The elite lending experience.

A FULL-SERVICE LENDER

Working together to help customers love where they live.

+ @properties, one of the nation’s largest residential brokerage firms, partnered with Guaranteed Rate Inc., the 2nd largest retail lender in the country, to form Proper Rate–an independent mortgage company with the strength of a big lender and the hands-on service of a local firm

+ Our select team of hand-picked loan officers thrive on developing strong relationships with their agent partners

Source: https://www.scotsmanguide.com/rankings/top-mortgage-lenders/2022/top-retail-lenders

Proper Rate founders Mike Golden, Victor Ciardelli and Thad Wong

Proper Rate founders Mike Golden, Victor Ciardelli and Thad Wong

PROPER RATE

Launched to streamline the client experience.

+ Overall home buying satisfaction levels are consistently higher among those who use one-stop shopping

+ 79% of consumers stated that one-stop shopping makes the home buying process more efficient and manageable

Macaw appraisal waiver eligibility requirements vary by investor and state and may be subject to additional restrictions. Subject property must not have or be required to obtain an appraisal by law. Cash-out refinance’s, property values over $1M, manufactured homes, coops and others are not eligible for approval. Please contact your Proper Rate Loan Officer for full list of ineligible loan types. Applicant subject to credit and underwriting approval. Not all properties will be approved for Macaw appraisal waiver. Not all applicants will be approved for financing. Contact Proper Rate for more information and current rates. Any finding provided through API is a preliminary finding. Final appraisal waiver eligibility shall be provided once a mortgage application is submitted to a Loan Product Advisor.

more recently in 2019.

Statistics were based on a NAR/Harris Poll of Consumer Preferences for Real Estate Services Performed In 2008, 2010, 2015

and

The CEO Mindset

You are the CEO of your business and should be doing $500/hour rainmaking activities, not wasting your time on $40/hour tasks. We take the day-to-day chores off your shoulders, so you can focus on what’s important.

Be a rainmaker Dynamic Marketing Helping you build your brand Business Development Building powerful partnerships Proactive POD Frees you up to be a rainmaker

TM Our Philosophy: Pricing Flexibility to win in your market

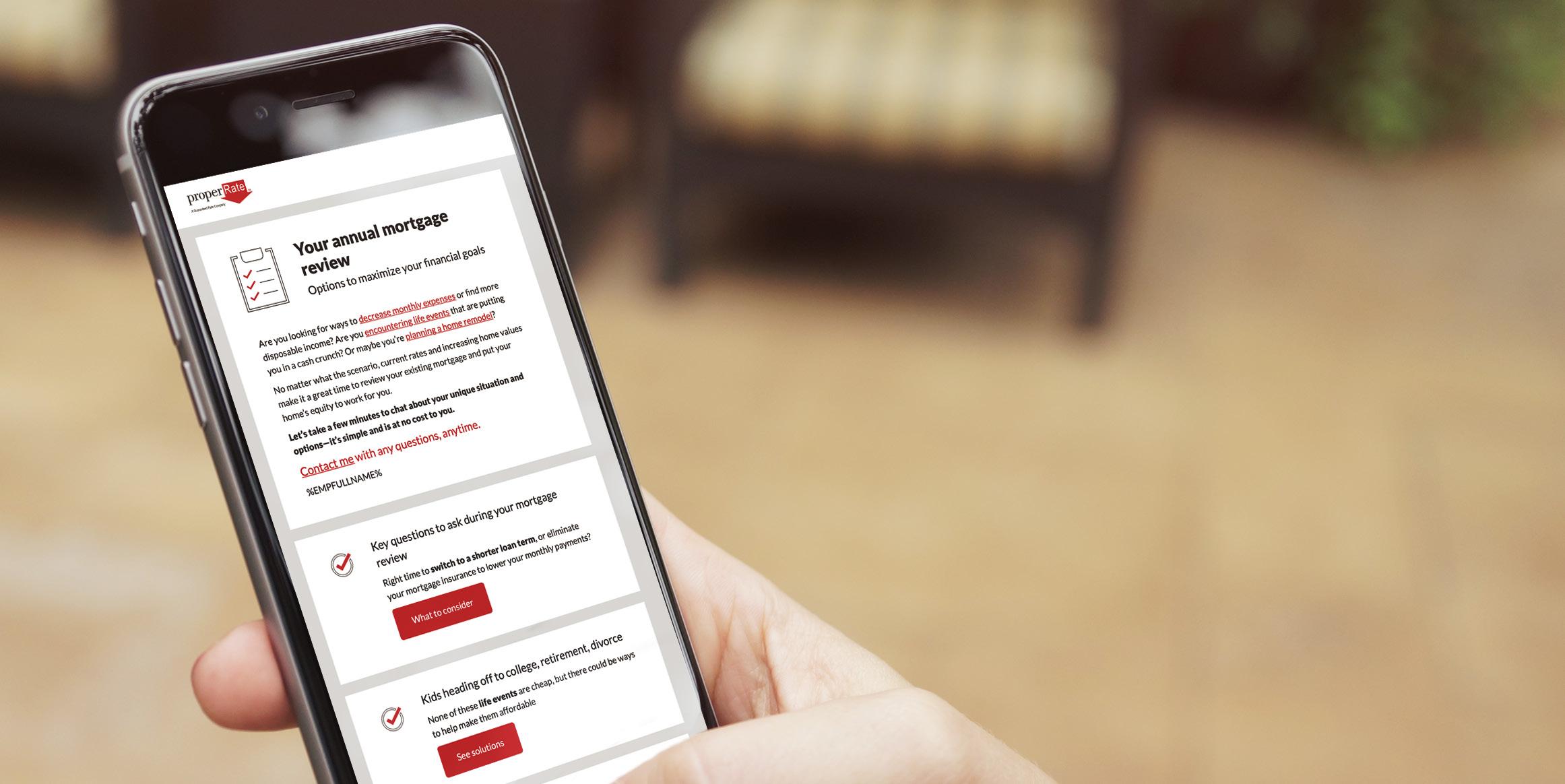

DYNAMIC MARKETING

Maximize the number of closings from your database by properly marketing to your past customers, friends, family and people who know and like you.

Dynamic Marketing

Automatic Marketing

Your contacts are everything. Transform your network into your sales force. Ignite your database to not only use you again and again, but also refer you to all their friends and family. At Proper Rate we have the best-practice model to constantly stay in front of your network in multiple ways— without having to do all the work yourself.

POSTCARDS

Automatic Marketing Let us do everything for you (and make your life easier)

up in their mailbox 12 times per year with monthly content series:

A message that introduces Proper Rate to the customer and creates a connection with the Loan Officer

Everybody likes to check their mail.

Show

+

Automatic Marketing Let us do everything for you (and make your life easier)

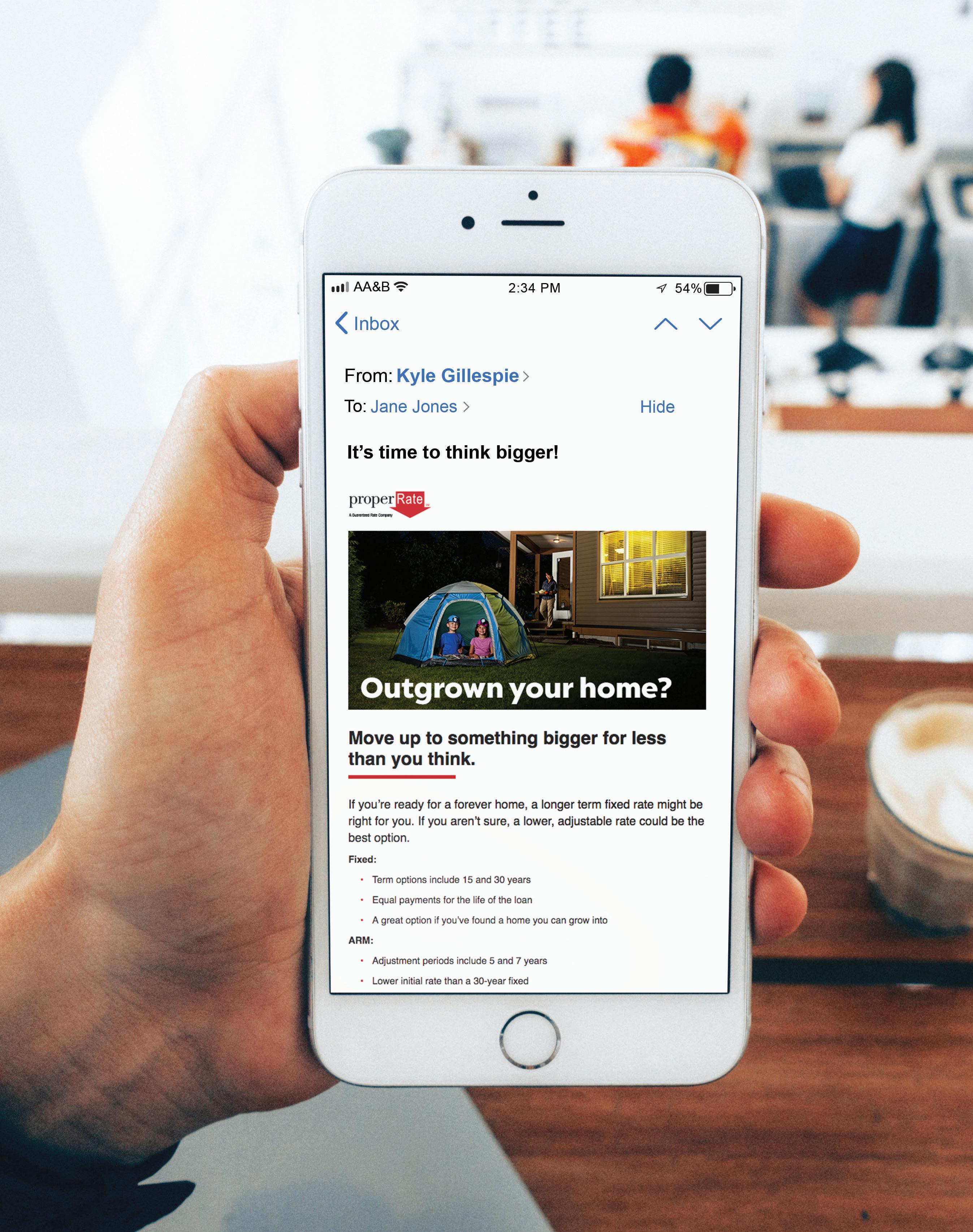

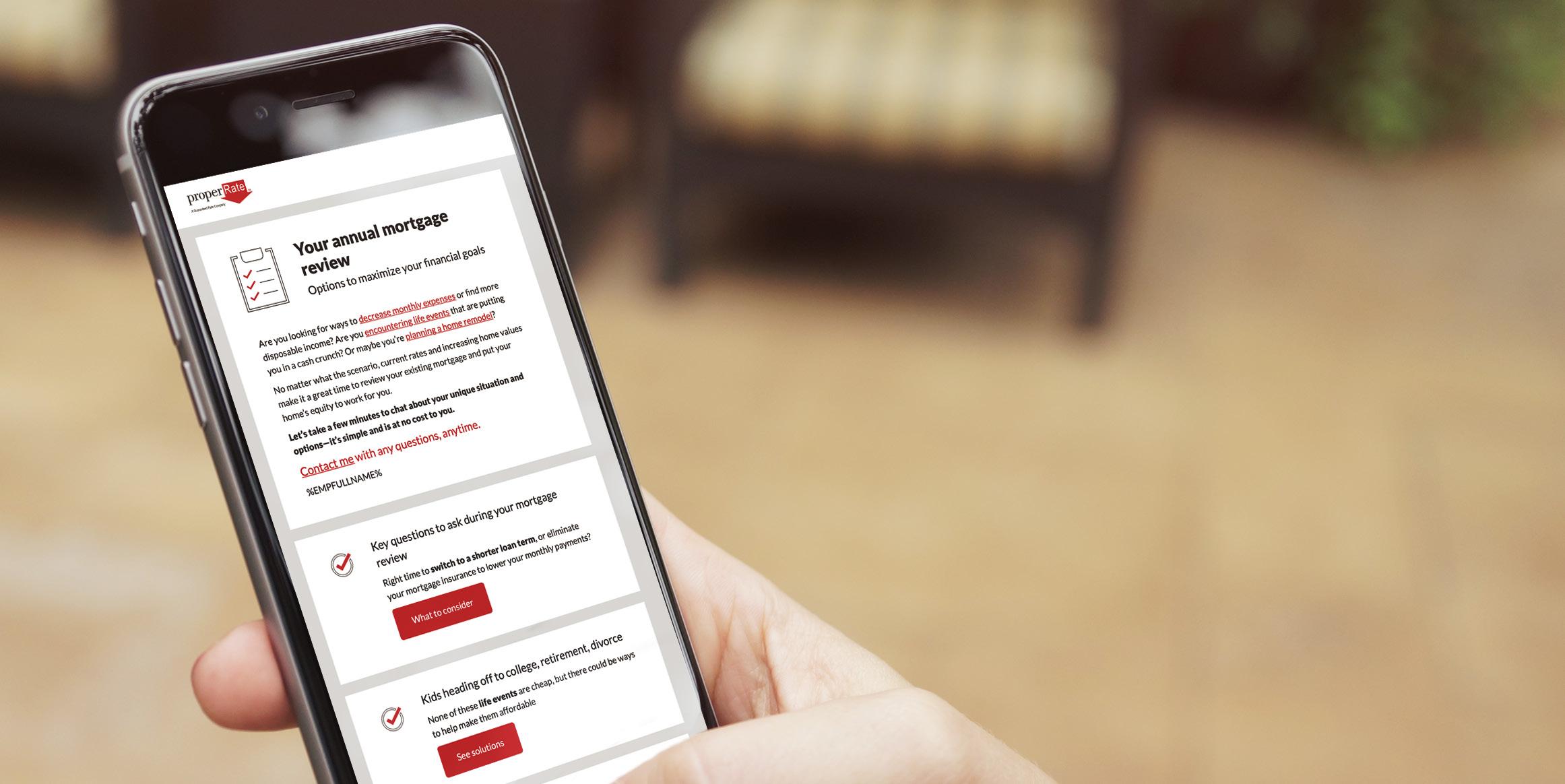

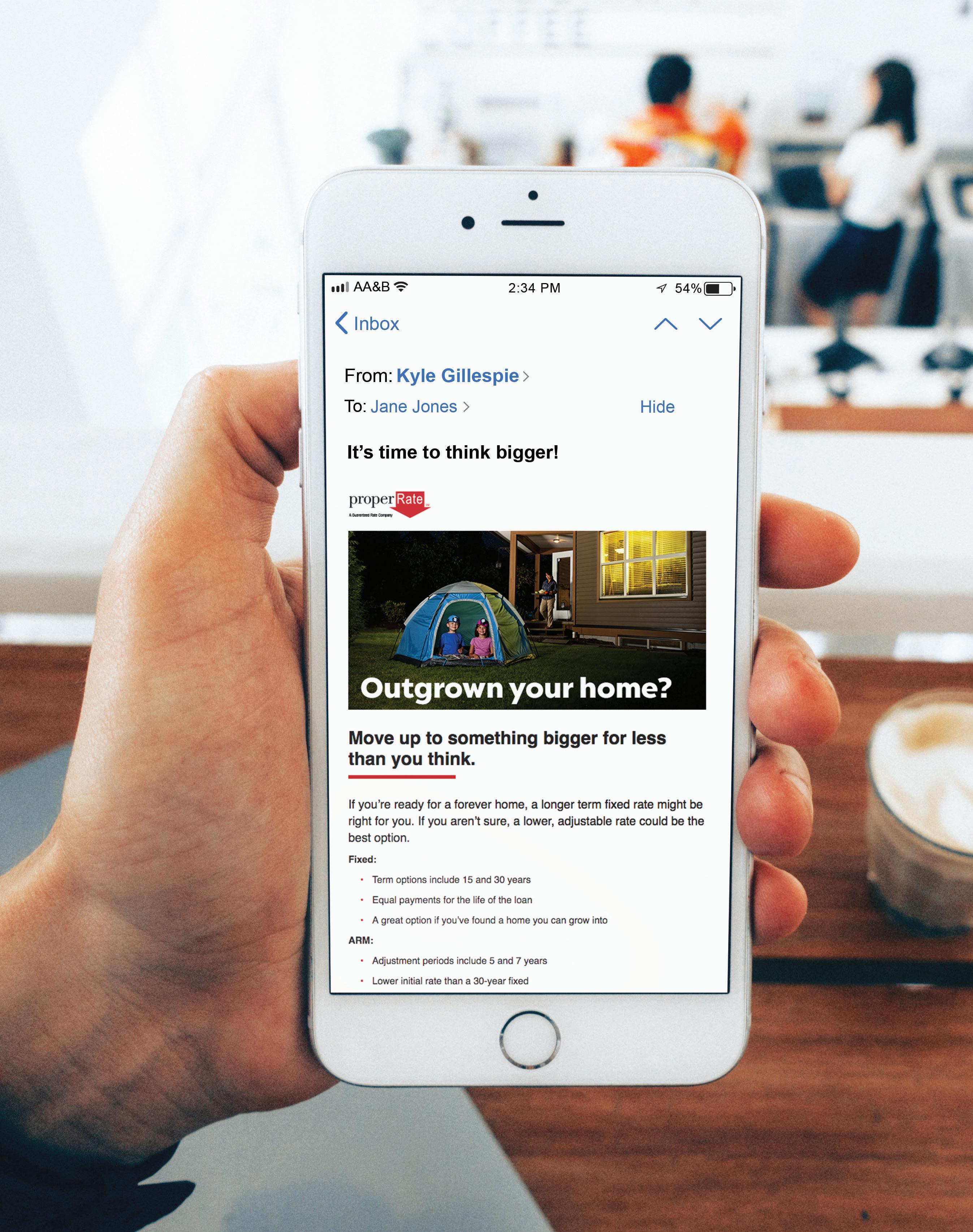

EMAIL Stay top-of-mind. Constantly. Consistently. Considerately.

+ Automatically send two emails a month which reinforce the postcards as well as give you trackable data

+ In addition, opt to send your customers and partners loyaltybuilding automated campaigns: Happy Birthday, Happy Loan Anniversary, Pre-Approval Journey, Thank You Post-Closing and more

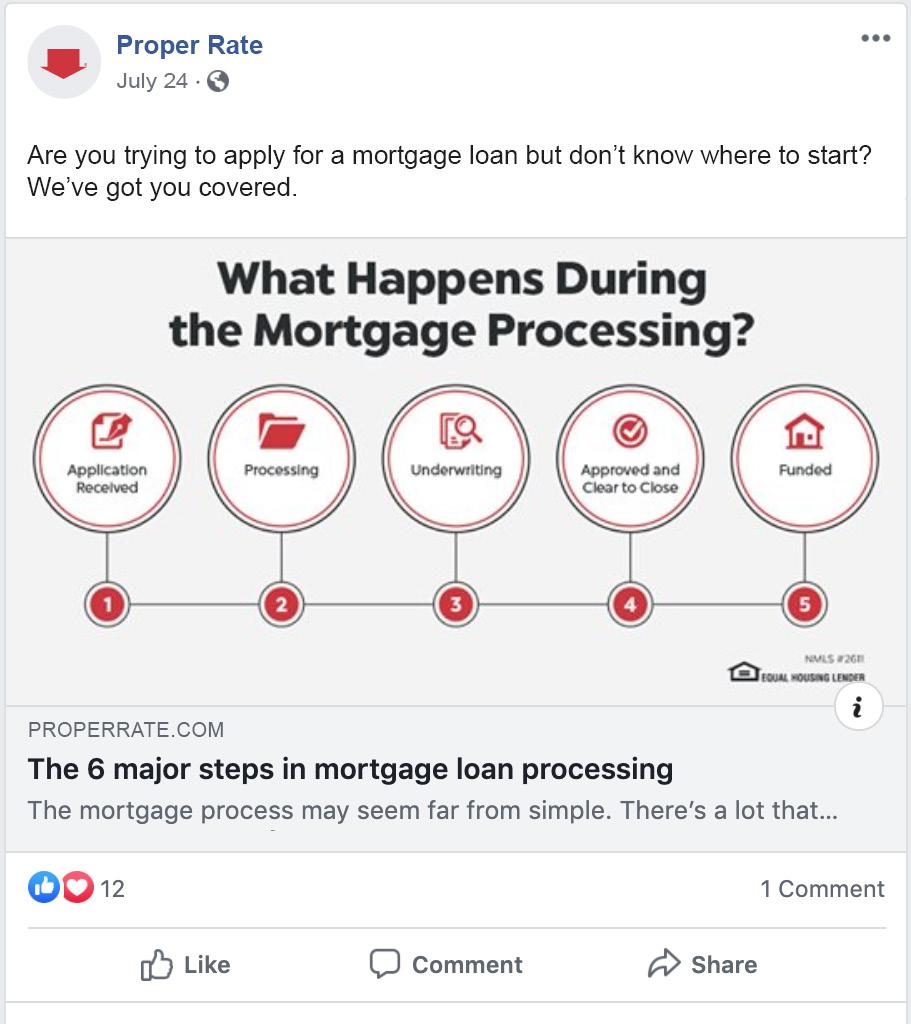

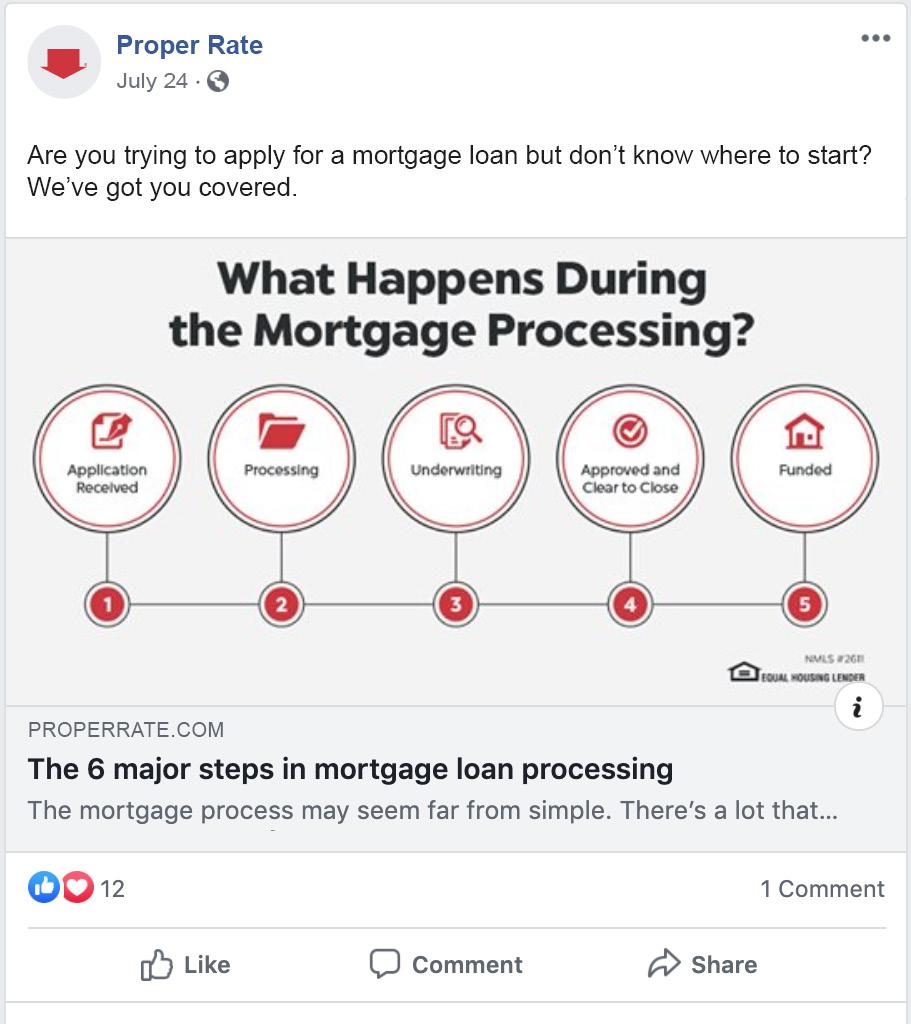

SOCIAL MEDIA

Consistently show up in your network’s newsfeed.

+ Learn useful tips and tricks to help grow your own social accounts

+ Generate conversation and leads with the help of our social media experts

+ Sign up for PR Social, and 12-15 posts per month that are engaging and relevant will be posted to your Facebook and LinkedIn by our Social Media Team

Automatic Marketing Let us do everything for you (and make your life easier)

RED ARROW CONNECT

+ Our centralized customer relationship management system, RAC, takes the thought process out of managing your database

+ Email functionality including auto campaigns, drip campaigns, personalized video emails and one-off emails

+ Journeys nurture leads throughout the sales funnel by automatically grouping contacts, email marketing and task reminders for follow-up

+ Instant branded marketing with an expansive library of print, web and social media marketing for single-branded and co-branded collateral

+ System integration with BombBomb, Zillow, Outlook, Facebook and LinkedIn

will

Macaw appraisal waiver eligibility requirements vary by investor and state and may be subject to additional restrictions. Subject property must not have or be required to obtain an appraisal by law. Cash-out refinance’s, property values over $1M, manufactured homes, coops and others are not eligible for approval. Please contact your Proper Rate Loan Officer for full list of ineligible loan types.

to credit and underwriting approval.

properties

for Macaw appraisal waiver. Not all applicants will be approved for financing. Contact Proper Rate for more information and current rates. Any finding provided through API is a preliminary finding. Final appraisal waiver eligibility shall be provided once a mortgage application is submitted to a Loan Product Advisor.

Applicant subject

Not all

be approved

Our optimized CRM and marketing platform makes it simple to reach out to your contacts and leads.

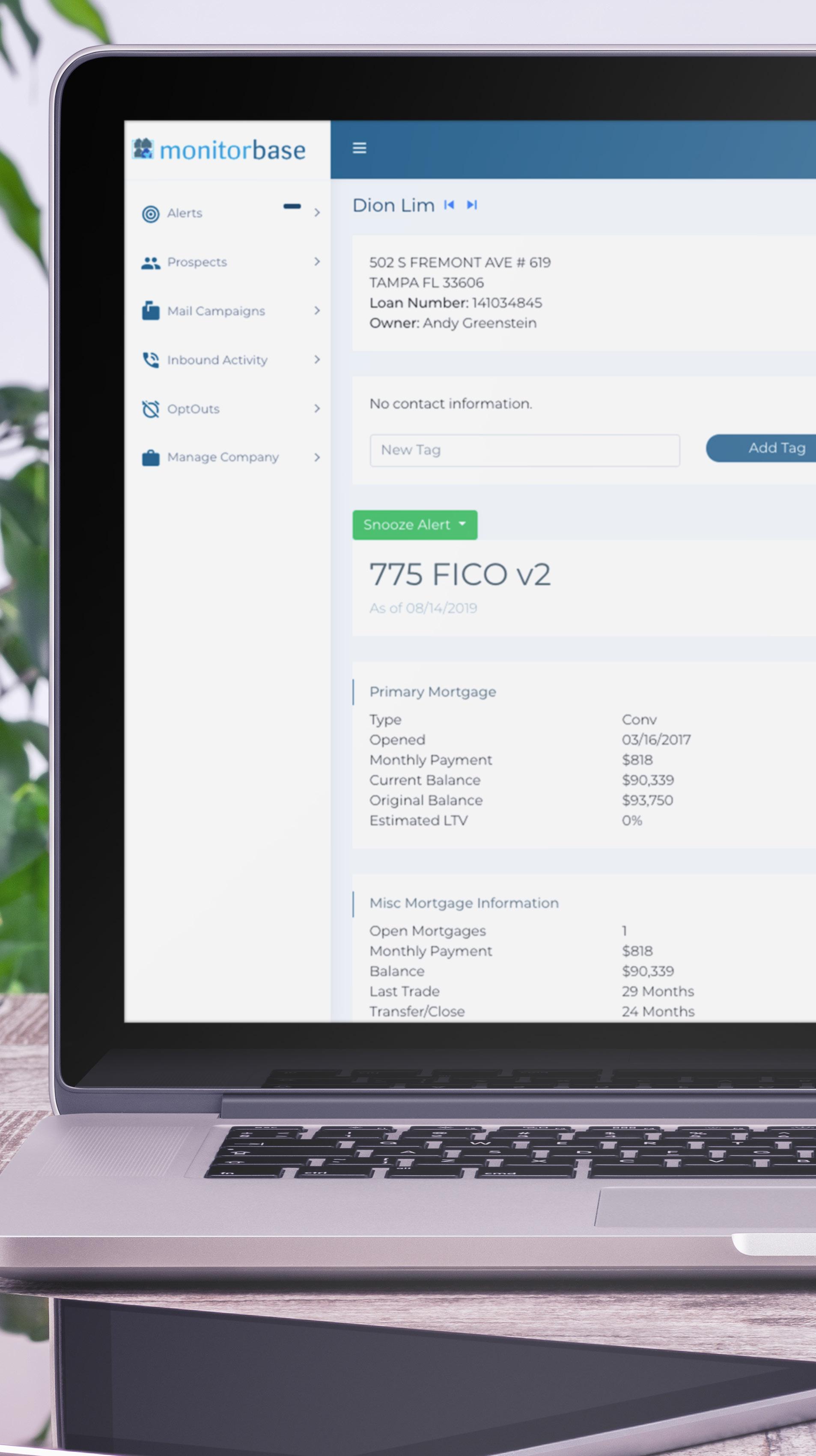

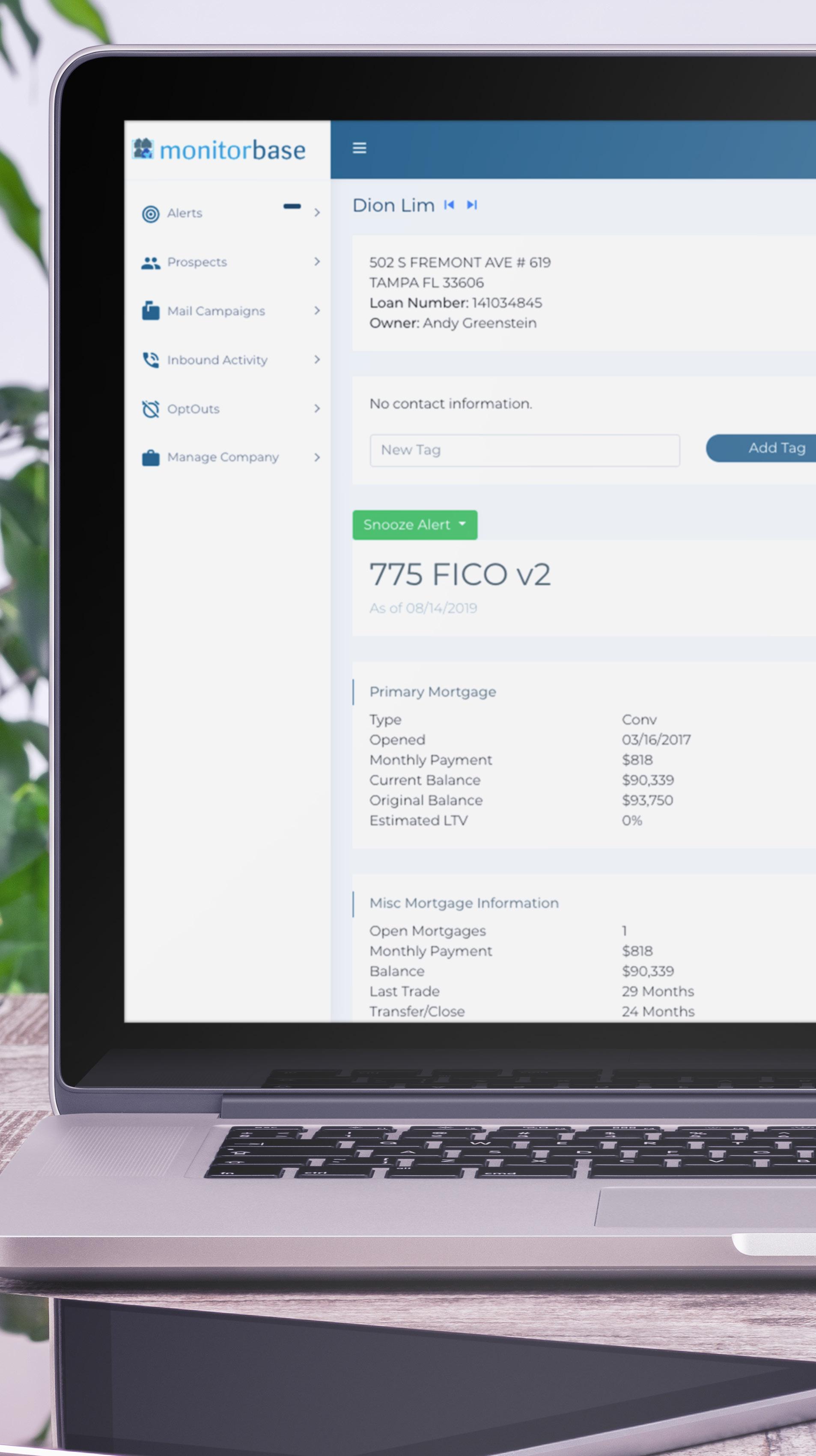

MONITORBASE

Our unique tech monitors customers’ credit for highly actionable trigger leads.

+ No closed loan, SSN or other PII required—just a name, address and phone or email

Four Alert Types:

1. Credit Pull

2. MLS Status

3. Predictive Analytics

4. FICO Improvement

Macaw appraisal waiver eligibility requirements vary by investor and state and may be subject to additional restrictions. Subject property must not have or be required to obtain an appraisal by law. Cash-out refinance’s, property values over $1M, manufactured homes, coops and others are not eligible for approval. Please contact your Proper Rate Loan Officer for full list of ineligible loan types. Applicant subject to credit and underwriting approval. Not all properties will be approved for Macaw appraisal waiver. Not all applicants will be approved for financing. Contact Proper Rate for more information and current rates. Any finding provided through API is a preliminary finding. Final appraisal waiver eligibility shall be provided once a mortgage application is submitted to a Loan Product Advisor.

+ Refi Opportunities in RAC notifies you of the number of targets available every morning

+ Automatically identify the “no-brainer” opportunities in your database based on current pricing, ARM adjustments, and other customizable criteria

+ Run up to 10 different filters at any time and customize scenarios to meet your goals

+ You can create your own filters or use pre-loaded filters in RAC

+ Once you’ve identified your eligible customers, contact those targets using the pre-loaded Refi Opportunities email templates in RAC

Macaw appraisal waiver eligibility requirements vary by investor and state and may be subject to additional restrictions. Subject property must not have or be required to obtain an appraisal by law. Cash-out refinance’s, property values over $1M, manufactured homes, coops and others are not eligible for approval. Please contact your Proper Rate Loan Officer for full list of ineligible loan types. Applicant subject to credit and underwriting approval. Not all properties

be

for Macaw appraisal waiver. Not all applicants will be approved for financing. Contact Proper Rate for more information and current rates. Any finding provided through API is a preliminary finding. Final appraisal waiver eligibility shall be provided once a mortgage application is submitted to a Loan Product Advisor.

will

approved

REFI OPPORTUNITIES

Refinance target reports let you know when it’s time to help past customers refinance.

+ Have branded items on hand for every situation: Charging stations, dog bowls outside restaurants and water bottles for showings, closings and open houses

+ Advertise via billboards, newspaper ads, flyers in windows, school programs

+ Sponsor local events with Proper Rate tents and banners

+ Our online promo store offers promotional items including everything from pens and stress balls to brand name merchandise in our “lux” product line, Black Arrow Collection

• Preferential pricing is negotiated with vendors, and the cost savings are passed on to you

will

Macaw appraisal waiver eligibility requirements vary by investor and state and may be subject to additional restrictions. Subject property must not have or be required to obtain an appraisal by law. Cash-out refinance’s, property values over $1M, manufactured homes, coops and others are not eligible for approval. Please contact your Proper Rate Loan Officer for full list of

loan types.

to credit and underwriting approval.

properties

Macaw appraisal waiver.

applicants

be approved for financing.

rates.

finding

API is a

finding. Final appraisal waiver eligibility

provided once a mortgage application is submitted to a Loan Product Advisor.

ineligible

Applicant subject

Not all

be approved for

Not all

will

Contact Proper Rate for more information and current

Any

provided through

preliminary

shall be

BRAND BLITZ Create a buzz in your local market and get your brand out there!

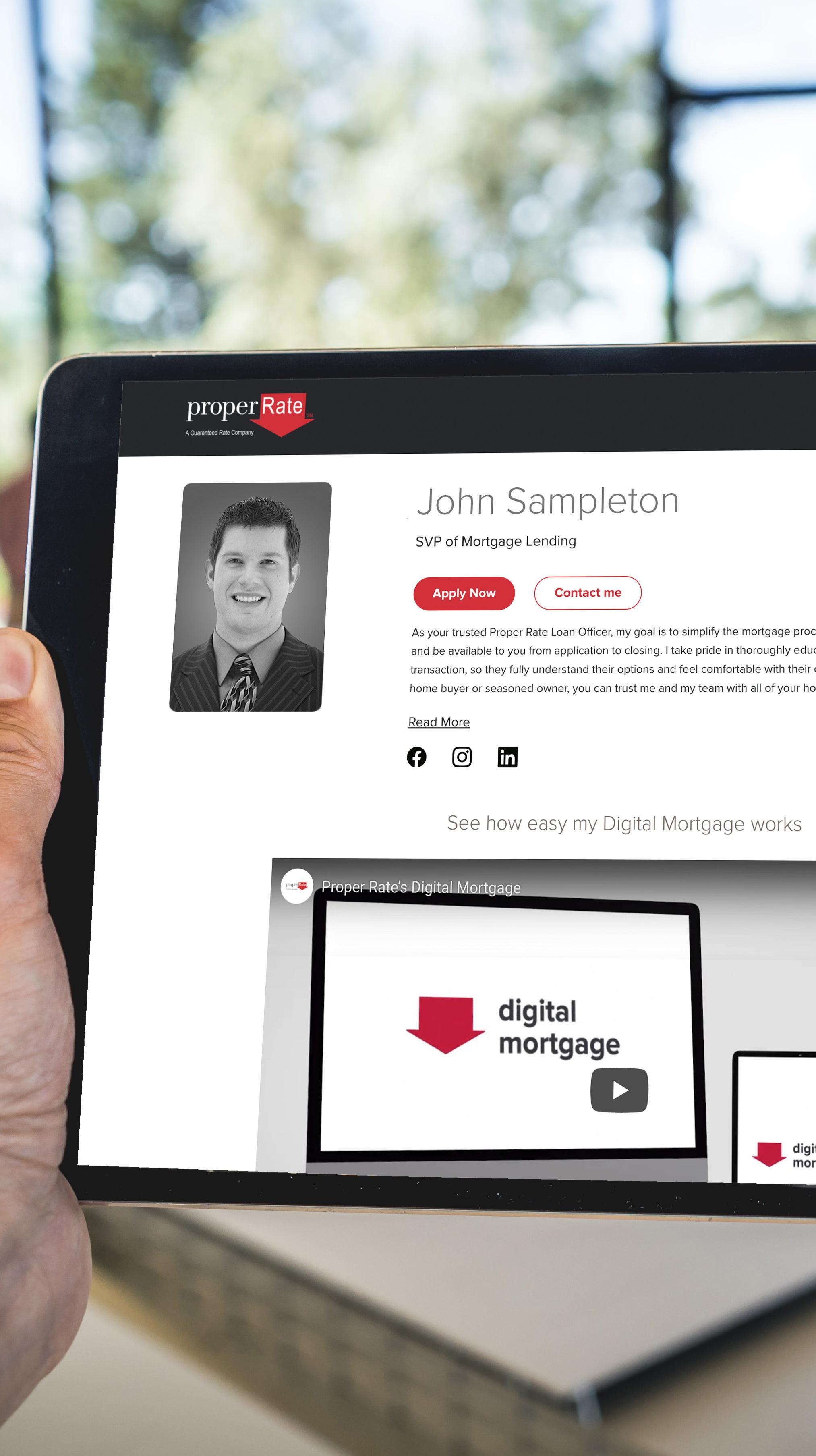

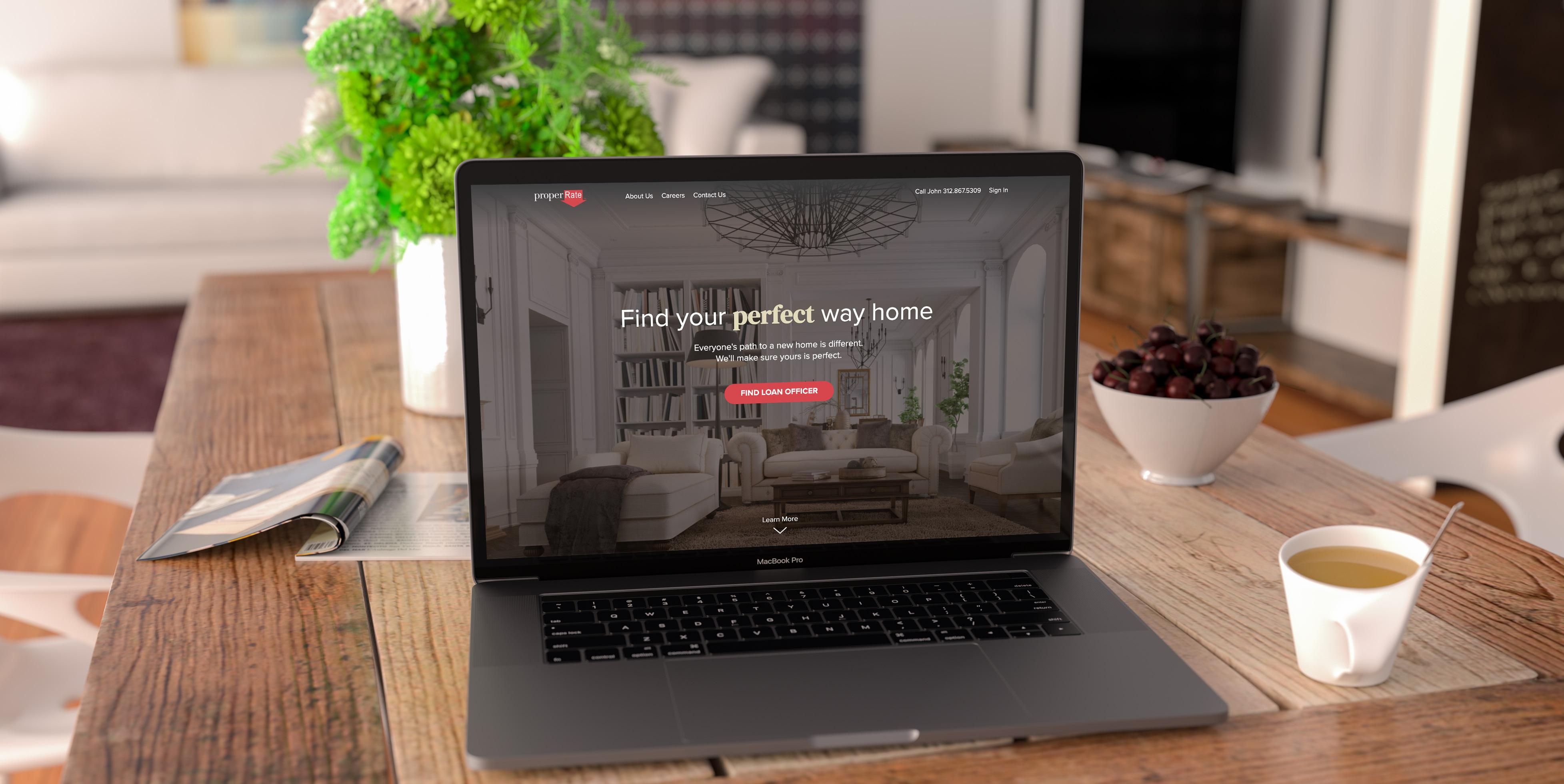

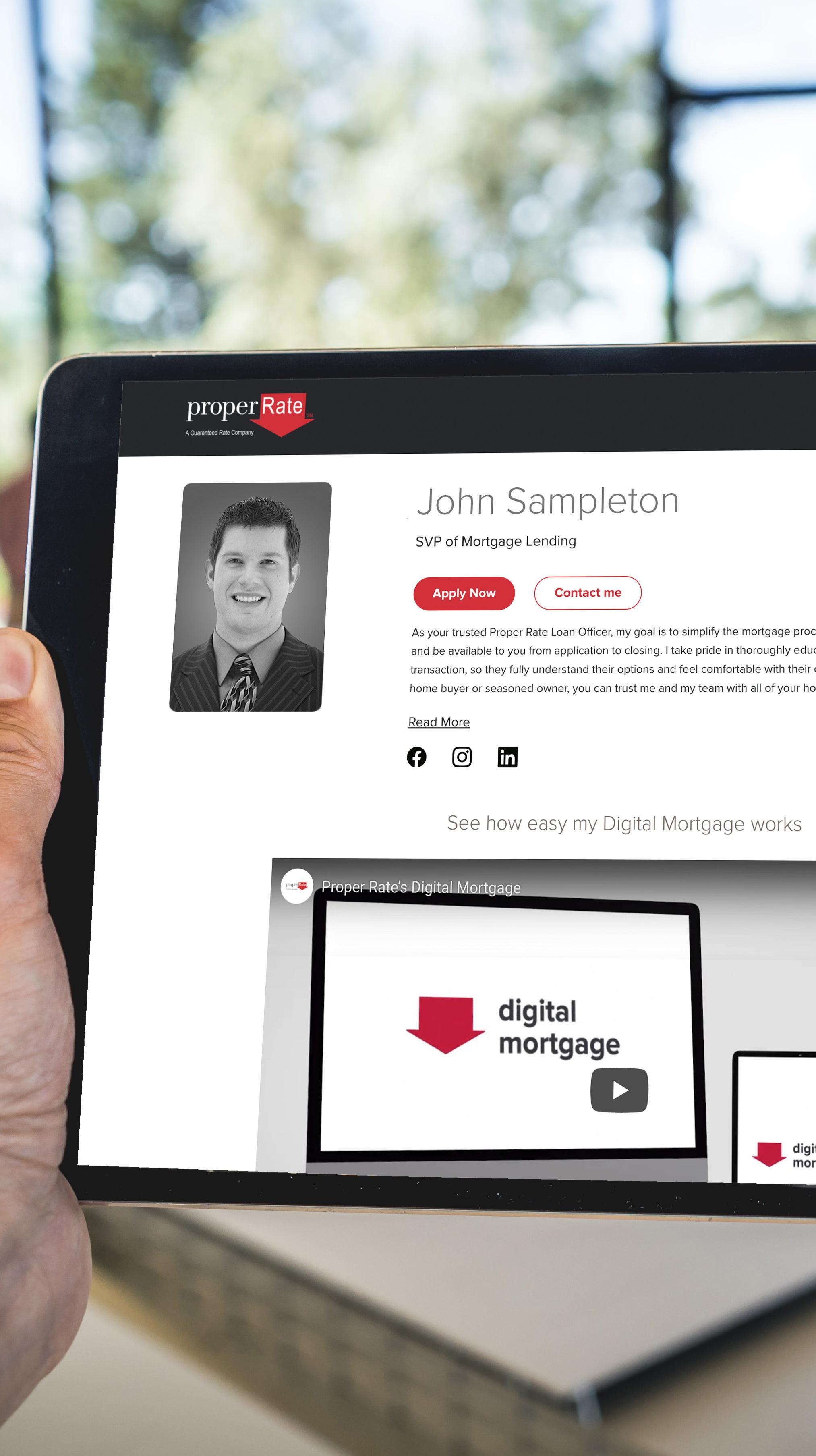

+ Your custom webpage includes your contact info, bio, testimonials, Digital Mortgage application, loan products and pricing specific to you

+ After your customer visits your VP page once, the entire ProperRate.com experience is customized to ensure that they always return to you

+ Your website is optimized to receive organic leads directly for you, so you can build your brand and grow your business

Macaw appraisal waiver eligibility requirements vary by investor and state and may be subject to additional restrictions. Subject property must not have or be required to obtain an appraisal by law. Cash-out refinance’s, property values over $1M, manufactured homes, coops and others are not eligible for approval. Please contact your Proper Rate Loan Officer for full list of ineligible loan types. Applicant

to credit and underwriting approval.

all properties

be

for Macaw appraisal waiver. Not all applicants will be approved for financing. Contact Proper Rate for more information and current rates. Any finding provided through API is a preliminary finding. Final appraisal waiver eligibility shall be provided once a mortgage application is submitted to a Loan Product Advisor.

subject

Not

will

approved

VP WEBPAGES

it easy for customers to locate you, see your information and

Make

testimonials, and apply.

+ Site visitors who are retargeted with display ads are 70% more likely to convert

+ Proper Rate marketing can leverage Adwerx to serve each of your website visitors retargeting ads up to 15x through digital ads

+ Audiences are retargeted based on contact lists and geofencing in addition to webpage visitors

Macaw appraisal waiver eligibility requirements vary by investor and state and may be subject to additional restrictions. Subject property must not have or be required to obtain an appraisal by law. Cash-out refinance’s, property values over

homes, coops and

for approval. Please

Proper Rate Loan Officer

list

loan types.

credit

underwriting

Macaw appraisal waiver.

approved for financing.

Rate

current rates.

finding

API is a preliminary finding. Final appraisal waiver eligibility shall be provided once a mortgage application is submitted to a Loan Product Advisor.

$1M, manufactured

others are not eligible

contact your

for full

of ineligible

Applicant subject to

and

approval. Not all properties will be approved for

Not all applicants will be

Contact Proper

for more information and

Any

provided through

Personalized

top of mind with

hottest prospects and

build

brand online. 70% Converstion data source: Kenshoo.com https://kenshoo.com/blog/retargeting-stats/

DIGITAL RETARGETING

retargeting ad campaigns keep you

your

help

your

PROPER PARTNERSHIP PROGRAM

A powerful new program designed to dramatically grow your referral partner business.

Proper Partnership Program

Building Partnerships

The best way to grow your referral partner business begins with selecting the right agents. Once you’ve selected the right agents, meet them face-to-face and demonstrate the real benefit you can provide to them. That’s how to build a value-based relationship that allows both of your businesses to grow.

Building Partnerships

We make it easy for you to be a rainmaker

EVENT PLANNING

Work can be fun

if you’re working with the right agents.

+ Our in-house Events Team handles all the details

+ From selecting the venue and choosing the type of event to creating and sending invitations, the team has you covered from start to finish

+ The key is to throw events with a comfortable feel so that your guests feel welcome and actually have fun

+ All you have to do is show up and follow up

Building Partnerships

We make it easy for you to be a rainmaker

BIZ DEV TEAM

Let us make the calls for you.

+ Our Business Development Managers do the recruiting activities that you don’t want to do, like cold calling agents

+ If an agent you have selected doesn’t attend the event, then the Biz Dev Team will invite them to coffee or lunch for you

+ An average of 50 calls are made for each VP per day if you enroll in the program

+ Your attention can be devoted to building the relationship, rather than on the little tasks

PROPER PARTNERSHIP PROGRAM

Demonstrate the tangible benefits of how you can help agents close more deals.

+ Build a true partnership based on real value by using our Proper Partnership Program binder with over 20 pages of ways we can support agents

+ Show them how you can help them look good to their customers

+ Set the stage for building a partnership that grows together

Helping you look good.

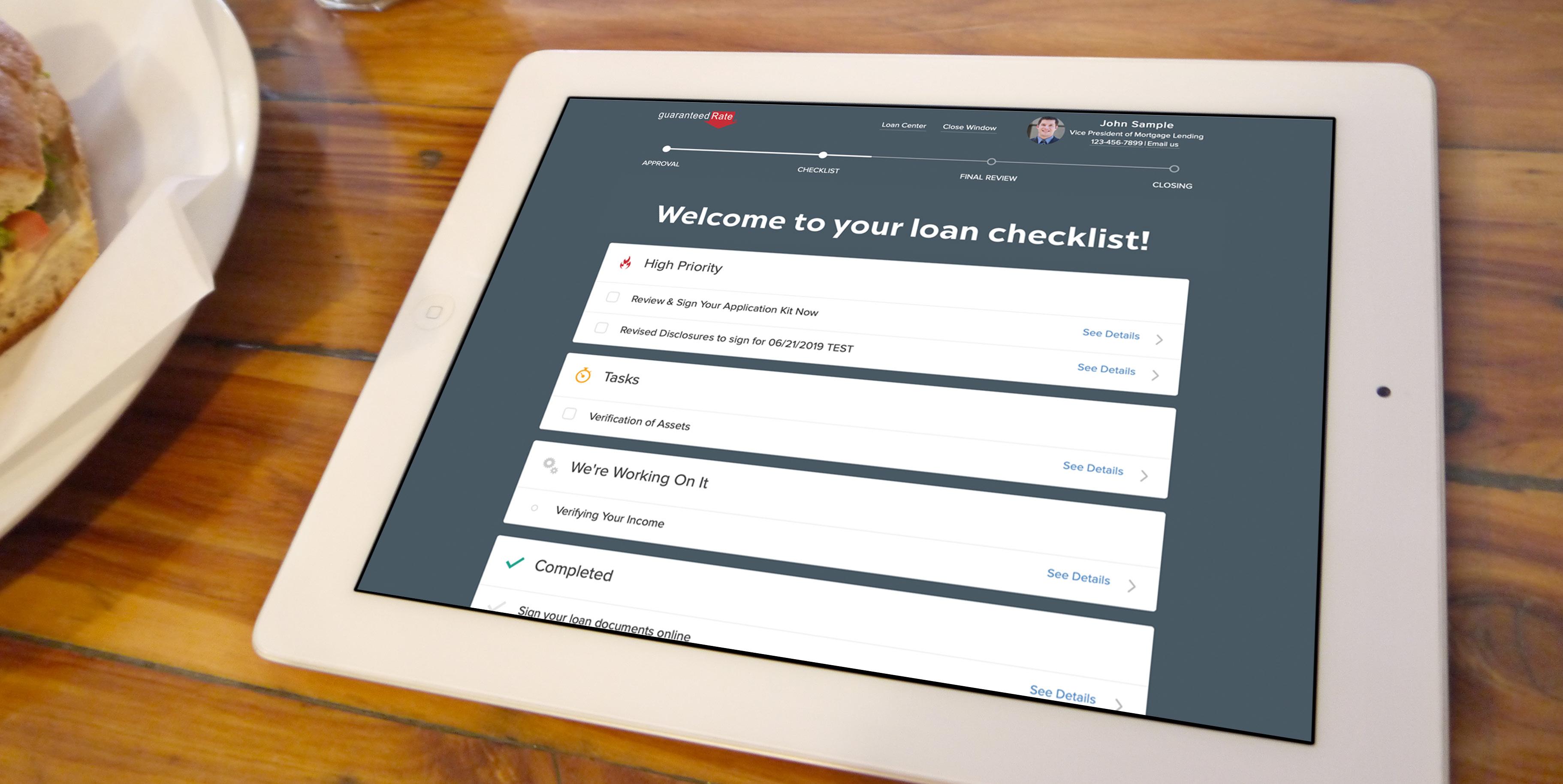

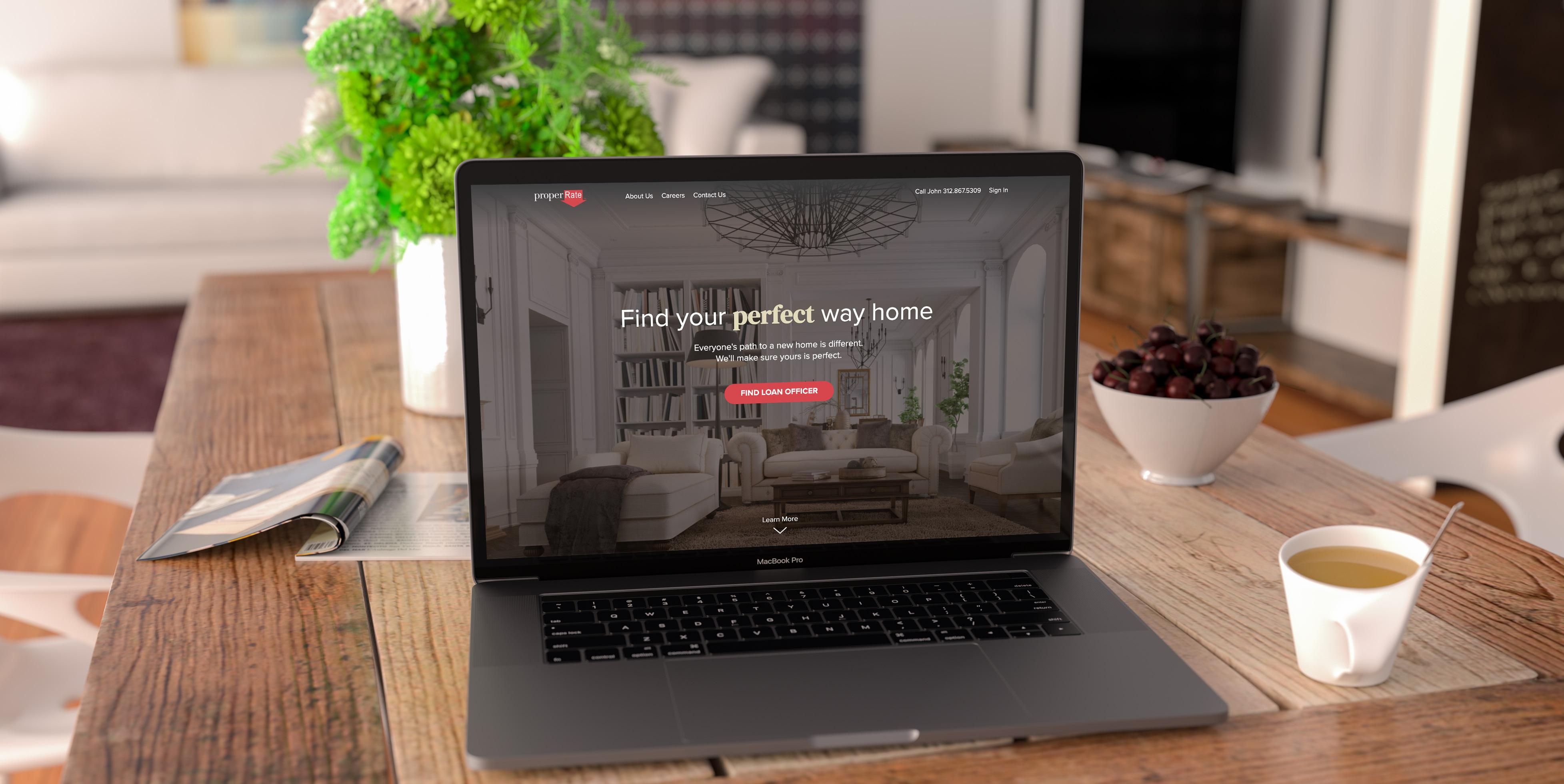

DIGITAL MORTGAGE

Your clients can easily complete the entire process in less than 15 minutes.

+ Generates recommended loan options with real-time rates

+ Advanced Asset Verification: Hassle-free automated bank statement gathering

+ LoanBeam technology simplifies tax-return income for faster and more accurate income analysis

+ Personalized document to-do list guides clients through the process

+ Never worry about getting your buyers’ pre-approval letters updated

+ We can send quotes to your buyers’ via text, lock loans and start the loan process in Toto

+ We don’t keep banker’s hours—we’re available Saturday and Sunday, day or night

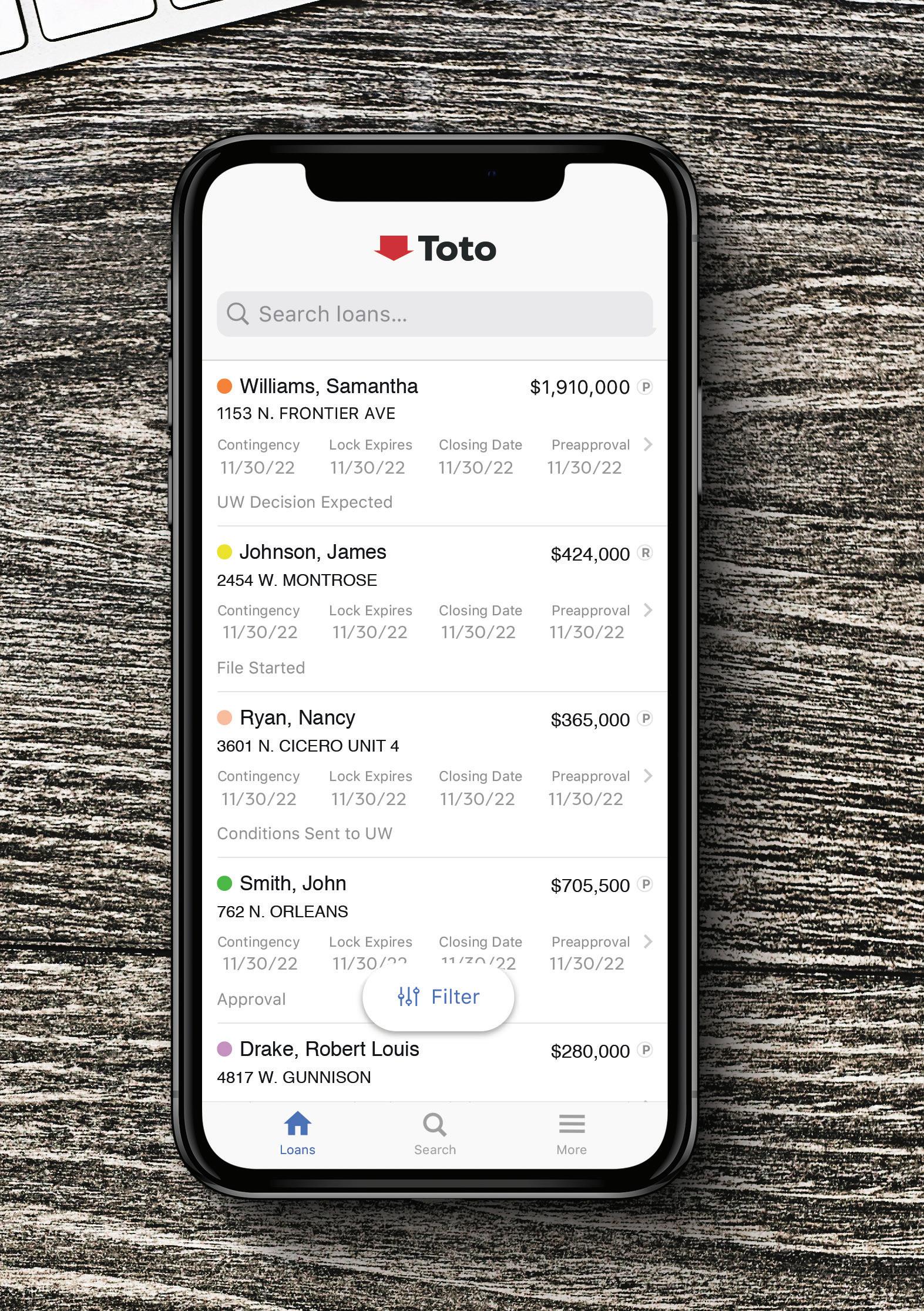

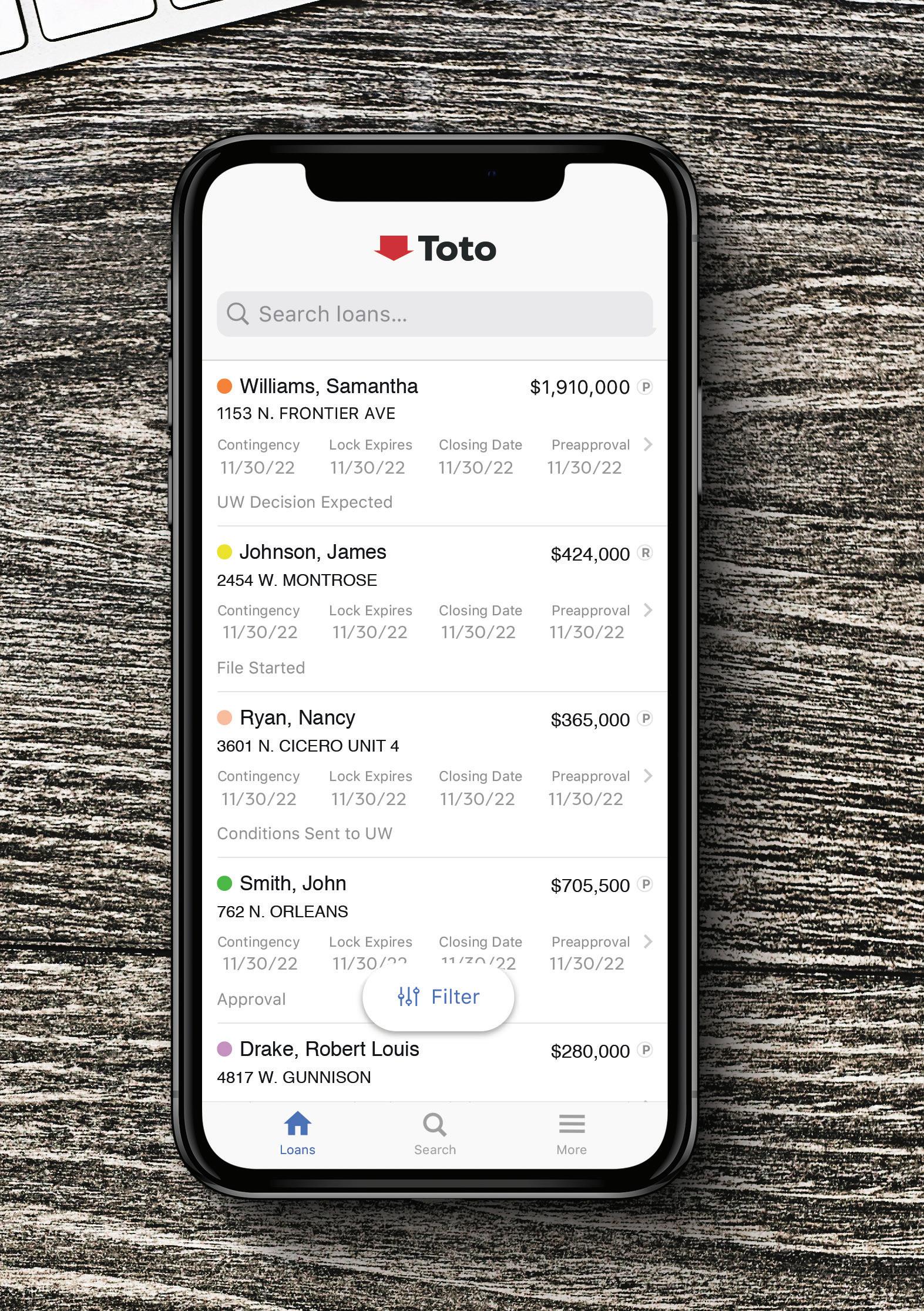

TOTO

Our on-the-go mobile tech allows you to update pre-approvals anywhere, in seconds.

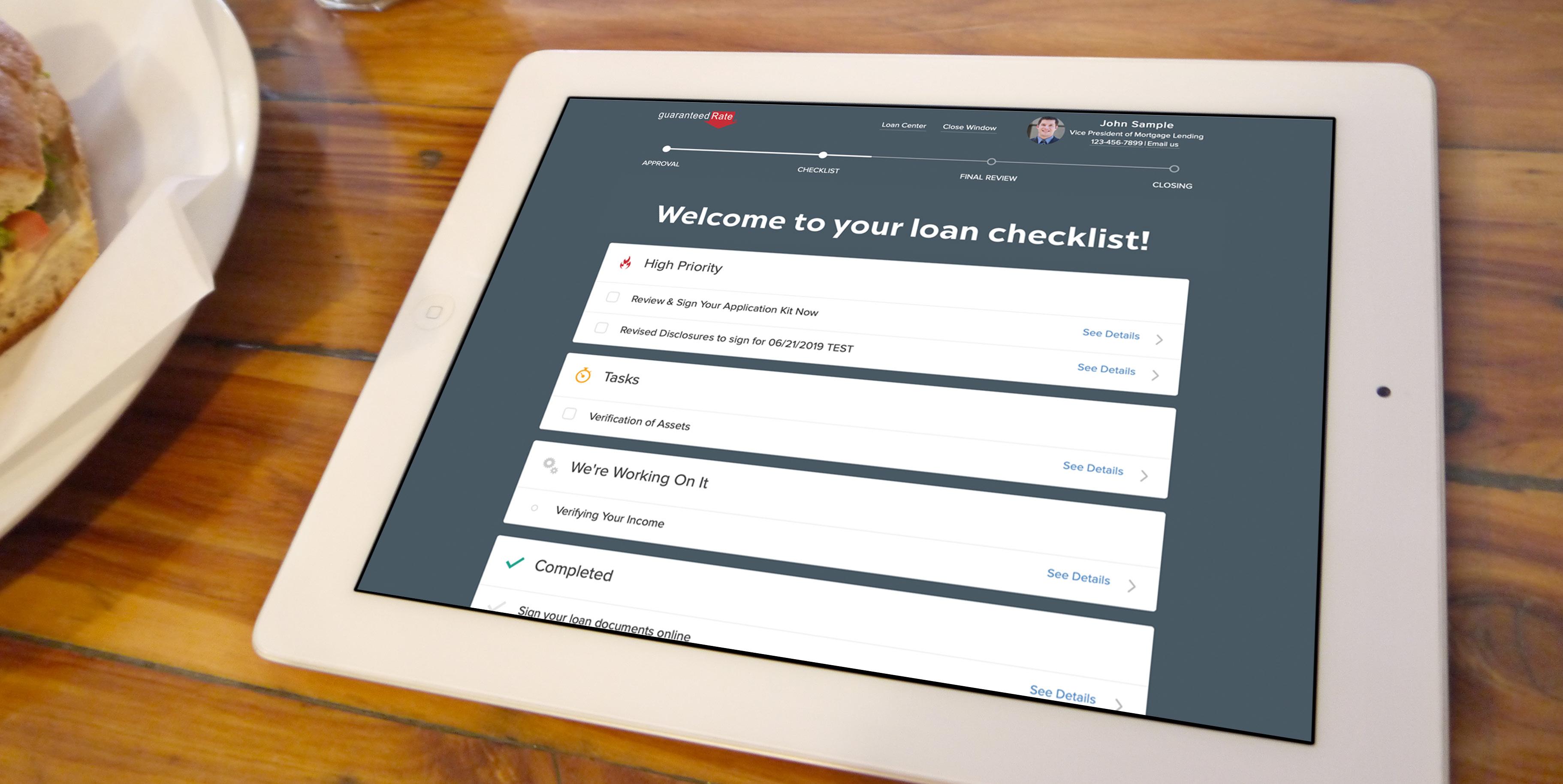

Real-time status updates for the loan milestones you care about.

+ Know exactly what’s going on with every customer

+ Full transparency with 24/7 access to all loans in process online and in your inbox

+ Opt into text notifications so you’re always in the loop even when you’re on the go

+ Our team is always available to talk on the phone

LOAN STATUS

MONITOR

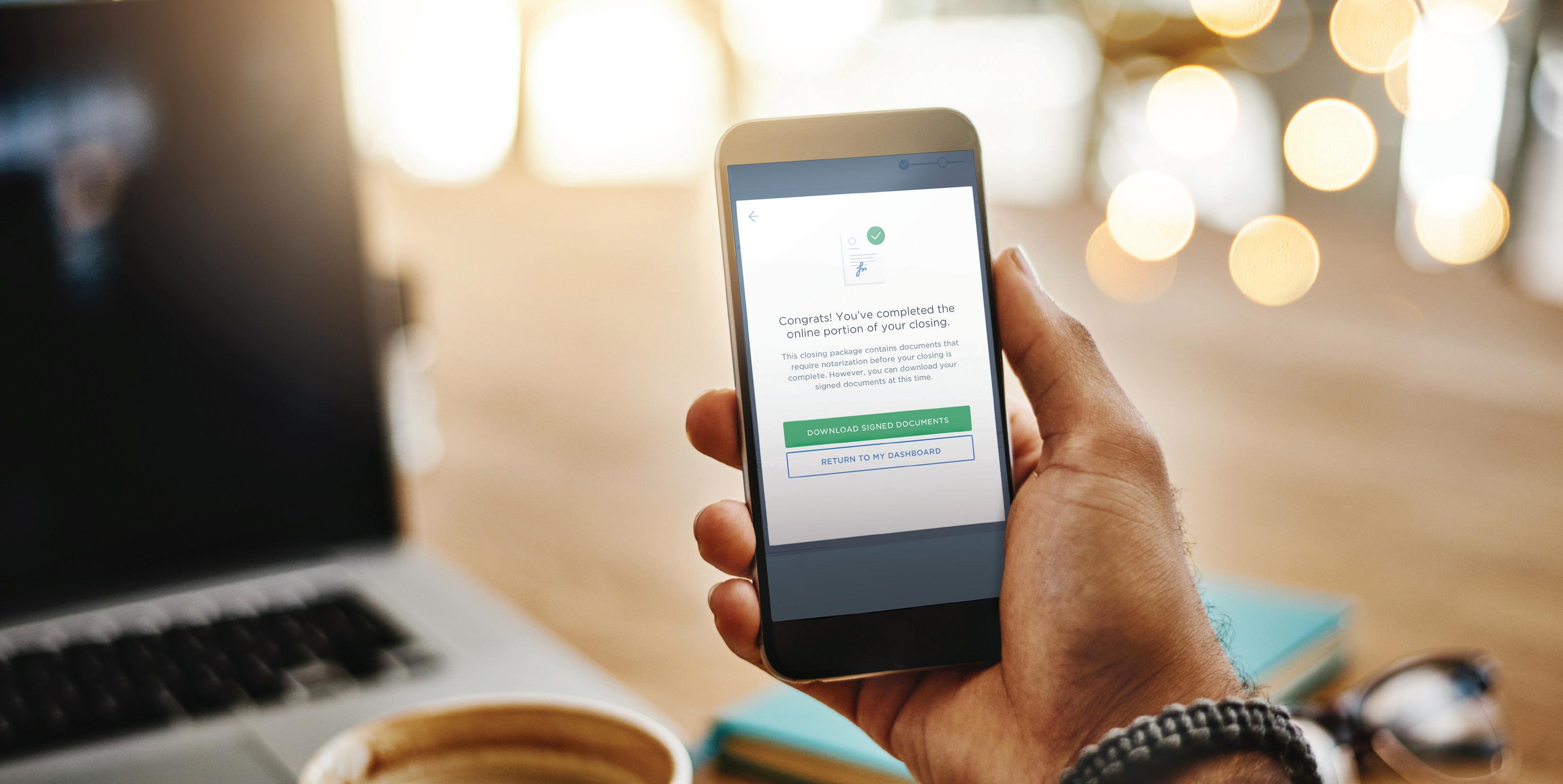

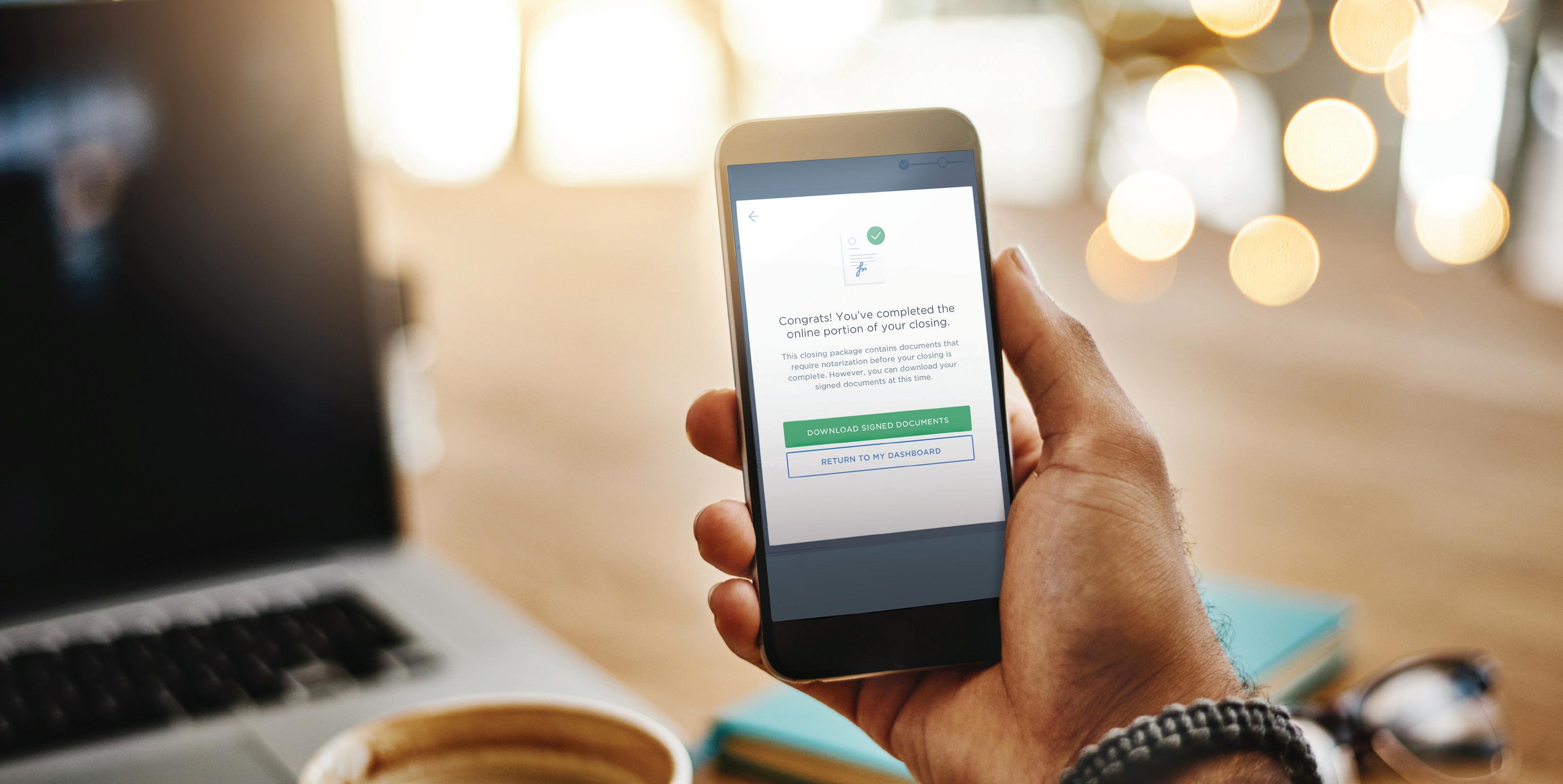

+ Borrowers can review and e-sign most documents prior to the closing appointment

+ Receive notifications letting you know that things are in order

+ At the closing, borrowers just need to sign a few remaining documents—saving everybody time

+ Eligible borrowers can use FlashClose/ E-Close* to complete a fully digital, paperless closing—no need to meet with a notary in person, the closing is completed entirely online

*Not eligible for all loan types, or investors. Conventional loans only. Eligible for primary, 2nd home and investment properties. Title company restrictions may apply, not eligible for HFA programs. Knowledge-Base Authentication (KBA) required in order to enter the digital signing session. Applicant subject to credit and underwriting approval. Full eClose is not currently eligible in California, Connecticut, Delaware, Georgia, Maine, Massachusetts, Mississippi, New York, North Carolina, Rhode Island, South Carolina, Vermont, and West Virginia

SM*

FLASHCLOSE

We’ve changed the game: Now closings take minutes, not hours.

Helping you grow your business.

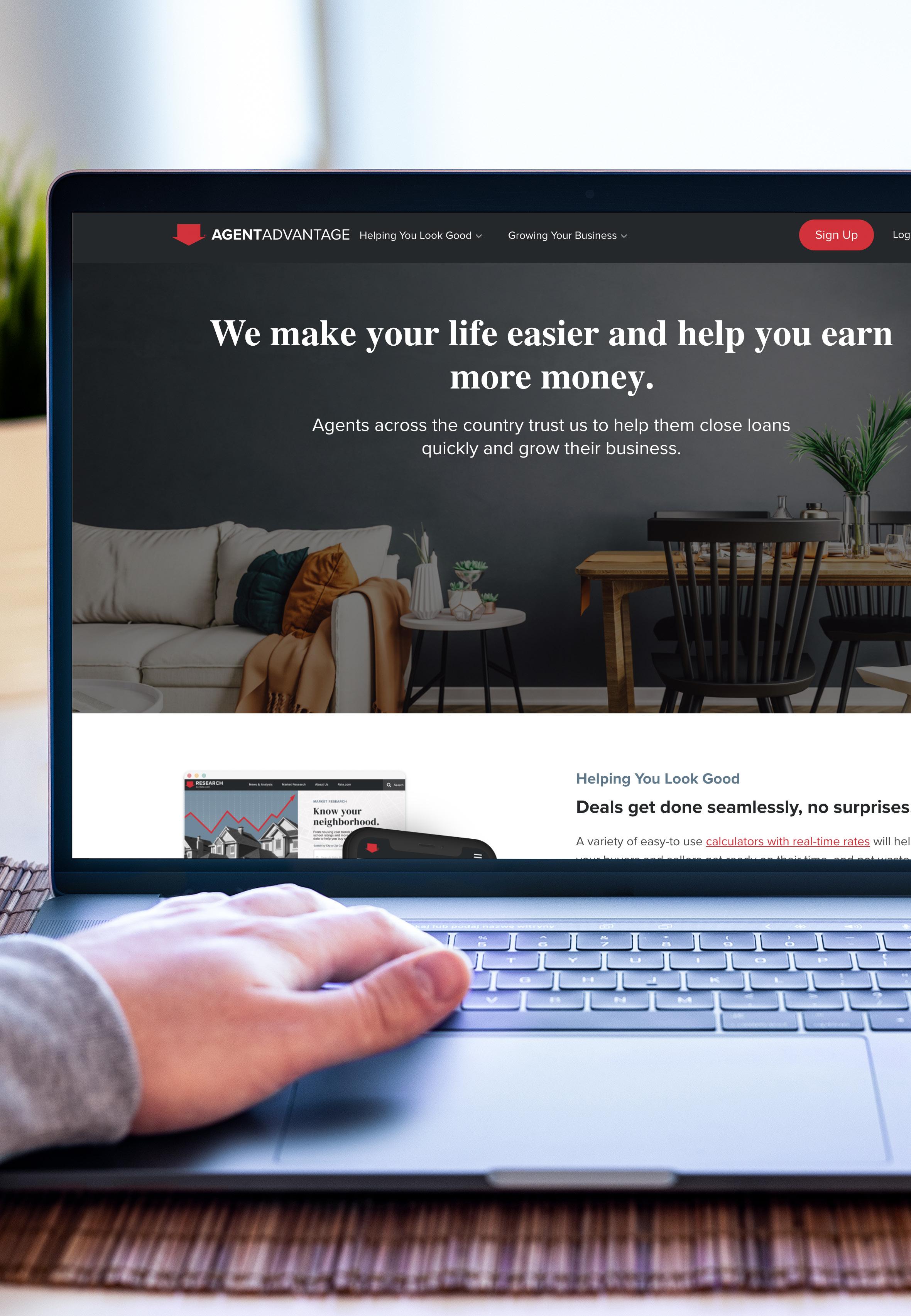

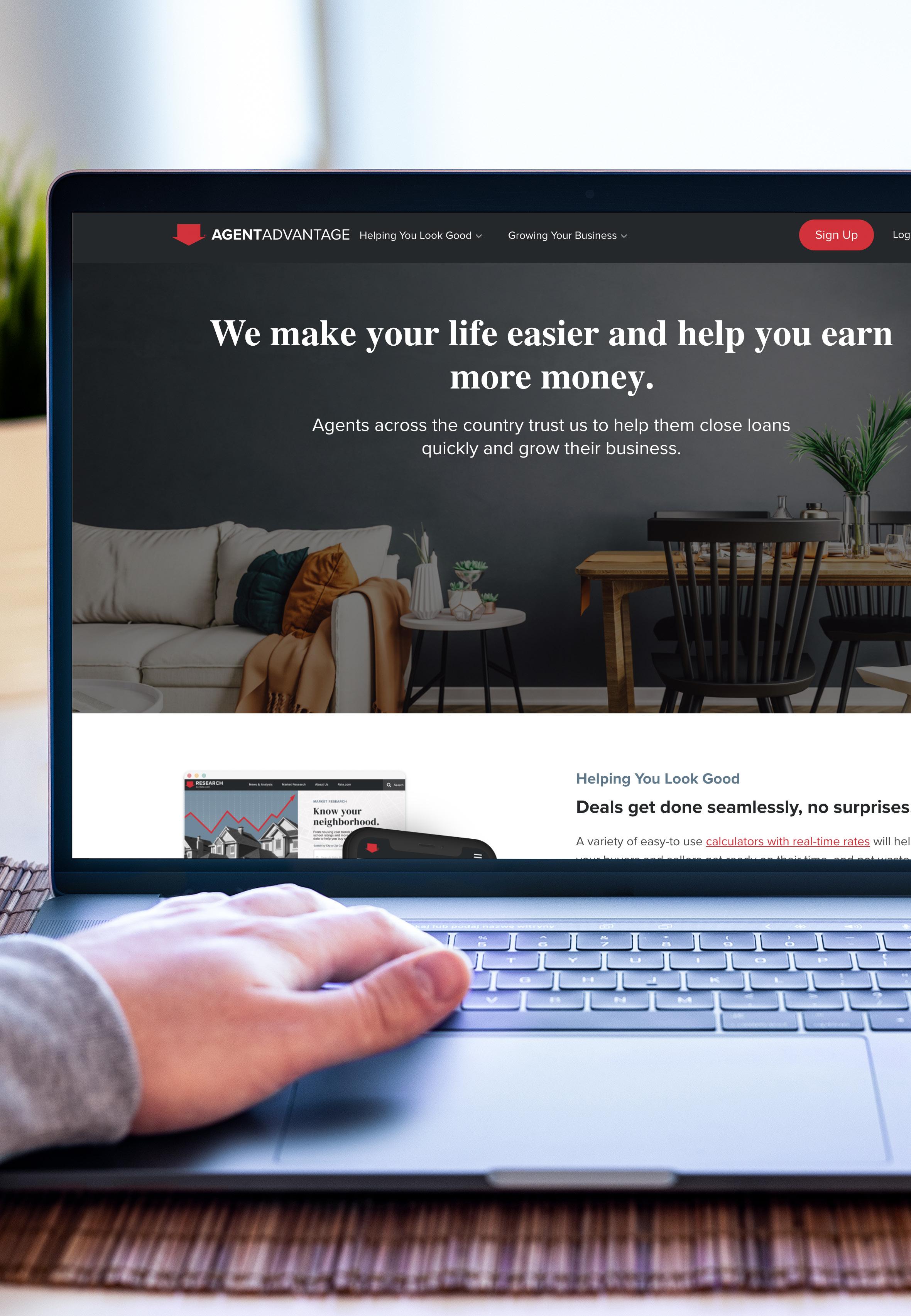

AGENT ADVANTAGE

Leverage our agentexclusive website to scale your business.

+ Coaching Videos: Best-of-the-best agents share the secrets of their success

+ Loan Status Monitor gives you total visibility on all your deals

+ Elevate your marketing with our proprietary customer relationship management platform

Agents shall be financially responsible for their pro rata share of marketing and event costs.

Turn every cool prospect into a warm lead.

+ Seamlessly capture contact info with our lead capture apps

+ Set up guest check-in on any device— phone, tablet or laptop, and the info automatically syncs to your database

+ Add buyers to a follow-up email drip campaign to start marketing to them immediately

CLIPBOARD SM

Make

+ Customized co-branded sites with full MLS and IDX integration

+ Modern, professional templates deliver a flawless user experience

+ Capture visitor information to continuously grow your database of interested buyers

LISTHOME SM

your listings as beautiful online as they are in person.

+ Keep the conversation going with prospects through customized drip campaigns

+ Leverage our co-branded email templates to highlight loan-specific or seasonally relevant information

CLIENTDRIP SM

“Plug and play” email campaigns that help you stay in front of potential clients.

POSTCARDS

Stay top-of-mind so your past clients always remember to refer you.

+ Direct mail pieces can help you continuously reach your entire database

+ Use our customizable designs to send out postcards multiple times a month

PROPERTY FLYERS

OPEN HOUSE

Turn

lookie-loos

into bona fide buyers.

+ Instantly generate co-branded home loan analysis sheets in seconds

+ The system autopopulates the MLS info, photo, contact info and pricing

+ Custom layout and color options are available

2282 MAIN ST CHICAGO, IL 80918

Beautifully updated N/E tri-level with breathtaking mountain views of Pikes Peak. Enjoy open floor plan, spacious rooms and cozy wood-burning fireplace. IKEA kitchen with soft-close drawers, glass tile back splash and stainless steel appliances. All three bedrooms upstairs and master offers dual closets. Huge 12,327 sq. ft. fully-fenced backyard with storage shed, flat-rock patio and second wood deck that is already wired for a hot tub. RV parking. Walking distance to Dublin Park. New carpet/New paint. Welcome home!

LISTED AT $285,000

For agent presentation only

credit profile. Sample payment does not include taxes, insurance or assessments. Not all applicants will be approved. The actual interest rate, APR and payment may vary based on the specific terms of the loan selected, verification of information, your credit history, the location and type of property, and other factors as determined by Lender. Contact Proper Rate for more information and up to date rates.

Contact

30 - YEAR FIXED

2- Sample monthly Principal and Interest (P&I) payment of $XXXX is based on a purchase price of $000,000, down payment of 0.00%, XX year fixed rate mortgage and rate of 0.000%/0.000% APR (annual percentage rate). Advertised rates and APR effective as of xx/xx/xx and are subject to change. Above scenario assumes a first lien position, xxx FICO score, xx day rate lock on a primary residence and are subject to change without notice. Subject to underwriting guidelines and applicant’s credit profile. Sample payment does not include taxes, insurance or assessments. Not all applicants will be approved. The actual interest rate, APR and payment may vary based on the specific terms of the loan selected, verification of information, your credit history, the location and type of property, and other factors as determined by Lender. Contact Proper Rate for more information and up to date rates.

NONCONFORMING, 20% DOWN Rate/APR 4.250% (APR 4.336%) Mortgage payment $5,049.29 Tax, Insurance & HOA $638.75 Total monthly $5,688.04 Down payment $167,800.00 NONCONFORMING, 20% DOWN Rate/APR 4.250% (APR 4.336%)2 Mortgage payment $5,049.29 Tax, Insurance & HOA $638.75 Total monthly $5,688.04 Down payment $167,800.00 15 - YEAR FIXED

1- Sample monthly Principal and Interest (P&I) payment of $XXXX is based on a purchase price of $000,000, down payment of 0.00%, XX year fixed rate mortgage and rate of 0.000%/0.000% APR (annual percentage rate). Advertised rates and APR effective as of xx/xx/xx and are subject to change. Above scenario assumes a first lien position, xxx FICO score, xx day rate lock on a primary residence and are subject to change without notice. Subject to underwriting guidelines and applicant’s

me today to learn more! NMLS ID:856043, LO#: AZ 0919996 - 0907078 NMLS ID #1901699 (Nationwide Mortgage Licensing System www.nmlsconsumeraccess.org) • AL - Lic# 21566 • AK - Lic#AK2611 • AR - Lic#103947 Guaranteed Rate, Inc. 3940 N Ravenswood, Chicago IL 60613 866-934-7283 • AZ Guaranteed Rate, Inc. - 14811 N. Kierland Blvd., Ste. 100, Scottsdale, AZ, 85254 Mortgage Banker License #0907078 • CA - Licensed by the Department of Business Oversight, Division of Corporations under the California Residential Mortgage Lending Act Lic #4130699 • CO Guaranteed Rate, Inc. Regulated by the Division of Real Estate, 773-290-0505 • CT - Lic #17196 • DE Lic # 9436 • DC - Lic #MLB2611 • FL - Lic# MLD1102 • GA Residential Mortgage Licensee #20973 3940 N. Ravenswood Ave., Chicago, IL 60613 • HI - Lic#HI-2611 • ID Guaranteed Rate, Inc. Lic #MBL-5827 • IL Residential Mortgage Licensee - IDFPR, 122 South Michigan Avenue, Suite 1900, Chicago, Illinois, 60603, 312-793-3000, 3940 N. Ravenswood Ave., Chicago, IL 60613 #MB.0005932 • IN Lic #11060 & #10332 • IA - Lic #2005-0132 • KS Licensed Mortgage Company Guaranteed Rate, Inc. License #MC.0001530 • KY Mortgage Company Lic #MC20335 • LA - Lic #2866 • ME Lic #SLM11302 • MD - Lic #13181 • MA Guaranteed Rate, Inc. 1234 Address Ave Chicago, IL 60601 properrate.com/johnsmith john.smith@properrate.com O: (917) 757-6633 C: (917) 757-6633 Senior VP of Mortgage Lending John Smith 3940 N. Ravenswood Chicago, IL 60613 samplerealty.com/janedoe jane.doe@samplerealty.com O: (917) 757-6633 C: (917) 757-6633 Real Estate Agent Jane Doe LIC # 123456 REALTY INC. $800,000

NEIGHBORHOOD

Show them that you really know the neighborhood. + Our neighborhood reports provide up-to-date information, including walk-scores, school ratings, restaurants, shopping and more + Attract more potential buyers by providing a quick snapshot of where they are about to live Contact me today to learn more! NMLS ID:856043, LO#: AZ 0919996 0907078 NMLS ID #1901699 (Nationwide Mortgage Licensing System www.nmlsconsumeraccess.org) • AL Lic# 21566 • AK - Lic#AK2611 • AR Lic#103947 - Guaranteed Rate, Inc. 3940 N Ravenswood, Chicago IL 60613 866-934-7283 • AZ Guaranteed Rate, Inc. - 14811 N. Kierland Blvd., Ste. 100, Scottsdale, AZ, 85254 Mortgage Banker License #0907078 • CA Licensed by the Department of Business Oversight, Division of Corporations under the California Residential Mortgage Lending Act Lic #4130699 • CO Guaranteed Rate, Inc. Regulated by the Division of Real Estate, 773-290-0505 • CT Lic #17196 • DE - Lic # 9436 • DC Lic #MLB2611 • FL Lic# MLD1102 • GA Residential Mortgage Licensee #20973 3940 N. Ravenswood Ave., Chicago, IL 60613 • HI Lic#HI-2611 • ID - Guaranteed Rate, Inc. Lic #MBL-5827 • IL - Residential Mortgage Licensee IDFPR, 122 South Michigan Avenue, Suite 1900, Chicago, Illinois, 60603, 312-793-3000, 3940 N. Ravenswood Ave., Chicago, IL 60613 #MB.0005932 • INLic #11060 & #10332 • IA Lic #2005-0132 • KS Licensed Mortgage Company - Guaranteed Rate, Inc. License #MC.0001530 • KY - Mortgage Company Lic #MC20335 • LA - Lic #2866 • ME - Lic #SLM11302 • MD - Lic #13181 • MA Guaranteed Rate, Inc. 1234 Address Ave Chicago, IL 60601 properrate.com/johnsmith john.smith@properrate.com O: (917) 757-6633 C: (917) 757-6633 Senior VP of Mortgage Lending John Smith 3940 N. Ravenswood Chicago, IL 60613 samplerealty.com/janedoe jane.doe@samplerealty.com O: (917) 757-6633 C: (917) 757-6633 Real Estate Agent Jane Doe LIC # 123456

REPORTS

CUSTOM PRINTS Tailor-made marketing collateral to suit any situation. + We offer a variety of customizable flyers to get buyers more comfortable with the process Materials Include: + Product flyers + Buyer education + Helpful hints Agents shall be financially responsible for their pro rata share of marketing and event costs. When you choose to work with me, your clients will get: {BASIC-S} Low mortgage rates. Lightning-fast pre-approvals through our industry-leading Digital Mortgage. Leading-edge tech that makes the process seamless. Constant loan status updates, every step of the way. Diverse loan options and programs. Unsurpassed service ensured by my elite team of local, experienced mortgage professionals. Rate.com/johnsmith john.smith@rate.com O: (917) 757-6633 C: (917) 757-6633 Your clients deserve the best possible home loan experience, and that’s why I’m here. Give me call today for 5-minute chat to learn more. NMLS ID:856043, LO#: AZ 0919996 0907078 NMLS ID #1901699 (Nationwide Mortgage Licensing System www.nmlsconsumeraccess.org) |CO Proper Rate, LLC. Regulated the Division of Real Estate Residential Mortgage Licensee IDFPR, 1800 Larchmont Ave, Suite 301, Chicago, 60613 #MB.6761454 #2019-0140 Lic FL0022695 SR0022695 MN #MN-MO-1901699 OH #RM.804550.000 1800 Larchmont Ave, Suite 301, Chicago, 60613 #MB.6761454 TX Licensed Licensed Mortgage Banker Licensed Residential Mortgage Loan Servicer- Department Savings Mortgage Lending Lic #199579 WI #1901699BA 1901699BR Senior VP of Mortgage Lending John Smith 1800 W Larchmont Ave, Suite 301, Chicago, IL 60613 Want the best for your clients? Down payment options start at 3.5% Allows non-occupying co-borrower Down payment and closing costs may be gifted USDA 100% financing options available No private mortgage insurance (PMI), plus low monthly guaranteed annual fee Only applies to designated rural properties VA For qualifying purchase borrowers who want 100% financing options No PMI 100% financing options on loans up to 1.5M No mortgage insurance requirements for borrowers with options less than 20% down Finance 2-4 unit property with 5% down options Jumbo For borrowers in the market for a home loan above $510,400 New Construction FHA, VA, Conforming and Jumbo Extended Lock options up to 12 months 2-1 temporary rate buydown available Financing options to include post-closing upgrades Escrow holdback waiver program Current as 04/23/2020 1-Gift funds may allowed down payment and closing costs for borrowers who meet FICO score minimums. Restrictions apply. 2-{FHFA-S} {BASIC-S} {GOV-1-S} properrate.com/johnsmith john.smith@properrate.com O: (917) 757-6633 C: (917) 757-6633 Contact me today to learn more! NMLS ID:856043, LO#: AZ 0919996 0907078 NMLS ID #1901699 (Nationwide Mortgage Licensing System www.nmlsconsumeraccess.org) CO Proper Rate, LLC. Regulated by the Division Real Estate Residential Mortgage Licensee IDFPR, 1800 Larchmont Ave, Suite 301, Chicago, 60613 #MB.6761454 #2019-0140 Lic FL0022695 SR0022695 MN #MN-MO-1901699 OH #RM.804550.000 1800 W Larchmont Ave, Suite 301, Chicago, 60613 #MB.6761454 TX Licensed Licensed Mortgage Banker Licensed Residential Mortgage Loan Servicer- Department Savings Mortgage Lending Lic #199579 #1901699BA 1901699BR Senior VP of Mortgage Lending John Smith 1800 W. Larchmont Ave., Chicago, IL 60613 BELMONT CRAGIN FOREST GLEN IRVING PARK EAST GARFIELD PARK HUMBOLDT PARK WEST GARFIELD PARK PORTAGE PARK JEFFERSON PARK NORTH PARK ALBANY PARK AVONDALE AUSTIN SHILLER PARK O’HARE ROSEMONT FRANKLIN PARK NORTH SUBURBS SOUTHWEST SUBURBS SOUTH SUBURBS NEAR WEST SUBURBS HERMOSA DUNNING NORWOOD PARK ARCHER HEIGHTS GARIELD RIDGE CLEARING PULLMAN HEGEWISCH ROSELAND WEST LAWN WASHINGTON HEIGHTS BEVERLY MORGAN PARK MOUNT GREENMAN RIVERDALE SOUTH DEERING WEST PULLMAN WEST ELSDON ASHBURN EAST SIDE NORTH LAWNDALE LITTLE VILLAGE EDISON PARK LOGAN SQUARE WESTERN SUBURBS NORTHWEST SUBURBS

SPONSORING BROKER OPENS

Get more agents to view your listings.

+ We offer a concierge service that sets your broker opens apart from the competition

+ Our team can arrange delivery and set up, with great lunch options from preferred caterers

+ My team will be there to answer any mortgage questions that come up

Agents shall be financially responsible for their pro rata share of marketing and event costs.

HAVING FUN

We know how to throw a party.

+ Our events team can help set up co-hosted happy hours, customer appreciation parties, agent networking events and more

+ We can come up with the ideas and handle all the details—all you have to do is show up

Agents shall be financially responsible for their pro rata share of marketing and event costs.

PROACTIVE POD

Managed correctly, our model will enable you to close anywhere from $10 million to over $500 million a year and have an amazing quality of life.

Proactive POD

What is the Proactive POD?

A best-practice platform built to provide you, your customer and referral partners the easiest and most efficient way to close loans—utilizing state-of-the-art technology, a smart workflow process and best-of-the-best employees who are compensated for both speed and quality. Managed correctly by you, the Vice President of Mortgage Lending, our model will enable you to exponentially grow your business.

Social Media Consistently show up in their newsfeed + 8-10 posts / month that is engaging and relevant + Posted to your Facebook, Twitter and LinkedIn by our Social Media Team + Learn useful tips and tricks to help grow your own social accounts + Generate conversation and leads with the help of our social media experts Automated Marketing Allow us to make your life easier and do everything for you Happy PathSM Delegates and audits using Proper Rate Technology

Mortgage Lending Underwriter 24 hour turn times Loan Coordinator Gets approval Submits files Mortgage Consultant Holistically manages pipeline Production Manager Proactive POD Closing Approval Underwriting Processing Application Digital Mortgage Digital Validation Transfersafe FlashClose

VP of

Happy PathSM Streamlines the customer experience

DIGITAL MORTGAGE

Social Media

Takes less than 15 minutes.

Consistently show up in their newsfeed

+ 8-10 posts / month that is engaging and relevant

+ Customers price their own loan, select their preferred product, complete the loan application, and run automated underwriting—providing a complete 1003

+ Posted to your Facebook, Twitter and LinkedIn by our Social Media Team

+ Learn useful tips and tricks to help grow your own social accounts

+ Customers instantly receive credit scores from three bureaus and a real-time approval letter*

+ You spend less time entering customer data fields and provide faster approvals

+ Generate conversation and leads with the help of our social media experts

*Customers receive credit scores from three bureaus • Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Restrictions may apply.

Happy PathSM Streamlines the customer experience

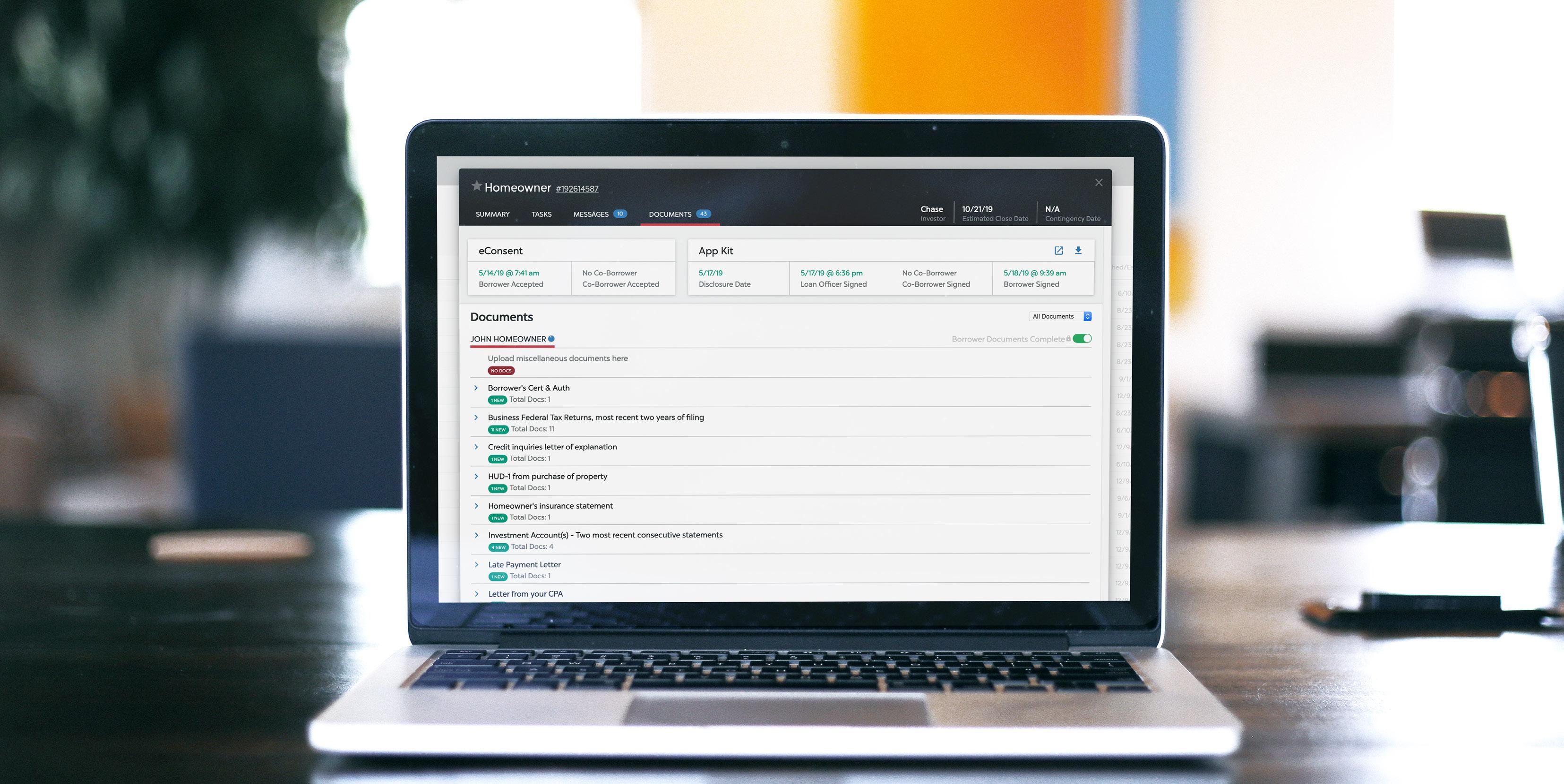

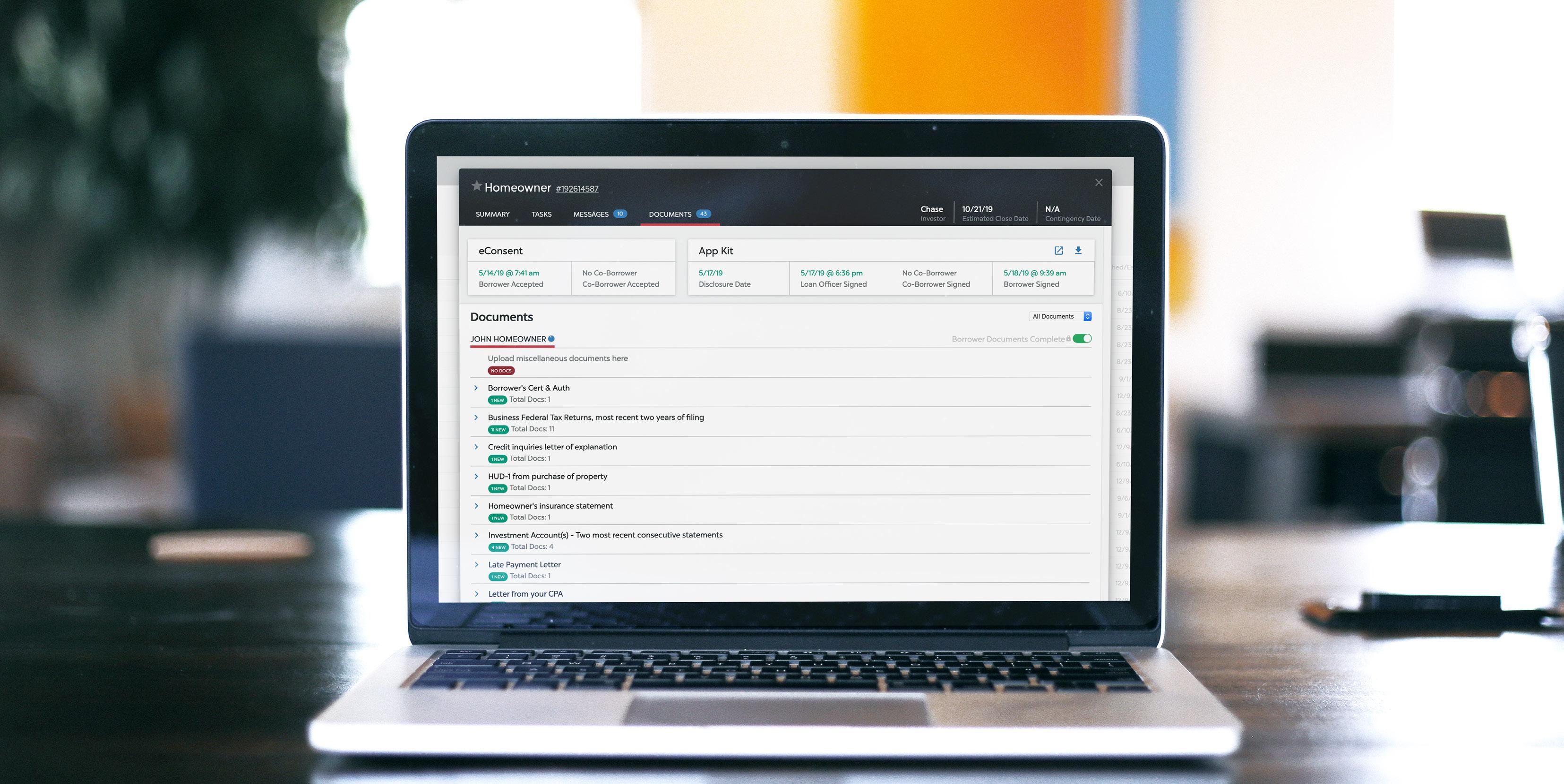

TRANSFERSAFE

A secure document portal that’s friendly and easy to use.

+ Customers can upload their documents from their computers or phones, and everything is collected in one safe, easy-to-access place

+ The personalized to-do list guides next steps and necessary loan conditions

+ Identifying and requesting additional docs from the customer is quick and efficient for your team

+ Timely status and progress updates keep customers engaged and focused on completing their tasks

Happy PathSM Streamlines the customer experience

AUTOMATION TOOLS

Make things easier for both your team and your customers.

AccountChek

Automated bank statement gathering and updating make asset verification as easy as possible

The WorkNumber

Automated income integration eliminates the need to collect paystubs and W-2s

AutoApp & e-Sign

Automated disclosures facilitate faster delivery and document signatures

LoanBeam

Automated tax return and income calculations, as well as identification of missing data, save hours

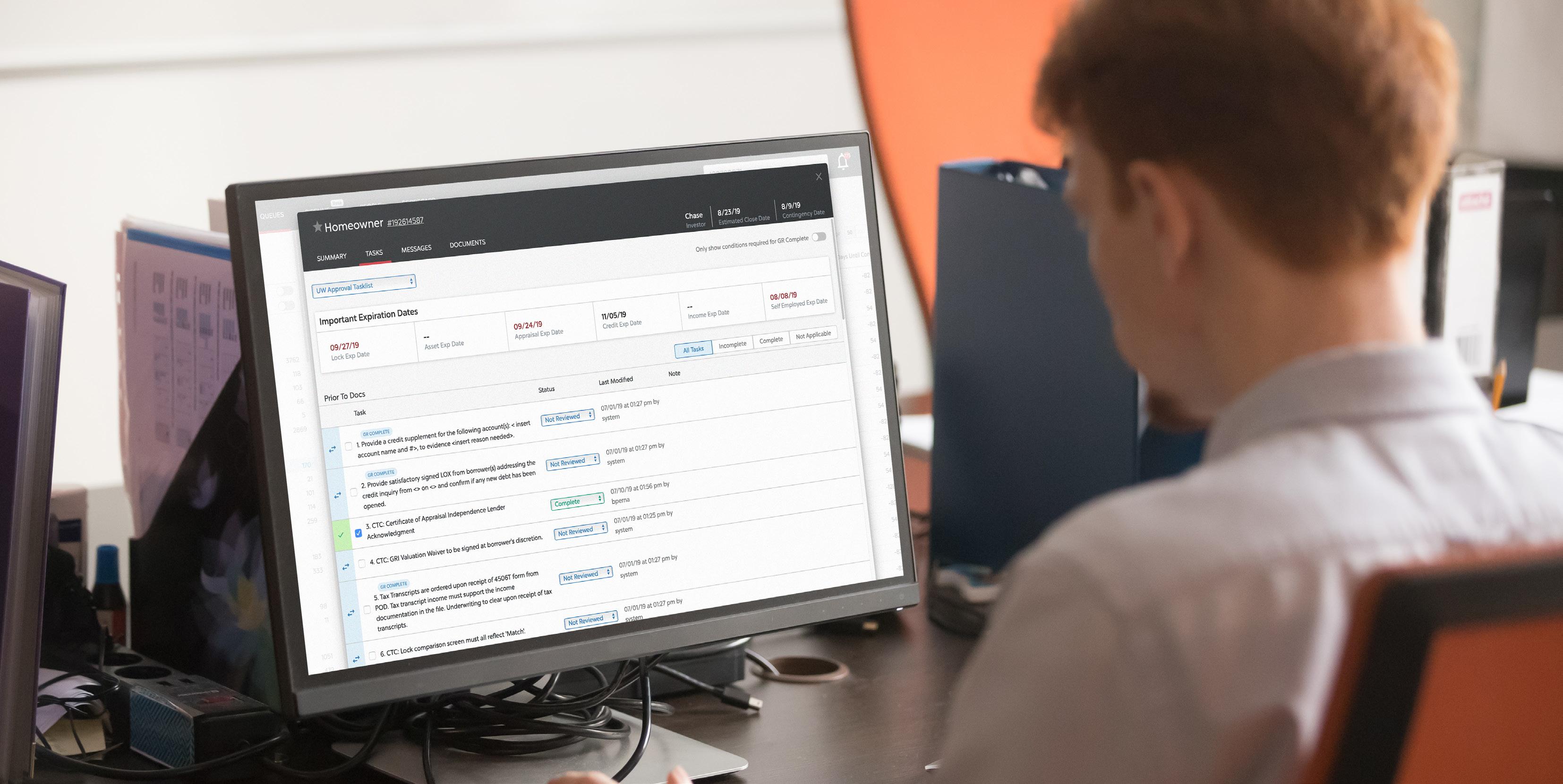

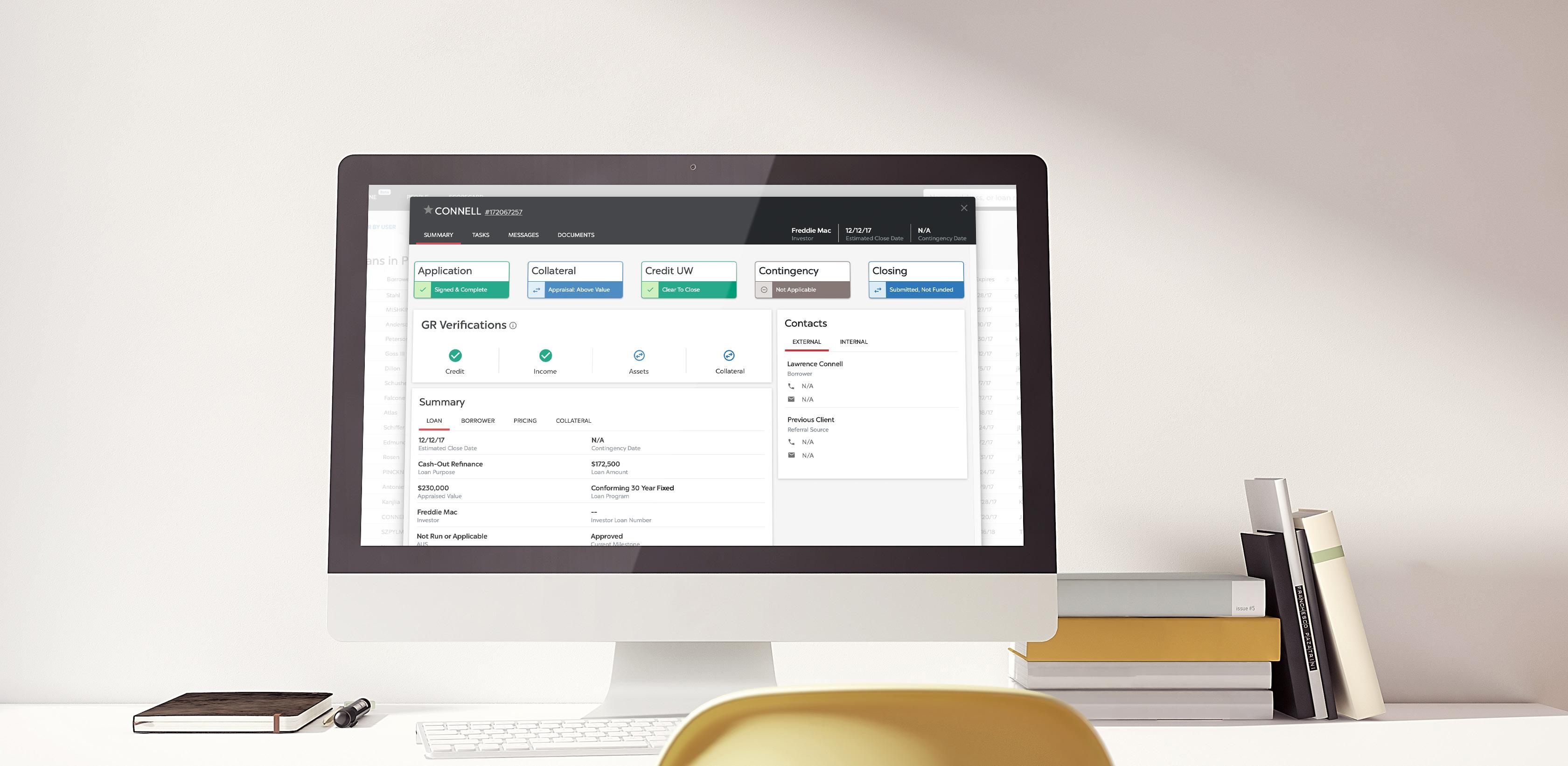

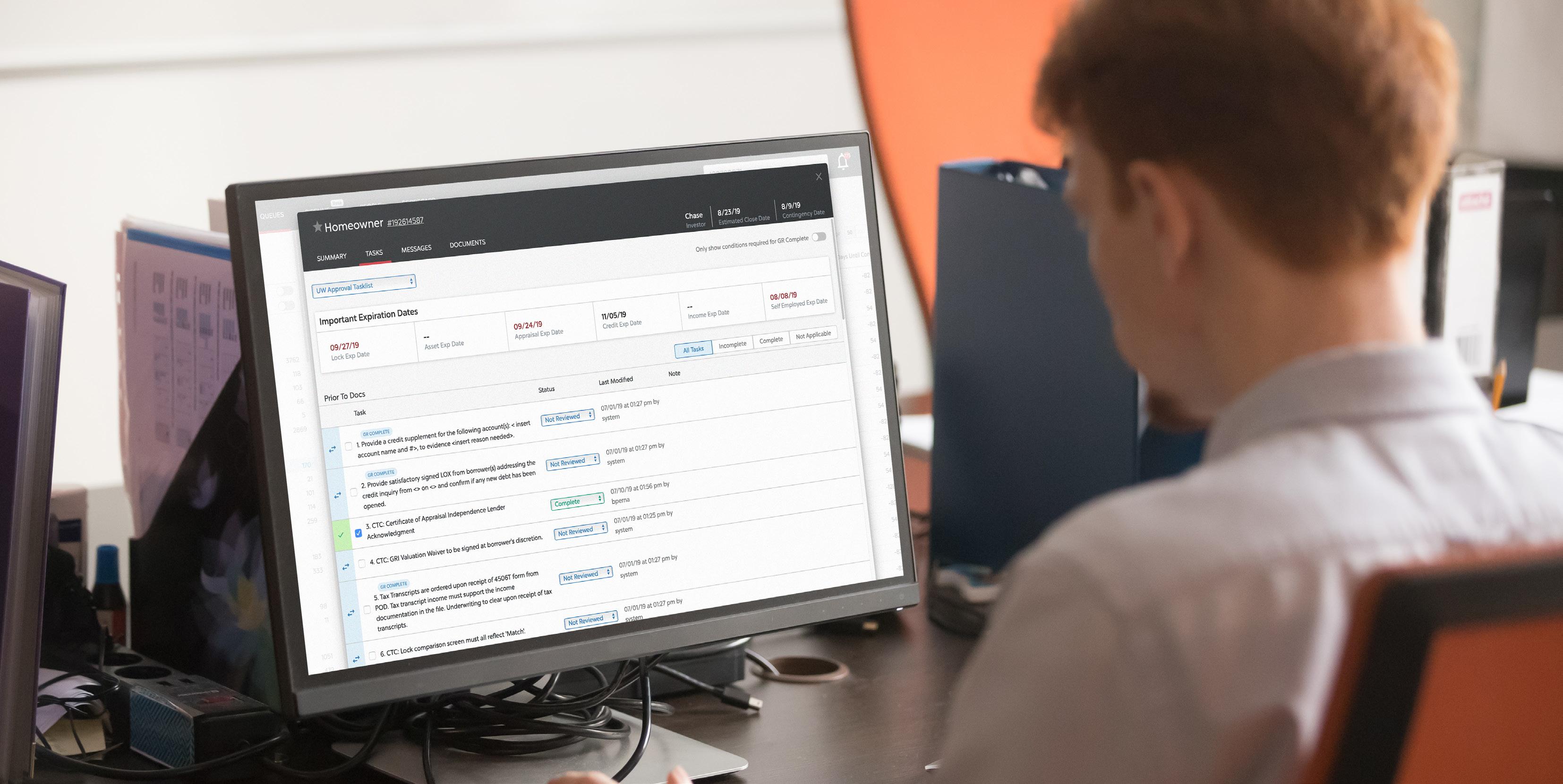

Proactive POD Elevates the loan officer experience

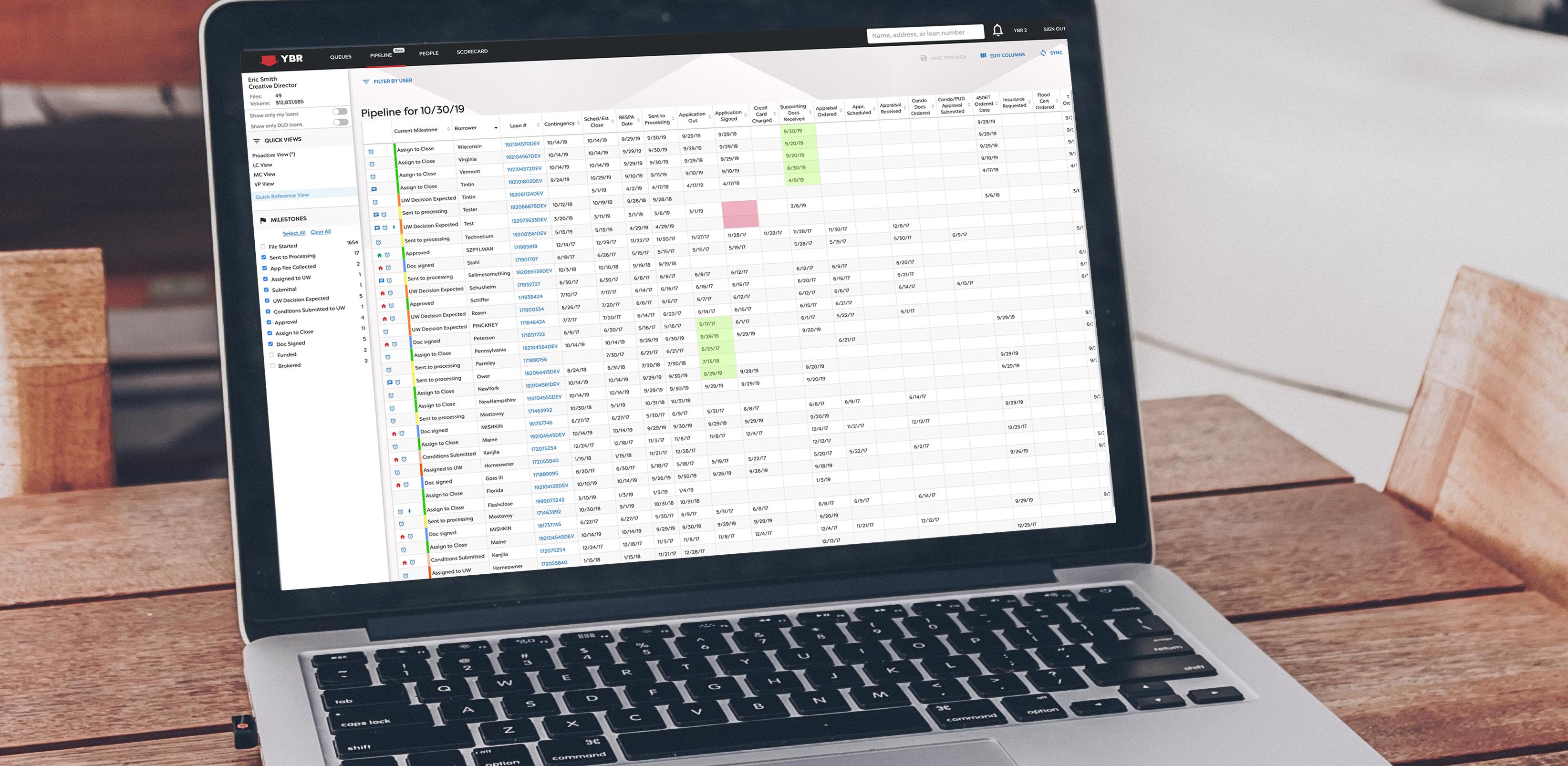

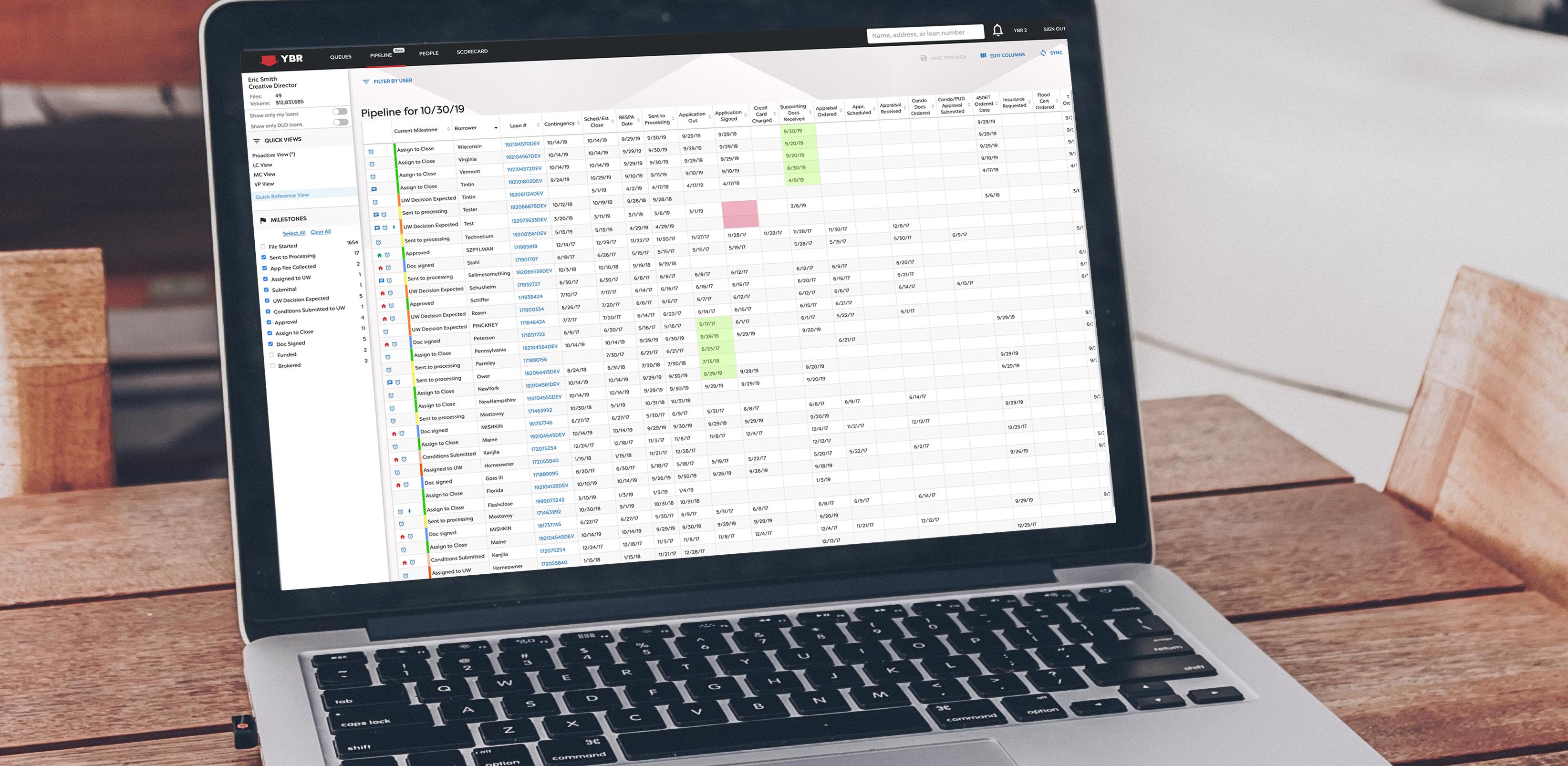

YBR

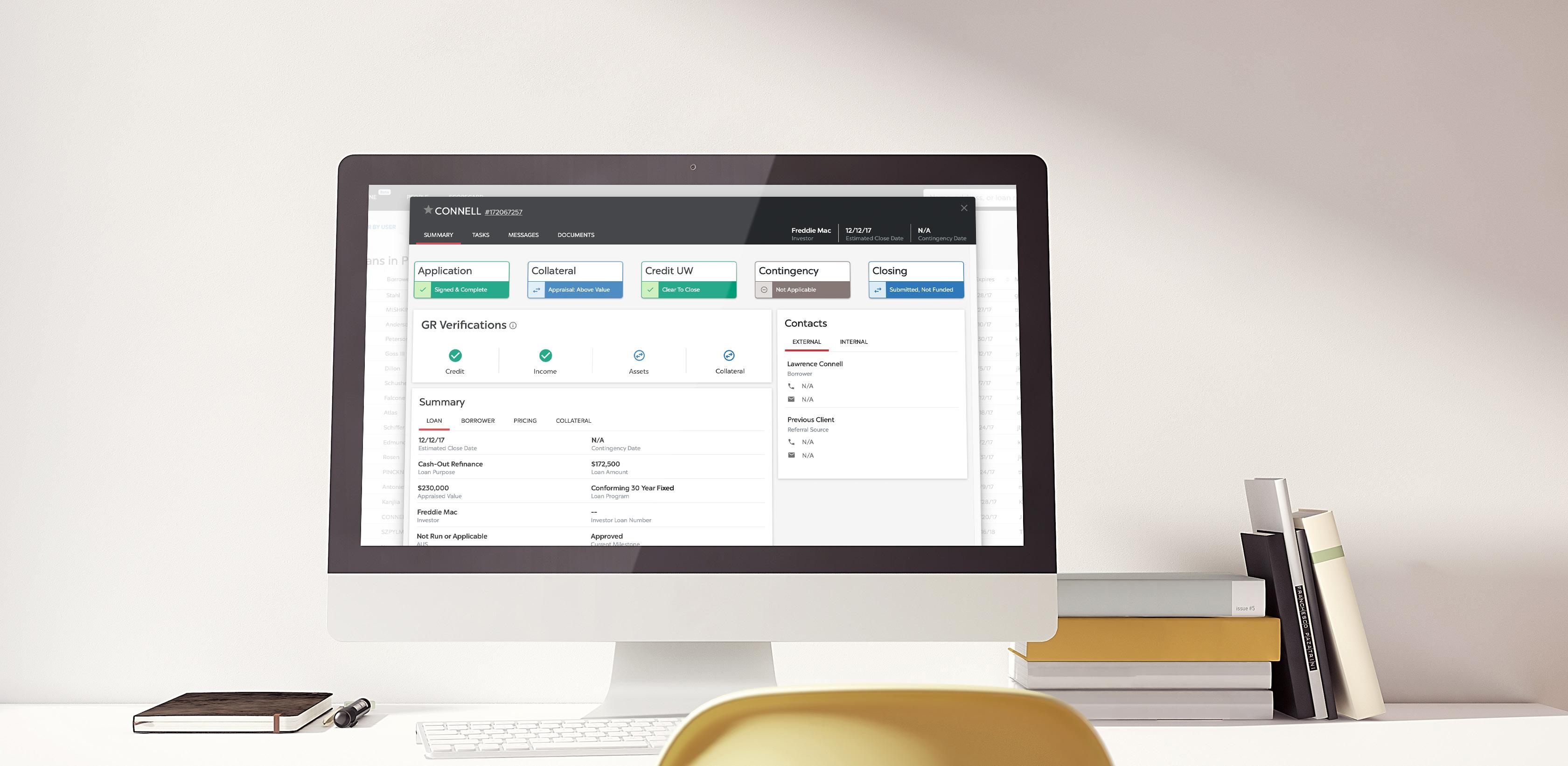

Your loan command center.

+ Our real-time automated pipeline management tool enables efficiency and facilitates POD communication

+ The Loan Profile view shows you key loan details, color-coded status boxes and actionable contact information

+ Curated, role-specific work queues and dashboards organize workload and prioritize files that require immediate action based on proven prioritization logic

+ Task lists, including underwriting conditions, allow for full transparency of tasks completed—no more printing stacks of checklists

+ Performance monitoring metrics based on time-to-task give you the ability to assess your team’s efficiency and drive down closing times

DEDICATED TEAM

Social Media

The POD is your team.

Consistently show up in their newsfeed

+ 8-10 posts / month that is engaging and relevant

Production Manager

Processing Team

+ Posted to your Facebook, Twitter and LinkedIn by our Social Media Team

Underwriting and Closing

+ Learn useful tips and tricks to help grow your own social accounts

Vice President Spend 80% of your time on rainmaking activities and 20% leading the team

The Production Manager handles 90% of processing issues for the VP

Specialized processing roles (MC & LC) allow individuals to master their jobs. All compensation is based on both speed and quality

+ Generate conversation and leads with the help of our social media experts

Regional experts support you based on your geography, providing you a concierge-level of service

Proactive POD Elevates the loan officer experience

Social Media

Vice President of Mortgage Lending Roles and Responsibilities

+ 8-10 posts / month that is engaging and relevant

Consistently show up in their newsfeed

Key Tools and Processes

+ Posted to your Facebook, Twitter and LinkedIn by our Social Media Team

+ Originates loans, sets up the file, and prices and places with investor

+ Learn useful tips and tricks to help grow your own social accounts

+ Toto: Our mobile tech fully enables you to manage your pipeline and edit pre-approvals

+ Generate conversation and leads with the help of our social media experts

+ Gets out of day-to-day loan activities and focuses on $500 / hr vs. $40 / hr jobs

+ Reviews and signs closing transmittal, reviews the CD with borrower and asks for referrals

+ Loan Summary lets borrowers compare multiple loan options

+ Loan Status Monitor provides real-time status updates for you

Proactive POD Elevates the loan officer experience

Social Media

Your support team

Consistently show up in their newsfeed

Roles and Responsibilities

+ 8-10 posts / month that is engaging and relevant

Key Tools and Processes

+ Posted to your Facebook, Twitter and LinkedIn by our Social Media Team

+ Manages the VP’s pipeline to make sure every loan is hitting all milestones

+ Learn useful tips and tricks to help grow your own social accounts

+ YBR: Your team can view, search, sort and filter loan details with our proprietary pipeline management tool

+ Generate conversation and leads with the help of our social media experts

+ Ensures transparency and proactive communication across all POD members, and between POD and customers

+ Coaches team to leverage tech and tools and improve performance

• Loans outside of time-to-task are highlighted to pro-actively identify issues

• Features integrated chat and dynamic, collaborative checklists

Proactive POD Elevates the loan officer experience

Social Media

Mortgage Consultant Roles and Responsibilities

Consistently show up in their newsfeed

+ 8-10 posts / month that is engaging and relevant

+ Orders appraisal, if needed

Key Tools and Processes

+ Posted to your Facebook, Twitter and LinkedIn by our Social Media Team

+ Appraisal Fee tool and the Property Inspection Waiver

+ Requests condo project docs

+ Learn useful tips and tricks to help grow your own social accounts

+ Sends app and makes sure it gets signed

+ Generate conversation and leads with the help of our social media experts

+ Places 3rd-party orders

+ Requests and reviews supporting docs

+ Prepares file and submits to UW

+ CondoPak eliminates chasing condo docs

+ Docusign and Smart Fees tool

+ One-Click automatically imports fees by clicking a button in Encompass

Proactive POD Elevates the loan officer experience

Proactive POD Elevates the loan officer experience

Social Media

Underwriting

Consistently show up in their newsfeed

Roles and Responsibilities

+ 8-10 posts / month that is engaging and relevant

Key Tools and Processes

+ Posted to your Facebook, Twitter and LinkedIn by our Social Media Team

+ Underwriting consists of three specialty groups: Conventional, Government and Jumbo

+ Learn useful tips and tricks to help grow your own social accounts

+ The Credit Concierge Department offers dedicated support for VPs on scenario questions, guideline clarification and upfront exceptions

+ Generate conversation and leads with the help of our social media experts

+ Dedicated teams increase quality and efficiency and provide unparalleled customer service and product knowledge

+ The Training Department provides underwriters ongoing development

+ 24-hour turn times

Proactive POD Elevates the loan officer experience

Proactive POD Elevates the loan officer experience

Proactive POD Elevates the loan officer experience

Loan Coordinator Roles and Responsibilities

Social Media

Consistently show up in their newsfeed

+ 8-10 posts / month that is engaging and relevant

+ Requests and reviews conditions

Key Tools and Processes

+ Posted to your Facebook, Twitter and LinkedIn by our Social Media Team

+ Clears conditions

+ Learn useful tips and tricks to help grow your own social accounts

+ Condo / Co-op Database allows faster determination for approvals and document collection

+ Generate conversation and leads with the help of our social media experts

+ Verifies cash to close figures and source of funds

+ Prepares Closing Disclosure

+ Submits clear file to the Closing Department

+ CD Xchange is our collaborative solution for closing agents to work with the LC to create and finalize an accurate Closing Disclosure

Proactive POD Elevates the loan officer experience

Social Media

FlashClose SM* + Closing funds are sent the day before every purchase so no one is left waiting for a wire

Consistently show up in their newsfeed

+ 8-10 posts / month that is engaging and relevant

+ Posted to your Facebook, Twitter and LinkedIn by our Social Media Team

+ The closing package is sent the day before, and Proper Rate Closers make a personal call to the title company closer or attorney to ensure they have everything they need

+ Learn useful tips and tricks to help grow your own social accounts

+ Generate conversation and leads with the help of our social media experts

+ FlashCloseSM allows customers to review their closing package and digitally sign their docs in advance of closing

+ Reduces anxiety, gives customers peace-of-mind and saves everybody time at the closing

+ Eligible borrowers can use FlashClose eClose* to complete a fully digital, paperless closing—no need to meet with a notary in person, the closing is completed entirely online

* Not eligible for all loan types, or investors. Conventional loans only. Eligible for primary, 2nd home and investment properties. Title company restrictions may apply, not eligible for HFA programs. Knowledge-Base Authentication (KBA) required in order to enter the digital signing session. Applicant subject to credit and underwriting approval. Full eClose is not currently eligible in California, Connecticut, Delaware, Georgia, Maine, Massachusetts, Mississippi, New York, North Carolina, Rhode Island, South Carolina, Vermont, and West Virginia

SPECIALTY TEAMS

In-house

experts who turn lemons into lemonade.

+ Panel of local appraisers who know your market

+ Builders and Renovation Department with 50 in-house Guaranteed Rate Renovation Specialists

+ Condo Department

+ Integrated title and insurance companies

COMPETITIVE LENDING OPTIONS

Automated Marketing Allow us to make your life easier and do everything for you

The flexibility to choose your pricing so you can win in your market.

Multi-Lender Platform

+ Direct lender to Fannie, Freddie, and Ginnie

+ Proprietary credit and condo variances

Jumbo Loan Experts

+ 15+ jumbo lenders

+ In-house jumbo delegated underwriting

+ We have our own jumbo products

+ Non-QM lenders

Social Media

Consistently show up in their newsfeed

Awesome Lock Options

+ 8-10 posts / month that is engaging and relevant

+ Posted to your Facebook, Twitter and LinkedIn by our Social Media Team

+ Extended locks

+ Learn useful tips and tricks to help grow your own social accounts

+ Flexible extension options

+ Generate conversation and leads with the help of our social media experts

+ Expansive investor rate renegotiation policies

+ Weekend locking and overnight rate protection

OUR VIBE

We are a company with a soul, a team of individuals connected by a camaraderie unique in the business.

Our Vibe

CORE VALUES

We live our values every day, professionally and personally.

+ We grow for good.

+ We put the customer first.

+ We work with the best of the best.

+ We think big.

+ We have grit.

+ We have an owner’s mentality.

+ We take decisive action.

+ We demand excellence.

+ We hold ourselves and others accountable.

+ We give a sh!t.

Headline Here

Ongoing

+ Open Forum Sales Call: A Bi-weekly call led by Dan Moran (EVP of Sales) and Traci Anastasia (EVP of Operations) at Proper Rate.

+ This is an opportunity for all Proper Rate Loan Officers to collaborate on best practices with top originators, ask questions and discuss scenarios in a supportive environment.

opportunities and resources to help you build your business as fast as humanly possible.

CALLS YOU CAN’T MISS

The Guaranteed Rate Organization of Women (GROW) was created to support the growth of every woman in the company, while pushing change in our industry.

GROW offers:

+ Dedicated monthly calls with industry leaders—get tips and advice from experts to better yourself and your career

+ Mentorship program with leaders in the company

Fighting unconscious bias with a conscious collaboration.

GROW

DIVERSITY & INCLUSION

We’re committed to representing the communities in which we live and work as well as have a goal of being the go-to lender for all communities. Here are just a few ways we are working towards this goal:

+ Fostering inclusion company-wide through the implementation of employee-resource groups:

• LEAD (Leadership, Equality & Development)

• GROW (Guaranteed Rate Organization of Women)

• PROUD (Our LGBTQIA+ leadership team)

+ Investing in executive leadership with the hiring of a National Diverse Segments Director

+ Supporting Hispanic loan officers and their customers with bilingual operations staff who assist with the mortgage process from application to closing

+ Expanding our Spanish-language marketing library, giving Hispanic loan officers more opportunities to market to referral partners and customers

+ Partnering with nonprofits and trade organizations, such as NAHREP and NAMMBA, to better service communities of color and be more involved at a local level

+ Providing entry-level experience and career training through our one-of-a-kind excelRate and GR University programs

We’re a little different.

INCENTIVE TRIPS

Headline Here

Our Top VPs celebrate at five-star resorts around the world.

• 2020: Riveria Miya, Mexico

• 2021: Tulum, Mexico

• 2022: Tulum, Mexico

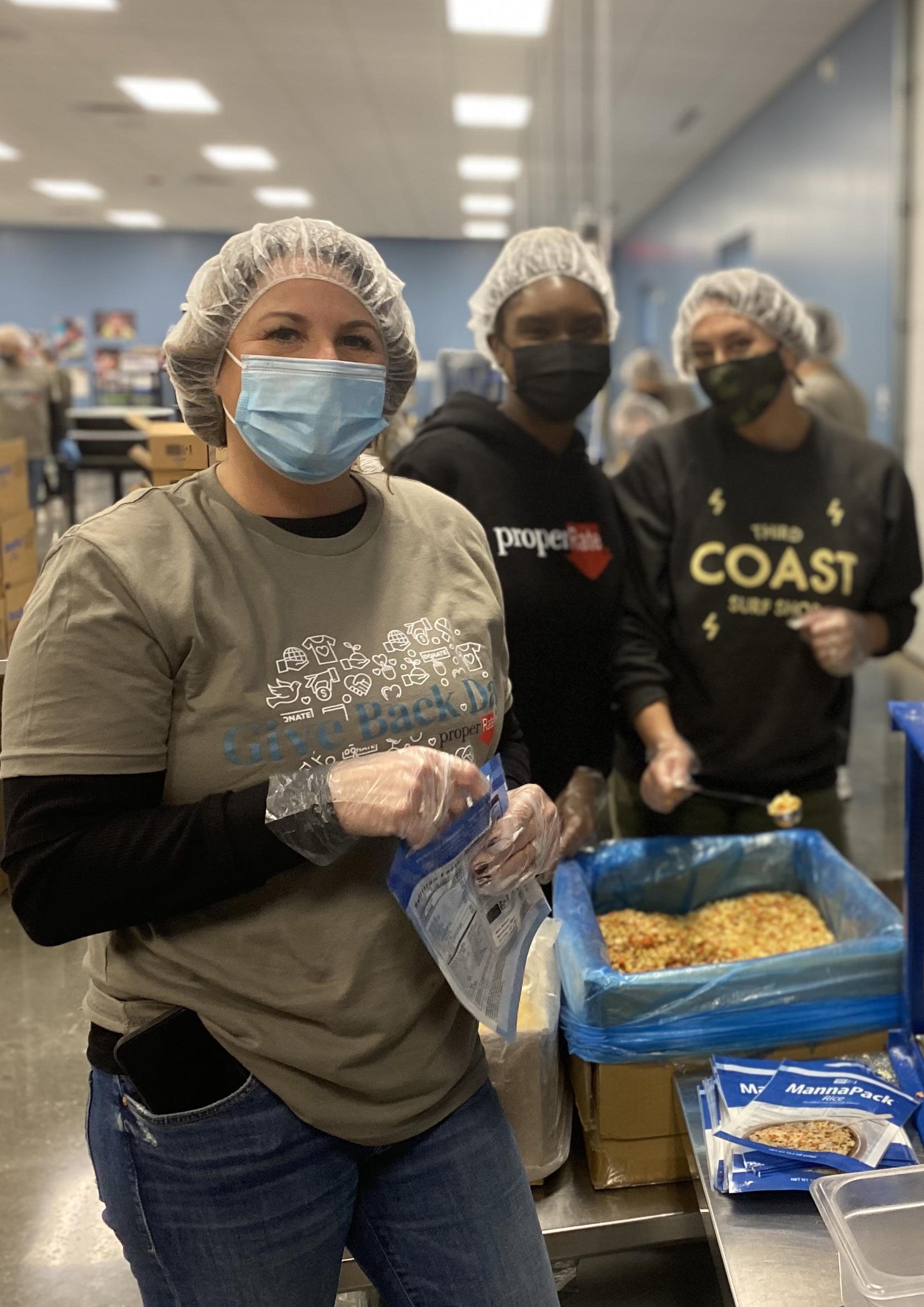

GIVING BACK

Headline Here

We rally together in all our communities across the country.

+ Give Back Challenge

+ Annual Food Drive: More than one million meals donated

+ Collecting and donating food and clothing in the aftermath of disasters

+ Volunteer days to clean up parks, beaches and rivers.

+ Serving on boards and commissions of local agencies and nonprofits

GRC FOUNDATION

Making a direct impact in people’s lives, when they need it most.

+ Since 2012, over $4.6 million has helped more than 1,400 individuals across the country

+ We granted $701K in aid in 2022

+ The average recipient receives $18,263 in forms of grants for rent, car payments, groceries or additional assistance

Headline Here

Companies,

The Guaranteed Rate Foundation is a non-profit charitable organization pursuant to Section 501(c)(3) of the United States Internal Revenue Code. Our Federal Tax ID # is 45- 4204135. Your donation to the Guaranteed Rate Foundation may qualify for an income tax deduction in accordance with Federal and/or State income tax laws. Please consult with your tax advisor to determine whether your donation is tax deductible in whole or in part. Nothing in this communication is intended to constitute legal or tax advice. No goods or services were forwarded or offered in exchange for this contribution. 1800 W Larchmont Ave, STE 2, Chicago, IL 60613.

+ 100% of Foundation costs are covered by Guaranteed Rate

so every penny donated helps those who need it most

We believe that both the way we approach the work and the way we work together are what have led to the phenomenal growth of our business.

+ #PRVibe

+ Milestone celebrations

+ National Operations Day

+ Free turkeys for Thanksgiving

+ Daily Positivity emails

We’re a little different.

PR VIBE

We

• Startup kit

• Training on technology and tools

+ Your loans keep moving

• Pipeline meetings begin right away

• A Consulting VP handles licensing activities

+ Dynamic Marketing

• We create your new marketing collateral

• Your Account Manager helps manage your database

• The Events Team sets up your first events

• The Social Media Team begins posting for you

Macaw appraisal waiver eligibility requirements vary by investor and state and may be subject to additional restrictions. Subject property must not have or be required to obtain an appraisal by law. Cash-out refinance’s, property values over $1M, manufactured homes, coops and others are not eligible for approval. Please contact your Guaranteed Rate Loan Officer for full list of ineligible loan types. Applicant subject to credit and underwriting approval. Not all properties will be approved for Macaw appraisal waiver. Not all applicants will be approved for financing. Contact Guaranteed Rate for more information and current rates. Any finding provided through API is a preliminary finding. Final appraisal waiver eligibility shall be provided once a mortgage application is submitted to a Loan Product Advisor.

+ Customized Business Transition Plan

TRANSITION PLAN

make sure you have a soft landing so that you can hit the ground running.

Proper Rate is an Equal Opportunity Employer that welcomes and encourages all applicants to apply regardless of age, race, sex, religion, color, national origin, disability, veteran status, sexual orientation, gender identity and/or expression, marital or parental status, ancestry, citizenship status, pregnancy or other reason prohibited by law.

Proper Rate, LLC; NMLS #1901699; For licensing information visit nmlsconsumeraccess.org. Equal Housing Lender. Conditions may apply • AZ: One South Church Ave, Suite 1200, Office 1248, Tucson, Arizona 85701, Mortgage Banker License #1010230 • CO: Regulated by the Division of Real Estate, 866-755-0679 • GA: Residential Mortgage Licensee #69357 • OH: MB 804550, 1800 W. Larchmont Ave., Suite 301, Chicago, IL 60613 • TX: 1800 W. Larchmont Ave., Suite 301, Chicago, IL 60613, 866-755-0679 (20220310-723199)

Macaw appraisal waiver eligibility requirements vary by investor and state and may be subject to additional restrictions. Subject property must not have or be required to obtain an appraisal by law. Cash-out refinance’s, property values over $1M, manufactured homes, coops and others are not eligible for approval. Please contact your Guaranteed Rate Loan Officer for full list of ineligible loan types. Applicant subject to credit and underwriting approval. Not all properties will be approved for Macaw appraisal waiver. Not all applicants will be approved for financing. Contact Guaranteed Rate for more information and current rates. Any finding provided through API is a preliminary finding. Final appraisal waiver eligibility shall be provided once a mortgage application is submitted to a Loan Product Advisor.

Proper Rate founders Mike Golden, Victor Ciardelli and Thad Wong

Proper Rate founders Mike Golden, Victor Ciardelli and Thad Wong

Proactive POD Elevates the loan officer experience

Proactive POD Elevates the loan officer experience

Proactive POD Elevates the loan officer experience

Proactive POD Elevates the loan officer experience