MAKE WAY FOR THE NEXT GENERATIONS

Millennials and Generation Z are taking over the world. Here is how you can address their financial concerns.

PAGE 12

ALSO INSIDE:

Jamie Hopkins: Financial services needs TRUST

PAGE 8

Keep sequence-of-risk returns from sinking retirement

PAGE 24

Individual DI could take your firm to the next level

PAGE 32

THIS ISSUE: SERVING GENERATIONS Y AND Z Life Insurance • Health/Benefits Annuities • Financial Services JULY 2023

Photograph courtesy of HBO

UNCOVER NEW MEMBERS WITH DATA-DRIVEN PROSPECTING

Extract New Member Gold with Personalized Messages that Prompt Consumers to Act

Discover the Power of Funnel from datadecisions Group

SEE HOW IT WORKS ON PAGE 3

JULY 2023

Ease of use and convenience are key to agent productivity. Admin work does not close sales.

If your agency is actively prospecting for Medicare clients, you need:

• The best available prospect lists

• 24/7 website to supply counts and facilitate an easy order process

• A platform that records previous orders and instantly handles ongoing suppressions/lockouts

Introducing Funnel — the ultimate lead generation front end that enables you to mine for Medicare gold:

Market research – We conduct comprehensive surveys with seniors to understand their opinions and intentions.

Model - Each senior is meticulously scored to assess their likelihood of purchasing a specific plan. Our custom models developed based on your members, policyholders or responders, help drive targeted results.

Filtering Criteria – Funnel suppresses irrelevant prospects, including deceased persons, PO Boxes, and seniors only interested in enrolling in Part A/B.

Defined Profile – You have the power to define the desired profile, which is seamlessly loaded into your portal for efficient targeting.

Example profiles:

• T65 or Age-ins

• Dual Eligible

• C-SNP

• Likely to buy Medicare Supplement

• Intend to enroll in Medicare Advantage

Strike Gold with Funnel

Clients have experienced a 5X increase in their response rate, while a national agency DOUBLED their premium production within just 12 months.

With Funnel, your marketing teams gain valuable insights into territory premium potential, enabling sales teams to enjoy a steady flow of high-quality leads. Funnel also enhances your ability to recruit agents by providing a visual representation of the tremendous opportunity in front of them.

Turn to page 3 to see how datadecisions

Group helps you extract new member gold with Medicare marketing that sets your message apart and positions your plan as the superior choice for seniors.

*Offer expires August 15, 2023. DDG approval of marketing materials is necessary.

Accelerate Agent Production with Funnel:

Visit datadecisionsgroup.com/medicare-goldrush today to explore more about better Medicare audiences, then give us a call to schedule

demonstration and receive 1,000 free contact names.*

Maximize Medicare Sales Success

a

Enhance your client’s financial future today! Call 1-888-501-4043 or visit img.anicoweb.com for more information or to run an illustration. AMERICAN NATIONAL INSURANCE COMPANY 888-501-4043 | img.anicoweb.com IMG23112 | INN 07.2023 ENHANCED PERFORMANCE from American National Insurance Company Potential for greater Interest Earnings, now with increased income New 25 bps interest bonus added to all interest crediting strategies2 Target premium increased an average of 20% across the board Help prepare your client for the future with protection from downside risk using our newly enhanced Signature Performance IUL.1 The Newsweek Logo itself is the intellectual property of Newsweek and all other rights are reserved. 1) No change in California. CA producers will continue to use the current product (IUL19) until otherwise communicated. Expert App and illustrations will reflect correctly by state. 2) The interest bonus will never be less than the minimum guarantee. Policy Form Series: IUL23; IBR23 (Forms may vary by state). American National Insurance Company, Galveston, Texas. For Agent Use Only; Not for Distribution or Use with Consumers.

INTERVIEW

8 A matter of trust

Trust and transparency are building blocks of an advisor’s success, said Jamie Hopkins, managing partner of wealth solutions at Carson Group. In this interview with Publisher Paul Feldman, Hopkins describes why he believes the industry must focus on building trust.

FEATURE Make way for the next generations

By Susan Rupe

Today’s young adults may have different financial concerns than their parents did at the same age, but they still need an advisor’s help.

IN THE FIELD

20 The top of the ladder

By John Hilton Chlora

LindleyMyers, one of the country’s top regulators, already had a successful insurance career and earned a law degree. But she has a few more goals she wants to achieve.

LIFE

24 Help clients keep sequence-ofreturns risk from sinking their retirement

By John McWilliams

By John McWilliams

A well-designed permanent life insurance policy can provide clients with additional confidence and peace of mind.

ANNUITY

28 How annuities can be part of your client’s retirement formula

By Shawn Plummer

Americans fear running out of money in retirement. Here are some ways to ease that fear.

HEALTH/BENEFITS

32 How individual DI took my firm to the next level

By Bryan M. Kuderna

By Bryan M. Kuderna

If you want to be a true financial advocate, start by incorporating disability insurance in your planning process.

ADVISORNEWS

36 Help clients turn their investment properties into retirement income

By Rob Johnson

Some considerations that might help you as you review clients’ long-term goals and strategy.

BUSINESS

38 How to get compensated with introductions

By Joe Templin

You deserve to be paid for the value you create for clients.

IN THE KNOW

40 Several major insurers post disappointing numbers even while annuity sales soar

By John Hilton

A look behind first-quarter results.

INSURANCE & FINANCIAL MEDIA NETWORK

150 Corporate Center Drive • Suite 200 • Camp Hill, PA 17011 717.441.9357 www.InsuranceNewsNet.com

PUBLISHER Paul Feldman

EDITOR-IN-CHIEF John Forcucci

MANAGING EDITOR Susan Rupe

SENIOR EDITOR John Hilton VP, SALES & MARKETING Susan Chieca

CREATIVE DIRECTOR Jacob Haas

GRAPHIC DESIGNER Shawn McMillion

SENIOR CONTENT STRATEGIST Lori Fogle

EMAIL & DIGITAL MARKETING SPECIALIST Megan Kofmehl TRAFFIC COORDINATOR Sorayah Talarek

MEDIA OPERATIONS DIRECTOR Ashley McHugh

NATIONAL SALES DIRECTOR Sarah Allewelt

NATIONAL ACCOUNT DIRECTOR Brian Henderson

NATIONAL ACCOUNT DIRECTOR Tobi Schneier

DATABASE ADMINISTRATOR Sapana Shah

STAFF ACCOUNTANT Katie Turner

Copyright 2023 Insurance & Financial Media Network. All rights reserved. Reproduction or use without permission of editorial or graphic content in any manner is strictly prohibited. How to Reach Us: You may e-mail editor@insurancenewsnet.com, send your letter to 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011, fax 866.381.8630 or call 717.441.9357. Reprints: Copyright permission can be obtained through InsuranceNewsNet at 717.441.9357, Ext. 125, or reprints@insurancenewsnet.com. Editorial Inquiries: You may e-mail editor@insurancenewsnet.com or call 717.441.9357, ext. 117. Advertising Inquiries: To access InsuranceNewsNet Magazine’s online media kit, go to www.innmediakit.comor call 717.441.9357, Ext. 125, for a sales representative. Postmaster: Send address changes to InsuranceNewsNet Magazine, 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011. Please allow four weeks for completion of changes. Legal Disclaimer: This publication contains general financial information. It should not be relied upon as a substitute for professional financial or legal advice. We make every effort to offer accurate information, but errors may occur due to the nature of the subject matter and our interpretation of any laws and regulations involved. We provide this information as is, without warranties of any kind, either express or implied. InsuranceNewsNet shall not be liable regardless of the cause or duration for any errors, inaccuracies, omissions or other defects in, or untimeliness or inauthenticity of, the information published herein. Address Corrections: Update your address at insurancenewsnetmagazine.com

InsuranceNewsNet.com/topics/magazine View and share the articles from this month’s issue IN

online » read it

THIS ISSUE

12 JULY 2023 » VOLUME 16, NUMBER 07

&

MEDIA NE TWORK 8 July 2023 » InsuranceNewsNet Magazine 1 Photograph courtesy of HBO

INSURANCE

FINANCIAL

Want to attract young clients? Learn to speak emoji �� ����

I’m a boomer. My generation didn’t use emojis. At least, not the online kind. About the closest we came to them were icons that we all recognized that were used in graffiti or on flags. Like the peace sign, or the Rolling Stones’ icon. Or this guy.

pandemic and to begin working with a financial advisor. The study also showed these young adults were more confident about their careers and in their ability to achieve financial security.

Generation Y, commonly known as the millennials, and Generation Z have left us in the dust. They have entire vocabularies of emojis. What’s interesting, though, is that the two generations interpret some of the emojis differently.

For example, take the skull emoji. There are more than one. The one I have in mind is this one.

Gen Z is also interested in having more investment and retirement options. For example, more than a third of them wish they could select environmental, social and governance investments, and nearly as many say they’re interested in fractional shares.

About half of Gen Z (52%) and millennial (48%) workers — my older daughter being one of them — are using their health savings accounts to save for future health care costs in retirement, and more than half are investing their HSAs in mutual funds and other types of investments.

making sure their financial decisions are aligned with their life goals. “Our advisors take the time to really get to know our millennial clients and discuss how they can use investing strategies to work towards their longterm objectives.”

I have found these differences in the ways my daughters approach their savings and investments.

My older daughter, the millennial, uses the tried and true — i.e., older — methods through her employer, like a 401(k) and HSA, for example. However, my younger daughter, while still in grad school, used an online savings app that had built-in access to savings advisors/counselors. Having just graduated in May, she was able to save significantly while going to school and working a part-time job.

According to dictionary.com, this emoji was added in 2015 and millennials used it in a “lighthearted way … usually to indicate playful exhaustion.”

Gen Z, says the site, is more likely to “respond to a joke with a line of skull emojis, intended to mean ‘I’m dying of laughter’ or ‘I’m dead from laughing.’”

Most likely, most of those reading this column haven’t realized that subtle difference between the generational interpretation of emojis.

How is this relevant to financial advisors, you might ask?

Well, understanding these generations — and the nuances in their differing needs and preferences — is the best way to build relationships and provide financial services to them.

Gen Z, for example, intends to retire early, according to Northwestern Mutual’s 2022 Planning & Progress Study. They were most likely to concentrate on their savings during the

These younger generations are also facing different obstacles in their investment planning than we older boomers are. While rising costs and market volatility continue to cause concern for all workers, Gen Z and millennial workers are more likely than older workers to cite unexpected expenses, education costs and supporting family members as obstacles to saving for retirement, according to a Schwab Retirement Plan Services study.

According to Linda Chavez, the founder and CEO of Seniors Life Insurance Finder, her firm takes a different approach to each age group. For example, with Gen Z investors, they are likely to focus more on digital solutions and take a more hands-on approach to engagement. Gen Z investors are used to having access to information instantly at their fingertips, she explained, so financial advisors should provide them with tailored online advice and mobile apps that allow them to see their portfolios in real time.

Millennials, she said, are more interested in planning for their future and

Both, of course, check out services and advisors online, especially via social media. Establishing a presence and building the beginnings of a relationship on those platforms — especially through financial education — are essential to reaching these generations. Though favoring apps and social media, younger generations do want a component of human advice amid the electronic do-it-yourself services. I know — a shocker.

So, delving into the particular wants and needs of each of these generations — and the individual members of these groups — will be the way forward to building a younger client base. Each of these younger generations is intent on savings and investing, and, of course, will reap the inherited wealth of the older generations. All important incentives to learn to speak their language — even if that language is emoji.

John Forcucci Editor-in-chief

WELCOME LETTER FROM THE EDITOR 2 InsuranceNewsNet Magazine » July 2023

?

Tapping into the Medicare Gold Rush

How to differentiate in a challenging member acquisition market

By Mike Hail, CEO, datadecisions

Group

Navigating the competitive market for member acquisition can be challenging, but with datadecisions Group (DDG), your Medicare marketing efforts can rise above the crowd and tap into the immense potential of the Medicare gold rush.

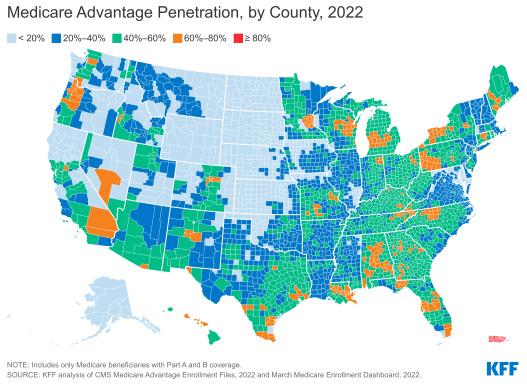

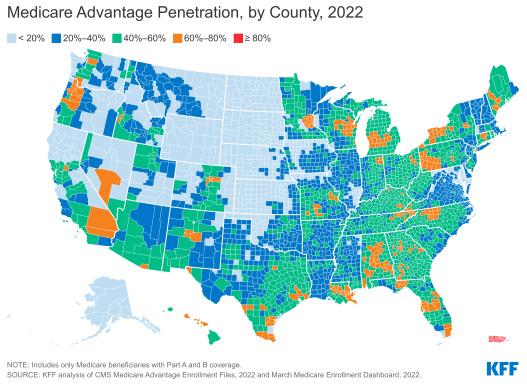

In 2022, an astounding 28 million individuals enrolled in a Medicare Advantage plan, comprising 48 percent of the eligible Medicare population. By 2032, the Congressional Budget Office projects that the share of all Medicare beneficiaries enrolled in Medicare Advantage plans will rise to 61 percent.1

With an average of 39 Medicare Advantage plans available to beneficiaries in 2022, they are presented with a wide range of options. In fact, it’s the largest number of plans available in more than a decade. However, crucial details such as network limitations, out-of-pocket expenses during illnesses, and the limited value of supplemental benefits are often overlooked when seniors are informed about how Medicare Advantage “will cost them less and provide them more.”

The adoption of Medicare Advantage plans varies across the country, with at least 50 percent of beneficiaries enrolled in 25 states last year. Additionally, in 2022, approximately one in five Medicare beneficiaries (21 percent) lived in counties where at least 60 percent of all beneficiaries enrolled in Medicare Advantage plans (321 counties). Furthermore, nearly 69 percent of beneficiaries were in zero-premium individual Medicare Advantage plans with prescription drug cover (MA-PDs) and paid no premium except for Medicare Part B.

Medicare Advantage plans offer various benefits, such as eye exams and/or

glasses (over 99 percent coverage), hearing exams and/or aids (98 percent coverage), and dental care (96 percent coverage). Similar benefits are also provided by most Special Needs Plans (SNPs).

plans that align with desired benefits, pricing, and most importantly, address the individual consumer needs in the messaging.

Modeled audiences: Simply relying on age and income-based targeting is no longer sufficient. Our sophisticated acquisition models analyze hundreds of variables to identify seniors who are genuinely interested in purchasing Medicare Supplemental policies, not just Medicare Advantage plans.

Our platform has doubled premium production within a 12-month period for field forces.

Implications for Medicare Marketing

The good news is that each day, a staggering 10,000 individuals become eligible for Medicare. Among them, 41 percent rely on their independent insurance agent for information, as 51 percent of new enrollees express a limited understanding of their options. 2 This indicates a significant opportunity for effective marketing.

However, the challenge lies in the fact that seniors often perceive that provider choice doesn’t matter, as many seemingly offer zero premiums with dental, vision, and hearing coverage.

At datadecisions Group, we empower your Medicare marketing initiatives to go beyond the status quo and position your plan as the superior choice for seniors. Here’s how we do it:

Market research: Our approach is rooted in comprehensive market research. By leveraging results from conjoint and segmentation studies, we design

MarTech platform: Our cutting-edge MarTech platform is designed to supercharge your marketing efforts. It creates custom models tailored to your local market, taking into account factors like Medicaid expansion status. It highlights the best available audiences for the specific plan being promoted i.e. Dual-Eligible Special Needs Plan (D-SNP). The platform also provides audience counts based on geography, including zip code, county, and designated market areas (DMA). Additionally, it ensures efficient follow-up by archiving order records and managing contact frequency. Rest assured, the platform securely delivers audience data to your production vendor.

Mike Hail, CEO, datadecisions Group has over four decades of lead generation management and audience development modeling experience in the healthcare industry.

Visit datadecisionsgroup.com/medicare-goldrush to learn more about better Medicare audiences, then give us a call to schedule a demonstration and receive 1,000 free contact names. (Marketing materials must be reviewed and approved by datadecisions Group. Deadline: August 15, 2023) 1 KFF analysis of CMS Medicare Advantage Enrollment Files, 2010-2022 2 DDG Medicare Options Consumer Key Driver Analysis, 2022

What’s in the news on InsuranceNewsNet.com

Nationwide’s claims adjusters speak out on their increased workloads, while another insurer is ordering its workers back to the office and a life carrier has decided to stop selling new fixed indexed universal life policies.

Nationwide adjusters make 6 demands to rectify overwork concerns

to “bundle” home and auto. In May, U.S. News & World Report ranked Nationwide third for home and auto bundling.

Nationwide reported one of its best years financially in 2022, with a record $57 billion in sales and $1.4 billion in net operating income. Nearly $19 billion in claims and benefits was paid to customers.

The message noted that degraded working conditions can only hurt Nationwide employee retention and also impact the company brand with policyholders.

“These circumstances not only compromise the quality of claims handling but also have the potential to negatively impact customer satisfaction and the overall reputation of the company,” the message reads. “It is imperative for Nationwide to take immediate action to address this staffing shortfall.”

by John Hilton

An email sent to all Nationwide employees aired complaints that “expectations have become overwhelming and impractical” for claims adjusters and made six demands for change.

Nationwide recalled the message the following morning, a source said. An emergency meeting held later in the day did little to placate employees, the source added.

“Over the past six months, we have noticed a significant increase in our workload accompanied by unrealistic deadlines and objectives,” the message reads. “While we understand the importance of meeting targets and providing quality service to policyholders, the current expectations have become overwhelming and impractical. This has led to a detrimental impact on

our well-being resulting in heightened stress levels, burnout, and a decline in job satisfaction.”

A Nationwide spokesman did not deny the existence of the email but did not respond to further emails and phone calls seeking comment.

Adjusters inspect property damage or personal injury claims to determine how much the insurance company should pay for the loss.

The message claims Nationwide is understaffed and asking its claims adjusters to take on too many hours. It asks for the company to undertake a workload study to determine what is the appropriate output for a claims adjuster.

The property and casualty market is highly competitive, with companies like USAA, Progressive, Allstate, Geico and others competing to convince consumers

The message, which was sent anonymously to InsuranceNewsNet, includes references to potential violations of Ohio Department of Insurance and federal Occupational Safety and Health Administration guidelines regarding work fatigue.

However, there are no federal laws that limit how many hours an employee can work in a single day. The federal law that applies to all employees is the Fair Labor Standards Act, which does not regulate how many hours a day or days in a row an employee can work.

Officials with the Ohio Department of Insurance did not respond to emails and phone calls for comment on the allegations in the message.

4 InsuranceNewsNet Magazine » July 2023

[Editor’s

Note: These are some of the major stories to which we are devoting ongoing coverage at InsuranceNewsNet.com.]

Read the full story online: https://bit.ly/nationwide23 InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback. com. Follow him on Twitter @INNJohnH. ICYMI IN CASE YOU MISSED IT

Farmers the latest to send employees back to the office

By John Hilton

While many Americans happily celebrate the three-year anniversary of working from home, and despite persistent labor shortages, some property and casualty insurers are mandating a return to the office.

Farmers Insurance recently informed its employees that anyone located within 50 miles of a Farmers’ office is required to be in that office at least three days a week beginning in September.

Headquartered in Los Angeles, Farmers is a private company. The insurer writes more than 19 million individual insurance policies across all 50 states through nearly 48,000 exclusive and independent agents and approximately 21,000 employees, according to the Farmers LinkedIn profile.

The move back to the office will allow employees to work together again in person, said Luis Sahagun, director, external communications for Farmers.

“We believe this will drive greater collaboration, creativity and innovation while also providing better opportunities

for learning, training, mentoring and career development,” he wrote in an emailed statement. “Over the course of the next few months, we’ll be finalizing details and working with our teams to make this transition smooth.”

Meanwhile, property and casualty insurers continue to battle fiercely for talent to fill positions such as underwriter, claims adjuster and agent. Lengthy employment ads can be found for these positions in nearly every urban area.

Working from home is proving to be an attractive and popular perk for employment seekers. Many workers value the flexibility, while others are happy to shed a stressful commute to the office.

The P/C insurance world is very competitive, and the big players are taking different approaches to the remote work question. InsuranceNewsNet reached out to several big insurers and here are their responses.

Allstate: Just 1% of Allstate’s 40,000member workforce is classified as

Global Atlantic to stop selling new FIUL policies

by John Hilton Global

Atlantic Financial Group will stop selling new fixed indexed universal life policies, effective July 1.

Employees were informed of the decision in a message from Rob Arena, co-president and head of individual markets. Officially, Global Atlantic is suspending sales of IUL, Arena said.

“During the last several years, sales of our indexed universal life insurance products have been steadily declining, from 16% of total Individual Markets’ new business production in 2013 to less than 3% today,” Arena wrote. “During that same time, we have continued to drive growth in our annuity and preneed platforms. The decision to focus on these opportunities is the right one for our business today.”

The decision will affect the employee count at Global Atlantic. Asked for further clarification, the company sent InsuranceNewsNet this statement:

“This decision has unfortunately resulted in a small staff reduction focused on life insurance new business roles. We are working closely with these employees to assist them in their transition to new career opportunities, both within and outside Global Atlantic.”

Global Atlantic’s fixed IUL sales dropped sharply in the first quarter, said Sheryl Moore, CEO of Moore Market Intelligence and Wink Inc.

“Frequent feedback from the field left me feeling unsurprised about their exit from the indexed life market,” she added. “The word on the street is that they

“office-based,” said Ben Tobias, senior public relations consultant for the insurer. Through surveys and focus groups, Allstate learned that 95% of its workers desire more flexible work.

Allstate sold its sprawling Northbrook, Ill., headquarters late in 2022 and has repeatedly stated no interest in finding another home.

State Farm: The largest auto insurer in the United States, State Farm leaned into the hybrid model early on. In spring 2021, the insurer announced that about 40,000 employees would be hybrid, and the remaining employees either remote or in-office.

Travelers: Travelers Insurance also gives employees the option to work from home up to two days per week. Travelers is home to 30,000 employees and 13,500 independent agents and brokers in the United States, Canada, the United Kingdom and Ireland.

Read the full story online: https://bit.ly/back23

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback.com. Follow him on Twitter @INNJohnH.

plan to reenter the indexed life market in 2025, but I would be surprised if they execute on that.”

Most private equity owned life insurers like to focus on fixed types of annuities, Moore explained.

The decision to exit the fixed IUL market does not impact existing policyholders, Arena assured staff. “We will continue to service those policyholders and deliver on our commitments,” he wrote.

Global Atlantic ranked 10th in total annuity sales during the first quarter with $3.2 billion, according to LIMRA. That is up from $1.95 billion in annuity sales during the year-ago quarter.

Read the full story online: https://bit.ly/globalfiul23

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback.com. Follow him on Twitter @INNJohnH.

July 2023 » InsuranceNewsNet Magazine 5 TOP PICKS FROM INSURANCENEWSNET.COM ICYMI

Could the insurance industry combat gun violence?

Could solving the nation’s tragic issue of gun-related deaths lie with the insurance industry? Insurers historically led the way in incentivizing improvements in auto, fire, flood and homeowner safety. Before seat belts, airbags and anti-lock brakes became standard equipment, insurance companies rewarded drivers with discounts for buying vehicles that came with such features.

Homeowners get discounts for installing smoke and carbon monoxide detectors, erecting childproof fences around swimming pools, and buying homes close to fire stations. So it follows that the insurance industry could perhaps be a catalyst for stricter gun control and firearm safety. Or does it?

A new survey by ValuePenguin, a personal finance website that analyzes and researches topics from insurance to credit cards, found that 75% of American consumers believe gun owners should be required to have liability insurance on their firearms and, insurance or not, 95% of Americans support some form of restriction on firearm access.

INSUFFICIENT RETIREMENT SAVINGS COULD BURDEN GOVERNMENTS

The chronic problem of Americans insufficiently saving for retirement has repercussions far beyond individual situations and could cost state and federal governments trillions of dollars in public assistance costs, reduced tax revenue, decreased household spending and standards of living, and lower employment.

A study by The Pew Charitable Trusts shows that every state in the country will be impacted over the next 20 years, with a combined $1.3 trillion extra burden for state governments

Populous states with aging populations are the most vulnerable, according to the study, with California leading the way with an estimated burden of nearly $200 billion, followed by New York ($103 billion), Texas ($99 billion) and Pennsylvania ($56 billion).

According to an analysis conducted for Pew, the share of households with people at least age 65 with less than $75,000 in annual income — a level that indicates financial vulnerability — will increase by 43% from 22.8 million in 2020 to 32.6 million in 2040. And as these workers age, inadequate

QUOTABLE

retirement savings will likely lead to reduced retirement income and quality of life for many. At the same time, this shortfall will put greater pressure on public spending and increase taxpayer burdens.

In addition, the survey said, Generation X is worried about retirement and longterm financial stability. Forty-three percent of Gen Xers worry their employer will suspend their 401(k) match, compared with 38% of millennials and 24% of baby boomers.

PROPERTY INSURERS EXIT CALIFORNIA

California homeowners who are looking for coverage have fewer options from which to choose as State Farm and Allstate announced they will no longer write new property insurance policies in the state.

The two insurers join AIG, which is withdrawing at least par tially from the state, as other insurers have ceased advertising and closed offices in response to huge losses from growing wildfire catastrophes and an unforgiving regulatory environment.

A spokeswoman for the Insurance Information Institute put it more succinctly. “With the five years of intense wildfires and losses that we’ve had, we pretty much lost all our underwriting profit that we had from the last 20 years,” said the institute’s Janet Ruiz.

State Farm’s displeasure with the California market has been brewing for years. In 2016, the giant insurer, which provides about 20% of the state’s fire insurance to homeowners, wanted to raise rates 6.9%. Instead, the California Department of Insurance ordered the company to cut rates by 7% and rebate policyholders more than $100 million.

IT’S CONSUMERS VS. THE FED, BANK CEO SAYS

What’s the greatest challenge to the Federal Reserve? It’s the power of the U.S. consumer, said Bank of America CEO Brian Moynihan.

“They were earning more money and they were spending it, and what you’re seeing is that’s dipping down,” Moynihan said when asked how the Fed’s policies are impacting the U.S. economy.

Regarding predictions of a mild recession, Moynihan said the Fed’s tightening policy has “had its effects.” Consumer spending for Bank of America customers is slowing down year to date. “That level is more consistent with a 2% growth economy and a 2% inflation economy, not a 4% inflation level economy,”

Source: Federal Reserve

6 InsuranceNewsNet Magazine » July 2023 NEWSWIRES

?

DID YOU KNOW

To me, it all really is going to come down to ‘is the economy gonna touch near a recession?’ Believe it or not, if that happens, I think it will be good news.

— Michael Yoshikami, founder and CEO of Destination Wealth Management

Nearly one-quarter of Americans spend more than they earn.

“GCU will NOT put a single penny of our annuity contract owners’ money into the Bermuda Triangle or any other financially engineered arrangement that could hurt the financial promise made to our members.”

an exceptional solvency ratio of 109.9% is the FIRST insurer ever to receive a GOLDEN TSR Ratio. Based on the GCU’s solvency, surplus to risk ratio, and reliability over 130 years, GCU is a standout for transparency and trustworthiness among insurance carriers in the United States!

Don’t send your clients’ safe money offshore! If you’re missing the booklet attached to this page, you can access it here: bit.ly/gcutriangle

WHY GCU focuses on protecting families and strengthening communities since 1892, with over $2.7 billion in assets. Protect your clients (and your business) by placing their money in a secure, trustworthy annuity offered by one of the most financially stable and transparent annuity carriers in the United States. www.GCUTrustedAnnuities.com

? Avoid the Bermuda Triangle By Protecting Your Clients Annuity Money

A Matter of Trust

Building trust and transparency are two keys to building success, said Jamie Hopkins, managing partner of Wealth Solutions at Carson Group, a national wealth management firm. A nationally recognized writer, researcher and educator, Hopkins is a regular contributor for Forbes, InvestmentNews and MarketWatch and he has been published in dozens of financial, educational and legal journals.

Prior to joining Carson Group, Hopkins was the co-director of the New York Life Center for Retirement Income and a professor in the Retirement Income Program at the American College of Financial Services.

Hopkins said his mother provided his “why,” as she raised him alone after his dad died when he was only 8. Facing retirement primarily reliant on Social Security and Medicare, Hopkins’ mother also provided another inspiration for him: to build trust in the financial services industry so that people like his mother can get the sound, honest strategy and advice to see them through their senior years.

In this interview with Publisher Paul Feldman, Hopkins describes why he believes the industry needs to focus on building trust.

Paul Feldman: How did you get into this industry?

Jamie Hopkins: In seventh or eighth grade, I wrote that I wanted to be a private equity attorney. I didn’t know what a private equity attorney was at the time — I must have seen it on TV. And I followed that path. In high school, I would tell people, “I want to be an attorney.” I went to Davidson College in North Carolina. They really pushed this notion of trust and being honorable. They have a great honor system. If you see $5 on the ground or you see somebody’s wallet, you don’t take it. That was drilled into us. You could leave your wallet with cash in it lying around for three days there, and nobody would touch it.

From there, I went to Villanova University for law school and my first real job was at a firm called Ennovance Capital, which is a private equity firm in Pennsylvania. After that, I ended up clerking in the appellate division, under

INTERVIEW 8 InsuranceNewsNet Magazine » July 2023

The Bernie Madoff case, says JAMIE HOPKINS, was a pivotal moment when he realized there's a need for improvement in the personal finance world. A financial services relationship must be a trust relationship. An interview with Paul Feldman, Publisher

Marie E. Lihotz, who’s one of my mentors. I worked on one of Bernie Madoff’s cases, I worked on some pension cases, some retirement benefits cases, and that kind of piqued my interest about that personal finance side of the world.

I eventually ended up doing some of my own estate planning work and then joined The American College and spent about seven years there building out the retirement income program. From there, I joined Carson Group to run its retirement division. And then on to many other things since then.

That was the physical path of my career. But my “why” story is a little bit different. My mom really is my “why.” My dad died when I was 8 and my mom took up that mantle of taking care of the family, running a business and giving us all opportunities. She’s done phenomenally well over the course of the years, but she looks like a lot of Americans: she’ll be very reliant on Social Security and Medicare, almost has her mortgage paid off — but gave all of us amazing opportunities. And what has always driven me is this: I want other people like my mom to have that opportunity to succeed and to have a secure retirement, and that’s really my “why.”

Feldman: Well, everybody needs to have a “why.” What was another pivotal point in your journey?

Hopkins: The Bernie Madoff case also was a pivotal moment when I started to realize that there’s a need for improvement in the personal finance world.

The Bernie Madoff case was about a total abuse of trust in what should be a trust relationship. A financial services relationship between the professional and the client must be based on trust.

I thought about how I could improve that level of trust so people like my mom could trust financial services. It was in that realization that I saw the opportunity to have an impact in that space. That’s usually how I look at an area: can I build something there?

I think I’ve built four or five different joint ventures. I’ve invested in a couple of different companies. I’m now running several divisions at Carson. But it was going after that trust aspect that attracted me to this profession.

Feldman: What are some strategies you give to somebody who wants to gain that kind of trust?

Hopkins: Trust is very easy to break but very hard to build. Trust can be developed, though.

From a consumer standpoint, there are certain things you can do to show levels of trust. I wouldn’t hire an attorney to represent me in court who didn’t go to law school, and I wouldn’t hire a financial service professional who didn’t emphasize their professional education in the same way. How dedicated are you to your craft? That’s one thing that’s important in building trust. The other is to be transparent.

There was some research that showed that if you were an advisor who had written a book, it was the No. 1 way that

Feldman: You’re a financial advisor, but you’re also doing insurance. How does that work together and why should everybody in this industry do that?

Hopkins: I’m a fan of comprehensive planning. Comprehensive planning to me means we look at insurance, we look at risk management, we look at investments in asset management, we look at tax planning and estate planning. So, we’re doing more of a full picture of financial planning.

I don’t want people to feel that if you’re good at insurance or you’re good at investments that you must become good at everything. You should focus on your strengths. If you want to say I’m a planner and I’m doing financial planning for my clients, you can’t ignore insurance, you can’t

consumers decided on trust. It was the biggest factor — more than your website, your education and your credentials. And if you kind of dive into that a little bit, it’s because you took the time to codify what you believe in.

You put down what you care about, and you’re able to articulate it.

I had previously done some research with data from about 1,200 or 1,400 individuals. We found that their trust with their advisor moved up when the financial service professionals were transparent with their fees before the arrangement. Meaning that the consumer understood how the advisor got paid before they engaged them.

That’s another thing that advisors can act on. I don’t know whether everybody feels comfortable putting fees on their website, but that has become more and more normal. I suggest that advisors do that.

ignore estate planning or trust services or tax services or the investment portion.

The advisory world has shunned insurance because for a while the only products out there were commission based and had to be farmed out to somebody else. That landscape has shifted dramatically. There are lots of different ways for you to place insurance today. The FMOs and IMOs all have outsourced desks now. There are advisory annuities and advisory insurance products. If you want to outsource, you can find a way today — and that has been a big shift from 15 years ago.

Feldman: Do you operate on a fee-only basis or are you a hybrid firm and how do you deal with that?

Hopkins: Carson is a hybrid firm. That allows us to be different and nimbler than some other firms. We do have a lot of advisors who have gone fee-only, but

A MATTER OF TRUST — WITH JAMIE HOPKINS INTERVIEW

July 2023 » InsuranceNewsNet Magazine 9

Live recording of the Framework podcast with host Jamie Hopkins and guests Carson Group’s Will Morales, senior body engineer, and Carson Group founder and CEO Ron Carson, discussing health and wellness.

that does not mean that their clients can’t get insurance. We have a joint venture with an IMO. So, we have access to their commission products, and they have an outsource desk.

We have advisors who are still insurance licensed and so they can place the business themselves, and we do have advisory insurance products available, too. We still have a relationship with the broker-dealer, Cetera.

Feldman: How do you view life insurance in an overall plan? How does life insurance fit into a portfolio?

Hopkins: There are four or five main roles that life insurance can play in a financial plan. And we’ll start with the simplest one — which is the reason that life insurance exists — offsetting the loss of future income due to an unexpected death.

You can go further beyond the protection it provides and get the tax benefits

The main reason to have a combination of bonds and stocks used to be, “Hey, don’t worry, these things kind of move in opposite directions, so they’re not both going to go down at one time.” And boom! Bonds got crushed, investments go down and people are looking around thinking, “Man, I wish I had something else.” And that can be life insurance. It can play a role in the diversification bucket.

Feldman: There are multiple types of life insurance. You’ve got indexed universal life, universal life, whole life, term insurance, and I know that it really depends on the client you’re advising. What do you recommend most often?

Hopkins: Just from a volume perspective, term insurance is easily No. 1. We do more term insurance than anything else. And that makes sense. That’s the purest form of insurance. It’s the cheapest form

product, that’s OK. I think that we’ve shied away from that. Our industry is one of the least trusted industries out there. We haven’t been good at our value articulation.

Another thing we miss the mark on is how to attract the next generation of advisors and insurance agents into this world. That is a struggle. There’s a talent crisis occurring. We’re losing a lot of advisors and they’re not being replaced by new people coming into the field. They go through school and then they end up somewhere else and disappear from the system quickly. And that’s concerning.

Feldman: How do we fix this problem? Because it’s a significant problem.

Hopkins: I started a nonprofit three years ago called FinServ Foundation. The notion was to take college students in financial planning programs and, going into their junior year, bring them into the program. Start doing group coaching with them that last year they’re at school and help them get internships.

The year after they graduate, we continue to provide them with a coach. And they get coaching while they are entering the profession, which is where there is a gap. We’re trying to bridge the gap between leaving school and getting to that first job by creating a community, and creating exposure, education and coaching.

that occur with life insurance. Then, we can get creative with wealth generation investments. And then look at how that fits into an overall strategy. Are we trying to fund things like college education, retirement income, in the sense of being able to take distributions from a well-funded policy? And so, I’d say that bucket number two is this investment wrapper we get with life insurance.

The next one is wealth transfer, which with 2025 getting close, is becoming a bigger part of conversations. We have this estate tax that could come back in a meaningful way in a couple of years. So life insurance becomes one of the most efficient ways to transfer wealth.

Lastly, I do view life insurance as an asset and there are continued benefits usually of asset and investment diversification.

just from a total dollar standpoint. I think most people who are married, have kids, have loved ones who would suffer financially, should have term insurance.

I would probably say the type of life insurance we’ve seen the most over the last of couple of years has been anything with the linked long-term care benefit riders on it.

Feldman: From your view of the industry, where do you see financial advisors and insurance agents missing the mark today?

Hopkins: One big miss of the mark today is not being transparent about fees and conflicts. How we get paid impacts our behavior.

If you earn money because you sell a

The other program that I’ve also worked on is a program at Carson where we take people out of school and pay them a salary to learn the business. They learn marketing, advisory, investments, financial planning — and they don’t have any insurance sales requirements. They get exposure to insurance.

If you look at TikTok or Twitter, or watch TV, it’s about wealth creation. It’s about how you build multiple businesses and have ownership stakes in them. Our industry must embrace that and show that it is actually a great industry to be an equity owner in, and to have that income stream that has a good business value to it. That’s something really appealing that we’re missing.

Feldman: Do you think that the future of this business is bringing people in on the financial advisory side or on the insurance side?

10 InsuranceNewsNet Magazine » July 2023 INTERVIEW A MATTER OF TRUST — WITH JAMIE HOPKINS

Jamie Hopkins speaking at Carson Group’s 2023 Partner Summit

Hopkins: I think the future of this business is bringing in people with a clear career path. I think that’s the future. I don’t think it really matters exactly how they come in — whether they come in and experience insurance and sales first or planning first or corporate life first. I think that we will see successful people come through all of those.

Very few people — I think it’s less than 12% — stay in the business five years.

things. Your value is not your ability to send an email. It is not your ability to create investment portfolios, as much as a lot of advisors and insurance professionals don’t like hearing that. You must find those strengths and delegate almost all the rest out. That allows you to do more of what you are good at.

And that is a really hard thing for an entrepreneur in a small business to do, to let go of those things. You have to realize that’s OK. The best use of your time is getting new clients in the door and working with them.

Our marketing team has started using things like ChatGPT for some aspects of their work. Now, I don’t think any of that is giving you great finished products today. It’s about the prompt, it’s about the time you spend with it, it’s about cleaning it up afterwards. But it can knock out some pretty fast versions of things that can at least give you an outline, a starting point. But it also lies really well.

Feldman: If you don’t have a human behind it, it doesn’t work.

Feldman: Let’s talk about somebody successful in the business. How do they get to the next level? What are some things you say?

Hopkins: I’m going to give them a couple of tips. In this business, if you want to move from successful advisor, insurance agent, to successful business owner, you must make that transition from being the doer to being the leader. And that is hard to do. Most of our coaching program at Carson Group is about how you make that transition from advisor to business owner.

One of the most important things you must learn to do is focus on your strengths and learn to delegate.

For example, Tom Brady was one of the best quarterbacks ever to play the game. Every once in a while, he would throw an interception and he might have to try to tackle somebody. He was probably one of the worst tacklers in the NFL. Slow, not super strong — just an awful tackler. He probably could get twice as good at tackling, and he’d still be the worst tackler in the NFL. He never practiced tackling. What did he do? He spent the off-season practicing what he was good at, and he surrounded himself with great teams of people who could tackle.

As you grow, you must let go of those

And I will also tell people to pick the right partners. When I say delegate, you can also insource and outsource things. The world is much more open to outsourcing things today. You can outsource your investment management. You can outsource your technology or your compliance. But if you are going to outsource, make sure you find good partners, because you need to trust them. If something breaks, that’s going to land on you. It’s going to land on the trust that you’ve built with your clients. And if you say, “Hey, let’s go use this other partner to come in and introduce them to our client,” and that goes south, you might ruin that trust relationship. So, pick good partners in this business.

Feldman: Are you using any artificial intelligence at the moment?

Hopkins: We are using machine learning techniques today and lead scoring and deep-level data analytics. I wouldn’t really say we’re using what I would look at as true AI today.

Feldman: AI today is all about human programming. It’s all about the human prompt at this point.

Hopkins: We have a client acquisition offering that we built out with Boston Consulting Group and Bain Capital over about the last 18 months. We have incorporated some of what I would say is closer to true AI capabilities inside that program, in the sense of learning about people, scoring, connecting them to the right type of advisor who matches up to their profile needs. And then on the financial planning part, we’re getting close with some of the programs we are using.

Hopkins: One hundred percent. So that stuff is coming. If you go back three years ago, we didn’t have anything functional. We now have some stuff that’s starting to work. In another three years, it’s going to be really meaningful.

Some of the stuff it can do is very scary, making up lies and creating some very convincing fake video. I don’t think we’re ready for it at all. It does concern me. Not all technological advancements have been good for humanity. I’m not against technological advancements — I don’t think it’s going to be the end of the world — but I do think that we’re probably not ready for it. It scares me in that sense.

Feldman: Where do we go from here? Robo assistant advisors? I think we still need a human. What do you think?

Hopkins: Most people, especially as you have more wealth, will want human interaction and that trust factor. Especially for those who didn’t grow up as digital natives, we still must learn to grow into technology.

Somebody who is 6 years old today — who grew up with iPhones and tablets in their hands, who grew up in a digitally native world — they may feel OK with it.

So, while I do think that AI and machine learning will start to become more important on the front end, the initial experience — the human behind it — will be really important. We will have more people to serve, with the number of advisors and insurance agents shrinking every year for the next 20 years. I don’t see us fixing that trend fully. But what that tells you is there’s never been a better time in the history of being alive to be in this industry as a professional than today.

A MATTER OF TRUST — WITH JAMIE HOPKINS INTERVIEW July 2023 » InsuranceNewsNet Magazine 11

Carson Group’s Jamie Hopkins, managing partner of wealth solutions, and Burt White, managing partner and chief strategy officer

MAKE WAY FOR THE NEXT GENERATIONS

Millennials and Generation Z are taking over the world. Here is how you can address their financial concerns.

By Susan Rupe

By Susan Rupe

COVER STORY 12 InsuranceNewsNet Magazine » July 2023

Photograph courtesy of HBO

When Thomas Kopelman entered the financial services profession, he soon realized that there was a large segment of prospects who needed his help — but they weren’t retirees.

“Everybody works with retirees,” he recalled. “I don’t know anything about retirement. I also can’t relate to retirees.”

But Kopelman did relate to young adults and their financial questions.

“I asked myself how I could work with people like me, with people who are going through the exact same things that I was going through — you’re going to get married, you have student loans, you have kids, maybe you’re going to start a business, maybe you’re going to get equity compensation. There’s a lot going on when you’re in your late 20s, in your 30s and in your early 40s.”

Kopelman co-founded AllStreet Wealth, with locations in Indianapolis and Kansas City. He describes his firm as “the opposite of what you think of when you hear the term ‘financial advisor.’”

He told InsuranceNewsNet he believes the financial services industry “wasn’t built around serving young adults.”

“I saw it as more like ‘Hey, let me sell you an insurance product or let me put you into an investment account, and that’s going to solve all your problems,’” he said. “But in reality, it doesn’t. Young adults have all these big decisions they need to make, and they have nobody who really can help them.”

The young adults of today have different financial circumstances than their parents did at the same age, Kopelman said.

“Their parents had lower student loans — or maybe no student loans at all. They worked at the same job for 40plus years, they had a pension plan, everything was more affordable for them,” he said. “And most young adults’ parents don’t know anything about money, so they have no one to go to for advice.”

Millennials and Generation Z are pushing baby boomers and Generation X aside to become a force to be reckoned with. Millennials represented 35% of the total U.S. workforce in 2023, with 56 million people, according to Deloitte, and the cohort is

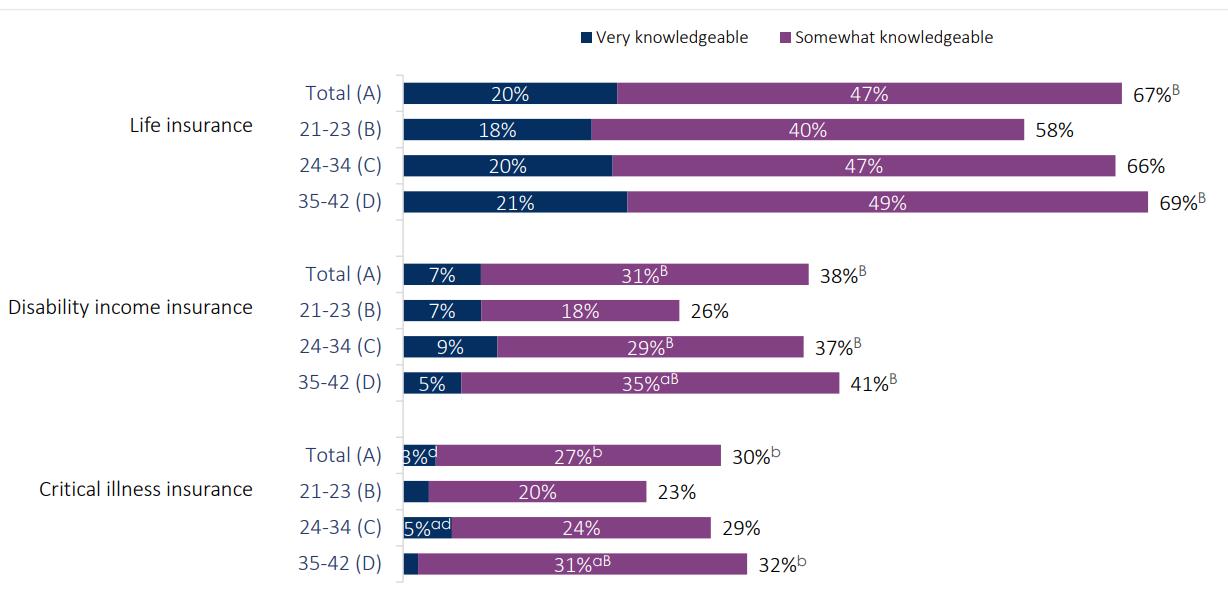

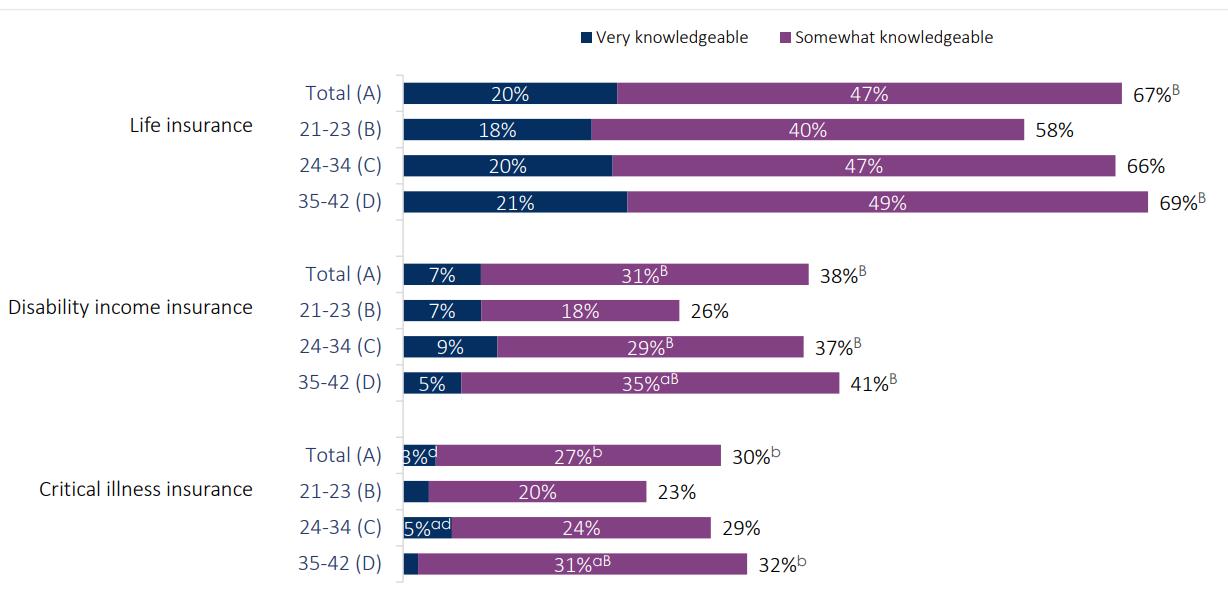

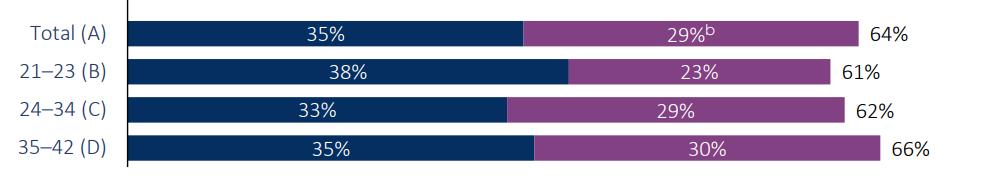

Concern About Financial and Insurable Risks

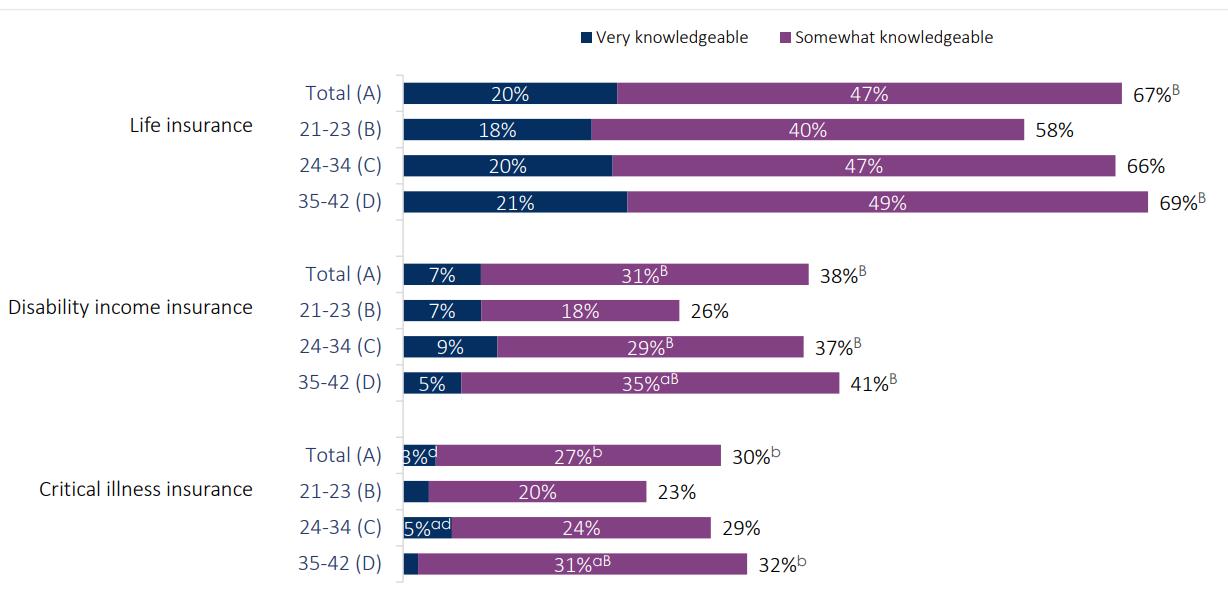

While concern about financial and insurable risks is high and the perceived likelihood of these risks being borne out are relatively high, younger consumers don’t necessarily translate higher incidence to higher concern.

• Between 60% and 80% of younger consumers are somewhat or very concerned about the financial impact of each of 12 financial and insurable risks. They are most concerned about accident (automobile or otherwise) and health-related costs.

• Younger consumers view the 10-year likelihood of the incidence of these risks coming true as nontrivial.

• Approximately half believe they will have an emergency savings or retirement savings shortfall in the next 10 years.

• They significantly overstate their chances of having a premature death; 23% believe it is at least somewhat likely, despite the actual 10-year likelihood of 1.3% to 3.6% for someone aged 21 to 42 today.

• A similar number believe they may become partially or totally disabled, preventing them from working at their job, despite the actual chances of disability being much higher than premature death.

• There also appears to be a disconnect between the perceived likelihood of an event and concern over it.

• These younger consumers are most concerned about being in a car accident that results in significant repair or medical costs, yet overall, they rank the likelihood of that happening lower than of four other events.

• Similarly, they believe it is most likely they will suffer a financial emergency requiring them to come up with $5,000 on very short notice, yet they are more concerned about five other financial and insurable risks.

• Other than the $5,000 emergency need, the survey did not ask about the potential severity of these events, which could be a factor in their concern level, as could whether they have adequate savings or insurance to mitigate these events/risks.

expected to grow to 75% of the workforce in 2025. Gen Z is entering the workforce in growing numbers and is expected to make up 30% of the U.S. workforce by 2030.

And these young adults recognize their need for help with securing their financial futures.

The 2023 Insurance Barometer Study by Life Happens and LIMRA revealed that nearly half of Gen Z adults (49%) said they either need to get life insurance or increase their coverage. Nearly the same percentage of millennials (47%) said the same. And they are ready to take action; 44% of Gen Z adults and 50% of millennials say they intend to buy life insurance this year.

Helping them take the first steps

Kopelman said young adults need term life insurance and disability insurance but have more of a need for planning. They often don’t know how to take the first steps, and they don’t know how to hold themselves accountable for following through on their plans.

Source: Society of Actuaries Research Institute

Although Kopelman has several clients he works with on an ongoing basis, his firm offers three different fee-based planning models that clients can choose to work with over a shorter time frame.

The first — which costs $1,500 — gets a client in to AllStreet Wealth’s financial planning software, and Kopelman spends two hours “really diving into the client’s information, getting a good understanding of where they are.

“I start to educate them on some of the things they should do, and then I create a financial plan and send it to them with a video explaining those things.”

The next model is for clients who want to get started working with a professional and want to take a do-it-yourself approach after they have compiled their plan but need to be held accountable along the way.

“We start out with a get-to-know-you meeting where we make sure we’re a good fit,” he said. “Then we have a second meeting to discuss what’s important to the client — their short-term, midterm, long-term goals and what their values are.

MAKE WAY FOR THE NEXT GENERATIONS COVER STORY July 2023 » InsuranceNewsNet Magazine 13

Kopelman

why their finances are the way they are, what their company benefits are, what their taxes look like, what insurance they have in place, whether they’ve started estate planning, what their cash flow is.”

About three or four weeks after Kopelman’s firm delivers the client’s financial plan, they schedule what they call the accountability meeting. “The goal of that meeting is to check whether the client did their homework or whether they have any questions about what they need to do to implement the plan,” he said.

The third model is for clients who want ongoing help. Kopelman’s firm meets with these clients quarterly to discuss issues ranging from tax planning to estate planning.

Tweeting for clients

Just as young clients don’t want to get advice the same way their parents did, they don’t want to find an advisor the same way their parents did. Kopelman attracts most

an avid blogger and podcaster.

Kopelman said he is careful not to use social media to sell. Instead, he positions himself as a subject matter expert and said he wants to nurture prospects along their financial journey.

“It’s really about educating people and being relatable,” he said. “I want people to think, ‘He explains things really well. He doesn’t ask for anything.’ So that when they do need help, you’re the advisor they feel they have to reach out to. That’s the goal of all my marketing.”

Young clients want advice — and are willing to pay for it

Forget the stereotype of young adults living on ramen noodles while saddled with student debt. Millennial wealth has risen faster than that of any other generation over the past five years, and advisors should begin to look at this demographic seriously as a viable market, according to a 2022 Cerulli Associates report.

Cerulli estimates millennials had an average net worth of more than $278,000 in 2021 — an average yearly increase of 23.1% since 2016, which is the highest growth rate of any generation. Millennials are raising families, buying homes and advancing in their careers. This generation is looking for formal financial advice and planning to best manage their affairs as well as to ensure their retirement goals are on track.

The research finds that 59% of millennials identify as advice seekers — those who want more financial advice than they receive currently, are interested in new ideas and are willing to pay for that advice.

Cerulli also found that younger generations stand to inherit substantial wealth over the next two decades. Cerulli projects that wealth transferred through 2045 will total $84.4 trillion — $72.6 trillion in assets will be transferred to heirs, while $11.9 trillion will be donated to charities. More than $53 trillion will be transferred from households in the baby boomer generation, representing 63% of all transfers. Silent generation and older households stand to transfer $15.8 trillion, which will primarily take place over the next decade.

What are the takeaways for advisors?

Chayce Horton, a member of Cerulli’s wealth management team, said Cerulli researchers asked high net worth advisors how to build relationships with the next generation and found the top recommended strategy was “to put the onus on the clients and their spouses, to bring their children into the relationship.”

“Nobody knows the clients’ children better than clients do. So it’s imperative to put that onus on the clients and also to do so right off the bat in a relationship. Rather than waiting until clients are in the later stages of their relationship with their advisor to be able to do that, it’s important to try and establish a household relationship instead of a one-to-one relationship rather quickly after establishing a relationship with a client.”

Listen to their story

But not every young adult wants to work with their parents’ advisor. Taven Sparks

14 InsuranceNewsNet Magazine » July 2023 COVER STORY MAKE WAY FOR THE NEXT GENERATIONS

Horton

Source: Society of Actuaries Research Institute

said successfully attracting and serving young clients often boils down to being able to relate to the needs of a younger generation.

Sparks is a private wealth advisor and partner at Sparks Financial, a Northwestern Mutual agency in Denver, Colo. His team comprises advisors from their 20s up into their 50s and serves multiple generations. About one-third of his clients are in their 20s and 30s. “Their careers are starting to take off, and they are looking for advice on holistic wealth management planning,” he said.

Sparks said he obtains most of his young clients from referrals. He finds most young adults fall into one of two camps.

“Some are working with their parents’ advisor, and that parents’ advisor is probably in their 50s or 60s and may be out of touch with the needs of the younger generation,” he said. “And some young adults want to do this themselves, and they often don’t know what they don’t know.”

Sparks said his work with young clients starts with building a firm financial foundation.

“We might start with budgeting, balance sheets, understanding their company benefits, helping clients understand the right protection that needs to be put in place — life insurance, disability insurance. Setting up that strong foundation allows us then to dive into the wealth accumulation phase for our clients once they get that foundation set.”

The best approach to begin working with a young client, Sparks said, is “to really listen to their story, their wants, their needs.” Giving clients the ability to perform many functions online is also appealing to young adults, he said.

Young clients are thinking about retirement, but not necessarily in the way their parents did, Sparks said.

“I would say that there are two types of younger clients — one that wants to work forever because they love what they do, and one that wants to retire tomorrow,” he said.

Beneficiaries need personalized care—and they rarely get it.

Empathy helps beneficiaries save time, money and stress, as they navigate loss, providing next-level support that helps carriers build loyalty for generations. Think bigger than a payout, and earn loyalty for generations.

Discover how carriers are:

Enhancing policyholder benefits

Saving on operational costs

Transforming beneficiaries into clients

Sparks said his firm brings together an insurance planner, an investment manager and a financial planner to help young schedule a demo

Scan the QR code or visit empathy.com/carriers to schedule a demo Sparks

rarely get it. stress, as they carriers build earn loyalty

About 6 in 10 young consumers are concerned about premature death.

Of the nonmedical insurance products, younger consumers claim

Source: Society of Actuaries Research Institute

clients with all aspects of their retirement planning.

“When we’re able to analyze the investment plan with the insurance plan with the financial plan that actually tells us where we might be off on our assumptions of retirement, it is a huge eye-opener to our younger clients,” he said. “It shows them that they need to start planning earlier. And that if they want to retire at 55 or 60 years old and they’re going to live another 30 or 40 years, they will need to make sure they understand the impact of starting to save for retirement early.”

Young adults might think that the life insurance they have through their employer is all the coverage they need. Sparks said the COVID-19 pandemic spurred many young clients to think about how to integrate life insurance with their overall financial planning.

“COVID-19 made young families real ize they need to get protection in place in case something happened to them. But I’ve seen research about how the integra tion of permanent life insurance can play a role in long-term retirement success. And after discussing this with my young clients, they often will end up incorpo rating life insurance — whether term or permanent — into their financial plan.”

Helping them fit the pieces together

Jamie Clark’s clients come to them “when they are trying to figure out something big or something new in their lives; they’re not quite sure how to put the pieces together.”

Clark is a financial planner and founder of Ruby Pebble Financial Planning in Seattle, where they specialize in working with young adults who work in the

but want Clark to re assure them “that what they’ve been doing is the right thing.”

“Many of my clients want a partner to help them navigate all of the different pieces and figure out all the steps of what they need to do,” they said.

Young adults are more likely than their parents to move from one employer to another during their careers, so Clark frequently is asked to help those young

16 InsuranceNewsNet Magazine » July 2023 COVER STORY MAKE WAY FOR THE NEXT GENERATIONS

Desire and need are on the rise.

Gen Z is growing up — they’re adults now who are in the weeds of financial responsibilities and stresses. Half of Gen Z is now 18-26 years old, which means 19 million young adults are ready for life insurance, most of whom are non-owners; and millennials, at 27 to 42, are well into their careers and starting families.

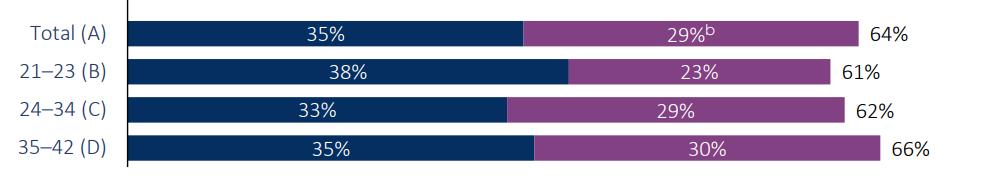

The study took a look at life insurance ownership among different age groups and found that half of all adults (52%) own life insurance, with 40% of Gen Z adults and 48% of millennials currently owning it

As Gen Z starts hitting life milestones such as finding a partner, buying a home and having children, half (49%) say they either need to get life insurance or increase their coverage. And millennials are not far behind, with 47% saying so. They are ready to take action: 44% of Gen Z adults and 50% of millennials say they intend to buy life insurance this year.

They also want to purchase it where they have become comfortable — online — and that goes for all generations. In 2011, 64% of people said they preferred to buy life insurance in person; by 2020, just 41% felt this way. In 2023, it dropped to 29%.

Education is key for Gen Z.

There is work to do on educating people about ownership: 42% of all adults say they’re only somewhat or not at all knowledgeable about life insurance

A quarter of Gen Z and millennials say that not knowing how much or what kind of life insurance to buy stops them from getting coverage. And 37% of Gen Z and 27% of millennials say they “haven’t gotten around to it.”

Across generations, cost is cited as the top reason for not getting life insurance. But only a quarter (24%) of people correctly estimated the true cost of a policy for a healthy 30-year-old, which is around $200 a year. More than half of Gen Z adults (55%) and 38% of millennials thought it would be $1,000 or more.

With the current climate adding financial uncertainties to Gen Z and millennials, including layoffs and inflation, it is imperative that the two age groups learn how to protect their loved ones financially.

Education around finances in general, inclusive of life insurance, will be extremely beneficial, particularly for millennials, who cite the highest overall level of financial concern (39%)

clients figure out what to do with the money they have accumulated in multiple 401(k) accounts. Many of Clark’s young clients receive stock compensation and need help planning for the tax consequences of that compensation.

Clark also advises their young clients about their need for life insurance and discusses whether the disability insurance they have through their employer is sufficient for their needs. “These things are usually not high up on a young adult’s list, but it’s something they need to think about,” they said.

An increasing number of Clark’s clients choose not to mingle their finances with their partner’s finances, something Clark said is different from the way their parents’ generation handled their money.

“I think there are times when that makes complete sense, and it totally

works fine,” Clark said. “I tell my clients not to use that as an excuse to not talk about money with their partner. I tell them to be transparent and communicate about money with their partner.”

Clients find Clark through Google search or social media, but Clark said investing in a robust website that promotes diversity when they began their firm was a good investment.

“I believe a lot of firms do not like thinking about diversity,” they said. “Who you want to serve starts with everything you put out there. If the pictures of the people on your website don’t look like someone who wants to work with you, they won’t want to talk with you. On my website, I’ve been careful with things such as making sure we have gender-neutral colors, and I don’t talk about working with specific genders. I just want people to feel that I

will respect the pronouns they want me to use and I will respect anyone who wants to work with me.”

Clark advised any financial professional who wants to work with young clients to invest in technology and “be accessible.”

“But also be yourself. I believe a lot of younger clients are picking you as a financial professional because they realize they need your expertise. And they want to work with someone they want to connect with and talk with as part of the process.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents’ association and was an award-winning newspaper reporter and editor. Contact her at Susan.Rupe@innfeedback.com. Follow her on Twitter @INNsusan.

July 2023 » InsuranceNewsNet Magazine 17 MAKE WAY FOR THE NEXT GENERATIONS COVER STORY

Source: 2023 Insurance Barometer Study, Life Happens and LIMRA

Photograph by Simon Ridgway/HBO

FOR GEN Y AND GEN Z

How does the industry serve the next generation of investors?

In this year’s Financial Services for Gen Y and Gen Z Thought Leadership Series, read an interesting perspective on how younger generations can invest in an ever-changing financial marketplace.

How to Win the “Great Wealth Transfer”: The Growing Demand for Next Gen Advisors

by Tammy Robbins, Cambirdge Investment Reseaerch, Inc.

PAGE 19

FINANCIAL

Special Sponsored Section

SERVICES

How to Win the “Great Wealth Transfer”: The Growing Demand for Next Gen Advisors

Over the next 25 years, an estimated $68 trillion1 will pass from Baby Boomers to their heirs in what is often referred to as “the Great Wealth Transfer.” This massive financial shakeup will certainly impact the wealth management industry; how can today’s financial professionals position their firms to come out ahead as trillions of dollars change hands?

The key to positioning your firm to both retain current clients and attract new ones is by focusing on “Next Gen” advisors, a group uniquely positioned to understand the goals, pain points, and preferences of Next Gen investors who will soon control 57% of current investor assets2 . By welcoming Next Gen advisors into your practice, you can gain unique insight into how these new investors are thinking, including the problems they face and their financial goals. Next Gen advisors are fluent in the trends, preferences, and languages shared by Next Gen heirs, and thus are better positioned to effectively communicate with these clients and, ideally, increase client retention.

What’s more, by welcoming these Next Gen advisors into your practice, you open the door to new succession options to ensure the longevity of your business. Within the next 10 years, 37% of financial advisors, collectively controlling $10.4 trillion, or 40% of total industry assets, are expected to retire. Yet, 25% of advisors who are expected to transition their business within the next 10 years are unsure of their succession plan3 . While it is never easy to turn over the proverbial keys to the castle, by recruiting Next Gen advisors now, current advisors will be able shape and mentor their potential successors in a way that is beneficial to their own independent business model.

Of course, in order to successfully reap what is sown and create a truly long-term plan for your practice, it is critical to not only attract Next Gen advisors, but retain them as well – a tall order in today’s competitive labor market. However, there are specific ways to increase Next Gen retention:

Foster a sense of belonging and purpose:

Engaged employees are 87% less likely to leave their employer4 One way to do this when working with younger associates is taking the time to listen to their ambitions and creating a clear path to help them toward their goals. Plus, taking a more hands-on approach to development is an excellent way to help associates gain a clear sense of the firm’s purpose and values. It is also crucial to provide ongoing feedback and clear expectations to further encourage engagement.

Give them a seat at the table: New advisors are a treasure trove of fresh ideas and unique viewpoints. Recruiting and retaining Next Gen advisors who are eager to ask questions and suggest new ideas can help clarify business goals and strategies and reveal new ways to achieve them. While many younger advisors are often saddled with a large number of small accounts, it is important to make sure they are also given ample exposure to the larger, more impactful client accounts. Mentoring and empowering these advisors to participate in enriching the experiences of the practice’s best clients is key to professional development and boosting engagement.

Trust in tech: Next Gen advisors want a tech stack that will set them up for success. They are used to doing almost everything digitally, which allows them to use technology to create an experience that Next Gen investors are seeking. Look to these Next Gen advisors for honest feedback on your current tech stack, as well as input on how to further enhance the experience of both staff and clients.

Embrace diversity: Creating a diverse and inclusive workplace is mutually beneficial to both new advisors and existing practices. For example, women now make up 51% of the U.S. population and control over $11 trillion in financial assets, with more than 70% of women who are seeking an advisor preferring to work with a woman5 . Opening opportunities within your firm to embrace women and minority advisors allows for opportunities to serve markets that have traditionally been underserved while bringing in new clients.

All actively working generations of today bring skillsets that are needed within an independent business model. Together, they can create a powerful partnership that will serve an array of clients, and leveraging Next Gen advisors will help today’s practices remain relevant.

Download Remaining Relevant with Next-Gen Investors at https://www.joincambridge.com/insights. Learn more at JoinCambridge.com.

1 Moss, W. (2022). Taking advantage of the coming Great Wealth Transfer. The Atlanta Journal Constitution.

2“It’s Time to Change Your Mind about Young Investors.” Fidelity Clearing & Custody Solutions, 18 Jan. 2023, clearingcustody.fidelity.com/app/literature/ item/9907600.html.