FORMULATION

Lactose-Free

COMMODITY

Plant-Based Milks Cheese

Kampala, UgandaFebruary 11-13, 2024

Lagos, NigeriaOctober 14-16,

FORMULATION

Lactose-Free

COMMODITY

Plant-Based Milks Cheese

Kampala, UgandaFebruary 11-13, 2024

Lagos, NigeriaOctober 14-16,

As Africa's dairy industry continues to evolve, we find ourselves witnessing remarkable transformations and innovations shaping this sector. In this issue of Dairy Business Africa Magazine, we explore the pioneering stories, trends, and challenges defining the continent’s dairy sector today.

Driving this transformation is Meved Dairy Farm, led by the visionary Anne Mwangi. Born into a farming family with only two cows to their name, Anne was intimately familiar with the challenges and opportunities inherent in agricultural life. What sets Anne apart is her unwavering belief that rural areas should not merely serve as providers of raw materials for urban centers. Instead, they can be the epicenter of innovation, job creation, and sustainable economic growth. Meved Dairy Farm embodies this philosophy, evolving from a simple farm into a processing unit that not only produces milk but also creates a variety of dairy products tailored to meet diverse consumer needs.

In our market trends section, one area gaining notable traction is lactose-free dairy. In Africa, where a large segment of the population is lactose intolerant, the demand for such products is growing rapidly. Major players like Nestlé, Danone South Africa, and Kenya's New KCC are making significant strides in this segment, developing products that cater to the lactoseintolerant population.

Meanwhile, the commodity market update on cheese reveals an exciting revolution as this beloved product continues to capture consumer palates across the continent. Local cheeses, such as Kenya's Gouda and South Africa's Karoo Blue, are gaining popularity, showcasing the rich diversity of flavors and textures African cheese offers. These products are carving out a niche in the culinary world, appealing to local and international markets.

In tandem with these trends is the surge of plant-based dairy alternatives. With health and sustainability becoming increasingly important, consumers are turning to plant-based options like almond and oat milk. African dairy producers

are not only adapting to this demand but are also driving innovation in this growing market segment.

Food safety remains a critical concern, particularly with the looming threat of Aflatoxin M1 contamination in dairy products. This issue highlights emerging trends and innovations aimed at controlling this toxin, ensuring safe consumption for all. As dairy producers embrace cutting-edge technologies and rigorous testing protocols, the focus on consumer safety is stronger than ever.

As you explore this issue, you'll find that the African dairy industry is on an exciting path of evolution and resilience. From Meved Dairy Farm’s inspirational story to the expanding horizons of cheese, lactose-free products, and plant-based alternatives, the industry is forging a bold new path. Together, these elements paint a vivid picture of a sector that is as dynamic as it is promising.

Welcome to the future of African dairy.

Catherine Odhiambo Senior Editor FW Africa

The Rise of Lactose - Free Dairy in Africa: Addressing Intolerance and Meeting Demand Nigeria's Quest for SelfSufficient Dairy Production

Plant-Based Milks Surge as Consumers Crave Cleaner, Healthier Options

Innovations in Aflatoxin M1 Control in Dairy: Exploring Emerging Trends From Ancient Origins to Modern Markets: The Global

FOUNDER

Francis Juma

SENIOR

Catherine Odhiambo

EDITOR

Mary Wanjira

EDITOR

Alphonce Okoth

EDITOR

Martha Kuria

BUSINESS DEVELOPMENT DIRECTOR

Virginia Nyoro

BUSINESS DEVELOPMENT ASSOCIATE

Vivian Kebabe

HEAD OF DESIGN

Clare Ngode

ACCOUNTS

Jonah Sambai

P.O. Box 1874-00621, Nairobi Kenya

Tel: +254725 343932

Email: info@fwafrica.net Company Website: www.fwafrica.net

Dairy

MOROCCO – Centrale Danone, a key player in Morocco’s dairy industry and a subsidiary of the global dairy giant Danone, has appointed Herve Orama Barrere as its new CEO.

Barrere takes over from Nathalie Alquier, who will assume new responsibilities within the Danone group after successfully steering the Moroccan branch since 2019.

Barrere, previously the General Manager for Danone South Africa, expanded his responsibilities earlier this year to cover the sub-Saharan African region. His experience includes leadership roles in Algeria and Nigeria, which have equipped him with deep insights into the African market dynamics.

His strategic expertise is recognized for integrating sustainability with

profitability, which is crucial for strengthening Danone’s foothold across Africa.

Under Nathalie Alquier’s leadership, Centrale Danone solidified its marketleading position and significantly advanced its social and environmental initiatives.

Danone shed light on Barrere’s strategic expertise and deep knowledge of African markets in the statement.

“Barrere is recognized for his expertise in strategy and his understanding of African markets, having worked in various regions of the continent,” the statement read.

“His integrated approach to sustainability and profitability has been crucial in strengthening Danone’s position in Africa.”

RWANDA – Rwanda is set to unveil its first milk powder factory in Nyagatare District, Eastern Province, by the end of July 2024.

The facility, owned by Inyange Industries, represents a US$45 million investment in the country’s agroprocessing sector. The factory boasts the capacity to process 500,000 liters of milk daily into 50,000 kilograms of milk powder, amounting to an annual output of approximately 15,000 tonnes.

“This factory will increase Inyange’s processing capacity to almost a million liters daily. That translates to nearly Rwf9 billion (US$6.8 million) monthly for farmers, with a minimum price of Rwf300 (US$0.23) per liter,” Managing Director James Biseruka stated.

According to Solange Uwituze, Deputy Director General in charge of Animal Resources Research and Technology Transfer at Rwanda

Agriculture and Animal Resources Development Board (RAB), Rwanda will produce 1,250,000 tonnes of milk every year by 2024 to satisfy milk demand.

She highlighted that the Ministry of Agriculture and Animal Resources has developed a marketing strategy to secure an off-take contract with Africa Improved Foods (AIF) for 2,000 tonnes of milk powder annually.

The factory in Nyagatare will require 500,000 liters or 500 tonnes of milk

per day or 180,000 tonnes per year. It will have an annual capacity to produce 14,000 tonnes or 14 million kilograms of milk powder and 5,460 tonnes of fat.

The remaining production will be exported to neighboring countries in the East African Community (EAC), the Common Market for Eastern and Southern Africa (COMESA), and the Middle East, where demand outstrips supply.

MALAWI – Malawian Kasungu-based non-governmental organization K2 Tigwiranemanja Aids Support Organisation (K2-Taso) has invested US$23 million in a milk processing plant to boost dairy product availability in the district.

The NGO’s production manager, Alfred Chimwenje, revealed that the plant, pending tax clearance by the Malawi Revenue Authority, has a processing capacity of 1,000 liters per hour.

Chimwenje made the announcement during a tour by the Kasungu District Council’s Agriculture Service Committee, led by council chairperson Mwambilaso Mbedza and Senior Chief Mwase, to assess various agricultural initiatives in the district.

He stated that the plant expects to process 11,000 liters of milk daily, producing yogurt, ghee, cheese, and other dairy products for local and external markets. Currently, the plant’s catchment area in Kasungu East houses over 200 dairy cows. The organization plans to increase cattle numbers through a pass-on arrangement.

Minister of International Development Anne Beathe Tvinnereim noted that 18.8% of Malawi’s population is malnourished. Local production covers only 65% of the country’s dairy needs, with the remainder met by imports. She highlighted the potential for reducing import dependence and improving food security through such investments.

Tvinnereim pointed out that milk intake in Malawi increased by 18%, from 26.5 million liters in 2020 to 31.4 million liters in 2021, with an estimated 16% growth to 36.4 million liters in 2022.

Additionally, smallholder farmers delivering milk to dairies rose by 11%, from 7,980 in 2020 to 8,890 in 2021, with a projected 10% increase to 9,800 in 2022.

Employment in the dairy sector also grew by 16%, from 403 to 468 in 2021, with an estimated 11% increase to 520 in 2022.

SOUTH AFRICA – Giraf Macadamia, a South African player in macadamia production, has announced the launch of their new range of Giraf macadamia drinks in South Africa and the UK.

According to Philip Moufarrige, Managing Director of Giraf Macadamia and Ambermacs, the product range is produced from macadamia sourced from local growers and packaged in 100% recyclable materials.

“Made from the finest South African-grown macadamias, Giraf Macadamia drink meets the growing demand from conscious consumers seeking tastier, healthier, sustainably sourced milk alternatives,” he noted.

“The Giraf brand was designed to stand out on the shelf and be as distinct as the product inside — something you can’t help but pick up and examine to find out more.”

Ambermacs is initially produced as a premium nut paste in South Africa and shipped to Italy for processing into milk using the UHT method. The final product is aseptically packaged in eco-friendly Tetra Pak cartons and has an impressive one-year shelf life.

Giraf Macadamia Milk contains 3% macadamia nuts, higher than many almond milk brands in South Africa. Plans are underway to increase this to 4% by collaborating with a local factory, enhancing the flavor and texture.

Macadamias are known for their exceptional nutritional profile. They offer a rich, creamy taste and are packed with essential nutrients and healthy fats. According to the company, the milk is naturally lactose-free, gluten-free, and low in sugar, catering to those with dietary restrictions or seeking a nourishing alternative to dairy.

As plant-based milk alternatives become more prevalent in South Africa, they are becoming competitively priced with traditional dairy, driven by rising dairy costs.

According to ProVeg South Africa Director Donovan Will, the local market for these products is increasing for two reasons. First, South Africans care about their health, the environment, and how animals are treated, so he believes that if there are goodtasting options that offer benefits in these areas, consumers will opt for them.

Secondly, companies are making these products more accessible, where most significant retailers carry multiple plantmilk options, and restaurants and coffee shops are embracing the possibilities, too.

In response, major companies have opted for that route to produce innovative products such as the Giraf Macadamia drink range, which consists of the Original Macadamia drink, the Giraf Macadamia drink with oats, and the Giraf Macadamia drink with vanilla.

KENYA – Glacier Products Limited, one of Kenya’s leading dairy processors and owner of the Dairyland brand, has announced plans to expand its operations to Tilisi, a mixed-use, masterplanned development in Limuru, Kenya.

In a LinkedIn post, the company announced that it acquired land and began constructing a new office space in Tilisi.

“Our current location in the Industrial Area has served us well, but these new offices will provide us with the space and resources we need to take Dairyland to the next level,” the post stated.

“We’re excited about this expansion’s opportunities and look forward to welcoming you to our new home soon.”

Glacier Products was founded in 1979 as an ice cream manufacturer and was acquired by its current owners in 1995. The company’s turnover is approximately US$10 million. It produces mass-market ice cream, tablet chocolate (including cooking chocolate), chocolate spread, and whipping cream.

Additionally, Glacier Products has a licensing agreement with Warner Bros for branded ice creams featuring Warner Bros characters. The company entered the chocolate market in 2015 with a factory in Kikuyu, northwest of Nairobi.

Dairyland-branded products are distributed in Kenya, Tanzania, Uganda, South Sudan, Ethiopia, and Rwanda.

In a previous interview, the company noted that the Kenyan ice cream market is promising, with more than ten other ice cream makers operating in Nairobi and Mombasa.

Last year, the company launched the first-ever Kenyan vegan ice cream under Dairyland Dairy-Free Vegan Ice Cream. According to the dairy processor, the product caters to the growing lactose-intolerant consumers and aligns with the global shift towards health, wellness, and environmental awareness.

GLOBAL – As plant-based milk alternatives gain popularity, a recent study published in the Journal of the Academy of Nutrition and Dietetics reveals their nutritional shortcomings compared to traditional dairy milk.

The study found that milk alternatives generally contain less protein and saturated fatty acids than dairy milk, with significant variability in added sugars. This variability extends across different types and brands of alternative milks, such as oat, soy, and almond.

The study suggested that consumers may not be fully aware of the nutritional differences, highlighting a need for clearer product labeling despite dairy milk being a key source of essential nutrients like calcium and vitamin D, crucial for public health.

According to the peer-reviewed research, titled, “Assessing the Nutrient Content of Plant-Based Milk Alternative Products Available in the United States”, fortified soy-based products most closely resemble the nutrient content of dairy milk. About 70% of plant-based alternatives were fortified with calcium and vitamin D.

However, alternatives tend to have lower levels of protein, potassium, and sodium, and only minimal amounts of fiber and iron—except for oat milk, which contains more fiber.

In 2021, milk alternatives reached US$2.8 billion in sales, with almond milk leading the market. Despite this growth, both dairy and plant-based milk consumption declined in 2023, although plant-based alternatives experienced a steeper drop.

The research involved evaluating 219 plant-based milk alternatives from 21 brands using data from the University of Minnesota Nutrition Coordinating Center. The findings emphasized the need to communicate the nutritional differences to consumers effectively.

ZIMBABWE/CAMEROON - Zimbabwe and Cameroon, two African nations with rich agricultural histories, are launching initiatives to drastically boost their national milk production.

With Zimbabwe setting a target of 113 million liters by 2024 and 150 million liters by 2025, and Cameroon unveiling a comprehensive $500 million plan to reach over 1.1 million tons by 2035, both countries aim to become more self-reliant in dairy production and reduce their dependence on imports. These efforts highlight a broader regional push to strengthen food security, boost local economies, and adapt to environmental challenges.

Zimbabwe’s Ministry of Lands, Agriculture, Fisheries, Water and Rural Development is spearheading the country's dairy revival, having set production targets of 113 million liters for 2024 and 150 million liters by 2025.

The country's Dairy Services Department is focusing on increasing livestock numbers and enhancing milk productivity per cow to achieve these goals. Zimbabwe’s dairy sector has already shown notable progress, with raw milk production rising by 20% in the first half of 2024 compared to the same period in 2023, reaching 55.11 million liters.

This resurgence is noteworthy, especially given the ongoing challenges posed by an El Niño-induced drought that has severely impacted agriculture across the nation. The dairy sector’s resilience in the face of climatic adversity underscores the effectiveness of strategic interventions and highlights the sector's potential for growth.

Historically, Zimbabwe's milk production peaked at 260 million liters in 1990 but plummeted to 40 million liters by 2008 due to persistent droughts and high feed costs. In response, the

government and development partners have worked tirelessly to rejuvenate the dairy industry. The current national target involves 1,500 dairy farmers and aims to produce 130 million liters in 2024.

A significant factor in this renewed growth is the collaboration between the Zimbabwean government and the EU-funded Transforming the Zimbabwe Dairy Value Chain for the Future (TranZDVC) project. This initiative has been instrumental in providing small-scale farmers with essential resources, such as calves and lucerne grass seeds, aimed at boosting production efficiency and sustainability.

Lucerne, a high-protein forage, has proven to be a gamechanger for Zimbabwe’s dairy industry. With its protein content ranging from 18% to 22%, lucerne surpasses traditional feed options like maize hay and grass silage. Its introduction has not only improved feed nutrition but has also reduced production costs from 70 cents to 50 cents per liter, offering economic relief to dairy farmers.

Cameroon’s strategic dairy development Cameroon, meanwhile, has launched a US$500.2 million plan, aiming to increase its milk production from less than 200,000 tons to 1,146,600 tons by 2035. This initiative, approved by the Ministry of Livestock, Fisheries, and Animal Industries (Minepia), includes six key programs: genetics, feed, housing, health and welfare, milk processing, research and development, and governance.

The plan was developed over two years by the Cameroon Veterinary Offices and Pharmacies Society (Caphavet) and is funded by German cooperation (GIZ).

Cameroon’s dairy sector faces a production deficit, with current national supply at approximately 185,570 tons per year, well below the demand of around 300,000 tons. This shortfall results in an annual deficit of nearly 120,000 tons, which is partially offset by imports.

In 2022 alone, Cameroon imported 20,596.1 tons of milk and derivatives for CFA40.6 billion (US$67.2 million) and 17,217.9 tons of powdered or concentrated milk for CFA35 billion (US$58 million) to fill the gap in national production.

To address this deficit, the government has invested in improving the genetic quality of dairy cattle, acquiring 495 dairy cows from France between 2020 and 2023 as part of the Livestock Development Project (Prodel), funded by the World Bank.

Despite these efforts, Cameroon still grapples with an annual production deficit of approximately 120,000 tons of milk. The government hopes these measures will reduce the need for costly imports, which currently amount to nearly 20 billion FCFA per year.

UGANDA – JESA Farm Dairy, Uganda’s leading dairy producer, has launched JESA BONGA, Uganda’s first ambient drinking yogurt.

This new product, which has been in development for three years, is designed to provide a convenient yogurt option that remains shelf-stable at room temperature for up to six months without refrigeration or preservatives.

The product is available in recyclable, spill-proof bottles and comes in three flavors: Mango, Strawberry, and Coconut. Each bottle is designed to be portable and easy to consume on the go.

Dow Goodfolk designed the packaging of JESA BONGA, which features a bold fist symbol representing

unity and convenience. The product also includes postbiotics, which benefit gut health and immunity.

The development of JESA BONGA addresses the growing demand for healthier, low-sugar varieties with fewer additives. The yogurt is made with minimal ingredients, focusing on milk and bacteria, and eliminates the need for additives often required due to mechanical processing.

JESA BONGA is intended to cater to busy lifestyles. It offers a yogurt option that does not require refrigeration, making it suitable for various environments. The introduction of this product provides a new alternative to traditional chilled yogurt.

UGANDA – Pearl Dairy Farms, a leading dairy processor in East Africa, has secured US$35 million in debt financing to fund its regional expansion.

The financing, arranged by advisory firm Delphos, comes from the International Finance Corporation (IFC) and FMO, the Dutch entrepreneurial development bank.

This funding will be used to upgrade and increase capacity at Pearl Dairy’s

powdered milk plant in Uganda and to acquire a packing facility in Kenya.

The expansion is expected to substantially impact the dairy value chain in both countries, highlighting the growing significance of the dairy sector in East Africa’s economy.

In addition, Pearl Dairy plans to implement a comprehensive Dairy Development Program, supported by the IFC, which aims to benefit over 15,000 local farmers. This program will provide training on best practices and access to data, helping farmers boost their productivity and profitability.

Amit Sagar, CEO of Pearl Dairy Farms, described the financing as a milestone that demonstrates the company’s commitment to driving growth and excellence in the dairy sector.

The deal highlights the role of the agricultural sector in Uganda’s economy, where agriculture employs approximately 72% of the population and contributes about 24.1% to the GDP. The country’s dairy sector is now valued at US$3.8

PEARL DAIRY FARMS, HAS SECURED US$35 MILLION IN DEBT FINANCING TO FUND ITS REGIONAL EXPANSION.

billion, with exports generating US$106.2 million annually.

The financing for Pearl Dairy Farms represents a continuation of Delphos’ active involvement in African agriculture.

Over the past 37 years, the firm has raised over US$4.7 billion for transactions across the continent, contributing to the United Nations’ Sustainable Development Goal 2, which aims to end hunger and achieve food security.

AUSTRALIA – LittleOak, an Australian infant powder producer, is set to launch a ready-to-drink (RTD) goat milk product in Asia, claiming it to be the region’s first palm oil-free option.

Sourced and manufactured in New Zealand, the product will be available by year-end to complement LittleOak’s current milk powder series for infants to 4-year-olds, providing a convenient natural solution in the Asia-Pacific region.

Elke Pascoe, founder and CEO of LittleOak, identified Singapore, Malaysia, and Vietnam as key markets for the next three years.

“With the rise of the middle class, Vietnam today feels like Singapore did 20 years ago. Big retailers there use palm oil and synthetics. This gives us a chance to offer something better. We aim to disrupt the market and provide natural nutrition for children,” Pascoe stated.

She also highlighted the potential of RTD formats for Vietnam, calling it an exciting opportunity for creativity and innovation.

According to Pascoe, whole goat milk did not cause bloating, gut discomfort, or rashes for her children, unlike common

retail milk formulas. This led her to develop goat milk formulas free of artificial and inflammatory ingredients found in cow milk formulas.

“Goat milk is closer to human breast milk in taste, texture, and nutritional profile. It has smaller, easier-to-digest fat globules and is lower in lactose, making it gentler on little tummies. It also contains naturally occurring A2 casein protein, reducing inflammation compared to cow milk,” she explained.

Goat milk is high in naturally occurring oligosaccharides and taurine, while cow milk lacks these benefits. Goat milk also has better bioavailability of key nutrients such as iron, calcium, and magnesium, making it more nutritious and convenient for growing children.

Pascoe emphasized the importance of being palm oil-free, differentiating LittleOak from most commercial cow milk formula brands. The firm uses cold-pressed flaxseed oil from New Zealand, known to boost immunity, aid development, reduce hyperactivity, and improve sleep.

“Palm oil inhibits the absorption of calcium, fat, and DHA in babies—three critical nutrients for healthy development. Despite claims of being palm oil-free, many infant formulas still contain palm oil derivatives, affecting nutrient absorption,” Pascoe added.

LittleOak’s goat milk is fortified with DHA and ARA, essential fatty acids present in breast milk. Unlike many brands that source DHA and ARA from fish oil, LittleOak uses natural and sustainable algae sources, resulting in 4 to 5 times higher DHA concentrations.

The RTD range will be available in 250ml packs with a cap closure, stored at ambient temperature for nine months. To serve, just shake and pour.

The RTD range will also be fortified with iron to reduce the risk of mental health issues like anxiety and ADHD.

GHANA – Fan Milk Plc, a Ghanabased manufacturer and retailer of ice cream and frozen dairy products, has appointed Freda Yahan Duplan as its new chairperson.

Freda succeeds Dr. Charles Mensa, who stepped down as Director and Chairman after two decades of dedicated service and instrumental leadership to Fan Milk Plc.

This leadership restructure aims to guide the company’s direction, influence progress, and enhance its prospects.

Freda Duplan brings over 40 years of experience as a successful business leader with a proven track record of leading and transforming organizations and teams. Her leadership style inspires young talent to think big, take bold actions, and make decisive decisions.

With her expertise in business transformation and guiding organizations through change, Duplan is ready to collaborate with other board members and Lionel Parent to steer Fan Milk Plc toward sustainable volume growth.

Duplan’s strong advocacy for supporting women in business, which led her to co-found the Executive Women Network (EWN), will be crucial as Fan Milk Plc strengthens its women-inleadership agenda.

GLOBAL – Nestlé’s research and development teams have unveiled a breakthrough technology to reduce fat content in milk powder by up to 60%.

This innovative technology is accomplished through a controlled aggregation of milk proteins, which effectively mimics the size and texture of milk fat. The result is a lower calorie milk product that maintains a creamy texture and mouthfeel similar to full-fat milk.

Isabelle Bureau-Franz, Nestlé’s Head of R&D for the Nutrition Business, highlighted the success of this new technology.

“Leveraging our expertise in nutrition science and product development, we have successfully introduced this proprietary technology in Ninho Adulto in Brazil. The reduced fat level in our milk product has been well-received by consumers for its creaminess and overall taste,” she stated.

In addition, she noted that the innovation is part of a broader suite of advancements from Nestlé’s R&D teams. The company has also developed an enzymatic process designed to lower intrinsic sugars in key ingredients by up to 30%.

This technology, introduced last year, allows for sugar reduction in malt, milk, and fruit juices without the need for additional sweeteners or bulking agents.

The result is products that not only taste great but also provide prebiotic fibers beneficial to the microbiome, according to Stefan Palzer, Nestlé’s CTO.

“Sugar reduction across our portfolio remains a top priority. This new technology is a true breakthrough, allowing us to reduce sugar without sacrificing taste while keeping cost increases minimal. Additionally, the sugar reduction process generates prebiotic fibers that support the microbiome,” Palzer explained.

The company is now focused on accelerating the global rollout of this technology across various product formats and categories.

Nestlé’s advancements come in response to consumer demands for healthier, indulgent, and cost-effective options.

According to a recent report from the International Dairy Foods Association (IDFA), consumers are increasingly seeking dairy ingredients that combine health benefits with indulgence.

Dairy ingredients, ranging from basic dried forms to enzymemodified concentrates, play a crucial role in meeting these demands. They enhance nutrition, functionality, flavor, and color in a wide array of food products.

Furthermore, the American Dairy Products Institute (ADPI) has set new standards for dairy ingredients to ensure quality and integrity.

In late 2023, ADPI published standards for two new dairy ingredients, reflecting ongoing efforts to maintain high industry standards and respond to evolving consumer preferences.

Nestlé’s recent fat and sugar reduction technology innovations underscore the company’s commitment to advancing dairy product formulations.

KENYA – The Kenya Dairy Board (KDB) has officially commissioned its new headquarters at Upper Kabete, a milestone in the country’s plan to double milk production within the next five years, as outlined in the KDB Strategic Plan 2023-2027. This move aims to enhance the board’s operational efficiency and service delivery within the dairy sector.

During the launch, KDB Managing Director Margaret Kibogy highlighted the plan to boost milk production from 5.2 billion to 11 billion liters by 2027, setting an annual growth target of 20% in milk production.

A key strategy involves shifting from volume-based to quality-based payment systems, which are expected to enhance the production of high-value dairy products such as cheese, butter, and ghee for export markets.

“The strategic plan focuses on enhancing value addition, improving production efficiency, and increasing market access,” Kibogy stated.

KDB aims to increase annual milk exports by 200 million liters, reaching one billion liters by 2027 while maintaining high milk quality through strict compliance with quality and safety standards. The plan is anchored on four pillars: boosting production, enhancing value addition, improving market access, and ensuring compliance.

Expanding market access is particularly crucial, with KDB looking to leverage the African Continental Free Trade Area to penetrate broader African markets beyond East Africa.

The commissioning of the new headquarters in Kabete is a vital part of the broader strategy to support the anticipated growth in milk production and value addition.

Kibogy emphasized the potential economic benefits, projecting that doubling milk production could increase the dairy sector’s value from KES 41 billion (US$319.96m) to over KES 80 billion (US$624.32m).

NEW ZEALAND – Fonterra, New Zealand’s dairy cooperative, has announced a significant US$36 million investment in a 20-megawatt electrode boiler at its Edendale site, marking a crucial step in its ongoing transition away from coal.

Fonterra is partnering with Meridian Energy, a hydroelectric power generation company, to source electricity from 100% renewable resources, including wind, water, and solar energy.

The move is part of Fonterra’s commitment to eliminate coal usage by 2037 and achieve a 50% reduction in Scope 1 and 2 emissions by 2030.

This investment is expected to slash emissions at the Edendale facility by approximately 20%, equivalent to 47,500 tonnes of CO2e per year.

Once operational in the fiscal year 2025, the electrode boiler will contribute to an overall reduction of nearly 3% per annum in Fonterra’s carbon emissions from its 2018 baseline.

Anna Palairet, Fonterra’s acting chief operating officer, emphasized the importance of continually assessing

energy sources and technologies for each site as the cooperative’s manufacturing operation spans the country.

With a massive daily processing capacity of up to 15 million liters of milk at the Edendale site, securing a reliable energy supply is essential.

KENYA – Dairy farmers in Kenya are set to benefit from the government’s commitment to install milk coolers in all wards across the country as part of the modernization program for Kenya Cooperative Creameries (KCC) facilities.

According to government representatives, the initiative aims to eliminate middlemen who often purchase milk at low prices in rural areas and sell it at higher rates in urban markets.

INVOLVE REINSTATING THE STALLED MILK COOLERS PROGRAM, WITH THE DISTRIBUTION OF 650 MILK COOLERS ALREADY UNDERWAY. INVESTMENT

Simon Chelugui, the Cabinet

Secretary for Cooperatives and Micro and Small Enterprises, highlighted the challenges faced by dairy farmers, including issues related to storage, milk preservation, high feed costs, and limited market access.

He noted that the government’s immediate steps involve reinstating the stalled milk coolers program, with the distribution of 650 milk coolers already underway.

He added that the government plans to establish a milk price-stabilizing

fund, allocating close to Sh3 billion (US$18.69m) for this purpose.

The fund, to be implemented by the New Kenya Cooperative Creameries, will address the issue of excess milk by converting it into long-life products stored in the Strategic Food Reserve.

GERMANY – Müller is set to construct a new production facility at its Alois Müller dairy in Aretsried, Germany, dedicated to jarred yogurt products under the Landliebe brand.

The new building will fill, sort, and clean returnable jars, significantly boosting yogurt production capacity.

The 4,500-square-meter facility is expected to be completed by summer 2025, with production starting in early 2026.

This expansion will create 50 jobs and is part of Müller’s ongoing investment in the Aretsried site, which has received around US$152 million over the past decade.

Cornelia Heiser, Managing Director of Müller Germany, emphasized the importance of this investment for the Landliebe brand, aiming to restore its market strength. The Aretsried site, the birthplace of the Müller brand, continues to be central to the company’s growth strategy.

Recently, Müller announced the closure of two sites acquired from FrieslandCampina in Schefflenz and Heilbronn due to their lack of long-term profitability.

Last month, Müller acquired family-owned UK dairy company Yew Tree Dairy for an undisclosed fee. The dairy major said it would use Yew Tree’s milk powder to grow its export business and “drive supply-chain resilience.

The acquisition is pending the UK’s Competition and Markets Authority (CMA) approval. If approved, this move will significantly impact the global dairy market, particularly in milk powder exports.

Müller’s acquisition plans include further investment in the Skelmersdale site, transforming it into a leading producer and exporter of powdered milk products in Britain.

Rob Hutchison, CEO of Müller Milk & Ingredients, expressed confidence in the acquisition, stating, “Yew Tree Dairy’s exceptional processing capabilities and experienced team are a great match for our network. Together, we can capitalize on the growing global demand for dairy products, creating new export opportunities and strengthening our supply chain resilience.”

NIGERIA – The Nigerian Government has unveiled the new National Dairy Policy to catalyze development in the livestock and dairy sectors.

The policy announced by Vice President Kashim Shettima is a key component of the National Development Plan (2021–2025) and seeks to achieve sustainable economic diversification.

Speaking at the unveiling, Mr. Shettima, represented by his Senior Special Assistant on Agribusiness, Kingsley Uzoma, highlighted the theme of the 2024 Milk Day, “Harnessing Nutrition and Investment Opportunities in a Sustainable Dairy Value Chain.”

He emphasized the global significance of dairy, noting that it supports the livelihoods of one billion people worldwide. Shettima stressed the economic and employment opportunities dairy farming presents, particularly for youth.

“Our livestock farmers often face issues such as inadequate animal feed, conflicts over grazing lands, and the adverse effects of climate change,” Shettima stated.

He acknowledged the challenges of violent conflicts between farmers and cattle herders over land use. He noted that the policy, formulated through extensive consultations with stakeholders, will serve as a roadmap for energizing the dairy industry in the coming years.

“The policy will tackle several obstacles, including the lack of modern best practices for cross-breeding and calving, high milk costs, and poor transportation infrastructure,” he said.

In addition, Shettima highlighted that Nigeria currently spends US$1.5 billion annually on dairy imports due to insufficient domestic production.

With Nigerians consuming an average of 1.6 billion liters of milk and its products annually, the policy aims to boost local production to meet this demand and eventually enable the country to export dairy products under the African Continental Free Trade Agreement (AfCFTA).

The policy’s implementation will focus on improving dairy farming practices, increasing investment in dairy processing and preservation, and promoting evidence-based policy implementation and enhanced collaboration.

By Alphonse Okoth

In the heart of Kenya, amidst the verdant landscapes and challenging climate, is Meved Dairy, a company that has grown from simply supplying milk for the family to a full-fledged dairy farm. Founded in 2007 by Mr. and Mrs. Mwangi, Meved Dairy has grown from a small, unintended project into a significant player in the local dairy industry.

In an interview with Dairy Business Africa Magazine, Annie Mwangi, Director of Meved Dairy, shares the origin of the farm, its growth, challenges, and its commitment to community and quality.

The story of Meved Dairy begins in the tumultuous year of 2007, during Kenya's post-election violence. Mr. and Mrs. Mwangi, initially using their three-acre plot for crop farming, particularly vegetables, found themselves seeking refuge from the chaos of Nairobi. It was during this period that they encountered a significant challenge: the absence of fresh milk.

"We had always bought milk from supermarkets in Nairobi," Mrs. Mwangi recalls. "But during

the post-election violence, we realized there was no fresh milk available locally." This realization sparked a conversation with a visiting friend, leading to the idea of keeping cows on their farm despite concerns about the local climate and disease challenges.

The initial foray into dairy farming was modest. Starting with a single zebu cow and later acquiring a crossbreed cow and its calf, the first shed was built from cut trees and timber. As the cows began producing milk, the community’s demand for fresh milk became evident. "We noticed there was a demand for fresh milk when mothers started coming to us asking for milk for their children," says Mrs. Mwangi.

Encouraged by the initial success, the Mwangi’s expanded their herd. By mid-2008, they had acquired six hybrid cows from a farm in Limuru. However, this growth was not without its challenges. "We had to build more structures, find employees, and secure a market for the increasing milk production," explains Mrs. Mwangi.

The first significant challenge arose when

the farm's milk production exceeded the local community's consumption capacity. "When we hit about 150 liters a day, we realized we had a problem," Mrs. Mwangi notes. The solution was to invest in a milk cooler, but even this was a temporary fix as production continued to grow. Efforts to sell milk to local cooperatives were met with resistance, as Meved Dairy was not a member of any cooperative.

This led to the heartbreaking decision to dispose of excess milk, a situation that highlighted the need for better market access and infrastructure. "We had to pour a whole tank of 500 liters of milk because we couldn't find buyers," Mrs. Mwangi recalls.

Determined to overcome these hurdles, Meved Dairy took strategic steps to manage their growing production. They obtained a number with the Kenya Co-operative Creameries (KCC) and started delivering milk to this national processor. This move marked a turning point, allowing them to further increase their herd size by purchasing additional cows.

The herd continued to grow, reaching a peak of 172 cows. However, the journey was not linear. The farm faced significant challenges during the COVID-19 pandemic and subsequent drought years. "We had to rely on our stored feeds to get through the drought," Mrs. Mwangi explains. "We always kept a lot of feeds for the cows, and that saved us during the two years of drought."

To cope with these challenges, the Mwangi’s made the difficult decision to reduce their herd size. "We reduced the number of cows to about 121 to manage better during the

OUR BIOGAS IS AS OLD AS THE FIRST COWS WHICH CAME HERE, THE SIXTH WHICH WAS DONE IN 2010. TODAY WE ARE WORKING 52M³ IN TWO BIOGAS DIGESTERS. WE HAVE ALWAYS USED BIOGAS.

- Ann Mwangi, Director, Meved Dairy Farm

tough times," Mrs. Mwangi says. They also diversified their livestock, introducing goats and sheep to make use of the farm's infrastructure and maintain employment for their staff.

Innovation has been a key driver of Meved Dairy's success. The farm is divided into four main departments: crop production, livestock management, milk processing, and value addition. The crop department is responsible for preparing and managing the farm's 75-80 acres of cultivated land (including leased farms), ensuring a steady supply of feed for the livestock.

The livestock department focuses on the health and productivity of the cows, with a current milking herd of 28 cows producing an average of 560 liters of milk per day. In addition, the farm has an in-house veterinarian who ensures the herd's health. “The vet ensures insemination of cows in need, sick animals are treated, and vaccines are given on time, among many others,” explains Mrs. Mwangi.

The milk processing department handles the milk from collection to cooling, ensuring it meets high-quality standards. Value addition has been a significant focus for Meved Dairy, driven by the need to manage surplus milk and offer diversified products. The farm has ventured into producing yogurt and other dairy products, providing additional revenue streams and catering to a broader market.

Additionally, Meved Dairy also buys milk from about 200 farmers locally. The farm trains these farmers to produce goodquality milk. Mrs. Mwangi explains, “We ask farmers not to look for market elsewhere. We take even a liter of milk.”

Meved Dairy's motto, "Farm Fresh for Better Living," reflects its commitment to providing high-quality milk and dairy products. This commitment extends beyond production to include community support and employment generation. "We wanted to create employment for the youth and provide quality milk to the community," Mrs. Mwangi emphasizes.

The farm employs local youth, offering them training and

employment opportunities. This initiative has helped reduce local unemployment and provided a stable income for many families. "We have always aimed to offer employment to young people, keeping them engaged in productive activities," says Mrs. Mwangi.

“At Meved, our products are made from real fresh milk. We do not introduce anything else in the milk,” emphasizes Mrs. Mwangi. From the beginning, the farm intended to provide quality products. This can be seen in its operations. “Our fresh milk has to be consumed immediately or stored in the refrigerator if it's to be outside for long.”

SUSTAINABILITY A KEY ASPECT OF THE BUSINESS

“For us, sustainability started way long before the farm,” states Mrs. Mwangi. “We had installed a solar panel on our first house in the year 2003.” The farm has installed about 199 solar panels to support electricity from the grid. “On a good day, the solar can contribute up to 30% of our energy needs, this figure drops during less sunny periods.”

At night, the farm relies entirely on electricity from Kenya Power and Lighting Company (KPLC) because the solar energy is not stored. “We had a report from an auditor that explains installing storage will be expensive,” explains Mrs. Mwangi. “There are plans to expand our solar capacity. Adding additional panels could improve our solar energy coverage, potentially increasing their solar contribution to 80% during the day.”

In regard to working with other authorities to ensure the waste meets the required standards, Mrs. Mwangi says that she doesn’t wait for authorities such as NEMA to visit the farm. “I normally take my quoter results to their offices and work together to improve the areas where we fall short,” she explains.

The farm also has installed a biodigester. "Our biogas is as old as the first cows which came here, the sixth which was done in 2010. Today we are working 52m³ in two biogas digesters. We have always used biogas. Since we built that house, we have

never bought gas,” affirms Mrs. Mwangi.

Looking ahead, Meved Dairy plans to continue its journey of growth and innovation. Sustainability remains a core focus, with ongoing efforts to improve feed production, manage resources efficiently, and reduce environmental impact. "We are committed to sustainable farming practices," Mrs. Mwangi states. "Our goal is to ensure we can continue providing quality products while taking care of our environment."

The farm also aims to expand its value addition processes, exploring new dairy products and markets. "We see a lot of potential in diversifying our product range and reaching more customers," Mrs. Mwangi explains. This vision includes potential collaborations with other farms and businesses to enhance production capabilities and market reach

Meved Dairy's story is one of resilience, innovation, and community spirit. From its unplanned beginnings during a time of crisis, it has grown into a significant dairy producer, committed to quality, sustainability, and community support. The journey of Mr. and Mrs. Mwangi and their farm serves as an inspiring example of how determination and strategic thinking can transform challenges into opportunities, paving the way for a brighter, more sustainable future in the dairy industry.

As Kenya's population grows, so does the demand for quality food. Dairy farming has emerged as a viable alternative for young farmers and job seekers, providing employment opportunities and creating jobs for others. According to Mrs. Mwangi, zero grazing "can be done anywhere as long as there is feed and clean water." Like any other business, commitment and sacrifice are key to success. Mr. Mwangi highlights the importance of passion and advises, "Engage in farming that you enjoy." DBA

By Alphonse Okoth

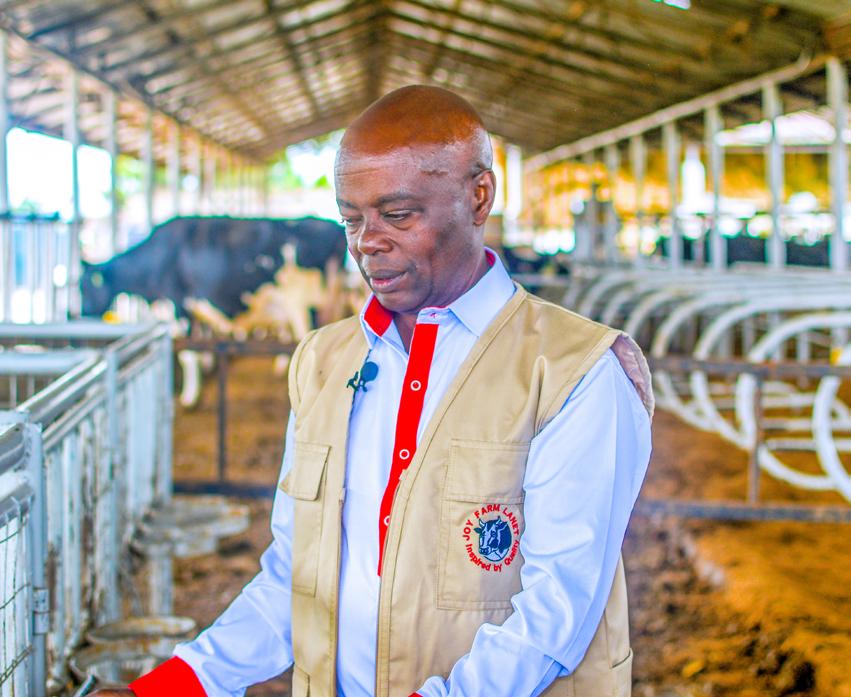

Nestled in the serene countryside in MUWA ESTATE, Lanet, Nakuru County, Joy Farm stands as a beacon of modern dairy farming practices. Founded in August 2008 by Francis Mwangi and his sons, Morris and Morgan, the farm has grown from a humble beginning with just four cows to a thriving enterprise with more than 100 cows.

Their journey, fueled by unwavering dedication, innovative practices, and a deep-seated commitment to animal welfare and sustainability, is a testament to the power of family and passion in the agricultural industry. This commitment to sustainability ensures that Joy Farm not only thrives but also leaves a positive impact on the environment. In an interview with Dairy Business Africa Magazine, Mr. Mwangi shares the achievements, plans, and challenges the farm has faced since its inception.

Francis Mwangi’s passion for farming was instilled in him during his childhood, inspired by his late mother, Lilian, who managed a small farm with just a cow. This early exposure laid the foundation for his interest in dairy farming, eventually leading to the establishment of Joy Farm Lanet. The farm's growth over the past 16 years is not just

a result of hard work but also a reflection of the Mwangi family's innovative spirit, constantly seeking new ways to improve their practices and the industry, making Joy Farm Lanet a hub of exciting advancements in dairy farming.

One of Joy Farm's standout features is its automated watering system, which ensures that cows can always access fresh, warm water. This system is efficient and minimizes human error and water wastage. “The system releases water when the nose of the cow comes in contact with it,” explains Mr. Mwangi. The water bowls are cleaned twice daily, maintaining hygiene and preventing contamination that could deter cows from drinking. “Cleaning removes saliva from bowls, and also the incidences of cow dung in here. If left there, the cow will not take water the whole day,” says Mr. Mwangi.

Feeding at Joy Farm is meticulously managed to ensure optimal nutrition for the cows. Lactating cows receive a balanced mix of 30 kilos of maize silage, 4 kilos of lucerne, and 2 kilos of hay daily. This method ensures the cows get the nutrients they need for maximum milk production. The feeding system avoids traditional troughs, which can harbor bacteria, and instead uses a continuous feeding alley that keeps feed fresh and nutritious.

Another highlight is the farm's approach to calf rearing. Calves are given water immediately after birth to differentiate between water and milk, and colostrum is administered meticulously to boost immunity. The farm maintains high hygiene standards with separate calf pens to prevent cross-contamination and encourage individual care. Regularly changed and sanitized bedding ensures a clean environment, reducing disease risk.

To prevent injuries among the herd, Joy Farm uses a humane dehorning paste on young calves. This method is less traumatic and ensures safer interactions among the cows. Weaning is carried out gradually, allowing calves to adapt to solid feeds while ensuring proper rumen development. These careful practices result in healthier, more productive cows.

Joy Farm leverages technology to streamline its operations. The farm uses a software system to monitor daily activities, including feeding, milking, and cow health. This system allows Francis Mwangi to stay informed about the farm's operations, even when he is away. He can access real-time data on cow health, milk production, and feed consumption, enabling him to promptly make informed decisions and address any issues.

The farm is also equipped with CCTV cameras, providing additional oversight. These cameras help monitor cow movement and ensure that staff adhere to the farm's high standards of care and hygiene.

Joy Farm collaborates with various organizations to enhance its operations and positively impact the local community. The farm works closely with the BIO FOODS PRODUCTS, which has been a major partner in processing and marketing its milk. This partnership has allowed Joy Farm to maintain high-quality milk production standards and has made it a model farm for other dairy farmers.

The farm also partners with governmental organizations like Kenya Animal Genetics Resource Centre (KAGRC), ADC

TO PREVENT INJURIES AMONG THE HERD, JOY FARM USES A HUMANE DEHORNING PASTE ON YOUNG CALVES. THIS METHOD IS LESS TRAUMATIC AND ENSURES SAFER INTERACTIONS AMONG THE COWS. JOY

- Francis Mwangi, Director, Joy Farm Lanet

KITALE in contract for mating bulls. In addition, the farm has also partnered with Smart Cow which provides training on dairy management to large, medium and small-scale farmers. Through these collaborations, Joy Farm shares its best practices and innovative techniques, helping other farmers improve their operations and achieve better outcomes.

Besides its agricultural contributions, Joy Farm plays a vital role in the local community. The farm supplies clean drinking water to around 70 households in the area at a subsidized cost, addressing a critical need. Joy Farm also provides silage to local farmers and offers training on best management practices in dairy farming, further supporting the community's agricultural development. It produces its own feed, a portion that it sells to other farmers.

Like any agricultural enterprise, Joy Farm has faced its share of challenges. In October 2019, the farm experienced a significant setback when a foot and mouth disease outbreak affected its dairy cows, reducing milk production from 740 liters per day to 150 liters. However, the farm's resilient management and preventive measures have helped it recover, with current production levels reaching 26.5 liters per cow daily.

Joy Farm's approach to disease prevention includes stringent biosecurity measures, such as disinfectant footbaths at entry points and strict hygiene protocols. These measures have been crucial in maintaining the herd's health and ensuring consistent milk quality.

Sustainability is at the heart of Joy Farm's operations. The farm employs efficient resource management techniques to minimize waste and maximize productivity. One innovative approach is the farm's emphasis on silage production. Joy Farm produces its maize silage, the main feed form, ensuring a consistent and highquality diet for the cows.

The farm also faces challenges, such as the lack of clean water in the area. To address this, Francis has invested in a five-cubic-meter per hour borehole, sufficient for both farm and domestic use. The farm plans to harvest rainwater from the roofs of its structures to supplement this supply, further minimizing water wastage.

One of Joy Farm's most remarkable initiatives is the biodigester project, which exemplifies the farm's commitment to sustainable and efficient farming practices. The biodigester is an innovative system designed to convert organic waste into valuable resources, providing multiple benefits to the farm's ecosystem and operations.

The primary function of the biodigester is to process animal manure and other organic waste into biogas and organic fertilizer. This helps manage waste effectively and produces renewable energy and high-quality fertilizer, enhancing the farm's sustainability. "Our biodigester project is a crucial step towards achieving our sustainability goals. It helps us manage

waste more efficiently and significantly reduces our carbon footprint," emphasizes Mr. Mwangi.

Looking to the future, Joy Farm aims to expand its herd. This growth is supported by constructing a new barn to house the increased herd. The farm also plans to enhance its sustainable practices and share its knowledge with other dairy farmers, promoting sustainable agriculture across the region.

As Joy Farm looks to the future, its vision is clear: to continue growing its herd, enhancing its sustainable practices, and sharing its knowledge with the broader farming community. Mr. Mwangi and his team are committed to pushing the boundaries of what is possible in dairy farming. Their innovative practices, dedication to animal welfare, and sustainable approach make Joy Farm a model for other farms to emulate. By integrating technology, promoting sustainability, and fostering community collaboration, Joy Farm is a successful business and a catalyst for positive change in the agricultural sector.

In conclusion, Joy Farm's story is about passion, innovation, and resilience. From its humble beginnings to its current status as a leading dairy farm, Joy Farm exemplifies how modern practices and a commitment to sustainability can transform the dairy farming industry. With its eyes set on the future, Joy Farm is poised to continue significantly contributing to sustainable agriculture and community development DBA

In the lively world of FW Africa’s highlevel events, the 2024 AFMASS Food Expo Eastern Africa edition wasn’t just an event—it was an experience that left an indelible mark. With a fresh rebrand as an 8-in-1 Trade Show, this year’s expo at the Sarit Expo Centre in Westlands, Nairobi, was a culinary and industry extravaganza. We’re talking eight pavilions packed with everything from food manufacturing and retail to hospitality, technology, and compliance.

And wow, what a show it was! Over 68 exhibitors and sponsors from across the globe brought their A-game. We had local heroes, regional champions, and international titans all under one roof. Ingredient suppliers were the real show-stealers, with over 10 multinational companies dazzling us with their innovations. But let’s not forget the SMEs from KIRDI—they came in hot with unique products that had everyone buzzing.

And the visitors! More than 3,800 food lovers, industry pros, and curious minds walked through our doors over those three days. One of the highlights? A live processing demo by Freddy Hirsch’s Lil Freddy, a machine that cranked out sausages, burgers, and minced meat faster than you could say, “I’ll take two!”

The conference? Absolutely packed! With over 200 attendees daily, the sessions were a hive of activity, covering everything from investment and trade opportunities to the latest in food safety and entrepreneurship.

Missed it? Well, you might have to live with the FOMO—at least until next year. But don’t worry; you’ll get your chance to redeem yourself at the AFMASS Food Manufacturing Expo Uganda Edition. Trust us, you won’t want to miss the sequel!

See you in Uganda, where we’ll do it all over again—only bigger, better, and even more unforgettable!

12-14 JUNE 2024, NAIROBI, KENYA

12-14 JUNE 2024, NAIROBI, KENYA

12-14 JUNE 2024, NAIROBI, KENYA

By Martha Kuria

Milk is renowned for its rich nutritional profile, offering significant amounts of calcium, vitamin B2, vitamin A, and vitamin D. A 250 mL serving of milk can provide 26-40%, 23-52%, 10-24%, and about 5% of the US Recommended Dietary Allowance (RDA) for these nutrients, respectively. These nutrients are essential for various bodily functions, including bone health, vision, and immune function. However, lactoseintolerant people often avoid eating dairy products, making it difficult for them to

effectively utilize the rich minerals, vitamins, and other nutrients in milk.

Lactose intolerance is a common condition characterized by the inability to digest lactose, a sugar found in milk and dairy products. This condition affects approximately 70% of the global population, with prevalence rates as high as 95-100% in some Asian and African countries. Studies indicate that lactose intolerance can affect up to 80-100% of adults in certain African countries, primarily due to genetic factors that lead to a reduced ability to digest lactose after infancy. This widespread prevalence has created a substantial need for lactose-free alternatives to traditional dairy products.

Lactose intolerance occurs due to the lack of lactase, an enzyme required to break down lactose into glucose and galactose. Without sufficient lactase, lactose remains undigested, leading to gastrointestinal discomfort such

as bloating, gas, diarrhea, and abdominal pain.

Undigested lactose is metabolized by intestinal microflora and converted into short-chain fatty acids (acetate, propionate, butyrate, lactate, and formate) and gases (hydrogen, methane, and carbon dioxide), causing gastrointestinal discomfort such as diarrhea, bloating and other symptoms. People with lactose intolerance can develop symptoms shortly after consuming lactose or up to several hours later. This occurs due to a combination of gut bacteria converting lactose into simple sugars in the large intestine—lactose acting as a prebiotic—and the increased presence of fluid in the large intestine to dilute the undigested lactose and resultant simple sugars.

For those with lactose intolerance, the primary management strategies include consuming low-lactose or lactose-free dairy products and using lactase supplements or probiotics. Lowlactose products typically contain less than 1 g of lactose per 100 g, while lactose-free products contain less than 10 mg of lactose per 100 g. Many studies have confirmed that most consumers diagnosed with lactose intolerance can tolerate up to 10 g/day lactose and have no observable adverse reactions to 2 g/day lactose.

Lactose-free dairy products offer numerous health benefits, particularly for individuals with lactose intolerance. These products provide essential nutrients such as calcium, protein, and vitamins without causing digestive discomfort. The increasing health consciousness among consumers is driving more people to opt for lactose-free and other specialized dairy products. Furthermore, the desire for dietary diversity is leading consumers to seek options that cater to specific health needs and

preferences.

According to Market Research, the lactose-free dairy market is experiencing significant growth, driven by increasing consumer awareness and demand for gut health products. From 2017 to 2022, the global lactose-free dairy market grew at a compound annual growth rate (CAGR) of 7%, reaching sales of approximately US$8.8 billion. Potable milk is the largest

STUDIES INDICATE THAT LACTOSE INTOLERANCE CAN AFFECT UP TO 80-100% OF ADULTS IN CERTAIN AFRICAN COUNTRIES, PRIMARILY DUE TO GENETIC FACTORS THAT LEAD TO A REDUCED ABILITY TO DIGEST LACTOSE AFTER INFANCY.

category of lactose-free dairy, representing two-thirds of the market and driving the absolute growth of the category. Lactosefree yogurt is the second category.

In the US market, lactose-free milk accounted for 4.0% of the total liquid milk sold annually, with sales increasing by 12% in 2017.

In Africa, the demand for lactose-free dairy products is on the rise as awareness of lactose intolerance increases. Consumers are

becoming more health-conscious and seeking dietary solutions that alleviate the discomfort associated with lactose intolerance, such as bloating, gas, and diarrhea. This shift in consumer behavior has led to the introduction and expansion of various lactose-free dairy products, including milk, yogurt, cheese, and butter. The Africa Dairy Alternatives Market is estimated at US$457.37 million in 2024, expected to reach US$641.01 million by 2029, growing at a CAGR of 6.98%. Egypt and South Africa were the major regional markets for dairy alternatives, collectively accounting for a 66% share of volume sales across Africa in 2022. The market is segmented by Category (Non-Dairy Butter, Non-Dairy Milk, Non-Dairy Yogurt), by Distribution Channel (Off-Trade, On-Trade), and by Country (Egypt, Nigeria, South Africa).

The future of lactose-free dairy in Africa looks promising. With

growing consumer awareness of lactose intolerance and an increase in the availability of lactose-free products, the market is anticipated to expand significantly. This burgeoning demand presents numerous investment opportunities in production, distribution, marketing, and ongoing research and development. Major dairy companies are already stepping up to meet this demand, introducing innovative lactose-free products tailored to consumers with lactose intolerance.

In 2018, Nestlé made a notable move by launching NIDO FortiGro Lactose-Free in several African countries, offering a nutrient-rich option for both children and adults without the digestive issues associated with lactose. Danone followed suit in 2019 with the introduction of Activia Lactose-Free Yogurt in South Africa, catering to health-conscious consumers who seek probiotic benefits without lactose. Lactalis entered the market with Parmalat Lactose-Free Milk in South Africa in 2017, providing a nutritious alternative for those avoiding lactose. Clover was a pioneer in this segment, launching Clover NoLac Lactose-Free Milk in South Africa in 2016. Fair Cape Dairies also launched its lactose-free milk in South Africa in 2018, emphasizing quality and taste.

Around 2020, Fan Milk, a Danone subsidiary, launched Lactose-Free Frozen Yogurt in Ghana and Nigeria, combining a refreshing taste with lactose-free benefits. FrieslandCampina WAMCO launched Peak Lactose-Free Milk in Nigeria in 2021, providing a nutritious and easily digestible option.

In Kenya, New Kenya Cooperative Creameries (KCC), in collaboration with Finnish firm Valio Dairy and Tetra Pak, launched the country's first 100% lactose-free milk in 2019, approved by the Kenya Bureau of Standards (KEBS). The milk named after KCC’s flagship product Gold Crown packaged as Gold Crown Lactose Free Milk, aimed to give lactose intolerant consumers an option to enjoy milk and dairy products. According to Nixon Sigey, then Managing Director of New KCC, the introduction of Gold Crown Lactose-Free Milk was a direct response to the rising prevalence of lactose intolerance in Kenya and the broader East African region.

Brookside Dairy entered the lactose-free market in Kenya in 2020 to meet the growing consumer demand. By 2021, Ayrshire Dairy introduced its Lactose-Free Milk in Kenya, reflecting a broader trend of local dairy producers addressing specific dietary needs.

In Uganda, JESA recently introduced JESA JUS, a blend of lactose-free dairy and fruit juice, offering a smoother taste and reduced acidity, further diversifying the options available to lactose-intolerant consumers.

Most hard cheeses, such as Parmesan, Swiss, and cheddar, are naturally low in lactose due to the cheese-making process. During this process, lactose is primarily found in the whey component that is drained off. Any remaining lactose is consumed by lactic acid bacteria during the aging process. “Many people don’t realize that all cheddar cheese, for example, is lactose-free as a result of the aging process,” explains Sara Wing, RD, Health

Program Director at Cabot Creamery in Waitsfield, Vermont. “Cheeses that undergo a natural aging process contain little to no lactose.”

Other dairy products, like ice cream and frozen desserts, have lactose-free versions created by either starting with lactose-free milk and cream or adding lactase to the mix before freezing. In 2023, Dairyland announced the launch of Dairyland Dairy-Free Vegan Ice Cream. By introducing this product, Dairyland aims to provide an inclusive dessert option without compromising on taste and quality.

"Our Vegan Ice Cream is a game-changer for individuals who are lactose intolerant. They can now indulge in their favorite frozen dessert without any limitations. We have carefully developed flavors such as Vanilla, Strawberry, Hazelnut, Cappuccino, and Brownie, ensuring a rich and satisfying experience for our customers," said Milan Kabata, Head of Marketing.

Many lactose-intolerant consumers turn to plantbased alternatives after finding it hard to digest dairy products. The growing consumer inclination toward plant-based food and the consumption of dairy alternatives, such as plant-based milk and cheese, to meet protein and essential nutrient needs are key factors expected to accelerate the growth of the dairy alternatives industry across the region. Many plant-based beverages have even higher levels of fortified calcium than dairy products. A review compared nutrient density in milk and 17 plantbased beverages, with milk containing 120 mg/100 mL calcium and fortified plant-based beverages containing 42–197 mg/100 mL calcium. However, the bioavailability of calcium supplements in plantbased beverages was inferior to that in cow’s milk, where the absorption of calcium triphosphate was only 75% of calcium in milk. According to Heaney et al., calcium precipitates can also occur in plantbased beverages.

Despite its promising growth, the lactose-free dairy market in Africa faces several challenges. Consumer awareness and education regarding lactose intolerance and the benefits of lactosefree products need improvement. Moreover, these products are often priced higher than regular dairy, limiting accessibility for low-income consumers. Nevertheless, these obstacles present

significant opportunities for innovation and investment. Technological advancements, such as enzymatic hydrolysis, membrane separation, and fermentation, have revolutionized lactosefree dairy production. These methods ensure that products maintain the nutritional, flavor, and quality attributes of traditional dairy.

Among the various methods of lactose separation, membrane technologies like ultrafiltration, nanofiltration, reverse osmosis, and electrodialysis are widely recognized. Furthermore, fermentation processes hydrolyze milk proteins and fats into peptides, amino acids, and fatty acids, enhancing digestibility and nutrient absorption. Studies have shown that fermentation can reduce lactose content in milk-based products to between 4.6% and 3.7%. However, epidemiological studies have shown that traditional fermented dairy products may still not fully meet the needs of lactose-intolerant individuals.

Companies investing in research and development can create high-quality lactose-free products tailored to local tastes and nutritional requirements. Governments and regulatory bodies are also playing a crucial role by establishing standards for these products, ensuring quality and safety while supporting industry growth. For instance, in 2021, the Kenya Bureau of Standards (KEBS) approved new analytical test methods to measure lactose levels in milk and dairy products sold in the market

SIZE OF THE AFRICA DAIRY ALTERNATIVES MARKET 2024 IN NUMBERS 457.37M US$

By Mary Wanjira

Nigeria's dairy industry is a cornerstone of the country's agricultural sector, providing essential nutritional value. With a population exceeding 227.9 million as of April 2024 and projected to reach 401.31 million by 2050, the demand for milk and dairy products is expected to rise significantly, according to United Nations data. However, the domestic dairy sector is fragmented and struggles to meet this growing demand.

The Nigerian dairy sector is divided into three primary production systems: the pastoral system, the semi-intensive or peri-urban system, and the intensive or commercial system. The pastoral system, primarily operated by Fulani herdsmen, produces about 95% of the raw milk in Nigeria. These pastoralists typically own an average of 18

cows each. In contrast, the commercial system, which is more structured and involves established dairy farms with a mix of indigenous cows and crossbreeds, accounts for the remaining 5% of raw milk production.

Despite these diverse production methods, Nigeria's dairy farms produce only about 600,000 liters of milk annually, far below the country's total demand. According to the National Livestock Transformation Plan (2019-2050), the aggregate demand for milk and dairy products is estimated at 1.6 million tonnes annually, with domestic production covering only 0.6 million tonnes.

Most milk produced in pastoral and semiintensive systems is consumed domestically or sold in informal markets, where it is often turned into powdered milk (70%), liquid milk (20%), and other value-added products like sour milk (nono), sour yogurt (kindirmo), local butter

(manshanu), Fulani cheese (cuku), and Yoruba cheese (wara).

Multinational processors collect about 5% of this milk and blend it with reconstituted imported milk for further processing. All commercially produced milk is processed and sold in formal markets.

However, this system falls short of meeting Nigeria's high demand. In 2019, the annual milk consumption in the country was 1.7 million tonnes, equivalent to 8.6 liters per capita, significantly below the FAO's recommended annual per capita consumption of 16 liters by 2050. This shortfall has led to Nigeria spending approximately US$1.5 billion annually on dairy imports, with around 70% of the demand met through imports, predominantly in the form of milk powder. FAO estimates suggest that less than 40% of domestic milk demand will be met by imports by 2050, highlighting the urgent need for improved local dairy production.

The formal Nigerian dairy market is dominated by multinational corporations owned by European dairy cooperatives such as Friesland Campina WAMCO (FCW) and Arla, as well as corporations like PZ Wilmar (Nutricima), Fan Milk, Promasidor, and CHI. These entities largely rely on imported milk as raw materials, with FCW being the only multinational currently sourcing raw milk locally. Arla, having signed an MOU with the Federal Government in 2017, has recently launched its dairy development program in Kaduna State. Indigenous processors like Integrated Dairy Limited, L&Z Integrated Farms, and Nagari Farms also contribute by using raw milk sourced from their own cows or from pastoralists and peri-urban farmers.

Despite these efforts and investments, the Nigerian dairy industry has seen stagnant development over the past few decades. One of the major hindrances is the lack of proper infrastructure. Poor roads in rural areas make it challenging for farmers to transport their products to the market, leading to significant losses. Additionally, inadequate storage facilities contribute to postharvest losses, further reducing the profitability of dairy farming.

Access to credit remains a significant challenge for Nigerian dairy farmers. Many farmers lack the funds to purchase necessary inputs such as improved breeds of cattle, veterinary services, and dairy equipment. High interest rates charged by financial institutions make borrowing expensive and unaffordable for many, forcing them to rely on personal savings or informal sources of credit, which are often unreliable and costly.

The productivity of dairy farming in Nigeria is generally low. Many farmers still rely on traditional and outdated farming practices, resulting in low yields and poor-quality milk. This low productivity is partly due to the lack of access to improved cattle breeds and inadequate veterinary services. Moreover, many farmers lack the necessary knowledge and skills to implement modern farming practices, such as improved feeding and breeding techniques, which could help boost their productivity. Addressing these issues is critical for the growth and profitability

IN 2024, THE COUNTRY'S MILK MARKET GENERATED REVENUE OF US$5.90 BILLION, WITH AN ANTICIPATED ANNUAL GROWTH RATE OF 10.70% BETWEEN 2024 AND 2028.

of the dairy industry.

Marketing and distribution pose additional challenges. The lack of organized marketing systems and distribution networks makes it difficult for farmers to find markets for their products. As a result, many farmers are forced to sell their products to middlemen at low prices, reducing their profits. Furthermore, inadequate packaging and labeling of dairy products limit their marketability and contribute to low demand.

Despite these hurdles, the industry showcases a promising trajectory, fueled by factors such as population expansion, increased disposable income, and a shift in consumer preferences towards healthier alternatives.

Market insights from Statista reveal significant growth in various segments of Nigeria's dairy market. In 2024, the country's milk market generated revenue of US$5.90 billion, with an anticipated annual growth rate of 10.70% between 2024 and 2028. This growth is largely attributed to the population surge and rising per capita income, which reached US$25.76. By 2028, the market volume is expected to surge to 2.90 billion kg, with a 4.2% growth rate projected for 2025. In 2024, average milk consumption per person was 10.8 kg.

The yogurt sector also showed strong performance, with revenue reaching US$2.72 billion in 2024 and an expected annual growth rate of 10.74%. Per capita revenues stood at US$11.85, with the market volume projected to hit 0.72 billion kg by 2028, registering a 1.0% growth in 2025. The average per capita yogurt consumption in 2024 was 3.0 kg.

The cheese market in Nigeria recorded revenue of US$4.88 billion in 2024, with an anticipated annual growth rate of 12.69%. Per capita revenues reached US$21.28, and the market volume is expected to reach 0.36 billion kg by 2028, showcasing a 7.4% growth in 2025. Average per capita cheese consumption in 2024 was 1.3 kg.

In the baby milk and infant formula segment, the market witnessed revenue of US$0.33 billion in 2024, with a projected annual growth rate of 6.21%. Per capita revenues were US$1.46, with the market volume expected to reach 24.30 million kg by 2028, growing by 5.3% in 2025. The average consumption per person in 2024 was 0.1 kg.

The market for milk substitutes stood at US$33.94 million in 2024, with an impressive projected annual growth rate of

20.09%. Per capita revenues were US$0.15, with the market volume expected to reach 10.87 million kg by 2028, showcasing an 11.6% growth in 2025. The average consumption per person in 2024 was minimal.

The yogurt substitutes market recorded revenue of US$1.25 million in 2024, with an expected annual growth rate of 6.20%. Per capita revenues were US$0.01, with the market volume projected to reach 143.40 thousand kg by 2028, growing by 4.3% in 2025. The average consumption per person in 2024 was negligible.

Lastly, the cheese substitutes market saw revenue of US$0.74 million in 2024, with a projected annual growth rate of 3.53%.

Per capita revenues were minimal, with the market volume expected to reach 37.01 thousand kg by 2028, showing a 2.3% growth in 2025. The average consumption per person in 2024 was also minimal.

Nigeria's dairy sector holds immense potential, and recent years have shown promising developments. With a rapidly growing population and increasing demand for dairy products, Nigeria has the opportunity to harness its local potential and transform the sector. By leveraging innovative approaches, empowering local farmers, and embracing sustainable practices, the country can meet its domestic demand and position itself as a significant player in the global dairy market.

To tap into this potential, the government and stakeholders have collaborated to promote agricultural investment and provide support to local farmers. Facilitating access to financing, modern technology, and improved infrastructure aims to minimize

barriers to entry, allowing more individuals to participate in dairy production.