Food security in Africa continues to be elusive despite the continent being home to 60% of the world’s arable land. It is surprising that Africa, a country of 1,119 million hectares of agricultural land relies on Ukraine, a country with only 42 million hectares of land. Its painful to see millions of people face hunger and lose their lives while so much agricultural potential lies idle year in year out.

One of the reasons for Africa’s failed agricultural sector is over reliance on imports. When country’s are used to cheap imports, incentives for local production are nonexistent, exposing millions of locals to uncertainties of the global market.

In theory, localizing key food supply chains could have enormous benefits to the economy. In practice, it can be harder to achieve due to a myriad of factors including low productivity, fluctuating production, inconsistent produce quality, the high cost of production, inefficiencies along the value chain and a large informal sector.

Nigeria, a country of over 200 million people, has however made attempts at localizing its supply chains and remarkably reduced reliance on imports

as a result. FrieslandCampina WAMCO, a local subsidiary of Dutch multinational dairy cooperative Frieslandcampina, has been one of the champions of this initiative.

Through its Dairy Development Programme, the dairy has invested heavily in Nigeria, increasing raw milk production to 40,000 litres per day and empowering over 7,000 dairy farmers. For its efforts in putting Nigeria’s dairy sector on the map, FrieslandCampina

WAMCO was chosen as the 2022 dairy company of the year. Read an indepth piece of the company’s activities in Nigeria on page.36

Our main feature Maisha Beverages company is a story of a company out to give African consumers wonderfully refreshing, incredibly tasty, and astonishingly affordable beverage alternatives to what they have been getting for the last 60 years.

"At Maisha Beverages, we believe in giving consumers a world-class product at an affordable price," affirms Brij Raja, Maisha Beverages CEO. "We want people to enjoy superb quality drinks and save their shilling."

Elsewhere we give you a deep dive into Nigeria’s alcoholic beverage sector and a detailed review of the food industry in Egypt. We also have interesting insights on the No and low alcohol-free beverages, Salt reduction, and Specialty fats.

We hope you enjoy your read.

Paul Ongeto Editor, FW Africa

ASHISH PANDE Country Head, Olam Agri, Nigeria

ESSAM EL-MADDAH HR & General Secretary Director, Danone Egypt & North East Africa

JUSTIN ARCHER COO East Africa & Group Head of Sustainability, Sucafina SA

CLAUDIA CASTELLANOS Managing Director, Black Mamba

JOACHIM WESTERWELD Executive Chairman, Bio Food Products

MILLICENT A. ADOBOE Co-Founder, Achiever Foods Ghana

CAESAR ASIYO Chief Development Officer, Victory Farms

SAINT-FRANCIS TOHLANG Corporate Affairs Director, Nestle East & Southern Africa

NICO ROOZEN Honorary President, Solidaridad Network

ROZY RANA Managing Director, Dormans Coffee

GAURAV VJ CEO, 260 Brands

BRETT THOMPSON Co-Founder & CEO, Mzansi Meat

ASHISH PANDE Country Head, Olam Agri, Nigeria

ESSAM EL-MADDAH HR & General Secretary Director, Danone Egypt & North East Africa

JUSTIN ARCHER COO East Africa & Group Head of Sustainability, Sucafina SA

CLAUDIA CASTELLANOS Managing Director, Black Mamba

JOACHIM WESTERWELD Executive Chairman, Bio Food Products

MILLICENT A. ADOBOE Co-Founder, Achiever Foods Ghana

CAESAR ASIYO Chief Development Officer, Victory Farms

SAINT-FRANCIS TOHLANG Corporate Affairs Director, Nestle East & Southern Africa

NICO ROOZEN Honorary President, Solidaridad Network

ROZY RANA Managing Director, Dormans Coffee

GAURAV VJ CEO, 260 Brands

BRETT THOMPSON Co-Founder & CEO, Mzansi Meat

Maisha Beverages Company is out to give African consumers wonderfully refreshing, incredibly tasty, and astonishingly affordable beverage alternatives to what they have been getting for the last 60 years.

Carcass

jowl

What makes the Art of European Meat? It’s that exceptional combination of Craftsmanship, Food Safety and Tailor-Made Service. And that’s what the Belgian meat suppliers truly master. As one of Europe’s leading meat producers and exporters, they turn their expertise into an art form. Up to you to savor it.

Find your Belgian meat master at artofmeat.eu

Hindquarter

Hindquarter

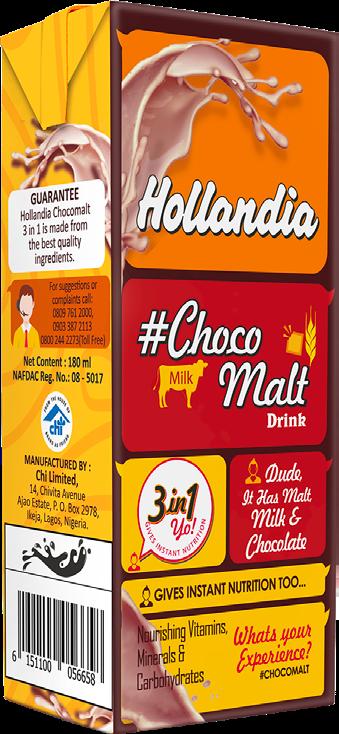

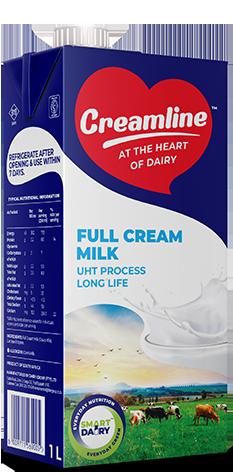

Voltic Ghana : Hollandia Choco Malt Drink in the country | Kevian Limited : Apple Ginger Boost Fruit Drink |Nestlé South Africa : medium fat dairy powder drink | Brookside Dairy: Fortified Milk

| Richester Foods: Chewing gum | Dairy Group South Africa: UHT milk, butter and dairy liquid blends

• High consumption of ultra-processed foods exposes you to dementia risk, new study finds

• CCBA Kenya injects US$2m into wastewater treatment plant upgrade

• Unilever invests US$275.6m in Mexican operations, wins lawsuit over Ben & Jerry's Ice Cream business in Israel

• Ardagh Glass double production capacity at South Africa based plant with US$95m investment

• Mozambique opens new cooking oil processing facility, modern abattoir

• Lactalis to convert Canadian dairy plant into a plant-based production hub

• Nestlé marks three decades of local manufacturing in Morocco

• Diageo to sell Guinness Cameroon to Castel Group

• Dufil Prima Foods merges with its 3 subsidiaries to bolster position in Nigerian market

• PepsiCo expands beverage portfolio with acquisition of stakes in Celsius Holdings, Aqua Carpatica

• CCBA merges Century Bottling Company, Rwenzori Bottling Company to form CocaCola Beverages Uganda

• Tyson Foods invests US$200m in expanding and upgrading Amarillo beef plant

• Krones unveils next gen contiform, taps into block chain to achieve 100,000 bottle/hour production line

• Packaging solution provider Sidel expands footprint in East Africa with new office in Kenya

• Packaging equipment supplier Krones opens cold glue manufacturing facility in Ethiopia

• Azelis expands its global food laboratory network with launch of new facility in Egypt

• MANE bolsters Middle East customer support capabilities with new flavor facility in Amman

EDITORIAL

Paul Ongeto | Catherine Wanjiku | Abel Ndeda

Jonah Sambai | Virginia Nyoro

DESIGN & LAYOUT

Clare Ngode

PUBLISHED BY: FW Africa

P.O. Box 1874-00621, Nairobi Kenya Tel: +254 20 8155022, +254725 343932 Email: info@fwafrica.net Company Website: www.fwafrica.net

Food Business Africa (ISSN 23073535) is published 6 times a year by FW Africa. Reproduction of the whole or any part of the contents without written permission from the editor is prohibited. All information is published in good faith. While care is taken to prevent inaccuracies, the publishers accept no liability for any errors or omissions or for the consequences of any action taken on the basis of information published.

September 14-16, 2022

Annapoorna - ANUFOOD India

Mumbai, India

Focus: Food & Beverages https://www.anufoodindia.com/

September 22-24, 2022

IFMEX Tanzania

Dar es Salaam, Tanzania

Focus: Food & Beverages https://www.expogr.com/tanzania/ifmex/

September 28-30, 2022

MeatEx Canada Toronto, Canada

Focus: Meat https://meatexcanada.com/

October 02-07, 2022

World Dairy Expo Madison, USA Focus: Dairy https://worlddairyexpo.com/

October 04-06, 2022

Fruit Attraction Madrid, Spain Focus: Fruit https://www.ifema.es/en/fruit-attraction

October 05-07, 2022

Cape Wine Cape Town, South Africa Focus: Wine https://www.capewine2022.com/

October 12-14, 2022

Dairy Industry Expo Pune, India

Focus: Dairy https://west.dairyindustryexpo.com/

October 12-14, 2022

Africa Food Show Nairobi, Kenya

Focus: Food & Beverages https://africafoodshow.com/

October 18-20, 2022

Devac Agrifca

Cape Town, South Africa

Focus: Agro & Food https://agrifca.com/

October 19-20, 2022

International Drink Expo London, UK

Focus: Beverage https://www.internationaldrinkexpo.co.uk/

October 19-21, 2022

WUWM Abudhabi 2022 Abudhabi, Dubai

Focus: Fresh Produce https://www.wuwmabudhabi.com/

October 25-26, 2022

Grocery Innovations Canada Toronto, Canada

Focus: Food & Beverages https://virtual.groceryinnovations.com/

October 25-28, 2022

Annual IAOM MEA Conference & Expo Zanzibar, Tanzania

Focus: Grains & Milling https://www.iaom-mea.com/upcomingevents/

October 26-28, 2022

China Fisheries and Seafood Expo Qingdao, China Focus: Fish & Seafood https://chinaseafoodexpo.com/about/

October 26-28, 2022

RMB WineX Johannesburg, South Africa Focus: Wine https://www.rmb.co.za/event/rmb-winex

November 08-10, 2022

ISM Middle East Dubai, UAE

Focus: Snacks & Confectionery https://www.ism-me.com/

November 08-10, 2022

Gulfood Manufacturing Dubai, UAE

Focus: Food & Beverages https://www.gulfoodmanufacturing.com/

November 09-12, 2022

SIAL InterFOOD Jakarta, Indonesia

Focus: Food & Beverages https://sialinterfood.com/

November 21-23, 2022

Connect with us Food Business Africa Magazine

Agritech East Africa

Dar es Salaam, Tanzania Focus: Agriculture https://www.agritecheastafrica.com/

November 23-25, 2022

Pacprocess India Mumbai, India

Focus: Processing & Packing https://www.pacprocess-india.com/ November 24-25, 2022

Africa Food Sustainability Summit Nairobi, Kenya

Focus: Sustainability https://www.foodbusinessafrica.com/ future/

November 24-27, 2022

OIC Halal Expo Bakırköy, Turkey Focus: Food & Beverages https://www.helalexpo.com.tr/en/

November 29-December 01, 2022

agrofood West Africa Accra, Ghana

Focus: Food & Beverages https://www.agrofood-westafrica.com/

December 01, 2022

World Coffee and Tea Expo Lagos, Nigeria Focus: Tea & Coffee https://www.worldcoffeetea.com/

December 05-07, 2022

Food Africa Cairo Cairo, Egypt Focus: Food & Beverages https://www.foodafrica-expo.com/

December 07-09, 2022

Drink Technology India Mumbai, India

Focus: beverage, dairy and liquid food https://www.drinktechnology-india.com/ en/

January 24-26, 2023

International Production & Processing Expo

Atlanta, USA

Focus: Food & Beverages https://www.ippexpo.org/

Follow Us Foodbizafrica

Follow Us Foodbizafrica

Like Food Business Africa Magazine

drinks, salty and sugary snacks, ice cream, sausage, deep-fried chicken yogurt, canned baked beans and tomatoes, ketchup, mayonnaise, packaged breads, and flavored cereals?

Well, you might want to cut down on these mouthwatering foods, as a new study has linked their consumption to a higher risk of developing dementia.

Academy of Neurology, ultraprocessed foods are associated with an increased risk of dementia.

The study also showed that replacing ultra-processed foods in a person’s diet with unprocessed or minimally processed foods was associated with a lower risk.

CHINA – Are you an ardent lover of ultra-processed foods such as soft

According to the study published in the online issue of Neurology, the medical journal of the American

It is, however, important to note that the study does not prove that ultraprocessed foods cause dementia. It only shows an association, researchers stressed.

MOROCCO – French multinational cheese producer Bel Group and Polmlek, a Polish dairy player, have signed an agreement to sell Bel’s stake in Moroccan dairy producer Safilait, and the Tarmast farm that supplies it.

Safilait, which Bel acquired in 2015, specializes in the processing, packaging, and selling of fresh milk, UHT milk, and fresh dairy products.

The company has since developed Safilait’s products and activities

Report.

With a turnover of US$18.2 billion, the Chinese dairy giant also remained among the global top five dairy companies, according to the Dutch multinational banking and financial services company's report.

Yili also achieved the highest growth rate of 31.7% among the top 20. It was also able to drastically reduce the margins between the top four while making it challenging for the rest of those on the ranking to catch

– including local brand Jibal and its investment in the company’s Moroccan production facility.

The divestment will allow Polmlek to continue accelerating the development and growth Safilait achieved under Bel’s previous ownership.

Bel's current brands within the Morrocan market include The Laughing Cow, Les Enfants, and Kiri, as well as its Tangier factory.

up by maintaining strong momentum.

Innovation has helped the Chinese dairy giant to maintain its market leadership in its long-standing core liquid milk and ice cream businesses.

In addition to rapid growth, Yili topping is also attributed to its contribution to the industry by promoting win-win collaborations across the industrial chain, global operations, and sustainable development facilitating development across the entire industry.

KENYA – Coca-Cola Beverages Africa (CCBA) in Kenya has invested US$2 million in upgrading its wastewater treatment plant at its Equator Bottlers Ltd plant in Kisumu.

Equator Bottlers Ltd plant sources its water from Lake Victoria. The water undergoes a series of primary and secondary treatments to achieve the quality standard required for human and industrial use.

quality requirements consistently while recovering more portable water and allowing sludge to be disposed of in solid form.

The investment follows a detailed concept and feasibility study which was conducted in 2021, benchmarking the Kisumu plant against global best practice water and waste treatment plants.

“CCBA, together with The CocaCola Company, are leaders in using water responsibly in our operations and giving it back.

MEXICO – British multinational consumer goods company, Unilever has invested MXN5.5bn (US$275.6m) in two Mexican food plants to increase production capacity to supply the local and international markets.

The two factories, in the northeast and southeast of Mexico, manufacture a range of products from the Wall’s Helados Holanda ice-cream line to foods sold under the Knorr, Hellmann's, Best Foods, and Maizena brands.

Unilever says the investment will enable the factories to improve infrastructure, add new equipment, and buy technologies to optimize water and energy usage.

Meanwhile, Unilever has won a lawsuit where the independent directors of its wholly owned ice cream company, Ben & Jerry's, sought to stop it from transferring the ice cream brand’s assets to a local licensee in Israel.

The board had protested the deal with Avi Zinger as it would allow the brand's ice cream brand to continue being sold in Israeli settlements in the occupied West Bank.

Meanwhile, the wastewater treatment plant treats the process water from the plant before being discharged.

The upgrade, including civil works, related equipment, and accessories, will treat water from the manufacturing process to meet company specifications and water

"We continue to manage water resources through projects that reduce water use in our operations, protect local water resources and provide safe, clean drinking water to communities in need," said Xavier Selga, managing director of CCBA Kenya.

CCBA has developed a robust sampling and testing plan for wastewater for quality assurance and to enable timely interventions for continuous improvement.

The company has adopted the ISO 14001 environmental management system at all its plants across Kenya in line with its commitment to conduct all its business activities responsibly, with due regard to environmental impact and environmental sustainability.

Ben & Jerry’s had earlier decided to stop the sale of its ice cream brand in the contested region, as doing so was inconsistent with its values.

In the ruling, the US judge said the ice cream company had “failed to demonstrate” that the move to sell the goods in the Israeli-occupied settlements caused it “irreparable harm.”

CCBA, TOGETHER WITH THE COLA-COLA COMPANY, ARE LEADERS IN USING WATER RESPONSIBLY IN OUR OPERATIONS AND GIVING ITXavier

Selga, Managing Director , CCBA Kenya

US$2m

SOUTH AFRICA – Ardagh Glass Packaging Africa (AGP Africa), formerly Consol Glass, has commissioned an R1.5 billion (US$95m) extension of its Nigel production facility in Gauteng, South Africa.

Ardagh, a global supplier of metal and glass packaging, finalized the acquisition of Consol Group, Africa’s largest glass packaging maker by manufacturing capacity in April for US$1 billion.

a new furnace and production lines, has more than doubled the facility’s capacity to provide sustainable glass packaging to support its customers’ current and projected demand growth.

It also provides significant energy, water efficiency, and environmental benefits, representing another

SOUTH AFRICA – RCL Foods, a leading South African food manufacturer producing a wide range of branded and private label products, has expanded its baked goods portfolio with the acquisition of Sunshine Bakery, one of the country's largest independent baking businesses.

Indirectly majority-owned by AFGRI Group Holdings, the bakery serves a diversified customer base in the formal retail and general trade channels, through two regional bakeries in Durban and Pietermaritzburg, as well as various depots across the province.

The maker of Rainbow Chicken and Nola mayonnaise brands already owns Sunbake bread, and the addition of Sunshine will increase bread volumes in its baking network by 28%.

RCL did not provide details on the price of the acquisition, saying the deal with AFGRI Group Holdings fell below the threshold for categorization in terms of JSE listings requirements.

The transaction is subject to the fulfillment of both regulatory and commercial suspensive conditions by no later than 30 November 2022.

As part of its terms and conditions for acquiring Consol, the Competition Commission required that the group invest in the construction of a new glass manufacturing facility, and favor small vendors when procuring recycled glass or cullet for use in its operations.

Expansion of the Nigel plant is part of the company’s adherence to the commission’s requirement, in addition to its commitment to a third furnace at the facility.

The new investment, incorporating

important step in AGP–Africa's journey to de-carbonize the glass production process and reduce emissions in the communities in which it operates.

in Ivory Coast under its subsidiary Dorado Ivory.

The new facility with an annual processing capacity of 75,000 MT is deemed to be the first of its kind single roof processing unit fashioned with a seamless online system.

The establishment of the new industrial site is in line with the country's target of processing half of its total raw cashew output by 2025.

IVORY COAST – Royal Nuts, a commodity trading & manufacturing company with headquarters in Singapore, has cut the ribbon on a US$23m cashew nut processing plant

Currently, only about 100,000 tonnes of cashews are processed within the country annually from a total production of 1 million tonnes, with the number feared to be dwindling as the processors face stiff competition from exporters of the raw commodity.

ARDAGH FINALIZED THE ACQUISITION ACQUISITION OF CONSOL GROUP, AFRICA'S LARGEST GLASS PACKAGING MAKER IN APRIL FOR US$1

UGANDA – Coca-Cola Beverages Africa (CCBA) has consolidated its two Ugandan bottling subsidiaries, Century Bottling Company Limited (CBC) and Rwenzori Bottling Company Limited (RBC) to form a single operating entity under the name Coca-Cola Beverages Uganda Limited (CCBU).

The amalgamation seeks to improve Uganda operations by streamlining the management of the business and improving efficiencies through standardized processes, optimized costs, and increased service levels.

The cashless transaction has seen all CBC employees transferring over to RBC, now renamed Coca-Cola Beverages Uganda.

"This is the final step in a process to create one Coca-Cola Beverages Uganda and consolidate our resources to drive growth and benefit for our employees, customers, consumers, and the wider communities in which we operate, with increased efficiency and opportunities to make Africa a better continent for all," said General Manager, Melkamu Abebe.

MOZAMBIQUE – Niassa Cotton Company (SAN), a subsidiary of the Portuguese Joao Ferreira dos Santos group in Mozambique, has opened a new vegetable oil factory in the city of Cuamba, in the northern province of Niassa.

The facility has a processing capacity of 7,500 tonnes per year of crude vegetable oil, and 3,000 tonnes of refined oil produced from soya beans.

Mozambican President Filipe Nyusi officially opened the state-of-the-art unit. He lauded the project, noting that it will beef up local availability of the highly sought-after vegetable oil, replacing imports and having a direct impact on the country's balance of trade.

Imports of vegetable oil have been a heavy burden on the balance of trade. Annually Mozambique spends about US$400 million on importing cooking oil – which is 30 percent of the import of all goods associated with agriculture.

The opening of the vegetable oil factory follows the inauguration of the country's largest and most modern meat processing unit in the western

city of Tete.

Known as the Canefood Processing Unit, the abattoir can process 200 head of cattle and 500 goats a day.

Fashioned with state-of-the-art equipment, the facility will meet the highest standards of international

certification for slaughter, processing, and conservation.

This will not only contribute to the gradual elimination of the practice of indiscriminately butchering animals without appropriate sanitary conditions, but also open prospects for the export of quality meat to international markets.

CCBA merges Century Bottling Company, Rwenzori Bottling Company to form Coca-Cola Beverages Uganda

Mozambique opens new cooking oil processing facility, modern abattoir

THE FACILITY HAS A PROCESSING CAPACITY OF 7,500 TONNES PER YEAR OF CRUDE VEGETABLE OIL AND 3,000 TONNES OF REFINED OIL PRODUCED FROM SOYA BEANS

SOUTH AFRICA – Private equity specialist RMB Corvest has teamed up with Masimong Beverages Holdings to acquire Halewood International SA, a well-established South African artisanal drinks manufacturer.

Masimong Beverages Holdings is jointly owned by Masimong Group Holdings (Pty) Limited controlled by Mr. Mike Teke, Sabvest Capital led by Chris Seabrooke, and RMB Family Office Group Solutions.

Established in 1999 Halewood has since become a fixture in South Africa's spirits industry.

The business currently manufactures, imports, and distributes a wide range of alcoholic and nonalcoholic beverages, including mixed drinks "RTDs" like Red Square Vodka and spirits including Belgravia Gin.

CAMEROON – British multinational alcoholic beverage company, Diageo, has once again brokered a sales agreement for another of its African subsidiary with French beverage company Castel Group.

The maker of premium whisky has agreed to sell its brewery in Cameroon, Guinness Cameroon S.A., to industry peer Castel for £389m.

This is the second deal fostered by both parties this year following Diageo’s sale of Meta Abo Brewery to the world-renowned wine producer.

On completion, Castel will take over the production and nationwide distribution of Guinness in Cameroon under a license and royalty agreement.

The deal reflects Diageo's flexible, asset-light beer operating model that seeks to select the most appropriate structure and route to market, based on local conditions, supporting greater efficiency and profitability.

According to Diageo, this agreement provides a robust platform for Guinness' expansion in both production and distribution via

Three depots (Durban, Cape Town, and Ladysmith) support the manufacturing operations with an additional eight outsourced depots across the country, enabling national distribution.

“Halewood has an exceptionally experienced management team. This, coupled with the company’s strong revenue growth, and potential for future growth along with new product lines, makes Halewood a perfect fit regarding our investment criteria,” said RMB Corvest executive, Brendan Wiebols.

The new partners will support Halewood International's commitment to growing its business by extending its product offerings in pursuit of consumer satisfaction.

SWITZERLAND – Switzerlandheadquartered multinational food company, Nestlé is once again the world’s most valuable brand, according to leading brand valuation consultancy, Brand Finance.

Valued at US$20.8 billion, Nestlé is far ahead of its peers, with Yili, the second most valuable brand in the ranking, being two times smaller than the Vevey-Switzerland-based food conglomerate.

To be at the top of the food chain, Nestle continues to pursue its longterm brand strategy by consistently innovating new products and moving forward in its digital transformation.

Castel's five brewing sites and their national distribution network.

As part of the agreement, Guinness marketing in Cameroon will continue

to be managed by the Guinness Global Brand Team, who will set a strategy with dedicated Diageo resources in the market working alongside Castel.

The transaction is expected to complete in the first half of fiscal 2023, subject to regulatory clearances.

The Swiss brand has invested in developing solutions that meet changing consumer preferences by anticipating growing trends, Brand Finance observed.

Meanwhile, the world's largest food company has committed to ending the marketing of infant formula for babies up to six months of age in all countries around the world, effective January 1, 2023.

The unprecedented decision by the world’s largest food manufacturer is particularly relevant in the United States, Canada, and Japan where no regulations currently exist.

Nestlé maintains position as the world’s most valuable food brand, commits to end marketing of infant formula globally

SOUTH AFRICA – Africa's largest retailer Shoprite, has secured R3.5 billion (US$205m) in loans to be channeled towards expanding its key environmental programs as part of its wider sustainability strategy.

The financing includes an R2 billion (US$117m) loan from Standard Bank, the bank's biggest sustainability loan in the retail sector to date, as well as an R800 million (US$46.8m) sustainability-linked loan.

Another R700 million (US$41m) green loan was obtained from Rand Merchant Bank, a first in the retail sector, with an additional sustainabilitylinked loan planned from the same bank.

The funds will go towards investment in renewable energy sources; recycling projects of cardboard and plastic; sustainable

packaging, including reusable, recyclable, and compostable packaging; and driving energy efficiency at its sites, including LED lighting, and a monitoring system for refrigeration to reduce energy consumption and waste.

This will give an added impetus to the substantial investments already made by the retailer aimed to achieve net zero-greenhouse gas emissions by 2050, power 25% of operations with renewable energy by 2027, and ensure 100% of its own-brand packaging is reusable, recyclable, and compostable, and contains on average 30% recycled material content by 2025.

NIGERIA – Dufil Prima Foods Plc, Nigeria's pioneer and largest producer of instant noodles, has merged and absorbed three of its subsidiaries De United Foods Industries Limited (De United), Northern Noodles Limited (NNL), and Pure Flour Mills Limited (PFM).

The merger of the four operations, focusing on noodles, pasta, wheat flour, and vegetable cooking oil processing, aims to consolidate the company's efforts to become one of the largest FMCG companies in Nigeria.

Dufil Prima Foods Plc, the surviving and enlarged company, will be a stronger and more dependable manufacturing company that has the critical mass, product line diversity, structure, and market intelligence to compete in the same market as other big manufacturing companies.

Chief Operating Officer Dufil Prima Foods Plc, Adesh Jain said, "This is a huge step towards consolidating our status as Africa's largest pasta and instant noodle manufacturer.

“This is an attractive combination for stakeholders as customers will benefit from our wider and better-

integrated array of products and services; employees will enjoy the advantages and opportunities of being a part of a larger, stronger company; and shareholders will have the opportunity to continue to

participate in the success of a bigger enterprise.”

A scheme of arrangement unanimously approved by the shareholders of each company and sanctioned by the Federal High Court and all appropriate regulatory authorities made the merger possible.

Dufil Prima Foods merges with its 3 subsidiaries to bolster position in Nigerian market

THIS IS A HUGE STEP TOWARDS CONSOLIDATING OUR STATUS AS AFRICA'S LARGEST PASTA AND INSTANT NOODLE MANUFACTURER

His Majesty

Mswati III of the Kingdom of Eswatini

BRAZIL – American multinational food, snack, and beverage corporation, PepsiCo has bolstered its beverage portfolio with the acquisition of a 20% stake in Romanian bottled-water business Aqua Carpatica and another stake in energy drink maker Celsius Holdings.

The Celsius deal involves an 8.5% stake, which Pepsico hopes to leverage to strengthen its strategic distribution arrangement in the US for energy drinks.

In a joint statement, the companies said PepsiCo will make a "net cash investment" worth US$550million for convertible preferred stock in the Florida-based business.

In addition, the deal will enable PepsiCo to have a long-term US distributor of energy drinks brands through a strategic distribution arrangement.

Meanwhile, the 20% stake in the Romanian bottled-water business will give PepsiCo distribution rights for Aqua Carpatica products in Romania and in Poland, where the brand is not present.

In addition, PepsiCo plans to take the brand which it describes as “premium Romanian spring water” into other new global markets, including the United States.

ZAMBIA – Zambeef Products PLC, one of the region's leading agribusiness companies, has received US$35 million financing from IFC to back its recently unveiled US$100 million expansion plan.

Under the three-year plan, Zambeef highlighted that it seeks to expand its crop production while adding associated value and capacity to the company's stock feed, milling, meat processing, and retailing operations. More capacity will enable it to source more key inputs, such as wheat, dairy, and animal feed ingredients, from local suppliers, the company said.

Central to the investment strategy will be a doubling of wheat and soybean capacity at the company's Mpongwe farms, with the area under cultivation growing from the current 3,343 hectares under irrigation and 7,621 hectares of rain-fed cropping.

US – World’s second-largest processor and marketer of meat products, Tyson Foods, has committed US$200 million to expand and upgrade operations in its beef plant in Amarillo, Texas.

The expansion project that will begin this fall involves the construction of an additional 143,000-square-foot to the existing beef complex that will expand and enhance the facility’s existing operations floor.

The expanded complex is also to house the upgraded team members' well-being areas, including locker rooms, cafeteria, and office space.

In addition, it will modernize the facility and prioritize team member safety, ergonomics, and food safety, and incorporate enhanced automation and new technologies, Tyson said.

The new space also supports several of the company’s sustainability efforts through energy and water conservation improvements. Specially designed water utility equipment, pumps, and piping will automate and allow for a reduction in water usage.

Earlier, Tyson Foods reported an increase in Q3 net revenue from US$12.48 billion in fiscal 2021 to US$13.5 billion in fiscal 2022 but warned of supply constraints.

Zambeef will also use the funds to upgrade its feed mill, develop more animal housing, purchase new farm equipment and develop 1,000 hectares of irrigation land, among others.

The project will improve the company's value chain, create almost 1,400 new jobs, expand the tax revenue, and support small-scale farmers and small and medium-sized businesses. It will also increase access to high-quality and affordable protein foods.

Further to that, IFC will provide advisory services to help Zambeef set up a comprehensive carbon assessment planning system, which will accelerate long-term climate-smart initiatives to combat climate change.

Tyson Foods invests US$200m in expanding and upgrading Amarillo beef plant

Zambeef receives US$35m support from IFC to spearhead its US$100m expansion plan

THE PROJECT WILL IMPROVE THE COMPANY'S VALUE CHAIN AND CREATE ALMOST 1,400 NEW JOBS

GERMANY – Packaging and bottling machine manufacturer Krones has unveiled its fourth generation Contiform stretch blow molder which is reportedly more environment friendly and highly efficient.

In developing the new machine,

Krones’ R&D team focused on reducing energy consumption in preform heating and, of course, in lowering compressed air consumption in the blowing process.

They shortened the distance between the heaters, made the heating space even more compact overall, and redesigned the heaters with parabolic reflectors.

“As a result, they’ve cut energy consumption by 11 percent compared to the previous generation,” Krones revealed.

The new Contiform is also now even more user-friendly: It features a large-screen interface with the latest touch technology and improved visualization software.

Tapping into the infinite capabilities of blockchain, the German manufacturer has also unveiled a the world’s first wet-end block achieving an output of 100,000 0.5-liter water bottles per hour.

According to Krones, the innovation represents a quantum leap in blockchain technology and responds to the need for appropriate machine speeds to meet the rising demand for packaged water.

With the ErgoBloc L, the company also proves that a single larger line offers better performance in terms of both energy and media consumption per packaged unit than multiple medium-output lines.

Krones

Setting base in Kenya is set to stamp its presence in the African market, which it has been serving for many years through its collaboration with SBA, the official partner and representative of a couple of multinational companies in Africa.

KENYA – Sidel, a leading provider of equipment, services, and complete solutions for packaging beverage, food, home, and personal care products, has opened a new office in Kenya, expanding its presence in the East African region.

The move heightens its support for customers in East Africa, a key market for Sidel and one of the continent's fastest-growing regions.

The new office will enable it to drive development in the region by working more closely with customers to provide them with dedicated engineering capability and on-theground customer service.

It is located in the heart of the country’s capital Nairobi, alongside its parent company Tetra Laval as well as the African head offices of other international companies.

Under the new plan, the packaging solution provider will continue to work closely with SBA in East Africa, tagging it as the exclusive distributor of its spare parts.

Moreover, SBA will increase its commercial and service-based resources and focus on Ethiopia, Central, and West Africa, using existing SBA offices in Côte d'Ivoire, Nigeria, Angola, Congo, DRC, and Ethiopia.

ASNEW INNOVATION CENTER

Krones unveils next gen contiform, taps into block chain to achieve 100,000 bottle/hour production lineMARKET EXPANSION

of KIC Krones officially opened the facility that will serve its customers in Ethiopia and neighboring markets with locally manufactured cold glue for their labeling needs.

“We are very happy to celebrate the inauguration of our glue manufacturing facility in Addis Ababa, Ethiopia!

AFRICA – Krones, a global manufacturer of filling and packaging technology, has inaugurated a new glue manufacturing facility in Addis Ababa, Ethiopia.

H.E Stephan Auer the Ambassador of the Federal Republic of Germany to Ethiopia, Gary Zeller Managing Director of Krones East Africa, and Stephan Maschke Managing Director

"Krones is committed to the Ethiopian Market and [we] will continue to strengthen our efforts to serve our customers," highlighted the company on a LinkedIn post.

Headquartered in Neutraubling, Germany, Krones designs and implements complete lines for beverages and food, which cover each production process step–starting from product and container production, filling, and packaging up to material flow and container recycling.

JORDAN – French flavor and fragrance giant MANE has opened a new flavor facility in Amman, Jordan in an effort to better serve its customers in the Middle East.

The Amman facility, located on the 4th floor of the Middle East Insurance Building on 3rd Circle, Zahran Street, is MANE’s second site in the region and will greatly support the existing MANE Dubai offices for fragrances.

EGYPT – Speciality chemicals and food ingredients supplier Azelis, has opened a new food laboratory in Cairo, Egypt, aimed at providing innovative and technical support to the customers in the Middle East and Africa region.

Other than facilitating efficient service delivery, the state-of-the-art laboratory will offer regular seminars and training sessions for its customers.

While fully equipped to service various food segments, the new laboratory will primarily focus on dairy and beverages, servicing the region with new value-adding formulations.

“We are very happy to have this new application laboratory in Egypt, focusing on dairy and beverages.

“The lab is equipped with modern technology to best support our customers. We will utilize our lateral value chain and our skilled

technical staff to bring new, innovative formulations to the market,” said Mattar Mattar, Country Manager, Azelis Egypt.

“The new facility reflects not only the Mane family’s strong belief in the potential growth of the region, but also its strong commitment to serving customers in the food and beverage industry at the highest levels and with local expertise,” Mane said,

The new facility complements the many other Azelis Food & Nutrition laboratories across the EMEA region and worldwide, an addition to its innovation capabilities and supporting the constant drive for discovery and sustainability.

MANE Amman is fully operational and has sales, technical, and evaluation departments and two laboratories to cover a wide range of beverage, dairy, confectionary, snacks and culinary applications.

It will mainly focus on providing customers with speedy, high-quality services and applications that suit the different taste profiles across the Middle East region.

Azelis expands its global food laboratory network with launch of new facility in Egypt

MANE bolsters Middle East customer support capabilities with new flavor facility in AmmanNEW INNOVATION CENTER

THE NEW FACILITY REFLECTS MANE FAMILY'S STRONG COMMITMENT TO SERVING CUSTOMERS IN THE FOOD AND BEVERAGE INDUSTRYMane

ZIMBABWE – Dairibord Holdings Limited, Zimbabwe's leading manufacturer and marketer of food, dairy, and beverage products, has appointed Mercy Rufaro Ndoro as the Group Chief Executive Officer, effective 1 October 2022.

Mercy Rufaro has held the positions of Financial Accountant, Finance Executive, and Company Secretary of Dairibord Holdings Limited. She was appointed Finance Director and an Executive Director of the Company in 2009.

She has a deep understanding of the business from experience in management positions spanning over 25 years in Dairibord and is firmly positioned to take the business through this transition period and beyond.

KENYA – Kenya Breweries Limited, subsidiary of East Africa Breweries Limited, has appointed Rosemary Mwaniki to the role of the company’s Operations Director.

Rosemary officially took office on 1st September, 2022, and has been tasked to oversee operations across the Tusker, UDV, Kisumu & EAML site as well as Engineering & Governance functions.

She has transitioned into this new role from Packaging Manager – KBL Nairobi Tusker Site, a docket she had held since July 2020.

Prior to that, Rosemary served under different capacities within the KBL Supply Chain team in Plan, Source and Move.

ZIMBABWE – Nestlé has appointed Luke Gomes as the new Cluster Head for the Greater Zambezi region, one of three clusters within Nestlé East and Southern Africa Region (ESAR).

The cluster covers five countries, Zimbabwe, Zambia, Malawi, Mozambique, Comores, and Madagascar. The new boss will be headquartered in Harare, Zimbabwe where he will also be assuming the Managing Director role for Nestlé Zimbabwe.

Gomes took the reins on June 1st, 2022, succeeding Asim Rifat, who has taken on the role of Business Executive Officer, Nestlé Nutrition Middle East, and North Africa.

Mercy will take over the helm of the company to replace the company's long-serving head Anthony Mandiwanza, who will be retiring from the organization with effect from 30 September 2022 after a distinguished tenure spanning more than two decades.

During her stint with the drinks maker, Rosemary has attained various notable achievements including being the Global Diageo Supply Chain Hero of the Year in 2019, Global Procurement Leader of the Year in 2018 and KBL Most Valuable Player in 2018.

She has been instrumental in embarking on a robust transformation agenda in packaging to improve overall culture and performance through focused actions around people, planning, asset care and capability.

Gomes will also become a board member of the Swiss Zimbabwe Business Chamber where he will play a role in transforming the Zimbabwean business community through fostering deep political and economic relations between Switzerland and Zimbabwe.

Kenya Breweries Limited names Rosemary Mwaniki as new Operations Director

KENYA – Kenya Association of Manufacturers (KAM) has named Rajan Shah, CEO of Capwell Industries as its new National Chairman to lead the organization for a two-year term.

Mr. Shah, who has served as Vice Chair since June 2020, takes over from Mucai Kunyiha whose term has come to an end.

To succeed Mr. Shah in his previous role at the association is Ms. Jane Karuku, the East African Breweries Limited Group Managing Director and CEO.

Ms. Karuku has also served on the KAM Board in various capacities, including that of the Chair of the Human Resource Committee.

NIGERIA – Olam has named Ashish Pande as the new Country Head of its food, feed, and fiber operating unit, Olam Agri in Nigeria, effective 23rd August 2022.

Before his new appointment, Ashish was the Managing Director & Senior Vice President of Crown Flour Mills, Olam's subsidiary in the West African country.

Having worked with the group for over 5 years, holding different positions, Ashish was instrumental in establishing Olam Agri’s animal feed business, successfully integrating the acquired Dangote Flour Mills, setting up Crown Flour Mills’ extensive fleet operations, and overall leading a successful wheat milling business in the West African country.

Ashish an Engineer with a master's degree in Business Administration, has more than 22 years of experience in the FMCG market having worked with several multinational companies across Africa, Asia, and Europe.

Meanwhile, the association has appointed Mr. Anthony Mwangi as the new Chief Executive Officer, effective 15th September 2022.

Mr. Mwangi has over 20 years of work experience and brings on board a wealth of expertise in public policy, government relations, stakeholder engagement, communications, and business development, cutting across the Transportation, ICT, Aviation, and Oil and Gas industries.

EASTERN AFRICA – Nestlé has appointed Luke Gomes as the new Cluster Head

(ESAR).

The cluster covers five countries, Zimbabwe, Zambia, Malawi, Mozambique, Comores, and Madagascar. The new boss will be headquartered in Harare, Zimbabwe where he will also be assuming the Managing Director role for Nestlé Zimbabwe.

Gomes took the reins on June 1st, 2022, succeeding Asim Rifat, who has taken on the role of Business Executive Officer, Nestlé Nutrition Middle East, and North Africa.

Gomes will also become a board member of the Swiss Zimbabwe Business Chamber where he will play a role in transforming the Zimbabwean business community through fostering deep political and economic relations between Switzerland and Zimbabwe.

Voltic (GH) Limited, a subsidiary of Coca-Cola Beverages Africa (CCBA), has launched Hollandia Choco Malt Drink in the country. The flavoured malt drink is a functional 3-in-1 beverage that combines all the goodness of milk, rich chocolate, and energy-giving malt in a ready-to-drink format for consumers. Packed with vitamins and minerals, the drinks come in handy pack sizes of 200ml and 300ml.

ww.volticghana.com

Kevian Limited has launched the apple cider ginger drink, a prebiotic drink that reportedly helps lower cholesterol, increase metabolism and maintain healthy blood sugar levels. The drink is comprised of a cold-pressed Apple Juice with a hint of ginger that can be enjoyed alone but also perfect for making cocktails for mocktails. It comes in stylish 380ml PET bottles and is available inleading stores in Kenya.

www.keviankenya.com

Nestlé South Africa has introduced NESTLÉ EVERYDAY, an affordable fortified medium fat dairy powder drink. NESTLÉ EVERYDAY is enhanced with locally sourced ingredients containing Calcium, Iron, Vitamins, and Zinc, to help build and strengthen immunity for the whole family. The nutritious powder drink is available in 250g packs. Each pack yields 1.75 litres of dairy drink. The product can be purchased at most informal and formal traders and retailers.

www.nestle-esar.com

Eastern Africa’s largest dairy processing company, Brookside Dairy Limited, has introduced a new range of fortified whole milk dubbed Brookside Plus+. Available in 1 liter carton packaging, the new UHT offering comes packed with fibre and vitamin A & D, aimed to give consumers nutrients that may otherwise be lacking in their diets.

www.brookside.co.ke

Richester Foods, a South Africa based company, has launched the first locally manufactured chewing gum dubbed Mintex. Individually wrapped for added hygiene and convenience, Mintex two-piece chewing gum sachets comes in three flavour variants: the traditional Peppermint, the cool Spearmint, and the Extra Strong for an intense burst of cool air. The gum is also vegan, gelatine-free and halaal, appealing to a broad consumer base.

www.richester.co.za

Dairy Group South Africa has introduced a new dairy brand dubbed, Creamline comprising of UHT milk, butter and dairy liquid blends. The UHT milk and dairy liquid blends are available in 1L composite carton boxes while the butter comes in a 500g pack. The new Creamline has joined the existing private label UHT milk produced by Dairy Group for both Usave and Checkers, brands under Shoprite Group.

www.dairygroup.co.za

Despite starting just before the Covid-19 pandemic, Maisha Beverages Company has produced and sold over 25 million bottles of soda to date. Theirs is a story of a company out to give African consumers wonderfully refreshing, incredibly tasty, and astonishingly affordable beverage alternatives to what they have been getting for the last 60 years.

By Paul OngetoAfrica’s soft beverage market is one of the fastest growing globally. Standard Bank, in its latest report, estimates the market to be worth US$14.703 billion by 2023. According to the report, the East African market is one of the most vibrant regional soft drinks markets with Kenya, its largest market, enjoying double-digit growth of 11% CAGR growth between 2008 and 2018. Despite robust growth in sales, the choice for consumers has been historically low, with American multinational beverage company Coca-Cola controlling up to 70% of the Kenyan carbonated soft drinks markets as of 2019 when the report was published. That same year, something interesting was brimming in the Kenyan beverage market: Maisha Beverages, a young but audacious company, was preparing to dive into the market with its flagship brand, Hola.

“We are here to provide better quality,

more affordable alternatives to the regional markets,” opens Brij Raja, the Chief Executive Officer of Maisha Beverages Company. "The increasingly discerning Kenyan consumer wants and needs unique, innovative flavors. The consumers are bored with the traditional flavors they have been getting for the last 60 years.”

Launching with a range of 5 drinks: 4 carbonated soft drinks and 1 energy drink, Maisha Beverages spiced up the market in September 2019. Hola Energy drink, a tasty and extraordinarily revitalizing drink, was the leader in Maisha Beverage's drinks portfolio. Brij confesses that since its launch, the drink has traditionally been the engine of the company's sales. “We call it our Liquid Gold,” he reveals.

Other brands in the original portfolio include Hola Mojito, a lemony-limey, slightly

minted soda that is sweet and slightly tangy; Hola Cola, a full-bodied cola soda with a lingering sweet taste of luscious caramel; and Hola Rose, a vivacious and vibrant, delicately sweet pink colored soda. Bright and Bold, the Hola Orange wrapped up the list of the 5 original brands that Maisha Beverages came to market with.

With the five different varieties, Hola was well on its way to giving Kenyans what they had long desired: "new, exciting and innovative flavors.” Brij and his team were, however, cognizant of the reality of the Kenyan market. "There are tens of millions who still have limited spending power," he confesses. “This market is not as mature as some more developed markets and still needs access to affordable drinks. We live and operate in a price sensitive market, and we must always keep this at the forefront of our minds.”

To reach all Kenyans, majority of whom live on less than US$2 a day, Maisha Beverages makes their signature Hola beverage brands available in 301ML PET bottles which are affordably priced at just KES36 shillings (US$0.30). "At Maisha Beverages, we believe in giving consumers a world-class product at an affordable price," he affirms. "We want people to enjoy superb quality drinks but to be able to also save their shilling."

We live through an age of disruption in the global consumer sector; the likes of which we have never witnessed before. To stay ahead, companies need to constantly innovate. Maisha Beverages being an innovator from the start is not taking chances. Brij reveals to us that his company collaborates closely with hand-picked European flavor houses to bring flavors suited for the Kenyan market. “These flavor houses look at all the global trends going on across the world,” he says. “We then sit down with them, brainstorm, and try to bring flavors that will work for this region's palate.”

So far, the company has been able to expand its range of energy drinks and soft drinks from 5 to 10: seven carbonated soft drinks and 3 energy drinks. The carbonated soft drink additions include Hola Very Berry, Hola Sweet Limao, and Hola Mango Special. The energy drinks that have been added to the range since Hola Energy brand took the market by storm in 2019 include Hola Energy Green, a peach and lemon grass-flavored drink with spicy but subtle flavor, and Hola Energy Red which is a red berry flavored drink with a touch of “tropical swagger”. Brij is proud to reveal to us that his company’s flavored energy drinks were one of the first in

AT MAISHA BEVERAGES, WE BELIEVE IN GIVING CONSUMERS A WORLD-CLASS PRODUCT AT AN AFFORDABLE PRICE. WE WANT PEOPLE TO ENJOY SUPERB QUALITY DRINKS BUT ALSO BE ABLE TO SAVE THEIR SHILLING

For the past 10 years, the Food Business Africa team has been closely following up on the progress the dairy sector has been making across the continent. We have covered everything from new product developments to the adoption of the latest technologies in the dairy sector. We have also highlighted how companies have embraced sustainable growth and made investments that have positively impacted different economies across the region.

Nigeria-based FrieslandCampina WAMCO has emerged as the African Dairy Company of the Year 2022 for its focus on high-quality dairy products, industry leadership, recent investments, adoption of latest technologies, and sustainable business practices that leave the communities and environment it operates in a better place.

FrieslandCampina WAMCO Nigeria PLC, an affiliate of Royal FrieslandCampina in The Netherlands, has been a key player in the Nigerian dairy sector since 1954 through its flagship brand Peak Milk. Commencing operation as

a net importer of dairy products into the country, the company was incorporated in April 1973 and commenced local production in 1975.

Since setting base in the West African country, FrieslandCampina WAMCO has expanded its offering from evaporated milk to the production of milk powders, infant milk, UHT milk, creamers, and flavored milk which are marketed in Nigeria in several brands including Peak, Three Crowns, Coast, NUNU and Olympic. These brands have not only become household names but are also credited for being pioneers in the local manufacturing of several dairy products in the country, including evaporated milk and creamers. They are also given credit for the introduction of fortified-based products, among other dairy firsts in Nigeria.

Despite being a subsidiary of a multinational dairy cooperative, FrieslandCampina WAMCO has redefined its operations to achieve localization prowess by addressing three national challenges i.e. nutrition security, sustainability, and good living for farmers. At the heart of the company’s operations is the passion to make quality dairy nutrition affordable and accessible. This is strongly rooted in the company’s mission statement of nourishing Nigerians with quality dairy nutrition and made possible by its innovativeness and extensive distribution network across Nigeria.

A stroll through the bustling markets of Lagos to Ilorin will validate this claim. It feels like walking through

a FrieslandCampina corporate display case with street vendors towering cans of peak milk, as shop attendants strategically hang sachets of Three Crowns milk powders at the shop fronts. In leading retail outlets, the company ensures all its brands are well laid-out along the dairy aisles, making it impossible for a customer not to catch an eye of them.

Following the COVID-19 pandemic outbreak, the dairy processor launched an e-commerce platform to cater to digitally savvy consumers and foster convenience for shoppers. Through e-commerce marketing across digital platforms, over 4 million consumers were reached in 2020 from zero in 2019.

It’s evident from FrieslandCampina’s wide placement of its products, that the company has perfected its route to

FRIESLANDCAMPINA WAMCO NIGERIA PLC HAS BEEN A KEY PLAYER IN THE NIGERIAN DAIRY SECTOR SINCE 1954 THROUGH ITS FLAGSHIP BRAND, PEAK MILK

THE PEAK DAIRY BRAND HAS BEEN PART OF FRIESLANDCAMPINA WAMCO'S PRODUCT PORTFOLIO SINCE ITS LAUNCH IN 1954

market. A review of its 2021 financial results indicates that the dairy processor earned a total revenue of N268.4 billion (US$636m). The performance, which was 34.5% higher than N199.5 billion (US$472m) attained in the previous year, was attributed to strong volume growth, a testimony to the high demand for its products. FrieslandCampina WAMCO ensures this demand is always met by availing products that align with consumers’ needs and demands. The company further builds consumer loyalty through its engaging customer-centric campaigns undertaken by the respective brands.

The company’s flagship brand, Peak, has over the years expanded to add more product lines from the evaporated and powdered milk categories, to the introduction of readyto-drink Peak UHT milk and flavored 3-in-1 milk powders i.e., Peak Chocolate and Peak Instant Tea Mix.

In 2013, the company launched the first and only maternal milk in Nigeria for pregnant and breastfeeding mums under the brand name Frisomum Gold. Coming in rice and wheat variants, the milk optimizes the baby's development through nutrition before, during, and after pregnancy. Frisomum's launch was in alignment with a key millennium goal aimed at improving maternal health and reducing infant mortality. The launch of maternal milk was followed by the introduction of Peak Baby, a new Infant Formula for babies aged 0 -12 months, and Peak 123 Growing Up Milk for children ages between 1 and 3 years

old. FrieslandCampina WAMCO stamped its dominance in the Infant and Toddler category (IFT) with the launch of Peak 456 in 2016 to provide specialized nutrition for kids aged 4 to 6 years. In a bid to showcase the importance of healthy eating among toddlers, Peak 456 since its launch has been undertaking yearly consumer education campaigns in schools by equipping teachers with the required knowledge and teaching aids to educate children on the importance of good nutrition.

The Peak brand has further moved into other valueadded products with the addition of a ready-to-drink line debuting Peak Drink Yoghurt in 2019, coming in strawberry, plain sweetened, and orange flavors. In the same year, FrieslandCampina WAMCO through its accelerator program Milkubator launched Milky Pap, a prepacked all-in-one powdered pap product that contains milk for protein, corn for energy, and also enriched with vitamins and minerals under a new brand known as Fristi.

Fuelling its second engine is the Three Crowns brand, which is positioned as Nigeria’s leading low cholesterol and heart-friendly milk. The brand was launched into the Nigerian market with evaporated milk in 1988 and extended into the milk powder category in 2015. Two years later, it launched Nigeria’s first locally produced Creamer. In pursuit to provide valuable experience and giving consumers strong reasons to buy the brand, Three Crowns has set itself apart to show care for mothers and acknowledge the important role they play in the family. To this end, the brand undertakes a yearly fitness challenge to encourage mums to cultivate a healthy lifestyle.

Further expanding its portfolio, the company acquired Nutricima’s dairy business from PZ Cussons Nigeria in 2020. The investment encompassed a production facility in Ikorodu, Lagos State, and its brands, Olympic, Coast, and Nunu; a range of powdered, evaporated and ready-todrink milk products. These brands have a good presence across the Nigerian dairy market and are set to strengthen FrieslandCampina WAMCO’s leading position in the sector.

It is important to note that all its production processes are regulated by the Commercial Dairy Ranchers Association of Nigeria (CODARAN) and the National Agency for Food Drug

THE NEW YOGURT PLANT STARTED BY PROCESSING 1.8M KGS OF MILK AND CAN ANNUALLY PRODUCE OVER 18 MILLION POUCHES OF DRINKING YOGURT.

and Administration Control (NAFDAC). Other than being locally certified, its operations align with internationally recognized standards such as FSSC 22000 Certification, ISO 9001:2008, and HACCP.

The growth of the brands has been majorly fuelled by huge capital injections into its operations. Some of the company’s recent investments include major renovations and improvements undertaken in the Powdered and Evaporated milk factories in 2016. In line with its policy of constantly exploring ways of optimizing operational efficiency, FrieslandCampina WAMCO in the same year commissioned a new ultra-modern and well-equipped finished goods warehouse with a capacity of over 14,000 pallet positions. This enabled the company to consolidate warehousing operations from five different locations in Lagos into a single new warehouse, improving efficiency in warehousing, distribution, and logistics.

Fast-forward to 2019, the company commenced operations at the state-of-the-art yogurt processing factory that enabled it to introduce the new Peak Yoghurt Drink range. Strengthening its yogurt production capacity, the company unveiled a mobile yogurt plant concept in 2021 to enable the production of yogurt drinks with a long shelf life from locally sourced fresh milk. The new yogurt plant

started by processing 1.8 million kilograms of milk and can annually produce over 18 million pouches of drinking yogurt.

Still, in 2021, FrieslandCampina Wamco accelerated growth with an additional processing line in the can factory, installed an end-of-line robotics sorting solution at the powder factory, and added a new lid supply line in the evaporated milk factory. In addition to that, a new homogenizer was installed at the recently acquired Nutricima operations, doubling its processing capacity.

To ensure constant production of its highly sort-after products, FrieslandCampina Wamco has channeled tonnes of resources towards boosting milk production in the country and improving the quality of the milk availed by dairy farmers. Being a trendsetter in Nigeria’s dairy industry, the company pioneered its first backward integration program in 1984 through the establishment of a dairy farm located in Vom, Plateau State. Since then, FrieslandCampina WAMCO has integrated all its operations and progressed into a more sustainable dairy value chain model named the Dairy Development Programme (DDP). The program was launched in 2010 with an investment of N21 billion (about US$50m).

DDP currently operates in various communities across the Southwest and Northern parts of Nigeria, covering the states of Oyo, Osun, Ogun, Kwara, and Niger. The DDP focuses on working with pastoralists, smallholder dairy farmers, and commercial farms, with support from various partners such as IFDC-2SCALE, Bles Dairies, Wageningen University, URUS, Barenbrug, Agrifirm, Federal Ministry of Agriculture and Rural Development (FMARD) and the Central Bank of Nigeria under different initiatives such

as the recently completed FDOV program and Value4Dairy, among others.

Through the Dairy Development Programme, local farmers are supported in the production of milk (yield per cow improvement), improving milk quality and hygiene, feeding, breeding, and farm management. The locally sourced milk from the farmers is collected through the company's Milk Collection Centers (MCC) which are 28 in total with a capacity of 85,000 liters. The milk is then transported to the WAMCO processing facility in Lagos, where it is processed into yogurt and other dairy products, in line with FrieslandCampina WAMCO's grassto-glass philosophy which seeks to ensure quality from the grass the cows feed on to the glass of milk taken by the consumers.

Some of the notable achievements attained by the DDP include improving the livelihood of over 120 communities and over 11,000 smallholder dairy farmers and pastoralists organized in 23 cooperatives. With improved dairy farming practices, the company recorded an increase in fresh milk collection from farmers, hitting an alltime high record of 40,000 liters of milk per day. In addition, it achieved

premium fresh milk quality levels with TPCs below 500,000 cfu/ml; increasing milk fat from 3.8% to 4% and total solids from 11% to 12%.

In 2019, DPP got a boost when the government assigned FrieslandCampina WAMCO 10,000 hectares at the Bobi Grazing Reserve in Niger State under a 40-year lease contract agreement in line with the CBN policy to discourage the importation of dairy products and other milk derivatives, of which the country spends about US$1.5 billion annually.

In its bid to widen the scope of the DDP and make it more inclusive, FrieslandCampina WAMCO, in partnership with key stakeholders, launched Nigeria’s first expertise dairy development hub, the Centre for Nigeria Dutch Dairy Development (CNDDD) in 2020. The Centre focuses on improving dairy productivity and sustainability through the entire dairy value chain in the country, supported by Dutch partners, who have experience and practice developed over a century. The CNDDD will strengthen cooperation among relevant stakeholders, including the Nigerian Government, dairy farmers,

academics, students, and key industry players.

Capacity building is engraved in the dairy cooperative’s DNA. To sharpen the skills of its over 700 employees, the company established a WAMCO Academy in 2019. The academy is a one-stop system and structure that provides generative and adaptive learning, leveraging technology. It is an L&D system for building competent people with the right skills, knowledge, and behavior required to deliver outstanding business results in a complex environment, accelerating its transformation culture from status

quo to high-impact learning and performing organization. Further navigating the wheels of doing business ethically, FrieslandCampina Wamco has availed a safe and conducive environment for its employees, substantiated by its 9 years of work without lost time accident (LTA) track record as of December 2021. The company also has a unique platform, dubbed Speak Up, that encourages employees and related third parties to speak up against malpractices and compromises on the fundamental Code of Business Conduct, Ethics, and Culture of FrieslandCampina, otherwise known as Compass. Through these and many other employee-oriented initiatives, FrieslandCampina Wamco has fostered an atmosphere that ignites team spirit, commitment, and loyalty to the business.

At the surface level, FrieslandCampina WAMCO seems to be ticking all the right boxes by having a wide array of innovative products, modern facilities with groundbreaking technologies, and even championing the country's dairy development agenda.

However, as a purpose-driven company, the owner of Peak Milk has strived to align its contribution to a sustainable world in line with the United Nations SDGs through its parent company’s Nourishing a better planet strategy. To this end, the company has prioritized offering better nutrition through its products by ensuring affordability to consumers and good returns to its member dairy farmers. To further improve milk output and quality, the company plans to train 75,000 local farmers through its Dairy Development activities by 2025. Alongside this, it seeks to source 100% of its agricultural raw materials sustainably and trace 95% of the materials by 2025.

In addition, the dairy processor aims to reduce over a third of its greenhouse gas emissions by 2030 compared to 2015 and become climate neutral by 2050 as it attains net positive biodiversity within the cooperative. One of the ways FrieslandCampina seeks to reduce harm to the environment is by utilizing better packaging. It targets that 100% of its packaging will be recyclable or reusable by 2025 and more than 99% of waste material will be reusable.

Going by its strategy, in 2019, FrieslandCampina WAMCO designed two recycling machines using scrap materials. This has helped the company achieve a 54% reduction of trademark wastes to landfills and a decrease in the cost of destruction by 91% in that year against a 2018 baseline. Through the Dairy Development Program, the company has promoted eco-efficient practices to safeguard the eco-system through the construction of 122 solar-powered boreholes as of December 2021, providing farmers with portable water. The dairy has also introduced hydroponics, a method of growing high-nutrient grass in harsh environments.

FrieslandCampina WAMCO has been lauded as a highly stakeholder-oriented business as its emphasis is not only on the products it sells but also on how the entire business contributes to the well-being of the system in which it operates. They have done this by deploying interventions for the advancement of society beyond commercial targets. Some of the notable initiatives undertaken by the company include ensuring the availability of quality dairy nutrition, especially among growing children through participation in school feeding programs; creating a link between industry and academia through championing knowledge transfer and fostering mentorship programs; and supporting charitable organizations and needy communities across the country through donations and kind.

Noteworthy, in 2019 following the outbreak of the COVID-19 pandemic, Frieslandcampina WAMCO was at the forefront in aiding the country to alleviate the negative impact of the pandemic. The company donated N500m (US$1.1m) towards Nigeria’s Covid-19 Intervention Fund through the Private Sector Coalition Against Covid-19 (CACOVID). This is in addition to the N100m (US$273,000) worth of products donated for distribution to 100,000 vulnerable families.

To acknowledge the company’s leadership position in the dairy sector and its key contribution to the economy, FrieslandCampina WAMCO has garnered tonnes of accolades and recognition both locally and internationally. In the previous year, the dairy company hauled over five awards from the Brand of the Decade and the Agribusiness Company of the year to the Best Tax Compliant Company in Nigeria. These add to the tonnes of awards received over the years since its inception, a testament to the company's leadership position in the region FBA

TO SHARPEN THE SKILLS OF ITS 7,000 EMPLOYEES, THE COMPANY ESTABLISHED A WAMCO ACADEMY IN 2018

Low-alcohol beer was for the first time brewed on a large scale during the American Temperance movement when a temporary Wartime Prohibition Act introduced in 1918, followed by the National Prohibition Act in 1920, was introduced to curb the consumption of alcoholic drinks. During that period, which lasted until 1933, it was illegal to trade any

alcohol that had an ABV level of over 0.5%, leaving brewers with little choice but to reinvent their beers into what at the time was a lackluster and less flavorful version of alcoholic beers.

Although the period was short-lived, the No and low alcohol (NoLo) drinks market remained resilient. What was previously dominated by low-strength beers is today

far more diverse, comprising a wide range of drinks from low and alcohol-free wines to zero-alcohol beers and Hard Seltzers. The innovation that has gone into this sector has jettisoned a once obscure and failing market into the mainstream, driving demand and threatening sales of all alcoholic drinks from beers and wines to vodkas and gins.

New research from IWSR shows that the once rare sector in the global beverage alcohol market grew by more than 6% in volume in 10 key global markets in 2021. The category now commands a 3.5% volume share of the industry, representing a 75% increase in global no- and low-alcohol consumption. The 10 key countries in which the category grew from US$7.8 billion in 2018 to slightly under US$10 billion in 2021 include Australia, Brazil, Canada, France, Germany, Japan, South Africa, Spain, the UK, and the US. IWSR is forecasting the no- and low-alcohol volume to grow by 8% CAGR between 2021 and 2025, compared to regular alcohol volume growth of 0.7% CAGR during that same period.

What used to be an annual phenomenon known as Dry January, a period when people around the world greeted the new year without alcohol, has morphed into a growing, year-round segment of the alcohol industry. Investors are taking notice and non-alcoholic spirits brands are landing top dollar funding. Canadian-owned non-alcoholic brewery Partake drummed up US$4 million in funding while CleanCo secured US$12 million. Recently, Diageo acquired a minority stake in Ritual Zero Proof to have a quick maneuver in the fast-growing sector. What is driving this craze for low and no-alcohol beers? What trends exist in this sector? Does it have the potential for future growth? This article seeks to find answers to these and many more questions.

According to the global alcohol market research firm, the

growth seen in 2021 was primarily driven by early innovation and investment in quality. The market for non-alcoholic beverages has grown to hold more than 50% share in the global beverage market in the past several years due to rising consumer preferences for healthy beverages enriched with nutrients.

A clinical study from the University of Oxford details that people who consume more than 17 units of alcohol in a week, equal to about five large glasses of wine or eight pints of beer, were found to have “older” DNA. This is one among many other studies that associate alcohol consumption with a good deal of health-related problems. Consumers are becoming aware of this health implication and are toning down.

Leaving alcohol entirely is difficult for many. Trading up high alcoholic drinks for those that have lower amounts seems to be the most natural option for many. These drinks are attracting more consumers because they not only offer the basic refreshment function but are also used as mood enhancements, fortified drinks, and satisfaction of sweet indulgences in the daily hectic schedule of consumers. According to YouGov and Portman Group’s research, the use of low and no alcohol products is being driven by current alcohol drinkers rather than teetotalers, with more than two-thirds at least trying alcohol-free drinks and a quarter being semi-regular consumers.

When cutting down alcoholic consumption, beer is the first option that comes to the mind of many consumers. According to the IWSR, the no/low beer and cider categories dominate the overall NoLo market, commanding a total of 92% share in the segment. The move to low and non-alcoholic beer could be due to familiarity or availability. Having been in existence since the temperance period, low alcoholic beverages certainly need no introduction to many consumers. Their production for decades means that the knowhow is relatively widespread and the production of high-quality low alcoholic beers has become relatively easy due to years of innovation and experience.

Over the past few years, the NoLo beer market segment has seen more and more big brewers throw their

weight behind 0% beers on a larger scale, further increasing supply. In 2017, Dutch multinational beer maker Heineken launched a 0% alcohol beer under its flagship brand Heineken. 4 years after launch, Heineken reached a key milestone of distribution across 100 markets. The company is now keen on expanding the market coverage to all regions where it is present “to help bring even more of our customers along on the journey.” But while increasingly larger brewers are shaping the category, IWSR says, smaller brands are working hard to carve a niche. IWSR adds that the segment is likely to become even more of a focus for smaller craft producers who can bring a diverse range of products to the market in the future.

Just as a majority of millennials and Gen Z consumers are turning to the NoLo drinks, a flurry of healthconscious drinks entrepreneurs is capitalizing on their urge to reduce alcohol consumption and live

healthier lives. The beverage industry is constantly being enriched by new, creative alternatives beyond simply alcohol-free beer, sparkling wine, and mocktails. For instance, NoLo alcohol wine grew by nearly 5% globally in 2020, making the strongest gains in the UK and US, according to IWSR.

The eager consumers who are looking for enjoyment in a bottle, but consciously avoiding alcohol, are turning to alternatives that offer a taste experience that comes close to the alcoholic original. In a January 2022 survey, MARTINI found that almost 35% of Germans approve of the development of alcohol-free

THE VALUE OF NOLO BEVERAGE MARKET IN TOP10 GLOBAL MARKETS

alternatives, while 80% of those surveyed for the Bacardi Cocktail Trends Reports 2022, wanted to integrate more NoLo alternatives into their day-to-day lives.

To support the surveys, IWSR details that the NoLo sector has remained resilient through the crisis, although the growth of NoLo spirits has been hampered by the absence of a fully functioning on-premise channel. Still, the pandemic has highlighted “that moderation and wellness trends continue to resonate with consumers,” IWSR observed.

As low and no alcohol drinks become more mainstream, manufacturers have turned to botanical extracts to bring out new flavors that align with the ever-changing consumer tastes and preferences. While brands such as Gordon’s 0.0% are created by distilling the same botanicals used in Gordon’s London Dry Gin, other distilleries are creating new non-alcoholic brands altogether, rather than a nonalcoholic version of an established brand. For example, Warner's distillery launched its 0% Botanic Garden Spirits in September 2020, which includes Juniper Double Dry and Pink Berry variants that are made with natural botanicals. Additionally, William Grant & Sons also launched low ABV ‘spirit’ brand Atopia in 2019 with flavor variants, including Spiced Citrus and Wild Blossom.

To further support the use of botanicals in beverages, Irish taste and nutrition specialist Kerry launched its “Botanicals Collection Zero”, a range of premium clean label, botanical extracts designed specifically for the lowand no-alcohol beverage markets. The portfolio included

15 standard products and 35 others, including juniper, rosebud, elder-flower, cocoa, turmeric, and cinnamon, which address consumer demands for moderation without compromising on taste and nutrition. During the launch, Kerry said the Botanicals Collection Zero will help beverage producers create sophisticated low-alcohol spirits and noalcohol options with the taste of gin, rum, cocoa, and ginger to be able to meet the emerging clean label and quality requirements.