MAY 2024

www.vertexawards.org RETAIL BRANDS FASTER AND BETTER PLMA Amsterdam At-Show Issue Accelerate Corporate Sustainability Goals with Private Label SPONSORED BY

www.globalretailmag.com

Hundreds of Billions in Commerce

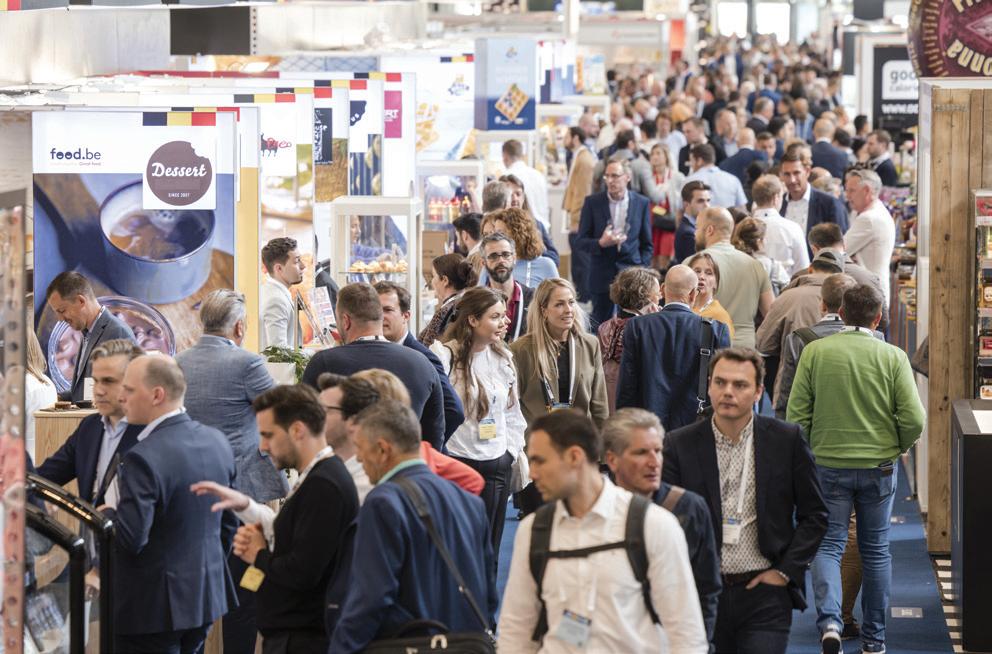

Here we are, back in Amsterdam, preparing for another few days of frenetic energy as thousands of exhibitors vie for the attention of tens of thousands of attendees. For retailers, there’s nothing that quite compares to the incredible array of suppliers that can offer unique solutions for your customers. For those suppliers, it would take years and years to meet and connect with this quantity and level of retailer. PLMA’s world of Private Label represents the enormity of our global industry.

Over the next year, these players will be responsible for hundreds of billions in store brands sales. We’ve learned that retail brands prosper even when the economy doesn’t. And, significantly, they remain so when the economy is strong. Why though? Here’s my theory - While A brands are backed by huge marketing money and other less than transparent influences, private brands take a different path.

Flash vs. Substance

You might say A brands have come to be seen as the loudmouth in the room—the bombastic one who never shuts up. But upon further examination, nothing much of value is being said. In some cases, they represent what ails our society: everybody shouting at each other…nobody listening.

Meanwhile, store brands simply move ahead with great design and branding, innovation, quality, and value.

Think of it in a political context. It’s the flashy, quick-tempered, reactionary frontman versus the calm, thoughtful, measured statesman. While perhaps a too-simple analysis of A Brands vs. Store Brands, the stats support my theory, and I like simple.

As you walk the many aisles, keep some of this in mind. You’ll be bombarded by aggressive salespeople and in-your-face marketing tactics. You’ll also notice some more reserved, quiet, and very successful companies. Decide which will be a more reliable partner, not just in the good times, but when you need them most.

Come by and say hello at Stand 2. C15. This will be my 22nd time exhibiting at PLMA, I’ve seen and heard quite a bit and would be delighted to engage in some insightful conversations with you.

Have a great show!

Kind regards,

Phillip Russo Founder / Editor phillip@globalretailmag.com

4 GLOBAL RETAIL BRANDS / MAY 2024

VIEWPOINT

28-29 May

Hall 1 - booths 1.E03 - 1.F96

Hall 7 - booths 7.Q02 - 7.R47 NON FOOD

Hall 12 - booths 12.E05 - 12.F44

PLMA

Amsterdam

Visit the Italian Pavilions RAI Exhibition Centre Amsterdam, The Netherlands

2024

FOOD

Download Italian Companies

8 GLOBAL RETAIL BRANDS / MAY 2024 CONTENTS GLOBAL RETAIL BRANDS I MAY 2024 I VOLUME 12 I NUMBER 2 DEPARTMENTS 4 Viewpoint 12 Contributors 14 Events Calendar TRADE FAIRS 72 PLMA Chicago Trade Show 74 PLMA Summit Milan 75 SIAL, Paris 76 Marca by BolognaFiere 78 Cosmoprof North America, Las Vegas 81 Tuttofood, Milan SERVICES 82 Advertiser’s Index Next Issue Highlights HIGHLIGHTS 20 PLMA’s World of Private Label, Amsterdam 24 PLMA’s Salute to Excellence COVER FEATURES 48 Retail Brands Evolving Faster and Better Perry Seelert 56 Leveraging Global Retail Media Trends Amber Roberts COLUMNS 58 Private Label Packaging Trends Maria Dubuc & Katie Locke 60 6 Trends Revolutionizing Retailer-Owned Brands Christopher Durham 72 Accelerate Corporate Sustainability Goals with Private Label Cristina Lampert 64 Mastering Private Label Manufacturing in Retailing Stijn DeBats 68 Store Brands Wine Put to the Test Hans Kraak 20 48 24

The “phenomenon” continues. Private label’s powerful growth in mainstream retail and expansion into other channels, including discounters, convenience stores, specialty chains, and online, set records last year in annual sales, at US$ 236B, and dollar and unit shares.

PLMA’s 2024 US Trade Show will empower retailers by presenting tens of thousands of food and non-food products from suppliers around the world. From wine and spirits to ethnic and gourmet food to frozen & refrigerated and sustainable packaging; from beauty & cosmetics and personal care to housewares and DIY, and more. For information, email info@plma.com.

CHICAGO PLMA’s PRIVATE LABEL TRADE SHOW Presented by the Private Label Manufacturers Association

17-19 NOVEMBER •

2024 I

Where Retailers Suppliers

12 I NUMBER 2 OF 4

Phillip Russo EDITOR / PUBLISHER phillip@globalretailmag.com

Jacco van Laar BRAND AMBASSADOR jacco@globalretailmag.com

Melissa Subatch CREATIVE DIRECTOR info@melissasubatchdesign.com

Andrew Quinn DIGITAL DIRECTOR andrew.quinniii@gmail.com

Luisa Colombo EUROPEAN DIRECTOR luisa@globalretailmag.com

Ana Maria Jimenez Aguilar BUSINESS DEVELOPMENT ana@globalretailmag.com

Sabine Geissler GREENTASTE.IT Italian Business Development s.geissler@greentaste.it

CONTRIBUTORS

Perry Seelert Emerge perry@emergefromthepack.com

Christopher Durham Velocity Institure cdurham@retailbrandsinstitute.org

Maria Dubuc Marketing By Design mdubuc@mbdesign.com

Hans Kraak Kraak Media kraakmedia@gmail.com

Elena Sullivan sullivan.elena@gmail.com

Tom Prendergast PLMA tprendergast@plma.com

Kevin Ryan, MS, PhD CEO, Malachite Strategy and Research kevin@malachite-strategy.com

Published, Trademarked and all rights reserved by: Kent Media

Phillip Russo, Principal 45 Upper Kent Hollow Road Kent, CT 06757 Tel. +1 917 743 6711

All rights reserved under the Library of Congress. No part of this publication may be r eproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying and recording, or by any information storage or retrieval system, except as may be expressly permitted in writing by the copyright owner. Opinions expressed by contributors are theirs alone and do not necessarily reflect those of the publisher.

Global Retail Brands is published 4 times a year.

Editorial Submissions phillip@globalretailmag.com

Advertising

luisa@globalretailmag.com

Advertising

Subscription Information phillip@globalretailmag.com

MAY

VOLUME

EUROPE

Inquiries –

Inquiries

AFRICA, AMERICAS, ASIA, AUSTRALIA, MIDDLE EAST

–

phillip@globalretailmag.com

www.globalretailmag.com www.globalretailmag.com

& MARCH 2024 www.globalretailmag.com www.vertexawards.org PLMA BOOTH H-1506 2024 SUPPLIER GUIDE 10 Bold Predictions for the Food Industry Rise of the New Global Consumer Imitation, Borrowing and Originality OCTOBER 2023 TENTH ANNUAL VERTEX AWARD WINNERS www.globalretailmag.com www.vertexawards.org BEST OF SHOW PLUS CHOCOLATE GOED VERHAAL PLUS Retail B.V. The Netherlands Anuga, Cologne PLMA Chicago Preview Beyond The Numbers MAY 2024 www.globalretailmag.com www.vertexawards.org RETAIL BRANDS FASTER AND BETTER PLMA Amsterdam At-Show Issue Accelerate Corporate Sustainability Goals with Private Label SPONSORED BY NOVEMBER 2023 www.globalretailmag.com www.vertexawards.org PLMA Chicago It’s Beginning to Look a Lot Like Christmas The Not-So-Secret Secret Weapon for Retailers HALL 2, STAND 2.C15 VISIT US AT PLMA

Meet

Everything we do is a root in the rich soil that takes strong relationships, knowledge, and timing to do it right. And it all starts with a single seed.

Seneca’s high quality produce is sourced from over 1,400 American farms—family farmers we have done business with for many years, and in some cases generations. Our motto of Farm Fresh Goodness Made Great echoes throughout our fundamental beliefs, which have been key to our success since 1949.

Next year, Seneca Foods will be celebrating 75 years in business. We have spent these years working hard to become one of the most highly integrated fruit and vegetable processing companies in the US. We manage many—and in some cases all—aspects of production, to provide families with a wide range of nutritious fruit and vegetable products that are safe, satisfying and sustainable.

We do it together, the same way we have for over seven decades. Because our roots run deep.

US IN BOOTH #F200

Seneca, we're still doing things the way we always have - the right way. Think globally, grow locally.

AMERICAN

99% Please visit www.SenecaFoods.com to learn more about our company, people and products. VISIT

Please visit www.SenecaFoods.com to learn more about our company, people and products.

of our produce is grown by

FARMERS

MARIA

DUBUC

President of MBD, is a creative and workflow expert in the retail landscape, Maria’s 30-year career translates branding experiences into eye-catching design that is unique and distinct for each client. he has created new private brands and redesigned/repositioned existing brands with leading retailers, while also implementing workflow management systems specifically tailored to the clients’ needs. Current clients include The Home Depot, Smart & Final, PetSmart, 7-Eleven, PriceSmart, BJ’s Wholesale Club, Sprouts Farmers Market, WinCo Foods, Natural Grocers and more.

STIJN DE BATS

Managing Partner at Cibus Nexum and a food technology expert with 25 years of experience in the food industry and private label manufacturing projects.Cibus Nexum is an independent service provider, specializing in connecting brand owners, retailers, and producers through innovative solutions and partnerships.

CHRISTOPHER DURHAM

President of the Velocity Institute

Prior to this he founded the groundbreaking site My Private Brand. He is the co-founder of The Vertex Awards. He began his retail career building brands at Food Lion and Lowe’s Home Improvement. Durham has worked with retailers around the world, including Albertsons, Family Dollar, Petco, Staples, Office Depot, Best Buy, Metro Canada. Durham has published seven definitive books on private brands, including Fifty2: The My Private Brand Project and Vanguard: Vintage Originals.

REBECCA HAMILTON

Rebecca is the CEO of award-winning Fish Agency and sister agency Whitespace Brands Inc. With over 30 years of experience, she has established herself as one of North America’s leaders in the fields of strategic branding, retail design, and communications for clients in the retail sector. Under Rebecca’s oversight, the Fish Agency brings brands to life at retail and has consistently delivered high ROIgenerating retail experiences for its clients. She mentors and leads highly experienced and integrated teams that provide store design, package design for CPG and private brands, digital/social initiatives, “phygital” experiences, and advertising services.

HANS KRAAK

Hans Kraak is educated in biology and journalism and wrote three books about nutrition and health. He worked for the Dutch ministry of Agriculture, Nature and Food quality and the Netherlands Nutrition Centre. As editor in chief he publishes in the Dutch Magazine for Nutrition and Dietetics, as a food and wine writer he published in Meininger’s Wine Business International and reports for PLMA Live EU and PLMA USA.

CRISTINA LAMPERT is Director of Growth and Innovation at HowGood, a third party research group with the largest food ingredient sustainability database, where she enables major retailers and consumer packaged goods with a sustainability impact platform that models environmental and social impact based on their ingredients and sourcing locations.

KATIE LOCKE

If you’ve ever met Katie, you’ve seen or heard her excitement for building or rebuilding brands. Her passions also include just about every facet of food and eating experiences. For the past 9 years, Katie has worked in Sales & Marketing for Marketing by Design (MBD), a branding and packaging design agency specializing in high volume retailer programs.

AMBER ROBERTS is the Partnership Director at Threefold, the global retail media expert agency responsible for 10+ Retail Media Networks. With nearly two decades in retail, including a tenure at Kroger, Amber’s expertise drives the success of omnichannel marketing strategies for retailers and brands across categories.

PERRY SEELERT

A retail branding and marketing expert, with a passion for challenging conventional strategy and truths. Perry is the Strategic Partner and Co-founder of Emerge, a strategic marketing consultancy dedicated to helping Retailers, Manufacturers and Services grow exponentially and differentiate with purpose.

12 GLOBAL RETAIL BRANDS / MAY 2024 CONTRIBUTORS IN THIS ISSUE

MAY

PLMA’S WORLD OF PRIVATE LABEL

Amsterdam 28 -29 MAY www.plmainternational.com

JUNE

IDDBA

Houston, TX

9 - 11 JUNE www.iddba.org

OCTOBER

SIAL Paris, France 19 - 23 OCTOBER www.sialparis.com

VELOCITY SUSTAINABILITY CONFERENCE

Phoenix, AZ 22 - 23 OCTOBER www.velocityinstitute.org

SUMMER FANCY FOOD SHOW

New York, NY 23 - 25 JUNE

FOOD TAIPEI

Taipei, Taiwan 26 - 29 JUNE

foodtaipei.com.tw/en/index.html

JULY

COSMOPROF NORTH AMERICA

Las Vegas, NV 23 - 25 JULY www.cosmoprofnorthamerica.com

PLMA’S PRIVATE LABEL SUMMIT

Milan, Italy 29 - 30 OCTOBER www.plmainternational.com

NOVEMBER

COSMOPROF ASIA

Hong Kong, China 12 – 15 NOVEMBER www.cosmoprof-asia.com

PLMA’S US TRADE SHOW

Chicago 17 - 19 NOVEMBER www.plma.com

14 GLOBAL RETAIL BRANDS / MAY 2024 INDUSTRY EVENTS

TECHNICAL SCIENTIFIC COMMITTEE

SHOW YOUR BUSINESS POTENTIAL www.marca.bolognafiere.it 15-16 January 2025 21 st EDITION

US Store Brand Sales

Off

to Good Start in 2024

Rebounding from a disappointing last few months of 2023, US store brand sales have started off the new year quite well. The products outperformed national brands in both dollars and units over the first quarter of 2024, according to Circana, PLMA’s provider of exclusive sales data in the US.

Private label dollar sales were up 1.8% compared to an increase of 1.2% for national brands. Over the first three months, total store brand sales were about US 60bn, a potential harbinger of another record year, as was the case in 2023 when all-time highs were set in annual sales, at $236 billion, as well as dollar share (18.9%) and unit share (20.7%).

Over the last three months of 2023, store brands were mired in sluggish figures. Dollar sales were, respectively, plus 0.3%, flat, and minus 0.9%; while unit sales were down 0.6%, down 0.5% and down 1.2%.

“It’s very reassuring and gratifying to see our sales numbers have turned positive again,” says Peggy Davies, PLMA president.

“After the topsy-turvy, post-pandemic period, we appear to have settled back into store brand’s traditional sales performance of solid, low to mid-single digit gains. More than one of every five food and nonfood grocery items sold in the US is a store brand.”

DOLLAR SALES

As of…

The Q1 2024 results in unit sales were even more impressive. Store brands rose by 2.3% while national brands fell 0.9%. As a consequence, store brand market share of both dollars and units increased.

UNIT SALES

as of…..

Looking at the results in the individual product departments for the first quarter of 2024, the leading gainers in store brand dollar sales were Beauty, up 7.9%; followed by General Food, ahead 5.8%, and Beverages, which rose 3.3%. Pet Care was up 2.9%, Home Care 2.7%, Frozen 2.3%, Home 2.2%, and General Merchandise 1.5%. Refrigerated slipped 0.6%.

For complimentary US monthly store brand and national brand sales data, and other actionable statistical information, PLMA members and retailers can sign in at plma.com.

18 GLOBAL RETAIL BRANDS / MAY 2024 NOTABLE

DATE PL DOLLAR SALES PL,DOLLAR VS YA% NB VS YA % 1/28/24 $19,998,014,551 2.1% 1.6% 2/25/24 $20,117,529,336 1.2% 0.9% 3/24/24 $19,957,711,437 2.2% 1.2% TOTAL $60,073,255,324 1.8% 1.2%

DATE PL UNIT SALES PL UNIT VS YA% NB VS YA % 1/28/24 5,144,354,509 3.5% -0.9% 2/25/24 6,067,096,002 1.8% -1.2%

1.7% -0.5% TOTAL 16,255,729,950 2.3% -0.9%

3/24/24 5,044,279,439

PLMA’s World of Private Label:

Experience the Excitement

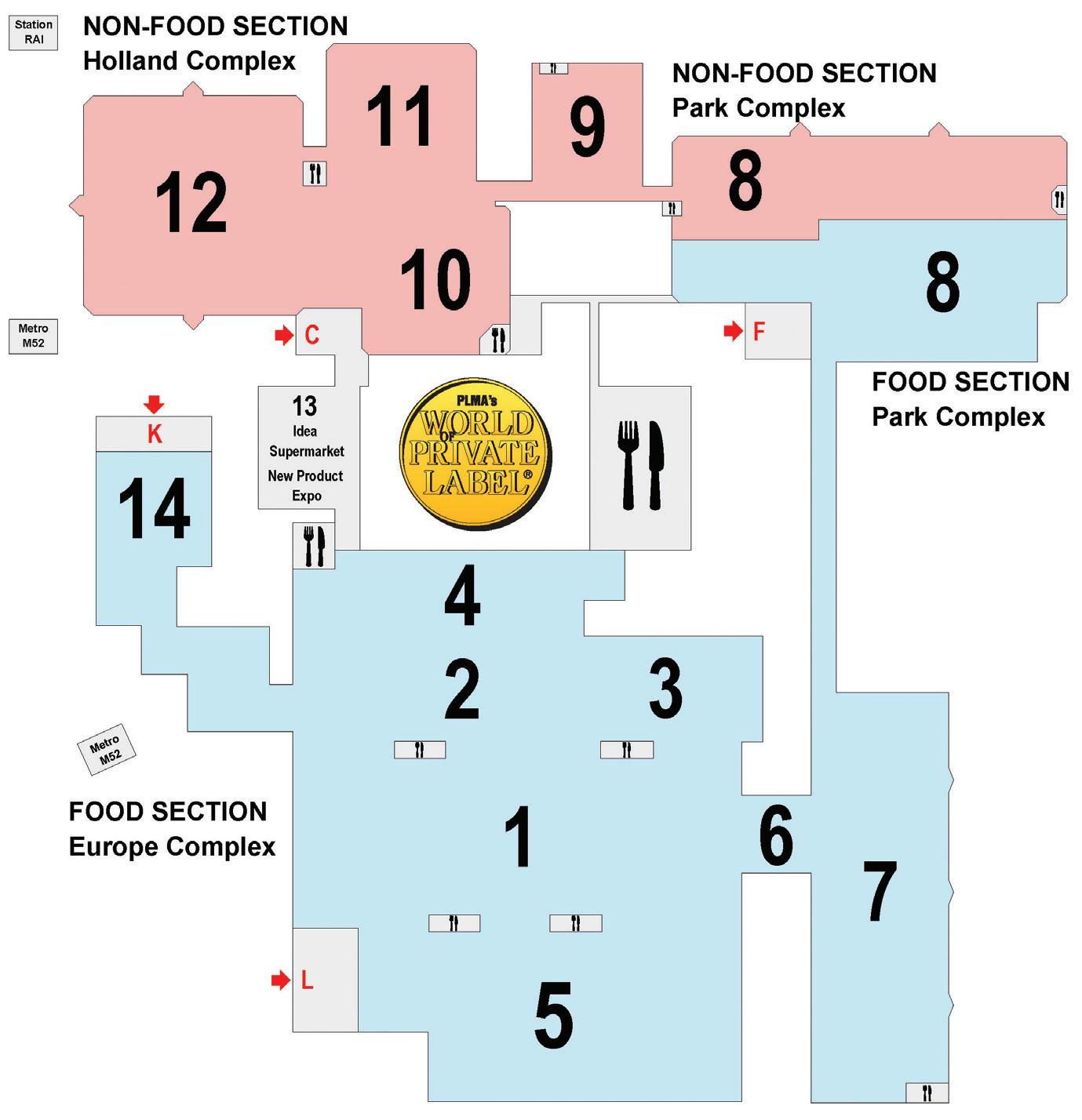

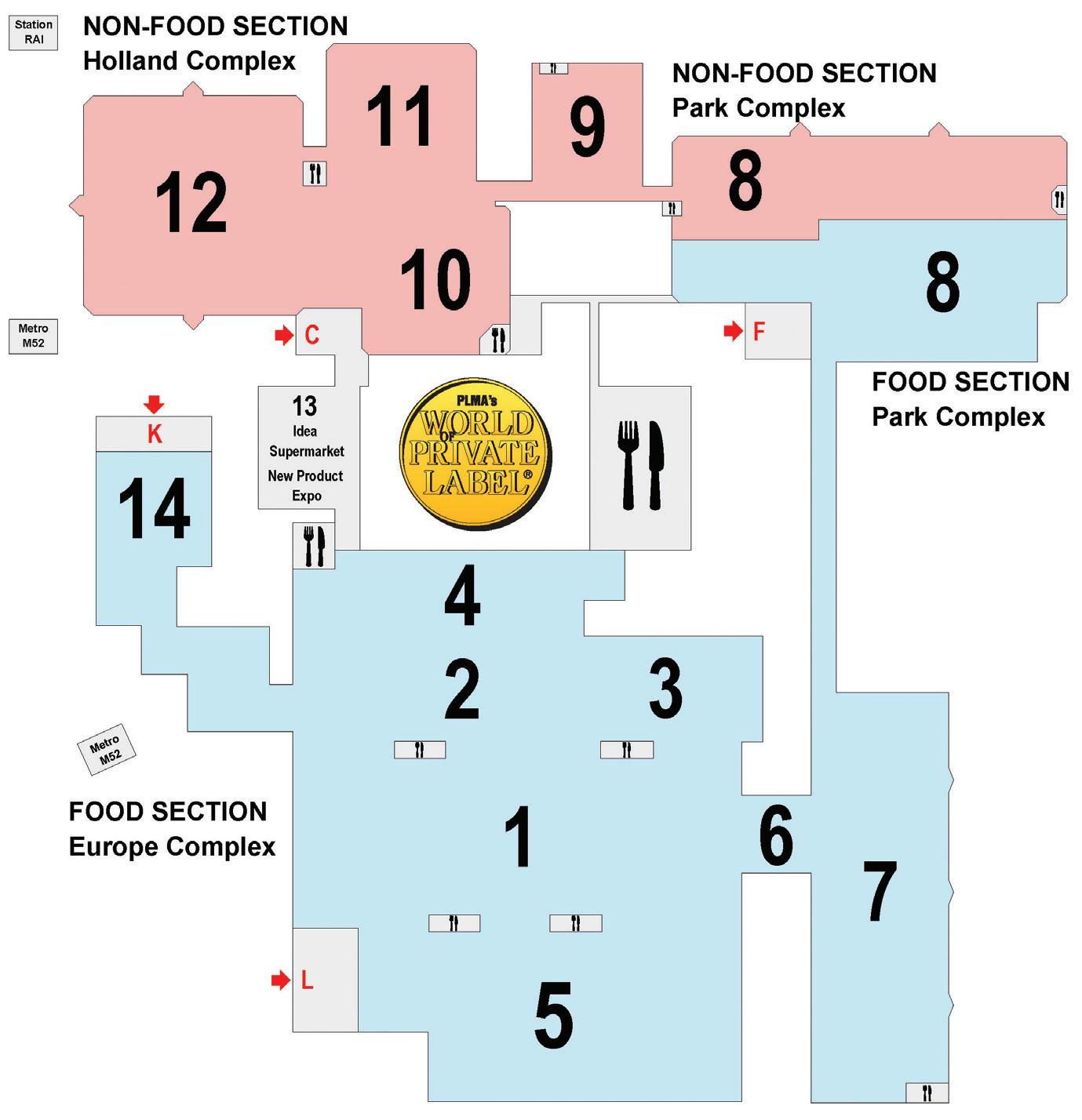

May 28 and 29 at the RAI Amsterdam Convention Center

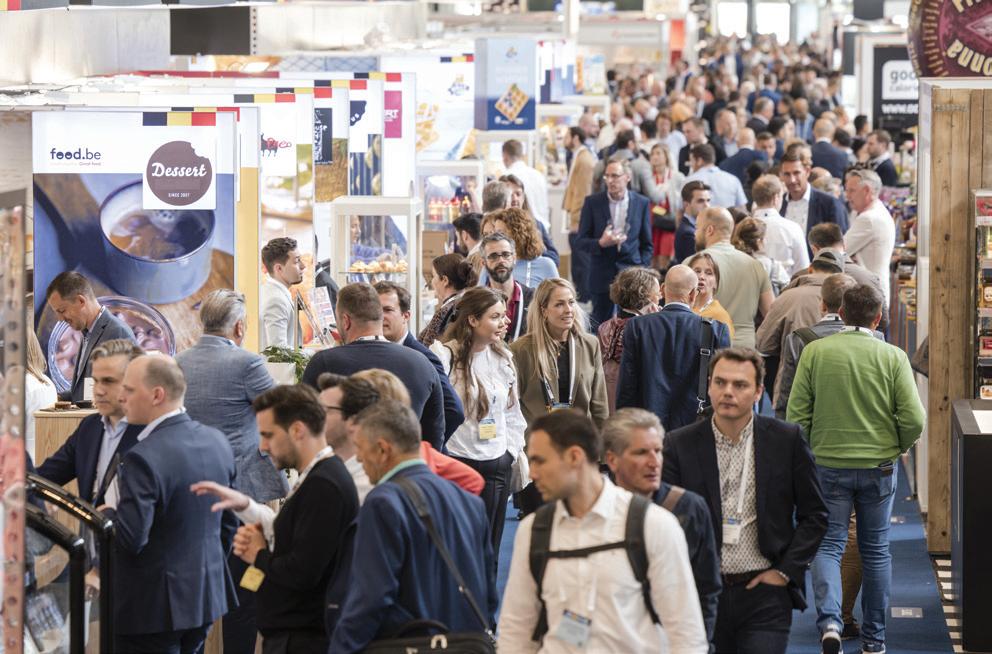

More than 2,950 exhibitors from more than 73 countries will fill over 43,500 m2 of exhibit space at PLMA’s 2024 World of Private Label International Trade Show, May 28 and 29 at the RAI Amsterdam Convention Center.

The show floor will span 14 halls, including nine for food and five for non-food. It will feature 67 national and regional pavilions.

“Our high-impact global event provides a dynamic two-day platform for more than 28,000 private label professionals from 120 countries to connect, source, and grow,” said PLMA President Peggy Davies. “The innovation unveiled for food and non-food products and packaging on

the show floor and in Idea Supermarket will strengthen the already booming private label industry.”

Products on display will include fresh, frozen, and refrigerated food, dry groceries, and beverages, as well as non-food categories, including cosmetics, health and beauty, household and kitchen, garden supplies, housewares, and more.

Among the product trends on the show floor:

• Sustainable Claims 39% or 1,150+ exhibitors

• Dietary Needs 31% or 900+ exhibitors

• Vegan, Plant-Based & Vegetarian 22% or 650+ exhibitors

• Organic 26% or 750+ exhibitors

A popular part of the trade show is the innovation and new product development area known as the Idea Supermarket. This section features private label ranges from 64 supermarkets, hypermarkets, discounters, specialty stores and drugstores around the world. Also in this area is the New Product Expo, which will feature 500+ new products developed by exhibitors. Plus, there will be a display of winning products from retailers that won a 2024 International PLMA Salute to Excellence Award for private label innovation.

The pre-show seminar program on Monday, 27 May, will include workshops led by industry experts on relevant topics. Participation in the seminars and workshops is free to all registered retailers, exhibitors, visitors, and industry professionals.

20 GLOBAL RETAIL BRANDS / MAY 2024

NOTABLE

Free Workshops & Pre-Show Seminars

Monday 27 May from 13.00 to 16.00 Forum Centre, RAI Amsterdam Convention Center

WORKSHOPS:

13.00 – 14.00 (pre-registration required)

GETTING TO YES

Strategic Partnership and Creating Mutual Value

A 50-minute workshop where you will be equipped with practical tools and insights to build sustainable strategic partnerships in the realm of Private Label.

Speaker: Erik Aapkes, Managing Partner, Blueprint Europe

PACKAGING & DESIGN

"Unboxing the Future: The Evolution of Packaging Design”

Stay ahead of the curve with insights into emerging trends in packaging design and technology, ensuring your brand resonates now and in the future.

Speakers: Loe Limpens & Sabine Louet Feisser, Yellow Dress Retail

Pre-Show Seminar Programme

14.00 – 16.00

(open to all registrants with a 2024 badge)

Announcing the Winners of the 2024 Int’l PLMA Salute to Excellence Awards

Impression of the 2 testing and tasting days, selecting the best of the best in private label, including the revelation of the winning products, honoring retailers for innovation and quality in private label products and packaging.

Private Labels:

Transformation for Growth

The session examines the retailer-led transformation of private labels in Europe and beyond, its impact on category development and consumer behavior, and opportunities for growth in 2024 and 2025. Circana will provide a forecast based on a proprietary model that takes into account a robust set of factors defining CPG category development.

Speaker: Ananda Roy, SVP Thought Leadership Europe, Circana

Top Global Consumer Trends Report 2024

An overview of the trends expected to have the most impact in 2024 and the implications for business, with supporting data. These trends provide insight into changing consumer values, exploring how consumer behavior is shifting and causing disruption for businesses globally.

Speaker: Ana Tique, Client and Insight Consultant, Euromonitor

RETAILER INSIGHT

An insight look at Picnic and COOP Italia.

PICNIC

“The story of Picnic’s own brand”

An inside look in Europe’s fastest growing and trendsetting online supermarket with inspiring insights of Picnic’s design and packaging process.

Speakers: Vibeke van der Bilt, Business Lead Private Label, and Fleur Randag, Business Lead Private Label, Picnic

COOP ITALIA

“ Coop and its Revolutionary Approach to Private Label”

Learn about its dynamic exploration of real-world success, grounded in practical insights as one of the largest established retailers in Italy.

Speaker: Paolo Bonsignore, COO, Coop Italian Food

PLMA Idea Supermarket® Area of Innovation, NPD and Inspiration

New Product Expo showcases the newest products developed by this year’s exhibitors. On display are nearly 500 of the latest innovations in the private label industry, from new products and flavors to marketing to packaging.

Retail Trends display the latest developments of private label ranges of 60+ retailers worldwide, conveniently presented in one location. The aisles provide a world tour of trends and new launches by retailers around the globe.

2024 International PLMA Salute to Excellence Awards. The Awards give recognition and honor retailers for innovation and quality in the creation of their private label programs. All award-winning products are displayed in the PLMA Idea Supermarket. continued on next page >

www.globalretailmag.com 21

continued from previous page

AT A GLANCE: PLMA’s World of Private Label

OPENING HOURS:

28 May: 09.00 – 18.30

29 May: 09.00 – 16.30

EXHIBITOR PROFILE:

Manufacturers of private label FMCG food and non-food products.

PAVILIONS:

67 national and regional pavilion organizers from 40 countries.

VISITOR PROFILE:

Trade professionals from 120+ countries, including buyers from supermarkets, hypermarkets, discounters, drugstores, and department stores, as well as importers and exporters, manufacturers, consultants, sales agents, and packaging & design experts.

HALLS:

9 Food halls and 5 Non-Food halls, covering all 3 complexes of RAI Amsterdam. Halls 1-8 and 14 accommodate the Food Section, Halls 8-12 accommodate the Non-Food Section.

FOOD SECTION

Beverages

Snacks

Confectionary

Shelf Stable Products

Bakery Products

NON-FOOD SECTION

OTC-Products & Healthcare

Baby Care accessories

Feminine Hygiene

Toiletries

Sauces & Spreads

Pet Food

Fruits & Vegetables

Meat, Poultry & Fish

Ready Meals

Cosmetics

Personal & Leisure

Hair Care & Skin Care

Household Products

Organic, Health &Dietary Products

Diary Products

Oils, Dressing & Seasonsings

Ingredients & Raw Materials

Paper & Plastic Products

Housewares & DIY Products

Pet Products/Accessories

Auto Care

22 GLOBAL RETAIL BRANDS / MAY 2024

NOTABLE

Achieving accelerated growth through customer obsession

To truly stand out in a crowded market, food and beverage brands need to connect rapidly with today’s consumers.

How Prof. Consulting Group can help brands thrive

As award-winning international Food consultants, we help food & beverage brands grow fast, through consumer-focused outcomes. With services including developing innovative growth strategies, leading responsible sourcing, trade mission facilitation and contract manufacturing programs or offering practical advice on accelerating your brand’s ESG journey, as you target new markets Prof. has the expertise to take your business to the next level.

A local business with international reach

Through our international offices in the UK and Australia, we are strategically positioned to target success in high-growth markets.

If you’re a food and beverage business looking to take your passion to the next level, contact Prof. Consulting Group. Together, we can bring your adventures to life and create food brands that resonate with consumers everywhere.

www.profcg.com

UK Email: hello@profcg.co.uk Tel: +44 208 616 7202 AUS Email: hello@profcg.com Tel: +61 180 000 3130

2024 International PLMA Salute to Excellence Awards

Show Retailers’ Support To Shoppers

Shoppers can rely on retailers supporting them in healthy and sustainable lifestyles while keeping an eye on their budgets. Trends in the 2024 International PLMA Salute to Excellence Awards are use of recycled materials, attention for origin and optimized quality and affordability.

Consumers are capricious. That’s why private label offerings cater to shoppers who are both healthconscious and keen on magic moments of indulgence. Consumers also care for the planet. That’s why innovative plant-based private label items have been introduced, helping shoppers with diets that are sustainable and healthy. Such excellent new items, along many more, have been rewarded with an International Salute to Excellence Award.

In this year’s edition, over 550 new private label items from 72 retailers in 23 countries were submitted for judgement. An international panel of judges – including former retailers, chefs, marketing professionals, nutritionists, and journalists – evaluated these items in intensive sessions. This resulted in 98 food and non-food winners of the International Salute to Excellence Awards.

99 winners by 43 retailers from 23 countries

These winners were introduced by 43 retailers from 23 countries. Most award winning private labels (19) were introduced last year in Germany, followed by Denmark and Italy with 13 Salutewinners each. Dutch and French retailers gained 7 awards each, while retailers in Spain, Portugal and Ireland were given 6 awards respectively. The other awards were divided between retailers from United Kingdom, Norway, Czech Republic, Poland, Türkiye, Ukraine, China, South Africa and Thailand.

High-quality products at affordable prices remain a focus area for retailers who clearly respond to the needs of today’s consumers. “These retailers have successfully responded to the changing wants and needs of today’s shopper,” said PLMA President Peggy Davies.

24 GLOBAL RETAIL BRANDS / MAY 2024

High-quality products at affordable prices remain a focus area for retailers who clearly respond to the needs of today’s consumers.

“They are providing not just quality and affordability but also innovative food and non-food products that reflect current lifestyle trends.”

A closer look at winning retailers learns that the German Rewe Group gained most awards for private labels introduced in its Rewe supermarkets and Penny discount stores. The 9 Salute to Excellence awards for Rewe Group clearly demonstrates the retailers’ innovative performance in new product development. Also from Germany is the drugstore chain Rossmann, who gained 6 awards, just like the Irish retailer Musgrave.

The Netherlands hosts 3 retailers who submitted their new private label items for judgement. The Dutch branch of ALDI (Nord) achieved 4 award winners, while drugstore retailers Etos (Ahold Delhaize) and Kruidvat (AS Watson) were honored in total with 3 awards.

Continente from Portugal, and the Danish retailers REMA 1000 and COOP each walked away with 5 awards. Auchan and Carrefour Group were honored with 4 awards each.

Italy had the largest presence of retailers in the competition and divided the 13 awards between COOP Italia, CRAI, Despar and PAM Panorama, MD, Végé Retail and Vega Soc. Coop. In Spain EROSKI Desarrollo de Marcas and Carrefour Spain divided the 6 awards.

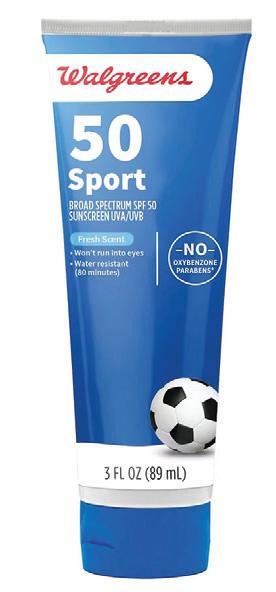

Wines

This balance between affordability and quality is also found at the wine awards. Judges tasted over 130 wines divided in some twenty categories. 14 retailers from 6 countries were honored with an International Salute to Excellence Award for Best Quality and Best Value in wine.

The private label wine category had its own separate tasting sessions. Under guidance of Master of Wine Cees van Casteren, two panels of wine experts blind-tasted over 130 wines divided in some twenty categories. From sparkling whites and rosés, through classic wines to organic cuvées, judges rolled the wine, smelled it, looked at it, tasted, and also scored it on a variety of criteria such as color, style, nose, and appellation.

The judges selected 33 winning wines in the category Best Quality and Best Value. Trendy sparkling, rosé and special grape varieties targeted to millennials and adventurous consumers, were offered in this year wine competition.

Catering to adventurous consumers, means sourcing wines from new regions. “Multiple retailers seem to be more open to source wines from non-mainstream origins and grape varieties”, a judge said, mentioning Portugal with Loureiro, Verdelho and Alvarinho as an example.

According to the tasting panels, the quality of the wines versus their price levels exceeded all expectations and received the praise of the judges. When tasing they experienced a much increased consistency in quality.

“I would definitely serve these wines at a dinner with friends without a doubt or reservation” Cees van Casteren said. “Some of the wines that were presented had such a high quality that they can compete with the most expensive wines on the shelves.”

“Private label seems to become a strategic choice for some producers rather than a Plan B”, one of the judges stated.

continued on next page >

www.globalretailmag.com 25

And the winners are….

Food for the Family

COLD APPETIZERS

Metro (Türkiye)

Metro Chef Gemlik Zeytini (Black Olives)

CONVENIENCE FOOD & READY

MEALS (tie)

REWE Group (Germany)

REWE Feine Welt Burrata Pesto Ravioli

CRAI SECOM (Italy)

La Rosa dei Gusti Ravioli All’Aragosta

FOODS FOR BABY & KIDS

Woolworths (South Africa)

Wooliesbabes Babes Meal Pea, Sweet Potato and Spinach 6+ months

FRUIT & VEGETABLES

COOP Trading (Denmark)

Änglamark Økologiske Klementiner

Rohlik (Czech Republic)

Kitchin Green Peas

MEAT & POULTRY

Musgrave Retail Partners (Ireland)

SuperValu Irish Beef Tomahawk Steak Aged on the Bone

NEW FLAVOUR COMBINATION

Woolworths (South Africa)

Woolworths Food Beetroot + Mixed Berry Flavoured Granola

ON THE GO FOOD

REWE Group (Germany)

REWE to go Wakame Salat mit Mu-Err-Pilzen & Sesam

PIZZA & PINSA

Desarrollo de Marcas (Spain)

Deleitum Pizza Fresca Ibérica

READY TO EAT MEAT

Musgrave Retail Partners (Ireland)

SuperValu Signature Tastes Irish Hampshire Slow Cooked Maple & Honey Bacon Roast

SMOKED SALMON (tie)

ALDI (The Netherlands)

ALDI Gerookte Noorse Zalm

COOP (Norway)

COOP Fra Havet Varmrøkt Krydderlaks

SOUPS

Musgrave Retail Partners (Ireland)

SuperValu Signature Tastes Chunky Vine Ripened Tomato, Pancetta & Mixed Bean Soup

SPREADS & DIPS

PENNY (Germany)

Best Moments Akazien-Honig mit Trüffel

SWEET BREAD SPREAD

Dirk Rossmann GmbH (Germany) enerBIO Kokos-Mandelmus

TAPAS

REMA 1000 Danmark A/S (Denmark) Gram Slot Økologiske Kartoffel Dippers

WORLD CUISINE

Continente (Portugal)

Continente Noodles com Camarão com Molho Picante

Vegan & Vegetarian

FREE FROM

EROSKI (Spain)

EROSKI Sin Gluten Pan de Bocadillo

PLANT-BASED DRINKS

Continente (Portugal)

Continente Barista Aveia (Oat Drink)

VEGAN FOOD

REWE Group (Germany)

REWE to go Vegan Falafel-Veta Bowl Salat

VEGETARIAN READY MEALS

REWE Group (Germany)

REWE Beste Wahl Veggie Bowl Kürbis Quinoa

Meal Preparation

CONDIMENTS & TABLE SAUCES

Globus Markthallen Holding (Germany)

Globus Ahorn Chipotle BBQ Sauce

COOKING INGREDIENTS & COOKING SAUCES

PENNY (Germany)

NATURGUT Bio Schmand

HERBS & SPICES

Woolworths (South Africa)

Woolworths Food Shisanyama Seasoning

HOME BAKING

Globus Markthallen Holding (Germany)

Globus Regional Weizenmehl Typ 405 aus Bayern

OILS & VINEGAR

EDEKA (Germany)

Genussmomente Steirisches Kürbiskernöl

REWE Group (Germany)

REWE Feine Welt Mango-Chili Fruchtessig

PASTA & RICE

PAM PANORAMA (Italy) Tesori dell’Arca Pappardelle Pasta all'Uovo

PASTA SAUCES

METRO AG (Germany)

METRO Chef Pesto alla Genovese Senza Aglio

26 GLOBAL RETAIL BRANDS / MAY 2024

continued from previous page International PLMA Salute to Excellence Awards

Bakery Breakfast & Desserts

BAKERY: (BAKE-OFF) BREAD

REMA 1000 Danmark A/S (Denmark)

REMA 1000 Grillet Madbrød (Grilled Balkan Bread)

BAKERY:

CHOCOLATE-BASED COOKIES

Auchan (France)

Auchan Kidy Milk

BAKERY: COOKIES

DESPAR Italia (Italy)

DESPAR PREMIUM Frolle con Ripieno ai Fichi

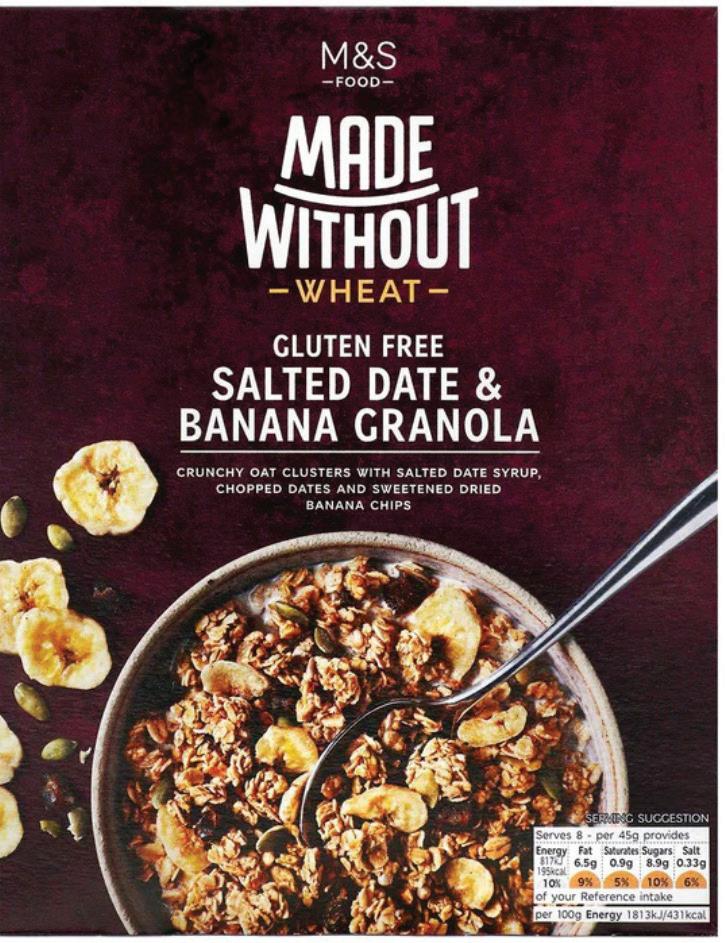

BREAKFAST CEREALS

Migros (Türkiye)

Mlife Yulaf Ezmesi (Organic Oatmeal)

CRISPBREADS (tie)

PAM PANORAMA (Italy)

Tesori dell’Arca Pane Guttiau

Vega Società Cooperativa (Italy)

Mondo Natura Bocconcini Croccanti Lavorati a Mano

DESSERTS & TOPPINGS

COOP Italia (Italy)

COOP D'osa Topping Amarena

ICE CREAM

COOP Italia (Italy)

COOP Fru Swing Ghiaccioli di Frutta Fragola e Mela Pronti di Congelare

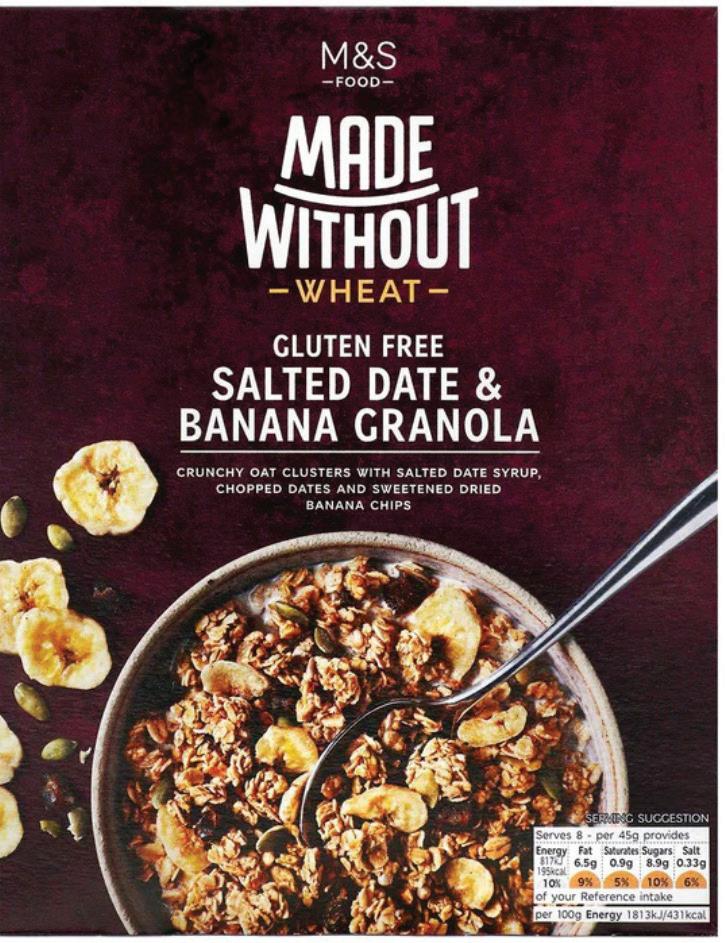

MUESLI & GRANOLA

ALDI (The Netherlands)

Golden Bridge Granola Rode Vruchten (Nutri-Score A)

SWEET BAKERY

ALDI S.R.L (Italy)

Gourmet Finest Cuisine Torta

Sbrisolona con Cacao e Nocciole

Dairy

HIGH-PROTEIN DAIRY

Musgrave Retail Partners (Ireland)

SuperValu Protein Strawberry Yogurt

MILK & FLAVOURED MILK

Rohlik Group (Czech Republic)

Miil BIO Fresh Milk Whole 3,6 % Fat

REMA 1000 Danmark A/S (Denmark)

GRAM SLOT Økologisk Kakao

Skummet Mælk

NATURAL & FLAVOURED YOGURT

Dagrofa Aps (Denmark)

Grøn Balance ØKO Pære & Banan Yoghurt

(SEMI)-HARD CHEESE

Musgrave Retail Partners (Ireland)

SuperValu Signature Tastes

24 Months Matured Vintage

Irish White Cheddar

SPECIALTY CHEESE

Musgrave Retail Partners (Ireland)

SuperValu Signature Tastes Baking Irish Cooleeney Cheese

Snacks & Confectionary

CONFECTIONERY

PENNY (Germany)

Choco’la ChoViva Peanut Butter Cups

DARK & FLAVOURED CHOCOLATE

Dirk Rossmann GmbH (Germany)

enerBIO Raw Chocolate mit Dattelsüße

DRIED FRUIT

M Commerce Group (China)

M Select Dried Apple

HEALTHY SNACKS (tie)

EROSKI (Spain)

EROSKI Minitortitas Sabor Jamón

COOP Trading (Denmark)

COOP Corn Snacks Sour Cream & Onion

NUTRITION BARS

Migros (Türkiye)

Mlife Slim Style Fruit Bars

NUTS & TRAIL MIX

Auchan (France)

Auchan Noix de Cajou Grillées à Sec Filière Responsable

SALTY SNACKS (tie)

Carrefour (Spain)

Carrefour Selection & Lord Dani

Patatas Fritas Sabor Salsa Bull

CRAI SECOM (Italy)

CRAI Chips di Ceci

SNACKS FOR KIDS

EROSKI (Spain)

EROSKI Galletas Tostaditas

SPORTS NUTRITION & PROTEIN BARS

COOP Trading (Denmark)

COOP Choco Mint Protein Bar

Beverages

COFFEE PODS

DESPAR Italia (Italy)

DESPAR PREMIUM Caffe’ Boheme

ENERGY DRINKS

Continente (Portugal)

GUAPA Bebida Energética

Ananás e Coco

FILTER & COFFEE BEANS

Migros (Türkiye)

M Single Origin Filter Coffee

ALDI (The Netherlands)

Barissimo Espresso Bio Fairtrade

JUICES

Pingo Doce (Portugal)

Pingo Doce Maçã, Coco, Maracuja, Spirulina Juice

SMOOTHIES & SHOTS

Continente (Portugal)

Continente Equilíbrio Immunity

Boost Super Smoothie

Continente (Portugal)

Continente Equilíbrio Energised Shot

SOFT DRINKS

MD S.P.A (Italy)

Lettere dall’Italia Chinotto di Calabria

TEA & INFUSION

REWE Group (Germany)

REWE Feine Welt Bio Früchtetee

Italienische Limone

continued on next page >

www.globalretailmag.com 27

Non-Alcoholic Beverages

MOCKTAILS & SPIRITS

Woolworths (South Africa)

Woolworths Food Non-Alcoholic

Strawberry Daiquiri Sparkling

Carrefour (France)

Hansha Whisky Blended in Japan

Health & Beauty

BABY DIAPERS & WIPES

REMA 1000 Danmark A/S (Denmark)

REMA 1000 Nyføot Bleer 2-4 kg (Newborn Diapers)

BABY & KIDS CARE

EVA (Ukraine)

Honey Bunny Liquid Soap

BATH & SHOWER

EROSKI (Spain)

Belle Gel de Baño Solido Aloe Vera

COSMETIC & BEAUTY ACCESSORIES

Etos (The Netherlands)

Etos Reusable Make-Up

Remover Pads

CLEANSERS & ACCESSORIES

Dirk Rossmann GmbH (Germany)

ISANA Bunte Wattestäbchen aus Baumwolle

FACE CREAM & MOISTURIZERS (tie)

Carrefour (France)

Carrefour Soft Chanvre Hemp Crème Visage

EROSKI (Spain)

Belle Crema Prebiótica

Equilibrante Sensitive

FACE SERUMS (tie)

Carrefour (France)

Carrefour Soft Chanvre Hemp

Sérum Visage

Dirk Rossmann GmbH (Germany)

ISANA Niacinamide Face Serum

HAIR TREATMENT & CONDITIONER

Dirk Rossmann GmbH (Germany) ISANA Professional Plex Spülung

HAND & NAIL CARE

Kremmerhuset (Norway)

DIS Neroli Vertiver Håndkrem

HAND SOAP

Kremmerhuset (Norway)

DIS Neroli Vertiver Håndsåpe

SHAMPOO

Salling Group (Denmark)

Salling Fri Shampoo

SKIN CARE FACE MASKS

Migros (Türkiye)

Like Me Collagen Arindirici Kil Maskesi (Clay Mask)

SUNCARE & AFTERSUN

Vita (Norway)

Harmoni After Sun Aloe Vera Lotion

Personal Care & Healthcare

BODY & PERSONAL CARE

Dirk Rossmann GmbH (Germany)

Alterra Sensitiv Deo-Stick Parfümfrei Bio-Hamamelis

DENTAL CARE (tie)

Auchan (France)

Auchan Brosse à Dents Sensitive à Tête Interchangeable + Recharges

Central Food Retail (Thailand) Smart-R Bio Care Toothbrush

HEALTH & WELLBEING

Etos (The Netherlands)

Etos Silicone Hydrogel Zachte Maandlenzen

MEN’S TOILETRIES

EVA (Ukraine)

Fabien Marche AbO9 Amber

Eau de Parfum

Home & Household

(ECO) DISHWASHER & WASHING UP

Salling Group (Denmark)

Salling Fri Opvaskemiddel Refill

ECO FRIENDLY HOUSEHOLD PRODUCTS (tie)

COOP Denmark (Denmark)

Änglamark Brun Sæbe

Marks and Spencer (United Kingdom)

M&S 2 Recycled Copper Wire Scourers

ECO-FRIENDLY LAUNDRY PRODUCTS

COOP Norway (Norway)

Änglamark Color Koncentreret

Detergent Refill

HOME & LEISURE

Jeronimo Martins Polska (Poland)

Smukee Vintage Electric Kettle

HOUSEHOLD ARTICLES

Shandong Quanfuyuan Commercial

Group (China)

Quanfuyuan Air Frying Paper

HOUSEHOLD CLEANING

ALDI (The Netherlands)

UNA Reinigingsdoekjes Cotton Fresh

LAUNDRY CARE

AS Watson Benelux (The Netherlands)

Kruidvat Extra Concentrated Vloeibaar Wasmiddel Reistube

PAPER PRODUCTS

Auchan (France)

Auchan Better Life Papier

Toilette 3 Epaisseurs

PET CARE & PET FOOD (tie)

VéGé Retail (Italy)

Mucho Amor Mini Croccantini

Gatto Cucciolo

COOP Italia (Italy)

COOP ESIGO Specialist Grain Free

Alimento Completo Secco Cani Adulti

28 GLOBAL RETAIL BRANDS / MAY 2024

continued from previous page International PLMA Salute to Excellence Awards

2024 International PLMA Salute to Excellence Wine Awards Winners

Red Wines

CALIFORNIAN CABERNET & BLENDS

BEST QUALITY: ALDI Inc. (U.S.A.)

Outlander Meritage Red Wine 2021 Paso Robles, California

BEST VALUE: Circle K (U.S.A.)

Sunshine Bliss American Cabernet Sauvignon 2023

CENTRAL ITALIAN REDS

BEST QUALITY: Coop Italia (Italy) Fior Fiore Brunello di Montalcino D.O.C. 2018

BEST VALUE: Gruppo VéGé (Italy) Casale del Duca Montepulciano d'Abruzzo D.O.C. 2022

NORTHERN ITALIAN REDS

BEST QUALITY & BEST VALUE: Pam Panorama Spa (Italy) Von Steiner Südtirol Alto Adige D.O.C. Lagrein 2023

FRENCH

APPELLATION

BEST QUALITY: Albertsons Companies Incorporated (U.S.A.)

Vinaforé Collection Châteauneufdu-Pape A.O.C. 2021

PINOT NOIR

BEST QUALITY & BEST VALUE: REMA 1000 Danmark A/S (Denmark)

Le Bon Negociant Pinot Noir Pays d’Oc I.G.P. 2022

IBERIAN REDS

BEST QUALITY:

ALDI Inc. (U.S.A.)

Specially Selected Rioja D.O.C. Reserva 2018

BEST VALUE: EROSKI S.COOP. (Spain) Chen de Passion Vino Tinto D.O. Cariñena 2022

SOUTH AFRICAN & AUSTRALIAN REDS

BEST QUALITY: REMA 1000 Danmark A/S (Denmark) Gustus Special Reserve Shiraz 2022

BEST VALUE:

Albert Heijn (The Netherlands) AH Shiraz Australie 2022

SOUTH AMERICAN REDS

BEST QUALITY:

New Seasons Market (U.S.A.) Partners In Crime Malbec Argentina 2022

BEST VALUE:

Albert Heijn (The Netherlands) AH Vino Tinto de Chile Stevig 2023

SOUTH ITALIAN REDS

BEST QUALITY:

ALDI Inc. (U.S.A.)

Grande Alberone Vino Rosso d'Italia

BEST VALUE:

Aldi Inkoop Bv (The Netherlands) Almoso Vino Rosso d'Italia 2022

continued on next page >

www.globalretailmag.com 29

White Wines

CHARDONNAY

BEST QUALITY & BEST VALUE:

Albert Heijn (The Netherlands)

AH Excellent Selectie De Dal Chardonnay 2023

(Tie) BEST QUALITY:

Albertsons Companies Incorporated (U.S.A.)

Creamery Chardonnay California Barrel Fermented 2022

FRENCH APPELLATION

BEST VALUE:

Aldi Inkoop Bv (The Netherlands)

La Capelude Grande Réserve Pays d’Oc I.G.P. 2023

IBERIAN WHITES

BEST QUALITY:

EROSKI S.COOP. (Spain)

Mar Blava Vino Blanco D.O. Binissalem Mallorca 2022

BEST VALUE:

Sonae MC (Portugal)

Contomporal Vinho Verde D.O.C. Loureiro Vinho Branco 2023

ITALIAN WHITES

BEST QUALITY: Migross (Italy)

Tenuta Sorgimento Lugana

D.O.C. 2023

BEST VALUE:

Coop Italia (Italy)

Assieme Terra Lavoro Piacere Vermentino di Sardegna

D.O.C. 2022

continued from previous page

SAUVIGNON BLANC

BEST QUALITY & BEST VALUE:

Albert Heijn (The Netherlands)

AH Excellent Selectie Touraine A.O.C. Sauvignon Blanc 2022

SOUTH AFRICAN & AUSTRALIAN WHITES

BEST QUALITY & BEST VALUE:

Albert Heijn (The Netherlands)

Mooi Kaap Suid-Afrika Droë Steen 2023

Sparkling

PROSECCO

BEST QUALITY & BEST VALUE:

Migross S.p.A. (Italy)

Tenuta Sorgimento Valdobbiadene

Prosecco Superiore D.O.C.G., Extra Dry

SPARKLING WHITES

BEST QUALITY:

Pam Panorama Spa (Italy)

Cilium Ribolla Gialla Vino Spumante Brut

(Tie) BEST QUALITY:

PLUS Retail BV (The Netherlands)

CAVA Bienvenido Brut D.O. 2023

BEST VALUE:

Gruppo VéGé (Italy)

Colli del Duca Pignoletto D.O.C.

Spumante Brut

SPARKLING ROSÉ

BEST QUALITY & BEST VALUE:

Pam Panorama Spa (Italy)

Cilium Prosecco D.O.C. Rosé

Millesimato 2022 Brut

Fortified Wines

MOSCATO, MOSCATEL & SWEET MIX

BEST QUALITY & BEST VALUE:

Sonae MC (Portugal)

Contemporal Moscatel Roxo de Setúbal D.O. 2014

PORTS

BEST QUALITY:

Sonae MC (Portugal)

Contemporal Porto 20 Anos

BEST VALUE:

Albert Heijn (The Netherlands)

AH Excellent Selectie Martinez LBV Port 2018

ORGANIC

BEST QUALITY:

Pam Panorama Spa (Italy)

Von Steiner Südtirol Alto Adige D.O.C. Lagrein 2023

BEST VALUE:

Pam Panorama Spa (Italy)

Cilium Ribolla Gialla Vino Spumante Brut

ROSÉ

BEST QUALITY & BEST VALUE: REMA 1000 Danmark A/S (Denmark)

Le Bon Negociant Rosé Pays d'Oc I.G.P. 2022

30 GLOBAL RETAIL BRANDS / MAY 2024

International PLMA Salute to Excellence Wine Awards Winners

Where Retailers Suppliers Meet &

Extraordinary Pasta Sauces from LeBontà

Accademia Toscana, a brand of the LeBontà Group, offers a complete range of extraordinary pasta sauces to satisfy the most refined plates.

The delicious, ready-to-use products represent authentic Tuscan and Italian gastronomic, traditional cuisine, a true expression of love and care for real homemade food.

Thanks to the excellent quality of the raw materials, fresh and without preservatives, Accademia Toscana is a point of reference for all who want to eat well and authentically every day without having the time to make special recipes.

Accademia Toscana, the tradition and authenticity of the Italian cuisine expressed in a range of excellent pasta sauces.

www.globalretailmag.com 31 NOTABLE For more information: www.lebonta.it

HALL 7 STAND 7.R27

www.globalretailmag.com

MARCH 2024 www.globalretailmag.com www.vertexawards.org 2024 SUPPLIER GUIDE 10 Bold Predictions for the Food Industry Rise of the New Global Consumer Imitation, Borrowing and Originality MAY 2024 www.globalretailmag.com www.vertexawards.org RETAIL BRANDS FASTER AND BETTER PLMA Amsterdam At-Show Issue Accelerate Corporate Sustainability Goals with Private Label NOVEMBER 2023 www.globalretailmag.com www.vertexawards.org PLMA BOOTH H-1506 PLMA Chicago It’s Beginning to Look a Lot Like Christmas The Not-So-Secret Secret Weapon for Retailers HALL 2, STAND 2.C15 VISIT US AT PLMA OCTOBER 2023 TENTH ANNUAL VERTEX AWARD WINNERS www.globalretailmag.com www.vertexawards.org BEST OF SHOW PLUS CHOCOLATE GOED VERHAAL PLUS Retail B.V. The Netherlands Anuga, Cologne PLMA Chicago Preview Beyond The Numbers

Sourcing

Certified Origins was born in 2006 thanks to the union of two Tuscan cooperatives of farmers and an organization specializing in international sales and distribution to export and provide fresh and authentic Extra Virgin Olive Oil to families everywhere in the world.

Today, we remain cooperative-owned and continually expand our portfolio by directly sourcing from farmers in the Mediterranean region. The confidence and trust built over decades in the industry means we can guarantee the quality of our products and give us access to the scale necessary to work with retail organizations.

Production

Our international distribution and warehousing network and services mean we can deliver anywhere in the globe within 4-8 weeks, and in as short as 2 days in the USA and Canada.

Distribution and Warehousing

Our international distribution and warehousing network and services are interconnected with our production plants, allowing us to offer efficient warehousing services and to deliver anywhere globally within 4-8 weeks and in as short as two days in the USA and Canada.

Research and Traceability

Since 2019, we have invested over $1.2 Million in Research & Development in technology & tracking systems. We deploy the latest technologies and third-party certifications to reduce the risk of information manipulation at the source while monitoring our food supply chain’s quality and safety standards.

We are ISO 22005 certified to guarantee traceability across our supply chain, and we utilize Oracle blockchain technology to ensure transparency from farm to bottle for our EVOO and Tomato sauce programs.

Thanks to our partnerships with the University of Salento and Eurofins, we can scientifically verify the authenticity of Extra Virgin Olive Oil’s origin by investing in nuclear magnetic resonance (NMR) and isotopic signatures technologies.

We built an extensive private database of unique «fingerprints» with 1k+ different geolocalized samples of olive oils to provide scientific support to EVOO authenticity to our partners. Each year, our data increases by hundreds of samples to further improve the accuracy of the results.

Sustainability Initiatives

• CARBON REDUCTION:

Certified Origins launched multiple lines of carbon-neutral certified Italian EVOOs under its flagship brand, Bellucci.

• RECYCLED PACKAGING:

Certified Origins utilizes 50% recycled PET and recycled cardboard materials.

• GREEN ENERGY:

Certified Origins Italian facility uses energy supplied by photovoltaic panels and olive pits as a fuel source.

32 GLOBAL RETAIL BRANDS / MAY 2024

www.certifiedorigins.com

NOTABLE

HALL 8 STAND 8.G51

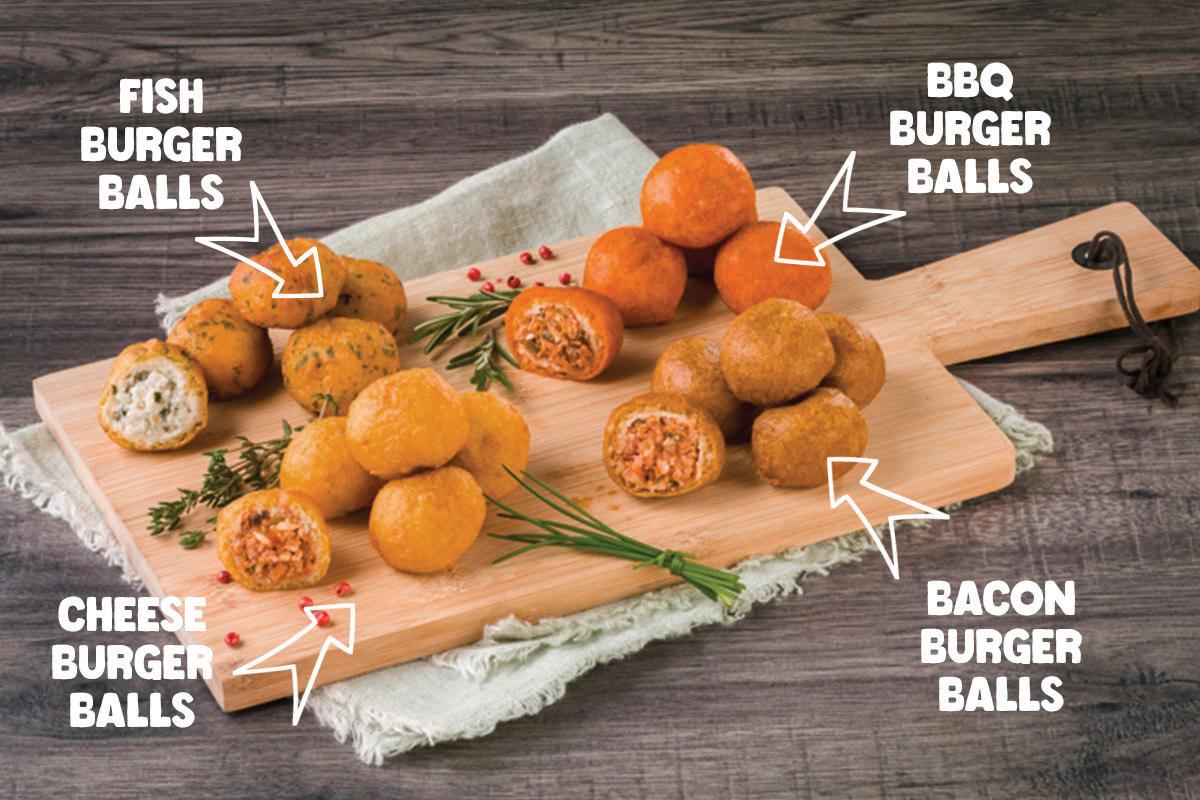

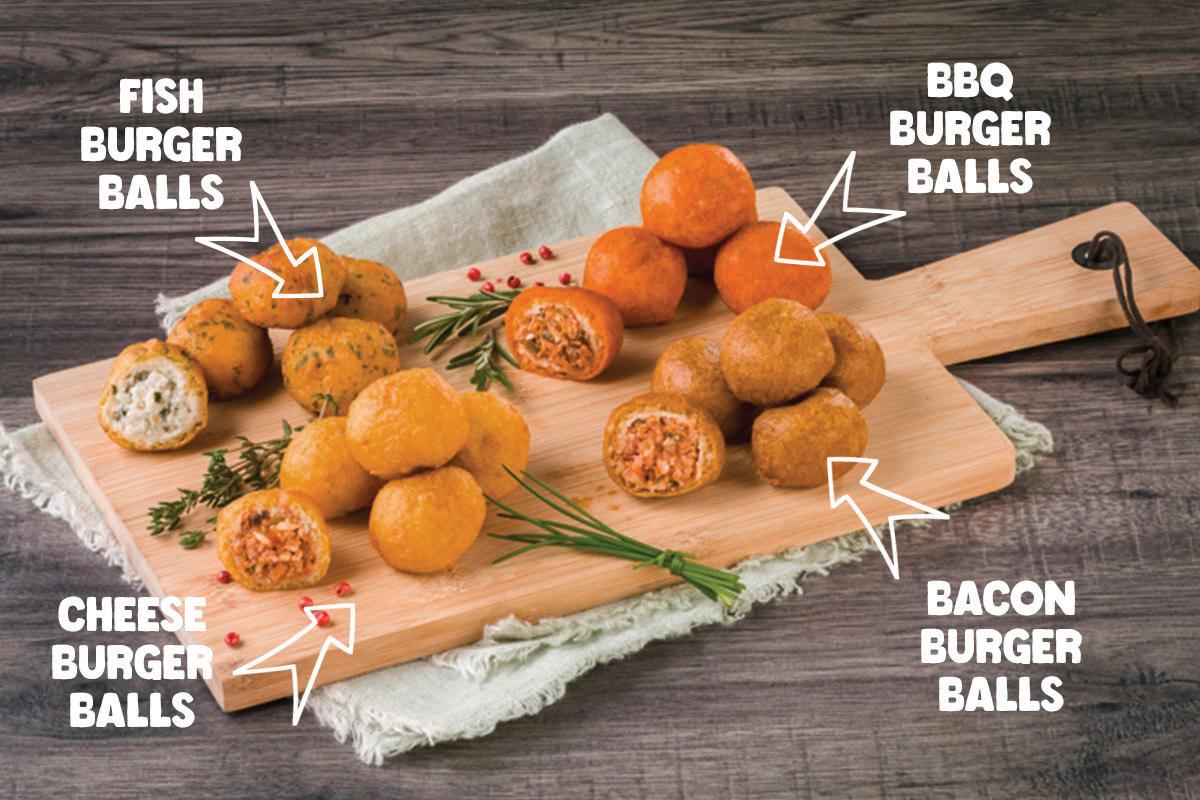

Frostkrone Food Group Sets New Street Food Trend

Foodies get ready: there’s a lush snack upgrade from the Frostkrone Food Group coming your way. Burger Balls boast the full-bodied taste of the original in the cool finger food style. Unlike the original, they are extremely versatile. Their handy size also makes them ideal when you’re just a little peckish. An evening with the family, out and about with your team or at the next party, served on their own, with a crispy salad or potato snacks: Burger Balls are a hit even with sophisticated pleasure seekers. The snacks are prepared in minutes in a deep fryer, fan oven or air fryer and can be savoured immediately.

Their typical square packaging is a real eye-catcher. It mirrors the look and feel so well-known for burgers. And their strong colours at the POS attract huge attention. Burger Balls come in five delicious flavours:

• Cheese Burger Balls - the perfect marriage of juicy beef, mature Cheddar cheese and aromatic tomatoes.

• Bacon Burger Balls rock with beef, bacon smoked over beech wood, Cheddar and tomatoes.

• BBQ Burger Balls - the culinary ensemble of hearty beef, creamy Cheddar, tangy BBQ sauce and smoky aromas.

• Fish Burger Balls created out of fresh fish and fragrant spices are sheer perfection.

• Chicken Burger Balls bring together tender chicken with a kaleidoscope of exquisite spices, a succulent texture making every bite pure bliss.

Frostkrone Loves Finger Food

Frostkrone Loves Finger Food Innovative product ideas and an amazing variety of finger food and snacks – setting the Frostkrone Food Group apart on the market for more than 25 years. The Company Group develops and produces finger food and snacks at eight locations worldwide. The products are available internationally.

An extensive portfolio, huge experience and international presence make the Frostkrone Food Group a strong partner for the retail and food service sectors. And the Company Group is known for responding flexibly to customer wishes and for acting with

foresight. “We love finger food.” This love drives the Frostkrone Food Group to constantly work on innovative product ideas, which hit the taste buds of consumers.

Visit the Frostkrone Food Group at the PLMA in Amsterdam

Come along to discover and try out the Burger Balls and lots more at the PLMA in Amsterdam on 28 and 29 May. In Hall 1 at Stand 1 H86, the Frostkrone Food Group will be showcasing its extensive range of finger food and snacks.

frostkrone-foodgroup.com

34 GLOBAL RETAIL BRANDS / MAY 2024 NOTABLE

HALL 1 STAND 1.H86

The Leading European Producer of Canned Legumes and Canned Tomatoes

Headquartered in Angri (Salerno, Italy), La Doria is a leading Italian group in the vegetable canning sector, particularly in the production of tomato derivatives, ready-made sauces, canned pulses, juices and fruit drinks. Today, La Doria is Europe’s leading producer of canned pulses, peeled and chopped tomatoes in the retail sector and one of Italy’s leading producers of fruit juices and drinks. The company is also Europe’s leading producer of private label ready-made sauces. As a supplier to major retail and discount chains around the world, La Doria stands out as a group that is primarily dedicated to the production of private labels, the brands of major retailers. In fact, more than 97% of the group’s turnover is generated in this segment.

Underlying this specialization is a strong and determined mission to dominate the large retail and organized distribution markets, offering excellent quality products at very competitive prices as an alternative to the brand.

The Group currently has 6 production plants, 3 in the province of Salerno (Angri, Fisciano, Sarno), 1 in Faenza (Ravenna), 1 in Lavello (Potenza) and 1 in Parma. The international market is the most important sales channel for La Doria, accounting for over 80% of its turnover. The company has significant market shares in the UK, Germany, the rest of Europe, Australia and Japan.

La Doria’s business model is based on the synergy between values considered inalienable - legality, ethics, transparency, respect for human rights, respect for the environment, development of the territory - and the economic solidity of the Group. Convinced that leadership also entails responsibility in the field of sustainable practices, the company has made a concrete and firm commitment to operate with respect for people and the environment at all stages of the production and distribution chain. The responsible management of energy resources, the reduction and recycling of waste and the sustainability of packaging are some of the main guidelines followed by the Group in terms of environmental sustainability.

A firm believer in responsible supply chain management, La Doria implements a series of measures aimed at promoting fair working conditions and the rights of workers involved in harvesting in conjunction with growers’ organizations. The link with the territory is another issue that has been close to the company’s heart since its origins. This includes initiatives to promote young people’s right to education and training and their integration into the labor market, as well as projects to regenerate the area and promote social welfare. The Group also contributes to the growth of the local economy by using a high percentage of suppliers operating in the South of Italy.

commerciale.estero@gruppoladoria.it

36 GLOBAL RETAIL BRANDS / MAY 2024 HALL 2 STAND 2.D18

NOTABLE

Innovation and Sustainability From Lucart Group

Lucart, a major European manufacturer of thin MG paper for flexible packaging, is a key player in the consumer goods and away-from-home markets as a producer and transformer of tissue and airlaid paper. Its attention to people, sustainable processes, and approach to innovation means they offer cutting-edge products that meet market challenges and customers’ needs.

Fiberpack® is their flagship project in this field: it combines advanced technology and environmentally friendly processes, demonstrating that circular economy principles are fully applicable to the tissue sector.

Lucart created this project starting from the idea of using all the elements of beverage cartons according to circular economy principles. The production process relies on an innovative technology that separates the cellulose fibers found in beverage cartons from polyethylene and aluminum by physical-mechanical action. With this technology, they avoid substances that may be harmful to people or the environment. They produce tissue products with the fibers obtained through

this process and recover the aluminum and polyethylene, converting them into a homogeneous material called Al.Pe.®, which other industries use to produce various items.

The tons of Fiberpack® paper Lucart has produced from 2013 to 2021 have contributed to the recovery of more than 7.6 billion beverage cartons, saving more than 3.3 million trees and preventing more than 195,000 t of CO2e from being emitted into the atmosphere.

Lucart’s continuous research and development work has led to many projects aiming to improve the quality and performance of its products. One such project has led to the innovative QMilk® process, which makes it possible to extract and transform the basic proteins in milk into a soft and precious fiber without using chemical agents. The process preserves the amino acids, and all the moisturizing and nourishing properties of milk in the resulting fiber. It guarantees a 100% natural formula that is dermatologically tested, ultrasoft, and highly resistant.

Lucart is also the only brand in its target market to offer Airlaid products with exceptional absorbency and strength performance. The Airlaid technology uses long, highly resistant cellulose fibers that never come into contact with water during the production process (dry paper) to remain super absorbent. Fibers treated with this process naturally form a “dam” structure, offering outstanding results: can absorb up to 7 times its weight and, thanks to its exceptional resistance, can be reused up to 20 times, compared to 1 or 2 for competitive products.

Lucart is a company made up of people who choose to use innovative and sustainable processes in development, transformation, and manufacturing of paper products, collaborating responsibly for the future of their business and the planet.

Lucart has always been at the forefront of the study of innovative packaging able to reduce the environmental impact of its products. After launching the world’s first line of toilet paper with materbi corn starch packaging in 1997, the company created a series of products with entirely plastic-free packaging in 2019.

38 GLOBAL RETAIL BRANDS / MAY 2024

www.lucartgroup.com NOTABLE HALL 8 STAND 8.C04

grazie.it For the planet’s needs.

V-LABEL: The International Vegetarian and Vegan Brand Par Excellence

The V-Label brand is an internationally recognized symbol to identify vegetarian, vegan and raw vegan products and services par excellence.

It was created in 1976 as an institutional symbol of the Italian Vegetarian Association and is presently the most recognized synonym for vegetarian and vegan products by consumers all over the world. Its clear, unique image is intuitively associated with vegetarianism and veganism in every corner of the world, effectively breaking down any language barrier.

Officially presented internationally at the first European Vegetarian Congress held in Italy in 1985, it quickly spread first to Europe, and shortly thereafter to the rest of the world.

The V-Label brand is now registered in more than 70 countries worldwide and can be found everywhere around the world: it clearly and safely identifies products and services of various types, from food to textiles, and from footwear to cosmetics as compatible

with the vegetarian and vegan lifestyle. In addition to being available in the food sector (finished products, raw materials, drinks) and in the non-food sector (cosmetics, personal hygiene and home care products, textiles, clothing, footwear), the V-Label brand is a point of reference for catering as well.

But being international doesn’t just mean being widespread, it requires much more than this. It entails being able to transmit and receive, often technical, content properly without making any mistakes. This is possible due to the the close relationships we have worked to maintain with our customers. In most cases, the V-Label brand is distributed by local managers who, because they are familiar with the local language and culture, are better able to convey information to producers and consumers. This local approach also allows us to handle technical material in documents without risking translation errors or problems with understanding.

Despite the widespread availability of the brand in extremely different areas, both in terms of culture and traditions, the V-Label brand has maintained the same verification criteria and standards in every place. This uniformity aims to offer seriousness and quality to consumers who rely on the V-Label brand when choosing which products to buy.

The balance between the local approach and adaptation and the standardization of criteria and processes so that they remain unchanged is what makes the V-Label brand truly international, even more than its widespread coverage.

www.vlabel.org

40 GLOBAL RETAIL BRANDS / MAY 2024

NOTABLE

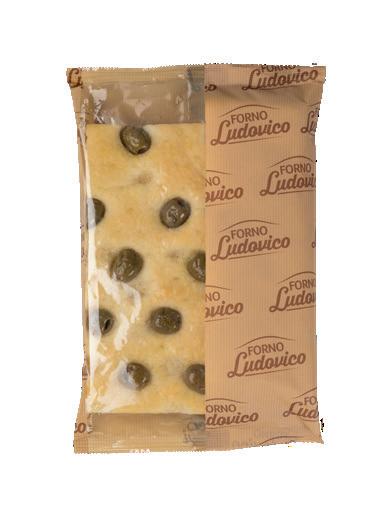

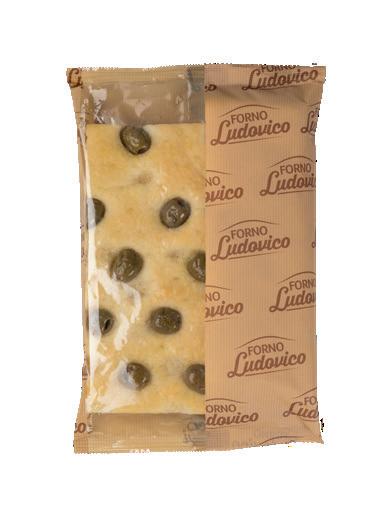

Reliable, Large-Scale, High-Quality Pizza Partner

Valsa Group is a leading manufacturer of frozen, chilled, and ambient pizza, pinsa, focaccia, and snacks. The company’s primary goal is to promote the true Italian food lifestyle worldwide. The headquarters of Valsa Group is located in Valsamoggia, in the heart of Italy, where the company history began. However, their roots span from North to South, through their ten plants, following a purely Italian entrepreneurial path. The company’s daily commitment can be easily summed up in three words: Culture, Excellence, and Innovation.

The Valsa Group has recently launched a new premium range called Her Majesty, La Pizza. This new range aims to bring the best and most authentic pizzeria experience to consumers worldwide, right in the comfort of their own homes. The pizza features a light, fragrant crust that is naturally leavened for a long time and hand-stretched, topped with the best quality Italian tomato sauce. With every bite, consumers can feel as though they are transported straight to Italy, enjoying a unique and unforgettable taste experience. Her Majesty, La Pizza embodies the high quality and outstanding standards that can only be found within Valsa Group.

The perfect way to complete a retailer’s range with a real Italian product is now available. Enjoy the best Italian pizzeria tradition in every home freezer!

Valsa’s strategic advantage lies in the synergy between its traditional manufacturing process and a strong emphasis on consumer convenience, while maintaining the highest quality standards. In today’s market, convenience paired with premium quality is crucial for creating value in the supply chain.

The Valsa Group is a reputable business partner operating in over 50 countries worldwide. This success has been achieved through their focus on sustainability, organizational integration, production capacity, and innovation in convenience, all while committing to process transparency, waste reduction, and the use of green energy.

Valsa Group operates through various brands such as Valpizza, La Pizza+1, Forno Ludovico, Megic Pizza, Ghiottelli, Il Borgo, and Tuscanya Bakery. As a unique large-scale and highly qualified partner, Valsa Group can provide a wide range of items in each category, from frozen to deli.

info@valsagroup.it

VISIT AT: IDDBA Huston Booth # 3747

42 GLOBAL RETAIL BRANDS / MAY 2024

NOTABLE

Innovating Cleanliness: Whitecat’s 76-Year Journey Safeguarding Healthy Families

Chapter 1: A Cat Was Born in 1948

In the quaint village of Yongtai, Shanghai county, China, 1948 marked the inception of an entrepreneurial venture that would evolve into Shanghai Whitecat. Initially focused on providing post-war China with essential laundry soap, this small, private manufacturing company embarked on a journey characterized by necessity, groundbreaking innovation, and an unwavering commitment to safeguarding the health of families.

Motivated by the pressing needs arising after World War II, Shanghai Whitecat tirelessly worked to supply the local community with laundry cleaning products that surpassed traditional soap made from soap beans and “Yizi” (a concoction of pig pancreas and plant ash). The goal was simple yet profound: to enhance cleanliness and well-being for families.

Chapter 2: Pioneering Innovation Since 1959

Shanghai Whitecat achieved its first milestone in 1959 by introducing mainland China to the first domestically produced package of synthetic laundry detergent powder, “Gong nong.” This marked the beginning of a series of groundbreaking innovations:

1963: Introduced the first autonomous washing powder paper bag packaging machine.

1981: Developed and produced the first domestically packed Super Concentrated Laundry Powder.

1987: Awarded the “Shanghai Famous Brand” certificate for both Whitecat and Jaimei brand Laundry Powder.

1995: Whitecat Laundry Powder received the “Golden Bridge Award” for National Best-selling Domestic Product for four consecutive years.

2004: Whitecat liquid detergent attained the prestigious title of “China Famous Brand.”

2018: Whitecat Lemon Black Tea Dishwashing liquid secured the “2017 China Biggest Award of Quality Consumer – Quality Gold Award.”

2018: Shanghai Hutchison Whitecat Co., Ltd., was honored as one of “China’s Top 100 Daily Chemicals.”

Chapter 3: Longevity Through Innovation

As Shanghai Whitecat celebrates its longevity, the narrative transcends labels and brands, becoming a story of enduring innovation, necessity, and countless lives touched. With trust built over decades of hard work and substantial investment in research and development, Whitecat boasts:

• Over 100 national patents.

• Annual investments of millions of dollars in R&D.

• A team of over 50 research and development personnel, with over 50% holding Master’s or doctoral degrees.

• The only national standard laboratory in the light chemicals industry.

• State-of-the-art scientific equipment, including gas chromatography/mass spectrometry (GC/MS) and Fourier infrared spectrometer.

Chapter 4: Sustainability for a Better Tomorrow

Whitecat’s dynamic culture of innovation, born out of necessity in 1948, is evolving towards sustainability, ensuring healthier lives for families and our planet. The company is proud to introduce a sustainable, natureinspired line of products, including:

• Concentrated cleaning pods, sheets, and tablets.

• Lactic acid-based cleaning products.

• Soda-based cleaning products. This marks the beginning of a green, sustainable tomorrow with Whitecat. Join us on this exhilarating journey towards a cleaner, healthier world.

About Whitecat

Shanghai Hutchison White Cat Co. Ltd. (“Shanghai White Cat” or “Whitecat”) is a foreign joint venture established by a wholly-owned subsidiary of CK Hutchison, a Global Fortune 500 company with an annual revenue of US$ 500M. With over 23 factories across China’s mainland, White Cat’s own brand products and private label services are available in China, Japan, Korea, the Middle East, Southeast Asia, the Americas, and Europe. Their motto is simple yet powerful: “If you can think it, we can make it!”

http://en.whitecat.com

44 GLOBAL RETAIL BRANDS / MAY 2024 NOTABLE

WHITECAT

Top-Tier Brand Over 70 Years

Home Care And Personal Care

Member Of Fortune Global 500

Amercias: salesusa@whitecat.com • USA & Canada: tpark@whitecat.com • EU/Africa/Asia: congy@hwccl.com • https://en.whitecatcom

46 GLOBAL RETAIL BRANDS / MAY 2024 www.certifiedorigins.com Certified Origins OLIVE OIL COFFEE DEK Deutsche Extrakt Kaffee www.dek.de/en Frostkrone Food Group FROZEN FINGER FOODS frostkrone-foodgroup.com ITALIAN FOOD & NON-FOOD ITA (Italian Trade Agency) plmaams24.eventidigitali.ice.it HALL 8 STAND 8.G52 HALL 1 STAND 1. A41 HALL 1 STAND 1.H86 CLIENT PRODUCTS AT PLMA HALL 1 STAND 1.E03 -1.F96 FOOD

www.globalretailmag.com 47 LaDoria CANNED TOMATOES www.gruppoladoria.it/en PASTA SAUCES LeBonta

HOUSEHOLD PAPER PRODUCTS www.lucartgroup.com Lucart HALL 2 STAND 2.D18 HALL 7 STAND 7.R27 HALL 8 STAND 8.C04 HALL 7 STAND 7.Q02 - 7.R47 HALL 12 STAND 12.E05 - 12.F44 NON-FOOD NON-FOOD

www.lebonta.it/en

Evolving Faster Better and Evolving Faster Better and Evolving Faster Better and

BY PERRY SEELERT

Own brands continue to evolve at a discernibly faster rate than CPG brands, but what does it all mean? What are the key areas of development, what is truly new, and where are the lingering bits of staleness?

If Darwin were still around to understand evolution as it applies to retailer brands he wouldn’t have believed it. They say evolution is unobservable. The process operates so slowly you cannot see it unless you have thousands of years of perspective. But what has happened over 50 years’ time in consumer packaged goods and own brands is astonishing, and even over the last decade, the dynamics that have led to retailer brand success are stunning.

We will start with three overarching areas of change that can be seen, and then we will shift the discussion to a little more micro look at what is more recently new in the industry, some of the catalysts for success, and the things still crying out for change.

THREE OVERARCHING CHANGES

There once was the idea in the own brand industry and across retailers that there were “taboo” categories that were untouchable. You might have been able to create a private brand product for a category, like an own brand wine, but certainly you would never launch it (or sell much of it).

www.globalretailmag.com 49

What retailers now think is possible has expanded dramatically, and not only is every category for CPGs vulnerable and reachable, but the scale of own brands has changed in a major way, as well as the credibility that people now attach to them. These three overarching changes stand out more than any others in the retail brand world.

NOTHING IS TABOO ANYMORE

It used to be that own brand succeeded only across big commodities. Milk, bread, eggs were the primary domains for own brand success, and it was for one simple reason, that consumers perceived them as verifiably and certifiably the same as CPG brands. But no category is taboo in today’s own brand industry.

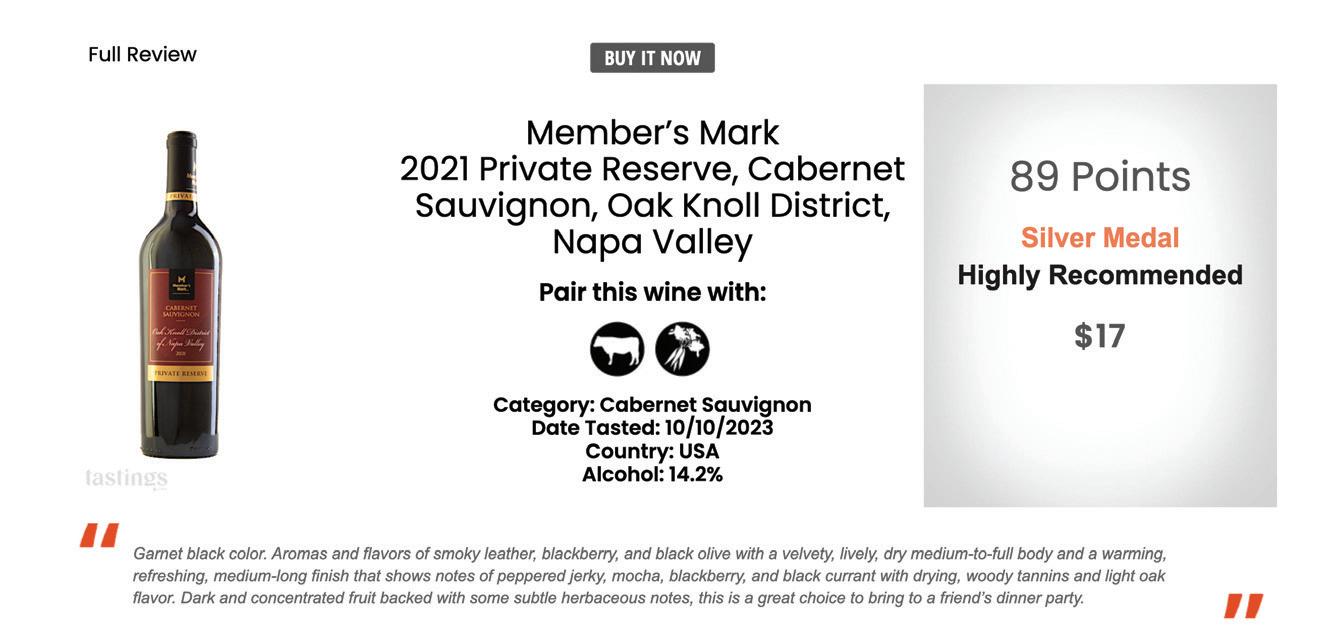

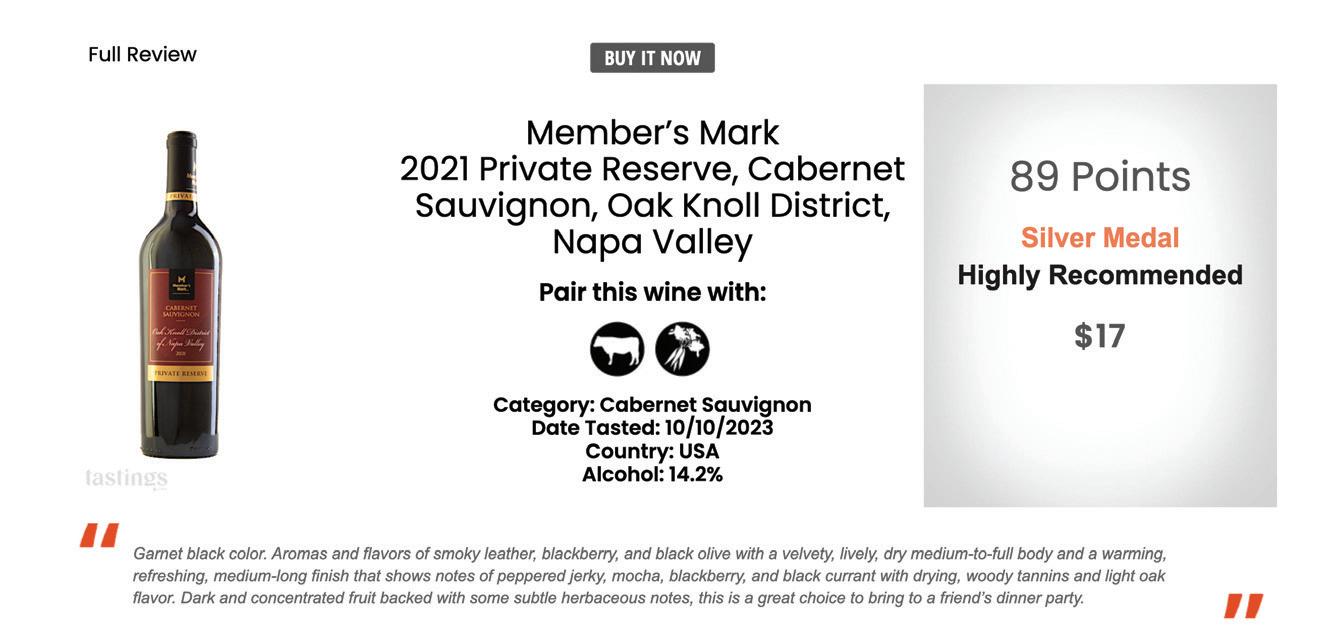

Some wines are receiving real accolades, especially those in the club channel. Personal care products like sun care used to be untouchable but now you see them in sprays, sticks, lotions, all types of SPF, clear, moisturizing, oxybenzone and paraben-free, reef-friendly, and many more.

Kroger sells no HFCS ketchup and a Black Truffle variety in their Private Selection tier, and there are all types of Mayonnaise in different packaging configurations, flavors and varieties (including those made with Extra Virgin Olive Oil or egg-free/Vegan).

Personal care (sun care, skin care), baby care, alcohol, categories with distinctive taste profiles, household cleaning – they are not only reachable through own brands, but now we think about how they could topple what once were considered to be vaunted CPG brands.

Categories that have very distinct taste profiles like ketchup and mayonnaise used to engender the greatest brand and consumer loyalties, so they were not considered to be portfolio priorities. Think about Helmann’s or Best Foods mayonnaise or Heinz ketchup, retailers used to only half-heartedly offer own brands in these areas. This has changed too.

50 GLOBAL RETAIL BRANDS / MAY 2024

1

COVER STORY I EVOLVING FASTER AND BETTER

THE TREMENDOUS SCALE OF RETAILER BRANDS

Today, there are many retailers whose unit share in private brands is over ¼ of what they sell (Kroger, Walmart, Sam’s, HEB and Costco) and the elite with over 50% share (Wegmans). While share and penetration are interesting measures, I think what is astonishing is the sheer scale of certain retailer brands.

Costco’s Kirkland Signature brand sells over $60 billion annually, just let that sink in for a second. Kroger’s “Our Brands” total sales annually is around $30 billion. Comparatively speaking, one of the biggest CPG brands in the world, Coca Cola, generated $46 billion in annual revenue for 2023. Retailer brands and the categories where they are represented is throughout the four walls of the store, their penetration is often over ¼ of total sales, but it is the size of these brands that now commands everyone’s attention.

ESTABLISHING CREDIBILITY, ESPECIALLY WITH

NEW CONSUMERS

The third larger, more overarching change with own brands is the degree to which they have established credibility, especially with younger generations of consumers. Now the most glaringly obvious and functional reason for increased credibility is the “quality” improvements over time with own brand. Consumers, at the product and brand’s core, must trust the quality, this is essential. However, there are three other drivers to establishing credibility:

• One driver is purely in consumers’ experience, or lack of it, with private brands. Many Millennials, Gen Z and Gen Alpha, those who are born from the mid 1990’s and beyond don’t remember generics. They have no experiential baggage. In fact, the word “generics” makes little sense to them as they associate it maybe with drug products and not really food. They have no memory of some of the beginning growing pains of dreary “private label”.

• The second driver in increasing credibility is in the improved visual language of own brands. The copycat language has to a large degree vanished, retailers have hired global design agencies, and the investment in custom imagery have all led to better impression. The strategy behind the design and the deft hand used to create it is a big part of gaining credibility, and we see this especially in English retail design.

• The last driver in credibility has been the move from “last to first”. Own brands have not relegated themselves to follower status alone, but actually lead the creative product development process at some retailers. Look at Trader Joe’s and you will see launches, like their Everything But The Bagel spice, that preempted the leading CPG, McCormick, to market with this new product.

continued on next page >

www.globalretailmag.com 51

2 3

Beyond these three macro transformations, what have been the most recent changes we have seen in own brands?

One of the most recent sea changes we have seen in the industry is that a retailer’s scale does not determine its ability to foster great and expansive own brands. Even with the scale of Costco and Kroger as we refer to in the more macro transformations, the smaller retailer can still leverage the power and exclusivity of a great own brand program.

THE AGE OF THE SMALLER RETAILER EXCELLING IN OWN BRANDS

Smaller Retailers are not excluded from having unique and attractive own brands, in fact, it’s just the opposite today

It is amazing to see what smaller, more boutique and regional retailers have done with their own brands from a creative point of view. Rather than feeling like they don’t have the scale to attract suppliers, they actually see their scale as the reason they need to have unique, compelling products that have a point of difference versus their chain retail competitors.

FOXTROT

Retailers like Foxtrot with its 33 stores today and 50 planned openings this year is making own brands one of its differentiators. Through unique products, beautiful design and interesting limited-time collaborations, the Foxtrot portfolio is becoming a centerpiece for what they do and how they do it. Notice the incredible appetite appeal and impulse they create through salty snacks, beverages and frozen novelties.

Sadly, Foxtrot ceased operating just before press time.

KOWALSKI’S

Kowalski’s Markets which covers 11 stores in the Minneapolis/St. Paul region also sees own brands as central to their distinction, and it shows in the way they develop new products, merchandise and market their brand. Categories like hummus are being disrupted by their own brand, which is smallbatch and healthier than the big brands. They also write very intentional stories about their own brands using social media that educate consumers about their unique products.

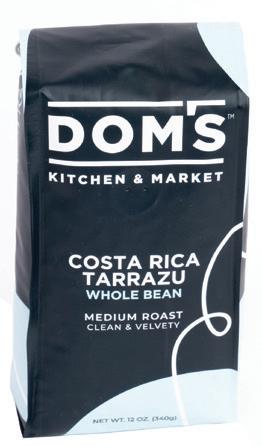

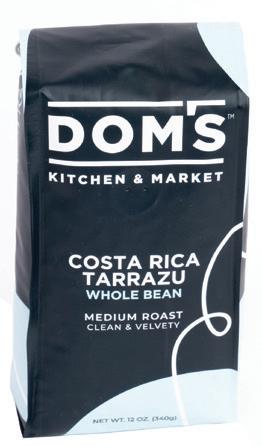

Other smaller, boutique retailers like Dom’s Kitchen & Market in Chicago (which just merged with Foxtrot) and Dorothy Lane Markets in Dayton, Ohio are developing and marketing unique coffees, snacks, bakery and pantry items, sometimes locally-sourced and all creative in their purpose.

52 GLOBAL RETAIL BRANDS / MAY 2024

COVER STORY I EVOLVING FASTER AND BETTER

MARKETING INVESTMENT, MARKETING PROWESS

The Marketing Investment for own brands by retailers continues to grow, and the influence and skill of their communications does too

The second more recent dynamic you can see in the own brand industry is that there is a more significant marketing investment retailers are making. The spend on own brands used to be a fraction of retailers’ overall marketing budget, but no longer. You see this in four important ways:

• Through television advertising

• Through continued celebrity/ endorsed exclusive brands

• Holiday and seasonal events that are own-brand focused

• The promotional calendar aimed at building shopper engagement.

Wakefern/Shoprite in the New York area has supported their Bowl & Basket brand on television more than any other retailer’s own brand I have ever seen. It is a non-stop barrage of family-oriented, heart-warming and even humorous spots that all tie in the portfolio and message behind the Bowl & Basket brand. Six of them in total, which represents a real investment.

Walmart continues to invest in own brand marketing and exclusive brands with their celebrity tie-in to Drew Barrymore, who like Joanna and Chip Gaines at Target, has designed everything from kitchen appliances to housewares to furniture.

A third example of retailers’ more significant marketing for own brands is how they are doing it through seasonal events and holidays now. Marks & Spencer supports Easter through their M&S Collection brand, and their Easter Egg, chocolate, and candy portfolio, which is absolutely amazing. It gets significant press coverage, youtubers talk about it, and it is a true marketing event where own brand is the driver.

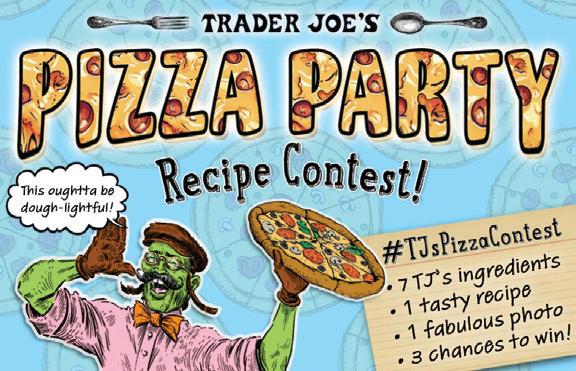

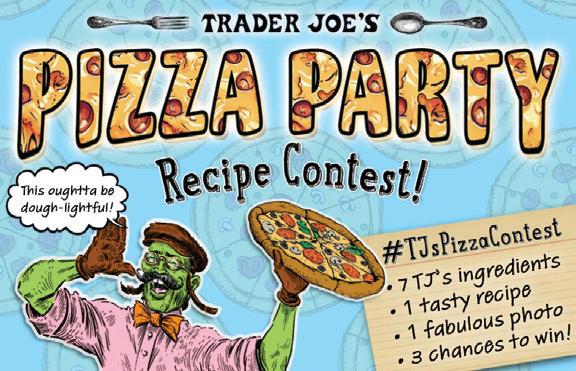

A fourth example that shows how retailers continue to invest in own brand marketing is through their promotional inventiveness, where the cost is largely in the ideation and not so much in the execution (if it is done through the social media you control). Take a current example happening at Trader Joe’s.

The idea is pretty simple, use 7 Trader Joe’s own brand products to make a pizza, snap a photo of it and tag it on social media with your recipe instructions and #TJsPizzaContest in your caption. There are literally thousands of entries, and it is this type of promotional creativity that generates engagement and interest around Trader Joe’s brands.

continued on next page >

www.globalretailmag.com 53

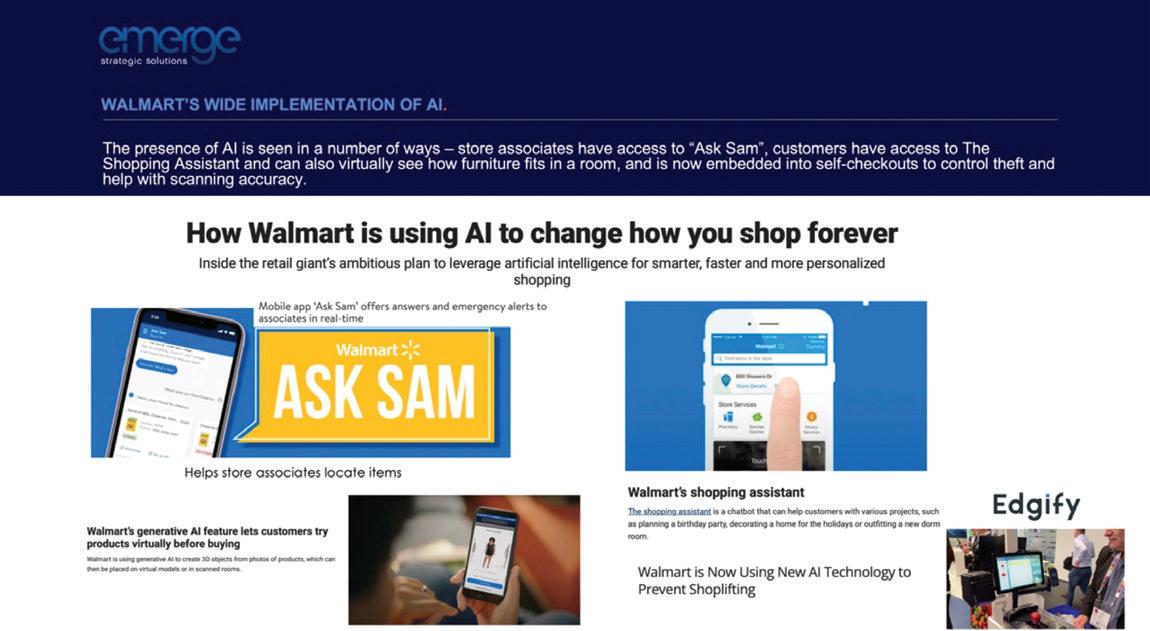

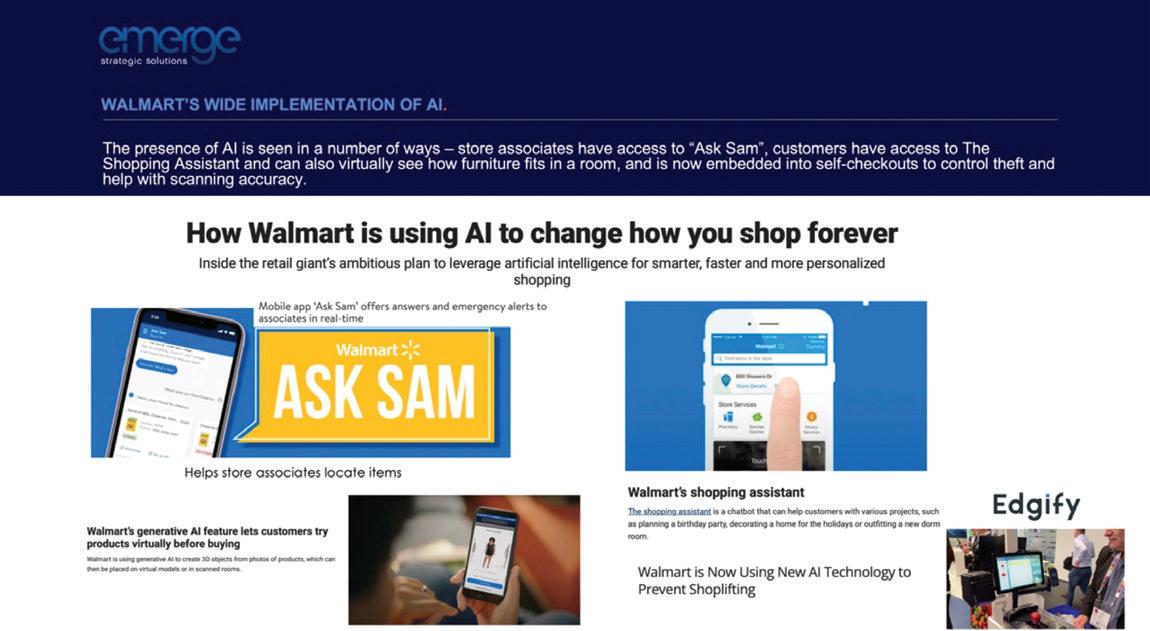

THE ROLE OF AI IN PRIVATE BRANDS

If you are already sick of hearing about artificial intelligence, we are just getting started