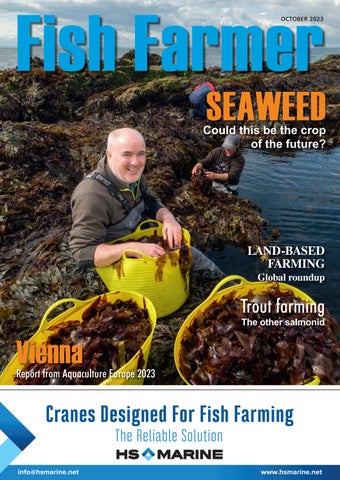

F ish F armer

Now available from stock.

The Damen Landing Utility Vessel (LUV) 2208 o ers the aquaculture sector a strong, stable workboat based on the proven credentials of the iconic Damen Multi Cat series. The LUV boasts ample deck space, with a capacity of 70 tonnes, or 2.5 tonnes per m2 She's the only LUV in her class capable of supporting a heavy duty deck craneHS Marine AK 72 series.

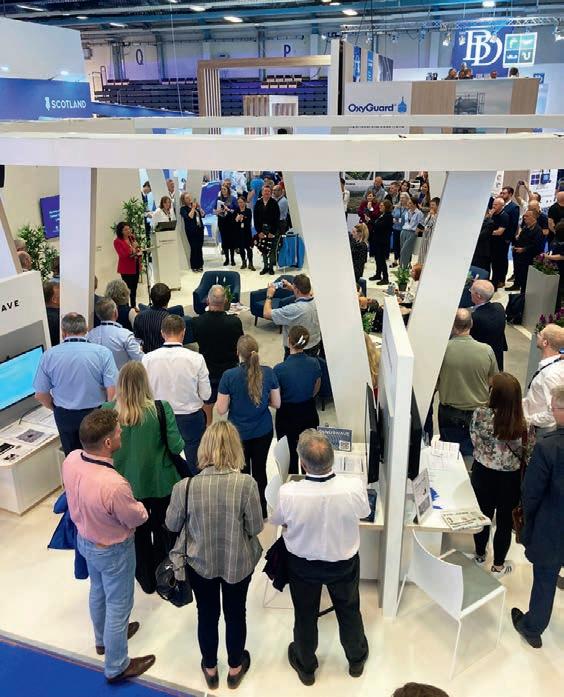

Vienna, the capital of land-locked Austria, was the venue for the European Aquaculture Society’s annual conference last month. Holding the conference in central Europe offered a reminder that aquaculture is not just about the marine economy – freshwater fish farming is part of the food system too and it will need to thrive if Europe is to achieve improved food security.

As those attending the conference discovered, traditional pond farming is highly sustainable but climate change and economics are proving problematic for this sector. You can read more about the conference in our report, starting on page 34.

The freshwater theme continues with our feature on trout farming, which finds that these farmers are facing many of the same challenges as the much larger salmon sector.

Meanwhile, as Salmon Scotland’s Tavish Scott writes in his column this month, although this has been another difficult year for salmon farming, the latest survival rates indicate that solutions are being found despite warming seas.

This month, we also focus on seaweed farming, an industry that is already huge in Asia and offers a fascinating potential in Europe and the UK especially.

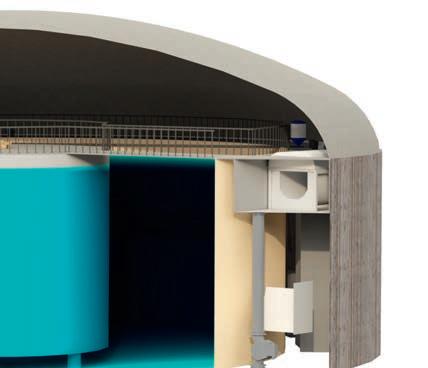

You can also read a roundup of the latest developments in land-based farming and hatcheries. Investment continues around the world in facilities to grow salmon – and other species – to harvest size without ever placing them in the sea. Technical difficulties and rising costs for a number of these have, however, demonstrated that combining new technology with biology is a risky business.

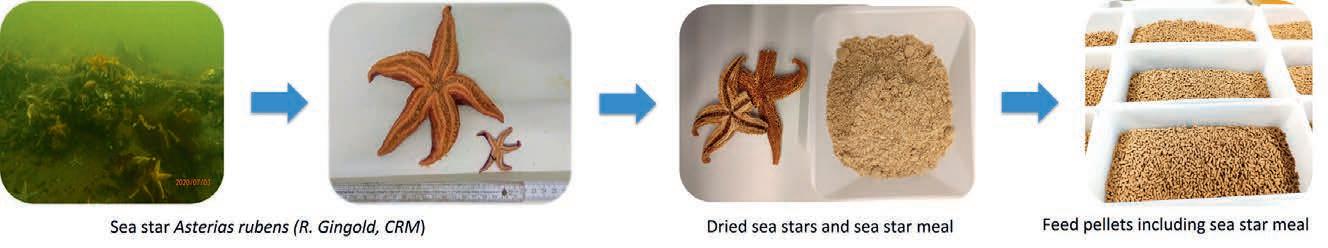

The October issue of Fish Farmer also features the concept of the circular economy, with a profile of EcoFishCircle – a company that aims to use waste from fish production to help create fish feed – and an article from BlueBio’s Ingeborg Korme on the regulatory barriers in Europe that are holding back the development of a truly circular food system.

Best wishes

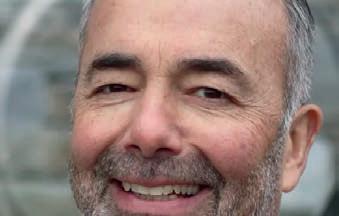

Robert OutramMeet the team

Editorial advisory board: Steve Bracken, Hervé Migaud, Jim Treasurer, Chris Mitchell and Jason Cleaversmith

Editor: Robert Outram

Designer: Andrew Balahura

Commercial Manager: Janice Johnston jjohnston@fishfarmermagazine.com

Publisher: Alister Benne�

@fishfarmermagazine

@fishfarmermag

www.fishfarmermagazine.com

Fish Farmer Volume 46, number 10 Contact us

Tel: +44(0)131 551 1000 Fax: +44(0)131 551 7901 Email: editor@fishfarmermagazine.com

Head office: Special Publica�ons, Fe�es Park, 496 Ferry Road, Edinburgh EH5 2DL

Subscriptions

Subscrip�ons address: Fish Farmer magazine subscrip�ons, Warners Group Publica�ons plc, The Mal�ngs, West Street, Bourne, Lincolnshire PE10 9PH Tel: +44(0)177 839 2014

UK subscrip�ons: £75 a year

ROW subscrip�ons: £95 a year including postage all air mail

SCOTTISH Sea Farms has been consulting with the local community regarding its plans for a large new salmon farm in Shetland.

The proposed farm at Billy Baa, west of South Whiteness, is part of the company’s plan to consolidate its farm. The strategy will involve closing some smaller facilities but these have not yet been identified.

The new farm is estimated to cost £4m and Scottish Sea Farms will be applying for an indicative maximum biomass of 4,000 tonnes.

The company’s plan comprises nine 160 metre salmon pens and one 120 metre pen, secured by a 125 metre mooring grid and with a surface area of 19,480m2

Each pen would be stocked to RSPCA ssured densities of just 1.5 fish to 98.5% water, with a combined maximum permitted biomass of 4,091 tonnes.

Pens would be equipped with predator defence netting systems

and pole-mounted top nets.

Adjacent to the pens would be a 400 to 500 tonne capacity feed barge. This would house the farm’s cameramonitored feeding system, office and welfare facilities for the team, and a store for fish feed.

Scottish Sea Farms said the barge will have a “boat-like” design to blend into the local seascape. The farm would be supported from

the company’s shore base at South Whiteness.

The proposed farm at Billy Baa is part of a wider strategy of consolidation at Scottish Sea Farms. At the company's Loch Nevis site, for example, 1,280m circumference pens are being replaced by five 1 m pens, reducing the overall number of units from 36 to just 10, while maintaining the same overall biomass.

or marketing activities – was 1,508, up slightly by 13. Production tonnage of rainbow trout increased by 7% in 2022 to a national record of 8,757 tonnes. Brown and sea trout production remained steady at 23 tonnes. The Scottish Government’s Cabinet Secretary for Rural Affairs, Land Reform and Islands Mairi Gougeon welcomed the report, saying: “Scotland’s aquaculture sector is a significant contributor to our economy, generating approximately £885m GVA [gross value added] and an estimated 11,700 jobs while producing healthy and nutritious products. It is good to see a small uplift in direct employment in the sector and to see innovations and new strategies being deployed by the sector having a positive impact.

THE latest figures from the Scottish Government confirm what the major salmon producers’ reports have already made clear – the biological issues experienced last year resulted in a significant fall in Scotland’s salmon production.

The Scottish Fish Farm Production Survey 2022 shows that production of Atlantic salmon in Scotland was 169,194 tonnes, representing an 18% decline year-on-year. Mortalities and premature harvests hit production numbers in 2022, particularly related to an increase in the population of micro-jellyfish (hydrozoans), which led to gill health issues and other challenges for salmon at sea.

Despite this, the total number of smolts produced in 2022 increased by 3.9 million (8%) to 55.1 million. Employment in salmon production – excluding processing

“For example, we’ve seen a reduction on the reliance of imported salmon ova and an increase in production and hatches in Scotland. This strengthens our domestic supply chain and improves resilience. We also know that some companies are working to change their production strategies, for example by increasing the average size of fish put to sea and reducing the marine phase of production.”

She added: “These figures also show that farmers are proactively responding to environmental and biological challenges and pressures, for example by making the responsible decision where necessary to harvest smaller fish to support health and welfare, which has resulted in decreased production figures.”

SCOTLAND’S salmon farmers have finally had some good news to report on survival rates. Preliminary data for September 2023 indicates that survival was above 96.5%, up on the 95.3% recorded in September 2022.

The improvement comes after several mitigation measures were adopted by farmers to further boost animal welfare amid the climate change challenge, including oxygenation of the water, less time spent in the sea, improved monitoring and new feeding strategies. It is also despite the warmer sea temperatures experienced around Scotland this year.

Even given the the year-on-year improvement for September, however, producers have reported reduced harvests for 2022 and the first half of 2023 due to “biological issues”.

Dr Iain Berrill, Head of Technical at Salmon Scotland, said: “September is usually one of the most challenging months for survival, but interim figures suggest that monthly survival in September is expected to be above 96.5%, compared to 95.3% in the same month last year.

“There is no question that 2023 has been a challenging year, but the ongoing hard work by our farmers has provided good conditions for their salmon, despite record-breaking seawater temperatures here in the UK and globally.

“However, while there is always a level of fallen stock in any farming operation, the numbers this year are not where any farmer would want them to be. It is utterly devastating to the farmers caring for those animals when any fish are lost.”

Last year, Salmon Scotland warned of a significant increase in microscopic jellyfish blooms, which had affected the survival of farm-raised fish.

But while the tiny translucent jellyfish, measuring as small as 2mm, continue to pose challenges for farmers who care for their livestock all year round, millions of salmon have been moved out of harm’s way in 2023 thanks to improved monitoring and mitigation measures such as aeration of the water, feeding strategies and putting larger fish to sea.

September survival rates typically drop to their lowest monthly level because this is when seawater temperatures peak – and this year has seen record temperatures. While these can actually encourage growth and allow harvest weight to be reached more quickly, record temperatures also contribute to an increase in naturally occurring organisms, which can reduce oxygen levels and compromise the health of the salmon.

Dr Berrill said: “Our ability to address the environmental challenges facing our fish while they spend up to two years in the sea has improved, but there is always more we can do to further improve survival.

“But the sector is resilient in the face of climate change and we have a track record of being proactive and constantly adapting to environmental challenges.”

MOWI’S fundraising “Salmon Wagon” has raised more than £14,000 for local charities in Scotland over the past three years.

Across the country this year, the Salmon Wagon served up delicious barbequed salmon dishes at events in Achiltibuie, Appin, Benbecula, Isle of Harris, Isle of Skye, Kilchoan, Kyle of Lochalsh, Newtonmore, North Uist and Rosyth. Arriving at events fully stocked and staffed by Mowi, 100% of proceeds from the sa e of food enefitted local causes.

In total, since its launch three years ago, the distinctive food truck has raised £14,258 for local causes, serving up over 3,000 salmon dishes at 26 events.

Jayne MacKay, Community ngagement fficer at Mowi Scotland, said: “In its second summer on the road, we are delighted that the Salmon Wagon has raised a significant amount for many worthy causes. Having attended the events, which

ranged from village galas and agricultural shows, to Highland games and festivals, we are lucky enough to have met first hand the charities and communities that will enefit from the funds raised “It was a privilege to be able to spend time at these important social occasions.

“Supporting the local groups that host them is an important element of Mowi’s commitment to helping local communities thrive. We can’t wait to learn more about some of the fantastic events scheduled for next summer as we seek applications for and ma e the difficu t decision of which ones to support.”

Mowi Scotland is now inviting communities and local organisations that would like the fundraising Salmon Wagon to attend their event in 2024 to apply online.

More information on the Salmon Wagon and application forms are available at mowisalmonwagon.co.uk

STAFF at Scottish Sea Farms (SSF) helped their colleague Arnaud Louis to celebrate 30 years with the company. Having first started out in processing back in 1993, he moved to fish husbandry, learning the ropes at the SSF farms around Loch Linnhe in Argyll before

settling down at Dunstaffnage, where he has been working for 15 years. Louis received his long service award and gift voucher from former Dunstaffnage Farm Manager David (below left) and current Dunstaffnage Farm Manager George (below right).

SUPPLIERS to the aquaculture sector were among the winners at the Highland Business Awards, held in Inverness on Friday 29 September.

Jacques Huysamer of marine engineering and support business Gael Force Group was named as Young Employee of the Year, while Alasdair Ferguson, Group Managing Director of Ferguson Transport & Shipping, was the winner of the Business Leader of the Year award.

Mowi Scotland was shortlisted in the Global Growth category and renewable energy specialist Ri Cruden was named as the overall Business of the Year.

Gael Force’s Huysamer has been involved in the nextgeneration design of the Seasight aquaculture camera double winch and he has also partnered with the Technical Development Manager to oversee the destructive testing of the new SeaQureLink Ultra mooring ring for a more

secure offshore fish farming cable installation inside the company’s sea farm pens.

Commenting on the win, Jacques Huysamer said:

“Hitting my first-year anniversary at Gael Force Group on the same week as the Highland Business Awards has been capped off by winning the award. I am grateful for all the personal development opportunities that the technical environment at Gael Force has given me. Being shortlisted for the award in the first instance was as much a reflection on the experienced team around me, so it is a proud moment for us all.”

SALMON producer Mowi is rolling out a new prime-time TV advertising campaign starting this month. Dedicated to generating more desire for salmon and supporting Mowi stockists, the “Lingo” campaign will further raise awareness of the Mowi brand and ways to enjoy it. With prime-time spots across

many channels including ITV, Channel 4, Channel 5 and Sky, the national campaign follows the brand’s sponsorship of the reality cooking show Gordon Ramsay’s Next Level Chef at the beginning of 2023. The TV campaign will be complemented with video on-demand advertising on ITVX, All4 and Sky.

BAKKAFROST Scotland has won the award for Excellence in International Business at the Scottish Council for Development and Industry (SCDI) Highlands and Islands Awards.The award

SALMON farming veteran Gilpin Bradley is retiring after a decades-long career in Scottish aquaculture.

Bradley was Managing Director of Wester Ross Salmon – the company his father Robin co-founded in 1977 – for 33 years. After selling the business to Mowi last year, he continued in the role during the transition to new ownership and also became Business Development Director, Farming Scotland with Mowi.

celebrates businesses working in the Highlands and Islands that demonstrate outstanding achievements in the global marketplace.

Bakkafrost Scotland’s Managing Director Ian Laister said: “We are passionate about our provenance and bringing the finest quality Scottish salmon to overseas markets. People across the globe enjoy our finest quality, sustainably produced Scottish salmon and winning this award recognises our commitment to quality, innovation and export growth.”

In retirement, Bradley “will remain available to Mowi and the team at Wester Ross”, a company statement said.

Bradley, who holds a business degree from Robert Gordon University, Aberdeen, is also a former chairman of the Scottish Salmon Producers’ Organisation (now Salmon Scotland) and founder of the Wester Ross Salmon Education Trust. He was named as 2022 Ambassador of the Year at the Highlands and Islands Food & Drink Awards, having already won the same award in 2013.

Ben Hadfield, COO at Mowi Scotland, said: “Gilpin is such a respected and admired leader, with many farmers having learned their trade from Gilpin directly. His experience spans every part of the business’ value chain and is a key reason for the growth and success of the Wester Ross Salmon brand. He is a charming artisan, which is supported by the grit, resilience and know-how needed to meet all the challenges of farming salmon in Wester Ross for over three decades. I wish Gilpin the best for his well-deserved retirement.”

INVERLUSSA Marine Services has taken delivery of Charlie Knight, an 18.5m by 12m CoastCat service catamaran, built by Salthammer shipyard in Norway.

Charlie Knight is a state-of-the-art DP0 hybrid diesel-electric service vessel, fully classed to DNV (the world’s leading maritime c assification ody with a strong focus on lowering emissions and increasing crew safety, especially when working with increasingly heavier mooring e ui ment he esse has een fitted out with more powerful cranes and full SHM deck equipment, including deck winches with incorporated load cells.

As with all Inverlussa-built vessels, crew comfort is a priority and so Charlie Knight has been built with four en-suite cabins along with a large messroom and separate galley to improve living conditions onboard.

The new vessel also complies with low emissions Notation from DNV, achieved

with Tier 3 engines in addition to a hybrid battery pack. Charlie Knight is the fourth hybrid vessel built by Inverlussa, showing the commitment of the company and their customers to reducing emissions.

Inverlussa Managing Director Ben Wilson commented: “Charlie Knight is a big step forward in terms of incorporating the latest technology and equipment into a service catamaran for Scotland.We e ie e this wi resu t in a more efficient work vessel, enabling us to achieve more work in the same time, as well as increasing safety onboard.”

The company has also recently taken delivery of Mimmi, renamed John Wilson, and is the third NabCat catamaran in n er ussa s growing fleet of wor oats John Wilson was built in 2019 for Norwegian owner FDA and is based on the versatile NabCat 15 by 10 design, which includes SHM deck equipment similar to Charlie Knight.

The addition of Charlie Knight and John Wilson ta es n er ussa s fleet u to 22 vessels and 130 specialised crew.

The company said: “Inverlussa aims to be a leader in the Scottish aquaculture service vessel market and these recent investments show a commitment to delivering this by providing the best possible service whilst driving down the cost to customers where possible.”

THE inquiry into the death of a Mowi Scotland employee is due to start with a preliminary hearing next month.

The Crown Office and Procurator Fiscal Service (COPFS) has lodged a First Notice to begin the court process for a Fatal Accident Inquiry (FAI) into the death of Clive Hendry.

The preliminary hearing is set for 27 October 2023 at Inverness Sheriff Court.

Hendry, 58, died on 18 February 2020 while transferring from a work boat, the Beinn Na Caillich, to a Sea Cap feed barge at the company’s Ardintoul fish farm.

In May this year, Mowi was fined £800,000 over the accident, having not contested the COPFS case. An earlier report by the Marine Accident Investigation Branch had determined that Mowi had failed to make a suitable and sufficient risk assessment or maintain systems of work for the health and safety of employees when transferring from

a vessel to a structure such as Sea Cap. The company also failed to provide employees with the necessary supervision to ensure lifejackets were properly tightened and secured.

Clive Hendry’s partner, Catriona Lockhart, has been pressing for an FAI, which she has said would go further than the court case to establish the root cause of the tragedy and to ensure that the right lessons are learned.

Responding to the latest news, she said: “I still, after three years and six months, don’t know the full facts and details of what really happened that tragic day. I just need to find out why my partner of 28 years is no longer with me and lying in a graveyard. I need to know why my life has been destroyed and what happened to my Clive on that tragic day, and to try and change these unsafe practices that Mowi Scotland were found guilty of so that no other family has to live this hell.”

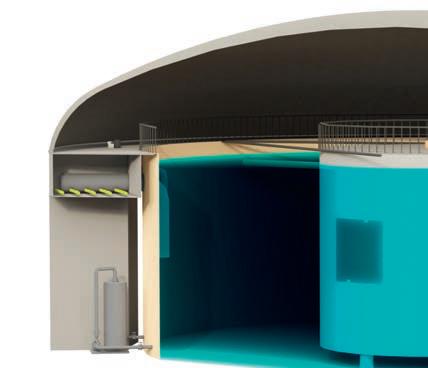

NORWEGIAN wellboat company Intership has taken delivery of its second new build from Zamakona Yards Bilbao.

The Inter Scotia, a battery-hybrid wellboat, is designed by Salt Ship Design and has a load capacity of 2,500m³.

Inter Scotia shares similarities with its sister vessel, Inter Atlantic. Both have been designed

with a focus on promoting good fish welfare, fish handling and biosecurity.The vessel features a substantial battery package that, when in combination with its heat-recovery system and other measures, significantly reduces fuel consumption and climate emissions.The fish-handling system is delivered by MMC irst Process and the vessel is equipped with a highcapacity freshwater production system capable of producing 5,000m³ of freshwater per day.

Since 2016, Intership has taken the lead in developing freshwater treatment for lice and AGD using a reverse osmosis system. Over the past seven years, the company has gained extensive operational experience in freshwater production and fresh-water treatments. Intership s eet of well boats with reverse osmosis systems provides a low-cost, highly efficient and environmentally friendly method for dealing with sea lice, AGD (amoebic gill disease)

and other gill infection challenges faced by salmon farmers.

Inter Scotia will initially be deployed with a salmon farmer in Scotland. After a few months, the vessel will be temporarily taken out of operation for the installation of the delousing system, LS Caligus .

Combining a freshwater bath and ushing the fish through the LS system is an efficient and gentle way to remove sea lice and gill infections in the same operation, Intership said.

“We are delighted to take delivery of our third vessel equipped with Intership’s industry-leading freshwater production and treatment setup,” said C le eter randal. reshwater treatment is arguably the gentlest method used for treating salmon and it offers both environmental and economic benefits in addition to increased efficiency through facilitating a high-capacity freshwater production system.”

CONTESTANTS in last month’s Craggy Island Triathlon were able to get their bikes across Oban Bay with a little help from salmon producer Scottish Sea Farms.

The event involved a 600m swim from the Scottish Sea Farms slipway at the marine on Kerrera Island off Oban on Scotland’s west coast, a 16km bike race around the island and then an 8.5km trail race through the north of the island.

Previously, organisers Durty Events had relied on the scheduled CalMac ferry service to get to and from Kerrera, but this presented some logistical problems, so Scottish Sea Farms made the company’s landing craft Hollie Rose available to transport the racers’ bikes.

Paul McGreal, Founder of organiser Durty Events, said: “Craggy Island Triathlon is a much-loved event. It gets amazing support both from our participants and the community of Kerrera over the whole weekend.

“The logistics of the event are tough for us as organisers. Getting that many people, bikes and equipment to the start line is tricky as everything has to move across from Oban by boat.

“We are hugely grateful to Scottish Sea Farms for their support of Craggy Island Triathlon – they literally have made it possible.”

Scottish Sea Farms Marine Engineering Manager for Mainland Craig Cameron was participating in the race as well as helping to organise assistance with the vessel and slipway.

Cameron said: “Durty Events had the whole thing really well organised, with private boats ferrying competitors and spectators to and from the Isle of Kerrera and Scottish Sea Farms’ Hollie Rose transporting the competitors’ bikes.

“It was impressive to see that many people getting to the island with such ease.

“Using the Scottish Sea Farms’ slip on Kerrera worked well too, as it meant people could be taken directly to the north of the island where the main facilities are, rather than to the south as was the case in previous years’ events.

“All in all, it was a real improvement on previous years in terms of logistics, making it more enjoyable for those who turned out on the day.”

He added: “Signing up for an event like this gives you a goal to train towards and a reason to get and stay active.

“On the day, the weather was kind to us, but the course was still challenging as there were some areas so wet underfoot that I thought my bike might disappear. I could also have done without the jellyfish sting!”

OFFSHORE salmon farming company SalMar Aker Ocean says it has received approval for the location of its Smart Fish Farm in the Norwegian Sea. The decision has come from the Norwegian Directorate of Fisheries. The Smart Fish Farm will be operated by Mariculture AS, a company wholly owned by SalMar Aker Ocean AS, which itself is jointly owned by seafood giant SalMar and marine engineering business Aker.

CEO Roy Reite said: “This is an important step forward in realising the potential of offshore aquaculture.” He added: “The next important milestones for us are the clarifications related to ground rent tax and the regulatory framework for offshore aquaculture.”

The salmon tax could become the sticking point against progress being made on this important next development in salmon farming.

SalMar has been the main pioneer in offshore farming with its Ocean Farm platform, but last week Gustav Witzoe, its Founder and Chairman, said there would be no progress if the tax issue is not clarified. t the moment, the ta is only levied against coastal or fjordbased fish farms.

It was almost two years ago that SalMar and Aker, two of the leading players in their respective field in fish farming and industrial engineering, came together to launch SalMar Aker Ocean. This new operation will operate fish farming in weather-exposed areas and far out to sea, and continues SalMar’s

long-standing investment in this field. SalMar and Aker have big plans for SalMar Aker Ocean. The aim is for the company to produce 150,000 tonnes of salmon annually by the end of 2030 under fantastic conditions and on the salmon’s terms.The company will thereby be one of the world’s largest salmon producers.

The major investment depends, among other things, on the authorities in Norway making arrangements for it, but they say they are not sitting idly by and waiting.

“We have already completed two successful production cycles with the sea cage Ocean Farm 1 and have concrete plans to expand the business with two more facilities,” SalMar Aker Ocean added.

THE Icelandic government has called a temporary halt to issuing new salmon farming permits.

The move comes amid a growing national debate over aquaculture in the wake of various incidents, including escapes.

Food and Fisheries Minister Svandís Svavarsdóttir suggested it was time to draw breath, stating that the country has been chasing an industry that has grown rapidly.

But the chief argument is that salmon farming has been allowed to expand rapidly with comparatively little supervision.

Aquaculture has grown almost sevenfold in the past decade and is on course to almost double by 2030 on existing permits alone.

The sector has brought huge economic benefits, including hundreds of new jobs to remote

areas, particularly in the Westfjords region, which had lost their traditional fishing activities.

Production has risen from around 8,000 tonnes a decade ago to more than 50,000 tonnes last year and industry profits have grown accordingly, hugely boosting the country’s tax take.

Much of the investment, however, is not home-grown, but from Norway, which makes the country vulnerable to important decisions beyond its control.

To outsiders, fish and Iceland are synonymous, but the country is deeply divided over some aspects. The government recently called a temporary halt to whaling, for example, an activity which is centuries old and deep in the DNA of coastal communities.

Recent salmon escape incidents have led to several calls for restrictions on open-pen farming, even in areas where it has brought economic benefits.

The Reykjavik government is due to announce a national aquaculture strategy, probably early next year. It is likely to include a ceiling on how much salmon should be farmed.

NORWEGIAN fish farmer

Norcod has been granted permission to establish a new production location in Nesna municipality in the Nordland region.

It has been allocated a total maximum allowed biomass (MAB) of 3,599 tonnes for a new cod farm.

It is the company’s second location in Nesna and, together with a site at Labukta, it forms a production cluster with a total capacity of 7,200 tonnes.

Norcod CEO Christian Riber said: “Norcod has been very well received by Nesna municipality, which we highly appreciate and we look forward to continuing our excellent cooperation. We will keep on working together successfully in the future.

“We consider this second site in Nesna also to be perfectly suited for cod farming

with good water depth, water temperature and currents. I am confident our fish will thrive here.”

The local mayor Hanne Davidsen said: “Nesna municipality is very happy that Norcod has received approval for a new location for cod farming in Nesna.

“Norcod is well established in the municipality and contributes to activity and jobs, which are very important to us.”

Riber said: “For the industry’s leading player, good community relations are integral to Norcod’s strong commitment to responsible farming of

premium product. Our ambition is to contribute not only to the industrial base of the coastal municipalities in which we are active but also to support employment opportunities and ensure sustainable operations with minimal impact to the environment.”

He said the new site will be equipped with state-of-theart aquaculture technology, driving sustainable production emphasising welfare for both fish and employees.

Riber added: “We have a highly skilled production team with many years of combined experience, so I anticipate this will be a smooth and efficient process.”

Norcod holds a total of six production sites along the Norwegian coastline, encompassing in total 24 licences with MAB of 17,500 tonnes.

TROUBLED Norwegian cod farmer Statt Torsk has been taken over by the larger whitefish group Vesterålen Havbruk AS.

Statt Torsk disclosed last month that it had been hit by high mortalities and production costs during the second quarter. The Q2 losses had almost doubled to NOK 18m (£1.3m).

It then began a strategic review of the business and a few days later revealed it was in merger talks with Vesterålen Havbruk AS, which also farms cod, processes white fish and has some salmon interests.

Statt Torsk issued a Stock Exchange statement saying: “The company is pleased to announce that it has entered into a transaction agreement with Vesterålen Havbruk for a business combination between the company and Vesterålen Havbruk… The merger will be carried out by the company transferring all its business, including all assets, rights and obligations, to a wholly owned subsidiary of Vesterålen Havbruk as the acquiring company in the merger.

The statement added: “Consideration shares in the merger will be issued by Vesterålen Havbruk, based on an equity value of the company at NOK 255m (£19m), implying a value per share of NOK 1.20 and an equity value of Vesterålen Havbruk at NOK 610m (£45.5m).”

The merger will involve a delisting of Statt Torsk’s shares on the Euronext Growth Oslo market.

Vesterålen Havbruk has also made available an interest-free working capital loan of NOK 40m (£3m) to Statt Torsk.

Gustave Brun-Lie, CEO of Statt Torsk ASA, said: “We are extremely pleased with this contemplated transaction. It solves our imminent needs of cash, reflecting the true values of our companies in the current market, but most of all it is a strategic move of consolidation of our young industry. A business combination with Vesterålen Havbruk is our preferred option to optimise shareholder value.”

Brynjar Kværnstuen, CEO of Vesterålen Havbruk AS, added: “Joining forces with Statt Torsk will give the new entity flexibility to deliver cod to market year-round in the future, combining harvests from sites in the north and south [of Norway].

“With decreasing quotas on wild cod in the coming years, the timing for scaling farmed cod has never been better.”

A recently launched investment fund has taken an ISK 10bn (£60m) stake in a salmon business to help provide capital for a new land farm project in Iceland.

The deal will give Haf Investments a 53% stake in Thor Landeldi, which plans to develop a 20,000 tonne facility near Þorlákshöfn on the southern coast of Iceland and close to where other land farms are planned.

Haf Investments was established earlier this year by, among others, Icelandic pensions funds and the fishing company rim, with a S 1m fund to focus on “ocean-related opportunities”.

ut according to reports the fund s investment capacity is even greater if the shareholders coinvestment authorisation is taken into account. y that measure, the investment capacity could go up to m to 35 m 1 4m to m .

Among other investors in the project are Norwegian investors Frank Yri, Chief Commercial fficer of Seaborn, and le Vassbotten, Chairman of the board of Seaborn.

Landeldi has secured a 20.3 hectare site at La abraut, west of orl ksh fn.The location is suitable for fishing as the area is rich in fresh and sea water, which are both needed for the production of salmon on land.

A statement said new capital in the company will be used to finance the first phase of the project, which is the construction of a hatchery.The project is currently in the environmental assessment process and if the plans go according to plan, it is e pected that the first eggs will be received in the hatchery in the autumn of 4.

The leaders of the project are Jónatan Þórðarson, Þórður Þórðarson and Halldór Ragnar slason, all of whom have e tensive e perience. r arson is an aquaculture e pert with more than years of e perience in the operation and development of fish farms and was Head of Aquaculture at Ice Fish Farm for 10 years between 2012 and 2022.

Þórðarson previously worked as a lawyer and manager at Fiskeldi Austfjarða hf. between 2012 and 2023, but Jónatan was among the founders of Fiskeldis Austfjarða hf.

slason is a fisheries scientist with an MSc in aquaculture from Scotland and most recently worked in the fisheries team in the corporate division of Arion bank.

ownership, following a review now being undertaken by the company’s owner, Nordly Holdings. Nordly is “identifying new strategic solutions” with the help of advisers ABG Sundal Collier.

MOWI has agreed a deal with Norwegian company Harbor to try out new technology aimed at protecting farmed salmon against sea lice. The preventive measure, Harbor Fence, is a low-voltage electric barrier that prevents sea lice from entering the salmon cages.

FISH health and aquafeed business

STIM could see a change of

Last month STIM CEO Jim-Roger Nordly stepped down in favour of aquaculture veteran Carl-Erik Arnesen, formerly Managing Director of the feed producer Polarfeed, also owned by Nordly. Nordly is still STIM’s owner – for now, anyway.

AUSTRIAN meat-free food producer Revo Foods has released a 3D-printed “inspired by salmon” offering for vegans that promises to replicate the taste, nutritional value and mouthfeel of a genuine salmon fillet. The new product, which is based on cultured myco-protein, uses Revo’s patented MassFormer™ technology. The company said: This fillet offers the juicy fibres aiming to recreate the mouthfeel of traditional fish fillets. This gamechanging extrusion technology allows the seamless integration of fats into a fibrous protein matri for the first time, opening the door to a new generation of authentic meat alternatives.”

NORWEGIAN salmon farming business Kvarøy Arctic has appointed une Mikalsen as its Chief ecutive fficer in a move it says will strengthen the company’s bid to grow in the American market.

Formerly the CFO of Kvarøy Fiskeoppdrett AS – Kvarøy Arctic’s parent company – Mikalsen is an experienced operator in the seafood industry. He will be responsible for overseeing the company’s operations, sales and marketing strategies, and strengthening relationships with key stakeholders, including customers, distributors and retailers.

Kvarøy said: “Mikalsen’s leadership skills and strategic vision will play a vital role in driving Kvarøy Arctic’s growth and enhancing its reputation for delivering high-quality salmon products to the US market.”

The trial will involve the deployment of the fence to Mowi’s Rogne site in the Møre and Romsdal region of Norway.

Henrik Trengereid, Group Manager Seawater Production Technology at Mowi, said that Harbor has shown interesting results over the past year and wanted to try out its Fence in a joint R&D project to document the effect on a large scale. The idea is to focus particularly on sites with challenging currents and wave heights.

In addition to the Rogne trial, Mowi also sees an opportunity to test the technology at another location next year.

Harbor and Mowi will collaborate closely through the first R&D project at Rogne, where the technology’s protective effect against salmon lice and impact on fish welfare will be documented. Operational safety and how the technology performs in exposed locations will also be measured.

Harbor has spent several years developing the Harbor Fence and said it has already shown very good results for Nova Sea, with approximately 70% fewer adult lice than other locations in the same area.

This result has led to increased interest in the farming industry and has also been important for Mowi’s decision to test the technology.

The General Manager of Harbor, Christian Bjørnsen, said the contract is important for the development of the company and added that he was very pleased to have signed an R&D contract with such a large player as Mowi.

“This is what we have rigged the company for in recent years,” he said. “We have moved production from Hjelmeland to Dusavik just outside Stavanger, where we are able to increase production capacity significantly.”

Harbor Fence is a research-based and patented solution for combating salmon lice developed by Harbor AS. Findings from the research work have shown that louse larvae lose their ability to attach to salmon after exposure to small electromagnetic fields. Harbor Fence utilises this effect through an enveloping electromagnetic field that is strung up around the cage. The field takes the form of an open fence and neutralises lice larvae on their way into the cage.

Harbor Fence is locally effective and, the company says, does no harm to fish inside the cage. Good flow of water means that lice hatched inside the cage are also rendered harmless when they drift out of a Harbor Fence facility.

Bjørnsen said: “It contributes to reduced contamination of adjacent cages in other locations and in villas. We look forward to a good and professional collaboration with Mowi.”

to this, but the weak Norwegian krone.”

Poland and Denmark, both major salmon processing countries, along with the USA, were once again the largest markets.

THE value of Norway’s salmon exports rose by 13% to NOK 31bn (£2.3bn) during the July to September quarter, the latest figures from the Norwegian Seafood Council show.

The volume of 347,000 tonnes was marginally lower (-1%) on Q3 last year.

While this represents a third quarter record, once again currency exchange rates played a big part, says the council.

Seafood council analyst Paul T Aandahl said: “The value development follows a pattern of growth over a long period of time,and September was the 31st month in a row with an increase in value.

“Unfortunately, it is not the growth in demand that is the most important contribution

China was the market showing the second-largest growth in demand during the quarter, with record quantities of fresh salmon supplied to China from Norway and elsewhere.

The September-only salmon export figure fell 5% in volume to 130,700 tonnes, while the value last month increased by 14% to NOK 11.2bn (£833,000).

Farmed trout exports continue to perform well and hit a new record during Q3, with the volume rising by 15% to 18,900 tonnes. The value was up by 10% to NOK 1.6bn (£121m).

Overall, Norwegian seafood exports, including white fish, pelagics and shellfish, also hit a Q3 record. They totalled NOK 42.1 bn (£2.42bn), a rise of 10% on Q3 last year.

ICELANDIC Salmon, the parent company of Arnarlax, has been isted on ce and s asda irst orth toc ar et for the first time, with a value of around ISK 71bn (almost £420m).

The company, in which the Norwegian salmon giant SalMar has a majority stake, had previously been listed on Norway’s Euronext Growth market.

The opening price per share was ISK 2,260. It rose to ISK 2,500 and then fell again as the day went on, ending at ISK 2,300 (£13.60). It is thought the move will make the company more accessible to Icelandic investors.

CEO Bjørn Hembre said: “We are proud to be on the Nasdaq First North growth market in Iceland.

“Arnarlax’s work is well known to Icelanders, who are known for their love of seafood and its sustainable use.This registration is a very important part of our road to further growth and we are grateful for the interest we have found.”

The move marks an impressive step forward for a business that is 14 years old. It was founded as a relatively small family venture around 2009 to 2010. SalMar bought into the company in 2015 and the first har est fo owed a year ater

FAMILY-owned fish farming com any s a is to carry out a ma or reorganisation of its usiness which it says is necessary to address its growing ta urden

other simi ar si ed sa mon com anies

NORWAY’S salmon farmers could face an extra tax if the number of salmon lice goes too high, a report has suggested.

The proposal has come in a 190-page report from the Aquaculture Committee, set up two years ago to look into various issues around the permit system in the industry. The changes suggested would relax the rules in some areas but introduce new financial penalties.

Linda Nøstbakken, who heads the committee, has now presented her report to the Fisheries Ministry. She says that the rapid growth of the industry has brought a number of challenges around the environment, fish welfare and biosecurity but problems with salmon lice and diseases have limited the growth opportunities.

A new, comprehensive management system for aquaculture must provide stronger incentives for sustainable choices that safeguard biosecurity and the environment, the report states.

Nøstbakken says she has taken “a little more whip and a little more carrot” to some of these challenges.

On the carrot side, the committee has proposed lowering the limit at which salmon companies are required to take measures against lice.

But the stick could mean a tax on lice that is above the acceptable measured limits.

The committee was appointed by the Norwegian government in October 2021 to review the permit system in the aquaculture industry.

Other recommendations proposed by the committee include removing a measure in the traffic light system – which divides coastal zones into red, yellow and green regions –mandating a reduction in production when lice numbers go beyond a certain level.

The committee is also proposing the removal of the yellow category in the traffic light system. This currently allows salmon and trout production to continue at current levels but does not permit increases.

The report is now out for consultation with a deadline of 2 January 2024.

Fisheries Minister Bjørnar Skjæran said the committee had carried out a thorough review of the permit system, adding that he planned to assess the proposals in more detail, taking in input from the consultation. However, he does not envisage major changes to the traffic light system.

he an in o es concentrating the iomass and a food fish o erations into one com any n ear y e tem er the orway- ased s a announced the a ointment of nders Hagestande as its new hief inancia fficer a though the mo e was ro a y in ace efore that news ro e s a has descri ed the an as a “ ro osa for fission and triangu ar merger t said the ur ose is to “ urify s a as a ho ding com any as we as to iso ate commercia food fish ermits in one com any ure arming “ urthermore it is desira e to transfer certain o erating assets and em oyees with associated assets rights and o igations to one com any ua arms artda the announcement added he shareho der set-u wi e the same as efore

s a s second uarter resu ts were disa ointing when com ared to

e enues fe y m m to m m whi e its o erationa more than ha ed down from m m in to m m this time

he com any amed higher feed rices and costs for treating sa mon ice a ong with ower har ests for the re ersa

t a so announced the scra ing of its a ua semi-c osed roof faci ity designed to o en u new sea farming areas and reduce ice c aiming that the sa mon ta made it economica y un ia e

A relatively young Icelandic land salmon farming company has just completed a six billion ISK (£35.5m) share capital increase.

Laxey, which changed its name from Icelandic Land Farmed Salmon last month, is building a new fish farm at Vi lagafjara on Heimaey in the Westfjords region.The proposed farm would have a production capacity of 32,000 tonnes by 2031.

Construction is due to start this ovember, with the first harvest expected within two years.

The project will create at least 100 direct jobs and many more indirect employment

opportunities, said the company.

Lárus Ásgeirsson, Chairman of the board at Laxey, said: “We are extremely happy that this milestone has been reached and the trust that investors show in Laxey.

“We have been working on this project since 2019 and see great opportunities in the production of Icelandic land-farmed salmon in the Vestmanna Islands and sales on international markets.

He added: “In the Vestmannaeys, there are ideal conditions for producing highquality fish products, a lot of knowledge and strong human resources – which is a key

factor in this sector.”

The farm will be built in six equal phases, with the first phase expected to be ready in mid- 4 and the first slaughter to take place in late 2025.

The first phase alone will be operationally sustainable but each additional phase will increase the efficiency of production, with lower investment expenses and operating costs per kilo of salmon produced,” Ásgeirsson said.

Although Iceland is now emerging as one of the world’s leading salmon farming countries, land-based operations are still fairly new to the country.

Laxey says the conditions for salmon farming on land in the Vestmanna Islands are very good: “A continuous water recycling system is used, where about 65% of the sea is reused, while 35% is fresh ground sea pumped up from boreholes in the area.The water temperature is particularly favourable for salmon farming.”

carried out regular sampling. It said it was doing all it could to limit the damage.

The Food Safety Authority has since taken its own samples, which confirmed the company’s suspicions.

PANCREATIC disease (PD) has been confirmed at a salmon research facility and farm in Norway, the country’s Food Safety Authority has said.

The site atYstøya in Nordland,

which holds an estimated 860,000 fish, is operated by the organisation LetSea, which is also a business.

LetSea first disclosed its suspicions last week after it had

Pancreatic disease in Atlantic salmon can reduce weight gain and lead to damage of the heart, pancreas and skeletal muscle.

A statement said: “The Norwegian Food Safety Authority has informed the company that they will be required to empty the facility quickly.

“The Norwegian Food Safety Authority takes the PD detection seriously. It is a highly contagious salmon disease that leads to poor health and welfare for the fish, and to great losses for the industry,” said Geir Arne Ystmark, Director of the Food Safety Authority’s north region. He added: “The location is in an area with other fish farms and in the main area for boat traffic... to limit the spread of infection, we will order a rapid emptying of the facility.”

ICELANDIC salmon company Arctic Fish looks set to face an investigation following the esca e of more than fish into a fjord last month.

The Mowi-owned business apologised for the incident, which took place in Patreksfjörður in the Isafjord region.

Now the food safety and veterinary agency MAST has requested an officia in estigation into what it says may be a violation of the Aquaculture Act.

MAST says on its website that according to Article 22 of the law, the Act concerns

the board members and the managing director of the operating licence holder cou d face with fines or im risonment of up to two years if the charges are proved and whether they have been committed intentionally or not. Local police are carrying their own investigation but have so far declined to comment.

The incident has led to renewed calls y s orts fishing and en ironmenta groups for an end to open-pen aquaculture in Iceland. Local politicians have also expressed their concern.

Arctic Fish has issued a statement saying it will continueto co-operate with MAST and the Icelandic Fisheries Agency.

PUBLIC hearings to consider a licence application by Cooke Aquaculture for two new farm sites in Liverpool Bay, Nova Scotia will take place in February next year, the Nova Scotia Aquaculture Review Board has announced.

The hearing dates have been set as 5 February to 9 February 2024.

Kelly Cove Salmon Ltd (KCS), a Cooke subsidiary, is seeking approval for an existing site boundary amendment at Coffin Island and two new marine finfish aquaculture licenses and leases for the cultivation of Atlantic salmon in Liverpool Bay at Brooklyn and Mersey Point, Nova Scotia.

Kelly Cove welcomed the opportunity to present its case and said: “After years of provincial government oversight and regulatory enhancements by the Department of Fisheries and Aquaculture (DFA) to ensure best aquaculture practices are conducted for sustainability, if successful, the KCS application would enable a modest Nova Scotia production increase to be phased in over a number of years. According to Statistics Canada, in 2021

Atlantic Canadian salmon aquaculture production in Nova Scotia was 8,592 tonnes, while Newfoundland harvested 15,904 tonnes and New Brunswick harvested 27,423 tonnes.

“In our view, there are only a handful of Nova Scotia locations with marine conditions suitable for finfish farming such as Liverpool Bay, so it is reasonable to expand sites where appropriate while adhering to the strict Aquaculture Regulations and Environmental Monitoring Program Framework.”

The statement added: “Nova Scotia has a fitting opportunity to realise increased investment, jobs and local community spending in the highly innovative ocean aquaculture sector that aligns perfectly with the provinces positioning as home to Canada’s Ocean

Supercluster and marine technology hub.”

The company has been operating Atlantic salmon farm sites for 25 years along Nova Scotia’s southern and western shores. In recent years, applications for the renewal of licences for its operations at Coffin Island and two other sites have been approved by the board.

KCS said: “These new Liverpool sites will allow Kelly Cove to improve its operational efficiencies in production and harvesting, and will result in up to 20 new direct jobs.

“The company also plans to install high-tech hybrid electric battery feed barge systems, which slash carbon emissions by reducing diesel generator run time and fuel consumption by up to 60%.

“The larger operation will require more services and materials to be purchased in the community, creating the potential for an aquaculture service hub to be established in the area. With this expansion, other freshwater hatcheries, feed production and trucking will expand accordingly.”

A 40-year-old Californian woman has had all her limbs amputated after eating infected tilapia fish.

Laura Barajas, a mother of a young son, from San Jose was taken to hospital where she was diagnosed with a serious bacterial infection known as Vibrio vulnificus. She bought the fish at a local market. Her condition worsened and doctors decided that her limbs would have to be amputated if her life was to be saved.

She was taken to an intensive care unit and the hospital website said Laura is now healing well.

Around US $60,000 (£49,000) has been raised out of their goal of US $150,000 (£122,000) through a GoFundMe campaign.

The aim is to try and help Barajas and her family during the healing process and meet medical bills and future needs.

Vibrio vulnificus infections are sometimes fatal and amputations often result. The bacteria can be found in seafood and seawater.

The name tilapia actually refers to several species of mostly freshwater fish. They are nutritious but depending on where the fish is sourced from, there may be a higher risk of safety concerns, including bacterial contamination.

It is not yet known if the fish Barajas consumed came from aquaculture sources, but it is an ideal fish for farming because it can tolerate crowded conditions, grows quickly and consumes a cheap vegetarian diet. It is also popular among American consumers, who say it tastes “less fishy”.

The benefits and dangers of tilapia depend largely on differences in farming practices, which vary by location. China is by far the world’s largest producer of tilapia (followed by Vietnam) and farms more than 1.6 million metric tonnes annually, providing the majority of the United States’ tilapia imports.

PROXIMAR Seafood has, through its subsidiary Proximar Ltd, taken full ownership of the entire land-based fish farm facility near Mount Fuji at Oyama, Japan.

The move, carried out through the company s subsidiary Proximar Ltd, marks the end of construction work at the first commercial tlantic salmon land farm facility to be built in Japan.

The handover also follows the completion of inspections by relevant authorities, third parties and Proximar.

ro imar C Joachim ielsen said Constructing the facility according to plan proves our significant progress in Japan. ith the construction now behind us, we can switch all our focus over to operations and production, where we remain on track with our plan of first harvest in 3 4.

He also praised Daiwa House, ro imar s construction partner, adding Daiwa House has been an important partner for Proximar since 1 . e are very pleased with their performance and they have completed the construction works according to schedule, with e cellent quality.

In conjunction with the handover, ro imar Ltd has also completed the second and final drawdown of the . bn Japanese en 55m blue-sustainability loan provided by Mizuho Bank, Shizuoka Bank and Development Bank of Japan. The second drawdown marks the continued strong support shown by the

company s Japanese banks. In the coming months, installation of the remaining recirculating aquaculture system S equipment will continue in the grow-out building, in close cooperation with technology supplier quaMaof.

This enables the first transfer of fish from the hatchery and nursery building in 4 3. ielsen said ith this completion, we will also proceed to review further capacity e pansion in Japan as previously communicated.

“Proximar sees a strong growth potential as

a leading supplier of tlantic salmon for the sian market. e are also motivated by the support for such growth by our Japanese partners and banks.

ro imar Seafood is a orwegian land-based salmon farming company using S technology, with its first facility and production at the foot of Mount Fuji.

The company inserted its first batch of eggs in ctober last year. Through land-based fish farming, using high-quality ground water secured close to uji, the company plans to produce fresh tlantic Salmon.

an accelerated book building process managed by Arctic Securities AS and DNB Markets, a part of DNB Bank ASA as joint book runners after close of markets on 19 September 2023.

“The net proceeds from the private placement will be used to reach an estimated EBITDA break-even for Phase 1 during H1 2024, with a cash buffer.”

Last month, Atlantic Sapphire warned of a lower than expected biomass during the current July to September quarter, which elevated farming temperatures and their impact on water quality.

costs by utilising excess buffer towards finalising investment in the new Phase 1 and 2 chiller plant.”

The private placement is divided into two tranches. These will be settled on a delivery versus payment (DVP) basis, facilitated through a pre-funding agreement entered into between the company and the managers.

The first tranche consists of 55,000,000 offer shares while the second tranche will consist of 446,428,571 offer shares.

ATLANTIC Sapphire has successfully raised a further US $65m (NOK 702m/£52.7m) with a new share issue, the Florida land-based salmon farmer has announced.

The move involves the private

placement of 501,428,571 new shares, at a price per new share of NOK 1.40.

The Oslo Stock Market announcement said: “The private placement was carried out on the basis of

The announcement said: “The company will deploy rental chillers estimated to bring water temperatures back to budgeted levels.”

It also said that, depending on satisfactory system performance, it would seek to “…eliminate chiller rental

Atlantic Sapphire completed the first commercial harvest of its pioneering Bluehouse (land-raised) salmon in the US in September 2020.

The company is currently constructing its Phase 2 expansion to bring production up to 25,000 tonnes. The long-term target is 220,000 tonnes.

FEED giant BioMar has named Derek Kohn as its next Managing Director for Chile. Kohn,

currently Commercial and Processing Director of Australis Seafood, brings more than 20 years’ experience in leadership positions within the salmon farming industry for companies such as MultiX and Mowi as well as Australis. He takes up his new post in November. BioMar Chile, which is part of the salmon division of the BioMar Group, currently provides feed solutions to a wide range of salmon farmers in Chile and is one of the largest business units within the BioMar Group.

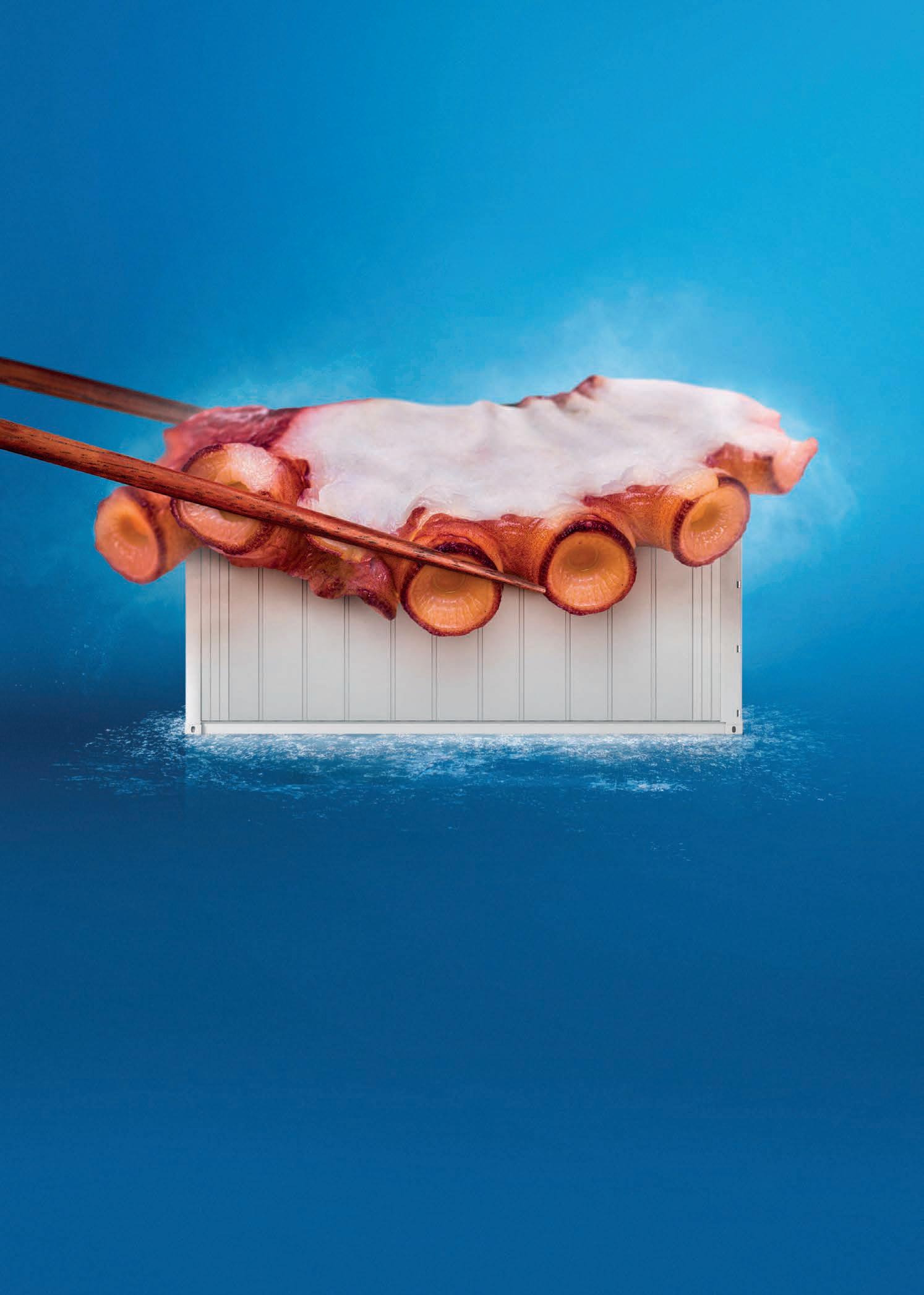

RISING demand for salmon in south-east Asia is being led by the region’s appetite for sushi, a special seminar organised by the Norwegian Seafood Council at Seafood Expo Asia in Singapore has been told.

The panel discussed the trends that have given Norwegian seafood a strong foothold in Asia

and what will apply in the future. Participants included Singaporebased investor Frank Arne Næsheim, Lerøy’s Åshild Nakken, the Seafood Council’s Johan Kvalheim, the Seafood Council’s envoy to Japan and South Korea and Malcolm Ong, long-term buyer of Norwegian seafood.

AUSTRALIA has opened the door to Icelandic salmon and salmon products. The authorities in Canberra have said that Iceland’s salmon producers have now met the necessary conditions to allow them to export to the southern hemisphere nation. MAST, Iceland’s food agency, said: “The licence has been a long time coming but the Australian authorities have made an assessment of the disease status of farmed fish salmon fish and subsequently authorised the import of aquaculture products from Iceland to Australia if certain requirements are met.”

ISRAEL’S AquaMaof Aquaculture Technologies has named Eli Amar as the company’s new CEO. He succeeds David Hazut, who now takes up the role of Chairman.

AquaMaof is a pioneer in recirculating aquaculture system (RAS) technology for land-based production of a diverse range of species, from concept to operational fish production facilities and ongoing service and support.

Amar has served as AquaMaof’s VP Strategy and Finance for the last four years. He brings to the company more than 16 years’ experience in corporate development, as well as mergers and acquisitions. Prior to joining AquaMaof, he worked atcrop protection giant Adama gricultural Solutions, playing a key role in multiple high-profile transactions, including the group’s $3.7bn merger with ChemChina – China’s largest chemical manufacturer – and the ramp-up of the company’s business in China.

He also worked in investment banking at Bear Stearns & Co in New York, where he was involved in several key M&A transactions in Wall Street. Amar holds an LLB from the Hebrew University and an MBA from the Wharton Business School at the University of Pennsylvania in Philadelphia.

Hazut said: “This is an exciting moment for AquaMaof and I’m sure that under Eli’s leadership, the company will break through to new records and achievements. As one of the company’s founders and the new Chairman of the board, I have full confidence in li. Together with the great management and employees of AquaMaof, the company will reach remarkable achievements.”

Amar added: “Our current aim is to widen our reach, both in terms of building additional large-scale projects, expanding the breadth of the species with which we work and deepening the quality of our solution by developing additional associated systems.

“With so many AquaMaof facilities already operational worldwide, including one at Proximar in Japan with a 5,000-tonne per annum capacity of Atlantic salmon, we are on the verge of a breakthrough in the scale-up of the company. We’re excited to explore the huge impact and financial potential of our technology.

US aquaculture expert Megan Sorby, formerly Operations Manager at ingfish Maine, is planning a new land-based project. She aims to farm red drum, a popular game fish in the nited States that is now in short supply.

ed drum Sciaenops ocellatus , also known as redfish, channel bass or a variety of other names, is found along the S tlantic coast from Massachusetts to lorida and in the ulf of Me ico.

The species has been protected from commercial harvest since overfishing reduced stocks in the 19 s. Demand for red drum in the S has largely been met by imported farmed fish.

Sorby plans to farm red drum in a location yet to be revealed, using recirculating aquaculture system S technology.

Sorby said This development brings together a well-understood culture process of the species and pairs it with the technological benefits and controls of S. e cannot continue importing this premium product when it is native to our waters.

There s deep S investment in the research and development of this species. airing red drum with S technology optimises this species to its fullest potential in a domestic location.

Sorby, with her partner Tom Sorby, played a key role in establishing The ingfish Company s new S S facility in Maine. Together with her team in the S and the ingfish Company, Sorby helped secure the required permits for the etherlands-based company to e pand in the S, built out a hatchery facility and increased S broodstock.

ingfish Maine celebrated its first harvest of Dutch yellowtail from Maine earlier this year.

She has taken up an advisory role with ingfish, while Tom is now perations Manager.

rom ingfish Maine s facility earlier this year, a limited release of Dutch ellowtail from Maine of , pounds was distributed to and served at restaurants in Maine, oston, DC and California.

ingfish is announcing another harvest scheduled in ovember, which will be distributed to select restaurants in the S, as well as being available to the residents of Jonesport.

SALMON giant Mowi has closed a processing unit at its Irish headquarters in Donegal, with the loss of 33 jobs.

The redundancy programme, which was announced with a consultation programme in May this year, affects the secondary processing unit at the facility. Mowi has now ceased secondary processing in Ireland, with fillets and portions now being dealt with in other locations. Primary processing continues, however.

Mowi told Fish Farmer: “The closure of this unit will allow customers to purchase fillets and portions from our Mowi secondary plants in Europe, which are closer to major markets. This decision will only impact customers who currently purchase fillets or portions (fresh or frozen) and will not impact those customers who purchase HOG [head on gutted] fresh Irish organic salmon, as the primary processing

section of the plant will remain operational. The closure has no impact on our Irish organic freshwater or marine operations, which continue to produce at full capacity.”

The Donegal Education and Training Board (ETB) has been on-site at Mowi’s Irish headquarters in Fanad in recent weeks to provide training and career advice to staff impacted by the redundancy announcement. Redundancy took effect as from 2 October. Redeployment options

had been offered to staff who worked in secondary production, to other aspects of operations within the company’s Donegal headquarters.

Mowi stated: “Mowi Ireland intends to grow other aspects of its operations in Ireland later in the year and the overall business outlook remains positive and healthy.

“Mowi Ireland would like to put on record its gratitude to all its staff for their exemplary commitment to the company and intends to provide every support possible through the entire process.”

AFTER five years in charge, Bjarni Ármannsson is leaving the top role at Iceland Seafood International (ISI).

The new CEO at ISI is Ægir Páll Friðbertsson. He has been Chief Operating Officer at the fishing company Brim hf. for the last five years and has worked in the seafood

industry for most of his professional career. He holds a business degree from the University of Iceland and a master degree in finance.

Ármannsson said: “I’m very grateful for the opportunity to lead Iceland Seafood for the last almost five years. It’s been a time of learning for me and characterised by volatile externalities that have at times been challenging. I would like to thank the people I’ve worked with and the board of directors in particular for its continued support.

He added: “The Iceland Seafood group is a strong entity with a very good potential for profitability and growth going forward.

“Its unique position in delivering quality seafood to its customers, particularly in Europe, is something that has been developed for a long time and remains with many good opportunities.”

NORWEGIAN indus r or anisa�on

Seafood Companies has urged the government to remove the employer tax on the seafood industry so ore sa on and o er s can be processed a o e uc o or a s sa on or e a p e is processed undreds o i es a a in o and and en ar Rober H ri sson ana in irec or o Sea ood o panies S a bedri ene in or e ian said a e nu ber o co panies i in e sea ood indus r as a en ro in o around oda Seafood Companies already points

ou a an sa on producers i no be pa in a sa on a o on op o corpora�on a o e addi�ona e p o er a is e ec� e a produc�on ee on eac i o ra o sa on e process p us an addi�ona pa en i e an

o increase ou pu ri sson ur er said a o s or e por as processed a o e in bu a ure ad no a en o

He ar ued: e arious o ern en s a e in ce ebra or speec a er ce ebra or speec ad oca ed a ore a ue be crea ed ro sea ood in or a and a is s ou d a e p ace a on o er in s in e or o increased processin ere a o e u e ru is a i e s orse and orse i eac passin ear and ore and ore o e s e e por oes o e ar e unprocessed

“The primary processing section of the plant will remain operational ”Above: MOWI salmon processing Above: Bjarni Ármannssonm (L); Ægir Páll Friðbertsson (R)

DESPITE a big drop in profits last year, the Scottish company Thistle Seafoods has issued an upbeat assessment on future prospects for the business.

Profits were down by 90% from £3.3m in 2021 to £303,000 during the year, largely due to higher raw material costs and external factors.

Thistle bought the Dawnfresh factory at Uddingston near Glasgow last year after the company was placed in administration. This increased space, said Thistle, would allow it to offer new opportunities as they arise.

Thistle reported higher sales of £115.6m against just over £105m a year earlier. But the cost of sales (mainly fish) rose by around £12m to £100,890,000.

The company’s strategic report said 2022 presented significant challenges, which included a direct impact from the war in

A new salmon processing factory has opened in Bergen, Norway to meet growing export demand.

The company behind the project is First Seafood, which is part of the larger Insula roup and un� recen ad been used b a roup o produce s ca es nsu a s parent company is Kverva, the investment vehicle set up by SalMar Chairman Gustav Witzoe.

First Seafood Managing Director Andreas Sundnes said: We see a si ni can increase in de and in e e por ar e or sa on e produc s and is ac or i or par of an already established structure in First Sea ood or e purc ase produc�on and sale of salmon products.

o e er i our e is�n ac or in

Kongsvinger (near Oslo), the new factory in Bergen will give us a capacity of up to 30,000 tonnes of salmon products a year.”

First Seafood AS, which produces a wide range of products for customers all over the world, has signed a 25-year lease on the premises and says it is there for the long term.

First Seafood and the food processing company BAADER have developed and adop ed round brea in ec no o at Kongsvinger.

odu ars ad R or a s Sa es Manager, said: “This has happened in close co opera�on be een s i ed sea ood people at First Seafood and a leading technical development environment at BAADER.”

Ukraine, which led to wide ranging sanctions against Russia, a major raw material supplier to the UK.

This was compounded by “extreme energy price inflation” at home along with other inflationary effects, labour and tight supply issues.

The report continues: “In spite of all this, the company reported growth in turnover and it remains profitable, which is highly commendable, given the significant external headwinds the company faced in 2022. The turnover increased to £115m, which is a record for the company.

“We would like to recognise the support from our key customers in helping us to navigate the most challenging of years.”

The new machinery features crate de-

each line to help meet increasing market demand.

CPUK Operations Director Gary Paterson explained: “The new machinery behind the production lines from Lan Handling Technologies will make a real difference to our ability to increase productivity and meet demand, and we will continue to look for ways to innovate our production and create efficiencies.”

The

Martin

Martin

THERE has been a plethora of anti-salmon farming articles in the mainstream press of late. Most are prompted by vegan organisations and it is easy to understand that they object to farming any animal.

Salmon farming has become an easy target due to a long history of criticism from the salmon angling sector, who have continuously blamed salmon farming for the decline in wild fish numbers. This criticism has provided a backdrop for others to attack the farming industry.

One of the latest articles appeared in the Observer with a subheadline of “Vegan charity and its drones reveal that parasites are infesting fish reared for UK supermarkets.”

What a scoop for the Observer!

In response to the article, Ben Goldsmith, environmentalist and member of the influential Goldsmith family, tweeted:“Farmed salmon is revolting. If you could see it before they slice it up, dye it pink and wrap it in plastic, you’d never touch it again.”

I can understand that anglers, who are often badly informed and are never exposed to the other side of the story, pump out such nonsense. When someone has been Eton-educated and runs a private equity business, one might think that they would actually do a little research before spouting such garbage. However, seemingly not.

I was fascinated by the idea that salmon are farmed, killed, sliced up and then dyed with a pink colour. This is so far from the truth that it is unbelievable that someone with such a background would write such factually incorrect statements.

What colour would you like your haddock?

Of course, farmed salmon are not dyed. They are pigmented with natureidentical carotenoids in their diet that are deposited in the flesh, giving an even colour throughout. Much has been written about pigmentation so I won’t repeat it here. Instead, I am more intrigued by the idea of dyeing the flesh pink. If that was what actually happened, would it be such an issue?

The reason I say this is because dyed fish flesh is widely available in the marketplace, including most of the major supermarkets, and no-one bats an eyelid. The idea that it happens in salmon farming, however, seems to appal some members of the public or at least those who are critical of salmon farming.

The reality is that pigmentation is simply another issue to attack the salmon farming industry. Critics are only bothered about such issues when it relates to this sector. They complain if a salmon farm should kill a seal but aren’t interested if the wild fish sector were to do so. They criticise the use of acoustic deterrent devices, even though they are widely used outside salmon farming, and they accuse the salmon industry of “dyeing” fish, yet make no comment when others actually do so.

industry of “dyeing” fish, yet make no fillets

One example of dyed fish can be found in Marks & Spencer. Their product description of M&S Scottish skinless and boneless smoked haddock fillets states: “Skinless and boneless dyed Scottish

”Pigmentation is simply another issue to attack the salmon farming industry

beech wood chips for a medium smoked flavour.”

Most other supermarkets make similar statements on their smoked haddock products. However, it is not just haddock that is dyed – cod, hake, basa, kippers and mackerel can all be dyed too.

The colourants used in smoked fish are primarily curcumin or annatto, but paprika is also used. Curcumin is extracted from turmeric. Annatto is an extract from the achiote tree. These colours are included in the brining process before the fish fillets are smoked. Perhaps Mr Goldsmith thinks that this is how farmed salmon is processed to get its colour?

It is unclear when dyeing smoked fish began, but the suggestion is that it might have been introduced during the Second World War to help conserve resources by reducing the time the fish was smoked. However, it has also been suggested that the process was introduced in the late 1960s and early 1970s to reduce costs with a reduction of the smoking time from 12 hours to just three. The shorter smoking time meant that the pale-yellow colour of smoked white fish was unable to develop, hence the need for a colour. Yet dyed smoked haddock is a much stronger colour than the undyed versions and now clearly appeals to consumers.

The latest figures from Seafish suggest that the UK public consume about 2,200 tonnes of smoked fish, although this has gone down in line with a wider fish and seafood decline due to the cost-of-living crisis. It seems that the public are happy to eat

salmon so contentious? The answer is that it isn’t, except amongst a handful of very vocal critics of salmon farming, who look for any excuse to have a go. Interestingly, smoked fish is not the only fish to be dyed. The glass fish is a freshwater fish from south Asia and is of the Ambassidae family. Their main attraction is for people who keep aquarium fish because they have transparent bodies with high fins.

They are popular because they are docile but also social and live happily in groups of five.

The fish are often sold as painted glass fish, having been injected with fluorescent dyes using a hypodermic syringe. The final effect is quite garish, but clearly appeals to some members of the public. Unfortunately, this process can result in high mortality but clearly, as it is not salmon farming, it attracts no criticism.

Top: Astaxanthin

Above right: Glass fish

Top: Astaxanthin

Above right: Glass fish

THIS July, the hottest seawater temperatures ever were recorded off the coast of Florida, where temperatures reached 38.4ºC.

This phenomenon was not unique to the US, with water temperatures in some places here around four to five degrees warmer than average. This was notably the case on the UK’s east coast.

Higher temperatures are not a direct issue for salmon, as they are within their natural range.

And given fish are cold-blooded, seawater temperature increases can actually encourage growth and allow harvest weight to be reached more quickly.

However, record seawater temperatures do contribute to an increase in naturally occurring organisms, which can reduce oxygen levels and also compromise the health of the salmon in areas such as the west coast of Scotland.

That’s why the aquaculture sector is constantly innovating to overcome challenges. The sector has been deploying a range of short-, medium- and long-term solutions to maximise survival.

”Mortality incurred in a natural environment is not an indicator of poor farming conditions, despite what uninformed activists might claim, but it goes without saying that the loss of livestock is devastating for farmers – just like when sheep farmers lose their lambs to poor weather or predation from foxes.

However, salmon are not like terrestrial livestock, which produce a relatively small number of young over their lives. When fish breed, they produce many thousands of eggs, which are fertilised outside the body.

In the wild, it’s a reproductive strategy that acknowledges a high natural level of mortality, with the goal that just a small number of salmon will survive to breed.

Of course, in farming, we want to make sure as many fish as possible survive. But all too often campaigners try to compare salmon to other livestock – and that’s just not appropriate.

This time last year, we faced a significant increase in microscopic jellyfish blooms, which affected the survival of farm-raised fish.