Workers Compensation Insurance • No volume requirements • Competitive rates • Multiple options for premium payments • Open to Shock Loss/High Mods Send in your submissions today. For more information contact a marketing rep at 844-761-8400 or email us at Sales@Omahanational.com. [ Coverage in: AZ • CA • CT • GA • IL • NC • NE • NJ • NY • PA • SC Smart. Different. Better. Omaha National Underwriters, LLC is an MGA licensed to do business in the state of California. License No. 078229. “A” (Excellent) rated coverage through Omaha National Insurance Company, Preferred Professional Insurance Company, and/or Palomar Specialty Insurance Company. You’l l l ike us because t here’s nobody l ike us.

What’s Out There?

What Are We Missing?

Thriving in a Hard Market: How Technology Platforms Empower Independent Agents

Scale to Grow Your Business Technology Committee

Member Survey Results

JULY 2023

Plus INSIGHT

InsurTech Voices

Independent, Authorized General Agent for An Independent Licensee of the Blue Shield Association

CONTENTS Factors That Affect Agency Value - Growth By Luke

Thriving in a Hard Market: How Technology Platforms Empower Independent Agents By

Scale to Grow Your Business By Ellen

InsurTech Voices: What’s Out There? What are we Missing? Technology Committee Member Survey Results By Shannon Churchill CONVO 2023 FAC Summer Meeting Wrap-Up By Shannon Churchill 13 15 17 20 24 28 30 The Independent Insurance Agents of Illinois (IIA of IL) has been providing members with a sustainable competitive advantage since 1899. Insight is the official publication of the Independent Insurance Agents of Illinois (IIA of IL). The magazine is published monthly for the members of the IIA of IL, with the office located at 4360 Wabash Avenue, Springfield, Illinois 62711-7009; Consumer Website: www.ChooseIndependent.com. The IIA of IL welcomes letters discussing concerns of the insurance industry, articles, editorials, other matters of interest to the membership. The editor reserves the right to edit and select submissions for publication. Address submissions for review to Rachel Romines at rromines@iiaofil.org. For advertising information, contact Tami Hubbell at thubbell@iiaofil.org. In This Issue President’s Message Brett’s 5 Sense Trusted Choice e-Insight 9 10 12 19 info@iiaofil.org | www.iiaofil.org | (217) 793-6660 Editor & Graphic Design - Rachel Romines | Advertising - Tami Hubbell Associate News Agency Members in the news Association Update IIA of IL News Classifieds 32 36 36 37 38 July 2023 2009 • 2010 • 2011 • 2012 • 2013 • 2014 2015 • 2016 • 2017 • 2019 • 2020 • 2021 • 2022 13 10 24 17

Hippler

Tara Mitchell

Lichtenstein

Board of Directors

Executive Committee

Chairman of the Board | Jay Peterson, AFIS, LUTCF (217) 935-6605 | jay@peterson.insurance

President | Kevin Lesch (630) 830-3232 | klesch@arachasgroup.com

President-Elect | Allyson Padilla (618) 393-2195 | allyson@blanksinsurance.com

Vice President | Patrick Taphorn, CIC, CSRM (309) 347-2177 | ptaphorn@unland.com

Secretary/Treasurer | Cindy Jackman, CIC, CISR (800) 878-9891 x8745 | cjackman@arlingtonroe.com

IIABA National Director | George Daly (708) 845-3311 | george.daly@thehortongroup.com

Regional Directors

Region 1 | James Sager (618) 322-9891 | james@sagerins.com

Region 2 | Ray Roentz (618) 639-2244 | ray.roentz@hwcrins.com

Region 3 | Christopher Leming (217) 321-3185 | cleming@troxellins.com

Region 4 | Bart Hartauer, CIC (815) 223-1795 | hartauer@hartauer.com

Region 5 | Noele Tatlock (309) 642-6855 | ntatlock@unland.com

Region 6 | Thomas Evans, Jr. (779) 220-6564 | tom.evans@assuredpartners.com

Region 7 | David Jenk, Esq. (312) 239-2717 | djenk@nwibrokers.com

Region 8 | Charles Hruska (708) 798-5700 | chas@hruskains.com

Region 9 | Lindsey Polzin (630) 513-6600 | lpolzin@presidiogrp.com

Region 10 | Mohammed Ali CS (847) 847-2126 | mali@aliminsurance.com

At-Large Director | Amiri Curry (847) 797-5700 | acurry@assuranceagency.com

At-Large Director | Jeff McMillan (815) 265-4037 | jeff@mcmillanins.com

At-Large Director | Patrick Muldowney (312) 595-7192 | patrick.muldowney@alliant.com

At-Large Director | Luke Sandrock, CIC (815) 772-2793 | lsandrock@2cornerstone.com

Committee Chairs

Budget & Finance | Cindy Jackman, CIC, CISR (800) 878-9891 x8745 | cjackman@arlingtonroe.com

Education | Lisa Lukens (618) 942-2556 | salibainsurance@gmail.com

Farm Agents Council | Steve Foster (217) 965-4663 | s.foster@ciagonline.com

Government Relations | Dustin Peterson (217) 935-6605 | dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC (309) 691-1300 | nickgunn@nixonagency.com

Technology | Brian Ogden (217) 632-2206 | brian@ogdeninsurance.com

Young Agents | Renee Crissie (224) 217-6577 | renee@crissieins.com

APPLIED

OMAHA NATIONAL UNDERWRITERS

Director of Information and Technology Shannon Churchill - (217) 321-3004 - schurchill@iiaofil.org

Director of Education and Agency Resources Brett Gerger, CIC - (217) 321-3006 - bgerger@iiaofil.org

Accounting & Admin Services Tami Hubbell, CIC - (217) 321-3016 - thubbell@iiaofil.org

Director of Human Resources, Board Admin Jennifer Jacobs, SHRM-CP - (217) 321-3013 - jjacobs@iiaofil.org

Sr. Vice President/Chief Financial Officer Mark Kuchar - (217) 321-3015 - mkuchar@iiaofil.org

Chief Executive Officer Phil Lackman, IOM - (217) 321-3005 - plackman@iiaofil.org

Central/Southern Marketing Representative Lori Mahorney, CISR Elite - (217) 415-7550 - lmahorney@iiaofil.org

Director of Government Relations Evan Manning - (217) 321-3002 - emanning@iiaofil.org

Office Administrator Kristi Osmond, CISR - (217) 321-3007 - kosmond@iiaofil.org

Director of Communications Rachel Romines - (217) 321-3024 - rromines@iiaofil.org

Director of Membership Services Tom Ross, CRIS, CPIA - (217) 321-3003 - tross@iiaofil.org

Products & Services Administrator Janet White, CISR - (217) 321-3010 - jwhite.indep12@insuremail.net

Director of Prof. Liability & Ins. Products Carol Wilson, CPIA - (217) 321-3011 - cwilson.indep12@insuremail.net

IIA of Illinois Staff 40 33 4 7 27 14 34 26 34 10 Cover Tip 39 9 8 16

UNDERWRITERS

EBRM EBRM FORRESTON

MUTUAL IIA OF

CONNECT

BERKSHIRE HATHAWAY GUARD INS. GROUP

MUTUAL INSURANCE COMPANY GRINNELL

IL

IIA OF IL SOLUTION CENTER

WILSON

INDEPENDENT MARKET SOLUTIONS JM

INSURANCE SECURA INSURANCE UFG INSURANCE WEST BEND MUTUAL INSURANCE CO

Find us on Social Media

SECURA

ADVERTISERS

Independent, Authorized General Agent for An Independent Licensee of the Blue Shield Association

At UFG Insurance, we’ve been insuring businesses of all sizes and specialties for more than 75 years. From simple small business BOPs to complex middle market packages, you can depend on us to extend our underwriting expertise and outstanding service on a wide variety of risks for your agency. Next time a new account crosses your desk, think UFG. We’re ready to get down to business with you! ufginsurance.com © 2023 United Fire & Casualty Company. All rights reserved. THINK UFG for new business opportunities CONSTRUCTION WHOLESALE AND DISTRIBUTORS SMALL BUSINESS COMMERCIAL REAL ESTATE BUILDERS RISK MANUFACTURING INSURANCE

Remarketing

The topic of remarketing has been a daily discussion at our office, particularly in the personal lines department. All our carrier partners need to take rate on these products, there is no way around it. Reinsurance rates are skyrocketing, material costs and labor costs caught the market off guard, bad legislation in California and Florida and some crazy ass weather have all contributed to a very hard property market.

The question we have in our office is “Do we want to remarket?”

Every insurance commercial on television will tell your client yes, you want to go out there and “get some quotes,” and the truth is (as we all know) most likely the client is going to save if they shop, however is that the best thing for the clients? Is this the best thing for our industry?

Our carriers need take rate because they must fund reserves that have been depleted. If they do not get the premium from the client they already have, they need to sell to a new client, or charge their current base of clients even more to fund the reserve pool.

I think we need to start selling the increases.

1. It makes us a good carrier partner.

2. Why do we want to work harder to make less?

Honest relationships

Our clients are smart, explain the marketplace to them. Make them understand what is happening and that this is a market adjustment – heck, investment advisors get away with it all the time. Obviously, every situation is different, there are some very large increases out there that need to be taken care of by finding another market, however if a carrier is adjusting our clients premium by only 10% at renewal, lets make the carrier the hero by considering this a gift. Well maybe I am going a little too far, but hopefully you get the point.

july 2023 insight 9 president's message | INSIGHT

Kevin Lesch - IIA of IL President (630) 830-3232 klesch@arachasgroup.com

SECURA’s team of insurance experts is making insurance genuine. They are here to support you and your clients. Our underwriting teams are quick to reply, open-minded, and know their stuff. Plus they are backed by our caring claims group who will get your clients back on their feet. Interested in building a relationship? Contact us at secura.net/IL-agents. Hear from our experts. Want to learn more about what SECURA has to offer? Scan the QR code or visit secura.net/IL-agents for more information about the SECURA team. Commercial | Personal | Farm-Ag | Specialty

Book of the month is “My Murder: A Novel by Katie Williams” – some good summer reading.

Technology Part 2

I had my reminder to produce this article sent to my beeper(pager) for you 1980s techno wizards. Technology to me is the game apps on my iPhone and used to be the spider solitaire on my home computer. Hopefully, we are all utilizing social media by now, and if you are not, shame on you. You better have Gram, Chat, Meta and Twitter agency accounts (Instagram, Snapchat, Facebook and Twitter). Technology is more than those things, though. Technology is how you navigate through all the aspects of running your agency. From accounting, marketing, quoting, claims handling, and chatting to engage your customers or potential customers.

First, you need to determine how valuable your time is, $1 or $500 per hour. This should be assessed when deciding whether or not to pay to have something done or to do it yourself. Many of us just look at cost and not the cost

of having you do a vital task, but you could better serve yourself, the agency, and your clients by doing another job that cannot be outsourced (meeting with clients, reviewing coverages, etc…). This hard market makes us look at costs with much more scrutiny to see where we can save money. If those money savings are at the expense of technology or do not employ technology to its fullest extent, you are doing your agency an extreme disservice. Technology will make the customer experience seamless, effortless and project that their agent is on top of things, giving them greater peace of mind. Isn’t that what we are all striving to achieve? Happy/content customers are less likely to shop. You tell your clients not to focus on price but to focus on whether or not they are appropriately insured. I would take some of your own advice. Do not focus on the technology’s price but on whether it provides your agency enough value to justify the price. Is your peace of mind worth it as well?

You better be using social media as it is free marketing (unless you pay for a boost). Even if there is a charge, it is typically negligible. Social media allows you to reach customers like never before. You can utilize social media schedulers (like Rachel) or create the content and posts yourself. If you rely on yourself or someone at your agency to create and post content from scratch, things can get missed. A solid scheduler or schedule ensures that you engage consumers and potential clients regularly. I have seen studies on marketing that indicate the first time someone sees something, they may not see it or ignore it as we are overloaded with social media posts and information. The second and third time we see something, we may now see it or take notice, but it probably will not drive us to action. The fourth through eighth time will annoy us, and we want it to go away. But then something happens, and when we see it a ninth time, we may take action. Who knows why? Maybe we just want it off our feed, we like their persistence, or we figure it must be important. (One of life’s mysteries.) I have also seen that creating different posts increases traffic rather than blasting the same post over all the platforms. I would imagine that this is due to customers thinking, “Hey, this took some time to do, and I want an agency that is thorough and pays attention to details, that is willing to put in the work. (Just my thoughts). In my opinion, agencies that don’t post or engage in social media or do so infrequently are at a distinct disadvantage. Agencies that blast the same posts over all platforms regularly are almost there, and agencies that regularly post on all platforms and vary their content will see the most success. I will provide the following analogy. If you hit .250 with 54 rbi and 11 home runs,

10 insight july 2023

2023 JM Wilson Insurance Insight OUTLINES.indd 2 1/12/23 10:52 AM

you could be a major league baseball player (infrequently posting on social media). If you hit .300 with 100 rbi and 35 home runs, you may be an all-star in the major leagues (blasting posts over all social media platforms on a regular basis). Lastly, if you average .350 with 180 rbi and 40 home runs for your career, you would be a hall of famer (regularly posting to all platforms, varying your content for the different platforms). So, you need to decide, do you want to be a major leaguer, all-star, or hall of famer? Get in the game, though, as you don’t want to languish in the minor leagues.

The biggest thing with technology is solving how to engage potential customers and how quickly this engagement can occur. We all want immediate satisfaction, gratification, and engagement (when I want to engage). Technology can help with that engagement by your agency utilizing email, texting, live people to talk to, and chatbots. Who knows how many opportunities you are missing out on throughout the year that your competitors are not missing. Only the shadow knows. (I just aged myself with an old, old, old-time radio show reference.) Think about yourself as a consumer. If you go to call or email someone, how long do you wait before moving on to their competitor? Some of you may wait one or two days, while others may wait three minutes (my daughter). Don’t we all just want to be wanted? Your response time tells the customer how important they are to you and how much you want their business. Technology allows you to shorten or speed up your response time. My daughter throws an absolute fit if I don’t respond to a text within seven seconds but fails to return my texts for hours. Realize that the only thing you can control is your response time, and if you manage that, well, the customer (my daughter) will be happy.

We have just touched the surface of technology, and you need to thoroughly research and vet which parts work best with your agency. This is why we created our technology committee - to help you navigate this tech-driven world. Each agency will have to develop their perfect fit as this is not a one size fits all. Do you want the be the abacus (ancient Babylonian technology), the Commodore 64 with a floppy disc (1980s called and wants their computer back), or the latest Mac Book Pro (the Cadillac)? If you can afford the Cadillac, I recommend purchasing the Cadillac. All will work to some extent, but the last one will allow you to shine, and don’t we all want to shine as the shiny objects get the most attention?

As always, this is just Brett’s 5 Sense (hopefully we get inflation under control and a can return to 2) and I hope it was helpful. You can contact me through my MySpace account and if it is urgent, do not hesitate to page/beep me. If you need any clarification or have any suggestions for future articles, please email me at bgerger@iiaofil.org.

july 2023 insight 11 Brett Gerger | IIA of IL Director of Education & Agency Resources bgerger@iiaofil.org | (217) 321-3006 5Sense Brett’s (inflation)

Video series now available for Big "I" members! “INSURANCE EXPLAINED” Easily educate consumers about various insurance topics: GREAT FOR USE ON SOCIAL MEDIA! Auto Insurance Identity Theft Cyber security Pet insurance AND MORE! Request a video customized with your agency branding today! trustedchoice.independentagent.com

Factors That Affect

By Luke Hippler

has true sales management, robust marketing, and accountability at their agency.

Agency B may be operating solely from word-of-mouth referrals, with vague producer goals, and is fairly complacent with their sales efforts.

The same example applies when it comes to our personal financial portfolio. Ten times out of ten, you would much rather invest in stocks that are growing at a rate of return of 10% over two years rather than stocks that are stagnant, not growing but also not losing.

The point here is that your agency is worth MORE when you are growing. When you have the people, culture, leadership, and systems in place and are committed to the growth of your agency, your value will increase.

Unfortunately, our team sees examples all the time of agency owners who are approaching retirement age and have taken their foot off the gas when it comes to growth. This means you could be leaving money on the table when it comes to selling your agency. Now, when it comes time to retire, or to “smell the roses”, wouldn’t you want to squeeze every penny out of your biggest financial asset? That is what the IA Valuations team, an IIA of IL Partner, is here to do for your agency.

By Luke Hippler, MBA, is IA Valuation’s Business Planning and Valuation Analyst and can be reached at luke@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation.

july 2023 insight 13

“Trust in Tomorrow.” and the “Grinnell Mutual” are registered trademarks of Grinnell Mutual Reinsurance Company. © Grinnell Mutual Reinsurance Company, 2023. grinnellmutual.com PERSONAL | BUSINESS | REINSURANCE TRUST US TO

THEIR ANCHOR With our personal watercraft coverage, your customers can set their course for smooth waters ahead. Trust in Tomorrow.®

BE

THRIVING IN A HARD MARKET

How Technology Platforms Empower Independent Agents

By Tara Mitchell

The insurance industry is constantly evolving, and independent agents face unique challenges in a hard market. As personal lines become increasingly difficult to place, it’s crucial for independent agents to leverage technology platforms such as quoting and lead generation tools to not only survive but thrive in this challenging landscape. In this blog post, we’ll explore the strategies independent agents can consider when reviewing their personal and commercial lines portfolio and how they can leverage leads to discover new opportunities in the personal lines market.

Embracing Technology Platforms

Technology platforms have revolutionized the insurance industry, empowering independent agents with tools and resources to streamline their operations and increase their efficiency. If you write commercial lines or want to expand those lines, commercial lines quoting and comparative rating tools allow agents to quickly generate accurate quotes for their clients, enhancing the overall customer experience. By automating the quoting process, agents can save valuable time and focus on building relationships and providing personalized service to their clients.

There are many new players in the market, including QuoteWell and BondExchange, which can help generate commercial lines quotes from a variety of carriers in BOP, GL, Workers Comp, Package, Auto, Umbrella, Surety, and Trucking.

Reviewing Personal and Commercial Lines Portfolio

In a hard market, it’s crucial for independent agents to review and assess their personal and commercial lines portfolio. By analyzing their existing book of business, agents can identify areas of opportunity and areas that require adjustments. Agents should carefully evaluate the profitability of each line of business and consider whether it aligns with the current market conditions.

For personal lines that have become harder to place, agents should consider implementing stricter underwriting guidelines and risk assessment processes. It’s essential to focus on clients who have demonstrated a low-risk profile and strong loss history. Additionally, agents should explore alternative insurance carriers that specialize in high-risk markets or niche industries.

Leveraging Leads for New Opportunities

Lead generation tools can be a game-changer for independent agents in a hard market. These tools provide agents with a steady stream of potential clients, allowing them to expand their personal lines market reach. By leveraging leads, agents can identify prospects who may not have been previously within their network and develop targeted marketing campaigns to attract their attention.

When utilizing lead generation tools, it’s important for agents to focus on quality over quantity. Rather than pursuing every lead that comes their way, agents should carefully evaluate each lead’s potential and prioritize those that align with their expertise and target market. By nurturing these leads through personalized communication and tailored offerings, agents can convert them into loyal customers and boost their personal lines business.

Lead generation tools such as SALT can help you find new opportunities online with personal lines prospects. Automating the lead generation forms can make a more seamless experience to help you connect with the next right customer.

Wrapping Up

In a hard market, independent agents must adapt to changing circumstances and leverage technology platforms to their advantage. Personal and commercial lines quoting and comparative rating platforms, as well as lead generation tools, offer significant benefits that enable agents to streamline their operations, review their portfolio, and discover new opportunities in the competitive personal lines market. By embracing these strategies and utilizing technology, independent agents can not only survive but thrive, even in the most challenging market conditions.

Tara Mitchell is the Director of IT and Project Management for Catylit, an IIA of IL partner. She can be reached at tmitchell@iiat.org.

july 2023 insight 15

Savings.

Is your client shopping for insurance?

By switching to a policy from West Bend – they can save everything.

Every memory. Every detail.

We promise we can help get everything back to how it was before. That’s an insurance partner you can trust.

The worst brings out our best.®

SCALE GROW TO YOUR INSURANCE BUSINESS

3 Ways to Reduce Operating Costs to Increase Revenue at Scale

By Ellen Lichtenstein, AgentSync

Help your business grow revenue exponentially without growing expenses at the same, rapid rate

Whatever your role in the insurance distribution channel – from individual licensed producer to agency owner to insurance carrier compliance staff, and many more –your organization wants to increase revenue and reduce expenses.

Historically, many roles can only do “so much” before they hit capacity, and another person needs to be hired. For example, if a producer working at full steam seven days a week (and we’re not recommending you do this) can only handle 100 clients at a time, then the agency has no choice but to bring on another producer if they want to serve more clients. You can see how this model doesn’t allow a business to efficiently scale because the costs go up proportionately to the new revenue coming in.

Lucky for insurance agencies, carriers, and MGAs/MGUs that are hoping to grow business without costs getting out of control, modern technology is changing the game. Here’s how technological investments can pay dividends for your revenue growth, so you can scale your insurance business without costs rising at the same fast pace.

WHAT DOES IT MEAN TO SCALE A BUSINESS?

Scaling a business refers to increasing revenue without proportionately increasing expenses. This is why “growing” a business and “scaling” a business aren’t the same thing. You can grow an insurance agency by hiring more producers, but with each new producer you add, you also add a proportionate set of costs. Scaling, on the other hand, is about efficiency and getting more output with the same input (or even with less!).

An example of scaling an insurance business is when you equip staff with something that allows them to do more work with less effort, resulting in more revenue without equivalent expenses coming along for the ride.

HOW TO GROW YOUR INSURANCE BUSINESS WITHOUT INCREASING EXPENSES

To bring more revenue into the business while at the same time limiting new expenses that send money out the door, many businesses turn to technology. Through investing in solutions that automate previously manual processes, and solutions that integrate across multiple systems, people’s time is freed up to do more revenue-generating work. And no, these solutions aren’t free of charge, but the goal is to find ones where the initial and/or ongoing cost easily pays for itself as you don’t have to hire more staff for these tedious tasks.

1. Reduce Operating Expenses

Excessive operating costs are the bane of most businesses’ existence. Whether it’s spending too much on something as small as web hosting and email or paying for unnecessary office space, all the costs that go into operating a business quickly add up.

A few tech-forward tips on reducing operating costs include:

• Consider a remote or hybrid workforce. This can save money on office space, allowing you to add more people without the cost of the physical space they would normally occupy. It can also help with attracting and retaining talent at a time when the insurance industry

july 2023 insight 17

continued...

is facing a talent shortage and most workers still prefer remote and hybrid work instead of fully in-office.

• Go paperless. Get rid of printers and paper whenever possible. Use dry erase boards instead of sticky notes. Invest in digital writing tablets for those who refuse to give up taking notes by hand. It might seem small, but research suggests that companies spend as much as 3 percent of their revenue on paper and that doesn’t even count all the added time employees spend organizing and searching through that paper!

• Use technology to automate any operational tasks you can. This overlaps with the administrative expenses we’ll touch on below, but it’s worth mentioning twice! You may be able to save a lot of human-hours by automating things like your payroll, new-hire onboarding procedures, and other common operational tasks that take up way too much time when done by hand. Then, repurpose those saved human-hours into impactful projects that either help the company bring in more revenue, retain more current customers and clients, or save money by increasing employee satisfaction and lowering attrition.

2. Reduce Administration Costs

Administrative expenses include all the paper shuffling (or, if you’ve gone paperless, email and PDF shuffling) that people spend time doing. None of this admin work is truly leading to revenue, but it’s definitely costing you in payroll, benefits, office space, and many other ways.

For insurance agencies and MGAs/MGUs, onboarding and offboarding producers are major administrative costs that are ripe for automating. Similarly, ongoing producer license compliance management is a task that could easily occupy a full-time employee (if not multiple full-time employees) yet can be reduced down to a fraction of the time commitment by implementing a tech solution.

For insurance carriers and some MGAs/MGUs, appointing producers and doing their own part in monitoring compliance in their downstream partners is equally time consuming. There’s also the added role of insurance adjusters who require attention during the onboarding and offboarding process.

For any insurance business still managing all of this on paper, or even in “modern” ways like spreadsheets and cloud-based shared documents, scaling is still a pipe dream. If you have to dedicate admin staff to supporting your revenue-generating roles, you have no choice but to increase the admin staff (and associated costs) as you increase other roles.

We’re certainly not suggesting that you not grow your business through adding more people! We just know that the business would rather add more people who bring in revenue, and at the same time, the people you’re hiring would prefer to spend their time on high-value work and not repeat data entry. It’s only possible to scale when you let technology take on some of the tedious work so your people can focus on their business impact.

3. Improve the Employee Experience

In a definitive case of “last but not least,” your bottom line isn’t the only thing that’ll be happier when you remove the busy-work from your staff’s plate. Now, more than ever, employees (and we’re counting producers and others who may not be traditional employees, by definition) are demanding a modern and pleasant experience.

If producer onboarding consists of a lot of data entry (and repeat data entry), a lot of follow up emails and phone calls, and a lot of waiting, your operations staff and producers alike are going to start looking elsewhere.

If claims processing involves cross-referencing different systems, hand-written documentation, and an excessive amount of human touch at each step of the way, your adjusters and other claims staff will soon be frustrated by the tedium.

Investing in technological solutions that both automate processes and integrate across systems dramatically improves the employee experience. When you reduce the number of places people have to look for – or enter – data, reduce the number of steps or clicks it takes to do frequent tasks, and even provide self-service capabilities so no single person has to act as your company’s central encyclopedia, employees are happier and more engaged.

Scale your insurance organization without scaling your compliance expenses

Compliance is a non-negotiable part of the insurance industry. But it doesn’t have to be complex, timeconsuming, or costly.

This article originally appeared on the AgentSync website at https://agentsync.io/blog/technology/3-ways-to-reduceinsurance-operating-costs-and-increase-revenue-at-scale. See how AgentSync can empower your carrier, agency, or MGA/MGU to quickly reduce operating and administrative costs while improving your producer and employee experience.

18 insight july 2023

Technological investments can pay dividends for your revenue growth, so you can scale your insurance business without costs rising at the same fast pace.

july 2023 insight 19 online journal at www.iiaofil.org/Resources/Insight INSIGHTeThriving in a Hard Market: How Technology Platforms Empower Independent Agents Scale to Grow Your Business Technology Committee Member Survey Results Plus INSIGHTJULY 2023 What’s Out There? What Are We Missing? InsurTech Voices In this month’s e-Insight. Long Live the Insurance Agency By Boston Consulting Group

The IIA of IL Technology Committee reached out to several members to get their thoughts regarding Below are a few of the answers we received.

Cindy Jackman, CIC, CISR, CPIA, is Illinois Sales & Marketing Manager for Arlington/Roe. She has been in the business for close to 40 years, 34+ on the retail agency side and five+ on the managing general agency/wholesale side.

What does the “landscape of tech” look like for insurance right now?

Shepherd: It looks amazing right now and in my opinion it is only improving. We’ve come a long way from paper files, handwritten notes to underwriters and issuing COIs on the 3-ply Acord carbon copy paper (white out, anyone?). We are able to service clients so much more efficiently. Artificial intelligence is already being used in the insurance world. And it’s only going to improve over time.

Has the investment in and focus on InsurTech accelerated the tech growth in the industry?

Ogden: Yes, InsurTech has definitely accelerated tech growth.

Roentz: I believe it has because we see the potential for more profitability and ease of doing business in it. Thus, you can’t ignore it. The trick is to implement the best attributes of Insurtech while maintaining the integrity of the independent insurance agent system.

What are we missing? Where is the disconnect that would likely have the most impact if a solution was put in place?

Roentz: We are missing an API that would allow for single entry into each direct contracted carriers’ own rating system. I would just simply say “single-entry,” but I feel like that is about as possible as finding the city of El Dorado. I can’t imagine carriers will abandon their own systems for a single-entry system used by all, and why should they? Suppose you’re one of the few carriers that got it mostly right by listening to agents in the development stages, investing millions into its implementation, and making adjustments along the way with an end result that gives your company a distinct advantage over your competitors. Why would you abandon that advantage to be just like your competitors who maybe didn’t invest the money and attention to their system?

20 insight july 2023

Goerge Daly is Division President & Shareholder of The Horton Group and has been in the insurance industry for 39 years.

James Sager is Owner of Sager Insurance Group and has been in the industry for eight years. He started his own agency 18 months ago.

Ken Samson, CIC, is President at Dasco Insurance Agency and has been in the industry for 30 years at the family agency.

regarding different facets of the technology space.

How important is it for agents to avoid “shiny object syndrome” when considering new tech for their agency?

Ogden: It is very important to avoid the “shiny object syndrome”, we must always look at the ROI on what it is.

Sager: Very important. You need to consider what is the immediate need for my agency, and how will this technology improve our agency goals.

Samson: This is huge and hard to avoid. There are so many new products out there – new ways to be marketing, posting to social media, gathering info on prospects, giving our clients access to their policy information…every day, it seems there is something new. The problem is, these things all cost money and time. Lots of time! I have tried many of the new products – some end up becoming useful tools for our agency and many fall to the wayside and we end up canceling because the new technology is less efficient than the previous workflow. Sometimes, it might work great for our office, but can’t be implemented by our carriers or clients. The frustration is, it takes so much time to bring a new technology or product in, convince the staff that this new technology is “worth it” and then train everyone to use it. If it doesn’t work, not only have you wasted all

that money and time, you make it less likely that people will want to try the next new tech product. You have to be diligent to not bring new products to the agency until you have tested them yourself and you believe in them.

Roentz: Extremely important. A tech product needs to be investigated thoroughly to make sure it will fit within your present workflow and processes, or eliminate an unproductive step in the workflow. If you intend to redefine the entire system with the use of new tech, you need to be certain you know what you’re doing before the point of no return. Making a wrong decision in this area can lead to extremely costly consequences including loss of profits, reputation, and staff.

Sandrock: There are a lot of great products in the marketplace, and we need to be constantly looking at what can make our agencies more efficient, but it can be overwhelming. Between the number of products and the number of solicitations we receive. It’s very important that products bring value from the start of implementation and that we don’t try to take on too much at once. Technology is changing daily so a product that was looked at six months ago may have changes coming. I believe it’s important to constantly be looking, but patient to implement until you know the full story of the upside and downside to a certain technology.

july 2023 insight 21

Ray Roentz, CIC, is President of Heneghan, White, Cutting & Roentz Insurance Agency and has been in the industry for over 12 years.

Tyler Sandrock, CIC, AFIS, is Partner at Cornerstone Agency, Inc. He started his insurance career at the Katie School of Insurance at Illinois State University.

Brian Ogden, CIC, AFIS, is President of Ogden Insurance Agency and has been in the business for 32 years.

continued...

Marlene Shepherd is the Director of Agency Technology at Snyder & Snyder Agency, Inc. and has been in the industry for over 35 years.

How would you recommend an agency go about reviewing their current “tech stack” and deciding what should be added or changed?

Ogden: As chairperson of the IIA of IL Technology Committee this is something the group discusses often. We look forward to providing agencies ideas to work through this question at CONVO this year during the Thursday morning general session.

Sager: Starting my own agency, I had the advantage of starting from scratch. I asked myself three very basic questions. What are my immediate needs? How can I utilize technology to grow my business? What current technologies meet the vision of where my business is going? For me, my first step was implementing an agency management system. This is a huge undertaking whether you are building from scratch or changing vendors. My biggest piece of advice is to do your due diligence on the vendor’s support team (both initially & ongoing). These are very complex programs and without a good support team, getting the most out of your investment is impossible. When considering the future of my agency, I opted to explore technology that would help me streamline the initial stages of information gathering. This allows a prospect the flexibility to gather information at their convenience. The use of technology in our industry will continue to grow and become more important as the years go on. I feel it is vitally important for my agency to embrace cutting edge technology while maintaining the traditional brick and mortar presence. I feel this positions my agency to service a wide range of clients, the traditional face-to-face client as well as the “tech type” customer.

Roentz: I recommend “mapping out” what you want in terms of the product and workflow. What needs improving? Where is the opportunity? Then preferably going to a similar agency that uses this tech and see it in action for a extended period of time. Take notes on how they use it, and whether it will work the way you want it to in your agency. (Editors Note: See sidebar on the next page.)

How would you rate the carriers in terms of tech advancement and adoption?

Ogden: Getting better!

Samson: Every carrier is different, which makes things VERY difficult. We want to have a single procedure or workflow but “Company A” still does things like it was 1988, “Company B” has an agent’s portal that we have to go to and “Company C” provides everything by download. I think many carriers are very proud of their technology and the investments they have made, but it seems like they never asked any agents how it should work. So, it is hard to give a single rate for all the companies, you would have to rate each company separately on each facet of their tech. They might have a great website, but their download is pathetic, for instance.

What else could the carriers be doing with tech to improve agent workflow and customer experience?

Roentz: Quit retro-fitting old systems, or sticking with systems that were never designed with a sales and customer experience in mind. A good rule of thumb is “If your system was designed by engineers and brought to agents to use, you probably have a bad system. If you had agents design it and told the engineers to build it, you probably have a good one.”

Sandrock: The claims experience. The carriers are leaving a big opportunity for agents on the table by not keeping us better informed about where claims sit and what’s next in the process. Agents can be a great buffer and advocate for carriers during the claims process but most times we waste way too much time trying to gather information or waiting to hear back on small items when the information could be readily available directly to the agency.

Do you feel artificial intelligence (AI) will begin to play a larger role in our industry? If so, how soon?

Jackman: Yes, AI will assist with the underwriting, quotes and claims.

Ogden: I think AI is already here and being used.

Daly: AI will help service teams respond to clients more effectively and efficiently. In addition, AI can analyze customer data to understand their needs and preferences, allowing agencies to offer personalized products and services. Certainly, this can lead to improved conversion rates and customer retention. Also, AI-powered chatbots can provide 24/7 customer support by responding to common questions to allow 24/7 service.

Could AI replace the independent insurance agent?

Jackman: No, it will be a valuable assistant, but not replace the insurance agent. Clients need a relationship with a person.

Daly: I don’t see AI replacing insurance agents but for a certain segment of clients, AI will be the go-to resource to ask questions like how can I shop for insurance? or how do I get a better price or coverage? We need to stay on top of this as an industry and continue to add value so that the answer is to go to an independent agent.

Samson: I hope not! Seriously, I do believe that if we do what we are supposed to do and keep up-to-date on our industry and what our clients are dealing with, we can never be replaced. But if we are lazy or complacent and just push paper or take orders – we have a huge target on our backs. I do believe people like working with people they like but there are limits to everything. If we don’t get back to our clients with good information, they will just go elsewhere to get it. I am hopeful that AI can help us be better, but not replace us.

Roentz: Possibly but there is no substitute for accountability and compassion.

22 insight july 2023

How is technology supporting or improving the most “human” areas of the insurance process –the relationships and service?

Daly: As I mentioned, I think technology and AI will provide great information that will allow our service staff to utilize and modify to respond to our clients in a sophisticated and efficient way. If we are using the technology effectively it will be a blend of artificial and human intelligence and save our busy staff time so they can service more clients and reduce response time thus improving relationships with clients.

Roentz: It has made it easier to store important information about the clients and disseminate it throughout the entire staff.

When you ask someone that’s been in the industry for 25+ years about the biggest difference they’ve seen over the years, they almost all begin their answer with “technology.” What do you think the answer will be 25 years from now?

Jackman: Technology – it is ever changing & evolving.

Ogden: Do you remember when we wrote Replacement Cost on roofs?

Samson: I think it will still be “technology”. 25 years ago, I don’t think anyone could have predicted how our offices would look and how we get through our days. I think we can count on new technologies that will keep coming at us but we probably can’t even imagine what those new technologies will be, yet. As my grandfather used to say, “The only constant is change.”

Roentz: The carriers and the relationships with them.

What do YOU Think?

The IIA of IL wants to hear from you!

Head over to CONNECT, the IIA of IL members-only online community, and let us know how you would answer these questions.

CONNECT is the perfect place to have conversations around technology. In fact, there is an entire group devoted to technology!

Want to pick other agents’ brains about AMSs? Looking to use a virtual employee but still have some questions? Need some assistance with anything technology related (or other agency items)? Ask in CONNECT for feedback from other agents and the association team.

connect.iiaofil.org

july 2023 insight 23

An IIA of IL Member Community

One of the biggest challenges agencies face is technology in the office:

Am I using the right thing?

How do I know which is best? I have a product, but I am not using it to its fullest potential.

It’s an ongoing challenge. In most cases, there is no right or wrong answer, but the need to do something, do better.

Recently the IIA of IL surveyed members about some of the technology they are using. We share those results here, but this is just the beginning. Check out the end of the article for what is coming next, and how you can help.

Which password manager do you use?

For those who don’t know, a password manager is a program that stores all your usernames/passwords in one space. Usually a “master password” is used to access the program. Think of it as a more secure virtual black book/ post-it notes (you know who you are).

47.6% of users indicated they are on LastPass. (See the article in CONNECT about the breach they faced last year.)

19% RoboForm

Other options being used: 1Password and Okta.

Here are a few others in the marketplace, but none in the survey utilized yet: Bitwarden, Dashlane, Keeper, Logmeonce, Nordpass, Password Boss, and Zoho.

We did have a couple of people who were honest and responded they use an excel document, post-its, or a “cheat sheet”. Although no password manager is 100% safe from being hacked, they are much more secure than other paper/spreadsheet options.

What CRM do you use?

We are seeing agencies beginning to utilize customer relationship managers (CRMs) more and more. When asked agents responded Zywave was at the top. Followed by several who indicated the CRM is built into their agency management system. Other notable ones included Agency Revolution, Agency Zoom, Microsoft Dynamics, and Salesforce.

What agency management system does your agency use?

As expected, we saw the biggest results with some of the most dominant players in this space.

Applied EPIC – 19% Vertafore AMS 360 – 19% Hawksoft – 15.5%

Splitting up the rest of the percentages would be some of the other systems by Applied & Vertafore such as QQ Catalyst, Sagitta, and TAM, but others included Easy Apps, EZLynx, and NASA.

There was a small percentage of respondents who do not use an agency management system. As a best practice, we recommend agencies consider implementing an agency management system. They are a great tool in retaining documentation and other preventative practices seen in errors and omissions claims. Check out the variety of resources available through IIA of IL’s partner program, Catalyit, who provides a wealth of information around management systems.

Which commercial lines quoting platform are you using?

While the majority (66.7%) are using Tarmika, Zywave & EzLynx both brought in (16.7%) of users. Others in the space include TurboRater, Relay, Quotit, Leadsurance, DAIS, and Coverwallet.

24 insight july 2023

“Am I using the right thing?”

“How do I know which is best?”

20% 15% 10% 5% 0%

“I have a product, but I am not using it to its fullest potential.”

AppliedEpicVertafore-AMS360HawksoftAppliedTAMVertafore-QQCatalystAgencySystemsAppliedSystems EZLynxNoneUsed Others

First was marketing automation, followed by commercial lines quoting, social media presence, feedback/customer reviews and agency management systems. Other areas of interest for agencies included: mobile apps, virtual assistants, website content creation and quoting through an agency’s website.

TECHNOLOGY

COMMITTEE

Member Survey Results

By Shannon Churchill

By Shannon Churchill

Almost two-thirds of the responses were Patra with Coverdesk, ResourcePro, and WAHVE coming in with 12.5%. The on-going list of options grows every month it seems. Here are some other players in the game: Agency VA, Eureka Virtual Assistants, Lava Automation, Marblebox, Savvital, and Virtual Intelligence.

Shannon Churchill is the Director of Information & Technology for the IIA of IL. She can be reached at schurchill@iiaofil.org.

HELP US HELP YOU!

The IIA of IL Technology Committee is working to provide a resource to help agencies when considering implementing new technology. The guide will include vendors for a variety of tech related products with listings of agencies in Illinois you can contact for true testimonials on how the product is working for them.

Which virtual employee vendor are you using?

Many factors are playing into agencies looking to outsource some of the remedial tasks so their staff can focus on more important things such as building relationships with customers. We saw an uptick coming out of the pandemic, and as the systems grow and more and more agencies expand their thoughts around incorporating virtual employees, we have seen a boom in the market. There are many things to consider when looking at hiring a virtual employee. IIA of IL offers a variety of resources available around this topic.

We will continually update our survey results so that we can monitor our member’s technology issues and needs, work to help provide solutions, and keep our new guide updated. But in order to do that, we need your help!

Have you completed the technology survey yet? If not, request that the survey be sent to you.

Interested in sharing your knowledge and helping to spearhead technology for members? Join the Technology Committee!

We’re also adding additional resources to the IIA of IL Solution Center! We cover items included in this article and so much more.

Find everything at www.iiaofil.org/Technology.

july 2023 insight 25

When evaluating your agency’s tech stack, what three things you are looking to add/ change within the next year.

IIA of IL

0% 5% 10% 15% Marketing Automation Commercial Lines Quoting Social Media Presence Agency Management System Feedback/Customer Reviews Mobile App Virtual Assistants Website - Content Creation Website - Quoting Through Agency Site Digital Signatures Personal Lines Rater Text Messaging Certificate Generation Email Encryption Utilizing Videos Need help with procedures before adding tech.

Manufactured Homes Rental Dwellings We seek to increase our presence in the manufactured home (1977 or newer) and rental dwelling insurance markets. If you are interested in learning more, please contact us. • No supporting business requirements • Competitive pricing • Attractive commission and contingency schedules • Fast, friendly claims service 208 S Walnut Ave · P.O. Box 686 · Forreston, IL 61030 (815) 938-2273 · (800) 938-2270 (309) 303-1490 · (815) 938-2273 Fax (815) 938-2785 · Email info@forrestonmutual.com www.fmic.org Contact: Carl Beebe 309-303-1490 Agents For Unique Opportunities!

Farm Agents Council

a division of the Independent Insurance Agents of Illinois

Summer Meeting Wrap-Up

The Farm Agents Council (FAC) hosted its 93rd Annual Golf Outing and Meeting on June 15-16 in Bloomington, IL. We couldn’t have asked for a better event… beautiful weather, a good golf game, cold beverages, hot food, niche specialty tradeshow, networking, education, and most importantly, lots of great industry professionals coming to enjoy a couple of days together. That is what the Farm Agents Council is.

It was another successful event, with over 112 golfers putting up some fantastic scores and then over 150 people coming together for the tradeshow/social hour. The Friday morning education session with Bobby Shomo on Agency Perpetuation had everyone taking notes and asking many great questions to benefit their agencies.

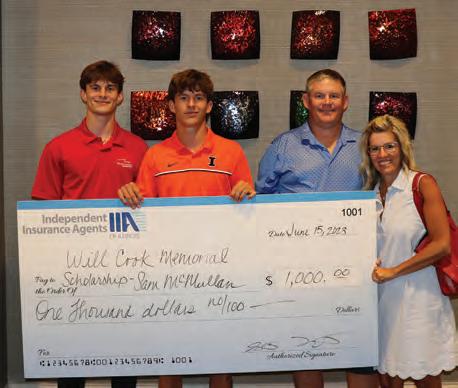

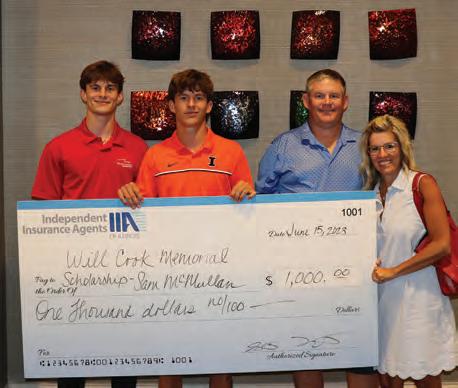

During the event, the FAC recognized the recipient of the inaugural Will Cook Memorial Scholarship, which was established in honor of late FAC member and Frontier-Mt. Carroll Mutual Insurance Company employee, Will Cook. The scholarship will be awarded annually to one Illinois high school senior interested in pursuing an agricultural area of study including, but not limited to, farm labor, grower, farm/ranch management, biology, horticulture, farm science, agriculture sales, or insurance. The recipient will receive $1000 towards their first semester of college. After careful review of many great applications, Governing Board Chair, List Quest, on behalf of the FAC Board, presented the inaugural scholarship to Sam McMillan.

During the Golf Outing & Annual Meeting, the FAC raised over $1,200 for IIAPAC, IIA of IL’s State Political Action Fund. The 50/50 winner, Kyle Johnson with Johnson Insurance Agency, was kind enough to donate his winnings back to the FAC Will Cook Memorial Scholarship fund.

By Shannon Churchill

Overall, the event was a great success, and the FAC Board looks forward to welcoming everyone back to Bloomington, IL, on June 13-14, 2024. Mark your calendars now!

Congratulations to the following winners from the event:

Hole Contest Winners:

Devin Conkright

Lisa Rau

Jon Miller

Neil Schippert

First-Place Winners:

Adam Krultz

Ryan Miller

Derek Carroll

Clark Carroll

Second-Place Winners:

Mike Sebben

Dayton Kilgus

TJ Welte

Brian Egan

30 insight july 2023

Thank you to our Sponsors of the 2023 Golf Outing & Annual Meeting

Harvesting Sponsors

Illinois Insurance Pre-Licensing Program

Cultivating Sponsors

Planting Sponsors

®

Save the Date

FAC Mid-Winter Meeting

February 1-2, 2024

Embassy Suites, East Peoria, IL

Stay Up-To-Date

Stay up to date with the Farm Agents Council on our website at www.ilfarmagents.com or through Facebook at www.facebook.com/FarmAgentsCouncil.

Not a member of the FAC, but would like to find out more? Reach out to us at farmagents@iiaofil.org.

Inaugural Will Cook Memorial Scholarship Recipient Named

Sam McMillan, a 2023 graduate of Iroquois West High School was very active as Captain the basketball and football teams, participating in a variety of organizations including the Spanish Club, National Honor Society, Lutheran Youth Organization, Mentor Program, Raider Rowdies, and the FFA. He has volunteered for the American Red Cross Blood Drive, Toys for Tots, Community Work Days, Meals on Wheels, and more. Sam will be attending Illinois State University this fall to study Insurance/Risk Management. He plans to graduate and return to his family’s insurance agency with the hopes of running it someday. Sam hopes to continue the legacy of involvement and plans to give back to the industry which has already given so much to his family. Congratulations Sam McMillan!

july 2023 insight 31

The McMillan Family (pictured left to right): Jack, Sam, Jeff, Lisa

Pekin Life Insurance Company Holds Annual Meeting

Pekin Life Insurance Company held its annual meeting on Tuesday, May 9, 2023.

The Company reported net loss of $4.7 million, for the year ending December 31, 2022. Premium income increased by 0.7 percent to $199 million. Life Insurance in force exceeded $21.1 billion at year-end 2022.

At the meeting, shareholders elected directors Anthony S. Burkhart, Vincennes, Illinois; Brian K. Lee, Pekin, Illinois; Sheri N. Roser, Enfield, Illinois, to three-year terms, to expire in May 2026.

Other directors whose terms continue are: Craig W. Concklin, Hinsdale, Illinois; Daniel V. Connell, Tremont, Illinois; Brian R. Dennison, Morton, Illinois; James W. Hefti, Peoria, Illinois; John S. Heller, East Peoria, Illinois; and Thomas C. Hornstein, Marco Island, Florida.

Pekin Insurance officers elected to Pekin Life Insurance Company included: Daniel V. Connell, Chairman of the Board, President & Chief Executive Officer; Craig W. Concklin, Vice Chairman of the Board; Jocelyn A. Duncan, Senior Vice President and Chief Operating Officer; Ryan J. Hanson, Senior Vice President & Chief Financial Officer; Joel M. Jackson, Senior Vice President; Tyler Petersen, Senior Vice President – General Counsel & Secretary; Gregory C. Bee, Vice President - Chief Risk Officer; Cynthia D. Blackburn, Vice President – Human Resources; Amy M. Darling, Vice President - Life Claims; Eric M. Shane, Vice President - Life Underwriting; Phillip L. Evans, Vice President – Administrative Services; David M. Coughlin, Vice President - Sales and Marketing; Amy L. Bingham, Vice President - Chief Information Officer; and Michele E. Ginther, Controller.

Pekin Life Insurance Company is an integral part of the Pekin Insurance® group of companies.

Pekin Life Insurance Company stock trades under the symbol “PKIN” and is listed on the OTC Pink Marketplace. A multi-line company, Pekin Life Insurance Company offers individual life which includes term life, whole life, universal life, as well as Medicare supplement, annuity, and pre-need coverages.

Other products offered by the Pekin Insurance group include personal automobile, homeowners, motorcycle, recreational vehicle, boatowners, personal umbrella, commercial automobile, businessowners, commercial property and liability, workers compensation, commercial umbrella and bonds.

Information about Pekin Life Insurance Company can be obtained by visiting www.pekininsurance.com.

Pekin Life Insurance Company’s Pathway® Division - 30th Anniversary Milestone

Pekin Life Insurance Company’s Pathway® division celebrated its 30th anniversary on June 1, 2023. Formed in 1993, Pekin Life Insurance Company’s Pathway® division is dedicated to helping clients and their families discover the benefits of pre-need funeral insurance through their network of over five hundred funeral home agents throughout the United States.

Over the past 30 years, Pekin Life Insurance Company’s Pathway division has established itself as a trusted partner to clients interested in pre-arranging and pre-paying for their funerals. They have delivered innovative product solutions, information, and exceptional service. The company’s success is a testament to its employees’ hard work and dedication, who have helped it evolve and adapt to the market’s ever-changing needs.

To mark the occasion, Pekin Life Insurance Company’s Pathway division is launching a series of initiatives and events to celebrate its 30th anniversary. These initiatives will include a special anniversary icon and a series of employee and client appreciation events.

Pekin Life Insurance Company’s Pathway division is an insurance industry leader in pre-arrangement coverage, licensed in twelve states and actively writing business in ten states, with their home office in Pekin, Illinois. For more information, visit www.pekininsurance.com/personal/life/ funeral-preplanning.

West Bend Mutual Insurance Company Leader in Top Workplaces

West Bend Mutual Insurance Company was announced as the first-place winner in the large company category for the Milwaukee Journal Sentinel’s Top Workplaces in Southeast Wisconsin. It is the twelfth consecutive year in which West Bend has placed in the top four among a prestigious list of 160 companies named to the 2023 Top Workplaces list.

Rankings are based entirely on employee feedback. Top Workplace companies are measured on company leadership, career opportunities, workplace flexibility, compensation, benefits, and the impact company policies have on innovation and morale. This announcement follows recent recognition as the sixth-place winner for Top Workplace in the USA. Also, West Bend’s Madison location received Dane County’s Top Workplace award for the third consecutive year.

32 insight july 2023 INSIGHT | associate news

At the same ceremony, Kevin Steiner, CEO of West Bend, was honored with a special Leadership Award as the result of the top workplace survey. Leadership award recipients were chosen based on scores from employee responses to a survey statement: “I have confidence in the leader of this company.” According to one statement, Steiner “leads the organization by example and places high value on relationships, excellence, integrity, and responsibility.”

“Our vision remains to be the company of choice for our associates, agency partners, and policyholders,” stated President Rob Jacques. “This award is evidence that we are succeeding at creating a positive and motivating environment.”

“The recognition we receive as a top workplace is significant,” says Kevin Steiner. “It helps us attract and retain talented individuals who want to be part of our company. Congratulations to our more than 1,500 associates who work daily to make West Bend a special place.”

Rockford Mutual Announces Employee Highlights

Rockford Mutual Insurance Company recently made several announcements.

Barb Ridley, Customer Service Specialist, celebrates 41 years with Rockford Mutual on June 28, 2023.

Nichole Dickerson was promoted to Assistant Manager –Commercial Lines Underwriting effective May 02, 2023. In her new role, Nichole is responsible for reinforcing the success of the Commercial Underwriting Department at Rockford Mutual.

Jamie Keltner, Commercial Underwriter, recently earned her Associate in Insurance (AINS) Designation from The Institutes.

Ethan Lane, Assistant Claims Manager, joined Rockford Mutual on May 15, 2023.

Zachary Dugger, Quality Assurance Analyst, joined Rockford Mutual on May 23, 2023.

Commercial & Personal Lines

july 2023 insight 33 associate news | INSIGHT

Insurance solutions for homeowners and small, medium, and large businesses. Competitive pricing, multi-product discounts, and easy submission process! APPLY TO BE AN AGENT: WWW.GUARD.COM/APPLY Not all Berkshire Hathaway GUARD Insurance Companies provide the products described herein nor are they available in all states. Visit www.guard.com/states/ to see our current product suite and operating area.

Check out the community - for members only! Here you can share, discuss, ask questions and more! connect.iiaofil.org Join the conversation! See what other members are experiencing in their agencies and chat about it!

Thank you to our Associate Members.

Diamond Level

Platinum Level

Progressive

Surplus Line Association of Illinois

Gold Level

Arlington/Roe

Blue Cross/Blue Shield of IL

Keystone Insurance Group, Inc.

Pekin Insurance

Silver Level

Imperial PFS

IMT Insurance

SECURA Insurance

West Bend Mutual Insurance Co.

Bronze Level

A. J. Wayne & Associates

AAA Insurance

AMERISAFE

AmTrust North America

Auto-Owners Insurance Co.

Badger Mutual Insurance Company

Berkley Management Protection

Berkshire Hathaway Guard Insurance Companies

BluSky Restoration Contractors

BriteCo Jewelry & Watch Insurance

Central Illinois Mutual Insurance Company

Chubb

Columbia Insurance Group

Continental Western Group

Cornerstone National Insurance Company

Cowbell Cyber

Donald Gaddis Company, Inc.

Donegal Insurance Group

EMC Insurance

Encova Insurance

Erie Insurance Group

Foremost Choice Property & Casualty

Forreston Mutual Insurance Company

Frankenmuth Insurance

Grinnell Mutual Reinsurance Company

IA Valuations

Illinois Mine Subsidence Ins. Fund

Illinois Public Risk Fund

Indiana Farmers Insurance

Insurance Program Managers Group

J M Wilson

Liberty Mutual/Safeco Insurance

Madison Mutual Insurance Company

Main Street America Insurance

Maximum Independent Brokerage, LLC

Mercury Insurance Group

Method Workers Comp

Midwest Insurance Company

Nationwide

NHRMA Mutual Workers’ Compensation

Previsor Insurance & Missouri Employers Mutual

PuroClean Disaster Services

Rockford Mutual Insurance Company

ServiceMaster DSI

SERVPRO of Gurnee

Society Insurance

SPRISKA - Specialty Risk of America

Travelers

UFG Insurance

UIG - The Agent Agency

Utica National Insurance Group

W. A. Schickedanz Agency, Inc./Interstate Risk Placement

Western National Insurance

Westfield

july 2023 insight 35

associate news | INSIGHT

Greg Steffen Receives 2023 Kenny Long Award

Greg Steffen, Agent and Owner of Compass Insurance is the recipient of the 2023 Kenny Long Award, presented by the Illinois Association of Fire Protection Districts (IAFPD). The Kenny Long Award was established in 1996 and was named after a leader, a strong visionary, and someone truly devoted to the mission of the IAFPD. The recipients of this prestigious award are carefully chosen by the IAFPD Board of Directors, recognizing individuals whose contributions have made a profound impact on the fire service industry as a whole, leaving a lasting legacy for years to come. The IAFPD recognized Greg as a “perfect fit for everything this award means.”

According to Joey Samuelson, another Agent and Owner at Compass Insurance, “Greg loves his Fire departments and has carved a niche for our agency over the past 20+ years. Being a First Responder and fighting fires himself, along with two of our other agents, Myron Munyon and David Fulton, we love our heroes.”

Compass Insurance has 11 Central Illinois locations and employs over 50 insurance professionals. Compass Insurance was the 2018 recipient of the IIA of IL Agency of the Year Award (10+ employees).

Congratulations, Greg!

Association Update

June Wrap-Up

Association Staff Present at High School’s Career Day

Association Staff Expand Their Knowledge

The IIA of IL training room served as the host site for the Illinois Society for Association Executives (ISAE) Annual Meeting on June 12th. The meeting offered the opportunity to network with other association executives and featured leadership speaker Steve Thomas who presented, “Culture is as Leadership Does!”

Association staff members Shannon Churchill (Director of Information & Technology), Jennifer Jacobs (HR Director), and Lori Mahorney (Central & Southern IL Marketing Rep) attended this event. Staff members continually expand their knowledge in order to better serve our membership!

Shannon Churchill, Director of Information and Technology, and Jennifer Jacobs, HR Director, presented to 8th grade students at Riverton Middle School’s Career Day. They shared the association’s careers in insurance video and a powerpoint developed using InVest program materials. These materials are available to association members to use at any opportunity you might have to spread the word about careers in the industry. Check out the video at www.chooseindependent.com/chooseinsurance and access InVest materials at www.independentagent.com/invest.

36 insight july 2023

INSIGHT | agency members in the news

July 18 & 20 Virtual Event

This is a full two day course split between Tuesday, July 18 and Thursday, July 20. CE Available in other States, contact IIA of IL for details

16 hours of IL CE credit

The July Ruble features instructors Keith Wilts and Richard Pitts. Keith will head up day one with topics covering business income coverage and claims and the debate on additional insured versus named insured. After taking a day off, you will head back refreshed on day two with Rick Pitts.. Rick will discuss employment practices liability insurance and employment liability. It is not to be missed!

www.iiaofil.org/education

New Members member agency

Haywood and Fleming Associates

Gary, IN

K. Marsh Insurance Vandalia, IL

MKINS LLC dba Mudron Kane Insurance Joliet, IL

Noah P. Sullivan Oak Park, IL

S. Craig Reincke Springfield, IL

The Insurance Gal, LLC Rockford, IL

copper associate member

ClientCircle Des Moines, IA

Enterprise Rent-A-Car Lombard, IL

STONEMARK, INC. “Premium Finance Group” Frisco, TX

For information regarding IIA of IL membership or company sponsorship, contact Tom Ross, Director of Membership Services, at (217) 321-3003, tross@iiaofil.org.

july 2023 insight 37 iia of il news | INSIGHT

October 10-12 Peoria, IL ILConvention.com Mark Your Calendar Education over 30 classes a month

Pre-Licensing, CIC, CISR, E&O,

Webinars

Ethics, Flood,

for the insurance professional by the insurance professional

OPPORTUNITIES/SPACE AVAILABLE/RETAIN OWNERSHIP

13. We are a 100 year old Northbrook agency looking to discuss any mutually beneficial opportunity. Our producers, mergers, clusters and agency purchases receive 50% commissions on new and renewal business without any expenses. We can provide: office space, phones, agency management system, service renewals and changes. The companies we represent are: Badger Mutual, Employers Mutual, General Casualty, Guide One, Hartford, Kemper, Progressive, Rockford Mutual, Safeco, State Auto, Travelers and Met Life. Contact:

Nancy Solomon

Martini, Miller & Schloss, Inc.

(847) 291-1313

Ron@martini-miller.com

INDEPENDENT INSURANCE AGENCIES WANTED

17. We are an Independent family-owned agency located in the Chicago area. We are looking to expand through growth and acquisition. If you have a small to medium sized agency and are looking to sell, call or send us a message. We are strictly looking for Personal Lines and Small Commercial accounts with preferred companies.

GALO Insurance Agency, Inc

(847) 832-0888

steve@galoagency.com

AGENCY WANTED

20. Since 2004, Central Illinois Agents Group LLC has been providing independent agents with a variety of markets with contingency opportunities. Agents have availability to several markets that they may not be able to sustain or maintain on their own. We have markets for personal, commercial, agricultural and crop insurance lines. Let us help you get to the next level.

Visit www.ciagonline.com for contact information.

AGENCY/AGENTS/PRODUCERS WANTED

02. Forest Park/Oak Park agency for over 60 years, will meet your needs by providing space, markets, marketing & sales support, automation, merging with or purchasing your agency. Perpetuation/ Succession Plans, BuySell Agreements also available. We have experienced, educated and dedicated staff for you and your clients. Have access to our numerous companies, office services and many other resources. Retain ownership in your book with contingency. Please look closely at us- we are an agency you want to do business with! We’ve done it before, we know how- we make it easy! Visit our website at forestagency.com/agents.html, or call for a confidential discussion and a list of Agency benefits.

Dan Browne will provide an agency evaluation/appraisal at little cost to you. Please call:

Dan Browne or Cathy Hall

Forest Insurance

(708) 383-9000

www.forestinsured.com/mergers-acquisitions

We

CareerPlug will provide IIA of IL members access to a free account that can be used to post jobs, manage applicants, and improve the organizations’ employment brand. Association members can also access a “Pro” version of CareerPlug for a special rate to take hiring to the next level. Learn

38 insight july 2023

INSIGHT | classifieds

Make Hiring Easier + CareerPlug’s hiring software helps agents attract more qualified candidates, identify the right candidates with confidence, and improve hiring results.

more about CareerPlug and check out the brand new IIA of IL job board at www.iiaofil.org

From tents to RVs, beaches to hiking trails, each campground offers a unique experience. SECURA Insurance and Bedford Underwriters work together to provide a comprehensive insurance program tailored for these accounts. Insurance for adventurers Interested in learning more? Contact Bedford Underwriters at 800-735-1378 ext. 112 or quotes@BedfordUnderwriters.com

Workers’ Compensation • Transportation – Liability & Physical Damage • Construction Liability • Fine Art & Collections Homeowners – Including California Wildfire & Gulf Region Hurricane • Structured Insurance • Financial Lines • Surety Aviation & Space • Environmental & Pollution Liability • Real Estate • Reinsurance • Warranty & Contractual Liability Infrastructure • Entertainment & Sports ...And More To Come. MORE TO LOVE FROM APPLIED.® MORE IMAGINATION. ©2023 Applied Underwriters, Inc. Rated A- (Excellent) by AM Best. Insurance plans protected U.S. Patent No. 7,908,157. It Pays To Get A Quote From Applied.® Learn more at auw.com/MoreToLove or call sales (877) 234-4450