Martin Jaffa 24-25 Salmon Scotland Hamish Macdonell 26-27 Shellfish feature 28 Shellfish and Brexit Nicki Holmyard 30-31

Shellfish conservation

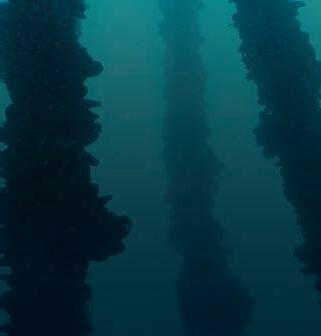

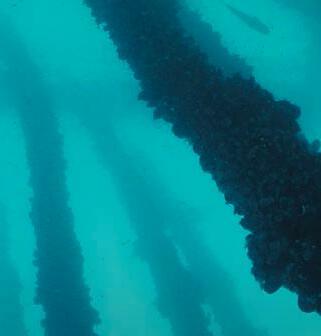

The Whitby Lobster Hatchery 32-33 Shellfish science Mussels on the move 34-35 Canada

Sandy Neil 36-40 Iceland

Striving to be your supply partner of choice.

Building stronger and better quality of equipment remains our driving motivation as a supply partner, supporting our customers in their aims for improved safety, security, and sustainability, all of which count towards the growth of a healthy, nutritious, and superior class of seafood.

the impact of offshore developments such as aquaculture and renewable energy.

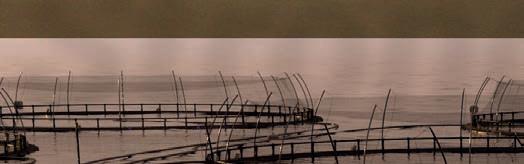

Loch Fyne Seafarms is to receive nearly £133,000 for a new facility to process its farmed shellfish for premium markets in the US and Asia.

Other funded organisations include fisheries and fishing ports, cold storage facilities and processors, seaweed producers and Seafood Scotland, which receives £1,625,000 for a promotional campaign in domestic and export markets, and £300,000 for the Scottish Nephrops Programme, promoting langoustines.

Duplication criticised

SEAFOOD processors, salmon and shellfish farmers, and fishing businesses are among the recipients of the latest round of funding from the Marine Fund Scotland.

The Scottish government-backed fund is distributing a total of more than £13m to 60 projects in the seafood industry, with grants ranging from £7,000 to £1.2m. As well as promoting growth for the industry, the grants are aimed at reducing its carbon footprint and improving sustainability.

Those selected for the current round include Organic Sea Harvest, which will received £1.1m for the installation of innovative full containment facilities at Lochinver. The project aims to reduce the number of wasted sea journeys due to bad weather, reducing fuel use, improving animal welfare and allowing the company greater continuity of supply.

Employee-owned processing business Aquascot will get £1.2m for improvements and modernisation of the salmon and trout processing facilities at its factory.

A grant of £855,000 will go towards the purchase of equipment for Thistle Seafood, which recently acquired the former Dawnfresh processing plant in Uddingston, near Glasgow. The investment, which includes around £2m from the company, is expected to save 40 jobs and create 60 more at the plant. It will allow investment in water treatment and cold storage will enable more efficient distribution, reducing the road miles for its products.

Thistle will also receive £33,000 for a new pastry machine to reduce waste in its en croute products.

Bell’s Seafood, in Scrabster, in the north of Scotland, is to get nearly £170,000 for a new salmon-filleting line, which aims to meet increase in demand by producing more product while also reducing wastage.

Hatchery Landcatch Natural Section gets just over £150,000 for new heat pumps and oxygen generation systems being installed. These will enable the site to meet 100% of energy demand from renewables. They will also improve fish health and growth by optimising water temperature and oxygen content.

Salar Pursuits Ltd, which is developing innovative containment technology to protect fish in net-pens against sea lice, receives £27,671

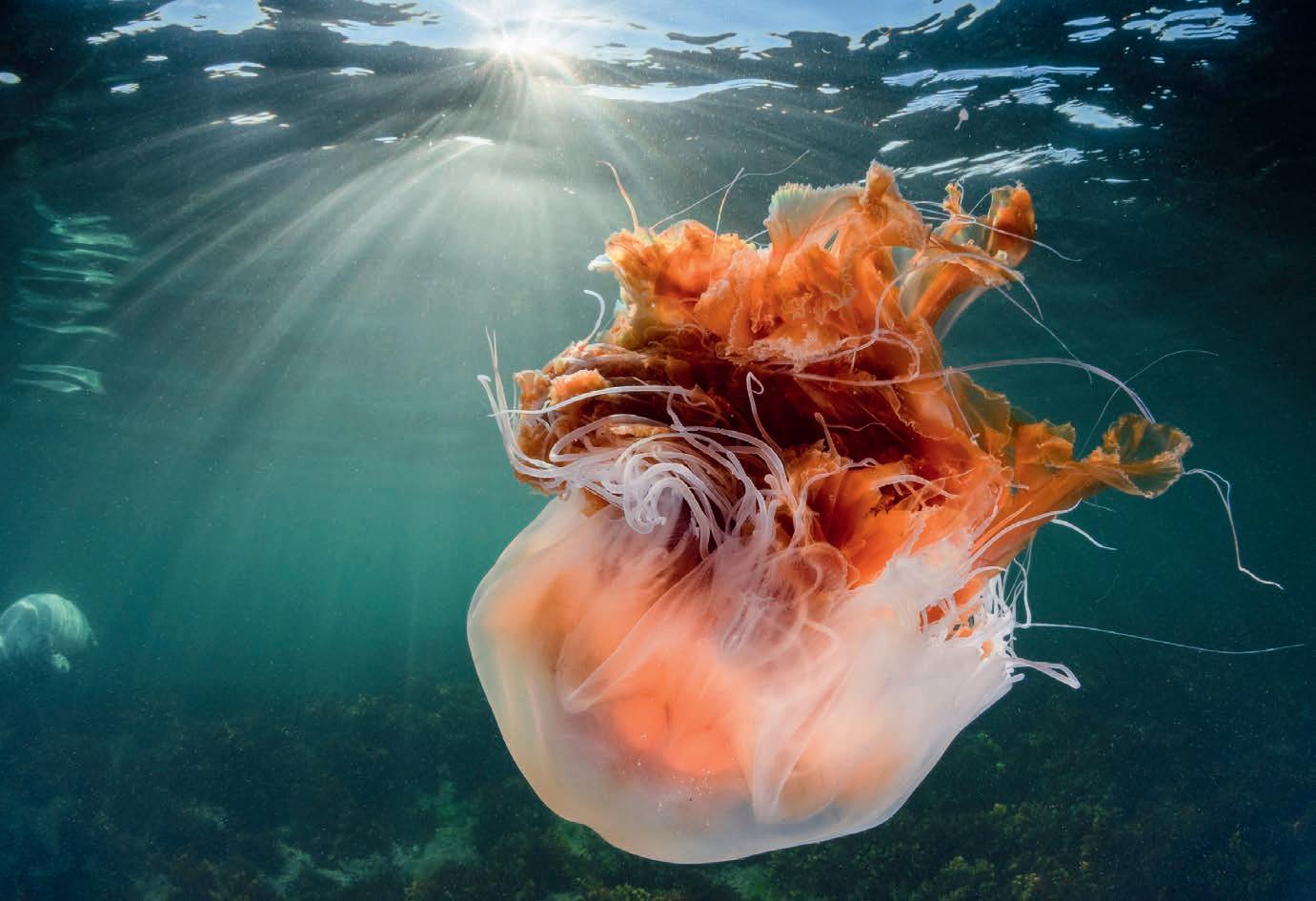

The Atlantic Salmon Trust will get nearly £623,000 for a project to improve information on the migration pathways of salmon smolts from nine west-coast rivers to the open ocean. The initiative aims to inform the regulatory system regarding

Announcing the recipients of the fund during a visit to a shellfish processing facility at Bellshill, Rural Affairs Secretary Mairi Gougeon said: “I am very pleased for those organisations and individuals whose applications have been successful this year.

“Marine Fund Scotland has enabled some really exciting projects in the past and I’m confident that this round of funding will play an important role in continuing to help our marine and fisheries businesses to develop and move to the next level.

“The Marine Fund Scotland will continue to be key in supporting sustainable development of Scotland’s Blue Economy –investing in Scotland’s seafood sectors, creating sustainable jobs,and helping to protect Scotland's marine environment.”

Earlier, Gougeon criticised the UK government’s UK Seafood Fund, which recently announced its own round of grants.

She said: “The UK government continues to make spending decisions on marine and fisheries in Scotland, which is an area devolved to the Scottish government.

“We have continually pressed the UK government to commit to providing the Scottish government with a fair share of the £100m pot that recognises the size and significance of our marine sectors, to distribute in line with our priorities.

“Instead, what we have is the UK Seafood Fund operating in the same space as our own established Marine Fund Scotland scheme, which already provides vital targeted grant assistance to the Scottish marine and seafood sectors to enhance quality, support innovation and add value. This causes unnecessary confusion and duplication.”

Ronja

18 November.

T he vessel has state-of-the-art life support systems, including highcapacity oxygen production, a carbon dioxide removal system, and a water cooling system to ensure the fish are kept in optimal condition during treatment. In addition, it has an automatic cleaning system, alongside sensors and cameras to monitor fish and water quality.

T he Ronja Star is fitted with dieselelectric propulsion and a battery hybrid solution, which reduces fuel consumption and emissions, as well as generating less noise.

BAKKAFROST S cotland has taken delivery of the largest wellboat to be deployed in the S cottish aquaculture sector.

T he Ronja Star is a hybrid vessel commissioned from Norwegian wellboat operator S ølvtrans. It boasts world-leading technology, with an FLS mechanical sea lice removal system and the capacity to provide freshwater

treatment. It uses a reverse osmosis system for the desalination of seawater, producing freshwater to improve gill health and remove sea lice.

S enior management from Bakkafrost S cotland (formerly T he S cottish S almon Company), A ngus Brendan MacNeil MP and A lasdair A llan MS P, as well as local government representatives, officially welcomed the

Ian Laister, Managing Director at Bakkafrost S cotland, said: “ Our ambition is to become the leading most sustainable salmon producer in S cotland. T he proactive management of the health and welfare of our salmon is at the forefront of our sustainability strategy.

“T he arrival of the hybrid Ronja Star reflects and enhances those ambitions. T he investment in this vessel will allow us to substantially increase the use of freshwater treatments for gill health and, when required, remove sea lice in a single treatment. This will improve fish health and biological performance.”

TRADE body Salmon Scotland has been accepted into the prestigious Worldchefs group, which represents chef associations across the globe. Through the partnership with Worldchefs, Salmon Scotland hopes to consolidate Scottish salmon’s position at the top of menus round the world, and encourage more leading chefs to visit Scottish salmon farms to “get their feet wet” and see for themselves where the finest salmon comes from.

Worldchefs Managing D irector Ragnar Fridriksson said: “Producers and chefs have a special, crucial connection. Worldchefs is proud to partner with Salmon Scotland and looks forward to supporting its world-leading standards in aquaculture, community initiatives and ambitious vision for a better future.”

The World A ssociation of

Chefs’ Societies, known as Worldchefs, is a federation made up of 110 national chef associations, founded in 1928 by the venerable Auguste E scoffier.

Salmon Scotland Chief E xecutive Tavish Scott said: “Top chefs across the globe want to cook with the very best ingredients, and that’s why they love cooking with Scottish salmon and serving it to their customers... as a member of Worldchefs we want to bridge the gap between farmers and chefs to increase awareness and understanding of where Scottish salmon comes from and cement its place in the world’s top restaurants.”

IN what is becoming an annual event, Mowi Scotland employees across the Highlands and Islands have chosen to provide a helping hand to over a dozen local community organisations at Christmas. Responding to

the company’s Community Support Committee’s invitation to nominate a local organisation that could benefit from a cash donation for the festive season, employees came forward with many ideas that covered most of the regions where the company does business. A total of 14 organisations were selected by Mowi’s Community Support Committee and offered up to £1,000 each, to be delivered by the nominating employee before Christmas.

PRODUCERS and suppliers from Scotland will have a dedicated pavilion at Aqua Nor, the largest trade show for aquaculture, for the first time since 2017.The event will be taking place in Trondheim, Norway, on 22–24 August next year.The “Team Scotland” presence is being coordinated by the Sustainable Aquaculture Innovation Centre (SAIC), state agencies Highlands and Islands Enterprise (HIE) and Marine Scotland, as well as trade body Salmon Scotland. Scottish businesses active in the aquaculture supply chain have been invited to be part of the collaborative delegation.

Right: Scottish Pavilion, Aqua Nor

SCOTTISH Sea Farms Hatchery Engineering Manager and volunteer coastguard Steven Nicolson has received a commendation for Meritorious Service for his role in rescuing a woman from a cliff edge in Lerwick last year. He was first on the scene and managed to build up

a rapport with the woman – who had been threatening to take her own life – but she slipped and was left clinging on to the grass verge above a 90-foot drop. Nicolson threw her a rope and held her full body weight until his teammates set up their equipment and completed the rescue.

A report into an accident on a workboat operated by Mallaig Marine has highlighted a number of safety issues contributing to the incident.

A deckhand on the workboat Annie E was taken to hospital on 3 April this year after being struck by a falling grid buoy, which the workboat’s forward crane was lifting at a fish farm site off the Isle of Muck on Scotland’s west coast.

The report, from the Marine Accident Investigation Branch (MAIB) of the UK’s Department of Transport, said that Annie E’s skipper had noticed that the grid buoy was out of position and needed to be lifted in order to recover and re-lay its mooring anchor.The workboat’s forward crane was used to lift the buoy and its anchor connection out of the water.The buoy was suspended nine metres above the water when its metal components experienced a mechanical failure, resulting in the buoy falling and striking the deckhand.

The MAIB said: “First aid was administered to the injured deckhand, who was evacuated by a coastguard helicopter to hospital, where he underwent surgery. He has since received further surgery and treatment.”

Mallaig Marine offers a range of services to the aquaculture sector and has an ongoing contract with Mowi Scotland (formerly Marine Harvest), including two workboats, Annie E and Emma C. The key safety issues identified by MAIB were:

• the deckhand was injured when he was struck by a falling grid buoy that had been lifted by Annie E’s forward crane;

• the deckhand was standing near to the suspended buoy, contrary to the workboat owner’s risk assessments, method statements, lifting plan and industry guidelines;

• the risk assessments and method statements did not fully mitigate the risks associated with a suspended load;

• the grid buoy was not certified as lifting equipment and the lifting technique used did not comply with the manufacturer’s recommended procedure, which the vessel’s owner and crew were unaware of;

• the grid buoy’s metal components were worn and the top washer was missing, both of which resulted in its failure; and

• there was no record of the buoy having been inspected before installation or routinely checked in accordance with manufacturer’s guidelines while in service.

The MAIB report said: “In view of the actions taken by the organisations involved in this accident, no safety recommendations have been made.”

The Annie E was built by Neptune Shipyards, in the Netherlands, in 2017.

SALMON was at the centre of an early St Andrew’s Day celebration in Paris in November.

Scottish Rural Affairs Secretary Mairi Gougeon was joined by acclaimed chef Hirose Abe and Tavish Scott, Chief Executive of industry body Salmon Scotland at the British Embassy for a celebration of Scottish food and drink.

The event also marked the 30th anniversary this year of Scottish salmon achieving the coveted “Label Rouge” designation in France, which recognises farmed or food products of superior quality.

The French market for Scottish salmon has boomed in recent years, with exports up from £221m in 2019 to a record £304m last year. France now accounts for half of the value of all the UK’s salmon exports.

Gougeon said: “This week as we celebrate all that Scotland has to offer on our national holiday, St Andrew’s Day, it is fitting that the Scottish salmon success story is high up on the agenda.

“I was pleased to be in Paris to continue the close collaboration between the governments of Scotland

and France, and to consider ways in which we can support exports of salmon to the EU and France in particular.”

Tavish Scott said salmon companies had “overcome the new bureaucratic

difficulties” caused by Brexit to bring salmon to France “as quickly and efficiently as possible”.

He added: “We are immensely proud to be at the heart of this new ‘Auld Alliance gastronomique’.”

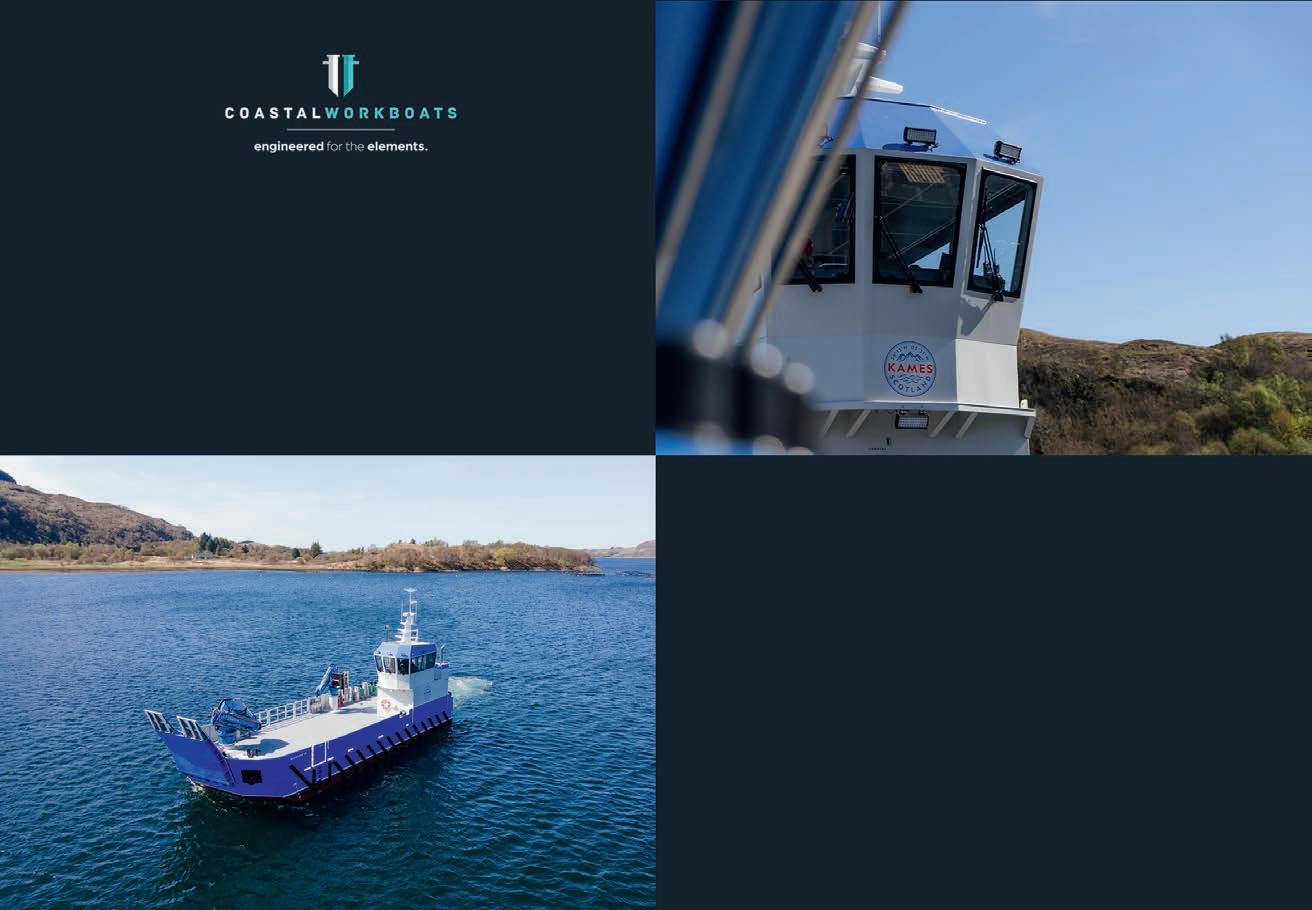

MULL -based Inverlussa M arine Services has taken delivery of its new service vessel, the Eloise Eslea . It is the latest addition to its growing fleet of modern, purpose-built workboats for the Scottish aquaculture sector.

Designed and built at N auplius Workboats in the N etherlands, the Eloise Eslea is equipped with the latest technologies, including dynamic positioning to increase usability out on farm during severe weather and provide a safer working environment for the crew.

The 27-metre workboat is also fitted with diesel-electric

propulsion and a battery hybrid system to lower fuel consumption and emissions during standby or overnight, further cementing Inverlussa M arine Services’ reputation as a leader in greener technologies.

Commenting on the new arrival, Inverlussa M arine Services M anaging Director Ben Wilson said: “The Eloise Eslea is another fantastic addition to our fleet, representing a huge investment both in terms of local job creation and in the future of the Scottish aquaculture sector."

O n contract to Scottish Sea Farms, the vessel will now travel to Shetland, where it will be fitted with a nextgeneration Scale AQ thermo-delousing system, with engineering works by O cean Kinetics, ahead of going into service in 2023.

Scottish Sea Farms Shetland Engineering M anager and project lead Keith Fraser said: "The Eloise Eslea adopts all the advances previously made when designing its sister ship, the Kallista Helen , and builds on those with a number of adjustments and enhancements. The result will be an even gentler, swifter experience for the fish and a safer, more secure environment for the crew."

The Eloise Eslea takes Inverlussa M arine Services’ fleet to 19 and has created a further six jobs within the company, bringing the total number of employees to 110 – the majority of those living in the same remote coastal communities as they work.

Notpla, based in London, has created a material derived from seafood that is environmentally friendly and biodegradable. As the winner in the “Build a Waste-Free World” category, the company will receive £1m.

A UK startup company that has developed a seaweedbased alternative to plastic was named as one of the

winners at the Earthshot environmental awards, held on 2 December in Boston, US.

The Earthshot prizes were presented by HRH William, Prince of Wales. They were the first of a series of awards over the next 10 years dedicated to promoting organisations and businesses with solutions to help repair and restore the planet.

Notpla was founded by Rodrigo Garcia Gonzalez

and Pierre Paslier while they were students at Imperial College London and the Royal College of Art. The material can be used to create a range of packaging products, such as a bubble to hold liquids, a coating for food containers, and a paper for the cosmetic and fashion industry.

Notpla has been used by food delivery service Just Eat in more than a million food takeaway boxes. At the London Marathon in 2019 36,000 Notpla-made Oohos – edible “bubbles” filled with Lucozade – were handed to runners.

THE Aquaculture Stewardship Council (ASC) has reported a 144% increase in Scottish salmon farms applying for ASC certification in the last year.

The ASC programme tests the social and environmental credentials of aquaculture businesses and provides assurance to consumers.

ASC CEO Chris Ninnes commented: “The availability of ASC-certified salmon products in the UK has increased by 61% in the last year alone, and three-quarters of UK consumers associate the ASC label with trust and sustainability. What’s clear is that salmon consumers want products that are in line with their values. They want to know that the fish they’re eating isn’t damaging the planet and has been raised with care for workers and communities. And retailers will follow their consumers’ values.

“With 16 more farms going through the initial audit stage right now, by this time next year it is possible that the number of Scottish salmon farmers who have achieved ASC certification will have doubled.”

Mowi was the first company in Scotland to achieve ASC certification for one of its farms. Mowi now has 30 salmon farms certified or in initial audit stage. The company was also recently named as the ASC’s Retail Supplier of the Year for 2022.

Scottish Sea Farms and Bakkafrost Scotland are now also on board – the former with three farms certified and the latter with three farms certified or in the initial audit stage.

ASC estimates that demand for ASClabelled salmon products is growing at 61% year on year in the UK.

AQUACULTURE biotech business Benchmark has reported strong growth in revenue and profit for the year to 30 September 2022, with adjusted EBITDA (earnings before interest, taxation, depreciation and amortisation) up 60%

Revenue for the 12-month period was £158.3m (2021: £125.1m) and adjusted EBITDA was £31.2m (2021: £19.4m).

Adjusted operating profit was down, however, to £9.1m (2021: £10.8m).

This year has seen the roll-out of Benchmark’s sea lice treatment solutions, Ectosan Vet and CleanTreat, and revenue from the Animal Health division was up markedly, from £7.8m to 20.1m.

Benchmark has also announced the terms of its contemplated private placement and retail offering in Norway in connection with a proposed admission to Euronext Growth Oslo.

The company expects to have a dual listing on Euronext Growth Oslo this year, with the intention to uplist to the Oslo Børs in H1 calendar year 2023.

Trond Williksen, CEO, commented: “In FY2022, Benchmark delivered another year of growth and strategic progress, underpinned by four quarters of consistently improved financial results.This demonstrates the success of our restructuring and culture change, the quality and potential of our business, and the talent and commitment of our people, as well as the underlying strength of our markets.

“Our strategic and commercial focus have contributed to strong results. Going into the new financial year, there is good momentum in line with our expectations and positive dynamics in our industry, creating significant opportunities to deliver value for all our stakeholders.”

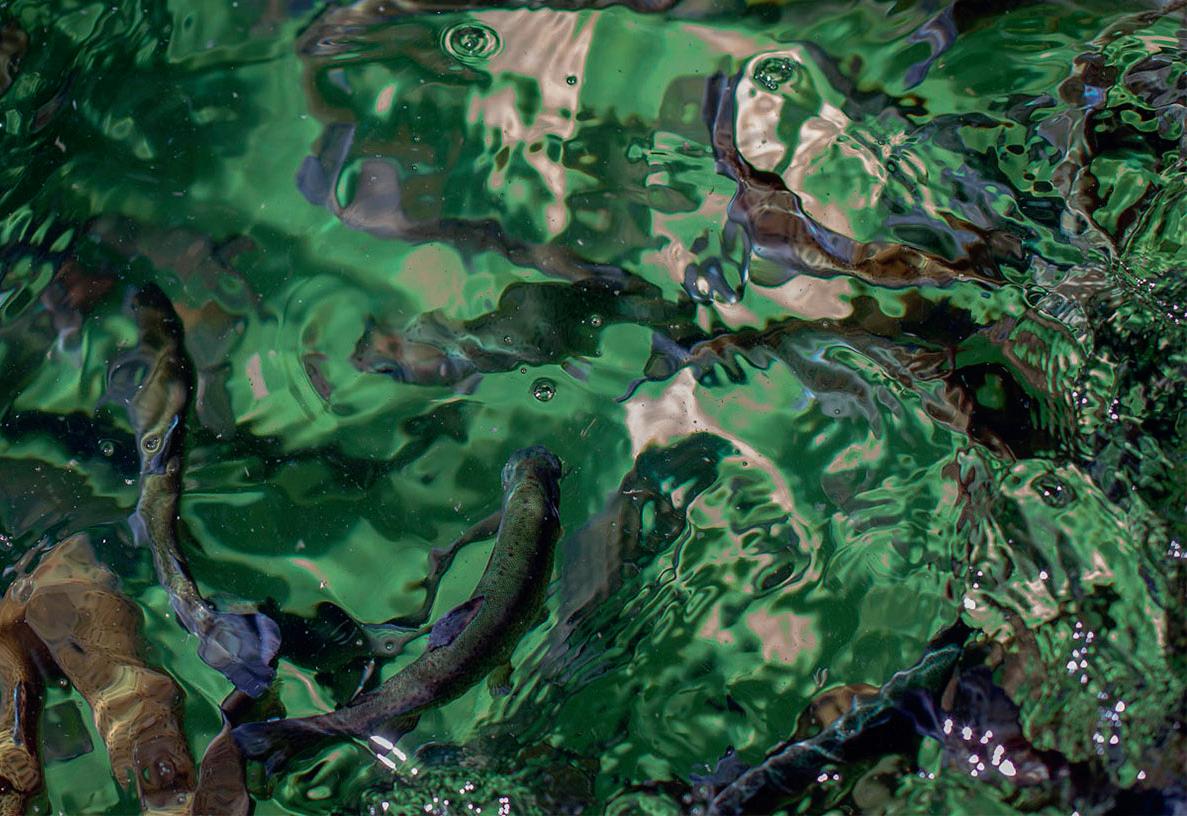

AFTER its parent, Dawnfresh Seafoods, fell into administration earlier this year, trout farmer Dawnfresh Farming continued to trade solvently – with the help of a £2m loan from one of its directors.

Dawnfresh Seafoods was placed into the hands of administrators, FRP Advisory, in February. The latest accounts for its subsidiary Dawnfresh Farming, published yesterday, show that the business recorded a gross profit of just under £4.48m on turnover of £20.4m for the period to 27 March 2022. Net profit was 2.24m, down 22% on net profit for the period 2020/21.

The fall in profit and turnover is attributed to “a significant environmental event” at the company’s Loch Etive 4 site. The annual report says that personnel were diverted to treat the fish rather than feeding them, which reduced the site’s harvest volumes.

Following the collapse of Dawnfresh Seafoods, the report says, the “vast majority” of sales for Dawnfresh Farming have been made to overseas companies directly. It goes on: “This has been very successful as export sales have largely been at higher prices and the exchange rates have been in our favour.”

The company’s going concern report states: “The directors have effectively managed their cashflow by securing £2m loan funding from a director at March 2022.”

In February, FRP Advisory sold Dawnfresh’s Arbroath processing facility to Lossie Seafoods Limited, part of the Associated Seafoods Limited (ASL) group, and in June it was announced that Thistle Seafoods had agreed a deal to acquire the former Dawnfresh plant at Uddingston, near Glasgow.

The administrators are reportedly confident that they will find a buyer for the fish farming business.

MOWI CEO Ivan Vindheim has published a consultation paper setting out an alternative to the Norwegian government’s proposed ground rent tax on fish farms.

Vindheim says the Norwegian government has formulated its tax model on false premises, but believes a solution can be found to what is becoming an increasingly bitter dispute.

His alternative plan would effectively see a big reduction in the 40% rate.

While the document is critical of the budget proposal, Vindheim’s tone is conciliatory. He says Mowi and the government share the same ambitions for Norwegian aquaculture – in that they want to create jobs and expand the industry along the coast. But the current proposal, he argues, completely undermine such plans.

The document says: “Mowi believes the government’s proposal does not meet academic goals and has been sold on false premises.

“Ever since the government’s press conference on 28 September, we have

calculated how the proposal will turn out for us and the rest of the industry.

“Although the proposed tax model apparently works as intended in the power and petroleum sectors, it is unfortunately not applicable to the aquaculture industry. Our value chain is significantly more complex. In addition, less than 20% of the breeder’s investments will be deducted, while 80% of the profit will be taxed.”

He said the 40% rate was the same as that set for the energy wind power sector, which was quite different from aquaculture in several ways, yielding substantially higher tax revenues than the NOK 3.65bn estimated by the government.

He said Mowi was proposing that the government should set up a special committee to

examine the entire taxation structure on the fish farming industry.

He concluded: “We hope the government is willing to take a step back and contribute to the design of a tax model that is adapted to the aquaculture industry through a broad cross-party settlement.”

Meanwhile, the Norwegian government is looking at setting up an independent body to set standard salmon prices, based on market values, as the basis for its proposed ground rent tax.

The plan was unveiled to the employer organisations Seafood Norway (Sjømat Norge) and Seafood Companies (Sjømatbedriftene), when they met Finance Minister Trygve Vedum and Fisheries and Oceans Minister Bjørnar Skjæran on 18 November.

The government had asked for a meeting with Norway’s big five salmon companies, but they turned down the invitation, claiming it was a move to split the salmon farming industry.

The full details have yet to be set out, but the government’s goal is to try to find the market price for salmon, and Vedum told a press conference after the meeting there were several possible ways to do that.

He said the ruling Labour-Centre Party coalition was considering setting up an independent body to determine standard prices as a basis for the tax.

It is, therefore, real income from the sale of salmon that must be used as the basis for taxation and it should be a fair tax, he contended.

The proposal was to set up an independent standard price council and there would be no tax on further processing, Vedum insisted.

He also repeated that the government would not back down from its plan to impose a ground rent tax on the salmon and trout industry (along with the offshore wind power sector) reminding the public that “the high profitability of the aquaculture industry comes from our shared natural resources and skilled people along the coast”.

So far the industry reaction has been lukewarm, but the idea has not been rejected out of hand. Further talks are expected on the issue.

Some large companies have expressed concerns that a spot price for salmon, which could be the basis for a producer’s assessed tax liability, might well be higher than the prices achieved under contract deals.

Paul Birger Torgnes, Chairman of Seafood Norway, said after the meeting clear views had been expressed on both sides even if even if there were differing opinions on the tax.

“We have received a concrete input today that helps to remove some of the uncertainty, and we appreciate that,” he added. “We must look at their proposal and we believe, along with the ministers, that real income should be the basis.”

Måsøval scraps innovative semi-closed fish pen project, citing tax worries

Meanwhile in November, fish farming company Måsøval announced it had decided to postpone the start of its high profile Aqua Semi project due to the government’s proposed ground rent tax on aquaculture.

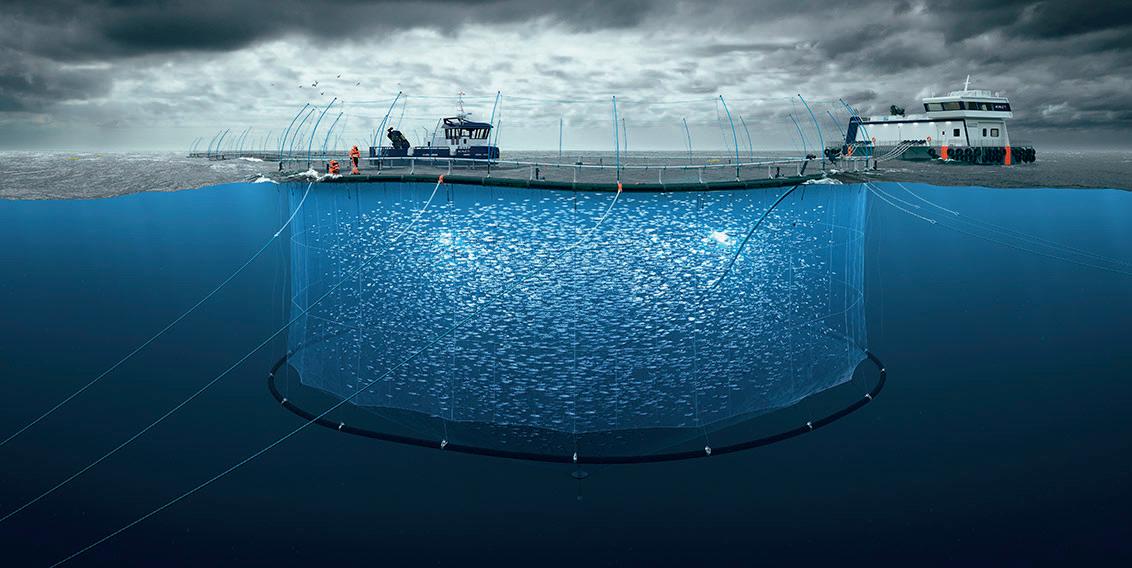

Aqua Semi is a semi-submersible, semienclosed salmon production unit built in steel. The unit has tight steel walls down to a depth of 25 metres and has all operating functions integrated. It is designed to significantly reduce the risk of escapes, lice and other waterborne infections. Måsøval has said the system will contribute to better fish health and faster growth.

Apologising for the impact the decision will have on suppliers, the company said: “As a

result of the proposed ground rent tax, Måsøval has chosen to postpone the implementation of the Aqua Semi concept.

“Aqua Semi is designed to open up new areas for salmon farming, reduce lice and disease contagion and improve fish health. The preproject is now finalised and the unit is ready to be built.

“The government’s proposed resource tax on aquaculture represents an unacceptable risk for the project. Måsøval AS has therefore decided to postpone a decision to start the project.”

Aqua Semi was due to be located at Fagerholmen in the Frøy Fjorden when it has been built, an area that has strong ocean currents, ensuring a good supply of fresh and nutrient-rich water.

The area has climatic challenges that make it unsuitable for small, traditional facilities. Aqua Semi is constructed to withstand weather and wind, but the industry has found that large facilities can have unique challenges.

Some politicians have expressed scepticism regarding the industry’s tax-related job cuts and are calling for state subsidies for redundancy pay-outs in the aquaculture sector to be ended, arguing that it is not as risky an industry as catch fishing (for more, see Processing News, page 22).

FORMER Mowi CEO Alf-Helge Aarskog has taken on a new role in aquaculture leading business development at Norwegian salmon company Eide Fjordbruk.

Aarskog starts in his new

post on 1 January. He has been taken on to continue with the development of the company and its Watermoon project, which involves the futuristic “Salmon Eye” aquaculture visitor centre.

Aarskog left Mowi in November 2019 after 10 years with the salmon giant. Since then, he has joined the board of Samherji, Iceland’s largest fishing and seafood business, and, in August, he joined a new business venture headed by NTS founder Helge Gåsø.

Left: Alf-Helge Aarskog

FORMER Salmon Evolution CEO Hakon Andre Berg has announced he will be joining Skeie Group as CEO next year. He left the land-based fish farmer earlier this year, citing family reasons.

Skeie Group is a family-owned investment company located in Kristiansand, focused on real estate, capital investment and technology. Berg said: “As one of the most successful serial entrepreneurs in Norway, Bjarne Skeie has an extremely impressive track record from industry and technology development, and I am privileged to get the opportunity to work closely with him and his excellent team.”

AFTER two years of disruption through Covid, the North Atlantic Seafood Forum (NASF) is set to make a physical return next year. It will be held at the Radisson Blu hotel, Bergen, between 7 and 9 March 2023.

This prestigious event has in the past attracted the leaders of global fishing and aquaculture industries. The organisers said: “After a couple of years with digital and postponed conferences, we are now pleased to be back on track.

“We have the privilege of inviting the leaders of the global seafood

industry back to Bergen at the usual time in March.

NORWEGIAN net and mooring business Mørenot is to join its Icelandic equivalent, Hampiðjan, in a merger

owns both

name.

FSN Capital V, the investment fund that owns a controlling interest in Mørenot and Hampiðjan, said: “The combination of Hampiðjan and Mørenot will create a leading global player and enable significant synergy potential due to increased product availability, optimisation of production, integration and a stronger position within core markets.”

The FSN statement added that an increased geographic footprint will enable the combined group to cross-sell products in their respective market areas. Hampiðjan has operations in 15 countries around the world and Mørenot has operations in eight countries. In some regions, the businesses are such that it would be suitable to combine them, FSN said, and in other regions, it will be possible to offer a greater breadth of product range to the customers.

The transaction will be paid in new Hampiðjan shares to FSN Capital V and the other shareholders in the Mørenot Group.

Following the transaction, the Hampiðjan Group aims to seek admission of its shares, which are currently listed on Nasdaq First North, to trading on the Main Market of Nasdaq in Iceland in the first half of 2023.

FSN said it is assumed that in conjunction with the listing, Hampiðjan’s share capital will be increased in order to diversify the shareholder base, optimise the capital structure and to secure capital for additional investments in the Group’s production activities in Lithuania, allowing the company to expedite the realisation of synergies through the sale of products within the group.

The combined group will employ over 2,000 people in 18 countries, and have a turnover of over €300m (£259m). Current Mørenot shareholders will hold approximately 9% of the combined group. No cash proceeds will be distributed in connection with the share transaction.

Ulrik Smith, Co-Managing Partner at FSN Capital Partners (investment advisor to FSN Capital V), commented: “During the last few years, Mørenot has continued its sales growth by developing into a more structured company with improved production, organisation and product portfolio. The combination with Hampiðjan will create a global leader and is a natural next step on this industrialisation journey of which FSN Capital V is excited to be a part.”

The transaction is subject to approval from applicable authorities.

FSN V is one of the funds operated by the Oslo-based FSN Capital Group, which describes its approach as “positive capitalism”.

THE Chief Executive of the Norwegian Seafood Council, Christian Chramer, has warned that the industry is facing tougher times ahead.

Three weeks ago, the industry hailed October as another recordbreaking month for both salmon and other fish exports.

However, last month, Chramer reminded Norway’s fish farmers and fishermen that global economies were tightening, which he said was worrying.

He said: “So far this year, a record high export value has been achieved for a number of species, such as salmon, cod, trout, pollock, haddock and prawns, but there is a gloomy veil over the strong growth.

“We live in a demanding and troubled time, with high food inflation and a fierce battle for proteins all over the world.

“This has led to historically high prices for Norwegian seafood. In addition, a weaker Norwegian krone in October helped to lift the export value. The price, in Norwegian krone, will be higher with a weaker Norwegian krone.”

Chramer said other challenging factors included changes in seafood consumption and tighter private household finances in the major markets.

LAND-based salmon farmer Andfjord Salmon has reported a third-quarter operating loss of NOK 14.7m (£1.2m), up from a loss of NOK 11.4m (£950,000) on the same period last year.

But the company has also reported continued good biological conditions at its first land-based pool at Kvalnes, Andøya, Norway.

Andfjord Salmon reports holding cash and deposits of approximately NOK 117m (almost £10m), which did not include further loan and undrawn credit facilities totalling NOK 30m (£2.5m).

Andfjord is developing a land-based salmon farm at Kvalnes, on the island of Andøya in the Vesterålen archipelago, which has a licence to produce 12,600 tonnes and rights to expand to an additional 77,400 tonnes. It operates a flowthrough system.

The Q3 report says that at the end of November the average weight of the salmon was 1,350 grams, a

healthy gain from 560 grams at the end of September. The average weight of the smolt was 120 grams when it was released in June.

The salmon’s survival rate remains high, standing at 98.7% at the end of last month.

CEO Martin Rasmussen said: “The foundation is strong biological conditions and a pool ecosystem that is as close as possible to the salmon’s natural habitat in the ocean outside Andøya.”

The company’s first operating revenues will be generated next year following the first harvest.

MÅSØVAL Eiendom has said it is exploring the potential of taking on a strategic partner in Icelandic salmon company Ice Fish Farm, which it says has the potential to outgrow its parent.

is the main shareholder in the business, which, unusually for a fish farm, is based on Iceland’s east coast. The majority of aquaculture businesses are located in the Westfjords region.

It is thought Måsøval has already received enquiries from a number of possible players.

Lars Måsøval, Chairman and CEO, Måsøval Eiendom, said: “Ice Fish Farm is the largest salmon farmer in Iceland in terms of licence capacity,and is the only salmon farmer on the east coast.

“The company has licences and applications, and additional capacity within its many fjords, to become a significant player in the global salmon farming industry and be much larger than Måsøval’s Norwegian farming operations.”

He added: “Furthermore, the company has just started this growth

journey and will be stocking about six million smolts this year.

“Hence, we believe it is the right timing for Måsøval Eiendom to explore the possibilities of bringing in a strong partner, alongside ourselves, to support the upcoming growth phase of Ice Fish Farm.”

He stressed that any establishment of a partnership would not change the fundamental objective of Måsøval Eiendom, which is to continue as a long-term shareholder of Ice Fish Farm.

The initiated partnership process is expected to be concluded by the first half of 2023.

Måsøval has also just announced its third-quarter operating profit, which is halved from NOK 121m (£10.05m) last year to NOK 62m (£5.15m) this time.

The company said it was hit by demanding biological challenges during the period, mainly linked to sea lice. The harvest volume dropped from 7,265 tonnes a year ago to 4,863 tonnes this time.

THE NTS group has unveiled a reduced third-quarter operating profit, or EBIT, of NOK 78.5m (£6.5m). The operating profit in Q3 last year was NOK 98.3m (£8.1m).

The results were announced as it emerged that SalMar is now making a bid for all the shares in the business, not just a majority holding.

The Norwegian and EU competition authorities approved SalMar’s planned acquisition of NTS during the summer, with the deal completed earlier this month.

The NTS group’s total operating income for the period was NOK 615.3m (£51.5m)

against NOK 453.8m (almost £38m) in the same period last year. Most of the farming operations, which have been sold to SalMar, are not included in these results and have been classed as discontinued operations.

NTS is feeling the impact of higher inflation, which is affecting all aquaculture businesses. It said salary costs had increased by NOK 4.5m (£375,000) over the past 12 month.

The NTS group has unveiled a reduced third-quarter operating profit, or EBIT, of NOK 78.5m (£6.5m). The operating profit in Q3 last year

was NOK 98.3m (£8.1m). SalMar has made a NOK 9.5m (£790,000) bid for all the outstanding shares in NTS. The offer is lower than expected because of the impact the salmon tax will have

on Norwegian aquaculture businesses.

It is also expected that SalMar will have to sell Frøy in order to reduce the debt burden incurred acquiring Norway Royal Salmon and other parts of NTS.

Norwegian, Scottish and Canadian subsidiaries – the opportunity to purchase shares in the company at a discounted price.

Based on that figure, eligible employees were presented with three alternative offers*:

• Alternative 1: Purchase 48 shares at a value of approximately NOK 7,500, with a taxable discount of NOK 1,500 and a purchase price around NOK 6,000.

• Alternative 2: Purchase 96 shares at a value of approximately NOK 15,000, with a taxable discount of NOK 3,000 and a purchase price around NOK 12,000.

• Alternative 3: Purchase 193 shares at a value of approximately NOK 30,000, with a taxable discount of NOK 6,000 and a purchase price around NOK 24,000.

MOWI

The offer is based on the average purchasing price for the company’s shares on 1 December 2022 of NOK 155.3365 per share.

The Board of Directors of Mowi ASA had approved an offer giving all permanent employees in the company – and its

Mowi said it had received acceptances of these offers from just over 970 employees for a total of 175,342 shares to a total value of around NOK 27m (£2.27m).

These shares will now be sold on to the employees who have agreed to participate in the offer.

Last month, Mowi recorded record high third quarter results including an operating profit of €240m (£207m).

*Current exchange rate NOK 11.9 = £1 sterling

NOVEMBER proved to be another record month for Norwegian salmon exports, with overall seafood sales rising by 19% to reach NOK 14.4bn (£2.2bn).

So far this year, the country’s recorded farmed and catch fish exports have totalled NOK 123bn (£10.25bn) – NOK 29.2bn (£2.4bn) more than over the same period in 2021.

Salmon export volumes fell marginally last month to 125,234 tonnes, but the value was up by 28%, reaching NOK 10.1bn (£840m), making it another record month for the pink fish.

Once again, Poland, France and the US were the largest markets, with North America recording the largest increase. Sales to the US rose by 87% to NOK 431m (£36m).

Christian Chramer, Norwegian Seafood Council CEO, said: “The export value in November is the third highest ever in a single month and confirms that Norwegian seafood still has a strong global position.

“It is nevertheless worth noting that the increase in demand is not from greater volume, but in increased prices.

“In general, we have a situation with high food inflation and increased costs, which are driving up prices throughout the value chain.”

He said price growth alone accounted for almost NOK 3bn of the total seafood exports of NOK 14.4bn in November. It was a particularly strong month for salmon, trout, pollock and cod, all of which achieved export records compared with November last year.

Farmed trout volumes were down by 25% to 4,897 tonnes, but the value rose by 7% to NOK 454m (£37.8m).

The main markets for Norwegian trout are the US, Thailand

and Lithuania. The latter bought 622 tonnes, a volume almost 1,000% higher than 12 months ago.

November was also a good month for fresh cod exports, which increased by 43% to NOK 178m (almost £15m).

Farmed cod export figures are being published for the first time, accounting for 500 tonnes worth NOK 28m (£2.3m). Spain was the largest market, taking 200 tonnes.

Frozen cod exports fell by 33% to NOK 234m (£19.5m). Shrimp exports rose by 40% to NOK 112m (£9m).

A group representing 25 environmental and sports fishing organisations has called on the Icelandic government to ban open-net farms in the country.

The demands comes just days after the Icelandic company Arnarlax was fined a record ISK 120m (£705,000) for allowing 80,000 fish to escape into a fjord. It has appealed the penalty.

The group, known as the National Association of Sports Associations, said it was issuing the challenge because Arnarlax could not account for the fate of so many salmon.

It said it wanted to see credible legislation that completely bans fish farming in opensea and fjord pens.

The statement continued: “The wild salmon population in Iceland numbers about 50,000 salmon. The accidental release is a grave environmental disaster for which Arnarlax has been fined ISK 120m and will have a serious genetic impact on wild salmon populations in Iceland.

“The accidental release is further confirmation that the beautiful promises of companies in fish farming are false and it also reveals the company’s indifference to the interests of nature when it has decided to protest the payment of the fine.”

Arnarlax has apologised for the incident, stressing that it had done everything it

could to prevent such an occurrence.

Mast, Iceland’s food and veterinary authority, said the administrative fine was for failing to report the loss of the fish.

Mast said: “During the slaughtering of sea pen 11 at Haganes in Arnarfjörður last October, it became clear that the company could not account for the fate of at least 81,564 salmon.

“A total of 132,976 salmon had been placed in the hatchery in October 2020 and July 2021.

“Recorded discards were 33,097 fish, but in October 2022, when the hatchery was slaughtered, the number that came out of the hatchery turned out to be only 18,315 salmon.”

Mast said that Arnarlax, which is owned by the Norwegian salmon giant SalMar, announced in August last year that a hole had been found in one of the pens.

The response was in accordance with requirements.

But when the numbers from the slaughter last October were revealed, it was clear that it was not possible to account for the fate of more than 80,000 salmon.

“MAST immediately started an investigation and… demanded, among other things, an explanation of the discrepancy in feeding, including the stated number of fish in the hatchery.

“It was then revealed that there had been significant deviations in the feeding of pen 11 since June 2021, or two months before the announcement of a hole in the pen last summer, which should have raised strong suspicions in the company that something serious was afoot.”

Below: Arnarlax farm

COMMERCIAL net-pen fish farming will be effectively banned in Washington State following an executive order from Commissioner of Public Lands Hilary Franz.

Washington, on the north-west Pacific coast of the US, had already turned down applications to renew the leases for the state’s last two remaining netpen fish farms, both operated by Cooke Aquaculture.

Franz’s announcement, made on 18 November, makes it clear that net-pen fish farming will not be permitted by Washington’s Department of Natural Resources (DNR) on state-owned aquatic lands, effectively closing down the industry permanently.

The order will align Washington’s net-pen salmon aquaculture policy with policies already in place in Alaska, California and Oregon.

Franz said: “Commercial finfish farming is detrimental to salmon, orcas and marine habitat. I’m proud to stand with the rest of the west coast today by saying our waters are far too important to risk for fish farming profits.”

Cooke’s US west coast subsidiary issued a statement saying: “The order is short-sighted, and the Commissioner’s position neglects extensive scientific analysis and judicial rulings, which found that there are no significant adverse environmental impacts arising from marine fish farming.”

Commissioner Franz said, when announcing the policy, that she had been in discussion with Cooke regarding land-based aquaculture. The company vehemently denied this and

said that no meetings on this subject had taken place with the Commissioner.

Licences not renewed

Earlier in November, the state’s Department of Natural Resources (DNR) decided not to renew steelhead trout farming licences for Cooke’s steelhead trout farms. The sites, in Rich Passage off Bainbridge Island and off Hope Island in Skagit Bay, were the last remaining net-pen finfish farms in the state.

Cooke was given until 14 December to finish operations and begin removing its facilities, repairing any environmental damage.

The DNR’s letters to Cooke confirming that the leases would not be reauthorised were highly critical of Cooke’s record in maintaining and managing the sites. In 2017, there was

a major escape from the company’s Cypress Island farm following a catastrophic net-pen collapse, resulting in a fine of US $332,000 (£280,000).

A court case is still ongoing regarding Cooke’s lease at Port Angeles, which the DNR alleges was operating in an unauthorised area and inadequately maintained.

The letters from the DNR also noted that Cooke had relocated a net-pen array to a new location without first obtaining a permit.

The DNR concludes: “The risks to the State’s aquatic lands from renewal of Cooke’s lease on this site are high, and therefore that Cooke’s proposed renewal is not in the best interests of the state.”

Cooke contests this, arguing that since the collapse of a steel cage system on its fish farm at Cypress Island in 2017, the company “has worked collaboratively and transparently with regulatory agencies to identify areas of improvement and implement regulatory and monitoring processes to ensure that our operations meet and exceed the highest standards”.

Cooke also said: “From an animal welfare perspective, with this decision, Commissioner Franz is forcing Cooke Aquaculture Pacific to kill 332,000 juvenile steelhead that were planned to be stocked at Rich Passage and Hope Island in 2023. This is a tragic outcome for fish that should have been healthy, sustainable food for our communities.”

The indigenous community in the state has been divided over the issue,

just as the First Nations in British Columbia have been split over fish farming’s future.

Swinomish Indian Tribal Community Chairman Steve Edwards said: “We are very pleased that Commissioner Franz rejected Cooke Aquaculture’s lease application. Removal of the existing net pen will restore full access to the tribe’s culturally important fishing area in northern Skagit Bay. Swinomish are the People of the Salmon and fishing has been our way of life since time immemorial. Cooke’s net pens have interfered with the exercise of our treaty rights for far too long. We look forward to the day when the Hope Island net-pen facility will be a distant memory.”

Supporting the Commissioner’s statement, Leonard Forsman, Chairman of the Suquamish Tribe, said: “Ending commercial finfish farming in our ancestral waters is an important step towards protecting marine water quality, salmon populations and the endangered southern resident killer whales. The impacts of commercial finfish farming put all of that at risk, and threatened treaty rights and ultimately our way of life and culture.”

Representatives of the Lummi Nation, Tulalip Tribes and Samish Indian Nation also spoke out in favour of the ban.

In contrast, W. Ron Allen, Chairman of, the Jamestown S’Klallam Tribe, which operates Salish Fish as a joint venture with Cooke, said the tribe: “…was seriously disturbed by the unilateral decision announced today.”

He added: “This action is an irresponsible denial of what science has proven: marine netpen aquaculture is safe for the environment and the most sustainable, climate-friendly way to feed the world… today’s DNR announcement was political; crafted to placate ill-informed activist groups who refuse to admit the vast array of scientific studies show us that well-regulated aquaculture is not a threat to the environment, or wild salmon.”

He also noted that the Commissioner had chosen to overturn bipartisan legislation passed in Washington State that explicitly

recognised a place for farming native species such as steelhead trout.

Allen concluded: “We urge the DNR to reverse this ill-informed order, follow science instead of politics, and continue to allow wellregulated and environmentally safe marine net-pen aquaculture in Puget Sound.”

Cooke said that it had been in talks with tribes in Washington regarding integrating a wild salmon restocking programme into its production, enabling wild smolts to grow bigger in pens and therefore enhancing their survival chances once released.

would be to study the decision and associated conditions before coming up with an implementation plan and investment options.

Earlier this year, New Zealand King Salmon reported that it had suffered high levels of mortality during 2021, which it attributed to exceptionally high sea temperatures. The company announced at the time that it would be fallowing three farms in New Zealand’s Pelorus Sound. The move meant the company would see its production fall, but it was hoped that it would reduce mortalities.

NEW Zealand King Salmon has been given the green light to begin farming the first openocean finfish site in New Zealand.

Following a hearing in Blenheim

last year, commissioners have announced their decision to approve the Blue Endeavour application.

“This is a first for New Zealand

and is a significant decision for the aquaculture industry,” said Acting Chief Executive Graeme Tregidga.

He added that the next step

COOKE Aquaculture has sealed the deal for its acquisition of Australia’s Tassal Group, in the completion of a process that was agreed in principle in August this year.

Cooke’s Australian subsidiary, also called Cooke, has acquired all outstanding shares of Tassal for AUD $5.23 (£2.93) per share in cash by way of a scheme of arrangement that values the total enterprise value at approximately AUD $1.7bn (£950m).

This followed a Tassal shareholder vote held on 3 November, which overwhelmingly approved the scheme. Final approval of the scheme was ordered by the Supreme Court of New South Wales on 8 November.

Tassal is Australia’s largest vertically integrated seafood producer, with operations from southern Tasmania to the north of Queensland. The company harvests 40,000 tonnes of Atlantic salmon annually in five marine farming zones, supported by four land-based freshwater hatcheries and four processing facilities.

Tassal also farms 5,500 tonnes of Australian black tiger prawns from two hatcheries, three pond farms and processing facilities.

The company domestically and internationally distributes and processes salmon, prawns and other seafood in fresh, smoked and frozen categories. Tassal’s brands – both for its own produce and the seafood it distributes in Australia – include Tropic Co. The Aussie Prawn, De Costi Seafood, Superior Gold and Tasmanian Smokehouse.

The Tassal purchase is Cooke’s first investment in Australia and the largest ever for the family-owned seafood and nutritional products company since it was founded, in 1985, in New Brunswick, Canada.

Mark Ryan, CEO of Tassal, said: “Producing healthy and nutritious seafood comes with great responsibility. Whether we are farming prawns on land or salmon in the sea, our commitment

New Zealand King Salmon’s General Manager of Aquaculture, Grant Lovell, said open-ocean farming made logical sense for both the environment and for the species in the long term.

is to be a responsible business respecting our people, the environment and communities we operate within as we deliver our vision of sustainably feeding tomorrow, which aligns perfectly with Cooke’s core purpose.

“We’re looking forward to becoming part of the Cooke family of companies and sharing the best of what our industry has to offer.”

Tassal had initially rejected Cooke’s bid, which came after Cooke had lost out in a bidding war for Tasmania-based Huon Aquaculture. Huon was eventually acquired by Brazilian meat group JBS.

YELLOWTAIL producer The Kingfish Company has passed the last test for its project to build a land-based fish farm in Maine, in north-east US.

In October, the Jonesport Planning Board gave initial approval to Kingfish’s local building permit. The permit conditions were formally approved and adopted in a final meeting this week.

Kingfish Maine is now fully permitted by local, state and federal regulatory agencies, the company said.

Kingfish Maine is a wholly owned subsidiary of The Kingfish Company, which already operates a recirculating aquaculture systems (RAS) farm producing yellowtail kingfish in the Netherlands.

Once the Jonesport facility is fully operational, the company said, Kingfish Maine will be the largest producer of yellowtail kingfish in the US.

Ohad Maiman, founder of The Kingfish Company, said: “From the introduction of our project to the town three years ago to the final building permit approval this week, we have received overwhelming support from Jonesport residents.

“We are excited for what the future holds in Maine – bringing our sustainable land-based technology to the US in a community where we can partner for growth.”

Last month, Maiman announced he was stepping down from his role as CEO of the company to take up an advisory position. He pledged that would continue to support Kingfish as “an active founder”.

SINGAPORE-based impact investor Silverstrand Capital has announced an additional €15m (£12.9m) investment in Netherlands-based aquaculture investment fund Aqua-Spark, bringing its total investment to €25m (£21.5m).

Silverstrand is a single family office with an impact-investing mandate focused on combating the biodiversity crisis, and is focused on advancing regenerative food systems and natural climate solutions.

Silverstrand’s Principal, Kelvin Chiu, will take a seat on Aqua-Spark’s advisory board while Patti Chu, Silverstrand’s Head of Impact, will join the investment committee.

With more than 300 investors in over 25 countries, Aqua-Spark has grown the amount under its management to over €450m (£386m) since its inception in 2013. The fund’s portfolio comprises companies such as eFishery and Calysta, among other notable leaders in the space.

Aqua-Spark calculates that it has reduced the use of wild resources in feed by the equivalent of 58.6 million fish, upcycled 49.3 million kg of industry waste, and improved the traceability for 40.4 million kg of food.

Amy Novogratz and Mike Velings, co-founders of Aqua-Spark, said in a statement: “Fish supply 17% of the world’s protein, and by 2030 the planet is expected to eat nearly 20% more fish. With our ocean approaching the brink of species collapse, this increase must come from sustainable sources: namely aquaculture. With its initial investment, Silverstrand Capital had already committed to a better future for responsible aquaculture and with this next round [it is] doubling down. We are honoured to work with [Silverstrand] and to keep advancing a commercial aquaculture system that puts our planet and its population’s health first.”

GRIEG Seafood British Columbia (BC) has agreed to decommission a number of salmon farms in a territory run by the shíshálh First Nation Community.

The company said the move was in line with its process of ongoing site restructuring in the region.

The statement affirmed: “Grieg Seafood BC Ltd fully supports the First Nations in whose territories it operates, including recognising and honouring the rights of First Nations to self-determine what aquaculture development they choose for their Nation.”

The shíshálh Nation’s territory, located around Sechelt Inlet near the Sunshine Coast of BC, held eight Grieg seawater licences.

Six of those farms have previously been removed from Grieg’s production planning cycle and have been inactive as they were older, smaller sites that were difficult to farm due to location (relatively shallow locations with warmer water temperatures and higher salinity).

Grieg said: “While some sites have been decommissioned, harvesting in the region has now been completed, and plans are in place to finish decommissioning all sites by early 2023.”

Grieg BC said the work was in line with its ongoing process of site restructuring, where the company seeks to develop sites that are well suited for salmon farming, and phase out older and smaller sites with more challenging biological conditions.

The aim of this process was to improve both the environmental footprint and fish welfare, while also reducing costs.

THE grant will be used to modernise the plant, including funds to buy equipment that will rapidly process fish and improve despatching of Mowi’s premium salmon.

The investment is aimed at:

• Increasing throughput from 65,000 tonnes to at least 95,000 tonnes per year.

• Reducing the number of single-use polystyrene boxes by 40% by 2026. This is a substantial contribution to reducing the carbon footprint of this product.

• Introducing automation to reduce manual labour, contributing to the health, safety and wellbeing of employees on the site.

Mowi has already invested in expanding the processing plant at Blar Mhor over the past two years. The facility has continued to operate while construction has gone on.

The grant for Blar Mhor is part of a £20m funding round for the UK government’s £100m Seafood Fund, which was set up to support

the long-term future and sustainability of the UK fishing and seafood industry. The infrastructure strand of the fund helps to pay for upgrades to ports, processing and aquaculture facilities. Other successful bidders in the latest round include:

• HSH Coldstores, which is investing in a cold storage and logistics facility to further expand seafood processing in Grimsby and generate new jobs in the area;

• Scottish company Denholm Seafoods, which is installing equipment to increase production of mackerel and herring landed at Peterhead;

• Cornish-based Falfish, which will invest in new technology to grade, freeze and pack pelagic fish in support of building two purposebuilt sardine fishing vessels; and Shoreham Port on the south coast of England, which is transforming a historic dry dock into a modern facility for local and visiting fleets.

Fisheries Minister Mark Spencer said: “Fishing communities are an important part of the

UK’s heritage and they make a valuable contribution to our economy, so we are backing them with funds to boost growth and opportunities across the industry.

“This funding will ensure seafood businesses throughout the supply chain are well equipped to keep pace with increasing demand at home and abroad, boosting production and sustainability, and building a resilient sector for the future.”

The second round of the UK Seafood Fund infrastructure scheme, which is worth £30m, opened on 25 November. Businesses will have until March 2025 to deliver their transformational projects, so a wider range of organisations will be able to apply. For more information see www.gov.uk/guidance/uk-seafood-fund

Mowi Scotland’s processing facility at Blar Mhor, Fort William, has been awarded a grant of just over £2m from the UK Seafood Fund.“We are backing them with funds to boost growth and opportunities across the industry ”

ICELAND Seafood International (ISI) has signed a “letter of intent” with a prospective buyer for the sale of its UK business.

ISI announced on 17 November that it was looking to dispose of the business, citing uncertainty over Brexit as the reason for withdrawing from the UK market. The decision placed a question mark over the future of its Grimsby-based value-added seafood business, with around 90 jobs at risk.

ISI’s latest announcement does not identify the purchaser, but says it is “a respected industry player”. While the letter of intent is a legally non-binding document, ISI said its provisions would serve as key terms in the event of the potential transaction.

The parties have agreed to run a swift due diligence process with the aim of reaching a binding agreement before the end of December.

Although ISI has extensive and highly successful salmon operations in Ireland and Spain, the UK business has been struggling for some time. The company said the

FOOD processing equipment business MARELEC Food Technologies has been acquired by Duravant, a global engineered equipment company based in Illinois, US.

MARELEC, headquartered in Nieuwpoort, Belgium, designs and manufactures high-tech portioning, weighing, grading and control systems for the food industry, including poultry, meat and seafood.

MARELEC has sales and service centres throughout Europe, the US and Asia, along with a network of distributors across six continents and in over 50 countries.

Piet Rommelaere, founder and Executive Chairman of MARELEC, said: “We are excited to enter our next phase of growth with Duravant and to collaborate with its world-class brands. We share a culture of unwavering commitment to customers and by joining forces we are able to accelerate our innovation investments, leverage Duravant’s extensive service infrastructure and deliver more solutions to our customers and partners.”

Mike Kachmer, President and CEO of Duravant, said: “Our new partnership further enhances Duravant’s front-line position in the growing food processing segment. MARELEC’s intense focus on providing outstanding service and continuous innovation has been the foundation of its success, and its legacy of market leadership makes it a perfect addition to the Duravant family.”

subsidiary was eroding profitability and the board no longer felt justified in continuing with it.

The ISI statement on 17 November said: “Iceland Seafood UK invested in operating facilities in Grimsby and merged its operations from Bradford and Grimsby into this location.

“The investment and decision of the merger was completed in March 2020, just before

Covid-19 started, and the renovation and installation of the factory was very much affected by Covid and later Brexit along with difficulties in overall operations.

“Iceland Seafood has now decided that it plans to exit this market from a valueadded perspective and has mandated MAR advisors to support the process. Although it has been concluded that the UK operation is not a strategic fit for Iceland Seafood anymore, the excellent facilities and strong management team in Grimsby can be a great addition to other companies in the sector.”

Chief Executive Bjarni Ármannsson said: “Although it has been concluded that the UK operation is not a strategic fit for Iceland Seafood anymore, the excellent facilities and strong management team in Grimsby can be a great addition to other companies in the sector.”

For Q3 of this year, the ISI group generated profit before tax of €2.3m (£2m) in the quarter and €0.5m (£0.43m) in the first nine months.

LABOUR and two other Norwegian left-leaning parties have said they want to reform redundancy rules in the aquaculture industry.

More than 1,000 salmon process workers were handed layoff notices over the past couple of weeks, with the companies making it clear these are the consequences of the Oslo government’s ground rent tax proposal. This was in spite of the fact that the tax will not apply to the processing sector.

However, existing legislation means it is the state, not the industry, which picks up most of the tab for this action.

Tuva Moflag (Labour), a member of the Labour and a Social Affairs committee at the Storting, told the left wing newspaper Klassekampen: “This is something we have to look at.”

Last year, the Norwegian Trade and Industry Workers’ Association (NNN), which organises employees in the fishing industry, passed a national meeting resolution that stated that the farming industry “is a profitable and forward-looking industry that should receive special treatment”.

NNN Association Secretary Yngve Hansen said: “We believe there is reason to look at whether that exception should apply to the salmon industry.

“Activity in the salmon industry is, in contrast to the wild fish industry, more predictable, and the [sector] has had such good earnings that [it has] the backbone to bear redundancies.”

Moflag said to Klassekampen: “When we see how systematic the layoffs in aquaculture have been over so many years, we have to look at whether the degree of unpredictability that is used as a basis for the layoffs is sufficiently justified.”

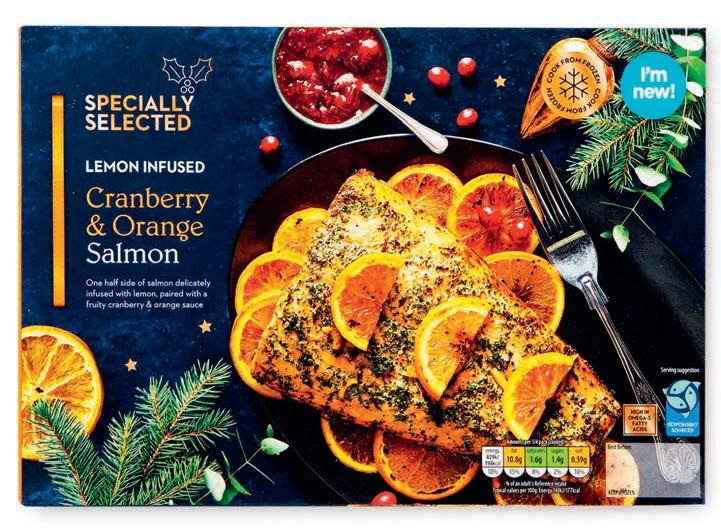

Christmas is coming. As well as being a celebration of the Christmas story, this time of year is a time for family feasts, with farmed salmon often playing a key role.

Christmas has always been the peak time for selling salmon even though increased availability throughout the year has meant the peak is no longer as great as it used to be. To paraphrase the famous saying: “Salmon is not just for Christmas.”

Christmas has provided food designers a real opportunity to develop new presentations of fresh and smoked salmon that can sparkle on the festive dinner table. At one time, the opportunities seemed endless. However, around the early 2000s, the range of not only Christmas products, but of added-value products in general, began to diminish. Salmon prices had begun to rise, and more costly salmon meant that developing new products became less viable. The price for the consumer simply became too high for many to pay.

I recently came across a presentation from a leading financial analyst who spoke about the benefits of salmon farming for the

investor. One graph he displayed showed the EBIT (earnings before interest and tax) for farmed salmon. Prior to the early 2000s, the EBIT was relatively stable, but then the EBIT increased rapidly and has stayed high ever since. This makes salmon farming an attractive proposition for investors, but in my opinion a poor deal for consumers.

High prices and high revenues are exactly what the investor wants to see as the share price will also rise. Investors have the potential to make a lot of money, but I suspect that this comes at a cost to the consumer. This begs the question whether salmon farming is principally for the benefit of the investor or the consumer.

Salmon remains the consumer’s fish of choice, dominating fish counters and chillers. Most retailers would struggle to sell many other fish species such is salmon’s domination of the sector.

Yet I can’t help thinking that there is much more to salmon than a standard fillet – and, of course, there is. Salmon is available in other formats including a few recipe dishes, cold- and hot-smoked salmon, flavoured smoked salmon, terrines and canapés.

I can’t help thinking that there is much more to salmon than a standard fillet

”

Salmon’s premium status means it is less likely to feature in “added value” products. By Dr Martin JaffaAbove: Salmon at Christmas Left: Aldi Cranberry & Orange Salmon Opposite: Lidl whole salmon side

Salmon used to be available in a much wider range of added-value recipe dishes, but the higher prices meant that these products were just not commercially viable. We are now left with the remnants of what salmon used to be. New products, especially for Christmas, are few and far between with stores sticking with a few tried-and-tested choices.

This year, the picture is even more complicated. Having had a couple of years when choice was further reduced by the Covid pandemic, soaring inflation has pushed up prices, not just of salmon but most fish and other foods in general.

Consumers are making difficult choices about buying food basics, let alone treats for Christmas. I don’t expect to see much innovation in salmon products this year. Last year, even the premium retailers stuck with the same products and I predict that their ranges will remain similar this year.

A foretaste of how the salmon market at Christmas is changing comes from budget retailer Lidl. It will have fresh salmon on sale in the week before Christmas, but

frozen products are already beginning to appear in store. The frozen salmon offering is a whole side with a choice of garnishes. These are lemon and dill or garlic and herb butter, with sprigs of rosemary. These are simply whole 600g sides that have had value added by topping with some garnishes. The price this year is £9.99, which remains unchanged from last year.

By comparison, Lidl’s main value-added fish dish is made from sea bass. This is a sea bass stuffed with salmon mousse, spinach, cracked black pepper and hollandaise sauce. The 535g product costs £12.99.

This year, Lidl’s main competitor, Aldi, has stuck with a salmon product: Specially Selected Lemon Infused Cranberry and Orange Salmon, costing £8.99 for a 534g pack. Cranberry and orange is a popular choice, with Morrisons likely to offer a fresh option weighing 870g at £13.00.

Aldi will also be offering whole salmon and salmon sides in the run-up to Christmas and these are expected to cost £8.99/kg and £14.29/kg respectively. This

year, Aldi is requesting that shoppers pre-order these fresh choices to guarantee availability.

The salmon retail sector is proving difficult to predict. As I write this in the last full week of November, stores are running promotional offers at the same time as increasing the process of other options. The best deal at the moment comes from Lidl, which is offering a fresh salmon side at £12.99/kg.

Other stores have slightly smaller presentations on offer, including Morrisons at £13.98/kg, Asda at £15.20/kg and Sainsbury’s at £17.49/kg. I guess the message for this Christmas is that you pay your money and take your choice.

It is one of those quirks of politics that a catchy phrase can be attributed to someone without them actually saying it, and before long everyone believes they said it.

Donald Dewar, the Labour architect of Scottish home rule, was supposed to have described devolution as “a process, not an event”.

His SNP rivals used this time and again to claim that even Labour accepted that devolution was not the “settled will” of the Scottish people, but a changeable system that would adapt, develop and grow – ultimately towards independence.

When I was a political journalist I searched and scoured the archives, but could not find any record of Scotland’s first First Minister actually uttering those words. That didn’t matter, though, as far as the political world was concerned. He said it and that was that.

I don’t actually remember any of the main disrupters in the Brexit drama describing the UK’s exit from the EU as a “process, not an event”. In fact, they usually liked to characterise Brexit as a “clean break” – a simple process that would see the UK cast off the dreaded shackles of bureaucracy and red tape that membership of the EU imposed.

Yet, here we are, almost two years from that “clean break” and the Brexit changes keep on coming. Indeed, there is no doubt that

this is not only a process, but also one that shows no sign of slowing down.

If anyone doubts that, just wait until we get into the meat of the Northern Ireland Protocol. This will bring significant changes to the Brexit settlement and cause disruption to the uneasy truce between the UK and EU.

On the ground, for our members, one of the latest and most disruptive of the recent changes has been the decision by the French border authorities to adhere to strict sampling rules.

This means that they can – and often do –take a sample of fish from every 20th box or consignment and test it, just to make sure nothing nasty is coming into the continent on our salmon.

But this doesn’t just involve taking a swab from the skin or slicing a tiny part of the gills for microscopic analysis. What the authorities are doing is taking a chunk, often 500g in size or more, testing it and returning the now mutilated fish to the box, which is then re-sealed and sent on to the customer.

Unsurprisingly, customers tend to get upset when they open a box to find a fish with a chunk taken out. They complain to the producers, we complain to the UK government, which then takes the issue up with the French – and nothing gets done.

This is partly because the French are perfectly within their rights to sample fish in this way, and partly because of politics. This little spat gives the French leverage in trying to sort out some of the many other issues that are bubbling up between the UK and the EU.

Meanwhile, the buyers have to deal with mutilated fish, our members have to deal

Above: Sampling premium seafood can reduce its value

Left: Brexit: could it be a better fit?

The UK’s exit from the EU was just the start of a process that will demand flexibility and understanding on all sides. By Hamish Macdonell

with grumpy customers and UK government officials are caught in between our demands that they sort it and shoulder-shrugging French resistance.

Every example like this – and there are dozens of others across other export sectors – helps undermine the certainty in Westminster that Brexit is hard, fast and unchangeable.

Indeed, I would argue that the everchanging nature of Brexit, on the ground, demonstrates not just that the system is flexible, but that it needs flexibility from both sides if it is to work at all.

What this should mean is that all of us –including hard-line Brexiteers – accept that Brexit is a process not an event. This means there has to be room for adaptability and change on all sides.

What is astonishing is how that realisation has not filtered through into public political debate. Politicians on all sides appear to realise that Brexit has not delivered the benefits that were supposed to flow from it. Everyone knows that Brexit has reduced trade, made exporting more expensive, cut the size of the labour market, and added costs and burdens to businesses that were never there before.

This has helped push the UK towards a recession, drive up inflation and widen the gap between us and our international competitors.

After accepting that, it would be logical to think that the result would be a proper political debate on what should be done to rectify the situation. But no. Labour won’t open the Brexit debate again for fear of alienating those Red Wall voters they need to lure back and the Tories won’t do it in case they rupture the party over Europe once again.

Last month someone in government dared to suggest that perhaps the UK might try to enter into the sort of relationship with the EU that Switzerland enjoys (outside the bloc, but enjoying key aspects of free trade and free movement).

It took all of a few minutes before that suggestion was completely shot down by official sources within the government.

The result of this political omerta is that the export-led Scottish salmon sector, like many others, finds itself in a state of limbo. Our members keep battling through every change, problem and hurdle that Brexit throws at them, officials in government do their best to offer support, yet the politicians do nothing to change the situation.

Brexit will not be reversed. That much is clear to even the most optimistic of Remainers but if it is indeed a process – and all the evidence suggests it is – then perhaps it is time we made it work to our advantage.

There should be a discussion – a proper, grown-up discussion – about getting the best from Brexit. This doesn’t necessarily mean adopting the Swiss model or the Norwegian option; it means finding ways to make it easier for our exporters to export to the EU.

By not even considering a flexible approach, all our politicians are doing is displaying their own insecurities. If they were really confident about Brexit and its advantages, then they would know it is not going to be abandoned, however detailed the discussions are about making it better.

Brexit is indeed a process not an event. Isn’t it time, therefore, that we made that process work for us?

They usually liked to characterise Brexit as a clean break

”

Todd Fish Tech has developed a new, unique, stacking bivalve purification system. The Oyster Pod uses less than half the floor space of purification tanks and between purification cycles the seawater can be drained into the integrated sump at the turn of a valve. This means no more siphoning water, spare tanks or puddles creating a slip hazard. The Oyster Pod has been very popular with customers, with a large number of repeat sales and fantastic feedback. It can be used for oysters, mussels, clams or razors. Sizes range from 1,000 –6,000 oyster capacity.

See www.toddfishtech.com for more information.