Are

our next Copywriter?

Are you our next Bookkeeper?

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

Every second Sunday of May, hearts around the world beat in unison to celebrate one of the most cherished relationships in human existence: the bond between a mother and her children. Mother’s Day, a day dedicated to honouring the women who gave us life, love, and endless support, serves as a poignant reminder of the invaluable role mothers play in shaping our lives.

In every culture, in every corner of the globe, the essence of motherhood is celebrated with great fervor. From the quiet moments of tenderness shared between a mother and her newborn to the enduring love and wisdom passed down through generations, the influence of mothers knows no bounds.

Motherhood is a journey marked by selflessness, sacrifice, and unwavering devotion. From the moment of conception, mothers embark on a remarkable voyage, nurturing life within them and embracing the profound responsibility of shaping the future. Through sleepless nights and tender lullabies, through scraped knees and broken hearts, mothers stand as the steadfast guardians of their children's dreams and aspirations.

Yet, the beauty of Mother’s Day lies not only in celebrating biological mothers but also in honouring all women who embody the spirit of maternal love. Whether it's a grandmother, an

aunt, a foster parent, or a mentor, these remarkable women leave an indelible mark on our lives, guiding us with their wisdom and showering us with their unconditional love.

As we celebrate Mother’s Day, let us take a moment to reflect on the countless ways mothers enrich our lives. Let us cherish the memories of laughter shared and tears shed, the lessons learned, and the dreams realised under their loving guidance. Let us express our gratitude not just through gifts and gestures but through acts of kindness, empathy, and understanding that honour the essence of motherhood.

In a world that often moves at breakneck speed, Mother’s Day serves as a gentle reminder to pause, to reflect, and to express our deepest appreciation for the women who have shaped us into the

individuals we are today. Whether it’s a simple, heartfelt "thank you" or a loving embrace, let us seize this opportunity to celebrate the pillars of love in our lives and to honour the boundless spirit of motherhood.

This Mother’s Day, as we gather with loved ones to celebrate the women who have touched our lives in countless ways, let us remember that the truest measure of a mother's love lies not in grand gestures or extravagant gifts but in the quiet moments of tenderness, the unspoken words of encouragement, and the eternal bond that binds us together, heart to heart, soul to soul.

So, here's to the mothers—the unsung heroes whose love knows no bounds, whose strength knows no limits, and whose legacy will endure for generations to come. Havppy Mother’s Day!

They say there are two things guaranteed in life – death and taxes. GST, or Goods and Services Tax, is a 10% tax added onto most products and services sold in Australia. It is the consumer who pays it, but every business that is registered for GST acts as the go-between, passing the tax from the consumer to the ATO.

As a small business, how do you know if you need to be registered for GST, and what does that mean? The first answer is relatively simple – when your business revenue is $75,000 or more each year, or you anticipate your revenue exceeding this amount, you must register for GST. If your revenue is less than $75,000 then you can choose whether you want to register for GST. Keep an eye on your revenue throughout the year though as once you hit that $75,000 revenue, you

Hey everyone,

will have just 21 days to register. A chat with your accountant or bookkeeper can help with this decision. A not-forprofit organisation has a threshold of $150,000 before they need to apply for GST, and a taxi/rideshare business must register regardless of their turnover.

As a GST-registered business, you must add the 10% GST onto every invoice you produce. Keep in mind though that not everything is subject to GST such as fresh food and rental income. There are also specific requirements when producing invoices depending on the amount of the invoice. I’ll cover this in a future edition.

When a client or customer pays for their goods or services, it is good practice to have a separate bank account to store the GST component. This is so that when it is time to pay the GST to the ATO, you already have it and do not need to scrounge around looking for those funds.

Keep in mind, this money is not yours

I'm thrilled to announce that I have the pleasure of assisting with judging the submissions from the 2024 Australian Wealth Management Awards finalists.

From what I’ve seen, the past year has been filled with many exemplary achievements, demonstrating the impressive abilities of individuals and businesses committed to the growth of the mortgage business industry in Australia.

All of the dedication and hard work over the past year will culminate in a huge night of celebration on 8 May at The Star, Sydney.

Visit the website at http://tinyurl.com/h68342re to learn more about the awards and to secure your tickets before they sell out!

I hope to see you there on the night.

anyway so you should not consider it as revenue and spend it in your business.

Each time your business buys something or uses a service, you will also be paying GST to that other business. It is important that you receive a GST invoice so you can claim the GST back. This is called a GST credit, or input tax credit.

Every three months, you are required to complete a BAS, Business Activity Statement, to determine how much GST you need to pay to the ATO. The BAS will calculate how much GST you paid to other businesses and how much GST your clients paid to you. The difference determines how much GST you owe the ATO, or whether the ATO owes you. If you are using accounting software such as Xero, you could do this yourself, otherwise you will need to use a registered BAS Agent.

Image - https://www.xero.com/au/ guides/gst-and-bas/what-is-gst/

1. Concessional contribution cap$30,000, up from $27,500 in the 2023-2024 financial year.

Concessional contributions include superannuation contributions made by your employer, contributions salary sacrificed by you as well as contributions you make post tax that you then claim as a deduction in your tax return.

Should you exceed this amount, the excess will be treated as assessable income and taxed at your marginal tax rate. However, an offset of 15% will be given to account for the 15% tax taken when the Super fund received the excess amount.

There are additional consequences to consider if you contribute more than the allowed cap.

• There is an excess concessional contribution charge on the excess amount to offset any timing advantage gained by the tax deduction.

• You can choose to leave the money in your super fund or transfer it back out.

• If you choose to take it back out it will be treated as a non-concessional contribution which means, there will be tax owing on it. You may also trigger the application of the bring forward of non-concessional contributions.

• If you choose to leave it in your super fund, 85% of it will be paid to the ATO to cover the tax liability and excess concessional contribution charge.

Once all charges have been paid, any remaining will be paid back to the member.

2. Non-concessional contribution cap - $120,000, up from $110,000 in the 20232024 financial year.

Non-concessional contributions are superannuation contributions where a tax deduction is not or cannot be claimed.

You need to be eligible to make nonconcessional contributions.

• You must be under 75years of age

• Your superannuation balance immediately before the financial year in which the contribution is made must be less than the general transfer balance cap. In the 20242025 financial year this cap is $1,900,000.

There are certain contributions however that aren’t included in the non-concessional category. These include downsizer contributions, CGT contributions, personal injury contributions and government cocontributions.

Should you exceed the cap, the excess amount will be taxed at 47%. To avoid the 47% tax liability, you can:

The first method is to apply the “bring forward” of non-concessional contributions. See below for more detail on this.

Withdraw the excess amount plus an additional 85% of the associated earnings. The 85% associated earnings needs to be included in your assessable income. The associated earnings are determined by a statutory rate of return. For the 2023-2024 financial year, this rate is 11.19%.

3. Bring forward (non-concessional contribution) cap - $360,000, up from $330,000 in the 2023-2024 financial year.

The “Bring Forward” allows you to make up to three years’ worth of non-concessional contributions in advance. Eligibility for this is includes:

• You are under 75years of age

• Your super balance is less than the general transfer balance cap - $1,900,000 for the 2024-2025 financial year

4. Transfer balance cap - $1,900,000, no change from the 2023-2024 financial year.

The transfer balance cap has two functions:

• Limit the amount of non-concessional contributions you can make to your super fund

• Limit the amount of superannuation that can be transferred to earnings tax exempt (retirement) phase.

5. CGT cap amount - $1,780,000, up from $1,705,000 in the 2023-2024 financial year. If you make a small business capital gain and take advantage of the 15year concession, you can make a nonconcessional superannuation contribution for that amount without affecting your non-concessional cap. Instead, this amount will count towards your CGT cap which is a lifetime cap rather than an annual cap.

This contribution is not reliant on your super balance being less than $1,900,000.

This means that if your CGT contribution will cause your super balance to go over the $1.9m balance, this will affect your ability to make non-concessional super contributions.

Additionally, if you have previously contributed up to the CGT cap in a previous year, you can make further cgt contributions in subsequent years up to

the increase in value each year. For example, if you have made contributions of $1,705,000 by the end of the 2024 financial year, you can then make a further contribution of $75,000 in the 2025 financial year.

6. Division 293 tax threshold - $250,000, no change from the 2023-2024 financial year.

If your Adjusted Taxable Income (ATI) exceeds $250,000 you will be subject to an additional 15% tax on either:

• The amount of the concessional contribution that causes your Taxable Income (TI) to exceed $250,000 OR

• The amount your Adjusted Taxable Income (ATI) exceeds $250,000, whichever is the lesser amount.

The ATI is the sum of you Taxable Income (TI) plus reportable fringe benefits plus reportable superannuation contributions plus total net investment losses.

7. Low-rate cap amount - $235,000, up from $230,000 in the 2023-2024 financial year. This is a cap on the amount of taxable components (taxed and untaxed elements) of a superannuation lump sum payment which can receive:

• A nil rate rather than a 15 per cent (taxed elements) or

• A lower rate of 15 per cent rather than the 20 per cent rate (untaxed elements) This only applies to

superannuation lump sum payments made to a member who has attained their preservation age and is less than age 60.

8. Preservation age and pension drawdown rates

There are no changes to either the preservation age or to the age-related pension drawdown rates.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

This information is of a general nature only. It does not take into account your particular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies,graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations. Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document. This information contained does not constitute legal or tax advice.

The ATO has advised that it will acquire account identification and transaction data from crypto designated service providers for the 2023-24 financial year through to the 2025-26 financial year (inclusive).

The data items will include:

a) Client identification details (names, addresses, date of birth, phone numbers, social media account and email addresses); and,

b) transaction details (bank account details, wallet addresses, transaction dates, transaction time, transaction type, deposits, withdrawals, transaction quantities and coin type).

The ATO says the data will be acquired and matched to ATO systems to identify and treat clients who failed to report a disposal of crypto assets in their income tax return.

As a business owner and employer, it is your responsibility to ensure the health and safety of your employees within your workplace. This includes providing your team with a safe work environment and protection from hazards. You can achieve this by understanding your obligations under the Occupational Health and Safety (OHS) laws and by complying with them.

Victoria's construction industry is being urged to check fall prevention measures after a worker died and several others were injured in a recent spate of serious incidents.

WorkSafe is investigating the death of a 56-year-old worker after an incident at a residential construction site in Doncaster East on Tuesday 26th March. It is understood the worker was pouring concrete when he fell more than two metres and sustained lifethreatening head injuries about 4:30pm. The man died in hospital on Thursday.

The death is the 11th confirmed workplace fatality for 2024. There were 18 workrelated deaths at the same time last year.

WorkSafe responded to a serious fall on a building site in each of the first three days of last week – making it four such incidents in nine days, and six in the previous three weeks.

• A 28-year-old worker suffered serious spinal and head injuries on 7 March, after falling 3.7 metres from a ladder at a construction site in Carrum Downs.

• A day later, a 32-year-old working from first storey floor joists fell approximately three metres onto a concrete slab in Glen Waverley, sustaining head and shoulder injuries.

• A 31-year-old worker was seriously injured after a three metre fall while working from roof trusses at a building site in Brunswick East on 18 March.

• On 25 March, a 27-year-old carpenter was taken to hospital after falling 3.1 metres when a ladder slid out from under him at a construction site in Dromana.

• A 53-year-old worker suffered back and pelvic injuries after falling from the second storey of a house under construction in Portarlington on 27 March.

WorkSafe Executive Director Health and Safety Narelle Beer said it was frustrating because falls from height were preventable, yet remained a top cause of workplace harm. "A fall can happen in just seconds but the consequences can last a lifetime, including devastating injuries and loss of life," Dr Beer said. "It might be easy to think that a tragic incident will never happen on your site, but if safety is not the top priority every day then the chances are high that it will."

Tragically, nine workers died in Victoria last year as a result of a fall from height, including four in the construction industry. More than 400 claims were also accepted from construction workers injured in a fall from height in 2023. Of those injured, 160 fell from ladders, 46 from steps and stairways, 31 from buildings or structures, 27 from scaffolding, and 13 from openings in floors, walls or ceilings.

Dr Beer said WorkSafe inspectors had conducted more than 3,700 visits to construction sites so far this year, issuing more than 1,100 notices. "We have a dedicated team of inspectors visiting sites across the state and there is zero tolerance for employers who fail to take the well-known risks of falls seriously," she said.

WorkSafe completed 39 successful prosecutions relating to the risk of a fall from height in 2023, with the courts imposing fines totalling more than $1.9 million.

To prevent falls from height WorkSafe Victoria indicated employers should implement the highest possible measures from the five levels in the hierarchy of controls:

• Level 1 Eliminate the risk by, where practicable, doing all or some of the work on the ground or from a solid construction.

• Level 2 Use a passive fall prevention device such as scaffolds, perimeter screens, guardrails, safety mesh or elevating work platforms.

• Level 3 Use a positioning system, such as a travel-restraint system, to ensure employees work within a safe area.

• Level 4 Use a fall arrest system, such as a harness, catch platform or safety nets, to limit the risk of injuries in the event of a fall

• Level 5 Use a fixed or portable ladder, or implement administrative controls.

As a business owner, are you confident that you do not have shortfalls in your efforts to keep your workers healthy and safe? Do you have an understanding of your responsibility to ensure the safety of your employees? Are you confident that you can provide a safe work environment and comply with OHS laws? Do you believe that you are effective in carrying out risk assessments, employee consultation and providing training? Do you regularly review these measures to ensure that they remain fit for purpose and keep you and your employees healthy and safe? Why not make a New Year’s resolution to get your house in order?

At Beaumont Advisory we assist business owners clarify what they currently have in place, as well as where there are shortfalls. We then assist in developing effective systems and documentation, working with businesses to ensure effective implementation. Checks are put in place to monitor ongoing effectiveness, to ensure that going forward, they are sound and comply with the Act, and most importantly keep you and your employees informed, and healthy and safe. Please feel free to contact me, Mark Felton, at Beaumont Advisory on 0411 951 372 or mfelton@ beaumontlawyers.com.au for an obligation and cost-free initial discussion.

Croydon Conservation Society has its origins in tree preservation. While this is still one of our highest priorities, we have affiliations with a number of other groups. One of these, is the group called Boomerang Alliance which began in 2003, the idea being that containers of all descriptions should be able to be boomeranged back to their place of origin. https://www.boomerangalliance.org. au/national_soft_plastics_summit_ producers_and_retailers_urged_to_ fastrack_solution

Croydon conservation society has been lobbying with Boomerang Alliance to get a container deposit scheme up and running, often being listened to, but with no foreseeable action. So, after 20 years of this lobbying, we are very pleased to see the roll out of the new refunding opportunities.

At last in Victoria, we have begun to see the first few return vending machines. The State has been divided up into 3 areas, each area is run by a different provider, lacking consistency. In the East the area is serviced by Return It, while the west is under Cleanaway and the north by Visy. Consistency would have been great, but Government contracts work in mysterious ways.

The concept is for people to collect the plastic drink bottles and aluminium cans, then when they have enough to make the trip worthwhile, they can return them to places like Mitre 10 on Mountain Highway who have a working recycling machine.

If left to blow around by the wind from parkland or in gutters, empty containers are caught up by storm water and end up choking our creeks.

First, they disappear down roadside drains, then they end up in creeks. This image was captured locally, from a litter trap in Dandenong Creek.

Some return venues are not quite where you would expect to find them. Currently the refund is done over the counter at many of these sites.Manufacture of these machines is underway for more locations in our area. Current locations include:

• K&B Plus Fresh Market Croydon 126 Main Street, Croydon

• Inflatable World Ringwood (Ringwood Indoor Sports Centre) 160 New Street, Ringwood

• Eastwood Milk Bar Ringwood East 83 Bedford Road, Ringwood East

• Chinland Asian Grocery Ringwood East 52 Railway Avenue,Ringwood East

• Dorset Convenient Store & Gifts Cart 500-502 Dorset Road, Croydon South

Some people want to redeem this cash for themselves and others are doing it collectively as Scouts Australia used to many years ago by collecting and stacking beer bottles for return. Whatever your reason, the most important thing is to remove this floatable litter from getting into our waterways and potentially being washed out to sea.

If you already recycle at home make sure that your milk bottle lids are separate. If they're taken off, cut through the ring that is left. This is particularly important as this can become snagged around a limb of a bird or other creature causing deformity.

When caught up like this, the creature cannot eat and will die. A simple snip through with scissors prevents this outcome.

Polystyrene, which is a problem product, is now able to be returned locally to this location. It must be free of sticky tape, packing tape, labels, texta, glue or food. The bin for polystyrene is at 7 Bessemer Road, Bayswater North. Domestic quantities. Open 8.30 am to 5 pm Monday through Friday.

As users of materials that are dangerous to the environment and our ecology it is absolutely our responsibility to ensure your recycling disposal is appropriate. Once a good habit is started, it is easy to continue and we all win the war against floatable plastic.

Liz Sanzaro

Liz Sanzaro

The insurance market is historically cyclical, moving through both hard and soft markets. A soft market is generally characterised by lower premiums, high limits and readily available cover. In a hard market, insurance premiums increase and insurer capacity will generally decrease. This can be caused by a number of factors:

• falling investment returns / low interest rates

• increases in frequency or severity of losses

• reduced capacity

• cost of reinsurance

• regulatory intervention

In recent years while interest rates were low, it meant that insurers could no longer rely on their investment returns to bolster unprofitable results. Insurers focussed on underwriting profitability, which meant raising premiums, tightening underwriting guidelines and being more selective about risk they were prepared to insure.

Rising interest returns for insurers and their investors, and falling loss frequency alone have not been enough to soften the market though as we have seen recently. The rapid inflationary pressure applied to claims costs has outstripped the savings created, and this has led to further increases. For example in regard to property damage losses, interest rates have now increased since 2020 by more than 3.5%, however the cost of materials like corrugated roof sheeting, plasterboard and plywood bracing have all increased in excess of 30% which is putting upward pressure on claims costs, and in turn insurance premiums.

Adding to this is the cost of the wellintentioned compliance regime implemented in the wake of the Wood Royal Commission. Insurers and Underwriting Agencies are spending more time, and more money on meeting recently imposer regulatory changes, and this has added to the staff costs which ultimately get passed on to the consumer.

A shortage of qualified applicants in the insurance industry has led to claims bottlenecks and this is adding costs due to the delays. In an effort to

shorten waiting times and to circumvent trade shortages there has been a shift towards cash settlements. Whereas the insurer may in the past have engaged the trades and supervised the works it's now harder to action, so the easier but more expensive option of cash settlements is taken. Big data has also had an impact Big data has also had an impact, as insurers can utilise more accurate flood mapping, and increase premium in a targeted way. This often means large jumps in specific areas, as opposed to a cost spreading approach. Reinsurance cost is now calculated using better long-term catastrophe models, so this additional future cost is factored in earlier. Rate adjustments are largely being driven by reinsurance markets, who are the insurers who provide the underlying capacity insurers need in order to provide their offerings to the public and businesses alike.

In relation to financial lines like Professional Indemnity, insurance claims are increasing because of social inflation, which is the societal trend towards increased litigation, broader contract terms, plaintiff-friendly legal decisions and larger jury awards (Insurance Journal, 4 December 2019). An example of this is the increased number of Securities Class Actions (think

Centro Group, Commonwealth Bank, Takata airbags) seen over recent years.

In fact in the 12 months to 31 March 2020 underwriting profitability decreased by almost 50% for most major classes of insurance, and that was before the impact of COVID-19 emerged over the following 12 months (KPMG General Insurance Insights, May 2020).

So where is the good news? The cycle always returns to a soft market eventually, and there is no reason to think that when inflation is under control, and financial conditions improve, that we will not see a return to the buyersmarket within the next few years.

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives,needs and financial situation).

Craig Anderson

GENERAL INSURANCE

Small Business

Insurance Brokers www. heightsafetyinsurancebrokers.com.au 0418 300 096

For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives, needs and financial situation).

By Ethan Strybosch

By Ethan Strybosch

In today's fast-paced digital world, staying ahead of the competition is crucial for any business. One innovative tool that can give you the edge you need is an AI chatbot on your website. Here are three compelling reasons why you should consider adding this technology to your digital arsenal.

1. Increase Productivity: Businesses that utilize an AI chatbot experience a significant increase in productivity. According to recent studies, companies with an AI chatbot are able to spend 14% more time solving complex, money-making problems. This means that by incorporating this technology into your website, you can free up

more of your staff's time to focus on critical tasks, ultimately leading to increased efficiency and profitability.

2. Reduce Inquiries, Increase Efficiency: An AI chatbot can significantly reduce the number of meaningless inquiries your business receives by up to 70%. This reduction in trivial queries allows you and your team to spend more time on highvalue tasks,ultimately leading to improved productivity and customer satisfaction.

3. Generate High-Quality Leads: Implementing an AI chatbot can also lead to an immediate increase in high-quality leads for your business. Studies show that 55% of companies using chatbots for marketing purposes experience a boost in the number of highquality leads. Additionally, businesses with AI chatbots are perceived as more

legitimate and established, which can further enhance your brand's credibility and attract potential customers.

In conclusion, incorporating an AI chatbot into your website can provide numerous benefits for your business, including increased productivity, efficiency, and lead generation. By leveraging this innovative technology, you can stay ahead of the competition and take your business to new heights of success.

Pennant might be over... but there’s still a lot

We might be at the end of the bowls season - but there is a lot happening down at Ringwood Bowls Club. We’re working on a new and improved newsletter, but here’s an interim version to keep you up to date with what’s going on!

• Wednesday

• Saturday

• Ash Webber is running coaching for members, starting Tuesday 7th May, 4-6pm.

• 4th May, 10am 2024/25 Pennant Season

Join us to celebrate an amazing season of bowls at our upcoming Presentation Night.

• 6pm - Friday 10th May

• Pizza - $ 10

• Lots of raffle prizes

$200 members draw up for grabs! (3 numbers to be drawn)

Put your name down on the list at the club or email clubsec@ringwoodbowls.com.au

It’s time to start thinking about the next bowls season. Sheets are up at the club for you to put your name down if you are going to play Tuesday or Saturday pennant next season! We want to have as many Eagles playing pennant as possible!!!

A very satisfactory turnout of eligible voters has resulted in the election of 2 x successful candidates for the position of Saturday Pennant Selectors who will assume office at the 2024 AGM.

Congratulations to Darrell Maguire and Mike Henderson

Thank you to all who nominated, participated in the voting process and to the returning officers, Brian Hackkett and Peter Gooey for their efforts.

What a fantastic day for the William Matthews Funerals and Bendigo Bank 2 Bowl Triples Over 60s tournament.

With testing weather in the days leading up to the event, everything went seamlessly and feedback on the day was amazing from all entrants.

Thanks to our chef Rod and the ladies in the kitchen for an amazing chicken and salad lunch, Jack McLean in the bar, Benjamin Thomason and Tony Buckingham for all of their hard work organising an amazing successful event.

Well done to the Boronia team that won the day!

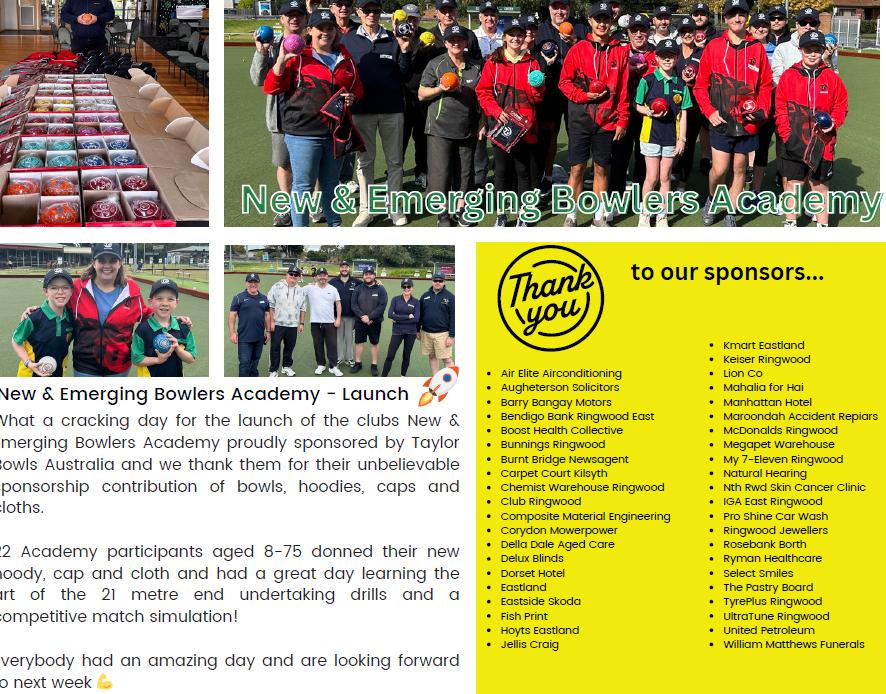

What a cracking day for the launch of the clubs New & Emerging Bowlers Academy proudly sponsored by Taylor Bowls Australia and we thank them for their unbelievable sponsorship contribution of bowls, hoodies, caps and cloths.

22 Academy participants aged 8-75 donned their new hoody, cap and cloth and had a great day learning the art of the 21 metre end undertaking drills and a competitive match simulation!

Everybody had an amazing day and are looking forward to next week Coach Funky

• Air Elite Airconditioning

• Augheterson Solicitors

• Barry Bangay Motors

• Bendigo Bank Ringwood East

• Boost Health Collective

• Bunnings Ringwood

• Burnt Bridge Newsagent

• Carpet Court Kilsyth

• Chemist Warehouse Ringwood

• Club Ringwood

• Composite Material Engineering

• Corydon Mowerpower

• Della Dale Aged Care

• Delux Blinds

• Dorset Hotel

• Eastland

• Eastside Skoda

• Fish Print

• Hoyts Eastland

• Jellis Craig

• Kmart Eastland

• Keiser Ringwood

• Lion Co • Mahalia for Hai

• Manhattan Hotel

• Maroondah Accident Repiars

• McDonalds Ringwood

• Megapet Warehouse

• My 7-Eleven Ringwood

• Natural Hearing

• Nth Rwd Skin Cancer Clinic

• IGA East Ringwood

• Pro Shine Car Wash

• Ringwood Jewellers

• Rosebank Borth

• Ryman Healthcare

• Select Smiles

• The Pastry Board

• TyrePlus Ringwood

• UltraTune Ringwood

• United Petroleum

• William Matthews Funerals

Local Warranwood Primary School teacher, Andrew Tonkin, is getting on his bike this July to ride 500km across Thailand to support charity Hands Across The Water.

The ride will see Andrew and other riders following the Mekong River before traversing areas not often seen by other foreigners.

The devastating effect of the 2004 Boxing Day Tsunami on the children of Thailand led to the founding of Hands Across the Water by Peter Baines. Since then, thanks to fundraisers like Andrew, over 350 children have received food, education, and a loving home after losing parents or being abandoned.

Peter Baines OAM was an NSW Police forensic investigator for 22 years and led the Australian and International teams following the tsunami. Peter was deployed into Thailand for several months leading the teams in the identification of the 5395 bodies that were recovered.

On his last rotation into Thailand he met a group of children who had all lost their parents. He then made a commitment to raise funds to contribute to the building of a home for them. That was the start of Hands Across the Water, the charity. 18 years later and there are now seven orphanages helping to take care of these children and give them everything they need to thrive, including lifesaving medication.

“Not only does the support change lives, but it saves lives. Due to a lack of life saving medicine, children were dying from HIV related illnesses. By making a long-term commitment we stopped the children dying” says Baines.

For Andrew, it is the physical and mental challenge that he is looking forward to. Being a casual rider before this event, he understands he will have to face and conquer the pain barrier that will inevitably come from pushing his body to cover the vast distances each day.

Add to that the extreme humidity that Thailand can face at that time of year with the start of the monsoon season and Andrew has his work cut out for him.

All 50 riders in the team each have a target of $5,000 to raise. If you would like to join many of the children in his classroom by donating to support Andrew, simply click here https://www.handsacrossthewater. org.au/fundraisers/andrewtonkin/red23ride-to-provide-2024

To find out more about Hands Across The Water, click here. https://www.handsacrossthewater. org.au/event/red23-ride-to-provide-2024

Polycystic Ovary Syndrome (PCOS) is a complex endocrine disorder caused by androgen excess. Androgens are male hormones which can be characterised by significant facial hair and seen in hormonal blood tests. Because the disease can present very differently amongst women, there can be a lot of confusion about what the best treatment is to bring these high androgen levels back within their normal range. The disease is characterised by hormonal imbalance, irregular menstruation (often months without a cycle), and sometimes the presence of small cysts on the ovaries. According to Dr. Lara Briden, there are four types of PCOS: insulin-resistant PCOS, inflammatory PCOS, post-pill PCOS, and adrenal PCOS.

Insulin resistance, leading to hyperinsulinemia can cause the increase in androgen production by the ovaries. Excess androgens, such as testosterone, can disrupt normal ovarian function, leading to irregular ovulation. If this is the cause of your PCOS, the first step is to regulate your insulin levels. This is best done with a combination of diet, herbal medicine and nutritional products.

Long term inflammation caused by allergies or autoimmune disease can stimulate the ovaries to increase cause, it may take longer to get your hormones under control, and the process will look different depending on the symptoms. As a naturopath, I spend time at every appointment to look at and treat the cause of the problem well as the current symptoms. So, in this case, treatment would also involve the immune system, and possibly removing allergens.

If you have recently come off the pill (or other hormonal contraception), you can have a temporary increase in androgens, but this should stabilise and your period return given time. If not, or if you have significant acne, herbal medicine is one of the best ways to regulate your hormones. There are so many herbs that effect oestrogen and androgen levels, and if the problem was caused by the birth control pill, your hormones can be brought under control in a relatively short time.

Adrenal PCOS is less common and largely genetic. This is best treated with herbal medicine and homeopathy to target the adrenal glands.

For those that do have PCOS and are planning to conceive, allow plenty of time to bring your hormone levels under control. Depending on how long you

have had an absent period, and the extent of other disease states, I would aim to have an established cycle at least 6 months prior to conception. If you do have an absent or very irregular period, regardless of the cause, I have seen great results in my clinic in not only returning the cycle back to normal, but also in treating period pain, hormonal acne,and hormonal mood dysregulation.

Kathryn Messenger

BHSc (Naturopathy)

kathryn@wholenaturopathy.com.au Suite 1 53/1880 Ferntree Gully Rd Mountain Gate Shopping Centre Ferntree Gully, Victoria

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

By Erryn Langley

By Erryn Langley

The tax-free portion of a genuine redundancy or approved early retirement scheme for 2024/25 is $12,524 plus $6,264 for every completed year of service.

The superannuation guarantee contribution rate is legislated to increase to 11.5% from 1 July 2024.

The maximum SG contributions base will be $65,070 per quarter or $260,280 per annum. Employers are not required to pay SG contributions on amounts over this threshold.

The maximum Government co-contribution amount of $500 is available where income is less than $45,400. The higher threshold above which the co-contribution will not be paid is $60,400.

The Low Income Superannuation Tax Offset income threshold is $37,000 and is not indexed.

When a superannuation death benefit is paid as a death benefit income stream, how is the minimum pension calculation performed?

As we know, there are minimum pension standards that apply to retirement income streams such as account-based pensions. These minimum payments are based on the age of the client and the account balance at 1 July each year or at the commencement of the pension.

However, when a death benefit account-based pension commences, the minimum pension payments that must be received by the beneficiary (usually the surviving spouse) will depend on whether the account-based pension automatically reverted to the beneficiary or not.

The following table provides a comparison of the minimum payment requirements in the financial year the death benefit pension started based on whether the pension automatically reverted to the beneficiary or not.

Scenario new death benefit pension is commenced by the beneficiary (eg BDBN to spouse)

The deceased’s ABP automatically reverts to the beneficiary Minimum incomebeneficiary

As a new ABP has started in the financial year, the minimum income is calculated based on the purchase price and age of the beneficiary at commencement.

The minimum payment is prorated based on the number of days remaining in the year.

As the pension payments from the deceased’s ABP continue to the beneficiary without a commutation, the minimum payment amount as calculated on the 1 July for the deceased continues to apply until the end of the financial year.

In the year of death (only), the beneficiaries age and the account balance is irrelevant for minimum payment requirements.

Pro rata rules to not apply in this situation.

1 July 2023 to 22 September 2023

Where the deceased owned an ABP at death, the requirement to take a pro rata minimum payment that normally applies with a full commutation of an ABP does not apply.

An exemption to the pro rata rules exists where the commutation occurs as a result of the pensioner’s death.

There is also no minimum payment requirement for the period between death and starting the new ABP in the beneficiaries name

The full year’s minimum drawdown will be met from:

- The pension payments received by the deceased (if any), plus

- The pension payments received by the reversionary beneficiary.

23 September 2023 to 30 November 2023

31 November 2023 to 30 June 2024

$0 Alex had not yet received a pension payment in the year before his death and there is no requirement to pay the minimum when the full commutation was made due to his death.

$0 No minimum payable as the death benefit pension had not yet commenced.

$14,290 Pro rata minimum payable based on 212 days remaining in the year, Sarah’s age and the starting balance of $615,000.

Total income Fy 24: $14,290

What would happen in the same scenario if Alex’s account-based pension automatically reverted to Sarah under a reversionary nomination?

As the pension already existed on the 1 July 2023 when Alex’s minimum pension payment was calculated as $30,000 and the account-based pension was not commuted at time of death, Sarah is required to receive the full minimum amount of $30,000 by the end of the financial year.

As Alex died before the first pension payment of the year was received, Sarah would have to receive $30,000 between 23 September 2023 and 30 June 2024.

Erryn Langley

1300 557 144 | erryn@findwealth.com.au www.findwealth.com.au

Alex (age 65) and Sarah (63) both have account-based pensions that were valued at $600,000 and $650,000 respectively on 1 July 2023. They have nominated each other as beneficiary under a non-lapsing binding death benefit nomination.

Alex has an annual minimum pension payment of $30,000 and Sarah’s minimum is $26,000. They have both elected to receive their pension payments quarterly with the first payment for the year due on 30 September 2023.

Alex dies on 22 September 2023 and therefore did not receive a pension payment before his death. Sarah ultimately decides to commence a new death benefit account-based pension with the proceeds from Alex’s super which is now valued at $615,000 on 31 November 2023.

In this financial year, how much income must be received from Alex’s account-based pension that is now in Sarah’s name?

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth. Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No.449221). Part of the CentrepointAlliance group https://www.centrepointalliance. com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

Pensioners and those on Veterans' entitlements will be enticed back into the workforce with an increase to their work bonus concession balance. This measure is being supplemented with an increase to the time limit for the suspension of pension entitlement from 12 weeks to 2 years. This means if a pensioner earns too much income over a period of time, their pension will be suspended instead of cancelled.

Effective from 1 January 2024, all pensioners over pension age and eligible Veterans now have a maximum work bonus balance limit of $11,800 up from $7,800 and all new age pension recipients have a maximum work bonus income balance of $4,000 (previously nil). Also effective from 1 July 2024, employment income nil rate will be doubled to 24 weeks (previously 12 weeks) for income support recipients.

The ATO has finalised guidance on whether an asset that is made up of a number of components (a composite item) is itself a depreciating asset, or whether one or more of its components are separate depreciating assets.

The Taxation Ruling TR 2024/1 provides the Commissioner’s view on identifying the relevant depreciating asset and hence its effective life and depreciation rate for the purposes of Div 40 of ITAA 1997.

Guiding principles have also been provided to help ascertain the level of “interest in the underlying asset” and apply the decline in value provisions for the purposes of s 40-35.

This Ruling does not address Div 43, which provides deductions for certain capital works expenditure.

The Labor government announced changes to personal tax rates that will provide a tax cut for every Australian taxpayer commencing from 1 July 2024.

Changing the original course of action, as announced by the previous Coalition government, the new tax changes aim to focus on the low and middle income earners and provide cost-of-living relief.

The Medicare levy low-income thresholds for 2023-24 have also been increased, reducing or eliminating the amount of Medicare levy paid by Australians on lower incomes.

The bills amending income tax rate thresholds, tax rates for individuals and Medicare levy low-income thresholds, have now received Parliamentary approval to become law.

Announced: 25-Oct-2022 Updated: 6-Feb-2024

Announcement(3-Oct-2023) Consultation period Released(31-Jan-2024)

Announcement(25-Jan-2024) Consultation(6-Feb-2024) Introduced(6-Feb-2024) Passed(27-Feb-2024)

Royal Assent(5-Mar-2024) Date of effect(1-Jul-2024)

In an initiative to promote women’s economic equality, the Labor government has announced plans to pay superannuation on paid parental leave (PPL) for government-funded payments from 1 July 2025.

If enacted, this measure will provide parents who access the PPL government scheme with super contributions paid into their nominated super account equivalent to 12% of their leave pay.

An expansion to Australia’s PPL is also currently before the Senate, which will give families an additional 6 weeks of PPL, increasing to 22 weeks from July 2024, 24 weeks from July 2025, and 26 weeks from July 2026.

This measure is currently in the announcement stage and requires parliamentary approval to become law.

Announced: 7-Mar-2024 Updated: 14-Mar-2024

The Commissioner of Taxation now has the power to allow companies to reduce their FBT compliance costs by utilising other corporate tax records.

This measure reduces the complexity of FBT compliance obligations as employers can rely on other substantiation documents to finalise FBT returns.

Employers may still choose to use approved forms such as employee declarations and the prescribed forms detailing the fringe benefits provided to employees and associates if they wish. In some instances, it may benefit an employer to continue using standard FBT measures.

The effective start date for the change will be 1 April 2024 (commencement date of the 2025 FBT year).

Announcement(9-Sep-2022)

Consultation(9-Sep-2022)

Introduced(23-Nov-2022)

Passed(21-Jun-2023)

Royal Assent(23-Jun-2023) Date of effect(1-Apr-2024)

Announced as part of the 2021-22 Federal budget, were the reforms to the reporting requirements for not-forprofit (NFP) oraganisations that would self-assess as income tax exempt.

From 2023-24 income year onwards, if an NFP has an active ABN number, it is required to lodge a NFP selfreview returm to access the income tax exemption.

The NFP self-review return may be lodged anytime between 1 July and 31 October 2024.

Charities registered with the ACNC are exempt from these new reporting requirements.

Announced: 12-Nov-2023

Updated: 8-Apr-2024

Individuals who receive an eligible lump sum payment in arrears after 1 July 2024 will not have to pay Medicare levy on that amount.

These payments are usually made to an individual for reasons such as compensation for previously underpaid wages.

If your client would be eligible for other offsets or rebates relating to arrears payments, and they otherwise would have a reduced Medicare levy, this exemption will be available for them.

The Treasury has released exposure draft legislation proposing amendments to the Medicare Levy Act 1986, which will commence in the quarter following the date the bill receives royal assent.

Announcement(9-May-2023)

Consultation(5-Apr-2024)

Introduced

Passed

Royal Assent

Date of effect

The Bill proposing to increase the instant asset write off threshold in Div 328 of ITAA 1997 has been passed by the Senate with amendments raising the threshold to $30,000 from the previously proposed $20,000.

Originally announced in the 2023 Federal Budget, the increased threshold applies from 1 July 2023, amendments made by the Senate also propose to increase the aggregated annual turnover eligibility from $10 million to $50 million, therefore also including medium sized businesses.

This proposed measure applies to the cost of eligible depreciating assets, second element costs and general small business pools.

Eligible assets must be first used or installed ready for use between 1 July 2023 and 30 June 2024, and the write-off applies on a per asset basis.

Announcement(9-May-2023)

Consultation(13-Sep-2023)

Introduced(13-Sep-2023)

Passed

Royal Assent

Date of effect

The Maroondah Business Excellence Awards (MBEA) recognise and celebrate business excellence in Maroondah.

The MBEA24 categories are:

• Manufacturing and Technology

• Construction, Trades and Related Supply Chain

• Retail and Hospitality

• Professional Services

• Innovation and Sustainability

• Education, Training, Health and Lifestyle

• Business of the Year (Chosen by the Judging Panel from the 6 category winners)

For eligibility criteria please visit the BizHub Maroondah website.

What's included

The Maroondah Business Excellence Awards celebrate the winners, however the program also enhances the journey towards excellence for all participants.

All entrants will receive:

• A free one-on-one business expert session with an experienced business management consultant who is the independent awards advisor.

• A tailored award entrant report highlighting business strengths, areas for suggested improvement, along with options for future development.

Additionally, the winner in each category will receive:

• Recognition as a leader in the Maroondah business community

• A Maroondah Business Excellence Awards 2024 trophy and certificate.

• Exclusive Maroondah Business Excellence Awards 2024 digital asset package

Take a guided tour and discover the interesting architectural and social history of Wyreena. The main building is 100 years old and has had three fascinating chapters: from family home to a convent and now a thriving Community Arts Centre.

Wyreena Community Arts Centre is a historical property in Croydon, featuring The Arts Lounge, The Conservatory Café, beautiful gardens and an interactive Playspace. Wyreena offers a wide range

of arts-based programs and workshops for all ages and abilities and is home to various community groups and creative businesses.

The main building was originally a family home, it was then sold to the Catholic Church in the 1950’s and was a convent and commercial college. In the late 1970’s, Wyreena was saved from development by passionate community members and in 1978 became a Community Arts Centre.

Two of the buildings on the property were built in the 1920’s and 1930’s, the main building was designed by Hudson and Wardrop who were the architects for the Shrine of Remembrance.

• Date: Tuesday 7 May

• Time: 1.30pm to 2.15pm

• Venue: Wyreena Community Arts Centre, 13-23 Hull Road, Croydon 3136

• Cost: $5. You will receive a voucher for a free hot drink from the Conservatory Cafe.

• Bookings are essential.

For more tour dates please visit Wyreena history and tours.

Further information

For further information contact Maroondah City Council on 1300 88 22 33.

When Tuesday, 07 May 2024 | 01:30 PM - 02:15 PM

Location

Wyreena Community Arts Centre, 1323 Hull Road, Croydon, 3136, View map Maroondah Council

Council’s recycling events are an easy way for Maroondah residents to recycle their e-waste for free.

Our e-waste events have grown and we are now accepting clean polystyrene, cardboard, textiles, vapes and e-cigarettes.

Council’s e-waste recycling events are an easy way for Maroondah residents to recycle their e-waste for free. See all acceptable items.

• Date: Saturday 4 May 2024

• Time: 8am to 2pm

• Where: Maroondah Council Operations Centre, 24-28 Lincoln Road, Croydon

• Bookings essential. Book one timeslot only. Each session goes for 1 hour and you can arrive any time up to 5 minutes before the end of your booked session.

online

At the event, follow the direction of the staff, stay in your car and a staff member will take your items straight from your car. While staff are emptying your vehicle, please put your car in park.

Acceptable items:

• Any item with a battery or cord, except for whitegoods or items that two people cannot pick up.

• Fluorescent light globes, including compact and tubes.

• Household batteries and car batteries. Gas bottles (up to 9kg).

• Clean packaging polystyrene (from small and large appliances e.g., polystyrene from big screen TV’s, dishwashers and oven packaging, free of any other material, such as sticky tape, soft plastics or labels).

• Cardboard - flattened.

• Clean clothing, bedlinen and shoes. Please keep shoes separate from clothing and bedlinen.

• Vapes/e-cigarettes - please keep vapes separate from other items and if leaking, place in a zip lock bag.

Please note items should be in residential quantities only.

What will we do with the items collected?

The e-waste is collected by The Activ Group who manually disassemble the e-waste, removing ferrous and nonferrous metals, precious metals and plastics. They also safely remove and dispose of any hazardous materials. Through the disassembly process, The Activ Group can recover up to 90 percent of recyclable materials, returning these back to the economic system and as such, playing a vital role in the circular economy.

Gas bottles

Suitable gas bottles are returned to the original supplier. Others

that are not suitable for reuse are recycled for the metal.

The polystyrene is collected by a local company Foamex, located in Bayswater North. It's extremely important that the polystyrene is clean and free of any contamination. The polystyrene is recycled by Foamex into a wide variety of products. Their specialty is sustainable building materials such as insulation for thermally efficient homes. Residents can also drop off polystyrene to the Foamex Bayswater North location or one of their other two locations at any time of the year.

Please visit the Foamex website before

Textiles will be collected by UPPAREL.

Did you know the average Australian purchases 27kgs of textiles per year and throws out 23kg? UPPAREL’s philosophy is how to turn the linear fashion economy into a circular one.

Everything is reused, repurposed, or recycled right here in Australia. UPPAREL ensure nothing is sent offshore or to landfill. Currently, approximately 65 percent of the items they receive are in new or fit-to-wear condition. These items are hand-sorted by their dedicated team and passed on to their charity partners like Save The Children, St Kilda Mums, Youth Projects, grassroots social enterprises and many more. The remaining 35 percent is either repurposed or transformed into new materials that are not only entirely recycled, but also circular in design.

Vapes and e-cigarettes will be sent to Envirostream under a newly developed Vape Recycling Pilot Program. Envirostream are using innovation to create new processing methods for lithium batteries, including those that power these portable devices. Their Australian-owned battery recycling facility in Victoria – which is fully enclosed and based on international best practice – was designed and built by the team at Envirostream.

North Ringwood Community House brings you lots of different courses to enjoy – wellbeing classes, arts and crafts, languages, special Classes

We have a wide range of fitness options you can enjoy without the gym intimidation! Swing by North Ringwood Community House crush those fitness goals together in this friendly environment!

At North Ringwood Community House you can enjoy our Bush Walking, Seated Yoga, Pilates, Zumba Gold, Jungle Body, Yoga, week – including evenings and weekends! All of our trainers are qualified and experienced, as well as patient and fun! So come and hello to a. friendly, laid-back atmosphere where you can work out at your own pace

At North Ringwood Community House we are all about supporting each other on our fitness journeys—join us for some fun and environment. Let's make fitness fun together—we are local to you, at 35-39 Tortice Drive in Ringwood North. Call us on 9876 3421

special interest, social groups, pre-accredited training and accredited certificate courses – let’s take a closer look at our Wellbeing

House and join our exercise classes! It's like working out with friends in your living room—relaxed, cozy, and totally welcoming. Let's

Qi Gong, Tai Chi, Laughter for Wellbeing, Meditation and Strong People Stay Young. We have classes running every day of the come hang out at our community house and get your sweat on in our super chill exercise classes! Say goodbye to the gym scene

and feel-good vibes! No need to worry about feeling out of place—here, it's all about being yourself in a welcoming, friendly

or visit our webpage at www.nrch.org.au We look forward to seeing you soon!

The Melbourne Highland Games& Celtic Festival has been around for more than half a century and, as the only traditional Scottish Highland games remaining in metropolitan Melbourne, we intend to be around for another 50 years.

The first Highland Games in Ringwood started from a desire to connect to Scottish culture, to bring people together and to celebrate Scots in Australia through staging a Highland Games in the tradition of the ancient Scottish Highland Games.

From the humble beginnings as the Ringwood Highland Games, this community event has survived many challenges and have now grown to be a vibrant diverse Celtic Festival celebrating our shared Celtic culture through music, dance, cuisine, athletics and great craic. To use a very Scottish expression this year’s event lived up to the promise of a “braw” event. The Games were opened with dignitaries including our Patron, The Right Honourable The Earl of Loudoun and our Ambassador, The Honourable Mr Ted Bailey AO.

The Games hosted the Victorian Pipe band Championships. The last time we were to host the Championships in 2020 it had to be cancelled, so we were very excited to host them again after such a long break and make them the biggest championships ever with 28 bands that competed from mainly Victoria.

This year the Games were again attended by even larger crowds than ever before. When you consider the calibre of the music, dancing, Games and vendors on offer this is not surprising. The 28 piper bands that came to the Games, were impressed with the support and venue, attests to that.

There were no heavy games staged at the Games for 17 years. Five years ago, with a lot of hard work, the Heavy Games has been re-instated and grows bigger each year to include a full program of Heavy Events that include men and women competitors. This year proved to be a brilliant lead up to our March 23rd, 2025 event which will, for the first time, be an international event with up to 30 athletes joining the Games from overseas. With guaranteed TV coverage in both Europe and the USA it will bring the world to the Games and our fair cities of Melbourne and Maroondah.

Included with the adult Heavy Games an adapted program for the children has become very popular as well. Instead of tossing the caber, the children get to toss the Welly Boot, as well as other competitions to draw their interest.

The diversity of our dance program is another aspect of our Games that has flourished over the past five years. We have a dozen different dance groups performing each year and this year was no exception.

A testament to the calibre of our dancers is that many have been invited to perform at other festivals all over the world.

All are always welcome at the Games as there is something for all ages at the festival. The range and extent of this event is such that all who attended were entertained all day, especially the children. With other exhibits including the ‘Heiland Coo’, and other roaming characters, not to forget the Roman Soldiers, all interacted with the children making this a fun and interesting day out for them and the whole family.

Whether it was the games, music, dancing, connecting to your clan, finding yummy food, Whiskey free sampling, sitting in the Irish Snug, or browsing the many vendors all with a reminder of Scotland, there was something there for everyone that made this a full day’s entertainment at the Melbourne Highland Games & Celtic Festival again and will be even bigger and better on 23rd March 2025. So mark the date in your calendar for next year, same place, same time 9am-5pm at Eastfield Park in Eastfield Rd, Croydon.

Please donate today!

Our nursery was started 30 years ago by a group of interested volunteers. Their aim was to conserve local native plants, encourage revegetation and regeneration to provide habitat for local wildlife and enhance biodiversity.

Within 5 years the nursery had won local and national awards for our contribution to the local environment and community and had become financially viable. In the past 30 years, we have educated and inspired many thousands of people across 3 council areas to get involved in protecting and enhancing our precious local environment.

After 30 years of successfully achieving our objectives, Covid struck and almost destroyed our community organisation; we need your help NOW to survive!

We have skilled seed-collectors and plant-growers, a dedicated team of enthusiastic volunteers and tens of thousands of low-cost, local native plants to sell, but we urgently need a cash lifeline to keep our doors open and regain the ground lost during Covid.

Donations can be made online here: https://www.gofundme.com/f/candlebark-community-nursery-survive-and-flourish

Every donation, no matter how small, will help us to revitalise this local institution so we can flourish into the future. If you are in the area,please visit us at 308 Hull Road,Mooroolbark,3138 between 10.00 am and 2.00 pm Wednesday,Thursday,Friday,and Sunday.

Elizabeth Fuller President Candlebark Community Nursery Incorporated

Thanks to the Ringwood & District Historical Society, we have the privilege of exploring the level crossing's past through captivating photographs dating back to the 1890s. These images offer a glimpse into a time when horse-drawn carts traversed the wooden planks, connecting communities with effortless charm.

Fast forward to now and the level crossing project has been removed. Check out some of the photos below which show moments of the Bedford Road level crossing over the past few decades.

your shopping experience with our Gift with Purchase

Be one of the first 100 customers to spend $100 or more at our fashion and accessory stores to receive a free gift from your favourite brands*

Indulge yourself or spoil someone special with a new gift each day:

Thursday: Country Road ‘Quilted Tri Cosmetic case’ valued at $49.95

Friday: Endota Spa ‘Clean by Endota duo pack’ valued at $45

Saturday: Lorna Jane ‘Active essentials kit’ valued at $55

Sunday: Mecca Max ‘Mini Mix Eyeshadow Palette’ valued at $22

Date: Thursday 2 May – Sunday 5 May

Time: Thursday 2 May - Friday 3 May: 12pm – 4pm and Saturday 4 May - Sunday 5 May: 11:30am – 3:30pm**

Location: Level 2, outside Swarovski.

Best Parking: Gate 6

Customers visiting outside of these times may collect their gift from the guest service desk, located on Level 2 next to Mecca.

Autumn / Winter

The time you’ll spend in retirement and the lifestyle you’re planning both make a difference to the savings and income you’ll need. Being realistic and getting clear about plans for your future can help you figure out the cost of your ideal retirement.

“I’ve always lived on a budget and live comfortably... I still believe in budgeting, wise spending, but I don’t feel restricted.

People who are retired re-evaluate priorities and where you are willing to spend the money”.

Donna, aged 66, retired for two years.

Start with a ballpark estimate

Retirement Standard figures from The Association of Super Funds of Australia (ASFA) make a good starting point for estimating the income you might want or need. By comparing these calculations with your own spending plans, you’ll get a rough idea of how your overall spending in retirement could add up.

The Retirement Standard estimates the total annual budget for either a comfortable or modest lifestyle for retired singles and couples. Figures are updated each quarter in line with the changing costs of living in retirement and include detailed budget breakdowns for all sorts of living costs. What they don’t include is rent or home loan payments. Each estimate assumes an individual or couple live in their own home, mortgage free.

Help the local community know you exist and what sets you a part compared to other aged care facilities, Financial Planners and other providers in the local area.

We have developed Find Aged Care Services (www.findagedcare. services) so you can promote your facilities and services to the general public. You can also place any job vacancies on our website that is available in your facilities.

We have made it cheaper and easier for you to get your returns completed & you can do it all from the comfort of your own home.

Here are the steps involved:

1. Email to info@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address

2. A Tax engagement letter will be emailed to you for signing via your mobile (no printing or scanning required).

3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes.

4. We will then require you to upload your documents to our secure portal.

5. Once we have received all your documentation, we will complete the return.

• Architect ------------------------------ 00

• Find Accountant ----------------- 34

• Financial Planning ------------- 36

• Find Insurance -------------------- 35

• Bookkeeping ---------------------- 00

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf. Email your artwork to editor@findmaroondah.com.au If you wish us to create your ad, we will do this for a minimal cost. Go to www.findmaroondah.com.au/graphic-design to upload your details and we will create this for you.

• Editor|Copywriter --------------- 00

• General Insurance ------------- 35

• Life Coach --------------------------- 36

• Mortgage Brokering ----------- 36

• Signages ------------------------------ 00

• Solicitor/Lawyer ------------------ 35

1/8

If you have any questions, contact the editor on 1300 88 38 30 or Email warren@findmaroondah.com.au *Available until your category is taken when a Tradie joins the Find Network Team.

• Lactation Consultant ----------- 39

• Swen Pouches ---------------------- 40

• Hair Dresser --------------------------- 00

• Chiropractor ------------------------- 00

• Beauty Therapy -------------------- 00

• Gym --------------------------------------- 00

• Massage Therapy ---------------- 00

Osteopathy in Australia is a government registered, allied health profession. Osteopaths focus on improving the function of the neuro-musculoskeletal system (bones, muscles, nerves and connective tissues) to optimise health and well-being.

Joanna is highly qualified and experienced in the osteopathic assessment and treatment of babies and infants.

She can assist with the following assessments:

• Gross motor development (milestones)

• Primitive reflexes

• Tongue function and it’s relation to sucking skills

• Biomechanics of the jaw and mouth

• Help increase or decrease milk supply ADVANCED PAEDIATRIC OSTEOPATH & LACTATION CONSULTANT PROVIDING PERSONAL & CARING SUPPORT FOR YOU & YOUR BABY

IBCLC lactation consultants are recognised around the world as the experts in lactation care. They provide evidencebased knowledge to assist mothers to establish and maintain breastfeeding. As professionals, they are charged with promoting, protecting and supporting breastfeeding.

Joanna can help with a broad range of lactation consulting services, including:

• Teaching a new mum how to hold and position her baby to breastfeed

• Assess the suck, swallow and breathing of an infant

• Assess for tongue function and determine any evidence of restriction (tongue tie)

• Pre and post-frenectomy breastfeeding support

Team gold - Ella McCallum gave it her all in golds defensive line up this week and really turned the jets on with her run!

Team Norwood - Gabby Hopper an outstanding game in goals scoring 12 out of 22 of Norwoods goals! Team Black - Amy Ryan she never stops running and giving second efforts! Earning player of the match 2 weeks in a row shows just how much she puts in for her team!

Thankyou to GYG Eastland & Croydon for supporting our ladies!

Time to look ahead to round four. Starting with netball this Friday night. Norwood Gold kick off our double header on Friday at HE Parker, followed by our Norwood side!

With a re-grade on the way we still await the fixture for Purple and Black. Saturday our senior and reserve teams are in action at Cheong Park - with our u19s having the bye. See you there.

Congratulations to Scotty Reece and Ben Barnard for their awards at the RDCA presentation night last night. Ben secured the bowling average in H grade while Scotty took home the All Rounder and the Pat Meehan Medal.

Week 3 - With a few away for the Anzac Day long weekend, the remainder of the RBC New & Emerging Bowlers Academy proudly sponsored by Taylor Bowls Australia kicked off at 10.00am this morning. With beautiful conditions all Academy participants practiced hard and learnt new skills which is what it is all about with the game of bowls we all love.

Arnold Spicer won the Juniors challenge to win some McDonald's vouchers and then we finished off with a Coaches pressure challenge drawing to between the kitty on the T and the ditch where Martin Patience won the $50 Manhattan Hotel.

Simply upload your ad at www.findmaroondah.com.au/nfp-free-advertising or you can email the ad to the editor@findmaroondah.com.au and we will do the rest for you.

Senior

Karen

NextGen

Worship

Transform

Community

Children's

Youth