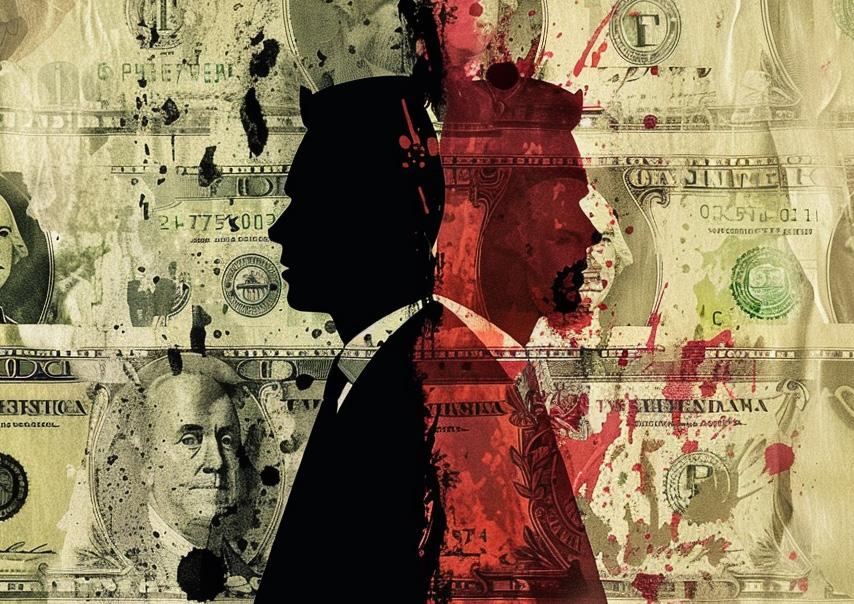

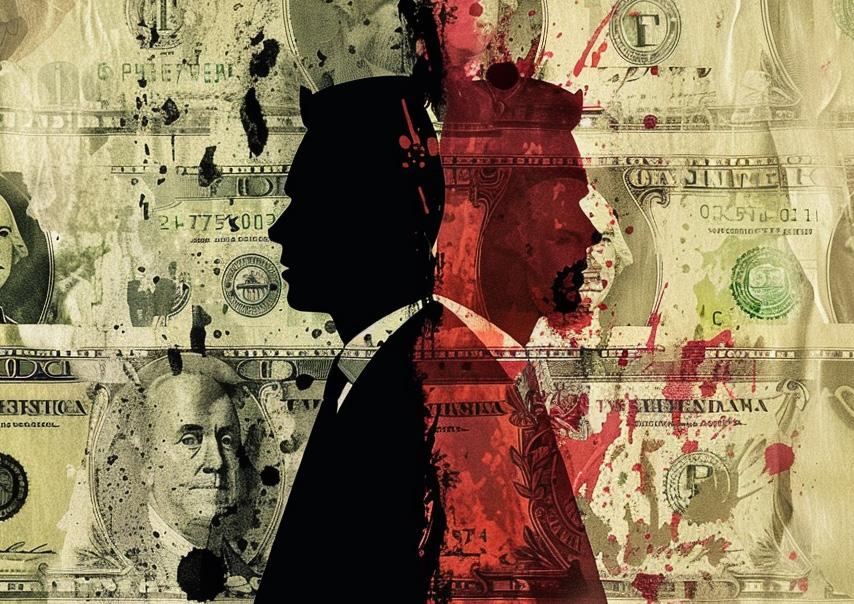

Economic conditions remain ripe for an ongoing annuity sales boom. But the Department of Labor’s new fiduciary rule expansion could be a major disruption.

PAGE 22

The Power of Persuasion — with Lynne Franklin

PAGE 10

Inherited annuities: Helping to stretch generational wealth

PAGE 36 ‘Magic number’ for comfortable retirement surges

PAGE 44

Annuities selling strong,

how long?

but for

THIS ISSUE: ANNUITY AWARENESS Life Insurance • Health/Benefits Annuities • Financial Services JUNE 2024

See how they are redefining the balance between financial strength and stability

Life Insurance • Health/Benefits Annuities • Financial Services JUNE 2024

PAGES 6–7

Charge ahead this Annuity Awareness Month with Ibexis

Revolutionizing retirement with fixed indexed annuities offering unmatched growth potential and enhanced flexibility

Power your clients’ financial ascent with the advantages of the Ibexis FIA Plus™ series

• Backed by an A-rated carrier

• Flexibility to refine risk and return profiles annually

• Amplify growth potential with innovative options to leverage gains

• S&P 500 cap rate as high as 23.50%

• Exclusive indices with industry-leading participation rates and daily adjustment capabilities

• Generous withdrawal terms

• Confinement and terminal illness waivers

• Attractive producer commissions

What’s new:

• 16% premium bonus on FIA Plus 10: Unlock lower floors with higher rates immediately with the flexibility to adjust risk and return profile over the contract period

• Bailout cap rate (one of the highest in the industry): Enjoy renewal rate confidence with the ability to liquidate the contract if the S&P 500 cap falls below the declared bailout cap rate

• Annual declared rate: Give clients enhanced flexibility and guaranteed growth.

For insights on how Ibexis is redefining the annuity space and leading the charge in retirement security, turn to page 6–7.

You deserve a provider with the financial know-how, superior service, and streamlined experiences that strives to reduce the confusion that complicates retirement planning. With Jackson®, you get expertise you can depend on, and a partner who will help you do right by your clients. That’s clarity for a confident future.

CMC25777AD 01/24 Not FDIC/NCUA insured • May lose value • Not bank/CU guaranteed Not a deposit • Not insured by any federal agency Jackson® is the marketing name for Jackson Financial Inc., Jackson National Life Insurance Company®, and Jackson National Life Insurance Company of New York® Jackson National Life Distributors LLC, member FINRA.

jackson.com Clarity you deserve.

retirement planning

Learn more at

A

partner you can trust.

IN THIS ISSUE

INTERVIEW

10 The power of persuasion

Lynne Franklin, a self-described neuroscience nerd, describes how advisors can do a better job of connecting with clients to get them to say “yes.”

IN THE FIELD

14 Building a bridge

By Susan Rupe

Deshawn Peterson is helping the next generation of financial professionals while helping existing advisors expand their practices.

FEATURE

By John Hilton

The Department of Labor’s new fiduciary rule expansion could be a major disruptor for booming annuity sales.

27 The 2024 Annuity Thought Leadership Special Section

Two elite companies offer their unique perspectives on product, process and the future of an ever-changing annuity marketplace.

32 Would you rather purchase items retail or wholesale?

By Ernest Guerriero

Why paying for life insurance premiums through a qualified plan might be a better option for your client.

ANNUITY

36 Inherited annuities: Helping to stretch generational wealth

By Susan Rupe

How to spread out tax liability while allowing an inheritance to continue growing.

HEALTH/BENEFITS

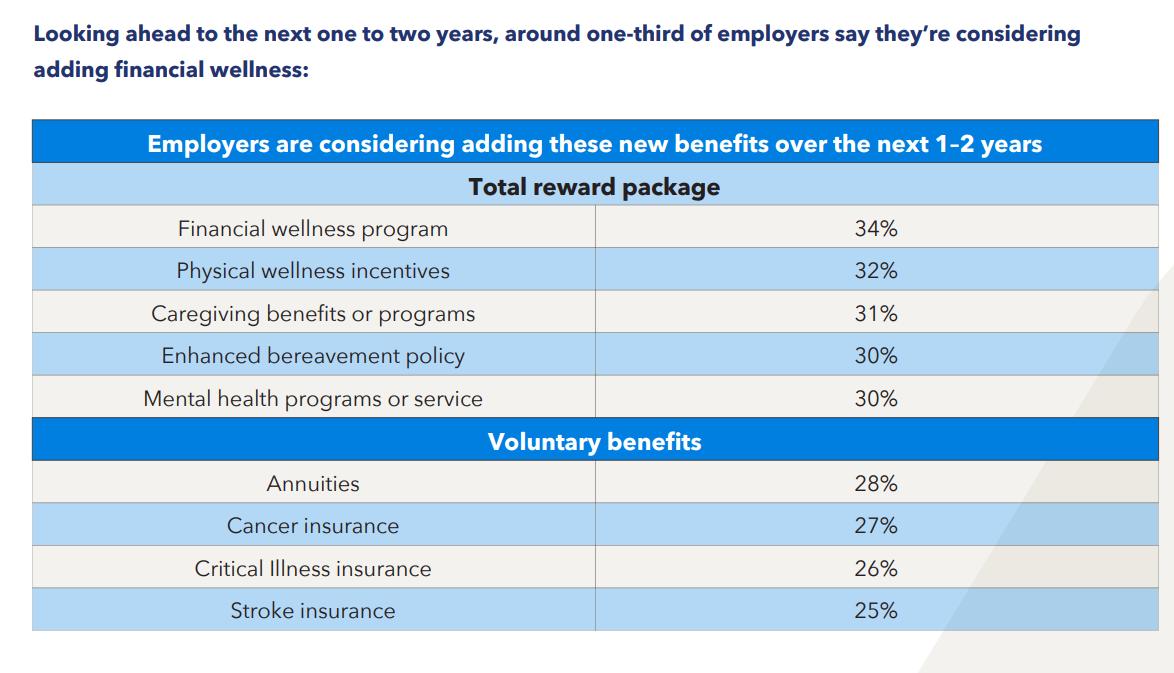

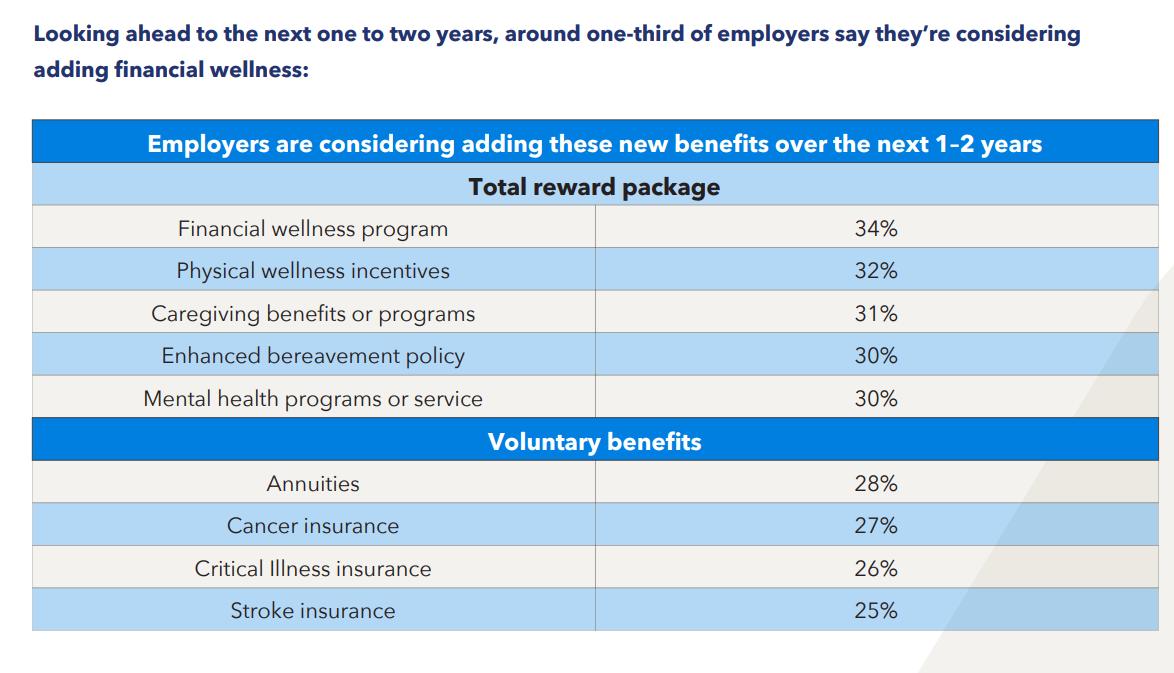

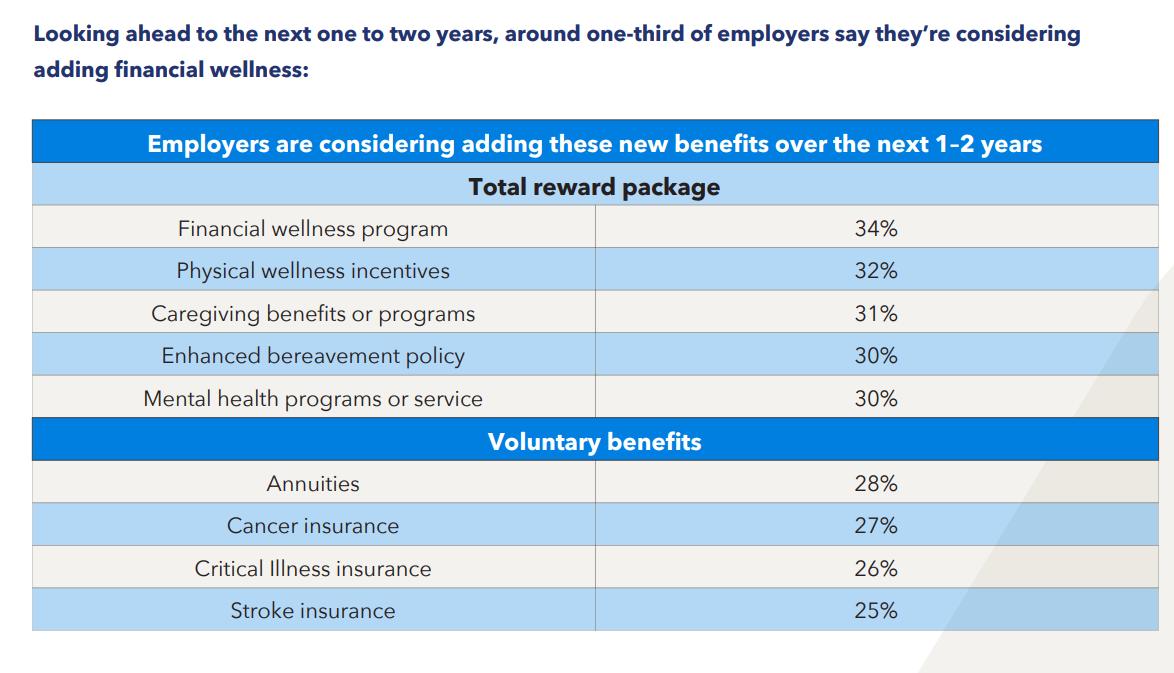

40 3 trends impacting employee benefits management

By Kim Buckey

Employers face a number of challenges in enrolling workers in health benefits.

ADVISORNEWS

44 ‘Magic number’ for a comfortable retirement surges upward

By Ayo Mseka

Americans believe they need $1.46 million for a comfortable retirement. Can advisors help them attain that goal?

BUSINESS

46 3 essential technologies to have in your toolkit

By Jonathan Georges

The technology tools advisors need to serve clients more effectively.

IN THE KNOW

48 How tech will revolutionize health care and life insurance

By Ken Leibow

Groundbreaking platforms are helping address inefficiencies while uniting underwriting professionals.

2 InsuranceNewsNet Magazine » June 2024

LIFE

InsuranceNewsNet.com/topics/magazine View and share the articles from this month’s issue

online » read it

Annuities selling strong,

long?

but for how

JUNE 2024 » VOLUME 17, NUMBER 05 INSURANCE & FINANCIAL MEDIA NETWORK 150 Corporate Center Drive • Suite 200 • Camp Hill, PA 17011 717.441.9357 www.InsuranceNewsNet.com PUBLISHER Paul Feldman EDITOR-IN-CHIEF John Forcucci MANAGING EDITOR Susan Rupe SENIOR EDITOR John Hilton SENIOR CREATIVE DIRECTOR Jacob Haas EMAIL & DIGITAL MARKETING SPECIALIST Megan Kofmehl MARKETING MANAGER Sorayah Talarek DIRECTOR OF SALES Ashley McHugh NATIONAL ACCOUNT DIRECTOR Brian Henderson NATIONAL ACCOUNT DIRECTOR Tobi Schneier STAFF ACCOUNTANT Katie Turner Copyright 2024 Insurance & Financial Media Network. All rights reserved. Reproduction or use without permission of editorial or graphic content in any manner is strictly prohibited. How to Reach Us: You may e-mail editor@insurancenewsnet.com, send your letter to 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011, fax 866.381.8630 or call 717.441.9357. Reprints: Copyright permission can be obtained through InsuranceNewsNet at 717.441.9357, Ext. 125, or reprints@insurancenewsnet.com. Editorial Inquiries: You may e-mail editor@insurancenewsnet.com or call 717.441.9357, ext. 117. Advertising Inquiries: To access InsuranceNewsNet Magazine’s online media kit, go to www.innmediakit.comor call 717.441.9357, Ext. 125, for a sales representative. Postmaster: Send address changes to InsuranceNewsNet Magazine, 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011. Please allow four weeks for completion of changes. Legal Disclaimer: This publication contains general financial information. It should not be relied upon as a substitute for professional financial or legal advice. We make every effort to offer accurate information, but errors may occur due to the nature of the subject matter and our interpretation of any laws and regulations involved. We provide this information as is, without warranties of any kind, either express or implied. InsuranceNewsNet shall not be liable regardless of the cause or duration for any errors, inaccuracies, omissions or other defects in, or untimeliness or inauthenticity of, the information published herein. Address Corrections: Update your address at insurancenewsnetmagazine.com

10 14

INSURANCE & FINANCIAL MEDIA NE TWORK

Allianz Life Insurance Company of North America Product and feature availability may vary by state and broker/dealer. This content does not apply in the state of New York. Allianz Life Insurance Company of North America does not provide financial planning services. Guarantees are backed by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America. For financial professional use only – not for use with the public. M-8094-A (4/2024) Illustrations with Impact , powered by Ensight , TM available from us WATCH THE VIDEO → Scan the QR code, or visit → www.allianzlife.com/Ensight Customized, interactive policy proposals –quick with a click Instantly create customized proposals –with interactive charts that use actual policy values, and content that explains all the benefits of Allianz Life Pro+® Advantage Fixed Index Universal Life Insurance Policy.

The resurgence of annuities and the DOL rule

The landscape of retirement planning has experienced a significant shift in recent years, thanks in part to the resurgence of annuities as a cornerstone financial product. With the rise in interest rates, annuities have come back into the spotlight, offering financial professionals and advisors renewed strategies to enhance their clients’ retirement outcomes. There is a shadow on the horizon, though, as the industry wrestles with the impact of the Department of Labor’s Retirement Security Rule.

Annuities historically have been viewed with a mix of skepticism and interest, often due to their complexity and the perception of high fees. However, the recent upward trend in interest rates has shifted this perception. Higher rates translate directly into more attractive annuity payouts because the funds accumulated within these financial instruments can now grow at a quicker pace. This shift is particularly important at a time when traditional bonds and fixed-income

investments are offering diminishing returns relative to historical standards.

A significant impact

The new fiduciary rule, however, will have a significant impact on the sale of annuities, especially in how these products are marketed and sold to retirement investors. The rule redefines “investment advice fiduciary” under the Employee Retirement Income Security Act and tightens standards to ensure that financial advisors act in the best interests of their clients, particularly when it comes to rollovers into individual retirement accounts and the purchase of annuities.

Under the new rule, financial advisors who provide investment advice or recommendations for a fee will be considered fiduciaries if they are in a professional relationship where a retirement investor expects to receive recommendations that are in their best interest. This includes advice on buying annuities. The rule aims to protect retirement investors by requiring advisors to adhere to a

fiduciary standard, thereby ensuring that the advice given is prudent, loyal, and free from conflicts of interest.

One of the significant changes is the removal of the “regular basis” and “mutual understanding” requirements from the previous five-part test, which allowed advisors to avoid fiduciary status under certain technicalities. Now, any advice that has a significant impact on retirement investment decisions, such as the purchase of an annuity, could place the advisor under fiduciary obligations if the other conditions are met.

Stringent guidelines

Moreover, the rule includes stricter compliance requirements for fiduciaries, including enhanced disclosure requirements about fees, costs and potential conflicts of interest. These changes will require that advisors not only disclose more comprehensive information but also follow stringent guidelines to ensure their advice aligns with the investors’ best interests.

For the sale of annuities, this means that financial advisors and insurance agents will need to carefully evaluate how — and whether — they can recommend specific products, in order to ensure compliance with the new fiduciary standards.

As we go to press, the new rule is set to take effect on Sept. 23. Legal battles are anticipated.

Many in the industry expect that the significant changes in the new fiduciary rule will require time and education to master. What many fear, however, is a loss of revenue as the stringent guidelines impact their ability to sell and reduce commissions.

At the end of the day, these strictures may well impact not only advisors, but also many Americans — especially those who are not high net worth — whose financial advisors either can’t or won’t make specific product recommendations based on the new rule.

This new rule will not only cast a shadow across the industry, but also may well cast that same shadow across the people the industry is there to serve.

John Forcucci Editor-in-chief

4 InsuranceNewsNet Magazine » June 2024 WELCOME LETTER FROM THE EDITOR

June 2024 » InsuranceNewsNet Magazine 5 Maximize potential, minimize risk. LAD10138-INN 06.2024 THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE PRODUCT(S). 1) The Interest Rate Guarantee Periods listed are subject to availability. Your agent can confirm which Interest Rate Guarantee Periods are currently available. 2) Information herein is not intended to be legal or tax advice. You should consult with your own attorney and tax advisor for your specific circumstance. Contract Form Series MYG20; AI20 (Forms may vary by state). CA Form: MYG16(04). Neither American National Insurance Company nor its agents offer tax or legal advice. Clients should consult their tax and legal advisors. American National Group, LLC is the corporate parent of the American National companies, which include American National Insurance Company and its insurance affiliates. American National Insurance Company, founded in 1905 and headquartered in Galveston, Texas, is licensed to conduct business in all states except New York. For Agent Use Only; Not for Distribution or Use with Consumers. Not FDIC/NCUA insured | Not a deposit | Not insured by any federal government agency | No bank/CU guarantee | May lose value AMERICAN NATIONAL INSURANCE COMPANY / 888-501-4043 / lad.americannational.com Palladium® MYG Multi-Year Guarantee Annuity Series Guaranteed Growth: Secure and steady earnings with an impressive fixed interest rate. Flexible Guarantee Periods: Choose from 3 to 10-year guarantees with competitive rates.1 Premium Benefits: Rate enhancements for premiums starting at $100,000.2 Visit lad.americannational.com for more information or to run a quote.

Leading the charge in retirement security:

Ibexis’ commitment to

excellence and innovation redefines industry standards

In this conversation with Nate Gemmiti, CEO of Ibexis, we explore how the company is disrupting the industry after launching its first annuity as Ibexis just two years ago. From innovative products to a distribution model elevating independent marketing organization partners and more, Gemmiti shares insights into how Ibexis is pioneering a path to greater financial certainty for retirees.

What key factors contributed to Ibexis’ remarkable growth last year, and how do these distinguish it from other carriers?

We’ve experienced tremendous growth. We launched our new product for the first time at the end of 2020, so 2023 was our first year of sales. Even annualizing sales growth for last year, we had 160% growth yearover-year rate, so it was a phenomenal year.

This growth stems from a mix of financial strength, the backing of a major financial institution, innovative products and a technology-driven platform. For products that are supposed to be safe retirement savings products, financial strength is very important, and we’re proud of our A-rating.

This combination distinguishes us in the market and cultivates stability, creativity and operational efficiency.

We also prioritize organic growth over acquisitions. This strategy focuses our efforts on producing high-quality products and fostering solid partnerships with firms and advisors. It allows us to sidestep the hurdles of integrating legacy assets, so we can stay at the forefront of technological innovation and remain incredibly efficient.

Following recent enhancements to your FIA Plus series, what sets your annuities apart?

We believe clients and advisors deserve solid alternatives as opposed to just rate shopping. Both of our products, at their core, are your traditional annuities. The plus feature on both of them offer additional functionality, or “optionality,” that built onto the base product. Clients can use these products just as they would any other product or they can take advantage of the additional functionality available.

This “optionality” caters to changing economic conditions and market fluctuations and offers a competitive edge that addresses varying risk appetites and market dynamics that can change over the life of the product.

For example, with the FIA Plus, over future periods, clients have the option to expose any gains to a partial loss in exchange for significantly higher caps and participation rates. It’s a different risk decision, but it’s an option to discuss with clients. This may sound similar to a registered index-linked annuity; however, with the FIA Plus the agent doesn’t need to be securities licensed and the client can’t lose their premium. This makes it a RILA alternative for insurance-only agents.

This is just one example of various alternatives available to clients, which enhances the value proposition for financial professionals and gives them meaningful talking points, such as risk preferences and potential returns, during annual client reviews.

Efficient processing is key to improving the agent and client experience. In what ways is Ibexis leading the charge in operational efficiency?

Clients deserve to have their policies promptly issued, and advisors deserve to be promptly paid for their work. I appreciate the frustration when neither of those happen.

However, because we don’t have legacy system issues like I mentioned earlier, we are able to operate on a 100% e-application system that utilizes DocuSign, allowing us to completely eliminate paper apps and almost all not-in-good-order requirements. We are striving to be leaders in operational efficiency. It isn’t an afterthought. It’s one of the core value-adds we’re putting in the market.

I’d also note that in order to drive outcomes, you need access to good information. Internally, we’ve built large internal data and reporting frameworks that allow us to monitor all of the relevant service matrix. This data allows us to see where our focus should go to ensure the entire infrastructure is working the way we expect. For example, I get metrics on our call center, and just recently I saw that our average hold time was around 5 seconds. As for processing times, we have high standards, typically issuing new business that comes in with cash in two business days.

Delivering exceptional service is paramount in today’s competitive landscape. Can you highlight how Ibexis is setting new standards in service excellence for agents and advisors?

One of the ways Ibexis is providing exceptional service is through our client and advisor portal. It allows access to necessary information such as case notes on individual policies and enables advisors to track the progress of applications.

The portal enhances transparency and streamlines operations, which contributes to the high level of service. From our company’s inception, we’ve operated like other insurance companies wish they could but can’t because they are bogged down by outdated systems and processing standards.

Ibexis is taking an innovative approach to distribution that sets it apart in the industry. Could you explain your distribution strategy and how it benefits your partners and the industry?

Ibexis selectively partners with primarily IMOs to create deep relationships that prioritize feedback loops. This gives us insight into the tools our partners need to be successful. What’s also different is that the partners we work with all flow under the IMO hierarchy, so we don’t have the typical competition between channels.

Ibexis is making a name for itself in the industry by being a disruptor. What does that look like?

There are a number of great fixed annuity companies out there. It’s very competitive. To be successful, we aim to disrupt the status quo and offer the market more, and perform better, while ensuring we run a financially responsible business that upholds our commitments to clients.

Because at the core, we are in the trust business — earning the trust of our clients and the trust of our advisors.

Different insurance companies are good at different things, and we believe we’ve hit the mark with a combination of financial strength, tech-driven operations, innovative products, and the backing of a large global financial institution. Our goal in everything we do is to maintain agility, efficiency and financial strength while delivering good products and service.

Looking forward, what exciting developments can the industry anticipate from Ibexis?

We’re focused on innovation. This year, we’ve rolled out enhancements to our FIA Plus, including an attractive bonus as well as a bailout rate that offers additional security. We’re also conceptualizing our next fixed indexed annuity. We’re doing that by listening to our IMO partners on what agents and clients want with the intention of designing a product that reflects those insights.

To learn more about the Ibexis FIA Plus series, visit ibexis.com/fia-plus

Spiraling insurance costs spur homeowners to seek alternatives

Due to spiraling — and in some cases unaffordable — costs of insuring one’s dwelling, more and more people are opting for insurance coverage for what they might truly need — say, fire and flood — and are willing to take the risks for any other calamity that might befall them, essentially seeking “a la carte” insurance coverage.

“People are saying ‘Hmm, is there a way that I can jettison all those other coverages to make my policy more affordable?’” says Robb Lanham, chief sales officer for HUB Private Client Insurance. “So suddenly, the industry is seeing an explosion of coverages being written in the non-admitted world.”

This flexibility in designing coverage may also be crucial for carriers in order to stay profitable and maintain their customers, Lanham said. Due to a confluence of factors like climate change, regulation, inflation and litigation, the very nature of insurance policies is becoming unsustainable, and they may eventually collapse on themselves, he said.

RETIRE AT 65? NO WAY, 7 IN 10 SAY

Age 65 has traditionally been the golden age, the age at which most Americans think they can retire. But a large percentage of pre-retirees believe retirement at 65 is an unattainable goal.

The majority of pre-retiree investors (69%) agree that the norm of retiring at 65 doesn’t apply to them, according to Nationwide’s ninth annual Advisor Authority survey, powered by the Nationwide Retirement Institute. The survey also found that two-thirds (67%) of pre-retirees expect to face more challenges in retirement than their parents and grandparents had to face.

This stress is shifting the perception of life as a retiree, especially for those closest to retirement age. Four in 10 pre-retirees (41%) said they would continue working in retirement to supplement their

income out of necessity, and more than a quarter (27%) plan to live frugally to fund their retirement goals. What’s more, pre-retirees say their plans to retire have changed over the past 12 months, with 22% expecting to retire later than planned.

ECONOMIST PREDICTS ‘MINIMAL RISK’ OF GLOBAL RECESSION

“At this point, it will take a lot to derail this economy,” Pierre-Olivier Gourinchas, economic counselor and director of the research department at the International Monetary Fund, told CNBC in a recent interview. Despite the ongoing rumblings of geopolitical uncertainty, the IMF nudged its global growth outlook slightly higher to 3.2% in 2024 and projects the same rate in 2025.

“When we do the risk assessment around that baseline, the chance that we would have something like a global recession is fairly minimal,” Gourinchas said.

He cited strong economic performance by the U.S. and several emerging market economies, along with inflation

QUOTABLE

My sense is still that the Fed has itchy fingers to start cutting rates, and I don’t fully get it.

— Former U.S. Treasury Secretary Lawrence Summers

falling faster than expected until recently despite weaker growth in Europe.

MILLENNIAL WEALTH GAP FUELS NEW CLASS WAR

Most millennials struggle with student debt, unaffordable housing and low savings. But an elite group of millennials are surpassing previous generations in their wealth and fueling a new class war in that age group. That’s the word from a University of Chicago study on life course trajectories and wealth accumulation in the U.S.

According to the study, the average millennial has 30% less wealth at the age of 35 than baby boomers did at the same age. Yet the top 10% of millennials have 20% more wealth than the top baby boomers did at the same age.

The study finds that millennials have faced repeated financial headwinds. Coming of age during the financial crisis, they have lower levels of homeownership, larger debts outweighing assets, lowwage and unstable jobs, and lower rates of dual-income family formation. At the same time, the authors say the top 10% of millennials have benefited from greater rewards for skilled jobs.

8 InsuranceNewsNet Magazine » June 2024 NEWSWIRES

DID YOU KNOW ? Source: United Way

29% of households with jobs struggle to cover basic needs.

Set yourself apart from the competition by providing your clients a guaranteed income for life with Kansas City Life Insurance Company’s Lifetime Income Rider that:

• Offers 7.2% guaranteed increase to Lifetime Income Amount for the first 10 rider years if no withdrawals in years 1 – 10.

• Provides a secure, guaranteed retirement income stream for life.

• Helps clients grow their retirement savings with a competitive fixed interest rate.

• Protects the value of a fixed annuity during market turmoil.

• Allows clients the ability to maintain the flexibility and control of their deferred annuity contract even after they start receiving income.

The Lifetime Income Rider provides guaranteed income for life and is an optional benefit available on all of Kansas City Life’s fixed annuity portfolio.

information

career with Kansas City Life Insurance Company,

Dwane Turnage, Vice President, Marketing, 855-277-2090,

visit

Put your client’s retirement income dollars on the right path

For

about a

call

or

join.kclife.com .

The P wer of Persuasion

Lynne Franklin has a unique definition of persuasion. Learn her secrets to helping a client reach their own decision and say “yes.”

An interview with Paul Feldman, Publisher

Lynne Franklin’s experience as a social worker taught her everything she needed in order to survive in the business world. That started her on a path of answering the question: “How do you get others to do what you want?”

Franklin’s journey took her from positions such as a reporter for a weekly banking publication to jobs with public and investor relations agencies to starting her corporate communications and marketing practice — Lynne Franklin Wordsmith — in 1993.

A self-described “neuroscience nerd,” she studies how the brain works, how this affects the choices people make, and how to create communications that move their minds to action. A professional speaker and trainer on persuasive business communication strategies, Franklin works with entrepreneurs and business leaders.

Franklin is the author of Getting Others To Do What You Want. In this interview with Publisher Paul Feldman, she describes how we can do a better job of connecting with clients to get them to say “yes.”

Paul Feldman: I love the title of your book: Getting Others To Do What You Want. How do we get others to do what we want?

Lynne Franklin: Well, first, because I’m a neuroscience nerd, I study all the boring brain research. And then I try to figure out what this means in the real world to help us do a better job of connecting. If I had to boil it down, I’d say I fast track leaders to be seen, heard and promoted.

All of this is about figuring out ways to better connect with other people, to make sure that your message lands in a way they can see it, hear it and feel it. And then to help them make a good decision about whether what you propose is what they ought to do. So it’s not just my opinion. It’s based on science.

Feldman: Where do we start?

Franklin: We start with knowing who other people are. It’s one thing to want to know more about yourself and how you are in the world, but it’s a little hard to sit across the table from somebody and figure out who they are.

INTERVIEW 10 InsuranceNewsNet Magazine » June 2024

I have my own four-quadrant system. The acronym for it is MIND. In this instance, “M” stands for movers. These are the people who want to get stuff done, and want to be “large and in charge” and in control of the situation. What they’re mostly afraid of is not being in charge and not being in control.

“I” stands for people who are igniters. They want to ignite, change and lead change, and have people follow them and be inspired by them. What they’re afraid of is that people will not follow them and will not see the contribution they make.

Then we have “N,” which is for nicers. These are people who want everybody to be involved and play well together. What they are afraid of is being excluded.

And finally, we have “D” for detailers. These are the people who cannot get enough information. Detail is where they live. What they’re afraid of is making mistakes. They figure the more details they get, the less likely they are to make a mistake.

You can sit across the table or Zoom or anywhere, watch how people are and figure out which of these are their primary styles.

Feldman: Once you’ve figured out who they are, what can you do with that knowledge?

Franklin: You decide how you will present the information you have to share with them in a way that is most comfortable for them. So, for example, if we’re talking about the movers, these people want just enough information to be able to make a decision. If we’re talking about the detailers, the absolute opposite is true. They want as much detail as you can give them. If we’re talking about the igniters, these are the people who want to get information in a way that shows how they can inspire others and get others to follow them. And if we’re talking about nicers, they want to see how everybody can work together to get to where we want to go as a group.

It’s about having this basic understanding of how people operate. The truth is, we all have all four of these characteristics. But we have a primary style. By observing what people are saying and doing, you can figure out which of these characteristics is their primary style. Then you have a

MIND Method ™

to Fast-Track Rapport, Reduce Judgments and Improve Understanding

clue of how best to share the message that you want to deliver to them.

Feldman: That makes sense. Let’s say you’re with somebody who is a mover. How do you connect with a mover?

Franklin: What you want to do is present enough information to show them how they can make a good decision. Don’t give them a whole lot of information. Just give them enough, because you want them to know that the decision is theirs.

One thing you can watch for is whether they show any indications through their body language — whether they’re showing any nervous tics, whether they’re not making eye contact with you anymore, or whether they are checking their phones or doing something else. At that point, you know you’ve gone on too long.

When you see signs like that, stop and ask them, “Do you have any other questions?” Or you can ask them, “What can we do to move this forward on your behalf?” Movers are the people who are used to being leaders.

Feldman: If you recognize that your client is an igniter, how do you work with them?

Franklin: If you’re dealing with an igniter, you want to show your appreciation of them. You indicate that you’ve heard what they have to say, that you’ve been listening closely. You appreciate their viewpoint. And as a result of understanding what their viewpoint is, this is what you recommend for them to get to where they want to go.

Once again, you look for those nervous signs that someone is not paying attention to you. If you observe any of those signs, you know it’s time to move on.

Feldman: What about nicers? How do you work with them?

Franklin: Nicers will sit there and smile at you all day long! These people are afraid of conflict. They are not going to ask you questions about things because they don’t want to be perceived as being pushy or not being nice. So you need to

THE POWER OF PERSUASION — WITH LYNNE FRANKLIN INTERVIEW June 2024 » InsuranceNewsNet Magazine 11

Source: Lynne Franklin

Active Passive Thinking Mover Detailer Igniter Nicer Feeling

show them how what you propose helps them meet their goals. And those goals are usually community based: What do they want for their family? What kind of legacy do they want to leave? Listen carefully to what they say they want to have in community, usually with their family. Then talk to them using “If I were you” statements. Because nicers often won’t ask questions. They are afraid of conflict. So you can say to them, “If I were you, I’d be curious about this,” and go in that direction to make sure you’re giving them enough information.

Feldman: That leaves us with detailers. How do you work with them?

Franklin: Once again, you cannot give them too much information. Be prepared to get lots of questions that drill down into the details.

You’ll also want to give them information that is printed, or you give them some kind of additional data they can access after the conversation is over. Because detailers are afraid of making a mistake, they use information to soothe themselves. They think, “The more information I have, the less likely I am to make a mistake.” Detailers will take a long time to make a decision versus a mover who will hear just enough information and then go ahead.

Feldman: One of the things you talk about is the Persuasion Cycle. Talk us through that.

Franklin: The Persuasion Cycle comes to us from Dr. Mark Goulston, who, among other things, does hostage negotiation and consulting for federal agencies. As Goulston was doing this kind of work, he started paying attention to the point when you know that people stop resisting you if they’re standing on a ledge and you’re talking them off the ledge. What’s that point? What’s the process of getting to that point? You need to take them from the point where they’re not going to jump off the ledge to where they step off safely. He mapped out this cycle for us. I’ll look at the 10,000-foot view, and then I’ll talk a little bit more in detail about the different steps that are particularly applicable to us as people who are giving customers insurance and financial advice.

Listening to people, we kind of already know early on what it is that they need. We’re ready to jump into that. But we have not yet earned the right to do that because if we do that now, we will push people back into resisting.

First, everyone starts at the top in resisting and our goal is to move people from resisting to listening to considering, from considering to willing to do, and then from willing to do to doing.

Neuroscience is why we start in resistance. Back in the days when we were in the jungle, our brains only had one job, which was to keep us alive. So, our brains were constantly standing on the horizon looking for physical and verbal risks and threats and trying to get us out of the way.

So, whenever you present a new idea to a current client or a prospect, part of their brain is asking: “Is this going to kill me? Am I going to get in trouble for doing this?” People automatically resist you. It’s like there’s an actuary living in their brain, and everything goes to the actuary first. How do we move people out of that? Here are the ways this applies to all four personality styles I described earlier.

The first thing you do is listen. There are two main types of listening. The first is listening to respond, which is hearing what is being said, processing that information, and then, while they’re speaking, you figure out what it is you’re going to say next. This is where we live most of the time, which serves us just fine. But when you’re trying to move somebody from resisting to listening, all you’ll get when you listen to respond is data. You’re not going to build a connection.

To move people along, we need to

create a connection. So, you opt for the second type of listening, which is called “listening for understanding and empathy.” This means we’re not only paying attention to what it is that they’re saying, we’re also paying attention to their body language. Do they look nervous or frightened? We’re also paying attention to their tone of voice.

We’re paying attention to their emotions, so that we’re getting a picture of the whole person — not just what they’re saying. Concentrating on them takes energy. But it’s good energy because you’re picking up the entire picture of who this person is. Then, when it’s your time to speak, you can draw on so much more.

Most of us wander through our lives feeling chronically unseen and unheard, and when somebody gives us their entire attention and focus, we appreciate that. Then something else happens, and it’s called the rule of reciprocity. When we have given somebody all of our attention, sooner or later most people will notice this. They really do want to hear what you have to say at that point, because you’ve listened so well to them. That’s how we move people from resisting to listening. We listen to them first.

Feldman: How do you move people from listening to considering?

Franklin: We start by asking good questions and paraphrasing what we’ve heard. Here’s the biggest mistake people make — especially those of us who are skilled in our areas in insurance and financial advising.

Listening to people, we kind of already know early on what it is that they need. We’re ready to jump into that. But we have not yet earned the right to do that because if we do that now, we will push people back into resisting.

This is why during the “listening” to “considering” phases, asking questions — paraphrasing what has been heard to make sure that we’re understanding correctly — deeper listening is important.

It’s when we have this kind of information, we can then start proposing ideas because the prospective clients are feeling that we’ve built up enough goodwill with them and we’ve shown them we’re paying attention. Now we have something to suggest to them.

12 InsuranceNewsNet Magazine » June 2024 INTERVIEW THE POWER OF PERSUASION — WITH LYNNE FRANKLIN

That moves them into the considering phase, which is when we can actually provide information to them. So don’t rush to create a solution. What you’re trying to do in this front part of the cycle is to create connection. You do that by listening, asking good questions and paraphrasing.

When they’re considering, you’re trying to answer their questions. Their questions get more specific about what it is that you are able to do with them or the solutions you’re proposing, because that moves them into willing to do.

And frankly, once they’re in the “willing to do” space, that’s a snap.

Agents and advisors know their offerings and the needs of this person they’re speaking with. That’s the easy part. So, it’s this whole front end of the cycle where we’re trying to get buy-in, moving people from “resisting” to “listening” to “considering” — that’s the toughest part.

You may end up thinking, after you’ve gone through this, that the person is in “willing to do.” And you get excited about this. OK, so now, we can actually make a difference for this person. But at that point you may end up with them saying, “Well, you know, I have to think about this,” or “I’m going to have to talk to my wife or my spouse about this.”

Here’s the thing about persuasion. Most of us think it’s a binary thing, that it’s a yes or no. It’s actually a process, which is what this whole Persuasion Cycle thing is about.

When people say what appears to be a “no,” that doesn’t mean “no,” really. It means they’re confused.

Feldman: How do you take that final step, so that they’re finally willing to commit?

Franklin: There’s usually something missing. We must be able to turn to them — and everybody will have their own language — and ask, “Is there anything I could have said or done that would have made it possible for you to say yes to this?” And then shut up. Because when we ask a person a direct question like that, most of the time people will be able to come back to us and say, well, you didn’t talk to me about this, or I don’t understand this. Then you can say, “My bad. Let me tell you a little bit more about that.”

There’s a sales coach by the name of

Brian Tracy who calls this The Doorknob Close. And he says, when you ask this kind of question, 50% of the time people you thought were going to say no to you will say yes to you, because what you’re dealing with is buyer’s remorse. People are suddenly afraid of something that they don’t know, and if you can walk them through that thing that they don’t know, they’re more willing to say yes to it.

You can see that when you’re moving somebody from “resisting” to “listening” to “considering” to “willing to do,” instead of requiring people to make a quantum leap to say yes or no, you’re moving them along in this process. That’s what makes this great. It’s bite-size pieces rather than quantum leaps.

Once you get somebody to “willing,” and you know your customers well, you can take them from saying “yes” to “glad to do it.”

Feldman: So, would you call that persuasion?

Franklin: Let me give you my definition of persuasion. And it’s not like anybody else’s. Persuasion is presenting your ideas in a way that people can see them, hear them and feel them — and then make a good decision about whether what you’re proposing is what they ought to do. And if it is, then to say “yes” faster. And if it’s not, then to say “no.”

But along the way, you have built such goodwill with them that should they ever need what you do, they’ll come back to you. Or if they run into somebody else who needs what you do, they’ll refer you.

So being persuasive is not about getting everybody to say yes to you, because everybody shouldn’t say yes to you. It is actually about helping people make good decisions. Which means you’re never a salesperson. You’re an advocate on behalf of your current or prospective customers.

It’s not the hard sell. I think most people confuse persuasion with being manipulative. No, it’s all about helping people make good decisions because you listen well to what they have to say, and you play it back to them, and you show them what you can do and help them get to where they want to go.

It’s not sales. It’s persuasion.

It gives them a chance to make a good decision.

With Foresters Financial™, you can have the confidence to o er more life insurance. Our consistent financial strength is our hallmark and vision for the future.

There’s more life with

Foresters.

Scan to get the facts

June 2024 » InsuranceNewsNet Magazine 13 THE POWER OF PERSUASION INTERVIEW

More life with confidence.

Foresters Financial and Foresters are trade names and trademarks of The Independent Order of Foresters (a fraternal benefit society, 789 Don Mills Rd, Toronto, Ontario, Canada M3C 1T9) and its subsidiaries. N744 423168 US 03/24

A Visit With Agents of Change 14 InsuranceNewsNet Magazine » June 2024

the Fıeld

Deshawn Peterson

is helping build a bridge for the next generation of financial advisors while he works to help investment advisors build their own practices.

By Susan Rupe

Deshawn Peterson was turning 30 when he fell in love — with the financial services business.

Peterson is vice president of advisor relations with PPB Capital Partners in Conshohocken, Pa. PPB works with wealth advisors to help them implement alternative investments into their clients’ portfolios.

Earlier in his life, Peterson had a taste of financial services. While he was a student at Western Michigan University, he worked in collection services at National Bank, now part of PNC Bank.

“But then I think I was just done with the business,” he said. “In retrospect, this was between 2007 and 2009. It was a crazy time with the economy.”

Peterson began working in the technology field after graduation and eventually moved to China, where he spent several years studying Mandarin and absorbing Chinese culture. But while he might have been done with finance, the financial world wasn’t done with him.

About a decade after leaving the bank, and while he was in China, Peterson was approached by an independent broker-dealer, who told him their company worked with high net worth expatriates and needed help growing their U.S. base. Was he interested?

“I was turning 30 and thinking a lot more about long-term decisions,” he said. “So I said yes. And I walked into the training the first day, and they started teaching me about financial planning, about things like compound interest. I was all in. I thought, ‘I wish I had learned this in high school.’ I’ve been in love with the business ever since.”

What Peterson said he loved most when he was a new advisor was having conversations with those who worked in the wealth business.

“I have friends who were at founding offices, venture capital firms, private

equity, and I just enjoyed their conversations,” he said. “I love how nuanced it was, so precise and complicated. It was so much to learn because no one person was smarter than the other.”

Curiosity led to a career

Peterson described himself as “curious by nature,” which helped lead him to PPB.

“When I put all I had learned in the back of my mind, I think it was an equilibrium moment when I started at PPB because I was looking for a change,” he said. “I was looking to learn, and I wanted to be in a smaller company where I can see the outcome of my efforts. I wasn’t familiar with this particular sector of financial services when I started here, but now I feel like I’m on a fast track, growing and learning. So even though I’ve been here for two years, I feel like I’m aging as far as my acumen, learning and speaking to the smartest people in the world. Every day is a new day.”

At PPB, Peterson works with registered investment advisors to scale their private markets programs.

internally. How can we take this business decision and build a strong partnership?

“There are three main pillars to this. The first one is using differentiated fund managers. The second one is devising custom solutions — taking the advisor’s best ideas and helping them execute those ideas. The third is providing operational efficiencies. We really try to be a partner with advisors and help them go where they’re trying to go.”

Getting the word out on FPA NexGen

Peterson isn’t working only with advisory firms who want to grow. He is also active in the Financial Planning Association and is public relations coordinator for the FPA NexGen community. FPA NexGen is made up of new and aspiring financial planners who come from a variety of life experiences and backgrounds. The community is a place for those who are early in their career to connect with their peers, share insights and learn how to be a better financial planner.

I wasn’t familiar with this particular sector of financial services when I started here, but now I feel like I’m on a fast track, growing and learning. Every day is a new day.

“We’re trying to meet advisors where they are in their alternative investment journey, and we help them scale that to where their end goal is,” he said. “We’re not here to push a product on them. We’re trying to plug into their system and say, ‘How can we build some additional efficiencies? How can we streamline? How can we make a team of eight feel like a team of 15?’

“We’re not coming in saying this is the greatest strategy of the year or trying to pick stocks or assets for them. We’re really just saying, you want to allocate to alternative investments, it can be burdensome and create a lot of bottlenecks

He said his involvement with FPA came after he went on Google to find a professional association or similar group that would help him advance in his career. Peterson said he found several organizations after his online search, but FPA was the only one that responded to him after he requested more information.

“After my first call with FPA, I felt as though I had found my tribe,” he said. “This is our hub to trade problems and trade questions and all be in a similar space. Every day, I ask myself how we can get the word out there to people who are new in the business that there is a space for them here.”

BUILDING A BRIDGE — WITH DESHAWN PETERSON IN THE FIELD June 2024 » InsuranceNewsNet Magazine 15

the Fıeld A Visit With Agents of Change

NexGen has three main initiatives over the next year or so, he said. The first is strengthening its social media presence, particularly on LinkedIn. The second is streamlining the local leadership and increasing communication among the various chapters. The third is to encourage NexGen members to contribute original content to industry media outlets, to share members’ expertise and perspective.

into my humanity and helped me connect with people,” he said. In addition to studying Mandarin, Peterson spent his time in China tapping into his entrepreneurial spirit, learning about importing and exporting.

“My time in China was a huge culture shock, but I wanted to do something. I didn’t know anyone there. I just wanted to go by myself and see if I could do it. And it turned into a phenomenal experience.”

We don’t have enough people coming into the business. So we try to create that bridge for opportunities for mentorship, networking and growth, professionally and personally.

One of the hurdles he sees FPA NexGen facing is “bridging that gap between the up-and-coming in the business and those who are already established.”

“There are countless executives out there who are retiring or leaving the business. We don’t have enough people coming into the business. So we try to create that bridge for opportunities for mentorship, networking and growth, professionally and personally.”

A trip to China is a life-changer

After Peterson had spent a couple of years working in technology after graduating from college, he had a big regret — he had never traveled or studied abroad. He decided to go to China but kept that decision to himself for a year. When he was ready, he bought a ticket, quit his job and went to Shanghai.

“I figured if it didn’t work out, I could always return home and go to grad school,” he said.

Peterson spent seven years in China. He spent part of that time studying at Donghua University, where he learned Mandarin Chinese. Eventually, he went to work for the IBD that launched his financial services career.

“Studying Mandarin helped me tap

Outside of work, Peterson enjoys physical fitness activities. He has done CrossFit and trail running. He currently participates in Spartan racing, which involves racing through and around 20 obstacles on an off-road trail course featuring water and mud. Spartan racers climb walls and ropes, crawl under barbed wires, maneuver on monkey bars and throw a spear as part of the challenge.

His next big goal is to compete in an Ironman triathlon.

“I like challenges, and I like trying difficult things,” he said.

An annuity is intended to be a longterm, tax-deferred retirement vehicle. Earnings are taxable as ordinary income when distributed, and if withdrawn before age 59½, may be subject to a 10% federal tax penalty. If the annuity will fund an IRA or other tax qualified plan, the tax deferral feature offers no additional value. Qualified distributions from a Roth IRA are generally excluded from gross income, but taxes and penalties may apply to nonqualified distributions. Please consult a tax advisor for specific information. There are charges and expenses associated with annuities, such as surrender charges (deferred sales charges) for early withdrawals. These materials are for informational and educational purposes only and are not designed, or intended, to be applicable to any person’s individual circumstances. It should not be considered investment advice, nor does it constitute a recommendation that anyone engage in (or refrain from) a particular course of action. Securian Financial Group, and its subsidiaries, have a financial interest in the sale of their products.

Insurance products are issued by Minnesota Life Insurance Company in all states except New York. In New York, products are issued by Securian Life Insurance Company, a New York authorized insurer. Minnesota Life is not an authorized New York insurer and does not do insurance business in New York. Both companies are headquartered in St. Paul, MN. Product availability and features may vary by state. Each insurer is solely responsible for the financial obligations under the policies or contracts it issues.

An annuity term, Earnings income withdrawn subject If the other deferral value. a Roth from penalties distributions. advisor There associated surrender charges) These and educational are not applicable circumstances. considered does that anyone from) Securian subsidiaries, in the Insurance Minnesota in all New Securian a New Minnesota New insurance Both in St. and features Each the financial policies

Securian name Inc., and Life Insurance

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents’ association and was an award-winning newspaper reporter and editor. Contact her at Susan. Rupe@innfeedback.com. Follow her on X @INNsusan.

Securian Financial is the marketing name for Securian Financial Group, Inc., and its subsidiaries. Minnesota Life Insurance Company and Securian Life Insurance Company are subsidiaries of Securian Financial Group, Inc.

For financial professional use only. Not for use with the public. This material may not be reproduced in any way where it would be accessible to the general public.

Securian are subsidiaries Group, For financial Not for material any way to the

16 InsuranceNewsNet Magazine » June 2024

Like this article or any other? Take advantage of our award-winning journalism, licensure and reprint options. Find out more at innreprints.com.

securian.com 400 Robert Street North, St. Paul, MN 55101-2098 ©2024 Securian Financial Group, Inc. All rights reserved. F103486-1 4-2024 DOFU 6-2023 2831710 PREPARE PROTECT SECURE Forever is a long time Are your clients’ incomes guaranteed? Call us at 1-866-335-7355 or visit securian.com Learn more about annuities:

Ameritas leaders are industry leaders

Membership does not imply a certain level of skill or training. Clients should conduct their own evaluation. See Membership Requirements at https://www.mdrt.org/join/member-requirements.

Any agency referenced is not an affiliate of Ameritas or of any of its affiliates. © 2024

Kim G. Allen, LUTCF United Wealth Advisors Group Watertown, NY

Ameritas Mutual Holding Company.

Stephen L. Bruneau, CLU, CFP Boston 128 Companies Weston, MA

Zachary H. Blume, CFP Price/Raffel LA Los Angeles, CA

Mark A. Cecil, CFP United Wealth Advisors Group Bethesda, MD

Amber D. Stitt Unique Advantage Cave Creek, AZ

Christopher M. Pirtle, LUTCF Peake Financial Silver Spring, MD

Arnold J. Price Price/Raffel LA Los Angeles, CA

Stuart J. Raffel, CLU, CPC, RFC Price/Raffel LA Los Angeles, CA

Frank S. Hennessey, ChFC, LUTCF Premier Planning Group Phoenixville, PA

Josh A. Jalinski Jalinski Advisory Group Toms River, NJ

Frank G. Heitker, CLU Premier Planning Group Cincinnati, OH

John C. Kenan Southeast Financial Services Greensboro, NC

Frank C. Kinter, CLU, ChFC WPA Pittsburgh Financial Center Indiana, PA

Joseph S. Pantozzi, CLU, ChFC Alpha Omega Wealth Las Vegas, NV

Stephen D. Andersen, RHU inSOURCE Inc. Lincoln, NE

2024 MDRT Top of the Table

Ameritas salutes our valued field associates who have attained the highest levels of MDRT membership.

Michael R.

Wilcox Financial | Wilcox Sports Management Toledo, OH Ameritas® and the bison design are registered service marks of Ameritas Life Insurance Corp. Fulfilling life® is a registered service mark of affiliate Ameritas Holding Company. DST 1364 5-24

Wilcox

William C. Moore, CFP W.C. Moore Financial Services Centreville, VA

Mitchell W. Ostrove, CLU, ChFC The Ostrove Group White Plains, NY

Tax Favored Benefits Overland Park, KS

David B. Wentz, J.D.,

LUTCF

Financial

Angelo E. Cilia, CLU, ChFC

CF Advisors GroupCanvas

Pittsburgh, PA

James R. Christensen Jr.

inSOURCE Financial Advisors LaVista, NE

Justin R. Craft, RFC Nowlin and Associates Homewood, AL

Keith M. Gillies, CLU, CFP, ChFC United Wealth Advisors Group La Place, LA

David R. Guttery, RFC, CAM, RFS inSOURCE-Keystone Financial Group Trussville, AL

Merle D. Miller Midwest Financial Solutions Iowa City, IA

Bret J. Klabunde, inSOURCE Financial Advisors Omaha, NE

Leslie J. Marsh, Retirement Nationwide Great Falls, MT

2024 MDRT Court of the Table

C. Robert Brown, CLU, LUTCF

UCL Financial/United Wealth Advisors Group Memphis, TN

Curtis May Practical Wealth Advisor Lansdowne, PA

Ann Baker Ronn, LUTCF United Wealth Advisors Group Houston, TX

Kyle J. Christensen, CFP Unique Advantage San Antonio, TX

David A. McBride Sovereign Financial Group Midvale, UT

Daniel J. Scholz, CLU, ChFC Amertias Wealth Advisors Omaha, NE

David J. Fazzini, LUTCF Premier Planning Group Phoenixville, PA

Timothy J. Moran, LUTCF UCL Financial/United Wealth Advisors Group Memphis, TN

Vance S. Wentz Tax Favored Benefits Overland Park, KS

Dominick Luongo Luongo & Associates Hauppauge, NY

Michael C. Polin Premier Planning Group Phoenixville, PA

Ameritas® and the bison design are registered service marks of Ameritas Life Insurance Corp. Fulfilling life® is a registered service mark of affiliate Ameritas Holding Company. © 2024 Ameritas Mutual Holding Company.

2024 MDRT Qualifiers

Richard T. Brunsman, CLU, ChFC, RT Brunsman Insurance & Investements

John Elias Calles, J.D., CLU, ChFC, National Wealth Group

Kimberly A. Carroll, CRC, WPA Pittsburgh Financial Center

Jenning Chen, Buena Park, CA

Lindsay N. Haas, Hoffmann Financial

Scott C. Hanna, Westpoint Wealth Management

Edward H. Harrell, CLU, Harrell-Virginia Beach

Carroll U. Hoffmann, Hoffmann Financial

Tobin C. Hoffmann, LUTCF, Hoffmann Financial

Bryan L. Holen, inSOURCE Financial Advisors

Sadie J. Hyde, LUTCF, Hyde Group Wealth Management & Insurance Solutions

Dominick F. Impastato, Jr. LUTCF, United Wealth Advisors Group - Metairie

Tyler J. Petersen, Sovereign Financial Group

Stanley B. Plocharczyk, CLU, ChFC, Plocharczyk & Associates

Jason M. Pratt, Life Solutions Group

Jonathan J. Pratt, Life Solutions Group

Zachary Sims, Nowlin and Associates

Douglas A. Thompson, CLU, Executive Benefits

John B. Tickle, Houston Agency

R. David Wentz, J.D., CLU, ChFC, Tax Favored Benefits

John E. Worrel, LUTCF, United Wealth Advisors Group - Metairie

Membership does not imply a certain level of skill or training. Clients should conduct their own evaluation. See Membership Requirements at https://www.mdrt.org/join/member-requirements. This information is provided by Ameritas®, which is a marketing name for subsidiaries of Ameritas

including, but not limited to, Ameritas Life Insurance Corp. in Lincoln, Nebraska and Ameritas

York, New York. Each company is solely responsible for its

visit ameritas.com.

Mutual Holding

Insurance

condition

Any agency

affiliate

Ameritas

any of its affiliates. DST 1423 5-24

Company,

Life

Corp. of New York (licensed in New York) in New

own financial

and contractual obligations. For more information about Ameritas®,

referenced is not an

of

or of

Annuities selling strong, but for how long?

Economic conditions remain ripe for an ongoing annuity sales boom.

But the Department of Labor’s new fiduciary rule expansion could be a major disruption.

By John Hilton

COVER STORY 22 InsuranceNewsNet Magazine » June 2024

On the surface, everything is A-OK in the life of an annuity producer. Huge numbers of Americans are at or nearing retirement age, annuities are selling like umbrellas at the beach and retirement plan rules are evolving to boost those sales even higher.

But dark clouds are not just lurking — they sit directly overhead and threaten to drop buckets of rain on producers.

The dark clouds, of course, are from the Department of Labor’s Retirement Security Rule. It is the department’s fourth swing at sweeping nearly all annuity producers into a fiduciary standard.

As of press time, the new fiduciary standard is set to take effect on Sept. 23, when annuity producers will need to adhere to the Impartial Conduct Standards. They include the agent gives advice that is in the best interest of the participant, receives no more than reasonable compensation and makes no materially misleading statements.

Compliance with these initial standards is no small ask of independent producers, said Fred Reish, partner at Faegre Drinker and a longtime expert on the Employee Retirement Income Security Act law.

the Fifth Circuit in its 2018 decision vacat ing a previous fiduciary standard.

Yet, “the underlying rule is still proba bly violative” of the Fifth Circuit ruling, a Midwestern insurance executive said.

Sales unaffected by rules changes

While the rules are changing and stress is high, Americans continue to buy annuities in numbers never seen before. And it’s not merely producers frantically pushing out sales before the rules change; Americans genuinely love annuities.

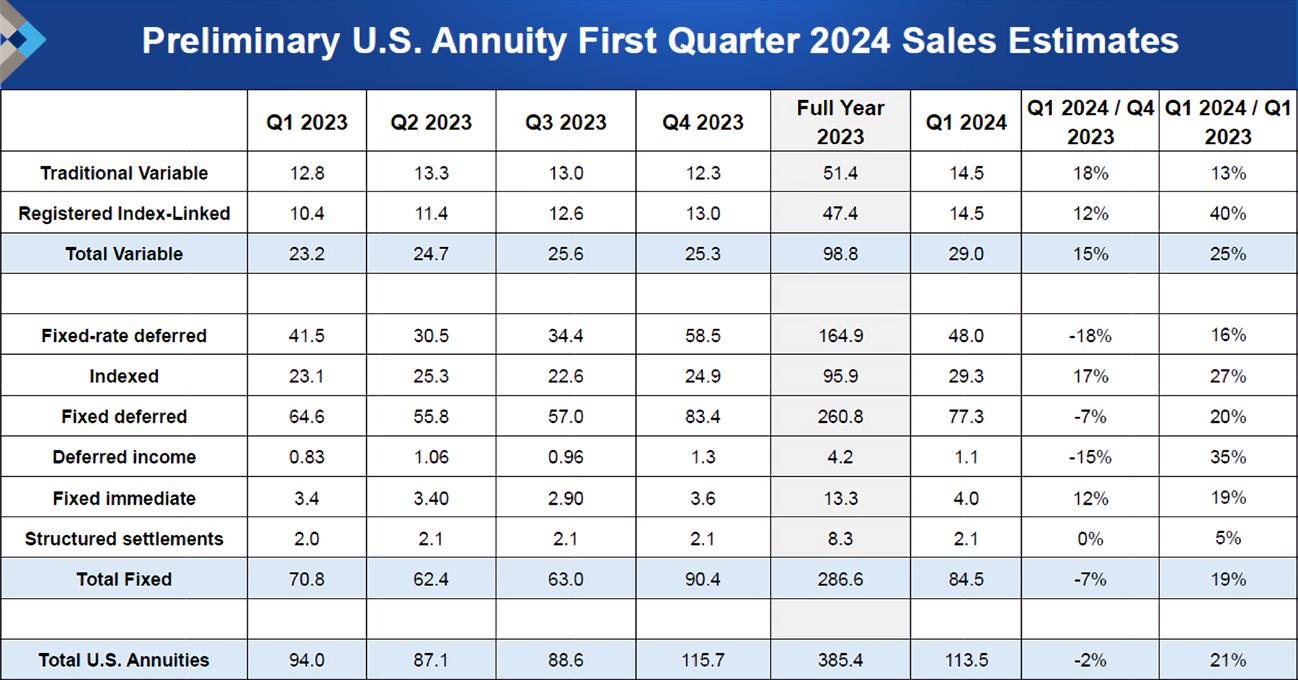

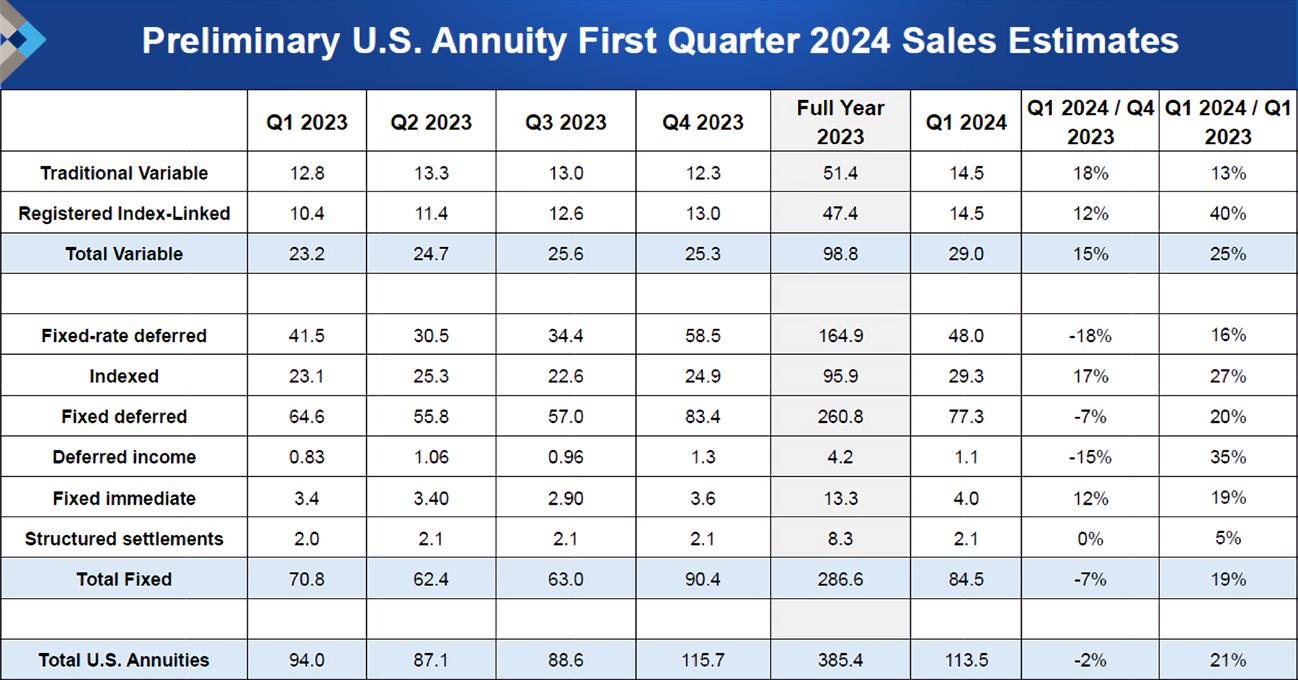

First-quarter 2024 sales of $113.5 billion were 21% higher than in Q1 2023 and the highest first-quarter results since LIMRA started tracking sales in the 1980s, the or ganization said.

“Favorable economic conditions and rising investor interest in securing guar anteed retirement income have resulted in double-digit sales growth in every product line,” said Bryan Hodgens, head of LIMRA research.

Fixed-rate deferred annuities led the way, with $48 billion in first-quarter sales, 16% higher than in Q1 2023. FRD annuities remain the primary driver of annuity sales growth, representing more than 42% of the total annuity market in the first quarter.

“ Satisfaction of the duty of care the duty of loyalty for rollover recom mendations will be the most problematic [compliance requirements].”

— Fred Reish, partner at Faegre Drinker

“Insurance companies and intermediaries will need to help independent producers with the initial compliance requirements” of the ICS and fiduciary acknowledgment, Reish said.

“Of those, satisfaction of the duty of care and the duty of loyalty for rollover recommendations will be the most problematic,” Reish explained. “That is a big change and will require education and information support for independent producers.”

For sure, legal battles are coming. But analysts say the insurance distribution world cannot rely on the courts to stop the fiduciary rule yet again. In its 476-page rule, the DOL takes meticulous care to address every fault found by the U.S. Court of Appeals for

“Eighty-five percent of FRD sales are short-duration products [less than five years]. Higher interest rates combined with insurers’ ability to offer, on average, better crediting rates have propelled prod uct sales to another level,” Hodgens noted.

But sales were strong across the board, with fixed-indexed annuities ($29.3 bil lion) and income annuities ($4 billion) setting records. Registered indexed-linked annuity sales rose a whopping 40%, to $14.5 billion.

The Federal Reserve is backing away from interest rate cuts, but Chairman Jerome Powell has not taken the op tion off the table. But annuity sales are simply too good to stop anytime soon, LIMRA forecasts.

ANNUITIES SELLING STRONG, BUT FOR HOW LONG? June 2024 » InsuranceNewsNet Magazine

“Favorable economic conditions and rising investor interest in securing guaranteed retirement income have resulted in double-digit sales growth in every product line.”

— Bryan Hodgens, head of LIMRA research

“While there are potential regulatory and economic headwinds in the second half of the year, LIMRA expects annuity sales to continue to perform well,” Hodgens said.

New York rules for all

To get a sense of how unpopular the DOL fiduciary standard is with the insurance industry, consider New York state and its Regulation 187. In 2019, New York amended the rule to add significant liability and training requirements and a stiff best-interest mandate for all insurance product sales.

Regulation 187 is very comparable to the DOL fiduciary rule. In response, many insurers refuse to do business in New York.

But it will be impossible to ignore a nationwide fiduciary standard. Industry opponents say it will result in Americans who most need advice and annuities unable to get help.

That market tightening might already be happening. LPL Financial is reportedly denying some annuity sales if the client already has at least 50% of their portfolio in one or more annuities.

“Similar to other wealth management firms, LPL maintains guidelines with regard to annuity concentration,” LPL said in a statement to InsuranceNewsNet. “However, it is not a one-size-fits-all rule, and we collaborate with agents and advisors in scenarios where a client may have 50% or more of their portfolio in annuities.”

From the DOL perspective, the rule modernizes the long-outdated 1975 ERISA regulatory regime. Lisa Gomez, assistant secretary, Employee Benefits Security Administration, called the fivepart test for establishing fiduciary duty ineffective for the retirement plans of today. When the test was created, employee 401(k) plans did not exist, Gomez said.

“If you hold yourself out as giving individualized advice that the investor can rely upon to advance their best interest, then that’s what you must do,” she said. “That means your advice should adhere to a professional standard of care.”

The DOL noted the number of indexes available in the market has grown from a dozen to at least 150 since 2005.

“Many of these indexes are hybrids, including a mix of one or more indexes as well as a cash or bond component,” the

rule states. “More than 60% of premium allocations for new fixed indexed annuity sales in mid-2022 involved hybrid designs.”

Compensation in the crosshairs

The most relevant rule changes are to compensation and the exemptions producers would use to continue receiving commissions. Two exemptions allow annuity sellers to collect a commission: Prohibited Transaction Exemption 84-24, which dates to 1977, and PTE 2020-02, an alternative created by the Trump administration.

Amended several times over the years, PTE 84-24 allows producers to receive commissions when retirement plans and IRAs purchase insurance and annuity contracts. Under PTE 2020-02, if an “investment professional” gives fiduciary advice to a retirement investor, the “financial institution” is also considered a fiduciary.

ERISA’s fiduciary responsibility rules mandate that ERISA plans pay no more than “reasonable compensation” to service providers, which include advisors. The definition of reasonable compensation isn’t fully known yet.

The DOL eased up in some areas with the final rule. For example, some differential compensation will be permitted, and new language allows reps and agents to make sales pitches and conduct investor education without triggering fiduciary status.

“DOL has recognized that a variety of sales activity does not give rise to fiduciary status,” Groom Law Group wrote in its analysis. “This opens up a range of possibilities for interactions amongst sophisticated parties to remain non-fiduciary in nature in a way that may not have been possible under the Proposal.”

The final amendment allows both cash and noncash compensation from any and all sources, subject to compliance with the exemption’s Impartial Conduct Standards and other applicable conditions, Groom added.

Perhaps most importantly, the rule does not create a private right of action — that is, lawsuit exposure — a difference from the 2016 fiduciary rule.

Still, industry opponents are not impressed with the concessions the DOL offered in its final rule.

“The DOL is conducting an ideological

COVER STORY ANNUITIES SELLING STRONG, BUT FOR HOW LONG? 24 InsuranceNewsNet Magazine » June 2024

June 2024 » InsuranceNewsNet Magazine 25

“More than 4.1 million Americans will be turning 65 each year through 2027. Most of them will not have access to traditional pensions and will need options for lifetime income like annuities provide.”

— Susan Neely, president and CEO of the American Council of Life Insurers

campaign to ban commissions, as evidenced by their inflammatory and offensive framing of this rule when they initially proposed it, the un-American and absolute disgrace of the lightning pace at which they have pushed this rule through, and the lack of questions or even spirited debate on the substantive issues within this rule,” said Marc Cadin, CEO of Finseca.

In its economic analysis, the DOL estimated that 1,577 career insurance agents, 86,410 independent agents and brokers, and 16,398 registered investment advisors will be affected by the new rule. The industrywide revenue hit could be about $325 million to $530 million per year over the next 10 years, the department concluded.

The DOL estimated that 442 life insurance companies underwrite annuities and will be affected by the amendments. The DOL based its figures on separate impact analyses provided by Morningstar and an academic paper prepared by a team of researchers led by Vivek Bhattacharya.

Retirement investors rolling over retirement funds into fixed indexed annuities would save over $32.5 billion in the first 10 years and over $32.5 billion in the subsequent 10 years, in undiscounted and nominal dollars “due to decreased pricing spreads,” Morningstar said in a comment letter.

IMOs in the clear

The big winners, if anyone can be labeled with such a term, in the new DOL proposal are independent marketing organizations. IMOs (and the related field marketing organizations) escaped significant regulatory burdens in the rule. In fact, the DOL suggests marketing firms could be part of the solution to troublesome conflicts of interest.

“These entities do not have supervisory obligations over independent insurance producers under State or Federal law that are comparable to those of the other entities, such as insurance companies, banks, and broker-dealers, nor do they have a history of exercising such supervision in practice,” the rule states of IMOs, FMOs and BGAs. “They are generally described as wholesaling and marketing and support organizations that are not tasked with ensuring compliance with regulatory standards.”

The decision to leave marketing organizations alone is significant and a major change from the DOL’s 2016 fiduciary philosophy. With that rule, marketing organizations were deemed a “financial institution” with substantial responsibilities and liabilities for annuities sold by their associated producers.

That rule, along with subsequent regulation efforts, is cited for driving merger and acquisition activity among marketing organizations. Smaller IMOs are viewed as not having the muscle to provide the watertight record-keeping, up-to-the-minute compliance, education, professional training and legal services for producers with whom they do business.

A major challenge

The DOL Retirement Savings Rule might take effect, but the end result likely won’t be known for a year or two. Many analysts say the department is playing the long game. The 2016 rule spurred much change in how the industry sold annuities.

Many of those changes remained even after the Fifth Circuit tossed out the rule two years later. Meanwhile, industry lobbyists continue to press for positive legislation for annuity sellers — specifically, a third version of the SECURE Act.

Many of the provisions of the SECURE Act of 2019 and its successor, SECURE 2.0, passed in 2023, are taking effect on staggered timelines and are removing the barriers to annuity sales in retirement plans.

That is the kind of legislation the annuity industry wants to see.

“More than 4.1 million Americans will be turning 65 each year through 2027,” said Susan Neely, president and CEO of the American Council of Life Insurers. “Most of them will not have access to traditional pensions and will need options for lifetime income like annuities provide. Now more than ever, public policy should expand and not limit people’s options for retirement.”

InsuranceNewsNet

Senior Editor John

Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at john. hilton@innfeedback.com. Follow him on X @INNJohnH.

InsuranceNewsNet Magazine » June 2024 ANNUITIES SELLING STRONG, BUT FOR HOW LONG?

In this year’s Annuity Awareness Month Thought Leadership Series, great minds from two elite companies offer their perspective on product, process, and the future of an everchanging annuity marketplace.

How annuities can help younger generations secure their future by GBU Life PAGE 28

Protect clients’ retirement savings by recommending an index that is designed to fit their needs by Oceanview PAGE 30

Special Sponsored Section

27

INSIDE

How annuities can help younger generations secure their future

As younger generations, particularly millennials and Gen Z, look toward their future, the retirement landscape presents challenges. Traditional pillars of retirement stability, such as Social Security and pensions, may be less reliable or available down the road. For members of these rising generations, a key aspect of retirement planning is diversification.

Nationwide Retirement Institute’s 2023 Social Security Survey showed that 45% of Gen Z and 39% of millennials don’t believe Social Security will be there when they retire.1 This lack of belief is not unfounded, as 2024 research shows 79% agree — America faces a retirement security crisis.2

While 401(k) plans are a primary vehicle for retirement savings, they focus on asset accumulation, as does most of the recommendations around preparing for retirement. This can leave individuals without clear guidance on converting those assets into a steady income stream. It is important to know when to convert to these funds to help create a smooth road into retirement.

“Where defined contribution plans like a 401(k) fall short is that there’s no prescription for what to do with those accumulated assets. And you don’t live on assets; you live on income,” said Lesley Mann, SVP/ CMO, GBU Life.

Despite being credited as the generation that saves the most, according to Vanguard,4 roughly 23% of Gen Z don’t expect to ever be able to retire, per a recent McKinsey & Company study.5 This dichotomy highlights the complex relationship between saving habits and retirement expectations among younger generations.

Millennials and Gen Z are often characterized as “job hoppers,” driven by a quest for personal and professional growth. While this may lead to increased income and satisfaction, it can result in fragmented retirement savings and difficulty maintaining consistent contributions to traditional retirement plans. The lack of loyalty-inspiring benefits, such as pensions, reduces the incentive for younger generations to stay with a single employer for an extended period.

The rise of the gig economy and the increasing prevalence of nontraditional employment further complicate retirement planning for younger generations. Limited access to employer-sponsored retirement benefits makes it chal-

“Where defined contribution plans like a 401(k) fall short is that there’s no prescription for what to do with those accumulated assets. And you don’t live on assets; you live on income.”

— Lesley Mann, SVP/CMO, GBU Life

The gradual disappearance of traditional pensions has further exacerbated the problem, leaving younger generations with fewer options to secure their financial well-being in retirement.

Younger generations face new challenges

Younger generations have unique characteristics and face new challenges that shape their approach to retirement planning. For instance, Gen Z members are on track to become the most educated in history, fueled by a desire to acquire new skills and secure a better future.3 However, they must navigate an overwhelming amount of information from various sources, not all of which is reliable or accurate.

The financial pressure of paying down student loan debt while trying to save for retirement, a rising cost of living, and uncertainties younger generations have encountered growing up — such as a recession, a pandemic, climate change, and social unrest — can lead to decisions that often times are better made with professional guidance.

Members of Gen Z have developed a pragmatic and cautious approach to finances, influenced by witnessing the financial challenges their Gen X parents faced during periods of economic instability. This has led to heightened financial stress and concerns about the future economy, with a significant portion of Gen Z reporting constant worry about their financial well-being. Consequently, younger generations prioritize stability and security.

lenging to plan for long-term financial security if traditional retirement plans are perceived as the only option. However, those in the annuity industry should recognize that alternative solutions exist to help millennials and Gen Z secure their financial future.

Personal savings may not be enough