They say that some dreams are valid - none of them has been as valid as our dream to enter the magazine publishing business nearly 20 years ago.

It all started with a trip back in 2004 to the US sponsored through the USDA Cochran Fellowship Program, where over the course of the program, I came across scores of magazines wherever we visited which covered all the spheres of the food industry - from baking, to meat, to the general food industryAmerican Institute of Baking, Kansas State University, the headquarters of commodity giants ADM and Cargill and many more interesting locations.

Eight years later in September 2012, we did register a business name that was premised on publishing Africa's first food industry magazine, out of South

Africa, which eventually was released in February 2013, with the title Food Business Africa.

It has been an interesting journey with Food Business Africa magazine over the last 9 years of publishing this ground-breaking magazine. It has has since become the most important and influential magazine focused on Africa's food, beverage and milling industry.

A lot has changed since the first issue of Food Business Africa landed onto the tables of the food industry stakeholders, and so has been the tremendous change in the food industry in Africa - where we have seen tremendous growth in the diversity of entrepreneurs, regional giants and multinationals investing in Africa's burgeoning food industry.

Over the course of the past decade, our business has changed substantiallyespecially in the last 3 years.

With six publications on our list of magazines - Food Business Africa, Food Safety Africa, CEO Business Africa, HealthCare Africa and Milling & Baking Africa and soon to be published, Packaging Africa, we have become one of the most important publishers of trade, industry focused magazines in Africa, out of South Africa.

Beyond the publishing of magazines, we are also one of the most well-known organisers of a growing list of eventsoriginally in the food industry (such as the AFMASS Food Expo events, Africa Food Safety Summit and a number of new events coming up your way), but also now into the healthcare sector (Africa Health & Wellness Expo), leadership and sustainability events (Africa CEO Summit), awards ceremonies, among others.

As we introduce to you Milling & Baking Africa magazine, our newest addition to our stable of magazines, we are pleased that we have stuck to our original goal of producing magazines that continue to change the African perception, and which celebrate the growth of the African economy, innovation and zeal.

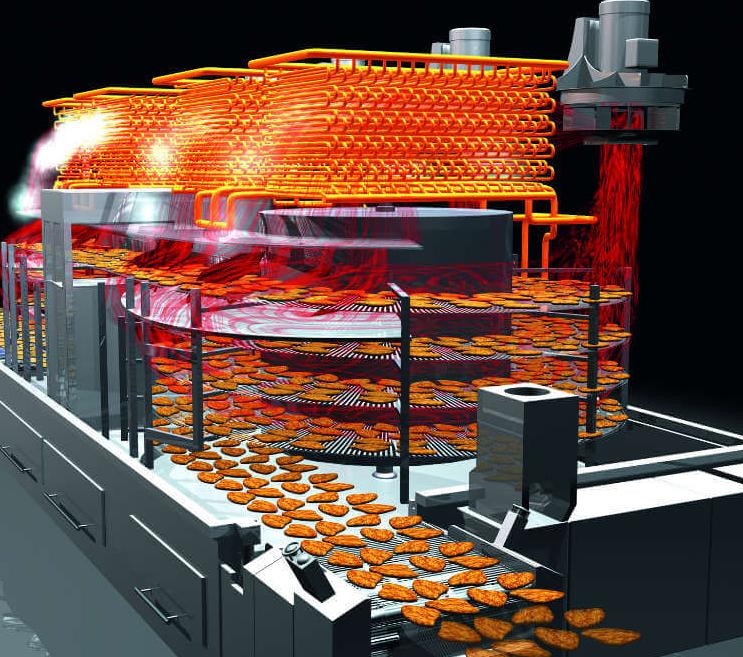

In this inaugural issue, we cover a number of key issues relevant to the grains industry in Africa. From a deep dive into the status of the grains industry in Uganda, to technical articles on yeast and its functionalilty in baked goods and animal nutrition, to latest trends in oven and feed peletting technologies, we have an issue of the magazine that will be worth your valuable time.

We wish you a delightful read.

Francis Juma Publisher1 Editorial 12 News Updates:

• Dufil Prima Foods merges with its 3 subsidiaries to bolster position in Nigerian market

• AfDB green lights US$1.5 billion African Emergency Food Production loan facility

• Le Duff snaps up Lecoq Cuisine to boost its bakery subsidiary

• Equity Group partners CFAO Group to support farmers increase output

• Cargill, Continental Grain finalize US$4.5b acquisition of Sanderson Farms

• Kenya wants greater share of Zambia, Tanzania and Uganda maize exports

• Tanzania Grain Board to invest US$8.7 M on construction of milling plants

• REMBE’s upgraded EXKOP isolation system is a safe and effective means of isolating enclosures

• Bühler launches latest optical sorter that cuts energy, water use by 50%

• Charles Ross & Son Co.’s Batch High Shear Mixers bring increased efficiency to mixing

• BoMill introduces new high-capacity grain sorting equipment

square metres of space and equipment for flour and grain analysis. A trial bakery with the latest machinery, including spiral kneaders, rolling machines, deck ovens and convection ovens, allows for extensive testing. Here, baking processes can be simulated, and the effects of enzymes and other ingredients tested. Tests can be run in collaboration with local mills, and the results quickly implemented in regular operations.

The laboratory will be under the direction of David Nolte. A trained miller, for 13 years, he has worked for Mühlenchemie as an Applications Engineer for Milling and Rheology. Commercial direction of the new location will be in the hands of Khalif Steinbrich, Area Sales Manager East Africa. He is very familiar with the African market and has extensive experience in customer consulting.

Flour treatment specialist Mühlenchemie has opened a new Technology Center in Nairobi, the capital of Kenya, in 2021. The subsidiary will operate as Stern Ingredients East Africa Ltd. From here, the MC Technology Center will help the milling industry in East Africa to maintain consistently high standards in the production of flour, and react more quickly to changing requirements in the markets and in raw materials.

The Kenyan location is of strategic importance for the African milling industry. The volatile grain market

presents East African mills with the challenge of responding ever more quickly to new conditions. Since the region is heavily agricultural, much of the raw materials like wheat and corn are locally sourced. With the analysis capacity of this new location, Mühlenchemie can develop solutions for individual needs and make them available to mills much faster. Furthermore, personal communication between customer and consultant from field to final product will be much more direct.

The heart of the new subsidiary is a baking laboratory and technical centre for development and consulting, with 400

“With its extensive outfitting, the new subsidiary will not just provide new impetus for the milling industry in its region, but will also be a milestone in the standardisation and enrichment of flour on the entire continent,” says Norman Loop, Regional Director Middle East & Africa at Mühlenchemie. “The new facility is intended as a knowledge hub for these specialists and for users, and will make communication and deliveries much faster.”

"Working together and creating solutions" is Mühlenchemie's motto in Africa. This motto keeps coming to life. Stern Ingredients Southern Africa will open its third site on the continent in Johannesburg before the end of 2022.

Dialogue. To us that means getting up and going to our customers, getting to know you and finding out what you want. Thanks to modern laboratories and production facilities close to our customers, we can quickly develop the right solutions and users can quickly test them. We like being close to our customers. Because that way, they get what they need.

ASHISH PANDE Country Head, Olam Agri, Nigeria

ESSAM EL-MADDAH HR & General Secretary Director, Danone Egypt & North East Africa

JUSTIN ARCHER COO East Africa & Group Head of Sustainability, Sucafina SA

CLAUDIA CASTELLANOS Managing Director, Black Mamba

JOACHIM WESTERWELD Executive Chairman, Bio Food Products

MILLICENT A. ADOBOE Co-Founder, Achiever Foods Ghana

CAESAR ASIYO Chief Development Officer, Victory Farms

SAINT-FRANCIS TOHLANG Corporate Affairs Director, Nestle East & Southern Africa

NICO ROOZEN Honorary President, Solidaridad Network

ROZY RANA Managing Director, Dormans Coffee

GAURAV VJ CEO, 260 Brands

BRETT THOMPSON Co-Founder & CEO, Mzansi Meat

ASHISH PANDE Country Head, Olam Agri, Nigeria

ESSAM EL-MADDAH HR & General Secretary Director, Danone Egypt & North East Africa

JUSTIN ARCHER COO East Africa & Group Head of Sustainability, Sucafina SA

CLAUDIA CASTELLANOS Managing Director, Black Mamba

JOACHIM WESTERWELD Executive Chairman, Bio Food Products

MILLICENT A. ADOBOE Co-Founder, Achiever Foods Ghana

CAESAR ASIYO Chief Development Officer, Victory Farms

SAINT-FRANCIS TOHLANG Corporate Affairs Director, Nestle East & Southern Africa

NICO ROOZEN Honorary President, Solidaridad Network

ROZY RANA Managing Director, Dormans Coffee

GAURAV VJ CEO, 260 Brands

BRETT THOMPSON Co-Founder & CEO, Mzansi Meat

Year 1 | Issue 1 | No.1 | Aug/Sept. 2022

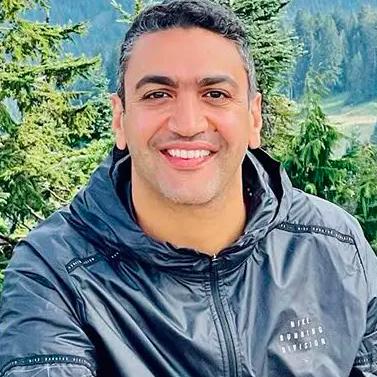

Francis Juma

EDITORIAL

Madeleine Orina | Paul Ongeto

ADVERTISING & SUBSCRIPTION

Jonah Sambai | Virginia Nyoro

DESIGN & LAYOUT

Clare Ngode

PUBLISHED BY: FW Africa

P.O. Box 1874-00621, Nairobi Kenya Tel: +254 20 8155022, +254725 343932 Email: info@fwafrica.net Company Website: www.fwafrica.net

Milling & Baking Africa is published 6 times a year by FW Africa. Reproduction of the whole or any part of the contents without written permission from the editor is prohibited. All information is published in good faith. While care is taken to prevent inaccuracies, the publishers accept no liability for any errors or omissions or for the consequences of any action taken on the basis of information published.

NIGERIA – Dufil Prima Foods Plc, Nigeria’s pioneer and largest producer of instant noodles, has merged and absorbed three of its subsidiaries De United Foods Industries Limited (De United), Northern Noodles Limited (NNL) and Pure Flour Mills Limited (PFM).

Merger of the four operations, focusing on noodles, pasta, wheat flour and vegetable cooking oil processing, is aimed at consolidating the company’s efforts in becoming one of the largest FMCG companies in Nigeria.

With Dufil Prima Foods Plc as the surviving and enlarged company, it is set be a stronger manufacturing

company that has the critical mass, product line diversity, structure, and market intelligence to compete in the same market as other big manufacturing companies.

Chief Operating Officer, Dufil Prima Foods Plc, Adesh Jain said, “This is a huge step towards consolidating our status as Africa’s largest pasta and instant noodle manufacturer.

“This is an attractive combination for stakeholders as customers will benefit from our wider and better-integrated array of products and services; and shareholders will have the opportunity to continue to participate in the success

of a bigger enterprise.”

Following the merger, the company still has two more independent subsidiaries in Nigeria i.e., Insignia Print Technology LFTZ Enterprise and Raffles Oil LFTZ Enterprise, alongside its Ghanaian operations.

UK – GA Pet Food Partners has invested US$104 million to build a new modern ingredient factory to enable it to meet the current demand.

The new production site called Ingredients Kitchen will be able to test, process and keep ingredients as well as ready-to-use products of the pet food industry.

The Ingredients Kitchen currently processes more than 600 ingredients by more than 130 distributors and has a couple of more useful features.

These include a Pick and Mix system,

a software watching every step of the production, a lander to store 5 million kg and two automated guided vehicles (AGVs) to bring products and ingredients around the factory.

The new Ingredients Kitchen offers the opportunity to test ingredients like wheat or rice in one of its laboratories to check quality and safety, as they enable a full traceability and a risk evaluation for the particular ingredient. GA also invested money in a new completely automated warehouse.

GA Pet Food Partners invests US$104m into a modern ingredient factory to meet pet food industry demand

Dufil Prima Foods merges with its 3 subsidiaries to bolster position in

THIS IS A HUGE STEP TOWARDS CONSOLIDATING OUR STATUS AS AFRICA’S LARGEST PASTA AND INSTANT NOODLE MANUFACTURER.

MOROCCO – Marrakech Fine Food (MFF), a Moroccan agrifood manufacturer, has inaugurated a US$7 million biscuit and chocolate processing factory.

This follows the signing of an investment agreement between the food processor and the government of Morocco in 2021 focused on industrial development and job creation in the Maghreb kingdom.

Opening of the new factory is set to create 80 direct jobs and boost local production of top-of-the-range confectionery.

Speaking at the inauguration, The Minister of Industry and Trade, Ryad Mezzour said that the new investment “will contribute to strengthening the industrial sovereignty of our country and to the development of national exports.”

MFF is part of the Imperium Holding Group. Through its MFF subsidiary, the Group has a leading market position in the high-end biscuit and chocolate segment, with a development strategy aimed at meeting market needs and to diversify its range of top-of-the-range products intended mainly for export.

AFRICA — The African Development Bank Group has begun disbursements of loans under its US$1.5 billion African Emergency Food Production Facility designed to help African countries avert a looming food crisis caused by Russia’s war in Ukraine and persisting impacts of the Covid-19 pandemic.

The facility seeks to produce an additional 38 million tonnes of food –worth US$ 12 billion – in Africa over the next two years.

The first beneficiaries of the fund are 850,000 Senegalese small-scale farmers, as the board of the developmental institution has issued €121 million (US$121m) loan to the West African country for implementation of an emergency agricultural programme.

Under the facility, Nigeria’s National Agriculture Growth Scheme – Agro has been granted a US$134 million loan to scale up food production and boost livelihood resilience.

In Egypt, the African Development Bank Board of Directors has approved a loan of US$ 271 million to finance the country’s Food Security and Economic Resilience Support Program.

The program includes two major components: Support for the Food Security Response and Build Private Sector and Fiscal Resilience.

The AfDB has also approved a

US$73.5 million loan to finance Tanzania Agricultural Inputs Support Project and a further €63 million (US$63m) to significantly boost cereals and oil seeds production in Kenya by over 1.5 million metric tonnes over the next two years.

The AfDB has also approved a US$8.1 million grant to South Sudan to fund the ongoing Agricultural Markets, Value Addition and Trade Development Project (AMVAT) which seeks to reduce

Moroccanconfectioner

Marrakech Fine Food opens new processing unit worth US$7m.

AfDB green lights US$1.5 billion African Emergency Food Production loan facility

NIGERIA — Nigeria’s leading integrated Food and Agro-allied group, Flour Mills of Nigeria Plc has reported a 45.3% rise in first quarter revenue to N339.6billion from N233.7billion reported in prior corresponding period.

The bullish top-line performance was supported by solid growth across all the company’s segments including the Food, Agro-Allied Sugar, and Supportive operations.

The Food segment attained 45% rise in revenue to N213.166 billion from N146.925 billion in 2021 while AgroAllied segment registered a 37% growth to N65.652 billion from N47.688 billion.

Its sugar portfolio saw a 64% revenue with stabilized trading environments and strong demand for brown sugar which is locally produced at its farm in Sunti.

Meanwhile the animal feeds business attained 21% revenue growth, driven by investments in logistics infrastructure and farmer training extension services across the country.

The interim results which were released to the Nigerian Exchange Group (NGX) indicated that operating expenses increased by 52% to N14.7 billion, versus the prior period of 2021 which stood at N9.7billion.

The miller continued to focus on investments enroute to consumer redistribution resulting in 8,000 new

outlets in Q1 2022 and launched new SKUs in the starch and fertilizer business segments, and commenced operation of fertilizer blending plant in Kaduna with a 90 tonnes per hour capacity.

Gross profit reached N33.2 billion in Q1’22, up from N25.7 billion in Q1 2021. In the period under review, FMN reported a nearly one per cent increase in profit before tax to N7.33billion in Q1 2022 from N7.26billion in Q1 2021, while profit after tax closed Q1 2022 at N5.49billion, representing an increase of one per cent from N5.45billion in Q1 2021.

The Group Managing Director Omoboyede Olusanya, in a statement, stated that despite the challenging socio-economic environment, the company continued to deliver strong business performance with resilience and operational excellence. “Our increased operational efficiency with

accelerated plans for our supply chain optimization, content localization, and cost optimization across our business segments has helped to cushion the sharp rise in the cost of raw materials.

“We would always be committed to our purpose of Feeding the Nation, Everyday through our offerings of quality products and services. The Group is dedicated to achieving sector strategic growth opportunities, both organic and inorganic with keen determination as we continue to create value for our shareholders.”

FMN forecasts future growth following the finalization of Honeywell Flour Mills Plc’s acquisition based on an enterprise value of N80 billion (US$193m). The miller announced its plan to acquire nearly 72% stake in HFM in November 2021, before receiving regulatory approval in May 2022.

the milling industry has put in place measures to protect companies from closing on account of grain shortages.

GMAZ Chairman Tafadzwa Musarara allayed fears that with grain shortages affecting millers, the sector could be forced to cut jobs. “We don’t anticipate any of the milling companies closing down on account of grain shortages,” Musarara told Standardbusiness.

and the market is well supplied and we believe that aggregate demand is slow and it will peak as we enter the agricultural marketing season."

ZIMBABWE

“We have a plan in place. We are currently operating at 45% capacity

The GMAZ secured 400,000 tonnes of maize as a means of ensuring food sufficiency in the country, following an invitation by Cabinet for private grain millers to commence maize imports using free funds to complement local stocks.

Moulins d’Abidjan (GMA), an agrifood company specializing in the production and marketing of flour and wheat products has invested US$15.7 million on 6 new cereal silos in Abidjan, Ivory Coast.

The new installations, which have a total capacity of 28,000 tonnes, allow the company to increase its storage potential in the nation to 50,000 tonnes of grain and achieve a crusher volume of 300,000 tonnes of cereals annually.

With the added capacity, GMA will be better positioned to meet the growing flour needs of the national market, both from consumers and from industrialists in the wheat-flour bakery sector.

“This storage capacity increase is one of our parent company Seabord Corporation’s objectives to be more competitive in the Ivorian millers’ market,” indicates Marc Alexy, deputy general manager of GMA.

This inauguration, which comes in a context of soaring wheat prices, should comfort the Ivorian government in its strategy to ensure a regular supply of wheat flour that meets the required standards in terms of safety.

SWITZERLAND Swiss technology group Bühler brought together decision makers from across the World at its Networking Days in Uzwil, Switzerland in late June, in a demonstration of the commitment of businesses to be at the forefront of tackling the climate crisis to protect and restore nature and biodiversity and close the gap in wealth distribution.

At the event, Bühler Group CEO, Stefan Scheiber, told guests from more than 1,000 representatives of the world’s leading companies from 95 countries in the food, animal feed, and mobility sectors that despite businesses recently facing myriad obstacles, the examples of vaccine research, advances in digitalization and the development of communication at scale during the lockdown all demonstrated the capacity of business to rise to global challenges when required. “We have experienced the power of science and innovation with industries collaborating at a new scale,” said Scheiber. “In our industries the innovation rate has never been as high as it is today, which creates impact because we need new technologies and widespread collaboration to tackle new challenges, and at the same time secure the future of our businesses in a responsible way. We need technologies, we need collaboration, and responsible leadership to shape the future.”

The 2022 event with the motto “accelerating impact together” focused on leadership, the need for corporate purpose, education, technology, and innovation, along with examples of how companies are leveraging technology to protect biodiversity, improve food security, and promote social equality.

Speaking at the event, Ranjay Gulati, Harvard Professor of Business Administration, and author of “Deep Purpose: The Heart and Soul of HighPerformance Companies”, warned company leaders not to get wrapped up in complex metrics around Environmental,

Social and Governance (ESG) and Corporate Social Responsibility (CSR) when companies achieve far more impact by having a clearly articulated social purpose.

In a session on how good business leadership is needed to mitigate climate change, Satya Nadella, CEO of Microsoft, said that in uncertain times leadership qualities could be distilled down to three key attributes: he told delegates that when assessing future leaders at Microsoft he looked for their ability to generate energy, deliver results under constraints, and create clarity when none exists. “We live in a complex uncertain world, there will always be ambiguity in our work, true leaders always bring clarity and make a call even during uncertain times,” said Nadella.

Speaking in the same session keynote speaker Christian Klein, CEO of SAP, the German multinational software corporation with over 400,000 customers globally, spoke of the need for leaders to thoroughly understanding their industry and business, especially when it comes to complexity within supply chains.

Delegates also heard from three startups driving sustainability through hightech advances in cellular agriculture, satellite monitoring of restoration projects, and carbon removal.

In a move to help achieve its own climate change targets to have solutions ready to multiply that reduce energy, waste, and water by 50% in the value chains of its customers by 2025, Bühler announced that it had assessed the impact of its different processing solutions, on waste, energy, and water consumption, land use and CO2e footprint, along with assessments of how the technological advances impact on the United Nations Sustainable Development Goals and the benefits for circular economy. “By evaluating the impact of our solutions, we can then start tracking their overall accumulative impact,” said Ian Roberts, Bühler CTO.

successful Networking

Grands Moulins d’Abidjan invests US$15.7M on 6 new cereal silos in Abidjan

provide essential agricultural inputs to vulnerable farming households before the main agriculture season starts in June. It will ensure that they can produce enough food to meet their needs for the months to come,” said Babagana Ahmadu, FAO Representative to the Sudan.

While the CERF donation is vital in attenuating the starvation threat, FAO added that another US$35 million is urgently needed to ensure adequate support for two million vulnerable farming and pastoral households in Sudan.

SUDAN — The UN Central Emergency Response Fund (CERF) has made a US$12 million contribution towards a new project to provide emergency agriculture and livestock supplies to thousands of farming and pastoral communities in Sudan.

The project aims to rapidly reduce dependence on emergency food assistance in a country where a decade high of 10.9 million people are faced with the looming threat of starvation.

Assistance covers the provision of crop, legume and vegetable seeds, donkey ploughs and hand tools, veterinary vaccines and drugs, animal feed, as well as donkey carts and productive livestock.

It also includes provision of cash and the rehabilitation of community assets such as small-scale water infrastructure, pasture and hafirs, or artificial ponds for harvesting rainwater.

“This generous contribution from CERF means that FAO can urgently

USA — Cargill and Continental Grain Company have finalized their US$4.5billion acquisition of Sanderson Farms, Inc. through a joint venture between the two companies.

Following the takeover, Sanderson Farms has been merged with Wayne Farms, a subsidiary of Continental Grain, forming a new privately held poultry business named Wayne-Sanderson Farms. Clint Rivers, currently CEO of Wayne Farms, has been appointed CEO of the combined company.

The combination of Wayne and Sanderson brings together two companies with different customer bases that could benefit from each other’s

strengths.

With sales in its 2020 fiscal year exceeding US$3.5billion Sanderson

Farms has a huge presence in retail stores such as H-E-B, Walmart and Albertsons with its trays of fresh chicken.

Wayne Farms, with annual sales of more than US$2billion, is largely focused on foodservice and restaurants, including Chick-Fil-A and Jack in the Box.

Together, the two companies would control roughly 15% of U.S. chicken production, trailing only Tyson Foods and Pilgrim’s Pride.

Wayne-Sanderson Farms will operate chicken processing plants and prepared foods plants across Alabama, Arkansas, Georgia, Louisiana, Mississippi, North Carolina, and Texas.

THE

AIMS TO RAPIDLY REDUCE DEPENDENCE ON EMERGENCY FOOD ASSISTANCE

faced by businesspeople in shipping in the produce, which has seen the cost of transport more than double.

The Treasury opened the import window in May to allow millers to bring in maize from outside of Africa duty-free. However, the processors said they could not ship in the commodity because of scarcity and high prices in the international market.

KENYA — Kenya is seeking to limit Zambia, Tanzania and Uganda from exporting maize to other countries at its expense in fresh efforts to curb the surge in maize flour prices and ease the pinch of inflation.

Kenya traditionally receives imports from Uganda and Tanzania, but trade flows in the grain have shifted to other countries, with the bulk of Ugandan maize now heading to South Sudan.

Countries in the region are also

competing for a limited white maize stock for both human consumption and manufacturing of animal feeds following disruption in the supply of the grain from Ukraine and Russia.

Agriculture Cabinet Secretary Peter Munya says the country has opened talks with the three countries to guarantee Kenya a share of the maize export to plug the shortfall in supplies.

Mr Munya also said the government would intervene on logistical challenges

USA — American packaged food company, General Mills has announced plans to acquire TNT Crust, a manufacturer of frozen pizza crusts.

TNT Crust manufactures frozen pizza crusts for regional and national pizza chains, foodservice distributors and retail outlets. Its net sales totaled approximately US$100m in 2021.

TNT’s products, which include partially baked and self-rising pizza crusts, “are highly complementary to General Mills’ existing frozen baked goods portfolio,” according to a company statement.

“This acquisition advances our Accelerate strategy and builds on our

strong position in the fast-growing awayfrom-home frozen baked goods category,” said Shawn O’Grady, General Mills’ group president of North America foodservice.

TNT also gives General Mills a deeper presence in frozen pizza, already having a presence in pizza and frozen offerings with Totino’s pizza rolls and Pillsbury Pizza Crusts.

As part of the acquisition, General Mills will acquire two manufacturing facilities in Wisconsin, and one in Missouri.

The purchase of TNT Crust is expected to be finalized in the first quarter of General Mills’ fiscal 2023 year.

The Kenya Nutrition, Health & Wellness Exhibitions are a range of weekend consumer expos and seminars that are targeted at creating and improving the consumer awareness on healthy living and general well being. The expos are held over the weekend to ensure the attendance of the entire family.

The goals of the Kenya Nutrition, Health & Wellness Exhibitions are:

• Provide a forum for food and beverage processors, distributors and importers to interact directly with consumers, with a goal of informing the consumers of the unique features and benefits of their products in relation to healthy eating and living;

• Provide a forum for providers of health, personal and home hygiene products to interact directly with consumers

• Bring together medical, nutritional, healthcare and wellness experts and practitioners face to face with consumers to discuss disease management, lifestyle choices, diet management, wellness goals and practices with a view to imparting the right knowledge to the consumers;

• Provide a platform for a number of industry associations and corporates to interact with consumers and the community, with a view to

TANZANIA — Tanzania Cereals and Other Products Board (CPB) is set to invest US$ 8.7 million to construct three new maize flour and paddy processing and milling plants with the aim of strengthening its competitiveness and exploring the emerging trade opportunities in the East Africa region.

The first facility is a maize-cassava composite flour processing plant to be set up in the city of Mwanza, with a value of US$2.1 million upon completion and an estimated daily production of 125 tons of flour mixtures made from maize and cassava.

The second plant is a paddy milling factory set to be constructed in Keyla district Mbeya region, with an expected daily production capacity of 96 tons of rice. The third factory will be installed in the town of Mzizma and is expected to have a processing capacity of 100 tons of maize flour per day.

The funds will also enable the CPB to install new warehouses and silos in order to increase its grain storage capacity to 600,000 tonnes, compared to the current 120,000 tonnes.

KENYA — The Government of Kenya has issued additional tariff exemptions for genetically engineered Bt. cottonseed cake, distillers’ dried grains with solubles, and rapeseed cake to address rising feed costs.

With the exception of Bt. cottonseed cake, the June gazette requires most feed ingredients to be 99.1 percent free of GE content to benefit from market entry and duty exemptions.

However, this threshold effectively excludes GE-derived products like DDGS. Kenya’s primary feed constraint remains a lack of an adequate supply of ingredients from non-GE producing countries.

International supplies of key feed ingredients are dominated by GE-producing countries, making conventional alternatives relatively scarce.

Additionally, advance contracting of

conventional crops reduces the supply of non-GE soybeans available for shortterm buying, complicating purchases for immediate delivery.

The revision stipulates that import of yellow corn, Soybeans, soy meal, sunflower cake and white sorghum must be accompanied by a certificate of conformity issued by KEBS, must only be used for the manufacture of animal feeds and must have been imported on or before October 31, 2022.

LIBERIA – Liberia’s rice value chain is set to benefit from a EUR 4 million (US$4.3m) support from the European Investment Bank (EIB), aimed to boost performance of the sector and enhance food security in the country.

The overall investment program is expected to support the entire rice value chain, improving production, building irrigation, upgrading food laboratories, enhancing warehousing and logistics.

This will in turn reduce Liberia’s dependency on rice imports to improve food and nutrition security and create local jobs in rice production, storage and distribution. It will further reduce the impact of the war in Ukraine and recent global economic shocks on Liberia.

Over the coming months, detailed feasibility studies will identify priority investment that can transform rice production in Liberia and enable large scale financing across the sector.

“The European Investment Bank is committed to scaling up investment to strengthen food security, improve domestic agricultural production and create jobs and reduce the impact of global food supply shocks on local consumers,” said Ambroise Fayolle, European Investment Bank Vice President.

Tanzania Grain Board to invest US$8.7 M on construction of milling plantsCOMMODITY TRADE

Liberia to cut on rice imports dependency courtesy of US$4.3m support from EIB

BRAZIL — Brazilian biofuels company

BSBIOS is set to put up an initial investment of US$58.25 million into the construction of the first large-scale ethanol plant in the state of Rio Grande do Sul processing wheat.

The project will be developed in two phases. The first phase is designed with an annual production capacity of 111 million litres of ethanol with production set to start in the second half of 2024. The second stage will expand the capacity of the plant to 220 million litres by 2027.

Currently, Rio Grande do Sul imports 99% of its ethanol to meet demand, and the new plant will supply 23% of this need by 2027 when it reaches full capacity.

The BSBIOS investment comes as part of the State Policy of Stimulus to Ethanol Production, which created the State Program for the Development of the Ethanol Production Chain (ProEthanol) to encourage more production within the state, a region not well-suited

for growing sugarcane for ethanol.

BSBIOS also has partnered with Biotrigo Genética, a leading company in genetic improvement of wheat in Latin America. The company is working on

the genetic development of two wheat cultivars with high levels of starch exclusively for ethanol production.

in the animal feed space and is set go towards accelerating the implementation of localized, sustainable complete feed production in sub-Saharan Africa.

The grant will directly fund 21 Hendrix4U complete feed production projects initially in Ghana, Ivory Coast, Nigeria and Uganda.

USA — Post Holdings, an American consumer packaged goods holding company, is set to invest US$110 million to expand its cereal production capacity its Sparks, Nevada facility.

The investment will address capacity constraints, reduce transportation costs and to serve West Coast customers more efficiently.

Project planning and implementation will begin immediately and once the expansion is completed— projected for 2025— it will create approximately 30-40 new jobs.

“Adding capacity in Sparks will help us balance our network geographically and provide us with greater flexibility to best serve our customers,” said Nicolas Catoggio, President and CEO, Post Consumer Brands.

AFRICA —– Nutreco, a Dutch producer of animal nutrition, fish feed and processed meat products, has received a US$4.8 million grant to establish feed mills to hard-to-reach communities in Africa

The grant, awarded by the Bill & Melinda Gates Foundation, is one of the first investments from the foundation

Hendrix4U provides a ‘factory-in-abox’ for rural areas ensuring access to quality compound feed production for small-scale producers, in a financially sustainable way, said Nutreco.

In addition to the facilities themselves, feed-producing distributors will learn how to evaluate raw materials in terms of quality and nutritional values to validate the use of local crops for specific animal nutrition applications.

The plant expansion is as wager that demand for its portfolio of cereals will continue as it is and with 34.4 million people living on the West Coast, making up roughly 11% of the U.S. population, according to U.S. Census data, Post has a large market base there.

The plant addition appears to be the newest construction project for Post, after having announced last year plans to spend US$86 million to construct a new 215,000-squarefoot manufacturing facility in West Jefferson, Ohio.

THE PLANT WILL SUPPLY 23% OF RIO GRANDE DO SUL'S ETHANOL BY 2027 WHEN IT REACHES FULL CAPACITY.

hard-to-reach communities in AfricaFOOD SECURITY

Post Holdings to invest US$110M to expand Nevada facility cereal production capacity

significantly reduce its imports

Rice is one of the main food products imported into Cameroon. According to the National Institute of Statistics

CAMEROON — The Islamic Development Bank (IsDB) has approved a loan of US$ 176.12 million to the Cameroonian government to contribute to rice self-sufficiency and enhance economic growth.

The objectives will be achieved through the development of 5,000ha of land; rehabilitation of roads; construction of markets; construction of storage facilities; establishment of rice processing units; capacity building of farmers and other stakeholders; and access to finance.

This would result in an increase in rice productivity from 4.5 Ton/Ha to 6 Ton/Ha, an increase in rice National production by 10%, the creation of 210,000 jobs and a reduction in postharvest losses.

The Cameroonian Minister of Economy, Alamine Ousmane Mey, who was also present at the meeting, said the resources will be used to promote the local rice sub-sector via the Rice Value Chain Development Program. With this initiative, the government seeks to boost the local production of rice and

China, Zambia sign agreement on soya bean meal, stevia exports

ZAMBIA — Zambia and China have signed two protocols on sanitary and phytosanitary export of soya bean meal and stevia leaves to the Asian country.

The protocols were signed by Chinese Ambassador to Zambia Du Xiaohui and Zambia’s Minister of Agriculture Mtolo Phiri in the presence of Zambian President Hakainde Hichilema who said it was a mark of true friendship between China and Zambia.

“We are very delighted that we have another market for our agricultural products,” said the president, noting that the move will ensure more trade cooperation between the two countries, which will create more jobs in Zambia.

The Chinese envoy said after signing the two protocols that China will strengthen its cooperation with Zambia in the agriculture sector.

The deal comes on the heels of an announcement by Zambia’s Ministry of an increase in soya bean production in the 2021/2022 farming season. With an estimated production of 475, 353 metric tonnes, oilseeds stakeholders have allowed the Grain Traders Association of Zambia-GTAZ to export 100,000 metric tonnes of soya beans.

This will allow the traders to participate in soya beans marketing and venture into the export market, which will in turn be of benefit to the entire value chain which is key to future expansion of

(INS), in the first half of 2021, rice alone accounted for 5% of Cameroon’s total imports, which amounted to US$ 2.9 billion for 5.07 million tons of goods.

soya beans production in Zambia, one of Africa's leading producers.

SINGAPORE — Olam Agri, the food, feed and fiber agribusiness subsidiary of Singapore-based Olam Group, has secured a US$200 million loan from the International Finance Corporation (IFC) to boost food production.

Olam said the loan will be used to finance the purchase of wheat, maize and soy from Canada, Germany, Latvia, Lithuania and the United States.

The commodities then will be delivered to Olam’s processing operations and customers in developing countries, including Bangladesh, Cameroon, Chad, Egypt, Ghana, India, Indonesia, Nigeria, Pakistan, Senegal, Thailand and Turkey.

The loan is a part of IFC’s broader efforts to address food insecurity in light of rising food prices driven by impacts of COVID-19, adverse climate events and the ongoing RussiaUkraine war.

The goal is to help ease food price inflation, particularly in fragile, conflict-affected, and poorer countries that are net food importers, which are among the worst affected, and where food purchases comprise an outsized share of disposable incomes.

MOROCCO — The new International Center for Agricultural Research in the Dry Areas (ICARDA) Morocco gene bank officially opened on May 18 in Rabat, Morocco.

The ICARDA Morocco genebank offers the key to climate-resilient traits that can help strengthen global crops in the face of stresses such as soaring temperatures, pests, and water scarcity.

It conserves and researches an impressive collection of 95,000 accessions (groups of plant genetic resources) collected from the region, including wheat, barley, chickpea, faba bean, lentil, and forage genetic material.

This plant and seed matter are the ancestors of today’s crops that evolved in the wild, in the harsh environment of

to conserve ICARDA’s entire genetic resource collection for up to 100 years before regeneration.

It also includes new, cutting-edge technology that allows for research

water scarcity and heat.

The new genebank has been designed with cold rooms large enough

on species within strictly controlled environmental conditions, essential to identifying useful traits in crops for climate adaptation.

The facility— the third that ICARDA has established since the research center was founded in 1977— supplements ICARDA’s existing genebanks at Svalbard in Sweden and Beirut in Lebanon.

Olam Agri secures US$200

M IFC loan to boost food production ICARDA furthers aim to fortify global crops with a new genebank in Morocco

THE GENEBANK OFFERS THE KEY TO CLIMATERESILIENT TRAITS THAT CAN HELP STRENGTHEN GLOBAL CROPS AGAINST SOARING TEMPERATURES AND PESTS

Agthia has been on a deal-making spree in an effort to become the biggest food and beverage company in the region by 2025.

In May, Agthia announced expansion into Saudi Arabia with a greenfield investment worth Dh90m (US$24.5 million) that will be used to set up a manufacturing unit in the kingdom.

EGYPT — United Arab Emirates food and beverage group Agthia is poised to take a 60% stake in Egyptian snacks company

Abu Auf Holding, subject to regulatory approvals.

After completion of the deal, which is subject to regulatory conditions, the founders will hold 30% and TCV, an Egyptian private equity firm which invested in Abu Auf in 2019, will hold a 10% stake.

Abu Auf, located in New Cairo,

manufactures a range of consumer products sold via the direct-to-consumer channel and through 200 retail outlets in Egypt, and three that recently opened in the United Arab Emirates. The business supplies markets in the Middle East, Asia, Europe and the US.

Financial terms were not disclosed for the stake in the Egyptian company, which generated revenue of AED236m (US$64.2million) in the year to 31 December and EBITDA of AED58million.

USA — Do Good Foods (DGF) has announced plans to invest up to US$100 million in an animal-feed production facility near Fort Wayne International Airport in Idaho which will create up to 100 new jobs by the end of 2024.

Launched in 2021 Do Good Foods is a sustainable foods producer that uses surplus from grocery stores and farmers markets to produce nutritious animal feed.

Do Good’s mission is to reduce and ultimately eliminate food waste. Each Do Good Chicken saves approximately four pounds of surplus groceries from being thrown away, preventing approximately three pounds of greenhouse gases.

The 150,000-square-foot facility

will allow the company to divert food waste from up to 450 supermarkets and repurpose about 60,000 tons of food waste on an annual basis.

Based on the company’s job creation plans, the Indiana Economic Development Corp. (IEDC) committed an investment of up to US$1.2 million in the form of incentive-based tax credits and up to US$100,000 in conditional training grants.

Construction is expected to be complete in late 2024 and production to begin in early 2025. The facility will reduce the amount of food waste, and the associated greenhouse gas emissions, in surrounding landfills.

AGTHIA HAS BEEN ON A DEALMAKING SPREE IN AN EFFORT TO BECOME THE BIGGEST FOOD AND BEVERAGE COMPANY IN THE REGION BY 2025.

USA — REMBE, a leader in the innovation of high-quality combustible dust explosion protection safety systems, has introduced a new and improved EXKOP isolation system, a safe and effective means of isolating enclosures.

The REMBE EXKOP is available for more applications, including ST2 dusts and features reduced explosion pressures of up to 2 bar and larger diameters. The upgraded controllers allow for flexibility as process requirements change.

Isolation is required per NFPA (National Fire Protection Association) and is essential to protecting adjoining system components against the spread of combustible dust explosions.

Process equipment is usually connected by pipelines through which, if an explosion occurs, fire and pressure spread very rapidly. REMBE’s EXKOP isolation system, consisting of a control panel, triggering devices, and one or more quench valves, can stop this sequence of events.

In the case of an explosion, the EXKOP controller receives a trigger signal from a burst indicator on a REMBE explosion panel, an infra-red signal, or a pressure sensor.

It then activates the connected EXKOP quench valves. These close within a few milliseconds and thus protect adjacent plant components. After being triggered, the quench valves can once again be put back in operation at the touch of a button.

UK — Swiss food technology group Bühler Group has launched its latest optical sorter for wheat, rye, oats, grains, coffee, and pulses: the SORTEX H SpectraVision.

Using British and Swiss engineering, the sorter offers three key benefits for customers: unmatched ease of use, high performance, and enhanced connectivity contributing to increased sustainability.

The SORTEX H also delivers up to 50% higher reject concentrations. Its

enhanced connectivity increases value for processors with over 500 data points that can be downloaded every second and sent to Bühler Insights to optimize and track performance.

Processors can monitor and control their machine performance from anywhere in the world, in line with Industry 4.0 standards. Real-time tracking of sorting performance and emergency warnings are also possible thanks to the SORTEX Monitoring System.

The SORTEX H SpectraVision is available for purchase globally and has already been installed at numerous customer sites around the world, including Spain’s first oat mill, Harivenasa.

The company which specializes in producing and supplying highquality oats and other cereal-based products had a seven-module SORTEX H SpectraVision machine installed last year in its brand-new oat mill.

“We’re extremely happy with the SORTEX H because it’s very efficient, boosts our productivity, and we get much better quality now than we previously did in terms of unhusked grains, defects, black spots and so on,” said Alberto Loizate, managing director for Harivenasa-Alea.

REMBE’s upgraded EXKOP isolation system is a safe and effective means of isolating enclosures

Bühler launches latest optical sorter that cuts energy, water use by 50%

A SLIM mixer assembly with Progressive Spiral Porting creates a vacuum that draws powders directly into the high-shear zone and rapidly disperses individual solid particles into the liquid vehicle.

High-quality dispersions, suspensions and emulsions are thus produced in dramatically less time. The SLIM can also be used to introduce minor liquid components and create fine emulsions.

Its method of powder addition is said to reduce the formation of lumps, prevents floating powders, eliminates dusting and accelerates mixing time.

“The SLIM is well-proven for hardto-mix powders, including thickening agents like CMC, xanthan, guar, gum arabic, carrageenan, alginates, pectin and starches,” said Christine Banaszek, sales manager, Charles Ross & Son Co.

Additionally, it enables a cleaner and more operator-friendly method of raw material addition, minimizing dusting in the plant atmosphere.

To raise and lower the High Shear Mixer in and out of the mix vessel, the company offers a floor-mounted design equipped with an air/oil hydraulic lift. Safety limit switches prevent operation

USA — Charles Ross & Son Co. has debuted new Batch High Shear Mixers equipped with Solids/Liquid Injection Manifold (SLIM) technology that deliver powders in an efficient manner for instant wet-out and complete dispersion into low-viscosity liquids.

“In conventional mixing systems, such challenging powders are added very slowly into an agitated batch — prolonged mixing is often necessary to ensure complete dissolution or dispersion.

The SLIM offers a much simpler method: rapid addition of powders without subsequent agglomeration,” Banaszek added.

of the mixer while in a raised position or without a mix vessel in place.

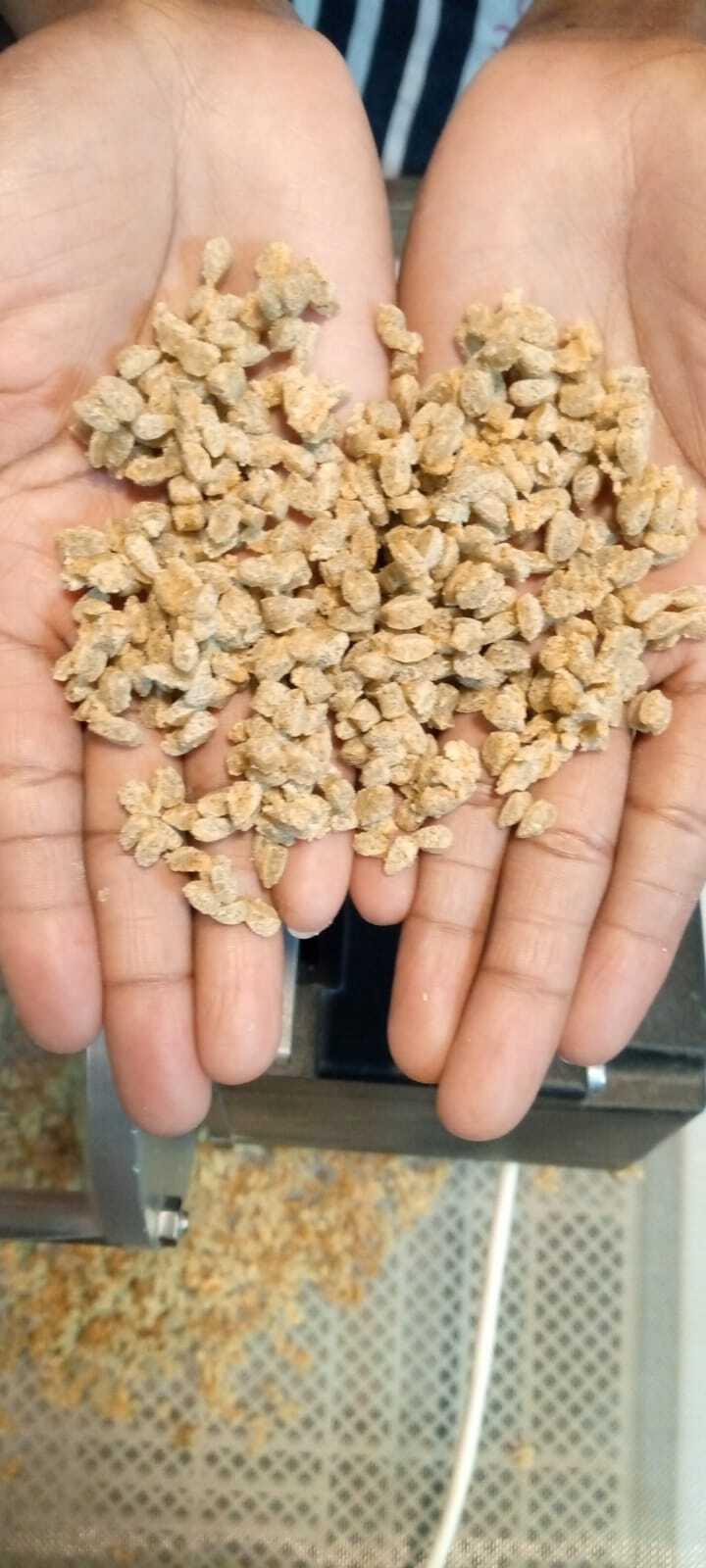

SWEDEN — Swedish agritech company BoMill AB has introduced BoMill InSight, an industrial grain sorting equipment that can sort grain lots kernel by kernel, at speeds up to 15 tph on each kernel’s internal properties.

Based on BoMill’s proven quality sorting technology using Near-Infrared Transmittance (NIR-T) spectroscopy, BoMill InSightTM is built on a brandnew technological platform developed with versatility and low total cost of ownership in mind.

It can also analyze about 125 000

kernels per second, responding to highly demanding industrial standards.

The BoMill InSight brand illustrates the unique ability of the equipment to uncover what cannot be seen, by looking inside each single kernel and sorting each individual kernel according to its internal quality parameters, at industrial speed.

Its modular design, composed of a light and sturdy frame with up to eight sorting modules, allows an efficient set-up and installation to suit different configurations, low utility consumptions, simplified maintenance to maximize customers’ uptime and an upgradable capacity to suit customers’ future needs.

USA — Reading Bakery Systems (RBS) has introduced a flexible, reliable, and more efficient system to make pita chips and a variety of other baked crisp products.

With a growing trend for healthconscious eating, product innovation relies on flexible equipment to perfect bakery products.

The new innovation adds to its portfolio of Healthy Baked Snack Systems, making pita chips that offers

snack manufacturers flexibility.

According to RBS, the new fully automated pita chip production system builds on the RBS Multi Crisp Technology with an additional multi pass proofer, pita dicer and a high heat application during the baking process.

In addition to Thomas L. Green sheeting equipment, the new system also incorporates a convection oven and dryer.

These, together with the multi-pass proofer, create an efficient solution that

delivers consistent quality within a relatively small space.

Beyond pita chips, this line can also produce other multi-crisp snacks by bypassing the proofer and pita slicing steps. The System is modular with a capacity of up to 1,000kg/hr depending on the number of oven zones.

The standard system includes a 3-Roll Sheeter, Gauge Roll, Optional Rippled Gauge Roll, Rotary Cutting Station, and Spectrum Oven and Dryer System.

offers enhanced quantitative analysis of peanut residue.

The Veratox for Peanut Allergen test is a sandwich enzyme-linked immunosorbent assay (S-ELISA) that is validated to detect three primary allergenic proteins in peanuts (Ara h 1, Ara h 2, and Ara h 3).

The new Veratox VIP for Peanut assay is very sensitive and able to detect low levels of peanut protein while remaining fast and easy to use,” said John Adent, Neogen’s President and CEO.

USA — Neogen Corporation has announced the release of Veratox VIP (Veratox Improvement Platform) for Peanut assay, an enhanced version of the Veratox for Peanut allergen test, which

This innovative quantitative test features an optimized antibody combination and extraction procedure for high specificity to all types of peanut protein, particularly further-processed peanut.

“It was very important that we offer a solution that gives producers confidence as they navigate this changing landscape.

The test optimizes sensitivity and flexibility across sample types while maintaining the rapid time-to-result and simple testing procedure standards set by the Veratox product line.

This product has been validated in a wide variety of product types, including both minimally and further-processed products. This flexibility makes the assay appropriate across different food manufacturing and laboratory environments.

Using

Founded in 2019, Böna Factory is an Africa-focused food startup burning with ambition to solve the continent’s food security problems. Before Böna, attempts have been made towards solving Africa’s food security crisis. In fact, billions of dollars have been pumped into development programs aimed at unlocking Africa’s food potential as the world’s grain basket. Although noble in motive, these development programs have not achieved much, years after they were first initiated.

As recent as 2020, more than one in five

people in Africa faced hunger—more than double the proportion of hungry people in any other region, according to report by Brooking’s Education. Böna’s seeks to change this narrative by tapping underutilized plants and crops to create nutritious meals for consumers from all walks of life.

Having been in the Africa food industry scene for more than 10 years, Sara Ahlberg, Founder and CEO of Böna Factory, simply found food security development programs to be a repetition of the same without any meaningful results. “While Europe is taking huge leaps in future food technology and science, we in Kenya still put millions on projects thinking how to store maize in a hermetic bag and how to sell cash crops to the European food industry,” Ahlberg tells Food Business Africa Magazine.

Frustrated with the lack of results, Ahlberg tried in vain to convince old employers and some international companies to focus on African markets. “The only solution was to start something which is right to do,” she says. The desire to do the right thing gave birth to Böna Factory. “This is not just something we try out for a sake of being in a start-up scene, this is something we can truly build and create something new,” a confident Sara says.

Sara reveals to us that her company is focusing on plant-based foods, given their proven potential to sustainably feed the world population. Plant-based foods are already a market sensation in Europe and North America where consumer concern for the environment and need to guarantee future food supplies is driving demand. A report by Bloomberg Intelligence even predicts that the plant-based market will undergo explosive growth in the next 10 years and could make up to 7.7% of the global protein market by 2030, with a value of over US$162 billion, up from US$29.4 billion in 2020.

Settling on plant based and gluten free innovations was therefore a no brainer for Sara. This is the future of the food industry and therefore the perfect solution to Africa’s food problems. Sara describes the shift to plants as a “plantastic fantastic revolution.” To have the greatest impact, Sara and her team at Böna are targeting customers from all walks of life. “We

are not focusing on niche specialty category of vegan and gluten free foods but streamlining new innovative options for all the consumers.”

Being based in Kenya, Böna Factory is out to offer its customers meals that they know, love, and enjoy but with what Sara describes as a Böna twist to make them even more exciting.

The company’s flagship product is known as Bö Pasta, a (dry) high-protein and high-fibre plant-based gluten free meal that has yellow grams and cassava as the main ingredients. Several variants of these products exist in the market with spirulina, greens, beetroot, chili, baobab, moringa, and lemon used interchangeably to bring out exciting flavors. The use of a diverse range of ingredients makes it easier for consumers to have more nutritious meals easily, diversifies their diets and helps them get a wider range of nutrients from one source, according to Sara. Although unique in both formulation and taste, Bö Pasta is already creating a buzz in Kenya’s food industry with over 5,000 packs already served to both first and repeat customers.

Bringing food to more Kenyan homes has been the target from the start and the company is already exploring other local meal options that Kenyans already know, love and enjoy. Under the company’s Hakuna Matata Series the company is planning to roll out ready-toeat meals for busy and urban consumers who don’t want to spend their time cooking. “We

start with githeri, with a Böna twist, ugali and greens, and peanut plantain with rice,” Sara reveals. “All these are amazing traditional plant based, naturally vegan and gluten free foods from Kenya, but of course with our Böna twist.” With the Hakuna Matata series Sara also hopes to enhance access to healthy and nutrition meals in addition to providing meal options that Kenyans will consider rather than going to burgers, pizzas and chicken wings.

Böna stands out from peers for its mission to have a lasting positive impact on the food system. For this reason, Sara and her team have made Research and Development a key pilar of the business. “Research and development are most crucial for Böna; we are driving for new innovations for consumer convenience from neglected crops and plants,” She says. According

to the Böna CEO, Africa has thousands of underutilized plants and crops, but our food systems have pushed few crops (maize, wheat, sugar, rice and soy) to even 80 % of products. Through R&D, the company is tapping into these rarely used crops to provide new options, mainstreamed in availability, accessibility, usage and pricing. So far, the company has managed to use plants such as baobab, moringa, spirulina to bring out quite interesting food profiles. “This makes it easier for consumers to have more nutritious meals easily, diversify their diets and get wider range of nutrients from one source,” Sara explains.

Work in this department is certainly not slowing down any time soon as Böna has ambitious plans for tomorrow. “In the future, we will launch our plant-based milks, designed now especially for the local consumer taste and usage, and our main target is in “plant-based protein products” or “the meat alternatives”,” Sara reveals. “For these, several steps need to be done, but we can assure, these will be amazing and change a lot in the industry!”

Globally animal based foods are responsible for over 30 % of the greenhouse emissions and are also significant drivers of deforestation and water pollution. Operating in the more environmentally friendly plant-based market

therefore puts Böna a step ahead when it comes to sustainability.

“Sustainability is inbuilt in all our operations,” Sara boasts. The company, according to Sara, focuses on plant-based innovations from crops and plants that are largely climate smart, drought resistant and adapted naturally to the ambient conditions. This reduces the need to invest in further practices such as fertilizer and irrigation which can also have an impact on the environment. When it comes to innovation, Sara reveals that Böna focuses on products where it can provide a better alternative for animal-based products. “Also, these products are combined from different ingredients to ensure better biodiversity through seasonal availability, regional differences and avoid increasing monocropping systems,” she adds.

“Food waste is also a huge food security and economic loss in Africa, partly because of lack of processing capacity,” Sara points out. Through R&D, Böna is working to tackle this challenge by providing food products that are packed with modified atmosphere (MAP), extending the shelf-life of the meals significantly up to two weeks.

Beyond the factory, Böna is working to build solid partnerships with local and regional farming communities for value addition and

better livelihoods. This is however a work in progress. “At the moment, we are still forced to buy through middlemen and traders, which is increasing our purchasing prices, but also decreases traceability and quality unfortunately,” Sara reveals. “Let’s take an example of our pasta – it’s impossible to get grinding quality we would require for us to ensure high-quality products, which now impacts our product quality directly.” By working with farmers directly, Sara hopes Böna will help farming communities transition to highly productive modern farming systems. “This is how we can create value at the source level, and Böna can focus on the consumer product processing.”

Back at the factory, the company is also looking after the welfare of its workers so they can sustainably manage their lives. “This means good employment, good salaries, and workfree time balance,” Sara explains. “Also, for employees, we are looking to provide day care for children to providing basic health care and legal services for our employees as these are taking a lot of time and resources for people.”

Böna has been commercial only from end of 2021 but has been there since 2019. The journey has been long but Sara is proud of what she has been able to achieve thus far achieve. “Starting

a business as a foreigner in Kenya was a first huge step which needs to be acknowledged,” Sara boasts. The journey was not easy as Kenya, unlike Europe lacked the necessary infrastructure to support a food startup with goals as ambitious as the one Sara envisioned for Böna. If Böna was to start in Europe, all Sara needed to do is to tap into existing food hubs for her products R&D and then transfer production to contract manufacturing which is also available in enough capacities. Sadly, in Kenya, “there are no contract manufacturing possibilities,” Sara points outs.

This made it difficult for her to affordably innovate and develop new products. Even putting up the first R&D stage facility up and running took a while but Sara was unflinching in her resolve to be part of the solution to Africa’s food security problem. Teaming up with other partners and directors, she pulled together resources that were enough to get the company from the ground. Böna also received funding from EU Horizon2020 program for food safety research and product development. “This has allowed us to focus on innovation, and to trial what’s possible to do with the ingredients on

hand.”

Getting products to market has also not been easy for Böna given its unique product offering. “Launching new products has been challenging in terms of not meeting the standards as such, and fitting those categories has been a bit weird,” Sara explains. “How to name a new product in a category which doesn’t necessary exist yet? We have not been able to figure it out yet.” How to reach large consumer groups in informal sector has also been a million-dollar question for the Nairobi based startup. “At the moment we are going through the urban shops, online stores and major supermarket chains in Kenya,” she reveals. These channels although satisfactory for now, Sara knows that they may not serve them full in the future, but she has a plan when that need arises. “We are looking for direct delivery systems especially when we have more product options.”

Böna’s target from day one has been the large consumer groups, low-income and mid-income mass markets. “At the moment, we can’t reach them as our capacities are too small, but we

THE START-UP LACKED THE NECESSARY INFRASTRUCTURE TO START OFF BUT THE AMBITION OF THE TEAM HAS PAID OFF

are building towards that,” Sara reveals. “Solid product development processes have been done, and we have learned from the sourcing to markets and consumers and updated the plan to provide better products.” With the progress made so far, Sara is confident that Böna is ready to enter the next step in its growth plan. This will however require an investment of 600,000€, according to the CEO. The funds will be particularly useful in getting Böna the technology, machinery, and infrastructure required to run the production at a level that will push more Böna products to the market. Sara cannot wait for this next step to happen. “With smart choices, deep industry knowledge and good planning we can definitely create something robust, flexible and suitable for our current and even more, future needs.”

Kenya has seen food startups launch and fold a few months or years down the line. Sara is however committed to her course to see Africa’s food industry transformed. “I am a food industry professional; this is not just something we try out for a sake of being in a start-up scene, this is something we can truly impact and create something new,” she says. Her long-term vision for the company is however to have it taken under the fold of investors with necessary capital and expertise to expand its reach and impact. “I would see that the business would

be ready to be sold for right investors certain targets have been achieved,” she admits. What she and her team will be looking for when that time comes is an investor that shares Böna vision of contributing to Africa’s food security. “We need to keep in mind, we have very unfortunate examples globally how old, traditional, simply wrong investors are buying out new businesses, but are lacking the deep vision, creativity, desire, and even organizational flexibility to create and sustain change at the level original founders saw it required,” Sara explains. “Many have failed because of this, and I will not want this to happen with Böna.” But first things first, Sara and her team are working to achieve the company’s short-term goals. “We need to ensure we have built our own cuttingedge, example leading manufacturing plant to lead the way for new food industry, and, we have strong academic relationships to region’s educational institutions to ensure high-tech learning, innovation, and creation processes.”

SOLID PRODUCT DEVELOPMENT PROCESSES HAVE BEEN DONE, AND WE HAVE LEARNED FROM THE SOURCING TO MARKETS AND CONSUMERS AND UPDATED THE PLAN TO PROVIDE BETTER PRODUCTS.

Provide a brief profile of Bühler’s operations in Nigeria and West Africa

Bühler operates from four different locations in West Africa and Central Africa to be closest to the market and customers: Abidjan, Ivory Coast (sub-regional headquarters); Lagos, Nigeria; Kano, Nigeria and Douala, Cameroon.

In Abidjan, we have a Management, Customer Relation and Customer Service Team with about 14 people covering West and Central Africa, as well as the CICC (Cocoa Innovation and Competence Center). The CICC is a fullyfledged cocoa processing plant on lab-scale, which our customers and partners can use for recipe, process, and product development as well as training with their and our experts.

In Lagos, we are present with a team of 25 people. We offer support in project conceptualization, technical consulting, project management, installation, and commissioning as well as prompt and reliable after sales services. We have just moved into a brand new office – feel free to visit us any time.

In Kano, we have a Sales and Customer Service Team with 4 people. We believe in the North of Nigeria to be the market of the future. We are currently building the Grain Processing Innovation Center (GPIC) in Kano –a fully fletched application mill for whole-grain products. Upon completion in Q1 2023, we will be able to support the Nigerian agribusiness and milling industry to successfully master the transition from a predominately wheat-importoriented industry to a diverse one, utilizing various local grains, which are produced and processed in Nigeria itself.

This will help Nigeria to gain food independence, improve food security and reduce the forex-burden that wheat importation generates. The GPIC will also become our Center of Competence for local grain milling with a sophisticated technology setup. We will use also use the facility to conduct trainings to improve the skill level available in Nigeria.

We started building up a Team based in Douala, Cameroon, which will cover the Central African Region.

What is the role of bühler in facilitating the growth of the food and milling industry in Nigeria?

We are heavily investing in our setup in Nigeria to facilitate the growth of the Nigerian agroand food processing industry through an holistic support approach covering support in conceptualization, business modelling, technology supply and financing solutions: Bühler is a one shop one stop solution provider.

What solutions does Bühler provide to the key sectors of the economy in west Africa?

A: Milling, grains, noodles, pasta and animal feed - Bühler provides full industrial solutions for grain and oilseed handling and milling including grain handling (cleaning, drying, storage, ship- loading and unloading) as well as milling and bulk/big pack/10-50kg bagging.

Commodities that we cover include but are not limited to wheat, rye, maize, oats, sorghum/ millets, pulses, teff/fonio, soya, rapeseed and sunflower.

Further, Bühler provides pasta plants for durum/wheat and gluten-free / local grain pasta as well as instant noodle lines (Asian Noodles). We also provide industrial solutions for animal and aqua feed plants.

B: Cocoa, chocolate and confectionery - Bühler offers industrial solutions for cocoa processing (from cleaning till pressing) as well as full chocolate, compound and spread processing solutions (chocolate mass till moulding). We also provide solutions for sugar grinding, nut grinding (nut butter) as well as various confectionary products (creams, marshmallow, cereal/snack/nut/protein bars).

C: Snacks and baked goods such as biscuitsBühler took over the Austrian company Haas, market leader in wafer and biscuit processing in 2016. Now Bühler is providing full solutions from grain intake till finished value-added product (e.g. wafer or biscuit). This allows us to support our customer taking advantage of the circular economy: Increasing profits while

reducing CO2e emissions: e.g. food parks, downstream integration.

Bühler also offers solutions for extruded snacks (e.g. chin-chin, cheese balls, etc.) and breakfast cereals (corn flakes, extruded products such as wheat pillows, choco shells, rice crispies, loops, etc).

What are the opportunities for the food industry in west Africa to adopt new technologies such as digitalization? What are the challenges ?

Opportunities: Vast and rich arable land, young work force, increasing wheat prices due to the war in Ukraine – this demands demand for sustainable local starch and protein sources.

Challenges: Access to finance, unstable political climate, security issues and inefficient supply chains.

What are the opportunities to incorporate sustainability in the food industry in West Africa?

Sustainability is becoming increasingly important not only in developed but also emerging markets.

The supply chain disruptions triggered by the Covid-19 and Ukraine crisis have shown that countries have to become more self-sufficient in terms of food supplies: Prices for energy and logistics are soaring, wheat availability is at stake and power supplies are inconsistent.

Bühler can support customers in leveraging

circular economy dynamics to add value to side-streams and by-products (e.g. from bran to animal and aqua feed or biscuits/wafers/baked products with nutritional benefits), add further value to intermediate products (e.g. from flour to biscuit/wafer) and use husks and shells to generate energy (bio-combustion).

We have executed several food park projects around the world (including Egypt and Angola), which can be multiplied in various geographies. Also, on a smaller scale, we have helped customers to turn their low-value by-products into added-value products.

What are Bühler’s future plans in Nigeria & West Africa?

We will support countries, governments, customers and partners with 360° support from conceptualization over business planning, financing, technology, training and after-sales support out of our knowledge hubs in Lagos, Douala and Abidjan.

For this, Bühler has already invested substantially into our infrastructure (CICC, Abidjan) and is continuing to do so (GPIC, Kano). In parallel Bühler, is building up capacities and capabilities within the region. We are expected to grow to a team size of about 100 by 2025. This will allow us to respond faster to our customers’ needs while we follow the credo: In the region, for the region.

Not many African countries are as well-endowed as Uganda, especially in Eastern Africa, where countries such as Kenya, Somalia, Rwanda, Burundi, Southern Sudan and even Ethiopia are reliant on significant and rising food imports to meet their surging needs for basic food products. Only Tanzania has the potential and capability to match and surpass Uganda, with both countries still at their infancy in developing vibrant agricultural sectors that

can tap into their rich potential in fertile soils, vast land resources and abundant rainfall.

Uganda is a significant producer of important commodities in the region, and whose demand keep on rising, either regionally or internationally: maize, rice, sorghum, cassava, millet, tea, coffee and a number of oilseeds such as soybean, groundnuts and sunflower. The country is also a leading producer of bananas.

While coffee and tea are traditional cash crops grown mainly for export, Uganda’s maize, beans, ground nuts, and rice crops are the

By Francis Jumaprimary agricultural commodities that are consumed locally and traded within the East African Community (EAC) and COMESA region.

According to the government of Uganda, Uganda has a comparative advantage in the region for its grain production and is considered to be the food basket of the region, with more than 2.5 million households deriving their income and employment from the grains sector in Uganda.

It also adds that grains are important commodities of socio-economic and political importance in the country. With one of the fastest growing and youngest populations in Africa and rapid urbanization, the demand for grain as food for consumption, ingredients for manufacturing animal feed and to serve the growing regional trade is bound to increase substantially as the country approaches 2030 – laying the foundation for Uganda to urgently seek new ways to increase production on the farm, reduce food losses and streamline vital grains supply chain infrastructure.

The quest for Uganda to take advantage of the rising opportunities, is however, hampered by a number of challenges, including inadequate supply due to low production and productivity, volatility of agricultural commodity prices, inadequate storage facilitates and minimum value addition.

There is urgent need for policies and strategies to increase production and productivity; address post-harvest management challenges and promote value addition to ensure competitive supply of quality grain and grain products, adds the government in its National Grain Trade

Policy, which is being implemented in 2018-22, and outlines the strategic policy actions that will transform the grain sector to ensure sustainable and accelerated growth in grain production, quality storage, value addition and trade volumes.

According to the Policy, the shortage of standardized storage facilities, unreliable electric power supply and high costs, as well as high interest rates for financing among other issues, pose serious challenges to the sector.

In terms of storage, the country lacks governmentowned storage facilities, thereby relying on private sector investments by the members of the Uganda Grain Traders Association who have constructed some storage and processing facilities. The national standardized storage facilities for maize only caters for only 12% or 550,000 MT out of 3.2 million MT of total production, hampering the significant trade with some organizations like the World Food Program (WFP), and other trade with regional countries such as Kenya, South Sudan and Rwanda.

Uganda has made some noticeable strides in the production of key commodities over the past few decades, with some exceptions.

Maize, which has increasingly become the country’s staple after the banana crop, has seen its contribution rise significantly over the last 20 years, with production rising from 800,000 MT in 2000 to a peak of 3.442 million MT in 2018, later dropping to below 3 million MT in subsequent years, with a forecast of 2.8 million MT in 2022, as per FAO

region.

The country’s maize consumption has kept pace with its production, rising from 776,000 MT in 2000, to 2.2 million MT in 2010, hitting 2.7 million MT in 2022, hence leaving minimal volumes available for regional trade – meaning that the recent stagnation in production volumes after hitting the highs of 2018 leaves Uganda with little to take advantage of rising regional demand.

Rice, another important crop, increased from 71,000 MT in 2000 to a peak of 154,000 MT in 2014, before slipping to a projected 137,000 MT in 2022. In terms of consumption, the country’s domestic consumption has nearly doubled since 2000, from 120,000 MT to 236,000 MT in 2019 and a projected 197,000 MT in 2022. Wheat consumption, which still lags behind other Eastern African giants like Kenya, Ethiopia and Tanzania has seen significant increases from 131,000 MT in 2010 to a high of 560,000 MT in 2020 and is expected to fall to 475,000 MT in 2020.

Uganda has made some of the most astonishing achievements in coffee production, as former regional giant Kenya lags far behind, as it threatens to dislodge Ethiopia as Africa’s largest coffee producer. Hitting an eye-watering 6 million-60 kg bags in 2021, Uganda is on a roll, as a focus on new Robusta variety plantations, favourable weather and government support has seen the country double its production from a low of 3 million bags recorded in 2012.