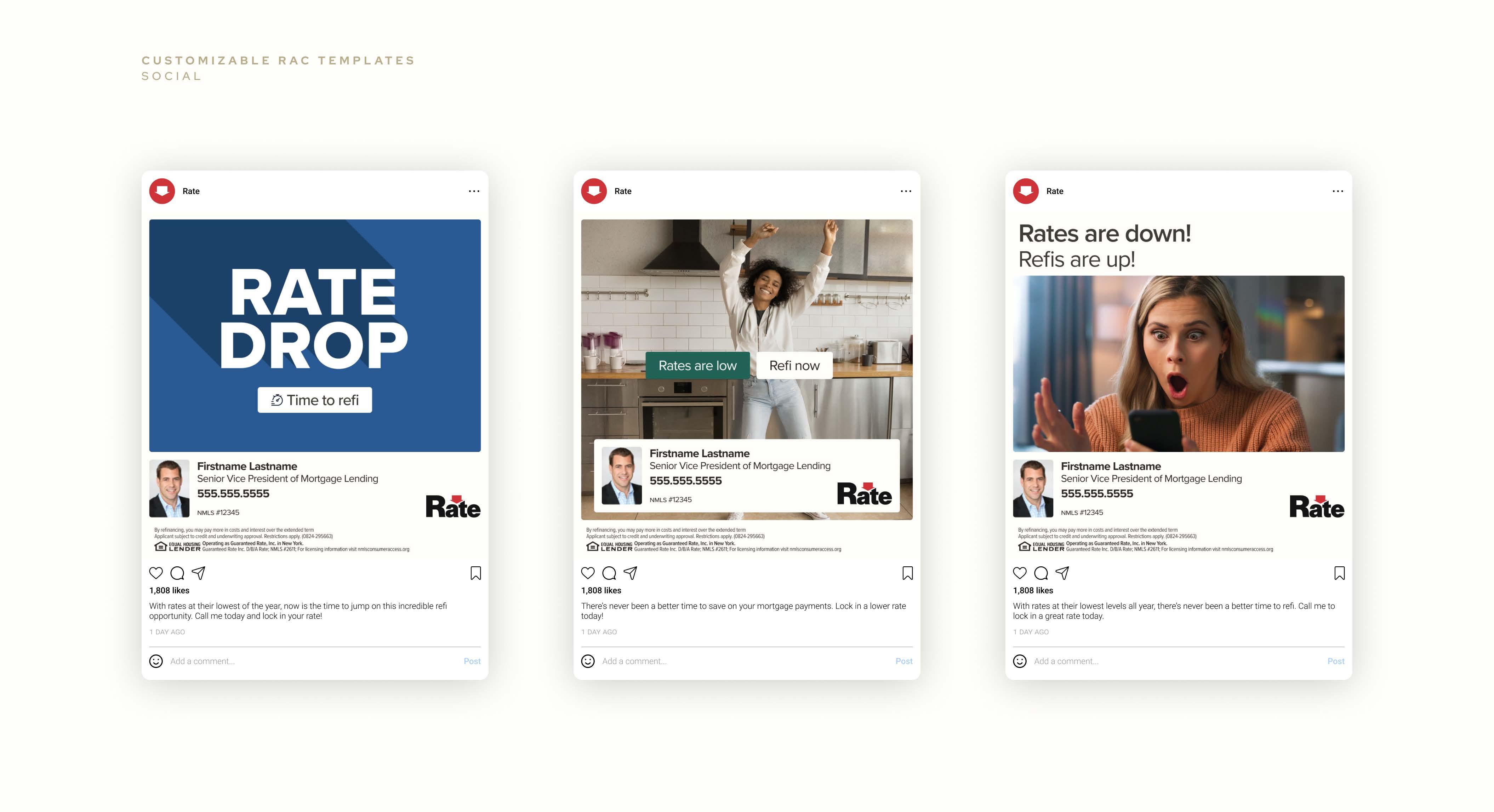

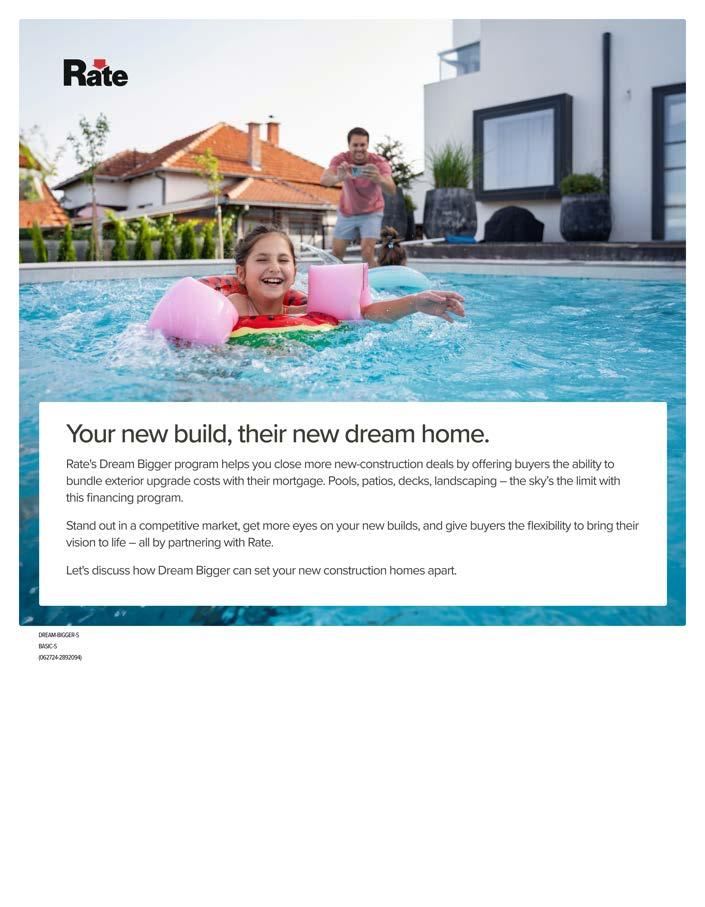

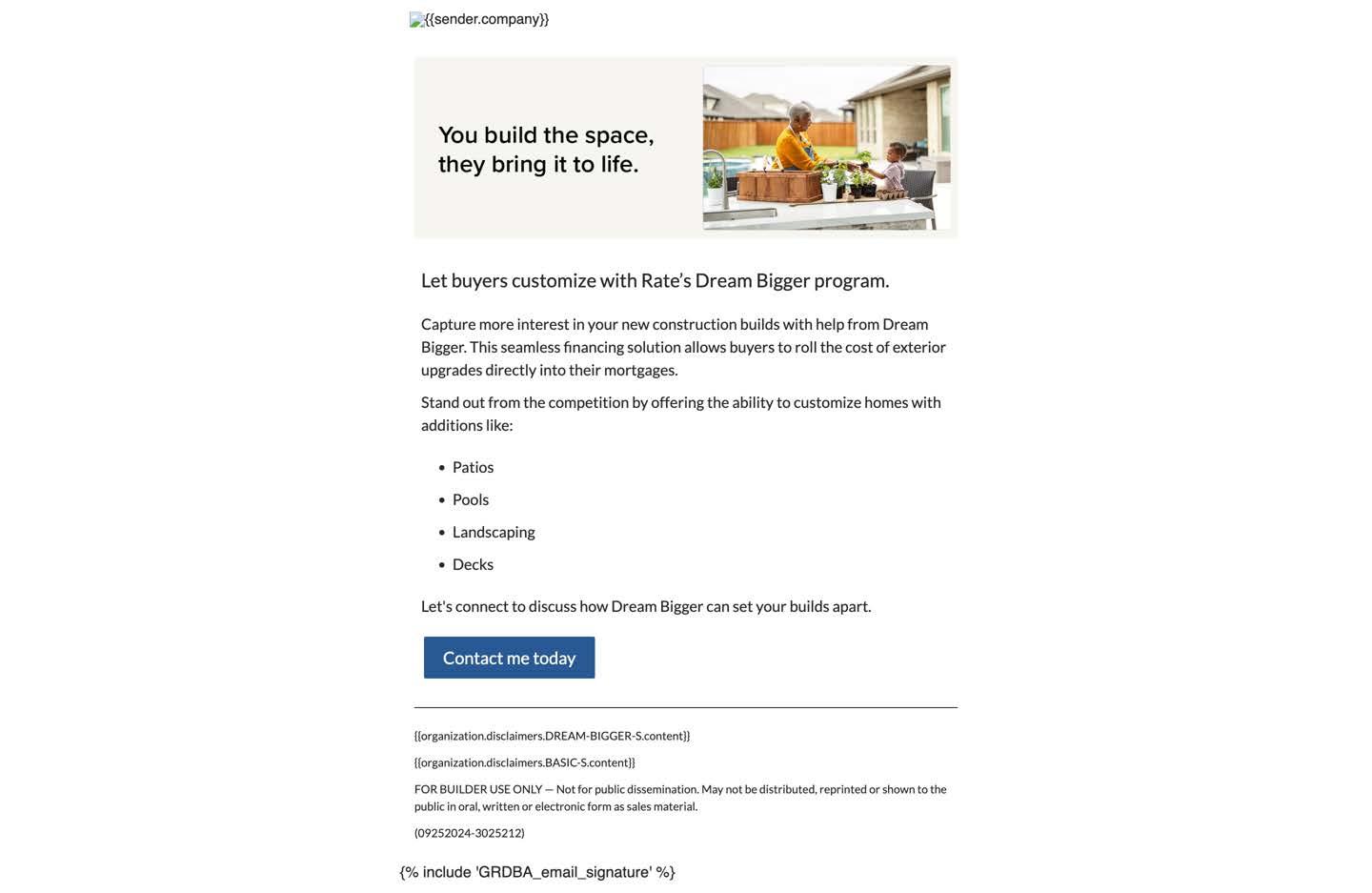

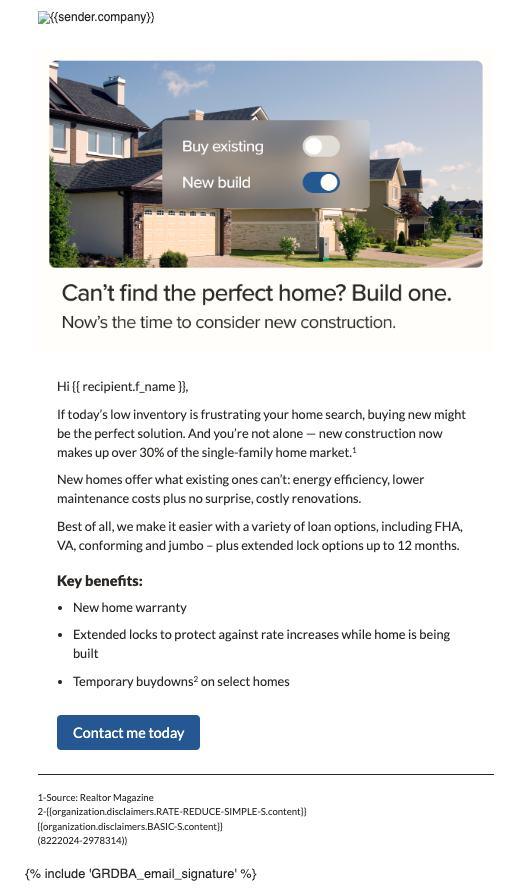

New Construction

In today’s tight housing market, new construction is increasingly appealing as an alternative buying option due to its customizability, energy efficiency and lower maintenance costs.

This campaign targets consumers frustrated by low inventory and real estate agents looking for viable solutions to close new construction deals. It is executed through RAC social, RAC print, and RAC email.

NEW CONSTRUCTION

RAC

Flyers: Consumer and Agent

RAC Emails: Consumer and Agent

GreenLiving: Energy Efficient Mortgage Campaign

Homebuyers often face high energy costs and contribute to environmental pollution.

This campaign targets homebuyers and agents working with clients interested in sustainable living and energy-efficient homes to reduce monthly utility costs. We offer a unique loan option to finance both energy efficient improvement costs and mortgage into one loan. It is executed through RAC social, RAC print, and RAC email.

Green upgrades. Energy savings.

All in one home loan.

Get all the upsides of GreenLiving.

Need an easier way to make the home you’re buying energy efficient? With GreenLiving rom Rate, it can happen sooner than you think

Buy the house you love and fix it up right away Because

GreenLiving gets you financed or you energy improvements and a mortgage payment, all in the same loan. No more wasting time shopping around or separate loans.

It s easy to achieve the energy-conscious li estyle that s

important to you ill out one simple applicatio

Save on monthly utility bill

Use or heating, cooling, appliances, solar, insulation

and mor

Increase the value o your home

Live the green lifestyle you love.

Contact me to learn more

Windows doors

Email: Agent & Consumer

Let’s go!

Rate’s GreenLiving program offers a way for homebuyers to roll energy-efficient improvement costs right into their mortgage. Whatever their home improvement needs, they can start upgrading sooner than they think.

73% of buyers in today’s market say they’d consider purchasing a fixer upper because of the potential for a lower listing price.

Over 50% of real estate agents say clients looking to purchase a home express interest in sustainability.

For agents, it’s your advantage. With an easier way to go green, buyers can see energy efficiency potential even in older homes or even fixer-uppers. And you can offer them more inventory at better price points.

Get them the green home and savings they’re looking for.

All in one home loan.

Explore the upsides of GreenLiving.

Need an easier way to make the home you’re buying energyefficient? With GreenLiving from Rate, it can happen sooner than you think.

Get financing for energy improvements and a mortgage, all in one loan. Rate’s GreenLiving program gets you to the more energy-conscious lifestyle that’s important to you at the same time you purchase your home.

Get going on improvements and start to see benefits

On simpl applicati n av n m nthly utility bill

Us f r h ating, c ling, applianc s, insulati n and m r

Incr as th valu f y ur h m

See how easy it is to achieve the lifestyle and savings you love!

Let’s go! BASIC-S

more!

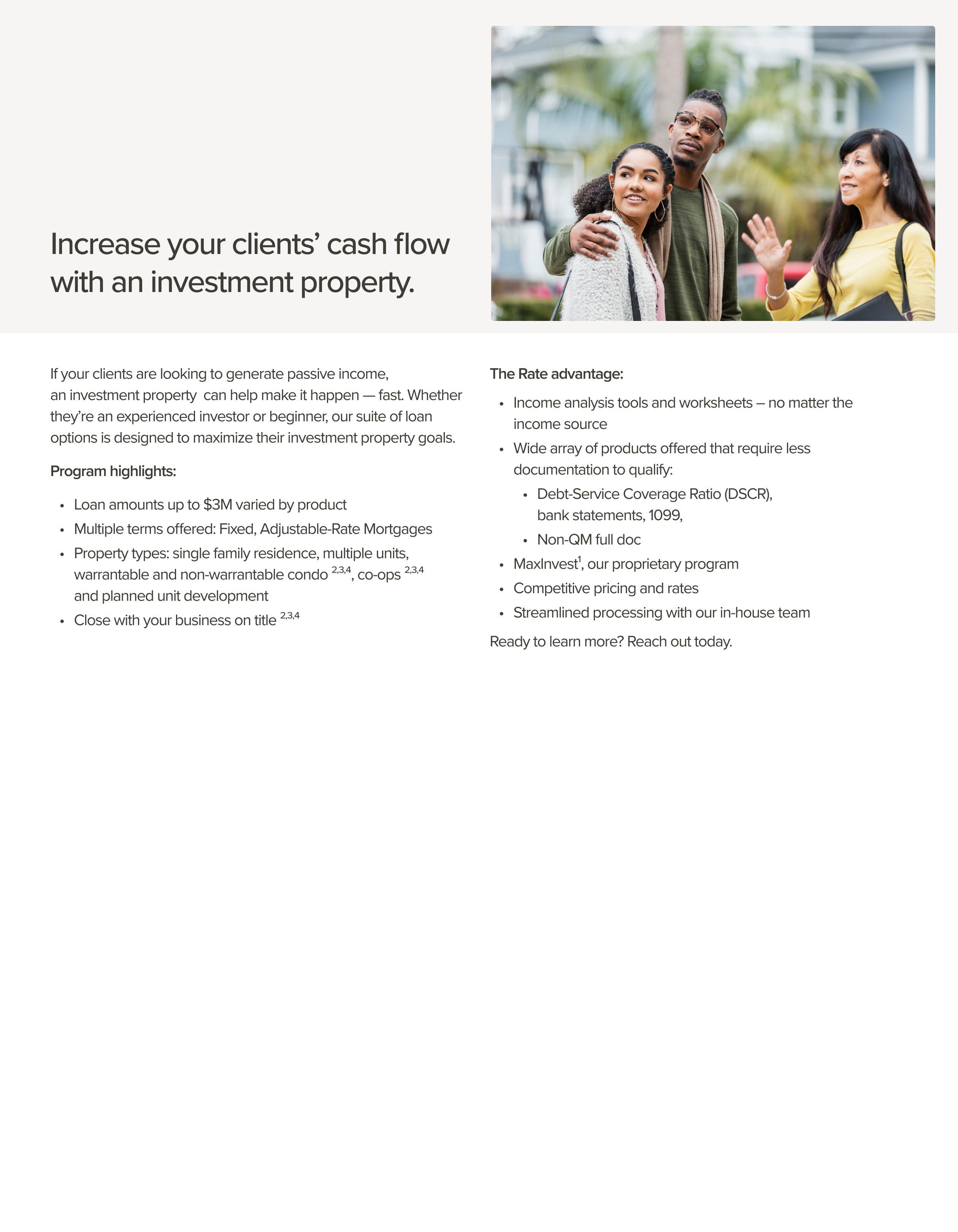

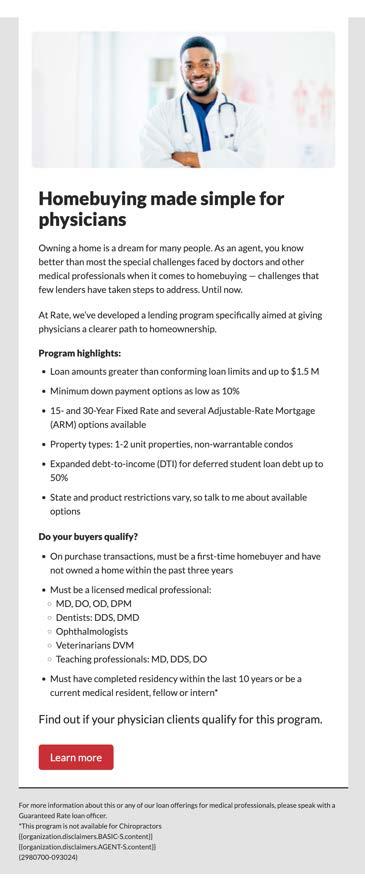

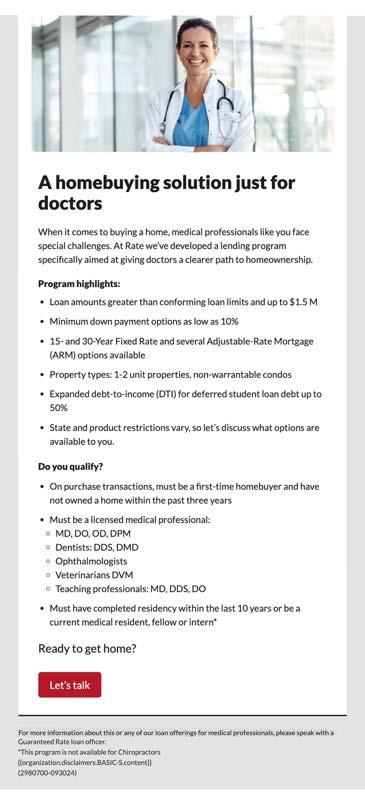

Regional Champaign Doctors Program Campaign

Physicians are concerned on the impact of their student loan debt on their ability to qualify for a mortgage.

This campaign targets prospective physician homebuyers and their agents. It empowers physicians to achieve their homeownership goals even with student debt. This campaign comes to life through RAC social, RAC print, and RAC email.

Homebuying made simple

for physicians

Rate’s doctor program is created specifically to meet the needs of physicians.

Program highlights

Loan amounts greater than conforming loan limits and up to $1.5 inimum down payment options as low as 3 -Year Adjustable-Rate ortgage (AR option

Property types: 1-2 unit properties, non-warrantable condo Expanded debt-to-income (DT for deferred student loan debt up to 5 State and product restrictions vary, so talk to me about available options

Call today to explore your options.

Do your clients qualify n purchase transactions, must be a first-time homebuye ust be a licensed medical professional:

D, D D, DPM

Dentists: DDS, D D

phthalmologists

Veterinarians DVM

Teaching Professionals: D, DDS, D ust have completed residency within the last 1 years or be a current medical resident, fellow or intern

Call today to explore your options.

ChampaigN Doctors Program Campaign

Affordability Reskin

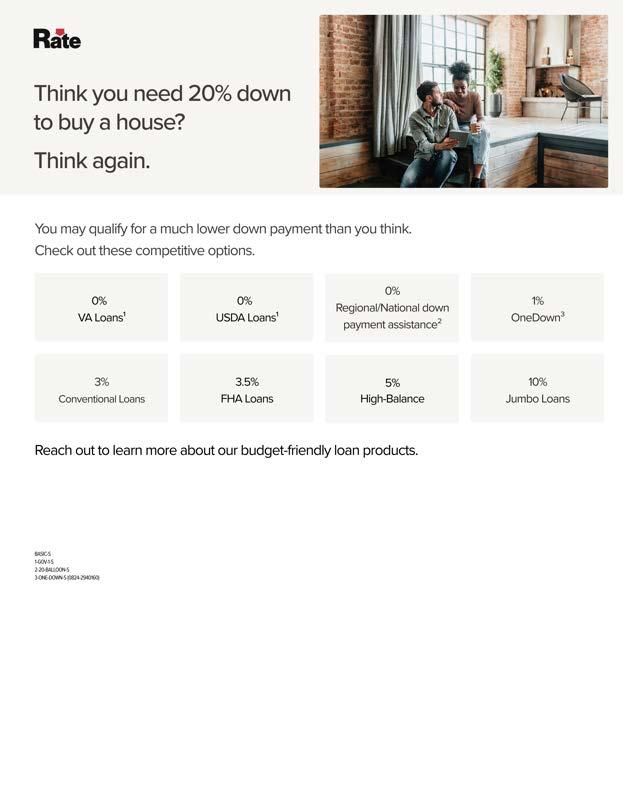

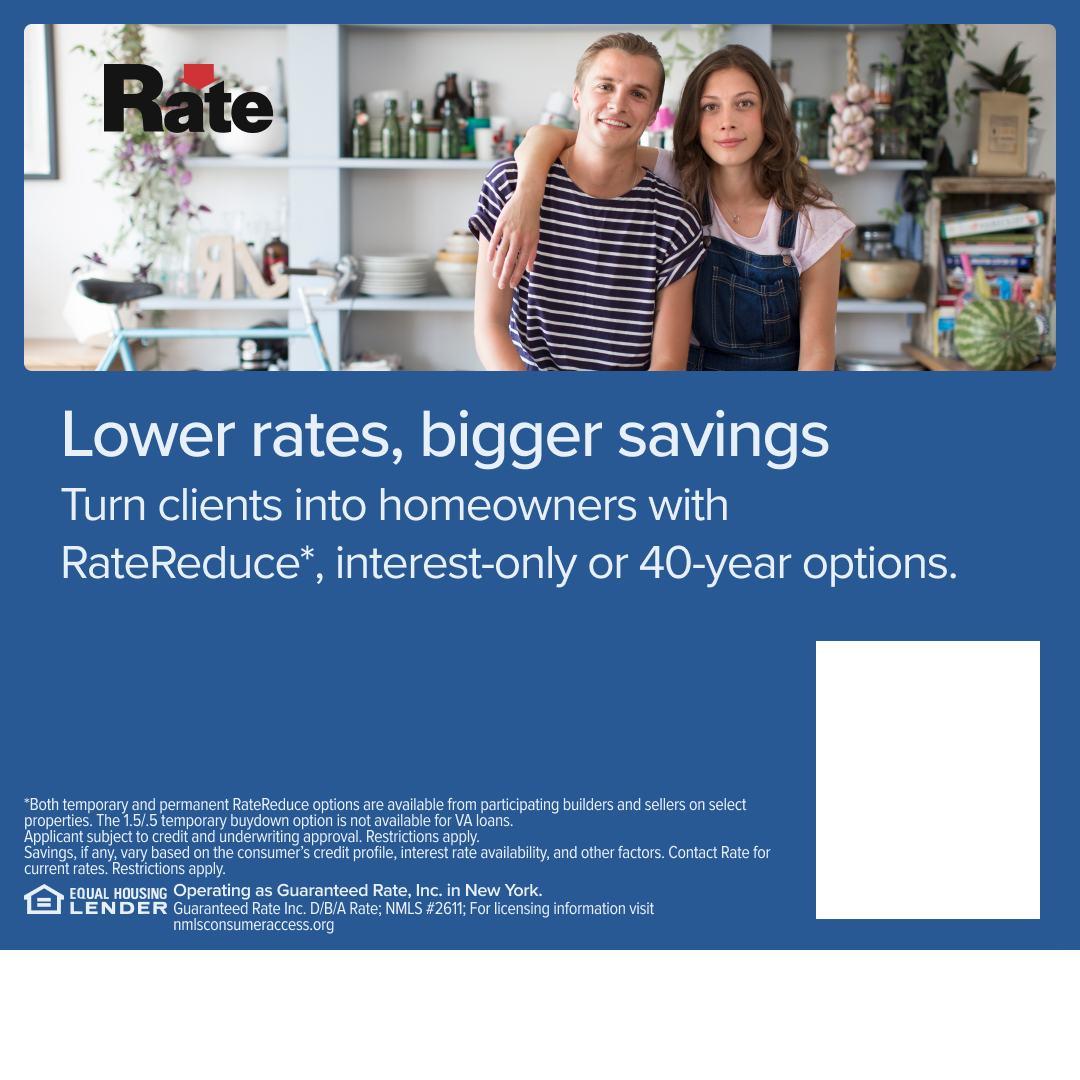

This campaign took previously created assets centered on affordability and brought it them into the new brand ID. The work focuses on showing homebuyers the products and programs Rate offers to make homebuying more affordable in today’s market. The campaign comes alive through RAC email, RAC social, RAC flyers and an Affordability Guide.

First-time homebuyer jitters?

Our loan products and programs can help make buying your first home more affordable. Reach out today and can help identify the programs and products that’ll save1 you the most:

Products That Could Lower Monthly Payments

RateReduce Temp2, Perm and Sell3, Interest-Only Mortgages4, 40-Year Products

National Down Payment Assistance Programs

OneDown5, EquityAid6

Ways to Make Funds Go Further

Rental Income from Additional Dwelling Units, Multifamily Home Loans, Non-Qualified Mortgages First-Time Homebuyer Programs

FirstHome+7

Special Purpose Credit Programs

Freddie Mac BorrowerSmart AccessSM8

Fannie Mae HomeReady® First9

can help guide you through the process smoothly, with products and tools that can lead to big savings.

business better than anyone. With an arsenal of incredible tools at our disposal and access to dozens of programs and grants, we have a myriad of ways – plus the will and energy – to connect your buyers with the home of their dreams.

Join us today!

Homebuying

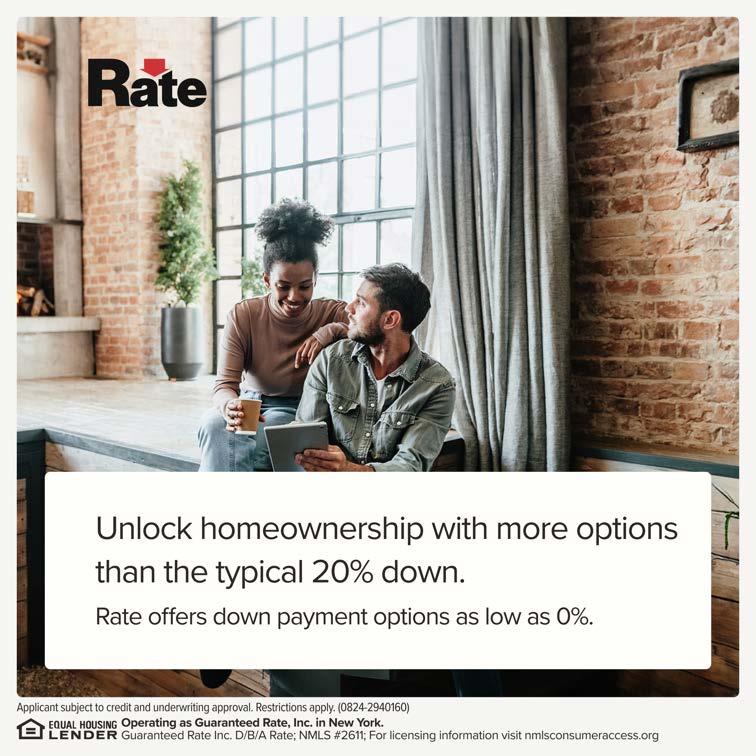

Homebuying really is possible

When it comes to homebuying, many budget-conscious buyers may choose to defer their dreams and opt out of the process without getting the full picture. Some may be waiting for “the right time,” some can’t swing that “mandatory” 20% down payment while others may have been knocked down so much they couldn’t possibly imagine getting approval.

At Rate, we believe you shouldn’t give up that easy. That’s because we know the intricacies of the mortgage business better than anyone — and that there are many, many avenues for you to explore that can offer substantial savings and opportunities which can literally open doors that might otherwise be closed.

With an arsenal of incredible tools at our disposal and access to dozens of programs and grants, here’s an overview to the myriad of ways we can connect you with the home of your dreams.

Products that could lower

monthly payments

Looking to buy, but the mortgage rate’s a dealbreaker? Then you might want to consider a buydown — which allows homebuyers to obtain a lower interest rate when taking out a loan (via a sellers concession) — or you may opt for alternative loan products that bust the “30-year mortgage” myth. These might be a better fit for your budget in the short term — or even the long term.

AFFORDABILITY RESKIN

Asset type: Affordability Guide

RateReduce

Th r ar two ty of buydown T m orary and P rman nt off d a Rat R duc T m and Rat R duc P rm.

Rat R duc T m low th int t rat on your mortgag for th fir y ar or two (or thr of your loan. Th quir d to contribut to your loan to r duc th rat during th initial riod and th n aym nt r v rt aft r th riod ov r. Thi call d a ll r conc ion” and it’ n c ary for th rogram to function. Rat off r fiv Rat R duc o tion which la from on to thr y ar .

With Rat R duc P rm th ll fund a rman nt rat r duction by aying oint to th nd r at clo ing to buy a low r int r rat for th lif of th loan. Not only will thi giv you th ot ntial for longrm aving but it could al o d cr a tran action co t on a futur r financ Th co t of a rman nt buydown vari ba d on th loan rogram.

Ove vie Ra eReduce Te Lo e s he in e es a e of you loan fo 1-3 yea fo he bo o e Selle con ibu es o you loan o lo e du ing he ini ial pe iod

Ove vie Ra eReduce Pe

Nego ia ed af e buye and selle go in o con ac Reduced a e fo he life of he loa May dec ease ansac ion cos s hen efinancing

Interest-only mortgages2

noth r ath to hort-t rm aving through an int t-only mortgag which r quir aym nt of only th int t (not th rinci al) for a amount of tim — ay fiv y ar or o — b for adding th rinci al back into th quation. Whil it’ not for v ryon an int r t-only mortgag may a al to borrow r who valu 5 – 10 y ar of low monthly mortgag aym nt mor than building hom quity.

Ove vie You pay he in e es only fo a se pe iod of Good fo bo o e s ho an 5–10 yea s of lo e on hly pay en

You ay have ouble building ho e equi y

40-year products

Com ar d to a conv ntional 30-y ar mortgag a 40-y ar mortgag r ad th aym nt out ov a long riod of tim which m an low monthly aym nt lthough you’ll nd u aying much mor in int ov r th lif of th loan th ca h you av could b a d rmining factor in wh th you can afford a hom at all.

Ove vie Sp eads

National Down Payment

Assistance Programs

Asset type: Affordability Guide

Ways to make funds go further

Buying down rates or getting grants aren’t the only ways to help you get a home of your own. Here are some paths you can take to explore new revenue streams or identify additional ways to save.

Rental Income from ADUs

When you purchase a home with an accessory dwelling unit (ADU), you can make your property work for you. Specialized home financing options, such as those offered by Freddie Mac, provide favorable considerations for ADUs, and allow borrowers to use rental income to qualify.

Multifamily home loans

Buyers can pay as little as 5% down on owner-occupied multifamily homes (duplexes, triplexes, and four-plexes). By renting out the additional units, you can use the added income to supplement your mortgage payment and

help pay for the property.

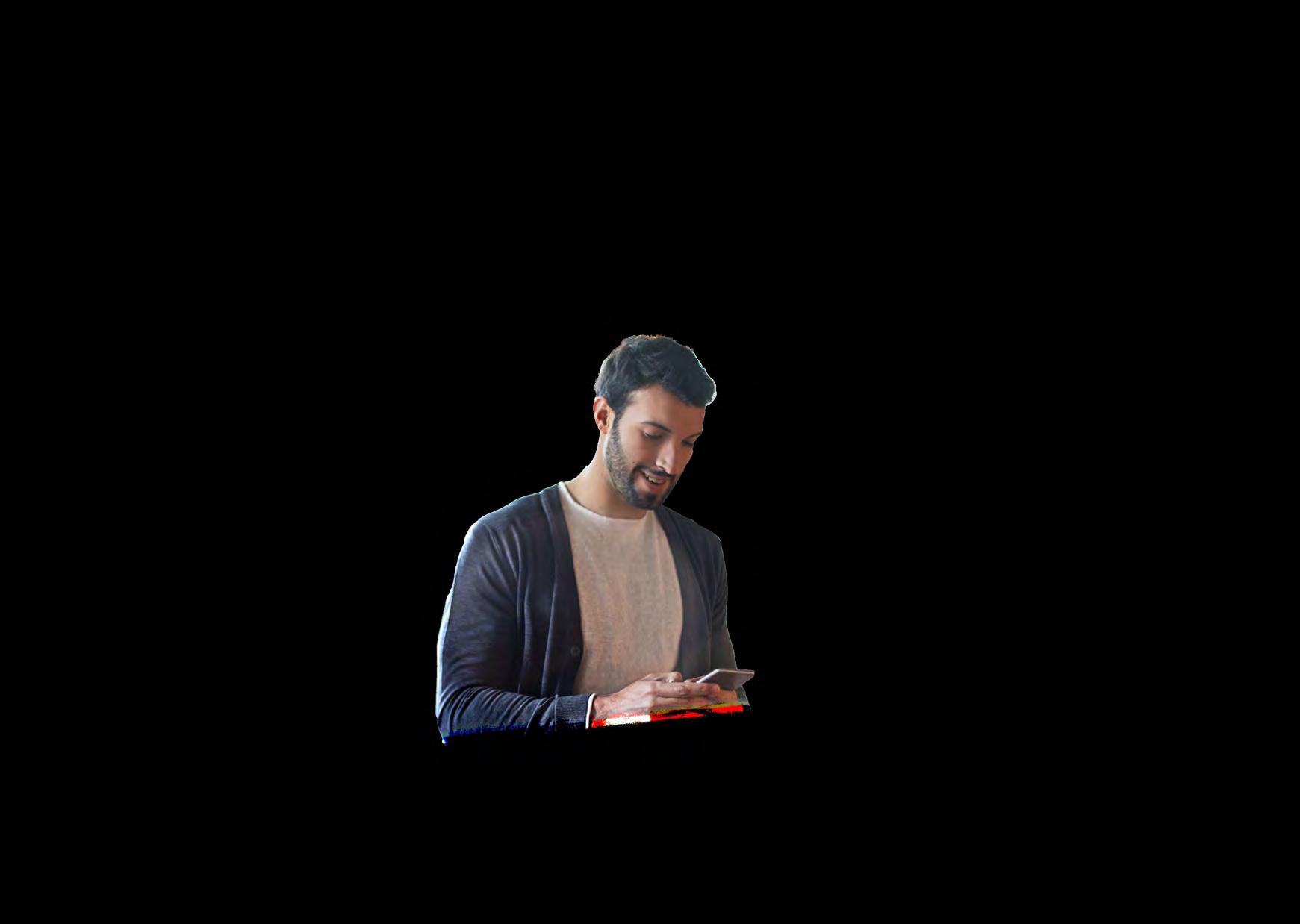

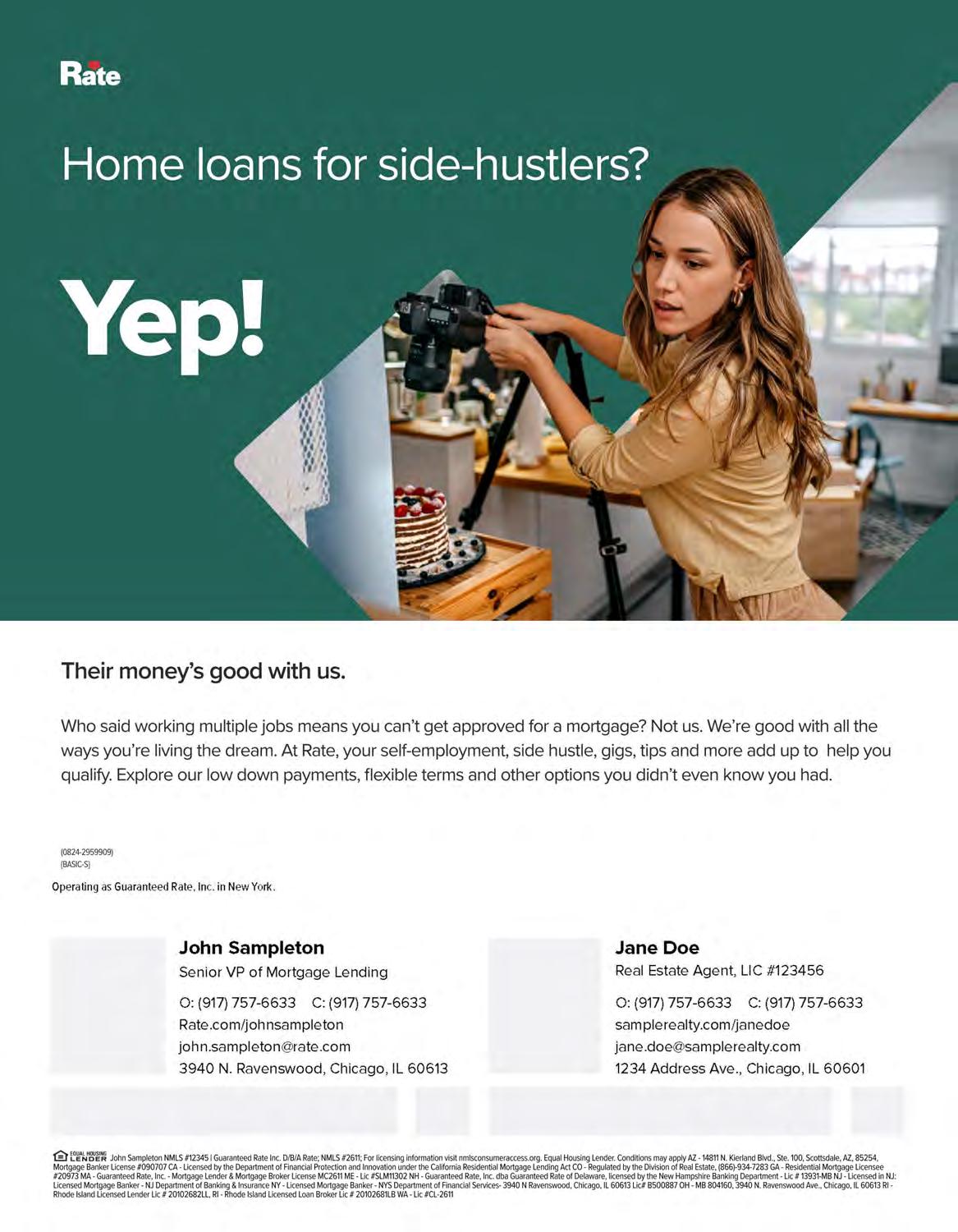

Non-qualified Mortgages

A Non-Qualified Mortgage (Non-QM) allows creditworthy borrowers to make the most of their unconventional income streams. This could mean making the best use of your selfemployment income or adding income from a side-hustle, gig work or serving job to your overall income to maximize what you could qualify for.

Multigenerational households

A tried and true method of making homeowning more affordable (or even possible) is through a multigenerational household. When multiple people live under one roof and all chip in financially, overall costs are reduced for everyone. Sharing expenses helps save everyone money.

First-time homebuyer programs

Sometimes, inexperience pays off. First-time homebuyer programs offer great incentives to help turn first-timers into proud homeowners.

Asset type: Affordability Guide

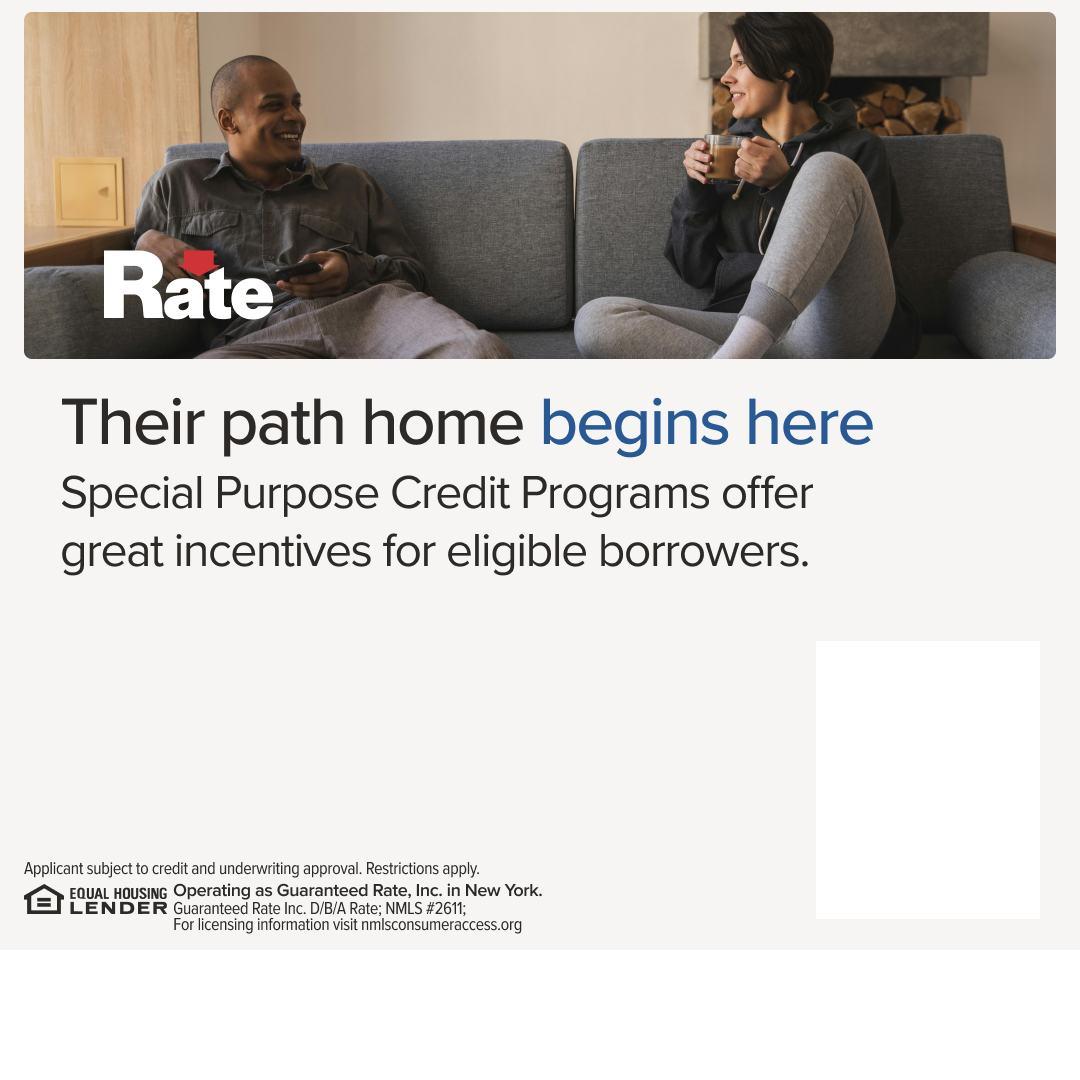

Sp cial-purpose

cr dit programs

Addr ssing communiti s historically und rs rv d by th financial and cr dit syst ms sp cial purpos cr dit programs off r pr f r ntial tr atm nt and asi r und rwriting guid lin s to r sid nts of sp cific ar as to h lp bridg th housing gap and build g n rational w alth.

for thos buying in an ligibl county within on of 10 m tropolitan statistical ar as. To qualify for this program you

n d a 3% down paym nt and at ast on borrow r must be

a first-tim buy r.

Asset type: Affordability Guide

Choosing to buy a home is no small feat. It’s a huge deal, not only financially but emotionally. And if the money stuff is giving you pause, don’t throw in the towel just yet. As you’ve just seen, there are many ways in.

Reach out to one of our qualified experts today and we’ll help get you on the right path.

Asset type: RAC Emails, Agent

Secure a lower rate

with a buydown

Lock in a lower mortgage rate with RateReduce Temp, RateReduce Perm or RateReduce Sell.

If your clients are ready to buy but worried about interest rates, a buydown may be the solution they're looking for. Available as temporary or permanent, a buydown lets your buyers obtain a lower interest rate when taking out a loan. We offer two options:

RateReduce1 Temp

As a temporary buydown, RateReduce Temp lowers the interest rate on your buyers' mortgage for the first year or two of their loan. The seller is required to contribute to their loan to reduce the rate during the initial period, and then payments revert after the period is over.

Get down with down payment assistance

First-timers on the fence?

Ease their fears with FirstHome+

RateReduce Perm

In this program, the seller pays points to the lender at closing to buy a lower interest rate that lasts the life of the loan. Not only will this give your buyer the potential for long-term savings, but it may also decrease transaction costs on a future refinance. The cost of a permanent buydown varies based on the loan program.

OneDown and EquityAid can help your buyers reduce costs and get a home they love.

Clients worried about covering their down payment costs? No need to panic! They could qualify for down payment assistance, reducing their overall costs.

OneDown1

Only 1% of the down payment is required from your clients.

RateReduce Sell2

This is a permanent buydown program in which the seller, before finding a buyer, pays an upfront fee to lock in a rate and agrees to pay discount points to lower said rate. This program allows the seller to agree to pay between 2% - 9% in discount points and protects the rate from market volatility while the seller is searching for a buyer.

Questions?

Reach out to learn more

EquityAid2

Clients can receive up to 5% of the home's purchase price to assist with their down payment or closing costs. Reach out to learn more

Down payment options as low as 3% and a potentially lower interest rate.

Don t let your first-time buyers lose hope when it comes to financing a new home. FirstHome+* offers down payment options as low as 3% with potential for a lower interest rate. So whether they re up against unpredictable rates or low inventory, FirstHome+ can help them get into a home of their own.

Benefits:

Down payment options as low as 3

Opportunity for a lower interest rat

Eligibility for households at or below 100% (120% in high-cost areas) of the Area Median Income

Reach out to learn more

Asset type: RAC Emails, Agent

Are your buyers feeling like homeowning’s

out of reach?

Help them explore additional revenue streams or identify new ways to save:*

Rental Income from Additional Dwelling Units

Specialized home financing options provide favorable considerations for homes with an additional dwelling unit (ADU), and allows your buyers to use rental income to qualify.

Multifamily Home Loans

Fannie Mae now permits options as little as 5% down on owner-occupied multifamily homes, which makes it easier for your buyers to rent out additional units for passive income.

Non-Qualified Mortgages

For creditworthy borrowers who don’t have conventional income streams, a Non-Qualified Mortgage allows your buyers to qualify based on alternative methods (like self-employment or gig work) instead of the traditional requirements needed for most loans.

Multigenerational Households

When multiple people live under one roof and all chip in financially, overall costs are reduced for everyone.

Don’t let your buyer defer their dream home

Help your buyers save* with our 40-year or interestonly mortgage options.

Clients anxious about affording a conventional mortgage? Just remind them that a 30-year fixed is not set in stone. In fact, there are two alternative loan products that might be a better fit for their budget in the short term … or even the long term.

Let me find an option that works for them:

Spreads the payment over a longer period of time

Could help lower monthly payment

They may end up paying more in interest

Special Purpose Credit Programs offer great benefits for borrowers in eligible areas.

Don’t let your clients give up on their homebuying dreams ust yet. If they reside in a designated area, they could be eligible for a Special Purpose Credit Program, which offers preferential treatment and easier underwriting guidelines to help bridge the housing gap and build generational wealth.

I can help find a program that s right for them:

Freddie Mac BorrowSmart AccessSM

Offers down payment assistance in the amount of $3,000 for those buying in one of 10 metropolitan statistical areas. To qualify, they need a 3% down payment and at least one borrower must be a

first-time buyer.

They pay the interest only for a set period of time

Good for borrowers who want 5-10 years of lower monthly payment

Appeals to those who value immediate savings vs. building equity Reach out to learn more

Fannie Mae HomeReady® First

Fannie Mae HomeReady® First offers flexibilities to borrowers who reside in an eligible metropolitan area. Income limits are waived for this special offering and grant funds from Fannie Mae and Guaranteed Rate are provided to the borrowers.

Asset type: RAC Emails, Consumer

Minimize your monthly payments

Lock in a lower mortgage rate with RateReduce Temp, RateReduce Perm or RateReduce Sell.

If you're all in on buying, but the mortgage rate's a bust, consider our RateReduce* products, which let homebuyers obtain a lower interest rate when taking out a loan. We offer two options:

RateReduce Temp

This program lowers the interest rate on your mortgage temporarily for the first year or two of your loan. The seller is required to contribute to your loan to reduce the rate during the initial period, and then payments revert after the period is over.

Open

more doors with

down payment assistance

RateReduce Perm

In this program, the seller pays points to the lender at closing to buy a lower interest rate that lasts the life of the loan. Not only will this give you the potential for long-term savings, but it may also decrease transaction costs on a future refinance. The cost of a permanent buydown varies based on the loan program.

Questions?

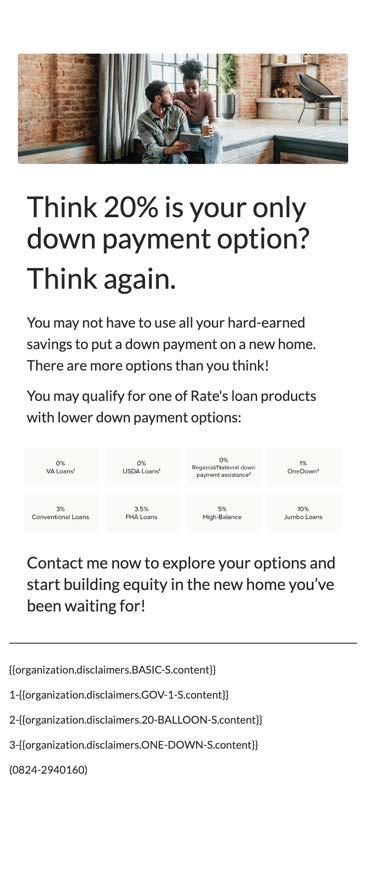

OneDown and EquityAid can help reduce costs and get you into a home you love.

Concerned about not having enough funds to cover a down payment? Don't panic yet! You may qualify for a down payment assistance program, which could cover or help lower your overall costs.

OneDown Only 1% of the down payment is required from you.

EquityAid

Get up to 5% of a home s purchase price to help fund your down payment or closing costs.

Down payment options as low as 3% and a potentially lower interest rate.

There s a first time for everything, even buying a home, but uncertainty about your finances shouldn't hold you back. I can help guide you through the process smoothly, with products and tools that could lead to big savings.

With FirstHome+**, eligible first-timers can buy a home with down payment options as low as 3% with potential for a lower interest rate. So whether you re up against unpredictable rates or low inventory, FirstHome+ can help you overcome the obstacles standing between you and your first home.

Benefits:

Down payment options as low as 3

Opportunity for a lower interest rat

Reach out to learn more fears with FirstHome+

Eligibility for households at or below 100% (120% in high-cost areas) of the Area Median Income

Reach out to learn more

Asset type: RAC Emails, Consumer

Homeownership

can happen.

Here’s how.

Exploring additional revenue streams or identifying new ways to save* could help make your funds go further and provide a pathway to owning a home.

Rental Income from Additional Dwelling Units

Specialized home financing options provide favorable considerations for homes with an additional dwelling unit (ADU), and allows borrowers to use rental income to qualify.

Multifamily Home Loans

Fannie Mae now permits options as little as 5% down on owner-occupied multifamily homes, which makes it easier for you to rent out additional units for passive income.

Non-Qualified Mortgages

For creditworthy borrowers who don’t have conventional income streams, a Non-Qualified Mortgage allows you to qualify based on alternative methods (like self-employment or gig work) instead of the traditional requirements needed for most loans.

Multigenerational Households

When multiple people live under one roof and all chip in financially, overall costs are reduced for everyone.

Reach out to learn more

Save* big with our 40-year or interest-only mortgage options.

If you’re getting nervous about affording a conventional mortgage, take a deep breath and remember that a 30-year fixed is not set in stone. In fact, there are two alternative loan products that might be a better fit for your budget in the short term … or even the long term.

Let me find an option that works for you:

40-Year Mortga

Spreads the payment over a longer period of time

Could help lower monthly payment

You may end up paying more in interest

Special Purpose Credit Programs offer great benefits for borrowers in eligible areas.

Don’t give up on your homebuying dreams without exploring all your options. If you re a resident of a designated area, you could be eligible for a Special Purpose Credit Program, which offers preferential treatment and easier underwriting guidelines to help bridge the housing gap and build generational wealth.

I can help find a program that s right for you:

Freddie Mac BorrowSmart AccessSM

Offers down payment assistance in the amount of $3,000 for those buying in one of 10 metropolitan statistical areas. To qualify, you need a 3% down payment and at least one borrower must be a

first-time buyer.

You pay the interest only for a set period of time

Good for borrowers who want 5-10 years of lower monthly payment

Appeals to those who value immediate savings vs. building equity

Reach out to learn more

Fannie Mae HomeReady® First

Fannie Mae HomeReady® First offers flexibilities to borrowers who reside in an eligible metropolitan area. Income limits are waived for this special offering and grant funds from Fannie Mae and Guaranteed Rate are provided to the borrowers.

Reach out to learn more

Your path home begins here