F ish F armer

THREE members of the governing SNP party rebelled in a debate over the Scottish government’s controversial proposals for Highly Protected Marine Areas (HPMAs), which would ban fishing and aquaculture in 10% of the country’s coastal waters.

The commitment to introducing HPMAs, in which virtually all commercial activity would be barred, was part of the SNP’s Bute House agreement with the Scottish Greens, which formed the basis for the SNP-Green coalition. The proposals have been met with alarm and hostility by many, however, in coastal communities, the fishing industry and aquaculture.

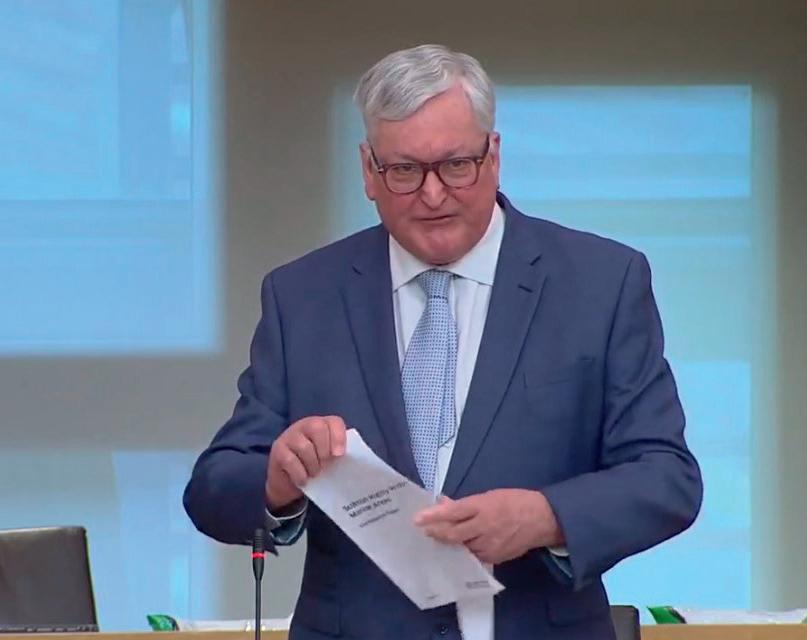

Debates on 2 and 3 May saw former Rural Affairs Secretary and SNP MSP Fergus Ewing dramatically rip up a copy of the HPMA proposals. Ultimately the government defeated a motion, brought by Conservative MSP Rachael Hamilton (Ettrick, Roxburgh and Berwickshire) calling for a complete rethink on the proposals.

A government amendment neutralising the motion was passed by 61 votes to 55, but three SNP members representing coastal communities – Fergus Ewing, Kate Forbes and Alasdair Allan – voted against the government, and three more – Ash Regan, Christine Grahame and Annabelle Ewing – abstained.

Bringing the motion, Hamilton said: “The fishermen in those vulnerable, fragile, rural coastal communities need to be heard… we can stand behind these communities, go back to the drawing board and work with them, rather than against them, to protect our seas; or we can press ahead with these unevidenced, unwanted and hugely damaging plans.”

Defending the HPMA policy, Mairi McAllan, Cabinet Secretary for Net Zero and Just Transition, argued: “If we do not protect our seas, they will not be able to protect us for much longer.”

She pledged that the Scottish government was in the midst of a consultation process that asks about the principles of HPMA and stressed that it was necessary to deal with the climate emergency “…in a way that is fair, just and leaves no one and no community behind”.

Mairi Gougeon, Cabinet Secretary for Rural Affairs, Islands and Land Reform, said that a full economic impact assessment for islands and coastal communities could only be made once HPMA sites had been identified, but said: “HPMAs will have a role in helping to preserve our

natural capital on which our marine industries depend, and in safeguarding our marine environment for future generations to enjoy.”

Tavish Scott, Chief Executive of industry body Salmon Scotland, commented: “Following this week’s parliamentary debates, the government can be in no doubt about the strength of feeling about proposed HPMAs, which have simply not been thought through.

“Rarely has one policy united so many different sectors and communities across the Highlands and Islands in opposition.

“Ministers must do two things: keep the promise not to impose HPMAs on any community opposed to them; and bring forward revised proposals based on scientific evidence.

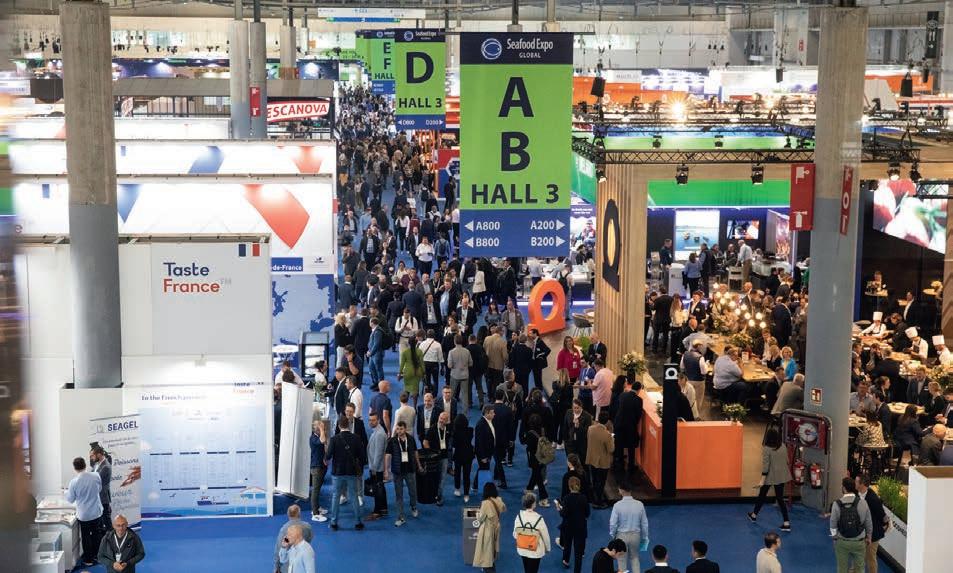

“Scottish salmon is a global success story – that is why the sector spent last week at the world’s largest seafood show in Barcelona as part of a Team Scotland approach that sells to many overseas markets.

“Exporting salmon is at the heart of the government’s sustainable blue economy vision, and this cannot be jeopardised by missing the opportunity of aquaculture investment here in Scotland.”

Consultation on the HPMA proposals closed on 17 April. Comments from a number of bodies such as the Scottish Fishermen’s Federation – which described the measures as “an exercise in government greenwashing” – have been highly negative.

Following the consultation, McAllan pledged that HPMAs would not be imposed on coastal communities against their will.

SEAWEED grown in Scotland could help to meet the demand for lithium-ion batteries as the world increasingly turns to electric vehicles, researchers in Glasgow believe.

Tailored alginates, a naturally occurring material found in brown seaweed, has the potential to be combined with silicon as an alternative to graphite, which is commonly used in the electrodes of lithium-ion batteries.

A team from the University of Glasgow’s School of Chemistry and private sector firm Marine Biopolymers recently received funding from the Industrial Biotechnology Innovation Centre (IBioIC) to investigate how alginates could be used in this field.

Silicon has been suggested as a viable alternative material for the battery anode and it can increase the charging capacity by up to 10 times. However, when used on its own, silicon expands and contracts each time the battery is cycled, eventually cracking and becoming damaged.This prototype combines silicon with the seaweed-derived alginate to improve the electrode’s elasticity and ability to store energy.

So far, a prototype the size of a typical watch battery has been created and tested by the researchers with very encouraging results.They are now keen to develop a larger-scale battery to test the technology at scale, proving that the seaweed alginates can be used to significantly boost charging capacity for a range of industrial and consumer products such as electric vehicles.

Professor Duncan Gregory, Chair in Inorganic Materials at the University of Glasgow’s School of Chemistry, said:“Battery technology is going to play a hugely important role in our transition away from fossil fuels. Electric vehicles, renewable energy production, national grids and other critical elements of a net-zero future will depend on having batteries that can store large amounts of energy in the smallest volumes possible and with extended lifetimes.

“As well as this, we need to find more sustainable production methods and ways to use naturally occurring materials as part of battery manufacturing.This project has been in the works for some time now and it is great to see initial positive results, combining the expertise from two key fields.”

Kirsty Neilson, Product Development Manager at Marine Biopolymers Limited, said:“This an exciting first venture into energy storage and we are hoping to be in a position to take a commercial solution to the market in the next three to five years. The new technology could underpin an entirely new supply chain and manufacturing market here in Scotland, and we have already had encouraging conversations with potential partners. It would be great to see seaweed species indigenous to Scottish coastal waters being used to power everyday electronics and technology in the future.”

STEWART Graham, Managing Director of aquaculture supplier Gael Force, has joined the board of industry body Salmon Scotland.

He was unanimously elected to the board at Salmon Scotland’s AGM in E dinburgh on 20 A pril.

Graham, founder of the Inverness-based Gael Force Group, brings 40 years of experience in the aquaculture and marine sectors and is a well-respected figure in Scotland and internationally.

Over those four decades, he has led Gael Force on a growth journey as a prominent supplier and manufacturer of robust aquaculture equipment, technology and services.

He is also credited with leading the initiative in 2016 to formalise a Vision for A quaculture to 2030, supported by the Scottish government, which led to the creation of an industry leadership group to drive progress in the sector.

He joins Hendrix Genetics’ Jarl van den Berg and Inverlussa’s Ben W ilson, who were appointed to the Salmon Scotland board in 2022, and the heads of the major Scottish salmon producers on the board of Salmon Scotland.

A tholl Duncan, Chair of Salmon Scotland, said: “Our farming companies couldn’t do what they do without the support of experienced supply chain companies such as Gael Force, so I’m particularly pleased that Stewart will bring his knowledge, experience and perspective from establishing and running one of the leading supply chain companies in the Scottish aquaculture sector…this time last year we opened up membership to salmon egg producers, support vessel owners, net manufacturers and technology and innovation companies, right through to secondary processors and hauliers.

“We’ve been blown away by the response from our new members and one year on we can say that we represent every part of the supply chain in every part of Scotland.”

MOWI Scotland has announced the summer schedule for its “Salmon Wagon”, which raises funds to support good causes at events throughout the country.

In summer 2023, the aquaculture leader’s Salmon Wagon is set to attend 10 major events from Rosyth to Kyle of Lochalsh, with stops at Achiltibuie,Appin, Benbecula, Isle of Harris, Isle of Skye, Kilchoan, Newtonmore and North Uist along the way.

The Wagon is stocked and staffed by Mowi and 100% of proceeds from the sale of food from the charity food truck will be used to support local causes.

Jayne MacKay, Community Engagement Officer at Mowi Scotland, said:“After the success of last year, we are excited to hit the road again to support another 10 brilliant events, which are vital social occasions for our local communities. From village galas, agricultural shows and Highland games to festivals, women’s shinty finals and fundraisers for RNLI lifeboat stations, we can’t wait to show our support for these gatherings, which forms a key part of Mowi’s commitment to help the communities we work in thrive.”

The calendar of events is shown below.

Date LocationEvent Supporting

Saturday 27 MayRosyth Rosyth Children’s Gala EATS Rosyth

Saturday 1 JulyAchiltibuieCoigach Gathering Coigach Community Trust

Friday 21 JulyKilchoan

West Ardnamurchan Show & Sports West Ardnamurchan Show & Sports

Tuesday 25 July Leverburgh, Isle of Harris South Harris Agricultural Show South Harris Agricultural Assoc.

Thursday 27 JulyNorth UistNorth Uist Show North Uist Agricultural Assoc.

Friday 28 July Liniclate, Benbecula Eilean Dorcha Festival Local community investment

Saturday 5 August Portree, Isle of Skye Skye Agricultural Show

Saturday 19 AugustAppin

Appin Agricultural Show

Saturday 2 September Newtonmore Camanachd

Women’s Finals Day

Saturday 9 September Kyle of LochalshMaritime Day

To find out more, go online to www.mowisalmonwagon.co.uk

Portree & Bracadale Free Church / Skye

Agricultural Show

Argyll Beats Cardiovascular Disease

Camanachd Women’s Association

RNLI Kyle of Lochalsh

AQUACULTURE biotech company Benchmark Genetics has announced a major reorganisation of its leadership team, with a new leadership position created to develop its business worldwide.

Dr Morten Rye – who previously headed Genetics and Innovation – will take on a new senior role as Director, External Services and Global Strategies, expanding Benchmark Genetics’ provision of genetics services to the global aquaculture sector.This will include providing genomic tools and analysis, making Benchmark Genetics a one-stop shop for genetic services.

Dr Ross Houston will lead the technical

genetics team, succeeding Dr Rye as Director, Genetics and Innovation. As part of the role, Dr Houston will take primary responsibility for the internal breeding programmes and product development while also retaining his leadership of R&D for the company.

The genetics team has been reorganised, with new leadership positions for each of Benchmark’s five internal breeding programmes within Atlantic salmon, shrimp and tilapia, and for the key technical support and R&D teams.This includes molecular genetics, reproductive technologies and

trait development.

This new structure will optimise synergies across breeding programmes, Benchmark said, as well as innovation and implementation of the latest technologies.

Commenting on the management changes, Jan-Emil Johannessen, Head of Benchmark Genetics, said: “These changes reflect a successful succession of our senior leadership team and are targeted towards securing our world-leading position within the applied aquaculture genetics field.

“We are confident that Ross and Morten will excel in their new roles, helping our team of over 25 expert geneticists to deliver genetic improvement to the aquaculture industry.”

THREE Bakkafrost Scotland salmon farm sites have been awarded the prestigious Aquaculture Stewardship Council (ASC) certification.

Bakkafrost’s operations in Sgeir Dughall, Glennan Bay and Gob a Bharra have all received the certification. The company has also obtained ASC Chain of Custody certification for all three of its processing facilities on the west coast.

The ASC is the world’s leading certification scheme for farmed seafood, and the ASC label only appears on products from farms that have been independently assessed and certified as being environmentally and socially responsible.

Bakkafrost Scotland Managing Director Ian Laister said: “This is a major achievement for our sites and for our teams. ASC develops and manages some of the

strictest aquaculture standards.

“These standards include hundreds of requirements covering the potential impacts of aquaculture – including water quality, responsible sourcing of feed, disease prevention, animal welfare, the fair treatment and pay of workers, and maintaining positive relationships with neighbouring communities.

“The award is a testament to the commitment of our people and it is a significant first step in our journey towards further accreditation across the business in Scotland.”

With the addition of the latest sites, a total of 54 farms in the UK are now ASC-certified or in initial audit stages, covering finfish and shellfish species. That represents an increase of 207% since Q1, 2022.

“We are delighted that Bakkafrost Scotland

MOWI Scotland more than doubled its EBIT, or operating profit, during the first three months of this year, the international Mowi Group’s Q1 trading update shows.

The Scottish division achieved an EBIT of €2.45 per kilo (£2.15) against €1 (£0.88) a year ago – the second highest in the group. Once again, Norway was the star performer with an EBIT per kilo of €3.75 (£3.31).

The Scotland harvest was 11,000 tonnes against 10,500 tonnes in Q1 2022.

On a global level, Mowi achieved an operating profit of €322m (£284m), up from €207m (£183m) during the first quarter of last year.

The global slaughter volume totalled

102,500 tonnes against 98,000 tonnes last year and higher than predicted a few weeks ago. Norway harvested 65,500 tonnes, up by around 6,000 tonnes.

Mowi update said the Chilean operation made an operating profit of €1.5 per kilo (£1.32), somewhat lower than expected

has been awarded ASC certification and is joining a growing community of farms in the UK that are working towards transforming responsible seafood farming for the future,” said Lorraine Gallagher, ASC Market Development Manager, UK and Ireland.

although higher than 12 months ago.

The Mowi Ireland harvest was, as expected, unchanged at 1,000 tonnes, while the operating profit on last year was also down at €1.70 per kilo (£1.50).

As with Scotland, Mowi Ireland experienced some biological issues last year, due in part to the exceptionally hot summer.

Mowi Canada produced a reduced of harvest 7,500 tonnes and a lower EBIT of €2.15 per kilo (£1.90).

The operating profit for Consumer Products was €37m (£32m) , while for the feed business the operating profit was €6m (£5.3m).

Benchmark Animal Health has entered an exclusive UK distribution agreement with STIM Scotland Ltd for the lice treatment Salmosan® Vet.

The agreement was signed on 28 March. Salmosan® Vet is a market-leading azamethiphos treatment for sea lice and one product within Benchmark’s Animal Health portfolio.The product is used throughout the global salmon industry for the control of pre-adult to adult stages of sea lice.

Benchmark said it was “…well recognised as a reliable, gentle and effective treatment option”.

Benchmark said: “STIM Scotland Ltd are professional distributors with a well-established and trusted network of delivery, which will ensure customers can access secure and consistent supply.”

Announcing the agreement, John Marshall, Head of Benchmark Animal Health, said: “At Benchmark, we are committed to helping customers manage the ongoing challenge of sea lice. Our exclusive agreement with STIM Scotland

offers us the opportunity to further support our customers in their use of Salmosan® Vet. I am confident this will have a positive impact on our customers’ operations.”

Campbell Morrison, Key Account Manager at STIM Scotland Ltd, added: “In the UK, as well as in Norway and

Mowi’s feed mill in Kyleakin on the Isle of Skye produces feed for salmon and trout at all lifecycle stages and for fresh and seawater environments.

R&D is central to everything we do at Mowi Feed and ongoing field trials inform our approach to optimising raw materials, growth rates and animal robustness.

We have a robust policy on sustainability and all ingredients used in fish feed are traceable. Mowi also holds certifications for feed production according to the GlobalGAP CFM, Label Rouge and organic (Naturland and Soil Association) standards and we are already working towards gaining accreditation to the forthcoming ASC Fish Feed Standard. Mowi is regularly audited by many of the major European retailers and comply with the quality standards prescribed by a wide diversity of retail outlets.

We offer bulk deliveries using our own vessels and we can deliver in bags by sea or road transport.

To find out more contact: kyleakinfeedsales@mowi.com

+44 7817 099 334 www.mowi.com/sustainability/mowi-feed

Chile, STIM strives to supply a complete range of the most important fish health products available. Salmosan® Vet is certainly one of those and we are pleased to add the product to our growing product catalogue.”

Above: Salmon treatment Photo: Benchmarkuncertainty and unpredictability are avoided further down the line.

However, the Centre Party, which shares the government with Labour, has repeatedly rejected any idea of a Faroese system, arguing that it breaks the traditional Norwegian tax model and claiming a majority in parliament want what is being proposed.

Seafood Norway (Sjømat Norge), representing the farming companies, said the government fundamentally lacked an understanding of how the value chain and the farming industry worked.

THE Norwegian business employers’ organisation NHO says the “ground rent” salmon tax plan should go back to the government for a fresh look.

It made the plea to Norway’s parliament, the Storting, during its finance committee’s open hearing about the tax.

The new tax bill, which mostly affects larger companies such as Mowi and SalMar, is now in force even though it had yet to be approved by the full parliament by the time this issue went to press.

NHO’s Deputy Managing Director, Anniken Hauglie, told the hearing: “We have one main message: The bill should

be sent back to the government for further investigation. And we request that the tax be postponed until 2024.”

She suggested the government should look at variants of the Faroese model or another profit-based scheme.

“It is important to take a step back to sit down with the industry and find an agreed solution,” she added, while stressing it is important that the Storting can come together on a broad settlement so that

“It is not about the industry not wanting to pay more in tax, but that the model will not work,” said Seafood Norway board member Line Ellingsen. She added: “It is about what kind of tax burden we can tolerate. There is a difference between producing fish along a value chain and using up the oil from the North Sea. Oil cannot die from viruses and oil cannot be moved.

THE value of the Irish seafood sector bounced back last year after the trials of Brexit and Covid lockdown, with farmed salmon leading the charge.

According to the latest GDP figure from the Republic’s seafood support body Bord Iascaigh Mhara (BIM), the seafood sector’s contribution totalled €1.3bn (just over £1.15bn) in 2022.

BIM said increased consumption higher prices and the reopening of the foodservice sector were the main drivers behind the revival.

The top-selling species on the Irish market during the year were salmon at €119m (£105m) and cod at €44m (£39m).

Organic salmon, an Irish speciality, was the top species produced by the aquaculture sector –accounting for 13,500 tonnes worth €124m (£109m), while Dublin Bay prawns were the country’s most valuable species landed by the fleet, accounting for 6,200 tonnes and worth €82m (£72.5m).

The farmed shellfish sector also performed well with positive growth recorded for oysters, and rope mussels increasing significantly in value.

Food and Agriculture Minister Charlie McConalogue said 2022 had brought new problems arising from the Ukraine conflict and soaring energy costs.

He continued: “Following from the economic shocks in 2020 and 2021 from the global pandemic and Brexit, 2022 brought with it a new set of challenges created largely by the war in Ukraine.

“This has seen energy prices rise to unprecedented levels and created a difficult trading environment for the whole seafood sector adding to challenges brought on by Brexit.”

GRIEG Seafood not only harvested fewer salmon during the first part of this year, it also saw a significant jump in its production costs.

Presenting its 2023 first-quarter trading update, the company announced a harvest of 15,350 tonnes against 16,900 tonnes over the same period last year. However, this output was higher than had been expected.

The harvest figures by region for the period were Rogaland, 7,500 tonnes and Finnmark 7,850 tonnes (both Norway).

There was no harvest from British Columbia this quarter.The company had announced last year that it was decommissioning its BC fish farms run by First Nations groups so they can determine what type of aquaculture they eventually want.The move was also part of an ongoing site restructuring plan. But it is the average production

cost per kilo that has attracted attention. In Finnmark, it was NOK 62.8 per kg (£4.76) and NOK 58.4 per kg (£4.43) against NOK 42 per kg (£3.19) in both areas this time last year, a jump of around 48% and 40% respectively.

Other salmon companies will almost certainly have experienced sharp increases in production costs to a greater or lesser degree over the past few months, notably for feed and energy.

The increased cost of production is one of the industry’s main arguments against the Norwegian government’s new salmon tax proposals. Grieg has already frozen some of its Norwegian investment plans.

Since selling its Scotland and Shetland business to Scottish Sea Farms in 2021, the company has concentrated its activities in Norway and Canada.

ANNUAL industry event the North Atlantic Seafood Forum (NASF) has entered a strategic partnership with the executive recruitment group Seafood People and investment firm Pareto Securities.

The agreement means Seafood People and Pareto will help assist the current management of NASF with further development of the programme, speakers and the technical implementation of the event.

NASF, based in Bergen, Norway, brings together senior figures from the seafood industry internationally, with aquaculture, catch fishing and the supply chain represented.

“We have just put behind us a very successful NASF event that is considered by many to be the best ever. The feedback we have received both from our sponsors and an almost fully subscribed list of participants has been just as good as we dared to hope for. However, the need for development is constant and NASF has therefore decided to enter into a partnership with Seafood People. Seafood People know the seafood industry very well and have a large network, and we believe they will add additional quality to NASF to develop programmes, find speakers and help make NASF an even better meeting place,” said Carl-Emil Kjølås Johannessen, Partner in Pareto Securities and Chairman of the Board of NASF.

Andre Akse, CEO of NASF, said: “The seafood industry is changing, and we want to change in line with our surroundings and thus ensure that we are attractive in perpetuity. Although the NASF is conceptually consistent, there is always potential for improvement. More hands, new thoughts and innovative concepts are always positive.”

LAND-BASED farming company Salmon Evolution issued a mortality alert last month after revealing that its new facility in Norway had been hit by biological issues.

In April, the company successfully raised half a billion kroner (around £40m) in a single afternoon, issuing 68,181,818 new shares in two tranches. It was soon fully subscribed and brought in a total of NOK 525m (around £40m).

The subscription price was NOK 7.70, but the share price at the end of trading after the first day closed at NOK 8.34 (£0.64) which meant the issue was priced at a discount of 7.7%.

But in an operational update on the Oslo stock exchange two weeks later, Salmon Evolution said it was experiencing increased mortality levels in selected fish groups at its new Indre Harøy facility, which were likely to lead to harvest delays.

It said: “As per 29 April 2023, the aggregated mortality level for each batch ranges from 0.3–7.9%.

“The reason for the increased mortality is relating to gill health, suspected to be caused by external pathogens.”

The company is investigating the root cause and taking precautionary steps to mitigate the situation, including increased UV treatment levels on intake water.

It added: “The facility is otherwise operating under stable conditions with relevant water quality parameters at normal levels.”

Summarising the problems, Salmon Evolution said: “Batch 2: Current biomass is estimated to be more than 800 tonnes (LW) with an average weight of approximately 4kg (LW).

“Harvesting is planned to commence shortly with the full batch expected to be harvested by early June at the latest.

“Batch 3: Currently split into two fish groups with an average weight of around 1.6 kg (LW). One of the fish groups is currently experiencing increased mortality.

“Batch 4: Currently split into two fish groups. Low accumulated mortality, but at increased levels for the smallest group.

“Batch 5: Normal feeding and low mortality levels.”

It now plans to stock five additional batches this year of which the next two batches are planned to be stocked during Q2.

The statement concluded: “Depending on the future performance of the existing batches and any potential decisions to commence early harvest at suboptimal weights, expected timing for Phase 1 steady-state production volume may be delayed from late Q3 2023 to late Q4 2023.”

A Finnish biotech startup that aims to produce fungus-based protein for animal and aquafeed has raised €11m (£9.7m) in its latest funding round.

The capital-raising exercise for eniferBio was led by aquaculture investment fund Aqua-Spark alongside Tesi (Finnish Industry Investment), with Valio, Voima Ventures and Nordic Foodtech VC also joining the round.

With the freshly raised funding, the company will begin to scale up the production of its PEKILO® mycoprotein powder to thousands of tonnes per year and seek Novel Food approval from the EU and other markets.

PEKILO® is a fungus that, through a special fermentation process, can produce a dried powder rich in protein and has a vast variety of usage, such as pet food and aquafeed. The process was originally developed by forestry industry scientists in the 1960s in Finland to produce cost-efficient animal feed protein from side streams of the pulp and paper industry.

Using the same, yet enhanced, proprietary technology and fermentation process, eniferBio can upcycle byproducts from diverse agri-, food- and forest industry processes into its PEKILO® mycoprotein, which consists of up to 70% protein, 20-30% of goodquality fibre, about 10% of fats and minerals, and has a high concentration of vitamin B. The production process is efficient, uses very little water, doesn’t require large land areas and doesn’t cause eutrophication like traditional agriculture.

CEO and co-founder of eniferBio Simo Ellilä said: “We are extremely excited to have our new investors, Aqua-Spark, Tesi, and Valio, join us on our mission to feed the world with sustainable protein. Together they put a huge amount of new sector-specific knowhow and networks at our disposal. We’re also glad to see our longterm backers, Nordic Foodtech VC and Voima Ventures, double down on their bets and show their continued support for our vision.”

Lissy Smit, CEO of Aqua-Spark, said: “Greening aquaculture feed by eliminating our reliance on wild ingredients and reducing our footprint is one of our biggest priorities in getting to a more sustainable aquaculture industry. eniferBio’s alternative feed ingredient serves as a replacement for soy in aquafeed. It significantly reduces land and water usage. Furthermore, early trials suggest that it has the potential to improve growth performance and immune response in fish.”

eniferBio already has ongoing partnerships with big global companies in the feed and food industries, such as Skretting, the global aquafeed division of Nutreco, Purina for pet food, and Valio for consumer food products. Its next big phase includes developing products fit for consumers through collaboration with Valio, a brand leader in Finland and a major player in the international dairy ingredients market.

A capital-raising exercise by Norwegian cod farmer Norcod has exceeded expectations, the company said last month.

The share issue took the form of a private placement and such was the high level of interest, the size was increased to allow for an allocation of 6,349,612 offer shares at a subscription price of NOK 30 per offer Share, raising gross proceeds of almost NOK 190.5m (£14.7m).

The original figure was between NOK 125m and NOK 175m (£10m to £13.5m).

The net proceeds from the placement will be used to increase biomass in accordance with the company’s production plan and to develop two new locations and for general corporate purposes.

Norcod had earlier issued a first-quarter trading update reporting that it had harvested 3,362 tonnes, whole fish equivalent (WFE), between January and March this year.

The biomass at sea at the end of March was 4,279 tonnes – equivalent to 5,384,000 individual fish.

It has been a difficult period for the company, in which it had to bring forward harvesting in a number of cages because spawning cod had been discovered.

This order, said Norcod, led to significant pressure on its operating expenses and cash flows.

TWO Norwegian salmon farming companies, SalMar and Måsøval, released 2023 first-quarter harvest trading updates last month, showing differing fortunes.

SalMar recorded a slight increase, slaughtering 48,500 tonnes during the January to March period, from 45,000 tonnes in the same period last year.

Some 42,000 tonnes came from its Norwegian farms, while 6,600 tonnes were slaughtered at its Icelandic Salmon operations. Firstquarter harvests are usually lower than those during the rest of the year due to various winter-related issues.

SalMar has hugely expanded its salmon ownership following

the acquisition of the NTS group, which includes Norway Royal Salmon and SalmoNor, late last year.

As a result, the company has indicated that it expects to harvest 243,000 tonnes from Norway (plus 16,100 tonnes from Iceland) this year against 193,700 tonnes for the whole of 2022.

Meanwhile, Måsøval’s slaughter volume came to 1,994 tonnes gutted weight against 3,284 tonnes this time last year.

The company is based on the island of Frøya at the far end of the Trøndelag coast.

It also has facilities in the neighbouring municipality of Hitra, and from Levanger in the north to Ørsta in the south.

HEART health in farmed salmon can be signifi cantly improved by changing production methods, according to new research by a team at Norway’s NMBU Veterinary College.

The NMBU study shows that reduced intensity in the hatchery stage can lead to better heart shape and function in farmed salmon. Heart disorders and circulatory disorders are often observed in connection with mortality after stressful interventions, and varying degrees of abnormal heart shape are also often reported in farmed salmon.

Led by Professor Ida Beitnes Johansen, a concentrated research effort is now underway to uncover causal relationships and possible measures that can ensure good heart health for the salmon. Called the Helsmolt project, it is a collaborative effort also involving the Institute of Marine Research and other groups.

The main aim is to fi nd out whether production conditions in the freshwater phase can be the cause of developing morphological abnormalities in the heart.

FHF, the semi government body set up to develop knowledge for the Norwegian seafood sector, said the results showed that intensive smolt production where the fi sh run at higher temperatures is associated with several deviations in the heart shape.

It explained: “Conversely, a slower production at lower temperatures produced fewer morphological deviations and resulted in the salmon [developing] hearts that are more similar to the wild salmon heart.

“The results also showed that abnormal heart morphology in intensively produced smolts is associated with accelerated stiffening of the heart’s main chamber (ventricle) and the bulbus muscle, which can be linked to symptoms of disease and reduced heart function later in life.

“There is, therefore, reason to believe that rapid smolt production increases the risk of heart disease in Norwegian farmed salmon and that this contributes to increased mortality in salmon approaching slaughter.”

THE world’s largest, and probably most environmentally friendly dedicated power plant for wellboats has been officially opened on the island of Hitra near Trondheim, Norway.

The ceremony also marked the inauguration of two new wellboats for the Leroy Seafood Group’s Midt operation, which has a nearby salmon plant.

The power plant means that vessels can discharge their fish for slaughter without the engines running, hugely reducing CO2 emissions.

The vessels are able to operate solely on electricity while handling more than 1,000 tonnes of live fish per hour.

Svein Olav Munkeby, Executive Director of NTE Marked AS, which designed and built the plant, told the broadcaster NRK that as diesel vessels of this type use up 1,000 litres of fuel per hour, the CO2 reductions could total 50,000kg per day or several thousand tonnes annually.

The Frøy-supplied vessels are named Kristiansund and Gåsø Høvding, with the latter equipped with several new solutions and thought to be the world’s largest.

The project is the result of a close collaboration between Lerøy Midt, Frøy ASA and NTE.

Harald Larssen, General Manager at Lerøy Midt, said: “This investment is one of many measures we are taking to achieve the company’s goal of reducing climate emissions by 46% by 2030.”

Jakob Hæhre Krogsrud, Marketing Manager at NTE, described it as a ground-breaking project, adding: “The new shore facility for wellboats is the largest of its kind in the aquaculture industry and I am convinced that it is an important step on the way to a greener industry.”

Andreas Moe, Regional Operations Director at Frøy ASA, said: “The fact that we can use shore power instead of diesel for such large and energy-intensive operations is worth its weight in gold for both for the environment and the whole seafood industry.”

PLANS to move fish farming further out to sea off the Norwegian coast have moved a big step forward.

The Norwegian Directorate of Fisheries has opened a new consultation to assess views on the potential impact of offshore aquaculture on the environment in the three areas already set out late last year by the Directorate. The deadline for comments is 24 May.

The Directorate has proposed three possible areas: one in the north, the second off central Norway and the third in the south, which is directly across from the north Scottish coast.

Originally 11 areas were proposed, but eight have been temporarily set aside until further information becomes available. Offshore fish farming is seen as one of the next major developments in aquaculture.

Companies such as SalMar began preparing for this expansion

over two years ago when it commissioned its Ocean Farm 1 platform. It has now teamed up with Aker in a joint venture, SalMar Aker Ocean, which is planning global offshore developments.

Norwegian Fisheries Minister Bjørnar Skjæran said recently “at sea” fish farming would be of great importance for future value creation in the industry.

He added: “We are keeping up the pace with developing a separate licensing regime for offshore aquaculture, while at the same time facilitating further growth in an industry that already brings great value to the community.”

Faroese fish farmer Bakkafrost has also indicated that it could move into offshore salmon aquaculture in future.

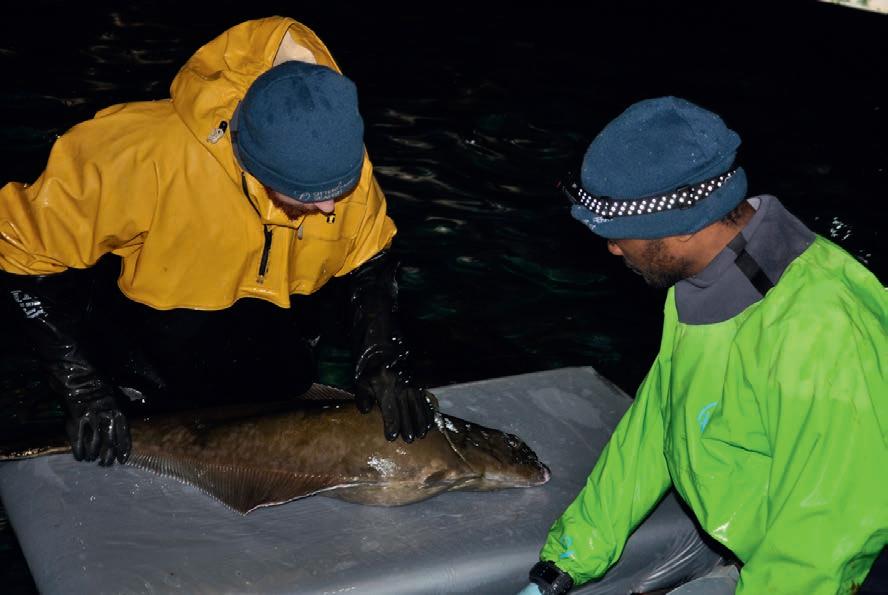

NORDIC Halibut AS has reported that it achieved a record high average sales price of N O K 169 per kilo (£12.91) during the first quarter of this year.

This represents a year-on-year increase of 26% for the prime white fish, which is particularly popular in high-end restaurants.

The company told investors it was experiencing “…a growing willingness to pay and acceptance for farmed halibut in key markets, as awareness of the product’s outstanding qualities and attributes continues to rise”.

The announcement said: “Exports of farmed halibut from Norway in Q1 2023 achieved approximately 50% higher prices compared to wild catches.

“During the period, Nordic Halibut harvested 224 tonnes of heads on gutted (HOG) halibut, with an average harvest weight of 5.9kg. Some 75% of the volume harvested was above 50kg [per fish].

“The company capitalised on favourable market conditions and utilised biomass at harvestable size to optimise revenue.”

Total revenues ended at NOK 38m (around £3m) during the quarter. Nordic Halibut said it was continuously seeking to maximise the use of its harvestable biomass in order to create a strong market presence and achieve optimised prices.

The statement went on: “The sales prices for larger-sized halibut, specifically those sold at 7–9kg and 9kg-plus, are notably higher, ending at NOK 188 per kg and NOK 203 per kg, respectively in Q1 2023.

“According to the strategic harvest plan for 2023, harvest volumes will decrease in Q2 to ensure optimal biomass utilisation towards the second half of 2023.”

In 2023, Nordic Halibut will release one million fish to sea –equivalent to the growth phase 1 production target of 5,000 tonnes (4,500 tonnes HOG) harvest in 2026.

“The company reiterates the harvest volume guiding for 2023 at 1,200 tonnes (1,080 tonnes HOG).”

and keep the parent company and its subsidiaries integrated, and in turn keep its headquarters in Galicia.

“The agreement makes it possible to integrate Nueva Pescanova into one of the main marine protein family companies in the world.”

It is thought Nueva Pescanova will keep its main base in Vigo, northern Spain after any deal.

Cooke involvement would help expand Nueva Pescanova’s operations and generate new investments in Galicia, Spain, Abanca said.

Nueva Pescanova is involved in fishing, aquaculture , processing and marketing of seafood employing around 12,000 people.

COOKE Seafood looked poised to acquire a majority stake in the large Spanish fishing, processing and aquaculture company Nueva Pescanova, as Fish Farmer went to press. If the deal goes ahead, it will be Cooke’s fourth major acquisition in less than 12 months.

Cooke has yet to make a comment on the move, but it is reported to have reached a deal which would give it 80% of the share capital in the business, with Nueva Pescanova retaining 60%.

Neuva Pescanova is owned by the Spanish bank Abanca which has been

seeking an investor for some time.

Rumours of Canada based Cooke Seafood’s interest in the company surfaced around the start of the year.

Abanca confi rmed it had entered exclusive talks with the Canadian giant regarding a sale.

It has not revealed how much is involved but Abanca said in a recent statement it would justify a future Nueva Pescanova valuation at around 800 million euros (£707m).

Abanca president Juan Carlos Escotet Rodríguez said: “Since 2015 we have made a considerable effort to safeguard the company’s viability

More recently it became embroiled in a row over a plan to open an octopus farm in the Canary Islands after marine scientists claimed they have a high level of intelligence.

The US is one country planning to ban intensive octopus farming, but Nueva Pescanova has denied the creatures would suffer.

Cooke, led by CEO Glenn Cooke, has been on an impressive growth march over the past year, acquiring the Tasmanian salmon company Tassal, Europe’s largest shrimp and prawn processor, Morubel NV and the large US seafood distributor Slade Gorton. It also owns a salmon farming operation in Orkney and Shetland.

BRITAIN and India have signed a landmark scientific research agreement which includes work on tackling a number of aquaculture related issues.

The memorandum of understanding, signed at the House of Commons on 27 April, is aimed at enabling quicker, deeper collaboration on science between the two science powerhouses that will drive economic growth, create skilled jobs and improve lives in the UK, India, and worldwide.

The £3.3m UK funding will be matched by India.

It includes a study into the use of cutting edge UK tech to spot diseases in shrimp aquaculture, in which India is a major player, and a partnership using UK know-how to detect harmful algal blooms.

There is also funding for ten new UK-India fishery-related research fellowships, while some environmental projects should also benefit.

The collaborative activities carried out under the

memorandum will be supported by joint funding agreed by both sides, with finances for each programme determined between the UK and India on a case-by-case basis.

George Freeman, Minister of State for the new Department for Science, Innovation and Technology said: “India is rapidly building on its phenomenal software and innovation sectors to become a global powerhouse in science and technology.

“With our extensive trading and cultural links, shared democratic values and interest in urgent global issues from green technology and agri-tech to biosecurity and pandemic preparedness, we have very strong platforms for deepening research collaboration.

He added: “Today’s agreement is part of our program of deepening UK collaboration with other global science superpowers on ground-breaking innovation and research, to help tackle shared global challenges. This partnership will grow the sectors, companies and jobs of tomorrow for the benefit of both our countries and the globe.”

MARINE conservation organisation the Sustainable Fisheries Partnership has signed a memorandum of understanding with the Aquaculture Stewardship Council, setting out an agreement to work together to help promote sustainable seafood practices.

The memorandum was signed in Barcelona at the Seafood Expo Global trade show. Under the agreement, ASC and SFP have pledged to build on work already carried out on data sharing and aligning information systems. ASC and SFP are currently building a work plan for the next steps of the collaboration.

Chris Ninnes, ASC CEO, said: “We are excited to explore new ways of collaborating with SFP who we have a longstanding and successful history of partnership for many years. By working together on scaling our efforts in the aquaculture improvement space, enhancing the sustainability of the reduction fisheries sector based on ASC Feed Standard requirements and coordinating our market engagement efforts, we aim to leverage our shared work with farmers, feed suppliers and other stakeholders.”

SFP founder and Chief Executive Jim Cannon said: “Our collaboration is a powerful opportunity to increase sustainable aquaculture production. With the ASC, we can innovate and enhance the scope of aquaculture improvement projects so that more producers can improve practices, more government regulators can strengthen governance, and more buyers can find meaningful ways to engage and support improvements.”

ASC runs one of the world’s leading certification schemes for farmed seafood. A key project for the near future is ASC’s Improver Programme to help producers who cannot currently achieve certification improve their farming practices and performance and reach a level that meets certification requirements. ASC and SFP plan to develop a process designating stepwise improvements across at least four impact area modules (water quality, disease management, feed and effluent). Together, the organisations will also look into developing a framework to track progress. ASC and SFP also intend to work together on sustainability and reducing the ecological footprint of aquaculture feed and production.

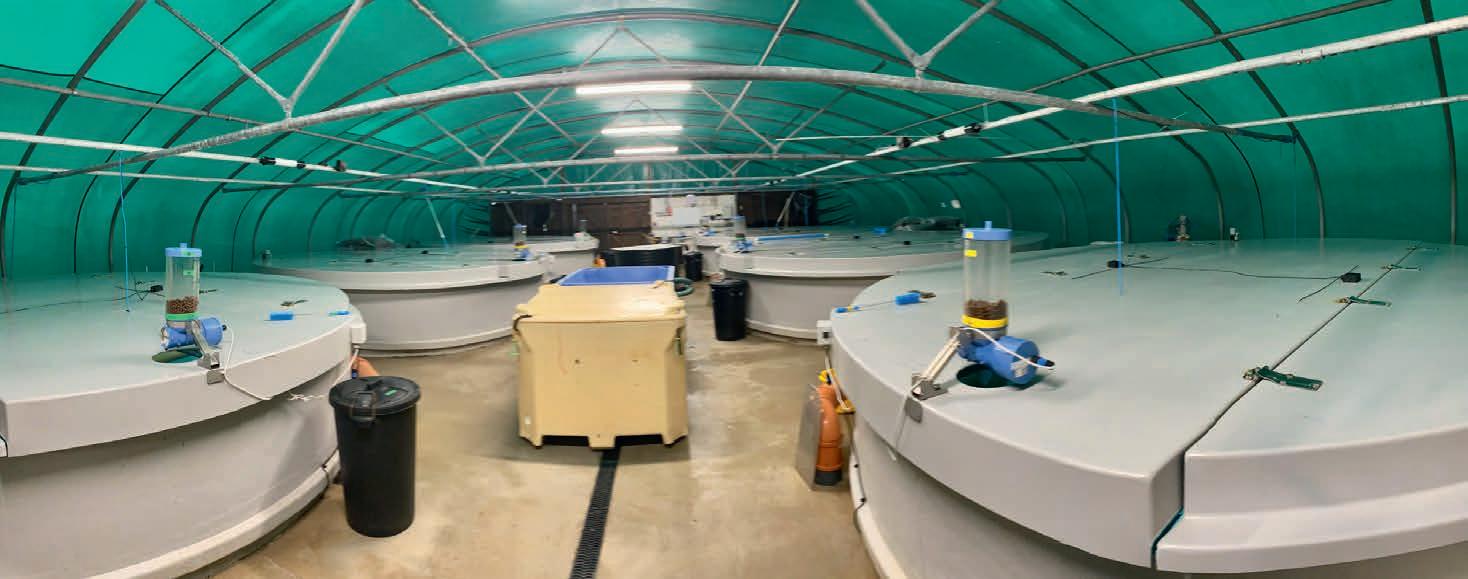

THE Kingfish Company achieved record production results last year despite several external political and economic challenges, CEO Vincent Erenst (pictured) has told shareholders in the company’s 2022 annual report.

The company also saw sales of its yellowtail up while bringing its Netherlands Phase 2 facilities close to completion and making major progress with its Maine, USA project.

Sales for the year increased by 81%, reaching €18.7m (approximately £16m).

Erenst, who took over as CEO in February this year said:“Last year we achieved a new production record of 1,511 tons of growth and sector leading productivity of 0.75 kg/m 3/day.

“Productivity further increased with the third generation of fingerlings showing improved growth resulting in increased harvest size.

“Mortality levels remained low and there were no mass mortality events.The Phase 2 hatchery is nearly complete with a successful start

of operations in Q1 of 2023.”

He said Kingfish was able to almost doubled output and sales, while the average sales price per kg increased by 15%.

“Market demand for high value Dutch yellowtail is strong in both Europe and the United States, with products being sold in 21 countries by high end foodservice distributors and leading retailers such as Whole Foods, Conad and Auchan,” he added.

Last December the operation in Maine, USA obtained the local building permit from the Jonesport Planning Board and is now fully permitted by Local, State and Federal regulatory agencies.

Broodstock was successfully shipped to the US and the fingerlings that were already shipped there were doing well with a first harvest planned for this summer.

Highlights for the first quarter this year include :

• Record sales in Q1 2023 with €5.6m (£4.9m)

revenue up 55% compared with Q1 last year.

• Average revenue/kg at €15.1, up €0.6/kg vs. Q4 2022, driven by solid demand and larger size fish.

• Steady production of 421 tons, and consistent sector leading productivity at 0.86 kg/m3 per day growth.

• Netherlands Phase 2 hatchery in operation since January. Grow-out facility nearing completion and will be commissioned in tranches from May till Sept 2023.

• US Maine first sale of trial batch of locally produced fish. Broodstock shipments from Netherlands completed.

• Sales volume up 18% year on year to 375 tons. Solid demand in all markets, both in food service and retail, driven by high product quality and customer satisfaction.

•

•

•

ATLANTIC Sapphire chairman Johan Andreassen has spoken of “a challenging year” as the company announced it had reduced its losses by more than half during 2022.

The land-based land salmon farmer, situated in Miami, Florida, reported a net loss of US $65m (£52.4m), down from $133m (£107.1) in 2021.

Revenues were up by $2.1m to $19m (£15.3m) on a harvest of 2,253 tonnes (heads on gutted), 121 tonnes less than for last year.

The company said slaughter volumes should increase greatly as a result of stable operations this year when the harvest should start producing 9,500 tonnes of its Bluehouse salmon in annual slaughter volumes.

Atlantic Sapphire has attracted significant investment recently, raising $55m (£44.3m) through a private placement on the Oslo Stock Exchange.

Chairman Andreassen said in the company’s 2022 annual report that Atlantic Sapphire had been faced with unforeseen setbacks and had missed its production and financial targets for the year.

“We decided to re-focus all our efforts from rapid growth to delivering profitability in our Phase 1 Bluehouse first, fixing issues that have impacted our fish negatively,” he said.

“These efforts have improved fish welfare and reduced operational risk, setting the stage for good biological performance in 2023.”

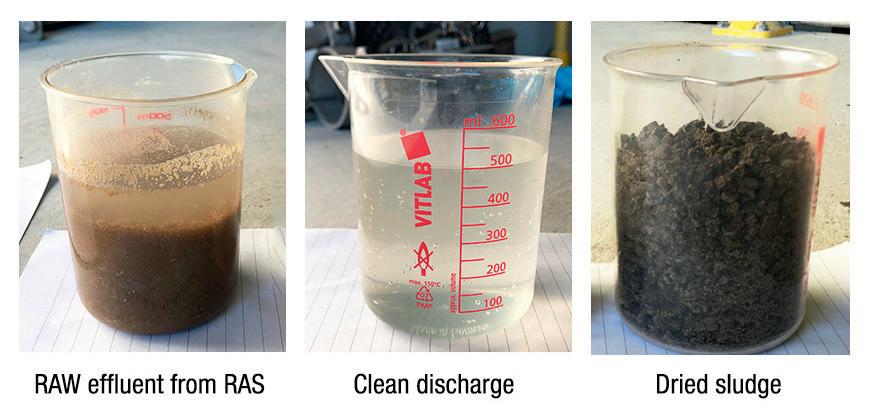

He outlined the most important operational improvements in 2022 as:

• A full review and “reset” of the Ongrowing RAS systems, particularly the biofilters, to minimize the risk of sedimentation and anoxic areas. This also included installation of 100+ new camera inspection points to identify and tackle potential risks early on.

• The commissioning of a new chiller system, the so-called “chiller bank”, which decreases operational risk, achieves significant financial savings and allows us to maintain lower and more stable water temperatures.

• A new ozone system that has improved water clarity and reduced nutrient load.

• Changes to the nutrition of the salmon that have had a positive effect on fillet colour.

• Changes to organisational structure and protocols.

• Additional tank lights installed across all systems to enhance appetite and mitigate maturation.

Andreassen said despite challenges, 2022 also brought a lot of positive developments as the company continued to mature.

“Our freshwater systems are consistently performing in line with the

best smolt producers in the world.

“Our filleting line was installed and commissioned leading to increased quality control, yields and cost savings once we are at scale.

“With several years of experience running our Bluehouse, first in Denmark and then in the US, we know how much it costs to operate the facility and have executed on many cost saving opportunities.

“More have been identified for 2023. In Atlantic Sapphire, operational costs are generally fixed in nature, with feed being the notable exception.”

The company had reduced fixed costs, achieved better pricing and, most importantly, increased feeding and thereby production. This will lower the cost per kilo of salmon produced, he stressed.

Concluding, Andreassen said: “In the bigger picture, the macro drivers behind our vision are more relevant than ever. Topics such as climate risk, global warming, GHG emissions, ocean acidification, effects on wild species, political risk and local food security have all become the centre of attention for our stakeholders.

“This gives us additional confidence that we’re doing the right thing. Similarly, on the consumer side, our brand awareness and its positive impact continued to increase, as Bluehouse Salmon has become ‘Friend of the Sea’ certified, and has earned the Seal of Approval from Parent Tested Parent Approved (PTPA).

“After a year with considerable heavy-lifting on the operational side, we are seeing improvements in the key parameters that will lead to higher productivity, fish health and product quality. We’re excited about what 2023 will bring.”

A trio of investment bodies has put capital into Vietnamese shrimp farming technology business Tepbac. Netherlands-based global aquaculture investment fund Aqua-Spark, global agrifood tech VC AgFunder, and Vietnamfocused VC fund Son Tech Investment have teamed up to invest an undisclosed sum in Tepbac, which supplies shrimp farmers with IoT (Internet of Things)-enabled hardware and a data-based platform to manage their farms digitally.

Founded by Phong Tran, whose family has farmed shrimp for over 25 years, Tepbac began as a media company and has grown into one of the leading aquaculture news websites globally.

Now, the company is focused on digitising shrimp farming with the mission to help shrimp farmers perform better, resulting in better quality of life. Its primary innovations include “Envisor,” a remote water cleaning and monitoring device which keeps track of water conditions such as pH, oxygen, temperature, and salinity. Phong also built the framework for the Farmext mobile app, which provides farmers with software and hardware to help automate farming operations.

“I started Tepbac to help shrimp farmers, first in Vietnam, and later around the world,” says Lam Nguyen, Co-founder of Tepbac. “With better tools, increased production and improved quality, we can develop a more sustainable global aquaculture industry. ”

To date,Tepbac is serving 1,500 farms, with its clientele ranging from small and large-scale farmers, to shrimp processing plants and the government.With this infusion of funding,Tepbac will scale its suite of technologies, which are known to reduce risk, simplify farming operations, and save costs, enabling better farming decision-making and quality of life. Already,Tepbac has proven valuable for farmers, the company said, reducing costs by 20% and increasing profits by 30%.

Lissy Smit, CEO of Aqua-Spark, said: “With Vietnam’s focus on increasing sustainable production of aquaculture and the limited number of aquatech companies currently serving the Vietnamese,Tepbac is uniquely positioned to digitise aquaculture while solving pain points along the way.Tepbac’s platform... has incredible potential to improve market access for small farmers and enable more sustainable practices, all while growing and protecting one of the largest shrimp markets in the world.”

JORGE Fernández Valdés, one of the pioneers of salmon farming in Chile, has died at the age of 85.

He had been involved with Chile’s seafood sector since the 1960s and went onto establish the salmon farming company Salmones Camanchaca a decade or two later which developed into a powerful force in the South American aquaculture industry.

He acquired 100% of the shares in Camanchaca, then mainly a fishing company, around 1980, partnering in the business with his friend Francisco Correa.

Together they set off on a seafood adventure which brought them into aquaculture, which was still a minor activity in South America, setting up some of the country’s first salmon farms. The

business grew rapidly.

Jorge Fernández Valdés later listed the company on the Santiago Stock Exchange in Chile which led to the opening of the Salmones Camanchaca subsidiary in 2018. He later resigned as Camanchaca president and was succeeded in the position by his eldest son Jorge Fernández García.

Ricardo García Holtz, general manager of Camanchaca, said: “He was a great man, with tenacity, vision and righteous action… an entrepreneur who knew how to take risks and challenges, and generate confidence in those who followed him.”

OHAD Maiman, founder and former CEO of yellowtail producer The Kingfish Company, has taken on a new senior aquaculture role. He has been appointed Chairman of the board of the Israeli high tech company BioFishency, which specialises in electro-chemical and biological filter technology treatments for RAS (recirculating aquaculture systems) plants.

Maiman stepped down as head of The Kingfish Company last November. He is currently the founder and Managing partner of AquaFounders Capital, an investment business focused on the landbased aquaculture sector. Under his leadership,The Kingfish Company became one of the world’s flagship RAS producers with the development of land-based

COOKE Seafood has urged the Nova Scotia provincial legislature to move forward with its plans for aquaculture development.

During the 2021 election campaign, the Progressive Conservatives said they wanted to introduce “coastal mapping” for fi nfi sh aquaculture, effectively introducing a Norwegian-style “traffi c light” system which would rate sites as green, yellow or red depending on their suitability for fi sh farming. The party won the election.

Last month, the provincial government imposed what many effectively see as a moratorium on further fi sh farm development (with the exception of shellfi sh and seaweed) until carries out the process of classifying coastal areas.

growth in Nova Scotia for several years, yet the demand from families for fresh, nutritious, affordable food has risen dramatically.

“In our view, there are only a handful of Nova Scotia locations with marine conditions suitable for fi nfi sh farming, so expansion of sites will be reasonable and adhere to the strict Aquaculture Regulations and Environmental Monitoring Program Framework.

“Salmon farming generates CAN $2bn [£1.19bn] in total economic output annually in Atlantic Canada, $213.5m [£127m] in Nova Scotia. Salmon farming created 8,000 jobs in Atlantic Canada, 886 of those in Nova Scotia.

yellowtail operations first in the Netherlands, and now the United States.

BioFishency CEO Michael Isakov said: “Ohad brings unrivalled business acumen in founding and leading landbased aquaculture initiatives, matched with an unprecedented track record in his knowledge and understanding of the sector.

“Working closely with Ohad will result in faster than anticipated success for BioFishency in our outreach to new target markets, while achieving the company’s aggressive goals.”

Explaining his move, Maiman said: “BioFishency’s innovative water treatment solutions, their in-depth understanding of market requirements, and the company’s skilled and professional team, prompted my decision to get on board.”

But that could take three years or more, however, and many in the industry believe that is too long.

Cooke, says it has been responsibly operating Atlantic salmon farm sites for 25 years along Nova Scotia’s Southern and Western shores, adding that fi nfi sh aquaculture and the lobster fi shery have co-existed in the province for decades under existing environmental compliance criteria.

The company adds: “There has been very modest aquaculture

Cooke says it purchases $51.5m [£30.7m] of goods and services from 309 local suppliers located across the province each year.

“Cooke has 400 employees in Nova Scotia and would like to grow our workforce, support small and medium business suppliers, and continue to contribute to coastal communities where we operate.”

The company urges: “We encourage the Nova Scotia government to move forward on aquaculture development as seen in New Brunswick, Prince Edward Island and Newfoundland.”

Today, its products have a global reach including the US, Europe and the Far East.

The company said: “Ever since its inception, Vikenco has been a good example of how hard work and the will to think big pays off.

“The development from the simple conditions in 1973 to today’s hypermodern factory with 250 employees has been formidable, and after SalMar bought 51% of the shares in 2010, all arrows have pointed upwards.”

Turnover quadrupled in the first 10 years, but the most dramatic rise occurred after 2020 when it has risen by NOK 1bn year (£76m) and now stands at more than NOK 4bn (£304m).

NORWEGIAN salmon farmer Vikenco has celebrated 50 years in business with the opening of its expanded factory, slaughterhouse and processing facility. Company Chief Per Olav Mevold said the expansion would allow the business to increase turnover to NOK 10bn (£760m a year).

Among the leading industry guests at the opening ceremony was SalMar founder

Gustav Witzøe who is Chairman of the Board at Vikenco. SalMar became involved with the business in 2010.

Founded in 1973, initially as a whitefish and shrimp business, Vikenco went into salmon farming, then a relatively minor activity, that same year.

The company is based on Aukra Island, north of Alesund, and is recognised as one of the pioneers in salmon farming.

THE MOWI salmon brand has expanded into a new category – the ready-to-cook, added-value sector with the launch of MOWI Bistro Bakes. A range of four oven-ready salmon recipes are now available in various UK retailers, including Sainsbury’s and Asda stores nationwide.

Mowi said its new recipes would take the hard work out of preparing delicious meals for a special occasion. This will appeal to consumers who are feeling the pinch of the cost-of-living crisis and are therefore looking to recreate a restaurant experience at home.

Mowi’s brand research found that 50% of Brits dine out less often than before the cost-of-living crisis, leading 71% to follow recipes in a bid to cook the perfect meal. Unfortunately, 70% are disappointed with their efforts.

Speaking about the launch, Robin Brown, Head of Development at Mowi Consumer Products UK, said: “Our research shows that the cost-of-living crisis is continuing to hit households. With half of us unable to dine out as often as before, and nearly three-quarters of us feeling disappointed by our efforts following new recipes, I think

Mevold said current growth plans would see the size of the workforce rise to around 400.

there is an opportunity to make fine dining at home a little easier for people wanting a special meal.

“That’s why we’re launching MOWI Bistro Bakes; a range of oven-ready chilled meals showcasing the best of Scottish salmon, which can be cooked to perfection by anyone in less than half an hour.”

The MOWI Bistro Bakes range of products includes:

• Salmon Pastries: Succulent Scottish salmon pieces on a rich red pepper mousse and a burst of sweet roasted tomatoes, on light puff pastry;

• Salmon & Cheese Melts: Lightly smoked Scottish salmon rounds with a soft cheese and lemon melt;

• Salmon & Spicy Tomato Bake: Pieces of Scottish salmon with chickpeas and black beans; and

• Zesty Salmon Roasting Joint: Prime Scottish salmon joint with a lemon marinade, topped with zest and parsley.

Brown added: “Nobody wants to spend ages in the kitchen only to be left disappointed so we’re making it simple. We are making the sauces by hand, we are preparing the puff pastry, salmon, toppings and ingredients so it is literally oven-ready... a meal created by Mowi chefs, but without the restaurant price tag.”

“Hard work and the will to think big pays off ”

CORNISH family-run seafood business Ideal Foods Ltd has been honoured with the King’s Award for Enterprise for International Trade.

Ideal Foods is one of 148 organisations nationally and 16 in the South West to be recognised with a prestigious King’s Award for Enterprise.

The award scheme was founded 57 years ago as the Queen’s Award for Enterprise and it confers the right to use the esteemed Awards emblem for the next five years.

Ideal Foods, whose head office is located in Liskeard, Cornwall, has more than 20 years of international trading experience within the seafood sector. The company exports fish, shellfish and fish byproducts to customers in more than 40 countries worldwide, specifically in the Far East, Europe and the US.

Ideal Foods employs 40 staff across four main business locations, including two fish-processing factories and a cold store located in Grimsby, where Managing Director Tony Horner grew up and learned his trade.

Over the past 15 years, the company has seen consistent year-on -ear growth and this year the company has announced another record year with turnover increasing to £22.4m. This equates to 18,396 tonnes of fish sold, 80% of which was sold and exported overseas.

Tony Horner, Managing Director of Ideal Foods, commented: “As Managing Director of Ideal Foods, it gives me immense pride to see our company honoured in this way.

“We are fortunate to have a wonderful team of committed, hard-working and high-achieving staff, and each and every one of our workforce has contributed to our international sales success.”

SIA Karavela, one of the largest canned fish producers in Northern Europe, has unveiled the new brand identity of Larsen canned fish range for distribution in Germany. This rebranding includes a new brand concept based on consumer behaviour studies.

Karavela’s Marketing Manager, Rolands Romanovskis, said: “In times like these, when inflation has soared to never-before-seen levels, customers tend to cut back on inessential purchases and move on to cheaper options to increase their

buying power.

“What has come as a surprise is the notion that consumers feel that with the increase in prices the quality of branded products themselves has started to noticeably deteriorate.

Karavela has chosen not to pursue this road and we are dedicated to provide the highest-quality products for the fairest prices.”

Karavela said its commitment to quality was proven by the launch of the products packaged in transparent lid cans that put the contents of the can on display.

The 24th edition of Europe’s largest commercial marine and workboat exhibition, is a proven platform to build business networks.

Seawork delivers an international audience of visitors supported by our trusted partners.

Seawork is the meeting place for the commercial marine and workboat sector.

JUNE 2023 Southampton United Kingdom 13 15 TO

12,000m2 of undercover halls feature 500 exhibitors with over 70 vessels, floating plant and equipment on the quayside and pontoons.

Speed@Seawork on Monday 12 June at the Royal Yacht Squadron in Cowes offers a sector specific event for fast vessels operating at high speed for security interventions and Search & Rescue.

The European Commercial Marine Awards (ECMAs) and Innovations Showcase.

The Conference programme, chaired by industry experts, helps visitors to keep up to date with the latest challenges and emerging opportunities.

The Careers & Training Day on Thursday 15 June 2023 delivers a programme focused on careers in the commercial marine industry. For more information visit: seawork.com contact:

Hopes that consumers will pay a premium for land-based Icelandic salmon may be ill-founded.

By Dr Martin Jaffa

At the end of March, I attended a workshop in London organised by the Icelandic Embassy and the Fishmongers’ Company. This delved into the experience and prospects for land-based aquaculture in Iceland.

The programme covered four areas: the development of land-based farming in Iceland; the suitability of Iceland for landbased farming; consumer expectations, especially about welfare; and, finally, the potential for production of high-quality products.

The programme also included presentations from leading Icelandic companies already engaged in land-based production or in its development. It did rather seem from these presentations that this meeting was somewhat akin to an investor forum. However, if this was the intention, my impression was that these companies would be disappointed. The audience was far from the city types that might be expected from the meeting’s location. Instead, the 40-strong audience was very mixed.

Most surprising was the strong presence of representatives of the UK’s wild fisheries sector, including the Chairman of WildFish, formerly Salmon and Trout Conservation, three members of the Atlantic Salmon Trust (AST) and one from the Missing Salmon Alliance. I can only imagine that the motivation for their attendance was to learn about land-based farming. However, the type of land-based farming presented at this meeting is likely to be uniquely Icelandic because the flow-through systems they use rely on water pumped through, and filtered by, Iceland’s volcanic lava fields.

The fact that representatives of the Scottish wild fisheries sector were in the room was an opportunity that I could not miss. I tried to speak to the Chairman of Wild Fish asking why they were so reluctant to talk and he suggested that he was not the person I should be asking and walked off. I had a slightly longer conversation with people from the AST, but they are so entrenched in the idea that salmon farming impacts wild fish that they are unwilling to consider the science that shows otherwise. I suspect that the reason that the wild fish sector came to the meeting was to be able to say that land-based farming works in Iceland, so it should work in Scotland too.

Above right: Bárðarbunga eruption at the Holuhraun fissures, Central Highlands, Iceland

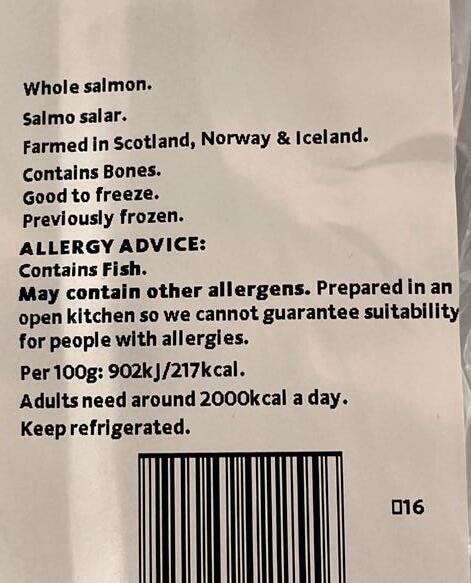

Far right: Retailers’ labelling suggests Atlantic salmon from different countries are viewed as interchangeable

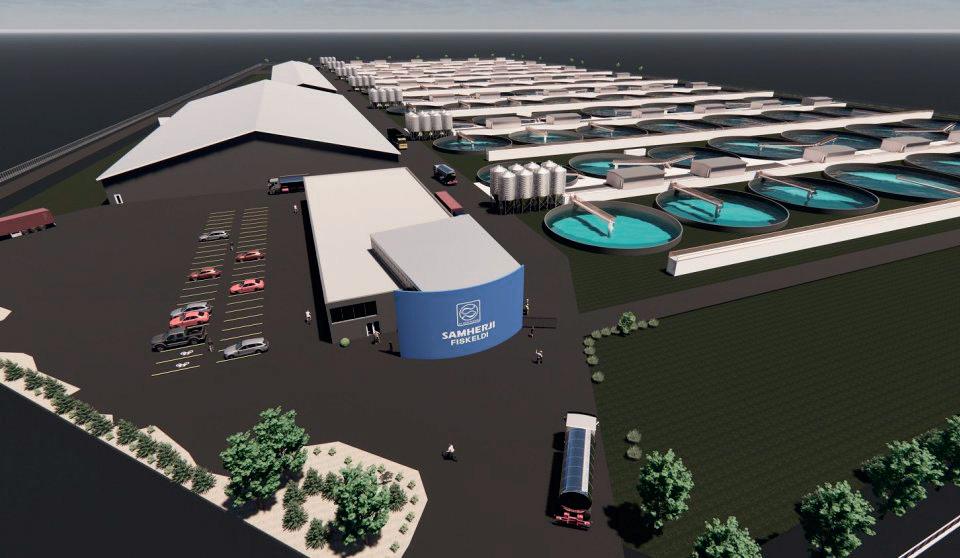

Below: Samherji’s proposed land-based farm, Reykjanes, Iceland

However, it seems that the main reason why land-based farming is even being pursued in Iceland is because of the continual criticism from the wild fisheries sector there, which wrongly claims that salmon farming is negatively impacting wild fish. Earlier in March, the Icelandic-based North Atlantic Salmon Fund (NASF) held its annual meeting in Reykjavik and this provided a platform for speaker after speaker to highlight the supposed negative impacts of salmon farming. The meeting ended with an Icelandic government minister expressing regret that they had not clamped down on net-pen salmon farming sooner. It seems to be the Icelandic government’s current view that has encouraged the development of land-based

farming there. Earlier, a government policymaker on aquaculture had related to the meeting how when he was much younger, he had regularly gone salmon fishing with NASF founder Orri Vigfússon!

One member of the audience from Iceland asked the panel of speakers whether their land-based farming developments were being driven by the technology or by the consumer. This somewhat flummoxed the panel, who seemed more intent on promoting the technology than the finished product. To me, this was made apparent by the fact that the subsequent lunch did not feature Icelandic fish (or any fish, for that matter).

The impression I gained was that most of these land-based developments were taking place in response to criticism of the established industry and the misplaced belief not only that landbased farming would solve the issues, but also that consumers would preferentially buy “more environmentally friendly” fish and pay more for it. This view was supported by market research undertaken by the

would generate a premium in addition to that for more environmentally friendly fish. Although I would mention that these recent developments are not the first time that land-based farming using lava rock filtration has been tried in Iceland because I went to visit one that was under construction back in 1988. Needless to say, it didn’t prove to be a success. There were also a handful of people from the fish processing and retail sectors at the meeting. Someone with experience of the marketplace suggested that those promoting the idea of creating an image for Icelandic salmon and Arctic char based on land-based farming might be disappointed because it was unlikely that consumers would respond favourably to such an image. Instead, they might end up more confused because land-based farming is probably an alien concept for consumers, who are largely unconcerned whether the fish they buy are even farmed.

For me, their research was overridden by a marketing message that I have repeatedly encountered: that what consumers say and what consumers do are two totally different things. My own long-term view is that consumers are unlikely to pay a premium for fish produced on land or from any specific origin.

The reality is that whilst the meeting was taking place, salmon was being sold in the UK that was listed as being farmed in Scotland, Norway or Iceland, at an identical price. Even cod and haddock from Iceland sold in UK retail outlets are interchangeable with cod and haddock from Norway. Origin is not a primary factor in why consumers buy fish, so they are unlikely to pay more for one over the other.

As a passionate advocate of salmon farming, I feel that the event focused on the wrong issues. The rationale for farming any species is about producing products that consumers want. Icelandic land-based

The panel… seemed more intent on promoting the technology than the finished product

”World leading electric underwater robotics Saab Seaeye saabseaeye.com

As I wrote this, the Salmon Scotland team were preparing for the Expo in Barcelona where we were getting ready to showcase our unrivalled product to the world. With our sector under a constant challenge from our Scandinavian rivals, and also Ireland which is eyeing up a fivefold increase in production, it is more important than ever to highlight the success and quality of Scottish salmon.

We have used Barcelona as an opportunity to unveil an ambitious European growth plan for our premium “Label Rouge” salmon to further enhance Scotland’s international reputation for food and drink.

Label Rouge Scottish salmon carries a quality mark that recognises it as the best in the world, becoming the first non-French product to be awarded the accolade 30 years ago.

It currently accounts for 12% of Scottish salmon exports and we want to increase this to 15% by 2026.

Label Rouge is not just a brand for our farmers – its higher value means higher revenues, which support the Scottish economy, fund public services, help rural communities thrive and create jobs. But progress like this will be held back if governments at home impose barriers on our growth.

And that’s precisely what the Scottish government’s controversial proposal to establish Highly Protected Marine Areas (HPMAs) risks doing.

As part of the so-called Bute House Agreement with the Scottish Green Party, 10% of coastal waters around Scotland would be closed to human activity.

Many fear that this government, and its Green contingent in particular, is increasingly indifferent to the struggles of rural life.

New First Minister Humza Yousaf would do well to listen to the concerns of his colleague Fergus Ewing, who urged him not to listen to the “wine bar revolutionaries” in the Scottish Greens.

HPMAs are strongly opposed by local communities, councils, fisheries, aquaculture and other marine users.

Quite simply, this proposal could put thousands of jobs at risk and undermine the government’s vision of a “blue economy”.

It runs counter to policies aimed at promoting food security and boosting international trade.

And when official figures show that population numbers in coastal and rural areas are already falling off a cliff, do we really want to exacerbate this crisis?

The fewer opportunities people have to earn a living in these communities, the less likely they will be to stay there.

The HPMAs appear to be nothing more than a sop to keep the Greens in government rather than a genuine attempt to improve the health of our seas.

The fact that there is no scientific justification for the proposals nor evidence they will work

only adds insult to injury.

We support proposals that can improve Scotland’s marine environment, but banning responsible sea use is not the answer.

One in three salmon farms already operate responsibly in Marine Protected Areas (MPAs), which cover 37% of Scottish waters.

Many of these MPAs were designated after the farms had already been established in the area.

We are yet to see any explanation as to why aquaculture cannot coexist within HPMAs as it already does with marine protected areas.

We know that in large parts of Scotland, the salmon farm at the end of the lane and the people it employs are what keep local schools and shops open.

We are part of a global success story that now delivers a £760m boost for the Scottish economy.

That includes a direct economic contribution of £303m in gross value added (GVA), up nearly a fifth on pre-pandemic levels, with the supply chain further supporting 10,000 jobs in every part of Scotland.

Scottish salmon is the best in the world and our farming companies stand ready to make the investment that Scotland so desperately needs as the economic storm clouds gather.

If the government’s proposals force salmon farmers out of marine areas, business will lose confidence and turn their attention to our Scandinavian competitors.

That means Scotland losing out on good, well-paid jobs and investment.

This could have a knock-on effect on the wider economy, as businesses that rely on the

sector, such as restaurants and food retailers, are forced to look abroad for their supply.

The Scottish government needs to prioritise evidence-based policies that protect both the environment and the livelihoods of hard-working Scots.

We need a thorough independent review of how science has been used to establish the policy and a balanced consideration of all the pressures on the marine environment.

The current HPMAs proposal is ill-advised, ill-considered and illjudged. It risks irreparable harm to our coastal communities and the Scottish economy.

The Edinburgh administration must base its decisions on evidence, science and facts – not perception, politics and pandering to campaign groups that are funded to attack the sector.

We need to be doing everything we can to support sustainable business growth, not putting up unnecessary barriers that will only lead to economic decline.

The Scottish government has long been supportive of farm-raised salmon and we want that positive relationship to continue.

Rather than implementing a blanket ban, it should work with Scotland’s fishermen and salmon farmers to promote the responsible use of our marine resources.

Scottish salmon and Scottish seafood is the best in the world, but HPMAs risk this global success story.

The government proposal is at an early stage and a public consultation has just closed.

We have shared our response with ministers and MSPs and urge them to listen.

By the time I return to Seafood Expo Global in Barcelona next year, we will know what the Scottish government has in store for our island communities.