jewellerynews

Diamond market trends changing the industry The magic of coloured diamonds

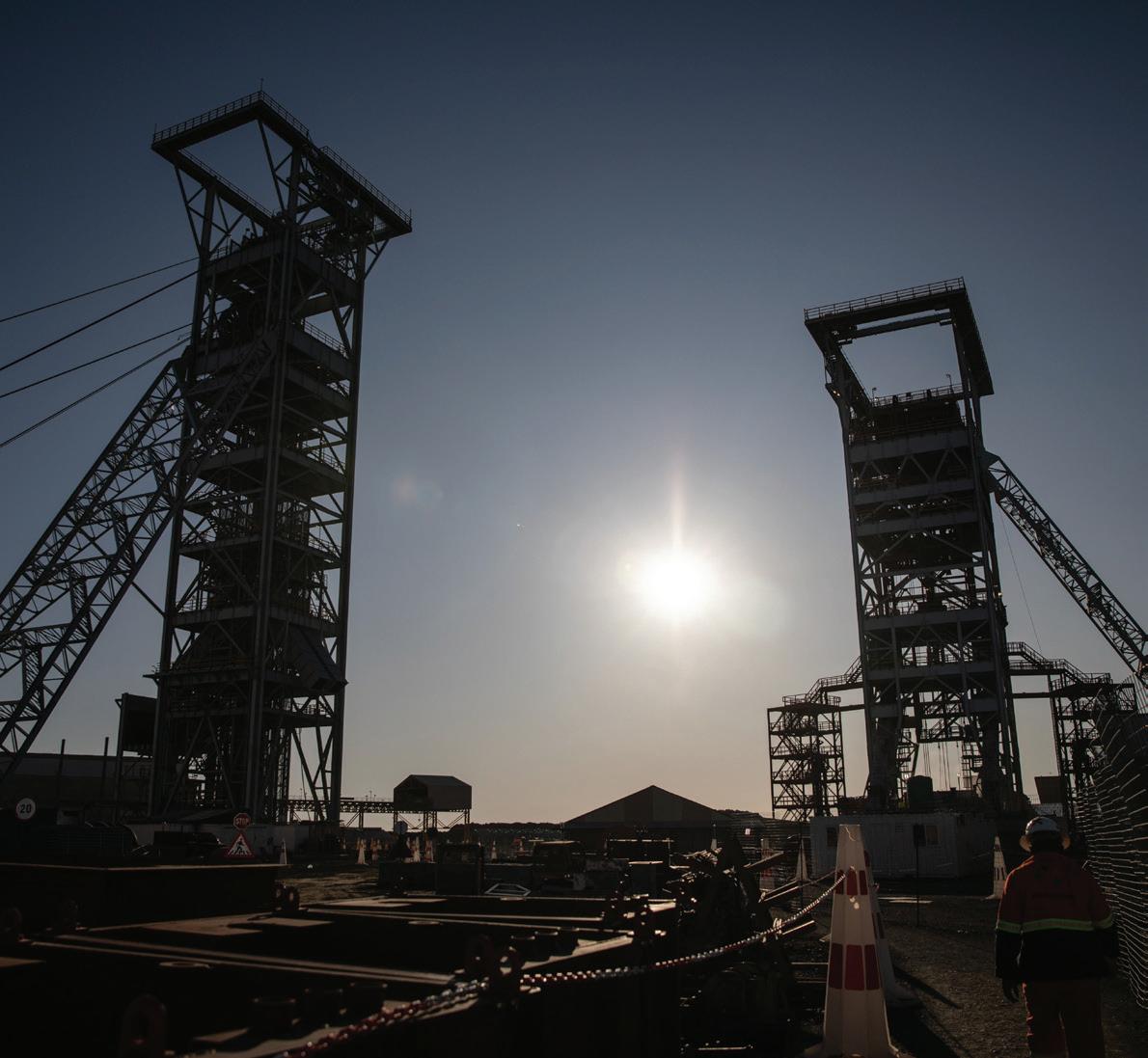

De Beers’ multi-billion dollar new Venetia Underground

Deep-focus earthquakes: the heartbeat of a diamond factory?

Diamond market trends changing the industry The magic of coloured diamonds

De Beers’ multi-billion dollar new Venetia Underground

Deep-focus earthquakes: the heartbeat of a diamond factory?

By 2030, we will increase the diversity of creative talent in the diamond jewellery sector #BuildingForever #AcceleratingEqualOpportunity

For more information, visit: https://www.debeersgroup.com/sustainability-and-ethics/building-forever-2030-goals

The Gem & Jewel product provides a tailormade sustainable solution for jewellery related businesses that navigate the changing jewellery industry, market conditions and challenges exacerbated by crime and global economic influences.

Working with the jewellery industry requires a detailed understanding of its unique requirements and with years of experience in developing niche insurance products, Bryte is one of South Africa’s leaders in providing cover for retail, wholesale and manufacturing jewellers, gem cutters and setters, watch importers, coin dealers, tender houses and dealers, goldsmiths, diamond and metal processors and refiners. Just as we know that one size does not fit all, we also appreciate that standard commercial cover is the wrong fit for these customers.

Contact us so we can show you what type of specialist cover the jewellery industry has enjoyed for over 22 years.

Bryte’s Jewellery and Precious Assets division is excited to offer you our Gem & Jewel cover, which is endorsed by the Jewellery Council.

Contact natasha.maroun@brytesa.com or robyn.lambert@brytesa.com and learn how we can assist.

WE ENSURE THE ENTIRE PROCESS FLOWS SEAMLESSLY FOR THE SELLER AND THEIR DIAMONDS ARE MARKETED WITH THE GREATEST EFFICIENCY AND EFFECTIVENESS.

At Alexander Bay Diamond Company, we work with mining and trading companies all across Africa and internationally to offer the finest selection of rough diamonds at regular diamond sales. By combining decades of experience with cutting-edge technologies, we have become experts in providing the most comprehensive, cost-efficient, and client-friendly sales service.

Our sophisticated infrastructure and market-sensitive sorting and valuation processes guarantee the highest levels of security and transparency.

• FICA changes relating to high-value goods dealers

• BlueRock’s mining unit enters business rescue

• Collaboration, compliance and tech emerge as key talking points at the Fourth Retail Jeweller Dubai Forum

• Hublot introduces third collaboration with Save Our Rhino Africa India

• PlatAfrica Pop-Up Store still open

As we approach mid-2023, the diamond industry is poised for several significant changes that will have a lasting impact on the market. Antwerp-based diamantaire Anita Diamonds share four prominent trends that will reshape the diamond industry.

Coloured diamonds are in the spotlight. They routinely break records at auction houses, make headlines when set in celebrity engagement rings and are gemmological marvels of the rarest order.

The De Beers Group has devised an autonomous roadmap for its Venetia underground operation that will result in the new US$2 billion mine becoming one of the most mechanised and automated mining

Some earthquakes originate from below the rigid outer layer of plates. The nature and cause of these so-called deep-focus earthquakes remain poorly understood, but recent research suggests they might have something to do with the growth of top-quality diamonds.

SA’s diamond heritage stems from a young boy who picked up a pretty pebble near Hopetown in 1867. The true nature of the stone was undisclosed for a while, as the children used it for playing games on the farm.

The SA Mint has introduced the penultimate collection in the second series of the popular Big 5 collectable range of coins, featuring the leopard. The range celebrates Africa’s pride, the five most iconic animals in the subcontinent’s rich wildlife.

A comprehensive directory featuring information and contact details of all members of the Jewellery Manufacturing Association of SA.

views expressed in this publication are not necessarily those of the owners, the Jewellery Council of South Africa, the Diamond Dealers’ Club of South Africa, its members, the publisher or its agents. While every effort has been made to ensure the accuracy of its contents, neither the owners, the Jewellery Council of South Africa, the Diamond Dealers’ Club of South Africa, the editor nor the publisher can be held responsible for any omissions or errors; or for any misfortune, injury or damages which may arise therefrom. The same applies to all advertising. SA Jewellery News© 2023. All rights reserved. No part of this magazine may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or any information storage retrieval system, without prior written permission from the publishers. ISSN 1817-5333.

Editor: Adri Viviers

Tel: +27 (0)11 883-4627

Cell: 084-261-1805

E-mail: adri@isikhova.co.za

Managing Director: Imraan Mahomed

E-mail: imraanm@isikhova.co.za

Director Brand Strategy: Jenny Justus

Cell: 083-450-6052

E-mail: jenny@isikhova.co.za

Creative Director: Joanne Brook

E-mail: joanne@isikhova.co.za

Operations Director: Thuli Majola

Tel: +27 (0)11 883-4627

E-mail: thuli@isikhova.co.za

Advertising Sales:

Tel: +27 (0)11 883-4627

Cell: 083-450-6052

Copy Editor: Anne Phillips

Distribution: Ruth Dlamini

SA Jewellery News is published by: Isikhova Media (Pty) Ltd,

Physical: 10th Floor, Metal Box, 25 Owl Street, Milpark, Johannesburg, South Africa.

Website: www.isikhova.co.za

While trends may change over the years, one thing is certain – diamonds are forever. That was evident again during this year’s award season, when diamonds took centre stage.

Diamonds are undeniably dazzling, brilliant and mesmerising gems which continue to inspire awe. They are also the focus of this, our annual Diamond Edition.

As one of the most sought-after and precious jewels in the world, as well as one of the hardest materials on earth, diamonds have been coveted for centuries and are steeped in myth for their breathtaking beauty and symbolic meaning.

With its long history of value and influence, and despite numerous challenges, the diamond market is still shining bright, with research projecting that it will grow from US$2,4 billion in 2022 to US$2,5 billion this year.

In these pages, as we enter the fourth month of 2023, we provide you with comprehensive coverage on the local and global diamond industry. It is poised for several significant trend changes that will reshape it and have a lasting impact on the market and we examine four of them.

We also delve into the autonomous mining roadmap the De Beers Group has devised for its Venetia Underground Mine, which will result in the new US$2 billion mine becoming one of the most mechanised and automated operations in the world.

Some earthquakes originate from below the rigid outer layer of plates. The nature and cause of these so-called deep-focus earthquakes remain poorly understood, but recent research suggests they might have something to do with the growth of topquality gem diamonds. The GIA shares its most recent findings.

We also look at coloured diamonds, which remain in the spotlight and routinely break records at auction houses. They make headlines when set in celebrity engagement rings and are gemmological marvels of the rarest order.

Diamonds are indisputably the embodiment of everything beguiling, elegant and extraordinary and transcend both time and culture.

With offices in Cape Town and Johannesburg, BYL Diamonds has cemented its reputation as one of South Africa’s leading diamond and jewellery manufacturers and wholesale suppliers. Through associates with mines in SA and state-of-the-art polishing factories abroad, BYL Diamonds has secured access to some of the world’s most impressive loose cut diamonds and gemstones, in a galaxy of shapes, sizes, colours and clarities. In addition to being a leading supplier of loose diamonds and gemstones, it is renowned for the quality of its ever-changing jewellery range, with each piece made up using the finest diamonds and gemstones carefully chosen for each individual item. For more information on its range of diamonds, gemstones and jewellery collections, contact BYL Diamonds on tel: (021) 419-2000, e-mail: orders@byldiamonds.com or visit: www.byldiamonds.com.

The members of the Diamond Dealers Club of South Africa Comprises of South Africa’s leading diamond manufacturers, dealers in diamonds and precious stones and jewellers.

• Ethical and honest conduct

• Accountability in case of grievances

• Legal expertise

• Prestige of its Members due to strict controls and criteria

• Confidence (the fifth “C”) Contact Joyce (Admin Manager - Diamonds) for more information

Phone: +27 011-334-1930 Fax: +27 0865165958

Website: www.diamonds.org.za

E-mail: joyceb@diamonds.org.za

The Jewellery Council of SA (JCSA) is asking its members to take note that the National Treasury has amended the Financial Intelligence Centre (FIC) Act with effect from 19 December 2022.

The FIC Act Schedule 1 (list of Accountable Institutions) was amended to include item 20 (high-value goods dealers). This amendment includes businesses dealing in high-value goods receiving payments in any form of R100 000 or more per item, whether payments are made in a single operation or more than one. This includes dealers in motor vehicles, Krugerrands, precious metals, precious stones or any other type of business where a single item valued at R100 000 or more is sold to a customer.

Members who are item 20 high-value goods dealers are required by law to register with the FIC as an Accountable Institution in terms of Schedule 1.

As an Accountable Institution, members are required to:

• Submit regulatory reports to the FIC. These are cash threshold reports which must be filed on cash received or issued if it exceeds R49 999,99.

• Suspicious and unusual transaction reports. Reports must be filed on transactions that are unusual or suspicious in terms of moneylaundering or terrorist financing activities.

• Terrorist property reports. A report must be filed if a dealer is aware that he/she possesses or controls the property of a natural person or entity linked to terrorist and related activities.

• Implement a risk-based approach to customer due diligence.

• Develop a risk management and compliance programme.

• Keep records of client information, transactional information and regulatory reports filed with the FIC.

• Appoint a compliance officer to assist management in discharging their obligations in terms of the FIC Act.

• Train employees in the FIC Act and the Accountable Institution’s RMCP on an ongoing basis.

Members who are Krugerrand dealers would previously have been required to register with the FIC as a Reporting Institution in terms of Schedule 3.

This requirement has now been removed with the addition of high-value goods dealers to Schedule 1 (Accountable Institutions).

For further information, visit: www.fic.gov. za/Documents/FIC%20Act%20Booklet%20 202012.pdf

Since 2019, Hublot has supported Save Our Rhino Africa India (SORAI), an organisation founded by Hublot ambassador and former international cricket star Kevin Pietersen.

“Two-thirds of rhinoceros species may disappear in our lifetime, which would be an irreversible loss for our planet – and its main

cause is poaching. Hublot has committed to a partnership with Pietersen and his platform, SORAI, to preserve rhinoceroses threatened with extinction,” says the watch brand. “This commitment takes the form of the Big Bang Unico SORAI, from which a large portion of the funds raised from sales will be directly paid to Care for Wild for the rescue and rehabilitation of orphaned baby rhinoceroses. In buying the timepiece, 100 people will become involved in this initiative undertaken by Hublot.”

Hublot recently introduced its third collaboration with SORAI.

The new Big Bang Unico SORAI uses grey and sunset colours for its design, a palette evocative of the heightened danger rhinos face as night falls.

The brand has opted for a zirconium-based

Kareevlei Mining, which runs operations at BlueRock’s Kareevlei deposit in South Africa, has been placed business rescue, according to a 24 February filing with the London Stock Exchange (LSE).

The miner has asked that trading of its shares on the alternative investment market, which is part of the LSE, be suspended due to the financial uncertainty, it explained.

BlueRock has been experiencing financial difficulties for the past few years because of a long-term shutdown due to COVID-19, as well as

ceramic case and bezel, resulting in an almost entirely scratch-resistant exterior. The case and bezel are alternatively micro-blasted and polished to give the watch a rugged, yet refined look. The new Big Bang Unico SORAI is 44 mm in diameter and water-resistant to 100 m.

“Our planet is home to five species of rhinoceros. According to the International Union for Conservation of Nature, of those five species, the black, Javan and Sumatran rhino are now considered ‘critically endangered’, white rhino are ‘nearly threatened’ and Indian rhino are ‘vulnerable’,” says Pietersen. “I’m appalled at the brutality they face. There’s an urgent need for action and Hublot’s support for this is crucial. By reducing the time it takes to act, we can protect as many rhinos as possible.”

extremely rainy conditions that delayed the commissioning of a new plant and the opening of the main pit. In July, the miner signed a financing deal with the Teichmann Company which saw the investor become a major shareholder, after running out of money to continue operating the site. Teichmann CEO Victor Dingle replaced Mike Houston as CEO of BlueRock in September. – Rapaport

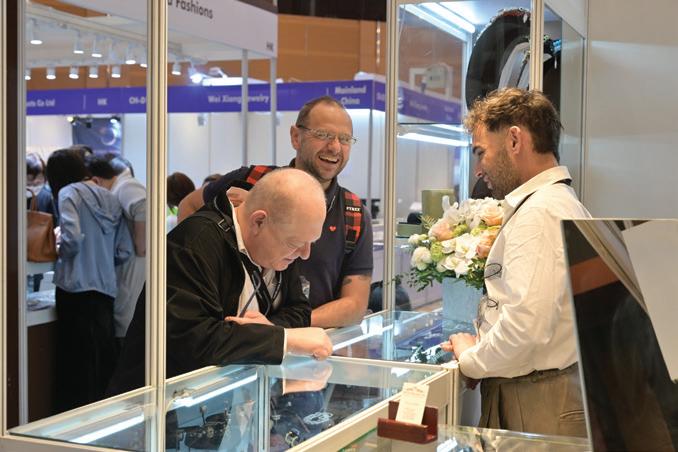

The fourth edition of the Retail Jeweller Dubai Forum held at The Hyatt Regency, Deira, brought together leading jewellers of the Middle East and beyond for a day of intense knowledge-sharing and debate on future trends. The accent was on technology coming into the business and the need for collaboration between players, underlined by compliance with safety and regulatory norms in the UAE, which has made the business robust.

Technology-focused companies showcased the latest advancements in tech for the gems and jewellery industry, providing attendees with a valuable opportunity to explore cuttingedge solutions that could help drive their businesses forward. Design and innovation were also widely discussed, along with a future-forward look at the industry.

In his inaugural address, Tawhid Abdullah, CEO of Jawhara Jewellery, issued a clarion call for collaboration among players in the UAE’s gems and jewellery industry that would redefine the future of the business. He pointed out factors such as extending the Gold Souk and amendment of the valueadded tax law in the UAE, along with other help from the government and customs authorities which had made business easier in Dubai, the “city of gold”. “We’re going through a big transformation. In the past we

unintentionally neglected the importance of compliance, but now it’s a priority,” he observed.

The first Spark Session at the forum, presented by Vivek Das and Sanjib Chatterjee of Unlearn Innovation, focused on “Smart Ways Jewellers Can Aid Consumers: A Product Search, Powered by Artificial Intelligence”. They decoded their digital offering, Trouve, which enables consumers to search for any product anywhere visually. They emphasised its application in preventing broken consumer journeys, turning them into conversions and maximising wallet share. “Typing is the past. Visual is the future,” said Das. Chatterjee added that Trouve was open to integrating all kinds of software.

Next on stage was Vaishali Banerjee, MD: India of the Platinum Guild International, who spoke on “The Platinum Opportunity for the Middle East” and creating the platinum edge for the GCC by identifying opportunities in the region. “The world’s best diamonds are set in platinum,” she said, pointing out that platinum symbolised love that withstood the test of time. She also spoke of the PT-950 mark, which had come in as a benchmark for the quality and preciousness of platinum, as well as building a new incremental business opportunity with the “Men of Platinum”.

Annually, Anglo American Platinum, Platinum Guild International (PGI) India and Metal Concentrators host the PlatAfrica jewellery design and manufacture competition. The competition celebrates and supports the South African platinum industry by giving student, apprentice and professional jewellers the opportunity to work, experiment, innovate and develop their technical expertise with the metal. PlatAfrica highlights the strength and beauty of platinum, while revealing the glowing jeweller talent of SA. Every year an original theme is chosen for the competition, producing one-of-a-kind, statement pieces of jewellery. Each year, many of those pieces are melted down in order to re-use the platinum.

The PlatAfrica Pop-Up Store, which is exclusively online, gives the public an opportunity to invest in the precious resource

of platinum and in the South African jewellery industry. To view or purchase pieces from the PlatAfrica 2022 Hope collection, visit: https:// plat.africa/.

Cape Precious Metals (CPM) has announced the creation of the CPM board. For 29 years, since the company’s inception, Sharon Eades served as its only Director. “However, this was only on paper,” says Eades. “In reality, our executives and managers were very much involved with, and responsible for, our everyday business and strategic planning.”

CPM’s newly appointed Directors are Olga Hood-Eades, Jolandie Binneman, Camilla Eades and Malcolm Jenner.

“I have the utmost faith in each person’s abilities and, more importantly, their

The creation of a KP Permanent Secretariat was a key recommendation of the ad hoc committee that oversaw the previous Kimberley Process’ Review and Reform cycle, which had ended in 2019. The TET was charged with making a selection from a group of nations that had submitted proposals to host the new body, and it was empowered to do that according to a set of pre-determined evaluation criteria.

Cape Precious Metals are suppliers of precious metal alloys, solders and paste, findings, tools, wire, plates, tubing, packaging and jewellery cleaners

Botswana’s successful bid to host the KP Permanent Secretariat was indicative of the country's and Africa’s growing role as the nerve centre of the diamond trade. For a long while the world’s largest producer of rough diamonds by value, the country is also today the headquarters of De Beers global sales operation.

The fact that no permanent secretariat has functioned during the 23 years since the

dedication. This team has played a vital role in CPM’s success and has been my rock.

“As we move forward as a collective, ensuring the company’s compliance and ethical duties, I have no doubt that this board will continue to strengthen our position as an industry leader, as we look for new ways to provide world-class products and exceptional service,” says Eades.

As a registered precious metal refinery, CPM specialises in the recycling of all precious metals, utilising modern techniques for maximum recovery and returns.

KP was established has posed an ongoing challenge to the organisation, which for the past two decades has overseen the creation, implementation and operation of the most extensive regulatory system in the history of the international diamond trade, the Kimberley Process Certification Scheme (KPCS) – an international mechanism that today encompasses 85 countries and, in 2021, monitored rough diamond sales to cutting centres worth about US$16,4 billion. The absence of a permanent secretariat was in part a result of the haste in which the KP was established, at the height of the conflict diamond crisis in Africa during the early 2000s, but was also due to the perception that a substantial infrastructure was not required.

The KP Permanent Secretariat is projected to begin operations in January 2024.

We refine all jeweller’s scrap and also provide casting and assay services to jewellers across Southern Africa

one year, reflecting a positive outlook for the jewellery sector.

“We're delighted to see the overwhelming support from industry buyers and exhibitors for the twin shows,” says Sophia Chong, Deputy Executive Director of the HKTDC. “The vibrant atmosphere, busy traffic and packed booths not only reflected the global jewellery market’s pent-up demand after three years and strong buying power, but also reaffirmed Hong Kong’s position as the world’s premier trade fair capital in Asia which brings the world together to do business and build relationships.

“Looking ahead, we have many more trade events lined up for different sectors throughout the rest of the year and with

Germiston: +27 (0) 11 334 6263

Cape Town: +27 (0) 21 551 2066

Durban: +27 (0) 31 303 5402

PE/Gqeberha +27 (0) 41 365 1890

the policy support from the Hong Kong SAR Government, we're confident that trade fairs and conferences will help to re-energise the city’s economic recovery,” she added.

In addition to the high volume of buyers and exhibitors, robust business results were also seen across the shows.

We deliver world class products and exceptional service through our experienced, well trained team

“This 100-year-old Smiths landmark electric clock is a marvel to behold,” says Philip Zetler, owner of Philip Zetler Jewellers.

The clock stands proudly outside the jewellery store in St. George’s Mall, Cape Town, affixed to the building. “Its vintage and antique charm added a touch of nostalgia to the busy street, now a mall transporting passers-by to a bygone era,” says Zetler.

He has been looking after the clock for more than 40 years and takes great pride in

its upkeep. He services it regularly, keeping it in pristine condition and ensuring it keeps perfect time. However, due to frequent power outages and load-shedding, it began to run 15 minutes fast.

“I knew I had to do something to keep the clock ticking correctly, so I climbed the ladder to adjust the time often,” says Zetler. “It’s a laborious task, but I do it with love and dedication, knowing that the clock’s not just a piece of machinery, but a symbol of a bygone era.

Gold Fields and AngloGold Ashanti have agreed the key terms of a proposed joint venture in Ghana between Gold Fields’ Tarkwa and AngloGold Ashanti’s neighbouring Iduapriem mines.

The Tarkwa Mine is held by Gold Fields Ghana, in which Gold Fields currently owns a 90% share and the Government of Ghana (GoG) holds 10%. The Iduapriem Mine is currently 100% owned by AngloGold Ashanti. Both mines are located near the town of Tarkwa in the country’s Western Region.

The parties have agreed in principle on the key terms of the proposed joint venture. The parties have commenced with preliminary, high-level and constructive engagements with

senior government officials in Ghana and will continue engaging with the GoG, relevant regulators and other key stakeholders, with a view to implementing the proposed joint venture as soon as practically possible. The parties have also agreed to mutual exclusivity during this engagement.

It is intended that the proposed joint venture will be an incorporated joint venture, constituted within Gold Fields Ghana and operated by Gold Fields. AngloGold Ashanti will contribute its 100% interest in Iduapriem to Gold Fields Ghana in return for a shareholding in that company. The parties do not anticipate that any material, additional capital injection will be required by either company to establish the proposed

“It’s seen many changes over the years. It’s witnessed the birth of new technologies, the evolution of fashion and design and the ups and downs of the local economy. It’s weathered storms, protests and celebrations, standing tall and proud throughout it all.

“People come from far and wide to marvel at the clock, have pictures taken with it and admire its intricate workings. It’s become a beloved landmark, a symbol of Cape Town’s rich history and a testament to the ingenuity of the people who built it.

“As the years go by, the clock continues to tick, its hands moving gracefully around its face, marking the passage of time,” says Zetler. “And as long as I’m around, I’ll continue climbing that ladder, adjusting the time and keeping it running smoothly. It’s a living, breathing piece of history that deserves to be preserved for generations to come.”

joint venture and is expected to materially improve its capital intensity once operational. Excluding the interest to be held by the GoG, Gold Fields will have an interest of 66.7%, or two-thirds and AngloGold Ashanti will have an interest of 33.3%, or one-third.

The joint venture would create the largest gold mine in Africa and one of the largest in the world. It will be a high-quality operation, supported by a substantial mineral endowment and an initial life spanning almost two decades. Operational synergies will be achieved by optimising mining of the combined ore bodies and consolidating the infrastructure of the immediately adjacent mines for the long-term benefit of all shareholders and stakeholders.

The diamond industry is a significant contributor to the global economy, with a rich history and culture dating back centuries. However, the industry has recently faced its fair share of challenges and changes. Various factors, including global events, evolving consumer preferences and technological advancements, drive diamond market trends. As we approach mid-2023, the diamond

industry is again set to experience a range of developments that are likely to significantly impact the market.

From the ongoing fallout of the RussiaUkraine conflict and the rise and fall of the lab-grown diamond market to wider economic uncertainty, there is much to consider for those working in and following the diamond industry.

Here are four significant diamond market trends expected to change the diamond industry forever:

According to a report by Rapaport, American sanctions on Russian miner Alrosa, which accounts for approximately 30% of global rough diamond production, did not result in the predicted scarcities when implemented in April 2022. Polished inventory levels remained consistently high throughout the year due to aggressive rough buying at the end of 2021 and the start of 2022, coupled with weaker demand later in the year.

As we approach mid-2023, the diamond industry is poised for several significant changes that will have a lasting impact on the market. Antwerp-based diamantaire Anita Diamonds shares four prominent trends that will reshape the diamond industry.

As a result, polished prices dropped in the year’s second half, leading manufacturers to reduce their rough buying and factories to lower polished output. Shortages of “Alrosatype” diamonds have emerged, but overall, polished suppliers are left with significant volumes of less popular goods that have been challenging to sell in the weaker market. De Beers’ strong year and increased rough sales in 2022 were due to Alrosa’s absence from the market.

Nonetheless, it is expected that Alrosa will gradually return to the market, influencing midstream polished-inventory levels. The first quarter of 2023 is expected to see a decline in manufacturing, leading to lower availability of newly cut supply, potentially affecting jewellers’ buying.

• The diamond market trend of labgrown diamonds

Recently Martin Rappaport, a prominent diamond dealer, referred to “the bitcoin of the diamond trade” and claimed they had no trust or value.

While lab-grown diamonds are attracting continued admiration, polished jewellery dealers ascertain the use of real stones over lab-grown ones.

The growth of the lab-grown diamond industry in 2022 resulted in a decrease in demand for natural diamond jewellery. The wholesale prices of synthetic diamonds continued to decline due to increased supply driven by technological advancements.

This shift in demand has led to a more nuanced lab-grown market, with retailers focusing on higher-quality production and a move towards better colour and clarity goods.

The diamond market trend of lab-grown diamonds may appear to be a viable substitute for natural diamonds, but they have certain limitations. There is ongoing debate regarding their worth, legitimacy and impact on the diamond market, which may make consumers wary of buying them.

• The opening of China's diamond market China has lifted its COVID -19 restrictions and quarantine measures for travellers, bringing renewed optimism to its economy. The recovery is expected to gain momentum in the second half of the year, as it will take time for Chinese consumers to return to normal and regain confidence in their government’s sudden change in policy. The return of Chinese buyers, absent for a significant period in 2022, is expected to help boost the global diamond market in the coming year, with growth measured against the weaker numbers from the second half of last year.

The most awaited comeback of HKTDC’s twin jewellery shows last month welcomed diamond dealers from around the world to Hong Kong. This, in turn, is expected to jet-start the Chinese diamond market, which has been on halt for the past three years. The opening of China is expected to bring a change in the global diamond industry.

• The rise of artificial intelligence (AI) The use of AI is becoming essential for

The diamond industry faces significant changes in 2023 that will shape the market’s future. From the impact of sanctions on Alrosa to lab-grown diamonds, the opening of the Chinese diamond market and the rise of artificial intelligence, diamond market trends are evolving rapidly.

diamond industry players to remain competitive in the rapidly changing global diamond marketplace.

The diamond industry is increasingly relying on AI to improve efficiency and accuracy in various processes, including mining, exploration, sales and marketing.

AI technologies such as machine learning, computer vision and natural language processing are being leveraged to extract insights and value from vast amounts of data generated by the industry. AI-powered solutions accurately assess rough diamonds’ characteristics to

optimise their cutting and polishing, providing a more personalised shopping experience and preventing diamond fraud.

The diamond industry faces significant changes in 2023 that will shape the market’s future. From the impact of sanctions on Alrosa to lab-grown diamonds, the opening of the Chinese diamond market and the rise of AI, diamond market trends are evolving rapidly.

To remain competitive, diamond industry players must adapt to these trends and leverage the opportunities presented by technological advancements. Ultimately, those who successfully navigate these changes will be well-positioned for success in the global diamond market.

– This article was first published on Anita Diamonds’ website, which can be found at: https://www.anitadiamonds.com/news-andblog/4-most-important-diamond-markettrends-changi-39/.

Anita Diamonds was founded in 2010 in Antwerp, Belgium, by knowledgeable and experienced brothers Chirag and Chinar Shah, who had developed unique and expert insight into the world of diamonds through their active involvement in that industry since 1994. Over the past 13 years, the company has expanded from a small business to a leading certified diamond manufacturer and trader of polished stones. Anita Diamonds has two offices in the Middle East and Europe.

The industry has recently faced its fair share of challenges and changes. Various factors, including global events, evolving consumer preferences and technological advancements, drive diamond market trends.

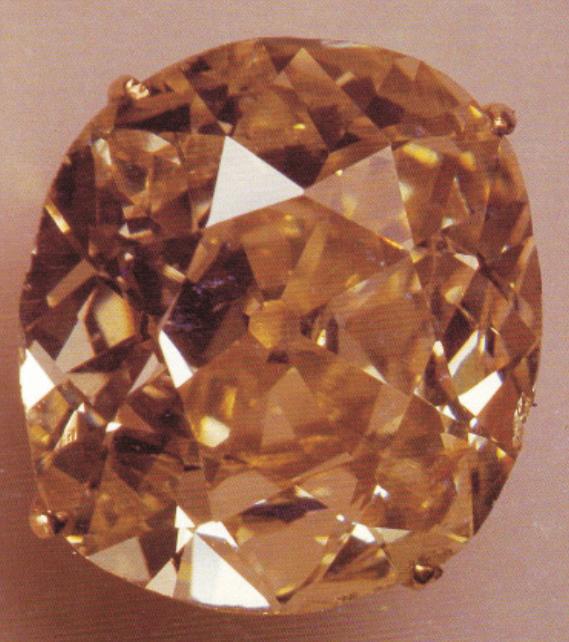

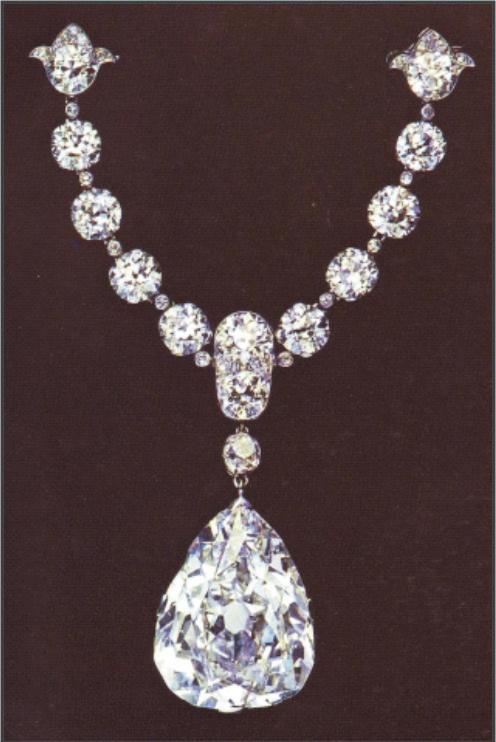

Coloured diamonds are in the spotlight. They routinely break records at auction houses, they make headlines when set in celebrity engagement rings and they are gemmological marvels of the rarest order.

Seen in practically every colour of the rainbow, coloured diamonds are far rarer than those in the D-Z colour range. Only one out of 10 000 fashioned diamonds displays fancy colour and a diamond’s chances of displaying intense colour are even less – one in 25 000. Browns and yellows are the most common fancy colours. Red, green, purple and orange are the rarest.

The Gemological Institute of America (GIA) issued its first origin-of-colour reports for coloured diamonds in 1956. Backed by decades of research and the examination of thousands of coloured diamonds, the GIA Coloured Diamond Grading System has become the standard for evaluating these extremely rare gems. Current GIA Coloured Diamond Grading Reports describe colour grades using these terms: Faint, Very Light, Light, Fancy Light, Fancy, Fancy Dark, Fancy Intense, Fancy Deep and Fancy Vivid. Virtually every coloured diamond sold at major auction houses has been graded by the GIA.

“The GIA Coloured Diamond Grading System allows a much more detailed description of diamond colour than what was available under the previous grading system. This has greatly facilitated trading of such stones worldwide, particularly as new sources expanded the quantities of stones in the market and the range of colours,” observes Russ Shor, Senior Industry Analyst at the institute.

Pink

GIA researchers theorise that the colour in many pink diamonds is caused by colour centres that can selectively absorb light in the visible region of the spectrum. Colour centres are the result of lattice defects, or imperfections in the arrangement of atoms in a crystal. These defects can sometimes cause pink graining in the diamond crystal.

of graphitisation. Concentrations of these internal features are responsible for the coloration. However, the actual body colour of a natural black diamond may range from near-colourless to brown or “olive” green.

Yellow

The presence of nitrogen causes a diamond to appear yellow. The intensity of the yellow colour is dependent upon varying amounts of nitrogen. Yellow diamonds are considered to be coloured and are graded as “Fancy” when they fall outside the D-Z range (colourless to light-yellow).

Once relegated to industrial use, brown diamonds gained cachet in the 1980s when marketers gave them romantic names like “champagne”, “cognac” and “chocolate”. The colour in natural brown diamonds is caused by internal parallel brown grain lines due to distortion of the crystal lattice (arrangement of molecules). Brown diamonds are generally more affordable than other fancy coloured ones.

The presence of boron impurities is often responsible for the colour of natural blue diamonds. The more boron, the deeper the blue. However, their colour can also be caused by radiation exposure or association with hydrogen. India was historically the source of blue diamonds. Within the last several years, though, notable blue diamonds have been found at the Cullinan Mine in SA.

Green diamonds get their colour when radiation displaces carbon atoms from their normal positions in the crystal structure. This can happen naturally when diamond deposits lie near radioactive rocks, or artificially as a result of treatment by irradiation. Naturally coloured green diamonds are extremely rare. Because of their rarity and the very real possibility of treatment, they are always regarded with suspicion and examined carefully in gemmological laboratories. Even so, advanced gemmological testing cannot always determine colour origin in green diamonds. Examined by GIA researchers in 1988, the 41ct Dresden Green diamond is the largest, and perhaps the finest, green diamond known to have a colour of natural origin.

Laboratory-grown coloured diamonds

In recent years, gem-quality laboratory-grown coloured diamonds have come to market. The GIA also offers synthetic coloured diamond grading reports for laboratory-grown coloured diamonds.

Most naturally coloured black diamonds get their colour from large quantities or clouds of minute mineral inclusions such as graphite, pyrite or hematite that extend throughout the stone. These diamonds may also have numerous cleavages or fractures that are stained black or have become black because

Only a handful of red diamonds larger than 5ct have been found. Red diamonds are so rare that from 1957-1987, the GIA did not issue a lab report for a diamond with “red” as the only descriptive term. “Predominantly red” means that red is the primary colour, with no secondary hues (like purple). GIA researchers, who have been studying diamonds for decades and have access to the most sophisticated equipment, are still unsure of what causes their colour.

Coloured diamonds are exceedingly rare and exceptionally beautiful. Because of this, interest in them is unlikely to wane. Expect these rarities of the highest order to continue to captivate gem aficionados and the public.

courtesy of the Gemological Institute of America (GIA). Established in 1931, the GIA is an independent non-profit that protects the gem- and jewellery-buying public through research, education and laboratory services. For further information, visit: www.gia.edu.

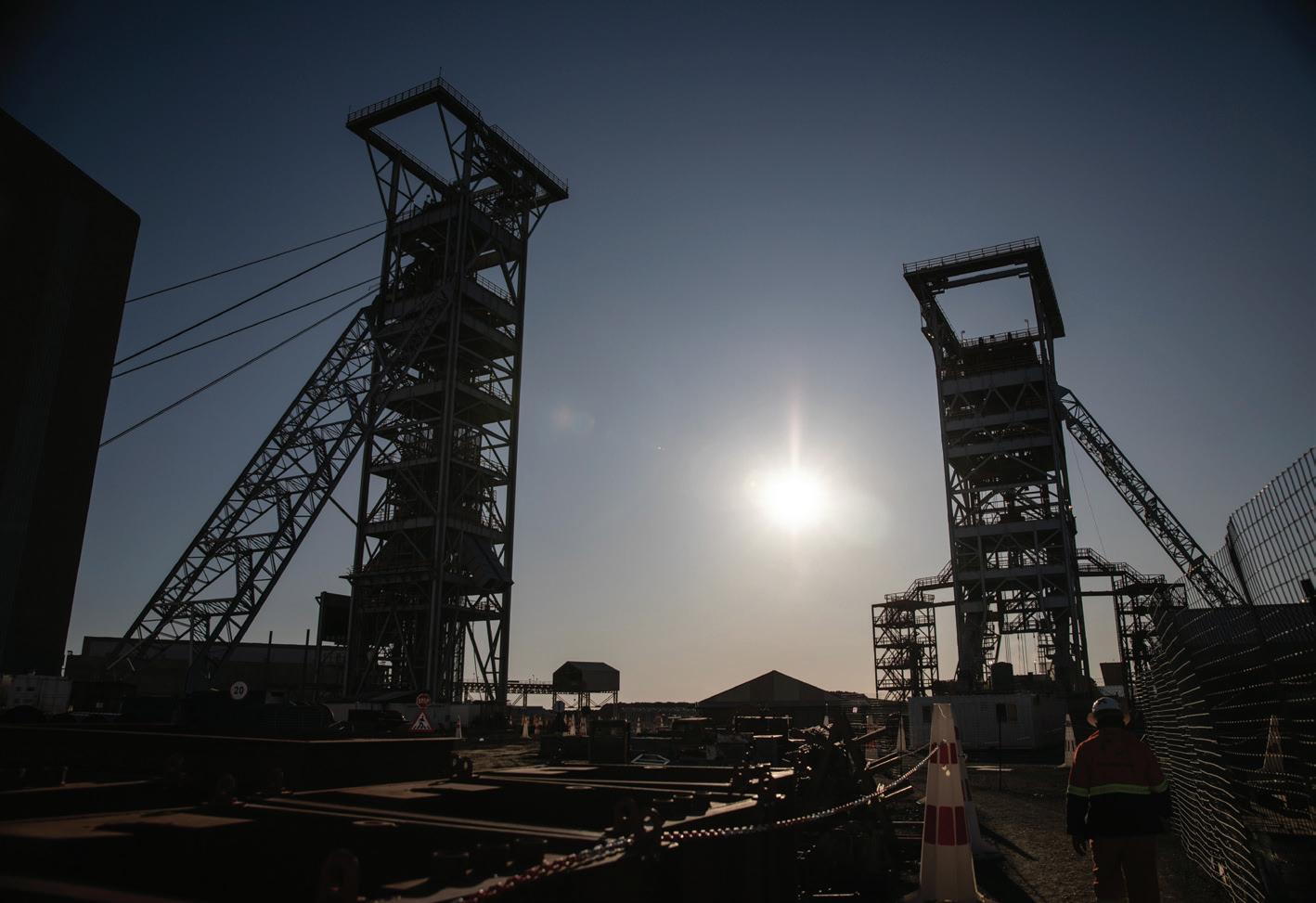

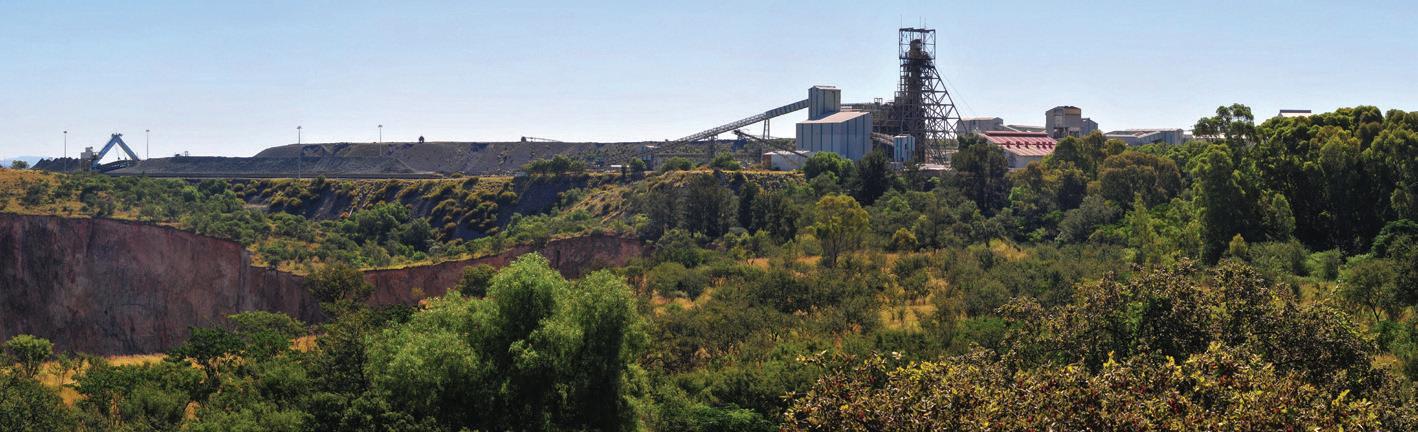

The Venetia Underground Mine (VUG) replaces open-pit operations at the Venetia Diamond Mine and extends mine life to at least 2046. Expected to start production this year, it will use the sub-level cave mining method.

According to Giel Marais, Principal Automation and Information Manager at De Beers, the objective of automation at the Venetia Underground Mine is to have a number of autonomous mining systems performing multiple mining processes by 2027.

“This is an ambitious goal, but we believe that it’s achievable, given the major technological advances made in recent years, particularly by the original equipment manufacturers who produce underground mining machines,” he says. “In the case of the VUG, our primary technology partner is Sandvik Mining & Rock Solutions, which manufactures a full range of ‘intelligent’ mining machines that can operate independently underground within access-controlled safety zones or be remotely operated from control rooms on the surface.”

Marais’s colleague Freddie Breed, Underground Technical Services Manager at De Beers, points out that the group has previous experience of autonomous mining. “We commissioned the first – and only –automated trucking loop in SA, and one of the first worldwide, at the Finsch diamond mine in the Northern Cape in 2005,” he says.

Marais says that while the Finsch system was revolutionary, it was also limited in certain respects. “The system had only one machine type –

articulated dump trucks [ADTs] – performing one process, namely hauling, on a single level of the mine,” he explains. “By contrast, at the VUG we’ll eventually have a number of mining systems operational, with a variety of machines, not just ADTs, executing multiple mining processes within the same operational area. These systems will be deployed and operating simultaneously during a shift on different levels of the mine.”

The implementation of automation at the VUG will be carefully phased in on an

incremental basis, starting with automated machines (which still require an on-board operator, although many functions are automated). Next will come autonomous machines (which do not require an onboard, operator as they are equipped with automated machine navigation and tramming and, while stationary,

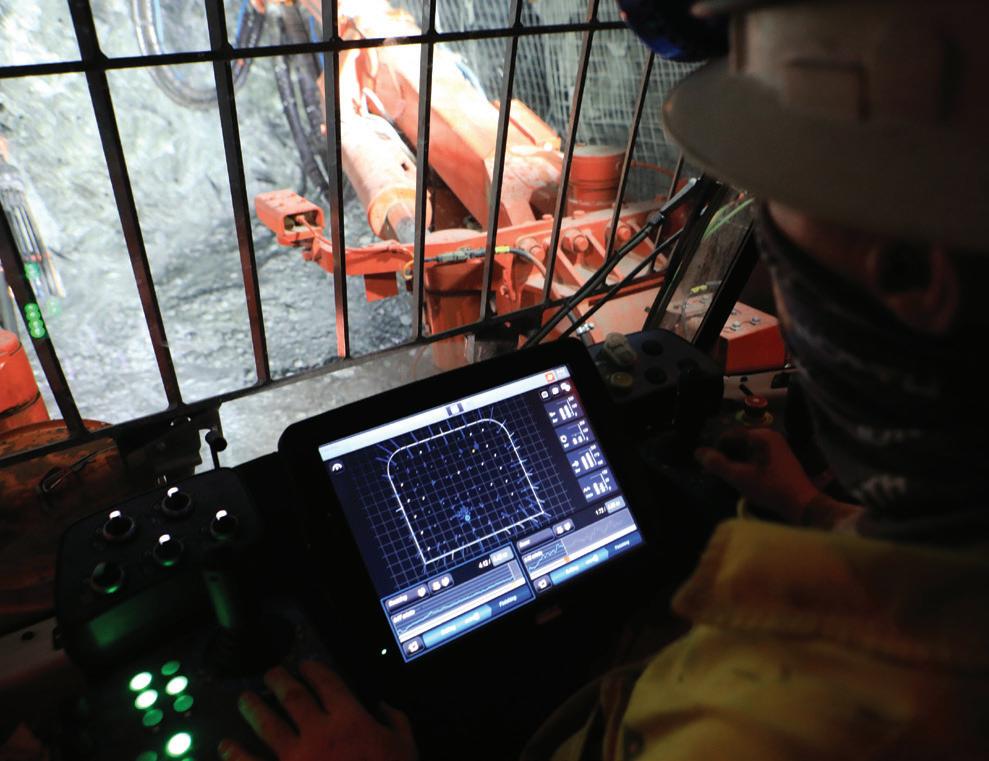

(Below): Sandvik DD422i is a development drill rig based on an intelligent control system and engineered to provide top-level performance, accuracy and reliability for underground mine development and small scale operations.

The De Beers Group has devised an autonomous roadmap for its Venetia underground operation that will result in the new US$2 billion mine becoming one of the most mechanised and automated mining operations in the world.

can perform most sets of routine functions without operator input required during the cycle). The final phase of implementation will see the introduction of full autonomous mining systems.

The key characteristic of autonomous mining systems is the use of multiple autonomous machines which are managed by an integrated central traffic management system. The machines operate in pre-defined safety zones that are dynamically combined to create autonomous operating areas.

Autonomous mining not only creates a safer and healthier environment for workers by removing them from potentially highrisk areas of the mine, but – if implemented correctly – is also more productive than traditional techniques in terms of output against available operating time.

Sandvik Mining & Rock Solutions is supplying all the primary mining equipment for the VUP for both mine development and production. This includes machines for development and production drilling, rock reinforcement, and loading and hauling. Sandvik is also providing its AutoMine system for the remote operation of loaders and trucks and its OptiMine system for machine health monitoring, task management and location-tracking.

As one of the first steps in its automation journey, the VUG is about to commission a

pilot project which will prepare the production team for the use of remote loading at the drawpoints and autonomous tramming to the tip. With cave mining, there is a risk of mud-rushes and water ingress at drawpoints and remote loading will allow material to be loaded without endangering operators.

“This pilot project will have a single loader operating under AutoMine Lite in a dedicated area on 44 level, which is isolated from other areas of the mine,” says Breed. “The machine

will be controlled locally from a mobile teleremote station just outside the autonomous operating area, not from the surface.”

He adds that an integrated operations centre on the surface at Venetia Mine is under construction and will be equipped and commissioned in the first half of this year.

According to Giel Marais, Principal Automation and Information Manager at De Beers, the objective of automation at the Venetia Underground Mine is to have a number of autonomous mining systems performing multiple mining processes by 2027.(Above, from left): An operator programming the Sandvik DD422i drill rig machine ahead of a blast underground. Underground mine simulators are used in training programmes.

• Proudly registered with SADPMR

-ProudlyregisteredwithSADPMR

-RoughDiamondDealersAssociationofSA

-MemberofSAYDBG

-MinistryofMiningLESOTHO

-DepartmentofMinesBOTSWANA

exceeds the expectations of our customers.

If you have any questions about diamonds, please do not hesitate to contact us. We have friendly, knowledgeable representatives available to assist you.

-HolderofProspectingMiningLicenseinFrancistown

#LetlhakaneBOTSWANA

LeThabo Diamonds is a diamond trader with branches in South Africa, Lesotho and Botswana. Our company was founded by the current Director Ntate Thabo Kgomare. Lethabo Kgomare, his daughter, is currently being groomed to take the reins in the future. We buy and sell rough and polished diamonds.

As an experienced diamond-cutter and dealer, LeThabo Diamonds can advise you on laboratory-certified diamonds.

We strive to deliver a level of service that

LeThaboDiamondsisaDiamondtraderwithbranchesinSouth Africa,LesothoandBotswana.Ourcompanywasfoundedbythe currentDirectorNtateThaboKgomare.LethaboKgomare,his daughter,iscurrentlybeinggroomedtotakethereinsinthe future.Webuyandsellroughandpolisheddiamonds.

Asanexperienceddiamondcutteranddealer,LeThabo Diamondscanadviseyouonlaboratory-certifieddiamonds.

• Rough Diamond Dealers Association of SA

• Member of SAYDBG

Westrivetodeliveralevelofservicethatexceedsthe expectationsofourcustomers.

After securing a guaranteed diamond supply from southern African countriesincluding South Africa, Lesotho and Botswana, our ultimate goal is to open an office in Dubai for international distribution through LeThabo Diamonds.

• Ministry of Mining LESOTHO

IfyouhaveanyquestionsaboutDiamonds,pleasedonothesitate tocontactus.Wehavefriendly,knowledgeablerepresentatives availabletoassistyou.

• Department of Mines BOTSWANA

• Holder of Prospecting Mining License in Francistown

#Letlhakane BOTSWANA

AftersecuringguaranteeddiamondssupplyfromSouthern Africancountries,whichare:SouthAfrica,Lesotho,Botswana, ourultimategoalistoopenanofficeinDubaiforinternational distributionthroughLeThaboDiamonds.

The geological landscape around us evolves so slowly that it can appear static, but the rigid tectonic plates that make up the outer layer of our planet drift across its surface over time. Interactions between plates result in large-scale bumping, grinding, and breaking of rocks that we feel as earthquakes. Some earthquakes originate from below the rigid outer layer of plates, even from depths greater than about 300 km where rocks are expected to be under too much confining pressure to break by brittle failure. Instead of being related to multiple plates jostling together, these deep earthquakes are always associated with cold, lone plates that have sunken down into the warmer convecting mantle through the process of subduction. The nature and cause of these so-called deepfocus earthquakes remain poorly understood, but recent research suggests they might have something to do with the growth of top-quality gem diamonds.

As a sinking or subducting plate, also colloquially called a “slab,” descends into the mantle, the pressure and temperature increase. Changing conditions can cause some minerals to melt or undergo phase changes that release water. Recent slab modeling shows that the measured depths of deep-focus earthquakes coincide with the depth where melts and fluids should be released from some slabs, especially those that are relatively cold to begin with (Shirey et al., 2021). The release of melts and fluids at depths beyond 300 km potentially serves to trigger these deep-focus earthquakes. Shirey et al. (2021) also linked this earthquake activity to the formation of sublithospheric or super-deep diamonds, which have been connected with subducted material and both carbonatitic melts and hydrous fluids in previous studies (Walter et al., 2008; Harte, 2010; Pearson et al., 2014; Smith et al., 2016, 2018; Thomson et al., 2016b; Smith and Nestola, 2021). Here we will explore the connection between deep-focus earthquakes and the growth of diamonds—specifically the variety known as CLIPPIR diamonds (Cullinan-like, Large, Inclusion-Poor, Pure, Irregular, and Resorbed) that make up many of the type II diamonds in the gem market (Smith et al., 2016, 2017).

An earthquake in the crust is caused by a sudden brittle failure of rock, often along a preexisting, large-scale fracture where two plates meet, called a fault. Tectonic plates move at a pace of a few centimeters per year, about the same rate our fingernails grow, but the motion is not smooth and continuous at the boundaries between plates. Friction along faults resists the motion. Stresses build up until they cause sudden brittle failure and movement that can shake Earth’s interior and surface. The vibrations or seismic activity can cause serious damage to buildings and infrastructure, or they can be so slight that they are only detected with sensitive instruments called seismometers

Scientists have been recording earthquake activity for more than a century, with increasing degrees of sophistication, accumulating a tremendous amount of data. With multiple seismometers recording the same earthquake, it is possible to calculate where it originated within the earth. The location in the earth where an earthquake starts is called the hypocenter, while the location directly above it at the surface is called the epicenter. When mapped out over time, earthquakes near the surface trace out faults, marking the boundaries between mobile tectonic plates.

There is also important information conveyed by the depth of earthquake hypocenters. Figure 1A shows a histogram of the depth of earthquakes worldwide, revealing two humps or modes in the data. The first and most prominent mode peaks within the uppermost 100 km and drops off exponentially with depth (Frohlich, 2006). These shallower earthquakes are associated with movements along faults between tectonic plates, especially where plates push together, at subduction zones and continental collisions (figure 1B). Deeper earthquakes, plotted all the way down to 700 km in figure 1A, are associated with subducting plates and record their activity as they sink into the mantle.

Initially, earthquake activity coincides with dehydration and the release of fluids from sediment and crust in a subducting slab. Seismicity tapers off sharply down to a depth of 300 km, and it is expected that dehydration and loss of volatiles from the slab are largely complete by this point. There should be no further earthquakes as the slab continues to descend into the mantle. For this reason, the deep-focus earthquakes below about 300 km that peak in a second mode at 500–600 km are anomalous (figure 1A).

Deep-focus earthquakes are a subject of active research. Several ideas have been proposed to explain them. One of the proposed mechanisms is that subducting slabs contain hydrous minerals in their interior from previous interaction with seawater at the surface, which eventually break down as the slab warms up, releasing water and promoting brittle failure within the slab (Omori et al., 2004). This idea is singled out here because it ties in with the modeling work by Shirey et al. (2021), who refined the idea and connected it with recent observations from CLIPPIR (~type IIa) and type IIb diamonds.

It is clear that deep-focus earthquakes are linked with subduction, so it is important to clarify some of the concepts of plate tectonics before moving further. The rigid outer layer of the earth that makes up the plates in figure 1B is called the lithosphere, and it rides on the weak and plastic (but not molten) rock beneath the lithosphere, shown simply as white space

under the plates. The lithosphere is an open-faced sandwich of two components, with the crust on top and a portion of rigid mantle rock beneath it. The bottom of the lithosphere or plate is a mechanical boundary where the mantle rocks transition from rigid and brittle to weak and plastic. The weak and flowing mantle beneath the lithosphere is sometimes specified as the sublithospheric mantle or convecting mantle, which extends all the way down to the outer core at 2900 km.

There are two very different kinds of lithosphere. Continents, including their underwater continental shelf extensions, are made of continental lithosphere, whereas ocean floors are made of oceanic lithosphere (figure 1B). Continental lithosphere is thicker, more buoyant, and relatively stable through geologic time. Oceanic lithosphere is thinner, denser, and has a relatively finite life cycle.

Oceanic lithosphere is created almost continuously at the spreading centers of mid-ocean ridges. On either side of a ridge, the plates gradually spread apart. Eventually, in 20 to 200 million years, the oceanic lithosphere bends and sinks down into the convecting mantle, a process called subduction (figure 1B). The creation and subduction of oceanic lithosphere are ongoing. The rate of spreading at mid-ocean ridges and convergence at subduction zones often differs and is not necessarily balanced in the same ocean basin, so oceans are dynamic regions that can open and grow or shrink and close. The opening of the Atlantic Ocean, for example, is facilitated by the creation of new oceanic lithosphere along the mid-Atlantic ridge. There is currently no subduction of oceanic lithosphere around the Atlantic’s perimeter. The Pacific Ocean, however, is almost completely

surrounded by subduction zones where oceanic lithosphere is subducting down into the mantle and fueling arc volcanoes that make up the Pacific Ring of Fire.

Nearly all the oceanic lithosphere on Earth is younger than about 200 million years old. Modern-style plate tectonics is thought to have been operating for about the past 3 billion years (Earth is 4.5 billion years old) (Shirey and Richardson, 2011). Over this time, several oceans have opened and closed (Wilson, 1966) along with the assembly and breakup of various continental configurations, such as the supercontinent Pangaea.

Hundreds of kilometers down inside the earth, where subducting slabs reach perhaps 360–750 km, there may be blossoming domains of diamond growth. Most mined diamonds are thought to originate from shallower depths within the continental lithosphere at about 150–200 km, but some (estimated to be approximately 2%) originate from below the continental lithosphere. These are known as sublithospheric or super-deep diamonds. Despite being a relatively rare mineral, diamond can form in multiple different ways. The variables that lead to different kinds of diamond include the host rock type, the composition of the diamond forming fluid, how carbon resides in the fluid and surrounding mantle, and the pressure and temperature conditions. Individual diamond deposits at the surface often contain several distinct populations that can be recognized by studying mineral inclusions or other features, such as their morphology, internal growth history, nitrogen content and aggregation, and carbon isotopic composition (e.g., Stachel and Harris, 2008).

The study of sublithospheric diamonds over the past few decades has been dominated by small (usually <1 ct), generally non-gem quality diamonds from the Juina region of Brazil and various other localities worldwide (see reviews by Stachel et al., 2005; Kaminsky, 2012; Harte and Hudson, 2013; Smith and Nestola, 2021). In the past few years, however, it has been discovered that the prevalence of sublithospheric diamonds is greater than previously thought and includes some of the largest and highest-quality gem diamonds (Smith et al., 2016, 2017, 2018). Diamonds such as the exquisite type IIa (containing no detectable nitrogen by FTIR) gems from the Letšeng mine (figure 2) are now recognized to belong to the sublithospheric variety termed CLIPPIR diamonds. These are argued to account for most of the type IIa diamonds in the gem marketplace, amounting to about ~1% of diamonds (Smith et al., 2017). Similarly, rare type IIb diamonds (boron-bearing), which can be blue in color, have also been shown to be sublithospheric (Smith et al., 2018).

A connection to subducted oceanic lithosphere is an emerging theme common to many sublithospheric diamonds, based mainly on the composition of mineral inclusions (Walter et al., 2008, 2011; Bulanova et al., 2010; Burnham et al., 2015; Ickert et al., 2015; Seitz et al., 2018; Smith et al., 2018; Thomson et al., 2016a). CLIPPIR and type IIb diamonds have also been linked to subducted slabs and to serpentinized peridotite in the mantle portion of slabs in particular. Serpentinization is a complex series of reactions between water and rock, resulting

in the formation of hydrous (water-bearing) minerals such as serpentine from normally anhydrous minerals such as olivine. The strongest piece of evidence for this connection between diamonds and serpentinites comes from measurements of iron isotopes in inclusions trapped in CLIPPIR diamonds (Smith et al., 2021). The iron in these inclusions has an isotopic signature produced during serpentinization reactions between seawater and the ocean floor. In order for this signature to be trapped in CLIPPIR diamonds, deeply subducted serpentinized oceanic lithosphere must have contributed to their formation. In a sense, subducting slabs are like conveyor belts feeding raw materials down to hidden super-deep diamond factories at 360–750 km depths. Exactly how these diamonds make their way upward to shallower depths where they can be swept up to the surface in volcanic eruptions of kimberlite magma remains an open question, however (figure 3).

Earthquakes and Diamond-Forming Fluid

Slabs gradually warm up as they subduct into the mantle. The temperature change with depth is called a geotherm. About half of Earth’s subducting slabs trace out warmer pathways while the remainder are colder, depending on the age of the slab and the speed at which it subducts. Warmer slabs generally lack deep earthquakes, which appear to be unique to colder slabs. Shirey et al. (2021) examined slabs around the world and modeled their temperature change with depth as they heat up during subduction into the mantle. They also made a careful comparison between earthquake locations, slab geotherms,

and the expected mineralogy and phase changes within slab rocks. Overlaying the slab geotherms onto phase diagrams helps to illustrate where water-bearing phases break down and release fluid, such as the relatively well-accepted loss of most water from warm slabs at relatively shallow depths (<200 km). This is the activity that generates melt and fuels arc volcanoes such as those of the Pacific Ring of Fire. Cold slabs, however, can partially bypass this shallow dewatering process and transport a budget of carbonate and water to depths beyond 300 km, where its later release can cause deep-focus earthquakes (figure 3).

The cold slabs can be thought of as having a carbonated crust component and a hydrated/serpentinized mantle peridotite component that lies shielded beneath the crust, toward the interior of the slab. The deep release of carbonatitic melt and hydrous fluid from each component, respectively, is shown in the two depth profiles in figure 3. The carbonated crust (mid-ocean ridge basalt, or MORB) of the slab surface will intersect a deep depression in its solidus, the curve describing the beginning of melting, meaning it exceeds the melting temperature. Beyond this point, carbonate melting (red arrows) is expected to occur within the top/crustal portion of the slab.

For hydrated/serpentinized mantle peridotite inside the slab, its stability also depends on temperature. If it remains cool, the serpentine can metamorphose into higher-pressure water-

bearing minerals called dense hydrous magnesium silicates (DHMS) rather than breaking down. DHMS phases are a good vehicle for transporting water, with some carrying as much as 10% or more water by weight. The geotherm for the interior of cold slabs remains in the DHMS stability field far beyond a depth of 300 km (far right in figure 3). The slab in figure 3 is shown deflecting as it reaches the top of the lower mantle (at 660 km), where there is a change in mantle density and deformability. As the slab stalls and warms up, DHMS phases break down to form minerals that carry much less water, thereby causing water release (blue arrows in figure 3). These are the mechanisms proposed to trigger not only deep-focus earthquakes but also super-deep diamond growth (Shirey et al., 2021).

Inclusions in the smaller, lower-quality varieties of sublithospheric diamonds often show evidence of growth from carbonatitic melts derived from slabs (Walter et al., 2008), but hydrous/aqueous fluids have also been implicated for some samples (Wirth et al., 2007; Pearson et al., 2014; Palot et al., 2016). Serpentinite in subducting slabs can be relatively enriched in boron, meaning that the eventual breakdown of hydrous minerals from serpentinized peridotite can release boron-bearing hydrous fluid, which has been linked with the formation of type IIb (boron-bearing) diamonds (Smith et al., 2018). Figure 4 shows a calcium silicate (breyite) inclusion with methane and hydrogen in a type IIb diamond. The original mineral inclusion may have been relatively hydrogen-rich

Diamond-bearing kimberlite eruption

High-quality CLIPPIR and type IIb diamonds

Low-quality, non-gem sublithospheric diamonds Lithospheric diamonds

Carbonated slab melting Hydrous uid

figure 1). Profiles on the right show the slab surface and interior temperature during subduction. Where the slab surface temperature intersects the solidus of carbonated mid-ocean ridge basalt (MORB), partial melting may occur (red arrows). At the far right, a cold slab interior remains within the dense hydrous magnesium silicates (DHMS) stability field until the slab stalls and warms up, causing the breakdown of these hydrous phases and the release of hydrous fluid (blue arrows). Large white and smaller brown diamond symbols signify the growth of high-quality gem diamonds (CLIPPIR and type IIb) and low-quality, generally non-gem sublithospheric diamonds, respectively. Poorly understood mechanisms transport some diamonds upward where they can be swept up in kimberlite eruptions and mixed with common lithospheric diamonds (small black diamond symbols). Modified from Smith and Nestola (2021) with carbonated MORB solidus from Thomson et al. (2016b) and DHMS stability field from Harte (2010).

upon trapping because it crystallized from, or was exposed to, hydrous fluids. Subducted serpentinized peridotite is also a key ingredient for CLIPPIR diamond growth, on the basis of recent iron isotope measurements (Smith et al., 2021).

Broken Diamonds

Evidence of natural deformation and breakage in diamond is not uncommon. For example, this evidence can be in the form of plastic deformation lines or internally fractured diamond overgrown by new layers of pristine diamond. Features such as these attest to the occasional turbulent conditions in the mantle, even before diamonds are picked up and scrambled by kimberlite eruptions. Little is known about the circumstances responsible for these features.

Sublithospheric diamonds in particular bear evidence of deformation and breakage, typically having irregular morphologies with broken and resorbed surfaces. CLIPPIR diamonds, which can reach thousands of carats (including the 3,106 ct Cullinan), often have surfaces that appear to be broken (fi gure 2). Some of those broken surfaces on large diamonds have high degrees of resorption or chemical dissolution, to an extent that would consume any small diamonds nearby (Gurney and Helmstaedt, 2012). For this reason, such extreme resorption is unlikely to be associated with volcanic transport in a kimberlite where smaller diamond

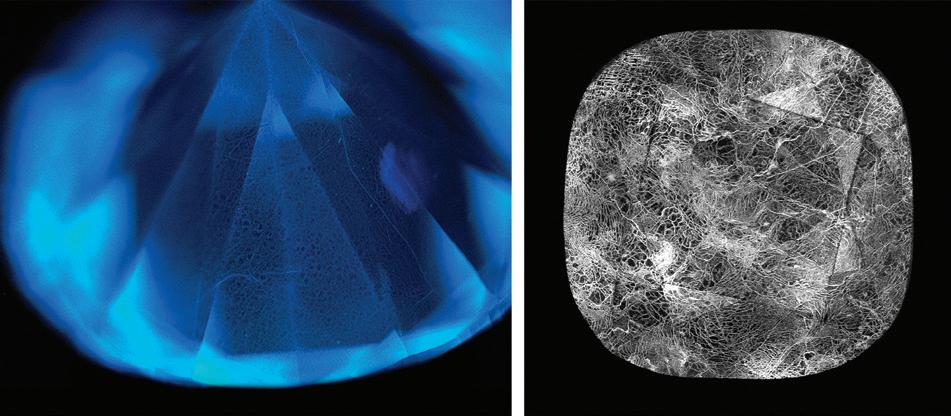

Figure 5. Evidence of the incredibly dynamic setting in which these diamonds form. A: Deep-UV luminescence image of a type IIa diamond with irregular blue lines (see arrows) that may be healed fractures lying within a typical dislocation network pattern. Image by E.M. Smith; fi eld of view 5.92 mm. B: Cathodoluminescence image of a type IIb diamond with an irregular dislocation network pattern that encloses several long straight segments, reaching up to 600 µm, interpreted as healed segments of brittle fracture/cleavage within an otherwise plastically deformed and annealed diamond. Image by E.M. Smith; fi eld of view 2.39 mm.

crystals survive. This indicates that the resorption, and in turn some of the breakage of large CLIPPIR diamonds, occurred early in the diamond’s history.

In addition to diamond breakage, some sublithospheric diamonds have internal evidence of more subdued brittle fractures that have healed rather than separated (figure 5). Network-like patterns of dislocations inside these diamonds often conform with the healed fractures rather than being cross-cut by them, suggesting the deformation and fracturing was followed by a protracted period of annealing in the mantle to allow the network pattern to develop. Again, this points to sublithospheric diamond deformation and breakage that is not due to kimberlite activity.

If fl uid and melt release from deeply subducted slabs causes both deep-focus earthquakes and diamond growth, it is worth considering how diamonds might be affected by earthquakes. Breakage and other signs of deformation could potentially be related to diamond growth in a dynamic setting punctuated by deep-focus earthquakes. Obviously, more research is needed to decipher the natural deformation history of diamonds. Nevertheless, it is interesting to speculate on a possible connection between diamond breakage and deep-focus earthquakes.

Figure 4. Evidence of hydrous fl uid presence during diamond growth. This inclusion of breyite (photomicrograph and bottom Raman spectrum) within a blue type IIb diamond is interpreted to have been trapped as CaSiO3 perovskite, which has inverted to a lower-pressure mineral form during exhumation from the mantle, originating from a depth greater than 360 km. Raman spectroscopy also reveals peaks associated with methane and molecular hydrogen (top right spectrum), which are present as a thin fl uid layer trapped at the interface between the solid inclusion and the host diamond. Photomicrograph by E.M. Smith; fi eld of view 0.65 mm.

Subduction is a fundamental aspect of plate tectonics that is driven by Earth’s internal heat engine – the means by which heat escapes from the mantle and core. It forces us to consider plate tectonics not just as a system of plates at Earth’s surface but also as a process that involves the exchange of material between the surface and the deeper convecting mantle over time (figure 1B). During its time at the seafloor, oceanic lithosphere interacts with seawater over many millions of years.

Water can circulate into fractures and react with the basaltic and peridotitic rocks that make up the oceanic lithosphere. As the aged and modified oceanic plates subduct, they now carry sediments, pore fluids, altered oceanic crust, and serpentinized peridotite along for the ride.

The sediments, water, and carbonate in the upper portion of the slab may be stripped off at shallower depths in the subduction zone (<200 km) where they fuel arc volcanoes, but some carbonated crust and serpentinized peridotite can be transported deeper. Deep-focus earthquakes and diamonds may be a product of some slabs, namely those that have remained cooler during subduction, carrying a budget of carbonate in altered ocean crust and hydrous minerals in serpentinized peridotite down to 300 to 700 km. The deep cycling of carbon and water has a big impact on the behavior of Earth’s interior, how it moves and melts.

These large-scale processes are relevant for the evolution of the atmosphere, the distribution of water at the surface, and

Bulanova G.P., Walter M.J., Smith C.B., Kohn S.C., Armstrong L.S., Blundy J., Gobbo L. (2010) Mineral inclusions in sublithospheric diamonds from Collier 4 kimberlite pipe, Juina, Brazil: Subducted protoliths, carbonated melts and primary kimberlite magmatism. Contributions to Mineralogy and Petrology, Vol. 160, No. 4, pp. 489–510, http://dx.doi. org/10.1007/s00410-010-0490-6

Burnham A.D., Thomson A.R., Bulanova G.P., Kohn S.C., Smith C.B., Walter M.J. (2015) Stable isotope evidence for crustal recycling as recorded by superdeep diamonds. Earth and Planetary Science Letters, Vol. 432, pp. 374–380, http://dx.doi. org/10.1016/j.epsl.2015.10.023

Engdahl E.R., van der Hilst R., Buland R. (1998) Global teleseismic earthquake relocation with improved travel times and procedures for depth determination. Bulletin of the Seismological Society of America, Vol. 88, No. 3, pp. 722–743, http://dx.doi.org/10.1785/BSSA0880030722

Frohlich C. (2006) Deep Earthquakes. Cambridge University Press, Cambridge, UK.

Gurney J.J., Helmstaedt H.H. (2012) The origins of type IIa diamonds and their enhanced economic significance. 10th International Kimberlite Conference, Extended Abstract No. 10IKC-123, pp. 1–6.

the formation of continents over geological time. All of these parts of the dynamic earth are connected. Despite the proven 1 to 3 billion-year-old ages of many gem diamonds that come from the lithosphere, there is no reason that diamonds cannot be forming in the present. If diamonds and deep earthquakes are truly related, as described by Shirey et al. (2021), the implication is that modern-day earthquakes herald the formation of new diamonds. In this sense, subduction drives a sort of modern diamond factory – one that has the potential to produce some of the largest and most valuable diamonds known (including type IIa and type IIb diamonds). Diamonds and earthquakes, while fascinating in their own right, are two of the most powerful tools we have to unravel the inner workings of our planet.

Many thanks to Dr. Steven B. Shirey for insightful discussion and suggestions that helped to improve this column.

Harte B. (2010) Diamond formation in the deep mantle: The record of mineral inclusions and their distribution in relation to mantle dehydration zones. Mineralogical Magazine, Vol. 74, No. 2, pp. 189–215, http://dx.doi.org/10.1180/minmag.2010.074.2.189

Harte B., Hudson N.F.C. (2013) Mineral associations in diamonds from the lowermost upper mantle and uppermost lower mantle. Proceedings of the 10th International Kimberlite Conference, Vol. 1, pp. 235–253.

Ickert R.B., Stachel T., Stern R.A., Harris J.W. (2015) Extreme 18O-enrichment in majorite constrains a crustal origin of transition zone diamonds. Geochemical Perspectives Letters, Vol. 1, No. 1, pp. 65–74, http://dx.doi.org/10.7185/ geochemlet.1507

Kaminsky F. (2012) Mineralogy of the lower mantle: A review of ‘super-deep’ mineral inclusions in diamond. EarthScience Reviews, Vol. 110, No. 1-4, pp. 127–147, http://dx.doi. org/10.1016/j.earscirev.2011.10.005

Omori S., Komabayashi T., Maruyama S. (2004) Dehydration and earthquakes in the subducting slab: Empirical link in intermediate and deep seismic zones. Physics of the Earth and Planetary Interiors, Vol. 146, No. 1-2, pp. 297–311, http://dx.doi. org/10.1016/j.pepi.2003.08.014

Palot M., Jacobsen S.D., Townsend J., Nestola F., Marquardt K., Miyajima N., Harris J., Stachel T., McCammon C., Pearson D.

(2016) Evidence for H2O-bearing fluids in the lower mantle from diamond inclusion. Lithos, Vol. 265, pp. 237–243, http:// dx.doi.org/10.1016/j.lithos.2016.06.023

Pearson D.G., Brenker F.E., Nestola F., McNeill J., Nasdala L., Hutchison M.T., Matveev S., Mather K., Silversmit G., Schmitz S., Vekemans B., Vincze L. (2014) Hydrous mantle transition zone indicated by ringwoodite included within diamond. Nature, Vol. 507, No. 7491, pp. 221–224, http://dx.doi.org/10.1038/ nature13080

Seitz H.-M., Brey G.P., Harris J.W., Durali-Müller S., Ludwig T., Höfer H.E. (2018) Ferropericlase inclusions in ultradeep diamonds from Sao Luiz (Brazil): High Li abundances and diverse Li-isotope and trace element compositions suggest an origin from a subduction mélange. Mineralogy and Petrology, Vol. 112, No. S1, pp. 291–300, http://dx.doi.org/10.1007/s00710018-0572-0

Shirey S.B., Richardson S.H. (2011) Start of the Wilson Cycle at 3 Ga shown by diamonds from subcontinental mantle. Science, Vol. 333, No. 6041, pp. 434–436, http://dx.doi.org/10.1126/ science.1206275

Shirey S.B., Wagner L.S., Walter M.J., Pearson D.G., van Keken P.E. (2021) Slab transport of fluids to deep focus earthquake depths – Thermal modeling constraints and evidence from diamonds. AGU Advances, Vol. 2, No. 2, http://dx.doi. org/10.1029/2020AV000304

Smith E.M., Nestola F. (2021) Super-deep diamonds: Emerging deep mantle insights from the past decade. In H. Marquardt et al., Eds., Mantle Convection and Surface Expressions, Geophysical Monograph Series 263, American Geophysical Union, pp. 179–192.

Smith E.M., Shirey S.B., Nestola F., Bullock E.S., Wang J., Richardson S.H., Wang W. (2016) Large gem diamonds from metallic liquid in Earth’s deep mantle. Science, Vol. 354, No. 6318, pp. 1403–1405, http://dx.doi.org/10.1126/science.aal1303

Smith E.M., Shirey S.B., Wang W. (2017) The very deep origin of the world’s biggest diamonds. G&G, Vol. 53, No. 4, pp. 388–403, http://dx.doi.org/10.5741/GEMS.53.4.388

Smith E.M., Shirey S.B., Richardson S.H., Nestola F., Bullock E.S., Wang J., Wang W. (2018) Blue boron-bearing diamonds from Earth’s lower mantle. Nature, Vol. 560, No. 7716, pp. 84–87, http://dx.doi.org/10.1038/s41586-018-0334-5

Smith E.M., Ni P., Shirey S.B., Richardson S.H., Wang W., Shahar A. (2021) Heavy iron in large gem diamonds traces deep

subduction of serpentinized ocean floor. Science Advances, Vol. 7, No. 14, http://dx.doi.org/10.1126/sciadv.abe9773

Stachel T., Harris J.W. (2008) The origin of cratonic diamonds –Constraints from mineral inclusions. Ore Geology Reviews, Vol. 34, pp. 5–32, http://dx.doi.org/10.1016/j.oregeorev.2007.05.002

Stachel T., Brey G., Harris J.W. (2005) Inclusions in sublithospheric diamonds: Glimpses of deep earth. Elements, Vol. 1, No. 2, pp. 73–78, http://dx.doi.org/10.2113/gselements.1.2.73

Thomson A.R., Kohn S.C., Bulanova G.P., Smith C.B., Araujo D., Walter M.J. (2016a) Trace element composition of silicate inclusions in sub-lithospheric diamonds from the Juina-5 kimberlite: Evidence for diamond growth from slab melts. Lithos, Vol. 265, pp. 108–124, http://dx.doi.org/10.1016/j. lithos.2016.08.035

Thomson A.R., Walter M.J., Kohn S.C., Brooker R.A. (2016b) Slab melting as a barrier to deep carbon subduction. Nature, Vol. 529, No. 7584, pp. 76–79, http://dx.doi.org/10.1038/ nature16174

Walter M.J., Bulanova G.P., Armstrong L.S., Keshav S., Blundy J.D., Gudfinnsson G., Lord O.T., Lennie, A.R., Clark S.M., Smith C.B., Gobbo L. (2008) Primary carbonatite melt from deeply subducted oceanic crust. Nature, Vol. 454, No. 7204, pp. 622–625, http://dx.doi.org/10.1038/nature07132

Walter M.J., Kohn S.C., Araujo D., Bulanova G.P., Smith C.B., Gaillou E., Wang J., Steele A., Shirey S.B. (2011) Deep mantle cycling of oceanic crust: Evidence from diamonds and their mineral inclusions. Science, Vol. 334, No. 6052, pp. 54–57, http://dx.doi.org/10.1126/science.1209300

Wilson J.T. (1966) Did the Atlantic close and then re-open? Nature, Vol. 211, No. 5050, pp. 676–681, http://dx.doi. org/10.1038/211676a0

Wirth R., Vollmer C., Brenker F., Matsyuk S., Kaminsky F. (2007) Inclusions of nanocrystalline hydrous aluminium silicate “Phase Egg” in superdeep diamonds from Juina (Mato Grosso State, Brazil). Earth and Planetary Science Letters, Vol. 259, No. 3-4, pp. 384–399, http://dx.doi.org/10.1016/j.epsl.2007.04.041

Although the first diamond discovery in SA was made in 1859, our country’s diamond heritage stems from a young boy, who picked up a pretty pebble near Hopetown in 1867. The true nature of the stone was undisclosed for a while, as the children used it for playing games on the farm.

Schalk van Niekerk could not make a living on his farm, De Kalk, near Hopetown. In desperation, he sold it to Daniel Jacobs and stayed on as a squatter. Jacobs’s children were always collecting pretty pebbles from the river bed which they used in their game of Five Stones. One day, 15-year-old Erasmus picked up a shiny stone and gave it to his mother, who placed it on a windowsill.

By chance, the “bywoner ”, Van Niekerk, saw the Jacobs children playing Five Stones and noticed an exceptional pebble among their collection. It had dropped from the windowsill to the ground outside, where they picked it up. He knew that a diamond would cut glass and, on a sudden impulse, drew the stone across the windowpane. A deep groove appeared in it.

The stone was then handed to a hunter, Jack O’Reilly, who showed it to Lorenzo Boyes, the Assistant Commissioner at Colesberg, who sent it by post to William G Atherstone, a doctor and amateur mineralogist in Grahamstown who finally identified it as a diamond of 21,25ct. Van Niekerk received £350 for his find. He offered half to Jacobs, who did not want anything for what he

still regarded as an “old stone”. It was later sold to the Governor of the Cape, Sir Philip Wodehouse, for £500.

The stone was shipped to London to be displayed at the Paris Universal Exposition of 1867/68. It was subsequently cut in London into a gem weighing 10,73ct and named Eureka. In 1966, 100 years after its discovery, Harry Oppenheimer purchased the stone and presented it to the South African government.

After the discovery of the Eureka, disillusionment followed. No new discoveries were made and most prospectors lost faith. However, Van Niekerk was still on the lookout. In March 1869, his luck returned when he bought a massive 83,5ct diamond from a Khoisan man who had been using it as a charm. He paid all he had – 10 oxen, his horse and 500 sheep. The Khoisan man had obtained the stone from a Griqua lad named Swartbooi. Soon afterwards, Van Niekerk sold it for £11 200 to a Mr Lilienfeld.

The sale of the stone, now named the Star of South Africa, soon gave rise to legal proceedings. The Diamond, Metal & Mineral Association (DMMA) had obtained sole prospecting rights from Nikolaas Waterboer, chief of the Griquas, in the territory which lay to the north of the Orange River. The Griqua community claimed that the diamond had

been found on their side of the river, thus entitling them to some financial benefit. They also asked the Supreme Court to restrain Lilienfeld from selling, parting with or in any way disposing of the stone.

Swartbooi refused to indicate exactly where he had found the diamond and was kidnapped on two occasions to induce him to reveal the locality. However, he stubbornly resisted these efforts and later disappeared. On 19 May 1869, the Supreme Court ruled that the affidavits produced by the DMMA were based on hearsay and inadmissible. The DMMA and Waterboer lost the case. The Star of South Africa made its final appearance in SA at an exhibition in Port Elizabeth before being shipped to (then) Great Britain on the steamship Celt, the same vessel which had carried the Eureka two years previously. On its arrival in London, it was sold to the Earl of Dudley for the then record price of £25 000.

The discovery of this diamond started a process which transformed SA from the pastoral land it had once been to its current position as the most industrialised country in Africa.