FREIGHT’S AGE OF A.I.

MARINO OPENS NEW CONTAINER DEPOT in port of Mobile, Alabama

ROAD PRICES HIT APRIL RECORD as double-digit inflation remains

ROADONE ADDS ACE TRANSPORT MIAMI to its national network

GEBRÜDER WEISS USA OPENS NEW AIR

MARINO OPENS NEW CONTAINER DEPOT in port of Mobile, Alabama

ROAD PRICES HIT APRIL RECORD as double-digit inflation remains

ROADONE ADDS ACE TRANSPORT MIAMI to its national network

GEBRÜDER WEISS USA OPENS NEW AIR

IN MIAMI

ISSUE 5

Manifest Vegas is the largest global supply chain and logistics event that brings together the most comprehensive ecosystem of innovation and transformation.

4500+ TOTAL ATTENDEES

1500+ SHIPPERS 1000+ STARTUPS & INVESTORS

250+ WORLD-CLASS COMPANIES

50+ COUNTRIES REPRESENTED

“Manifest Vegas exceeded my expectations on the ease to network, interact and find solution providers as well as companies who are seeking similar solutions. I would definitely recommend attending this conference.”

BeelianOng

The average adult spends most of their day looking at a screen. Checking their news feed, in front of their computer, on social media, online shopping, watching TV. Be on those screens. •

•

The ultimate in customer engagement. Mobile usage now outweighs desktop, so give your audience a focused, useful portal where you control the content and they remain interested.

•

Welcome

We have our usual selection of US-specific articles, with a smattering of global ones as well. We also have an interesting feature titled Freight’s age of A.I. has already begun, and we'll be publishing an issue soon that focusses on A.I. and its influence on our industry. Oh, and it's a long shot, but if you're planning to go to Multimodal in Birmingham (that's the original one, in the UK) in June, we'll see you there!

Tim, Designer, FORWARDER magazine

AIR FREIGHT

If it flies and it's freight, we'll feature it.

SEA FREIGHT

If it floats and it's fr... you get the idea.

ROAD FREIGHT

By far the largest share of cargo transport in the USA.

RAIL & INTERMODAL

The second stalwart; road's right-hand man.

PROJECT CARGO

Oversized, heavy, high-value or mission-critical stuff.

PORTS & HUBS

Gateways to the wider world.

TECH & DIGITISATION

From data to drones. Welcome to the future.

EXHIBITIONS & EVENTS

From promo to expo, don't risk FOMO.

CUSTOMS & SECURITY

If only COVID had been subject to this...

INDUSTRY SERVICES

Everything from freight forwarding to insurance.

CRISIS RESPONSE

The latest emergency, from money to monkeypox.

RECRUITMENT & TRAINING

Growing, perfecting, and certifiying your business.

MERGERS & ACQUISITIONS

The other way to grow your company.

MEDIA & MARKETING

This is a vital industry. Let's shout about it!

GIVING BACK

Environment. Fundraising. Charity. The feel-good stuff.

CRAIG EDITOR-IN-CHIEF craig@freightsolutions.com

WILL CONTRIBUTING EDITOR editor@forwardermagazine.com

PAUL MEDIA /EVENTS MANAGER paul@forwardermagazine.com

+44 (0)1454 275 946

TONY SALES EXECUTIVE tony@forwardermagazine.com

+44 (0)1454 628 795

OMAR SALES EXECUTIVE omar@freightsolutions.com

+44 (0)20 3872 6909

TIM DESIGN & PRODUCTION tim@forwardermagazine.com

MOHIT DIGITAL & SOCIAL mohit@freightsolutions.com

ADVERTISERS

Manifest ...inside front

Freight Solutions...intro

Atlantic Pacific...p11

DF Alliance...p13

FreightApp.design...p32

Gaston Schul...p42

ForwardingJobs...p53, p59, p60

Headford Group...p62

Freight Mergers...p69

FreightWebsite.design...p74

FORWARDER directory...p114

FORWARDER magazine...inside back

AIR FREIGHT

If it flies and it's freight, we'll feature it.

SEA FREIGHT

If it floats and it's fr... you get the idea.

ROAD FREIGHT

By far the largest share of cargo transport in the USA.

RAIL FREIGHT

The second stalwart; road's right-hand man.

PROJECT CARGO

Oversized, heavy, high-value or mission-critical stuff.

PORTS & HUBS

Gateways to the wider world.

TECH & DIGITISATION

From data to drones. Welcome to the future.

EXHIBITIONS & EVENTS

From promo to expo, don't risk FOMO.

CUSTOMS & SECURITY

If only COVID had been subject to this...

INDUSTRY SERVICES

Everything from freight forwarding to insurance.

CRISIS RESPONSE

The latest emergency, from money to monkeypox.

RECRUITMENT & TRAINING

Growing, perfecting, and certifiying your business.

MERGERS & ACQUISITIONS

The other way to grow your company.

MEDIA & MARKETING

This is a vital industry. Let's shout about it!

Environment. Fundraising. Charity. The feel-good stuff.

Abu Dhabi Airports, the owner and operator of five airports in the emirate of Abu Dhabi, welcomed the first SF Express cargo plane to Abu Dhabi International Airport.

The inaugural flight signalled the launch of operations for the global freight leader for the first time in the region. This strategic partnership is in collaboration with Etihad Cargo and Kerry Logistics, and further strengthens Abu Dhabi International Airport’s position as a key regional cargo hub.

Chinese-based SF Express, one of the world's largest providers of express logistics services and solutions, has gained significant attention in the logistics industry due to its recent international expansion strategy. With its sights set on strengthening its position as a major logistics and cargo player, SF Express has made impressive breakthroughs by launching operations between China’s Wuhan and Abu Dhabi.

Speaking about this achievement, His Excellency Eng. Jamal Al Dhaheri, Managing Director and Chief Executive Officer of Abu Dhabi Airports said: We are proud to welcome SF Express to Abu Dhabi. This marks a new milestone in our efforts to become a leading cargo and logistics hub in the region. We eagerly anticipate further partnerships as we continue our growth journey to establish Abu Dhabi as a major air cargo hub in the region.”

By partnering with industry leaders Etihad Cargo and Kerry Logistics, SF Express is set for success in the Middle East. With Etihad Cargo's prominence in the air cargo and logistics industry and Kerry Logistics' strong presence in the region, SF Express will be able to tap into the expertise and resources of these global providers, resulting in higherquality and more reliable service delivery for their customers.

Working with Abu Dhabi Airports will undoubtedly be a significant milestone and we are confident that this partnership will be beneficial for all parties involved. Abu Dhabi Airports is an important cargo hub in the region, and we are eager to work together as we connect and create value for our customers and strengthen our growing network.

Li Sheng, Chairman, SF AirlinesEtihad Cargo is fully aligned with the emirate of Abu Dhabi’s vision of becoming a global logistics hub. The inaugural SF Express cargo flight’s arrival in Abu Dhabi marks the beginning of a partnership between Etihad Cargo, Abu Dhabi Airports, SF Express and Kerry Logistics that not only supports SF Express’s Middle East expansion plans but also benefits Etihad Cargo’s customers, adding another mega hub gateway in China to Etihad Cargo’s growing global network, further strengthening cooperation between Abu Dhabi and China.

Martin Drew, Senior Vice President – Global Sales & Cargo, Etihad AirwaysAbu Dhabi International Airport has been determined to establish itself as a prime air cargo and logistics hub by forging new strategic partnerships. This new announcement further bolsters its standing in the region and is an important move to foster the growth of logistics business in the Middle East.

DHL Express upgrades its fleet with the order of nine Mammothconverted B777-200LR freighters

First delivery expected in 2024, with aircraft to replace older B747 freighters

Renewal of long-haul aircraft fleet strengthens DHL’s intercontinental air network

State-of-the-art aircraft support goals of Deutsche Post DHL Group's Sustainability Roadmap

DHL Express has ordered nine Mammoth-converted B777200LR freighters from Jetran. The first cargo aircraft will be delivered in 2024, with the remaining aircraft to be supplied until early 2027.

This agreement is part of the overall sustainability priority to modernize DHL Express’ long-haul intercontinental fleet, including the replacement of older planes. Ordering converted freighters with a shorter useful life provides an efficient bridge between current and new airframe technologies, such as new generation wide-body freighters B777-8F and A350F.

We are excited to welcome Mammoth-converted B777-200LRFs to the DHL Express family. With the modernization of our intercontinental fleet, we can simultaneously enhance our proven ability to meet growing demand, improve our environmental footprint and deliver best quality service to our customers. We are pleased to continue demonstrating to partners and customers alike how these advancements elevate our service and bring us closer to our Sustainability Roadmap goals. Robert Hyslop, EVP Global Aviation, DHL Express

The Mammoth converted B777-200LR freighter promises similar characteristics and benefits as the production freighter and is an ideal fit for DHL. With a payload capacity of 102 tons and a range of 9,200 kilometer, the B777F has the largest capacity and range of all twinengine freighter aircraft and is more reliable than older B747 planes. It is also more fuel-efficient and reduces CO2 emissions by 18 per cent compared to legacy airplanes.

Between 2018 and 2022, DHL bought 28 new B777-200F freighters from Boeing – 18 of those aircraft are currently in service. The remaining aircraft will be delivered from 2023 to 2025. The aircraft forms the backbone of DHL’s intercontinental air network, in which DHL Express operates more than 300 dedicated aircraft with 18 partner airlines on over 2,400 daily flights, across 220 countries and territories.

Hongyuan Group and cargo.one today announced a partnership that will see Hongyuan capacity available for instant booking on the market leading air cargo marketplace. Hongyuan Group is rapidly becoming an important operator for air cargo services between destinations in China and across Europe and South America. Partnering with the established, go-to marketplace for thousands of active freight forwarders will enable Hongyuan Group to boost sales and gain valuable ground rapidly in its digitalization of sales processes.

With over 20 years of professional cargo logistics service experience, Hongyuan Group is well known to freight forwarders globally for its high-frequency air cargo flights between China, Europe and the United States. In addition to its self-owned capacity resources such as B747-8F and A330-200F, Hongyuan is significantly expanding its available capacity for the coming years to meet future air cargo demand.

For the first time, thousands of freight forwarders will gain real-time digital access to Hongyuan’s routes and rates, with the new choice of instantly bookable offers and confirmation, all within a few minutes. For example, due to its front-loaded aircraft, Hongyuan Group offers forwarders the exciting option of booking up to 6 meter shipmentssoon with cargo.one’s digital booking speeds.

Customers using cargo.one also benefit from valuable booking management and collaboration functionality, combined with cargo.one’s renowned expert customer support. The addition of Hongyuan Group capacity reflects cargo.one’s strong diversity of supply options for all important air cargo markets.

Since 2018, we have been building up air cargo services with a strong mission to open up the world for freight forwarders. Digital sales is an important step in offering our customers greater convenience and service quality, and cargo.one is the ideal expert partner to enable us to seize maximum potential in all our relevant markets.

Mr. Wen Yi, business representative, Hongyuan GroupWe are proud to bolster our clear leadership for digital distribution by becoming Hongyuan Group’s partner of choice for their digital sales efforts. Thousands of freight forwarders using cargo.one will soon benefit from Hongyuan’s strong offerings into Asia. Hongyuan Group can now accelerate its digital sales journey and gain important ground with our established frameworks and digital best practices.

Moritz Claussen, Founder & Co-CEO, cargo.oneDigital distribution comprises an important strategic component of Hongyuan Group’s global expansion. cargo.one will deliver the industry’s leading standard for customer-centric digital booking experiences. cargo. one’s team will also support Hongyuan Group through technological and organizational changes needed to maximize digital distribution effects. For example, cargo.one guides airlines towards enhanced sales efficiencies by leveraging compliant data insights in cargo.one360 to optimize its offer quality and win new growth opportunities.

The partnership with Hongyuan Group, its first Chinese carrier, is the latest step in cargo.one’s Asia-Pacific growth trajectory. Over the past year, cargo.one has signed major airline partnerships to deliver greatly increased capacity options across the Asia Pacific region. Soon freight forwarders on cargo.one can book Hongyuan Group capacity to important destinations in China including Shanghai, Beijing and Chengdu.

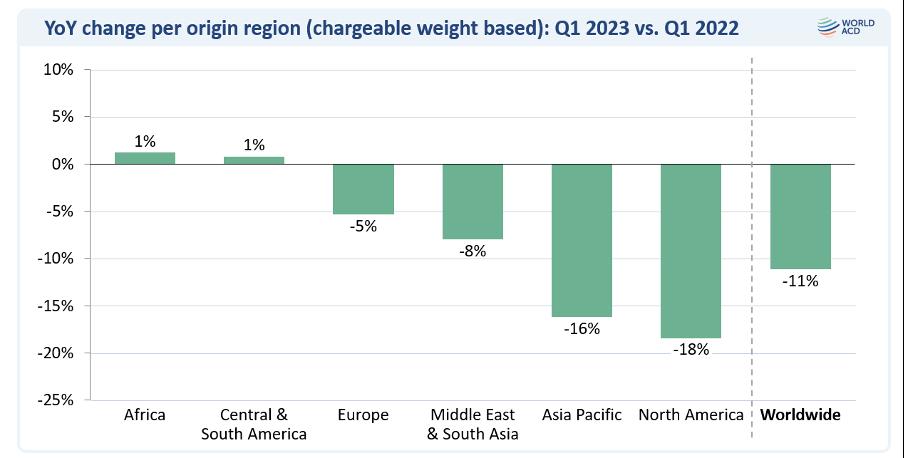

In-depth examination by WorldACD of global demand and pricing figures in the first quarter of 2023 highlights markets, lanes and product types still recording gains or deviating significantly from the worldwide average, plus other underlying trends

In-depth analysis of global air freight demand and pricing figures in the first quarter (Q1) of 2023 reveals some big variations behind the overall declines, with some markets, lanes and product types still recording gains and others deviating significantly from the worldwide average, according to WorldACD Market Data.

As the air cargo data specialist reported earlier this month, worldwide air cargo chargeable weight flown in the first quarter (Q1) of 2023 ended up -11% below that of the equivalent period last year (Q1 2022). But a deep-dive into WorldACD’s data reveals that behind those figures there is a tremendous amount of variation globally, depending on factors such as origin point or region, product type, shipment weight, and whether cargo was flown via freighter or passenger belly capacity.

For example, the overall tonnage performance of the different main origin regions ranges from a +1% year-on-year (YoY) rise in air cargo volumes originating from Africa and from Central & South America (C&S America) to a decline of -18% from North America and a -16% drop from Asia Pacific, with Europe at -5% and Middle East & South Asia (MESA) closer to the average at -8%.

Breaking down those origin figures further reveals that the -16% drop from Asia Pacific includes a -24% decline in intra-Asia traffic and a -21% fall in traffic to North America, and more-modest declines to Europe (-10%) and Africa (-9%), YoY, despite a capacity rise of +7% ex-Asia Pacific. But that total -16% figure also hides a +30% rise in traffic ex-Asia Pacific to C&S America and a +9% rise to MESA.

Meanwhile, the -18% drop from North America comes despite a capacity rise of +9% and includes a -29% decline to Asia Pacific markets, compared with Q1 2022.

Also highly revealing is an examination of the demand profiles of different shipment weight bands, which highlights a continuing trend towards smaller shipments, correlated with the ongoing growth of e-commerce. Analysis by WorldACD reveals that shipments up to 1000 kgs increased by +3%, YoY, whereas those in the 1000-5000 kgs bracket decreased by -5% and the total tonnage of shipments greater than 5000 kgs decreased very significantly in Q1, by -18%.

Live Animals recorded the biggest growth (+10%), with moremodest gains for Valuables (+3%), Perishables (+2%) – including Fruit & Vegetables (+3%), Fish & Seafood (+2%) and Flowers (+1%) – and Pharma/Temp products (+1%). However, there were modest declines on certain other product types including Dangerous Goods (-5%), Human Remains (-4%), Vulnerables/High-Tech (-3%), and Meat products (-2%) that meant demand for special products as a whole remained flat at 0% in Q1, YoY.

From a carrier perspective, the overall decline in global demand was shared relatively evenly in terms of airlines’ regional geographic bases, although airlines from MESA (-8%) and the Americas (-8%) did best, and airlines from Africa experienced the greatest drop in cargo (-17%), with carriers from Asia Pacific (-12%) and Europe (-14%) performing slightly below the global average.

Zooming in on the relatively stable Perishables markets, where total worldwide overall volumes were up by +2%, we can see some significantly different performances among the top origin countries and between different Perishables categories.

For example, while Fruits and Vegetables ex-US Pacific states were down -20%, YoY, demand from Egypt rose by +35%. And although Fish & Seafood tonnages from Norway were down -6%, they rose by +3% from Chile and +27% from the UK. And shipments of Flowers from Ecuador rose by +10% whereas demand from Colombia was more or less stable (+1%) and increased by around +3% from Kenya.

Examining the results on a product or verticals level, there is also considerable variation. Continuing a long-term trend towards a growing importance of special products, General Cargo experienced the biggest decline, falling -16%, YoY, whereas the various special products categories saw either a much more modest decline or growth in some verticals.

Unsurprisingly, given the recent pandemic and market dynamics, there was also a strong difference between the relative performance of those operating all-cargo aircraft versus passenger belly capacity, consistent with the progressive return of passenger aircraft to the market as part of post-Covid recovery.

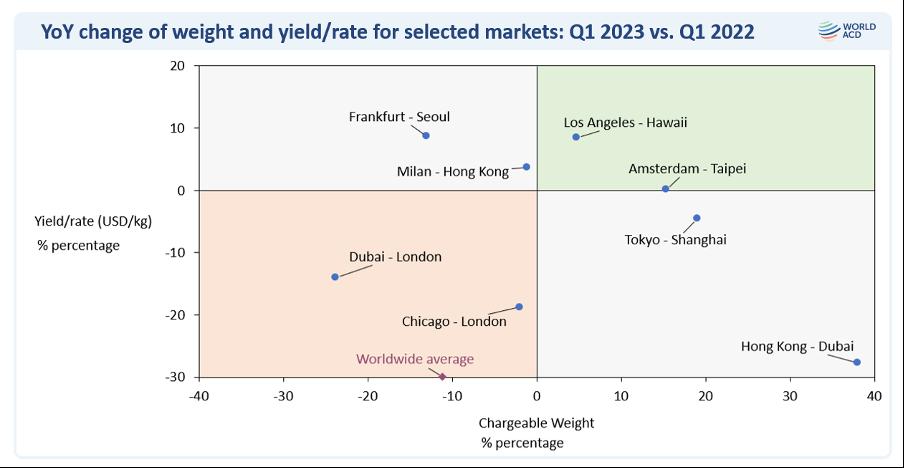

But more dramatically, while Dubai-London volumes were down by -24%, Hong Kong-Dubai tonnages rose by +38%, YoY, although average rates on that lane fell by -28% – consistent with a rise in capacity from the Far East to the Middle East, due in part to the war in Ukraine and some post-Covid reopening of Asian markets.

Last but by not least, WorldACD has done an extra-deep analysis of the dynamics of the Pharma/Temp market to reveal some highly noteworthy trend developments, particularly by splitting the Pharma/Temp category into two subcategories: shipments requiring Active cooling versus those using Passive cooling or temperature-control methods. Active cooling represents 10.6% of the total Pharma/Temp volume in Q1 of 2023, versus 10.3% last year.

Freighter operators experienced the largest decline (-19%) in traffic volumes compared with last year, while airlines with only passenger aircraft performed best (-2%). Airlines operating both passenger and freighter aircraft fell somewhere in the middle, recording a -11% drop in tonnages.

A selection of some key lanes highlights that many lanes experienced weight and rate trends that are significantly different from the worldwide average of -11% and -31%, respectively. For example, Frankfurt-Seoul recorded a -13% decline in volumes, but a +9% rise in average yields, with Milan-Hong Kong seeing a much smaller volume decline (-1%) but also achieved a rise (+4%) in average rates.

The Pharma/Temp category as a whole – which accounts for around 4.1% of total worldwide flown air cargo and includes Pharma and other temperature-controlled non-perishables products – saw a worldwide rise in Q1 of almost +1% (+0.7%), YoY, partly thanks to a significant rise (+4.5%) in shipments requiring Active temperature control or cooling. In contrast, shipment volumes using Passive temperature control grew just +0.3% during this period, on a global basis.

This analysis becomes even more interesting when we examine specific lanes or origin and destination markets. WorldACD’s analysis reveals that the top 10 origins for shipments using Active cooling technology in 2023 Q1 were: USA, Germany, Switzerland, Italy, France, Belgium, Ireland, India, and Austria. Among these, the four largest countries (USA, Germany, Switzerland, Italy) account for 56% of Active worldwide volumes.

Within this group, shipments using Active cooling are growing by more than 10%, YoY, from the following origins: France (+113%), Belgium (+65%), Italy (+17%), Germany (+14%), Netherlands (+14%). Among the top 10, there were declines ex-USA (-9%), Austria (-8%) and ex-India (-5%).

In terms of destination markets, WorldACD has identified the top 10 destinations for Active cooling in Q1 2023 as: USA, China, Brazil, Japan, Canada, Australia, Switzerland, Taiwan, Belgium, South Korea, with the four largest destinations (USA, China, Brazil, Japan) accounting for 54% of worldwide volume in Active cooling.

Among this group, shipments flown using Active cooling grew by more than 10%, YoY, to the following destinations: Taiwan (+81%), USA (+44%), and Japan (+13%), with double-digit declines to China (-39%), Australia (-29%), South Korea (-18%), Brazil (-17%), and Belgium (-15%).

Region to region, the two largest regional markets (Europe to North America and Europe to Asia Pacific) account for 55% of worldwide volume in Active cooling, with double-digit YoY growth on Europe to North America (+45%), North America to MESA (+22%) and Europe to MESA (+15%).

But analysing specific origin and destination markets also reveals significant growth in certain parts of the Passive Pharma/Temp market, which still makes up almost 90% of Pharma/Temp shipments. For example, there was double-digit percentage growth from top origin markets including Italy (+45%), Ireland (+16%), India (+13%), the Netherlands (+13%) and Switzerland (+12%). And Passive Pharma/Temp shipments continued to rise to key Asia Pacific destination markets such as Taiwan (+34%), China (+20%), South Korea (+13%) and Australia (+8%), plus also to Brazil (+6%).

Import cargo volume at the major US container ports is climbing back from a nearly three-year low in February but is expected to remain well below last year’s levels heading into this fall, according to the Global Port Tracker report released today by the National Retail Federation and Hackett Associates.

Consumers are still spending and retail sales are expected to increase this year, but we’re not seeing the explosive demand we saw the past two years. Congestion at the ports has largely gone away as import levels have fallen, but other supply chain challenges remain, ranging from trucker shortages to getting empty containers back to terminals. We were pleased by recent reports of progress related to the West Coast port labor negotiations but will continue to monitor the situation closely until there is a new agreement ratified by both parties. With economic uncertainty continuing, the impact on trade is clear.

Jonathan Gold, Vice President for Supply Chain & Customs Policy, NRFYear-over-year import volumes have been on the decline at most ports since late last year and declining exports out of China highlight the slowdown in demand for consumer goods. Our forecast now projects a larger decline in imports in the first half of this year than we forecast last month. Our view is that imports will remain below recent levels until inflation rates and inventory surpluses are reduced.

Ben Hackett , Founder, HackettU.S. ports covered by Global Port Tracker handled 1.62 million TwentyFoot Equivalent Units – one 20-foot container or its equivalent – in March, the latest month for which final numbers are available. That was up 5% from February – which saw the lowest levels since May 2020 – but down 30.6% year over year.

Ports have not yet reported April numbers, but Global Port Tracker projected the month at 1.73 million TEU, down 23.4% year over year. May is forecast at 1.83 million TEU, down 23.5% from last year’s 2.4 million TEU, the all-time record for the number of containers imported during a single month. June is forecast at 1.9 million TEU, down 15.9%; July at 2.01 million TEU, down 7.9%; August at 2.04 million TEU, down 9.9%, and September at 1.96 million TEU, down 3.4%. The large yearover-year declines are skewed by unusually high volumes last year.

The first half of 2023 – previously forecast at 10.8 million TEU – is now forecast at 10.4 million TEU, down 22.8% from the first half of 2022. Global Port Tracker has not yet forecast the full year, but the third quarter is expected to total 6 million TEU, down 7.2% from the same time last year, and the first nine months of the year would total 16.5 million TEU, down 17.8% year over year. Imports for all of 2022 totaled 25.5 million TEU, down 1.2% from the annual record of 25.8 million TEU set in 2021.

Global Port Tracker, which is produced for NRF by Hackett Associates, provides historical data and forecasts for the U.S. ports of Los Angeles/ Long Beach, Oakland, Seattle and Tacoma on the West Coast; New York/New Jersey, Port of Virginia, Charleston, Savannah, Port Everglades, Miami and Jacksonville on the East Coast, and Houston on the Gulf Coast. The report is free to NRF retail members, and subscription information is available at NRF.com/PortTracker or by calling (202) 783-7971. Subscription information for non-members can be found at www.globalporttracker.com.

As the leading authority and voice for the retail industry, NRF analyzes economic conditions affecting the industry through reports such as Global Port Tracker.

The nature of demand on the headhaul legs of both lanes is very different, according to experts appearing on the latest episode of The Freight Buyers’ Club podcast

The post-Covid US trade slowdown is impacting household goods demand far more seriously than industrial freight demand, according to analysts appearing on the latest episode of The Freight Buyers’ Club podcast, produced with the support of the Dimerco Express Group.

But demand for imported non-industrial products typically shipped by container or via air freight solutions such as clothing, computers, phones and furniture had significantly fallen away.

Anything single family housing related has been very much hit by this huge cool down of housing activity of roughly 30% from this time last year, said Miller. This is one reason why, according to Miller, the US trucking market has been in recession since the third quarter of 2022.

This explains why since the second half of 2022, the trans-Pacific container trade has seen freight rates and demand drop far more significantly than the trans-Atlantic, and why domestic trucking and air cargo markets have turned bearish.

Jason Miller, Interim Chairperson, Department of Supply Chain Management, Michigan State University, Eli Broad College of Business, believes the U.S. economy is not displaying any serious 'red flag indicators' that an economic recession is imminent, but is suffering 'a freight recession' that is affecting logistics and shipping lanes in varied ways. He said US credit card delinquency rates were still below pre-Covid rates, mortgage delinquency rates were falling, wage growth was still 'very robust' and demand across key parts of the economy including motor vehicles, parts, heavy equipment and 'everything associated with infrastructure' was performing well.

It also helps explain why the westbound trans-Atlantic container shipping market has been performing far better than imports to the US from Asia, according to Judah Levine, Head of Research, Freightos.

Levine told The Freight Buyers’ Club that the current US freight recession was in part due to heavy imports in the first half of 2022 which had left many retailers with huge inventories. But, he added, this had impacted the trans-Pacific headhaul market far more than US imports from Europe.

If you look at the trans-Atlantic, rates there are still more than double what they were in 2019, he said.

Even though rates on the trade have fallen around 50% since their peak earlier this year, Levine said the decline had been far less severe than on the trans-Pacific where spot freight rates had collapsed.

He said this was because the two trades were driven by different types of imports.

When we talk about the trans-Pacific; it's consumer goods, he said, adding that what people were buying now was also very different than during the pandemic when bulky household goods were in high demand.

On the trans-Atlantic, it's a different mix of goods and actually demand is still higher than it was in 2019, even though it has been declining, he added.

Miller said when he examined individual tariff codes in detail, he found the trans-Pacific boom in 2021 and second half of 2022 was 'really primary housing'.

By contrast, the containerised goods being shipped in heavy volumes on the trans-Atlantic from Europe to the US in 2022 were products such as Portland cement, gypsum, electrical storage batteries and other chemical products.

So, it's much more that industrial side of things, and especially the non-residential construction space, which is still very strong right now in the US. And so that's why we just can't generalize. Eastbound transPacific is down, but that doesn’t mean that westbound trans-Atlantic is going to fall off a cliff in the same manner.

Average container prices bottoming out in Europe, no further steep falls in Q1

Lower freight rates and heavy price competition, bigger players inching towards consolidation

Europe’s economic rebound is mixed as the service sector bounce back is the biggest since 2009 while the manufacturing sector witnessed a decline in orders for goods. The economy is expecting a modest recovery which is a very encouraging sign for the supply chains in the longer term.

The industry sense is that the freight rates and the container prices have bottomed out globally. The industry surveys conducted by S&P Global indicate a subdued economic rebound. The eurozone’s annual rate of inflation stood at 6.9% in March, its lowest level since the invasion of Ukraine in February 2022.

Clearly, the ocean market has not deteriorated further but still a far away from normal in Europe. Strikes in France and Hamburg during March, the Easter holidays in early April and the persistent inflationary pressures, have caused service closures and limited labour availability in this market but we do not expect further disruptions in the foreseeable future for carriers and freight forwarders.

The problem of overloaded depots persists in Europe throughout. There are more containers coming back to the depots as compared to the number of containers going out of depots. We see lower freight rates and heavy price competition, especially for small freight forwarding companies. The bigger freight forwarders are providing rates below market prices to push competition out towards consolidation. The China to EU rates is as low as $700. There is an overall reduced demand for goods in Europe, and we witness a slowdown in movement of volumes. On the Europe to China route, freight rates are as low as $91 dollars. Carriers only give 7 days of ‘free days’ for container storage and then need to pay high Demurrage and detention charges for another 7 days if they need to use containers for longer.

The smaller freight forwarders are struggling for margins and the bigger players are moving towards consolidation in Europe.

The geopolitical tensions coupled with the port strikes posed major headwinds for the shipping industry in Europe. But the overall industry is bullish about the market and hopes for recovery.

With our platform data, we do observe that the container prices are not falling at a staggering rate, and these seem to be rather resilient in Europe over the past 30 days.

The average prices in Europe for cargo worthy 20 ft dry containers has continued to decline month on month until April. These prices are significantly lower than those in Shanghai and in Los Angeles. (See chart below). The average price for a cargo worthy 20 ft DC is anywhere between $750 to $1700.

Container xChange reported in March 2023 that there is a situation of excess of containers in Europe. But the situation seems to have improved since last month.

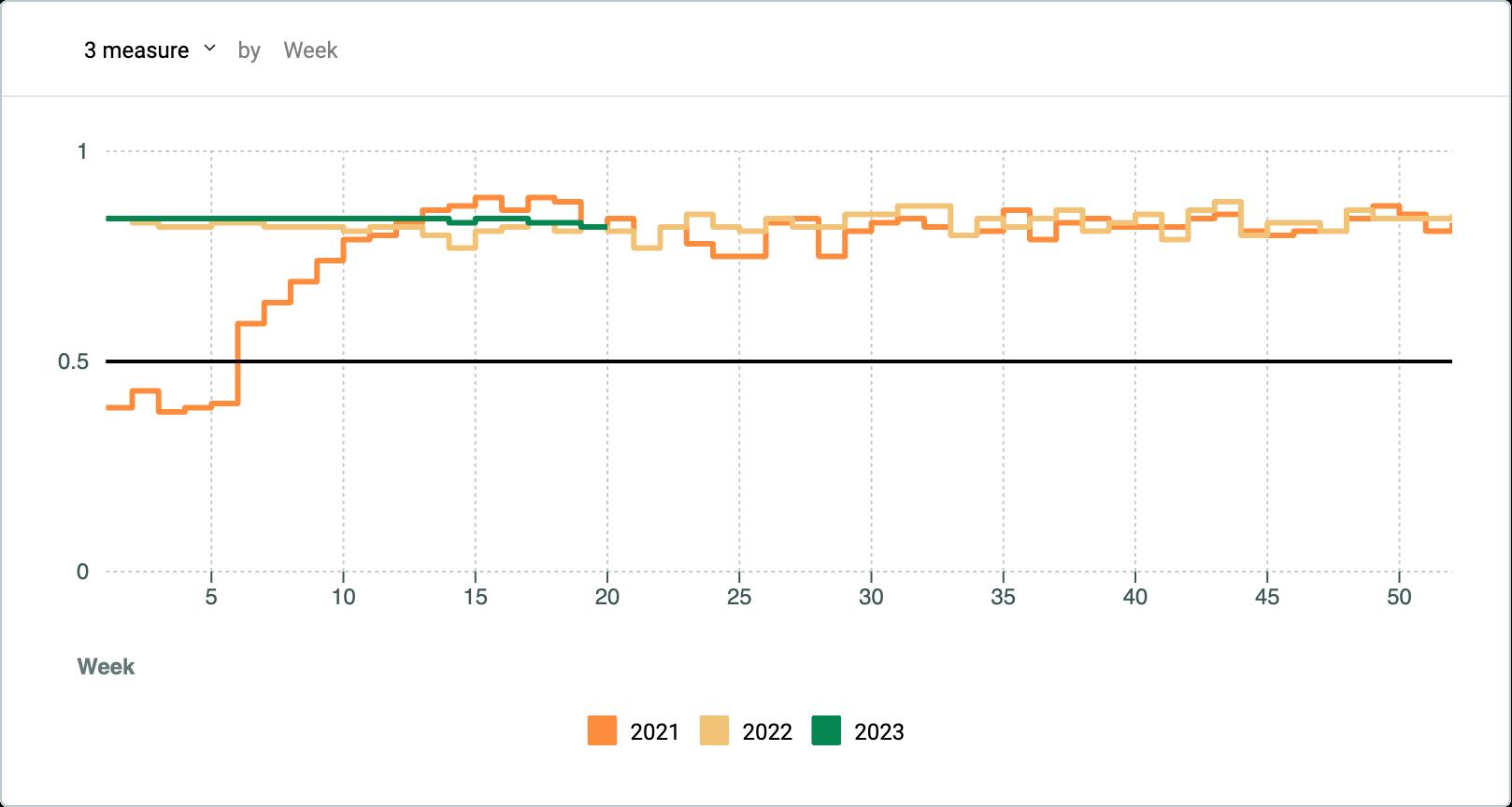

Looking at how container availability has improved, we infer from our data that the Container availability index (CAx) has improved significantly if we compare to the past two years. The elevated CAx values are now coming down which indicates a better balance of inbound to outbound containers.

While the overall economic outlook for Europe brings signs of rebound, the container logistics industry in general is grappling with many struggles like depots being overwhelmed, rates bottoming out, the global bank crisis, and overshooting demurrage and detention costs. Companies are struggling to find their feet on the ground, and it will still take a few months before the demand recovers. Till then, the industry players are focusing on improving their margins and sustaining their business.

In Hamburg, we see bloated CAx figures, but if we compare those year on year, then there seems to be an improvement in the inbound to outbound containers ratio.

Container xChange is an online container logistics company that provides a neutral infrastructure and operating system for container trading, container leasing and container management.

Expansion strengthens RoadOne’s Southern Florida footprint by providing its customers with another reliable container logistics gateway in the Southeast for import and export freight

RoadOne IntermodaLogistics, a single source intermodal, warehouse, and logistics services company, announces today its acquisition of Ace Transport Miami LLC, an intermodal and transload service provider in Miami, Florida. Going forward the company will become a division of RoadOne known as Ace IntermodaLogistics.

Ace is a top-5 logistics and transportation carrier in the Miami market, with 70 drivers serving the Southern Florida market and a fleet of 300 company-owned chassis that provide shippers with added value by ensuring chassis are available when needed. Ace has established itself as a niche provider handling overweight loads out of PortMiami and Port Everglades, and is one of the few carriers that handles overweight containers in the Southern Florida market today. Additionally, the company's 100,410 sq ft warehouse in Miami supports transload and distribution services for import and export freight moving through the busy PortMiami and Port Everglades.

This acquisition is a significant milestone for RoadOne IntermodaLogistics as it increases its overall Florida service network, with Miami being the 10th largest port in the U.S., and Port Everglades the 12th ranked port in the U.S. This expansion is an important addition to RoadOne’s network as it continues to complete its overall national scope of logistics services covering every major port in Florida, and now has the capability to offer dedicated logistics and distribution services to the busy Miami market.

Rudy Alvarez, Founder and Owner of Ace Transport Miami LLC, and his brother, David Alvarez, VP of Operations, will remain as shareholders in RoadOne IntermodaLogistics and continue to run the day-to-day operations of the company, working alongside the RoadOne team.

It’s a thrill to join the RoadOne organization. In today’s competitive market, we know that as part of RoadOne we will have the resources necessary to continue our strong growth and provide optimal logistics and distribution solutions to support our customers supply chain needs.

Rudy Alvarez,

Founder & Owner, Ace Transport Miami LLCThis new Southern Florida presence enables RoadOne to enhance its collaboration with industry partners in the region and service new customers, as well as offer its existing customers a new Southeast service option with a key gateway for imports and exports between the U.S. and Latin America.

Welcome Ace Transport Miami LLC to our family of companies. We are confident that Ace's strong market presence, differentiated service portfolio and niche position handling overweight loads will complement RoadOne's existing capabilities and enable us to better serve the transportation needs of our customers.

Ken Kellaway, CEO, RoadOne IntermodaLogisticsRidgemont Equity Partners, a middle market private equity firm, recently announced the recapitalization of RoadOne, alongside RoadOne’s co-founders and Nonantum Capital Partners. This transaction provides RoadOne with significant capital for growth to support strategic acquisitions and continued investment in technology and platform operations.

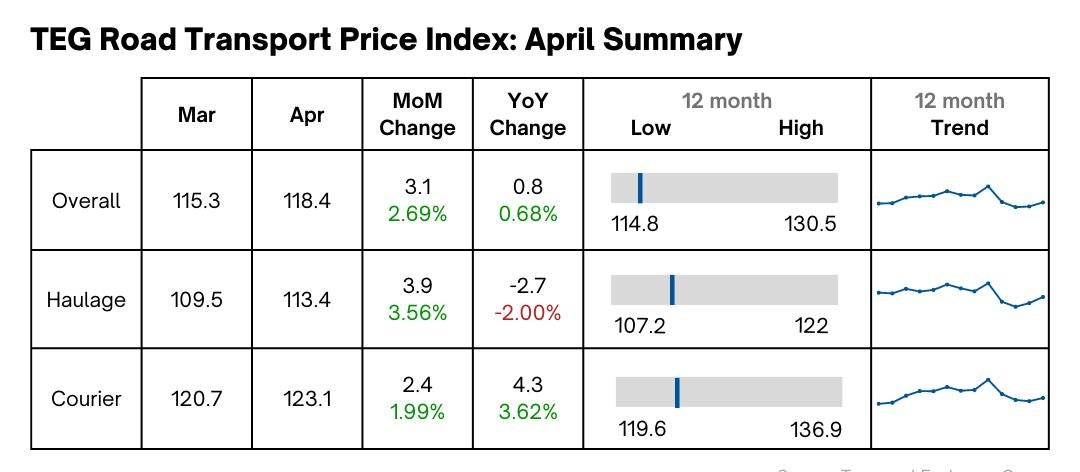

3.6 % haulage price rise pushes overall prices up, even with diesel costs falling

The latest data from the TEG Road Transport Price Index has revealed that haulage and courier prices increased slightly from March to April. With haulage prices up 3.6% and courier prices up 2%, this follows the pattern of the last four years, except for the immediate aftermath of Covid-19.

Year-on-year, haulage prices are actually 2% down, but courier prices are 3.6% higher, leaving the overall index slightly up on its April 2022 level.

In the face of stubborn inflation, driver shortages and supply chain troubles, it seems falling diesel costs haven’t been enough to keep prices down.

Recent analysis revealed that the UK economy is losing £12 billion a year to supply chain issues. When supply chain costs spiral, they affect businesses’ bottom lines, which is often reflected in price rises being passed onto customers.

For example, even though haulage prices are 2% down, year-on-year, hauliers are having to charge 11% more than they did during the same period four years ago.

Businesses can lessen the impact of supply chain issues through the kind of integrated digitisation Integra offers. With a quarter of the UK’s trucks running empty, digitisation can help hauliers looking to share truck space and create efficiencies.

Falling diesel prices is very welcome news for the industry. It reduces a day-to-day expense for everyone, making every mile cheaper. But it’s clear that there are more permanent problems affecting hauliers’ and couriers’ prices. One of those is the driver shortage, so it’s encouraging to see the government once again taking action to get new drivers on the road. Another issue altogether is supply chain costs. Streamlining operations through digital solutions can help greatly here, so I’d encourage any road freight transport company to build digital tools into everyday processes. Then they’ll be more able to weather any costly supply chain disruptions.

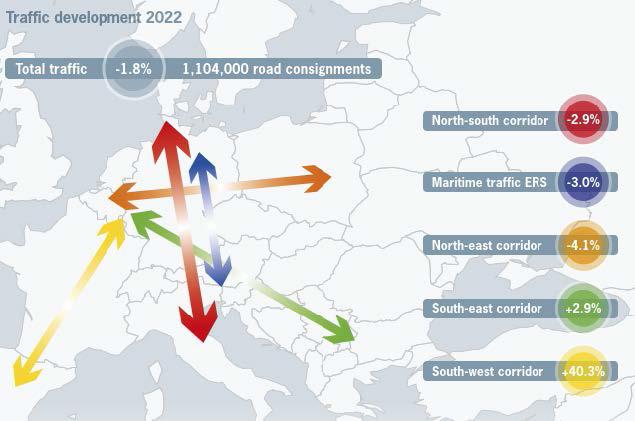

Lyall Cresswell, CEO, IntegraThe traffic volume of the Hupac Group stagnated at 1,104,000 road consignments in 2022. Nevertheless, Hupac achieved a satisfactory financial result. Transport policy support measures are necessary to stabilise combined transport in the current economic downturn.

Last year, the Hupac Group carried 1,104,000 road consignments in combined road/rail and seaport hinterland transport, which corresponds to a slight decrease of 1.8% or 20,000 road consignments. Capacity bottlenecks in Germany in particular had a negative impact. After a strong first quarter with monthly growth rates in the high single digits, traffic slumped in April and June and again in the autumn due to intensive construction activity on the Rhine-Alpine corridor. At peak times, up to 20% of the ordered trains could not run for operational reasons. In the last quarter, an economic slowdown set in due to the unfavourable development of energy prices.

Overall, traffic on the high-volume north-south corridor decreased by 2.9% to 767,000 road consignments. Transalpine traffic through Switzerland declined by 2.1% to 585,000 shipments. In contrast, transit traffic through Austria developed positively with an increase of 9.7% to 44,000 shipments. The south-east and south-west corridors also developed positively with growth rates of 2.9% and 40.3% respectively.

Seaport hinterland traffic also continues to be subject to strong external influences. Keywords here are the global supply chain disruptions caused by COVID-19 with shutdowns in Asia and the uncertainties caused by the war in Ukraine. ERS Railways' maritime traffic from the North Sea ports declined by 3% to 184,000 road consignments.

The turnover of the Hupac Group decreased by 2.1% to CHF 668.5 million. With a net profit of CHF 7.6 million, Hupac nevertheless achieved a satisfactory annual result. Investments reached a high level of CHF 84.3 million as various projects could be resumed after the pandemic break.

Due to high energy costs, energy-intensive industries such as steel, chemicals and paper are particularly under pressure. Hans-Jörg Bertschi, Chairman of the Board of Directors of Hupac Ltd, explained at the annual media conference in Zurich that the base load of combined transport in Europe is falling with the decline in these rail-related transports. In addition, since January 2023, price increases for rail transport in Europe have been significantly higher than those for road transport. At the same time, as the industrial economy stagnates or declines, significant capacity is again available in road transport. This leads to a significant shift of transport from rail to road. In Hupac's transport network, this can be quantified as a minus of 10 to 15 percent for the period January to April 2023 compared to the same period of the previous year, depending on the transport segment.

The sum of negative factors such as the decline in traffic due to the economic situation, high rail costs, falling road freight rates and the chronic instability of the rail network represent a real risk of modal shift, says Bertschi. Although the volume of combined transport in Europe fell significantly in the first quarter, the quality and reliability of the international rail infrastructure has hardly improved. Too many trains are still canceled or delayed for days. If the reliability of the rail infrastructure and the quality of combined transport do not improve, we can expect a further shift back to the roads in the coming months.

Hupac keeps its transport network stable despite a decline in demand. Where necessary, operational concepts are being optimised and overcapacities reduced. Strict cost management in cooperation with its partners helps to overcome the crisis with lean structures and flexible production planning.

However, whether combined transport will be able to maintain its market position in the current situation and, if possible, expand it, depends above all on the transport policy framework. Hupac President Hans-Jörg Bertschi lists a number of measures that would strengthen the marketability of combined transport and secure the successes achieved so far:

• Quality management for shuttle trains in international Alpine transit: Introduction of a consistently effective operational management for international Alpine transit trains of combined transport on the Rhine-Alpine corridor under the management of the corridor's railway infrastructures - a measure that is particularly urgent in view of the forthcoming corridor renovations and construction work on the Rhine Valley Railway. Because of its importance for transport policy in this corridor, Switzerland would have a leading role in providing impetus. This would be done with the support of Italy, which urgently needs a functioning transalpine transport system to safeguard its economy and foreign trade

• Support for the competitiveness of combined transport: Temporarily suspend the annual reduction of subsidies for combined transport until the economic crisis is over. By adjusting the subsidy to the reduced transport volume in the first quarter of 2023, the loss of competitiveness of combined transport can be partially compensated

• Continuation of the Rolling Highway until 2028: The Rolling Highway is currently very well used due to the increase in road traffic. The continuation of the Rolling Highway service until 2028 is an appropriate measure to counteract the shift back to pure road transport

• Improving performance through digital transformation: A transparent flow of data along the entire combined transport service chain helps to ensure that capacity is better used and that individual partners can plan better. Existing open systems such as DX Intermodal's Data Hub must become the standard for all combined transport in Europe

Despite the current difficult situation, Hupac is maintaining its investments in terminals, IT systems and network expansion, thus securing the conditions for future growth. We welcome the positive decision of the Swiss Ministry of Transport to finance the major terminal Milano Smistamento, which Hupac will realise in a joint venture with Mercitalia Logistics by 2026, emphasises Michail Stahlhut, CEO of the Hupac Group. This new central gateway terminal in Milan will significantly accelerate the ongoing development of seaport hinterland traffic from the Italian ports to Switzerland and southern Germany.

Other Hupac terminal projects are already in the realisation phase, such as the Piacenza terminal to be completed by 2025, the extension of the Novara terminal by 2025 and the replacement investments in gantry cranes at the Busto Arsizio-Gallarate terminal.

In terms of network development, Hupac is focusing on the expansion of services from the Köln Nord terminal, the operation of which was taken over by the Hupac Group at the beginning of the year. The new Brwinów terminal near Warsaw is being developed as a hub for transports to/ from western and southern Europe. In the core market of transalpine transport through Switzerland, the focus is on the Benelux markets and the economic areas of north-eastern, central and southern Italy. In maritime transport, the Hupac Group pursues a long-term strategy based on its European network. While the northern ports are served by the subsidiary ERS Railways, Hupac Intermodal makes its network available for volumes from the Mediterranean ports.

We are convinced that our competitive, market-oriented combined transport products offer real added value for environmentally and climate-friendly logistics, says Stahlhut. Compared to pure road transport, the Hupac network saved around 1.5 million tonnes of CO2 in 2022, reduced energy consumption by 17 billion megajoules and took 21 million tonnes of goods off the roads. Says Stahlhut: Our long-term corporate strategy is part of the answer to the major challenges facing society, such as climate protection, energy transition and sustainable economic development. We will continue to focus on this in the current year.

Contargo starts new barge service between Dourges and the western Seaports

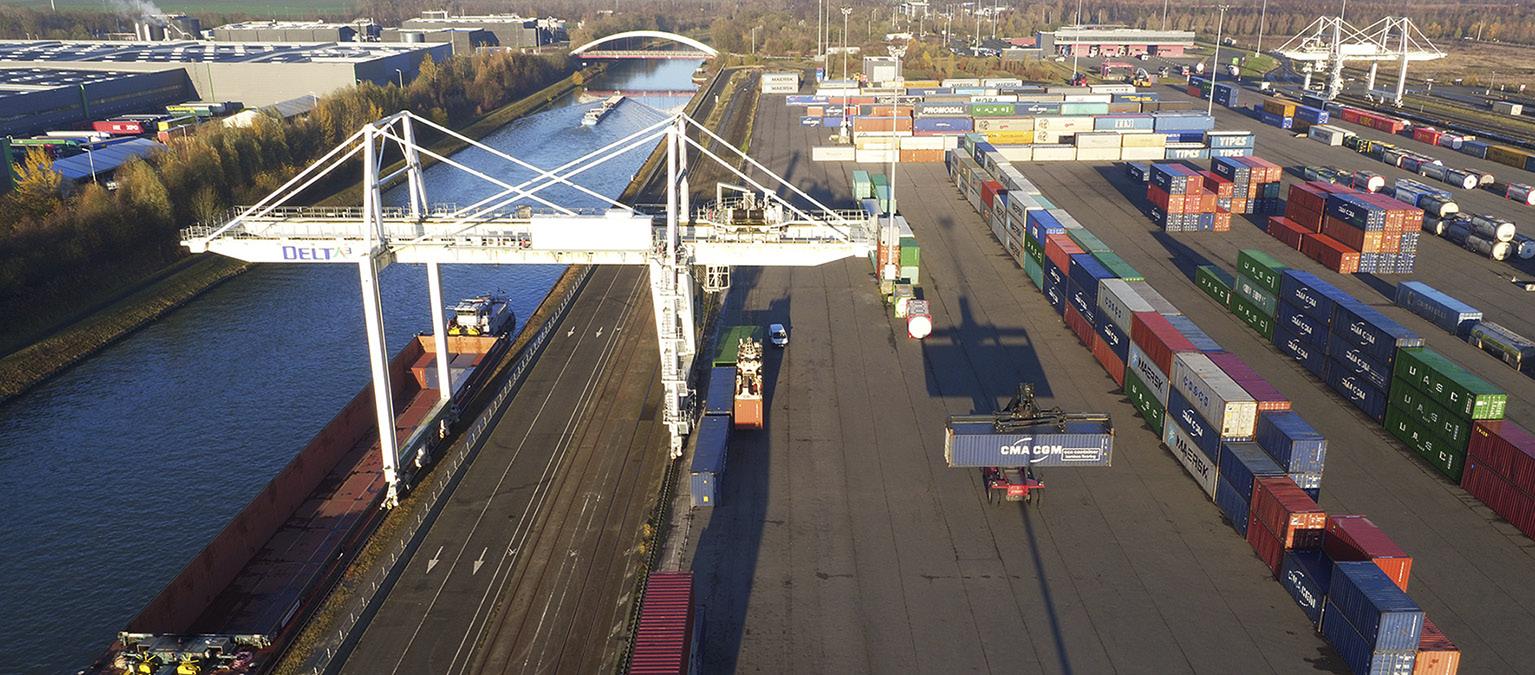

Contargo has started a new container barge line with two round trips per week between the seaports of Antwerp and Rotterdam and the multimodal terminal in Dourges.

Contargo has expanded its network for container transport by inland waterway in northern France. In addition to its barge service in combined transport via the terminal in Valenciennes, Contargo North France is now also offering direct barge connections between Antwerp and Rotterdam and Delta 3, the LDCT terminal in Dourges.

The service, with two round trips a week, is performed by two push barge units with a capacity of 78 TEU. All types of containers are transported, including dangerous goods (apart from classes 1 and 7) and reefers. Contargo will also organise pre- and on-carriage by truck for these transports. The transit time is 30 hours between Antwerp and Dourges and 40 hours for the Rotterdam–Dourges line.

In order to meet market demand we have decided to expand our network to include the Dourges terminal, where we see great potential for development. This will be in addition to the regular services we have been providing for years now in Valenciennes, the most important terminal in the region for sea containers. Altogether we operate seven barges with a weekly capacity of more than 1,200 TEU for multimodal container transport in northern France.

Gilbert Bredel, Managing Director Contargo North France

The Polish division of 3p Logistics' projects team are pleased to report an interesting shipment they coordinated from Gdansk to Singapore.

The cargo included four large lifeboats which were made in Poland, measuring 11.5 (L) x 3.00 (W) x 3.50 (H) meters each. From Gdasnk, the lifeboats were collected by truck for onward delivery to Singapore by sea freight. 3p Logistics handled operations such as re-loading & securing the cargo using the appropriate containers.

The cargo is now sailing toward Asia for our satisfied customer!

Gebrüder Weiss is further expanding its presence in the USA, opening an air and sea freight office in Miami, Florida. Miami is a central logistics hub for transports to and from Latin America, Europe, Asia and the Caribbean, explains Mark McCullough, Country Manager USA at Gebrüder Weiss. Miami primarily handles imports from Asia for onward transport to South and Central America, as there are only a few direct routes from Asia. The new location is situated in the immediate vicinity of the international airport, one of the country’s busiest cargo handling facilities. The company currently employs six people in Miami. Headed by Marcin Gonzalez, the location is set to keep growing and become a gateway for transports to the Latin American markets.

Since the country organization was founded in 2017, Gebrüder Weiss has continuously expanded its network of locations and services in the USA. Today, in addition to air and sea freight services, the logistics provider also offers its customers national and international full load services, heavy transports and specific logistics solutions, with the portfolio ranging from goods warehousing and local distribution to e-commerce solutions. Gebrüder Weiss has firmly established its brand and services in the market over the past five years. Our customers benefit from a globally integrated network with a high level of local expertise, says Mark McCullough. Only recently, the company moved into a larger head office in Chicago and opened another logistics warehouse. Gebrüder Weiss operates a total of five warehouse locations in the USA and employs 130 people in Atlanta, Boston, Chicago, Dallas, El Paso, Los Angeles, New York, San Francisco – and now also in Miami.

Marine Repair Services-Container Maintenance Corporation responds to burgeoning growth of container traffic through the region

The Marino Group announces it has opened a 34-acre depot to meet the needs of the container and intermodal trade through the growing port of Mobile and the U. S. Gulf. The new facility provides container maintenance and repair, loaded and empty container storage, warehousing, chassis start-stop and repairs, grounded temperature-controlled unit pre-trips and genset rental programs. The new facility is open and fully operational as of today.

The Marino Group’s Marine Repair Services-Container Maintenance Corporation (MRS-CMC), a leading supplier of depot services, unmatched dry and reefer equipment maintenance and repair, equipment sales drayage and over-the-road services, is responding to the needs of the burgeoning trade in the market. In the last decade, the port has experienced doubledigit growth every year. Recent statistics indicate that for 2022, there was an 11 percent increase in container through-put.

Establishing our presence with our state-of-the-art depot in Mobile demonstrates our commitment to strengthening our position in the Gulf. The new depot has plenty of capacity for growth, top-of-the-line equipment and a strong team of professionals ready to serve the market.

David Miller, Senior Director of Operations, MRS-CMCThe depot is conveniently situated less than a mile from the marine terminals at 1251 Baker Street and complements terminal capacity issues. To meet the needs of the trades in the region, the new depot includes load lifts, empty handlers, a chassis stacker and downstacker and reefer plugs.

For more than 50 years, since containerization in shipping became a reality, The Marino Group has been responding to the needs of the industry with services that enhance and support supply chain fluidity. We say that the Marino Group has been looking at the future for a half-century.

More outbound containers at ports of China; CAx over 0.6 since of 2023

62% slump in average container prices* Y-O-Y in China

Increase in shipments to Southeast Asia is reflected in an 85% drop in pickup charges on the Intra-Asia trade lane since January 2023

Asia's maritime and supply chain industry is on a tumultuous ride, experiencing significant disruptions in trade patterns resulting in container prices dipping, according to the April Asia container market forecaster published by Container xChange, an online container logistics company that provides a marketplace, an operating infrastructure, and a layer of services like payments to container logistics companies globally.

The year-on-year comparison of the Container Availability Index (CAx) in Shanghai presents some interesting insights into the problem of excess containers at the ports in China. Traditionally, the CAx values in Shanghai during Q1 have been lower than the 0.5 balance due to a higher number of outbound containers compared to inbound containers. However, this year, the trend is just the opposite with CAx value over the 0.6 threshold. The current trend is attributed to the drop in exports during Q1, owing to reduced demand post the peak season quarter (October- December) and the Chinese New Year shutdowns.

Consequently, the number of containers at ports is usually lower during the Q1 of last two years. However, the situation this year is different. With a demand deficit and a higher number of containers lying idle at the ports, there is a significant rise in inbound containers in China as observed in the Q1 of 2023. This shift in the trend is reflected in the CAx graph below.

Since the beginning of week 37 (September) in 2022, the Container Availability Index (CAx) has consistently remained higher than the previous two years. This indicates an increase in inbound containers at the port of Shanghai since September and a continued upward trend. The trend is also observed in Yantian and Tianjin ports in China.

Our research and interviews with Chinese customers reveal that the post-Lunar New Year recovery in the industry has only recently started and is below the normal expectations for this time of year. According to Descartes, US imports have declined by 16.2% from January, 25% year on year, and 0.3% compared to pre-COVID February 2019.

The Container Availability Index measures the ratio of inbound to outbound containers port-wise and a reading above 0.5 suggest more inbound than outbound containers at the ports. It suggests that ports in China currently have a higher CAx value than in 2019, 2020, 2021, and 2022, indicating a significant container surplus in China. A higher CAx index rating means that there are more inbound containers than outbound containers. Thus, if China's outbound containers are low, it suggests that main import countries have not been importing goods from China as usual. This trend is apparent in the industry as well.

According to the analysis by Container xChange, we compare the container prices between March of this year and the same period last year, there has been an average fall of 62% in prices across China. The table below provides a detailed breakdown of the decline in prices at different ports in China. It is noteworthy that this quarter (January to March) has been relatively more stable compared to the overall price fluctuations throughout the year.

*Average prices for containers are the prices at which containers are available to buy at these port locations.

It is evident that there has been a decline in average container prices in China since the past one year. However, the graph below indicates that the prices have remained relatively stable during the first quarter of 2023. This observation suggests that if there is no further decrease in prices, it is possible that the container prices have already hit the bottom and are not expected to fall any further.

On one hand, concerns are being raised due to the shifts in supply-chain and weakened global demand, as companies are diversifying their trade and increasingly sourcing goods from Southeast Asia. On the other, China's export numbers for March have exceeded expectations, with a significant increase of 14.8% in US dollar terms from the previous year, as reported by China government data.

The unexpected rise in exports can be attributed to improved demand from many Asian countries and Europe, as well as the resumption of production in China's factories. This is a positive glide considering the container pileup on China ports in the beginning of 2023.

The uptick in shipments to South-East Asian nations is evidenced by sliding pickup charges on the Intra-Asia trade lane. Average pickup charges dropped by 85% since January 2023.

The shipping industry is on the verge of completing its lap in terms of container prices bottoming out, excessive inventory, empty containers and everything in between. Once it's through with its rep, the demand will crop back up. The alluring box rates present for traders offer a ray of hope for the growth of container demand. As the spot rates on significant container trade lanes settle down to levels like those before the pandemic, the trend of decontainerization that prevailed from 2020 to 2022 is now reversing. The container freight rates reached record heights during the peak of the coronavirus pandemic, which resulted in cargo overflowing from containers into minor bulk vessels.

Christian Roeloffs, cofounder & CEO, Container xChangeHowever, we cannot compare it to the demand that existed until 2021, as there is still a surplus of inventory that has not been exhausted yet. China has already initiated the process of diversification, although it is still too early to see any visible trade patterns. However, we have noticed a rise in intra-Asia trade. As a result, capacity needs to be adjusted to regions with more stable rate levels and demand to ensure more resilient supply chains in the future. This relocation strategy will decrease reliance on one production and supply chain hub and move towards a smaller and more diverse trading pattern.

The Asia-Europe container shipping lane, which is critical, has experienced a rapid decrease in demand since the summer of 2022, resulting in a sharp decline in container shipping spot freight rates. Carriers have responded by cutting services or cascading capacity to regional trades. However, this has left many empty containers stranded across Europe instead of being returned to Asia and other origin markets for loading with more exports. This accumulation of boxes will gradually decrease when export demand rises again, with the majority being returned to Asia.

China's expertise in developing world-class port infrastructure that can be an asset to strengthen global trade ties and create opportunities for collaboration, despite potential challenges for western countries to compete in this domain. While US and European companies are signalling their intent to shift manufacturing to India and other countries in Southeast Asia, the lack of port infrastructure in these regions remains a major obstacle, said Christian Roeloffs as he commented upon the current state of the container shipping in Asia.

The lack of harbours able to accommodate large ships in other Asian countries means that investment is essential to handle the megacontainer ships that drive world trade. Therefore, it will take a great deal of investment from other Asian emerging markets to catch up with China, and it generally takes port operators up to five years to build a new terminal.

The data from research group Drewry reveals that the rest of Asia needs significant investment to match the capacity of Chinese harbours, which have become essential for transporting goods from east to West. China's investment of at least $40 billion between 2016 and 2021 in coastal port infrastructure has allowed the country to handle the equivalent of 275 million 20ft containers at its ports last year, up to 80% more than the amount processed annually by all countries in Southeast Asia combined, according to figures from data group Dynamar and the UN. In contrast, the rest of Asia has only 31 port terminals capable of handling the largest ships. Large vessels make up about two-thirds of the shipping capacity for services between East Asia and Europe, according to data provider MDS Transmodal.

Clients can move freight more efficiently to provide exceptional service in volatile market conditions

E2open Parent Holdings, Inc. (NYSE: ETWO), the connected supply chain SaaS platform with the largest multi-enterprise network, announces an expanded partnership with Loadsmart, allowing shipper clients to access instant pricing on any lane from Loadsmart’s network of more than 45,000 carrier partners without leaving e2open’s Transportation Management (TMS) application.

Loadsmart is now included in e2open’s Carrier Highlight innovation, which offers shippers access to featured transportation providers’ rates and capacity when favorable. The enhancement gives clients a streamlined and automated way to identify cost-saving opportunities while getting reliable service from a preferred e2open carrier partner showcased within the application. The shipper can seamlessly onboard Loadsmart to benefit from the currently highlighted cost savings and access Loadsmart as a new carrier partner for future savings opportunities.

With API connectivity in e2open Carrier Marketplace, pricing comparisons happen instantly, enabling shippers to take immediate action. In addition, carriers in the network are afforded exposure to more shippers. As part of the Carrier Highlight workflow, e2open TMS users are presented with optimal transportation options dynamically during load planning, when there is an opportunity to tender the shipment at a lower cost.

to being leaders in their space. Our expanded partnership with e2open allows all shippers to react quickly to market dynamics and move freight reliably and sustainably at an optimal cost—all from within the e2open TMS. We look forward to continuing to push the frontier of end-toend freight management and to empower our clients further as they progress their supply chains toward digital maturity.

Felipe Capella , CEO, LoadsmartLoadsmart has been an e2open strategic partner since 2020; the expanded partnership provides e2open clients with access to real-time rates across their entire transportation network with the opportunity to achieve savings in all modes.

We formed our partnership with Loadsmart around a shared ambition to advance transportation management and seamlessly connect logistics to larger enterprise supply chain strategies. In this next phase of our partnership, clients will be able to simplify rating complexity across their entire transportation network and take advantage of the best rates per shipment to move goods cost-effectively and deliver reliably on customer commitments.

Peter Hantman, COO, e2openA fragmented landscape of essential service providers means access to one central control tower that integrates and synthesises all of these is an essential component for informed decision making and future success, says Raft’s Lionel van der Walt

Technology is bringing the human back into freight forwarding and proving to be a catalyst for change management, forcing us to radically rethink the nature of work. And yet many in the industry are still failing to benefit from the opportunities driven by digital transformation, which go beyond simply adopting smart automation.

This can be for a number of reasons, including a fear that technology, and Artificial Intelligence (AI) in particular, will replace roles, whether by eliminating specific jobs, or by stepping into the freight forwarder’s space.

The tech is only the beginning of a change process, which can enable our industry to go beyond transactional workflows and concentrate instead on the value ads that only humans can bring – expertise, relationship building, nuance, and creativity. This human know-how is augmented by the technology and especially AI applications, which automate timeconsuming tasks across the entire shipment lifecycle.

Artificial intelligence is having a revolutionary impact on freight forwarding by completely transforming how forwarders work. It’s helping freight forwarders in various ways, such as:

Streamlined workflows and processes: AI automates a lot of cumbersome workflows and manual work that forwarders do, from manual data entry and document compliance to invoice processing and reconciliation. This frees up teams to refocus their time on more meaningful work like customer value-add activities or strategic initiatives. By automating manual work, forwarders have the ability to scale efficiently without increasing overhead costs.

Improved logistics planning: AI is helping forwarders to optimise their logistics planning by analysing data on shipping routes, transportation modes, and delivery schedules. This analysis can help to identify the most efficient and cost-effective logistics solutions for their clients.

Actionable visibility and analytics: AI can help to improve visibility across the supply chain, enabling air freight forwarders to track shipments in real time and provide up-to-date information to their clients. This can help to increase customer satisfaction and reduce the risk of delays or disruptions. Accessibility to real-time information has the additional benefit of ensuring better collaboration and transparent communications between teams – guaranteed to make life easier for forwarders.

Risk and performance management: AI can help to identify potential risks and hazards along shipping routes, such as adverse weather conditions, geopolitical events, or port congestion. This allows freight forwarders to plan alternative routes and avoid delays. AI can also help to analyse team and client performance, to identify operational bottlenecks so forwarders can resolve issues faster and act as a strategic lever for their businesses, working to improve things like cash flow or comply with shifting regulatory requirements, for example. In this way, AI is a crucial cost and efficiency lever that facilitates revenue growth.

Ultimately, AI is ushering in a new wave of smart logistics by helping freight forwarders to increase efficiency, reduce costs, and improve customer satisfaction.

Back in 2017, our co-founders created Raft, a company that was ‘AIfirst’ in supply chain. They felt like they’d caught the first wave. A new way of tackling an age-old problem with tools – machine learning – still in their infancy. Machine learning (often interchangeable with ‘AI’) back then was for innovations like self-driving cars, but it wasn’t really applied to traditional industries like supply chain management or freight forwarding.

Even in the rare cases that AI and supply chain were mentioned in the same breath, the value of AI was always discussed from a top-down point of view, like modelling complex supply chains using big data, instead of looking at operations from the ground-up. One of the main reasons for this oversight was simple: companies with operational know-how didn’t have machine learning engineers, and vice versa. Put another way, the venn diagram of companies with access to both profiles looked like a figure of eight.

Raft’s founders saw an opportunity to empower freight forwarders with a smarter way to manage and control their shipments and finally break free from the shackles of tedious manual processes and workflows and focus on delivering unprecedented value to their shippers. Its platform extends beyond streamlining internal operations, however. Its integration partner ecosystem provides forwarders with the ability to gain a centralised view of all their operations, and the ability to automate processes across the entire lifecycle of a shipment, from payments to carbon emissions reporting, making it the ultimate supply chain control tower.

Powered by AI, Raft is able to offer a sharper, smarter, and more efficient way for forwarders to communicate, operate, and serve their shippers. Freight forwarder customers ultimately benefit as forwarders have more time to create the experience that shippers have grown to demand and expect.

AI has the potential to transform the freight forwarding industry by improving efficiency, visibility, and customer service, and reducing costs. The full potential of AI for the industry has not yet fully been realised. And with a constantly expanding and fragmented landscape of essential service providers, access to one central control tower that integrates and synthesises all of these together is an essential component for informed decision making and future success.

Lionel van der Walt , Chief Growth Officer, Raft, an AI-driven start-up that automates operations for freight forwarding

Silk Way West Airlines partners with customer-experience leader cargo.one to deliver the most rapid and user-friendly booking option for forwarders

cargo.one will equip the airline with best practices to boost digital booking adoption

cargo.one’s unrivaled innovations, such as cargo.one 360leap, provide the airline with the ability to delight forwarders and win more business

Silk Way West Airlines and cargo.one today announced a global partnership to bring the airline’s freighter capacity to the air cargo booking marketplace. By joining customer experience advocate cargo.one, favored by forwarders in all important markets globally, Silk Way West Airlines will expand its digital footprint and align with the highest standards for digital air cargo booking. The airline also gains the market experience and actionable support of cargo.one teams to accelerate digital sales adoption for its capacities.

Headquartered in Baku, at the heart of the Silk Road, Silk Way West Airlines is the largest cargo airline in the Caspian Sea region. The airline carries over 420,000 tonnes of freighter capacity annually, utilizing a fleet of 12 Boeing 747F aircraft with front-loading capabilities. Silk Way West Airlines is progressing an impressive strategy of expansion, in which maximizing its digital distribution to every relevant market plays a vital role. The strategic location of Baku as a hub helps Silk Way West Airlines to span over 40 key destinations across Europe, the CIS, the Middle East, Central and Eastern Asia, and the Americas. Silk Way West Airlines is unique in building an attractive digital offering for larger shipments, where the market is currently under-served. Freight forwarders have long been attracted to the airline’s connectivity, which cargo.one will now deliver to agents with digital speeds and greater convenience than ever before.

Our partnership with cargo.one is an important milestone in our ambitious digitalization journey. By bringing our capacity to cargo.one’s expansive customer base, we will both broaden our reach and enable many more forwarders to benefit from our services. cargo.one and Silk Way teams are collaborating very closely, and we are relying on their proven expertise to enhance our buying journeys and drive up our share of digital air cargo sales.

Wolfgang Meier, President, Silk Way West Airlines

For the many thousands of agents who are thriving with digital bookings on cargo.one, the addition of Silk Way West Airlines' capacity is fantastic news. Due to its keen awareness of the changing market, Silk Way West Airlines is now putting cargo.one, as the best-in-class digital enabler, at the center of its digital sales growth trajectory.

Moritz Claussen, Founder& Co-CEO, cargo.one

cargo.one’s more than 40 airline partners profit from its targeted innovations that enable forwarders in dozens of countries to book more easily and often. Silk Way West partners with cargo.one shortly after the launch of its revolutionary cargo.one pro and cargo.one protect solutions for instant and seamless agent-to-agent bookings.

A transformed digital booking experience for all import and export shipments now makes cargo.one the air cargo one-stop-shop for many agents worldwide.

project44, the leader in supply chain visibility, and Nexxiot, the leader in Asset Intelligence, today announced a partnership that unlocks new areas of value for joint customers to deliver realtime network insights and IoT-centric conditional and location monitoring.

As logistics innovators, project44 and Nexxiot are substantially expanding their combined capabilities to transform the client experience for shippers and other logistics stakeholders around the globe. This partnership allows customers to integrate conditional and location data with the largest supply chain network in the world. Prior to this partnership, shippers, cargo owners and supply chain participants lacked critical asset intelligence and insight, exposing them to unacceptable risks, lack of visibility and insufficient process control.

This partnership gives joint customers enhanced ETAs using carrier milestones, signals, and historical performance with precise GPS tracking. Additionally, project44 and Nexxiot customers now have capabilities to drive advanced risk management strategies on order and inventory health. Finally, joint customers also unlock new use cases to better manage asset efficiency.

At project44, we strive to provide the most comprehensive supply chain visibility for all of our customers, and combining forces with Nexxiot is a huge step towards that goal. This partnership enhances the insights of our Movement platform with essential real-time asset level tracking, benefitting everyone with the new standard in actionable insights.

Jett McCandless, Founder & CEO, project44This partnership between project44 and Nexxiot adds vital real-time asset-level monitoring to enhance project44’s Movement platform by improving data-driven assurances on safety, security and compliance.

We are focused on supporting our customers with very large operational and service ROI opportunities. The decision by Hapag-Lloyd to go full-fleet with smart containers in record-time has forever changed the industry. We are inspired by the leadership position of project44 and together keep pushing forward to create the most accurate and insightful data to the benefit of our joint customers.

Stefan Kalmund, CEO, Nexxiot’sTogether, project44 and Nexxiot unlock new and innovative features and use cases that create immense value for BCOs globally and deliver unmatched value for the global supply chain marketplace.

project44 is on a mission to make supply chains work. As the supply chain connective tissue, project44 operates the world's most trusted end-to-end visibility platform that tracks more than 1 billion unique shipments annually for over 1,300 of the world's leading brands, including top companies in manufacturing, automotive, retail, life sciences, food & beverage, CPG, and oil,

chemical & gas. Using project44, shippers and carriers across the globe drive greater predictability, resiliency and sustainability.

Easy access to your company overview.

Showcase the brains behind your business and have a searchable directory with profiles for each of your staff members.

Allow your customers to request a quotation directly from the app.

A simple and user-friendly contact form to handle any customer enquiries.

The perfect feature for keeping your customers updated with latest news and posts.

Air freight? Sea freight? Include all your company services.

Track your shipment’s location and delivery with your chosen third-party platform intergrated with your app.

List your capacity / return loads with real-time notifi cations directly to your customer mobile devices.

Recruitment platform on which companies can post their latest vacancies. Candidates can apply directly from the app.

Make it easy for clients to get in touch with their requirements directly from the app.

Schedule your notifi cations to be sent at specifi c times or send geofenced notifi cations to your clients based on their location.

With registrations up 49% on last year, visitors to Multimodal 2023 are set to benefit from a cutting-edge line up of speakers during the free, three-day conference. In a new addition to the programme, attendees can also benefit from skills training and mentoring thanks to Google Digital Garage, which will deliver a broad range of digital and social media tactics to visitors.

Running across four theatres, the core conference theme focuses on sustainability, resilience, technology and people, and boasts a stella lineup of leading industry speakers. These include:

• Jon Gore, Head of Primary & Global Logistics, Tesco

• Sally Wright, Head of Delivery Transport Hub, Nestlé UK and Ireland

• John Lucy, Director, Liverpool Freeport

• Hizmy Hassen, Chief Digital & Supply Chain Officer, Apollo Tyres

• Christian Pryce, Chief Commercial Officer, Port of Dover

• Joep Kusters, Senior Vice President, Head of Europe, Coyote

Discussions and themes are built around the most pressing issues and relevant industry topics, covering:

• Peak Season Preview 2023

• Digitalisation of International Trade and Transport

• A Rail Retail Revolution

• Roadblocks to sustainable freight, and how to overcome them

• Cargo integrity

• The UK’s new approach to import controls – understanding the Target Operating Model

Multimodal brings together businesses, thought leaders and associations from across the supply chain industry from June 13th to 15th, with the most outstanding firms and individuals recognised at its glittering Awards ceremony.

The addition to this year’s conference is the Google Digital Garage, which offers a range of courses and learning for some of the most sought-after marketing skills, whether visitors are looking to grow their business, start a career, or just want to try something new.