THE Scottish Government has set up a Consenting Task Force to help streamline the process for approving proposals for new or expanded fish farms.

The announcement was included in the Scottish Government’s Strategy for Seafood, launched by Mairi Gougeon, Rural Affairs Secretary, at the Association of Scottish Shellfish Growers conference in Oban on 6 September.

She said: “With increasing competition and pressure on our seas and coasts, it is important to recognise the value that our world-renowned seafood sector brings to the Scottish economy. In 2021, fish and seafood exports were valued at £1bn, which is 60% of total Scottish food exports.

“Today’s publication of the Strategy for Seafood marks our commitment to the sector, which employs almost 15,000 people across the country – primarily in our coastal and island communities.”

The Strategy reiterates the government’s commitment to a number of initiatives already announced, including the Blue Economy Vision and the introduction of a new category of Highly Protected Marine Areas, covering at least 10% of Scottish waters, in which all but minimal commercial activity will be barred.

For aquaculture, the strategy underlines the commitment to publish a Vision for Sustainable Aquaculture by the end of this year and to enact the recommendations set

out by Professor Russel Griggs for reform of aquaculture regulation.

The Aquaculture Council has been set up to oversee the reforms, and the strategy document says that a “consenting task group” will be established “to look at efficiency, effectiveness and transparency of the system, following an immediate change to the marine licence renewal period for finfish and shellfish farms from six to 25 years, bringing it in line with the Crown Estate Scotland Lease cycle.”

Gougeon also announced changes to fishing licences to ensure that more catches are landed in Scotland, benefiting local processors (see Processing News, page 22).

Tavish Scott, chief executive of Salmon Scotland, welcomed the publication of the strategy document: “This strategy recognises the important role the Scottish salmon sector plays as part of Scotland’s world-class seafood offering.

“A growing global population needs healthy, nutritious food, and Scotland can help feed the world by growing responsibly.

“The UN has pointed out that seafood and sustainable aquaculture is the way forward, and there is a real opportunity through the growth of the Scottish salmon sector.”

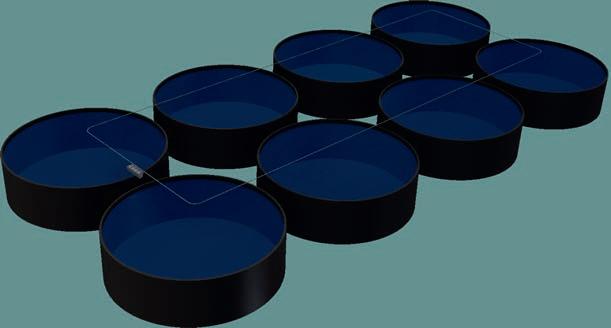

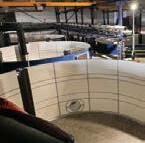

Top: Salmon fish farm pools in the see lochs near Portree, Sound of Raasay, Isle of Skye, Scotland.

Above: Mairi Gougeon

NOMINATIONS are now open for an awards programme that sets out to highlight excellent examples of learning and teaching in aquaculture and other farming sectors in Scotland.

The process for Lantra Scotland’s 2023 ALBAS, the Awards for Land-based and Aquaculture Skills, has now started. Employers, colleges and schools, delivering learning in land-based and aquaculture, are being asked to nominate their top candidates.

Lantra is a not-for-profit organisation, that works to support the rural economy and enhance the natural environment through supporting skills development.

This year, industry categories cover agriculture, animal care, aquaculture, equine, environmental conservation, fisheries management, game and wildlife, horticulture, land-based engineering and trees and timber.

As well as prizes for Overall Winner, Runner-up and Modern Apprentice of the Year, there are also prizes for Higher Education, School Pupil and Secondary Schools, CARAS (Council for Awards of Agricultural Societies), Jean’s Jam for inspirational tutor, the Tam Tod Trophy for outstanding young learner, and the Anna Murray Award for Partnership Working.

Lantra Scotland is encouraging entries online. Individuals are invited to nominate themselves, someone else, a school or a partnership at www.scotland.lantra.co.uk/how-nominate-personschool-or-project-our-albas

ADMINISTRATORS for the collapsed Dawnfresh Seafoods group say they are working to ensure the sale of its fish farming subsidiary, Dawnfresh Farming, “at the earliest opportunity”.

Callum Carmichael and Tom MacLennan were appointed as administrators for Dawnfresh Seafoods in February of this year.The group’s two processing sites, in Arbroath on Scotland’s east coast and Uddingston near Glasgow, have already been sold to Lossie Seafoods and Thistle Seafoods respectively.

The administrators’ progress

report, filed at Companies House, shows that the group as a whole was running at a deficit of around £1.08m. It also reveals that the sale of the Uddingston plant fetched £6.8m.

The administrators expect that preferential creditors, including staff and HM Revenue & Customs, will be paid in full. Unsecured creditors are expected to receive a payout, but the amount cannot be determined yet.

The report says that the Dawnfresh Farming business, which operates seven fish farms and hatcheries across Northern Ireland and Scotland, continues to trade solvently. The company is currently being marketed for sale and, the administrators say, “offers are expected to be received in the coming months.”

The UV and Ozone water treatment specialist for fresh and salt water disinfection

Natural technologies to improve water quality & fish welfare

Easy to install, operate & maintain

State-of-the-art controls & communications

Live OPEX calculator & trending

BAKKAFROST Scotland (formerly the Scottish Salmon Company) celebrated another significant industry win after scooping two top awards at the Scotland Food & Drink Awards 2022.

Native Hebridean Smoked Scottish Salmon won

the top prize of the night to be named "Product of the Year" and also beat off some strong competition to be named the "Artisan Product of the Year". Managing Director of Bakkafrost Scotland, Ian Laister said: “To receive not one but two Scotland Food & Drink Awards and the top award is testament to our commitment to quality products, local provenance, and continued innovation.”

FISH health diagnostics business PatoGen has appointed Dr Johanna Baily as Senior Adviser in Histopathology. PatoGen, which has its headquarters in Ålesund, Norway, has been operating in Scotland since 2014 and opened a laboratory in Oban last year.

Dr Baily joins PatoGen from the University of Stirling, where she was Senior Lecturer in Aquatic Pathology. She is a European specialist in veterinary pathology, member of the European College of Veterinary Pathologists (ECVP) and brings first-hand expertise in health and welfare of farmed fish.

She was previously a lecturer in Veterinary Anatomical Pathology at the University of Edinburgh.

MOWI Scotland is appealing to the Scottish Government to reverse the planning decision that has blocked expansion at the company's farm on Loch Hourn, a sea loch on Scotland’s west coast.

The salmon producer had applied for permission to add another cage and increase biomass at the site by 10%, to 2,750 tonnes, but in June the Highland Council’s Northern Planning committee, in Dingwall, voted by a narrow margin against the application.

Opposition to the farm site expansion was coordinated by the Friends of Loch Hourn Group, including local campaigners and environmentalist organisations who believe that fi sh farming in the loch is harming wild salmon, especially in terms of increased sea lice numbers in the loch. The group also says fi sh farming threatens native shellfi sh.

assessment of the application and Environmental Impact Assessment Report.”

Mowi will be arguing that the risk assessment carried out on the application by the Scottish Environmental Protection Agency (SEPA) concluded that the site expansion would not pose any signifi cant risk to protected species and seabed habitats.

The company also believes that that fewer, larger pens will have a number of benefi ts including reduced visual impacts, operational effi ciencies, reduced fi sh stocking densities and improved health and welfare for the sale salmon.

Despite the green light from SEPA, campaigners opposing the site compiled an alternative report putting the case against the Loch Hourn site, which appears to have swung the planning committee to a 7-6 decision against.

FISH farmers will have the opportunity to find out how better connectivity can lead directly to better fish welfare –and more profitable operations – at a webinar jointly hosted by Fish Farmer magazine and technology experts Krucial.

The webinar, taking place on 2 November 2022, will explore ways in which resilient connectivity and timely data can help farm operators achieve a clearer view of their operations.

Connectivity for good: why better connected fish

farms will lead to healthier fish takes place on Wednesday 2 November 2022, 2pm-3pm (UK time). For free registration or to find out more, please go online to: content.krucial.com/connectivity-forhealthier-fish-webinar-sign-up or scan the QR code. To find out more, turn to page 44 of this issue.

Stephen MacIntyre, Head of Environment at Mowi Scotland, said: “After careful consideration we have concluded there are strong evidence-based grounds to contest the reasons for refusal and, in accordance with the statutory provision, we intend to appeal against the decision.

“In this appeal we present clear evidence and information showing why we believe the decision to refuse planning permission was not consistent with development plan policy nor a proper

Stephen McIntyre commented, announcing the move to appeal: “We acknowledge that the planning application resulted in a mix of positive and negative feedback from local residents about the farm that has been operating near the Arnisdale community for the past 30 years. Notwithstanding, we expect that development decisions that affect the livelihoods of many local families be evidence-based when considering social, economic and environmental sustainability.”

FISH farming companies in Scotland were doing their bit in September as part of the Great British Beach Clean. Employees, families and friends took part in the annual event to clear litter from local beaches. The UK-wide initiative was organised by the Marine Conservation Society, which will use the litter collected to analyse the sources of shoreline pollution and how best to tackle it.

Mowi was represented in clean-ups across Scotland, including Caol Shore near Fort William (pictured, above), Maclean’s Nose, Poll na Gille and Muck, where the team collected 35kg of rubbish.

Staff from Scottish Sea Farms also got involved at sites on Shetland, Orkney and the Scottish mainland. Staff from the company’s Barcaldine hatchery took part in the clean-up at Teithil beach, and teams also got stuck in at three sites each on Orkney and Shetland (pictured, right).

THE Scottish business of Bakkafrost has reported a pre-tax loss of £46.18m, on turnover of £154.35m, for the year to 31 December 2021.

The 2021 report for the Scottish Salmon Company (SSC), which now operates as Bakkafrost Scotland, describes 2021 as “a challenging year”.The losses before tax represent an increase of just over 150% while turnover was down by 14.5%.

The company describes “…continued volatility and uncertainty in global markets during 2021 due to Covid-19.”

SSC also faced biological challenges in 2021, notably with compromised gill health and secondary complications including blooms of micro jellyfish and “fish handling during necessary treatments.”

The situation improved towards the end of December last year, the company says, with improvement continuing into early 2022.

Bakkafrost’s five-year investment

plan for Scotland has so far included a new wellboat with a large freshwater treatment capacity and a new delousing and farm service vessel, the Bakkanes (pictured).

Construction also started, last year, on the fourth phase of the company’s hatchery at Applecross, on Scotland’s west coast, which is intended to allow for the rearing of larger, more resilient smolts before they are transferred to pens at sea.

A trading update from Bakkafrost earlier this month shows that its operations in Scotland are continuing to turn around.

The expected third quarter harvest is 8,100 tonnes against 6,900 tonnes a year ago.This is made up of 5,100 tonnes from Scotland South and 3,000 tonnes from Scotland North.

The Q3 harvest from the Faroe Islands has also increased, up from 14,900 tonnes in Q3 2021 to 16,800 tonnes this year. This makes a total group Q3 harvest of 24,900 tonnes, an increase of 3,100 tonnes on Q3 last year.

achievement for the farm team. It also fuels appetite across the region to see more Orkney farms work towards, and achieve, certification.”

Scottish Sea Farms said Lober Rock, which became operational just three years ago, has had an excellent start, with 91% superior grade fish and a survival rate of 88% for its first generation.

Scottish Sea Farms Aquaculture Technical Lead for ASC, Anna Price, said: “Having produced a really strong first generation of fish, Lober Rock was an obvious contender to be put forward for ASC certification.

“The farm team are passionate about what they do, ambitious to do even better and understood from the word go that the certification process could only help push them on further.

SCOTTISH Sea Farms’ Lober Rock site in Orkney has been awarded Aquaculture Stewardship Council certification. It is the first of the company’s sites in Orkney to win ASC status.

Lober Rock, a marine salmon farm at the south-easterly corner of Scapa Flow, underwent a series of audits to meet the ASC’s stringent criteria. Earlier this

year Scottish Sea Farms’ Summer Isles site, on the west coast of Scotland, was awarded ASC certification.

Orkney Regional Manager Duane Coetzer said other farms in Orkney are now being considered for accreditation.

He added: “For Lober Rock to be the second farm to be ASC accredited, and do it quite flawlessly, is a fantastic

“The aim is now to have at least another two farms in the region accredited within the next 12 months – along with our wider farming estate, because the more we go through the certification process, the more we learn and the greater the opportunities for real and positive change across the company.”

THE salmon industry contributed £760m to Scotland’s economy in 2021, according to the latest economic report from trade body Salmon Scotland.

The figures from Salmon Scotland show a direct economic contribution of £303m in Gross Value Added (GVA) in 2021, up nearly a fifth on pre-pandemic levels of £254m in 2019.

The study calculates that the sector also indirectly generated a further £397m in GVA through the industry’s supply chain, which supports jobs throughout Scotland.

The salmon sector’s economic contribution was up by nearly 20% last year when compared to 2019.

Salmon Scotland Chief Executive Tavish Scott said that reforms to the regulatory and planning system for salmon farming, currently being discussed, could potentially result in Scottish salmon generating as much as £1bn for the Scottish economy through sustainable growth.

Salmon farming directly employs more than 2,500 people in coastal communities in rural Scotland, with a further 10,000 Scottish jobs elsewhere dependent on the sector.

The study found a further £66m positive impact in employment costs (up 22.2% from £54m in 2020), benefitting local communities and companies like accommodation providers and retailers all year round, taking the combined total to £766m.

It also breaks down the economic contribution the sector makes to Scotland’s five salmon producing regions:

• £224m across the north west Highlands

• £151m in the Western Isles

• £150m in Argyll and Bute

• £137m in Shetland

• £75m in Orkney.

Tavish Scott, chief executive of Salmon Scotland, said: “Scottish salmon generates vital wealth for the country, and specifically for our islands and Highland coastal communities.

“Farm-raised salmon is the economic backbone of some of Scotland’s most isolated areas, creating thousands of local jobs and opportunities.

“Everyone in the sector is part of a global success story with the highest environmental and welfare standards that puts the besttasting and healthiest protein product on people’s plates around the world.

“All this has been achieved by a dedicated workforce despite the incredible challenges of Covid and Brexit, so by tapping into salmon farming’s full potential I am confident the blue economy can deliver even greater benefits for local communities – and could be worth £1bn to the Scottish economy in just a few years.”

He went on to say: “It is imperative that the Scottish Government enables a framework that is both transparent and efficient and the UK Government works to address the post-Brexit challenges at the border to ensure that Scottish salmon can turbocharge the country’s economy.

ORGANISERS of the biennial International Sea Lice Conference have announced that Scotland is to host the next meeting in 2024, after a successful bid was led by the Sustainable Aquaculture Innovation Centre (SAIC).

The conference will bring together leading international scientists, fish health practitioners and regulatory agencies to share research and exchange insights on the key biological and environmental factors associated with sea lice and their management.

The 2024 conference, which will be the 14th event since the 1992 inception of the series in Paris, sees the return of the International Sea Lice Conference to Scotland, after it was last held in Aberdeen in 2001. The decision-making process kicked off earlier this year during the 2022 summit, hosted by the Faroe Islands after a twoyear Covid-19 delay. SAIC’s bid highlighted the growing role of Scottish aquaculture in serving the global need for sustainable protein and the importance of collaboration and knowledge sharing across the sector to tackle environmental and health challenges.

Planning for the conference is already underway, and organisers expect that researchers travelling to Scotland will have opportunities to experience the aquaculture sector firsthand with site visits and a range of sessions hosted by local and international experts on sea lice. Past events have featured a variety of research topics including the biology of sea lice, sea louse management, epidemiology, and interactions with the environment.

Heather Jones, CEO of SAIC, commented: “It is great to see such an important global summit returning to Scotland, where our aquaculture sector is thriving and we have a wealth of leading academic expertise. In collaboration with other ‘Team Scotland’ organisations, SAIC is looking forward to welcoming representatives from the international academic community to share knowledge and new ideas about the management of sea lice, which is an ongoing focus for the sector as we continue to expand the economic impact of aquaculture while minimising its environmental footprint.”

NORWAY’S fish farmers are still reeling from the news that the Norwegian Government is to introduce a new “ground rent tax” on their marine operations.

The levy, also referred to as a “resource tax”, was confirmed in the Norwegian Government’s budget on 6 October, the first to be delivered by Trygve Slagsvold Vedum, Finance Minister in the centre-left coalition which came to power this year.

It is expected to generate revenues of up to NOK 3.8bn (£325m) annually. The measure will take effect as from the 2023 tax year. Proceeds from the tax will be shared equally between national and municipal authorities.

The resource tax is also being levied on Norway’s offshore wind industry, but it will not apply to land-based fish farms.

Smaller farmers, producing less than 5,000 tonnes a year, are set to be exempt from the new tax, but larger producers of salmon and trout have seen their share prices plummet and many have taken action to scrap investment plans.

Mowi, which is cancelling a £19m biomass increase, said: “The aquaculture industry is a future industry that we, as a nation, want to grow, and the proposed tax proposal affects investment ability and willingness very negatively.”

The company argued that what will become a total tax rate of 62% will stop significant investment along the entire coast which will not only lead to fewer jobs locally, but also the transfer of value from the coastal communities to central areas.

Mowi also pointed out that it is a global business, suggesting that there are other countries, (including Scotland and Ireland), where it can funnel investment.

The Lerøy Seafood group and Cermaq are also

shelving investment plans. Cermaq CEO Steven Rafferty said: “Based on the new proposal, we have no choice but to put investment plans on hold. The proposal will affect growth and job creation in many coastal municipalities in which we operate.

“Cermaq has investment of more than NOK 5bn [£415m] in its two Norwegian farming areas of Nordland and Finnmark since 2016 and the intention was to invest a similar amount in the coming years.

“We planned a new hatchery in Hasvik municipality in Finnmark that would contribute 30 new jobs, but that project has now been put on hold.”

Similar sentiments have been expressed by Lerøy, which is cancelling plans to purchase 614 tonnes of maximum permitted biomass worth NOK 123m (£10m) and postpone a NOK 420m (£35m) increase in production capacity in Troms county.

The company said: “It [the tax plan] creates unjustifiable framework conditions for the industry in Norway, and changes opportunities and incentives for investments other than maintenance.”

CEO Henning Beltestad added: “Norway should take responsibility, not least in these times, and continue to facilitate the production of food for the world’s population.

“The proposal for ground rent tax will stop the development of the industry’s value chain and thus reduce all its direct and indirect ripple effects along the coast.”

There has also been speculation that some large salmon producers could be broken up in order to bring production below the 5,000 tonne threshold.

Seafood Norway, the fishing and aquaculture

employers’ organisation, has accused the Norwegian government of worsening an already dramatic situation for the country’s seafood.

Chief Executive Geir Ove Ystmark said that while the shock of the 40% ground rent tax was starting to subside along the coast, the industry was already witnessing an investment freeze that the country cannot afford.

He continued: “The aquaculture industry has already had the handbrake completely pulled up. This is very dramatic for activity and job creation along the coast.”

“Increased wealth tax and increased dividend tax reinforce the cocktail of increased valuation and increased rates on the two taxes. This creates further challenges for the aquaculture companies. But it does not exclusively affect aquaculture directly. It affects all Norwegian ownership.

“For the fishing industry and the supplier industry, there are initially tight margins. The proposed changes to the aquaculture tax have already created reduced assignments for the supplier industry and the structure of the ground rent tax weakens the potential for processing salmon and trout in Norway. The increased rates intensify the problems for this part of the industry as well.”

Ystmark added: “Norwegian business must have the finances to carry out the green shift.

We need 250,000 new, profitable jobs by 2030.

“I can’t see that the government has realized that this requires economic muscle.”

Calculations by the business organisation NHO showed that the country is facing

significantly tougher economic times than the government has anticipated in its budget plans. Ystmark said Seafood Norway will thoroughly review the totality of what the government has put forward and continue the political work until the budget hearings in the Storting, Norway’s parliament.

Trygve Slagsvold Vedum appears to be undeterred by the industry’s reaction. He told financial website E24 that Mowi alone has paid out around three billion krone to shareholders so far this year.

He said he wants the industry to be profitable, pointing out that companies also get a 40% tax allowance for investments. He also intends to consult local communities about his plan.

Vedum also told E24 that Mowi’s largest shareholder John Fredriksen and SalMar founder Gustav Witzøe had made enormous fortunes from using Norway’s fjords, so they should share more with the local communities.

Asked if he had nightmares about “emigrating salmon barons and dying coastal villages”, he replied “No – I have not”.

SEAFOOD Norway, the aquaculture and fishing employers organisation, has hired Peder Egseth, the former right hand man to ex Conservative Prime Minister Erna Solberg, to head the organisation’s business policy.

He takes over next month and will lead and coordinate the organisation’s work with the Storting, authorities, political parties, NGOs and other central actors.

“With a background as state secretary at the Prime Minister’s office and a heavy political, economic and organisational background, Peder is the right man for Sjømat Norge [Seafood Norway]”, says CEO Geir Ove Ystmark.

In Norway, a state secretary is a partisan political position within the executive branch of government, below that of a minister.

Egseth takes over from Aina Valland who is leaving to take up the post of Communications Manager at Lerøy Seafood Group.

Egseth said: “Working closely with the coastal industry is very motivating. The seafood industry consists of owners and business managers who are passionate about building communities and creating more jobs.”

position as the country’s second most important export industry.

In the third quarter (July-September), exports hit a record NOK 39 billion (£3.25bn) up from NOK 36bn (£3bn) last year with salmon representing 72% of that figure and 49% of the total export volume.

Salmon exports during Q3 totalled 355,000 tonnes and were worth NOK 28bn (£2.3bn).

Chramer said in the EU home consumption was falling but restaurants were now taking an increasing share, compensating for the decline in grocery sales.

He added: “However, there are challenges in other parts of our seafood exports. Dry fish has a weak development so far this year, and there is a decrease in volume for both fresh and frozen cod fillet products.”

NORWEGIAN seafood exports have broken through the significant 100 billion kroner barrier, three months before the end of the year.

Figures from the Norwegian Seafood Council published earlier this month show exports totalled a new record of NOK 109 billion (£9bn) in the first nine months of 2022, with farmed salmon accounting for almost 75% of that figure.

This represents a growth of 29% compared with the same period last year, almost certainly due to soaring salmon, cod and haddock prices.

Christian Chramer, the Council’s new CEO, described the growth as “impressive” adding: “Norwegian seafood has maintained its strong global position both through the corona pandemic and the demanding times we find ourselves in now.

“Increased production costs, challenging logistics and soaring food inflation in our most important markets have raised seafood prices, but at the same time means that we are facing uncertain times when purchasing power weakens and markets are changing rapidly.”

Fisheries Minister Bjørnar Skjæran said the achievement once again confirmed seafood’s

Poland and Denmark, two important salmon processing countries and France were once again the most important markets.The average price for salmon during the quarter was NOK 71.8 (£5.99) per kg, up by 26% on the same period last year.

September turned out to be another record month with exports increasing by 27% on a year ago to NOK 15.1 bn (£1.25bn), a rise of 30% or NOK 6.5bn (£540m) on Q3 last year.

The value of September salmon exports rose by 34% to NOK 10.4bn (£866m) on a volume growth of 6%.

Above left: Norwegian salmon

ICELANDIC salmon farmer Arnarlax has received Aquaculture Stewardship Council (ASC) approval for its Foss site in Arnarfjörður.

ASC is one of the strictest environmental certifications for aquaculture and was developed in collaboration between the industry and the World Wildlife Fund for Nature (WWF).

Arnarlax is also known as Icelandic Salmon and is owned by the Norwegian group, SalMar. The company said: “With the ASC certification, the company commits to reducing the impact on the local ecosystem in various ways, often beyond what is required by law and regulations.”

Silja Baldvinsdóttir, Arnarlax’s quality manager, added: “It is a great recognition for Arnarlax to receive this certification for

our farm Foss in Arnarfjörður, as there are strict conditions that must be met.

“Now all our active farming areas are ASC certified, underlining the great emphasis we put on the operations of the centres having as little impact on nature and the surrounding ecosystem as possible.

A month ago, Arnarlax announced a 103.5% increase in half year operating revenues to just over €72m (£63m). H1 operational EBIT (profit) rose from €3.13m (£2.74m) to €23m (£20.13m).

Björn Hembre, CEO of Icelandic Salmon and Arnarlax said growth plans were progressing as planned, particularly after the acquisition of an additional smolt plant at Ísþór in Iceland, allowing access to larger smolt and lower biological risk.

Above: Arnarlax workers and workboat, at one of the company’s sites in Iceland

“Therefore, the ASC certification gives us great motivation in our continued progress to work in harmony with the environment and society.”

THE Faroese Government has presented the country’s parliament with details on how it plans to increase the revenue tax on the salmon farming industry.

The Faroes proposal includes three important changes to the current revenue tax system, originally introduced in 2014:

• changing the number of applicable tax rates from three to five;

• increasing the salmon price thresholds that determine when each tax rate is applicable; and

• linking the salmon price threshold to the average production cost for the Faroese salmon industry, which will be assessed annually.

The thresholds are based on the average annual production cost for the Faroese salmon industry. For 2023, an average production cost of 39.15 DKK (£4.63)/kg will be applied.

For 2023, the proposed change means that the revenue tax rates are likely to be:

• 0.5% if the salmon spot price is less than 39.15 DKK per kg (approx. £4.63 per kg);

• 2.5% if the salmon spot price is between 39.15 and 44.15 DKK per kg (approx. £4.63-£5.22 per kg);

• 5.0% if the salmon price is between 44.15 and 54.15 DKK per kg (approx. £5.22-£6.40 per kg);

• 7.5% if the salmon price is between 54.15 and 69.15 DKK per kg (approx. £6.40-£8.18 per kg); and

• 10% if the salmon price is above 69.15 DKK per kg (approx. £8.18 per kg).

The proposed changes have yet to be approved by the Faroese Parliament.

Ahead of the official announcement, the CEO of Faroesbased salmon producer Bakkafrost CEO Regin Jacobsen alerted shareholders to the news that the Faroes is following Norway in imposing new taxes on the aquaculture industry.

Jacobsen has yet to disclose how much the proposals will cost the company but some reports suggest the industry as a whole may have to stump up an extra DKK 60 million –around £7m.

The vessel was handed over by the builder, MEST shipyard, to the Faroese salmon farmer.

The all-electric catamaran is the result of an energy project organised by the Nordic Council of Ministers, which aims to find sustainable energy solutions for more remote fish farming areas.

Regin Jacobsen spoke about his company’s sustainability strategy and the importance of co-operation between the authorities and the industry if sustainable solutions are to be implemented in the Faroe Islands.

He said: “Co-operation enables dreams and visions to be realised, but they can turn into nightmares if the cooperation does not work or is unorganised. Thus, it is of the utmost importance that we facilitate a land-based grid, which can produce and supply enough green energy”.

BAKKAFROST has taken delivery of its first fully electric catamaran as part of the company’s strategy to increase the use of sustainable energy.

The company’s CEO, Regin Jacobsen, used the launch to call for greater investment in the Faroes power grid in order to help wean industry off its dependence on fossil fuels.

He added: “We need to co-operate openly and be willing to explore new paths in all areas if we want to make a positive (environmental) impact. There are still many changes that must be made if we are to reach our goals, but currently, things are going too slow, and if we do not start to make courageous decisions, we will be too late”.

MEST Shipyard CEO Mouritz Mohr said the electric catamaran will give Bakkafrost employees a more comfortable working day without engine noise or the smell of diesel engines.

Guests at the ceremony included the Faroese Prime Minister Bárður á Steig Nielsen.

LAND-based fish farmer Salmon Evolution has announced that it plans to start its first commercial slaughter within the next few weeks – possibly by the end of this month.

In an Oslo Stock Exchange announcement, the company said the strong biological performance reported in its second quarter presentation had continued into Q3 at the company’s first production facility, at Indre Harøy in Møre og Romsdal county, Norway.

In September the average weight was estimated at around 3.3kg with some individual fish well over 4kg.

The company said it was still on track for its first slaughter in the final quarter of this year, adding: “The first fish transfer process in the facility has been completed, and Batch 1 is now divided into two tanks.

“Salmon Evolution is now in the process of preparing the next smolt releases, further fish transfer activities, as well as the first slaughter, the [last] of which is tentatively expected to take place in late October/early November.”

It says that during the last few months extensive testing of product quality had produced very positive results confirming

good fish health and fillet quality, a firm meat texture, a uniform red meat colour and excellent salmon taste.

Batch 2 was put into the plant on 13 July with an average weight of 125 grams. Good biological performance is also reported for this fish, where the average weight is now estimated at around 710 grams.

Established in 2017 and listed on the Oslo Stock Exchange, Salmon Evolution is a relatively new land-based salmon farmer. The company is targeting a production capacity of 100,000 tonnes HOG (head on, gutted) by 2032.

THE seafood sector along Canada’s east coast was battered by storm Fiona at the end of September. The damage is likely to run into millions of dollars and Prime Minister Justin Trudeau has committed to CAN $300m (£197m) in emergency funding.

Such events are rare in this part of Canada and Fiona was one of the most powerful storms for many years.

The storm hit provinces such as Newfoundland, Nova Scotia and Prince Edward Island. It tore up buildings and left much of the region without power.

Along with the damage to homes, Fiona tore into fish farms, fishing harbours and seafood processing sites.

But reports suggest that the region’s lobster industry in some areas may have been the hardest hit.

However, because the level of lobster fishing is lower in the autumn the damage may not be as severe as it could have been. The industry is likely to ask for an extension to the fishing season to make up for some of the losses.

Osborne Burke, general manager of the Victoria Coop Fisheries in Neil’s Harbour, Nova Scotia, told CBC news that the plant suffered “horrendous” damage, and several 40-foot sea containers full of frozen fish were “thrown around like dominoes”.

The extent of the damage to salmon farms is still being assessed but major names such as Grieg and Mowi have facilities in that area.

The Canadian Aquaculture Industry Alliance (CAIA) estimates are that the farmed shellfish sector alone on Prince Edward Island has suffered at

least CAN $50m (£33m) in damages.

Almost all these marine farmers are small and medium-sized businesses, the CAIA says, who cannot access private insurance for crop loss and disasters, while land farmers have access to government cost-sharing programs to support them.

Timothy Kennedy, CAIa President & CEO, said: “Food security and infl ation are the top concerns of Canadians, and we have a massive opportunity to grow healthy, sustainable seafood in Canada through aquaculture. However, our sector growth has flatlined for two decades, in large part because of a lack of will at the federal level.

An event like Fiona sets us back, but also brings to attention the lack of consistent, national programs for seafood farmers to succeed.

“We appreciate the Prime Minister’s commitment of $300m for Fiona recovery, but the federal government must build the proper system of longterm supports to grow the seafood farming sector in Canada.”

never been

Filter Value series focuses on reduced

simplified

A bipartisan group has been set up in the United States Congress to support the growth of America’s aquaculture sector.

The House Aquaculture Caucus is co-chaired by Representatives Kat Cammack (Republican-Florida), Ed Case (Democrat-Hawaii), Steven Palazzo (Republican-Mississippi) and Jimmy Panetta (DemocratCalifornia).

Caucus members include Reps. Salud Carbajal, Jerry Carl, Buddy Carter, Rick Crawford, Scott Franklin, French Hill, Maria Salazar, Abigail Spanberger, and Rob Wittman.

It was established as a resource and forum to educate Members of Congress about the economic opportunities that an expanded US aquaculture industry would provide for congressional districts nationwide. The caucus will also provide policy updates and share initiatives in Congress that will help make American aquaculture more competitive globally.

Congresswoman Cammack

said: “Aquaculture should be one of the United States’ priorities as we grow our focus on food security. In Florida, we’ve seen the benefits of aquaculture first hand, breeding, raising, and harvesting shellfish, fish, and aquatic plants in our waters.

“We’ve demonstrated that it’s possible to provide healthy, fresh food that’s produced sustainably at home to support our growing population. The Aquaculture Caucus shares our enthusiasm for pushing these industries and their innovations forward while growing our infrastructure and market domestically.”

Bipartisan legislation, the Advancing the Quality and Understanding of American Aquaculture Act (AQUAA) Act, was introduced in November 2021 with the intention of establishing a clear, predictable permitting process for offshore fish farms to encourage more business investments in the US and encourage the industry to grow.

opportunities. With positive support from our communities and governments, Canada can realize this great sustainable, healthy and secure food opportunity for Canada.”

Outgoing Chair Jennifer Woodland added: “This sector has incredible potential for Canada. Low-carbon, innovative sustainable and secure food production, great jobs in coastal communities in all ten provinces and one territory, Indigenous partnership, economic opportunity and leadership. With deepened collaboration and united together we will continue our work to realize this sector’s great future in Canada.”

Additionally, Amédée Savoie (La Maison BeauSoleil) and Cyrus Singh, (k’awat’si Development Corporation) were newly elected to the Executive Committee while four others were re-elected including: Joel Richardson, Cooke Aquaculture Inc. (ViceChair); Cyr Couturier, Marine Institute, Memorial University of Newfoundland (Treasurer); Mia Parker, Mowi Canada West (Secretary); and Linda Sams, Cermaq Canada.

MOWI’S Director of Communications for Scotland, Ireland and Canada, Ian Roberts, has been elected as the new Chair of the Canadian Aquaculture Industry Alliance (CAIA) Board of Directors succeeding Jennifer Woodland of Nuuchah-nulth Seafood Limited Partnership who has

stepped down after almost three years. Roberts said: “The seafood farming community in Canada is focused and resilient. We are the seafood growth pathway for Canada with many coastal communities looking to grow sustainable foods and economic

Four new CAIA Board members were elected: Larry Johnson, Nuu-chah-nulth Seafood Limited Partnership; Cyrus Singh, k’awat’si Development Corporation; Jeff MacPherson, Atlantic Aqua Farms Ltd. (PEI); and Jennifer Wiper, Aquaculture Association of Canada (NB).

THE co-founder of a Japanese tech company using machine learning to make aquaculture more efficient has been honoured with an international award. Ken Fujiwara has been named as a Hero of Progress in an awards programme initiated by digital security business ESET. Together with his colleagues Masahiko Yamada and Takuma Okamoto, Fujiwara founded UMITRON, a business based in Japan and Singapore which builds user-friendly data platforms using IoT (Internet of Things), satellite remote sensing and artificial intelligence. UMITRON aims to reduce business risk, cut waste by ensuring precision feeding and improve fish welfare. For example, an algorithm developed by the company can determined fish appetite levels based on their behavioural responses.

ESET’s Heroes of Progress awards feature nine visionary thinkers across a range of fields, as determined by an expert judging panel, headed up by ESET chief business officer Ignacio Sbampato, which reviewed more than 50 shortlisted applications.

The events we hear about every day on the news at a global level will often filter down to local level, and changes and adaptations have to be considered as ways to deal with the consequences. The likes of the pandemic, global warming and changes in trade regulations are geopolitical events to manage at government level, but the impact of these have led to labour shortages, social distancing, interrupted supply chains and energy price hikes, to name but a few challenges that were not part of a traditional working model that now must be navigated in daily activities.

Where any move from traditional practices has taken place, it is often technology that has been injected into the process and creative methodologies have been applied as a way to solve the new problems that arise.

The new solutions can involve the automation of processes that would normally have been done by hand, but lack of resource has led to new ways to plant, pick, harvest, sort or pack produce.

Or, where land has been damaged or the annual cyclical routine interrupted from drought, flood or combination of both, ingenuity has been applied to capture water through attenuation to drain, store, filter and ultimately re-use for irrigation.

There usually are not any off-the-shelf solutions for many of these problems, since there will be considerations unique to each location. This is where time, effort and expenditure

Stephen McCallion Founder & CEO, ZLX Business Solutions

Stephen McCallion Founder & CEO, ZLX Business Solutions

can often be applied to come up with process, system or tooling that help maximise the activity to keep it at the level of throughput that is required to be sustainable as a business. These activities can be considered as overhead costs, going beyond the normal working practices to find new, effective, sustainable solutions. Where development has taken place, there is help in the UK through HMRC to soften the blow of that expenditure. Where development has been applied, there are mechanisms available through tax rebate to claim back some of the outlay. Support to navigate this legislation and make sure that any potential rebate reaches its maximum potential is available. Visit the ZLX site below for more information

“There are mechanisms available through tax rebate to claim back some of the outlay”

the label, and cooking it until it is piping hot right through.”

Food Standards Scotland has developed an online Safe Smoked Fish Tool for manufacturers to assess their individual practices and ensure that they minimise the risk of contamination. The tool covers cold and hot smoking, as well as shelf life assessment.

THE message comes jointly from Food Standards Scotland, the UK Food Standards Agency and the UK Health Security Agency. Food safety professionals are concerned that an ongoing outbreak of Listeriamonocytogenesbacteria could be dangerous for some individuals, particularly those aged over 65, or who are pregnant, or have weakened immune systems.

The agencies recommend that people in these groups should make sure readyto-eat smoked fish is cooked through before they eat it.

An investigation has identified 14 linked cases of listeriosis since 2020, with eight of these occurring since January 2022, in England and Scotland. While the majority of Listeria cases cause mild gastroenteritis which usually persist for a few days, people in vulnerable groups can suffer more

serious illness, including meningitis and life-threatening sepsis.

Ian McWatt, Food Standards Scotland (FSS) Deputy Chief Executive, said:

“While the risks to the general public of becoming seriously ill due to Listeria are very low, we need people who are vulnerable – specifically those over 65, pregnant women and people with weakened immune systems – to be aware of the ongoing risks of consuming readyto-eat smoked fish.

“If anyone from these groups is eating ready to eat smoked fish, we are reminding them of the advice to ensure that it is thoroughly cooked before they eat it including when served as part of a dish.

“People can also further reduce the risk by keeping chilled ready to eat smoked fish cold (5⁰C or below), always using products by their use-by date, following the storage instructions on

Adam Wing, Head of Trade Marketing –UK, Americas & New Markets, commented: “Seafood Scotland fully supports robust consumer protections in terms of the foods we eat. We are confident that Scottish seafood farmers and processors meet the required safety standards, and indeed we know that many go beyond these standards, such is their dedication to quality.

“People who are in higher risk groups are routinely advised to steer clear of a whole range of foodstuffs. Given this context, it is disappointing to see that smoked fish has been singled out in this way.”

Meanwhile, also in September, French retailer Leclerc withdrew its Norwegian-produced Ronde des Mers smoked salmon line after Listeria was found in several batches of the product.

CHANGES to fishing licences in Scottish waters could help ensure more trade passes through processors in Scotland.

The Scottish Government is bringing in new requirements for vessels over 10 metres landing stocks “of key importance to Scotland”. From 1 January 2023 they will need to either land a set minimum percentage in Scotland (with the percentage required being dependent on the species landed) or give back fishing opportunities for the Scottish Government to allocate to other operators in the fleet.

The measures were announced as part of the launch of the Scottish Government’s Strategy for Seafood, which was presented at the annual conference of the Association of Scottish Shellfish Growers in Oban, on 6 October by Mairi Gougeon MSP, Cabinet Secretary for Rural Affairs and Islands.

She told the conference: “Each year Scottish vessels land around £100m worth of fish outside of Scotland, often for species for which we have ready processing capacity. These changes are an important step in ensuring

the people of Scotland benefit first and foremost from our fantastic natural assets and resources.”

The strategy document also reiterates the Scottish Government’s commitments to bringing out a new National Marine Plan, and to publishing its Vision for Sustainable Aquaculture before the end of this year.

Donna Fordyce, CEO Seafood Scotland, said: “Seafood Scotland supports the publication of this strategy which brings together a number of programmes and activities and sets out clear action areas in terms of innovative and sustainable practices that will enable our seafood industry to compete globally and contribute towards the circular economy.”

The strategy document also criticises the “confusion” caused by the UK Government’s £100m cross-UK Seafood Fund, arguing: “Fisheries funding is devolved and it should be for Scottish ministers... answerable to the Scottish Parliament, to make the appropriate spending decisions in this area in Scotland – not the UK Government.”

Consumers in vulnerable groups have been warned not to eat smoked fish unless it has been thoroughly cooked.“We need people who are vulnerable to be aware of the ongoing risks ”

CONSTRUCTION work for the expansion of Mowi’s Blar Mhor processing facility in Fort William, in the north of Scotland, is on track – and it has not stopped the plant’s day to day operations, the company says.

When complete, the upgrade, which includes the installation of state-of-theart robotic technologies for handling and grading salmon, will enable the facility to process and pack 200 fish per minute, and increase plant capacity to more than 80,000 tonnes annually.

Greg Riddle, from project manager Northern Light, told Mowi Scotland’s in-house newsletter The Scoop: “The walls

and roof for the new section are up, allowing for work inside to advance before the new equipment is installed. All this is taking place while the plant continues to process and deliver

salmon daily, which is very impressive.”

Donald MacIsaac, Mowi’s processing manager, said: “In addition to improving capacity and efficiencies on the processing

lines and packaging areas, our engagement with our employees has brought about plans to significantly improve our staff canteen and lounge facilities.

“Our new office space will be accessible by elevator, enabling new career opportunities to prospective employees with mobility challenges.”

NORWEGIAN salmon producer Kvarøy Arctic has won the Best Frozen Product category at Expo East in Philadelphia, USA, for its salmon hot dogs.

HILTON Food Group saw falling profits on increased earnings, year on year, for the first half of 2022.

The UK seafood and meat processing group reported revenues of £2.04bn for H1, up 19.2% on 2021. Operating profit was also up, by 5.6%, to £41.2m.

Adjusted profit before tax was affected by high interest rate costs, however, falling 3.9% to £34.4m, bringing adjusted earnings per share down 13.6% to 28p.

Volume was up by 3.6% to 271,708 tonnes.

In its investor presentation on the first half results, Hilton said that macroeconomic uncertainty will continue to influence consumer behaviour, but the group’s diversification would enable it to meet changing customer needs.

Hilton’s seafood arm saw the completion of its acquisition of Foppen, the Dutch salmon specialist which the group snapped up at the end of last

year. Combining Foppen with the existing UK seafood operation has created a business with revenues of more than £400m, the company said. The group expects the seafood segment to see growth of 5.73% annually.

Commenting on the results, Chief Executive Philip Heffer said: “In the first half of the year Hilton has further strengthened its position as the international protein partner of choice. We have continued to focus on our strategy of diversification and differentiation, driving a further increase in volumes, sales and operating profit... Hilton has not been immune from the impact of heightened inflation. While we remain watchful of any near-term changes in consumer sentiment, we believe that our international scale, strong customer relationships, and diversified protein offer leaves us well-placed within a growing global market.”

The Expo East natural foods trade show features healthy and sustainable lifestyle products. Kvarøy’s salmon hot dogs were praised not only for their taste and texture but also for reducing food waste, as they are made from trimmings and off-cuts from salmon processing.

“We are honoured to have both our product and related efforts be recognised by the New Hope Network, which has a proven track record of spotting the biggest innovators within the CPG

and retail ecosystem,” said Kvarøy Arctic CEO Alf-Gøran Knutsen. “It is our continued goal to marry the ideas of delicious, nutritious, and sustainable through our products and make these factors accessible to all consumers, and we believe our salmon hot dogs do an excellent job of conveying this.”

Kvarøy Arctic is a thirdgeneration Atlantic salmon farm on the Island of Kvarøy along Norway’s Arctic Circle. Recognised by Fast Company as one of the World’s Most Innovative Companies in 2022, Kvarøy Arctic is the first farmed finfish to carry the Fair Trade USA seal, and is BAP, ASC and GlobalG.A.P certified.

Above: Kvaroy Arctic’s hot dogs Left: The Blar Mhor construction Above: Staff at Blar MhorAswe leave the Elizabethan age and Prince Charles ascends the throne as King Charles III, the press has speculated whether our new king will continue to champion his environmental agenda or whether he will now take a back seat.

According to the BBC News, his friends say that he will not cool on environmental issues including climate change, even though the monarch is obliged to remain politically neutral. However, the BBC say that his concerns began long before environmentalism became mainstream. They say that within months of his investiture as Prince of Wales in 1969, the 20-year-old prince wrote to the then Prime Minister Harold Wilson expressing his worry about the decline of salmon stocks in Scottish rivers. He wrote that “people are notoriously short-sighted when it comes to questions of wildlife.”

Unfortunately, the BBC did not elaborate any further.

The letter was publicised when official papers were released under the 30-year rule. It seems that Prince Charles warned the Prime Minister of the dangers of over-fishing in a confidential hand-written note from Balmoral, dated September 12, 1969, it was not overfishing by anglers that had raised the prince’s hackles but rather commercial netting off Greenland. His note went on to claim that several species had been wiped out because no-one had woken up in time to see the danger.

However, it appears that his concerns were not all that they

might have seemed.

He told the Prime Minister that modern methods of commercial fishing seem to allow the fish absolutely no chance and the numbers taken each year had been increasing rapidly. By comparison, he said. the sport of angling has a huge following in this country and as a result there was great value to be gained from promoting the sport, especially to anglers from abroad.

A year later, Harold Wilson wrote to the prince to say that greater restrictions had been imposed in Norway in relation to salmon fishing to which Prince Charles replied that it was a step in the right direction.

Prince Charles has always had a love of fishing, encouraged by his late grandmother who was a keen angler. It is not surprising that one of his first trips to Ireland included a private visit to go fishing.

The Irish Times recalled, following his accession as King, the prince’s first official visit to Ireland as the Prince of Wales. It was also the first official visit to the Irish republic by a member of the royal family. He took time out of the visit to spend two days at the fishery. Peter Mantle, the then owner of Delphi said of the visit in 1995 that the prince had a “genuine interest” in one of the big conservation issues in the west of Ireland at the time: the impact of salmon farms on wild fisheries such as Delphi’s.

Clearly, the Prince remembered these comments because seven years later in 2002, he held talks with Scottish Ministers at Balmoral to voice concerns that fish farms were damaging Scotland’s wild fish population. In 2016, this magazine reported that, as Patron of the Atlantic Salmon Trust and a keen angler, Charles was closely associated with the wild fish lobby and a vocal opponent of salmon

Left: Prince Charles (as he was then) addressing the Missing Salmon Alliance launch by video link in 2019

Opposite: Charles, Duke of Rothesay and Prince of Wales, at the Marine Harvest farm visit in 2016

farming. However, he had encouraged the International Sustainability Unit, a group he had established to help resolve some of the key environmental challenges facing the world, to look into the issues of sea lice. This led to Charles actually visiting a Marine Harvest farm in Loch Leven to look at their work with cleaner fish.

Interestingly, the visit was reported by the Herald as saying that Prince Charles has long championed sustainable fish farming, which isn’t true. He did support an aquaponics unit in Todmorden in West Yorkshire, but whilst being promoted as sustainable, it was never viable.

Since his visit to Loch Leven, Charles has remained somewhat quiet about salmon farming. This is no doubt due to the fact that by 2016, salmon stocks in Scotland’s

east coast rivers had collapsed and these rivers were many miles away from the nearest salmon farm.

In 2017, the prince spoke at the 50th Anniversary Dinner of the Atlantic Salmon Trust. He reminisced that he had begun to fish when he was aged seven at a time when the rivers were crammed with fish and the experience meant that he never wanted to fish for anything else.

He told the guests that in 1967, when the AST was formed, catches in the River Dee that flows through the Balmoral Estate were 8,000 fish whereas in 2016, the catch was only half that number. He also said that 30 years ago, one in four fish would return to Scottish rivers and now the number was one in 20. More importantly, he said that no-one had any idea why the fish were failing to return. Seemingly, the wild fish sector has not responded to his anguished speech because five years on we still have no idea as to what has happened to wild salmon. Instead, the focus remains firmly on the impacts of salmon farming.

Any hopes that the Prince of Wales would have continued to highlight the failure of salmon to return across all of Scotland were dashed when his office made it clear that the prince does not get directly involved in the activities of the organisations of which he is patron. His accession to the throne makes this even less likely than ever.

Now, 50 years after the man who is our King first expressed concern about wild salmon, it appears that their future is just as uncertain as ever.

People are notoriously short-sighted when it comes to questions of wildlife

”

sure you can imagine the scene: a school canteen at lunchtime, it is loud, it is busy, there is good-natured pushing and shoving while teachers try to keep order.

When the students get to the front, there is something new on the menu. This week it is salmon and spicy noodles; next week it will be Moroccan salmon with rice, and the week after, cold Mexican salmon pasta.

This was what happened in the Stirling area between April and June this year as the Salmon Scotland “Salmon in Schools” project went live.

For 10 weeks, salmon was on the menu once a week at six of the seven secondary schools in the area. The aim was not just to find out if it could be done, but whether it could be scaled up to the whole country and how the students would react to salmon on the menu.

Well, thanks to SAMS Enterprise (the consultancy arm of the Scottish Association of Marine Science) and the Rowett Institute at the University of Aberdeen, we now have the results.

The headline conclusions are clear: about 750 salmon meals were sold over the course of the project and the most popular dishes were salmon with spicy noodles, cold pasta and fried rice.

But, crucially, of those who tried the salmon, three quarters (74%) said they would eat salmon more often if these dishes were offered at school more often.

From a broad, strategic view, this suggests the scheme has been a success. The project has introduced students to a locally sourced, healthy food and, if taken further, many more children will get the chance to up their intake of salmon and get a healthier diet.

However, there were some other, really important, lessons that we learned during the project.

There is still a negative view of school meals in general. Many pupils bring packed lunches in with them while many others nip out for fast-food alternatives.

At a stroke, this negative impression of school meals removes a huge number of pupils, all of whom could have had the chance to try the salmon meals had they joined the queue for lunch in the canteen.

If school meals in general could be made more appealing, across the board, then the take-up of salmon could rise significantly.

What seems baffling, particularly to those – like me – of an older generation brought up on some pretty poor school meals years ago, is that this impression persists even when modern school meals are so good.

I can’t understand why anyone would want to go into town for a pie and chips when there is salmon with lime and ginger noodles on the menu or salmon in batter with a sweet and sour sauce; but that, I suppose, is our challenge.

What was also clear was that it really matters what the alternatives are. Putting salmon up against firm favourites like pizza or hotdogs depressed the uptake significantly, even if cost was similar. In fact, the fewer the choices on offer, the more salmon was consumed.

Working with the team from Stirling Council, we did a lot of work to try to inform and educate about salmon, why it is healthy and why it was being offered in this pilot project. We produced a video explaining where the fish come from, why they are good nutritionally and how to prepare them. We also produced an email leaflet and handed out hard copy versions in the schools.

Yet very little of this information managed

The project has introduced students to a locally sourced, healthy food

”The findings from the Salmon in Schools project should help us in the campaign to get young people eating healthy, nutritious food. By Hamish Macdonell

Above: (From left)

Dunblane school students Audrey McQuaid and Warris Ahmed, with Catering Supervisor Maryellen Cullen

Left: Schools need more dishes like this on the menu

to penetrate. Indeed, only 16% of the students surveyed actually registered that the pilot project was taking place. Of these, one in five did talk about the project with their parents at home, but that represented only about 3% of the overall student body.

So the challenge for us, as we go forward, is to make sure we produce material that the students register, absorb and share. It is not an insurmountable problem but one that will definitely have to be addressed as this initiative gets rolled out further.

What the project has done, though, is provide us – and others, in government and elsewhere – with a really good database of seafood-eating habits and trends among the young.

Almost 1,000 young people completed the initial survey linked to the project and a further 500 plus completed the second survey, providing a really strong survey base of information.

One of the least surprising, but most depressing, results from the survey was that it is the children from the most deprived areas – those who have the biggest need for healthy food – who have the worst access to nutritious seafood.

What we found was not only that pupils from the most deprived areas were eating the least fish but fewer believed fish was a healthy choice.

Less than half the school children from deprived areas eat fish, significantly down from the two thirds of those in more well-off areas who eat fish. As one of the key reasons given for eating fish was “my parents make me eat fish”, perhaps this is understandable but it is still something we, and government agencies, are keen to address.

Everyone involved in the sector knows the trend of seafood consumption is going down.

The aim of this project was to introduce a new generation to the benefits and experience of eating fish. If this project worked, then the idea has always been to see if it could be rolled out further.

Even if it turned out to have converted just a small number of children, it would do something – however modest – to arrest that decline.

We found that it did work – but we still have a lot to do if we are to take it further. We need to make the educational material more accessible; somehow, we need to make school meals more attractive to fast-food alternatives and packed lunches, and we need to be aware of what else is on the menu.

But can we deliver good, nutritious, healthy, locally sourced produce to our public sector institutions? Absolutely.

This was a small step, but a very important one, and what all of us in this project want to be able to do, is to look back in a few years’ time, when salmon is on the menu, every week, in every school in Scotland and say – it was worth it.

Two pilot farms trialling seaweed and shellfish species have been operating since 2020 in Ramsey Sound, just off the St David’s peninsula. The small-scale project has been invaluable in enabling members to learn how a regenerative ocean farm – also known as integrated multi-trophic aquaculture (IMTA), polyculture or 3D farming – works.

“We recently installed a larger, threehectare farm, which will enable us to operate at a more commercial scale, and a new 10m x 5m work barge is currently being built in St David’s by Robust Boats,” Haines said.

Can a community benefit society succeed in stimulating local jobs and give people a route into the Welsh seafood sector, while improving the coastal environment through regenerative ocean farming?

This is the task that Câr-y-Môr, based in St David’s, Pembrokeshire has set itself, led by a dedicated board of volunteers. The organisation’s name means, appropriately, “for the love of the sea”.

Owen Haines, one of the founder members of Câr-y-Môr, told Fish Farmer that the society has a growing membership of more than 200 people from all walks of life, from fishermen, divers and marine biologists, to accountants and chefs. He believes that the variety and breadth of their talent and experience has been the biggest driver and asset in the project’s success to date.

“Anyone can be a member, as long as they support the aims of the society, and we are keen to encourage wider participation and investment,” Haines said.

“Câr-y-Môr committed to starting the first commercial seaweed and shellfish farm in Wales and aims to motivate and inspire others to duplicate its work. To date we have created 11 jobs, largely through our seafood processing and retail operation, and more people will be needed on the farm and in primary processing as we scale up.”

Volunteers work on a rota basis on the farm, undertaking admin, processing and helping with the weekly market stalls, and can give as much or as little time as they wish. Qualified skippers operate the work barge, and the society is training employees and volunteers in all aspects of the operation.

“Around 600 metres of seaweed lines were trialled this summer, and we plan to seed 1,500 metres in October, which will help us to understand the potential for year-round cultivation. That should return a harvest of 60 tonnes wet weight in 2023. We have collaborated with a seaweed hatchery on Rathlin Island, with PEBL on Anglesey, and Hortimare in the Netherlands, all of whom have helped us to work with seed collected from Ramsey Sound.”

Car-y-Mor is also expecting to harvest approximately 1.5 tonnes of mussels (Mytilus edulis) in January 2023. The organisation is also growing native oysters

This page from top left: Owen Haines harves�ng kelp; Oysters; Trial farms with Ramsey Island in background

Opposite from top left: Owen Haines grading oysters; Rosie Rees with sugar kelp; Na�ve oysters; Oyster farm

(Crassostrea gigas), and trialling scallop (Pecten maximus) cultivation. All sites are classified Grade A.

“We have around 40,000 native oysters left from our trial batch, and took in 90,000 seed oysters in early September, which are currently growing in lantern nets suspended beneath the headlines. We hope to grow Pacific oysters (Magallana gigas) but at present it’s more likely I’ll get picked for Wales than that Natural Resources Wales (NRW) will send us a licence!” Haines said.

He explained that much of Câr-y-Môr’s precious time is spent liaising with regulatory authorities, and it is currently appealing the fiveyear licence awarded by NRW for the three-hectare farm.

“How can we encourage investment, provide job security and build a business with a five-year licence to operate? We had applied for 25 years and what we have been given just doesn’t make sense,” he said.

WWF is keen to support seaweed farming in the UK and has provided funding to employ a stakeholder engagement officer, along with funds for PEBL to carry out environmental and species monitoring. There is a long list of organisations with which the business interacts, not least local people, who have mostly bought into the project with enthusiasm, and local schoolchildren. Haines is keen to counteract any misplaced opposition to the project, through public education.

Câr-y-Môr is also collaborating with scientists from the universities of Swansea and Aberystwyth and the Shellfish Centre at Bangor University.

Haines explained that around onethird of the running costs are paid for by processing seaweed, lobster and crab which are purchased from a dozen local

fishermen and shellfish gatherers, and from Menai Oysters. Also, a dedicated chef is developing a range of seaweed products that will be offered at Christmas in a Câr-yMôr Welsh Seafood Box.

“Our shellfish processing and retail unit will move to a new multi-functional space named St David’s Seafood house later this year,” Haines said. “It will also serve as a zero input farming educational space and will hopefully incorporate tanks of shellfish and seaweed for the public to view.”

Câr-y-Môr is delighted that interest is growing in seaweed, both as a food and as an additive in many different industries. The society is aware, however, that it needs a market, and to this end, has been investigating fermentation techniques as one method of treating the wet seaweed, which would make it available as a biostimulant and other products.

“We are applying for an infrastructure grant to have the capacity to handle the increase in production and product development” Haines said.

Within five years, Câr-y-Môr aims to have substantially increased annual turnover from the Seafood House, and be producing 200 tonnes of seaweed, 80 tonnes of mussels, 10 tonnes of oysters, and 1 tonne of scallops per year. The plan is also to help 10 new farmers to set up their own 3D ocean farms, thereby providing 20 full time jobs and £2m turnover.

Haines concluded: “Câr-Y-Môr wishes to bring as many benefits as possible to coastal communities and we are off to a good start, but marine licensing remains our biggest challenge. We live in hope that key Welsh Ministers or even UK Ministers will visit our unique farm and see first-hand the compelling logic to developing this sector. They are all welcome any time.”

How can we encourage investment, provide job security and build a business with a five-year licence to operate?

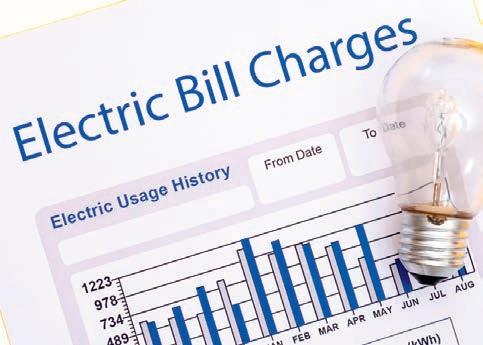

Rising energy and commodities costs are a problem for business and governments around the world. By Sandy Neil

what a month it’s been since last we were here. Back then, we looked at the RussoUkrainian War in Europe raging on, and food and fuel costs rocketing up. Within a fortnight, Britain got a new Prime Minister and Cabinet, lost one monarch and gained another, and the UK government promised billions for households and businesses struggling with spiralling energy prices.

How are rising energy costs playing out for fish farming, and will the government support help the industry to weather this storm? Are farmers able to take practical steps to reduce their energy consumption? We also look at how energy costs are impacting aquaculture elsewhere in Europe and further afield.

It was looking a little bleak this winter. Rabobank’s Global Aquaculture update in July, ominously titled On the brink of recession, stated: “Weaker seafood demand is expected in the second half of 2022 compared to both the second half of 2021 and first half of 2022.”

“With softening demand, price corrections, and persistently high production costs, salmon and shrimp farmer profits are likely to decline from recent highs,” reported Gorjan Nikolik, senior analyst in Rabobank’s seafood division.

Norwegian equipment and technology group Akva announced decreased earnings in the second quarter, as a perfect storm of increased freight rates, high energy prices and increased price levels struck the company’s operations.

At the beginning of August, aquaculture technology business Akva

Group issued a statement warning shareholders that it was about to sink into the red. Earnings for the quarter fell from NOK 16m (£1.3m) last year to negative NOK 41m (-£3.4m).

The group said the significant shortfall in EBIT was caused by high inflation rates and supply chain restrictions driven by the Russia-Ukraine conflict, which added an estimated NOK 37m (£3.1m) in additional costs.

Dire warnings, and desperate pleas for help, followed from the Scottish seafood industry. “As with other sectors, week after week energy costs, particularly for gas, in the Scottish seafood processing sector are escalating,” said the CEO of the Scottish Seafood Association, Jimmy Buchan.

He continued: “As businesses try to cope with ever-changing prices, it is of great concern that some energy suppliers are unable to give quotes on tariffs for next year.

Top: Electricity pylons

Above: Electric meter Opposite: Salmon fish farm, Norway

Top: Electricity pylons

Above: Electric meter Opposite: Salmon fish farm, Norway

This cannot continue or jobs will be lost, and food affordability and our country’s food security will be severely impacted, leading to us becoming increasingly reliant on foreign countries for our food.

“The cost of energy needs to be capped at the current level to give business some clarity and certainty over pricing in the medium term.”

For some fish farmers in Scotland, planning ahead has helped to mitigate the risks. A Scottish Sea Farms spokesperson explained: “We (very fortunately) signed a three-year contract last October (2021) capping our exposure to any price increases at 5%.”

What parts of the salmon farming process use the most energy? The Scottish Sea Farms spokesperson said: “At first glance, our new RAS [recirculating aquaculture system] hatchery at Barcaldine would appear to consume the most electricity.

“However, when you consider that it produces the equivalent number of smolts as multiple traditional hatcheries, it equates to a substantial saving in power consumption overall. Similarly, when you add up the combined generation of electricity from diesel generators out on farms, it equates to a consumption greater than Barcaldine. Thereafter, our processing facilities would have the next highest consumption.”

What practical steps can they take to reduce energy consumption? The fish farmer listed several options: “Efficient use of diesel generators to minimise running time. Further reducing the running time of diesel generators

via hybrid systems/battery technology. Connecting farms wherever possible to mains supply. Trialling renewable energies – wave, wind, solar, tidal and hydro – with the longer-term goal of transitioning away from diesel generators wherever possible.”

Last month the UK Government, led by the new Prime Minister Liz Truss, answered the growing calls for support. On 8 September, just hours before the Queen’s death was announced, ministers introduced a £150bn plan to help households in Great Britain with their soaring bills for two years.

Under the Energy Price Guarantee, a typical household will pay on average £2,500 a year on their energy bill for the next two years from 1 October. The scheme limits the price suppliers can charge customers for units of gas and electricity. It is expected to save the average household £1,000 a year based on current energy prices from October. It also comes on top of a £400 energy bill discount for all households. Together, these measures will bring costs close to where the energy price cap currently stands, the government said.

Two weeks later on 21 September, two days after the Queen’s funeral and the end of a national period of mourning, the government announced another huge support package, where energy bills for UK businesses, charities and public sector organisations will be cut by around half their predicted level this winter.

The Energy Bill Relief Scheme will fix wholesale gas and electricity prices for firms for six months from 1 October. Industry groups have welcomed the package, but warned further support may be needed after the winter.

“As with the Energy Price Guarantee for households,” ministers declared in a joint statement, “customers do not need to take action or apply to the Energy Bill Relief Scheme to access the support. Support (in the form of a p/kWh discount) will automatically be applied to bills.

“To administer support, the government has set a Supported

This intervention is unprecedented and it is extremely welcome that government has listened