case was overturned on account of the term “permanent place of abode” which is part of the Australian tax residency question. The ATO has recently provided further guidance with TR 2022/D2 for expatriates wishing to remain a non-resident of Australia for tax purposes when working overseas.

Announced: 27-Feb-2019

Updated: 20-Jan-2023

The Commissioner of Taxation now has new powers to direct a small business taxpayer to undertake a record-keeping education course in lieu of an administrative penalty.

The new directive will be initially limited to small business owners in order to assist them in keeping up to date with tax obligations.

The individual must then provide the Commissioner with evidence of completion of the course in order to avoid financial penalty. The Commissioner will be able to issue a tax-records education direction to an entity from 12 March 2023.

Announcement(3-Aug-2022)

Consultation

Introduced(3-Aug-2022)

Passed(28-Nov-2022)

Royal Assent(12-Dec-2022)

Date of effect(12-Mar-2023)

The facility, proposed to be named Maroondah Edge, has entered the internal fit out stage of the project, with fittings and fixtures currently being installed.

Overlooking the Premier Grade Russell Lucas Oval in the Jubilee Park sporting precinct, the centre will be one of four indoor cricket training hubs in the Melbourne metropolitan area, and a one-of-a-kind facility in the Eastern Region.

Mayor of Maroondah, Councillor Rob Steane, said the new centre will add significantly to Jubilee Park’s sporting

and leisure precinct. “We are excited to see the indoor cricket training centre at Jubilee Park nearing completion,” Cr Steane said.

“This new facility is set to be a fantastic addition to the range of sporting and leisure facilities we have at Jubilee Park, which includes facilities for local cricket, football, tennis, soccer, and croquet, along with children’s playgrounds and of course Aquanation.”

Once complete, the facility will boast five lanes for indoor cricket training and will become a regional women’s centre of excellence for cricket, as well as being used by the premier grade Ringwood Cricket Club, Cricket Victoria and the Ringwood District Cricket Association (RDCA). The state-

of-the-art facility will continue to further raise the profile of women’s cricket in Victoria, and the outer eastern suburbs of Maroondah.

The building will be fully accessible for all users, with a Changing Places bathroom to also be constructed adjacent to the facility.

Expected to be completed by May/ June this year, the facility will be a welcome addition to Jubilee Park sporting precinct. This project has been funded by Maroondah City Council in partnership with the Victorian Government.

Join us at the Maroondah Kinder Expo!

Do you have a young child and want to know when you should enrol them for 3 and 4 year old kinder? Join us at the Maroondah Kinder Expo on Thursday 2 March, 6pm to 8pm at Karralyka, Ringwood East, to find out more.

The expo shines a light on the preschool years - a time of significant growth and development - and will be held at the start of the kinder enrolment period for

2024. Enrolments open on 1 March 2023 and close on 30 June 2023. Mayor of Maroondah, Councillor Rob Steane said the expo is a great learning opportunity.

“The Maroondah Kinder Expo provides a fantastic opportunity for parents and carers to learn about kinder in Maroondah, such as what kinder options there are, how and when to enrol, funding and how to support their child’s transition to kinder.

Join us for our International Women's Day breakfast on March 2023.

IWD provides an important moment to showcase commitment to women's equality, launch new initiatives and action, celebrate women's achievements, raise awareness, highlight gender parity gains and more.

Find out more

“I encourage families with young children to come along, speak with Council representatives and educators and ask any questions they might have,” Cr Steane said. Families can visit stallholders and learn about Maroondah Integrated Kindergarten Association (MIKA, Maroondah’s central enrolment system) and Maroondah Kindergarten Outreach Program.

Families can also speak with:

• Representatives from Council and local MIKA kindergartens

• Council’s Maternal and Child Health Nurses

• Council’s immunisation staff

• Council’s National Disability Insurance Scheme (NDIS) Coordinator.

• Council’s Kindergarten Officers will be onsite to support families who may require translation assistance (Hakha Chin, Falam Chin, Burmese).

Find out more about the Maroondah Kinder Expo or contact Council’s Children’s Services Project Officer on 9298 4598 or email childrens.services. events@maroondah.vic.gov.au

Join Persephone Thacker with Frances Cannon, Silika Baselala, and Onella Muralidharan as they share perspectives on body in/visibility, fatphobia, pride and the role of art and fashion. The talk is an opportunity to hear directly from these artists, advocates, designers and models in the creative, textile and fashion industries on the contradictions of being hypervisible yet invisible, along with how wearable forms and art can inform the process of acceptance and celebration of self.

Find out more

Whether you’re overstocked with food right now, or if your cupboard is running bare, with some know-how and a little planning there are simple ways you can manage your kitchen. Make the most of your leftovers and food scraps with a little creativity to turn them into meals or more.

The workshop will cover:

• ideas for using random leftovers so nothing in your fridge goes to waste

Help shape our new Play and Gathering Places Strategy

Connections provide us with a sense of belonging and purpose. Play and gathering together in our natural environment can foster those connections and create a thriving community. That’s why Council is calling on our community to tell us where, why and how you play and gather.

Your feedback will help inform Council’s new Play and Gathering Places Strategy, with the vision to provide inclusive places within our open spaces that aim to cater for all cohorts within our community.

These places will promote gathering, interaction, connection, wellbeing

• tips for waste free packed lunches

• how to get your portions right to avoid waste

• we’ll demonstrate how to make a quick and easy zero waste meal out of leftovers

Event details

• Date: Wednesday 15 March 2023

• Time: 10am to 11.30am

• Location: Maroondah Federation Estate - Federation Room

Waste education webinars and workshops

Council hosts a range of community waste and recycling webinars within the municipality each year.

and liveability while being thoughtfully and sustainably planned to honour Maroondah’s natural environment and culture.

Mayor of Maroondah, Councillor Rob Steane, said the strategy will impact residents throughout Maroondah.

“Whether it’s a play in a park, a walk with a friend, a family picnic, a workout or an adventure in our bushland, we want to know what you enjoy and what you think could improve your experiences in open spaces in Maroondah,” Cr Steane said.

“This important strategy will impact everyone in Maroondah, so I encourage you to share your thoughts.”

To share your feedback, visit Council’s Your Say Maroondah website, where you can complete our five-minute survey and drop a pin on our interactive map to share your experiences with playing and gathering in Maroondah.

You can also share your thoughts at one of our onsite consultations at our upcoming Celebrate Maroondah events

Council endorsed the Melbourne East Regional Sport and Recreation Strategy 2022-2032 in December 2022. This updated strategy seeks to build on the foundation provided by the original strategy while acknowledging new trends and issues across the Melbourne East region. These include predicted population growth, communities that are ageing and becoming more diverse, and increases in informal activities and demand for flexible ways to participate in sport and recreational activities.

Find out more

Maroondah City Council is working with 13 Melbourne Councils to develop a targeted education program that will increase the use of reusable nappies and reduce waste to landfill. The Best Practice Reusable Nappy Program - Implementation, led by Glen Eira City Council, has been awarded $128,000 from Sustainability Victoria, through the Victorian Government’s Circular Economy Councils Fund. It will offer families and expectant parents more support to learn about and use modern reusable options.

Chin Arts & Multicultural Festival - Free Community Event. Come and enjoy a Summer Festival down at Main Street Croydon and celebrate an afternoon of cultural performances from our Chin and Multicultural Community. There will be plenty to see, do and taste!

• wrestling

• cultural dances

• singing

• fashion show

• children's face painting

• craft tables

• traditional food stalls

Read More

In December 2021, Council consulted with the community and key stakeholders on how they use the existing Woodland Park in Croydon South and what they would like to see in the southern part of the Councilowned section of the former Croydon South Primary School land.

From the feedback provided, a draft enhancement plan has been developed and includes:

• enhancement and preservation of the environmental values

• improved connections for walkers

• enhanced play and gathering spaces.

Mayor of Maroondah, Councillor Rob Steane, encouraged residents to view the draft enhancement plan and invited them to share their feedback.

“The draft enhancement plan aims to ensure Woodland Park continues to

Volunteers in Maroondah are invited to take part in our two-day Mental Health First-Aid training.

Across two days, Wednesday 22 March and Wednesday 29 March, Council is offering free Mental Health First Aid training to Maroondah volunteers 18 years and older who are interested in gaining their Mental Health First Aid accreditation.

The aim of the training is to build up a participant’s knowledge of mental health first aid to help them identify mental illness and further support the people they care for in their service.

The two-day workshop will provide participants with:

• skills in how to recognise the signs and symptoms of mental health conditions and possible causes or risk factors

meet the needs of the community, so we are calling on those who use the Council-owned space to share their thoughts and help shape its future,” Cr

• how to give appropriate initial help and support to someone experiencing a mental health condition.

Anyone can learn Mental Health First Aid regardless of prior experience or training. Mental health first aid is the help provided to a person who is developing a mental illness, or in a mental health-related crisis, until appropriate professional treatment is received or the crisis resolves.

This event has sold out however please click on the link below to join our wait list.

Book online

Participants who complete the training will receive a 3-year Mental Health First Aid certificate from MHFA Australia.

Council is proud to be recognised as a Mental Health First Aid Champion Community with Mental health First Aid Australia.

For further information on the training, please contact Fiona Burridge, Be Kind Facilitator at bekind@maroondah.vic. gov.au or phone 1300 88 22 33.

• Wednesday, 22 March 2023 - 9.30am to 4.00pm

• Wednesday, 29 March 2023 - 9.30am to 4.00pm

Learn about reusable options for people who menstruate.

This workshop suits those who want zero-waste periods but are unsure how to take the next step.

The presentation will comprehensively cover:

• washable cloth pads

• menstrual discs and cups

• absorbent period underwear,

• how to wash and care for each product and;

• which reusable product may suit your needs

• This session is LGBTIQA+ inclusive, with no gendered language used.

Find out more

Join the Team Challenge Relay 2023 and "Carry the Baton for Disadvantaged Kids." Join the Team Challenge Relay 2023 and "Carry the Baton for Disadvantaged Kids."

Please join us in raising money to help socio-economically disadvantaged children participate in team sport across Melbourne.

The Team Challenge Relay 2023 is a virtual, fun, team-building event. You choose your own baton, location, activity, distance and date between 25 March and 2 April 2023.

Find out more